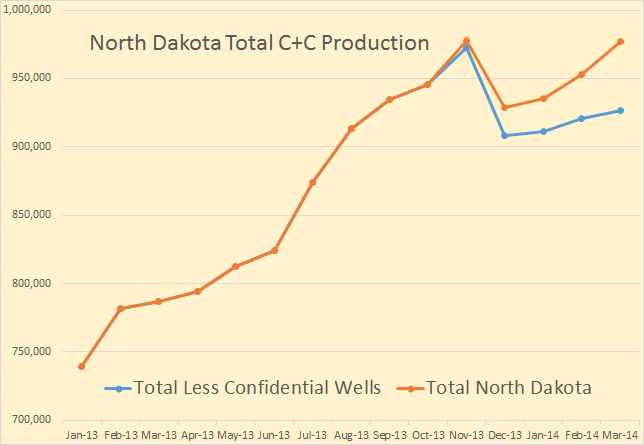

North Dakota publishes crude oil production numbers for each county. The problem is these numbers do not include confidential wells. Their totals for all North Dakota do include these wells however. I have figured out a way to estimate, pretty closely I believe, each county’s share of those unreported wells. That is take each county’s percentage of total production, then assume they would have the same percentage of confidential wells. It is not exact but close enough.

The data is published only as a PDF file and cannot be copied and pasted. Therefore I must input the data for each of 18 counties, each month, manually. That is very time consuming and I only had the patience to do 15 months. But that is plenty for what I am trying to show.

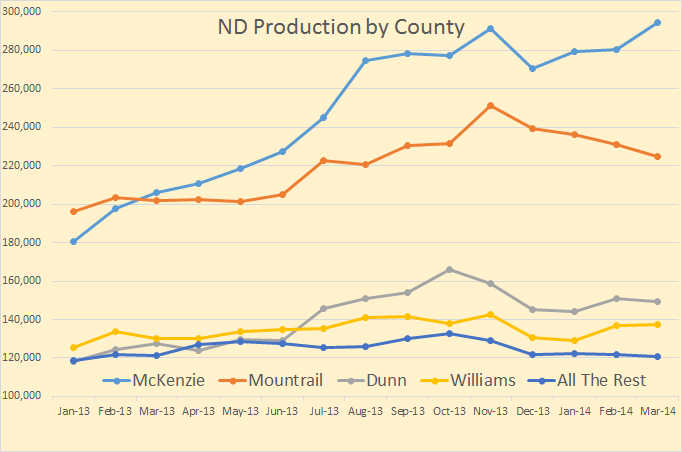

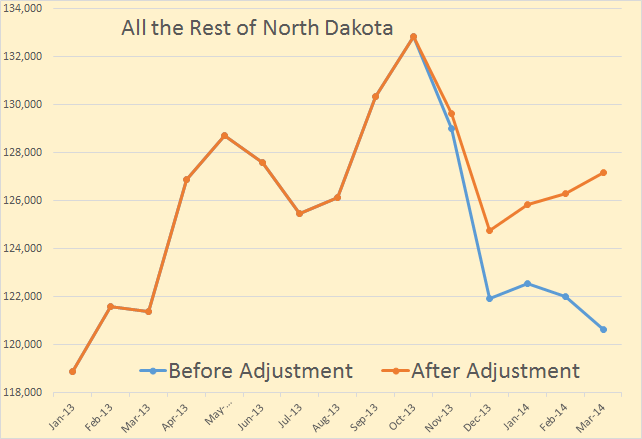

All the rest of North Dakota combined produces less than the lowest of the big four.

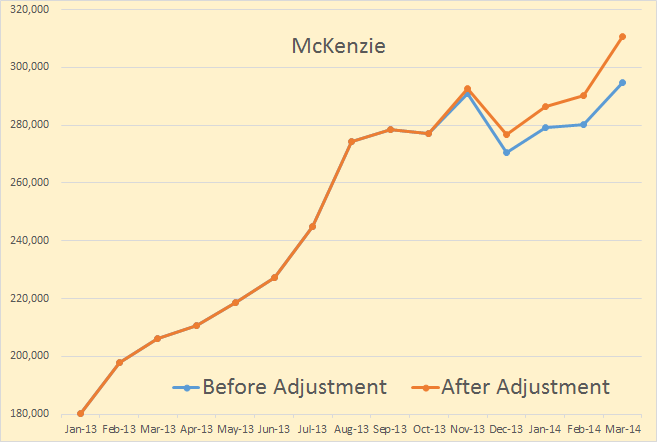

McKenzie County is where most of the action is. It shows no sign of peaking yet. After adjustment for confidential wells, McKenzie County’s adjusted production was up 20.5 thousand barrels per day in March. All the rest of North Dakota combined was up 3.5 thousand barrels per day in March.

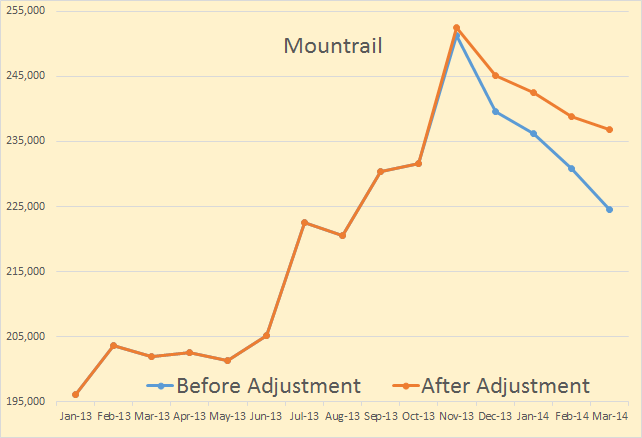

Mountrail, the second largest producer in North Dakota seems to clearly have peaked. Mountrail County’s adjusted production was down just over 2 thousand barrels per day in March.

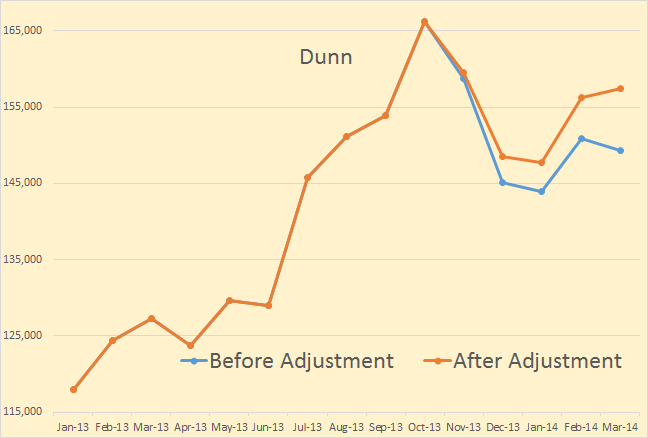

Dunn looked like it was about to take off in February, up over 8 thousand bpd but slowed dramatically in March with adjusted production up only about 1.25 thousand bpd.

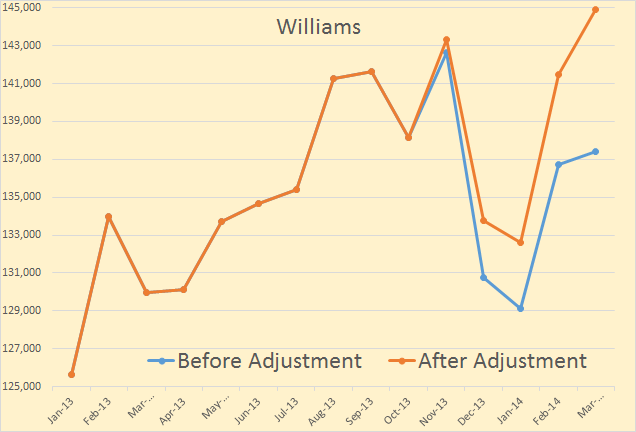

Williams County, North Dakota’s fourth largest producer, was up about 3.4 thousand barrels per day in March, less than half its gain in February.

I think the rest of North Dakota has peaked. Though they were up about 900 barrels per day in March they are still down about 5.6 thousand bpd from their peak in October 2013. And notice their peak was in October, not November when the other four counties peaked just before the bad weather outages in December.

The bottom line is that all North Dakota, except for three counties, has peaked. And only one of them, McKenzie, is still increasing relatively strong. I expect North Dakota to keep increasing the rest of the year but to peak late 2014 or early 2015.

The below chart of is in thousand barrels per day.

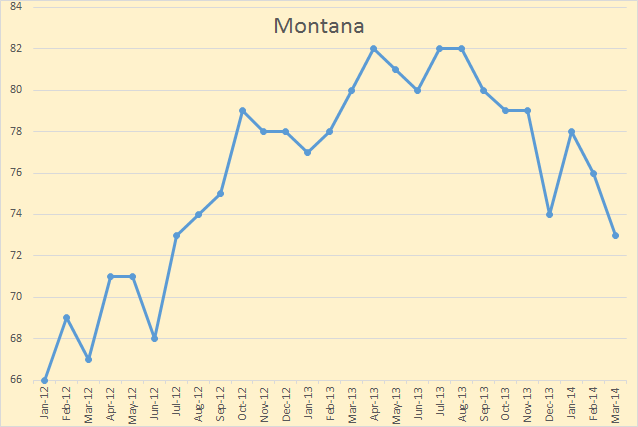

Part of the Bakken is in Montana. Montana peaked back in September of 2006 at 102 thousand barrels per day but the Bakken boom brought a new surge of drilling rigs into the state. That brought on a new surge of production which peaked in July and August of last year at 82 thousand bpd. They are now down 9 thousand bpd at 73 thousand bpd.

Though McKenzie County ND is still going great, it is the only sweet spot left in the Bakken. All increase in McKenzie County and any slight increase in Dunn and Williams Counties must overcome the decline in Mountrail County and the rest of North Dakota and Montana.

The Outlook for the Bakken is not really as great as a lot of the Bakken cheering section would lead you to believe.

And just one bit of news to report:

Russian daily oil production down for fifth month in a row

MOSCOW, June 2 (Reuters) – Russian oil output edged down to 10.53 million barrels per day (bpd) in May from 10.54 million bpd in April, declining for the fifth month in a row in terms of daily production, Energy Ministry data showed on Monday.

In tonnes, Russian oil output reached 44.535 million last month, versus 43.119 million in April.

That is an decrease of only 10,000 barrels per day. May was a 31 day month so the monthly figures show a larger figure for May.

I send out an email notifying some folks of every new post. If you would like to be put on that list or removed from it, please notify me at DarwinianOne at Gmail.com.

184 responses to “In North Dakota it is Mostly Just One County”

Where are the recent drilling permits? All in that county?

David Hughes just sent me the following post;

Ron,

Here’s an answer to your first commenter on permits. These are permits granted in the last 180 days for the Bakken and Three Forks by county.

(Posted Below)

Personally I think that Mountrail has life in it and it does have the highest cumulative production. Well quality is best in Mountrail and a close second in McKenzie. I’m analyzing well quality trends over time among other things for release in September.

Thanks for your post.

Dave

Now that’s a response.

David Hughes did a great presentation last October on Shale gas and light tight oil in the United States.

I will post at the bottom so the chart will show up better.

Some info about confidential wells: What is a confidential list? – Mineral Rights Forum I was familiar with the term “tight hole” for such a notion, where the operator reserves the right for data to remain confidential for some length of time – the prime example being the test well drilled in ANWR in the 80s, the KIC well I think it’s called. But that just seems to be in regards to data collected, not production values.

Why do the ND total and total minus confidential numbers only part company last October? Does this mean the operators are trying to mask production declines, or is it just some fluke of the ND data gathering modus – in other words, do discrepancies like these show up whenever you gather numbers, with the breach always manifesting itself 9 months previous to the current date? The fact that the discrepancy shows in all counties 9 in October leads me to believe the latter theory is correct, but perhaps others know more about what’s going on here.

“Why do the ND total and total minus confidential numbers only part company last October? ”

From ND’s purpose and limiation on confidentiality:

“To provide for the confidentiality of well data reported to the commission if requested in writing by those reporting the data for a period not to exceed six months.”

Confidentiality expires after 6 months, so when a well’s confidentiality agreement expires, the protected production data is then entered into the public database. That means that 6-month-old production data will be complete, but more-recent monthly production data will be missing an increasing amount of confidential production data.

Is there any way of telling whether the confidential holes are high producers or just poor.

No, there is no real way of telling. But you can get some idea by looking at them after they are released. Go here: Bakken Blog then click on: “ND drilling permits issued week ending May 30”. That will give you “Released from ‘tight hole’ or confidential status” as well as “Producing wells completed” and permits.

But in more than half the “Released” well data they do not give you any data at all. Some give you “bopd” barrels of oil per day and “bwpd” barrels of water per day. And as you can see many of them are god awful, starting with just a couple hundred bopd and more water than oil. But a few of them are pretty good. However I suspect the ones that they give no production data at all for are really bad. But I have no way of really knowing that. The “producing wells completed” I think, in general, are a bit better than the released confidential wells.

If I may offer an actual operators perspective on “confidentiality;” withholding down-hole logs on a conventional resource wildcat well, even a development well after the discovery is made, is common and is protective of information the operator has paid dearly to obtain and that may benefit it with regards to further leasing in the area of the discovery. Offshore, for instance, where leasing for federal blocks is often very competitive, communications from platforms and digitally transmitted data, offshore to the office, is often encrypted for confidentiality reasons.

In unconventional resource plays, where sweet spots have all been pretty much delineated and information about little tweaks in technology, for instance frac techniques, gets spread from beer joint to beer joint within days, withholding well logs is a simple matter of checking a box on a form and being lazy, or overloaded with other things more important. I honestly don’t think its very much more complicated than that. There are very few secrets on the tight oil boulevard anymore and given the vast amounts of HBP (held by production) acreage, what would an operator gain, or lose from not sending in its downhole logs or MWD data?

I don’t know much about any place other than Texas but here, withholding information about production is impossible. When oil gets moved off lease, the State knows about it. It may be taking the State a while to do the right things with that data (lol), but I am told it is working that out. I believe that Mr. Patterson is correct, some of the form filling in almost borders on 5th grade level failures, but good help is hard to get round these parts these days.

Tiny additional . . . pretty sure I read in a Bakken forum that confidentiality status requires nothing more than filling out a form. There is no evaluation of justification. A request gets the status.

There are screen image to OCR tools that will convert an image to text to get around the pdf DRM. One is http://www.boxoft.com/screen-ocr/ and there are others. I would not expect them to be perfect, but they may be better than doing it by hand.

Thanks OldTech but I have just been informed, by Ovi Colavincenzo, that Excel already has a “Text to Columns Wizard” already built in. Imagine, I have been using Excel for years and I had no idea.

And it only took a minute to figure out how it works. It is so easy it’s silly. It is right there, click on “data” then “text to columns” and follow the simple instructions. And to think I have been printing out the data on paper, then entering it keystroke by keystroke.

Ron/readers; There’s this guy who posted here a few times, he wrote a (paid unfortunately, but guy’s gotta eat right) report on oil depletion / eroi etc. I was checking out his site and there was some extra info there now, what’s your opinion on his numbers? As far as the main idea goes it’s not really far out; decreasing eroi, more energy/$ needed for production, etc. But it’s interesting to see some numbers, which honestly seem very DOOMy to me. (And I’m “into” DOOM)

What he’s saying (at least what I think he’s saying) is that work put into “getting oil” comes from oil which has an efficiency of 20%-ish , thus there is an amplified decrease in oil/energy available to society etc. And in 2030 the party is over in terms of ROI.

http://www.thehillsgroup.org/depletion2_019.htm

http://www.thehillsgroup.org/depletion2_020.htm

He should spellcheck and pimp the site some though, even DOOM needs some marketing. 🙂

Interesting comment in the explanation of the first graph that oil will increasingly become an energy carrier rather than an energy source. We are already seeing that in the oil sands and steam injection in old oil fields using natural gas for the heat source. Could easily see coal used for this purpose also as it will probably be cheaper, for awhile, to upgrade coal using the heat to extract oil rather than gasification and conversion to oil products.

I haven’t delved into it that far but I am pretty much in agreement with his findings. As to the doom date however, I would need to examine it a bit closer before I agreed with his date.

Please do delve into it Ron! I can’t wait to see what you parse out of that analysis!!

BAU said:

“What he’s saying (at least what I think he’s saying) is that work put into “getting oil” comes from oil which has an efficiency of 20%-ish , thus there is an amplified decrease in oil/energy available to society etc. And in 2030 the party is over in terms of ROI.”

Your read it correctly. For petroleum to act as an energy source it must be capable of providing sufficient energy to support is own production process. If it can’t, it becomes an energy sink as opposed to a source. That is certainly not a world shattering concept, but it is one that is usually overlooked. Over the 60 years period we looked at the conversion of the energy from crude into the work input at the well head, it took place at about a 20% efficiency rate. For every one BTU increase in work needed to extract petroleum, the energy remaining for use by the general economy declines by about 5. It is the quintessential Red Queen Scenario.

Ron,

If you would like a copy of our report, go to the site, and send me your mailing address. If your in the US we’ll pay the postage. It’s a dollar in the US. Sent one to Russia the other day, and it was $13. I hope the Russians can run their shale operations cheaper than their Postal Service?

http://www.thehillsgroup.org

hey BW, thanks, appreciate it. And I found the site really interesting. But check it one more time there are some text errors witch distract from the message a bit. I don’t mind but some do and it’s good info you have, rgds.

The oil and gas ARC IMS viewer shows that most of the rigs are in the McKenzie County area or nearby.

Ron, have you tried using something like Tabula to pull the data out of the PDF? It doesn’t allow selection over multiple page boundaries, as I recall, but you should be able to simply select the data from each page in turn to extract it and get it into a more usable environment. Just an idea. Hope it’s helpful.

Thanks Brian but I have just discovered that Excel has a “Text to Columns Wizard” already built in. I had no idea. I don’t think my older version, 2003, had it but I now have Office 2013 and it does have it. It looks rather simple so I will be using that from now on. It will really make things easier for all the North Dakota data which is all in PDF format.

Ron ,

Do you know how many exploratory wells have been drilled outside the handful of counties in ND that are producing oil now?

This might throw some light on whether more sweet spots will be discovered.

If I remember correctly over a hundred wells were drilled in the North Sea before hitting a good spot.

Well I do know of eight such wells.

Chesapeake Drills Unsuccessful Wells in Southwest ND

In 2012, North Dakota made oil headlines by taking over as the number two producer in the nation.

While production continues to ramp up daily, there is one part of western North Dakota were the excitement of oil has gone bust.

Chesapeake’s attempt to find the southern edge of the Bakken, is being described as the largest failure in drilling in the state since the 1980’s.

There are a few well sites in western North Dakota that look more like ghost towns than multi-million dollar holes.

Chesapeake secured leases in a large part of the state, south of I-94.

They drilled 8 wells, only 3 produced oil — but at minimal amounts.

So little that all holes have been shut in.

“That is an decrease of only 1,000 barrels per day.”

10,000 🙂

Yeah, fixed it. Thanks.

I am usually very skeptical when I see new technology that could harvest hydrogen as a fuel–for those who are ready to sarcastically point out that hydrogen is not an energy source, note I am not saying hydrogen is an energy source. But this idea seems quite interesting. When combined with recent developments in catalysts for the electrolysis of water it presents interesting possibilities.

http://www.sciencedaily.com/releases/2014/06/140602115839.htm

Cave Bio, fixed your typo. However… The article is all transforming hydrogen into a safe liquid fuel. It is not about a cheap way to get hydrogen from water. That is a physical impossibility. That is if you could separate hydrogen from water using less energy than you get when you burn it and turn it back into water then you would be violating the first law of thermodynamics.

Hi Ron,

Thanks for fixing my typo. I guess I was not clear with my post. There have been other recent developments using catalysts that significantly lower the energy needed to drive the electrolysis of water. While no catalyst can ever turn an endothermic reaction into an exothermic reaction, catalysts can lower the energy needed to drive the process forward.

The innovation noted in the link I provided allows for the storage of hydrogen. As you know, the problem with solar energy has been storage. This type of innovation, combined with innovations and drops in the cost of the production of solar PV, and the catalysts I noted, are, in combination, potentially significant developments.

Listen, I know we are currently in a race against doomsday. Perhaps I am grasping at straws, but I hope against hope that we can move fast enough to prevent total collapse.

Best,

Tom

As examples of recent developments in catalysts to produce hydrogen from water:

http://www.sciencedaily.com/releases/2014/01/140122134030.htm

http://www.sciencedaily.com/releases/2014/01/140126134645.htm

http://www.sciencedaily.com/releases/2014/01/140108081221.htm

Best,

Tom

“The innovation noted in the link I provided allows for the storage of hydrogen. As you know, the problem with solar energy has been storage. This type of innovation, combined with innovations and drops in the cost of the production of solar PV, and the catalysts I noted, are, in combination, potentially significant developments.”

Producing Hydrocarbons from Hydrogen and CO2 gas is terribly inefficient as the bonds between Carbon and Oxygen are quite strong and required a lot of energy to break them, no matter how efficient the catalyst are. Catalysts do not allow negative energy reactions to occur (violation of thermodynamics), in the sense that they can liberate energy from chemical reactions that required energy inputs. The theoretical limit for a catalyst is that 100% of the input energy drives a chemical process at 100%. Unfortunately even the very best catalysts never come close. The research you’ve looking at is improving dismal converstion rates into just bad conversion rates. For instance an older method to split CO2 might be 5%, meaning that 95% of the energy is lost to thermal processes. the newer processes might be 25% to 30% efficient.

The issue is that all these electrochemistry processes that manipulate carbon and hydrogen need lots and lots of electricity to function. where as fossil fuels already provide energy. Even if they found catalysts that are 98% efficient there is still no viable power source to drive the processes. At this point there is no alternate energy source to replace fossil fuels with the same EROEI (or even close).

“innovations and drops in the cost of the production of solar PV”

PV farms are less than a drop in the bucket of energy demand. It would take more than a 100 years to scale up PV and storage system to replace fossil fuels, even if every possible economic resource was devoted to alternative energy.

FWIW: Don’t bet on the world saving itself. Put together your own mitigation program instead and rely on yourself to make the transition.

I get the feeling that many people just don’t thoroughly read a person’s post before responding.

1)Nothing that I stated suggested a violation of the laws of thermodynamics.

2) The papers I noted are not published in rags. These are genuinely interesting and potentially scalable results.

3) Saying it would take 100 years to scale up PV is as meaningless as saying we have 100 years of natural gas.

Best,

Tom

Ron, thank you for your harld work putting the data together. The Russian update is very interesting as well.

Two comments:

re: electrolysis catalyst break throughs. The break throughs involve creating less expensive catalysts required in the process to break down water into H2 and O2 via electrolysis, which would make H2 production equipment less expensive. The process currently requires very expensive platinum-based catalysts (kind of like what is used in the catalytic converter in automotive exhaust systems) . Catalysts can accelerate a chemical process by lowering certain reaction energy input thresholds, but do not change the fundamental thermodynamics that govern net input electrical energy requirements to electrolyze water into H2 and O. That is the hurtle that makes electrically-derived H2 inherently uneconomic.

re: science daily article. This is about a way to STORE hydrogen in the form of liquid formic acid, which increases energy volumetric density and reduces the issue of gaseous hydrogen storage volumes and pressures. This does nothing to resolve the fundamental long-term issue of how to create hydrogen in the first place without reforming natural gas (the electrolysis issue).

oops – should have been nested under Cave Bio’s post.

Hi HVACman,

I guess I was really not clear with my initial post. I guess I just assumed it was common knowledge that the current catalysts are expensive platinum based catalysts. Anyway, I have added a few links above about new cheaper catalysts, which I had in mind when I wrote my initial post.

Best,

Tom

It is perfectly true that there is no way to obtain molecular hydrogen that consumes less energy than can be obtained by then burning the hydrogen.

But the copper clad cast iron laws of physics and chemistry don’t necessarily ALWAYS directly apply as a practical matter in real everyday engineering situations.

It is altogether possible that machinery such as fuel cells or even internal combustion engines can be built cheap enough to make portable power obtained from H2 economically viable.

IF for instance the energy cost of obtaining hydrogen by electrolysis of water can be reduced ENOUGH the energy lost in the electrolysis process can potentially be ” recovered” at a big energy ”profit” in actual use of the hydrogen thru increased efficiency. A fuel cell and an electric motor can drive a car or truck far more efficiently energy wise than a gasoline or diesel burning engine.

IF both fuel cell costs and electrolysis costs come down far enough- this essentially means attacking the problem from both ends- we could someday be hauling potatoes with hydrogen fueled trucks with the hydrogen obtained with wind or solar power from wind and solar farms located where the land is politically dirt cheap and the wind and sun resource is excellent.

I know virtually nothing about chemical engineering but a hydrogen electrolysis plant would seem to be a potentially perfect way to use any surplus renewable energy or even the entire output of a wind farm or solar farm or even a wind or solar plantation——-if the plant doesn’t cost so much to build it that it must run constantly in order to pay for it.

It is even possible that there will still be substantial increases in the efficiency of internal combustion engines – if materials suitable for pistons and cylinders can be invented that can withstand higher temperatures in the combustion area that are also cheap enough to be mass produced. Since H2 burns super clean it might go a long way in making such an engine practical by preventing the formation of combustion byproducts that tend to corrode engine components.

But for what it is worth I think batteries are going to eventually dominate in light transportation and rail and diesel will continue to dominate in heavy transportation for the foreseeable future.The grid is there and battery costs are falling fast. So are the rails and the diesel fueling infrastructure for the trucks.Hydrogen is hard to handle and tanks capable of holding enough to really matter cost both arms and both legs. Fuel cells may never catch up with batteries in terms of costs.Mobile fuel cells just aren’t going to be very common for a long time if ever.Synthetic diesel made from coal or even biodiesel burned in conventional engines may always be cheaper than fuel cells and hydrogen.

Now compressed natural gas is another matter.The technology is ready and affordable if the cost of natural gas stays lower than the cost of diesel by at least a third or so in terms of energy content. It may be that larger trucks will be running on it in considerable numbers in a few more years. The only thing REALLY holding this up is the lack of truck stops able to dispense it and the fear of truckers that if they buy a dual fuel truck the extra purchase money will be wasted because the price of the gas will go up to the equivalent of diesel.

There are enough truck stops located on or very close to natural gas pipelines for natural gas trucks to become a practical reality. Most trucks stay pretty close to main highways and most trucks don’t go over a few hundred miles from ” home base” anyway.

Based on the public monthly detailed production reports from the NDIC, I performed a county analysis, please see below the results.

A few comments:

– based on all wells since 2009, I averaged the 1 year cumulative well production (pre peak month + peak month + 11 months, only oil), per starting year. You can see this in the first table.

What I found interesting is that from these numbers a downward trend emerges since 2011. The average 2011 well (there were 1221 of them) produced 81738 barrels of oil after 1 year, while the average 2013 well (that already reached 1 year production), produced 79443 barrels of oil after 1 year (there were 565 that did).

– I listed the average 1 year well return since 2009, per county, in the table below. Mountrail has so far produced the best wells, followed by Mc. Kenzy. You can see the total # of wells per county, since 2009, in the last column.

– From the 4 counties that had at least 500 wells during those years, I show the 1 year production graph, per starting year, in the chart on the right.

These well & production numbers include confidential wells and their production.

where it reads “bpd” or “barrels per day”, I mean just “barrels of oil”, not per day.

Hi Enno,

Your analysis applies to all of North Dakota, and not just the Bakken (which is true of Ron’s analysis as well, I think), is that correct?

I only ask because of the title of Ron’s post and you didn’t say explicitly that it was all North Dakota.

Oops. My bad, I guess when I see North Dakota I think Bakken automatically.

Hi Dennis,

Indeed the whole of ND.

Thanks Enno. And thank for your cogent analysis.

Using data provided by Enno Peters, the 12 month Bakken well average for wells which started producing between Jan 2009 and March 2013 in North Dakota is about 79 kb. I use a slightly different method from Enno and just take the average of all Bakken wells where month 1 is the first month of production.

Looking only at the trend from 2009 to 2013 for all North Dakota Bakken and Bakken/Three Forks wells. I used 12 month windows from April to March because March 2013 is the latest date for wells with 12 months of output data. Basically the 12 month well output for Bakken wells dropped from 2010 to 2011 and then has remained steady at about 79 to 80 kb. see screen shot below.

I should have said well output dropped from the april 2009 to march 2010 12 month period to the following 12 month period (2009 to 2010 more or less).

I have taken a quick look at the 3 month cumulative output and 6 month cumulative output for the Bakken for wells which started production from Jan 2008 to Aug 2013 for the 6 month series and Jan 2008 to Nov 2013 for the 3 month series.

So far the EUR does not look like it is decreasing and based on 12 month data for wells brought online in April 2013 the EUR also looks pretty steady.

Part of this is more proppant and more fracking stages mitigating lack of room in the sweet spots which cannot continue forever. I think the EUR decrease will become apparent by Dec 2014 to June 2015, time will tell as it always does.

Hi Dennis,

Thanks for verifying this. Indeed it looks like the variation I spotted is not statistically significant yet. As you say, we need more data before we can conclude anything.

Hi Enno,

I just wanted to filter out the non-Bakken wells because my focus is the Bakken. Your analysis shows that the non-Bakken doesn’t really effect things much, but I just wanted to see what a Bakken only analysis looked like.

And again thanks for sharing your data and analysis.

Any chance the talk above about confidential status for 6 mos is involved here? Confidential declaration may have grown . . . well it must have grown as well count pre month grew. So you’d lose production data, unless you limit your analysis to over 6 mos ago?

Hi Watcher,

No, the above numbers include the confidential wells and their production. The detailed reports provide a reliable way to closely estimate these.

Things are getting interesting.

How long can equilibrium be maintained?

Inquiring minds want to know.

Re economic effect of Peak Oil –

The two scenarios emerging – either

1) a fast collapse, being perhaps a few weeks to a few years, where governments disintegrate and we fall off the cliff into the next dark age; or

2) a slow collapse, possibly a decade, possibly a century or more, where governments recognize the predicament and ramp-up mitigation efforts to stem the fall onto a soft-landing…..

It’s not unreasonable to believe that varying degrees of both scenarios might emerge, among nations, among regions, states, cities, towns , even within neighborhoods.

Some cities and towns are being proactive now, already having installed networks of interconnecting bicycle pathways, walking trails, light rail, and promoting community local food and community and neighborhood gardening associations. Portland, Oregon comes to mind, among others – Seattle, Denver, Austin, Minneapolis, New York, and Boston, to name a few.

While some might suggest that the large cities will be the greatest losers, I can see a circumstance where they instead emerge among the strongest. Many of the large cities are also among the wealthiest worldwide, and have the money and resources to execute their own express mitigation efforts even in the event of failure of national or statewide efforts.

I’ve attempted my own efforts at mitigation, relocating to small-town rural America – a town of 7,000 at least three hours from anywhere in the middle of a high desert plateau, uber fertile with a very productive farming community.

Yet, I found that even such a community was totally dependent on outside fuel supplies , electric utility, maintenance, goods manufacturing, healthcare, and that is just to name a few, off the top of my head. It doesn’t help that over 65% of population of such communities are dependent on federal and state aid, in the form of food stamps, subsidies to women and infant children (WIC), federal military bases or federally-administered farm land, social security income, and school aid, among too many other programs to count on two hands and two feet.

I believe that both Ron’s and OFM’s are the most likely scenarios and that they will likely occur simultaneously around the world to varying degrees, depending on the national, state, and local circumstances of wealth distribution, remaining natural resources, propensity to cooperate, populations, preparedness and mitigation efforts.

Why does it have to be either or rather than both at the same time?

A fast collapse in the US isn’t likely. If the US can’t get to, let alone sustain the 9.6m+ idiocy that the EIA’s consultants have slapped together, it’s not a huge problem *for us.* ~ 8m is still a whole lot of production and the US can buy imports; we buy from a wide variety and buy almost all of Canada’s production, at 3.1m bpd last year. Venezuela, Mexico and Colombia sent another ~ 2m in 2013 and they don’t have alternate buyers. Plenty of waste to cut as well; scrap all the oil power plants, rationing such that wasteful junk like Jet-skis go away, etc.

At a fundamental “do we have resources” level, the United States is fine. Not for a good economy, but that’s not really what is being discussed if we start talking a permanent downward trend in oil and ~ 20 years estimated to adapt.

Where it’s going to hurt Americans immediately is in those places with high fixed oil usage and little-to-no disposable income. Non-agricultural rural areas will get hit worst (they have no ability to raise wages to match fuel inflation), then poorer suburbs (same issue). Nevada eats it hard between Las Vegas being a car country mess and it living off of recreational air travel; that state could collapse because no one would live there otherwise, no agricultural or natural resource value and already running out of WATER, ffs.

What else is going to hurt America is the global depression that would be set off by Asia and Europe running headfirst into a wall. I guess the question becomes how well the US can take that psychologically.

“What else is going to hurt America is the global depression that would be set off by Asia and Europe running headfirst into a wall.”

This is what collapse might look like to us, but it is life as usual to billions…

http://safeshare.tv/w/vwncRciSFb

Good luck to our children!

Fred, maybe they need a communal ladder to get on the roof of the train. Does someone crawl along the roof saying, “Tickets please, tickets.”

Brings back a few memories when I traveled through the Indian sub continent on a motor bike nearly 40 years ago. some of the tributaries in the Delta are so wide you cannot see the other side. Not quiet true, but near enough, you have to imagine a massive delta the size of West Germany with over twice the population, to put things in perspective. It was bad enough then with overcrowding, large barges being pulled by gangs of men along tow paths is a sight I will always remember. The problem is that it is too fertile excellent alluvial soil plenty of water and sun with perfect growing temperatures and it is not unusual to get four crops a year. It is a disaster waiting to happen, all it is it is going to take is a failure of the rice crop such as the failure of the potato crop in Ireland 150 years ago and the consequences do not bear thinking about. The fatalism of the Islamic religion will only add to the problem. I can clearly remember seeing a farmer who had just had his villages wiped out by a typhoon pleading too the world for help what he really wanted was money to rebuild the mosque as they hadn’t got a place to pray. They are also the largest uses of nitrogen fertilizer in the world using nearly 60 tons per sq kilometer. nearly twice as much as Egypt there nearest rival.

A little bit of imperial history might be in order, when the East India Company took over the running of Bengal after winning the Battle of Plassey in 1757 there eyes must have shone at the mouth watering prospect of being able to tax a population the size France 21 million and a standard of living about the same.

Anon, no one is talking about a fast collapse while the US is still producing 8 million barrels per day and imports are still pouring in. We, or at least I am, talking about when US production is less than half that and almost no imports are coming in. And we are talking about a global collapse, though it might start in other countries it will not take very long to spread around the world.

We live in a global economy. We outsource almost everything we consume. A collapse of worl trade would be a collapse of the economy.

So consumption in the US can cut by 1/2 to the 8 mbpd domestically produced, and what? Imports still coming in? Well, maybe China will outbid the shipments from Mexico and Ven. And KSA. And the 400K bpd coming from Russia. And Nigeria.

Remember, China has to add 60 mbpd of consumption to get to US per capita standards. Ditto India. That’s their fair share, after all. No reason for them to accept a lesser lifestyle.

Pretty much only Canada has nowhere else to send their exports. So the US would be operating on what, possibly, 11 mbpd? Call it 12, because all the domestic drilling will be nationalized and workers will be forced at gunpoint to drill rather than look for another job. That extra 1 mbpd has to be squeezed out.

That’s what, a 7 mbpd chop? I gotta say . . . jetskis don’t burn that. So what industry is going to get shut down in order to ship food to NYC? NASCAR? Okie doke, but I kinda don’t think they are up to 7 mbpd either.

The airlines? Maybe. Shut them down. That’s a lot of workers just lost their jobs. All of Boeing. All the airport staff and concessions. All the parking kiosks. That’s rather a lot of tax revs just disappeared, too. And of course civil service rules require finding new work for the FAA staff, so no decrease in expenditures.

Basically, for the gentle, kindly, congenial scenario of citizens linking arms and singing party songs as they walk to walmart’s grocery shelves to unfold you have to outright and overtly say China and India agree to wave a hand of acquiescence and accept their subordinate position of perpetually weaker economy and consequent weaker programs for the poor than America has.

Do the math, folks. 17ish mbpd US consumption of 320 million ppl is 0.053 barrels/day per person. 1.2 billion X 0.053 barrels/day/person 64ish million bpd. Up from their present 10. And fast. Right now. They need to get their people properly supplied as fast as possible. Why make them suffer one moment longer than necessary? (and double all that for India).

THAT is the Great Wall of China, coming soon to a Walmart near you.

‘Remember, China has to add 60 mbpd of consumption to get to US per capita standards. Ditto India. That’s their fair share, after all. No reason for them to accept a lesser lifestyle.’

Never gonna happen. And the US is going to keep cutting use too; no one is going to have US per capita consumption of recent years, this change is already well underway in the US and elsewhere in the west. The major developing nations are still going up but will reach peak per capita use at way lower levels than what you fantasise as their right. No peoples have a ‘right’ to any resource in particular; we will all only get what we can afford.

Copy of a post I made on Econbrowser.com:

From “A Christmas Carol in Prose, Being a Ghost Story of Christmas,”

Then there is the “Chindia Factor.” Following is a chart showing normalized liquids consumption for China, India, (2005) Top 33 Net Oil Exporters and the US, from 2002 to 2012 (2002 values = 100%), versus annual Brent crude oil prices.

On the following chart, note the divergent responses to the post-2005 increase in Brent crude oil prices for “Chindia” and the Top 33 exporters versus the US:

http://i1095.photobucket.com/albums/i475/westexas/Slide14_zpsb2fe0f1a.jpg

The $64 Trillion question is what happens in the next 10 to 20 years. At the 2005 to 2012 rate of decline in the ratio of Global Net Exports of oil (GNE*) to the Chindia region’s net imports (CNI), the GNE/CNI Ratio would be at 1.0 in the year 2030, 16 years hence, which would theoretically leave zero net exports of oil available to net oil importers other than China & India:

http://i1095.photobucket.com/albums/i475/westexas/Slide1_zps9ff3e76d.jpg

*GNE = Combined net exports from (2005) Top 33 net exporters, total petroleum liquids + other liquids

“Pretty much only Canada has nowhere else to send their exports.”

And we’re working at fixing that. Our dear neighbours to the south don’t pay enough and we’re not entirely happy about that. There’s no good reason for any bitumen bubble to be suffered by Canada again. No good reason at all.

Nah, y’all have been had. Your envirowackos are getting checks from Warren whenever they have a chance to stop that pipeline to the coast.

As for insufficient exports, one sort of doesn’t care. China has no reason to abuse its citizens by not providing the sort of health care and welfare benefits funded by bigger GDP, and bigger GDP only happens with explosively bigger oil consumption. To deny them this is to abuse the poor and they have no reason to allow the US to abuse Chinese poor like that.

Then add India’s poor to this. India can’t afford it? Maybe India should counterfeit dollars.

If exports can’t grow, then take from those burning the most, by any means possible.

When things start getting really tense powerful countries usually start playing hardball for real. The Chinese are testing their new muscles in the areas near their borders already and unless I am badly mistaken they will be able to do pretty much to suit themselves in ” their own backyard” just as we Yankees have for the last couple of centuries.

There is not much we can do about it. There is not much the Chinese can do about what we do in this part of the world.

IF we were to decide to export some democracy down Venezuela way the Chinese do not and will never have the navy and conventional arms to sail across the Pacific and stop us. They aren’t going nuke us and we aren’t going to nuke them except in the last extremity other than by accident.

The gloves always come off at some point when countries are in desperate need of the same limited resources.

There will come a time when China will just shove the miserable little Philippine and Vietnamese navies aside and take the fish and oil.

The Japanese may wake up and go nuclear and be able to protect their immediate home waters.

We are going to stand aside and watch it happen.There is no way we will be able to play world cop forever.

There may well come a time when our navy will not allow a tanker to sail from Canada or Venezuela to Asia and there won’t be anything the Chinese can do about it.

A big wide ocean is a hell of an advantage if you want to do what you please locally and the only people capable of stopping you are on the other side of it.

It takes about five to ten times the resources to cross an ocean and put up a serious fight as it does to fight back in your own backyard.

Neither side is going to be able to muster that big an advantage in conventional arms.We Yankees have it for now in naval terms but we don’t have the the justification to go and beat up on the Chinese who would without a doubt resort to nuking our navy if necessary.They might even lob a few over to our mainland.

If things continue as they are the Chinese will be able to deny us naval access to their local waters in a decade or less.They might be able to do so already. Missiles can reach a lot farther than guns.

Stalemate.

Rockman is the first person I personally remember using the acronym MAD in a second sense meaning mutually assured distribution of resources between various power blocs. I wish I had thought of it first!!

In terms of military science all this stuff is first grade in terms of principles and historical precedent.

All that doesn’t really work.

Shale will rollover soon. US population grows. Canada will never be more than 3-4 mbpd and Ven no more than that, too. So, there won’t be enough.

BTW the Chinese said they finished drilling off Vietnam in May. If that was anything other than a dry hole, production rigs would be enroute. They aren’t.

“Why does it have to be either or rather than both at the same time?”

Yeah, why can’t we whittle down the planet’s life support systems gradually, sharing all available calories equally until everybody dies of starvation simultaneously.

I’m pretty sure the fast collapse scenario you provide isn’t in the cards. Even Rome didn’t fall that fast.

Wet One, Rome, at the time of her collapse, had absolutely nothing in common with the world today. During Roman times the population was a tiny fraction of what it is today. Their prime source of energy was animal, slave and peasant labor. Today it is fossil fuel. The whole Roman Empire was an agrarian economy. We have a manufacturing and consumption and service economy and we especially have a “just in time” economy.

We depend on the electric grid for almost everything we do. It heats our homes in the winter and cools them in the summer. We cook our food and light our homes with grid supplied electricity. We refrigerate our food with electricity for the grid. And electricity is required for all the stores where we buy our food. If the grid were to go down, permanently, well over half the the people in the developed world would be dead in less than a year. And every sick person in all the hospitals would be dead within a week.

The Romans did not have to worry about the grid, or just in time delivery for food, or any of the hundreds of other things we absolutely need to insure our survival.

I must repeat, times during the rein of the Roman Empire are not even remotely like our situation today. You might site many reasons that you believe there could not be fast crash, but siting the time it took the Roman Empire to collapse is definitely not one of them.

So if you really believe there could not be a fast crash then you need to come up with some other reason to explain why you hold this opinion.

That’s a pretty sound argument.

I guess I just find it hard to fathom how things can collapse that badly that fast.

Which raises a thought I had this morning in response to the comments here. Is there anywhere that the nature of the collapse is thoroughly detailed? Over the last several years I’ve come across various doomer predictions for the future, but is there a repository of them somewhere?

Now that I’m over the shock of the fast crash, TEOTWAKI collapse type scenarios and can probably look at them a bit more skeptically and objectively, I’d kinda like to go back over them and see how realistic they are.

Clearly, Rome isn’t a good example. Are there any modern examples that are worthwhile? I thought of Syria, but they still have fuel, a partially functioning grid (where it hasn’t been blown to smithereens) and a still functioning outside world. Of course, 1/3 or 1/2 (I forget which) of the population are now refugees in neighbouring lands (which is a bad enough “crash” if you will), so things are pretty danged dire. I’ve heard that starvation looms as well, or is being used as a weapon in the conflict.

Anyways, my reference to Rome is probably just my hope talking. I’m planning to bring a kid into this mess. I would rather the world not fall down all around my and my future offspring’s head. I just don’t want to believe that the worst is inevitable, even if a decline is inevitable.

I just don’t want to believe that the worst is inevitable, even if a decline is inevitable.

Neither do I, neither do I. But a crash is inevitable, even if we were never to run low on oil. Only the speed of the crash is open to question.

Hi Ron,

I have never heard you say that the worst is not inevitable, I suppose you have never specifically said it was, but the tone of your comments always implied as much (at least to my eyes.)

I agree that a decline in fossil fuel energy is inevitable, the speed or rate of decline matters a lot.

Whether this decline is a crash or not is all about the rate that output decreases. Think about a car crash, if you go from 60 mph to 0 mph in 2 seconds, you have probably hit a fixed object with your car, if you do so in 20 seconds, you have probably just pushed on your brake pedal.

I would not call the second example a crash and I am pretty sure you would not either.

So a decline is not the same thing as a crash, IMO.

Dennis, I see what you are driving at, and I must say I completely disagree. Crash or collapse, call it what you wish but yes it is inevitable. But there could be many mini crashes/collapses along the way. We have already had one, the collapse of the housing bubble in 2008.

But back to your point, you believe a total collapse is not inevitable, that we could, and very likely will, engineer a soft landing where we will likely have severe hardship but no real collapse of civilization as we know it.

Well I cannot, in the short space of a reply to your post, refute your belief. But it has been done by others. Those others are Joseph Tainter, Gail Tverberg, Nicole Foss, Dennis Meadows and many others.

I invite you to watch Dennis Meadows 2012 video where he explains where a collapse was preventable in 1972 but we have now passed the point where it can be prevented and is now inevitable.

Dennis Meadows Collapse inevitable 2015-2020

Or you can go directly to the Youtube video and directly to Dr. Meadows presentation here:

Dennis Meadows – Smithsonian Institution – 2012

We could have an entire post on this subject later.

Very important point! The collapse will not happen because of only peak oil. It will happen because the collapse of the whole ecosystem. Finite natural resources are declining but so is everything else. The fish are disappearing from the ocean, topsoil is being depleted, rain forests and all other forests are disappearing, food production is declining, deserts are expanding, water tables all over the world are dropping by meters per year, rivers and lakes are drying up, species are going extinct at over 1000 times what would be expected were humans not the cause, and a few hundred other things. Yes collapse is totally inevitable.

Hi Ron,

I realized that I had misread your previous comment

where you said “No neither do I.” I failed to realize that you meant that you didn’t want to believe it, that is very different from not believing it, which is not what you meant. I need to read carefully, especially when something that I think you are saying does not match with what I know you have said in the past.

I of course am not convinced by the arguments that collapse is inevitable. For every person that argues that this is the case, there are others that argue that a decline is inevitable, but depending on the choices that are made by humans, that a collapse is not inevitable.

On ecological destruction, as people become more educated about this, they make better choices, all of the problems you cite can be mitigated and as people move to smaller family sizes (on a World Level the TFR has fallen from 5 children per women in 1960 to 2.53 children per woman by 2010, the trend is that replacement level is reached by 2020 and a TFR of 1.5 by 2040.

For every person that argues that this is the case, there are others that argue that a decline is inevitable, but depending on the choices that are made by humans, that a collapse is not inevitable.

No, for every person that argues that collapse is inevitable there are at least a thousand who would argue otherwise. So what’s your point? Are you arguing that these numbers prove something?

No, better choices and better education will not fix anything. The animals are already extinct and the rest will be extinct long before there can be any mitigation.

It doesn’t matter what the fertility trend is, we are already way, way beyond carrying capacity. And because of population momentum it will take many decades for the population to reach maximum and another century for it to decline.

And anyway that’s not how human nature works. We will always push against the limits. The industrial revolution brought on the ability for the world to feed many more people. When that ability disappears then the people will do likewise. But it will not happen until then.

Hi Ron,

In Jared Diamond’s Collapse, he lays out all the problems that you mention and still remains cautiously optimistic, see Chapter 16 especially pages 519 to 525.

Nothing can be done about the species that have become extinct, the mitigation referred to all of the problems that you mention including protecting existing species.

On population I am quite aware of population momentum, if total fertility ratios reach 1.5 by 2040, then population will continue to rise for 25 years and then will be back to 2040 levels by 2090 and will continue to fall from there. By 2140 population would be at half of the 2040 level.

In the UN’s low fertility scenario maximum population is 8.3 billion in 2049 and falls to 2010 levels by 2097. The UN’s assumptions are quite conservative, population. A cool population momentum simulator is at the link below:

http://www.learner.org/courses/envsci/interactives/demographics/demog1.html

HI KC

”stem the fall onto a soft-landing…..”

I don’t expect any locality or nation to have a truly soft landing.My thoughts are that some places will survive with some industry for an indefinite period that can extend out to centuries with a little luck. By then who knows – it is very likely there will still be plenty of coal and enough good ore left – or enough salvageable metal around- to restore an industrial society on a small scale. What people will make of that opportunity in a century or two is anybody’s guess.

There really isn’t any reason I can see given a couple of decades to adapt that a modern society cannot retrench and get it’s energy mostly from coal and hydro with a little oil and gas and maybe even a few nukes that might have been recently built. Nukes last fifty years or more.

But the landings of various communities and nations are going to be like plane crashes. Most of them are pretty ugly but pilots have a saying that goes something to the effect that any landing you walk away from is a good one.

Some of us are likely to walk away although our lifestyles are mostly going to be as wiped out as the crashed planes. I spent my early years in a two room board and batten green oak house my Dad built with his own hands while holding down a full time job. I was about twelve when we got running water and a bathroom in our new house.We were as happy as most people with money.

Most people on a world wide basis are going to perish when tshtf. But not all of us.

It could be that not more than a relative handful in a country such as the US will perish in the short term but the population will certainly contract over time.Uncle Sam will probably morph into Poppa Stalin but the people who actually starved or died of exposure in the old Stalinist USSR were the perceived enemies of the regime.

Hi OFM – pardon reference to “soft landing.” All things relative…. I don’t mean to suggest that a soft landing @ peak oil might be the same as a soft landing engineered by the federal reserve…. I mean to suggest that such a soft landing in the peak oil scenario might be… “softer” than an outright economic crash and full-scale collapse….

“It could be that not more than a relative handful in a country such as the US will perish in the short term but the population will certainly contract over time.Uncle Sam will probably morph into Poppa Stalin but the people who actually starved or died of exposure in the old Stalinist USSR were the perceived enemies of the regime.”

I am in fairly close agreement to this way of thinking, although I certainly don’t think the military government in place will be communist. My most likely scenario for short term collapse is an economic shock caused by the realisation of peak oil. When enough people realise economic growth is impossible because we can’t fuel it, the current market system will crash.

The big losers in a crash will be the middle classes. They will lose their jobs, their savings, their pensions, and the value of their houses. These people will be angry, really angry. They will be looking for someone to blame. The ‘blamed’ will include the political and banking elite. They will be swept out of power. The ‘not blamed’ will be the military and religion. They will take power. Absolute power.

It is still easy to assume that the US will be militarily supreme after the ‘collapse’. Do people really think that the Mad Max biker gangs from the inner city stand a chance to militarily defeat the US army.

Folks with no military experience generally don’t picture this well.

If you have a collapse and rampant starvation unfolding, every member of the armed forces is going to be getting phone calls or emails from his or her wife or parents begging for help. I can guarantee you 90% of troops will go AWOL in such a scenario. It’s just so obvious that I am frequently astonished that people think the Army will keep order when their parents are starving. It’s just bizarre to hear this.

I did not mean to imply that Uncle Sam would morph into a communist as such but rather that our government would become an authoritarian one with many characteristics in common with Stalin’s government. Uncle will in his new form have a lot in common with any dictator or emperor of times past.

Expect the unexpected!

I tend to think that collapse will be like the great depression only worse. And it will never end!

The great depression it was depressing for many. Things were not getting better for many. On the other hand my Dad’s boss in the late 40’s attributed the Great Depression as the reason he got his start and made his own fortune.

It is possible it will never end. Consider the possible response by governments to this crisis.

I do not think it impossible that renewables, efficiency, nuclear, and even coal (though that would be a bad choice) will be ramped up along with investment in rail, light rail, HVDC transmission. All of these investments will create employment, if private industry is unwilling to invest, the government can get things started with public-private partnerships or create state owned enterprises if necessary (though this would be less efficient than private enterprises).

There is no reason that such a depression would be permanent, though I may be worse than the Great Depression because economists seem to have forgotten what was once common knowledge.

Paul Samuelson and Milton Friedman would both be amazed with what currently passes for economics.

I am always surprised by the collapse or downslope scenario’s that are written in the comments on this site. Most of the time, I presume, the authors are US citizens. The collapse scenario’s have the USA as main topic mostly.

When I visit the USA, and I look at it with these European eyes, I see a country that has already collapsed and is still doing so. I am sorry to tell you that.

– Look at your countryside. From Arizona to Pennsylvania: villages that are 10% to even 60% empty. The amount of abandoned houses is shocking. (The shift to large scale suburbs adjacent to big cities is even less sustainable!)

– Look at your shops: Almost everywhere the Main Street is more or less abandoned. Sometimes trees are growing through wat used to be shops. (The shift to Big Box Stores takes money away from your local economies.)

– Look at your small businesses. The most prevalent image of the USA is a sign on a pole, next to the highway, where only the frame and the pole still stand. The advertising and the light tubes have been blown out of it long time ago. The business itself is closed. The building abandoned, sometimes collapsed into debris. Burnt down, whatever.

– Look at the incredible amount of abandoned gas stations. I do not want to know what the environmental impact is of the now leaking tanks in the ground.

– Look at what used to be the downtowns of your medium size cities. (e.g. Jackson, Mississippi; Amarillo, TX): You really need to visit the residential areas 0.5 miles away of the heart of the city to believe what you see.

– Look at what is sold as “Fresh Food” at Dollar Generals, the only remaining store in hundreds of small towns. They have empty shelves where the dairy used to be. Looks like Moscou 1987.

So Peak Oil already happened, Collapse already happened, the life of a doomer is doomed!

Verwimp, have you visited downtown Amarillo recently? It may not be the best example as it seems to be doing fairly well.It is true that Amarillo has lost various businesses over the years. Among others Levi closed its Amarillo plant. Boone Pickens moved his operations to Dallas. But unemployment is currently low. I grew up in Amarillo and still love to visit. Have not been back this year. I met Boone when I was in the 9th grade and he was in high school. I played basketball with Boone on a daily basis for two years. He stayed over an extra year hoping to win the Texas High School Championship. Lost the ball and the semi-final game to Kyle Rote at a critical moment. Amarillo came in 3rd place in the 1947 tournament. Did manage to set some Texas records in the consolation game playing against the near 7 foot Marcus Freiberger. Boone played guard opposite Jewell McDowell (who later became All American at Texas A&M). They were flashy.

http://downtownamarillo.publishpath.com/development

Robert, I was in Amarillo three weeks ago.

– The downtown consists of more parking than buildings. Where are the buildings that once were on the parking lots? My rough estimate is that 50% of the downtown has disappeared. This must have happened when the 1920’s buildings were replaced by 1970/80’s buildings. But then suddenly someone pulled the plug out of that transition and that was it. (Dallas Downtown has the same strange mix of high buildings and empty lots, but not as outspoken as Amarillo.) The parking lots are +/- 30% occupied.

– North of I40bus, West of R.E.Lee School Park, there is a neighbourhood where at least 50% of the dwellings is gone. I hope the rest is abandoned, because I do not hope people need to live in these circumstances.

– Thanks for the link. I found a document about the “revitalisation” and “redevelopment” of downtown Amarillo. I learned one is aware of the fact that there is something to revitalise.

– South of I40 a new neighbourhood/suburb was built. Why? Why was the existing infrastructure of the quarter north of I40bus not redeveloped?

<a href="http://amarillo.com/stories/091503/usn_downtown.shtml"Downtown Dilemma: How did it happen?

Thousands of downtowns across the country, including many in the Texas Panhandle, have suffered…many of their storefronts empty, their movie houses long since silent and their department stores gone. They are the byproducts of interstate highways, suburbia and discount superstores….

The Interstate Highway Act of 1956 dramatically changed where Americans lived and spent money, said [Kennedy] Smith [a Washington, D.C., expert on downtown revitalization] … In 1950, the average city in the United States drew shoppers from about 15 miles, she said. Today, it’s 50 miles. With the advent of the interstate, people flocked to the suburbs and away from town centers.

It was part of the American Dream, wanting your own acre of land with a house and a yard, Smith said. And retailers followed them. Shopping malls – and later discount superstores – took up shop along highway exits….

The resulting mix of shopping ease and low prices found at malls and superstores left many of the relics of downtown – the local business owners – out of business….

And although many have begun to change their philosophies, city planners traditionally have considered new commercial construction as economically advantageous, boosting property and sales tax revenues.

I know the story. But “city planners traditionally have considered new commercial construction as economically advantageous” is new and interesting to me. It explains to a certain extent the amount of empty businesses. We here in Europe have a tradition of reusing buildings. Refurbishing them of replacing them. Since we are living on this land for like 2000 years, we have to. If we would just abandon a building and build a new one on another location, our continent would have been completely built up.

That is a big nuance I learned: The USA has a “throw away attitude”. That starts with plastic plates and cutlery (instead of doing dishes), That goes to houses, neighbourhoods and entire cities. So ruines are not necessarily a sign of poverty. The owner may have just abandoned his property to build a better and larger house somewhere else.

When the land is valuable the buildings get demolished or refurbished but if the city is in decline the buildings are often abandoned. I don’t imagine that happens often in Belgium, but perhaps there are small cities in Eastern and Central Europe where things are as bad as Amarillo, I have not visited either place so I cannot really comment.

I drove through recently, and even spent the night.

Your corporate strip mall world, something out of The Last Picture Show.

Kunstler Poster Boy for ‘Merika for sure.

I too grew up in Amarillo. I last went there, sadly, for my parents’ funerals. My comment to my wife was that downtown Amarillo looks like Beirut.

Amarillo is hyper-conservative, run by a small number of wealthy families like a banana republic. I know and went to school with most of these wealthy people. The newspaper is hyper-conservative: there will be a detailed story about the drought and fires in the area, but never any mention of global warming. Amarillo has no 4-year university; I heard that they were offered one, but turned it down. Most of the best and brightest young people leave.

The thought that occurred to me is:

If conservatism were right, Amarillo would be paradise.

It isn’t.

My mother was recently on a 6 week road trip (yeah I know) through the western U.S. She noted how dilapidated and run down everything looked.

That was quite a wake up call. I haven’t been through that part of the world in over 20 years other than short trips here and there. I get the feeling that I really don’t know just how bad it is. The outsider perspective is useful that way.

Is your own Mother an outsider?

To the western U.S., yes she is. From what she told me, it’s not like western Canada. Apparently, it’s a lot worse off.

By outsider viewpoint, I meant non-American, like Verwimp’s which appears to be an western European viewpoint.

I am from Belgium. That is Western Europe indeed. Good guess 🙂

Thanks for the confirmation. “Dilapidated and run down” are exactly the right words. I get the feeling that even the US citizens living nearby don’t know just how bad it is. They seem to avoid passing through the worst neighbourhoods/villages. Or they just stay at home and watch big city life on TV?

Hi Verwimp,

I guess you see what you want to see, there are depressed areas in the US, and it is more widespread since the recent depression. I have not visited Europe for a few years, but the reports I read indicate that the economies in many European countries are doing quite poorly. There are no areas in Europe that are depressed?

Certainly what you describe is not what I see where I live in the US. I would not describe this as collapse, collapse is when you have conditions like the Great Depression throughout the world. So 25% unemployment (as in 25 % of people who are actively looking for work can find no employment) would be one measure, we are far from that in the US. I do not buy into the nonsense at Shadowstats, I am talking about government or intergovernment (UN, OECD, etc) statistics.

Hi Dennis,

When I go to the doctor with a severe headache, I do not need a statemant like: “Your heart is doing fine, so do your lungs, your liver, your kidneys and your stomach. So you are in good shape.” I want him to examine my head.

The USA may have wealthy area’s. I presume they are situated along the Atlantic and Pasific coasts, partly along the Gulf Coast too. In the 19 states I visited I saw wealthy neighbourhoods too. But… Am I aloud to consider that as just “normal”? Am I aloud to consider the tremendous amount of buildings, towns, parts of cities in complete disrepair as “not normal” and thus worth mentioning?

I see what I want to see, indeed: when I visited the Rust Belt in 2012 I expected what I saw (Detroit!). But when I visited Texas and its neighbourstates I tought I would see a prosperous country. That was not the case.

We have difficulties in Europe as well. Just for that reason it is interesing to visit the USA. To be able to compare. I was happy to go back home.

Hi Verwimp.

You are allowed to say anything you wish. Your previous comment made it sound as if depressed areas was the only thing you encountered in the United States. The United States is pretty large country, with most areas having a very low population density. There are depressed areas all over the US, my guess is that these exist in Europe as well, though possibly not so much in a smaller country (in area) such as Belgium, my understanding is that Southern Europe has not been doing very well lately, have you been to Spain or Greece lately?

There is no doubt that there are many areas in the United States which are doing very poorly, my point was that this is likely to be true in all places, economic development is never uniform.

Spain is really interesting! I visited the country last year. If you ever have the opportunity: do it! The country seems to have broken its neck on a building bubble. They buit/rebuilt everything. Dwellings/appartments, Office buildings, business areas, roads and highways, you name it: it is all brand new. Then came the crash. The result is a tremendous amount of empty brand new, mostly unfinished buildings, business areas without businesses, office buildings where no lights are on in the evening, highways that are completely finished, but not used because the interchanger to connect it to the network is not yet ready (and will never be built). Very interesting!

I didn’t have the opportunity yet to visit Greece.

Hi Verwimp,

I agree that Spain is wonderful, though my last visit was in 1982, so I imagine things have changed a bit. I have never been to Greece, but have been to many of the Western European countries.

I have not really visited much of the Unites States except the East and West Coasts, Michigan, Chicago, and Colorado, Utah, Wyoming, and Hawaii. Perhaps I have only been to the places that have not collapsed. Europe is wonderful and probably much better prepared for the coming crisis than the United States.

Sorry to seem so defensive, the picture you initially painted seemed more negative than what I see, but perhaps that is because we visited different places.

Hi Dennis,

For the record: I crisscrossed DC, VA, WV, OH, MI, KY, TN, NC in may 2012 and TX, NM, AZ, LA, MS, AR in may 2014. I flirted with the borders of some neighbouring states too. 10.000 miles, in a search for the ‘real America’ (That is: staying away from Interstates, visiting numerous towns; and staying away from New York, Los Angeles etc.)

I look at things with an interest in sustainability. I like to analyse things that go wrong. Therefore NY and LA, cores of prosperity, are not so attractive to me: I can not learn lessons from succes stories. You understand?

I was highly surprised by Santa Fe: a sort of ‘cosy’ downtown. Very European! Small scale, walkable distances. Relatively high density. Lovely. I was highly surprised by New Orleans too. Despite Katrina I saw an amazing city. Resilient. Fighting back. Vivid. Beautifull architecture.

I was highly surprised by Phoenix too. I saw hundreds of square miles of fenced suburbs, with clusters of ever the same McDo, Walmart, Subway… And an extremely tiny downtown with only a dozen multistory buildings. No one around after sunset.

Detroit surprised me too: They are so far down the drain, that they have the feeling of having hit the bottom. From now on things can only improve. There was a strange feeling of hope, despite the horrible condition that city is in now.

I visited Cleveland, Dallas-Fort Worth, Houston, DC, … From a European point of view these cities have a lack of history; but that is not their fault. One should not expect century old things in the US, that would be dishonest. Nevertheless from a European point of view these cities are clearly prosperous, but a little bit boring.

This year I visited medium size cities too. Amarillo, Baton Rouge, Jackson. The images I got are never to forget. The abandoned areas, the poverty, the state of disrepair… I went there on purpose. To witness that. And still I was shocked by the magnitude. You see?

I visited the old Texas oilfields too, and the villages there. I visited the Barnett Shale and Eagle Ford too; to see the difference. To my surprise there is no difference. A town called Tilden, TX, in the heart of Eagle Ford, is still in atrophy. Strange, no? How is that possible?

I learned a lot about the drought too. Talking to empoyees of the US Army Corps of Engineers is interesting (as is talking to every American: you guys are very open people!)

Anyway: Your first reaction was quite defensive indeed. No problem. The purpose of my first post was -ofcourse- to trigger feedback 🙂

Verwimp,

That is very interesting, I had no idea you had travelled so extensively in the US.

An interesting exercise would to try to sample some cities throughout Europe for comparison.

Are there areas in Europe that are as run down as what you saw in the US, you would probably need to go to most parts of Europe to get a similar sampling of economic diversity. I am surprised you didn’t visit any of the “success” stories. they may have been less successful than you imagine.

For example there is quite a bit of economic diversity just within the 5 boroughs of New York city (I am more familiar with the Northeastern part of the US, I cannot really comment intelligently on the west coast.)

And thanks!

Dennis,

Visiting Europe the way I visit the USA is impossible for three reasons.

1) Language barriers. I am a native Dutch speaker. I speak French when I really need to, and I speak English quite fluently, but that is it. In three quarters of Europe I can not talk to people. I can not ask explanations for the things I see. I can not talk about how things go and why.

2) The density. The USA has a few dozen of cities. When I would visit a few dozen of cities in Europe, I would’n even have reached Paris (250 miles from where I live.) It takes a lifetime to get a proper view on Europe.

3) The age: You understand we have a longer history. That makes things really more complicated, less readable. The US is straightforward: Everything you see exists for the really first time. Without a profound study of the local history one can not really understand a European city. With Settlement, Civil War, Dust Bowl, Boom-era, you are done with a lot of American cities. (My own house, a random house in a random street, has the same age as the city of Dallas. It would be a monument on Founders Plaza, You see?)

I visited Northern Spain last year (Bilbao, San Sebastián, Barcelona) and was surprised with how there was pretty much no sign of the doom and gloom that is reported fro Spain. These are very successful and civilised cities with sophisticated infrastructure and institutions. I know that northern Spain, like Northern Italy is very different from the centre and south, with different culture and economies, but still, I was surprised.

These are among the most wonderful cities in the world. And way more sustainable than any Texan town.

This is an interesting piece about cultural decline.

http://www.bbc.co.uk/news/magazine-27309446

Glasgow is the UK city with the shortest life expectancy. This is not explained by medical or ordinary social poverty factors – other similar cities live longer. In Glasgow young men are drinking and drug taking and murdering each other at rate faster than elsewhere, because they have lost their social rank as the traditional breadwinners and they have lost pride in themselves. Orlov reported the same in Russia in the 90s.

In India it appears the same demographic take out their frustration by attacking and murdering low caste women.

http://www.theguardian.com/commentisfree/2014/jun/04/india-gang-rapes-deep-crisis-men

There is no question things are going downhill. Globalization is and has been a great bargain for the lesser developed parts of the world but it was and is one of the greatest mistakes we could possibly have ever made in terms of the health wealth and security of the United States and other highly developed countries. It is for damned sure that our bureaucrats and white collar professional class and the rich are richer than ever as a result of it but only at the price of the means of living and the living standards of the working class of this country.

At first it seems like a great bargain to any given businessman who can import or outsource or whatever to cut his costs.

Suppose I am a widget maker with one thousand employees and can get rid of every body but my sales and marketing and book keeping staff , laying off forty fifty sixty seventy or maybe even eighty percent of my people and afterwards be making more money than I have ever made before.

I will still have a three hundred million potential widget customers minus my eight hundred former workers who cannot afford widgets any more and wouldn’t by mine anyway.

But when a thousand businesses each lay off a thousand employees that is a million out of work and some businesses have laid off ten thousand or more to take advantage of the profits to be made by importing rather than manufacturing.And there have been millions of businesses doing this.

The end result is that the wages and living standards of the working class are in the pits while the government employees( who as a rule are unlikely to be laid off compared to private sector workers) and the white collar types who cannot be laid off- because their jobs cannot be outsourced- are living relatively large.

Now we are paying the price of dealing with a working class without work and mostly without hope. This means social workers and cops and jailers and food stamps and such out the ying yang without much hope of things getting any better.

It means peak oil is several decades closer, that runaway global warming is several decades closer, that almost any environmental problem is worse than it would have been otherwise.All resource depletion problems are advanced towards critical tipping points by decades since the demand for resources is so much greater.

And while there is useful research going on in developing countries without any doubt most of the scientific research is still getting done in the rich western countries. Nearly all of it would still be happening here in the west except for globalism.