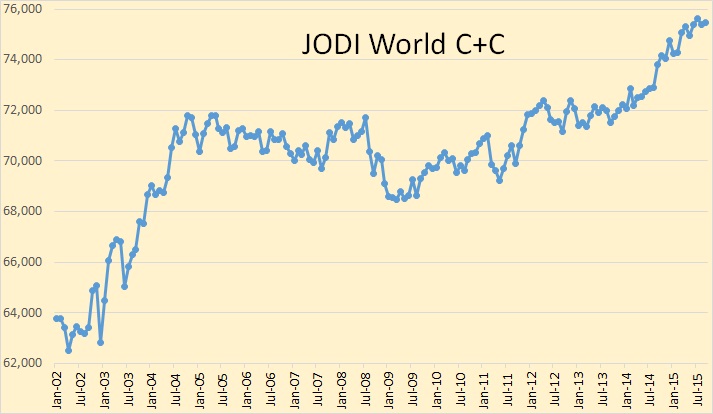

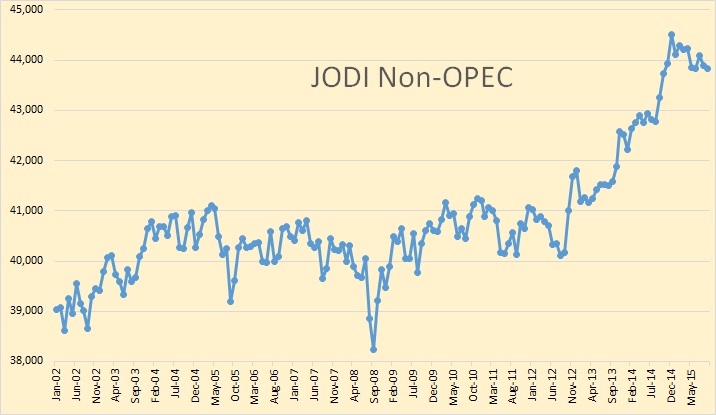

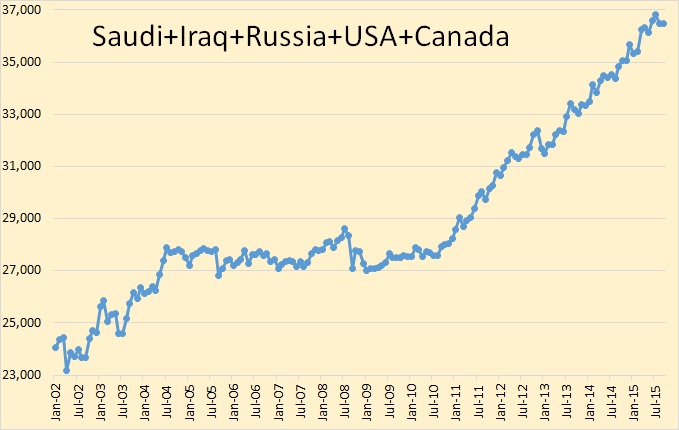

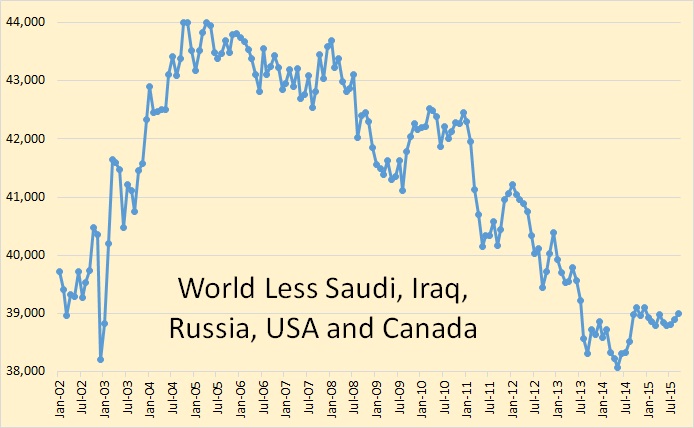

All charts below were created with data from JODI, the EIA and OPEC MOMR. It is in thousand barrels per day and the last data point is September 2015.

World crude oil production has taken off during the last two years due primarily to US shale oil production and higher output from OPEC. However very high oil prices has enabled many other countries to increase drilling rigs and production.

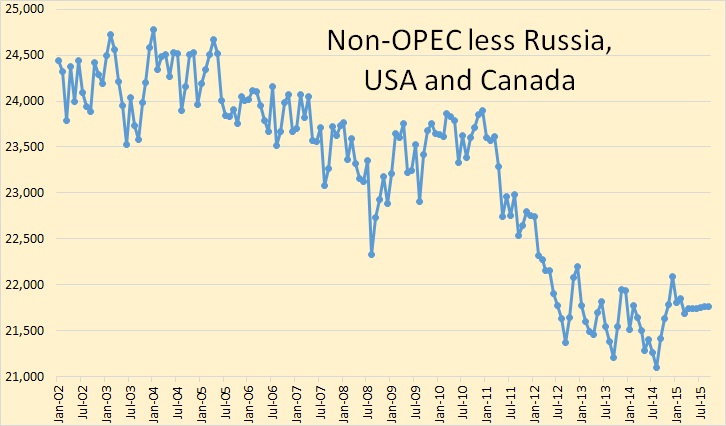

Low oil prices are having an effect on Non-OPEC oil production though not nearly as much as a lot of people thought they would, and not nearly as soon either.

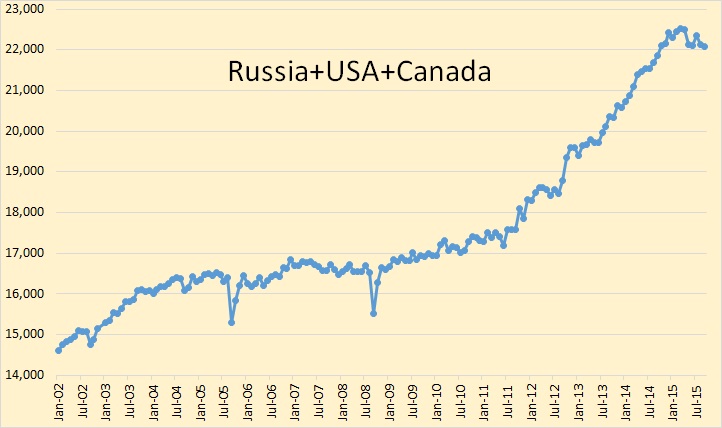

Five nations, Saudi Arabia, Iraq, Russia, USA and Canada, have been responsible for way more than 100 percent of the increase in oil production in the last decade.

The world less the five nations charted above is down 5,000,000 barrels per day since 2005. This decline is despite the fact that oil prices, during much of that time, has been above $100 a barrel.

A look at the Non-OPEC segment of this group.

The combined production of these three nations peaked in March and is down 431,000 bpd since then, back to basically where they were in October 2014.

There is little doubt, given that oil prices are where they are, that the rest of non-OPEC will continue to decline. Though they have been relatively flat for seven months now, I expect them to head down sharply in the fourth quarter and next year.

We have already discussed Russia and the USA. Just about everyone expects the USA to drop sharply next year but many believe Russia will stay flat for the next two decades. That is not my opinion of course but at least these folks don’t expect much, if any, increase in Russian crude production.

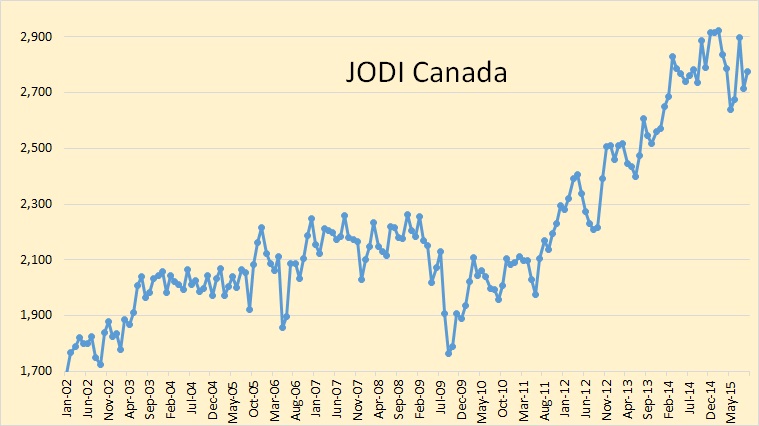

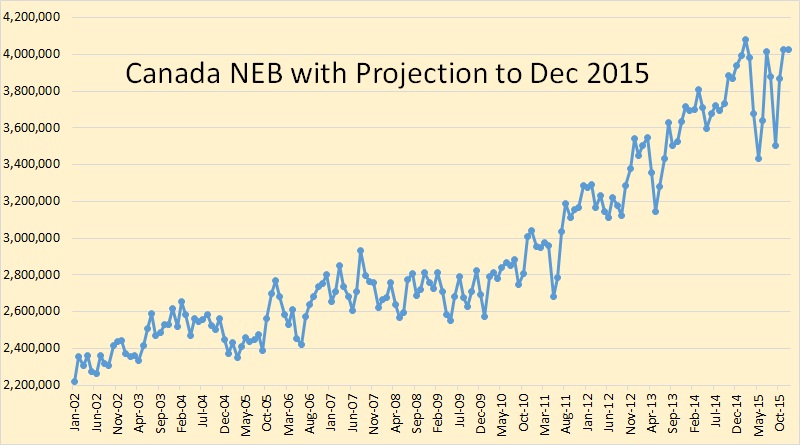

But what about Canada?

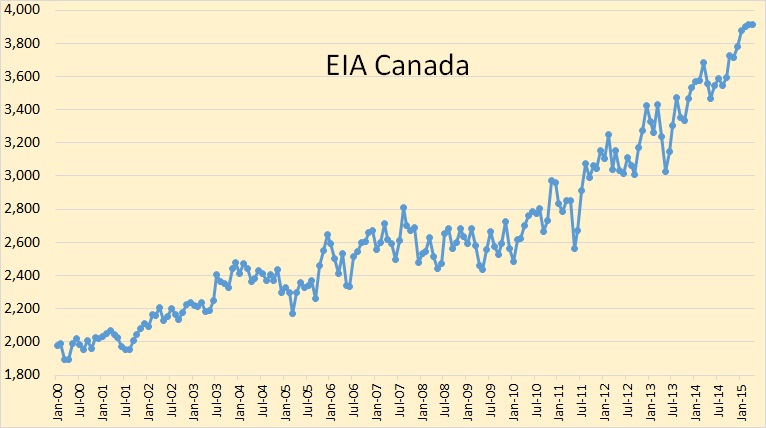

The below is EIA Canada. The data is only through April 2015.

I have inserted Canada’s total oil production according to Canada’s National Energy Board. The data is through December 2015 with the last few months being mostly projections. The peak month, so far, is February 2015.

A lot of prognosticators expect Canada to massively increase production during the next couple of decades. I don’t. Notice that Canada’s production started to stall in April 2014, well before prices started to fall.

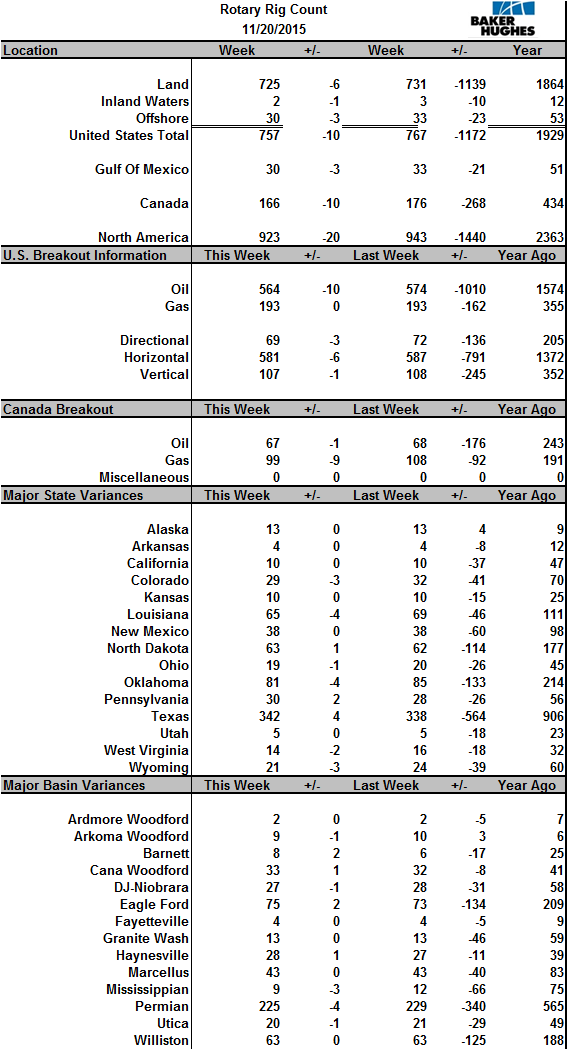

Canada’s rig count has fallen by about 60 percent and capex has declined considerably in the oil sands. I expect Canadian production to decline and even if prices return to $70 a barrel, (they ain’t going much higher than that,) it will still be years before Canadian production reaches 4 million barrels per day, if it ever does.

Production decline, throughout the world, seems to be lagging the rig count by about one year. This should not be a surprise because this is historically the norm, whether rig count is increasing or decreasing. But a lot of people seems to have expected the decline a lot sooner. And that includes Lukoil Vice President Leonid Fedun. The below article was written in March.

Lukoil predicts 8 pct Russian oil output decline in next two years

* Lukoil’s Fedun says drilling to drop steeply in Russia

* Refining hit by new tax changes, some refineries to close

* Sees oil prices returning to $80-$100/bbl by year end

By Dmitry Zhdannikov

LONDON, March 3 Russian oil output is expected to fall 8 percent in the next two years, the steepest fall since President Vladimir Putin took power at the end of 1990s, as low prices force companies to cut back on drilling in Siberia, a top Russian oil executive said.

Leonid Fedun, vice-president and a large shareholder in Russia’s top private oil firm Lukoil, said the drop could amount to as much as 800,000 barrels per day (bpd) by the end of 2016.

His forecast is one of the most pessimistic yet by a Russian oil executive since the country was hit by sanctions and a steep drop in oil prices.

By contrast, the energy ministry expects Russian output to be steady this year at around 10.56-10.60 million bpd. Oil and gas sales account for half of Russia’s budget revenue.

Russian oil output halved in the 1990s following the collapse of the Soviet Union but has recovered by more than 70 percent on the back of high oil prices since Putin took over as president in 1999. Russia is the world’s largest oil producer.

Sanctions imposed on the country over its role in the Ukraine crisis have drastically limited Russian firms’ access to Western capital and technology over the past year while low oil prices are forcing them to slash exploration budgets.

“Everyone will reduce production because everyone is reducing drilling,” Fedun said. He said he expected drilling in Siberia to drop by as much as 15-20 percent.

Fedun said Lukoil’s output was likely to stay flat or drop slightly in 2015 as the company was drilling fewer wells in Siberia. In 2016, it could recover as it brings new fields in Russia on-stream, he said.

$100 PER BARREL AGAIN

Fedun said he saw oil prices returning to $80 per barrel or even $100 by the end of the year as production around the world was set to drop due to lower drilling activity.

“We are seeing a decline in drilling rigs in the United States. We see this happening in Russia … Latin America is also actively cutting drilling and in Nigeria we expect production to decline significantly. These are also difficult times for the North Sea,” he said.

“In the second half of the year, we can confidently say we will see oil surpluses in storage and production beginning to disappear”.

Fedun also said he expected U.S. shale oil to deter risky and expensive exploration such as deep water in the decades to come.

Of course Fedun is very wrong concerning the price of oil. It shows no signs of recovering any time soon and most definitely it will not recover very much by year’s end. And I think Russian oil production will not decline as fast as he predicts. However on that count he is wrong only in the fact that he is too early with his prediction.

Unless oil goes above $100 soon then I must conclude that the USA has peaked. Ditto for Canada. Russia has peaked regardless of what oil prices do. Ditto for Saudi Arabia. The only one I am not so sure of is Iraq. But they have serious political problems and my prognosis is that they have far more downside potential than upside potential.

The political situation in North Africa and the Middle East will get a lot worse before it gets better. That could prove to be very bad for many Middle East and North Africa oil producers.

I am more convinced than ever that 2015 will be the final peak in world oil production. And we may know well before a lot of people realize. It all depends on the decline rate… and on the state of the economy… and on the political situation in MENA… an on…

Ther Baker Hughes Rig Count is out. Another big drop in US Rigs.

Ron, why can’t oil soar above $100 if the production lag from dropping rig counts turns sharply lower?

It can John. What we are talking about here is what is most likely to happen, not what possibly can happen.

Hi Ron,

The question then would be, is a severe recession lasting 10 years (or perhaps forever) the most likely scenario? I think your answer would be yes. I would say it is highly unlikely until we have high oil prices coinciding with peak output. That is when we will truly know that we have reached peak oil. The current peak in World C+C output (probably the 12 months ending in June or July 2015,) is likely to be surpassed when oil prices rise above $100/b. I think it most likely that will occur by at least mid 2019, and my best WAG is 2018 for oil prices (in 2015$) climbing above $100/b (12 month average price).

Of course, I rarely get oil prices right, perhaps Heinrich Leopold could give us his current guess for future oil prices.

Dennis, I think we have a different idea about what the economic future holds for the world. No, I do not expect a severe recession to suddenly happen. What I do expect is for things to get gradually worse as time passes. After all they have gotten gradually worse since 2008. I see no reason to be optimistic and believe things will turn around.

I am sure neither of us expect peace to break out all over the world any time soon but what I expect is for the situation to get gradually worse, as it has for the last several years.

Dennis, all I am really expecting is for the economic situation to get gradually worse, for the terrorist situation to get gradually worse, for the Arab Spring to intensify and for the turmoil to get gradually worse…. as it has for the past several years.

So yes, I see the above scenario as, by far, the most likely.

Hi Ron,

I think things tend to go in cycles. They get worse, then they get better, rinse and repeat. Pretty much the story throughout human history, no guarantee it will continue. The idea that things will get gradually worse forever, I don’t buy it.

Dennis, if this is a cycle it is the very first cycle of its kind. There has never been a time in history like today. China has built hundreds of ghost cities, almost all empty. They have 65 million empty apartments that the average Chinese will never be able to afford. That cycle has never happened before. Over the last few years their stock market tripled, now it is crashing. That cycle has never happened before.

Total US National debt is 18 trillion… and climbing. That cycle has never happened before.

The Arab Spring is not a cycle, it just gets worse every year.

World population is at 7.3 billion. That has never happened before. The population is increasing by 82,000,000 per year. That is not a cycle, it just keeps going up.

The number of failed states is increasing each year. They now number about 25, depending on your definition of a failed state. Yemen just became a member of that group. This is not a cycle, it has never happened before in such numbers. And in the last two decades no failed state has become “un-failed”. Their number will likely only increase.

I have no idea what you are not buying, but if you think the situation the world is in right now is just some kind of cycle then you have just not been keeping up with the situation.

Hi Ron,

I believe part of your alarm about what you see going on around you is not because it’s new stuff, but because of the information age. Most of the things you list are not new. The debt has always been at record level. The population has always been bigger than the year before. Poor failed states aren’t new either. Before Bush opened up Pandora’s box there was plenty of killing in the Middle East. It just wasn’t in our face like it is today.

Fifth teen years ago, you read the local newspaper with mostly local news and got the 6 o’clock nightly news. The rest of the world was out of sight and mind.

Now I’m not saying there aren’t a lot of big problems that aren’t getting bigger. I’m just saying, this shit has been going on a long time and will go on a lot longer.

Hi Ron,

Things have gotten worse better, worse, better over time.

That is the cycle I am talking about. On population, it will peak and decline. The old models that proposed an eventual stable total fertility ratio(TFR) of 2.1 are likely incorrect, based on what some demographers think. I do not know the field well enough to know what the mainstream view is, but many countries have gone below 2.1 for total fertility (in fact more than half the World’s population lives in nations with TFR less than 2.1 (excluding the population of the People’s Republic of China). The average TFR for these counties is under 1.7.

If the rest of the World (with higher TFR) follows the past trajectory of the now low TFR countries, population will peak around 2050 and then begin to decline.

There are good things happening in the World along with the bad, you choose to focus on the negative. I believe my view, which sees both the good and the bad, is more balanced and more realistic. Time will tell.

The number of failed states is increasing each year.

Ron,

what you’re calling a “failed state” is nothing new. The remarkable thing is how many countries are doing better than that.

Have you ever read A Tale of Two Cities?? Go back and read the first few pages, and be reminded of how much England of two centuries ago sounds like Yemen now.

DC wrote:

“I think things tend to go in cycles. They get worse, then they get better, rinse and repeat.”

The US has kept interest rates at Zero for the past 7 years. This isn’t by any means just another “cycle”. We would have been in a long term depression if it wasn’t for ZIRP and QE.

The world is now going to the Japan economic model which has been in a permanent decline since 1989 with some short term blips. For the past 7 years its been the Emerging Market Debt bubble that has propped up the global economy. However the EM debt cycle is reached its peak. The West (EU, US) had been helped as Emerging Market consumers bought western made products (Heavy machinery, cars, trucks, etc).

I think we will see another rise of Military Keynesium as major powers turn to extreme methods to prop up their economies. I see a military build up in China as it civilian economic bubble pops. Other nations will match China’s (Japan, India, US, EU, etc). We been through this in the pre-WW1 era through the WW2 era.

I don’t think military Keynesianism will work this time.

The planet simply does not have sufficient natural resourses to sustain another round of growth (which brings those debt to GDP ratios back in line) like that which followed in the wake of WWII.

This, of course, will not prevent the world powers from trying it.

things… have gotten gradually worse since 2008.

What makes you say that?? Check the chart (overall GWP growth from 2008 through 2015, as well as an estimate for 2016, according to the International Monetary Fund (IMF)’s World Economic Outlook database. )

Need to plot that against a growth in Debt. Global debt has been increasing about 10 times world growth. Without the expansion of debt there would have been no growth and a global retraction (ie depression).

The Debt growth cycle has reached its peak as all of the emerging markets have peaked and now will be forced to pay back trillions in borrowed money (which they do not have).

Remember, that debt based growth creates short term demand at the expense of future demand, since debt has to be paid back causing consumption of fall as more cash flow is used to service the debt.

FWIW: The world is now in a recession, You can see it in all of the commodities (base metals, energy, even some grain foods). Unless the central banks collectivity start printing money and make it more ready accessible to consumers the global economy will be heading towards a deep recession or depression.

debt based growth creates short term demand at the expense of future demand, since debt has to be paid back causing consumption of fall as more cash flow is used to service the debt.

Uhhmmm…..who is the debt paid back to? This is the whole world we’re talking about. For every debtor there’s a creditor who’s receiving income. That means the net impact on consumption is different. It’s not quite zero: if the income is being reallocated to wealthier people who don’t have as high a propensity to consume, it might hurt. OTOH, KSA is certainly consuming all of it’s oil income AND it’s creditor income right now…

Have you read “This Time Is Different – 8 Centuries of Financial Folly”??

“For every debtor there’s a creditor who’s receiving income. That means the net impact on consumption is different.”

Sorry Nick, Its “NOT Different this time”. Unsustainable debt will not be paid back. The Creditors will be losing their shirts as defaults unfold.

Nick Wrote:

“It’s not quite zero: if the income is being reallocated to wealthier ”

Actually most of the money originates from the middle class savings from pension plans, insurance funds, etc. All the OPM has been spent into mal-investments. The Rich just play with OPM, by leveraging it into investments and collecting fees and 2% of the paper profits. Its very easy to get into a high risk investments and show paper profits. Liquidating investments is not so easy.

So, have you read the book (“This Time Is Different – 8 Centuries of Financial Folly”)???

Dennis My guess is, the price drop, in commodities across the board, will, with time, make for a lot less usage for oil. Mining, transport, steel mills, construction, etc. are all taking a hit. China “Imports plunged 18.8% year-over-year to $130.8 billion, after a 20.4% cliff-dive in September, the 12th month in a row of declines. This isn’t weak global demand, but a swoon in demand in China. Part of the plunge is due to falling commodity prices and weak demand for commodities in China. But even then: for the first three quarters of the year, import volume, which eliminates prices as a factor, was down 4%.”

” And now Maersk CEO Nils Smedegaard Andersen told Bloomberg, “We believe that global growth is slowing down,” and is worse than forecast by the IMF and others, as trade is “significantly weaker than it normally would be under the growth forecasts we see.””

And just as in the shale business, we also have overproduction/malinvestments in copper, due to QE money. http://wolfstreet.com/2015/11/11/what-copper-just-said-about-china/

Even US freight not counting commodities droped 5.3% y/y in Oct.

http://wolfstreet.com/2015/11/12/us-freight-plummets-worst-october-since-2011/

Bottom line is; it is taking so much energy to extract, refine, and deliver oil these days that there is little energy left to power the economy, and the monetary policies of our time have financed the producers but done little for the majority of consumers, so that the consumers can not increase income, while expenses like housing, insurance, and healthcare keep increasing. So the consumers end up buying less stuff, and stuff is manufactured, delivered, and often made from, oil.

Hi Farmboy,

Bottom line is; it is taking so much energy to extract, refine, and deliver oil these days that there is little energy left to power the economy…

As long as the oil produced and sold has the same energy per gallon as it has had in the past (about 124,000 BTU/gallon for gasoline), the fuel will be as useful as it has been in the past.

The fall in commodities is due to an overvalued Yuan hurting Chinese manufacturers.

Money is not the same thing as resources, either physical or human. The commies understood that much, at least, which is more than quite a lot of people in this forum understand.

There is no doubt in my mind that most of the debt in this world will never be repaid, except in sharply depreciated money, which essentially means the same thing as partial default.

When debts are not repaid, the true effect, first, is that the people who do not repay them have IN EFFECT “EARNED” or made a lot of money, and the people who don’t get paid in effect made bad investments, just as they could have made bad investments in the stock market.

The quantity of ACTUAL PHYSICAL and HUMAN RESOURCES does not change appreciably, unless the resulting shit storm escalates to war, or the resulting economic depression is so deep that people retire, etc, without new people coming into their trade or profession.

Defaults large and small, from the fifty I recently loaned to a dead beat so called friend to entire national debts, are historically as common as ants at a picnic.I HAVE a copy of “This Time It’s Different” around here someplace.

(That so called friend will probably never repay me.It is well established farmer wisdom that a very effective and economical way to get rid of less than desirable relatives and so called friends is to loan them a modest amount of money. They have a way of disappearing from your life for as little as fifty bucks, which can be money extremely well SPENT. I will not be bothered with this fellow again, wanting to borrow more money,or tools, or anything else. )

Defaults on a large scale result in troubles such as major economic depressions, which can and sometimes do escalate to outright war between debtors and lenders, right up to the nation state level. But unless the depression lasts so long (it can and does happen this way ) that people lose their trades and professions , IN THE LAST ANALYSIS, the quantity of physical and human resources remains about the same as before the default.

Money is merely an extremely useful tool, but not one that actually does anything except as act as a medium allowing people and resources to be used efficiently.

The deadbeat I loaned the fifty in effect made or earned or got that fifty as a gift. I lost it as a bad investment. The ownership of fifty dollars worth of real resources changed hands, the quanity of real resources existing in the world did not change.

SO- DEBT might kill us, the same way enemy bullets might in a gunfight, or a contagious disease might kill us. . But there is a significant possibility, on average, of surviving a gun fight, and with a little luck, you don’t catch the disease, and if you do, you may still live over it.

The people who are SURE debt is going to bring down the world economy are not on entirely solid ground. I am not saying debt won’t be the straw that breaks the camels back, by any means, but rather that the camel might live.

Confidence always returns,eventually, and money is always eventually available for the lending, after a default, at any level.

Sometimes nations that are in desperate economic straits and flat broke, according to the usual standards,and unable to borrow a dime, nevertheless manage to pull off economic miracles. Confidence is the key, not electrons.

I won’t name the best example so as not to encourage somebody to call me a XXXX.

“As long as the oil produced and sold has the same energy per gallon as it has had in the past (about 124,000 BTU/gallon for gasoline), the fuel will be as useful as it has been in the past.”

Of course, I agree, A gallon of gasoline is the same as any other gallon past or future. The problem is, that the percentage of the population involved in producing petroleum products needs to keep on increasing. So that means we have less people to put this fuel to good use and with time they are no longer able to pay the prices that they could at one time.

Its like having an increasing portion of the population, busy building the pyramids. while less and less people are employed in supplying the necessities of life. In both examples, the total population becomes poorer and poorer. Printing money will not help any in the medium let alone the long term.

Hi Farmboy,

More inputs will need to be allocated to produce energy (labor, natural resources, and capital) and the cost to produce the energy will increase. The economy will over the long term shift to the cheaper sources of energy and if externalities are taxed appropriately we will gradually shift away from oil , coal, and natural gas.

In addition as energy becomes more expensive we will use it more efficiently.

Heck, EVs use 1/3 as many joules as ICEs.

And Passive Houses require no joules at all.

Dennis,

I have just seen that you have cited my name in your post. If you really want my opinion, I can only say that US production has to come down significantly until oil prices can rise in the short term. Legacy decline in Eagle Ford stands at 149 kb/d and at 84 kb/d and month in the Bakken. So this makes for Bakken Eagle Ford and Bakken alone 250 kb/d and month, which is annualized 3 millb/d of decline and year. Of course production from new wells, which is around 120 kb/d and month compensates somehow for the slowdown yet new well production slows down very sharply as long as oil prices stay low. So, if shale companies are wise, they cut production as much as possible and start production again when prices are high. If shale companies choose to produce as much as possible, an oil price rise will take much longer. In my view shale production is only sustainable at much higher prices as decline rates are very high. Recently Marcellus has reached a decline rate of 50%, which means current capacity has to re-drilled every two years. Overall US producers have to drill 3mill b/d (or 18 bcf/d of natural gas) of oil equivalent in natural gas and 3 mill b/d of oil every year to compensate for an overall decline of 6 mill b/d per year. Total world decline is the same, although total world production is four times higher. So this is a significant competitive disadvantage for US producers. It will cost US producers and investors astronomic amount of resources to wait until the worldwide low cost production expires. So, it is in my view better to cut production now and produce the remaining resources when prices are much higher.

Hi Heinrich,

I was wondering about your oil price prediction (and looking for a number and date).

The legacy decline is not fixed, as fewer new wells are drilled its absolute value will become smaller. This is a fact which you seem not to grasp. I have shown in several ways that a 3 million barrel per day decrease in US output by the end of 2016 is virtually impossible.

The only exception might be a financial crisis in the interim on the level of 2008/2009, even in that case, US C+C output will be likely to remain above 6 Mb/d through the end of 2016. Maybe WW3 would do it though.

I will give up trying to explain it further.

Dennis,

Yes, the decline rate will go down when production goes down, yet the percentage of the decline towards the total remaining production is actually still growing. So the real decline will probably be a little bit slower compared to a linear decline, yet just a few months. The decline of production from new wells is already -50% yoy and soon trending to zero growth from new wells. So, the decline is luckily accelerating. It is not possible to give an exact date for an oil price rise as this depends from the behavior of the players in the market. If shale players stop production from new wells, US production will be at least 2 mill b/d lower by the end of 2016 and then the oil price can rise, very likely sharply. In 2016 conventional production will fall as well, so the decline could be higher than 3mill b/d. If producer fight on it will take at least until 2020. Shale players can survive lower production if they do not invest in new drilling and serve debt from existing production.

I have also copied your statements and I will remind you and show you your comments again by end of 2016. So far , my statements have been spot on about the oil price. Beginning of 2015 I have warned you to accumulate UWTI. The value of this investment is now down manifold. In spring 2015 you have predicted an oil price of over 70 USD per barrel in September and over 80 USD per barrel in November 2015. I have reminded you in October 2015 about your wrong predictions when new predictions came out (some oil veteran experts predicted oil far above 80 USD per barrel by the end of 2015) and wrote that oil is much more likely to go below 40 USD per barrel than to go to over 80 USD per barrel. Here we are at the end of 2015 and oil is on the brink of falling below 40 USD per barrel. So far all my predictions have been spot on and you were out of everything. I am wondering that you still have the confidence to make such strong statements.

Dennis,

Here is some quote from http://www.resilience.org/stories/2015-11-23/peak-oil-review-2015-Nov-23, which shows that I am not alone in my assessment.

Quote of the Week

“U.S. production is about to have a Wile E. Coyote moment where it literally falls off a cliff. One-hundred-and-twenty-thousand barrels, maybe even next month, will drop off…. The supply and demand mismatch will probably come in 2017.”

Emad Mostaque, analyst with London-based consultancy Ecstrat

Hi Heinrich,

I used similar terminology the other day (Wile E. Coyote) to describe a Minsky moment where everyone runs for the door at once. Even in that case the decline in US C+C output will be no more than 2500 kb/d, and a more likely value would be about 1750 kb/d decline from the peak until Dec 2016 for a worst case scenario.

Also we are in agreement that output in the US will fall and that oil prices will rise in the future.

I just think output will fall by more like 1250 kb/d in the US (from the April 2015 peak to Dec 2016), where you have predicted that US C+C output may fall to under 6 Mb/d by Dec 2016, a fall of 3599 kb/d from the April 2015 peak.

My guess is that this estimate will be off by about a factor of 3.

Hi Heinrich,

I have mentioned that your predictions have been better than mine on the oil price. I thought before that what you are now predicting for 2016, would happen during 2015. I was wrong. Now I may understand better how these boom busts might play out. Your argument that high output wells will be abandoned does not make sense from a financial perspective. The money has already been spent on a producing well, it is a sunk cost. Do you think that most of these LTO focused companies are in a position to shut in a well that is generating cash and wait for higher prices?

Let’s assume your answer is no.

In that case you may expect that all of these companies will go bankrupt and that all (or most) producing wells will be temporarily abandoned. From the big three LTO plays (Bakken, Eagle Ford, and Permian)there is only about 3700 kb/d of output. About 500 kb/d of Permian output is conventional and I have deducted this from “LTO” output. You are suggesting a 3300 kb/d drop in US output by Dec 2016. I will remind you of that prediction which I think will be as good as my oil price predictions in the Spring of 2015.

I notice you have said nothing about price that could be pinned down ( basically you have said they will rise in the future, a pretty bold prediction which I agree with).

So you were almost right (as oil prices are not below $40/b) and I was wondering what your crystal ball says for 2016 as you seem to be clairvoyant.

Dennis, I completely agree with you.

Thanks Enno.

Your Bakken analysis and that of FreddyW, Shallow sand, and of course the master, Mr Likvern are the best analyses that I have seen, much of what I have learned from all of you I try to apply to the Eagle Ford (but the data is much more difficult to collect in Texas), for the Permian I simply have some output data, no information on the number of new wells and such.

Does my WAG of 1000 kb/d to 1500/d decline for the big three plays (B,EF, and P) seem in the ballpark, if prices remain under $60/b for the next 12 months?

Heinrich wrote:

“So, if shale companies are wise, they cut production as much as possible and start production again when prices are high”

They cannot. They owe a collective $300 Billion, and need cash flow to support the debt. The Shale drilling model was never sustainable. It was mostly about drilling for Money on Wall street.

TechGuy,

Shale companies are definitely in a difficult position. However, if they cut production as much as possible they increase the chances for an oil price rise. If they carry on, the situation gets even more difficult. In my view it is possible, that companies could manage the decline in production by serving the debt from existing production and in some cases with the help from banks. The alternative is just a total collision. Probably this is how the system works.

Hi Techguy,

They will not cut producing wells unless they are cash flow negative. Drilling new wells (or even completing wells that have already been drilled) only put them further into debt at this point and eventually more credit will not be available and the game ends.

Maybe by Jan, they may be waiting to see what OPEC does.

Heinrich Leopold Wrote:

“However, if they cut production as much as possible they increase the chances for an oil price rise.”

I don’t think you understand the point I was driving at. They are already losing money, and need every damn penny to service the debt. Cutting production does not cut their debt servicing costs.

For a simple analogy, consider if your trapped in a room with a fire (falling Oil prices). if you cut off the oxygen supply (oil production) the fire will go out, but you’ll also perish since you need oxygen to breath (no cash flow to service the debt).

DC Wrote:

“They will not cut producing wells unless they are cash flow negative.”

They are already been cash flow negative. They been cash flow negative since they started drilling. they used Money from wall street (stocks) for CapEx. When the WallSt. money punchbowl was taken away they turned to the bond market to keep the pumps turned on. Most have turned to the legal loan sharks (aka junk bond market) and are paying yields north of 10% just to keep on breathing.

This is like a home owner who took out a jumbo loan, then a home equity loan, and then leveraged any remaining assets they had to hold on to their home. The home was lost many moons ago, but the homeowner tried to hang onto it hoping for a miracle.

No matter what OPEC does is irrelevant since the Shale drillers are will never recover. Any price increases in energy is own going to cause demand destruction. The reason why Oil prices have fallen so much is because demand is collapsing in the emerging markets. Its not just Oil that has collapsed, but all commodities (Steel, Copper, Cement, lumber). Rising prices would only re-enforce further demand destruction, cause even further price declines a few months later.

FWIW: Icing on the Cake will be if the FED falls through with its “promised” rate hike next month. Although I doubt they will raise. I think we could see Oil in the low 30s sometime in the spring. The situation in the Emerge market is bound to get worse.

Hi Tech guy,

For a producing well the CAPEX is a sunk cost, now the question becomes is the revenue from the oil produced greater than OPEX plus downhole maintenance. For a Bakken well producing 30 b/d or more the answer is yes. So at the well level the well is cash flow positive in the sense that shutting down the well leaves you less cash than continuing production.

CapEx originated from “borrowed” money. Debt needs to be serviced long after the Money was spent. We’ll call it DebtEx 🙂

Current Canadian production is 4.3 million bbl/day. It remains flat with infrastructure in place in the Oil Sands. Drilling is certainly off, for sure. You expect a 25% decline in production?

http://business.financialpost.com/news/energy/canadian-oil-output-hits-record-4-3m-bpd-amid-higher-global-demand

regards

The EIA and JODI have totally different numbers for Canada. I heard the reason for that a few years ago but I cannot recall it now but I think it has something to do with in situ oil sands production. Perhaps someone on the list can enlighten us. I have now posted the EIA chart for Canada as well.

Hi Ron,

It is probably best to use the data from Canada.

https://www.neb-one.gc.ca/nrg/sttstc/crdlndptrlmprdct/stt/stmtdprdctn-eng.html

Data through July (except estimates from BC and NS) and estimates by the NEB for Aug 2015 to Jan 2016 in chart below.

Dennis, I cannot locate a legend on those Excel charts. What is the data in? Not bpd for sure.

Ron,

We’re metric in Canada, but being right smack dab next to our American cousins we’re also out of necessity imperial. The NEB reports in metric tons if I recall. Though they do have some data in barrels too.

Okay thanks. Now how many barrels per ton do you guys get. I would guess that with all that heavy bitumen it is less than 7.

EDIT: Looking back over my old Excel spreadsheets I found where I had something using the Canada NEB files from 2013 and earlier. I used 6.2898 Canadian barrels per ton. I don’t remember where I got that number but to be precise to the fourth decimal point I must have gotten it from somewhere official.

Hi Ron,

There are two sheets in the Excel file, one is in cubic meters and the other is in barrels per day. A conversion from barrels to cubic meters is unaffected by the density if the oil.

It is 6.29 b per cubic meter.

You converted using cubic meter. Last time I visited Calgary we used the term “cubes”.

Thanks Dennis and Fernando. I have a handle on it now. I will convert everything to barrels and insert that into my JODI spreadsheet and use the NEB data from now on.

I only use JODI data when there is nothing better. I have better OPEC data and now I have better Canadian data.

Actually, the legend is at the top (kb/d) stands for kilobarrels/day so this chart shows that they´re hovering between 3.5 – 4 million barrels a day, but they state these numbers are estimates from May on and less than 1 million daily is conventional oil, the rest is “upgraded bitumen, condensate and heavy oil” So, if I get this right, these data from Canada equals to what others report as “total liquids” and 75%-80% of canadian output is unconventional/not oil.

Hi Jorge,

Unconventional oil is still oil, it is crude plus condensate, with most of it being crude.

Note that when oil sands crude is refined into gasoline, it gets my car down the road just as well as gasoline refined from “conventional” crude.

Jeffrey Brown complains that much of C+C is from condensate with API gravity above 45 degrees. That is not a problem with oil sands which is very heavy stuff with API gravity of 10 or less.

I think the OPEC report itself provides the clue to why the Cdn production numbers from the EIA are different than those from Jodi. In the attached OPEC table, US production is shown to be 13.6 Mb/d in Q4-15. This number is composed of C+C+NGPl +processing gains. From this I presume that the Jodi number for Canada could be either C+C or just C.

Hi Paulo,

That is IEA data which is total liquids, the NEB data has C+C at about 4 Mb/d, which suggests that NGL+ Other liquids is about 300 kb/d. I prefer to focus on C+C because it requires less hand waving than trying to estimate crude only.

Thank you.

From the summer of 2004 to the summer of 2008, world oil production (c+c) hovered around 70-72 million barrels a day (mbd). There was a temporary drop afterward during the oil-shock-triggered Great Recession. Production rates elevated after the initial economic shock of 2007-2009, with perhaps a little delay following the second oil shock of 2011, and have reached 74-76 mbd in 2015. That is, roughly speaking, a growth rate of about 5% over a decade. Compare that to the oil production increases in the 1950s and 1960s and the crisis becomes obvious. It seems like an “undulating plateau” has been underway since the 1970s oil shocks, again roughly speaking.

Jeffrey will weigh in here regarding all oil not being the same.

Jeffrey has a point

As I have periodically noted, in my opinion the only reasonable interpretation of the available data is that actual global crude oil production (45 API and lower gravity crude oil) has been approximately flat to down since 2005, while global natural gas production and associated liquids, Condensate & Natural Gas Liquids (NGL), have (so far) continued to increase.

Global Gas, NGL & C+C 2005 to 2013/2014 Rates of Change

(EIA, 2013 for gas, 2014 for other data)

Gas: +2.6%/year

NGL: +2.6%/year

C+C: +0.6%/year

OPEC Gas, NGL & C+C and OPEC Crude Only 2005 to 2013/2014 Rates of Change

(EIA + OPEC, 2013 for gas, 2014 for other data)

Gas: +5.1%/year

NGL: +1.3%/year

C+C: +0.2%/year

OPEC Crude Only Data: -0.2%/year

Implied* Condensate: +8%/year

*EIA C+C less OPEC Crude Only

Link to essay & graphs:

http://peakoilbarrel.com/worldwide-rig-count-dropping-again/comment-page-1/#comment-546170

Hi graywulffe,

I would call it a plateau from 2005, but that is a pretty wide plateau if we include all C+C, if we redefine oil at specific gravities we can probably get any result we want as the data is not very good when you slice and dice too much.

We don’t really know what will happen when oil prices go back to more reasonable levels (above $80/b) and remain at that level or higher for a couple of years. Maybe a 2015 peak will be surpassed, my guess ( a WAG) is that once oil prices increase, output will return to 2015 levels or higher.

My WAGs are probably less informed than Ron’s educated guesses, but I think 2020 to 2030 is a more likely time frame for the final peak.

Don’t sell yourself short Dennis, your knowledge and guesses are probably as good as anyone’s.

I’m an ‘armchair’ peak oil enthusiast – have followed it since 05′ – and my own personal guess is that it will be around about 2020 before the peak occurs. I think the 2015 is a bit premature but it’s impossible to say due to all of the variables it involves.

Ron thinks oil will stay cheap for a long time because he thinks the economy is headed to hell in a hand basket, according to his comments below.

Hi Old Farmer Mac,

I agree. My guess is that Ron is pre-mature on that as well. I think it more likely the economy will do poorly once the true peak is reached, which in my view is when high oil prices (say $150/b in 2015$) can no longer increase output, this may not be until after 2025 ( see my scenarios down thread). Those are just possibilities, nobody knows of course, though my guess is based on a model ( from Webhubbletelescope using Jean Laherrere’s data) and reserve growth similar to that experienced in the US from 1980 to 2005 (2.9% annual reserve growth, prior to the LTO reserve increases which began in 2007). That does not make my guess correct, but makes the assumptions behind it very clear.

OIL 2 BURN.. Ratio of Tanker trucks + Bicycles TO Leaflets + A10’s?

http://www.military.com/daily-news/2015/11/16/us-a10-attack-planes-hit-isis-oil-convoy-crimp-terror-funding.html

After watching the ups and downs of the oil industry over recent decades, I conclude that this is just another up-down cycle. At prices north of $100 a barrel the incentive was for every producer to go full out on exploration/drilling/fracking/tar sands, etc. and the result was an over supplied market, leading to a much lower price. Once the oversupply ebbs, price will rise to a consumer affordability level in the $70-80 dollar range and the oil industry will have regained incentive for new drilling to insure future supply. It won’t be over a hundred to satisfy many countries spend wish lists, but supply-demand will balance out for a while and a new peak will occur in 2016-2018.

Hi Stilgar,

I agree with you, your simple analysis without counting all the drilling and ground holes is most likely spot on or as good of probability as anybody else. I’ll give you a big wet KISS( keep it simple stupid).

“The Energy Report 11/19/2015

Getting Through the Glut

Global oil demand growth is at almost a 20 year high but will it be enough to sop up the extra oil supply.

Global oil demand is up close to 2.0 million barrels a day or 2% growth the fastest pace in 20 years assuming you dismiss demand recovery in the depths of the global financial crisis. Low prices are curing low prices from the demand side of the equation but at what point will it start to impact the supply side? Demand expectations are rising, not only for the rest of this year but next year and 2017 and beyond. Instead of China leading the way the biggest demand growth will instead come from by a rapidly growing India.

In today’s Wall Street Journal Saudi Arabia’s oil minister Ali al-Naimi said, “There is a big drop in the production capacity of oil wells across the world, estimated around four million barrels a day, which means the petroleum industry needs new additional production capacity of around five million barrels a day every year.”

http://www.321energy.com/reports/flynn/current.html

The demand outlook for 2016 is likely to return to long-term trend, as recent downgrades to the macroeconomic outlook and expectations that crude oil prices will not see repeats of the heavy losses of 2015 filter through. Global demand growth is expected to slow from its five-year high, of 1.8 mb/d in 2015, to 1.2 mb/d in 2016.

https://www.iea.org/oilmarketreport/reports/2015/1015/#Demand

It seems that the fall in prices by >50% has increased demand a modest 0.8% for three quarters. It is clear that low oil prices have very little impact on demand. This is like having a huge sale and nobody shows up. Yet somehow, some people see this as a positive.

>>It seems that the fall in prices by >50% has increased demand a modest 0.8% for three quarters. It is clear that low oil prices have very little impact on demand.

I really wouldn’t read too much into that. Oil is not so unusual in that regard – it could laundry detergent. A drop in price of 50% for laundry detergent will not result in a huge increase in demand for laundry detergent in the short term – only more washing machines being sold will. An increase of 50% in the price of laundry detergent will not greatly reduce demand for it either.

Look up credit suisse report which shows China demand. It is up 600,000 barrels a day, YOY.

Did I ever say Chinese oil demand was shrinking? Of course not. China is the single biggest beneficiary of the huge drop in oil prices. It makes perfect sense that demand for oil is increasing in China. If it wasn’t that would indicate something very serious. China is still growing, car sales I believe are still growing – no analysts that I have heard are saying the Chinese economy is shrinking – it is growing at a slower rate than in the past, but still growing. Look for huge growth in Asia in the coming two decades with Chindia at the forefront.

“It seems that the fall in prices by >50% has increased demand a modest 0.8% for three quarters. It is clear that low oil prices have very little impact on demand.”

The fall in oil prices has increased demand growth by 100%, from 0.9mb/d in 2014 to 1.8 mb/d this year, the highest annual increase from 2010.

Oil demand is price-inelastic, so, if you were following the oil market for many years, you should understand that this acceleration is quite significant..

Also note, that global GDP growth this year is slightly slower than in 2014.

Particularly important is a slowdown in China’s economic growth.

Finally,for most countries , oil price decline was mitigated by depreciation of local currencies vs. the dollar

I would agree that it is quite significant if it is long term (for as long as prices remain at <50$), but if it is just for three quarters as predicted, then it is just a small bump in the graph, barely noticeable. A total increase of less than 1 mb/d for a huge drop in price that has created the biggest oil crisis in years, perhaps decades.

For the moment I fail to be impressed.

Javier,

Are you driving much more than a year ago thanks to lower oil prices?

Hardly as I don’t own a car. I get to use my girlfriend’s car whenever I need one, but I wouldn’t use it more than I need to even if oil was free. Collective public transport and a bicycle are my preferred methods of transportation.

I may not buy into the global warming scare, but as a biologist I try to be as eco-friendly as possible.

Hi Javier,

Does your girlfriend drive more because oil prices are lower? Most people’s habits are not affected much by lower prices, over the longer term some people might buy less fuel efficient vehicles due to low fuel prices, but that takes some time.

I know some people drive more due to lower prices. It must be difficult to contemplate for many here, but there are quite a lot of people that run out of money before the month is over and have to drive less because they cannot refill the tank until they get their monthly salary. If fuel is cheaper they get to fill the tank more often or with more fuel.

Hi Javier,

No doubt that happens to some very small degree. The more likely scenario is that the savings on lower fuel expenditures (due to lower fuel prices results in higher demand for other goods and services. There will be a very small bump in fuel demand due to lower fuel prices and a small bump demand for other stuff, some of the money saved on fuel might also be used to pay down debt (which does not increase aggregate demand) or is saved for future demand.

This from NY Times:

When gas prices fall, Americans reliably do two things that don’t make much sense.

They spend more of the windfall on gasoline than they would if the money came from somewhere else.

And they don’t just buy more gasoline. They switch from regular gas to high-octane….

The JPMorgan study compares gas spending between December 2013 and February 2014, when prices averaged $3.31 a gallon, with gas spending by the same people in the same period one year later, when average prices were one dollar lower. The study found that the average American spent $136 per month on gas during the high-price period and $114 per month on gas during the low-price period. While the price of gas fell by roughly 30 percent, spending on gas declined by only 16 percent.

http://www.nytimes.com/2015/10/20/upshot/when-gas-becomes-cheaper-americans-buy-more-expensive-gas.html?_r=1

Hi Javier,

The demand for oil correlates much better with real GDP than the oil price.

Run a simple regression and it is very clear. In the short term the oil price has a minor effect on demand for oil.

“The demand for oil correlates much better with real GDP than the oil price.”

exactly!

“In the short term the oil price has a minor effect on demand for oil”

And this is called low price elasticity of demand

Hi Dennis,

I understand and mostly agree to that since oil is an input, not an end product. And you don’t use more input than you need to to get your end product.

I have two things to add, though. The first is that oil price can and will destroy demand if high enough and in that sense oil price can have a major effect on demand.

The second is that in the link above to the IEA oil market report, it says clearly that:

The demand outlook for 2016 looks markedly softer as… …expectations that crude oil prices will not repeat the heavy declines seen in 2015, filter through.

So it looks like IEA does think as I do that the fall in prices has had something to do with the increase in demand seen in 2015. I got tired of reading how the Chinese were taking advantage of low prices to build up their strategic reserves.

As the new price becomes “permanent” the incentive to buy the cheap oil before prices go up disappears.

Hi Javier,

I didn’t say there was no effect, I said it was minor. I agree 100% that over the long term high oil prices will reduce demand for oil. We will see this mostly as lower demand growth rates as energy is used more efficiently and people move to public transportation, more fuel efficient ICE vehicles, hybrids, plug-in hybrids, and EVs. In addition there may be a move to better designed neighborhoods that are more walkable (to local market, restaurants, pharmacy, etc).

Stilgar wrote:

“After watching the ups and downs of the oil industry over recent decades, I conclude that this is just another up-down cycle. At prices north of $100 a barrel the incentive was for every producer to go full out on exploration/drilling/fracking/tar sands,”

Who is going to afford $100 bbl? Prices in the past was supported by soaring debt. We are likely to see a wave of bankruptcies in the Emerge Markets (EM), and the Energy sector as the Boom/bubble has popped. Lots of investors will lose large fortunes and there will be a lack of investor money to support the a recover in energy.

High prices also cause consumers to cut back spending as they need to spend more money on energy and less money on other goods and services. Its cheap and abundant energy resources that fueled the global economy over the past century. For the past 2 or 3 decades its been cheap debt that has fueled\sustained the global economy, but that cycle is now coming to end, as now the last debt expansion in the Emerging Market (China, India, Brazil, etc) has peaked. The tsunami of debt is coming back home and there is no way the world can afford to pay it back, even at near Zero interest rates.

Thanks for the post Ron.

There was a question 2 posts back about the number of Bakken wells that were producing with a low daily output. The following table shows all producing MB+TF wells, grouped by their daily oil output in September, and also shows their share of water and gas production.

E.g. the # of Bakken wells that were producing less than 50bo/d in September was 29.8% (6.9+22.9), their share of Bakken production was 8.1%, their share in water production was 13.5%, and gas production of 8.2%. The actual totals are listed below (in barrels/MCF for the whole month).

Thank you Enno,

Exactly what I was looking for. If all 695 wells producing 20 b/d or less were shut in output would be 208 kb/d lower. I doubt that wells producing over 30 b/d would be shut in so going up to the 20-50 b/d category would be too extreme in my view.

Just for kicks, it would be a 2400 kb/d drop in output if all wells producing 50 b/d or less were temporarily abandoned. That’s 2873 wells, not a realistic scenario in my view, but I have not been able to get anyone else to venture an opinion.

Heinrich Leopold thinks US C+C output may fall to under 6 Mb/d by Dec 2016 if oil prices remain under $50/b, that is about a 3500 kb/d decrease from the April peak.

So I looked at the Bakken and Eagle Ford with no new wells completed or connected to sales after Sept 2015 until Dec 2016. The decline from the two plays combined would be about 1650 kb/d from April 2015 to Dec 2016. We could throw in a WAG of 700 kb/d decline if no wells are completed in the Permian basin (I have no model for this so very much a WAG) for a 2350 kb/d decline.

Needless to say such a scenario strikes me as very unrealistic.

To get to the 3500 kb/d decrease that Heinrich thinks plausible he suggests producing wells will be abandoned, we might get another 600 kb/d if the Eagle Ford and Permian are similar to the Bakken in numbers of low output horizontal wells.

That would get us close to 6.5 Mb/d.

Maybe I am the only one that thinks this is far fetched.

Dennis,

The oil actuals are in barrels/month, not per day. So you got to divide by 30.

Heinrich has not shown a detailed model to support his extreme forecast.

Hi Enno,

Yes you are correct as usual. Thanks. It is 208 kb/month produced by wells producing 20 b/d or less so 6.95 kb/d. I was off by a factor of 30 too high.

So the 600 kb/d for Bakken, Eagle Ford, and Permian would be about 20 b/d, not very significant.

If we use all wells of 50 b/d or less it would be an 80 kb/d drop for the Bakken/Three Forks and 240 kb/d for all three plays (assuming the Eagle Ford and Permian are similar to the Bakken).

With the correct calculations and using all wells 50 b/d the total decline would be about 360 kb/d less than my original calculation of 600 kb/d for low output wells (which should have been 20 b/d).

In any case, a scenario with no new wells being completed in the Bakken/Three Forks, Eagle Ford, and Permian is not realistic and shutting in all wells producing 50 b/d or less is even less realistic.

A more sensible (but still very pessimistic scenario) would be a US decline of about 1300 kb/d from April 2015 to December 2016, if oil prices remain under $50/b on average over that period.

Dennis, Enno

I have just made an analysis of Marcellus data from the latest EIA drilling report. The EIA drilling report exists just a few years, yet the data revealed an huge change of the legacy decline rate as percentage of the total production. The rate has been moderate in 2013 and went to -50% by 2015. In other words companies have to drill new capacity every two years if they want to keep production flat. This meets exactly my point that monster wells experience also a monster decline after some time. A similar analysis of Utica wells show that Utica has decline rates of below 30%, yet Utica is still in its infancy and the decline rate will follow Marcellus to -50% very soon. In my view this will show up quite soon in the overall production rate, which is just down by 4% year over year. In my opinion I have a point here and time will tell if this evolves accordingly.

Heinrich,

The DPR does not get the legacy decline correctly, the report should be ignored (or at least the legacy decline).

As fewer wells are connected to sales the legacy decline becomes smaller (in absolute value).

Enno. Thanks for the post!

Are you able to break this down further by completion or first production year?

Shallow,

I think the cumulative curves may be a better way to visualize that, as those already show how production progresses over time. Also creating, posting and analyzing the above table for each year since production started is a bit of hassle. I could add the average age in each category? Do you have a suggestion of what you’d like to see and keep it somewhat simple? 🙂

Enno. I didnt realize how much time is involved. I should just break down and pay for the data, lol.

I’m interested in later years. Do wells converge in a narrow range?

Hi shallow sand,

I can send you Enno Peters data file to play with, just let me know, I can find your e-mail so you don’t have to post it here. I assumed that you were already getting this data.

0.004*9641=38, 38 wells producing 1000 bpd and more.

0.023*9641=221, 221 wells producing 500 to 1000 bpd.

259 wells pumping a minimum of 138,000 bpd.

9,382 wells the remainder of the oil produced.

0.108*9641=1041, 1041 wells producing a minimum of 208,000 bpd.

1300 wells producing a minimum of 346,000 bpd. 10,380,000 dollars from 1300 wells.

8,341 wells producing 640,000 bpd, 76 bpd average per well. 76*30=2280 dollars per day, 19,200,000 dollars per day from 8341 wells.

29,580,000 dollars per day from 9641 wells.

Have got to be losing 60 million dollars each day. Shut the 8341 wells producing not much, operate the 1300, but that means job losses and idle wells, so it is more important to have the labor pool on the job, buys stability and provides jobs, even if it is some loss, it still pays.

Sitting at home with nothing to eat doesn’t pay.

Thanks Enno, very interesting information, as always.

Your table shows that the share of wells with very low daily output in total Bakken oil production is insignificant. Given that shutting down wells may cost more than continuing production, I don’t think there will be massive shut downs of producing wells.

Hi AlexS,

I believe you are correct. When the calculation is done correctly (I forgot to divide by 30 days per month) shutting in all wells producing 20 b/d or less amounts to 7 kb/d less output, so relatively insignificant. Most of these wells are probably older wells that have been paid for and as long as revenue is greater than OPEX, royalties, taxes, and G+A (overhead) they will not be abandoned as they are generating cash.

Dennis Coyne says:

Given the financials of the companies which operate in the Bakken which Shallow Sand has so generously provided us — which almost ubiquitously reveal growing debt structure and a failure to generate free cash flow — I wonder about the veracity of that statement.

Perhaps the sunk cost terminology would be easier to defend.

Hi Glenn,

Most of these low output wells are from 2010 and earlier (some probably going back to 1990. During the high price periods most of these wells probably paid out (and on average this is virtually certain). Also these wells were probably much less costly to drill and complete.

However, the sunk cost argument will do as I am not going to sift through data for 9500 wells to back up my argument.

Hasn’t someone done average cumulatives of wells of various vintages drilled in the Bakken?

If so, it would be interesting to do some back-of-the-napkin calculations to see which vintages have achieved payout.

Hi Glenn,

The Average well from 2008 and earlier probably was fine.

It would have produced 228 kb after 7 years, using real oil prices from the EIA real oil prices viewer, the net present value of the oil produced by an average 2008-2014 Bakken well that started producing in June 2008 would be about 10 million 2015 dollars. This assumes an annual discount rate of 10% nominal (7% real rate at 3% inflation rate), 27.5% royalties and taxes, $12/b transport costs, OPEX $4/b, and other costs $4/b. These are similar assumptions to what Rune Likvern has often used.

Some of the lower flowing wells might not have paid out, but many of these wells are probably older than the June 2008 well analyzed above.

Dennis,

Thanks.

Those wells drilled in 2008 probably cost less than $10 million to drill and complete, and land cost would be lower then than now. So it looks like you’re correct, and the average well drilled in 2008 would have payed out by now.

According to the graph Enno Peters posted below in his 10:14 a.m. comment, it looks like the median well drilled in 2008 is still producing 40 BOPD.

Only 20% of the wells drilled in 2008 are currently producing 20 BOPD or less.

The most amazing thing his graph reveals, however, is that production from the better half of the wells has been flat for the past couple of years: I discern no decline at all. That’s remarkable. If that trend continues, these wells may actually have the 40-year lives that their promoters have promised, a claim which I was always highly skeptical of.

Hi Glenn,

That may be true of the better wells, for the average well, it is not really the case.

Keep in mind that Enno filtered out wells that are no longer producing, so the picture is incomplete. I include all wells in the analysis to avoid a positive bias.

Alex,

I think you’re right, and indeed even if that would happen the reduction in output will be quite low. Also, the NDIC seems to be more lenient to operators to just temporarily abandon wells than regulators in other states.

Shallow,

Interesting question. I tried to answer it with the graph below.

The graph shows for each 10% percentile of producing Bakken wells the daily production after x months since first flow. Wells that didn’t have any reported productive day in a month are filtered(!). The 50% percentile is the median well at each moment in the well life cycle. The vertical axis shows the daily production in a logarithmic scale to visualize the differences better.

I removed 2007 wells, as they had a very distorting (negative) effect on this result after 6 years. The last point is after 88 months, when the population still contained > 100 wells.

For example, 70% of the wells produce <= 80 bo/d after 4 years (48 months).

50% of the wells produce <= 40 bo/d after 5.5 years, and then they seem to enter a bit of a steady state.

Hi Enno,

Nice chart thanks.

It is interesting how the high output wells skew the average. For the average well (rather than the median well) for 2008 to 2014 wells, using a hyperbolic model to match the data, the output doesn’t fall to below 40 b/d until 7 years. So a smaller number of higher output wells are making up for a greater number of low output wells.

Thanks very much Enno.

Dennis states what I suspected.

Also, Dennis, see if you can find a post of mine about two Duperow wells Condor had for sale recently. They were early 1980s vintage. The cumulative oil was 300K+. They were now making around 30 bopd gross (15 each). OPEX was over $40, operating at around a $10 per barrel loss in 2015. Yet not shut down.

As discussed many times, lots of reasons to keep producing, even at a loss.

However, ND has a lot of pre LTO boom wells shut in. When I reviewed OAS Bakken TFS, I noticed many of OAS non Bakken TFS wells were shut in. I suspect all were losing at least $10 per bopd. MT, CO and WY sites show the same. Shallow stripper wells are hurting economically, but the deeper are likely worse.

Does anyone know what is happening to those horizontal wells in Saudi Arabia?

Tech Talk – Improving Horizontal Well Flow at Berri and Ghawar

April 2012

http://www.theoildrum.com/node/9143

Tech Talk – Saudi Arabia and Production from Safaniya

June 2012

http://www.theoildrum.com/node/9278

Tech Talk – Saudi Arabia and What Lies Ahead

July 2012

http://www.theoildrum.com/node/9340

Tech Talk – Saudi Arabia Then and Now

July 2012

http://www.theoildrum.com/node/9360

More here:

Articles tagged with “ghawar”

http://www.theoildrum.com/tag/ghawar

http://satelliteoerthedesert.blogspot.com.au/

I don’t know nearly as much about this as you do, but I’m not sure I agree with the assertion that the rest of the world outside of USA, Russia, Canada, Saudi… will suddenly see a steep decline after the last seven or eight months have actually seen a bit of a bounce. The reason I wonder about that is that I assume a lot of these projects that have led to the recent bounce were long lead time projects and that more are still coming on stream that were committed to before the collapse in prices so that it may be a fair bit longer before we see a significant decline in those areas again.

Why do you think the bounce will be so short lived?

Hi Mario,

Good point. I imagine there will be decline while prices remain low, how steep it will be is unknown.

I usually give a wild guess, but I am out of my depth (more so than usual.) 😉

Bounce? I don’t see any bounce. I see lots of ups and downs in the general downward trend. And I would expect to see a lot more as the downward trend continues.

Hi Ron,

He is talking about 2014.

I know what he was talking about Dennis. He was talking about the last hump, or increase in production. There were lots of them but he was only talking about the very last one.

I was talking about the whole chart, or at least the whole downward trend. There are lots of ups and downs. There will very likely be a lot more.

http://www.financialsense.com/contributors/roberto-aguilera/decades-low-oil-prices-shale-boom-global

Ron, Have you read the book this discusses? I doubt we will get a global shale boom at these prices, ever, but do other countries have similar shale resources as US?

No I have not read this book: The Price of Oil

But from your link:

In our recent interview with Roberto Aguilera he explained that the twin technological revolutions of fracking and horizontal drilling, which allowed for a massive explosion in US oil production (see chart above), will inevitably expand to the rest of the world. Given that the US only sits on a small fraction of total shale reserves, ample supplies will be unlocked in countries like Russia, China, Australia, and elsewhere, which in some cases hold much larger deposits.

They expect low oil prices to remain almost forever because of shale oil. But are they missing something, or am I missing something. Production of shale oil exist only because of high oil prices.

Yes, shale oil deposits do exist in other parts of the world. The Bazhenov Shale in Western Siberia for instance. Russia saw that as way too expensive to produce even when oil was above $100 a barrel. Building the infrastructure in such a remote and frozen area would be a daunting task.

I just don’t see shale oil as keeping prices cheap. The shale oil boom happened because of very high oil prices and it will disappear at very low oil prices. But I would love to hear others take on this.

Hi Ron,

I agree. If prices rise above $80/b, LTO in the US can be profitable in core areas. Low prices (less than $75/b) will not enable the LTO in the US to recover.

My main difference is that I expect lower oil supply will drive oil prices above $80/b by mid 2017 at the latest. In the mean time 2015 may well be a temporary peak, but when oil prices rise it will be surpassed in 2018 or 2019.

The peak could be as late as 2025, it will depend on oil prices, demand and how fast oil output recovers.

DC Wrote:

“I agree. If prices rise above $80/b, LTO in the US can be profitable in core areas. Low prices (less than $75/b) will not enable the LTO in the US to recover.”

I don’t know if $80 would be enough. Shale drillers now have close to $300 Billion in debt. Yields have been rising 8% to 15%. Servicing all that debt is going to take a lot of extra cash. I think 90% of current drillers are now insolvent even if Oil suddenly bounced back to $100.

Plus in the US, they are only drilling in the sweet spots. What happens when the sweet spots reach depletion? ROI outside the sweet spot required even more expensive Oil.

Hi Techguy,

Where we have the most information is in the Bakken. The average well breaks even at around $77/b. If oil prices go to $100/b, the Bakken producers will be fine, the Eagle Ford is pretty similar for the breakeven price, $100/b will also be fine there, the Permian I have no data on, but many companies have moved their fous to the Permian basin so my guess is that the economics are best there.

When the sweet spots get fully drilled then the new well EUR will decrease. When this will happen and how quickly the EUR will decrease is unknown.

I have guessed about this based on USGS estimates for the Bakken/ Three Forks.

I depends in part on the rate that new wells are drilled and the price of oil, nobody knows that either. So one has to climb very far out on a limb to estimate future output in the LTO plays. I do that on a regular basis, which you can find on this blog.

In fact anyone can give me their predictions of future oil prices and I can show how that fits into Bakken or Eagle Ford production. I have given up trying to guess the price of oil.

DC Wrote:

“we have the most information is in the Bakken. The average well breaks even at around $77/b. If oil prices go to $100/b”

I am sure this is not include the exploding debt servicing costs. The majority of Shale drillers turned to the Junk bond market with yields above 10%. At this point the cost of servicing high yield debt is going to raise the break even costs. Its likely that the higher interest rates is going to push the break even near $100 bbl.

I believe Arthur berman said the breakeven was between $80-85 bbl. Don’t forget that LTO sells at a steep discount to conventional crude.

FWIW: The Shale drillers all went bust a year or more ago. They leveraged assets to acquire expensive loans (ie junk bonds) to keep the Potemkin village standing.

Ron,

Much of the infrastucture, including pipelines, power lines, roads, etc. in Western Siberia already exists.

The Bazhenov shale is a source rock for conventional fields in this region and is located just below those fields.

However I agree with you, even with $100 bbl oil LTO production in Russia would grow much slower than in the U.S. On my estimate, based on company plans, it would not exceed 400 kb/d by 2020 and would never reach the levels of the U.S. At $40-60 oil most plans will be postponed, not just in Russia, but in other countries as well. The only exception could be Argentina:

WoodMac: Vaca Muerta output to double by 2018

HOUSTON, Nov. 19

http://www.ogj.com/articles/2015/11/woodmac-vaca-muerta-output-to-double-by-2018.html

Production from the giant Vaca Muerta shale play in Argentina is expected to double by 2018, according to a new development study from research and consultancy firm Wood Mackenzie Ltd.

While a marked ramp-up can be expected by 2020, the study highlights that oil and gas output in 2016 should be moderate with year-over-year production at 10%. WoodMac estimates total capital spending for 2016 to reach $1.2 billion as companies prepare for full development.

Horizontal wells will become the development of choice as operators are increasingly able to target the most productive intervals of the play, the firm says, adding that it anticipates 200 wells will be brought online in 2015 and fewer in 2016 as vertical wells are phased down. Currently 460 wells are producing.

“YPF [SA] and its [joint venture] partners continue to decrease drilling and completion costs aiming to move into ramp-up and development phases,” explained Horacio Cuenca, WoodMac research director for Latin America.

Alex, Mr. Patterson

Regarding the potential global spread of shale development, it will be a matter of where and when, rather than ‘if’, as is the case with Argentina.

The $10/$8 million cost for drilling and completing unconventional wells has plummeted to the $4 million dollar range in the Permian and Niobrara. (Tiny Bonanza Creek is spending $3 million per).

The early $18 million Duvernay wells are closer to $12 million and the Deep Utica’s are expected to cost $12/$14 million per and yield between 30/50 Bcf EUR.

Granted, a significant portion of these savings stem from unsustainable cost reductions from service providers, but the efficiency gains are continuing and spreading as this entire ‘unconventional’ industry gradually morphs into the norm. A quick glance at the vertical/horizontal rigs in the Permian from 2012 to today should clearly show thus.

I am halfway through reading a 200 page PDF on ‘Best Practices’ in maximizing optimal, long term conductivity in fractured horizontals in various formations . Kinda wonky but fascinating as the body of evidence continues to grow that these well recognized decline rates in shale wells are largely due to fissures NOT remaining open over time.

As there remains 90%+ of the OOIP, strenuous efforts are being exerted to both understand and overcome this problem.

No, the politics and macro economics will greatly influence the spread if this technology, to be sure. But the ability to identify, target, drill, fracture, produce and transport hydrocarbons via unconventional means is continuing to be both operationally and economically feasible, this despite the immense heterogenous nature of these formations.

Hi Coffeguyz,

There will be some cost reductions and innovations, at the same time more frack stages and increasing amounts of proppant per well tend to increase costs. In the Bakken/Three Forks for the standard well average costs per well were reduced from $9 million per well to about $7 million per well, but wells that are “super-fracked” with many more frack stages and much more proppant cost about $2 million more than the standard frack job, bringing us back to $9 million per well. So far the “super fracks” have had little effect on the average new well EUR, with a possible increase of 10 kb over the standard well EUR of 350 kb ( a 3% increase in EUR).

The closer spacing of wells will also increase the cost per barrel of EUR. Eventually the sweet spots in all these plays will be fully drilled and new well EUR will start to decrease (again raising costs).

You have also suggested water or CO2 floods to increase the recovery factor. Again this will increase costs.

I would suggest that you look at the hype a little more critically.

coffeeguyzz

One of the key conditions that enabled the shale boom in the U.S.A. was access to cheap financing and ability to indefinitely increase debt load and burn cash.

Oil and companies outside U.S. could not have negative cash flows for 18 years out of 20 last years, like did Chesapeake.

Therefore shale developments outside the U.S. will be much slower

Chesapeake Energy free cash flow, $ per share

Source: http://www.bloomberg.com/news/articles/2015-07-21/chesapeake-energy-eliminates-dividend-as-gas-prices-slump

Argentina subsidizes oil prices to sustain activity. I lived and consulted in Argentina, the industry costs were low until the Kirchners took over, nowadays there’s a lot of union hassles and logistics problems, but there are work arounds. However, if the government weren’t subsidizing prices the whole industry would collapse.

Hi Ron,

I ignore the bumps up and down, since Jan 2014 the downward trend seems to have flattened, you think it will continue downward at the same rate, but perhaps it has flattened somewhat, like what has happened in the North Sea. Trends can change, I doubt there will be an increase, but the rate of decrease may become smaller.

Ron,

I hope you’re right, and that we’re seeing Peak Oil. That would be a good thing for the world. I’d be a little surprised, given that Russia and KSA seem able to keep production at least level for a while, and the US seems likely to bounce back if prices rise. If we’re seeing peak, then that would suggest that oil prices will never rise significantly above, say, $70. And that only seems possible if the transition to electric transportation accelerates dramatically.

That kind of acceleration in the next year or two doesn’t seem likely to me, but it’s conceivable: here’s Audi: “the brand is targeting at least 25% of its US sales to be e-tron—i.e., plug-in hybrid or full electric—models by 2025.

Further, Keogh said, Audi will support the broad adoption of EV technology in the US by developing a nationwide 150 kW fast charging network that would charge the 95 kWh battery pack of the e-tron quattro to 80% in only 30 minutes—enough for 200 miles worth of driving in the battery-electric SUV. The network will be in place for the launch of the fully electric SUV in 2018. Audi is one of the very few automakers to now put out a firm aspirational target for electric-drive vehicle sales. Volvo had earlier said it expects 10% of its total sales to be electrified by 2020.”

http://www.greencarcongress.com/2015/11/20151119-keogy.html

There is enormous potential for reduction of marginal consumption by SUVs and inefficient cars.

The idea that PO will cause collapse seems to be based on the fact that oil shocks have contributed to past recessions. The idea that PO would cause collapse is what one PO blogger might call “ruthless extrapolation” – it doesn’t follow. Especially if there’s no price shock.