A Guest Post by George Kaplan

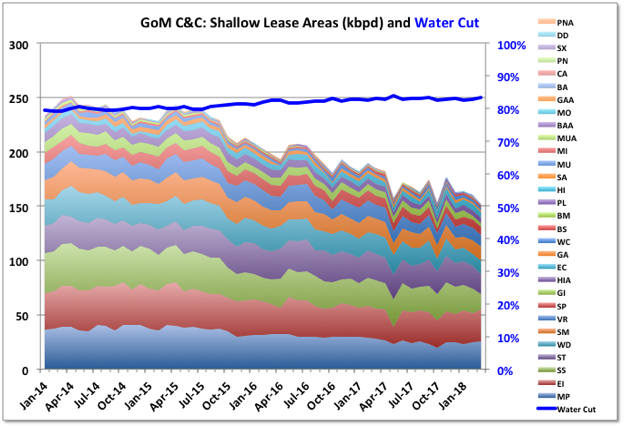

Crude and Condensate

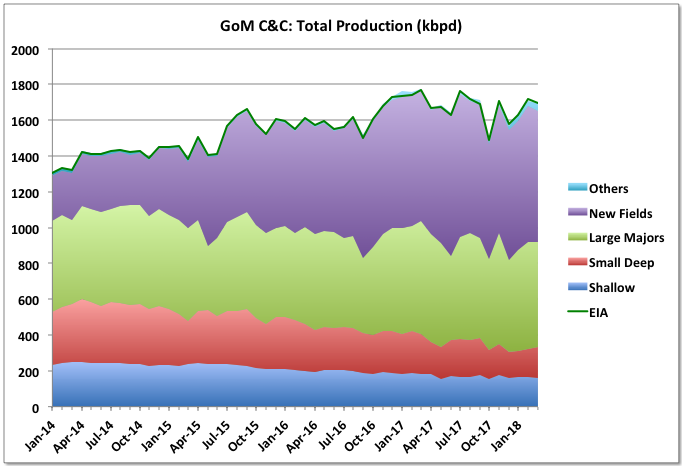

BOEM has March 2018 production at 1696 kbpd, which is down 1% month-on-month and 4% year-on-year (March 2017 was the peak production month for GoM so far). EIA numbers were very similar, although last month’s were higher and haven’t been revised yet – typically EIA numbers end up almost exactly corresponding to the BOEM reported total qualified lease production, whereas BOEM can be a little higher, maybe including test wells or non-qualified leases.

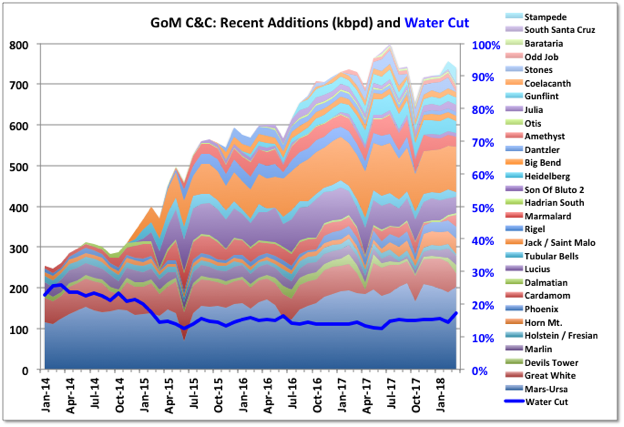

The major new project, Stampede, started in January, has no reported production numbers yet. BOEM and EIA estimate non-reported values and then retrospectively adjust their reports when actual numbers are available. I don’t know how they estimate new production but Stampede could produce around 60 kbpd with current plans, though likely a lot less initially as only one of two leases has been ramping up. I’ve assumed 20 and 40 kbpd for February and March respectively, which still might be high. Even allowing for that, and assuming other late numbers are the same as the previous month, since December EIA and BOEM both have estimates about 30 to 40 kbpd higher than the reported lease and well production numbers (which always match closely) would suggest. Usually the difference is no more than ten. It is unlikely that the other late numbers, of which there are few, and none for all four months, will show such large, sudden and unexplained increases so either I’m missing something (maybe a lease not yet included in the numbers, but also not reported as starting up) or there could be some future downward adjustments.

Rigel and Otis are still off-line following the failure at a subsea manifold last October and are taking out about 22 kbpd plus some gas (Otis is a small gas field). Great White, Stones (for the full month) and Caesar/Tonga all had noticeable downtime in March taking about 90 kbpd off-stream.

The Kaikias Phase I development for Shell, a tie-back to the Ursa hub, was brought on line one year ahead of schedule in early June. It has an expected peak nameplate of 40 kboed (which may only be around 30 kpbd average oil), and will likely take a bit of time to ramp up to maximum. Equally to accelerate production like this probably meant using a drill rig that was previously scheduled for alternative wells on Mars-Ursa, so there may be faster than previously planned decline on some of the other leases there.

In the second quarter there is likely to be downtime showing for Marlin, Horn Mountain and Holstein as they have planned turnarounds to prepare them for new production and, presumably, to allow normal maintenance; they should then come back online with higher overall flows. Marlin has one new Anadarko well planned, plus two from LLOGs Crown and Anchor field. Holstein has a platform rig and is developing four side-track wells this year and next. Horn Mountain has one more tie-back from Dorado field planned.

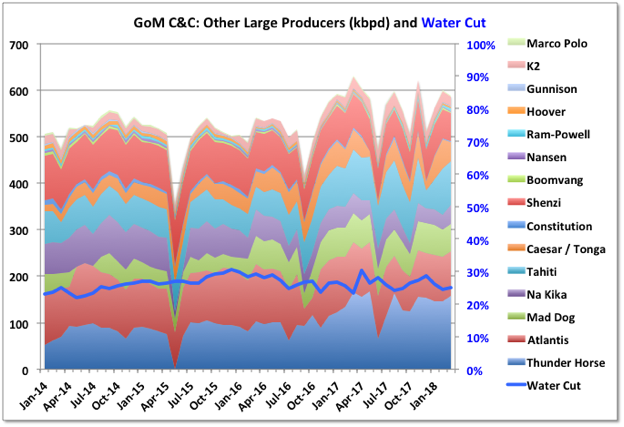

Atlantis has no drilling or work-over activity currently shown and in the past its wells have declined at around 20% year-on-year (see below), which may continue until the first Phase III wells come on line in 2020.

Llano, Cardamom and some of Baldpate/Salsa production came back on line following the partial repair of the Enchilada pipeline, adding around 45 kbpd, but there is some still off line, which I think has to be processed through the Enchilada platform and for which I’ve seen no expected restart news; however Anadarko have said it will be “later this year”, which I’d take to mean a few months yet. All these fields are fast declining so although they give a jump for March they will result in steeper declines for the remainder of the year

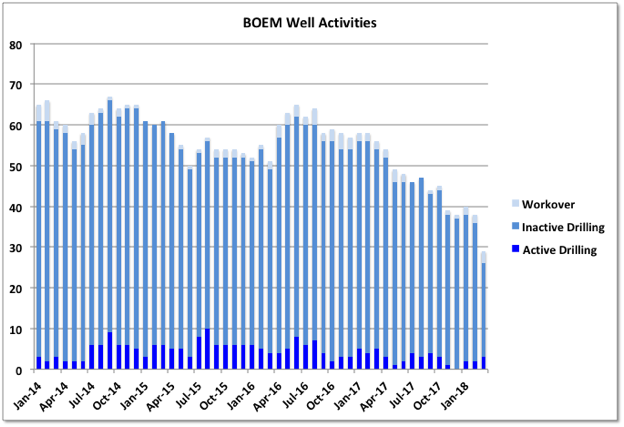

The BSEE deep-water activity report showing wells with drilling, completion, P&A or work-over activity currently shows 40 actions, this is down from around 50 at the beginning of the year and has been fairly steady for the past two months.

Overall C&C looks to be continuing an overall slow decline started in the second half of last year, and if the unaccounted for 40 odd kbpd is revised out, then it is clearly accelerating. A lot will depend on downtime for turnarounds and hurricanes. So far this year these losses look higher than last (e.g. the early Tropical Storm Alberto took out about 7 kbpd for about a week, and also disrupted P&A activity on Lena and installation work at Appomattox) plus Mars-Ursa looks set for a partial shut down in April and the current Perdido / Great White turn around looks to be quite prolonged. Another major unplanned outage, like Enchilada or Delta House, is also possible. The Kaikias development by Shell has been advanced, but that may be countered by delays to Constellation, Hadrian North and some Delta House tie-backs.

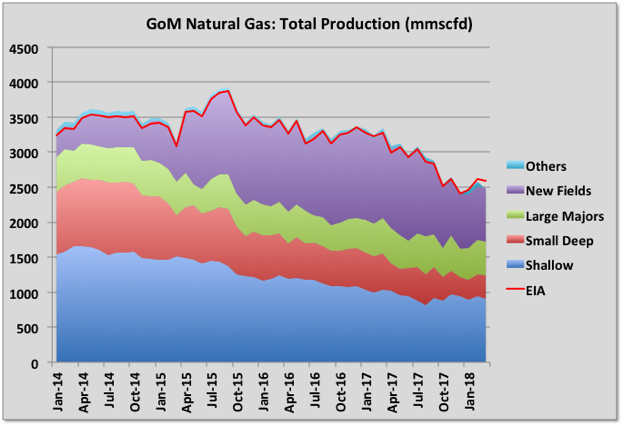

Natural Gas

Natural gas production is in continuous decline. BOEM had March production at 2.59 bcfd, down 1% month-on-month but 21% year-on-year. The loss of 300 mmcfd from Hadrian South since last year and the losses from Baldpate / Salsa, one of the few other remaining significant gas fields, and Otis, because of the Delta House failure, meant last year showed accelerating decline which is unlikely to recover. Na Kika has a few gas leases, and a new long distance tie-back, Coulomb II, is due soon, but mostly the gas now is associated with the oil and will decline accordingly.

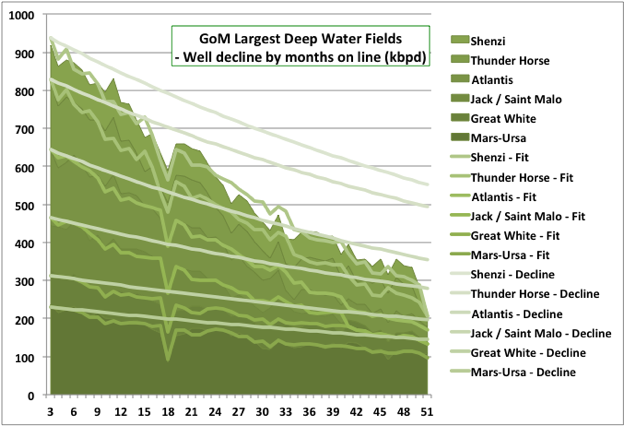

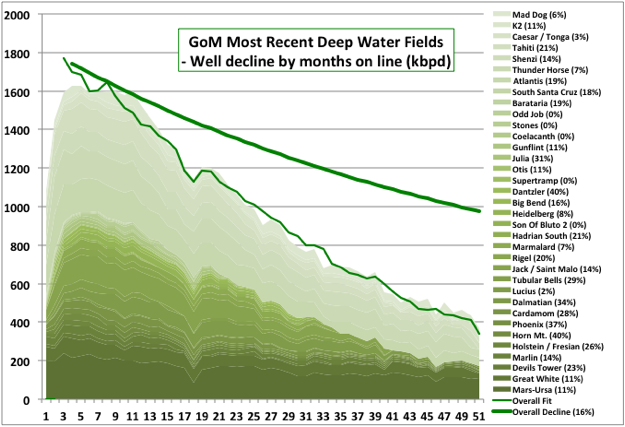

Deep Water Well Decline Rates

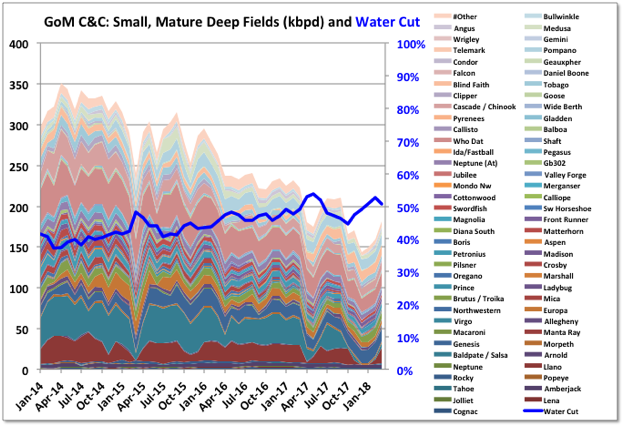

I had a go at finding the decline rates of the wells in the more recent deep-water fields. In the charts below for each field all the wells are lined up so month one is their first production or January 2014, whichever is later, and a decline curve is fitted, from the third operating month to avoid the ramp-up period, assuming all wells in a field follow the same exponential decline and according to how many wells were producing for each month.

Most of the fits came out reasonably well. Six of the largest fields are shown in detail below. The overall (stacked) decline curves indicate the expected decline rate for all the wells remaining online, they are not predictions of future production.

The fields where the fit was poor were either new projects that are still on plateau, have had fairly patchy start-ups, or have produced a lot of water (or all three) and include Lucius, Stones and Odd Job; or ones where there has been some sort of well rework, e.g. K2, which had gas lift added, and Mad Dog, which had various new measures including water injection added on some blocks. I didn’t include Na Kika as it is a collection of several different fields, some of them gas, and has a pretty uneven production history. The individual decline rates for each field are shown in parentheses after the name and run from 0% for fields on early plateau, up to 40% and with a pretty good spread between.

The decline rate for the fields analysed is likely to increase because of new projects coming off plateau, water breakthrough or acceleration (e.g. at Great White, Mad Dog, Lucius and Mars-Ursa might be the most likely) and a normal development feature that the best wells are drilled first; but overall that would likely be balanced by new projects reaching plateau. The overall average decline rate came out as 16%, which is maybe not surprising given that depletion rate for the whole GoM based on BOEM 2P numbers for 2016 (the latest available data) was also 16%. With depletion and decline close it would imply there isn’t much being added to reserves on operating fields, or any that has been was quickly put on-line.

Applying these decline rates to the 2017 field production rates gives an expected drop this year of 175 kbpd. Shallow fields are likely to decline 30 kbpd and the deep-water fields that I didn’t include about 45 kbpd. So total would be 250 kbpd; assuming 90% availability that would require 275 kbpd of additional nameplate capacity added to hold production steady.

2018 and 2019 Developments

The only certain major new fields this year are Stampede, adding up to 60 kbpd, and Kaikias Phase I, which may add about 20 kbpd averaged over the year. Constellation was due but looks to have been pushed into 2019, and Big Foot is due late but may not contribute much to the average, although could boost the 2018 exit rate. There are four smaller field tie-backs for LLOG with one or two wells: Red Zinger, Crown and Anchor, Claibourne and La Femme / Blue Wing Olive. Some of these may be limited by available capacity at the host, and will contribute only in the second half of the year. Recent small field wells tend to start at around 6000 to 8000 bpd and immediately decline, but those fields together could add 50 to 60 kbpd at end of year. Bigger wells are likely to come from in-fill and development drilling at Jack / St. Malo (two wells), Horn Mountain Deep and Marlin for Anadarko (three wells, but very high decline rates if they are like the recent ones), Tonga (I think one last production well), one side track well at Holstein (with three more next year), continued BP drilling at Thunder Horse, and Shell projects at Mars-Ursa, Stones and Great White. BP and Shell wells may add the most but they are also the ones with the least information.

There should be some offline production returning at Rigel and Baldpate, maybe 40 kbpd, but also fast declining. With the new fields that would leave 120 to 180 kbpd needed this year from the in-fill drilling to keep annual rates about average (the range is dependent on the timing of all the wells coming on); I think that is going to be difficult. Next year decline is likely to accelerate because a lot of the mentioned in-fill wells and tie-backs are the last available for those projects and some of the rigs are being released, plus Kaikias has been accelerated, so will contribute less additions next year than originally planned. Atlantis Phase III has also been moved back to 2020. 2019 has some planned continued development for Thunder Horse, tie-backs for Hadrian North and Buckskin to Lucius and the delayed Constellation tie-back to Constitution, but overall things look thinner than this year, at least until Appomattox (with 175 kboed nameplate) begins ramp-up towards the end of the year.

The drop off in the number of wells showing drilling or work over in the chart below highlights the possible slowdown coming in 2019.

Better projections will be possible when the BOEM reserve estimates for the end of 2016 are available. These are quite late compared to last year, but in the past they have come out in July or August, and EIA reserve estimates were also pretty late this year.

EIA Forecasts

The above summary for near term new developments and added production does not agree much at all with EIA predictions, either in outcome or details: U.S. Gulf of Mexico crude oil production to continue at record highs through 2019

Among the fields given it lists significant new oil production as expected from: Amethyst, a small and failed gas project and Phobos, both of which are rescinded leases with no current activity; Otis, an existing gas field; Son of Bluto 2, a small oil field started in early 2016 with no current drilling and indicating slight decline; Rydberg, a recent Shell discovery with reported 100 mmboe resource base, which I think would be a later addition to the Appomattox project; Gotcha, a lease which is part of Great White, started in 2014 and in slow decline; and Bushwood, a single gas well tie-back started in 2014 and now almost exhausted (although there has been some drilling there this year). There is little new oil, or much significant oil at all, in that collection.

It does also list Horn Mountain Deep, Stampede (though listed as two fields, when it is really only one) and Kaikias, which will be bigger contributors, but not enough by far to meet the given growth expectations (and I think the Horn Mountain developments will be showing rapid decline by next year).

It does not mention Big Foot, Appomattox, Buckskin, Hadrian North, Red Zinger, Crown and Anchor, Claibourne or Blue Wing Olive as new fields, or the Thunder Horse developments and other Anadarko in-fill wells. I don’t know how they come up with their assessments but they seem to be getting more removed from actuality, and not just from being overly optimistic. Similarly the EIA STEO is just a constant exponential growth that is re-zeroed each month to current production figures with no changes made based on FID decisions, reserve numbers or overall production history.

Off Topic Finish

As the last country music link went down fairly well here is another. Two minute thirteen seconds of downbeat alt.country bliss. It’s the title track of an album that I always expect to see in ‘Top XXX’ lists, but never have, which shows how much I know. The singer and writer, Willy Vlautin, also writes books, one of which, “Lean on Pete,” was made into one of my favourite films of the last year, a classic American road movie with a sort of happy ending (though not for Pete).

Richmond Fontaine

And here is Vlautin’s new band, more traditionally country, with an apposite song (I think the singer is the sister of the vocalist on the previous tune).

The Delines

George,

Awesome post, as usual.

Thanks.

Permian water ‘cut’ is 500% – this looks like an ecological disaster – turning fresh water into salt water and re-injecting into underground reservoirs. Will Permian just sink into the GOM and become shallow water wells?

From the CEO of Carizzo – I think this description of the problem just kind of stunned Cramer…

https://www.cnbc.com/2018/06/19/carrizo-oil-and-gas-ceo-flags-an-unusual-problem-for-drillers-water.html

Captjohn – “Ready to sail away into the larger GOM”

A five to one water to oil ratio is converted to water cut as follows: 5/(5+1)=5/6=0.83->83% water cut. This water is probably being produced by older wells in water floods and tertiary floods. One solution is to reinject it into the producing reservoirs, but experience shows the water has to be filtered and oil removed, and most small industry players don’t know how to operate a very high standards filter system. The article doesn’t give the right information therefore it’s hard to comment on the problem. However, most of these glitches are self inflicted.

Ok, hang on. You have no idea how water cut is calculated first off.

Secondarily, its been like this for a century. Injecting produced water, which is salty and full of heavy minerals, back into deep storage is the safest place for it.

Feramonger elsewhere. The basement rock in west texas isn’t sinking into the ocean.

Did some reading on the WaterOilRatio and WaterCut calculations – thank you Fernando showing how this is calculated. I’ve learned tremendously from the expertise of Ron, Fernando, Dennis, George, ShallowSand – and many others here on the Oil industry – I respect the Science – certainly don’t intend to ‘Fear Monger’.

This is the ‘stuff’ that runs the world economies – just learning as much as I can.

Thanks for the years of data – interpretations – forecasts – too many take the BAU as guaranteed into the future – Venezuela shows us one more time – the veil of civility is easily removed – and extremely difficult to put back.

Captjohn,

Stay with the site–you picked a good one.

We reinject produced water where it’s convenient. Sometimes we clean it and dump it in the ocean. In some areas the water is injected in shallower sands. And in some areas it’s reinjected in the producing reservoir. Most waterfloods use salty water, some use sea water, and a few use fresh water. Fresh water is better because it improves oil recovery a couple of percent. In some unusual cases we use treated sewage water we get from a municipal source. If you want to learn a bit more, don’t hesitate to ask.

Thanks

I don’t understand it fully, but a concise summary sure helps.

Ok-

And that has what to do with waterflooding?

Why would someone who is not increasing production not reinject water?

I do not disagree that the industry should be looking into enhanced recovery and/or pressure maintenance. However, if it was easy there would be more of it going on by now.

Some problems I can think of with waterfloods are:

Most resource plays are pretty deep to very deep. Waterfloods eventual result in cycling water, and pumping water from deep wells is expensive.

Most resource plays are in very low permeability rock (by definition), so I imagine it is difficult to get and keep injectivity.

Sweep efficiency and conformance problems from the horizontal wells will also be hard to deal with.

Finally, some kind of gas injection will probably be a better option for most of the plays, except on the wetter edges.

A new IHS Markit report assesses the impacts of the first ten years of the U.S. unconventional gas revolution and looks ahead to its future potential.

IHS Markit expects natural gas production to rise by almost 8 billion cubic feet per day (Bcf/d), more than 10 percent, in 2018. Altogether, U.S. production is expected to grow by another 60 percent over the next 20 years

Approximately 1,250 trillion cubic feet (Tcf) of U.S. supply is economic below $4 per MMBtu Henry Hub price today, up from a previous estimate of 900 Tcf in 2010

IHS Markit expects U.S. LNG export capacity to more than double in the next five years and rise to at least 10 Bcf/d by 2023.

Highlights https://ihsmarkit.com/Info/0618/shale-gale-turns.html

If I did my math correct, the USA production of Nat Gas (98 Billion cu ft/d)

is equivalent in energy to 16.3 Million barrels of crude/day.

We consume about 20 Million barrels of crude/day currently.

[Natural Gas Equivalent- 6,000 cubic feet of natural gas is equivalent to one barrel of oil]

Don’t forget to back out refined product exports.

Larger than expected stock draw.

https://www.eia.gov/petroleum/supply/weekly/

Crude draw actually 6.1 with .2 reserve draw.

June 20 (Reuters) – Venezuela, PDVSA exported 765,000 barrels per day (bpd) in the first two weeks of June, a 368,000-bpd drop versus 1.133 million bpd shipped in May. The numbers do not include cargoes of upgraded oil by two of PDVSA’s joint ventures, which are exported separately.

PDVSA’s exports so far in 2018 average 1.24 million bpd, 26 percent below the 1.68 million bpd shipped last year due to falling output and a lack of access to the Caribbean ports it previously used for shipping and storing oil, according to the company’s documents.

https://uk.reuters.com/article/venezuela-pdvsa-exports/update-1-pdvsas-exports-sink-in-june-amid-seizures-shipping-backlog-data-idUKL1N1TM14K

Venezuela drop 400 kbpd (I can’t see too much of that coming back net overall given the longterm background decline numbers), Libya 400 (and it looks like they may have stopped trying to avoid targeting the oil infrastructure), Norway 100 this year, Asia-Pacific 250 to 300 per year, Mexico (might be doing better than expected but they seem to fall after shut downs) but say 250, Iran and Iraq obviously don’t have any more coming soon and may decline, Angola and Nigeria may drop off rapidly next year after the last new projects are started, OPEC small producers are all in gradual decline, summer shut downs in UK and offshore Canada due about now, Brazil slower than expected, final tailing off of the big projects started in the boom years, and Permian bottlenecked in all sorts of ways – hmmm? Stocks have shown decline or levelling when seasonally they usually have been rising a bit.

A modest Opec/Russia increase seem to be already priced in. I think the only thing holding prices down is a threat of a global downturn with the tariff issues (and more general turns to nationalism and against globalism), rising energy prices, continuing debt overhang, and most growth predictions seeming to be continuously revised downwards.

Probably a lot of factors holding the price back. The dollar is pretty strong so the price is higher for many non US-importers, relatively speaking.

To your list I would add the stability/security issues in Nigeria (350-400kbd) https://af.reuters.com/article/nigeriaNews/idAFL5N1T24ET. “The market” has started to notice that lack of pipelines may limit Permian production growth https://www.bloomberg.com/news/articles/2018-06-20/shale-giant-says-permian-oil-faces-shut-ins-on-pipeline-shortage and that just a handful of OPEC countries may have capacity to increase their production https://www.bloomberg.com/news/articles/2018-06-20/opec-maths-reveals-gap-between-headlines-and-real-barrels. Big unkown is if the Houthi groups will manage to hit some important Aramco facilities. Supply has big downside and not much upside.

2018-06-20 (SEB Bank) Chart1: Weekly crude and product inventories US, EU, Singapore, Floating given as change vs. start of year in million barrels.

http://ravarumarknaden.se/iran-hard-to-swallow-a-double-insult/

“Libya’s oil production drops to 600.000 bpd from a recent 1 million bpd due to fighting”

http://www.libyabizinfo.com/story-z15301065

Tank 6 is now also burning.

Posted my prediction on April Texas production in the last thread. Down 21k to 4140. Just thought I would chip in with all the decreases everyone else has posted.

Started to have a clue the slowdown may have started sooner than I was thinking, when I read a blurb about completion crews already being cutback, some. They don’t cut back until it has already slowed.

I think, George, is being overly conservative on Venezuelan drop. It was at about 1 to 1.1 early in June, which puts it 600k below what they had the end of 2017. May go down another 300 by the end of 2019, or .9 million. Permian may go up some, yet, but probably mostly sideways until the end of 2019. So, my guess is that EIA’ s prediction of 1.3 for 2018, and .9 million for 2019 is going to be far, far short of reality for 2018 and 2019, by about a million barrels a day. With all of the other drops included above, we are over 2.5 million barrels shorter than estimated before, so whatever OPEC and Russia will do, we will still be far, far short even before you factor in any demand increases for 2019. Forget Iran drops, as with this kind of shortage coming, they will find a buyer.

Sounds about right. My thoughts, not very well put together, were more about what might be affecting the current price, not overall long term supply. For comment below EIA STEO has 2019 GoM average at 1850, but I think it more likely to be closer to 1550, also UK will be back in clear decline by then. Kazakhstan, Azerbaijan and Oman will be interesting in second half of 2019 as well – can they hold a plateau or slow decline or will it be accelerating.

https://oilprice.com/Energy/Energy-General/Permian-Bottlenecks-Begin-To-Bite.html

Yeah, Ven decreased 400 short term, I see that. The above article gives more credence to my unusual prediction of April Texas production. I had my doubts about Nick, at first. Since then, he has become an important source of information.

March US production was slightly less than 10,500k, and I is basically stalled under 10,600 going in to April. From that, we will eventually take about 150k from the Gulf per your estimation. Some more will be added from the Bakken and Eagle Ford, but probably not much more in 2018, because it is too late in the year to get to completion stage, and prices do not support that quite yet. I expect a lot next year, as I expect prices will be higher, and the Permian will not be an option until the second half. When it does come back online, the Permian producers will have to compete with the Eagle Ford for completion crews. So, 600k for next year as an increase is probably a good wag. About 400k short of EIA projections. From the monthly reports, I’m guessing the Permian did not, and is not going to make it to 600k for 2018. For US production, if we take 10,500k add 600k and subtract 150k from the Gulf, we get 10,950k as a wag for next year. We are, I am guessing, about a million short of EIA and IEA projections for the US for production for 2018 and 2019. Once, all of this is thoroughly absorbed, which may take awhile, we get a price spike, and higher into 2019. Whatever OPEC produces is too little, too late. From what I am reading, it looks to be about 600k, which will only make up for the Venezuelan loss to this point in time.

The real curiosity is how long EIA will keep up their facade?

What’s about Lybia – I don’t hear updates.

Rumors where about 300-500k short in exports – and longer problems due to the destruction of the storage tanks needed for running the harbour.

Longer downtime here should call the Opec spare capacity, or we’ll get in real shortage.

Libya has all kinds of risk. I have been speculating about how susceptible the warlords are to outside powers. I think they are easily bribable, and also the culture in the country is likely to be corrupt. So if OPEC/Russia want it, I just think there will be outages in Libya. And OPEC is itself divided Iran vs. KSA and in addition election in Libya is due end of year 2018. Just to make it even more complicated. There have been practically no rigs working in Libya since the revolution btw (1 now, gas rig offshore?).

Thoughts on this from the article?

“The pipeline bottlenecks are unfolding alongside other problems cropping up in the Permian. Barclays noted that ‘productivity improvements are slowing and the decline rate is accelerating in the Permian,’ even as absolute production is still expected to rise 600,000 bpd year-on-year in both 2018 and 2019.

“The bank downgraded its projection for Permian supply growth by 50,000 bpd this year and next because the estimated ultimate recovery from the average Permian well is not increasing at the same rate as it once was, ‘despite the continued increase in proppant intensity and average lateral lengths,’ a situation likely the result of ‘parent-child well interference and expansion into less-lucrative acreage.’ In other words, the shale industry dramatically ramped up the intensity with which it drilled shale wells, but they have nearly picked just about all of the low-hanging fruit in terms of productivity gains.”

Not sure where they determined that from. They didn’t say. If it is from the EIA drilling productivity report, it’s from a useless calculation. Try’s to find the average banana by adding apples and oranges and dividing by walnuts.

I had US any easy 1 million off EIA estimates, because George has also pointed out EIA’s habit of over estimating the Gulf by the tune of 100k or more a year. Only nine days until EIA has to post their monthly production figures. That should shake some trees. Dean predicted a small drop, too. EIA weeklies must be far over actual.

Frack Master,’ now infamous oil industry darling from Dallas, arrested in $80 milli0n Fraud Case

https://www.dallasnews.com/business/energy/2018/06/20/frack-masterwho-posed-oil-industry-expert-arrested-sec-called-80-million-scam

Basically, the same type fraud used in the Austin Chalk scams during the 80’s.

We have an OPEC deal:

https://www.zerohedge.com/news/2018-06-22/we-have-deal-principle-opec-agrees-real-production-increase-600000-barrels-day

Paper increase of 1 million barrels – now they have to show who has spare capacity and who not.

Yeah, that won’t even take care of the Ven drop through the next couple of months. Then we will be short 600k from the US, 600k from Libya, and another 750, or more George pointed out, above. And that is only for 2018.

… undtil atumn next year, when in the Permian everyone wants to drill at the same time when all the new pipelines open.

Looks like they get the most epic traffic jam with all these heave utility trucks.

When the oil price gets into the 100, fracking must run to a completely crazy level in the USA.

Eulenspiegel,

According to oil producers from Texas like Mike Shellman, when the fracking ramps up the costs for oil services tends to increase so average well costs are likely to rise as oil price approaches $100/b. Even at $65/b for WTI prices are already starting to rise as there is a shortage of qualified workers in the oil industry in Texas and possibly in the US in general.

A lot of the skilled people are either retired or fast approaching retirement. High wages and salaries will be needed to coax some out of retirement or to keep the older folks working.

Yeah, that may even be more confused in 2019. Eagle Ford will, no doubt, ramp up. Some will transfer closer to that. Then, there will be less in the Permian for awhile. Sudden ramp up may be questionable. The drilling ramping up is not in question. The completions are. So, completion cost will rise, for sure.

By the way – the WTI/Brent gap is closing rapidly at the moment.

Perhaps distributing fracking more evenly across the USA at least solves the traffic jam problem and ineffictivities through this.

Prices will go up anyway – I think this 7.5 million $ for a super frack well ist history due to the boom. The money is earned by more people than the upstreames, besides their CEOs.

WTI should drop, as it represents Cushing. Cushing pipelines are operating at close to full capacity to the Gulf, and Cushing inventories are dropping fast. Permian is not going to raise it further. Gulf WTI (MEH) is only two to three dollars less than Brent, now. If Permian production levels out, the curren $20 spread to MEH should go down, substantially.

Guym,

If the inventory at Cushing drops, wouldn’t the price tend to rise? Maybe you mean the spread between Brent and WTI will drop, I may not have understood what you mean by “WTI should drop”.

The spread is what I meant.

According to most analysts about a 650 kb/d increase from OPEC/Russia and co., I agree it looks like along with Permian bottlenecks higher oil prices should be expected.

There is a lot of room for error in my estimations. We could see 200k to 300k more from the US than my estimations. Venezuela may drop 200 to 300k less than my estimation. Libya may come back online in the next couple of months. We will still be short because there will be SOME demand increase in 2019. Plus the decreases that George estimates, and as he is usually conservative, and knows knows a bucket to my thimble, I will go with that as expectations. And, which ever estimation you use for OPEC and Russian spare capacity will not cover the shortage in 2019.

Probably set at 650k, because that is what they can do easily, and it pacifies Russia, or rather Lukoil.

Guym,

Yes all estimates of the future are problematic, but yours and George’s estimates look pretty reasonable to me, if we add +/-100 kb to any given estimate for each nation estimated, and probably about +/-500 kb/d for the change in World C+C output for next year.

In other words, let’s say when we add up all the increases and decreases that we expect for 2018, the World C+C output ends up 1000 kb/d higher in Dec 2018 than it was in 2017 (note that neither you nor George has explicitly made such an estimate), if that were the case, I am suggesting a good estimate would be 500 to 1500 kb/d higher World C+C output as these estimates are highly uncertain.

My guess is that World C+C output will increase very little in 2018, maybe 0 to 1000 kb/d, with a best guess of about 500 kb/d, this would be a comparison of Dec 2017 output levels with Dec 2018 levels.

I look at it differently, but not enough to argue with. 600k US less 600k Venezuela, plus OPEC output, less projections by George. May be 500, but I’m guessing less. Mainly because OPEC is only half a year, and George’s guesses are a lot closer than anyone’s. And don’t forget GOM is not expected to stay up. But, I forgot to include about 300 additional from Canada?IEA estimated 1.8 million from non OPEC to closely approximate their conservative demand figure of 1.4. With that, we were expected to be close, or a little under. Your 500 less 1.8 leaves it a tad short?

The difference carries over into 2019 when we will see an increase of 600k? from the US plus whatever increase OPEC and Russia can manage. Less whatever demand increase there is. Roughly, 1.3 supply shortage carried over into 2019, plus a negative for demand increase of 800k? Gives negative 2.1 plus a positive $600k, leaves a demand on OPEC of 1.45 million additional over the 650k they propose to increase. A year ahead is impossible to predict, but it looks pretty bleak. If it could happen, there would be NO excess capacity. Trump antics are only rearranging the selling locations of US and Iranian oil.

The leveling off of US production would probably mean a much greater draw on US inventories in the next year. With a current draw of 6.1 million, it looks like the start.

This just looks like rubber stamping something that was already happening. The only production profiles that look like real cuts that were held are Kuwait and Oman, maybe UAE. Russia is just normal decline of mature fields with some new start-ups happening this year. If they did cut production it was by delaying start-ups or advancing maintenance, not by shutting off a lot of flowing wells. Same with Saudi – if they did cut stuff it was something they’d started up to boost production the month before. They don’t announce anything much these days – no FIDs or start-ups, you have to go on the service company news – but until proved otherwise I’m going with all the new production coming from Khurais.

George, even if you were off a half million barrels it would be close enough to see the precipice.

Other news, rig count down in the Permian by two. I really don’t expect much of a decrease, as they are loading up for DUCs next year. WTI up $2.92. WTI/Brent spread under $6 now.

I’m sensing this OPEC/NOOEC announcement is the mirror image of the November 2014 meeting that changed the world’s perspective from scarcity to abundance. I wouldn’t be surprised to see oil go over $100 the second half of the year even without any major additional disruptions. To me the big question is the Saudis, always a black box…

Baker Hughes weekly US rig count

Oil -1 to 862

Natural gas -6 to 188

Permian -2 to 474

http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-reportsother

Reuters chart for oil rig count https://pbs.twimg.com/media/DgT_4fnXkAAFC3M.jpg

Libya, there’s no mention of damage or repairs…

2018-05-22 (Bloomberg) Libya: Oil shipments from two key export ports may restart as early as tomorrow, Libya National Oil Corp. Chairman Mustafa Sanalla says in Vienna on Friday.

2018-05-21 (Platts) Forces from the Libyan National Army militia have recaptured the Ras Lanuf oil terminal and are moving to retake the Es Sider terminal in eastern Libya, the chairman of state-owned National Oil Corporation said Thursday.

https://www.platts.com/latest-news/shipping/vienna/libyan-forces-recapture-ras-lanuf-oil-terminal-26977578

Libyan damage.

https://mobile.twitter.com/TankerTrackers/media/grid?idx=0

Yes, sorry, I should have written, he doesn’t mention if the loss of storage will mean lower exports?

Just found this on TankerTrackers, Libya oil exports down -124 kb/day so far in June: https://pbs.twimg.com/media/DgU00q-XcAAtk6u.jpg

One wonders if the oil buyer has two bank accounts to which money must be deposited depending on the holder of the port that day. If one group holds the port they presumably will not let the oil leave port until money shows up in their account, and the same would be true for the second group.

June 22 (Reuters) – The government-owned Isla refinery in Curacao is seeking a company to immediately replace Venezuela’s state-run PDVSA as operator of the 335,000-barrel-per-day facility, which has been largely idled due to a lack of crude shipments to the plant, according to a document seen by Reuters on Friday.

https://af.reuters.com/article/commoditiesNews/idAFL1N1TO0PL

OPEC, Iraq says +770 kb/day, which makes me wonder if they’re quoting the number from OPEC’s technical report?

2018-06-22 (Reuters) The Organization of the Petroleum Exporting Countries and other top crude producers, meeting in Vienna, agreed to raise output from July by about 1 million barrels per day (bpd)

The real increase, however, will be around 770,000 bpd, according to Iraq, because several countries that recently suffered production declines will struggle to reach full quotas, while other producers may not be able to fill the gap.

https://www.reuters.com/article/us-global-oil/oil-jumps-4-percent-on-modest-opec-output-increase-idUSKBN1JI03B

“… other producers may not be able to fill the gap.” That would suggest there are 770 kbpd capacity that could be bought on (could be off-line spar but I think mostly new developments, whether new fields, expansions or just in-fill) after that no more spare. No spare usually means rising prices on it’s own but all indications are for a significant slow down in new production, rising decline rates, increasing geopolitical issues, possible maintenance overhang from cut backs over the last few years, and it’s looking like growing issues with the distillate mix . That 770 could be taken up by a factor of 2 or 3 just from Venezuela and Iran drops in the next six months.

A good summary of it all. People don’t want to think negative, but when you have two empty bags of greenfield projects in 2015 and 2016 and in addition strong powers try to keep oil prices low for as long as possible, this situation more or less had to occur. The market is behind in understanding what is happening imo; it would surprise me if not second half of 2018 makes the picture more clear for the press also.

The Permian has become the world’s pacifier. Take that away, which will become apparent soon, and tears will roll.

2018-06-23 Saudi Energy Minister: OPEC+ crude oil production increase closer to 1,000 kbd than 600 kbd

2018-06-22 Saudi Energy Minister: If we take no action then the supply deficit in H2 could rise to unacceptable high figure of 1,700 kbd

Saudi Arabia and Kuwait are in talks to restart output from the neutral zone

And how much of the exports right now are coming from storage? Talk is cheap, we have to see what they really got.

801 is closer to 1000 than 600, and pretty near to 770. And restarting the neutral zone almost certainly confirms that neither Saudi nor Kuwait has anything else left.

Yes, I read once upon a time that the neutral zone contained heavy oil that needed some kind of steam treatment; and it would never be touched unless really high oil prices. I could be wrong, but who could not given the information policy of the country?

Definitely the (ex?) Chevron operated field was effectively close to exhaustion without EOR, and steam looked the most likely. I think there were “environmental” issues as well, which could mean gas flaring or water disposal.

I guess only subscribers get the numbers…

2018-06-23 (ClipperData) Core OPEC countries, crude exports from SaudiArabia, Kuwait and UAE are up massively this month, easily the highest exports on our records from the three combined

That said, crude exports are all lower so far this month from Libya, Iran, Angola, Nigeria and Venezuela. Combined, they are at their lowest since late 2015.

https://twitter.com/ClipperData

2018-06-22 (Bloomberg) Iran said it doesn’t believe buyers of its oil will get waivers from the U.S. government that would allow them to continue purchasing cargoes after President Donald Trump’s renewal of sanctions.

Major international oil companies Royal Dutch Shell Plc and Total SA have halted purchases already, Iranian Oil Minister Bijan Namdar Zanganeh said Friday in a Bloomberg television interview.

His comments came after American officials were said to have asked Japan to completely halt oil imports from Iran, going beyond the cuts demanded during previous Obama-era sanctions. Those curbs in 2012 removed about 1 million barrels a day of crude from the market, suggesting Trump’s restrictions could have a big impact on the market.

https://www.bloomberg.com/news/articles/2018-06-22/iran-doesn-t-expect-its-oil-customers-to-get-sanctions-waivers

China was up to 600k a day in imports from the US. Trump completely ticked them off, and they will insert tariffs, or quit buying. Already, billions designated by China in US oil and gas have been thrown in the trash. China will buy probably anything not bought from Iran because of sanctions. Long term, there is more oil in the Middle East than the US, so which direction do you expect China to go? Most of his actions are pathetic in planning. ADD plus.

Trump’s decisions first and foremost are to undo anything Obama did, and that is on a personal hatred and probably racist level. I’m lost as to what Iran is actually being asked to do in order to end the sanctions (Trump probably doesn’t now either) and also what the penalties would be for countries on complying.

I would not rule out that Iran will let their production slide. In that way they can punish Trump that wants low fuel prices for his midterm election. Iran doesn’t loose that much given the underbalance the oil market will face in the second half 2018. Lower export volumes, but higher oil price most likely. And time to fill up some storage as a consequence. Time will show what will happen, better follow Iran’s export volume to find out.

In the meantime Iran looks to Russia to develop some existing fields and 2 greenfield developments (Azar and Changuleh) with about 5 billion barrels of proven reserves combined. In my opinion Iran has a good potential to increase production more than most countries in the Middle East given enough investments and access to technology. A bit of irony that the American administration is eager to sanction them right now.

https://oilprice.com/Latest-Energy-News/World-News/Iran-Plans-400000-Bpd-Increase-In-Oil-Field-Capacity.html

https://www.rferl.org/a/iran-signs-4-billion-dollar-oil-development-deal-russian-firm-zarubezhneft-/29100944.html

Good points. Also they are looking to start exporting gas (pipeline to Oman I think and maybe talks of local LNG export). And there’s always the question of what happens as more of the oil trade switches away from the USD, which just the general odiousness of Trump must be accelerating, even without his specific policies.

https://www.bloomberg.com/amp/news/articles/2018-06-21/unfracked-oil-wells-growing-as-permian-pipeline-scarcity-worsens

When they say three to four months, I assume that means for companies that have available pipeline contracts. Obviously, they started sucking wind in April.

https://www.nasdaq.com/article/oilfield-service-investors-pull-back-on-worries-about-us-crude-production-20180622-00604/amp

https://mobile.reuters.com/article/amp/idUSKBN1JG3GI

I thought that is the way it worked, but confirmed by Pioneer statement. Those currently on the pipeline without guarantees, will be kicked off when those with guarantees submit their oil. So, swim in your own oil, or shut it in. Every article I read quotes different pipeline capability. Whatever it is, I’m sure it’s full by now.

Dennis, could you post Dean’s chart for April. We have been running neck to neck on this Texas estimation thing.

Local reports of slowdowns and layoffs in the Permian.

https://www.myhighplains.com/news/state/slow-down-in-the-oil-gas-industry/161413002

His April charts are on Twitter if that is of any use

https://pbs.twimg.com/media/DgDxvr_W4AEEl8L.png

https://pbs.twimg.com/media/DgDxjnNW0AIsTi6.png

https://twitter.com/DeanFantazzini

Thanks, EN. I don’t do twitter, because I’m pretty much a dinosaur. Mines right there with him at 4140. But, his was calculated the first day RRC posted. I had to wait two days for the pending data.

Guym,

Here you go. The most recent data points from EIA and Dean’s “corrected last month vintage” estimate shown on chart (Dean’s April 2018 estimate is slightly lower than the EIA’s March 2018 estimate.)

I think his vintage last month chart is nailing it.

Guym,

I agree that looks like the better estimate (compared to the “all vintage data” estimate).

2018-06-22 (Reuters) – Production at Syncrude Canada’s oil sands facility near Fort McMurray, Alberta is offline at least through July, after a power outage this week, a spokesman said on Friday.

The site can produce up to 360,000 barrels per day, upgrading thick bitumen to light oil.

https://ca.reuters.com/article/businessNews/idCAKBN1JI2S1-OCABS

We don’t have New Mexico increase through April, but I am guessing that the increase for Texas and New Mexico from Dec 2017 to April is around 300k. Total Texas production does not tell what fields went up and down. Permian may actually increased in April, while others declined. Rough estimate is that Texas production is 63% Permian, 28% Eagle Ford, and 9% other. But, I am guessing that changed somewhat.

Texas April flatlined, but that’s not saying it is the last of the increase. Based on the above analysis, there is another 200k coming in May and June. Just a guess, unless Eagle Ford and other declined dramatically.

Guym,

There is an EIA estimate for tight oil output through May 2018 here

https://www.eia.gov/petroleum/data.php#crude

link to spreadsheet below

https://www.eia.gov/energyexplained/data/U.S.%20tight%20oil%20production.xlsx

Note that for Texas and New Mexico LTO output from Dec 2017 to April 2018, output did increase by about 300kb/d, not sure about conventional output over that period however. Also the May LTO increase in Texas and New Mexico was about 70 kb/d, if June is similar we would have about 140 kb/d for May and June, but I would expect with the wide price spreads in Midland, June output increases may be less than 70 kb/d.

It will be interesting to watch, maybe investment dollars will flow to other LTO plays from the Permian, the Bakken may be the next most profitable play, so I expect we might see an increase in the Bakken completion rate.

Chart for Texas and New Mexico (Permian, Eagle Ford and Austin Chalk) LTO below for Oct2017 to May 2018.

About an 826 kb/d annual rate of increase for the trend line so far. I expect that will change due to pipeline constraints, probably a 600 kb/d Texas and NM YOY increase from Dec 2017 to Dec 2018 imo, once the completion rate slows down due to lack of transport capacity (from June to Dec 2018).

Data is from drillinginfo data and estimates, no doubt. Good info, and some interesting info. Yeah, I think 600k would be hard to get to. Some vindication to our estimates. My question is when the EIA will remove OZ’s curtain. The facade has gone on much too long. They could keep it up for as long as production was increasing. It becomes more difficult when production goes sideways, people talk about shutting in and losing jobs.

And from alternate info, EIA weeklies are far overstated, again. They were good through March. Figuring about 10,500k for April, and adding in 140k is around 10,640k, not 10,900k. Around 200k, or more overstated. Unless, there is some surprise from the GOM that no one knows about. The change to increments of 100k for estimating is going to help them save face, some. Russia’s title is safe for the next 12 months.

Early numbers, with about one third of the leases reporting, suggest GoM could drop 100k for April because of Mars-Ursa and Perdido / Great White turnarounds.

Guym,

I think of the weekly estimates as a random number generator. Sometimes they match the monthly estimates, but mostly they are either far above or far below actual output (which the monthly estimates usually get pretty well, especially after revisions are made over the 6 to 12 months following the initial estimate.

All of the initial data needs to be taken with a grain of salt, and maybe a teaspoon for weekly data(which does not get revised unlike the monthly estimates.) The smart money simply ignores the weekly data.

I agree, with the exception of the press, and most banks. The EIA data to them is gospel, and constantly quoted. You’d be hard pressed to find any article, or quotation by “experts” that says anything different about US production than it is currently anything other than 10.9 million, and is expected to be 1.3 million by year end. Increasing next year by an additional one million barrels. And I don’t believe for a moment, there are not a substantial number of people at EIA who don’t know that is malarkey. Why? Because, that is the EIA storyline. Until that changes, they will continue to be misinformed.

Nobody says it is at 10.5 and expected not to increase much until the last half of 2019 at current prices.

Except us.

I think the monthly estimates are about right and US C+C output will increase about 600+/-100kb/d from Dec2017 to Dec2018.

Tar sands oil spill in Iowa.

https://www.mprnews.org/story/2018/06/23/crews-scramble-to-clean-up-oil-spill-after-nw-iowa-train-derailment

Deepwater Horizon led to new protections for US waters. Trump just repealed them.

https://www.vox.com/2018/6/22/17493414/trump-executive-order-deepwater-horizon-drilling-oceans

The world as republicans prefer it…

kakistocracy (plural kakistocracies)

Government under the control of a nation’s worst or least-qualified citizens.

And if you think the losses BP incurred are enough to ensure that doesn’t happen again even without strict rules try this:

BP reports drilling mud spill off Nova Scotia:

“BP Canada Energy Group reported an unauthorized discharge of drilling mud from the West Aquarius drilling unit on Friday. An estimated 136,000 litres were discharged.”

https://www.cbc.ca/news/canada/nova-scotia/bp-spill-offshore-nova-scotia-1.4718942

Drilling mud usually forms a monomolecular film which gives a big rainbow coloured slick, but usually disperses quickly (despite the name it’s actually a highly refined product).

The good thing about clear rules to prevent high consequence events is that there is no need to continually justify safety and environment decisions to superiors who usually, despite what might be thought, won’t put their careers on the line and try to avoid making decisions that cost money over any budget allowance. Almost always better safety and environmental standards lead to better overall company profitability, not just because risks are reduced but because operations just run better overall, but it’s very difficult see that on a project by project basis.

There’s an interesting parallel to that in home and office ergonomic design: better safety and accessibility standards for the disabled also improve safety and operations for everyone else.

ENRON 2.0? Fractionalized Fracking by the FrackMaster?

“An affidavit accuses Faulkner of an investment scheme involving the sale of fractionalized working interests in oil-and-gas prospects. If convicted on the charges, Faulkner could be sentenced to up to 35 years in prison and fined $750,000.”

https://www.usnews.com/news/best-states/texas/articles/2018-06-21/dallas-businessman-dubbed-frack-master-charged-with-fraud

A really good article on the problems in the Permian.

Is the Permian Barreling Toward a Breaking Point?

https://www.spe.org/en/jpt/jpt-article-detail/?art=4321

So if all those pipelines get built; and there are enough water disposal sites with all the collection and high pressure pumping needed also getting built; and there is enough gas takeaway and processing capacity; and enough people to support all that construction, drilling, completions and general logistics without project cost inflation going through the roof; and the local road systems don’t collapse under all those trucks; and Trump doesn’t make the steel too expensive or difficult to get hold off; and there are enough reserves to support all the long term investment without risking a lot of stranded investment – then there’s an extra 2 mmbpd by 2021, (which also looks like it might be close to the peak; in fact it might be that the US alone will be declining by then if that is all that’s available)?

The chap from UEA said at the OPEC meeting the world needed a new North Sea or Iraq every year – that’s over five times what the Permian will give, (and really at least 50% of all oil news stories seem to be about the Permian so the other supply is either a really well kept secret or mostly non-existent).

Almost half way through the year now and the last six months must be the worst for announced oil and gas discoveries since … ever in the oil age?

As to the Permian, you left off, if they can get enough sands for the completions. Local sands can work some, but the protected lizard is giving them fits. Any one who has seen the area, would question all these wild predictions of growth. Considering that to increase production from the previous years increase, you need to add about 1.6 times the number to the resources you used the previous year. Actually, more than 1.6, because of legacy declines from older wells.

2018-06-25 (Bloomberg) Syncrude Canada expects Fort McMurray oil-sands upgrader will be shut until the end of July, company said. (350,000 b/d facility)

Goldman Sachs says the outage will create shortage of North American supplies, and draw down inventories at Cushing.

Cushing inventories: https://pbs.twimg.com/media/Dgh2eVxXcAAFXQy.jpg

That’s more than a simple power outage, a major part of the high voltage distribution system must have been destroyed.

They’re saying that a transformer blew up and so I guess it might need to be replaced?

They probably need to fix their control and safety systems to make sure it doesn’t happen again too.

There was an outage last year, although this year, high Alberta inventories might lessen knock-on effects…

April 04, 2017 (Reuters) Syncrude outage limits ConocoPhillips oil sands production

A shutdown at the Syncrude oil sands facility in northern Alberta has curbed output from ConocoPhillips’ Surmont plant, the U.S. company said on Tuesday, as the shortage helped push heavy Canadian crude prices to the narrowest discount in nearly two years.

ConocoPhillips has had to reduce production at its 140,000 bpd Surmont thermal plant because it uses light synthetic crude from Syncrude to dilute tarry bitumen into a heavy blend that can flow through pipelines.

https://www.reuters.com/article/canada-conocophillips-surmont-idINL2N1HC1PW

Alberta April 2018 high inventories https://pbs.twimg.com/media/Deog5wTXcAA7VUB.jpg

Alberta production, you can see the April 2017 dip https://pbs.twimg.com/media/Deoe9T2WkAALj8f.jpg

Yes, the shortage of heavy oil from Canada will be significant for the refineries. They are not getting Venezuelan oil, at this point. The pipelines from Cushing to the Coast were running full speed, as you posted earlier. I read that the heavy oil from Canada was given priority. A significant drawdown is expected, if transportation is slowed.

https://oilprice.com/Energy/Crude-Oil/Gulf-Of-Mexico-Production-Expected-To-Hit-Record-High.html

I think the high is coming from the strange smell from the EIA offices, and they have been sharing their stash with Woods McKenzie:

https://www.woodmac.com/press-releases/deepwater-gulf-of-mexico-stages-a-comeback-in-2018/

Four days before the Permian pacifier is removed. EIA monthly for April due out 5/29, Friday. But, then if they are really intent on keeping oil prices down until November, they can post an increase and correct it later. Or, slowly correct it until November. Do I really think the Federal Government would mislead the public? Hell, yes, they have been. They have access to much more information than I do, and they are still singing the Permian song.

Second thought, I don’t think it is possible for EIA to delay it much further. We crossed the Rubicon. Singing Permian songs when there are reports of service employers cutting back, wells shut in, and overall reports of slowdowns, creates a lot of cognitive dissonance.

Must be a slow news day for OilPrice. The headline is misleading – the predicted record is only for deepwater total (oil and gas) production, not total GoM. It is almost certainly going to be wrong – if nothing else the 50 kboepd dropped from the loss of Hadrian South gas and the prolonged Enchilada and Delta house outages are impossible to make up, but even without those there probably wouldn’t be enough new, plateau production through this year.

As to the industry having this great revelation and deciding not to go for big, bespoke developments and use standard designs and tie backs – it’s the other way round – they ran out of larger developments that were affordable, so didn’t need the bigger, on-off designs. Also the standard designs come at a cost – they have less flexibility for future tie-backs or changing reservoir conditions, and probably lower availabilities. Note also the talk of ultra-deep-water and HPHT developments like Anchor, that’s a switch back to expensive bespoke design (actually almost research projects).

It also references that crap EIA paper without making any effort to check the facts.

Yeah, I doubt you chose the headline for your article, either. smile

I have nothing to do with it at all. I’ve noticed OilPrice, and is it seekingAlpha, sometimes post an entire article from here, including a couple of mine. I don’t know if Ron or Dennis has an agreement with them or it’s just normal internet practice; or if that’s how they get all their articles or some are commissioned. Most of their stuff seems to be aimed at investors and that is certainly not who I have in mind when putting the data together.

George,

No they don’t ask for permission, they just take the stuff.

Guym,

George decides on the title of his posts at Peak Oil Barrel.

http://www.indmin.com/Article/3815675/Permian-pipeline-bottleneck-stalls-fracking-activity.html

It’s going to be difficult to scale up end of 2019.

https://seekingalpha.com/amp/article/4183852-game-oil-prices-going-higher

Fun to look at this analysis, and plug in a one million shortage from North America. Obviously, there would not be a one million drop in Iran, as it would be sold somewhere.

We might be seeing similar articles about gas over the next couple of years. Driving a bit less is maybe a good thing, pensioners and children freezing to death and industry shut down with rolling blackouts is maybe less negotiable.

Suppose there is too little oil and the price doesn’t change. Producing countries will be sure their own countries have a sufficient amount so regardless of price, that oil isn’t leaving the country. It stays right there for consumption. External price is meaningless to that country, as it should be.

There are countries that produce about what they consume. Mexico is one. Argentina. Their oil isn’t going anywhere. A higher price elsewhere tries to get it exported? Clearly the govt will stop anything like that. Just as the US did with its export ban in the 70s. Price doesn’t matter if bans are in place.

Oh, and another annoying thing in that article. Something like . . . if supply shrinks, only “demand destruction” can avoid some sort of catastrophe. This is absurd. Demand is not destroyed. The desire for oil will grow with population. The population demands oil. It is consumption that is destroyed by lack of supply. Can’t consume what doesn’t exist.

Besides which, if some level of “grim” is approached, then some decision is going to be made to liberate that Orinoco heavy from the horrible popularly elected government that controls it. As I noted before, there is a large ethnic Russian population in Venezuela. The 1917 revolution sent many people there, fleeing confiscation. Liberation may not go smoothly.

Mexico doesn’t use what it produces, it doesn’t have the refining capacity – it exports crude and imports products.

Invading Venezuela wouldn’t necessarily stop the decline in production – their equipment and wells are falling apart, to get back to where they were a couple of years ago would require a five year occupation, probably with forced labour (or really high wages), and the investment money all coming from the invading country, with no net returns for longer than that.

Demand is usually defined with some relation to price, not assuming a commodity is free.

If you would pay a tenth of the wage of an oil redneck in Texas, there would be long queues before the recruiting offices.

Forced labour is no good idea – especially when handling expensive equipment. Pay a good local! wage, and you’ll have enough people.

You’ll have to import foreign workforce, too, to rebuild this mess to modern standard. So billions will be needed before the oil starts flowing again.

George Kaplan:

“Invading Venezuela wouldn’t necessarily stop the decline in production – their equipment and wells are falling apart”

VZ would need sustained prices around$100/bbl and a return to capitalism to have any chance of a production recovery. High oil prices would support high wages for crews and companies to fix VZ’s oil infrastructure. That said nothing will happen as long as the socialists remain in power. Perhaps if VZ miltary has a successful coup & institutes a Miltary dictatorship, it might have a chance to turn exports around. That said, I would have though the Miltary would have overthrown the socialist years ago.

Regarding the Iran discussion.

The debate seems to be around what effect the risk of secondary sanctions from US government for international companies will have. Some argue that the US allies and their companies will not pick a fight over this with the US right now. In either case, it certainly is not good for the Iranian economy which contracted after the last round of sanctions and boomed when they were lifted afterwards. Also the Iranians want western equipment and competence to develop their oil and gas fields (some of their oilfields are somewhat complicated to develop), and it is not certain Lukoil and russian service companies can be a good enough replacement.

There are some hurdles with switching customers for large oil volumes. Tanker freight and insurance services now done by western companies afraid of sanctions will have to be replaced or the obstacles overcome somehow. But I agree with you that China, while also having a futures market trading in yuan, will look to Iran when shortage arrives. However the perception of shortage has still not arrived in oil markets today. Some reduction of export from Iran is likely both initially and for some time further. Hard to say how much, some argue that it takes 6-12 months to see the full effects of US sanctions. And once sanctions now are in place, even if it was untimely given the supply situation in the oil market, it will not be practical and too confusing as a political move to see them lifted soon (less than 1 year).

Libya’s Tripoli-based NOC Says Exports from Benghazi-based NOC in the east are “illegal”

2018-05-26 BENGHAZI, Libya/TUNIS (Reuters) – Eastern Libyan commander Khalifa Haftar’s forces have handed control of oil ports to a National Oil Corporation (NOC) based in the east, a spokesman said on Monday, a move the internationally recognized NOC in Tripoli dismissed as illegal.

If implemented, the transfer of control would create uncertainty for buyers of Libyan oil who normally go through NOC Tripoli.

In comments later confirmed to Reuters, Ahmed Mismari, spokesman of Haftar’s Libya National Army (LNA), said on television that no tanker would be allowed to dock at eastern ports without permission from an NOC entity based in the main eastern city, Benghazi.

https://www.reuters.com/article/us-libya-oil/east-libyan-forces-say-oil-ports-handed-to-eastern-based-noc-idUSKBN1JL2DQ

Tripoli-based NOC https://pbs.twimg.com/media/DgkrEMeXUAADLGS.jpg

Some kind of summary with some details from Libya (from comments section in HFIR article above – Game Over – Oil Prices Are Going Higher).

Nigeria and Libya are also becoming disruption hotspots. Three of Nigeria’s main crude streams (Forcados, Bonny Light and Qua Iboe) are either halted or severely disrupted, but violence in Libya grabbed the recent headlines. Militias led by Ibrahim al Jathran, former head of the local Petroleum Facilities Guard, attacked and briefly seized the 0.35 mb/d Es Sider and 0.22 mb/d Ras Lanuf terminals from Khalifa Haftar’s Libyan National Army (LNA). Although the LNA are back in control, Libyan oil output has collapsed from 0.95 mb/d to around 0.55-0.60 mb/d because of the fighting and NOC has declared force majeure at the two ports (along with apparently unrelated technical issues undermining production at AGOCO-run fields in the east).

After around 10 days of fighting, the extent of the damage at the two terminals remains unclear. There is currently no information about the status of Es Sider, which exported around 0.30 mb/d in the previous three months. The destruction of two storage tanks at Ras Lanuf, which was exporting around 0.10 mb/d before the clashes, has reduced storage capacity from 0.95 mb to 0.55 mb. Seven tanks at the terminal had already been damaged in previous clashes and the destruction of another two leaves only four tanks capable of operating. Once the fighting is over (and there is a considerable risk of further clashes over the next few weeks), it will take several days to evaluate the status of Es Sider and Ras Lanuf. This would be followed by emergency repairs, which could take a week or two, with export capacity recovering only gradually. Consequently, we expect output to remain at 0.55-0.60 mb/d until early/mid-July, even as NOC studies options to bypass Ras Lanuf and possibly divert exports to the Zueitina terminals.

In conclusion: Libya is good for no more than 0.8 Mb/d, but likely less than that in 2018.

So, an important question for this board is, could we have reached peak oil production this year? The Permian will increase substantially into 2020. However, that will be partially offset by the Venezuelan drop. Add in other declines, and the drop could easily offset any US production. At some point, OPEC will see that extra production will never meet demand, and not just waste what they have.

It depends totally on political scenarios, not technical and not financial.

There’s still a lot of growth potential to offset the declines:

– Permian

– Other US shales to a degree

– Kanada with it’s vast heavy oil ressources

– Venezuela

– Russia

– Iraq

– Iran

– SA (nobody knows), at least they can call to their spare capacity

– Kuwait

– UAE

-Brasil

That’s 10 locations, some are politically knocked out ( Ven, Iran partly) from growth.

The more important thing for world economy is: How long can they support the consumption growth, additional to the decline of all other countries.

I think peak oil is somewhat more melodramatic: When Ghawar finally dries up, we have reached peak oil. It will dry fast, due to all these horizontal tapping keeping the oil flowing until the last feed of oil column. And replacing these 5 mb/d will require an additional fully developed Permian – something not in sight at the moment.

Yeah, we may not have reached it, but we’re scaring the heck out of it. I doubt production will exceed demand for awhile.

The future?

Donate the fuel you save each year to running someone else’s SUV. You too can drive less, drive a Prius or EV and give your saved fuel to SAVE-THE-SUV’S, a non-profit endangered vehicle program.

We all just hate to see those big SUV’s and pick-up trucks down-sized and being neutered and half-bred with electric motors and batteries.

Give before they become extinct.

Also the Save an Oil Rig Fund can really make a difference. Just send $10 a day to your local chapter and know that deep down the fracking and pumping will continue, allowing some old ICE car to roam this fine nation. We will miss these classics when they are just sitting n the front yard, just rusting away.

🙂

2018-06-26 (Bloomberg) Saudis Are Said To Plan Record Oil Output Of 10.8 million b/d In July

Covering for the various outages, sanctions and fuel price worries

2018-06-19 Egypt (Reuters) the government of President Abdel Fattah al-Sisi on Saturday declared it was slashing fuel subsidies, pushing up prices of petrol and public transport by as much as 50 percent.

The fuel price increase was the latest in a raft of austerity measures Egypt is carrying out as part of major economic reforms, the price of a $12 billion loan from the International Monetary Fund.

https://www.reuters.com/article/us-egypt-economy/forking-out-egyptians-angered-by-new-austerity-after-eid-feast-idUSKBN1JF1ZC

That will be the clearest test of “real” spare. They hit highs close to that before the OPEC cuts in 2016, but is it truly sustainable once planned or unplanned maintenance come along.

Russia isn’t a growth area. Their additions to production are all infill and EOR in the same old fields. Produce more, deplete reserve faster. They haven’t new discovered anything exploitable in a long, long time. Whether you can do fracking in Russia and if it pays at any sane price is also an open question beyond the political problems.

The absolute best anyone should expect from the former USSR is steady. A more reasonable case would be Russia going into steep decline like what happened in China.

I think if the world economy starts to drop, which is ldue and ooking increasingly likely every time Trump opens his mouth, and keeps the oil price down then it’s likely we’ll be in a slow but accelerating decline. That might be a good thing – the further the peak is pushed out the steeper the decline when it comes.

What has surprised my most recently has been the fall in discoveries for oil and, maybe more so, gas, and with that the number of new frontier plays that have been a bust. With the seismic and visualisation technology improvements the E&Ps should know better where and where not to drill. They seem to be more selective with falling wildcat numbers (and that is not much of a function of price that I can see as it has been happening since 2010) and yet the commercial discovery rates are staying fairly low. I can only interpret that as indicating that there just isn’t that much left. With Rystad indicating 6 to 8% decline rates in mature fields, and rising, and few new prospects how can there not be a peak?

The oil drop might have been more expected than the gas, and was predicted by some when peak oil was first mentioned, I think gas less so, but perhaps the price has had a bigger effect there. Whatever the cause many countries have been banking on ever rising supplies, either by pipeline or LNG, that might not be forthcoming.

Having said that simple economic arguments rarely seem to work as predicted, oil supplies would have peaked well before now without, mostly non-proftable, LTO; Venezuela production should be rising not a basket case; Saudi ministers spout out any thing that comes to mind to support flip-flop policies and their feud with Iran seems to be bubbling in the background of a lot that’s going on; every year Iran and/or Iraq say they have a new plan and target for higher production, which is 100% guaranteed not to be met even remotely.

At the moment the traders don’t seem certain which way to turn – falling/rising supplies, short/long term demand rise/fall – you can see why they tend to fixate on US crude stocks, everything else is too complicated. The next few Wednesday/Thursday trading patterns will be interesting.

(ps if anything highlights the state of the oil industry at the moment it’s that Fram, a two well, eight year life-cycle, gas condensate tie-back with about 10 mmboe reserves, has been the main headline news on at least four of the trade magazines this week.)

2018-06-26 (Rudaw) When US sanctions were placed on Iran in 2012, the four Asian countries were given a waiver, requiring them to reduce their business with Iran by 20 percent each six months rather than halt trade immediately.

The Asian oil buyers are less likely to receive a similar waiver from the Trump administration

Iran may need to resort to a bartering system to continue selling its oil. Under the 2012 US sanctions, India imported $10.5 billion worth of goods, mainly crude oil, and exported commodities worth $2.4 billion.

The barter system will be inefficient, as Iran’s oil sales are greater than the value of what it imports from these countries. It also cannot use the currencies of these countries for international business transactions.

http://www.rudaw.net/english/business/250620181

2018-06-26 (Bloomberg) U.S. presses allies to cut Iran oil imports to *zero* by November

* U.S. isn’t granting waivers on Iranian oil imports ban

(State Department Official)

added link https://www.bloomberg.com/news/articles/2018-06-26/u-s-is-said-to-press-allies-to-end-iran-oil-imports-by-nov-4

Well, maybe that explains why oil prices are up right now.

“The global economy looks like the Titanic right now. The iceberg is the incoming oil price spike and the complacent investment community won’t even know what hits them. ”

-Baby Domer

Not good!? (I’m practicing for my presidential run)

Yes higher oil prices. There are too many negative things all starting at the same time: trade tariffs, interest rates rising, sanctions

Yeah, we are setting ourselves up for creating a 2.5 million barrel a day shortfall by sometime in 2019. The US is creating these surprises by far overestimating Permian output, and the Iran sanctions. Now, Perry is saying the OPEC increase may not be enough. Really, ya think? What do we do now, President “Not good!”?

So strangling Iran to force SA to release their spare capacity is the master plan? I am confused.

Trump’s master plan was written on the back of a business card with a crayon. Nobody, can decipher it, it more difficult than the most complex code.

I think probably the most telling take of his presidency, is the aide in charge of keeping Presidential documents complaining that he tore every sheet of paper on his desk into little shreds, constantly. Sure sign of a serious mental disturbance. Captain Queeg.

There is no plan. The only thought process is hurt Iran. The huge implications of that with everything else going on are lost on these people.

Rotterdam oil spill: Hundreds of birds hit after Dutch leak

The Bow Jubail ruptured its hull, pouring 220 tonnes of oil into the harbour on Saturday and officials immediately tried to contain the spill.

Rescue workers have been overwhelmed by the number of contaminated birds

https://www.bbc.com/news/world-europe-44602023

Well, we’ve had the last of the big bearish myths uncovered. (1. OPEC will flood the market. No, they don’t want to, and it wouldn’t help much now, if they did. 2. Permian will flood the market. Well, most don’t have the news of its hiatus, but they will.) Now, it’s time to watch the very slow motion train wreck.

https://oilprice.com/Energy/Crude-Oil/Is-The-Eagle-Ford-About-To-Boom-Again.html

Ok, the BS is starting again. “Average” of $50 barrel break even in the Eagle Ford is complete BS. Higher end tier one stuff, yes. An average, absolute malarkey. Lose your shorts at $50. Some tier two stuff good at $70, and tier three stuff is doing good to break even at $100. Tier three stuff probably better to wait for better gas prices. I think, at least, half of the oil window in the Eagle Ford would be tier three. Condensate window is mostly gas and condensate, and gas window is mostly gas. Rough guess.

New companies sprouting up in the Eagle Ford that are buying hand me down tier three and two stuff. There is no end to stupid money.

https://www.oilandgas360.com/privates-are-driving-the-pace-of-growth-in-the-permian/

Smaller producers are half the activity in the Permian. I have read Pioneer’s statements in multiple articles. When they say September, it relates to the amount of contract capacity they have. The pipes are being used by smaller companies that do not have contracts. When the contracted company adds oil, the non-contracted operators are kicked off. Leaving them to swim in it, or shut in. Point is, it appears about half of the oil being produced is from small producers who would not have contracts. Continuing to complete with no guarantee of transportation could doom a smaller producer. It’s a good bet, many of these have stopped, at this point. As there is little publication of the situation of these producers, that could have happened by April, causing a slowdown in production. Just a guess.

The press covers the big to medium producers. A lot we know about the Permian comes from that. What are the 100+ other operators doing? They are half the production. There is a 100 other stories of what is happening. EIA is probably not getting a 914 report from many of them. Hence, it may come as a complete shock to EIA of a slowdown in April.

Guym. I assume most of the small conventional producers are receiving a low price in the Permian. Bad deal for them, situation not of their making. Hoping very much that does not spread to the Midcontinent.

Anecdotally, zero rigs presently drilling in our little field. Drove the width of Kansas twice recently, including OK and TX panhandles. Saw zero drilling rigs. Saw just three workover rigs.

The shale plays appear to be the USA oil future. The rest are not big enough to draw outside money.

Really have to wonder how many of the world’s fields are “self sufficient” at $70-80 at this point.

Not much at $70 to $80 anymore. Not very much of a profit, at those prices. But, you get what you pay for, and soon the world will find out that the price they wanted to pay results in a deficit to what they need.

Yes, market really overdid it dropping prices to the 2015-17 levels.

I still blame a lot of the overdone price crash on US shale CEO talk. Their true costs were murky, and they continually talked the price down through 2015 by claiming they could do well financially at those levels or below.

Those companies should be doing great now, given the claims of 2015-17. Lol.