By Ovi

The focus of this post is an overview of World oil production along with a more detailed review of the top 11 Non-OPEC oil producing countries. OPEC production is covered in a separate post.

Below are a number of Crude plus Condensate (C + C) production charts, usually shortened to “oil”, for the oil producing countries. The charts are created from data provided by the EIA’s International Energy Statistics and are updated to October 2025. This is the latest and most detailed/complete World oil production information available. Information from other sources such as OPEC, IEA, STEO and country specific sites such as Brazil, Norway, Mexico, Argentina and China is reported to provide a one or two month outlook.

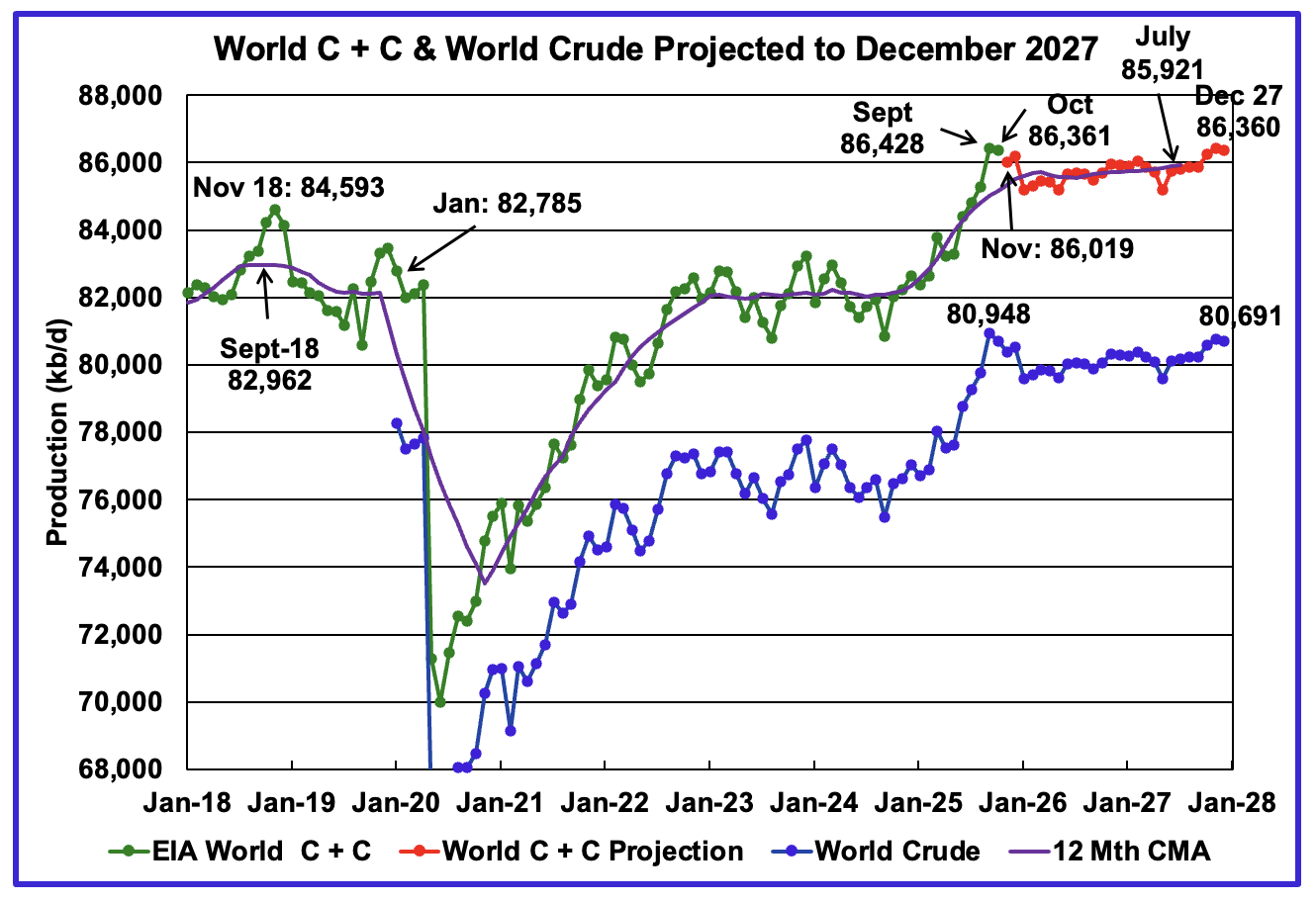

The World’s October oil production decreased by 67 kb/d to 86,361 kb/d. The small October drop may be due to the large September C + C increase due to the large increase in crude production shown in the crude graph and which was also revised up by another 395 kb/d in the current report. That increase then drops in January 2026. The large January drop is just as surprising as the September increase.

September 2025 could be the new World Peak Oil at 86,428 kb/d for the next few years and possibly longer.

This chart has been updated using the February 2026 STEO to project World C + C production out to December 2027. It uses the STEO report along with the International Energy Statistics to make the projection. Production in November 2025 is projected to decrease by 342 kb/d to 86,019 kb/d.

The 12 month Centred Moving Average shown at July 2027 is 85,921 kb/d vs the September 2018 12 month CMA of 82,962 kb/d.

For December 2027, production is projected to be 86,360 b/d, an upward revision of 442 kb/d from the previous report.

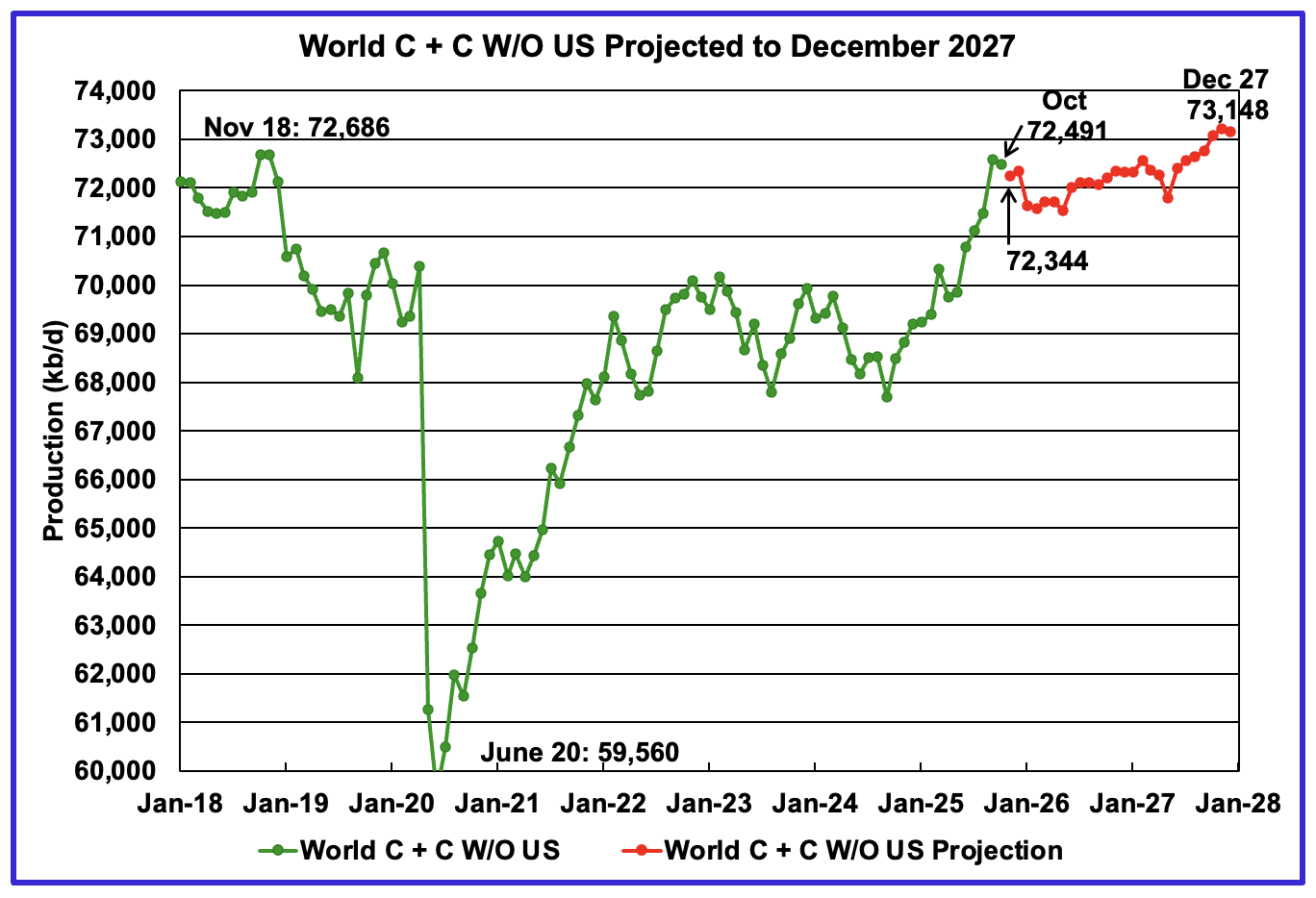

October’s World oil output W/O the US decreased by 99 kb/d to 72,491 kb/d. November’s production is expected to decrease by 147 kb/d to 72,344 kb/d.

The projection is forecasting that December 2027 World W/O US oil production will be 73,148 kb/d, an increase of 657 kb/d from October 2025.

A Different Perspective on World Oil Production

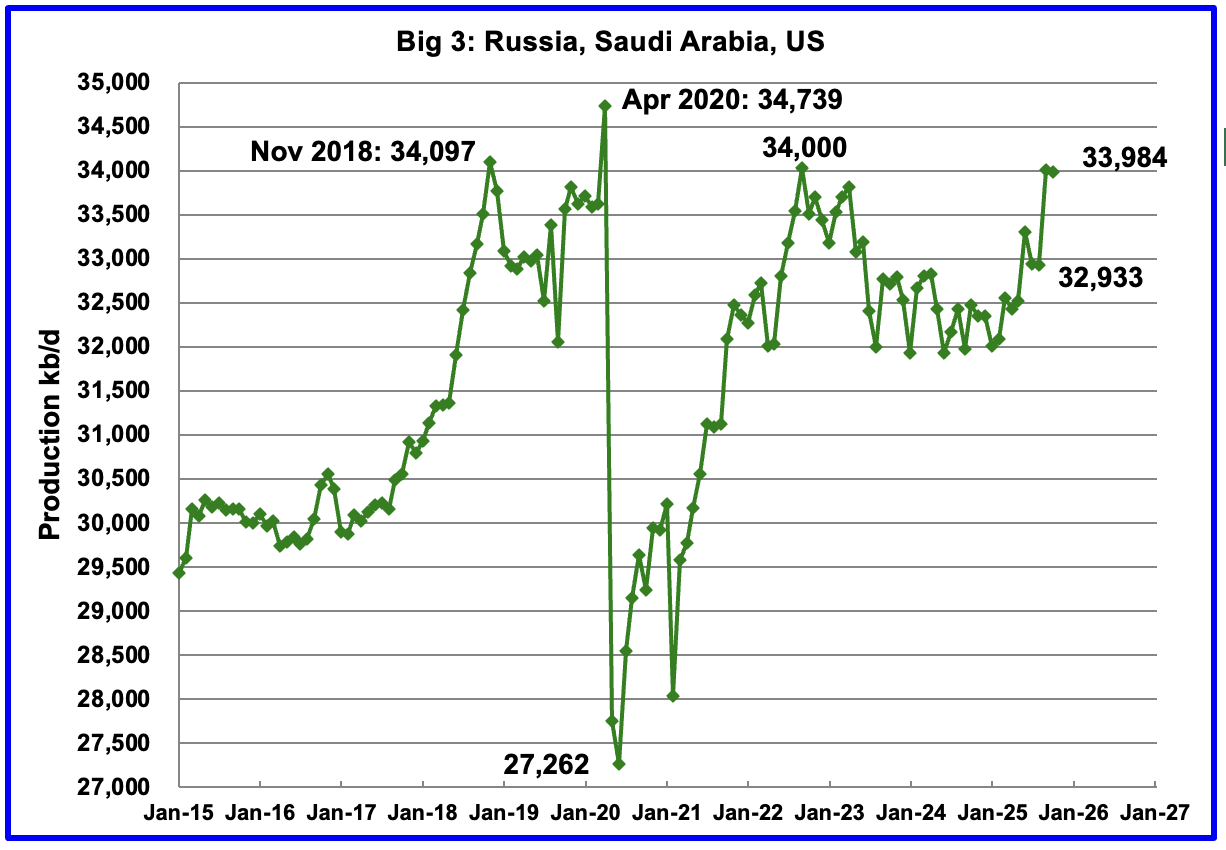

October’s Big 3 oil production decreased by 21 kb/d to 33,984 kb/d.

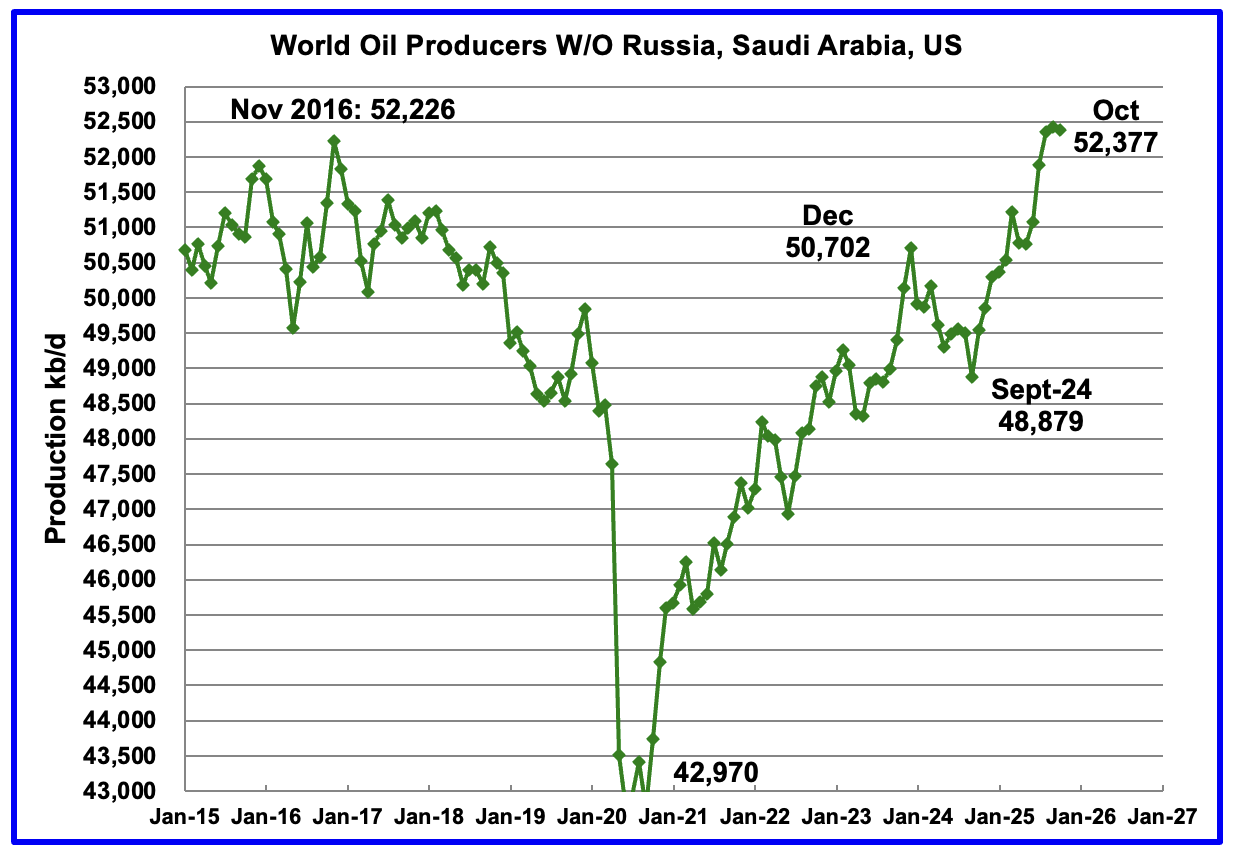

Production in the remaining countries has been slowly increasing since the September 2020 low of 42,970 kb/d. However production dropped in October 2025 by 46 kb/d to 52,377 kb/d.

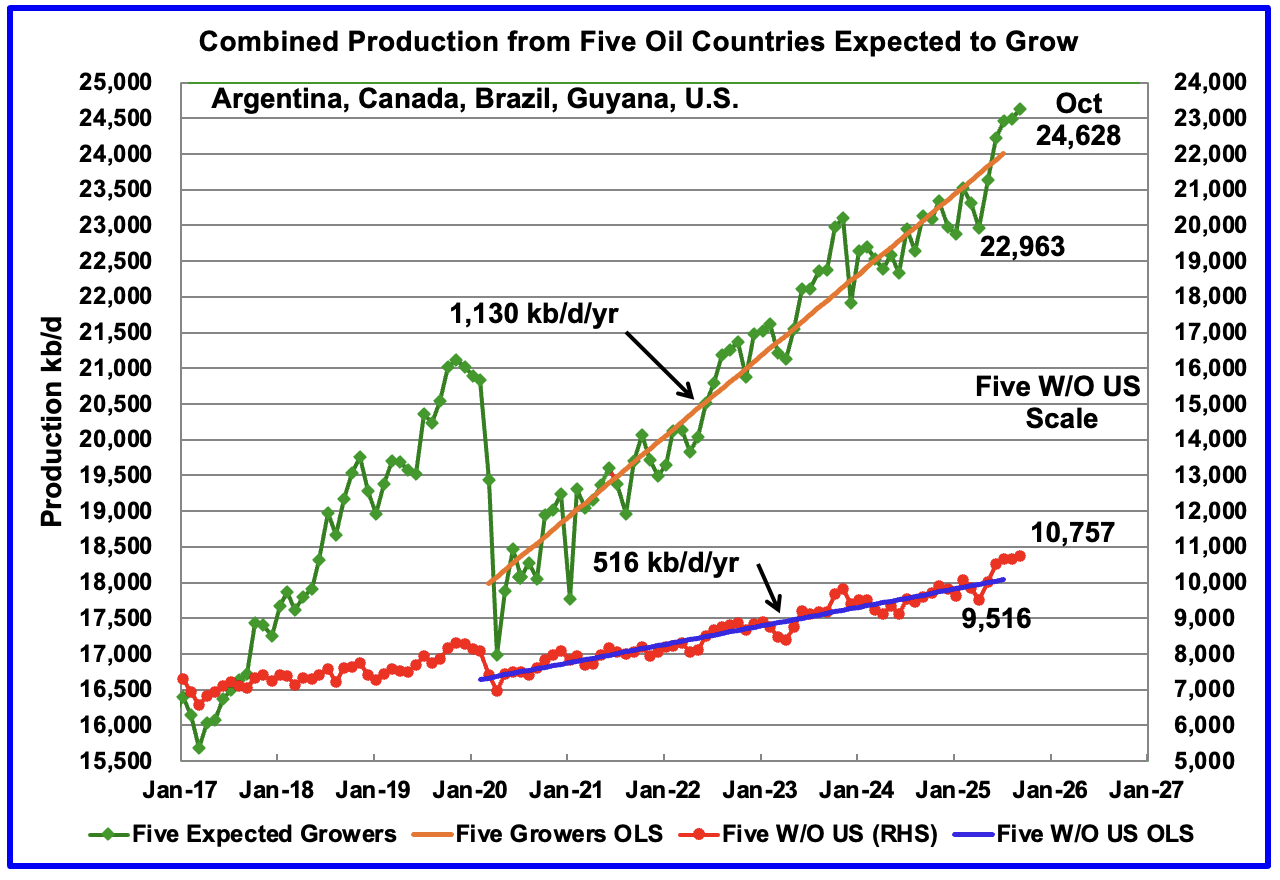

Countries Expected to Grow Oil Production

This chart shows the combined oil production from five Non-OPEC countries, Argentina, Brazil, Canada, Guyana and the U.S., whose oil production is expected to grow. These five countries are often cited by OPEC and the IEA for being capable of meeting the increasing World oil demand for next few years. For these five countries, production from April 2020 to July 2025 rose at an average rate of 1,130 kb/d/year as shown by the orange OLS line.

To show the impact of US growth over the past 5 years, U.S. production was removed from the five countries and that graph is shown in red. The production growth slope for the remaining four countries has been reduced by 614 kb/d/yr to 516 kb/d/yr.

October production has been added to the five growers chart, up by 140 kb/d to 24,628 kb/d. October’s production increase was a mix of small gains and declines. For the Five growers W/O U.S., October production rose by 107 kb/d to 10,757 kb/d.

November production for the five countries is expected to be down slightly.

Note: The OLS lines are updated to July. 2025

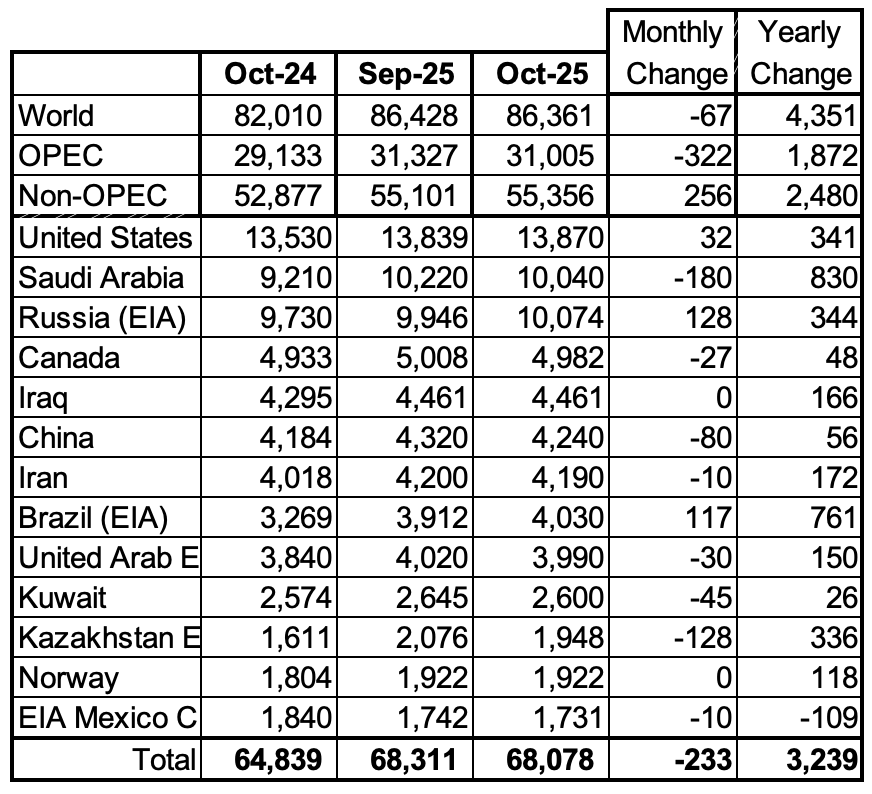

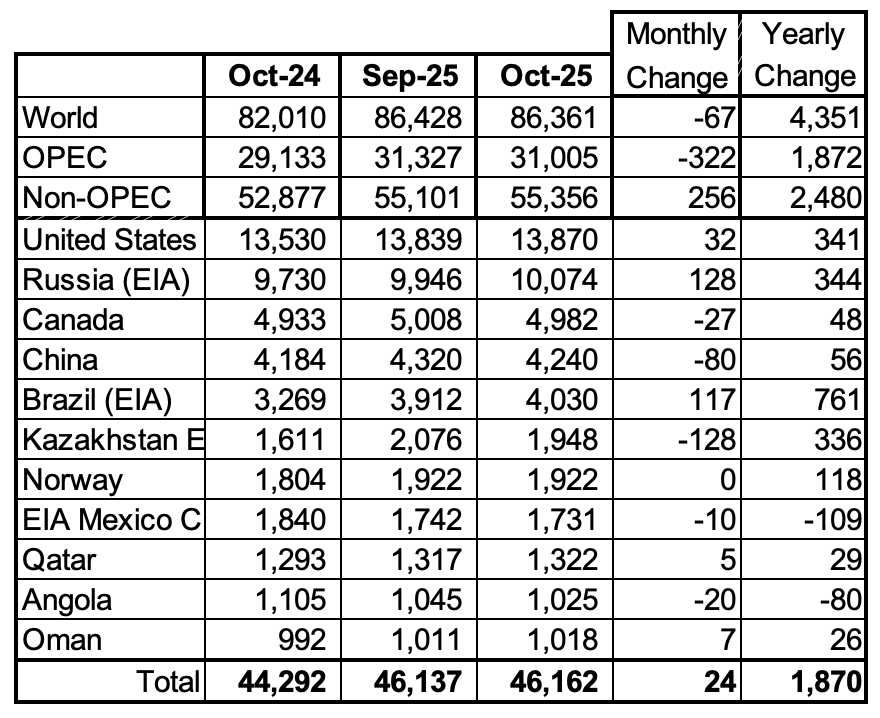

World Oil Countries Ranked by Production

Above are listed the World’s 13th largest oil producing countries. In October 2025 these 13 countries produced 78.8% of the World’s oil. On a MoM basis, production decreased by 233 kb/d in these 13 countries while on a YOY basis production rose by 3,239 kb/d. Note the large YoY increases from Saudi Arabia and Brazil

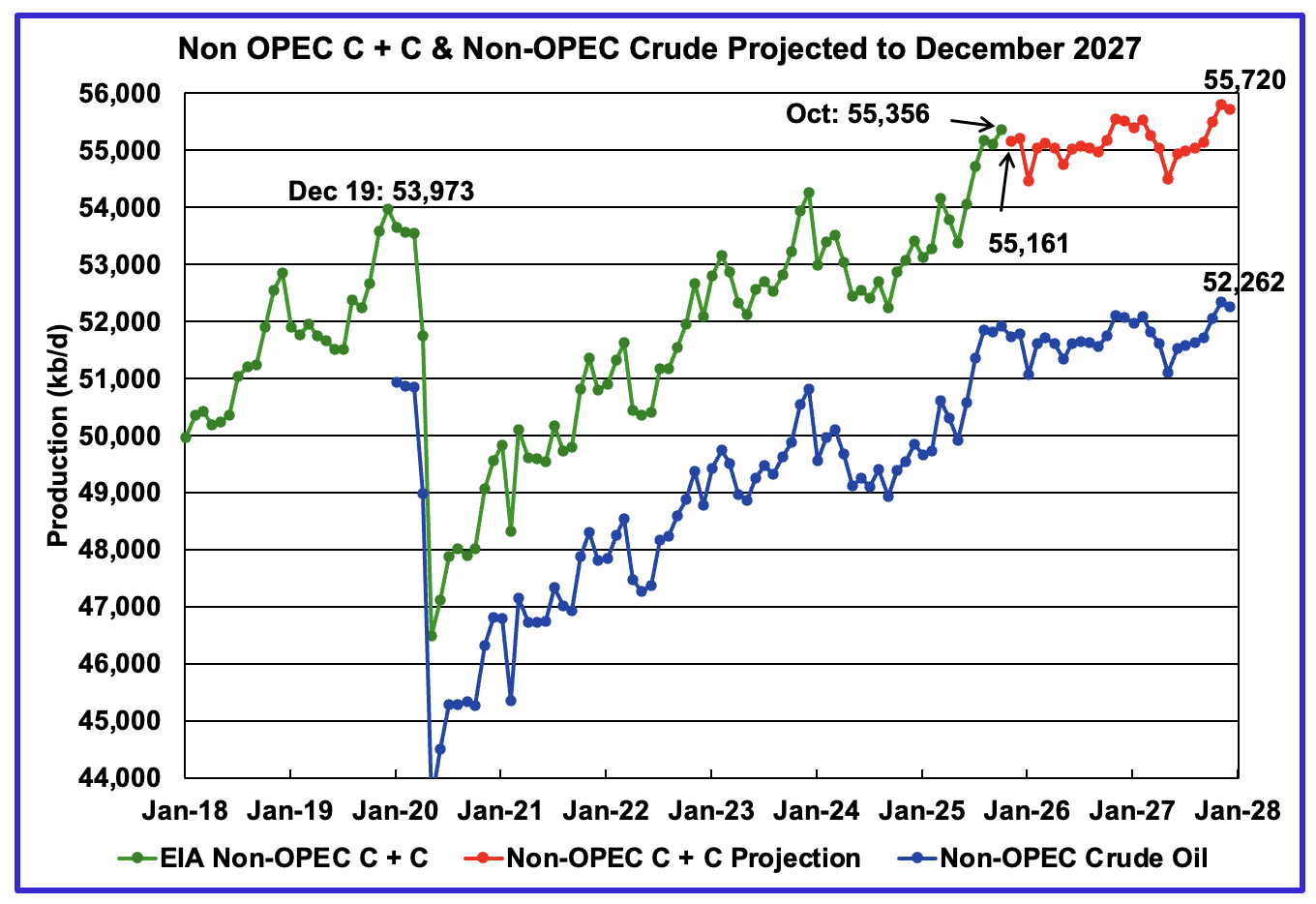

October Non-OPEC Oil Production Charts

October’s Non-OPEC oil production increased by 255 kb/d to 55,356 kb/d. November is expected to drop by 295 kb/d to 55,161 kb/d.

Using data from the February 2026 STEO, a projection for Non-OPEC oil output was made for the period November 2025 to December 2027. (Red graph). Output is expected to grow by 364 kb/d from October 2025 to reach 55,720 kb/d in December 2027.

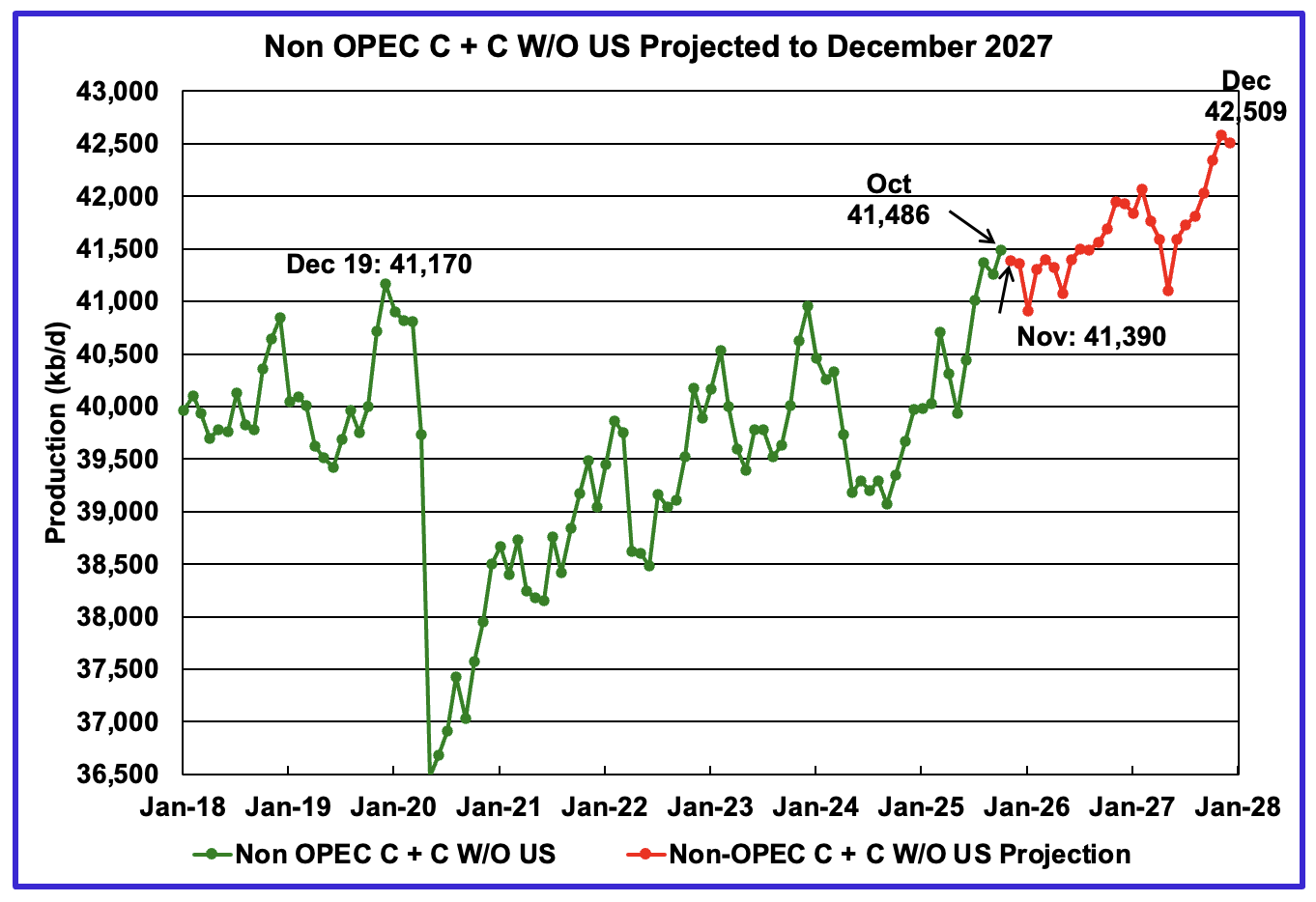

October’s Non-OPEC W/O US oil production increased by 224 kb/d to 41,486 kb/d. November’s production is projected to drop by 96 kb/d to 41,390 kb/d.

From October 2025 to December 2027, production in Non-OPEC countries W/O the U.S. is expected to increase by 1,023 to 42,509 kb/d.

Non-OPEC Oil Countries Ranked by Production

Listed above are the World’s 11 largest Non-OPEC producers. The original criteria for inclusion in the table was that all of the countries produced more than 1,000 kb/d.

October’s MoM production increased by 24 kb/d to 46,162 kb/d for these eleven Non-OPEC countries while as a whole the Non-OPEC countries saw a yearly production increase of 2,480 kb/d to 55,356 kb/d. Major yearly gains came from Brazil, Kazakhstan, Russia and the U.S.

In October 2025, these 11 countries produced 83.4% of all Non-OPEC oil.

Non-OPEC Country’s Oil Production Charts

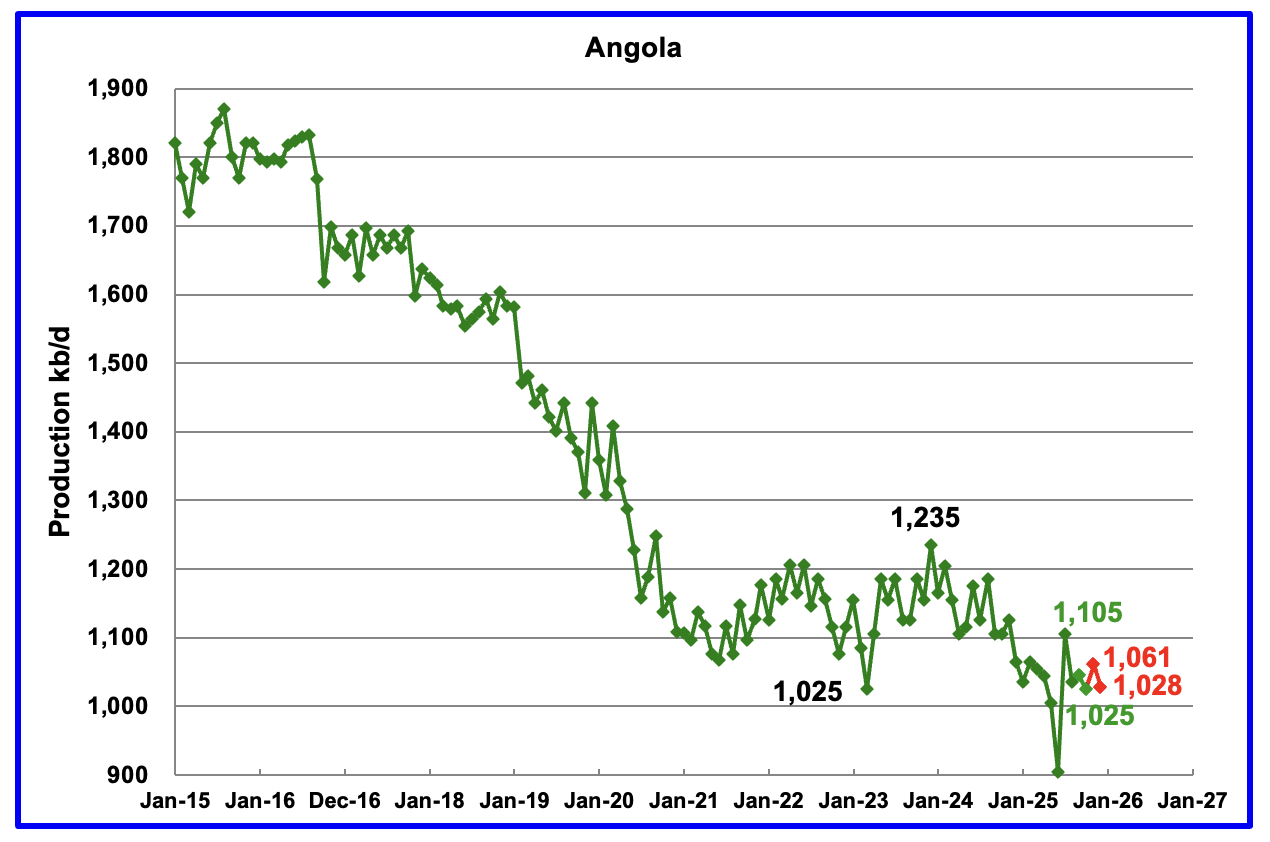

Angola’s October oil production dropped by 20 kb/d to 1,025 kb/d in the EIA’s report..

According to the National Agency for Petroleum, December’s production was 1,028 kb/d, red markers.

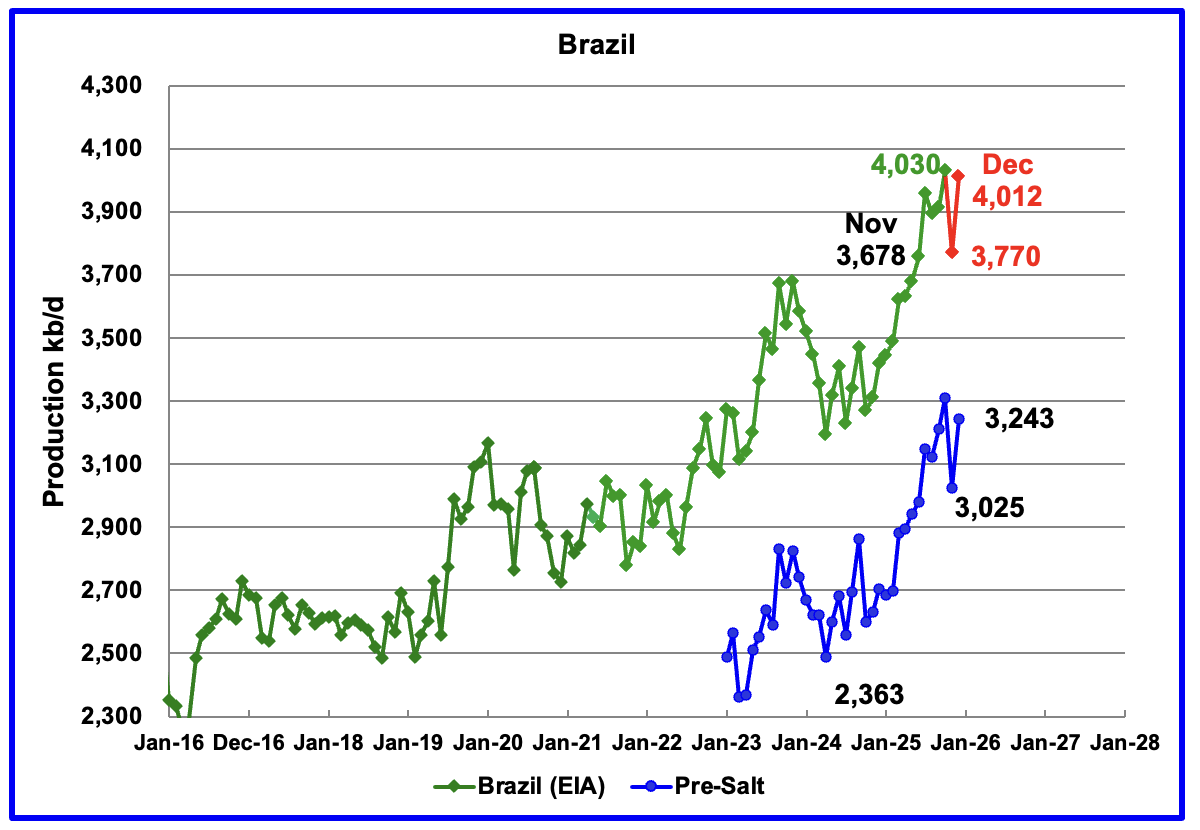

The EIA reported that Brazil’s October production rose by 117 kb/d to 4,030 kb/d, a new record high.

Brazil’s National Petroleum Association (BNPA) reported that production dropped in November to 3,770 kb/d. December production rebounded to 4,012 kb/d. Pre-Salt production was a major contributor to December’s rebound. Pre-salt production increased by 216 kb/d in December to 3,243 kb/d.

According to this article, the November Production drop was due to platform outages at offshore fields.

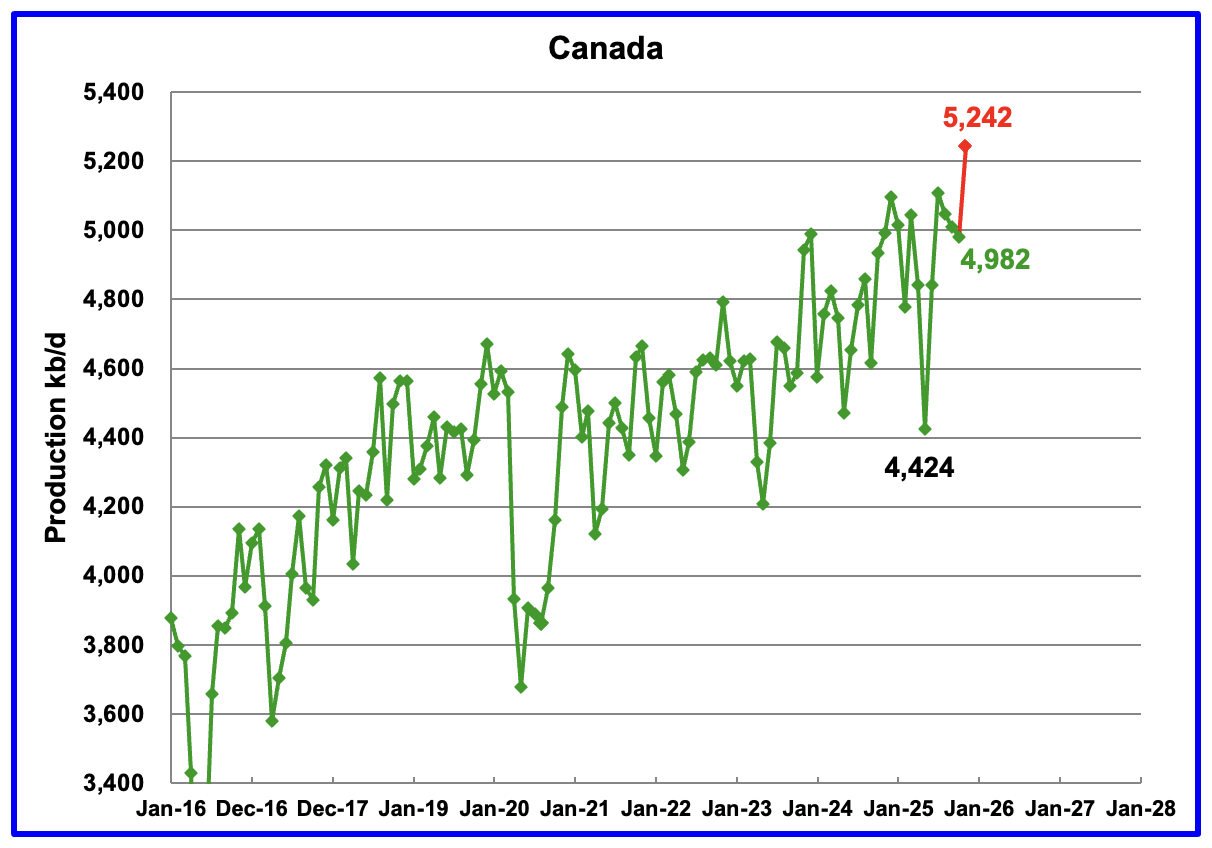

Canada’s oil production decreased by 27 kb/d in October to 4,982 kb/d.

A projection has been made for November production based on preliminary production provided by the Canada Energy Regulator (CER). November’s projected production rose to 5,242 kb/d, a new record high, red marker. The CER estimate contains some NGLs which have been removed from the projection. On average the EIA reduces the CER’s monthly production by 375 kb/d which was also done for the November estimate.

The EIA reported China’s October oil output dropped by 80 kb/d to 4,240 kb/d.

The China National Bureau of Statistics reported November production rose by 49 kb/d to 4,289 kb/d and then in December dropped to 4,190 kb/d.

On a YoY basis, China’s production increased by 56 kb/d from 4,184 kb/d.

Note the large drop of 310 kb/d from March 2025 to December 2025. That appears to be a record drop over those nine months.

However according to OPEC’s February MOMR: In the short term, additional infill drilling and EOR projects are expected to markedly slow the decline rates in legacy wells. Offshore projects, especially in Bohai Bay in northern China and the South China Sea, are expected to remain the main drivers of production growth, supported by recent E&P spending.

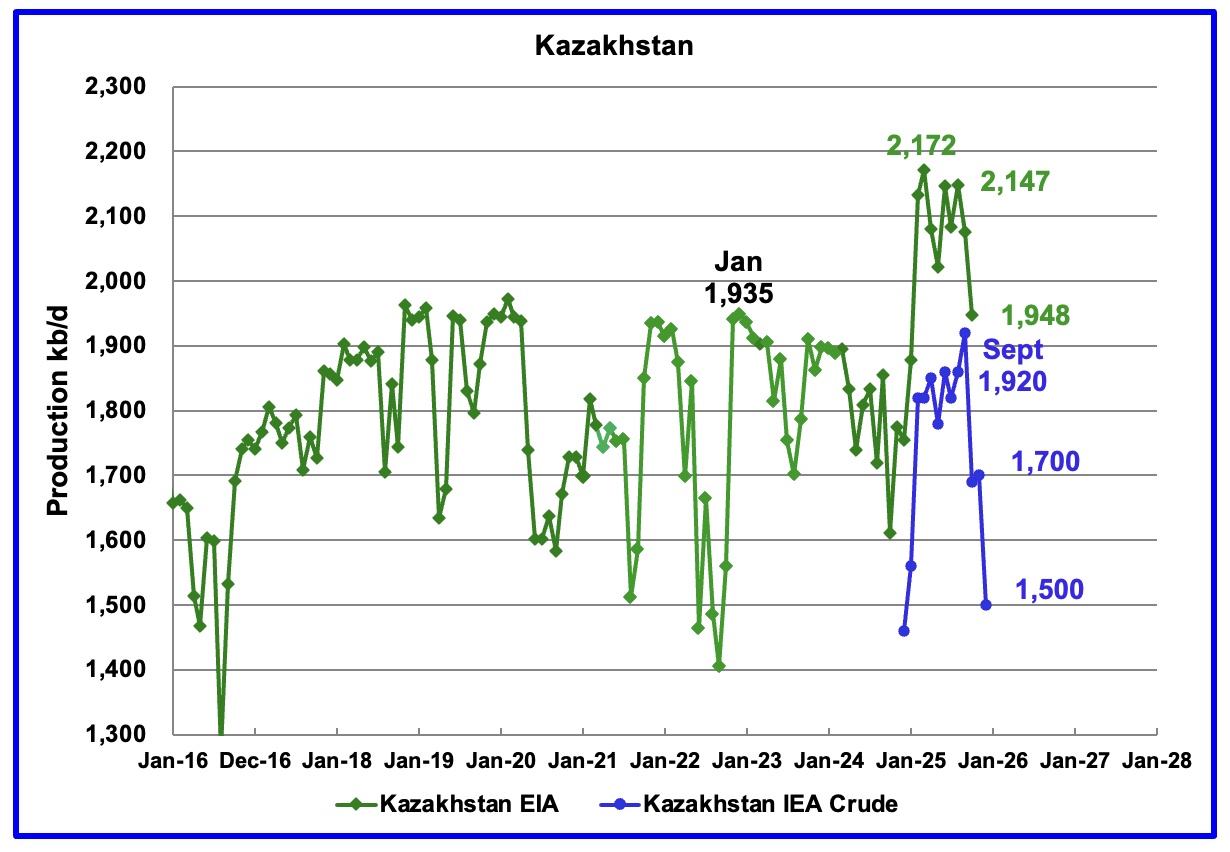

According to the EIA, Kazakhstan’s October oil output decreased by 128 kb/d to 1,948 kb/d.

Since Argus no longer reports OPEC + crude production, production data for Kazakhstan will now be taken from the monthly IEA reports. In November 2025 pre-salt crude production was 1,700 kb/d. The IEA’s January 2026 report stated December’s production dropped to 1,500 kb/d.

According to this Article: Four Opec+ producers plan to triple compensation cuts by June. Kazakhstan will make the deepest cuts.

“Kazakhstan will account for the largest share of the increase, with its cutbacks totalling 669,000 bpd by June, from 131,000 bpd in December. Baghdad, which frequently overproduces its quota within Opec+, will maintain cuts at a 100,000 bpd level by midyear.”

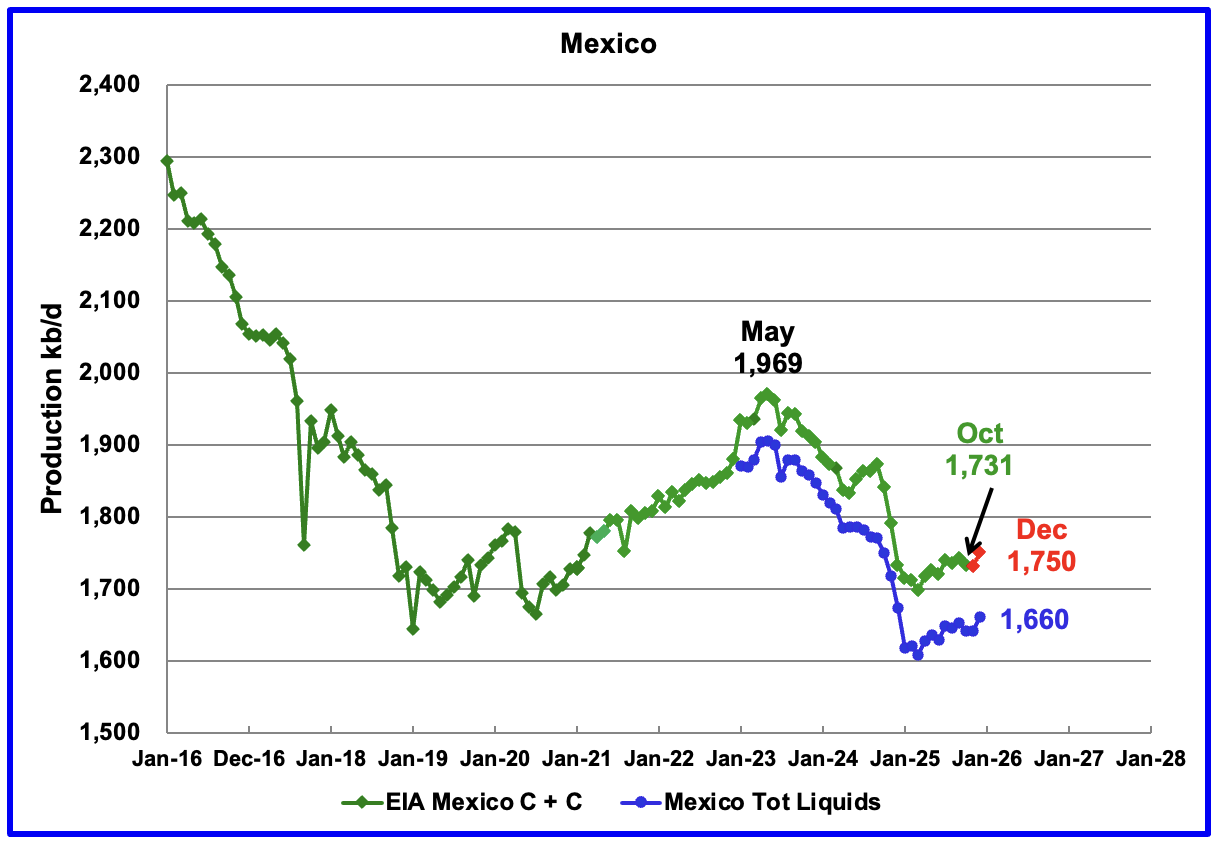

According to the EIA, Mexico’s October output dropped by 10 kb/d to 1,731 kb/d.

In June 2024, Pemex issued a new and modified oil production report for Heavy, Light and Extra Light oil. It is shown in blue in the chart and it appears that Mexico is not reporting condensate production when compared to the EIA report.

In earlier EIA reports, they would add close to 55 kb/d of condensate to the Pemex’s “Total Liquids” report. More recently the EIA has been adding 90 kb/d of condensate to Mexican production. For November and December production, 90 kb/d have been added to the Pemex report. December’s production is estimated to be close to 1,750 kb/d. Note that Mexico’s production, as reported by Pemex for the last four months has stabilized around 1,650 kb/d.

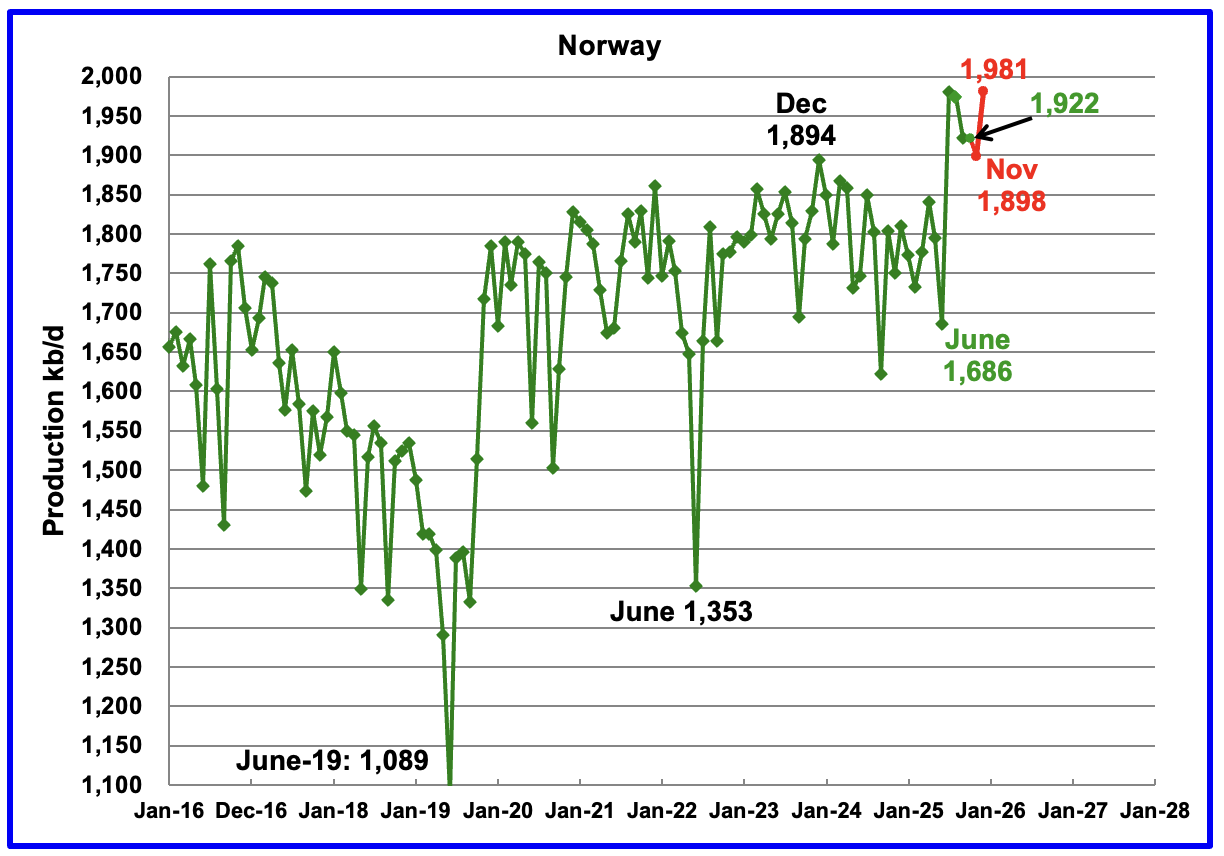

The EIA reported Norway’s October production was unchanged at 1,922 kb/d.

Separately, the Norway Petroleum Directorate (NPD) reported that December’s production rose to 1,981 kb/d, red markers.

The Norway Petroleum Directorship also reported that December’s oil production was 5.1 % above forecast.

According to OPEC’s December MOMR: “For the remainder of the year, output is expected to be underpinned by the Johan Castberg and Jotun FPSOs, complemented by strong contributions from Johan Sverdrup”

However this Article states that Johan Sverdrup output could fall between 10% to 20% this Year.

“Chief executive Anders Opedal said production could fall by more than 10% but remain below 20%, following a period in which the field delivered sustained growth to European oil supply. Exports from Johan Sverdrup averaged about 712,000 barrels a day last year, based on loading programs compiled by Bloomberg, underscoring the scale of the asset as it enters a new phase.”

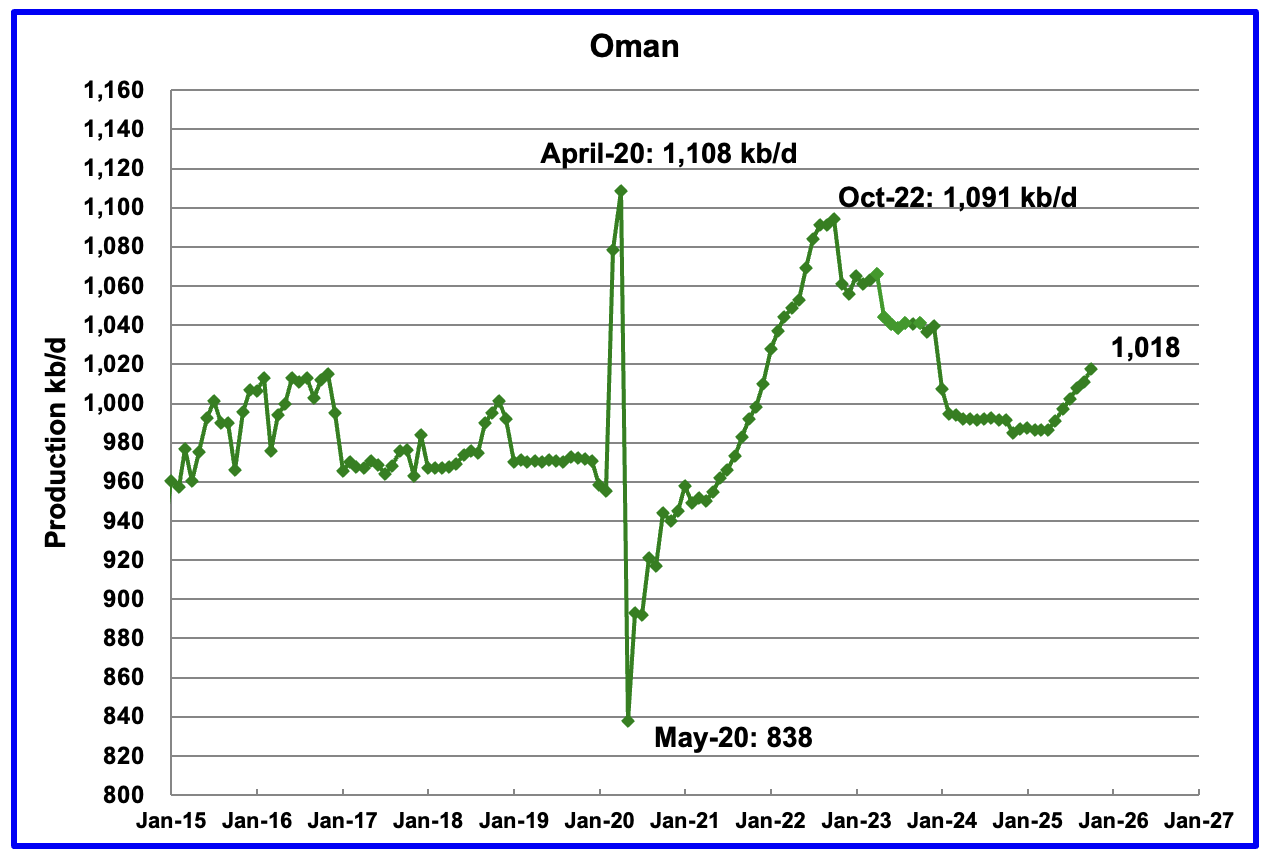

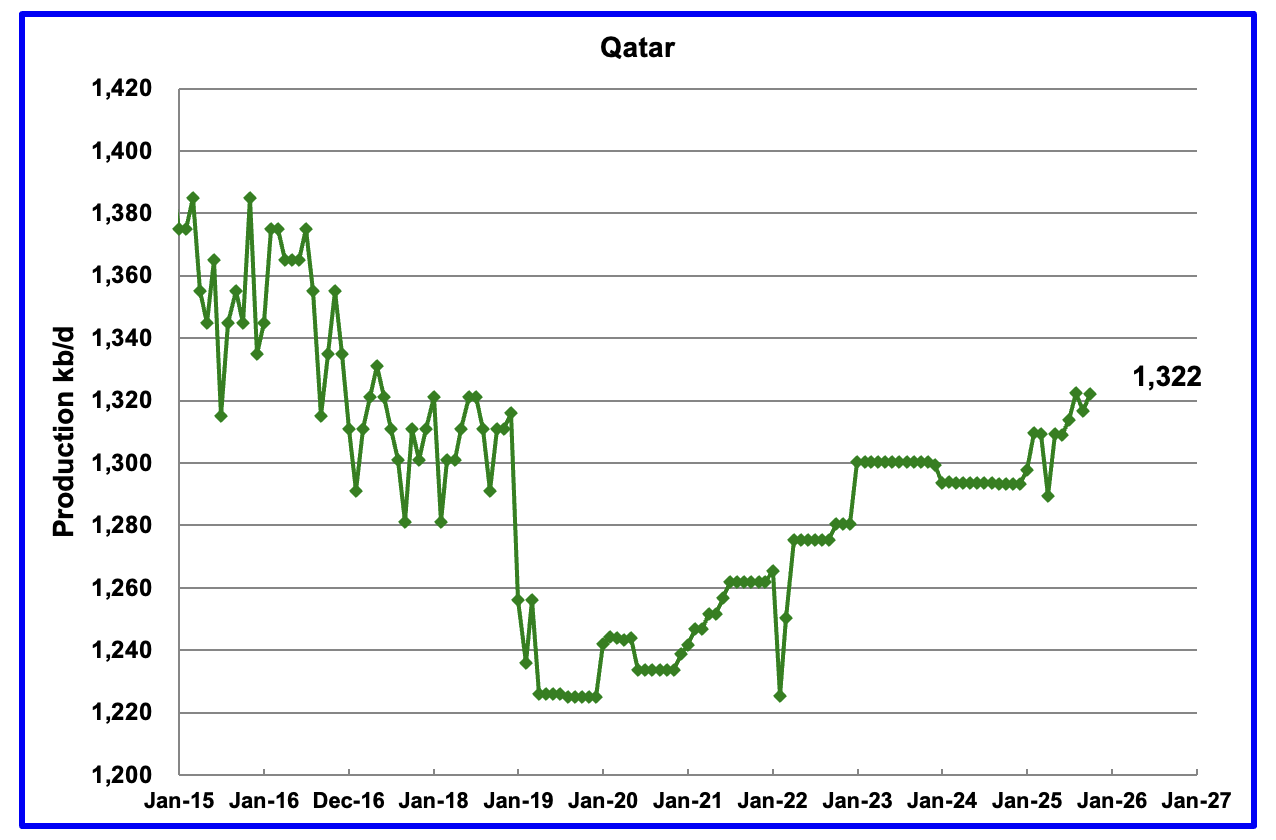

According to the EIA, October’s output rose by 7 kb/d to 1,018 kb/d and appears to have begun a budding growth phase. Previous production peaked in October 2022.

Qatar is now providing the EIA with monthly updated oil production back to January 2025. Qatar’s October output was reported to be 1,322 kb/d up 5 kb/d from September.

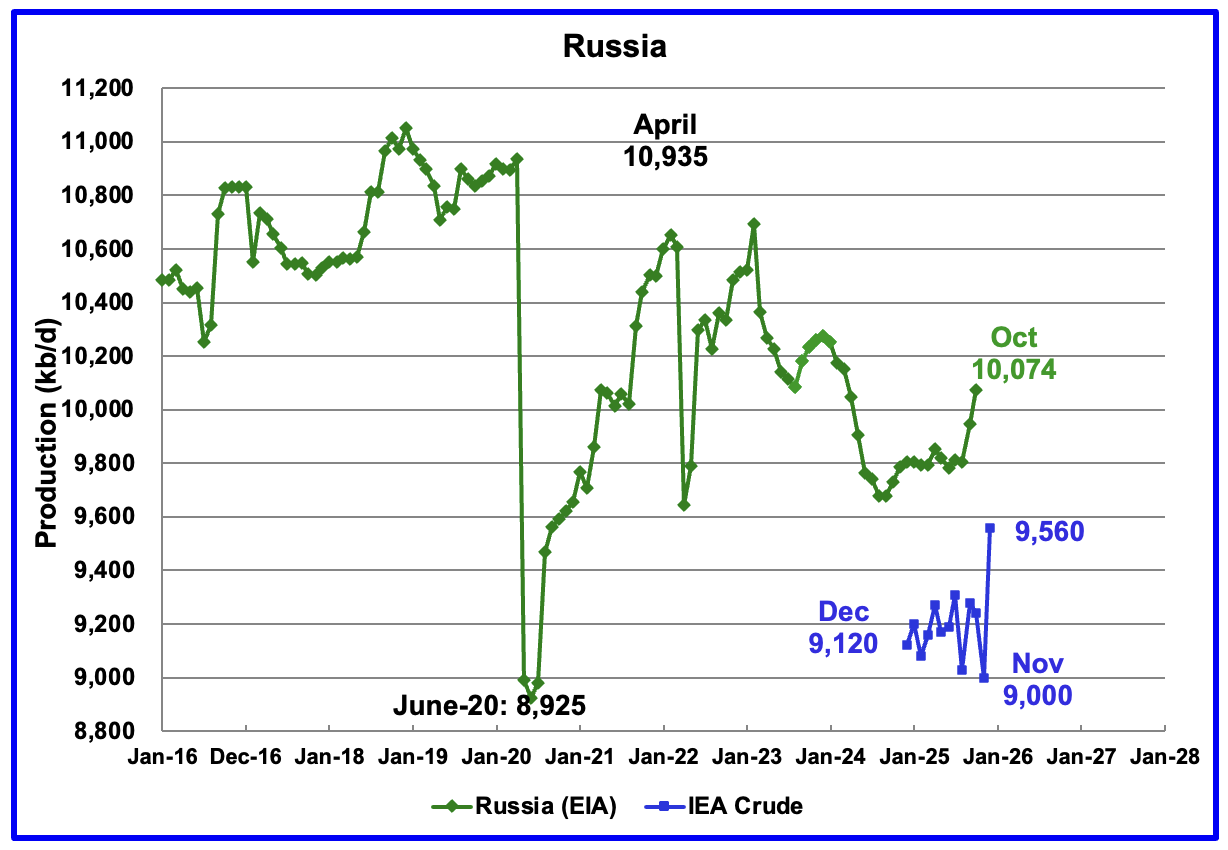

The EIA reported Russia’s October C + C production increased by 128 kb/d to 10,074 kb/d and was up by 271 kb/d from August 2025.

Up to August 2025 Argus Media used to report OPEC + crude production. That monthly report has now been discontinued. The above chart now also shows Russian production as reported by the IEA. It is difficult to assess the accuracy of the IEA report but over the last few months the IEA’s Russian production has been around 100 kb/d to 150 kb/d higher than Argus’ Media. The best that can be done at this time will be to compare the production trends between the EIA and the IEA. I think that Russian oil production continues to be a major state secret at this time because of the damage being caused by the heavy bombing to its related crude oil processing facilities.

According to the IEA’s January report, November crude production was 9,000 kb/d and then December production rose by 560 kb/d to 9,560 kb/d.

However according to this Article: Russia’s Crude Output in December Made Deep Plunge due to Ukrainian drone attacks.

“Russia’s crude oil production plunged by the most in 18 months in December, pincered by western sanctions that are causing the nation’s barrels to pile up at sea and a surge of Ukrainian drone attacks on its energy infrastructure.

Adding to the confusion is OPEC’s February MOMR. These are their production number for November to January, 9,377 kb/d, 9,304 kb/d and 9,246 kb/d respectively. No steep plunge in December, just a slow steady decline. Take your choice.

It is difficult to know what the real facts are regarding Russian oil production.

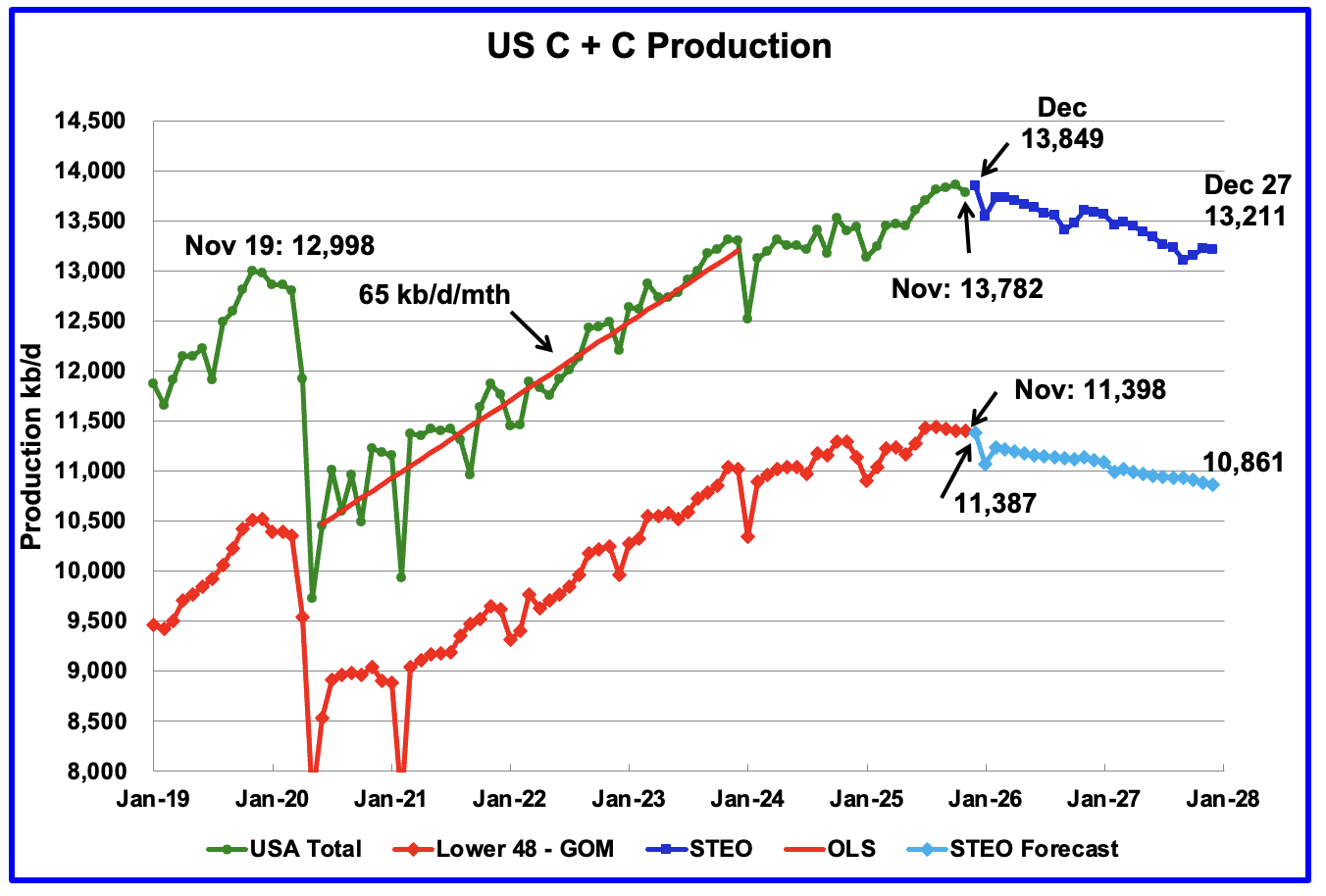

This US production chart up to November 2025 is the same as the one published last week in the US update. However the projected portions of the two production graphs have been updated according to the February 2026 STEO.

U.S. December projected production has been revised up by 13 kb/d to 13,849 kb/d.

Production in December 2027 is expected to be 13,211 kb/d. January’s drop to 13,545 kb/d reflects the severe storms that hit the mid US and the Permian basin.

Note production in the Onshore L48 essentially peaked in August 2025 at 11,440 kb/d. Production decline steepens starting in December 2025.

Production in Argentina rose by 13 kb/d in December to 861 kb/d. Vaca Muerta keeps on giving.

Leave a Reply