When will Peak Oil actually arrive? There has been considerable debate on that point recently. Well if you are talking about “Conventional Crude Oil” it arrived in 2005. But in many cases unconventional crude oil works just as well so I think we must count that. I will comment on that at the end of this post below.

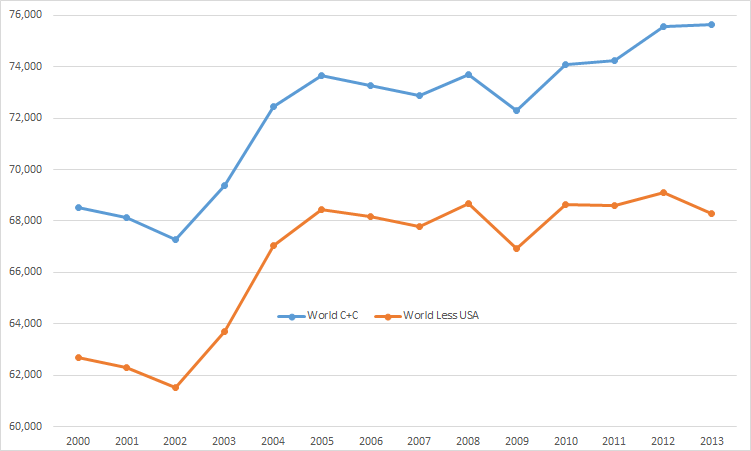

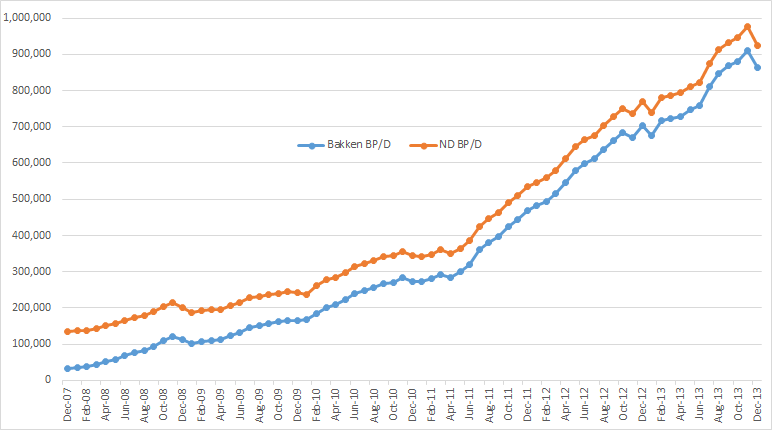

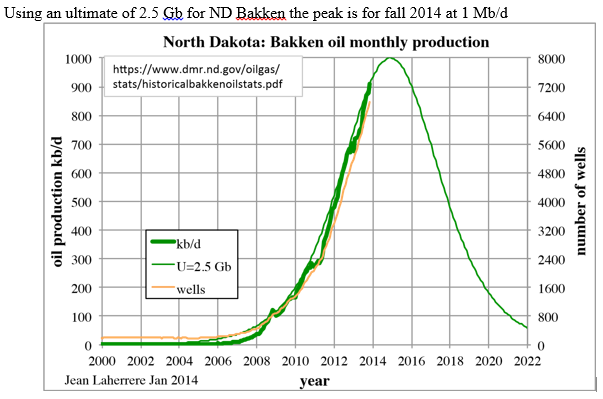

The chart below is kb/d with the last data point, 2013, is the average through October.

Averaging the first 10 months of 2013, World oil production was up only 66,000 barrels per day. And without the US LTO input, world production would have been down 807,000 barrels per day, lower than the 2005 level.

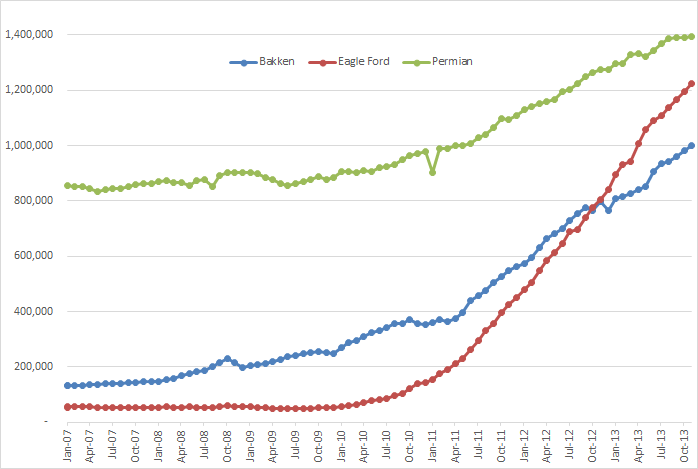

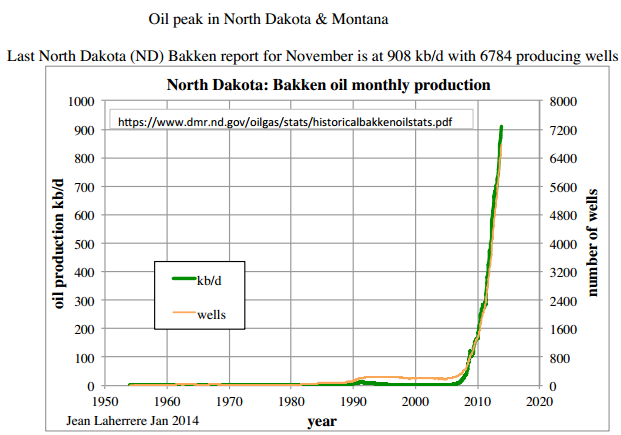

And it is all about LTO, primarily it is about three oil plays, the Bakken, Eagle Ford and the Permia.

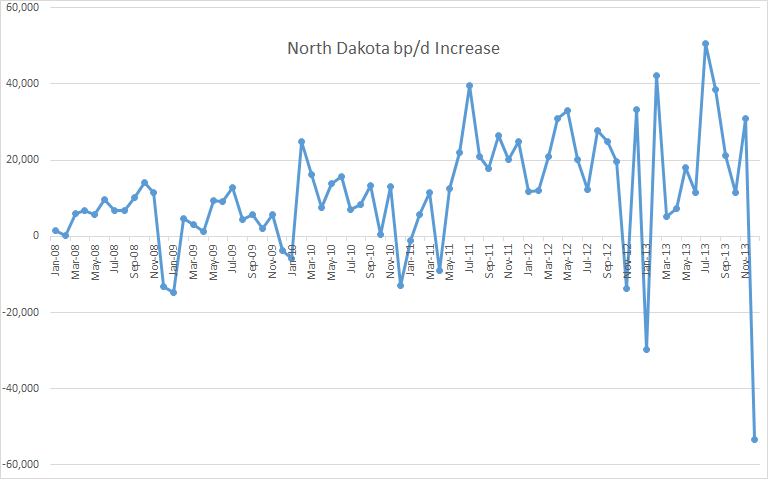

The data for this chart was taken from the EIA’s Drilling Productivity Report. The data is through December 2013 but the last four months must be taken with a grain of salt. They are nothing but a wild guess from the EIA. For instance December production in the Bakken was down over 50,000 barrels per day but the this report has the Bakken up by over 20,000 bp/d. Not to worry however they will correct the data in three or four months.