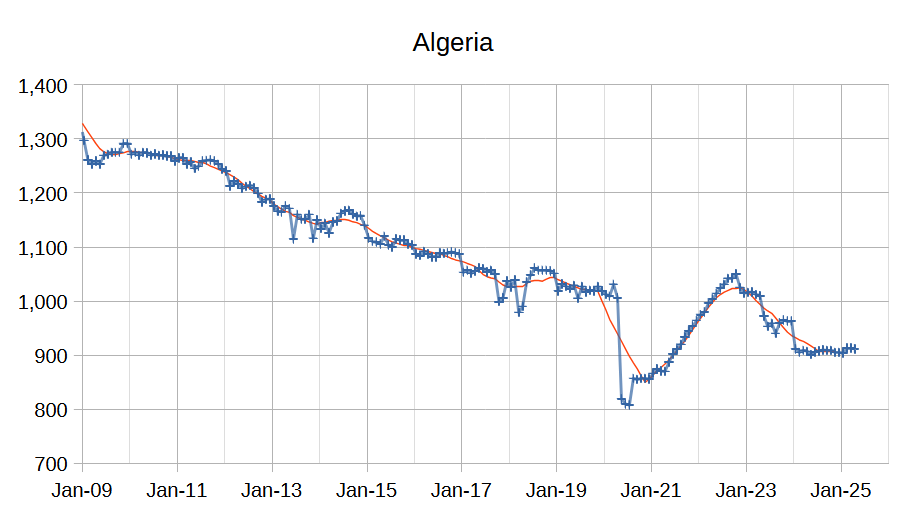

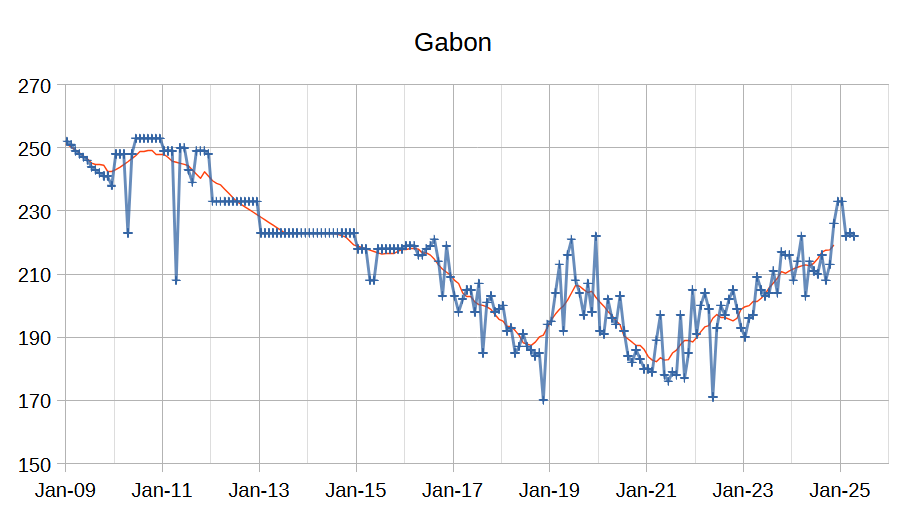

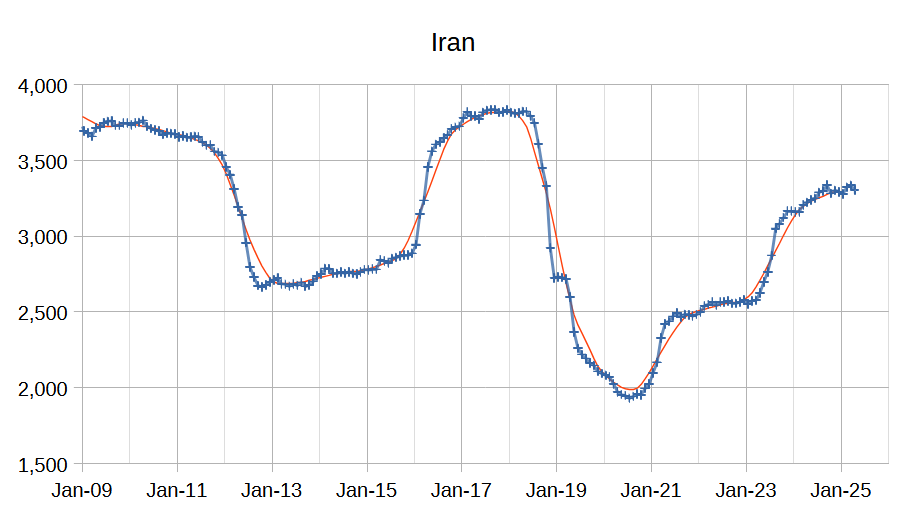

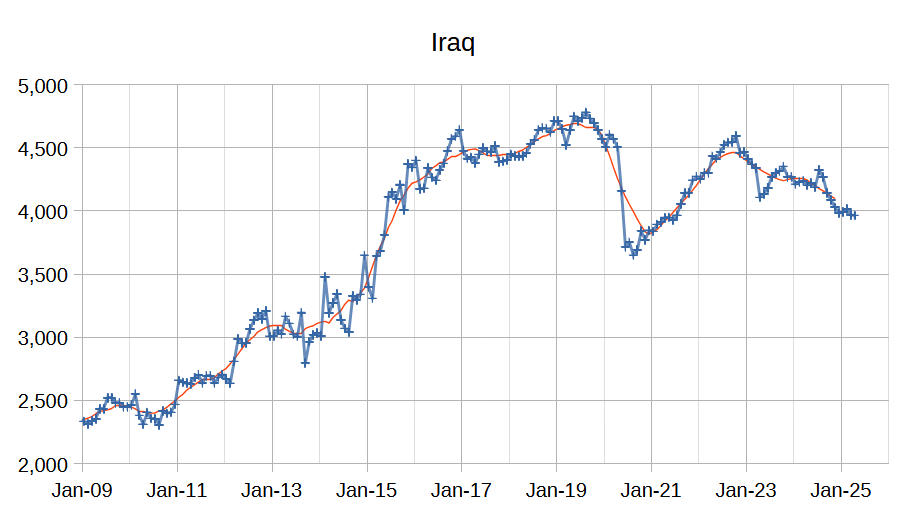

The OPEC Monthly Oil Market Report (MOMR) for May 2025 was published recently. The last month reported in most of the OPEC charts that follow is April 2025 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In the OPEC charts below the blue line with markers is monthly output and the thin red line is the centered twelve month average (CTMA) output.

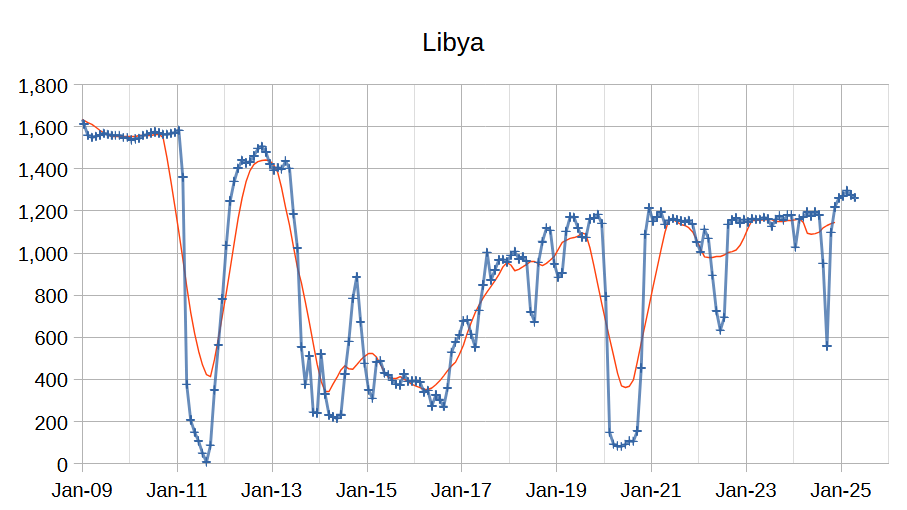

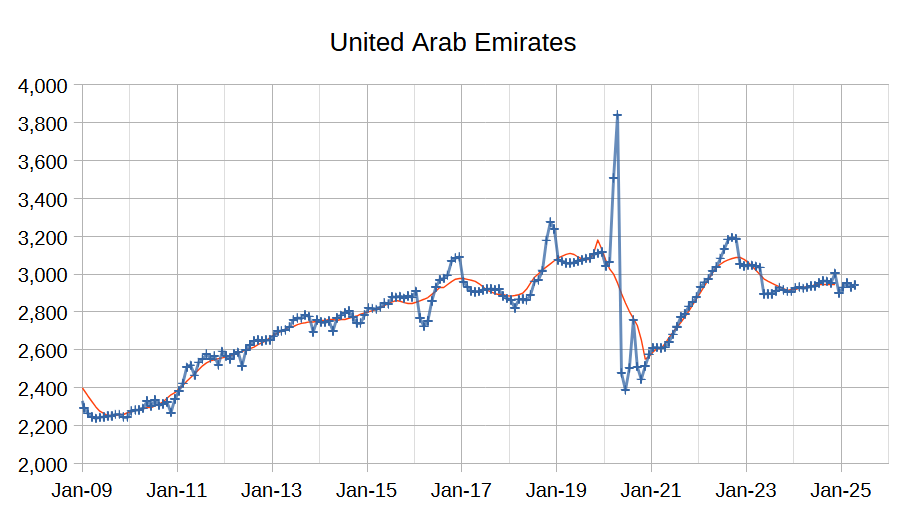

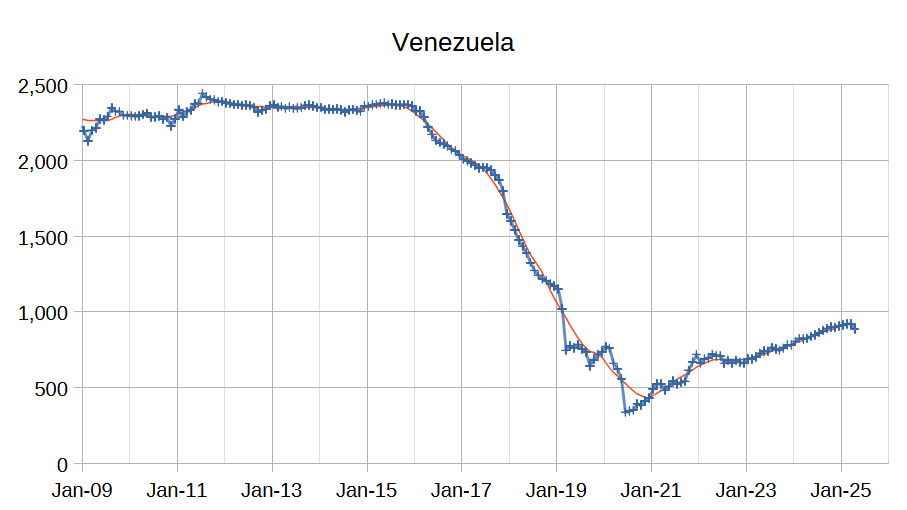

Output for March 2025 was revised lower by 4 kb/d and February 2025 output was revised higher by 12 kb/d compared to last month’s report. OPEC 12 output decreased by 62 kb/d with the largest decreases from Venezuela (34 kb/d), Iran (30 kb/d), Nigeria (28 kb/d), and Libya (14 kb/d). Saudi Arabia (49 kb/d) and UAE (11 kb/d) saw increased crude output, other OPEC members had small increases or decreases of 6 kb/d or less.

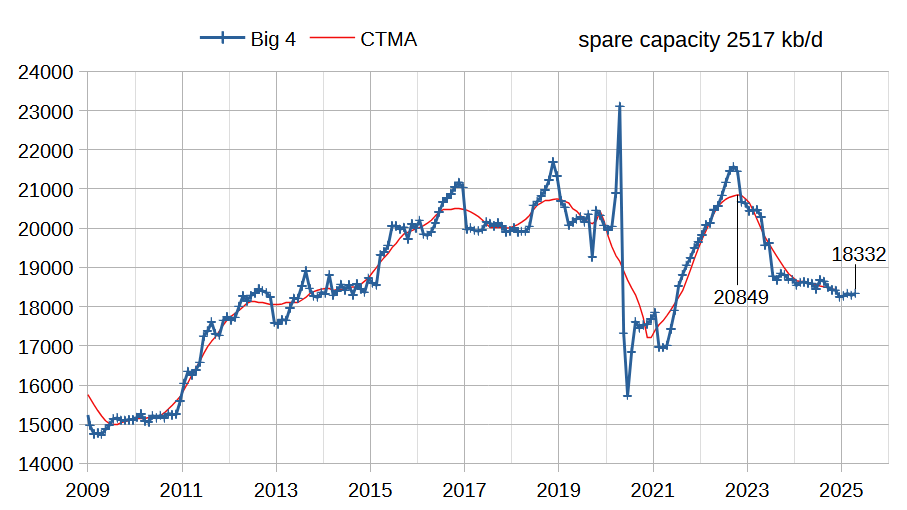

The chart above shows output from the Big 4 OPEC producers that are subject to output quotas (Saudi Arabia, UAE, Iraq, and Kuwait.) After the pandemic, Big 4 average output peaked in 2022 at a centered 12 month average (CTMA) of 20849 kb/d, crude output has been cut by 2517 kb/d relative to the 2022 CTMA peak to 18332 kb/d in April 2025. The Big 4 may have about 2517 kb/d of spare capacity when World demand calls for an increase in output. OPEC has announced plans to increase output at about 400 kb/d each month from May to October 2025, which would increase output by about 2400 kb/d and reduce OPEC spare capacity to only about 100 kb/d, based on my estimate of OPEC spare capacity.

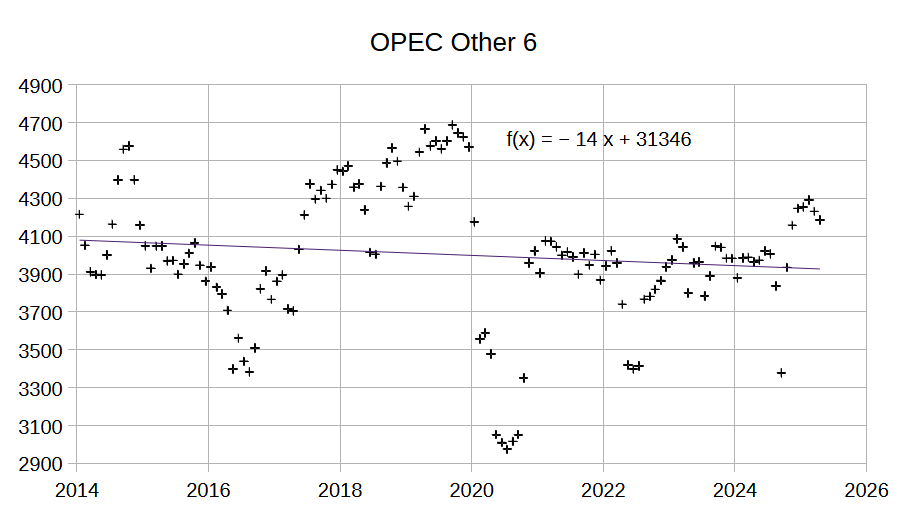

The chart above looks at Other 6 OPEC crude output which is OPEC 12 minus OPEC Big 4 minus Iran and Venezuela from May 2021 to April 2025. The average annual increase is only 60 kb/d.

The longer term trend for OPEC Other 6 crude from Jan 2014 to April 2025 is an average annual decline of 14 kb/d, basically flat output for about 10 years. My expectation is that Iran and Venezuela will increase their crude output very little after April 2025 and OPEC Other 8 crude output (OPEC 12 minus Big 4) will be relatively flat in the future or possibly declining slowly.

OPEC revised its World liquids demand estimate lower by 100 kb/d in 2024 compared to last month, otherwise the demand estimates for 2025 and 2026 are unchanged. Also non-DoC Liquids and OPEC non-crude liquids were revised lower by 100 kb/d in 2025 and lower by 200 kb/d in 2026 compared to last month’s MOMR.

Refinery throughput may be the best way to evaluate World C+C demand, from OPEC data the peak was 81.68 Mb/d in 2018. For the most recent 4 quarters the average refinery throughput was 81.05 Mb/d, the previous 4 quarters had average refinery throughput at 81.02 kb/d and 2024 had refinery throughput at 80.84 kb/d, so only about a 210 kb/d increase in the annual average over 6 months which suggests another 18 months to return to the 2018 peak if the recent rate of increase in refinery throughput continues for the next 6 quarters.

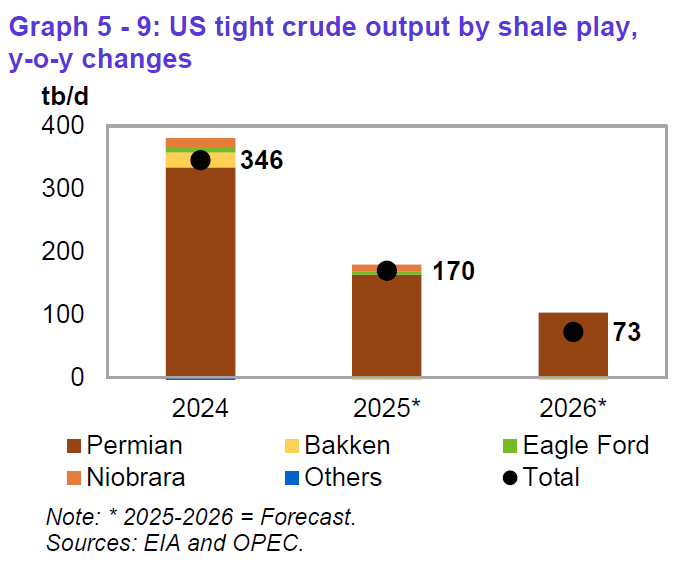

The OPEC estimate for US tight oil output in 2024 increased by 46 kb/d compared to last month and the increases for 2025 were revised lower by 51 kb/d and for 2026 were revised lower by 67 kb/d compared to last month’s estimates. Permian Basin output remains the main source of US tight oil growth from 2024 to 2026.

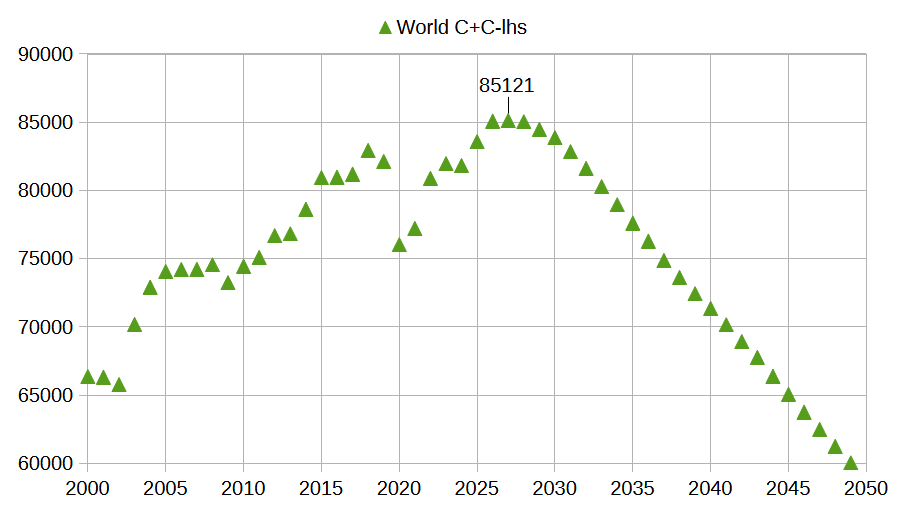

The scenario above uses the same scenarios for the rest of the World (all nations except the US and OPEC plus nations) and the US as in the last OPEC post. The OPEC plus nations are assumed to add 385 kb/d for each of the six months from May 2025 to October 2025 (400 kb/d added by Big 4 and OPEC other 8 assumed to decline by 15 kb/d each month.) Total increase from OPEC plus for the 6 month period is 2310 kb/d for this scenario. After October 2025, OPEC other 8 continue to decline at 15 kb/d up to 2036, with higher decline rates after that.

148 responses to “OPEC Update May 2025”

Dennis

What does the last paragraph mean. What scenarios except U.S?

Also where are you getting 400 kb/d?

https://www.reuters.com/business/energy/opec-further-speed-up-oil-output-hikes-three-sources-say-2025-05-04/

Loadsofoil,

Sorry the scenario was not stated clearly, I have edited to attempt to make it clearer, thanks.

The article you cite suggests output from OPEC plus will increase by 2200 kb/d, my scenario has output increasing by 2310 kb/d (an increase of 385 kb/d each month for 6 months from May to October 2025). See last OPEC post (link below) where there were three scenarios for US, OPEC plus and ROW, only the OPEC plus scenario has been modified as described in the last paragraph to get the World C plus C scenario shown.

https://peakoilbarrel.com/opec-update-april-2025/

Average annual output in 2025 rises to 83579 kb/d from 81828 kb/d in 2024. Monthly World C plus C output was 82184 kb/d in Jan 2025, peak annual output is 85121 kb/d which is 2937 kb/d higher than Jan 2025 output, the extra 627 kb/d (over the 2025-2027 period of 35 months) comes from the rest of the world (World minus US minus OPEC plus) primarily Argentina, Brazil, Canada, and Guyana.

Like every scenario of future output this is certain to be incorrect, it simply makes the same assumptions for US and Rest of World (ROW) as previous OPEC post and assumes OPEC plus increases output by 385 kb/d (Big 4 increases minus decreases from OPEC Other 8) for 6 consecutive months from May to October 2025.

ROW output rises at an average annual rate of 400 kb/d from 2024 to 2027 for this scenario (from 2021 to 2024 ROW C plus C output increased at an average annual rate of 419 kb/d, I assume the future rate from 2024 to 2027 is 400 kb/d.)

Link to spreadsheet with scenario below

https://docs.google.com/spreadsheets/d/1cqmREmnIuV3ySPVfQjGffRS_DiPbttCb/edit?usp=sharing&ouid=105320434049434900507&rtpof=true&sd=true

Dennis

Thanks.

A peak between 82 and 85mb/d probably represent the lower and upper limits of global production. The higher OPEC goes the smaller their spare capacity and the more likely we will get a serious oil shock down the line.

By 2030 with the U.S. falling, Guyana nearing full production their will hardly be a single country that can increase production at all.

A dangerous situation to be in.

There has always been some region that could produce more oil if needed. Norway and The United Kingdom in the 70s 80s 90s. Egypt in the 80s. Mexico. Brazil and many others. The U.S. being the main recent country to prevent peak and stabilise the market.

This will be the first time in history, there will essentially not be a single country that can add additional oil to any substantial level.

Loadsofoil,

I agree. Note that I doubt OPEC will increase output as fast as the scenario presented as it is likely that oil prices will crash if output increases as fast as 2400 kb/d over a 6 month period. After 2030 I do expect World output of C plus C will be decreasing at about 1500 kb/d per year on average over the 2030 to 2050 period. Oil prices might be very high unless demand for oil falls for some other reason.

Perhaps they want to damage some non-opec-producers, especially shale companies and canadian oil sand companies pumping like mad.

Driving them into red ink to force them a bit of discipline, especially since the investment story into oil isn’t as strong as in downtimes before so they won’t have it easy to finance a drilling boom during price downtime.

Canadian Oil Sands are probably the best assets out there. They just keep chugging along with low op costs. Oil sands production has little to no decline. Oil sand Co’s have really strong balance sheets. The oil sands are also are not going to grow significantly as the Canadian government has restricted the ability to grow.

“This will be the first time in history, there will essentially not be a single country that can add additional oil to any substantial level.”

Well, better learn to get by with less and less oil. Quickly.

Maybe still Canada, Irak, Argentina, Namibia and Venezuela. Irak is uncertain without a stable contexte and without the completion of the Common Sea Water Supply project, essentiel for pressure support. Venezuela is also very uncertain in the long term. The other three might represent a few 100s kb/d of capacity but if (and it’s high probability one) Russian oil industry decline too, it won’t help much overall.

It maybe we have finally reached peak oil:

One of the more notable warnings came recently from Travis Stice, CEO of Diamondback Energy. In a letter to shareholders, he said flatly: “It is likely that U.S. onshore oil production has peaked and will begin to decline this quarter.”

Shale was the bridge that kept the conventional production for the past 20 years from looking like the decline of human civilization. With the peak US shale oil production now probably going into decline this will look much worse than the conventional oil decline because of the short life of Shale Oil output.

I have noted that over the past 8 months the EIA Weekly Petroleum Status Report has noted nothing but declines from the 5 year averages:

At 441.8 million barrels, U.S. crude oilinventories are about 6% below the five year average for this time of year. Total motor gasoline inventories decreased by 1 million barrels from last week and are about 3% below the five year average for this time of year. Finished gasoline inventories increased and blending components

inventories decreased last week. Distillate fuel inventories decreased by 3.2 million barrels last

week and are about 16% below the five year average for this time of year. Propane/propylene

inventories increased by 2.2 million barrels from last week and are 9% below the five year

average for this time of year

All major groups are down from the 5 year averages, Total 6%, gasoline 3%, diesel 16%!!!!, and propane 9%.

This is a developing story that hasn’t gotten any attention.

Keep in mind in 1998 when we were getting $8.25 per barrel at the wellhead, everyone thought we’d be awash in oil for decades. Remember the $5 oil headlines from The Economist in March, 1999. Remember how that turned out?

From 1998-2008, the price ran from $8.25 to $143 in our neck of the woods, before the GFC hit hard and crashed it temporarily, only to spike back to $100 range until the Thanksgiving, 2014 crash.

Trump just needs to hammer oil down very low to trigger another long term super-spike like we had from 1998-2008.

Maybe something like down to $30, the rocketing up to $300 until either some major new source is found, renewables take over, or the world economy goes into free fall?

Keep inflation in mind on oil prices. If we look at real oil prices in 1998 US$ per barrel the annual average prices look like the chart below. From

https://www.eia.gov/outlooks/steo/realprices/

I wonder how much oil is traded with futures contracts and how much is sold on daily spot price?

https://www.eia.gov/energyexplained/oil-and-petroleum-products/prices-and-outlook.php

Anyone know?

This is not hedging but actual contracts to sell oil.

BP still made a good profit in 1998 and 1999 when oil prices were very low which leads one to believe that they were selling a good proportion of their oil at prices higher than $10 or $12

I don’t know about how BP hedged back then, but in general the majors don’t hedge as much as the independents.

I get what you mean about contracts. The 10k show the average price the company received.

I’ve went back and looked at 10k from the pre-shale era. CAPEX and operating costs were a lot lower.

Shallow

Thanks

Shallow Sand,

Did your family drill any new wells during the 2007 to 2014 period? I assume no new wells have been drilled since 2015.

Dennis. Yes.

We drilled just 2 wells from 1985-2004.

From 2005-2014 we drilled a minimum of 2 and a maximum of 4 wells per year. Most years 2.

None since the fall of 2014.

We will need $100 sustained for a couple of years for us to consider drilling again, and that will depend on costs, which I am sure will be much higher than 2005-14.

We were drilling, completing and equipping wells 2005-14 for $50-$70k per well. These were mostly infill, where gathering facilities were already installed.

During that time we also acquired several abandoned leases which we re-equipped. Those went well, including one which has two wells making 2.25 barrels per day. The lease has produced over 16,000 BO since 2006, and we just have $34k of CAPEX in it to acquire, equip and put back into production. I discovered that one and am still proud of it, as you might be able to tell.

To compare, we drilled two producers and one injection well and built the gathering system in 2006, and it cost just north of $200k. This was a new lease on our land where we own the minerals, so 100% lease. 4 miles from the one we reactivated. It’s cumulative is a little over 12k BO. It actually is up to around 2 BOPD, seems we finally have the water injection optimized on it. Or maybe it just took a long time to break through. The two wells IP were 18 and 4, but dropped down to about 1 BOPD total for quite awhile until coming back up to 2 BOPD.

We have done nothing since Thanksgiving, 2014, except sell some leases, and with some of those proceeds, bought some leases which had lower LOE. We have converted some production wells to injection since 2015, have reactivated a few, plugged a few and re-completed a handful.

These are almost all 900-1,100’ wells. Vertical.

Thanks for the information.

My guess is that oil prices will not be high enough in the future to justify new wells in your basin, and you might need $150/b as costs will be significantly higher and I doubt that price or higher can be sustained for more than a year.

I doubt we will even reach the $90/b level needed for profits in the tight oil space for any significant stretch (see comment below).

Dennis.

As you know, never say never on oil prices, to either the high side or low side.

We have no drilling plans and that’s ok. We would have sold this stuff by now if anyone would pay us something decent, but they won’t.

So we continue to operate it, build the plugging fund and distribute the balance, when there is a balance left over to distribute.

Shallow sand,

As I am sure you know, it was a guess on future prices, and historically I have been wrong 100% of the time, a perfectly imperfect record. (In this case I would confidently say I have never been correct on future oil price in the past and will never be correct in the future.)

I hope for you that oil prices increase, but I think such an increase in oil price will tend to accelerate the transition to EVs that is already happening.

In 2024 there were 17.1 million plugin vehicles sold (BEVs plus plugin hybrids) out of 77 million new light duty vehicles sold. Growth from 2023 to 2024 in annual sales of plugins was 25% and the sales share in 2024 was 22% (17.1/77). The only question after 2030 is whether supply decreases faster than demand for oil.

In China the share of plugin sales in 2024 was about 41% (12.9 of 31.4 million vehicles) with plugin sales increasing by 35% over the 2023 annual level. Also note that vehicle sales in China are about 41% of the global total.

Soon India may follow China as there may be enough capacity in China to supply the Indian market for plugin vehicles. Also Chinese EV manufacturing may expand to India.

Actually a number of Chinese companies are already making cars in India, see following from 2023

https://www.evmechanica.com/top-chinese-ev-selling-brands-in-india/

Great piece at oilystuff.com at link below

https://www.oilystuff.com/forumstuff/forum-stuff/u-s-shale-oil-debt-and-corresponding-additions-to-breakeven-prices

Bottom line, the full cycle breakeven for US tight oil wells is about $90/b when dividend payments, interest on long term debt, and payment of principal on long term debt are included, along with costs to plug the wells and clean up the site at the end of a well’s life. There is much more to it, and my summary is no doubt incomplete, read everything at the link including the comments for the full story.

Some countries understand the reality of oil depletion and are rapidly electrifying the transport sector and beefing up the domestic electrical production and infrastructure systems.

The US is relatively limp in this sphere, as if the future scenario is a condition for only others to experience.

Hickory,

There was a time when government in the US was able to function, that seems to have ended. Even spending on infrastructure has become controversial and thus the US will be left behind.

Hickory

What needs to be understood is that if several countries like India, Russia, Iran, Iraq and the U.S. fail to drastically reduce oil consumption in line with decline. Then everyone suffers. Sure some countries which reduce demand by 2% a year will pay less for their imports, but they will still be paying $120 and more for a barrel.

It would take every country to reduce oil demand by a minimum of 1% per year in order to prevent very high oil prices. The problem being why should India reduce oil consumption when Indians use a fraction of people in the United States or Russia.

https://energynow.com/2023/09/infographic-oil-consumption-per-capita-energyminute/

I think many Americans think Indians still ride around on donkeys.

https://urbanland.uli.org/design-planning/indias-airport-building-boom-aviation-propels-growth-innovation-and-global-connectivity

They are building 200 new airports at the moment.

They are building thousands of miles of new roads. Any cuts that Europe manage at great cost will be taken up by India and other countries. So when global production starts falling year after year. Countries like India will go to extreme lengths to get the oil they feel entitled to.

At the moment electric vehicles are in addition to increasing oil and gas consumption, mainly powered by massive increase in coal consumption. Peak oil is just a four years away max.

some people can fantisize about electric self driving cars but reality is so different

Loads- a country that electrifies its transport sector and support capabilities will be more resilient to depletion (high oil prices) than one that doesn’t. Its no cure, but the illness is handled with a slower pace of disability.

What other modes of adaptation to oil depletion do you suggest?

Hickory

As I already said countries that electrify their cars will import less oil and be better off.

Do you understand the maths?

Peak production may hit 85 mb/d in 2029, shortly after production will start to fall by 1mb/d. This will leave a hundred oil importers bidding for a vital resource that becomes more and more scarce with each passing day. Forward contact prices will skyrocket.

The world is totally interconnected, if Brazilian or Indian farmers can’t afford to irrigate their fields we are all in the shit.

When poor countries struggle to pay for gas or diesel we will all be impacted because loss of food production in one area effects every area.

https://www.tbsnews.net/bangladesh/energy/depleting-reserves-deepening-crisis-why-gas-shortfall-has-no-quick-fix-1137791

There are several countries already that are struggling to get the dollars to pay for oil, gas and diesel.

The world economy is not based on the strongest links it will start to fall apart at the weakest links.

I get that. As I said we have no cure for the condition of vast population overshoot, and energy depletion.

And we are far late on taking emergency level measures to adjust to the realities of it.

Message was written big on the wall by the 1970’s.

Since then population has doubled.

Global air travel passenger miles has exploded roughly 10 fold.

We burn as much as we can get our hands on.

The clock is ticking, the global combustion sets new records each and every day.

There will be 9 billion in just 12 more years.

some people can fantisize about electric self driving cars but reality is so different

I think electric self-driving cars are already a reality.

I seldom use an Uber or a taxi: the autonomous car service Waymo shows up at my front door on time, and when I get in it takes off, drives the speed limit, and lets me off at my intended destination without wanting a tip and without mindless chatter, usually about political views.

What used to be $30 + tip (or risk getting a bad rating) is now $15, no tip. When I’m ready to go home, it shows up.

In a densely populated city I can’t imagine driving myself; it doesn’t pencil out.

Gerry

I should not have added that last line,about vehicles that cost $200,000 and represent 0.000001% of the vehicles in the world. Really distracted from the main facts that India is building over 200 airports and tens of thousands of miles of roads.

https://about.bnef.com/blog/indias-traffic-is-so-bad-its-changing-the-cars-people-buy/

Not many driverless cars here.

Global oil consumption is increasing and that’s because 5 billion people in Africa, Asia and South America want to drive and fly just like Americans and Europeans do. Any savings by America or Europe will be snapped up by those countries. It would be bad enough supplying those countries at current production rates. Impossible when production is falling year by year by a million barrels.

Loadsofoil,

The point is that driverless cars are here already. Dr. Maddoux is likely affluent and though he can afford his own car, he finds using robotaxis cheaper than owning a vehicle. I imagine it is also more convenient.

Waymo is not available in many places yet, but I imagine it will expand. Other companies such as Tesla, Mercedes, BYD, and several other Chinese companies are working on this technology, it may become quite widespread.

Dennis

India has 1,400 million people, can you explain why India will not use as much oil as The United States?

Even at that point Indian people will only be using a quarter of what the average American is using.

https://www.ceicdata.com/en/indicator/india/oil-consumption

The crass reasoning I have heard why Other countries will not use the resources that Americans use comes from a belief that Americans should have wealthy lifestyles but other nations should make do.

Well the charts are showing that many nations are no longer going to make do.

And there ain’t enough to go around.

Do you think the United States could cut oil consumption to 10mb/d by 2035 so other countries can have a bit more?

Where will the 5 million barrels lost by 2035 fall?

Loadsofoil,

Smart nations (this does not include the US) will reduce their dependence on crude oil by increasing their infrastructure to support electric transport. What people want is transportation and oil isn’t really necessary any longer. China is likely to prove this over the next few years and India and other Asian nations will follow, Europe may be smart enough to also follow this model. North America, especially the US will probably lag behind the rest of the World in realizing this transition is necessary, much to the detriment of the people living in those nations. Canada is a bit smarter than the US with the average fuel tax at ($0.69 US/gallon or $0.18 US per liter) vs about 51 cents per gallon of gasoline in the US and diesel at about 59 cents per gallon in the US. The European average tax on fuel is $2.24 per gallon with diesel a bit lower at $1.82 per gallon, but the policy is much more sensible, the tax levels vary from nation to nation from a minimum of $1.47 per gallon in some EU nations to a maximum of $3.73 per gallon in the Netherlands.

European data from

https://taxfoundation.org/data/all/eu/gas-taxes-in-europe-2024/

Unfortunately the US will be the last to cut motor fuel use due to a broken government and lack of long term thinking by most politicians in the US.

Indians may choose to be smarter than people in the US and will use electricity for transport which will be far cheaper.

Dennis

From your own data, crude oil production will fall by around 8 million barrels per day by 2035. Who will take that hit?

Next year 80% of cars sold will have an ice motor, in 2031 as oil production declines 90% of those vehicles will still be on the roads and will continue to require diesel and petrol for another 8 years or more.

99% of trucks sold next year will be diesel, supplying food and goods to a population that has increased by another 78 million.

Farmers are using more and more petrol and diesel to irrigate land which is increasingly affected by droughts.

Global aviation fuel consumption will increase this year by the equivalent of 20 million cars.

Who will take the hit?

Loads- “Who will take the hit?” (shortage of available oil for purchase)

-the poorest people in countries

-the poorest countries

-importing countries…which will be most countries in the world including the US

-countries who are boxed out of the market for geopolitical reasons

Dennis …. ” What people want is transportation and oil isn’t really necessary any longer. China is likely to prove this over the next few years…..”

Possibly one of the most ridiculous statements ever posted on this forum, ignoring the reality of what is used to build all the electrical gizmos. Take ‘traditional biomass’ out of energy use totals, as we don’t build anything in the modern world with ‘traditional biomass’ and fossil fuels are still around 92% of all energy use with oil still in the lead for energy use.

We have a system based on growth. All modernity which we use and require to obtain all the the lower grades of deeper and more remote metals and minerals to build every aspect of modern civilization totally relies upon oil to explore, mine and transport all these commodities.

As others keep telling you Dennis, without oil the EVs don’t get built, the metals don’t make it to the factories, the coal doesn’t get mined, the gas drill rigs will not operate.

you seem stuck on the premise we can do this, this and this all with EVs, while ignoring we are not doing it with EVs because it’s not cheaper. It’s exactly the same reason why no-one is going off grid with any heavy industrial energy use to use solar, wind and batteries exclusively. It’s too expensive in energy and material terms to do so, which comes back to uneconomic in monetary terms, so no business is choosing to do it..

Your precious economics theory clearly states that if something was ‘cheaper’ to do, then the businesses that flock to the cheaper method would put others out of business, yet no heavy industrial industry business anywhere is choosing to go off grid, based on solar, wind and batteries as the numbers do not add up!!

When we get to oil production reduction on an annual basis, because of depletion, all the input costs for oil extraction, gas extraction, coal extraction and transportation will rise, taking the cost base of all renewables and EVs up much higher as well, totally stifling growth in the world economy everywhere and our debt based monetary system will not be able to cope.

Overall energy production will fall, meaning less metals and minerals able to be mined, because of the relentless march of lower grades, reducing the ability to produce as much of anything, leading to constant recession/depression throughout the world economy.

It’s staggering to many of us how the person running the only/last peak oil web page doesn’t understand how important oil is to the world’s existing civilization….

“What people want is transportation and oil isn’t really necessary any longer. ”

DC – A few more points to consider:

– What people also want are roads to drive on, which requires asphalt, an oil product, as well as rebuilding all those crumbling bridges and such, mainly with diesel powered construction equipment, and petroleum derived materials.

– People also want all the components in an EV, like plastics, wire insulation, and synthetic fibers & fabrics, all of which come from oil.

– Oh, and people want to fly, which requires jet fuel.

– And I suppose they also want stuff shipped from overseas on big boats (bunker fuel) and then trucked to their homes (diesel) or put on trains (diesel).

– Finally, I have it on good authority that people will want to eat in the future, necessitating diesel tractors and potash and phosphate mining, not to mention distribution and storage.

Nate Hagens made the great point that even if gasoline demand dropped to zero, we’d still need 100% of the oil coming out of the ground because of the inelasticity of demand for all the other uses.

By the way, demand for EV cars and trucks is dropping presumably because they simply aren’t as economical as ICE vehicles…but I do tend to trust markets to sort these things out, so maybe I’m missing something.

Cheers.

CM

Chris,

The point that you and others are missing is that I am proposing that a reduction of oil use for road transport there will be more oil for other uses. For those that believe EVs are not cheaper or better. Many do not agree. Less and less fossil fuel per unit of GDP is being consumed since about 1972, I expect this trend will continue.

Chris-

“By the way, demand for EV cars and trucks is dropping presumably because they simply aren’t as economical as ICE vehicles”

tell that to the Chinese

“In 2024, electric vehicles (EVs) made up approximately 47.9% of the total passenger car sales in China, a huge increase from 2020, when plug-in EVs accounted for just 6.3% of total sales.”

US fumbled the ball on electrification innovation….a massive failure.

Chris,

Also note that there is quite a bit of bitumen in Canada and Venezuela which can be used for roads, also concrete can be used if necessary.

Hideaway,

Oil is important now, but will become less so over time. The chart below shows C plus C production (which in the long term is similar to consumption) from 1930 to 2024 using a logarithmic vertical axis so that the slope of the line indicates the rate of growth. Recently (2016 to 2024) oil output has grown very slowly and soon will start to decline. I agree with Chris Martenson that the market will allocate the declining resource relatively efficiently and believe we will find ways to adjust. The future remains unknown, we can only speculate how things will play out.

@Chris Martenson

I believe that I take your point and agree if I do. The current global population, existing consumption patterns and an increased share of the world moving to a western standard of living will continue to require a lot of oil. Agreed.

A few quibbles though.

Those crumbling bridges you reference are much more dependent on fossil fuels other than oil. Cement and steel are the two most energy intensive materials in most bridges. Think coal and gas, depending on a number of factors. Oil in the form of diesel is a relatively small share. More importantly, any such structure carrying a relatively modest traffic volume has a life cycle energy use that pales in comparison to the fuel used by the vehicles it carries. EV adoption at scale would change this.

Concrete is indeed an alternate wearing surface for roadways. Keep in mind also that much of the world continues to rely on dirt roads. Even in a ‘modern’ country like the US, and even in more densely populated area like the NE US.

Do you have a source for your suggestion that EV demand is dropping? That would be quite a surprise globally. Or did you mean that the rate of increase in adoption is slowing?

Also, the world is estimated to have had 1.5B people in 1900 being fed without diesel tractors. From a physics standpoint, arguably more efficiently.

The status quo will certainly change.

Hideaway —

Electric gizmos have played a major role in transportation in the developed world for some time now — more than a century.

Alimbiquated, my comment was about what all the ‘electric gizmos’ were built with, even those 100 years ago.. Answer is fossil fuels, if you think differently give some examples.

Also do you really think a modern directional drill on an off shore oil rig could work on the electric gizmos of 100 years ago??

You and others here do not seem to understand where and how all our complexity/technology/innovation has come from. It’s all due to the amazing growth of energy, net fossil fuel energy, allowing so much time spent by the large and growing population and market size to be away from food, material and fuel gathering.

Complexity, technology, innovation is not a one way street, it’s only been growing in a world of increasing energy and material use, enabling markets to flourish for every new ‘electric gizmo’, that enhances life for oil, gas, coal, food, material gatherers as well as gamers, financial geeks, insurance actuaries, home use and a thousand other non productive uses.

Take away any aspect of the the growth of complexity and the lot can unwind very quickly as we require the complexity to gain access to all the lower grade, more remote energy and materials gathering.

Take away the use of computer gamers, porn and online gambling from the overall market for computer chips, and will the makers of these chips survive? What about if financial markets and insurance companies collapse as well? What current computer chip business chip maker would survive if the only demand was for computers used in geology and drill rigs??

All we’ve known in modern economic times of the last 200 years is exponential growth of energy use, population and material use, along with huge growth in complexity, technology and innovation. At what point does it occur to you they are all irrevocably connected, you can’t have any in isolation as it’s all interdependent??

The thought or assumption that complexity, technology and innovation which all suffer from diminishing returns, can grow when energy use, population materials availability start to fall, is just human hubris at best.

Loadsofoil,

India imports about 87% of the oil they use. Over the next 20 years or so as oil imports vanish from the global market. India will have to find a way to make do with 87% less oil.

China is very much in the same boat as they import 74% of the oil they use.

They will be fighting each other over available oil imports until those imports reach zero.

China is in worse shape. They will run out of coal roughly about the same time oil imports disappear.

The idea that transitioning to EV’s in China will cause a huge amount of oil to be left in the ground is false. Oil will become cheaper and sent elsewhere that doesn’t have the capability of transitioning to EV’s and the oil will still get produced and used. Right up until oil exports go to zero that is.

If the oil is there it will be used by someone. All EV’s do is free up oil to be used elsewhere until oil is depleted to the point imports aren’t available at any price.

Nobody is escaping the realities of oil depletion just because they transitioned to EV’s.

HHH,

What would prevent a nation from transitioning to EVs? BYD makes an EV for $14K that has a range of 240 miles, I imagine these cars will sell well in nations that import them. There are many other more expensive options between 14K and 30K available in the Chinese Market with some small city cars (with less range and no cargo space) for as little as 5k.

Pretty sure most nations have electricity and roads so not sure what you are talking about.

I agree oil will continue to deplete, but as less is consumed depletion is slower.

Dennis,

China, without subsidized cheap coal and no oil imports. The amount of cars they build goes to zero. Literally!

Even if China could replace their coal production with coal imports which they can’t. They wouldn’t be able to subsidize the cost of coal. They will have to pay whatever the market going rate is.

Is coal going to be cheap? Are places like Indonesia and Australia going to be able to get not just the same amount of coal out of the ground that they are currently producing but perhaps double or triple the amount produced? And are they going to be able to do it without diesel? And at what price? Will China even be able to pay for imports?

Go beyond cars. Does China have any industry without coal?

China isn’t going to be mass producing cheap EV’s so the rest of the world can transition to EV’s 20 years from now. No they will be doing good to just replace their current EV’s with new ones.

Without oil, without diesel, yeah you can still get coal out of the ground. But you have to use the energy in place. So you accelerate the depletion of coal.

Nobody is going to be spared the realities of oil depletion by implementing a transition to EV’s.

Imagine all these countries that you referred to as having roads and electricity. Not being able to get cars made in China cheaply. All the investments in upgrading infrastructure to accommodate the EV’s will become worthless assets that can’t repay the debt it took to build them in the first place.

“Nobody is escaping the realities of oil depletion just because they transitioned to EV’s.”

Of course not, but they (China) will still be able to drive around when oil production subsides.

At dramatically lower cost/mile than those still relying on the old system.

Hickory,

What does it matter when there are no jobs to go to? Do you need transportation? Where exactly are people going to be going?

The amount of cars of all types on the roads will drop dramatically over next 20-30 years.

Cost per mile doesn’t matter much. If you aren’t employed you won’t be going anywhere.

Employment in China depends on oil and coal coming out of the ground. Yes even those employed in the solar and EV’s industry heavily depend on oil and coal coming out of the ground to keep them employed.

HHH,

There are a lot of coal resources and natural gas resources and as nuclear, hydro. solar, wind, and geothermal energy expand those fossil resources that are used for energy can be replaced and as that occurs the resources deplete more slowly. Things change over time, film gets replaced with digital technology, copper land lines used for voice an data communication get replaced with cellphone technology and fiber optic cable, kerosene lamps get replaced with incandescent light bulbs which get replaced by cfl which get replaced by LED. Horses get replaced with ICEVs to be replaced with EVs.

Dennis,

The thing about it is solar, wind, hydro and nuclear aren’t replacing oil, gas and, coal. They are just being added onto oil, gas, and coal.

No signs of a slowdown in usage of FF. FF decline will be geological not by choice. The whole rush to renewables is base on geological limitations of FF. It’s governments saying oh shit we better try something else.

So far no replacement to FF. All the replacements require lots of FF to build and maintain them.

HHH,

So far fossil fuel use has continued to increase, but growth is slowing. For the past 10 years fossil fuel energy consumption has increased by 0.85% per year. Non-fossil fuel energy consumption has increased by 4.2% per year over the past 10 years. When fossil fuels decline they may become expensive and there will be more economic incentive to use alternative sources of energy.

Yes fossil fuel will continue to be needed during the transition, but they will gradually be replaced.

This is just more futurist cope peddled by Silicon Valley hype machine.

https://www.bbc.com/news/articles/cly41yx9w88o

It’s up there with OpenAI making the machine god that with a single thought, solves overshoot and climate change and allows us to continue living as we are.

The linked article says Pakistan may have the fourth largest fossil fuel reserves in the world. Namibia has lots of gassy oil. Production will grow somewhere, but will it suffice for 8 billion people?

https://oilprice.com/Energy/Energy-General/Why-No-Major-Oil-Company-Is-Rushing-To-Drill-Pakistans-Huge-Oil-Reserves.html

DClonghorn,

Probably depends on price, at this point they don’t know much. These small discoveries could help slow decline, but this discovery is years away from development. Demand may be the issue as electrification of the World Vehicle fleet gains momentum. It may be like land lines for communication compared to cell service. The Third World mostly skipped land lines for communication, the same may be true for EVs, they might skip the ICEVs and move directly to EVs. Time will tell.

South Asia makes heavy use of two and three wheelers, which are good for getting around in crowded cities.

The market for small electric vehicles is booming. It is naive to project one’s own experience growing up in the 60s in suburbia on the current situation in the giant cities now forming in the tropics.

Alimbiquated,

In a few years only the very wealthy will drive ICEVs because EVs will be so much cheaper, somewhat like horses for transport today.

This story has been around since at least last summer. As far as I can tell, no wells have been drilled. Maybe, they have seismic data that indicates a big structure? Not sure. Until some wells get drilled, it’s just a prospect.

This is similar to a story from a year or more ago about a big discovery that Russia supposedly made in the British owned waters of the Antarctic. Again, no wells, but maybe seismic data indicating a big structure?

Bob,

Thanks for injecting your extensive knowledge of geological exploration into the mix, very helpful.

Pakistan is not saving the world when they run out of water and/or get nuked by India.

No power no metal

“The Aluminum Association estimates that a new U.S. smelter would need a minimum 20-year power contract at a price of not more than $40 per MWh to be viable at current aluminium prices.”

https://www.reuters.com/markets/commodities/us-aluminium-smelters-vie-with-big-tech-scarce-power-andy-home-2025-05-22/

Current US price per MWh is $75.00-115.00 so which is it energy prices get cut in half or aluminum doubles in price? If solar and wind is so much cheaper why aren’t they using it? Why aren’t they building out where it can be used to offset their electricity costs?

When will a few of you comprehend that BYD and all the other EVs are actually coal and oil based. How about this simple challenge build only the motors and batteries without fossil fuel based insulation.

JT

Oklahoma inks deal with UAE company to build $4B aluminum smelting facility

Did you see this announcement? I wonder if it is just an announcement that will be reviewed and will vanish about 6 months before T’s time is finished. Does Oklahoma have excess and inexpensive power generation available?

“Oklahoma state officials announced a deal Friday with a private company in the United Arab Emirates for the construction of a $4 billion aluminum manufacturing facility in northeast Oklahoma.

Gov. Kevin Stitt and Oklahoma Department of Commerce officials say the deal with Emirates Global Aluminum would result in the first new aluminum smelting facility to be built in the U.S. in 45 years.”

https://apnews.com/article/aluminum-smelter-oklahoma-united-arab-emirates-ab8c6c382691245a5098d3ea8fb88586

OVI

Read the article I sent they can’t get the power at the price they need. That’s the whole point. Just paper with ink on it. Even with Federal loans it doesn’t pencil out.

Read it not the headlines

At the end of the piece that JT linked they talk about much of US Aluminum in cans and bottles not being recycled.

The country has an astonishingly low beverage can recycling rate of just 43% and throws away the equivalent of 800,000 tons of aluminium every year.

Implementing deposits on aluminum cans and bottles would help.

Maine and Michigan recycle about 85% of aluminum (both have deposit laws on bottles and cans, Nevada, Utah, Idaho, and Arizona only recycle 16 to 18% of their aluminum.

Right, when aluminum is being wasted at this level it seems unlikely that increasing the price is a problem.

Aluminum is cheap. It looks expensive compared to steel, but steel is dirt cheap. Both are wasted on a vast scale. The sky won’t fall if the price of a commodity that is wasted on a grand scale goes up.

People often confuse two different ideas about what expensive really means. One is if a commodity is more expensive than a competing commodity. The other is whether raising the cost would really create a problem, or just shift behaviors.

Lots of coverage on social media for this small find 6 billion barrels shale oil

https://www.turkishminute.com/2025/05/21/us-company-estimates-6-1-billion-barrel-shale-oil-reserve-in-turkey-minister/?r=4

North Dakota was up 27,733 Kbpd in March. The 12 month moving average is still down however.

Click on graph to enlarge.

Perhaps this has been posted, but our old friend RR (R-squared) is talking PO again:

https://oilprice.com/Energy/Energy-General/The-Return-of-Peak-Oil.html

HHH and Hideaway

Dennis has a certain economic viewpoint which you will never shift him from. He is of the view that history shows, that there has always been new alternatives and new technologies to carry us forward.

What he misses is the devastating effect that peak coal has had on countries that have experienced it.

https://www.researchgate.net/figure/British-coal-production-from-1815-to-2009-The-maximum-production-was-reached-in-1913_fig1_277983025

Britain became the greatest industrial power during the 19th century, building an incredible 60% of the global shipping fleet. It was not because they had the only engineers,Britain had vast amounts of cheap coal.

https://ourworldindata.org/grapher/coal-production-by-country?country=GBR~ITA~FRA~DEU

As coal started to deplete it could no longer compete with other countries such as America, Germany.

Italy with great engineers and architects had limited coal so their industry output was smaller.

China has become the industrial powerhouse simply because of the massive amounts of coal it has.

https://ourworldindata.org/grapher/coal-production-by-country?country=GBR~CHN

There has not been as Dennis thinks some fantastic technologies that have evolved over time. We still dig out dirty coal from deep underground and burn it just like we did a hundred years ago.

British steel towns, ship building cities and coal towns were once thriving are now grim and propped up by billions of pounds of ever increasing debt.

Germany is buckling under the cost of electricity prices, factories shutting down or laying off people.

China is having to mine deeper and thinner coal seams with costs and dangers increasing. Once China peaks which will be soon, it will suffer the same fate as Britain. Very Cheap coal, which can be stored for free, being replaced by wind and solar. The storage costs of electricity is the most expensive source of energy.

China will start to lose its industrial advantage and just like in Britain, factories will close and things will get very bad.

China also has another serious resource issue. Water. It uses vast amounts of free water which in many areas is running out.

People really don’t understand how expensive it is to replace free water with desalination etc.

We entirely depend on rain and free soil and cheap coal and oil.

Loadsofoil,

Generally humans have learned to produce more goods with less fossil fuel energy input over time. I suppose this could change in the future, we will see.

It is true that we still use oil, coal, and natural gas, but we use it more efficiently and as price increases we use alternative sources of energy (nuclear, hydro, wind, and solar).

How this dynamic plays out in the future is unknown. There are many historical examples of a dominant good (horse for transportation, film for photography, copper land lines for communication) being replaced by an alternative. Suggesting this is not possible in the future seems a stretch to me.

Oh Dennis

You really have constructed in your head a fantasy that no facts will impinge upon.

Once Great Britain coal production started to decline, the result was not fantastic efficiency and wonderful new jobs. These industries crumbled. The mines shut, the shops shut and became derelict.

High energy prices has destroyed most of the heavy industries.

You are a broken record with your stilly GDP graph. GDP tells us nothing of what is made and who buys it.

https://davidmrobinson.co.uk/product-category/watches/patek-philippe/all-patek-philippe-collections/

It takes a fraction of the energy to make a watch as opposed to 1,000 washing machines. Yet while millions can’t afford a washing machine, sales of luxury watches has never been higher. I have said this to you before, but it is like throwing pearls.

All you know is GDP and you say it’s the best indicator of wealth. I say now you lie. There are far better indicators, but economists who whisper in the ears of politicians don’t want to use them.

If they used Gina or energy consumption by decile, or food security data.

https://www.ers.usda.gov/topics/food-nutrition-assistance/food-security-in-the-us/key-statistics-graphics

Your forever quoted GDP goes up and up yet 45 millions struggle with high energy costs rents and can afford to eat properly.

You make a mistake when you think everyone is as crass as politicians.

Look in the mirror long and hard.

LOADSOF….. Please just adress DC’s comments without attacking him personally.

And to your statement “You make a mistake when you think everyone is as crass as politicians” I would argue politicians pander to their constituency.

Cheers, Phil S

Dennis,

Couple of points on the “humans have learned to produce more goods with less fossil fuel energy input”.

First, the phrasing is a bit misleading. Maybe “humans have learned to produce more goods with not as much more fossil fuel energy input” ?? Fact is, consumption of all fossil fuels, incl. coal is at an all time high.

Second, you talk about “goods” but show a chart of GDP. Share of services in world GDP has been expanding, relative to goods. Services are not as energy-demanding…

Yes GDP includes goods and services, I agree. I thought the chart made it clear, yes real GDP in 2015 US$ per exajoule of fossil fuel consumed is larger is how it should have been phrased, sorry about not being clear.

Kdimitrov,

I guess the point is that real GDP increased from 14.3 T 2015$ in 1965 to 93.3 T 2015$ in 2023, an increase by a factor of 6.5. For fossil fuel consumption in 1965 it was 146 EJ and in 2023 it was 505 EJ, and increase by a factor of 3.5. I agree fossil fuel consumption was at an all time high in 2023, as was World real GDP, the main point is that real GDP grew more quickly than fossil fuel use (1.86 times faster).

I just have to say, having “GDP” in “USD” in comparison to exajoules used leaves two undefined items in the formula. The important thing is what you use it for, and what you get from it.

Laplander,

I agree those choices are made by the people on the planet over which I have no control.

I know the choices I would make, ones that minimize environmental damage and maximize personal freedom while minimizing behavior that impedes the personal freedom of others. This is best accomplished in my view by maximizing recycling, minimizing fossil fuel use, redistributing wealth through progressive taxation and establishing a national healthcare system in places such as the US and many less developed nations, and universal free education for all people.

In short policy matters and who we choose to wield power in democratic nations makes a difference.

Dennis,

GDP, as you know, is an imperfect measure. At a minimum, and quite logically, we should adjust it by subtracting debt from the “growth” in GDP. Many economists understand and call for this adjustment to be made which, again, is logical.

The US alone has over $100 trillion in just debt. Unfunded liabilities are another ~$150 trillion. Assuming these must be honored/paid back, then the future economy is going to have to spin off $250 trillion just be square with current IOUs. Sadly, each year those just get trillions larger, and the Big Beautiful Bill is pouring more fuel on that fire. Assuming the future will be exponentially larger than the present, while amassing debts at 2x the rate of GDP growth (before factoring out the illegitimate debt contribution) is a gigantic math predicament without a graceful solution.

Chris,

Generally GDP is considered production of goods and services. Debt is fine as long as it can be serviced.

I agree GDP is an imperfect measure. Income inequality is a big problem that could be addressed with better tax policy.

Dennis

“The point that you and others are missing is that I am proposing that a reduction of oil use for road transport there will be more oil for other uses. For those that believe EVs are not cheaper or better. Many do not agree. Less and less fossil fuel per unit of GDP is being consumed since about 1972, I expect this trend will continue.“

First of all Dennis 40-60% of a barrel of oil is gasoline that’s about half the marketable value. What do you suggest? Double the price of the other products and just burn it? How about this run through a combined cycle gas turbine and make electricity out of it to power all those dreamy EVs. Or maybe the most efficient use is to power transportation since the infrastructure is already built and the debt hasn’t been paid.

Secondly what you observed in 1972 was the effect of peak oil lower 48. The financial system didn’t decouple it had to grow and 2-3% or it collapses. So debt was increasing cost were increasing inflation was increasing and oil was stuck. Don’t mistake the symptom for the cause. That’s why we have a mountain of debt now the real economy has already collapsed.

JT,

We have debt because people and businesses gained access to credit and chose to take out loans. It was not Oil peaking in the US as much as OPEC asserting its market power and a supply disruption due to Iranian Revolution and Iran/ Iraq war leading to a supply shock from 1979 to 1982. Then we had GFC due to poor banking regulation, Covid pandemic, and now Trump trying to reorder the Global economy and no Republicans in the US with a spine to stand up to a would be authoritarian. I don’t buy the oil is everything thesis, the World is a bit more complicated than that.

There will still be uses for oil, refineries will be reconfigured to produce less gasoline as demand decreases or oil will be extracted a a lower rate if that proves too expensive. There is nothing inevitable about using oil, if there is demand it will be produced at an appropriate level to meet that demand, prices will adjust to ensure this is the case. It is the way a free market system operates.

Dennis

Your views are rather selfish, as long as debt is serviced, your comfortable existence can continue. So if the government must continue to load up with crippling debt so you can continue driving on debt repaired roads and have police all paid for with debt.

All is well.

https://www.crfb.org/blogs/interest-costs-could-explode-high-rates-and-more-debt#:~:text=We%20estimate%3A,to%20%242.2%20trillion%20in%202034.

Fact is, it is not the likes of you that pays the cost. The near trillion of interest comes from tax. Tax should go to pay for decent schools, fire services and police. Because of these massive debt cost. Schools are cutting teachers, buildings are left to rot and police cuts mean 90 of robberies are not investigated.

You are typical of the elite who live in the best areas, go to private hospitals and private schools. The only time you see deprivation is on the TV when of course you turn over to watch something that doesn’t clash with your self created view of the world.

Your type of economic theory is evil. You put money at the front of everything. So humans suffer so terribly. My type of economics puts human being first. There may be a little less money. But it would be far better distributed.

Your type of economics of driving down costs has created an elite who move their factories to slave wage countries. The top 1% own half the wealth of the world while the bottom half own 0.75%. Half the world are slaves who if they dare complain see their factories shut down.

Loadsofoil,

There is no national Healthcare System in the US, only veterans Healthcare system is public Healthcare in US.

I only attended public schools in the US.

Personally I favor a highly progressive tax system such as that which was in place from 1944 to 1969 in the US, that would reduce government debt and wealth inequality in the US, higher estate taxes and changes in tax laws to eliminate tax shelters would also help. Any money moved to tax havens should be taxed at estate tax rates or higher, maybe 50%.

Loadsofoil,

Just a fact that if debt can be serviced it is not a big issue. I would prefer higher taxes and paying down debt, I think the tax cuts passed by various Republican administrations starting with Ronald Reagan were stupid at the time and have led to widening wealth disparity in the US. Republicans cut taxes without cutting spending and Democrats raise spending without raising taxes in the US, it is not a good mix.

I looked quickly at estate taxes in the US and the highest rate above the exemption is 40%, this should be the minimum rate charged to any US money that is transferred from the US to foreign tax havens like Switzerland or the Cayman Islands. Various trusts and such that were devised to shelter the wealthy from estate taxes should also be eliminated.

No special treatment of dividends or capital gains should exist in the tax code all income, wages, interest, dividends, capital gains, and any other category should all be taxed in exactly the same way. The rates should be highly progressive with the top rate at 50% for annual income above 1 million (for joint tax returns in the US) in 2025$ and adjusted for future inflation. Also the current 37% tax bracket (income over 750k) should be changed to 40%.

US Tax brackets for head of household (equivalent to Married filing jointly at that time) in 1952 adjusted to 2025$

22.00% $0.00

23.00% $23,640.00

27.00% $47,280.00

29.00% $70,920.00

34.00% $94,560.00

35.00% $118,200.00

41.00% $141,840.00

44.00% $165,480.00

47.00% $189,120.00

48.00% $212,760.00

52.00% $236,400.00

54.00% $260,040.00

57.00% $283,680.00

60.00% $330,960.00

63.00% $378,240.00

66.00% $449,160.00

71.00% $520,080.00

72.00% $591,000.00

73.00% $709,200.00

77.00% $827,400.00

79.00% $945,600.00

81.00% $1,063,800.00

85.00% $1,182,000.00

88.00% $1,773,000.00

91.00% $2,364,000.00

92.00% $3,546,000.00

In 1953 median family annual income was $4242. So most (likely 80% or more) people’s income tax rate was about 22%. Also for a family of 5 there would be a $3000 tax exemption so only $1242 of income for a family of 5 with median income would be subject to tax. So $273 in tax on 4242 income or a 6.4% net tax rate.

Dennis

I have seen many people here and elsewhere complain about shortcomings in the GDP metric.

I am not economist, but the criticisms that make the most sense to me are those related to the utility/benefit of the various components. The personal services cost for my doctor should count, the salary of MLB athletes not so much. The plastic parts in a medical device yes, the plastic parts in a disposable dime store toy less so.

So why haven’t the worlds economists come up with a better alternative?

T Hill,

If somebody is willing to pay for something, it has utility for that consumer. Who decides the utility of a good? The person who chooses to purchase the item. Not clear how a determination of what is “real” utility and what is not, utility is in the eye of the purchaser as it were. That’s the mainstream economic theory of the present era.

No it is not perfect. One shortcoming is what is included in GDP. If a parent stays home and cares for children and takes care of the house it is not a part of GDP. If a parent works and uses daycare and hires a cleaning service to clean the house and do laundry then some of the same service work is then considered a part of GDP. Similarly for an aging parent placed in a care facility vs being cared for by their spouse or children. Another issue is income disparity where much of income growth is concentrated in the highest decile or quintile, this is not addressed by looking at GDP alone.

A couple of links which explore some of this

https://www.economicshelp.org/blog/167255/economics/alternatives-to-gdp/

https://ethical.net/politics/gdp-alternatives-7-ways-to-measure-countries-wealth/

https://journals.sagepub.com/doi/full/10.1177/002795011924900110

Thanks Dennis. Your response includes some good thoughts about what might or might not be included in an alternative metric. I am familiar with all of the alternatives that you cited.

I get the sense that a number of people that frequent sites like this are interested in some type of metric that has a focus on energy and physical goods that are truly critical to life. Say energy, food, timber and various minerals, ores and elements to start with.

T Hill,

Yes that is probably what people are looking for. My question, what goods should be included, the goods that are important change over time and the relative importance varies from person to person. So most economists would say this is not a problem that is worth solving as we could have a different yard stick for every person that exists.

Simpler to just use the market values and adjust for inflation over time which sums up what people are willing to pay for.

By no means a perfect measure, but like democracy, just the best we have, including inequality is the mix is useful, but how to weight this is problematic. Income inequality is important to address in my view, but I do not rule the World, thankfully.

Chris, and others. Have you read Bernard Connolly’s 2023 book with the title “You always hurt the one you love”, (subtitle “Central banks are murder of capitalism”). What he points out is now reflected in signs from Japan and Trump’s attempt to reset world trade. for both are signals that the end to the road to increasing indebtedness is approaching.

‘Connolly does not take prisoners… a book to be read by anyone interested in political economy today’ Merwyn King’s statement on front cover.

Depleting resources have been a concern as long as anyone can remember.

Thomas R. Malthaus (1766-1834) was foremost concerned that population growth could not be supported by food production growth in the long run. In some ways the statement is right, it is just that a lot more energy could be exploited for an extended time period than he ever imagined. People living from 1850 and onwards did not experience these problems in general. Quite the opposite.

A part of the solution to “living with the problem” (overshoot), is to embrace technological solutions that are more efficient. Some of these are dependent on scale and some are not that much. Since we are talking about energy loosely defined it should be pointed out that useable energy at “end point” is what matters. If you need heat, what is the most efficient way to get there? If you need colder temperatures, effective work or stored energy; what is the most efficient way to get there? There is a wealth of creativity out there as a consequence of the capitalistic system we have as of now. We have yet to tap fully into that. To choose the most energy efficient washing machine and reduce the size of it somewhat could potentially reduce energy consumption 50%+ for that appliance. And it should be “black” maybe (reference to that every T-Ford should be black back in 1910-20s). The supply side of fossil fuels is so wast even if it is now explored extensively a lot of places based on today’s understanding. Demand side efficiencies based on technology are not tapped into fully either. That is the basis of the conservative long term scenarios. Wars, financial crises, social unstabilities along with climate issues are likely to be more prevalent in our lifespan than the long term trajectory of energy supply and demand. Well, maybe climate issues are more long term as well; not my area of expertise. Overall – overshoot is the most important issue the way I see it.

I’m having a good chuckle at this being that I have history in being raised in one of those coal dominant towns that ate shit during the later 20th century.

Sorry, I mean, became way more efficient and prosperous with no real impact on standard of living.

Loadsofoil–

We entirely depend on rain and free soil

I strongly agree. That’s why it was such a terrible mistake to wipe out the beavers in North America. People mourn the loss of the bison, but the beavers were what kept the rainwater in the soil.

Wiping out the beavers turned much of the Southwest into a desert, and is probably the origin of the old Appalachian saying “The good Lord willin’ and the crick don’t rise”.

The crick wouldn’t rise, dumbass, if you hadn’t killed the beavers to make funny hats. It has nothing to do with any imagined gods.

Loadsofoil

To your point what Dennis doesn’t understand is technology doesn’t help it makes the cycle faster. Britain got a 200 year bump US 100 China 50 .

AI will solve this…

Great discussion, y’all!

My 2 cents.

Why are oil prices relatively low?

Shale Oil Revolution was the last super-cycle, and that has been looking tired now for the last couple of years, with nothing big coming down the pike. The theory is that when non-OPEC oil becomes scarce, prices should go up sharply until they reach the price level desired by the Saudis. This is not happening. Why?

Here are my drivers, ranked by importance.

1. COVID. There was an unprecedented demand crisis that took away billions of barrels (total) of demand, which are not coming back. There is no make-up demand. You don’t drive twice to work just because you didnt drive during the pandemic. The world had invested in oil production and the oil was not consumed. Thus, the pandemic extended the supercycle by a few years at least.

2. China property crash. For two decades China was the main driver of world oil demand growth, and that ended abruptly when the property bubble busted. CCP has been trying to pivot the economy more towards factory manufacturing, but that is an electricity story, not an oil story. Construction is where the oil gets burned, mostly as diesel: trucks, cranes, excavators, etc…

3. Oil intensity. I don’t rank this as a major factor, but we will see what happens. Oil intensity is always going down, but in a gradual manner, and has been historically offset by expanding demand activity. Over the past decades we have seen multiple gradual changes: rising CAFE standards, abandoning oil as heating fuel and in the electricity sector, ethanol, biodiesel, CNG/LPG vehicles, electrification of heavy diesel equipment (e.g. the shale oil frac fleet went from 100% diesel to only ~25% diesel now), rising refinery complexity (i.e. more fuel produced from a barrel). The latest thing is EV, we’ll see if that has a major step-wise impact, but there is no evidence for it so far. COVID and the China property crash are disruptive events; oil intensity is not disruptive, so I rank it lower.

Another thing I want to mention. Even if oil prices start going up, I doubt we’ll see the same steep slope as in 1998-2008. Oil is a lot more elastic now, for two reasons:

1. Incremental growth comes from emerging markets and demand there is very price-sensitive. This is very different from the past where the demand driver was OECD. in USA and EU people just fill-up the car, regardless of the price. Not the case in India and Vietnam.

2. There is a lot more short-cycle CAPEX that can be deployed now, relative to prior eras. This includes shale, but not only. The vast number of producing fields can be stimulated when prices go up and add meaningful supply. In-fill well, tertiary floods, artificial lift, etc… There is a lot of producing fields that can be squeezed if the price is right, to buffer the price assent.

Kdimitrov,

Nice analysis. I think expanding wind, solar, nuclear, hydro, geothermal, EVs and batteries will also reduce the price elasticity of fossil fuel along with your number 1 and 2 above.

KDIMITROV: “Shale Oil Revolution was the last super-cycle, and that has been looking tired now for the last couple of years, with nothing big coming down the pike. The theory is that when non-OPEC oil becomes scarce, prices should go up sharply until they reach the price level desired by the Saudis. This is not happening. Why?”

Non-OPEC oil hasn’t become scarce, and probably won’t for a couple of years. Despite low prices, very few rigs have been laid down in the shale basins, so while a plateau in American shale production may seem like a big deal, it’s not, at least to an over-supplied global market.

Exxon, Conoco, Chevron and Occidental aren’t going to cut back much on drilling the Permian. They will stay active, drill right on through pretty much whatever the market throws at them, and wait for smaller operators to get into a financial jam, then buy them. Especially Exxon.

Once the world oil supply becomes tight enough to incite fear and high prices we will finally get the last super cycle. It will be marked by frenzy in previously overlooked places (Mowry shale in Wyoming, Duvernay in Alberta, Uinta in Utah, Eaglebine in Texas), as well as refracking every “monster” well in the over-drilled shale.

And that’s just shale; there are still places to put conventional wells for modest production. It wouldn’t be such a bad scene for small vertical wells to pepper the landscape again–once the demon shale has played out. The point is, scarcity is the mother of invention, and when the world sees a scarcity of oil there will be a super cycle of hunting and pecking. At high enough prices, a 50 barrel-per-day well with a 20-year-life-expectancy will once again be thought of as a home run.

Thanks Gerry,

I tend to agree in part, but I expect the best we will do is to flatten the downslope a bit if oil prices rise and expect high prices would accelerate the transition to electric transport so that low demand might become a problem for oil producers in high cost plays.

Gerry,

This sounds like a very underwhelming supercycle, at least compared to the previous two: North Sea/Alaska and Shale…

KD, you may well be right, but in my mind’s eye I try to picture what the scene is going to be when there is truly a global oil scarcity. I think every little rig will be working. In the early eighties, for example, there were over 4,000 rigs working in the U.S. Today, there are fewer than 600, almost all in the shale basins.

The massive Iraqi field (name escapes me) has been more or less isolated since the toppling of Saddam Hussein and the mess over there. Some people think that field can double (it’s at about 4 mbopd now). Kazakhstan is still growing oil production, too. Much to Saudi’s chagrin.

The Dean and Woodford shale hasn’t been drilled very much. Neither has the Duverney or even the Montney, compared to the name-brand Permian shales. The Mowry shale underlies much of the Powder River Basin, extending into Colorado (which probably will shut out new production) and also into Utah. The Mancos shale in New Mexico is oil rich. So is the Mississippi lime in northwestern Oklahoma, near the Cherokee Outlet.

I’m not trying to argue the point, nor be a pollyanna, nor even to make a scarcity seem insignificant, but there are just a lot of shales and oil sandstones that were more or less neglected due to the lure of the Permian. I’m also not trying to say that the Bakken isn’t in decline, but there are a lot of drill sites in the Bakken that were totally ignored due to the Permian. And why not? The shale benches are thicker, and there are more of them, and even more importantly, the state understands oil and gas and is willing to do whatever is necessary to develop the resource and the infrastructure to carry it. As the Permian goes into further decline, though, which it will most certainly do, then many of these neglected spots are going to look better.

I believe that, in composite, there are enough of them to carry us over the hump. There’s a lot of oil on this old planet that we haven’t tapped, because it’s not as economical or as easy to get at. And there’s NG everywhere anything died. We’ll be fine when the prices escape the heavy thumb that’s currently on the scales.

Gerry,

Based on the analysis at oilystuff.com, Permian Basin needs around $90/b to be profitable for full cycle costs, my guess is that the number would be higher in other basins. What oil price do you have in mind for extensive development in these other less profitable tight oil plays? Are you thinking $300/b in 2025$? (A number suggested by Shallow Sand, which was probably tongue in cheek.)

DC: “What oil price do you have in mind for extensive development in these other less profitable tight oil plays?”

Anything over $110/bll, providing the price of NG is also good. Massive (insane) leasing bonuses were paid in the Permian, and with the large produced water cut and transport to Texas SWD’s (from New Mexico) this has become the most expensive oil around. Add to that the fact that in the interior of the Permian NG has been selling at the wellhead for 50 cents per Mcf (and makes up one-half the hydrocarbon flow from the well). These forces have colluded to demand a self-inflicted breakeven price of incredible proportions.

The major difference (in our lines of thinking) is that I don’t actually think one-hundred-dollar oil would be expensive, in this day and age, but instead perhaps the biggest bargain on the planet. Traditionally, an ounce of gold will buy 30 or more blls of oil (usually more). In fact, only about three times in history has that ratio been breached. Currently, an ounce of gold will buy 55 blls of oil, so either oil should be at $110 or more, or gold should be at $1800 or less.

The next big wave in the shale basins will be a) extensive development of more marginal shale, or b) refracking of old wells. I believe refracking will be a big deal. We will have a population density of over 100,000 spent shale wells. Most of the fractures were random, in very different target directions at the heel compared to the toe of the lateral. All shale is laminated and also interbedded to different extents with a variety of carbonates, so horizontal extrusions might not penetrate the shale as much as interrupt the stressed layers of shale. I suspect the next “innovation” will be to direct new fractures to virgin rock, vertically, from both inferior and superior orientation. Just as there was one hell of a learning curve with shale 101, there will also be one with 202.

I’m not trying to be argumentative or different; I just believe that oil prices are being kept artificially low by mild over-supply that is interpreted by traders who don’t know if laminated shale is two words or one. Think about how utterly ridiculous this has gotten: here we are on this blog looking at graphs and charts that warn of a GLOBAL oil scarcity perhaps as soon as five years from now, while over at the NYMEX they’re trading this stuff at levels less than you’d get for that much Starbucks coffee–only it took at least a million years for the cheap oil to be produced! This is nuts!

Not to get political but President Trump has made it worse, and wants it even worse than it currently is ($50 oil is what his lieutenants say). Well, in a diminishing resource, you can only put your thumb on the scale so long until somebody pries it off, and when that happens the market forces will raise it to an overshoot.

Dennis.

I just came up with $300 based upon previous super spikes. With $300 being a very short term top.

In very rough terms, oil went from $3 to $38 from 1971 to 1979, and went from $10 to $147 from 1998 to 2008.

Of course, nobody knows.

I personally would be fine if we just went back to the 2023-24 averages with the price going up in line with inflation.

But that hasn’t been, and never will be, how oil prices roll. 2023 and 2024 were very stable.

Shallow sand,

I was pretty sure you were throwing numbers out with 30 as a low and 300 as a high at a factor of 10 higher, and to be honest it sounds reasonable to me (for say daily or weekly highs and lows). For annual average WTI oil price my guess would be a low of $55 and maybe $150 for an annual average high maybe in 2027 or 2028 (nominal US$). I agree with Gerry that $110/b is not really a very high price, especially considering that the average WTI annual oil price from 2011 to 2013 was over $135/bo in 2025 US$.

Much will depend on future supply and demand about which we can only speculate.

KDimitrov,

While ‘nothing big coming down the pike’ may – or not – prove accurate in the oil capacity realm, there are other developments looming VERY large in the future.

Today, it is expected that a White House announcement will be made to expedite the introduction of Small Modular Reactors (SMRs) into commercial adoption.

There is a simply eye popping projection of ~400 GW capacity to be available from these units in the US in 25 years’ time.

That is the equivalent of four hundred massive 1,000 Megawatt power plants in the US alone.

While I have no idea if this will come to pass, the economics, operational parameters, and – certainly – overwhelming market demand makes for a very compelling argument that small scale, modular nuclear plants are on the cusp of having a paradigm-shattering impact.