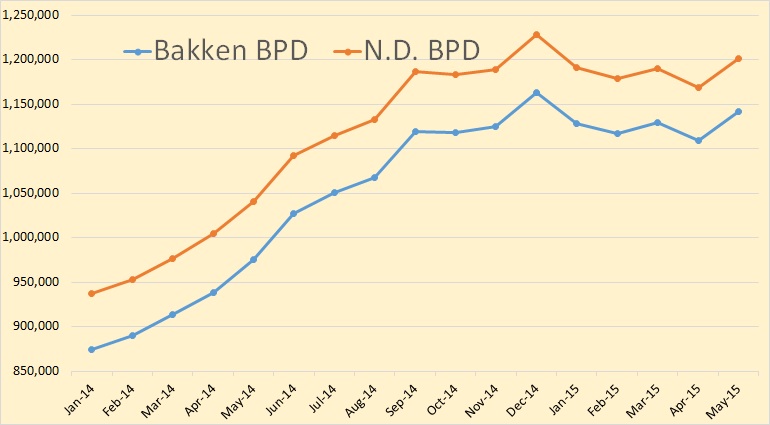

The Bakken and North Dakota production data fir May is in.

Bakken production was up 33,352 bpd and North Dakota production was up 32,114 bpd. This is quite a shocker. I had not expected production to be up this much. Bakken barrels per day, in May, stood at 1,142,034 and all North Dakota barrels per day was at 1,201,159.

| Wells Producing | |||

| Bakken | All N.D. | Non Bakken | |

| Apr-15 | 9,527 | 12,123 | 2,596 |

| May-15 | 9,704 | 12,264 | 2,560 |

| Change | 177 | 141 | -36 |

From the Director’s Cut:

Apr Sweet Crude Price = $38.33/barrel

May Sweet Crude Price = $44.70/barrel

Jun Sweet Crude Price = $47.73/barrel

Today’s Sweet Crude Price1 = $40.75/barrel (all-time high was $136.29 7/3/2008)

Apr rig count 91

May rig count 83

Jun rig count 78

Today’s rig count is 73 (lowest since November 2009 when it was 63)(all-time high was 218 on 5/29/2012)

The drilling rig count dropped 8 from April to May, 5 more from May to June, and has since fallen 5 more from June to today. Operators continue to experiment with running 1 to 2 fewer rigs than their planned 2015 minimum to see if drill times and efficiencies will continue to improve. This has resulted in a current active drilling rig count that remains 5 to 8 rigs below what was operators indicated would be their 2015 average if oil price remained below $65/barrel. The number of well completions rose slightly from 102(final) in April to 114(preliminary) in May but initial production rates are increasing 10-20% per month as drilling and completions focus more and more on the best portion of the core Bakken and Threeforks area.

Renewed oil price weakness anticipated to last into next year is by far the main reason for the continued slow-down. There was one significant precipitation event in the Williston and Dickinson areas and a separate one in the Minot area, 7 days with wind speeds in excess of 35 mph (too high for completion work), and no days with temperatures below -10F.

Over 98% of drilling now targets the Bakken and Three Forks formations.

At the end of May there were an estimated 925 wells waiting on completion services, the same as at the end of April. To maintain production near 1.2 million barrels per day, 110-120 completions must be made per month.

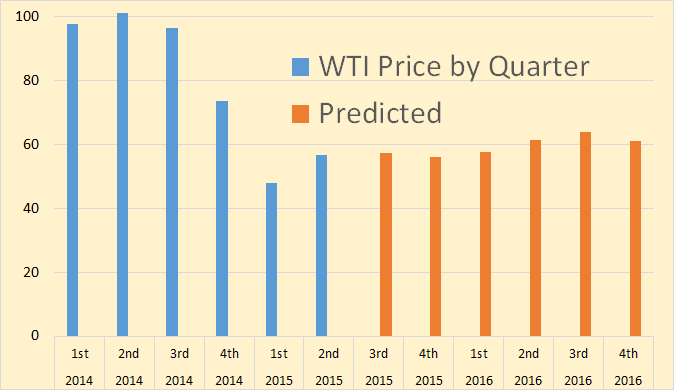

The EIA’s Short-Term Energy Outlook came out a few days ago. That is where they try to guess the future production and price for oil, for the USA as well as the world. As of late they seem to be getting a little timid with their predictions. They are saying not much growth is happening until the fourth quarter of 2016, and only a slight bump then.

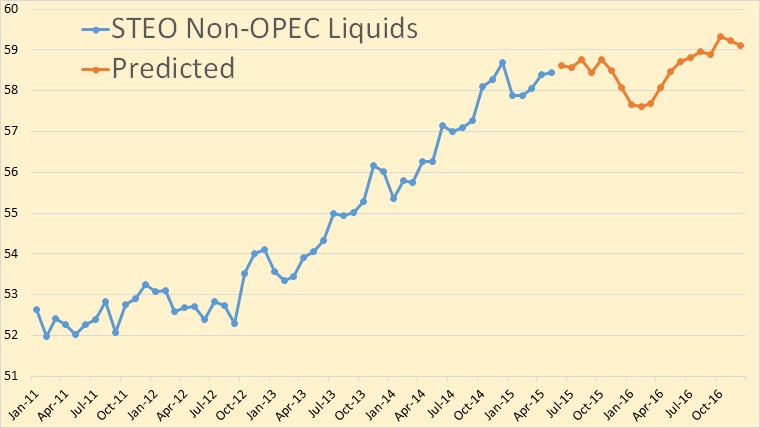

This chart is Non-OPEC Total Liquids in million barrels per day. Production of N.O Liquids surged upwards from September of 2012 until December 2014, gaining 6.38 million barrels per day in those 27 months. That’s an average increase of 236,000 barrels per day per month. But then in January 2015 there was a drop of 800,000 bpd.

Non-OPEC total liquids still have not reached that December high again but the EIA thinks they will by August. I have my doubts. I also think they have their April and May liquids production estimates a little too high here. I have their predictions here starting in June though the EIA starts their projection in July. But there is no way that June production is anything but a guess here, and a bad guess at that.

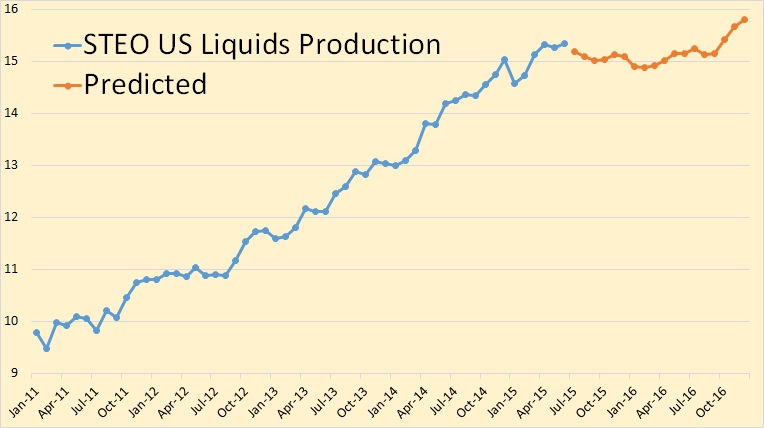

For four and one half years, US Total Liquids increased by an average of over 100,000 barrels per day per month. Now the EIA says US Liquids have reached a plateau where they will remain through September of 2016. Then for some unknown reason the US will resume it upward surge.

Notice the huge decline of 460,000 bpd in January 2015. But then there was an increase of 160,000 bpd in February, 390,000 bpd in March and 190,000 bpd in April. That’s an increase of 740,000 barrels per day over three months when the US rig count was falling dramatically. I look for those numbers to be revised in the next couple of months.

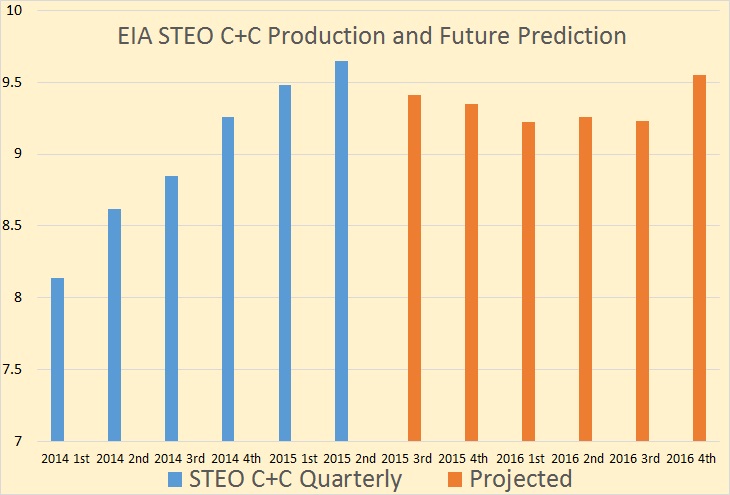

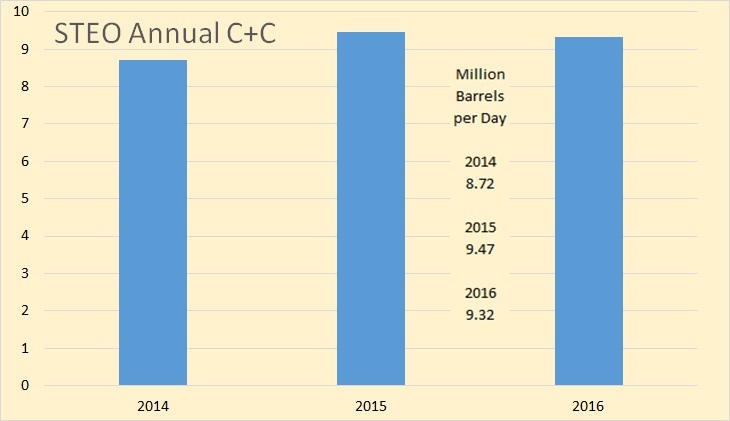

The EIA STEO has Quarterly US C+C production climbing steadily right through the second quarter of 2015. But then they have C+C production falling through the first quarter of 2016 before leveling out and then climbing again in the fourth quarter of 2016.

The EIA expects prices to stay low through 2016. In the fourth quarter of 2016 they have production increasing but prices falling. There seems to be a contradiction there somewhere.

The EIA has US C+C peaking in 2015. Of course I am sure they expect the increase to continue in 2017 and possibly taking out the 1970 high either in 2017 or soon thereafter. I believe that all depends on the price of oil. If prices stay low I think shale production will continue to collapse.

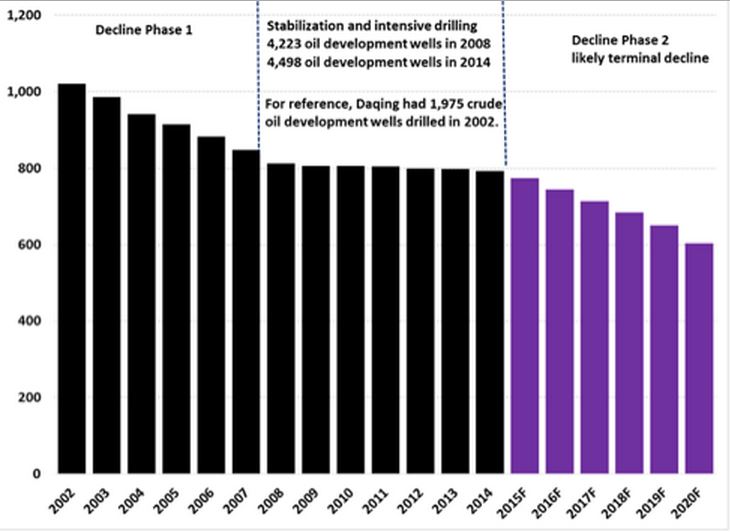

China Peak Oil: 2015 Is the Year

Intense focus on the North American shale boom, Saudi Arabia, and ISIS obscures an important emerging energy trend: China’s oil production is peaking. This has profound implications for the world oil market, because China is not just a massive importer of crude; it is also among the world’s five largest oil producers, trailing only the U.S., Russia, and Saudi Arabia, and virtually neck-in-neck with Canada.

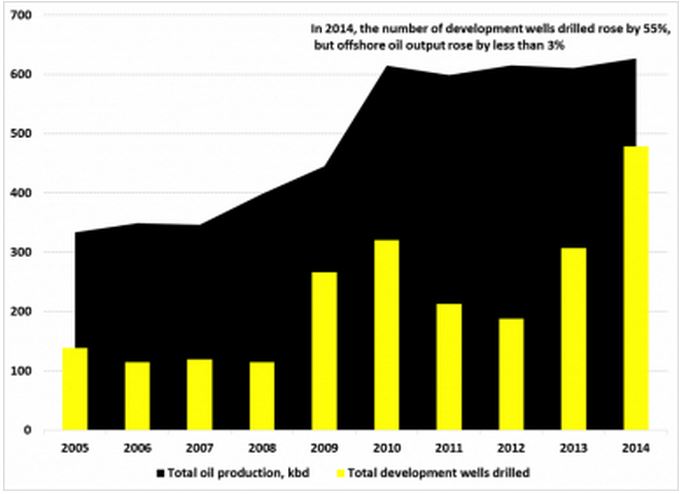

Daqing’s oil production has declined relentlessly, despite PetroChina’s significant increase in drilling activity in the field during recent years. This suggests a significant risk that production could fall faster than planned. For reference, PetroChina drilled 1,975 development wells in 2002 when oil production averaged 1.079 million barrels per day, but was forced to boost this to 4,498 development wells in 2014, when oil output at Daqing averaged 792,000 barrels per day. In short, the number of development wells drilled increased by nearly 250 percent while oil production fell by roughly 27 percent.

Daqing is the perfect example of what infill drilling can do, and what it can’t do. Infill drilling slowed the decline rate of Daqing but increased the depletion rate. I believe if the infill drilling drops off to what it was before the program began, then production will drop a lot faster than they show in this chart.

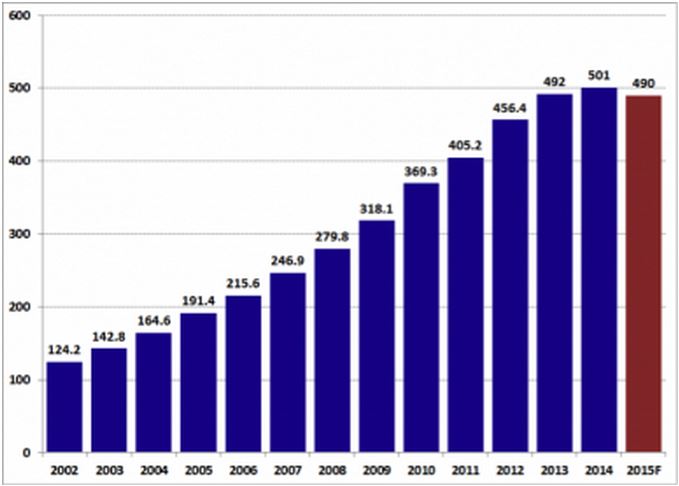

Changqing, China’s second largest oil field peaked in 2014.

Despite some recent announcements of additional tight oil discoveries, Changqing’s slowing production growth rate over the past three or four years contrasts sharply with the hyperbolic production growth seen during the booms in world-class tight oil plays like the Bakken and Eagle Ford shales in the U.S. This difference is critically important because to offset production declines and propel significant net growth in a mature oil province like China or the U.S. requires multiple massively robust unconventional fields.

China offshore production will not save the day. A 55% increase in development wells resulted in a 3% increase in production.

China and Russia, two of the world’s five largest crude oil producers peaks in 2015. The US, the world’s third largest producer also peaks in 2015, at least temporarily. And it is very likely that Saudi is at maximum production also. 2015 will be the year of peak oil.

Shale drillers’ safety net is vanishing

The insurance protecting shale drillers against plummeting prices has become so crucial that for one company, SandRidge Energy Inc., payments from the hedges accounted for a stunning 64 percent of first-quarter revenue.

Now the safety net is going away.

The insurance that producers bought before the collapse in oil — much of which guaranteed minimum prices of $90 a barrel or more — is expiring. As they do, investors are left to wonder how these companies will make up the $3.7 billion the hedges earned them in the first quarter after crude sunk below $60 from a peak of $107 in mid-2014.

“A year ago, you could hedge at $85 to $90, and now it’s in the low $60s,” said Chris Lang, a senior vice president with Asset Risk Management, a hedging adviser for more than 100 exploration and production companies. “Next year it’s really going to come to a head.”

The hedges staved off an acute shortage of cash for shale companies and helped keep lenders from cutting credit lines, many of which are up for renewal in October. With drillers burdened by interest payments on $235 billion of debt, $89 billion of it high-yield, a U.S. regulator has warned banks to beware of the“emerging risk” of lending to energy companies.

__________________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com .

284 responses to “The EIA’s Short-Term Guessing Game + Bakken Data”

old farmer mac – re “extra fuel to backup renewables”,

I answered that (again) at the end of the last article – just in time to see a new Ron-post.

http://peakoilbarrel.com/oil-shock-models-with-different-ultimately-recoverable-resources-of-crude-plus-condensate-3100-gb-to-3700-gb/comment-page-1/#comment-526014

Two key papers:

Greenhouse Gas Emissions from Operating Reserves Used to Backup Large-Scale Wind Power, Environmental Science and Technology

http://www2.hawaii.edu/~mfripp/papers/Fripp_2011_Wind_Reserves.pdf

Impacts of Wind and Solar on Fossil-Fueled Generators

http://www.nrel.gov/docs/fy12osti/53504.pdf

old farmer mac – re (something like) “nobody debates Fernando’s statement that RCP8.5 is fantasy”

Did you read the beginner’s guide?

http://www.skepticalscience.com/rcp.php

RCP 8.5 is a scenario whose premise is basically:

* no GHG emissions controls, e.g. “no policy, business as usual”

* minimal renewables

* maximum fossil fuels.

It’s just a scenario – not a prediction. Scenarios depend on politics, so they can’t be predicted.

That’s why they developed 4 of them: low, low medium, high medium, and high.

By saying RCP8.5 “didn’t even consider” resources, Fernando has placed himself in loony tunes land.

If you read the paper ezrydermike linked to:

RCP 8.5—A scenario of comparatively high greenhouse gas emissions

Keywan Riahi, et. al.

http://link.springer.com/article/10.1007/s10584-011-0149-y/fulltext.html

down in section 3.2.1.

“Secondly, availability of large amounts of unconventional fossil resources extends the use of fossil fuels beyond presently extractable reserves (BP 2010). The cumulative extraction of unconventional fossil resources lies, however, within the upper bounds of theoretically extractable occurrences from the literature (Rogner 1997; BGR 2009; WEC 2007).”

See – they considered it, and give you the references about the resource/reserve estimates they used.

QED Fernando is lying in his hysteria.

down in the footnotes:

“In RCP8.5 unconventional natural gas extraction amounts to 17 ZJ and unconventional oil extraction to about 21 ZJ over the course of the century.”

A zeta joule is 10^21 joules.

a Barrel of Oil Equivalent is roughly 6.1 GJ.

https://en.wikipedia.org/wiki/Barrel_of_oil_equivalent

21 x 10^21 joules / 6.1 x 10^9 joules/BOE = 3.4 x 10^12 BOE, or 3.4 trillion BOE

So, is that backed by any numbers?

“A 2008 estimate set the total world resources of oil shale at 689 gigatons — equivalent to yield of 4.8 trillion barrels (760 billion cubic metres) of shale oil, with the largest resource deposits in the United States, which is thought to have 3.7 trillion barrels (590 billion cubic metres), though only a part of it is recoverable.[5] According to the 2010 World Energy Outlook by the International Energy Agency, the world oil shale resources may be equivalent of more than 5 trillion barrels (790 billion cubic metres) of oil in place of which more than 1 trillion barrels (160 billion cubic metres) may be technically recoverable.[1] For comparison, the world’s proven conventional oil reserves are estimated to be 1.317 trillion barrels (209.4 billion cubic metres), as of 1 January 2007.”

https://en.wikipedia.org/wiki/Oil_shale_reserves

So a trillion + BOE from oil shale.

The World Energy Council 2013 says:

https://www.worldenergy.org/wp-content/uploads/2013/09/Complete_WER_2013_Survey.pdf

“if the unconventional oil resources, including oil shale, oil sands, extra heavy oil and natural bitumen are taken into account, the global oil reserves will be four times larger than the current conventional reserves.” They claim 223 Gtonne, or 1.6 trillion BOE conventional, (about what everybody else claims),

so 3x that is 4.8 trillion BOE of unconventional reserves.

So in fact the RCP8.5 is a bit more conservative than WEC.

Now, you can debate how likely something like oil shale would actually come to pass,

(I think basically zero, because I spent time in Western Colorado, and know the water situation there),

but plenty of people count oil shale resources and hypothetical reserves.

It is dishonest to claim the RCP8.5 was invented to cause hysteria.

The old scenarios needed updating, so people got together and settled on 4 new ones, with some actual meaningful names this time. (RCP8.5 is based on the old A2r scenario – now what does A2r mean? is it more or less warming than a B2 scenario?)

It would be dishonest to presume politics would never be so crazy as to cook the planet a la RCP8.5,

or people would never come to their senses sooner rather than later a la RCP2.6.

So if one is going to model “what if”, model a reasonable number, like 4, of reasonable possibilities of political inputs across a reasonable range.

thank you

The RCP8.5 scenario is used to make temperature forecasts to 2100. This scenario assumes oil production peaks at 160 million BOPD, coal production increases ten fold, blah blah, blah. Those who are reading the posts by Ron, Dennis, and others, realize that its going to be impossible to reach 100 million BOPD crude plus condensate by 2040, never mind reaching 160 million BOPD in the 2060’s to 2070’s time frame.

The fatal flaw in the IPCC work was to create an upper bound case which uses surreal (some would say rather stupid) data, and packaging it as a “business as usual” case. What follows is a tragedy: we have thousands of studies which pick up the climate model forecasts and use them for other studies. And that shit gets published as if it were gospel. Now we are supposed to listen to calls to react in a panic caused by a bullshit buildup of gigantic proportions.

My suggestion is that those of us who realize that fossil fuels are running out should point out the flaws in rcp8.5, steer them on a temporary basis to RCP6, and advocate a model revision which incorporates well documented reserve and producibility studies.

This theme can be used to push for more transparency and auditing of oil and gas reserves in OPEC and other major producers with dodgy numbers. Your cooperation will be appreciated.

Fernando, have you taken a look at Dennis Meadows Club of Rome update?

http://www.clubofrome.org/?p=326

It is also about scenarios and we seem to be right on track with the BAU trajectory.

I assume you don’t think those hold any validity either.

How about The Global Footprint Network do you just dismiss their methodology, data and conclusions out of hand?

http://www.footprintnetwork.org/en/index.php/GFN/page/footprint_science_introduction/

Just curious do you really think that we are going to stop emitting carbon tomorrow and that what we have already added to the atmosphere is having a negligible long term effect on long term global warming and ocean acidification?

I could provide a thousand links mostly to papers by biologists as to what is happening in ecosystems all over the world… such as this one.

http://www.sciencedaily.com/releases/2015/07/150709144848.htm

The big picture tells us that our ecosystems are FUBAR and it seems most of your counter arguments boil down to saying that you know more about everything than all these scientists and that our main problem is communists.

Really?!

Meanwhile,

GLOBAL TRENDS SHOW SEABIRD POPULATIONS DROPPED 70 PERCENT SINCE 1950S

http://www.sciencedaily.com/releases/2015/07/150709102850.htm

“The world’s monitored seabird populations have dropped 70 percent since the 1950s, a stark indication that marine ecosystems are not doing well, new research indicates.”

And,

CLIMATE ‘VICE’ CONSTRICTS BUMBLEBEES’ NATURAL RANGES – RESEARCHERS

http://www.bbc.com/news/science-environment-33442006

“Climate change is threatening the survival of bumblebees, significantly reducing the habitats in which they can survive……….”

And,

TUNDRA STUDY UNCOVERS IMPACT OF CLIMATE WARMING IN THE ARCTIC

http://www.sciencedaily.com/releases/2015/07/150706114229.htm

“Significant changes in one of Earth’s most important ecosystems are not only a symptom of climate change, but may fuel further warming……….”

The over-fishing has almost finished the albatross. So go many of the other birds.

There is no great way to control fishing because it is ocean based. The best we can do on land is protect the bays, marshes and nesting areas. I have seen some excellent work done in that area but there little we can do to stop the fishing problem.

Maybe an increase in the shark population is eating the other fish.

No,

http://news.fiu.edu/2013/03/100millionsharks/52935

The Old Farmer’s Almanac is much more reliable for their weather predictions (uncannily right at times) than any of the flawed models spit out by the global warmists. That’s because computer climate modeling and software is designed by computer programmers, not actual scientists, and has already been shown to be easily manipulated for political purposes in the past…so what is the point of continuing to beat a dead horse on this blog by talking about alleged climate change?

That’s because computer climate modeling and software is designed by computer programmers, not actual scientists,

By the same logic we could say no computer program about anything is worth a bucket of warm spit because all programs are written by programmers and not by those who practice that discipline. For instance the program that the auto mechanic uses to analyze your car is worthless because it was written by a programmer and not an auto mechanic. Or programs that a hospital uses to analyze blood are worthless because they were not written by doctors specializing in blood disorders but by programmers who know squat about blood. Stupid!

so what is the point of continuing to beat a dead horse on this blog by talking about alleged climate change?

Well I, for one, like to try to figure out what drives the human belief system. That is what caused them to build the world view they have and to what extent they can twist logic in order to hold on to it. Also I need a good laugh occasionally. The idea that “computer programs are no good because they were written by programmers” gave me the best laugh I have had in weeks.

What drives the human belief system is advertising and peer pressure.

Climate deniers are likely to be drivers/motorists. To halt climate change/global warming/boiling means getting rid of the cars. This is anathematic to motorists who have large sunk investments in auto infrastructure.

At the same time, the credit consequences of current oil shortages means larger areas of the world are being de-carred right under everyone’s nose. Greece, Syria, Japan, Portugal, Egypt, Yemen, etc. The issue is not whether the oil industry might-might not be able to extract 140 million barrels of oily slop per day 50 years from now … it is that there is absolutely no way the finance industry can support motorist borrowing in order to pay for those barrels.

First chance is the best: the current credit regime is falling down on our heads. Any replacement will be less capable, there will be less credit, less ‘confidence’ in any replacement system (Bagehot). When that 2d system fails the 3d gen replacement will be even less capable, the 4th gen replacement for that less so, etc.

Hi Steve,

It is likely that most people who believe the climate science are also motorists, but they drive a Prius or Volt 🙂

For many people, they would choose public transportation if it were better than it is currently in the US (most places outside of major cities) and biking or walking could work in some cases, though winter in Northern climates of the US would be tough for bicycles, and summer would not be much fun in the south.

I do not believe in IPCC conclusions from climate science and I bike or use public transportation. I do not own a car, and besides being an environmentally concerned biologist, I am trained in organic farming. My CO2 and energy footprint is probably lower than >90% of this blog’s readers.

Believing in stereotypes is like believing in catastrophic warming. Very likely to get you wrong.

We have an energy problem. We do not have a climate problem, nor are we going to have it in our lives time.

“What drives the human belief system is advertising and peer pressure. ”

Are Climate Deniers Racketeers? or just Good Fellas?

Senator Sheldon Whitehouse website:

Washington, DC – Today, in his 98th weekly “Time to Wake Up” speech on climate change, U.S. Senator Sheldon Whitehouse (D-RI) highlighted the similarities between the tobacco industry’s efforts to mislead the American public about the dangers of its product and the ongoing effort by fossil-fuel interests to cast doubt on climate science.

“Yet the fossil fuel industry continues its crafty, cynical campaign of denial and delay. Big coal, oil, and natural gas, and related industries like the Koch Brothers’ companies, profit by offloading the costs of their carbon pollution onto the rest of us. They traffic in products that put health and safety at risk, and they don’t tell the truth about their product.

Sound familiar? It should, because the fossil fuel industry is using a familiar playbook, one perfected by the tobacco industry. Big tobacco fought for more than four decades to bury the truth about the health effects of its product.

But the government has a playbook too. It’s called RICO, the Racketeer Influenced and Corrupt Organizations Act. The elements of a civil racketeering case are simple. The government must allege four things: defendants (1) conducted (2) an enterprise (3) through a pattern (4) of racketeering activity. ”Conducting” means everything from directing to aiding and abetting the activity. An “enterprise” can be any form of association or a common scheme. “Pattern” means continuity of the scheme, and for civil RICO particularly the prospect of ongoing conduct. “Racketeering activity” simply means the violation of designated federal laws, including the federal mail fraud and wire fraud statutes.”

http://climatecrocks.com/2015/07/10/are-climate-deniers-racketeers-or-just-good-fellas/#more-24320

If a domain expert cant write the programs themselves, they will provide the algorithms to the programmer who will then program them.

The software will be “User Acceptance Tested” (UAT testing) by the domain experts.

This is how software/applications are written in almost all domains.

In many cases you hire consultants/contractors who have experience in the relevant industries to lead the development effort so they are not completely ignorant of the field.

Programmers aren’t accountants, so I guess accounting software like Turbo Tax is all bunk…LOL!!!

The people that write the code for the climate models are often geophysicists, or if the physicists don’t write the code they are very familiar with the models that the code attempts to simulate. The idea that scientists don’t know how to write computer programs or that computer scientists know nothing about science is incorrect.

Dennis, “The people that write the code for the climate models are often geophysicists….” I wonder if that’s true. When I started (exploration geophysics) we did write ALL our code then began incorporating subroutines obtained from various sources then relying more and more on specialist programmers: More cost effective because oil companies always have fancy computers at their disposal and fancy programmers hanging around. You may be right though, specific problems often require their unique algorithms and no doubt a lot of scientists do write at least some of their own code. Maybe Sam Taylor has a comment?

You can take it to the bank from a real old farmer that if the Old Farmers Almanac ever gets the weather forecast right it is a matter of pure luck.

Even stopped clocks are right on the button twice a day.

I do think however that Dave knows this and his comment is all about the climate models and sarcasm.

Hi Fred,

Fernando’s main point is that the RCP 8.5 scenario requires more fossil fuels than are likely to be extracted. Roughly 3 times more energy burned per year in 2100 than is likely to be burned under a high URR scenario at peak (likely to be between 2020 and 2030 for all fossil fuels based on Mohr’s analysis).

In my view he is correct on that point.

His other point that most climate models have too high an equilibrium climate sensitivity (ECS) and that the correct ECS is around 2 C is not correct in my view. There are studies supporting both high ECS = 4C and others suggesting lower ECS of 2C. We do not know with certainty what the ECS is, but it is likely to be between 2 and 4C and experts think 3C is the best guess at present.

The precautionary principle suggests that we err on the side of caution, in my view, Fernando disagrees with me on that point.

Fernando’s main point is that the RCP 8.5 scenario requires more fossil fuels than are likely to be extracted.

I’m actually willing to grant him that point. My beef with it is that this is just one of many scenarios and he hangs everything on that one alone.

I posted a link and Doug did too about climate change, specifically warming, having severe impacts on Bumble Bees. This has nothing to do with scenarios about the future or politics for that matter. This is real world observation being made by ecologists today. It is happening now! Perhaps people don’t really understand how interconnected ecosystems are. You can’t keep pulling threads out of the tapestry forever without it having consequences.!

Climate Change is having serious impacts right now! We don’t have to wait till 2100 to see what will happen. And even if we stop burning all fossil fuels today the impacts are already baked in and we really have no idea as to what kinds of things we have already set in motion.

It is as if we are 10 meters from a brick wall doing 100 mph and we are discussing the fact that the break pads we installed earlier are actually better than we thought and they will bring our car to a halt in 150 meters. Guess what, we don’t have 150 meters… so the entire discussion is moot. It’s time to hit the eject button and hope the parachute works.

Hesitate to join in but looking a while back at scenarios projected by both Aleklett and Laherrere – and taking into account optimistically that the ocean etc continues to provide significant carbon sequestration services as now – I calculated that it was extremely unlikely that we can avoid a ‘Peak CO2’ any less than double the pre-industrial level i.e. 570ppm plus: probably around year 2100; or within a decade or so.

It would then take centuries to reduce CO2 assuming the carbon cycle is still in good enough condition to do so. Although the ppm should come off the peak fairly fast for a few decades the level then remains high by present standards for a good historical period. The results of that ongoing ‘heat pulse’ even as it moderates will continue for a very long time – centuries – before reaching full effect on the climate system – thermal inertia of the ocean for one reason: and plenty of ‘positive feedback’ still lurking in the system.

Judging by what we see now, I would agree Fred that any ‘surprises’ are most likely going to be on the nasty side, not the other way about.

best

Phil

Hi Phil and Fred.

I agree. Fernando thinks ECS is 2C and a doubling of CO2 wil not be a problem, perhaps he is right, perhaps not.

The smart thing to do faced with uncertainty is to play it safe. Most engineers realize this, Fernando is not one of them.

We were taught to look at the worst case. If it was bad, play it safe.

Worst case here is very, very bad. So– play it really, really safe.

Sad thing here is that playing it safe could be so easy, given our hugely wasteful BAU.

But we just keep the pedal to the metal. Idiotic!

”Sad thing here is that playing it safe could be so easy, given our hugely wasteful BAU.

But we just keep the pedal to the metal. Idiotic!”

DEAD ON BULLSEYE!!!!!!!!!!!!!!!!

All my right wing bau buddies are completely oblivious to the unquestionable fact that mandated fuel economy standards are saving them a thousand bucks or more a year driving their newer model trucks and cars DIRECTLY in gasoline purchases alone.

There is an additional savings involved which is substantial but hard to quantify.

This savings results from the fact that when less of a commodity is sold, the price of it tends to decline.

Mandated fuel economy standards have probably reduced our domestic oil consumption by anywhere from a million to two million barrels a day for a rough guess.

“But we just keep the pedal to the metal. Idiotic!” ~ wimbi

“While I am a pedal to the metal guy when it comes to building out renewables I also believe in the utter and absolute necessity of maintaining business as usual.” ~ old farmer mac

“I am an agriculturist by profession when I bother to work. I was a believer in the more or less business as usual model for the first half of my life although I never forgot the red faces and impassioned lectures I heard in the lecture halls over in the biology department where I took many many credits…

The biologists were a little early in their predictions of the clusterfxxks that are currently resulting from the excessive use of pesticides and fertilizers and irrigating with fossil water etc but they have been proven right in the end… I was wrong to disregard their warnings in lieu of believing the short term evidence presented by my own colleagues that everything was/is just hunky dory…” ~ old farmer mac

Let me expand on the “ongoing heat pulse” idea:

CO2 causes a continuos forcing (it reduces the planet’s ability to shed energy via outgoing long wave).

The forcing increases temperature. The higher temperature raises water vapor, the water vapor absorbs more outgoing long wave, and makes clouds.

As temperature increases the Earth radiates more energy, eventually the system stabilizes. If the CO2 hits a peak at say 600 ppm then it’s evident things won’t be nearly as bad than a stabilization at 800 ppm.

My training tells me it’s very critical to establish what’s the peak concentration based on simple market forces, and then see how this can be reduced by investing in key projects (items such as the Tesla S wouldn’t qualify for anything). It’s also important to understand how to reduce methane emissions, soot, and other minor gases.

And we really do need to get off medievalism and research geoengineering. Maybe all we need to do to get in a safe mode is to grind up rocks and expose them to rainfall.

How much rock, how much rain, how much time, how much energy?

These are, to first order, pretty simple numbers to get near to. So, anybody already done it?

Somebody tell us the answer, and then, we either do it or forget it as the case may be.

My guess, and guess only it is, that It don’t work near fast enough.

And think of the hellish noise of all those convicts in ball and chain pounding down the hills with all those sledge hammers.

Biomass pyrolysis works for certain sure, can be done anywhere with any biomass no matter what, and produces fuel gas and carbon from air to ground.

Carbon-negative fuel source. Do that.

http://www.ncbi.nlm.nih.gov/pmc/articles/PMC2996662/

“Costs for mining and grinding are estimated (22) to be €10 per tonne of sequestered CO2 (€37 per tonne of C). Taking into account costs for applications (36), total costs might be in the range of €20–40 per tonne of CO2 sequestered (or €70–150 per tonne of C). “

This comment is in response to the one made at seven eleven five fifty one by Caelan.

If anybody had asked me about peak oil back in the seventies I would have told him we would certainly run out of oil someday but the issue did not matter to me back then.

I was like most young technically well educated people – immortal because I was young(Weren’t we all when we were young ?) and confident in our collective ability to solve just about any problem.

I didn’t join the Peace Corp for basically one reason. One crusty and profane old ag professor asked me if I realized the consequences of what I would be doing -helping subsistence farmers double their production so there would twice as many people to starve when the next really bad year hit.

SO-I was not oblivious to environmental realities even back then but just not focused on the environment. I had a ” hot young blossom” of my own, the sort that Twain said enticed the Gods down from the heavens to consort with mere mortals, and other things on my mind.

Now as far as the absolute necessity for the continuation of business as usual -IN CONTEXT .

”Business as usual” for some time yet is NECESSARY and ESSENTIAL to solving our environmental problems. This may sound sort of strange at first glance but anybody who thinks about it a minute will get it.

IF we are (collectively ) successful in lowering the price of renewable energy, educating the world, inventing and deploying vastly more efficient transport, building houses that are extremely easy to heat and cool, breeding crops that need few or no pesticides, etc ,etc , etc then ALL these things must be accomplished WITHIN THE CONTEXT OF TODAYS ” BUSINESS AS USUAL”.

IF these problems are solved successfully then todays business as usual will morph into a NEW generation of business as usual based on renewables, conservation, efficiency, etc.

The flip side of the survival of business as usual is COLLAPSE.

Collapse is the LAST thing we actually want.

Collapse means everything from riots right up to a nuclear WWIII. We will NOT quit burning coal in a collapse situation – not until the grid goes down for good. We will not be deploying solar pv by the hundred of acres in a collapse, or manufacturing insulation and triple glazed windows by the trainload. There won’t be any trains running.

Of course as usual I am painting fast with a broad brush but my meaning should be clear. Collapse could come about very quickly for a number of reasons but it seems more likely to me that with luck the current version of business as usual will survive in most parts of the world for some time yet, possibly as long as half a century or more.

That seems like a long time to a monkey brain but in the context of history it is not very long at all.

Don’t get caught in Egypt.

If anybody had asked me about peak oil back in the seventies I would have told him we would certainly run out of oil someday but the issue did not matter to me back then.

I became concerned about oil depletion during the Carter administration. And I have been concerned about it ever since.

Therefore, for decades I have felt we need to plan for the end of cheap oil, and also do what we could to slow down its use.

The climate data hasn’t changed my thinking other than to perhaps add some urgency on the timetable. So all the discussions about the data and its political interpretation is of interest, but about as much interest as new space discoveries. I don’t feel it has much to do with my life personally.

And I continue to be surprised that anyone feels the need to point out the holes in the data and the theory as if that might change how people and countries will respond to energy production, distribution, and use.

Coal was likely going to be phased out by gas anyway. And China realizes it needs to move away from coal not because of climate but because of air pollution.

Nuclear would be a good solution to reducing CO2 generation, but the economics aren’t favorable.

As for moving toward solar, wind, EVs, and distributed generation, those were going to happen anyway no matter what the climate data. They are increasingly becoming more economic, they are less polluting, they provide more local control of energy, and they are growing industries that should make some folks money.

Fernando

I think I was painting an optimistic picture and at the same time assuming fossil fuel depletion would be as quick as Aleklett et al think.

If I am more pessimistic, the extreme rapidity of the forcing taking place now and I assume for the next 100 years, is outside relevant precedent in the geological record of a few million years, and this has its own uncertainties – call them dangers. For example, the resulting stratified ocean (slow turnover) flags up enormous risk.

Unless they decline early because the fossil fuel is in part replaced by more expensive alternatives, I can imagine that industrial networks will exhaust most of the Aleklett inventory in the next decades, and even use up in addition some presently economically stranded fossil fuel assets. Thus ‘industry’ might in extremis feed itself for longer than we think now, and we end up with a more prolonged heat pulse than I am guessing at. But whether industry sags early or late, I cannot see super-large non-profit projects to repair the biosphere becoming possible. There is very little chance of escape in my view.

Phil

I don’t know, Phil. Some of the renewables subsidies are so bizarre and expensive it may be worthwhile to pay Congolese to grind up volcanic rocks and spread the sand over the ground. At $50 per ton it’ll may just get them out of poverty.

And I’m always looking at the potential wildcard on the + side. We MAY be entering a Maunder Minimum. If that’s the case we are going to cool down for a while.

Some of the renewables subsidies are so bizarre and expensive it may be worthwhile to pay Congolese to grind up volcanic rocks and spread the sand over the ground. At $50 per ton it’ll may just get them out of poverty.

That could be true. But what is accomplished by encouraging people to consume more and more fossil fuels?

Does it make financial sense (other than to enrich certain groups) to use up resources that can’t be replenished?

Fernando

The recent work by Professor Valentina Zharkova seems to prompting a number of highly qualified fuzzy heads to take another look at some of the climate related data and … think about it.

Coffee, I already saw one climate model result for a Maunder type event. It shows severe cooling over the northern hemisphere.

And I also showed you another model that predicts only 0.1-0.3° C cooling from a grand solar minimum.

Plus the experience that the Sun is in grand minima 27% of the time (one every 250 years on average with a mean span of 70 years). It cannot be such a terrible thing if it is so frequent.

Hi Fernando,

The Tesla Model S is no different than the Mercedes S series or BMW 7 series and is meant to compete with those high end cars. EVs are probably not the best way to solve the eventual liquid fuels problem, just one solution amongst biofuels, CNG, rail, light rail, and buses.

Fossil fuels are likely to peak before 2030 oil first, then coal, and finally natural gas.

We should focus on both the climate change and peak fossil fuel problem and solve both problems by finding substitutes for fossil fuels and attempting to eliminate their use before depletion forces this change. When we have accomplished that we can focus on the best way to grind up rocks (and whether that is in fact a viable solution without unintended consequences).

Maybe a vast mobilization of planting and nurturing a whole lot of native vegetation– including food forest gardens/permaculture/etc.– around the world by many people around the world would help with carbon sequestration? And greening some deserts? If this is done and much of BAU is abandoned, cold turkey, this could be the appropriate smooth transition that many are concerned with.

Relying on leveraging the wreck that is BAU for this smooth transition seems just daft, like, maybe relying on someone who committed a murder to make autopsy and funeral arrangements for the victim’s family.

Actually, I think what you say is the ONLY way to do something that might work at the scale and speed we need.

This conclusion after at least 5 minutes of deep analysis.

Now, everybody hear that? So, get together and do it. Now. Chopchop.

Kuzu anyone?

Right,Right,Right Fred. So glad to see somebody around here with their eye on the ball. I was starting to despair.

Now I return to my parachute factory.

And maybe a glassa beer might help a little.

Make mine a cider. Beer tastes like hell and is way overrated. Maybe I should at least try a beer with some chocolate chip cookies or caramel and nuts popcorn.

Mind you, I have cooked with beer to good success and very much enjoyed Stubbes’ European beer and dark chocolate truffle. (third from right side at bottom). Probably my favorite actually.

So maybe that’s how I should

drinkeat my beer… And maybe explore some European and other unusual beers if I am thirsty and wish a flavor sensation.Hey Wimbi, I’ll join you for one of those cold beers!

Fred: ref “My beef with it is that this is just one of many scenarios and he hangs everything on that one alone.”

I emphasize RCP 8.5 because it’s the extreme outlier, it’s the weakest, and it is used by scientists for thousands of follow up studies. It’s also used in agency, NGO, activist and government propaganda as the “business as usual case”.

What this leads to is a ton of hard work by naive scientists who use the IPCC product without questioning it. On top of that we see lots of people having panic attacks over a non issue.

What I’m trying to emphasize is the need to perform a very high level study to establish fossil fuel resource boundaries, what can be produced and at what cost. A parallel study needs to research how deep renewables can penetrate worldwide and at what cost and what subsidy level.

With that in hand they can run models to project emissions scenarios with a better set of numbers. This in turn can be fed to climate models and we can see the spread of results.

The propaganda machine within the IPCC knows very well they have a serious weakness and are trying to create “peer reviewed literature” to back their outsize fossil fuel projections. This effort seems to have started around the time I started writing comments about RCP8.5 being flawed.

I’m not saying I triggered it but I rarely read others writing about this.

Blair, the Chemist in Langley wrote a post about it, and a few others mention it. But I’m the terrier hanging on to the bone. So let’s see what happens. I don’t have much hope this will ever be fixed, we got too many people whose careers are already set based on the rcp8.5, so it’s like a religious book, it can’t be challenged.

Mother Earth cares naught about any human laws, modeling or anything but the filth in the air- put there by us. And she is saying ever louder by the day that she already has more than enough to make us regret it, and the more we toss up there the more deeply we are going to regret it later.

“Turn back, O man, forswear thy foolish ways

Old is the earth, and none may count her days

But thou, her child, whose head is crowned with flames

still will not hear what her voice proclaims”

What this leads to is a ton of hard work by naive scientists who use the IPCC product without questioning it. On top of that we see lots of people having panic attacks over a non issue.

Fernando, you continue to discount the work of thousands of scientists who are NOT using IPCC projections for anything! These scientists are in the field making observations and collecting data today. They are reporting what they are seeing and expressing growing concern over what they are seeing.

They are telling us, that based on their current observations, the climate is changing faster than expected and that this is too fast for myriad organisms and as a consequence entire ecosystems are on the verge of being wiped out.

Granted biological evolution tends to continue even after mass extinction events but based on what we know from the fossil record, that may not be a very good thing for us.

F Magyar,

Very well put, Fred. Thank you.

Fred, I’m not discounting anything. The bulk of dire projections are based on IPCC projections. And these dire projections are being used to drive the public and politicians to make irrational moves.

The bulk of dire projections are based on IPCC projections.

No Fernando, they are not! An ecologist reporting from the field is not looking at IPCC projections! He or She is telling us what is happening on the ground today and what is happening is massive change. They are witnessing and reporting a massive extinction event and there is overwhelming evidence from myriad fields of very diverse scientific inquiry to back up those reports!

“First, let’s acknowledge the irony in all this: Life on Earth is the scramble for energy-rich carbon; lately humans have dominated that competition; and now that domination is undermining life on Earth. We’re #1 for now, and it turns out that being #1 in this fashion means that over the long haul we lose big. And, increasingly, the long haul looks like it’s going to be a short trip. Our grandest failure is the product of our greatest success.

So, our task is to face a simple question that has serious consequences: Is the human with the big brain an evolutionary dead end? If so, what are we going to do with our species’ time remaining?

“Homo sapiens’ domination of Earth is coming to an end, not in some imagined science-fiction future but as the result of today’s processes of resource extraction and waste generation. The trajectory of the multiple, cascading ecological crises that define our world cannot be predicted with precision, but the trend lines are clear enough. Our task is not to figure out how to maintain the illusion of human control of the ecosphere—and it always was an illusion, even when we seemed to be more successful—but instead, borrowing from my friend Jim Koplin, “to learn to leave the planet gracefully.”

-Jensen

Thanks for the links. I am not very skilled at finding this stuff myself.

I am bookmarking them this time.

I have not said ” nobody ” questions the questionable assumptions.

What I have said ( or INTENDED to say at least!) is that I do not know of a single case of a prominent spokes person or ANY spokesperson for the climate science community publicly saying that the business as usual scenario used to create the RCP 8.5 scenario is complete and total bullshit .

This scenario runs ENTIRELY at odds to just about every thing I have ever read written by professionals involved in environmental work in other fields- professionals who are not directly invested in the climate issue.

And when it comes right down to it I have a certain amount of expertise in these matters myself when it comes to what is physically possible given ecological and resource limits.

The RCP8.5 IS BULLSHIT.

Constantly promoting the predicted consequences of this scenario is a lie by omission if I have EVER heard one, and the same sort of propaganda technique used by the anti science crowd on so many occasions.

But this does NOT mean forced climate change is bullshit. It simply means that there IS POLITICAL MANIPULATION INVOLVED in discussing the actual data in public. . There are good reasons to believe that we have ALREADY passed some critical tipping points and the non linear nature of the problem means things MIGHT get a lot worse than three or four degrees even if we quit burning coal today.

Pardon my french folks but anybody who believes in LIMITS TO GROWTH in general and peak oil and peak soil etc etc etc and who also credits this scenario as being realistic is has his head totally out of sight up his backside.

Fernando is fucking A one hundred percent RIGHT about this. (He is also quite a bit closer to the mark about there still being commies around than most of us suspect. It is true that the exact flavor of despots is not especially important but commies have a sort of religious dynamic that enables them to hang in there in academic and political circles in a way that ordinary scumbags cannot match. )

This sort of behavior is one hundred percent par for the course when it comes to just about ANY ISSUE and any particular group of people, professional or amateur.

When I was teaching and it was already PERFECTLY OBVIOUS that tobacco is a KILLER drug I was hauled into a state level supervisors offices to get my ass chewed out for refusing to teach a basic unit on tobacco and substituting one on the health risks involved. The best I could do was either get fired or give it up. So the next time I turned in my calendar it included the unit on tobacco production. But I didn’t teach it.I just let the other units take an extra day here and there until there was no time left for it.

The following year I just gave it up and went to work at the nuke. They paid about five times as well anyway.

How many of us have heard a doctor moaning about the high cost of health care point out that the average doc is making upwards of half a million bucks a year these days ?

Everybody goes along to get along once they are enmeshed in a large program involving dozens of layers of bureaucracy. You either conform or you find a new line of work.

In medicine for instance there was at least ONE brilliant woman who as a med school professor was teaching that you can cure ulcers with antibiotics FORTY FUCKING YEARS before the profession as a whole recognized this now perfectly obvious truth.

But nobody would support her or even consider her evidence. The urge to conform was too strong.

Given all the evidence presented in forum such as this one hardly anybody in the msm takes peak oil seriously.

For sky daddys sake we are all just one damned big bunch of tailless monkeys. Why anybody would expect better escapes me.

Of course I DO understand the necessity of maintaining a united front in opposition to the united front of the entrenched fossil fuel industry when it comes to this particular issue, and so I go along myself in all other forums where I post under different handles at times.

But this need for unity does not necessarily extend to discussing this matter among the regulars in this forum. Only an extremely minute percentage of the public will ever read a site such as this one until AFTER the shit hits the fan hard and fast.

My own PERSONAL agenda is to go wherever the facts lead me. If I am wrong then there are people here in this forum who are smart enough to point out my errors and I will change course as necessary.

You got it Old Farmer. The system resists new knowledge and heavily persecutes those who stray from the line of acceptability. I know many examples of this but here is one. The medical system refused to acknowledge the Lymes epidemic and the work of a researcher proving that the effects could be relieved quickly by using cholestryamine (an old cholesterol lowering drug which is basically a highly branched polystyrene with trimethyl ammonium end groups). The researcher had discovered the mechanism of how the lymes spirochete causes nerve damage and found a way to quickly remove the low molecular weight neurotoxins. It took a decade for this method to be accepted and legalized. Meanwhile people suffered greatly.

Another was the research into frog mutations found downstream of farms. The research team found that the frog mutations were caused by a pesticide at very low levels. Apparently at higher levels the frog’s antibody systems eliminate the toxin but at very low levels it sneaks “under the radar” and acts as a mutagen since the antibodies were not activated.

The old school “the dose makes the poison” bureaucracy shot down the research and I don’t think it has been accepted yet.

Hi Old Farmer Mac,

The average physician does not make $500,000 per year.

See

http://www.medscape.com/features/slideshow/compensation/2014/public/overview#2

On slide 2 the income depends on the doctor’s specialty, the range is 174k to 413k.

For the primary care physician (non-specialist) the median salary is $156k according to

http://www.payscale.com/research/US/Job=Family_or_General_Practitioner/Salary

Yes my mistake, I intended to say specialist physician. To the best of my knowledge quite a few make a good bit more than actual ” salary”.

Hi Old Farmer Mac,

Just because a few make a lot does not mean they all do. Warren Buffett is a multi-billionaire, that does not make it so for all investors.

Oh, and not even the highest paid specialty has an average salary of $500,000 per year, so if you had sais specialist physician you would still be wrong unless you were very specific about the specialty.

Physicians certainly do well, but most physicians are not as wealthy as even intelligent people such as you, think they are.

I am using the same technique as the political portion of the climate establishment is using , lol. To wit, misrepresenting the facts by painting extremes as norms and exaggerating.

😉

Forced climate change scares the hell out of me but it does not scare me half as bad as the MORE LIKELY consequences of overshoot which we will have to deal with much sooner.

Times are going to get to be very tough and rough indeed , barring miracles, within the next half century. I am not knocking any miracles that might happen to come to pass but good sense dictates not basing our hopes on them.

Please everybody note that all the links aimed at Fernando are NOT actual proper responses to his arguments. The decline in sea birds for instance is almost for dead sure a consequence of overfishing – part of overshoot in general- rather than a consequence of changing climate.

Of course in the last analysis forced climate change can be attributed to overshoot too.

But the climate has not YET changed enough to explain such issues as the depletion of fish stocks etc which are very easily and convincingly explained by overfishing, loss of critical nursery habitat, pollution etc.

It’s all fossil fuel driven technology guided by a completely false sense of good.

Too many mouths, too few fish.

Hi MarbleZepplin,

Old Farmer Mac’s point stands. Many of the environmental problems are unrelated to climate change. More related to human overpopulation destroying the natural world. Ironically, a higher standard of living seems to help with the overpopulation problem as the explosion of both population and wealth since 1965 resulted in half the number of births per woman wordwide from 1965 to 2005 (from 5 to 2.5). If we get to 1.25 births per woman by 2050 and then remain at that level for 200 years, then human population falls to under 1 billion and might be a sustainable level for the planet or we could go to 500 million in 250 years. In my view less is more to give the planet a chance to heal.

Dennis

I didn’t mention climate change.

OFM

I think your comments, while having a reasonable basis, are aimed at a feature rather than a bug, and really miss the issue.

If you look at figure 5 in the primer it shows how IPCC changed their methods. On the left is how they previously did things, which is to try and develop a socio-economic model, giving GHG values and a radiative forcing curve. If they still did this then your criticism would be valid. However as the primer states this process was very slow – the model is highly nonlinear and there are (to some extent subjective) feedbacks so that a warming climate will change how the world works and what GHGs are emitted. Therefore this was a highly iterative process.

They have therefore switched to the method on the right, which is that they generate four, “reasonable,” forcing curves. This is more an interpolative method, and as such must span the expected solution points (or where the IPCC thought those points were about 10 years ago when this was being put together). The low case should be a bit better than the expected minimum scenario and the high case should be slightly higher than the worst imaginable. Also as the system is highly non-linear the more internal curves the better, but this has to be weighed against the time to generate the models and analyze them, so they have two.

These four scenarios are then handed over to the second row in the diagram for analysis – part of which is to come up with a narrative that explains the GHG emissions as they have been shown. The models have one set of narratives but really any team that uses them can come up with and critique any narrative they think fits. As is said about the RCPs: “They are representative in that they are one of several different scenarios that have similar radiative forcing and emissions characteristics.” I

If there are no reasonable scenarios that can match the high case all the better, but that doesn’t mean that any work done is wasted,; and it would be far worse if a less severe high case was chosen resulting in some issues being missed. Ideally there would be a set of probabilities for achieving each scenario (i.e. the sum of all narratives that produce that trajectory) but that’s probably too much work at this (or really any) stage.

By having a common set of scenarios it means the research teams have common starting points as a basis for debate, and I’m sure a lot of that debate concerns the sort of issues you are raising. Since the scenarios were developed there have been changes in the expected URRs for fossil fuels. However just looking at coal, by WEC 2013, there are 891 Gt of reserves which is about 300 ppm of CO2 (assuming 70% goes to the atmosphere), but WEC indicate there may be 4 to 5 times as many resources – which is enough to give the forcing in the RCP8.5 case alone (of course the probability for full use of everything would be very low). Equally feed back mechanisms that may increase GHGs are being identified, and are still very poorly understood. These are not just hydrate releases although that is probably the biggest store, but include for example: rotting vegetation from melting permafrost, release from the shallow seas as they warm, release from the deeper Arctic seas as sea ice is lost and wave action can work down to the sea bed, fee methane trapped beneath permafrost, peat bog decay, tundra forest fires, tundra peat fires, tropical forest burning etc. I would be happy to find that every one of these is completely insignificant going forward, but nothing I’ve seen leads me to think this is likely; to ignore these issues without proper consideration would be extreme hubris.

I only know some of the people working directly on this at second and third hand but they are as aware and knowledgeable, and probably more concerned and intelligent than the average poster here, and to describe their work as bullshit is belittling to you and them.

Sorry that went on so long – and if it was a repeat of something already given elsewhere here of from the previous post.

See: https://www.worldenergy.org/wpcontent/uploads/2013/10/WER_2013_1_Coal.pdf

The follow up work is wasted if the rcp8.5 model results are used and presented as “business as usual”. I think the IPCC and other responsible parties are guilty of scientific fraud when they misrepresent how rcp8.5 came to be, and what it really means. It’s fraud, buddy.

I think the IPCC and other responsible parties are guilty of scientific fraud when they misrepresent how rcp8.5 came to be, and what it really means. It’s fraud, buddy.

What is the motivation to commit fraud?

And if you say they do it to maintain their sources of funding, then why would their sources of funding want to commit fraud?

What does fraudulent climate data accomplish that the economics of energy is going to accomplish anyway?

It seems to me we have found evidence of VERY LARGE SCALE scientific fraud and your defense is the presumed lack of motivation? Hell, what drives unethical behavior and scientific fraud? Why don’t you look it up?

It seems to me we have found evidence of VERY LARGE SCALE scientific fraud and your defense is the presumed lack of motivation?

I don’t think we have seen evidence of very large scale scientific fraud.

You start with a scenario that you say won’t ever happen because we’ll never burn up that much fossil fuel.

Fine. I haven’t checked your figures, but I’ll accept that at face value.

But here’s where you lose me.

1. You are saying that the extreme scenario is evidence of fraud. But I’d need more info for me to believe that. Perhaps it’s just a matter of tossing out a scenario that could happen if we proceeded at our current rate. That’s not fraud in my mind.

2. You say fraud is committed in order to panic the public so that communists/leftists can take over. That definitely doesn’t make sense to me. There are better ways to panic the public.

So if you had just stopped with “extreme scenario can’t happen” I wouldn’t think anything of it.

However, when you say it is fraud committed by leftists/communists to take over the world, I don’t buy that.

“I think the IPCC and other responsible parties are guilty of scientific fraud ”

Only deniers use that meme, but, of course, you deny being a denier.

Hi Sunnyv,

I think conventional oil reserves (subtracting Orinoco belt and Canadian oil sands) are about 1300 Gb, based on BP data, so 3 times that is 3900 Gb of unconventional oil reserves.

The question that I would ask is, does this WEC estimate seem reasonable?

My answer would be a definitive, no!

The most reasonable estimate is found in Steve Mohr’s PhD Thesis from 2010

a summary is at link below:

http://www.theoildrum.com/node/6782

see table 8.2 and 1 Gboe=5.73 EJ

full thesis at

http://ogma.newcastle.edu.au:8080/vital/access/manager/Repository/uon:6530

His case 2 is his best guess and for conventional oil resources his guess as a little too low in my opinion (if conventional is defined as all oil that is not extra heavy with API <10 or kerogen) at 2300 Gb for C+C+NGL which I would put at 3200 Gb (with 400 Gb of NGL), but his estimate for extra heavy oil (extra heavy plus natural bitumen in his table) is about 800 Gb which is reasonable.

His case 2 estimate for shale oil (kerogen) is about 1000 Gb, which I think should be at most 750 Gb, but realistically will be zero due to water constraints.

Note that we have already produced about 1300 Gb of C+C+NGL, so using even optimistic projections of future URR of 3500 Gb of C+C+NGL-XH plus 1800 Gb of XH (including 1000 Gb of kerogen) we get a total C+C URR of 5300 Gb.

When we subtract cumulative output we get 4000 Gb total reserves (existing plus future potential reserves). Then we need to deduct current conventional reserves of 1300 Gb and 900 Gb of future conventional discoveries and reserve growth and we are left with 1800 Gb of unconventional future reserves (including 1000 Gb of kerogen which is unlikely to ever be produced).

So the 3900 Gb of unconventional technically recoverable resources estimate is at least a factor of 2 too high and it is more likely to be too high by a factor of about 4 or more.

The RCP8.5 scenario should only be considered realistic, if one accepts the cornucopian position, I do not, and agree with Fernando that the scenario is not realistic.

If you are arguing that it is consistent with many of the projections by the IEA and EIA, I would agree, but those forecasts are also not very realistic imo.

According to Figure 14 the total oil and natural gas used in RCP8.5 is less than RCP6 and about the same as RCP4.5; and the statement is given: “The use of oil stays fairly constant in most scenarios, but declines in the RCP2.6 (as a result of depletion and climate policy).” The big differences for RCP8 is the huge increase in coal use and a large switch from vegetation (which I think means forest) to grassland. No one can deny that there is a lot of coal left and the trend in land use at the moment seems to be in line with that scenario. This site has a lot of knowledgable persons posting but I’m not sure there are experts in those two aspects here. I think also that the IPCC models specifically excluded a lot of positive feedback loops so the coal use could be looked at as a proxy source of greenhouse gases from. for example, permafrost melt leading to vegetation decay or hydrate release.

Hi A Yeats,

The key concern is how much coal gets extracted and burned. There is much less coal that will be extracted than many realize. Rutledge estimates about 700 Gt and Steve Mohr’s best estimate is about 1000 Gt, so again the RCP 8.5 falls down there as well. With a well thought out supply and demand model, even Steve Mohr’s very optimistic(or pessimistic if one cares about the planet) case 3 does not come close to the RCP 8.5 scenario (case 3 coal estimate is 1400 Gt or about 2 times the David Rutledge estimate and case 2 is about 1000 Gt coal).

See fig 8.11 on page 155 of the thesis chart A showing 12 of 40 IPCC scenarios from AR4 compared with 9 scenarios from Mohr’s thesis, note that Mohr only chose the IPPC scenarios with less than 105 Gboe/y output in 2100 (the lower scenarios) for comparison.

From the paper on the RCP 8.5 at the link below (page 12 fig 4) the output of primary energy in 2100 is 1700 EJ/y (296 Gboe/y).

http://link.springer.com/article/10.1007%2Fs10584-011-0149-y#page-1

Nearly all of this is fossil fuels in this scenario. In Steve Mohr’s more reasonable case 3 (which is still very high), the peak of fossil fuel output is less than 600 EJ/y (105 Gboe/y), Gboe is a billion barrels of oil equivalent.

Mohr excluded scenarios like RCP8.5 because they are so far fetched. Chart below.

Yes, I think this forum is onto something big. The IPCC is clearly a communist conspiracy. The cited link for the energy scenario we are discussing is —-

WEC (2007) 2007 Survey of Energy Resources, World Energy Council, London W1B 5LT, United Kingdom, ISBN: 0 946121 26 5

I have traced this to the World Energy Council at http://www.worldenergy.org/ which is clearly a communist group.

it gets worse. The WEC was apparently started by a Scotsman!

That link you show has no data. Furthermore the World Energy Council, even in their most drug addled dreams , wouldn’t back up the IPCC figures. So far all I get is bullshit.

WEC (2007) 2007 Survey of Energy Resources, World Energy Council, London W1B 5LT, United Kingdom, ISBN: 0 946121 26 5

http://ny.whlib.ac.cn/pdf/Survey_of_Energy_Resources_2007.pdf

Ok. That’s a 600 page report. Now show us where it supports the IPCC rcp8.5 numbers? As far as I can see it doesn’t.

re “WEC 2007 doesn’t support RCP8.5…”

see, for instance, chapter 4 “Natural Bitumen …” pg 135 (per page numbering, not pdf sheet number).

resources 2.5 Trillion bbls OOIP….

recover 1/3 of that, things start to add up.

(would be an economic and environmental debacle, but is technically possible).

It is terribly annoying they don’t have a summary section.

And this WEC 2007 was only 1 of several references.

Plenty of projections of total liquid fossil fuels in the 3 to 4 trillion boe range.

Technically possible, economically insane.

But that wouldn’t stop the likes of Stephen Harper, Jeb Bush or Tony Abbott from trying.

You don’t show me the link between the WEC report and a quality estimate of extra heavy oil potential. When Dennis discusses the total ultimate oil resources he includes a sound, well reasoned amount of extra heavy (what you call “bitumen”).

Look, there’s no way anybody in their right mind can support the rcp8.5 estimate. I see a lot of rearguard action trying to protect an indefensible figure.

I’m not trying to defend RCP8.5, I don’t know enough to be able to, but the objections given to it above are incorrect. The reason for generating the scenarios is given by IPCC as being to engender debate amongst modellers and those looking at the consequences and I think they have succeeded in that (although some deniers’ non-evidential rants might be stretching the term ‘debate’ a bit). However I don’t see much real action of any kind at government levels being taken as a result of these models, so the debate is just an academic exercise. There is action being taken that will mitigate some climate change but really it’s more from private companies and often based on weather events over very recent history, and for renewables is difficult to know whether the drive is from knowledge of global warming or because of fears due to fossil fuel shortages.

I also think if the feed back mechanisms that can generate non fossil fuel greenhouse gases in great volumes do kick in then RCP8.5 might be seen as an underestimate.

On coal use – do you think it will all stay in the ground if it come to the point of people knifing each other in gas lines in Baltimore, or perpetual rolling black outs through southern and eastern Europe, or China fighting USA, probably by Proxy, for some oil in Venezuela or Africa?

If IPCC is planning to update these maybe the next set we will be more representative of current knowledge (or at least that from five years previously as that seems to be the cycle time required).

Good comment, thanks.

Evidently you don’t know anything about RCP8.5, nor do you understand how it is used and mislabeled? Sounds like you got a case of ignorance coupled to an urgency to defend something you don’t know anything about. What is driving you? Religious faith?

Hi A Yeats,

If you were referring to my comment, it would be clearer if you said hi dennis. What objection is incorrect?

You should take a look at Steve Mohr’s PhD Thesis or the summary presented at the Oil Drum. Do you think his thesis was incorrect?

If you do not think fossil fuels will ever peak and the musings of Michael Lynch and Daniel Yergin on the unlimited nature of fossil fuel resources are correct, then the RCP8.5 makes perfect sense.

The simple point is if you think that fossil fuel resources are limited, you cannot also believe that the RCP8.5 scenario is reasonable.

Also note that the melting methane hydrates scenario is not a mainstream climate science view, that might happen in a worst case scenario in 2400, but it should not really be a part of serious discussions. Read Real Climate for the mainstream view.

Also note that the melting methane hydrates scenario is not a mainstream climate science view,…

Where in God’s name did you ever get that idea?

Scholarly articles for arctic methane hydrate emissions

And this is just one of the dozens of scholarly articles, but it is a very important one:

Seven facts you need to know about the Arctic methane timebomb

And this one: PRESS CONFERENCE ANNOUNCEMENT

Arctic Methane Emergency Group

I could post literally dozes of such articles. Methane release is starting to get the attention of just about everyone in climatology these days.

The melting of methane hydrates is a very mainstream view. You are behind on your climate science Dennis. You should try to catch up.

Ron,

I very much share your concerns and I very much have been tracking some of the science on methane hydrates. However, as a report on mainstream climate science concerns Dennis is right. The IPCC reports have a passing nod to the issue but indicate that there is no evidence at this time to suggest this is major concern. I consider this quite astonishing. Frankly, I don’t see how we can expect the mass of carbon in the Arctic to stay in the permafrost or in the shallower areas of the Arctic Ocean. I have been telling my friends that the IPCC review process seems to be broken.

The comments made by Dennis , Ron, and Don just above are perfect examples of the problems associated with the ” go along to get along” meme in any large bureaucratically controlled organization.

The modeling which is most commonly(actually almost exclusively ) cited in the msm assumes fossil fuel use which is unrealistic. The lack of inclusion of huge methane releases in the Arctic is equally unrealistic although the reasons for this lack are more justifiable. Adding a lot of methane into the climate cake in the oven is PERHAPS NOT YET justified by an adequate amount of data.

It is not the SCIENCE ITSELF that is at fault but rather the way it is being reported and manipulated by both the environmental camp AND the fossil fuel camp.

Of course you must sometimes fight fire with fire.This means oversimplifying cherry picking data to get the message out in a sound bite world inhabited by tailless monkeys.

Here is a link to a WSJ piece by a guy who works at IHS.

There is a lot of very good commentary in it regarding the international political situation as it relates to oil supplies but he manages to very skillfully avoid mentioning the frack log back up of wells drilled but not yet completed which according to the opinion of the folks in this forum has a hell of a lot to do with tight oil production holding up so well in the face of the low price.

It seems totally unrealistic to me to think that the tight oil industry can reduce costs as fast as this fellow predicts.

http://www.wsj.com/articles/whats-giving-the-world-oil-market-the-jitters-1436569628

Whereas the things he does say are apparently or obviously true, the things he does not mention are elephants in the living room- things such as hedged prices, the back log of wells awaiting production etc.

In order to read this article you may have to access it thru google news or some other trick to penetrate the paywall.

I found many articles on the web about methane hydrate release. Some regarded it as serious but not catastrophic. Others had a different position.

Emerging Methane Sources: A Bang or Whimper?

Will continued warming of Arctic regions destabilize permafrost and methane hydrates rapidly increasing global atmospheric methane that results in a catastrophic climate change emergency? These risks are currently described in two different guises, with unconventional gas as persistent and gradually unfolding threat and Arctic rapid warming and release of methane as a low-probability event that could in an instant change everything. Current research is far from answering the question of whether these emerging methane sources will lead to a climate change bang or whimper.

The jury is still out but mainstream science is seriously looking at the problem.

I can post dozens of articles about aliens landing at Roswell

I am reply to Ron’s comment “The jury is still out but mainstream science is seriously looking at the problem.” Frankly the science effort seems so profoundly lame that I would suggest that it cannot be considered to be serious. I see little effort even to discern if the atmospheric methane is coming from the permafrost or ocean hydrates. There is a hypothetical mechanism suggested that bacteria could eat the methane from the permafrost and thus significantly mitigate the risk. Well if we are betting the future of humanity on this possibility wouldn’t it be good to actually test this hypothesis? I don’t see this effort. I don’t know if the lack of science comes from lack of funding or the lack of scientists who are willing to work in the far north. However, if we are going to be serious about the science we need to do the required work.

It’s not a “hypothesis”. Methane is edible. If we look at shallow land cores (I have), we can see a layer full of frozen organic material which will gradually thaw out. Our estimates range down to an additional 2.5 meters beyond the current thaw layer, but this thawing effect takes place over decades to centuries.

As the layer thaws there’s bacterial activity, similar to a rice paddy or a garbage dump. These bacteria generate methane and the methane in turn has to work its way through the soil. The process allows some bacterial feeding on the methane, and methane which does escape turns into co2 within years.

I think the key is to remember that as the thawing penetrates deeper the overlying layer gets thicker. The deeper permafrost can be several hundred meters thick, but that’s just too deep to be impacted very fast. And this is why this is considered something to watch but not a critical issue. The methane hydrates below 200 meters water depth are a bigger problem.

However I don’t see much real action of any kind at government levels being taken as a result of these models, so the debate is just an academic exercise.

That one reason I have not been persuaded that a certain set of numbers have been published for political reasons.

Claiming climate scientists have a political agenda strikes me as relevant as saying scientists who investigate the origins of the universe are doing so BECAUSE they want to undermine the Bible.

Also, if we won’t reach the RCP 8.5 scenario because we either willingly reduce CO2 production or because we are forced to do so as supplies run low. what’s the difference?

So I don’t see the point in protesting the RCP 8.5 scenario as a political concoction.

If it isn’t going to happen because of reduced CO2 (however it might be achieved), that’s a good thing right?

Oh, so I identify a weakness used to justify irrational actions and I’m supposed to drop it because the weak case is so far fetched the whole thing doesn’t matter?

I happen to think the flawed case continues to be used as a political weapon, and given the nature of such politics I’ll keep bringing it up.