A Guest Post by George Kaplan

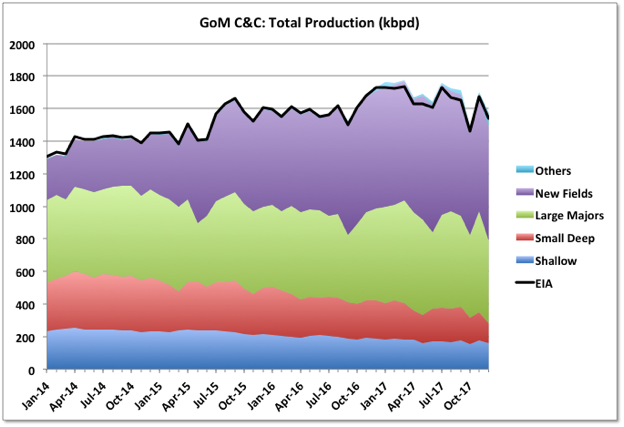

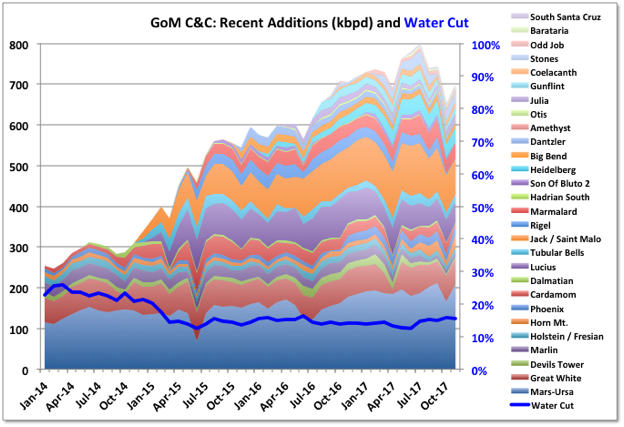

2017 was the highest producing year for oil in the GoM and included the record month in March. Gas, which has tended to come from shallow water wells, had accelerated decline. The production would have been higher but for some disruptions from Hurricanes, in particular Nate, though that had the least impact onshore, and some unplanned outages in November and December due to equipment failures. The failure to Delta House subsea manifold affected Rigel, Otis and Son of Bluto 2 fields, and the first two still appear to be off-line while Son of Bluto 2 resumed production in December (LLOG, the operator, I think calls the Rigel field Neidermeyer, which is much better for the Animal House theme). The Enchilada gas pipeline appears to have ruptured at the main platform and has resulted in Baldpate, Salsa, Llano, Cardamom and Magnolia going off-line. Plans were recently announced to restart Baldpate/Salsa, which do not go through the platform, but I haven’t seen any notice of the restart.

|

|

Oil Average |

Oil Exit Rate |

Gas Average |

Gas Exit Rate |

Total Average |

Total Exit Rate |

| (kbpd) | (kbpd) | (mmscfd) | (mmscfd) | (kboed) | (kboed) | |

2016 |

1600 | 1728 | 3308 | 3363 | 2151 | 2289 |

2017 |

1685 | 1570 | 2955 | 2381 | 2177 | 1967 |

Change |

85 | -158 | -354 | -982 | 26 | -322 |

Ratio |

5.3% | -9.1% | -10.7% | -29.2% | 1.2% | -14.1% |

C&C Production

December production numbers were dominated by the unplanned outages, so comparisons with November don’t mean much. As well as the two issues given above the Tahiti and Caesar/Tonga fields were off line for a few weeks, though I have seen no news why (these share a common set of leases but are produced separately to the Tahiti and Constitution platforms). Each month that these are three issues hold current outages would knock about 10 to 12 kbpd off the achievable average production for 2018.

Despite recent variability it certainly looks like the new fields brought on since late 2013, and which have seen all the net growth since then, have peaked. Any average decline rate can’t really be extrapolated yet, given the recent upsets, but the BOEM reserve estimate updates, due in the next couple of months, will provide better R/P numbers as there will be longer operating data for all the fields.

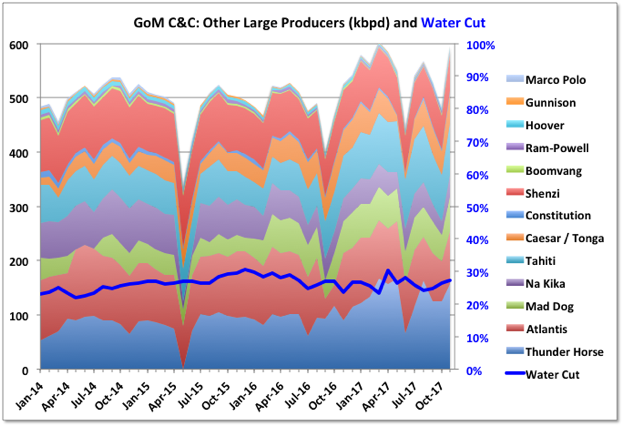

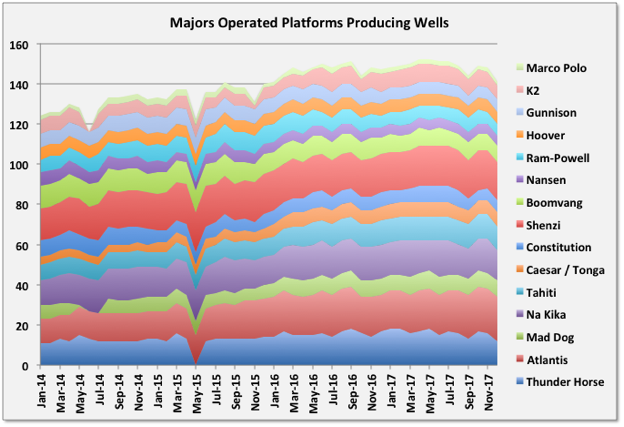

BP, Shell, Anadarko, Chevron and BHP have completed a lot of brownfield work and in-fill drilling to maintain production at their large, operated platforms, but they may be running out of options for the next couple of years, and there is some evidence of rising water cut in some of the larger leases at Shenzi, Atlantis and Thunder Horse (and also in West Boreas, a recent start-up for Shell in Mars-Ursa).

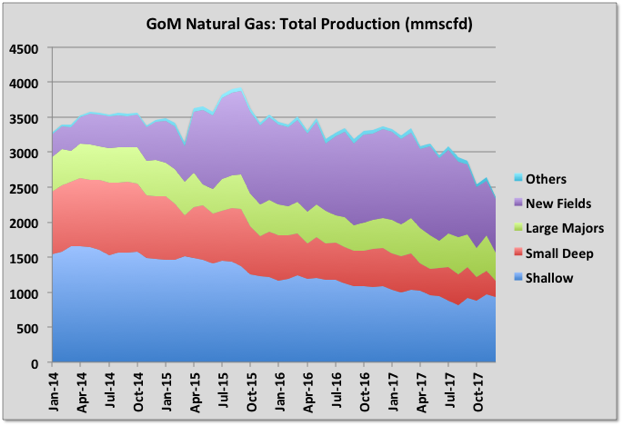

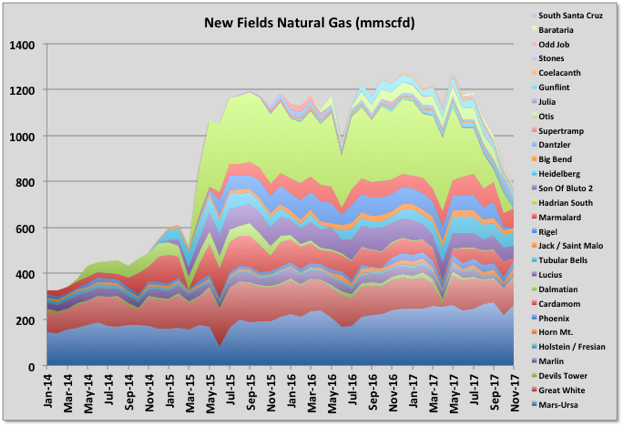

Natural Gas

Natural gas production saw accelerated decline through 2017, mostly from rapid decline of Hadrian South and the Enchilada outage. Shallow fields added some production late in the year, all from one lease in the Eugene Island area.

Apart from Hadrian South most of the gas from new fields is associated with the oil production and will decline in line with that. Otis is a small gas field that has been held offline by the Delta House outage.

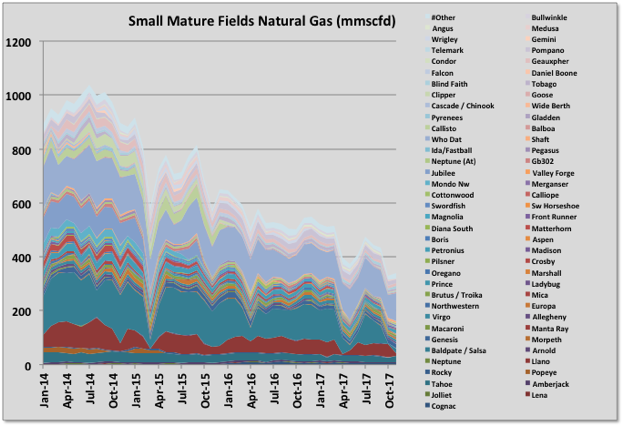

The impact from the loss of Baldpate / Salsa production, which are mostly gas producers, is shown here, however also evident is how fast those fields had been declining anyway since 2014.

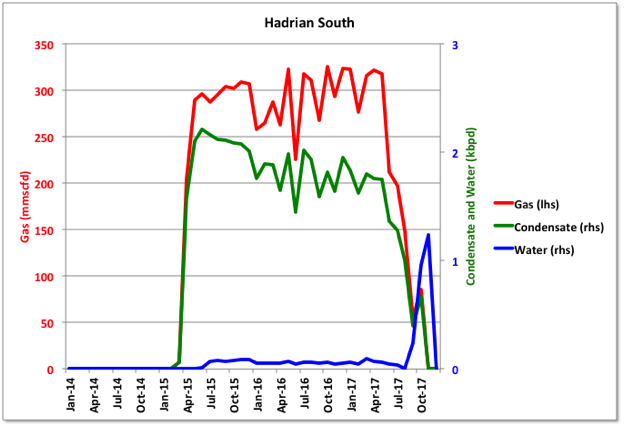

Hadrian South

Hadrian South looks to have finished. Production had been dropping fast since the summer and then, in October and November, water production appeared and gas flow stopped. On plateau it produced 300 mmscfd from only two wells, which is pretty prolific and slightly higher than planned. The wells had been producing about equally but one died between May and July and the second in November. Both were offline throughout December. Overall the field’s total recovery is lower than the BOEM reserve estimate, but only by about 38 bcf (6.5 mmbbls) so it’s questionable whether there will be any further efforts at increased recovery, certainly in the near future as there is no drilling rig contracted there, although there is another qualified lease for the field that has not yet been produced.

Production Wells Creaming Curves

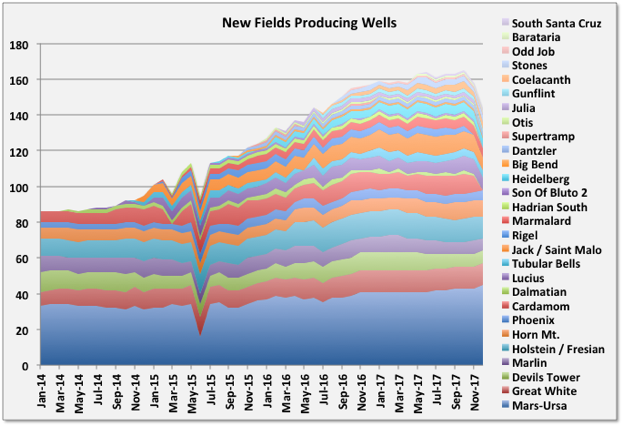

The following two charts show the number of producing wells for new fields and the larger, mature platforms. They both show how wells were added from 2014 through 2016, leading to the increased production in these two groups, but both numbers have now flattened off, which is likely to precede the start of a decline. For the new additions the move to tie-backs with one or two wells in 2016 and 2017 is evident and the continuous development at Mars-Ursa also stands out.

Drilling Activity

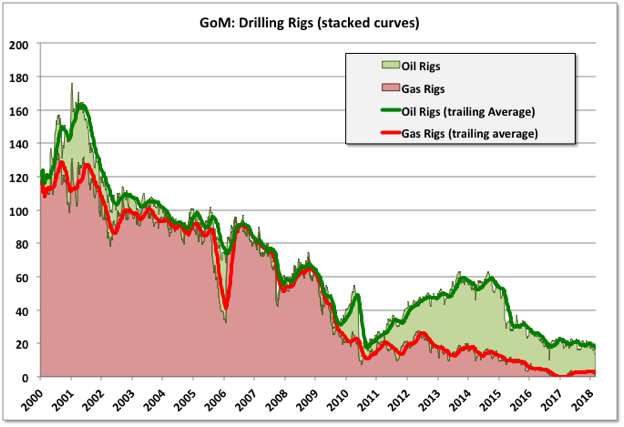

By Baker-Hughes active drill rigs averaged 20 in 2017 compared to almost 23 in 2016, and the numbers have continued to drop this year with a low of 13 earlier in March (the lowest since 2000, though the drop in shallow gas drilling is responsible for, by far, most of the change).

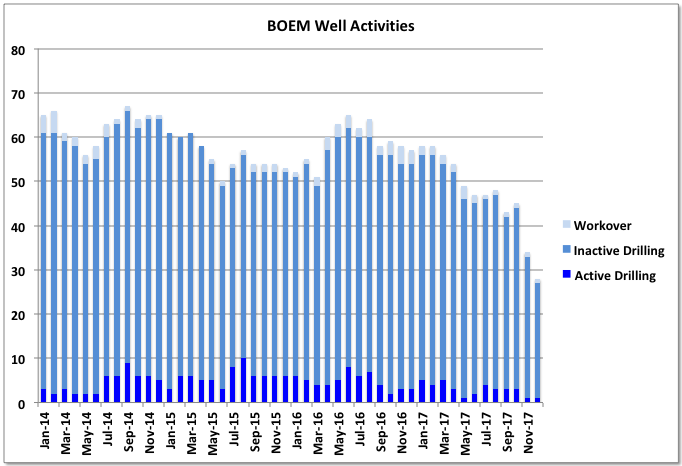

BOEM gives a monthly break down of each well by category, and it is noticeable how the number of wells being drilled has fallen off in the second half of 2017. (I think inactive wells are those that have not yet seen any production, but sometimes these are counted as “temporarily abandoned”, of which there are many and therefore it’s impossible to pick out new ones from old.)

2018 Plans

The Stampede platform started up in January. It has nameplate of 80 kbpd but some of that is for potential future tie-backs. The wells are pre-drilled and it should reach 50 or 60 kbpd streamday production quickly, though maybe not with high availability initially.

LLOG plan to bring several fields on line with one to three well tie-backs to existing platforms. However Red Zinger and La Femme / Blue Wing Olive go to Delta House. The subsea system is likely to be fixed when these are due, but the Platform was operating at nameplate capacity and with extended production deferral may not have processing capacity for these new wells this year.

Anadarko has planned five wells in existing fields, in particular for Constellation with BP, which will be about 15 kbpd. Anadarko have stated that they are looking at redeploying spar platforms onto other fields (probably for Shenandoah). I think that means one or more of their developments are nearing end of life, despite recent near field tie-backs, and that their remaining green field prospects are not very attractive at current oil prices. The platform mentioned was Marlin, though they have other mature Spar facilities like Holstein, which may impact LLOG as their tie-backs for Crown & Anchor are due to go there (but may have relatively short lives) and also is the site for two of this years new wells so maybe this is just conceptual speculation at the moment.

Big Foot is due at the end of the year. It was originally planned for 2015 start-up but had mechanical failures during installation, which are now fixed. Capacity is 75 kbpd nameplate. It is heavy oil and uses dry trees with ESPs. Two wells are pre-drilled but the rest only have the top two conductor sections ready, therefore ramp-up will be through 2019 as new wells get completed.

Off Topic Finish

This painting is by Mary Cassatt. There has been no better painter of children before or since. One theory for this is that she was a woman in, at the time, a man’s field, and the men all tended towards painting nudes; but maybe she was just really good at it. The greens in the carpet and blues in the chairs are gorgeous, though better in real life than here (it’s home is Washington DC), the dog is happier than it has any right to be, and I can’t help thinking the girl grew up to like an occasional night on the town.

RADAR IMAGES SHOW LARGE SWATH OF TEXAS OIL PATCH IS HEAVING AND SINKING AT ALARMING RATES

“The imagery, coupled with oil-well production data from the Texas Railroad Commission, suggests the area’s unstable ground is associated with decades of oil activity and its effect on rocks below the surface of the earth.”

Read more at: https://phys.org/news/2018-03-radar-images-large-swath-texas.html#jCp

Pretty good stuff, Douglas. In orbit C band SAR has a wavelength of about 5 cm so resolution of measurement more fine than that will be improbable, even with processing.

But they are claiming 40 inches of change and that’s big enough that even with all the doppler issues, pulse repetition frequency variance, keplerian element drift and even airplanes flying through the centroid, their conclusion is probably legit.

This is first class data.

Thanks!

I don’t think this has been posted. My apologies if it has.

Saudis ‘may run out of oil to export by 2030’

A report by Citigroup has warned that Saudi Arabia could run out of oil to export by 2030, raising fears that oil prices may rise significantly in coming years.

The Kingdom is the world’s largest oil producer, accounting for about 13pc of global supply, but it may need to use a growing share of its production for power generation to meet rising electricity demand, Citi said.

Its export capacity could steadily reduce and, “if nothing changes, Saudi may have no available oil for export by 2030”, Citi analyst Heidy Rehman wrote.

Saudi Arabia consumes 25pc of its oil output and oil accounts for about 50pc of its electricity production. With peak power demand rising by about 8pc per year, the nation is aiming to more than double its power capacity by 2032 through new nuclear and solar instalations.

But Ms Rehman cast doubt on the nuclear plans, given problems of underinvestment, safety fears over “keeping reactors cool in the desert” and the risk of cost overruns.

That’s pretty dumb to use oil to produce electricity, there’s plenty of natural gas that could be imported from Qatar, or they could use solar or nuclear power. They also waste a lot of oil because they charge below World market prices within their country, bad public policy. In any case oil will become expensive and the World will move to other sources of energy.

Yes, it is really dumb to burn oil instead of buying natural gas from Qatar. I have no idea why they choose this route but it is likely that it has something to do with a feud between Saudi and Qatar.

Yes, I agree, oil will become more expensive. As far as the World moving to other sources of energy…. that remains to be seen.

I used to think that KSA was well run. They seem to do a superior job of managing their oil resource and production, with an eye to the long term.

But, I’m starting to think that they’re generally terrible outside the technocratic world of oil.

First, as far as I can tell they have plenty of gas, but they haven’t developed it because they insist on reserving it for domestic industrial use, and they badly underprice it. As a result, it’s badly underproduced – no one wants to bid on gas projects in KSA because they can’t make money.

2nd, they have more solar power than they could ever use for electricity. They’ve been talking about building solar for at least 10 years, and consistently pretty much not doing anything at all. I don’t know why – I assume it’s resistance from the domestic oily folks.

Really, really dumb.

They use a million barrels a day just for air conditioning.

Might be best to go back to being a small, tribal culture .

“My father rode a camel, I drive a car, my son flys a jet plane, his son will ride a camel.”

Might be best to get back to riding camels.

Or they could use the latest silicon technology. I am sure they noticed that bright ball in the sky that tries to cook them every day.

First, as far as I can tell they have plenty of gas,…

I really don’t think this is the case. They are using every cubic foot of gas they produce to generate electricity, and still, that is not enough. They have to dip into their crude oil production to make up for the shortfall of natural gas.

What makes you think they have plenty of gas? Just curious.

If I remember correctly a few years back they signed a number of contracts to explore for gas in the empty quarter. The campaign was an almost total failure and came as rather a shock to the house of saud.

They are developing some shale gas, but it is a difficult development. I think there has also been talks of imports – I’d guess from Kuwait as Qatar or Iran seem unlikely, but there is also a general pushback on being seen to import any hydrocarbons.

I’m not talking about production, I’m talking about resources/reserves that are being neglected. Some years ago I explored this issue – I’ll see if I can find those articles again, if I have time. From memory:

Exploration is inadequate because KSA controls domestic NG prices at a very low level. They keep prices low to subsidize domestic industry (unsuccessfully). The low prices mean that KSA tries to bid out projects and fails, because the ROI isn’t there at such low prices.

Maybe Prince MBS will raise domestic NG prices along with oil. Maybe…probably not, given that they’re trying to develop non-oil industries.

It reminds me of the failure of Ukraine to develop wind power. Wind power would help make Ukraine independent of Russian power imports. But, Ukraine won’t allow the import of wind turbines – they’re hoping to kickstart domestic turbine manufacture. That has failed, which in turn has prevented wind power from being developed. A classic example of trying to do too much, rather than compromising and doing what’s possible.

Hi Ron,

I forgot about that dispute, solar is still an option, or they could import coal, but solar would probably be the cheapest way to go.

Dennis are you still waiting for your tesla? how much did you put down? where do you stand on Musk’s pay package?

https://www.zerohedge.com/news/2018-03-26/tesla-without-any-doubt-verge-bankruptcy

Tesla has always been over-hyped. But if the company goes down, other companies can buy up the technology and keep the ball rolling.

Zerohedge runs many anti-Tesla and anti-Musk articles. No surprise. I wouldn’t invest any money on their advice. I haven’t seen them say anything intelligent on the subject yet. Funny you never see anything positive, even on SpaceX.

Yes. 1000.

Pay package fine. If Tesla does well, Musk does well. Interests of ceo and shareholders aligned.

… akin to washing your hands with fine scotch whiskey 😉

Is this a reminder of a 2012 report (Fig 7)

http://peak-oil.org/wp-content/files/pon120908.pdf

or is there an update with 2017 data ?

It’s dated: 7:47PM BST 05 Sep 2012.

Why should using oil to make electricity be such a horrible thing, when you have the oil and don’t have the gas. Ignore money. Evaluate it on a have vs not have basis. Why is it horrible?

Money is created by central banks from nothingness. Why not just do what is clear and logical? You have the oil. You don’t have the gas. Burn the oil.

Burning oil in internal combustion engines is a horrible thing. Ken Deffeys said: ‘Our grandchildren will say, “You burned it all, you mean you just burned it?”‘. Yes, burning such a very valuable product ought to be a crime. But burning it just to generate electricity when there are so many other ways to generate electricity… is a very horrible thing.

Watcher,

If you can import coal or natural gas and produce electricity for 5 cents per kW hr or instead use oil at 15 cents per kWhr the choice is pretty clear.

Oil is much more valuable as an export. No sensible nations are using much oil for power plants.

“No sensible nations are using much oil for power plants”.

… ‘cept New England during cold snaps … 2 million gallons worth early January.

Apologies ahead of time for the cheap shot on my part, Dennis.

Couldn’t hep muhself.

Those smart Yankees will come around, spurred by their frugal neighbors, at least.

Yes that’s dumb as well. Massachusetts is the problem as the pipelines need to go across Massachusetts. Each state is different. And it’s up to those states how to manage energy policy. A lot of oil is also used for home heating in rural areas where there is little natural gas infrastructure, in many cases it is still cheaper than propane which is the only convenient alternative, for ground source heat pumps in new construction, electricity can be used powered by wind and solar with natural gas backup (to produce electricity for the grid).

Oil for electricity is not very smart, whether in New England or Saudi Arabia, I agree.

It’s none of your business. That’s the problem here with y’all’s perspective.

They have the oil. It belongs to them. What they do with it is absolutely outside any concern you’re entitled to have.

They have the oil. They don’t have these other items suggested as an alternate mechanism for creating electricity. They can’t be cut off from electricity if they use their oil to create it. That’s the best reason of all for choosing what they have chosen.

It’s just simply stupid.

Export the oil and import for a 3rd of the dollars coal / nat gas. Buy big sedands and SUVs from the remaining 2/3rds, or an additional palace or 2.

It was viable in the 70s / 80s with the bottom oil prices, but not now.

Dollars are created from thin air by the Federal Reserve. No reason for KSA to care about those.

Better they just look after their people and be sure those people will have electricity on some day the US decides to impose its banking sanctions to prevent anyone from buying Saudi oil.

Watcher, on this we agree. Natural gas is vital to the KSA from the standpoint of re-pressurization and recycling of liquids in depleting oil fields. The KSA has a long term plan for its gas, when it is done using it for important things. Advising the Saudis what to do with their sovereign hydrocarbon wealth is like tweeting Tiger Woods what to do with his golf swing.

The “intellectually superior (?)” always like to meddle in the affairs of foreign countries, be it their form of governing, or whatever. Take Iraq, for instance. Or Venezuela, where its people are eating house cats to live, yet we impose sanctions and tariffs on the country like we can somehow “fix” it. In this case most of advise being given the KSA is simply from the anti-oil crowd worried about air, or ice, and trying to advance its agenda. Americans, of course, have no business whatsoever giving advice on anything related to energy; fossil fuel, renewable or otherwise. The US is depleting its remaining, high-cost hydrocarbon resources now at an alarming rate, using fake money, wishing to “dominate” the rest of the world with exports, and can’t get off first base with renewables or any other form of transportation fuel unless it too is with fake money. In a decade America will be back on its knees begging OPEC for its oil.

Hi Mike,

I am simply suggesting there are cheaper ways to produce electricity, but it’s their oil and money. If they want to spend 3 times as much to produce electricity, then they can have at it.

It is not the choice I would make, but maybe you are different.

I try and stay away from making predictions other than the only one I can offer that is rational and that is that America is being “played” like a sap regarding its hydrocarbon future. Shale oil and shale gas is speed bump, and not a big one at that. As to what other countries do, or don’t do, with their sovereign resources, they will indeed have at it, without interference from arrogant Americans: https://www.oilystuffblog.com/single-post/2018/03/27/Coming-To-A-Theatre-Near-You

Hi Mike,

Ok, let’s say the US did something dumb like start a trade war, because they are easy to win.

That would be akin to using resources that are about 3 times higher in price (on World markets) to burn in power plants.

I call them as I see them, if that’s arrogant, fine.

Mike,

I agree with everything you wrote except for Americans getting back on their knees in a decade begging for OPEC oil.

I see U.S. Shale Oil production falling precipitously within the next five years. Maybe down 25-40% from where it is now… maybe even more.

So, Americans may be begging for OPEC oil a lot sooner than analysts promoting U.S. Energy Independence realize.

steve

Steve,

When oil product prices go up to levels close to European levels, then Americans will buy more fuel efficient vehicles, Microeconomics 101.

2018-03-21 (Reuters) – The largest lease sale in American history in the offshore Gulf of Mexico yielded $124.76 million dollars in winning bids on Wednesday, a modest response to the Trump administration’s effort to pump up investment in the region.

The Interior Department had offered up more than 77 million acres (31.2 million hectares), an area twice the size of Florida.

Companies bid on just 1 percent of that acreage, and won those tracts with bids averaging $153 an acre – 35 percent below average winning bids at a similar auction last year, and a fraction of the level paid in the region in 2013 when oil prices were much higher, according to a Reuters review of the data.

https://www.reuters.com/article/us-usa-drilling-gulfmexico/record-size-u-s-offshore-oil-lease-sale-draws-modest-bidding-idUSKBN1GX18D

That is really bad, and after a similar flop in Alaska last year:

Interior Secretary Ryan Zinke had said ahead of the sale that the record-sized offering would be a “bellwether” of industry demand in the region …

Message for Mr. Zinke: “there is no demand.” All the spokespersons then talk of technology limits and other investment opportunities, it’s like they think they’ll spontaneously combust if they even mention geological limits.

Lets be honest.

Zinke is a profit seeking idiot, like the rest of the Trump Regime.

Major Oil Companies Interest Expense Tripled In Just Four Years

With the addition of a massive amount of debt to offset falling oil prices, the major oil companies’ interest expense has tripled in just four years. This is not a good sign, especially when the oil price falls back towards $30-$40 when the stock market rolls over and suffers a well overdue 50+% correction.

In 2013, the major oil companies paid $5.7 billion in interest expense, but this ballooned to $15.4 billion last year.

The nearly $10 billion in extra interest expense payments really cuts into profits. How long before the U.S. and Global Oil Industry finally experiences the SENECA CLIFF?

Probably a lot sooner than we realize.

steve

Steve,

What’s the ratio of interest to free cash flow for these companies? That’s a more revealing metric.

Profits have decreased due to low oil prices, oil prices are likely to rise to $80/b in 2018, to $94/b in 2019, and to $100/b in 2020 as oil supplies fail to keep up with demand. Things may stabilize a bit from 2020 to 2025 as demand and supply may grow slowly at the $100 to $120/b price level. The peak in 2025 will see further price rise to perhaps $180/b by 2030 ($12/b per year for 5 years), then we might see a financial crisis as the World economy struggles to adjust to peak oil and perhaps a Seneca cliff due to a fall in World GDP, oil demand, oil price, and oil supply due to low profits for the production of oil.

Alternatively there will be excellent public policy which leads to a rapid transition to alternatives to oil for transportation, as well as alternatives to fossil fuels for producing electricity.

I hope the second option will be chosen, but I am not holding my breath.

excellent public policy…not holding my breath

It’s worth pointing out that public policy could have been a lot worse.

Wind-power and solar exist now because of Carter’s policies. Solar is cheap now because of German government policies. EVs and hybrids both exist now because of government interventions that forced the issue (California for EVs and Clinton for hybrids). We still have subsidies for wind, solar and EVs despite the Current Occupant – there has been a very quiet bipartisanship in the US about these things for a while now.

Could be worse.

Nick,

I suppose it could always be worse, but a carbon tax is really the way to go in my opinion, tax breaks for renewables are a next best policy choice.

We could also use more investment in public transportation and an HVDC grid which ties all of the nation and perhaps all of North America, or even North and South America into one super grid.

The same should be done for Eurasia and Africa. I am afraid Australia and New Zealand are on their own (probably too far from Asia to be practical).

Absolutely.

There’s a pretty decent high voltage link from Australia to NZ. And, of course, Australia is pretty big, and awfully sunny – I think they’ll get there, though they are getting a bit of a slow start.

I can’t find any info about a high voltage link from Aus to NZ. There are communication cables. There are HV links between the north and south islands of NZ, and HV links between the Aus mainland and Tasmania.

Am I missing something, or are you another geographically challenged North American? (second half of question just exhibiting poor Australian sense of humor and self-pitying sense of neglect lol)

Phil S,

I thought they were too far apart, but I have never been down under. Can’t find anything on the internet. About 2200 km from Australia to New Zealand.

The UK/Denmark HVDC wind power interconnector is 750 km (due 2022?), the Norway to UK for hydro. is 730, and the proposed Iceland to UK for geo.would be 1500 km (all about 1.2 to 1.5 GW). So 2200 sounds possible.

Hi George,

Probably not impossible, expensive though, at some point they may do it. They may even connect Australia to Asia at some point.

Oops. I think I was thinking of Cook Strait, between the islands.

Here’s an interesting overview: http://www.mdpi.com/1996-1073/11/1/200/pdf

The only HVDC link we have here in New Zealand is between the North Island and the South Island.

Dennis,

It may not be prudent to compare the Interest Expense to Free Cash Flow because the majors have reduced capital expenditures by 60-80% since 2013. Companies can make more free cash flow by significantly cutting CAPEX spending, but this strategy destroys their ability to grow or at least, maintain production.

While the cutting of CAPEX spending will not impact production immediately, it will do so over the next few years.

steve

When oil prices are low, cutting capex is a good business decision. No point spending capital on wells that are unprofitable, that’s what the LTO players do.

The problem with these big companies is: Big oil projects, especially offshore, need a project time of several years before the first drop of oil.

Times with low oil prices can be the ideal point of time to start these projects, to have oil to sell when others stopped producing from decline and low investing and prices go up again. Starting to invest in an up cycle can lead to selling into the downturn.

I’m with you that drilling LTO wells makes no sense with low prices, since you have to sell the heavy frontloaded production into low prices. Or you have to simulate business to keep stockkeepers happy.

It’s not easy.

Eulenspiegel,

You are correct that there is a large investment lag especially for deep water offshore and predicting future prices is a fool’s errand.

In any case, no point investing on a money losing proposition.

Perhaps this is why many majors are moving into LTO, the shorter investment cycle from decision to first oil may lead to greater profits with proper discipline.

In any case oil prices are likely to be higher than AEO 2018 reference oil price forecast. Probably closer to their high price forecast.

https://www.eia.gov/outlooks/aeo/data/browser/#/?id=12-AEO2018®ion=0-0&cases=ref2018~highprice~lowprice&start=2016&end=2030&f=A&linechart=ref2018-d121317a.3-12-AEO2018~highprice-d122017a.3-12-AEO2018~lowprice-d121317a.3-12-AEO2018&sourcekey=0

Following some comments on the Laherrere aspo paper in the last post the chart below shows how drilling activity came and went in the non-core Bakken counties – it actually peaked well before the oil price crash.

Hi George,

I believe that chart uses annual data (or it looks that way). Generally there is a 4 to 6 month lag between price moves and changes in completion rates (once the decision is made to complete a well it takes some time to finish the project). From your chart it looks like the peak in non-core completion was in 2014 when oil prices were still high (annual average price). When prices fell in 2015 and stayed low in 2016, there were fewer completions in non-core areas because those areas had lower EUR wells which were not profitable to complete.

Higher prices in the future (probably in 2019 or 2020) may change the rate of completion in some of the non-core Bakken areas, unless the Permian or Eagle Ford are more attractive due to higher ROI.

They stopped drilling mostly because they were hitting 50% dry holes, not because of the price.

That’s a good reason.

So from 2010 to 2013, they continued to complete about 20% of wells in the non-core areas. Perhaps it was coincidence that when the oil price dropped from $93/b to $49/b, the percentage of non-core wells drilled dropped from 17% to 10% in 2015.

I guess it took about 4 years (2010-2013 where non-core completions remained 20% of the total) to delineate the best areas in the non-core counties, but lower oil prices no doubt were a part of the story for why the non-core county completion percentage fell after 2014.

Were all drilled wells dry at a 50% rate in those counties or just exploratory wells? My guess there are still areas which could be developed further in the non-core counties, if oil prices were high enough to make such development possible.

This might make it clearer – it shows only the non-core counties.

… but lower oil prices no doubt were a part of the story for why the non-core county completion percentage fell after 2014. – why, the curve looks like a normal discovery logistic, just over a very short time scale? Would there not have then been some sign of recovery last year instead of continued decline (maybe there was with a few new wildcats, but to no avail.)

Were all drilled wells dry at a 50% rate in those counties or just exploratory wells? – just wildcats, but I don’t understand the relevence. If more than about 1 in 100 development wells are dry the geologist/reservoir team need to be replaced.

Hi George,

As you well know the dynamics are complex. In the 2010-2013 period the Permian Basin had not yet been developed and oil prices were about $95/b on average.

My point is that the best areas of the non-core counties have been delineated so no more exploratory drilling is necessary. Fewer wells are being completed because there are more profitable opportunities for applying their capital (such as Bakken core areas, Permian basin, Niobrara, and Eagle Ford).

Even if oil prices return to$95/b, if there are areas where capital can be invested that will yield a higher ROI, the rational entrepreneur will choose the more profitable opportunities.

I know you know this, others might not.

George,

the use of annual data will not show recovery until 2018. low numbers in early 2017 could offset higher numbers towards the end of the year and there is at least a 4 month lag between price changes and change in number of completions due to higher prices.

Not much change in oil price through June 2017, where annual completions would have been affected for 2017 totals.

There were about 50 wells, that’s 4 a month, some counties had 0 or 1 over the whole year. I don’t think any granularity less than a year is going to have much statistical sway.

However, just to be sure – below are the production figures for the non-core counties, which show pretty much steady decline, so I’d guess the completions were, on average, fairly flat across the year.

With minimal drilling in non-core counties the decline rate was about 8%/year from 2016 to 2018. The non-core areas produce about 7% of North Dakota’s C+C output.

David Hughes “realistic case” is for 6.8 to 7.6 Gb of oil recovered from Bakken/ Three Forks with a middle case of 7.1 Gb. I think Hughes’ estimate is conservative.

This shows, creaming curve for wildcats, I’d say this is indicative of a play that is fully delineated, and the few, and mostly dry, recent wildcats show they did a pretty good job in the earlier years. I might be wrong, but I think the single wildcat discovery last year was drilled by the local university, so maybe they know something different.

Hi George,

I agree they may have delineated the best areas, the point was that those “best” areas may be more fully developed as oil prices rise and there might be limited reserve growth as they develop these areas more fully as oil prices rise.

Typically the higher oil price also results in more of the probable and possible reserves being reclassified as proved.

OK, but that wasn’t my original point, I was just looking at non-core possibilities.I look at the ND DMR well maps and see a ring of dry holes around the core with nothing much outside that, and the numbers every year seem to confirm there really isn’t much there.

OK hang on here. There is no ‘creaming’ in an unconventional reservoir, certainly not in the way its generally understood to work, and not completing wells happens for a variety of reasons.

Drilling a wellbore and waiting as long as possible to complete it is a way to hold large swathes of acreage under CDCs with minimal capital outlay.

Assuming that every well that wasn’t completed was just left for dead is not what happens at all. In the peak of the boom in the core eagle ford, many operators would leave drilled wells for 6-9 months before completion to optimize logistics and frac crew scheduling. The oil isn’t going anywhere, you’ve drilled the well and you’re holding the land, so you bring it on when the logistics line up and you can complete as many wells in one area as you want depending on your overall strategy. Its all about the supply chain in these mining plays.

You’re a smart man, but I get the impression you’ve never actually drilled/operated unconventional wells. Correct me if I’m wrong about that certainly, but you have no evidence that I can see to categorically state that they started hitting 50% dry holes in the core of a resource play.

Your graph above shows wildcat wells dry hole rate, while your other graph shows Bakken completions. That’s very disingenuous of you. Those wildcats could be anywhere in the strat column, anywhere in the basin. Vertical, conventional pay tests, other resource targets, non-core Bakken counties, etc.

Showing these two graphs and implying that they are in anyway related is either dishonest, or shows a fundamental misunderstanding of what wildcats usually are. By definition, wildcats are not “development wells” so your 1 in 100 criteria doesn’t apply.

My graphs are exactly labelled with the data they contain, how is that disingenuous? As far as 1 in 100 is concerned that was just an example to try to understand why Dennis was asking about development wells, and I think they do better than that in the core areas. All I was showing is that there is almost no activity in the non-core counties (and what there is is declining), and almost no successful wildcats being drilled anywhere at the moment, which tends to support the Laherrere’s analysis for the area, from the last post, rather than EIA’s. The ND DMR numbers for 2017 came out last week so it seemed a reasonable time to look at them. They also give drilled footage, so you could figure out well type if you feel so inclined.

To describe me as disingenuous implies I have something to gain, which I really don’t either way, and don’t much give a fuck what you think – – it’s a comment on a blog, not a fucking IPO manifesto.

George,

I agree there is not much happening in the non core areas, I just wanted to be clear that the 50% dry wildcats is not the reason completion rates are low in non core areas. The simple fact is that average new well EUR is too low in these counties at current oil prices to make them attractive.

They probably need at least $80/b.

The 50% dry hles is exactly why the completion rtes dropped, they came to the edge of the productive area and stopped looking. There’s no point drilling more if you know there is no oil. The few that have been tried since have pretty much all come in dry. The EUR is zero over most of the area for the non-core counties, so obviously it’s too low.

Hi George,

I agree there are lots of areas in the non- core counties that are dry, nobody that I know of expects oil will be found in 100% of the area of North Dakota. Clearly there are some areas in these non-core counties that produce some oil. Those areas have seen very few completions due to further development wells because the average EUR is too low for the wells to be profitable when the price of WTI is $64/b, it really is fairly simple economics from my perspective.

You keep going back to wildcats, most completions are development wells, not exploratory wells, you know this, but keep focusing on dry wells, which is not really part of the story, the area where prospects are good has been known since 2014 in the Bakken/Three Forks, most drilling is for development not exploration since that time (probably 99% or more of wells drilled have been development wells since Dec 2014 in the North Dakota Bakken/Three forks).

From the ND footage data for 2015 and 2016, the ratio of wildcat to development drilling in North Dakota was 0.3%.

For wells the ratio was 0.5% wildcat to development wells in 2015 and 2016.

https://www.dmr.nd.gov/oilgas/stats/DrillStats.pdf

Before 2014 or so, most of the wells in the Bakken were being drilled to hold onto leases and define the sweet spots of the basin. There were very few dry holes, certainly not anywhere near 50%. There were many areas found to be uneconomical given the amount of oil produced by a typical well though. That is why, even before the price of oil decreased, overall drilling slowed and coalesced around the areas within the sweet spots most ripe for in-filling with new high performance wells.

ND DMR issue figures for wildcats with production those on and dry holes, every year. I simply plotted their data. You are perfectly free to come to your own conclusions, or go back to the original data and look for different things that might be of interest, you can even post your findings here so the rest of us can see as well.

Hello George Kaplan

How are you?

When will the peak oil and peak gas for Gulf of Mexico?

Thanks

Gas peaked several years ago, oil I’m going to say last year.

Exclusive: Rosneft, Eni fail to discover oil at Black Sea well – source

https://www.reuters.com/article/us-rosneft-oil-eni-exclusive/exclusive-rosneft-eni-fail-to-discover-oil-at-black-sea-well-source-idUSKBN1GX0ZU

The Black Sea was one of the few recent, promising frontier discoveries.

We are about a quarter through the year and I think discoveries are down from last year’s lows. I can think of only BP (gas I think) in North Sea, AkerBP in Norway (from memory around 50 mmbbls), Ballymore in GoM (I’d guess fairly small given the lack of headlines), some small onshore gas in Australia and a bit of oil/gas in Malaysia. UK/Norway have reported 10 to 15 other wells this year, mostly dry or with non-commercial gas and a couple still tight.

I got that wrong: Petronas made the discovery but pre-salt in Gabon, rather than in Malaysia.

http://www.npd.no/en/news/Production-figures/2018/February-2018/

Preliminary production figures for February 2018 show an average daily production of 1 944 000 barrels of oil, NGL and condensate, which is a decrease of 83 000 barrels per day compared to January.

Oil is down on the year, month and forecast. Why the drop?

Not sure why it is dropping. Will have to wait for the release of detailed production numbers next month (for February) to find an explanation.

I wonder what this means: https://www.libyaobserver.ly/inbrief/top-eni-executive-says-his-group-plans-reduce-oil-output-libya

That’s a 37.5% decline in 4 years or about 11% decline per year.

Schinzy,

Probably due to a lack of new wells completed due to turmoil.

Not surprising from my perspective.

There must be a question whether they have damaged the reservoirs given the way they have had to be operated over the last few years. I wouldn’t be surprised if they just opened the taps whenever they got a chance, and voidage replacement and balancing the water contact was pretty much left to chance.

So there IS a way to do permanent damage to an oil field.

The german oil service company branch of Wintershall has been very active to restart some fields in Libya. Other than that, more than 6 years without any rigs operating in the country has to take a heavy toll, even with a starting point of 1.6 million barrels/d of oil production in 2011. Will be surprised to see any upside going forward.

https://www.bloomberg.com/news/articles/2018-01-22/libya-restarts-wintershall-s-oil-fields-to-boost-national-output

Hi George

You might find this of interest

http://www.lse.co.uk/share-regulatory-news.asp?shareprice=ENOG&ArticleCode=d90jig8q&ArticleHeadline=Energean_Takes_FID_on_Karish__Tanin_Gas_Project

2018-01-16 (Bloomberg) Saudi Arabia expects to start up to $7 billion of renewable energy projects this year, with solar plants leading the way.

Tenders will be issued this year for eight projects totaling 4.125 gigawatts of capacity, Turki Mohammed Al Shehri, head of the kingdom’s Renewable Energy Project Development Office, said Tuesday in an interview in Abu Dhabi. The cost will be $5 billion to $7 billion, he said.

Saudi Arabia and other Middle Eastern oil producers are looking to renewables to feed growing domestic consumption that’s soaking up crude they’d rather export to generate income. The kingdom wants to have 9.5 gigawatts of solar and wind capacity installed by 2023. Developers have been cutting their bids for solar power to record lows in recent years.

https://www.bloomberg.com/news/articles/2018-01-16/saudi-arabia-plans-up-to-7-billion-of-renewables-this-year

Good stuff for them. If getting solar energy on the rooftops, then..for an average home they probably need 40 solar panels (250 watts each) for a total capacity of 10 kw. That high capacity is needed for high AC consumption during summer, maybe 40 kwh per day per home per day. About the same need as a not too good isolated apartment up in the north during winter time. If 5 million homes in Saudi Arabia invest in solar panels, they will need 20kwh of lithium batteries to almost make it through night time each day (or lead based batteries of 300-500 kg..hm not really convinent). Average cost per home 25 000 dollars, 65%-70% of that would be batteries (Tesla quality, 2 batteries to cover 25 years lifetime for solar panels). If not batteries are utilised, then the grid will most likely break down due to peak afternoon demand if investments are per home..options are to make gas/oil power plants make up the difference (not a very long term solution). So to make it all work they need to invest 125 billion dollars (25000×5 mill homes), a little more than the inflated price target of 100 billion for their 5% share of Saudi Amarco to invest in a whopping 200 million solar panels. If you divide the investment cost on 25 years and assume inhabitants clean the solar panels for sand themselves, then 3-4 billion dollars is the price per year. Probably will failures and maintenance will bring the cost a little bit up.. Per home the annual electricity price will be something 35 000 dollars over the life time of the investment and 1400 dollars annually per home + extra grid supply of electricity when needed. But then you end up with solar power system per home that is at a small deficit during the summer, and during the rest of the year self supplied. And the investment will probably be heavily subsided both when it comes to direct investment and grid by the government. In Australia there is the option of investing in pumped hydro storage that can even out demand/supply issues I believe, but not in Saudi Arabia. Alternatively SA can invest in solar panel farmes for public electricity generation, as long as they keep a lot of people employed to weep the sand of the solar panels. Such a demand of lithium batteries (which is the bottleneck), will consume 63% of the annual lithium battery market for electric cars and an annual basis. However, if divided over the lifetime it will consume only 5% of the annual market for electric cars (assuming 2 million cars a year with average battery of 400 kg). And if the market for electrical cars grows to 10 million cars a year then only 2% of the market is needed for SA solar power ambitions. Quite doable, not very unrealistic. Assuming they somehow manage to fund it all. As I said, good stuff for them. They probably have the money to do it.

Why assume home installations?

Utility scale installations seem to be coming in at very roughly $1 per kW of capacity – the article above seems to assume about $1.50 per kW.

Average load seems to be about 30GW, and peak may be around 60GW in several years, so 30GW of solar would simply shave the peak off, and wouldn’t require any battery storage at all. At the moment KSA seems to be planning less than 10GW – not much, but far better than nothing.

In the short term and most likely medium term, SA can do whatever they like. Oil prices are going to be high anyway. So you are saying solar power generation on a utility scale is cheap with no conversion loss, subisides does not matter, including maintenance, grid expansion expenses also included and no batteries whatsoever needed. It works to think this way as long a solar power is just a perk.

solar power generation on a utility scale is cheap

Yes, very cheap. KSA has gorgeous solar insolation – they should be able to generate solar power at well below 3 cents per kWh. That’s mighty cheap. Oil generation, on the other hand, has opportunity costs of at least 10 cents per kWh, and probably closer to 20 cents, all told. Diesel generation is around 20 cents now, and will be higher if oil prices rise.

What do you mean by conversion loss?

What subsidies are you referring to? Certainly oil generation in KSA is subsidized by the use of under-priced oil. And, that may be the problem – perhaps KSA can’t figure out how to reduce that subsidy while keeping it in place for other domestic consumers.

Yes, I assume that “grid expansion” costs are included – if major transmission costs are involved. OTOH, some grid authorities don’t assign transmission costs to generators, on the assumption that all generation needs to be connected to the grid.

Yes, I’d estimate that no batteries would be needed as long as solar capacity was below the level where it’s only shaving the peak. For instance, if average demand is 30GW, and the mid day peak is 60GW, you could install up to around 30GW of solar with no or little need for storage (you might need a little to handle the vary rare event of weather that blocks the desert sun). As an example: California’s grid is about the same size as KSA’s. They have about 20GW of solar, and they have very little battery storage.

I’d say that 30GW of solar is far beyond a ”perk”.

Maybe at such immense capacities and low prices synthetic gas or hydrogen for energy storage would be better than batteries?

Or under water pumped storage:

https://www.greentechmedia.com/articles/read/fraunhofer-races-hydrostor-for-underwater-storage#gs.cZh2zf4

First, you don’t need storage until you get to a high percentage of solar power – that’s very roughly in the area of solar capacity at 50% of peak demand: 30GW if peak demand is 60GW.

2nd, Storage isn’t the first strategy to implement. It will be cost-optimal to build solar past that point, and simply curtail it’s production when it’s occasionally not needed. It will be far cheaper to manage demand with Demand Side Management, like dynamic EV charging.

3rd, different types of storage are best for different things: batteries and pumped storage are great for daily storage, to get you through the night.

Daily storage needs high efficiency, because you’re cycling power through it every day. It’s not expensive to build because you only store a fraction of a day’s energy needs. It achieves low cost per unit of energy because it’s amortized over thousands of cycles. So, that’s when batteries and pumped storage are good.

They’re way too expensive per kWh for seasonal storage: the dark week in the winter with low wind power. You need very low costs per unit of energy, because you’ll need to store a LOT of kWhs. Plus, you’ll use it rarely, so you won’t have many cycles to amortize those capital costs over. You don’t need high efficiency because you won’t push a large percentage of your annual power consumption through it.

Synthetic H2 or other compounds (methane, NH3), are what you need for this. Store it cheaply in your NG distribution network at first (up to about a 10% mix), after that store it cheaply underground, burn it in cheap ICEs or turbines, not expensive fuel cells (which give you unneeded high efficiency at a very high capital cost).

Thank you for your answer.

You do get your points across in an efficient manner. Basically the main one will be to aviod battery storage and pumped storage as much as possible, because of the price tag. SA will still need to keep all their traditional fossil fuel power plants operational to be able to supply electricity in peak hours in the afternoon from 18-22. But I get the point that excessive burning of oil to produce electricity can be reduced quite a bit and replaced by cheap solar power.

Dynamic EV charging is also a good idea, if batteries are needed why not use the ones already available in electric cars (not really relevant for SA at the moment though).

You do get your points across in an efficient manner.

Thanks! I try to write well – it’s more fun, and other people get more out of it that way.

Basically the main one will be to aviod battery storage and pumped storage as much as possible, because of the price tag.

Absolutely. Storage won’t be the low cost option for quite a while. Unfortunately, most utilities are incentivized by their regulators to invest money – most can only raise profit by increasing their capital base and getting a guaranteed ROI. So, they spend money, and more money, and even more money, on unneeded generation and storage projects.

Sigh.

SA will still need to keep all their traditional fossil fuel power plants operational to be able to supply electricity in peak hours in the afternoon from 18-22.

Probably not. Solar would eliminate the current mid-day demand peak, and the remaining evening peak would be substantially lower. If the Saudi’s manage their grid properly, they’d implement time-of-day pricing, which would likely reduce that evening peak quite a bit (A/C could run earlier, EVs could charge earlier, etc.). More aggressive demand-shifting, like producing ice at mid-day to use for A/C in the evening, would likely be more cost effective than peak generation plant.

So, it’s very likely that they wouldn’t need to build any more conventional generation for quite a while, if ever, and they might be able to retire some of it.

excessive burning of oil to produce electricity can be reduced quite a bit and replaced by cheap solar power.

Exactly – even if they kept most of the current generation plant, it would be used about 80% less (80% is roughly the current consensus for the upper limit on easy implementation of wind/solar). After that point the marginal cost would rise somewhat, though I think the rise wouldn’t be that big of a deal: we’d overbuild, we’d build some storage, and we’d use DSM more than now. Really, dealing with variance in both supply and demand is not a new thing for utilities and grid managers.

Dynamic EV charging is also a good idea, if batteries are needed why not use the ones already available in electric cars (not really relevant for SA at the moment though).

Exactly. If SA raises domestic fuel prices as much as they should, that would help EVs.

Story today from the Wall Street Journal on Ultra Petroleum having 2 successful unconventional wells in their southwest Wyoming acreage (Green River Basin).

24 hr IPs of both wells were over 50 MMcfe (90%+ gas).

Each well could provide entire population of Wyoming annual gas consumption. (3/4 of a million customers in western Pennsylvania just saw their gas bills drop to $75/month. This to heat, cook, provide hot water. One reason businesses starting to flock into the region).

Ultra was one of the bigger companies to have gone through bankruptcy.

They claim to have 16 productive horizons totalling over 5,000 feet of pay on their holdings.

While the focus has been on oil availability/scarcity for many years, the unfathomable amount of recoverable natgas is starting to manifest – and will continue to do so – globally for decades to come.

Dow down 724.42 (2.93%).

And this was after a short walk.

I may be completely wrong, but if I hear a company tout 5000′ of pay, bells go off.

Right now Ultra is upside down by about $1B, so I will be curious on how this shakes out.

Reno

Check out the Conasauga.

Interesting drilling history, also.

I just did a quick scan of CNG developments, especially the MOFs.

Fuzzy heads are going wild all over the place. (“White graphene” is a new one for me, even if it relates to hydrogen).

Bottom line, the bigger the price spread between coal, oil, natgas, solar, wind, nuclear, and all the other sources of energy, the more impetus to move towards the lower source.

Geez, $2.70 HH in March??

Lottsa moving pieces all over, but – and I cannot more strongly emphasize this – unconventional development strongly favors gas over oil.

The amount of recoverable gas continues to expand … and, frankly, at a pretty vigorous clip.

I think the editors must have been active. Coffee I agreed with your comment “and I cannot more strongly emphasize this – unconventional development strongly favors gas over oil.” and noted not one in ten contributors to this blog understand why or the significance of that.

TT

Keeping a close eye on the 2 Aikens wells from CNX and the Marchand which just tested/flared for 7 days.

All Deep Utica in Central Pennsylvania where virtually no production has yet taken place.

XTO will bring online 1 Utica in Indiana county and 1 also in Jefferson county.

CNX is planning a massive build out in the coming years here with 3.7 Bcf per 1,000 foot expected.

Just to the north, in the slightly shallower Utica, Seneca is planning a complete transition away from the Marcellus to the Utica.

In both SWPA and north central PA, the Upper Devonian formations continue to expand their productive footprint.

Tremendous amount of gas due from the Appalachian Basin and associated gas from Oklahoma and Texas in coming decades.

If the international community wants to shift away from the dirty coal, tremendous amounts of non expensive gas are needed.

The USA has a very deficit trade bilance anyhow – this can be a part of shifting it more even.

I would like to see a replacement from the dirty brown coal here in Germany with gas, too. But Russia can’t deliver these quantities, and it’s not political wanted.

It’s 180 million tons of brown coal per year, + round 60 million tons in hard coal. This alone are a billion barrels of oil equivalent in gas that could be absorbed.

Not to speak about China with it usage of more than 4 billion tons of coal every year.

Eulenspeigal

In a few weeks, Cuadrilla should announce the results of the 2 wells they are ready to fracture in the UK (Bowland Basin?)

Preliminary findings from the company are optimistic.

Both China in the Fuling and Argentina in the Vaca Muerta are continuing to have positive results from their unconventional efforts despite challenging logistical and operational circumstances.

Russia is planning on attempting to develop the Bazenhov.

This entire approach of horizontal drilling and high volume hydraulic fracturing may continue to spread globally as the US operators have brought an astonishing degree of efficiency to this whole endeavor.

http://www.businessinsider.com/largest-ever-natural-gas-field-found-2015-8

https://www.spe.org/en/jpt/jpt-article-detail/?art=3989

Looks like they are tapping the Leviathon, the mega super duper gas field off Israel.

I notice notice nothing has happened there, either.

India (crude oil + condensate) production for February, total: 726 kb/day up +11 kb/day from January

February, split: Onshore 362, Offshore 364

Average for 2017, total: 732 kb/day

(Conversion, 7.44 barrels per tonne is the one given by JODI Data)

India import more than 90% of its Crude Oil and is third largest consumer. No point looking at their production, future is scary!

https://pgjonline.com/2018/02/16/operators-race-to-build-pipelines-as-permian-nears-takeaway-capacity/

https://seekingalpha.com/amp/news/3341064-magellan-nixes-texas-crude-pipeline-lack-shipper-support

https://www.bloomberg.com/news/articles/2018-03-22/oil-sands-pipeline-shortage-takes-toll-as-cenovus-cuts-output

https://www.reuters.com/article/us-southchinasea-vietnam/vietnam-scraps-south-china-sea-oil-drilling-project-under-pressure-from-beijing-bbc-idUSKBN1GZ0JN?il=0

URL says it all.

Baker Hughes US weekly rig count

oil rig count: +4 to 804

natural gas rig count: +1 to 190

Permian: +7

Cana WoodFord: -5

February’s production figures that have been released so far, the chart title is in the order of the release date.

Radar images show large swath of West Texas oil patch is heaving and sinking at alarming rates – “This region of Texas has been punctured like a pin cushion with oil wells and injection wells since the 1940s”

http://www.desdemonadespair.net/2018/03/radar-images-show-large-swath-of-west.html

Maybe just add some of that excess water in Houston (probably doesn’t matter if it is polluted)?

“These hazards represent a danger to residents, roads, railroads, levees, dams, and oil and gas pipelines, as well as potential pollution of ground water,” Lu said. “Proactive, continuous detailed monitoring from space is critical to secure the safety of people and property.”

Bogota, 23 March (Argus) — Venezuela is clinging to a decades-old ambitious campaign to tap the Orinoco extra-heavy oil belt despite its growing failure to sustain it, putting the Opec country at risk of shedding another 500,000 b/d of crude production by year´s end.

Because PdV no longer produces enough naphtha to dilute the crude, it has to import it. And because of its chronic lack of cash and credit, supply is irregular at best, falling far short of the 70,000 b/d or four-five cargoes a month that are needed, the official said.

But even if naphtha supply was steady and abundant, development drilling in the oil belt has trickled to 20-25 completed wells per month, down from 50-60 needed to sustain output, the official said.

(free article) http://www.argusmedia.com/news/article/?id=1650033

You do know who Argus is?

It is owned by General Atlantic

“General Atlantic (also known as “GA”) is an American worldwide growth equity firm providing capital and strategic support for growth companies. GA is based in New York, New York. The firm was founded in 1980 as the captive investment team for Atlantic Philanthropies, a philanthropic organization founded by Charles F. Feeney, the billionaire co-founder of Duty Free Shoppers Ltd.”

This is a good representation by General Atlantic– other have more terse words.

2018-03-23 (FT) US refiners are among Venezuela’s last remaining suppliers of “diluent”.

Most of Venezuela’s other possible foreign suppliers of diluent have been burnt by non-payment.

(one free) https://www.ft.com/content/5f5e0b2a-2b75-11e8-9b4b-bc4b9f08f381

Peak Oil is Back! For some reason, I cannot copy and paste from the below Forbes link. But it tells us that we will likely never have to worry about peak oil demand, but we will most definitely have to worry about Peak Oil Supply as soon as 2020.

Sleepwalking Into The Next Oil Crisis

Okay, peak oiler Robert Rapier wrote the article. Nevertheless I believe he is spot on.

My concern with the “not enough investment in oil projects” is that it will encourage more environmentally damaging drilling.

I believe we have run out of cheap oil sources and should be transitioning to that reality through a combination of energy substitution, higher efficiency, and lower consumption.

Perhaps but higher prices would affect consumers car choice too and the credibility of limits to growth (peoples memory is short). $40-60 oil has increased SUV sales, peak oil is not on the radar and many seem to think that fracking disproved the whole “resource scarcity issue”.

The last ten years have partly been wasted using low interest rates and QE to continue an unsustainable path. Yes, EVs and renewables perform better now but the transport infrastructure is still based on ICE cars and trucks (at least where I live), complexity in society has increased and we are more vulnerable than ever before.

That’s what I used to hope. Raise oil prices high enough and people will switch to transportation that uses less of it.

Now, I am more of a mind that low prices discourage new drilling and alternative transportation is moving along anyway.

Alternative transportation technology is an area where other countries can beat the US in terms of innovation and economic strategy, so I think whether or not the US makes the switch, other countries will.

Hi Ron, and anybody else,

About Robert Rapier

I used to read his blog religiously but he doesn’t have one anymore, not that I know about anyway.

He used to be very pessimistic about electric cars and trucks in particular, and wind and solar power to a lesser extent, because the costs were so high.

I haven’t run across anything he has written in the last few years about wind and solar power, with both being at least three or four times cheaper than ten years ago, and the costs still falling.

So…What does he have to say NOW about electric vehicles and renewable electricity?

I have noticed that even the most upright of people don’t really care to advertise their mistakes, lol, but I have no doubt at all about him being a competent and ethical scientist.

I have no doubt at all about him being a competent and ethical scientist.

I agree. But, he has had his blind spots. His early training and much of his experience is in biofuels, and the fact that biofuels aren’t very scalable as a substitute for fossil fuels seems to have made him pessimistic about transitioning away from oil. If, for instance, you look at his article in Fortune about EVs, you’ll notice that he refers quite a lot to biofuels – I didn’t have to read the article to predict that.

To answer your question, I read RR’s two articles on Fortune, and he says he likes PV and expects it to replace coal relatively quickly, but he’s pessimistic about EVs putting a serious dent into oil demand.

And…he might be right in the next 5 years, which is the timeframe he’s talking about. But…it’s entirely a policy decision, so it could change in the next 5 years, and it will definitely change in the longer term. IMO he’s misleading his readers by omitting those two elements, as we can see by Ron assuming he meant “never”, rather than just for the next few years…

Before 2020, means by 2019. See, I’m not that slow. Agree, for sure, and it will begin to become more apparent by the end of 2018.

it tells us that we will likely never have to worry about peak oil demand

He doesn’t say “never”. He’s only talking about the next 5 years:

” don’t be surprised in 2023 to see that instead of crude oil demand being 2 million bpd lower than today per the Bloomberg article, we see that oil demand grew despite continued growth of electric vehicles.”

https://www.forbes.com/sites/rrapier/2016/02/25/is-the-electric-vehicle-a-crude-oil-killer/2/#19545d5f19f9

“Sleepwalking” would imply an unawareness of the issue, but there are warnings coming from all over, just no suggestions, or maybe no available mechanisms, for mitigation. “Somebody should invest more” isn’t very helpful given current prices, company debt loads, producer country fiscal shortfalls and, particularly, lack of decent E&P prospects.

I think sleepwalking is caused by the hypnotics given to the public by IEA and EIA. As recently as one month back, IEA was saying that we may be facing a future glut from US shale. Even if it attained their lofty projections, it should have been apparent that a shortage was looming soon. IEA also stated that a “possible” shortage was due in years coming by a drop in investment, because OPEC has been saying so. Opec’s best interest is to see those prices as high as they can, so talks of extending the “cuts” persists. The public discounts OPEC to IEA and EIA. It doesn’t matter what other experts say, or what OPEC says, IEA and EIA are providing the belief that oil is still cheap. Hence, limited investment. One of the two has to step up and say, hey we may be standing in deep dung. But, they won’t. Because if they do prices will rise, possibly causing a decrease in GNP. Which will happen, anyway, but later it will be worse.

The Permian is not the answer, just yet, and it is unknown whether it will attain the lofty projections of EIA. It has constraints that will persist for awhile. The latest pipeline in the works was dropped for consideration due to shipping disinterest. That wasn’t due to lack of shipping, because there is an over abundance of tankers, now. We couldn’t get it out the front door to the world even if it could be produced. Even if we could, it wouldn’t be enough. Which is good from the US perspective, as it is needed here for later, not in China, now.

Ron,

Thanks. Great piece by Rapier, his analysis seems very solid.

He concludes:

It is understandable why people would be complacent about this scenario. After all, didn’t the world face similar risks a decade ago, only to have shale oil save the day? But it isn’t clear that there is another “shale oil miracle” that is ready to save the day. There are indeed more high-cost oil resources out there that can be developed, but these projects take a long time to complete. That’s why we can look out two to three years and see an impending supply crunch. The longer investments in the industry remain depressed, the more unavoidable this scenario becomes.

Robert Rapier has over 20 years of experience in the energy industry as an engineer and an investor. Follow him on Twitter @rrapier or at Investing Daily.

I like Rapier, not that I agree with everything he writes, but compared to other “writers” who comment on the energy markets he does bring a level of fact based reporting that escapes most. Also he does not hesitate to take on conventional wisdom, like calling out Al Gore for the charlatan he is. If a person writes about energy and can not come to the conclusion that Al Gore, at best is a “con man”…that individual has no credibility on any other position he may take.

I can understand why all global warming deniers hate Al Gore. Is that your motive Tex? If not then what is that “other position” Gore took that you so strongly disagree with?

Ron, Mr Gore is the most hypocritical of all climate change charlatans. Recognizing that fact does not require a motive, just a open and honest mind.

Are you talking about the fact that Gore continues to fly and drive, and own a large home?

That’s irrelevant. Fossil fuel investors and advocates like to focus on that to change the subject.

If Trump does good things for your industry, or pursues policies that you like, I’d guess that you’d vote for him no matter how many affairs he might have – you would say that his private life is irrelevant. If you don’t like imports, and Trump cuts imports, you won’t care that he imports things for his businesses – you would say that his private life is irrelevant.

And…you’d be right.

Ron, Mr Gore is the most hypocritical of all climate change charlatans.

That is nothing more than an opinion with no stats or facts to back it up. That is just so fucking typical of all climate change deniers. All hat and no cattle, or all blowhard and no facts.

Goddammit, you fucking deniers are all so full of bullshit!

The future of oil and energy seems increasingly difficult to predict. On one hand, there are chances for peak oil (supply). On the other hand, transitions to renewable energy, decreasing population growth, eletric vehicles etc may give a peak energy demand. On the supply side there is large uncertainties about global shale oil production potential, and on the demand side there is large uncertainty about how fast the transition will be. I picture very volatile oil prices in the next years and decade. It must also be increasingly difficult to do proper investment analyses om oil and gas field developments.

If you agree with Ron, as I do, then peak oil supply is at, or near, the apex. So, the argument of peak oil demand hitting in time, first, would not really apply. I hope for rapid transition. I think “volatility” is assured.

It could be twenty or thirty years from now, we could establish a new “peak” with advanced technology. Maybe nanotechnology would be able to coax more of the oil from existing fields. But. That would be rather anticlimactic.

Guym,

I think the “peak supply” vs “peak demand” is over done. If the market is allowed to set the price of oil for the World, then supply=demand and the peak in oil output is both peak supply and peak demand at a market price that balances the two.

Whether it is demand or supply is difficult to determine, just as it is difficult to know which blade of the scissors cuts the material between the blades.

There may be a peak in World C+C output in 2020, but anywhere 2020 to 2030 could be right, my guess remains 2025.

While that is theoretically a good argument, constraints on supply can make it less “balanced”. Constraints can be the time it gets to find the oil and get it out of the ground, or simple pipeline constraints. A higher oil price does not necessarily find the oil. But, take it with a grain of salt, as that is how much my opinion is worth. Heck, we may be swimming in oil by the end of 2019?

Hi Guym,

I agree in the short term there can be shortages because of the lag between changes in oil price and changes in output. Price will spike to adjust such an imbalance, so I agree that there is likely to be volatility.

Especially as any surplus capacity that may have once existed in OPEC gradually falls to zero.

I am not at Ron’s level yet (and may never become so knowlegdeable as him about oil). My amateur guess has been peak (supply) oil in 2030. That gives some more time for an energy transition, but probably not enough time. In Norway, it has been sold EV since 2010 / 2011 and currently about 30% of new cars are EV. Still, only about 3% of all cars are EV. So, it will take at least 10-20 years before the majority of cars are EV. In Norway. And in the rest and the most of the world it will take longer.

My opinion is not backed up with years of experience, either. Just an opinion, and doesn’t weigh much.

Mexican net exports (crude oil + products (without LPG))

Average 2015: 733 kb/day

Average 2016: 628 kb/day

Average 2017: 434 kb/day

Average 2018 (Jan & Feb): 501 kb/day

Mexican exports and refinery processing

https://pbs.twimg.com/media/DZJum6wXUAASm7h.jpg

https://oilprice.com/Energy/Crude-Oil/What-Trumps-New-Appointment-Means-For-Oil-Prices.html

It won’t take much to escalate it from this point.

25 Mar 2018 (Platts) Total and ExxonMobil will drill the first deepwater well in a block awarded at a Mexican hydrocarbon auction in October.

The companies have identified a potential ultra-deepwater structure named Etzil at Block 2 of the Perdido Fold Belt, Mexico’s National Hydrocarbon Commission, or CNH, said at webcast session on Friday.

.

To date, CNH has awarded 27 deepwater blocks between Round 1.4 and 2.4, holding 30 billion boe of prospective resources.

S&P Global Platts Analytics expects deepwater production from these blocks to begin after 2025, with output growing to about 700,000 b/d by 2040.

https://www.platts.com/latest-news/oil/mexicocity/total-exxonmobil-to-drill-ultra-deepwater-well-27939743

TRRC Pending file

MARCH 26, 2018 – EIA’s estimates for Texas crude oil production account for incomplete state data

TRRC’s initial reports tend to be low relative to EIA’s PSM because some oil and natural gas operator reports are placed in a pending file while waiting for other state reporting requirements to be satisfied. Reports may be filed late or have other discrepancies to resolve. Once resolved—generally these resolutions take up to two years—these reports are ultimately included in TRRC’s published reports. On average, TRRC’s published reports are within 95% of their ultimate value after seven months.

Today In Energy https://www.eia.gov/todayinenergy/detail.php?id=35492

Pending file initial report dropped 35k barrels from the previous month’s initial, rather than increasing. Based on the initial figures, I would estimate total production not over 3971k bbls a day for Jan. No big jump apparent for Jan. However, Jan and Feb had shortages of frac sand. Halliburton has lowered its first quarter estimate by 10% due to the sand.

03/25/2018 (RBN Energy) Crude oil production in the Permian Basin is coming on strong — faster than midstreamers can build pipeline takeaway capacity out of the basin. You can see the consequences in price differentials. On Friday, the spread between Midland, TX and the Magellan East Houston terminal (MEH) on the Gulf Coast hit almost $5.00/bbl, a clear sign of takeaway capacity constraints out of the Permian.

.

So, what will be the next pipeline-capacity addition out of the Permian? It’s likely to be the planned 150-Mb/d bump-up in flows through the Midland-to-Sealy Pipeline. Enterprise has indicated that it expects to complete the installation and testing of additional pumps that would enable the pipe to start transporting that incremental crude sometime in the second quarter of 2018.

https://rbnenergy.com/here-they-come-again-mmmm-mm-mm-permian-crude-oil-takeaway-capacity-maxing-out

I wonder if the hedging contracts allow for the producer to get the hedged price when there is a discount?

Discount has gone from $1 to $5 pretty fast. The Magellan pipeline for 350k bbls a day, was dropped due to lack of commitments from shippers, not disinterest from producers, per my earlier post above. As VLCCs have an overabundance, I assume it is because they are unsure of loading it fast enough. Just a guess.

Hey great.

They found a new method to pump themselves into oblivion. Now with rising oil prices they can sell their stuff for less, even with rising prices.

And increasing production faster could lead to even lower prices – soon we’ll see long chains of oil trucks on the interstates driving to oil terminals when the price difference is big enough.

The Port of Corpus Christi is planning to accommodate larger ships by 2021

2018 March (Corpus Christi Caller-Times) Port commissioners on Tuesday voted unanimously to move forward with the issuance of new debt to ensure enough funding is available for deepening and widening the Corpus Christi Ship Channel.

The idea is to have the six-phase ship channel expansion completed shortly after the replacement to the Harbor Bridge is opened and the same year the old bridge is demolished. The goal of widening and deepening ship channel is to, in conjunction with the taller bridge, accommodate larger vessels and a greater variety of goods in and out of the port.

There are also talks about how to move the project along at a faster pace to meet a 2021 deadline the port has set.

The Port of Corpus Christi also accounts for 60 percent of the nation’s crude oil exports, and is preparing to stake a claim on liquid natural gas. One of the largest examples of that is a pending project from Cheniere Energy, which does business locally as Corpus Christi Liquefaction LLC.

Other Texas ports, including in Freeport and Brownsville, are trying to get their channels deepened to over 50 feet, as well.

https://www.caller.com/story/news/local/2018/03/20/port-corpus-christi-issue-new-debt-ship-channel-expansion/442139002/

https://www.caller.com/story/news/2018/03/23/push-port-funding-waiting-game-where-prize-growth/443461002/

2018-03-26 (Houston Chronicle) Port officials have hatched a plan to raise funds to finance the project if Congress doesn’t come through. The port authority last week approved plans to solicit an underwriter to issue revenue bonds, commercial debt and acquire a $100 million loan to fund the ship channel expansion, as well as other projects to build docks, railroads and other infrastructure in the region. Within the next four to five months, Strawbridge said the port authority plans to raise something between $200 million and $500 million, depending on how much money Congress appropriates for the project.

https://www.houstonchronicle.com/business/article/Corpus-Christi-port-authority-races-to-bridge-12783009.php