The EIA’s Petroleum Supply Monthly has just come out. That report gives production from individual states as well as offshore production.

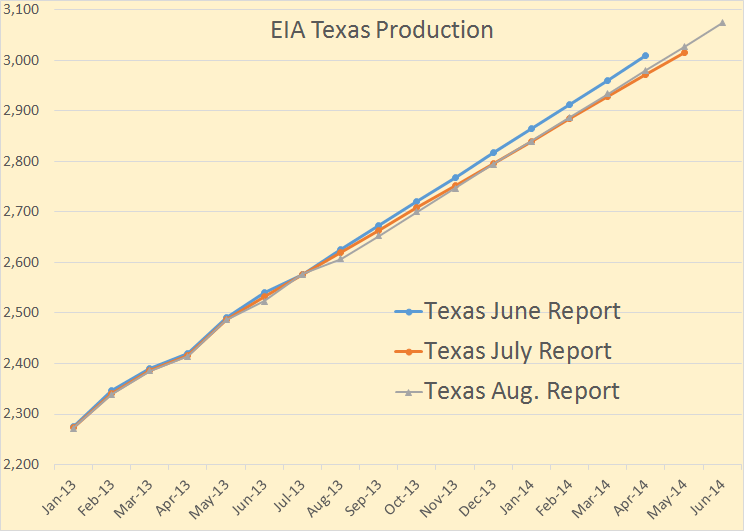

The below chart is thousand barrels per day with the last data point June 2014.

For February, March and April there is about 60 thousand barrel per day difference between what the EIA and BSEE reports. Eventually the EIA and BSEE will be the same and it will be the EIA data that suffers the greatest revisions. I believe they have the June GOM numbers quite a bit too high here.

The EIA is still tweaking its guess as to what Texas production will be when it finally comes in.

Largest changes in US Production, May to June, in thousand barrels per day:

Alaska -40

Colorado 20

GOM 40

New Mexico -9

North Dakota 43

Oklahoma -21

Texas 47

All The Rest 4

Total US 95

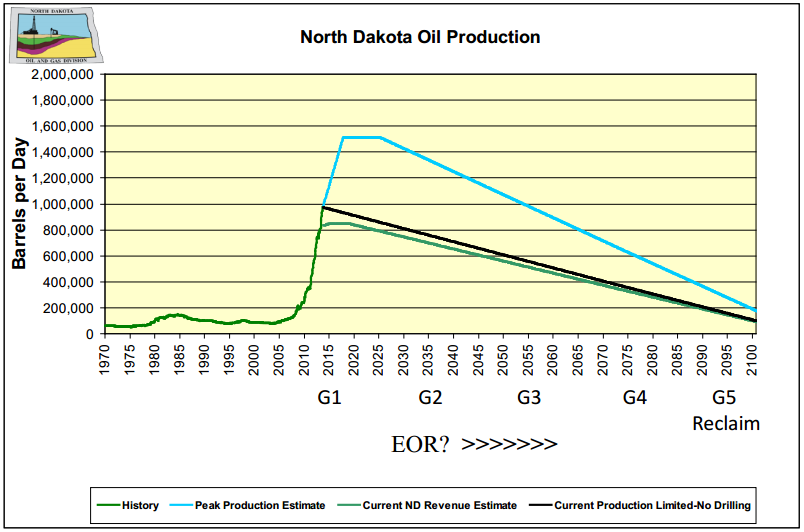

I found the following graph really interesting. It can be found at:

North Dakota Department of Mineral Resources slide 24 and I will label it:

What North Dakota Really Expects.

North Dakota expects tight oil production to continue its rather steep production increase to continue until about 2018 where it will plateau for about 7 years at just over 1.55 million barrels per day. Then they expect production to begin a very long, very linear, decline. And… I think… the line labeled “Current ND Revenue Estimates” is the revenue curve they expect from currently existing wells.

Notice what they say would happen if drilling stopped at the end of 2013, (black line). They say production would decline, over the next 87 years, from about 975,000 barrels per day to about 100,000 barrels per day by 2100. I did the math and that would mean an average decline rate of about 2.5% per year.

But compare that to what they really expect to happen. The decline will not begin until 2026 and will decline, over the next 75 years, from about 1,550,000 barrels per day to about 185,000 barrels per day by 2100. That works out to be an average decline rate of about 2.8% per year.

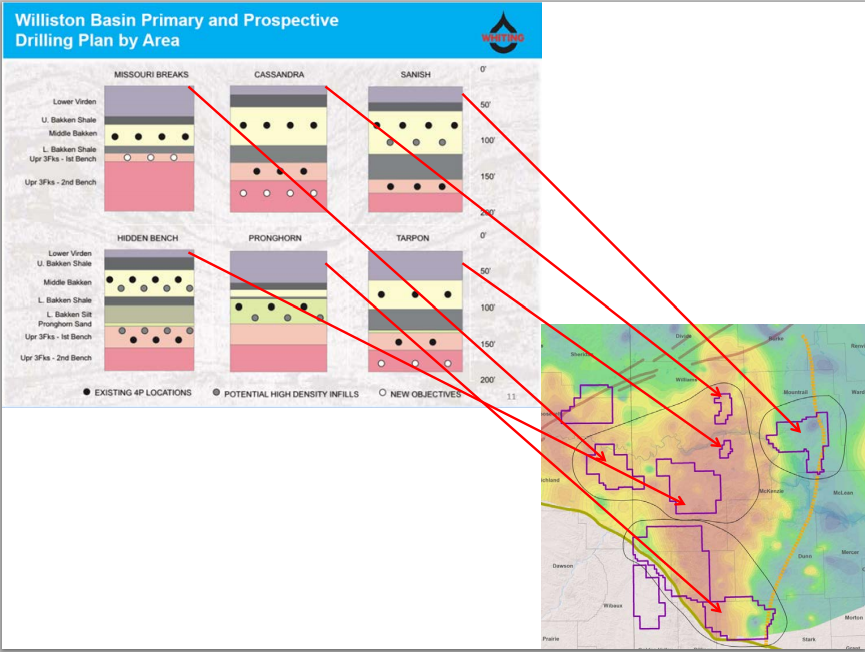

Slide 18 from the same PDF file shows that’s it’s mostly about the Bakken. Three Forks is not everywhere and is not uniform over any wide area.

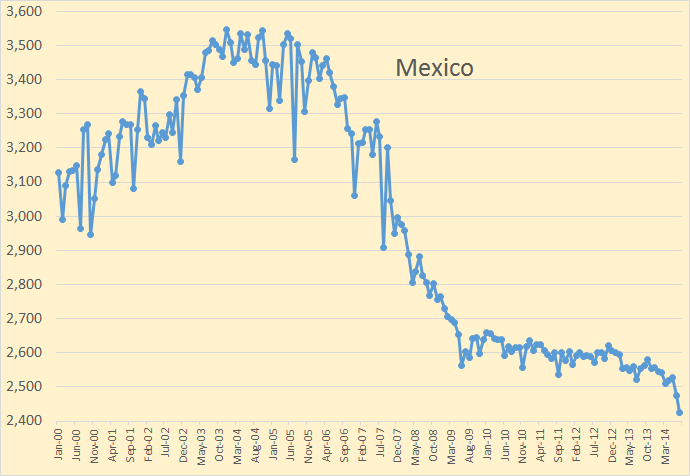

Mexico has started to decline in earnest again.

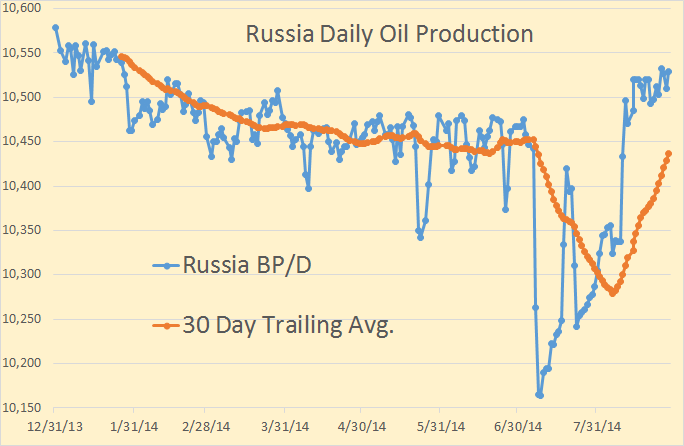

This is a daily chart of Russian C+C production in kbd, last data point August 28th. I am assuming 7.27 barrels per ton here. Russia’s website CDU TEK stopped reporting daily production the 28 of Aug. They might begin again as they have stopped before only to start back a week or so later. But their format has changed. They no longer list companies, just totals.

Also, Russia’s web site always report about 400 thousand barrels per day more than the EIA or JODI. I have no idea why this is but I suspect Rosneft, Russia’s national oil company, may be reporting oil the company produced in Iraq or somewhere else.

I just found a great site for finding the current and historical exchange rate for any currency versus any other currency. Historical Exchange Rates.

The Dollar seems to be gaining ground on the Russian Ruble.

With the peg of the Swiss franc to the euro came the death of national non-fiat currencies, as the franc was partly backed by gold. Now all currencies are fiat currencies. And their value will fluctuate versus other currencies. The currency that inflates the less will be the one people and countries will want to hold.

217 responses to “Petroleum Supply Monthly and Other News”

Hi Ron and everyone, it’s great to see many interesting new posts here.

Ron, from the North Dakota graph, it seems North Dakota expects the oil plateau to start in 2016 (not 2019 as you wrote).

It is certainly interesting to see that the North Dakota authority expects their total decline rate after the plateau ends (with lots of drilling) will be lower than the decline rate of existing wells (with no drilling).

I laid a square on the bottom of my computer screen with the vertical through the chart. I would say perhaps 2018 but not 2016. Anyway I changed it to 2018.

The decline rate the chart shows is truly absurd. The decline rate with no drilling would be several multiples of what they are guessing.

I would really appreciate it if somebody can explain to me why the practice of various countries manipulating their currency in order to sell more exports does not essentially result in a ”race to the bottom” in plain every day language.

I see how it works out like a charm in the short order, no problem there. Employment remains high and the workers and factories in the exporting country that boogers it’s money.

But – and this is a VERY BIG BUT INDEED- at some point money earned EXPORTING simply must be spent outside the country on IMPORTED goods.Otherwise that money is like a check in payment for merchandise that the merchant misplaces and never cashes. He is out his goods with nothing in return.

When that happens….. well , the money is not going to buy very much because it has been deliberately depreciated in relation to other currencies.

So in the end- it seems like a race to the bottom would result.

It is easy to see how a country such as the US which controls the banking system can get people to loan money on the never never to us the US by selling to us on credit.

( The never never means they are never never going to get paid. The debts we owe other countries are going to – for the most part- eventually be repudiated or else inflated out of existence.)

What in principle stops other countries from following suit and depreciating their own currencies to protect their own exporters and domestic manufacturers from artificially cheap imports?

Plain English Please!!

In plain English, the Central Banks of the world recognize that post 2008 (and oil scarcity, though not on their radar screen) the system hangs by a thread, so they coordinate actions to ensure no currency collapses vs any other and cuts that thread.

It’s not a free market. It’s a desperately managed orchestration to hold the system together behind a facade of “normalcy”.

Oh and btw, re exports, of course China has done this for years. Sold goods to Walmart and used the cash to buy oil.

But to watch something critical, watch Japan. The focus of all Japanese policy is to trash the yen, take it up to 140 yen to the USD and SELL A LOT OF TOYOTAS.

If that were to happen, GM and Ford would be destroyed. So guess who won’t let the yen fall to 140 from its level of 102 two weeks ago (105 today)?

OK lets follow this thru in the case of Japan. Any given commodity such as iron ore or nitrate fertilizer or crude oil sold on world markets can be bought with just about any convertible currency right?

So with yen at one hundred and five to the dollar a barrel of oil bought by the Japanese will cost them about one hundred bucks in yankee dollars since oil is selling for about a hundred bucks right now.So they can either pay one hundred bucks or one hundred times one hundred five yen per dollar and pay ten thousand five hundred yen per barrel. The various banks involved will convert dollars to yen for a very modest fee.

Now if they manage to depreciate the yen to one hundred fifty to the dollar they can certainly sell the hell out of Toyotas no doubt.

But all those depreciated yen per TOYOTA SOLD will buy only about two thirds as much oil at one hundred fifty to the dollar as the lesser amount per TOYOTA SOLD used to buy at at one hundred five to the dollar.

In the meantime every body in Japan who has some yen in the bank or under the mattress is losing his butt on his savings. Imported fish that used to sell for say five hundred yen per pound will have gone up to about seven hundred fifty per pound.

Correct, correct and correct. But the issue is end user demand. Not inventory. End user demand. They Need To Sell Cars in order to have reason to build them. Yup, it’s going to cost them more for oil and other imports, but They Need To Sell Cars.

You didn’t think economics in general was supposed to be like physics where all the equations balanced? This is why “green shoots” and “animal spirits” phrases were invented. You’re supposed to do something to have a desired effect and presume that animal spirits and green shoots will overcome the negative effects that will be subsequent.

So if you can smash the yen to 140 per USD and sell a lot of Toyotas, this is supposed to goose all sorts of derived economic activity from the toyota builders who will go out and buy other stuff and goose all sorts of unconnected industry and thus goose generic GDP and thus afford the increased oil price. Yes, magic.

So if you can smash the yen to 140 per USD and sell a lot of Toyotas, this is supposed to goose all sorts of derived economic activity from the toyota builders who will go out and buy other stuff and goose all sorts of unconnected industry and thus goose generic GDP and thus afford the increased oil price. Yes, magic.

Sounds to me, like their ‘Goose’ is pretty much cooked. 😉

Yo Fred, someone pointed out to me the other day that one of the mutation generations of Crichton’s Andromeda Strain ate plastic.

You might like this…

http://www.nature.com/news/2011/110328/full/news.2011.191.html

Marine microbes digest plastic

A ‘little world’ eating ocean garbage might be a mixed blessing. Gwyneth Dickey Zaikab

Specialist bacteria seem to be eating the plastic garbage we throw into the ocean. But whether they’re cleaning up our poisons or just passing them back up the food chain remains to be seen.

Nod, but don’t care about environment this or that.

Care about a weapon to destroy oil fields underground.

This is the answer I have heard before. Lots of times with minor variations.

Yes – in the end checkbooks and money and economics have to balance just like chemical reactions. Not right away of course. But a dollar spent must eventually come home or else the seller who took it somewhere along the line gets nothing for his goods.

The biggest way the equations do not balance in reality is thru defaults and inflations.If person can write a bad check and get way with doing so he makes out like a bandit. Likewise a country that can borrow lots of good sound currency with real purchasing power and spend it on real goods and services and repay it later with inflated currency worth substantially less is in effect making out like a bandit by in essence defrauding the lender.

Your answer does not explain why depressing the value of a currency does not lead other countries to depress their own in retaliation in order to protect their own industries.

Hi Mac,

I tried to respond, but I messed up and put the comment in the wrong place.

The currency manipulation is often just nations utilizing monetary policy in an attempt to either increase employment (by increasing the money supply during a recession) or to reduce inflation (during an economic boom).

If every nation’s economy was in sync with all other nations (the peaks and valleys of the business cycle matched perfectly), then there might be the attempt to inflate the currency to gain an export advantage.

This will tend to cause inflation because some goods are imported (think oil in the US) and a weaker dollar will make imports more expensive, it can also lead to an outflow of capital because it tend to drive the real rate of return down. Also other countries could respond by inflating their currency.

As Ron pointed out earlier the amount of currency traded on international markets is huge and these moves by governments have very little effect on exchange rates (for currencies that are freely traded like the dollar, yen, and Euro). The moves in the values of currencies in terms of other currencies is mostly just a function of supply and demand for capital and goods (and the currency of the country of origin of the capital or goods).

“Your answer does not explain why depressing the value of a currency does not lead other countries to depress their own in retaliation in order to protect their own industries.”

They do. The Euro is advancing because the ECB has done no overt QE (for reasons unknown outside either the Bundesbank or the Kremlin). So now, this week, pressure is on Draghi to do QE and smash the Euro to defend Germany’s exports (not France or Italy . . . they have almost none).

>Germany’s exports (not France or Italy . . . they have almost none)

France is the 20th largest country by population but the 6th largest exporter. Only China, the US, Germany, Japan and UK do better, and four of those are much bigger. Italy is the 23 largest country and the 10th largest exporter.

We have a serious epistemological problem here.

I think a lot of Americans think Germany is the only country in Europe that exports anything. This may be due to news reports that Germany is doing better economically (lower unemployment rate) than many other nations in Europe.

Thanks for correcting the false impressions.

Your data, and subsequent applause, appears to be incorrect.

http://www.tradingeconomics.com/germany/exports

http://www.tradingeconomics.com/france/exports

German exports per month 90+B euros. France 36B.

Hi Watcher,

He said Germany had more exports. I guess if you think 36B is almost none, that is your prerogative.

Also if we look at it on an exports per capita basis (data from 2011), Germany is number 15 and there are 9 European nations that are ahead of Germany on an exports per capita basis. So if we adjust for population, in the same way one normally would for GDP to make the comparison meaningful, there are many European nations besides Germany that export quite a bit. Note that France is number 30, Japan is 39, and the US is 45.

http://en.wikipedia.org/wiki/List_of_countries_by_exports_per_capita

Have a look at the trade balance, which is nicely laid out on the industry standard website I provided.

No leg to stand on.

So is it exports or trade balance we are talking about here?

Using your website Germany has a trade balance of 203.75 EUR per capita. The Netherlands has a trade balance of 284 EUR per capita.

As I said there are other countries in Europe besides Germany that export more than they import, you have to look at things on a per capia basis to make reasonable comparisons.

Dennis, that list is actually very interesting and shows Germany`s economic strength.

Take the top 20 countries and you will find that they are (almost) all tiny to smaller countries in terms of population. Some are energy exporters, some are small countries adjacent to larger ones (and thus good export opportunities) and the the top two are highly efficient dictatorship-like city states. There is one country among them that is special, and that`s Germany because it doesn`t fit these criteria.

So it seems Germany has the benefits of a large home market combined with an unprecedented export drive among the big and developed countries. The Euro has only accelerated this mechanism.

Lars,

There is no doubt that Germany is very strong economically. They have benefitted greatly from Europe’s move to the Euro at the expense of some of the other nations of Europe.

Old Farmer, has it never occurred to you that with the introduction of the Euro this possibility (currency devalutation) was denied all the countries in the European Union that currently are using the Euro? The EU is the World`s largest economy, even larger than the US but smaller on a per capita basis, so this is no small thing.

The main beneficiary of this new currency, Germany, has seen it`s exports going through the roof amidst economic turmoil because the Euro is weaker than the old Deutsche Mark would have been. On the other hand, countries like Spain, Greece, Portugal etc. are called “PIGS” among other things. These countries simply did not have the option of devaluation anymore. For Greece for instance the result has been that tourists increasingly have chosen Turkey as a destination instead.

Hi Lars,

As a European (I am assuming you are from a Scandanavian country), does the Euro make sense to you? From the US perspective, it seems unwise for countries to have given up monetary policy (on a nation state basis) in return for more convenient trade and currency transactions.

If I were a Greek, Spanish, or Italian citizen,I would surely vote for a potitician who supported a return to a national currency rather than the Euro.

should have been politician.

Dennis, I fully agree with you from a national perspective. These countries that have given up their currencies are not sovereign anymore since the economy is such a vital part of a nation state and since control of the currency in turn is vital for the economy. The problem is probably that the ordinary man in the street in Italy, Spain, Greece etc. recognize this.

It only makes sense if you want to abolish nation states and create a bigger “super-state” instead. And of course if you are a huge exporter like Germany seeking to secure it`s European home market and even expand your exports.

>From the US perspective, it seems unwise for countries to have given up monetary policy (on a nation state basis) in return for more convenient trade and currency transactions.

That’s probably because Americans don’t do near as much foreign trade as Europeans do. The reason they don’t is because the US is so big, so there are plenty of domestic trading partners.

Imagine the plight of the pre-Euro Belgian dentist wanting to invest some cash in the stock market. Either he has to accept currency risk in all his investments, or he has to invest in the Belgian stock market.

I did a lot of high volume cross border business in Europe in the 90s, and it was almost all done in dollars. This creates a lot of costs and headaches for everyone, but it was easier than messing with the local currencies of all your trading partners.

Another point is that the ECB seems safer and more credible to a lot of Europeans than their own central banks. This certainly applies to Eastern Europe, but also to the Mediterranean countries as well.

Finally, you say “from an American perspective” but you don’t specify how the American experience leads you to the conclusion. America doesn’t have a history of successful regional currencies to look back to.

so they coordinate actions to ensure no currency collapses vs any other and cuts that thread.

And please explain how they do that? Exactly what actions are coordinated? Also, I don’t think currencies collapse overnight. They inflate and that takes a bit of time, albeit in some cases a rather short time.

I understand what you are trying to say Watcher, but I just don’t believe that bankers have the power nor the resources to keep a currency from collapsing.

Central banks directly trade in the foreign exchange markets. I can stop there and let that settle in. And this is not a controversial statement. They’ve done it for years and decades. It’s not done every day or every week, but it’s not even remotely unheard of.

They intervene directly with essentially infinite money to adjust currency exchange.

Here’s a good example:

http://blogs.wsj.com/marketbeat/2011/09/06/swiss-fire-up-massive-printing-press/

The SNB used first verbal intervention to try to scare currency traders and then overtly traded to define the Swiss Franc vs Euro ratio.

Happens . . . not all the time, but semi often. About 5 yrs ago the Fed stopped the Yen from falling above 107 or so.

You said banks…

Central banks directly trade in the foreign exchange markets.

Governments can print money, banks cannot. Governments can print enough money to inflate their currency. That’s what the Swiss are doing to keep up with the inflation of the Euro and keep their peg. Governments can print trillions and make their currency worthless. But that is causing collapse, not preventing it.

No one has enough money to buy currency on the FOREX and prevent the currency from collapsing. But governments can print enough currency to cause a collapse.

Ron,

not trying to interfere in your discourse with watcher here…just trying to help, for it is obvious (to me, anyway.. although I am NOT continuing a somewhat “spirited” exchange we previously had on this blog) that your understanding of money and finance stands diametrically opposed to that of oil/energy….I still cannot explain how/why?!?!

-1): in the modern finance/economy only 3%-5% of “money” including: M1-M3 is created by central banks, aka guber’ments…95%-97% is created by commercial/investment banks, i.e.: JPM, Goldman, WellsFargo, etc – most accurately explained by what is called “the balloon model” – contrary to the belief of many even enlightened and truly knowledgeable economists who believe the “Fractional Reserve” model.

Furthermore, what you and al. call “money” are indeed “currency units” …fundamental difference between the 2 (and explaining why would be impossible here for many reasons)…and they are not “printed” nowadays, they are “typed”.

Even though it sounds crazy and inaccurate, to add another trillion with a T to the monetary base, Yellen-and-Co LITERALLY just go to their computer and Type a ONE followed by 12 Zeroes…although I know you will not believe it and already probably made your mind up about me to be a moron, in our current system it is indeed that simple!!! You and all of us shall see soon enough…

-2) FederalReserve(which creates/makes the dolar) is as federal as FedEx is…indeed, ALL CentralBancs are PRIVATE Institutions (as in: have private shareholders/owners) and were created that way from the beginning…that was the goal to go from dolar being “money” , to being a “FederalReserveNote” (explaining the difference here, again, would be impossible)

-So, when you say:

“Governments can print money, banks cannot” maybe you should reconsider in light of what I wrote.

Again, my reply is not meant to interfere with your discourse with Watcher ..just trying to help you understand better “money”. And by the way, maybe his understanding is simplistic in the subject, but Watcher is right. Through complex (and ranging from barely legal to outright illegal/criminal) instuments nobody understandsts including, but not limeted to: currency swaps, LIBOR, CDS, etc – CB (especially FR) not only influence, but so far indeed CONTROL liquidity and credit (therefore “money”) throughout global economy. When they will not be able to do so (and is just a matter of time) heaven help us all, for domestic and foreign ennemies ranging from bundy/ranch to RussiaChina will be created to make war and take the blame off themselves.

Be well and keep us informed!

Petro

Petro, I know how money is created by banks by the fractional lending system. Creating money by lending and printing money is totally two different things.

The US government does not just print money like Germany did after WWI. They print the debt. But countries can just print money with a printing press. That was what I was talking about and that should have been obvious from the dialogue.

Banks also cannot just create money at will. They must have money to lend to create money. The money is created when they lend that money. That money is then re-deposited, then re-lent and that creates more money.

And here is the kicker Petro, when that money is paid back, just disappears back into the same thin air that it appeared from when it was created. However money that is created with a printing press never disappears like that, it is instead inflated away.

That is not what we are talking about when we talk about printing money with the press. Germany just printed paper money. The Swiss also did the same thing in order to inflate their currency and hold their peg with the Euro.

And that is very close to what the US Government does when they print the debt. Not exactly the same thing because the government does add that to the debt where just printing money does not add to the debt.

Please watch Crash Course: Chapter 7 – Money Creation by Chris Martenson and you will understand that creating money by fractional banking is totally different from just printing money with a printing press.

And there is one other very obvious difference. Governments can just print money, banks cannot.

Okay, no need to watch Chapter 7, I know you know how money is created just as I do. But you simply did not understand that bank money creation via fractional banking has absolutely nothing to do with the subject of printing money with a printing press, aka Germany after WW1.

And just one more thing Petro, the debate between Watcher and I was not about creating money in any fashion, it was about whether banks can keep a currency from crashing by manipulation of the foreign exchange market, (FOREX). I contend that this is impossible because banks have neither enough money not the authorization to do that with depositors money. What do you say?

EDIT: On second thought, printing the debt is almost exactly the same thing as printing money with a press. And yes I know, it all done with keystrokes, not an actual press.

All money is loaned into existence.

Dave, I have replied to your post below where the column is wider.

Money is a lubricant, facilitating exchanges of items that have real value (e.g. my labour, your goods). Since money itself has no value of itself, I stay away from it. I do not save money. I do not save lubricants either. I spend every penny I got. Some of it, I spend on everlasting things with real perpetual value.

Typing on a tablet so ain’t gonna be much more than simplistic, but a cb has infinite money, by definition almost. They will buy or sell the target currency on the trading floor and glare at traders that might want to try the other side of that trade, and often tell them flat out that every penny the trader commits will be destroyed if they so dare. They have infinite money. They can make it happen. And if there is some sort of danger of the currency falling (or rising) as a result, threatening The System, the other CBs of the world will hold a conference call and collectively stop the collapse or spike that is dangerous.

There is no longer any integrity to money. The yardsticks are all maneuvered to prevent disaster.

Of course everyone trades in the foreign exchange markets. Bankers, oil buyers, oil sellers, foreign governments, everyone. The FOREX is where all the world’s trade is bought and paid for. Also speculators all over the world place their bets on the FOREX.

Five Trillion Dollars A Day change hands on the FOREX. Do you realize just how much money five trillion dollars really is? No one, not even governments, have enough money to sway that kind of market.

In this case, I agree with you completely Old farmer. We are now in stagflation. Stagflation is characterized by decreasing wages relative to necessary items such as food and energy. Depreciating a currency today is a politically correct way of reducing wages. Eventually you shoot yourself in the foot with this tactic, because the bulk of the low salaries goes to essentials which reduces demand in other parts of the economy and you get the standard loss of ecodiversity which characterizes stagflation. This leads to lower prices for goods which leads to lower profits which then leads reduced investment which brings on the contraction phase.

The short answer is that when you depreciate the currency the value of investments fall, causing capital flight.

Which would confirm Ron’s observation that the collapse is unlikely to happen suddenly.

I can imagine that there might be a tacit agreement among investors. But they would each flee as quietly as possible so as to get as much as possible out. It’s not like they have no experience with such scenarios; there are case studies in business schools.

Exactly. Lowering the exchange rate to get money into the country doesn’t work, thanks to electronic banking. Cash can flee the country through disinvestment much faster than you can export goods and services (in exchange for cash).

Foreign exchange daily volumes are in the neighborhood of $5 trillion. Most of this is done by traders who couldn’t find the countries whose currency they are trading on the map. That pushes countries to keep exchange rate high.

As Ron already pointed out in this thread….

Hi Mac,

Usually the “manipulation” of the currency (with the exception of countries that restrict capital flows, so this excludes China) is simply a matter of monetary policy. The countries in question are trying to use monetary policy to increase the nation’s GDP.

Under normal circumstances (when short term real interest rates are positive), this is very effective and avoids the difficulties of enacting legislation which is necessary for most fiscal policy.

When the economy is at this “zero lower bound”, the usual types of monetary policy (government buying or selling government bonds to increase or decrease the money supply) is not effective.

The lack of aggregate demand results in money piling up in the banks with consumers and businesses being either unwilling or unable to secure loans.

What in principle stops other countries from following suit and depreciating their own currencies to protect their own exporters and domestic manufacturers from artificially cheap imports?

Well some of them can just create a new world order and create their own alliances and finance it all with their own development bank. This is a picture of the leaders of the BRICS meeting in Brazil. You gotta love their smiles, if nothing else… Obama and Merkel probably wish they could have attended.

http://goo.gl/bSvoGc

What happened in Oklahoma? They are supposed to be a shale story. And similarly, New Mexico?

Oklahoma – I assume you are referring to the Woodford. There is some production coming from it, but since it is a mainly gas play, there simply is going to be limited development at the current price. There was major development up until 2011, and gas production is now falling. Though I am not sure if that is simply because there has been limited drilling at the current price or if it is at its true peak. However, Oklahoma crude production is still up 250 % from its low in 2005.

New Mexico – The big thing currently is the Bone Spring within the Delaware Basin of the Permian Basin. There is also the Avalon, Wolfcamp and a few others, but the Bone Spring has been the main target thus far. The states crude production is up 200% from 2007.

You must remember that these May and June numbers are mostly estimates, or wild ass guesses. They will later be revised when more hard data comes in.

Aha. Ya I just did a search for Oklahoma news that would explain a decline in the data.

Ain’t much to be found, though there does seem to be a lot more attention paid to quakes and the details are different than elsewhere.

It’s the salt water disposal injection wells blamed. The quakes are magnitude 3-4, but they are shallow. Really shallow. The production water wells are only a few thousand feet down and the water is not poured, it is pressure injected. They are shaking things up. I was looking to see some regulatory stoppage on drilling to explain the data decline, but nada.

The EIA appears to have gone cornucopian on Mexican liquids production due to the allowance of US investment in Mexican oil and gas production.

http://www.usnews.com/news/blogs/data-mine/2014/08/25/eia-mexican-oil-gas-production-to-see-profound-increase

Trader Who Scored $100 Million Payday Bets Shale Is Dud

“…In his counterarguments, he digs deep, delving into the minutiae of how Texas discloses oil production, the tendency of some shale wells to play out quickly and the degree to which the boom has relied on debt. The simplest of his reasons, though, is that producers have already drilled in many of the best areas, or sweet spots. Hall predicts that growth in shale output will begin to moderate this year and U.S. production will peak as soon as 2016.

“Once those areas have been drilled out, operators will have to move to more-marginal locations and well productivity will fall,” Hall wrote in March. “Far from continuing to grow, production will start to decline.”

http://www.bloomberg.com/news/2014-09-03/trader-who-scored-100-million-payday-bets-shale-is-dud.html

Interesting article out or Russia this morning: Rosneft May Cut 2014 Oil Output by 2 Million Tons

Sanctions-hit Russian oil producer Rosneft may cut its 2014 output by 2 million tons (40,000 barrels per day), the daily Kommersant reported on Wednesday, citing several sources close to the company.

Rosneft nearly doubled production to 206.8 million tons in 2013 following the acquisition of TNK-BP, but it has reduced drilling as part of cost cutting and because of disputes with contractors.

Asked about the report, Rosneft said in a statement it had managed to “stop a historic decline in production in several key regions in Western Siberia”, but those oil fields would still see a decline in production until 2020.

Data from the Energy Ministry showed on Tuesday that Rosneft’s daily oil production was down 1.3 percent in August, year-on-year.

Sanctions will hit Russian oil production. That and the fact that their old fields are now starting to decline in earnest could present a double whammy to their production numbers.

And another great article on the same subject, bold theirs:

EU sanctions to target Russian oil industry and strip Russia of World Cup

The European Union will strike at the heart of Russia’s economy by extending sanctions to block all investment in the country’s oil companies unless Vladimir Putin pulls invading Russian troops out of East Ukraine…

Along with American sanctions, the EU measures, to be agreed by Friday unless Russia withdraws its military, will force President Putin to run his economy on a war footing placing a huge burden on state finances to stave off economic collapse at a time when the Russian rouble is hitting a record low.

“Sanctions-hit Russian oil producer Rosneft may cut its 2014 output by 2 million tons (40,000 barrels per day), the daily Kommersant reported on Wednesday, citing several sources close to the company.”

haha 40K bpd out of what, 10.3 million? That’s 0.4%. hahahah. That would be 40 cents a barrel price increase required for revenue neutral. Oil is up $2 today. hahahah

They are talking about Rosneft’s production, not all Russia’s. Rosneft is currently producing just under 4 million barrels per day so that would be about 1% of their production. Rosneft is the Russian national oil company. The others are owned by the public or privately owned.

okie doke. That’s still just a dollar.

Factoid: Rosneft is publicly traded. The country owns a majority stake, which it is slowly divesting. 15% in 2006 and upcoming another 19% sold to the public.

Old Johnny Mack, ex CEO of Morgan Stanley, is on the board. I think Barclay’s chief honcho is too. Probably both will have to vacate to avoid getting on a no fly list.

But regardless, they are not 100% state owned. Think Petrobras. They have sold lotsa shares to elevate market cap and become “the 6th largest company in the world” with a lot of suspicious reserves. Rosneft could get even bigger as they divest shares.

Hi all,

Based on data collected by Enno Peters from the NDIC, the North Dakota Three Forks formation is more productive than I expected. From April 2013 to March 2014 we have data on the specific formation (middle Bakken or Three Forks) for about 92% of the Bakken/Three Forks wells which started producing over that 12 month period. Of those 92%, about 59% were in the middle Bakken and 41% were three forks wells.

Enno Peters presented a chart showing that the three forks wells were improving (higher EUR) until 2011 and then had levelled off. So I compared the average middle bakken well which started producing between Jan 2011 and March 2014 with an average three forks well which started producing between Jan 2011 and March 2014.

Surprisingly the Three Forks wells cumulative production over 24 months is about 12% less than the middle bakken wells with a breakeven at about $80/barrel. Based on the 2011 to March 2014 data I would estimate the EUR30 of these three forks wells to be about 300 kb. The USGS estimates about 11,300 risked wells in the sweet areas of the North Dakota Three Forks (at 3 wells per 2 square miles). If we assume some decrease in EUR over time so that the average three forks well has an EUR of 250 kb for the 11,300 thee forks wells and that oil prices remain at about $100 per barrel (which ensures profitability), then about 2.8 Gb would be produced from the three forks wells. If about 11,000 wells are eventually drilled in the middle bakken with an average EUR of 300 kb (assuming that this decreases from the present level of 375 kb over time), that is about 3.3 Gb from the middle bakken wells for a total of 6.1 Gb from the North Dakota Bakken/ Three Forks if 22,300 wells are completed. Note that the NDIC expects 60,000 wells, but I think 30,000 to 40,000 wells is a more likely scenario, with somewhere from 6 to 10 Gb of C+C produced from 1951 to 2070.

Chart below with average cumulative well output for Bakken/Three Forks avg well from Jan 2008 to March 2014, middle Bakken avg well from Jan 2008 to March 2014, middle Bakken avg well from Jan 2011 to Mar 2014, and three forks avg well from Jan 2011 to Mar 2014.

I’m really enjoying the work you and Enno have been doing with the formation information of individual wells. The more reading and thinking I do on the side, though, the more I am realizing that nomenclature is a really tricky subject here (and, I believe, is something Watcher has previously pointed out). Without question, the Bakken and Three Forks are recognized as distinct formations, but considering how thick each is (or isn’t, as the case may be), fractures induced in one of the formations are going to extend to the other. For example, the fracs from the wells in the Upper Three Forks (TF1) are going to extend to the Lower Bakken at least, but considering the drilling plans most operators are proposing and implementing do not have Middle Bakken and TF1 wells layered on top of each without a horizontal offset, I am wondering if they believe the fracs can go all the way up to the Upper Bakken as well.

In any event, the problem here is going to be that, due to the fracs, a well drilled into the Three Forks formation is not going to drain exclusively from that formation. The reverse would also be true if fracs from the Middle Bakken wells can penetrate the Lower Bakken and reach into the Three Forks. If that is possible, the companies testing out placing TF2 wells directly underneath Middle Bakken ones are likely going to run into communication problems that will lower individual well EURs.

I also wonder if any of this has implications on reserve estimates. More specifically, do estimates of recoverable Three Forks oil only consider the oil Three Forks wells will drain from the Three Forks formation, or do the numbers include the total of Three Forks and Bakken oil collected by the wells?

Part of what got me thinking about this is viewing Continental’s presentation made at the Enercom conference last month. There was some information in there that is not among the usual information placed in investor presentations. Most interesting was the first look on page 9 of micro-seismic information being obtained from the Hawkinson density test. Also, page 28 shows their view of the “Bakken Petroleum System” (probably the better name to use to avoid confusion). In a footnote they state that the system ranges in thickness from 250 to 400 ft.

Hi Wes,

Thanks.

I am not sure if Watcher’s observations are correct.

I will try to explain what I have read.

The natural fractures in the Bakken/Three Forks are in the x-z or y-z plane, where the z axis is vertical and the x-y plane is horizontal.

So the natural fractures can be thought of like the walls in your house and the horizontal section of well as a pipe running through your house.

Watcher has the impression that the fractures that are induced by the fracking process extend in both the vertical and horizontal directions. I believe that the frack job attempts to induce the microfractures in the horizontal direction to improve flow between the natural vertical fractures and the horizontal pipe (or well) that collects the oil.)

Note that the shale layer of the upper and lower bakken have very low permeability so there will be no oil flow between the middle bakken and three forks formations because the lower bakken is essentially a no flow zone.

I don’t know if there are similar impermeable layers between the TF1, TF2, TF3, and TF4, if there is perhaps that is what defines them of it may be an arbitrary designation.

http://oilandgas-investments.com/2013/energy-services/bakken-oil-three-forks-formation/

The article above suggests there are impermeable layers between the TF1, TF2, TF3, and TF4. It also claims that most three forks wells so far have been TF1 wells and only a few economic wells have been drilled in the TF2 and TF3, with none in the TF4 so far (Article date is Nov 6, 2013).

“So the natural fractures can be thought of like the walls in your house and the horizontal section of well as a pipe running through your house.”

I should have said this pipe in your house is a horizontal pipe which might intersect several walls (natural fractures) the frack job tries to extend the reach of the horizontal well by connecting it with more of the vertical natural fractures.

Some months ago I found a picture of the pipes used in the horizontal direction, which had holes drilled in it for proppant/pressure to escape into the rock.

The holes were three dimensional. They were drilled into the sides of the pipe all around the pipe. Not just the sides of the pipe. If we can find pictures of the horizontal pipe with holes only in the sides, and then somehow imagine how a spinning pipe can be arranged to always end up laying with holes horizontal, I’ll sign on. I will say the bend from vert. to horizontal drilling would probably happen easiest for pipes with purely planar holes, though such pipes would be weaker.

Additionally, if natural fractures are X-Z and Y-Z, then induced fractures would tend to go in that direction. In other words, fracturing would more readily occur vertically than horizontally.

We are sort of dependent on the diagrams we’ve seen. No question, the low darcy layers block flow. If they aren’t fractured, the oil bearing layer under them won’t flow up. But, the diagrams say those distances are flat out shorter vertically than frack distances in the same diagrams. If fracking is 3D, those low perm layers are compromised.

Hi Watcher,

I think we would need a comment from someone more familiar with the process in a hands on way. We must have read different material, but let’s assume the oil companies know what they are doing and the diagrams in the Continental investor presentations are roughly accurate. Doesn’t horizontal fracturing make more sense, essentially force from an explosive charge or a water jet (more likely) is applied in the y direction (assuming here that the x-axis is parallel with the horizontal section of the well) and not in the z-direction. There may be some unintentional fractures in the z direction, but the attempt is to minimize these and attempt to reach the natural vertical fractures.

Ya, agreed on that. Explosives is a thought. Shaped charge does happen for tank killers. Explosion energy released does not have to be 3D.

But it’s really hard to see how pressure and proppant can be restricted like that. Do you remember the photo? I doubt the search function here is going to find it. The pipe had holes drilled in it all around.

Hmmm, downward is higher pressurized rock. Maybe pressure can be calibrated to prevent downward fractures by making the pressure applied just the right amount to do sideways and upwards. Maybe not enough muscle to punch downward because pressures are higher downwards, but that’s gotta be pretty precise calibration if so.

I did some more reading and mostly came away with more questions than answers. I get the sense that the operators themselves aren’t fully aware of how their wells behave in the real world. Hence probably why press releases discuss and hype all sorts of different completion methods and there’s a lack of consensus over how many wells will truly be needed or how best to develop the play.

Anyway, I found a technical presentation from Marathon titled “Bakken Formation Characterization: Understanding impacts of Vertical & Horizontal Communication in the Bakken.” I have to admit some of the stuff in there is beyond my knowledge level, but they definitely present evidence that Bakken fracs extend vertically from the horizontal wellbore. This presentation also provides more evidence, corroborating with what I have read elsewhere, that Three Forks wells interact/communicate with Bakken wells at minimum during fracture stimulation and perhaps very early on during the production time frame (I found this article just the other day — “like other producers, Oasis sees communication among the Bakken and Three Forks benches during fracture stimulation….[Oasis President and COO Taylor Reid] says Oasis continues to monitor this…’whether that communication continues in production, we’re trying to understand. The work we’re doing is to determine which of the benches are going to be economic in our areas and, then, which communicate so we can design a program to efficiently drain all of those reservoirs together.’”)

I also found a FAQ section on the website of a service company that fracs Bakken-Three Forks wells. Here’s part of what they have to say about Bakken fracs (they don’t say if this information extends to wells drilled into the Three Forks):

Thanks Wes,

Great stuff. Based on the presentation by Marathon, Watcher is correct and I am wrong on the vertical fractures from the hydrofracking.

Maybe there are significant differences between companies in the way they approach fracking because based on the Marathon presentation, the way that Continental has laid out their high density wells does not make much sense. If the fractures are 200 ft in the vertical direction (they reach 200 feet from the well) and the high density project places the TF1 and TF3 wells at a 140 foot vertical spacing then there would tend to be interference between these wells. It may be possible that the frack job was set up to minimize such interference by only fracking on the deeper side of the TF3 well.

Thanks.

Upon re-reading it looks like the fracks tend to work better in the upward direction so perhaps they are fracking only on the top side of these wells in the high density projects, it still seems that 140 feet is too close together.

The Three Forks formation is directly beneath the lower Bakken Shale and is all Bakken oil that has leaked through the fissures in the lower Bakken created when the temperature and pressure from the oil being formed in the Middle Bakken and cracked the fissures in the lower Bakken Shale.

The Lodgepole has Bakken oil above the the upper Bakken Shale.

The Middle Bakken is where all of the oil formed from the kerogen and is still creating new oil all of the time.

When it comes to money, only minted gold and silver coin is legal tender, not paper. according to the US Constitution, but it is no longer in circulation. What we have is an illegal government that does not abide by the US Constitution.

A fall from Grace, as it were, and pride goeth before fall.

Hi Ronald,

The constitution was written by intelligent men that realized that it could not be a fixed document that would apply for all time, it provides a framework for starting a representative government and can be adjusted by amendments and legislation as necessary.

A good discussion of this can be found at the link below:

http://www.publiceye.org/conspire/flaherty/flaherty3.html

From that link:

“The Supreme Court had its say on the matter in McCulloch v. Maryland (1819). It voted 9-0 to uphold the Second Bank of the United States as constitutional. The Court argued with the doctrine of implied powers, stating that to be ‘necessary and proper’ the Bank needed only to be useful in helping the government meet its responsibilities in maintaining the public credit and regulating the money supply. Chief Justice Marshall wrote, “After the most deliberate consideration, it is the unanimous and decided opinion of this court that the act to incorporate the Bank of the United States is a law made in pursuance of the Constitution, and is part of the supreme law of the land” (Hixson, 117). The Court affirmed this opinion in the 1824 case Osborn v. Bank of the United States (Ibid, 14). ”

Essentially the idea that paper money is unconstitutional is not correct according to the Supreme Court.

What about plastic money? Or digital money? Would they be constitutional? 😉

Nope. The constitution says nothing about plastic or computers.

They are not allowed. 🙂

Computers too. Where in the Constitution does it say the gubmint is allowed to use computers?

And don’t get me started on the air force.

The reason “money” abandoned gold or fixed underpinning was the economic smashes of the late 1800s and very early 1900s derived from economies constricted by a money supply that could not grow — because it was dependent on mining of gold.

You can’t have a global economic structure dependent on some guys with shovels digging out shiny metal. Of course, it’s not clear some guys with 1’s and 0’s defining a money supply based on reaction to economic disasters is any superior.

CBs generally print. They are loathe to and it is rare to see them raise rates and reduce money in existence. It does happen. Volker crunched down and spiked rates to wipe out inflation that had become systemic via union indexed wage contracts. Everyone usually celebrates his courage, brilliance and success, but truth is . . . Alaskan oil arrived about that time.

It was all going to work out anyway.

Want a great laugh, watch this 2 minute video:

Petrolify®: Don’t Just Seize the Day, Seize Life

Dave Ranning says: All money is loaned into existence.

Really now, was this money just loaned into existance?

No, all money is not loaned into existance. Some money is just printed. The first money was stamped from silver or gold. That money was definitely not loaned into existence. Later other metals were added to the silver, debasing the currency.

That is still happening today with printed money by the government. The government just prints the debt. (actually they just enter it with a few keystrokes). Then they “sell” these debt instruments to the central bank for money. The government calls this “borrowing money” but they never intend to pay it back. When the notes come due they will just “borrow” more money to pay it back.

Two things:

1. Only governments can do this. Banks cannot do this. They call it borrowing money, increasing the debt. But they are really only printing money.

2. Only banks can create money by loaning it into existence via the fractional banking system. The government is not a bank.

Reviewing the above.

1. Governments create money by printing it.

2 Banks create money by loaning it into existence.

Hey, think about it. When the government creates bonds or other debt instruments, they are just printing money where no money existed before. Printing a debt instrument is no different than what Germany did when they just printed the Marks themselves.

Sort of no?

A government can run a fiscal deficit (aka create debt, aka issue bonds) without there being an increase in money. The buyers of the bonds can buy out of already existing money. No change to how much money exists.

The central bank (the Fed) choosing to buy those bonds from money created whimsically is how money gets created. But if they don’t buy those bonds (aka QE), someone else does and out of money already existing (orrrrr a PD (primary dealer) could make the purchase from its reserve ratio which would increase money total). . . orrrr an individual could buy Savings Bonds out of their cash amounts, which does not increase the money existing.

And thus governments don’t print money. Only central banks do, which is why they are called “independent central banks” (like the Fed) — they are not part of the govt.

Andddddd central banks can withdraw money from the money total (aka supply) by selling govt bonds from their portfolio.

This buying and selling was the norm and was the mechanism whereby interest rates were forced upward or downward. Buy bonds, money is injected, demand for the bonds increases, price of the bonds increases, and their yield decreases. So they force rates down. Sell bonds from the CB portfolio/balance sheet, money is extracted from the system because someone bought the bond from the CB with money (which then disappears into the CB’s computer to be erased), the bonds are being sold so their price falls, this drives yield up and thus rates rise.

You don’t really have to care about this stuff if you are an oil exporter. As long as your people eat, whimsical pieces of paper should not influence your society. Because you can print your own.

A last useful example would be argentina of about hmmm I will get this wrong . . . about 5 yrs ago. Their INDEPENDENT central bank’s . . . chairman . . . refused to do something Cristina wanted done, I don’t remember if was buying bonds to punch down the rate or what, but he refused.

She had him arrested and thrown in jail and replaced him, against the wishes of Parliament and my recall is she replace them, too.

Now in that case the government takes control of printing or withdrawing money, but that happens when an independent central bank loses its independence. This is why the only control the govt has over the Fed is approval of Fed governor nominees. To provide independence.

When the Fed embarked on QE3 2 months before the 2012 election, however, this was called an abrogation of independence. The Fed could be seen as trying to influence the election. If Romney had won, they would have lost their independence formally. It was a hugely risky move by Bernanke in that context.

When the government creates bonds or other debt instruments, they are just printing money where no money existed before.

I’m sure the Chinese or the Brits are using their own money to buy them.

And those debts will be erased if ever paid back, and the money destroyed.

Except the PBOC and BOE can print the money used to buy those bonds.

All orchestrated and coordinated.

I don’t think governments are buying these US debt instruments. Governments usually borrow money, not lend it. Banks and institutions are buying them.

I’m sure the Chinese or the Brits are using their own money to buy them.

That has nothing to do with it. It really doesn’t matter who buys the debt instruments that the government just created out of thin air.

And those debts will be erased if ever paid back, and the money destroyed.

Surely you are aware of the fact that this will never happen. Money created by banks when lending money is destroyed when the loans are paid off. But money created by the government by printing debt instruments is there forever. It will never be destroyed by buying back the debt, but the debt will mostly destroyed by inflation.

I know notes and bonds are eventually redeemed. But the government just issues new ones to replace them, rolling the debt forward.

It’s Official: Federal Debt Will Never Be Paid

The massive federal debt never will be paid. One reason is the simple economics of debt: The more debt there is in a society, the more current income is needed to service the debt rather than to produce new wealth. The marginal productivity of debt (that is, the amount of new wealth produced per dollar of new debt added) has been declining in the U.S. for half a century. During the 2008-9 financial crisis, it fell below zero. Whatever the figure is now, we simply aren’t able to get much bang for our additional debt bucks, sort of like a junkie in the advanced stages of addiction.

There is a subtle second way for money destruction, and it has been offered as justification for QE. And btw paying off debt doesn’t destroy it because the cash paid to a bank who loaned the money remains on the bank’s balance sheet and merely expands its reserves ratio.

But the second way, as it were, is more subtle and has been suggested as the cause of QE. Default. That is true money destruction.

But of course a country with a central bank can’t default. The money to pay off a debt can be printed. Defaults would be private, as in mortgages.

Maybe the decline in marginal productivity is a function of the shift in policy. I wouldn’t take it as universal proof of anything.

Ron,

Although this video requires a lot of time and effort to view, it’s well worth it. It explains quite clearly what you are trying to say. http://youtu.be/jqvKjsIxT_8

Sorry if this has been posted.

http://www.businessinsider.com/andrew-john-hall-predicts-150-oil-2014-9

No, no one has posted that Ed, and thanks for posting it. An expanded version can be found at:

Trader Who Scored $100 Million Payday Bets Shale Is Dud

In his counterarguments, he digs deep, delving into the minutiae of how Texas discloses oil production, the tendency of some shale wells to play out quickly and the degree to which the boom has relied on debt. The simplest of his reasons, though, is that producers have already drilled in many of the best areas, or sweet spots. Hall predicts that growth in shale output will begin to moderate this year and U.S. production will peak as soon as 2016.

“Once those areas have been drilled out, operators will have to move to more-marginal locations and well productivity will fall,” Hall wrote in March. “Far from continuing to grow, production will start to decline.”

Slowing Growth?

So far this year, there are signs that he may be on the right track. In North Dakota’s Bakken and Texas’ Eagle Ford formations, which have accounted for almost all of the jump in U.S. output, the combined year-over-year growth in production in July fell below 30 percent for the first time since February 2010.

I did not know that. But they are saying year over year growth fell below 30%. Not a decline but a slowdown in growth. Well that had to happen before the decline. And he is predicting a peak in US production by 2016. Not a really earth shattering prediction because that is when the IEA’s AEO 2014 says US production will plateau.

This reminds me of the time the Nixon administration that the rate of increase of inflation (which is price increase itself) was falling. First time in history a third derivative made headlines.

One should keep in mind money is not capital, it is a claim on capital. Central banks are currently increasing these claims on capital in an attempt to inflate debt away. The economics behind the Great Financial Crisis were such that earth lacked sufficient resources to pay back total outstanding debt at existing purchase power. Since increasing real, natural capital is not possible, the only way to get the system “back in balance” is to destroy the purchasing power of the currency. That is the process currently underway.

That sounds logical. But what is the ultimate outcome of such a strategy? Will it lead to god times or ruin, or somewhere in between? I assume somewhere in between is the best outcome possible.

Now even Forbes is jumping on the Peak bandwagon. But it’s peak gas in this case.

The Popping of the Shale Gas Bubble

America’s shale gas resources and reserves have been grossly exaggerated and today’s level of shale gas production is unsustainable. In fact, due the distortions of zero interest rates and other factors, an enormous shale gas bubble has developed. Like all bubbles, this one will pop sooner than expected and when it does, the aftermath will be very unpleasant….

From the US government’s Energy Information Administration (EIA), to Pulitzer Prize-winner author Daniel Yergin to T. Boone Pickens, to Michael Lynch; all these experts have supported the notion that we have a surfeit of natural gas just waiting to be harvested. How can they be wrong?

However, the shale gas boom is rapidly maturing and we are quickly approaching a point where shale gas production heads into decline. In fact, the majority of shale gas basins in America are already exhibiting declining production.

I could say the same thing about the majority of the world’s oil reserves.

Hi Ron,

I suppose you could say that about the majority of the World’s oil fields, but based on EIA data through April 2014 the 12 month average is still increasing so if we think about total world reserves output is not declining yet. When the Russian summer slowdown hits the EIA data (probably in December) this may change. I believe you expect output to decrease (or stop increasing) by Jan 2015, you may be correct because shale output will slow and not be able to offset declines elsewhere, it will be interesting to see how fast output declines.

Dennis, the majority of the world’s old oil fields are in decline. I don’t think that is disputed by anyone except perhaps yourself. Only the US shale oil is keeping the world decline from becoming obvious. Well that and the Canadian oil sands. But the majority of the world’s oil reserves are in decline.

And even with the US shale oil input production has declined since February. But take away the US input and the peak was in January 2011.

And take away a byproduct of natural gas production, AKA condensate, it’s very likely that actual global crude oil production has been flat to down since 2005.

With respect to all present I’d like repeat the following from a few posts back:

“Dave Demshur of Core Labs (CLB $150) says we are now at the maximum possible oil output of the planet, and it will not get higher — ever.”

These guys are as knowledgeable as anyone, or any group, and certainly more qualified to make such a statement than ANYONE I know about. THIS IS NO LONGER A DEBATABLE ISSUE for God’s sake. All we can reasonably argue about now is the shape of the decline curve.

Hi Doug,

He may be right, I will remain skeptical until we see data confirming this.

Hirsch likes to use 96% of peak to determine if we have left the plateau, if we define the peak as 76 Mb/d (highest 12 month average rounded to nearest whole number) we would need output to fall to 73 Mb/d before we reached this 96 % level and could claim we are off the plateau.

Or we could use the Feb 2014 monthly peak (77 Mb/d) and 96% of that would be 74 Mb/d.

We could discuss the decline, but I would rather wait for it to arrive.

When I see the 12 month trailing world average C+C output from the EIA a couple of percentage points below the most recent 12 month peak.

Another consideration is that maybe he is right that it will go no higher than 77 Mb/d, we were on a plateau from 2005 to 2010, we have been on a new plateau at about 76 Mb/d for a year, maybe he thinks we will remain at this level for a few years.

I agree that the peak or a plateau either is here or will arrive soon.

Once it is clear to everyone that output is at or near its maximum, I think oil prices will rise, until they crash the economy, then they will fall along with output, prior to that recession I think decline will be under 2%. Oil prices are notoriously hard to predict. A slow rise in oil prices might allow the economy to adjust. Any oil price rises over 5% per year for a sustained period (4 years or more) and a recession will result.

Hi Doug,

The Core Labs guy thinks we will remain on a plateau until 2015 or 2016,

see http://earthprojects.s3-website-us-east-1.amazonaws.com/peakoil.html

Hi Ron,

I agree that most of the world’s fields are in decline, but I guess I think of world reserves as more generic as in saying the supply of oil.

So when someone says world reserves, I think of a number like Jean Laherrere’s estimate of 850 Gb of crude less extra heavy 2P reserves in 2010.

If you had said oil fields or crude basins it would have been clearer to me.

The near term monthly peak in Feb 2014 is no more significant than the near tern peak in Nov 2012, 12 month averages are the numbers to follow.

Hi Ron,

I think that North Dakota production chart from the NDIC that is labelled “limited-no drilling” might mean that a few wells are drilled, but less than the current rate. In fact a scenario can be created which matches the “limited-no drilling scenario”, but such a scenario is very unlikely to play out. It would require a pretty rapid drop to 100 wells added per month and then a gradual reduction in the number of wells added per month over time. I find it hard to imagine a realistic scenario where this would happen. Chart below.

No I think I misread that. The black line in the NDIC certainly does not match what would happen with no more completed wells. Chart below for that case. EUR30=331 kb/well, no new wells after June 2014.

Note cumulative output is 2.9 Gb in 2070 and 2.7 Gb in 2040 for the chart above(includes all North Dakota Bakken/Three Forks output starting in 1951.)

Like all such things, you can get to 100 wells drilled and only 100 drilled by decree.

What well count would generate exactly the NDIC drawing, or is it well count plus their assessed decline rate. Can the latter be deduced by their drawing given a quoted well count from them?

Hi Watcher,

the first chart is pretty similar to the NDIC chart through 2040, I can’t add wells to my model after 2041 which is why it stops at 2040. Too much work to go beyond this point, I’ll let Doug do it cause he loves those long term projections 🙂

We don’t have well counts from the NDIC except that in one slide from the presentation linked in Ron’s post they claim that 60,000 wells will be drilled.

Initially I misread the chart and thought “limited” meant fewer wells than at present, but I think Ron’s interpretation is correct and his suggestion that the decline rate would be much steeper agrees with my model results if no new wells are added after June 2014 (second chart above).

Interestingly the model predicts 2.7 Gb even if no new wells are drilled. This assumes the EUR of wells drilled through June 2014 will have similar output as the average well over the 2008 to 2013 period. There have been a lot of three forks wells drilled in the last year which may not perform as well as the mostly middle bakken wells drilled over the 2008 to 2010 period.

roughly 40% of these recent wells were three forks wells or about 720 wells. These wells produce about 15% less than the middle bakken wells call it about 50 kb over the well life times 720 wells or 36 Mb, so it might not affect things much (.04 Gb).

“the first chart is pretty similar to the NDIC chart through 2040,”

No it isn’t, they show 800+K bpd in 2030.

These no drilling lines from NDIC, how can these declines be so gentle when 64% of present production is from wells < 18 mos old? Come 2030, at LEAST 60% should have been lost because nothing will be < 18 mos old.

Their lines can’t be no drilling.

Hi Watcher,

You are correct. My first chart is steeper than theirs.

I also believe that you are correct that “limited drilling” makes much more sense than no drilling.

Hi Watcher,

These numbers change once we stop drilling. Currently 64% of output is from wells less than 18 months old, but once we stop drilling new wells those numbers go out the window. That is why I do the model, it is not perfect, but will be much closer than assumptions such as 64% of production is now from wells less than 18 months old so 18 months from now production should be 64% lower.

See http://peakoilbarrel.com/oil-field-models-decline-rates-convolution/

The simple Bakken model can be found at

https://drive.google.com/file/d/0B4nArV09d398Umd3RUJhNE9vbzQ/edit?usp=sharing

Just adjust wells added to zero in output sheet for month 50 to month 200, for no wells added case.

A bigger spreadsheet(18 MB) with ability to add wells to 2040 can be found at link below, number of new wells added is near the top row of the output sheet.

https://drive.google.com/file/d/0B4nArV09d398dExKQWtQekNDYzQ/edit?usp=sharing

Hi Watcher,

I revised the scenario to better approximate the “limited-no drilling case”.

This scenario assumes the new well EUR does not decrease (not realistic, but we can only guess at what this will be), if we guessed the number of wells added would need to be higher than in this model. About 30,000 wells must be drilled up to 2040 under these assumptions and cumulative output in 2040 is about 9 Gb (which suggests that the peak scenario is very optimistic). Chart below.

The squiggly dotted orange line doesn’t make any sense.

What is the decline rate NDIC is using to achieve the line they achieved? That is at least as powerful or (more powerful) a parameter as drilling rate — to get the line they got.

I just went back through Ron’s link to the NDIC presentation.

They have 60K wells quoted in there and call EUR a question mark which seems to depend on the big unknown of well spacing. They present the CLR diagram of pilot program for differing well spacing, and my recall is we saw a test result from a different company doing the same thing saying that narrower spacing was not getting equivalent flow for the marginal well, and particularly for different depths. The previous well had drained that area already from where the new narrow-spaced well was to drain.

The slide says “big question”.

Hi Watcher,

The decline rate is not fixed. The squiggly orange line is the number of new wells added each month, see the right axis. It starts at 200 wells per month in June 2014 and decreases from there, the messy part before June 2014 is the actual number of wells completed based on producing wells (for the early part of the data) and well completions reported in the monthly comments by Lynn Helms (for about 2 years from 2011 to 2014). I am using my model and adjusting number of wells added from July 2014 onwards to get the output chart shown (see left axis). Note that the same well profile is used from 2008 to 2040 and a lower well profile is used from 2005 to 2007 (EUR is about 50% of the 2008 to 2013 well profile for that early period).

Well profiles below.

On the “Peak Production estimate” in the NDIC chart from Ron’s post.

I estimated the area under the curve from 2014 to 2100 and about 29 Gb of oil is produced over the 2014 to 2100 period in that scenario. Let’s assume the average well produces 375 kb. It would take over 77,000 wells to reach that level of output, no doubt the NDIC is using the very optimistic 500 kb/well EUR, which matches better with their 60,000 well estimate (58,000 wells).

It somehow doesn’t occur to the NDIC that the EUR of new wells will decrease as the sweet spots get fully drilled. A more realistic estimate would be 40,000 wells with an EUR of 300 kb/well (to account for decreasing well productivity over time) which would give us 12 Gb (still optimistic).

A more realistic estimate would be 29,000 wells with an average EUR of 275 kb/well which would result in 8 Gb and a pessimistic estimate would be 16,000 wells with an EUR of 250 kb/well for 4Gb.

Bakken Source System:

http://www.undeerc.org/News-Publications/Leigh-Price-Paper/pdf/TextVersion.pdf

Hi Ronald,

I have read the paper, but Price’s views were not necessarily the prevailing view and his suggested recovery rate of 50% is not believable. If we estimate 400 Gb OOIP (original oil in place) and a recovery factor of 2%, we get 8 Gb. Note that all three of these numbers are likely incorrect, basically we don’t know the OOIP, or recovery factor and the URR will be the product of the two and it is unknown as well, my guess is 6 to 10 Gb with 8 Gb most likely, others think 2.5 Gb to 4 Gb, I doubt it will be that low for the North Dakota Bakken/Three Forks URR and I also doubt the optimistic estimates of 25 Gb or more.

At a rate of a million barrels per day, the 4 GB amount will be reached in approximately 8 years. If that happens, it will be the a gargantuan mal-investment, with no hope of any substantial return on the investment. The amount is too little too late, if you ask me.

If a well has a cost of 10 million dollars to be up and running, then 60,000 wells will have a total investment of six hundred billion dollars. A 4 GB top will have an value in 2014 dollars of 400 billion dollars.

It is a losing battle if there is only going to be 4 billion barrels of oil. The number will have to be more than that for the numbers to look like they are going to work. Every single oil company will be holding the bag at the end of it all in 8 years. An exercise in futility, at end of the line. After 7 years if build up to one million bpd, it is not going to come to a screeching halt in the next eight. There will be more oil than 4 GB or their will lots of hand wringing and gnashing of teeth.

A 3 percent extraction should produce some 27 billion barrels of oil if there is a total of 900 billion barrels.

After 10 years of oil production, there will be more accurate predictions, 4 GB is much too low.

After 7 years of build up, ‘of’ not ‘if’.

There will be more oil than 4 GB or their will lots of hand wringing and gnashing of teeth. oops, made the correction:

There will be more oil than 4 GB or there will be lots of hand wringing and gnashing of teeth.

Hi Ronald,

Let’s assume the 60,000 wells is wrong and only 15,000 wells are completed, let’s also assume 4 Gb of oil (267 kb/well). 4 Gb of oil would be worth 400 B dollars at $100/barrel (and I agree with Mac that real oil prices will probably be higher than this). The wells at $9 million each would be $135 billion for 15,000 wells. So even with discounting to present value and accounting for OPEX, transport costs, royalties and taxes and so forth it is still profitable. OPEX and other costs are about $10/barrel, royalties and taxes are $22/barrel, transport cost is $12/barrel so the net per barrel would be $56/barrel. At 4 Gb we get

$224 billion in net income (but this would be less with discounting).

When we use a 10% discount rate, the net present value of the future income is $52 billion(2013 $) in the pessimistic case of 4.6 Gb from 14,500 wells ( assuming real oil prices follow the EIA’a Annual Energy Outlook reference scenario.) Note that a more realistic scenario does not have new well EUR decreasing so rapidly and profits would be greater.

According to the Oil & Gas Journal Bakken field production reaches 1 billion bbl mark earlier this year:

Citing data from IHS, Continental Resources Inc. reported that Bakken field has surpassed 1 billion bbl of cumulative light, sweet crude oil production during this year’s first quarter.

Two thirds of the total was produced in the last 3 years, Continental said.

I believe the Bakken will peak next year, plateau for about one year and will be in steep decline by 2017. Total cumulative production by 2020 will be less than 3 billion barrels. I will not predict what stripper wells will produce after that.

OK that sounds right: How about the Eagle Ford Formation? [Yellow Face]

David Hughes thinks at least 6 Gb from the Eagle Ford, but a lot (20% or so) of EF output is condensate, so if we ignore that it would be about 5 Gb of crude. So Bakken plus Eagle Ford would be about 10 Gb to 14 Gb, the Permian may equal the Eagle Ford (it is too early to tell) so lets say 4 to 8 Gb.

All three (Bakken/Three Forks, Eagle Ford, and Permian Basin LTO) would be 14 Gb to 22 Gb, my best guess would be 18 Gb total from all 3 plays(Bakken, Eagle For and Permian).

Hi Ron,

I devised a scenario using past NDIC output and well data for the Bakken and the individual well data collected by Enno Peters to develop an average new well profile.

If we assume 170 wells are added per month on average from July 2014 to Dec 2015 and that the new well EUR starts to decrease from the Jan 2014 level of 360 kb by 30% per year (this is not decline rate it, is the total output of the well over it life) with the decrease starting gradually now and reaching this 30% rate of decrease in 12 months (by June 2015) we can get an output profile that peaks in 2015 at under 1100 kb/d and declines steeply in 2016. Cumulative output is 2.7 Gb in 2020, 3.6 Gb in 2030 and 4.2 Gb in 2040. About 15,000 total wells and these are economically recoverable resources. Note that 2P reserves in the Bakken are likely to be at least 3.2 Gb so this would entail adding only 1 Gb to reserves from possible reserves or contingent reserves between Dec 2012 and Dec 2040.

I think this is a very pessimistic scenario that is highly unlikely.

Through March 2014 their is no evidence that the average new well EUR in the North Dakota Bakken has started to decrease and Three Forks well data indicates these wells will produce 300 kb per well and will break even at prices as low as $85 per barrel.

The scenario which matches your prediction has the average new well EUR dropping from 360 Kb/well to 200 kb/well by Dec 2016, very doubtful in my mind.

Chart below with annual rate of decrease in new well EUR on right axis and average new well EUR per well in kb/well on left axis for this pessimistic North Dakota Bakken/Three Forks Scenario

A note on the chart above.

In Jan 2016 the reduced well output(lower EUR per well) leads to fewer new wells added and the monthly rate that new wells are added falls from 170 per month to 7 per month by July 2017 (a decrease of about 8 to 9 wells per month over an 18 month period).