There is new data out today. The EIA published their International Petroleum Statistics yesterday. The EIA also published their Drilling Productivity Report which gave their expected shale oil and gas production through September. Then this morning OPEC published their Monthly Oil Marketing Report with OPEC crude only production numbers through July.

First the Drilling Productivity Report. Of course most of the Drilling Productivity Report is projection, not history. And that projection goes through September 2015.

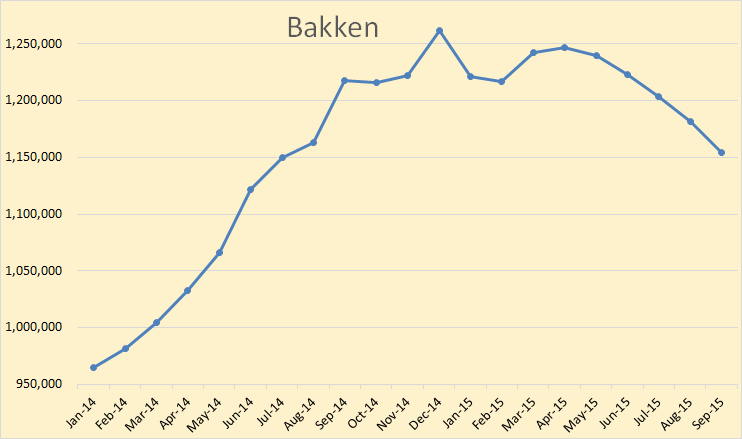

The EIA has the Bakken peaking in December and declining 107 thousand barrels per day since that point. A secondary peak was reached in April and declining steadily since then.

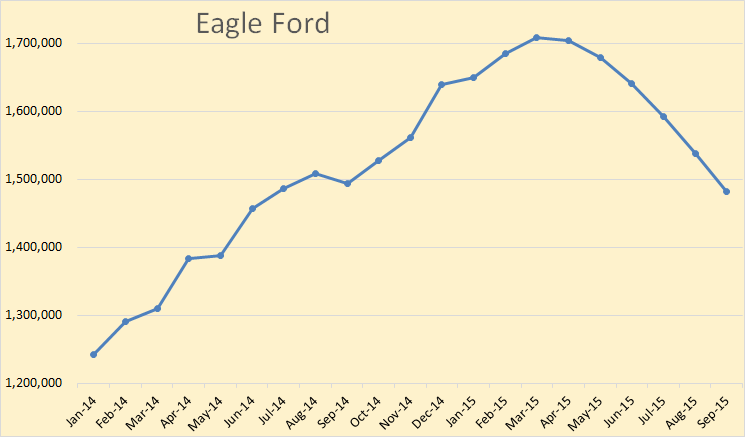

The EIA has Eagle Ford peaking in March and declining 226 thousand barrels per day since that point.

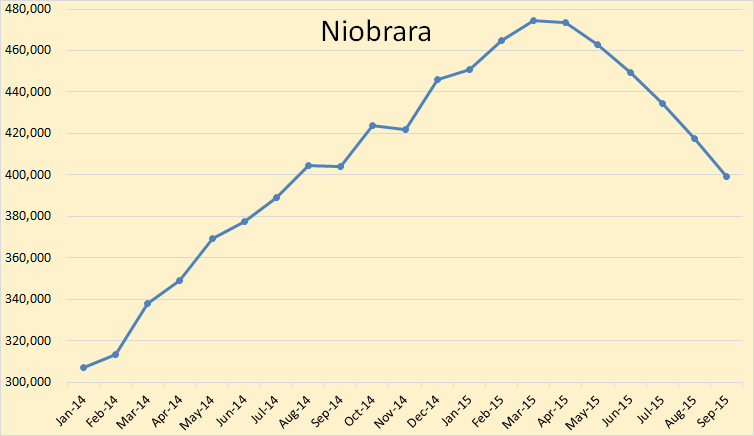

The EIA has Niobrara peaking in March, almost flat for one month then declining sharply after that for a total decline of 75 thousand barrels per day after that.

The Permian was the only major shale area with no decline so far. The EIA has the Permian up 29 thousand barrels per day since the rest of the field, combined, peaked in April.

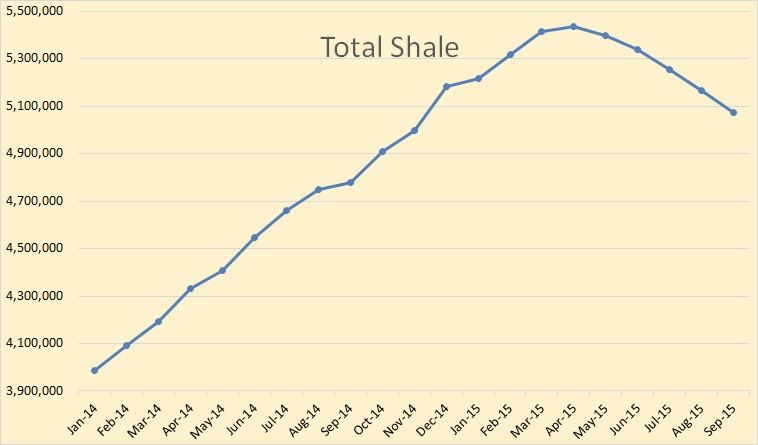

The EIA has total shale peaking in April at 5,434000 bpd and declining by 360 thousand barrels per day by September to 5,074000 bpd. 360,000 barrels per day is quite a decline by September.

All EIA data below is through April 2015.

The EIA’s International Petroleum Statistics has data only through April, 2015, the month where they have total shale production peaking. World C+C production reached a new peak in April at 79,996,000 barrels per day. It is unlikely that this peak will hold as OPEC production was up 437,000 bpd from April to June.

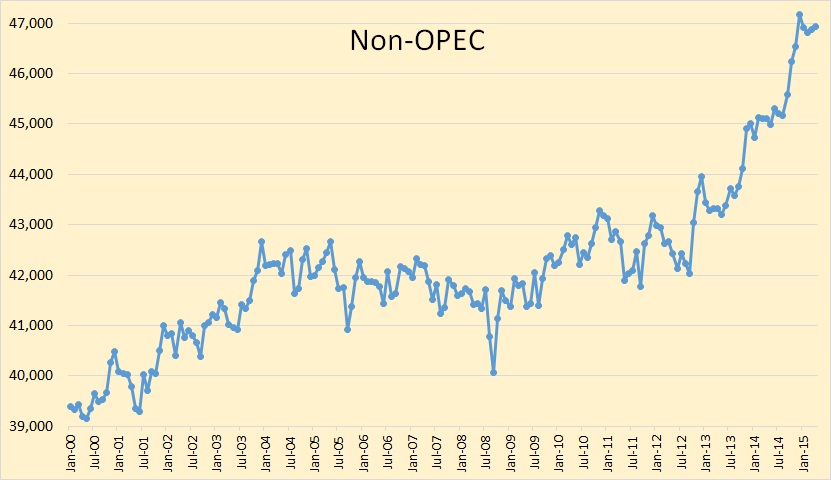

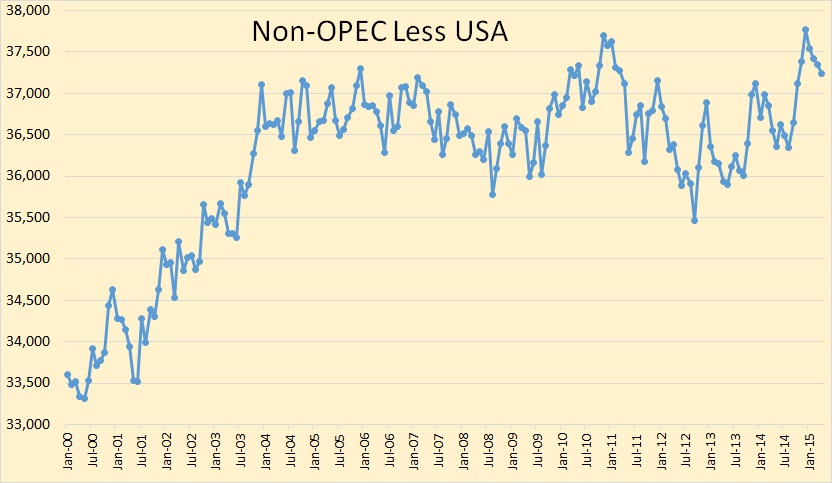

Non-OPEC C+C production peaked in December 2014 at 47,186,000 bpd and had declined by 230,000 bpd by April. I believe this will be the final non-OPEC peak. By the end of the year US production will be down by .5 million barrels per day and the rest of non-OPEC will also be down by at least that amount. And even if higher prices turn US production around the rest of Non-OPEC will continue to decline.

From December to April US production was up 307,000 bpd bun during that same period the rest of non-OPEC production was down 537,000 bpd. It is very likely that this non USA, non-OPEC production decline will accelerate at the very time US production decline is also accelerating.

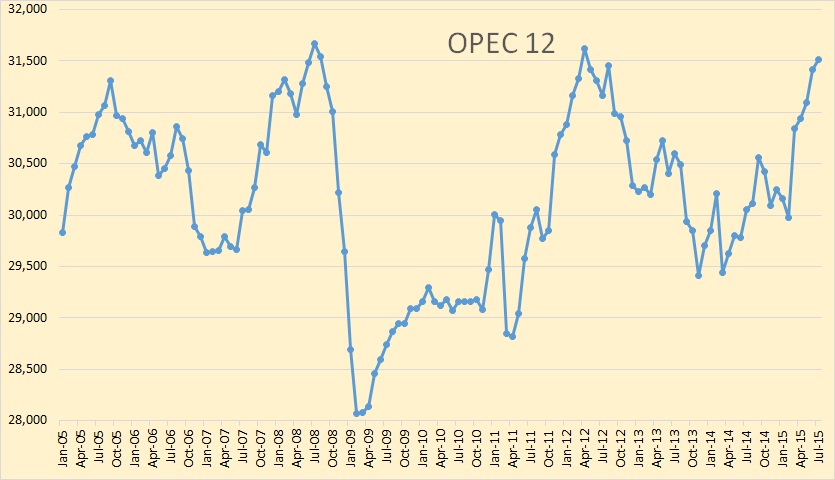

All OPEC data below is crude only through July 2015.

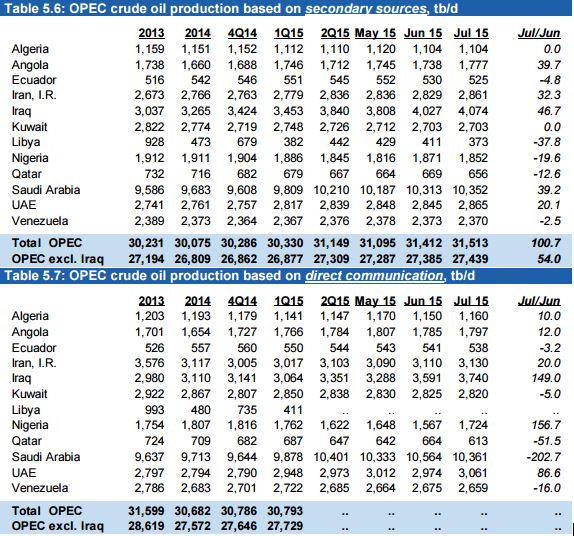

OPEC production still increasing through July. OPEC Crude only increased by 101,000 bpd in July to 31,513,000 bpd. That was less than one third the 317,000 bpd increase in June.

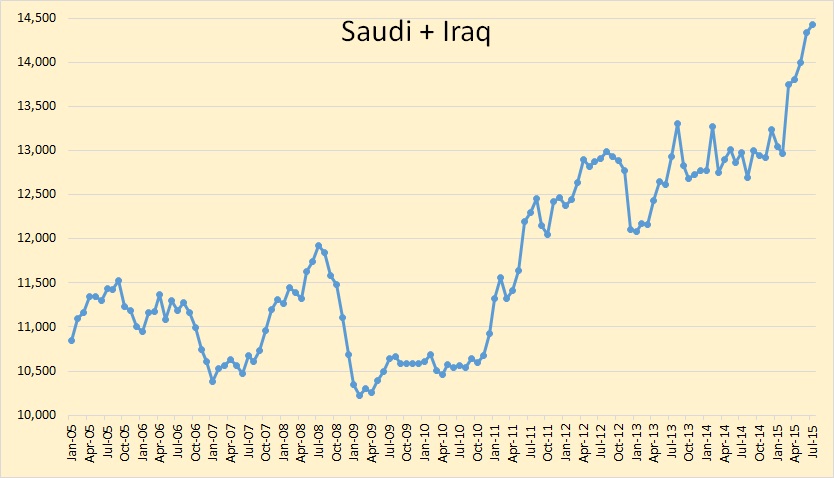

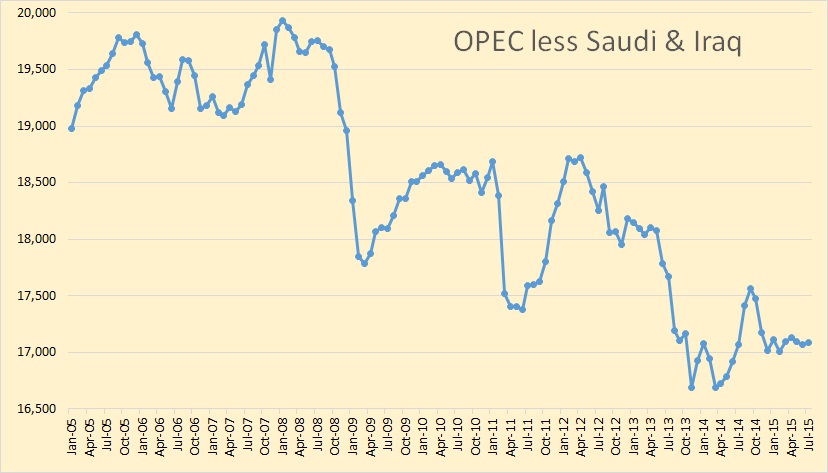

The OPEC increase has all been the Saudi and Iraq show. From January thru July OPEC 12 was up 1,355,000 bpd. During that same period Saudi and Iraq was up 1,384,000 bpd.

During that same January thru July period the rest of OPEC was down 29,000 bpd.

Iranian production is creeping up. They are now just short of 200,000 barrels per day above their low of 2,665,000 bpd of October 2012. Their output now stands at 2,861,000 barrels per day.

Here we have OPEC production according to secondary sources as well as OPEC production according to the producing nations themselves. Note that the secondary sources said Saudi was up 39,200 bpd in July while Saudi said their production was down 202,700 bpd in July.

The page OPEC Charts has been updated with the July data.

A new fight over oil shows why it’s so hard to keep Iraq from splintering

https://www.washingtonpost.com/world/middle_east/a-new-fight-over-oil-shows-why-its-so-hard-to-keep-iraq-from-splintering/2015/08/09/a17fd04e-240a-11e5-b621-b55e495e9b78_story.html

Fascinating! Who wudda thunk it?

It’s pretty obvious by now, at least to anybody paying attention, that the US is locked in an economic war with Saudi Arabia and Russia.

But maybe Saudi Arabia isn’t down for the count just yet, as the US’s #1 war propaganist, Ambrose Evans-Prichard, would have us believe?

The latest war propaganda from team USA:

“The Saudis took a huge gamble last November when they stopped supporting prices and opted instead to flood the market and drive out rivals, boosting their own output to 10.6m barrels a day (b/d) into the teeth of the downturn….

If the aim was to choke the US shale industry, the Saudis have misjudged badly, just as they misjudged the growing shale threat at every stage for eight years. “It is becoming apparent that non-OPEC producers are not as responsive to low oil prices as had been thought, at least in the short-run,” said the Saudi central bank in its latest stability report….

By causing the oil price to crash, the Saudis and their Gulf allies have certainly killed off prospects for a raft of high-cost ventures in the Russian Arctic, the Gulf of Mexico, the deep waters of the mid-Atlantic, and the Canadian tar sands.

Consultants Wood Mackenzie say the major oil and gas companies have shelved 46 large projects, deferring $200bn of investments.

The problem for the Saudis is that US shale frackers are not high-cost. They are mostly mid-cost, and as I reported from the CERAWeek energy forum in Houston, experts at IHS think shale companies may be able to shave those costs by 45pc this year – and not only by switching tactically to high-yielding wells….

“There was a strong expectation that the US system would crash. It hasn’t,” said Atul Arya, from IHS….

IHS said an astonishing thing is happening as frackers keep discovering cleverer ways to extract oil, and switch tactically to better wells. Costs may plummet by 45pc this year, and by 60pc to 70pc before the end of 2016. “Break-even prices are going down across the board,” said the group’s Raoul LeBlanc….

IHS said shale is so competitive that it may “take off” again early next year after troughing in the fourth quarter, adding 500,000 b/d in 2016. “It could crowd out other parts of the world. In the long run the US could get a bigger share of the pie,” said Mr LeBlanc.

http://www.telegraph.co.uk/finance/oilprices/11768136/Saudi-Arabia-may-go-broke-before-the-US-oil-industry-buckles.html

http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/11556531/Oil-slump-may-deepen-as-US-shale-fights-Opec-to-a-standstill.html

I see the squeeze aimed at Russia. It’s the Saudis and the USA government. In other words, it’s a neocon type project. I also suspect the Saudis have enough influence within the OPEC bureaucracy to make it publish “funny looking” production statistics.

For example, the outside source production for Venezuela is oscillating around the same value. But everything I heard says production is going down, by now it’s about 2.1 mmbopd. Venezuela oil production is a bit hard to figure out, because they are importing crude oils and gasoline components. This allows them to load an export stream that’s inflated by imports being blended with the country’s production.

It’s difficult to know who threw down the gauntlet, or who is playing footsie with who.

But one thing is sure. Given Russia’s rejection of Saudi Arabia’s repeated offers to cut oil production if Russia would do the same, Russia has certainly decided to take up the gauntlet.

We’ll see whose oil and gas production suffers the most, whether it be Russia’s or the US’s. This is the criteria by which “the winner” in this tussle will be determined. (All sides will of course lose in absolute terms, as in all wars.)

So far Russia’s production, as well as Putin’s popularity (which has soared to all-time highs) have proven quite resilient. Time alone, though, will tell, and we’ll see whose oil production cracks first.

So Saudi Arabia has replaced North American shale and sand oil as the oil production increase that is preventing Peak Oil from taking place. Funny we still read headlines that US is winning the oil war. Reminds me of the Argentinian press news on how they were winning the Falckland Island war.

So the question is if Saudi Arabia can keep increasing enough its oil production during the rest of 2015 to compensate for global decline.

I would think not. The low prices are accelerating the reduction in production globally as time passes. Although we can think that Saudi Arabia can increase its production, it is hard to think that it will increase it in an accelerated way. Already Saudi Arabia spare capacity is all but gone.

It’s difficult to understand the Saudi strategy. When the rest of the world is cutting production, why max out production so that the oil can be sold at a lower price? The only reason that makes sense to me is that a conflict is immiment in the Middle East, or the House of Saud doubts they will be in power much longer.

Even if the price is reduced, it is still true that the more you sell the more income you make. Plus the more you sell the less your rivals sell and the smaller their income.

To me their tactics make sense. During the 86 oil glut they cut production and suffered enormously because of lost market share. This time they are going after the market share no matter the price. They have cheap-to-produce oil and huge monetary reserves. They think they’ll be the last one standing.

I also think that the Saudi strategy is quite understandable. The rest of the world is NOT cutting production. Some countries have declining oil production due to natural declines, temporary outages or political instability, but not as a result of deliberate output cuts. Others have stable ot even increasing production.

If the Saudis cut production by, 1-2 mb/d, that would have a temporary effect on oil prices, but would also stimulate more drilling by the U.S. shale companies and more LTO production. Ultimately, prices will drop again, but the Saudi market share would be lost to the U.S. competitors.

Nobody wins in this price war, all producers are suffering. But those who deliberately cut production would suffer not only from low prices, but also from decreasing market share and sales volumes.

But what about 2009?

How do you explain that the Saudis followed a completely different strategy now than they did in 2009?

see my two comments below

>>Even if the price is reduced, it is still true that the more you sell the more income you make. Plus the more you sell the less your rivals sell and the smaller their income.

Thanks for the reply, but this does not make sense. Would a rational businessman rather sell 10 million barrels of oil at $60 or 11 million barrels of oil at $43? And frankly, I’ve never bought the “market share” excuse either. Having spent considerable time overseas, and having dealt with various cultures, the “market share” comment always struck me as a convenient fallback excuse the Saudis agreed to use to conceal their actual strategy.

It’s entirely possible, the Saudis are now not being rational. Perhaps pride is involved. Perhaps they can not admit their strategy is not working as they thought it would. Perhaps they take too much pride in being the top oil producer. Or perhaps, they know something most of us do not and in that case know exactly what they are doing.

The oil market is not every businessman market. As AlexS explained any unilateral cuts from the Saudis will work in the shale industry advantage and in Saudi disadvantage. It will result in the Saudis selling less oil and the rest selling the oil that the Saudis cut. This is a nightmare scenario for the Saudis, and they have already been there during the big oil glut of 1986. They can only cut production if they keep market share and control. They cannot cut production to lose market share and control.

Could it be that the Saudis and Russians aren’t hunting squirrels, but have an elephant in their sights?

Maybe the real target of the Saudis and the Russians is dollar hegemony?

If one looks at the record of meetings between Russia and the Saudis, the Saudis don’t seem to make any decisions before meeting with the Russians first:

https://www.youtube.com/watch?v=40Y-BgCBnHY

https://www.youtube.com/watch?v=gYqDLE4Jcac

Of course we are not privy to these meetings or what is said and discussed, so we can only speculate as to what is really going on.

Yes, I think you may be on to something there…

So far the USD is only getting stronger. If that was the target, and I doubt it, the gun blew up.

Whether one speaks of the mercantilitst strategies of China and Germany, which of course entail the devaluation of their currencies relative to the dollar, or the current oil price war between Saudi Arabia and Russia and the US, the objective seems to be the same: to destroy the productive might of the United States.

In the long run — it is important to remember that it is only in the long run — the inexorable force of the quantity theory of money seems to invariably come into play.

Can you name one single global hegemonic empire since the advent of capitalism, some five or six centuries ago, which has managed to retain its financial dominance once its productive dominance has been lost?

They lost market share but they retained something more important- their outright ownership of the country and the good will of the only country willing to guarantee their title – the USA.

Maybe the Saudi royals are beginning to have second thoughts about whether their deus absconditus is as omnipotent and all-powerful as it claims to be?

Maybe the Saudi royals are being to doubt whether Uncle Sam’s potentia absoluta is all it’s cracked up to be?

Uncle’s right arm is plenty strong to keep the Saudis on their throne but I can see that they might have some recent worrisome doubts about his trustworthiness and willingness to stick around when the going gets tough.

Our problem is that we want to fight quickly and then be nice to the loser. We helped restore Germany and Japan after WWII and TRIED to help Iraq move ahead after kicking out Saddam Hussein.

But in a country that has long been under the rule of men rather than the rule of law… you can’t just turn things over to the men again. It takes generations for the rule of law to establish deep roots. It takes only a year or two for the bad guys to seize control again when we pull out- assuming we even left good guys more or less in control.

There is little chance we will ever keep actively engaged troops on the ground in Sand Country except as a last resort to keep the oil flowing. As soon as things calm down a bit we want them back home again.

Rinse and repeat.

I doubt the Saudis are willing to hitch their national wagon to the Russian bear under any circumstances if they can possibly avoid doing so – but they will perhaps play ball with the Bear for limited business purposes.

We have plenty of people even in a forum such as this one who are totally convinced that the USA is Satan’s right hand man but we have never occupied a country and built a wall around it to keep the people IN.

The Saudis are not stupid. If they cannot depend on us and our close friends then they are looking at going it alone.

Their relatively impoverished but large and potentially powerful neighbors are NOT their friends.

Sand Country is Old Testament country, the sort of place where people routinely start wars for no more reason than they think they can win them and live on the proceeds of victory. And for the Glory of Allah etc.

( This is not to say modern western countries have behaved any better in historical terms but we modern westerners don’t make a HABIT of starting wars in recent decades.)

Actually the Saudis have plenty of reason to want to hurt the Russians due to their siding with the Iranians.

I am sticking with my own analysis, that the Obumbler administration and the rest of official Washington left and right could care less about the domestic oil industry given the shaky state of the economy.

Low oil prices are one of the best available tonics for the economic flu.

The Saudis in my estimation are playing ball with Uncle Sam to an extent not apparently recognized by anybody other than myself, at least in this forum. Of course there are plenty of other reasons for them not to cut production. I have listed most of them here in recent days. So have numerous others.

It is not uncommon for people and countries having relationship difficulties to fight in public but cooperate in private when compelled to do so by necessity.

The ENTIRE world economy is at high risk of collapse right now.

The Saudis have ample numbers of the very best qualified people on their payrolls including sons of the family trained at the finest western universities in economics and finance etc.

MAYBE -JUST MAYBE – they think they are serving their own best interest by selling oil cheap for a year or two and thus reducing the short term risk of a devastating world wide depression.

That might cost them more than they are losing now by selling cheap for a while. It might cost them their country and maybe their very lives in some cases in the event of a hot resources war breaking out and escalating out of control.

The idea that they can destroy the American tight oil industry is utmost foolishness in my estimation. Tight oil will be back in a matter of months once the price of oil goes up again. The only way anybody can DESTROY tight oil is to buy up the mineral rights and sit on them.

The best or worst depending on the point of view they can do is bankrupt the current companies working the tight oil fields.

The men will still be around, the equipment will still be in lay down yards somewhere not too far away. The exploration is done and the roads are built and the pipelines are in place. The regulatory apparatus is in place, the housing is in place.

There are plenty of people and organizations around with money enough to drill a few ten million dollar wells without borrowing a dime. Once they are making money the lenders will be back too.

Oil cannot and will not stay cheap very long in the face of depletion, capex cut to the bone , and growing population unless the world economy goes continuously downhill.

Of course for people in the industry even a year is a VERY long time. Hopefully most of the ones who have been doing ok for the last decade didn’t spend ALL the money they have made on new trucks and easy living.

Farmers who make it thru a lifetime learn early watching their daddies to pay down the big debts and save as much as possible in good years because the bad years are as sure as the seasons coming at random intervals, sometimes three or four in a row.

Who thinks the Saudis are planning to PERMANENTLY sell oil dirt cheap just to keep American tight oil off the market? OR any other oil for that matter ?

They aren’t even going to slow down the alternative energy industry to any REAL extent. The sale of electric cars is lagging because gasoline is dirt cheap but the research labs all over the world are still working around the clock on a hundred different fronts to bring super duper batteries and fuel cells and super light materials etc etc to market.

The longer these new technologies incubate in the research lab the faster they will succeed when they DO make it to market.

If there had been no impetus to develop solar cells due to high energy prices the various scientists working on the basic science involved would have kept right on working on it albeit at a relatively leisurely pace .

>> The idea that they can destroy the American tight oil industry is utmost foolishness in my estimation. Tight oil will be back in a matter of months once the price of oil goes up again.

You may be right. Or not. I think you underestimate the damage a few years of $40 oil will do to the tight oil industry in the U.S. Up to 80% of current workers may leave the industry, find other jobs in something less unpredictable, never to return. Companies will be down-sized. Many, many future petroleum engineers, already worried about the shift to alternative energy, will never graduate much less enter the industry. Much of the essential infrastructure will never be built out, and once active oil fields will fall into disarray. Will the coal industry of Appalachia revive itself if the price of coal eventually rises? Probably not.

You don’t need petro engineers to operate a drill rig or lay a pipeline. And I might be wrong but I believe nearly all the jobs involved in running a drill rig , excepting the BOSS job , can be learned in short order by intelligent men who are motivated by high pay.

Folks who work outside the trades seldom understand the EXTENT to which the skills involved overlap. The basic skills are common to all trades. The next level up involves reading drawings etc. If you can read a building blueprint you are eighty percent of the way to reading welding blue prints. Safety training is much the same across the board in all trades. Being a world class rolling stone I have worked at a journeyman level in construction, mechanics, welding, and operation of heavy equipment.

Between times I played around on the farm spending the money I made doing other things.

Most of my life you could get hired on as a mechanic , welder, trucker or construction jack of all trades on the basis of a quick interview and maybe the boss making two quick phone calls. Start today or tomorrow.

So I could quit when I pleased and go back to work when I pleased. Sometimes I quit on a whim to spend a few days fishing with old buddies or shacking up with a new girlfriend. I generally found a suitable new job within two or three days once I started looking.

Those days are LONG GONE. 🙁

They will never be back.

Achieving journeyman status as an auto mechanic from scratch takes maybe four years max. If you know auto mechanics you can make journeyman truck diesel mechanic in a year. If you grew up driving trucks on a farm you can make journeyman trucker in a couple of months. I could pass as a journeyman level painter without ever having worked as a painter in my life. Learned that on odd days when SOMEBODY had to pitch in and help the real painters catch up.

For sure there will be no shortage at all of heavy equipment operators, welders ( welding takes a while to learn ) cooks, truck drivers, accountants, laborers etc. Top dollar wages will get the ESSENTIAL men back. It won’t take long for ENOUGH of them to return to train new guys.

The overall economy in my opinion for a ton of reasons is going to be sluggish from here on out.

ONE REALLY good guy made straw boss can keep anywhere from two to six ok guys on the straight and narrow in trade work.

We get it, Old farmer mac.

You’re on the same yell team as Ambrose Evans-Pritchard.

USA! USA! USA!

To wit, here’s Evans-Pritchard attempt at moving the goal posts:

“Until now, shale drillers have been cushioned by hedging contracts. The stress test will come over coming months as these expire. But even if scores of over-leveraged wild-catters go bankrupt as funding dries up, it will not do OPEC any good.

The wells will still be there. The technology and infrastructure will still be there. Stronger companies will mop up on the cheap, taking over the operations. Once oil climbs back to $60 or even $55 – since the threshold keeps falling – they will crank up production almost instantly.

OPEC now faces a permanent headwind. Each rise in price will be capped by a surge in US output.”

http://www.telegraph.co.uk/finance/oilprices/11768136/Saudi-Arabia-may-go-broke-before-the-US-oil-industry-buckles.html

The Saudis will need to keep oil prices low for at least through 2016 in order to inflict serious damage on the US oil industry, and the investors who bet on the industry. After that, we will see how quickly the US industry and its investors can recover from these wounds.

Personally, if the Saudis do decide to keep the pressure on through 2016, I don’t see investors lining up to invest in domestic oil ventures again, or any high-cost oil production ventures as far as that goes, with the knowledge that Saudi Arabia can wipe them out again if it wants to. It’s going to be difficult to get those animal spirits going again.

If future US oil and gas projects require more of a down payment (cash) than they have since the shale boom started, there will be far less of them and production will fall.

Farmer,

True about rig hands, but reservoir and completion engineers, geologists, geophysicists…not true. You don’t need drilling hands let alone rigs if G&G aren’t developing drillable prospects. Yes, my conventional background shows. And true, with shale once the field is identified you don’t need G&G. But yo DO need engineers.

A lot of people don’t realize the talent pool problem in this industry. There are few replacements when the older guys hang it up in a few years. I am a rarity being a geophysicist and only in my mid forties.

All these cuts could come back with a vengeance.

Mac, I guess it depends on the rig, the well, the pressures, how fast you want to go, how many people you want to hurt, and how much oil you want from the well. I prefer everybody to have at least five years experience. The rookies get to wear a special color hat to let the others know they don’t know what they are doing. I also like to check their “x years without injury” tags. Anyway, it’s just a consideration. I prefer to pay more and get better and safer workers.

where were all the LTO crews working 10 years ago?

Ten years ago they were ALMOST EVERY ONE OF THEM working at some other trade or profession and had to be trained to do tight oil by the handful of self trained pros in tight oil- who no doubt mostly were experienced conventional guys when they moved into tight oil.

Now if we were talking five or ten years down the road, a hell of a lot of these people REALLY WOULD be retired or would have really found good jobs in other professions.

But my guess is that oil prices will be high enough for the tight oil guys to be back at work within three years.

Most of the regulars here seem to think oil will go up again within this time frame too, or sooner.

If you have to work with green hands, you slow down and work with them. If it takes an extra week to drill a well , so what- so long as you are getting a cheap rate on the rig and everything else because business is STILL SLOW.

It will take the competition an extra week as well. You can still make money if the price of oil is high enough. If it is not then you will not restart operations.

You get really good help by robbing it from other companies. I may be altogether wrong but I think anybody who is a qualified hands on journeyman oil guy who comes from a conventional oil background will get up to speed in tight oil in maybe a year at most.

I don’t really have any idea how many engineers it takes to run a tight oil operation but probably not very many considering the biggest part of the exploration work seems to have been done already. Do you REALLY need an engineer to set up a rig and drill a well? Does he have to be on site or can he supervise from a remote location? Is he needed around the clock or can he just check in every four hours?

Fernando, how did you get guys with a minimum of five years experience ?I can tell you- you offered them a better deal than the competition.

Your competition somehow managed to stay in business using a lot of less experienced help though, did it not?

If I am still around, and this blog is still around, in three years we will know whether the tight oil industry is unable to expand due to a lack of good help.

I am ready to place small bets if any regular will consent to hold the money.

Now as to how long the industry will LAST- I expect any given tight oil field to peak in only a decade or maybe two , judging from what I read here.

Maybe there will be new places to move to- maybe not.

Shell is not exploring up near the North Pole just for the fun of it.

I don’t hear much about potential tight oil hot spots outside the ones mentioned so often here.

If I am wrong then I will laugh with all you guys laughing at me.

Mac, I use the term “rig spread”. This includes all the variable costs we incur when drilling and completing a rig (excluding high cost operations such as logging and perforating). A typical variable rate can range from $30,000 per day to $150,000 per day.

Low quality personnel can cause delays which cost a ton of money. But they can also get people killed. And that’s not acceptable.

Maybe the Saudis want to maintain their exports to supply their customers but need extra production for their needs at home i.e. air conditioning in the summer. If that is the case they will lower production in the fall.

Because it will destroy the US producers for years. Saudi oil itself still makes money at these prices. Their national budget doesn’t but they have other ways of covering that. Each barrel of oil sold still net brings in money.

Shale…ha, no. ~ $30 in NoDak sustained is twice as bad as anyone thought it could get. And they’re out of hedges.

The current crop of oil men remind me of the two Aggies who were in the watermelon selling business.

They were buying watermelons for a buck and selling them for six bits.

First Aggie: I can’t figure out why we’re losing money.

Second Aggie: I can. We lack volume. What we need to do is take out a loan so we can buy a bigger truck.

Arceus, either they have an agreement with the USA to reduce prices and break Russia, or they need this production to produce gas and generate electricity. It’s summer time and the AC demand must be very high? The third alternative is a move to beat down on the unconventional and marginal oil producers (and their lenders). They may wish to have some of them go bankrupt. A fourth alternative blends all three. They see so many advantages at this point on several fronts they’ll keep it up for a few months. If gas is a key reason then we should see Saudi Arabia cut production in late September.

Javier,

Nick Cunningham reports:

“The International Energy Agency (IEA) predicted in its July oil market report that oil demand will hit 94.97 million barrels per day (mb/d) by the end of the year, a nearly 2 mb/d jump from the second quarter. Demand will increase in 2016 as well – the IEA says by another 1.2 mb/d.”

http://oilprice.com/Energy/Oil-Prices/Bullish-Bets-On-Oil-Go-Sour.html

Recent reports out of China seem to indicate China is not going to crash and burn anytime soon, which would have a deleterious effect on oil demand :

“The commodity crash may feel as if Armageddon has arrived but it is, in reality, the tail-end of China’s hard landing, compounded by Saudi Arabia’s political decision to flood the global crude market….

It hard to know whether premier Li Keqiang misjudged China’s hard-landing earlier this year. The Politburo is deliberately trying to deflate the country’s $26 trillion credit bubble – up from $9 trillion in early 2009 – knowing that stimulus-as-usual is becomes more dangerous with each stop-go mini-cycle….

The authorities were slow to respond to multiple shocks but they have finally get their bond market off the ground. Local entities are issuing securities at a pace of $130bn a month, amounting to a shot of stimulus. Real borrowing costs have halved since late last year….

It is not a return to the manic uber-stimulus of the boom years, but it is unlikely that China will spiral deeper into its slump over coming months.

http://www.telegraph.co.uk/finance/economics/11782568/Day-of-reckoning-postponed-as-global-recovery-builds.html

Meanwhile, dissidents like Euan Mearns are predicting US oil production to fall by 830,000 barrels by the end of the year.

http://oilprice.com/Energy/Oil-Prices/When-Will-Oil-Prices-Turn-Around.html

Mark me up in the dissident school.

“Meanwhile, dissidents like Euan Mearns are predicting US oil production to fall by 830,000 barrels by the end of the year.”

The EIA is predicting US oil production to fall by 630 kb/d by the end of the year and by

926 kb/d by August 2016.

And then, in the last quarter of 2016, the EIA is predicting US producton to rebound to just a tad shy of 2015 highs.

All this by the magic of the hallowed ” US shale oil revolution,” I suppose.

http://oilprice.com/Energy/Oil-Prices/When-Will-Oil-Prices-Turn-Around.html

Arthur Berman uses data from July STEO. The latest EIA STEO issued today predicts December 2016 production 350kb/d below March 2015 levels

So the EIA finally decided that it can no longer play a role in sustaining the myth of the great US shale revolution, that the gap between fantasy and reality is just too wide, and threw in the towel?

What does that tell you about the EIA?

They have significantly reduced oil price forecast

WTI oil price forecasts ($/b) : EIA STEO August 2015 vs. July 2015

But the EIA still clings to the belief that, as your graph below shows, US oil production will stage a recovery in the last quater of 2016.

And this, in turn, is based on what? The belief that shale oil drilling activiy will take off once again when oil prices rise above $55?

Various industry cheerleaders are claiming to have already reduced drilling and completion costs for shale oil wells by 50%, and can reduce those costs another 30% in 2016. “We’ve driven down drilling costs by 50pc, and we can see another 30pc ahead,” said John Hess, head of the Hess Corporation.

http://www.telegraph.co.uk/finance/oilprices/11768136/Saudi-Arabia-may-go-broke-before-the-US-oil-industry-buckles.html

IHS, whose executives have been some of the key players in crafting US global energy policy, are chanting the same chant.

But if one takes a peek at, for instance, Pioneer Resources’ Q2 financials, which is hardly free of exaggerations and industry boosterism itself, it claims to have reduced drilling costs by only 20% to 25%.

In addition, Pioneer is touting only a 17% reduction in lease operating cost, most of which, by the way, can be explained by reductions in wellhead severance taxes.

http://investors.pxd.com/phoenix.zhtml?c=90959&p=irol-presentations

So shale oil companies can drill a well for $3 or $4 million in 2016 that it cost $10 million to drill in 2014, $3 or $4 million being the cost that would be needed, at $55 oil, to make these drilling ventures economically viable?

When donkeys fly!

It’s pretty clear that the EIA is still heavily influenced by industry and American exceptionalist cheerleading.

Javier,

And some are claiming that at current production rates, OPEC spare capacity is hovering around only a couple of million bopd.

If demand continues to surge and US production does indeed fall by 830,000 bopd by the end of the year, the current glut of oil could end pretty quickly.

http://www.reuters.com/article/2015/04/15/oil-opec-buffer-idUSL5N0XC3MD20150415

Glenn,

My crystal ball is not working, so I have to make use of reasoning only.

A. Supply side

-Increase: Saudi Arabia, Iraq and Iran may still have room to increase production. Libya is an unknown.

-Decrease: Essentially all the rest. US Shale, Canadian sands, Venezuela, North Sea and perhaps Russia. To the decline we have to add supply destruction from low prices.

-Unknown: Storage capacity. If it starts running short its price will increase and supply will have to abruptly be adjusted to demand. No oil can be extracted that cannot be sold or stored. At low oil prices storage capacity build up does not make sense.

-Conclusion: Oil supply has limited upward momentum and significant downward momentum. I think it will come down in a question of a few months at most.

B. Demand side:

-Increase: Relatively low prices are certainly a positive. If the global economy recovers from the soft spot demand should increase.

-Decrease: Leading indicators, trade, forex all suggest the economy is so far worsening and the economic cycle is mature. Commodity countries are about to enter recession. A global recession is a real possibility in the next months. An interest rate hike by the FED is also a negative.

-Unknown: The stock market is tremendously overvalued and losing its risk appetite. A stock crash would precipitate a recession.

-Conclusion: The risks are high and demand recovery depends on economic recovery. The probabilities are on the side of a weak demand due to poor economic conditions.

So even though anything can happen, I believe chances are that over the next 6-12 months we will see a production decline but the demand is also likely to decline and depressed oil prices will be the least of our problems.

Hi Glen Steele ,

I am not on the USA one! USA one ! cheerleading squad.

I am just a white haired bunged up OLD observer of reality who has worked in the trades beginning in the early sixties as a part-time equipment operator while in university and continuing thru today, off and on.

I shut down the commercial part of the farm recently and am now remodeling three old houses two hours at a time, twice a day, that I bought to fix up as rentals. I pass as a carpenter, drywall hanger and finisher, painter, plumber , and electrician to the entire satisfaction of the building inspector. I hired the flooring done due to not liking to be on my creaky old knees anymore.

Jobs in the trades come and go cyclically.

There are ALWAYS enough old guys around to get the wheels turning again with new guys, no matter the trade.

All the talk , ONE HUNDRED PERCENT OF IT, about lack of skilled help has always in my experience been industry bullshit put out by employers wanting four guys to show up for two openings so as to keep wages down.

Tight oil will come back quickly once the price of oil gets high enough and stays high enough to convince people there is money in it. Tight oil is not going to be a scratch job like bringing on a new field entirely which the pros here tell me takes eight to ten years in total.

From what I read here and elsewhere a permit can be had in North Dakota in a matter of days or weeks and a mothballed drilling rig moved onsite in less than a month and work started immediately assuming roads are in. There are plenty of roads already in. There are plenty of men out of work who will be GLAD to go back to making high five incomes rather than getting by doing whatever they can find other wise.

MY ARGUMENT is that times are slow and will remain slow and therefore good help will be easy to find for years to come if high wages are offered.

YOU otoh are making the USA !USA! argument by saying the guys who lose jobs in the oil fields will find something else so good they cannot be hired back with an offer offer of a raise and a bonus.

Record high production into record high stockpiles at record low prices. Preparation for war?

Meanwhile, Bentek says that U.S. LTO production was still growing in June:

Shale oil production in Bakken, Eagle Ford grew slightly in June

August 3, 2015

http://www.ogfj.com/articles/2015/08/shale-oil-production-in-bakken-eagle-ford-grew-slightly-in-june.html

Oil production from the Bakken and Eagle Ford shale plays increased marginally in June vs. May, according to Bentek Energy, an analytics and forecasting unit of Platts.

Oil production from the Eagle Ford shale basin in Texas remained strong in June, jumping 18,000 barrels per day (b/d), or less than 1%, vs. May, the latest analysis showed. This marked the fourth consecutive month of production growth, albeit small, since February when production dipped nearly 10,000 b/d month on month. Meanwhile, crude oil production in the North Dakota section of the Bakken shale formation of the Williston Basin remained relatively flat, increasing 6000 barrels b/d, or less than 1% in June vs. May.

The average oil production from the South Texas, Eagle Ford basin last month was 1.6 million barrels per day. On a year-over-year basis, that is up almost 240,000 incremental barrels per day, or about 17% higher than June 2014, according to Sami Yahya, Bentek energy analyst. The average crude oil production from the North Dakota section of the Bakken in June was 1.2 million b/d, or up nearly 100,000 b/d from year ago levels.

“It is astonishing to see what producers in the Eagle Ford and Bakken shale basins are accomplishing despite dwindling rig count numbers,” Yahya said. “Rig count in the Eagle Ford basin decreased by roughly 65% from a year ago, from 233 in June 2014 to the 105 active rigs today. And yet, production is almost a quarter of a million barrels per day more.”

Similar trend is observed in the Bakken shale, where rig count dipped about 50% from approximately 160 rigs last year to the current 80 active rigs, Yahya noted. In the Bakken, too, production is up about a hundred thousand barrels per day, he said.

The contradictory relationship between rig count decline and production growth speaks volumes to the efficiency gains producers have achieved over the past year.

“Gains in efficiency have been swept every facet of the drilling and production operations,” Yahya said. “Drill times have been reduced on averaged by three to five days in most of the major shale plays in the country. As well, producers are continuing to focus more on their more productive acreages, where initial production (IP) rates are higher.”

Bentek analysis shows that from June 2014 to June 2015, total US crude oil production has increased by about 750,000 b/d.

It’s a different story for prices, noted Luciano Battistini, Platts managing editor of Americas crude. “The price recovery oil producers were hoping for has been delayed as the massively oversupplied oil complex continues to pressure prices. Eagle Ford crossed the $65 per barrel (/b) mark on June 11 and has been sliding since,” Battistini said. “Bakken prices at the Williston basin, however, ranged between $55/b and $60/b from the end of April to end of June, showing resilience.”

The Platts Eagle Ford Marker, a daily price assessment launched in October 2012 and reflecting the value of oil out of the Eagle Ford shale formation in South Texas, has increased 31% between January and June, with an average price of $57.56/b for the first six months of 2015. But it is down 41% from year-ago levels. The marker has ranged between $46.22/b and $66.23/b since the beginning of this year.

The price of oil out of the Bakken formation at Williston, North Dakota, was up 44% between January and June, with an average price of $49.31/b for the first six months of 2015, according to the Platts Bakken assessment. Platts Bakken, however, is down 40% when compared to last year’s corresponding month. The wellhead assessment has ranged between $37.67/b and $59.32/b since the beginning of January.

The Platts Bakken, introduced April 22, 2014, is a daily assessment of price for oil closest to the wellhead prior to determination of transportation by rail or pipe. The assessment reflects a sulfur content of 0.2% or less and an American Petroleum Institute (API) gravity of 42 or less, similar to the nature of North Dakota Light Sweet crude. The Platts Eagle Ford Marker reflects the value of a median 47-API Eagle Ford crude barrel, based on the crude’s product yields and Platts product price assessments, adjusted for US Gulf Coast logistics.

—————————————

My comment:

Bentek says that EF rig count decreased from 233 in June 2014 to 105 active rigs today.

For comparison, Baker Hughes data shows a decline from 210 to 73 rigs.

The reason is that Baker Hugues data for EF covers 14 core counties in Texas, while other sources include a larger area. For example, this source http://eaglefordshale.com/news/eagle-ford-rig-count-at-112/

includes 30 counties to its EFS rig count

Astonishing. Can only guess all producers are resigned to the fact oil is going much lower and so will pump and sell as much as they can while the price is relatively high. And whether their belief is true or not, it doesn’t really matter – their actions enable it to be a self-fulfilling prophecy.

What is the alternative: 1) unilateral cuts by some producers (see Javier’s and my own comments above) or 2) a cartel-like agreement between OPEC and non-OPEC producers, including hundreds of U.S. independents?

Output cuts make sense only if low oil prices are due to temporary (cyclical) declines in demand, like in 1998-99 and late 2008 – 2009.

If lower oil prices are due to secular trends in oil production, like in the 80s or now, unilateral cuts in production are self-defeating strategy.

The best cure against low oil prices are low oil prices

AlexS: “If lower oil prices are due to secular trends in oil production, like in the 80s or now….”

Personally, despite all the hype coming out of the US oil industry, I believe the US’s “great shale revolution” is a flash in the pan.

The next few months will tell, and we’ll know soon enough if the great shale miracle was reality or fantasy.

As I see it, the increase in production above the increase in demand that has brought about the price collapse is likely going to bring forward Peak Oil a few years from the future.

This is such an important and serious matter for the world that the UN and world leaders should be sponsoring your number 2 alternative: A global agreement on oil production and export quotas to stabilize the oil market and the global economy as we orderly transition as much as possible to other sources of energy.

By not doing it and keep silent about this problem while touting climate change, they are making sure that a global solution is not found. The price to pay will be unaffordable.

Javier,

a multilateral agreement on fixing oil prices is wishful thinking:

1) too many parts are involved

2) how can you force private and publicly-traded companies to cut output?

3) UN and other international organizations have no mandate to regulate markets. They also proved inefficient in resolving much easier issues.

4) cartel agreements are illegal in most countries.

5) There would be fierce opposition from oil consuming industries

I’m not saying that free market can fix all the problems. But in this case I think that only market forces – steady growth in global demand (1.1-1.4 mb/d per year) and slowing or declining output from all sources (with few potential exceptions, like Iran and Iraq) will ultimately change the current situation in the oil market. And it will take not 15 years, like in the 80s-90s, but only 2-3 years to return to price levels acceptable to the majority of producers ($75-80).

The big unanswered question is why the Saudis abandoned their role as “swing” producer. The role of “swing producer” has generally worked to their advantage. They could increase production when oil demand (and oil prices) were high, and decrease production when oil demand (and oil prices) were low. The shale tight oil producers are really just minor players with limited resources. Why did the Saudis abandon their long-time role of swing producer? I’m sorry, but “market share” is not the reason.

I don’t understand why people expect a low cost producer to play the role of swing producer so higher cost producers can stay profitable. It’s also not very “capitalistic”. Expecting a producer of product with low costs of production to cut production so the competition with higher production costs can stay in the game makes no sense.

>>I don’t understand why people expect a low cost producer to play the role of swing producer

Yes, well we are talking about Saudi Arabia here. The Saudis are in a unique situation to play the important role of “swing producer.” It is a role only they can play. But before I get into that, it helps to remember that Saudis are very few in number and filthy rich in a world that is very, very poor by comparison. Historically, the Saudis exist due to the benevolence of others, particularly the military might of the United States. American blood has been spilt on more than one occasion to protect the free flow of oil from the Middle East. For a quite a long time, the U.S. not only protected the kingdom of Saudi Arabia from harm, but has also dutifully paid hefty sums to the House of Saud due to cartel pricing (OPEC). In a perfect world, the Saudis would be allowed to exist, to charge whatever they wanted to charge for their oil, and could even, if they so desired, suddenly drop the price of oil to an unbelievably low amount to drive most of their competitors from the marketplace. But this is not a perfect world, and actions have consequences.

Perhaps that is some sort of answer to your question…

Moreover, oil is appreciably different animal than say limestone. Most countries consider oil to be a strategic national resource and domestic production to be highly important. If a country should get even 50% of its oil from the Middle East, and one day the region disappears in a mushroom cloud, then what?

Pearl Harbor was attacked by the Japanese due to an oil embargo. Should another country attempt, by market forces or otherwise, to destroy the domestic oil infrastructure of another country, how many countries would stand by and allow it to happen if they could prevent it?

Understandably, if there is one country that might stand by and let it happen without much of a protest, it might be the United States.

Arceus,

Market fundamentalism is the rule of the day in the US.

This faith — which has acquired the trappings of religion — rules out the regulation of US oil producers.

We’ll see how well market fundamentalism fares as it comes up against some of the more regulated forms of capitalism in Saudi Arabia, China and Russia.

”I don’t understand why people expect a low cost producer to play the role of swing producer so higher cost producers can stay profitable”

This is not hard to understand. If the Saudis can keep the price HIGH by cutting production THEN they make AS MUCH or MORE profit on their higher priced low production cost of oil while selling a LOT LESS of it.

In the past they have been able to pull off this very trick. They probably could NOW but so far at least have been unwilling to do so for reasons we can only speculate about.

It seems to me that the Russians and the USA can also keep the price HIGH by cutting production. It seems only KSA is expected to do this. I would assume their motive for not doing so is similar to Russia’s and USA’s. The message from KSA might be “we’re not your swing producer anymore”. The marginal cost producers will perhaps be the new swing producers. That’s how it is with most products other than oil. I can’t think of any other product or resource that when the price of it drops the lowest cost producer puts production on ice to shore up the price so the marginal cost producers can stay in business. In early 2008 GWB was in KSA asking for more oil production to bring the price down. In 2015 USA now wants less production from KSA to bring the price up. I suspect KSA has had enough of what USA wants. Maybe that’s the message.

I can’t think of any other product or resource that when the price of it drops the lowest cost producer puts production on ice to shore up the price so the marginal cost producers can stay in business.

You have to look at other cartels. DeBeers certainly does what you describe for diamonds.

As I see it, the media has it all wrong. The Saudi’s aren’t afraid of US shale. They’re afraid of global shale. In the last few years, the world has come to understand the true size of the shale oil resource…it is about 6 times as big as US shale. If the Saudis allowed upstart shale projects to gain critical mass and infrastructure elsewhere in the world, they’d be pushed out of the market for sure. So long as those projects never gain the required size, infrastructure, hundreds of rigs, frack fleets, roads, rail, electricity, etc, the Saudis can tolerate low price environment for 12-24 months. US shale will rebound gradually when prices recover, but these other projects will never get lift off. What gets killed as collateral damage is the long lead mega projects, deep water and heavy oil projects.

“the true size of the shale oil resource…it is about 6 times as big as US shale.”

Got more detail, and some links for that?

I think Javier’s idea is quite possibly workable if undertaken within the U.S. Avoiding a senseless price collapse in a limited national resource, in fact, seems quite sensible. The big difficulty in doing it would be finding the competent bureaucrats who could implement it (who are also apolitical). I imagine it would work something like this: U.S. oil companies that want to sell oil to the U.S. market will be given a yearly quota based on a formula that uses say proven reserves and past five year production history. Companies will be paid a fixed price of say, for example, $70 per barrel of oil. If any U.S. companies do not want to be part of the U.S. market they would be free to sell their oil overseas. Any U.S. companies that do sign on to supply the U.S., market would be allowed to produce more than their quota but would be required to sell that oil overseas. Japan used this model very effectively with their fledgling electronics industry. After five years or so, the quota system may need to be reviewed.

Arceus says: “I think Javier’s idea is quite possibly workable if undertaken within the U.S.”

I respectfully disagree. Having followed the Industry closely since the early 1970’s, it is crystal clear to me. If any collection of politicians/bureaucrats put in place any rules that were intended to stabilize or increase the price of oil they will be vilified by the opposition as well as by 100% of the media. Even if it were in place for a year, and prices did not go up, followed by an Atomic Bomb going off in the Saudi Arabian oilfields, they will get the blame for increased prices, not the bomb.

Yes, it would take a strong political leader to pull it off. He would have to address the country directly: “Fellow citizens, I need to speak with you about an urgent situation. Our country has, in the last five years, nearly achieved something that previously was almost unthinkable – energy independence. We are now producing more oil at home than ever before. This has resulted in an economic boom that has helped all of us. We no longer rely on the Middle East for the energy that powers our economy. We no longer send our hard earned dollars to OPEC. However, that may soon change. Our old rival OPEC, led by Saudi Arabia, is now attempting to destroy all that we have built the last five years. These countries are using predatory pricing to bankrupt our oil industry. If we let it happen, the results will be disastrous. In short order, our energy costs will spike, our money will be again sent to Middle East for more imported oil, and our economy will be in tatters. There is a solution…”

Surely you do not believe that the Saudis are engaging in predatory pricing? Or are you just suggesting that your fictional US political leader should try and bamboozle the public with that line?

If you do believe that It’s the Saudi’s fault then you are wrong and misguided at best or dishonest at worst. I looked up “predatory pricing” some time ago and it is the act of selling product at a very low price in such a way that you force competitors to also sell at a loss. For predatory pricing to achieve it’s intended purpose, the party engaging in predatory pricing must be able to sustain selling at a low price long enough to totally bankrupt the competition to the point they have to cease operations. According to the Wikipedia article linked to, US Courts have established that for prices to be predatory, they must be below the seller’s cost.

This is not what is going on in this case. If the Saudis are engaging in predatory pricing, they would have to be producing at a loss, their production costs would have to be higher than the prevailing market prices. I have not seen anybody attempting to make the claim that the Saudis or the Russians or the Norwegian for that matter, are loosing money on every barrel of crude they sell. It is my understanding that the countries named have done so well over the years that, they have built up considerable reserves of assets and can better ride out this downturn in prices than most. A quick look at Sovereign Wealth Fund Rankings, if only the funds whose origin is listed as oil are considered, Norway has the biggest nest egg followed by Abu Dhabi and Saudi Arabia. Two funds are listed for Russia that come in at number seven and eight however, the two of them combined would be the sixth largest oil based SIF in the world.

What is going on with LTO would fit in better with the idea of predatory pricing in that these companies are going “all in” to increase the supply to an oversupplied market and doing so at a considerable loss as shown by the fine work of Shallow Sand. The only problem with that theory is that most of the companies supposedly engaging in predatory pricing, do not have a nest egg or another arm of the business that can generate a profit to cover the losses of the LTO operations. Most of these operations are highly leveraged and AFAICT none of them are financing current operations out of cash flow since none of them have been making much in the way of profits since the price collapsed.

Interestingly but, not surprisingly for most of you guys, my interest in predatory pricing comes from the area of solar pv module pricing. Over at TOD I wrote on the subject a couple of times including this post in which I discuss the bankruptcy of Suntech and the problems at Yingli. Both companies are still operating since the assets of Suntech were acquired by another company and if Suntech is going at anywhere their pre bankruptcy pace, the two companies should make up more than ten percent of worldwide module production. I have a hard time understanding why one would invest billions to set up facilities to manufacture solar pv modules and then operate at a loss but, how is that any different from what is going on in the LTO business?

Arceus,

Well FDR pulled it off. But that was only after the Great Depression clipped the wings of the market fundamentalists so they couldn’t fly so fast.

You might want to try to get your hands on a copy of Nicholas George Malavis’ “Bless the Pure & Humble: Texas Lawyers and Oil Regulation, 1919-1936.” He discusses the hurdles the Roosevelt administration had to overcome in the legal battle over regulation of petroleum production before production limits could be imposed.

It wouldn’t be done to regulate the price of oil. It would be done to reduce emissions and help electric vehicles ?

You seem to be joking, but you’ve hit on a big motive for KSA to lower prices: they’re very sensitive to the growth of EVs.

LTO isn’t the only competitor they want to slow down with low prices.

Alex, I agree with your assessments completely.

I understand the predicament KSA finds itself in and I do not blame it for not cutting it’s production; quite the contrary. I do believe, however, if the KSA capitulates later in the year and does cut its production, the rest of OPEC will follow suit, with at least temporary convictions to each country’s individual quotas. Non-OPEC conventional production is still on it’s predictable decline path and for the next several years anyway, is not a threat to supply/demand fundamentals.

Those supply/demand fundamentals were changed beginning 2013 with the onslaught of 2 million barrels more barrels of LTO production in the US. The world did not need that oil and current prices reflect that.

I agree, the solution to low oil prices is low oil prices, save how that pertains to LTO production in the US. We’ve seen within the past 6 weeks an indication of what $60.00 oil did for the LTO business model and subsequently how fast the price fell back to 43 dollars. Save demand fears in China, oil prices fell simply on the “threat” the shale oil business was ready to ramp back up.

Unlike conventional exploration and production, mass shale oil well manufacturing can have an immediate affect on supply/demand fundamentals and prices. That is a direct threat to price stability and I believe that is what frightens the KSA more than anything.

I agree that shale oil production in the US cannot be cut, nor restricted. The natural decline of the these wells, once producing, would make that entirely unfeasible. What I would suggest, however, is that the number of shale wells drilled in the US could be easily restricted. It has been done in Texas via the Texas Railroad Commission for the past 80 years thru well density (wells per acre) and well spacing (distances between wells and/or lease lines) requirements. It would be easy for any state with LTO production in the US to follow the regulatory guidance of Texas and restrict the number of wells drilled. Rules regarding density and spacing use to be made in the name of conversation and the long term preservation of our hydrocarbon resources. Everything we were concerned about 80 years ago we should be even more concerned about today.

If OPEC cuts it’s production it is logical to me the US LTO industry should therefore cut it’s production. It can’t. It can, however, be forced, quite easily, to actually limit the number of shale wells it drills. This would help ensure stable oil prices and a healthy domestic oil industry going forward. It is also in the best interest of our long term energy future.

The LTO industry has not succeeded in self-regulating itself; it’s deep in debt, caused oil prices to tumble, and is now facing extinction. State regulatory agencies should be required to regain control of what is now an out of control LTO industry.

Mike

Interesting that you blame shale for the slump to $43 per barrel and not Saudi Arabia which seems hell bent on increasing record production into the teeth of record oversupply with oil prices continuing their drop to multi-year lows. Also interesting that you want to give shale producers quotas, but let conventional producers pump as much as they wish. Perhaps if I was in your situation (a conventional guy), I would feel the same way.

I do blame the shale business, yes; it was not KSA that caused the 2 MBOPD overhang in 2013-2014. Expecting OPEC to cut its production to make room for US shale oil is not reasonable. You apparently want them to “swing” down, not up. I did not write anything about shale oil “quotas,” I don’t know where you got that. I spoke about regulating the number of shale wells drilled in the US. Its not a new concept. As a conventional “guy” I am already regulated as to where I can drill wells and how close they are together. The shale industry can do whatever it wants to do as long as it can borrow the money to do it.

Maybe the Obama regime and the Saudis are working together to marginalize the Russians? That’s why the Saudis aren’t cutting production? That’s why the LTO guys get all the Bucks they want? No sane people would do all this just to corner the Russians but the Washington crowd has their own Agenda.

>>>Maybe the Obama regime and the Saudis are working together to marginalize the Russians?

Maybe. Perhaps it’s different. Maybe the Saudis, the Russians, the Chinese, and (an unknowing) Iran are working together in a loose coalition to marginalize the USA. They all seem to have top secret access to Obama administration emails and docs… Obama is worried about his legacy… perhaps their timing is very good.

“Interesting that you blame shale for the slump to $43 per barrel and not Saudi Arabia which seems hell bent on increasing record production into the teeth of record oversupply with oil prices continuing their drop to multi-year lows. ”

Yes, since November 2014, when OPEC refused to cut production in response to falling oil prices, Saudi Arabia’s crude oil production increased by 740 kb/d, while U.S. C+C output was up only 240 kb/d.

But, looking at the chart below, can you still blame Saudi Arabia for flooding the oil market?

Oil production in Saudi Arabia and U.S. (mb/d)

Sources: JODI, OPEC, EIA

You need to start the chart at Jan 2015 at the earliest. For 2015, who has been increasing production – U.S. shale or Saudi Arabia. Prior to that time, the market was not oversupplied, correct?

For 2015, who has been cutting rigs and who has been increasing rigs?

Mike,

It’s an interesting idea: not to force shale producers to cut output, but to restrain they growth by regulating the density of shale wells.

Paradoxically, the main winners would be shale companies themselves: they would burn less cash thanks to higher oil prices and lower capex. Unfortunately, in the real world, I don’t think TRRC or any other government agency would dare to introduce such regulations

Alex, you are exactly correct, sir. Limiting the “growth” of LTO resources is a win, win, for everyone. For shale companies and all Americans.

The regulatory statutes are already in place in Texas, they need only be implemented, again. They are in place in OK as well. There would need not be any “introduction,” only enforcement. In my opinion ND would follow. Texas has always been willing to take the lead on these sorts of things; it is not a decision to me made by the Federal government, by vote; its the sole decision of 3 Railroad Commissioners in Texas.

I think, personally, it would take some guts, and some leadership in saying to Texans…we are wasting our natural resources at 45 dollar oil prices by allowing this out of control spending spree the shale oil industry has undertaken. Let us step back in and take control. It will help stabilize oil prices, stabilize jobs, jobs, jobs, and better ensure a viable tax base that will benefit all Texans, all Oklahomans, all the good people in N. Dakota and all Americans. Stand back and watch. We’ve been doing this for 80 years (check out the price of oil between 1946 and 1977); we know what we are doing.

This, I believe, is precisely what needs to be done, Alex. Leadership. This “nationalistic” attitude Americans have, this “we were almost energy independent bullshit,” is wrong. Its stupid. We were not even close to energy independence. Its a global oil market; we need to behave in the same way we expect the rest of the world to behave. We are no better, and deserve no more.

We have identified what the problems are, I want to move forward and fix those problems. Yaking endlessly about big frac’s, or whining about the Saudis isn’t gettin’ it.

Mike

On the face of it, it would seem a difficult task to ask the shale drillers to further reduce their rig counts while OPEC (Saudi and Iran) continues to set new monthly production output numbers. Perhaps the EPA could become involved and some type of “environmental concern” could be used to reduce the activity of the tight oil companies in the way it helped the country ease away from coal usage. Not sure if Bloomberg would fund such as cause or not. Possibly

Arceus, I wrote very clearly, so I thought, that if the KSA and OPEC agree to cut production, so should the US. The manner in which that could be done is by restricting the number of shale wells drilled in the US. That is already done in conventional reservoirs, in the name of conservation, not pollution. In spite of 45 dollar oil prices and an 8 billion dollar debt load, one of the biggest shale players in the EF is still drilling wells on 60 acre spacing, with laterals 330 feet apart. Oh wait, make that 43 dollar oil.

If one believes that there are 2 million LTO locations remaining to be drilled in the US I am sure the idea of restricting the development of shale resources is hard to swallow. I do not believe any such thing. Conserving those LTO locations for the future, slowing the pace of development, cooperating with the rest of the world in stabilizing oil prices seems like a pretty good idea to me.

Mike

Mike,

Here is an interesting (some would say controversial) article by your namesake. Or is that yours? :)

Could North America Pull Off Its Own Oil Cartel?

By Michael McDonald

Posted on Thu, 06 August 2015

http://oilprice.com/Energy/Energy-General/Could-North-America-Pull-Off-Its-Own-Oil-Cartel.html

That’s not me, Alex. As early as 1910 oil operators in the United States coined the phrase “independent producers” to separate themselves entirely from Rockefeller and the anti-trust, monopoly issues facing Standard Oil. We are all indeed fiercely independent (of each other) and any kind of collaborative effort at a domestic cartel would just be one big chicken fight. It would never happen.

Mike

They would do better simply by regulating flaring and venting, and the amount of time a well can produce without a direct connection to a pipeline.

They are doing that. Infrastructure is improving. Limiting flaring is not he answer to limiting the development of LTO resources. Regulating spacing and densities is. Or, hopefully, the money train stops and that slows development.

Hey Mike, since I see numbers for “permits issued” floating around here all the time, that implies that before one drills, one must get a permit from some regulating body, obtain permission if you will.

Shouldn’t it be a fairly simple matter for companies to submit the financial estimates for any well that they are seeking a permit for? The estimates would have to be based on verifiable current cost and revenue projections based on a wellhead price calculated on the basis of a reference price on the futures market. If the company cannot show how they are avoid losses on a given well, no permit. Permits would expire after a given period to prevent companies building up a inventory of permits when prices are high and not drilling for whatever reason.

The regulators could justify not granting permits by saying something like “Based on the production from other similar well in this area we do not see how losses can be avoided on this well and will not permit anybody to throw investors funds and/or borrowed money at such an obviously poor risk.” Before anybody says that operators will just submit rosy estimates, any estimate that is too far out of line would result in the operator being called in to explain exactly how they plan to do what others have failed to do and face extra scrutiny if they manage to convince the regulators that they can successfully pull it off.

If something like that was in place, I’m pretty sure that a ton load of wells that are currently producing, would never have permitted.

Island, I liked your post up hole about predatory pricing. It is wrong to blame the KSA for this mess and is absolutely wrong for America to expect OPEC to cut production to make room for more LTO stuff.

Your idea above is reasonable and is indeed a way to restrict shale oil development, for sure. Its complicated though and, respectfully, not necessary.

It is interesting to me the difficulty people have with the concept of regulation by states with regards to well spacing and well density rules for the oil and gas industry. All producing states have laws in place regarding conservation of natural resources and all of those states have regulatory agency overseeing the oil and gas business. Those agencies issue permits to drill oil and gas wells based on statewide rules for spacing and density, or specific rules for individual field designations. It is not a free for all by any means. No permits can be issued that circumvent state or field rules unless by complicated hearings and special orders.

The problem began when the shale industry sought special rules for their self-serving development of a field or pool it was developing. Conservation principles were thrown out the window in a mad dash to energy independence. Now the shale industry can just about do whatever it wants. Again, to use my previous example, it makes no sense to me whatsoever to be drilling shale laterals 330 feet apart from each other at 43 dollar oil prices. Those wells will never pay out at anything less than 75 dollar oil prices. Each one of those wells require 400 tons of steel and 10 million gallons of fresh water to drill and complete. Let’s save those wells for 10 years from now, when we’re really going to need the stinky stuff.

I personally do not believe this uncontrolled spending spree the shale oil industry has been on has worked. In fact, it has failed miserably. By Thanksgiving we’re going to know exactly how miserably. Its time to reel those fellas in a little bit. We can do it easily with existing laws.

Puerto Rico, have I heard you say?

Mike

Hi Mike,

Excellent analysis, I agree with all both you and AlexS have said above.

Thanks.

Talk with the commissioner.

Dennis, thanks. You and I have written about this before and you have brought it up many times.

I of course cannot bring any influence to bare on the need to regulate shale oil development. It is going to take some serious news regarding production decline and company failures to get law maker’s attention. That’s coming in a few more months. Having said that, Americans feel entitled and I trust that if you were to poll people here they would say, without hesitation, that America should be allowed to develop its resources and its OPEC that should cut, it’s OPEC that should be the swing producer and regulate oil prices.

Its a bit different than in years past, isn’t it? When prices were high all of America wanted OPEC dissolved and blamed them for high gasoline prices…now we need their help.

I think the public relations campaign the shale oil industry engaged in years ago, and that is still waging with false information, has been nothing short of remarkable, really. It has taken years for the public, and the media, to finally begin to understand what is really going on with this high cost production. They really still don’t get it. And BTW, the oil lobby is a very powerful thing.

Mike

a multilateral agreement on fixing oil prices is wishful thinking

Perhaps. But I also know that is ridiculous that we allow Peak Oil to happen because we are unable to match demand and supply. Arabia Saudi was capable of doing that for decades for the entire world.

Lordy! Lordy!

Another day, another load of horse manure from the US oil and gas industry.

I was active in the oil and gas business back in the 1970s and 80s when the industry made the switch from industrial (productive) capitalism to finance (predatory) capitalism.

In this war between the US’s finance capitalism and Russia’s and China’s industrial capitalism, who do you reckon’s gonna win?

There is a lag time between when drilling begins to when a shale oil well’s preciptious decline in production begins. Maybe we won’t begin to see the really serious decline in shale production begin for a few more months.

Haynesville Shale Gas Play Production Vs. Rig Count:

http://i1095.photobucket.com/albums/i475/westexas/Haynesville-rig-count-and-natural-gas-production1_zpsb1n95tiz.jpg

Here’s another producton graph of a lease located near one of my properties, with the spud dates of four new shale wells indicated.

As one can see, there’s about a 7 or 8 month delay from spud date until the wells come on line. Then there is four or five months of flush production until the wells begin to decline precipitously.

So there can easily be a year lag time between spud date and when precipitous production decline sets in.

Here’s the graph.

Mr Yahya needs to study petroleum and projects engineering so he can avoid being amazed by year on year production increase in spite of decreasing rig counts. I think I could train him in three days so he can avoid such statements. ?

It is astounding, isn’t it, that people continue to write this sort of thing about rig counts and initial production figures, when a fairly cursory glance at the figures shows that completions matter more than rigs for short term production, and initial production has very very little relationship to production profile.

Looking at Sand Country ( my personal euphemism for the Middle East oil producing countries) from the point of view of an arm chair historian leaves me believing another hot large scale war – one involving outsiders in large numbers – is likely within the next decade at the longest and could get started just about any year.

People such as Saddam Hussein and the ones in control of ISIS are not apt to ever be satisfied so long as they believe they can accumulate more power and more territory.

Todays Ron post indicates that barring miracles on the production front Peak Oil is going to be an obvious reality pretty soon, maybe within the next two years. (It will take a while for obvious facts to sink in.)

A couple of million barrels a day is the difference between fifty dollar oil and hundred dollar oil. A shortfall of a couple of million taken off the market by depletion of legacy production and a couple million more taken off by folks eager to put the pitchfork into the Great Satan and his minions will be enough to trigger all sorts of economic troubles.

( One man’s poison is another man’s meat however and oil shooting up well past a hundred bucks would certainly solve the business problems of our regular hands on guys such as Mike and Shallow Sand.)

A very common response of leaders in big trouble is to go to war to fix the troubles if war looks like a workable option. War does not generally solve resource problems in the long term but it can work like a charm in the short term both to divert attention from the shortcomings of leadership and to actually solve the problem – sometimes, for a while – so long as victory is achieved.

There is little question that the USA and allies if in desperate enough economic straits will again put massive armies on the ground in Sand Country to keep the oil flowing. This is a temporary solution which costs an arm and a leg day after day , but it is cheaper than a super massive depression.

It is now obvious that nation building in Sand Country is a tougher nut than we know how to crack so any oil that flows due to boots and tanks on the ground will likely cease to flow within a year or two at the most if and when we pull out.

But it is going to start flowing in lesser quantities year after year starting pretty soon ANYWAY.