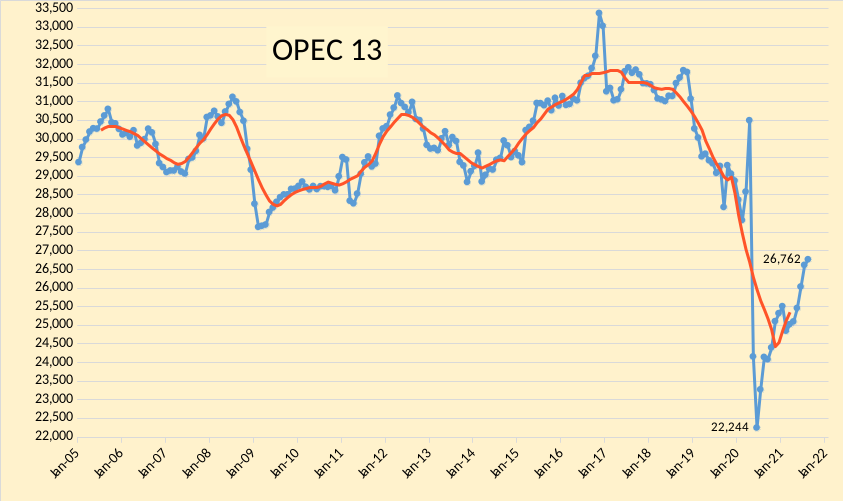

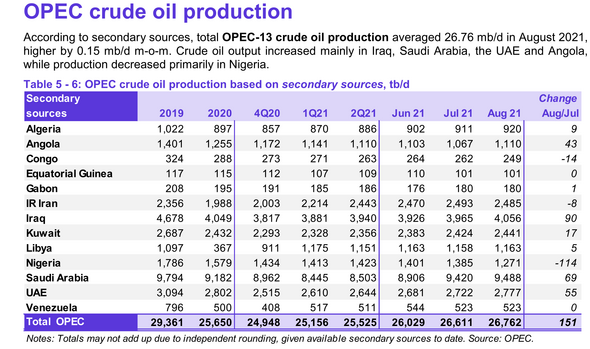

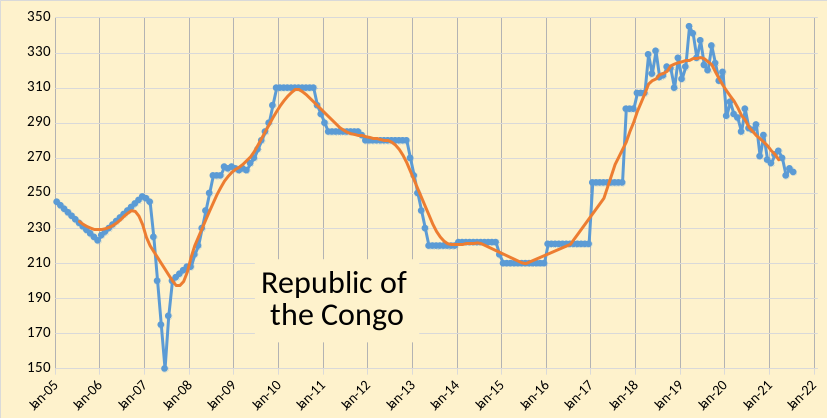

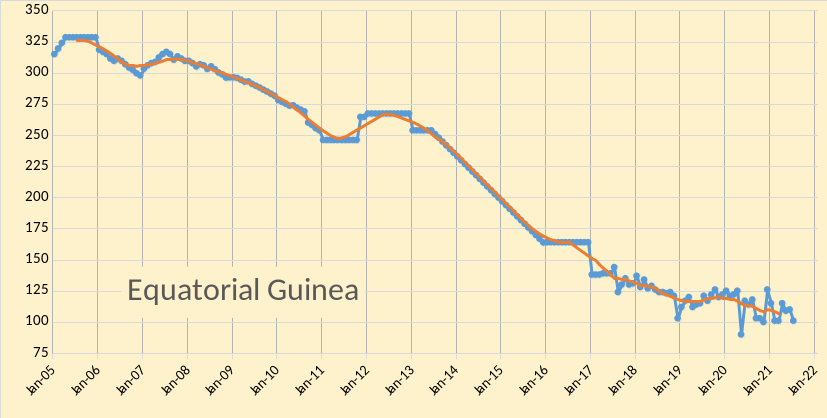

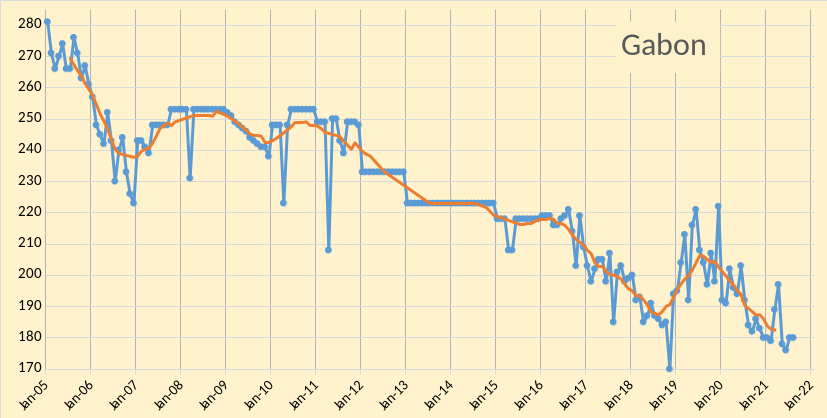

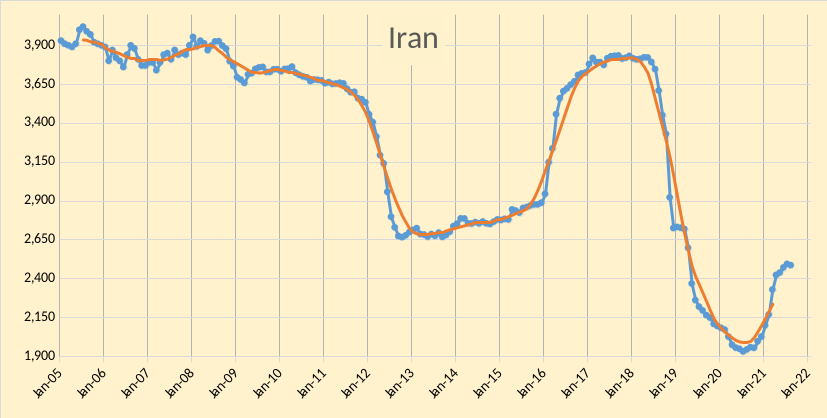

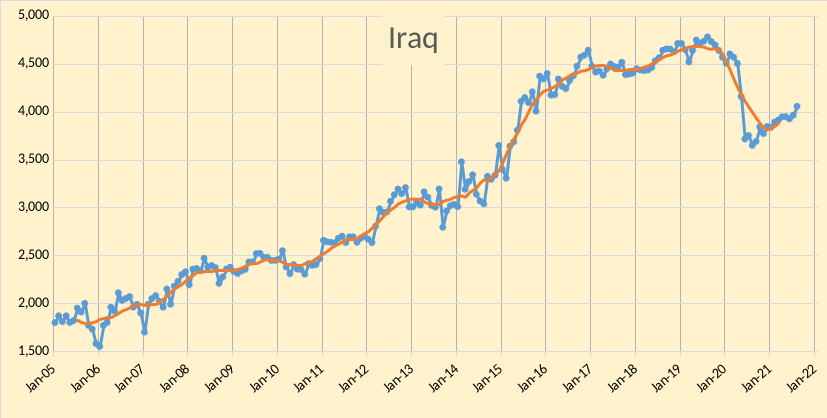

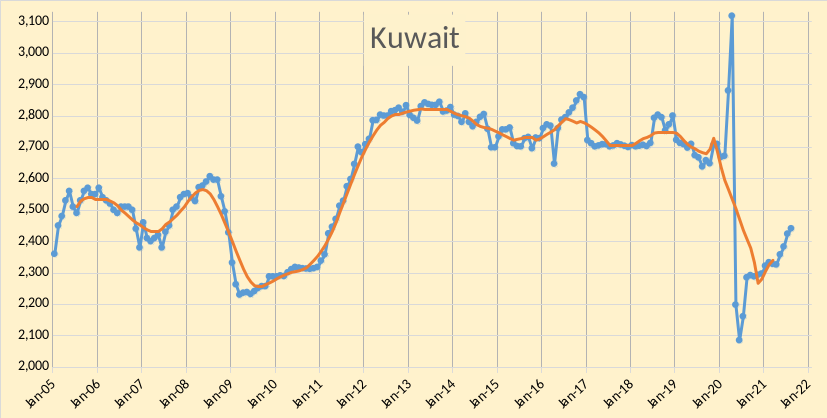

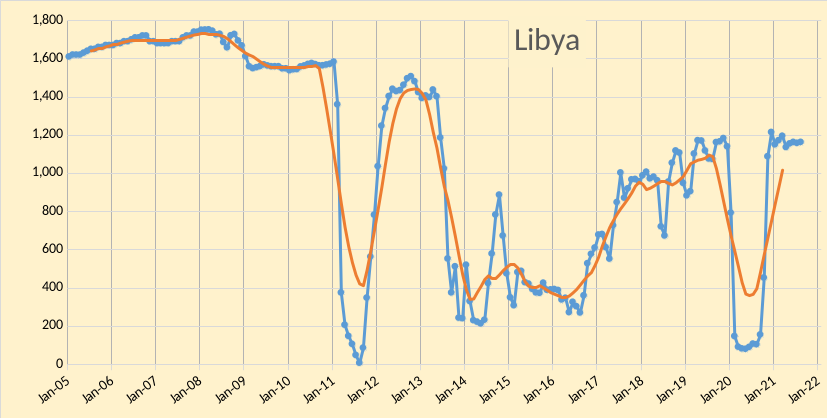

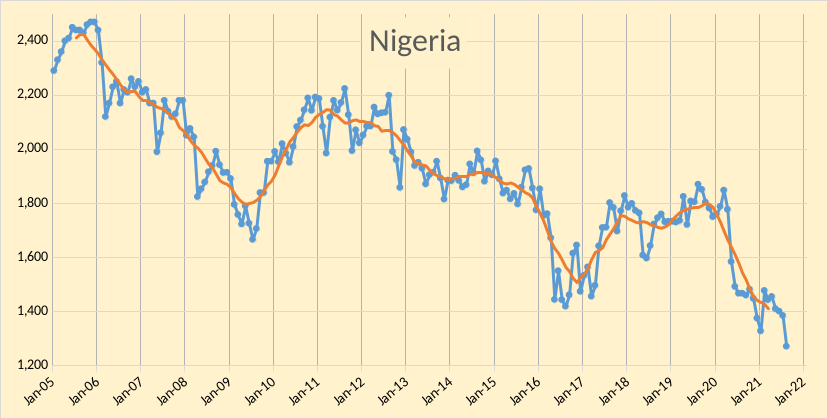

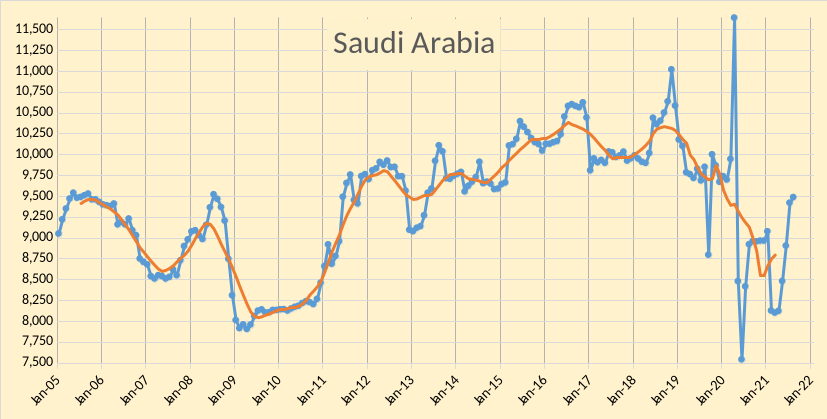

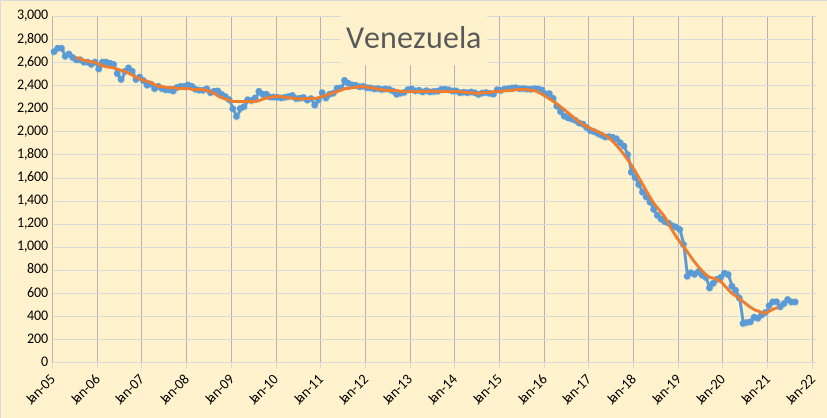

The OPEC Monthly Oil Market Report for September 2021 was published this past week. The last month reported in each of the charts that follow is August 2021 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In the charts that follow the blue line is monthly output and the red line is the centered twelve month average (CTMA) output.

OPEC produced 26762 kb/d of crude oil in Aug 2021 based on secondary sources, an increase of 151 kb/d from June. July output was revised down by 46 kb/d from what was reported last month and June output was revised up by 9 kb/d. Most of the increase in OPEC output was from Iraq (90 kb/d) followed by KSA (69 kb/d), UAE (55 kb/d), and Angola (43 kb/d). The biggest decrease was in Nigeria (-114 kb/d), with small decreases in Congo (-14 kb/d) and Iran (-8 kb/d). All other OPEC members saw increases of less than 10 kb/d in August 2021 based on secondary sources.

World oil supply decreased by 30 kb/d in August, relatively flat compared to last month, most of this was due to Hurricane Ida which caused US petroleum liquids output to drop by 370 kb/d in August.

The chart above uses data from the Russian Energy Ministry and converts from metric tonnes to barrels at 7.3 barrels per tonne, the combination is OPEC crude plus Russian C+C output. Russian output decreased by 35 kb/d in Aug 2021 to 10383 kb/d. OPEC13 crude + Russian C+C output increased by 116 kb/d in Aug 2021 to 37145 kb/d. The centered 12 month average OPEC crude plus Russian C+C output in March 2021 (most recent data point) was 35545 kb/d an increase of 265 kb/d from the Feb 2021 level.

OPEC 13 + Russian C+C output in August 2021 is about 5.2 million barrels per day below the Jan 2018 level which is similar to the centered 12 month average from July 2017 to June 2018, some nations may not be able to return to the Jan 2018 level, I would estimate this is about 3.3 Mb/d so roughly 1.9 Mb/d might be added to OPEC 13 and Russian output, about 0.5 Mb/d of this is Russian output. OPEC 13 output may struggle to rise above 28.4 Mb/d unless sanctions are removed from Iran or other OPEC countries increase their capacity which is doubtful in the short term.

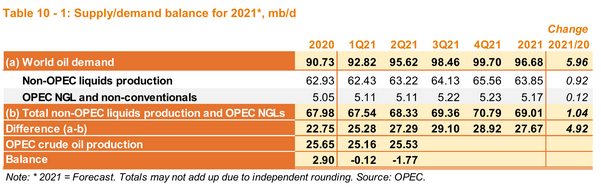

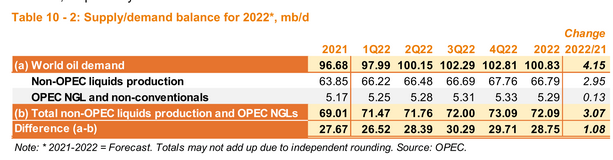

Based on the OPEC supply and demand balance for 2021 and 2022 in figures 17 and 18 above and a likely OPEC capacity of 28.4 Mb/d, it seems likely the World will be short on oil unless Iranian sanctions are removed and even if that occurs OPEC 13 capacity would increase to only 29.7 Mb/d. Note also that OPEC has very optimistic expectations for future non-OPEC output so their estimates for future OPEC demand may be too low. The OPEC estimates for future World oil demand look reasonable, based on past relationships between real GDP and oil consumption, adjusted lower by 20 to 25% gives an estimate similar to the 2022 World demand of 101 Mb/d.

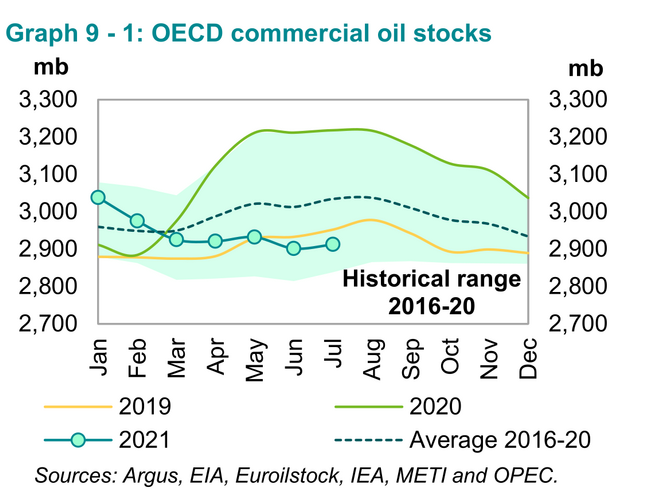

OECD stocks were 122 Mb below the latest 5 year average in July 2021. If we look at the Appendix of the Sept 2021 MOMR we find the second quarter closing stocks for OECD commercial petroleum were 2902 Mb. The OPEC estimate for the 2021Q3 call on OPEC is 29.1 Mb/d and if September 2021 output is 250 kb/d higher than August 2021 output, the OPEC output would be 26.8 Mb/d. This suggests stocks would be reduced by 2.3 Mb/d times 90 days in the third quarter is a total reduction of 209 Mb in 2021Q3. This would bring closing stocks to 2693 Mb and OECD demand for 2021Q4 is expected to be 45.85 Mb/d. In terms of days of forward consumption the Third Quarter 2021 closing commercial stocks would be at 59 days which is lower than the 2018 average (60 days). In short, at the end of the 3rd quarter of 2021 oil stocks will be low suggesting that oil prices will be moving higher in the fourth quarter of 2021.

Thank you all for all the efforts, have been following the issue since -08 or so on various websites, I think we´ll see in short order how things finally works out. China has been keeping things going for a long time since GFC, but things there are getting shakey lately. Think I`ll hug my bag of NPK a bit later…

But hopefully for us our close connections to the norwegians will assure us of a little bit of oil in the future to keep things running, at quite reduced speed of course.

Best regards from the far north of Sweden!

All going downhill!

Good stuff Dennis!

Everyone including OPEC seems to be overestimating future supply. I wonder how much of that is intentional, especially from OPEC. OPEC especially can then use this overestimation to justify reduction in its own capex. Capex levels at OPEC are very low (see: https://www.opec.org/opec_web/en/647.htm) exemplified by perhaps the number of oil rigs in operation in Saudi with only about 27 oil rigs in operation now compared to 60-70 in 2019.

When the world demands more oil next year OPEC can show it’s empty pockets and say ‘no more oil in the bank’. Oil will reach triple digits and OPEC will be like – sorry, I thought there was gas in the tank. It might even point fingers at US shale for not producing enough!!

The world is in for an interesting time!!

Ancientarcher, Another way is to appeal to the current thinking that peak demand is at hand. I wonder how many oil company executives, knowing that they are hard pressed to find new oil fields, will use this as a fig leaf to explain their actions. The same goes for politicians and economists, both groups being in their own kind of bubbles.

Thanks Ancient Archer.

It could be that CAPEX will increase in 2022, there is no doubt a lag between oil price and CAPEX. The low levels in 2021 are likely due to low oil price levels and excess capacity that existed in 2020.

OPEC produced 26762 kb/d of crude oil in Aug 2021 based on secondary sources, an increase of 151 kb/d from June.

I though OPEC+ had agreed to a 400 kb/d increase every month for the rest of the year? If so, they’re not living up to their promise.

Frugal.

OPEC increase should be 250 and the non-OPEC part of OPECplus about a 150 kb/d increase. If Nigeria had not dropped by 114 kb/d, OPEC would have been 14 kb/d above their target.

Dennis.

I think there will be more and more “if”:s going forward.

“If” you had purchased Occidental shares (king os the Permian) one year ago today. You would have more than doubled your money.

Or,

if you bought it 3 years ago you’d still have 30 cents

for every dollar that you used to have

🙂

I had to write a financial analysis of OXY for a class in 1988 or 1989. My conclusion was sell.

Got a C- because I probably butchered the math. But as far as whether is was right or wrong, pretty clear on that one compared to the market as a whole.

Why natural gas prices have surged to some of their highest levels in years

A marriage of factors in North America and Europe — from summer storms to an overseas supply crunch — have contributed to sharp rise in the price of the fossil fuel.

Natural gas kicking in Europe and N. America. Coal kicking in Asia. What about the price of electric power? How will the economy react if oil kicks at the same time? Inflation? We will see how Nordstream II effects the gas price.

This recent era of inadequate reserve replacement and now a general malaise over taking the Exploration and Production industry seems almost like total capitulation by the industry. With impossibly volatile prices governing and in many cases destroying economic returns, it really feels like the industry has made a statement through their inaction that enough is enough and we are done battling all of forces that have attacked this healthy and important industry. I don’t see a vibrant restart in the cards. ESG investing or whatever we want to call it has no goal or fundamentals that tied to real life but more so to a dream that sustainable green alternative energy will fill the gap. The overthrow of our old system of supply and demand has given way to let’s get rid of the old with a bear hug embrace of the new even if the new doesn’t provide solutions or sustainability of our accustomed lifestyles.

Just yesterday I had a meeting with an old friend who is from Texas and lives in the Northeast. He is amazed at the speed in which investing and banking institutions are fleeing the fossil fuel industry. He said their is zero appetite for new oil and gas deals in his circle of high powered and well heeled investors.

Whether it is due to this recent period of low to negative returns of the past 6 years or the expedient desire to jump on the ESG bandwagon, reserve replacement has vanished and it will take many many years to gear back up and a political reversal away from the climate change investing to provide enough supply to narrowly avert an all out war for survival in a dark period of energy poverty.

I am in favor of alternative energy and have been for the last 30 years which is when we should have begun this effort to combat the peak oil reality. Our leaders and institutions I am convinced are convinced that by throwing unlimited amounts Funding to this new industry, the result will somehow solve the climate change issues while providing affordable and abundant energy for all. Sadly it will not and I expect the fossil fuel industry will continue to sit on the bench and watch the shit show unfold. As an energy producer for 40 years, it has been an uphill slog with a few bright spots of technological breakthroughs like 3D and 4 D seismic, horizontal drilling, bright spot analysis, and many other advancements, but my colleagues and professional staff are worn out, tired and have little faith that the market will be stable and reliable enough to warrant the humongous risks necessary to continue to explore, find and produce new reserves in a meaningful way. This seems vastly different in that the political will against this industry is so overwhelming that I am not sure that even $150 oil will yield the results that we experienced in the last 20 years. It’s simply too unpopular and now more than ever being popular, cool, and woke has usurped good and rational common sense.

Please forgive me for sounding like an “old man” but I am amazed and stunned every day by the magical thinking and activities that rule the day. Shoot maybe it will all turn out just fine and I am just a bit out of step with the new world realities.

LTO Survivor,

I can’t agree more with what you wrote.

As regards investors fleeing the sector, I have personal experience of this. I work for one of the largest pension funds in the world with hundreds of billions of dollars under management. For the last few years, for each of our investments we had a CO2 budget i.e. whatever we invested in, say Google, we had to note how much CO2 they are emitting directly or indirectly (very little for Google obviously). The investment committee would reject anything that had high CO2 emissions even if it was a good potential investment. There was a tight CO2 budget and hence we invested little in oil and gas and related companies, especially in oil even though we had a dedicated team of people analysing the sector and investing in the equity market. Now, top management has decided that there will be no further investment in the O&G sector from 2022. Remember, this is a huge fund with hundreds of billions under management and them stepping back will affect valuations and yields in the equity and debt markets. They will still invest a little in gas related projects/companies (CEO says gas is a transitional fuel) but zero, nada for oil. In the last townhall, an employee asked the CEO why we still invest in O&G and the CEO was defensive. The employee didn’t obviously think that his entire lifestyle depends on oil – he probably travels to work in a petrol powered vehicle, the metals in the vehicle have been extracted using oil as energy, he has clothes that are derived from oil, the paint he has on his car or house is from oil, the food he eats is transported using oil.. I can go on and on. But you get my point – people are losing sight of what is enabling their lifestyle in the madness to go woke and green.

I see how it works in these large funds and I can tell you we are not alone in moving away from O&G. Other large funds are facing the same pressure from their investors, shareholders, partners, governments, activists and even their own employees. The pressure is relentless. No one wants to invest in O&G but everyone wants to enjoy the benefits. This is not going to last!

Another thing – young people don’t want to join this sector. If you look at the technical schools, intake has reduced considerably. Technical companies, like those doing seismic are shutting down or laying off lots of people. When the old guys retire, there will be no one to take their place. There is a significant skill deficit in the future. Even if the world wants to invest in O&G extraction, I don’t think it will be possible to do that in 5-10 years time because the skills would have disappeared.

Points very nicely made, LTO and AA. I am an oldie marine exploration/engineering geophysicist, but with skills transferable to offshore wind farm installation.

Pleasingly I am still in demand from both O&G and wind, but will probably have to hang up my hard hat before long.

Looking at the rocketing price of natural gas in Europe, along with same for domestic consumers, both gas and electricity, I wonder if this site should not temporarily be renamed ‘peakgastank’.

Although the situation will likely be resolved over the coming months with Nord Stream II coming online, and Russia increasing exports, it would be an irony if during our long discussion of peak oil, the straw the breaks the camel’s back derives from a shortage of NG.

There is as yet little MSM coverage in the UK of the impending crisis. Domestic prices are capped until April ‘22, which may lead to some failures amongst the smaller energy suppliers that have not hedged their supplies sufficiently. I get the impression that most people are unaware of how dependent they are for all aspects of modern life on FF energy.

Although this is probably a short-term issue, nevertheless it will be a wake up call if inflation spikes over the coming months.

Magical thinking is the key word.

The election battle here is all about moral and high intentions. Children reporters are asking the candidates… We want world peace and everything is clean an fine and everyone is happy. Not a tiny bit less.

That all doesn’t work at all. Energy is only solar and wind – atomic plants are a completely no go, about geo energy nobody speaks. I’m sitting here on a spot where you have to drill only 2000 meters to get boiling hot 160 degree celsius water. And they are speaking to convert all heating to insulation and heat pumps. Drilling technology from oil experts can be come handy here, too, I think.

From one “old man ” to another “old man ” .

One has to be young and stupid before one is old and wise . 🙂 . Copy ,paste from Eulen’s post

“The election battle here is all about moral and high intentions. Children reporters are asking the candidates… We want world peace and everything is clean an fine and everyone is happy. Not a tiny bit less. ” 🙂

“it is due to this recent period of low to negative returns of the past 6 years” LTO

Yep.

Nothing will damper enthusiasm more than loss of hard earned money, year after year.

LTO Survivor,

A smart investor ignores the herd mentality.

Oil companies that do so stand to make a lot of money from 2021 to 2030. Atvthat point they should have an exit strategy prepared as oil prices may see a steep decline over the 2030 to 2035 time frame.

The breakup between the oil industry and the financial industry (and the rest of society) reminds me of Gwen Stefanie’s breakup with her bassist boyfriend.

I really feel

I’m losing

My best friend

I can’t believe

This could be the end

It looks as though

You’re letting go

And if it’s real,

Well I don’t want to know

Don’t speak

I know just what you’re saying

So please stop explaining

Don’t tell me ’cause it hurts

Don’t speak

I know what you’re thinking

I don’t need your reasons

Don’t tell me ’cause it hurts

Very emotional. I wondering if both sides will be able to muster as much honesty as this video shows.

https://youtu.be/TR3Vdo5etCQ?t=31

I doubt it. Expect a long drawn out case akin to one pretending they own all the CDs in the house and the big screen TV, while the other goes about changing the locks and gaslighting.

If we were really good at honesty, we’d have accepted what was going to happen thirty years ago and made a rapid transition when the writing was on the wall and not manifesting as reality. Instead, it looks like we’re going to half arse everything here to no one’s satisfaction but whoever creams off any profits to be had.

Excellent work Dennis. I notice that UAE and SA both experienced sharp spikes in oil production around March 2020. Does this reflect oil released from internal storage, or did these countries use additional shut in production capacity to reach these peaks?

Tony,

In April 2020, all OPEC countries were positioning themselves for quotas. So, they pumped out as much as they could and on top of that, they added oil draws from their storage and called it production. That production level (production + inventory draw), in April 2020, was used to arrive at production quotas for each country going forward. Obviously, no producer will admit that some of their so-called production in April 2020 was from their storage, but everyone knows it.

If the question is whether the OPEC production for April 2020 level is achievable in the future, for each country or the group as a whole, then I will bet that it is not. Definitely not a sustainable level for two reasons:

1) Part of that production was actually not production but inventory draws

2) Capex has plummeted in 2020 and 2021 so obviously capacity to produce has gone down

I don’t see how OPEC will be able to reach April 2020 levels in the short and medium term, or even in the long-term.

Good observation , ancient archer .

TonyH

I think it was actual production and not from storage as many claim.

I do not think those levels are sustainable, I focus on the centered 12 month average. In my post I adjusted for nations with declining output, capacity is probably 28 Mbpd and if sanctions are removed for Iran perhaps 29.3 Mbpd for OPEC 13

If there is low CAPEX going forward for OPEC then these levels will drop as all but 5 nations have flat or declining output in the OPEC 13 group.

Mike S on the Permian ” the last hope ” .

https://www.oilystuffblog.com/single-post/chart-to-make-your-hair-stand-up?postId=e1c1ba82-acba-4a7c-8cbf-fe1f32f8fb84

When is squeaky bum time for the US oil sector then? Are we close to seeing the production output waver?

HIH

It is all about DUCs. Attached is a Table which summarizes the July DUC data for the four major oil producing basins.

The “% DUCs” column shows the percentage of the completed wells that were DUCs. The last column shows the percentage increase in oil production relative to June.

Let’s look at the Permian data shown at Oilystuff and what happens when no DUCs are completed to get an idea of the significance of the last column.

I have to go back a few months to the July production data since that is the latest month for DUC data.

During July, 263 wells were drilled and 393 were completed. The drilled wells added 286 kb/d to the forecast July output. The decline was 238 kb/d which resulted in a net increase of 48 kb/d. If no DUCs were completed, output would have been close to 191 kb/d. (263/393*286 = 191). This would have resulted in a decline of 47 kb/d rather than the 48 kb/d increase. Note that this is just a one month estimate. As time goes on and fewer wells are drilled and completed, the decline rate would also drop.

While the forecast production data for October is mostly positive, as opposed to mostly declines in July, the percentages are still small, less than 1.6%.

At some point more drilling will be required as the number of Prime/Sweet DUCs diminishes. The outstanding question is “How many of the remaining DUCs are dead DUCs.

Shale profile has an excellent long term projection for the Permian.

https://shaleprofile.com/blog/permian/permian-update-through-june-2021/

Ovi , thou art great . I have earlier commented ” What would we do without you ? Tweddle our thumbs .”

HIH

Thanks.

While I don’t know much about oil and I have never seen a drill rig, I can flip numbers to make a point.

Ovi , we are in the same boat . The only thing I know about oil is what I fill in my gas tank, good at numbers but not good at ” flipping ” them as you are . Be well , we need you here .

Ovi,

Enno Peters does great work. The supply projection is very conservative as it assumes a constant rig count and constant completion rate from Aug 2021 to Dec 2029. The recent annual rate of increase for Permian basin horizontal oil rigs is about 60 per year over the April to Sept 2021 time frame.

A projection which assumes an increasing rig count would be more realistic.

More stories like this will come . The lies and the chickens are coming to roost .

https://www.businessdailyafrica.com/bd/economy/80pc-of-kenya-s-crude-oil-cannot-be-tapped-3553040

https://www.abc.net.au/news/2021-09-18/australia-nuclear-submarine-deal-aukus-change-relationship-world/100471990

Is Australia going nuclear not a sign of Peak Oil?

#1 Coal and Natural Gas exporter; Largest Uranium Reserves; Huge Shale RESOURCE, Fishing and Seafood, Farmland, Rare Earth Metals and other finite commodities….

They broke a contract and they bought nuclear submarines (it is the first time that I see USA selling nuclear submarines, by the way) to have more autonomy and to comply in a political and military alliance with USA and UK. Perhaps, Taïwan will buy the submarines which were supposed to be sold to Australia. They have no facilities to process and enrich uranium. They will be dependent of USA or UK.

The French weren’t going to deliver till 2030. The original contract was 60 billion, already overrun to 90 billion

https://www.news.com.au/technology/innovation/military/important-detail-we-missed-in-the-arrival-of-chinese-warships-to-sydney/news-story/a8474e5d7219ee21d42f3bf73388c7c1

The Chinese parked 3 military vessels in Sydney Harbor.

We aren’t waiting for the French to sew their surrender flags, before we act.

If you don’t think the Chinese are after Australia’s resources…you aren’t very smart.

Downunder , you are going to get second hand equipment which is past expiry date . You are being taken to the cleaners . Rejoice . As to the Chinese parking three vessels , it is under a reciprocal agreement . Aussie’s knew they were coming and what was there nature . If they are squatting what is stopping the Australian navy and army from evicting them ?? Think . My favorite George Carlin ” My first rule is never believe what the government says “

The Chinese were sending a message. Just like they are by driving by Alaska.

China has 1.4 billion people. Australia has 20 million.

If you think Australia could single handedly beat China in a war you aren’t thinking properly.

A nuclear submarine fleet give Australia away to strike China, which they don’t currently have.

US and UK are training Australia how to build their own.

Buying SSNs from other members of the Five Eyes is a purely strategic move in terms of securing Asia against an expansionist, or at least emboldened, China. Australia is happy to have UK and US expertise in attack subs, and the UK and US are happy to enable an ally to assist in looking after our interests on the other side of the world.

JFF , Kleiber , both of you are correct . Nothing but a way for US, UK (NATO) to get rid of some old equipment and profit from it . By the way the Scott Morrison govt just printed a ” bullseye ” target over Australia for the Chinese to aim at . Best of luck to my friends in ” The Lucky Country ” .

That’s not second hand equipments. It’s going to be a submarine model developped from scratch and it will take at least a decade to see a nuclear australian submarine while the construction of the Attack class submarines was supposed to start in 2023. In the mean time, a lot of things can happen and the Australian navy is going to be deprived of modern submarines to deal with naval problems. https://www.globaldefensecorp.com/2021/09/16/australia-to-acquire-nuclear-powered-submarine-scraps-conventional-submarine-project/

You are assuming the US isn’t parking nuclear subs in the meantime.

Australia is buying subs that are already working. They don’t need to be built.

Hello from Down Under . You my dear friend are living in delusion . Your Achilles heel is climate change and water . The country is becoming drier and precipitation is decreasing . Your farmland is deteriorating by the day . Are you aware that Australia is now importing ” millers wheat ” ? As to the rest let me dismantle them one at a time :

Coal and NG : Coal OK , you have a lead , but till when ? CC is real and you will have to stop or you will fry the planet . NG , stupid decision to export to China and prefer to have rolling blackouts in Australia because the power plants are short of NG .

Shale : Forget it . Shale is a US phenomena . It cannot and rpt cannot be duplicated in any part of the world .

Fishing and seafood : I don’t know much about this , but never heard of Aussie being a major exporter .

Farmland : Explained already with CC . The Murray – Darling basin( major food growing area ) is drying up .

Rare earths ; Maybe you can mine them , but you will send them to China for processing . Where do you win on this . ?? . Hey , do you have technicians and engineers to even mine the rare earths ?

Now let us get real . Australia shut down it’s last refinery . You are dependent on your basic fuel requirements ? Island nations are at high risk as and when international trade slows down ( the end of globalisation ) . This is what is happening now . Read Tainter .

Reluctantly mention the most grotesque lockdown and subversion of civil liberties by the Scott Morrison govt on the public due to Covid . My opinion , start a reverse countdown . Read this website every day . Might save your a***.

https://crudeoilpeak.info/

Downunder , read this . I didn’t write this , it is from the ” Sydney Morning Herald ” . Like they say ” If you don’t know who the sucker is at the poker table then you are it ” . Enjoy the coffee .

https://www.smh.com.au/national/morrison-the-third-amigo-speaks-loudly-to-xi-20210916-p58sfk.html

https://foreignpolicy.com/2021/09/16/u-s-seeking-basing-in-australia-after-submarine-deal/

I forgot to mention the US and Australia have a joint plan to develop Hypersonic Missiles.

Also, the US is parking B2 bombers over here.

Shale – I said a huge shale RESOURCE. Desperate times and people will try to develop like the Chinese.

Fish and Seafood – Look at a map. Australia is a giant Island by itself.

Farmland – Australia has abundant Farmland

Rare Earths – US will want them

Listen up. All I said is the US/UK giving Australia nuclear is a sign of Peak OIl. There is no doubt in my mind the Chinese want Australia’s resources.

The US and UK want them too!

You could think of Germany as the canary in the energy mine. Watch how this country scrambles to navigate this decade. Sure other countries are just as vulnerable, but it is the productive hub of Europe.

Something like 98% of crude oil product consumption in Germany was imported as of 2018.

No wonder they are scrambling to find some degree of a workaround. No good or easy answer.

They also import most of their nat gas and coal, with the biggest supplier of all three fuels being Russia.

https://www.cleanenergywire.org/factsheets/germanys-dependence-imported-fossil-fuels

Germany does have a lot coal, but it something like 95% soft/brown coal with lower energy content. It is all stripped mined, being close to the surface. Far from optimal.

“opencast lignite mining has altered 179,490 hectares of countryside in Germany. Since 1924, 313 settlements have been lost to lignite mines in Germany.”

Additionally, Germany is poor in solar reserve- if they were in the US they would rank last in the lower 48.

https://globalsolaratlas.info/map?c=46.346928,10.59082,4

They do have a good wind resource in the north part of country and offshore.

https://globalwindatlas.info/

Volkswagen has arrived on the electric car scene in a big way in Europe, and has very ambitious plans-

https://www.carmagazine.co.uk/electric/volkswagen/

This past month vehicles with plugs made up 28% of sales in Germany. VW #1

https://cleantechnica.com/2021/09/16/plugin-electric-vehicles-get-28-market-share-in-germany-in-august/

North Dakota Monthly Oil Production took a hit in production in July, down 55,709 barrels per day. Daily oil per well dropped from 69 barrels per day to 65 barrels per well, the lowest since May 2010. Wells producing increased by 20 to an all-time high of 16,486.

More information may be gleaned from the Director’s Cut.

Wow. No good news in that one. Rigs are up, completion crews are up, summer is prime time to drill and complete wells in ND, yet wiped out last few months incremental gain.

Ron,

I agree, the North Dakota Bakken has likely peaked, scenario below assumes future Brent oil price in 2020$/bo never rise above $70.50/bo in the future. ERR is about 7.5 Gb with cumulative tight oil production through July 2021 at about 3.97 Gb. High oil prices might allow a bit more total output, but is unlikely to increase output to levels above the previous peak.

Ron,

Indeed. And take a look at this seriously ANOMALOUS situation with Bakken’s Water Production & Ratio shooting higher while oil production heads south.

I stick to my 75% Collapse of U.S. Shale Oil Production by 2030.

steve

Ron, has the Bakken reached a permanent peak in your opinion?

North Dakota peaked at 1,519,035 barrels per day in November 2019. They had declined by 83,722 barrels per day before the covid collapse. And they are now down 441,246 barrels per day below their peak at 1,077,789 bpd.

So yes, I think they definitely peaked in November 2019, and will never see that level of production again.

Posters really need to pay attention to the posts of Mike and LTO.

You might not always like what you read, but you are getting a wealth of inside info for free.

This site isn’t visited as much as it should be. The world has ran on petroleum since WW1. It is now a dirty word in the Western world.

Lots of uncertainty. It is taken for granted that food and fuel will be there, because it generally has been for generations.

Maybe the transition won’t be bumpy?

Yes, and I appreciate all the thoughtful and experienced comments here [even when they don’t jive with my take on things].

Such important set of issues.

“Maybe the transition won’t be bumpy?”

Boy, I wish I could be optimistic about that. But considering everything I certainly am not. At some point here we are likely to see a very painful and hard scramble. Most likely the energy available to mankind over the coming decades will be considerably lower than is now the case, and it won’t be on purpose.

If you want optimism speak to Ron

(hah).

“Maybe the transition won’t be bumpy?”

People have to discuss the transition properly in order for it to go less bumpy.

I discovered a long time ago that it is impossible to discuss peak oil with people.

It’s a simple concept that people cannot or refuse to grasp, kind of like evolution.

You try to explain what peak oil is, and they say, “But there’s still plenty of oil in the ground.”

You try to explain peak flow rates, and they say, “You’re saying we’re going to run out of oil.”

You try to explain the possible societal effects, and they say, “You’re saying the world is going to end.”

Peak oil has been permanently straw-manned. Add to that the fact that I’m just a lay person, not a geologist or oil industry professional, and some people just think I’m crazy. I have given up and mostly read here in silent communion with the rest of you.

Ain’t that the truth. I have recently been informing my father of the natural gas issues brewing in Europe, since he has a habit of enquiring what my utility tariffs are so he can gloat about his better deals. Trying to get him to grok the production versus reserves thing, or to understand that there is no magic alternative to FFs that can come on stream any time soon and enable such profligate energy expenditure and so economic growth, is an uphill struggle.

I’m pretty sure, deep down, most people get the concepts. It’s just a cognitive dissonance of wanting life to continue as they have always known it (and perceived via poor education about the past, as how it’s always been), despite the idea that nothing grows forever. People will happily embrace the net zero narrative and not question that it means lifestyle changes and hard choices in what we do in the transition, not that the reality isn’t a case of unplugging one energy source and plugging another in as one would a battery pack.

It’s hard, even for graduate educated friends in science, to comprehend how much time and energy needs to go into making an RE powered society and how just having FFs plateaux is painful enough. We’ve not even hit the declining FFs while building out replacement RE phase yet. And I already have neighbours complaining about solar panels and turbines nearby, LOL. They ain’t seen nothing yet.

I don’t see any problems at all Shallow.

At least legal disputes in the future will be quicker to resolve: two men enter, one man leaves.

😉 .

Shallow sand,

Life is a bumpy ride. The transition is likely to be bumpier than usual.

Despite the great information from you, Rasputin, LTO Survivor, and Mr Shellman, in my view the high future oil prices which are likely in the future will allow those willing to invest in oil production to earn a high return on their investment. The less that other investors are willing to risk, the higher the returns will be for those willing to take the (considerable) risk as supply will be very short and oil prices will be very high.

It does not matter that politicians are making bold claims about no new ICEVs after 2030 and other edicts. The fact is the transition to EV and other plugin transport will not make a significant dent in World oil demand until 2035. In the mean time those with the knowledge and ability to produce oil have the potential to make a lot of money as their product will be needed by society in order to make the transition to lower total fossil fuel use in the future.

Dennis.

I agree with you.

I just wish the need for oil would be acknowledged by our Federal and certain state governments and that producers would not be looked upon so unfavorably.

“I just wish the need for oil would be acknowledged ”

Agree with the sentiment, and not just from government, but among all people who live in the modern world.

And not just oil- but all forms of energy (yes- including coal and solar and wind)

People (and business) take energy for granted, and waste much of it, burn with a frivolous mindset.

It will take energy poverty for most to pay attention.

Most people don’t even realize that the explosion in energy use in the past 150 years enabled the explosion in population size, and prosperity. Who among us is ready to acknowledge that population size will need to rapidly reverse to make due with less energy after peak fossil fuel. They don’t even teach this in school. What country policy or business plan, or family plan, takes this into account?

Shallow sand,

I agree. The bright side is that those willing to accept the risks of investing in an unpopular industry may reap very high rewards. It is not a popularity contest, the harder it is the less competition and lower supply which tends to favor a high price environment.

Generally that will be good for producers.

My medium oil price scenario has WTI at 92 per barrel in 2020 $ by 2027. There is money to be made at that price.

Dennis , sorry to be the party pooper . Oil at $ 92 in $2020 by 2027 ?? ” If wishes were horses beggars would ride . There is a bright side to everything . Let me tell you a joke . In India we have arranged marriages and a dowry system where the girl’s family pays a handsome amount to the boy’s family if the marriage is finalised . Well , on an event the boy rejected the girl because she was deaf and dumb but the dowry was huge , so what do the parents tell the boy ” doesn’t matter if she is deaf and dumb but she has a perfect teeth line ” 🙂 . Very similar to the justification provided by you .

Hole in head,

I remembered incorrectly, it is $92/bo in 2029, not 2027.

Oil supply will not meet demand at lower oil prices, just a fact.

For tight oil high prices will mean lots of profit, if oil prices are low (note that vey few of the oil pros predict low oil prices in the future, in fact LTO survivor has told me recently he expects higher oil prices as supply is likely to be short. I think he has this right.

Other oil pros steadfastly maintain that oil prices cannot be predicted, I agree with that as well. Surely I have never predicted future oil prices correctly, but I have yet to hear an oil pro say that your prediction of $25/bo in 2025 seems reasonable, perhaps I missed it.

Your metaphor is far from the mark. Time will tell us which oil price prediction is closer to reality, mine at $79/bo for WTI in 2020$ (for my medium oil price scenario) or yours at $25/bo for WTI in nominal dollars (or $22.10/bo in 2020$ if we assume an average annual inflation rate of 2.5%). We will see.

Dennis,

High STABLE prices will encourage capital to come back into the sector and I agree with this for sure. However, the Shale segment of the industry is really struggling with inventory count, well spacing and pressure depletion. Higher prices may allow for five wells per section instead of 4 wells per section but I just really see nothing but consolidation ahead and modest growth. The Shale sector depends on high Stable Prices to capture the return in the first year to be profitable and the Energy Service side of the business needs to ramp back up as well, Capital is going to Charging Stations and Solar Panels so I dont know when the Capital will come back into this world. It surely wont happen at $70 per barrel.

LTO Survivor,

I think the pandemic will eventually subside and I doubt we will see the supply glut of 2015-2017 or 2018-2019. As far as capital, my scenarios have all future Permian CAPEX funded from cash flow by E&P firms, interest on debt is assumed at a 7.5% annual rate and 25% of net revenue is paid out in dividends, even at WTI at 67.50 per barrel in 2020 $ as a maximum price (my low oil price scenario) it works. I assume 4 wells per mile (1320 foot spacing) and assume wells are shut in at 20 bopd (though the economics suggests 10 bopd is possible at the oil, natural gas, and NGL prices I assume (natural gas assumed to sell at 2.50/ MCF, NGL at 35% of crude price per barrel.) I also have excluded many of the lower quality benches from the analysis, eliminating 20 million acres included in the USGS analyses so that only 30 million prospective acres at the end of 2017 are included in the analysis, this reduces the mean TRR estimate from 75 Gb to 50 Gb, with fewer potential wells.

Note my scenarios don’t have any meaningful increase in tight oil until 2023, giving some time for service side to ramp up.

Note that I do not expect oil prices to remain at $70/bo. See my medium oil price scenario below, prices are Brent Oil in 2020 US$/bo.

LTO Survivor,

Can you give us your best guess for future oil prices? Thanks.

I think my medium oil price scenario is relatively conservative, I would say there is roughly a 50/50 chance oil prices will be higher or lower than this scenario. Also note there is likely to be volatility, think of this as a 3 year centered average price.

Chart below has centered average 3 year (36 month) average Brent Oil price in 2020 US$/bo.

Natgas blurb

There now exists something called EMGF — eastern Mediterranean gas forum. Members Egypt, Cyprus, Greece, Israel, Italy, Jordan, Palestine, and France. Devoted to cooperation and blah blah blah. Notice Turkey not there nor Lebanon and Italy and France are nowhere near it all.

Headquarters Egypt.

Egypt has LNG facilities and Israel is already exporting gas to them for LNG forwarding. There is talk of pipelines to Europe. Ain’t happened yet.

Israel is now the source of Jordan natgas. Israeli domestic consumption of natgas has risen from 1.2 billion cubic meters/year in 2001 to presently 11.7. Offshore production is about 13 bcm. So they are exporting 1 bcm/yr.

Haven’t done the math to confirm, but articles claim this is about $13 billion per year influx to Israel. Shouldn’t run out for a decade or 3. I think this is more than 2X US aid to Israel.

Dennis,

You may want to look at North Dakota’s production this past month. The decline of LTO wells plus the reduction in inventory will make it nearly impossible to reach 9605. Let’s say the price goes to $100 per barrel over the next six months, we could see more rigs employed but from everything I have experienced, the best locations have been drilled and each successive well will yield less production. I would be stunned if we can keep production flat for the next several years even with higher prices. One other issue that we are facing is labor shortages, supply chain delays with regards to steel and other items. We would have to see the rig count double in order to eek out modest growth in my opinion.

Regarding those labor shortages. I haven’t looked into how it will effect LTO producers at the margins. But lots of companies are having to increase wages in order to attract and keep employees. And at the margins it’s becoming a problem. Companies that are loaded with debt are starting to squeezed at the margins. And right now the only thing they can control in the situation is labor.

So if labor shortage continues and it continues to force higher wages. Expect layoffs to follow. Which only compounds the problem of not having enough help. Again inflation is a major headwind for economy. Higher priced oil does not help this.

I’m of the belief that oil prices can chug along higher might even reach $100. But something somewhere breaks sending oil prices right backdown to $30 or below. I think higher prices can happen but the aren’t sustainable over a long enough timeline to make Dennis’s models reality.

I think Steve’s 75% less LTO production by 2030 is closer to reality of what is actually going to happen. And in meantime US conventional oil also contracts 4% a year for another 8 years.

LTO Survivor,

We will see. Most of the increased output is from the Permian basin, with a bit from Niobrara and other plays. About 44 Gb ERR from Permian basin.

LTO Survivor,

Higher oil prices will eventually get things sorted, Bakken saw a down month, but mostly output has been pretty flat due to low rig count, in the Permian rig count is rising and if that continues output will continue to rise, at a constant rig count Enno Peters has Permian output rising see (from shale profile)

https://public.tableau.com/shared/D8M5WSNK3?:display_count=y&:origin=viz_share_link&:embed=y

Note that a more realistic projection has completion rate rising as rigs are likely to continue to increase at about 60 rigs per year (rate from April to Sept 2021) in the Permian basin (horizontal oil rig count).

From shaleprofile supply projection for Permian where 286 well completions per month are assumed from Sept 2021 to Dec 2029 (constant rig count over the period). Output of tight oil from Permian basin projected at 4893 kb/d in Dec 2029, this projection is exceedingly conservative, since April 2021 horizontal oil rigs have increased at an annual rate of roughly 60 per year, the scenario below assumes this suddenly stops and the rate of increase becomes zero, this is highly unlikely.

Click onchart for larger view.

LTO Survivor,

Here is the North Dakota Bakken/Three Forks part of my US tight oil scenario for my medium oil price scenario, ERR is 7.9 Gb (consistent with cumulative production plus proved reserves at end of 2019), total wells completed about 24700, with about 16576 wells completed through July 2021 (shaleprofile.com estimate for July 2021 ND Bakken/Three Forks wells completed as of Sept 21, 2021 at 5:23 pm).

Notice that my model has underestimated ND Bakken/Three Forks output since August 2020, the model is quite conservative.

Watcher , you simplified everything , so no reason for me to elaborate .

“Natgas blurb ”

You are a genius . KISS ( Keep It Simple and Stupid ) . 🙂

Oh , forgot “Headquarters Egypt.”

A country where only 3% of the land is agricultural to feed a population of 70 million . The world’s largest importer of wheat . Human memory is short but it was the increase of prices of “roti ” ( bread ) that ended the regime of Hosseni Mubarak . Those who forget history are condemned to repeat it .

Considering that the Nile river dumps more than 500 cubic kilometers of water into the Mediterranean Sea each year, water shortages in Egypt hardly seem like a problem.

And considering the amount of land and sunshine available, all that is really lacking is fertilizer. Wheat production is growing slower than the population, but population growth is slowing.

Of course the real problem, as so often is inefficiency.

https://www.al-monitor.com/originals/2021/09/egypt-develops-ambitious-projects-meet-growing-water-needs

Here is what tight oil output looks like for my medium oil price scenario which has WTI at $92/bo in late 2029 or early 2030 in 2020 US$/bo. ERR is 74 Gb with cumulative tight oil production to date at about 20 Gb, peak in 2028 at about 9600 kb/d.

Click on chart for larger view.

Dennis, that tight oil peak will be after the Bakken and Eagle Ford have run dry, so all that is coming from the Permian? Even though folks who work in the Permian who comment here are saying that by 2027 it will be completely picked over by then, even at current drilling rates. Are you sure you want to stick with this excessively optimistic forecast? You seem to be putting all your eggs in one basket in terms of believing the EIA’s estimates…

Stephen Hren,

This will not be the first time that a scenario I have created is considered very optimistic. In almost every case this has been said in the past, the scenario proved to be pessimistic despite claims that the scenario was “wildly optimistic”. In my view there is a 50/50 chance output will be above or below this scenario.

Below is EIA AEO 2021 reference case scenario for US tight oil. The cumulative output from Jan 2021 to Dec 2050 for my scenaio is 54 Gb and for the EIA’s scenario is 94 Gb, the two scenarios are very different.

There are many intelligent folks who read and/or contribute to this site. With all due respect to your work, Dennis, are there any other people who think the above scenario that you laid out is likely? You seem to be the lone optimist amongst a large group of knowledgeable folks who visit and comment here.

But perhaps I am wrong?

The point is relevant, because your boosterism leads to complacency imho. Promoting a view of abundance when the opposite is more likely true could materially increase the level of misery in the world by lulling people into believing the status quo is maintainable for much longer than it is.

Stephen,

I stand by my scenario.

The same knowledgeable group has always considered every scenario I have created as being wildly optimistic, the group has consistently been wrong and I have in fact always proven to be wrong also by being too pessimistic. Perhaps the future will be different, peak oil won’t be taken seriously when wildly pessimistic scenarios are the norm.

I create realistic scenarios to counter the group think here.

Mr. Hren

“There are many intelligent folks who read and/or contribute to this site”.

That is not only demonstrably correct, I would go further in saying that most who contribute to this site are sincerely striving for a – collective – betterment of all of us.

This does not mean that these intelligent, sincere folks are employing accurate data, and I would use you, specifically, as an example.

During our last back and forth, years ago, you posted a retort to my positive appraisal of the General Electric 7 HA gas turbines.

The then-present manufacturing shortfalls were not only overcome, the accelerated adoption of 3-D printing ‘fixes’ has had profound ripple effects on large scale hardware maintenance throughout the world.

The incredible global build out of CCGTs (Brazil right now turning online ~1.6 GW capacity outside of Rio – the ACU/GNU complex – is just the preliminary phase of a 6 GW total. Siemens hardware being used) is just one example.

Vietnam’s gargantuan ~16 GW buildout is primarily using GE turbines.

Many, many more projects could be cited.

A poster above mentioned increasing WOR in the Bakken.

I am not sure how much that individual is aware of the current status of HVFRs, (these are enabling the long term underground retention of frac fluid.

One consequence is that the former ‘flowback’ fluids are now counted – frequently over several months – as produced water). This skews any historical comparisons as different practices are now being used.

This same above poster, btw, enthusiastically – right on this site – claimed a peak in Marcellus production back in ~2014/5 when a temporary drop occurred at the ~14 Bcfd level.

Current Pennsylvania production is over 20 Bcfd with total Appalachian Basin putput at 34 Bcfd.

So much for ‘experts’.

Mr. Hren, this site has taken on the commonplace characteristics of online exchanges in becoming an echo chamber … an increasingly thick siloed repository of information that confirms, rather than informs, that which intelligent folks wish to be true.

Stephen,

There are few that think my scenarios are likely, there are many that believe they are either too low or too high. Note that the Permian scenarios were adjusted by reducing TRR to 50 Gb which is 25 Gb below the USGS mean estimate and only 6 Gb more than the USGS F95 TRR estimate (which is the USGS estimate that has about a 95% probability of being too low.) Bottom line the Permian scenario is very conservative which makes it more likely the Permian scenarios will be pessimistic rather than optimistic.

Dennis

Somewhat surprising, but not entirely, that you continue to get negative feedback from so many on this site.

You are entirely correct in many of your assumptions, and may yet prove to be underestimating future output depending upon many factors … economic (aka price of hydrocarbons and their production costs) being a prominent component.

The remaining hydrocarbons in mature shale formations still retain ~90% of the OOIP/OGIP. Current practices assure much of that will be extracted along with ever increasing percentages in future wells as techniques continue to evolve.

Proof is in the pudding, so they say.

Summer of 2022 production numbers should indicate that your projections will – roughly – show to have been accurate.

No, there is almost no doubt next year’s shale numbers will be better, and probably through 2025. That tells us nothing unfortunately. Based upon what the many other commentators have to say about it, I give Dennis’s projections a 3-5% chance of being accurate to within 10% by 2028. That’s my two cents from a hippie/doomer/optimist who is also wrong 90% of the time.

Stephen,

I would guess at between 8000 and 10000 kbpd for US tight oil output in 2028 for 12 month average output,with perhaps a 60% probability it will fall between those numbers. I would guess at roughly a 50/50 chance it will be above or below 9000 kbpd.

As far as abundance, we are talking about 54 Gb over a 30 year period.

The US consumes about 6 Gb of crude per year, over 30 years that would be 180 Gb, tight oil is a drop in the bucket.

For the World recent crude consumption levels are about 30 Gb per year, over 30 years that would be 900 Gb my tight oil scenario would supply 6% of that total.

Note that if the transition to electric transport is quick we would see low oil prices and lower output. Oil prices are difficult to predict, my scenarios are based on a set of future prices that are likely to be incorrect.

Coffeeguyzz,

For Williston basin about 9 Gb of C plus C is the likely ERR, mean OOIP estimates are about 400 Gb for Williston basin, That would be about 2.25%, and I do not expect we will see 10% of the OOIP resource extracted for tight oil. For shale gas, I have not really focused on that, no idea. The notion that we will see 40 Gb of C plus C extracted from the Williston basin, is investor hype from 2015, not to be taken seriously. The mean USGS TRR estimate for the North Dakota Bakken/Three Forks is about 11 Gb, about 8 Gb will be extracted profitably under reasonable economic assumptions.

Below I have two tight oil scenarios for low oil prices (maximum of $67/bo in 2020$ for WTI) and medium oil prices (where oil prices gradually rise to a maximum of $92/bo for WTI in 2020$ by 2030.) ERR is about 60 Gb for the low price scenario with a peak of about 8300 kb/d in 2027 and ERR is 74 Gb for the medium oil price scenario with a peak of about 9600 kb/d in 2028. Permian ERR is 44 Gb for the medium oil price scenario and ERR is 35 Gb for the low oil price scenario.

This graph above is physically impossible.

LTO Survivor,

Enno Peters has (with no change in rig count) US tight oil at 7918 kb/d in Dec 2029. My scenario assumes the rig count does not remain fixed, and the low price scenario has output at about 8000 kb/d in Dec 2029. Is there some reason that it is physically impossible to increase the rig count?

Note that a few years ago (circa 2017) I thought it physically impossible for Permian output to reach 8000 kb/d in the future. I was wrong.

We will see how it plays out, I think my medium oil price scenario will be about right if oil prices are close to my medium oil price scenario (linear increase in Brent oil prices from today’s level to $95/bo (2020 $) by Jan 2030. Lower oil prices will result in lower output.

LTO Survivor,

There are two scenarios shown. Do you believe both are physically impossible?

Stephen,

Note that my scenarios are based in part on USGS estimates for technically recoverable resources (TRR), this is coupled with average well profiles developed using data available from shaleprofile.com, historical completion rates and historical tight output to verify the model over the 2005 to 2021 period. Then a discounted cash flow model is used with realistic CAPEX, OPEX, transport cost, oil prices, natural gas prices , NGL prices, interest rates, discount rates, tax payments, and royalty payments and future completion rates consistent with potential future well completions. This exercise is done with a particular focus on the Permian basin, but a slightly less sophisticated model (which focuses only on C plus C and ignores natural gas and NGL) is used for the Bakken/Three Forks, Eagle Ford, Niobrara, and other US tight oil (all other tight oil plays and also including condensate from shale gas plays).

Bottom line, the EIA estimates for tight oil are not very good, I ignore them.

The Permian is over 85,000 square miles in size. How do workers in the Permian know the statist of the Majors holdings now and in the future ?

Stephen,

Permian scenarios below for low medium and high oil price scenarios.

Dennis

Looking at the OPEC forecast for Q4-21, they are expecting an increase of 1.43 M/d over Q3 in world output. These are the primary contributors.

All Liquids. M/d

US. 0.5

Canada 0.1

Norway 0.1

Brazil 0.2

Russia 0.3

Azerbaijan 0.1

Total 1.3 M/d

I still can’t see how the US will add 0.5 Mb/d in Q4. I wonder if they are just accepting the EIA’s STEO projection which starts to ramp up in October.

I understand your incomprehesion. I read on a article of reuter that the backlog was seriously dropping in several county : ”At current well completion rates, the EIA estimates that the top U.S. shale field responsible for U.S. oil gains in the last decade has less than six months of DUCs remaining.” Furthermore, the output of GOM will shrink (shrank) of 100 kb/d due to the effects of Ida : ”this year’s output is running about 11.4 million barrels per day (bpd), according to the EIA, and will shrink by 100,000 bpd through the end of this year, on losses from Hurricane Ida, the EIA said.” So I don’t see how the oil output of USA is going to increase of 500 kb/d for what is left of the year. Perhaps they are hoping that the rest of the world will not need the oil that they can’t no more extract. https://www.reuters.com/business/energy/oil-well-backlog-shrinks-us-shale-may-upset-investors-drill-more-2021-09-14/

Ovi , I am wondering how the heck can any of the listed countries add anything . All are members of the ” red queen ” club .

HiH

Canada is not part of the Red Queen club. Oil sands are a mining operation. Essentially no exploration required. Just keep mining and find more efficient ways to do it.

For example, Suncor which runs an open pit mine, uses huge trucks to take two or three scoops of oil sands to the first stage separation plant. The trucks are now being modified to become driverless. These are $200k jobs.

Ovi,

I agree, I have US tight oil down a bit about 50 kbpd in 2022Q4.

Mistake above output down in 2021Q4 and up a bit for 2022Q4, see comment below where I referred to spreadsheet to get the right numbers.

Ovi,

I agree. OPEC is likely overestimating non-OPEC output for 2021Q4, especially the US. My tight oil scenario has output down slightly in the fourth quarter of 2021 (by about 25 kb/d from the average third quarter level). Tight oil output then gradually rises by 100 kb/d from 2021Q4 to 2022Q4. Output then increases more rapidly from 2022Q4 (7161 kb/d) to 2025Q4 (9094 kb/d), an average annual rate of increase of 644 kb/d each year over that 3 year period.

Ovi,

Thinking a little further on this and remember that this is all liquids so it includes NGL which has been increasing at about 450 kb/d annually. In addition Q3 output will be affected by Ida and there will be a rebound from that by Q4, so perhaps the OPEC guess will be right, but even with these adjustments I still believe it will be an overestimate.

Unintended consequences of the NG problem in UK . Empty shelves .

https://mishtalk.com/economics/alarm-bells-ring-in-the-uk-over-critical-shortage-of-carbon-dioxide

The Transition to Green Energy Wind & Solar will be the DEATHKNELL of Europe & the United States. What we are witnessing now is just a mere WHIFF of the coming ENERGY CLIFF that I have been warning about for years.

This is not a European problem, but global as Japan/Korea LNG prices surged 23% just on Friday. With Dutch TTF Natgas prices reaching nearly 80 Euros on Wednesday, we had a nice Fed Powell imitation by Kremiln Spokesman that Nord 2 would help elevate the high gas prices.

https://oilprice.com/Energy/Gas-Prices/Kremlin-Spokesman-Assures-Markets-Nord-Stream-2-Will-Stabilize-Natural-Gas-Price.html

This announcement had a profound impact on the Dutch TTF gas price as it fell down to 62 Euros in two days. But, mere words don’t stop the REAL PROBLEM that RUSSIA’s Natgas storage levels reached a low of just 19% in April this year. Thus, the lack of Russian Natgas supplies to Europe has nothing to do with Geopolitics or Nord 2. Rather it’s simple SUPPLY-DEMAND FORCES at work, along with lousy Wind & Solar power generation.

Russia will continue to build Natgas stocks until November, thus Europe is going to likely have to EAT CROW or pay much higher prices elsewhere to get supplies before the winter hits.

Unfortunately, Europeans that went along with their INSANE Politicians GREEN ENERGY policies have set themselves up with a Natgas Shortfall disaster in the future.

This is the beginning stage of the ENERGY CLIFF.

steve

Yes let’s continue on forever with intermittent fossil fuels, available for a mere six generations before disappearing forever. That’s the joke here, that’s energy sources that have been consistently available for billions of years are “intermittent “. While fossil fuels that are available for less than two hundred years are “reliable”.

Y’all there is literally no other option than trying to transition to renewable energy, even if we fail spectacularly. Because we know absolutely we will fail by persuing further growth from fossil fuels.

We do have another option in the Integral Fast Reactor and related closed fuel cycle nuclear reactor concepts. It is not inconceivable that these could be built quickly if we pulled out all stops. But from what Steve is saying above, we may be out of time for any kind of solution now. Until now FF depletion has been a slow burning problem that is gradually eating away at the average man’s prosperity. It does appear that we are approaching a discontinuity, at which point supply will rapidly decline in absolute terms.

I don’t have Steve’s level of knowledge. Whilst I knew that production of oil and gas would decline eventually, the speed with which shortages have emerged in Europe (where I live) has shocked me. For the first time I begin to feel seriously worried that the end may not be far away for a lot of people, myself included. Peak oil has gone from being something that I saw as a problem for the future, to being an imminent threat to life for me and real people that I know. If the grid goes down, we lose fresh water. We lose food production and distribution. Under that scenario, a rapid die off scenario is quite plausible.

I can only hope that this will turn out to be an early warning that frightens people into action. Some nations will be effected sooner than others. One can only hope that nations with better resources are shaken into action by the tragedy of others. If a systematic collapse occurs in the UK and a large chunk of the population dies off, it would certainly be a wake up call for other countries. One has the hope at least of not dying in vain.

One easy way to reduce the impact of lower FF extraction might be to use triple glazed windows and more than a brick or 1″ of insulation (goes for TX too), air/air heatpumps are also a great way to reduce heating bills in mid- and northern Europe and comparable climates. In general the manufacturing industry, as I´ve experienced and studied, also has plenty of low hanging fruits when it comes to reducing energy use. It will take a while to get there but when it hurts your wallet the will to invest a bit in reduced energy consumption will become much, much stronger! Being less reliant on imported food items while exporting to Africa, hurting local farmers there will also help, maybe something for the EU council and British parliament to consider. But the big picture stays the same, use less but live well anyway (and possibly grow a garden, if possible). Best wishes!

I agree Laplander, most “energy” problems can easily be solved by wasting less energy.

As Jimmy Carter pointed out, if you are chilly in the winter you can wear a sweater.

And as Steven Chu pointed out, if you are hot in the summer you can paint your roof white. If gas costs too much at the pump you should check your tire pressure.

Most driving in America could be eliminated by getting rid of current brain-dead zoning laws. My father rode a bicycle to work in a munitions factory in WWII when gas was rationed. And so on.

Societies that refuse to accept this logic are setting themselves up to fail. It’s like being an anti-vaxxer. Fine, whatever, but don’t act surprised when your loved ones kick the bucket.

Mr. TonyH

Naval ships around the world have been successfully nuclear powered for decades.

It may make some curious as to why more implementation has not been done on a wider basis.

The Bowland and Weald Basins contain sufficient recoverable natgas to comfortably supply the UK for many decades.

Fracturing restrictions such as .5 seismic readings – a mere fraction of the 2.0 commonly registered by foot stomping football fans – have stymied production in the UK.

As you have so poignantly stated, being ‘shaken into action’ is an absolutely imminent requisite for prompt (dramatic?) engagement that might best be grasped with an accurate understanding of WHY things have gotten to this point.

Absent that, the continuing downward spiral is inevitable.

Stephen Hren,

Unfortunately, you are trying to compare APPLES to ORANGES when it comes to Fossil Fuel Energy & the Non-Renewable Renewables. I wish people would stop using that silly term “Renewables.” Most of the wind turbines and blades are CHUCKED into the landfills when they reach their end of life. Same with Solar. There is nothing renewable about Green Energy, similar to clothes that aren’t renewable when you throw them out after 10-15 years

Sure, some of this GREEN SHYTE is recycled into a few nice Parks or made into expensive Filler for more High-tech stuff that won’t have that much of a lifespan.

Regardless… I say ramp up Wind & Solar as fast and as much as we can so we can really MUCK up the Natural Gas Supply Chain and reach the ENERGY CLIFF sooner than later.

I am all for it.

steve

Steve, you are being sarky. I don’t believe that you really want to see us reach the net energy cliff. Crossing that threshold is going to result in unimaginable amounts of human suffering.

I am starting to realise that this is something that is real and is going to happen to me and those around me, maybe in the near future. It isn’t an abstract idea that I read or write about, it is a real thing that is going to happen. We spend years writing about the approach of these things that our logical minds tell us are inevitable. But somehow, our subconscious minds don’t quite perceive these things as real until we see them happen. Even if you know its going to happen beforehand, there is still a psychological threshold later on where these concepts suddenly become real to you. Here in the UK, with imminent natural gas supply shortages leading to surging electricity prices and industries shutting down; the net energy cliff is becoming real.

I can see more suffering if we again “dodge the bullet”. There were worries about reaching peak oil around the year 2000. Now 20 years later and about 1.7 billion more people, the suffering is going to be greater the further the point of maximum production will be pushed.

I was listening a podcast by Jim Rutt and he repeated the complaint of Albert Bartlett, that people just cannot comprehend what kind of hardships exponential growth will bring to future generations.

I agree that ‘renewable’ is a very poor choice of terminology Steve.

As opposed to the depleting sources of energy, the proper term for wind or solar or wave energy would be

Perpetual Energy.

[per.pet.u.al- 1. occurring repeatedly; so frequent as to seem endless and uninterrupted 2. never ending or changing. 3. continuing or enduring forever; everlasting. ]

Of course the collectors of that Perpetual Energy are prone to degradation, just like the metal and concrete in a nuclear reactor, thermal coal plant, internal combustion engine or oil rig. Nothing unique in that regard.

No golden ticket.

Just lots of energy for even when you can no longer afford oil to get around.

Yeah, very perpetual. Unfortunately, the Earth’s supply of minerals and other concentrated resources needed to build the energy hardware are not perpetual. They are being depleted (or dispersed more accurately) in the blink of an eye compared to the geological timescales needed to concentrate them from base rocks. So it is important to build hardware that uses mineral resources as sparingly and efficiently as possible.

Here are the steel and concrete requirements for several different powerplants per average MW:

http://fhr.nuc.berkeley.edu/wp-content/uploads/2014/10/05-001-A_Material_input.pdf

Wind turbines = 450-470 tonnes steel (per av MW);

New nuclear = 10-40 tonnes steel (per av MW) – range depends on technical option.

Which is the more sustainable in terms of of its use of the Earth’s resources?

What do you need for a coal power plant.

Please don’t forget the requirements for the coal mine, and the super carrier to get it from oversee. Ah, and the two giant harbors. Plus all the additional goodies as a few hundred miles of rail and giant excavators.

Nuclear is very resource efficient – but it has to be some newer tech. For the old nukes, uranium will run out in short time when they are rolled out widely (let’s say 10 times more installations than now).

You’ll need breeding tech, or better tame the thorium cycle. All the current nuclear technology is more or less from the cold war to have the back door of breeding bomb material – but not to maintain a fuel efficient fission.

The price of coal in China might rise too much for the green energy transition to occur.

Steve you absolutely hit the nail on the head!

Steve-

You should check out the European Landfill Directive. Landfills are being phased out in Europe. In Northern Europe, many all have already closed. You need to update your story.

It would make a lot of sense if Americans followed suit. We’ll see.

More problems with Europe NG

UK energy provider Bulb seeks emergency fund injection

“The spate of failures comes amid a record spike in energy prices due to a combination of low wind power and global gas shortages.”

Double whammy from NG prices and low wind speeds. Are low wind speeds associated with CC?

https://www.cityam.com/uk-energy-provider-bulb-seeks-funds-to-avoid-collapse/

I’m watching this NG situation in Europe closely. This could lead to both the GBP and EUR getting hammered. And a stronger dollar. Which will weigh in on oil price.

Also watching situation in China As it plays out it’s likely the Chinese yuan CNY gets hammered also. Which will push dollar higher also. Which will weigh in on oil price.

If your leveraged long CL futures and the dollar goes against your position. This run up in oil price can get unwound in a hurry.

Hilariously, Bulb is my electricity provider and 100% RE powered. I’ve had several e-mails over the last 9 months relating to price increases since they use a one month rolling, single tariff contract. I was only joking the other day with my father that I may get hit, and here we are.

There are something like 70 energy companies in the UK. There may be only 10 by year’s end. These companies are basically just middlemen if they’re not, say, British Gas or EDF, so looks like their ways of cutting costs by being brokers for wholesale energy won’t get them out of this pickle.

”Are low wind speed associated with CC?” It depends on where and when… Modifications of climate dynamics due to climate change are a difficult question about which climatologists don’t agree (they don’t agree about the consequences and about the interpretation(s) of the observations, not about the phenomenon itself). About mid-latitudes, it has been recorded a slowdown of ”westerlies” : the succession of anticylones and depressions on a specific location has slowed which is linked to the decrease of temperature gradient between Equatorial areas and Arctic areas. The Arctic is warming faster than the Equatorial areas. This can have the result to fix ”in place” the anticyclones and the depression which in turn provokes weather persistence. When you are in the first case, you have possibly less winds and dryness and when you are in the second option, you have more rain and winds. After it depends on where you are located. That’s what can be said quickly. After, it is perhaps a question of mere coincidence and bad luck.

JFF

A puzzle. “The Arctic is warming faster than the Equatorial areas.” If the Arctic is warming that fast why is there more ice in the Arctic in 2021 than 2007 and 2012?

The dashed line is 2012. Lowest ice year. Solid red is 2007. Blue is 2021.

https://nsidc.org/arcticseaicenews/charctic-interactive-sea-ice-graph/

Ovi,

Perhaps the amount of ice in the Arctic in Summer has a lot to do with wind and weather patterns?

It is a fact that the Arctic and Antarctic have warmed much more than the equator.

Ovi , I follow this but not too closely , so excusee (French ) if I am incorrect . If the area is increased but the volume is decreased , then ?? . I follow Paul Beckwith(you tube ) occasionally to update myself on this matter . He is what Mike S , SS , LTO’s , Rasputin, Dennis, Ron on oil issues . Maestro . Last minute , Doug Leighton on the non petroleum thread is doing an excellent job by providing updates on CC . Thanks Doug , appreciated .

JFF,

The answer is simple, stated by several Arctic scientists. The massive melting of ice is creating a higher percentage of freshwater. Freshwater freezes more readily than saltwater.

While freshwater freezes at 32 degrees, saltwater freezes at 28.4 degrees.

steve

Steve , Dank u well , merci , bedankt , Koszonem , meherbani , shaukriya . They all mean ” thanks ” . 🙂

Extent/area ≠ volume.

There is not more ice in the Arctic. There may be more first year ice in certain areas leading to extent, and perhaps area is on the high end as well for some seas, but volume of ice and integrity of said ice is negligible. Single year ice is totally different to five year ice in mechanical strength and composition. Compare what we have today to being like a Slush Puppy versus having a cold drink with whisky stone like ice cubes.

The other thing to note, insolation plays a big role. There was practically no sun through peak solar insolation this summer, meaning very little of the ice above 85º got hit full on with the sun. A lot of the Siberian side fared worse, but areas on the opposite side of the Arctic were more or less average. Export through the Fram Strait can also make a difference, and that is entirely down to wind patterns. Ice that gets pushed down to the Atlantic gets murdered.

So, weather plays a huge part of this. You get years like 2007 and 2012 that are phenomenal in what they do to the ice, and indeed the former year was a true paradigm shift. But make no mistake, the state of the ice this year, despite it being a very average year for melt enhancing factors, illustrates just how fragile the situation is. It would only take another 2007 or 2012 now to get us decidedly below all time records.

The trend is unchanged. Ice loss is accelerating and the period where melt happens is also expanding.

Tks, Klieber .

What you are seeing is surface of sea ice. This can be reduced by winds (the ice is compacted) or extended by winds. The fact is that meteorological conditions in Arctic area have not been favorable this year for an extensive dispersal of sea ice promoting more ice melt. Beyond this, you must see that the ice pack is in three dimensions : the ice pack has a thickness. And from this point of view, the record is very bad. First, the multiyears ice (more than one year old) is now representing 26% of the surface of Arctic sea ice during summer while at the beginning of the 1980s it represented 75% or so of the surface of Arctic perennial ice during summer. Second, the PIOMAS has evaluated the decrease the volume of ice stock to 300 km3/year or so for both March and September period of the year.

The Chinese stuff is big discussion in the WTI chatroom now. Some chatists associate the Chinese economic problems with bad news for bullish oil price expectations.

My guess is FED will be uber dovish at their meeting this week and stocks bounce. And oil finds support to move higher.

I don’t believe FED can allow any correction to take place. We’d get a pension fund crisis if stocks are allowed to correct. In order to make up shortfalls pension have borrowed massively. So they are not just long but leveraged long corporate debt.

They are buying the market at all time highs with leveraged. It will end in disaster one day. But until then. I expect markets to move higher. Oil might just get carried with them higher.

What going on in Europe and China would have to turn into a full blown crisis to drag these markets down. Not there yet. And neither may turn into full blown crisis. It’s wait and see at moment.

My speaking.

The FED and other central banks can’t reduce the dose of opium, crack and meth. They can only talk about it, as the alcoholic about drinking less booze. The market would immediately crash completely, tearing down anything with it. The beginning would be a margin call crash bringing margin to zero. Both in stock and bonds.

Even with the inflation the damage of tapering or even ending QE would be too big. There will be a day when we get a new, full electronic $ and €. Without cash.

Then they won’t need QE anymore – without cash they can set interest to -5% if they like or need. Nobody can flee as today. Today -5% isn’t possible – big banks and funds would lend out money, convert it to cash and hord it in fortified mountainside vaults to make an arbitrage yield.

In my opinion they will bail out evergrand somehow – not completely to punish invesetors somewhat, but enough to stop a chain reaction. Let’s see.