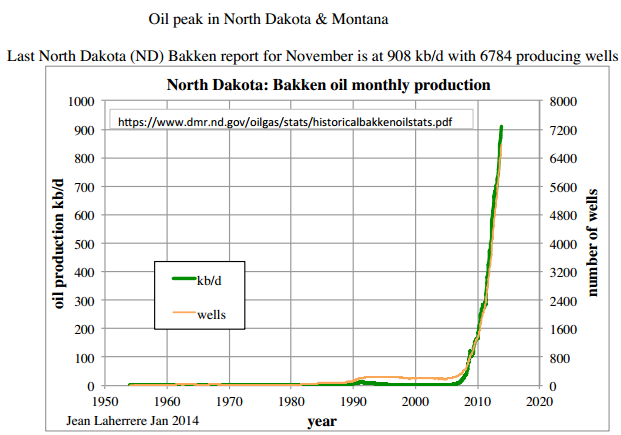

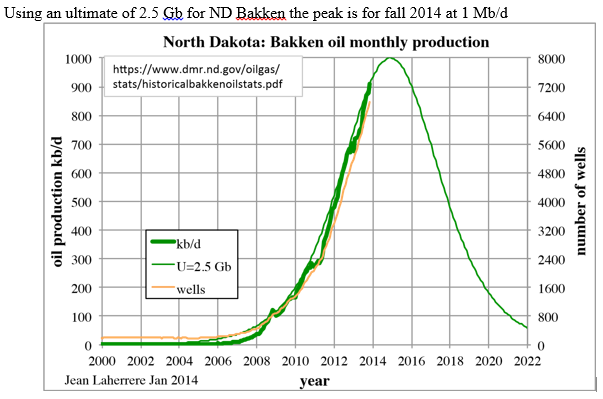

North Dakota published their monthly report on Bakken Production and All North Dakota Prouction. Nothing to get excited about. Bakken production was up 28,285 barrels per day while all north Dakota was up 27,864 barrels per day. This means that North Dakota production outside the Bakken was down 421 bp/d.

The Director’s Cut comments on the price they are getting for Bakken Oil:

Oct Sweet Crude Price = $85.16/barrel

Nov Sweet Crude Price = $71.42/barrel

Dec Sweet Crude Price = $73.47/barrel

Today Sweet Crude Price = $71.25/barrel (all-time high was $136.29 7/3/2008)

Interesting that they are selling their oil at about a $21 discount to WTI about a $35 discount to Brent. More of the Director’s comments:

The drilling rig count was unchanged from Oct to Nov, but the number of well

completions dropped from 166 to 138. Days from spud to initial production remained

steady at 114. Investors remain concerned about the uncertainty surrounding federal

policies on taxation and hydraulic fracturing regulation.

We estimate that at the end of Nov there were about 510 wells waiting on completion

services, an increase of 50.

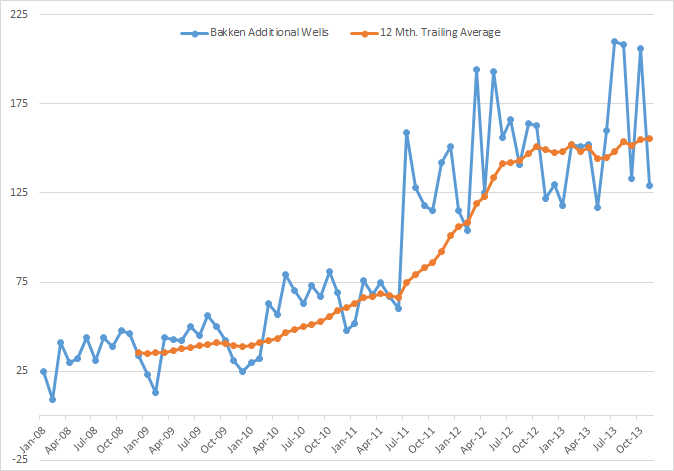

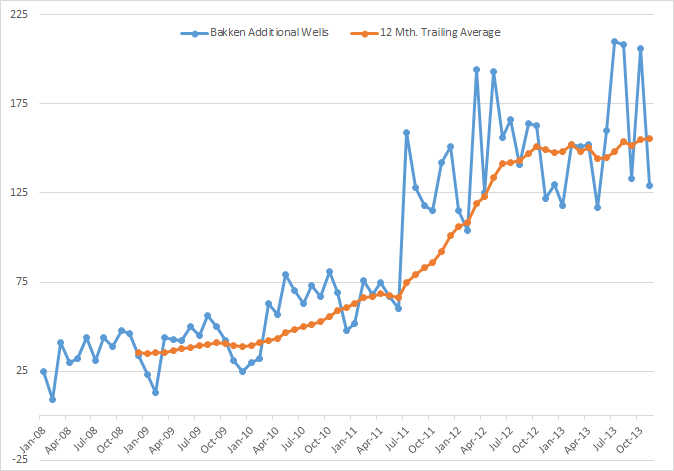

This plot is “Bakken Additional Wells” and the 12 month trailing average. As you can see the average for the last 15 months or so has been pretty flat, around 150 additional wells per month.

Read More