The EIA’s Short Term Energy Outlook is out. The data is in million barrels per day.

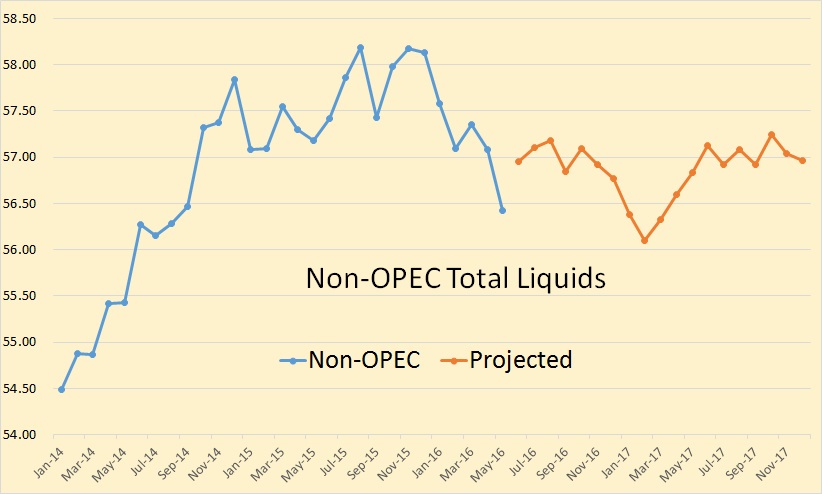

Not much has changed in the EIA’s projection since last month, however their projection for the remainder of this year and next year has increased slightly.

The EIA’s Short Term Energy Outlook is out. The data is in million barrels per day.

Not much has changed in the EIA’s projection since last month, however their projection for the remainder of this year and next year has increased slightly.

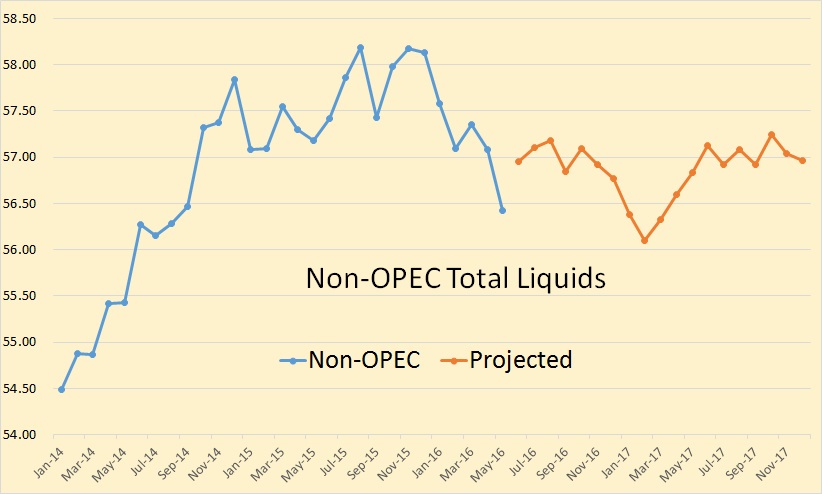

The EIA has apparently stopped publishing its International Energy Statistics. Instead they are now publishing an abbreviated version on their Total Energy web page titled: Tabel 11.1b World Crude Oil Production. Here they publish crude + condensate production numbers for Persian Gulf Nations, Selected Non-OPEC Countries, Total Non-OPEC and World. The “Selected Non-OPEC Producers are Canada, China, Egypt, Mexico, Norway, Russia, United Kingdom and the United States. They have just released their latest data through February 2016.

All the data below is in thousand barrels per day and through February 2016 unless otherwise noted.

They have world C+C peaking, so far, in November 2015 at 80,630,000 bpd. February production was 79,653,000 bpd, or 977,000 bpd below the peak. World C+C production, they say, averaged 80,035,000 in 2015. Average for the first two months of 2016 was 79,933.000 or 102,000 bpd below the average for 2015.

So with world production continuing to decline, there is little doubt that 2016 production will be well below 2015 production.

The JODI Oil World Database came out a few days ago. The data is through December 2015. The JODI C+C production numbers differs somewhat from the EIA numbers. The JODI OPEC numbers are crude. Also there are a few very small producers that do not report to JODI so their numbers will be slightly less than the EIA. But otherwise they are pretty accurate.

Also, JODI, for some reason, does not count all of Canada’s oil sands production. So for Canada I use Canada’s National Energy Board numbers instead.

The JODI C+C numbers, for Non-OPEC, will average about 2.4 million barrels per day less than the EIA. This is largely due to some countries not reporting to JODI. But these countries only have small changes in their overall production so would have little effect on any of my charts or calculations.

According to JODI, world crude oil production peaked, so far, in July and has declined by 339,000 barrels per day.

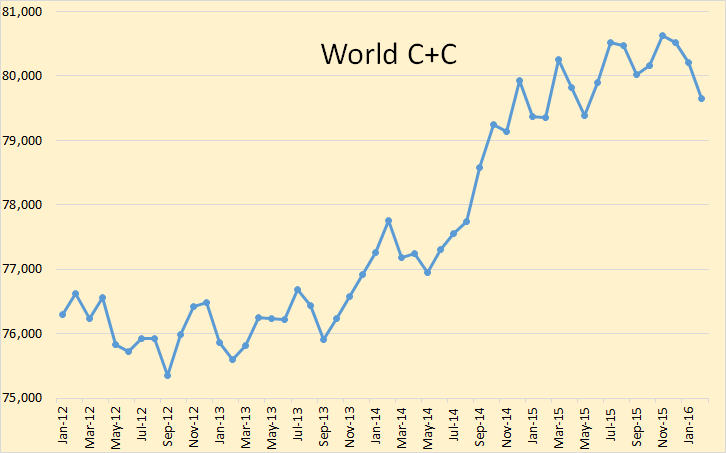

The EIA recently published the February edition of their Short-Term Energy Outlook. If you follow this month to month, and I do, you will notice their prognostications change a little every month. And over several months those small changes can add up to some rather dramatic changes. Nevertheless, below are several charts with their current oil production projections.

The EIA STEO only gives monthly data for total liquids. All C+C data is quarterly and annually. The monthly projected data begins in February 2016. Projections for quarterly and annual data begins January 2016.

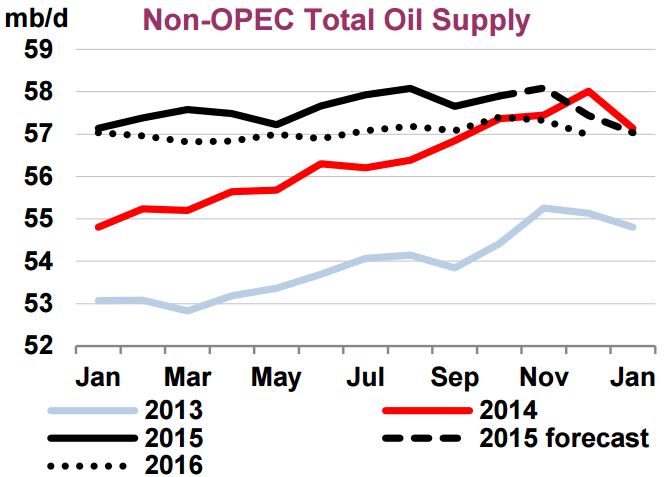

The EIA says Non-OPEC total liquids dropped .5 million barrels per day in December and another .36 mbd in January. But then, other than another short drop in the first quarter of 2017, they see things leveling out for the next two years.

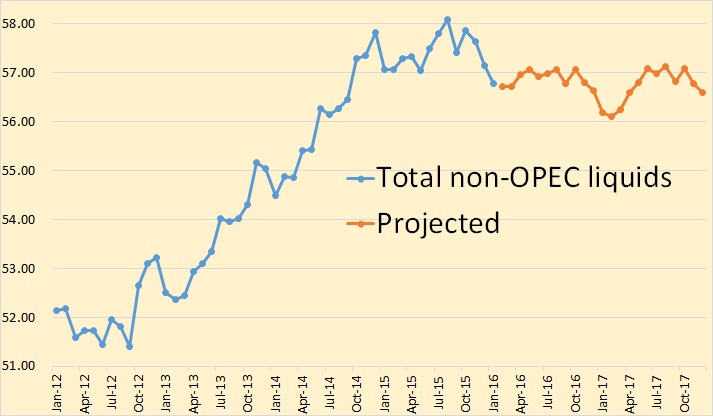

The IEA Oil Market Report, full issue, is now available to the public. Some interesting observations:

Non-OPEC oil supplies are nevertheless seen sharply lower in December. Overall supplies are estimated to have slipped by more than 0.6 mb/d from the month prior, to 57.4 mb/d. A seasonal decline in biofuel production, largely due to the Brazilian sugar cane harvest, of nearly 0.4 mb/d was the largest contributor to December’s drop. Production in Vietnam, Kazakhstan, Azerbaijan and the US was also seen easing from both November’s level and compared with a year earlier. Persistently low production in Mexico and Yemen were other contributors to the year-on-year decline.

As such, total non-OPEC liquids output slipped below the year earlier level for the first time since September 2012. A production surge in December 2014 inflates the annual decline rate, but the drop is nevertheless significant should these estimates be confirmed by firm data. Already in November, growth in non-OPEC supply had slipped to 640 kb/d, from as much as 2.9 mb/d at the end of 2014, and 2.4 mb/d for 2014 as a whole. For 2015, supplies look likely to post an increase of 1.4 mb/d for the year, before contracting by nearly 0.6 mb/d in 2016. A prolonged period of oil at sub-$30/bbl puts additional volumes at risk of shut in as realised prices fall close to operating costs for some producers.

The IEA has every month of 2016 Non-OPEC production below the year over year 2015 production.