This is a guest post by Steve Srocco. The opinions expressed in this post do not necessarily represent those of Dennis Coyne or Ron Patterson.

END OF THE U.S. MAJOR OIL INDUSTRY ERA: Big Trouble At ExxonMobil

The era of the mighty U.S. major oil industry is coming to an end as the country’s largest petroleum company is in big trouble. While ExxonMobil has been the most profitable U.S. oil company in the past, it suffered its worst year on record.

For example, just four years ago, ExxonMobil enjoyed a $45 billion net income profit in 2012. Now compare that to a total $5 billion net income gain for the first three-quarters of 2016. If Exxon continues to report disappointing results for the remainder of the year, its net income will have declined a stunning 85% since 2012.

Actually, the situation at Exxon is much worse if we dig a little deeper.

Profitability Is Much Less When We Factor in Capital Expenditures

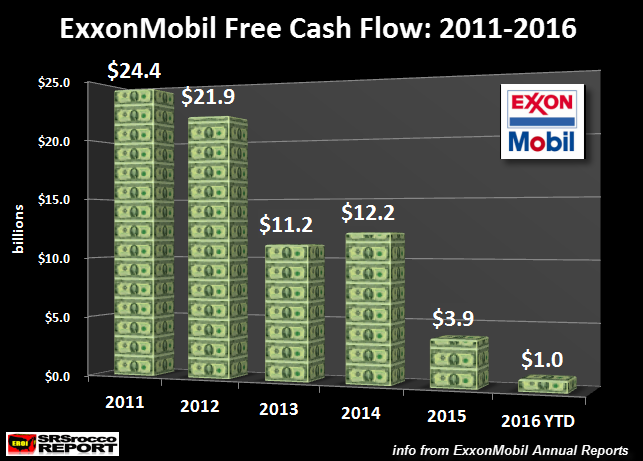

To understand the real profitability of a company we have to look at its cash flow, or what is known as free cash flow. Free cash flow is calculated by deducting capital expenditures (CAPEX) from the company’s cash from operations. ExxonMobil’s free cash flow declined from $24.4 billion in 2011 to $1 billion for the first nine months of 2016:

So, here we can see that Exxon’s free cash flow of $1 billion (2016 YTD) is down 95% from $24.4 billion in 2011. The reason for the rapidly falling free cash flow is due to skyrocketing capital expenditures and falling oil prices. But, this is only part of the picture.

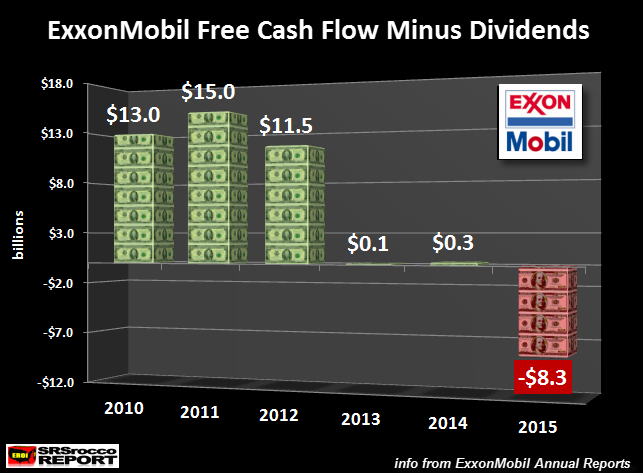

If we include dividend payouts, Exxon’s financial situation drops down another notch. While free cash flow does not include dividend payouts, the money Exxon pays its shareholders must come from its available cash. By including dividend payouts, the company was $8.3 billion in the hole in 2015:

Now, even though Exxon stated a $45 billion net income for 2012, its free cash flow minus dividends was only $11.5 billion. Moreover, the company didn’t make any money in 2013 or 2014 after dividends were paid to their shareholders. Thus, deducting dividends from the equation provides a more realistic picture, especially since Exxon has been forking out serious sums of money to its shareholders.

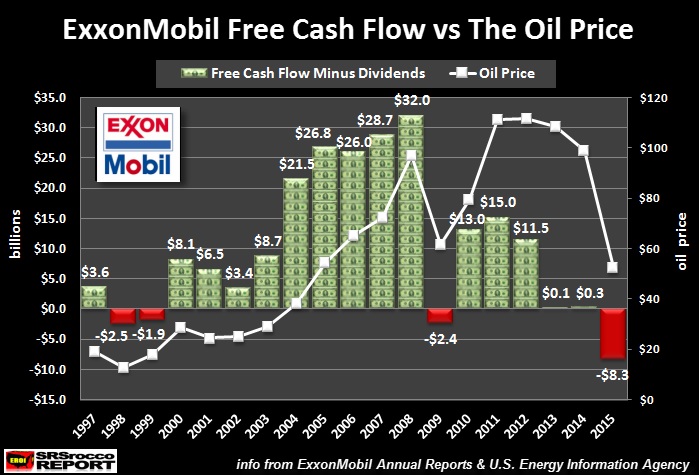

That being said, there seems to be something seriously wrong going on at Exxon when we look at the long-term chart below:

Let me start off by saying, this chart is an extension of the chart above it. Even though the title doesn’t include dividend payouts, the legend in the chart displays it. The white line represents the average annual oil price. There are several important factors shown in this chart.

- As the price of oil increased from $20 in 2002 to $97 in 2008, Exxon’s free cash flow minus dividends surged to $32 billion from $3.4 billion. Thus, the higher oil price led to larger free cash flow profits. Well, that was the good news.

- The bad news is, Exxon’s surplus cash declined significantly when the oil price was over $100 from 2011 to 2013. Even though the oil price in 2011 and 2012 was higher than it was in 2008, the company’s free cash flow including dividends was less than half. Furthermore, Exxon made no surplus cash in 2013 when the oil price was above $100.

- While Exxon enjoyed surplus cash over $20 billion from 2004 to 2007 when the price of oil was between $38 and $72, how is it that the company made no surplus cash in 2013 when the oil price was north of $100?? We will get into that in a minute.

- Even though Exxon suffered negative free cash flow (including dividend payouts) in 1998 (-$2.5 billion) and 1999 (-$1.9 billion), the oil price was at a low of $13 and $18 respectively. Compare that to a cash deficit of $8.3 billion in 2015 at an average oil price of $52…. triple of what is was during the 1998 and 1999.

- The reason for the huge decline in ExxonMobil’s surplus cash, even at much higher oil prices, was due to two factors; 1) higher capital expenditures and, 2) higher dividend payouts.

While higher dividend payouts put more stress on the company’s financial situation, the real problem is the massive increase in capital expenditures

The Massive Increase Of Capital Expenditures Is Causing Havoc At ExxonMobil

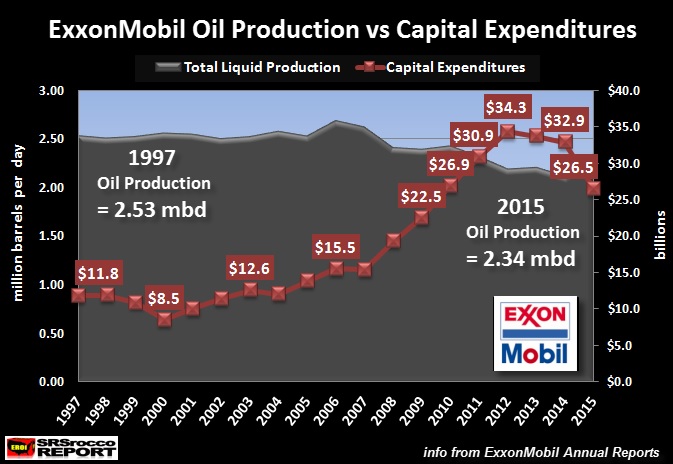

Very few investors realize the devastating impact of rising capital expenditures on Exxon’s financial bottom line. This chart shows annual capital expenditures versus the company’s oil (total liquid) production:

For example, in 1997, Exxon spent $11.8 billion on capital expenditures while producing 2.5 million barrels per day (mbd) of oil. However, their capital expenditures nearly tripled to $34 billion in 2012 as total liquid production fell to 2.2 mbd. Basically, Exxon spent three times more money in 2012 to produce 300,000 barrels per day less than it did in 1997.

When the company realized towards the end of 2013 that the market would not afford to pay $120 a barrel (the cost for new oil projects), Exxon started cutting back on exploration and capital expenditures. Even though total liquid production increased to 2.34 mbd in 2015, capital expenditures declined to $26.5 billion.

Unfortunately, the situation continued to deteriorate in 2016. According to Exxon’s Q3 report, capital expenditures in the first nine months of the year declined another 40% compared to the same period in 2015. Without increased capex spending, it is going to be quite difficult for the company to sustain production and to remain profitable.

So, when we consider that Exxon had to triple its capex spending to maintain production as well as increase dividend payouts to keep shareholders happy, the falling oil price is totally gutting the company from within.

While the evidence shown here is bad enough, I hate to be a broken record, but the situation is even far worse for Exxon when include two more negative factors.

Exxon Spent The Majority Its Surplus Cash To Buy Back Shares Rather Than Fund New Oil Projects

It seems as if Exxon realized early on that peak oil had finally arrived (privately, of course), so it decided to not waste too much money on future oil projects. Instead, the company spent a massive amount of money on stock repurchases over the past two decades… especially since 2005.

While Exxon had been repurchasing their stock for several years, I had no idea of the total amount. You see, the net total free cash flow, including dividends, for Exxon was $190 billion from 1997-2015. Looking over company’s balance sheet, I had no idea where all that money had gone. I was talking to financial expert Vic Patane a few days ago, and he said, “You should check out their stock repurchases. So, I did… and what a surprise.

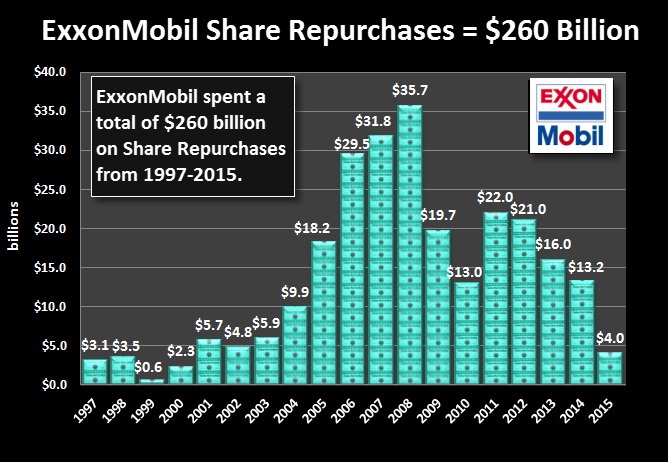

According to ExxonMobil’s Annual Reports, the company spent a staggering $260 billion on stock repurchases since 1997:

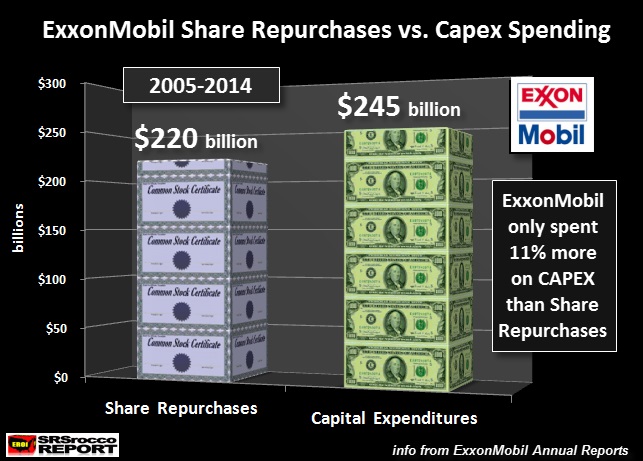

The lion’s share of their stock buybacks were between 2005 and 2014. In that ten-year period, Exxon purchased a staggering $220 billion of its own shares. Now compare that to the company’s total capex spending of $245 billion during the same time period:

Amazingly, Exxon only spent 11% more on it total capital expenditures than it did on stock buybacks. Which means, the largest oil company in the United States decided to repurchase roughly a third of its outstanding shares (2005 to 2014), than use its surplus cash to fund new oil projects. Exxon’s outstanding shares declined from 6.1 billion in 2005 to 4.2 billion in 2014.

This is certainly an interesting way for the leading U.S. oil company to use its surplus cash. For those who continue to be skeptics of the peak oil theory, YOU NEED TO WAKE UP AND LOOK AT THE DATA.

Okay, now that we know the lower oil price is gutting the entire U.S. oil industry, what is it doing specifically to Exxon? Good question.

Exxon’s Long Term Debt Surges In The Last Three Years

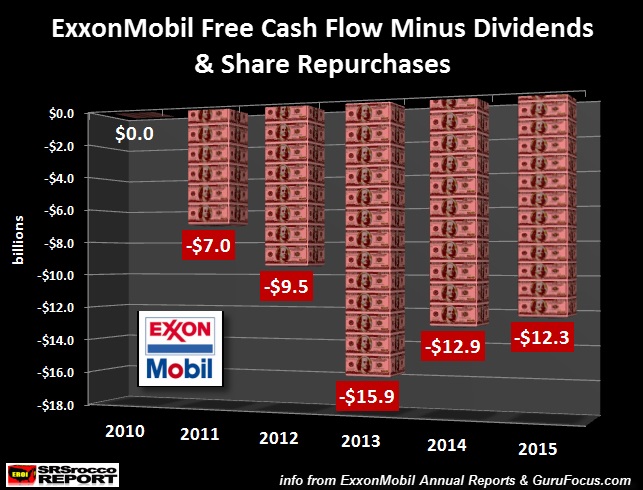

Before I present Exxon’s chart on its rising long-term debt, we need to look at the impact of the company’s share buybacks on its bottom line. When factoring in Exxon’s share repurchases on top of its increasing capital expenditures and dividend payouts, the company’s financial situation started to deteriorate in 2011… when the oil price shot up to $110… GO FIGURE:

So, if we include share buybacks, capex spending and dividend payouts, Exxon basically broke even in 2010 and actually had to start tapping into cash reserves or borrow money to fund their deficits. In just five years (2011-2015), the company spent $58 billion more than they received from operating cash.

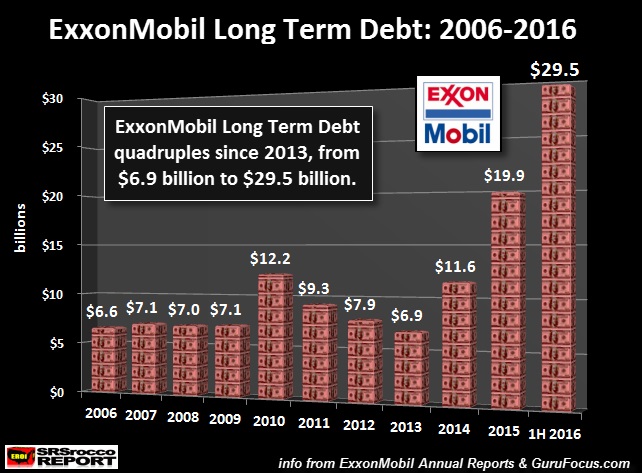

This has had a profound impact on Exxon’s long-term debt, shown below:

As we can see, Exxon’s long-term debt has exploded from $6.9 billion in 2013 to $29.5 billion in the first half of 2016. Basically, the company is now borrowing money to repurchase shares or pay dividends. This is not a viable long-term business model.

And, we are already seeing the negative ramifications of low oil prices as Exxon only repurchased $4 billion of its shares in 2015 versus $35.7 billion back in 2008.

Investors need to realize the situation in the U.S. major oil industry is in BIG TROUBLE. If the largest oil company in the country is already suffering, what does it say for the rest of the industry?? Well, let me give you just one example.

Chevron is the second largest oil company in the United States. In 2015, Chevron spent a stunning $18.2 billion more on capital expenditures and dividend payouts than the company’s operating cash. Thus, Chevron spent $10 billion more than ExxonMobil did last year ($8.3 billion after capex and dividends).

This paints a very gloomy picture for the sustainability of the one great U.S. major oil industry, especially when oil prices continue to decline. As was mentioned in previous articles, the Hills Group and Louis Arnoux forecast that within ten years, 75% of U.S. gas stations will be closed, and the oil industry as we know it, will have disintegrated.

Well, it seems as if their forecast is playing out just as they forecasted as Exxon recently announced some extremely bad news.

Exxon To Write Off 20% Of Its Petroleum Reserves

I don’t know how many American’s caught this little tidbit released last week when Exxon stated its Q3 report, but it was a whopper. According to the article, Exxon Warns On Reserves As It Posts Lower Profit:

Exxon Mobil Corp. warned that it may be forced to eliminate almost 20% of its future oil and gas prospects, yielding to the sharp decline in global energy prices.

Under investigation by the U.S. Securities and Exchange Commission and New York state over its accounting practices—and the impact of future climate change regulations on its business—Exxon on Friday disclosed that some 4.6 billion barrels of oil in its reserves, primarily in Canada, may be too expensive to tap.

From what I have read, the 4.6 billion barrel reserve write-off is mostly from its oil sand projects in Canada and its onshore shale deposits in the United States. However, this amounts to more than 20% of ExxonMobil’s oil or liquid petroleum reserves.

At the end of 2015, the company reported a total of 24.7 billion barrels of oil equivalent. That figure includes oil, liquids and natural gas. However, if we just consider their oil and liquid reserves of only 14.7 billion barrels, a 4.6 billion barrel write down would amount to nearly one-third of their oil reserves. This is much greater than the 20% stated in the article.

When Exxon reduces its oil and liquid reserves by 4.6 billion barrels, it will only have 12 years worth of reserves remaining, at current production levels. But, what if the price of oil continues to decline toward the $12 maximum price suggested in The Hills Group Report by 2020? What would that do to Exxon or other U.S. oil companies’ reserves and future oil production??

The 100+ year era of the U.S. major oil industry is coming to an end… and fast. Unfortunately, Americans have no clue just how dire the situation has become as many probably still believe in the delusion of “U.S. Energy Independence.”

I would imagine by 2020, the U.S. will be a much different place. Regrettably, most Americans are not prepared.

Check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter, Facebook and Youtube below:

Hi Steve,

On Exxon’s buy back of it’s stock. In the current price environment this seems like a good business decision. Why invest in more wells if current prices will just lead to more losses? As a share holder, a buyback of shares makes the shares I own more valuable.

On increasing debt, the rates that Exxon pays on its debt is very low. If the shares are currently undervalued in the opinion of management and the return on that investment is larger than the rate of interest on outstanding debt, then again a smart business decision.

Exxon Mobil is a well run company and will be well positioned when oil prices rise.

In a World where the oil price is determined by supply and demand, oil prices are likely to increase in the future as the supply of oil falls due to depletion. Even if oil supply does not fall in the medium term (5 years), demand for oil is likely to increase unless there is a major recession (the time of which is impossible to predict).

You often assume there will be a major depression in the near term, eventually you will be correct (my guess it will be in about 14 years or so.) In the mean time as oil prices start to rise, Exxon will be fine.

Oh, on the reserve write down this is pretty common when oil prices fall. A good article discussing Exxon’s reserves at link below:

http://www.wsj.com/articles/when-should-a-company-write-down-assets-1474064470

From the article you linked near the end of the post at:

http://peakoil.com/business/exxon-warns-on-reserves-as-it-posts-lower-profit

The company said the 20% reserves reductions, which are governed separately by SEC rules, may be necessary based on the average 2016 price by the end of the year, though higher prices in November and December could mitigate the extent of the decline. It added that any reserve reductions could be added back if prices recover. (bold added by me.)

Does this look like the share has been undervalued in recent years? If the numbers in the article are correct, they bought back shares especially when the prices where highest, or not?

I would judge the stock on price earnings ratio. Since 2009 interest rates have been very low, fewer shares reduces the outflow of dividends if we assume the yield holds steady.

There may have been few attractive real investments to make while earnings were good.

Since the crash in oil prices share repurchase has been low.

Chart below for XOM shows yield and price earnings ratio (PE) from 2005-2016.

Hm…you say: ‘There may have been few attractive real investments to make while earnings were good.’ – this is probably the most important point. Isn’t the article saying this as well, kinda? As I understood it, they put a huge bet on oil prices going up again (considerably), also because there haven’t really been other attractive options for the company. The question is, are the prices going up again and enough so that it pays off? So, does Exxon Mobil think we are already past or at least near peak oil, or what should be the takeaway here?

I doubt XOM thinks we are past peak oil, and even if they did, they would not say. Steve thinks XOM is in trouble now, I think they will be ok another 10 years or so once prices rise. Steve believes oil prices will remain low, I disagree. Eventually oil prices will rise, likely within two years as demand grows more than supply at current price levels in my opinion.

Steve’s basically right. We were doing projections for when electric cars really put a bite into oil demand, a few threads back. I believe it came out to 2024 or so? That’s only 8 years.

Investors are *forward-looking* so the oil price will drop *ahead* of the actual drop in demand, maybe 2022.

That doesn’t give much of a window for oil prices to rise before they have to crash again. If oil prices rise in two years (2018), it accelerates the drop in demand — by that time Tesla will be pumping out 500K cars per year. A rise in oil prices will simply cause financiers to funnel money into Tesla (or BYD, or another electric-car competitor) to build more factories and produce more cars.

A more important point: the oil majors can no longer finance their dividends out of internally generated profits. They’ll have two choices: slash the dividend (stock price crashes, makes it hard to raise money), or borrow more money (which is what they’re doing now). However, they have to borrow that money from outside the company. At some point, as the unprofitability of the oil majors becomes clear, investors will stop lending them money, or at least charge them ruinous interest rates. Exxon already had a bond ratings downgrade. Why lend money to Exxon when you could be lending money to Tesla instead?

And I mentioned that investors are forward-looking? If the oil price will drop a couple of years before the demand drop, the stock price for XOM will crash significantly before that. This will take longer than it should because most investors are creatures of habit and don’t think much. But the fact that Exxon and Chevron are paying their dividends by borrowing money hit Bloomberg News more than once, so it’s something a huge number of investors are already aware of. As the awareness spreads, investors will be getting out of these companies and the stock price will drop.

Looking at it from an investment point of view, the oil majors are doomed. XOM is in disastrous trouble. The company and its operating units will continue to operate for quite a while but the *stock* is pretty much screwed already.

Exxon is fine. The analysis has quite a few flaws. In any case, do you remember when we were in the African bush, we saw lions approach, and I put on my track shoes? Exxon is like that, they have pretty good track shoes, they’ll outrun the slower ones, and may even come back later and feed on lion leftovers.

Feel free to lose your money investing in XOM. I don’t give investing advice out for free, so this isn’t investment advice.

I’m not saying the company will go away. Most companies continue to exist even after multiple bankruptcies — look at Peabody Coal and Arch Coal. I think some of the coal companies are on their *second* bankruptcy in the last 10 years? What I’m saying is that I personally think the *stock* is a terrible investment.

The company can continue to operate and the stockholders can lose their shirts. A very minor example: with the current cash flow, Exxon will eventually be forced to cut its dividend.

The key is to work out what condition their condition is in at $60 to $70 per barrel and say $4 per mcf in the USA. I don’t take investment advice from strangers, so feel free to bad mouth or tout whatever. I don’t think I own Exxon stock (I have a bad memory). I believe I own Halliburton and Shell. But if I were you I wouldn’t buy stocks right now, they are too high. It’s better to have cash and buy stocks when the market drops.

Exxon’s buyback of its stock is an insane and incompetent business decision for the company. If the business is going downhill (which it is) and general stock market investors should not invest in it, the company should not invest in it either. Exxon would have done much better if it had put that cash into Tesla stock. That’s the correct business decision — take the cash you have and put it into a growing business.

HOWEVER. The Exxon CEO and other top executives get pay and bonuses based on the Exxon stock price. The buyback of stock artificially raises the stock price. So every buyback increases the CEO’s take-home pay. So it’s a rational profit-making decision for the CEO (though not for the company).

A suggestion that an oil company buy Tesla stock is incredibly out of this world. If they have that much cash they can either buy back stock (which I don’t like), pay a special dividend (I like that a little bit), or buy a smaller company (not a bad way to grow when prices are low). Well run companies reduce debt so they can issue bonds in leaner times. What they never, ever do is invest in a business they know little about.

Total bought SunPower.

Berkshire Hathaway — the *fabric company* — is now an insurance and stock investment company.

Turning into a conglomerate is a move which a lot of companies took when they found themselves in declining businesses. It requires management which can look outside their own tunnel-vision area. The oil companies are mostly run by men with tunnel vision who cannot see outside oil and gas, so they will not do that. But if they were run by a different sort of man or woman, they could.

Another example is GE. It incorporated in 1889. It has bought and sold many businesses since then. Most recently it sold off its appliance business.

Its current subsidiaries.

GE Aviation

GE Capital

GE Global Research

GE Healthcare

GE Home & Business Solutions

GE Oil and Gas

GE Energy

GE Transportation

Thanks for this work. On graph 3 it is clear there is a structural change going on irrespective of oil prices.

I found the same problem at Shell:

Royal Dutch Shell’s upstream earnings peaked 2008, now in the red

http://crudeoilpeak.info/royal-dutch-shells-upstream-earnings-peaked-2008-now-in-the-red

Matt,

Yes, I read your article and agree that structural changes have taken place in the major oil industry since 2008. Even with high oil prices (2011-2013), earnings were not has robust as they were from 2004-2008. Matter a fact, the oil price was much lower from 2004-2008, but earnings were much stronger than at three digit oil prices.

steve

Yep. Peak cheap oil has passed. The oil majors are now caught between sharply rising production costs due to peak cheap oil (each new field costs more than the old ones to produce) which sets a minimum price they need to be profitable, and the dropping price of alternatives to oil (especially electric vehicles) which sets a maximum price they can get anyone to pay on the market. This is a vise which is closing on them. When the maximum crosses below the minimum, they lose money and go bankrupt.

I’m proud to say I called this in 2008 and moved my money then.

So you moved your money out of oil stocks in 2008? You charge for investing advice???

Damn good timing. They haven’t gained a penny since the October 2008 peak. Go look at the price graph for XOM on Google Finance if you don’t believe me. I’ve been in *much* better investments over those years.

Sure, it would have been better timing to go back in from 2009 and sell again in 2014, but one can’t call the timing perfectly on everything.

I’ve a new update on US shale production, here.

This evening there should be another update on North Dakota, which has advanced their schedule and will release September production today.

I don’t think so. They have revised their schedule again.

Oil and Gas Division tenative schedule.

Now it is Wednesday, November 16th at 2 PM.

Yep, today they changed the schedule again.

Holy smokes! Layman here, obviously, but this is a huge story. It reminds me of our local and highly efficient forest industry. The weak sisters have been squeezed out and absorbed long ago by one or two majors, almost all work contracted out with temp contractor employees as much as possible, and harvest ramped up to a frenetic rate while log prices remain high. But, they are barely hanging on. Nobody is making any real money. The old growth left is far away on ridge tops, (easy stuff logged decades ago), access roads require much drilling/blasting, and those who have been through these cycles before know the shoe drop is just one or two factors away.

It seems like all industry is like this nowadays, operating in direct relation to our energy industry and their energy return ratios.

Thank you for this fine post. I am sending it on to some friends.

Extractive industry is like this nowadays, yes. (Forestry is typically extractive.)

Sustainable industry is different. We don’t have enough of it.

Steve

Nice analysis.

I think you do yourself a disservice concluding w that crazy THG study. Some good insights on net energy there but very flawed. Bedford is probably right -as are you- that oil industry is in decline, but not for the reasons he states. Makes your post less credible.

Just sayin

Steve has admitted he doesn’t understand the contents of The Hills Group Report. People who do understand it have shot it full of holes. Thoroughly! Steve still believes it is a valid report. Perhaps so because what the report predicts of the future seems likely to be the case in his opinion. This is a faith based belief that Steve poses and mentioning it often certainly detracts from his credibility. He’s even go so far as to state that if things don’t turn out too rosey in the future it proves the validity of THG report. Perhaps Steve is good at crunching numbers and making charts but he certainly doesn’t seem to understand science or the scientific process. If Steve is so pessimistic about the future I guess I’m to assume he doesn’t put much faith in Dr Louis Arnoux’s ‘little green box’ invention. Faith is an odd thing.

Kevin, the oil industry is obviously in decline. Diminishing returns on energy invested seems equally obvious. If not diminishing returns on energy invested, then what other reasons might you suggest are responsible for the (rapidly) deteriorating oil industry? I would also be interested to know what specific aspects of THG study you find “crazy”.

“If not diminishing returns on energy invested, then what other reasons might you suggest are responsible for the (rapidly) deteriorating oil industry?”

Uh, the price of oil might be a good guess lol

Here’s a link to the Etp report.

http://www.thehillsgroup.org/petrohgv2.pdf

Perhaps you could explain its merits. What do you think about equation number 7 on page 8?

And to what do you attribute the falling price of oil? Too much being produced, no doubt, i.e. “glut”. Or some other reason?

I would rather you explain its lack of merit — I did ask the original question. If you can’t explain what is wrong with that report, or are not interested, that’s okay. I’m not trying to defend the Hills report, but I do see that you (and Kevin) are actively attacking it — without attempting to qualify you criticisms. I don’t come here often, but when I do and I read posts like yours, they strike me as lacking credibility.

One thing IS obvious, and that is that it is taking more and more energy (oil) input to get a barrel of (useable) oil output. Diminishing returns, obviously, an observable fact of life and a demonstrable result of physic in action. We see it everywhere — in logging, mining, fishing, basically everywhere. Or will you argue otherwise, and insist on taking the simpleton’s path of explaining away oil industry decline as JUST “falling price of oil”.

Whether or not the ETP report has equations/math that can be nit-picked by the likes of you (though you don’t seem capable of doing so), the central message of the ETP report is rock-solid and obviously correct. And that is, that with every barrel of oil that we get out of the ground, the amount of net energy available in that barrel to power economic activity is declining. Only a fool would argue otherwise.

“I’m not trying to defend the Hills report”

I’m rather sure that you are. Interestingly enough Mr Hill is not defending it. MIA.

I’m not attacking it. I’m doubting it. A distinction that is apparently lost on you. The eTP report has been discussed thoroughly, ad nauseam, in the comments section of this article.

http://peakoilbarrel.com/bakken-production-down-opec-production-up/

And this article

http://peakoilbarrel.com/texas-petroleum-output-october-2016/

And this article

http://peakoilbarrel.com/open-thread-petroleum-oct-28-2016/

Please consider reading them if it interests you. For the sake of the dear readers I will not repeat it. It’s all there, and then some, if you’d like to see it. I’ve been following discussions on the eTP report ever since Futilitist blew a gasket. I must say my doubts have not been persuaded.

Exxon Mobil needs to be in the coal industry owning coal-fired power plants to provide electricity. Electricity is the big dog on the energy block these days, well, has been ever since Ben Franklin lit himself up like a Christmas tree during an electrical storm. lol

You may think I am being facetious, but I’m not. Exxon Mobil should really consider the electricity market in their future.

People, consumers, want electricity all of the time.

Mercedes Benz has targetted its all electric car market all to China.

http://www.reuters.com/article/us-daimler-china-idUSKCN11D0N5

All electric cars are going to go ballistic, sales will go up like crazy.

Exxon Mobil needs to go electricity crazy.

Oil can still be there, but it is running last.

Yep, with the new administration coal might be a winner. Power storage would be a bigger winner worldwide. Carbon sequestration was just getting started, now who knows where that will go.

My understanding, from several sources, is that the US coal industry is declining and can’t be brought back. It is too expensive relative to natural gas.

Hi Boomer II,

Eventually Natural Gas will peak and prices will rise, then coal would be competitive, at current prices for coal and natural gas I believe you are correct.

One thing that will change is that EPA regulations were going to shut down most coal plants, with Trump as president that is less likely to continue. EPA regulations will not be enforced aggressively in a Trump administration.

New coal plants are too expensive, but electricity produced by old plants is cheap, unfortunately half the population of the US is not concerned about climate change (or perhaps more).

There are others who are close to coal who think it is permanently declining.

Kentuckians can handle the truth, the coal truth and nothing but the truth | Lexington Herald-Leader: “Natural gas is expected to overtake coal this year as the country’s No. 1 source of power and could continue to underprice coal for the next 20 to 50 years. Kentucky Power chief Greg Pauley said that because natural gas and wind energy are ‘the price winners,’ demand for coal isn’t coming back ‘no matter who is elected in November.'”

I live in Southwest Virginia, and while the coal mines are to the west of me, I am close enough that the local community college library has the local paper from a number of coal towns. I spend a day once in a while there going thru these coal town papers. You can take it to the bank that I do not read the sports pages, or articles about automobile accidents, on such days.

It’s common knowledge in this part of the world, among people actually on the scene and actually involved in the coal industry, or local government, etc, that the local industry can no longer compete, given the price, and that in any case, most of the mines will have to close within another fifteen to twenty years NO MATTER WHAT, because coal depletes too.

By then it is unlikely there will be any significant amount of coal left, locally, that can be profitably mined, at any likely prevailing price. What will be left by then will be too deep, and the seams will be too thin.

But even the most obvious of facts don’t matter to most of the local people around here. They WANT to believe there is a war on coal, so they do.

And while federal regulations are not primarily responsible for the decline of the industry, these regulations are certainly hastening the decline , so there is a kernel of truth in the war on coal argument.

I live in a place that used to have a major smog problem. If you asked people here if they want to go back to those days, when the sky was brown, they would say no. While people may think the EPA interferes too much, people who have better air quality as a result are pleased with that.

They probably still voted for Trump though?

No, my state was one that went for Clinton.

Hi Boomer,

When I was a kid, it was a rare day, except if raining, that I couldn’t see the tops of mountains upwards of a hundred miles away from the mountain we live on.

Then it got to be that it was a rare day when I COULD see these same mountain tops, because of the smog blowing in from Ohio and environs.

For the last decade plus, with the coal fired power plants being forced to clean up their act, the air is MUCH better, but still not as good as it was when I was a kid.

I can easily walk to the boundary of The Blue Ridge Parkway, which is part of the National Park system.

The problem is that most people don’t realize the air IS much cleaner than it used to be, and even when they do, only the small fraction of people who are environmentally tuned in really appreciate the cleaner air is the direct result of clean air law.

I grew up in the LA basin during the 60’s and on a smoggy day you couldn’t see a car coming down the street 900 feet away. My lungs thank regulation of clean air laws everyday.

OFM,

Last time I looked at the US coal industry, a year or so ago, I read that employment had been declining since 1978. My guess was that most of the decline was in Appalachia, partly because mountaintop removal requires fewer miners than the underground part of the industry does, and partly because the Western coals of the Powder River Basin could be mined and transported for three to five times less than the Appalachian stuff.

Would you say that the coal industry has really done much for the people who live and have lived in the region? You’d have a better idea than I would. I’ve long wondered how many coal miners wanted to see their sons go into the mine when they were old enough.

Good ol’ Tennessee Ernie Ford.

I’ve also wondered why people might want coal jobs rather than jobs in other industries. I suppose they were better paying jobs than what they imagine they might get as a replacement.

I always thought that people worked in coal mines because they either did not have a choice because they would not move away from their home or because they just weren’t bright enough to think of something else.

Would anyone actually go to work in a coal mine because it seemed like the best of all possible worlds?

A job working one of those huge trucks hauling coal in an open pit mine can be a good gig for a 30 year old with a music degree.

Fernando,

Just for you!

Bill T. Jones: The dancer, the singer, the cellist … and a moment of creative magic

https://www.ted.com/talks/bill_t_jones_the_dancer_the_singer_the_cellist_and_a_moment_of_creative_magic

The Union Pacific and the BNSF will be hauling coal out of Wyoming on their double mainlines with a slave engine in the middle and one at the end of the the coal train. The return mainline track will be running empty coal trains back to the mines.

The power plants in Omaha, Nebraska and Wheatland, Wyoming will be operating night and day all year round for years to come.

There is a lot of coal in Wyoming, Montana too, for that matter.

It is going to go on for a long, long time.

There are plenty of coal companies on the big board at penny prices.

Coal is king and will remain so.

The dragline to remove overburden to dig down to the twenty-foot thick coal seam is a huge machine.

The machines will not be mothballed any time soon and the coal-fired power plant will continue operations for as long as it can, which, at this point in time is approaching plenty of years. They represent hundreds of millions in investments, there will be a return.

Burning coal to provide electricity is not a problem.

Not burning coal and shutting down coal is a problem.

Plenty of coal underneath the Missouri slope up and down the Great Plains.

It will be mined and burned for many years to come. Thems the facts.

ExxonMobil might want to focus on coal if they’re losing in the oil world.

>> Burning coal to provide electricity is not a problem.<<

RW, I wish you were right. Nat gas is bad enough but coal is obnoxious..

You don’t understand the economics of coal or railroads. BNSF would rather be running high-margin intermodal trains than heavy coal trains. The coal trains end up having to pay very high transportation prices. So even if the coal is cheap when you get it out of the ground in Wyoming, it’s expensive by the time it reaches the Texas power plants.

More expensive than cheap Texas wind.

The only coal with any economic chance is the coal where the power plant is physically located next door to the coal mine. There are only a few of these. And it’s not profitable to build new plants like this, because it’s cheaper to build wind or solar or operate natgas.

I just looked it up and the lowest production cost for Powder River coal is $9.97 per ton — that’s Peabody — the others are higher. Transportation costs are harder to extract, but EIA reports them. Powder River Basin to Texas by railroad averages *$24.46* per ton as of 2014; however it has probably gone up, as it seems to go up every year (it’s competing with other products for time on the railroad).

This means the minimum cost for fuel to a Texas coal plant from the Powder River Baisin is something like $34.43 per ton *if the coal mine makes no profits at all and has no money to cover overhead or interest*. This translates to 1.5 cents per kwh for a highly efficient (40%) plant (these old plants aren’t that efficient) or 2.1 cents per kwh for a world average (33%) plant. O&M costs at the plant add 0.2 to 0.5 cents per kwh. But realistically the coal companies have to make a profit — if we call the profit $5 a ton, add another 0.26 cents/kwh, and get something like 2.71 cents — and so do the power plant operators — so you’re really not going to see a profitable bid below 3 cents/kwh. And that assumes no interest on bonds to cover or anything like that.

Some new solar and wind projects are now making bids to provide electricity below 3 cents/kwh for decades in the future, and that’s includiing hefty financing (borrowing) costs *and* a healthy profit margin.

Now, it still looks like coal is sort of almost price competitive… but that’s if you never have to make any capital investments. No new plant can be price-competitive. If an old plant needs major repairs like a boiler replacement, there’s no profits to cover that.

And a lot of this is the transportation cost.

Hi Synapsid,

It would take a book to answer your questions well, but I can skip most of the needed book, because that would be the part about what the coal industry has done TO the people in it, and TO the environment.

Regulars here already know that sad history.

Now as for what it has done FOR the people involved, that’s a VERY mixed bag. At times coal miners were very well paid, earning money far out of proportion to their actual skills, although they sacrificed their health and maybe their life to get that money.

At times in the past, some miners would have wanted their sons to go into the mines, and exerted such influence as they had to get them a spot on the payroll and membership in the union, etc.

I doubt if any American coal miner today would want to see his kid working in an underground mine.

Now as to the people who stuck around in coal country, when they were treated like dirt, worse than draft animals on an average farm, probably……

First off, they generally had no way of knowing how much better life could be elsewhere, and little to no hope of making the transition out of coal country, not knowing anybody elsewhere, and having few skills useful in other places, and not a dime to spend to make the move and get established.

Moving meant leaving friends and family and church and community, leaving elders behind in at a time when there was little or nothing in the way of a social net for old folks………. old folks who weren’t going to live very long unless they had kids around to look after them.

OTOH in the case of miners who were lucky enough to own a little land and homes of their own, as opposed to those who weren’t that far from slaves, living in company housing, in debt at the company store, well…..

THOSE miners actually lived pretty well, considering the average living standard of other people back then. Some of my family were that sort of miners, but well before my time.My maternal grandfather spoke of them frequently, and except for the accidents and lung diseases, etc, the wages paid enabled them to live independent lives on their little farms where they had no water bills, no sewer bills, no significant taxes to pay, no electric bill, no energy bills, etc.

They grew most of their own food, excepting a few staples such as wheat flour, pinto beans, and minor items such as coffee and sugar, and nearly all of them had their own bees for honey. They could cut firewood, and get logs or lumber for almost nothing and build their own houses, etc.

And the ones who were related to me lived in some of the most scenic parts of the country.

We tend to hear only one side of nearly any story these days, and the history of the coal industry is no exception.

They had roots, family roots, religious roots, and an overwhelming love for owning their own land, since they knew their own family history of living as tenants in Ireland and Scotland, where they were generally treated no better or not much better than the trapped miners who lived in company housing and in debt to the company store were treated.

When things started turning sour for them in mining areas, my folks mostly moved out, and some of them wound up here, where they mostly pursued the same life style, with the mining job being replaced by work in a textile mill or furniture plant etc up thru the fifties and sixties.

That self supporting farming lifestyle is mostly history now. Only a very few of my relatives still farm, and the ones that do are doing it on a fully commercial basis, with a lot of money tied up in land and machinery.

My parents raised most of what I ate as a child, or sold our produce to buy what we didn’t grow ourselves.

Successful farmers these days generally don’t even have kitchen gardens, unless they just happen to enjoy gardening.

Thanks OFM,

Those experiences are just what I was wondering about. Thanks especially for the positive side; we generally hear only the bad parts.

The Appalchian coal is mostly depleted already.

The Illinois coal is sustantially depleted, but not entirely. It will probably hang on for a while.

There’s plenty of coal in Wyoming, but no power plants. Accordingly the price is controlled by the high price of *transporting* the coal. We’re getting to the point where it’s cheaper to build a solar or wind power plant than to haul rocks from Wyoming to Texas, and it’s already cheaper to pipe natgas than it is to haul rocks.

Coal is screwed. The key thing to keep an eye on is Lazard’s LCOE reports, which although flawed are extremely valuable summaries.

New coal plants are simply not cost-competitive with anything. It’s cheaper to build a solar farm or a wind farm and it’s pretty nearly cheaper to build one with batteries. It’s much cheaper to operate a natgas turbine and there are lots of them — it’ll be cheaper to operate even if natgas goes up to $4 or $5.

Old, paid-off coal plants are another matter, but they suffer a fatal flaw: you have to transport the coal to them. This is staggeringly expensive. This means that even if coal is super cheap at the minehead, it ends up too expensive at the power plant. It’s competing with much more profitable intermodals for space on the railroad, so the prices of coal transportation aren’t going down, they’re going up. We’re getting to the point where a new solar farm is cheaper than operating an *existing* coal plant.

The caveat here is that an existing coal plant which is located next door to a mine (no transportation costs) is still quite economically viable. But there aren’t very many of those.

You’re full of crap!

Trump hates windmills and solar farms. He’s going to be that industry’s worst nightmare,and a lot of the industry’s bogus claims will be smoked out.

Coal is coming back in a big way

can’t be brought back? Here’s how it’s brought back.

-President T throws money at coal

-Coal plants are built

-Coal is mined

-Coal is consumed

Done! It’s back

Since Continental Resources had an $8 billion PV-10 last year reserve report and about a billion barrels of reserves, ($8 per barrel value)- Will they write off all of their reserves this year since the SEC mandated oil price is destined to be $10 lower?

I would suggest the death of Exxon in lieu of the shalers might be premature.

Brook

Awesome work!

It looks like the green energy backers are finding great success in destroying the oil industry by keeping oil prices far below the marginal cost of production for over 2 years now.

For oil producing countries like SA, the marginal cost of production also includes feeding, housing and protecting your citizens.

Well, that’s a different spin. I thought the goal of “drill, baby, drill” was to have so much oil flowing that oil prices would be kept low. It was the oil industry that did it to itself. Plus very high gas prices is what greens want so renewables are better by price comparison.

By gas prices, I mean gasoline, not natural gas (though that helps, too).

The higher fossil fuel prices go, the better renewables look.

The people who have brought about low oil prices are the very people who have wanted to drill everywhere RIGHT NOW. No planning. Just drill and get it out on the market. But I am learning that if some people want to blame low oil prices on greens, then they aren’t equipped to deal with reality.

Capitalism is about adjusting to the market and then hopefully taking advantage of it. Coal is dying because it is heavy and has to be hauled places. Natural gas is cheap right now and is better and cleaner than coal. So were we supposed to prop up coal for the rest of time?

And are we suppose to prop up petroleum and natural gas even if something better comes along?

Flexibility gets rewarded in a changing world. If your own world is declining, maybe it is wise to recognize it and move on.

It looks like the green energy backers are finding great success in destroying the oil industry by keeping oil prices far below the marginal cost of production for over 2 years now.

Muahahahaha! and as soon as the demonic green energy backers, have utterly and completely destroyed every last trace of the oil industry in every last corner of the globe! They will unleash the final part of their evil plan of world domination! Which is, to raise the price of solar energy until it literally goes through the roof (uhm, excuse the bad pun there 🙂 )

And there won’t be a damn thing that Donald Trump will be able to do about it!

Trump, Clinton, Election, Clean energy, wind, solar—commentary: “Ultimately, the energy sector is being driven by market forces and consumer demand, not by politicians who make promises bigger than they are able to fulfill. The market will ultimately dictate which sources of energy our country will rely on in the future and we fully expect to see the continued expansion of clean energy based on its own merits. I’m looking forward to the election because either way, clean energy will emerge the winner.”

Commentary by John Berger, the CEO and co-founder of Sunnova. He has more than 20 years of experience in the power industry and previously co-founded SunCap Financial, Standard Renewable Energy and Contango Capital Partners.

There’s a lot of misunderstanding here.

The world changed in 2009. Historical this and that aren’t relevant.

In yesteryear, share repurchase was a method of return of capital, particularly for non IRA / 401K investors who had to pay the standard (salary) tax rate on dividends. Sale of their shares (for a profit) to the company’s tender offer would get capital gains tax treatment, lower than tax on dividends. That was the normal rationale and so looking back a LOT of years is invalid (because assets in IRA/401K tax shielded vehicles grew, and the old repurchase rationale was lost).

Rates have been falling for 30 years. There’s nothing to be learned there.

Index correlation has increased across the board since 2009, mostly from HFT and proliferation of ETFs, so there’s not really a lot to be learned from individual issue valuation.

And share repurchase reduced to hoard cash to pay the dividend, which is far more compelling a need to the board. There doesn’t have to be a different explanation than that because so much money is in retirement vehicles.

Exxon is in no more trouble than anyone else.

Exxon is borrowing money to pay dividends. This is, in fact, a Ponzi scheme (by the literal definition — paying old investors with the money from new investors). One can get away with it for a few years, but unless you generate real profits, it blows up after a while.

It’s not sustainable and it’s doomed.

Healthy companies do not engage in Ponzi schemes.

It’s sustainable because oil and gas prices are going to increase.

I sure wish you guys would look at history and understand Exxon dropped their debt over the years so they could be ready to deal with a low price period. Taking on debt is fine if they get it at low cost it can increase the return on stockholders investment.

Oil prices can’t increase above $62/bbl without destroying gasoline demand, and that “price cap” is dropping every year. I’ve explained this earlier.

Natgas is another matter, but have you tried calculating ExxonMobil’s situation if you remove all gasoline demand, leaving only the other oil products (aircraft kerosene is the major one) and natgas? Even at higher natgas prices, they’re screwed financially speaking.

Your “explanations” don’t wash, and I got the sense this blog is getting spammed. Bye.

“Fernando Leanme says:

11/14/2016 AT 5:39 PM

Your “explanations” don’t wash, and I got the sense this blog is getting spammed. Bye.

TrumpNando spams every climate science and oil blog, so it’s a case of psychological projection on his part.

Many including Matt Simmons have predicted the decline of the oil age years ago. EROEI is also a major factor. Some seem to believe there is plenty of easy to to access deposits as the arctic opens up from meltdown. Others believe in shale or alternative energies. What appears to be happening is that EROEI, P/E and other traditional financial measurements are intentionally ignored or manipulated in order to maintain stock values and keep the system afloat. However, the cheap oil that runs the world won’t last forever and economic decline (already evident) will occur long before it’s gone due not just to oil but financial extremes and bubbles and overpopulation and climate issues that result in resource depletion.

Green energy is a false hope since nothing comes close to the energy output per unit of volume of cheap oil and cheap oil is needed to produce much of the green energy alternatives.

Green energy is a false hope since nothing comes close to the energy output per unit of volume of cheap oil and cheap oil is needed to produce much of the green energy alternatives.

Sorry, but that’s a rather tired and worn out old canard!

I invite you to start thinking in non linear systems.

Maybe participate in some of these discussions…

https://www.thinkdif.co/schedule/topics#energy

You want false hope? Then stick with a linear growth based economy, powered exclusively by fossil fuels. That seems to be working out real well for ALL life on the planet, doesn’t it?

Per land area used PV is much more productive in useful than oil in the US. Also extremely less polluting.

Fred, I’d like to see you do your own interpretations/analyses/write-ups right here about your links. Thanks.

Ok, two words: systems thinking!

Either you get it or you don’t. Currently we are stuck in a linear thinking mode. We either get beyond that and start to understand how complex dynamic non linear systems work and that all the major interacting systems on the planet are such systems or we are fucked!

Everything from human social interactions, politics, economics, the atmosphere, the geosphere, the oceans, the ecosystems, the biosphere etc… are all non linear systems subject to the rules of chaos theory.

However this thread is not the place for an in depth discussion of chaos math and its implications.

Over here.

Fred, thanks for the link. I will look closely at the topics. However, I’m not a big supporter of fossil fuels but I also believe that technology no matter how ingenious can’t be our salvation on a planet with FINITE resources plus growing populations.

Do you believe technology will somehow overcome the finite store of energy resources that are economical enough to market?

Our planet fortunately has an effectively infinite energy source: the sun.

Solar panel costs are coming down so rapidly that Deutsche Bank predicts 80% of the planet will be at grid parity by the end of 2017.

https://www.youtube.com/watch?v=Kxryv2XrnqM

(see solar section at approx 46 minutes in)

When everyone has solar electric photovoltaic panels (which is when exactly?), is large-scale centralized pseudogovernment still running? Shipping? Roadway infrastructure? Taxes? Jobs? Industry?

From what I understand Exxon made a big investment in Kearl Lake and also took a big hit in reducing the reserves booked there too.

From what I understand Alberta is using a lot of natural gas to supply the energy to mine bitumen. Plenty of deisel and petroleum burnt on site too but natural gas is the big input. There was talk about nuclear power being installed up around Peace River at one point but that got shut down pretty hard.

Anyway, the EROI story on these ‘oil’ reserves is interesting. Natural gas production has an EROI ,and then using the natural gas to make syncrude has an EROI. Once Canada becomes a natural gas importer I suppose the whole thing will become a lot less profitable.

http://energyskeptic.com/2016/tar-sand-eroi-2013-poisson-and-hall/

http://energyskeptic.com/2016/why-tar-sands-a-toxic-ecosystem-destroying-asphalt-cant-fill-in-for-declining-conventional-oil/

Survivalist,

Canada has some NG prospects that might supply enough NG for the oil sands, and they’re relatively close to the Athabasca plays. The names of the two main units I’m referring to are the Duvernay and the Montney, both in BC. There’s been a great deal of land acquisition and drilling going on, with juniors and majors both jumping in.

‘Course, guarantees are sparse on the ground, but NG supply might work out OK for the oil sands.

Interesting opinions. However, how many of the writers are professional O&G people. People in the business of the upstream and downstream O&G business know that a companies wealth is in their proven and undeveloped reserves. Sure the price fluctuation has an financial effect. But the proven and undeveloped reserves and exploration commitments to foreign held concessions have an major impact on the continued profitability of a O&G company. The majority of financial analyses have no patients and are geared to instant gratification. Have some patients and you will be standing in line to by O&G stocks.

Feel free to lose your money in O&G stocks. But look at the history. Oil priced itself out of the heating market (in favor of natgas and then electricity) Oil priced itself out of the petrochemicals market (in favor of natgas). Oil is mostly used for vehicle fuels, but it’s now pricing itself out of the land vehicle fuel market (in favor of electricity). This is a business with dying demand.

ExxonMobil is a large vertical integrated major oil company.

In the article;

Long term debt of $29.5B at 2H 2016 on (assumed write downs) 14.7B barrels is about $2/b of debt.

I have seen data on several oil companies and ExxonMobil is so far those with relative lowest debt.

“Profitability is much less when we factor in capital expenditures”

The author confuses several financial terms; it is difficult to derive profitability from capital expenditures.

The metric to look for is Return On Average Capital Employed (ROACE), see also p 2 and 82 of the report linked below. Look also at net income developments on the same page.

ExxonMobils upstream CAPEX on p 84.

Compare ExxonMobils liquids production (2011 – 2015) on p 48 with the numbers presented by the author in his figure 4.

On page 92 ExxonMobil lists Free Cash Flow and Distributions to Shareholders for 2011- 2015.

http://cdn.exxonmobil.com/~/media/global/files/financial-review/2015_exxonmobil_financial_and_operating_review.pdf

This article is “much ado about nothing”.

A lasting (maximum) oil price of $12/bo in 2020 (+/-) will shut down a lot of global oil (C+C) production.

It is expected that the Hills Group and those cooperating with them also present a forecast about how global oil supplies would look like at $12/bo.

Rune, I really do not understand comments such as this. “A lasting (maximum) oil price of $12/bo in 2020 (+/-) will shut down a lot of global oil (C+C) production.”

I say that because at $12, ALL global oil production will be shut down, including everything in the Mideast. With respect to the US, just check with shallow sand, and others. With respect to the Mideast, it will be a vast wasteland of desert dwellers fighting each other with knives while riding camels. These desert dwellers have increased from small nomadic tribes to millions of people living in huge cities entirely funded by “oil” money. Most of the world’s farmland will revert to mules and horses pulling plows [no oil].

Meanwhile, at $12 barrel, all other sources of energy are uneconomic – solar, wind, electric, bio, etc. [never mind the fact that they cannot even be produced in a zero oil world]. So, the demand for oil will be more than it is today [because all alternatives are unavailable] and the supply of oil will be zero. In economics 101, I think that I learned that this would not be possible. Not to mention the die off of billions of people in such a scenario.

I just hope that you were being sarcastic about waiting for a Hills Group forecast.

PS: I truly believe that at some point humans will make an astounding energy breakthrough of some kind, be it cold fusion or something else, that is totally unforeseen at this point in time. 2020 does not look like the right timeframe, but who knows.

Deep in his bunker in March of 1945 Hitler was imagining that some awesome divisions of German soldiers would arrive on the eastern front just in time to save the 1000 year Reich.

It didn’t happen.

Hoping and believing just don’t make it so.

“at $12, ALL global oil production will be shut down, including everything in the Mideast. ”

That’s why $12 oil is complete nonsense. And there is nothing to discuss.

AlexS.

I agree that $12 oil is nonsense.

In February, this year, our basin’s posted price went to $19 and change a couple different days, producers in the Bakken received in the teens many more days, and there was a negative posted price for North Dakota sour.

I thought that was nonsense too. So did Russia, as I recall, who began to talk to OPEC about some production cuts around that time.

I don’t agree w the Hills Group.

However, prices have been very low in 2016. Our average price thru 10 months has been $37, and here we are today at $38.50. I think that likewise is nonsense.

Seems like Russian, OPEC and US producers have gone mad, trying to grow production in this price environment. Questionable senior management IMO, across all of them.

Shallow sand,

I did not mean some specific cases of regional oil prices (like the Bakken crude), but international benchmarks, Brent and WTI.

As regards Russian, OPEC and US producers, these are different cases.

Russian producers have been investing in new projects for the past several years and it simply does not make sense to postpone project start-ups with 90-100% readiness. This also applies to other large or relatively large conventional projects with long investment cycles (US GoM, Kashagan, Brazil, some projects in Norway, etc.).

Iraq is more or less in the same situation, as its new projects have been developed for years.

Iran is increasing production after embargo on its oil supplies was lifted, and it is keen to regain market share.

Libya and Nigeria have increased production in October as they restarted capacity that was previously shut-in due to internal instability.

The U.S. LTO is a completely different case, as these are projects with a very short investment cycle. And indeed it doesn’t make sense for heavily indebted shale companies to increase capex in the current market situation.

AlexS. My comments were somewhat in sarcasm.

I do not know enough about the timelines or costs of projects outside of onshore US to make an intelligent comment.

I hope that by the end of 2017, projects outside of the US will begin to slow. I have little hope the Permian will slow until the New York bankers leave Midland, TX.

So, shallow sand, coming from the *production* side, you think that $38.50 is too low to keep the oil companies afloat. I accept your expertise here.

I, of course, look from the *demand* side. The average car in the US costs about $33560. The Tesla Model 3 will start at $35000. So let’s say it’s addressing 40% of the car market. You can get solar power to power your car for 14 cents / kwh pretty much anywhere (this is lower in sunnier states and it’s dropping every year). The average US electricity price is 11 cents / kwh. The model S AWD runs at roughly 0.33 kwh / mile, so that’s $0.036/mile at average prices and $0.046/mile at the maximum possible price. (Model 3 will be more energy-efficient.) To have the same cost of operation (as the high end cost), a gas car which gets 55 MPG would have to be looking at a gas price of $2.54/gallon or less. A regression on gas prices to WTI oil prices gives us $62/barrel.

So that’s the maximum possible sustainable price for oil, at least until *40% the car market is electric*. Above that price, people buy electric cars and displace oil demand.

But I used super pessimistic assumptions for the electric car here. Suppose I use the average price of electricity and the new required CAFE average of 39 mpg for new cars. I find a gas price of $1.40 and an oil price of $19/barrel. (The price of oil could be a bit higher if refining and transportation costs drop a lot, but I don’t see why they would drop.)

All new oil exploration is madness. It is likely that there are existing wells which have variable production costs less than $62 or even less than $19, but you certainly can’t drill any new wells which are profitable at $19 and probably not at $62 either.

I likewise think the electric car phenomenon will reach a tipping point and happen quite rapidly once a few things happen: 1) charging infrastructure appears sufficient to the average person that they will not worry about finding a place to charge if need be; 2) battery range is closer to what a week’s worth of driving is for the average person rather than 1-2 days.

Our family has one electric car (2013 Leaf) and one gas (2014 Fiat 500L). Usually I have to drive the Fiat, but on the days I get to drive the Leaf I’m very excited. Why? It has much better pickup and drives way smoother than any other car I get to drive, and this includes my parents’ higher end BMW gas-powered sedans. It is very fun to easily “smoke” all the other ICEs at stop lights. Even the sports cars can’t really compete if I push the pedal all the way down. Also, the rpm’s from an ICE cause a barely perceptible shake to the car that is highly annoying if you get used to its not being there (by driving an EV). This sounds trite probably, but I can guarantee you this is a high priority for anyone buying a new car – the “smoothness” and acceleration. ICE cars are clunky and uncomfortable by comparison, by design. Besides range and ease of “filling up,” they are an inferior product.

Also, when I go for the Leaf’s annual maintenance, they pretty much don’t do anything but check the battery level and brake fluid. Last time I asked “Is anything wrong with her?”, and the mechanic just shook his head and said, “Not really anything TO go wrong.” It’s like when you got your first smart phone and you asked your buddy with his old flip phone when he was going to get one, and he said he was fine with it. Next time you run into him he has a smart phone and a gleam in his eye and he’s saying “This thing is awesome!”

Next time you run into him he has a smart phone and a gleam in his eye and he’s saying “This thing is awesome!”

Oh yeah! Once you’ve gone Volt, you can’t go back!

http://www.forbes.com/sites/brookecrothers/2016/11/13/cold-turkey-my-switch-from-electrified-chevy-volt-to-icey-chevy-cruze/#56abb9143b2f

After driving a Chevy Volt for almost four years I was forced, temporarily, to switch to a Chevy Cruze. Zap! And I was transported, cold turkey, back to last century and (crappy) ICE car tech….

… Start your engines: little things and not-so-little things bother me about going back to ICE. (1) I like (I missed) starting the Volt and not having a plume of toxic exhaust immediately fill up the garage; (2) I like the near radio silence of an electric car when I start it; (3) I like emerging from my garage quietly on little cat feet (to borrow from a poem) — in contrast to one of my neighbors down the street who rattles the windows when he backs out his Jeep Grand Cherokee SRT (4) As a corollary, I like zooming up the Hollywood Hills and passing a loud, in-your-face $100K-plus Maserati in stealthy silence; and (5) most importantly, I really like not going to gas stations (in Los Angeles my Volt is essentially a pure electric, I rarely need the range-extending gas engine).

And that’s the experience in a crummy little Volt, imagine what it would be like to go back to an ICE after Driving a TESLA PD90 for a while…

The future of energy and transportation is electric it is happening right now in front of everyone’s eyes. Some people just don’t want to see it.

You do realize the Volt has a gasoline engine?

Yes I do, I can read! It says so right there in the quote I posted!

I really like not going to gas stations (in Los Angeles my Volt is essentially a pure electric, I rarely need the range-extending gas engine).

Doesn’t change the point or the Volt owner’s experience! I have a few friends who own Volts, They often go weeks at a time without going to a gas station. they Charge their cars at home and have daily commutes that are less than the battery range allows! So essentially they drive on electric only.

Hi Nathaneal,

Electricity is about 16 cents per kWhr where I live (NE part of US).

Eventually oil demand may decrease, but it is a World Market with about 1.2 billion vehicles, Tesla and Chevy are unlikely to replace those cars very quickly. If they each sell 1 million per year and grow sales by 20% per year and the overall car market grows by 1% per year, then half of cars would be EVs by 2040.

Eventually demand for oil will fall but it will be 2035 before it is significant. Scenario below with 2 million EVs sold in 2017 and 20% increase in EV sales each year to 2040, total car market grows by 1% each year starting at 1.2 billion in 2017. Scenario is intended as an illustration, not intended to be realistic (I doubt 20% sales growth for 25 years is realistic).

It may not be a matter of replacing ICE cars with electric cars. It might be a matter of people not driving their cars so much.

Some folks are suggesting that suburbs will become traps for seniors who can’t get around but can’t find buyers for their houses.

Also, as jobs continue to be downsized, perhaps there will be fewer people commuting from their homes in the suburbs to jobs elsewhere.

Hi BoomerII,

It could be that all the supposedly happy folks living in cramped apartments with a fifty square foot patio and one parking space, or none, will be interested in buying those suburban houses, with the non driving elderly owners of them moving into town.

If electric cars get to be cheap enough, this is a real possibility.

I have lived all three ways, entirely urban, suburban, rural, and I can truthfully say that the average urban man or woman of my acquaintance would gladly live in the suburbs, if they could afford to do so, excepting those who are truly well off.

You can drive to shopping, restaurants, etc, but you can’t afford space and privacy in the city unless you are really raking in the loot.

I don’t have research in front of me to say where people prefer to live. I know what in places like Silicon Valley/San Francisco, Denver/Boulder, and NYC people want to live closer-in and not farther out. Rentals and condo prices are skyrocketing because of the demand.

There’s this. As it says, we don’t know yet if these trends will hold. If baby boomers drive the most, as they age, they will drive less. Will other generations take up the slack or not?

I think it is probably permanently the case that kids who grew up not coveting a car probably aren’t as inclined to feel cars are as necessary as their parents and grandparents did.

I heard about one family who did this. The son was at college in LA. Rather than getting him a car, his parents just gave him enough money to get around via Uber.

Millennials and Generation X Commuting Less by Car, But Will the Trends Hold? | Brookings Institution: “Based on the latest Census data from the 2013 American Community Survey, changes are underway for younger and older commuters alike, especially in the country’s largest metropolitan areas.* By and large, millennials and Generation X are leading the charge toward a range of alternate modes, including public transportation and walking, while baby boomers continue to use their cars at high levels.”

Hi Boomer II,

I am referring more to the World, growth may be slow in OECD, but non-OECD nations may continue to grow. So though I agree there may be less driving in the OECD, it might be offset by increasing vehicle miles travelled in non-OECD.

There will be improvements in fuel economy, less driving, and a switch to EVs so clearly there is much more to it than a switch to EVs and plugin hybrids. If the “shock models” for oil I have created are in the ball park then decline in oil output might be 2% per year or less, whether demand can fall at that same rate without a big disruption (Great Depression 2) remains to be seen. I think oil prices are likely to increase in order to bring demand in line with supply from 2018-2035, after that there might be enough EVs, public transport, moves to urban areas, and other changes that might lead to lower oil prices as demand falls faster than the decline in oil output.

A very big guess though and I expect a severe economic downturn around 2035+/-5 years (also a huge WAG).

Oil shock at

http://peakoilbarrel.com/oil-shock-models-with-different-ultimately-recoverable-resources-of-crude-plus-condensate-3100-gb-to-3700-gb/

and an intro at

http://peakoilbarrel.com/oil-shock-model-dispersive-discovery-simplified/

Nah, there are still existing wells which have variable production costs below $12/bbl. No new exploration, obviously, but some existing wells still have $5/bbl production costs.

Important to distinguish between exploration costs and existing-well production costs.

Exxon should not have bought XTO for $31 billion. That showed a lack of understanding.

ExxonMobil finalized the acquisition of XTO in June 2010.

http://breakingenergy.com/2013/05/30/timing-was-off-for-xto-deal-says-exxon-ceo/

Exxon CEO: ‘Losing Our Shirts’ On Low Natural Gas Prices

http://www.rigzone.com/news/oil_gas/a/118907/Exxon_CEO_Losing_Our_Shirts_On_Low_Natural_Gas_Prices

The U.S. and Canadian upstream divisions proved the most vulnerable to low oil prices within Exxon’s upstream segment.

This also applies to other oil supermajors.

Note that during the previous downturn in oil prices in 2009, which was before the acquisition of XTO, Exxon’s U.S. upstream division remained profitable.

Exxon: Financial results of oil and gas producing activities by geographic division (US$ million)

source: Exxon annual reports

Interestingly, profitability of Exxon’s U.S. upstream division per unit of oil and gas sales dropped significantly after the acquisition of XTO.

However, the Canadian division suffered even steeper decline in earnings per boe.

By contrast, unit profitability in other regional upstream divisions has remained relatively steady until the drop in oil and gas prices in 2015.

Earnings per unit of oil and gas sales in Exxon’s upstream segment by geography (US$/boe)

The key reason is the sharp differential between average realized oil and gas prices in North America and other regions that emerged during the shale boom

Exxon’s average realized oil prices by region ($/barrel)

Exxon’s average realized natural gas prices by region ($/thousand cubic feet)

After XTO deal, the share of natural gas in Exxon’s U.S. output mix increased from 36% in 2009 to 61% in 2011.

Exxon’s U.S. hydrocarbon production mix (kboepd)

(Gas converted to oil-equivalent at 6 thousand cubic feet = 1 barrel.)

Alex,

Yes, Exxon’s financial situation has changed considerably since it added XTO. For example, Exxon’s net income Q1 2012 was $9.4 billion. For the first three quarters of 2016, Exxon’s combined net income is only $6.1 billion.

If the price of oil continues to weaken over the remainder of the year, I doubt Exxon’s total net income will even surpass what it reported in the first quarter of 2012.

steve

Steve,

While XTO deal had a negative impact on Exxon’s profitability, the key reason for the current slump in earnings is obviously the drop in oil prices.

Oil and gas is a cyclical industry, and big fluctuations in net income, free cashlow, etc. should be viewed in this context.

In 2015, Exxon’s upstream revenues per unit of oil & gas sales were $34.7/boe,

half of 2011-2013 average ($68.8/boe). No wonder that company upstream earnings were much lower, even despite lower costs (mainly taxes). In 9 months of 2016, the decline in prices and earnings continued.

Revenues, Costs and earnings per Unit of Sales or Production in Exxon’s Upstream Segment (US$/boe)

source: company reports

If you follow Bloomberg, you’ll discover that refinery income is cratering now too. Petrochemicals is holding the business up…

There was no decline in earnings in Exxon’s downstream segment in 2015

Exxon’s downstream and chemical earnings (US$ billion)

Downstream margins have weakened in the first half of this year, but started to recover in 3Q16.

The downturn was cyclical, like in 2009-10.

For the full year 2016, downstream earnings will be higher than in 2009-10 and 2013-14.

Exxon’s quarterly downstream and chemical earnings in 2015-16 (US$ billion)

IEA OMR came out yesterday (summary only – have to wait two weeks for full details for free).

https://www.iea.org/oilmarketreport/omrpublic/

It looks like this month (Nov.) will probably be a new global oil supply record barring major disruptions anywhere. But it gets more apparent with each report they are concerned with a sudden drop in supply in the medium term (I think supply will decline gradually through 2017 but then accelerate in 2Q2018 and fall off a cliff in 2019 given current project planning. It is now becoming too late to do much that will impact supplies then and with the likelihood of low prices through next year and few attractive recent discoveries (and getting worse each quarter in that respect) there are unlikely to be many more FIDs next year than this – I think only 12 so far and more gas than oil – therefore that supply drought will probably extend through 2020. Decline rates could increase on existing fields at the same time as in-fill drilling marginal gains start to decline and the impact of reduced maintenance and brownfield spending during these low price years start to impact.

People may point to US LTO fields to be able to quickly fill any gap, but I’d point out it took about 5 years for Bakken to ramp up to 1 mmbpd, and that was when the sweet spots were available and with an industry not already loaded down with debt. That rate is not much better than a new conventional basin with similar reserves would have achieved (as long as it wasn’t in Kazahkstan of course).

“It is not the role of the IEA to urge any oil industry player to take one course of action rather than another, and we are not doing so now. Over time, market forces will do their job and the oil price will respond to the signals provided by demand and supply. What the IEA has argued for consistently is the need for investments necessary to meet rising oil demand. Such investments ensure that the market remains close to balance and that prices are as stable and as fair for both producers and consumers as can ever be possible in such a dynamic industry.”