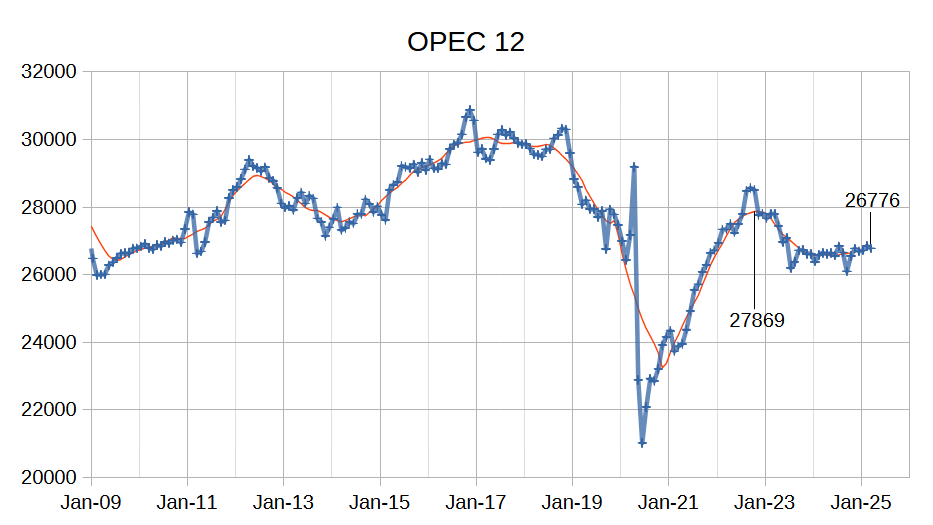

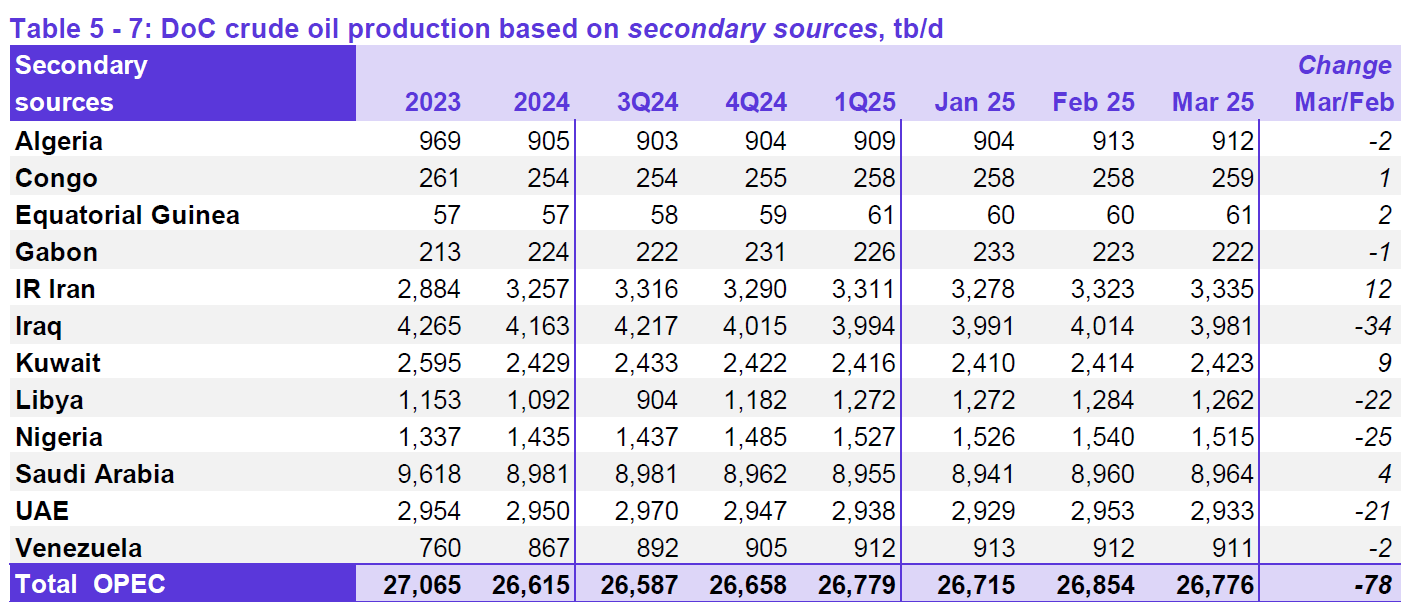

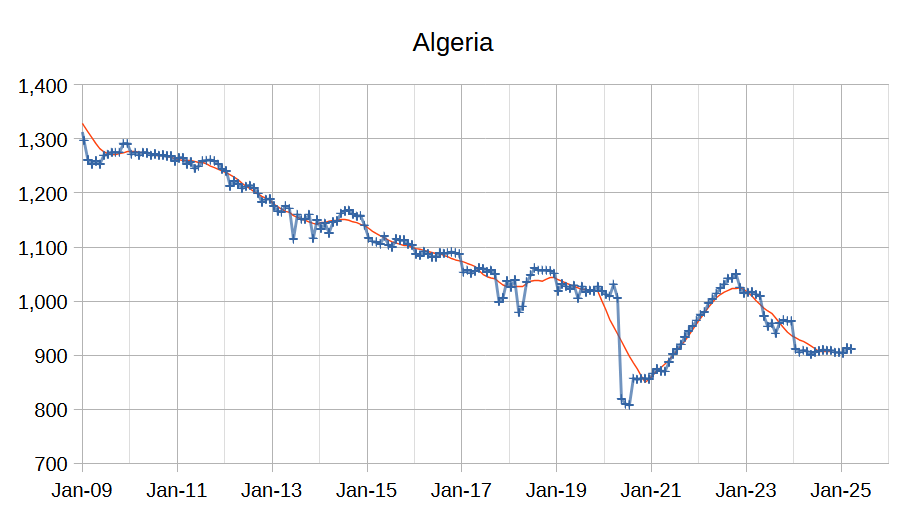

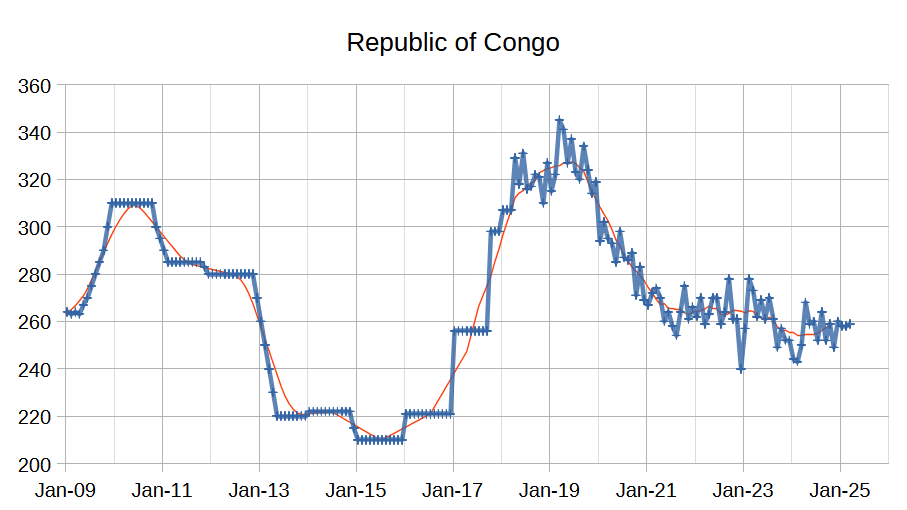

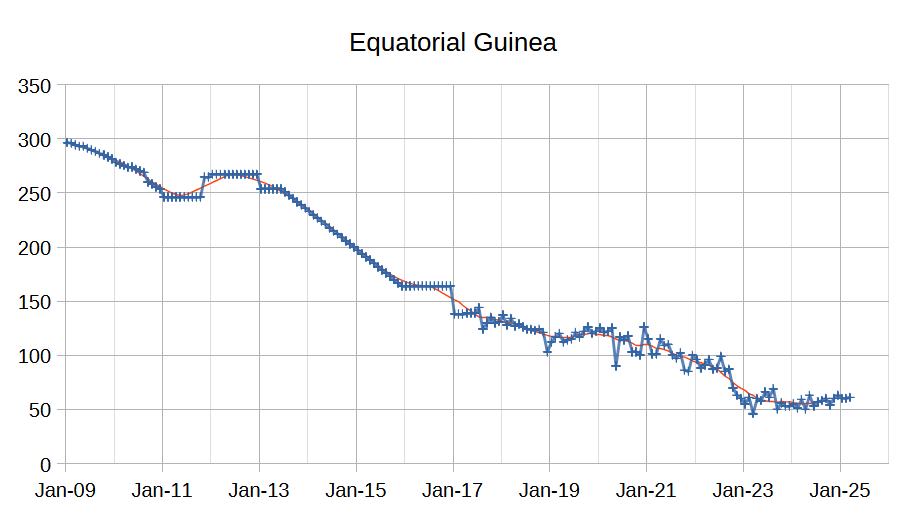

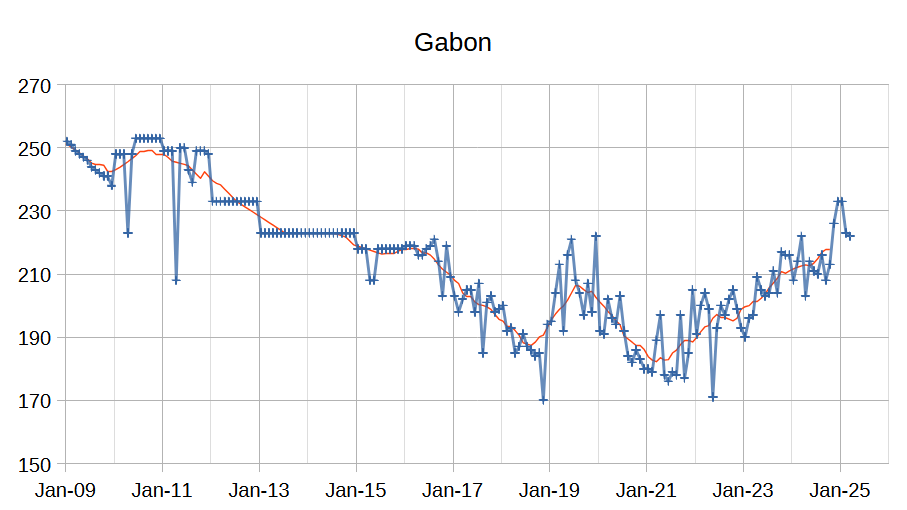

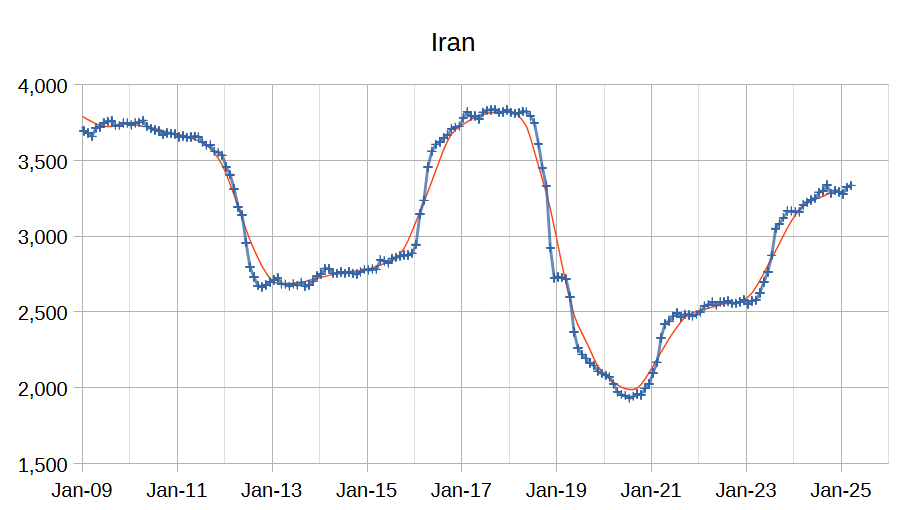

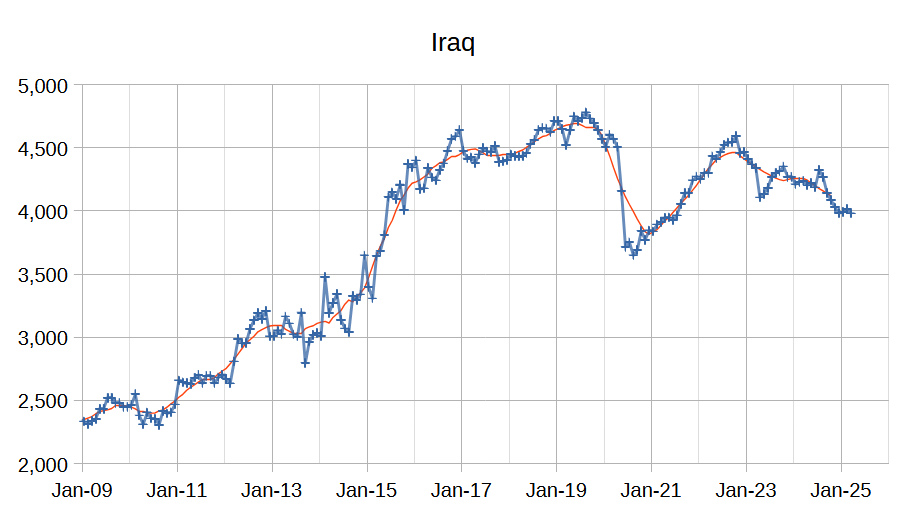

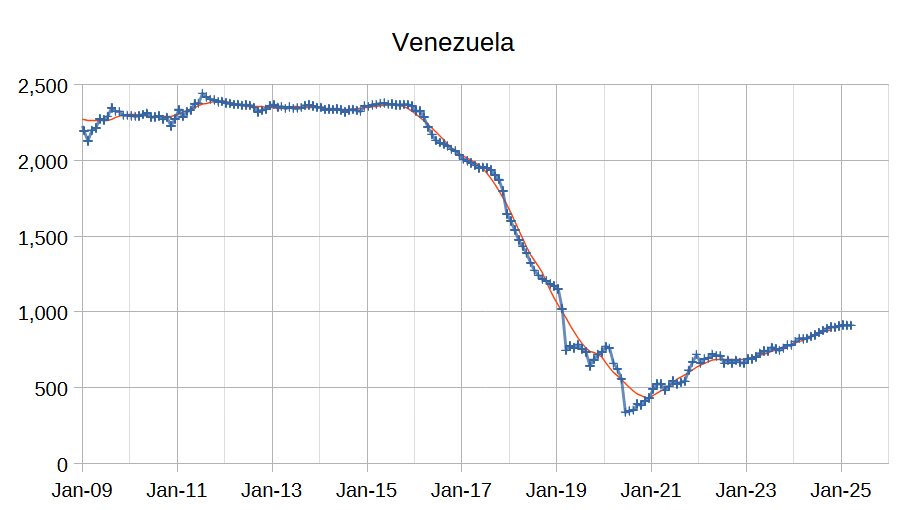

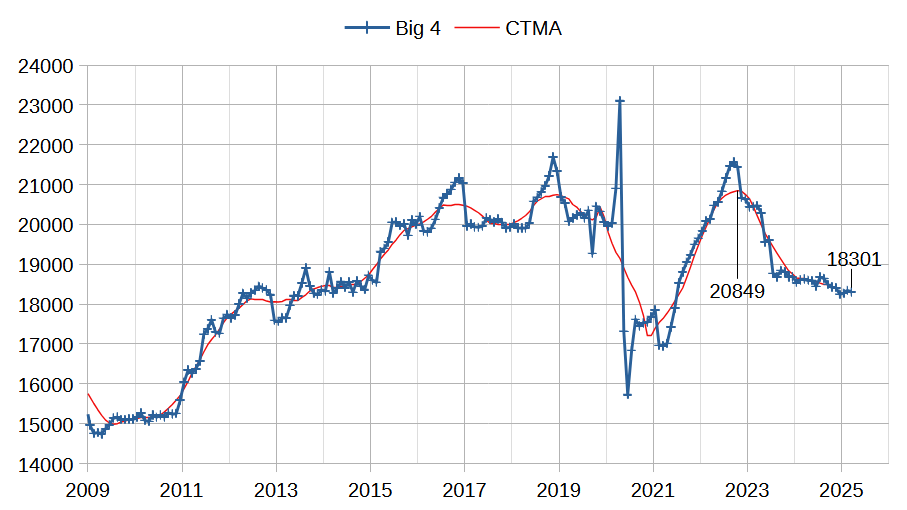

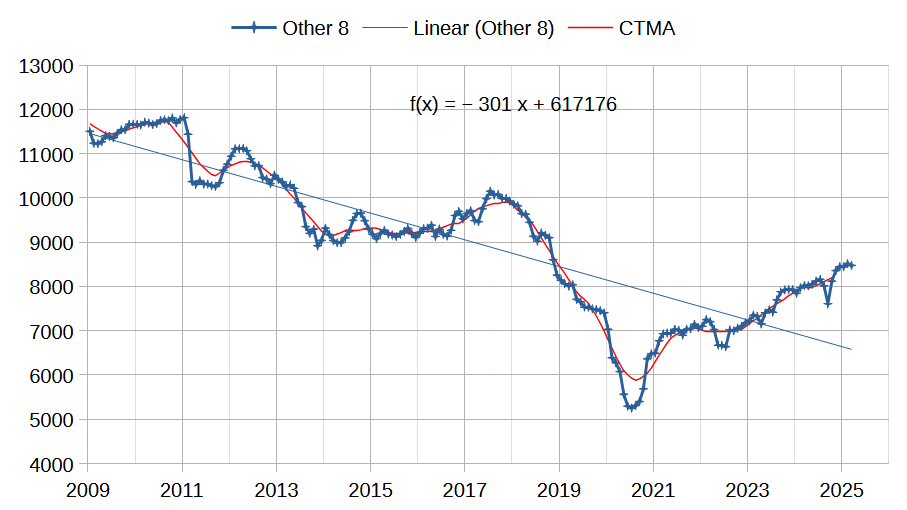

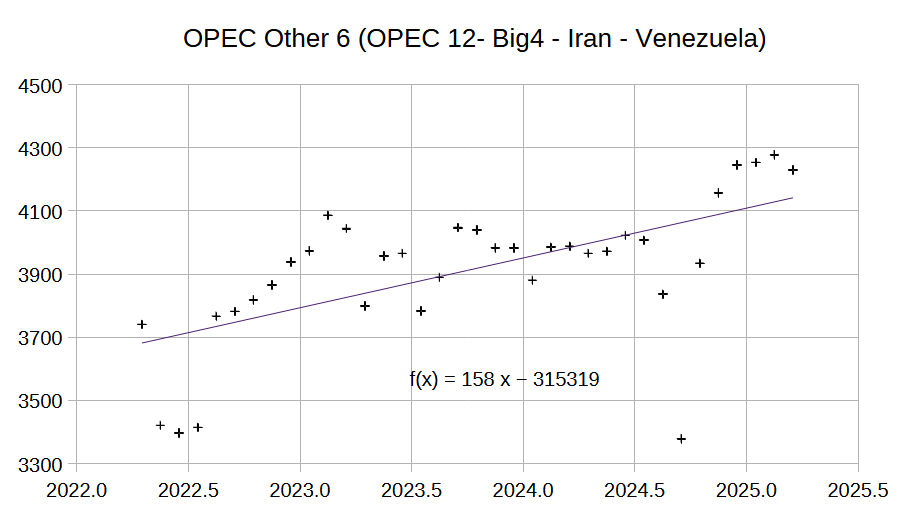

The OPEC Monthly Oil Market Report (MOMR) for April 2025 was published recently. The last month reported in most of the OPEC charts that follow is March 2025 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In the OPEC charts below the blue line with markers is monthly output and the thin red line is the centered twelve month average (CTMA) output.

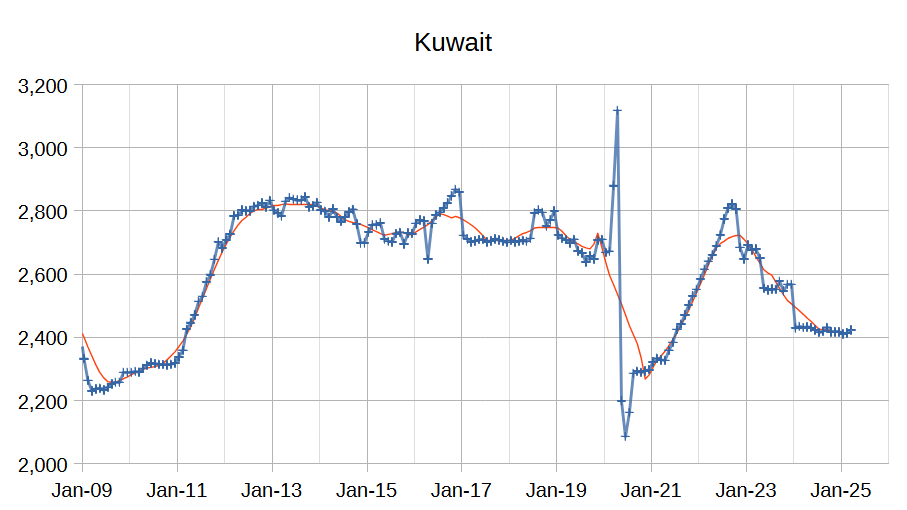

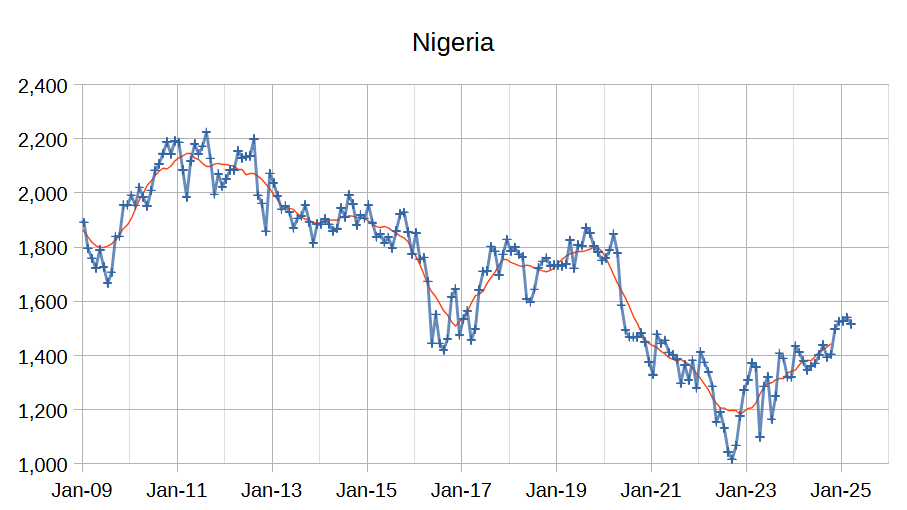

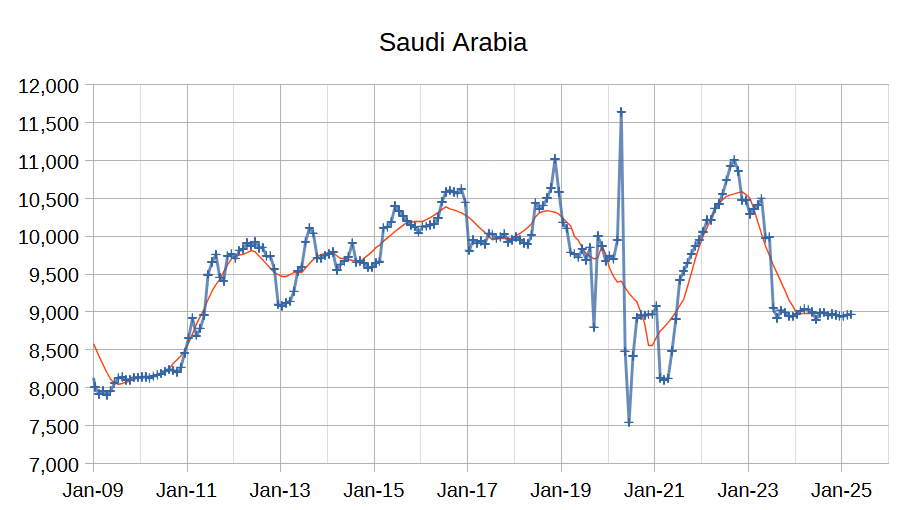

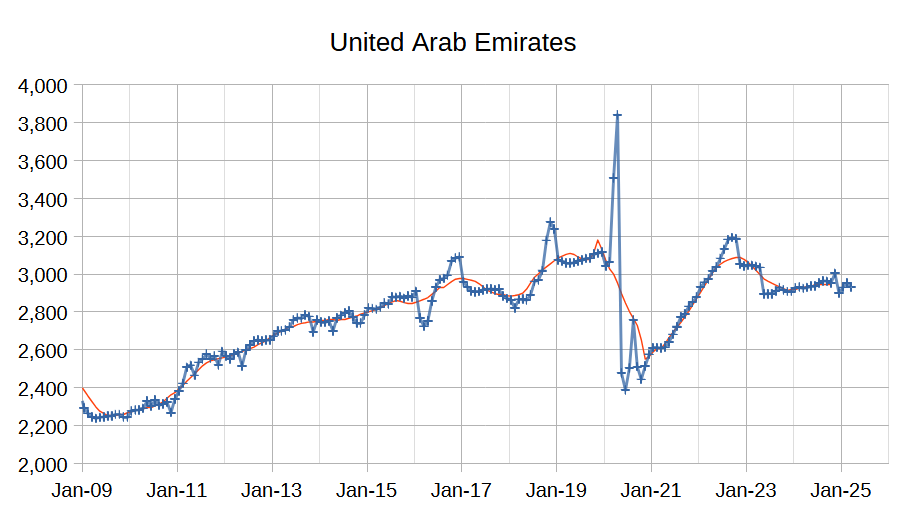

Output for January 2025 was revised higher by 9 kb/d and February 2025 output was revised lower by 6 kb/d compared to last month’s report. OPEC 12 output decreased by 78 kb/d with the largest decreases from Iraq (34 kb/d), Nigeria (25 kb/d), Libya (22 kb/d) and UAE (21 kb/d). Iran (12 kb/d) and Kuwait (9 kb/d) saw increased crude output, other OPEC members had small increases or decreases of 4 kb/d or less.

The chart above shows output from the Big 4 OPEC producers that are subject to output quotas (Saudi Arabia, UAE, Iraq, and Kuwait.) After the pandemic, Big 4 average output peaked in 2022 at a centered 12 month average (CTMA) of 20849 kb/d, crude output has been cut by 2548 kb/d relative to the 2022 CTMA peak to 18301 kb/d in March 2025. The Big 4 may have roughly 2548 kb/d of spare capacity when World demand calls for an increase in output.

The chart above shows the trend in output for the OPEC 12 members that are not part of the big 4 producers. These Other 8 OPEC nations are producing at close to maximum capacity with the possible exception of Iran and Venezuela that are subject to US sanctions which limits their crude exports and their output. The long term trend is an annual decease of 301 kb/d since 2009, but since the pandemic their output has risen at an annual rate of 600 kb/d mostly due to increases in Venezuela and Iran as they have become more adept at avoiding US sanctions. I expect slower increase in the future for the OPEC Other 8 unless Iran and Venezuela see sanction relief.

The chart above excludes Iran and Venezuela from the Other 8 OPEC grouping presented in the previous chart. Annual output growth is much slower at 158 kb/d. I believe this output growth is also likely to cease within a few years and Other 8 output may revert to the long term annual decline trend of 300 kb/d by 2027. I also expect OPEC Big 4 spare capacity could be used to keep OPEC 12 output on a plateau for about a decade (spare capacity of 2500 divided by 300 would be 8.3 years and it will be a few years until OPEC other 8 returns to the long term decline trend.)

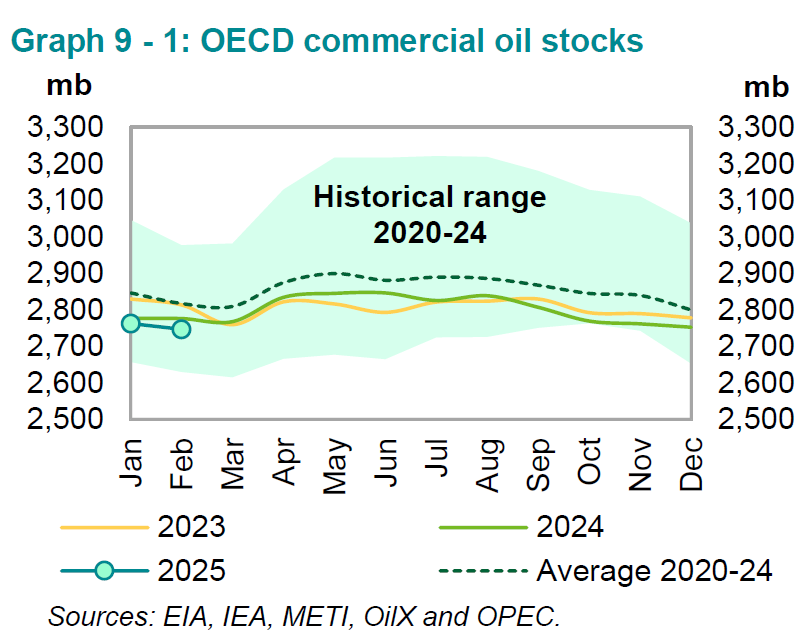

OECD commercial stocks remain well below the 5 year average, but oil prices remain low so this seems to be the new normal. It is also possible that the very high stock levels during the Pandemic may be skewing the average higher. On land commercial stocks have remained at 87 days of forward cover from 2022 to 2024 while oil on water has fallen from 34 days of forward cover in 2022 to 30 days in 2024, about a 3% decrease in total days of forward consumption for on land plus oil on water stocks over a two year stretch.

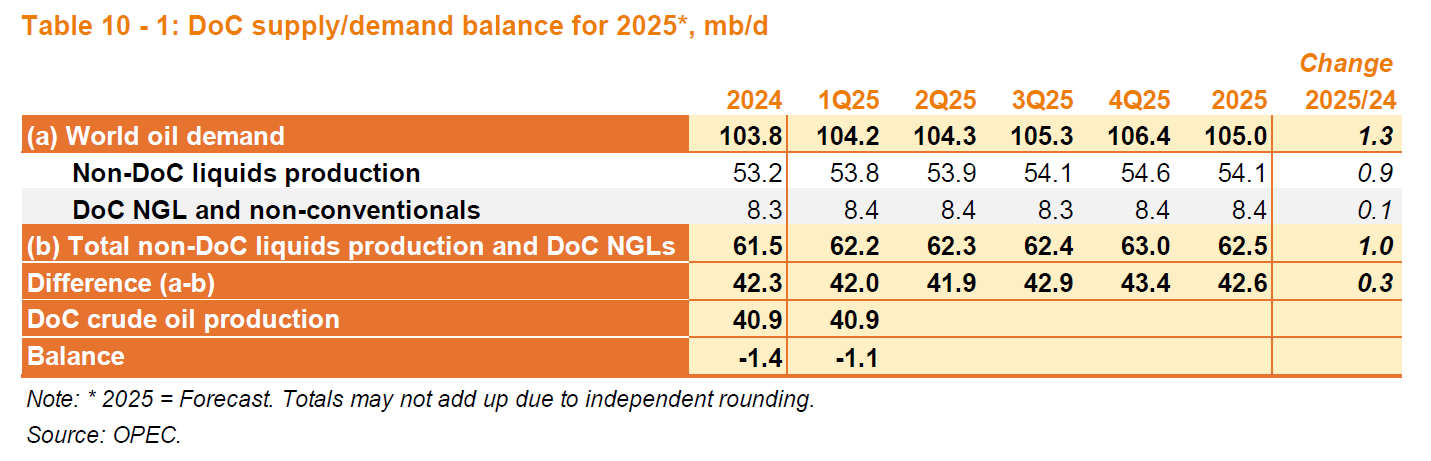

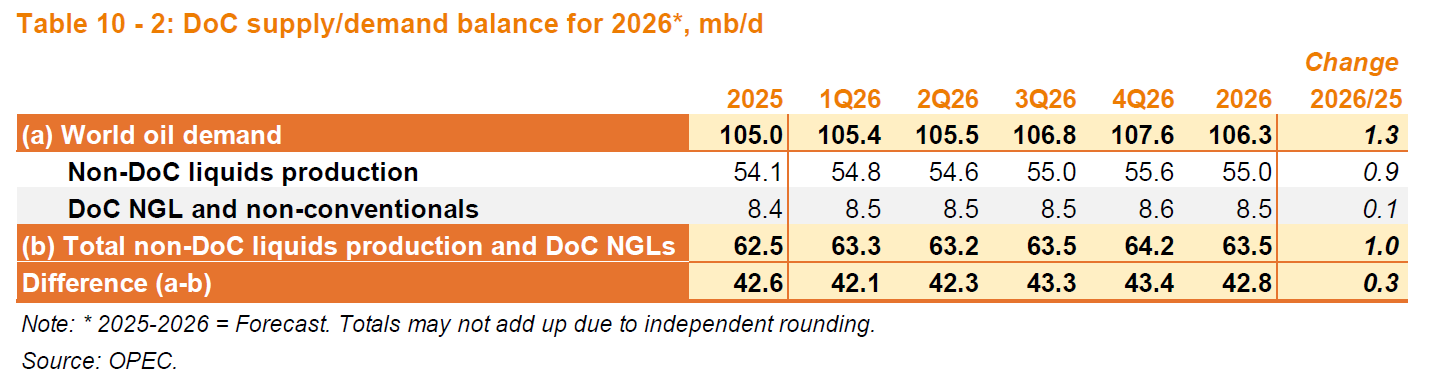

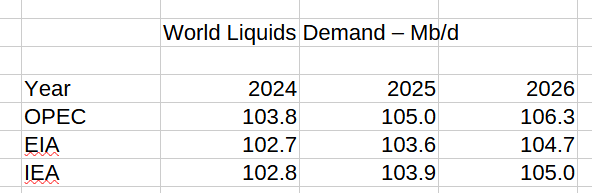

OPEC has reduced its demand estimates for World liquids in 2025 and 2026, but revised its 2024 demand estimate higher by 100 kb/d compared with last month where 2025 was 105.2 Mb/d and 2026 was 106.6 Mb/d compared with 105.0 and 106.3 Mb/d in 2025 and 2026 respectively in this Month’s MOMR.

The chart above compares EIA and IEA estimates with OPEC estimates, IEA does not have a 2026 estimate I just added 0.3 Mb/d to the EIA estimate as that was the difference between the EIA and IEA estimates for 2025, but that is a WAG. The average of the OPEC and EIA estimates is 105.5 Mb/d in 2026, the average of the EIA and OPEC estimates in 2025 is 104.3, with the IEA estimate 0.4 Mb/d less than this average, using that as a guide we would get an EIA estimate of 105.5-0.4 or 105.1 Mb/d. In any case the OPEC forecast looks high, perhaps because their 2024 estimate is too high. In fact subtracting 1 Mb/d from the 2024 to 2026 estimates by OPEC results in a similar result as the IEA forecast.

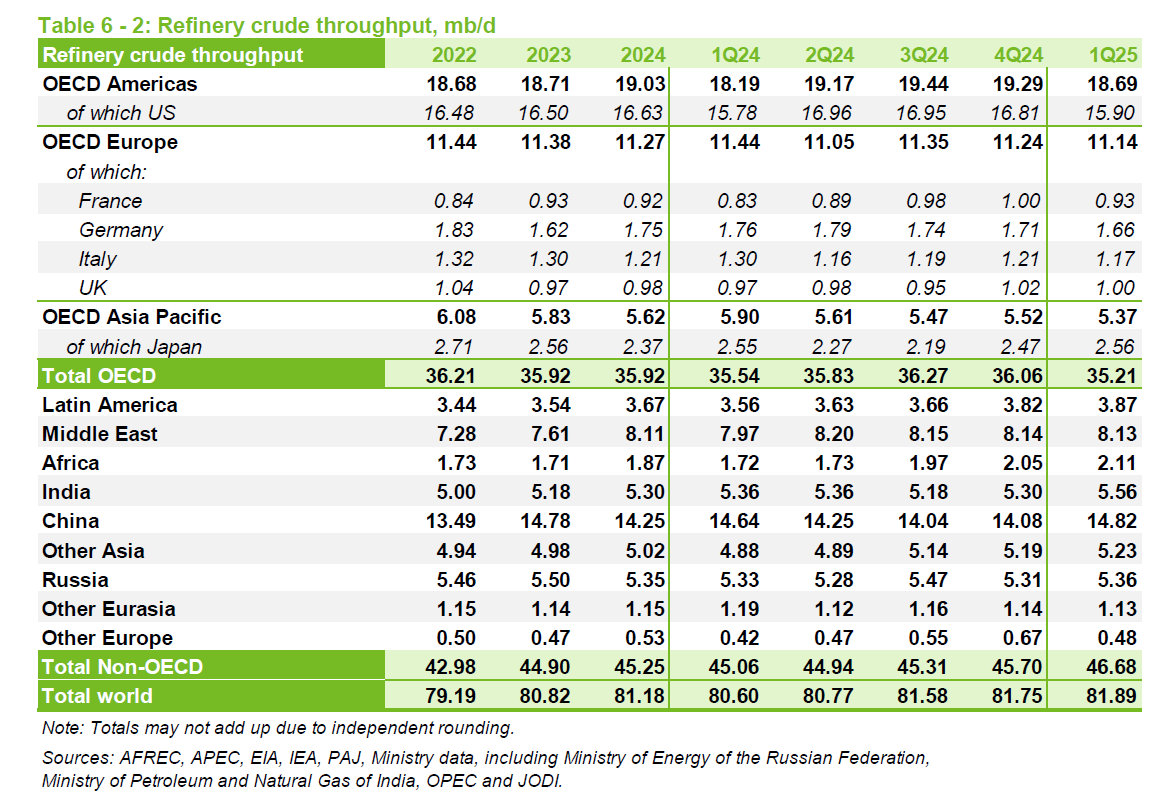

Refinery throughput is likely the best way to evaluate World C+C demand, from OPEC data the peak was 81.68 Mb/d in 2018 (some crude is burned directly for electric power in the Middle East). For the most recent 4 quarters the average refinery throughput was 81.5 Mb/d (higher than last month’s estimate by 0.1 Mb/d) so we may see a new peak this year unless there is a recession due to tariffs and economic turmoil.

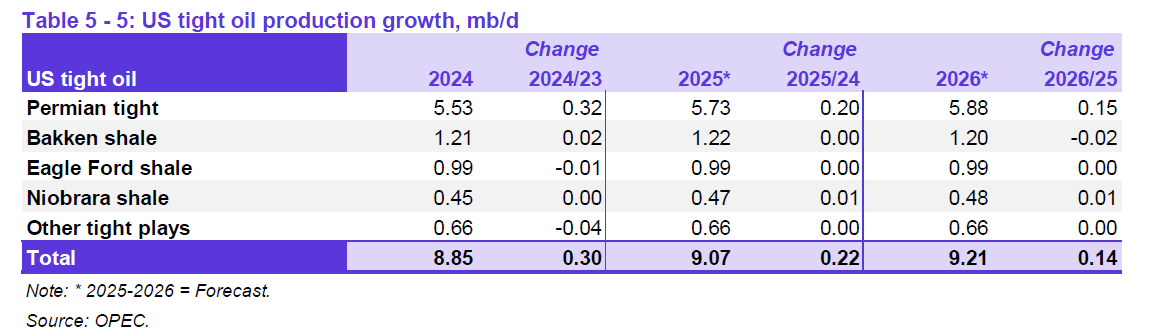

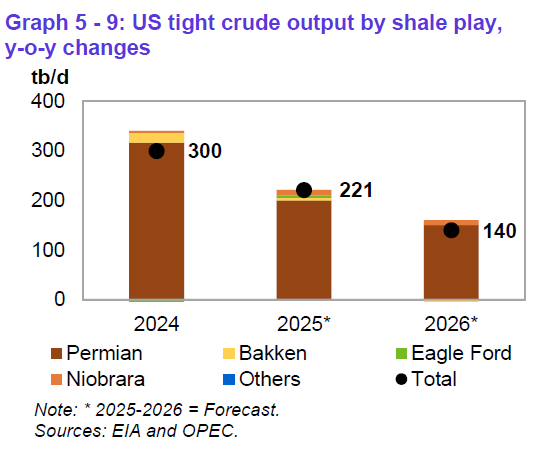

The tight oil forecast for the US in 2025 and 2026 has been revised lower by 30 kb/d in 2025 and 30 kb/d in 2026 compared to last month’s MOMR, the 2024 estimate is unchanged. Most of the increase comes from the Permian Basin.

The chart above shows very clearly the slowing growth in US tight oil output and that most of the increase is Permian output.

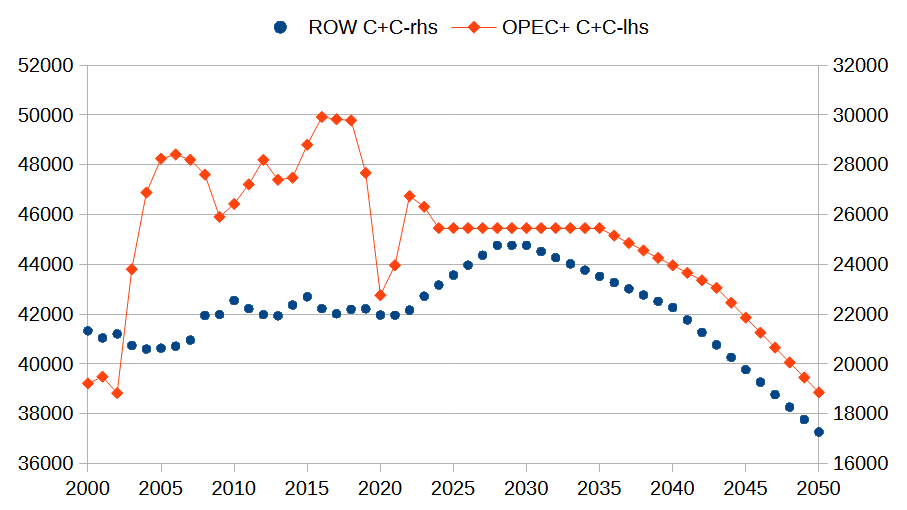

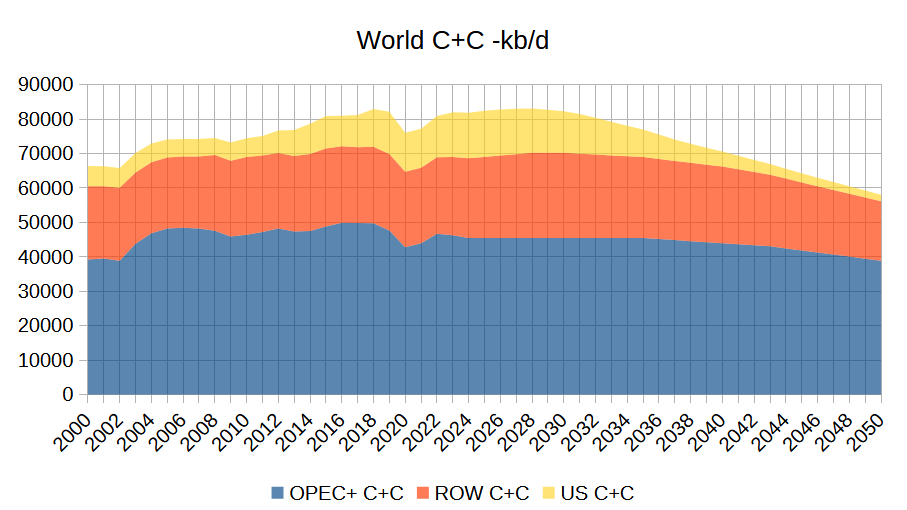

In my previous post I presented an oil shock model with roughly 2.2% annual decline in World C+C output from 2030 to 2050. In the chart above I present a scenario for future output from OPEC + which assumes a plateau in output from 2024 to 2036, then annual decline of 300 kb/d from 2037 to 2043 and annual decline of 600 kb/d from 2044 to 2050. I assume the OPEC Big 4 can offset declining output from the OPEC Other 8 up to 2036 and then Big 4 remains on a plateau while other 8 declines at 300 kb/d up to 2043 and then Big 4 declines at 300 kb/d after 2043. For the Rest of World (ROW) defined as World minus OPEC+ and US, output increases at an annual rate of 400 kb/d (2020-2024 average rate) up to 2028 and then declines at an annual rate of 250 kb/d starting in 2031 and then 500 kb/d starting in 2041.

The chart above shows the US scenario (right scale) and World scenario for C+C output. The US scenario uses the tight oil scenario presented in my previous post (URR=72 Gb) and assumes US non-tight C+C declines at an annual rate of 3% per year after 2024. The World scenario after 2024 is the sum of the OPEC+, ROW and US scenarios presented in the previous two charts. An Excel spreadsheet with this World scenario at link here.

Same scenario different view. Peak is 2028 at 83.1 Mb/d.

The stark difference between a country where oil production peaked 25 years ago.

https://www.rac.co.uk/drive/advice/buying-and-selling-guides/the-top-10-most-popular-cars-in-the-uk/

And a country where oil production has been increasing for the last 15 years.

https://www.caranddriver.com/news/g60385784/bestselling-cars-2024/

Best selling car in the U.K. reaches 52 miles per gallon.

Best selling car in the U.S. if you can call it a car, does 20 miles per gallon.

Average UK petrol price is $6.78/US gallon, average US petrol price is $3.164/US gallon. UK has smarter fuel tax policy in my view.

Regardless if Ron was right about 2018/19 beeing the peak, which I think he was btw, there´s still very interesting things to observe going forwards. The major issue is if things politically will change calmly or violently, both ways have happend before. Resource avavilibility and sources matters a lot, probably really the key matter.

Regarding electricity, personally I´m in favour of hydro, wind and solar. Nuclear just leaves shit for “someoneelse” to care for it, for a very long time, in my view.

Still got beer….

Thanks Dennis!!!

Thanks Dennis!

I agree with the comments in the last thread about the great value in looking at these production forecasts normalized by population. Very helpful. I also think that some of the demographic work outside the UN (like you cite) seems more likely than the UN median that is quoted in the press so often.

In this context of resource availability on a per capita basis, I do think that factors such as economic turmoil and EV displacement are likely to have a tendency to flatten the peak towards a plateau.

IEA’s April 2024 forecast for STEPS scenario was for about 5 million barrels per day of reduced demand in 2030 due to EV adoption, with that growing to about 11 million barrels per day in 2035. The last update at our-world-in-data was also for April 2024 using 2023 data which showed 18% of global light duty vehicle sales as what they defined as EVs. This trend will have an impact.

T Hill

Obviously global oil production is a sum of all oil producing countries.

To really understand what will happen you have to look at each individual country to see where we are.

The United Kingdom peaked in 1999 at 2.6 million barrels per day and was a net exporter of over a million barrels per day. In less than 8 years it became a net importer.

https://www.ceicdata.com/en/indicator/united-kingdom/crude-oil-production

Australia was briefly self sufficient, now it hardly produces any oil, it has become another country dependent on imports.

https://www.ceicdata.com/en/indicator/australia/crude-oil-production

From memory in 1995 about 40 countries were or would be able to increase oil production, today that number is less than 10. All the others are in decline.

The main one being the United States, which single handedly prevented peak happening. It will peak by 2028. The decline rates of many post peak countries is high and the spare capacity of the few OPEC countries will be gone in a couple of years. From 2030 every single country will be in decline or unable to increase production. Decline rates could be as high as 5% in some years.

A world with no spare capacity will see massive fluctuations in oil prices. A hurricane in the Gulf, or a war somewhere, a terror attack on pipelines.

By 2028 if every single one of the 90 million cars sold were electric then things would still be difficult. Best prediction is for only 40 million and probably will not be that high. Best selling vehicle in America is the F150 it is the absolute opposite of what should be happening with only a few years to go.

Loads of Oil- Yes indeed on this general oil scenario.

So, for all the countries who aren’t going to be flush with oil in about 5 years do you foresee a rush by the citizenry to get EV ownership popping up later in this decade?

I think we may be setting up for a buying frenzy.

China in the pole position.

Way out front, in fact they have already lapped the field before the race (peak) has even begun.

Hickory

There are only 1.5 million electric cars out of 42 million vehicles in the U.K.

Yet travelling to see relatives at Christmas we saw a vey long queue of cars at a service station. Could not figure out why then someone said they were all electric cars trying to charge up.

A service station ceo said they can install chargers but the electric grid can’t supply the power because we have closed down all our coal power stations and the grid can’t transfer power from where the wind turbines are.

If we have these problems with 1.4 million vehicles think what it would be like with 20 million.

https://www.worksinprogress.news/p/the-breaking-of-britains-national

How many vehicles in the U.S. and how many electric vehicles?

Infrastructure like that take a couple of decades to upgrade.

We are in deep trouble

Nonetheless, it is clearly the direction the world is moving. In China sales of plug vehicles are now over 50% of the total each month, and this for a country that ranks 72nd in gdp/capita.

Apparently they can read the writing on the wall better than most.

And yes, most countries are very late to the game. Thats why I suggest there is a setup for an EV industry frenzy.

The EV industry in China is an extension of the coal industry. Coal is heavily used in the production of EV’s and solar panels.

EV’s are coal powered cars in China. Regardless if solar panels are used to produce electricity to power EV’s or if coal is directly burned to create electricity. It’s all an extension of their coal industry.

The Chinese aren’t escaping their demise due to lack of oil. They are accelerating their demise due to lack of coal by going all in on EV’s and solar panels not only for themselves but for most of the rest of the world as well.

Pakistan’s nice solar industry was built in factories in China for instance, using coal.

When the coal is gone there will be no EV and solar industry in China.

The Chinese will likely ramp up coal to liquids as the diesel supply contracts. Putting further stress on their coal supply.

What HHH is saying about China’s coal is in my view exactly right. According to Energy Institute’s latest report, China mining 93 EJ worth of coal and consumed 92 EJ’s worth. Its imports were 10 EJ, so these numbers do not match. It appears to me is that they are putting some of the imports into the column of production and perhaps have reached peak coal. By the way 10 EJ is larger than the entire US production that peaked in 2008 most likely because new power plants are by natural gas rather than coal. China’s imports in 2024 were 543 Mt and US production was 458 Mt. The heating values that I use is on the average 20 MJ/kg, as this seems to be the one used by Energy Institute

So I’m hearing that countries should refrain from facing the reality of peak oil in transportation because

-there are not enough charging stations deployed in the UK…the same UK that is an importer of oil, and

-China will run out of coal faster than if it had no EV industry…the same China who is an importer of oil, and who has the 4th largest reserves of coal in the world. And yes of course, coal is a fossil fuel like nat gas and oil….they are all in line to enter decline before too long.

Good job guys. Any more brilliant comments on the need to refrain from getting up off of our collective asses on making adaptations during the late plateau phase of peak oil, which yes we are now in.

T Hill,

It is possible that a transition to EVs will mitigate the declining C plus C output to some degree. A STEPS scenario would be enough, my scenario in 2035 is about 6000 kb/d below 2028 peak output. It reaches 11000 kb/d in 2039.

Chart with C+C per capita using Lutz population projection

Dennis

Do you think the United States could make do with 4 million barrels per day?

Two thirds of countries are increasing oil consumption and have raced past 3.5 barrels per person per year.

The U.S. will have to outbid other countries for what’s left

Loadsofoil,

Probably not, but there is lots of oil on World Market for sale, so the US will continue to import crude oil as it has done since 1944.

https://www.eia.gov/dnav/pet/pet_move_neti_a_epc0_IMN_mbblpd_a.htm

Dennis

It is all very well drawing graphs, but they do not reflect the political and psychological situation in the world once everyone knows that oil production will continue to fall year after year.

The electricity grids in many are very old and in no way fit to increase wind and solar very much.

https://www.worksinprogress.news/p/the-breaking-of-britains-national

Countries will do anything to get their hands on ever declining oil exports. You think India is just going to sit back and let THE U.S. take the oil it desperately needs?

At the moment the U.S. can do what it likes. Once oil production starts to fall in the U.S. and globally the oil exporting countries will have you by the proverbial.

They will not want dollars which are becoming toilet paper they will want useful things like food and weapons. They will need them to protect their countries from attack.

LOADSOFOIL

I transcribed and edited part of an interview with Eric Dollard about the electrical grid.

Interviewer: You just brought up the subject of the electrical-grid. I’d like to touch on that before we go to the dangers of what the power companies are doing; the way they’re rearranging the electrical system such that it makes us very vulnerable to EMP and other types of potential disasters that would come from a foreign source; but also bringing the danger right into our homes with the grounding system not being a true ground; that your refrigerator, the dishwasher, etc., all connected back to the substations where the high-voltage is.

Eric Dollard: The entire metallic structure of the nation’s power system is being bonded together; every transformer is being bypassed; all the way up to the grid tie-lines; so, the metal in your house is connected to all this metal; as a giant receiving antenna and the transients are hideous; they’re burning out people’s appliances; people are getting shocked and electrocuted.

Interviewer: You told of an incident of where just a cross-arm fire ended up severely shocking cattle.

Eric Dollard: Yes, and people’s pets are dying when they sleep outside next to the ground rod and the circuit-breaker box and the power companies are spending a fortune to rebuild the power-system in this configuration, that every old textbook said stay away from. It’s jamming-out all of my Earth receiving capabilities in Nevada. It’s taken on surreal proportions. There are literally millions of watts of stray electricity. Rivers of it flowing around in the Earth which completely overwhelms my telluric equipment. The interference is 10 million times stronger than the signal and you know being a third-generation electrical worker; starting from my grandfather and having an integral mental and archetypical connection to the infrastructure since I was an infant and to watch everything get turned inside-out; I mean it really affects me psychologically. It’s insane, it’s absolutely insane. So that was the objective of my last presentation; the history, theory, and practice of the electrical utility system; from an engineering, mathematics, and historical standpoint.

Interviewer: You have been talking about your ground receptacles sporadically responding to these transient-impulses that are sailing into your house because every single transformer is bypassed. Bring everyone up to speed.

Eric Dollard: My family in Pennsylvania are dairy farmers and they were milking their cows. They put their heads in head-locks and they feed them while they milk, and one day on the power-pole, which was quite a ways away, there was an incident that took place with the insulator, but instead of there being isolation, instead of there being protective ground, all the cows that were being milked took a very heavy shock twice and it brought them down to their knees and that wouldn’t have happened with the proper wiring and grounding and isolation. So, what that means potentially is that if you’re taking a bath and there’s an incident on the power pole or something like this; what would happen to the average person? People are going to get killed in their showers. They are getting killed and the power company engineers don’t know why. Well, it’s just basic electricity and electronics. You know, when you bypass the transformer and you use a neutral and Y-connections, with all the harmonics and transients, this is what you’re going to get.

Interviewer: I had mentioned yesterday that Congress had before them a bill to upgrade the power-grid to help avoid EMP’s or any other type of surge and it was voted down. That was in 2008 and it sounds like they’ve continued and taken [grid danger] to an even further extent. It is being forced and I don’t know exactly why.

Eric Dollard: Everybody asks me this, you know, what’s behind it. I have to conclude that it’s a nefarious conspiracy, for the lack of a better word, because it’s forcing the power companies to spend a lot of money. Here in Nevada, we have this Envy Energy, owned by Warren Buffett, and they are brutal in enforcing this. They are loathed by the entire state of Nevada. They are the most hostile, uncooperative utility company. They’re putting pressure on everybody to rip-out their Delta connections and get their hot-neutral into your facility. There’s no maintenance; no workmanship. When I was in the hospital, a lot of the nurses there have husbands who are engineers and they were telling me that their husbands are saying that this thing’s insane and they’re all going for early retirement.

I’d argue that between the Ukraine war and reciprocal tariffs from China that the US is already finding out that it can no longer just do what it likes. I expect this to accelerate in the coming years.

Hillcountry

That is beyond scary.

This is what happens when you get politicians who understand very little wanting to make a name for themselves.

All wind and solar companies should be forced to finance the storage of excess electricity either with batteries or conversion to hydrogen.

Politicians are always 5 years behind any problem.

Loadsofoil,

When the World realizes that peak oil has arrived, policies may change, exactly what those changes will be cannot be known in advance. The scenario is a guess at what might happen in the future, output might be higher or lower, impossible to foresee.

The assumptions have been stated clearly and they will be wrong. Download the spreadsheet and change the assumptions to whatever you like and present them if you wish.

If India wants more oil, they simply need to outbid the competition, in a free market prices will rise enough so that consumption will match production in the long term. Typically as prices rise supply will rise and demand will fall until they match.

Thanks DC.

I’m not sure if we’re comparing exactly the same numbers and scenarios, but they do look close.

If the IEA is correct, the demand destruction in 2035 from EV adoption will exceed the absolute decline in this production forecast and the per capita impact as well. 11MBD reduction is equivalent to 0,5 barrel per person per year in your chart above.

Add in a lot of smart people in the oil industry working to squeeze every bit they can out of this Faustian bargain and it seems like a good portion of impacts (other than environmental) will continue to get pushed down the road.

For most countries, and certainly for the US, it takes a complex global supply chain of materials and manufactured components to come up with a modern device such as those that become an EV (with batteries, motors, controllers, computers), or other base industrial items like transformers, turbines, compressors, etc.

If the functioning global supply chain and free-ish trade does not hold up then the EV implementation (not to mention things like nuclear power, grid upgrades, data centers, robotics) will come to be deployed much more slowly.

Laggard countries will be at risk, just as they have been at all other major economic transitions in history.

The risk in this case being that oil depletion happens quicker than adaptation measures have been deployed.

People have mentioned nuclear power as being a big part of the fossil fuel off ramp.

A few comments

-The tariff regime that is being crafted will result in a higher cost of build of what is already such an expensive project that the US has only commissioned a couple reactors in the last 35 years.

-Being realistic, it would take the US 10-20 years to plan and build a new full scale nuclear reactor.

-So far SMR’s (small modular reactors) are penciling out to be much more expensive/Mwh than are the full scale nuclear generating stations. Perhaps that price can come down with mass production, however there is no guarantee on that point and with inflation between now and actual time of scale deployment it might not be true at all.

-SMR’s may end up being useful as niche generators, but it won’t be inexpensive energy, and various components will be required to be sourced internationally indefinitely.

T Hill,

Took a quick look at announced Pledges scenario from IEA and in 2035 that scenario has Oil Consumption about 81% of 2023 level which for my scenario is about 15 Mb/d lower than 2023 (67 Mb/d), my scenario has World output at 77 Mb/d in 2035. The stated policies scenario has output at about 80 Mb/d in 2035, so in that case demand would not be met.

T Hill.

IEA WEO 2024 at link below

https://www.iea.org/reports/world-energy-outlook-2024

Chart below compares my World scenario with the Stated Policies Scenario (STEPS) and Announced Pledges Scenario (APS) for World Oil Supply.

Rig Report for the Week Ending April 25

Very little change in the rig count as the drillers face a low WTI price and assess their options.

– US Hz oil rigs were unchanged at 443.

– New Mexico rigs were unchanged at 90 while Texas dropped 1 rig to 232. Texas Permian was unchanged at 186.

– In New Mexico, both Eddy and Lea were unchanged at 45.

– In Texas, Midland and Martin were unchanged at 21 and 26 respectively. Midland is down 6 rigs from the beginning of the year, 27 to 21, and also down 6 over the last 5 weeks.

– Eagle Ford was unchanged at 41.

– NG Hz rigs added 1 to 82.

Frac Spread Report for the Week Ending April 25

The frac spread count rose by 5 to 210. It is also down 52 from one year ago and down by 36 spreads since October 11.

A Question: Do drillers/companies have to drill and complete wells even if the latest wells are slightly uneconomic. Here is the problem as I see it.

If the public oil company stops drilling, production will start to drop rapidly and the quarterly report to shareholders showing dropping production will not look good. So better to show a smaller profit but steady or rising production to try to maintain the share price. It is not clear for how long a company can do this, depends on debt, dividend, etc.

Ovi,

Producers tend to high-grade wells when the price is low. There are many locations that are economical at $60/bbl.

KDIMITROV: “There are many locations that are economical at $60/bbl.”

Shale? Can you be a bit more specific please? I’m not being argumentative, just inquisitive. Thanks.

Gerry,

Excellent question. It seems there are many E&P CEOs that are claiming that $50/bo will be a problem, when we look at quarterly reports for shale producers, there are many not doing well even at $65/bo. There may be a few spots that are profitable at $60/bo, but this is only known once the well is flowing, the idea that a producer knows in advance which wells will be the best wells is disproven by the productivity distribution. If this were known in advance only the best locations would be drilled, the fact is it is not known except in a very general way. Also there is very little room left for new wells in the highest productivity areas, fewer and fewer locations by the day.

Dennis/Gerry

“It seems there are many E&P CEOs that are claiming that $50/bo will be a problem”.

Maybe $50 is where the losses are so big that a company can’t afford to drill. That is the nub of my question. Maybe the drilling/completion loss at $60/b is not enough to put earnings into the negative column while still maintaining production/drilling at a good enough level to not scare off investors.

The financial strength of the company is critical in determining whether it can sustain drilling and completions at a small loss to keep up good appearances.

Gerry,

I am just referring to a recent report from NOVI Labs, which says there are 65,000 locations in Permian/Bakken that have IRR of 25% at $60/bbl.

https://www.linkedin.com/pulse/wtis-near-60bbl-producers-really-feeling-squeeze-novi-labs-n6pme/?trackingId=z7w7FMHeR1i8KHsr9DDIHA%3D%3D

Various companies also claim that they have massive inventory that are profitable at <$60

So, imagine what it will be like as the world realizes with a start that it’s undeniably at peak oil. It’s an inelastic commodity so soon thereafter the price of a barrel will begin to rise–maybe by as much as 20%.

As in anything that goes into short supply, there will be hoarders, and these will be in the form of high-dollar speculators. In fact, it wouldn’t surprise me to learn that a certain cabal of Texas oilmen had purchased a massive salt deposit along the Gulf Coast and hired a crew to carve out a cavern with a high-pressure hose, until they have a couple of hundred-million-barrel caverns identical to the ones used for the SPR—yes, the one that is half empty and may remain that way. They’ll hoard in China, that’s a given. And in just about any oil-starved place where they absolutely must have a certain amount of feedstock, say a place like Taiwan.

Eccentric billionaires will undoubtedly hoard aviation fuel: try telling a man who has accumulated a hundred-billion dollars that he can’t fly his jet from NYC to Aspen for a weekend skiing trip. Helium is absolutely necessary for MRI machines to work and there are thousands in the world. Helium is in very short supply, being found as a significant component of Natural Gas in a very localized part of the country: W. Oklahoma and SW Kansas close to the old Hugoton Oil Field. Helium is almost certainly going to be hoarded. So is ethane.

Graham Allison at the Kennedy School at Harvard has spent almost his whole adult life studying Thucydides’ Trap, using it as a jumping off place to debate day by day whether China and the U.S. are destined for war, or if they can work it out by negotiation. This year, particularly, negotiation has gone badly. Unless a dense, reliable fuel source is found quickly, it would pay both China and the U.S. to keep plenty of jet fuel and diesel on hand. Even if the initial combat zone is commanded by nuclear missile-loaded drones operated by kids in Beijing and the Pentagon, it’s eventually going to involve thousands of planes, tanks, ships, armed personnel carriers, trucks and the like. Human nature hasn’t changed much since the time of Thucydides, so I’m betting on conflict.

I’m doing this little exercise for a reason: to point out that there are factors, mostly due to the quirks and foibles of duplicitous men (and women), that will significantly influence the already stretched supply of oil when we let the news out we’ve hit the peak. Hoarding and warfare go together like horse and carriage.

Absolutely.

A second underappreciated factor is the breakdown of the trading system for oil. It is highly likely that trading blocks of nations will become much more heavily walled off. This recent example with Russia/Europe in regard to natural gas is just an appetizer.

Dennis

Graph 9-1 shows the OECD commercial oil stocks. However, the April MOMR in Table 11-3 also shows total OECD stocks. I assume this implies we do not know the Chinese and Russian stocks. That table also shows Oil on the Water. A lot of that must be Russian, US and OPEC oil.

Attached is a chart that shows total OECD stocks and Oil on Water. It seems that the biggest drop since January 2023 is Oil on Water, 187 Mb. I wonder if this big drop in Oil on Water is the reason OPEC + felt it could increase production in May and is now also considering another increase for June.

Ovi,

I think at the world level, the visibility for oil stocks is very unclear, note that OECD stocks are probably less than half of World Oil Stocks, given that less than half of World oil is consumed in the OECD (in 2023 OECD consumed about 44% of World Consumption of oil, based on Energy Institute data).

Dennis says

“If India wants more oil, they simply need to outbid the competition, in a free market prices will rise enough so that consumption will match production in the long term. Typically as prices rise supply will rise and demand will fall until they match.”

I say Dennis does not actually understand geological peak oil.

In the U.K. oil production started to decline in 1999, oil prices went from $40 a barrel to $140 yet oil production continued to fall. All the technology available was already being used, no price increase made any difference.

Hence in 2015 after 3 years of $100 plus oil, 50 plus oil producing countries continued their decline in production.

Loadsofoil,

Supply is higher at high prices than at low oil prices. I am talking about World Supply. Let’s give a concrete example. In 2018 the average World Price for Brent Oil was $89/b in 2024 US$ and World Supply of C plus C was 82.9 Mb/d and in 2020 the average price of Brent Crude in 2024$ was $50.85/b and World C plus C supply was 76 Mb/d. In 2024 the average annual price for Brent Crude was $80.52/b in 2024 US$ and World C plus C output was 81.8 Mb/d. The basic idea is that supply is relatively higher at a higher oil price even when we are past peak oil output so that at $100/b output will be higher than it would be at $50/bo. This is freshman level Econ 101, not hard to understand.

First, in 2020 there was a covid economic ‘slowdown’ (!) and thus a glut of oil hoping for a buyer.

Flip side of that, is that when demand is relatively high but does not exceed geological economic supply capacity, then there are higher oil prices – until supply catches up and slightly surpasses demand.

Equally, past peak (absent recession/depression) IF economic conditions demand a lot more oil, using up the OPEC+ ‘buffer’, then oil prices will be higher – but ONLY so long as geology can now supply.

If, past peak, demand is muted due to poor economic conditions – as is likely – then prices will be lower – within cost of production hard limits.

But once falling geological production capacity is insufficient to supply global economic demand at a price that various segments can afford, then we enter a very complicated economic ‘shock pulse’/stasis/segmented expansion period where interacting feedbacks and sub-system stalls and failures (economic and political) have hard to predict consequences and timelines.

Very dishonest Dennis

Everyone here knows that 2020 was the lockdown. Supply had to be reduced because there was no demand. Price reflected the loss of demand. You can’t produce more oil than the system can absorb.

Can price bring on supply? Sure but it’s not some elementary calculation of supply and demand the way the army of dult economists explain things.

In 2013 oil was WTI $91.00 and inflation adjusted to 2025 $124.00 2018 was WTI $57.00 and inflation adjusted $73.00

Why didn’t you include that in your example? Cherry picking numbers to make your argument undermines your credibility maybe that’s why Mike is so mad.

Secondly high prices do not immediately result in higher production and you know that. It takes time to deploy CAPEX and bring new production online. But low oil prices can immediately reduce production because of necessity. Bringing production back from a low price event isn’t a supply demand function the production was already built.

Lastly to believe oil is headed to $100.00 is to avoid the last 4 year trend.

2022 $ 87.40 $94.93 second column is 2025 inflation

2023 $ 70.60 $73.59 adjusted

2024 $ 69.29 $71.88

2025 $ 65.00

Oil prices have been steadily declining so maybe the pie in the sky EIA and IEA that are so often quoted here have no clue what is going on.

Inflation adjusted oil today is 30% cheaper than 2022. If what you say is true production should have already fallen off a cliff. Inflation adjusted today’s prices are half of 2013!!! What you’re witnessing is the death of the industry which seems to be what everyone wants anyway but it isn’t being caused by EVs it’s being caused by geology.