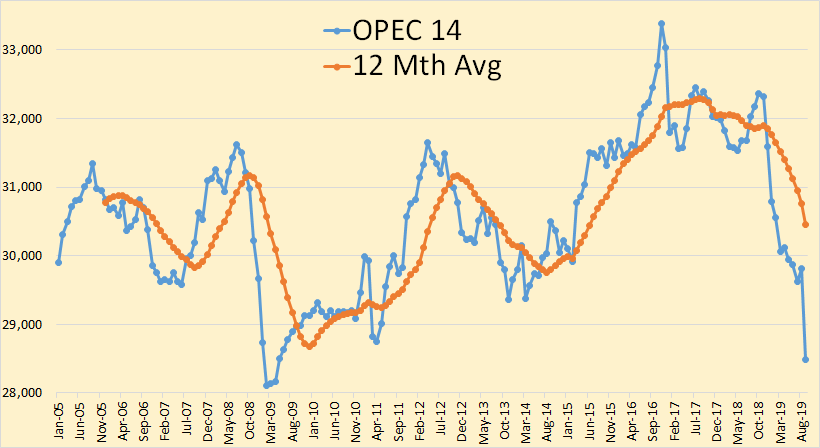

Data for the OPEC charts below were taken from the October OPEC Monthly Oil Market Report

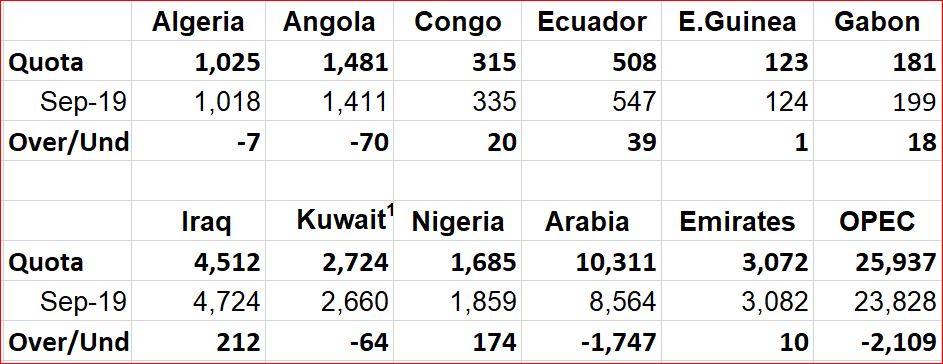

OPEC 14 crude oil production was down1,318,000 barrels per day in September. Most of that decline was due to the Iranian attack on the Saudi oil complex at Abqaiq.

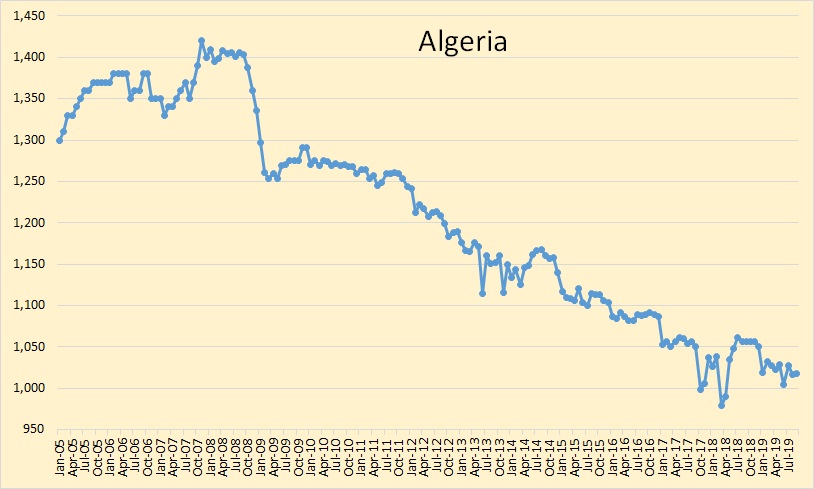

Algeria is in slow decline.

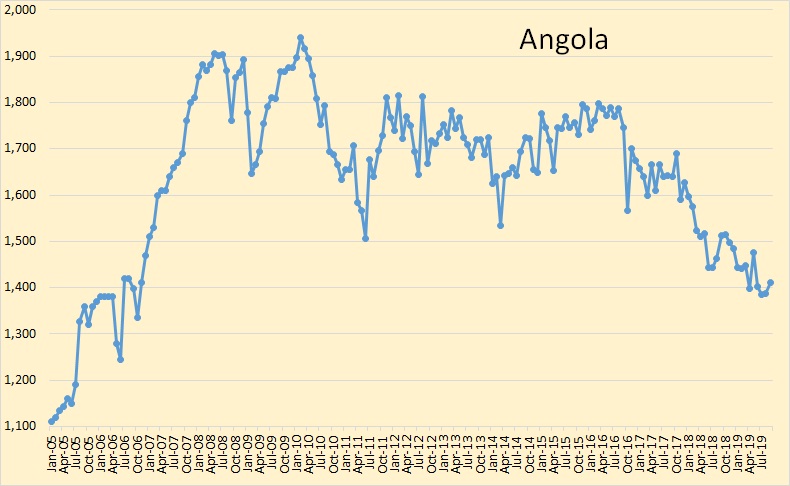

Angola is also in slow decline.

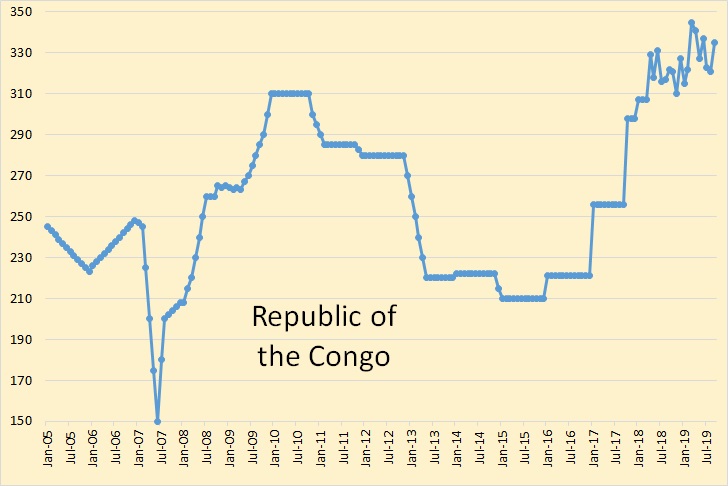

The Republic of the Congo does not have enough production to be a factor one way or the other.

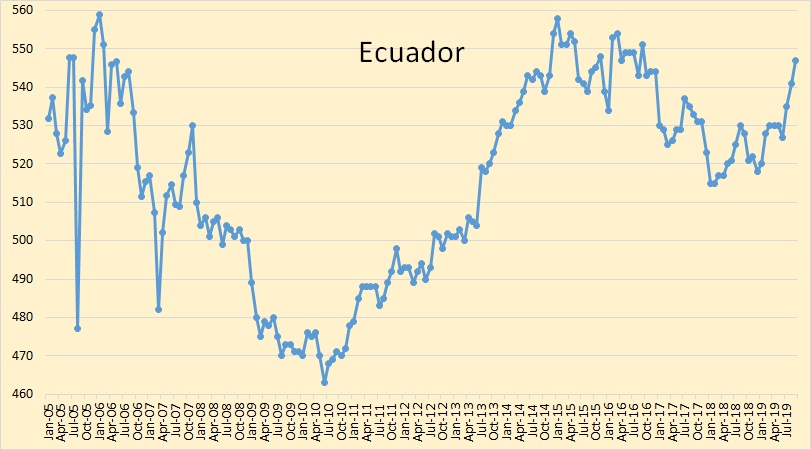

Ecuador will leave OPEC at the end of December.

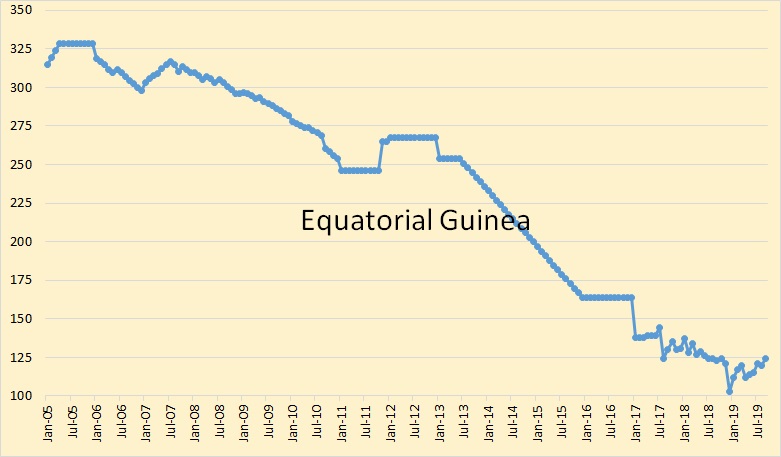

Equatorial Guinea hardly produces enough to make a difference.

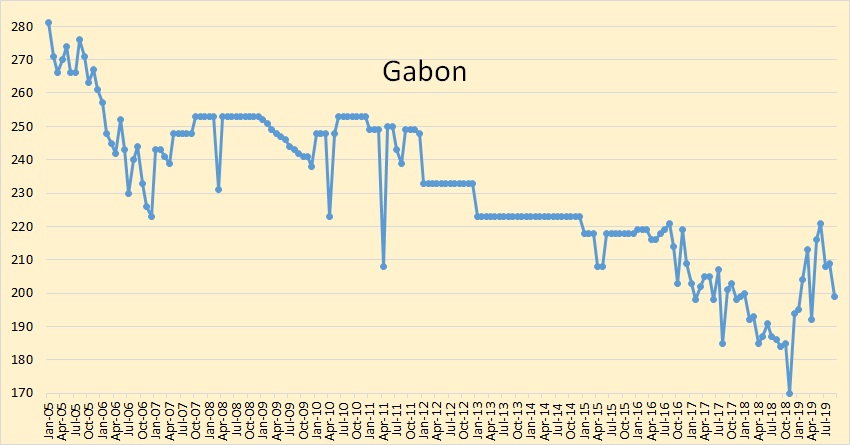

Gabon is at 200 kb/d.

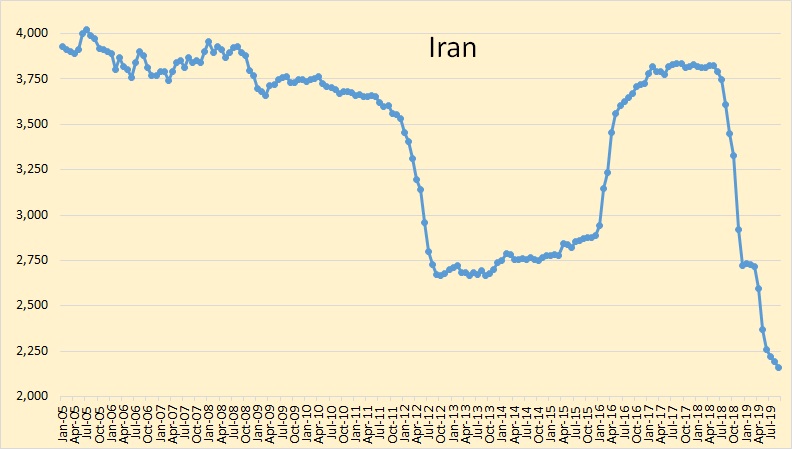

Iran is trying desperately to overcome sanctions but is not having a lot of luck.

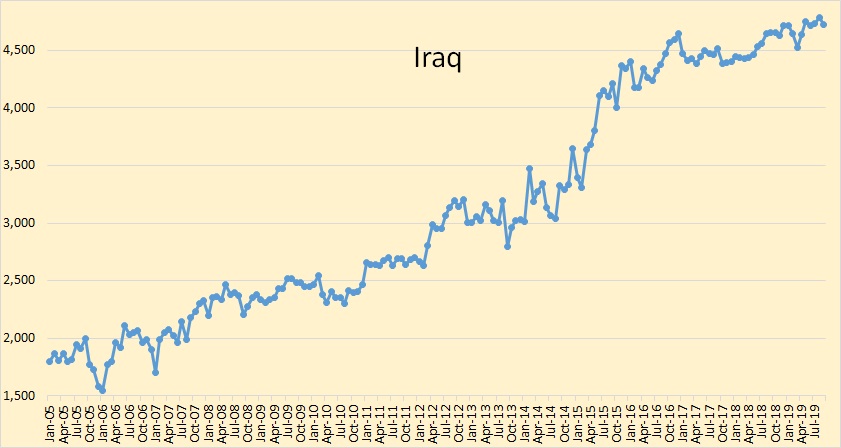

Iraqi crude production was down 60,000 bpd in September but they are still 212,000 bpd above their quota.

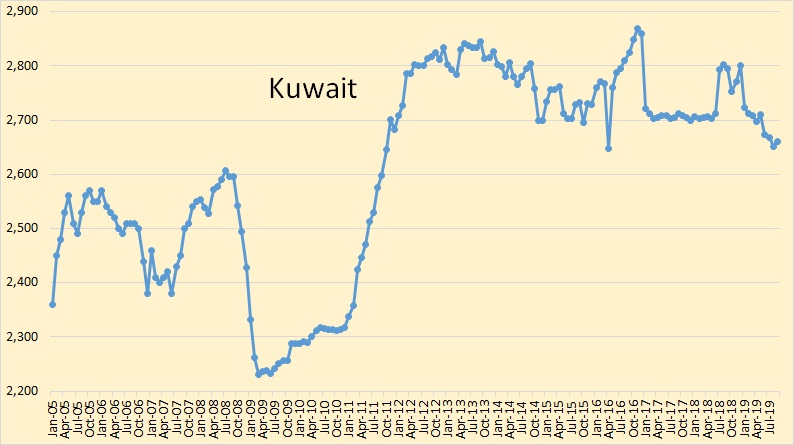

I believe Kuwait is producing flat out and will continue a slow decline. That is except for the Neutral Zone of course, which is shut down due to a conflict with Saudi Arabia.

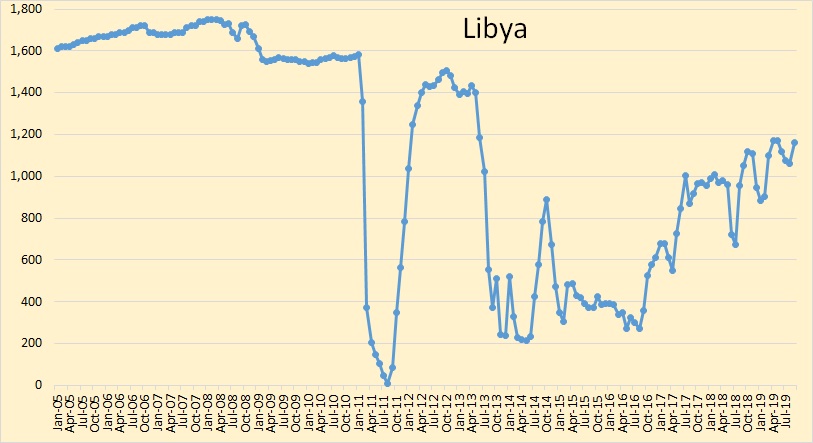

Libya is exempt from sanctions due to ongoing conflict in the area. Nevertheless, I believe the conflict is having little effect on their production

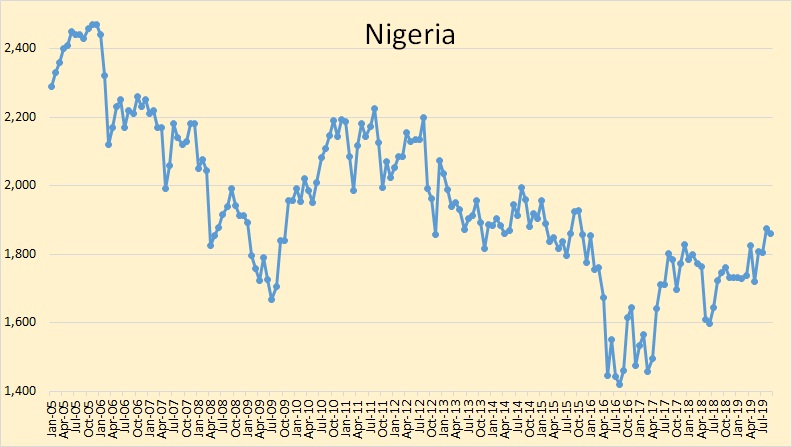

Nigerian crude oil production was down slightly in September, 16 kb/d. However, they are still producing at 174,000 bpd above their quota.

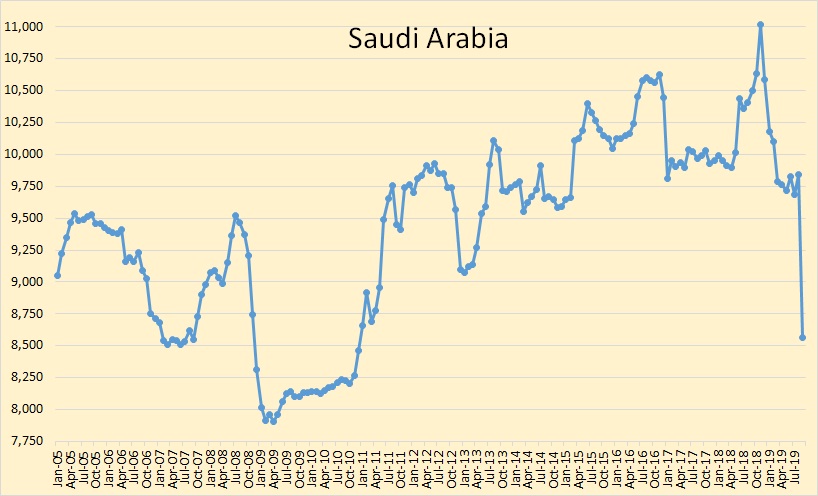

Saudi crude oil production was down 1,280,000 barrels per day in September due to the attack on their Abqaiq facility. It remains to be seen how much they have recovered.

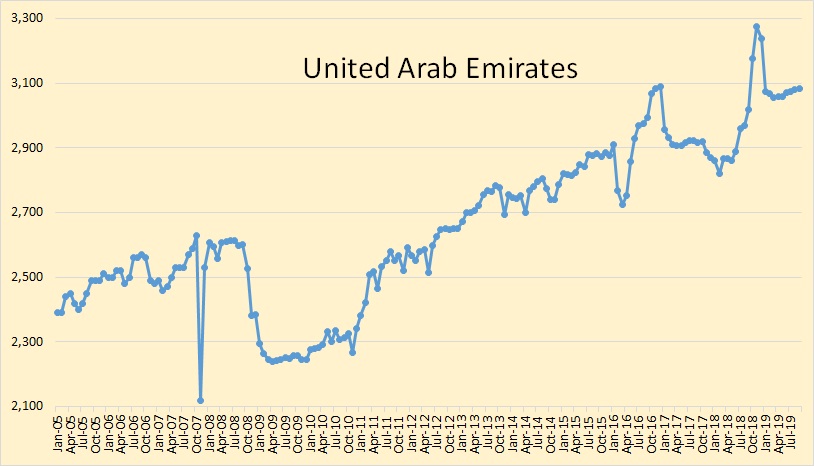

UAE crude oil production is holding steady. They are only 10,000 bpd above their quota. Their October, November, December surge was simply positioning for a higher quota. They may have simply saved oil in storage preparing for quota positioning.

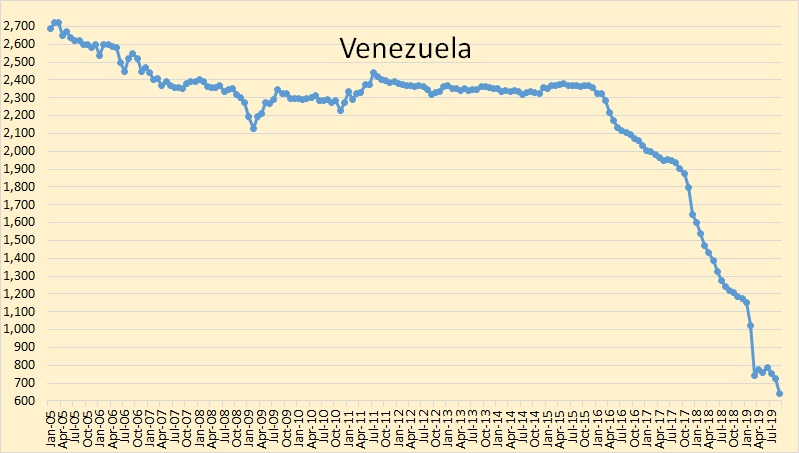

Venezuela took another big hit in September, down 82,000 bpd. What happens to Venezuela is a big question. If their government collapses completely, what will happen to their oil production?

Eleven OPEC nations are subject to quotas. Most of them are simply ignoring their quota and producing flat out. Saudi Arabia is having the only country having a major effect on world oil production.

World oil supply was down 1,770,000 barrels per day in September. Most of that was obviously due to the Saudi Arabia Abqaiq attack. However Non-OPEC total liquids production, according to the OPEC Secretariat, was down 450,000 barrels per day in September. That is very significant. I wonder where it came from?

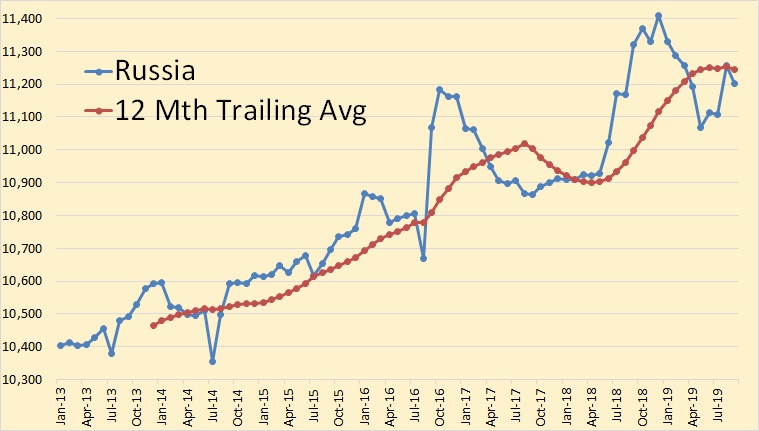

Russia was down 56,000 barrels per day in September.

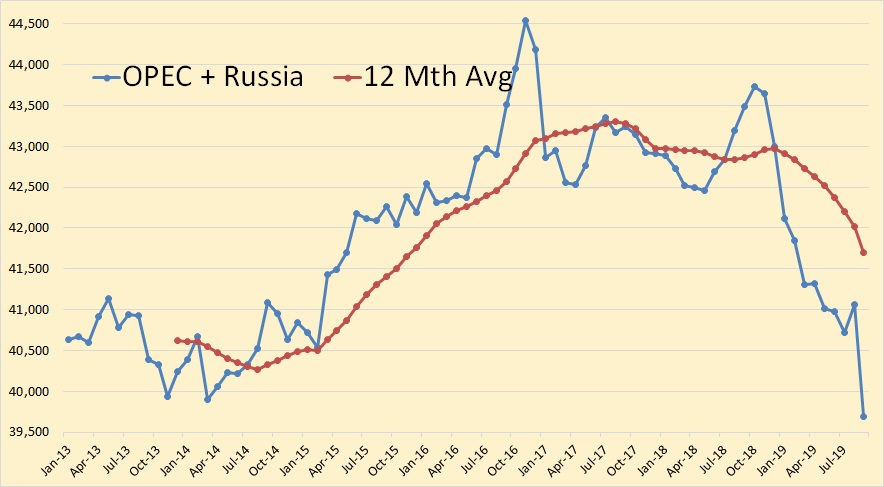

OPEC + Russia was down 1,377,000 barrels per day in September.

“Most of that decline was due to the Iranian attack on the Saudi oil complex at Abqaiq.”

Interesting that there has been no overt response as of yet.

There won’t be because Iran will respond by finishing the job and everyone knows it.

Yep–

Even the Fat Boy knows Iran could put the planet in a depression in 15 minutes.

I’m sure it has been explained to him.

Just look at the actions (none).

“Interesting that there has been no overt response as of yet.”

Also interesting that there has been no conclusive evidence that Iran was the attacker and yet here are all these articles writing this in the past tense as proven fact.

Simply repeating something often enough does not make it true to me.

+1

“Simply repeating something often enough does not make it true..”

Completely agree Chris.

Tell dick and donald that.

https://www.reuters.com/article/us-iraq-war-quotes/factbox-iraq-war-the-notable-quotes-idUSL212762520080311

I agree. The Houthis have been pinging the system and taking out radar components for years. Craft up some long range fuel tanks and you’re good to go. This is well within their wheelhouse, with lots of help from Iran lol. I’m also starting to feel that the Houthis thanking persons in the kingdom for help on the mission didn’t just mean some maintance guy putting transponders for targeting on the structures. Something is afoot in The House of Saud.

Absolutely correct Chris. This is the era of false flags and asymmetric warfare.

Let’s be done with it. Say along with me; “Peak Demand”, “Peak Demand”, “Peak Demand”.

Well, sort of . . . peak oil at $60 (after 6 years of $100 oil) crushed the world economy, hence “Peak Demand”.

Total absolute bullshit Peter. Peak oil will be peak oil regardless of the cause. If we have peak demand it will be because the oil supply is so short, and the price of oil too high, that people can no longer afford to buy oil. So peak demand will be because of peak supply.

However, demand is still rising and shows no sign of letting up until the supply peaks.

Peak demand is nothing but utter bullshit.

Ron,

There will come a time, probably after 2040 when at a given oil price level, perhaps $125/bo in 2035 that supply will fall, but demand will fall at roughly the same rate as people switch to EVs and other non-oil types of land transport (in this situation oil price remains roughly stable at $125+/-5 per barrel. By 2040 or so demand may start to fall faster than supply and we will know this because the economy is growing at roughly the normal rate (for the World this would be real GDP per capita growth of about 1.4% per year), but oil prices start to fall.

I know you think this is a pipe dream, in 1910, the same was said of ICE vehicles, especially by old guys like you and me.

We probably won’t be around to see it, in the mean time we can tell each other we are full of it. 🙂

I agree that right now we are probably not at peak demand, but the low oil prices do suggest either an excess of oil supply or a lack of oil demand. This is likely due to trade disputes and other factors reducing the rate of economic growth, which reduces the rate of growth in oil demand.

So not really peak demand, just low demand.

Dennis,

Your extrapolation of technological progress is shortsighted at best. You make some fallacies in my humble opinion.

1) Just because an event took place in the past doesn’t necessarily mean it will take place in the future. (tech progress)

2) Moores law is no longer valid as limits of size of CPUs is reached. I believe this might have implications in the future. We shall see.

3) Your predictions about what will or will not happen in 2030+ etc is questionable and i am highly critical of your predictions.

No one can predict oil prices, supply or demand in the short term, but at times it seems you talk with such high confidence about the price, supply and demand of oil in the year 2030+.

You obviously have every right to make a prediction. But others have every right to critique it.

For me it is laughable that someone could talk with confidence about the price, supply and demand of oil in the long-term (2030+), when even short term predictions becoming undone is seemingly the rules of the game in this complex world we live in.

Iron Mike

I am confident oil will peak.

I am also confident that initially demand will outstrip supply unless oil prices rise.

The rise in oil prices is likely to spur a transition to alternatives.

Timing is unknown. I am far from confident about specific timing. You wi note if you read carefully that I suggest demand might fall below supply after 2040. That is a pretty large window 2040 to infinity wouldn’t you say. ;

You are basically correct and I have repeated over and over we don’t know what will happen tomorrow.

In my scenarios I make careful assumptions about the future and simply see wher the model leads.

There are an infinite number of different assumptions that might be made.

Make your own.

It occurs to me that peak demand vs peak supply comes down to oil prices at the peak.

I agree with Ron that oil prices are likely to be high at the peak and are likely to continue to rise after the peak unless/until there is a major recession. My rough guess is peak oil in 2025 followed by severe recession in 2030.

If 2018 proves to be the peak, that might suggest peak demand due to low price level.

My expectation is output will rise above the 2018 level by 2021. A peak over 85 Mb/d after 2023 seems likely, 86 to 87 Mb/d in 2025 is my best guess, but 2023-2027 at 85 to 89 Mb/d probably with 60 % confidence.

“If 2018 proves to be the peak, that might suggest peak demand due to low price level.”

Can you elaborate as to why? Wouldn’t low prices be more attractive to consumers of oil ?

Iron Mike,

The idea is that oil prices are low because supply meets demand at the low price. So if 2018 was the peak in World output and oil prices were relatively low (certainly they were low relative to 2011 to 2014) then the peak would have been the result in a peak for World demand rather than supply.

We would expect in a peak supply scenario that we would see high oil prices as high oil prices would be needed to reduce consumption level (demand) to the level of available supply (production).

I doubt that the peak in 2018 will not be surpassed in the future and doubt the peak in oil output will be due to peak demand, I expect high oil prices, probably $100/b+/-10 at the peak.

Dennis,

What are your thoughts on the following common argument:

As oil becomes scarce, since it is an essential input to the economy, the marginal parts of the economy simply cease. This would have the effect of countering any price increase due to scarcity, as the same scarcity would be destroying demand. This is what is meant by “demand destruction”, and would imply the possibility of prolonged low prices, with temporary high price spikes, as oil production peaks and declines.

This argument can be extended, first to all fossil fuels, and then to energy in general. Then, if we extend the concept once more to surplus energy, taking into account the energy cost to get energy, we could come to the idea that, as surplus energy available to society peaks, the resulting long depression will act to keep energy prices low. This would be a continuous process, and we would never expect a prolonged period of high energy prices.

Another way to think of this is that the economy will be operating in an opposite manner to how it has the last 250 or so years: rather than growing with the occasional spike of degrowth, or recession, it will instead be shrinking, with the occasional spike of growth. It’s worth noting that prolonged periods (hundreds of years!) of the global economy shrinking have happened in the past, so this is not unheard of or impossible.

Surely you agree this would totally change “the rules”, so to speak? There would be a constant downward pressure on demand, until such point as the economy resumed growth in general. Bear in mind, our understanding of economics has all been developed during a period of prolonged growth. We simply do not know what “rules” govern an economy which is shrinking in the long term.

Niko,

I don’t find the argument convincing. Consider 1980 to 1983 when World C+C output fell and did not return to 1980 level until 1993. Oil prices went up economic growth slowed and the economy adjusted to using less oil.

I think much the same will occur when oil peaks. The World economy will adjust and in this case it may become apparent that supply will not increase in the future spurring greater effort to transition away from oil.

It may also become apparent that coal and natural gas will also peak once oil production has peaked, this will spur greater effort to transition away from fossil fuel.

At some point World population will peak (my guess is 2065, but that may be too hopeful) and when it does and starts to decline then economic growth will cease when growth in real GDP per capita matches the decline rate in population (currently real GDP per capita grows at around 1.4% annually). If the growth rate of the past 50 years of real GDP per capita continues long term (it might be more or less than this, likley less) then a fall in population at 1.4% per year would lead to zero economic growth.

I agree with you that the old rules of economics may no longer apply at that point, we may not need to worry too much about that for 60 to 70 years, there will be plenty of other challenges to address in the interrim such as the necessary transition to other forms of energy besides fossil fuel.

Dennis,

In your other comment you said

“I don’t find the argument convincing. Consider 1980 to 1983 when World C+C output fell and did not return to 1980 level until 1993. Oil prices went up economic growth slowed and the economy adjusted to using less oil.”

However, during this time period (1980 – 1993) oil prices(inflation adjusted) fell dramatically, from around $100 in 1980 to $30 – $40 in 1993. More surprising, oil prices were on a downward trend between 1980 to 1983, a period when world oil output was on a downward trend.

How do you reconcile this with your contention that as production decreases, prices will necessarily rise?

https://www.macrotrends.net/1369/crude-oil-price-history-chart

What I think is happening and will continue to happen is that companies, investors, and lenders see better places to put their money. Drain the gas and oil industry of financing and new development slows down or stops.

When you can do anything with your cash, putting it into gas and oil may not be at the top of the list. And if the price gets high enough to make it a premium investment target, likely consumption will go down. Commodities have built in limits to how much they can grow and be profitable.

Niko,

The rise in oil prices from 1973 to 1982 (average annual increase in oil price of $8/b) from $35/b in 1973 to $100/b in 1982 (trendline) led to demand destruction as people moved to more efficient vehicles and reduced oil use for home heating and electric power. At the same time there was development of new reserves in Alaska, North Sea, GOM and Africa and generally more drilling everywhere. Output fell sharply from 1979 to 1982 leading to higher prices for a time, but reduced demand and increasing supply after 1983 led to falling prices, especially in 1986 there was a surge in oil output OPEC increased output by 2.5 Mb/d as the Iran/Iraq war came to an end. This caused a big drop in oil prices from $64/b to $33/b. There is often a lag in the response to rising or falling oil prices as in the short term one does not buy a new home or new car, but over the longer term in a high oil price environment one might switch to a natural gas boiler or heat pump or buy a more fuel efficient vehicle.

Things will be different in 2025 to 2030 from 1974 to 1985, because high oil prices are not likely to bring on much in the way of new supply, but there will be a demand response over the 2025 to 2035 period as the transition to electric and possibly natural gas transportation is likely to accelerate as oil supply becomes short.

At some point demand for oil may start to fall faster than the supply of oil, difficult to predict, but I would say 2040 to 2050.

Note that I do not mean oil would no longer be used, simply that oil prices may begin to fall as oil supply may be greater than consumption at the higher oil price level and oil prices will need to fall for supply and demand to match.

Iron Mike

You do understand what a scenario is I assume.

Any probabilities I assign are quite subjective and I would agree they have little basis except my reading of expert opinion. The confidence you ascribe to my opinions are off by 180 degrees. I often say the future is unknown, the number of possible scenarios is infinite and the odds that any future scenario is correct is zero.

If you call that high confidence, we understand the concept differently.

Dennis,

“Expert” opinion usually doesn’t mean much, well to me anyways. I am an extremely skeptical person i guess.

You might be right. Both on your prediction and your “often saying the future is unknown”. I might not visit the site enough, but as far as your particular comments that I’ve read, I’ve seldom ever seen you saying you don’t know or its too hard to predict. In my shortsightedness, all i see is your linear prediction to a highly non-linear topic.

Just so there is no misunderstand, i am mostly talking about your 2030+ predictions and projections and especially with regards to oil prices. With oil prices i am critical of your near term predictions also. Your peak oil prediction ~2025 +/- 3 years? or so is very plausible (in my humble opinion) and your charting is helpful to many on here, and I am sure they appreciate your efforts, as I do.

Iron Mike,

I too am skeptical about future oil price predictions.

To make a guess some assumption must be made.

That is all it is, an input to a model to create a “what if” scenario. If prices were such and such, what would happen. Highly likely the assumptions are incorrect as we do not know the oil price tomorrow, much less 2030 or later.

How will oil get to $150 (or whatever) if people or nations do not have enough money to pay for it?

Adam, you simply do not understand the market or the law of supply and demand. Of course, many people will not be able to afford oil at that price. But there will not be enough oil to go around. So only those few people who can afford it will get the oil.

Yes Ron, I’m as thick as a post. My comment was somewhat rhetorical – I have absorbed a bit among peak oil discussions for the last 25 years of The Oil Drum and its predecessors.

We’ve seen what $100 oil does for the function of the global economy, and it was not nice. That economy is now more fragile, the risk of large chunks of light oil production going broke at any price seems higher than ever, and a true peak of decent ordinary usable crude oil seems iminent, if not past. So an oil price spike above $100 and anywhere aiming at $150 just seems an impossible hurdle for the economy to cope with, without drastic effects.

Its komplicated. We all know that. I think too we have become somewhat battle-fatigued with all that peak-oil followers have gone through over the last couple of decades – its been a bumpy ride, and very educational for those prepared to learn as they go.

Behind it all is Hubbert’s original illustration showing oil as a 200-year blip in the otherwise miserable global energy supply available to humanity. That picture still stands, the slide down awaits. Its the timing that eludes us, and we are, I think, frustrated that The Powers That Be have not chosen to work out for us a pleasant way down.

https://peakwatch.typepad.com/.a/6a00d83452403c69e201127906eb1028a4-pi

Adam,

The GFC was not due to $100+ oil, that is a common misconception, it may have been a contributing factor, but in my view was not the main factor. The main problem was poorly regulated financial markets. The lessons of the 1930s seemed to have been forgotten by 1979 and there was a move to “free” the financial industry from “unnecessary and burdensome” regulation.

Once this was accomplished, the World economy was “free” to experience a severe financial crisis nearly matching the crisis of the early 20th century.

High oil prices are merely a footnote in that story.

The real question is – how will oil get to $150 without most nation states collapsing. And the answer is – it wont. Once nations collapse and demand dies down (literally), oil will probably dip for brief periods. It’s also very dependent on how well the finance systems maintain during these collapse periods. If money flows stop then maintaining oil production could be a factor preventing “the dips”

Twocats,

The $150/b will be less of a problem because World GDP will be higher. From Jan 2011 to June 2014 the average price of oil was over $110/b. Just the average World growth rate of World GDP (about 3% per year on average) over 10 years gets us to $148/bo.

It will simply mean that less oil is wasted driving big SUVs and pickup trucks to drive the kids to school and buy groceries. The pickup trucks will be driven by those who really need them for their work. In addition there will be more goods shipped by electric rail and plugin hybrids and EV trucks and more personal vehicles will be electrified. The higher the price of oil the quicker such a transition occurs.

Some people will choose not to drive when possible and will use public transport, car pool, etc.

The $150/b will be less of a problem because World GDP will be higher.

Dennis,

GDP counts, but not so much for the majority of world population, the part with low and very low income. With oilprices of 150 $/b the basic necessities of life, like food, get considerably more expensive. Salaries will not (have) increase(d) enough for the majority of world population under this scenario. Then there is the situation of a fragile monetary system now, and the tremendous amount of consumer debt (mortgages, student loans, car loans, credit card debts). That just doesn’t bode well for the coming oilprice increase, a type of increase that we saw 1,5 decade ago.

Imho we won’t see a gradual energy transition because of slow rising oilprices, simply because the oilprices are not going to increase slowly. Yes, the world will get 150 dollar oil. I think that after 1-2 years of 150 dollar oil, oilprices will crash because of world economic recession, and the resulting underinvestment in the oil sector could lead to rapidly increasing oilprices about five years later. It will be a roller coaster of oilprices the next two decades. That’s my prediction, or assumption.

Reading your response is like listening to a child explain a game they created or listening to a lullaby. Relaxing if not a little naive. To think that the consensus economics of 2011 – 2014 is still intact is to almost completely ignore the past 6 years. But I can’t blame you for having hope. It’s a good way to go.

Two cats,

Can you elaborate on the drastic changes from 2014 to 2019, 5 years as far as I can tell?

For World debt see

https://www.bis.org/statistics/totcredit.htm

Chart below uses data from link above for all reporting nations of the World, debt for all non-financial sectors of the economy.

Debt to GDP using market exchange rates for GDP (rather than PPP measure, which gives higher GDP estimates and lower debt to GDP ratios).

Oh and your stories also sound like fairy tales.

Note that I fully expect there will be a severe recession at some point, my guess is 2030, if my guess of 2025 for the peak proves correct (low probability that anyone can guess the peak date correctly).

Han,

Of course there may be a spike in oil prices, this cannot be predicted, when I claim prices will rise to high levels Mike Shellman thinks that is too optimistic (as far as tight oil profitability) so I tend to keep the oil price scenarios lower, generally I would agree prices will rise and may do so quickly, but eventually the higher prices result in reduced demand.

Of course this will be difficult for the poor and food prices will likely rise making life more difficult. I have no simple solution to that problem, though redistribution of wealth through stronger ability for workers to unionize to bargain for higher wages as well as higher tax rates on the wealthy so the government can support the poor are relatively obvious solutions. Social revolution is an alternative and the wealthy and powerful would be wise to consider which option they prefer.

Also consider that emerging economies are growing more rapidly than developed economies, some (India and China) at 6 to 7% per year vs 1 to 2% for more developed economies.

Generally for developed economies especially in Europe, there is a safety net in place for the poor.

Another way to consider $150 oil- its still very cheap horsepower.

Try doing the work with just human muscle,

or try it with horses.

Then you’ll know how cheap $150 oil is.

Still an incredible deal.

Can it be afforded? Perhaps not by most.

Especially when you have a system where it has allowed something like 26 people to sequester unto themselves enough wealth to equal the combined wealth the lower 1/2 of all human beings [3.9 billion people].

A related question on this- how much oil would be necessary in the world, if it was only used for important purposes? Depends how you define important, but important purposes could surely justify higher prices.

Most oil is used for relatively low value purposes. For instance, in the US the average driver could cut their costs by 50% by changing to a cheaper vehicle. The average MPG for passenger vehicles (aka light vehicles) is only 23.

Only 23MPG!

The cheapest Prius gets over 50MPG, and is one of the cheaper vehicles on the road to buy, and one of the very cheapest to own and operate.

The average new vehicle price in the US is about $34k. The cheapest Prius costs about 20k. And, again, is incredibly cheap overall.

We actually had a comment on the current non-oil post that real men drive large pickups. That’s very expensive fake virility.

“Most oil is used for relatively low value purposes”

Did you ever do any work with your body?

Grow an acre of potatoes, then tell us how low value it is.

Yeah, I’ve planted potatoes by hand. It’s hard work…

Uhmm…you’re comment sounded a bit sharp. It’s as if you thought I was disagreeing with you. And…I wasn’t – I was agreeing with you!

So, I said “most”, not all. Passenger vehicles use just under 50% of oil burned in the US. They get abysmal MPG, and only carry an average of 1.2 people – that’s a lot of SUVs and pickups carrying one person and no cargo. They’re used about 4% of the time (an hour per day), and carry less than 20% of their capacity. That means they’re about 1% utilized.

On the other hand, the oil used on the farm is a relatively small percentage of all oil consumption.

Hickory,

Here in Germany with high gas prices farmer have his tractor for all the hauling and working (they don’t use a pickup truck, they pull wagons with it when they have to transport).

When driving to town, they use a normal passenger car using much less fuel. This car has most times a trailer hitch for small transporting.

“…… I claim prices will rise to high levels Mike Shellman thinks that is too optimistic“

Dennis,

Or too pessimistic because high oilprices are no fun and won’t last long in my opinion.

“…., though redistribution of wealth through stronger ability for workers to unionize to bargain for higher wages as well as higher tax rates on the wealthy so the government can support the poor are relatively obvious solutions.”

Obvious solutions but difficult to realize. In many countries we have seen social unrest already, many of them connected with salary issues and high petrol prices. Not much has changed though

“ consider that emerging economies are growing more rapidly than developed economies, some (India and China) at 6 to 7% per year vs 1 to 2% for more developed economies.“

Those high growth percentages make it even more difficult to cope with declining world oilproduction.

A fully electric fleet is an extrapolation, but the switch from combustion engines is pretty much a done deal on the manufacturing side. Big car companies are stopping development of future combustion engines. Development cycles are slow, so you won’t see the results for years, but the last generation of combustion engines is less than a decade away.

In the mean time, there will be a piecemeal replacement of traditional tech by electrical components starting in more expensive vehicles.

Furthermore electronics will continue to reduce the influence drivers can have on performance and efficiency. The same way ABS fixes the bad side effects of slamming on the brakes, mild hybrid makes more careful use of the combustion engine.

Electronics can also do other magic tricks like allowing the navigation system to influence the suspension. Purely mechanical system are being replaced step by step by an overarching electronic architecture. The final disappearance of the combustion engine will be a footnote.

I am nowhere near as confident as you regarding the future.

I can see EVs possibly growing in number due to government subsidies or maybe carbon tax etc.

In my neck of the woods (Australia) I don’t think they will grow in number. Or if they do, it will lag heavily behind the world. The cheapest Tesla here is 2016 S70 which is $70,000 AUD not including taxes. Which is ~ $50,000 USD not including taxes. Right now it’s only for rich people who use coal power electricity to recharge them.

Correction the cheapest is the model 3 ~ $75,000 AUD including taxes.

Iron Mike.

Toyota Camry SL is $44,500, Model 3 is $72,896 (Australian dollars).

Not sure why the difference is so large in Australia (Tesla is 1.63 times the price of a Camry).

In US Tesla Model 3 is 38990 and Camry about 30130 so about 1.29 times more for Model 3 ( the Tesla is much nicer, eventually less expensive EVs will be available).

It may be that EVs will catch on later in Australia. Australia only uses about 1% of World’s oil (in 2018) according to BP Stats, so a slower transition there may be fine. Will be interesting to watch, any projections about EVs I make are clearly guesses based on a set of assumptions about growth rates in sales of EVs. You would be very wise to be skeptical of such a projection, I am as well.

My aim is to see what rates of growth are needed to accomplish such a transition.

I think research into ICE vehicles will diminish, but production of ICE vehicles can fluctuate up and down in perpetuity depending on the oil prices we are constantly debating. If oil prices are kept low despite dwindling reserves and profit margins – then there is no reason to see ICE demand dwindling to zero before 2030.

As far as conversion to electric vehicles – if cities continue to build apartment without assigned parking and charging stations, and people keep using house-sharing as a way to afford big cities, and people super-stretch their budgets just to afford a house – then electric vehicles will not make as many in-roads as you think because those with money won’t have access to reliable charging, and those with reliable charging won’t have access to money.

“2) Moores law is no longer valid as limits of size of CPUs is reached. I believe this might have implications in the future. We shall see.”

This applies for conventional computers. However, quantum computing is now leaving pure academic applications, we “only” need the counterpart to ICs. :-))

Dennis,

“There will come a time”

Ok now you are betting on your version of the future playing out as you think it will fair enough and who doesnt but still its far from certain.

“I know you think this is a pipe dream, in 1910, the same was said of ICE vehicles, especially by old guys like you and me.”

Comparing horses -> ICE transition isnt really the same thing as EV will make demand for oil to dissapear, more like mitigate and then its about speed of mitigation vs other application and global population increase or?

“We probably won’t be around to see it, in the mean time we can tell each other we are full of it. ?”

I dont know how old you are but i think you will be around to see the peak production, and with that you will also see peak demand just at another price point 😛

“I agree that right now we are probably not at peak demand”

I agree, increasing yearly demand hints at that.

“So not really peak demand, just low demand.”

My opinion about it is demand is increasing still and until we actually see 0 barrels per year increase/decrease or less we still have increasing demand, the low price is due to supply excess or the perception of supply excess and that it will last for many many years.

Just my vision of the same future, we will see i guess.

Agree demand is increasing just less than supply at present.

Baggen,

Note that nowhere did I say oil demand disappears completely. I said demand will fall faster than demand (and I should have used may or might as this is far from certain, it is merely a possibility).

land transport uses over 60% of World C+C output based on EIA data for C+C and BP data for consumption of gasoline and diesel.

My modelling for World C+C output (which does not factor in oil price except in LTO scenario) suggests World output will fall from about 87 Mb/d in 2025 to 35 Mb/d (40% of peak level) in 2077. Use of C+C for things other than diesel or gasoline has been fairly steady from 2000 to 2018 (trendline is flat for past 18 years), I assume that trend continues do that the roughly 35 Mb/d of demand for C+C tat is not either gasoline or diesel fuel remains steady from 2019 to 2077, of course this assumption will be incorrect, it is a simplifying assumption we do not know if this other oil demand will rise or fall over the next 58 years.

The main point is that some of the demand for C+C from land transport (estimated at about 52 Mb/d in 2025) might fall as the World transitions to EVs and other forms of non-oil transport over the 2025 to 2077 period.

Perhaps the scenario is far fetched, seems possible to me, perhaps better than 50/50 odds.

For those that think I am certain about the future, nothing could be further from the truth, in fact I am far less certain the many here who are certain that we are doomed.

It seems only bad outcomes are certain. 🙂

Dennis,

“Note that nowhere did I say oil demand disappears completely. I said demand will fall faster than [Supply] (and I should have used may or might as this is far from certain, it is merely a possibility).”

I dont think i claimed you did either, if i did that was not my intention.

“The main point is that some of the demand for C+C from land transport (estimated at about 52 Mb/d in 2025) might fall as the World transitions to EVs and other forms of non-oil transport over the 2025 to 2077 period.”

I agree there and that is what i tried to convey by “mitigating” perhaps its the language barrier here that i cant express myself well enough. I just believe that whatever gets mitigated by EV will be more then replaced in new demand simply by global population growth, globalization where people are mass-moved from low energy lifestyles into high energy society/consumption.

If i remember correct you believe we will have peak oil around 2025 right, or is that peak shale or peak permian only perhaps?

Anyway say its only peak permian i think most of us agrees or believe that when US tight oil peaks the world peaks or rather the world will peak a little ahead of this since it will already be in decline. So more when tight oil hits plateau or even when tight oil production increase slows down the world peaks.

So if we have tight oil peak in 2025, world should have peaked in 2024-25. I dont expect any demand reduction before those years, and by that my conclusion is peak oil will be first and as Ron so gently put it, peak demand is BS. 😀

“It seems only bad outcomes are certain. ”

Yeah and i think my vision of the future is gloomier than yours im afraid.

Baggen

Poorly stated by me,

Will should have been may.

I just have an alternative vision of how things might play out from Ron.

It is correct that just because there has been tech progress does not necessarily mean that it will continue.

Assuming that all tech progress will stop seems a leap to me.

But hey an asteroid could hit the Earth.

Dennis,

“Assuming that all tech progress will stop seems a leap to me.”

I dont know if this is directed at me? I dont think i have claimed tech progress will stop somewhere.

“But hey an asteroid could hit the Earth.”

Would that mean peak oil or peak demand? 😛

Baggen,

No the tech progress comment should have been directed to iron Mike.

World real GDP grew at an average annual rate of 2.77% from 1998 to 2018 based on IMF data. From 1998 to 2018 World C+C minus gasoline minus diesel grew on average by 3.5 kb/d each year, if that rate continued to 2077 the consumption of C+C less gasoline and diesel fuel would be only 28.93 Mb/d in 2077. Most of the growth in liquid fuel demand has come from increased gasoline and diesel consumption even with 2.77% annual real GDP growth (at market exchange rates, PPP rate is higher).

Note that this extrapolation is probably wrong, rate could be higher or lower. Probably real GDP growth will gradually slow as population growth may continue to slow down in the future, which would tend to lead to lower growth rates in oil use.

To me it makes no sense predicting oilprice for the year 2040, or even 2030. Too many variables.

Predicting oilprice (+/-10%) for the year 2040 is almost comparable with going for winning the jackpot.

Han,

It is not a prediction, it is an assumption. One cannot evaluate the economics without a price. Essentially I pick several price levels $75/b, 90/b and $110/b for a maximum 12 month average price level, these are real oil prices in constant 2017$.

Any price could be chosen, and of course we don’t know what oil prices will be in the future, this point is so obvious it is left unstated.

We don’t know precisely what oil prices will be tomorrow, but I can state with 90% confidence they will fall between $10 and $1000/bo in 2017$ for the 12 month average Brent oil price between Sept 2019 and Dec 2050.

The $75 to $110 price window for maximum 12 month average Brent oil price that I use I would guess has about a 50% probability of being correct through 2045. Beyond that I am simply assuming there will be a slow transition to alternatives to oil for land transport as expensive oil might lead to changing demand. If that is incorrect the economy would falter also likely leading to reduced demand, if neither of those scenarios is correct then oil prices may remain high forever and my output scenarios may be too conservative in that case as I assume higher prices would allow more oil to be profitably produced.

Don’t get hung up on the fact that we don’t know future prices, this is simply an assumption about future prices and we see what happens if prices were what we have assumed (it is highly unlikely that any future scenario created would be correct, probability equal to zero).

I find the whole ‘peak demand’ story bogus, it’s just a rebranding of the problem definition; from, we’re running out and we’re fucked, too, we didn’t really want it anymore anyway (cognitive dissonance much?), So, don’t worry about famine, you just need a new car. Saved by consumerism, as it were.

https://en.m.wikipedia.org/wiki/Cognitive_dissonance

Part of this derives from a concept of gentle decline. It’s not human nature to share and share alike.

Ron has had this particular item correct for years now. You cannot burn what is not produced from the ground. And we can define ground as including where we keep the SPR.

You cannot consume what you do not have.

When scarcity arrives it’s just not reasonable to expect there to be a gathering of people to agree globally to share out what exists evenly. What you will see in the media are quotes about measures being taken to share things evenly, but what you’ll see in behavior is whatever gets people re-elected, and what gets people re-elected is whatever keeps voters out of gas station queues.

Seeing gas station queues in the media in a different country does not affect someone’s re-election. So share and share alike is just a bizarre perspective to expect.

The American perspective of share and share alike would necessarily be maintain the relative ratios of consumption. The US burns 20 million barrels a day, others burn less, and if there’s scarcity then share and share alike would evolve in a sequence which starts out we get everything that we want — and then after enormous debate and argument the US in its generosity announces that it will accept a lesser amount equal to our current ratio of consumption applied to the smaller overall pie. When there is international rage about this and how it is not share and share alike, that rage will largely be ignored and a transition from everything we want to maintaining the current ratio of consumption will be talked about and will be moved towards. Slowly. With slowly defined as the rate at which voter queues at gas stations are minimized.

Other countries won’t tolerate this. Then global consumption will decline sharply in response to population decline from the wars.

It certainly seems obvious that this is the most probable scenario.

I’m sorry Ron, but my impatience is showing. Your comment “oil supply is so short, and the price of oil too high” was precisely my point. Demand all over the world was crushed (by 6 years +$100 oil). Wasn’t that clear enough? Timelines, and peak oil is a multi-year event. Not a news story. Or a simple geographic analysis.

Peter, peak oil, that is the decline of oil supply will cause the price of oil to go so high people cannot afford it. But here is the bottom line:

Peak supply will occur before peak demand. Peak demand will be a non-event because peak supply will occur well before peak demand. Therefore:

Peak demand is pure unadulterated absolute bullshit. End of story.

Ron,

Whether it is peak supply or peak demand is really a moot point in my view as supply is equal to demand so in a sense peak supply vs peak demand cannot really be determined, the peak is the peak regardless of reason. I tend to agree that at the peak oil prices are likely to be high which suggests that supply is the real problem, I doubt oil prices will be low at the peak (I will arbitrarily define low as under $90/b for Brent in 2017$).

I have heard that S.A. has maintained contractual deliveries from storage so it is not so surprising that prices haven’t moved to much this month. I am more impressed that between November 2018 and June 2019 supply decreased by about 3% and price decreased by about 15%. To me this price decrease was the result of Fed tapering.

Our latest take on how things will play out can be found here: https://www.math.univ-toulouse.fr/~schindle/articles/2019_oil_cycle_v2.pdf

Thanks for the link Schinzy. Very interesting, as usual.

“Our analysis sees a high probability of financial collapse” (p. 22).

Schinzy,

“I am more impressed that between November 2018 and June 2019 supply decreased by about 3% and price decreased by about 15%. To me this price decrease was the result of Fed tapering.”

Your analysis on price-supply works fine over longer periods but I think it would be prudent to use consumption data (perhaps seasonal adjusted) when you analyse short periods. I assume that consumption of low cost energy (oil) during a certain period of time is what matters for economic growth – not how much was produced. Nov 2018 saw pretty high overproduction and resulting inventory build, consumption has not declined – yet.

Concerning your paper: Do you think that a new oil price spike is likely in the near term?

I interpret your paper this way. Particularly figs. 4 and 6, seems to suggest that oil prices will first spike before the next financial turmoil also on p. 20 you wrote “Such an event could be set of either by a rise in interest rates or the price of oil”

“Demand all over the world was crushed (by 6 years +$100 oil).”

/Checks charts/

Sorry, but the charts don’t align with your assertion.

Right! I never noticed that. Demand was definitely not crushed by 6 years of +$100 oil. Sometimes people just make shit up in order to make their point. In doing so they just end up making themselves less credible.

But that is not the point. Peak demand, or peak supply, does not mean peak for one year or even six years. Peak oil, regardless of the cause, is the peak forever. If high prices suppress demand for a given period, that is not peak demand or peak oil. That is just a rough patch in the road.

Ron,

Whether it is peak supply or peak demand is not that important, the peak itself (regardless of cause) will be important as well as the choices we might make to mitigate the problem.

Hi Chris,

Long term, production is roughly equal to consumption. If we look at C+C output growth from mid 2004 to mid 2014, the average annual rate of growth was 405 kb/d (see chart below). The long term rate of growth for World C+C output from 1982 to June 2019 is about 800 kb/d. The rate of growth was indeed quite slow (half the normal rate from 2004 to 2014).

You seemed to have checked the wrong chart. 🙂

Dennis,

weird time frame to use…you put the Global Financial Crisis of 2008 right in the center of it.

In case you were unaware, there’s a relationship between economic expansion/retraction and oil consumption

What’s the slope from 2009 to 2014 one wonders?

By eyeballing it [(78 – 72.5)/5] it looks to be about 1.1 mbd/yr. Well above your stated average and during a time of very high oil prices.

Whenever I hear people say “this or that price oil cratered demand” I always check my charts…the *only* thing that I can correlate with a decline in consumption, ever, is a recession or (once) an embargo.

The rest is wiggly noise as the charts head upwards from left to right.

Chris,

I agree World C+C output correlates very strongly with World GDP and not very well with oil prices.

If high oil prices have an effect on output or consumption it is likely a second order effect. In most cases high oil prices result from high demand for oil and a lack of supply to meet that demand, the “reduced demand” or demand destruction is at the margins where expensive oil may reduce the less important uses of oil (heating a home to 25 C in winter or going on a “Sunday drive”.

I chose a period where the average annual oil price was about $94/bo in 2018$ (2005-2014).

Yes, I am well aware that the primary thing that affects oil demand is real GDP. However the point is to look at a high price period, regardless of GDP. I chose a 10 year period, cherry picking high growth periods (like the recovery from GFC) proves very little in my opinion.

If we wanted to eliminate the GFC and recovery we would use only 2011 to 2014 and you are correct that during this high oil price period C+C output grew at 1000 kb/d annually.

From 2015 to 2019 World C+C output growth has been slower at 649 kb/d. Part of this difference might be accounted for by stock builds and stock draws, Unfortunately consumption data depends on stock level estimates and those are not very good at the World level.

Chris,

I took a look at BP data for middle and light distillates and fuel oil (about 90 to 92%% of World C+C output).

The long term trend from 1983 to 2018 is an annual increase of 791 kb/d, from 2000 to 2015 the annual average increase was 800 kb/d (a bit higher than the 35 year average). For 2011 to 2014 (high oil prices of $117/bo in 2018$ on average) this “liquid fuel” increase was 850 kb/d over this short 4 year period. During the lower oil price period of 2015 to 2018 (average oil price in 2018$ was $57/bo) “liquid fuel” consumption rose at an average annual rate of 922 kb/d. The average annual increase in liquid fuel consumption was 929 kb/d over the 2010 to 2018 period. From 1988 to 2007 liquid fuel consumption increased at an average annual rate of 812 kb/d. Liquid fuel=light distillates+middle distillates + fuel oil. Liquid fuel consumption was about 91.7% of World C+C output from 1980 to 2018. BP Statistical Review regional oil consumption was used for the data source.

Is water still wet in your reality Pete?

Broadly –

2002 – 2007 – oil prices rise due to “peak cheap oil”. Debate – how much did that lowering of supply, and subsequent rise in prices have to do with GFC. Doesn’t really matter – supply and demand rules were in effect. (Final spike in prices was just capital fleeing in different directions – not supply/demand)

2007 – 2009 – GFC causes uncertainty and blow to demand – prices fall. S&D rules in effect.

2009 – 2014 – Golden Era of Central Bank Easing – flooded market with cheap dollars, some of which invariably speculated in oil commodity, shale, etc. This caused oil prices to rise. Yes demand was rising, but its unclear whether +$100 barrel of oil was really demand caused or just Gold Rush mentality.

2014 – 2019 – Late Era CB Easing – Without ungodly sums of free money, shale oil economics begin to clash with economic limits. Shale still producing largely at a loss, so its really unclear how the rule of Supply and Demand can be applied. If the Demand is there, but Supply is willing to Supply below cost, then there is no real test of Demand.

2019 – forward – Demand finally overtaking Supply? Even with Supply coming at a loss (on the margins, 10%?), demand has finally creeped up on Supply. We are also adding in that the business cycle itself is one of the most extended in modern financial history, and that several countries are already in various modes of recession, which could affect demand outside of supply.

So for the last 17 years, the significance of supply and demand has been present, but probably not universally significant. Oh, and no where in there is Peak Demand. that’s not a thing.

Except Iraq and UAE, everyone seems to be in steep or not-so-steep decline.

I think we can assume the loss of at least 1 mbd per year in future.

It is instructive to look at World C+C output minus US tight oil output. In the chart below I show the trailing 12 month average through June 2019 (last data point for World C+C output). Pretty much a plateau from Jan 2016 to June 2019. Average output over that period was 76145 kb/d with a TTM minimum of 75918 kb/d and a TTM maximum of 76539 kb/d.

As Ron has said before the peak in US tight oil may well coincide with the peak in World C+C output.

Great chart Dennis. While not exactly apples to apples, I have yours next to the recent one by Enno at shaleprofile for USA LTO to June 2019. They’re a great pair. It’s not hard to imagine a 12 month trailing average on USA LTO.

https://shaleprofile.com/2019/10/08/us-update-through-june-2019/

Thanks Survivalist.

Here is EIA’s estimate of US tight oil TTM average from Jan 2015 to June 2019.

US tight oil TTM average increased at an annual rate of about 1250 kb/d for the past 2 years. I expect the annual average rate of increase over the next 5 years to be roughly 500 kb/d, so considerably slower than the recent past.

Thanks Dennis. Much appreciated. It’ll be interesting to see how World C+C output minus US tight oil output does in the meantime.

Survivalist,

I expect the plateau will continue until 2025-2030. Falling tight oil output after 2023-2027 may lead to falling World c+c if my guess is roughly correct.

The above Saudi graph shows a drop of production from 9,800 kb/d to 8,500 kb/d. If the numbers are correct, this means that production in the 2nd half of September was around 7,200 kb/d. Assuming that the Saudis maintained supplies to customers at pre-attack levels and not counting Saudis asking Kuwait and UAE to step in, Saudi inventories of 180 mb must have declined by roughly 40 mb.

Maybe they are filling the empty tanks with oil only partially processed, i.e with high sulfur content.

I had shown that Ghawar oil supplied to Abqaiq has peaked anyway

1/10/2019

The Attacks on Abqaiq and Peak Oil in Ghawar

http://crudeoilpeak.info/the-attacks-on-abqaiq-and-peak-oil-in-ghawar

In the meantime, the tanker war seems to continue

https://www.aljazeera.com/ajimpact/oil-prices-jump-iranian-oil-tanker-explosions-191011065750928.html

Tanker trackers stopped reporting about Adrian Darya off loading oil to the Baniyas refinery in Syria

Seems number of active riggs in Permian is increasing again, I believe this is mostly Exxon ramping up. Would be interesting to see a report related to the majours like Exxon now investing heavey in shale. Are they doing better than the average related to profit each foot latheral drilled, produced and how much in persentage if any.. I believe it should be possible to have some data after 6 months and indication after 3 months as decline courves , wellcost and oil price forcast is relative known. I guess also Quarterly reports from Exxon will be interesting as it will show profit of production guess to drill a well is an investment djuring lifetime in production that is funded with profit in bank after tax or borrowed money and only depressation will be written in the income budget the rest remain in the ballance . Perhaps one way if known how many foot wells Exxon produce in Permian there could be estimated how much they sit back with each foot average producing before capital cost , depreation and Compare this with other Shale Companies there. This is important because EIA ,Rystad have stated that companies like Exxon will invest heavey in US shale espesial Permian and this will add millions off profittable barrels anual. What if they fails , decline rate ruin their dreams , stock holders sells and Exxon will be transfered to a sinking ship. In that case there will be shortage of oil that will increase oil price before resession in world economy for decades.

Rystad’s 2019 global exploration update through 3 quarters was recently released – showing discoveries totaling 7.7 BBOE, with a year end projection of about 10 BBOE, which is in line with 2018. 58% gas/42% liquids. This equates to resource replacement of about 15% from conventional discoveries.

GOM’s biggest discovery was Blacktip – in the subsalt part of the Perdido Fold Belt in the western gulf.

Biggest oil discoveries world wide were from multiple Exxon wells offshore Guyana – totaling a little over 1 BBO.

In my opinion, 2 places with good hopes for future offshore oil projects are Mexico and Brazil.

Chevron and Shell just inked a 3 lease deal offshore Mexico – where Chevron will partner with Shell on some of the leases they picked up a few years ago. These are mostly an extension of the Perdido fold belt into Mexico waters.

A lot of interest in offshore Brazil where in a November-2019 auction numerous leases will be made available to industry. These are leases where discoveries have already been made, so the exploration risk is eliminated. Total lease bonus amounts are expected to be over $20 billion. (I’m a bit confused about some of this – I thought this auction was in November, but I’m seeing reports that some of the leases have already been awarded, but, those may be a separate sale for pure exploration blocks?? Regardless, a lot of interest and activity in this area)

The northern GOM still has a lot of significant projects in the queue for first oil in the next 2-5 years or so. These include Mad Dog 2, Vito, Anchor, Ballymore, Whale,, and a number of smaller projects that will probably get developed. The Wilcox trend, from an exploration standpoint, is already quite mature. Maybe more in the east central Gulf associated with the Norphlet, and, maybe untested Mesozoic targets (deepwater Tuscaloosa is a good example).

Link to Rystad article referenced above, from Offshore Magazine.

https://www.offshore-mag.com/drilling-completion/article/14068341/oil-and-gas-resource-replacement-ratio-lowest-in-decades-rystad-energy-report-finds

SouthLaGeo,

You had mentioned before that GOM should getto about 2Mb/d in late 2019(I think). Do you have a rough guess on output in 2020? Does the EIA’s STEO for GOM output seem in the right ballpark to you?

Thanks.

Dennis,

There are a lot of strong, legacy assets where production, as a whole, has been flat since about a year ago. (At that time, starting in July-2018, GOM seemed to take a step change in production from about 1.6-1.8 to 1.75-1.95 mmbopd). These assets include Atlantis, Thunderhorse, Mad Dog, Perdido/Great White, Jack/St.Malo, Tahiti/CaesarTonga, Mars/Ursa/Olympus, Shenzi. These fields account for about 1/2 of GOM production. These assets have spun off a lot of new projects, and it’s these new projects that are helping maintain GOM production. Thunderhorse, I believe, has at least one more new project in the queue, as well as Mad Dog (Mad Dog 2), St Malo waterflood, Atlantis also has at least one more, It’s too early to know if Appomattox is going to achieve it’s 150 kbopd+ or not,, but, assuming it does, then, I think a couple things can be predicted about GOM production. I think it could stay at least at or above 1.8 mmbopd until as late as 2025 or so.

I believe, in the short term, say between now and the end of 2019, we could see a month or two where production exceeds 2 mmbopd. Through 7 months in 2019, GOM has averaged about 1.84. And I do think this trend could continue through 2020. In a most likely scenario, I could see both 2019 and 2020 averaging about 1.9 mmbopd.

Without spending the time looking at more specifics, this is about as far as I’m willing to go . Our old friend George Kaplan was better at this kind of thing than me! I’m OK at talking about the geology, but George, and a lot of the other contributors to this site, including you, Dennis, are better at making informed projections.

SouthLAGeo,

Thanks for the kind words. George was much better than me for sure, and so are you especially for GOM, but probably in general as well, you are too humble.

Thanks for the insights I am sure I am not alone in thinking that every time I read one of your comments I learn something important.

https://www.theguardian.com/environment/2019/oct/10/oil-firms-barrels-markets

Guardian talking of supply glut…

This article seems to almost ignore the issue of natural decline. Assuming a conservative decline rate of 1%, that is roughly, 1Mb/d/yr.

7 Mb/d in 10 years is an addition of 0.7Mb/d/yr, a replacement shortage of 0.3 Mb/d/yr. This, IMHO, is saying supply shortage, not glut, and we haven’t even added increasing demand.

Can anyone confirm or provide a more realistic number for a world wide natural decline rate. Saudi Aramco says that natural decline in Ghawar is 2%/yr.

Hi Ovi,

Just posted as interesting to see what mainstream media is saying.

No talk of what would happen in oil shortage scenario, (i.e. potential famine due to supply chain disruption), entirely focused on carbon/ climate.

Ovi can you define natural decline?

Dennis

When I used the words “Natural Decline”, I was thinking of what is happening in Ghawar and did not want to get into the weeds of 8 and 2 and was explained in a report published in 2006, as noted by Ron.

I would define natural decline rate as that associated with the drop in pressure associated with the depletion of the reservoir, assuming no water injection. The pressure drop is strongly linked with the size of the field and with the rate of extraction. The difference in decline rates associated with large and small fields is best exemplified by what is happening in Ghawar and the Permian.

Ovi,

The term means different things to different authors, so I was trying to zero in on what you meant.

Most well decline is hyperbolic a d the rate of decline changes with time. For a field the rate of decline of the field will depend on the rate of development of the field which varies from field to field.

When people have looked at production weighted averages for declining fields for the World it is usually 5 to 6%.

Whether this coincides with natural decline is another matter as most large fields have had secondary or tertiary recovery methods applied.

Natural decline would probably be higher as you define it, perhaps 7 or 8%, a petroleum engineer might have a better guess.

Ghawar has seen water flood and lots of other fancy tech for many decades.

Saudi Aramco says that natural decline in Ghawar is 2%/yr.

No, they say they have a natural decline rate of 8%.

They said, in 2006, that with their massive infill drilling program, they had gotten their decline rate down from a hypothetical 8% to almost 2%. Understand however, that is not a natural decline rate. They had a natural decline rate of 5% to 12% with their old vertical wells. (An average of 8%). However, with massive infill drilling with horizontal wells, skimming the top of the reservoir, they had gotten the decline rate to almost 2%.

So a natural decline rate with vertical wells, for Saudi fields, was 8%. The unnatural decline rate with horizontal wells is now 2%. But what they don’t tell you, and perhaps they do not understand, is that by decreasing their decline rate they have greatly increased their depletion rate. That will, sooner or later, bring about a Seneca Cliff in their oil production.

Note: In their reports, Saudi uses the terms “decline rate” and “depletion rate” as if they were interchangeable. They say they have gotten their depletion rate down to 2%. Obviously someone doesn’t understand the difference.

Check it out–From 2006. Bold mine.

Saudi Oil Field Depletion Rates

• The Kingdom’s average state of reserve depletion for all its fields is approximately 29%.

• The oldest field, Abqaiq, is 74% depleted, and the world’s largest field, Ghawar, has produced just under 50% of its reserves. By contrast, Shaybah, one of the Kingdom’s youngest fields, has 95% of its proven reserves remaining.

• Without “maintain potential” drilling to make up for production, Saudi oil fields would have a natural decline rate of a hypothetical 8%. As Saudi Aramco has an extensive drilling program with a budget running in the billions of dollars, this decline is mitigated to a number close to 2%.

• These depletion rates are well below industry averages, due primarily to enhanced recovery technologies and successful “maintain potential” drilling operations.

“They say they have gotten their depletion rate down to 2%. ”

It’s hard to believe they would not know the difference. Is this possibly just a bad translation or a wording error?

Its the KSA—-

Reality only gets in the way.

It’s hard to believe they would not know the difference. Is this possibly just a bad translation or a wording error?

No, neither is possible. The author of this bit of information obviously spoke perfect English. He simply thought the two words meant the same thing. Here is the “about the author” at the bottom of the article. Except for the name, bold mine.

Nawaf Obaid

Managing Director

Nawaf Obaid is currently the Managing Director of the Saudi National Security Assessment Project, a government consultancy based in Riyadh. He is also the private Security & Energy Advisor to HRH Prince Turki Al Faisal, the Saudi Ambassador to the US.

He is the author of The Oil Kingdom at 100: Petroleum Policymaking in Saudi Arabia (Washington Institute for Near East Policy, 2000). He is also an Adjunct Fellow in the Office of the Arleigh Burke Chair in Strategy at the Center for Strategic & International Studies (CSI) in Washington DC where co-authored with, Anthony Cordesman, National Security in Saudi Arabia: Threats, Responses, and Challenges (Praeger & CSIS Publications, September 30, 2005).

He has a BSFS from Georgetown University’s School of Foreign Service, an MA in Public Policy from Harvard University’s Kennedy School of Government, and completed doctoral courses at the Massachusetts Institute of Technology’s Security Studies Program.

Good discussion of depletion rate in paper below

https://royalsocietypublishing.org/doi/pdf/10.1098/rsta.2012.0448

For Saudi Arabia if we use 300 Gb for their URR and 10 Mb/d for output then the depletion rate for their URR would be 3.65/300=1.2%, if we do the calculation in terms of remaining reserves it would be about 2.4% where remaining reserves are about 150 Gb at the end of 2018.

I think decline rates are less confusing as people forget to specify whether they are using URR or RR for the denominator for a depletion rate.

I often use the term extraction rate which is related to the depletion rate but uses producing reserves in the denominator.

For the Saudi case, let’s assume that 50% of their remaining reserves are developed producing reserves (a guess on my part as I do not have this information). If output was 3.65 Gb in 2018 and at the beginning of 2018 the producing reserves were 75 Gb, the extraction rate would be 3.65/75=4.87%.

Based on the information in the presentation Saudi fields were 29% depleted at the end of 2005, cumulative production was 108 Gb, so the implied URR was 108/0.29=372 Gb, with remaining reserves(RR) of 372-108=264 Gb so in 2006 the depletion rate for RR would have been 3.34/264=1.26%. In 2017 RR=222 Gb and 2018 depletion rate from RR would be 3.8/222=1.7%.

If you look at the charts provided by Ron, of Saudi Arabia, Venezuela, and Iran,

you can see a common thread- significant dropoff in production that is not based on

geologic depletion or weak demand.

Rather it is due to human policy factors, such as military activity, trade sanctions, and failed state/poor management status.

These factors have taken about 4.6 Mbpd out of production (Iran 1.6, Saudi 1.3, Venez 1.7). That is roughly equivalent to the entire production of Iraq- no small potato.

Libya certainly served as another example of this kind of disruption over the past decade.

My guess is that human factors will only serve to bring about peak production much more quickly than forecasts derived from geology based URR capabilities. Certain countries will have seneca cliff patterns due to failed state status/war, and this may severely disrupt the amount of oil available to importing countries.

Below are the 15 countries that imported the highest dollar value worth of crude oil during 2018.

China: US$239.2 billion

United States: $163.1 billion

India: $114.5 billion

Japan: $80.6 billion

South Korea: $80.4 billion

Netherlands: $48.8 billion

Germany: $45.1 billion

Spain: $34.2 billion

Italy: $32.6 billion

France: $28.5 billion

Thailand: $28.4 billion

Singapore: $28 billion

United Kingdom: $26 billion

Taiwan: $23.4 billion

Belgium: $19.5 billion

Of these countries, the USA is most capable of losing oil importation I suspect [USA net imports of oil consumption is 11% of total as of 2018- eia], as long as LTO production holds up.

The rest are all highly vulnerable.

Hickory,

Of your big 3 only Venezuela is likely to be a long term problem, other nations may see such drops in output on a temporary basis. A change in policy by the US would bring Iranian output back online in short order, KSA output may have already come back online (unless there is another attack).

All of these potential disruptive events are not likely to happen simultaneously throughout the World in my opinion.

If I am wrong, then oil prices rise because supply is short and nations reduce consumption due to high oil prices.

That seems true to me, but these kinds of disruptions are a major source of error in predictions of supply, and they can be completely unexpected and sudden- Libya 2011-2014, for example.

The big wild card in all this is the Gulf. I place no bets on stability in that region.

Hickory,

I agree, definitely impossible to predict these disruptions. If we see a major war between Iran and Saudi Arabia, the World will be short of oil supply and we would see $150/bo or more for Brent in short order.

It would not be pretty, the World would be in chaos no doubt.

FED restarted QE the day after i last posted here. Out of nowhere with no warning or build up or talk. This changes the whole outlook for price of oil. It’s $60 billion a month. Not far from the $75 billion when QE was at it peak. Regardless of the details their back expanding the balance sheet.

It’s going to support oil price. It’s going to support US equity markets as well. Combine that with enough on US/China trade to keep market happy and possible deal on Brexit. Bottom just might be in for the price of oil with Brent actually reaching it’s long-term supporting trendline and WTI hoovering a few dollars above it’s supporting trendline. The price action on Brent chart suggest trendline will hold. And if that is the case WTI will never reach it’s supporting trendline.

Dollar is going to roll over here. How much depends on FED. But this will be a broad base risk on move. Stocks up, oil up, US treasuries at least the long end of it will steepen somewhat. Yen crosses have all put a turn in as the Yen will weaken in a risk on move. Which will also crush those who ran to gold and silver. Safe haven trades that worked so well leading into the trade war and Brexit won’t be working so well anymore.

Things went from a world stacked against the price of oil to stacked in it’s favor in a matter of 2-3 days.

This is why it is impossible to forecast the price of oil, I have been following the oil market for 20 years, the best you can do is stick to a low cost producer and ride the cycle through them, they’ll make money in the ok years, breakeven in the bad years and make a ton in the good years.

Folks really should be aware QE did restart this week. That was off the mainstream radar screen.

Powell announced that asset purchases by the Fed of bonds were now taking place at $60B/mo. He further announced that this was not QE. This was a measure taken to address technicalities in unbalance in the repo market. Y’all can go look up what that means, or you can go dig into the QE wiki and find this:

— QE is not monetization of debt. It is monetary stimulus injected when interest rates are so low that lowering them further would have no stimulative effect [note this was written before negative rates became common]. So whereas monetizing debt (using a central bank to finance a deficit) involves the central bank buying government bonds, QE is the central bank buying government bonds while saying they are stimulating, not financing a deficit. —

In other words . . . it’s in other words. The action is identical. You just say it is something different.

Look familiar? The action taken by a CB for monetizing debt, quantitative ease or addressing Repo imbalance is exactly the same. You define the identical action with a claim, to embrace whatever definition might be least embarrassing at that time.

“The action taken by a CB for monetizing debt, quantitative ease or addressing Repo imbalance is exactly the same. ”

This really isn’t true, as much as the recent move is eyebrow raising. Buying bonds to finance the debt is a different animal from buying MBS to shore up the housing market is a different animal from buying short term treasuries held at member banks.

Absent obvious cuts, outages and short-term boosting, did Russia effectively peak in 2016 at 11.2-11.3m? That production is all *heavily* supported with infill drilling and EOR, they don’t have big new fields or even discovery prospects (Arctic anything will take a decade to bring online). And they were forecast to have peaked in the middle of this decade, including by domestic forecasts.

Norway’s Huge New Oil Project Clashes With Growing Focus on Climate

Sverdrup, discovered in 2010, in an area that had been disregarded by most explorers, the site started production on Saturday and is set to reach 440,000 barrels a day by next summer. That represents a 33% addition to Norway’s crude output in the first half of this year, a hike not seen since the 1980s.

https://www.bloomberg.com/news/articles/2019-10-07/norway-s-huge-new-oil-project-clashes-with-growing-climate-focus?srnd=climate-changed

Hi,

I’ve been following this arguement now since 1997 and I have to say I agree with Gail Tververg from our finite world that the models used to predict peak oil were far too simplistic…. the EIA 2019 report published a few weeks ago clearly shows a massive increase in oil production in the USA over the last number of years from approx 5mbd to over 12mbd … if this technology and methods can be used in all the other oil production regions the peak of global production is beyond a decade away.

Meaning , humanity has enough oil, gas and coal available for production and burning to literally cook the world. Peak oil will not arrive in any meaningful timeframe to avoid the worst case scenario in the IPCC reports.

We are going to have to choose to shrink the global economy and reduce emissions.

I give us a 5% chance of that happening….. why? Because fossil fuels are required to power the system that produces the renewable energy infrastructure. The mining, transport, refining, manufacturing, distribution, selling, installation and maintenance all depend on oil at every level…. there is no substitute even on the drawing boards!!

cheers

We are going to have to choose to shrink the global economy and reduce emissions.

You’re telling 7.7 billion people what they must do. They ain’t listening.

We are going to have to choose to shrink the global economy and reduce emissions. . . .

Response:They ain’t listening.

How about:

The economy will shrink. Emissions will be reduced.

The economy will shrink. Emissions will be reduced.

But of course the economy will shrink. And of course emissions will be reduced. The decline in world oil production will have a dramatic effect on both. And I must add, the shrinking economy will be extremely painful. It will be a never-ending great depression. A depression that gets worse every year. And hungry people are angry people. They will lash out at those whom they hold responsible, that is whoever is in power.

It will get nasty, real nasty.

But apparently they will still buy EV’s and motor about as normal. So say some on this site.

I don’t get it.

R Stone,

There are differing opinions. Some think EVs will make no difference and they are very certain they are correct. Others are certain EVs will allow the World to transition away from oil as a land transport fuel.

I am certain of nothing, perhaps EVs will help a bit, but it is far from certain that this will occur. With proper policy it seems feasible to me, but proper policy is rarely followed, so maybe a 50/50 chance a transition from oil to other forms of land transport (electric, natural gas, and biofuels perhaps) might be accomplished.

Hi Dennis,

I know there are different opinions about the future and that is fine, we shall see.

What I do not understand, but would like to, is how we transition, the theory is easy. Where will people get the money as the economy contracts. I am with Ron on this. After peak the economy will contract. Energy is the ability to do work. Less energy – less work. EV’s do not really solve anything. They still need to be made, bought and powered and that requires a functioning economy and political system. Good luck with that.

R Stone,

I know that many are convinced that a transition to less oil use is not possible, I just do not agree based on my expectation of future oil output. Cars and trucks get replaced every day, that is simply an ongoing feature of a dynamic economy. ICEVs simply get replaced by EVs gradually over time and less and less oil is required. As oil prices rise and people become aware that the peak in oil output is permanent, the process likely accelerates and over a 5 year period the sales of ICEVs may fall quite rapidly.

As the EV industry ramps up there will be economies of scale and innovation that will reduce the cost of EVs so that by 2025 the ICEV may no longer be competitive on a TCO (total cost of Ownership) basis.

Also note that Exergy per unit of primary for many non-fossil fuel types of energy is much higher as there are fewer thermal losses, average thermal power plants waste about 60% of the primary energy burned as waste heat, for an ICE vehicle (non-hybrid) typically 70% of the energy content of the fuel is waste heat.

So an economy running on wind, solar, hydro, and electric transport would require far less energy (50% to 60% less) than the economy of today.

Will this happen? Nobody knows.

Is it possible?

From a physical perspective, yes.

Will it be a smooth and easy transition?

Highly unlikely in my view.

R Stone,

In the USA ‘after peak’ doesn’t mean oil or Nat Gas will just disappear one year. There will be a rough plateau and then decline. This will play out over a long enough period that considerable adaptation will occur, unless we get into some sort of abrupt failed state situation.

Critical uses of oil for industry, manufacturing, and agriculture isn’t about to go away one day. If we had an energy policy, those uses would be prioritized.

Light vehicle transport could be transitioned from petrol to primarily electric over a decade. I’ve no doubt we could do that if it was a priority, even without any further innovation [ex- I have a plugin hybrid van, and about 70% miles is on solar electric and 30% on petrol. Made in the usa vehicle. It was easy to get, and rides better than any vehicle I’ve had before. I can put a sheet of plywood laying down in back if I choose].

We could save about 10% of vehicle consumption just by slowing down to 60 mph. We don’t need to fly around so much. Many trips people take are frivolous. There are many ways to keep up a quality of life without using so much energy.

Those are ideas are short term. Longer term its tougher. I think we will need a combination of population (demand) downsizing, and build out as much domestic renewable energy production as we can muster. There really is a lot of nat gas, solar, and wind energy available on this continent.

My first reaction on reading this was to think looking from afar I thought the US was already a failed state, certainly a mad house.

Your van sounds great, can I have one. Our one car is 14 years old and on its way out. It will be replaced by a 10 year old car. Some people just do not have the money. I know about TCO but if its all you can afford at the time hard luck.

On flying, yes we are entertaining ourselves to death.

“I thought the US was already a failed state, certainly a mad house.”

yeh, good point.

Certainly a country without any energy policy.