A post by Ovi @ peakoilbarrel.

Below are a number of oil production charts for Non-OPEC countries, created from data provided by the EIA’s International Energy Statistics and updated to August 2019. Information from other sources such as the IEA and OPEC is used to provide a short term outlook for future output and direction.

Non-OPEC production increased by 752 kb/d to 50,482 kb/d in August from 49,730 kb/d in July. This is the first significant monthly increase in 2019. Output declined from January to May. The main contributor to the increase was the US by adding 599 kb/d. This leaves August production just 295 kb/d short of the previous high of 50,777 kb/d reached in December 2018. New output from Norway and Brazil, along with increasing US output coming in the next few months could raise Non-OPEC output beyond the previous December 2018 high. The question “How much higher beyond the December high” is of great interest to OPEC+.

The charts and table below are primarily for the world’s largest Non-OPEC producers and are updated to August 2019, except for the U.S., which is updated to September 2019. The first set of charts is for Non-OPEC countries with production over 500 kb/d and the last few provide a world overview.

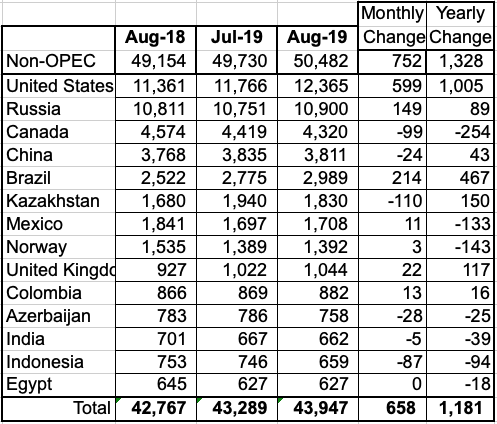

Above are listed the world’s 14th largest Non-OPEC producers. They produced 87% of the Non-OPEC output in August. One year ago, the US produced 550 kb/d more oil than Russia. In August 2019, that lead was extended to 1,465 kb/d. What also stands out in this chart is the large monthly increase in Russian production in August 2019 even though it is supposed to control its output according to their OPEC agreement. Also note the large increment from Brazil which is starting to produce oil from its deep pre-salt layer.

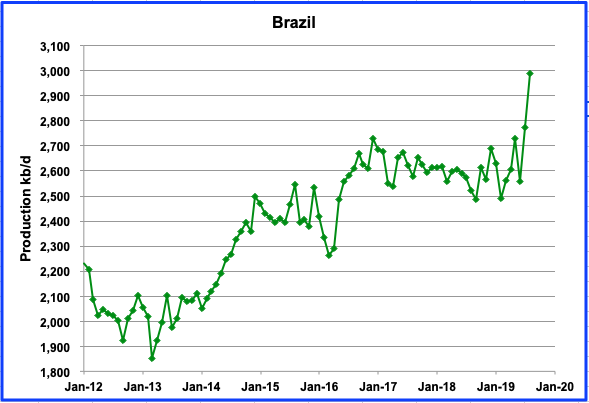

Brazil’s production added 219 kb/d in August, coming in just shy of 3.0 Mb/d. Its output is now beginning to show the results of adding four floating production, storage and offloading units (FPSO) in 2019 to its offshore fields. Output is expected to remain close to 3.0 Mb/d for the next few months. It is estimated that the deep pre-salt layer could potentially raise Brazil’s output to 7 Mb/d by 2030. In early November Brazil held an auction for foreign and domestic oil companies to bid on four offshore blocks containing the the pre-salt layer.

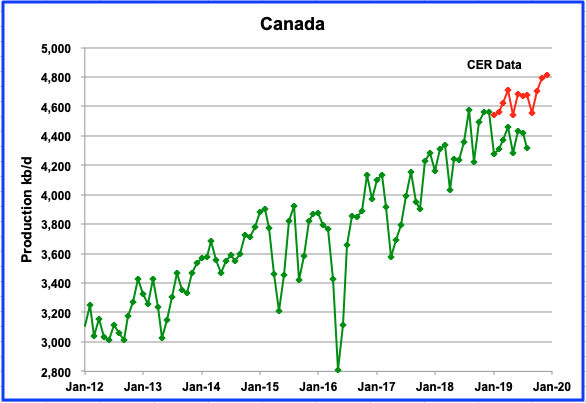

Canada’s production dropped by 99 kb/d in August. This drop appears in both the EIA report and the Canadian Energy Regulator (CER) report, shown in red. I am not clear why the CER reports higher output than the EIA. Output from Alberta continues to be limited by the curtailment rules imposed by the government. In August and September rail shipments of crude were 319,594 b/d and 310,146 b/d respectively. This is a significant jump from March when shipments were 168,483 b/d.

As long as the Enbridge line 3 expansion is on hold in Minnesota, it will be difficult for Canada to increase production significantly for the longer term. On December 9th, Line 3 received a favourable report from the state’s Department of Commerce when it found no serious threat to Lake Superior if crude oil leaked from the pipeline. Public hearings are next.

While exporting Canadian oil continues to be a challenge, Enbridge and TC Energy are looking at changes that could quickly increase capacity by another 100,000 b/d by adding drag reducing chemicals to the pipeline. Enbridge is also looking at additional strategies that could provide more capacity. In addition the Conference Board of Canada is saying that the outlook for Alberta production is brightening and that several factors will conspire to boost production in the oilsands by an average of 4.2 per cent per year from 2020 to 2024.

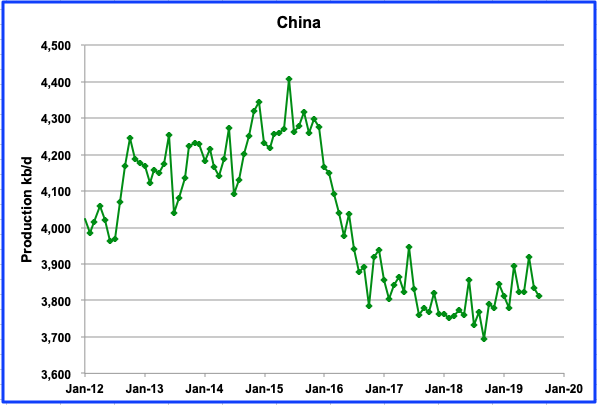

China’s production dropped by 24 kb/d to 3,811 kb/d in August. It is expected to maintain this level of production into 2020 due to increased spending by China’s major oil companies, according to the IEA.

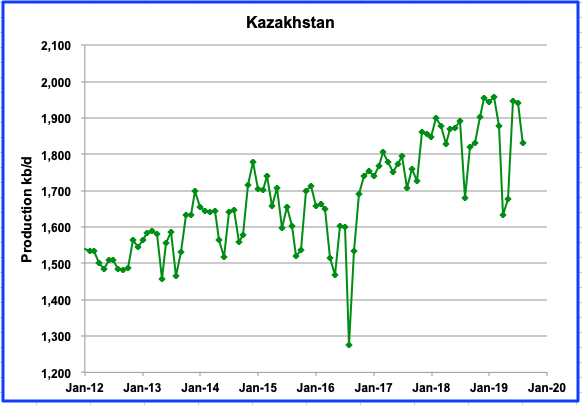

Kazakhstan output declined by 110 kb/d in August. It is expected that their production will stay close to 1,800 kb/d according to OPEC.

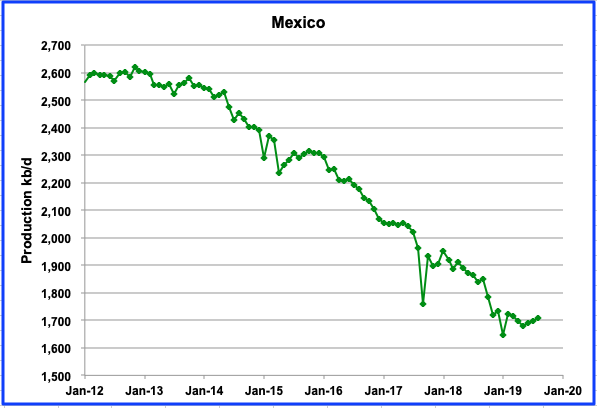

While production declined in the first quarter, Mexican output has shown a small increase in the second and third quarters. However, according to OPEC, the decline in Mexico’s mature fields, such as Cantarell, Abkatún-Pol-Chuc and Tsimin-Xux, will result in the resumption of overall declining output by 2020.

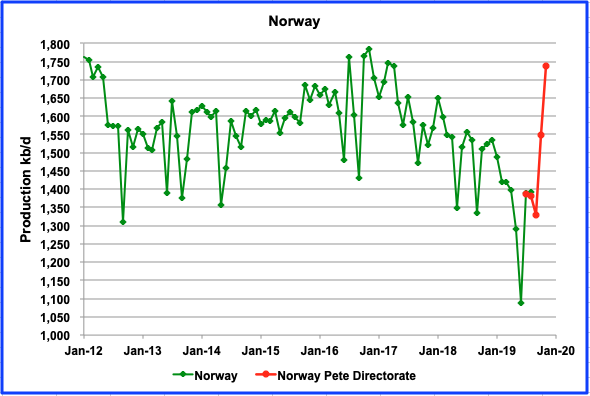

Norway’s output for August was flat due to technical and maintenance problems in some fields. However this is going to change in October when the Johan Sverdrup field comes online. Output began to increase in mid October and by early December it was producing at a rate of 350 kb/d according to Reuters. Phase I of the project is expected to add 440 kb/d of oil production by mid-2020, which will account for over 20% of total Norwegian supply.

The increased production from the Johan Sverdrup field should begin to show up in the EIA’s report a few months from now. However production data for C + C is published monthly by the Norwegian Petroleum Directorate, which reported output of 1,739 kb/d in November, and has been added to the above chart and is shown in red.

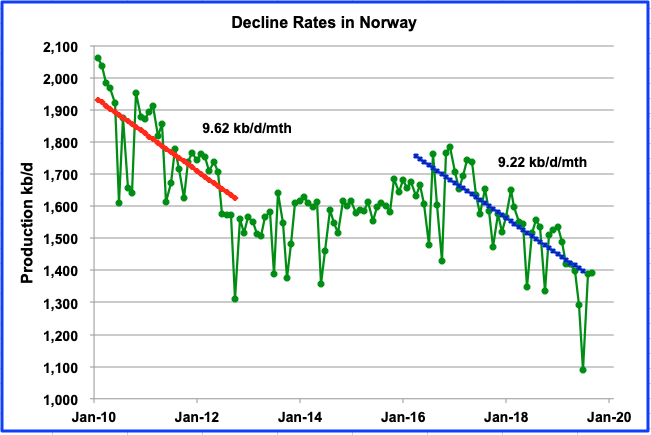

This chart shows the decline rate of Norwegian oil fields to be essentially somewhere between 100 kb/d/yr to 110 kb/d/yr or roughly 7.1% using 1550 kb/d as an average reference rate. The decline will re-appear again midway through 2020 when the Johan Sverdrup field achieves its expected peak rate of 440 kb/d. Adding 440 kb/d to its current August production should raise total output close to the previous high of 1790 kb/d in October 2016. It will be interesting to see if it achieves its previous high or whether the monthly decline will prevent it.

Russia continued to exceed its production targets in August. However, for Russia, which achieved its targeted cuts in only three months this year, full compliance got easier at the December OPEC meeting, as OPEC agreed to exclude condensate from Russia’s quota. The Russian Energy minister stated that the only reason Russia was falling short of its pledge was due to condensate production.

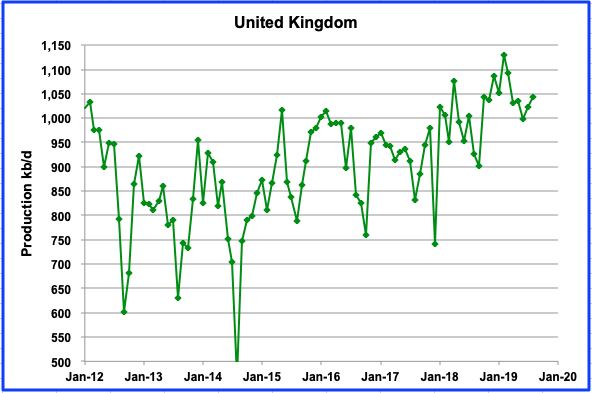

The UK’s output has begun to recover from unplanned outages. According to the IEA, “Overall, UK production is flat in 2019 and growing modestly by 20 kb/d in 2020, as field declines are just offset by rising production from fields West of Shetlands and Equinor’s Mariner project.” Mariner came online in August and will add close to 55 kb/d when it reaches its plateau next year.

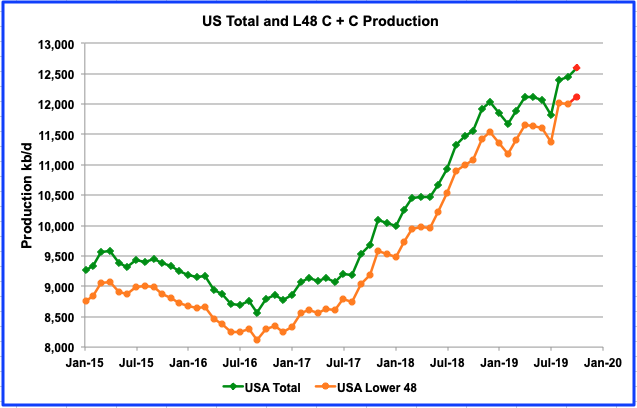

There continues to be much speculation and information pointing to a potential slowing of US oil production. However the latest production data from the EIA continues to point higher, albeit at a slower rate.

US production reached a new high of 12,463 kb/d in September according to the November EIA 914 report. Looking forward to October production, the November Monthly Energy Review (MER) estimates US production for October to be 12,600 kb/d, an estimated increase of 137 kb/d and shown in red as the last data point. Similarly, the October estimate for the L48 is 12,123 kb/d.

The initial growth estimate for 2019 is slower than for 2018. In 2018, growth to September 2018 was 1,432 kb/d. For 2019 it is 426 kb/d, ~30% of the 2018 growth rate. So while US production is growing, yearly growth is slowing.

There was little increase in September production relative to August in the L48 states. Increases in Texas, New Mexico and Oklahoma were offset by large decreases in the GOM (-114 kb/d) and North Dakota (-40 kb/d) that led to no growth.

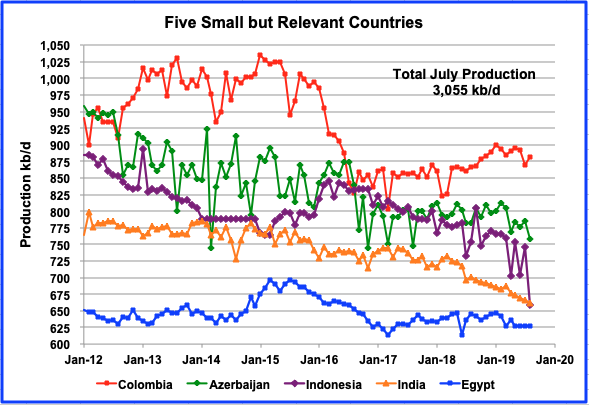

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1000 kb/d. All five are/were in decline. However, Columbia started to increase its production in July 2018 but that has slowed now due to riots. Egypt started production from its newly discovered oil wells in its western desert in December. Initial flow rates are reported to be 7000 bbl/d.

Their combined August production is 3,588 kb/d. Indonesia’s August output dropped by 12% to 87 kb/d but is expected to recover in September while Azerbaijan dropped 28 kb/d.

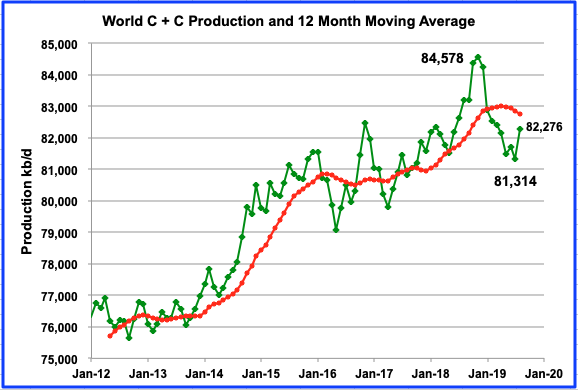

World oil output bottomed at 81,314 kb/d in July and added 962 kb/d in August to 82,276 kb/d. Of the 962 kb/d increase, 752 kb/d was contributed by Non-OPEC and 210 kb/d by OPEC. August production is still 2,302 kb/d below the November 2018 high. Note that even if the current OPEC quota cut of 1,700 kb/d were to be removed, it is not sufficient to overcome the 2,302 kb/d drop from the November high. It would take new production from Brazil, Norway and the US to fully overcome that drop, in addition to the repeal of the OPEC cuts.

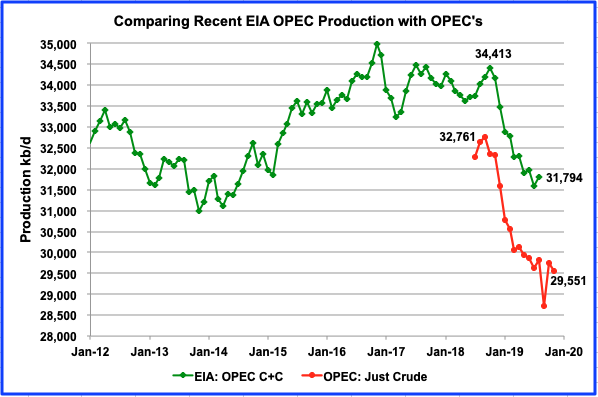

This is a comparison of the EIA’s estimate of OPEC’s C+C production vs OPEC’s crude output. The EIA’s estimate is roughly 2,000 kb/d higher, due to the inclusion of condensate. OPEC’s big production drop in September is shown in the OPEC graph but has not yet been reported by the EIA. Will it ever get back to 34,413 kb/d of October 2018 or the previous high at 34,976 kb/d of November 2016. Some say it is not likely using a conservative decline rate of 2% that never sleeps.

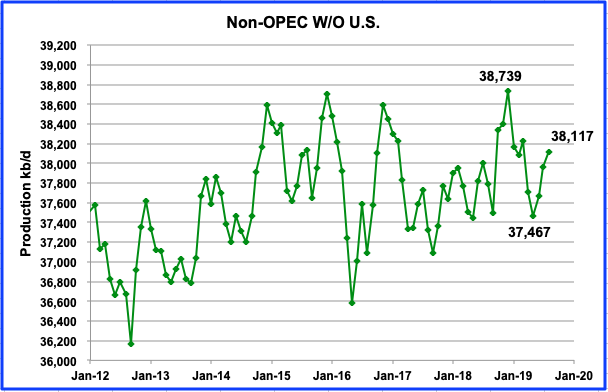

This chart shows Non-OPEC production without the US. This is one of the more critical charts that bears watching in the future. It is providing an early indication that Non-OPEC oil producing countries, excluding the US, could be on a plateau. This year will be critical since Brazil and Norway are both bringing new fields online with a production capacity of 400 kb/d and 440 kb/d respectively. Brazil has added one half of their expected increase this year and could add 200 kb/d next year. Norway has already added 350 kb/d before year end and could add an additional 50 kb/d to 100 kb/d next year. Adding the new production of 550 kb/d from Norway and Brazil to the 38,117 kb/d in August, would result in an output increase to 38,650 by year end. Of course, this excludes the decline that never sleeps and is discussed below.

Decline vs New Supply

This chart shows the total C +C production from 45 Non-OPEC countries that are experiencing declining production. The red line shows the average decline rate from January 2010 and is slightly above 30 kb/d/mth. The blue line, covering the years after January 2015, has a higher decline rate. Provided the higher rate from January 2015 is on average representative of what is currently happening in those countries, then on a yearly basis, Non-OPEC countries are experiencing a decline rate of 48.2 kb/d/mth or close to 580 kb/yr.

Using a midpoint output level of 14,500 kb/d/yr in October 2016 as a reference point, and the higher decline rate, the yearly decline for these Non-OPEC countries is 4%. For 2020, both the IEA and OPEC are expecting world demand to rise between 1,200 kb/yr and 1,100 kb/yr respectively. After accounting for the 580 kb/yr decline, world oil supply next year will need to increase by close to 1,700 kb/d and possibly higher to meet the expected demand increase.

HSBC issued a report in 2017 that discussed decline rates of oil fields. It notes that 81% of world liquids production is already in decline. It further notes that the IEA and Uppsala coincidentally appear to agree on a ~6.2% average post-peak decline rate. This is higher than the 4% noted above and when combined with 81% of world production is in decline, the 580 kb/d estimated above could be conservative.

The report further notes that some analyses differentiate between natural decline (which purely reflects physical factors) from managed decline rates, which include the impact of reinvestment. The IEA estimates that the difference between natural and managed decline rates is between 2% and 3%, and has been rising over time. Based on the distinction between decline rates, the 4% estimated above would be classified as “managed decline” and accordingly, the natural decline rate of these NON-OPEC countries is closer to 6%.

So if the natural decline is 6% for these Non-OPEC countries, then the monthly decline estimated above may actually 50% higher at 870 kb/yr or 72.5 kb/d/mth. Considering that the above decline graph stops in August, we can expect an additional five months of decline or a further drop of 362.5 kb/d by year end. So the estimated Non-OPEC output without US of 38,650 k/d noted above could be closer to 38,300 kb/d. We will revisit this prediction in five months. If correct, this could be significant since it would be close to 400 kb/d lower than the 2018 peak of 38,739 kb/d.

Answer to Question in Title

Looking at the first chart, it is clear that Non-OPEC production is recovering from the the May low of 49,580 kb/d. However, the bigger question is will it exceed the December 2018 high of 50,777 kb/d. Looking at the charts above, the following production increases can be expected, Norway 350 kb/d, US 600 kb/d, and other 100 kb/d. Adding these to the 50,482 kb/d output in August gives 51,532 kb/d by year end. As above, removing the additional five months of decline, 362.5 kb/d, gives an estimated output of 51,170 kb/d by year end, which is close to 400 kb/d higher than the previous high. While it is higher, the year over year increase is only 12.5% of the 2018 increase and may be signalling a coming change.

A chunk is Russia filling in for KSA when they got hit.

Ovi

It should be noted that the regulators have already jumped on the claims made for Egypt forcing the company to announce the following to prevent market abuse.

https://www.lse.co.uk/rns/UOG/egypt-update-in-response-to-media-reports-w54wwhxyjl17efa.html

Holy crap, is this spam? Here?

Thanks Lightsout for the heads up.

“Egypt said the newly discovered oil and gas wells in the Abu Senan area in the Western Desert started production on Thursday, the Ministry of Petroleum and Mineral Resources said in a statement.”

When I saw the above statement attributed to the Ministry, I took it to be official.

In Norway the Johan Sverdrup field will have full production off 440 kbpd in 2020. After this not much volume will be added , and as so far wells with high impact was dry or not economical to build out. In Norway most oil is already pumped up and gaz , liquid petroleum / condensate remains.

https://www.norskpetroleum.no/en/production-and-exports/production-forecasts/#production-forecasts

Low investment in maintenance have also increaced depleation rates since 2014.

Seens perhaps Brazil, GOM deepwater will add some barrels in future outside Opec. Russia have also lately made some onshore discoveries that might be built out.

Ok i will make a prediction, by mid summer 2020 JS will produce above 440.000 boepd.

There has been some very economical barrels found in Norway 2019, but size of those im aware of were close to or below 100m barrels, still if they are at 20$ barrel break even for full field life its kinda nice. Not high impact as you say but at least economical.

We also have the as far as i know best in class producer with opex sub 4$/barrel in Norway.

Then the new frontier on barents who sofar has delivered mixed results but is under drilled.

I would not count Norway out just yet but i agree they will never reach former peak.

Any opinions about how likely this is?

‘ It is estimated that the deep pre-salt layer could potentially raise Brazil’s output to 7 Mb/d by 2030’

[up from 3Mb/d currently]

Just as likely I will inherit the billions when my aunt dies . 🙂

you just speculating, or have any specific knowledge to share?

I am unable to get back to the original site directly but found a back way. Here is the statement:

“By the 2030s, the development of the offshore sites is predicted to raise Brazil’s daily oil production from 3m to 7m barrels a day, an increase that would make it the world’s fourth-largest producer, after the US, Saudi Arabia and Russia. Brazil is currently the ninth largest.”

Also found an update after the auction that appears to have failed.

“Officials in Brazil had hoped the auction would by the 2030s trigger a huge uptick in the nation’s oil production — from 3m to 7m barrels at day — a prospect that now looks unlikely.”

4 Mbpd increase in 10 years is about 1 Johan Sverdrup field anualy. Think that seems a bit to much also considering the time it took to develop the 3Mbpd they produce today. At the same time 4 Mbpd will be less than 30% of the world demand same period if increase is about 1.5 Mbpd average anualy. Will Saudi add the remaining 11 Mbpd + natural decline world wide ? I doubt it will ve US Shale as it seems now…

Well (no pun intended), even if its 2 or 3 Mb/d more by 2030, that ain’t shabby.

Iran and Venez could each add that much also,

in a world where things go smoothly.

Is there a world like that?

Possibly…but there’s also a world where they don’t even produce as much as they do today.

Venezuela – continued political decline seems to be the status quo

Iran – riots; military provocation; sanctions

Brazil – political corruption; extremely difficult area to develop

And of course the numerous other black swans that each have a 2-10% possibility of occurring:

– Iraqi political dissolution;

– Chinese debt bubble implosion;

– Terrorist attack on Saudi oil facilities;

– American shale debt bubble meltdown;

Etc…

Stephen,

The most likely scenario is that some negative stuff and some positive stuff will happen (negative means less oil, positive more oil or vice versa from an environmental perspective). Impossible to predict which specific events will occur, but highly unlikely they will be all positive or all negative.

I appreciate your optimism, Dennis, but a major escalation in the political situation in Iraq that would wipe out 5MM/day or Iran starting a war with KSA and taking 20MM/day+ off the market are NOT balanced by the upside of Brazil possibly producing a few extra barrels in 2030. Everything may very well end up hunky dory like your estimates suggest, that may very well be the most likely scenario in fact, but that doesn’t change the fact that one or two unexpected events could radically alter oil production to the downside.

Stephen,

It seems realistic to not expect a major war in the Middle East from my perspective, but bad stuff can surely happen. Oil prices would rise sharply under your scenario, no doubt, many projects that were not profitable at $60/bo for Brent would become profitable and output from non-OPEC would increase, as well as from OPEC producers not involved in the conflict. It would take 5 years, but the World would adjust and use the crude available. Oil prices would likely rise to $200 or perhaps $300/b, that destroys a lot of oil demand.

It also speeds resource development.

Dennis – I appreciate your optimism, the “can do” spirit of adjustment that you place so much faith in, but I don’t think you’ve fully internalized the role of money and debt as the prime organizing agents of our just-in-time economy.

Shocks to any system are bad. An oil price shock will slam into the largest aggregate and ratio-level debt pile in human history.

1 in 8 companies are zombie companies, meaning their operating cash flows are insufficient to even make the debt interest payments they carry.

What we call “subprime” is a line in the sand under current conditions, which are themselves primarily enabled by abundant oil. Remove the oil, and you see a price spike. Remove the oil and the current conditions shift. Remove the oil and the subprime line ratchets far higher. Move that line far enough and the entire edifice of debt becomes unstable and it topples over.

This is why I have been a fierce critic of the central bankers insane belief that credit cycles are preferable to business cycles.

Credit cycles are fun on the way up and offer the false belief that we puny humans are in control, and can manage the outcomes of an inherently chaotic and complex set of interlocking systems.

Business cycles are far more frequent and less fun. They tend to wipe out the excesses and bad decisions before they go “too far.” Little brush fires that happen frequently.

Credit cycles go on far too long and when they finally catch fire, it is a devastating crown fire that ruins the shrubbery and biggest trees alike. It’s an ecosystem reset.

There’s no “adjusting” to such an event. All the crap that really shouldn’t have happened gets reset, not adjusted. Shale companies that have lost a quarter trillion dollars simply go bust. 1 in 8 companies go out of business. But that number might be 1 in 4 once the subprime line migrates north during the deflationary bust.

It’s far more interconnected and complex than you lay out as something that can be adjusted to. And it’s very hard to see from our current perspective because everything seems to be working okay.

But it’s not. Not when you look at the growth in debt relative to actual income (GDP). Not when you understand the unmet pension and entitlement promises. Not when you see how governments at all levels (fed, state, local) have organized themselves around the “reality” of the credit machines.

But especially not when you see the extent to which the entire machinery of economic growth is addicted to perpetual growth and endless resource extraction.

The math just doesn’t work.

At a minimum credit growth needs to match actual organic economic growth. It’s vastly exceeding that and has been for a few decades.

That’s all just potential energy in the system, and that system is fine as long as it doesn’t receive any sort of a big shock.

Rapid oil price spikes have traditionally been one of the most reliable shocks in the data. No reason a future shock would be any different. Especially not with record levels of debt and unmet IOUs in the system.

Over the last 40 years the rich have turned their federal taxes into IOUs. The bigger they are the harder they fall. Poetic justice.

“Adjustment”, “reset” really. You seem most interested in an argument and part of the noise.

Chris,

My expectation is another financial crisis at least as severe as 2008/2009 or perhaps Great Depression 2.

I understand the World is far more complex than can be modeled by boiling things down to a few key variables (which I would call a reductionist analysis), that is why your claims that “energy is everything” seems far too simplistic. It is important, no doubt, but from my perspective, though I agree with much of what you wrote and also agree there can be too much debt, it is not clear where that line is.

Consider that a typical metric for mortgage lending is a total debt to income ratio of no more than 3. The same sort of metric for the World would put debt to GDP for the non-financial sector at no more than 300%. Using BIS data for the World we get the chart below. It is not that alarming.

The World economy will recover from the coming Great Recession/Depression that might begin in 2029-2031 that may occur in response to peak C+C in 2024-2026. The speed of recovery from that economic crisis will depend upon policy makers remembering their Keynesian economics. Unfortunately many graduate programs in economics (in the US) pay little attention to Keynes and are all about microfoundations for macroeconomics. Those economists will be of little help and will argue for nonsense like fiscal austerity in response to a lack of aggregate demand, much like Hoover’s advisers in 1930-1933.

“Using BIS data for the World we get the chart below. It is not that alarming.”

Couple of errors there. First, just counting the debt and forgetting the liabilities is a no-no. Any mortgage broker, to follow your household analogy, is going to ask about both your debt levels and your liabilities.

Got three kids entering college next year and nothing saved up? That counts against your borrowing capability. Got plenty of income but also ten years of alimony left? Another ding.

Second, as I’ve tried to illustrate for you before, if your income (GDP) is spiked by borrowing (debt) it’s not actually real “income.”

Remember the example of your and my hypothetical GDP’s but one was spiked 100% by debt?

The funny part about the BIS data you cite is that it (1) counts the GDP portion that resulted from borrowing in full but (2) does not subtract or adjust for debt at all.

It’s a glorified form of double counting.

That “system” works as long as everyone holds the same fantasy; credit growth can exceed income forever,

I’ve beaten my head against the wall for over a decade trying to get people to see this simple logical error. It’s hard.

Like explaining water to fish hard. That’s what happens after too many years in a given system, it’s never even questioned any more…

The data:

The noise continues

“It’s a glorified form of double counting”

No, it’s a means of investing against the future

Almost every metric of debt and financing is beyond 2007, so why was there a GFC in 2007 but not now?

http://creditbubblebulletin.blogspot.com/2019/12/q3-2019-z1-flow-of-funds-repo-madness.html

1) there is nowhere for capital to run – there are no healthy actors / parties

2) 2007 was relying on the credit stability of people commuting from Stockton to SF (4 hours a day), housing developments sprawled across Las Vegas, and the slums of Cleveland. 2019 is relying on companies with fairly direct access to the money hose.

so you are both likely wrong. dennis’ idea that $200/b oil would be a “tough adjustment but we’d get through it” is extremely improbable and chris’ idea that the credit cycle will end by some magical mechanic as to yet unnamed even after 10 years of digging (by many people) also has serious impediments to occur.

Two cents-

You don’t want to be around when this huge debt/credit bubble breaks. And it will.

HB- “No, it’s a means of investing against the future”

That’s straight-up word salad…what does it mean to “invest against the future?”

Maybe this is a verbal Rorschach test?

So true hickory. The end of this credit bubble will obliterate the global economy. But it won’t be an artificial trigger. I think only peak oil, true geological peak oil will end it.

Chris, good luck talking to fish, but for you I will keep it simple.

When a business or individual borrows money. They agree to pay it back, get this “in the future”. If you know of a bank that doesn’t have that requirement, please let me know.

Then the business or individual puts it to work. That’s an investment good or bad. Be it to drill a hole into the ground, put up a factory to build cars or pay their sales force. The objective is to profit enough to pay back the loan with interest and have an asset left over to keep.

When an individual takes out a mortgage. It’s an investment in real estate and a place to rest their head at night. Same with a car loan, it’s an investment in a vehicle and access to transportation. Even using a credit card at McDonalds is an investment against hunger.

I never said all loans are wise decisions. That’s for the borrower and loan officer to figure out.

No “glorified form of double counting” here. Just the opportunity for those who are short on capital to succeed and expand an economy beyond the wealthy.

Chris,

GDP is income, by definition. The debt is a balance sheet item, for every asset there is an equal liability. For planet Earth as long as there is no interplanetary economic interaction any debt that has spiked GDP is a liability for one citizen of the Earth and an asset for another citizen. I consider the terms debt and liability to be synonyms, so perhaps I should have used the term liability, I am not in the Mortgage lending business, all of my “liabilities” are debts. Low interest mortgages that there is no need to pay off early as the money earns a higher return invested.

You seem to have a very different understanding of GDP from economists.

https://en.wikipedia.org/wiki/Gross_domestic_product

I will go with mainstream economics on this one.

Quick question for you? When you borrow 200k for a mortgage does that show up as income on your W2?

Did not work that way for me, maybe the rules are different where you live. :)\

GDP=national income, debt is a separate issue. It is properly left out of GDP. One entity lends x and holds that promise to pay as an asset, another entity gets x and now holds a liability equal to x which is paid over time with interest.

I am confident that the BIS understands the economics quite well, perhaps their are some who understand less well.

two cats,

I doubt the price of oil will get to $200/bo in 2018$. Keep in mind that real GDP grows about 3% per year on average (at market exchange rates) for about the past 10 years.

So let’s take 2012 when oil price averaged around $110/b in 2018$, in 2022 if World real GDP grows at 3% per year on average from 2012 to 2022 then in 2022 World real GDP will be about 34% higher than in 2012 (1.03 raised to the 10th power is roughly 1.34). World output may be about 10% higher in 2022 vs 2012, so 1.34/1.1=1.22 and oil prices could be 22% higher and the proportion of World income spent on C+C would be about the same as in 2012, so a price of $134/bo would be a similar load on the economy in 2022 as $110/bo was in 2012. My guess is that the peak in 2025 would result in slightly higher prices perhaps $150/bo, if the economy does not slow its growth in response to peak oil.

Competing factors here, the transition will be disruptive, but it will also open up opportunities for new businesses (those that will need to expand to produce batteries for EVs, rail, light rail, EV production of cars, trucks, and buses) on balance the effect might be more growth, difficult to predict, I would say less growth perhaps slowing to 1.5% real GDP growth is the more likely outcome.

Despite everyone saying my scenarios are too optimistic, my best guess scenarios of the past have in every case proven to be too low rather than too high (so optimistic only from the perspective of environmental degradation).

I think we are well beyond the point that we should acknowledge that even in a world where things don’t go smoothly, the incentives to produce enough oil to keep the “civilized” world from collapsing are existentially astronomical. In addition, individual actors are well incentivized to maximize revenue (for state actors) and show “growth” (for market actors). Without the ability to “cartel” to limit production and maximize profits, market actors can’t really limit supply to adjust to demand. Some will reduce capital expenditures but others will raise capital expenditures. Some will bet on lower oil prices, others on higher.

This is all to say – oil production will probably stay near the top of what is possible geologically, and considering OVIs post, that should mean recovering or at least stabilizing.

Brazil got attention here some years ago.

The offshore presalt stuff is very deep and very high pressures, as I recall. Kashagan level pressures.

There was also a bizarre regulatory problem in that helicopters capable of that round trip range were very rare, and this was going to obstruct staffing of the platforms. Maybe more have been built by now.

But again, if prices crept up to even close to $100 for more than 4 months, I bet someone would find those helicopters.

Dennis thinks debt boosts the economy, yet when US debt was low in the 50s GDP growth was far higher than now.

https://www.zerohedge.com/news/2017-01-27/barack-obama-now-only-president-history-never-have-year-3-gdp-growth

The reason GDP is lower and debt spiraling out of control is obvious to anyone who really understands what debt can and cannot do.

Dennis

GDP is not income. It is the value of all goods sold. If a house builder builds a house, they first have to buy all the bricks and mortar, windows, piping and pay for Labour. Their income is the difference between all expenses and what they sold the house for.

US government income is NOT the GDP of the country, it is total tax receipts, which is about £3.4 trillion. The government is spending $1 trillion more than this. The government is having to borrow $1 trillion in order to pay the $350 debt interest and other liabilities.

When people buy a house they pay down the debt, in this case, the family is not paying down the debt. It is borrowing more and more simply to pay the interest and food and bills.

The fix is simple.

The next government must tell the people they must work 10 hours per month extra and all that money must go to the government to pay for pensions, medicaid the armed forces etc.

The alternative will be far worse.

Peter,

See section 2.2 (income approach) of page below

https://en.wikipedia.org/wiki/Gross_domestic_product

The second way of estimating GDP is to use “the sum of primary incomes distributed by resident producer units”.[5]

If GDP is calculated this way it is sometimes called gross domestic income (GDI), or GDP (I). GDI should provide the same amount as the expenditure method described later. By definition, GDI is equal to GDP. In practice, however, measurement errors will make the two figures slightly off when reported by national statistical agencies. (part left without italics for emphasis by me).

I agree that government debt levels should be reduced during periods of high employment either through higher taxes or lower government spending.

You might not realize this, but when the government spends money on military equipment, healthcare, or roads and bridges the jobs that are supported by that spending creates higher national income. This is described in any standard textbook.

See

https://www.amazon.com/Macroeconomics-Paul-Krugman/dp/1464110379/ref=zg_bs_2596_33?_encoding=UTF8&psc=1&refRID=APFZ057AFAP7SAASBCBA

or for a classic text

https://www.amazon.com/Economics-Paul-Samuelson/dp/0072314885/ref=pd_cp_14_2/145-5526016-7266342?_encoding=UTF8&pd_rd_i=0072314885&pd_rd_r=f80e09a0-5802-4c6b-8231-fdec497f331e&pd_rd_w=FzVYR&pd_rd_wg=Swwm5&pf_rd_p=0e5324e1-c848-4872-bbd5-5be6baedf80e&pf_rd_r=AJ8WTH132C4GZ8AY6PVT&psc=1&refRID=AJ8WTH132C4GZ8AY6PVT

No doubt there is something at your local library.

Also on GDP growth one should look at real GDP per capita

https://fred.stlouisfed.org/series/A939RX0Q048SBEA#0

The average real per capita GDP growth rate from 1950 to 1959 was 1.5% per year in the United States. From 2010 to 2019 the average annaul growth rate in real GDP per capita in the US was 1.57%. The average rate of growth of real GDP per capita from 1950 to 2019 was 2% per year in the US. From 1960 to 2007 the average annual growth rate in real GDP per capita was 2.15% per year.

Dennis

I am still not sure if you understand the difference between GDP and revenue.

Real GDP is like the turnover of a private company, if run properly that turnover will generate a profit. That profit is the equivalent of all the taxes a government can raise out of the GDP.

You do not appear to understand the difference between profit generated by a properly functioning business and a company that has to borrow increasingly more and more money to pay it’s workers.

The first can go on for ever, the second will crash and burn at some point.

I do not think you really have a grasp of what is coming down the road and what a sustainable economy looks like.

Keynes never envisioned his theories would be twisted to this level by such dishonest men in government.

Peter,

I understand very well. Did you read the Wikipedia page on GDP?

You could also try any introductory macroeconomics textbook. I used to teach this stuff in graduate school, I understand it quite well. I also have read and understand Keynes’ work quite well. One of us does not understand this well. 🙂

Dennis

I have a couple of friends who teach economics to degree and masters level.

They have explained to me what is structurally wrong with many economies particularly the US. It’s fiscal deficit and trade deficit are the result of gross malfunction. Just like an engine you can inject more power “money” to overcome a malfunction. However at some point things break up.

When it does people like you will blame everyone else except your own deluded thinking. Trouble is, you will take down many hard working people in the ensuing chaos.

I hate people like you who give legitimacy to politicians that they can run up large debts and there will never be a reckoning.

Nonsense, your hate is unjustified

Nonsense, your hate is unjustified

Huh? I detected no hate in anything Dennis said. I think your comment is unjustified.

There are many things that people do not understand, including myself. Simply pointing this fact out carries no characteristic of hate whatsoever.

My response was to Peter, not Dennis. I thought it was pretty clear if you read Peter’s comment.

Dennis shouldn’t even respond

Sorry HB, but you should indicate to whom you are replying when comments get to this level.

I agree, hate is almost always unjustified. I don’t even hate Donald Trump. But I do hate what he is doing to our country and to the office of the Presidency. Our president has become the laughing stock of the world.

Nancy prays for him 🙂

Peter,

I stand by what I have said.

Perhaps you have not understood what I have written.

I have said the fiscal government deficit is a problem at high employment rates and should be corrected.

Tax cuts when the economy is doing well is stupid policy unless there are equal reductions in government spending.

One needs to look at more than trade deficits, service, and capital flows must also be included to fully understand the international economics.

Your friends probably understand this, not clear from what you have written that your understanding is clear.

It is the value of all goods sold.

It is the value of all goods and services produced in a specific time period.

But also what Dennis said.

Actually the next government should undo Trump’s dumb tax break. And Bush’s dumb tax break. And Reagan’s dumb tax breaks. Also a lot more money needs to be spent on the IRS, because they are where to government gets its money.

America’s government debt is too high, but it is not the biggest problem facing the country. The biggest problem is the current account deficit, which is the result of excessive consumer spending. Taxes on consumption would help, and energy is an obvious place to start.

And now that we have a solution, I am going back to sleep . If wishes were horses beggars would ride.:-)

If horse turds were biscuits they would eat till they died. 😉

To get an emoji you must put a space between your period and your smiley face.

https://www.wsj.com/articles/banks-get-tough-on-shale-loans-as-fracking-forecasts-founder-11577010600?redirect=amp#click=https://t.co/Zg0IfVvcXf

Banks Get Tough on Shale Loans as Fracking Forecasts Flop

Oil and gas companies face tightened credit after wells produce less than projected

Dec 22, 2019

Some of the banks that helped fuel the fracking boom are beginning to question the industry’s fundamentals, as many shale wells produce less than companies forecast.

Banks have begun to tighten requirements on revolving lines of credit, an essential lifeline for smaller companies, as these institutions revise estimates on the value of some shale reserves held as collateral for loans to producers, according to people familiar with the matter.

Some large financial institutions, including Capital One Financial Corp. and JPMorgan Chase JPM -0.08% & Co., are likely to decrease the size of current and future loans to shale companies linked to reserves as a result of their semiannual reviews of the loans, the people say. The banks are concerned that if some companies go bankrupt, their assets won’t cover the loans, the people say.

JPMorgan Chase declined to comment. Capital One COF -0.01% didn’t respond to requests for comment.

The tightening financial pressure on shale producers is one of the reasons many are facing a reckoning going into next year. Chevron Corp. said Dec. 10 that it plans to take a charge of $10 billion to $11 billion, roughly half of it tied to shale gas assets, which it said won’t be profitable soon. Royal Dutch Shell PLC said Friday it will take a roughly $2 billion impairment, and other companies are expected to follow suit in writing down assets, according to analysts and industry executives.

The heat is greatest for small and midsize shale producers, including many whose wells aren’t producing as much oil and gas as they had projected to lenders and investors. Some of those companies may be forced out of business, said Clark Sackschewsky, the managing principal of accounting firm BDO’s Houston tax practice. Large companies are likely to weather the blow because of their size and global asset diversity, but for some smaller shale operators, tightening access to bank loans could prove disastrous.

“We’ve got another year under our belts with the onshore fracking assets, which includes less than optimistic reserves results, less production than anticipated, a reduction in capital investment into the market,” Mr. Sackschewsky said.

Oil and gas producers expect banks to cut their revolving lines of credit by 10% as a result of the reviews, according to a survey of companies by the law firm Haynes & Boone LLP. The cuts may be more severe, say some people familiar with the reviews.

Banks have extended billions of dollars of reserve-backed loans, though the exact size of the market isn’t known. JPMorgan said in a regulatory filing in September that it has exposure to $44 billion in oil and gas loans, and Capital One COF -0.01% said in October it has extended more than $3 billion in oil and gas loans. It wasn’t clear for either bank what proportion of those are backed by reserves.

Banks have typically applied a 10% discount to the value of reserves, meaning a shale company could borrow against 90% of its reserves as collateral. Banks have typically lent as much as 60% of that value. But some are now discounting the value by as much as 20%, the people say.

Meanwhile, some regional banks have begun writing off bad energy loans. Net charge-offs shot up at Huntington Bancshares in the last quarter. The Ohio-based lender attributed the move primarily to two energy loans where the borrowers’ production had not met expectations, Huntington Chief Executive Officer Stephen Steinour said in an interview.

“Geology and the assumptions were just flawed,” Mr. Steinour said.

Many investors have lost faith in the viability of shale drillers, as natural-gas prices stayed low and many companies broke promises on how much their wells would produce and when they would begin to turn a profit.

As investors have retreated, cracks have begun to show. Energy companies accounted for more than 90% of defaults on corporate debt in the third quarter, according to Moody’s Investors Service. There were more than 30 oil-company bankruptcies in 2019, exceeding the number in 2018 and 2017. Exploration and production companies are now carrying more than $100 billion in debt, according to Haynes & Boone.

Skepticism among banks has grown in part because lenders have more closely scrutinized public well data on production and seen that it is falling short of forecasts, as a Wall Street Journal analysis showed earlier this year.

Specifically, banks have begun questioning shale producers’ predictions about their wells’ initial rate of decline, which are proving overly optimistic, according to engineers. If shale wells, which produce rapidly early and then taper off, are declining faster than predicted, questions arise regarding how much they will ultimately produce.

Share Your Thoughts

What do you think tightened credit requirements mean for the shale industry as a whole? Join the conversation below.

Some lenders have flagged publicly that they will be less generous with loans in the future. “With respect to any new energy loans, we are highly cautious; it’s a very high bar we must clear,” said Paul B. Murphy, CEO of Cadence Bank, in an October call with analysts. The firm operates in Texas and the southeastern U.S.

Bank lending has slowed across the board in the country’s hottest drilling region, the Permian basin in West Texas and New Mexico. After leading Texas last year, loan growth in the region shrunk to 4.8% below the state’s 7.5% average in the last quarter, the Federal Reserve Bank of Dallas said Thursday.

More than a decade into the shale boom, investors are trying to wrap their arms around the true value of producers’ assets, said Michelle Foss, an energy fellow at Rice University’s Baker Institute for Public Policy.

“There is a struggle now for investors to determine what things are actually worth,” Ms. Foss said.

Dwindling access to bank loans will put more pressure on an industry that has already lost access to other sources of money. Without new cash infusions, many companies may be unable to drill their undeveloped reserves, which could further diminish the value of their assets.

Some shale companies have been lobbying the Securities and Exchange Commission to change its rules governing reserves reporting, allowing them to count undeveloped assets as reserves for a longer period. The SEC currently allows oil and gas producers to report reserves as “proved” if the companies plan to develop them within five years.

In an August letter to the SEC, Continental Resources Inc., one of the largest shale companies, pushed for the regulator to extend that period to 10 years. The company, founded by the billionaire prospector Harold Hamm, said its proved reserves would be around 16% higher with such a rule change.

A Continental spokeswoman declined to comment. An SEC spokesman didn’t respond to a request for comment.

“There is a struggle now for investors to determine what things are actually worth,” Ms. Foss said

although this is exceptionally true for LTO companies, it is broadly true for the whole economy due to the economic distortions frequently pointed out by Watcher, et al. I’ve read a lot of broader economic articles stating that ONE DAY these distortions will unravel, revert to the mean, etc, but rarely do I see discussion of the exact mechanics of how that happens. It is possible that a fall-out in oil/gas spreads contagion to broader economy, but is $100 billion enough to create that?

Doesn’t seem big enough. More likely something really big like Chinese debt bubble collapse. 30-40 years of unchecked growth fueled by massive debt has created some crazy distortions with huge ripple effect potential.

Agreed oil business not big enough. China has been straining for a while to maintain growth, while stopping capital flows, and fixing its currency, and juicing the economy as needed. But nobody can call them on it because its a Mutually Assured Destruction scenario. No one could take down China without also taking out themselves for quite a while (supply chains would shatter, Amazon business model destroyed, growth engine for STEM lords would vanish, etc). It may happen by accident…

Ovi,

Enbridge (Canada) has said that it can increase pipeline capacity without building more pipeline since that is currently difficult to do there. TC, which I believe was TransContinental, may be saying the same.

Two of Enbridge’s approaches are first to stop carrying crude from the Bakken, maybe completely, and second reverse the Sunshine pipeline which carries condensate from the US to be used for diluent in Canada. They say they can do this because more condensate is coming out of Western Canada so they don’t need it from the US.

Canada’s problems exporting its crude are looking to have more effect in the US than they have been having.

Synapsid

In looking at the Enbridge web site, they are enthused at what friction reducers can do for increasing pipeline through put.

I had read that they were thinking about reversing the sunshine pipeline. It sounds easy but if they have the same issues we had in Canada it can take a while.

Quebec asked Enbridge to reverse the pipeline from Sarnia to Montreal so that the two refineries there could keep functioning. Now that has been done, New Brunswick would like a pipeline to help their refineries. Quebec now says Canada does not have the social license to do that. (Note: pipelines are a Federal jurisdiction when they cross provincial borders) Excuse me for digressing into my rant regarding Social License

Back to reversing that pipeline to its original flow direction, Sarnia to Montreal when it was first built. It took three years of environmental assessments and hearings and protests to get it approved. I am not sure what the procedures would be in the US. The Canadian part being in Alberta might be easy.

TC Energy, formerly Trans Canada pipeline.

This crept up on us.

Canadian condensate 420K bpd. Canadian production is 4 mbpd and 1/2 of that is out of Edmonton and oil sands.

So 2 mbpd diluted with 420K? Doesn’t seem right. We need to know that ratio because if 420K is enough, the Eagleford is in big big trouble.

Permian sweet spots continue decreasing as shown by decline in production from high production wells > 800bd.

Mar 2019 681 wells producing 824 kbd, average of 1,210 bd/well

Sep 2019 575 wells producing 696 kbd, average of also 1,210 bd/well

https://shaleprofile.com/2019/12/19/permian-update-through-september-2019/

For Permian wells that started producing in 2018, the chart below gives the productivity distribution based on 4 month cumulative output. Average cumulative 4 month output is 68467 for the 5181 wells that started flowing in 2018.

For the Permian wells that started producing in 2019 and have at least 4 months of output we have the 4 month cumulative output productivity distribution in chart below. Average 4 month cumulative output for the 2444 wells that started producing in 2019 and have produced at least 4 months is 73383.

Based on this it would suggest little change in sweet spots.

The number of high output wells has decreased because there have been fewer wells completed, it is that simple. In addition the most recent months are incomplete with many wells not included.

There has been little change in productivity from 2016 to 2019 when normalized for lateral length, see

https://shaleprofile.com/wp-content/uploads/2019/12/Cum-vs-time-600×361.png

from https://shaleprofile.com/2019/12/19/permian-update-through-september-2019/

Tony,

If we look back at the July Permian report

https://shaleprofile.com/2019/07/04/permian-update-through-march-2019/

we find 643 wells producing 774 kb/d for Permian wells over 800 b/d, 1203 b/well for March 2019.

Using only wells with more than 800 b/d output is not a great way to define sweet spots, depends on acres per well, lateral length, type of completion, pounds of proppant, and many other factors that change over time, average well profile is a better measure. As sweet spots become fully drilled, the cumulative output of the average well will decrease. There is little evidence of this to date.

See chart below with quarterly changes in well profiles in 2018 and 2019.

Using only wells with more than 800 b/d output is not a great way to define sweet spots, depends on acres per well, lateral length, type of completion, pounds of proppant, and many other factors that change over time, average well profile is a better measure. As sweet spots become fully drilled, the cumulative output of the average well will decrease.

You listed many factors that influence well production. But at the very least production should be normalized, either per lateral lineal foot or acres per well. If drillers keep increasing lateral length, average cumulative output per well could stay the same even as drilling moves to less productive areas. Average well profile is a poor measure unless corrected for changes in well length.

Joe,

I agree, see the chart at the post below for the Permian basin.

https://shaleprofile.com/2019/12/19/permian-update-through-september-2019/

image at

https://shaleprofile.com/wp-content/uploads/2019/12/Cum-vs-time-600×361.png

what this shows is that the well profile has not changed significantly when normalized for lateral length from 2016 to 2019. I do not have access to the full analytics at shale profile, too expensive.

Thank you very much for the chart link, which is just what I wanted to see.

It looks like production per 1000 ft of lateral length increased until 2016 and has remained stable since then. I only know what I read here and at Oilprice.com, but my guess is that increasing the number of frac stages and volume of proppant led to increasing production per foot. It looks like technical improvements have maxed out, since per foot production isn’t increasing anymore.

When the average well cumulative production curve per foot starts declining, which hasn’t happened yet, we will know that the best acreage is saturated with wells and drillers have had to move to areas with poorer production.

Joe,

Agree 100%. From what I see, the sweet spots are not fully drilled up yet in the Permian Basin, when we see output per foot of lateral decrease significantly, that will be the key signal. Unfortunately I only have access to the free stuff on htpps://shaleprofile.com and a similar chart (well profile normalized for lateral length) for other plays like the Eagle Ford and ND Bakken is not freely available.

Correct web address for shaleprofile is

https://shaleprofile.com

The blog link has a ton of great information.

Thanks for the great post Ovi. I really like coming here for the condensed data and analysis.

A quick Q: In the first image of the article there’s an arrow pointing to a month and it’s indicating that it’s “Dec. 18- 47,615.

I think it actually might be pointing to Dec. 17. As it seems to precede the January 2018 data point.

Or maybe I’m confused, which is not uncommon BTW.

Survivalist

You go to the Front of the Class. Fixed

Thanks

Cheers Ovi,

again, great post. Thanks so much.

On the non-OPEC decliners, note what happened from Jan 2011 to Dec 2014 when Brent Oil price averaged about $110/b in 2018$, the decline rate was relatively flat. From 2015 to 2018 the average Brent oil price was $57/b in 2018$. The oil price matters as there are more oil resources that are profitable to produce at high oil prices. This fact will affect World decline rates.

Not that I am not suggesting that there will be no peak, simply that it is likely to be accompanied by high oil prices similar to 2011 to 2014 (and likely higher than that level). Using a low oil price period to forecast future decline rates is highly problematic from my point of view.

I agree Dennis and it also complicates projecting and or predicting peak even more so.

Iron Mike

As noted below, the objective was to find some realistic number to use for yearly decline rates to add to IEA/OPEC demand numbers. I have never seen one except as a percentage of wells that are in decline. No a very useful statistic. So we have a number now 500 kb/d/yr. As usual, I will continue to look for clues as to how real this is. My hunch is that it is too low.

Hi Ovi,

Thank you for the post. Are you basing the decline rate based on the linear regression ?

Some of the non-opec countries production rates look more like polynomial regressions, and projecting them based on different polynomial degrees might come in handy and interesting.

Iron Mike,

Random polynomial curve fitting without theoretical justification is unlikely to tell us much in my opinion. I agree linear regression is also not ideal, just gives us future trend, but again those trends are very likely to change so may tell us little about the future. Slope might become more steep or less steep or remain the same.

Totally agree, just for fun to see which future data points correlate the best or not at all with which polynomial curves.

It works rather well with climate, since we can justify it with a warming earth, and on different places on the earth the polynomial fitting differs by some margin.

Iron Mike,

One can play with historical data (say data up to 2005 or 2010) and fit some curves to that data (without looking at data beyond that date, no cheating) and see how well the polynomial fits will do. I am fairly sure you will find that it does not match the future very well, unless you cheat and use the “future” data to pick your best fit.

Predicting the past is not difficult, it is the future that is problematic. 🙂 (as Bohr and others have correctly suggested.)

Iron Mike

The best one can do with the current data is linear regression, keeping in mind that straight lines don’t go on forever. Doing a segmented analysis with lines can point to changes.

One can do better when there are multiple countries, fields, producing zones, etc. Group by type and do a linear projection for each type. Some types will project well. Others have problems or successes as events. They do not project reliably. But they will give an estimate of the reliability of the linear projection.

Dennis

Not quite sure what you mean that the slope from Jan 11 to Dec 14 is relative flat. See attached updated chart. It is 21.54 kb/d/mth or 258 kb/d/yr. Not insignificant.

The objective in undertaking this exercise was to see how much has to be added to world projected demand to meet the Real yearly oil demand increase which is “Market demand from OPEC/IEA + Decline rate”. As noted above Brazil and Norway are expected to add 750 kb/d over the next year. As you are aware, you just can’t add that to today’s output because decline is steadily working.

What we are looking at here, as noted above, is “managed decline rates ” which are affected by investment. This is why the calculated rates are lower than what is provided by hard data from individual wells. However, it was encouraging to get a managed decline rate of 4% since it tied in well with the IEA’s estimate of actual decline as obtained from individual wells.

So looking at the two extremes of decline rates of 258 kb/yr and 870 kb/yr, for our purposes, it is worthwhile to assume that roughly 500 kb/d should be added to the demand numbers published by OPEC/IEA.

Ovi,

I would disagree. The 260 kb/per year decline seems more likely in a high oil price environment. Output for the World is roughly 80,000 kb/d, add the 800 kb/d increase in demand (long term average) and we have 1060 kb/d extra needed each year, about 1.3%, but note that high oil prices are likely to reduce the 800 kb/d increase in demand to zero, so the 260 kb/d is 0.3% of 80,000 kb/d of World C+C output.

My point was simply that 260 kb/d is a smaller slope than 870 kb/d, so it is less steep.

So a beginner slope vs an expert slope and thus flatter (or less steep). I believe I said relatively flat rather than that the slope was zero.

Dennis

Not sure what you are disagreeing with, 500 kb/d decline rate?

Relevance depends on the denominator one chooses. I was looking 260 kb/d relative to demand. It is an increase of 25% using your 800 kb/d long term demand.

Also consider all of the effort and investment required by Norway and Brazil to bring on 440 kb/d and 300 kb/d, respectively. The 260 kb/d is a significant percentage of these two fields maximum output.

As an aside, I see no mention of zero in my response, only “relatively flat”.

Ovi,

My comment said relatively flat, you came back with, “not really”, I am comparing the less steep slope with the steeper slope that you highlighted, so where you seem to think it is likely to be steeper than 500, I think it is likely that it will be less steep than 500 kb/d for the annual decline of the non-OPEC decliners, probably around 270 kb/d. Canadian, Brazilian, US, and OPEC output is likely to be able to meet a 270 kb/d decline. Higher oil prices will reduce demand growth as Brazil, Canada, US, and OPEC approach peak output over the next 5 years. That is how I see things playing out, with the market adjusting to whatever supply disruptions occur.

Ovi,

I misinterpreted, “not sure what you mean by”… in your comment as you disagreed, I should have read it literally.

As all I meant, was the slope looked like it’s absolute value was smaller, which your chart confirmed.

And yes at the time I wrote that comment, my guess was that the decline rate might be closer to 260 kb/d in a high price environment, since then it has occurred to me that lags in response to prices may confound the analysis, so either 500 kb/d annual decline or perhaps 4% (if we look at the natural log) decline seems a good guess.

Regarding well decline rate we know reduced profit since 2014 have made oil producers to cut maintenance cost of wells and equipment. This have increaced decline rates and I believe a continuing low oil price in the 55 – 65 usd WTI range might have same impact of shale wells abd might add some decline. Else I read from a Newspaper in Texas hotell rooms in permian district are vacant, reduced rent level. Workers are layed off , sent home. Value off homes decrease. All this is sign of a slow down.

Dennis,

Fed is increasing it balance sheet to a all time high over next 4 months. Adding $400 billion to it. And guess what the dollar hit a bottom and will be going higher over next 4 months. Now if your able to answer how the dollar will rise in value while the Fed is expanding the balance sheet at the rate that they have stated it was going to be. You’ll also figure out why the price oil will roll over here and head south.

I believe the oil comes out the ground regardless of profit or price. Even if the government has to go in and produce it at a loss it’s coming out of the ground. Price really shouldn’t be part of the equation anymore. Peak will be a geological thing not a price thing. Sure we could see a lot of companies go bankrupt and cease operations due to low oil price. There will be a dip in production. Then the Fed will nationalize these fields and produce it at a loss if need be.

Capitalism isn’t going to make that oil flow at $140. Mainly because we don’t have true capitalism where things are allowed to fail. Or even allowed to run their natural coarse like oil price. Shit i can already imagine the tweets from the white house if price even gets to $80.

Interesting observation .I am saving this post for the future .Tks ,HHH . Your correlation of oil price to oil/dollar relationship is an out of the box observation .Always interesting .

Only thing is government can’t produce oil like crazy like now. They’ll have time lines, etas, some corruption(big buddy gets contracts), burocracy – like every big state oil company world wide. They won’t pay double price for fracking trucks, as in a fracking boom, too.

So they’ll produce, but not with these crazy growth rates. Propably much less than today, but perhaps even without much loss. Simply because they won’t pay oil boom moon prices anywhere.

Think more Statoil then, less Texas oil boom small company.

HHH,

It will be both geology and economics that will determine the peak. Currency values are relative. Other central banks will respond with easing as well. An expansion of the money supply does very little at the extreme, the velocity of money just shrinks as balances sit in the bank.

Tweets from the white house produce very little oil and will have little effect on long term oil prices.

Talk to an oil producer and they will explain that higher oil prices will lead to higher profits ceteris paribus.

Velocity of money for US MZM Money stock.

On no failures, there has been considerable bankruptcy activity.

Haynes and Boone has monitored the number of North American oil and gas producer bankruptcies since 2015. After the initial wave in the first two years of more than 100 bankruptcy filings (2015-2016), the number of filings decreased substantially in 2017 and 2018 (24 bankruptcy filings in 2017 and 28 in 2018). So far this year, however, there has been an uptick in the number of filings, (33 bankruptcy filings as of September 30, 2019, with 27 filings since the beginning of May). Over the entire period, 199 producers have filed for bankruptcy since Haynes and Boone’s Oil Patch Bankruptcy Monitor began tabulating E&P filings, involving approximately $108.9 billion in aggregate debt.

https://www.haynesboone.com/-/media/Files/Energy_Bankruptcy_Reports/Oil_Patch_Bankruptcy_Monitor

So you are thinking this was handled better in 1929-1933 compared to 2008-2011?

I would disagree. 🙂

Great post Ovi. The non opec less us sure looks like an undulating plateau.

Thanks

It will be interesting to see where it ends up in December. Will give an idea if the estimated decline rates are close or miles off.

Either way it doesn’t matter. We are having a great dialogue that might lead to better insight.

On the opec side, Iran will not be isolated forever. That’s another 2m barrels when back online….

On non-OPEC decliners, I took a quick look at non-OPEC nations that had lower output in August 2019 compared to Jan 2005 and got 49 nations (Ovi may have chosen a different start date or end date to determine decline). From 1994 to 2019 those 49 nations combined C+C output is in the chart below.

From Jan 2005 to August 2019 the annual decline rate is 470 kb/d, and from Jan 2013 to August 2019 the annual decline rate was 277 kb/d. Also from Jan 2005 to August 2019 all of the increase in non-OPEC C+C output was from US and Canada (top two increasing non-OPEC producers over that period).

Wow great chart, peak happens at $10 barrel oil, and goes south as oil price skyrocketed over the following decade, strongly suggesting geology is key in these declines.

And global peak crude oil export was in 2005, I believe.

Has that changed?

Stephen,

It is geology and economics, each region competes with other regions for capital to develop resources, these declining regions lost that battle with regions where resources were more profitable to produce, part of the story is geophysics and part is economics, this is the case everywhere and at all times, it cannot be reduced to one thing, the World (or reality) is never that simple.

Dennis

My decline data starts in January 2010. It is interesting to note that the decline started in 2004 even as oil prices were heading for $145 in July 2008. Interesting that the average decline rate from 2005 to August 19 is 470 kb/d, darn close to my average 500 kb/d mentioned above. Also the average decline rate from 2004 to 2014 is close to 600 kb/d, even though the price of oil went through a few extremes doing that period. Not sure why the decline rate slows after 2014, since this a low oil price period. Maybe a better explanation is technology. Conventional oil fields migrating from vertical drilling to horizontal drilling?

Ovi,

For most oil projects (with the exception of tight oil) there is about a 5 year lag between decision to proceed with a project and first output. So the high oil prices for most of the period from 2007 to 2014 would have affected output from 2012 to 2019. The low oil prices starting in 2015 will hit in 2020 and thus steeper decline rates might occur from 2020 to 2025. From Jan 2005 to Dec 2012 the decline rate for the non-OPEC decliner group of 49 nations (based on Jan 2005 to Aug 2019 decline) was 599 kb/d. It is possible we might see this rate over the 2017 to 2024 period, if my guess at the lag in investment in non-tight oil resources, proves correct.

In short, your estimate may be correct and your guess that it might be conservative may also be correct.

On the technology idea, it is not clear there has been a technology shift in the period we are talking about (with the exception of tight oil.) Tight oil is very short cycle and very different for other types of resource development (particularly deep water offshore).

The sudden growth in Brazil’s production surprised me. If they manage to expand production further, this could push the peak into the future.

All the other things are the variables largely discussed here:

What’s going on in SA?

When US-production is going to flatten out?

How big is the global decline rate?

When will the sanctions against Iran be lifted (and the economical and political pressure against Venezuela)?

Wins and losses could easily wipe each other out – or one side could be winning. So many economical, political and geological uncertainties!

Westtexasfanclup,

Agree, there is much uncertainty.

Hickory,

Concern over net exports has been reduced as US net imports decreased from about 10 Mb/d in 2005 to 4324 kb/d in the most recent 12 months. This has taken considerable pressure off the World oil export market.

Friend , I disagree .Losses will wipe out the wins . Why ?

1. KSA will continue to be unstable and continue to tell lies . For lies you confirm with the boss Ron .

2 . US production not only flattens out but falls in 2020 . The fraud of shale is over .

3 . Global decline rate median will be 5% . Best estimate or guess ,take it any way .

4. Iran sanctions are not having any effect . They sell thru the black market . They mastered the art with about 40 years of sanctions . Sanctions only make selling difficult but not impossible .

5 .Venezuela is never coming back . They will produce until they can and then the party is over . Equipment is dead ,manpower has immigrated ,there is only stuff to salvage .

So now tell me where are the uncertainties .

holeinhead,

All of your “facts” are guesses that are highly uncertain.

Eventually oil will peak. My guess is 2025+/-2.

As Mark Twain said ^ There are only two certainties , taxes and death ^. 😉

Not totally sure about death 😉

holeinhead,

On Venezuela, never is a very long time, I expect output will remain low until 2030, perhaps longer, at this point Venezuela is producing about 700 kb/d, it might continue to decrease until democracy is restored in Venezuela, or a more competent leader is “elected” under the current system.

Saudi Arabia is likely to continue to produce at around 9 to 10 Mb/d, unless a major war erupts in the Middle east. Yes some older fields will decline while new fields will be developed.

Oil prices will rise and US tight oil will continue to grow through 2026 (where I expect the peak).

Little evidence that Iranian output has not decreased due to sanctions.

In short I disagree with 4 of your 5 points and sort of agree with number 5 at least for the next 5 to 10 years, I doubt Venezuala will have much effect on the timing of the peak, in my World Models I expect modest increases in Venezuelan output after 2030 when I hope the political situation will have improved.

I guess we have to wait it out to see who is correct .

holeinhead,

Only one of us has made a prediction. What is yours?

Is it peak in 2019, 2020? If so we won’t need to wait long. 🙂

Even my 2024-2026 best guess for a peak in World C+C is only a few years away.

If I were a betting man, the best bet would be against both of our predictions. If the bet was will the peak be after 2021, I would take that bet on the side of after 2021. Note that I define the peak of World C+C output with respect to the centered 12 month average as reported by EIA.

Denise for me the ^peak^ was when the black goo peaked . If I recall it was in 2005 . After that the definition of oil was changed to include NGL,NGPL,bio fuels and stupid refinery gains . This expansion of the definition means tomorrow we will add used cooking oil ,used frying oil and maybe also hair oil to extend the peak . Anyway for me the peak is unimportant ,what is important is affordability . If it is unaffordable then it is the peak . In my point of view we are already past peak even for ^ all liquids^ when you have to produce shale oil at $ 70(I trust Mike and SS more than the MSM) and sell it at $40-50 at the well head then the party is over . Affordability is the key and not the ^peak^ . At least that is the way I see it .

Holeinhead,

EIA reports World C+C output (which excludes NGL, biofuels, refinery gains, GTL, and CTL. The peak for World C+C was in Dec 2018 for the centered 12 month average, but this is likely to be surpassed by the end of 2020 in my opinion.

As to peak affordability, that was probably 1969, but your measure of “peak oil” is a bit unusual at least from my perspective as “affordability” is more difficult to measure than barrels of output.

I like to keep it simple. 🙂

Data from

https://www.eia.gov/beta/international/data/browser/#/?pa=00000000000000000000000000000000002&f=M&c=00000000000000000000000000000000000000000000000001&tl_id=5-M&vs=INTL.57-1-WORL-TBPD.M&cy=199401&vo=0&v=T&start=197301&end=201909

Oh,it is so simple . The world can^t afford $70 oil so to buy it they took on debt .If you got to have oil then you got to have oil .Frack it at $70 and sell it at $50 . Nothing can be simpler .;-)

Holeinhead,

Oil consumption is a very small part of total expenditures in the World economy, especially since oil prices dropped by a factor of 2 from 2014 to 2015.

An alternative explanation for expanding debt is simply better access to credit by more citizens of the World as the World has become more developed. Total World debt has expanded from 200% of GDP to 250% and has stabilized at that level. At some point Governments will need to reduce debt levels by either raising taxes or reducing government expenditures (or both) during periods when unemployment levels are low.

Such fiscal responsibility is not very fashionable, but will be necessary.

hole in the head- global demand includes the farmer in India, the bus driver in Nigeria, the Fed Ex truck in Cleveland, etc. They all can afford oil perhaps twice as expensive as it is now. Its cheap for what you get. People will divert money from other expenditures to keep buying such inexpensive energy.

Horsepower. Imagine how much more expensive horse power would be to achieve the same work. Almost 8 billion people now. Most use oil.

And will compete hard for it.

I will dismantle your argument .

1. The Indian farmer is broke . 35 farmers commit suicide EVERYDAY because they have no income ,I repeat ,Nada,Nulla. He cannot buy food where is he going to buy diesel .Unaffordable at any price .

2.The Nigerian truck driver is equally broke . He drives the truck with pilfred oil from the pipeline.Unaffordable at market price .

3.Fed ex man is driving his truck ,thanks to the QE and now the NOT QE policy of the FED . Otherwise unaffordable .

You say they could buy it if it was priced two times . What are you smoking ? At $130 a barrel India would run out of dollars in 45 days and then what ? Imagine this for countries like Pakistan,Thailand,Phillipines etc .All would go bankrupt.

I agree that it is cheap for what you get , but what is cheap when you are bankrupt ? What expenditure is there to divert from if you are committing suicide because you have no food . My guru said ^ Gold at $2000 is a bargain if you have the money and gold at $ 2 is a waste of time if you are bankrupt ^ . Financialisation of oil has distorted the price . At $ 65 oil is unaffordable,so to cover our butt we go into debt .Keep it simple ,like Denise said .

P.S : There are no volunteers for starvation .So how many horsepower a gallon of diesel deliver is immaterial for someone who is going into his field to mix some pesticide with water and drink it to end his life .

Denise,you are correct that oil consumption is just a small part of the total world’s expenditure . The human heart is 350 gms .How about shutting that off and see what happens to a 80 kg human? What matters is not oil consumption but what wonders oil consumption permits mankind to do . Tongue in cheek ,5mg of Viagra does wonders.So to that extent you are incorrect . What matters besides other things is criticality .Oil is critical for the modern civilisation to run . Put a drop of oil less on a wheel bearing and the wheel stops turning,and so does your $70000 Tesla .

As to expanding debt/credit take your choice , the GFC of 2008 put the world in a coma . It took $ 16 trillion in printed money to get it out of the ICU . It has been muddling and wobbling from then (I talk about the real economy and not wall street)and continues to do so .The financial world is again in trouble as is evidenced by the repo crisis only this time it double the last crisis . So now another dose of money printing .Yes some money from the QE trickled down to mainstreet but 99% went to the 1%.

As to bringing govt expenditure down and raising taxes , that is a pipe dream.Try winning an election with that as your theme . I challenge any politician in the world.

No, what will happen is that they will continue printing money until they print(by the way printing money is debt and not wealth) so much that the financial

itself breaks under it^s weight . Then TSHTF .

For me QE is not a moral issue because the other alternative was to crash the system in 2008 . With QE we bought society another 12 years of survival . I was 60 when GFC 2008 happened and am 72 today . I pray they can keep kicking the can down the road because when the road runs out society will face an abyss .I understand that QE is unfair to society as leads to inequality , but this is a TINA issue .

Holeinhead,

World economy did fine from 2011 to 2014 when Brent oil price averaged about $110/b0 in 2018 US$.