An interesting analysis was recently published by BNP Paribas (one of the top 10 banks in the World by assets) entitled Wells, Wires, and Wheels… . In that analysis they argue that long term oil prices will fall to $20/b or less in order for oil used for personal land transport to compete with EVs powered by wind and solar at current cost levels.

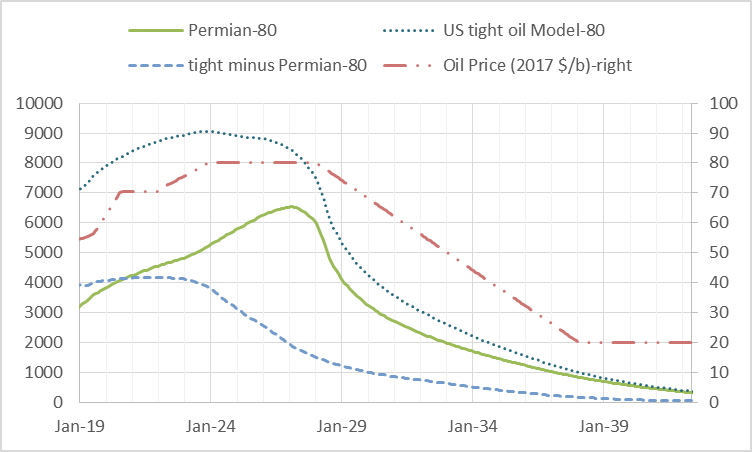

I reworked my oil price assumptions, first with a simple scenario that follows the EIA’s AEO 2018 reference oil price scenario up to $70/b in 2017$ and then remains at that level long term. Second I noticed that a scenario with such an oil price assumption sees tight oil output fall in 2022 so the scenario was revised with oil prices rising from 70 to 80 per barrel from 2022 to 2024 and then remaining at that level until 2028. The BNP Paribus analysis suggests that EVs will have cut significantly into oil demand by 2022 to 2025 so I assume oil prices fall to $20/b over the next 10 years.

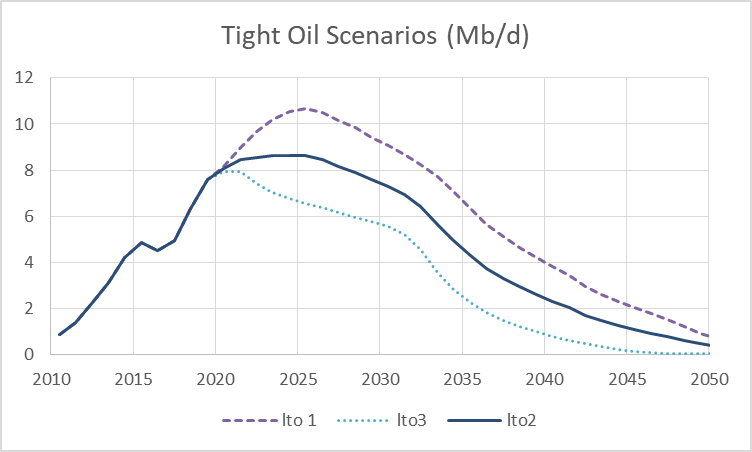

Scenarios below.

Tag: Peak Oil

World Oil Production as of March 2019

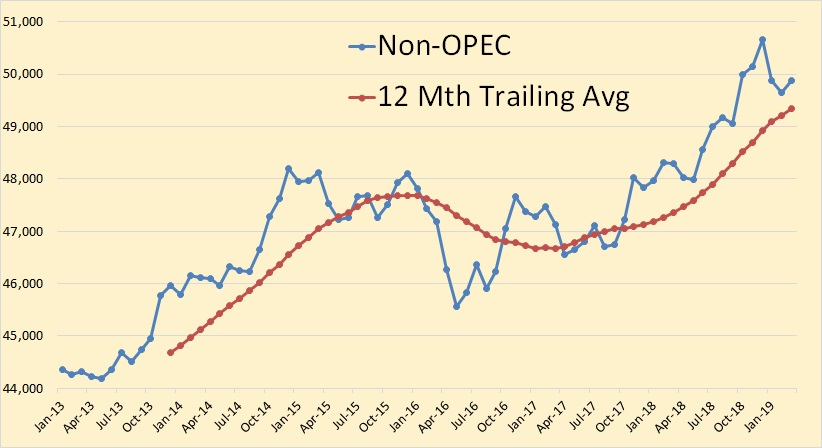

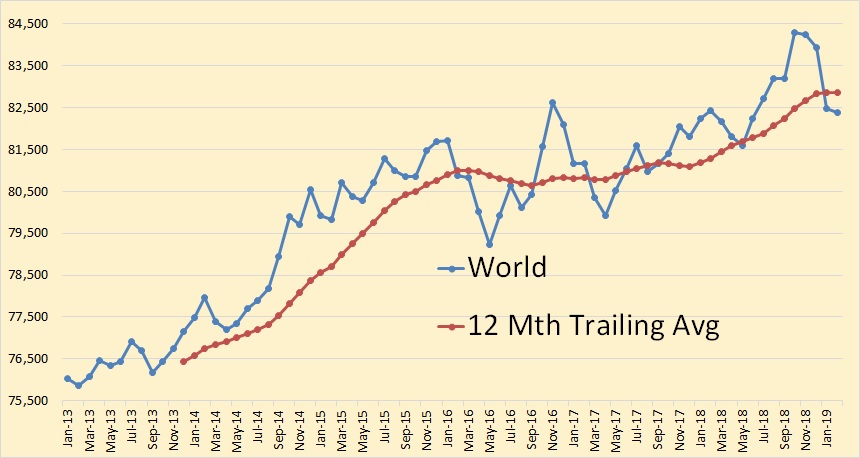

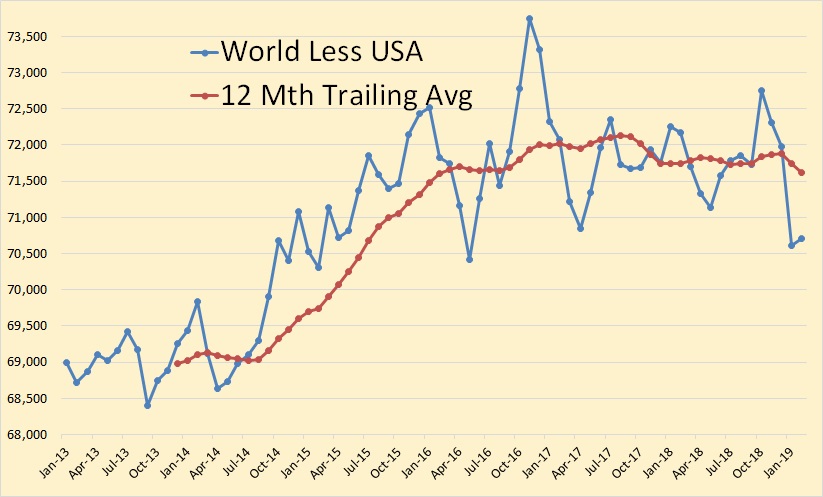

The data for the charts below were taken from the EIA’s Monthly Energy Review. It is crude plus condensate through March 2019 and is in thousand barrels per day.

World C+C was down 281,000 barrels per day in March.

Non-OPEC was up 218,000 barrels per day in March.

OPEC May Production Data

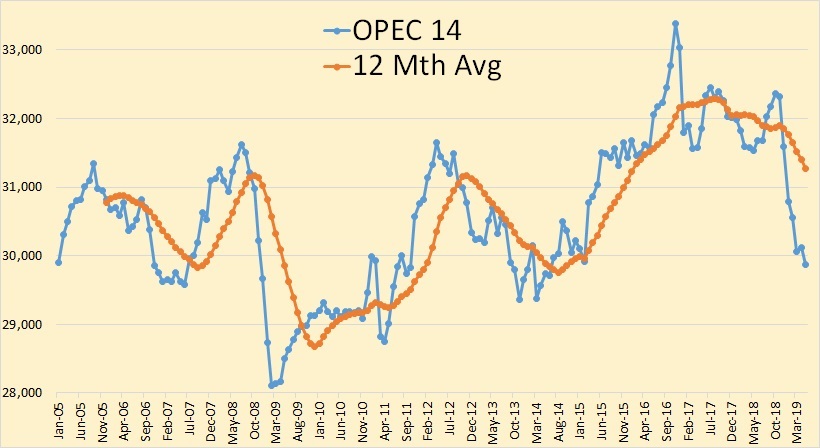

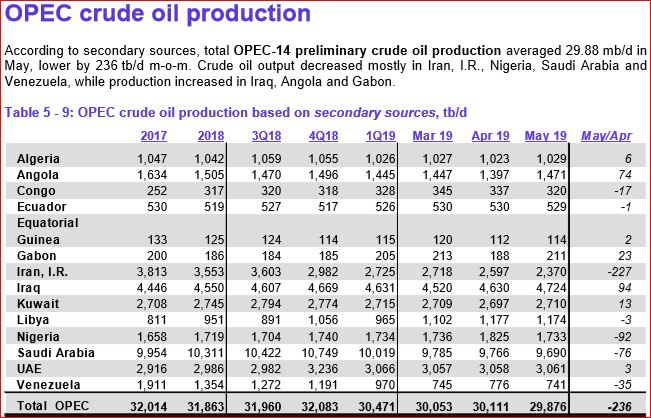

The below charts, unless otherwise noted, were taken from the OPEC Monthly Oil Market Report. The data is through May, 2019 and is in thousand barrels per day.

OPEC crude only production was down 236,000 barrels per day in May but that was after April production had been revised upward by 82,000 bpd.

Iranian April production was revised upward by 43,000 bpd and Saudi Arabia April production was revised upward by 24,000 bpd.

Oil Shock Model Scenarios

Many different oil shock model scenarios have been presented over time at Peak Oil Barrel. Information on the Oil Shock Model, originally developed by Paul Pukite can be found in Mathematical Geoenergy. The future is unknown, so future extraction rates from conventional (excludes tight oil and extra heavy oil) oil producing reserves are unknown. Also not known are future oil prices which will affect the amount of tight oil and extra heavy oil that is ultimately produced.

For tight oil I have created three scenarios corresponding to a low, medium and high oil price scenario. Likewise I have created three scenarios for extra heavy oil which correspond to the same low to high price scenarios used for the tight oil scenarios.

The mean estimates by the United States Geological Survey (USGS) for technically recoverable resources in tight oil plays combined with reasonable economic assumptions and data gathered from www.shaleprofile.com are used to model tight oil output. The EIA’s AEO 2018 reference oil price scenario is used for the high oil price case and the low scenario uses the AEO reference price case up to the date when it reaches $70/b in 2017$ and assumes oil prices remain at $70/b for all future dates. The medium oil price scenario is the average of the low and high price cases.

World Oil Production, February 2019 Data.

The data for the charts below are from the EIA’s Monthly Energy Review. I will update this post Friday, May 31st with March data for the USA and charts for several states when the EIA’s Petroleum Supply Monthly is published. All data is through February 2019 and is thousand barrels per day.

World C+C production was down only slightly in February, dropping only 87,000 barrels per day to 82,389,000 bpd.

It is my contention that World, less USA peaked in November 2016 with the 12 month average peaking in 2017.