This is a Guest Post by Rune Likvern Fractional Flow

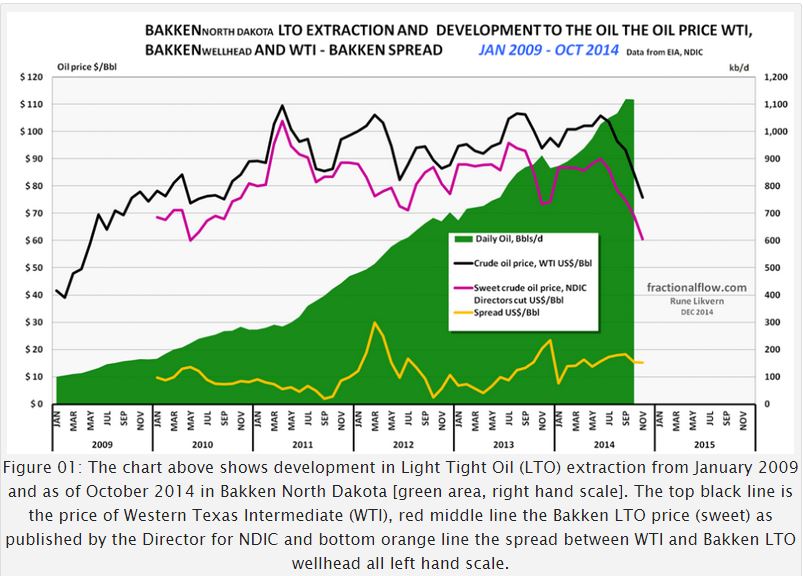

This post is an update on total Light Tight Oil (LTO) extraction from Bakken in North Dakota based upon actual data as of October 2014 from North Dakota Industrial Commission (NDIC). It further presents a statistical analysis on developments of well productivity with a detailed look at developments in Parshall, Reunion Bay and Sanish.

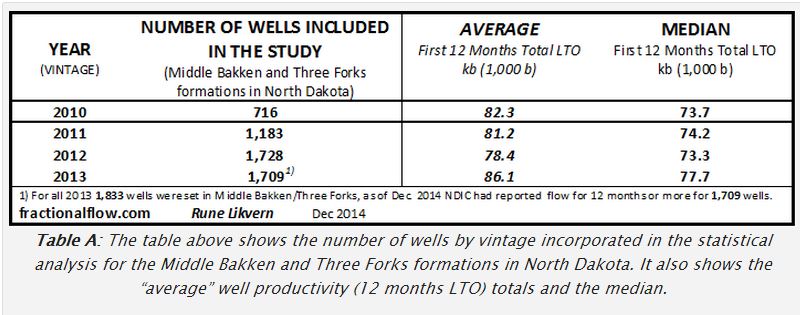

- There were general improvements in LTO well productivity in Bakken during 2013.

- Present trends in LTO well productivity for Mountrail’s sweet spots (Alger, Parshall, Reunion Bay, Sanish and Van Hook) suggests these are past their prime.

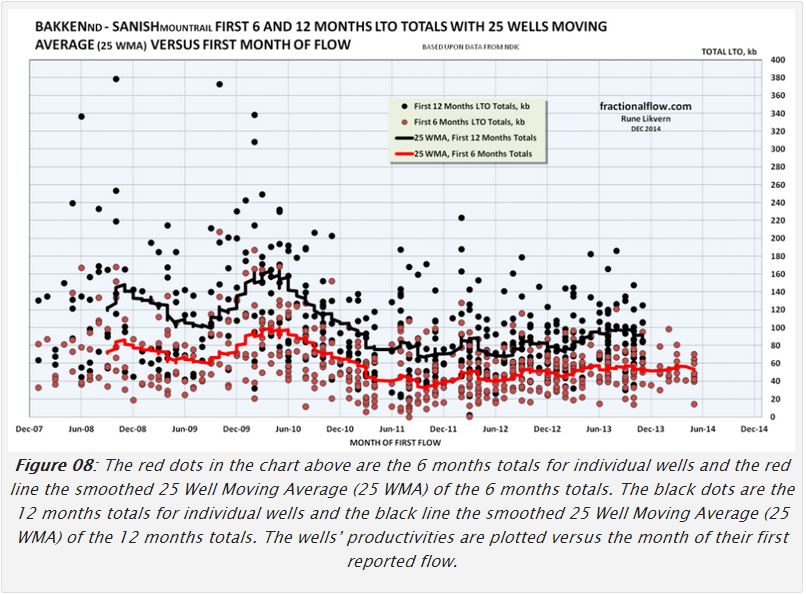

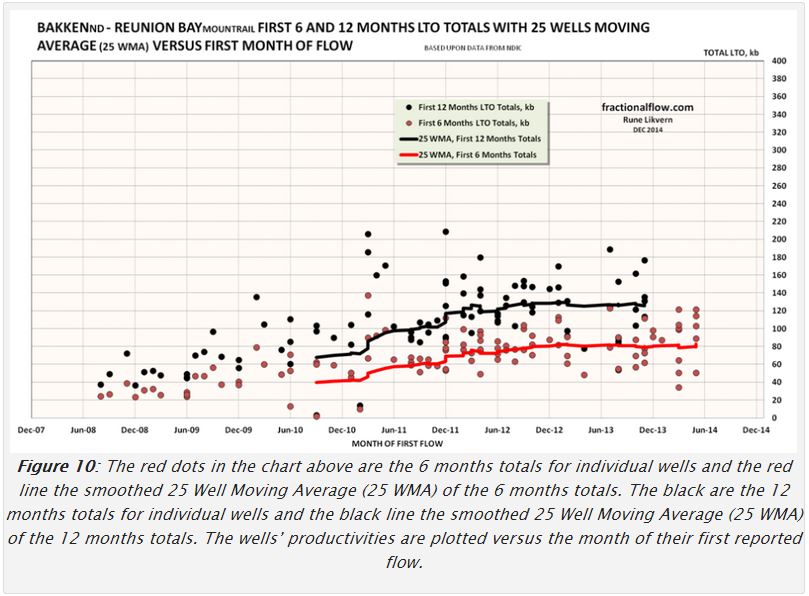

- Figure 29 in this post show development in well productivity for Alger and Van Hook and figures 06, 08 and 10 for Parshall, Reunion Bay and Sanish. A common feature for Parshall, Reunion Bay, Sanish, and Van Hook is that these reached new highs in well productivity for wells started in 2013.

Alger has been in general decline since 2011. - LTO extraction in recent years may be viewed as a source for global swing production for oil.

NOTE: Actual data used for this analysis are all from North Dakota Industrial Commission (NDIC). Data are incomplete for around 2% of the wells.

NOTE: Actual data used for this analysis are all from North Dakota Industrial Commission (NDIC). Data are incomplete for around 2% of the wells.

For wells on confidential list, data on runs were used as proxies for extraction.

Production data for Bakken, North Dakota: Monthly Production Report Index

Formation data from: Bakken Horizontal Wells By Producing Zone

The important messages from this analysis are the trends in well productivity.

This post is an update and expansion of my post “Will the Bakken “Red Queen” Have to Run Faster?” from the summer of 2013 and may be read as a continuation of my post “Will the Bakken Red Queen Outrun Growth in Water Cut?”.

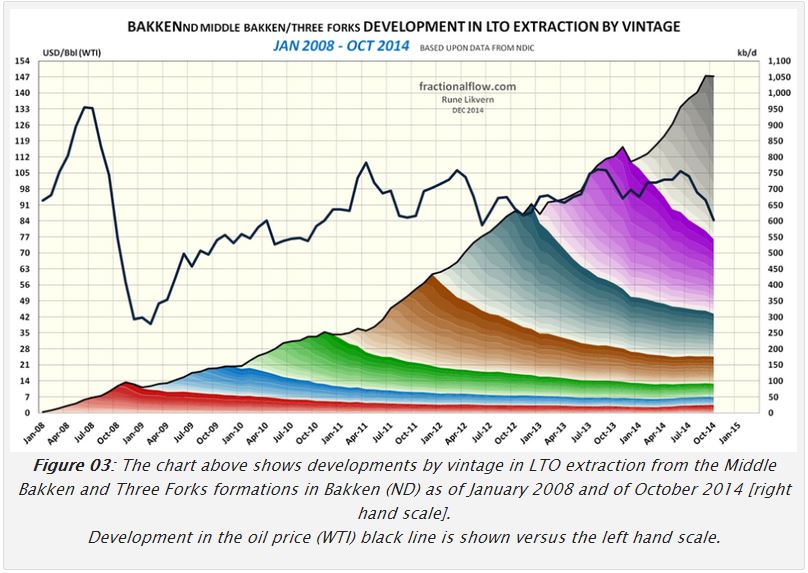

The chart shows the rapid decline in LTO extraction by vintage.What is the month over month legacy decline in total LTO extraction?

The month over month total decline for LTO extraction wobbles around due to seasonal effects, differences in productivity of the wells started in any month, variations to when in the calendar month the wells were started and number of days of the month.

Measurements from actual data showed that the smoothed month over month legacy decline varied between 5 – 6%.

From figure 03 it may be observed that the legacy decline rate slows with time.

How many net producing wells needs to be added to sustain the LTO extraction level from October 2014?

In October 2014 total LTO extraction from the Middle Bakken and Three Forks formations in North Dakota was 1.12 Mb/d.

The “average” well, so far in 2014, had a first month flow of 486 b/d.

This works out to a need of net monthly additions of 115 – 135 producing wells to sustain the October 2014 extraction level.

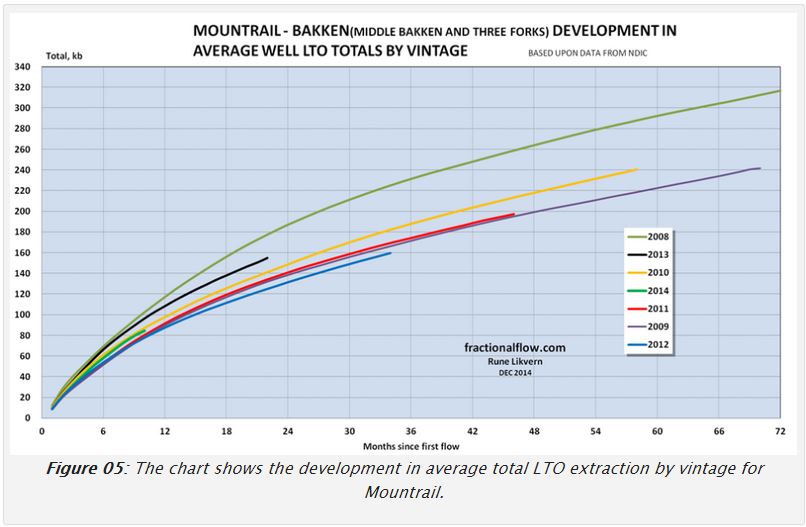

Mountrail

LTO extraction from Bakken in North Dakota really took off in Mountrail, which as of Janaury 2010 had around 60% of total LTO extraction.

In Mountrail the growth in LTO extraction in the second half of 2013 coincided with the improvements in well productivities re also figures 06, 08 and 10.

The data show that the best wells came early, those started in 2008. Then follows 2013 (refer also figures 06, 08 and 10).

So far “average” 2014 wells in Mountrail have been poorer than those started in 2013.

Parshall

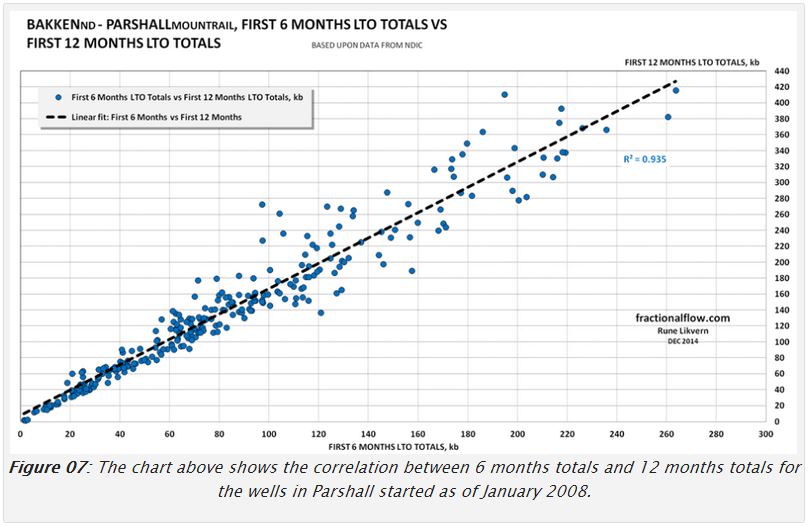

The wells in Parshall are very good LTO producers.

Parshall covers an estimated area of 300 square miles (1 square mile = 640 acres) and had 340 reported flowing wells as of October 2014.

Sanish

So far it appears the best wells in Sanish was brought to flow during the first half of 2010. In Sanish wells with less than 6 months reported flow have totals close to those with more than 6 months flow started in 2014. The well productivity appears to have flattened.

Reunion Bay

For Reunion Bay there was a gradual improvement in well productivity starting in the second half of 2010. As of recently this productivity has remained fairly stable.

The Analysis/Study

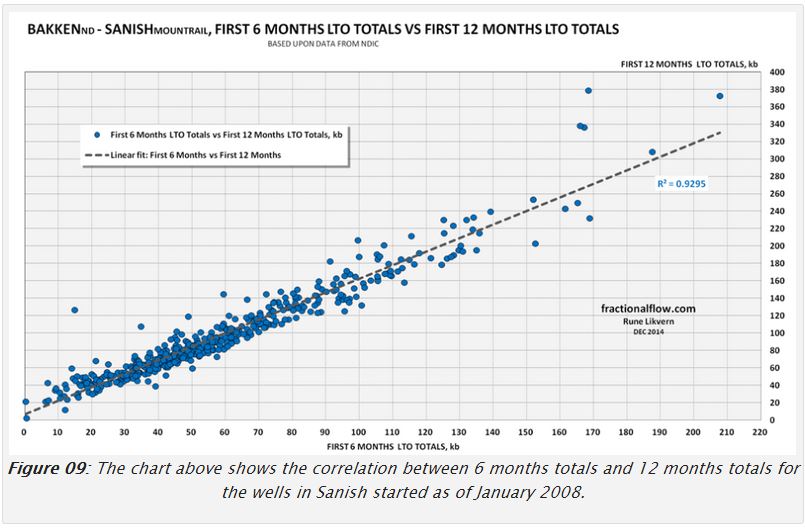

The correlation analysis includes around 3,600 wells started in 2010, 2011 and 2012.

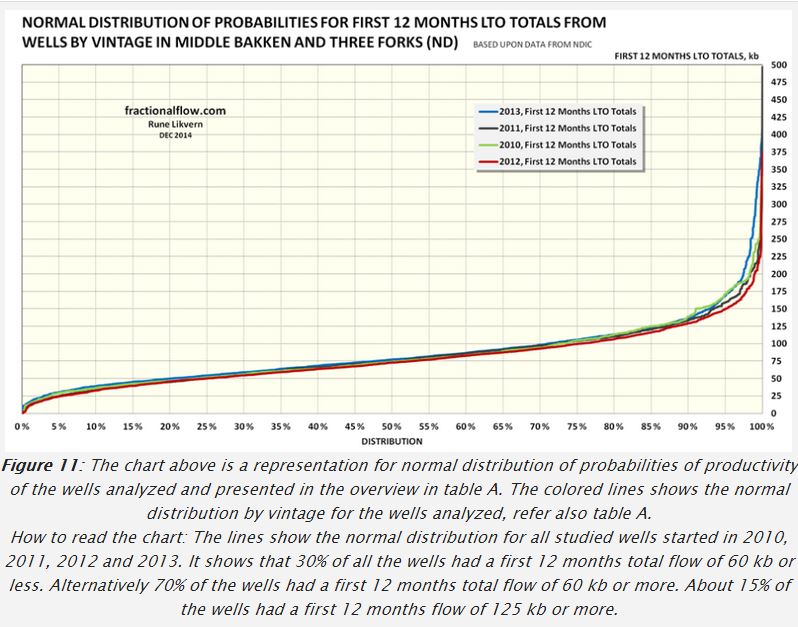

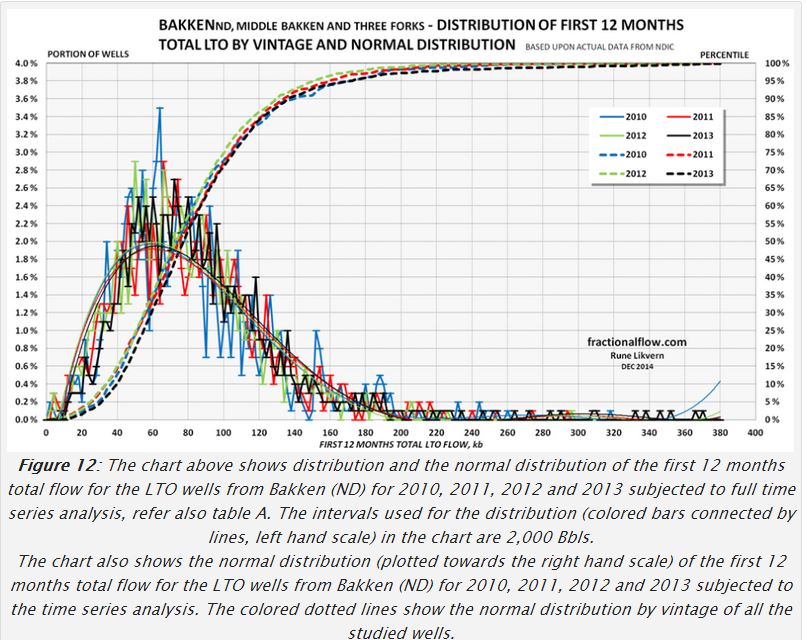

Distribution of LTO Wells by Vintage

Initial Production (IP), 30, 60 days flows is short term and early indicators that give away some information about a well’s productive potential, but shows poor correlations with long term well productivity developments.

The focus on short term performances should be considered with some reservations.

Our societies depend on long term predictable flows of oil and its affordability. Short term fluctuations may obscure worrisome underlying trends that easily become drowned out by noise, thus obscuring THE SIGNAL.

The distribution of wells productivity begs the question about how much this is influenced by the oil price, well design and geology. Improvements in well design have so far resulted in improvements in well productivity, but as demonstrated in this post water cut has increased, suggesting more recent LTO extraction comes from formations with lower oil saturation.

Correlation analysis, how the length of the time series improves accuracy

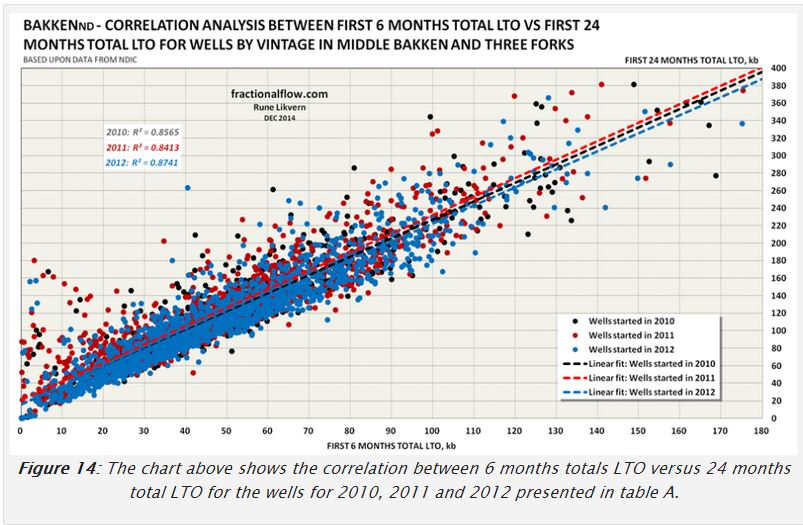

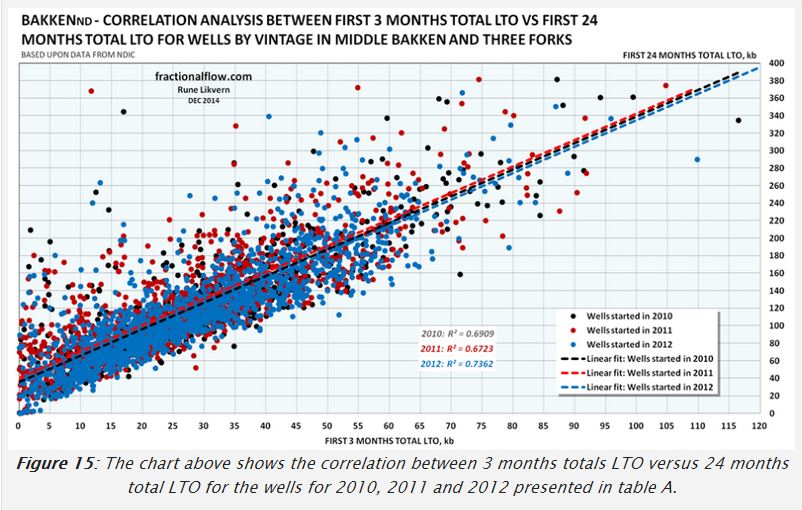

The correlation analysis includes around 3,600 wells started in 2010, 2011 and 2012 and that had 24 months or more of reported flow.

The linear fits show that wells started in 2012 were poorer than in previous years.

Figures 13, 14 and 15 shows that correlation improves with the length of the LTO extraction time series thus improving the predictability of the wells’ productivities.

Rune, you have a massive amount of data analyzed, the work is excellent, and this should give you the ability to project production, including production from wells starting in 2015 and 2016.

The only way I can see to improve the predictive ability would be to study water production tendencies. I worked in fields with about 800 producing wells and we mapped water trends in several ways.

A friend of mine came up with a really nifty way to plot data in map form using excel. At that time we were working with a company which wanted to save money on production data bases, so they didn’t have the typical package oil companies buy.

So, what we did was download the well x and y coordinates into excel. Then we added a value (for example water cut average in the first 12 months) and plotted bubble maps. We did all sorts of data visualizations this way, and some of it really helped.

Fernando, thanks!

Some time back (August 14) Enno Peters in a guest post here on POB presented a method showing development in LTO productivity (based on actual well data and their location) over time for Bakken ND and certainly it should be possible to conduct similar studies for both water cut and Gas Oil Ratio.

Link to Post with Enno’s work

http://peakoilbarrel.com/enno-peters-post/

That’s a really good set of contoured maps. Does the state data show the well location in x and y coordinates? Or does it have to be converted to the old township/range system?

I hope Enno is around to answer that one.

Thank you Rune for an interesting post. I am also glad that you provided the correlation between 6 month cumulative production and 2 years cumulative production. I think it supports my assumption that you can roughly estimate ultimate recovery based on 6 month production.

I checked this page

https://www.dmr.nd.gov/OaGIMS/viewer.htm

to see if there has been any movements of rigs to better producing areas. But it doesn´t look like there has been any major movements to me. It will be interesting to see if the companies can increase average production the coming months. Because they must surely loose alot of money for each well (on average) if they can´t.

Yes, the correlation between cumulative times is definitely related to the physics of the flow. That’s really why these hyperbolic/diffiusive formulations that Dennis Coyne and I have worked with can project later flow so well.

We tend to think that the engineer is controlling what comes out of these wells, but in reality it is nature that determines the rates and time-series profile after the initial fracture occurs.

Hi WHT and Dennis,

I have not been able to make much out of your theory since most of it is over my tired old head. I last studied math close to half a century ago and even if I could remember it I might not have gotten enough of it and statistics to truly understand it anyway.

But I will stick my two cents worth in anyway for the benefit of us lesser souls who can”t quite follow your model- which incidentally is not available in simplified textbook style to my knowledge.

If it can be simplified to the point that a well educated layman can follow it – then it would be great if somebody would post a simplified online version of it with examples textbook fashion.

You say” We tend to think that the engineer is controlling what comes out of these wells, but in reality it is nature that determines the rates and time-series profile after the initial fracture occurs.”

Would it be more accurate to say that nature sets limits on the rates and time series profile after the initial fracture and that engineers can manipulate the flow to a significant extent within these limits?

This is the sort of point that is often overlooked in a discussion between pros who all know the answer and thus just don’t bring it up.

Laymen don’t usually know the answers to such questions.

Thanks!

Hi Old Farmer Mac,

In general, I think you are correct that there are limits based on physics, geology, and technology (along with other factors such as prices, taxes, interest rates, regulations, and lots of stuff I don’t know about), especially in conventional reservoirs. I think that in LTO plays the engineers are still learning the best way to do things and there is less of the designed decline rates that Fernando speaks of and things are more dependent on physics and geology for LTO plays than for conventional oil reservoirs.

Also see my comment below, for an attempt at a fairly concise non-mathematical explanation of my model (which is actually a copy of Rune Likvern’s model, with any mistakes that are mine and not Rune’s). No convolution or convoluted reasoning are needed.

No, that is not what the profiles show.

—

As a challenge to the laymen question, let me turn the tables. I really don’t read much of what you have to say because I would rather not follow these “just-so” narratives that seem to proliferate. A just-so story is a type of explanation of a phenomena that seems to make plausible sense because it triggers certain intuitive associations. Yet seeming plausible doesn’t cut it — there needs to be more substantiation than that.

Working out the science along with math and statistics is the only way around this predicament because some objective standards are needed to make sense of what is happening.

Take a look at this post by Dennis in which he does an excellent job of explaining the mathematical principle of convolution:

http://peakoilbarrel.com/oil-field-models-decline-rates-convolution/

I don’t think it can be made any more fundamental than this. At some point one can’t blame the teacher any longer, and the student has to lift a finger and get engaged in the details of the math.

Mr. Web! Mr. Web! Imma proud, card-carrying ‘layman/student’ who is always willing to lift a finger or three in an ongoing effort to glean whatever intellectual crumbs that may fall from the table of my ‘betters’.

I also greatly appreciate the heart, soul, and wisdom so often revealed in OFM’s posts, especially so as I have yet to find that stuff in Excel spreadsheets anywhere.

With your vast (seemingly) self acknowledged expertise in all things math and science oriented, perhaps you can enlighten me and save me TONS of time and explain the growing view that long-term (5 years or so) pressure drawdown is suspected of prompting subtle shifts in the matrix and potentially allowing refrac’ing older wells in a much more expeditious fashion.

Some months back, Mr. Web, you acidly commented on my unfamiliarity with the minutiae of CO2 EOR, and you were correct. The fact that you seemed unaware of the field testing in the Elm Coulee, in the ND Bakken by Whiting, the dual HuffnPuff/field injection test EOG did in the EF, the vast amount of EOR research being done by the EERC folk up at the University of North Dakota, prompted me at that time of your comment to respectfully refrain from drawing your attention to these – and many, many more related, substantive issues.

This student is presently lifting a cyber finger in your direction, sir.

Oil production AFAICT is a story told by numbers. Numbers are the stuff of math and science, not of qualitative arguments. In other words, you can’t get numbers from words alone.

That is my point. Try not to read too much into it. It just explains why I don’t read verbiage that is in the category of “TL;DR”.

Enjoy your obsession.

If the rest of us were concerned solely with the basics of the peak oil story we would have spent a few hours boning up on it years ago and forgotten the subject except for taking it into account in managing our affairs.

Being a generalist with a good grasp of the nature of reality I don’t really give a flying xxxx about the fine grained details of the oil story because the end is already baked in.

In the end you are going to come to the same conclusions that everybody else has already except a few idiot economists- that oil depletes, that the Earth is a finite body, and that we are going to have to change our ways.

Economists will simply keep changing the definition of oil until they die of old age so as to avoid admitting oil has peaked or soon will peak.

I know enough physics, math, chemistry, geology, and biology to discuss these things in a meaningful way. Beyond that I have spent more than a few thousand hours acquainting myself with what is known about how we naked apes behave and why.

Story and narrative control human behavior to a far greater extent that hard science ever has or ever will.

” Just so” is the very heart and soul of effective communication.

Physics and math tell us what is possible at the limits.

Story and narrative are precisely the things that enable us to understand what has happened and what will happen or might happen within the limits set by physical realities.

Nuanced understanding of the political and economic possibilities grows out of detailed discussion of these possibilities.

The really interesting question is what we will do and what will happen to us as we run out of natural resources.

Check out http://forum.azimuthproject.org for discussions of physics and math.

Thanks.

Now it is often said that English is a common language that separates two nations and given words really do often mean different things to different people from different backgrounds.

At first glance it would seem to me that you are saying that an engineer cannot influence the flow of oil by adding various chemicals to his fracking mixture or that the flow of oil out of source rock cannot be influenced by injecting co2 or water for instance.

So we are not communicating on the same wave length since these things are obviously done on a regular basis. Hard nosed bean counters would put a stop to them if they didn’t work.

I seldom speculate on the actual physical process of getting oil out of the ground and I try hard to keep my speculations involving above ground factors well within the realm of the ”known to be possible” but also to vary them so as to add to our collective insights into what might come to pass in the foreseeable future.

I might occasionally indulge in a flight of fantasy but as a general rule I don’t just make ”intuitively plausible” comments.

I base my comments on plenty of well known history and well accepted science.

I don’t generally resort to arguments based on authority but if you have any doubts about my speculations describing potential actual future events and or conditions I will be glad to provide you with back up opinions from professors of biology etc at highly respected universities.

I don’t recall that you have actually posted your own qualifications here.

Mine are not impressive but then on the other hand my conclusions are not original with me in any substantial sense.I am merely repeating what others have said before me in my own words with some color commentary thrown in.

I went back and looked at Dennis’s article and can follow the math and graphs in it with some moderate head scratching ( after forty five plus years of not needing the math ) so your model is not so complicated as it seems from just reading your occasional comment about it.

This is assuming that Dennis RELIED on your model as the BASIS of his article rather than just as a tool along with many other tools.

Now with a hat tip to the both of you for having done a hell of a lot of hard work that has obviously consumed a WHOLE lot of time and energy – it seems to me that this is basically the same sort of results that any bunch of bright young MBA’s with programming and statistical skills who bothered to really research the easily available production data ( easily and quickly found here and on lots of government websites etc ) would come up with.

I am confident that this is original work on you guys part – excellent original work no doubt.

But I have yet to understand what it is about it – if anything – that it is going to change our conclusions in respect to peak oil.

My own knowledge of such fields as statistics and programming is badly limited but adequate to understand that while an engineer or mathematician can construct a machine or a model and predict its performance quite well – assuming his assumptions hold- there are almost always some overlooked and unforeseeable variables involved and that even the best machine or model will be misused and occasionally abused.

I use my screwdrivers for crowbars occasionally . 😉

I strongly suspect that lots of people working for large investors and government agencies such as the NSA ( in secret in that case ) and multinational oil companies have in fact done similar work and come up with similar conclusions – of course such people don’t ordinarily show their work to anybody except their employers.

You guys deserve a big thank you for sharing work for free that would have netted you hundreds of thousands or even millions of dollars if you had been able to sell it to some corporate chieftain.

But you would do well to remember that the guy who supposedly figures out new stuff that changes the ball game is forgotten in a few years except maybe one time in ten thousand .

Maybe you will be remembered as a researcher who revolutionized the oil business after some fashion.

Your oil conundrum on the other hand may never rate more than a foot note in the history of the energy industry.

I am hoping my comments are good enough future students of the history of oil will get a laugh out of some of them on nights when they are burning the figurative midnight oil.

They might even gain a little insight into the nature of the naked ape as it behaves in crowds from other comments I have made.

Having said this much I personally gave up teaching because it is as you point out impossible to explain even moderately complicated subjects to people who are no more than barely literate.

If I may clarify, the flow of fluids from the reservoir is controlled by humans AND nature. We humans control what we do, and the rocks and fluids react to it.

An analogy would be that we are like mule train transporters. We can decide what kind of mule, the number of mules, the size of carts, the loads, and lay out the route. But we can’t alter mule behavior to make them behave like horses, reduce gravity or make the mule drivers behave like geniuses.

This is why I wrote earlier that we do design the decline rates. And of course we can control the oilfield to alter well and overall reservoir behavior. Whether we choose to do it is a matter of choice. Don’t get hung up too much on the really low permeability seen in the Bakken or Esgle Ford. Most reservoir rocks are much nicer, and this allows the wells to share the same pressure environment.

What we use to drive hydrocarbons out of the ground is basically changes in fluid saturations and pressure. And we can control those to some extent.

Fernando, The data differs with what you are saying. That is not surprising because you are only talking in qualitative terms.

The frackers are setting a bomb off underground and acting like they know where the damage will occur. That’s the analogy.

Webby, I’m pontificating about reservoirs in general. Those very low quality Bakken reservoirs are a small part of world reserves. However, the same basic principles apply.

Why would you think in terms of “bombs” and “damage”? Fracturing is more like a deep soothing masage applied to squeeze the oil and gas out of the rocks.

Fernando, I apply the physics and math of stochastic processes to a chart such Rune’s Figure 5. We are talking about Bakken because the post is on Bakken.

With most of the uncertainty in what happens during the first month, the time series profile is a dead-ringer for a dispersive diffusion profile. That is a purely physical phenomenon.

Why would you think of it as a bomb and as if it were damage?

Hi Fernando,

I understand that the decline profiles are engineered to some degree based on technology, geology and economics (with a little politics thrown in for good measure). When Paul (WHT) talks about dispersive diffusion, it is in reference to LTO. I would think that once the natural pressure drive is depleted, that the flow of oil to the well is governed more by a diffusive process (a random walk kind of phenomenon with reversion to the mean) than by pressure. Using a hyperbolic/exponential probably is close enough, but there may be a tendency to overestimate the tail.

Most of us do not have access to the data necessary to model world output on a well by well basis, I think Paul’s oil shock model is a great way to approximate what future World output might be. What do you think about USGS URR estimates for conventional and extra heavy oil which are about 3000 Gb for conventional (1750 Gb remaining) and 1000 Gb for extra heavy from Canada and Venezuela at roughly 50/50 split?

Dennis, it’s always driven by pressure. What you call the natural pressure drive is what we call depletion drive. Fluid withdrawal by the well and artificial fractures cause pressure drops. The pressure drop causes fluid expansion, which helps sustain pressure. Eventually the pressure drops below the bubble point and the gas evolves. A gas phase has much higher compressibility. But it also gas much lower viscosity. This is the reason why the gas oil ratio is something we watch. As it increases we lose energy. If you look at the Bakken gamma ray curves you will see it’s not really a shale. It’s just a really tight rock.

Fernando, You seem to miss the step that pressure also has the capacity to force the liquid away from the collection region as well as toward it. Or the fact that it could take a circuitous route. These processes have the tendency to follow a random walk profile, i.e. diffusion.

Also very presumptuous of you to think that a massive hydraulic fracture event is something that humans have that much control over. Heck, they can’t even prevent the setting off of nearby earthquakes, LOL !

Hi Old Farmer Mac,

I am far less sophisticated in my mathematical capabilities than Paul Pukite (aka WebHubteelescope) who I believe has a PhD in Engineering (possibly Mechanical, though I am not sure), his current website is Context Earth and his focus lately has been on climate change rather than peak oil.

I find your comments very enlightening by the way.

It is really pretty easy to understand my “model” for the Bakken, which is based more on the work of Rune Likvern than Paul Pukite. I actually presented the idea of convolution so that I could attempt to explain the Oil Shock model.

Unfortunately many people who are highly intelligent really are turned off by mathematics and think that any idea which cannot be presented in words alone is not worth pursuing.

I tried to present the Bakken and Eagle ford models using very simple mathematics and if you cannot understand it, I did a poor job of presenting it. Paul actually pointed out that the name “convolution” immediately connotes something that is hard to understand and a different name would probably aid in understanding. Generally if people think something is “convoluted”, that it is probably not worth bothering with.

So forget convolution, in fact I did not even realize my Bakken model used convolution until Paul pointed it out to me in his final post at the Oil Drum.

The model just uses NDIC data to construct an average well by taking the average monthly output for all wells which started producing over a range of dates say Jan 2010 to June 2014. Then we look at how many new wells started producing each month from Jan 2010 to June 2014.

Then as an approximation I assume that all wells are average wells and just do an accounting exercise using a spreadsheet.

For example lets say we have data for 4 years of monthly output for the average well, we can fit a hyperbolic (a function of the form 1/x raised to some power n) to the data to estimate output beyond 48 months using a least squares fitting routine in a spreadsheet (sum of the squares of the residual error is minimized).

This constructed hyperbolic is used to represent the average well output over 240 months.

Then we look at how many new wells were added each month from Jan 2010 to Nov 2014. Now if we assume all wells are average wells we just need to multiply the number of new wells in Jan 2010 by the first month output for a single well to find the output for Jan 2010 from wells which started producing that month.

I use the same “average well” from March 2008 to March 2014, prior to that I use an average well with lower productivity to estimate output from wells which started producing before March 2008. The model uses data from Jan 2005 to the present (only about 200 wells were producing oil in the North Dakota Bakken/Three Forks in Dec 2004 and over half those wells were more than 10 years old at the time).

When I first tried this in Oct 2012, I was amazed that it worked as well as it did see

http://oilpeakclimate.blogspot.com/2012/10/using-dispersive-diffusion-model-for.html

At the time I was using data gleaned from Rune Likvern’s research.

Interestingly this initial model was pretty close on its guess for output in late 2014 at about 1100 kb/d, though this could have simply been a lucky guess, to be honest it looked too high to me at the time as it implied a doubling in output in just two years. It looked suspiciously “cornucopian”. See chart below.

I just realized that the model in the old chart was using a dispersive diffusion model developed by Paul Pukite. Eventually I switched to using a hyperbolic well profile as it seem to match the first 24 months of data more closely, see the following

http://oilpeakclimate.blogspot.com/2012/12/update-on-bakken-model-using-hyperbolic.html

The model presented in that post (Dec 2012) had slightly lower output in Nov 2014 (about 1020 kb/d). Part of this difference was an assumption the average well productivity would start decreasing by 0.5% per year starting in Jan 2013, this assumption was incorrect and well productivity remained relatively stable fro 2012 to 2014 with an increase in well productivity towards the 2nd half of 2014. So my Dec 2012 was predicting a a gradual decrease in new well productivity which reached 11% by Jan 2015. That was a poor guess, from there I started making more conservative estimates of the average well profile based on a misinterpretation of the April 2013 USGS update on Bakken resources.

http://oilpeakclimate.blogspot.com/2013/09/update-to-north-dakota-bakken-three.html

I got back on track with the post at the link above, but was still underestimating the USGS mean TRR estimate, because I did not have proven reserve data through the end of 2012 at the time. The mean USGS estimate for the North Dakota Bakken/Three Forks is about 9.8 Gb. I try to make my scenarios roughly match this estimate. Chart below shows my current model based on NDIC data through Nov 2014. No guesses about the future are included, this is just the average well profile based on NDIC data and the number of wells added each month also based on NDIC data.

Not bad.

Thanks Fernando,

For such a simple model it matches the data pretty well, in 2014 it looks like the average well profile must have been changing, even increasing the average well profile by 1% each month from March to November 2014, was not enough to get the model to match actual output data.

Clearly there is no average fixed well profile in practice, but this simple assumption works ok from March 2008 to Feb 2014.

Maybe the older wells don’t decline as much as expected? Have you looked at it by excluding the recent wells?

Freddy, thanks!

You have posted/shared some impressive work here on POB.

It will be interesting to see if the companies can increase average production the coming months.

I agree. One thought that I have why drill/complete a gusher (good well) while prices are depressed?

As LTO extraction is heavily front end loaded, the first year or two of production has a considerable bearing on the profitability for the well

If they have heavy contract commitments, may it be better to target those better spots to get better payoff of their costs?

NAOM

Thanks!

Good point. I suppose no matter what they do, it will be bad. They may hope this is just temporary and just continue as usual. It could be. I think the oil price should start to go upwards again by the second half of this year. If production drops faster than IEA anticipates, then we may even see a quick recovery of the price.

Actually IEA expects supply to grow this year. From the OMR:

“The oil selloff has cut expectations of 2015 non-OPEC supply growth by 350 kb/d since last month, to 950 kb/d”

So there is room for downward revisions.

Hi FreddyW,

Based on EIA data NGL output has increased by about 900 kb/d from 2010 to the 12 months ending Sept 2014 (12 month averages), generally this is more related to increased natural gas output (NGL is a by product). Over the past 12 months NGL output has increased by 270 kb/d. If the IEA is assuming NGL will rise by 300 kb/d next year, that would leave about a 650 kb/d increase in C+C output (assuming biofuels and refinery gains are unchanged).

I definitely agree that a 650 kb/d increase will be difficult unless oil prices rise. The EIA expects average US C+C output (12 month average) to rise from 8.7 mb/d to 9.3 mb/d from 2014 to 2015 or by 600 kb/d, so this is in line with the IEA forecast (if we assume most of the rise in output will come from the US and that Canadian increases can offset declines elsewhere). The scenario seems a little to rosy to me, I think we might maintain C+C output if oil prices rise, but I doubt the World will increase C+C output by more than 250 kb/d and a 250 kb/d decrease is also reasonable. Basically flat output is my guess (especially if we focus on 12 month averages and ignore small changes like 200 kb/d or less).

However, the oil price started to drop about the same time as US QE stopped. Right now it seems they even out. So perhaps right now the economy can´t support an oil price as high as it was before.

Rune, Thanks for a great post that obviously required a lot of work. I find figure 03 shows just where we would be, had drilling not continued at any given time. I think it would be a good visual aid for those who have difficulty understanding the concept in abstract of rapid depletion and the need for constant drilling.

Thanks for the recognition.

That was exactly the point of figure 03 (the transparencies of the colors shows production by month).

Note that as of October 2014, approximately 50% of the production came from wells started in 2014.

To me this illustrates how challenging LTO is to sustain an extraction level.

Then throw in the price sensitivity for LTO extraction.

“Parshall covers an estimated area of 300 square miles (1 square mile = 640 acres) and had 340 reported flowing wells as of October 2014.”

More than 1 well per square mile. 640 X 300 = 192000 acres.

A 30 stage well should drain 5280 feet X about 2000 ft sideways from the horizontal (1000 ft each side) = 10.5 million square feet or 240 acres.

192000 / 240 = 800 That sweetspot is over 1/3 drilled, that’s of drilled and flowing. Maybe some were drilled and failed.

Watcher, there is virtually no company in the Bakken, Niobrara, EF currently attempting fracs with lateral communication extending out 1,000′. The current model is the one touted by Whiting and others where an intensive ‘rubblization’ occurs optimally no farther than 300/500′ horizontally from the wellbore. In addition to far more effective communicstion / conductivity with the formation, additional wells can be, are being drilled in close proximity to one another. The Parshall has the highly productive Three Forks formation below the Bakken and these ‘benches’ are still in the early stages of being developed.

Coffee. Thanks for the info you provide about the shale plays.

It appears that rig counts will continue to drop until the price rebounds.

Do you think that when the price rebounds the shale drillers will start up again at break neck speed, or do you think they will take a more measured approach?

It appears there is a tremendous amount of oil and gas in these areas, but in retrospect it may have been developed too rapidly. Like a version of the East Texas oil field over 80 years ago.

It seems to me oil at $80 or so WTI would provide a very good return in many areas. Any possibility TX and ND step in and try to regulate things a little bit? It would seem especially in Bakken and EFS, pacing things could help get the governments caught up with roads and other necessary projects. That would seem to also help the drillers get debt to more manageable levels.

Do you think that when the price rebounds the shale drillers will start up again at break neck speed, or do you think they will take a more measured approach?

It won’t really be up to them, the drillers, it will be up to their creditors. If a lot of them go bust then they won’t be around to keep drilling. Also if junk bond interest rates stay high, they will not be able to get financing.

A lot depends on how long the price stays low. And I do expect a rebound if the price does go back up but it will never again be the boom times we saw during the last three years.

Ron Wrote:

“It won’t really be up to them, the drillers, it will be up to their creditors… And I do expect a rebound if the price does go back up but it will never again be the boom times we saw during the last three years.”

I second that. The boom is over. It will take at least a generation for another boom (bubble) to replace it. By Then, global Oil production will too far deep and the global economy will be too depressed. At best the semi-completed wells will be finished when prices rebound, but its very unlikely there will be any significant number of new wells be drilled in Bakken in the future. Texas is also iffy on further new LTO drilling.

Its likely global Oil production will start tanking soon, Cap Ex for Oil (and perhaps Ngas) will likely collapse this year, which will have a dramatic impact to future production in a few years. The Cap Ex spent today, usually takes 1 to 5 years to bring to market. Global debt problem are being to become a huge problem and there global stability is collapsing, which will prevent Cap Ex from rising to stabilize production.

The Middle east is now engrossed in War, and the collapse of oil prices is going to lead to much more instability as the regional gov’ts dependent on high oil prices can’t meet their obligations to maintain their economies. Perhaps if Oil prices quickly rebound in the next 60 days the day of reckoning can be postponed be a couple of years.

China continues to beat war drums and is now has the second largest miltary budget, and is building MIRV (Multiple target Ballistic Nuclear missiles) obviously to deter the US for whatever China plans to do in the future. As its debt/credit driven economy begins to fail, Chinese leaders will likely turn to external affairs in order to avoid internal civil disobedience (unemployed workers). Either China will be directed towards external military engagements, or it will be plunged into a civil war, as it unsustainable economy begins to collapse. Perhaps China and delay its economic crisis another year or two.

The US (NATO) and Russia are locked on the Ukraine conflict as both sides continue to build up troops in eastern Europe. The Proxy war slugfest in the Ukraine as resumed last week, and this week Russia cut NatGas Supplies to Europe this week. The Ukraine is struggling and had to scram (emergency shutdown) one of nuclear reactors last week. Risks for a second Chernobyl are rising as the gov’t pressures mount to keep reactors running without sufficient maintenance budgets. Humanity probably has never been closer to WW3, probably since the blockade of Cuba during the Cuban missile crisis.

Tech guy, don’t softpeddle things. Tell us what you REALLY feel.

If CAPEX can be reduced (I think 20 % is achievable) AND oil prices rebound to $80 per barrel (Likely in the future) AND transportation costs are reduced (?) then….

What’s the ability to make a 10 % return on investment IF all of this happens?

a lot of “if”. Even if prices rebound, most companies and investors will be reluctant to jump back in. I believe most will be cautious and delay. Some will want long term pricing contracts, which will be difficult to obtain as those contracts just got crushed. Who is going to back long term pricing contracts now?

Without constant investment, production will decline and so will the global economy. Demand for $120 bbl oil will remain weak and so will Cap Ex. Most of the newer big projects (ie Arctic, deep water, etc) need $120 bbl to be economical.

I also think we are running out of road on infill drilling in many places (Alaska North Slope comes to mind). I think infill drilling had has a significant role in postponing declines. Its not just about problems with LTO.

My guess is that from now on. Oil prices will become very volatile with large frequent price swings every couple of years. This will prevent expansion of Cap Ex. Consider that most of the oil majors had already begun to cut cap ex (back in Q3 2013), when the price of Oil was near $100. Why would they increase Cap Ex if the prices rebounds to $80?

If I see $80 per dollar, transport cost lower than $10 per barrel, and I estimate costs to be $100 million for a fully equipped 14 well pad, I can convince quite a few companies to proceed and invest, using a 10 % IRR after all taxes. Not all oil companies use financing, and they are more realistic when it comes to hurdle rates.

Fernando Wrote:

“If I see $80 per dollar, transport cost lower than $10 per barrel, and I estimate costs to be $100 million for a fully equipped 14 well pad”

Yes, there will be wells drilled in the future! I am sure there are many economical sites that can be drilled. However, the Majority of oil that needs to be drilled will be much more expensive. Off the table will be large deep-water, LTO, and other expensive projects. Conventional Oil Production peaked in 2005 and it was the unconventional drilling that prevent global production from declining.

That said I am not sure Oil prices will stabilize at $80. I think from now on prices will swing between ~ $120 and $55. As long as Oil make dips below $80 or what ever prices you deem is necessary for economic drilling, its not going to happen. I think demand destruction is going to take the lead, and intensify future prices swings.

I wouldn’t back off a large deep water project thats viable at $80 per barrel. But I wouldn’t put my money on Gulf of Mexico pre Miocene.

“…. and this week Russia cut NatGas Supplies to Europe this week. “. No, they did not. It was reported by ZH and copied by some newspapers without fact checking . ZH, by mistake described an event in 2008/09 where the Ukraine diverted (stole) NG and Russia cut the flow through the Ukraine.

http://atlanticsentinel.com/2015/01/russias-gazprom-says-will-end-gas-transits-through-ukraine/

January 15, 2015:

“Russia’s energy monopoly Gazprom announced on Wednesday it would stop transiting natural gas through Ukraine and urged its European customers to link up with a future pipeline to be built in Turkey or lose access to supplies.”

http://www.bloomberg.com/news/2015-01-14/russia-to-shift-ukraine-gas-transit-to-turkey-as-eu-cries-foul.html

Jan 14, 2015:

Russia plans to shift all its natural gas flows crossing Ukraine to a route via Turkey, a surprise move that the European Union’s energy chief said would hurt its reputation as a supplier.

Are telling me Bloomberg copy and pasted this article from ZH?

Given european warmongering we see in the media, the Russians are responding rather mildly. I realize these opinions are formed based on our background and information flows. But for what it’s worth what I see is USA and EU aggressive behavior, and this was quite evident since the Clinton administration began to betray informal handshake agreements the U S had set with Russia.

Thus a Russian response to outside attacks is to be expected.

Russia plans to build a new pipeline to Turkey and divert its gas flows to Europe from the pipelines crossing Ukraine to this new pipeline.

So this are plans for a distant future. Current supplies to Europe were not cut.

I live in Europe, and I think russian pipelines to China are a much more worrying idea. I studied this topic when I worked in Russia, and they are definitely competitive.

Europe is trying to diversify its sources of energy supply. Russia is trying to diversify the customer base for its energy supplies, as well as transportation routes.

Yes, i read European countries are buying ground up trees and coal from the U.S.

TechGuy you are talking about events that are many years into the future. The ZH article said that last week Gasprom actually cut the gas flow to Europe by 60%. How can this be true since there would have been an outcry all over Europe? But there was none and the major newspapers did not even report on the ZH article.

Gas sales arent impacted at this time. I believe they are reassigning reserves to the chinese market. In these large scale contracts the seller commits to deliver a reserve volume, and the buyer commits to a take-or-pay quarterly rate, with flow rate and price adjustment formulas. I believe (but I’m not sure), the Russians are shifting reserve commitments to China and withdrawing future commitments to the EU. This is a reasonable position given EU hostility. I see the EU playing a really stupid game to cage Russia. This isn’t the right site to discuss these politics, but let’s just say I see a pretty aggressive move by usa neocons to restart the same engine they used for their stupid Iraq invasion.

Hey, Shallow. As you may recall, I hesitate to speculate regarding the financial aspect of the shales as there are many aspects that can and do come into play. Operations have always been my forte.

Having said that, the price obtained for the product obviously is crucial, as is the cost of production.

Hamm has just been quoted as saying his near billion barrels of oil will stay in the ground rather than be sold for 30 bucks per.

The high volume early production from new wells will be poorly realized if marketed at these low prices.

The E&P guys will probably do what they have just done … hunker down turtle-like till the storm passes. Despite extensive analysis, there should be NO doubt that hydrocarbon production will resume in the shales when it is deemed profitable. If the company’s name is no longer ‘Goodrich’ or ‘Sandridge’ but rather EOG or Shallow sand Inc., so be it. This so-called “Good Sweating” (pressuring new, upstart oil producers) dates back as far as J.D. Rockefeller.

One tangential, little recognized aspect of this squeeze is the efficiencies that will be/ are being implemented. As ol’ Nietzsche said regarding adversity, “That which doesn’t destroy me only makes me stronger”.

Mid-summer should offer more clarity price-wise, ss. When you and I can head today to the supermarket, look at a gallon of cheap, bottled water selling for 99¢, throw 42 of ’em in our cart, head out the door and realize we just paid more the a barrel of Bak crude, something’ ain’t right.

Hang in there, ss.

(Quick aside … my admiration of the accomplishments, the out n out ballsiness of a lot of these shale guys in NO way minimizes my awareness of, and empathy for those who are especially adversely impacted by this stuff … hard working guys in conventional fields in south Texas, guys working on offshore rigs, guys such as yourself scratching out a living that have been severely affected. Disruptive processes disrupt, and this shale stuff is one mighty huge disruptor.)

The 1000 feet is always confusing when quoted, but it comes from a CLR investor briefing and it is a slide that has appeared in multiple quarters.

Now it’s always possible the 1000 (1200 as I recall) was the sum of 600 on both sides because I think I have quoted that misremembered a couple of times, but regardless, there were 1000 foot experiments performed — and the phrasing is not “communication” — it is “cannibalizing” — oil from adjacent wells.

As for vertical to TF, the distances should tap downwards as well as horizontal and note that wells quoted as targetting TF depths specifically have underperformed the more shallow wells. If your portfolio is leaning on TF output to save the day, your odds aren’t good.

Hey, Anonymous, thanks for the input, but I’m not sure I completely follow. There have been several slides and graphic presentations from Continental and others showing the placement of multi-well laterals from the same pad. Can’t check this moment, but I think the Rollefstad pad had 600′ distance between laterals in at least 2 or 3 benches. (I do recall that the pad’s cumulative 24 hr IP was over 24k boe).

The term ‘communication’ seems to be the most commonly used description when there is any observed interaction between wells, or even between individual stages in one well being frac’d, including proppant exchange and pressure interference.

While I certainly do not wish to sound like some authoritative source in these matters (I’m not), the cannabilization is centered as much on the pressure drawdown/interference as much as the actual oil transfer.

As far as the TF not being as bountiful as the Bak’s middle bench, some of us ‘glass is half full’ guys may simply view the MB as being especially productive. 😉

Yogi sez predictin ‘ is hard. Truer words were never said.

But some things can be predicted with great certainty in general terms and two such things are the eventual depletion of all current conventional oil production -within a few decades at most -and continued improvement in the efficiency with which we use oil.

Somebody up above says ”its very unlikely there will be any significant number of new wells be drilled in Bakken in the future. Texas is also iffy on further new LTO drilling.”

This may prove to be true under certain scenarios such as the world economy crashing so hard that nobody would be able to buy expensive oil.

But there will be no more CHEAP oil. A few producers may still have some that can be cheaply gotten out of the ground but they won’t have to sell it cheap.

My guess is that the economy world wide will remain healthy enough to continue to consume all the oil that can be produced at less than astronomical costs for the next ten or twenty years.The current glut won’t last.

There will be plenty of people who CAN afford gasoline and diesel fuel made from one fifty or two hundred buck crude because they are going to be using less of it in generating a dollar of income and also because they are going to be using less than half as much when just burning it in the family grocery getter.

There is no doubt in my mind that barring the economy going to hell in a hand basket within the next few years there will be new hundred mpg ice powered cars on the road in countries that don’t outlaw them by means of well intended but foolish safety regulations.

A death trap car is still safer than the safest scooter and I have seen no indication that scooters are going to be outlawed.

Such a car could be marketed today. All it would take is building it very low and narrow single seat or two seat fore and aft with mostly lightweight materials and a very small engine no frills and a forty mph top speed- the same speed some but not all fifty cc scooters can attain – scooters which are street legal just about every where.

Nobody would buy such a new car today but later on …. lots of people who are more or less compelled to drive will be glad to buy one rather than walk away from the mcmansion. If their enclosed go cart is a hybrid it may get the equivalent of two hundred mpg depending on the way the mileage is computed. A plug in that is regularly plugged in can sometimes be driven for weeks at a time using no gasoline at all if the driver sticks close to home.

Even very poor people will be able to afford a little bit of expensive oil as their lives improve a little at a time until the baked in crash eventually arrives. Tens of millions of people still farming by hand will be able to buy a little bit – a few gallons each even at a pretty high price to run a few cooperatively owned pieces of equipment- and hundreds of millions more will be able to buy a gallon or two a week to feed a motor scooter that enables them to get to work.

Personally I have come to believe that so long as oil production does not decline TOO fast shark fin fashion that the economy in a country such as the US can adapt thru substitution and improved efficiency – adapt at least well enough to prevent a catastrophic near to mid term crash at least.

Coal to liquids will probably come on fast enough – in a slow decline scenario – to put an effective cap on oil prices at less than two hundred bucks current day money.

Of course what COULD happen and what will happen are two almost entirely different propositions.

Overshoot is going to get most of us but maybe not all of us.

If I were a parent in Venezuela knowing what I know now I would figure out a way to make sure my kids learn ENGLISH.Quietly.

I did a very crude calculation of the cash return of a well that started out at 500 bbl/day and depleted at 5%/month in a $50/bbl environment. It looks to me like the well would return about $7.25 million in the first year. If I guess correctly that is order-of-magnitude what a well completion costs. So from a forward looking standpoint that would be a very risky bet for an investor, thereby reducing the amount of money available for future wells.

However from a cash flow basis there would be plenty of incentive to keep pumping from existing wells.

Has anyone done a more detailed analysis of how this combination of low price and decline is likely to affect the future output?

JJHMAN,

Is the $50/bbl WTI or net back for the well owner/company?

JJHMAN. I don’t follow how you get that high of a $ return in year one.

$7,250,000/$50 = 145,000 net barrels.

145,000/.80 Net revenue interest = 181,250 gross barrels.

181,250/365 = 496.58 gross barrels of oil per day average for the year.

Also, there would possibly be gas sales if not flared.

Plains posted price for Williston Light Sweet is $32.44, so likely best price operators receiving today is $36-38 per bbl.

Need to deduct severance and extraction taxes, operating expenses and general and administrative taxes.

A well producing 181,250 barrels of oil in year one appears to be a little over two times the average, which seems to be about 85,000 barrels in year one.

I think for a well that produces 85,000 gross barrels of oil in years one, a range of $1,400,000-$1,800,000 EBITDA is realistic assuming a 20% royalty burden and $38 oil price. I think part of extraction tax goes away in February possibly due to a price trigger being hit, so that would help.

The current oil price in the Bakken, or for that matter, anywhere, is challenging.

Delete taxes from g&a

Oil is usually sold as a “delivered” product. This means producers get a price that is market, less transportation. In the Bakken almost 75% of the oil, and all increased production for the last two years goes by rail at a cost of $10 to $18 per barrel.

So, net to Bakken producers is usually around $31 to $39 per barrel, nowhere near current $49 WTI price.

Helms most recent DC quoted sub $30.

However from a cash flow basis there would be plenty of incentive to keep pumping from existing wells.

I think this applies almost to all oil wells, tight oil or not. Once the sunk costs have been spent getting a well flowing, why would anybody give up the cash flow unless it was insufficient to service debt. The only exception I can think of is deep water where operating costs are astronomical.

Why would a deep water well be an exception?

Why would a deep water well be an exception?

The answer: operating costs are astronomical.

Sure, but are operating costs for the typical deep water field higher than $35 per barrel?

I don’t think anyone is talking about the “typical” field, or more correctly the typical production platform. But they are very expensive to operate and the decline rate of deep water wells is very steep. So sooner or later every platform reaches the point where it is no longer economical to operate even though a considerable amount oil is still being produced.

After Katrina there was about 35,000 bpd of production that was never restarted after being shutdown for the Hurricane. Of course that was the combined production from several platforms. It would have cost more to repair them and then operate the platforms than the oil would be worth. Their production was already in steep decline when they were shut down for the hurricane.

Yes. It’s just that in not convinced that deep water is an exception. All operating wells will continue to produce as long as the oil price and production justify it.

Once a well goes down and needs to be repaired the ball game changes. For example, if a deep water well sands up the repair may not be scheduled until 2017. If a high water cut well in Colombia loses the esp it may not be repaired.

Don’t know it to be true, but I’ll offer this up. It’s pretty common lots of places.

Specifically, “code” and grandfathering. Things go down and need repair. It’s not legal to repair the failure to old “code” requirements. It must be “brought up to code”, and if the equipment was long term grandfathered (permitted to operate out of modern code reqmts) it can be a LOT of upgrades required.

That doesn’t usually apply to wells (not that I know of). What we found in many cases when a pump went down was that well equipment could be pulled, the pump refurbished, the cable cleaned, and we could get a better cash flow recycling the equipment. This was more applicable when oil prices went down or if the government started increasing taxes. In some large fields we estimate well costs assuming we recycle old equipment.

On a per barrel basis the operating costs in deep water better not be astronomical, as the finding and developmental cost are astronomical.

All things are relative. Operating cost are not astronomical when compared to developmental cost but they are astronomical when compared to the cost of operating a land based well.

Oilfields Estimated Production

Costs ($ 2008)

Mideast/N.Africa oilfields 6 – 28

Other conventional oilfields 6 – 39

CO2 enhanced oil recovery 30 – 80

Deep/ultra-deep-water oilfields 32 – 65

Enhanced oil recovery 32 – 82

Arctic oilfields 32 – 100

Heavy oil/bitumen 32 – 68

Oil shales 52 – 113

Gas to liquids 38 – 113

Coal to liquids 60 – 113

Source: International Energy Agency World Energy Outlook 2008

My niece said she presumes deep/ultra-deep-water oilfields operating to be double land based costs (as a general rule) and to be $30/bbl without any other information.

Wow, then the deep water OPEX could be at $40 per barrel easy.

Thanks for the table. However in Latin America the Direct Field Operating cost can be as low as $5 per barrel. On the other hand some range as high as $70 per barrel (due to high water cut and remote location).

Remember, it is not over until the fat lady sings.

At current prices, I think that she has started to sing. Keep your gas tanks full because it will not take the market all that long to figure it out.

Doug Leighton says: Oilfields Estimated Production Costs ($ 2008)

That is 2008 data. Since then production costs have increased by about 35%. At $50.00 oil a lot of those fields have already been priced out of the market. By the time prices have recovered to the $60 range (late 2016) a lot of those fields will be gone. Discussing shale is like taking a history lesson; it is about something that was, and will never be again.

The cost of finding the oil is mixed up quite often with the cost of producing the oil. I am not an industry professional so please correct anything in error.

Since the Bakken is usually the subject, from what I have read, in general terms:

A. Acreage initially cost in the low hundreds of dollars per acre. Later, this cost went to $20,000 per acre or more. Most drilling units appear to be two sections, or 1,280 acres. I have seen units that have one or two wells, up to some presentations that show plans for up to 30 or more wells in a 1,280 acre drilling unit.

B. Drilling and completing a Bakken well, with a 10,000′ lateral appears to cost anywhere from $6 to $12 million dollars.

C. Lifting costs, being the costs to produce the oil, appear to range from $2-$20 per barrel, with most falling in the $5-$10 per barrel range. These costs do not include general and administrative expenses, which appear to range from $1-$5 per barrel, nor severance taxes, which are 11.5% of oil sold, but may be less due to certain exemptions/WTI average prices. Finally, this generally does not include maintenance CAPEX, such as down hole pump repair/replacement, etc.

Therefore, it appears to me that the costs drilling new wells in the Bakken are generally more than what can produce a suitable return (or any return) on the investment at the present wellhead price of under $40 per bbl.

On the other hand, for wells in production, the price is still high enough to produce net income on almost all in the Bakken.

These terms are mixed together often in media reports, as are many reports which mix up all of the above costs with the price of oil exporters need to balance their budgets.

Nailed it pretty much 100%, ss. CBR (Crude By Rail) adds bout $8/$15/bbl (Tesoro has a chart somewhere depending on destination). More is headin’ out Cali way as Alaska is goin’ dry.

coffeeg,

Washington State has been receiving Bakken crude for, I guess, a couple of years now. I haven’t looked at a map but I expect it moves by train to the Columbia, barge down the river and then train up through the Puget Lowland.

coffeeg,

Looked at a map; it’s rail all the way. It comes into the state through Spokane.

Is it likely that there will be attempts to explore and develop ANWR before Alaska goes completely dry? Will economic oil be found? Was KIC-1 a dry hole?

Robert w, I don’t follow Alaska closely, but I think it’s widely recognized that there is still a Kardashian-size asston of oil still up there. Guess politics and economics will largely guide future operations.

Hi Robert,

I follow Alaska closely having worked there as a geophysicist/geologist and I have friends still active in Alaskan. The thing to remember is Prudhoe Bay was a supergiant (now entering old age): All the satellite fields are trivial by comparison. So the North Slope is slowly approaching death. ANWR may extend life but, in any case, it would be intravenous feeding: No significant change in the diagnosis.

Does anyone have information on what type of down hole chemical treatment is used on these wells? How corrosive is the produced water?

Also, would be interesting to see OPEX for flowing wells v those on pump.

What is the power source for those 640,000 lb. Pump jacks? Do they run on produced gas? Electricity?

I read somewhere to pull a well in Bakken for a pump change is around $80,000.

Also wonder if over time as the wells produce lower volume if they will have to be shut down in the winter in the Bakken.

To me it would be interesting to go out there and take a tour, when it warms up, of course. I wonder if anyone offer’s informative tours out there?

I googled it and yes, there are tours of the Bakken offered. Now I have to convince my wife of our summer vacation destination! Ha!

I agree with you, that is why they must make spectacular finds in deep water. In the tens or hundreds of thousands of barrels per day. I think BP blowout in Gulf of Mexico released about 3 million barrels of oil.

Tens of thousands of barrels per day is reasonable. Hundreds of thousands of barrels per day from a field in the Gulf of Mexico is highly unlikely. There’s a practical limit to the size of the facility. And the wells have to produce at extremely high rates. If fully optimized they tend to be designed for peaks around 100 kbd tops.

I tend to think they overshoot the initial rates, which leads to very fast declines. It’s not the smart way to do it.

Exactly. An outfit I worked for had wells drilled into deep and high pressure sands in Venezuela. The reservoirs were very touchy and I can’t visualize developing and producing them profitably in 6000 ft water depth at less than $100 per barrel. The amount of oil we found could be quite large, but porosity tended to be poor in the deeper zones.

What about viscosity and gravity of the oil? Venezuela is importing high API oil to mix with their thicker low API stuff and this adds a cost. Venezuela’s Orinoco basin is largely a very thick oil not much different than tar sands oil , but at a depth of 5000 ft plus. Can’t see how much of this would ever be profitable, but then the Chinese may see a way to get it.

mbnewtrain, there are several medium to light oil trends to the North of the giant extra heavy oil deposit in the Orinoco Heavy Oil belt.

The main area is called the Furrial trend, which is found below a very thick shale and can have commercial production down to around 18 thousand feet. These oils are found with significant amounts of gas and reservoir pressures can exceed 10 thousand psi. They also contain small amounts of asphaltines.

The reason why venezuela is importing light crude is the dwindling production from the medium and light crude fields. PDVSA just lacks the technical capacity to manage the fields, and the deep trend has been producing about 25 to 35 years. This causes production decline caused by their poor practices. Meanwhile they try to sustain production by drilling the 8 degree API oil. And this requires diluent to make the ~18 degree API export blend.

Hi Rune,

Great work as always, I always learn a lot from your posts and appreciate you sharing your knowledge.

Using the decline rate data for an average Bakken well provided by D Hughes, an Arps hyper was fitted. The theoretical production ratios associated with the time spans used by R. Likvern in this post were then estimated. These were then compared with the linear correlations for the Bakken production areas shown.

The results are shown below. The correlation is very good, with the largest discrepancy being the 3 mth vs 24 mth. The 12 month and 6 month vs 24 month comparisons are almost perfect.

It’s a credit to D Hughes’ and R Likvern’s work that the comparisons correlate so well.

Hi Dennis and thanks.

I think everyone learns from each other through a process that enhances the understandings.

The flows are pure physics. Nice that we can demystify this whole process and show the professional reservoir engineers that they really don’t have the keys to the kingdom on how all this plays out.

Hi Paul,

I have learned a great deal from the work that both Rune Likvern and you have done.

I still have much to learn, and find the information provided by Fernando Leanme, Mike, ManBearPig, Doug Leighton, Shallowsands, Ron Patterson, Jean Laherrerer, and others very helpful in improving my understanding.

Darn. Misspelled Jean Laherrere, my apologies.

Dennis, I also appreciate all of those who post such detailed and useful information, and definitely include you in that group.

I wish we had more information on the economics in conjunction with the production information that is provided concerning the LTO plays. I take the production information and then use cost figures from public company reports, but I am lacking in ability in this area.

It seems we read varying accounts of productivity in the Bakken, and you and others take the data and set the record straight.

We also read varying accounts of the economics. I suppose hard numbers are tougher to come by in that area. I think it is interesting how the financial numbers keep changing. I am convinced drilling and completing wells now is not only unprofitable, it is not very smart, given the large rate up front. There are so many factors to consider, however.

Keep up the good work.

Rune and others have done a great deal of good work analyzing well productivity in the Bakken. I hate to suggest more work, but I think it is necessary.

Over the course of LTO development in the Bakken the structure of wells has changed somewhat. Earlier wells tended to have shorter laterals. Some wells that have laterals under surface water have especially long laterals. I think the to get the best picture of productivity, all data should be normalized to a per foot of lateral basis, rather than to an individual well basis. Of course very early vertical wells should be analyzed (if at all) on a per foot of oil stratum contact basis. Length of well lateral also bears highly on the cost of drilling and completion, so cost of production will depend on lateral length also. Surely your databases already contain the lateral length data. It should be not too difficult to look at changes in production on the per foot basis I suggest.

The volumetric effect of the fracking pressures used by Bakken producers are likely to be proprietary and not publicly available, otherwise I would suggest normalizing on a volumetric basis. After all, the ultimate amount of the Bakken resource is defined by the overall volume of the oil bearing strata times the oil removed by each bit of volume contacted by wells. How much of that volume is developed by each well would give the clearest picture, but production per foot of well lateral would be a close second.

What you point out is correct. I for one would like to dig deeper into the data for length of laterals, number of fracking stages, costs etc. to get an even more detailed understanding of other metrics for productivity.

If possible find a metric for productivity on a volumetric basis, per foot (or 1,000 foot) of lateral.

This could give away more detailed information about oil saturation sorted by area and formation which to me is an important metric to trend. A good indicator here is developments to the water cut.

From the data used productivity changes may be tracked, and it would be very helpful if these also were compared to changes in well design.

Mr. Likvern, the info you mentioned is available via the North Dakota DMR with either a basic subscription ($50/yr) or premium subscription ($250/yr).

A possible cautionary note to you folks viewing the water cuts to get a ‘glimpse’ of the status of these horizontal wells … The Dec. 2014 issue of American Oil & Gas Reporter (aogr.com) contains an extremely informative – albeit ‘wonky’ – article describing the results of a comprehensive testing/evaluation of several variables in the fracturing of Bakken wells. This is in an attempt to figger out just what the heck is going’ on down there.

As per water intrusion, they (WPX) discovered the vertical fracs extended upwards 300′ to 600′. The targeted payzone, meanwhile, was 30′ and 50′ thick. By manipulating induced pressure and flow rates, the vertical fracs will more probably/effectively stay in zone and thus greatly reduce the amount of unwanted produced water.

A significant follow on to minimally vertical fracs is the enabling of ‘downspacing’ in a vertical as well as the horizontal plane.

Thicker formations such as the Niobrara, Marcellus, and formations in the Permian will all employ this approach. The so-called ‘high-low’ placement of wellbores is already underway in the Eagle Ford utilizing this approach.

I would like to know how they can effect fracture length in the vertical plane different from the horizontal plane, except that tensile strength of the strata above may be different than the oil bearing shale below (cracks will tend to go up to areas of lessor pressure). Fractures will go farther in solids with lower elasticity and lower tensile strength solids than those with higher values. Does the oil bearing shale have that much less elasticity and less strength than the surrounding rock or non oil bearing shale?

mbnewtrain, Beats me how these guys do it. If you get to check out that aogr article and give us your ‘take’ on it, I would be much obliged. As far as I can tell, (I’ve re-read the article several times now), the down hole pressure is monitored along with micro seismic readings, and when a pressure/distance of fluid and or proppant is noted, frac volume and pressure is altered /changed to halt the too-far vertical fissure from continuing.

This is a half-ass layman’s description of how it seems to be done. Whatever the particulars, they ARE significantly effecting vertical as well as horizontal fracs.

The “oil bearing shale” isn’t really shale. The trick is to find “shales” with a high carbonate and silt content. The less shaly the more rigid, and this allows the rocks to fracture and for the fracture to stay “open”.

The easiest way to eyeball a candidate rock is to look at its gamma ray log (this measures the rocks natural radioactivity). I will look up a bakken log I can link and you will get a sense for how the rock properties change.

Here you go

http://ej.iop.org/images/1742-2140/11/2/025001/Full/jge484118f8_online.jpg

I guess these curves are too complicated. Focus on the curve on the left. A shift to the left means low radioactivity and low shale content. Notice how the Middle Bakken and Three Forks are shifted way to the left. IN THIS WELL the two zones have low shale content. I could have picked a different well, with a more radioactive (shalier) Middle Bakken and Three Forks. Also look at the curve labeled porosity. As you will see the overlying zone (above the upper Bakken shale) has really low porosity. These properties change horizontally, this means we could see a gradual shift to a shalier Bakken, the Lodgepole can have better properties, etc. I think this could help you understand why the induced fractures extend more horizontally or get sealed in the vertical direction. Or why some wells make a lot of water. And remember wells are like people, these property logs are like photographs, and they change as we look at different wells.

Hi Joe,

Good idea. If you have access to the lateral length od each well in the Bakken, I would love to see it.

I do not have access to such data, though perhaps Rune has access to more data than I have.

The best we can do is to look at how the well productivity has changed over time, I think the lateral length and number of frack stages has increased over time, but there has not been much change in well productivity. A small increase to about 2011 and then random jumps up and down from year to year.

The basic subscription to North Dakota oil and gas information ($50 per year) is supposed to contain the following-

“Basic Subscription: The GIS map server, a complete index of all wells permitted in North Dakota in a Microsoft Excel spreadsheet saved with Zip compression. The scout ticket data contains basic well information, log tops, completion data, initial production tests, cumulative production and injection volumes, drill stem test recoveries. The well files are scanned into Adobe PDF documents that include all forms, letters, geological reports, drill stem test reports, core analysis reports, and other miscellaneous information. All well files are available, except for confidential wells or confidential information.”

One would think that lateral length information would be included with this information. Perhaps someone who has already subscribed would know.

For $175 per year one can get the Premium Service which includes well logs, which surely would have dimensional information.

I thought that these services were where you analysts were getting your information. Please correct me if I am wrong.

Just noticed that coffeeguzz posted the same information about subscriptions as in my comment in his reply to Rune.

Are Saudis hoping that if price too low new wells will be really cut back, and existing wells will decline quickly ? This will lead huge loss in world oil supply. but how long will it take for price of oil to spike ?

Steve K Wrote:

“Are Saudis hoping that if price too low new wells will be really cut back, and existing wells will decline quickly ? This will lead huge loss in world oil supply. but how long will it take for price of oil to spike ?”

FWIW: I doubt KSA is targeting US drilling. If I was a betting man, I would put my tokens on an attempt to Bankrupt Iran. Iran has been trying to tip the balance of power in the ME to its favor and had tried to take over Iraq via supporting Iraqi Shite and Iraqi Politicians. Iran is already having tough economic problems and the failing oil prices are not helping.

That said, KSA is not dumping Oil on the market to force prices lower. Its just not cutting production. Prices are tumbling because global demand is falling as the global economy is falling back into recession again. As Ron stated a few weeks ago, KSA may just be sick of being the first to cut production in order to stabilize prices.

As we have discussed, excluding the US and Canada, global crude + condensate (C+C) production fell from 2005 to 2013, as annual Brent crude oil prices averaged $110 for 2011 to 2013 inclusive.

Since the global industry was only able to show an aggregate increase in production because of tight/shale plays and tar sands plays in the US and Canada, and if those plays now have severe viability issues at current oil prices, and since non-US and non-Canada production fell even as oil prices doubled from $55 in 2005 to the $110 range for 2011 to 2013, how is the industry going to be able to even maintain current global production?

In any case, a key difference between the 1985 to 1986 price decline and the 2013 to 2014 price decline is that the Saudis boosted their net exports by almost 50% from 1985 to 1986 (from 2.9 mbpd in 1985 to 4.3 mbpd in 1986), although the 1985 net export rate was low because of voluntary production cutbacks, in response to declining oil prices. In contrast, 2014 was almost certainly the ninth year in a row that Saudi net exports were below their 2005 annual rate of 9.1 mbpd (total petroleum liquids + other liquids).

Re: A Reuters column that has been posted previously:

COLUMN-Breakeven and shut-in prices for oil wells: Kemp

http://www.reuters.com/article/2015/01/13/oil-shale-prices-kemp-idUSL6N0US2GE20150113

At a 9%/year gross decline rate from existing wells, in order to maintain current production, we would have to replace the productive equivalent of every currently producing oil well in the world over the next 11 years.

Of course, existing production would be down to 37% of the current level in 11 years (at 9%/year), but if we stipulate a steady state production rate, we would be declining against the current production level, not against a declining production level.

Mr. Brown

re: “we would be declining against the current production level, not against a declining production level.”

Is this the argement for a seneca cliff decline rate when PO starts to be felt in the not too distant future?

I was mainly pointing out that if we stipulate flat production, we have to replace the productive equivalent of every currently producing oil well in the world, from Texas to Saudi Arabia to Russia, over the next 11 years, given the IEA’s estimate of a 9%/year decline rate from existing production.

Usually, someone points out that at a 9%/year decline rate, production would not drop by 100% in 11 years, which is true, but the question I am asking is how much new oil do we need to maintain flat production at a given decline rate from existing wells.