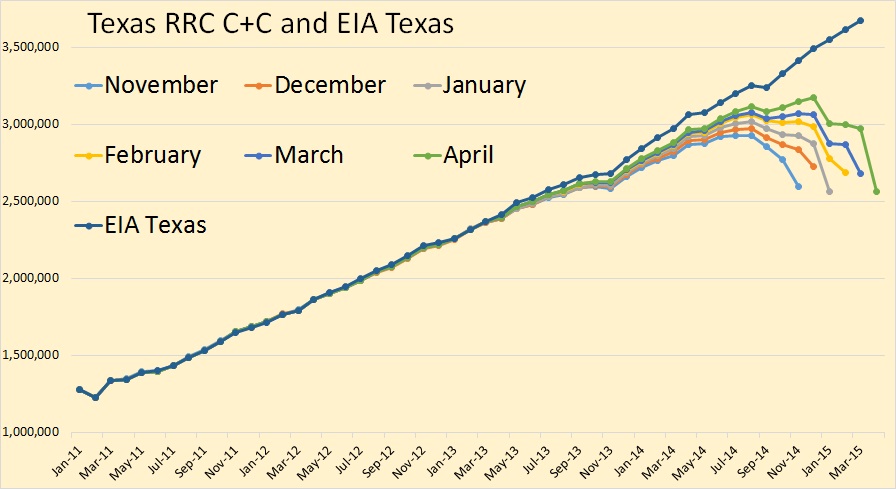

The preliminary Texas RRC Production Data is out this morning. There appears to be a considerable drop in Texas crude oil production in April. All Texas RRC data in the charts below is through April 2015 and all EIA data is through March 2015.

For those new to this site, the Texas RRC data is incomplete. The drooping lines will eventually, after the final data comes in, closer resemble the EIA data. Though I believe the EIA data is quite a bit too high at this point.

It appears that, when the final data comes in that Texas will have took a huge hit in January, recovered somewhat in February and March, then took another hit this past April.

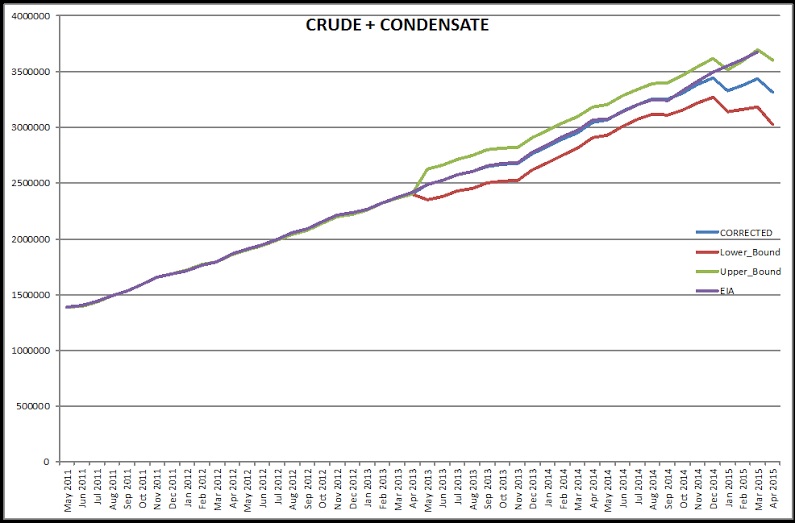

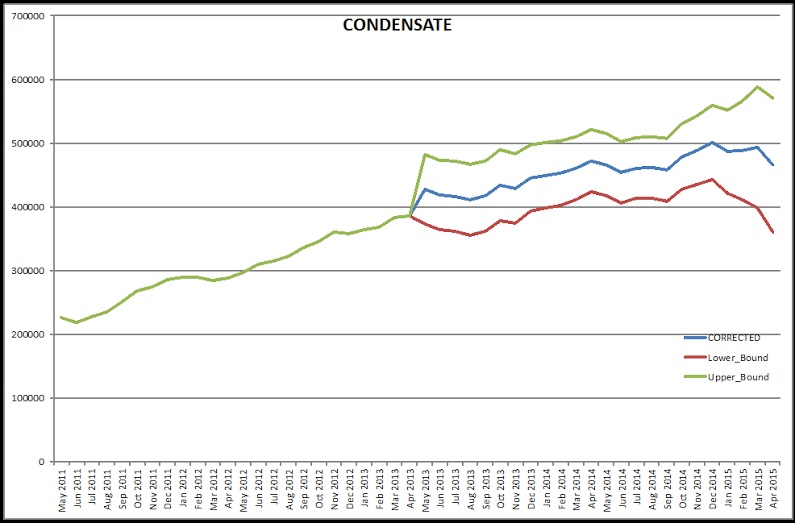

Dr. Dean Fantazzini, with his algorithm that calculates the final production numbers, also comes to the conclusion that Texas took a hit in April production. Dean has three results with the most probable in the middle.

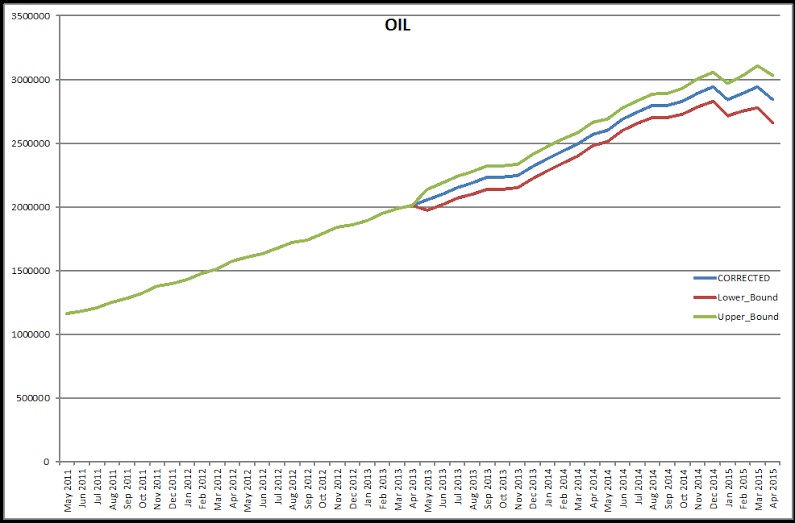

Texas Crude only, in April, when the final data comes in, should be slightly above January but still well below December.

Dean’s corrected data shows Texas crude only declining in January, recovering in February and March, then declining again in April.

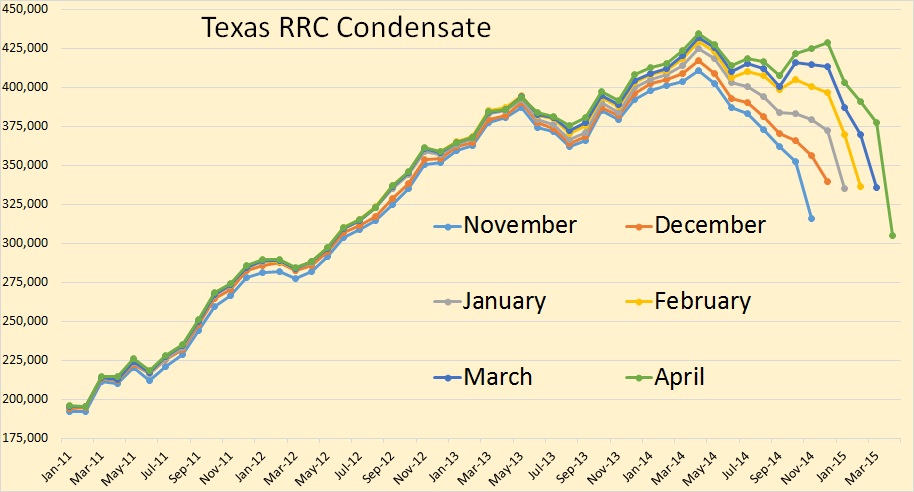

Condensate took a far greater hit in April than did crude only. This is likely because natural gas production in April took a bigger hit than did oil production.

This is Dean’s take on what Texas Condensate will be when the final data comes in. December appears to be the peak… so far.

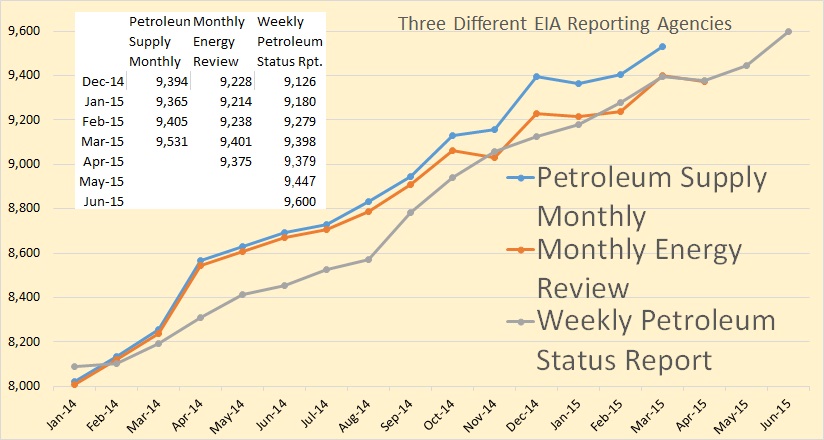

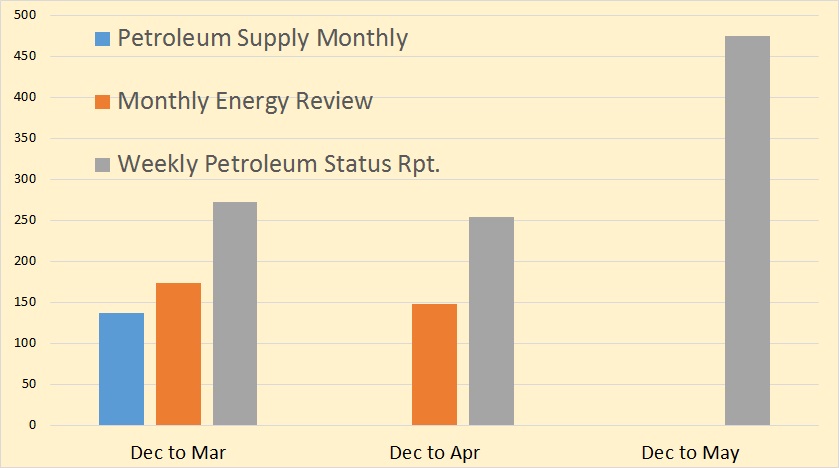

There is no doubt that North Dakota, the USA’s second largest producer, is down since December. And I believe the data clearly shows that Texas, the USA’s largest crude oil producer by far, is down also. Then how is it possible that the EIA has US Production up so much since December?

In the chart above as well as the one below, the weekly production data are the averaged per month. The June weekly numbers are the average of the last two weeks reported data.

This is what the three different reporting departments say has happened to US C+C production since December 2014. I believe this will turn out to be the largest production error in the history of the agency.

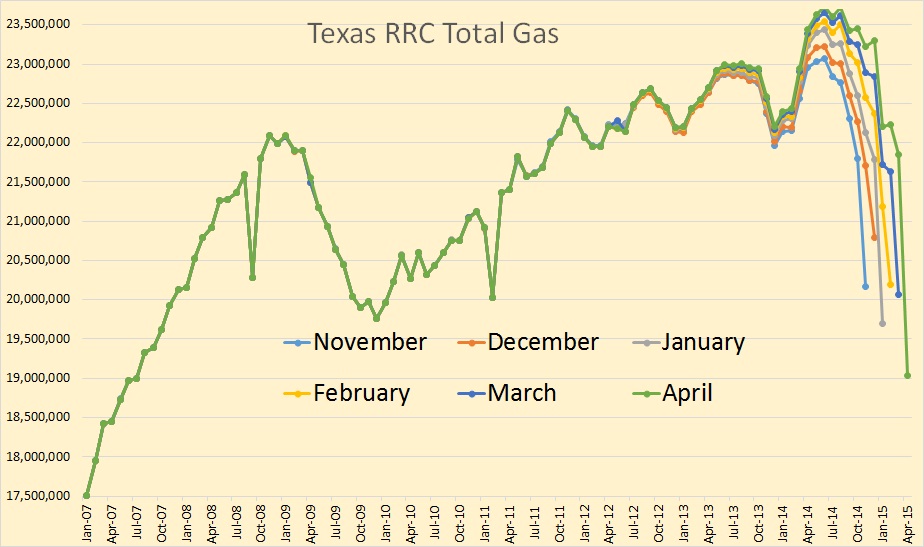

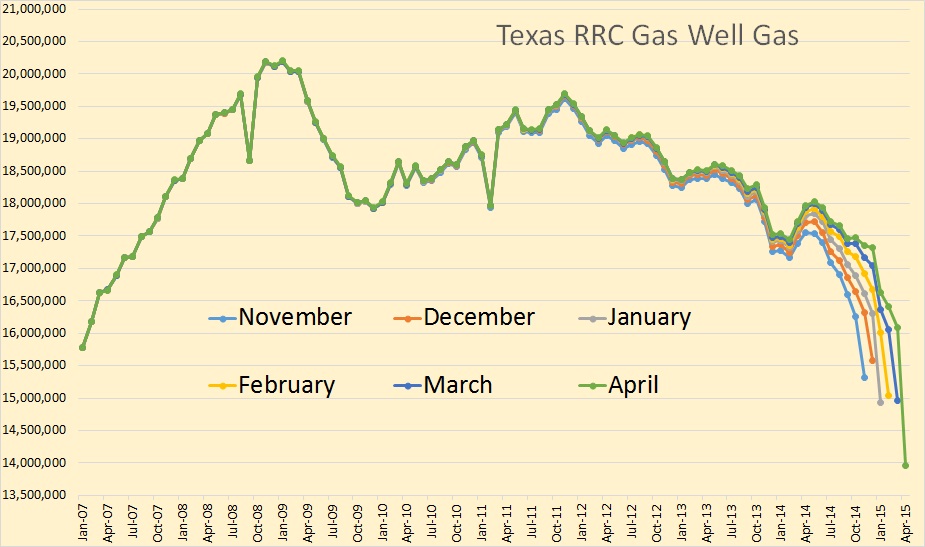

It appears that Texas Natural Gas took a bigger hit than did oil. All natural gas data is in MCF.

This is Dean’s estimate of what the final Texas natural gas production will look like. The peak, so far, is in December, just like crude oil.

Texas gas well gas peaked way back in April of 2009. In April it was Texas gas well gas that took the biggest hit of all.

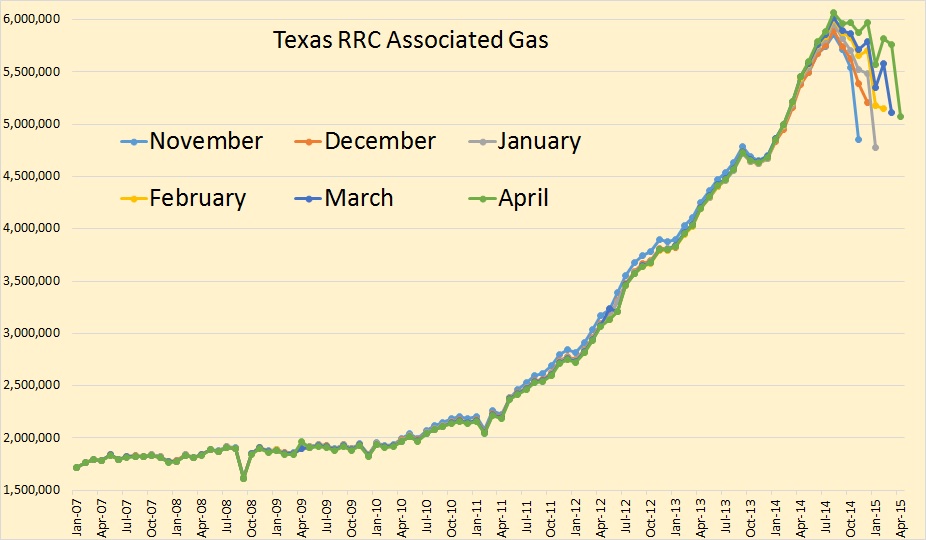

Texas associated gas did not take nearly the hit that gas well gas did. This is gas from oil wells. So it appears that even though oil production did take a hit in April, natural gas took an even bigger hit.

The North Dakota Director’s Cut is just out.

Mar Sweet Crude Price = $31.47/barrel

Apr Sweet Crude Price = $38.33/barrel

May Sweet Crude Price = $44.70/barrel

Today’s Sweet Crude Price = $48.00/barrel (all-time high was $136.29 7/3/2008)

Mar rig count 108

Apr rig count 91

May rig count 83

Today’s rig count is 79 (lowest since December 2009)(all-time high was 218 on 5/29/2012)

The statewide rig count is down 64% from the high.

Comments:

The drilling rig count dropped 17 from March to April, 8 more from April to May, and has since fallen 4 more from May to today. Operators have each been experimenting with running 1 to 2 fewer rigs than their planned 2015 minimum to see if drill times and efficiencies will continue to improve. This has resulted in a current active drilling rig count that is 5 to 8 rigs below what was operators indicated would be their 2015 average if oil price remained below $65/barrel. The number of well completions dropped sharply from 244(final) in March to 94(preliminary) in April. Continued oil price weakness anticipated to last into next year is by far the primary reason for the slow-down. There was one significant precipitation event in the Dickinson area, 10 days with wind speeds in excess of 35 mph (too high for completion work), and no days with temperatures below -10F.

At the end of April there were an estimated 925 wells waiting on completion services, an increase of 45. To maintain production near 1.2 million barrels per day, 110-120 completions must be made per month.

Drilling permit activity decreased slightly from March to April and significantly more from April to May as operators positioned themselves for low price 2015 budget scenarios.

Helms is saying that wells awaiting completion increased by 45. This makes no sense whatsoever. Wells completed in April totaled 153. Spuds were 129 in March and 94 in April. How on earth did “Wells Drilled” increase by 45 above “Wells Completed”?

___________________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com .

464 responses to “Texas Oil and Gas Production for April”

For all,

Ron, nice post.

Not about Texas, I just posted an update on Bakken LTO with data as per April 2015 and with a closer look at 8 companies;

Continental Resources, EOG Resources, Hess Bakken Investments, Marathon Oil Company, Oasis Petroleum, Statoil Oil & Gas, Whiting Oil and Gas Corporation and XTO Energy.

There are some interesting differences between the companies and their response to the collapse in the oil price.

http://fractionalflow.com/2015/06/18/status-on-the-bakken-red-queen-with-data-as-per-april-2015/

(Lots of statistics)

That is probably the most informative info on the Bakken that I have read. I knew Continental was still trying to out produce OPEC, but the percentage of production these companies represent tells a lot.

Could the big difference between what you think and the government estimate be related to the gulf of Mexico?

The Gulf of Mexico federal has been declining since it hit a peak in December 2014. I don’t think new projects will offset additional decline. However, we need to wait for more information.

Saudi oil exports down 500,000 in April. due to higher domestic use and their ever increasing refining capacity. Ramadan began yesterday so there oil consumption will the much higher June/July: http://mobile.reuters.com/article/idUSKBN0OZ0YG20150619?irpc=932

India’s oil consumption is increasing rapidly causing it to ascend to being the world’s third largest importer: http://oilprice.com/Energy/Crude-Oil/India-Becomes-3rd-Largest-Oil-Importer.html

Link to Saudi net exports discussion, and to discussion of Chindia’s Net Imports (CNI), on the prior thread:

http://peakoilbarrel.com/bakken-april-production-data/comment-page-1/#comment-521843

Key Points:

Net exports are, of course, the ultimate measure of “keeping it for the grandchildren” but the more compelling point is simply China’s 11.056 million bpd oil consumption as those relentless car buys define reality, and of course now India –>

3.846 million bpd burned, up 3% on the year. Only US at 19+ (up 0.5%), China at 11+ (+3.3%) and Japan at 4.3 million bpd (-5%) burn more. Japan’s pop down about 1% and economics pathetic so there is no hope to be found there for any efficiency boost.

China and India have those huge populations so they MUST ramp up their per capita consumption. There is nowhere else to get it than tankers going somewhere else. They have their own central banks so they’ll always be able to pay any price.

Not if they’re smart: EVs are cheaper and better. And in fact, Chinese EV sales are growing very fast.

I suppose if we’re feeling competitive with China, we should hope that they buy more ICEs, and dig themselves into a bigger hole.

Nick G,

“I suppose if we’re feeling competitive with China, we should hope that they buy more ICEs, and dig themselves into a bigger hole”

Such a statement is truly effective cynical sarcasm that forces people to think and ponder the effects. Very straightforward, easy to grasp statement that forces ones mind to delve into whether such a scenario is “good” or “bad” for the U.S.

My biased hypothesis is that more ICEs = more non-discriminatory oil demand = higher (all else being equal) oil prices = negative impact on world’s largest oil consumer.

Many tribes requiring fruit from a single tree yields a common need, separate cultures that can relate and understand each other. Demand for a single good yields economies of scale and, through economies of scale on both the demand and supply side, makes the good cheaper to produce and consume.

That is, until it plays musical chairs and mandates that any party requiring a chair pay whatever maximum marginal value they can afford. Whomever is more entrenched pays dearest, and every party is forced to ante up to their highest price.

Clearly a tongue-in-cheek statement to get people thinking, and a successful one at that. The more inelastic demand produced by China’s dependence on ICEs, the more both the U.S. and China suffer as a declining harvest forces a bidding war.

If China follows our path and buys more ICEs we both lose, if China buys more EVs they win. Both options result in the U.S. losing. The U.S. only “wins” if its own path, regardless of China, is one of a strong transition to EVs, renewables, and acceptance of autonomous vehicles.

If the U.S. maintains its lead in those technologies (primarily through Silicon Valley), then the game of musical chairs will be to our advantage. As chairs are taken away we’ll not only be reducing our demand for chairs, but will be selling new chairs to the world as the old ones deplete.

The U.S. became a superpower by being the world’s largest supplier of the fuel of industrialization. It could happen again if circumstance and policy allow the U.S. to be the world’s largest supplier of the next revolution in energy. I’m not referring so much to supplying renewable energy, but in providing the vehicles and infrastructure that make it possible – batteries, services (like apps that make autonomous EV service convenient and cheap), and products (vehicles, charging stations, autonomous software).

Possible? Yes. Likely? Can’t say.

When it comes to oil demand the U.S. is coming to be in an oddly beneficial position, relatively speaking. Potential growth in marginal U.S. demand is limited; everyone already has ICEs, so competing for MORE isn’t essential. China is only just beginning its suburban, consumer oriented, gas dependent transition. The U.S. is already saturated which means it has the highest inelastic demand in the world, but that very problem may not be as bad as China’s need to not only MAINTAIN inelastic demand but to GROW its inelastic demand.

Neither country has a preferable position, and declining supplies will impact both in severely harsh ways.

What is worse? A stable need for 1L of vodka per day, or a need of .75L of vodka that grows higher every day? An oversimplified analogy in every way, but certainly something to think about.

All of us are swimming in the same pool. All of us are pissing in it.

So if one or the other of us gets the others to piss more than they— all of us are now swimming in yet more piss.

And here we all are, with super-abundant available energy pouring all over us every day from our local gravity-stable thermonuclear reactor, which can easily drive that piss back thru the membrane into purest water.

So, let’s all get together and DO IT.

BTW, those chinese “need” more ICE’s like I need another heart attack.

Mustn’t forget that we have been pissing in the pool for longer than the Chinese. The baseline yellow colour in the water is from us. The fact that the Chinese are now able to piss at the same rate as us should not obscure the fact that we’d already soiled the pool.

Anyway here is hoping that the Chinese, Germans and Californians, by embracing solar, might save us from ourselves.

It’s a forlorn hope.

That suggests that it’s a sacrifice for the Chinese to transition away from coal and oil.

That’s the point: the faster the Chinese move away from coal and oil, the more affluent and healthier they will be.

nick (ouch) – do you seriously think that there is even the slightest possibility of manufacturing the 20 million or so EVs that china NEEDS each year and the hundreds of millions of batteries that that would take?

And thats just china never mind the rest of the world which would triple those numbers. Ridiculous.

So what you’re saying is, invest in lithium mining companies?

I know.

Can you believe there are people who think that the US can get up to 1 million barrels of oil per day production?

I mean, even if there were that much oil in Pennsylvania, there wouldn’t be enough horses and barrels to transport it anywhere.

I hear that fancy new electricity is going to replace kerosene for lighting, then what are those oil drillers going to do?

Let us take a step back and rise up out of the weed-hopping to a higher analysis vantage point:

Point to ponder: What is the Chinese adopt manufacturing automation/robotics in a big way to increase their manufacturing efficiencies/productivity?

Great! Right? Higher productivity can mean lowers costs, greater market penetration, more profits…what’s not to like?

Ask Henry Ford.

What will be done with the displaced workers? Back to the fields? Sweeping streets? Back to the higher education/vocational training mill to retrain X people to compete for X/?? jobs? Will these jobs have lower compensation due to a surfeit of workers and a reduced number of available positions to fill? Put them on the state dole? Put them in the PLA and menace their neighboring countries?

http://www.naturalnews.com/042357_China_robotic_labor_manufacturing.html#

But this issue is Much larger than just China:

http://www.nytimes.com/2012/08/19/business/new-wave-of-adept-robots-is-changing-global-industry.html?pagewanted=1&_r=2

Between the quest to continually outsource human touch labor to countries with lower-cost labor (and lax to practically non-existent environmental and labor/safety protections) and the drive to automate everything possible, there is a profound question about what exactly all the surplus people are supposed to do to ‘earn a living’….especially given that a high number of displaced workers will likely equate to lower wages for the jobs that are left for humans to do (with exceptions at the minority report level for the superstar engineers and scientists and managers/owners in the system).

Henry Ford know that in order for there to exist consumers with enough scratch to buy his wares, these consumers needed to be employed and be paid enough money to buy his stuff!

Here is a short fiction book that attempts to address these issues:

Manna:

http://www.amazon.com/Manna-Two-Visions-Humanitys-Future-ebook/dp/B007HQH67U/ref=sr_1_1?ie=UTF8&qid=1434911110&sr=8-1&keywords=Manna

I think the book is a technocopian pie-in-the sky cop-out that invokes techno-majic to avoid both the .001 % phenomenon (Morlocks-Eloi) and also to duck any Limits-to-Growth issues, but read the book and judge for yourself.

there is a profound question about what exactly all the surplus people are supposed to do to ‘earn a living’

In my opinion, this is a huge issue and not one addressed by most economists or policy makers. We’ve got more people than we need for the workforce.

Now, there isn’t really any reason why we need to have the world’s population all working 40-50 hours a week. We could have a system where everyone works 10 hours a week. But right now we would rather pay a few people to work a lot and then we don’t know what to do with everyone else.

In terms of future scenarios that get talked about here, it means that the top 1% or the top .1% don’t really need most of the world’s population. So if lack of resources, disease, war, or so on eliminate a lot of people, that shouldn’t lessen the quality of life for those few who have amassed a nice life for themselves with sufficient resource to keep themselves, their families, and a small support community going.

At the same time, the fact that the wealthy don’t need a lot of people, and many people may turn out to be economically dispensable, is good for the environment. If a significant number of people disappear, then the few that are left and the other species that are left may have a better chance at survival.

None of this is fair. The wealthy don’t deserve a better chance at survival, but I think it will happen.

We don’t have a surplus of workers. We have inadequate aggregate demand, largely due to misplaced priorities of the 1%.

There’s a great deal of work that needs to be done in the world: health care, medical research, childcare, education, building of infrastructure, including renewables, environmental remediation, etc.

There’s a great deal of work that needs to be done in the world: health care, medical research, childcare, education, building of infrastructure, including renewables, environmental remediation, etc.

Definitely we could use more people in childcare, elder care, care of the disabled, and so on. But we don’t want to pay them. So until the economic system is reconfigured to pay people for necessary work, or until the system is reconfigured so that everyone works a little at paid work and then has time for unpaid work, it doesn’t function well.

Where the surplus worker idea comes in is that when the wealth is concentrated in few hands, they are the ones to determine who they choose to pay. They need relatively few people to sustain their wealth. Everyone else is surplus to the wealth-holders.

In feudal times the landowners needed people to work the land. They needed people to make the food. And so on. They didn’t want to wipe out entire villages because those people provided manpower. But now manpower and horsepower can be supplied to the wealthy by machines.

Good conversation.

Once again, recommend the book ‘Manna’…it is fiction, but seems to represent the author’s ideas on this subject.

It is a whopping 99 cents on Amazon, and a short and interesting read. The automation aspects book evoked my memories of the Phillip K. Dick short story ‘Autofac’, although the plots are quite different.

http://www.philipkdickfans.com/mirror/websites/pkdweb/short_stories/Autofac.htm

It is thought-provoking…enough to perhaps motivate people to consider these issues.

No, I am not the author…no self-promotion in play!

Pervasive automation, the Limits to Growth, and their collision with the non-negotiable U.S. American lifestyle (goes for other countries as well) are topics of top-shelf importance…profound predicaments.

Watcher Wrote:

“China and India have those huge populations so they MUST ramp up their per capita consumption. There is nowhere else to get it than tankers going somewhere else.”

Both India and China have high inflation, China is also in a massive bubble (Real Estate morphing into equities). China and India can not print themselves prosperty or use it fund oil imports.

Saudi oil exports down 500,000 in April. due to higher domestic use and their ever increasing refining capacity.

If their refining is increasing, then presumably their imports of refined products are decreasing. Decreasing refined product imports would offset lower crude exports. That’s why Jeffrey refers to “net exports”.

Nick, here’s a quickie look at the storage requirements for a hypothetical interconnected wind power grid built in Western Europe.

http://21stcenturysocialcritic.blogspot.com.es/p/blog-page_19.html

I played around with actual data I got from Euen Mearns’ blog, and pretty much copied a similar study he had performed, but I changed some of the parameters to investigate the energy storage requirements. This is a very rough look, I sort of cut it short, maybe later I’ll see if I can optimize it and add the total demand to visualize whether this makes any sense.

Hmmm. If I read this correctly, for this period average production would be about 23.3GW, 22% short of the specified 30GW. Storage of 160GWh’s would cover the shortfall.

82GW of wind power would cost about $164B. 160GWhs of pumped storage would cost about $16B (at $100 per kWh). That’s a premium of about 10%. That doesn’t seem like a break-the-bank kind of cost.

NickG Wrote:

“82GW of wind power would cost about $164B”

Either divide power by 3 or multiple the cost by 3. Wind output only operations at about 30% of nameplate capacity. Solar is worse, only about 20% of nameplate output.

I used 30. You should look over the graphs. But that quickie study only used the month of January. If I get a chance I’ll do the month with the lowest wind availability.

I went back and looked over the spreadsheet, extracted the max hourly delivery for each sector and got a total 110 gigawatts. If we allow an extra 5% for units being repaired or maintained we need 115 mw to get the 30 mw. That’s less than the 30 % suggested for wind.

I think the problem arises because some of this network is installed in areas with poor wind? Thus far I haven’t seen a well crafted study showing a really large wind power kit can deliver reliable power at a reasonable cost. As the pope says, renewables need a battery.

Total and complete nonsense from an electrical infrastructure perspective. Every single bit of “kit” connected to the grid requires back up or “battery” in your parlance. The demand itself is variable!

I think this can be optimized (I did it in a couple of hours). Let’s assume your figures are right: $180 billion for 30 gigawatts. I think the cost is slightly higher, because this requires a very sturdy interconnect. But what I’m focused on is the procedure.

I was thinking the key may be to have a control system, to be installed in each metered facility (commercial, industrial, residential, etc) which can send a shutdown signal to appliances. This would allow load shedding on a tiered basis. Those who don’t want to have their washer shut down can pay more. For example, I don’t run the AC, but use fans in the summer. It wouldn’t be a huge deal to have the fans shut off automatically, if it happens a couple of times per month.

Yeah, Demand Side Management (DSM, aka Demand Response) makes a lot of sense.

There are a lot of ways to do it. You’re describing a traditional Industrial/Commercial curtailment model, but you could use Time of Day/Use pricing with smart meters, or just have devices that sense the grid frequency.

I prefer the pricing model myself: just set pricing dynamically, and have devices programmed to respond. Your smart meter could receive 24 hour forecasts, and your EV would choose when to charge (or discharge back to the grid) to minimize overall cost.

In that case i may need the ability to re order priorities. I wouldn’t want my tv turned off in the middle of a football game.

That’s the nice thing about the pricing model: you program in your priorities, and the device uses your preferences to respond to price signals.

It doesn’t give quite the same top-down control of the I/C curtailment model, but utilities would learn how consumers respond, and develop the pricing model they need to shape consumption.

Consumers could choose to pay more, if they really need to something at a particular time, and utilities would spend what was needed to match supply & demand. In turn, if that was expensive, consumers might respond with lower consumption at that time. It would develop naturally over time.

A smart grid system as you describe has already been tested.

The study ran for three years between 2010 and 2013 on a few villages in the North West of Jeju island. In the show-house I visited the smart meter could be set to turn off individual appliances as the price varied.

For a look at some of the results of that study see

A Study on Jeju Power System Considering Smart Grid Elements.

http://www.tandfonline.com/doi/pdf/10.5370/JICEE.2013.3.4.300

Need a larger test using a market with a representative profile. Maybe the Germans will volunteer?

More research is always good. Of course you can’t find a tougher test than a small island. A much larger grid will be much easier to keep stable, due to the law of large numbers.

Demand Response is semi-old news, at least in the U.S.

Several 10’s of GW of DR exist in the US as of 2013.

http://iet.jrc.ec.europa.eu/energyefficiency/sites/energyefficiency/files/files/documents/events/8_dnv_kema_15102013.pdf

https://en.wikipedia.org/wiki/Demand_response

case study from vendor of system for Pepco Holdings (aka Pepco, Delmarva Power, Atlantic City Electric):

http://www.comverge.com/comverge/media/pdf/Case%20Studies/Pepco-Holdings,-Inc-Case-Study.pdf?ext=.pdf

373 MW, 392,000 customers enrolled, starting in 2009.

blah blah from vendor about how it works:

http://www.comverge.com/home/demand-response/

hardware is getting kind sophisticated:

http://www.comverge.com/product-pages/hardware/

I would like to see a test of people behavior. We don’t know how a large Western European population will cut its demand when given a price signal.

The total system cost is $230 billion plus $16 billion plus say $20 billion for the grid. Total is $266 billion for say 35 gw to 40 gw (asumíing some demand management). That’s $6.7 million per mw. What may work better is to jack up storage somehow. It always seems to come back to storage.

We don’t know how a large Western European population will cut its demand when given a price signal.

Well, Europeans tax personal transportation fuel to create prices that are about twice as high as the US, and they use only 18% as much personal transportation fuel per capita. That’s pretty clear.

$6.7 million per mw.

Which is pretty cheap. Amortize that 6.7M over 30 years at 7% interest, and you get an annual cost of 54 cents per watt. Divide that by 8.76 kWhs per year, and you get 6.2 cents per kWh.

That’s mighty affordable, especially given that you’ve included some of the grid overhead costs.

I’ve used the following example to illustrate the differences between gross and net exports:

The same garbage put out by the Energy Idiots Agency is used by the IEA.

So if EIA forecasts are so bad, why does anyone pay attention to EIA forecasts for renewables??

habit 🙂

Does anyone know anything about IRENA?

Am posting a couple of comments about windmills.

Firstly in the UK – With an installed capacity of 576 megawatts, Gwynt y Môr the world’s 2nd largest offshore wind farm was inaugurated yesterday.

See – http://www.4coffshore.com/windfarms/gywnt-y-mor-launches!-nid1953.html

Whereas in South Korea the big plans announced in 2011 to build the world’s biggest offshore windfarm are going nowhere. The big Korean conglomerates that were investing heavily in wind turbines all seem to have backed out recently (Samsung Heavy, Doosan, Hyundai Heavy). I live on Jeju Island. Official policy is that this island of half a million people will be 100% reliant on renewable energy by then. Seems unlikely! A second part of the policy is that all 400,000 vehicles on the island will be electric by 2030. The local governor has teamed up with LG Chem in promoting this idea. Currently EV’s make up about 0.5% of the cars on the island.

My own feeling is that peak oil and associated financial ‘collapse’ will happen long before 2030. But I expect all advanced nations to survive intact and for the electrical grid to remain on. Gasoline for regular civilians however may be either a) expensive b) rationed or c) unavailable. EV’s will become more valuable. Windmills however may not. Without a working storage solution their usefulness is debatable.

Great comment(s), thanks for the update.

Maybe you should buy up all the Jeju horses and make a killing!

Of course, EVs provide storage. They can buffer supply variation by charging when supply is high. They could also buffer low output with Vehicle-to-Grid power.

There’s a nice synergy between EVs and wind/solar.

If this scenario unfolds my Volt will be my most valuable asset. I’ll be able to purchase my alloted, rationed amount of gas since I do have an ICE. However, I can simply resell it to the most needy person as I won’t need it.

I can only imagine the re-sale value would skyrocket as people clamor for used EVs. I’m of course assuming high oil prices would make most people poor, induce recession, and reduce the ability of people to purchase new EVs. Demand for any and every EV would rise, but due to negative economic conditions demand for relatively cheaper used EVs would skyrocket.

Really I’m just fantasizing about a hypothetical future where people envy my EV purchase instead of questioning it. Really they already should! I got my Volt for $16,500 when an equivalent Prius was $24,000. By paying $7,500 less I got superior acceleration, 1200 mpg (my overall mpg after 3,600 miles) compared to a Prius’ 60mpg, and my near zero use of my gas engine means that at 100,000 miles I’ll have an ICE with a youthful 30,000 miles in wear and tear.

The best way to think of a dual vehicle like the Volt is this: even if the battery craps out after 70,000 electric miles you still have a completely functional ICE with only a few thousand miles on it. Drive it as an EV for 10 years, and even then you still have a low mileage ICE. The way the market is priced at the moment is confirmation that this fact is entirely forgotten.

Even that “battery goes bust after 70k EV miles” scenario is absurdly pessimistic. There are now hundreds of Volts with over 70k electric miles now. None of them, not even ONE, is experiencing range loss of over 5%. Don’t get me wrong, Nissan LEAFs, due to a higher SOC and their cheaper air cooling system, are frequently experiencing range loss of 20-30%. Chevy Volt’s only use 50% of their battery capacity (50% SOC). This means you pay for a much larger battery, but only get to use half of it. It is quite literally equivalent to paying for a 16.5 kWh battery, but only getting an 8.25kWh battery. Combined with the Volt’s more expensive liquid cooling system it means that you pay much more money for not just an equal EV range, but a LOWER EV range.

The end result is that people’s real world experience in a Volt is to go 70,000 EV miles with no range loss while a Nissan LEAF can go 40,000 EV miles and rewards you with a 20-30% range loss. Over the next few years this data will transition from being common knowledge amongst EV enthusiasts to being common knowledge in the public arena. Resale values of older Volts will increase as consumers transition from fears of battery capacity loss to the crystal clear fact that some EV models were specifically designed to never experience such things.

I am not paying close attention to LEAF battery life but it is my impression that the typical Leaf battery does not go down hill so fast.

The ones used in extremely hot or cold climates may be wearing out as fast as you indicate.

OFM,

As usual you are correct. Severe range declines in LEAFs are found in climates with pronounced hot and/or cold temperatures. They’re outliers in other more moderate climates, but are not uncommon in the numerous non-moderate climates of the Midwest, Northeast, and Southwest.

Nissan went for the unfilled niche of affordable EVs, and in order to achieve that they did what they had to. As they update the LEAF this issue will be less of an issue, but it is a significant issue that is unique to the LEAF at the moment.

More extreme, albeit common, climates that experience the heaviest capacity declines are merely indicative of the flaws inherent in using an air cooled battery design with a higher SOC. That being said, it was the only way to produce a vehicle in the affordable EV market, and the result was clearly an overwhelming success – the Nissan LEAF is consistently a top seller in the EV market.

I don’t mean to bash Nissan as I see what they were doing as a business strategy and it clearly was successful. I just think that the long-term consequence will be that current Gen LEAFs will experience sharply declining resale value compared to that of the Volt. As of right now, the difference in MSRP for a new Volt is far, far higher than a LEAF, reflecting the much higher costs of the Volt’s battery size and liquid cooling system. However, the price difference between a used LEAF and a used Volt are marginal. After a lot of research I concluded that the price difference in the used market between these two vehicles is highly, and temporarily, distorted.

If buying a new vehicle, then the LEAF is a better option, but, then again, the people who buy new vehicles aren’t concerned about depreciation – otherwise they wouldn’t buy new in the first place.

If one seeks the best value, and is looking to mitigate the risk of depreciation of their vehicle, then the Volt is, at the moment, the best opportunity in the entire vehicle market – be it EV, ICE, PHEV, hybrid, or whatever.

All very interesting. I bought a Leaf because I knew I could get a combustion car more or less immediately any time I needed it, so why bother to tote one around in our usual short trips?

In two years we have used that Honda only twice, a couple of hundred miles. All the rest was the Leaf.

My wife was at first timid in using the heater or AC, but soon learned to do so freely, since her average trip is usually less than 30 miles.

We have not noticed any battery decay.

We also bought the necessary PV at the same time, all of it together a real bargain compared to my friends and their big pickups.

I gave a little talk to local energy group on the Leaf as a used car bargain, and was greatly surprised that a lot of them then went out and bought one, 11-13K each around here, that is, an essentially new car just like mine for less than half price.

Of course I myself would prefer a bare bones model A version EV, but wife loves the cushy feel and the great sound system.

https://www.dmr.nd.gov/oilgas/directorscut/directorscut-2015-06-19.pdf

The number of well completions dropped sharply

from 244(final) in March to 94(preliminary) in April. Continued oil price weakness

anticipated to last into next year is by far the primary reason for the slow-down. There

was one significant precipitation event in the Dickinson area, 10 days with wind speeds

in excess of 35 mph (too high for completion work), and no days with temperatures

below -10F.

Over 98% of drilling now targets the Bakken and Three Forks formations.

At the end of April there were an estimated 925 wells waiting on completion services, an

increase of 45. To maintain production near 1.2 million barrels per day, 110-120

completions must be made per month.

Hi Toolpush,

The very poor estimates by Lynn Helms on the number of wells completed relative to the number of new wells that start producing each month (which is the more important number). makes me question if Helms estimate of the frack log is any better. If the estimate is correct and the 75 rigs can drill one well per month and we need 140 new wells per month for relatively flat output, then we would need 65 wells per month out of the frack-log. If there are 900 wells waiting on completion, then 900/65=13.8 months until we run the frack-log to zero, at that point output will fall if the rig count is not increased.

I think by June 2016 oil prices will be at a level where more rigs will be working and output can remain flat unless new well productivity starts to fall before that time.

Hi All,

I agree with Ron about the petroleum supply monthly data being too high, but it is not clear to me that Texas will be lower in April, it seems to me that Dean’s estimates for the most recent couple of months (say March through April in this case) will tend to creep up over time. My guess is that the Monthly energy review estimates will be within 100 kb/d of the correct output for April 2015.

In fact, I would estimate that the petroleum supply monthly estimate is mostly incorrect due to a poor estimate of Texas C+C output. If we take the difference between the Petroleum Supply Monthly and Monthly Energy review for US C+C output and assume that all of this difference is an overestimate of Texas C+C output we get a “modified” EIA estimate for Texas which I show in the chart below. Looking back at Dean’s estimate from last month it looks like the March C+C estimate has indeed increased somewhat from last month’s estimate and I think if Dean looks back at his old estimates for the most recent couple of months for each of his estimates he will find that they are always an underestimate relative to the newer estimate, so that his estimates are biased on the low side for the most recent 2 or three months. Dean can correct me if this is not the case, I am guessing based on only two month’s estimates (from June and May of 2015). A chart of the “best estimates” from Jan 2015 to June 2015 would be instructive (similar to what Ron does for the RRC data).

So my guess is that Dean’s estimate is correct through Feb 2015, but that his estimates may be a little low for March and April. My estimates below for Texas C+C in kb/d:

Sep-2014 _ 3202

Oct-2014 _ 3265

Nov-2014 _ 3289

Dec-2014 _ 3326

Jan-2015 _ 3402

Feb-2015 _ 3447

Mar-2015 _ 3545

Apr-2015 _ 3581

Dennis, you have Texas January production up 70,000 barrels per day. The Texas RRC data, after three months of corrections still has January down by 165,000 barrels per day from December. I would bet you big money that Texas production actually declined in January and your January estimate is off by well over 100,000 bpd.

Incidentally, another EIA reporting agency just published their numbers through February 2015. The International Energy Statistics just came out. They have January US C+C production down 14,000 bpd and US Total Liquids down by 351,000 barrels per day. Eventually the EIA gets it right. But those January C+C numbers will still be revised lower.

Hi Ron,

The December estimate I made may be too low, the assumption that the Monthly Energy Review is always the better estimate is probably incorrect, I would not sweat the specific month to month variations too much, the bottom line is that we will know in two years what actual Texas output is (as in a complete accounting of all Texas output).

In the mean time you can claim that Texas output was down sharply in January and perhaps you are correct, I don’t really get too excited by little wobbles up and down from month to month, the overall trend is what matters, I believe that trend is up, time will tell.

the bottom line is that we will know in two years what actual Texas output is

Well it will not be nearly that long before we have a very good idea what is happening. For instance we already know that there was a big drop in Texas oil production in September, 9 months ago. And I already know that there was a huge drop in January. But apparently you are not yet aware of that fact. 😉

Dennis, apparently you are of the opinion that the Texas RRC data is totally worthless. That is far from the case. Every time there is a huge drop or a huge increase in the RRC data that change always shows up in the final data. Not by the magnitude it first appeared of course, but the hugh change does not magically go in the opposite direction months later.

Just check September and May of 2014 and November of 2013. These months showed huge drops the month they first appeared, and that decline is still there.

Hi Ron,

It depends on how you define huge, if 100 kb/d is a “huge drop”, perhaps you are correct. A bet would need to define “well over 100 kb/d”, does that mean 150 kb/d. Note that my December value may be too low. Are you saying that January output will be 153 kb/d under the value I have estimated, which would be less than 3250 kb/d for all Texas C+C output?

I am thinking that is more than Dean’s best estimate.

If Dean is reading, it would be interesting to see the numbers for his central estimate from October 2014 through April 2015 for TX C+C.

Hi Ron,

It looks like Dean’s central estimate for TX C+C in Jan 2015 is about 3300 to 3350 kb/d , my estimate for Jan 2015 is about 50 to 100 kb/d higher than this. In my mind, given how little good data we have, this essentially the same estimate, it is well within the 95% confidence interval in Dean’s chart( the low end of his range is about 3200 kb/d vs my estimate of 3400 kb/d and the high end of his range is above 3500 kb/d).

Dennis, my point is that you show the trend climbing ever upward just like the EIA. My point is that Texas April 2015 production is below December 2014 production. Therefore the trend is down.

Dean is on vacation, out of range of the internet and will be there for about a week. He sent me his charts from the airport as he was leaving.

Hi Ron

December was a high point we don’t want to cherry pick.

Dennis, December happened. Oil peaked, so far in the Bakken, in December. It was very likely the high in a lot of other places also.

Pointing out a high in production is definitely not cherry picking. Also any downward trend always begins at the high point. It could not possibly do otherwise.

I will not point to the peak in any production and call that cherry picking though you are, of course, free to do so.

Hi Ron,

The trend at this point looks very slightly down, based on Dean’s central estimate, note that his high estimate shows and increasing trend. The estimates will be revised next month. Dean shows a downward (very slightly so), and the EIA shows a steeper upward trend, reality is likely to be a slightly upward trend in my view, through May, then the trend will flatten and probably decline slightly by the 3rd quarter. If oil prices rise to $100/b by May 2016 output will flatten or rise slightly.

The EIA’s Drilling Productivity Report has total shale down 208,000 bpd in July. But they have the decline beginning in May. I think the decline began in January and will be down by a lot more than any of the EIA groups believe.

Hi Ron,

The Drilling Productivity Report(DPR) is not very good. In the case of the Bakken the DPR is at least 30 kb/d too high in March 2015. The Eagle Ford estimate in March 2015 for the DPR is at least 150 kb/d too high, and the Permian DPR estimate is at least 50 kb/d if we assume all New Mexico output is from the Permian Basin region. So the DPR overestimates in March 2015 by at least 230 kb/d.

Bottom line, I ignore the DPR, it is not very good.

Dennis, in spite of what you tell me, clearly you still think we don’t know how to add down here in Texas and don’t understand the accounting process. You are stuck in the mud and I can’t pull you out.

Remember, its not possible to maintain Eagle Ford LTO production levels (that decline at the rate of 65% the first year) with half the rig count we had one year ago. Don’t buy too much into the frac back-log thing in Texas; ain’t so, IMO. And for the record, I’d say at least a dozen of Baker’s rigs still working in the EF or not actually drilling shale, but fractured carbonates. The trend is down, not up. Take 3 Advil and call me in 3 more months.

Mike

Hi Mike,

I think you guys can add just fine. I think one computer system (for taxes and such) does not communicate with other computer systems (for the PDQ) in a timely manner. Or you guys like to make sure all the data is perfect before it is reported, I just don’t know.

I have shown over and over that the PDQ data is incomplete, everyone seems to agree.

Ron seems to think it is a big deal that there was a decline in January, I don’t care what happens in any single month, the trend over several months is what is important in my view.

The output levels in the Eagle Ford have been maintained so far, with a possible small decline (about 50 kb/d), depending upon what the best guess for total Texas output is.

Ron seems to think it is a big deal that there was a decline in January, I don’t care what happens in any single month, the trend over several months is what is important in my view.

The decline in January and April is runs contrary to what the EIA and Dennis is saying. That difference is as plain as black an white.

Dennis your data shows Texas April production 255,000 bpd higher in April than in December. So you believe the trend is not just up, but sharply up. No the trend is slightly down. I said up thread that your January guess is off by over 100,000 bpd. Now I am saying your April guess is off, I believe by about 300,000 barrels per day.

The trend is down. Do you think that is important?

Hi Ron,

As I said before, these are all guesses, I am assuming that the EIA has access to information that I don’t have access to, perhaps the EIA estimates are too high in the MER.

I have plainly stated my assumptions and that they could be incorrect. I will be very surprised if my April estimate turns out to be 200 kb too high. Do you really feel confident that April TX C+C output will be less than 3380 kb/d?

I maintain my position that we will not know what final output for Texas C+C output in April 2015 is until June 2017, in June 2016 output as reported by the PDQ will only be at about 99% of its final output, if the speed of production data reaching the PDQ remains the same as the past history.

The trend is actually pretty flat from Nov to April based on dean’s estimate. I think output in TX is flat or up slightly the trend is not down.

I give up on the reporting thing, Dennis. I have two questions for you, however:

a.) to what do you attribute your fairly consistent production levels to in Texas with a 60% decline in rig count in the past 8 months?

b.) if rig count has had no effect on production trends in Texas, what, if anything, will? In other words, do you believe we will stay relatively flat (or as you say, trend upwards) until oil prices improve and LTO can simply ramp back up again?

Mike

Hi Mike,

Unlike you, I believe what I have read about there being a substantial frack-log in Texas, I have no data to back me up.

My estimates of Permian and Eagle Ford data in April suggest that so far the completion of wells in the frack log have kept output up.

If the Texas LTO plays follow what is going on in the Bakken/Three Forks, I think that the decline in rigs will only have a big effect when the frack log is close to zero.

Another fact is that in Texas a lot of the rig count decline is in vertical rigs rather than horizontal rigs, so the horizontal rigs have been cut in half, most of the output is going to come from the horizontal rigs rather than the vertical rigs.

So if oil prices go back up to $90/b by May 2016 as I expect, I think TX output will be flat or possibly up slightly ( we may see a small decline, but no more than 200 kb/d below November 2014 levels over the course of 2015.) By June 2016 TX output will be higher than it is today (though we won’t know until August 2018).

If the Texas and ND tight oil production stays flat (say through 2020) then will we not see a significant decline in world oil supply (i.e. a clear 2015 peak rather than your plateau for five years). I’ve seen figures indicating development projects worth $200 to $400 billion being cancelled or delayed. If this was all for oil production facilities this would equate to 3 to 6 mmbpd lost. Admittedly some of this is for gas and some may be for exploration which would have a longer time frame to impact supply. The reports don’t always give enough detail to understand exactly how the numbers are arrived at, but I think they mainly only cover IOCs and maybe some medium sized companies – OPEC NOCs also seem to be cutting back on projects so the numbers might be low. At the best of times the industry had a maximum capacity for development and I doubt they will ever be able to get back to that level with an already ageing workforce being hit with current lay offs and recruitment hiatus. Plus I don’t think $90 or even $110 per barrel would be enough of a drive to even try. Therefore there seems to be a major short term (5 year) supply shock about to be added to the early post peak downslopes that you have modelled so well.

Hi Mike,

Bloomberg reported at the end of April that about 4700 wells were waiting on completion.

http://247wallst.com/energy-economy/2015/04/24/oil-well-completion-backlog-could-weigh-on-crude-prices-for-years/

Excerpt below:

More than 1,500 wells in the Permian Basin, 1,250 wells in the Eagle Ford and 632 wells in the Bakken have been drilled but not completed.

A slightly different estimate of Texas C+C output using the Petroleum supply monthly estimate through October 2014 and then using changes in lower 48 monthly C+C output in the monthly energy review from November 2014 to April 2015.

I assume all change in lower 48 C+C output is from the North Dakota Bakken/Three Forks and Texas. We have complete data for North Dakota, so if we subtract the Bakken change from the lower 48 change in output we can estimate the Texas change in output each month from Nov 2014 to April 2015.

Chart below.

The Eagle Ford estimate is based on the TX C+C estimate, so the different estimate above results in the EF estimate below.

The Permian Basin output (Texas only) changes as shown below.

The weekly EIA report is showing 9324 kb/d for the last week in February while the February EIA international monthly report is showing 9238 kb/d, a difference of 86 kb/d too high. As you suggest it will probably get worse.

Hi ovi

the best estimates of us output are in the monthly energy review. The weekly numbers are a snapshot and do not get revised.

Article on carnage in the service industry, with a focus on the GoFrac case history:

http://kfgo.com/news/articles/2015/jun/18/small-us-frackers-face-extinction-amid-drilling-drought/

It’s going to take quite a while to get anywhere close to last year’s drilling and completion numbers, even with the right oil price incentive.

Given the documented very high decline rates in US gas production*, it certainly seems quite possible that we could see a natural gas supply shortfall this winter in the US.

*My comment on US decline rates:

http://peakoilbarrel.com/opec-the-eia-and-other-news/comment-page-1/#comment-520916

That will catch many by surprise, given the press headlines about fracking for gas.

An interesting study of the press is to look at the U Texas Bureau of Economic Geology (BEG) study of the Barnett shale.

In 2013, they called the peak in the Barnett in 2012 (though using data only to 2010),

see oil and gas journal reprints down at the bottom of:

http://www.beg.utexas.edu/shale/pubs.php

The 2012 peak in the Barnett is born out in the data thru March 2015:

http://www.rrc.state.tx.us/media/22204/barnettshale_totalnaturalgas_day.pdf

But the press responses to the BEG study?

http://www.beg.utexas.edu/shale/media.php

Media articles from Feb. 2013

“New, Rigorous Assessment of Shale Gas Reserves Forecasts Reliable Supply from Barnett Shale Through 2030” – UT Austin News service

“Gas Boom Projects to Grow for Decades” – Wall Street Journal

“2/28/2013 Study: America Is Just At The Beginning Of A Gas Boom That Will Last For Decades” – The Business Insider

You have to go down 9 articles to get to this one:

“Barnett Shale Output to Tumble Through 2030, Study Says” – Bloomberg

Reading the text of the articles and they all pretty much say the same thing,

production peak in 2012 at 2 Tcf/yr, down to 900 Bcf/yr in 2030.

How can people say “boom” in the headlines, and “declining” in the article?

How is a “reliable supply” one that declines by more than half over 18 years?

Is the math beyond them?

Does 900 Bcf look bigger than 2 Tcf?

Is trillion bigger or smaller than billion (many of these are financial media!) ???

Are they so used to growth they can’t even conceive of decline?

That’s reliable supply for Texas. It doesn’t involve gas exports outside the republic to other countries.

The Baker Hughes Rig Count is out. US rig count down by 2, Oil rig count down by 4, Gas rig count up by 2, GOM down by 2.

Ron, great post. Thank you!

The month that I think points out the most that EIA is just estimating TX, without a lot of hard data to back things up, is January, 2015.

It has been discussed at length that weather related issues caused a significant loss of production volume in January in TX, both on this site and elsewhere.

Per RRC, 12/14 production C+C bbl per day 3,155,128. 1/15 production C +C bbl per day 2,997,593.

Per EIA, 12/14 production C +C bbl per day 3,492,000, 1/15 production C + C bbl per day 3,553,000.

So the difference between RRC and EIA in 12/14 is 336,872, in 1/15 is 555,407. I don’t think that big of a differential can be entirely explained by incomplete data. Especially when the differential between the two in 1/15 is 555,407, but by my calculations goes to 620,002 in 2/15. EIA is not factoring in weather related issues at all, it appears, even though those issues are well known and happened five months ago, giving EIA plenty of time to make adjustments.

My guess is that 12/14 will end up being shown to be the peak of US production, or at least very close. It looks to me the EIA could be off by 200-300,000 bopd of C +C at this point?

If that is correct, would seem to be enough to move the WTI market a little?

AlexS, had two very good links about shale oil economics, one from Bloomberg and one from EIA, at the end of the last of Ron’s post. I think it would be good if those were posted again here, since many may have not been reading the end of the Ron’s previous post in anticipation of this new TX post.

It appears that MSM and EIA is finally taking notice that at low oil and gas prices, these companies are in too deep. I have also read, maybe on another link here, that banks will likely take a much harder line in September during borrowing base redeterminations than they did in March, 2015.

I think US production is peaking, but if the capital is shut down, there could be a steep drop at the end of 2015 and into 2016. Look what happened to EOG Bakken production when they stopped completions, per Enno’s and Rune’s data.

Finally, I wonder why EIA sees the rigs returning in large numbers in 2016, boosting US oil production again. This seems contrary to it’s recent data post, which AlexS linked, indicating the massive losses shale oil companies experienced in Q1, 2015, plus EIA’s own low price forecasts through 2016. Those three data points do not reconcile.

Maybe the people looking at the economics of shale oil at the EIA never talk to the people who are estimating future US production?

“……..Those three data points do not reconcile.”

Indeed shallow sand. EIA people seem crazy.

Hi Shallowsands,

I think the EIA may be a little high, which is why I adjusted the numbers from the petroleum supply monthly to lower values. Not low enough for many here, but I think, as I usually do, that reality will be between the optimists (EIA) and the pessimists (POB).

Dennis. I am not referring to the debate you are having with others here about late 2014 US production levels through this month.

EIA forecasts WTI to average $55.35 in 2015 and $62.04 in 2016.

EIA came out with a report which showed large losses for US independent oil producers in the first quarter of 2015, which followed small losses in the fourth quarter of 2014. AlexS posted same at the end of the comments to Ron’s previous post. In the fourth quarter of 2014, oil prices were significantly higher than EIA projection of $62.04 for 2016 WTI.

EIA also forecasts that US oil production is declining now and through the end of 2015, but that there will be a rebound in 2016.

What is going to cause US independents to ramp up production in 2016 if WTI averages $62.04? If anything, I think production would fall further, as any current completion backlog would be pretty well worked through by this time next year.

I think you feel prices will be much higher soon. EIA does not, yet they see US production returning to growth next year. I don’t get why they do.

If EIA is correct on price through 2016, my opinion is several companies will file bankruptcy. Possibilities include Halcon, Sandridge, Goodrich, Emerald. Many others could be in the boat the aforementioned are in now at the end of 2016 with $62.04 WTI.

Hi Shallow Sands,

I mostly agree with you, but I have always said the Drilling Productivity report is not very good and I ignore it. For Production Data estimates through April 2015, the EIA has US C+C output up, not down through May 2015. Then output falls in the Short term energy outlook from May 2015 to Feb 2016, by 400 kb/d.

I don’t think much of the EIA’s price forecasts or output forecasts, so I will not try to defend them. The EIA estimates of past output in the Monthly Energy Review are probably within +/-3% of actual output, time will tell.

Worth a read:

https://carboncounter.wordpress.com/2015/06/17/there-is-no-renewables-revolution-in-china-here-are-the-numbers-that-show-this/

I suspect that this isn’t news to many or most here, but it was instructive to me. I suppose building 1 coal fired plant a week (that’s still happening right?) is a huge thing to overcome in terms of which energy source is growing faster.

Anyways, putting it out there for everyone’s consideration.

The link didn’t work for me – I had to google it, and use another site.

In any case, this comparison is misleading – it’s apples and oranges. It compares fossil fuel consumption in all energy sectors to renewable consumption in the electricity sector, when it’s only the electricity sector that people are talking about; and it compares overall energy growth over a number of years to the most recent renewable growth – China’s slowdown of coal consumption is very recent.

About 3% of their electricity comes from non-hydro renewables, and the rate of growth in electricity generation from those sources actually seems to have slowed in the last year.

If one looks at purely the electricity statistics from the BP data, and finds the % share of the annual growth in electricity consumption which came from wind and solar, it maxes out at 14% last year. His claim still rings true.

14% of new generation from wind really isn’t bad.

Remember how exponential growth works – it starts out at a small base, and then surprises you. Wind power is relatively new in China. Look at it’s growth (and remember, the last year is always understated, because it only includes part year production from new installations):

Yes, but it’ll likely be more like a logistic curve, which is what it looks like we’re seeing in Europe at the moment. China is somewhat hamstrung by its lack of offshore wind, though, so I suspect wind penetration will end up on the low side. Course a lot will depend on whether this economic slump everyone’s talking about turns out to be as bad as suspected.

I’ve often experienced ongoing bitterly cold winds coming from Mongolia in the winters (in China). Perhaps this airflow can be utilized for turbines? If so, it would certainly be a blessing.

They are planting millions of trees to slow down the wind and reduce the growth of desertification. Maybe the wind turbines will slow the wind too, so they need to build a lot of them.

I am only reading what I run across rather than actually researching anything in a serious fashion, but it is my impression that the Chinese have built wind farms faster than new transmission capacity.

So if they get caught up on transmission lines the rate of growth of wind power will probably pick up for the next year or two at least.

Fourteen percent is nothing to sneeze at. That much wind power has obviously already saved them a FORTUNE in avoided coal purchases- not to mention reducing the local pollution levels at least a little bit.

Delivered coal ain’t cheap.Coal mined in the the upper western states USA is selling for five or six times the mine mouth price delivered to Atlanta the last time I checked.

The less coal is sold, the cheaper it gets for everybody who uses it for any purpose.Hence the Chinese steel industry (for example) is saving money too , because of Chinese wind farms.

The only people who should not be happy about wind power growing by leaps and bounds are the people directly involved in the fossil fuel generation industry and maybe the nuclear industry.

Environmental considerations and the price of labor are not likely to stop the Chinese from building pumped storage facilities so as to take full advantage of their increasing wind capacity.

Maybe some of the engineers who hang out here can look at some maps and tell us how much pumped storage they can build at reasonable expense if they choose to do so.

NIMBY’s and BANANA’s aren’t very influential in China. Pumped storage will get built wherever there is a suitable site when they get around to doing it.

Any body who complains too loudly is apt to get relocated to one of the relatively unspoiled parts of Mongolia instead of a few miles to a new village.

Here’s the chart for growth of new wind power per year:

Installations are a little clearer:

If I read the tables correctly, China increased it’s average power consumption by 24.9GW in 2014. That’s about 75GW of wind capacity, so about 1/3 of new consumption is being handled by wind.

Even linear growth at the same rate we’ve seen recently would get China to 50% of new power coming from wind alone in just 5 years.

Ecological sustainability 101 says that neither exponential growth nor linear growth can be maintained indefinitely. So the wind growth graphs shown above look quite unsustainable to me.

About China, I wrote about it. Here it is again. In 2014, China built 22GW of hydro power, 47 GW of fossil fuels power, 5 GW of nuclear power, 21 GW of wind power, and 8GW of utility-scale solar power.

Fossil fuels electricity generation (mainly coal fired power) declined by 0.7%, mainly because hydro electricity surged by 19.7%.

In 2014, China’s electricity generation grew by 3.6% or 193 TWH. Hydro electricity grew by 19.7% or 175 TWH. Wind electricity grew by 12.2% or 14 TWH, only 7 percent of China’s electricity growth. Solar electricity grew by 171% or 15 TWH, 8 percent of China’s electricity growth.

Even wind and solar combined is far from accounting for more a half of China’s electric power growth.

PE,

A few thoughts:

First, your numbers don’t agree with the BP statistical review. Have you compared your numbers and tried to reconcile them?

Second, I absolutely agree that those curves will level off. That’s not the question. The question is when and where they will level off. What limits to their growth do you see, before they reach a level sufficient to replace fossil fuels?

Finally, it’s interesting to note that your numbers indicate that less than half of China’s new generating capacity in 2014 was fossil fuel.

These are Chinese electricity industry association’s official numbers.

I checked BP’s data which says in 2014, China installed 24 GW of wind power and 10 GW of solar power. These are similar to the Chinese source.

It’s normal for data from different sources to disagree because of different data coverage / statistical methods etc. For example, the Chinese source for solar power (as I said) includes only utility-scale solar (6 MW or above). And, of course, normally the BP data is second hand.

Yes, new fossil fuels power (by generating capacity) is less than half of the total newly installed capacity. Still, it’s 47 GW. That alone is close to the total global wind installed capacity in 2014 (52 GW).

By replacing fossil fuels, are you talking about just replacing the growth or the entire fossil fuels electric power, or the entire fossil fuels?

The world elecricity use grows by about 3% a year. World current installed capacity is about 6000 GW. To sustain 3% growth, it takes 180 GW.

The average capacity utilization rate for the world’s current electric power sector is 40-50%. Let’s say 45%. The observed world average capacity utilization rate for wind is less than 25% and for solar, is less than 15% (please refer to BP). Say, the average for wind and solar is 20%.

Therefore, to replace 180 GW (required for growth of electricity) of conventional power, it wil require 180 * 45% / 20% = 405 GW of wind and solar power

That’s just to replace the growth and just for the electric power sector!

Until the total annual installation of wind/solar hits 400 GW, it’s premature to talk about “replace”

To build 180 GW of conventional power, it consumes about 9 million tons of steel (at the rate of 50000 tons per MW of coal/gas power plant). To build 400 GW of wind/solar power, it consumes about 40 million tons of steel (at the rate of 100000 tons per MW of wind/solar power plant). This is close to 3% of world steel production and requires the burning of about 20 million tons of coal.

My guess is that wind/solar building will begin to level off long before it hits 400 GW because of the intermittency problem and the higher steel price in the future.

To sustain 3% growth, it takes 180 GW.

First, that’s dominated by China. And, as we just saw, less than half of China’s new capacity is fossil fuel. So, we don’t have to replace 100% of new generation, but rather much less than that, to eliminate fossil fuel growth.

2nd, didn’t someone just say: “Ecological sustainability 101 says that neither exponential growth nor linear growth can be maintained indefinitely”?

To build 400 GW of wind/solar power…is close to 3% of world steel production

And that’s barely above a rounding error. You’re not really suggesting that would create a limit to wind installations?

wind/solar building will begin to level off long before it hits 400 GW because of the intermittency problem

That’s a different question. And, as we’ve seen elsewhere, a grid that eliminates fossil fuels entirely is practical. Of course, we’re not going to get close to that for many decades, so that’s a distant challenge.

To put things in perspective, China has been increasing it’s electricity production very quickly using mostly coal and produces more electricity than the US. Coincidentally renewablesinternational.net has a post today Global electricity overview for 2014 which basically links to this PDF. Lots of data based primarily on the BP STATISTICAL REVIEW 2015.

My take is that the world wide growth rate of renewables, in particular solar, over the period under review is nothing short of phenomenal. From the summary

Wind power electricity production jumped in ten years by a factor of 8.25 (+ 23.5 % per year) to reach 706 TWh in2014 (3 % of world electricity and + 621 TWh/year compared to 2004 when the annual production was only 86 TWh).

Solar production (mainly PV) was multiplied by a factor of 71 in ten years (+ 53,2 %/year), up to 186 TWh in 2014 and 0.8 % of world electricity production.”

Now this is for the whole world and as our own Robert Wilson points out over at Carbon Counter the scale of coal fired generating capacity in China is just staggering! The thing is, it is the rate of growth that suggests a revolution and the rate of growth of PV capacity in China since 2008 has been impressive. Only between 2013 and 2014 did it not double at a minimum. See graph below.

The growth of hydroelectric power has been quite remarkable as well with China generating over 27% of the total amount of hydroelectricity in the world and just under three times the amount generated by Canada or Brazil (see page 116 of “Global electricity overview for 2014”). Despite this China still only ranks 20th in terms of the amount that this hydroelectricity contributes to the national total at 18.8%.

China generates the most electricity from renewable sources (including hydro) in the world, generating 24,6% of the world’s renewable electricity more than twice as much as the second place US with 10.4%. (see page 115 of “Global electricity overview for 2014”). From page 116 of “Global electricity overview for 2014”, China Ranks second behind the US generating 16.7% of all the electricity generated using non-hydro renewable sources in the world but, still only manages to rank number 33 in terms of the contribution of non-hydro renewables to the national total at 4.2% (see page 115 of “Global electricity overview for 2014”).

It is the sheer size of electricity consumption in China that is masking the renewables revolution in a similar way that the absolute size of US capacity makes it easy to ignore the fact that non-hydro renewables now contribute some 6.7% to the national total.

Based on the graph below, my advice would be, ladies and gentlemen, do NOT take your eyes of that ball. It is moving very fast. That exponential growth thing will catch you off guard everytime!

Using RRC data for the Permian basin and statewide Texas C+C output I found the percentage of Texas C+C produced from the Permian basin. This is multiplied by my estimate of Texas output from the monthly Energy Review(MER) and Petroleum supply monthly(PSM) where the difference is subtracted from Texas output in the Petroleum supply monthly (basically assuming that the MER is correct and all errors in the PSM US total are due to a bad Texas estimate, the assumption may be incorrect).

Using the same method as I used for the Permian Basin (and the same modified EIA estimate), I estimated Eagle Ford output.

EPA New! Proposed Rulemaking: Phase 2 Greenhouse Gas Emissions Standards and Fuel Efficiency Standards for Medium- and Heavy-Duty Engines and Vehicles

http://www.epa.gov/otaq/climate/regs-heavy-duty.htm

One of their presentations refers to a unit called a “megagram”. They also use grams per mile. I’m going to ask them if they want to use solar masses per parsec.

Mason Inman has a new post up, covering much the same ground as you and Dean, Ron. Perhaps it would be productive if you, Mason and Dean all compared data? Three heads are better than two!

https://www.beaconreader.com/mason-inman/all-my-guesses-live-in-texas-part-1?ref=profile

REN21 Renewables 2015 Global Status Report

http://www.ren21.net/status-of-renewables/global-status-report/

It is amazing that we are in a position to need a highly refined crystal ball simply to understand the past. Obviously the community here is much more skilled at that than many elsewhere. I found an article, The Texas Natgas Massacre, projecting an incredible 3.25 bcf/d decline in Texas natural gas production by the end of this year. It is a very detailed and interesting read even if it might have little credibility to the more informed community here:

https://oilandgas-investments.com/2015/natural-gas/the-texas-natgas-massacre/

The author of this article is projecting sharply higher natgas prices based on this supply decline. There seems to be evidence for an emerging El Nino that may exceed the very powerful El Nino of 1997-98. This will almost certainly create a sharply higher global average temperature record for 2015. Unfortunately for the bulls on the natgas market, such a strong El Nino is likely to produce very low total heating degrees for this summer (expected cool central US all summer and cool July and August for the Eastern US) and rather low total heating degree days for a very mild upcoming winter. If this comes true we might have less that $2 natgas and an additional wave of declines in natgas directed rig counts. I don’t know if anyone wants to extend their crystal ball visions this far into the future or to include the possible implication of an El Nino. However, we should be aware that we are moving into a very strange and interesting future.

El Niño conditions have been on and off since early 2014. I would bet on a warm winter for the world average. But the North Atlantic is showing a cold anomaly…the NE and Midwest could have a cold winter. Or maybe not.

I don’t think there’s a safer bet than 2015 being warmest on record by a considerable margin.

The cold North Atlantic shouldn’t be considered an anomaly anymore, it’s a feature caused by accelerating cold melt water flow from the Arctic and Greenland. It has been estimated to be able to keep global warming temperature rises in North Europe down to about half the world averages through this century. It also disrupts significantly the ocean thermohaline circulation and may virtually stop the gulf stream which will have many effects, and is not fully understood by a long way. The worst that has been posited is to lead to producing anoxic oceans over a few centuries, but as a minimum it will raise the sea level for north eastern US coasts by 1 or 2 foot due to the loss of the current (some form of coriolis effect I think).

A recent paper reported the thermohaline circulation is speeding up. It helps to read gobs of papers about the subject. I’d like to quote from it:

“Since the mid-1990s, hydrographic properties and current velocities of the Faroe Current have been monitored along a section extending north from the Faroe shelf. From these in situ observations, time series of volume, heat, and salt transport have previously been reported, but the high variability of the transport series has made it difficult to identify trends. Here, we present results from a new analysis of the Faroe Current where the in situ observations have been combined with satellite altimetry. For the period 1993 to 2013, we find the average volume transport of Atlantic water in the Faroe Current to be 3.8 ± 0.5 Sv (1 Sv =106 m3 s−1) with a heat transport relative to 0 °C of 124 ± 15 TW (1 TW =1012 W). Consistent with other results for the Northeast Atlantic component of the THC, we find no indication of weakening. The transports of the Faroe Current, on the contrary, increased. ……..During the same period, the salt transport relative to the salinity of the deep Faroe Bank Channel overflow (34.93) more than doubled, potentially strengthening the feedback on thermohaline intensity. The increased heat and salt transports are partly caused by the increased volume transport and partly by increased temperatures and salinities of the Atlantic inflow, attributed mainly to the weakened subpolar gyre.”

http://www.ocean-sci-discuss.net/12/1013/2015/osd-12-1013-2015.html

The Jetstream over North America is still truncated and slow. If that does not change, the northeastern US is in for a cold winter again.

You really like to talk the big talk, don’t you Ferny? It’s almost as if you want to control the discussion, no matter what the topic.

We think we have figured out the math and physics behind the El Nino-Southern Oscillation (ENSO) phenomenon over at the Azimuth Project, http://forum.azimuthproject.org/discussion/1608/enso-revisit#latest

http://www.azimuthproject.org/azimuth/show/Experiments+in+ENSO+modeling

If this is right and the fact that it works pretty swell at fitting the data over the last 130+ years, it could mean that we have a handle on predicting future sloshing events with much better accuracy.

”El Niño conditions have been on and off since early 2014.”

I can’t see very well past the end of my nose without specs but I do read a fair number of articles about the climate.

My personal seat of the pants estimate is that Fernando’s comment is pretty much in the ball park according to the varied opinions of climate pundits. There has been substantial disagreement among the pros as to the extent and or intensity of the El Nino for the last year or so.

WHT,your articles are no doubt extremely interesting to people who are really into the details of modeling and who have the time available to digest them – but they are TLDR for me, in addition to being too technical for me, given my background and age. I forgot most of the math I once learned thirty or forty years ago and to be honest I probably never learned enough in any case.

What is YOUR prediction for the remainder of this El Nino cycle?

Mac, this is a Japanese webpage, showing a really comprehensive look:

http://ds.data.jma.go.jp/tcc/tcc/products/elnino/elmonout.html#table

Here’s their prediction

http://ds.data.jma.go.jp/tcc/tcc/products/elnino/outlook.html

I like the Japanese data and predictions, they seem to be much more focused on the science and less on the politics.

Here’s an Australian Southern Oscillation Index.

http://www.bom.gov.au/climate/enso/#tabs=SOI

The Australians use SOI < -7 as El Niño conditions. The index went below -7 in April 2014, but bounced back during the following months.

I've read several analyses, and they seem to agree this is a two year event, with the high temperature conditions staying in a borderline area during 2014, swinging into full Niño in 2015. The huge question is whether the subsequent Niña will be a strong event. If so, the summer of 2016 will be a cool summer (just speculating).