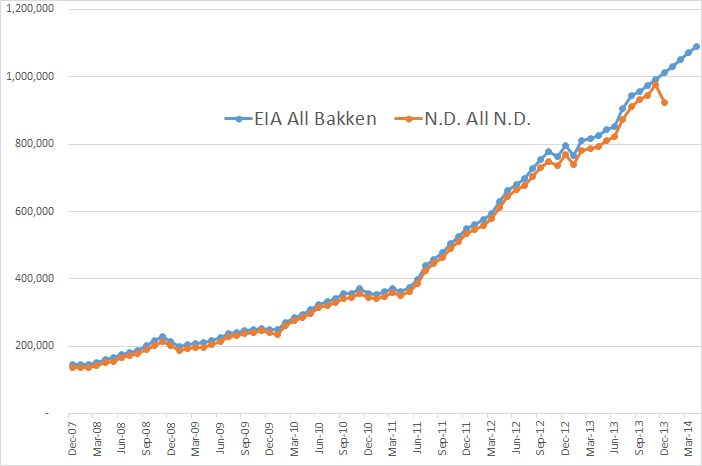

The EIA’s latest Drilling Productivity Report has been published. I found some strange things in the report. For the Bakken, their data does not jive with that posted by North Dakota. I have plotted the two together. The North Dakota includes all North Dakota but not the Montana part of the Bakken. The EIA data includes all the Bakken but not the non-Bakken part of North Dakota. Almost a wash but not quite. Montana produces slightly more than the non-Bakken part of North Dakota, but not very much. Anyway…

I thought for sure that the EIA would hear that Bakken Production was down about 50,000 barrels per day in December. But Nooooo… they have the Bakken up by over 20,000 barrels per day in December, a difference of 70,000 bp/d. But up until the last two or three months they follow the North Dakota data pretty close so we can hope they update their data in a few months.

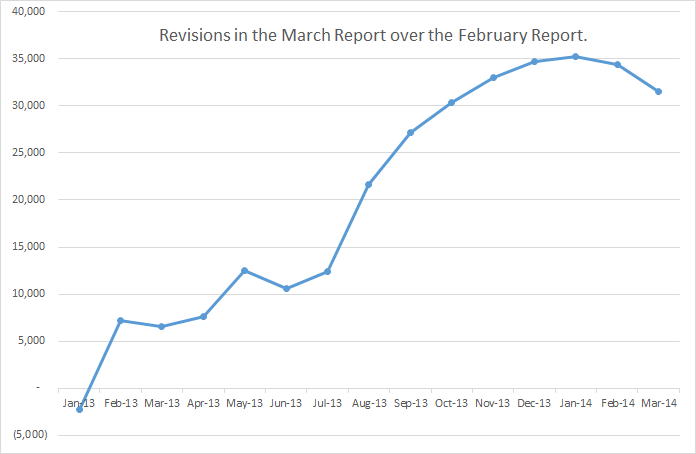

However all LTO production was revised upward in this last report. The chart below is the barrels per day that all tight oil was revised upward.

Doesn’t the strange shape of that chart raise suspicions? December production was revised upward by 34,672 bp/d when it actually should have been revised downward by perhaps twice that amount. January production was revised upward by 35,243 barrels per day. I doubt very much that this was the actual case.

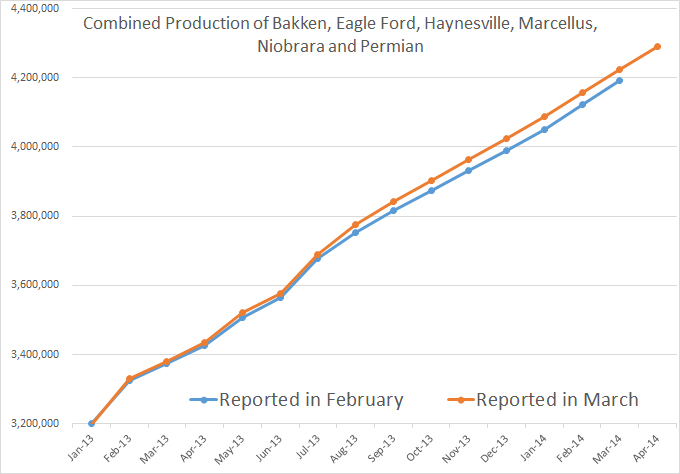

The chart below is total LTO as reported by the EIA’s Drilling Productivity Report. Of course it is not nearly that much because a lot of conventional oil is included, especially in the Permian.

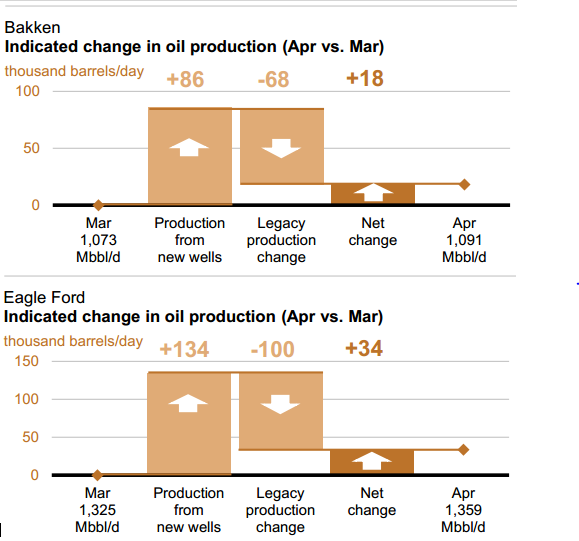

I had to include these decline charts published by the EIA.

They are saying that in April, in the Bakken, 86 kb/d of new oil will be produced but there will be a decline of 68 kb/d leaving a net increase of 18 kb/d. And as you can see they are predicting a similar pattern for Eagle Ford.

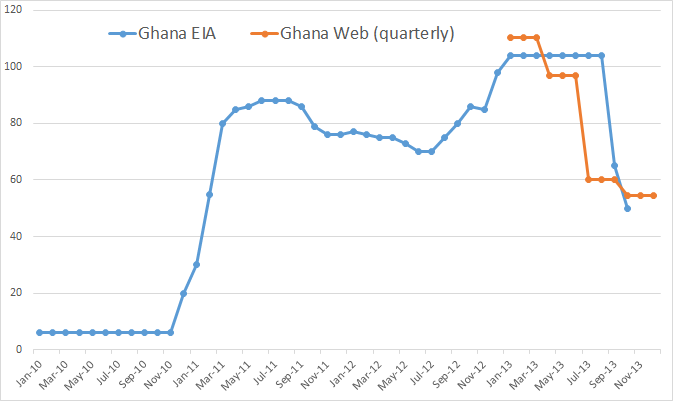

Oil Production Plunging in Ghana

The third year of oil production in Ghana, precisely in the Jubilee fields, has ended and the economy of Ghana is reeling with the Cedi in a free fall. The economic consequences of this free fall are common knowledge, down to the common man in the street, because of the biting effects.

The Cedi is of course Ghana’s unit of currency. This shows what happens when a country has oil, then doesn’t, or doesn’t have nearly as much.

Tullow Oil Ghana, which owns 49.95 percent of the action in Ghana’s Jubilee field, denies this drastic drop in production but Ghana Web says they get their data from the quarterly per barrel royalties that the oil companies pay to the Ghana government. Apparently that’s where the EIA gets their information also, albeit a bit delayed. The EIA’s data is C+C where the royalties are apparently paid on “Barrels of Oil Equivalent”. That likely accounts for the difference.

What makes this development so alarming is the fact the Jubilee Oil Field was supposed to hold 2 billion barrels of proven reserves. It is yet to produce even 100 million barrels or one twentieth of that amount. What does this tell us? Likely two things, that early assessments of reserves are not to be trusted. These assessments are based, at least partially, on test well flow rates. And that the decline rate of these small deep water fields can be swift and sudden.

There was a lot of talk these last few days about the first ever China bond default. I am of the opinion that things are about to start popping in China.

Whistling Past The Graveyard After China’s 1st Ever Bond Default

If the economy continues to erode, there must be a series of defaults. Expect troubles soon, especially in the second half of this year. Haitong Securities, China’s second-largest brokerage, estimates that 5.3 trillion yuan of trust products will come due this year.

“In the U.S., it took about a year to reach the Lehman stage when the market panicked and the shadow banking sector froze,” the Bank of America Merrill Lynch note pointed out last week. “It may take less time in China as the market is less transparent.”

And it may have already started.

Disappointing China exports halt stocks, hammer commodities

Investors in Asia started the new week on a cautious note as China’s exports unexpectedly tumbled 18% year-on-year in February, swinging the trade balance into deficit and adding to fears of a slowdown in the world’s second-largest economy.

Note: I send out an email notification to about 110 people when I have published a new post. If you would like to be added to that list, or your name removed from it, please notify me at: DarwinianOne at Gmail.com

59 responses to “The EIA’s Drilling Productivity Report, Ghana and China”

Ron,

1. On the Bakken December: looks like more of that modeling versus actual. Good call out. Seems pretty strange that they are so off when it’s so easy to just look at the numbers on the ND website. And the DEC drop got lots of press.

2. For the other adjustment: I wonder how much of that is Texas? I have heard that RRC allows pretty straggling reporting, so you have to watch for the back months changing.

3. Also, I wonder are the EIA still showing the too-exact-to-be-true 50K per month increases or did the latest release fix that?

Most of the upward adjustment was the Permian. But that is not the fault of the Texas RRC. The EIA estimates Texas production and usually estimates it too high. I think that is the case here.

No, this report did not fix anything because they are two entirely different departments who, apparently, don’t talk to each other. The (recent) data published in this report is not related to any data published anywhere else. However after eight or ten months all data will match, or be pretty close. The data published in this report is not accurate beyond October although the December data is available from every state except Texas. And the January data will be available in a few days but that will not matter to the folks who publish the “Drilling Productivity Report”. They won’t publish the correct January data until June or July, if then.

Here’s a link to an article about pipelines out of the Bakken. It’s a month old but it indicates that at least one major line is likely to be constructed in the next two years because this time the builder has succeeded in getting enough shippers to sign on the dotted line.

Other proposed lines have fallen thru due to not enough shippers being willing to commit.

http://www.startribune.com/business/245633161.html

I just read this company presentation:

http://www.kodiakog.com/pdf/KOG_Feb2014.pdf

They are an almost pure play in the Bakken. Have a lot of info on downspacing tests and even early results. Also, they give some details (b factor, etc.) on their decline curves. Can disagree with the claims, but I just like that at least you know what the basis is.

I went thru that .pdf.

It’s an investor pitch so the data is cherry picked.

Things of note — 44K bpd is not a huge player. CLR is way past that.

The dimensionality of fracking was discussed some time ago. The final conclusion that I recall was 3D. If a fracture extends 1000 feet, it does so in all directions. The chart in the .pdf would seem strange then because they have various layers of the formation far less than 1000 feet apart.

Page 9 is their cherry picking, but even so 30 day average IP of over 1000 bpd compares favorably with the rule of thumb quotes in previous discussion. I will caution all, though, that the CLR pubs say they went more or less entirely to 30 stages beginning all of last year, from 20 stages in 2012. AND, and this is big, AND they are choking all new wells. They have decided lower IP equates to higher pressure and better long term totals.

This is a little puzzling in that quite a few companies have shown up to pursue their business model, which is buying older producing wells that flow at low rates and make money on them. If CLR is stretching production, they are saving it up for a different company. Shrug.

The downspacing diagram on page 11 is where layer thickness is quoted around 100 feet. Is this right or a typo? If it’s right, fracks are draining all formations. Maybe that’s the intent and the “pitch”. Look at how clever we are. We are going to tap Bakken and Three Forks with one well. Give us money.

The offset spacing for zero interference is 2000 feet. Companies go tighter because it’s not about maximizing individual wells, but about how much oil you get out of the total formation versus what you put into it in terms of capital. So there is interference at the tighter spacings. I don’t know the exact numbers but it could be something like drilling 4 times as many holes to get 3 times as much oil. It’s still worth it, to get the most profit out of the acreage.

As far as the different layers, there’s interference between the different layers, too. But you also won’t get all the oil from all the layers, if you just drill and frack one layer. It’s still beneficial to drill some in the different layers to maximize production. That’s why they do the checkerboard with spacing and depth. I did think the holes they had that were between the second/third benches were kind of cool looking.

As far as their IPs, they have nice acreage. You can look at the 1 year IP if you’re worried about chokes.

I figure it’s a skewed view, but you still learn a lot from looking at these things. Their b factor is probably optimistic (1.98…pretty high), but what I appreciated was that at least they disclosed it. Similarly with showing the results of the downspacing test rather than just saying ‘went well’.

The point is the 1000 foot fractures extend up and down as well as side to side. 3D. One horizontal hole would extend fracking into the other layers above and below and drain them, as well as the layer at whatever depth the bore went down to.

There is support for this concept in slide 5 of

http://images.sdsmt.edu/learn/presentations/Vincent%202.pdf on the right where they talk of longitudinal fractures. They explicitly mention attempts to drain multiple layers. This is happening and it says talk of “tapping the Three Forks after the Bakken is empty” doesn’t fly. Starting as best I can tell late 2012 fracking was already getting at the TF.

That presentation essentially says refracking worked only on the old wells.

The point of mentioning choking was a caution to all the guys obsessing over doing models of uncertain data with varying technology and technique.

Oh btw, I saw mention of 2.2 million pounds of proppant per multi stage well. Can’t find the link. And a quote of 100,000+ pounds of proppant per stage, which would imply more than 2.2 for 30 stages.

This would go some distance towards explaining 3 months to frack, even if a well that sits and waits some weeks gets included.

I looked through the refract presentation, thanks. Some interesting stuff in there and obviously some work done. That said, it is 2010 dated. I don’t see a lot of systemic refraccing going on currently. Seems like what is refracced is mostly old, poor, completions. Not regular wells. Presumably completion quality has gone up or become more systemic since 2009-2010.

I guess it will be interesting to see if refracs are done 5 or 10 years from now. His last slide has a good point about there being a lot of oil left in the stone. Some sort of better understanding of the oil connectivity and placement in the stone (micro and macro structure) might help us to devise better ways to access more of it.

Given that there’s not much refraccing going on now, I think modeling the development without accounting for refracs (or EOR) makes most sense. Then if the refraccs or EOR happens treat that as upside. And I don’t think it will be a simple situation, analogous to past practices, but of figuring out the right key to get that additional oil.

That was not meant to be touchy. I appreciate your reading the material.

CLR is still 70% privately owned. So, perhaps that affects some of their decisions in terms of development speed.

Relaxing restrictions on U.S. exports of oil and natural gas

This entry was posted on March 9, 2014 by James Hamilton.

Hamilton touches on the issue of rising API gravity that Nony, Watcher myself and others have been discussing. Worth reading the comments, also, as the usual suspects can be found there.

How do you make italic letters on this blog?

Is there a way to do it other than composing in a word processor and copying and pasting?

Test angled brackets: test

Test square brackets: [I]test[/I]

Angled brackets are shift-period and shift-comma on your keyboard (below “L”).

Just do what I did on the second sentence, but with angled brackets, not rectangular. Don’t forget the “/” on the termination.

I wonder if we can use strike through for

fucking aroundhumor?Oil and gas extraction in UK -7,4% year over year in January: http://www.ons.gov.uk/ons/rel/iop/index-of-production/january-2014/stb-iop-jan-2014.html#tab-Production-and-Sectors-Supplementary-Analysis (look at “Division 06”).

The UK is the source of saying “Europe only depends 33% on Russia gas”. England has LNG terminals. They don’t send it eastward. Their independence from Russia gas and including them in the word “Europe” just provides support for the narrative du jour that Russia has no power.

Europe has some gas of their own also. Dutch have some big fields and there is North Sea production (Norway, UK).

DC:

I printed and read through the 2013 CLR 10-K last night. If you have not done so (or equivalent), I highly recommend it. There’s a lot of explanation of acronyms, reserves definitions, industry practices, cost factors, etc. They even have a 3 page glossary at the front! (Wish I had looked at that a few weeks ago when I had no idea what PUD or the like was). I would just be a little careful about using their cost figures directly as they are 20% Oklahoma, not a pure play. But mainly, I just find reading these company reports teaches me the industry. If I were looking at…an airline…or a makeup company…I would read through the Delta or Revlon report and learn about factors that apply only in that space, not a prototypical manufacturing industry.

I may be a little scarce. I think I’m probably annoying the peaker regulars and I’ve basically gotten as up to speed as I wanted from casual Internet reading.

>> I printed

What?? You mean, like on paper??

134 pages! But I was getting tired and I’ve been sort of Internet addicted. I don’t have an Ipad or a reader or the like, so it’s hard on the eyes after a while. And paper is more transportable. Plus, you can flip pages back and for the easier (compare a table to the discussion of it).

It’s not like I’m going to print every companies 10K. But one, to learn the industry is no big deal. I can throw it in a file folder and refer to it if needed in future. I mean I went to Barnes and Noble and bought Yergin’s book as well. LOT of info in there (very global). You don’t have to be cornie to appreciate it. It’s just a useful historical baseline and knowledge infusion.

I read Yergin’s first book “The Prize”.

He is a superb writer and a pretty good historian too and I guarantee anybody really interested in oil will enjoy The Prize but only if he likes to read. It is a very thick book.

I haven’t read the new book and have no idea what is in it but I will bet it is chock full of factual information.

The trouble with such books is that most people have a hard time separating facts from an author’s conclusions and opinions.

Now insofar as my opinion of Yergin as soothsayer goes I would rather take my chances with the tattooed lady that reads palms when the fair comes to town.

Was 2013 the year of peak global fossil-fuel capex?

http://www.jeremyleggett.net/2014/03/was-2013-the-year-of-peak-global-fossil-fuel-capex/

BG Group has announced that 2013 will be the peak year for CAPEX, which will now be trending downwards. And now ExxonMobil is talking about disciplined capital allocation, with total capex down slightly in 2014.

So it seems that the oil companies and their shareholders are realising that it does not add up that companies can both cover dividends and maintain ever rising capital expenditure.

———–

Looks like Dave Demshur, Ceo of Corelab may indeed be correct by his recent forecast that 2014-2015 will probably be GLOBAL PEAK OIL.

I’m reminded of Stephen King’s book and movie “Thinner,” in which a guy has a curse placed on him. He loses weight every day, and only by consuming vast amounts of food every day is he able to keep the daily weight loss down.

Note that as the incremental increase in global crude oil production approaches zero, the incremental cost per bpd of new production (necessary to offset production declines and to add one bpd of new production) approaches infinity.

Jeff,

Agreed. By the way, thanks for clarifying that NGL’s were included in the Marketed Gas Production. Unless the industry really starts to increase NatGas drilling rigs, I don’t see how they are going to increase natural gas production this year… looks to be FLAT to slightly DECLINING.

steve

Based on the Citi Research report (estimating the annual decline from existing US natgas production at about 24%/year), all we have to do to maintain 24 TCF/year of dry processed natgas production is to put on line the productive equivalent of slightly more than all of Canada’s dry processed natural gas production–every single year.

Jeff,

I am completely surprised that the industry is not factoring in these decline rates. As I have mentioned before, that 24% annual NatGas decline rate is combined peak production from the Woodford, Haynesville, Fayetteville & Barnett combined.

I don’t see how they are going to add that much new production with the Rig Count down to historic levels.

One more question. Where on the EIA site can we find actual consumption of total petroleum products in U.S. I know the U.S. has net imports of 5.5 mbd, but I am trying to find the percentage of U.S. imports to domestic consumption. It used to be two-thirds, but it looks closer to one-third now.

steve

Most recent four running average weekly supply estimates:

http://www.eia.gov/dnav/pet/pet_sum_sndw_dcus_nus_4.htm

Some observers think that the short term preliminary EIA data are underestimating product exports (and thus overestimating the apparent rebound in US liquids consumption).

Note that the most recent product supplied data show no real year over year change.

I think we can assume that the Big Boys at the Big Oil companies really do understand their industry, and that they know all about the decline rates, and that they are factored into their business model. To think otherwise, is to assume that they are totally clueless. If that was the case, they would be run out of management very quickly.

Of course, what they know, versus what they say in public, are sometimes different things. Case in point, an article from 2004:

http://www.nytimes.com/2004/04/08/business/oman-s-oil-yield-long-in-decline-shell-data-show.html

So what about the decline curve? You all beat that like a drum, but everyone at a producer knows about it. What matters in the end is pricing and total production. And you’re leaving out some of the other factors relative to shale gas wells. Very low dry hole percentage. High IPs, etc.

Bottom line is that prices are relatively low and that is without a demand loss. It’s a supply glut. And the futures market expects it to continue!

Berman has been pretty damned negative about shale gas since 2009. Well, that bubble seems pretty damned strong to be lasting so long. I really recommend to step out of the warm comfort of the peaker chat sphere and watch talks, read articles by various sources…

Nony,

Let me see if I can try something on FOR SIZE here. I see you are spending a “Good portion” of you day trying to convince us here that the “SKY IS THE LIMIT.”

I think blogging is a good way for individuals to have an open debate on interesting topics and subjects.

However, you seem to spend a lot of time here pontificating the theory that PEAK is bad and GROWTH is good.

While it doesn’t seem that you pay much attention to the climate issue, there is more to life than producing as much oil and gas as we can. If anyone took the time and did a little research… we have indeed screwed up the environment and climate for our own good… as well as for many of the other plant and animal species that many of us could give a RATS AZZ.

Again, part of the reason the Shale Industry (especially shale gas) is still alive and kicking has more to do with the wheeling & dealing of Wall Street, than it does common sense fundamental business practices.

Without Wall Street & the Fed’s low interest rate policy, the U.S. Shale Gas Industry would have blown away a few years ago.

Lastly, the U.S. Economy is nothing more than what I call… A LEECH & SPEND ECONOMY. Without hoodwinking the rest of the world by exchanging worthless U.S. Dollars and increasing worthless U.S. Treasuries for real goods and services… our economy would disintegrate.

Those days are numbered….

So… there is more to life than SQUEEZING more blood out of the Shale Oil & Gas Fields. In the whole scheme of things… its quite meaningless.

steve

I can respect that. I actually don’t want to bring you down if you have different politics or lifestyle. But, I just worry that from the start the “peak oil” movement was also confounded with some wish fulfillment from the environmental/political perspective. [And yes, cornies can be as guilty as peakers. It’s just something to watch out for, our biases.]

Yeah, there is more to life than spudding in oil wells. It is kind of exciting and romantic though, no? I mean the whole wildcatter mystique?

”So what about the decline curve? You all beat that like a drum, but everyone at a producer knows about it.”

What could possibly matter more in the end than that curve if you are talking long term.?

Do you mean too much emphasis is being put on decline rates in the short term?

I can see that as a reasonable argument depending on the time frame you might have in mind because it seems pretty obvious that in American tight oil plays that the drillers can outrun the red queen for at least a another year or so.

Or maybe the decline curves you have in mind are the ones for the entire world oil industry ?

”What matters in the end is pricing and total production.”

I couldn’t agree more.

But you aren’t one of the people who believes that there is an infinite supply of oil on this finite planet.

And while I lack any expertise in the oil industry as such I did make good marks in economics and the hard sciences.

The decline curves are going to have at least as much to do with total production as anything the industry can do to develop new unconventional sources of oil and in my humble opinion the industry has hardly any hope at all of bringing on new unconventional production fast enough to even offset the decline of conventional fields very much longer.

Just how much longer do you think total production of oil can continue to increase?

And even if new production is brought on line fast enough to more than offset declines in legacy fields

the appetite of the world for oil is going to grow along with population and the overall economy -which again in my own humble opinion probable has not yet hit it’s ultimate peak although I think it will within a few more years.

What all this boils down to is comments about new production and decline rates and all such matters are hard to interpret unless a time frame is clearly indicated.

Sometimes it is clear from context what time frame the commenter has in mind.

But sometimes it isn’t.

My point about not treating decline cuves or field depletion as some “aha” is that oil wells have ALWAYS declined a few months after production. We’ve ALWAYS relied on more drilling to get more oil. Even while consumption was rising for the last 150 years. Now, how much longer it can go on is an open question. Answer might be peak soon…or not.

But it’s not some fundamental aha that the Red Queen exists in shale. She’s there too in conventional fields. You just have to keep drilling.

Coal mining is even worse. Stop advancing the mine front at the coalface and production drops to zero overnight. Oil mining is not an annuity. You have to keep mining to get more. [And yes, I accept that it is rarer than coal or iron ore…and that we might run out of good veins of oil ore fast enough to send the price up permanently.]

BARCLAYS predicts 6% increase in oil and gas E&P spending this year: http://www.pennenergy.com/content/dam/Pennenergy/online-articles/2013/December/Global%202014%20EP%20Spending%20Outlook.pdf

That’s dated Dec 2013. Heard an interview today with the CEO of Chevron.

He says he’s cutting 2014 capex slightly below 2013’s, and even lower after inflation. He also says he had a robust plan to increase production 20% over the next 4 years. The interviewer pounced in two says.

1) How will you increase production with a capex decline? Answer: “We will be asking our suppliers to do more with less.” (IOW we will try to steal profit from them, but have them deliver more while we do it)

2) Your production growth expectations are far above Exxon and BP and Total, and they are cutting Capex about the same. Answer: “Our production growth plans are second to none.”

Jubilee has been having flow line problems recently, so that could contrubite to the dramatic drop in production. It could also be that the field is already in decline, but it would seem odd for a field that was being managed properly (i.e. injection and production and regulated) to have such a steep decline. The only large offshore field that I can think of that declined in such a way is the Cantarell field, but in my opinion that was mainly caused by the reservoir managment of PEMEX.

Nony,

When you graduate from school after studying Engineering Physics it becomes evident you don’t actually know anything. So you decide to move on and work on degrees in geology and geophysics: as expected, you quickly figure out that you still don’t know anything. Then, at some point, you start finding yourself in rooms containing arrays of computers, technicians, paleontologists, engineers, and other scientists studying maps, reports, detailed drill logs, seismic logs, etc. In the end you still don’t know much but by pooling thoughts, and as a group, you can make educated guesses. You emphatically do not second guess anyone, which would be rude, ill-mannered, tactless and counterproductive. In other words, as my doctor once remarked: “Our worst problem is patients who come in after reading an article in Wikipedia – they already know everything.”

Now, I don’t know anything, never did. And, I realize you are an expert in many different fields, none of which I understand. However, perhaps through my own stupidity, you now-and-then seem to presume knowledge beyond your ken. I hope not. Regardless, you could do me one really big final act of kindness: Which is, not replying to this (my) comment.

To know is to know you don’t know.

Totally OT, but anyone know what happened to Island Boy from TOD? I appreciated his insightful energy-related comments from a 3rd-world economy perspective, especially regarding Jamaica and their power grid and power plants. I just watched the following interview of JB Straubel, Tesla CTO. His comments regarding island grids being the most logical and economic place for a 100% renewable grid reminded me of IB’s frequent laments about JPA’s fuel-oil-based power plants and their management’s total lack of consideration of PV power.

http://www.energybiz.com/magazine/article/346913/tesla-s-power-play

He’s posted here a few times. I expect he might chime in. I appreciated Alan’s Caribbean perspective as well.

Also wouldn’t mind hearing from wiseindian to get his perspective on what’s going on in India. I noticed Ulenspiegel comments on Jim Hamilton’s posts. Here’s hoping we can bring greater and more diverse international participation here at POB.

I think Caribbean islands don’t really have much choice but to go 100% renewable, and mostly solar.

BTW, citizens don’t usually like to have their country referred to as third world, no matter how well intentioned. : )

Trinidad and Tobago have oil. About 100K bpd. No need for solar at all, which of course is expensive, gets destroyed in hurricanes so that you get to buy it twice and three times, and it don’t power ships carrying chicken food for Jamaica’s enormous poultry industry.

The St Croix and Aruba refineries are closing, however. That’s interesting. Jamaica has a 37K bpd refinery, but consumes more than that and has to import gasoline . . . and always will.

If your solar blows away you ain’t doin’ it right.

One small good thing we are doing in NZ is installing PV systems on for isolated island communities across the South Pacific. Way better than hoping you can afford another shipment of diesel. And yes we have hurricanes in the Pacific too, only they’re called cyclones, no idea why the difference.

https://www.aid.govt.nz/media-and-publications/development-stories/july-august-2011/renewable-energy-pacific

Of course, they won’t help the low lying atolls with sea level rise… never mind perhaps Anandarko can send their rig ship up there, it ain’t achieving much down here [see comment below]

Don’t need to get blown away. Need only get a roof torn off a nearby house and smashed into it.

In regard to net exports, Trinidad & Tobago’s net exports fell from 136,000 bpd in 2005 to 75,000 bpd in 2012 (total petroleum liquids + other liquids, EIA). Their ECI ratio (Ratio of production to consumption) fell from 4.9 in 2005 to 2.7 in 2012, which implies that they will approach zero net oil exports around 2024. I estimate that they have already shipped about half of their post-2005 Cumulative Net Exports of oil (CNE).

Trinidad & Tobago are one of eight major net exporters in 2005 (countries with 100,000 bpd of more of net exports in 2005) that fell below 100,000 bpd in net exports in 2012 (and in some cases became net importers, e.g., Vietnam).

Regarding Capex – Anadarko have just kissed $300m good bye drilling off-shore New Zealand:

http://www.stuff.co.nz/business/industries/9818674/Anadarko-still-has-oil-hopes

I did point out to a few folk here that it was a mark of such companies desperation that they were prepared to come so far and spend so much……..

There has been a fair bit of interest in offshore NZ but apart from a few small fields (50m barrels) it has been a bust.

This sounds a lot like Cairn Energy’s dry holes off the west coast of Greenland and Shell’s problems trying to drill anything in the Chukchi Sea off northwest Alaska.

Maybe the USGS estimate of total global oil reserves is a tad optimistic.

Not much is ever found near earthquake zones. Millions of years to disrupt the geology.

California is a weird exception, but a rare one.

Comment by Steven Kopits:

http://econbrowser.com/archives/2014/03/relaxing-restrictions-on-u-s-exports-of-oil-and-natural-gas#comments

Carrying Capacity

The notion of carrying capacity is central to supply-constrained forecasting.

During late 2007 and into 2008, a number of pundits, including Goldman Sach’s Arjun Murti and the late Matt Simmons, speculated that oil could go to $200, or even $500, per barrel. I had my doubts. Ordinarily, there are natural limits on these sorts of numbers, given primarily by our propensity to try to equalize marginal rates of substitution (a very important forecasting concept). We wouldn’t spend 100% of our income on oil regardless of the price. Nor would we spend 50%. Nor 25%. In fact, if you check the historical record for the US, when oil consumption of GDP has exceeded 4.25% of GDP, the consumer has chosen to reduce consumption rather than sustain spending at that level. This was true after the first modern oil shock (1975), the second oil shock (1979), the fourth oil shock (2008) and the fifth oil shock (2011). (The third modern oil shock, the 1991 Gulf War, really didn’t qualify on a number of fronts.)

If we know the budget constraint (P*V, specifically 4.25% in terms of GDP), and we know the volumes, which are relatively stable, then we can calculate the maximum price which the economy can sustain over an extended period of time. For the US, it’s estimated in the $105-108 / barrel Brent basis range.

The notion of carrying capacity and the monopoly price are pretty close. In essence, if a commodity is supply short, then the price rises until it approaches the monopoly price, that is, where any movement from this price leads up or down leads to lower profits. From this point, the price can only increase with increasing GDP (more income allows you to pay more for a commodity); efficiency gains (if you use less of it, you can pay more per unit); and dollar inflation (the value remains the same in real terms). In theory, carrying capacity could grow around 7% (2.5% GDP growth + 2.5% efficiency gain + 2% inflation). In practice, carrying capacity appears to have grown more slowly, around 4.5%.

Thus, at the carrying capacity level, P does not equal MC. That is, if your costs go up, prices will not follow you. So, imagine that the cost of ingredients go up at Papa Johns, and it now costs $11 to make a Pizza. You’d expect Papa John to raise the price to $11 and pass the cost increase on to the consumer. However, at the carrying capacity price, any movement from the previous price, let’s say it’s $10, reduces revenues. Thus, if Papa John wants to raise price by 5%, volumes will fall by more than 5%. So Papa John is essentially stuck with the price. Thus, if costs are rising, Papa John will have to absorb them.

Now, if that cost increase is small and one-time, then that may not be the end of the world. However, if costs are rising by 11-13% each year and the total profits are 10-15% of revenues, then you can see that Papa Johns will be loss making within a short time. And that in turn means the supply of Papa John’s pizza must fall, and it could fall a lot. And if Papa John has to invest a lot to stay in business, you can see that the investment stream is going to dry up.

This is exactly what is happening to the oil majors.

Thus, the concept of carrying capacity is very important, because it establishes limits on oil prices and price rises over time. It tells us that oil prices are not going to rise that fast from hereon out. They will not rise to cover costs; instead oil companies are going to be pushed off their projects. Capex is going to fall; hence the expression “capex compression”, which is exactly what we’re seeing now. With falling capex, we can also infer that production will also fall. Indeed, we can calculate exactly how much production will fall.

That’s where we are in oil markets theory today.

Don’t feel bad if you don’t understand this. BP, Exxon, Chevron, EIA, IEA, Barclays, Goldman Sachs–not one of them understands the concept of carrying capacity or how to calculate it. And they’re professionals.

Jeff,

isn’t what you’re describing elasticity of demand (and supply)? Also, as spending on oil reaches a certain percentage revenue from oil will be identical. By and large it’s a transfer of $.

Rgds

WP

SPR release…

This is somewhat unusual. The DOE just announced they are releasing 5 million barrels from the SPR to “test the infrastructure”. Granted 5 million barrels is not that much but it does make me wonder how much shale production has fallen during the winter and how much we are becoming dependent on it.

Drawdowns on the SPR are pretty irregular. Here’s a list from the DoE:

• 2011 IEA Coordinated Release (Libya) – 30,640,000 barrels

• 2005 Hurricane Katrina Sale – 11 million barrels

• 1996-97 total non-emergency sales – 28 million barrels

• 1990/91 Desert Storm Sale – 21 million barrels (4 million in August 1990 test sale; 17 million in January 1991 Presidentially-ordered drawdown)

• 1985 – Test Sale – 1.0 million barrels

http://www.businessinsider.in/The-Energy-Department-Is-Testing-The-Might-Of-The-Strategic-Petroleum-Reserve-Today/articleshow/31904347.cms

http://www.ft.com/intl/fastft

Apparently the Obama administration has deciderd to do a test draw down of the strategic petroleum reserve and some people think that selling five million barrels of crude will influence world markets enough to put some pressure on MR PUTIN.

But five million barrels is less than two hours supply for the world and if we announced we were selling the entire reserve it would probably wouldn’t force the price of oil down more than a few bucks for a few months at the most.

I agree. Too little and not sustainable. Typical politician fail. Putin judges real action not PR moves. Approving Keystone, greenlighting all LNG export, etc. would send more of a message even if there is no instantaneous hydrocarbon in the market.

Maybe Mr. Obama will approve Keystone XL to use for future refills of the Reserve and one day use increased Canadian production as a means of influencing world events? Yes, (I know the numbers make this silly), but the idea is no crazier than mobilizing military forces.

Seriously, I can see current geo-political events as a way out of taking responsibility for the decision he is going to make, anyway. Problem is, there must be a fessing up that US is not energy independent or any kind of swing producer in energy.

Paulo

Banks see rising CapEx

http://mobile.reuters.com/article/idUSBREA2A1LV20140311?irpc=932

How does that square with the oil majors cutting CapEx?

I am really pleased to read this blog posts which

consists of lots of valuable facts, thanks for providing such information.

my homepage; Toronto ON mortgage attorneys