This is another Guest Post by David Archibald

Who’s Got Liquids?

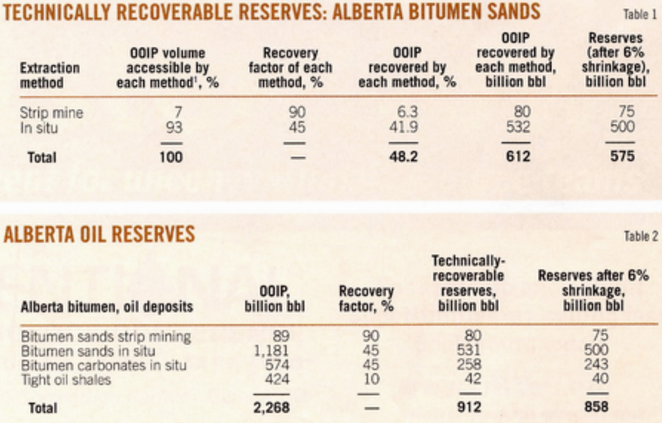

An article by Canadian consultant Mike Priaro in the 7th July, 2014 edition of Oil andGas Journal, “Grosmont carbonate formation increases Alberta’s bitumen reserves”, included the following tables:

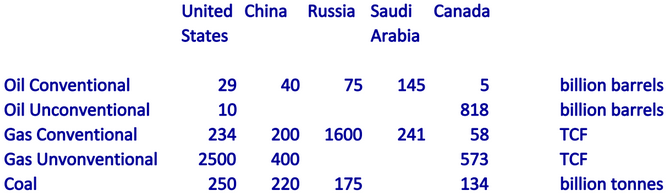

Mr Priaro’s estimate of Canada’s recoverable bitumen is 818 billion barrels. Almost all of that is in Alberta. Combined with their coal resources, Alberta has the biggest fossil fuel resource on the planet. I have updated my estimate of what some of the major countries have in the way of fossil fuels in this table:

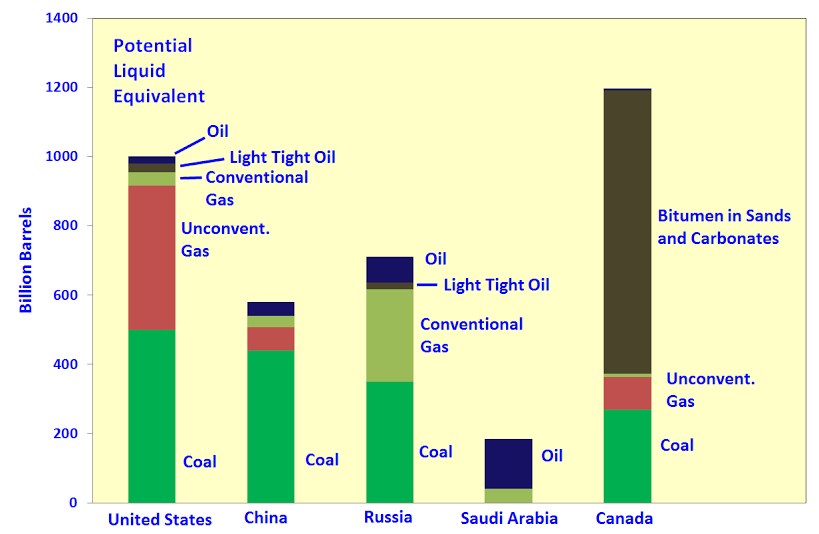

The highest value fuels are those that can be used as liquids in transport. High quality coal produces 2.2 barrels of liquids through a FT plant. In the following graphic I have used a factor of 2x to convert coal to its oil equivalent. Six thousand cubic feet of gas has the energy equivalent of one barrel of oil. Natural gas can be used directlyin some transport applications. Putting it through an FT plant to make diesel, for example, would lose at least 30% of its initial energy. Natural gas has traditionally traded at the oil price in the US and conceivably might return to close to that level in a tight market. So in the following graph, natural gas in TCF is divided by six to produce its oil equivalent in billions of barrels. This is the graph:

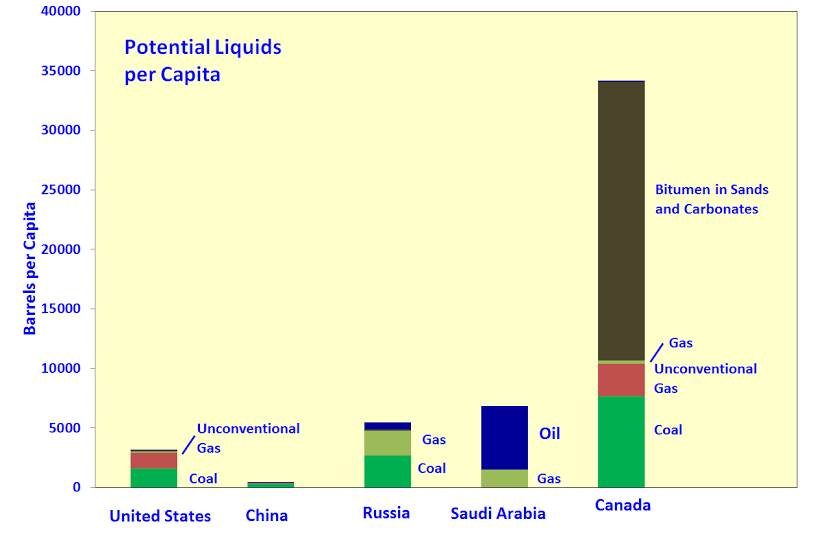

From there, one can divide each national resource endowment by the country’s population to produce this graph of per capital potential:

For the United States, the Green River oil shales are not included. Some parts of this formation might be economically recoverable at some point, for example the Mahogany Zone, but the unit as a whole has a total organic carbon content of 6%. Rocks with a carbon content down to 10% will burn in pure oxygen. It may be that only a few percent of the Green River Formation might be worth mining. In the absence of good data, it would be best to exclude it.

China’s coal resources are about the same size of that of the United States but they are burning through them four times faster. The average mining depth is approaching half of the possible ultimate depth. China has plans to increase coal consumption by another 10% to make synthetic natural gas. This process was pioneered by the Carter Administration with a plant based on lignite at Beulah, North Dakota. The Beulah plant burns through 18,000 tonnes per day and exports by-product carbon dioxide for EOR in Canada. Converting coal into syngas is a more efficient use of the contained energy than putting it through a power station. There is a 90% transfer of the inherent energy in gas in domestic cooking for example. Gas is also more storable than electricity. China appears to be on a path to have burnt through half of its initial coal endowment by the mid-2020s. Their cost of production is likely to rise thereafter.

In theory, the Chinese are building power plants that will run out of coal before the power plants wear out. They have one thing up their sleeve that has a good chance of saving the day for them. That is their thorium molten salt reactor project. The team running that project was told recently to get it commercialised in ten years instead of the original twenty years. Molten salt reactors could be added to existing power plants to replace the coal-fired boiler. That technology might come along in time to provide a seamless transition.

The figure for China’s unconventional gas potential is nominal. Results to date have fallen short of expectations and it may be a few more years before clarity is achieved.

Similarly, while the Bazhenov Fm of the West Siberian Basin in Russia has a number of similarities to the Bakken but is many times larger, well productivity for commerciality may be too low at any oil price given the much high drilling costs of this region. This is due to the rock having too high a clay content and not enough silicates so that it deforms plastically rather than fracturing to the required extent.

Further to the Bakken

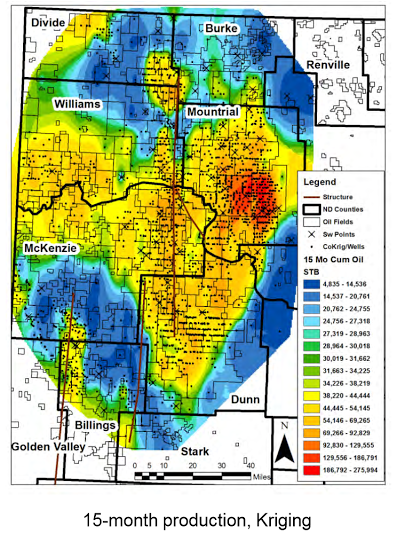

In this post I had looked at the contribution of the Bakken and the other three main US tight oil plays. Another look at the data suggests to me that my prediction that the peak is imminent may very well be right. There may only be six and a half years of production data but it is monthly data giving close to 80 data points. As to the evidence, this is a map by Schmidt from 2011 showing 15 month production for the Bakken:

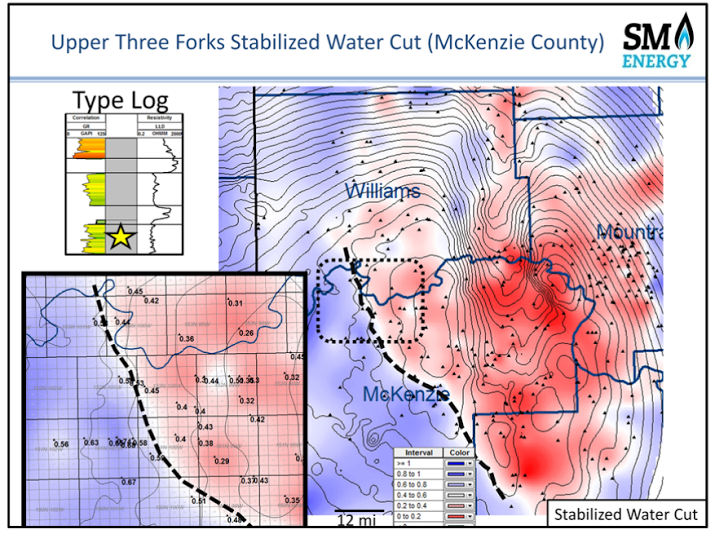

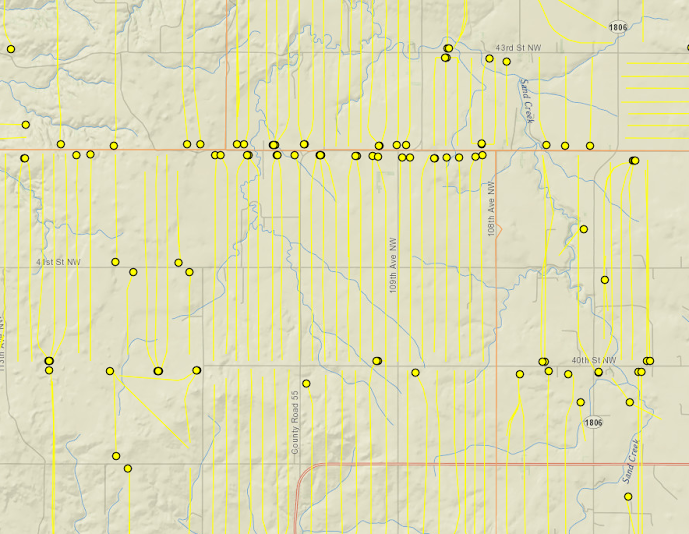

Only the wells doing 100,000 barrels or more in their first 15 months have a chance to produce 300,000 barrels or more. This is the bottom three orange colours. Four counties provide 87% of Bakken production and the prospective area may be 60% of these counties at best. With respect to the Three Forks, the area that is possibly prospective is smaller again as show by this map by Millard and Dighans from May 2014 of water cut:

Millard and Dighans make the case that the abrupt transition from high oil saturation to low oil saturation in McKenzie County shown by the dashed black line is due to the overlying Pronhorn Shale blocking downward migration of oil from the Lower Bakken into the Three Forks.

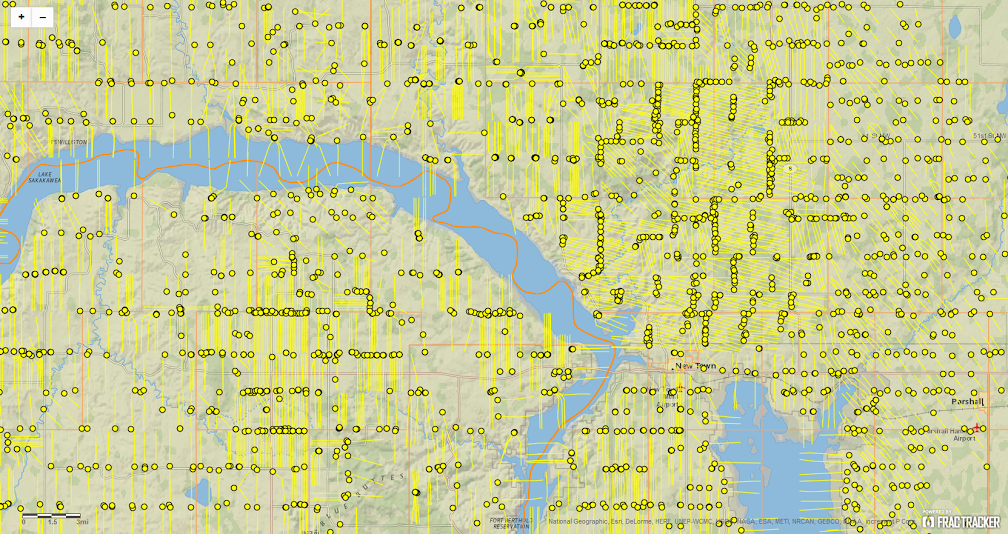

Fractracker provides very good detail on completions to dat in the Bakken including the postion and length of the laterals. Clicking on a well will provide details of its spud date, ownership and drilled depth.

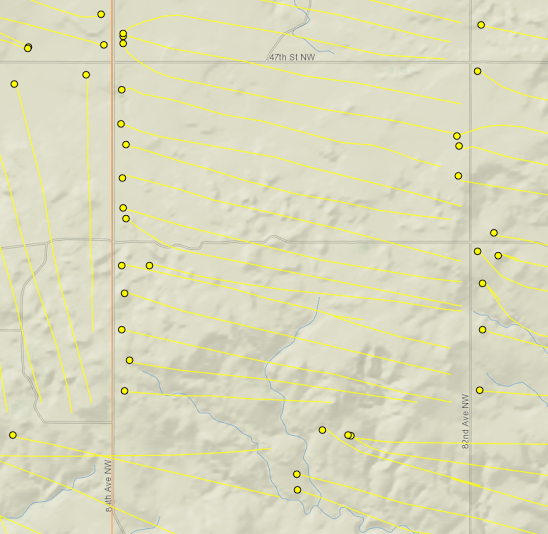

Some areas are already drilled on a tight spacing. For example, this is an area north of New Town that has been drilled on a 700 foot average spacing:

And this is an area west of New Town that has been drilled on a 620 foot average spacing:

It appears that the sweet spots of the Bakken have already been heavily drilled. There may not be that many locations left in areas that are going to provide a good return.

David Archibald, a Visiting Fellow at the Institute of World Politics in Washington, D.C., is the author of Twilight of Abundance: Why Life in the 21st Nasty, Brutish, and Short (Regnery, 2014).

This is the second article showing some density towards Mountrail.

I’m gonna suggest it is too much coincidence that the big lake happens to be there. I think proximity for truck trips of water is deciding some of this and not underground geology.

Or maybe that close they can pipe the water. Regardless, the lake is the big deal.

Ron, I’ve not called by for a while having decided to stop posting links here that may upset more than 50% of you readers 😉 As you probably know we have a referendum here in 3 weeks to decide if Scotland remains part of the UK. Kind of like Louisiana deciding if it wants to stay part of USA. Oil and energy figures in the debate and so a couple of posts linked to propaganda that is circulating.

North Sea Oil and Scottish Independence: where does the truth lie?

The Clair Oilfield – distilling facts from fiction

And for those with scientific curiosity about how Earth works, a post on Earth’s magnetic field that was prompted by a comment left by a NASA astronaut who was mission scientist on Apollo 14.

The Laschamp Event and Earth’s Wandering Magnetic Field

Pretty quiet out there:

http://www.wunderground.com/blog/JeffMasters/comment.html?entrynum=2779

Euan, getting a not found error for the last link re laschamp event.

The Laschamp Event and Earth’s Wandering Magnetic Field

Marcus, thanks for heads up on that. This link should work.

If anybody is knowledgeable concerning the energy budget involved in manufacturing syngas I am sure a lot of us would appreciate hearing what you happen to know about it.

Thanks in advance.

Farmer Mac,

That depends on a great many variables. Technology used, scale, feedstock, transport distance, etc etc etc. It can be quite profitable though, as evidenced by the stock price of Sasol (ticker SSL).

There are a few right ways to do it, and a whole lot of wrong ways to do it.

“Energy budget” is only one important variable. You also need to be most mindful of scale economics and carbon lifecycle. Coal derived syngas without CCS will be a non-starter in north america.

Done right, you get cost effective low carbon fuels at scale. Done wrong, you get non-price-competitive fuel with twice the carbon footprint, or an existential reliance on government subsidy/transfer payments (i.e. tax-dollars-to-liquids).

Thanks Stephen,

You have said a lot ( Thanks !) some of which I could have guessed more or less- there are always more wrong ways to do things than right ways.

Let me rephrase my question.

If you build a modern syngas plant- and by this I mean you get out gaseous fuel and waste products such as CO2 which may be salable but has energy content-how does the energy content of the new gas compare to the energy content of the coal used as raw material?I realize the answer can only be an estimate.

From what I recall, there is at least a 25% loss of energy in converting coal to syngas (CO+H2). To convert it to gasoline or diesel you get about a 50% loss in energy, but new technology may reduce that loss somewhat.

I don’t know what the loss is to convert coal to methane.

On fracking the Bazhenov:

High costs “due to the rock having too high a clay content and not enough silicates…”

All clays are silicates. Maybe shales rich in some clays deform more plastically than shales rich in other clays do? Anyone know?

Actually almost all minerals are silicates whereas clays (and micas) are classified as phyllosilicates. That is: sheet like in form. However, the key here is that clays tend to exhibit plasticity (when mixed with water). They bend (or flow) rather then brake. Clays also have extremely low permeability. So think of Playdoh or Plasticine as opposed to something crunchy.

Yo can we get a source link on this flexible rock presumption for the Bazhenov?

Certainly not from me. I’ve never heard about Bazhenov’s fracking suitability or unsuitability before. However, I’d guess a high clay content, assuming it exists, would be a killer. By-the-way, weren’t you supposed to be nulled out by the new software upgrade? [yellow face]

I fracked the upgrade.

I found this pdf poster from Price Waterhouse of global shale plays.

http://www.pwc.com/en_GX/gx/oil-gas-energy/publications/pdfs/pwc-eum-global-prospective-shale-plays-map.pdf

The data is from Rystad Energy Research.

BUT, the note by the formation says: “… Salym field… high clay…”

whose thickness is thinner that the Bazhenov listing in the data table.

Not clear is Salym is part of the Bazhenov, or a higher level fed by the Bazhenov source rock (leaning toward this).

Clay content of the whole Bazhenov itself (15-20%) is low compared to Bakken. (34-44%). But the quartz content is about the same in both.

For the real nitty gritty, the EIA did a world shale assessment, last in 2013.

http://www.eia.gov/analysis/studies/worldshalegas/

Chapter IX is the Bazhenov

http://www.eia.gov/analysis/studies/worldshalegas/pdf/chaptersviii_xiii.pdf

They say “low” clay content.

Also – few faults, but tax/regulation issues.

I dunno about the “too much clay” thing, Shell/Gazprom did some vertical test wells, and are now starting to frac. I guess they think (from cores, etc.) that the stuff is frack-able.

http://www.bloomberg.com/news/2014-01-13/shell-venture-starts-fracking-giant-russian-shale-oil-formation.html

I’m thinking 5 wells in 2 years is just due to being in Bum Fracking Siberia,

which is 1000 miles from anywhere, where there are two seasons: mud and frozen.

Peak oil is about peak production rate – due to economics (or lack thereof, operating at the ends of the earth) and politics as well as geological factors.

Bum Fracking Siberia… 🙂

Don’t care about clay or non clay or silicates or whatever.

Care about this bendability. Care about big pressure from the surface pump just pushes bendable rock away and doesn’t fracture it.

You can do that without clay, yes?

Another issue with clays is that they swell in the presence of water. When they swell, it inhibits the fracture from propagating properly and decreases the effectiveness of a frac.

True, montmorillonite clay (known commercially as Bentonite) absorbs nearly five times its weight of water and at full saturation it occupies a volume up to 15 times its dry bulk weight: On drying it shrinks to original volume. The swelling is important, since the entire swollen mass, the clay and water, acts as though they were clay.

Furthermore, there is no such thing as a driller (or gardener) who’s not familiar with Bentonite in its various formulations BUT all this is more-or-less moot because any subsurface clay can be presumed already water saturated (expanded).

Well now that’s a good description.

Water certainly bends.

Bentonite in its various formulations

AKA Kitty Litter.

Those of us in the manufacturing sector use it to absorb lubricant/coolant/cutting fluid spills.

Then we ship it to your local landfill.

Clay can behave in surprising ways. There is a clay soil spot on a neighbors place that gives when you drive on it and springs back just as if you were driving on a mattress or trampoline.The ground sinks a couple of inches under a heavy tractor wheel and then comes back up immediately as you watch in a matter of a second or so.

I doubt that particular clay could be fracked. It would probably open up but then it would just close in around the sand grains.

>Converting coal into syngas is a more efficient use of the contained energy than putting it through a power station.

This claim surprises me, considering how much coal capacity has been built in recent years.

I mean to clarify that, Siemens and RWE have been bragging for years that they have the most efficient coal fired power plants in the world. And they’ve invested billions in the technology.

Syngas is not an unknown in Germany, they’ve had wood-burning internal combustion engines since the 30s. But they didn’t use the technology for their new coal plants. I wonder why not, if it is the most efficient way to burn coal.

http://www.hk-gebaeudetechnik.ch/typo3temp/pics/Abb_1_Holzvergaser-Auto_2.4.2010_003_807f53f96c.jpg

I think maybe what the author had in mind is that the energy lost in converting from coal to syngas is more than made up for in the final stage of using the fuel.

There is a similar thing that happens when you burn oil or coal to generate electricity and use the electricity to charge an electric car battery. The electric motor in an electric car is so much more energy efficient that it more than compensates for the loss in energy involved in generating electricity to charge the battery- compared to just burning it directly in a car engine.

But I have cooked on a gas stove and I find it hard to believe an ordinary gas fired kitchen range is anywhere close to ninety percent efficient in putting the energy into a cooking pot.

I prefer electricity in large part because it does not overheat my kitchen when cooking. I can boil water slowly with electricity with hardly any convection currents of hot air around the pot. A gas burner turned high enough to barely boil the same pot with the same contents creates a steady column of hot air easily felt over the pot.This comparison was made at a former home everything else held roughly equal such as outside temperature and humidity windows open or shut etc.

I hardly ever ran the ac in the kitchen after switching back when I lived in that house. I ran it a lot using gas.

“High quality coal produces 2.2 barrels of liquids through a FT plant” … 2.2 Barrels per MT?

So 2.2 * 159 = 350Ltr * .9 (SG of syn gas ? ) = 315kg or 31.5% of the mass of coal is converted to liquids. (?)

Seems like more Syn Gas than I would have expected. Guess there a lot of H paired with that density of carbon.

In addition to conventional oil, Venezuela is supposed to have oil reserves similar in size to those of Canada, and about equal to the world’s reserves of conventional oil. Further, the Orinoco’s tar sands are supposed to be less viscous than Canada’s Athabasca tar sands, meaning they can be produced by more conventional means: Estimates of the recoverable reserves of the Orinoco stuff I’ve seen range from 100 billion barrels to 270 billion barrels. I realize they are buried quite deep (too deep for surface mining).

I don’t have an opinion on the validity of claims about Venezuela’s heavy oil resources but it seems to me if a big thing is being made of the Canadian goo, our southern brethren should be mentioned as well.

The thing with Venezuela is that the politics are so thoroughly dysfunctional that it has killed their investment. There’s no practical timeline for developing any of those resources (if anything, their production has been falling) so it’s not really worth counting.

Of you’re right about Venezuela’s current dysfunctional state BUT things can change and it doesn’t seem right, to me, to ignore the existence of a reserve/resource simply because of current chaos. Hell, Canada’s tar (“oil”) sands could conceivably be declared an environmental/economic disaster affecting optimistic exploitation projections.

I am a great cynic when it comes to giving serious consideration to the people of Canada or the world deciding the tar sands are to be ignored rather than exploited but I must admit stranger things have happened.

If climate change were to get bad enough fast enough we might decide to give up automobiles or at least automobiles powered by petroleum.Some people in Pacific island societies gave up pigs when it became obvious that it was a choice between them and the pigs, long term.

The race is not always to the swift nor the contest to the strong but that is the way to bet.I am not betting on society giving up automobiles unless and until forced to do so.

I may not live to see it come to pass but here is a future history scenario that is in my estimation very likely to come to pass.

It is based on the assumption that synthetic liquid fuel supplies do not grow fast enough to compensate for falling oil output and that the world economy is about to crash for lack of sufficient liquid fuel.

Somebody is going to export something to Venezuela at about that time. It may be the American brand of democracy or it may be Chinese commie capitalism or it may be a hybrid of these two plus soft European socialism. Socialists are not more timid about claiming a share of an essential resource than anybody else.

But unless the engineers and entrepreneurs come up with ANOTHER way to keep the economic wheels turning post peak oil Venezuela is going to be a country with a lot of visitors making offers they are going to be unable to refuse.

At first they will arrive with offers of loans and grants and technical assistance and if that doesn’t work they will arrive via parachute and armored calvary.

History doesn’t precisely repeat but it rhymes and it ain’t over.

Yep, eventually they will be developed and sold.

The lockout by Wester Oil was a lesson that will not be repeated.

They can wait. Maybe. A corrupt and dangerous situation, but a mature revolution.

We will see, but they do hold the joker.

The third table is titled Potential Liquid Equivalent in Billion Barrels. It shows unconventional gas in the US to be almost three times greater than oil in Saudi Arabia. Do POB posters consider that a realistic “Potential”? What is the future of natural gas transportation in the US?

Robert, being a Peak Oil man I don’t really follow gas that close but that does seem like a lot. David is talking about shale gas here and it is kinda hard to get a handle on just how much is there. At present the price of gas is so low that many drillers have pulled out. If gas were the price it is in Europe right now, how much gas could we produce? A lot more for sure but like you, I would like to hear from some gas people, a club of which I am not a member of.

But I do have opinions on Saudi oil reserves. I think 145 billion barrels is about twice as much as Saudi actually has, though as of 2012 they claimed 265.9 billion barrels. I believe they have perhaps 70 to 80 billion barrels of reserves and Russia has perhaps 60 to 70 billion barrels.

With respect to the Bashenov Fm: http://www.oxfordenergy.org/wpcms/wp-content/uploads/2013/10/WPM-52.pdf

With respect to US shale gas: http://www.npc.org/Prudent_Development-Topic_Papers/Topic_paper_1-8_update-Onshore_Gas-102013

One thing from the 15 month production map by Schmidt of Bakken production above, there is a relatively sharp transition from acreage with currently commercial production rates to the blue areas of negative returns at any price. The significance of this is that as the oil price rises, there is not a vast area of well locations that can be brought on.

Big Picture Agriculture posted this video of an electric farm utility vehicle. Kind of interesting to see where this goes.

http://youtu.be/6esgDSpMNGQ

What crap. NOT A WORD about duration.

First of all this is touted as a recreational vehicle. It is German engineering and the Germans have a decent track record of building some pretty good machines. If you go to their website this is what is posted:

derziesel.com

Specifications:

Drivetrain:

2x PMS electric Disc Motors

Rated power 2x 4,4kW

Peak power 12/14/18 kW

Torque more than 500Nm

Topspeed 30/35 km/h or 18.6/21.7 mph

Battery:

Lithium-Ion Battery

96V nominal Voltage

6,3/7,9/10,8 kWh Capacity

Autonomic heating system for low temperature use

Integrated function-surveillance guarantees highest safety

Controls:

Joystick with intelligent input-analysis

Permanent, redundant securitychecks of complete system

Selfdiagnosis and errorhandling

Preset driving-profiles for different use scenarios

Construction:

Tubuluar steel frame with rollover protection

4-point safety seat belt and body-conoured seat for best traction

Deltatracks for maximum road grip and best stability on every surface

Height: 154 cm

Width: 122 cm

Length: 132 cm

Weight: ~275/295kg

http://derziesel.com/wordpress/?page_id=81&lang=en

UNLIMITEDLENGTH

Driving pleasure for hours at the time along beautiful beaches or up and down the dunes, no problem for the Ziesel.

The nature of farm work in the field is such that it requires substantial amounts of energy on a continuous basis.

Aero resistance at farming speeds is negligible but it takes a substantial amount of horsepower just to move any machine across soft ground. The ground is always soft if you are farming it.

Even a lawnmower sized tractor needs ten horsepower continuously to operate a small mower or pull a cultivator or plow at walking speed. This same ten horsepower will propel an aerooptimized lightweight subcompact car at highway speeds on a level road.

And a tractor needs to be able to go for hours on end when you need it.Stopping to recharge batteries is not generally an option in time sensitive work such as planting and harvesting and swapping out batteries would probably be cost prohibitive since the most expensive part of the machine is the battery by far.Keeping spares on hand isn’t going to work.

We will be driving battery electric cars on a regular basis decades before we ever farm with battery power- if we ever do.Personally I think it probably will always be easier to power farm machinery with locally or regionally produced biofuels than with electricity…

Now it might be possible to do a little boutique farming with battery powered machinery under certain circumstances. An acre of strawberries or green peppers worked intensively mostly by hand brings in a whole lot of money- enough that using a battery powered utility vehicle might not eat all the profits.

Electricity given the current state of the art just doesn’t have a place out in the fields where the bulk of our food comes from.Maybe in a few decades……….

That may be true for producing cash crops but I could see certain fruit and vegetable growers looking at that vehicle with interest.

Driving my Prius up my icy and snow covered drive in winter has opened my eyes to the kind of torque at low speed an electric motor offers. We’ll just have to see what develops.

You’re looking at it the wrong way. Trying to judge a technology by thinking of cases where it would fail doesn’t really tell you where it might succeed. Equipment built for high end applications are often overkill in many niches.

For example, it is often said that electric cars can never succeed because cars need a 300 mile range. But most car trips are much shorter — 100m Americans commute 40 miles or less.

Another example is tablet computers, which were widely dismissed because they are terrible at common business applications like word processing and spreadsheets, and can’t play high end games either. There turns out to be a huge market for people who want computers but don’t want any of that.

Electric equipment like this already has advantages, and could fill a lot of niches. If liquid fuel prices increase significantly, the number of niches would increase, and the industry would focus on changing its practices to find ways to create more niches.

An interesting question would be what percent of a farm’s fuel consumption goes into applications where this this technology would fail. The next question would be what changes in practices could be introduced to reduce that “irreplaceable” consumption.

On farms where the vast bulk of food and fiber are produced- meaning large scale highly mechanized farms of the kind found in the US – nearly one hundred percent of the fuel used in field work is used in machines that simply cannot be powered with batteries at present and probably not for a long time to come if ever.This is not to say battery powered equipment has no place on farms.Just about every farmer in the US has battery powered hand tools by now.

I have a battery operated electric fencing system .But you just can’t go out into a field and do production work with battery powered equipment.A Volt battery would power my utility tractor about as long as it would a Volt climbing a steep mountain such as Pikes Peak- maybe fifteen or twenty minutes max.Considering that ten minutes of that might be used up just in getting from the equipment shed to the field and back……….

Even a little tractor such as the onesI use to trim the grass in my orchard needs at least twenty kilowatts on a continuous basis. I can get by with it being retired and a small operator mostly out in the field to pass the time considering it was paid for back in the early seventies. Tractors last.

My neighbor who is still raising apples successfully commercially uses an eighty horsepower tractor with a twelve foot wide mower to trim his orchard and it runs hammer down for hours on end.When he is not mowing he uses it to tow the air blast sprayer he uses to apply pesticides which weighs about four tons loaded up with water.I guess a Tesla battery might last fifteen to thirty minutes on a charge doing this sort of work.

The smallest fairly new tractor you are apt to find on a modern midwestern grain farm is going to be at least a hundred fifty horsepower and two hundred fifty is common. The big boys have even bigger ones.

A farmer who raises cattle or hogs will have a couple of small tractors suitable for work in close quarters hauling feed and cleaning up manure and other chore work.

Now farmers who operate such specialty businesses as greenhouses could use battery operated machinery for some jobs that they normally do with very small tractors and off road vehicles commonly called all terrain vehicles. They seldom stray very far from an electrical outlet and are mostly used intermittently and can be left plugged up between uses.

OFM, don’t diss the electric cars on Pikes Peak!

A Nissan Leaf, stock except for the tires, was entered in the Pikes Peak hill climb race. Not only did it win its class, it beat some of the gasoline cars 🙂

I saw it earlier!!.

But it only takes a little old lady half an hour to do the route at a sedate crawl .

I am a big fan of the Leaf and the Volt as well but neither of them has a battery capable of powering a small tractor for more than about a half hour to an hour at the most.A working tractor doesn’t cruise like a car at part throttle. The engine works hard continuously.

Switch off your car engine at seventy mph on a good level smooth road and it will go another mile at least before it stops rolling. Switch off a tractor engine with a plow in the ground or a mower attached to it mowing hay and it will stop as fast as if you hit a bridge abutment head on. One second with the plow in the ground and three seconds or less with the mower engaged.

So I see a max battery of 10.8 KW Hrs. At 96 volts this is 112.5 ampere hours.

Rated and peak power (always tricky, do wires melt at peak power?) let’s pick a number half way between them or 11.2 Kw. So it runs less than an hour before recharge.

To get those 112.5 ampere hours back into the battery from house current, you’re looking at about 3 hours on a 40 amp circuit breaker, which is higher than most.

And yo, Fred, about the critters from last Ronpost — I pulled 200 degs out of the air. The various places say temp rises 30 degs C with each kilometer down so 200 is a bit high.

Also, ya, protoplasm nearly boiling at 90 degs C looks dicey for critters, except water boils at a lower temp on Everest and thus a much higher temp at Bakken depth pressures?

Did some more reading about biocides in the Bakken. There is some hand waving. They want to kill all the critters. There is concern about the oil itself for sure, but there are also critters that eat iron ore or whatever and can clog the apertures. It’s a moist, warm environment. Stuff grows.

Yeah, but…

The problem is a lot more complex than the actual boiling point of water under different pressure constraints.

We need to really understand the physical and biochemical effects of extreme heat on say the essential proteins of living organisms. Should we wish to genetically modify these organisms for a specific task, we are also forced to work within the evolutionary constraints of an apparently limited gene pool of existing extreme thermophiles. The link below is to a very interesting proposed study…

http://www.astrobio.net/topic/origins/extreme-life/lifes-boiling-point/

Read it. Lotsa talk about diminished mutation rate for those hot critters.

Be all that as it may be, Ghawar is more shallow than the Bakken. Even the Eagleford is. There would seem to be a lot of targets, and probably a good market for such genetically modified critters — that market being those folks not yet sanctioned and labeled horrible terrorist.

I could certainly see something like this being useful on the small farms and vineyards near my sister’s home in Southern Germany. Almost everyone in her area already has large solar arrays that could probably easily power charging stations for these things.

Anyways, here is a bit more info on real word use:

Can you elaborate on the work/industrial or other commercial applications of the Ziesel? What is its battery life, towing capacity, range, etc. (I see the specs on the website but it would be useful to put it in terms of “two-hour battery life at 10mph” for example)?

We have had a trailer made for the Ziesel, which is only slighter bigger than the Ziesel itself. This way, you can tow the Ziesel with your car, drive the Ziesel off of it, then turn it around and hook the trailer to the Ziesel.

We had the Ziesel towing another vehicle with about a ton (1000kg) of weight on an even surface with no problem.

The range and endurance depends a lot on the surface you are driving on. Wet and heavy snow eats more power than driving on a normal street. The time the Ziesel can be used is going to be between two hours and four hours. But this means continuous driving. 2 hours is the mentioned heavy snow with full speed.

As for its potential, I think I have mentioned most areas. Those that we list are as follows:

Fun and Action, Tourism, Agriculture, Patrol and Rescue, Hunt and Forest Control, Transport, Municipal Use.

The peak power number, or even a number well under it, does not support 2 hrs as above. Something is not right. Can’t be me.

I agree and am a bit skeptical myself, having worked with battery storage systems for photovoltaic systems. However the people behind this have some pretty impressive credentials… From what I could figure out Zeisel is a product of GmbH Mattro who are affiliated with enerChange and they are the ones who developed this battery pack. I guess I could ask my brother in Germany to contact them directly and find out a bit more about this machine and its battery technology.

As a shareholder of enerChange GmbH Mattro developed a modular battery system, which on the one hand as storage buffer for renewable energies and the other as a replacement system for mobile applications is a range-independent power source for electric vehicles. More information can be found under http://www.enerchange.net

outsourced research society “enerChange GmbH”

The most extensive work in the subject area of renewable energy has led to the creation of an inter-company research center in the EU co-financed “K-Regio-program” the state of Tyrol in early 2011.

To utilize the results of this collaboration of seven companies and several universities began operations in January 2011, our sister company enerChange GmbH.

We carry out research activities in these areas as part of the K-Regio project “enerChange” (now successfully completed) together with the following companies and public bodies and with a total budget of over one million euros by:

ATB Becker, Absam

enerChange GmbH, Innsbruck

inndata Data GmbH, Innsbruck

Mattro mobility revolutions GmbH, Schwaz

mechatronics engineering GmbH, Kufstein – Ebbs

RED Bernard GmbH, Hall in Tirol

Westcam Data GmbH, Mils bei Hall

SWARCO Aktiengesellschaft, Wattens

MCI, the entrepreneurial university, Innsbruck

course of Mechatronics

Program for Environmental and Process Technology

University of Innsbruck, Faculty of computer science

I’m at least willing to give these guys the benefit of the doubt for now!

Cheers,

Fred

http://www.flyingbeet.com/electricg/

I’m putting one of these electric conversion tractor kits together, and intend to use it for mowing and PR, as a part of our attempt to lower our town carbon footprint.

Since I got my excessively big PV system, I have gone all-electric with house and car, and like all of it very much.

The Car, a Leaf, is the first new car we have ever had, and FAR too fancy for my taste, which goes for bone-simple everything, since I am the fixit man around here.

My wife loves the car, but I look at it as an example of one of those things which could get a huge improvement with obvious design changes, like- throw away all the fancy electronics, electric doors, all-around video camera, and so forth, and get the resulting lower cost and bigger range.

Enjoy your Volt, especially since you are the fixit max. Simply put, you won’t have to fix it.

Re: “Molten salt reactors could be added to existing power plants to replace the coal-fired boiler.”

If China has about 623 coal-fired power plants, with an average size of 2.5 GW, and are adding about 50 plants per year, then the transition to molten salt reactors is possible over 10+ years.

But, from my experience in China, there are coal-fired power plants spaced about every 2 to 5 km in a grid in a city. There must be large power plants outside of the city that provides the bulk of the power, and the local ones provide hot-water heating for factories and universities. These small ones produce a lot of pollution, and cannot be ignored.

The coal fired plants could not simply be”converted” to nuclear, the entire plant would have to rebuilt. They might be able to use the same turbine and generator but I doubt it. At any rate it would take a lot longer than ten years to convert everything, more like twenty to thirty.

The turbines and generators and associated infrastructure such as roads and power transmission lines and transformers etc actually do make up the bulk of a coal fired power plant especially in terms of cost to the best of my knowledge.

So using a reactor simply to replace the boilers would be practical in principle at least assuming the coal plant is of a size that matches an available reactor size.

But I agree that it would take a lot longer than ten years to convert a nation’s worth of coal boilers from coal to nuke. It would probably take ten years just to ramp up the capacity to build such new reactors to a useful level.AND we shouldn’t forget that so far they exist only on drawing boards.

We know it can be done, that the design does work, but not if it can be done economically on a large scale.

By far the largest expense and time consuming factor in building a nuclear plant would be the reactor . The heat exchanger is the boiler in a nuclear plant. And there would be the problem of fuel for all those plants. I am not so sure it would be available.

You have a good point about fuel and reactor construction too. A little more thought indicates that the only way this would likely work is that reactors would be modular and dirt cheap compared to today’s cost.

Whether such reactors can be built in factories and assembled on site is technically possible I suppose but the cost of them would most likely still be prohibitive for a small installation.

Now if you are talking about a big coal fired plant in the thousand megawatt range then saving existing infrastructure and just scrapping coal boilers makes plenty of financial sense assuming the turbines and generators etc are in good condition. In that case even a conventional site built reactor would probably be a good investment compared to doing without electricity.

It is my impression that the primary argument for molten salt reactors is that thorium which is cheap and plentiful will be used as fuel rather than uranium which is potentially in short supply.

Of course a practical way may be found to extract uranium from sea water and even though the cost might be five or ten times the current cost of mined uranium it could still be an economical fuel considering that fuel for a reactor is dirt cheap compared to the power output.

I have hope too for breeder reactors being perfected but the proliferation problem is one to keep any sensible person awake at night.

Watcher, my spam filter catches about 99% of all spam but occasionally some get through. I have no control over how it works however.

Because of declining production, Mexico no longer has sufficient domestic light, sweet crude oil production to meet the domestic demand from refineries designed to process light crude, so they are going to have to start importing light crude, although they remain a net oil exporter.

In any case, the Pemex official quoted in the following article had an interesting comment about condensate (which is basically natural gasoline that is not of much use as feedstock for producing distillates like diesel fuel).

As I have previously noted, in my opinion it is very likely that actual global crude oil production (45 and lower API gravity crude oil) probably peaked in 2005, while global natural gas production and associated liquids–condensate and NGL’s–have so far continued to increase.

Mexico’s Pemex aims to start importing light crude this year

http://uk.reuters.com/article/2014/08/28/mexico-pemex-idUKL1N0QX2TL20140828

Kurt Cobb’s article on this topic:

Did crude oil production actually peak in 2005?

http://resourceinsights.blogspot.com/2014/04/did-crude-oil-production-actually-peak.html

As a possible footnote:

“KMZ produces about 865,000 barrels of oil per day — more than twice the current output of the gasping Cantarell. KMZ also produces a lot of natural gas. But it consumes more than twice as much gas as it produces. That’s partly because Pemex must inject vast quantities of gas into KMZ to help push the remaining oil up to the surface. Said Joram Carriles, a KMZ operations manager: “It’s a dying field.”

Sorry, forgot to add link: http://fortune.com/2014/08/15/great-mexican-elephant-safari/

This subtle little tidbit is creeping out into the open more and more.

A few days ago we had Bloomberg reveal an effort underway to “redefine WTI” because Cushing’s content, filled chock full with shale oil, no longer conforms to all of the parameters of WTI (not just API degs). So rather than note that, they just redefine WTI.

I was just reading about Ghawar. Its API degs are 33-36. THAT is first class oil, not the thin Mountrail stuff at API 42-47.

Happy days are here again!

http://www.nytimes.com/2014/08/29/business/energy-environment/shale-oil-in-texas-keeps-gas-prices-affordable.html

The NYT is often referred to as the ” paper of record” for the USA and it is the root source of most of whatever you might happen to read in the more liberal papers and and websites. Generally the NYT can be counted on to show some understanding of everyday reality which is neither liberal or conservative but rather just ” reality”.

But when it comes to oil they publish puff pieces like this one which is nominally accurate for the most part but gives a totally erroneous impression of what the actual situation looks like.

Countries that are exporting to the Far East these day are not being forced to sell their crude ”at a deep discount”.

The Chinese pay the same or very close to the same as everybody else. So do the Japanese etc and the bills are settled in dollars most of the time. So far as I can see the only people who can buy crude at a discount on the world market are the people willing and able to buy a relatively small amount of otherwise embargoed crude sneaked out of countries on Uncle Sam’s shit list.

And of course the real reason , the continuous depletion of legacy oil fields, for oil being a hundred bucks a barrel is scarcely ever mentioned at all in such articles.

When it comes to conspiracies I am with Ron and seldom ever believe in them. But I have a cynical streak a mile wide and sometimes I have a hard time believing there is NOT a defacto conspiracy that includes nearly all the MSM which is geared to keeping the country and the world in the dark about oil supplies.

I don’ t mean to say that all the media moguls get together at some resort like the heads of Mafia families and agree to keep the truth buried in this respect but rather that each and every msm outlet has a very powerful incentive to ignore the truth in situations like this one.

The owners of any major paper are more than likely to also be in part the owners of many other large businesses that depend on Joe Six Pack staying on the consumer treadmill.And beyond that even the biggest newspaper has to have advertising revenue to keep the doors open. Only a fool would believe that the advertisers are unable to exert substantial influence on the content of the news and editorial columns.

And beyond that the owners or managers of msm media have political axes of their own to grind and debts to settle with the people that have done them favors in the past.NPR for instance is one of my favorite sources of news but I cannot think of a single recent instance of hearing anything on NPR that is not subtly or blatantly presented in a fashion more favorable to the democrats than to republicans. This is as natural as the sun coming up because the people at NPR basically owe the existence of NPR to the democratic party and everybody knows it.

The Wall Street Journal can be counted on to just as reliably slant coverage to favor republican politics of course.

The trouble with some issues getting honest coverage in the MSM is that sometimes it is in the interest of just about all the MSM to fake it. Oil is such an issue.

You can pretty much determine what the truth is concerning almost any issue by carefully reading both the pro and con press about it for a few months but not in the case of oil.

The conservative press is dominated by people determined to maintain business as usual. The liberal press is not going to push the truth about oil supplies anytime it looks as if doing so is going to cost the democrats politically. Bad news on the oil front- spiking oil prices- would be bad for the democrats with elections coming up. Good oil news makes the democrats look good or at least better in terms of voters this fall and next presidential election.The party in power always gets the credit for good news no matter whether that party had anything to do with it or not.The out party is generally able to capitalize on bad news no matter whose fault it may be.As often as not bad news is not actually anybody’s fault but the average voter generally doesn’t understand this and wouldn’t care if he did.

If you want the truth about a whole lot of issues these days the best place to look for it is on the internet at sites such as this one.

I have a hard time believing there is NOT a defacto conspiracy that includes nearly all the MSM which is geared to keeping the country and the world in the dark about oil supplies.

Never attribute to malice that which is adequately explained by stupidity.

”Never attribute to malice that which is adequately explained by stupidity.”

This is a bit of wisdom that we should never forget and it applies to the oil supply situation as it is covered by the MSM but only in a way one step removed from day to day considerations.

In terms of day to day business the media are playing it smart rather than dumb. They are all keeping their mouth shut like a bunch of nice people at a party who will pretend the food is good when it is actually awful or maybe even rotten. This is of course what we should expect since the media are big businesses owned by big businesses and big businessmen and bad news is very bad for the bottom line.So everybody has an incentive to keep his corporate mouth shut.

I have been looking for a word or a phrase for a long time that describes these situations that look like conspiracies but actually are not.

Of course if the food really is rotten … then a whole lot of people are going to be tossing their guts up tomorrow and some may die.Peak oil – when it hits really hard – is going to be a lot worse than corporate food poisoning.It is going to kill a lot of businesses as dead as last weeks fish bait.

So at a step removed from immediate considerations big business and big media are certainly playing it dumb.

If I had any money it sure wouldn’t be in airline stock or hotel stocks!!

“I have been looking for a word or a phrase for a long time that describes these situations that look like conspiracies but actually are not.”

OFM, here to assist .The phrase is “conspiracy of silence” . example we would have visitors to a terminal cancer patient in a hospital . No one will say ” you are dead ” . They will talk general . None of the visitors conspired to do that ,but then that is the way it is . Recall seeing the movie “Mississippi Burning ” where the whole town said they had no clue how the murder happened in spite of being that done in full view .

The way this stuff works is systemic. There is no conspiracy. There is merely an alignment of self interest of a huge number of people.

This is particularly true with the distribution yield or assay of light tight oil. Everyone knows it’s not Libya quality oil. So phrasing will always be “this oil has the same API degs as WTI”. Only the refineries care and they have no reason to dwell on it.

I thought is was interesting that the NYT now sees $100 oil as “affordable”.

I also liked the part where the guy claimed that cheap oil helped him pay the smart phone bills. It shows how priorities are changing as dematerialization moves forward and oil prices increase.

I’ve corresponded off and on for a few years with the NYT reporter who wrote the article, Clifford Krauss. Following is an email I sent him:

This is the point of the Enno stat.

Industry **IS** adding that much. 63% of Bakken production is wells less than 18 months old. It requires frantic truck activity, and that’s what they’re getting. Frantic truck activity.

If you want to see that all collapse, bring the Teamsters in to unionize the guys hauling salty production water to disposal wells. That will end the whole boom.

Watcher,

I know you are very concerned about trucks and congestion, but as wells get closer together, and some plans are for up to 30 wells per pad, then centralized infrastructure come into play.

First run a few poly pipe to the farmers gate and off load fresh water, on load up salt water. Extend those pipes to the county road, maybe a few holding tanks. Extend a little further to the freeway exit and supply several pads. It may get to the point of running all sorts of pipe work. Fresh water, salt water even natural gas . Sand will always have to be trucked, but it will be handled in bulk and transferred in pipes and air. Casing, chemicals for mud, people and food will still be using the roads of course. But there a lot of ways once the area is established that many trucks can be taken off the road, especially the last mile around the drilling site.

The reason I don’t see that happening is the 63% number is growing. More and more of the production is recent. Those pipes add time to “well completion.”

You can redefine well completion, or reemphasize it. Spud to first oil. Just delay the spud until the pipes are in? Sure, you can do that, but it still takes more time to get the well done from time of decision to put a well there to first oil.

You got 30 wells on a pad? Great. They’ll be doing just a few barrels a day in a couple of years or so and pipelines might be good for them, but we’ll soon be looking at 70 and 80% of production in the last 18 months. You just can’t get the pipes in that fast. If you try, you slow down drilling and the peak happens.

”You just can’t get the pipes in that fast. If you try, you slow down drilling and the peak happens.”

I don’t know any more about drilling wells and fracking them that anybody else here but over a long career as a rolling stone it the trades I learned a good bit about pipes.

Unless you are restrained from doing so you can lay temporary pipe pretty damned fast.You just root out a ditch for it or maybe even just smooth up the ground a bit and lay it right on top of the ground. Pipes carrying hazardous materials like oil need to be very good quality and installed very carefully and this costs a ton of money.

But pipes of the sort needed to move water can be laid a mile a day with a couple of men operating the right sort of machinery and a few trucks to keep them supplied with pipe plus a half a dozen ground crew.

I may be way off on the price of it but I think you can buy an eight inch pipe strong enough to pump water five miles or more or two and up and down hill a couple of hundred feet for less than ten bucks a foot if you buy it by the carload. Such a pipe would carry more than enough produced water to eliminate a hell of a lot of trucking at least during warm weather.

At first glance it looks as if it would work in Texas but maybe never in the Dakotas.

If the wells are no more than a mile apart there will be power available to drive booster pumps as needed.

Plastic water lines don’t have to be welded in the usual sense.. They can be either glued or clamped. Glue is more properly called solvent weld.

It costs at least eighty to a hundred bucks an hour to keep a big truck on the road these days and probably considerably more in places such as the North Dakota oil fields.

You can easily load an eight thousand gallon truck with an eight inch line in fifteen minutes or less.

Something other than the price of pipe and the cost of manpower to lay it is stopping it being used at least to carry away produced water..

Table 1 above shows that there are technically 575 billion barrels of oil that are recoverable. This is approximately 8 to 10 Ghawars (40 to 50 MBOE/day?). Of course the bitumen has to be converted to “oil”. I understand that natural gas and water are part of the process for converting bitumen to oil and then the oil is transported by pipe and rail to refineries. This leads to a lot of questions:

What is/will be the approximate resultant cost per barrel?

Is the output quality of oil good enough by itself to be cracked into gasoline?

Is this going to delay the onset of peak oil in terms of production?

Will this be part of the “undulating plateau” that Daniel Yergin was talking about?

Is there enough natural gas available in North America for the conversion process?

Since the deposits are so far north, will this be a seasonal extraction effort?

I assume the MacKensie River has enough water flow for these efforts.

Morgan Stanley Extends Diesel-Buying Spree Amid Supply Surge

By Rupert Rowling, Bloomberg, Aug 29, 2014 12:37 PM ET

The banksters have placed their bets.

Recent paper in the American Meteorological Society Journal…

>Assessing the risk of persistent drought using climate model simulations and paleoclimate data

At the rate California is drying up we may have to find some money in Appalachia to fund an invasion of Canada so we can divert some rivers. One thing to be said about that scale of civil engineering job- it sure would put a million men to work !!

Sarcasm light is ON!!

Seriously speaking there is a significant possibility the drought will break with a repeat of the rare and little known phenomenon known as an atmospheric river.

Most people have never heard of the west coast floods that happened in the 1860’s while we were fighting our civil war.

Given that flooding on this scale has happened only once to my knowledge in modern times in North America it is impossible to estimate what the odds are of it happening again other than to say it will happen again eventually.

But a better guess is that the state will be ok except in terms of agriculture.So long as our current government lasts in a recognizable form the end result of tens of millions of sweaty thirsty city dwellers wanting the water currently used by a few thousand mostly very rich farmers can only end one way.

The cities will get the water and the farms will revert to scrubland until the rains return in a decade or a century.

This will actually be very good for people like me. Veggies don’t grow here in the winter but taking California production off the market will raise prices for fruits and vegetables across the board anyway.

California may never slide off into the ocean but there may come a day the rest of us wished she had when we have to start paying for her environmental troubles.

So far as I am concerned I wish we could build a Berlin Wall around my part of the country to keep OUT the ”damyankees” pouring in daily. In recent years we are getting invaded from both directions as tens of thousands of the ones who moved to Florida decide to move halfway back home again to escape Florida summers which are much worse than our southern mountain winters.

It is virtually impossible for a local kid to buy enough land to farm anymore given the megabucks these invaders have to spend after a lifetime in places where wages are higher and they sell their old house for a half a million tax free.

If they start pouring in from the west coast too I guess I will have to move to Canada or something lol.

OFM,

Seriously speaking there is a significant possibility the drought will break with a repeat of the rare and little known phenomenon known as an atmospheric river.

Most people have never heard of the west coast floods that happened in the 1860′s while we were fighting our civil war.

There is no doubt those rivers are up there and they can occasionally cause sudden and catastrophic floods, Europe in 2009, comes to mind but the question is where exactly are those rivers being diverted to? The Jet Stream is a major driving factor and right now there is an almost 4 mile high, 2000 mile long high pressure ridge along the California coast that is diverting precipitation events away up towards Alaska and British Columbia. If you recall there was massive flooding in British Columbia just last year. Coincidence? Probably not. A large part of those floods were caused by precipitation that should have fallen on California. Unfortunately it looks like things are not going to get better anytime soon.

Climatologist Who Predicted California Drought 10 Years Ago Says It May Soon Be ‘Even More Dire’

http://thinkprogress.org/climate/2014/03/07/3370481/california-drought/

“Back in 2004, Sloan, professor of Earth sciences at UC Santa Cruz, and her graduate student Jacob Sewall published, “Disappearing Arctic sea ice reduces available water in the American west” (subs. req’d). They used powerful computers “to simulate the effects of reduced Arctic sea ice,” and “their most striking finding was a significant reduction in rain and snowfall in the American West.”

As far as I know Artic sea ice continues to disappear at ever increasing rates!

Granted we do not have unequivocal ‘PROOF’ that any of this is being caused by anthropogenic induced climate change due to continued burning of fossil fuels. Of course it might be nice to apply the precautionary principal and stop burning them anyway…

I know, I know, all those poor truck drivers in the Bakken making 100K/yr would suddenly lose their jobs and all the bankers would become deeply depressed, because they even though they care deeply about the little people, they wouldn’t be able to give them any more loans, so they could go out and grow the economy by buying things they didn’t really need. And the last thing we want is a bunch of depressed Bankers walking around /sarc

Cheers!

Fred

Global warming aside, it seems a little over the top to drill a well every 200 yards across half of ND just to get a few sips of oil… would it be more rational just to use a little less?

First of all, oil is freedom.

Secondly, using just “a little less” would mean that all the glorious benefits of modern civilization given to us by oil would become reserved for the wealthy and powerful.

I believe you’ll find those of us who inhabit the real world are just a little bit skeptical of your cries of immediate doom.

I believe you’ll find those of us who inhabit the real world are just a little bit skeptical of your cries of immediate doom.

About 99.9 percent of those of us who breathe are skeptical that anything is going to interrupt this wonderful age of exuberance. And they will go on being skeptical right up until the moment of collapse.

Oil isn’t freedom, oil is Jesus. Of course some theologians argue that Jesus is freedom, so maybe you’re right. My old dad used to say there were two St. Patricks, so you never know.

This reminds me that time is money and money is power. So time is power by the law of transitivity. But power is work divided by time, so work must be the square root of time.

@Mac

You would be a welcome neighbour, Mac. Land is expensive here on Vancouver Island; at least compared to other places. Cheap enough where I live, though.

Winters grey and wet…the odd snowfall of 6-12 inches, some winters no snow.

Harvest update:

Canning salmon this morning. 2nd to last batch. 10 cases so far and 100 fillets in the freezer. Veggies almost all processed although we are still eating fresh tomatos and cukes. The sockeye run was unbelieveable for all users…commercial, native food fish, and sporties. Coho still to come in. I used to order grapes in from California, but the drought nixed that and I may never do so again as I have switched back to fruit wines which I made 30 years ago. Currently 30 us gal of apple/plum, which makes a nice dry white/rose. Blackberry for red. The whole house smells like a winery. Broilers done and frozen and I obtained an elk draw this year…even these Rosevelt cows can top 600 lbs!

Building a stainless still as we speak.

My wife and I supply a few families with fish and vegetables as we always produce too much.

It is a good place to live. By the way, my brother and sister-in-law just renounced their US citizenship. His wife was a US army vet from a military family so this was a big deal for them. I have never considered myself to be an American even though I was born in California in ’55. Lived here all my life. I think it was Fergusson Mo that finally tipped the scales for them but they also mentioned drones and the rigged economy/dysfunctional Govt.

This post was very interesting for me as I have been agonizing about going solar for almost everything. However, whenever I research solar applications it is always 2-3X the cost than using our grid supplied hydro and using FF for tractor, pumps, etc. I just deepened a pond for irrigation and will stick with a honda irrigation pump due to cost. We have a small FF footprint, living simply, no commute, seldom go to town, and heat with wood. Having said that I have been concerned about how we can continue without FF in the mix? These graphs show that Canadians will be able to. Plus, I doubt that folks will choose to forgo Canadian Select if it means going without. As for water exports to US, this country would self-destruct with protest if that were even considered, much less embarked upon. Las Vegas and Phoenix would have to be abandoned with mass migrations from elsewhere emphasizing the point. We’re still pissed off at the US fucking us on the softwood tariffs, (protectionism for an inefficient industry….pure and simple). No, I believe the water will stay where it is, regardless of drought.

regards…Paulo

Hi David,

You said,

“Only the wells doing 100,000 barrels or more in their first 15 months have a chance to produce 300,000 barrels or more.”

Enno Peters has again shared his data collected from the NDIC. For the 5500 North Dakota Bakken/Three Forks wells that started producing between Jan 2008 and March 2013 (all wells with 15 months of data or more) the average well produced 90,600 barrels over the first 15 months and the median well produced 81,000 barrels over its first 15 months.

If we assume a very conservative well profile with the wells declining exponentially at 10% per year after 66 months, the average well produces about 355 kb at 325 months when it reaches 5 b/d at which point it is abandoned. So your numbers are roughly correct, wells are still above breakeven at present price levels if the output is as low as 220 kb.

What is the energy source going to be when these wells get down to five barrels a day? Locally generated electricity using locally produced gas to fuel the generators? Locally manufactured diesel?

Grid sourced? It twenty years the grid might actually be extended to the individual wells if they are only a half mile or less apart. We extend the grid to houses in rural areas where the houses are farther than that apart.

A relatively small line would be enough power pumps but it is obvious the power needed to drill and frack is many time past the practical capacity of a grid running out into rural area where all that power will be needed for only a few weeks at the most at any given spot.

The net energy gotten from a well that must be more or less continuously pumped that produces only five barrels a day might be so little as to hardly be worth the bother. Natural gas is not going to stay cheap even in North Dakota unless I am badly fooled.

Environmental regulations will make sure it is collected rather than flared and once collected it can be sold for whatever the market will bear.

Using it to pump the last few thousand barrels out of an old exhausted well might not be as profitable as just selling it outright.

Hi Old Farmer Mac,

As I said in my comment to watcher below, there are lots of old Bakken wells that are producing with output between 1 and 5 b/d, if real oil prices decrease relative to other operating costs then perhaps this will no longer be the case in the future. I expect that when peak oil hits (within the next 5 years would be my guess) that real oil prices will rise rather than fall, but in the ensuing economic crash oil prices may fall and many wells will be abandoned between 5 and 10 b/d, it depends on oil prices and this is hard to predict.

Hi Mac,

Think about this a little more. The energy source will be the same as when the well produced 50 b/d, not really any reason to change things as flow rate decreases. If the costs are more than the oil can be sold for the well shuts down.

A Texas oil man who runs a bunch of strippers suggested 5 b/d might be the limit, lots of Bakken wells are currently producing at 5 b/d, perhaps a horizontal well changes things, but I don’t really think so, as the pressure decreases you have to pump up from where the horizontal well turns up to become vertical, there may be some pumping losses along the radius, but if the horizontal section runs slightly downhill so that oil collects at the start of the radius (where the pipe turns from horizontal to vertical) the cost to pump the oil to the surface may be very similar to vertical wells.

Maybe toolpush or someone in the oil business can correct this if it is wrong.

Below is a histogram of 15 month cumulative output from 5286 wells in the North Dakota Bakken/ Three forks which started producing between Jan 2008 and March 2013.

I’m gonna frown at 5 b/d as shutdown.

A **LOT** of things have to be going on to keep a well open for bizness.

You have to fill the on site tank. A truck won’t be by until about 200 barrels. You also have to fill the on site production water tank, which will happen 8ish times faster. Then a truck has to come by for that.

You also have to bring a freshwater truck in to flush down into the well with that biocide laced water and dissolve the salt encrustation building up in the well. Frequency of that event . . . don’t know. Weekly seems right. If you don’t do it, you don’t get 5 bpd. You don’t get anything.

$500/day –> $3500/week. Offset those costs. I suspect 5 is too low. Gonna shut down earlier (hmmmm unless plug and abandon expenditures are over budget that month). Shrug. 5 just seems too low with all that operations stuff happening.

Hi Watcher,

The 5 b/d estimate was based on the observations of an oil man from Texas who has much more insight than me.

In addition if we look at the data collected by Enno Peters for wells that started producing in July 2006 or earlier in the North Dakota Bakken/Three Forks 37.5 % of the producing wells had an average output below 5 b/d on average for the 96 months from July 2006 to June 2014.

Of the 164 wells that started producing in July 2006 or earlier and were still producing for most of the months from July 2013 to June 2014, 32 % of the wells produced between 1 and 5 b/d over the 12 months before July 2014.

So the 5 b/d estimate is pretty conservative.

Of the 164 wells that started producing in July 2006 or earlier and were still producing for most of the months from July 2013 to June 2014, 32 % of the wells produced between 1 and 5 b/d over the 12 months before July 2014.

Really? Those 164 wells obviously bear no resemblance to the multistage fracked wells they are drilling today? Therefore they cannot used as any kind of a guide as to what we can expect from today’t wells.

Yeah, that would be my reply. Too early. Those are not horizontals. They may not have salt water issues.

The production water and salt encrustation are the determining items, it is said. Texas doesn’t have this problem, it is also said.

Regardless, one can complain about 5 bpd being too low (That’s 210 gallons/day -> 8.75 gallons/hour -> 0.145 gallons/minute and that’s a trickle (a garden hose is 2-3 gallons/minute) and no question salt will build up, fast) but I really wasn’t going to ask for more than 10. Maybe I should.

In this context I know I have seen some well IPs that were way under the hyped EOG numbers. The right question would be are there any wells flowing 5 bpd that were drilled post 2011? If they weren’t great wells, they may have degraded down to that level by now.

The better question would be have a look at wells drilled post 2011 flowing 20 bpd last year. How many have gone off line?

Hi Watcher,

All wells since 2011 with 12 months of production data with most recent 12 months of data between 5 b/d and 20 b/d (1.5% of 4100 wells) have not been abandoned. Wells that only produced for 3 months or less were ignored.

About 0.5 % of 4100 wells produced less than 0.5 b/d for the last 12 months, most of these wells were producing 10 b/d or less in their first 3 months and then output fell to zero for many months.

There is little evidence in the data that wells are shut down when output is 5 b/d or higher in the Bakken.

Histogram below is average output for the last 12 months in b/d for wells which started producing between Jan 2011 and July 2013.

>About 0.5 % of 4100 wells produced less than 0.5 b/d for the last 12 months, most of these wells were producing 10 b/d or less in their first 3 months and then output fell to zero for many months.

>

This is 20 wells flowing < 0.5 bpd. What does that mean?

Are you saying they got to 0.5 bpd because they fell to zero for many months, and are still at zero? Or did they fall to zero and suddenly start flowing again for an average of 0.5 bpd, but really are flowing presently 50 bpd because they got clogged and then unclogged?

Is there some suggestion here that 21 gallons per day (0.5 bpd) over the last . . . week is enough to pay all the bills? More specifically, are these flow rates averaged over some time period or the latest measure?

$50 per day can pay all the bills? One of which is royalty to the landowner.

I have information.

Plug and Abandonment. Costs vary, average looks like several 10s of thousands of dollars.

Texas regs say a well that produces more than 10 barrels/month for 3 consecutive months can be called “active” and regulations do not then require the P&A expenditure.

This is 0.3 bpd. A coincidence?

The point would be that the wells may be operated below cost. If the trucks and de-salt processes cost more than the oil flowing value, the company may endure that. In fact, text suggests that (again, in Texas, operators have three choices — record > 10 bpmonth, P&A, or request a P&A deadline extension. The last option is usually cheapest, but the Texas people aren’t stupid and they won’t let that go on forever.

http://www.liftek.biz/canyouafford.html

http://www.npc.org/Prudent_Development-Topic_Papers/2-25_Well_Plugging_and_Abandonment_Paper.pdf

oooh more:

http://www.legis.nd.gov/assembly/60-2007/session-laws/documents/MINE.pdf

This NoDak law (proposal) apparently says a well isn’t dead unless it’s been dead for a year (i.e., non paying). Whatever that means. But it seems overall to be an attempt to force P&A funding via a bond arrangement rather than just walking away from an empty hole.

Most of these 20 wells produced nothing for the last 12 months, in fact most produces for a couple of months, dropping to under 5 b/d by month 3 and to zero by month 6.

I created an average profile for 16 of the 20 wells, these were basically not good wells cumulative output from these 16 wells was less than 0.001% of total output from all wells that started producing between Jan 2011 and July 2013 (so they are not really worth concerning ourselves with). Basically very few wells have been abandoned that started producing since Jan 2011.

vertical axis is b/d and horizontal is month from first output

I’m going to have to look carefully at wording. How can a well be producing 0.5 bpd when it is producing “nothing for the last 12 months”

This sounds like what I was wondering, is the quote of 0.5 bpd an average or is it the last measurement.

But. . . they were bad wells so maybe it’s not useful to obsess over those 20. Hardly representative of anything.

The P&A numbers and regs remain potentially decisive and can be an engine of deception. Wells stay active if declaring it inactive will cost $80,000. You can declare 2 bpd, pay taxes/state royalties, owner royalties and just never pay for any trucks — all to avoid the $80K.

Hi Watcher,

I said,

“About 0.5 % of 4100 wells produced less than 0.5 b/d for the last 12 months…”

So basically they produced less than 0.5 b/d (note that 0 is less than 0.5) on average from July 2013 to June 2014.

On the cost to abandon a well, eventually this cost has to be paid unless the company goes bankrupt.

In many cases the stripper wells are sold to Mom and Pop operators who run these wells very efficiently.

Note that royalties and taxes are a percentage of oil produced.

I think we’ve lost sight of the forest for the trees.

Yes, of course royalties are a % of flow, and if there’s no flow, but one pretends there is flow, you pay a tiny amount — which justifies not declaring 0 ( which starts the P&A regulatory clock).

The overall question is whether or not 5 bpd for very long periods of time for large (growing) numbers of wells is a good number for analysis. The operators don’t care what barrels/well numbers get tracked. They just want to avoid the P&A cost, which they might do long enough to unload the well.

The result of all this . . . quoting flow that isn’t there.

Hi Ron,

The point is that wells producing 5 b/d and less are still producing. there are very few wells in the Bakken which have been completed recently that have output that low.

Per above, they don’t have to be producing. They need just be reported as producing, to avoid P&A expense. It will cost royalty and some truck trips, and ongoing loss, but the P&A expense gets deferred.

Who would complain?

QEP Resources (QEP) is doing 1 million barrel EUR wells in the Bakken now. Look for the other E&Ps to be doing the same these days thanks to Slickwater Fracks and other innovations like the Whiting (WLL) Cemented Liner technology. More and more of this oil is just going to continue coming out of the ground thanks to the profit motive and longevity of the American Free-Enterprise System. I’d just like to wish a Happy Labor Day to all the hard-working American roughnecks, roustabouts, geologists, truck drivers, frackers, etc. humbly bringing us to within sight of Energy Independence!

Yair . . . Sure do like the blue highlight Ron, works a treat.

Cheers.

Mr. Archibald,

I hope your article is a bit more relaible than your latest effort on Wattsupwiththat, where you state of solar radiation incident at the surface of the oceans:

“Most of the heat energy of sunlight is absorbed in the first few centimetres of the ocean’s surface.”

Actually sunlight, which at the Earth’s surface is predominantly in the visible region, penetrates many metres into the ocean. As an experiment to check this could I suggest that you find a bottle or jug – as deep as is available and fill it with water. Now: looking down from the top can you see the bottom of the vessel?

Yes? You have witnessed the experimental refutation of your claim.

Your subsequent claims, such as the lack of heat transfer below the first 100 m of the ocean’s surface can be similarly discarded. Ever heard of ENSO, AMO, etc??

Hey Bill,

While many of the readers on this site do disagree with David’s views on climate change we have agreed at Ron’s request (in case you missed the memo) not to engage in that debate with him here. We still consider his work and views posted here in this article to be valid.

Cheers!

Fred

It speaks to his credibility. When someone subtitles his book “Why Life in the 21st will be Nasty, Brutish, and Short”, you have to think his main aim is to be controversial.

His scholarship is also called into question when he can’t understand the current research on climate science, and actually opposes the consensus with his own wild theories.

I know his background, so that is why I am hesitant to give him any kind of free pass when it comes to technical analysis. The earth is a system and that system involves the climate and natural resources taken together as a whole.

btw, I think I did miss the memo, as I search for “memo” on this page and didn’t find anything.

Well stated, and I couldn’t agree more.

Fred,

Thanks for the information. If Ron feels that he is well qualified to speak on fossil fuel resources then I am happy to trust his judgement. I’m not aware of any memo, however.

I can go back and make a memo if you guys like.

I just mentioned it in the email I send to about 140 people notifying them when I put up a new post.

I will not judge of who is qualified and who is not qualified to speak on fossil fuel resources. In fact I have some disagreements with just about everyone on the subject. But this is a forum for all who are concerned with Peak Oil and related subjects.

I just wanted this post to deal primarily with the subject David was posting about, not his opinions on other subjects. However is no harm in bringing up other subjects just a long as such subject is not used as a club to beat one over the head with.

Actually I am correct. I said most of the “heat energy” and I was referring to the infrared. I’m glad to see you are keeping up with my stuff at WUWT. Heat can’t travel vertically in the oceans as per the Trenberth requirement. Let’s leave it at that.

The floor seems to be open then…

Arguments about global warming always end up either comparing conspiracy theories or using intuition and a bit of data to try to prove a point.