Baker Hughes has published its International Rig Count with production numbers for October. This is a monthly rig count and breaks out the international rigs by oil, gas and miscellaneous. Baker Hughes does not include the Former Soviet Union countries in their count or totals. Baker Hughes also includes the US and Canada in their monthly count but they do not break US and Canada monthly totals out by oil and gas.

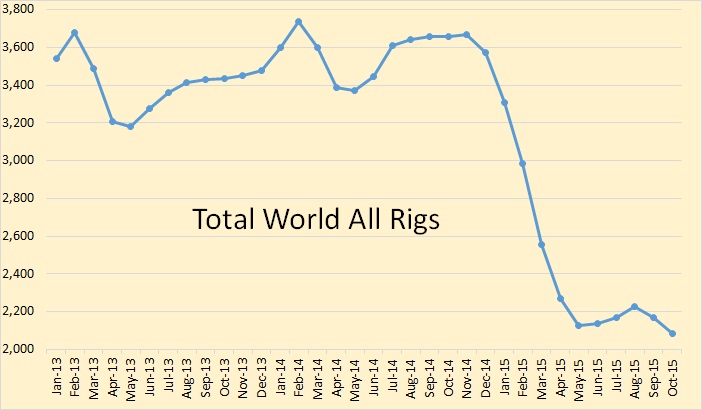

All rigs were down 85 rigs in October to 2,086 rigs. October 14 to October 15 total world rigs were down 1,571 rigs of 43%.

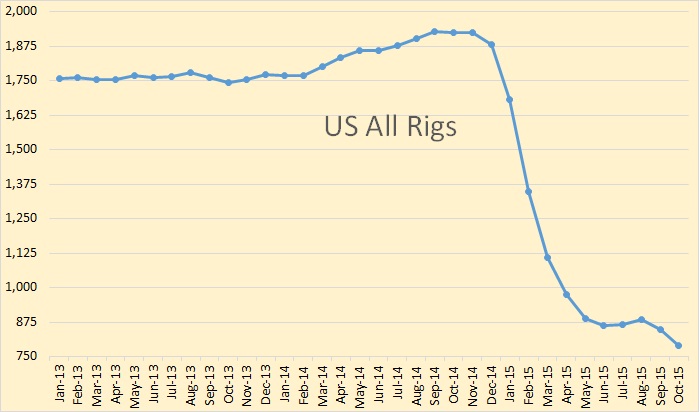

US total rigs were down 57 rigs in October to 791. October 14 to October 15 US rigs were down 1,134 rigs or 59%.

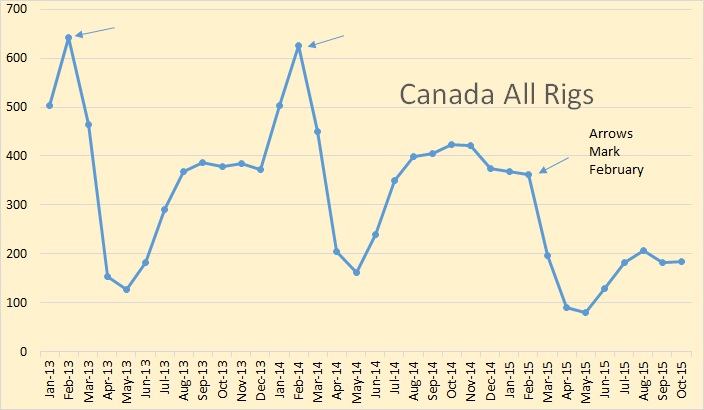

Canada was up one rig in October to 194. October 14 to October 15 Canada is down 240 rigs or 56.6%. For several years now Canadian rigs have peaked in February. This year it was different however.

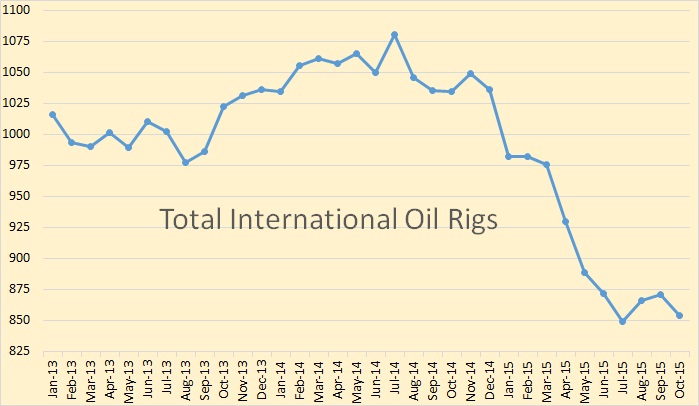

Total international oil rigs were down 17 rigs in October t 854. October 2014 to October 2015 total international oil rigs were down 180 rigs or 17.41% but have dropped 21% since last July. Keep in mind this does not include Russia or any of the other FSU countries.

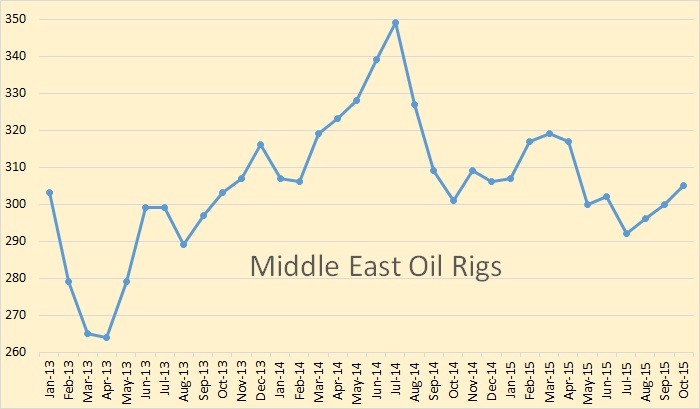

The Middle East rig count has been up three months in a row. They were up 5 rigs to 305. October 2014 to October 2015 they were up only 4 rigs however.

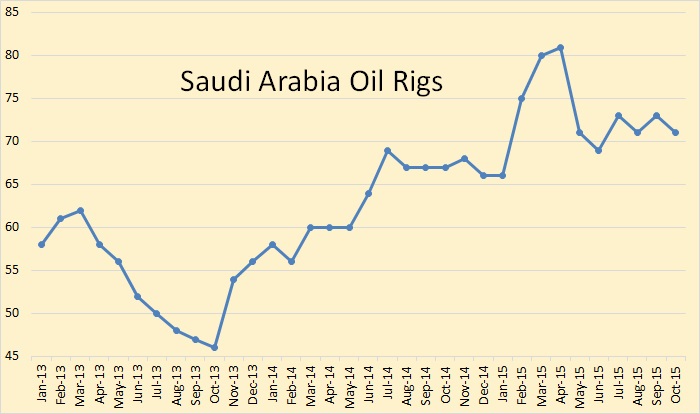

Saudi Arabian oil rigs peaked in April at 81. Saudi gas rigs stand at 54 giving them a total of 135 rigs in the country.

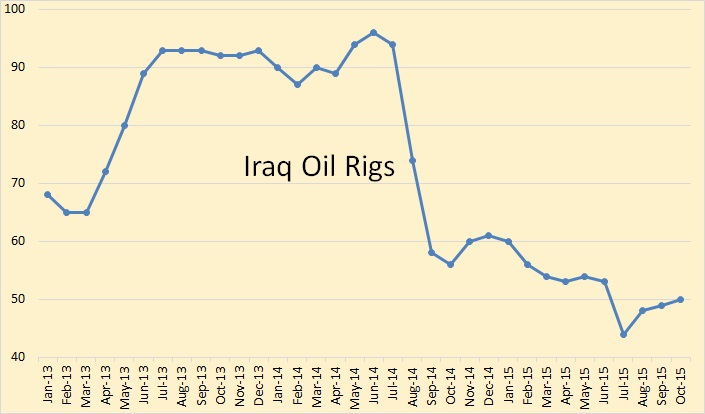

Iraq is one place in the Middle East where the rig count is falling. This is likely due to the ISIS insurgence there.

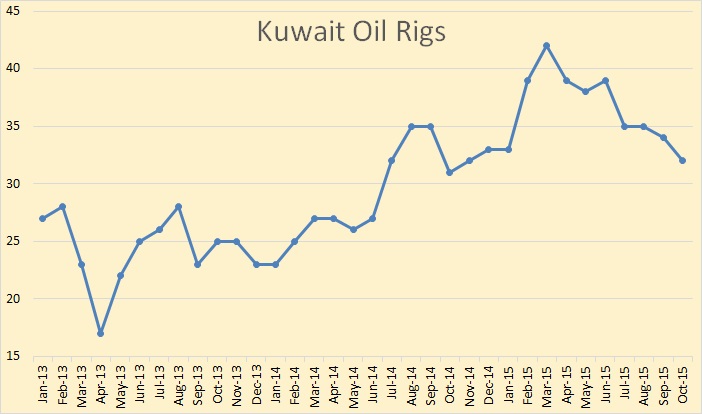

Kuwaiti rigs peaked in March 2015 at 42 and have since dropped by 10 to 32.

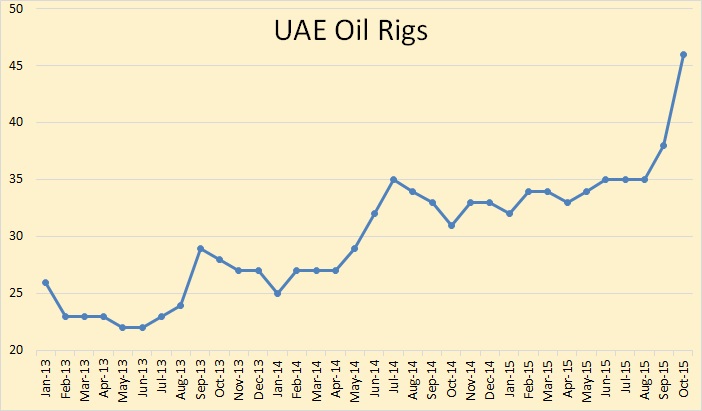

The UAE has doubled its rig count since 2013.

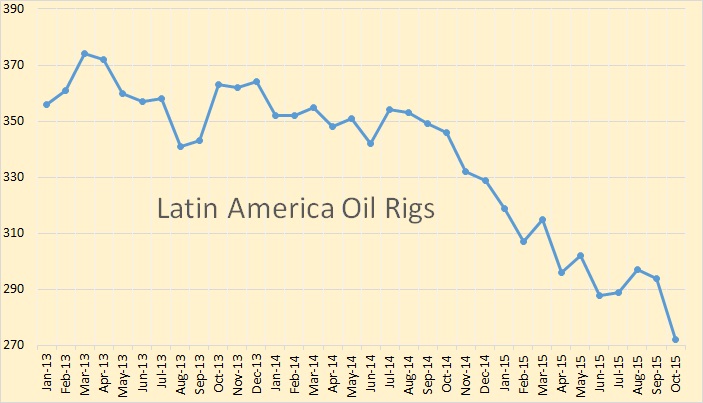

Latin America lost 22 rigs in October. That took them to 272. October 2014 to October 2015 they have lost 74 rigs or 21.39%.

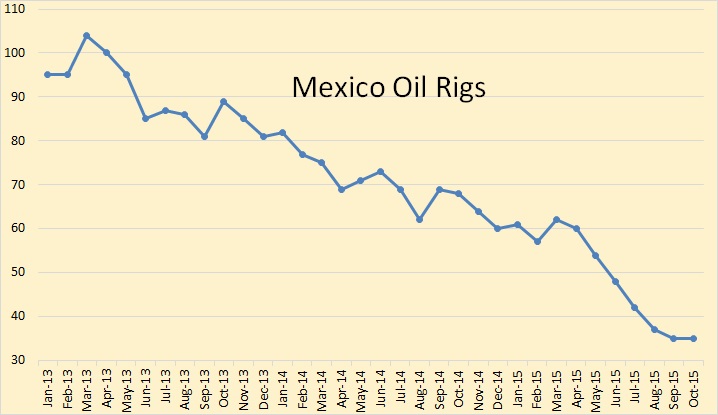

Baker Hughes uses “Latin America” instead of South and Central America. And of course Mexico part of Latin America. Mexico’s oil rigs started declining long before the price collapse. They hit 104 oil rigs in March of 2013 but are now at about one third that amount. They have had 35 oil rigs working for the last two months.

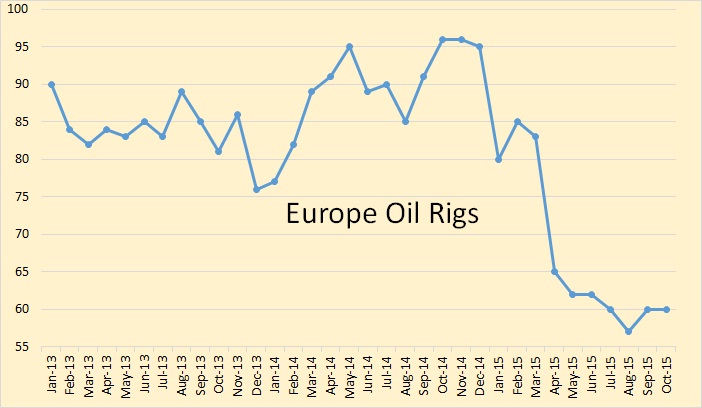

Europe, since last October, has dropped 36 rigs but now seems to have leveled out at 60.

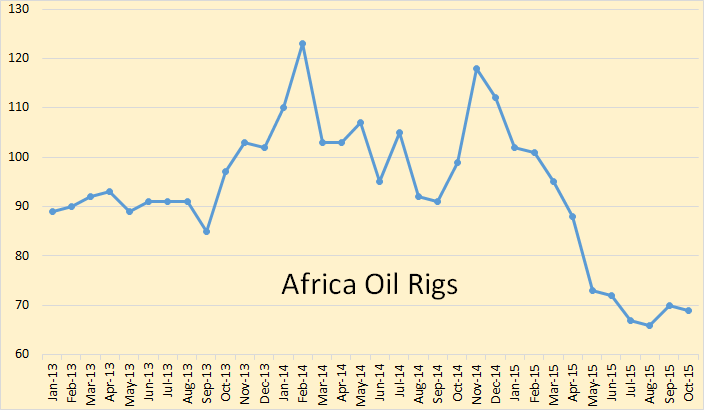

Africa hit 123 rigs in February 2014 and 118 in November 2024 is now down to 69.

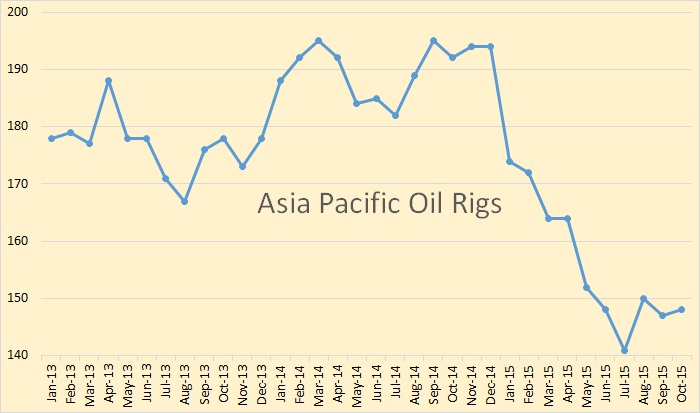

Asia Pacific oil rigs have followed the same pattern as the rest of the world, dropping about 24% since last fall.

Historically production has followed rig count with a delay of about one year. The worldwide rig count did not start dropping in earnest until January 2015. I would expect to see world oil production follow a similar pattern.

A couple of weeks ago I posted a bit about a new peak oil book: “Peak Oil: Apocalyptic Environmentalism and Libertarian Political Culture“. There is now an excellent review of this book on line: Past Its Peak.

Schneider-Mayerson’s questionnaire drew responses from about 1,750 committed adherents of the peak-oil scenario in 2011. That year now looks like the end of peak oil’s era of maximum public exposure. My own unscientific survey of otherwise well-informed people suggests that the whole concept is less than universally familiar, so first a word of explanation.

The claim that oil production has peaked, or will soon, is grounded in a hard ecological and economic reality: as the pool of oil in a well shrinks, it takes more effort and expense to pump out. The return on investment will eventually hit zero. An enormous amount of petroleum remains underground, but the energy consumed in extracting each barrel will exceed the energy produced by burning it. And once we reach that point on a worldwide scale — as must happen, sooner or later, when the last untapped deposit has been located and exploited — the effect can only be catastrophic.

I found another really good peak oil book on Amazon:

The Third Curve – The End of Growth as we know it

This book is a little dated, published in 2013 and is available on Kindle only for $7.99. But I found it an excellent and very easy read. If you have Kindle on your computer then you know you cannot copy and past from it. But Windows Snipping Tool works just fine. From the book:

My next post will very likely be Thursday, November 12th, after the OPEC MOMR comes out.

MEXICO’S CANTARELL OIL FIELD POSTS RECORD LOW OIL PRODUCTION

“The Cantarell oil field — an aging supergiant oil field in Mexico — saw its lowest production in over 30 years with an output of 206,000 barrels per day in October, said PEMEX Exploration and Production (PEP) on Thursday. In its latest weekly report, Pemex said that Cantarell was producing 256,000 bpd at the beginning of 2015, its lowest level since 2004, sparking fears that Mexico’s most productive field was running out of oil.”

Meanwhile Ku-Maloob-Zaap remains on a production plateau of about 850,000 bpd which is expected to continue until 2017.

http://www.shanghaidaily.com/article/article_xinhua.aspx?id=308285

Wow, thats an average decline rate of about 18% per year (since 2003).

Yeh, so much for the long fat tail theory. Mind you, there are extenuating circumstances (Aren’t there always?). I.E., PEMEX started shifting resources away from Cantarell a year or so back.

But I seem to recall a year or so back the big celebration over Mexico passing laws/regulations that were going to bring in foreign technical skills and undo the decline.

Nada.

Yes I guess the relatively low oil price is behind some of it. But on the other hand, as produktion declines it can support less and less resources working on it economically.

Yes, a year ago PEMEX announced a plan to spend $6 billion on Cantarell in 2017 to try to maintain production levels but this was cancelled owing to budget issues (coinciding with the drop in oil prices).

Hi Doug,

Long fat tails are for World output. The decline curves for different regions will not be in sync, or it is highly unlikely to be the case.

Long fat leads with short smaller tails. Western Oil production began in 1860. Over the past ~150 years demand and technology improved to create a very long and fat production curve. However, it’s likely that due to economic contraints, depletion, and extraction Tech peaking, future production will be well below expectiations. the decline curve can not possible match the long ~150 year period before peak.

Hi Techguy,

It is possible that the time to develop oil reserves will lengthen relative to the last 40 years.

Note that there is no expectation that the curve will look similar as oil output declines as it did when oil output was increasing.

Note that most of the oil output has occurred since 1900. The level of output prior to 1900 was pretty low. The average rate of increase in oil output from 1900 to 1973 was about 6.6% per year. The downslope will be far less steep unless a recession or depression reduces demand or oil prices become expensive enough that substitutes and increased efficiency reduce demand for oil. The URR of all C+C will be at least 3000 Gb (with 500 Gb from oil sands in Canada and Venezuela according to Jean Laherrere) and 2500 Gb from C+C less extra heavy oil based on Hubbert Linearization. About 1250 Gb of C+C had been produced at the end of 2014, if 2014 or 2015 are the peak output years, the 500 Gb of extra heavy oil will help to mitigate the decline rate. If oil demand is adequate to keep oil prices near $100/b and supply is adequate to match demand at this price, then oil output will decline slowly after the peak.

There is certainly the possibility that oil prices will rise too high too fast a rate of increase so that a recession will result. If oil prices rise relatively slowly (3 to 5%) per year, then the economy may be able to adjust as people buy hybrids, plug-in hybrids, and EVs, as well as use more public transportation and car pool in response to higher oil prices.

Once the peak is recognized, people will realize that high oil prices are here to stay and there will be greater incentive to use oil more efficiently. In addition car manufacturers will begin to offer more choices in fuel efficient vehicles so that consumers have a broader set of options (instead of the Volt, the Leaf, and the Prius all nice choices in my view, but limited).

“from oil sands in Canada and Venezuela according to Jean Laherrere) and 2500 Gb from C+C less extra heavy oil based on Hubbert Linearization.”

Oil sands need cheap and abundant natural gas. As more and more Coal plants are shutdown the demain for NatGas will increase considerably. Its very likely Oil sands net loser for drillers. I think for the most part Oil sand production growth is in the rear view mirror.

“Once the peak is recognized, people will realize that high oil prices are here to stay and there will be greater incentive to use oil more efficiently”

There will be considerable fewer jobs. Already just about every business is looking or moving to automation. Factories, IT, business systems, and even fast food businesses are all embracing automation. The world is moving to a rising level of poverty as job losses grow from automation, higher energy costs and more regulation. My guess is that within 10 years more than a third of existing jobs will disappear from automation and lack of demand for produced goods and services. Excluding a global war event.

Hi Techguy,

The oil sands that are extracted can be burned instead of natural gas, so the increase in oil prices that is likely to begin in 2017 will lead to continued growth in oil sands output.

Also you are correct that natural gas will become more expensive, this will lead to the expansion of wind and solar power and this will create employment. Automation is a problem, but not every task can be automated. The structure of the economic system may need to adapt to increasing levels of automation, if unempoyment rises as you foresee there will be social pressures for such changes or the economy will become more service oriented.

“The oil sands that are extracted can be burned instead of natural gas, so the increase in oil prices that is likely to begin in 2017 will lead to continued growth in oil sands output.”

That only works if the price per BTU of NatGas is much cheaper than the cost of Oil per BTU. Since Oil sands is very energy intensive, its NatGas needs to be considerably cheaper. I doubt this will hold as natGas prices rise.

Also consider that Prices for energy are falling because of falling demand. Much of the demand in the past 10 to 15 years was fueled with debt expansion. for the past 5 to 7 years its been the Emerging markets (China, India, Brazil, etc) that was driving globe growth. However they too have reach a credit crunch. Debt expansion has likely reached its peak, so the future is likely to experience tepid growth and probably decline as the debt needs to be paided down. Over capacity (driven by the global borrowing binge) is going to result in a large number of defaults that reduces employment.

“Automation is a problem, but not every task can be automated. The structure of the economic system may need to adapt to increasing levels of automation, if unempoyment rises as you foresee there will be social pressures for such changes or the economy will become more service oriented.”

You be surprised what can be automated 🙂 Its already “service oriented” economy, but even the service jobs are getting replaced with automation. Kiosks replacing cashiers\tellers. Call centers, IT, clerk jobs, etc. Its all getting automated, as well as outsourced overseas enabled by high-speed, low cost data comm. Not everyone can become a plumber or electrician 🙂

I’ve read the exchange above between Dennis & tech guy, and want to add the following:

1. When we design very large extra heavy oil projects we have to consider gas and electricity supplies, dilution, upgrading, transport, and marketing. Marketing includes ensuring we have refineries able to handle and process the resin and asphalt molecules.

Thus the tendency for these giant projects (100,000 BOPD or larger) is to design to hold a plateau for many years. I’ve designed projects as large as 400,000 BOPD, and those tend to be optimized with 20 to 30 year plateaus.

2. The industry is developing lower energy cost technology. This technology uses less energy but can cost more money. I can’t remember where my public versus confidential boundary lies, so all I can do is suggest you look up steam additives, vapex, and cold heavy oil production.

3. I’m aware of one study to use nuclear power in cogen mode for giant heavy oil projects.

Hi Fernando,

Thanks. Is the correct interpretation that increased natural gas prices may simply lead to substitution of bitumen, coal, nuclear or some other energy source to replace the expensive natural gas?

DC,

The Montney is a possible player in the Alberta oil-sands game. It’s NG rich and located in NW Alberta and adjacent BC, and some of the big guys are in there a-drilling. (ConocoPhillips and Shell come to mind.) It would be a source of supply of NG to the oil sands.

I only come across mention of it when James Burgess at OilPrice writes it up, but it might be more than just a puff, judging from the interest.

Any indication of what the M o M drop was?

Don’t know, but: PEMEX REPORTS BIGGEST LOSS EVER AS OIL MARKET ROUT CUTS DEEPER

“The company’s losses worsened as U.S. benchmark oil prices fell more than 50 percent from the third quarter of 2014, and the Mexican peso declined 21 percent versus the U.S. dollar in the same time frame. Pemex had a 50 percent reduction in the number of rigs producing oil and natural gas in the third quarter versus a year earlier. Output fell 5.5 percent to 2.266 million barrels a day.”

“Production has declined for 10 straight years since reaching more than 3.3 million barrels a day in 2004. As part of Mexico’s efforts to open the country’s energy industry to outside firms, the next round of offshore oil exploration leases will include joint ventures between Pemex and private companies.”

http://www.bloomberg.com/news/articles/2015-10-28/pemex-reports-12th-straight-loss-as-oil-price-batters-profits

I operate in Mexico. You guys should keep in mind that Pemex is a very poorly run outfit for a long list of reasons, not just poor management. Theft of their products, embezzlement, fraud, corruption and the fact that the government uses it as a piggy bank and all that’s just an appetizer. Their production is directly affected by all that and now they’ve asked the gringos to come in to spend the money to increase production.

There is a lot of corruption and fraud that is well hidden in the US but Mexico is Byzantine.

Byzantine! LOL. Old friend of mine (whose been dead for years) owned and ran a drilling company. He always said:” I’ll operate in any country in the world, except Mexico.” Reason: they’re all crooks plus a legal contract is meaningless there.

The US government is almost as bad and even worse in some ways.

But my point is that the Mexicans could increase production if they wanted.

How would the Mexicans increase production when its declining like it is? What price environment do you envision to make this possible?

Nein Herr Leanme, you know as well as I do that this price won’t support much of anything but Mexico still has a lot of good ground.

Tanker hijacking has been quite the lucrative pastime the last few years. They’ve had to find a way to move all the product being stolen from Pemex. Even moving it across into Texas and selling it to oil guys over there, a few of which were unaware they were buying stolen goods. And everybody got sued by Pemex for real money.

I keep a tight leash on my tankers.

I’ve been assigned to manage technical teams for assets with declining production, and managed to reverse decline and increase it slightly, but it required a huge amount of cash, very competent personnel, good rigs, and unorthodox approaches. For example, I had multiwell pads permitted and built without having a full understanding of where the hell the wells would be drilled.

HR, you are absolutely full of shit. The US government is in no way as corrupt as the Mexican government. It is the the lower levels of Mexican government that is the most corrupt. Everyone is on the take in the lower level local governments.

To say that Mexico could increase production if the wanted sounds like something so stupid it might come from the mouth of Ben Carson or Donald Trump. Mexico would love to increase production. They couldn’t do it because of laws that prohibited foreign companies from having a piece of Mexican production. Then the tried to open it up to foreign companies but got few takers.

To rattle off statements like you do is something you hear on schoolyard playgrounds. All mouth and no evidence of anything you say.

And tanker hijacking is what is keeping their production down? There was a lot of tanker hijacking off the coast of Somalia a few years ago. And it is still happening in Southeast Asia. It is in the news every time it happens, tanker or just a cargo ship. Funny, I haven’t seen any news stories about those Mexican oil tankers getting hijacked. Was that in the Gulf of Mexico? How on earth are they keeping those hijackings out of the news?

HR, you just make up shit. Stop it, go somewhere else if all you can do is make up a bunch of lies.

Well Ok.

For those of you who are so inclined OilPro has a good article from six months ago about PEMEX reported the number of illegal taps as 3,674 in 2014.

http://oilpro.com/post/12258/pemex-battles-ongoing-pipeline-theft

It also discusses an AP article about- The AP reported recently that there has been a 70% increase in illegal taps causing PEMEX to alter necessary processing steps when putting product in the pipelines.

The TV outfit 60 minutes did a 20 minute segment on the severity of the situation a while back and you can watch it at their website.

One of the most concise articles:

Mexico’s state-owned oil company Pemex filed a lawsuit in Houston against nine U.S. oil companies accused of buying and selling natural gas stolen by organized criminal groups.

According to Pemex, those companies facilitated black market sales of gas condensate stolen from the Burgos field which stretches across the north Mexican states of Tamaulipas, Nuevo Leon and Coahuila.

The company claims that “Some of the defendants knew, or at least should have known, they were trading in or transporting, stolen condensate.”

Much of the Burgos field is in Tamaulipas, which is controlled by the Zetas drug trafficking organization. Pemex said it had lost, at times, almost 40 percent of the production from the field, and that several Pemex officials had been kidnapped and threatened.

In June 2010 Pemex brought a lawsuit against five U.S. companies it accused of buying stolen natural gas condensate from Mexican criminal groups. Several were fined by a Texas court.

Mexican drug cartels increasingly use fuel theft as a source of revenue, particularly in the north of the country, as InSight has reported.

http://www.insightcrime.org/news-briefs/mexicos-pemex-sues-us-firms-over-oil-theft

But the most entertaining is from vice news on you tube that discusses the villages that have been burned to ground with the people in their houses after petroleum products that were running through the streets ignited. Im not sure if this was from 60 minutes or vice news, you can watch it here and it’s a good show

https://search.yahoo.com/yhs/search?p=60+minutes+pemex+pipeline+theft&ei=UTF-8&hspart=mozilla&hsimp=yhs-003

As far as “low level corruption.” This spring I’ve been working in Mexico for seven years. I deal with a lot of legit Mexican businessmen. We are surrounded by an ongoing drug war. Whenever the violence flares up and the topic of conversation turns to the drug problem, the Mexicans, to the man, point the finger at the Federal police and the Army. The Federales and the Army control the highways with checkpoints and heavily armed patrols. They are everywhere all the time. Nothing moves thru Mexico without their knowledge.

And I don’t think they are low level. I won’t even get into what they say about who controls the Army and the Federales.

As far as corruption on the US side, this scratches the surface:

http://www.insightcrime.org/news-analysis/us-police-corrupted-by-mexican-cartels-along-border

This will give you a flavor:

A Department of Homeland Security (DHS) report published this year revealed that approximately 2,000 police and other law enforcement officials are under investigation for their involvement in organized crime. The DHS is currently investigating public officials who have received bribes to protect criminals, facilitate drug trafficking, escort drug shipments, and traffic the Mexican cartels’ drugs.

I wish you all a happy and productive day.

This conversation mentions, then goes on to totally disregard, a crucial upstream factors point: The failed ‘War on Drugs’ ™. My brief premise: If the U.S. and Canada, then Mexico, all the rest of the Central and SouthAm countries, would implement the Portuguese solution to the ‘Drug Problem’ ™, then all the oxygen would be sucked out of the situation and the fire would go out. Look stuff up yourselves, I am not your Internet research intern.

Of course you utterly leave out the below-ground factors main point: depletion never sleeps….highest EROEI resources extracted first, diminishing returns cannot be escaped….things wind down as we struggle harder and harder, up to societal structural financial chicanery limits, to extract and burn the last remaining hours of ancient sunlight. All the talking points about hijacked tankers and illegal taps and corrupt federales are just faded margin notes in a tattered decaying old tome.

Ron,

I read HR’s “tanker hijacking” as referring to tanker trucks.

And you would be correct my friend.

Pemex is being deprived of many tens of billions of dollars through the years that could be put back into operations. I mean there is a massive theft going on.

There is one Mexican company that had, at my last glance of their equipment list, around 350 tankers. They had so many tankers get hijacked that more than half of their drivers quit. Said it wasn’t worth it anymore.

Here is the 9 month report for Pemex. Overall production looks stable. Something must be offsetting Cantarell’s decline.

Ron. Thanks for the post! Do you have statistics on number of oil rigs for OPEC members?

OPEC claims just 36,140 producing wells across all members in 2014, 35,272 producing wells in 2010, yet that 16,483 wells were completed 2010-2014.

For example, Ecuador recently announced oil production costs of $39 per barrel. Why would 3,592 onshore wells producing 556,600 bopd cost $39?

OPEC’s numbers look very strange, yet I cannot find any analysis of them.

Maybe those who have worked in OPEC countries could shed some light.

Based on OPEC information, across all OPEC members, over 40% of all wells producing in 2010 were abandoned by 2014?

I am surely missing something.

Shallow, the only data I have is the data published by Baker Hughes, OPEC, the EIA and IEA and other public data that can be found on the net. And it looks like you have researched this subject much deeper than I have.

I’ll try to put it together.

I just wonder about OPEC well count. I do not doubt OPEC countries are able to produce oil more cheaply than US on the whole, but since most keep the info private, and given many fields are very old and under EOR, I am skeptical.

shallow sand,

Here is a table from World Oil.

Wells drilled in 2013, 2014 and forecast for 2015 – Middle East

And North Africa

Rest of OPEC:

AlexS. Thanks!

What’s in the $39??

Fernando. I am not really sure about how the $39 is calculated. I think that private companies operate the production, and each has a contract which provides for how they are compensated. I believe $39 is the overall average cost to the government of Ecuador, per a report earlier this year that they were selling oil for an average of around $30 per barrel in August, and therefore operating at a loss.

The President of Ecuador announced this in late August and many news agencies picked it up on 8/26/15.

I think you are familiar with their production? I am just going off of news reports.

I consulted for an Ecuadorian subsidiary of a foreign company several years ago. I suspect you are right, they must be listing the delivery price charged by these ventures. The real opex is lower, but the oil is transferred with the CAPEX recovery included. They also have fairly steep pipeline tariffs and there’s a natural gas shortage.

Shallow

I did read some time back it was on the oil drum I think that the saudis were busy drilling shallow horizontal wells in northern ghawar to produce oil pockets but they only flowed for around six months.

Oil Production Vital Statistics October 2015

I think I would modify this a bit.

“Banks”. It’s perhaps more so high yield paper issuance, and we have seen at least one story indicating a bank (JP Morgan) orchestrated placement of the issuance in order to service debt JPM had actually loaned. So this would mean banks are selling debt to the public (with their powerful sales force), and doing so to protect their own loan portfolios. One might also wonder about their managed accounts (client money entrusted to in-house advisors) and if those accounts were put into this HY paper.

There was that JPM quote in response to a question about the risks to their loan portfolio. “We have offloaded that risk to investors.”

To a certain extent it all says that I forgot my own mantra: Nothing relevant to money is going to be allowed to destroy civilization, because it can be created from nothingness.

We imagined that a mini Apocalypse loomed, derived from shutting down oil production via loan shutoff simply because it was not profitable. How absurd, in retrospect. Profitable. Profitable was a lot more powerful a requirement pre 2009 than post 2009. Now, it’s almost laughable. No one is going to allow horrible outcomes just because numbers on a screen are red.

Mostly I disagree with Watcher, but I believe he is right when he says MONEY, or the lack thereof, will not be ALLOWED to destroy civilization.

I will put that into other words and say that a LACK of money MIGHT destroy civilization, in the same sense that an auto accident or plane crash might kill you. The possibility is very real that MISMANAGEMENT of money could result in the world going to hell in a handbasket, but imo the odds are at least fair to good that life as we know it will not end PERMANENTLY because of a lack of money.

Money is only a tool, no doubt one of the most useful tools ever invented, and NECESSARY, so far as I can see, but still only a tool. The modern world is not amenable to running on barter, and money is ESSENTIAL, needed as a MARKER to allow us to know who owns what and owes what to who.

But the RULES or LAWS we use to regulate the creation and supply and availability of money are man made, rather than laws of nature.

Money is like gold, which serves very well AS money, if you happen to have some gold, in that it is VALUABLE only because everybody or just about everybody BELIEVES it is valuable. About the only actual USE, other than as jewelry or money, I can personally think of for gold, in my own case, is as a material to fill cavities in my teeth, and a few grams would suffice for a lifetime. BUT if anybody wants to sell me some cheap, I am ready to buy- because I know I can sell it at a profit, or trade it at a profit.

But this is ONLY possible because just about every body has FAITH in the value of gold. Even skeptics will gladly buy today at eight hundred, knowing they can sell tomorrow morning for over a thousand to a million different eager buyers.

Likewise we have FAITH in dollars, or yen or marks or whatever, because we KNOW everybody else will accept them in exchange for goods and services. What this really amounts to is that we have FAITH in our governments creating and maintaining this abstraction we call money as a useful concrete tool (although most of it exists only as patterns of electrical charges on a screen or drive someplace. )

The world REALLY runs on physical goods and physical services, and on TRUST that we will be able to continue to exchange goods and services on terms agreeable to all of us, or most of us anyway.

Basically all that it means when we say we are a billion in debt for this, and ten billion for that, and fifty for something else, and a hundred billon for this and that and the other, and a few trillion for every thing all together, is that all those goods and services have been CONSUMED, and SOMEBODY has been PROMISED PAYMENT for them.

But human affairs involving money and commerce etc are not subject to rigid physical laws of the sort physicists and chemists and engineers ( and even old farmers ) are compelled to observe.

Everything that goes INTO a chemistry experiment, or a chemical factory, emerges at some point FROM the factory. Every last molecule, every last joule of energy appears on both sides of the equation, NOTHING is either CREATED or DESTROYED.

But in the case of credit extended to people ( or entire countries ) the actual goods and services are CONSUMED and no longer existent, except as waste and memories, remaining on the LEFT side of the equation. ON the RIGHT side, there is a pile of IOU’s, promises to pay to the people who were dumb enough to do the lending.

There is in the end NOTHING that can FORCE payment, because for the most part, the people who owe the debt, personally or in the aggregate , are either insolvent, or close enough to insolvent that the debt CANNOT be paid.

Now IF perpetual growth were indeed possible, perhaps the debts could be partly paid,and partly rolled over, and BAU could continue as usual for some indefinite length of time.

BUT I think it is safe to assume that most of us in this forum either believe that eternal growth is NOT Possible , or that even if it is, there is a substantial danger growth will stall for any number of reasons.

SO- what this boils down to, IF growth stalls, is that the holders of all that debt are going to find themselves on the receiving end of some extremely painful involuntary sex.

Some of them are one percenters, and they will fight to maintain their exalted status, but ninety nine to one odds against them mean they are going to LOSE that fight.

Some of the “owners ” of all this debt are people expecting to collect pensions, health care, etc,as they get older, based on past contributions. They are going to get the shaft too. People who expect to reap big profits on residential real estate are going to find their profits negligible to non existent.Fortunes based on high status BRAND NAMES will vanish, because in a collapse, good jeans for forty bucks are going to sell,for a while at least, whereas three hundred dollar jeans will not.

The physical resources we need to continue living as usual are growing short, but not so short as to threaten our current way of life IMMEDIATELY.

OTOH

A MONEY crisis is imo almost sure to erupt WELL before there is a truly serious resource crisis. Such a crisis could erupt tomorrow or next month or next year.

Leviathans are going to have to find a way to get rid of the old debts and restore faith in a new sort of money. ONCE faith in this new sort of money is established, we can get on with life.

Getting rid of the old money, and declaring the old debts effectively null and void, is going to be one hell of an interesting experience.There will be plenty of blood in the streets in plenty of places.

But there is nothing new about this sort of thing, it has happened many times in the past. Countries have lost wars, the local people lose their property and often their lives, the old debts are forgotten because the owners of them LOST the fight. Kings have borrowed money and then imprisoned or murdered the lenders.

The only real difference this time is that the fights are going to be INTERNAL mostly, rather than EXTERNAL. The banks these days are no more powerful than royal families and their allied nobles were in past times. They may win, in terms of surviving as businesses, but the people of the world are going to REPUDIATE their debts, and in the end, there is NOTHING the one percent, The OWNERS of all that debt, will really be able to do about it.

Whatever physical resources still exist at that time will STILL exist, and whatever human capital exists at that time will still exist.Most of it,at least, a lot of infrastructure will be torched, and a lot of good people will die.

If CONFIDENCE can be restored, life will continue as usual, within the limits of physical constraints such as climate and geology.

Confidence WILL be restored, but it might take a generation or two or longer for the restoration to happen.Eventually people will pitch in again on large undertakings.

The pyramids got built without oil and without bankers, although the rulers bookkeepers might be properly described as forerunners of bankers.

Mismanagement of money might result in the end of life as we know it, just as a plane crash can kill everybody on the plane.

But planes in trouble usually manage to get on the ground again without killing everybody aboard, and the mismanagement of money by governments and bankers is not necessarily going to do us all in. There is a big difference between WILL and MIGHT.

In reality, the world economy runs on real physical goods and services,on the one hand, and FAITH on the other, FAITH that we can continue to exchange goods and services on terms agreeable to all or at least most of us.

Money is an abstraction that is the actual EMBODIMENT of that faith. When, or IF we lose faith in our money, there is going to be hell to pay, plenty of blood in the streets, troubles of every sort out the ying yang.

But most likely ( no gaurantees ) the various Leviathans of the world will simply repudiate and declare null and void most or maybe even all debts, and start over again.

Whatever physical resources and human capital still existing at that time WILL STILL EXIST, and people will eventually be willing to engage in large scale works together again. The pyramids got built without oil and bankers.

The people who own OWN all the debt are going to find that they have been awarded the ultimate haircut, they are going to be not only pulled down off their thrones, but stoned and imprisoned and executed. People who own small chunks of it, for instance in the form of an expected old age pension, are going to lose those small chunks as well.

There is nothing new about REVOLUTION.

Elites and governments have been overthrown on a frequent almost clocklike basis since we first evolved societies with elites TO BE overthrown.

Countries have lost wars, the people who lived in them lost everything. Kings have imprisoned and murdered people who lent them money.

Business as usual is a dead man walking, and may die sooner than necessary on account of money troubles.

But in the end, we are collectively in deep DOO DOO MOSTLY NOT because of money but PRIMARILY because of overpopulation, environnmental degradation, and depleting one time gifts of nature such as oil.

There is a time lag of around six months between rig count and production change (see below chart for Bakken). In the comparable period during 2008/9 rig count started to rise in February 2009, yet production rose for the first time in October 2009. Should rig count start rising next month (if oil probably rises by an OPEC cut), production would be still down until at least April 2016.

What is the current fracklog to work through in the Bakken?

Are you using the EIA’s production figures? Oil production increased according to North Dakota state figures in May and June 2015, and September figures aren’t out yet (maybe this week).

Gwalke, the chart shows year over year change in production not production in barrels per day.

I thought it was m-o-m, not y-o-y. Reading what’s actually in the graph often helps understanding!

gwalke,

I used the numbers from https://www.dmr.nd.gov/oilgas/stats/2015monthlystats.pdf, the site Ron gave in his last post. For the previous years I have just changed the year within the address and this worked well. Although total EIA numbers show a resilient US production it is somehow mitigated by the still rising Golf of Mexico production, which is conventional and has a time lag between rig count low and production of around 18 months. Conventional production will start declining around April 2016 and then the recent trend in the Bakken will also show up in the EIA numbers.

Hi Heinrich,

I was unable to reproduce your production %yoy chart using NDIC data. Can you share how you interpret %yoy change in production? I would do it as this year divided by last year (for the same month) minus one and then multiply by 100 to put in percentage terms.

Dennis,

I took the month of the current year substracted the same month from the previous year and divided this results by the month from the previous year and multiplied the whole with 100. If you look to the chart of AlexS, it has the same pattern except he took numbers from 2010 to 2015 and my numbers were from 2003 to 2015. The whole point was to show the time lag between the low of rig counts and the restart of production. It perfectly fits a time lag of six months. Oil prices started falling in October 2014 – hence the production peak in April 2015. The same was true in 2008/9 when oil prices fell in August 2008 and production peaked in February 2009. Rig count recovered in Spring 2009 as production then started rising in the fall 2009. As a conclusion production will only recover by earliest April 2016 as rig counts are still falling. So far, the model works quite well. However, this works just for shale oil and gas. For conventional production the time lag stands around 18 months. Golf of Mexico production is still rising and will very likely start its decline by April 2016

Hi Heinrich,

Ok. the denominator of these calculations is never clear. I would tend to use either the current month or the average of current and previous month, using the earlier month in the denominator is an odd choice (at least to me).

I don’t think the rig count is a great indicator because the size of the frack log can change the lag time, as can the level of rig efficiency(wells drilled per rig per month). Both of these are variable over time so it is hard to predict what will happen going forward. The price of oil is the key variable and the future oil price is unknown.

Heinrich, all North Dakota stats can be found here:

North Dakota Industrial Commission, Department of Mineral Resources, Oil and Gas Division, home page

The chart I published with the monthly spuds update can be found by clicking on “General Statistics ” on the left of the page, then clicking any year after :

•Monthly statistical update”.

Ron,

Thanks for the link. This is why I like your website as you are open with your knowledge, which gives me a lot of input and insight. Thank you again.

Bakken y-o-y oil production growth (%)

Source: NDIC

Y-o-y oil production growth in the Bakken was still positive in August, but it will turn negative in 4Q

Y-o-y oil production growth in 4 key shale oil plays

Source: EIA DPR November 2015

The decline is more visible in this chart:

AlexS,

The whole point of my post was to show the time lag of rig count and actual production with some real numbers. However, the steep Eagle Ford decline confirms my view that there is something big going on in Texas as the decline is not linear – which is the basis of many mathemathical models – but exponential. It looks like producers in Texas are aggressively slowing down production, which is the right thing to do as this will pave the way for an oil price rise. There might be also something else going o other than a simple production cut as the well productivity shrank the first time ever in shale (see my below post). Nevertheless, I am already curious what the next numbers will be.

Thanks for clearing this up, Heinrich. I would definitely trust North Dakota DMR figures over EIA any day of the week. I was just having a brainfreeze and thinking the change was m-o-m not y-o-y.

Anecdotal…Canada

A friend of my nephew recruited him to start as a driller right after high school this year due to his work ethic, size, and that he obtained his C ticket welding while still in grade 12. Prime candidate. The job was to begin this September. The drilling company anticipated needing new employees. The experienced driller (his friend) was dispatched to a job after a long layoff just last month. He was recently sent home and told there would be nothing for even the experienced hands. There would be no openings in the forseeable future.

Nephew is drilling, but drilling water wells around Victoria and the gulf islands. He is very busy and doing pretty good for a kid 18 just out of high school. The wages are decent, there is lots of OT, a per diem, the works….all heady stuff for a kid. Many experienced welders have returned home from Alberta looking for shipyard work in Victoria. As such, he probably will not end up welding, either. However, when I got him into the welding program it was to get a leg up on kids who leave school not knowing what end of a wrench to hold. It was simply to get him his start, which it has. He can always return to school, later, with cash in his pocket as opposed to student loan applications.

Nephew is now saving for a condo or house. Old uncle (me) has advised him to wait until ‘after the housing collapse’ sure to hit Victoria any month now, at least as far as I can tell.

Having a profession such as engineering PLUS a trade such as welding is potentially the difference between a young man doing very well in the future and maybe just getting by.

I have always been a rolling stone myself, and always found it very much to my advantage to have qualified myself in multiple lines of work. My degree got me in the door on some occasions, on others my certifications as a welder, professional trucker, pesticide applicator, etc got me in or kept me in.

My CDL A with hazmat enabled me to keep working on a construction job once when pink slips were being issued right and left. SOMEBODY had to drive the equipment service truck a few hours hours every day, but there was simply no longer enough work to justify a driver with no other duties.

You can get a cdl in a month or less at a commercial school, or in a couple of months weekends at a community college.It’s as easy to get as falling off a log, it’s just a third grade level written test. I got mine by taking the road test and swearing truthfully that I had five hundred miles experience.

The more things you can DO , the more valuable you are as an employee, especially when business is slow.

A years hands on varied experience in residential construction and a quick course in reading drawings at the community college is enough to enable a willing man with a brain to save a hundred grand by building a himself a nice house. I know a couple of people who have done just that living in a camper in the back yard for a year while building.

With regard to peak oil book publications:

Permanent Oil Schock, L.F. Ivanhoe

“The two basic factors of the world’s oil supply are (1) geologic (discoveries) and (2) economic (distribution). Petroleum geologists have done such a good job of finding oil that it looks as easy as growing crops, and our engineers deliver the petroleum like clockwork. Consequently, the public and many planners consider global distribution to be the only supply problem and attribute all price swings to simple economics. They erroneously ignore critical long-term geological facts and assume that cash spent = oil found. This premise is invalid where no oil exists or where prospects are poor. Most people are unaware that the global quality of geological/oil prospects has declined so much that the amount of new oil found per wildcat well has dropped 50% since a 1969 peak. Discoveries of the most critical but easiest to find giant fields (each with over 500 million bbl of recoverable oil) are now stalled at 315 known worldwide. We are simply no longer finding enough new crude oil to replace the world’s huge consumption of 20 billion bbl (840 billion gal) per year.”

http://www.searchanddiscovery.com/abstracts/html/1987/annual/abstracts/0571a.htm?q=%2BtextStrip%3Aopec+textStrip%3Astatistics

Looks like the troubles are here to stay.

Hi R Walter,

Using production data for C+C less extra heavy (XH) oil, following Laherrere, a Hubbert Linearization (HL) results in an estimate for World URR of 2500 Gb. This method has tended to underestimate URR in tthe past (Laherrere in 2008 and 2013 at 2000 Gb and 2200 Gb) so I assume that future increases in estimated proved plus possible (2P) reserves will result in an increase in C+C-XH URR to 2800 Gb (a 12% increase over the HL estimate. I also assume extra heavy (oil sands from Canada and Venezuela) URR will be about 600 Gb, with C+C URR= 3400 Gb (including oil sands resources).

In Ron’s previous post I showed a possible scenario with extraction rates increasing though 2025 at ra similar rate to the 2009 to 2015 period. (This is the extraction rate from proved producing reserves of C+C-XH resources). Below I present an alternative scenario with extraction rates remaining at 2016 levels of 8.3% (in 2014 the extraction rate was 8.1% and 2015 is based on the October OPEC forecast for 2015 and EIA data through March 2015).

As Ron Patterson has pointed out occasionally, I don’t know what future extraction rates will be. I agree.

Below is the scenario presented in an earlier post which was more optimistic about future extraction rates. If oil prices are above $100/b and remain at that level, I think the scenario below is more reasonable, but I have been wrong in the past.

In the a post above I typed “ra” and it was supposed to be “a”, just caught it now. sorry. Note also that the lower extraction rate in the scenario with the lower peak in 2015(less than 80 Mb/d), results in a lower annual decline rate, mostly less than 1% except for 2015 where it is 1.5%.

For completeness, I did a scenario with extraction rates falling after 2015 to a level below the 2005-2008 average extraction rate by 2024. The annual decline rate rises to almost 2% from 2017 to 2021 and then falls below 1% by 2025.

I do not think falling output and the resulting high oil prices are likely to reduce the level of extraction of producing reserves unless there is a severe recession like 2008/9, note on the chart how little the extraction rate changed over the 2007 to 2010 period.

2200 Gb would be 300 billion metric tons.

2,200,000,000,000/7.3=301,369,863,014 metric tons of total oil extracted, yet of be extracted, past production and future production.

If consumption is 10 million metric tons burned each day, it is 3,652,500,000 tonnes per year consumed by the gaping maws of industry to allow civilization be in the gluttony mode, with half of it gone, 150,000,000,000 tonnes to go, then there is a fifty year supply in the ground and under the seas and oceans.

The metric system is of an advantage when calculating the numbers, IMO.

Thanks to Robert Wilson for the links to L.F. Ivanhoe’s findings and conclusions, appreciate it.

Hi R. Walter,

Note that cumulative production of C+C through 2014 is about 1250 billion barrels or about 170 metric tonnes. Also remember that the 2200 Gb does not include oil sands resources which Jean Laherrere estimates at about 500 Gb, these cannot be developed as quickly as conventional resources but the will help to reduce the decline rate if they continue to be developed after the peak.

Hubbert linearization for C+C less extra heavy oil for 1970-1986, 1987-2004, and 1993-2014 with URR of 850 Gb, 2000 Gb, and 2500 Gb respectively in chart below using EIA data and XH output estimates from the Canadian Association of Petroleum Producers (CAPP) and Venezuelan Orinoco output estimates from Jean Laherrere’s 2013 Oil Forecast.

Regarding your quote from Ivanhoe – “We are simply no longer finding enough new crude oil to replace the world’s huge consumption of 20 billion bbl (840 billion gal) per year.” When I divide 20 billion by 365 days, I get 54,794,520.5479. Unless misquoted, I do not have a clue what Ivanhoe is talking about. Using only crude, the world is producing over 70 million barrels per day. I know that we are not adding over a billion barrels of oil into storage every 2 months. So the world’s consumption of whatever he is talking about is significantly greater than 20 billion bbl per year.

The time it written was 1987.

Follow the link and read it all.

correction: the time it was written was 1987.

I noticed a mistake above. I said “proved plus possible (2P) reserves”, I meant to say “proved plus probable (2P) reserves”.

R Walter – Buz Ivanhoe’s newsletter was initially intended for snail mail distribution. Buz did not use computers. Jay Hanson was the first to post issue #1 on the internet.

http://hubbert.mines.edu/

Addendun http://www.mombu.com/politics/politics/t-lf-ivanhoe-has-come-and-gone-4430597.html

https://www.project-syndicate.org/commentary/debt-threatens-global-economy-by-richard-kozul-wright-2015-11#9bVidMsfaVX73OEz.99

Hi Schintzy,

If global growth stagnates, interest rates won’t rise by much. So high interest rates and low GDP growth is not a very realistic scenario. Very poor monetary policy could accomplish it (like Volcker in the 80s), but we may have learned something since then about monetary policy.

xxxxx test

http://www.theonion.com/graphic/beijing-fire-department-extinguishes-massive-five–51720

Good for a belly laugh and a test to see if I can get something to post.

“An oil-workers strike launched Sunday has shut down up to 13% of Petrobras’s daily crude production”

In 2007-2008 this would have sent oil up $20.

http://www.marketwatch.com/story/board-turmoil-hits-brazils-petrobras-2015-11-06

It’s a real debacle down there.

It’s a real debacle down there.

Yeah, sorta, kinda… this comes on the heels of a recent and prolonged bankers worker strike. The problem is that the current government can no longer afford all the social programs for the economically disenfranchised that it started during times of greater prosperity. It depends heavily on income from natural resources and the system is rife with corruption which further leaks away capital from many of these social programs compounding these issues. Everyone is still operating on the old models which can no longer work when the system encounters physical limits. These are precisely the circumstances one would expect when cheap oil is no longer available. The next thing to watch for is more political unrest which will not be able to be handled by either side of the aisle. Neither the left nor the right has viable solutions for these issues because they are not problems to be solved, they are solutionless dilemmas. The system is just plain broke, (pun intended) so you gotta fix the system and the good folk with all the vested interests don’t want to change or give up their gravy trains. Should be an interesting ride. The good news is that it has been raining quite a bit and the drought has begun to lift a little and there is more water in the reservoirs but I still think it is going to be a long hot summer. Of course Carnaval is just around the corner and all will be well, at least until ash Wednesday 🙂

Of course Carna(ge) is just around the corner and all will (not) be well, at least until ash Wednesday.

There, fixed that.

Everyone is in a real bind, might as well face the music.

Carnaval…bread and circuses…better than implementing a ‘The Purge’ tradition…or reinstating sacrifices to the Gods to bring good harvests or whatnot.

Are you ready for some Football? ™

Everyone is in a real bind, might as well face the music.

Did you say face the music?! Right, might as well! It’s a tough job but since someone has got to do it might as well be me… 🙂

Bellini – Samba Do Brasil

https://goo.gl/2d6idE

“G-o-o-o-o-d morning, slaves, and welcome to another sedition of,

It’s The End Of The World As We Know It And I Feel Fine

The show where all of the popos’ darkest fears come to life…”

The Silhouette Of The Amish (Instrumental)

There seems to be a gremlin in the soft ware that prevents a comment from appearing right away sometimes.

I could not SEE the one I posted at five eleven pm after an hour, and presumed it was not going to show, and posted a shorter version of it a couple of hours later, which also did not show on my screen— until this morning.

Hence the xxxxx test, which DID show up right away.

Are other commenters having similar problems sometimes?

I had one or two of my posts last week get snagged in the spam filter, but I edit the hell out of some of them anyway, recently thanks to Dennis. 😀

“Worldwide Rig Count Dropping Again”

Oh noes! 😀

Mac, your comments were caught by the spam filter for some reason. I released them this morning. Hope you don’t have this problem again. But I now check the spam filter several times a day to see if any comments are there that are not spam.

Hi Old Farmer Mac,

Maybe the spam filter looks for words capitalized, if you use boldface or italics, this may be less of a problem. Your comments did have a lot of capitalized words for emphasis. I know this is easier to type, but generally all caps is considered shouting on the Web and we like to keep our voices down 🙂

Hi Dennis,

I understand about the caps being considered shouting, but my comments are seldom directed at anybody in particular, and while the filter may be snagging caps, it has not been doing so in the past.

I can do italics and bold face, but it takes about eight or ten keystrokes the way I was taught to do it. The cap key is one stroke on and one off.

Perhaps there is a faster way?

Hi old farmer mac,

I was kidding about the shouting. I don’t know why the spam filter is picking up the all caps, but I have no way to adjust it. You seem to be using more of the all caps lately. I don’t know of any tricks for making bold easier to do.

WARMING SET TO BREACH 1C THRESHOLD

“Global temperatures are set to rise more than one degree above pre-industrial levels according to the UK’s Met Office….. This is the first time we’re set to reach the 1C marker and it’s clear that it is human influence driving our modern climate into uncharted territory….”

http://www.bbc.com/news/science-environment-34763036

Meanwhile:

CO2 LEVELS HIT RECORD HIGH FOR 30TH YEAR IN A ROW

“Greenhouse gas levels in the atmosphere reached a record high in 2014 and the relentless fuelling of climate change is endangering the planet for future generations, the World Meteorological Organization said on Monday….”

http://newsdaily.com/2015/11/co2-levels-hit-record-high-for-30th-year-in-a-row-wmo/

And of course:

The rise in carbon dioxide levels is being amplified by higher levels of water vapor, which are in turn rising because of carbon dioxide emissions, the WMO said.

Levels of the other two major man-made greenhouse gases, methane and nitrous oxide, also continued a unrelenting annual rise in 2014, reaching 1,833 parts per billion (ppb) and 327.1 ppb, respectively. Both rose at the fastest rate for a decade.

My only question: Who will be the first “armchair expert” to deny the significance of this?

Hi Doug,

Peak fossil fuels will help reduce the magnitude of the climate change problem. If the mean estimate for equilibrium climate sensitivity(ECS) is correct (3 C for a doubling of atmospheric CO2) and if Steve Mohr’s best guess for fossil fuels is roughly correct, the atmospheric CO2 would top out at about 520 ppm and then slowly decline. This would mean the equilibrium temperature would be about 2.7C above the pre-industrial average (Holocene up to about 1750). This ignores possible effects from methane and other GWGs, but mainstream climate scientists usually focus on the CO2 as this is the biggest effect. The other effect I ignore is the aerosols in China which may be masking some of the effects of increased CO2.

Fernando often claims that the GISS models have an ECS of about 2.5C (I checked this and he is correct). Using that value for ECS and the other simplifying assumptions the temperature rises by 2.2C. Still a problem, and of course there are other models with ECS of 4.5C and higher and we don’t know which of these are correct.

I often mention to Fernando that we don’t build bridges with a factor of safety of 0.83, usually it is 2.5 or higher. Not sure about fighter jets I guess those are just strong enough not to fail.

ANY REAL DISCUSSION of any serious issue NEEDS gadflys of the Fernando sort, because they help keep the political aspects of the discussion honest.

EVERYBODY in this forum ought to know by now that I am a firm believer in forced climate change which will mostly manifest as warming and that I am a pedal to the metal renewables and efficiency advocate.

But the simple goddamned TRUTH is that the environmental movement as a whole tends to gloss over or totally ignore some TRULY PERTINENT FACTS- the most important such fact being that fossil fuels DEPLETE.

Now a hell of a lot of people are perfectly willing to wink and accept such lies by omission if they agree with the overal goals of the people who tell them.

But there are also PLENTY of good reasons to make sure the ENTIRE truth gets out.

For example, I personally think a hot WWIII brought on by resource wars, with the KEY short supply resource being oil, might very well finish us off before we NEED to worry much about climate change, considering nearly all that might be left of us might be a few bones glowing in the dark. ( not literally )

I am not talking about oil being short enough to fight WWIII as a consequence in the VERY NEAR future, but ten or twenty years down the road ? We just don way of knowing for sure.

Dennis and Ron Patterson might not think of themselves as climate change gadflies, but insofar as THINKING and WELL INFORMED people are concerned, THEY ARE GADFLIES, because they point out very real weaknesses in the usual forced climate change arguments.

ANY REAL DISCUSSION of any serious issue NEEDS gadflys of the Fernando sort, because they help keep the political aspects of the discussion honest.

EVERYBODY in this forum ought to know by now that I am a firm believer in forced climate change which will mostly manifest as warming and that I am a pedal to the metal renewables and efficiency advocate.

But the simple goddamned TRUTH is that the environmental movement as a whole tends to gloss over or totally ignore some TRULY PERTINENT FACTS- the most important such fact being that fossil fuels DEPLETE.

Now a hell of a lot of people are perfectly willing to wink and accept such lies by omission if they agree with the overall goals of the people who tell them.

But there are also PLENTY of good reasons to make sure the ENTIRE truth gets out.

For example, I personally think a hot WWIII brought on by resource wars, with the KEY short supply resource being oil, might very well finish us off before we NEED to worry much about climate change, considering all that might be left of us could be a few bones glowing in the dark. ( not literally )

I am not talking about oil being short enough to fight WWIII as a consequence in the VERY NEAR future, but ten or twenty years down the road ? We just don’t have any way of knowing for sure.

Dennis and Ron Patterson might not think of themselves as climate change gadflies, but insofar as THINKING and WELL INFORMED people are concerned, THEY ARE GADFLIES, because they point out very real weaknesses in the usual forced climate change arguments.

Hi Old Farmer Mac,

As I said above. Using all caps for emphasis is probably what causes the spam filter to catch your comments.

It may take longer to use italics, but once you get used to it, it is not that hard, also as I mentioned all caps is considered shouting (on the web) and is impolite 🙂

I’m familiar with those arguments which all seem to underrate the affect of atmospheric moistening. Of course we all know that climate warms from burning of fossil fuels but the concentration of water vapor will (is) also increase in response to that warming. Moistening of atmosphere (especially in the upper troposphere), in turn, absorbs heat and further raises the Earth’s temperature. Methane, as you have alluded to, is a big unknown. The biggest mystery to me Dennis is how you project your big fat tails so far into the future, on one hand, and then presume that decreases in fossil fuel burning will somehow save us from catastrophic warming. Water vapour is the most dominant greenhouse gas. Water vapour is also the dominant positive feedback in our climate system and amplifies warming caused by changes in atmospheric CO2. This feedback is why climate is so sensitive to CO2 warming.I confess to being an armchair observer on this.

Hi Doug,

The equilibrium climate sensitivity takes into account the increased water vapor in the atmosphere as it is the main mechanism that results in warming due to increased levels of atmospheric CO2.

Fernando as repeatedly pointed out that the RCP8.5 scenario is nonsense if one accepts the limited fossil fuel resources that are likely to be extracted. I agree with that point.

Some people do not realize that most of the atmospheric carbon dioxide will remain in the atmosphere for many centuries (tens of thousands of years to reduce the level by half) if only natural processes remove it from the atmosphere, so that fat tail of carbon I am well aware of having read a lot of David Archer’s work on this subject.

In a fossil fuel scenario I have created using reasonable estimates of coal, natural gas, and oil and estimated land use change and cement production and natural gas flaring, there are 1200 Gt of carbon emissions (not CO2) and using a modified Bern Model I get about 520 ppm of CO2 for a maximum in about 2100.

If ECS is 3C for a doubling of CO2, because the effect is logarithmic that would be ln(2) or 0.693 for an atmospheric CO2 of 560 ppm, in my scenario we would have ln(520/280)=0.619. Using basic algebra we have

x=3*0.619/0.693=2.68 C.

I know that you know all this, this is for those who know less Math and Science than you.

I am not sure why you are arguing as I said this is a problem, any thing above 2 C is a problem in my view, and 1 C would be better still (though not very realistic).

A rapid transition away from fossil fuels is needed so we “only” emit 1000 billion tons of carbon from fossil fuels, cement production and land use change. Even this might be too much if the ECS estimate of 3C turns out to be too low (maybe it is 3.5C rather than the 2.5C or less that Fernando favors).

The folks at Real Climate think the methane story is overblown, but they (and I agree with them) think climate change may be a serious problem.

Short story, I agree with you.

Hi Doug,

It also occurred to me that Gavin Schmidt is one of the lead scientists developing the GISS models. I am fairly confident that he is aware of the effect of water vapor in climate change.

In the Real Climate post linked below Schmidt and Mann say the GISS E2-R model has an equilibrium climate sensitivity (ECS) of about 2.33 C (2.1/0.9 if you read the whole post).

http://www.realclimate.org/index.php/archives/2014/01/a-bit-more-sensitive/

The main point of the post is that some research suggests the models with ECS of about 4C give more realistic results, much of the difference in the models has to do with how they deal with clouds which is an area of great uncertainty in climate science.

Another interesting aspect is that it takes a long time for the system to reach “equilibrium” temperatures. See

http://www.gfdl.noaa.gov/blog/isaac-held/2011/03/19/time-dependent-climate-sensitivity/

For a model with an ECS of about 3.2C,it would take about 200 to 300 years to reach 2 C after atmospheric CO2 doubles (560 ppm). This is largely due to the time it takes to warm the ocean (with a mixing time on the order of 400 years).

Again my point is not that climate change is not a problem, only to point out that the “fast” climate responses are fast only in geological terms. By human standards the climate will change relatively slowly.

After 600 years the system has still not reached equilibrium temperature (temperature has risen to 2.7 C over pre-industrial for atmospheric CO2 doubling to a maximum of 560 ppm).

If we assume only 1200 Gt of carbon are emitted (due to fossil fuel depletion) and atmospheric CO2 reaches 510 ppm rather than 560 ppm, then the temperature would rise to 2.4C above pre-industrial (before 1750) Holocene average temperatures (roughly the year 2700). This is if the ECS is about 3.2C, using Isaac Held’s data from the link above and assuming the response to atmospheric carbon dioxide levels is logarithmic.

By human standards the climate will change relatively slowly.

Perhaps for those humans who live in shopping malls and office buildings… out in the real world the signs are already evident everywhere. Go talk to some ecologists!

Hi Fred,

I don’t know that it was an April Fool’s post. Did you read the post? Lambda is actually used in these equations, if you follow the links in the post it is referring to a real conference, that Schmidt thought was important.

Do you think that all problems in climate science have been solved? I can’t imagine you would.

Hi,

The post above I put in the wrong place.

Yes the temperature has increased rapidly compared to most of history, on that point we agree. The value of the climate sensitivity is not known with precision, if it is 4C it is certainly a bigger problem than if it is 2 C.

In fact the uncertainty is a big reason we should be cautious.

Another major positive feedback;

“What does a climate catastrophe look like in a real world context? Since September, daily emissions from Indonesia’s fires exceeded daily emissions from the entire U.S. economy on 26 days. To put it into perspective, the U.S. economy is 20 times larger than Indonesia’s. Van der Werf pointed out in a recent report that emissions from these fires over a three-week period are also already higher than the total annual CO2 emissions of Germany.”

http://www.wri.org/blog/2015/10/indonesia’s-fire-outbreaks-producing-more-daily-emissions-entire-us-economy

There is an estimated 1.2 to 1.6 degree increase already baked into AGW due to the 10 to 40 year lag time in warming. That plus there is an estimated 1.3 degree temp increase that can happen if we were to loose our umbrella known as Global Dimming. Odds are we are already past the tipping point so all planing needs to be from that perspective not the perspective that we have a certain time frame or carbon budget.

What should we do you ask? LESS!!!!

Hi Jef,

The research I have read says that 1000 billion tonnes of carbon emissions will keep us at 2C or below if the ECS is 3C. This does not include earth system feedbacks, but not all climate scientists agree with the 6C estimate by Hansen and the Earth system effects will happen over thousands of years, the focus should b on the ECS (equilibrium climate sensitivity) or the transient climate response (TCR).

Using current CO2 levels we have 1.57C of warming above pre-industrial baked in if the ECS is 3C. So if the current estimate of 1 C above pre-industrial is correct we have another 0.57 C of warming coming. The “aerosol effect” from Chinese pollution may or may not be significant, further research is needed on this as clouds and aerosols and their interaction is an area of active research with a great deal of uncertainty.

If you think we should be cautious and emit less carbon rather than more, I agree. I do not think it prudent to overstate the case.

Dennis – Not sure why you so easily dismiss the other top 3 or 4 greenhouse gases that are increasing and in fact nearing the hockey stick stage of exponential growth without any logical, physical reason for them to peak or decline.

Also aerosols are a global issue. China might be the biggest emitter but India is massive and in fact just about every Country is adding to global dimming. The science is much better understood than you seem to think and has been for a long time now.

To my knowledge there is nothing I have said or any others for that matter that is overstating anything AGW related, in fact the opposite is true.

Understating the urgency is the #1 reason that we are so screwed.

Hi Jef,

Read the following post from Real Climate, there is much work to be done.

http://www.realclimate.org/index.php/archives/2015/04/reflections-on-ringberg/

I am not disputing the science that is well understood. I am making claims that can be substantiated. The other gases are much less important than CO2, note how the levels are in parts per billion and at least for methane its residence time in the atmosphere is very short relative to CO2 so its effect over the long term is far less significant.

For a main stream climate scientist’s (David Archer) take on methane see

http://www.realclimate.org/index.php/archives/2013/11/arctic-and-american-methane-in-context/

Also note that if you believe that fossil fuels will peak, then scenarios that assume atmospheric CO2 will rise to 4x pre-industrial levels (1120 ppm) are to be ignored. We will not extract enough fossil fuel to accomplish that feat (though Michael Lynch may believe that we will).

Dennis,

I think there’s a risk here that needs to be included: “pedal to the metal” burning of fossil fuels.

I agree that the models you’ve presented of oil and other FF consumption are likely. But, they’re not geologically determined. The current curve of FF consumption and renewable/efficiency development is partly the result of public policy, which takes pollution, climate change and supply security into account. The current curve of coal consumption is largely the result of competition from cheaper energy, including cheaper gas and wind power.

The curves developed by Rutledge, Mohr, et al are descriptive – they’re not determined by geology. The obvious counter example to a simple HL projection for is the recent experience of the US: when prices rose, the US peak was revealed as not a simple geological fact, but as also strongly affected by pricing. And the clear counter example to a simple HL projection for coal is the large amounts of coal in the Illinois Basin (about 190 billion tons) which are not being burned because of relatively minor differences in cost vs sub-bituminous Powder River coal due to sulfur content.

Why is this important? Because we can’t depend on geology to take care of Climate Change. We can’t accept arguments like -“it’s not important….there’s not that much FF. So, just leave us poor drillers alone to Drill, Baby Drill!”.

Hi Nick,

So you think that there will be no peak in fossil fuel output?

How much is extracted is determined by two main factors, geology and economics. When the cheaper resources are extracted, what is left? More expensive resources. As the price of fossil fuel rises other energy resources will be developed. The total resource in place will not be extracted. Coal reserve estimates have continually been declining. I agree that it should not all be burned, higher process will prevent that from occurring.

think that there will be no peak in fossil fuel output?

Of course that’s not what I’m saying.

When the cheaper resources are extracted, what is left? More expensive resources.

Yes, but the increase in cost may be small, and/or due to government regulation (which could change). The obvious example is Illinois Basin Coal. There’s 190B tons of high sulfur coal which is denser and closer to consumers. It’s production is declining only because of regulation which imposes a cost penalty of about 2 cents per kWh.

I think most Illinois Basin coal is likely to stay in the ground. Eventually it’s reserves will be considered not economically recoverable, and no longer be counted as reserves.

But, forcing producers to deal with external pollution costs is a political decision. That’s something that Peabody Coal and the Koch brothers understand very, very well. They’re fighting pollution regulation every inch of the way. They’re trying to elect presidential candidates who would roll back pollution regulation dramatically.

So, we can’t just let down our guard, and assume geology will solve our problems.

Right?

Hi Nick,

The supply of low sulfur coal is probably ample for a decade or two or three yet, but if times are hard, and I for one expect times to be hard in MANY countries, then it seems likely high sulfur coal will be burnt, and gladly, given the choice between affordable and otherwise unaffordable electricity.

The use of high sulfur coal would be ESPECIALLY tempting in any country with domestic supplies of it.I will even go so far as to say the temptation might very well be irresistible . 🙁

Of course we can hope that renewables and conservation come along fast enough to allow us to leave coal before coal leaves us.

I am with you all the way concerning the kochbros agenda.

Hi Nick,

When fossil fuels peak, you expect that the rise in fossil fuel prices will be small?

I again am reminded of cornucopian arguments that just in time technological development will save the day.

Do you expect that the clean air act will be repealed? I do not.

In most cases, new wind power is cheaper than new coal power, so wind with natural gas backup until widely dispersed wind and solar can reduce the natural gas backup needed to 1% of total power consumed.

Other developing countries will hopefully learn from the Chinese experience that coal is not a great option and will choose wind, solar, and nuclear with a little natural gas backup. The high price of coal once peak coal is reached an hopefully with appropriate carbon taxes on all fossil fuels will help speed the transition.

Basically I agree with the idea that we should work toward moving as quickly away from fossil fuels as possible.

I just don’t agree that scenarios of “business as usual” that are highly unlikely (emitting 2000 Gt of carbon, when any more than 1400 Gt is not likely), are useful. As I have said, Michael Lynch and a couple of other people think such scenarios are likely, but they are wrong.

When fossil fuels peak, you expect that the rise in fossil fuel prices will be small?

Well, there are several questions:

When will FF peak?

When will FF supplies peak?

When will FF demand peak?

When will coal peak?

Look at the US – coal prices are declining, and reserves are being abandoned. The US could easily reach (and sustain for a long time) coal production levels 50% higher than it’s peak several years back. But, production may never even match it’s historical peak, not because of a supply problem, but rather a demand problem.

Right??

That’s the problem with Rutledge and Mohr’s analysis: declining production and prices are very often not due to declining resource quality or supply problems. In both the US and the UK, this is definitely the case: production peaked and declined primarily due to declining demand, not declining resources.

I just don’t agree that scenarios of “business as usual” that are highly unlikely (emitting 2000 Gt of carbon, when any more than 1400 Gt is not likely), are useful.

I think I agree.

But, not because those scenarios are impossible. That’s a key point: people like Fernando will say: ” we don’t need to worry about Climate Change, because geological limits prevent the high level scenarios”. That’s incorrect: it’s current public policy (combined with cheap Natural Gas and falling costs for wind & solar power) that make those scenarios unlikely.

Hi Mac,

Yes, I agree. In many cases the problem will come down to ineffective and corrupt government. For instance, India has failed to take advantage of wind and solar power, and is planning to build lots of coal plants, despite the enormous public health costs that will force on their citizens.

Hi Nick,

Mohr’s analysis is an analysis of supply and demand, and it seems from your comment you have read no more than a summary.

I will try yet again, it is never a question of supply or demand by themselves, it is the intersection of the two that is important.

As Supply is equal to demand, the peak in supply is also the peak of demand at the oil price where these meet when output is at its maximum.

Public policy is great and can improve outcomes especially for negative externalities such as air, water, and carbon pollution.

World coal will probably peak in 2020 to 2030, the price of coal will rise and much will be left in the ground due to demand for coal falling at the higher level of prices, this is what Rutledge’s work shows for coal, he does not have an explicit demand model (Mohr does), but because the amount of coal produced is determined in part by demand, a demand curve is implicit in the analysis.

Mohr’s analysis is an analysis of supply and demand, and it seems from your comment you have read no more than a summary.