This is a guest post by Rune Likvern

Who’s Website is: Fractional Flowa

This post presents a closer examination of actual data on Light Tight Oil (LTO) extraction, developments in water cut and Gas Oil Ratio (GOR) for some pools and individual wells in the Middle Bakken and Three Forks formations in North Dakota.

LTO extraction’s primary drive mechanism is (differential) pressure and there are some noticeable trends for LTO extraction from Bakken:

- LTO productivity (measured as average totals by vintage) in 2014 have increased, most notably from the Middle Bakken formation which has better well productivity than Three Forks.

There are differences to LTO productivity developments amongst the pools. - Water cut; generally increases as the wells ages.

An indicator for depletion. - Water cut; generally increases for newer wells.

This suggests that the areas with the highest oil saturation has been developed. - Gas Oil Ratio (GOR, produced and expressed as Mcf/Bbl); generally increases as the well ages.

- What appears to characterize a Bakken sweet spot is the presence of natural fractures (favorable geology), high oil saturation and a pressure above hydrostatic pressure.

Further, this post also has a brief look into well economics and describes how well manufacturing is likely to be affected by the decline in the oil price and what this may entail if a lower oil price ($70/Bbl, WTI) is sustained.

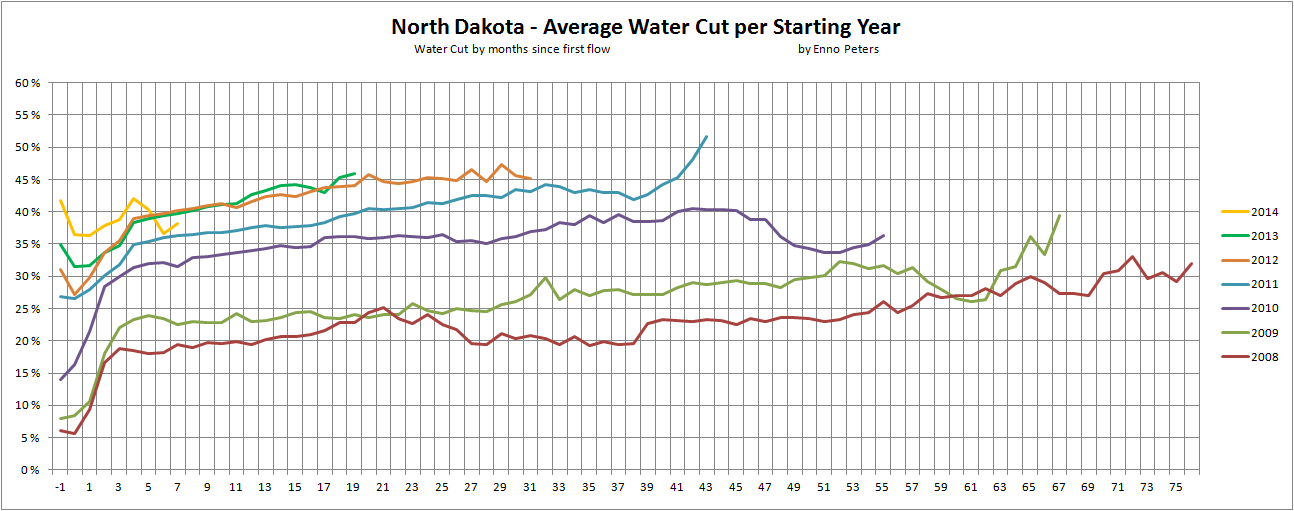

Figure 01: The chart above shows development in the water cut [water cut = [water/(water + LTO)] for the “average” wells by vintage in North Dakota. Produced water (brine) is transported to dedicated disposal sites.

Figure 01: The chart above shows development in the water cut [water cut = [water/(water + LTO)] for the “average” wells by vintage in North Dakota. Produced water (brine) is transported to dedicated disposal sites.

Chart by Enno Peters.

What is fascinating about LTO wells in Bakken is that the individual wells appear to have their own “personality” when it comes to productivity, surrounding rock properties, water/oil saturation and GOR which makes well management (of close to 9,000 “personalities”) a paramount task.

This post contains in total 30 charts that hopefully are self explanatory.

Acknowledgements

This post was made possible by contributions, comments and suggestions from several professionals within the oil industry and the academia.

The invaluable talents and expertise of Enno Peters made it possible to transform the NDIC monthly production data with the formation data into spreadsheet format.

The spreadsheet format allows to sort well data by formation, pool, vintage, company and much more.

NOTE: Actual data used for this analysis are all from North Dakota Industrial Commission (NDIC). Some data are missing for some wells and after discussions, the consensus was that the presented average LTO numbers after the first 12 months should have around 5% added to account for missing data from some wells as well as adjusting for the effects from assuming all wells starts at day one of its reported first month of operation (on average each well flows for half a month during its first month of reported operation).

For wells on confidential list, data on runs was used as a proxy for production.

By adding around 5% of the presented average flows for the first 12 months and around 4% after 36 months numbers should come close to actual.

Production data for Bakken, North Dakota: Monthly Production Report Index

Formation data from: Bakken Horizontal Wells By Producing Zone

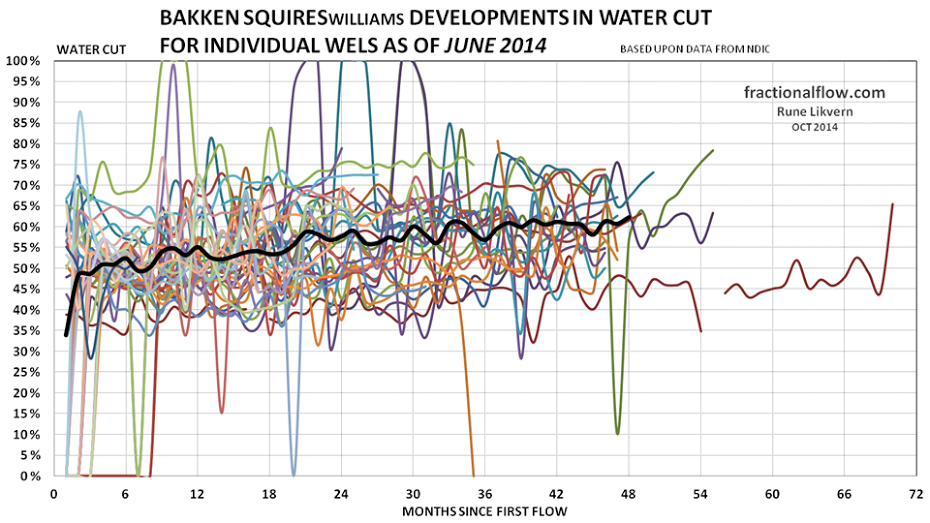

Water cut is the ratio of [produced water/(produced water + produced oil)] and expressed as a percentage.

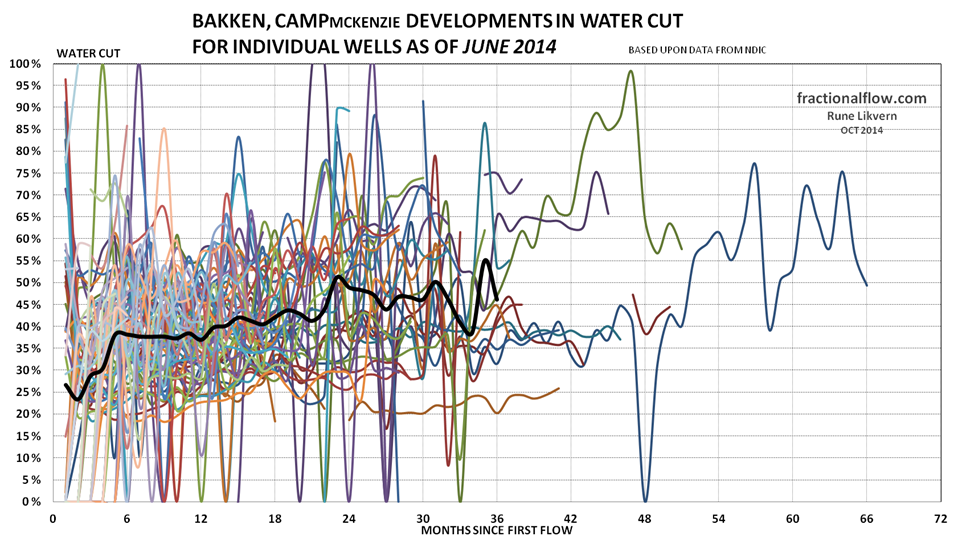

Water cuts for individual wells may swing from 0% to 100%, suggesting a shut in well or data not reported. For the early months of a well’s life the water cut may be influenced from water used for fracking.

The important messages from this analysis are the trends in well productivity, water cut and GOR on an aggregate level and by vintage.

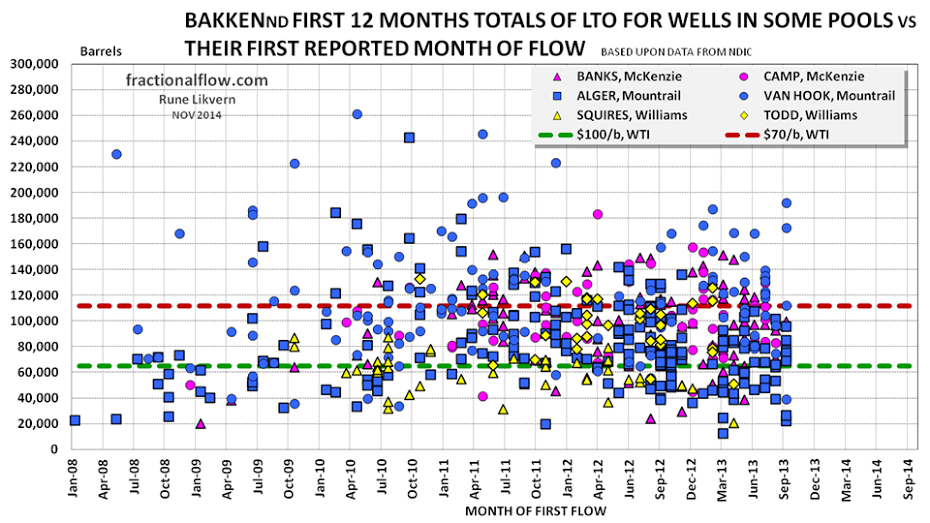

For this presentation wells from two pools in Mountrail (Alger and Van Hook), McKenzie (Banks, Camp) and Williams (Squires, Todd) are presented. Hopefully these pools constitutes a good representation of developments for similar pools.

A growing portion of wells have been/are being targeted the Three Forks formation which may suggest something about remaining attractive targets to drill in the Middle Bakken.

Growth in the Water Cut

It was identified two main causes for the growth in water cut;

- The growth in water cut for newer wells was found to be due to a growing number of wells drilled into formations with lower oil saturation (or higher water saturation).

- The growth in water cut as the wells ages is very likely associated with pressure depletion.

A growing water cut will increase the specific operational costs ($/Bbl) as produced water (brine) needs to be disposed of at dedicated sites that pumps it into a suitable formation.

Gas to Oil Ratio (GOR)

On average Bakken wells has a production Gas to Oil Ratio (GOR) of 1.1 – 1.2 Mcf/Bbl, and this shows considerable variation between pools and individual wells within the same pool. Monitoring the developments in GOR is one paramount task for formation/reservoir/well management.

As (differential) pressure (pressure depletion) is the primary drive mechanism for LTO extraction, a gradual lowering of the down hole well pressure lowers the oil’s ability to hold gas and thus some additional (free) gas gets produced with the oil.

In the shale formation gas is dissolved in the oil and one of the objectives of pressure management of the formation/well is to control the depleting formation pressure relative to the bubble point of the oil. If the pressure in the shale formation falls below the bubble point these risks the formation of unwanted free gas, which affects the flows of liquids (LTO and water).

Normally the lower the bubble point pressure is, the lower the GOR becomes as oil loses its ability to hold dissolved gas.

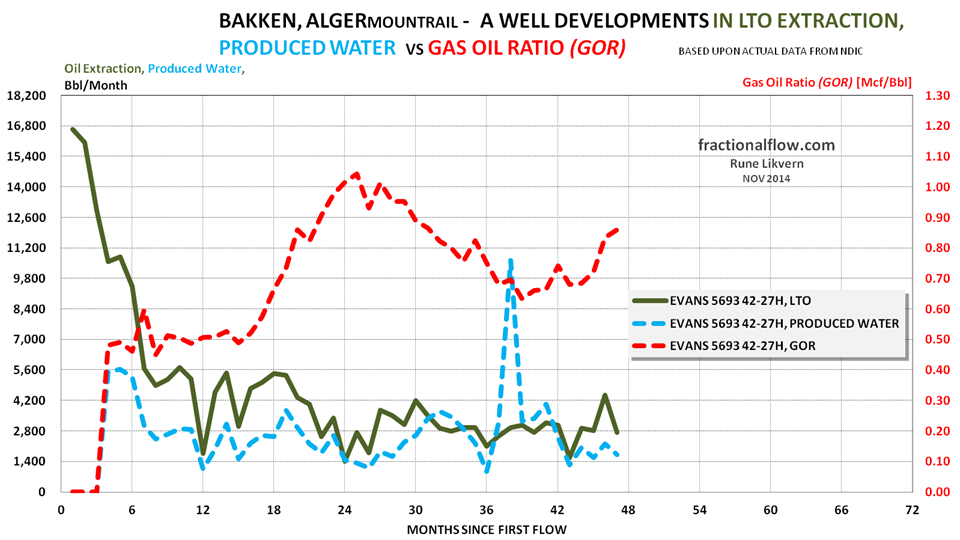

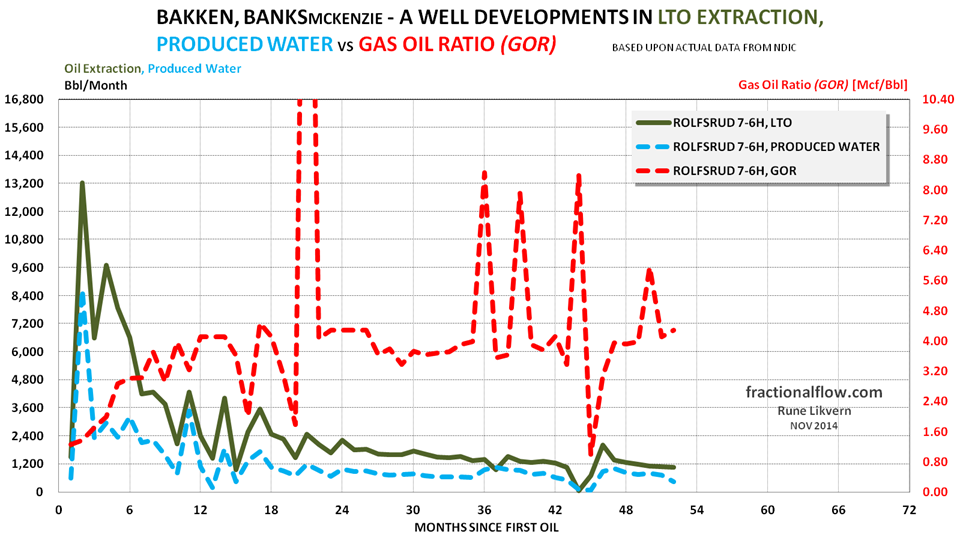

A general observation from observing the developments for a few Bakken LTO wells showed that when the (produced) GOR suddenly increased the LTO and produced water extraction rapidly fell below trend, refer also figures 09 and 21.

Mountrail

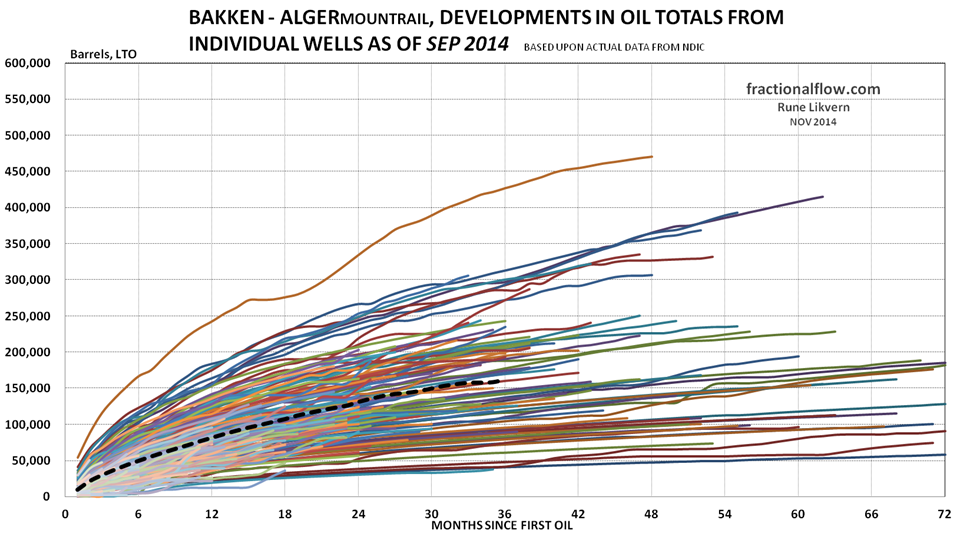

Figure 02: The thin lines in the chart above shows development in total LTO from the individual wells in the Middle Bakken and Three Forks formations in the Alger pool. The thicker black dotted line shows the development for average total LTO for all the wells studied.

Figure 02: The thin lines in the chart above shows development in total LTO from the individual wells in the Middle Bakken and Three Forks formations in the Alger pool. The thicker black dotted line shows the development for average total LTO for all the wells studied.

For Alger well productivity has declined with time and 2014 is too early to make a final call on.

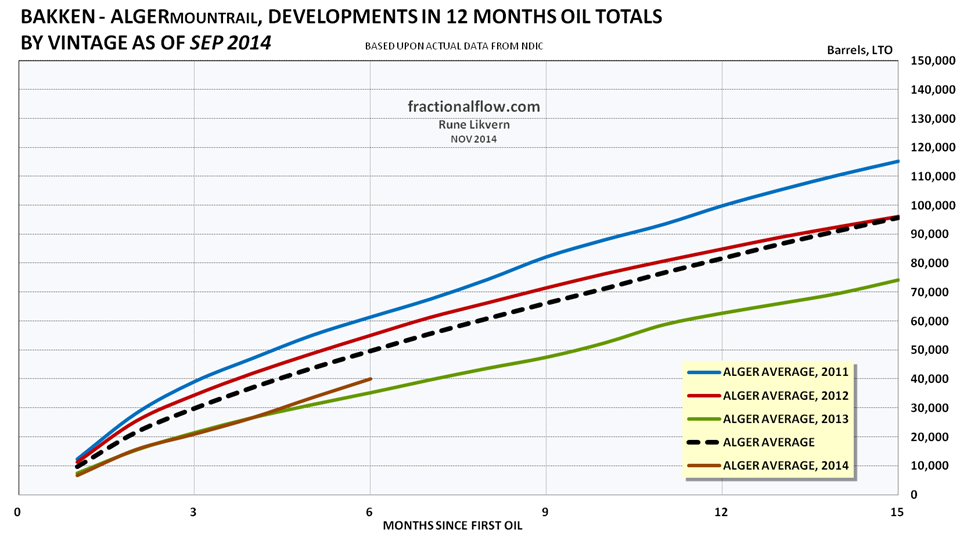

Figure 03: The colored lines in the chart above shows development in total first 12 months LTO by vintage of the wells in the Middle Bakken and Three Forks formations in the Alger pool. The thicker black dotted line shows the development for average total LTO for all the wells.

Figure 03: The colored lines in the chart above shows development in total first 12 months LTO by vintage of the wells in the Middle Bakken and Three Forks formations in the Alger pool. The thicker black dotted line shows the development for average total LTO for all the wells.

Note for 2014 the selection were limited to wells with at least 6 months of flow.

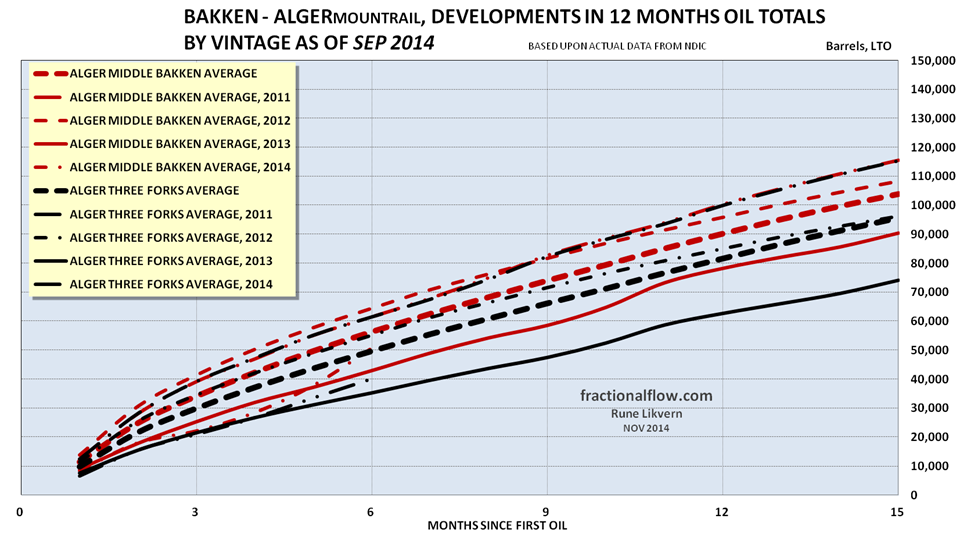

Figure 04: The red lines in the chart above shows development in the average total LTO extraction from the Middle Bakken formation in the Alger pool by vintage. The black lines from the Three Forks formation.

Figure 04: The red lines in the chart above shows development in the average total LTO extraction from the Middle Bakken formation in the Alger pool by vintage. The black lines from the Three Forks formation.

Note for 2014 the selection were limited to wells with at least 6 months of flow.

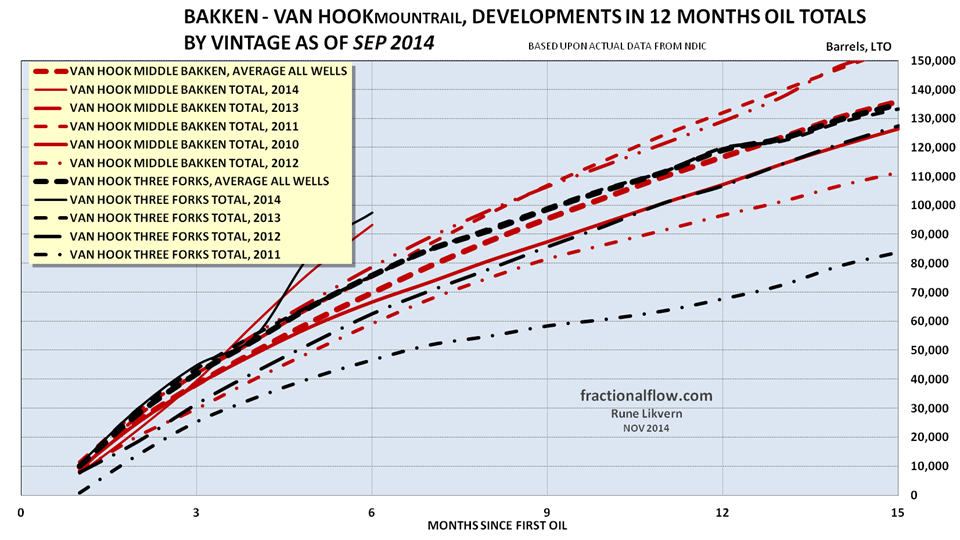

In general the productivity of the Three Forks formation in Alger is somewhat poorer than the Middle Bakken formation. For the Van Hook pool the productivity (first 12 months totals) appears to be the same, ref also figure 12.

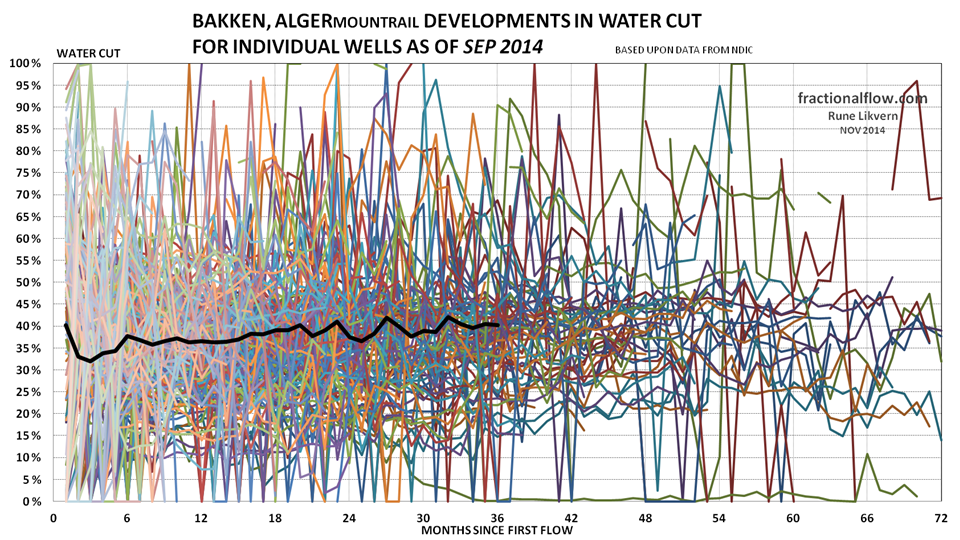

Figure 05: The thin lines in the chart above shows development in the water cut from the individual wells in the Middle Bakken and Three Forks formations in the Alger pool. The thicker black line shows the development of average water cut for all the wells studied.

Figure 05: The thin lines in the chart above shows development in the water cut from the individual wells in the Middle Bakken and Three Forks formations in the Alger pool. The thicker black line shows the development of average water cut for all the wells studied.

Water cut of 0% for some wells suggests these were shut in or produced water not reported on the forms where the data was pulled from. The first months flow of produced water may be influenced from water used for fracking the wells.

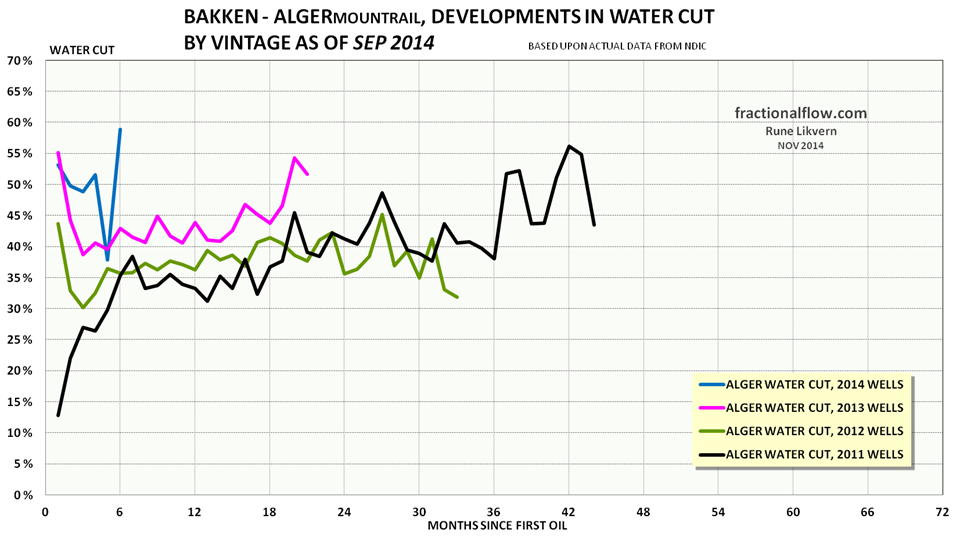

Figure 06: The colored lines in the chart above shows development in water cut by vintage of the wells in the Middle Bakken and Three Forks formations in the Alger pool.

Figure 06: The colored lines in the chart above shows development in water cut by vintage of the wells in the Middle Bakken and Three Forks formations in the Alger pool.

Note for 2014 the selection were limited to wells with at least 6 months of flow.

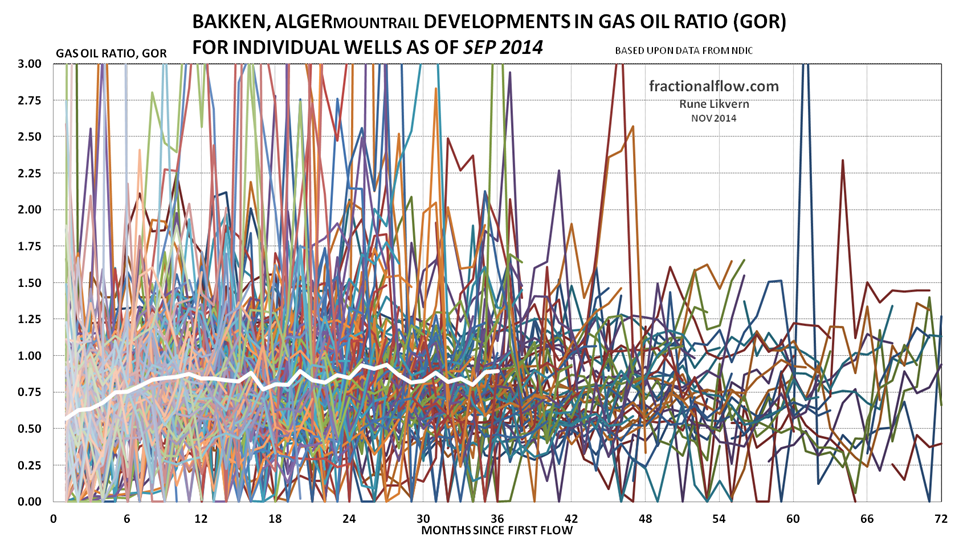

Figure 7: The thin lines in the chart above shows development in the gas oil ratio (GOR, Mcf/Bbl) from the individual wells in the Middle Bakken and Three Forks formations in the Alger pool. The thicker white line shows the development for average GOR for all the wells studied.

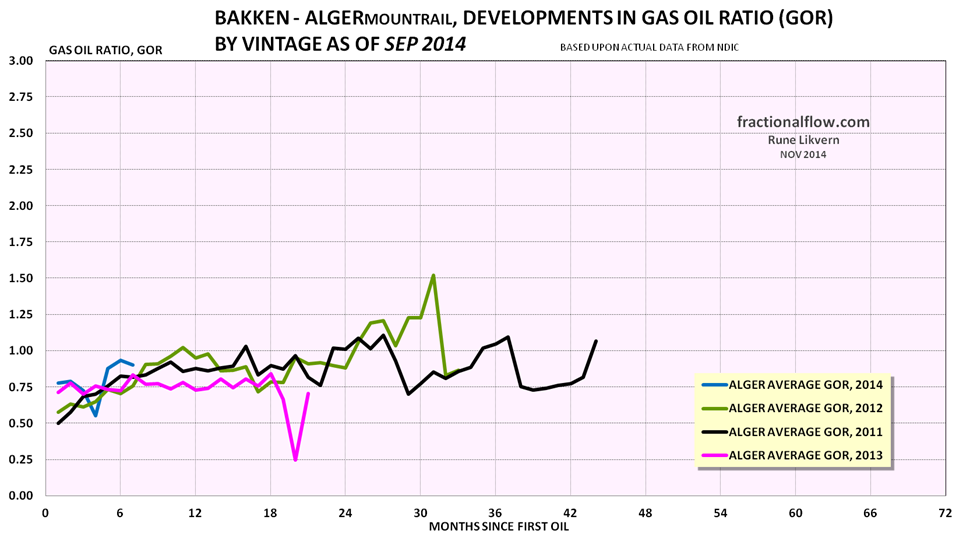

Figure 08: The colored lines in the chart above shows development in the GOR by vintage of the wells in the Middle Bakken and Three Forks formations in the Alger pool.

Figure 08: The colored lines in the chart above shows development in the GOR by vintage of the wells in the Middle Bakken and Three Forks formations in the Alger pool.

Note for 2014 the selection were limited to wells with at least 6 months of flow.

Figure 09: The chart above shows developments in LTO extraction, produced water [lh scale] and Gas Oil Ratio (GOR) [rh scale] for one well in the Alger pool in the Middle Bakken formation.

Figure 09: The chart above shows developments in LTO extraction, produced water [lh scale] and Gas Oil Ratio (GOR) [rh scale] for one well in the Alger pool in the Middle Bakken formation.

Note how an increase in the GOR reduces total liquids (LTO and water) flows

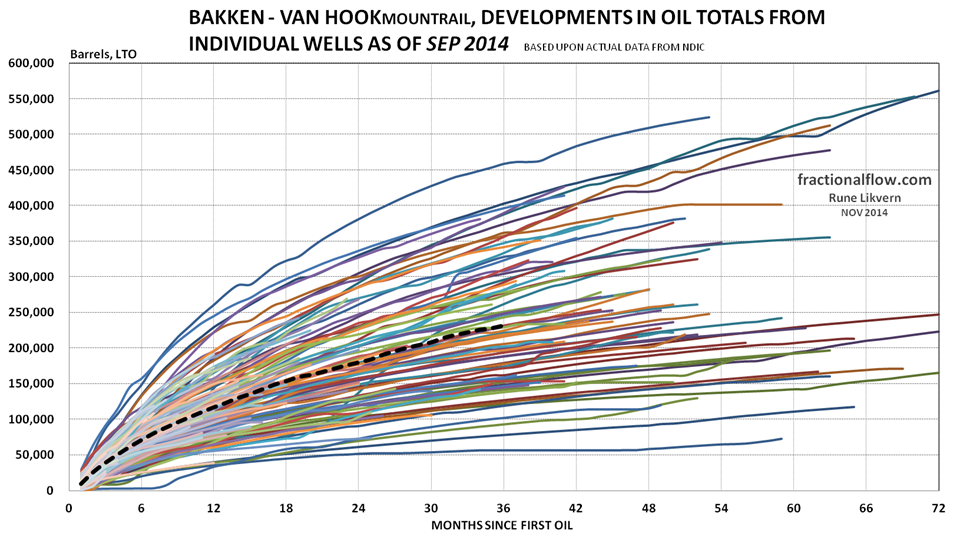

Figure 10: The thin lines in the chart above shows development in total LTO from the individual wells in the Middle Bakken and Three Forks formations in the Van Hook pool. The thicker dotted black line shows the development for average total LTO for all the wells studied.

Figure 10: The thin lines in the chart above shows development in total LTO from the individual wells in the Middle Bakken and Three Forks formations in the Van Hook pool. The thicker dotted black line shows the development for average total LTO for all the wells studied.

Developments in total LTO extraction from wells in the Van Hook appear to be all over the chart. Note also that wells in Van Hook are generally better than in Alger shown in figure 02.

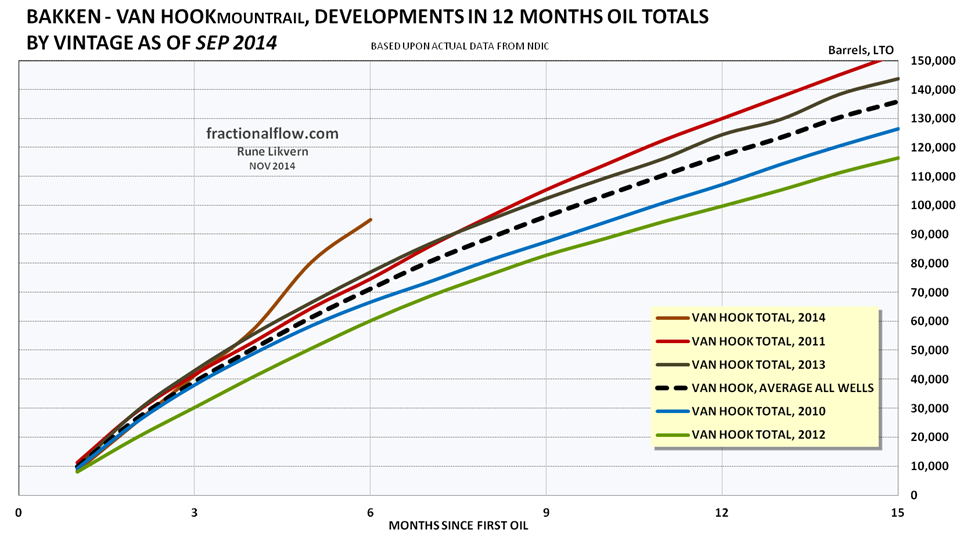

Figure 11: The colored lines in the chart above shows development in total first 12 months LTO by vintage of the wells in the Middle Bakken and Three Forks formations in the Van Hook pool. The thicker black dotted line shows the development for average total LTO for all the wells.

Figure 11: The colored lines in the chart above shows development in total first 12 months LTO by vintage of the wells in the Middle Bakken and Three Forks formations in the Van Hook pool. The thicker black dotted line shows the development for average total LTO for all the wells.

Note for 2014 the selection were limited to wells with at least 6 months of flow.

Well productivity for Van Hook has in general improved in recent years.

Figure 12: The red lines in the chart above shows development in the average total LTO extraction from the Middle Bakken formation in the Van Hook pool by vintage. The black lines from the Three Forks formation.

Figure 12: The red lines in the chart above shows development in the average total LTO extraction from the Middle Bakken formation in the Van Hook pool by vintage. The black lines from the Three Forks formation.

Note for 2014 the selection were limited to wells with at least 6 months of flow.

Figure 13: The thin lines in the chart above shows development in the water cut from the individual wells in the Middle Bakken and Three Forks formations in the Van Hook pool. The thicker black line shows the development of average water cut for all the wells studied.

Figure 13: The thin lines in the chart above shows development in the water cut from the individual wells in the Middle Bakken and Three Forks formations in the Van Hook pool. The thicker black line shows the development of average water cut for all the wells studied.

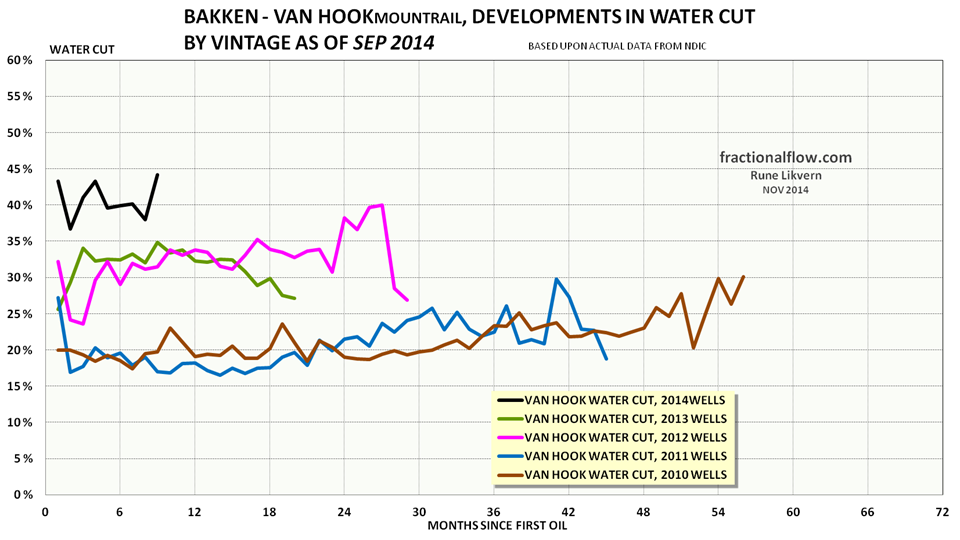

Figure 14: The colored lines in the chart above shows development in water cut by vintage of the wells in the Middle Bakken and Three Forks formations in the Van Hook pool.

Figure 14: The colored lines in the chart above shows development in water cut by vintage of the wells in the Middle Bakken and Three Forks formations in the Van Hook pool.

For Van Hook the increase in water cut by vintage is considerable.

McKenzie

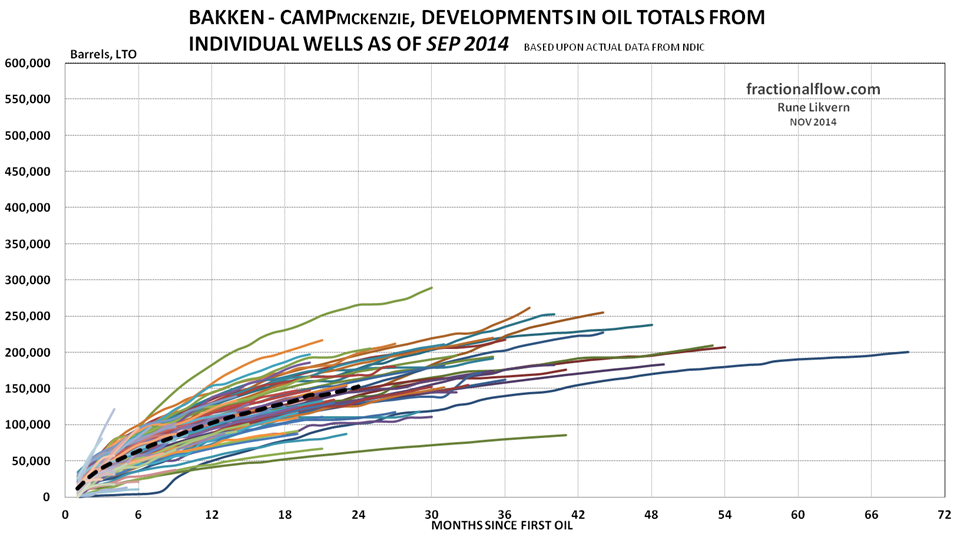

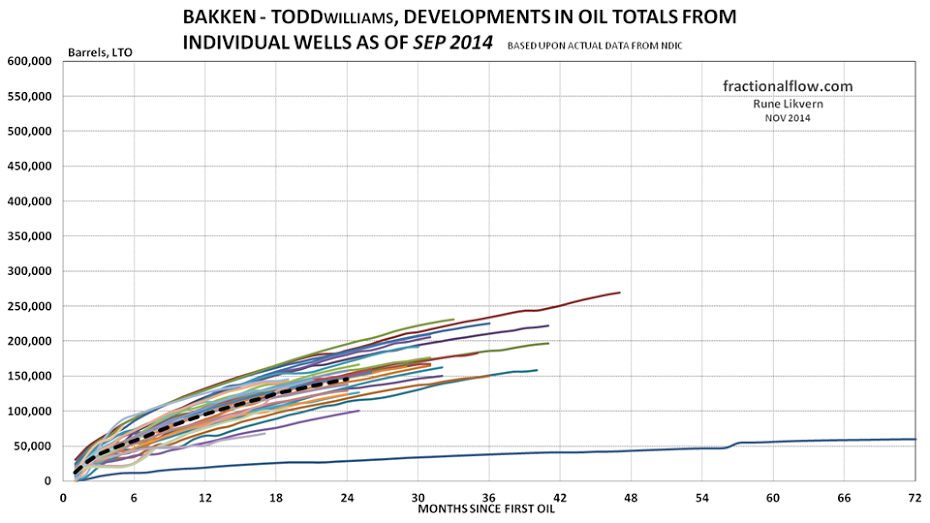

A general feature of the presented wells for pools in McKenzie and Williams counties is that those with time shows less spread in total LTO.

Figure 15: The thin lines in the chart above shows development in total LTO from the individual wells in the Middle Bakken and Three Forks formations in the Banks pool. The thicker black dotted line shows the development for average total LTO for all the wells studied.

Figure 15: The thin lines in the chart above shows development in total LTO from the individual wells in the Middle Bakken and Three Forks formations in the Banks pool. The thicker black dotted line shows the development for average total LTO for all the wells studied.

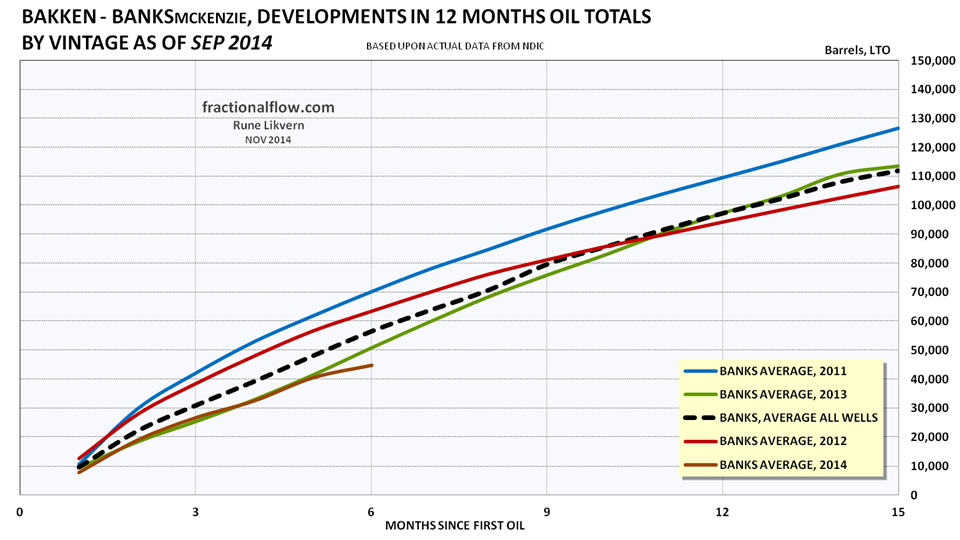

Figure 16: The colored lines in the chart above shows development in total first 12 months LTO by vintage of the wells in the Middle Bakken and Three Forks formations in the Banks pool. The thicker black dotted line shows the development for average total LTO for all the wells.

Figure 16: The colored lines in the chart above shows development in total first 12 months LTO by vintage of the wells in the Middle Bakken and Three Forks formations in the Banks pool. The thicker black dotted line shows the development for average total LTO for all the wells.

Note for 2014 the selection were limited to wells with at least 6 months of flow.

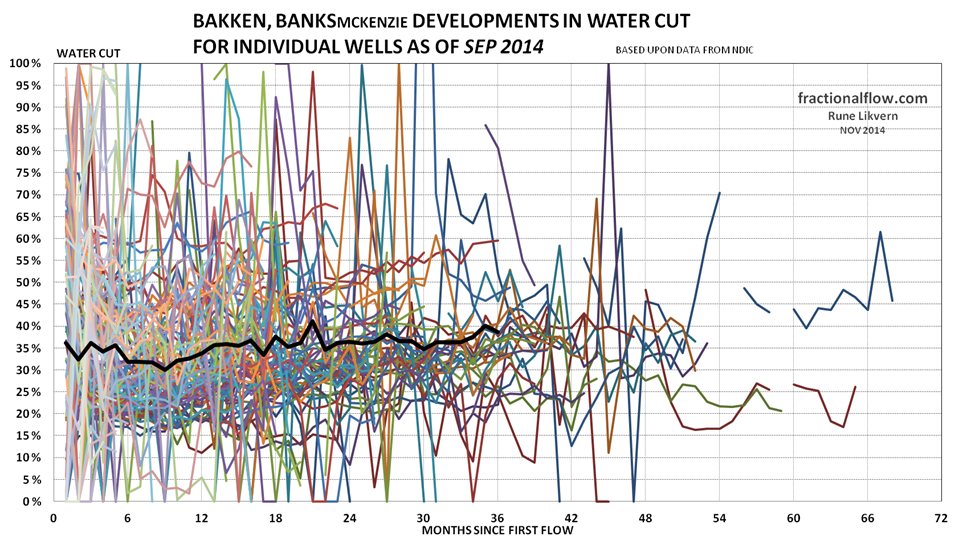

Figure 17: The thin lines in the chart above shows development in the water cut from the individual wells in the Middle Bakken and Three Forks formations in the Banks pool. The thicker black line shows the development of average water cut for all the wells studied.

Figure 17: The thin lines in the chart above shows development in the water cut from the individual wells in the Middle Bakken and Three Forks formations in the Banks pool. The thicker black line shows the development of average water cut for all the wells studied.

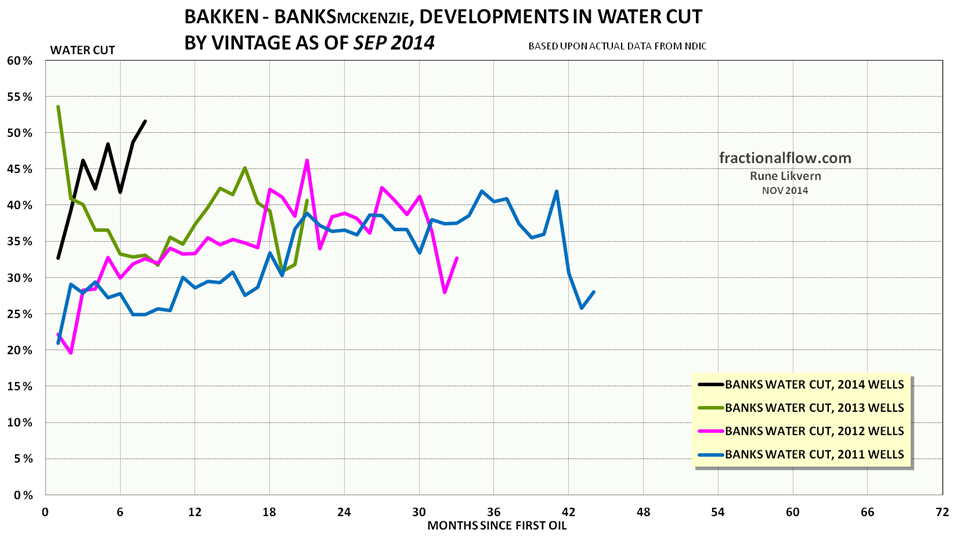

Figure 18: The colored lines in the chart above shows development in water cut by vintage of the wells in the Middle Bakken and Three Forks formations in the Banks pool.

Figure 18: The colored lines in the chart above shows development in water cut by vintage of the wells in the Middle Bakken and Three Forks formations in the Banks pool.

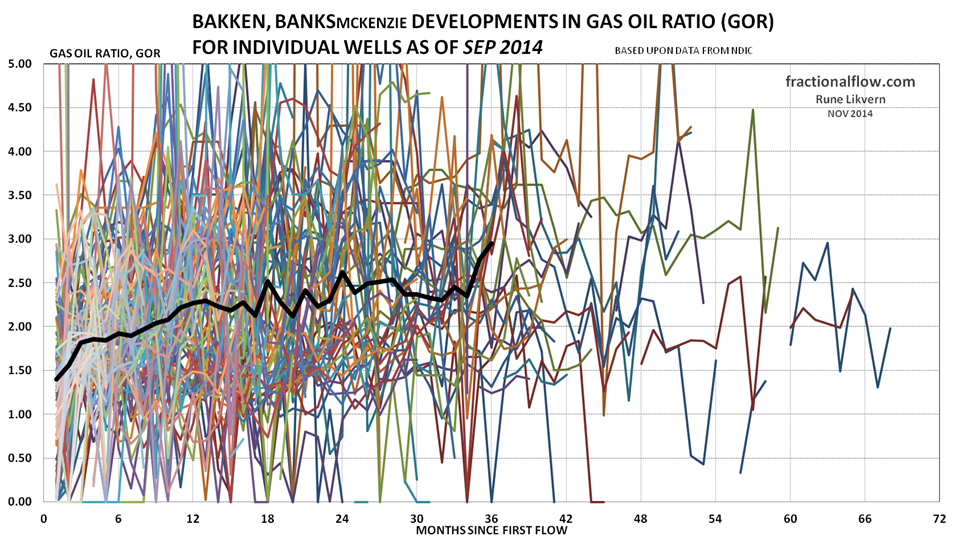

Figure 19: The thin lines in the chart above shows development in the gas oil ratio (GOR) from the individual wells in the Middle Bakken and Three Forks formations in the Banks pool. The thicker black line shows the development for average GOR for all the wells studied.

Figure 19: The thin lines in the chart above shows development in the gas oil ratio (GOR) from the individual wells in the Middle Bakken and Three Forks formations in the Banks pool. The thicker black line shows the development for average GOR for all the wells studied.

Figure 20: The colored lines in the chart above shows development in the GOR by vintage of the wells in the Middle Bakken and Three Forks formations in the Banks pool.

Figure 20: The colored lines in the chart above shows development in the GOR by vintage of the wells in the Middle Bakken and Three Forks formations in the Banks pool.

The initial GOR appear to be fairly constant by vintage and increases at the same rate as the wells age. The same was observed in the Alger pool, refer also figure 08, and Alger had a lower GOR than Banks.

Figure 21: The chart above shows developments in LTO extraction, produced water [lh scale] and Gas Oil Ratio (GOR) [rh scale] for one well in the Banks pool in the Middle Bakken formation.

Figure 21: The chart above shows developments in LTO extraction, produced water [lh scale] and Gas Oil Ratio (GOR) [rh scale] for one well in the Banks pool in the Middle Bakken formation.

Figure 22: The thin lines in the chart above shows development in total LTO from the individual wells in the Middle Bakken and Three Forks formations in the Camp pool. The thicker black dotted line shows the development for average total LTO for all the wells studied.

Figure 22: The thin lines in the chart above shows development in total LTO from the individual wells in the Middle Bakken and Three Forks formations in the Camp pool. The thicker black dotted line shows the development for average total LTO for all the wells studied.

Figure 23: The thin lines in the chart above shows development in the water cut from the individual wells in the Middle Bakken and Three Forks formations in the Camp pool. The thicker black line shows the development of average water cut for all the wells studied.

Figure 23: The thin lines in the chart above shows development in the water cut from the individual wells in the Middle Bakken and Three Forks formations in the Camp pool. The thicker black line shows the development of average water cut for all the wells studied.

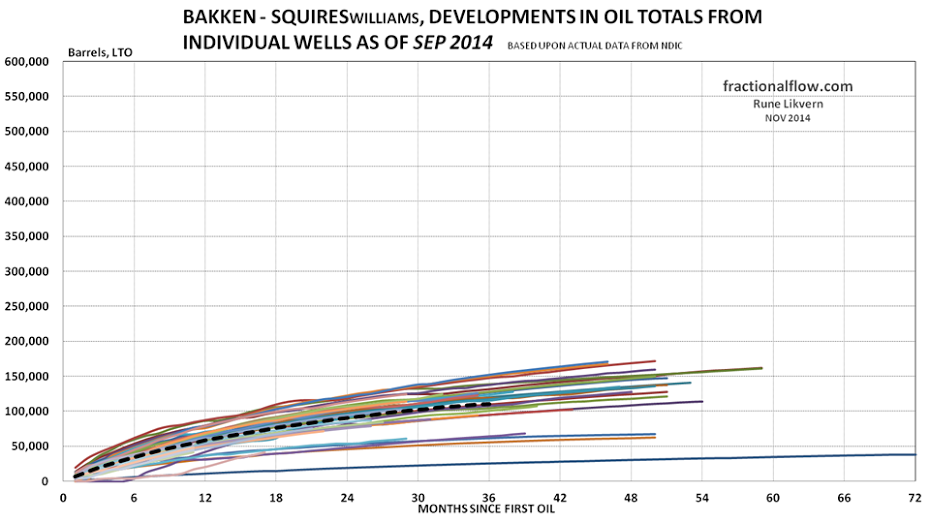

Williams

Figure 24: The thin lines in the chart above shows development in total LTO from the individual wells in the Middle Bakken and Three Forks formations in the Squires pool. The thicker black dotted line shows the development for average total LTO for all the wells studied.

Figure 25: The thin lines in the chart above shows development in the water cut from the individual wells in the Middle Bakken and Three Forks formations in the Squires pool. The thicker black line shows the development of average water cut for all the wells studied.

Figure 25: The thin lines in the chart above shows development in the water cut from the individual wells in the Middle Bakken and Three Forks formations in the Squires pool. The thicker black line shows the development of average water cut for all the wells studied.

Figure 26: The thin lines in the chart above shows development in total LTO from the individual wells in the Middle Bakken and Three Forks formations in the Todd pool. The thicker black dotted line shows the development for average total LTO for all the wells studied.

Figure 26: The thin lines in the chart above shows development in total LTO from the individual wells in the Middle Bakken and Three Forks formations in the Todd pool. The thicker black dotted line shows the development for average total LTO for all the wells studied.

Figure 27: The thin lines in the chart above shows development in the water cut from the individual wells in the Middle Bakken and Three Forks formations in the Todd pool. The thicker black line shows the development of average water cut for all the wells studied.

Figure 27: The thin lines in the chart above shows development in the water cut from the individual wells in the Middle Bakken and Three Forks formations in the Todd pool. The thicker black line shows the development of average water cut for all the wells studied.

Production Management

Given the wide range of individual characteristics of pools and individual wells within the same pools, production management appears to be a very demanding task as this involves dealing with a portfolio of wells with individual characteristics and thus bear much resemblance to herding cats.

A little on Light Tight Oil Economics

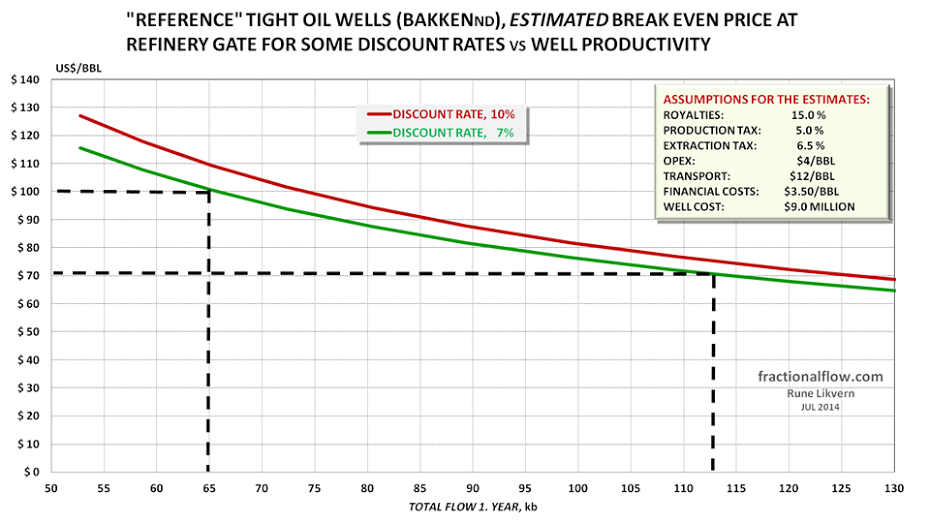

An alternative approach to break even price is to reverse the equation and solve it for estimates of break even flows (first 12 months totals) against various oil prices.

At a lower oil price a higher flow (well productivity, here defined as first 12 months totals) is needed to break even (meet expected return requirements) and vice versa for a higher oil price.

A LTO well recovers around an estimated 30% of its Estimated Ultimate Revoverable (EUR) during its first 12 months of flow. This makes the well economics sensitive to the price during the wells’ early life.

The break even oil price is for the estimated lifetime of the well. A lower price than the estimated break even reduces the return (profitability) and vice versa.

Figure 28: The chart above shows the development in well productivity (first 12 months LTO totals of reported flow) for all the wells in the 6 pools presented in this post versus time (month) of reported first flow.

The red dotted line shows estimated first 12 months break even flow with an oil price of $70/Bbl (WTI), the green dotted line at $100/Bbl (WTI). Well data as of September 2014.

Assumptions to break even flow as described in figure 30 and with a 7% discount rate. Estimates are on a point forward basis (half cycle) and does not include costs for acreage acquisition, exploration etc.

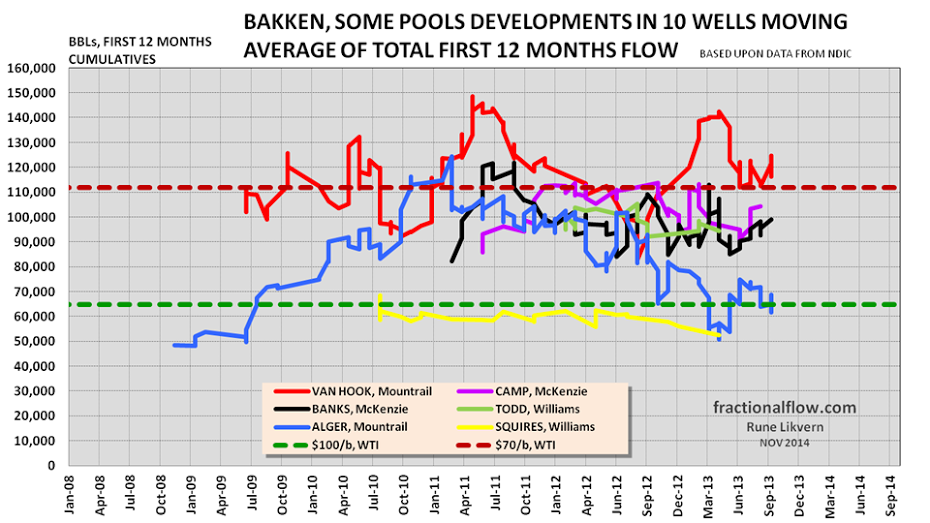

Figure 29: The chart above shows developments in the trailing 10 well average for the first 12 months total flow for the wells in the pools presented in this post.

Figure 29: The chart above shows developments in the trailing 10 well average for the first 12 months total flow for the wells in the pools presented in this post.

The red dotted line shows estimated first 12 months break even flow with an oil price of $70/Bbl (WTI), the green dotted line at $100/Bbl (WTI). Well data as of September 2014.

Assumptions to break even flow as described in figure 30 and with a 7% discount rate. Estimates are on a point forward basis (half cycle) and does NOT include costs for acreage acquisition, exploration etc.

Figure 30: The chart shows estimated break even price (WTI) versus break even flow for Bakken type LTO wells (first year/first 12 months total LTO extracted). The green line is at a discount rate of 7% and the red line at a discount rate of 10%.

Figure 30: The chart shows estimated break even price (WTI) versus break even flow for Bakken type LTO wells (first year/first 12 months total LTO extracted). The green line is at a discount rate of 7% and the red line at a discount rate of 10%.

NOTE: Presented estimates are on a point forward basis (each well looked at as a freestanding project) thus estimates does NOT include costs for acreage acquisition, exploration etc.

The higher the requirement for return, the higher the breakeven price or breakeven volume becomes.

Cash Flow Positive

The LTO wells will flow as long they are cash flow positive, estimated at an oil price above $10 – $12/Bbl at the wellhead (or roughly $25 WTI).

This should not be confused with what price the wells require to break even, that is; earn a return on their investment.

What a lower Oil Price may lead to

If oil prices remain low ($70/Bbl WTI) I would expect the oil companies to target those areas that have profitable potential at this price level. This will with time, reduce the scale of well manufacturing, but also result in an increase average well productivity.

A sustained lower oil price brings also with it the prospects of lower costs for well manufacturing in the shales as suppliers reduce their prices.

A sustained lower oil price and higher interest rates may bring deleveraging forward in time, that is companies with a heavy debt load will bring this down by using a portion of their lower cash flow. This will affect the company’s capital expenditures for well manufacturing.

According to the Directors Cut for November 2014 there were more than 600 wells awaiting completion in Bakken North Dakota and it takes money to complete these wells and bring them into production.

What remains to be seen is how a sustained lower oil price will affect developments in total LTO extraction from Bakken.

Some of your pics have not shown up.

A question you can perhaps answer. What is the LTO attitude towards their drilling inventory? Do they target their sweetest spots first, or do they use it evenly, or they do not know exactly what they are targeting?

When these oil companies say they have 10 years of drilling inventory should I believe them?

I think most claim a longer time.

First company acknowledging this fuck up in prices for what it is.

http://www.lightstreamresources.com/news/news-releases.cfm?newsReleaseAction=view&releaseId=169

2015 average and exit production of 30,000 – 32,000 boe per day, 77% oil and liquids-weighted;

That is a 25% reduction folks. 25%!!!!!!!!!!!!!!

Good luck holding on to $55 a barrel in 2015.

Rob Sparrow is wrong. I suggest he start by browsing USA federal tax and financial accounting, corporate governance, and SEC rules. Afterwards he can move to OSHA and EPA.

Both right and wrong. The regulatory apparatus is subject to capture by the very people it is supposed to regulate and this has happened at the very top- in the banking industry..

Bankers control the banking regulations. OBAMA has put enough people from gold in sacks alone in positions of high authority that expecting the banking industry to be properly regulated is naive. Of course that damned fool Romney would have done more or less exactly the same thing.

Other than banking I must agree that Leanme is more nearly right.All the other really important industries are pretty much right out in the open when it comes to what they are up to.They get away with murder sometimes but it is no secret that they do so.Tobacco companies still sell cigarettes but every body knows smoking causes cancer these days.

“…the State has the self-limiting mechanisms of a separation of powers such that no one institution or agency can dominate the State and thus the nation.

But as we have seen, the separation of powers has failed to limit the expansion of the State; rather, it has become a competitive advantage, feeding the State’s expansion. There are no State-based limits on the State’s concentration of wealth and power.

There is a great irony in this concentration of power in the State: the power is concentrated to protect the citizenry from predation and exploitation, but that concentration becomes an irresistible attractor for all those seeking to increase their private gain via monopoly, cartels, collusion, fraud, and other forms of predation.

The wealth that can be concentrated in private hands is not limited or self-regulated, and so private concentrations of wealth inevitably exceed the ethical threshold of individuals within the State (i.e., their resistance to bribes and self-interest). This structural imbalance leaves the State intrinsically vulnerable to the influence of private wealth. Once this wealth has a foothold of influence within the State, it can then bypass the State’s internal controls and become the financial equivalent of cancer: a blindly self-interested organism bent solely on growth at the expense of the system as a whole.

Rather than protect the citizens from exploitation, the State’s primary role becomes protecting the private gains of elites who have taken effective control of the State’s vast powers.” ~ Charles Hugh Smith

My previous post was accidentally posted in the wrong place, incidentally, but no matter…

This is a highly unrealistic reversal of reality.

Prior to the “state”, private parties owned everything. Feudal lords owned the land and the slaves or serfs on that land.

The history of the “state” in the last 1,000 years is one of growing democracy.

The idea that we have fallen from an early egalitarian state of grace requires us to reach back to a pre-history hunter-gather society which was far more violent than current society and far, far smaller.

That you don’t notice the everyday violence ‘steam’, in part because it is overseas in places like Iraq, Afghanistan or Ukraine, or in a sweatshop in other places overseas, or relatively-invisibly-embedded in your own daily life, slave, and/or neatly-stuffed into a policed/militarized stainless-steel ‘pressure-cooker’ doesn’t mean it is not there, or that it won’t explode at some later date.

When one considers things, it seems rather important to consider them as holistically as possible, and this includes over time, space and scale, etc..

“Inverted totalitarianism is a term coined by political philosopher Sheldon Wolin in 2003 to describe the emerging form of government of the United States… In Days of Destruction, Days of Revolt by Chris Hedges and Joe Sacco, inverted totalitarianism is described as a system where corporations have corrupted and subverted democracy and where economics trumps politics. In inverted totalitarianism, every natural resource and every living being is commodified and exploited to collapse as the citizenry are lulled and manipulated into surrendering their liberties and their participation in government through excess consumerism and sensationalism.” ~ Wikipedia

“Neofeudalism… signifies the end of shared citizenship… As such, the commodification of policing and security operates to cement (sometimes literally) and exacerbate social and spatial inequalities generated elsewhere; serving to project, anticipate and bring forth a… ‘neo-feudal’ world of private orders in which social cohesion and common citizenship have collapsed… Out of such a marriage of business and government, a symbiosis emerges between the commercial sector’s own private security forces and the local government’s police forces, with repressive outcomes shaped by profit-driven definitions of deviance and a commodification of social control…” ~ Wikipedia

Again, it’s unrealistic to suggest that there was in the past a utopia, in which private interests had little or no control over government.

I agree that more democracy would be wonderful – that, in fact, appears to be the direction of history.

And, of course, greater “social development”, including industrialization, has been an essential component to greater democracy. Nothing causes more tyranny than poverty.

There is no real democracy– not even close– in the current model of ‘industrialization’, and there probably never will be, to use ‘probably’ ridiculously charitably.

Maybe in another few million years when another species that actually gets the concept and replaces us or we evolve beyond our technofetishistic illusions.

“Industrial democracy” is practically an oxymoron and only exists in part in the minds of those who might let the MSM do their thinking for them.

I suspect you’ve been Borgged, Nick. Yes, like in Star Trek.

Again, can you give any examples anywhere or anytime of what you’re talking about??

You can find it here, sweetie.

I mean;

Are there any examples anywhere anytime of the ideal civilization that you’re talking about??

Lots of focus now on shale oil junk bonds:

http://fuelfix.com/blog/2014/12/15/u-s-shale-junk-debt-tumbles-amid-oil-crunch/

”The $173 billion in U.S. energy junk bonds make up the biggest portion of the high-yield debt market after the Federal Reserve set low interest rates for years and pushed yield-starved investors toward riskier investments.

Now, as prices for those bonds are in free fall, those investors may begin wondering “what sector would be next,” prompting them to avoid or sell off more debt-market sectors, said Phil Flynn, senior market analyst at Price Futures Group in Chicago. “It doesn’t take a lot for one sector to affect another.”

Spread to broader junk bond market:

http://www.bidnessetc.com/business/will-the-junkbond-market-bubble-burst/

Various bond funds, not labeled HY, when they could not get yield up by moving maturity out, they moved ratings of their portfolio down. There are quite a few of these with average rating for the portfolio at BBB, which is the HY/Junk threshold. They are probably required by the fund bylaws to be BBB or higher, but it means 1/2 of their portfolio is junk.

In other words, non junk bond fund investors are also feeling it. The FOMC starts its meeting tomorrow. Conclusion language is released noon Wednesday. That will be their first opportunity to jawbone a bailout.

There is a bit of a self-correcting dynamic going on in those funds. As the junk proportion is going up in yield / down in price the proportion as a part of the whole portfolio shrinks. If anything that may even allow them to buy more junkbonds (catch a falling knife). new additions to the portfolio may be supportive of yield, offsetting some of the capital losses on existing holdings.

rgds

WP

certain strategic initiatives, including a 62.5 percent dividend reduction and plans to monetize all or a portion of our Bakken business unit

Translation: Dump the cargo boys! We’re sinking!

Was that Mr. Stamper’s handywork?

Rgds

WP

Hi Rune, the images from #24 to #30 are missing. Can you fix this?

Sorry Joe, the mistake was on my part, not Rune’s. It has been corrected now.

https://www.dmr.nd.gov/oilgas/stats/historicaloilprodstats.pdf

In 2006, month 10, there were 3412 wells pumping oil in all of North Dakota’s oil producing counties, all formations. The total amount of oil was 3,524,450 barrels, the average per well monthly total was 1033.

In 2014, month 10, there are 11,507 wells which produced 36,647,393 barrels of Bakken crude oil. The average per well monthly production is as of October of this year 3185 barrels, the highest per well monthly total for all formations in North Dakota ever.

3412 wells pumping 3.5 million barrels per month in 2006.

11,507 wells pumping 36 million barrels per month in 2014.

34,120 wells pumping each day to obtain 36 million barrels would have triple costs. It is a cost savings, leads to a tax credit, reduced costs should be rewarded, leads to greater profitability, profits which should not be taxed at all, a tax credit should be allowed, an oil production tax credit, equal to the value of the oil, will guarantee a profit. Congress could pass an oil production tax credit similar to the PTC for wind energy. Energy from oil is more important than energy from wind. Another tax credit, one for oil, is probably necessary now, it will offset market volatility and balance the cash flow for oil producers and shippers. In essence, make sure everybody gets paid because they need the money.

Translates to print more money to pay for the actual value of the commodity, not the market value, which is too low; double the price and you have what it is worth. A direct subsidy to the taxpayer, more or less, subsidized gasoline by Fed fiat. Just supply the Navy, Air Force, Coast Guard, and Army with Bakken oil production, buy it all every day, for all purposes and it will be gone each day. The bail out will help the oil industry regain profitability and the military will have a guaranteed source of supply. It is far better and easier to support the oil industry, financially and logistically, than it is to butter Wall Street’s bread each day.

Those drilling for oil in the Williston Basin and the Bakken are improving well production and oil production, it should be rewarded, not financially burdening.

The only reason to reward people for pumping oil is if you don’t want the oil in the ground as far as I can see. Why not just leave it there?

I think it was you that weighed in on the supply/demand discussion with the gem . . . how can there be oversupply when there are no warehouses large enough to store the excess product?

Ah, the Should Be meme.

The universe doesn’t care about noble endeavor. The universe doesn’t care about hard work. The universe doesn’t care about the price of oil, body count after a war or interest rates on high yield paper.

God fights on the side of those with the biggest artillery.

Russians are going to be faced with high prices for imports, and thus not buy ’em. They’ll eat Russian food shipped using Russian fuel. Germany will be hit very hard by the loss of Russian purchases. Nigeria will buy less stuff. KSA, Kuwait, UAE, will all buy less stuff. If you depended on selling to them, you will be smacked. Which sounds a great deal like reduced economic activity (and reduced oil consumption).

It’s called “anti-globalisation.”

Caelan MacIntyre …..

You can post damn near anything here, as long as it is related to peak oil or energy. But links to punk rock videos?

Well, hell, Ron, while I appreciated your appearance on the Doomstead Diner, I would have linked to it instead if you were singing something similar!

(Actually, DD posts all kinds of relevant music videos, for what it’s worth and yes, much of it I wince at.)

More seriously, while it was just a short link, at least over here, rather than the actual embedded video, I just thought it went ok with the Nuland brilliant quote, that’s all. Like a smiley face at the end.

For the record, I’m less than crazy about most punk rock, but do appreciate some of the POB-issue-related sentiment behind it sometimes. In fact, now that I recall, lyrics of Leonard Cohen’s The Future was recently posted without a peep from you, so I figured I could get away with it.

Less income for oil exporters, more income for oil importers.

It evens out.

I generally think NICK is a little too optimistic although I agree with most of the points he makes about efficiency and innovation and so forth.

In this case I am with him one hundred percent. It evens out.

But it won’t stay ” evened out” very long. Depletion never sleeps. Population growth is constant for decades to come.. Oil will go back up again before very long- a year or two at the most. AND WHEN IT DOES- it will probably stay up for years and years. And when it crashes again- the new low will be higher than the low it goes to this time almost for sure.

Now if the global economy progresses from chronic heart failure to a heart attack oil will stay down longer.

Hi OFM,

I also think Nick is too optimistic, but I think he nicely balances the pessimism of others, I think your view is a nice balance between the optimistic and pessimistic views.

As I understand your position (which seems to vary day to day), there will be collapse, but it will be uneven, some places with good resources (US, Canada, Russia) will make it through the energy bottleneck, but it will be very difficult with another Great Depression which will make Great Depression 1 (1929-1938) seem like a nice day at the beach.

Thanks.

I make a distinction between “could” and “will”. We could replace oil relatively quickly and cheaply. A Nissan Leaf is cheaper than any ICE car, even without the tax credit. A Chevy Volt is one of the cheapest vehicles around, even without the tax credit.

If oil were suddenly scarce, there’s things that “can” be done. We’re not doing them now out of sheer social inertia.

I don’t look at cars much, but Google tells me a Leaf MSRP is $29K and a Yaris or a Ford Fiesta about half that??

Duane,

I would agree, but Americans in general call those cars “death traps”, because they refuse to understand safety and refuse to wear a seat belt??

Look at Edmunds.com, five year total cost of ownership.

Actually, to compare apples to apples, I think that you would have to compare the average length of time the 3,412 wells [from “all” of North Dakota] in 2006 were on production to the average length of time that the 11,509 wells in 2014 have been on production. For illustration purposes, let’s say it was 6 years in 2006 and 3 years in 2014. Then adjust for the extra 3 years of average decline curve for the 2006 wells and then see how much more productive the drilling has been to get a “rough” idea. I say rough because I believe that the % of “all” wells in ND coming from the Bakken has likely increased in 2014 over 2006, so comparing to an exactly right average decline curve is dicey. In summary: Newer wells have a higher natural monthly productivity than older ones.

“11,507 wells pumping 36 million barrels per month in 2014”. Typing error? 36Mb/month is much more than whole of OPEC pumps per month.

No, you are looking at OPEC barrels per day versus Bakken barrels per month.

Awesome post Rune.

Based on the latest NDIC well information, I updated my numbers.

Below 2 charts that show:

1) The contribution from wells starting production in a certain year. Wells starting production before 2014 currently contribute just over 50% of the current output in ND.

2) The average cumulative production of wells in ND, per year. It now has become increasingly clear that the average well performance in ND has not improved since 2010. Wells starting production in 2012 and 2013 have more front loaded oil production compared with 2010/2011 wells, but at the expense of output after the 1sts year of production. This approach seems to reduce the overall average well EUR, with the benefit of a slightly improved cash flow in the first year. Although 2014 wells again show an improvement, I would not be surprised if also these wells will start a slow descend to below the cumulative output of 2010/2o11 wells, at the same well age.

“It now has become increasingly clear that the average well performance in ND has not improved since 2010. Wells starting production in 2012 and 2013 have more front loaded oil production compared with 2010/2011 wells, but at the expense of output after the 1sts year of production. ”

This is startling. Is there some interpretation issue here, because this would say stage count increase since 2010 has not achieved improvement in total lifetime well output.

BTW the chart, Enno, and your text above says half of production is from wells before 2014, and given this was the October report damn near half is coming from wells only 9 months old!!

Hmmm.

With almost half of 1.2 million bpd coming from wells less than 9 mos old, and those wells in that steep first year of decline, a cessation of drilling should smash production somewhat more than we’ve projected.

If 600K bpd drops 60% in one year, we lose 360K just from that half of production. The out years decline less steep, call it 20%? That’s another 120K.

We’d lose almost 500K in the year.

In regard to your thoughts about demand, I wonder if we have seen a small decline in demand combined with Saudi Arabia aggressively cutting their selling price while trying to also talk the price down.

Tough to deduce agenda. For KSA, I’d guess they are reacting and trying to optimize, rather than cause.

It’s not in Russia’s best interests, nor in KSA’s best interests, to allow the US shale industry to survive. So now that the ball started rolling (or was pushed), optimal strategy is to put their heels on the neck of that industry and bear down on it (no pun intended).

But I would guess no one whatsoever knows what results from Fed intervention — which would have profoundly powerful justification if there is a claim of foreign efforts.

Russia has very expensive oil too (relatively speaking, of course). The Pechora Sea and Nenetsky Okrug developments are in the Arctic environment. I assume companies such as Lukoil are extremely concerned.

Russia sits very pretty. If their cost of production averages $15/barrel, so what?

If inability to drill to offset decline, so what? That means they start declining about maybe what, 4% / year with a little bit of drilling so that’s net decline.

So they lose 400K bpd out of 10.5 mbpd? So what? They only burn about 4 mbpd. If price is too low for them to bother, why produce more? For foreign currency, of course, but the can grow enough ruble based food for themselves and ship it to themselves. Losing output to decline rate doesn’t put their populace at risk of their lives. They’ll have to import none of it.

The US, on the other hand, when it loses its 3 mbpd from shale, will have to import every drop to replace it, or endure a likely much worse recession than Russia would.

Or produce more Ethanol

40 Facts About Ethanol

Also, I don’t believe there is that much shale oil production currently in the US.

http://www.usfunds.com/media/images/investor-alert/-2012-ia/2012-11-30/IA_Energy_ShaleOil.gif

Or carpool.

Oh, the horror.

Watcher, the Russian industry reaction is better guessed at by looking at it by cost segments. I say “guess” because I lack the detailed cost data, but simply consider that, within Russia, there is a large diversity as well technical conditions of individual wells and fields. The low price environment erodes the ability to keep producing at an average decline because wells are not economic to repair, and in some cases they aren’t economic to produce either. Think about it.

Enno, thanks!

Without your expertise and patience this post would not have happened (I never planned for it, but from back in 2012 I had noticed the (produced) water numbers with some interest.)

Rune has done some great work. Everyone should be able to get valuable information for future investment.

Specifically, looking at Figure 30 for breakeven and the assumptions [which we all understand are educated guesses, that nonetheless are valuable for general computation purposes]: At $70/bbl there is $31.95/bbl left after expenses. At $60/bbl, there is $24.60/bbl left. So with a $9 million cost and a $70 price it will take 281,690 bbl to repay the $9 million. At $60 it will take 365,854 bbl.

Can someone [Rune??] create a graph that shows, based upon the average well, how LONG it will take to breakeven at various prices of oil. For example, at $70 it might be 5 years and at $60 it might be 8 years. And, for each selling price point have a graph that shows what % of wells will never payout. For example, at $100 it might be 1% and at $60 it might be 50% (or more).

If these figures are in the ballpark, and the bankers are smart enough to do the math [I know that the oil producers can], then the Bakken is about to come to a screeching halt. I assume ditto for the Eagleford. Alternatively, the price of oil could bounce back quickly.

Musings. Should we take OPEC at its word – they just want to find out the true market price of oil? They have been blamed for manipulating prices higher for over 40 years. What if current OPEC production is near a peak? They can put out 30 million bbl/day, but that is about it. So they set that as their production and the price plummets. Then rises dramatically the next couple of years with the same OPEC production because non-OPEC has cut production. Don’t like high prices? “Don’t blame OPEC, we did not cut production – YOU did.”

Another amusing thing. Shale contribution to GDP disappears. Maybe the conomy enters freefall.

“See! This is what happens when you elect a GOP Congress!! Don’t make it worse in 2016.”

But see my claim in the last thread that the loss to the US GDP caused by the crash of shale will be offset by the gain from falling import costs.

At $100 those import costs are largely profits coming from the pockets of American consumers and going to foreign producers. So that loss is no loss to American GDP (although perhaps to GNP) and it’s a huge sum.

But the S&P earnings, 50% from overseas, are slashed by the dollar differential. Can’t be good for GDP.

Earnings from overseas are part of GNP, not GDP. Compared to GDP, GNP adds earnings from domestic entities overseas, and subtracts domestic earnings from overseas entities.

But I have ignore the value of the assets (mostly mineral rights and such) of the LTO companies. Those are the only profits the oil companies have made in most of these plays so far, and it is disappearing fast.

On the other hand, those profits were mostly unrealized (the assets were never actually sold). On the other hand if the S&P falls because of falling overseas profits that would be realized losses and GDP too.

Are you referring to overseas profits being reduced by a stronger dollar?

yup

Actually I was talking about something different though. I was talking about the lost profit in the oil business by foreign oil companies owned by US companies. That would be part of GNP but not GDP.

The loss Watcher was talking about (which I wasn’t thinking about because it is related to the currency change, not the oil price change) would be part of GDP.

I think Watcher and I agree there is probably a connection between the changes in oil price and the dollar exchange rate, but the two aren’t the same.

“But see my claim in the last thread that the loss to the US GDP caused by the crash of shale will be offset by the gain from falling import costs.”

I would doubt that claim:

1. The Last few times the economy had strong growth, even when oil prices was much lower, there was a Bubble. In the 1990s it was the Internet\Y2K bubble, in 2004 to 2008 it was the housing bubble. The US will need another bubble, fueled by Cheap and easy credit. Its seems unlikely this will materialize anytime soon.

2. Shale drilling was a mini-Bubble as investors pour billions into drillers which created a boom in jobs based upon cheap and easy credit. Investors are going to pull that punch bowl away.

3. American consumers and probably all of the West are tapped out. They still have the debt the accumulated from the previous bubbles, and now student loans (as large numbers of consumers went back to school when they could find jobs).

Exactly, the chart of break even prices/break even flows is to provide general guidance, not to make investment decisions from. The numbers are believed to be close.

I sense you refer to undiscounted cash flows (which does not earn a return). Disounting the cash flow and depending on the discount rate, you will arrive at different numbers (and/or different time frames before you have recovered your investment with expected return).

In my post “Will the Bakken “Red Queen” Have to Run Faster?” of July 29th 2013 on The Oil Drum

http://www.theoildrum.com/node/10102

And I figure SD2 I presented the distribution of wells, according to productivity (first 12 months totals) for around 500 wells…it is possible to update this by vintage etc…but takes some time, but I do not expect the distribution to have changed much from my post on The Oil Drum.

So with a $9 million cost and a $70 price it will take 281,690 bbl to repay the $9 million. At $60 it will take 365,854 bbl.

Can someone [Rune??] create a graph that shows, based upon the average well, how LONG it will take to breakeven at various prices of oil. For example, at $70 it might be 5 years and at $60 it might be 8 years.

Five years is 60 months. The last chart (average cumulative well production) shows the best vintages get to 200K barrels in 60 months. The quantities you mention are off the chart — no data available.

The Eagle Ford is showing a similar trend, the production at the Egale Ford is increasingly front loaded with decline accelerating in year two from 30% to 50% (not sure how to post images here, but here is the link):

http://www.eia.gov/todayinenergy/detail.cfm?id=18171

Regards,

Nawar

Thanks Nawar, interesting link.

You can add a single pic to your post, by selecting it with “choose file”, when creating a new post. It will be displayed below your comments.

There may be another explanation for the stagnating well profiles: perhaps there are improvements in well performance over the last years, but combined with more drilling in the fringes that may not be visible in the average well performance. I can imagine that this happened when oil prices where high, and the expected return still good.

Using the same logic, we now may expect well performance to go up, as only the best remaining spots are being drilled.

The first year decline has stayed about the same, and the second third and fourth year decline rate has zoomed up.

I suppose very clever geologists could arrange this…

Enno, Thanks (the image link was hiding under the bottom of my screen!), attached is the relevant image.

I was wondering if this trend could also be due to down-spacing? perhaps improved completion is leading to better initial performance, but interference is kicking by year two and thus leading to accelerated declines.

One thing for sure, this front loaded production makes those wells ever more sensitive to prices as a big chunk of EUR is produced early on, even though higher production could be lowering the overall average cost per well assuming constant drilling/completion costs.

Another observation, rising decline rates in year two seems to argue that declines at the field level are unlikely to slow down soon since newer production is leading to higher overall decline rates in subsequent years. Thus, while higher initial production will lead to a higher peak, the decline will be ever sharper on the other side.

Regards,

Nawar

Higher IP, greater pressure drawdown, greater decline. Makes sense to me.

I hope we all do realize what that says.

Get the oil faster! Collect the money now!

That claptrap about people having jobs for generation upon generation doesn’t buy management’s yachts. There is ZERO imperative to keep people working for many years.

Kill 20 guys a week on the highways? Collateral damage. Get The Yachts NOW!

People that work in the oilfield accept the uncertainties of it; the money is good. Price volatility and boom to bust cycles are as old as the oil business itself; everyone knows that. Well, almost everyone, I guess.

More people get killed in New Jersey yaking on cell phones when their driving than in the oil business. There is no “claptrap.”

I know, you are a former member of the KGB living in Moscow, now in the vodka export business.

That’s it, uh?

People that work in the oilfield accept the uncertainties of it…Price volatility and boom to bust cycles are as old as the oil business itself

If peak oil is really a thing, then drilling the stuff is a matter of urgent public interest, not just a question of whether drillers accept their fate. Also, this bust cycle, or one in the near future, would be the last.

I won’t even get started on why health and safety standards are a good idea. But it would be nice to see your data on car accidents in New Jersey.

The safety standards in the oil and natural gas business are very, very high. Nevertheless, it is dangerous line of work because of the big iron and long days, Occasionally accidents happen. Just like any other business. Oilfield traffic accidents on highways are due to congestion and often fatigue (and I am sure cell phones).

I’ll leave the data on car accidents in New Jersey up to you; my point is that people out of the oil business, that do not know which end of a rig to walk to, should not criticize it’s labor force. Why people want, or need to work, and the risks they are willing to take to feed their families, should not be questioned. I work in the oilfield and I am sensitive to armchair quarterbacking by people on computers.

Safety first. I had a zillion days with no lost time accidents….and I never killed anybody. I did have a close call once. Or twice.

Why aren’t those jobs automated? It’s a legit question. We’ll forgo the truck drivers issue because there is indeed talk (in australia) of automating that, but what of the other jobs.

Can’t see why robots can’t be built to do them. Pretty much all repetitive high paying jobs should have no future.

Nawar, one of the numerous reasons for difficulty in judging reservoir performance in the Bakken and the Eagle Ford, in my opinion, is how financing the manufacture of these wells enters into the evaluation. Debt to reserve asset ratios, interest, cash flow demands, stock performance, etc. all must play a big role in how shale wells are drilled and produced; different companies have different IRR requirements, different financing standards, that sort of thing.

The biggest shale operator in the US, in the Eagle Ford, is quite famous for enormous IP’s and spontaneous press releases. Within weeks those wells are going on rod lift, however. In Texas, a pooled unit is formed, named, and eventually 12 wells get crammed into that unit with no requirement for individual well production data; only total production for the unit is reported. If interference is an issue, it is going to be tough to sort out, in Texas anyway. For instance there might be re-frac’ing efforts planed for #2H that is 5 years old, as soon as #9H has pipe set and is ready to be frac’ed for the first time. We see a big jump in production in that unit and assume some new technological breakthrough has occurred, incorrectly, on #9H.

In other words, its hard to judge a book by it’s cover, or a shale well by its performance, without knowing the author, editor, type setter and what its publisher is expecting in the way of sales. Excuse the bad analogy.

Mike

You should have production data from all wells off of the W-10. Its only a single data point a year, but it is production data.

Yes, sir, you are right about W-10s. W-2s for retests also, I guess. I doubt I am the only operator in Texas who embellishes those from time to time, however; I like to be underbalanced instead of overbalanced, so to speak. It is a one time thing, however.

Nawar that spacing sure looks tight. As far as I know well spacing isn’t scientifically established in Texas.

How about a combination of clever geologists who are better at locating the remaining not quite as sweet as they used to be sweet spots – and clever operators who are choking to make the wells look better on paper in the near term- getting a more even production for the first twelve months by choking enough early on to flatten out the first year’s production?

This could be a worthwhile trick to pull to keep investors and lenders happy maybe. Just speculating not proposing.

Do investors and lenders know how to look at well performance? I didn’t know that.

Mr Peters, first of all thanks for all the work, and may I suggest some more. What might be useful is your upper graph with a projection extended out three years. We would then get an idea of what sort of hole has to be filled.

Hi David,

I show two cases in the chart below. A no new wells added case (not very realistic) and a case where new wells added decreases to 60 wells per month and remains at that level until 2040 (also not very realistic , but more realistic than no wells after Oct 2014). The number of wells added is for the second case (read off right axis).

Chart mislabeled sorry, the “no new wells” is the lower of the two cases(TRR= 3 Gb), the other is the “low case” with new wells following the dotted line shown on the chart(TRR=7.5 Gb). About 28,000 total wells are completed on the “low case”, EUR decrease begins in June 2018 and the 5% maximum annual rate of EUR decrease is reached in June 2019.

Chart below with 30 year estimated ultimate recovery (EUR30) in kb and the annual rate of decrease of new well EUR for the 7.5 Gb scenario.

Dennis,

“new wells added decreases to 60 wells per month and remains at that level until 2040”

Projecting 60 wells per month out to 2040, may not be realistic as you say, but I feel it may be very realistic over the next year or so, as some companies cut drilling by 60% and I would suggest others will cut by 100%, when they go bankrupt that is.

With the combination of winter and some drastic early cuts in drilling, we may just have seen a peak in Bakken oil, at least in the medium term?

Hi Toolpush,

I misread a comment in a previous post where someone said Helms said the rig count may go down by 50 rigs so that would be 130 rigs still turning, so I was off by over a factor of 2. Wells were at about 200 per month at 195 rigs so if Helms estimate is correct and the wells drilled is proportional to the rig count (which may not be correct) we would expect the new wells added to fall to about 130 new wells per month rather than 60.

Elsewhere I showed scenarios where the rig count drops to 60 by Aug 2015 and then turns around and rises back to 150 wells/month completed by April 2016. In this case we get a secondary peak in 2018.

“Elsewhere I showed scenarios where the rig count drops to 60 by Aug 2015 and then turns around and rises back to 150 wells/month completed by April 2016. In this case we get a secondary peak in 2018.”

That seems quite realistic as there may be a bounce back in prices within an year or so which will lead increased activity in the tight oil patch. I seemed to have missed your post. Can you please post it again if it is not too much trouble? Thanks!

Got it. Its right down the page! I imagined it was in some other post.

Looking at the graphs, it looks like we are not going to see an implosion in production as commonly assumed by many folks here particularly if there is going to be a price bounce back anytime soon.

Dennis,

I did see where you miss-interrupted Helms numbers. My gut feeling is your miss-interruption will be closer than Mr Helms actual number, so I didn’t comment as such.

I am sure we will not have too long to wait to find out. I think how the bankruptcies are handled will be the telling point of what is left drilling.

Toolpush and Thirunagar,

Thanks for the feedback, maybe 90 to 100 new wells per month may be right, if the rig count falls to 95 rigs or so, hard to know what will happen, even if the rig falls to 60 rigs and assuming 60 new wells per month are added, the decline will be rapid for the first 12 months, but then will be more gentle. I do expect that prices will increase by late 2015 and drilling will pick back up, how much depends on prices which are very hard to predict.

Dennis,

The Hayneville shale, should actually be a good model. When Nat gas was $10 mcf, they were pedal to the metal. Not sure how many rigs, but they have since dropped back to 40. The gas production dropped quickly but now seems to have leveled out. It maybe worth a look and see how it compares to your models.

Good luck

Does the public data show if a well is on pump or gas lift?

Mr. Leanme, in the Eagle Ford gas lift was popular several years ago and may still be in high GOR areas in the condensate window. ESP was vogue for awhile but I don’t see a lot of that anymore either. There are sometimes paraffin issues to deal with in shale in Texas and lots of scale issues. In the oil window of the EF, where initial GOR is lower, gas lift is problematic. The vast majority of Eagle Ford wells go on rod lift very quickly in the well’s life. Rod lift I believe is more economical. Perhaps Tfark can elaborate on the Bakken.

As you pointed out once, rod lift does not preclude putting a choke in the well head configuration to hold back pressure, or regulate static producing fluid level in the annulus, or manage reservoir pressure. Honestly, I don’t think there is too much of that going on. I think they get those wells on rod lift as soon as they start to get a little weak in the knees and thereafter its wide open liquids extraction. Cash is king.

Mike

Mike, that’s really interesting. wax and scale must be a huge pain in the behind.

The problem of the missing graphs has been corrected. Sorry it was a mistake on my part, not Rune’s. Thank you for your patience.

Rune, thanks for this. It turned out really well.

In spite of the rhetoric for, and against unconventional shale oil, its growth and contribution to domestic production rates has been very important to America. I understand the ongoing debate about at what cost, nevertheless, shale resources are going to be an important component to our energy future. The more we can learn about that future, the better.

I am a member of the Produced Water Society; in 1993 we estimated 1.09 trillion gallons of produced water were generated from oil production in the US – enough water to flow over Niagara Falls for 9 days. I am quite certain that number today is twice that volume. Produced water gives us insight into depletion, as you elude to in your article, and it also impacts the economic viability of oil production in a huge way. In many areas of the Eagle Ford in S. Texas disposal rates for produced water can be as high as $5-6.00 a barrel. Several hundred barrels of water per day per shale well and we are beginning to talk about real costs. As produced water rates increase over time, managing that water has a direct impact on the wells ultimate recovery.

I think this is important work on a number of fronts; thank you, Rune.

Mike

Mike,

Thanks! Our (private) email exchanges of viewpoints (from real field experiences with produced water) on interactions between LTO, water cut and Gas Oil Ratio (GOR) were very helpful in speeding up the process and feeding my inspiration for producing this post.

There are others (not named) who also contributed in a great way to this post.

There is something about details and devils.

This comment is no doubt WAY out there in left field – but in a place as hot and dry as a lot of Texas it seems to me that a large enough area of flat land could have a clay floor compacted and a berm built around it and a HELL of a lot of water gotten rid of by evaporation- especially if the wind is blowing even a little bit.

I hear the wind blows just about all the time in Texas.

This would not work worth a damn on a small scale- but the area squares as you double the dimension.

With just one good size pump attached to a fountain rig- shooting the water a few feet into the air from hundreds or thousands of nozzles – the evaporation rate ought to be awesome and adequate if the evaporation pond is measured in square kilometers to get rid of enough water to make this a profitable undertaking.

Say the volume is lowered by fifty to eighty percent- that could cut hauling costs in proportion from the pond to a disposal well in proportion and also the amount of water going into the well in proportion.

It could be that evaporation could be pursued to the point that only solids are left if enough ponds were built- and there might even be a market for some of the solids. Maybe there are rare earth metals or something dissolved in the brine -just joking about this last but even so – evaporation by the square kilometer sounds cheaper to me than hauling by the barrel at six bucks or more.

And if the ponds are numerous enough and large enough there might even be an occasional extra tenth of an inch of rain someplace immediately down wind of them.

Ya all heard it here first. I am ready to take on a partner experienced in quick money scams – er, I mean venture capital and startups. 😉

Beyond this there might be ways to capture some of that nice clean water vapor and condense it and use it right in the neighborhood.Say by flowing that very humid air coming off a hot pond over a huge black sheet of plastic exposed to the sky on a nice clear cool night??? There is probably not enough water to be recovered that way to be profitable but what do I know about the price of water in Texas? Only that it is high.

Hi OFMac,

It is an interesting idea. The problem will arise after the water has evaporated and the compounds have dried. At that point, any toxic particle can become air borne under moderate wind speeds and redeposited outside any berms. From there, any additional winds or rains can transport the particles further.

There would have to be a way of containing said particles. Placing the solutions under glass might speed the operation without letting the wind in but what about the toxic substances that can evaporate at relatively low temperatures? How would they be contained?

Can the residued compounds be separated and reused??

I like the idea in concept but a lot of work would have to be done to make it work.

Of course you don’t have to dry it completely. Just reduce it to sludge. That would reduce shipping costs as well.

where would you ship the sludge?

Using the water locally sounds like the saltwater greenhouse concept, which apparently works.

http://en.wikipedia.org/wiki/Seawater_greenhouse

I think you may be underestimating the extent of the contamination of the water…trace oil, VOCs, metals, salts, radioactivity, etc. Also, there is probably a huge variation in the contamination concentrations and ratios.

As the water content goes down, the contamination % goes up and eventually you’ll get to the hazardous waste area. Costs then would skyrocket. Even before that, the brine sludge itself would be suitably nasty and difficult to deal with and likely to be very hard to deepwell inject. What exactly would one due with high metal and oil contaminated radioactive brine sludge?

I’m not sure but evap rate is probably to slow to keep up with production of the water, so these ponds would have to be everywhere.

Ponds would literally have to be leak proof or you’re back to groundwater contamination. Leak proof evap ponds are not just digging a hole in clay. Spraying the water in the air would be a sure way to release all the VOCs.

Also, I imagine that a good piece of the disposal cost is actually transportation. Actual deepwell injection is probably relatively cheap.

I have visions of pig shit sludge ponds like the ones in the southeast only worse.

Mike, at that cost I think I can lay a line to the sea, head 100 miles offshore, and use it to improve the mineral contents of sea water in the Gulf of Mexico. Did anybody look into it?

What about recycling the water with reverse osmosis filtering?

too expensive.

I have the impression that reverse osmosis costs less than a penny per gallon, or $.42 per barrel. That’s cheaper than trucking water in, and cheaper than disposal wells.

Here’s a February 2012 piece on frac water [470KB PDF] which I think goes into savings and costs of recycling-disposal. http://www.spe.org/ogf/print/archives/2012/02/02_12_10_Feat_Water_Hydraulic.pdf

Another: http://www.aogr.com/index.php/magazine/cover_story_archives/march_2009_cover_story/

There are several methods for purifying water, and they’re all relatively cheap in this context (well below a penny per gallon):

http://en.wikipedia.org/wiki/Desalination

produced water society.

your in the big time Mike

http://www.producedwatersociety.com/index.php/produced_water_facts/

Someone was predicting the Permian Basin would be the first to stop drilling in a recent thread.

http://eaglefordtexas.com/news/id/142290/rig-count-drops-permian/

Rig count down 4% this week. Could be a coincidence of course.

Eh I know Apache was/is laying down a few rigs. I’m sure several others are doing the same. However, most of the production is still conventional, which can operate at a lower price, so there will still be plenty of rigs active.

Having a little experience in the conventional oil patch (none in shale) I found Rune’s post interesting. The main “take away” for me was the hole-to-hole variability. We always seem to be given the opposite slant: That LTO sources are vast more-or-less homogeneous reservoirs with a few scattered “sweat spots”. I’ve seen many boring shale formations in my life so this misconception was (almost) creditable but Rune’s analysis kills any false impressions: Which is great. Now, with oil prices below $70, I suspect the economic ill-effects of the US being the world’s high-cost oil producer will kick in. With a lot of investment in the oil sector becoming unprofitable a wave of bankruptcies may result.

The Fed has its first chance to speak tomorrow — either in the official FOMC language release or in the followup Yellen Q&A.

Doug, Thanks!

The different well “personalities” is part of the (IMO) bigger story. That is about trends for several of the key parameters driving LTO extraction. Further the interactions between LTO extraction, water cut and Gas Oil Ratio. These are not conventional reservoirs.

As one puts this into context, what has been happening/going on in Bakken is by all measures impressive.

I see oil flat to + 10 pennies. With equities up 1%, oil issues are dragged up by the rising tide. Suncor up an absurd 6%, Continental up 6%, Exxon up 1%.

The 10 yr Tnote is down 3 bps screaming deflation. HYG up 1/2 a smidgeon.

Suncor up 6%. ?

Did they found their gas for in situ, equipment and employees for free? This stock markets are all matrix. 🙂

Oil at $55.98 up 9 pennies. Suncor and CLR now +7%.

How’s this for Fed intervention. “The Federal Open Market Committee has decided on aggressive action to protect the banking system from any difficulties resulting from the fall in the price of oil. Therefore effective immediately, in its traditional role as lender-of-last-resort, the Fed will make available lines of credit to shale producers until the credit markets for energy stabilize. This will prevent widespread defaults.

There will be an as yet undetermined limit placed on oil production permitted by any producer who avails itself of such LOCs, in order to prevent inappropriate windfall profits.”

That would be cool.

so invisible hand of market worked again 🙂

That last paragraph in your quote is a beauty 🙂

That’s not a quote. It’s an imagined quote. So far.

True story:

In his memoirs alan Greenspan talks about his visit to the Soviet Union (shortly before its demise). He visited the central bank and Gosplan, where the five Year Plans were worked out. He remarks that he came away with the impression that the Fed is the American equivalent of Gosplan, and that the Soviet central bank was more like the Mint.

Holy crap, equities have given up that 1% in just 1 hour, with no news. Ahh, the unmanipulated market of Greenwich, Connecticut HFT engines.

”Ahh, the unmanipulated market of Greenwich, Connecticut HFT engines.”

I am totally lost on this one.

Greenwich is where a lot of hedge funds reside. HFT is high frequency trading, I believe, with the implication that the market moved quickly on computer/algorithmic trades I assume, and maybe a hint of conspiracy in who and why the algorithms act.

Though I think true HFT shops are set up nearer the exchange due to the limits of the speed of light, Greenwich is too far and too slow (35 miles, .18 milliseconds according to Wolfram Alpha)

You can still quote stuff that far out. The hedgies funded some of their own engines, but they are hurting now.

Thanks I got the HFT from seeing it before but I didn’t know that Greenwich is home to a lot of hedge funds..

http://headlines.ransquawk.com/headlines/libyan-rival-force-says-will-continue-to-liberate-eastern-oil-ports-and-not-damage-oil-facilities-16-12-2014

Ransquawk

Russia to boost Q1 daily oil exports from Q4 to 52.32 million tonnes. (I think that’s about 7.3 mbpd).

Kuwait minister says some shale producers are pumping at a loss, according to Kuna (I think that’s the Kuwait news agency?)

A glance at mazama says this is a slight uptick for Russian output.

Russian net exports hit 7.2 mbpd (total petroleum liquids + other liquids, EIA) in 2007 and have been at or below that annual rate since 2007. Their ECI Ratio (Ratio of production to consumption) fell from 3.7 in 2007 to 3.2 in 2013, which implies that they shipped about 23% of their post-2007 CNE (Cumulative Net Exports) through 2013.

Item posted on Peakoil.com. Decline in Rouble continues:

http://www.bbc.com/news/business-30492518

ZH just blasted an article saying Russia has achieved what Japan and Draghi long for, inflation driven demand.

There is a current explosion of spending in Moscow as shoppers are flooding stores to buy furniture and jewelry before the price rises.

Very intersting post as always Rune, thanks to both you and Enno for putting the time in. It is certainly interesting to see that well productivity is going nowhere, despite all the noise that the industry is making to the contrary with longer laterals and multi-stage fracs.

One thing I’m starting to hear a bit more about is refracking of wells that are already drilled. I appreciate that it’s still rather in its embryonic stages as a technique, but does anyone have much in the way of data/theory on how long this might serve to extend things for? Part of me thinks that it’s just a way of getting what’s there out even more quickly, and won’t really serve to increase EUR significantly. There’s also the possibility that it will increase communication between wells in areas where they’re drilled extremely tightly together.

A further question, has anyone looked at how production might be affected if there’s a dropoff in drilling for, say, a year, and then it picks back up again? I wonder just how hard they’d have to drill to make up for a period of low activity.

Sam, Thanks!

I expect the most important dynamic going forward will be the financial one. The lower oil price reduces cash flows, thus limits the abilities to fund new wells in addition the companies will be looking at deleveraging, reducing their debt load in the face of lower cash flows.