Comments not related to Oil and Natural Gas production in this thread.

The Real Reason Why US Oil Production Has Peaked

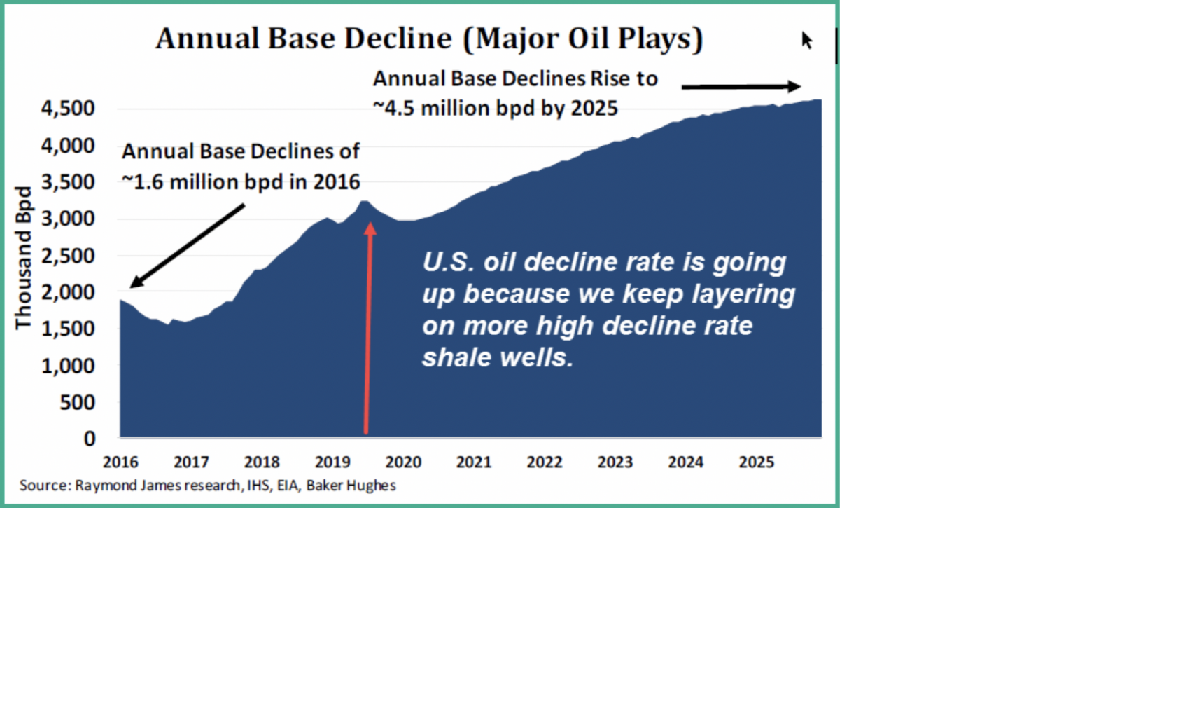

Raymond James recently estimated that over the last three years the U.S. decline rate for oil has doubled from 1.6 to 3.2 million barrels per day. The drilled but uncompleted well inventory (“DUC”) is back to normal, so the number of wells being drilled and the number of wells being completed is now about the same. We need over 12,000 new horizontal oil wells completed each year to hold production flat and the number of completed wells will need to go up each year.

The U.S. Energy Information Administration (“EIA”) forecast at the beginning of this year was that the U.S. shale oil plays were just getting started and that production would increase by at least 2 million barrels of oil per day (“MMBOPD”) each year for several more years.

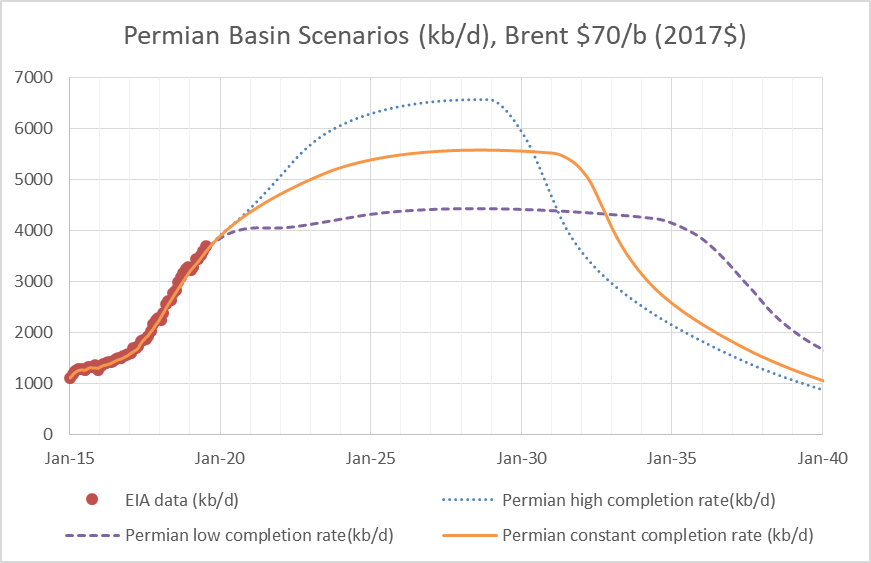

Read MoreSeems we don’t know what future completion rates will be in the Permian basin or anywhere. There are many different opinions on whether the completion rate might increase, decrease or stay the same. In my view, the conservative assumption is to assume they will not go up or down, but that the completion rate will remain constant. I have created three different scenarios: in the first, the completion rate increases; in the second, the completion rate decreases; the third scenario has a constant completion rate.

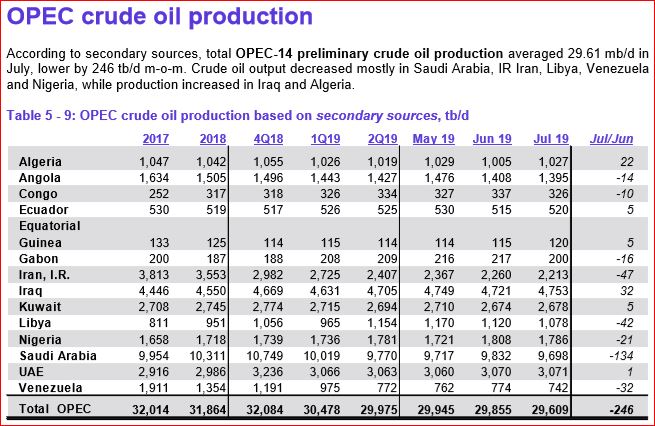

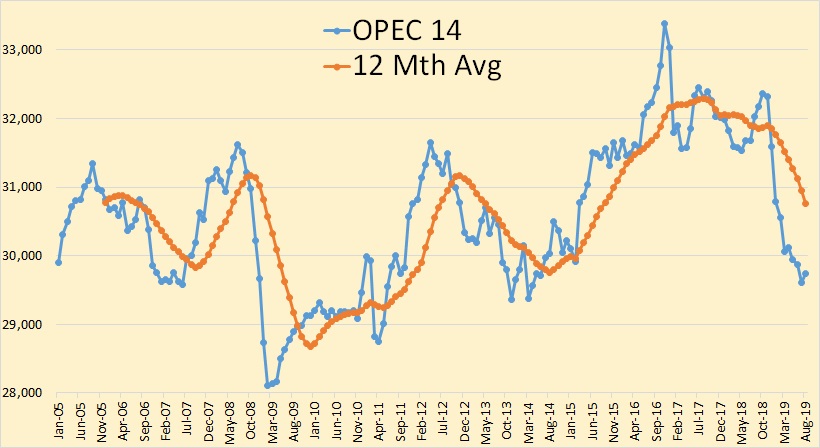

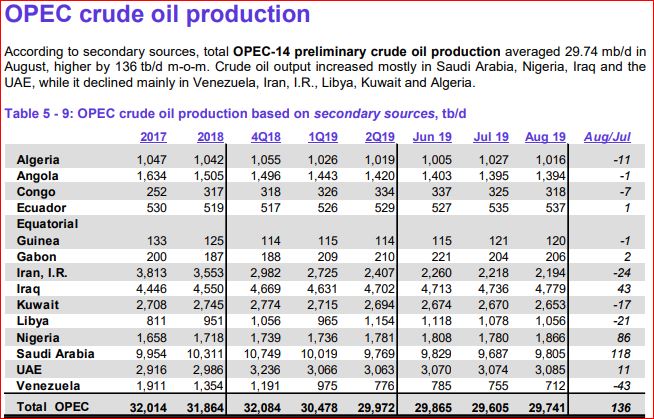

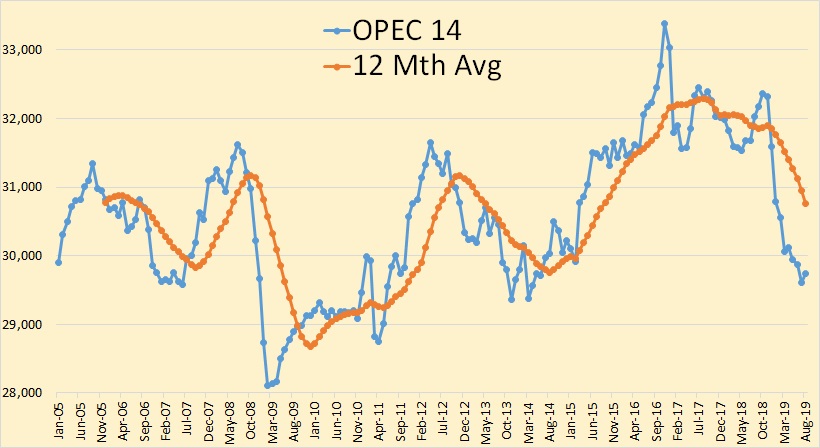

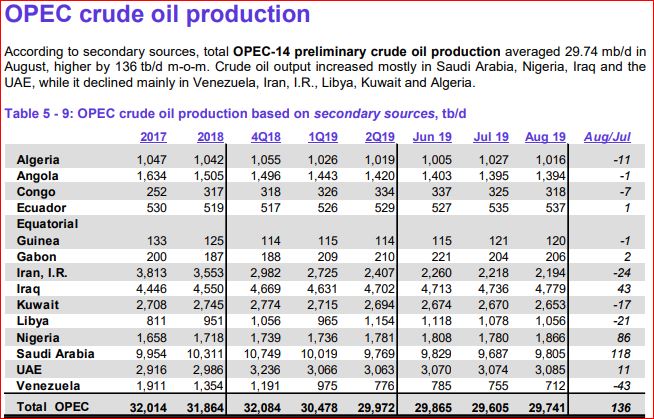

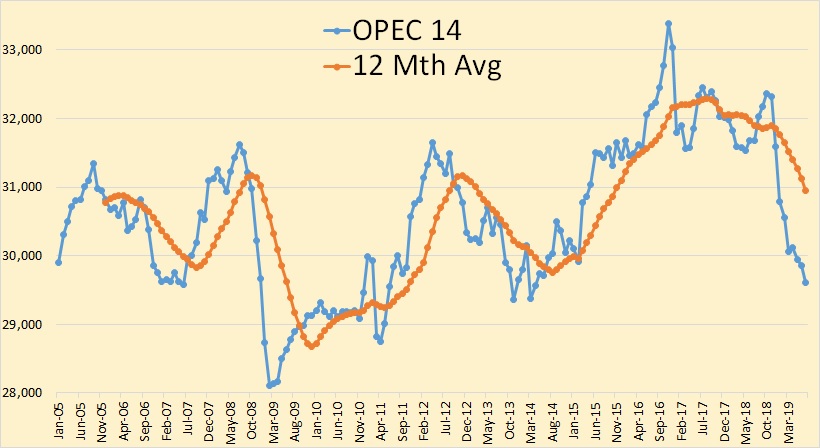

All data below, unless otherwise specified are from the latest OPEC Monthly Oil Market Report. All data is through July and is thousand barrels per day.

OPEC crude oil production was down 246,000 barrels per day in July’