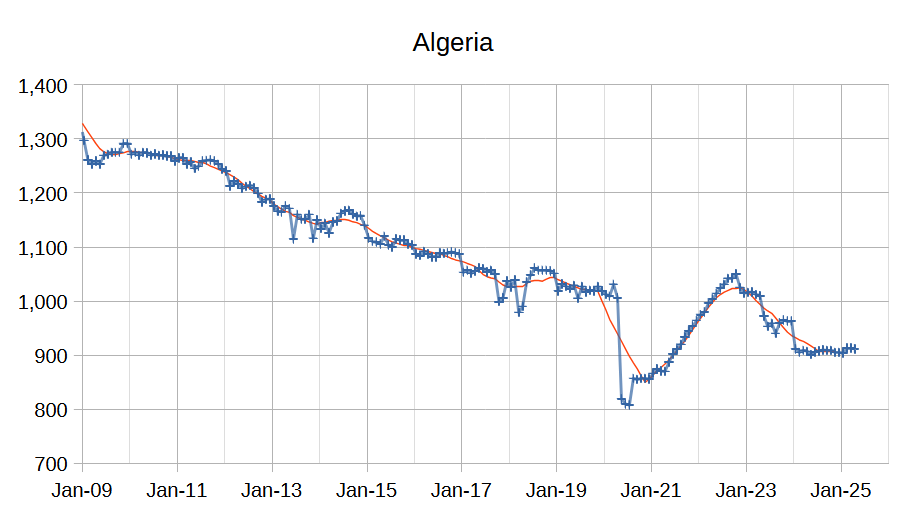

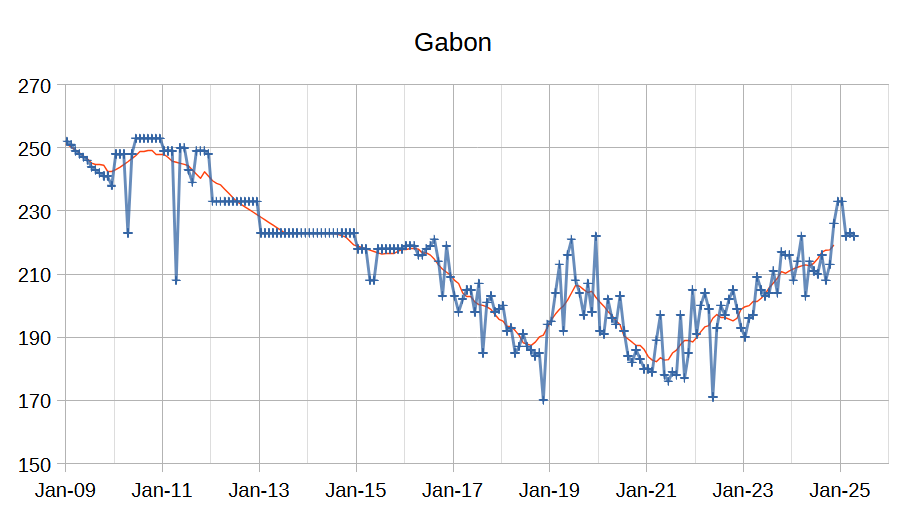

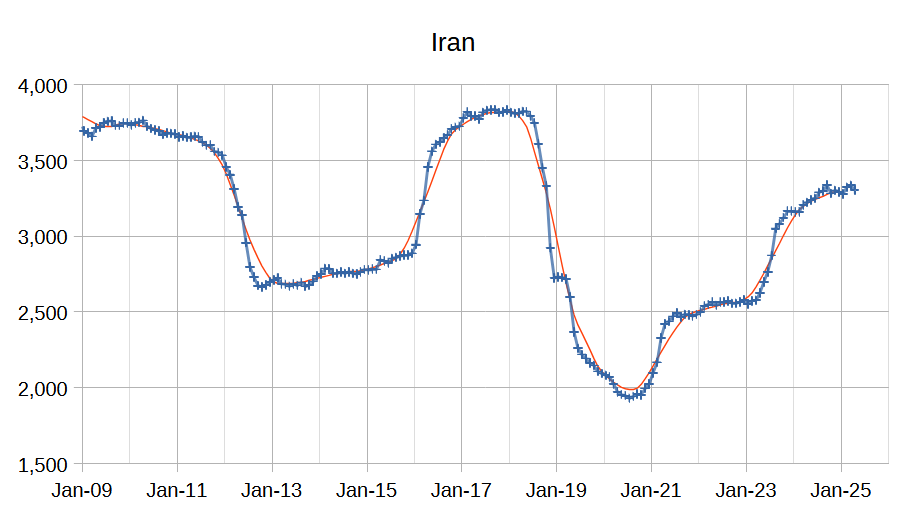

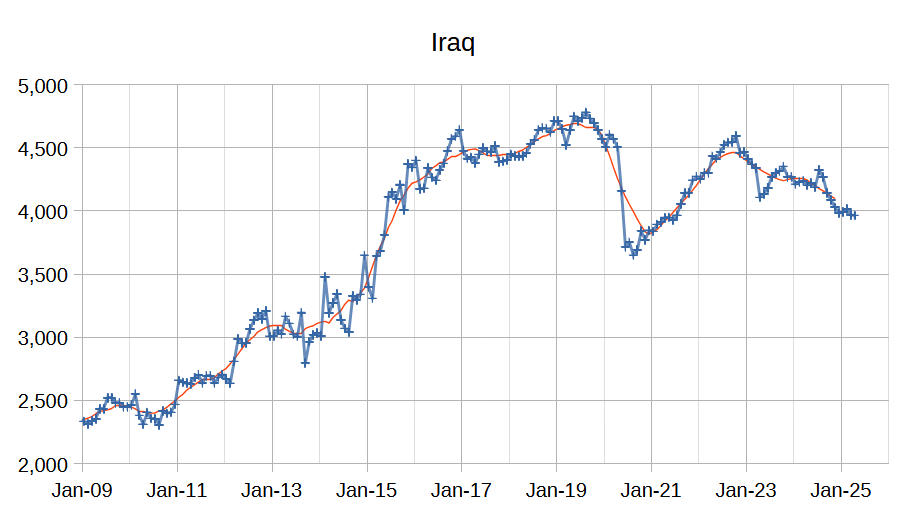

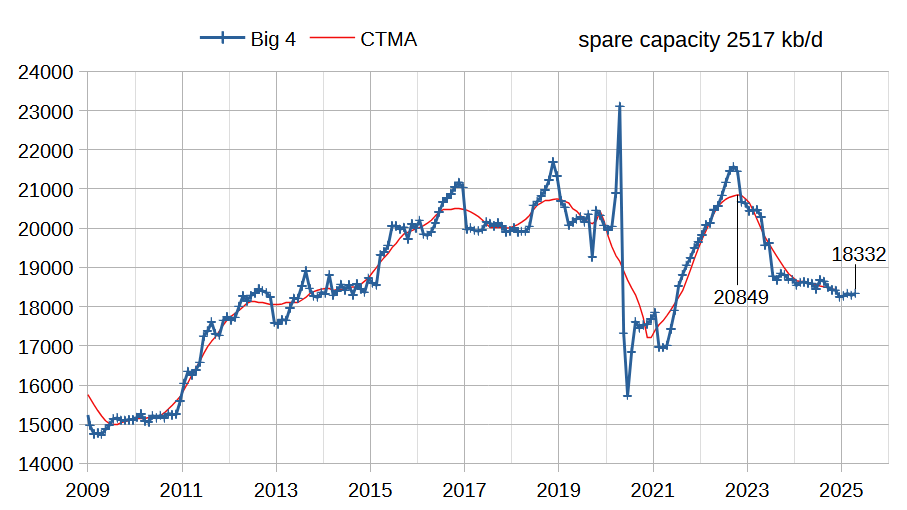

The OPEC Monthly Oil Market Report (MOMR) for May 2025 was published recently. The last month reported in most of the OPEC charts that follow is April 2025 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In the OPEC charts below the blue line with markers is monthly output and the thin red line is the centered twelve month average (CTMA) output.

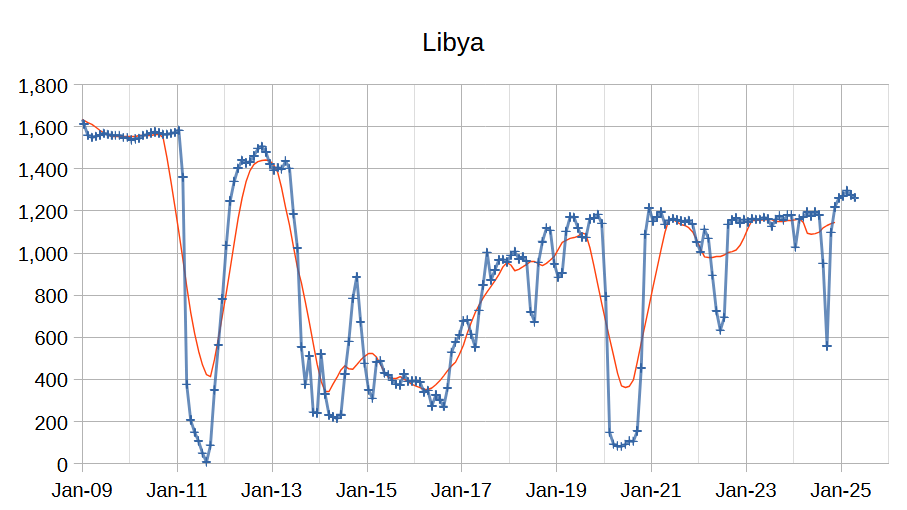

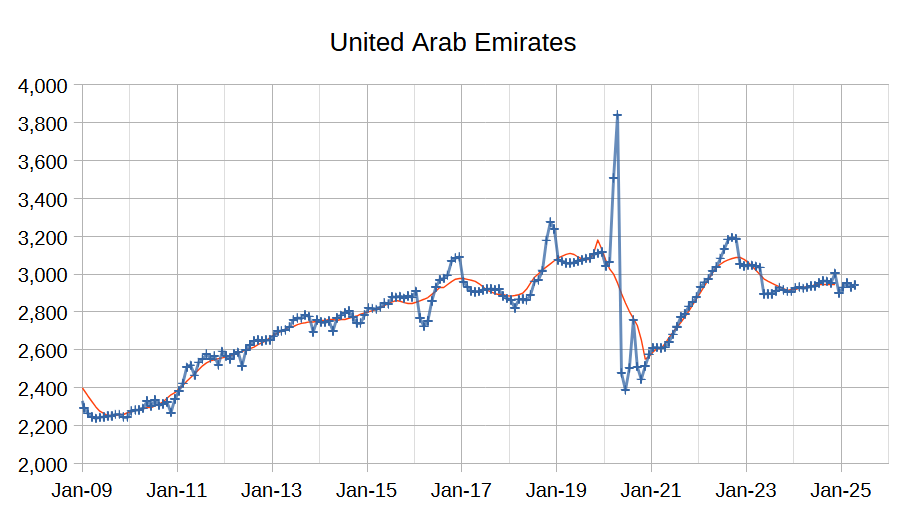

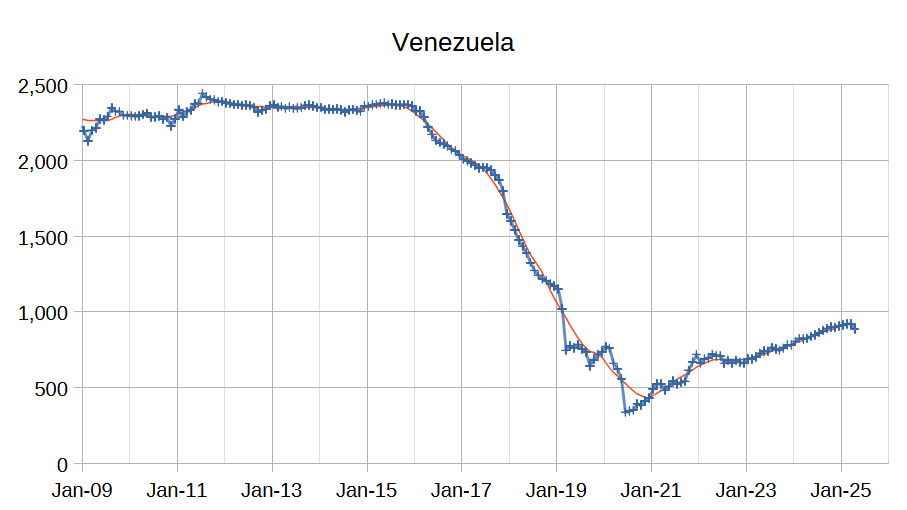

Output for March 2025 was revised lower by 4 kb/d and February 2025 output was revised higher by 12 kb/d compared to last month’s report. OPEC 12 output decreased by 62 kb/d with the largest decreases from Venezuela (34 kb/d), Iran (30 kb/d), Nigeria (28 kb/d), and Libya (14 kb/d). Saudi Arabia (49 kb/d) and UAE (11 kb/d) saw increased crude output, other OPEC members had small increases or decreases of 6 kb/d or less.

The chart above shows output from the Big 4 OPEC producers that are subject to output quotas (Saudi Arabia, UAE, Iraq, and Kuwait.) After the pandemic, Big 4 average output peaked in 2022 at a centered 12 month average (CTMA) of 20849 kb/d, crude output has been cut by 2517 kb/d relative to the 2022 CTMA peak to 18332 kb/d in April 2025. The Big 4 may have about 2517 kb/d of spare capacity when World demand calls for an increase in output. OPEC has announced plans to increase output at about 400 kb/d each month from May to October 2025, which would increase output by about 2400 kb/d and reduce OPEC spare capacity to only about 100 kb/d, based on my estimate of OPEC spare capacity.

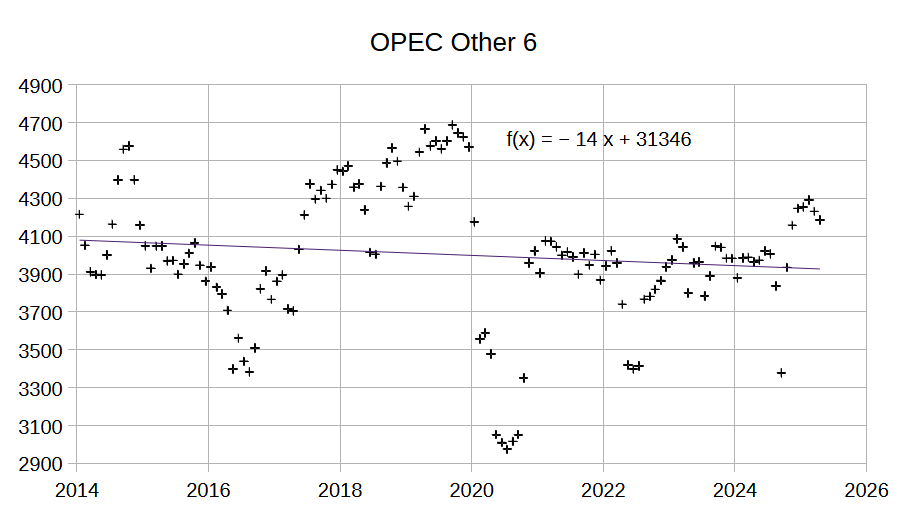

The chart above looks at Other 6 OPEC crude output which is OPEC 12 minus OPEC Big 4 minus Iran and Venezuela from May 2021 to April 2025. The average annual increase is only 60 kb/d.

The longer term trend for OPEC Other 6 crude from Jan 2014 to April 2025 is an average annual decline of 14 kb/d, basically flat output for about 10 years. My expectation is that Iran and Venezuela will increase their crude output very little after April 2025 and OPEC Other 8 crude output (OPEC 12 minus Big 4) will be relatively flat in the future or possibly declining slowly.

OPEC revised its World liquids demand estimate lower by 100 kb/d in 2024 compared to last month, otherwise the demand estimates for 2025 and 2026 are unchanged. Also non-DoC Liquids and OPEC non-crude liquids were revised lower by 100 kb/d in 2025 and lower by 200 kb/d in 2026 compared to last month’s MOMR.

Refinery throughput may be the best way to evaluate World C+C demand, from OPEC data the peak was 81.68 Mb/d in 2018. For the most recent 4 quarters the average refinery throughput was 81.05 Mb/d, the previous 4 quarters had average refinery throughput at 81.02 kb/d and 2024 had refinery throughput at 80.84 kb/d, so only about a 210 kb/d increase in the annual average over 6 months which suggests another 18 months to return to the 2018 peak if the recent rate of increase in refinery throughput continues for the next 6 quarters.

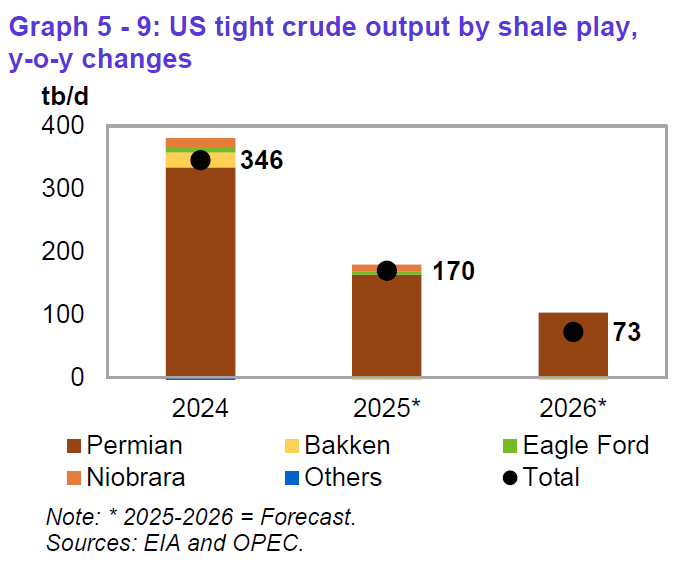

The OPEC estimate for US tight oil output in 2024 increased by 46 kb/d compared to last month and the increases for 2025 were revised lower by 51 kb/d and for 2026 were revised lower by 67 kb/d compared to last month’s estimates. Permian Basin output remains the main source of US tight oil growth from 2024 to 2026.

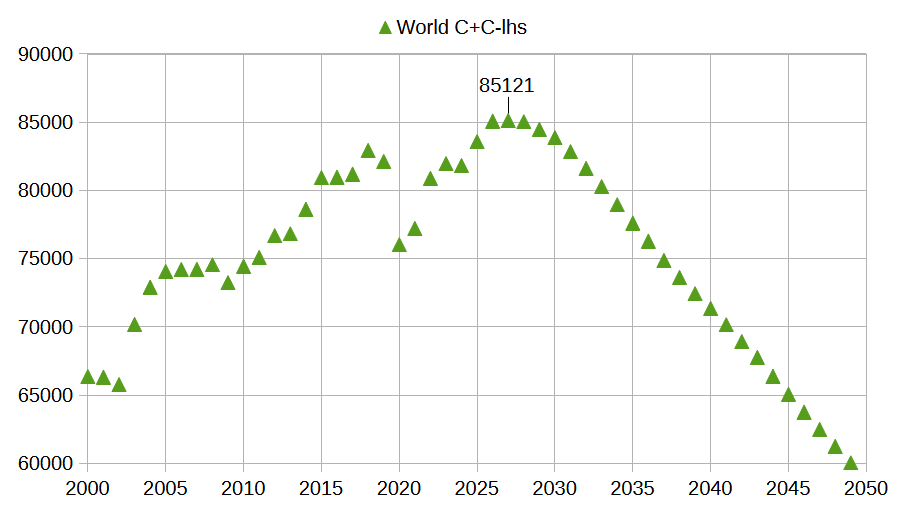

The scenario above uses the same scenarios for the rest of the World (all nations except the US and OPEC plus nations) and the US as in the last OPEC post. The OPEC plus nations are assumed to add 385 kb/d for each of the six months from May 2025 to October 2025 (400 kb/d added by Big 4 and OPEC other 8 assumed to decline by 15 kb/d each month.) Total increase from OPEC plus for the 6 month period is 2310 kb/d for this scenario. After October 2025, OPEC other 8 continue to decline at 15 kb/d up to 2036, with higher decline rates after that.

Dennis

What does the last paragraph mean. What scenarios except U.S?

Also where are you getting 400 kb/d?

https://www.reuters.com/business/energy/opec-further-speed-up-oil-output-hikes-three-sources-say-2025-05-04/

Loadsofoil,

Sorry the scenario was not stated clearly, I have edited to attempt to make it clearer, thanks.

The article you cite suggests output from OPEC plus will increase by 2200 kb/d, my scenario has output increasing by 2310 kb/d (an increase of 385 kb/d each month for 6 months from May to October 2025). See last OPEC post (link below) where there were three scenarios for US, OPEC plus and ROW, only the OPEC plus scenario has been modified as described in the last paragraph to get the World C plus C scenario shown.

https://peakoilbarrel.com/opec-update-april-2025/

Average annual output in 2025 rises to 83579 kb/d from 81828 kb/d in 2024. Monthly World C plus C output was 82184 kb/d in Jan 2025, peak annual output is 85121 kb/d which is 2937 kb/d higher than Jan 2025 output, the extra 627 kb/d (over the 2025-2027 period of 35 months) comes from the rest of the world (World minus US minus OPEC plus) primarily Argentina, Brazil, Canada, and Guyana.

Like every scenario of future output this is certain to be incorrect, it simply makes the same assumptions for US and Rest of World (ROW) as previous OPEC post and assumes OPEC plus increases output by 385 kb/d (Big 4 increases minus decreases from OPEC Other 8) for 6 consecutive months from May to October 2025.

ROW output rises at an average annual rate of 400 kb/d from 2024 to 2027 for this scenario (from 2021 to 2024 ROW C plus C output increased at an average annual rate of 419 kb/d, I assume the future rate from 2024 to 2027 is 400 kb/d.)

Link to spreadsheet with scenario below

https://docs.google.com/spreadsheets/d/1cqmREmnIuV3ySPVfQjGffRS_DiPbttCb/edit?usp=sharing&ouid=105320434049434900507&rtpof=true&sd=true

Dennis

Thanks.

A peak between 82 and 85mb/d probably represent the lower and upper limits of global production. The higher OPEC goes the smaller their spare capacity and the more likely we will get a serious oil shock down the line.

By 2030 with the U.S. falling, Guyana nearing full production their will hardly be a single country that can increase production at all.

A dangerous situation to be in.

There has always been some region that could produce more oil if needed. Norway and The United Kingdom in the 70s 80s 90s. Egypt in the 80s. Mexico. Brazil and many others. The U.S. being the main recent country to prevent peak and stabilise the market.

This will be the first time in history, there will essentially not be a single country that can add additional oil to any substantial level.

Loadsofoil,

I agree. Note that I doubt OPEC will increase output as fast as the scenario presented as it is likely that oil prices will crash if output increases as fast as 2400 kb/d over a 6 month period. After 2030 I do expect World output of C plus C will be decreasing at about 1500 kb/d per year on average over the 2030 to 2050 period. Oil prices might be very high unless demand for oil falls for some other reason.

“This will be the first time in history, there will essentially not be a single country that can add additional oil to any substantial level.”

Well, better learn to get by with less and less oil. Quickly.