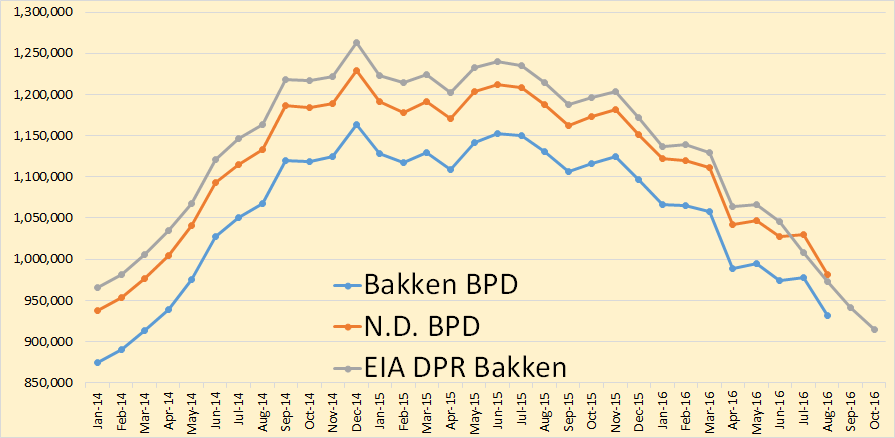

North Dakota has released August production data for the Bakken and also for all North Dakota.

Bakken production was down 46,433 barrels per day to 930,931 bod, All North Dakota was down 48,695 bpd to 981,039 bpd. This is first time North Dakota has been below 1 million barrels per day since March of 2014.

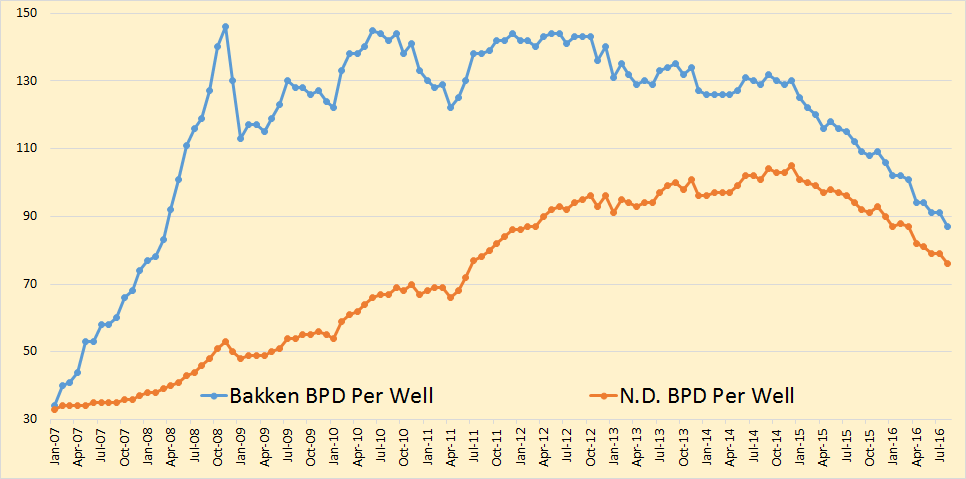

Bakken barrels per day per well dropped by 4 to 97 while all North Dakota bpd per well dropped by 3 to 76.

From the Director’s Cut

Oil Production

July 31,921,757 barrels = 1,029,734 barrels/day

August 30,412,200 barrels = 981,039 barrels/day (preliminary)(all-time high was Dec 2014 at 1,227,483 barrels/day)

Producing Wells

July 13,265

August 13,289 (preliminary)(all-time high)

Permitting

July 86 drilling and 0 seismic

August 99 drilling and 1 seismic September 63 drilling and 1 seismic (all time high was 370 in 10/2012)

ND Sweet Crude Price

July $35.57/barrel

August $33.73/barrel

September $32.98/barrel Today $39.75/barrel (all-time high was $136.29 7/3/2008)

Rig Count

July 31

August 32

September 34 Today’s rig count is 33 (all-time high was 218 on 5/29/2012)

Comments:

The drilling rig count increased one from July to August, then increased two from August to September, and is down one more from September to today. Operators remain committed to running the minimum number of rigs while oil prices remain below $60/barrel WTI. The number of well completions rose from 44(final) in July to 59(preliminary) in August. Oil price weakness is the primary reason for the slow-down and is now anticipated to last into at least the fourth quarter of this year and perhaps into the second quarter of 2017. There were no significant precipitation events, 11 days with wind speeds in excess of 35 mph (too high for completion work), and no days with temperatures below -10F.

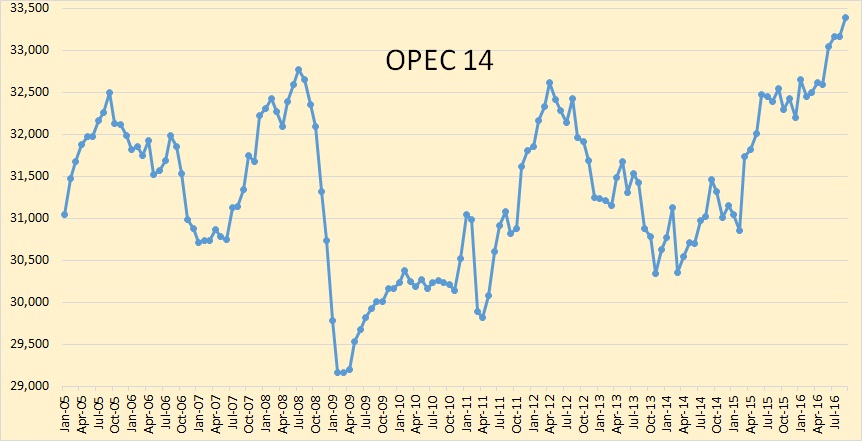

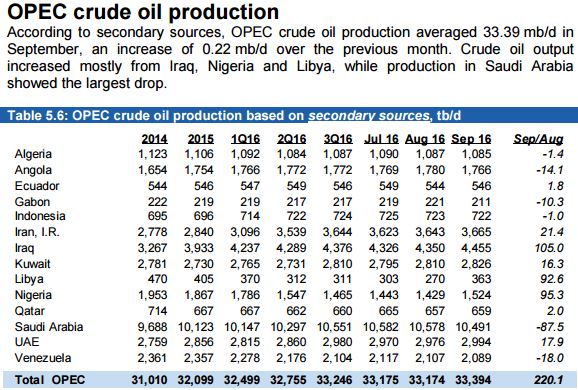

The new October OPEC Monthly Oil Market Report is out with crude only production numbers for September 2016. All charts are in thousand barrels per day.

OPEC crude only production reached 33,394,000 barrels per day in September. This includes Gabon. Since May, OPEC production has increased .8 million barrels per day.

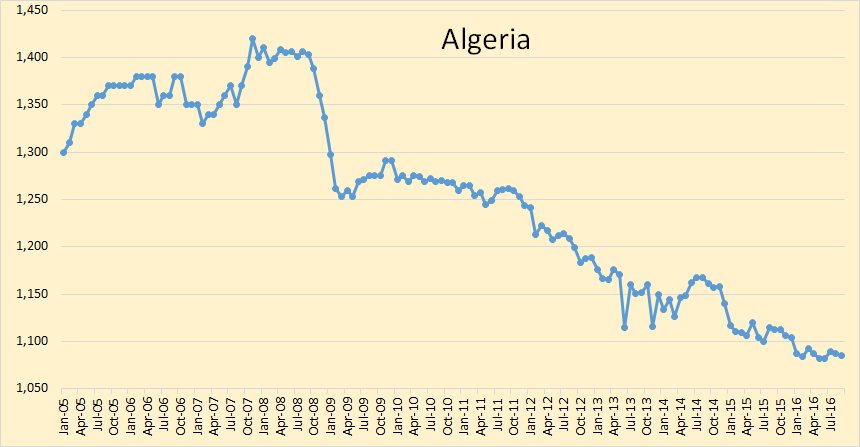

Algeria is in slow decline.

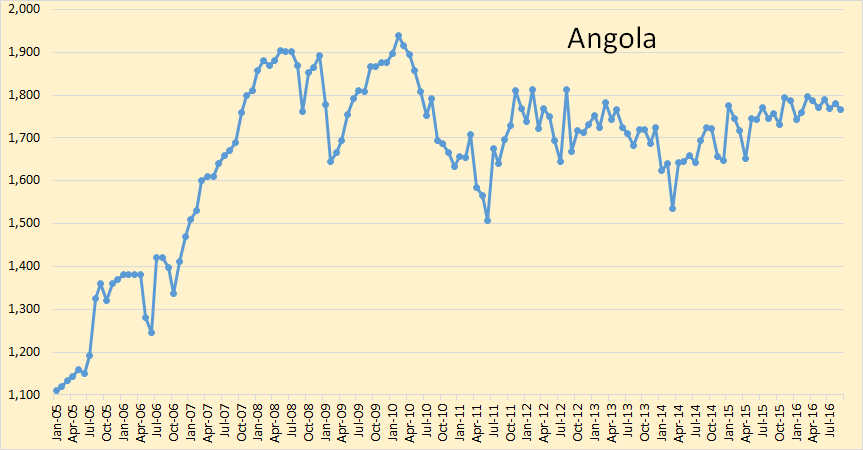

Angola seems to be holding steady.

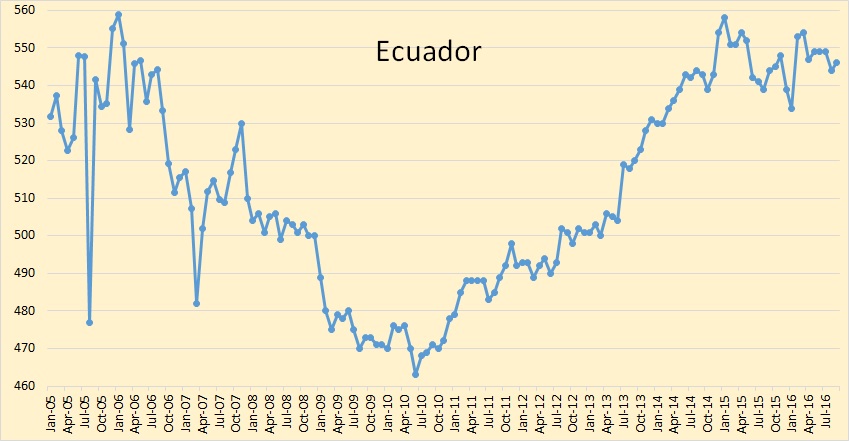

Ecuador was sharply down in August but seems to be holding steady for the last two years.

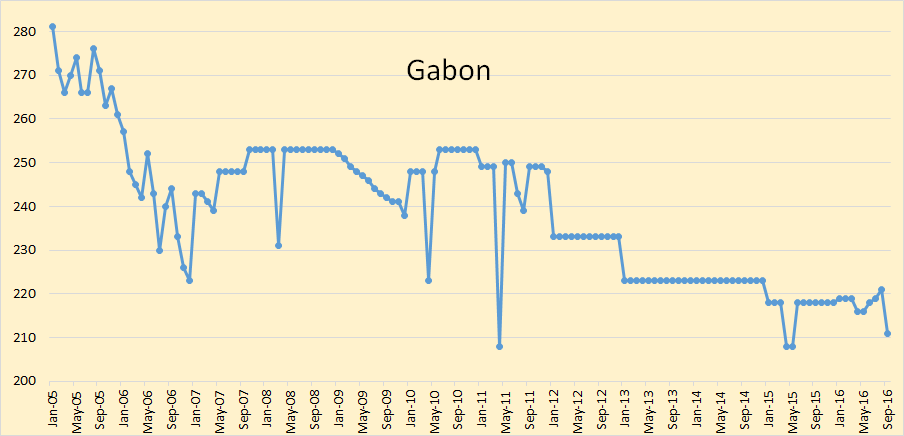

Gabon has been added to OPEC but their production is so low it will have little effect one way or the other.

Indonesia will also not affect OPEC production in a big way one way or the other.

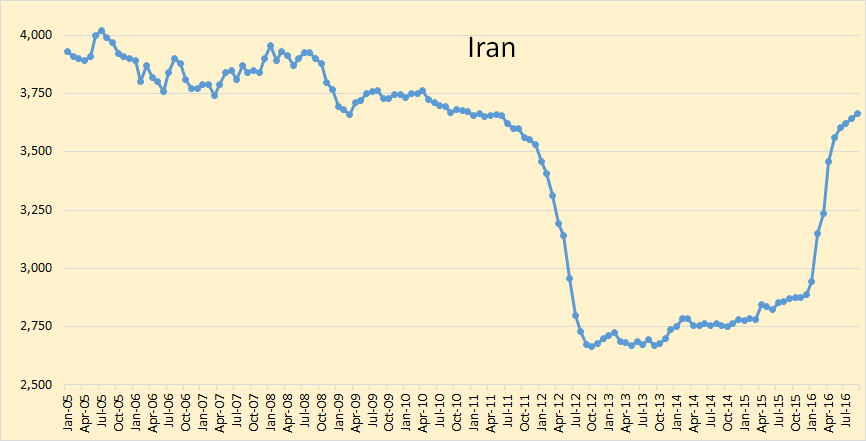

Iran’s increase since sanctions were lifted has slowed to a crawl. There are other problems on the horizon for Iran. They are talking about changing all their oil field contracts to “buy back” contracts. That is they want the option to nationalize all everything. This will likely cause a mass exodus of foreign oil companies from Iran and hit their production considerably.

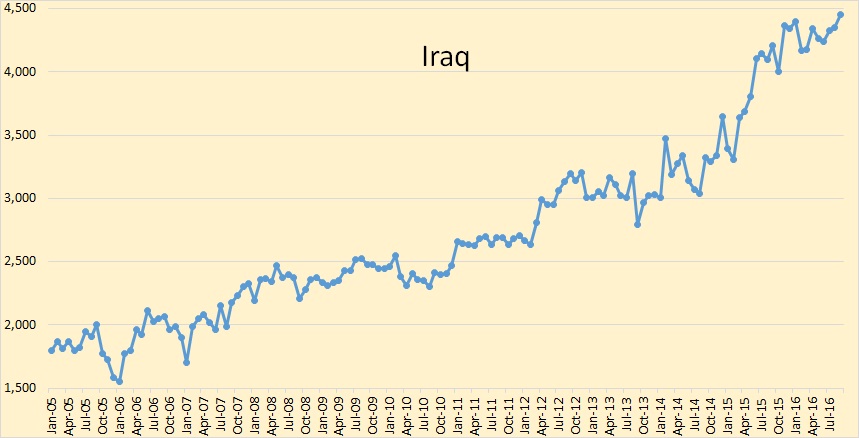

Iraq’s production was up 105,000 bpd in September. Though this was 56,000 bpd above their January high, I don’t think it is anything to get excited about. Iraq, like everyone else in OPEC, is positioning themselves for an OPEC “freeze” in oil production. So they are producing every barrel possible in order to freeze at the very highest level possible.

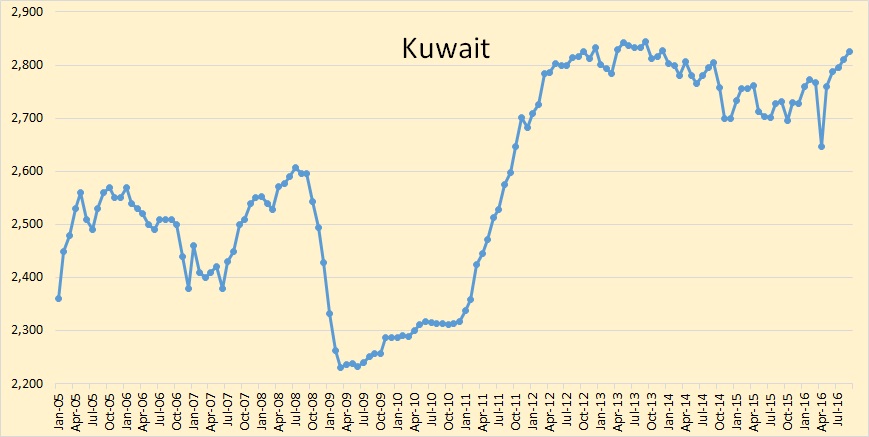

Kuwait has recovered from the problems they had in April. I expect their production to flatten out here with a slight decline over the next few years.

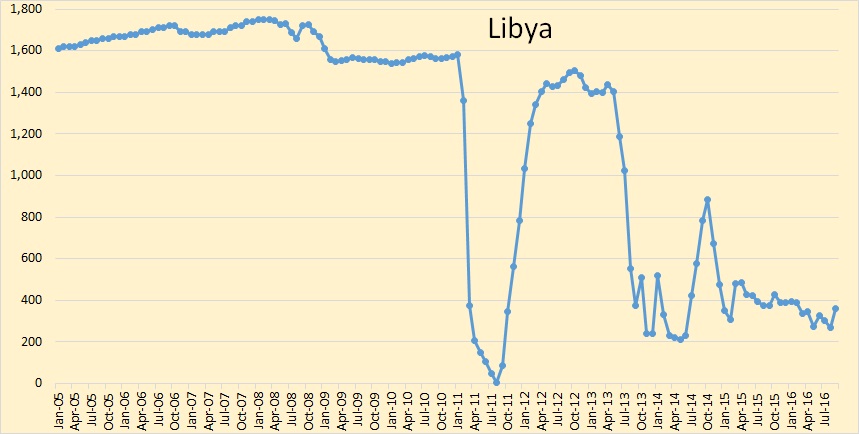

Libya’s problems continue, and will likely continue for a long while yet.

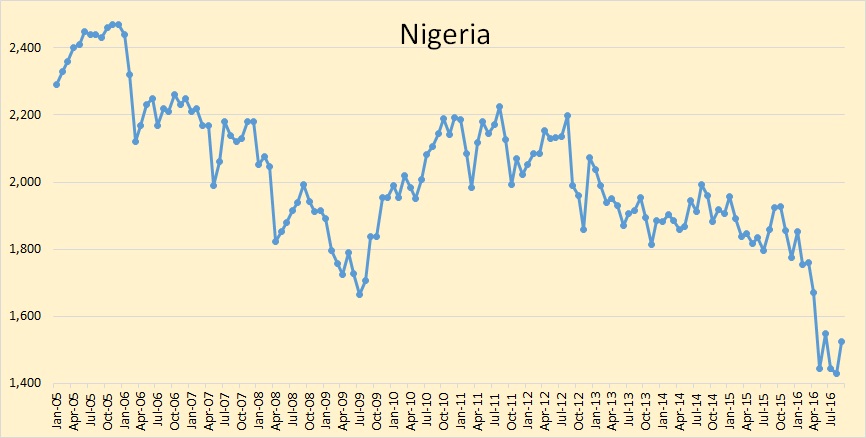

Nigeria’s problems continue and shows little signs of improving.

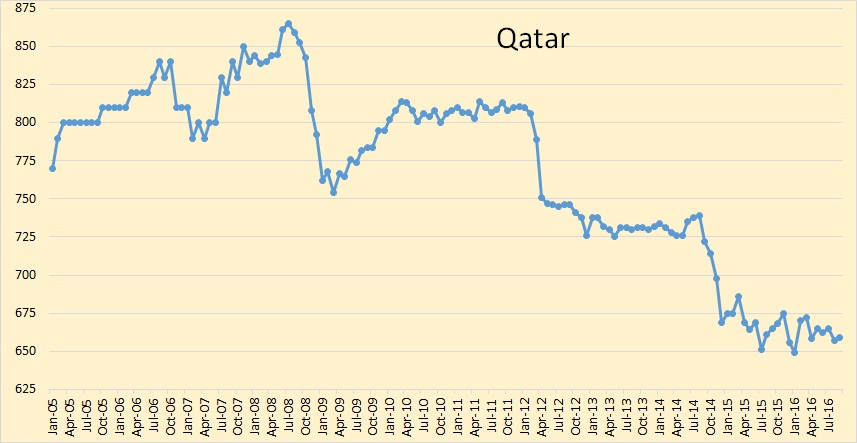

Qatar’s oil production seems to have bottomed out since late 2014.

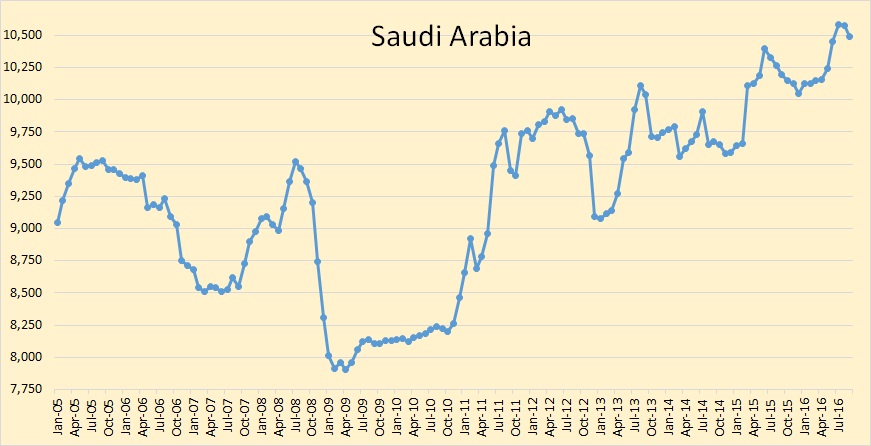

Saudi saw a slight decline in September.

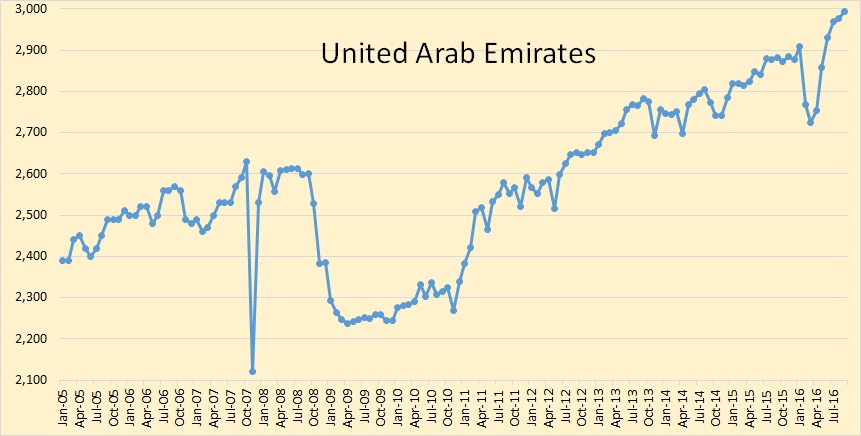

The United Arab Emirates had some problems earlier this year but they seem to have recovered. I think they will hold production steady for a while now. I really don’t think they can increase production much above 3 million barrels per day.

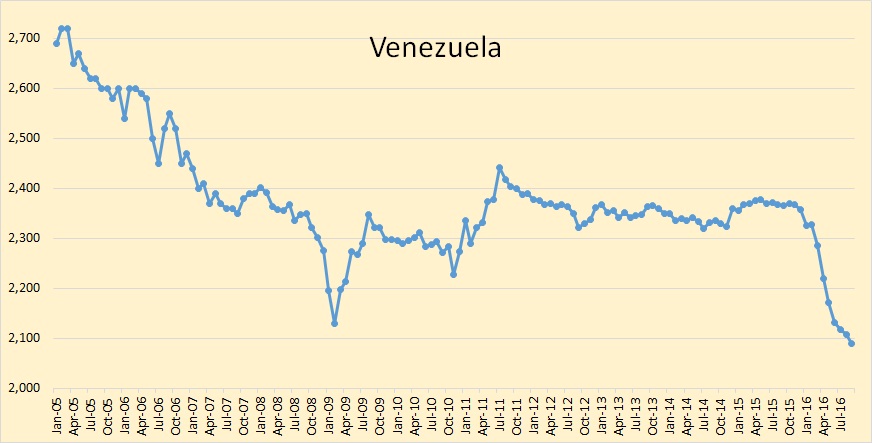

Venezuela’s oil production is still dropping but the decline seems to be slowing. Venezuela has very serious economic problems. They are nearing the “failed state” status.

Ron,

Excellent article. Let me start off by saying, the downturn in Bakken oil production is likely just a temporary blip. I would imagine when the oil price recovers and heads back to $100, on its way to $200, we should see a new high in Bakken Field oil production. I wouldn’t be surprised to see the Bakken reach 2 million barrels per day.

However, for that to take place, the Federal Reserve will most certainly have to send $10,000 checks to every American family in the country. First, they will likely start buying the Broader Stock market as Chairman Yellen suggested during the FOMC last week. And why not… everyone else is doing it.

Secondly, while OPEC is producing more oil than ever, we see that the Saudi Govt is in big trouble. No doubt, they are producing all out just to keep the doors open there at the Kingdom of Saud.

Lastly, I believe after another year or so of financial and economic insanity, the U.S.S. Titanic will likely hit a big ICEBERG. This will finally wake Americans up from the dead.

steve

Hi Steve,

If the World economy crashes before 2018, as you expect, oil prices might remain low forever.

Oil prices of $85 to $90 per barrel will be enough to make the Bakken/Three Forks of North Dakota profitable based on research by Rune Likvern. It is doubtful that the Bakken will reach 2 Mb/d, but it might return to its previous peak if you are wrong and there is no World economic collapse before 2025.

Yeah, as soon as the unicorn starts shitting lightning skittles, we don’t need affordable oil anymore.

the titanic has already hit the iceberg and is sinking… we are (fortunately) up on the dry end. i doubt we will see $200/bbl oil. the limits to growth cannot afford those prices.

todd cory,

Yes, we are in agreement on that. However, I was just making a “Funny.” I believe the past-time of calculating reserves and making nice charts showing we don’t have nut’n to worry about because we have several trillion barrels of crude, ready for the pick’n, will dry up and blow away (like collecting Beanie Babies) in the next 2-5 years.

Instead, people will be realizing they should have been spending their time learning how to grow food or something more important than counting digital barrels or digital wealth.

GOD HATH A SENSE OF HUMOR….

steve

Hi Steve,

I think there is plenty to worry about as I expect oil output will begin to decline within 5 to 10 years, oil prices will rise and the World economy may have great difficulty adjusting. I also expect the inability to adjust to declining fossil fuel output may lead to a depression in 2030.

Which leads to a strong public policy prescription of an aggressive buildout of EVs, mass transit, ride sharing, etc.

I expect oil output will begin to decline within 5 to 10 years…

Really now? Within 5 to 10 years?

I also expect the inability to adjust to declining fossil fuel output may lead to a depression in 2030.

And the bad news keeps getting worse. A depression in 2030. Not by 2030 mind you, but in 2030. Well hell, my crystal ball is not at all that clear. All I have is an educated guess, and I am not at all sure as to how well my education is. But I expect all hell to break loose way, way, before 2030. Perhaps by or before 2020.

And as to oil output beginning to decline in 5 to 10 years, I think you are a little off base here. I think oil output began to decline in 2016.

Addendum: I am on my third toddy right now. A little background info is in order here. I have a hiatal hernia and and cannot eat or drink late. Because if I do I am up all night with heartburn. So I have my first toddy at 3:30 PM Central Time. And usually two more after that and no more. I must quit then or I am still up all night with heartburn. But goddammit I enjoy those three, each at least two ounces each (Canadian Blended). So when I write around 5 PM Central, please don’t take me too seriously. 😉

But goddammit I enjoy those three, each at least two ounces each (Canadian Blended). So when I write around 5 PM Central, please don’t take me too seriously. ?

Cheers! I raise a glass to toast you!

Hi Ron,

Yes I should have said around 2030. I expect 2030+/-3 years for the start of a World Depression. Yes output has declined a little, but the 12 month centered moving World C+C average output has only declined a little from 80.14 Mb/d in Sept 2015 to 79.92 in Jan 2016 (most recent centered 12 month average based on EIA monthly data). My guess is that we will see an undulating plateau between 79 and 81 Mb/d from 2015 to 2022 and then output will begin to decline.

Chart below has centered moving 12 month average World C+C output from the EIA from Jan 2004 to Jan 2016. Note the undulating plateau between 73 Mb/d and 75 Mb/d from Oct 2004 to Sept 2011, I think we might see a similar plateau from 2015 to 2022 as rising oil prices leads to more drilling.

Generic zantac is $5 for 60 tablets OTC. One before bed.

I don’t drink much at all, so 3 of those would put me to sleep quite nicely at 5pm. ‘u’

But I’d like to brew my own cider shortly and also make a freeze distillation out of it, as well as a ‘mead’ made from its ‘live [yeast] dregs‘, so that could change.

The Peak Oil 101 bible says that basic brewing and distilling knowledge and skills can of course be important to have, post peak oil, like in an apocalyptic scenario, and like, where people are sad and want to drown their sorrows.

Moonshine or ethanol are good for all kinds of things, like electricity-free lighting; running ICE engines in the absence of normal gasoline/petrol (probably not for prolonged periods though); medical emergencies (sterilizing cuts and scrapes); preserving things like fruit; and making crêpe flambés.

I think jet engines can also run on ethanol, so if you have a spare jet lying around in your garage, and your normal fueling stations are empty or have been bombed, like in riots or worse, and/or there are hours-long lineups at them, and people fighting each other because someone butted in, in front of them in line (I hate that), then you should still be good to go.

Caelan,

If you’re looking for a simple refreshment for summer, making hard ‘cider’ with supermarket apple juice is possible (it’s pasteurized, so you don’t have to boil it). The problem is fermentable sugars, which some of us get around by boiling a pound of honey in 1/2 gallon of the juice (for, say, 10 minutes – to pasteurize the honey), and combining it with, say, 4 gallons of the juice (in a **sanitized bucket**), then throwing some champagne yeast in (some other yeasts are ok, too).

This year I’ll try throwing in a little malted barley extract. It needs to stay in the bottle for a while, though, so I do it late October for drinking in summer. Carbonating it is something you can look up online (or are you already a brewer??)

Also, should we not be talking about this on the other thread?

Yes. Better on non-Petroleum thread.

Dennis,

Where would we be without your excellent oil thread moderator skills?

Steve

Thanks for the input, Stu.

Perhaps we can let each other and the forum know how it goes, (since it’s social-decline-relevant) and on the other non-oil thread. I’ll look for you there.

https://www.youtube.com/watch?v=qNi1sevKNd0

“End of the Ship” by Roy Zimmerman

Hey Steve,

I believe under current legislation, the federal reserve can only buy government issued debt instruments with “printed” money.

The fed is beholden to congress under the 1914 federal reserve act.

SatansBestFriend,

While that is true on “paper”, I would imagine the Presidents Working Group On Financial Markets has been buying stocks on behest of the U.S. Treasury and Fed for some time now. If everyone else is doing it, do you really think the Fed & U.S. Treasury would be left out of the party??

I wouldn’t be surprised to see Fed Chairman Yellen getting the ‘GO” on buying stocks “PUBLICLY” as they need it to go FULL RETARD now.

After the Fed realized it was issuing more debt than the market could swallow, it had to start buying Bonds, HAND OVER FIST. Unfortunately, the stock market is now in big trouble as the business model of borrowing money at zero interest rates to buy back shares or issue dividends, is not a long term solution.

So, I would bet my bottom $100 Trillion Zimbabwe Fiat Note that Ol’ Yellen will get the go at some point. However, this will signal the end of the system…. that is, if they don’t use their last bullet by issuing everyone a $10,000 check.

If they do… well then, we could enjoy another 3-6 months driving to WalMart, Starbucks or Walt Disney World.

steve

I would be more concerned with deflation than hyperinflation ( in the USA ).

When the defaults start happening the asset base of the country ( stocks, houses, etc). Will implode.

This will also trigger the derivative monster. No one knows what is being hidden off the balance sheets of big companies, like major banks.

SatansBestFriend,

The MOTHER of all Deflations is the ultimate outcome. This is due to the Thermodynamic Oil Collapse. I didn’t understand it before, but now that I have looked at the report, charts and spoke with the project manager of the model, DEFLATION is most certainly coming.

We are going to see a collapse in the value of most Stocks, Bonds and Real Estate.

The only debate here is the timing. My crystal Ball says its within the next 1-3 years.

steve

Steve. Another 2008?

Shallow,

Unfortunately, 2008 was a shot across the bow. What’s coming is orders of magnitude far worse. Again, this ETP Oil model and Thermodynamic Oil Collapse really changes how I look at energy now.

I will be interviewing Louis Arnoux on my site, the SRSroccoReport.com next week. I plan on putting on the site next Friday. It will be a youtube video interview including seven charts. Some of these charts will really get (some) people looking at energy and economics in a much different way.

Lastly, I just published an article on the disaster taking place in the copper mining industry. Copper is the King base metal. When things start to get rough in that industry, it is an OMINOUS SIGN:

https://srsroccoreport.com/big-trouble-for-copper-the-breakdown-of-the-industry-has-begun/

steve

Thanks for this, Steve. I look forward to the interview with Louis. The copper article is interesting and, as you say, ominous.

Medicare and Medicaid are costing the govt 1.3 trillion per year and compounding at 9%.

Simply look at a pie chart of govt expenses and their growth rates.

Even Javier couldn’t get this wrong.

No this is not 2008, it is an exponential doubling later from 2008.

All the problems in 2008 were papered over with fed money printing.

None of the structural problems were fixed.

On the up side, people are getting a lot more health care.

But what in the world do you mean by compounding in this context?

Growing exponentially. Compounding might not be the appropriate word, but I love the way it sounds.

Yeah we have more health care. For a few more years till it bankrupts the country.

Without the monopolistic pricing practices, that same health care will be ALOT cheaper. But the industry will need to collapse first.

Oil only makes up about 40% of total energy consumption. Even if it completely disappears, it won’t be the end of energy, or even fossil fuel.

Most energy is wasted anyway. Cutting consumption by half is feasible from a thermodynamic point of view. A few applications of oil are hard to replace, but this is not a thermodynamic issue, it’s a technology issue.

It’s a food issue. The shelves get stocked by trucks.

When oil goes away, so do you.

You’re being silly.

Diesel used for food delivery is a small fraction of overall oil consumption. That small fraction won’t go away for many decades, unless we want it to. There are good substitutes (rail, local electric trucks).

Hi Watcher at least half of oil use is personal transportation which can easily be reduced.

For example the UK uses less than half the oil per capita America does.

https://upload.wikimedia.org/wikipedia/commons/9/91/Energy_Use_per_Capita.png

And they aren’t exactly frugal.

Me,

The trouble is, in the US the wife feels she needs a F-350 to do the weekly shopping. While in the UK, the wife realizes a diesel Fiesta does the same job.

Nothing like $5 diesel to change the wife’s mind about what to drive.

Steve wrote;

”This is due to the Thermodynamic Oil Collapse. I didn’t understand it before, but now that I..”

As you understand this Thermodynamic Oil Collapse, pls enlighten us.

I agree with Rune. I have a cursory understanding of thermodynamics, Rune’s knowledge is far better than mine.

What I don’t understand is why the net energy provided by oil really matters. Even if oil becomes an energy carrier like electricity, it will still have value and the price will be determined by supply and demand.

Maybe Steve can explain why the price of electricity hasn’t collapsed. The price of a product has nothing to do with its net energy.

If the net energy of all energy produced by society was zero we would have a problem, the analysis needs to be done with wider boundries for all forms of energy to be convincing.

Steve,

We are still awaiting your explanation to the Thermodynamic Oil Collapse.

After all since you understand it it should be easy for your to explain.

I am not sure why people think this is really complicated. Net energy concept is just an application of the law of conservation of energy. If you cannot understand the following video, well there is nothing else to say

https://www.youtube.com/watch?v=CmttxT1Wl1M

Hi mynamett,

Why is electricity produced? It is not an energy source, but still it’s price is positive.

The Hill Group argues that petroleum must be an energy source or it’s price will fall to zero, or at least below the cost of production.

I believe there is no logical reason that petroleum cannot continue to be used even if it only serves as an energy carrier.

The net energy of all energy produced by society, probably needs to be above 6:1. It does not need to be the case for every energy product, some types of energy will have higher net energy than others.

Of course price matter. The drop in demand was driven by 2 oil price shocks in 1973-74 and 1979-80.

But:

1/ In 1979-81, the cost of oil to global economy was much higher than in 2011-14, as oil intensity of GDP has significantly declined since early 80s.

For a similar effect, today’s prices should be above $160 for 2-3 years.

2/ Oil substitution in power generation and cost-saving measures of early 80s were low-hanging fruits.

Nominal Global Oil Expenditures as percent of Nominal World GDP

Based on Toolpush’s remarks, I’d say the definition of thermodynamic collapse is when your wife doesn’t have a big enough car.

Wealth – any income that is at least one hundred dollars more a year than the income of one’s wife’s sister’s husband.” – H. L. Mencken

Steve,

I’ll take the heat to say I am with you on this. Most of us cannot wrap our heads around the reality that systems run on available energy, not its poorly linked proxy of money or value.

Mother Nature’s systems run on the laws of physics and energy is king, in the form of flows and storages. Natural systems exist because of energy that flows through them and what they can store, mostly in the form of complex molecules. Tiny changes make big differences given some time.

Our global economy/society/whatever is a system subject to the same rules of physics. Changes in energy flows will modify the system. Less net energy from oil will yield less to run the system, and the system will reduce in size accordingly.

How and when? Mostly gradually and constantly, although organized efforts to delay the inevitable changes can cause sudden changes when the delaying tactics run out and the system resets to match the energy actually captured by the system.

The predicament is that the declining net energy from oil is a one way trend, and we don’t seem to have an equivalent alternative. If we did, we would just crap ourselves out of our nest sooner and more severely than we seem hell-bent to do.

Interesting times. Glad I’m much closer to the end of my life than the beginning. Best wishes for everyone else.

Steve, good luck explaining systems ecology in a nutshell to folks who know economics. No matter what you write, the money and value distortions get in the way.

It is all about energy flows, not economics. Economics is noise and market manipulation which distorts our understanding and obscures the subtle changes and effects from less cheap oil in the system. The signs of collapse are subtle, but everywhere, in my observations. I don’t claim to have any idea as to deflation versus inflation, but I do see less energy available in the near future and that will make parts of the systems go away.

Jim

Thanks cracker, excellent. And with 7 billion + people, a very highly leveraged financial system and social tensions already rising there’s a LOT of downsizing to do. Net energy is the key.

Hi Cracker,

I agree net energy is important. It is not important for any single energy source however and that is what the Hill Group is claiming. If for some reason the petroleum industry could only use energy from liquid petroleum and not energy from natural gas, coal, nuclear, or any other energy source, the analysis might be correct. Energy can be used more efficiently and there are plenty of energy sources that have adequate net energy such as wind, solar, nuclear, coal and natural gas (at present). As oil, coal and natural gas deplete the EROEI will decrease and more importantly the cost of each unit of energy will increase, other energy sources such as wind, hydropower, solar, geothermal, and nuclear power that have a lower relative cost will replace fossil fuels over time.

Note that I have two semesters of thermodynamics as a mechanical engineering student on one semester of statistical physics as a physics student with undergraduate degrees in Physics and Economics as well as a Masters in Economics. The proper boundry for the type of net energy analysis attempted by Hill is the entire economy rather than a single industry.

Net energy is of little importance on an industry scale relative to cost of production and price, there is no need for petroleum to remain an energy source, as long as it is profitable to produce economically.

The Hill Group argues that the oil price is determined by its net energy. I think even if the average net energy of oil was zero, it will continue to sell for a price of more than zero until demand for oil falls to zero. This may occur at some point in the far future (after 2080 at least), in the mean time gradually rising prices will lead to a gradual move to hybrids, plugin hybrids, EVs, ridesharing, and greater use of public transportation. AVs may also reduce fuel use as ridesharing may be easier. Eventually demand may fall faster than the fall in oil supply (after 2050 would be my guess). As I have said many times I doubt the transition to other energy sources will be smooth and expect a severe recession/depression to begin between 2027 and 2033 after an undulating plateau in oil output from 2015 to 2023 (79 to 81 Mb/d). In the scenario below based on a URR of 3300 Gb for C+C, the annual decline rate remains under 1% until 2026 and in 2030 the annual decline rate is 1.5%.

When I get to thinking about that World C+C graph Dennis, I see that 2022-2024 timeframe as critical. If it pans out the way you project, I believe that the writing will be so clearly on the wall that some very vulnerable countries will go ballistic- literally. I think we will get a big crude war, with countries trying to reshuffle the deck.

If so, the oil available for export (which peaked in 2005), will plummet even faster than it already will do under your projected scenario. This is the big intermediate timeframe risk as I see it.

Hi Hickory,

That is just one scenario where extraction rates level off over that period, it is possible that a plateau might be maintained a little longer than I have guessed, but that would lead to steeper decline later.

It is hard to know how it will play out. Oil prices will rise and this will help the exporting nations. It is not clear who will go ballistic, the wealthier nations are likely to be able to outbid poorer nations for oil and there may be a move to lower oil consumption in OECD nations as more EVs, plugin hybrids and hybrids will sell, this may take some of the pressure off declining oil supply. Eventually I expect too much stress on the economy from rising oil prices (as supply is likely to fall faster than demand at lower oil prices) will lead to a recession. Maybe it will be 2025, but I still like 2030 as a guess, 2035 does seem quite unlikely if the scenario in the chart above is close to correct.

Yeah, war could happen. The Iraq wars were partly motivated by oil.

But….it would be incredibly stupid. It would be far, far smarter to invest in EVs, mass transit, car sharing, etc.

That kind of investment would stimulate economies, prevent the depression that Dennis worries about, and make everyone better off. War, of course, just makes everyone poorer (or dead).

As of 2013, the % of net energy imports by country includes Singapore 98%, Japan 94%, Korea 83%, and countries in the 70-80% range include- Ireland, Italy, Spain, Belgium, Portugal, Turkey. These are example of countries that will come under extreme duress as the ‘oil available for export/import’ [OAFE/I] declines. Who will protect those tankers coming up through the strait of Malacca toward Asian ports, as they head through the South China Sea?

Any question why Turkey has moved armed columns into northern Iraq?

For comparison- Germany imports 62%, India 33%, and USA and China 14%, of total energy use. These big consumers of energy will be certainly big players in the game as well, as OAFE/I declines.

In the past I have spoken against the country having a big debt load (entitlement). This is because I think we will need every bit of economic resource at our fingertips as this scramble gets underway- whether its to build solar, wind or nuc generating capacity, or help protect friends from becoming failed states, for example.

http://data.worldbank.org/indicator/EG.IMP.CONS.ZS?year_high_desc=true

Hi Hickory,

Here is the problem with reducing government debt. Generally in an economy that is doing poorly, this leads to higher unemployment and idle resources (unused production capacity) and lower national income.

Your thinking seems to be very 1920s. The policy of everyone tightening their belts and balanced government budgets didn’t work very well from November 1929 to February 1933,it will work no better today.

When oil supply starts to decline in approximately 2023,oil prices will rise so that demand is reduced to the level of supply. The last time that World supply contracted (1979-1982), the decline rate was very sharp and the only major wars were between Iran and Iraq and the Soviet invasion of Afghanistan.

I think unless there is aggressive policy action a recession is very likely, and war is not unlikely, but hopefully if their are oil wars they won’t escalate to WW3.

Unfortunately most humans don’t learn from history. Not much reason for optimism.

Aggressive policy action won’t be taken until a crisis occurs, so we will have to wait for Great Depression 2, before governments will implement necessary policies to speed up an energy transition.

There’s ‘education’ and then there’s the real world, Dennis (which seems to be getting worse, despite all those masters and phd’s running rampant). While I wouldn’t lean too heavily on textbooks, your ‘qualifications’ are duly noted, thank you.

Dennis,

You simply do not appreciate the essential nature of oil in leveraging everything else, along with its own dominant share of utilized energy, and unmatched utility.

Everything you point to as mitigating factors are true and part of the equation, but they cannot be enough to match declining net oil energy. H.T. Odum’s systems ecology modelling showed me that in the early 1970s. It didn’t matter how we adjusted the inputs, oil energy drove the global system, and it still does today.

Your arguments are precisely what I mean when I write that economics distorts and obscures the reality that declining net energy from oil will reduce the systems dependent on it, and the people in that system will be less, too. Your knowledge of economics (which I very much admire) affects how you see things. The systems numbers that really matter in physics are energy flows (storage, too, but flows are usually the critical piece). Money and value are not the same and describe different parameters to serve different purposes that do not lend themselves well to honest and critical evaluation of energy flows.

Forget economics, that’s people stuff. Mother Nature manages all systems based on physics. Follow the energy flows. They rule, along with time for their manifestations. Economics is just fluff in the real world.

Jim

Jim,

That misses something:

We have an *enormous* net energy surplus at the moment. Half of all oil consumption is for passenger transportation: the average US vehicle only gets 22MPG, and only carries 1.2 people. Only about 1/3 of US passenger vehicles are in use on a daily basis for commuting.

The US could reduce it’s oil consumption by 25% almost literally overnight by shifting it’s mix of vehicles, and raising vehicle occupancy. Putting most SUVs up on blocks would be easy. There would be some relatively small inconvenience for carpooling and carsharing.

And industrial/commercial consumption has a very large component of low-value consumption: trucks and ships could slow down, fleets could implement other low-cost efficiencies, and could switch fuels.

“The US could reduce it’s oil consumption by 25% almost literally overnight by shifting it’s mix of vehicles, and raising vehicle occupancy. ”

Do you really believe that the U.S. can almost literally overnight change its vehicle fleet?

This goal can be achieved only by introducing very high fuel taxes (like $3-5 per gallon).

Do you think this is acceptable politically?

But even in this case it will take no less than 10 years to drastically change the mix of vehicles.

Do you really believe that the U.S. can almost literally overnight change its vehicle fleet?

Well, remember, I pointed out that only about 1/3 of the US light vehicle fleet is in use at the peak commuter periods. The US could stop using SUVs almost entirely just by choosing to use the sedans that are already on the road. For instance, many families use an SUV for the parents, and the teenage kids use the 3rd vehicle, a sedan. Sedans, you see, are less expensive and less fashionable, so they’re used less.

This goal can be achieved only by introducing very high fuel taxes (like $3-5 per gallon).

That would make sense. Various kinds of rationing would also work.

Do you think this is acceptable politically?

Of course not, or we’d be doing it. But…the US economy is not likely to collapse for lack of fuel. If it gets really scarce, more efficient utilization of existing supplies would be relatively easy.

Hi Cracker,

Oil provides 33% of World primary energy.

If we look at it in exergy terms it is far lower, 20% or possible as low as 10% of the total exergy used by society.

I agree net energy is important, but oil provides a fairly small proportion of the World’s net energy, much less than the 1970s.

Hi AlexS,

I agree Nick tends to be on the optimistic side.

He didn’t really say the fleet would change overnight, there would be a gradual change in the efficiency with which vehicles are used. The more efficient vehicles will be driven more when families own several vehicles with different efficiencies, people will drive less by ride sharing and combining trips.

I agree it will take 10 years at least to significantly change the efficiency of the vehicle fleet, even with high oil prices.

I agree in the US high fuel taxes are not likely, though it is the correct policy. When peak oil becomes apparent, perhaps higher fuel taxes may be enacted.

Hi Dennis,

If we take a look at global primary energy for fossil fuels– not just oil– it’s whopping.

If oil has been and is being replaced, what has it been/is it being replaced with (and when do they decline); what are their energy-densities/EROEI’s, (trans)portablilities, C02/pollution emissions and reservoirs like, and how’s everything working out for the pseudoeconomy? How healthy is it currently?

Also, what amount of oil/FF’s is/are embedded in nuclear, hydro and alternative energy, and general electricity-generation, including proper/rigorous mining/sourcing, building, maintenance and decommissioning? Nuclear waste has yet to be decommissioned. (Would you know of, or would you like to fashion a guess as to what proportion of relatively non-renewable energies might go into that? How about financing for those kinds of things in a debt-based and ostensibly-failing pseudoeconomy?)

How about the impacts of a growing and ‘developing’ global population and national-competition in those regards, as well as the use of fossil fuels in war-time scenarios, such as in their security and in national security?

Lastly, if we agree that the economy is not really economic at all in the classical sense of the word (‘frugal’) then what of our contentions and calculations? Do they all kind of fall apart and/or have much less meaning than what we might have learned?

Incidentally, did you take any anthropology, sociology or psychology majors, minors or electives, and if so, what might they have taught you, such as about such things as true community, anarchism, democracy, freedom, self-ownership and self-empowerment, scale, ethics, equability/equity, (‘sociopolitical’) power or decline/collapse, etc..?

3000-word essay, due by Friday, Oct. 21st.. 10% off final grade, each day it is overdue.

tends to be on the optimistic side.

That assessement depends on the context.

Remember, I’m pointing out the fundamentals: how much energy is available, what could be achieved with different strategies.

These strategies may seem unrealistic in the current environment, but when people suggest that we may be staring at a possible collapse, or even just a depression caused by energy costs…well, in such a context people will be willing to do things that seem unrealistic today.

Carpooling for instance. It’s inconvenient, but in a world where *everyone* has a smartphone, it’s obviously doable. It could literally reduce US oil consumption by 25% overall in weeks: just increase the average number people in cars from 1.2 to 2.4.

Reminds me of the old WWII poster: “If you don’t drive with your carpool, you’re driving with Hitler”.

Hi NickG,

You often state your case as if it will not be difficult to accomplish.

Let’s assume there is no war and no recession in response to declining fossil fuel availability.

In that case do you think the policy actions that are necessary to accomplish an energy transition will happen seamlessly through the magic of “the invisible hand” of the free market.

I most surely do not think that is likely given the assumptions above (which are not realistic in my opinion.)

Hi Caelan,

I studied Mechanical Engineering, then switched to physics and economics.

Mathematics, Chemistry, Physics, zoology, economics, history, English, music, and philosophy are some of the areas outside of mechanical engineering that I can remember, it was long ago.

often state your case as if it will not be difficult to accomplish.

Well, this all depends on context. Countries like the US and Switzerland reduced their domestic oil consumption in WWII by very large fractions – I think the Swiss managed about 90%. Was it easy? No. But, it was done while increasing GDP dramatically.

Perhaps I should clarify that when I talk about possibilities I’m typically talking about what’s possible from a technical, engineering and economic point of view. NOT the political.

do you think the policy actions that are necessary to accomplish an energy transition will happen seamlessly through the magic of “the invisible hand” of the free market?

Absolutely not. If things were up to an unregulated free market US MPG would have been about 12 up until 10-15 years ago, when we would have hit an earlier and more vicious peak in oil production. Wind and solar power would be primitive. EVs as we know them wouldn’t exist. Tesla wouldn’t exist – Elon Musk is NOT out for commercial profit. The Paris Climate agreement wouldn’t exist. China and the US would be burning 20% more coal.

No, we need a *regulated* free market, with the proper incentives and pricing mechanisms, as well as strategically chosen energy regulations, such as CAFE.

So, where are we now? Well, we have *part* of what we need, public policy-wise. I do think that if we get 10 years of very high oil prices you will be very surprised by how much things change. OTOH, to deal with Climate Change we need much more, and there’s no guarantee that we’ll get it. It requires conscious human choices, personally and politically.

Finally, remember where this discussion started? It was with “Cracker” saying Your arguments are precisely what I mean when I write that economics distorts and obscures the reality that declining net energy from oil will reduce the systems dependent on it, and the people in that system will be less, too.

He was saying that the *fundamentals* of energy would dictate economic decline and collapse. I’m arguing that the fundamentals are very different!

Fair enough, Dennis, and thanks for sharing.

Hi Nick G,

I gave the context.

The point is that without a crisis (and most people would include WW2 as a crisis) the kinds of changes needed are unlikely to occur.

Also how do you define “regulated” free market, do you mean what exists currently in the US and Canada for example?

Especially in the US the existing regulations are unlikely to result in fast enough change in energy use.

Leaving out what is politically possible, takes us from reality, what is technically possible is nice, but helps little without the political will to implement needed changes.

So generally I use the context of the real world as my starting point, a world where politics matters a great deal.

Only a crisis is likely to lead to the changes that are needed, hopefully it will only be a severe recession similar to the GFC, but I expect it might be close to the level of the Great Depression with World unemployment approaching 20% maybe more. Hopefully economists will re-read their Keynes and military leaders and politicians will re-read history and potentially avoid the mistakes made from 1936 to 1945, perhaps WW3 will be avoided.

Windmills, solar panels, EVs, and batteries would be a better use of resources than weapons in my opinion.

Dennis, slow changes in oil production would produce exactly the types of changes needed since the economics would drive them and given time there are more than enough options. Quick changes in oil production could result in exactly the wrong types of reactions since politics would drive the choices. It is the quick change scenario which is problematic.

It is the quick change scenario which is problematic.

Exactly. If the world economy has 10 years to adapt to high oil prices, it can do amazing things. Heck, the world economy handled high prices in the 2011-14 period quite well, and we saw the beginnnings of dramatic change.

It’s the very fast changes, like a disruption in oil supplies due to war or embargo, that are really problematic. Then you have a situation where industries can’t respond quickly, and you have “capex lag”. For instance, car buyers suddenly stop buying SUVs, but there isn’t a big enough supply of hybrids and EVs, so car sales crash. Crashing car sales causes financial problems for the car industry, which requires very good management to deal with properly (e.g., Obama rescuing GM vs Romney wanting a disastrous bankruptcy), and recession is hard to avoid because it takes time to ramp up the proper alternative capital investments into EV/battery production. Which in turn makes it hard for car buyers to make their capital investments in new EVs.

It’s interesting to watch the growth in EV and PV sales. They seem to be doubling about every 2 years. If that continues for 12 years, that gets you to a level that’s 64x higher than today: that would be a major change!!

Hi Stan and Nick,

I am less optimistic about the World economy’s ability to adjust to a long tern decline in oil supply. It is uncharted territory.

I suppose one could argue that oil supply declined sharply from 1979 to 1982 and did not rise above 1979 levels (C+C output) for 15 years. At that point in time the World was using oil very inefficiently so there was more room for less oil use, but also oil was a bigger part of the economy. The decline rate will gradually increase to about 2% and oil prices will rise. When the money spent on oil gets to 5% of World GDP we are likely to see a recession. It is possible the World might make a seamless transition to other types of energy besides fossil fuel, I don’t believe it is likely.

I would put the odds at less than 1 in 10.

Yeah, this is certainly uncharted territory. We have to look at analogous situations and try to inform our intuition.

One thing to keep in mind: most of our experience with high oil prices has been with very fast, short term changes. Then we’ve seen recessions. But, our one experience with slow, fairly seamlessly rising oil prices, from 2004 to 2014, was a fairly “successful” one.

That’s not to say that I would suggest complacency!!!

First of all, you’re absolutely right: deliberately planning for high oil prices is a risky strategy. 2nd, there are many, many costs to our oil addiction, including climate change, loss of foreign exchange, supply insecurity, and world conflict.

Dennis,

“oil supply declined sharply from 1979 to 1982 and did not rise above 1979 levels (C+C output) for 15 years. ”

The decline in supply was a result of the decline in demand largely driven by a shift of the power generation sector from oil to natural gas, coal and nuclear, but also to energy saving measures.

In order to stabilize prices, OPEC countries significantly cut production, but this policy failed and oil prices continued to decline.

By 1985 OPEC spare capacity reached 12 mb/d and the Saudis and others started to gradually increase production with the aim to gradually regain market share. This led to a further drop in oil prices.

Oil prices remained generally low (except a temporary spike during the 1st Gulf war) until the beginning of the 2000s when global surplus capacity was eliminated by rising demand.

The decline in supply was a result of the decline in demand largely driven by a shift of the power generation sector from oil…

And, of course, that shift by the power generation sector was driven entirely by high oil prices! The US reduced oil consumption by 18% from 1978-1982, while growing GDP slightly, a reduction entirely due to oil prices.

Prices matter…

Of course price matter. The drop in demand was driven by 2 oil price shocks in 1973-74 and 1979-80.

But:

1/ In 1979-81, the cost of oil to global economy was much higher than in 2011-14, as oil intensity of GDP has significantly declined since early 80s.

For a similar effect on global economy, today’s prices should be above $160 for 2-3 years.

2/ Oil substitution in power generation and cost-saving measures of early 80s were low-hanging fruits.

Nominal Global Oil Expenditures as percent of Nominal World GDP

See my comment at the very bottom. Things are getting narrow here…

I am sorry but I believe it is all about economics. Our problem is government and a dishonest money system.peak oil could be used as a ready excuse for the collapse of the present system by the government and bankers .the best way to deal with the consequences of peak oil is with economic freedom. Our current system now is going to be a nightmare.

What is economic freedom? I’ve never seen it identified in the wild.

I am a firm believer that when economic collapse is staring the government in the face, and the choice is between immediate collapse and printing that ten thousand buck check for everybody, and putting collapse off by a few days, weeks, months, or possibly even longer,

THE CHECKS WILL BE PRINTED. And they will be cashed, and the cash will be good. Anybody who has money owed to them, and tries to refuse that cash, will be in violation of some very heavy duty federal law.

This is in part why I believe in holding onto actual physical goods rather than cash to the extent it is practical to do so. I am not much afraid that I will be UNABLE to buy fertilizer or diesel fuel, or nails, but rather that the prices of them will go thru the roof at some point.

Think about this, we are mostly all realists in this forum, with differing opinions of course. IF it is possible for Uncle Sam to use a sledgehammer to create inflation, will he allow the economy to collapse rather than use the sledge hammer?

The sledge hammer will not FIX the economy, but it will probably keep the economy more or less functional for some period of time, in the same way that powerful poisonous drugs keep a cancer victim alive for some period of time.

If this hypothetical deliberate inflation is well managed, it might prevent an actual collapse from happening for some significant period of time, maybe even a year or two or longer.

I apologize for putting this in the wrong thread, but it goes part and parcel with a major shortfall in the supply of any critical resource- any resource that is important enough to upset the economic apple cart.

If this sort of inflation comes about, it is my intention to be ready, and sell some land for cash, before the public figures it out, enough to pay off all my debts.

When people run from the stock and bond markets, they run to gold, real estate, and collectibles. This is well worth remembering.

Hi Old Farmer Mac,

In the Great Depression inflation was not a problem, it was deflation that caused much bigger problems. Perhaps this time will be different. Though note that deflation was also a problem in 2009.

Traditionally, most folks think of inflation as what happens during the “boom-cycle” – i.e. when high capacity utilization, low unemployment and rising wages puts an upward pressure on prices.

Asset inflation and deflation are two sides of the same coin. Central banks fear deflation (and unemployement) and therefore they will do whatever they can to combat it (last resort is to print money/hand out helicopter money as mentioned above). This causes inflation but not for the same reason as “normal inflation” and different assets will be impacted differently.

(Hyper)Inflation can also arise as result of debt that is issued in another currency combined with deteriorating ability to repay it.

Hi Jeff,

There has been very little inflation since 2009 in the US, but very loose monetary policy.

US issue debt in its own currency. Money currently flows into the US, not because it´s good but because it is the least bad of the major currencies.

The loose monetary policy has resulted in asset inflation, see e.g. the stock market. These assets are not included when calculating inflation.

Hi Jeff,

Stocks are a little overvalued at present when considering the PE of the S&P 500, but not anywhere near the level of Sept 2008 to Aug 2009. See chart at link below.

http://www.macrotrends.net/2577/sp-500-pe-ratio-price-to-earnings-chart

Most of the excess money is just sitting in bank accounts and the velocity of money has fallen to compensate for the large money supply.

In an earlier comment you mentioned helicopter money. Only the legislature can do that, not the central bank. It’s called fiscal policy, either a reduction of taxes or government spending. Government spending tends to be a better stimulus as reduced taxes could simply be parked in a bank account, especially tax reductions for the wealthy, reduced taxes for the middle class (income of 50k to 150k) could be pretty stimulative. Or the government could repair roads, bridges, and water systems, which might be useful.

Hi Dennis,

In the Great Depression era, we were looking at at what was nothing more than a major economic slowdown, rather than an actual collapse brought about by a shortage of critical resources. Resources of every physical sort were plentiful.

The things that were short were confidence and credit mostly.

When I speak of major inflation as the result of dire economic conditions, I mean this within the context of the economy already being in a state close to actual collapse – and within this context, deflation WILL be very real, and already have happened, as likely as not.

But consider things being in this dire state, and the options available to the government at that time. With most of the people broke, and the ones who still have some money either afraid to spend it, or holding out for even lower prices before buying anything except groceries…………

Well, at that time the government will still have the option of printing that ten grand helicopter check, and those who are broke WILL spend it.

I have never contended that this would FIX the economy, but rather that it is a very likely last resort that will postpone the end -Assuming we do get into such dire economic troubles that we are belly to belly and nose to nose with collapse.

Now while I do not contend that such a deliberate grand scale inflation WILL fix the economy, and never have, there IS a possibility that it MIGHT allow the government to buy enough time to figure out and implement policies that prevent outright economic collapse.

And for what it is worth—In the last analysis, central banks, and the banking industry itself, are outgrowths of our political culture as much as our economic system.

We can never be sure what politicians will do at some future date, depending on the circumstances prevailing at that time.

It is possible that we will see money printed and handed out, directly to the public, even though there might be no actual real need for this to be done. If such a trend becomes established, Sky Daddy alone knows where it might end.

We are already in essence giving money away by the billions in the form of welfare for businesses and individuals, although it is not considered pc to talk this way, lol.

OFM- “We are already in essence giving money away by the billions in the form of welfare for businesses and individuals, although it is not considered pc to talk this way, lol.”

Well, you are right about that for sure. According to the St Louis Fed- the government transfer payments (social benefits) to individuals in 2016 Q2 = 2,024 B (or 2T$).

https://fred.stlouisfed.org/series/B087RC1Q027SBEA

This does not include any subsidies to companies. The entire budget is soon to be entitlements and interest on debt. I don’t see the government having too much available for infrastructure, energy innovation or other discretionary projects before too long.

Mr. Verwimp. Is ND still fitting the “curve”?

Hi shallow sand,

My curve changes depending upon the number of wells completed. The scenario below is fairly conservative with the number of new wells completed gradually increasing to 70 per month (56 per month until Feb 2017, then rising by 1 per month until April 2018, then remaining at 70 wells completed per month until 2041 when 32,000 Bakken/Three Forks wells have been completed in North Dakota (21,000 wells completed from Sept 2016 to August 2041). ERR is 7.6 Gb. No new peak just slow decline in this scenario. This would coincide with oil prices (WTI) remaining relatively low (under $90/b until 2020 at least).

This would coincide with oil prices (WTI) remaining relatively low (under $90/b until 2020 at least).

The NDIC Director gives a threshold of $60 for changes in drilling and completions. I would guess that your model above is more consistent with $70 than $90.

Hi Nick,

The model goes to 2040, oil prices will need to rise above $70/b as the new well EUR will decrease over time and wells will not be profitable to drill even at $80/b (in 2016$) after 2018. In the model the new well EUR falls from 326 kb in June 2017 to 236 Kb in June 2028. In 2015 it takes at least $80/b for the average new well to be profitable, lets assume all costs are unchanged in real terms from 2015 to 2028 for simplicity. The 38% lower output of the 2028 well will require higher oil prices in order to earn a reasonable rate of return (assumed to be a real rate of return of 7% for the $80/b 2015 estimate).

In fact the $90/b (in 2016$) estimate for the oil price needed in 2030 is likely to be too low rather than too high. The NDIC estimate is a short term estimate (for 2016 and 2017), my estimate is a long term estimate, very different (and much more speculative).

Thanks Dennis.

I wonder if your new well EUR decrease assumed is steep enough?

It is very difficult to model that, no doubt.

Do you have a breakdown of where the remaining wells will be located, maybe by county?

I am just guessing, so feel free to be critical of my guesswork. Maybe shale will be different from the steeper drops seen in most conventional fields.

Hi Shallow Sand,

The EUR decrease will depend on the rate that wells are drilled. The 1P reserves in the ND Bakken/Three Forks at the end of 2014 were about 5.5 Gb, typically 2P reserves are at least 50% higher, so 2P reserves would be 8.25 Gb. Also David Hughes analysis has about 7 to 8 Gb of oil from the Bakken and the USGS has a mean estimate for TRR of about 10 Gb for the ND Bakken Three Forks and their F95 estimate is about 8 Gb. So the model is based on these three independent estimates of URR. The number of wells in my model is similar to Hughes, most other models have estimated between 40,000(Mason) and 60,000(NDIC) total wells drilled in the ND Bakken/Three Forks.

I do not have county by county analysis, if prices remain under $60/b (WTI) long term (until 2025), this scenario will not be correct.

Proved Reserves for North Dakota at link below, 0.5 Gb in 2007 and 6.1 Gb in 2014, I have assumed most reserves added since 2007 have been Bakken/Three Forks reserves.

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RCRR01SND_1&f=A

The EUR decrease is very easy to model I just put it in the spreadsheet. Do you have a suggested rate of decrease, just let me know and I can do it and post it in 5 minutes?

What kind of new well EUR decrease do you see in conventional fields as sweet spots become fully drilled? Note that if I doubled the drilling rate to 140 new wells per month, I would also double the rate that the new well EUR would decrease to 6% per year.

Dennis.

I am probably missing the boat here, but I will take another crack at it.

What I am referring to is individual well quality, which would then impact field wide production rates.

You assume completions of 70 wells per month from 4/18 through 2041.

How much less productive do you believe wells will be in 2030 than those of 2018, for example? Are you assuming a gradual decline of 3%

(For example, wells completed in 2017 EUR 300K BO, wells in 2018 EUR 291?). Note, these are my “made up numbers”.

My observation is that at some point, well quality will decrease dramatically. Absent a price spike, this, in turn, leads to greatly decreased drilling and completion activity.

How long this takes varies field to field and is dependent on many factors. The first drilling boom in our field lasted about 5 years from field discovery. Suddenly, IP’s dropped greatly, and drilling all but ceased. Production fell off a cliff. Only the advent of waterflooding and then price spikes reversed this, with waterflooding being a much greater factor.

I do not know enough to suggest an EUR decline rate, but I suspect once the best areas are drilled up, absent an EOR breakthrough, the large public companies with access to large amounts of capital will move on, leaving it to smaller firms to eke out the remaining barrels.

Over half of our field’s cumulative production occurred in the first six years, ours being 111 years from the discovery well.

Again, ours is but one small field. My guess, however, is that decline of the shale fields will not occur in a straight line, but will look more Hubbert curve like, as suggested by Bruno Verwimp.

My understanding is that “conventional” oil migrated from it’s source, and a small percentage was trapped in various domes and prevented from migrating to the surface and being dissipated. Those domes created pools of oil that could be sucked dry pretty efficiently, and when the metaphorical straw hit the bottom of the milkshake there was a very distinct regime change.

My understanding of most other mineral resources is that they’re much more widely distributed, and the boundaries between the resource and it’s surrounding are much blurrier, much more extended. Conventional oil goes from something to nothing: most resources go from some to 90%, then 80%, then 70%. And, the quantity of resource tends to expand dramatically when you step down slightly in terms of resource quality.

My understanding is also that LTO is source rock, unlike these secondary pools, and is more like most other resources than it is like conventional oil. Therefore,declines in resource quality are also likely to be different, and traditional oil industry paradigms and models, like Hubbert linearization, don’t apply.

Does that make sense?

Yes. I agree that makes sense.

I also made an error, more than half of the oil in the field I am most familiar with was produced in the first 6 years PRIOR to widespread water flooding. Actually, the first six years represent 28% of cumulative. Waterflooding greatly increased cumulative production.

I still guess that there will be a steep drop in EUR per well as time goes by, but I can see the difference between shale and conventional.

Hi shallow sands

I doubt most fields would be drilled at the rate in my scenario.

I also don’t think prices will remain low. It is pretty rare for an individual field to follow a Hubbert curve.

The analysis applies to large regions.

Hi shallow sand

I also did not consider economics in that scenario.

At some point before 2041 the economics won’t work without high oil prices.

I will revisit the problem when I have a chance.

Just curious if there is no economic crash and demand grows as it has for the past 5 years but supply is flat for the next 5 years. What seems like a good guess for oil prices in 2020?

I think over $100/b in 2016$.

Hi Shallow sands,

For the scenario to work, oil prices would need to rise to $72/b by Jan 2017 and then continue to rise to $130/b by Oct 2020 (all in 2016$), then oil prices would remain flat until 2041. This assumes real costs are unchanged.

Most think such a scenario is absurd. I think oil is very valuable and demand may drive oil prices to $130/b by 2020. I agree that it is unlikely that oil prices will remain high once the economy collapses which I expect between 2025 and 2035, with my best guess as 2030 for the start of Great Depression 2.

I wonder at what price oil would be costly enough that economic growth would grind to halt, but not so high that the cost alone would cause economic contraction?

Certainly this is a simplistic question, since there are so many other variables- like the supply of Nat Gas, Coal, Solar, etc, and the ability of the culture to adapt.

Nonetheless, we may be in a very choppy phase of ‘seeking equilibrium’, after about 150 yrs of rapid growth, largely built on back of cheap energy.

If so, I believe this will just a temporary phase prior to downsizing toward carrying capacity.

Hi Hickory,

Usually the economy either grows or contracts, rarely does it remain steady state.

I think $150/b in 2016$ is the most the World economy might tolerate without a severe contraction.

Hi shallow sand

On EUR decrease yes.

If EUR was 100 in 2019 it would be 97 in 2020, and every year after 97% of previous year if 840 new wells are completed each year.

Hi shallow sand

The rate of decrease in new well EUR was chosen so ERR was about 8 Gb for the assumed 70 new wells per month.

Clearly I don’t know how new well EUR will decrease. It may not decrease at all for many years and then drop suddenly. I have just assumed gradual decrease. Probably I am incorrect.

This datapoint is not what I expected. There was supposed to come decline, but only in a couple of months.

I’m on a beer drinking weekend with friends now. I will comment on this datapoint sunday evening mote profoundly.

Cheers!

Hi Verwimp,

The last datapoint seems to be off by 12 months (maybe Aug 2017 rather than August 2016?)

Cheers!

Hi Dennis,

A little confusing, but I think that might be the graph legend rather than a data point.

Hi econ

I believe you are correct. Thx.

Indeed: It’s the graph legend. Indeed: It’s confusing.

Anyway: ND Bakken data have had some noise earlier. This datapoint (Aug ’16) might be the beginning of a new trend; it might just as wel be some noise. The HL linearisation suggests this datapoint is well within the noise range we have experienced earlier. Time will tell.

The model suggests a severe drop in production at some point during the coming winter, before stabilising again at around 800,000 barrels per day next summer.

So far so good: total production in ND Bakken since the model was built 33 months ago ( 1.055 billion barrels) is only 0.7% higher than predicted with the model (1.048 billion barrels).

The drilling rig list shows no MIRU and the list only shows a few rigs with a start date last week. The oil price is on its highest level in a year and the number of active rigs seems to be declining (from 33 to 31 last week).

LOL

That’s complexity in a nutshell.

I did a joint post with Art Berman

8/10/2016

U.S. Storage Filling Up with Unaccounted-For Oil

http://crudeoilpeak.info/u-s-storage-filling-up-with-unaccounted-for-oil

From Matt and Art’s article above:

Matt, what does this mean and what are the implications beyond that and with regard to the price?

How is net imports estimated? If stocks being reported are high, then something is sneaking into those tanks. That something isn’t NGL because they evaporate. So it has to be imported oil.

On the other hand maybe NGL production includes a huge amount of molecules which can be put in a tank. Do NGL pay different royalties? ?

Misinformation by the media in Australia

27/9/2016

ABC TV a true believer in US shale oil supremacy

http://crudeoilpeak.info/australian-public-broadcaster-a-true-believer-in-us-shale-oil-supremacy

ABC not the only ones. Why must Bankers need their clients to loose more on pet tight rocks.

http://seekingalpha.com/news/3213944-oil-rally-may-thwarted-u-s-shale-rebound-credit-suisse-says?source=desktop_notifications

A short question. As US-production and OPEC-production seem to balance each other – where does the world stand as a whole? I’m sure the actual peak is still November 2015 (and I’m quite convinced it will be the definite historic production maximum). But what’s the trend for now and the next months? Upwards? Level? Downwards? Thank you all in advance for your kind response.

According to EIA STEO we are almost balanced for last quarter, but then supply exceeds demand again until late next year. Supply increases overall by about 1 mmbpd, mostly from OPEC. EIA don’t always get things right.

World Oil Production In Balance, U.S. Natural Gas Production Way Down

http://www.artberman.com/world-oil-production-in-balance-u-s-natural-gas-production-way-down/

The E&Ps in Bakken may be running out of good places to drill. September they opened 63 new permits but cancelled 28. So far this month they have opened 22 and cancelled 16. The number of permits opened is quite variable month to month (i.e. March and May were at 56 and 42 and then recovered) but I think the net number of open permits stayed almost level in September and may now start to decrease as drilled wells and cancellations exceed new applications. The number of DUCs also is now declining on a definite trend. There was a boost to drilling in Dunn County earlier this year, I think from a new pipeline or better infrastructure, but that impetus may be running out of steam, though with 12 it still has the most rigs of any county now, when for a long time it had one or two only.

Including all the producing wells, DUCs, permits and current drilling locations in the core area (a 50 km radius circle) gives a well density of about one per 120 acres now, which I think is near the limit some companies have given. There are still permits and wells completed outside this, but relatively few at the moment.

It looks like Verwimp’s model predicted the seasonal impact on production close to spot on again.

As you will recall, about 18 months ago I explained how the economic environment induced companies to drill but not complete wells, delay fracturing, completion and hook up for a while. I believe this “while” is now over, because the service industry has been shaken down and prices are probably as low as they will be, and OPEC is now starting to break. This means wells can be put on production expecting $50 to $65 per barrel WTI, with lower CAPEX, which allows a better return than completing a well in 2015 or 2016.

Thus, if the companies holding these Driilled Uncompelted wells think the wells will produce an average amount of oil, the DUC count should start dropping. Do remember some of these DUCs will have been identified as dogs usng the log suites, cuttings, and offset well information. These dogs will be held back.

So now we get to see whether the operators behave prudently, focus more towards the Permian basin Wolfberry and other low cost targets, or if they manage to get more financing from the usual mullets and get into a fight with OPEC.

What is clear is that service company charges and tangibles are at the bottom, so anybody who wants to be in the business in the USA does have to drill and complete to hold acreage.

Things aren’t nearly as clear in countries like Canada and Brazil. Operators in these high cost areas will have long term outlooks and may seek project financing from banks likely to be a bit scared. What we do know is their reaction time will be much slower than the “shale” drillers’ in the USA.

Regarding Venezuela, companies would have to very desperate, or managed by idiots, to risk anything at this time.

To give you a symbolic glimpse of how bad it is, a couple of days ago Brazil’s soccer team went to Venezuela to play a World Cup preliminary round, around minute 75 the power went out, and the crowd began chanting “it will fall, it will fall, this government will fall”. International media also reported the stadium didn’t have running water, and there was no toilet paper in the stalls. Brazil won 2-0.

Another development that’s bound to make things even worse is Maduro’s move to have the Supreme Court anoint him a defacto dictator. They ruled the National Assembly isn’t allowed to approve the 2017 state budget. Maduro went in public, led a crowd chanting coarse insults against the National Assembly president, and said he would approve the budget after he discussed it today with a “Pupular Assembly”. This is a turning point because Maduro is now crossing a threshold which hasn’t been crossed by previous dictators (at least in the prior 100 years). Things may not go smoothly for the communists. The National Assembly is now preparing a warning to all outside financing sources that any funds provided to Maduro will not be repaid because they haven’t been approved by a budget law, as provided for by the Venezuelan constitution.

Thing is, most oil investments require foreign financing of some sort, and this means companies and banks which do provide financing will either have to commit to backing a full blown dictatorship which is clearly run by a criminal Mafia, or hope their cooperation with the Maduro regime will be forgiven (something I don’t think will happen, because Venezuela doesn’t have much money, and repaying outlaw lenders won’t be a priority).

Where? Anybody can claim they said anything they want.

I do recall Fernando making exactly that argument with a little sketch of the math of decision points

Lower down I do not recall the hills group being secretly negative on oil for two years and then releasing it. I recall them being dramatic both ways, wrong when bullish and probably soon wrong when bearish

Perhaps I am too much of an old time right wing redneck myself, but I read a hell of a lot of history, including twentieth century history, and I take most of what Fernando says seriously, although I do not necessarily agree with him on all points.

He may not be ENTIRELY justified in calling the Maduro gang commies, but there are certainly plenty of commie genes in the family political tree, so to speak. Does anybody think he is not right in saying only fools would invest money in Venezuela, with the Maduro regime, right now?

He most definitely has commented about actual oil field operators planning their work so as to take advantage of recent tough times at the expense of service contractors who do the actual work. He said the oil field operators would hire drillers, etc, at rock bottom, because doing the work and delaying the completion of the wells drilled was good business strategy. In a very low interest rate scenario, this is a sure fire winner for oil field operators, assuming the price of oil DOES go up before the operator goes bankrupt.

There is nothing new about this strategy , it is often employed by business people in a position to utilize it. I hire big ( in relation to my economic shoe size ) jobs done when business is slow, and can generally negotiate a serious discount for this reason. I saved twenty percent on some bulldozer work over the last few months this way.

The dozer owner operator wanted the eighty percent, which still allows him a decent profit immediately.

I have reason to believe he really needed the money,

Just like most or all of the service contractors. Bringing in enough to keep good men on the payroll is important, and maintaining market share is important, even if you just barely break even or lose a little.

They say they are Marxists. They call themselves communists. They worship Castro. They are now saying elections aren’t a priority, they like to torture prisoners, etc.

The problem I see is simply that you don’t listen to the savagery they spout. They are savages. And they are communists.

By the way, there are reports of cannibalism in Maduro’s jails because prisoners are barely being fed. Also lots of reports of children dying due to poor Medicare care, and increasing numbers of babies being born with a missing piece of brain, caused by zika, which the dictatorship neither responds to nor cares to reveal is spreading. In a sense, Maduro is genocidal. But the USA left and Obama aren’t about to even discuss these matters. It’s an inconvenient truth at a time when Obama is in bed with Raúl Castro.

Ignoring elections and torturing prisoners is something the USA has also shown no aversion to. It seems to me that you’re rather selective in who you find intolerable for such behaviours. We’re you as hot and bothered to see Chile rid of Pinochet and Argentina rid Galtieri or is this a passion you posses for only left wing tortuters and tyrants? You perhaps seem like a bit of a fanatic to me.

https://en.m.wikipedia.org/wiki/List_of_authoritarian_regimes_supported_by_the_United_States

This is an oil discussion site, and I bring up the Venezuela case because I’m observing Venezuela being torn apart by the communists. What is taking place is getting close to genocide. And this is impacting Venezuela’s production, which will likely be even lower as Maduro tries to entrench a dictatorship which copies the Raúl Castro system.

Regarding whether this bunch is communist, here’s an overview of what has been going on:

https://panampost.com/enrique-standish/2013/11/29/venezuela-communist-finally/

For those who wish to read about this very real humanitarian crisis caused by this thuggish communist regime, please read this article in The Guardian

https://www.theguardian.com/world/2016/oct/19/venezuela-crisis-hospitals-shortages-barcelona-caracas?CMP=Share_iOSApp_Other

Finally, I’d like to point out to the readers that a regime like this is incredibly difficult to overthrow, especially when President Obama encourages it by being friendly with its mentor and boss, the Castro family dictatorship. Obama has simply had a really good knack for timing his moves very poorly, getting into dead end alleys, and causing wars and suffering he doesn’t know how to stop (Syria is an excellent example).

So where do we go from here? I wouldn’t expect the Venezuelan people to go quietly into Raúl Castro’s gulag. I’m seeing too many calls for resistance, people who were afraid of writing are now stating openly they will oppose the. Maduro dictatorship. And quite a few of the people I know are still working in the Venezuelan oilfields. This tells me we may see a surge in “accidents”, including explosions and oil spills.

And for those of you who worry mostly about the oil prices, this should have some of an impact. Forget the humanitarian issue, to most people the Venezuelans might as well be cardboard cutouts. But to me they aren’t.

Fernando,

I share your opinion about the Castro regime. Thanks for the links. God help Venezuela …… especially if the USA gets involved

At least you are trying to help those people.

It doesn’t look like anyone else is doing much.

South America has not been particularly stable for quite some time. Will this be contained to Venezuela?

Apology in advance to Ron/Dennis for getting off topic.

Put a lid on it Fernando.

Or else take this topic over to a non-petroleum thread. If you want to discuss which countries are in worse shape, I have Haiti for you to consider.

John S: thanks for the comment. Last night the regime made a move to stop the vote to kick off Maduro’s recall referendum.

I saw a message from one of the opposition parties which informed people should be ready to hit the streets.

And a response on Twitter suggesting they organize a resistance to stop traffic flow between the Orinoco fields and Maturin (the logistics center for oil field goods in Eastern Venezuela). It also suggested people be prepared to hit the streets and block roads on the eastern side of lake Maracaibo. That would paralyze the offshore fields as well as the old fields located near the lake.

If this type of street action takes place I expect a harsh regime response, but Venezuela could lose 100-200 kBOPD in November.

If this was specifically addressed to me then, no I don’t recall that, but I think I followed other sites like Rigzone and Upstream more then anyway. I don’t follow how it relates to my comment either way. If not addressed to me then please ignore.

As with the 70kbpd drop earlier in the year, next month may well see a ‘dead cat bounce’ in production i.e. a slight increase. Aside from simple reversion to the mean, one reason is that completion number being higher – many of those wells were completed right at the end of August, so most of their production will come in Sept.

There were a unusally high number of new wells put on production in August. Around 65 compared to around 45 in April-July. The initial production from those wells were quite poor, 210 barrels per day for the month. Historically it´s usually around 300 and during May and June it was 450 and 510. The average production days in August was 16,2 which is expected as the average well is put on production in the middle of the month. So the reason for the low number is not as you said because of the wells were put on production late in the month.

The number of rigs have not increased that much so it must mean that those extra wells comes from the drilled uncompleted backlog. But poor quality of the DUC wells cannot alone explain such a low number. It may be a combination of poor DUC well quality and that they are drilling more wells outside the core areas. What I can see is that around a third of the non confidential wells that came online in August were from counties outside of the top 4 counties, which is very high historically. The first month of data is usually a bit unreliable though. So we may see some improvements from those wells next month.

Of the 68 new wells in the data released last week, 3 were completed in September while 11 were confidential (i.e. with no completion date known, other than it is likely to be in August). 20 of the remaining 54 were completed on the 15th or before, while 34 were completed on the 16th or after. Check the graph here: http://imgur.com/a/1E1Ka – average well completed per day is 1.333 first half of the month and 2.125 second half of the month.

More wells in August is not unusual, it’s in line with seasonal variation.