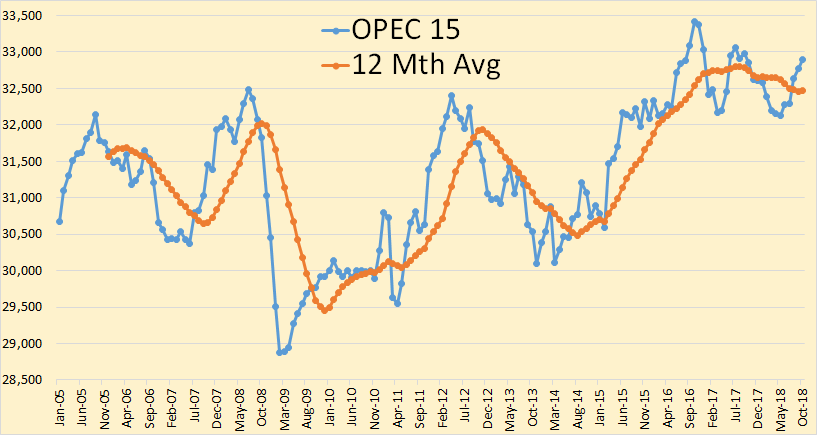

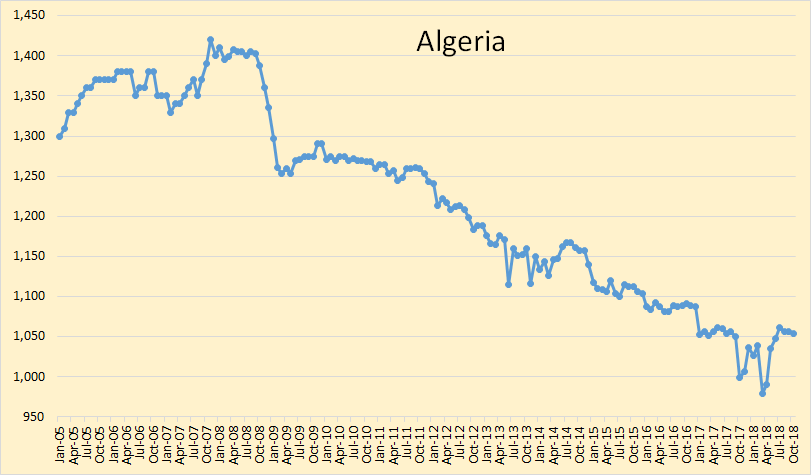

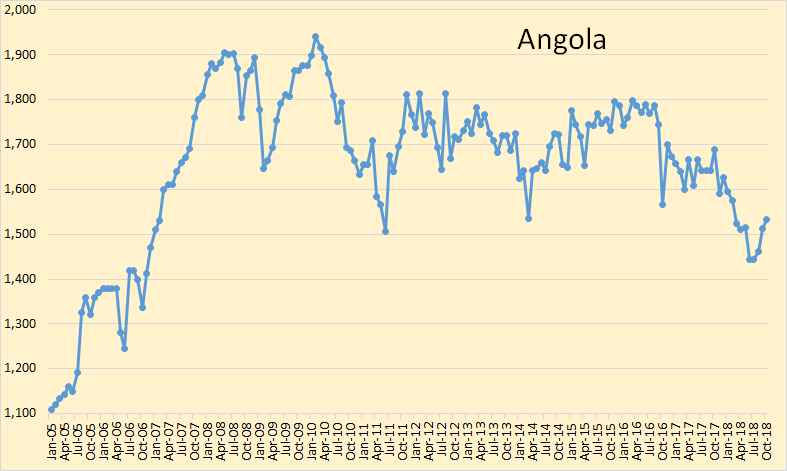

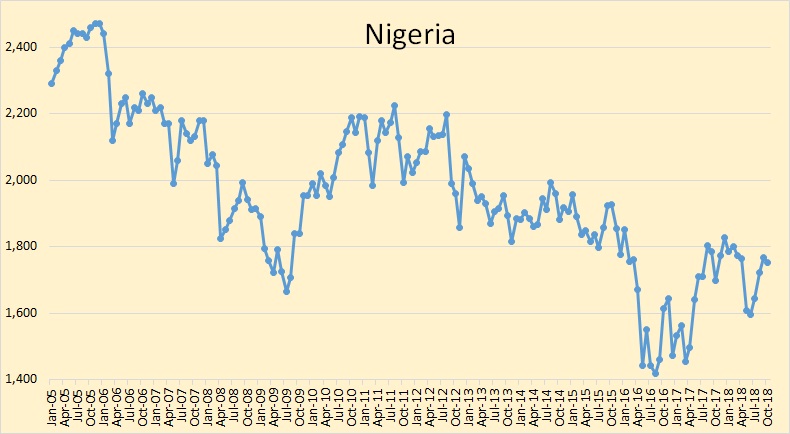

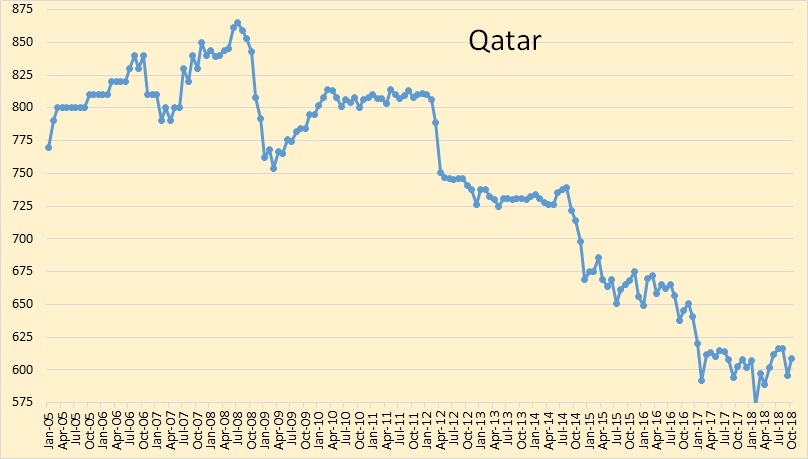

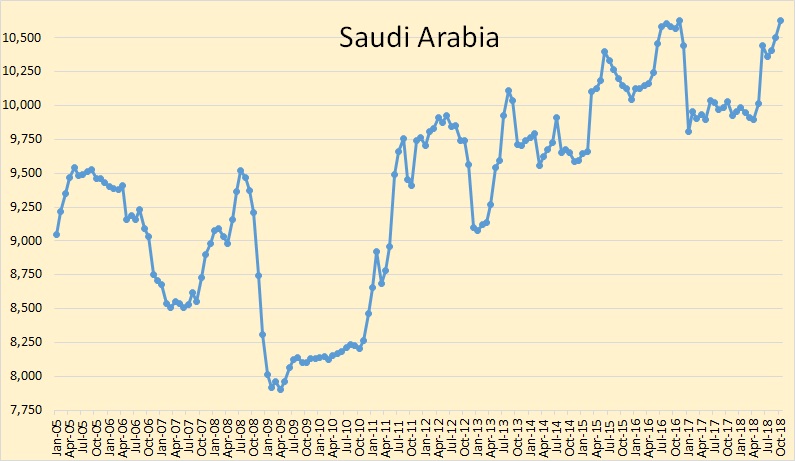

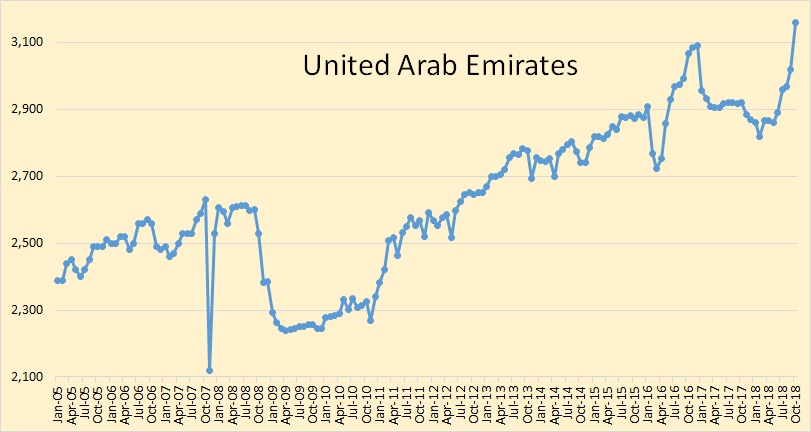

All OPEC data below is from the OPEC Monthly Oil Market Report The data is through October 2018 and is in thousand barrels per day.

OPEC 15 crude oil production was up 127,000 barrels per day in October. that was after September production was revised upward by 13,000 bpd.

OPEC production will likely be up a bit more in November but down considerably in December.

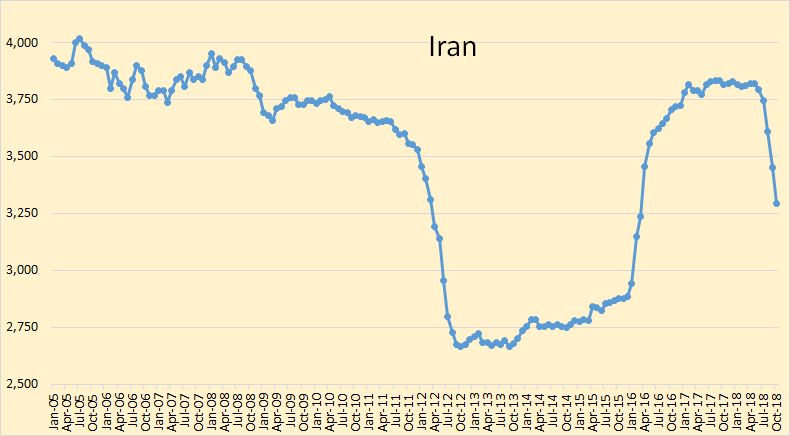

Iran down 156,000 barrels per day in October due to sanctions.

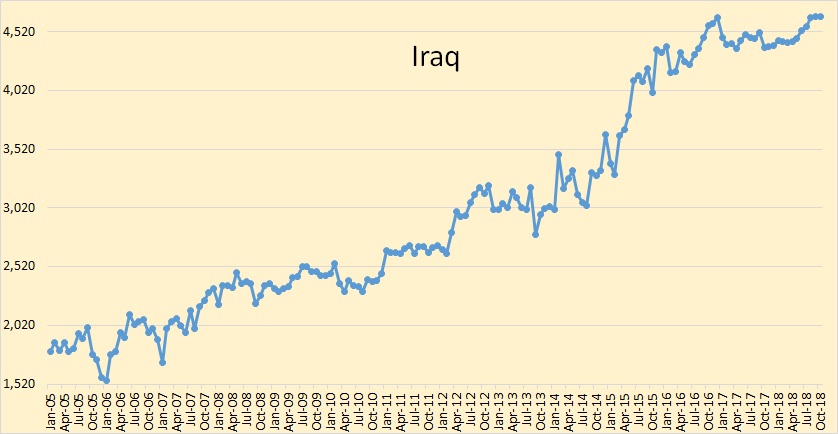

Iraq production has been flat lately. They are obviously pumping every barrel they possibly can.

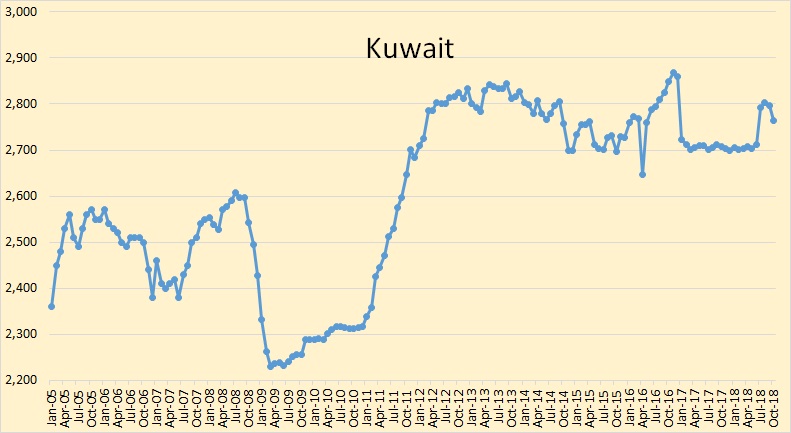

Kuwaiti crude oil production has been relatively flat for 6.5 years. During that period their oil rig count increased from around 20 to a high of 44. It has recently dropped to 35 however. It should be obvious that they are producing flat out.

Saudi Arabia reached a new all time high in October of 10,630,000 barrels per day, 5 thousand bpd higher than their previous high in November of 2016.

The UAE also reached a new all time high in October of 3,160,000 barrels per day, 70,000 barrels higher than their previous high in December 2016.

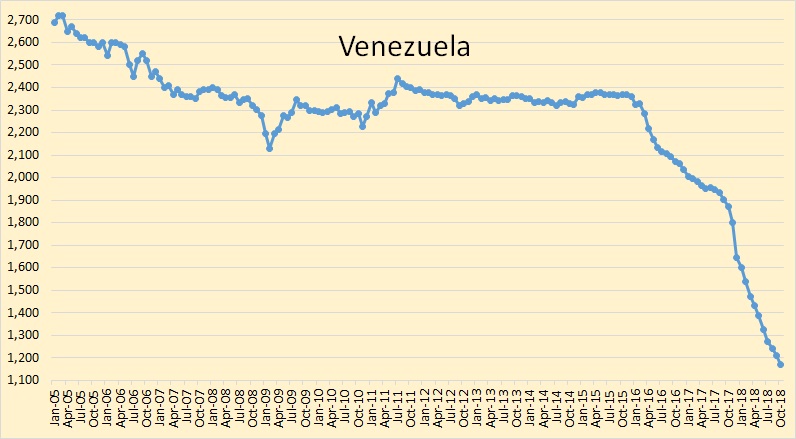

And of course, Venezuela continues their decline.

World oil supply, that is total liquids, is now just short of 100,000,000 barrels per day.

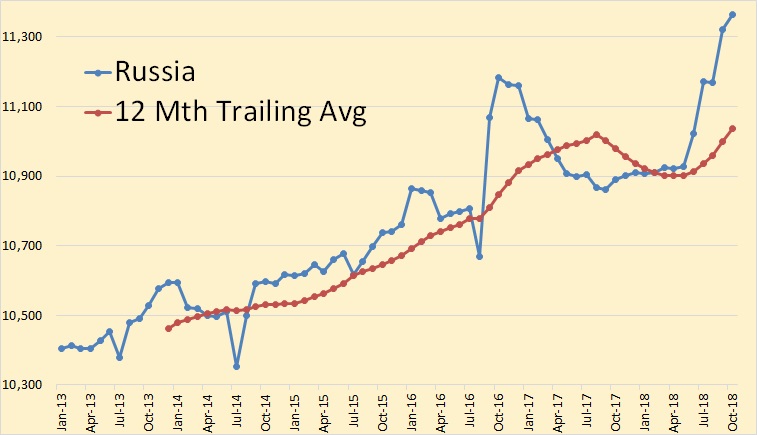

Russian oil production was up 43,000 barrels per day in October to 11,365,000 bpd according to the Russian Minister of Energy.

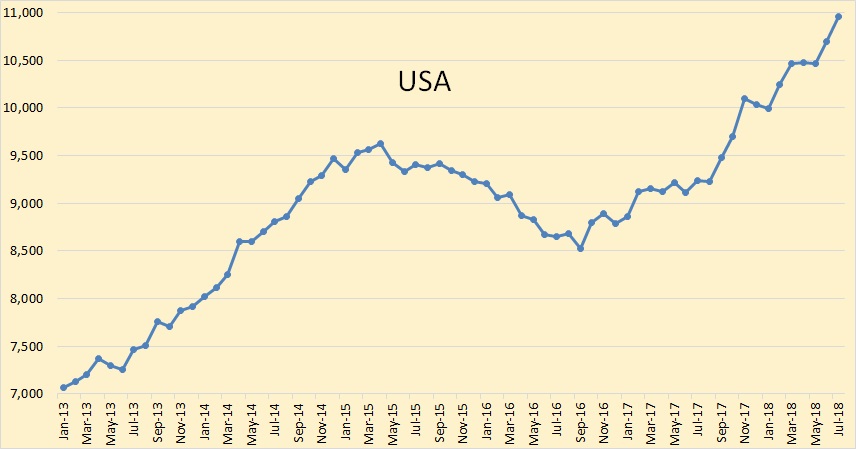

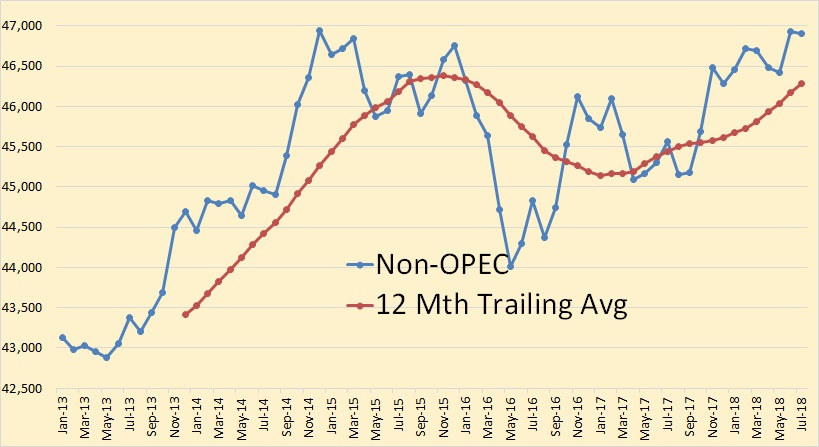

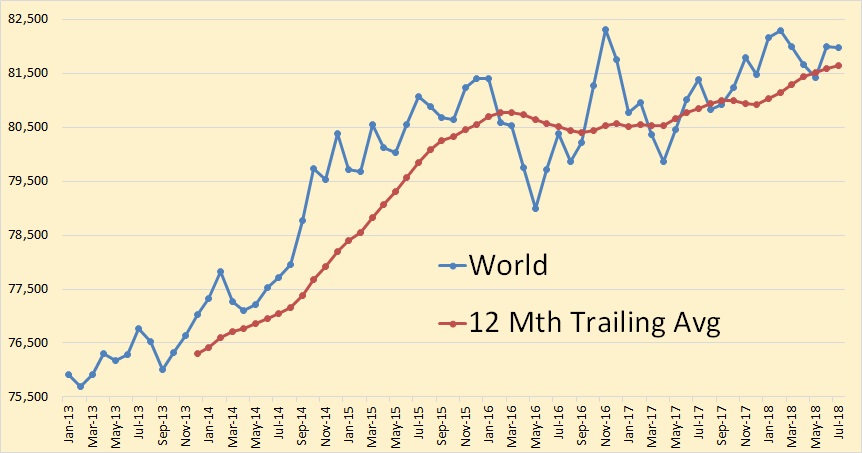

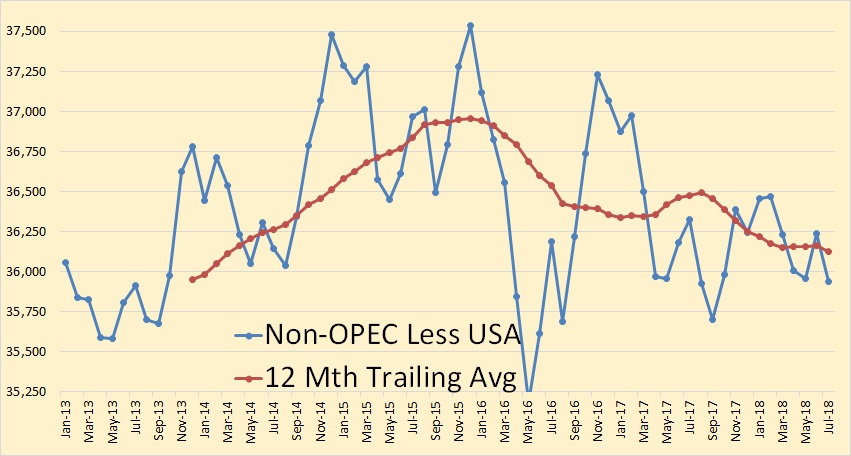

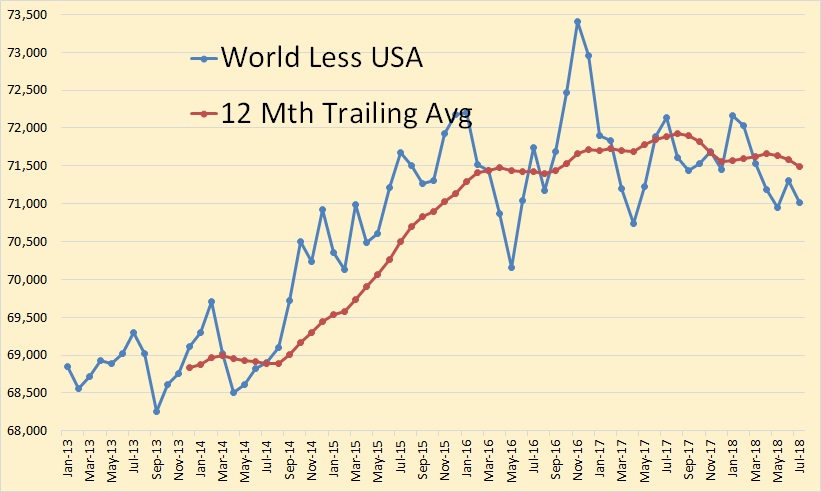

All USA and world production numbers are only through July 2018.

US production was up 269,000 barrels per day in July to 10,964 bpd.

Even though the US increased production in July by 269,000 bpd, Non-OPEC production was still down 29,000 bpd to 46,903,000 bpd.

World C+C production was down 18,000 barrels per day in July to 81.983,000 bpd.

Non-OPEC less USA peaked in December 2015 at 37,934,000 barrels per day. It was down in July by 1,595,000 bpd from that point.

World less USA peaked in November 2016 at 73,407,000 barrels per day. In July it was down 2,388,000 barrels per day from that point.

The question is: Just how long will the USA be able to continue to increase production in order to hold off peak oil?

And on another subject:

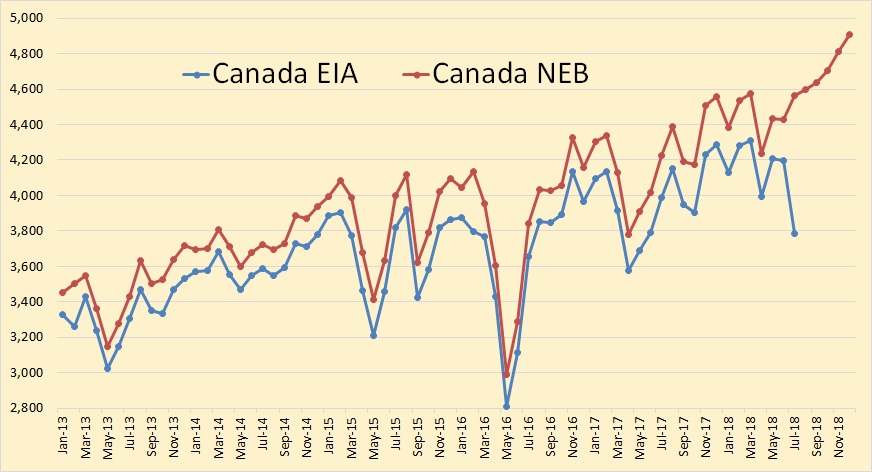

The EIA has Canadian C+C production down 415,000 barrels per day in July while the Canadian National Energy Board has Canadian production up 133,000 bpd. However, both numbers are subject to revision. On average, the EIA has Canadian production about 200,000 barrels per day below the Canadian NEB estimate.

So the biggest 3: US, Russia, KSA keep pushing the envelope

Yes but Russia and Saudi Arabia are at, or very near peak production. Saudi will be up a few bpd in November but down in December and down in 2019. Expect Russia to start trending down in 2019 also. And of course, the rest of the world, except the USA and Canada will keep their current trend, down.

I said earlier that I think 2019 will be the year crude oil peaks. I am now more convinced than ever of that prediction. Keep in mind that the World less USA has already peaked, and was, in July, 2,388,000 barrels per day below that peak.

I think the EIA estimate for Canada is more correct for July since Syncrude had a total power outage that took 350 kb/d offline due to cokers not being shut down in an orderly manner. Production was restored by mid September to full production.

Nonetheless it seems that they all have production records, except Russia which has post-soviet records, is hard to have 12Mbarrels/day without all those republics. After all this effort the fall might be hard. Maybe Ugo Bardi is into something with his Seneca cliff.

Sir Ronald Patterson,

love your work.

dont forget we have thorium coming out of our human holes.

we will be eating rat and bird soup and having karaoke parties for many moons from now

ya heard it here first,

Satan, Evil Demon

The reason why North American production keeps rising and the rest of the world is either rising slowly, flat or declining, is because of where the oil investments occur. If the oil industry was indeed a “free-market” then imagine the stupendous amounts of oil that could be produced if the billions wasted in shale and tar sands were invested in Russia, Iran, Iraq, KSA & the Emirates. Like I said so many times before, these countries at least, can increase production (under the right circumstances) way, way beyond where it is at the moment.

In America, anything is possible. It starts with cutting down enough trees to print enough money to create enough debt. Without QE/fiscal stimulus, and credit, the shale oil phenomena would have lasted only 3 years, just long enough to realize what shale oil decline rates actually were, and how grossly unprofitable it is to extract that crap. Its now a decade old, only because of credit.

That’s exactly my point. If so much oil can be produced from such difficult regions as are the North American shale formations and Canadian sands, then imagine what the production boost would be in places like Iraq/Iran/KSA and Russia, where oil extraction is immeasurably cheaper. What I am trying to say is that we are nowhere near Peak Oil, it’s only geopolitical games that may make it appear so from time to time.

Oil extraction is cheaper in the middle east because mother nature was kind enough to place world class reservoirs able to capture giant oil reserves from prolific source rocks. But conditions for producing crude oil from these source rocks are not as attractive as in the US. Their costs are higher, the crews less efficient, there’s no fresh water, and the geology isn’t likely to be as good as the top US basins.

The reason why North American production keeps rising and the rest of the world is either rising slowly, flat or declining, is because of where the oil investments occur.

Oh! You mean the amount of reserves in the ground have nothing to do with it? Well hell, I guess I learn something every day.

Like I said so many times before, these countries at least, can increase production (under the right circumstances) way, way beyond where it is at the moment.

Pardon my French, but you are as full of shit as a Christmas Turkey.

You have been anticipating and prophesying Peak Oil for decades now, yet you remain steadfast on insisting on this discredited theory. It also amazes me, how ignorant you seem of true oil reserves in the ME and Russia. There’s a reason why the US & the EU are so intensely interested in these two regions.

Apropos “amount of reserves in the ground”. Reserves in the ground are secondary, what is primary is the capital available for their extraction. You cannot possibly believe that shale and tar sands are the best option for oil companies at the moment. It’s only geopolitical imperatives that make it so.

Reserves in the ground are secondary, what is primary is the capital available for their extraction.

But of course, reserves don’t matter all that much. Enough money will create more reserves in the ground.

You cannot possibly believe that shale and tar sands are the best options for oil companies at the moment. It’s only geopolitical imperatives that make it so.

Geeze, you don’t seem to understand one damn thing about world oil production. Yes, shale is the best option for the United States.* That is because conventional reserves are dropping like a rock. And yes, tar sands are the best option for Canada for the same reason. But not for Saudia or anywhere else in the Middle East. They don’t have either.

We have been debating world oil reserves, on this site and other sites, for over a decade. And you, Jhonny come lately, suddenly declare that reserves are not a problem because… I don’t know, perhaps you think there are still many trillion barrels left?

If you are going to claim that the amount of reserves left in the ground are not a problem, then produce your evidence.

*Shale is not a good option at all because it cost more to produce than you get when you sell the stuff. But if you are talking about increasing US production, that is the best option we have.

“I read somewhere oil oozes from the earth’s core”

And I read somewhere that the earth is flat. Which proves there are still idiots posting stupid shit on the net.

I know. I keep reading the same old bs about Thomas Gold discovering oil in sweden every two months or so.

I’m trying to get my adopted son a gig at ITER for the summer, to get a better idea of how that’s going. That’s a more viable answer. I hope.

I totally agree with Chris Nelder, the likes of Jeremy Leggett took the discussion of peak oil into the gutter. You can get his 2005 book on Amazon for £0.01. Cheaper than fire lighters

https://www.forbes.com/sites/michaellynch/2018/06/29/what-ever-happened-to-peak-oil/#70d60ad4731a

From your Michael Lynch link:

“This is not a controversial statement. It is just a question of when.” Jeremy Leggett in 2006

And those who disagreed were treated with derision.

To disagree with that statement means you believe oil will never peak. Anyone who believes oil production will never peak deserves to be treated with derision.

And that includes Michael Lynch, who’s mantra has always been, “no peak in sight”.

Ron

There were many environmentalists who bought into early peak oil. They believed that global warming was no longer a problem because oil production would peak in 2008-2012.

https://www.youtube.com/watch?v=9FOhCHiuKMQ

Production now would have fallen to 80 million barrels per day and the solar, wind and electric transportation industry would be far cheaper than the fossil fuel alternatives.

Unfortunately Jeremy Leggett was wrong and the main analysts proved correct.

The argument always should have been that we need to move to a renewable world. Yes the cost will be high but far better then floods, fires and failed harvests.

Waiting for coal, gas and oil to become expensive was a big mistake.

It has been calculated that $2.5 trillion dollars invested in wind and solar each year would have avoided and still may avoid the worst.

Global warming would still have been a problem even if oil did peak between 2008d-2012. No environmentalists worth his salt thought anything different. Coal and oil would have been burned and will be burned decades after oil has peaked. Peak oil has never been posited, by any reputable environmentalists as a solution to climate change.

Waiting for coal, gas and oil to become expensive was a big mistake.

I don’t know who the hell you are talking about there. Just who was doing that waiting? But as far as the price of oil, or the price of anything is concerned goes, economics is an uncertain science. It is more of an art than a science. And everyone makes mistakes, sooner or later, when trying to predict the future price of anything or the future supply of anything.

But one thing is certain, oil production will peak. It has peaked already in most countries.

Ron

Your view of things is so simplistic. Environmental scientists are still debating exactly what the effects of a 1.5 degree and 2 degree rise will have.

Perhaps you should contact them and tell them exactly how much Co2 will cause a 1.5 degree rise and a 2 degree rise.

https://www.cicero.oslo.no/en

You say peak oil is a problem, and you also say burning too much oil is a problem. You also say living without fossil fuel would take us back to the stone age. Do you have any solutions or are you simply very confused?

Do you disagree with Islandboy that renewable energy is a solution?

You say peak oil is a problem,

Of course, it’s a problem. We are almost totally dependent on oil for a transportation fuel. How in God’s name could anyone possibly say it is not a problem.

and you also say burning too much oil is a problem.

What the fuck? Of course burning too much oil is a problem. You seem to think that the two are mutually exclusive. No, they are not, they are both a problem.

You also say living without fossil fuel would take us back to the stone age.

Oh fuck, I never said that. But if we totally abandoned fossil fuel today, the dieoff would start tomorrow. We are in no way prepared to live without fossil fuel. If you think we are we are, then you are living in a dream world. But most of you guys think we can gradually ease out of fossil fuel over the next couple of decades. I do not. That is the debate, not if we just abandoned fossil fuel tomorrow. That is impossible.

Do you have any solutions or are you simply very confused?

That is the very stupidest sentence I have read since I read Trump’s latest tweet. You are implying that if I don’t have solutions then I am very confused.

No, fuck no, I do not have solutions. There are no (painless) solutions. And I am not confused. I don’t think you are confused either. You are just delusional.

Do you disagree with Islandboy that renewable energy is a solution?

I am totally in favor of renewable energy. I would turn cartwheels if I thought renewables could replace fossil fuel. Fossil fuel is a serious problem and is poisoning the earth. But we are totally dependent on it. I am sorry, and I do mean I am very sorry, but renewables will never support eight billion people. I dearly wish it could, but I am a realist instead of a dreamer, it cannot and will not.

I think you’d be extremely lucky to support 1 billion people on renewables. Frankly it doesn’t seem likely to even hit 1/2 that number without fertilizer manufactured from petrochemicals.

800 M

The possibility is much higher – but then the investments of 1 trillion $ / year into fossile energy have to be rerouted into alternative energy then.

Think about 100 x 100 miles solar farms in Australia / other deserts and liquid hydrogen tankers in a long row waiting at the ports there. Maintained and perhaps even build by mainly robots.

It’s not the rooftop solar alternative dream, it’s big business then.

And it’s not now, so we need this oil to bridge the gap until there.

Or they get these fusion plants working and payable – but I believe more in huge solar farms because it is existing tech only need to scale.

PS: Transportation could be done in a national show of strength – if it has to be now, cover the land again in railroads and trams. It has been done in 19th century in a short time, and could be done today under warlike conditions (oil war in the gulf, fracking is a dud in a few years …) again. Use the existing batteries only for electric busses and local delivery trucks.

It will be dirty but could be done. It can get people to work and food and goods to customers.

We have still these networks in Europe, but not big enough. We would need to double and double again capacity here if we needed to replace oil.

Yes you did

“Are all global warming deniers stupid idiots? So far they seem to be. If you think CO2 is real, but drive your car, or travel by air, you are a hypocrite. Bullshit! We must function in the world we were born into or else die of starvation. Just because we point out the obvious, does not mean we must return to the stone age with our daily lives or else we are hypocrits.”

What is the point of this website if there are no solutions?

It is like counting gravestones.

The point of this website was never to stop global warming. It was to spread the word about peak oil and hopefully to enable some people to find a less painful way down the decline slope.

Many of the earlier comments were about finding ways to be among the survivors.

However Dennis decides the purpose of this site now. But if you think this site can somehow stop global warming, you have a very serious problem with reality.

Why do people buy tickets to the seventh game of the world series? Just to watch of course.

CO2 is real. I breathe it out. I drive an old diesel car. What’s obvious to me is that climate change is now used to support political ideologies ranging from communism to broccoli diets.

Most people misunderstand the industrial agriculture revolution. Industrial agriculture brought us more food per hour of work. Ecoagricultural techniques bring us more food per hectare of land. In addition ecoagricultural techniques store carbon in the ground. Industrial agriculture is responsible for 25% of global greenhouse gas emissions

because it vents the carbon from the soil into the atmosphere (all of transportation is only 17% of GHG emissions). If we switch to ecoagricultural farming, rather than being a net emitter of greenhouse gas, agriculture could remove C02 from the atmosphere. That is why Toensmeier

proposes the Carbon Farming Solution. Toensmeier has calculated that we could feed the earth’s human

population on 5% of the land currently cultivated.

Schinzy

I will certainly get the book.

Besides the more efficient use of land which would as you say convert land back to being carbon sinks. The food distribution system needs to be made efficient, the waste is staggering.

http://www.fao.org/save-food/resources/keyfindings/en/

NEW solar is already cheaper than most EXISTING fossil fuel generation. It’s over.

Traditional energy sources now compete with batteries, not with primary energy production.

For transportation that means the oil industry is pretty much doomed. Oil is a terrible source of energy, much too expensive. That is why there are so few diesel power plants. They just can’t compete.

That fact that oilmen think of themselves as the energy business shows how clueless the really are. The oil business is not the energy business. It’s about disposable liquid energy storage in moving vehicles.

Oil is a wonderful way to STORE energy, which is why it is insulated from the extremely low cost of electricity. But batteries are already eroding this insulation. More and more vehicles are becoming electrified.

Turning to the more competitive electricity business, nobody seriously claims that traditional electricity can compete on price with renewables. Instead you get the mantra “What happens when the wind doesn’t blow and the sun doesn’t shine?”

The answer to intermittancy is storage. Traditional power generation competes with storage, with batteries. You can tell by their own arguments, which focus on “reliability” and “dispatchable” energy, not on generation costs.

The argument about the cheapest way to generate energy has already been lost. That’s what the whole “reliability” claim boils down too — that coal and gas fired plants are cheaper than batteries.

The final use of fossil fuels is heating, which can be highly efficient. My guess is that it will be the last niche that they can survive in.

These are the levelised generation costs in the UK.

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/566567/BEIS_Electricity_Generation_Cost_Report.pdf

Obviously you have to add the cost of battery storage to wind and solar.

https://www.bmreports.com/bmrs/?q=eds/main

What is the cost of storing 40Mw, multiplied by say 12 hours?

Hugo, what’s obvious is that we shouldn’t be wasting so much energy. Then we wouldn’t have to generate it or store it.

In a free market, prices are primarily set by short term considerations. When renewables produce energy, traditional plants bleed cash. When renewables stop producing, traditional plants compete against batteries.

I’m not sure if you are agreeing or disagreeing with me. Your argument simply confirms what I am saying. The batteries are the issue. Competing with them is the only hope traditional energy sources have to survive.

One final point: You have a report from 2016, which is no doubt based on earlier data.

https://www.lazard.com/media/450773/lazards-levelized-cost-of-energy-version-120-vfinal.pdf

Old data isn’t much help in fast moving markets. Solar panel prices are falling at a rate of a quarter or a third each year.

Batteries costs are falling almost as quickly, but factories can’t be built fast enough to keep up with demand. So the ax hasn’t fallen yet. That will change in few years.

Oil is a terrible source of energy, much too expensive. That is why there are so few diesel power plants. They just can’t compete.

For generating electricity, oil cannot compete with coal, which is a far worse polluter.

2017 Coal use number worldwide is 37%. C’mon Ron you can’t use 2007 numbers here…

If new solar is cheaper then we can stop subsidizing it and let market forces handle the changeover. We can go back to debating more interesting stuff like football or whether the US Navy LCS is a shitty warship design.

To Ron, I’d love to see the source article that the graphic you posted came from. I have sensed an anti renewable bias from Der Spiegel in the past so, I’m really curious about the background of that graphic. I’m a little surprised that you would use it since the latest edition of my report EIA’s Electric Power Monthly – October 2018 Edition with data for August has the YTD contribution to electicity generation in the US from coal at 27.21% and the last one with annual figures, EIA’s Electric Power Monthly – February 2018 Edition with data for December 2017 and the data for the whole of 2017 has the contribution from coal for 2017 at 30.1%. From the data, the last time coal contributed more than 49% to the US electricity generation mix was 2005!

To Fernando, the market is moving in that direction, see:

Lazard, Lazard, LCOE – what’s the cheapest energy?

The headline information making the rounds with this analysis is that building new wind and solar power, in some cases, is cheaper than running already built fossil and nuclear facilities. Well, we already knew that at pv magazine.

For instance, Indiana finalized their plans to shut down coal plants and exchange them renewable facilities because its “the most viable option for customers”. Colorado recently voted for retiring Xcel’s coal-fired Comanche Generating Station ten years early, which represents 660 MW of total capacity for two separate units at the site – again, for economic reasons. Carbontracker.org noted that all of the wind bids for the above Xcel RFP were cheaper than coal, and 74% of the solar bids were.

Yesterday, Lazard released its Levelized Cost of Energy (LCOE) analysis version 12.0 for Energy (.pdf), and Version 4.0 for Energy Storage (.pdf). The document shows that utility scale wind, solar offer the cheapest absolute electricity pricing – without subsidies. When federal tax subsidies are applied, essentially politically palatable forms of a carbon tax, we see all thin film solar cheaper than all gas, and the majority of crystalline silicon solar cheaper than gas..

What do you think of this:

Spain wants 100% renewable electricity by 2050 as part of climate change strategy

I believe peak oil arrives too late to become a solution to climate change.

Human beings have always made use of all the energy they had within their reach. With fossils we are doing the same. Oil has not replaced coal but has allowed us to increase its production and consumption. And when the best quality oil has begun to become scarce, we have used technology to exploit the less accessible fossils (ultradeep, offshore).

Our increase in technological efficiency and, above all, the ability to move resources around the world, is allowing even low yield products (LTO, tar sands) to be exploited.

For many years there has been sufficient knowledge about the magnitude of the threat posed by global warming, but even today there has not yet been a real commitment to limit emissions. Since our objective has never been to consume less, but to maintain perpetual growth of GDP, improvements in efficiency have only succeeded in postposing the fossil peak, thus moving the peak of emissions beyond the point of no return.

Given the climate system inertias, and the fact that after the peak we will still be burning FF for some years (and probably multiplying deforestation), an increase of 1,5ºC on pre-industrial levels, which the IPCC recently marked as a key limit, is today more than guaranteed. What’s more, if we take into account the feedback loops that this will trigger, the possibility of avoiding a runaway global warming seems increasingly remote.

If the renewable transition had been posed seriously 40 years ago, perhaps today the picture would be less dramatic. But of course, a sustainable world not only demands the use of renewable sources, but (and above all) reducing consumption until we reach a really sustainable stationary state economy, something that is totally incompatible with the current economic system.

Tragically, the U.S. elected Ronald Reagan in 1980 partially as a reaction to a renewable energy transition proposed by President Carter in a 1977 speech which called for ending dependence on foreign oil as the “Moral Equivalent of War.”

Americans didn’t want to conserve gasoline, turn down thermostats, or fund the National Renewable Energy laboratory so we (some of us) elected President Max Headroom to blow smoke up our asses and tell us to go shopping, buy a bigger car because, “It’s morning in America!”

So we get floods, fires, and failed harvests? On a world wide basis? Do you really believe that?

World wide basis- you mean all at once?

If so, no.

But yes to here and there, over time. With a high degree of probability.

Enough to hurt bad.

Hope that you don’t live there, or have cable TV.

Hard to watch, unless you revel in those kind of scenes.

I don’t see much evidence for such catastrophes. We know that crop yields and water use efficiency are improved by more CO2, that warming is mostly caused by higher water vapor content which leads to more precipitation, that crops can be planted earlier and harvested later, that the earth is greening, that trees are larger, have more leaves, and that the main problem seems to be sea level rise, which is manageable.

Fernanado- Since your whole career has revolved around around the oil extraction industry, you are known as a extremely biased ‘observer’. Enough said.

You think I’m biased. So what? Keep trying to smear me, it actually makes me help my case: you have nothing to debate with.

Fernando, let’s examine your claims more closely. Oh, I don’t have to do it, it’s already been done for me at the Skeptical Science website. To the question “What would be the effects of an increase of CO2 on agriculture and plant growth in general?” they reply:

1. CO2 enhanced plants will need extra water both to maintain their larger growth as well as to compensate for greater moisture evaporation as the heat increases. Where will it come from? In many places rainwater is not sufficient for current agriculture and the aquifers they rely on are running dry throughout the Earth.

On the other hand, as predicted by climate research, we are experiencing more intense storms with increased rainfall rates throughout much of the world. One would think that this should be good for agriculture. Unfortunately when rain falls in short, intense bursts it does not have time to soak into the ground. Instead, it quickly floods into creeks, then rivers, and finally out into the ocean, often carrying away large amounts of soil and fertilizer.

2. Unlike Nature, our way of agriculture does not self-fertilize by recycling all dead plants, animals and their waste. Instead we have to constantly add artificial fertilizers produced by energy-intensive processes mostly fed by hydrocarbons, particularly from natural gas which will eventually be depleted. Increasing the need for such fertilizer competes for supplies of natural gas and oil, creating competition between other needs and the manufacture of fertilizer. This ultimately drives up the price of food.

3. Too high a concentration of CO2 causes a reduction of photosynthesis in certain of plants. There is also evidence from the past of major damage to a wide variety of plants species from a sudden rise in CO2. Higher concentrations of CO2 also reduce the nutritional quality of some staples, such as wheat.

4. As is confirmed by long-term experiments, plants with exhorbitant supplies of CO2 run up against limited availability of other nutrients. These long term projects show that while some plants exhibit a brief and promising burst of growth upon initial exposure to C02, effects such as the “nitrogen plateau” soon truncate this benefit

5. Plants raised with enhanced CO2 supplies and strictly isolated from insects behave differently than if the same approach is tried in an otherwise natural setting. For example, when the growth of soybeans is boosted out in the open this creates changes in plant chemistry that makes these specimens more vulnerable to insects.

6. Likely the worst problem is that increasing CO2 will increase temperatures throughout the Earth. This will make deserts and other types of dry land grow. While deserts increase in size, other eco-zones, whether tropical, forest or grassland will try to migrate towards the poles. Unfortunately it does not follow that soil conditions will necessarily favor their growth even at optimum temperatures.

Skeptical Science is one of those bogus warmist sites crafted for the echo chambers of believers. They are the ones who wrote the bogus 97% of scientists paper. Find something else.

Hi Fernando,

Name calling is not really an effective rebuttal. How about

http://www.ipcc.ch/report/sr15/

your “warmist” claim is unconvincing.

The last IPCC report tells me it’s ludicrous to go for a 1.5 degree anomaly limit. But I knew that. Seita Emori et all already documented this in their masterpiece report.

With regards to point number 4 of Phil S’ comment, I have noticed something in my neck of the woods that could support that idea.

There used to be a lot of acreage under sugar cane but the farming practices were very bad and harvesting practices even worse. Sugar cane fields are always set on fire before they are harvested to get rid of insects and the leaves, since the cane is harvested manually and the leaves can cut. This led to severely depleted soils requiring heavy use of fertilizer.

Competition from sugar beet drove down prices and a since the factories were nationalised back in the seventies, little or no maintenance or upgrades were done to keep the industry competitive. As a result the sugar industry in Jamaica is now on life support, despite the efforts of new private (Chinese) ownership of the few remaining divested factories. The rum industry that uses the same feed stock, remained in private hands all along and is doing fine.

What I have noticed is that it appears that several species of the genus Leucaena appear to be flourishing on the nutrient deficient former sugar lands. Leucaena is a legume so it fixes it’s own nitrogen, does not need nitrate fertilizer. Sugar cane is still being grown in some spots and in other areas there are plots of vegetables growing but these efforts are probably heavily dependent on artificial fertilizers.

Maybe Leucaena is just mother nature’s response to what mankind has been doing, both to the soils and the atmosphere. By the way, what is this climate change discussion doing in the petroleum thread? I thought that was what the non-petroleum threads were for. I notice there’s been a fair amount of discussion on renewable energy and EVs as well!

Islandboy, sugar cane doesn’t have to be burned before it’s harvested. My grandfather ran a sugar mill for a while, and the harvest was never burned. This gave him more material to burn in the boilers, and yielded a richer better tasting guarapo.

Fernando, The Chinese owners of last divested sugar factory that is still in operation have instituted a policy of paying less for cane that has been burned to try and discourage the practice but, it is still very widespread. The old cane cutters must have handed down the tradition to the current generation and the only way I see this being stopped is to get the people who burn the cane out of the picture altogether and switch to mechanised harvesting instead of using manual labour.

You will no doubt love the background as to why manual harvesting is still being used in Jamaica and why it’s sugar industry is in such a sorry state. In the seventies the left leaning Michael Manley led administration had very pro union policies coupled with a penchant for price controls in response to spiraling costs associated with the oil price shocks of the era. The administration also instituted a levy on bauxite production which provided a lot of money in the short term but, resulted in most of the companies operating in the country threatening to cease operations. The same hostility towards capitalism was having the same effect on the municipal bus company, the telephone company, the electricity utility and the sugar industry among others.

The Manley administration’s response was to use the cash from the bauxite levy to nationalize everything and preserve the jobs of the employees, ignoring any principles of astute management of the enterprises. Many of the nationalised entities were allegedly used to provide “jobs for the boys” and the concept of cutting jobs was vigorously resisted, so measures like using mechanical cane harvesting were out of the question. Jamaica has never fully recovered from that decade that ended with the election of a much more business friendly administration in 1980. Supporters of Manley’s policies point to the IMF and subversive activity of the US CIA as reasons for the failure but I’m pretty sure you will say that his friendship and admiration of Fidel Castro had far more to do with it.

Failed harvests and associated risks concern me the most, for obvious reasons (mortality & morbidity). I don’t feel that simultaneous world wide failed harvests are necessary to create widespread and largely negative population health outcomes. Regional and sub regional failed harvests, unaccompanied by either fires or floods, will be sufficient. If you, or anyone else, wish to discuss crop failure/famine further I’d be happy to discuss it on the non petro side of the street.

There seems to be a lot of focus on trends in pending ice free Arctic Ocean. The more concerning event, though perhaps tied to arctic ice, might be significant crop failures in the bread basket regions. Robert Fanny, and other self styled “emerging threat analysts” (although to be fair I think Fanny stopped calling himself this, none too soon), seem to ignore the risks associated with failed harvests/crop failure. Paul Beckwith, in his otherwise fantastic series, also fails to address it. Prof. David Battisti, who I highly recommend, does though have some very good presentations on it. You should check him out for sure!

There is no indication of failed harvests. We do see the earth is greening, trees have more leaves, growing season is longer, plants manage water more efficiently, and the extra CO2 really helps them. The key to take advantage of this trend is to make sure we get the extra nutrients in the ground. We will also have to develop new varieties able to yield even more food, larger vegetables, etc.

Quim

I agree that the current economic system makes cutting energy consumption very difficult. In order to get a steady state economy, would that not require a stationary population?

Naturally, in a finite world human populations can not grow indefinitely. The problem is that determining what is the maximum number of humans that our planet can feed is a complex task. In any case, I think that in general (I do not mean you) the debate about the population increase is being used in a biased way, with the intention of hiding the other two elements of the ecological footprint equation: technology and wealth .

The problem is that determining what is the maximum number of humans that our planet can feed is a complex task.

Oh fuck, that is not the question. The earth may be able to feed 20 billion people. But if it did human beings would be the only large or even small animals left on earth. Even rabbits would disappear because they would be killed because they ate growing human food.

The question is, what is the long-term human carrying capacity of the earth. That is how many humans can the earth support, long-term, without destroying the environment that supports other wildlife? That number would very likely be less than one billion people.

I didn’t want to say that maximum population “feedable” is THE question. I rather wanted to point out that there are many factors we must take into account, if we don’t want to give wings to ecofascist speeches (that’s where we are heading). I live in Spain, and I often listen about the risks of overpopulation in the “underdepeloped” world, but zero words about reducing our hyperconsumption (Spain per capita >4kW, close to twice world average). If we are to reduce population, where to begin?

Moreover, earth carrying capacity is not stable, because conditions change continously. Even so called ecosystems climax can’t behave as steady systems for many time.

I agree with you that less than one billion people would be a reasonable figure if we put resource scarcity on the table, but I guess there is a growing chance that climate change reduce this by several orders of magnitude in a not distant future.

About 20 yrs ago I went to Hanoi, and was touring around the nearby countryside for a few days. Rice paddies and big rugged mountains interspersed. What surprised me was how little wildlife I saw.

Many, many people. Hard working. Most very very poor. Simple living (because they didn’t have any money to buy stuff).

When I got back to Hanoi, I was walking along a food market street when it dawned on me. This is where all the animals all. In sorted piles, dead.

Even all the snails were here, sorted by size. The most numerous were the tiny ones, smaller than your pinky tip. The bigger ones were very few.

Any wildlife that could be gathered was. And eaten. And still the protein intake of the populace was meager.

Thats what carrying capacity looks like.

Add some fertilizer. More people perhaps.

Less and less of everything else.

>In order to get a steady state economy, would that not require a stationary population?

Not when per capita consumption is falling, as it has been in rich countries for decades.

Not when per capita consumption is falling, as it has been in rich countries for decades.

I would like to see a link that supports that statement. One like this one that shows per capita meat and seafood consumption growing by leaps and bounds all over the world.

Meat and Seafood Production & Consumption

Of course, you just said “per capita consumption”. Consumption of what? Buggy whips?

Ron,

Consumption to an economist means purchases of goods and services, so yes it would include buggy whips, food, oil, legal services, … (it is a long list).

I imagine you know this already. 🙂

I agree, that consumption has likely increased in advanced economies, that is certainly the case for the World where per capita GDP has increased (market weighted exchange rates) at about 1.45% per year from 1971 to 2017 (average trend).

If world population peaks and then declines at a rate of 1.45% per year or more then Real GDP growth will cease (at exactly a 1.45% decrease in population, if we assume the 1971-2015 growth rate continues) or it may decrease if the rate of population decrease is higher than the rate of GDP per capita growth.

82 million new homo sapiens on the planet.

If world population peaks and then declines at a rate of 1.45% per year or more then Real GDP growth will cease (at exactly a 1.45% decrease in population,

Oh my goodness no! Consumption decline, (GDP decline), will lead population decline by many years. In fact, population decline will be because of consumption decline. Consumption will decline because there will be fewer consumer goods to consume. Primarily there will be less food to consume, that will be the primary reason for population decline.

I don’t think consumption decline has yet begun. But when it does, that will be a sign that population decline is only about a decade or less away.

Hi Ron,

For the World as a whole, there is no evidence of lower GDP per capita, though a more unequal distribution of income may have lead to falling consumption for the poor.

Progress on poverty is slowing according the piece linked below

http://www.worldbank.org/en/news/press-release/2018/09/19/decline-of-global-extreme-poverty-continues-but-has-slowed-world-bank

actually your link is a bit of a self-own. if you look at meat supply per person for the United States, although the detail is a lacking, it shows a basic jump in the 1970, another in late 1990’s and then a fall back in 2010. But more or less steady for… decades.

Thanks to the dry weather, Germany will be a net importer of grain for the first time in decades. The maize crop was down by 75%. I just read in the newspaper today that potato prices will increase by half.

Your choice of a question as a rhetorical trick is an example of “proof by incredulity”. It only says that you don’t know whether your position is tenable or not, but you have deeply seated beliefs anyway.

Yep, I took part in a project to replace dead and dying fruit trees in Southern Germany this past week. Had to use pick axes to dig the holes because what is normally supposed to be soft muddy soil is currently hard as cured cement due to this past summer’s drought in this region. Anyone who doesn’t think climate change is a big problem and will cause crop failures is welcome to come join the pick axe crew…

Cheers!

“They believed that … … oil production would peak in 2008-2012.” Now, think about CONVENTIONAL oil, no fracking, no sands, no deep sea: Since 2005 that production is on a flat plateau. Now, let’s suppose that Ron is right and the peak is next year and that also that flat conventional production is getting south. Then let’s assume a smoothed out, idealized bell curb for the last decades of oil production: Voilá: The peak happened at the middle of the production plateau in 2012!

Of course in the real world, nothing is idealized and smooth. All I want to say is that the predictions made a decade ago maybe weren’t that wrong. In a way, they still could prove basically right!

The main short term cost of renewables is putting everyone out of business who’s trying to sell fuel. Coal is much cheaper than oil, but coal won’t survive the relentless onslaught of renewables, and gas won’t either.

It is truly incredible the impact of hydraulic fracturing has had on this. Remove this source of production from the market over the past 8 yrs and see what impact you would have. Energy desperation far and wide.

A big question is- Will another region of the world pull off a similar result as N. America did? Most people discount the possibility, but no-one foresaw the N. American results either.

The question with fracking is it scalable? For now only US has a “success story” with it.

The answer broadly speaking appears to be “no.” It needs the right type of rock and the right type of logistics. Close enough to civilization that the capex and manpower are reasonable, far enough removed that it’s politically doable.

And it’s not like US LTO has been economical. Most of the operators lose money even at decent prices. It’s all debt, and debt that tends to outlast the well that it is taken out to drill.

IMHO is not about the type of rock but about the free buck.

It’s like asking if anyone could produce as much steel as the Soviet Union. The question is whether anyone would want to.

Argentina has a nice shale called the Vaca Muerta, which is being tapped for crude oil and gas. Ddevelopment will be much slower but it will be a nice future contributor. It may even reach 1 mmbopd in say 10 years.

Anyone seen mapping of offshore shale? I assume it would be off the scale expensive to go after any such deposits.

The need for rig platforms makes the bulk drilling in LTO a literal impossibility. Not to mention spill risk.

The short answer is no, and not for a lack of trying. Canada and Argentina both have good shale reservoirs, but with questionable economics. It will not likely work in Europe, the infrastructure is not there, and population density is too high, one pad to drill from might be ten to twenty acres, and in most places the minerals are owned by the state, so there is little incentive for the Farmer on the surface to not protest any drilling. Needing a large supply of water to frac with means the middle east is out of luck, as is most of Australia, China and South Africa. Offshore might have the right source rocks in places, but the cost is so ungodly high you would be hard pressed to have a shale play work. Usually you don’t get repeatable economic wells in a shale play until about well 100 to 200. Russia probably has unexplored potential, but that is it.

I think i can design a 24 well onshore pad which only takes up a 100 m by 100 m square for about $30 million USD. I would use a combination of what i know about offshore rigs, Arctic and Siberian well pads. Construction time would be about two years because it would involve making a deep pit to hide wellheads and equipment ( the rig would be skidding on steel rails at ground level).

The January, 2018 story from the Pittsburgh Post-Gazette has a pretty good description of western PA wells, including a picture.

5 acres is more than enough for most pads that might contain 20 to 40 GAS wells. (Encana still has the world record of 51 producing gas wells on a 5 acre pad in the Piceance).

Oil wells will always be more problematic with the needed infrastructure required for long term production.

I have worked with large pad developments (up to 28 wells per pad). What we found was most effective was to run two separate test headers, a production header, two test separators (we had two multiphase meters which seemed to work well on two pads to learn how to operate them), and to ship the pad production multiphase to a small plant.

Depending on the set up, this plant could simply pick up production from a few pads, take some gas we needed for fuel and ship to the central plant.

I prefer to fine tune development to allow the facilities to get fully loaded abd run a plateau with a bit of surplus capacity, and this requires managing the drilling and completion schedule while making sure the most efficient rigs and crews are kept busy (this issue is neglected by the power point tassel loaf pansy management i see nowadays who dont understand a good rig crew has to be kept together because they are like a good football team).

When i hear about these large pads, the excessive use of single well pads, and the mess some companies make managing truck traffic i get tempted to buy one of those rock star buses and park it in a nice town like Midland and with a sign “Experienced oil hand for rent, fee negotiable”.

This fracking can’t go on much longer. They’ve drilled out much of the sweet spots already, and from what I hear, there are already 7 ‘child’ wells being drilled for every ‘parent’ well. (as I understand it, a ‘child’ well is drilled in close proximity to the ‘parent’ without – hopefully-hitting and drawing from the same formation’) If fracking were to stop tomorrow, you’d lose over 600k bbls/day in production immediately and the whatever is leftover tapering off to zero over the course of two-three years.

You see this in Ennos oil site, too.

When you compare 2017 and 2018 well quality (all US sites), well quality has improved but only a tiny amount. ALL years before this growth was much higher – so rock quality decline is finally catching up to improved tech.

The question is: Just how long will the USA be able to continue to increase production in order to hold off peak oil?

Yes will it go bankrupt first or continue to run on until peak and depletion. Meanwhile it drags down the oil price artificially making most other oil development less likely, and increasing volatility.

The FED is reducing money supply by 50 billions per month at the moment. The first feeling it will be comanies needing to sell junk bonds.

This is a big ploblem for the relentless “drill baby drill” programs of several LTO companies.

And a global economic crises, even if only a few years long, will crash oil prices AND credit supply. This will hurt LTO more than the oil price crash from 2015.

Oil bonds appear to be starting to feel the burn at $55/barrel.

https://seekingalpha.com/article/4222006-oil-plunges-energy-junk-bonds-turn-dangerous

I have the feeling that investors’ patience with a quarter or two of low oil prices will not sit well with the oil bond market, especially if there’s a recession on the horizon.

https://www.bloomberg.com/opinion/articles/2018-11-13/oil-collapses-the-fallout-may-hit-junk-bonds-hard

I was surprised to see evidence of reason yesterday: Cenovus has asked the government of Alberta to impose a production cap. Alberta provincial law exists to do this.

The piece is at Rigzone.

https://oilprice.com/Energy/Crude-Oil/Crude-Recovery-OPEC-Eyes-14-Million-Bpd-Production-Cut.html

OPEC and non opec, considering a 1.4 million cut. Mainly to counter EIA’s ghost oil.

You didn’t see David Blaine levitating oil to gulf ports last week? In all seriousness when will the EIA give up the ghost.. mid 2019 you think?

We are only a few days from putting together Texas production for Sept. from the initial production and pending data file. I already have the pending file for the second month, and it’s been adjusted down by about 60kbpd. My guess is that it will come up with a decrease for Sept. probably for Oct, too. Even though there was an uptick in completions in Oct., most of that will show up in Nov. Bottom line, EIA’s projection of 12mbpd by mid year is a complete fairy tale. It will probably rock along at around 11.1, or slightly over, until the fourth quarter of 2019. When oil is close to $55 by mid November, budgets for the other shales are probably not going up much. EIA won’t give up the ghost, they are believers in ghosts, Santa Clause, and the tooth fairy.

Guym,

There have been increases in other states besides Texas (North Dakota, New Mexico, and Colorado), eventually lower output from OPEC and Russia (if they decide to cut) and from Texas will lead to higher oil prices and perhaps higher output, non-Permian basin output has increased at an annual rate of about 450 kb/d for the past 6 months, if Permian output were flat due to pipeline constraints, but the rest of US rolls along at a 450 kb/d annual rate of increase, then we get to 11.8 Mb/d by August 2019, not quite 12 Mb/d, but pretty close and I doubt there will be no increase in Permian output over the next 12 months, 200 kb/d (17 kb/d each month on average) increase from the Permian gets US output to perhaps 12 Mb/d (if non-LTO output remains flat over the Sept 2018 to Aug 2019 period).

I would agree there are a bunch of very optimistic forecasts such as the EIA’s DPR. The EIA STEO projects a 740 kb/d increase in US C+C output over the next 12 months (Sept 2018 to Aug 2019) and expects 12.09 Mb/d of output in August 2019. Might be a bit high, we will find out in about 11 months.

Honestly, Dennis, how much do you think they are planning additional capex next year for areas outside of the Permian with oil at $55 a barrel? Agreed, if prices go up later, they can always shift gears, but there is a six month lag time on that, at least.

Guym,

I think an increase in the completion rate for DUCs could be accomplished in much less than 6 months, maybe 2 or 3. I also suspect we won’t see $55/b for very long, when OPEC cuts, prices will go up (actually just the decision to cut will move the price of oil). Note also that output increased while oil was $55/b, and the capital not spent in the Permian may move to other basins, while they wait for pipeline construction in the Permian basin. No way to know for sure, but as the Permian basin slowed their rate of completion, other areas have seen bigger increases in output. Have you seen a big slowdown in activity in the Eagle Ford due to the recent fall in the price of oil?

You have a huge amount of ducs in the Permian, not that much elsewhere, except dead ducs. There hasn’t been much in the way of new permits in the Eagle Ford, even when prices were much higher. Except for tier one stuff, there is no profit at $55. Tier one stuff in the Eagle Ford is just to keep afloat, not increase production.

And how long would you think it would take for higher prices to be sustained, before a company takes a leap up???? You drill a well, and the highest production is in the first five to six months. Up and down prices would not tickle my interest much, but then I’m not an operator. Just an investor and royalty owner, but I hope they wait to drill mine when prices are consistently higher.

Guym,

I don’t know how long an operator might wait, with the volatility, if they wait they may miss the boat, say oil goes back to $65/b in the next 4 weeks and remains between $60 and $70/b for another 4 weeks (or continues higher), some may decide to pull the trigger. I don’t know how these decisions are made as nobody knows what tomorrow’s oil price will be.

Everyone in the oil industry hopes for consistently higher oil prices (except the refiners I suppose), some day that might happen 🙂 I hope so.

Guym, I’ve noticed some things about recent EIA reports that seem odd. The info you give, if correct, indicates a wide divergence by EIA reporting. Do you suspect that the EIA could be intentionally overstating production?

The President is willing to tell bs to keep prices down. The EIA is part of his admin, so what are the odds?

dclonghorn,

Are you talking weekly reports and DPR? Those are garbage. The only data reporting worth paying attention to are the monthly reports for US crude oil production and tight oil production in my opinion (see page linked below.)

https://www.eia.gov/petroleum/data.php

Also the page linked below has some good information

https://www.eia.gov/petroleum/production/

especially good are the “crude oil comparisons with other estimates” scroll down looking at right hand column.

I also came across the article below which discusses production rates from horizontal and vertical oil wells and the relative drilling rates for each.

https://www.eia.gov/todayinenergy/detail.php?id=37492

Hi Dennis, The DPR’s are useless to me. The weekly reports must be taken with a grain of salt, or maybe a bag. But the weekly’s do indicate some trends sometimes, and when taken with the monthly’s they should give a good indication of production and inventory of crude and products. I’ve watched them for a while and though I can’t put my finger on it something seems wrong.

If Guym’s hypothesis of declining permian production in sept. and oct. is correct then comparing it to the monthly and weekly EIA’s leads to the kind of differences that are not easily explained by inaccuracies.

I’d say it will be more flat until November, when it may pick up about 200k to the fourth quarter of 2019. However, you have to adjust that for about a 100k overstatement on August monthlies in Texas, and GOM probably will trend down. But, George or others are better to comment on GOM, than I. But, the weeklies probably have an overstatement of close to 500k, or more.

Guym,

Agree Permian output will probably be flat until more pipeline capacity (or rail capacity) is available. Mike has said using trucks is too expensive and no doubt he is correct, in my opinion.

Guym and dclonghorn,

I just ignore the weekly production data and the monthly data is also not perfect, but it gets revised as better data comes in over time. Also weekly data doesn’t tell us what is happening in Texas, GOM, or any particular state, it just gives us a US total (which is often far off the mark and is never revised). So weekly data can be looked at for storage trends (but these are also not very accurate).

Guym, I looked up the Texas completion info you were talking about. Oil completions in Oct. were 987 compared to 553 in Sep. and an average of 694 for the first 9 months. Isn’t that a pretty large uptick?

From reading third Q earnings releases, I was thinking 4th Q activity was supposed to be down a little. Any thoughts on this?

dclonghorn,

Probably a three month centered average would give a better indication, as the data on completions is pretty noisy. Past 3 month average (aug to oct) has been 713 oil completions per month, for the 3 months centered on June 2018 the 3 month average was 802 oil completions, so a drop of 12.5% from June to Sept for centered 3 month average oil completion rate. For the 3 months centered on March 2018 the 3 month centered average oil completion rate was 648 completed oil wells per month for Texas. Note that Texas oil output was increasing pretty rapidly over the first 6 months of 2018, and that the Sept 3 month centered average oil completion rate (which was higher than the March 3 mo avg rate) may be high enough to result in continued increases in Texas output (though I expect the rate of increase will be smaller than the first 6 months of 2018).

I don’t consider that a large uptick, no. May was 739, June 914, July 763, August 601, September 553, October 987. But, RRC only reports when the completion reports were turned in. There is sometimes a two to three month lag before they are finally reported. Could be a lot of those 987 were completed in earlier months. Quien sabe? But I am with Dennis on the probable flat production. May be up and down month to month.

Thanks for the info. I have not been watching those stats much so that’s helpful. It is amazing how much EIA reported production has grown over the last year. Texas up 100,000 bbl per day per month for the last year.

Guym,

We are in agreement, flat or maybe up a bit would be my guess, though much will depend on oil prices and I always think they will be higher than they actually turn out, it is a tough business to be in of that there can be no doubt (at least in my opinion.)

Came across this at EIA, kind of interesting

https://www.eia.gov/todayinenergy/detail.php?id=37532

November 16, 2018

The Wolfcamp play has been key to Permian Basin oil and natural gas production growth

From Aug 2017 to March 2018 Texas output increased by 800 kb/d and from March 2018 to Aug 2018(133 kb/d per month), the increase was slower at about 400 kb/d (67 kb/d per month) based on EIA monthly data estimates.

Guym is absolutely correct on the completion data, it is probably not 100% accurate (no data is.)

What a different world we live in. Ten years ago, having followed Deffeyes, Campbell, et al. for many years, reading shelves full of books, even dipping into a scientific journal every now and then, I thought I knew approximately what would happen with oil production within five, ten years or so. The luxury of such certitude is dead and gone.

I wonder if things aren’t altogether worse now: Before, we had the cold comfort of “knowing” what would happen, and when, and what the effects would be. Now it seems we don’t know shit.

Mike Lynch’s comment quoted above –“no peak in sight”–is true, with a dreadful irony: no peak in sight, because we’re blind to it. And now that we’re making sure we burn it ALL up, there is no recourse when the decline sets in.

Whenever that will be.

All we can say for sure is that, because we live on a finite planet, every day that passes it is more likely to happen; and the longer it takes to happen, the worse it will be.

How about in five years? Maybe sooner.

Sleepwalking Into The Next Oil Crisis

https://www.forbes.com/sites/rrapier/2018/03/23/is-the-world-sleepwalking-into-an-oil-crisis/#6f4c87d244cf

Gone Fishing that is an older article from March 2018, but the analysis is excellent and I agree with Rapier 100% and believe it remains correct today.

“older article” Yeah it’s this year, but I have a tough time getting 202o articles so find the old ones that make some sense. 🙂

Gonefishing,

Much changes in the oil industry from month to month, so viewpoints change quite a bit in 6 months time in some cases. A more recent article by Rapier at link below does not seem to contradict his viewpoint from last March and as I said, I agree with the March analysis and his more recent post below (generally Rapier is very good in my opinion).

https://www.forbes.com/sites/rrapier/2018/11/11/oil-is-oversold/#70ae7a031fbc

Europe 15 + Norway crude oil inventories to September – OPEC MOMR

Chart: https://pbs.twimg.com/media/Dr_t6v4XQAAQ9if.jpg

Europe15 + Norway crude oil & products inventories to September

(Crude Oil + Gasoline + Naphtha + Middle distillates + Fuel oils)

Chart: https://pbs.twimg.com/media/Dr_uo2-XQAEmZFO.jpg

Lights https://pbs.twimg.com/media/Dr_vWV7X0AMrKQM.jpg

Middles https://pbs.twimg.com/media/Dr_vJYmX0AMtAY2.jpg

Hi Ron, thanks for the post, the great blog, and your comments. I see on the world production chart that November 2016 and February 2018 are pretty close to being roughly tied for peak. Do you, or anyone else please, happen to have the production numbers for those two months?

Nov-16 82,304,000

Feb-18 82,286,000

Yes Ron, thank you for an excellent post.

On the shale topic; it is marvelously stupefying to observe a heavily indebted shale industry supplying increasing volumes of oil, to an extent that the price/bbl never hits a level where any debt reduction can be realized. (to say nothing of profit)

Its’ almost as if they have no intention of becoming solvent.

Not to mention Uncle Jerome at the Fed is tightening the vise on cheap money. I wonder what the industry average is on rate of interest paid on debt. You see junk debt ranging from 6-8% but how much of the industry is actually paying that high of a rate?

Amazon has had problems with profitability for its whole existence, yet is the darling of Wall Street. Netflix is following the same path, so too with the shale companies. Because of all the technology these companies have at work to produce oil, I think the markets largely see them as a subset of the technology industry, and the usual paradigm in tech is that profitability isn’t as important so much as growth.

Some time ago presented estimate of oil used to create and move food in the US. My recall is the number wasn’t huge.

Recently came across new data. Will get around to laying it out.

25% of total US consumption. Tractors, insecticides, some fertilizer(transport of those to the field), transport of animal food to hogs, beef, etc, transport of human food to shelves, transport of people to the shelf and home. 15% pre transport of human food, 10% transport human food.

Pretty efficient agriculture in the US. No squeezing that 5 mbpd.

Unless people stop eating too much, switch towards a vegetable diet and buy locally or start growing their own food.

Or you know, stop wasting food. It’s ludicrous to call a system efficient that wastes 150,000 pounds of food a day.

https://www.theguardian.com/environment/2018/apr/18/americans-waste-food-fruit-vegetables-study

This country needs to spend more time looking in the mirror. I’m not talking about the fact that a third of adult Americans are obese either. I’m talking about how stupidly wasteful the economy is.

Now Bakken is in queeze mode with discount up to 20$ to WTI due to pipelines booked out.

Looks they have a drilling frenzy there and exploding production. Or is part of the problem canadian oil pressing into these pipelines via rail end points, too?

https://oilprice.com/Energy/Energy-General/Bakken-Prices-Crumble-On-Pipeline-Woes.html

Canada – August seems like a long time ago, Alberta AER says production came back down in September…

2018-11-09 Statistics Canada – August crude oil and equivalents production up +9.6% compared with the same month in 2017.

Press release (in cubic metres)

https://www150.statcan.gc.ca/n1/daily-quotidien/181109/dq181109d-eng.htm

Chart https://pbs.twimg.com/media/DsAauhqXgAARbVF.jpg

Crude oil inventories up +9 million barrels in August

https://pbs.twimg.com/media/DsAbUzYWkAAi3Y2.jpg

https://pbs.twimg.com/media/DsAbnKTXgAEuV-9.jpg

2018-11-14 Canada’s oil industry to spar over forced output cuts

https://www.worldoil.com/news/2018/11/14/canada-s-oil-industry-to-spar-over-forced-output-cuts

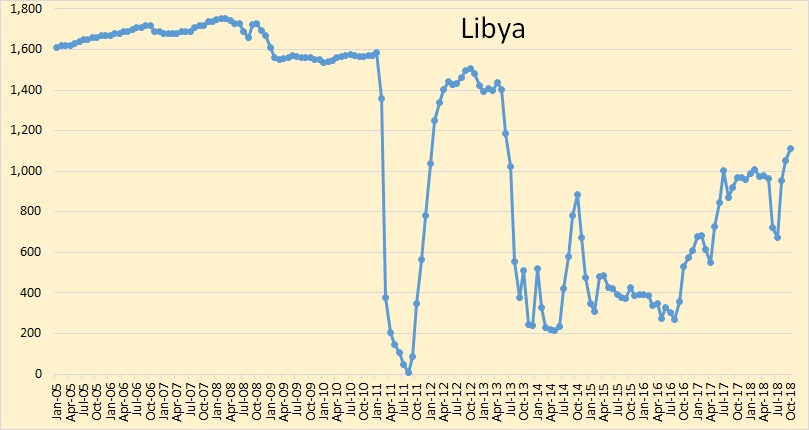

Libya wants to invest $20bn in upstream. It sounds like Libya could produce another +150 kb/day just by increasing maintenance spending…

2018-11-15 (The National UAE) Libya’s National Oil Corporation said. “By 2022 we are going to have more than two million bpd of oil, and more three billion standard cubic feet of gas, so we need a total of $20bn for the next five years, so this [is going] to increase production,” he added.

“We could add more than hundreds of thousands of barrels per day if we do some repair on pumps, generators,” said Mr Sanalla.

https://www.thenational.ae/business/energy/exclusive-libya-needs-60bn-to-overhaul-energy-infrastructure-says-noc-chairman-1.792088

Record products supplied – crude oil, big build but products equally big draw…

U.S. Petroleum Balance Sheet, Week Ending 11/9/2018

Products Supplied, Line 26, Total: 22,387 Difference: +2,001 kb/day w/w

http://ir.eia.gov/wpsr/overview.pdf

Saxo Bank chart summary https://pbs.twimg.com/media/DsDkmkYWsAI9Kgm.jpg

Energy News,

Happens every year during fall refinery maintenance and then again in the Spring (another round of refinery maintenance). Crude piles up and product stocks go down due to lower refinery throughput.

Pennsylvania just released September’s gas production reports.

524 Bcf total comes to 17.4 Bcfd.

2018 exit rate will exceed 6 Trillion cubic feet per year.

Combining Ohio and West Virginia Utica and Marcellus (and Upper Devonian) with Pennsylvania will assure excess of 8 Tcf per year from the Appalachian Basin in 2019, possibly even 2018.

For context, size-wise, the highly touted gas reservoirs recently found in the eastern Mediterranean are said to contain 30 to 50 Trillion cubic feet total resource gas in place.

The highest recent producers such as the McGavin 6 and the Howell 8 are at the 11 billion plus mark at 14 months online.

For those tracking financials, these 2 wells – at $3 HH – have each grossed about 35 million bucks in a little over a year.

Tomorrow afternoon’s Directors Cut is expected to show another new production record for the Bakken.

Cowboyistan with Appalachia Rising.

Coffeeguyzz,

So two wells are making money, that is nice. The average cumulative output at 14 months for the 7486 Marcellus wells that have been producing at least 14 months is about 1.73 BCF according to shaleprofile.com so a gross revenue of 5.2 million per well. At 36 months the average well has a cumulative output of 3 BCF so gross revenue of about $9 million for the average well, probably at least half of the revenue is paid out in royalty, taxes, transport cost, and OPEX, leaving a net revenue of 4.5 million, my guess is the average well cost (for all capital expended for drilling, completion, needed well infrastructure, land, and plugging the well at end of life) is probably at least $8 million, so they have only lost 3.5 million per well on average. I know you don’t worry about silly stuff like profits so you should definitely invest. 🙂 Note that experienced oil men like Mike Shellman look for the well to pay out in 36 months for a profitable experience, though Shallow Sand looks for a 60 month payout, the difference is possibly due to the different nature of the wells that they operate in their respective operating areas.

Note that the 60 month cumulative for the average Marcellus well is 3.9 BCF, so only a 2 million dollar loss on that basis. Sign me up 🙂

https://shaleprofile.com/2018/10/23/marcellus-pa-update-through-august-2018/

You’re gonna stick to viewing these operations largely through the filter of ‘averaging’, I reckon. That is, plotting a bunch of numbers and neatly computing an abstract composite.

So be it.

You are the math guy, not mois.

Kinda makes me wonder though …

If half of Americans are male, and half female, would the average American then be Caitlyn/Bruce Jenner?

I think I’ll stick to what is actually going on and make evaluations accordingly.

Average is what counts.

You buy 100 lottery lots for 1$ each.

2 win with 40$ each, the rest are duds.

Do you have made 78$, or lost 20$?

If you drill only 1 well, or own only the best sweetspot – good for you. The whole industry can be measured with the average – and every company’s earning is based about their average, too.

Coffee, this comment is, well, I’d ask Dennis pretty please to take it down if I were you. You can stick to all the “evaluations” you need from investor presentations but it hardly represents what is actually going on. It is just more “filtered” crap.

Trillions of MCF’s got produced in the App Basin over the years at less than 70 cents an MCF. Unlike the shale oil industry, who is severely market challenged and can’t think past next week with regard to the relationship between supply and price, the shale gas industry seems to have manipulated this years gas situation nicely by elimination of storage. To its benefit, of course. The plus $4 spike currently must be killing debt ridden households in the NE.

At $2.80/ MMBTU, however, about the norm the past few years, after royalty, marketing, etc. etc. those guys must be netting something around $1.65, maybe. And those super long laterals completely stuffed with sand are costing $10MM plus.

Basically, the shale gas phenomena (see Webster for definition of phenomena) is only slightly less of a money loser than shale oil.

And the Bakken data that is coming out that has Coffee puffed up…phffttttt. They’re getting likely less than $40 a barrel in the Bakken at the moment. That hurts the ‘ol pocketbook, trust me.

Hey Mike,

Texans don’t borrow money?

Historically RBL was played a role in oil and natural gas development but not to the extent it is being used today by the shale phenomena. If a well takes 4 years to reach payout and the best one can hope for is a 40% ROR over the ensuing 14 years, one better be very good at managing that wells indebtedness. I hope you are sitting down because the shale industry has made a stinking mess of it. Unlike borrowing money to buy a duplex there is nothing out there above or below ground that is actually appreciating; from day one it is all depreciating. When the well reaches its economic limit there is nothing to sell, little to salvage, there is only an enormous liability.

If you don’t have a shale well, Dennis, get one, as the old saying goes. You can buy tons of non-op NPWI in the Bakken and, if oil prices behave as you expect them to, you will make a killing. If nothing else a rational understanding of the burden of debt on an industry subject to volatile product prices will at least make a better ‘analyst’ out of you. Just think, you could even get some longhorns for the front of your Tesla. Or moose horns.

Hi Mike,

The “debt” cmment was in reference to the “indebted” people of the Northeast that won’t be able to afford natural gas. Many in the more rural areas of the Northeast use oil, propane, wood, or coal for heat as there is no natural gas infrastructure, in the cities and metro areas (where most of the people live) you are correct the higher natural gas prices will hurt.

It just is not clear to me that household debt is any higher in the Northeast compared to Texas.

I agree with you that at current price levels for oil, investing in a shale oil well would not be a great idea (at least for the average well). About $85/b at the refinery gate (typically close to Brent of LLS), assuming $5/b transport cost for Permian and $10/b for Bakken, would be needed for a decent rate of return at a well cost of $9.5 million (2017$).

Using the AEO reference price scenario from the AEO 2018 from the EIA, the debt can be paid off in the Permian basin, the med/low case oil price in the chart below does not allow the debt to be paid off. Neither of us knows which of these oil price scenarios is more likely, but my guess is that oil prices will be closer to the AEO reference case or higher. Note that I call the “reference” case AEO med in the chart below, med/low is the average of the med and low cases and med/high is the average of the med and high cases.

Click on chart for larger view.

Mike,

Yes I am well aware that capital depreciates in the oil industry, more like borrowing to buy a car than a home, to do it right the loans should be paid back over 3 to 5 years and when a business is mature (no more increase in output), debt should be paid off and operations should be out of cash flow.

Also I agree low oil prices (under $60/b at the refinery gate) will be the undoing of LTO producers. Those with high debt levels are likely to fail.

Hi Coffeeguyzz,

Think of someone who designs elevators. When they say 10 people can be carried, what do they mean? You would say it means the elevator can carry 14,000 pounds because the heaviest person ever weighed about 1400 pounds.

I would say the elevator is probably designed to carry about 1600 pounds because the average mass of a human is about 154 pounds.

The average is much more representative of “what’s really going on”. The 11 billion cubic foot wells at 14 months are more like the 1400 pound person, they are outliers and not representative of the entire population of wells.

Have you ever taken any courses on statistics?

The average is most certainly NOT representative of what is unfolding in this unconventional realm and those of you who continue to hold that stance will continue to be surprised at ongoing developments.

There is WAY too much heterogeneity, WAY too much dynamism amongst regions, individual horizons, well by well, stage by stage differentials that just the geology alone makes for continued adaption.

Throw in innovations starting with pads, then micro seismic, diverters, remotely monitored drilling/fracturing, the amassing and analyzing of stupendous amounts of data, on and on.

You guys have been demonstrably wrong and will continue to be so unless and until YOU adapt to these emerging realities.

Those 2 Marcellus wells are the best of the best and in no way represent the norm.

However, they show what CAN be accomplished and so serve the industry wide engineers to dissect the minutia of particulars in the ongoing collective efforts to both mimic and improve upon those stupendous results.

And that’s a fact, Jack.

Coffeeguyzz,

Yes there are good wells and bad wells due mostly to differences in geology from one location to the next. On that point I agree.

Perhaps you are familiar with the idea of a distribution of different well productivities.

If we consider the 2016 Marcellus wells completed from Jan 2015 to Dec 2017, the mean cumulative output at 14 months was 2.157 BCF, the median was 1.8 BCF, about 63% of wells completed had cumulative production of less than 2.1 BCF and 38% of wells completed had cumulative output of less than 1.3 BCF. Also 23% of wells have cumulative output of less than 0.9 BCF at 14 months and 75% of wells less than 2.7 BCF of output at 14 months (again this is for wells completed from 2015 to 2017.)

In your initial comment you mentioned 2 wells at over 11 BCF cumulative at 14 months, how many of the wells completed in 2015, 2016, and 2017 produced 11 BCF or more? Exactly 2 out of 2016 completed wells or 0.1% of all completed wells.

If you consider that sample representative, I don’t really know what to say. You have noticed that I don’t pull the same crap from the other end of the distribution. In this case there are 135 wells (2%) with 0.1 BCF of cumulative output or less after 14 months. I make no claims that such wells are typical.

In a business that aims to make a profit one has to take account of all the wells completed, which is what the average well reflects. Read up a bit on statistics maybe and perhaps you will understand.

Read up a bit on the ongoing operations in the Appalachian Basin and perhaps you will understand what is taking place there.

I’ll not again spend the time disproving Marcellus well results as I did a few years back when you and Mr. Roughneck offered some preposterous statements regarding Cabot well EURs.

While educational for me, I am not interested in knocking down strawmen.

However, although I have difficulty navigating Enno’s site – the source, I presume, for your data – I will go over some of your stated statistics and validate/invalidate/contextualize what I find over the coming weekend.

To be clear, I am totally disinterested if you proceed to make erroneous claims.

You have always displayed a genuine desire to obtain the truth of things. I would think all these years of ‘missing’ this so called Shale Revolution would prompt a self examination as to the causes.

Or, mebbe not.

Coffeeguyzz,

You may not read what I write. Generally I have used the data I have and tried to simply make forward projections, see for example the post below where a made a range of projections for the Bakken based on different assumptions.

http://oilpeakclimate.blogspot.com/2013/10/exploring-future-bakken-decrease-in.html

see figure 4 and note that in Oct 2013 I did not anticipate the fall in oil prices that would occur a year later.

In many cases I match the analyses of the EIA AEO, USGS, NDIC, and others. Yes there has been a shale revolution, but most companies are not very profitable and eventually new well productivity will decline as it has always done in every oil field ever discovered. Despite what some people believe the resource is not unlimited, and eventually if these firms do not become profitable the well completion rate will fall to zero.