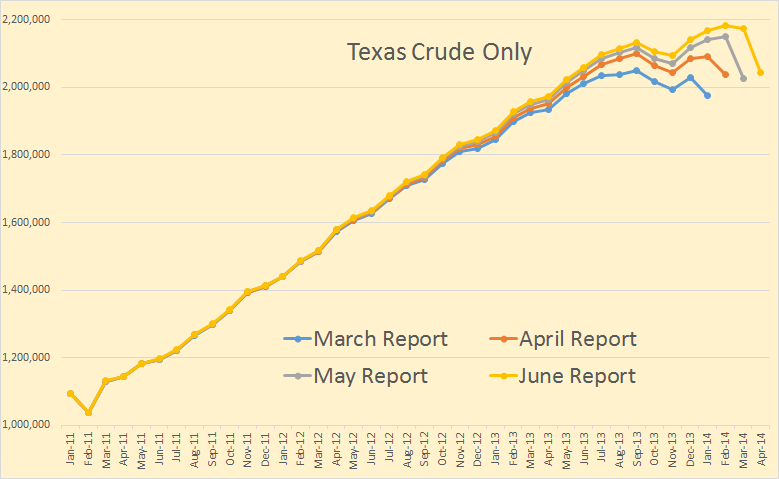

The Texas Rail Road Comission has released their latest report with oil, gas and condensate production for April. The RRC data is always incomplete however and takes many months for the all the data to trickle in. The below chart shows that problem.

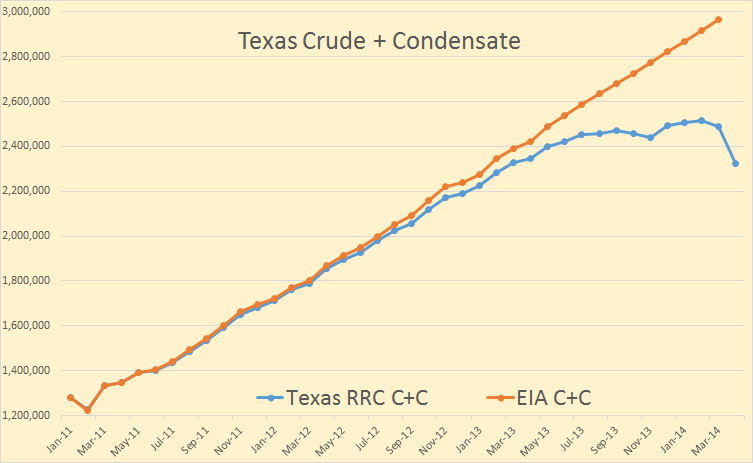

The data is barrels per data with the EIA data through March and RRC data through April. The EIA has Texas C+C data is highly linear for the 10 months June 2013 through March 2014, increasing at 48 kb/d for 4 months, 41 kb/d for one month then 49 kb/d for the last 5 months.

The EIA has Texas C+C increasing at an average of 48.6 bp/d each month for the last two years. I think that is a little high. I think the production has been increasing at close to 43 kb/d each month but with a recent slow down in that increase.

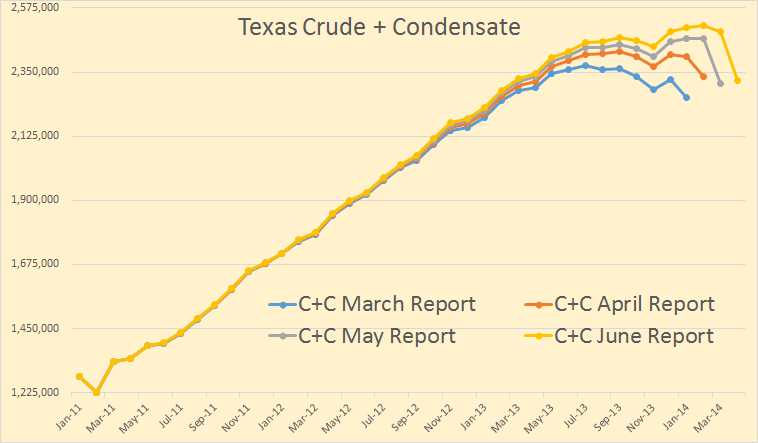

All Texas RRC June report data is through April. The RRC does not combine Crude with Condensate so I have to add the two. But here you can see the problem. Each month the reported data increases with the latest months showing the largest increase. However even if this is the case, the latest month should show an increase almost equal to the final total increase for that month. That was the case in the April Report, (January to February), but not the case for the last two reports.

Texas RRC seems to have Crude Only increasing at a slower rate each month.

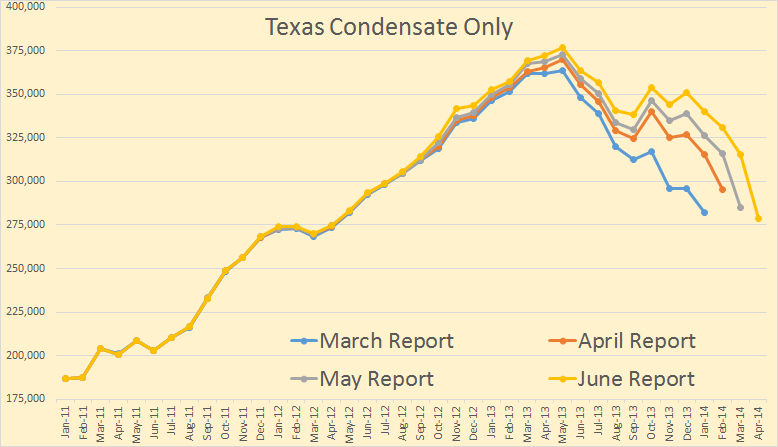

The condensate only chart looks radically different than the crude only chart. It looks like Texas condensate seems to have peaked back in May of 2013. Even if that turns out not to be the peak there is no denying that Texas condensate growth began to dramatically fall off beginning in June of last year.

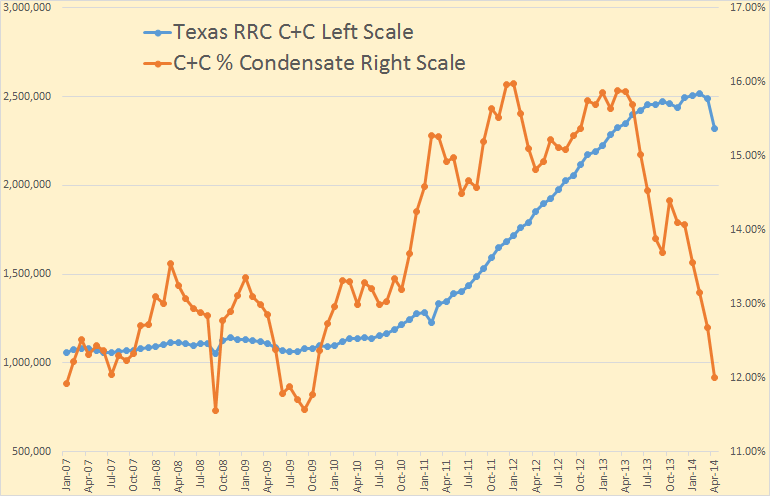

But this is the chart that really tells the story. The orange plot is the percent of condensate in Texas Crude + Condensate. Notice that the percent condensate takes of at the exact same time that the shale boom started in Texas, in late 2010 and early 2011.

Of course those late months are incomplete, with not all the data in yet. Nevertheless that holds true for both crude only and condensate. Therefore the percentage of condensate should remain about the same. Obviously it does not, the percentage of condensate falls off sharply beginning in June 2013 from 16 percent back to 12 percent or about to where it was before the shale boom began.

My conclusion is that Texas C+C is beginning to slow down in spite of what the EIA reports. And that condensate has even started to decline.

130 responses to “Texas RRC Report April Production Data”

There’s currently a big effort down in Palestine and Tyler TX to pop seismic maps to see if there are potential small formations that can yield a tablespoon or two of some vaguely combustable substance.

We may be looking at the stuff at the bottom of the barrel.

Wait, what? That’s over in East Texas. Nowhere near the Eagle Ford or Permian. This doesn’t sound desperate. Just looking elsewhere.

George Ure reports that seismic crews are preparing to do surveys on his property in east Texas:

http://urbansurvival.com/coping-petrology-and-the-dangers-of-fracking/

Meanwhile Militants Fly Their Black Flags Over Iraq Refinery

Read more: http://www.businessinsider.com/militants-fly-their-black-flags-over-iraq-refinery-2014-6#ixzz35C93RBxF

Brent at $115 and rising. Yet “U.S. Stocks Rise as Oil Advance Boosts Energy Shares”.

Something’s gotta give soon.

That would be the valve on the SPR.

Using the latest RRC data up to April and the previous data up to march, I computed the amount of corrections that each month should undergo to be close to the real data. In doing this, I consider only the last 24 months (older months have only negligible corrections): what I did was to sum for each month the corrections which took place in the previous “h” months, where I put h=24 for computational simplicity.

For example, the correction for the last month (which is one subject to the highest degree of corrections over time) were equal to 412357 bbl/day (only oil , no condensate).

By doing this for all the past 24 months, I reconstructed the supposed “real” Texas oil production data. The result is the figure attached to this comment.

The corrected data for condensate is reported in the plot below: it seems that condensate has peaked

the previous data are in bbl/day. Oil + condensate is below

As for natural gas in MCF/day here is the latest corrected data

The correction factors for oil and condensate are (slightly) decreasing over time, while the reverse seems to hold for gas. These are corrections with absolute factors. If I find the time, I will do also with correction using percentages.

Hey Dean,

Great stuff thanks!

That is a lot of zeroes on the vertical axis, in the future could you either put the thousands commas in or maybe do it in kb/d to make it more readable? For natural gas maybe BCF/day.

Thanks for the comments. I will do them

I just computed the corrections also using % instead of absolute correction factors, but the the new corrected series are basically identical to the previous one: see below the case of oil+condensate (kb/day)

Dean,

Wonderful. Thanks.

I wonder why condensate is peaking. Could the region of wet gas wells be saturated or is the drilling being done elsewhere? Condensate is a higher profit material than natural gas, so it is strange that this component is falling off.

Lots of indication that higher quality liquid regions are getting the drill rigs.

Excellent work Dean. I was looking at the graphs in Ron’s article and thinking that the data has about a one year lag before it becomes smooth and accurate. Your work lends a lot of credence to that observation.

So in reality the Texas RRC data is incomplete for a year and there is a two month lag in publishing. That is 14 months behind real-time. A lot can happen in fracked fields in 14 months, so that warnings of actual reduction in production will have to come from your predictive analysis and not the RRC data which will always have a drooping tail due to incomplete reporting.

Heck of a way to run a show, but I guess it doesn’t hurt profits so why should they worry?

It seems that these problems with reporting are due to local tax rules which allow to delay how much oil/gas you produced, but I am not an expert in that field . If there is someone from Texas, maybe he/she can shed some light on this

Hi Ron,

The condensate is produced with the Natural Gas, I think if you looked at barrels of condensate per million cubic feet of natural gas you would find that that has either remained the same (or possibly increased).

Bottom line, condensate is decreasing because the amount of natural gas produced in Texas is decreasing.

What I see is that the gas well gas has increased its condensate content since 2009 with the barrels of condensate to billion cu ft of gas well gas increasing from 7000 to 21,000 b/BCF. In a nutshell the gas well gas has gotten wetter in Texas. Gas Well Gas output stayed pretty flat until 2013 and has begun to fall.

So there are a lot of things changing, gas getting wetter and gas well production decreasing which counter act each other.

It may be that the shale boom is petering out, it will happen at some point for sure, it is not clear that it is happening at present.

What we could be seeing is that the shale play operators have gotten better at finding oil rather than gas so that less gas is being produced in the eagle ford play. I will try to pull together the Eagle Ford Data soon.

In the chart above the GW gas is on the right axis and the other two ( condensate and cond/GW gas) are on the left axis

Bottom line, condensate is decreasing because the amount of natural gas produced in Texas is decreasing.

Not exactly the case. There is a portion of Eagle Ford that produces almost exclusively condensate. The RRC did have an Eagle Ford page which showed that area but they have taken that site down. It once could be found at http://www.rrc.state.tx.us/eagleford/

However this Seeking Alpha article discusses this corridor:

Eagle Ford Shale: Dry Gas Production In Free Fall

Investment returns in the Eagle Ford’s most prolific, albeit narrow, oil/condensate corridor remain exceptionally strong,..

And this statement is very important:

The 0.8 Bcf/d decline in production from gas wells has been only partially offset by the growing volumes of casinghead gas from oil and condensate wells.

Wells that produce only oil and wells that produce only condensate are offsetting the decline from gas wells.

To put that in perspective, one rig drilling in the dry gas sweet spot in Susquehanna County, Pennsylvania in the Marcellus may be able to generate more dry gas production than 15-20 rigs drilling for oil and condensate in the Eagle Ford.

Those oil and condensate wells are just not producing very much gas.

Hi Ron,

There are two types of wells oil and gas. The writer of the seeking alpha article that talks about a “condensate well”, might mean a gas well that produces a lot of condensate, but it is still referred to as a gas well. That is why I looked at natural gas production from gas wells and the condensate per billion cubic feet of gas well gas, the gas well gas has gotten a lot wetter and most of this is from the Eagle Ford which you have pointed out.

All of the excess condensate production has pushed condensate prices down and the companies in the Eagle Ford play are focusing on the oil window and have moved away from natural gas and condensate because it is less profitable.

For this reason we would expect that the condensate output will decrease, it does not necessarily spell the end of the Eagle Ford. I would guess that David Hughes guess is best, I have made a more conservative guess of 5 Gb, but Hughes knows a lot more than me about geology (and more than Blanchard as well.)

Hi Ron,

No I guess I am wrong on that, there are condensate wells.

In Texas it seems they are either oil or gas (as reported by the RRC), but it may be different elsewhere.

This article talks about “Condensate Wells” and “Gas/Condensate wells” and “Gas/Condensate/Oil wells”.

Sweetspot Mapping in the Eagle Ford using Reservoir Analytics

BHP plans to double Eagle Ford output by 2016

Black Hawk, in which BHP Billiton holds 70,000 net acres in DeWitt and Karnes counties, is receiving the greatest development emphasis. BHP figures the area, in the heart of the Eagle Ford’s lucrative condensate window, is generating 70% rates of return on individual wells.

Eagle Ford has a condensate window, imagine that.

And then we have this: An Unexpected Surge in U.S. Condensate Production: From Eagle Ford to Canada

Take the Eagle Ford shale basin, which stretches across much of south and east Texas. The basin’s tight sedimentary rocks contain a range of hydrocarbons: wells on the southeastern flank generally produce dry gas, wells in the middle produce gas, natural gas liquids (NGLs), and condensate, and wells to the northwest generate oil and condensate. Eagle Ford producers drilled their wells looking for oil or gas. Condensate was an unexpected bonus – but it now makes up as much as 40% of the hydrocarbons produced from the formation.

I did not know that there was any such things as an oil/condensate well. But I guess we learn something every day. Dennis just learned about condensate wells today. 😉

If NoDak classified the liquid the way Texas does, maybe half of those counties would be flowing something defined as condensate.

No Dennis, that is simply incorrect. I would have agreed with you a few months ago. It was about six months ago when I first saw the Blanchard article. I researched it and found the answer on RRC’s web site. The Eagle Ford link, before they took it down showed a map of exactly what Blanchard explained, Oil in the north, or actually it was northwest, condensate in the middle and gas in the southeast.

Believe it or not, there are actually condensate wells in Eagle Ford.

I will search further and see if I can find that map anywhere else.

Hi Ron,

Yes I was aware of the condensate window. I thought that an oil man had explained to me that there were oil wells (which produce oil and some gas) and gas wells ( which have varying degrees of wetness, some are dry and produce very little NGL and some are wet and produce lots of consensate). I checked after making my comment and at Wikepedia they clearly say three types oil, gas and condensate. I was also fooled by the RRC of Texas reporting system where there are no “condensate wells” only oil or gas, so I fell into that mode of thinking.

I have never heard of an oil condensate well, I am not sure how you would tell the oil from the condensate at the lease as they would all tend to mix, but I am no oil man, obviously.

I try to avoid this subject. There is no short and simple answer. So here are the words directly from the TRRC:

Condensate is defined by some as a hydrocarbon liquid produced AT AN OIL OR GAS WELL and having American Petroleum Institute (API) gravity greater than 40 degrees. The API gravity of oil/condensate can vary from 20 to 70 degrees. In practice most producers do not distinguish between oil and condensate, calling any liquid petroleum “oil”. The TRRC handles the distinction very differently and distinguishes between them thusly: oil being the liquid produced from “oil wells” and condensate being the liquid produced from “gas wells”.

Simple enough…not. LOL. So as far as gravity goes that doesn’t define the definition in Texas. IOW an oil well producing 40 degree API liquid is producing oil. And a NG well producing 40 degree gravity liquid is producing condensate. And a critical aspect: that’s how it is reported.

So the next issue is the definition of oil and gas wells. So again by TRRC regs:

Gas well– Any well:

(A) which produces natural gas not associated or blended with crude petroleum oil at the time of production;

(B) which produces more than 100,000 cubic feet of natural gas to each barrel of crude petroleum oil from the same producing horizon; or

(C) which produces natural gas from a formation or producing horizon productive of gas only encountered in a wellbore through which crude petroleum oil also is produced through the inside of another string of casing or tubing. A well which produces hydrocarbon liquids, a part of which is formed by a condensation from a gas phase and a part of which is crude petroleum oil, shall be classified as a gas well unless there is produced one barrel or more of crude petroleum oil per 100,000 cubic feet of natural gas; and that the term “crude petroleum oil” shall not be construed to mean any liquid hydrocarbon mixture or portion thereof which is not in the liquid phase in the reservoir, removed from the reservoir in such liquid phase, and obtained at the surface as such.

And the simple definition of an oil well: it doesn’t qualify for the gas well designation.

And now the even more confusing aspect: the TRRC focuses on the phase (liquid or gaseous) of the hydrocarbon as it exists in the reservoir and not what’s coming out of the well head. And that’s a function of temperature and pressure. And this is why I dislike going into area. A well may be producing a liquid hydrocarbon initially classified as condensate by the TTRC. But as the reservoir pressure declines (very common in the shale plays) the hydrocarbon phase can change from gaseous to liquid in the reservoir (often called the bubble point). This reservoir pressure/phase change can be calculated. So at some point the operator can apply for a status change from a gas well to an oil well. This is not a minor technical issue. It has huge financial implications. The TRRC has very clear rules on the spacing of wells, how close they can or can’t be drilled to the lease line and how much acreage can be assigned to a producing well. And that hinges on whether it’s classified as an oil or gas well.

IOW a well initially classified as gas/condensate might hold a 320 acre producing unit…and only that one well can produce from that reservoir in that producing unit. But if it’s eventually reclassified as an oil well the acreage assignment could be reduced to 80 acres. So now the 240 acre balance (320 – 80) can be drilled and produced by additional drilling.

I’ll stop now since I’m sure I’ve completely muddied the waters. Especially since I’ve left out even more details and complications. All the details can be found at the voluminous TRRC website. But be forewarned: it isn’t an east read for me and I’ve been doing it for 4 decades. Which also explains why there are many consultant companies in Austin that get paid nice fees to help even experienced operators thru the maze. And lawyers who specialize busting companies that don’t get it exactly right.

And if you find this confusing and frustrating just drop a line to the commissioners. They really enjoy constructive criticism.

Holy crap. We have no decent data at all.

(FYI Montrail county in the Bakken flows liquid that is all north of API 40)

(And FFYI (further FYI), Libya has 9 export brands, from API 26 to 43, vast majority below 40, which is why that stuff has so many joules)

Rockman,

Thanks. I believe you may have been the “oilman” I referred to, but I wasn’t sure. I definitely don’t understand this stuff at the level that you do (surprise, surprise). I always appreciate the education from those in the know.

More on Eagle Ford Condensate Production from Roger Blanchard, March 2013

Commentary: Texas and Eagle Ford – Where the Action Is

Eagle Ford actually has separate regions that produce dry gas, condensate and crude oil. Crude oil is produced on the north side of the formation, condensate in the middle and dry gas on the south side. Table I contains crude oil and condensate production data for Eagle Ford.

Among the interesting aspects of the data in Table I is the rapid rise of crude oil production in the last few years and the small increase for condensate production in 2012 relative to 2011. Is condensate production on the verge of declining? Time will time.

I think the drop in Texas condensate production is coming primarily from the Eagle Ford condensate corridor. Blanchard saw it coming a year ago.

Hi Ron,

Blanchard also suggests in that piece that the TRR is 3.3 Gb about half of David Hughes

more recent estimates of 7 Gb for the Eagle Ford. Also by EIA estimates there are about 3.3 Gb of proved reserves in district 1 and District 2 of TX which is where we find the Eagle Ford Shale.

The production profile suggested by Blanchard is one that we would expect if all development suddenly stops in the Eagle Ford play, an unlikely scenario at best, the new well EUR is unlikely to decrease to unprofitable levels all at once, the process will be gradual.

“Eagle Ford actually has separate regions that produce dry gas, condensate and crude oil. Crude oil is produced on the north side of the formation, condensate in the middle and dry gas on the south side.”

So much for the oft spoken of Mexico bonanza.

Yikes! You people certainly do need more accurate information, if you want to have a meaningful speculation of ideas about PO, condensate etc. THERE ARE FOUR HYDROCARBON WINDOWS IN THE EAGLE FORD! Most (almost all) maps however only show three. The condensate window is a very narrow sliver between the oil window and the NGL window, and is thickest at the Mexican border, then becomes even thinner and pinches out about halfway across the EF to the east. Condensate is like nature’s own naturally refined gasoline. That’s why it’s usually worth much more than unrefined raw oil. NGL’s and condensate are NOT the same thing at all. Because of an over abundance of production (like with NG) the price of NGL’s has greatly fallen. The significant fall in condensate production does not necessarily mean anything at all. It has very little to do with oil production. Like the Bakken, the EF is not expected to peak until at least 5 more years…..and for all the same reasons. It has become a stacked play with multiple lower layers that are proving to be econmic viable with today’s technology and oil prices. The Permian peak is so far away no one even thinks about it. I think everyone should start getting used to increasing shale oil production everywhere, regardless of what happens with condensate. Just sayin’.

Like the Bakken, the EF is not expected to peak until at least 5 more years…..

I think everyone should start getting used to increasing shale oil production everywhere…,

Yikes, Carl Martin certainly does need more accurate information.

Mr. Patterson, please explain to me exactly how the EIA gets its information about crude and condensate production in Texas and why its reporting is more accurate, or timely, than that of the Texas Railroad Commission. I have been reporting crude and condensate production in Texas for 40 years. My P-1’s and P-2’s all go to the TRRC. I report nothing to the EIA or any other federal entity. I am curious how the EIA gets its numbers so quickly and reliably (?). Thank you for your response.

Hi Mike,

The EIA estimates output based on the historical RRC data. If you track the RRC data you see that the reported output increases over a 12 to 18 month period. I believe that the EIA looks back in time at how the RRC data has progressed and then assumes the same will be the case in the future in order to estimate output.

For example if TX output is reported as 2 MMb/d in April 2014 the EIA may look at previous reports from March February and so forth and note that on average the data needs to be corrected by 25% for the most recent month, and 10% for the month before that and so forth. These are only estimates, but in the past they have been much better than the initial data reported by the RRC.

I think that what may be happening is that the RRC does not report data for the confidential wells in the state totals. In North Dakota the roll up all the data when reporting the state totals and just hold back the data for the individual wells.

No doubt in Texas this is the way it has always been done and always will be. North Dakota probably wanted to displace Alaska as the #2 oil producer and wanted to report every barrel ASAP.

Texas on the other hand knows it will always be the number one oil producer and figures people can wait a year or two to find out how much oil is being produced.

I think that what may be happening is that the RRC does not report data for the confidential wells in the state totals.

I don’t think that is the problem. Or at least that is not all the problem. The problem is that Texas RRC, apparently, gives producers up to two years to report all their production. North Dakota only gives them a couple of months, regardless of whether they are confidential or not. Only the North Dakota county data does not report confidential wells and that data must be in within six months.

Okay, I have never, even once, claimed that the EIA data is more accurate. It most definitely is not more accurate. The Texas RRC data is very accurate, it is just incomplete.

The EIA gets its data from the Texas RRC. I have made that point more than once in the past but apparently you did not see any of those postings.

What the EIA does is get the Texas RRC data then estimates what it will be after all the data has come in. I believe the EIA estimates are very inaccurate. I have made that point several times in the past also.

After a couple of years, after most all of the data has come in, the EIA data matches exactly what the RRC reports. It matches because that is where the EIA gets their data.

I hope that clears everything up for you Mike.

Hi Mike,

I disagree with Ron about the EIA estimates, when I look back at what the EIA estimates were 12 months ago for TX C+C and compare it to present RRC data, the estimates are pretty good, within about 2%, at that point in time the RRC estimates for the most recent month were low by 25 to 30%, even when the RRC adjustment factor was used (to account for the incomplete data) the EIA estimate was highly accurate compared to the RRC data.

Are the EIA C+C estimates inaccurate, absolutely. Highly inaccurate, no not the C+ C estimates found at the link below:

https://drive.google.com/file/d/0B4nArV09d398WXI5TTFaME8xYzg/edit?usp=sharing

Currently the EIA estimates 2968 kb/d for March 2014, I will be surprised if 18 months from now the RRC is not reporting between 2800 and 3100 kb/d for March 2014(about +/- 5%).

Ignore that link (in my comment above) I meant

http://www.eia.gov/dnav/pet/pet_crd_crpdn_adc_mbblpd_m.htm

at that point in time the RRC estimates for the most recent month were low by 25 to 30%, even when the RRC adjustment factor was used (to account for the incomplete data) the EIA estimate was highly accurate compared to the RRC data.

And I will have to disagree with Dennis. The RRC does not estimate, except for the final month of crude and dry gas. All other data is the actual data they get from the field, not estimates at all. I know that the final month for oil and gas well gas is not accurate but I think they post that because they have such a small fraction of the data in by then that they feel they must make some adjustment. But they cannot possibly post what they think the final total may be when the final total will not be in for about two years. If they did that then they would have to post estimates for all the past 24 months. They simply chose not to do that.

I think the RRC data is simply incomplete because there is no strong requirement for the oil companies to get their data in on time.

But then I am just guessing and really have no idea why the final data is so late in getting in.

Thank you, Mr. Patterson. No, I have not seen previous explanations and I am now very clear that the data from the EIA is estimated only.

I have no explanations for the delay in reporting by the TRRC, though I do not believe it is confidentiality exclusions (public companies typically make press releases before well testers are even rigged down and need the biggest numbers they can get, as fast as they can get them). There is insufficient storage on locations to stock pile liquids from 800 BOPD wells; when those liquids are moved off location by the crude oil buyer the accounting process begins and multiple Texas entities have their fingers in that pie for taxation reasons. Barrels sold and reported by the operator must balance to the jar with barrels bought and reported by the crude oil buyer; perhaps that is one of the delays in reporting hard data. It is most definitely not a Texas conspiracy, as Mr. Coyne implies.

I appreciate, and agree, with the work done on this site and empathize with those who have to use estimates to make predictions about the future, two years before the real data is available. I think over time that will sort itself out…probably when this shale stuff starts sliding downhill. Thank you for your response.

Mike

Mike,

How are the volumes coming out of the wells measured?

On these bigger wells is their an intermediate tank and then straight to a pipeline?

Do you know how the oil is moved and accounted for from the smaller producing wells?

I think Mike has offered a quote before — something like — there is no oil that comes out of the ground in Texas, be it shale or anything else, that at some point doesn’t travel by truck.

E – All oil in Texas follows the same path initially: well head thru the lease production equipment to lease oil tanks. The only accounting of the well head production is done at the lease tanks. The lease gauger with measure the oil level in the tanks on a regular basis. Typically daily on better wells. That tank measurement is THE production metric reported to the state. Rarely is oil transferred from the lease tanks via pipelines. Usually trucked to an oil depot where it is accumulated from with production from multiple wells/fields. There is an accounting done at the depots which is also reported to the state. From that initial depot the oil could be transferred via trucks or pipelines to a number of other depots before it ends up at a refinery.

An if you’re not familiar oil has title just like your car. When oil is sold from one owner to the next the title moves thru the system with the oil. This is done to not only track its movement but to also cut own on oil field theft. Untitled oil (stolen) is called “hot oil” and is typically sold at a 40% to 70% discount. There are ways to launder small amounts of untitled oil into thc system.

Mr. E: At such time as a well begins to produce in Texas the operator will designate a crude oil purchaser via TRRC form P-4. That buyer will then come out and measure the precise volume per barrel per linear inch in various diameter stock tanks and provide that information to the operator. Oil is accumulated in the tank and gauged for production increases and reported internally, between operator and its field representative (gauger). When oil is sold, both the operator (thru its field gauger) and the crude oil buyer will gauge the volume of oil in the tank and the margin for error in gauges is nil. Before the sale can be initiated the crude oil must be tested for basic sediment and water content (BS&W) and generally the maximum allowed is 1% BS&W by volume. That amount of crap in the oil (and it is impossible to completely separate or treat oil to 0% BS&W) will be deducted from the total volume. It is then loaded on a truck, typically at 155-165 barrel volumes, and taken to a LACT station at a pipeline hub and metered again. That measurement however is between the crude oil buyer and the pipeline company because once that crude oil leaves a location, once it is loaded onto a truck, the sale is consummated and that oil no longer belongs to the operator. Simple gauges of the stock tank evidence the volume sold. The operator gets a receipt for the sale at the location. Twenty days later the operator will get a crude oil statement verifying the amount of oil bought and the amount to be paid for the oil. Ten days after that the crude oil buyer disburses revenue to all interest owners based on the sale.

Within 30 days of the end of each month the operator must file a TRRC P-1 that shows the amount of oil produced and the amount of oil sold for the previous month. Some oil is held in storage, for instance, and does not get sold for a number of reasons each month (high BS&W, or the buyer failed to pick up the oil before midnight, the last day of the month, that sort of thing), but that inventory is reported to the TRRC and the accounting of oil produced versus oil sold is monitored by the TRRC and eventually must balance precisely. The crude oil buyer must report the exact amount of oil bought and that number must also balance precisely with that reported by the operator. If there are discrepancies between operator and buyer they must be dealt with immediately by both parties least the TRRC will sever the so called “pipeline connection” (trucking connection) and no oil can be sold from the lease or unit until the accounting is fixed and pipeline severance lifted. Sometimes stock tanks are sealed by the TRRC but it is implied that if the operator is severed that no crude oil buyer can take any oil off the lease, or unit, the penalty for doing so severe.

One hundred dollar barrels of oil are not lost easily, or stolen easily anymore; as you can imagine every interest owner and every taxing authority that benefits from that barrel wants to, by Gawd, know where it is, at all times.

Its been this way for over 100 years in Texas; it works fine. There is nothing to fix. As to getting the final numbers sorted out and published, the TRRC either is behind (overloaded) or its position is, relax, stay calm; it all comes out in the wash.

Unevbieballe how well-written and informative this was.

Hi Mike,

I did not mean to imply any conspiracy, I think things have been done in a certain manner for a long time in Texas and people there probably see no reason to change things.

I agree with Ron that the data is incomplete and it is not an estimate, the problem is that most people do not realize that the data is incomplete and some people (not Ron, but others) assume that there is a conspiracy by the EIA to over report the output from Texas, they simply try to estimate what the eventual output will be.

I looked at the EIA estimate from Jan 2013 and compared with the RRC data from June 2014, the EIA estimate was between 1% too low to 1.5 % too high for the 12 months prior to Oct 2012 (last data point for the Jan 2013 data).

To me that is not very inaccurate, especially when it is compared to the RRC data from Jan 2013 which was between 6 and 31% too low for the Nov 2011(6%) to Oct 2012(31%) period. It takes almost 2 years for the RRC data to get within 1% of the true data (going back in time 2 years). The RRC data is mostly on the low side and the EIA data is a little high so for months 12 to 24 before the most recent estimate and average of the EIA and RRC data will be pretty close, for the most recent 12 months taking 99% of the EIA estimate will get you pretty close.

Chart below shows most recent RRC data compared with Jan 2013 EIA estimate.

Hi Dennis,

Is there any chance of plotting a “moving window” or series showing the historical disparity between EIA and TRRC reporting to see the divergence being resolved after 6 months to a year after the TRRC catches up to the EIA estimates?

What I’d like to see is any hint that the divergence is not being made up over the 2013 and forward snapshots in time. Then again isn’t that what we’re all trying to squeeze out of these data points?

Best,

O3K

Hi O3K,

I am not sure I understand what you are looking for. I have data sets (at irregular intervals back to Jan 2013. Shoot me an email if you want the data I have and you could produce the chart. It is dcoyne followed by seventy eight (numbers no spaces) at geemail dot com.

Hi Dennis,

I think all I really want to know is if the divergence between EIA estimates and TRRC is going to close or not, and how long before we know the answer.

O3K, the divergence between the RRC and the EIA closes a little each month. Also, the EIA adjusts their data a little each. If they think they are high they will adjust it down and if they think they are low they will adjust it up.

There is no set date when we will know how accurate their latest guess is because it will change a little each month and it will eventually match the RRC data exactly. But when it does that data will be many months old. The latest RRC data will always look the way it does, well below the EIA estimates.

Hello again Mike,

I just re-read my comment and am not sure where you see the implication of a conspiracy. Possibly where I talked about confidential wells.

To clarify, there are a lot of wells that are on schedule, but do not report any output for many months. I have assumed (possibly incorrectly) that these wells are confidential wells and do not have to be reported until they lose their confidential status. The online research tool just adds up all the reported data and spits it out. In North Dakota the NDIC (their RRC) creates a report each month which totals everything including the output from confidential wells.

Texas does things differently, that was all I was attempting to convey. I would prefer it if Texas reported the data as well as North Dakota does, but Texas has been producing oil much longer than North Dakota and has its own way of doing things and they are unlikely to change.

I just use the EIA data and muddle along.

Dennis,

I have no idea as to the validity of my guess (and a wild assed one at that) but if more wells are being drilled, then more topside completion needs to be done to develop and put these systems into lifecycle production. There are only so many services companies out in the patch and manpower must be spreading thin to get the completion work done. Might that one factor (among many) to explain the increasing lag in production data?

Just as an aside, I’ll be doing cosmetic rehab on the truck and trailer over the next couple of weeks and then rolling out to Wyoming to jump into the fray of aforementioned completion work. Two new windshields, manifold pressure sensor on the 3406B Cat engine, replace a couple of inner and outer bearings on the drive axles, new u-joints, re-install the sleeper, trailer brakes, tractor brakes, new door window regulators, new wood on the lowboy, relocate hyd oil tank for wet kit, retrofit the cab/sleeper to air ride, buy chains… wow, I need a nap.

There are only so many services companies out in the patch and manpower must be spreading thin to get the completion work done. Might that one factor (among many) to explain the increasing lag in production data?

No, that would not explain it at all. We are talking about a lag in reporting the production data, not a lag in production. Reporting the production data requires picking up the phone and saying “We produced XXX barrels of oil and XXX barrels of condensate this month. Goodbye.” Then hang up the phone. That would take about a minute or two. I hardy think that the fact that roughnecks and roustabouts being spread thin would cause a two year delay in making a two minute phone call by the big boss in Houston.

I got nuthin’.

You implied, Mr. Coyne, that because we are Texans, and the biggest producer in the nation, that we think we can do whatever we want regarding production reporting to the EIA. If Texas were a country, as many of us of old farts still long for, maybe that would be true. I think this reporting problem, which seems to me to be only relevant to making predictions about the future a few months sooner than they might otherwise be made, is a simple matter of the State being overwhelmed with new data, and limited resources to handle this new data, nothing more.

If I wish to research a new drilling prospect near other producing fields, or an acquisition of existing production, I can use any number of different means to research that data on a lease by lease basis at the TRRC. That data is rarely more than 2 months old. From my perspective that TRRC data is reliable enough for me to take enormous risks to drill a new well, or buy old production on. I rely on current TRRC data all the time and spend big bucks because of it. So, I don’t get the constant reference to the TRRC being 2 years behind on its data. Nor do I believe it takes 2 years for the TRRC to get the right data from producers, or correct bad data. There is no guessing, or estimating production in Texas; its all right there for the taking. Every barrel of liquids extracted from the subsurface in Texas is accounted for, like dollars in a bank. Taxing authorities need to know, mineral owners absolutely need to know; its all accounted for.

The data that the TRRC updates on this link, specifically for crude and condensate production from the Eagle Ford shale, should more or less good enough for anyone needing to predict EF performance, IMDAO:

http://www.rrc.state.tx.us/oil-gas/major-oil-gas-formations/eagle-ford-shale/

Sorry if the link did not come up.

Thanks to all for the good work here. The message is correct…we are very soon going to be a very big bind. There are a number of reasons that current tight oil resources are not sustainable. Contrary to your thinking I believe, Mr. Coyne, I think us believers sometimes focus too much on the details of that. The message needs to be taken to the street, to the non-believers, and accuracy in predicting future reporting is not what most Americans are capable of hearing. When it hurts their family budgets, then they pay attention.

Mike

The message needs to be taken to the street,

Tried that the other day with well educated local environmental types. Their indifference to my suggestion that we work towards meaningful local action on climate change was only exceeded by there reception of what I had to say about the rising cost of fossil fuels.

They were all envious of the eco-tour to the the Galapagos that one of those present was about to venture off on. It was at about that point that I realized we truly have no hope.

I agree, there is little hope. We took the peak production theory hill about 5 years ago, and had American’s incredibly short attention span, but for a brief moment. Then this stinking shale stuff came along and the media jumped on the public company, tight oil abundance band wagon, and we lost the ground we gained. I think it might be awhile before we can take back the hill, now. You know, technology will save the day. Who cares what fossil fuels cost to extract as long as the haves can still get to the Galapagos.

It never ceases to amaze me how dumb people are, until of course, it is too late.

If y’all read Rockman’s layout above, you’ll see that there will be no peak — because definitions of anything can be made to be whatever you want them to be.

Voters won’t accept discomfort, and if they become uncomfortable they will elect whoever tells them they are going to become comfortable again. No one that tells people they must embrace lifestyle decline so that the Chinese can increase theirs is going to win.

Hi Watcher,

Changing definitions does not create energy.

People may vote for someone who says I will maintain your lifestyle, accomplishing that feat will be difficult. Saying there is more energy does not make it so.

Oh, it doesn’t matter if it works or not. The one who promises it will get elected.

That’s why it will be so much easier to advance along the conflict spectrum. The “integrity of keeping campaign promises” trumps keeping non American oil consumers alive.

I have had experiences comparable to AWS’s in trying to explain the true ( as we here in this forum generally see it ) state of affairs in respect to energy and environment to well educated and mostly liberal friends and acquaintances.

These are the sort of people who constitute the core of support of the environmental movement as a general rule but they tend to have a touching and scary faith in the efficacy of government that goes way past naive in my estimation.

Very few people are willing to seriously consider the possibility of a severe downward adjustment in their standard of living or safety.

The few I know personally who are willing to do so are mostly hard core conservative types who are convinced the world is headed to hell in a hand basket- which it undoubtedly is- but for all the wrong reasons.

This is ironic in the extreme. Government in principle has the power to save us but it won’t because it actually works in terms of responding to the demands of the people rather than being a good Mommy and giving all her children what they need instead of what they want.

What we need is a draconian war footing energy conservation and efficiency policy first of all which would keep the worst of our problems from getting even worse even faster.

What we are getting with the support and collusion of both parties is more ” quantitative easing” and other pain killing medicines that are doing nothing to cure the underlying diseases we are afflicted with these days.

Ok Mike fair enough. As far as I know Texas can report production in whatever way it chooses. I only meant to say that those states that are behind Texas want to be able to say they are # 2 in production and want to report output as soon as possible for bragging rights. Texas is not too worries about anybody catching up, that is all I meant. So Texas will do its reporting the way that it wants, it is a States rights thing. No conspiracy as far as I can see.

Hi Mike,

You said,

“So, I don’t get the constant reference to the TRRC being 2 years behind on its data. Nor do I believe it takes 2 years for the TRRC to get the right data from producers, or correct bad data. There is no guessing, or estimating production in Texas; its all right there for the taking. Every barrel of liquids extracted from the subsurface in Texas is accounted for, like dollars in a bank.”

In the chart below I show data from the RRC for TX statewide C+C downloaded in Dec 2012 and compare with Data downloaded in June 2014. Perhaps this explains why some people claim it takes 18 months at least for all the TX C+C data to come in.

Note that the June 2014 data is cut off at Sept 2012 which was the last data point for the Dec 2012 data.

We’re good, Dennis; I appreciate your work.

I don’t have an explanation for you as to the reporting differentials that causes you guys so much angst. I know if you feel the need to make predictions about the future on a real time basis it makes it difficult for you. I understand. On a practical basis, from a oilguy’s perspective, cumulative production data from the TRRC on a well by well basis, lease by lease, or unit by unit basis is 2-3 months behind and dependable.

When I take my “peak liquid production rates-the tight oil revolution is BS” message to the street I often use data from this site. The simpler the data is the better I get my message across. Americans are not too afraid of bears until they have one sitting on top of them chewing their arm off. Five dollar gasoline is not too far away; then America will want to hear more about this peak oil stuff. Right now, for the moment, the tight oil industry has won the hearts and minds of all Americans.

I piped up because I honestly did not understand how the EIA could get data before the TRRC. I don’t report to the EIA. Now I understand they are just estimating.

Mike

Hi Mike,

I absolutely understand that reported data is accurate. As Ron has already said all of the leases are not reporting on a timely basis to the RRC or the RRC is taking a while to process the data, I really have no idea.

It is fine with me, Texas can do its reporting the way it thinks best, I just use the EIA estimates for statewide totals because they are much closer to actual output than the recent (2 to 18 months) data found for statewide output on the RRC website. The individual lease data, where it is available is excellent and I have used it myself for estimating the average well profile for the Eagle Ford play.

I’ve been writing a piece for Scientific American about U.S. natural gas (it should be online on Monday), so I asked the EIA about how they get their numbers for recent shale gas production, since they are reporting stats through May 2014 in their Natural Gas Weekly report: http://www.eia.gov/naturalgas/weekly/

They said: “We use analysis from our Drilling Productivity Report and Short-Term Energy Outlook modeling to near-cast recent production history when it has not been reported by the states and DrillingInfo. Drilling rig activity (which is reported weekly) combined with drilling rig efficiency and initial production rates from wells are key parts of the analysis.”

(Note the numbers in the Natural Gas Weekly reports are labeled as “official” estimates, and differ significantly from the numbers EIA has in their Drilling Productivity Report. It looks to me like the Drilling Productivity Report lumps together shale gas, tight gas, and conventional gas in each region, whereas the Natural Gas Weekly reports include estimates for just the shale gas.)

On TX RRC data and delinquent reporting, I’ve looked at individual well data over the past few months, and it looks like the delinquent reporting is overwhelmingly from *new* wells. That is, once operators start reporting production from a well, they continue reporting data for that well on time. But they seem to be slow in reporting production from new wells.

So if *new* wells have a significantly different share of production that’s condensate, compared with the average of all other wells, then the % condensate for a given month might shift as more data comes in. With the data you show here, it looks like the condensate numbers for a given month are going through larger revisions (percentage-wise) than the crude-only numbers—but that’s just from eyeballing it.

I agree that it may be too soon to judge, based on the numbers we have, about condensate production in Texas. Baker Hughes rig counts this year have consistently shown a shift away from drilling in the Barnett and EF, in favor of an 18% increase in rigs in the Permian. The Permian is very likely going to be increasing production, with a lag, as these rigs do their work.

This is an excellent subject to be revisiting as the data dribbles out.

Gas prices hit record 155.9 cents per litre in Vancouver

This works out to US$5.49/gallon. Definitely the highest ever nominal price in Vancouver. And it’s starting to affect people’s transportation choices — loads of cyclists out there.

Finally, here is the plot comparing the latest EIA data for Texas C+C compared to my corrected C+C (data in kb/day)

Apparently EIA extrapolates current data from past data (linear extrapolation). If this is the case, EIA cannot “see” increase or decrease diverging from a linear growth. Could you compare EIA estimates from the last 6 months of 2010 to actual data? So my question is what is the distance between EIA estimate of the current month comparing to actual data (known about 24 months later).

I also think that EIA is using some linear regression model. Unfortunately, I do not have their vintage data to compare their past performance. I have started only recently to save Texas data (since December 2013) because the data situation has become interesting and it seems oil production will peak there at the end of 2014/beginning of 2015. Probably, one could try ask EIA and RRC for their vintage data and do a good analysis, but currently I do not have time for that.

Hi Dean I have several sets of EIA data for texas going back to Jan 2013.

Let me know if you are interested.

Thanks for the info. Currently for 2014 I am really full, but next year who knows. Definitively, it is a good topic for an academic paper about energy reporting and forecasting. I will think about it in the future.

Hi Chris,

I compare the EIA Jan 2013 estimate with current RRC data in a chart up thread.

Yes I saw that but I am not sure it is what I want to test. My idea is to test the EIA first prediction against actual data in this period where the slope is changing. I am then interest to the period end of 2010 – beginning 2011. Especially the first data published by EIA for July 2010 to June 2011.

From June 2011 to now the actual production is basically linear. So a linear extrapolation will work with a good accuracy. If the correction model of Dean is predicting the actual production with high accuracy, than the EIA cannot see yet the change in the slope by linear extrapolation.

If linear extrapolation is used by EIA than their prediction for the period June 2010 – July 2011 will be systematically too low.

The problem is to get their historical data. One can use the latest RRC/EIA from that period to do the comparison.

So if somebody has the historical EIA data, I am interesting in doing the comparison. Probably Ron should have the historical data.

Sorry Chris, I have only been tracking the RRC data for a few months. I do not have any historical data prior to 2014.

Hi Chris,

The Dec 2012 data is the oldest that I have. At that point the predictions were pretty good. You are correct that when the slope of the output curve changes is where the interesting area is. It is likely as the slope increased that the EIA estimates may have been too low. It is also true that when the slope decreases the EIA will over estimate TX output.

Figuring out when that change in slope occurs is the tricky part. We will only be aware of it about 18 to 24 months after it occurs. For now I think the best guess for recent months (most recent 10) is to take 98.5% of EIA estimates and for months 11 to 24 before the most recent RRC estimate to use the average of the EIA estimate and RRC data.

Baghdad’s Sunni fighters: we are ready for zero hour

As tensions rise in the Iraq capital, Sunnis reveal concerns about Isis, and some say they are ready to rise up

Ghaith Abdul-Ahad in Baghdad, The Guardian, Friday 20 June 2014 17.29 BST

Ya good for them. Rumor has it ISIS has a few Syrian oil wells the output from which is being successfully sold and funding them.

Can’t be all that much longer before they can buy an old fighter jet on the surplus market, hire a merc pilot, and figure out how to mount some ordinance.

I believe they already have a significant amount of military aircraft when the capture an Iraq air force base in Mosul, along with $400M USD from the Central Bank in Mosul.

I suspect that the cash will be used to purchase small arms and road vehicles than aircraft.

FWIW: My understanding is that ISIS is made up of Sunnis. Its probably unlikely that the Iraqi Sunnis will fight against ISIS. They probably will be more likely to join ISIS to take control of Iraq away from Shia. ISIS is also likely financed and supported by KSA (Sunni) as KSA is deeply worried that the Shia Leadership in Iraq will team up with Iran to dominate the Middle East. Iraq’s PM Maliki, was exiled to Iraq during the Saddam regime. Iran and Maliki have strong ties. Considering the players behind the scenes (Iran and KSA), unless the US puts boots back on the ground I think Iraq is the next Beirut, in a state of civil war and anarchy for years as the two regional powers use Iraq as a proxy war state.

In a heartbeat, America’s multi-trillion dollar Iraq project is swept into the dumpster.

LNG opponents flash mob a TransCanada open house in Northern B.C. (VIDEO)

50 citizens crashed a TransCanada open house in Hazelton, B.C, to protest the company’s plans to build $9-billion natural gas pipelines for LNG terminals

Mychaylo Prystupa, Vancouver Observer, Posted: Jun 19th, 2014

Some context and background for anyone interested.

Going in which direction?

Asian export.

Merci à tous !

thanks at all of You!

thanks, Ron,

passionnant!

best regards

An item posted on Peakoil.com, that I think was also previously posted here:

CNBC: “If the Baghdad government can keep Sunni militants away from its oil fields, production in Iraq may actually increase—though global prices are still seen staying higher.”

http://www.cnbc.com/id/101774498

My comment:

I guess we could always use the civil wars in Syria and Libya as models.

From the fourth quarter of 2010 to the fourth quarter of 2013, Syria’s total petroleum liquids + other liquids production fell by 90%, while Libya’s production fell by 80% (EIA).

Actually this is making the rounds on Wall Street, where folks when away from a microphone will admit that GDP isn’t going to endure $107 much longer.

So the story is the Kurds can triple their output by end of year. No description of how. It’s supposed to be a giant valve that has been closed that they will now choose to open. And of course we’re approaching SPR release.

The Kirkuk area is on the frontier of the jihadi state. The min northern export pipeline runs *through* the jihadi state. No one is doing capital projects there anytime soon.

Wall Street parasites are incapable of understanding how serious real world grievances can get. At the rate Baghdad is losing men killed, deserted and executed, and equipment, they’re going to be defending the city proper with militia and rocks.

The Sunni are on the warpath, full tilt.

You slightly misunderstood. The story is to triple. The story’s purpose is to drive WTI down. Accuracy isn’t a necessary part of the process.

Things would get very “interesting” if the Sunni/Shiite conflict spreads to Saudi Arabia, especially in the context of a possible struggle over which son will succeed what Karen Elliott House calls a geriatric band of brothers in Saudi Arabia.

WSJ OpEd by Karen Elliott House*

Behind the Saudi-U.S. Breakup (October, 2013)

Furious over Obama’s Mideast policy, the Saudis are shifting away from the U.S.—but where else will they turn?

http://online.wsj.com/news/articles/SB10001424052702303615304579154161420868356

*Author of an excellent book regarding Saudi Arabia, “On Saudi Arabia”

Cool. Very murky crystal ball with succession melded with 20+% non citizen population.

Abandoned Oil Wells Spouting Significant Levels of Methane: Study

Princeton researcher measures leaks that risk groundwater, and increasingly the climate.

By Andrew Nikiforuk, 14 Jun 2014, TheTyee.ca

Isis takes control of border crossing between Iraq and Syria

Militant group able to move weapons and equipment as fighters prepare for likely assault on Baghdad, say officials

Kevin Rawlinson and agencies, theguardian.com, Saturday 21 June 2014 15.53 BST

Re-posting it here. I inadvertently posted this in an old post.

Items from the article:

“the terrorist group and allied Sunni militants ” Notice the delineation. They have local Iraqi support.

“He is coming under increasing pressure to form an inclusive government or step aside in the face of deepening divisions between Iraq’s Sunni, Shia and Kurdish communities.”

AlMaliki is the scapegoat du jour. He tried to get those other groups to participate in the government. They could not be gotten. Now is no different, and it’s not his fault.

“One security official said that JRTN fighters had refused an Isis demand to give up their weapons and pledge allegiance to the jihadist force. Witnesses, however, told AFP the two sides clashed over who would take over multiple fuel tankers in the area.”

God fights on the side of the biggest artillery. If you don’t have fuel, your ideology doesn’t matter.

Re: fuel tankers.

Amateurs talk strategy professionals discuss logistics!

… Something to that effect.

Close. Tactics, not strategy.

Similar stuff in Ukraine re who captured what tanks and who got tanks driven across the border from Russia.

People aren’t born knowing how to drive a tank, load its cannon or simply put fuel in it. They have to be trained. The Ukraine forces aren’t going to surprise anyone because Russian orbital recon can see their supply vehicles just fine.

Don’t know the reliability of the source, but it sounds like something the US would be up to:

http://www.wnd.com/2014/06/officials-u-s-trained-isis-at-secret-base-in-jordan/#QGWfYvogKOJGMCiC.99

Yes its true, there have been a significant number of US Miltary officer resignations, because they didn’t want to arm and train Al Queda (now forked into ISIS or ISIL).

Here is McInsane’s view in ISIS back in 2012 and 2013:

http://www.thedailybeast.com/articles/2013/09/02/obama-to-arm-syrian-rebels.html

McCain calls for US to support Syria rebels

http://www.ft.com/intl/cms/s/0/a3fcb690-5be8-11e1-bbc4-00144feabdc0.html

The Iraqi army is just plain up getting stomped. There was something on ABC this morning how ISIS has captured 28 tanks (nevermind the ones they’ve blown up) and killed three attack choppers since this began (excluding the captures and what they killed earlier this year); the Iraqis have actually run out of air-to-ground missiles and only have two fixed-wing aircraft that can drop them anyway. Estimates are that the IA lost at least a brigade in this stupidity in the western desert.

That country is going to implode.

See above. Not even ISIS is born knowing how to drive a tank.

An older retired army guy I talk to occasionally says anybody with some seat time on construction machinery can learn to drive an older tank in a couple of hours. DRIVING it is not the same thing as FIGHTING it of course.

Likewise the armaments on older tanks are mostly manually operated or only semiautomated and can be learned well enough to fire the guns in a few hours. The tanks ISIS has are almost for sure older Russian models and considered obsolete by modern standards but thus very easy to learn to operate. ( This is not to say operated skillfully in combat of course which would take substantial practice and training.)

This does not mean they are worn out or incapable of destroying almost any sort of stationary target from a good distance away if the gunner can put the crosshairs on the target.With the tank itself stationary that should not be much of a problem.

Newer tanks probably can’t be operated without some classroom time or extensive time with an experienced operator due to having a lot of dedicated electronics.

If ISIS has ammo for them they can probably put them to good use.Finding one or two experienced tanker crew members already trained on them is probably not a problem given the size of the movement. Beyond that there are probably plenty of mercenaries in the area who will gladly train a tank crew.

What this boils down to is that ISIS seems to have achieved the critical mass necessary in terms of size and organization to be considered in almost the same category as a regular army.If they need certain kinds of experienced personnel they will find them, at least in sufficient numbers to act as trainers.

Success begets success. There is a very good chance they have some tankers experienced on the tanks they have captured in the ranks already.Soldiers seem to be deserting the regular army and joining ISIS from one day to the next on a regular basis.

If they can sustain the momentum they will soon have all the properly trained soldiers they could want to act as leaders and trainers.

Keep in mind that in the not so distant past American troops went into combat with as little as six weeks of training and only a minor portion of that was weapons training.

“An older retired army guy I talk to occasionally says anybody with some seat time on construction machinery can learn to drive an older tank in a couple of hours. DRIVING it is not the same thing as FIGHTING it of course.”

It would NOT surprise me is that the ISIS already has trained tank commanders. Recall that after the US took control of Iraq they disbanded the original Iraq army that was mostly Sunni.

Separatists in Ukraine have finally gotten their hands on some tanks, but there’s a hitch: They don’t have anyone to operate them. To solve that problem, the Ukrainian militia groups have taken out an ad on several media sites requesting drivers, gunners and mechanics, and even listing a number to call for more details.

see http://www.vocativ.com/world/ukraine-world/interviewed-tank-operator-job-ukraine/?ModPagespeed=noscript

For a conversation by a journalist who actually applied.

Its more that any ISIS tank isn’t in the Iraqi Army anymore than the blown up ones are. Not much question as to which side has harder soldiers at this point; if Iraq loses all its heavy gear, this will be a slaughterhouse.

And ISIS has ~1,000 Chechans who have plenty of experience with tanks, plus whatever Syrian & Iraqi army defectors. They may be able to operate this stuff.

I’ll shrug. Take a step past driving and you have the ugly word maintenance in a general sense and . . . it ain’t easy or cheap.

I will say one thing for ISIS. There is a lot of talk about how the US was 6 years trying to keep the peace among those folks with a far more overwhelming force and could not. The implication being ISIS won’t be able to govern.

Except that Hussein governed a long time somewhat “just fine”.

All you gotta be is brutal. You don’t have to get along with the enemy if you wipe them out.

All you gotta be is brutal. You don’t have to get along with the enemy if you wipe them out.

You have nailed reality down tight and perfectly with this remark but don’t you know it is extremely impolite to mention such harsh truths where they may come to the attention of the women and children and men who wear panties?

Modern western armies cannot be defeated in the field by a few hundred or a few tens of thousands of fighters no matter how good they are.

They are defeated by the terms of engagement imposed on them before they ever leave home.

Hitler or Stalin or Mao or Genghis Khan if in possession of modern western equipment and communications would not leave anything that walks on two legs behind when they passed thru a place like Iraq unless they planned on needing some slave labor.

The later Russian leadership could have mopped the landscape clean but even they were not able to get away with it politically when we Yankees helped the Afghans run them out.

We could convert a fleet of heavy bombers to crop dusters and put a couple of weed killer factories on a round the clock schedule and empty the Iraq in a year and hardly lose a man in the process.

Television put a stop to hard core offensive combat operations on the part of western governments.This is a good thing of course – until a day comes that survival depends on playing total hardball. Hopefully that day won’t come for those of us reading this forum. But it has come many times to many peoples.

It has come now to maybe a fourth of whichever side loses the current conflict in Iraq. The losers will be disarmed and treated as badly as ever slaves were treated for the next few years.

Killing a slave meant killing a valuable trained draft animal.

Killing a Sunni or Shiite whose father or grandfather might have killed a member of your own family a decade or two ago will be a pleasure for a good many of the winners.

Both sides have long memories and an Old Testament mindset.

Interesting (and distinctly worrying) interpretation on events in Iraq and the broader ME:

http://www.yementimes.com/en/1750/opinion/3403/Why-the-great-Sunni-Shia-conflict-is-getting-ever-closer-to-the-surface.htm

The poor hosts, infected by nasty parasitic memes fighting to replicate, and rewiring the brains of the infected hosts.

Kinda like a lancet fluke infecting a ant, rewiring its brain, and alternating its behavior so it will get eaten so the fluke can reproduce.

Andy, from your linked article: “But for the U.S., the reasons for that new lack of interest are obvious. With America soon predicted to attain energy independence, why should the country continue to involve itself deeply in a region which has cost it so much in blood, treasure and international reputation?”

US energy independence?

Yes I find that comment ironic. Wouldn’t it be odd if the meme of US energy independence (however untrue) led to the US effectively stepping aside from any meaningful future involvement in the developing ME crisis – along the lines of we don’t need to be involved, we have all our energy problems sorted. If nothing else, the lack of US involvement/interference would create a substantial vacuum. There are no good outcomes to any of this, but it is possible to postulate such a vacuum as the cause of a much more rapidly developing disaster than perhaps would have been the case. US retreat/isolationism (based on the energy independence baloney) leads in my view to a quicker end-game.

Thanks for that link, very good historical perspective.

For a while now Halligan has been one of the best informed MSM Finance writers:

”Although it’s impossible to know how Isis will fare, I have three observations. The first is that, while I’m in no doubt America’s “shale revolution” is important, I’d still argue an awful lot of nonsense has been written about it to drum up investor interest, while pretending the West is no longer dependent on energy imports from “nasty” places like Russia and the Middle East. ”

”Secondly, this new threat to Iraqi oil supplies is set against an alarming trend barely mentioned by Western analysts. Last year, the global oil industry discovered just 13,000m barrels of oil, a third less than in 2012 and the lowest discovery rate in 62 years. I know 13,000m barrels still sounds a lot, but consider that 2013 global consumption was almost 33,500m. More wells are being sunk yet discoveries are falling, with field sizes on a long-term downward trend. All this points to much tighter energy markets going forward, not least given relentless demand from the Eastern emerging giants. ”

http://www.telegraph.co.uk/finance/comment/liamhalligan/10917145/Turmoil-in-Iraq-could-engulf-global-oil-market.html

Here are some numbers to contemplate.

My GNE/CNI Ratio* chart follows, with the extrapolation based on the 2005 to 2012 rate of decline.

Available Net Exports (ANE) fell from 41 mbpd in 2005 to 35 mbpd in 2012. Based on the 2005 to 2012 rate of decline in the GNE/CNI Ratio, I estimate that Available post-2005 CNE are about 168 Gb (total estimated cumulative volume of GNE available to importers other than China & India). Cumulative ANE for 2006 to 2012 inclusive were about 96 Gb, leaving estimated Available CNE at about 72 Gb at the end of 2012. ANE in 2012 were 35 mbpd, or 12.8 Gb. At the 2012 rate consumption in remaining estimated Available CNE, estimated remaining Available CNE would be depleted in about six years, but of course ANE are presumably on a downward trend, so remaining Available CNE would of course last more than 6 years.

In any case, based on EIA data and BP data, I estimate that the 2013 GNE/CNI value for 2013 was right around 4.4, which would fall on the extrapolated curve on the following chart. I estimate that ANE in 2013 were probably around 33-34 mbpd, versus 41 mbpd in 2005.

While we all agree that we won’t actually see Chindia consuming 100% of Global Net Exports of oil, the fact remains that it would appear that 2013 was another year that showed a progression toward that theoretical point.

*GNE = Combined net exports from top 33 net exporters in 2005

CNI = Chindia’s Net Imports

ANE = GNE – CNI

As someone said, what can’t continue tends not to continue, and there is no way we would have a functioning global economy if two countries consumed anything close to 100% to Global Net Exports of oil, but here’s the problem:

Given an inevitable ongoing decline in GNE, unless the Chindia region cuts their GNE consumption at the same rate as the rate of decline in GNE, or at a faster rate, the resulting ANE decline rate will exceed the GNE decline rate, and the ANE decline rate will accelerate with time. It’s a mathematical certainty.

In any case, the projected rate of decline in the GNE/CNI Ratio puts us at a point in 2030 at which we cannot arrive, but the 2013 data will almost certainly show that we continued to slide toward a point at which we cannot arrive

Quite the conundrum.

So at current glide-slope, On target for 50% ANE for OEDC in just 7 years, Of relevance would be to overlay an set of Global GNE assumption due to ELM, If forward GNE was also something ~50% in 7 years- .5 times .5 = .25% available. Am I Lost? Pondering how long might we have to “ACHIEVE” energy independence. Wonder what the average car loan is these days?

Production by the (2005) Top 33 net exporters was up slightly from 2005 to 2012, but their increasing consumption caused net exports in 2012 to be below 2005, with a sizable rate of decline in their ECI Ratio (ratio of production to consumption).

What happens from 2012 to 2022 is what I call the “$64 Trillion Question.”

Here are the 2012 values for the Top 33 net exporters in 2005, along with 2005 to 2012 rates of change (total petroleum liquids + other liquids, EIA, for net exports):

Production: 63 mbpd (+0.3%/year)

Consumption: 19 mbpd (+2.2%/year)

Net Exports: 44 mbpd (-0.5%/year)

Chindia’s Net Imports in 2012 and 2005 to 2012 rate of increase:

8.8 mbpd (+8.7%/year)

ANE (GNE less CNI) in 2012 and 2005 to 2012 rate of change:

35 mbpd (-2.3%/year)

If we assume that Top 33 production falls at 1.0%/year and consumption continues to increase at the same rate (2.2%/year), GNE in 2022 would be down to 33 mbpd, almost a 3%/year rate of decline. Given this decline rate, unless Chindia’s consumption of GNE falls at 3%/year, or more, the resulting rate of decline in ANE will exceed the GNE decline rate, and the ANE decline rate will accelerate with time.

For example, less assume that Chindia’s rate of increase in net imports falls to 5%/year. Their net imports in 2022 would be up to about 15 mbpd. ANE would be 33 – 15 = 18, approximately a 50% reduction in 10 years. The 2012 to 2022 rate of decline in ANE would be 6.6%/year.

“while pretending the West is no longer dependent on energy imports from “nasty” places like Russia and the Middle East. ”

I think last time (semi recent) I looked at the relevant EIA page, the imported 400K bpd from Russia.

That’s more oil than Greece burns.

the US imported

There’s a great deal more to ‘The West’ than just the US. Europe imports a bit, and if The West means the OECD then that includes Japan…

Patrick,

Obviously you’re confused but coming from New Zealand it’s not too surprising. “The West” means the states and territory lying west of the Mississippi River. Why do you mention Europe? They don’t even have any sheriffs there, I don’t think. And OECD, just don’t understand that at all. If you need anything else clarified…………

Doug

Very droll Doug….

Off Topic: China on path to “Nuke” themselves:

http://www.zerohedge.com/news/2014-06-22/china-builds-worlds-most-powerful-nuclear-reactors-regulators-overwhelmed

France has a lot riding on a smooth roll out of China’s EPRs. The country is home to Areva SA (AREVA), which developed the next-generation reactor, and utility Electricite de France SA, which oversees the project. The two companies, controlled by the French state, need a safe, trouble-free debut in China to ensure a future for their biggest new product in a generation. And French authorities have not hidden their concerns.

“Unfortunately, collaboration isn’t at a level we would wish it to be” with China, Jamet said. “One of the explanations for the difficulties in our relations is that the Chinese safety authorities lack means. They are overwhelmed.” “the state of conservation” of large components like pumps and steam generators at Taishan “was not at an adequate level” and was “far” from the standards of the two other EPR plants,

Chinese builders are entering the final construction stages for two state-of-the-art European Pressurized Reactors. Each will produce about twice as much electricity as the average reactor worldwide.

[OK so China building the worlds largest PWR plants, twice the size of US/EU plants, using substandard Cheap Chinese parts. How can this possibly not end in disaster? We have to be dumbest people in the Universe! I prey that one of these reactors completely fails during testing on before they fully power it up]

Hopefully the Chinese are better at building heavy machinery than they are at consumer goods.

California Drought: Snowmelt’s path shows impact from Sierra to Pacific

There’s some great quotes in this article:

Once, millions of salmon swam off California’s coast. This year’s population is estimated at 630,000. The drought has triggered emergency measures to save them from extinction, with the state shipping baby salmon, by truck, because there’s not enough water for them to swim.

The Emerson family of four uses 125 to 175 gallons of water a day — far above the 5 gallons of water used by the average African family, but far below California’s per-person average of 196 gallons a day.

When there not enough water for the salmon to swim up the river and you have to truck them to their spawning grounds, you know something is very wrong.

Peak oil and peak water (at least for California) at the same time. These are signs of an upcoming collapse.

I have memories of a drought in Southern California during the mid/late 1970s. The usual voluntary measures were put into place. When in a restaurant, for example, they no longer automatically brought water to the table. One had to ask. Cities turned off fountains, and let various municipal plantings (such as median strips, etc) turn brown. And I remember watching people in Newport Beach using their garden hoses to blast the sand away from their beach front home doors.

80% of water use in California is agricultural, so that is noise in the system.

Growing cotton and almonds, not to mention alfalfa and Rice, is a welfare give away from the corporate whores that carter to the AG pigs at the trough .

Hopefully, sanity will prevail soon.

Still, food production is way more important than car washes, green lawns, swimming pools, and golf courses. But I do agree that growing water intensive crops in a semi desert is a bad idea.

I believe that this is another case of the Republicans just saying “NO”.

Sydney can transform herself, like a cuttlefish, in a wink

of an eye. We pay our taxes but they don’t go to fixing our

roads, or the 1 in 4 bridges in this country that are almost

beyond repair.