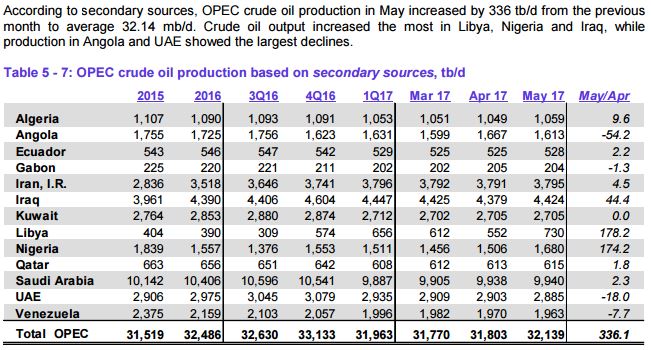

All data below is based on the latest OPEC Monthly Oil Market Report.

All data is through May 2017 and is in thousand barrels per day.

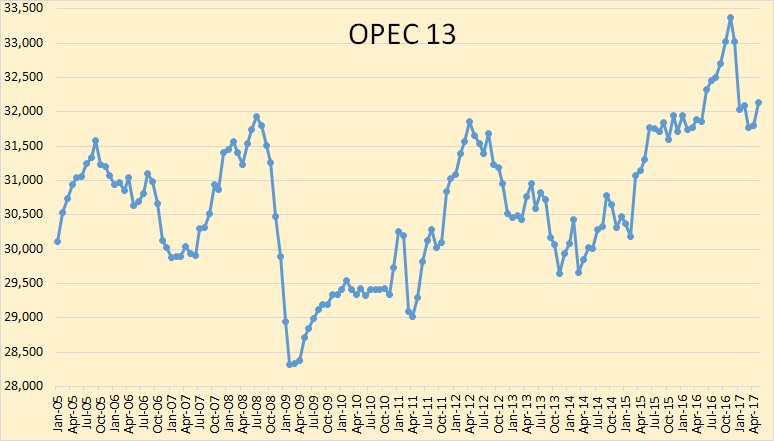

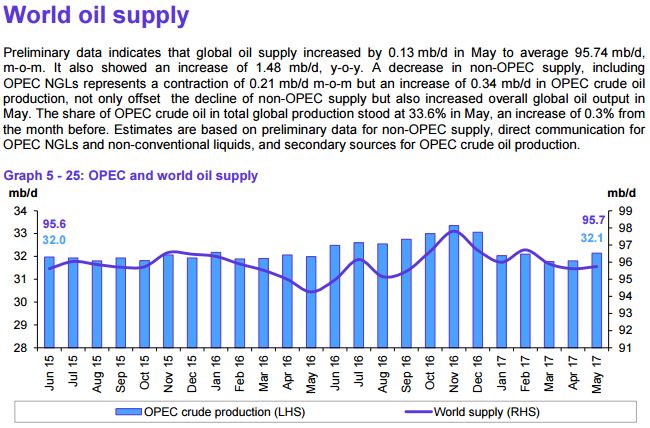

OPEC crude only production was up 336,000 barrels per day in May. The two countries that are not subject to OPEC quotas, Nigeria and Libya, were up a combined 352,000 barrels per day. That means the rest of OPEC was down 16,000 bpd. And all this was after OPEC April production was revised upward by 72,000 barrels per day.

March OPEC production was revised upward by 23,000 bpd while April production was revised upward by 72,000 bpd.

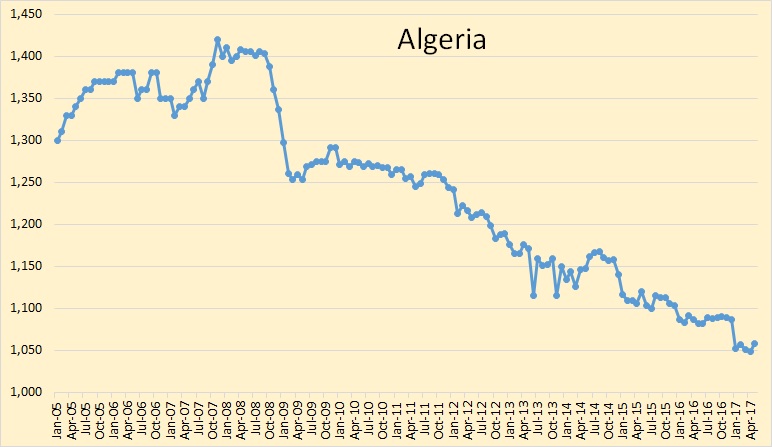

Not much is happening in Algeria. They peaked almost 10 years ago and have been in slow decline ever since.

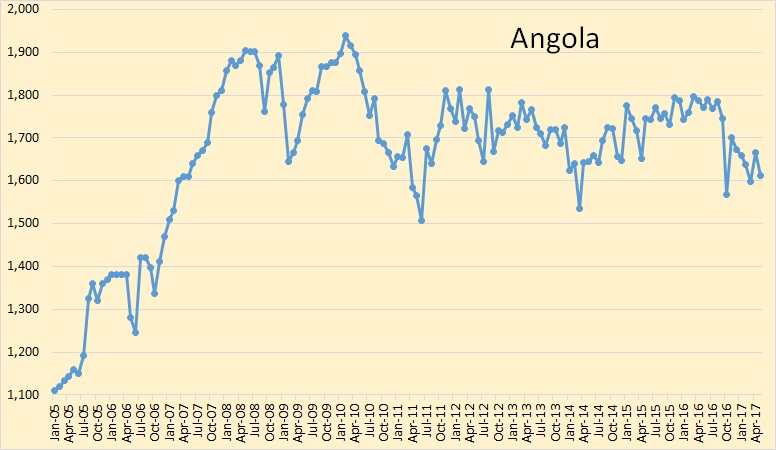

Angola peaked in 2010 but have been holding pretty steady since.

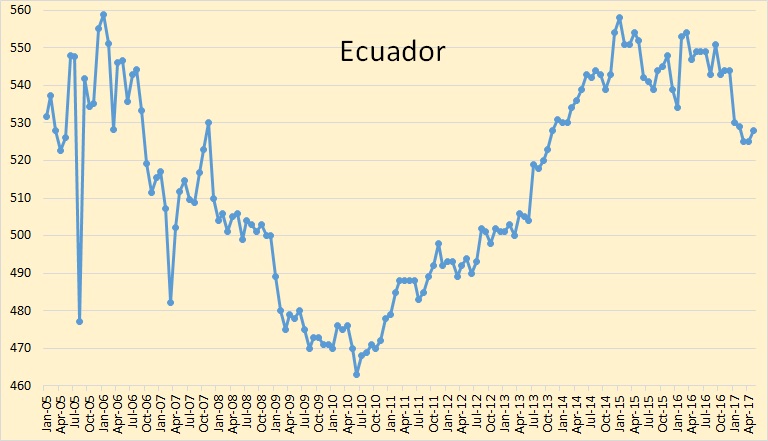

Ecuador peaked in 2015. They will be in a slow decline from now on.

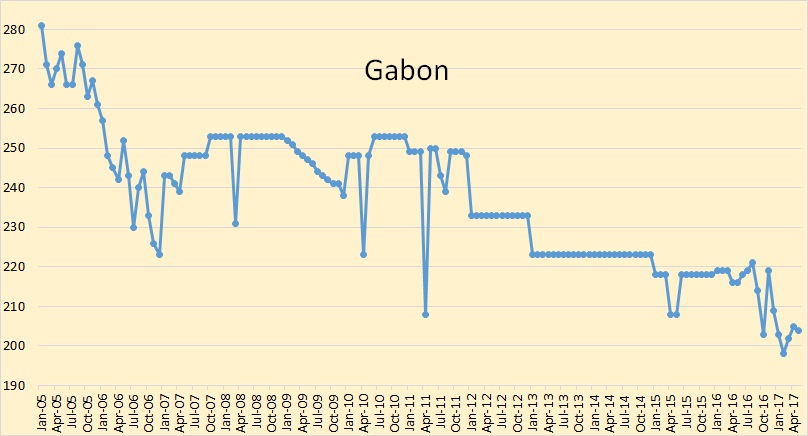

Any change in Gabon crude oil production is too small to make much difference.

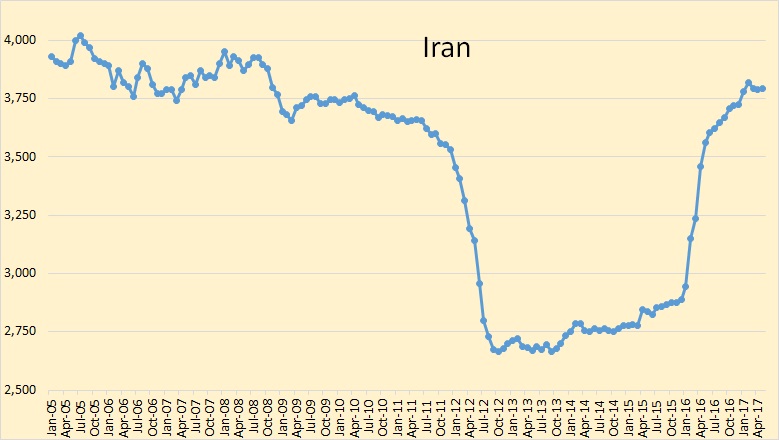

Iran’s recovery from sanctions has apparently peaked. I expect a slow decline from here.

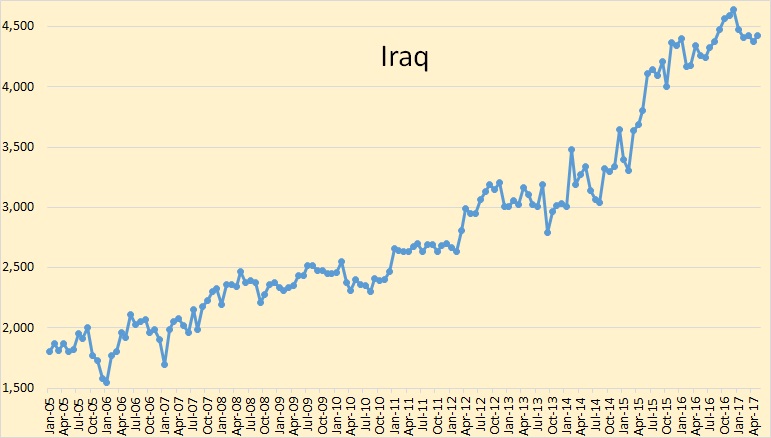

Iraq is down 218,000 barrels per day since their December peak.

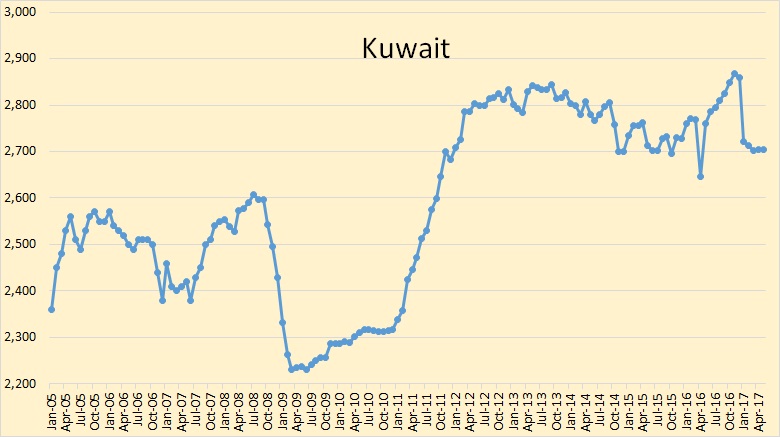

Kuwait is down 154,000 bpd from their November peak. That is about 5.4%.

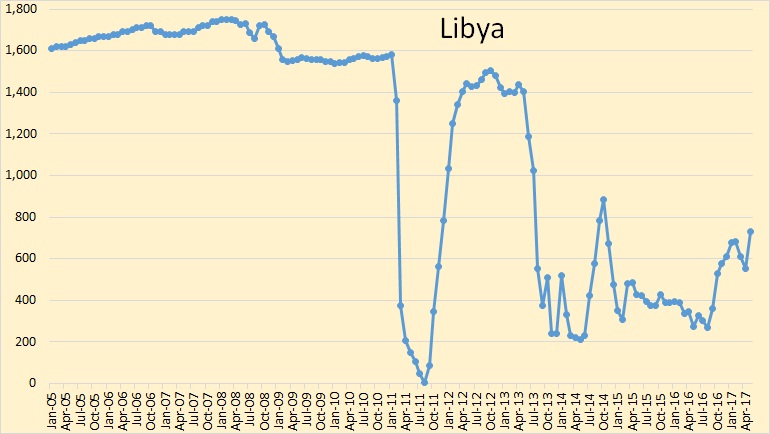

Libya was up 178,200 barrels per day in May but they still have a long way to go before they get back to their maximum possible production level, which is around 1.4 million bpd.

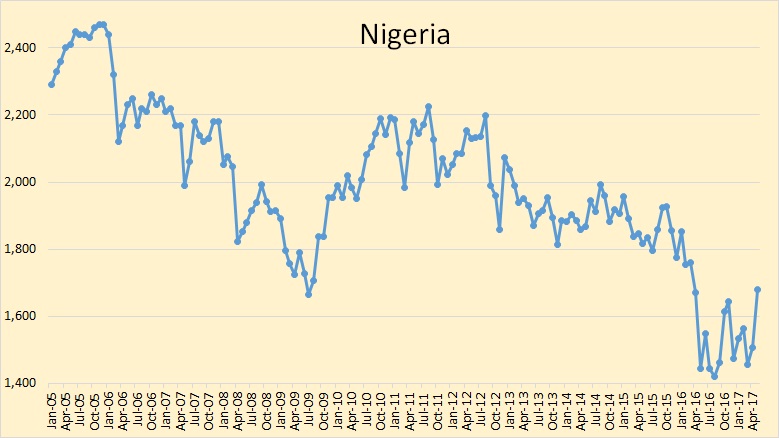

Nigeria was up 174,200 bpd in May but they had more labor problems in June. So look for their production to drop slightly next month.

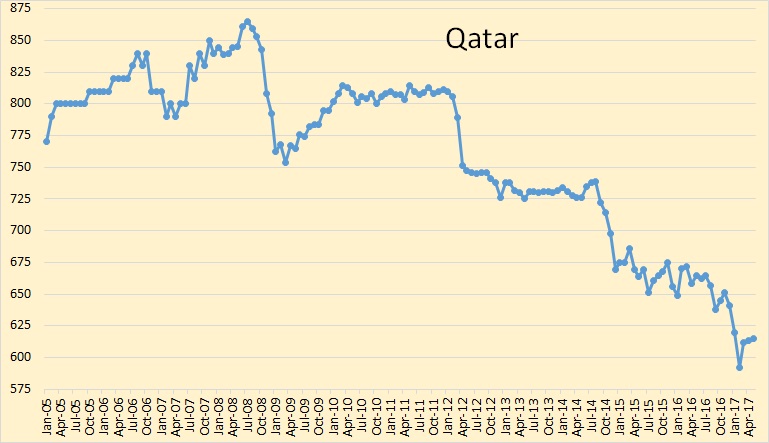

Qatar has been in decline since 2008. Her decline will continue albeit at a very slow pace.

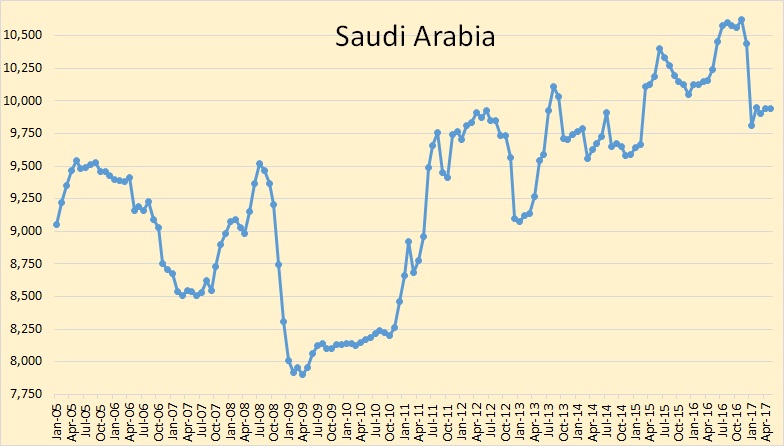

Saudi Arabia cut in January, then stopped cutting. I think this is where we will be for some time unless there is a real shake up in OPEC.

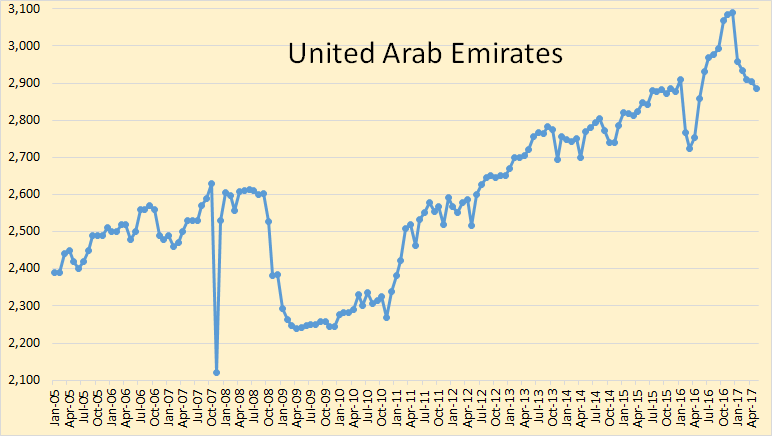

The UAE is down almost 205,000 bpd since December. This is the largest percentage cut in OPEC. I don’t think it is all voluntary.

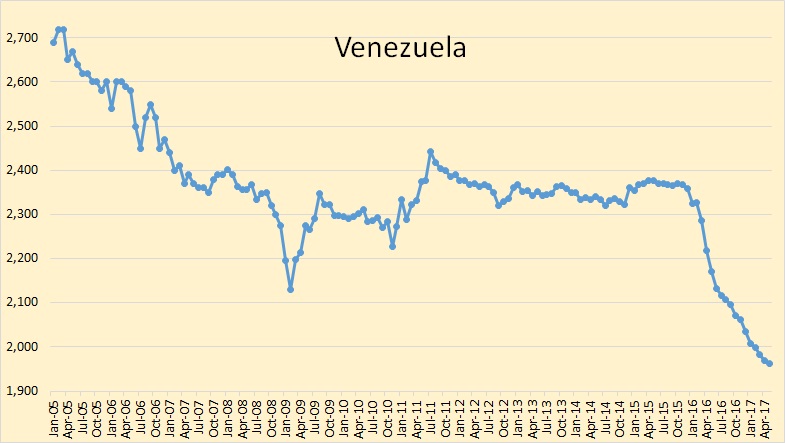

Venezuela’s problems will continue. They are now below two million barrels per day. They are at 1,963,000 bpd. Last March their production was 2,286,000 bpd.

They are saying global oil supply was up 113,000 barrels per day in May. OPEC production was up 336,000 bpd in may. If these two figures are correct then Non-OPEC had to be down 223,000 barrels per day in May.

Hi Ron, Did you mean up in the first sentence? D

Yea, I caught that about five minutes after I put it up. But it turns out I only corrected it only on the “OPEC Charts” page and forgot to correct it on the post.

Enno Peters has a new post up on the latest North Dakota production data.

North Dakota – update through April 2017

Thanks Ron for keeping us up-to-date. Not many have the endurance to do this. Especially as the data are not easily available in Excel format. Your graphs show that OPEC increased production before the November 2016 meeting and then cut production by almost the same amount. This is similar to what they did in the 1980s when they all increased oil reserves within a very short time (quota wars)

http://crudeoilpeak.info/opec-paper-barrels

My latest post is on the UK oil and gas industry which is now in negative post-tax cash flow

13/7/2017

Brent Exit

http://crudeoilpeak.info/brent-exit

While I’d agree with your general points I think you’ve omitted the observation that ther is going to be quite a boost to production over the next two years with Glen Lyon and Greater Stella ramping up (130 and 55 kbpd nameplates) plus Clair Ridge, Kraken, Mariner, Kraken Western Isles, Montrose Area due this year and next. I predict headlines of the great North Sea comeback. It depends a bit on whether Buzzard production stays up – it should be coming to the end of plateau, but has been for over a year, but water cutis now on rising above 50%, which is often the beginning of the end

After these though there’s not so much – Rosebank, which has been around for a long time, the Hurricane field if the extended production tests work out and some small gas projects and oil tie-backs. I don’t see the discoveries Rystad predict even on a high case – this year is busy and I think Douglas Westwood are only predicting about 100 mmbbld unrisked (could easily be zero).

You also say there haven’t been many studies on the consequences of the decline. There have been a few but they aren’t good news and tend not to be widely reported. There was a all party group for peak oil and gas, and now there is one for limits to growth, There was also a study which showed a very high correlation between UK productivity changes and changes in North Sea production, which would suggest we might sustain productivity for a couple of years as the new fields arrive, and then it’s likely to plummet (there are regular media columns from high profile commentators on our productivity issues – none of them ever mention this correlation, it’s always a question of taxes, management, generational attitudes etc. – i.e. soft data that is almost impossible to question, and where everything would be fine if only … etc. ).

(should say 400 mmbbls unrisked)

Do you have web links to the reports or articles you have mentioned?

http://speri.dept.shef.ac.uk/2016/04/14/new-speri-paper-innovation-research-and-the-uks-productivity-crisis/

http://limits2growth.org.uk

http://powerswitch.org.uk

http://www.arup.com/news/2010-02_february/10_feb_2010_action_on_peak_oil_crunch_threat_to_uk_economy

APPGOPO – has finished but if you google it you can still find articles, the Charles Hall presented there once

BP’s released data yesterday shows this for UK oil production:

2010 1.36 mbpd

2011 1.112 mbpd

2012 946K bpd

2013 864K bpd

2014 852K bpd

2015 963K bpd

2016 1.01 mbpd

Consumption 2016 1.6 mbpd up 2% from 2015

Matt

You say in your article that the world cannot afford $100 oil. The evidence for that is circumstantial. Recessions have happened over the centuries and has nothing to do with oil prices.

https://en.wikipedia.org/wiki/List_of_recessions_in_the_United_States

Recessions are far more related to excess lending and borrowing, followed by a time of prudence.

global GDP is $80 trillion and to spend $4 trillion on everything related to oil is not a great deal. At $100 which would cost $4 trillion globally would pay for all oil exploration and production. All the oil to power agriculture, all the road haulage, all the cars driven, all the plane fuel. All the ships transporting people and goods.

Cars now can get 80mpg and more.

http://www.carbuyer.co.uk/reviews/peugeot/208/hatchback/review

People who buy cars like this will be effected more.

https://www.fueleconomy.gov/feg/Find.do?action=sbs&id=37980

The great advantage to $100 oil is that it shifts outlays from consumption to investment. For countries with high current account deficits, like the US, this is an important market signal. So America’s best bet now would be to tax consumption of liquid fuel so that the oil looks like it costs $100 a barrel to consumers.

I have thought we should have been doing that ($100 apparent) since the 1980’s. The revenues could have been used to build the long-term infrastructure and R/D to make the USA energy independent and on economic sure footing.

That kind of thinking assumes a long term plan- purely wishful thinking.

In the U.K. petrol and diesel is around £1.10 per litre.

https://www.petrolprices.com/

159 litres to a barrel or oil equals £175 per barrel, with an exchange rate of £1.30. We are paying around $227 for a barrel of oil.

There are still a lot of cars here but at least we have a reasonable public transport system. You can get anywhere in Britain by bus and train and of course by train to Paris, Brussels and beyond.

In Europe public transport is far better and cheaper, so Europe can adapt to peak oil reasonably well.

Since mid-2014, Canadian tight oil production decreased from a peak of about 425 thousand barrels per day (Mb/d) to about 345 Mb/d at the end of 2016.

http://www.neb-one.gc.ca/nrg/ntgrtd/mrkt/snpsht/2017/06-03cndntghtlprdctn-eng.html

Hi all,

Enno Peters has a new North Dakota update up.

https://shaleprofile.com/index.php/2017/06/13/north-dakota-update-through-april-2017/

Coffeguyzz suggested that the well profile presented by the NDIC in the presentation linked below should be better.

https://www.dmr.nd.gov/oilgas/presentations/NDPC092116_.pdf

The NDIC well Profile would be about 962 kb over 45 years.

In my model, (recently updated) the well profile from 2008 to 2015 is 325 kb to 335 kb (a gradual increase in well productivity over time). In July 2016 to April 2017 the well productivity may have increased to around 350-360 kb (difficult to estimate with limited data). The model using these well profiles is below.

Note that even cutting off the NDIC well profile at 30 years would still result in 872 kb of output about 2.5 times my high estimate (for recent Bakken wells). The NDIC well profile is not credible.

The model below would not be possible without the data generously provided by Enno Peters.

Thank you Enno.

The wells added from May 2017 to Dec 2019 is assumed to average 80 new wells per month, obviously I cannot know the number of wells added in the future so this scenario simply guesses at the future number of future completed wells. For the past 12 months the average was 62 new wells per month with a low of 45 and a high of 83 new wells per month. The number of completed wells increased by 12 in April (from 56 to 68).

Dennis

To both expand upon and, possibly, clarify my observation, suggest you and/or readers go to page 12 from that presentation to see the current 60 day IPs in color-coded ‘dashes’. These hash marks show both the wells’ productivities and locations.

You should see hundreds of blue, green, purple and dark orange lines – on both the light grey (TF) and dark grey (Bakken/TF) – which are all incorporated into Enno’s vast data base. (Hats off to you again, Enno. Incredible display of time and effort on your part).

So, Dennis, the DMR folks exclude many of those poor wells as they are not considered ‘typical’.

Now, there is no way that I will attempt to define their ‘typical’ parameters, but I will say that as recovery techniques improve and drilling and extraction processes continue to decline in cost, the productive footprint of this Basin will tend to enlarge.

Hi coffeeguyz

In my view the mean well is typical anything else is cherry picking.

The average well was about 335 kb EUR in 2015, in 2016 it went up to perhaps 350 kb though it may be too early to tell.

The average well will not have an EUR of 950 kb.

That’s called hype.

Hi Coffeguyzz,

The point of my chart was to show how well the model works with average well productivity (EUR) of 325-360 kb. The point was perhaps unclear.

To reinforce further, the scenario below assumes the same well profile as before until Jan 2015 and then the average well profile is changed to a mean of 647 kb from Feb 2015 to Jan 2018 (essentially it was multiplied by 2), as a reminder the NDIC well profile is 950 kb (about a factor of 2.5 times the correct average well profile of 345 kb).

I think it is fairly clear that the actual North Dakota Bakken/Three Forks output of the model does not match the data well using such a well profile (from Feb 2015 through April 2017).

That is the reason the NDIC typical well profile is not correct.

Note that this scenario is not correct, the point is to show that the average well profile must be closer to a 350 kb EUR than a 650 kb EUR (or even a 950 kb EUR).

Dennis

I will not attempt to suade you regarding your views.

Suffice to say that the Department of Mineral Resources from the state of North Dakota has a very different perspective than you, partially, I would think, as a consequence of the factors mentioned in my above comment.

… and a quick PS …

Do you know how many of the wells in Enno’s data base are from non Bakken/Three Forks formations?

The DMR folks use the term ‘pool’ to indicate the targeted formation.

Hi Coffeeguyzz,

In shaleprofile one can select the Middle Bakken and Three Forks formations. That is what I do when I find the average well profiles.

There are 11,360 wells that have been producing at least 2 months in the Middle Bakken and Three Forks Formations, 7294 of thes ewells were in the Middle Bakken with the rest in the Three Forks.

When all the wells in Enno’s database are included the total is 11,871 wells, so 511 wells are either unknown (confidential wells) or “other”, 47 of the wells with at least 2 months of output are unknown and I am confident these at the “confidential” wells. There are 464 wells in the “other” category.

The Middle Bakken, Three Forks, and Unknown(confidential) wells were chosen under formation and years 2015, 2016, and 2017 were chosen for year of first flow. Chart below from shaleprofile.com

Dennis, don’t forget how useful the BOE tool is to the shale oil industry. The Bakken appears to be getting gassier, as one might expect from four years of high grading and depleting sweet spots. The same is happening in the Eagle Ford. There is also a slow transition in the Eagle Ford from the oil window back to the wet gas window, because of prices. And the Permian is naturally gassier. At 6:1 all that gas can make BOE EUR’s look really peachy. They keep getting higher and higher. And it hardly matters whether that gas nets 20 cents an MMBTU, or goes up a flare stack…its not about profitability, its about productivity and big numbers. When 99.999% of American’s hear BOE they think BO. But that’s the point, isn’t it?

Hi Mike,

Yes and at $50/b for oil and $3/MCF for gas, a boe of natural gas is worth about $18/boe or 2.8 times less than the barrel of crude.

In terms of value the natural gas “barrels” should be divided by 3 and the NGL “barrels” by about 2 (usually NGL sells at about half the price of crude, I think).

So for a financial analysis with 700 kb0, 50 kb NGL, and 200 kboe of natural gas, often touted as 950 kboe EUR, a more honest analysis would call it 800 kboe.

There is also the problem that type curves often use b=1.4 or higher which if carried out to 45 years (as is done by the NDIC) leads to an EUR of 950 kb. The reality is that the C+C produced is about 340 kb, I haven’t really followed the gas closely, because in the past most of it was flared, it adds very little value to a Bakken well,operators are forced to collect it because of EPA regs.

I examined this in a post in April 2013.

http://oilpeakclimate.blogspot.com/2013/04/bakken-model-suggests-7-billion-barrels.html

hyperbolic well profile uses (EUR30=304 kb)

Di=0.19, b=0.95, and qi=14,225

James Mason well profile (EUR30=500 kb)

Di=0.197, b=1.4, and qi=14,225

NDIC well profile (EUR30=570 kb)

Di=0.185, b=1.094, and qi=21,500

Chart from post below

Hi Glenn,

Your chart from the EIA tells us very little as it does not break out out flaring by basin.

The data can be gathered at shaleprofile.com

Mike said:

The truth, however, is something quite different, and the talk of “6:1” is just more fact-free nonsense from our resident “expert consensus.”

The reality is that the Permian is not “naturally gassier.”

One of the attractions of the Midland Basin is that on the northern end of the basin the wells are not very gassy at all, with gas composing only 6% to 15% of BOE, depending on the area and the zone of completion.

The average GOR for all Permian Basin wells (both the Midland Basin and the Delaware Basin) according to information gleaned from Enno Peter’s website Visualizing US Shale Oil Production, is only about 2,000 CFG/BO, and has trended generally downward since 2012 as operators have focused on drilling wells in the less gassy areas of the basin.

What then is the current gas to oil equivalent ratio being used in the Permian if not 6: 1, Mr. Stehle ?

Its deceiving to the American public, whatever it is. BOE is not BO. Dennis has proven, with actual realized production data, that oil UR is not improving that much. Gas in the Permian is getting flared by the B’s. If they’re are moving to very specific, less gassy prone areas in the Permian maybe it is because of this: https://btuanalytics.com/permian-gas-takeaway/

What makes you our “resident” expert on POB, besides being a royalty owner receiving revenue from shale wells, free and clear of all costs? Are you an engineer, Mr. Stehle? A petroleum engineer and still a member of the SPE?

“Since 2011, the largest 30 independent U.S. shale producers spent an average of nearly $1.33 for every $1 they made drilling wells, according to a Wall Street Journal analysis.

In the past two years, those 30 have lost $130 billion. More than 120 companies have gone bankrupt, and many of those that survived have done so with cash infusions from Wall Street, which rewarded the drillers for their fast growth.”

http://www.msn.com/en-us/money/markets/big-oil-firms-are-exploring-a-new-frontier-in-shale-profits/ar-BBCKV0l?li=BBnbfcN&ocid=DELLDHP

The lower the price goes, the less relevant “growth” becomes and soon it becomes necessary, again, to impair all those reserve assets, again.

And this is really not good: http://www.reuters.com/article/us-usa-permian-funds-idUSKBN1970EW

Your royalty income is down 21% in just the past 2 months. Man, that’s gotta hurt, even the staunchest of gung-ho shale oil supporters.

Its ironic that not three months ago, at CERA, Harold Hamm, of all people, warned the Permian boys not to overproduce and drive the price of oil down. Knotheads they are, one and all.

Mike said:

More fact-free nonsense from our resident “expert consensus.”

If we look at the natural gas being flared for the entire state of Texas, it amounts to less than 1% of the total produced.

Flaring or venting of natural gas in Texas is illegal except under the following conditions:

An operator, however, can apply for a flaring permit to flare natural gas at times other than those mentioned above if certain conditions are met.

But as the RRC explains, this is typically in “areas new to exploration.”

And “areas new to exploration,” needless to say, does not describe most of the Permian Basin, where oil and gas production has been going on for nigh on 100 years. (“Areas new to exploration,” however, is an apt description for the Eagle Ford, or remote areas of the Delaware Basin like the Alpine High.)

The Texas Railroad Commission says:

But as the Railroad Commission goes on to note, flaring permits are of a very limited duration:

Glenn. Do you have any views on the availability and costs of water in PB for high intensity frac as well as costs of disposal of produced water? Seems that water may be the biggest issue in PB.

Also, given that the price has dropped in Q2, but expenses are rising somewhat in PB, will Q2 earnings reflect that? Maybe why there has been some fund selling of PB shares, as Mike alluded to?

Glenn

Mike IS an expert by any definition. Feel free to dismiss him but I value any mans opinion who backs it up with action and his own money. Decades of experience in the oil business and lessons learned the hard way. with HIS money.

Mike brings a perspective to this board that not many have. Anyone can pull a powerpoint off of the internet. I prefer input from people who have seen the AFE’s JIB’s and monthly runs. Although your perspective is appreciated, I would just stick t what you have seen first hand. It would be much more persuasive.

Hi Glenn

Looks like 33% of the boe is gas in 2016Q4.

That’s a lot compared to Bakken.

Also, if your source of information is corporate presentations, take those with a grain of salt. If the goal is to raise stock prices or attract more investment money/loans or to sell assets, of course the presenters are going to put the best possible spin on the numbers.

That’s why this forum is so useful. It’s about numbers rather than hype. There are, of course, individuals who post comments which seem to be sales pitches, but if there are holes to be poked, they usually are.

Mr. Hightower, you are kind, thank you. I feel the same way about your opinions. And Shallows. The shale oil industry is getting stressed out, clearly, and relying more and more on lies to maintain appearances. That is the part of it I can’t stand, the lying. Thankfully nobody seems to be buying much of it here on POB.

The flaring standards in the NM part of the Delaware are very lax, not anything like those of Texas. Over 170 new shale oil wells are coming on line each month out there in the Permian and it is taking months and months for infrastructure to get built to gather gas, particularly out in the Delaware. I flew over it a month or so ago, at a low altitude, and was stunned at the gas being flared. I stand by my belief that BCF’s are getting flared, WASTED, from the Permian. Its clever to quote TRRC rules but anybody that has ever actually operated in Texas knows rules are easily circumvented with the TRRC when everybody is behind and tax money is involved. Remember, the same folks regulating flaring are allowing lateral toes on $9M wells to be drilled 330 feet apart. Money talks.

How stupid is it, by the way, to tout thousands of drillable locations in an investor presentation, then have to wait 6-8 months after your 8 well pads are frac’ed and producing, for gas infrastructure to get built.

Ironically, for those that believe that America can become hydrocarbon independent thru unconventional shale resources, the shale oil industry is doing everything it can to actually PREVENT that from occurring by driving the price down. The guys’ porch lights are on, but nobody is home.

To answer your previous question regarding economic limits: it depends on produced water, of course. But we did some interesting work months ago about increasing incremental lift costs as the life cycle of the shale well goes on, particularly intervention, or workover costs, and it was an eye opener. I am thinking economic limits have to now be 15 BOPD with 4-6 BW per 1 BO. And that is not taking into consideration the debt burden that well must carry for billions of dollars of debt still on the books.

All of America has a right to expect the truth from the shale oil industry and the shale oil industry has an obligation, a fiduciary responsibility to all Americans, to TELL the damn truth.

Hi Mike,

One thing is clear.

Those who claim that other people are making fact free claims are doing so because their comments have very little factual basis.

Most people reading this blog know which is which.

Investor presentations often stretch the truth way beyond facts.

There seem to be some that fail to recognize this basic fact.

Mike said:

“The flaring standards in the NM part of the Delaware are very lax, not anything like those of Texas. Over 170 new shale oil wells are coming on line each month out there in the Permian and it is taking months and months for infrastructure to get built to gather gas, particularly out in the Delaware. I flew over it a month or so ago, at a low altitude, and was stunned at the gas being flared. I stand by my belief that BCF’s are getting flared, WASTED, from the Permian.”

While some, like Reno Hightower and Dennis Coyne, seem to be quite taken in by your anecdotal observations and other defactualized nonsense, I prefer facts and empirical data.

Take this from the EIA, for instance:

Glenn

Your flared gas chart assumes all things are equal. Namely number of wells. Want to compare the number of wells that produce gas in New Mexico to the number of wells that produce gas in Texas? Now if you can tell me how many Texas wells in the Delaware flare gas vs New Mexico wells in the Delaware that flare gas, you might have something.

This is pretty basic stuff. Mike knows this because he is an operator in Texas and has probably, from time to time, flared gas from his wells. I would bet that he has participated in wells in New Mexico, if he ahs not operated any, so he is familiar with the rules. But you pull up some chart from the EIA which is completely misleading to prove your point. Not sure why you are in a pissing contest with Mike, but if you would get past that you might realize he knows quite a bit about the oil business. From all points. Land, legal, geology, engineering, business, etc..

Reno Hightower,

The way Mike carries on about how he “was stunned at the gas being flared,” you’d think he was a spokesperson for the Center for Biological Diversity (CBD) or the Sierra Club, and not for the oil and gas industry, which invariably takes the exact opposite position as what Mike has taken:

New Mexico Business Leaders Endorse Repeal Of BLM Venting And Flaring Rule

http://westernwire.net/new-mexico-business-leaders-endorse-repeal-of-blm-venting-and-flaring-rule/

And for those with such a pronounced political-economic agenda, such as Mike and the renewables industry (who would like to see competition from shale producers eliminated by means of state intervention), facts don’t matter.

But the fact of the matter is that oil and gas producers in New Mexico do not vent or flare an inordinate amount of natural gas.

Here’s what the EIA figures indicate for the state of New Mexico:

Reno Hightower,

To continue, it looks like on the surface that New Mexico vents and flares gas at about double the rate of Texas. But upon closer inspection, this isn’t the case.

Only about half of the total natural gas flared and vented is at the well site, with the other half being done at gas processing plants.

The Texas Railroad Commission only monitors and reports those volumes under its purview — the gas vented or flared at the well site. So the Texas Railroad Commission figures tell only half the story.

Reno Hightower,

If we look at EIA data for the total amount of natural gas vented and flared in Texas — which includes both well sites and processing plants — it doesn’t look that much different from New Mexico.

So the bottom line is this: Mike has produced no factual or empirical evidence, only anecdotal evidence, to support his and the CBD´s and the Sierra Club’s claims that New Mexico oil and gas producers are venting and flaring an inordinate amount of natural gas.

In my opinion there are likely 250-300 wells in the Permian at any give time in 30 day test (shaleprofile.com). At 33% of 2000 BOEPD IP’s, that’s at least 165,000 MCFPD getting flared right there, more than your EIA predictions for all of onshore Texas. Old data, I might add. And is THIS EIA data optimistic, or pessimistic; you seem to go back and forth. You have actually witnessed well testing, I assume, Mr. Stehle?

Further, if there are 500-800 wells at any give time awaiting gas hookup in the Permian, at 500 MCFPD each, that’s another 300,000 MCF getting flared, at least. So, its not a BCFPD as I suggested. That is an exaggeration on my part. But it is too damn much and its a waste. It is something you, as a so called “oilman,” or as someone who claims to be knowledgeable of the Permian (clearly only from an internet standpoint, not an operational standpoint), should be embarrassed by, and critical of. The oil business should be better than that by now.

The subject, by the way, before you went off on a link induced tangent, was grossly overinflated EUR’s and the role that BOE plays in exaggerating those EUR’s.

Look, I think people are sick of you and I going back and forth. I am after the truth, which is really hard to get from people like yourself and the rest of the shale oil industry. Its Fathers Day. Fathers tend to be worried about the future. They want a good life for their kids, a life that includes ample hydrocarbon supplies that they may, or may need in their lives. The people that are currently in charge of America’s unconventional oil and natural gas resources, or promoting it for their own self interests, like yourself, can’t think past next week. They are lying about our hydrocarbon future, wasting it, and exporting it all away for a quick buck now, so in a decade we’ll have to buy it all back from OPEC at 3 times the price. Get somebody else to try and explain that to you. I give up.

Relax; take the rest of the day off the computer and go mow the grass or something, productive.

Mike,

It isn’t so much that Wall Street or the EIA tried to meddle in the competition between conventional oil producer and shale oil producer. You may recall that back in 2014, when oil was $100/barrel, Wall Street looked quite favorably upon non-shale producers like ConocoPhillips, ExxonMobil and Chevron. And as Energy News pointed out on another thread, the EIA has consistently been overly pessimistic when it comes to predicting future shale oil production. Didn’t hear a lot of screaming about that from non-shale energy providers.

What matters is that, even though there is zero evidence for it, the non-shale oil producers and wind and solar energy producers continue to hypothesize that the shale producers colluded (whatever that means) with evil Wall Street and evil government to deny them the right to become the nation’s leading energy producers.

Conventional oil producers like yourself, just like renewables energy producers, never lose economic competitions. Their economic success is always stolen from them. They believe that the only fair outcome is when they win – otherwise, there has to have been some dirty tricks that stole economic victory from them.

According to you, everyone from Wall Street to the commercial banks to the EIA to the Texas Railroad Commission to the New Mexico Energy, Minerals and Natural Resources Department are responsable for your loss.

Those of us who have followed the energy wars for many years have heard this constant theme: non-shale oil producers and wind and solar energy producers have never ever ever ever lost a ‘fair’ economic competion. It’s always something other than their own costly production methods and techniques or their being out of touch with the American people, who overwhelmingly opt for the cheapest and most reliable energy supply when given the choice.

Mike,

Interesting thread, if one skips Glenn’s drivel, which is my SOP. Thanks for the comments.

I bet 90%+ of the readers of POB now FLY past Glen’s comments. I’ve never seen Dennis decline to comment so the biggest worry is carpal tunnel on my “mouse wheel” finger, which is appropriately my middle finger, so in a sense you could say I’m CONSTANTLY giving glenn my middle finger.

Hi Coffeguyzz,

Many will not bother to look at the presentation so the chart with the NDIC typical well profile from the Sept 16, 2016 Presentation is below.

https://www.dmr.nd.gov/oilgas/presentations/NDPC092116_.pdf

So we can see at 2 years the “typical well” is supposedly at 216 b/d for the yearly average output, where from shaleprofile.com we see that average output in year 2 for the average 2015 well is about 130 b/d. Also by year 2 the 2015 well has fallen in output to the level of the 2010 to 2014 average wells.

In all fairness, aren’t P4 reserves the only reserves that matter?

Hi Reno,

When considering profitability we need to assess the likely output over a well’s productive life.

In the Bakken a well that produces 11 barrels per day of oil after 45 years is quite unusual, maybe 0.5% at most of wells completed. At 11 years the typical well should be producing 65 b/d. The average 2005 well (first production in 2005) produced about 12 barrels per day in its 11th year of production. Only 36 wells in the database.

For 2009 wells (470 wells) output in year 7 was 42 b/d on average, the “typical well” has output at 84 b/d.

The average Bakken well is unlikely to produce beyond 20 years and most will not be economic to produce at even 10 b/d.

P4 reserves=Powerpoint=raising equity/increased stock price

Win, win win all the way around

Mike

What is the minimum production needed to keep these wells producing at a profit. Forget them getting their money back, but at some point they will sell, and take the loss. What do you need to pay the LOE and regular workovers, etc to make money?

Hi Reno,

I had never heard of p4 reserves so I didn’t get the joke.

Reno, yes, but only if your selling, not if your buying. Howzabout the tail on that puppy, from a gas-expansion driven chunk of shale, wow !

Hey Mike,

Does 350 kb seem a little more reasonable than 950 kb for an average Bakken EUR?

Hi all,

Mike answered this question over at shaleprofile.com.

https://shaleprofile.com/index.php/2017/06/13/north-dakota-update-through-april-2017/#comment-1170

He said, yes 350 kb is more reasonable than 870 kb over the life of the well.

I am fairly sure he thinks 350 kb may be too optimistic, I think 300-350 kb cumulative output over the life of the average Bakken well which started production between 2010 and 2016 is reasonable.

The fact is we don’t know what these multi-stage fracked horizontal wells will look like after 10 years (they only optimized the method in 2008, so we have 9 years of data).

The 870 kb NDIC well profile (over a 30 year well life) is not credible at all. Even their older 570 kb well profile (from 2012) is almost 2 times higher than the average Bakken well profile supported by actual output data.

I have no doubt that the one million boe EURs touted by Pioneer in the Permian Basin are also overstated by about a factor of 2 and in terms of revenue from oil and natural gas sales more like a factor of 2.3.

Based on the data it looks like the average Permian basin well in 2016 has an EUR of 305 kb of oil and when natural gas and NGL are included the EUR in boe is roughly 327 kboe, the “barrels of revenue equivalent” (bre) would be about 314 kbre.

Dennis,

With charts like these — one’s where you make projections — what technical methods do you use for extrapolation?

Hi John,

The May 2017 to Dec 2019 scenario makes two assumptions.

1. Number of wells completed each month averages 80 wells/month over that period

2. Average well profile is unchanged from May to Dec 2017 and then gradually decreases at an annual rate of 3.5%per year (varies depending on rate that wells are completed) over that period.

So the future values are based on those assumptions, if you have other assumptions I can easily put them into the model (completions could rise by one per month or they could be 70/month or 100 per month).

As an example the scenario below assumes the well productivity remains at April 2017 levels(EUR=358 kb) until Dec 2019.

I am happy to show other possibilities, just make a suggestion.

The Guardian is a good paper, but when it comes to predicting the future of the oil biz, I don’t put any more stock in the Gaurdian than in any other paper. They do at least however mostly add a few more qualifiers and ifs and maybes to the projections of government agencies and oil companies.

So –

https://www.theguardian.com/business/2017/jun/14/global-oil-glut-continue-despite-efforts-prop-up-price

Production in the USA is expected to be going up for the next year or so.

Here’s a question. Sometime back, a lot of people including some regulars here, but I can’t remember which ones in particular, were saying that there would be no demand for the extra light oil coming from places such as North Dakota, due to just about all the refineries being set up to do medium to heavy oil.

Then there was talk of exporting it, in exchange for heavier oil suited to our refineries.

What’s the situation now? IS most of the extra light oil gotten by fracking being exported? If so, where to? Have some domestic refineries been overhauled so as to process it efficiently?

Thanks in advance, anybody.

Some others were arguing that the domestic industry would have a hard time ramping up again, due to a shortage of experienced oil hands.

I said the people who were laid off would be back, enough of them, due to lack of other good employment opportunities. I believe I was right in this case, that the economy has been and is slow enough that anybody offering good wages can hire plenty of skilled help.

This of course does not mean that a guy in his mid fifties or older when he was laid off will be coming back.Most likely he won’t hire on again, unless he is offered good money and light duties, even if he is still working.

So top hands might be hard to find, at any price.

Please, the official miss-spelling of Guardian is Grauniad. 😉

NAOM

Diluent for oil sands flow. Dumbbell yield profile.

Hi Old Farmer Mac,

The oil between 35 and 44.9 API gravity commands a premium price, the Bakken/Three Forks oil is about 42 degrees API.

See

https://btuanalytics.com/quality-matters-api-gravities-of-major-us-fields/

It is the condensate from the Eagle Ford and Oklahoma that is not very useful for refineries and is used for diluting oil sands (and maybe as input to refineries that have mostly heavy crude input).

Chart below from article linked above (from Nov 2014)

Would be interesting to see how this has changed over the last 2.5 years.

I read somewhere the USA exports about 1 mmbopd of light crude/condensate. Refineries take whatever if the price is right, price differential will get hit if exports go up to say 3-4 mmbopd.

I wrote a post a while back where I guessed OPEC had to hold at 31.8 mmbopd for prices to move up. They are exceeding it, so I guess I got sort of lucky…prices aren’t going up.

Fernando

In addition to the 1.1 MMbbls C/C exported in February, the US now exports over 1 million bbls/day propane/propylene and 170 thousand barrels/day liquefied ethane/ethylene.

CEO of Swiss based petchem company, INEOS, just said no other country can now overcome US’ cost advantage for feedstocks derived from NGLs.

This is the single biggest reason Foxconn is set to announce the location of its new $5 billion manufacturing plant in either Wisconsin or Michigan rather than expand in China.

Inexpensive, NGL derived feedstock coupled with methane-fueled electric plants will make US an extremely potent industrial locale for decades to come.

Old Farmer Mac

There is, currently, a sharp labor shortage in the Bakken area.

Mechanics, truck drivers and welders in particular are in short supply and it is impacting scheduled production.

Coffee,

In terms of US LNG natural gas export to certain countries in Europe (Netherlands, Poland) in both cases it is political export. And why it is political?

Because natural gas transportation by pipeline is significantly cheaper than building and employing expensive LNG port infrastructure. Russian Gazprom can produce and export gas to Europe at a much lower cost than LNG from across the Atlantic.

What you have to take in consideration that in order to squeeze the other EU gas suppliers you have to have political pressure at the same time like recent US senate bill that has a provision that enables the United States to impose sanctions on European firms involved in financing Russian energy export pipelines to Europe. The main target being Wintershall, Shell, OMV and Engie financing Nord Stream II.

Well again who said the world is fair place. But than again you have to be aware that it could be dire consequences where Russia can flood Europe with cheap gas to kill off US sea exports. It has 100 billion cubic meters of annual gas production capacity sitting on the sidelines in West Siberia, which can effectively be used as spare capacity. So US Natural gas industry could end up like today mature & expensive North American, North See, Oil Sands oil industry when OPEC does not want to play along and accommodate their production.

For oil & gas employee word “cooperation” is always better than “competition”. But for politicians and bankers word cooperation does not exist in dictionary.

Ves

That is a great comment on so many levels.

Your astute observation is but a part of the much bigger geoplotical ‘stuff’ that is ongoing in the global hydrocarbon world.

Howevuh …

The LNG (Liquified Natural Gas – aka methane) you allude to is quite distinct from the LPG (Liquified Petroleum Gas – propane) of which the US is now the world’s leading exporter.

That exported LNG from the US is certainly skyrocketing and gets all the attention, but the below-the-radar NGLs (Natural Gas Liquids – aka ethane/propane/butanes/pentanes) are starting to exert an impact on an increasingly global scale.

These acronyms can drive anyone batty, but they are what they are.

And Americas occupation of the al Tanf border crossing between Iraq and Syria (illegal, but what the hey) was intended as the basis of a seizure of Syrian land proximal Jordan. The idea was a territory controlled by US etc backed ‘moderate’ terrorists who could be armed to push into Damascus – not far away. From Damascus, with a newly installed US etc backed Govt, the way is open for Saudi gas pipeline through Syria, to Europe via the Med (or Black Sea across Ukraine – who may have some unused pipes – admittedly in need of much overhaul – they can use to take gas into Europe)

Then there will be the Israeli gas, needing to pipe to Europe somehow…what about the one now a conveniently short distance across the border?!

Israel and Saudi Arabia seem to have a sort of understanding, and USA may be the deliberate catalyst for their mutual gas interests to merge in a collaborative pipeline across the Palestinian area, and through Israel. This would, for security sake, require some kind of arrangement with Hamas – but, oh no! – Qatar is chief financier and sponsor of Hamas. Hmmm….that’s odd, hasn’t Saudi fallen out with Qatar just recently?

Iran needs a pipeline to Europe, and a pipeline via Iraq, then Syria to Greece or Bulgaria may do it. If Turkey turns more to Russia, it may become the pipeline transit option to Europe for both Russian and Iranian gas. But you have to trust – or have leverage – over Turkey (a NATO ally).

Oh, and if Qatar mends a few fences with Iran, why, it could join Iran in piping gas to Europe!

The puzzling demonization of Iran (last invaded another country many hundreds of years ago…) and Russia is not really puzzling at all.

It’s about who will be the lowest cost gas provider to Europe (in the main).

Its about who will be the reliable gas provider. Russia is at the moment…but NOT in future IF USA can control it’s European ‘partners’. (Germany in particular, seems to be ‘talking back’ just a little over having it’s energy arrangements scuttled by Mr. Trump’s USA! USA! USA!).

Business is business, even when it has to be exceptionally well dressed up as something else.

Ves,

The geopolitical and economic objective is to break Russia’s near-monopoly stranglehold on Europe’s natural gas supply.

Since regime change in Syria (and therefore a terrestrial natural gas pipeline across Syria to bring natural gas up from the Gulf States, northern Africa and the Levant to Europe) seems to be hopelessly stalled, and renewables have brought nothing but unreliable and high-cost energy to those who have tried them, LNG imports from the U.S. present a third way to try to break Russia’s natural gas monopoly, and pricing power, on Europe.

Ves,

And as far as the sort of free-market, frictionless “competition” imagined by Adam Smith, that exists nowhere except in those countless tomes and text books penned by classical and neoclassical economists.

Glenn,

I agree with you that books are useless. Suffering is all you need if you want to find the truth.

At the moment oil producers, small or large, independent or national, are suffering so they are closer to the truth. Dislocation between finance and resources happened in 2014 when the price collapsed 70%. I don’t think it is one single reason but combination of many things over longer period that just culminated in 2014. It is like boiling of water. It takes time to warm up but boiling point happens in a single moment.

I would speculate that peak of conventional oil and zero interest monetary policies by CB since 2008 as main reasons. When interest rates are 0% then there is no capitalism.

Ves,

Well it truly is a dog eat dog, all against all free-for-all.

Russia and its allies Syria and Iran are pitted against the US and Europe and their natural gas rich allies in the Gulf States, Egypt and Israel.

The renewables industry is pitted against the fossil fuel industry, and they both compete with the nuclear industry.

Natural gas is pitted against coal.

Conventional oil and gas producers are pitted against shale producers.

And according to an article in Rigzone, even shale producer is pitted against shale producer:

Shale Gas Giants Battle for Dominance as US Supplies Surge

http://www.rigzone.com/news/article.asp?hpf=1&a_id=150568&utm_source=DailyNewsletter&utm_medium=email&utm_term=2017-06-14&utm_content=&utm_campaign=feature_2

And almost everybody wants some omnipotent, all-powerful state to intervene and crown them the winner of the competition.

Hi Glenn,

Mike has never suggested that the state intervene.

Should the government intervene to protect US workers that are hurt by low priced imports?

Dennis coyne said:

Oh really?

Then what is the meaning of this?

Or this?

And those are just a couple of examples on this thread. Many others can be found on older threads.

From comments like these it can be seen that Mike, just like wind and solar advocates, would love to see the state step in and cripple the shale industry, if not completely regulate it out of business.

Hi Glenn,

He is pointing out that the regulations are different.

A fact.

He said nothing about the other state changing its laws except that energy was being wasted.

Also a fact.

He is also pointing out that the regulators allow wells to be drilled close together.

Another fact.

I don’t know enough about the industry to know if there is a good reason to change this as far as I know Mike didn’t say it should be, you are reading something that isn’t there.

Mike has never said the state should regulate the shale industry out of existence.

There was a 35 year period when the oil industry in Texas thought state intervention was a good idea (1935-1970).

Overproduction does not serve the industry well.

I noticed you ignored the question I asked. You seem to love Trump’s America first policy, should that apply to the oil industry?

Gawd you are an asshole, Mr. Stehle. And clearly a bored one at that. Have you tried woodworking?

Look, I am an environmentalist, a conservationist, a helluva tennis player, I floss twice a day, am a conservative Republican AND an oilman with a long, proud heritage of success. I can be ALL those things. I am not Russian, do not belong to the Sierra Club and am no way tied to the renewable’s industry other than to hope, ultimately, it succeeds in some form or fashion that will be beneficial to my country. You are trying to paint me as someone other than who I am, simply because I think your analysis of shale oil and America’s energy future is horribly wrong.

I do indeed believe that the rate of shale oil development in America should be regulated. It would raise the price of oil, yes. I happen to believe that is important for me, my family, and the families of my employees. I ALSO believe, however, that higher oil prices would be good for my industry, and good for America. It would ensure that ALL facets of my industry are healthy and prepared to meet America’s hydrocarbon needs in the future, not just ‘your’ facet of my industry. It would promote conservation, something I feel strongly in, because I do not believe we have 50 years of unconventional shale oil resources to piss away at $40 oil. I would simply “love” to see the shale oil industry pay back all its debt. Perhaps if it did it would be financially successful. Now it is failing miserably.

I can like what is best for my family AND what is best for my country. If you believe that makes me “un-American” somehow, or a traitor to my industry, you can kiss my Texas ass.

Mike,

I realize you harbor a great deal of anger against the shale industry. This is only natural since it was partly responsible for your loss.

I also realize these angry outbursts may be of some emotional value to you.

Nevertheless, they will not change the economic reality, which is that the operators of stripper wells cannot compete with the shale operators, assuming the state does not intervene to hogtie the shale operators.

I don’t get the logic of saying stripper well operators can’t compete with the LTO industry. Stripper wells don’t involve nearly as much investment as LTO wells, so the breakeven numbers should be better for the stripper wells.

Low prices are unwelcome by everyone in the industry, but I would think stripper well operators are better equipped to survive low prices than those companies spending millions on new wells.

Maybe it’s a different Mike.

And of course, one industry– in main energy cases, usually the nation-state, itself– is sometimes owned or cannibalized by another, and then subsequently owned– including petroleum and so-called renewables. And so forth.

Besides, it still takes a lot of fossil fuels to make so called renewables, so why not invest in renewables if you’re a petro company…

Oh, wait, does that mean a collapse of the nation-state as a result? Then I guess it’s the Middle East, etc., for ‘good’ measure…

Hi Ves,

Last I checked the prime rate was about 3%.

If people are willing to lend to goverments at a real interest rate of zero or negative rates, that is their choice.

As long as inflation is under control it simply leads to poor allocation of capital.

I agree better policy would shut off expansionary monetary policy at real rates of 0.5% and use fiscal policy if needed.

Hi Dennis,

What was the rate in the last 10 years? I don’t know. It is 3% now but we had several increases just in the last year.

I just checked prime rate Eurozone and I was not that much off at 0% ?

UK 0.25%, Japan 1.4%, Sweden -0.5% (brrr ?)

US has little bit of room to maneuver that is only thanks to domestic shale. But conventional guys are paying the price for that so the system always must be in balance.

Hi Ves,

European economists need to learn a little economic history and re-read Keynes.

Trying to use monetary policy to help the economy at interest rates of 0% is like pushing on a string, the excess money created simply sits in the bank and the velocity of money decreases, very little extra economic activity occurs and capital is poorly allocated when the price of liquidity is zero.

This should be pretty basic stuff for most economists.

Hi Dennis,

We are not discussing books, we are discussing the reality based facts that there is 0% rate in the largest trading block in the world. That is the fact. Europeans will have to re-write another set of books to match their reality. And US will have to re-write another set of economic books to match reality of drilling unprofitable oil. Existence does not care about written books.

Hi Ves,

Books are real, not imagined. Do you think Keynes’, General Theory did not have a profound effect on the World?

The effects of zero percent interest rates:

Please expound on what effects you believe this will have, and don’t use anything you have learned from books that you or your teachers might have read. 🙂

The books suggest what is likely to happen with very low interest rates (they will help the economy very little and result in poor allocation of capital).

Books often reflect what humans have learned about reality. Have you read any physics or chemistry books? They are a reflection of the understanding that humans have gained about the facts on the ground.

Hi Dennis,

Would you be able to give logical explanation to Mike and Shallow and all of us from your economy books why shale drills unprofitable oil for 4th straight year? Why there are 800 rigs in the US at $44.

You can’t.

I will tell you why. Your books are logical but life is illogical. Your mind is logical but life is dialectical. Life always moves from one extreme to other. You don’t know the answer and you don’t want to admit that you don’t know.

At least be Socrates that said: “When I was young I taught I knew much. As I become older I started thinking I knew everything. But as I become still older and my consciousness become sharper, I suddenly realized I don’t know anything.”

Hi Ves,

I agree, there is not a good explanation for the expansion in the LTO plays, though one potential explanation is that when prices went to $55/b they bought hedges and now they can sell a lot of their output at $55/b, when rig counts went up they may have been expecting that oil prices would go up.

There is a delay between price movements and drilling and completion decisions, maybe these companies expected higher prices which did not materialize.

But certainly reality is more complex than economic models, just as physical reality is more complex than what is taught in most undergraduate physics courses.

And yes new books are always being written, generally informed by what has been written before.

Oh and I am well aware that I don’t know the answers, you need to read more carefully.

The unprofitable wells may be drilled in a game of last man standing, money has been sunk in land and equipment and drilled but uncompleted wells. Often the decision is if I complete this well will my cash flow be higher or lower than if I don’t complete the well. If the answer is that there will be more cash flow, the well is completed even if a full cycle cost analysis shows the well will not pay out.

Hi Ves,

That is not the Prime rate that is the equivalent of the Federal Funds rate in the US, the Prime rate is the rate that banks lend to the customers with AAA credit ratings.

Ves, it’s very easy, you can earn a lot of money drilling unprofitable wells.

That’s basic economic written in the books – as seen before in the 1999 tech market. Lots of money was there earned, too.

It’s only important to have a hype, so you can burn other peoples money while getting fat checks as an CEO, consultant, wall street bank selling the debt nicely packed to investors, doing all the marketing.

You see, lots of money can be earned, so it’s very logical to drill these wells.

On the other hand, leases have to be hold so some drilling is forced.

As whole, the shale industry can survive heavy blows thanks to US bankrupcy regulations – just file, throw off the old debt and be rebirthed without debt, ready to continue drilling and take new debt. There are enough investors needing to buy junk bonds to “improve” performance.

Dennis: “though one potential explanation is that when prices went to $55/b they bought hedges and now they can sell a lot of their output at $55/b, when rig counts went up they may have been expecting that oil prices would go up.”

Dennis, whose explanation is that? Is it yours or from “Tsvetana” from oilprice.com or WSJ ?

That is a lie, and I have to tell you that people are so tired of lies and not just regarding energy issues.

Everyone knows, including you, that you need $70-$90 at least for full cycle costs so you think that “explanation” that by hedging at $55 is somehow believable explanation?

If it is not your speculation why are you mentioning? Write your authentic speculation even if it is wrong. Because it cannot be wrong if it is your authentic knowing. But if it is “borrowed” from someone else, Bloomberg, WSJ that it is not yours. Than you are just carbon-copy.

Eulenspiegel: “Ves, it’s very easy, you can earn a lot of money drilling unprofitable wells.”

Who makes money? Yes, only selected individual accidentally. CEOs at that moment, mineral right owners….

But as society you don’t make any wealth drilling finite resource so you can have some “job” to pay for various bubbles created by CB.

Eulenspiegel “That’s basic economic written in the books – as seen before in the 1999 tech market.”

That is not the same. When you have bubbles in tech or real estate wealth is not created and than destroyed. It is just the price that goes up and down. House is still there and can be utilized. Yes, the house is now half price but it is just the number in people’s minds.

Do you sell your residential house when the price goes down? No, you still need a place to sleep.

But with oil is not the same. When it is gone it is gone.

Ves says:

The managers, engineers and scientists at ExxonMobil and Chevron don’t seem to know that “you need $70-$90 at least for full cycle costs.”

But of course “everybody knows” that the managers, engineers and scientists at ExxonMobil and Chevron lie.

Dennis: “And yes new books are always being written, generally informed by what has been written before.”

Dennis, books can be even dangerous in many cases.

For example, that law or theory of diminishing returns from economy books that you have learned and were discussing with someone the other day.

How that law applies to love? Do you have law of diminishing returns in terms of kisses when you are in love? So, law of diminishing returns is not universal law and that means it is not law at all. Dangerous things can be learned in the books.

Ahh Glenn, If Exxon is doing great at $43 with what it has in US in terms of production, they wouldn’t be dispatching Rex to be Sec of State. It’s all about oil or lack of it. Think about it.

Ves, yes, someone pays the bill.

But when individuals can make money, they’ll do it in a capitalistic society.

You asked why people drill unprofitable wells, and that’s the reason.

Capitalism is a lot about letting other people pay your bills. Why paying the bill by yourself when you can persuade your congress member to help you out with a little help from the state, either direct or indirect.

Or setting up a little ponzi scheme nobody notices, and it could even work when the oil price would bounce back to 100$. Good ponzi schemes run longer than 10 years, so nobody really notices them while they work.

Hi Ves,

The “law of diminishing returns” is short for the law of eventually diminishing returns.

It is not a physical law, but just a rule of thumb in economics.

It works like this. For a production process there are variable inputs to the process, to keep things simple we will call them A, B and C. The fixed costs (factories and equipment) are taken to be fixed in the short term.

If we hold B and C fixed and increase A (lets say A is hours of labor) eventually output per worker will decrease because machines and other inputs are limited.

Very basic stuff covered in introductory microeconomics.

Yes the hedged output idea is not original, but it is one possible explanation, businesses will do some strange things to survive and some firms have better land leased and technology so they will be better than average.

For example at full cycle the average Pioneer well breaks even at about $54/b at the well head (10% annual discount rate). That is the net present value of the output of an average Pioneer Permian basin well at a wellhead price of $54/b and a discount rate of 10%/year is zero. Well and land and all other costs are paid and ROR is 10%/year.

Pioneer has hedges for about 85% of its expected 2017 output at $55/b according to SEC data.

Hi Dennis,

” It is not a physical law, but just a rule of thumb in economics.”

So, it is not law now but rule of thumb ? Are you trying to dig yourself out? There is law of gravity. That is a law. The law of diminishing returns is NOT a law. Its man made up stuff. In love, there is no diminishing return on kisses. So, there is no law on diminishing returns. It is very basic concept.

Hi Dennis,

What is your opinion on that WSJ article about US oil exports that was analyzed by Mr. Berman?

That’s yet another reason why I keep calling it ‘pseudoeconomics’.

Adam Smith didn’t really expect markets to function without state intervention.

In The Wealth of Nations he says “People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.”

Right.

And just as often as not, the “conspiracy against the public” or “contrivance to raise prices” consists of a pubic relations and lobbying effort to get the state to intervene on behalf of one’s or one’s group’s own special interests.

Which means the state should never intervene in some quarters. Of course that ignores the fact that the state always intervenes since the simple act of printing money is an intervention. Even just setting the rules to create markets is an intervention. Those quarters that dislike intervention (primarily since they are enjoying the current results) don’t acknowledge these basic economics facts.

coffeeguyzz says:

This is the reason why the price theory of value that Dennis Coyne invokes above has its limitations.

From Dennis’ comment above:

Hi Glenn

Standard practice in economics.

How do you measure the value of a good?

Apples? 🙂

Dennis,

If you are interested in exploring other theories of value beyond the very dogmatic and doctrinaire price theory espoused by orthodox economists, you could start here:

The Problem of Value in the Constitution of Economic Thought

https://www.jstor.org/stable/40970879?seq=1#page_scan_tab_contents

No Glenn there is no objective theory of value.

You brought it up and I am very familiar with the literature.

It could be discussed on the non oil thread.

Current mainstream economic theory uses a subjective theory of value.

Price is not value, just an agreed exchange of money for a good.

Nothing more or less.

Dennis coyne says:

No, it was you who first invoked the word “value” when you iterated the price theory of value, emphasizing the word in italics to boot!

Hi Glenn,

Yes my mistake. I should have used revenue.

There is no price theory of value, value is subjective, any objective value theory depends on the arbitrarily chosen measure of value. In many cases I suppose people use money as a measure because it is conveniently exchanged for goods, but it is just as arbitrary as labor, capital, or anything else as a measuring stick.

I used the word value without intending to talk about theories of value, it was you who brought up value theory.

Not interested.

Quite an old article.

Read Piero Sraffa, he showed using linear algebra that all goods can be reduced to the labor used to produce them to measure their value.

The problem for neoRicardians is that one has to defend the assumption that labor is the correct measure of value.

One could just as well choose capital as the measure of value.

Marxism could then be turned around so that workers would exploit capitalists by extracting surplus capital.

I agree their are many problems with economic theory. I also agree markets do not always result in the optimized outcome.

I note it is you who complains when the gobernment intervenes in markets.

So which is it, markets are best or government should intervene?

You cannot have it both ways.

I think limited gobernment intervention is necessary, I am very far from a free market fundamentalist.

Dennis coyne said:

1) Shale energy producers are currently winning in the “free market” free free-for-all.

2) Wind and solar have been made competitive by the generous state subsidies that are lavished on them.

3) The track record of government intervention for the past few decades has been, generally speaking, to attempt to regulate the fossil fuel industry out of business, and speaking more specifically to regulate the shale industry out of existence.

So what is there for me to like about state intervention into the markets?

Hi Glenn,

What has happened to the US oil and natural gas industry over the past 10 to 15 years?

The government seems to be having trouble “regulating it out of existence”.

Talk about fact free, wow.

Maybe you are talking about coal, which has suffered mostly because natural gas has been so successful.

Oil has also been a victim of its own success, overproduction is a problem for any industry, but oil has trouble changing direction quickly, that is the reason the RRC and OPEC attempted to regulate output.

You have suggested perfectly competitive markets don’t exist, I agree.

It follows therefore that the efficient markets theory is not accurate as it rests on the myth of competitive markets.

The criticisms that you level against mainstream economic theory (some of which I agree with) undermine the faith in markets leading to optimal outcomes and support arguments for government intervention.

So it just boils down to politics.

Oil and natural gas will not do well with low oil and natural gas prices.

It will also lead to shortages eventually (3 to 5 years) unless oil and natural gas prices rise.

Dennis,

You do realize there is a difference between “attempt to regulate the fossil fuel industry out of business,” which is what I said, and “regulating it out of business,” which is what you said?

So yes, it is true that the 350.org and Bernie Sanders types did not get their way completely, and were not successful in regulating oil and natural gas out of business, although this was not for lack of trying.

Which brings us to your second claim that coal “has suffered mostly because natural gas has been so successful,” which doesn’t pass the sniff test either.

If we plot the price of natural gas vs. the share of total U.S. electricity generation that came from coal, what we see is that the demise of coal began well before the shale revolution began. We also see that the demise of coal continued unabated regardless of what the price of natural gas did. So there doesn’t seem to be much correlation between the price of natural gas and coal’s demise.

So there’s something else going on besides “natural gas has been so successful.” Could that something else be regulation?

But yes, yes, I know that, since the destruction of the coal industry has proved to be political kryptonite in the heartland, that the environmentalists want to deny their handiwork. So they came up with this narrative that “It’s natural gas wot did it.”

But you are at least correct about one thing, and that is when you say, “So it just boils down to politics.”

So yes, absolutely, either the fossil fuel industry will be allowed to compete on a level playing field, free of burdensome regulation and state intervention, or it will be regulated out of business.

Either fracking will be banned, as 350.org and Bernie Sanders advocate, and as has already happened in New York, or it won’t.

It’s all politics, and that’s the reason why facts and sound logic carry so little weight in this debate.

Hi Glenn,

You said “the state”, which I interpreted as government.

Bernie Sanders and 350.org are not “the state”, so you are wandering pretty far from “the state”.

Now New York State can pass laws that it believes will protect its citizens.

This is often referred to as state’s rights.

Do you believe that you should be deciding the laws of New York State?

Are you a citizen of New York?

I think the people of New York should decide what is best for their state.

Just as the citizens of Texas should decide what is best for their state.

One last thing, so you still seem to be chanting it will be regulated out of existence.

The externalities from oil and natural gas (and coal) were ignored for a long time. Those mistakes of the past have tilted the field in favor of fossil fuels for over a century.

So yes there are two reasons the fossil fuel industry will fail to exist in the future, depletion will lead to high prices so that fossil fuel cannot compete and just as eventually humans realized that smoking cigarettes is not good for them, climate change will be recognized as a serious threat that needs to be addressed.

http://history.aip.org/climate/index.htm

As far as his points go, they are very weak and actually subvert his argument:

1) Shale energy “wins” because we have a peak oil problem.

2) Subsidies exists because we have a peak oil problem

3) Government intervention exists because we have a peak oil problem (some AGU too) and haven’t come up with anything near an optimal solution

It’s probably not worth arguing with this guy — too much like Jay Sekulow going around in circles and eating his tail

“We have a peak oil problem”?

Can you show me where that “peak oil problem” exists on this graph?

Glenn,

substract the shale oil from your graph, and you’ll see the peak oil problem.

Substract tar sand and you’ll see it more in detail.

And US shale oil won’t run more than 30 years, even in most optimistic scenarios (or in pessimistic scenarios where at oil prices of 200$ even marginal shales will be fracked).

Eulenspiegel says:

Why?

Shale oil isn’t oil?

Hi Glenn,

Using EIA monthly data for World C+C output

https://www.eia.gov/totalenergy/data/monthly/index.php#international

The World C+C monthly peak was Nov 2016 at 82.27 Mb/d.

The centered 12 month average World C+C peak was October 2015 at 80.69 Mb/d.

click on chart for larger view.

Hi Glenn,

Tight oil is oil of course, but the resource is much more limited than investor presentations would lead you to believe.

Pioneer suggests they have 20,000 drilling locations, which is probably correct.

What is not correct is the assumptions in the investor presentations that the EUR will be 1 MMboe per well, it is more likely to be a third of that so URR falls by a factor of 3 from 20 Gb to 6.3 Gb under the optimistic assumption that all 20,000 locations will have an average output equal to the 2016 Q1 average well in the Permian basin.

US LTO URR will be about 50 Gb+/-10 Gb, on the World scale this amounts to very little relative to conventional reserves of 1250 Gb. LTO output will peak by 2023 and decline will be rapid, the 2015 12 month centered average peak may be surpassed by 2025 and perhaps we will reach a 12 month World average C+C output level of 84-85 Mb/d, but such a level will be maintained for 2-3 years and decline will begin by 2030 (higher output levels will result in a shorter plateau and steeper decline).

It would be better to conserve resources to prepare for the needed transition.

Dennis,

So am I to take it that you believe that Nov 2016 is peak oil?

Hi Glenn,

No.

I expect the peak will be between 2020 and 2030, a more precise date is impossible to predict, but my guess is 2025+/-2 years.

So far the 12 month peak (centered) is Oct 2015 (centered running 12 month average output). I think the 12 month average is more interesting than month to month fluctuations.

When OPEC ends its cuts, I expect a new 12 month peak will be reached within 12 months.

By 2030 oil demand may start falling faster than supply and lower prices may lead to a more rapid decline in oil supply. The transition to non-fossil fuel powered transportation may be well underway at that point.

Regulation will be much less of a problem than competition.

Though I am sure the fossil fuel industry will seek to have the government intervene on their behalf. 🙂

Hi Glenn,

When doing an economic analysis revenue and cost are important.

So the revenue collected from natural gas for a barrel of oil equivalent is one third of that of a barrel of crude at $50/b oil and $3/MCF natural gas.

Do you dispute this basic fact?

Or are you going to change the subject again?

Dennis

Please don’t let me interrupt the back and forth in which you and Glenn are engaging …

but, if you could look at the numbers you posted, ie, cost/revenue of energy measured in barrels of oil, and temporarily take the view of the purchaser of that energy, different and important potentialities emerge.

Put aside, for the moment, some of the preposterous declarations such as Continental’s recent describing a well with 99% methane content and presenting it in terms of boe thus, having a boe of a gazillion plus.

Almost comical that they would do that.

Also, put aside (NOT dismiss) the important EUR determinations that can skew when a high gas component can mask diminishing liquid content.

I would ask you to review your above stated boe/oil/gas numbers from a purchasers position.

Now, it’s not the revenue from the gas/oil that is paramount, it is – predominantly – the COST to obtain said energy potential.

This is a huge reason the oil-derived Naptha feedstocks are facing daunting competition from the much cheaper NGLs.

This is why Mexico is importing vast amounts of US natgas to fuel their power plants and to stop burning domestic oil.

The gasoline and diesel transportation industries are under increasing assault from their gas cousins as well as a growing legion of localized power (ICE plants) in applications far and wide.

From new ocean going ships to the household generator, dual fuel engines are becoming the norm in order to capture the big price/cost differential you described above.

As this horizontal development becomes the norm – in the US, at least – the cost and operational peculiarities vastly, vastly favor the gas producers.

The broader, downstream consuming market will continue to adapt to this new reality.

Coffeguyzz,

I do not dispute that low prices are good for those who purchase energy.

For producers do you believe that is true?

Dennis

Of course the producers of oil are being crucified in the marketplace.

This holds true for smaller, independent operators, huge multinationals, and entire countries dependent upon oil based revenue.

It is a huge upheaval in the established order that we all, especially folks who engage in sites such as this, are witnessing on a day by day basis.

My main point being, there is now – and will continue to be – a vast amount of hydrocarbons coming to market via these unconventional techniques … all the more so in gaseous form.

… and in a related note, a record producing Marcellus well for 1 month, the T Kropa (8-10?) from Cabot, just came online.

Flowing over 43 MMcfd, it produced 1.3 Bcf for the month of April.

Its sister well actually has a higher cum at 1.9 Bcf with it being online 2 weeks longer (51 days).

These are simply staggeringly high numbers and portend Appalachian Basin gas output far off into the future.

Not if they continue losing money.

Hi Coffeguyzz,

I guess in the first quarter 2017 the two largest natural gas producers in the Appalachian Basin did not lose money, Chesapeake was barely profitable (8 cents per share, PE=64) and Cabot earned 23 cents per share (PE=98).

So better than most LTO firms.

Dennis

Little time to ‘research’ but Cabot might be a leading indicator in this field due to its compact footprint sitting stop the most carbon-rich shale on the planet.

Chesapeake may divest large withholdings in coming months/years to better optimize operations.

Over in the wetter southwest regions, Range, EQT and Antero, in particular, are poised to capitalize on increased pipeline takeaway in the coming months as well as increasing efficiencies (minimal new pad building).

In a somewhat related vein, the wholesale spot electricity price in New England briefly spiked above $150/KWh last night, which is 5 times the normal.

Those commercial operations up there will find it increasingly challenging to successfully compete against competitors whose juice does not rely upon Ra and Zephyr.

Hi Coffeeguyzz

Do you expect natural gas fueled transportation is likely to become ubiquitous in the near term?

The world will run short on liquid fuel for transport.

NGL will be unlikely to fill the gap.

I focus more on LTO and less on shale gas. How are shale gas producers doing?

Take the top 5 producers, what are the earnings per share?

So for shale gas, the top producer is Chesapeake with 2017Q1 earnings of $0.08 per share and debt of $9.5 billion. Cash and equivalents decreased by (aka cash burn was) $633 million in 2017Q1.

Cabot earned $0.23/share and had positive cash flow ($39 million). Debt is $2.5 billion.

These two companies produced about 26% of total Appalachian Shale Gas (5 of 19 MMCF/d) and about 14% of the US Shale Gas Produced in the first quarter (around 35 million CF/d).

US Natural gas output has plateaued since 2015 at about 90 million cubic feet per day.

Shale gas lately (2016-2017) has been about 39% of gross natural gas output in the US.

Dennis

This may not mean much to you, but news just came out that EQT bought out possibly the most skillful operator in the AB, Rice Energy.

Their complementary lease holdings and pipeline infrastructure will – if it doesn’t already – make it/them the biggest gas producer in the country.

The New Zealand case is instructive. In the last liquid fuel shortage in the early ’70’s liquid fuel for private transport (largely imported) was so short that the Government mandated:

1. ‘Carless days’ for private transport. Every citizen had to select a day of the week when they would not drive their car. A windscreen sticker showed which day they had selected. Fines imposed for transgressors.