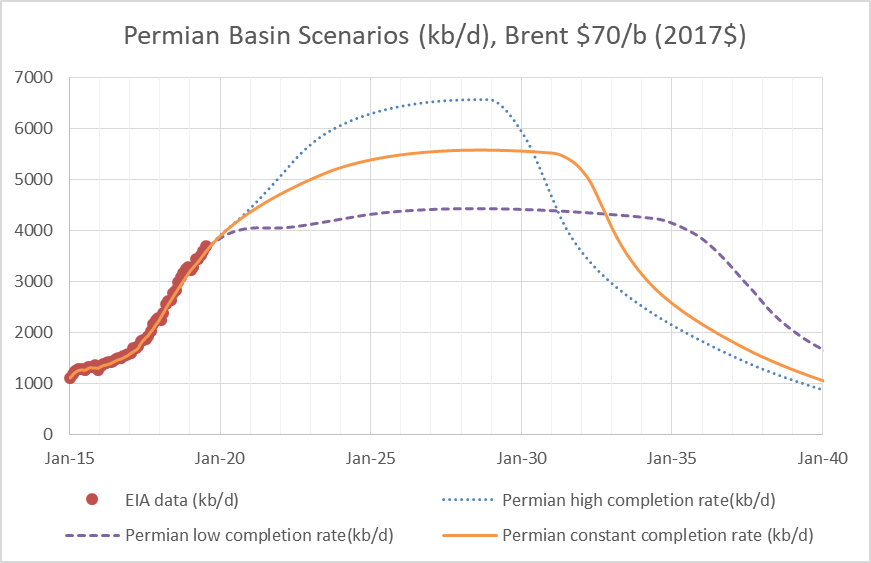

Seems we don’t know what future completion rates will be in the Permian basin or anywhere. There are many different opinions on whether the completion rate might increase, decrease or stay the same. In my view, the conservative assumption is to assume they will not go up or down, but that the completion rate will remain constant. I have created three different scenarios: in the first, the completion rate increases; in the second, the completion rate decreases; the third scenario has a constant completion rate.