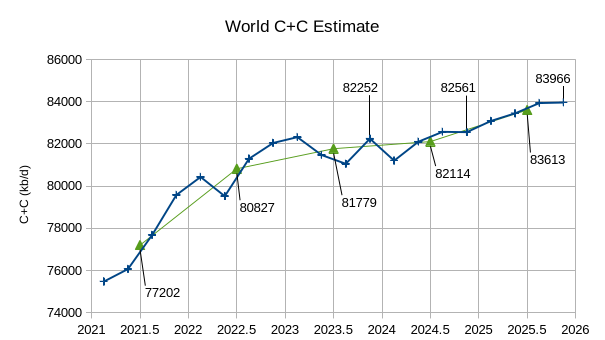

The EIA’s Short Term Energy Outlook (STEO) was published in early February. The chart below estimates World C+C by using the STEO forecast combined with past data from the EIA on World Output.

The World C + C estimate by the EIA has increased in the most recent STEO, especially for 2025 where average annual C+C output rises to 83613 kb/d, about 600 kb/d more than the centered 12 month average peak in August 2018 (83009 kb/d). Output increases by a relatively small amount in 2024 (335 kb/d for change in annual average output) and by a much larger 1499 kb/d from 2024 to 2025.

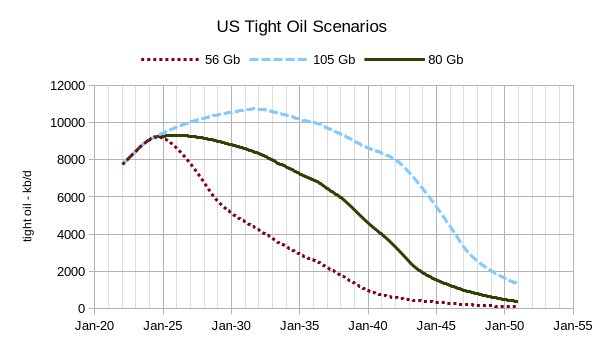

The scenarios above correspond roughly to the F95, mean, and F5 USGS assessments for US tight oil. Only the Permian Basin scenarios were modified the US tight oil minus Permian tight oil scenario is the same for all three scenarios. If the rest of US tight oil was modified to create a low and high scenario the URR would be reduced to 49 Gb for the low (56 Gb) scenario and increased to about 115 Gb for the high (105 Gb) scenario. The medium (80 Gb) scenario is my best guess for medium tight oil scenario, though any scenario between 49 Gb and 115 Gb is pausible depending on technology and price assumptions and assumptions about the level of technically recoverable resources. Note that about 27 Gb of tight oil has already been extracted and likely 40 Gb could be recovered with no new wells drilled (about 13 Gb of additional oil from wells that have already started development). The low scenario peaks in about 6 months at 9.2 Mb/d, the medium scenario in about 2 years at 9.3 Mb/d and the high scenario in 2031 at 10.7 Mb/d.

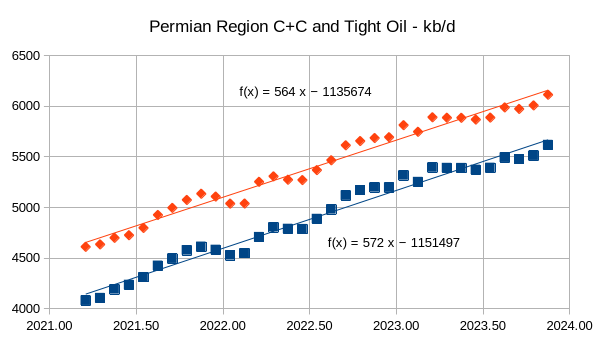

The chart above uses State data from Texas and New Mexico for the Permian region counties (upper line red diamonds) and also uses Novi labs, EIA, and State data to estimate Permian tight oil output (blue squares), the trend from March 2021 to November 2023 is nearly the same suggesting that conventional oil outut in the Permian basin has been nearly constant over this period at about 500 kb/d.

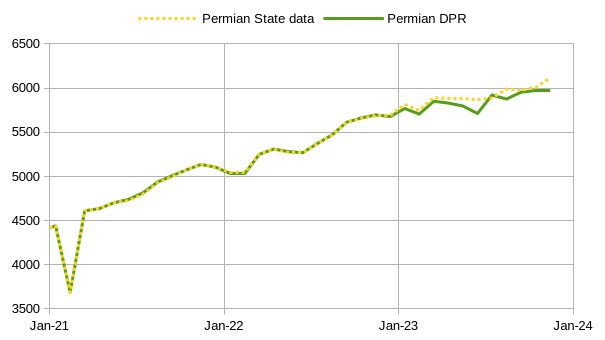

The chart above compares the Permian Region State Data with the Drilling Productivity Report estimate for the Permian region, the match is very good through the end of 2022.

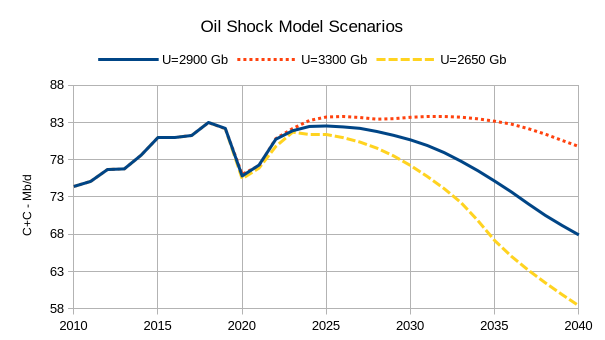

The chart above has three different Oil Shock Models. The high model with URR=3300 Gb assumes higher oil prices and a slow transition away from oil use for land transport which leads to higher unconventional oil output (tight oil and extra heavy oil), the medium model has similar levels of conventional output as my recent best guess models, and the low model assumes a lower level of conventional recoverable resources (2500 Gb rather than the usual assumption of 2800 Gb). My guess is that the probability that World C+C output falls between the low and high scenario is roughly 80% with about a 10% probability that the output path will be above the high scenario or below the low scenario. The middle scenario represents my best guess with an equal probability the output path will be above or below that scenario.

Thanks, Dennis!

This is fascinating. Even your “high model” seems to peak and plateau at 2025. This means that all of the demand growth for mobility energy will be met by non-oil energy sources from 2025 on. That’s still a very aggressive oil transition timetable.

kdmitrov,

In order to save time, I did not use my high TRR model for conventional resources, this probably was a mistake, probably the F95 URR is about 2600 Gb and the F5 case would have a URR of about 3500 Gb.

The chart below adjusts both the 2650 Gb scenario to reflect the low tight oil scenario in the post and increases the Conventional oil URR to 3100 Gb for the 3500 Gb URR scenario (from 2800 Gb in the chart in the original post for the U=3300 Gb scenario) . The peak for the low and medium scenarios is 2018 at 83 Mb/d and for the U=3500 Gb scenario the peak is 86 Mb/d in 2035. My expectation is that World C plus C demand will never rise to this level, but there is a high probability (virtually certain) that my best guess scenarios will be incorrect.

Thank you Dennis for your work. As we are approaching (or crossing) the peak, it’s natural that different positions close in towards the only one that counts: the truth. It’s always inspiring to read this community where people still manage the art of dissent.

KDIMITROV: “That’s still a very aggressive oil transition timetable.“

The word aggressive preoccupies me. It might not be so much the resources in the ground, but the human ability to collaborate peacefully that is going to peak. I hope we will get through this turning point in human history as smoothly as possible.

People might even be forced to take public transportation!

Or carpool…the horror!!

Or work from home…

Dennis

The graphs match well with this article.

https://www.sciencedirect.com/science/article/abs/pii/S0306261921011673

Our net energy peak is already behind us.

from the article-

“We determine the energy necessary for the production of oil liquids (including direct and indirect energy costs) to represent today 15.5% of the energy production of oil liquids, and growing at an exponential rate: by 2050, a proportion equivalent to half of the gross energy output will be engulfed in its own production.”

These EROI arguments are often way too silly…

So what if it takes 15% now of the energy in a bbl to produce it, if the energy is coming from gas for example? 0.15 BOE of gas is only 0.9 mcf, costs $1.50… Who cares? Oh, it’s gonna go to 50%? Well, it’s 3 mcf, or $5.50…

It’s not about the energy inputs, it’s the required complexity, infrastructure, technological know-how that make non-conventional liquids harder to extract and process.

(BTW, making humans is super inefficient in terms BROI, biomass return on investment …)

Kdmitrov,

I agree the argument is silly if we look at only one energy product, but if we look at the EROEI for all energy products that society uses and also look at energy input required for all non-energy producing endeavors by society then it is definitely important in my view. The money doesn’t really matter it is the thermodynamic requirement of energy services that is the point. It matters a great deal, though the research is lacking.

“These EROI arguments are often way too silly…”

Sure, what matters is where the ‘rubber meets the road’ so to speak-

its the price of the energy product that matters.

Harder to produce oil gets more expensive (all other relevant factors held steady).

Energy return on cash invested seems easy enough to figure out. Energy return on energy invested is rather vague and ambiguous; can’t figure it out; must be silly. I would advise against dismissing it, in these waning days of Babylon.

oil is such a premium “energy product”, why would anyone care how much gas or coal or wind or whatever it takes to extract it?

But if by 2050 you’re having to use half the reserve to get the other half then that’s a completely different kettle of fish (i.e. the reserves are really only half as much as you think). And the speed with which this is rising is probably making development and exploration decisions increasingly difficult with risk aversion having a big say.

Kdimitrov,

Simply, the more energy it takes to produce the product the more expensive it becomes.

At some point that higher price will become unaffordable for many people/many uses.

JT,

Thanks, great paper. Chart from page 10 of 23 for pre-print below.

Thanks Dennis

What I see is even a best case production scenario we never get past the 2018 net energy peak. Meaning we’re now working with less or a lot less depending on how things go.

JT

Probably correct, but note that what is more important is EROEI for all types of energy used by society. Kdimitrov makes a good point that oil is a premium source of energy and like electricity people will pay a premium for its convenience. In this regard the EROEI analyses do seem silly.

We need to focus on all types of energy and the EROEI for energy use in general by society.

You are assuming people can afford to pay a premium for the hydrocarbons. But what if they can’t?

Perhaps they can’t afford to commute to their job. Perhaps they can’t even afford to buy food. Perhaps there is no job to commute to, nor food to buy.

It could happen.

Pasander,

I think the point that Kdimitrov makes is likely correct, oil prices have been much higher in the 2011 to 2014 period than they are today, in 2023 $ the equivalent price for Brent in 2011 would be about $140/bo. The World economy grew at about 3% per year in real terms over this period.

Pasander. It looks to me like we will have a situation where

billions of people will have the purchasing wherewithal to pay a premium for oil,

while at the same time there are/will be billions of people who simply cannot. Increasingly so.

It has always been this way…those who have had plentiful food and/or energy while others have had little, or simply not enough to even live.

The number of people in the world who a this very moment are flying at 36,000 ft on non-essential excursion while there are starving people below looking up at the contrail, is as high as ever. ‘Airlines are projected to carry 4.7 billion passengers in 2024’.

Will the post-peak era see more or less equality in the ability to purchase fuel, or its derived products and services?

Which trade block will your country be excluded from?

That article/analysis is very interesting:

For every barrel of oil that we sacrifice to the ever bountiful oil/energy gods, they currently bless us with 3.5 barrels to do what we will (move things/people/food/planes/boats etc).

On the other hand, by ~2037 that same sacrificial barrel will become cursed and instead of 3.5 barrels, will only get 2 in return, still not terrible.

However by 2050, for every sacrificial barrel, only 9/10s of a barrel will appear, there will be no net oil/energy gained…

Realize that all attempts at carbon capture of fossil fuel combustion requires energy input that subtracts from the net energy equation.

Sleight of hand, it’s not only good for magic tricks…also works wonders on convincing green washed minds that the genie can be put back in the bottle…

Did Mexico eventually go ahead with these measures (“Petroleos Mexicanos, also know as Pemex, will reduce crude oil exports in 2022 before phasing out sales abroad in 2023”)?

https://www.aljazeera.com/economy/2021/12/28/mexico-plans-to-end-oil-exports-in-2023-to-reach-self-sufficiency

I checked the exports data from the OPEC website and as of 2022, they were still exporting about 1Mbd.

More generally, has anybody picked up the torch from Jeffrey Brown and the research he was doing with his Export Land Model (https://en.wikipedia.org/wiki/Export_Land_Model)?

I would be very interested to see how global net exports of crude and/or condensate are doing.

The extra part on the top essentially folds over

Or instead of cannibalizing from the supply, one can think of it using extra NG to process. That NG can’t be used for heating or fertilizer then.

It shows energy needed currently increasing rapidly (is this part true?) then the rate stops. Seems off to me but nevertheless it’s sobering because the trend is probably right.

And given the increasing population people will see the repercussions much sooner if not now.

Maybe we’ll restart the research on those integral fast reactors.

Or maybe the oil companies will pull another rabbit from our hat?

I get a slight drop in ratio of oil produced per barrel required between now and 2028 (3.4:1), then steeper decline during 2030s (2.3:1), trailing off by 2040s (very little energy returned maybe 1.2:1 or so).

That roughly means that oil production in 2035 will be half as profitable as today and by ~2045 it will not be profitable at all…

Chevron operates and 50% owns the Tengiz (TCO) oil and gas field in Kazakhstan. There is a current expansion project based on adding compression to reduce wellhead pressures to increase nameplate capacity from 600kbpd to 860kbpd liquids, originally due to start in 2022 but most recently delayed to late March. There may be three problems with this. First it has been delayed several times now, second Kazakhstan has a nominal production with OPEC plus, and third reserves have been falling quite rapidly in the last few years through production and negative revisions while no compensating discoveries. Most of the negative revisions have been from undeveloped reserves and 85% of the fall in the last three years is from liquids. Given the project’s maturity and negative revisions there is not much probable reserve left.

Production could be added to compensate for decline in the other major fields in Kazakhstan or to all maintenance turn arounds, or the OPEC limit could be ignored. If the flow is increased however the oil R/P, which has been dropping steadily to under 10 years, would jump down to under 7. That is low enough that typically the field would be in exponential decline (i.e. production and reserves would fall together and the R/P would stay approximately constant), so the production plateau would not be maintained. 860kbpd would translate to about 150mmbbl annually for Chevron, compared to 110 recently (NGL may add some variability to the numbers). Tengiz uses gas injection for pressure support and there must be some conceptual design going on for the coming blowdown phase – the wellhead pressure lowering compressors would play a part in this.

When will people wake up from Lala land?

Seems like Dennis is starting to…

Dennis – I would add a 2200 Gb run for your model, it’s possible for one reason or another production falls off faster than your other runs suggest…

Thanks for your work on this, it’s greatly appreciated…

Kengeo,

If we use Hubbert Linearization to estimate World Conventional C plus C URR, the result is about 2500 Gb, generally this method has historically underestimated actual URR, so I won’t be doing a 2200 Gb model for conventional oil as that would be roughly an F99 scenario. Here is some food for thought. Conventional oil output reached a cumulative output level of 1100 Gb in 2010 at an output level of 71.6 Mb/d, in 2016 World conventonal C plus C output was about 73.6 Mb/d (this has been the peak to date) at cumulative output of about 1266 Gb whhich is consistent with a URR of 2530 Gb for conventional C plus C. Generally I discount the HL types of analyses, my best guess is 2500 Gb for conventional oil URR due to lower demand for oil in the future.

See this, seems like there is a reason to do a lower URR 2,000-2,200 Gb…

Kengeo,

The red dashed line is the current estimate, the other black dotted lines are earlier estimates which proved incorrect, do you also think I should do a model with an 800 Gb URR?

First Signs of US Oil Production Topping. Increase from September has been 63 kb/d.

December: 13,315 -4 kb/d.

Ovi,

Alternatively we could consider the change in November to December output in the US over the years. Since 2015 US C plus C output from November to December has decreased every year except 2018, so far except in early 2020 we have not seen a top in output, perhaps this time will be different. There are lots of ups and downs in US output from June 2020 to December 2023, the trend over that period is an annual increase of 779 kb/d. I would agree it is slowing down in 2024 to 2025 to perhaps half that rate or less, based on the forecast of the EIA STEO.

Another consideration is to look at the STEO from Feb 2023 and compare with actual output for the US. In 2023 actual US C plus C production had an annual increasing trend of 940 kb/d, but the Feb 2023 STEO was forecasting an annual increasing trend of 175 kb/d for US C plus C output (about 5.37 times less than actual.) No doubt there are many other cases where they missed this badly in the opposite direction. Bottom line, the Short term Energy Outlook is pretty good one or two months ahead, but longer term can miss very badly.

Dennis

That is correct, however I did not say that without other information. There is the first indication that Martin county has now just entered the bubble point phase. Also recall that the EIA STEO is showing no growth for 2024 and the DPR and LTO are flat. Many indicators pointing to an undulating plateau phase.

Looking at the GOR chart, the right red boundary possibly should be at 2.5, where the peak occurred. The next few months should confirm if it has entered the bubble point. Note the steady drift to the right after November.

I guess we will have to see what the future holds. Note how closely the state data matches the DPR Permian Region estimate when we adjust state data for recent 12 months to match the EIA PSM estimates for Texas and New Mexico (chart in post). For all Tight Oil Basins the DPR estimate through December 2023 is below, the model estimates after December are probably not reliable in my opinion.

Dennis

The outlook may be about to change. The effects of the huge drop in rigs from last August may be about to show up.

Ovi,

Permian Horizontal rig count from Sept 2020, if we assume a 6 month lag to completion of wells drilled, this would correspond with completions starting in March 2021. Recent December 2023 completions would correspond with rig count in June 2023. The count at 325 horizontal oil rigs at the end of June, the rig count has fallen another 25 rigs by mid September and then has remained at about 300 since then. So perhaps not a “huge drop” in rigs, a little under 10% over 3 months or roughly 3% per month.

Ovi,

I found this short piece at the primary vision website.

https://primaryvision.co/2024/01/25/us-oil-drillers-operational-efficiency/

Excerpt:

With frac spread counts (FSC) decreasing by 6.4% over the past year and rig counts down by 19.9%, a superficial analysis might predict a downturn. Instead, crude oil production has surged by 9.0%, revealing an industry that has mastered the art of doing more with less. This paradigm shift from drilling to completing wells suggests a maturing industry that is leveraging technology to extract more value from existing assets.

They fail to account for the 6 month lag between the rig counts and numbers of first flow wells, there is also likely a few month lag between frac spread count changes and and changes in the number of first flow wells.

Ovi,

For discussion…. I suppose as new well completions drop, the average well age increases and the GOR with it. Without new higher liquids/crude percentage wells coming online to keep the GOR down, the county will naturally rise through attrition.

I do not have new well completion data by time for Martin County, but will look. However, the past year trend of active frac spread reductions is likely a source of the rising GOR in Martin County, and other areas…if they also had the same frac spread reduction profile allowing existing well age to mature on average.

If things get peppy again out there, or other less developed zones become the more dominate target, you could see a reversal of the rising GOR trend, for the moment at least. I do not think Martin County is doomed to the permanent bubble just yet.

Gungagalonga

I have downloaded the Frac Focus database but they have changed it again. Not sure what I have is 100% correct but I did one long way check and it came out the same as in the table below.

I was hoping to get weekly data but could not find a way to get it. Attached is monthly frac spreads for Lea, Eddy, Martin and Midland from June 2023 to January 2024.

Providing the data is up to date, frac spreads peaked in September/October and then start to fall off. I confirmed the long way the 1,121 fracs for Martin in December.

The low January numbers are probably due to late updating. December is about right. I will try to do this again next Friday to see how much the numbers change. That will provide some idea on the update lag time.

There are three benches in Martin County that make up 94% of all HZ tight oil production from that county. Just three. To get to all three primary benches operators have to drill thru a severly pressure depleted “upper Sprayberry” zone (the “largest, most unprofitable oil field in the world”) that often, almost always, requires setting another sting of casing, liners, open hole packers, etc. etc. and it raises D&C costs signficantly. Economics are worse in the Midland Basin than the Delaware.

There are no new, “less developed” benches in the Midland Basin to get people “peppy” again, unless its deeper Devonian/Mississippian Woodford/ Barnett which will be 90% gas and gas liquids related. All those children out there sitting those drilling rigs are scared to get that stuff in ther face and burn a rig down. Why would they want to put themselves thru the stress anyway? WaHa Hub prices in West Texas were trading around 19 cents per MCF this week.

Look at Ovi’s frac spread chart. For God’s sake. Please. How can people NOT see what is happening, even the liars and the deniers? When DUC’s get deducted from the scheme, and rig counts fall, what is there to frac?

If they are NOT pouring 300,000 pounds of dirt and 600,000 BW into new wells, where is the production growth going to come from?

Who’s lying more these days than the US tight oil sector, than all the people who make free money, or $40MM compensation packages as CEO’s, or sell manipulated data to make a living to promote US tight oil and keep their jobs?

The renewable, transition-away-from-fossil-fuel crowd, thats who. Those folks are telling big whoppers. You EV guys make the shale oil and shale gas sector look like saints.

Why do so many people participate on social media these days hiding behind a fake, anonymous name?

Because they are lying and it helps ease their bad consciousness.

Charlie didn’t lie. He stood tall in his beliefs. Unafraid.

https://www.oilystuff.com/single-post/us-energy-independence-is-a-terribly-stupid-idea

Mike, what a wonderful book! It is a gift. I’ve just spent hours engrossed in it. I’ll share one quotation and a comment:

This is anathema in today’s Cult of Self-Esteem, but fuck them.

A good quote from this discussion by Munger:

” We should conserve and subsidize new forms of energy “

Charlie Munger was a very smart man.

Mike,

I use the data from Statistical Review of World Energy for renewable energy to show historical trends.

We can’t lie about the future, it is unknowable. All we can do is guess what the future trend might be based on past trends, there are many different opinions on what the future path might be, none of them will be correct.

Mike,

Your wrote:

>>The renewable, transition-away-from-fossil-fuel crowd, thats who. Those folks are telling big whoppers. You EV guys make the shale oil and shale gas sector look like saints.<>Oil and gas are absolutely certain to become incredibly short and very high priced.<< Me: Maybe until we can't afford it.

I'm one of those EV guys and I have been driving an EV for about 5 years. My colleagues always thought of me as a straight shooter. I see the writing on the wall where we will be peaking in World crude oil production. I have PV on my roof and it offsets some of the electricity I use and it does help to recharge my EV. I expect that one of these days, if I live so long, I will be generating and storing what I produce. I'm not naive to think that is going to solve what is coming. I may eventually become "energy Independent" and "export" all my surplus electricity. Little to none in winter to a lot more in summer.

Exporting oil is not a "The renewable, transition-away-from-fossil-fuel crowd" thing. It's a supply and demand and geopolitical thing. I assume we blew up the Nordstream pipeline to cut off revenue to Russia over its invasion of Ukraine and have had to export our oil and natural gas to stave off loss of energy to our European allies. There is money to be made in sending "our surplus" to our allies.

Yeah, Germany screwed up and bought into the "the renewable, transition-away-from-fossil-fuel crowd" with what you are describing. Some of the Big Automakers are backing away from EVs; likely to their detriment. Norway is going ahead with transitioning to electrifying all their transportation systems from cars to ferries to buses to figuring out how to do so for trucks (I doubt they will be successful in the near term).

How **do we conserve** with respect to what is remaining?? Oil and Gas are too precious for wasting on frivolous things. Supply and demand is going to be a bitch from insidious to overt. If I use less, then there is more oil and gas for vital things like growing food and for other more important things than me using an ICE to go grab some fast food. I like to eat.

Bottom line what do you think should be done?

Canadian Natural Resources Reported Q4 results.

Another blowout quarter. IMO, this is the best run oil company in the world. Paying down debt, raising dividend and no exploration costs. Below are an analyst’s comments.

Q4/23 Results Beat; Net Debt Target Achieved Earlier Than Expected

Bottom Line:

Canadian Natural reported better-than-expected fourth-quarter cash flow and achieved the largest quarterly production in the company’s history. More importantly, the

company was able to reach its net debt target a quarter earlier than expected and will begin returning 100% of its free cash flow to shareholders. Additionally, Canadian Natural announced another dividend hike, which is its third over the past year. We believe the results and updates will be positive for the shares.

Key Points

Better-than-expected Q4/23 financial results. Canadian Natural reported Q4/23 cash flow of $4.05/share (diluted), above of our $3.68 estimate and consensus’ $3.70. Relative to our estimate, the beat was primarily driven by lower operating costs, royalties, and cash taxes. Capital spending in the quarter was $1.12 billion (including ARO) vs. our estimate of $1.12 billion and consensus’ $1.15 billion.

Record production. Canadian Natural posted a production record of 1,419 mboe/d in Q4/23, ahead of our estimate of 1,405 mboe/d and consensus’ 1,409 mboe/d. Liquids volumes came in at 1,048 mb/d vs. consensus of 1,040 mb/d, while natural gas production averaged 2,231 mmcf/d vs. consensus of 2,216 mmcf/d. The company achieved record volumes at its mining and natural gas operations.

Net debt target achieved. Net debt fell to $9.9 billion, below the company’s targeted floor of $10 billion. Canadian Natural was able to achieve this a quarter earlier than expected due to the cash flow beat coupled with a ~$550 million working capital tailwind. As a result, the company will now begin returning 100% of its free cash flow to shareholders.

Raising the dividend again. Canadian Natural has raised its quarterly dividend 5% to $1.05/share (4.7% yield). The company has hiked it base dividend 24% over the past year through three separate raises. This increase reflects the confidence the board has in the sustainability of the company’s business and will mark the 24th consecutive year of dividend increases, with a CAGR of 21% over that time.

Reserves update. 1P reserves rose 2% to 13.9 billion BOE and 2P reserves increased 3% to 18.5 billion BOE, implying reserve replacement ratios of 166% and 194%, respectively. Proved FD&A costs (including changes in FDC) were $9.25/boe, representing an attractive recycle ratio of 3.4x.

https://www.cnrl.com/investors/financials/#investors

Ovi,

Do you think oil sands production can be ramped up much? I can see a long plateau if oil prices remain relatively high, but I wonder if we will see much future growth in oil sands output.

Your perspective would be of interest as it is your nation that produces the bulk of oil sands output. Doubtful that Venezuela will see much growth imho.

Dennis

The typical number I keep hearing is close to 100 kb/d/yr. One of the hold backs is the Carbon intensity of the extraction process and we have a current Prime Minister that has decided that Canada needs to be a leader in CC, even though we produce slightly over 1% of world’s CO2. At one point before he was elected he said “We have to shut down the oil sands”.

Below is a production statement from the CNQ Q4 report. Production increase is primarily from SAGD pads.

The Company’s thermal in situ assets continued to demonstrate long life low decline production before royalties, averaging 278,422 bbl/d for the fourth quarter of 2023, an increase of 10% from 253,188 bbl/d for the fourth quarter of 2022, and a decrease of 3% from 287,085 bbl/d for the third quarter of 2023. The increase in thermal oil production in the fourth quarter of 2023 from the fourth quarter of 2022 primarily reflected pad additions at Primrose and Kirby in 2023, partially offset by natural field declines. The decrease in thermal oil production in the fourth quarter of 2023 from the third quarter of 2023 primarily reflected the cyclical nature of steaming at Primrose and natural field declines.

Attached is a chart that shows in situ production (SAGD). From January 2021 to July 2023, production increased by 115 kb/d. With TMX coming on, SAGD could increase but I think 100 kb/d/yr is close to the limit.

https://www.cnrl.com/content/uploads/2024/02/12.31.2023-Q4-MDA.pdf

This is a fascinating sector. Some random notes.

1. SAGD is one of these lower EROEI resources, where EROEI doesnt matter much. There is plenty of gas in Alberta to boil steam.

2. Speaking of which, Canadian gas and condensate producers should be seeing some brighter days ahead. LNG Canada is almost ready to go, TMZ-related SAGD ramps will bump gas demand in the basin, rising demand for C5 condi as diluent will keep its WTI-parity pricing, if not even higher.

3. Given its ample gas resources Canada should be building more upgraders and refineries to ramp exports of syncrude and products. TMX would probably narrow the WCS spread as people say, sure, but the country can do much better to maximize the value of its bitumen….

Kdimitrov

Yes it is a fascinating sector, but the times are changing. Fortunately some of the better decisions on upgrading were made in the 1990s.

SAGD: Cost is an issue with SAGD as the price of NG fluctuates. Mining operations costs would fluctuate from being cheaper to more expensive than SAGD as NG costs changed. However today the game has changed.

The challenge to is to lower CO2 emissions. The big push today is two pronged. Reduce the Steam Oil Ratio (SOR) and reduce CO2 emissions. Much research has been done in adding solvents to the process and companies are now implementing their findings. Leaders in this field are Cenovus and Imperial Oil (Cdn subsidiary of XOM).

https://innotechalberta.ca/news/a-novel-solvent-will-make-bitumen-recovery-more-energy-efficient/

https://www.canadianenergycentre.ca/long-awaited-oil-sands-emissions-reduction-technology-going-commercial/

As for building new upgraders, forget it, a big disaster. The smart time to build upgraders was in the 1980s and 1990’s. That is when they were built and are still operating. I recall when Syncrude added a 100 kb/d Coker and upgrader to their facilities in the 1990s. The initial cost was $Cdn4.8 B. The final cost was $Cdn8.4 B. I remember this because of the flipped numbers.

Around 2010 studies indicated that a Refinery/Upgrader should be built in Alberta that would upgrade 79,000 b/d of bitumen into ULSD and by products. The estimated cost was $Cdn5.7 B. Final cost was $Cdn11 B. Funding was a combination of public and private money.

In the end the Alberta government had to take a 50% stake and CNQ bought out the original investors. It is still losing money and the government is trying to sell its half. It is not clear if there will be a buyer. CNQ is a possible buyer but may only be willing to pay $1.

Maybe when TMX becomes operational and the WCS discount becomes clearer, a deal could be made. Attached are two articles providing some background.

https://calgaryherald.com/opinion/columnists/varcoe-danielle-smith-alberta-options-sturgeon-refinery-stake

https://financialpost.com/commodities/energy/oil-gas/alberta-takes-50-stake-in-troubled-sturgeon-refinery-as-cnrl-north-west-refining-see-combined-825-million-payday

Very interesting and illuminating, Ovi. Thanks!

It’s disheartening that Canada – or most western countries for that matter – doesnt seem to be able to build industrial installations (upgraders, refineries) efficiently, on time, and on budget anymore.

Thanks Ovi.

Ovi,

Looking at all Canadian output in the 2023 Canada Energy Futures Scenario (current measures scenario) the rate of increase in all Canadian C plus C (most likely coming from Oil sands) is about 100 kb/d as you suggested from 2024 to 2029, then this decreases to 45 kb/d from 2030 to 2035 and then flattens to roughly zero from 2036 to 2040 with decline after that at about 24 kb/d from 2040 to 2050.

You may not agree with the government scenario.

https://open.canada.ca/data/en/dataset/7643c948-d661-4d90-ab91-e9ac732fc737

https://aspofrance.org/2023/12/23/extrapolation-of-past-oil-production-to-forecast-future-production/

abandoned well issue:

https://www.texastribune.org/2024/02/28/abandoned-oil-wells-west-texas-railroad-commission/

Tax payers will pick up the tab?

Astonishing amount of risk as billions of barrels of produced water continue to be injected back into the Permian. Great article.

For the US medium sized independents with most of oil and gas production coming from fracking the following are some results from their 10-ks for 2023.

Spending was up a bit from 2022 even after deflating based on the North American capital cost index (diamond symbols).

Long term debt about the same as last year.

Dividends continued to be payed by most firms but were down from 2022.

Share buy-backs were still high but down from 2022. Overall I would have thought investors were pretty happy with the year, financially at least.

Mr. Kaplan,

Great stuff, thank you for sharing.

Great graphs!

Financially there is some slack at 80 dollars per barrel in the US it seems; at least in the short term. I guess the current oil price at 80 dollars per barrel is somewhat fair. The dollar strength is subdued as of lately. It is impossible to reconcile the need for low fuel price for the consumer and for other uses all over the world and at the same time allow for enough economic muscle for expansion of the hydrocarbon complex. Well, who knows how much dry powder is left at these prices in Africa, Central Asia and in South America? Export of technology is occuring and will occur one way or another – the seismic phase is probably very important given this a long term game no matter how you look at it (as well as efficient drilling).

The obvious solution is to reduce demand for fossil fuels with renewables. It is great if the financial system can balance somehow, the alternative would be imbalance. Painful most certainly – not necessarily wrong, but the lack of stability would not be something to urge for in my opinion.

For the combined E&Ps shown above 2023 saw a return to negative revisions after some price related additions in 2021 and 22. Negative revisions mean there are no reserves in probable and possible categories and the proven were overstated at the average annual price. The large cumulative revisions mean the original estimates for recovery were all overstated (CLR has been the worst for this, SM and EOG have been conservative and show positive revisions every year).

Discoveries, which mostly represent FIDs for new drilling but may include some extensions, appear to have peaked even given the higher prices in 2022 and 2023, which would tend to agree with there being fewer tier one locations available now but may have some impact from investors’ desire for returns over growth.

Remaining liquids reserves for theses companies have risen steadily but may be showing signs of flattening out, with undeveloped reserves maybe having clearer indication. R/P has been falling but the early numbers are skewed a bit because they include a lot of conventional and the numbers reported include NGL, which is a large proportion and dependent on the shale gas holdings rather than the oil fields. For conventional fields R/P dropping below 10 often indicates a move to continuous decline but there is no real history to compare for non-conventional.

Remaining dry gas reserves have also risen but may be plateauing, with undeveloped showing signs of declining and R/P maybe declining. For oil and gas the choice seems to be between a plateau or an initial decline but the days of clear growth have gone.

EIA publishes reserve estimates for individual areas (i.e. basins) and with C&C separate from NGL, which give clearer indications of trends and cover more companies, but they are alway a year behind the 10-ks and this year are three months late so far.

Rig Report for Week Ending March 1

– US Hz oil rigs increased by 1 to 453. The rig count continues to hover close to 450 since the beginning of October.

– Permian rigs were up 1 to 296 and also have been flat around 295 since October 2023.

– Texas Permian was unchanged at 203 while NM was up 1 to 92. In New Mexico, Lea county was up 3 to 46 while Eddy dropped 2 to 47.

– Eagle Ford rigs held steady at 46.

– NG Hz rigs were unchanged at 107, (not shown), even though NG prices are weak.

Rig Report for Week Ending March 1

The frac spread count was up 2 to 272 and down 4 from one year ago. How high will the Frac count go in 2024? It is starting to show signs that Fracs will bounce around 275.

There was some discussion last post about the Marcellus. I used data from Novi Labs on the Pennsylvannia shale gas output (about 98% from the Marcellus) to create a rough model. I assume the mean USGS estimate for area of the 3 highest EUR Assessment Units (AU) and about 300 acres per well on average after 2018. The average well EUR from 2010 to 2020 is estimated based on the data, for simplicity I assume 2021 to 2023 wells have similar productivity as the average 2020 well then I assume productivity decreases at 3% per year starting in 2024, wells are added at a constant rate of 44 per month from Jan 2024 to Dec 2040 then wells decrease by one each month.

The guess is likely to be wrong.

better to add the scenarios where the productivity “decrease only 1%”, “stay the same” or “increase 1%”

Sheng Wu,

I assume a 300 acre well from 2020 to 2040, under that assumption it is highly unlikely we will see productivity increase as core areas become drilled out and producers move to less productive rock. Scenarios below cover 2% annual productivity decrease and 1% annual productivity decrease. (This is the decrease in EUR for the average well over time.) The scenarios are for the Pennsylvania Marcellus only. Also in the original comment I mistakenly said that productivity was assumed to decrease at an annual rate of 3%, the correct value is 2% per year for the model assumption.

great additions, but I still think you should also add scenarios for “high, med, low” price scenarios, e.g. it is quite possible that pipeline issue/negative spread will be alleviated if the production drops 20%?

An example is the Marcellus in WV, the production is still growing at quite brisk pace, probably due to NGL spread help the economics. Total Marcellus is now well above 10TCF annual now.

Sheng Wu,

I only do such an analysis with more information, I have no data on average CAPEX, OPEX, etc for Marcellus. Note that these scenarios would be for a high oil price assuming the mean USGS TRR assessment is correct (the 5% annual EUR decrease scenario). The higher scenarios are something like an F25 or F10 scenario (very rough guess). As far as growth of Marcellus output, it has been 1.1% over the past 24 months, relatively flat. West Virginia shale gas grew at about 669 million cubic feet per day annually from 2013 to 2022, so yes significant growth in W. Virginia, but note for the Marcellus as a whole the growth from 2013 to 2022 has been about 1741 million cubic feet per day, so W. Virginia provided about 38% of Marcellus growth over this period.

Sheng Wu,

Note that the USGS Mean estimate for Pennsylvannia is approximately 185 TCF for Marcellus Shale Gas, in the chart below I also include a scenario with a 5% annual decrease in new well EUR (or productivity) which has a URR of 188 TCF, more in line with the USGS mean TRR estimate for the Marcellus shale gas resource.

if UTRR for Penn M only then it is closer, just checked by 2023, Penn M produced close to 70TCF, and WV M at close to 20TCF, total close to 90TCF.

If the WV M continue the brisk pace, probably it will peak later at more than half of Penn M? Then maybe WV M will have UTRR at also more than half of Penn M, and then total M UTRR at around 300TCF, and plust 90TCF already produced, total at 390TCF.

Compared to 2019 USGS mean, 50TCF produced, 130TCF proven, and ~90TCF Undiscovered, or total at 270 TCF, we see increase of ~35%.

Sheng Wu,

At end of 2018 proven reserves were 135 TCF with cumulative output at 37 TCF, so 172 TCF plus 97 TCF for USGS Mean estimate, so yes 269 TCF for mean TRR (I mistakenly forgot to add cumulative output.) So far cumulative output and proven reserves for Pennsylvania Marcellus are about 77% of the Marcellus total, which might suggest Penn Marcellus TRR of 207 TCF rather than the 185 TCF I estimated incorrectly. Thanks for the corrections.

Note that I expect most of the output from the best three AU will be viable to produce, but the other 3 AU from the 2019 assessment with lower EUR (about 26 TCF) will not be extracted, this reduces the overall TRR by 26 TCF to about 243 TCF for Marcellus with Penn Marcellus at about 77% of that for a Penn Marcellus TRR of about 187 TCF. I expect W. Virginia Marcellus TRR to be about 56 TCF.

Can you clarify “we see increase of 35%”? Based on the area of core production in the Marcellus (in Pennsylvania 75% of Marcellus output comes from 4 counties) the mean USGS TRR seems optimistic, I would say ERR is likely to be at least 10% below the USGS mean estimate even with high natural gas prices which is by no means a given. If the US slows it building of LNG export terminals it may keep natural gas prices in the US relatively low and if natural gas prices rise wind and solar may take market share in the electric power industry from natural gas which may reduce demand, also heat pumps may take more share for space heating if natural gas prices rise.

We may see low natural gas prices in the future.

I also miscalculated the “35%” when comparing USGS 2019 and the latest numbers based on your Penn M projection (200TCF UTRR) and WV M trajectory(100TCF UTRR, my rough estimate based on WV M still fast rising production), which is about 390TCF including produced 90TCF, UTRR at 300. It should be more like 40% increase from USGS 270TCF total, and if you further deduct the USGS fringe M 26TCF, then it is more like over 50% increase.

Sheng Wu,

I don’t have much information on West Virginia except output. Note that much of the 26 TCF in less productive assessment Units is in West Virginia. I think you overestimate W Virginia. Through 2021 looking at cumulative output and reserves the split between W Virginia and Pennsylvannia is 25%/75%, W Virginia is about one quarter of total Marcellus output with W Virginia one third of Pennsylvania output.

So W Virginia looks like it would be 269 times 25% or about 67 TCF, much of that 26 TCF is from the Eastern Interior assessment unit (about 21 TCF) which is primarily W Virginia (roughly 60% of the area). Very doubtful we see 100 TCF from W Virginia imho, even 70 TCF is not very likely.

Also note that if the TRR ratio for Pennsylvania and West Virginia is similar to the ratio of shale gas proved reserves, then the USGS mean estimate for the Pennsylvania Marcellus would be about 185 TCF. This suggests my model estimate may be too high by perhaps 15%.

Sheng Wu,

I just realized I forgot to label vertical axes on Penn Marcellus charts, the units are billions of cubic feet per day (BCF/d). For 2022 Penn shale gas averaged about 20 BCF/d and W Virginia shale gas about 7.58 BCF/d for a total of 27.6 BCF/d. As you suggested this is over 10 TCF per year.

I am also surprised by WV M production rise in the past 3 years, and it definitely still has room.

My guess is that the liquid part of the production really helped the economics in WV M, and it is extremely productive in terms of liquid— better than some of the best wet gas condensate liquid producers in Eddy/Culberson co, Delaware basin.The GOR could be as close as 6MCF/bbl, i.e. 1:1. The first 3 year liquid could be as high as 200 KBO (almost at $12M, yet just 1.2BCFe), and plus 1~3 BCF of gas (only $1-2M if only consider dry gas, but with high wet NGL, probably $3~5M if there is plant ).

Also, the well depth are so shallow, at only 7000′, and one 15K well could be drilled in one shot in less than a week, and all the fracking is a lot easier. The per foot cost probably is half of Haynesville, or 2/3 of Delaware and 3/4 of PA NE. Plus, the water production is so low, so lifting cost is minimal too.

So, if USGS or someone only use gas economics, then the well BCFe EUR will not be good, but with the liquid plant infrastructure all ready, the well economics is improved significantly, although the railroad will be under pressure. The only way the similar wells in Permian could survive is to make the gas plant and infrastructure as good as the Appalachian.

Sheng Wu,

Note that NGL only gets about 30% of the crude price, but even at that price the average West Virginia shale gas well may get 2.92 million barrels of NGL over its first 3 years of output (based on recent ratios of NGL to NG in WV, which at 30% of $80/bo would be about 69 million before royalties and taxes, if we deduct 30% for those and another 10% for transport cost we still have 40 million, assume the well costs 15 million (probably less than this) and we are left with 25 million even if natural gas prices were zero. If we assume natural gas sells at $1/MCF that adds another 7 million to the picture, but note also there may be about 17 million in OPEX so this reduced the profit to about 15 million on a 15 million investment over 3 years, a pretty attractive investment as there will be future revenue after year 3.

it isn’t clear how much of the Marcellus has this liquids rich character, but at present it looks like WV is the better area for higher profits unless there is a glut of NGL which could cause prices to plummet.

Note that the USGS does not look at economics they look at what is technically recoverable only.

hahaha, Dennis,

WV M is a mega million jackpot.

I believe your numbers above are all inflated — from income to OPEX, NGL bbl MCF conversion is a huge mess even for Art and Patzek, god knows how could they did not make a scam there yet. In China, few Petro engineers could distinguish M and K, or MM with million, and there are news writers claiming one M well is producing 1/3 of China total gas production.

Hi Sheng Wu,

Yes I was mistaken in my calculations and was off by a factor of about 10 on NGL produced (used annual data NGL with monthly data for NG by mistake). With the correct calculations the well does not pay out in 36 months assuming 15 million CAPEX and $24/b NGL and $2/MCF NG. True though that the higher NGL output in WV (roughly 5 times higher NGL per MCF NG compared to PA) is likely to make the wells there more profitable than the PA Marcellus wells, especially in NE PA if NG prices remain low.

I was able to find a wellhead price for NG in Dec 2023 in Susquehanna County, PA at about $2.29/MCF. Statewide the average price was about $2.17/MCF. This is based on crowd sourcing and may not be valid pricing, only 23 samples for Dec 2023. From site linked below.

https://www.marcellusgas.org/pricing/

Article below discusses NG prices in PA

https://stateimpact.npr.org/pennsylvania/2023/09/22/pa-gas-prices-drilling-falls-report-says/

WV M has lots more liquid (NGL+oil) than SW PA M, and gas to liquid at about 2TCF:100Million Bbl. Or, if one use the maturity based wetness, the molar mass ratio should be about 5 NGL and 1 methane, and or 1TCF methane dry gas should have 200BCF of NGL. The NGL barrel can not be converted to gas volume at 6MCF=1bbl, and it actually varies for different components of the NGL.

So, EIA has a composite price based on Million BTU, besides price for each components, i.e. butanes, propane, ethane…

https://fred.stlouisfed.org/series/MNGLCP

https://www.eia.gov/energyexplained/hydrocarbon-gas-liquids/prices-for-hydrocarbon-gas-liquids.php

From this Million BTU price, if 1MCF methane is roughly 1Million BTU, then 1MCF ethane, propane and butane will have higher BTU. 6MCF of NGL should fare price quite close to oil, at around 50% of oil, or each MCF of NGL should get better than $6 as the link above shows.

Sheng Wu,

The prices reflect dry gas after NGL plant separation, I realize the WV natural gas has more NGL per MCF gross gas than Pennsylvannia wells, typically the NGL composite barrel sells for about 25 to 30% of the price of a barrel of crude, though this depends on supply and demand for the various components of NGL (ethane, propane and butane in their various isomers). In any case the WV wells will do better under the current price environment. I don’t convert NGL based on the 6 MCF/ 1 bo metric only the dry natural gas.

I was looking at a Delaware Basin Wolfcamp well being auctioned this month. The operator is Callon.

The well was completed in 2017. It has cumulative oil of about 275k and cumulative gas of about 581k.

The well is currently producing 55 BOPD.

What struck me was the expense for disposing of water. The water is truck hauled. There are 6 750 Barrel water tanks on the lease (and 2 1,000 Barrel oil tanks).

Water disposal expense is running anywhere from $10k to $18k per month for the past six months.

The company doesn’t show how many BWPD is being produced. I assume this well is an outlier on the high end for water production? Suspect that is why it is being sold.

LOE for this well was over $25 per BO. I didn’t figure in the gas. The average price for gas had been $1.70 per MCF, but I think that has since fallen quite a bit.

Does anyone have access to statistics for the amount of water being disposed of from operations in the Delaware Basin?

That well probably should be a giveaway. It will cost someone (probably the taxpayers) about $250,000 to P&A, and it’s getting there fast. The water cut is almost certainly very briny, which makes it difficult to clean up for use in fracking other wells, and the brine at the bottom of the well bore is going to become more concentrated, pulling in more water with each mole of salt. The SWD wells that are closest are full, and the transportation cost is going up. The wellhead gas is likely bringing no more than 50 cents/tcf, and that’s not likely to change much, as the European winter is mild and about over, not to mention the ban on new LNG trains. The Delaware is close to Carlsbad Caverns–a massive limestone karst that is at some point (with such loss of water) likely to weaken–perhaps with catastrophic consequences.

That whole thing (it’s not unusual for a well in the Delaware to put out ten barrels of water for each barrel of oil) is indicative of the desperation of a basin to claim oil hegemony. This is a well in terminal decline, put on the market as sucker bait. Has the entire Permian shale oil industry turned into a Ponzi scheme? It is beginning to look like that. By my calculations they have made about a 1:6 return on that well, which after taxes and tax savings just about breaks even. But as they say, future returns can’t be based on past earnings. An uneconomic, environmentally-dangerous well like this should be put to sleep.

You fellows (with good intentions) who are making these models on Permian production, extrapolating into the future, should be aware that there are tens of thousands of similar wells right behind this one. This well could go on in this fashion for another ten years, eating up truck tires (and lives) in water transport, adding to the seismic dangers of SWD wells built along Texas fault lines, until its end-owner goes belly up and the taxpayers plug it and mercifully put it out of its misery. A shit-show is coming.

This particular well may be an outlier, but there are a bunch almost as pathetic coming right behind it. Count on it. If the oil and gas “experts” who move markets actually did the work to understand the natural history of these wells, and the precarious nature of the Permian Basin in its current form, the price of oil would be $150.

Hi Gerry,

Here are the scenarios I used for the Permian Basin for my US tight oil model. Note that as of December 2023 approximately 12 Gb of tight oil has been extracted from the Permian Basin, so the low scenario has about 12 more Gb extracted after December 2023. Note also that if no more wells were completed after December 2023 the total oil extracted would be about 18 Gb. The low scenario seems fairly conservative to me, YMMV.

Hi Dennis:

You may be right. I’m reluctant to respond, because it’s morbid.

I have difficulty seeing past performance define the future. The reservoir pressure has dropped all over the place. There is already a massive problem disposing of produced water yet we’re about to see a deluge as wells in terminal decline draw in more salt, which pulls in more water. NG is now such a glut that it’s at giveaway prices at the hub, yet we’re going to see more and more as thousands of wells hit “that point” and many of the new wells have higher gas cuts. EUR’s of the pilot (parent) wells drilled in 2018 do not by any stretch denote the EUR’s of the infill (children) wells drilled in 2022. Take away proceeds from NG, increase expenses of production, give us lower EUR’s and what kind of net back is there?

How do we get out of this mess? Where do we put the water? What about all that gas? With XOM paying 3.5 million for each drilling site, the cost of a well just went up to about $15M. Is someone actually going to drill that well?

When we have fifty-thousand wells similar to the one delineated by Shallow Sands, we’re talking about a massive field of expensive-to-run stripper wells that are producing all the wrong things: brine and methane gas. If all that water is taken away from the “People’s Well” and sequestered in a SWD well that is already exceeding physical limits, I suspect it’ll change the local climate.

I suppose I’m sensationalizing the matter, but I just don’t think the tail-end of this is going to be pretty–or the production amenable to modeling. In point of fact, as the saltwater flood hits as the earth shakes, I’m pretty sure that a lot of marginal wells are going to be merely abandoned–not plugged.

Gerry,

The assumptions of any model will always be proven wrong by future events. So yes the future will be different than shown here for all the reasons you cite.

Interesting discussion on shale strippers. Their economics will be becoming more and more relevant, as an ever increasing fraction of LTO will be coming from these <100 BOPD wells.

I would imagine that the more wells per pad a company has, the better efficiency and lower costs per bbl can be achieved from scaling these intense operating activities. So companies that developed these cubes with multiple benches will benefit at the later stages, while companies who were cherry-picking and hopping around will fare worse…

Hi Gerry. I agree with basically all you said about the well. I hadn’t considered how the long-running effects of the Delaware could lead to damage or destruction of one of earth’s treasures, Carlsbad Caverns. Do you have any idea how close they are drilling?

Hi DC, I’m sorry, I missed your note. They’ve drilled in Eddy county as close as the USGS would allow them. That whole area is a carbonate karst. Sinkholes develop when slightly acidic rainwater dissolves the limestone “bedrock,” and God knows they’ve got enough CO2 in that area to make the rainwater “slightly acidic.” In fact, there is the fabled JWS Sinkhole in Eddy county. In a limestone karst, there is a network of interconnected underground streams. These frequently meander around brine deposits. This whole area was studied out the wazoo by the USGS due to the placement of the WHIPP site down there in Eddy county, so presumably they know what they’re doing. They had the common sense to limit the number of SWD wells, which could have been disastrous to that fragile area–that’s one of the big reasons the produced water is trucked back to Texas. Several brine deposits reside directly under the city of Carlsbad. The very southern tip of the largest reservoir in the United States, the Ogallala, comes down south of Lubbock. Many of those underground interconnecting streams also connect to it. No one on God’s green earth knows what will happen to this exceptionally fragile area in a few years. I’m not trying to be a fear-monger, and I’m no geologist, but anyone who has been down in Carlsbad Caverns or has seen the JWS Sinkhole nearby can appreciate the delicate balance between the limestone karst and the underground water system.

Thanks Gerry. I’m glad to hear they are at least trucking the water out of the area. It does sound like I should get back there by this summer to see it again. It would be a shame for us to screw up Carlsbad Caverns just for entries in a ledger.

Totally agree! The companies have been lying about the EURs (estimated ultimate recoveries) for the past decade. My company drilled over 200 wells in the Delaware Basin and only a few were stars (the first wells drilled on a lease) everything else sucked. Many operators who own the SWD systems servicing their wells and take the opportunity to over-charge the non-operators for water disposal. Common practice among Permian Basin Operators. Economics at current prices provide extremely marginal single well economics. I wouldn’t drill a well in that pin cushion unless costs remained the same with an oil price over $100 per barrel. Lots of 50 bopd stripper horizontals all over the Permian.

Last year I drilled 3 wells in Eddy County during a very high oil price environment (2022). Recovered all of my capital and based on current cash flow 18 months later, I will make approximately 1.35 times my money on an undiscounted basis over the entire life of the well. Does this sound like a good business to anyone based on the inherent mechanical risks? Not to me.

This comment by the “Survivor” should put an immediate end to all speculation about remaining URR from the Permian, be it 10, 20 or 200 G BO. End of story. Declining liquids productivity, gas and gas liquids is fast becoming the principle component of the production stream, as gas prices collapse and produced water costs go thru the roof…135% rates of return on $11MM wells is NOT profitable. Enough. That was in 2022; now, because of natgas, economics are worse. In the Midland Basin most remaining well costs increased to $14MM each because of M&A. There is no more OPM; they are on their own financial feet now and still losing money. Debt is increasing.

I simply do not understandy why people don’t get that. Who is going to pay for this wonderful tight oil and America’s 5MM BOPD of oil exports? Where is the money going to come from? Drill baby, drill…with what?

More importantly, why?

Mike,

At current prices for crude, natural gas, and NGL I would think the number of first flow wells should decrease, if they do output will fall. Somehow the wells continue to be drilled and completed. There are still 296 horizontal oil rigs running in the Permian as of last Friday and about 272 frac spreads in the US operating as of last Friday, the Permian horizontal oil rig count has been stable since October and is down about 10% since June 2023, frac spreads are at roughly the average level of 2023. If prices remain at current levels for oil, nat gas and NGL we should see output in the Permian start to decrease between April (5 well per month decrease in completion rate) and September of 2024 (2 well per month decrease) depending upon how quickly the completion rate starts to decrease.

Permain economics have changed, signficantly, the past 8 months; rig counts have declined, DUC’s are gone. Half the production stream of a typical Permian Basin well, and corresponding revenue, is now N/A. Past results are never indicative of future performance in the oil and natural gas business.

The question is likely better directed at businessmen or women, particualarly those IN the oil business…where will the money come from? The US shale sector is now standing on its own financial feet, for the first time ever, and it looks to me its getting a little weak in the knees.

Wells are now designed to be as long as possible, where there is room, and frac’s designed for maximum up front cash flow, NOT EUR’s. Its about cash flow.

Once that is all over, where will the money come from to drill 100,000 more tight oil wells in the Permian Basin when the profit margin it is working within is currently <2% annually? Are we still hoping for higher oil prices to solve the problem?

Mike,

It won’t happen at current price levels, I agree economics have changed significantly since 2022 when prices were higher. I expect prices will probably rise which is why my best guess scenario has a flat completion rate. In my view the money will come from cash flow, companies may need to reduce dividends and start paying down debt. If not completion rates will decrease, the scenario below has a total of 85k wells (40k more than at present). URR=33 Gb. If oil, natural gas, and NGL prices remain where they are or fall this might be how it goes in the Permian. We will see.

The scenario above assumes the completion rate decreases by 3 wells per month starting in Jan 2024 and also that new well EUR decreases at an annual rate of about 3.5% initially and a gradually falling rate over time as the completion rate falls. Chart below has assumed annual rate of EUR (productivity) decrease for Permian basin horizontal tight oil wells over time (where the date is the month of first flow for a given new well).

One thing I have not done for this scenario is to analyze the economics at some assumed level of CAPEX, OPEX and oil, NG, and NGL prices. The falling new well productivity might be offset by falling costs per foot of lateral for longer wells, but eventually we run out of room for 15 thousand foot laterals (Pioneer claimed recently they have about 1000 of such future wells, perhaps basin wide there might be 4000 such opportunities (this would be 6000 of the 10k wells assumed in my scenario). Also note that although cost may decrease, the productivity per lateral foot decreases faster for these wells than for a 10 thousand foot well so it is not clear that operators come out ahead on this (it may be investor presentation hype that big tight oil companies are well known for.)

In any case, at current oil, NG , and NGL price levels the scenario presented above may be quite optimistic because falling EUR will lead to falling profits which will in turn lead to a more rapid decrease in well completion rates than I have presented in my scenario.

Mike,

The scenario below takes account of the effect of falling new well EUR on profits at current prices. After December 2025 the wells do not produce enough oil, NG, and NGL to be profitable at current price levels so completion rate falls at faster 10 well per month rate in this scenario. Total wells drilled are 65k (20k more than at present) and URR for Permian is 27 Gb (18 Gb with no future wells drilled). So with these corrections this would be my best guess for a scenario where future oil, NG, and NGL remain at present levels in real 2023 US$ and costs also remain flat in real dollar terms in the future. Of course this will be wrong, like all my scenarios as I agree the past does not predict the future.

Click on chart for larger view. The new well completion rate in wells per month is shown on right axis for this chart.

Mr. Coyne, declining well completions in the Permian are inevitable for reasons you correctly point out. I am not seeing well costs go down much and I’ve looked at AFE’s for wells scheduled 6 months out. Longer laterals are carrying the day at the moment because of cash flow; cash flow allows Juan to be robbed to pay Jose. Those guys are lying about how many 15K well locations they have to drill in already overly drilled, pressure depleted core areas. The economics on those lataerals are terrible anyway.

I am always amazed, and saddened, by people that know so little about the business end of this stuff. For instance 450 K BO EUR’s = $34MM; they’ll keep drilling. Yikes. Breakeven prices less the oilprice.com price is net back price. Divide $32/ BO net back into $14MM well costs in todays consolidated Permian to see what an EUR has to be to pay the well out, pay dividends, service debt and drill new wells with declining liquids productivity… and its easy to see where this is going. Survivor’s 135% ROI in 2022 was as good as it got back then. Things ARE worse now.

Good work.

Thank you Mr. Shellman, I agree 100%.

Maybe I am starting to get it, at least a bit. I owe the little knowledge I have about the real oil business mostly to you, Shallow Sand, and one other person who prefers I not mention his name.

BTW, so sorry about the wildfire disaster in Texas. My thoughts are with your fellow Texans.

Don’t listen to me, Dennis, listen to Survivor, Shallow, Longhorn and Gerry; they’re saying things that are important.

Thank you. The Texas Panahandle is actually quite beautiful and the Canadian River Basin very unique. It has been devestated. A friend in Borger says over 25K head of cattle through the big burn (Smokey Creek) were burned to death and another 25K will have to be put down from underbelly burns. Its calving season too. There are thousands of oil and gas wells in the burn area. I live 400 miles south but in the mornings, even here, we can see and smell the smoke.

Mr Shellman,

I listen to all of the people you named, but you and Shallow Sand have offered a lot of useful information over many years. LTO Survivor, Gerry Maddoux, DC Longhorn, George Kaplan, South LA Geo, and Fernando Leanme have also taught me much, all the mistakes I make are my own and I am happy people point them out to me, that is part of how i learn and there is much that I don’t know.

LTO. Maybe you can confirm or dispute something I have believed.

The shale companies have been paying a lot of dividends. It doesn’t look to me, after looking at 10k, that they can afford to do both this and keep drilling and completing a significant number of wells each year.

Case in point, Pioneer burned over $4 billion of cash from 12/31/21 to 12/31/23 and borrowed $700 million, despite paying large dividends in 2022 and 2023. As you know, oil and nat gas prices were good in 2022, not as strong in 2023. Yet they still burned cash both years due to the dividends.

Did Pioneer sell because the dividend model is unsustainable without $100 oil and $6 MCF in the field?

Shale pundits have argued to me, saying look at the earnings. But aren’t the shale companies juicing earnings by overstating EUR/reserves, thus overstating GAAP earnings, as cost depletion is being understated 2-3 times?

For a simple example. $10 million well. EUR 1 million BOE. Unit cost depletion taken is $10 per BOE. If BOE EUR should really be 500k BOE, that would make unit cost depletion $20 per BOE instead of $10? Am I correct on this?

And thus, earnings are being juiced to the hilt, as $10 v $20 per BOE is huge, when a lot of BOE is nat gas and liquids selling at rock bottom prices?

I know I’m oversimplifying things some, but hasn’t this been the game all along?

Investors were lulled into thinking these guys must be making money because they are paying these big dividends and showing GAAP earnings. But then, after just two years of paying these, the pure shale companies are almost all bailing and selling out for little to no premium.

These guys have managed to all build huge NOL’s and pay almost no income taxes. They aren’t taking much percentage depletion, so the depletion is almost all “real.”

In an earlier life I prepared some oil and gas company tax returns. But they were mom and pops, so there is a lot I don’t know and more that I have forgotten. But we still file a couple ourselves every year, and I try to understand them best I can, including meeting with our CPA.

This is my take and would really appreciate yours. If I’m wrong, please let me know where I have messed up.

Shallow sand,

The average Permian well in 2020 has an EUR of 455 kbo, 180 kb NGL, and 361 kboe NG (assumes 1 boe= 6 MCF) that totals to about 995 kboe for EUR with the well assumed to be shut in at 10 bo/d ( C plus C only). So EUR is in fact close to 1 million boe for average Permian wells, note that 2022 wells look very similar to 2020 wells, at least for first 12 months. Unfortunately we are in need of updated data for the Permian (last update was November).

Dennis.

The numbers used were to make a simple illustration.

I have no idea what the actual EUR figures should be.

I just know back in 2015-16, the EUR being used were inflated.

Do you know what companies such as PXD are booking now?

as discussed by many, both sides, pro or bashing shale drilling,

2021 wells are the best, and might have been affected positively by Covid, i.e.high grading, and postphone hold back productions that push up the IP, and rest 2019~20 and 2022~23 are obviously lower, and according to Art,

https://www.artberman.com/blog/beginning-of-the-end-for-the-permian/

his 2021 best numbers are close to your number above, but rest are obviously lower.

The oil and gas EUR and break even table actually shows that the GOR for EUR is not going up — yes, when oil is down, gas is down faster, Art must be using some special shale-bashing DCA analysis.

Seems more reasonable average EUR numbers should be 400K BO, and 200K BOE of gas and NGL. If overdrilling induced bubble point death gets worse, we will see 350K BO, and 200K BOE of gas and NGL.

Shallow sand,

No I don’t know what companies are claiming, I go with the data that I get from Novilabs. Took a quick look at recent Pioneer investor presentation and they don’t give specific new well EUR. Looking at Pioneer wells at Novi labs they are fairly average in 2020, but a bit below the average in 2022.

Sheng Wu,

I use the data from Novilabs, yes the 2021 wells were the best (ignoring lateral length, I don’t have that data), but 2022 looks very similar to 2020. The oil is 455 kbo, NGL and NG about 540 kboe combined based on the data.

455 kbo @ $75/bbl is $34M, without even counting gas and NGL.

CAPEX is $11-12M, for D&C and ~$3M for acquisition.

LOE, taxes and other OPEX: ???

I think it is a good business @ $75/bbl, if you have efficiencies in lift, maybe not gangbusters, but decent.

A company like XOM, who have already paid for the acreage with the PXD acquisition has no choice but keep drilling and even ramping up. They do get the cash flow increments, and besides, if you are the CEO what’s the point of sitting on that huge acreage and wait for “peak demand” and “energy transition”. Your job security as a CEO is higher if you drill.

Small private operators may have different economics, due to probably less efficient lift costs. But whoever’s got the acreage will drill, I think.

Kdimitrov,

OPEX is probably about $13/bo, royalties and taxes are about 28.5% of gross revenue. Income tax is another 25% of net revenue. Natural gas sometimes trades for close to zero at Waha Hub in W Texas and NGL prices have also fallen to about 25% of the cost of a barrel of crude. Mr Shellman likes to see a well payout in 36 months to earn a decent profit on a conventional well, his rule of thumb might be lower for a tight oil well (maybe 30 months ?) The economics for these wells at current prices is not very good. Also note that wellhead prices tend to be below WTI price when we account for transport cost, so at the wellhead the price of goods sold may be $70/bo.

Also realize that average new well EUR is falling and normalized EUR (kbo/foot lateral) has been falling since 2016 in the Permian basin. Compamies tout lower cost per foot for longer 15k lateral wells, but fail to explain that EUR per foot may decrease just as much as costs decrease so the claimed increase in IRR may simply be investor presentation hype.

Unless oil, NG, and NGL prices rise these Permian wells will no longer be profitable once EUR falls to 90% of the average 2022 well which may occur by Jan 2026, then things really fall apart at current price levels.

Ovi,

It is unclear what you are counting here. The frack spread count for the nation was 272 frack spreads for week ending March 1. Is this total wells fracked per month in these counties? Even is this case it seems high.

Dennis

I know. I realized that after I posted the data and then discovered the problem about three hours ago and decided to take a break from this new database. Frustrating and took a long walk in some fresh air. The Frac Focus company is just making it harder to work with their data.

In my original post I noted it was different. I keep discovering different columns. The latest discovery is that each line is for a different chemical. In other words there are 20 to 30 rows for each frac spread. Just ignore the posted stuff. I have figured out how to clean out the duplicates. Will post updated info in about and hour. While the numbers will be smaller, I don’t think the trends will change.

My apologies to all.

Dennis

I eliminated my charts and in the process your comment.

I discovered the problem about three hours ago and took a long walk. Very Frustrating working with the new data base. There are multiple rows associated with each frac spread. One for each chemical. Frac Focus is just making it more difficult to work with their free stuff.

I have a fix and will re-post in an hour or two. I think the numbers will come down by a factor of 30 but I think the trends will be the same.

Apologies to all.

Ovi,

Not a problem, thanks for looking into it, I found the old database difficult to work with, too bad they have made it even more difficult. Took a quick look, it seems unusable in its present form, at least as a CSV file, I am not competent with SQL files, perhaps that would be better, if I knew how to do it.

Dennis

I use the csv file. Don’t know SQL

Dennis and Ovi.

If you have produced water data available for the shale basins, it might be a good idea to post it and get some feedback from those in the know who post here.

From my experience, truck hauling large volumes of produced water is not economic. But my experience is with wells that do not produced much BOPD.

We truck haul from two leases. One lease is just one well, which produces about 400 BO per year, and just one 70 barrel load of water being hauled a year. The other lease has two wells, also produces about 400 BO per year, and we haul 1-2 70 barrel loads of water per month.

A 70 barrel load of water only costs about $100 to be hauled. Each lease is near other leases of ours where we have water injection wells. So the tank truck, which is a bobtail, just has to haul the water about 1/4 mile and dump it into our plant.

Trucking several semi-loads a day eventually has to become uneconomical? Do the Delaware basin wells see lower levels of produced water as oil production drops.

Seems we have discussed this in the past? Maybe there is some updated data?

SS

NM publishes water data. Attached is a table for Lea county for 2023. Note how much water they inject and how much is produced. Looks like they have to haul a lot away. Is the injected water recycled?

I’m making an assumption. The difference between produced and injected is water that is not disposed of in Lea County. I assume much of that is being truck hauled to Texas.

If all of the water is truck hauled, that would be around 600,000 semi loads a month. Surely that isn’t the case and some is moved by water lines?

To me, 3 barrels of water per barrel of oil isn’t bad. What can be bad is if that increases over time.

It would be interesting to see how much water per BO wells make from each year, such as 2013, 2014 etc. Basin wide.

I haven’t owned part of a SWD for some time (Toyah), but in mid-2022 there were just over 5-million barrels of brine water PER DAY injected down 2,100 SWD wells in the Permian. I suspect that has increased a great deal. This is a massive industry: a few trillion barrels of saltwater a year. Mike Shellman will know current numbers.

The Delaware wells have in general a higher water cut, from inception. This gets worse as the wells decline, not better. Because of the extensively-surveyed limestone karst (where the old WHIPP Project was scheduled), NM got squirrelly about SWD (rightly so), and much of that water has to be trucked back to Texas. This whole situation is a travesty, as the depository wells are busting at the seams, literally.

Gerry

How is a SWD well created? Us city slickers know didly of what happens in oil fields.