The Bakken, as well as other shale oil areas, is not one homogeneous area where equal amounts of can be found. David Hughes in DRILLING DEEPER puts it this way, though here he is talking about gas wells, the same applies to oil wells:

All shale gas plays invariably have “core” areas or “sweet spots”, where individual well production is highest and hence the economics are best. Sweet spots are targeted and drilled off early in a play’s lifecycle, leaving lesser quality rock to be drilled as the play matures (requiring higher gas prices to be economic); thus the number of wells required to offset field decline inevitably increases with time.

However the Bakken, at least through the September North Dakota Industrial Commission production report, has given no real indication that the Bakken is even close to peaking. But a closer look at the data makes me believe that is all about to change.

The NDIC issues a Daily Activity Report where they list permits issued as well as wells completed and wells released from the tight hole confidential list. These reports usually, but not always, also give the number of barrels of oil per day and barrels of water per day for the first 24 hours of production. I have gone through every day, back to November 1st, 2013 and collected the data on every well listed that gives production numbers and copied that data to Excel. In that one year and three weeks I have gathered the data form every one of the 2,171 wells that give production numbers. Sorting these wells by well number, which is the original permit number, gives some startling results.

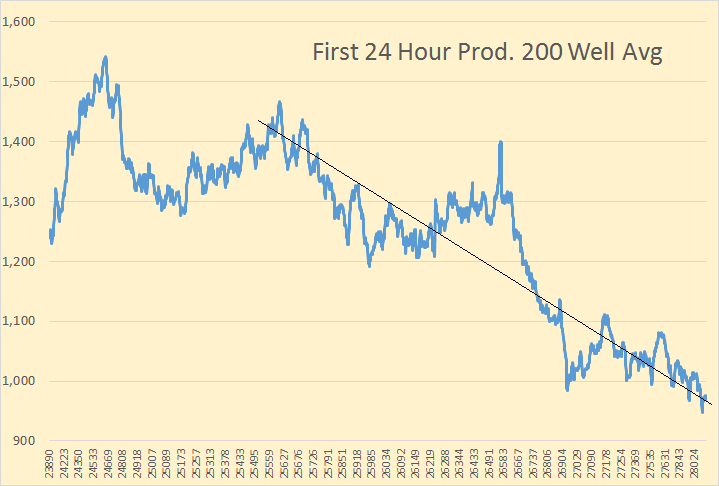

To smooth the chart I created a 200 well average of barrels per day per well. The first point on the chart is therefore the average to the 200th well, #23890 and the last point is the 200 well average to the 2171st well, #28971. As you can see there has been a continuous, though erratic, decline in first 24 hour production as the well numbers increase.

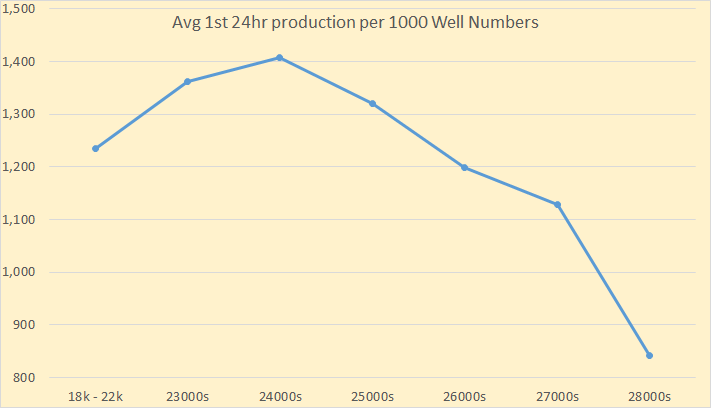

Breaking this down according to well numbers we see production peaked with the 2400s and have steady decline since. Every group of well numbers do not contain the same number of wells.

Well Numbers BOPD Number of Wells in Sample

18s – 22s 1,235 81

23000s 1,362 134

24000s 1,497 285

25000s 1,320 676

26000s 1,198 591

27000s 1,016 361

28000s 841 40

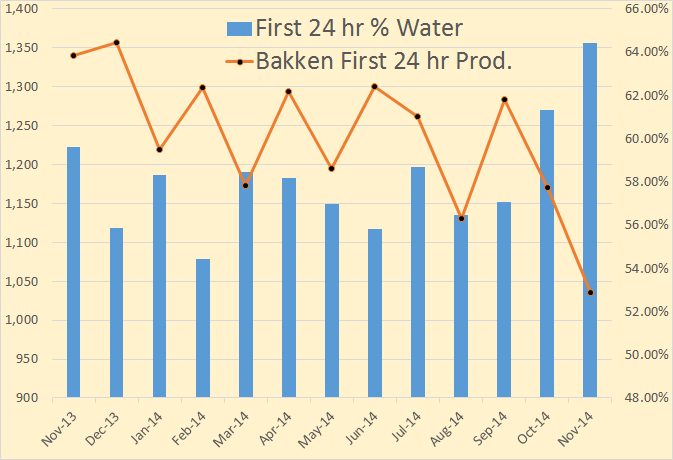

The above chart is monthly first 24 hour production per well and first 24 hour percent water per well of all wells that the NDIC listed production numbers. The November 2014 numbers are only through November 21st.

Note: The first 24 hours of production is far from being the average first years production. And though all wells are different I am relatively sure there is an average conversion rate but I have no idea what it is. I would guess it is somewhere between one quarter to one third of the first 24 hours of production. But if anyone has any idea what the average conversion factor is, if one exists, please email me at DarwinianOne at Gmail.com, or post it in the comments section of this post.

North Dakota issues drilling permits in sequential order. But those permits are not drilled in sequence. Drillers will often sit on a permit for two to three years, renewing then as the law requires.

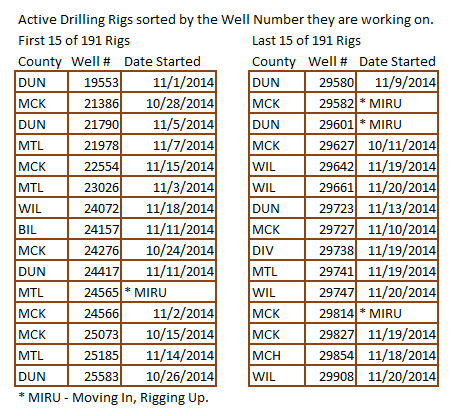

A list of all active drilling rigs, the well number they are working on and the date they started can be found at the NDIC’s Current Active Drilling Rig List They are listed according to their API number but the list can be copied and pasted into Excel and sorted according to your wishes.

Of the 191 rigs working, 39 or 20% are working well numbers below 28000. 76 or 40% of rigs are working well numbers in the 28000s. And 76 or 40% are working well numbers in the 29000s. Permit #28000 was issued on March 26. 2014. So 80% of all rigs are working on recently issued permits.

As of November 21st, the highest well number completed was #28971. The highest number well currently being drilled is #29908. The highest permit number issued is #30076.

Will enhanced oil recovery keep the Bakken going into the future. A simple one word answer is “no”, as this article explains.

Enhanced oil recovery techniques limited in shale

Energy companies currently leave about 95 percent of the crude in the ground at today’s unconventional oil wells, but they face major technological challenges in boosting recovery rates, a Schlumberger scientist said Tuesday…

“Our entire spectrum of secondary recovery methods don’t work,” Kleinberg said, in a sobering talk at the Energy Information Administration’s annual summit in the nation’s capital.

Water flooding — where water can be swept from separate injection and producer wells — isn’t an option because the tight oil formations are too dense to permit those water flows.

And while carbon dioxide can be used to pressure up a conventional oil well, there’s currently a limit on the amount of that gas that is available to pump underground. “The oil industry would like to have more CO2, which is a great way to get more oil out of the ground, but there are limits on affordable, accessible supplies of CO2,” Kleinberg said, quipping: “The oil industry lives in a CO2 constrained world; it is only the oil industry that thinks there is not enough carbon dioxide.”

In conclusion, first 24 hour production per well, when measured by well number, has dropped by 40 percent since peaking in the 24000s. This, to me anyway, clearly indicates that the sweet spots are playing out and companies are now drilling on less productive acreage. I now believe that North Dakota production will peak no later than 2015 with a high probability that 2014 will prove to be the peak year.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com.

Disturbing graphics… nothing that those should come as any surprise.

This is not going to end well, when it does.

Not end well? This play produces well over 1 MMBOPD, and will ultimately recover 4 – 80 BBO, from rocks that were previously considered tombstone a few short years ago. Great for the U.S. and the world at large. By my way of thinking, it is a fantastic result no matter how it ultimately ends.

It has bought some time, but that time won’t necessarily be used well.

We had a great wake up call during the Carter years. We could have had a comfortable transition period, developing options for a time when the oil runs out. But each oil find has led people to believe long-term planning was unnecessary.

But then again, a significant number of Americans think Jesus is coming back and the worse it gets, the more the signs point to him coming soon. So long-term planning doesn’t exist for some folks.

Also, I wish we had asked, decades ago, this question:

“Oil will run out. How can we use less of it?”

If we had, we might have extended the oil age for a much longer time. Then we could look at alternative energy as an extender rather than a primary energy source.

When I recall the opportunities we missed in the 1970s and early ’80s, I just shake my head in disbelief. We had the incentive, the public support, even the beginnings of green technology. U.S. oil consumption declined through 1982, then began climbing again as oil prices dropped and the SUV era began. If we had continued the trend … well, we didn’t, did we. It would have required a more enlightened leadership that Reagan offered.

Interesting posts. I was born and raised in the middle of the Bakken and wanted to make a few comments about the Bakken sweet spots petering out. I will use a number of Hess wells that refute this thought. All the following wells are in the same 1280 acre spacing and the point of my post is to show what changes in technology in the oil industry and especially in shale areas can do for production. Hess Well number 18873 was put into production in 2/2010 and has produced 110,000 barrels of oil in 46 month. Wells 23374 and 23375 have been producing since 9/2012 and have produced 123,000 and 101,000 barrels respectively in 22 months. Wells 27294, 27295 and 27296 have produced 23,600 barrels in 22 DAYS, 37,900 barrels in 55 DAYS and 24,000 barrels in 28 DAYS respectively. All three started producing last month. As the producing companies come across new technology, the percentage of oil that can be captured will continue to grow. The Bakken will be a super viable field for many years to come.

Hess Well number 18873 was put into production in 2/2010 and has produced 110,000 barrels of oil in 46 month. Wells 23374 and 23375 have been producing since 9/2012 and have produced 123,000 and 101,000 barrels respectively in 22 months. Wells 27294, 27295 and 27296 have produced 23,600 barrels in 22 DAYS, 37,900 barrels in 55 DAYS and 24,000 barrels in 28 DAYS respectively.

Getting more oil out in the beginning doesn’t mean there will more cumulative oil, right? Getting the most possible oil upfront probably means more ability to pay off loans faster, but to what extent does it make the entire operation more lucrative?

It does in fact make the entire operation more lucrative. Older wells had initial production rates of about 1/3 of what the newest wells are producing initially. Production rates fall at about the same rate for both older and newer wells. After 2-3 years of production, many of the older wells were producing about 30 BPD while the newer wells are producing about 100 BPD. Also the multipad wells are now the norm. 6-7 years ago, 1280 acre spacings were seeing 1-2 wells. Now the norm is 8-9 wells per 1280 acre spacing. January dockets at NDIC are seeing approval requests from EOG for up to 60 wells on 1 @ 1280 acres spacing.

Nice detective work!!!!

Hi Ron,

As you suggest in your post, the permit numbers do not correspond with when the well starts producing, a chart with wells grouped by the month they started producing would be more interesting in my view.

So far, by looking at the first few months of production there is little evidence that the average Bakken/Three Forks well is decreasing as dramatically as you show in your chart (about 1500 to 1000 or a 33% drop.) Perhaps we will see this soon.

One would think permit numbers are assigned at time of permitting, not at time of production.

FreddyW’s comment/post/graphs for the September Bakken report about 3 Ronposts ago did show 2014’s wells with a higher IP (no wait, a higher 1st month production, not the same thing) than 2013’s wells, but falling under 2013’s well output at the 6-months-into-production point. That suggests a difference in 1st month production vs IP. Odd.

Here’s FreddyW’s graph: http://peakoilbarrel.com/wp-content/uploads/2014/11/4372131.jpg just a few days ago.

Don’t know how I missed it, but the Directors Cut has pointing page https://www.dmr.nd.gov/oilgas/ has an entry at the top above 2014 Permitting. It’s about oil conditioning. Worth a read. There is a LOT of obfuscation going on. Recall there was an issue about vapor pressure in the oil and how it was helping to blow up railcars. Then all of a sudden as Congress held hearings on the matter early this year, Marathon’s oil assay website changed the numbers of the Bakken assay from 2013 values to make the vapor pressure (volatility) numbers look benign. So as best I recall the hearings adjourned with no mandate for any change to rail cars or anything else.

Well, NoDak seems to think that air brushed assay isn’t important and something should be done. The Oil Conditioning regulation is laid out and comments were to be in by COB yesterday. They are specifically to address vapor pressure. Worth reading.

One would think permit numbers are assigned at time of permitting, not at time of production.

They are assigned at the time of permitting. Whatever gave you the idea that they were not? They are assigned at the time the driller request them and that number stays with that spot on the ground forever whether there is ever a well drilled there or not. The driller may immediately start to drill on that permit or he may sit on it for years before drilling. Or he may just cancel it.

“the permit numbers do not correspond with when the well starts producing”

Somewhat, that, from Dennis.

He is correct, and they also do not correspond to when the drilling started. That was part of the point of my post.

All the sweet spots were permitted first. And the drillers drilled the sweet spots as their time permitted, one well after the other. Now they are sitting on no more sweet spot permits, or damn few anyway, so they must now start drilling on the borders of the sweet spots. And the production drops off as they move further and further away from the sweet spots.

That’s what I hoped my post would imply.

Well, that’s the logical sequence of thought.

But have we heard any indication that sweet spots can be identified pre drilling for those formations? I’m remembering our conversation about imaging pores but not what’s in them.

I’d guess when one doesn’t really know for sure a spot is oil content sweet, one drills the lowest cost spot first. That would be sweet in a different way, perhaps. Low cost sweet. I seem to recall a LOT of density around the water reservoir.

Oh, let’s be precise here. I have no doubt you found what you found. IPs falling. That doesn’t correspond with FreddyW’s recent graph, but absolutely IP is not the same as first month production and your data does not have to agree with his graph.

Overall, the confluence of data we’re seeing recently does look ominous. His graph showing 2014 output under 2013 output at 6 months out, and your IP falling, and we also have the recent water cut data looking poor . . . we may be seeing geology arrive on the scene regardless of price.

Very clever.

Pasting from that new reg, this is interesting:

“The working draft order further requires operators to condition crude oil to a Reid Vapor Pressure of no more than 13.7 pounds per square inch and prohibits the blending of light hydrocarbons back into oil supplies prior to shipment.”

Why did they feel it necessary to include that last portion? Is that actually done? Companies take something out for measurement . . . and then put it back in???? haha

Without a link, which you did not post, I have no idea what new reg you are talking about. But…

Light hydrocarbons make the shipment more volatile, more explosive and that’s why it is prohibited.

I posted the pointer above:

https://www.dmr.nd.gov/oilgas/

Oil Conditioning Order

here it is:

https://www.dmr.nd.gov/oilgas/OilConditioningOrder25417a.pdf

Thanks for that pointer, Watcher.

“I’m shocked … to find gambling going on …”

What I’m shocked about is that the DMR finds a RVP (Reid Vapor Pressure) of 13.7 psi (atmosphere sea level is 14.7 psi) “safe” to transport “crude” with,

but the EPA RVP for summer gasoline is 9 psi at most, and as low as 7 psi in “non-attainment” areas that have bad ozone problems.

In other words – Bakken crude is more volatile than gasoline!

I note North Dakota mean altitude is 1,900 feet.

2000 feet altitude is 13.7 psia (pounds per square inch absolute).

http://www.engineeringtoolbox.com/air-altitude-pressure-d_462.html

Hmmm …

So there must be a lot of butane left (or added back!) in it (butane RVP 52 psi).

If you have to take it out (i.e. can’t sell it at crude oil prices), and can’t pipeline it away to a NGL plant (sell at butane price – i.e. half), you’d have to flare it – ouch, paying to get rid of it.

Is this pressure to up the quality of Bakken crude (–> higher price)

and/or stop flaring )make the NGL stream big enough to be more worthwhile?

To make it safer to transport (no bad press about fiery exploding tank cars)?

FYI, Robert Rapier on butane and gasoline (2013).

http://oilprice.com/Energy/Gas-Prices/The-Reason-for-the-Fall-in-Gas-Prices.html

Good find. I did wonder about the sheer number selected, but was too amused by the requirement that vapor pressure not be re-elevated AFTER the measurement to bother looking it up. How weird that this had to be said.

And so, to the surprise of no one, a regulation is to be imposed that will burden the industry not at all.

Part of a post I received from a North Dakota resident, commenting on my post where I stated that Bakken water, that comes up with the oil, is just injected in special disposal wells drilled for that purpose. Bold mine:

From: tfark45

Hello, I live here in North Dakota, yes that is what they do with the water here in the Bakken, they haul it down the street and pump it into what is called the Dakota Sand Formation. I remember reading somewhere that CO2 and water injection only drives the oil back into the rock. These SWD salt water disposals (frac flow back disposals) are everywhere.

I went back and tried to relate that story about how water injection only runs the well, found this page.

http://fuelfix.com/blog/2014/07/15/enhanced-oil-recovery-techniques-limited-in-shale/

You get one window when fracking the first time. I have challenged people for the past several years to find me one well that has been fracked more then once. Still haven’t got one.

I was born and raised here in North Dakota and had left the state in 2004 and came back here in 2010. I like so many people never gave any thought about oil. Until I came back here. And I got tired of Halliburton employees always saying to me, “You guys are the next Saudi Arabia”. In 2013 I asked myself what does that mean. Will I know now. Bunch of crap. I started keeping production numbers in 2013 and built a small website, it has now gotten quite big. If their is anything you would like to know directly about what I see in western ND, please ask me, I travel in the western part of the state several times a week, I live in Minot.

There is something really really wrong as of late. Numbers tell so much. The hype is still going strong here in the state. When one explains to people the cost and the debt and the decline rates, most of them actually listen and realize something is wrong.

But with the money flowing into mineral rights owners, they turn a blind eye to the pollution and poison of fracking.

The pollution levels are mind boggling, its like the sky is on fire. You can smell and taste it when you go outside, especially at night. North Dakotan s by nature are quite naive to what they are told by politicians. Ill include the link for my fracking page and you can get a better idea of how they frack here in ND. Thank you, Donovan.

http://bakkenboomorbust.com/frackinghydraulicfracturingshaleoilgastightoilgas

http://bakkenboomorbust.com/

Excellent post Ron! Thank you very much for all the work you do in gathering this information and putting together these posts. I appreciate it very much!

My personal opinion is that the numbers Ron has posted this time are definitive handwriting on the wall as far as the Bakken is concerned.

I just can’t see any way oil prices can stay down very long unless the world economy in figurative terms goes from having the flu to developing a bad case of pneumonia.

One thing that seriously pisses me off is pundits saying the price of oil is determined by news from China or any other such claims. The future price may go up or down on that sort of news but the actual price is determined by two things- existing contracts that were mostly probably signed months or years ago between suppliers and buyers and the spot price which is what somebody is actually willing to pay for a shipload within the NEXT FEW DAYS OR WEEKS.

I strongly suspect most of the oil being delivered by any really big oil company is being delivered at a price that is somewhat higher than todays quoted prices.Conversely if the price does stay down for a while most of what is delivered once it starts back up will probably be delivered for less than the prices we see quoted every day.The little guys may be selling at the going spot price but I expect a whole lot of them have hedged their sales to whatever extent they could and thus may be getting somewhat more – for now – than the quoted prices.

Hopefully somebody who is an oil trader or seller will have something to say about this comment which may be way wide of the mark.

Six months or a year from now can’t possibly have much to do with spot prices today unless the buyer is planning on putting a hell of a lot of oil into storage.

“I just can’t see any way oil prices can stay down very long unless the world economy in figurative terms goes from having the flu to developing a bad case of pneumonia.”

China is the source of big GDP growth and despite their claimed 7% numbers, the PBoC cut rates yesterday. The US will not be logging 7% this year, or next year, or the year after.

There is so much lying going on everywhere that the process of finding the data point that *leaked* out becomes perpetual and usually not satisfying. And so . . . they cut rates, maybe because they do in fact have pneumonia.

Let’s not forget that 7% or even 6% growth in 2014 China is vastly higher LINEARLY than even 12% growth in 2005 China.

In 2005 China’s GDP was a bit less than $2 trillion.

In 2014 China’s GDP over $9 trillion.

6% growth in 2014 is equal to $540 billion; this is equal to 27% growth in China in 2005.

This is why Albert Bartlett says people are innumerate. That 6% growth, much less 7%, is massively higher on a linear scale. So, yeah, China’s growth rate is slowing, but it’s total increase in demand for resources is higher than it’s ever been.

That’s a broad strokes picture. On a microeconomic level we need to parse out which sector that growth is coming from. The huge glut in construction in China means their demand for cement, copper, steel, and many other materials is likely down, but this only means that growth in some other sector of the economy is increasing demand in huge numbers to reach that “27% growth in 2005 China” number.

That growth is in the consumer sector. A lot of that growth since we’re simply talking GDP may simply be increases in service sector jobs, and not raw material demand. However, when increases in GDP come from expanding employment and/or wages, this equates to a rapidly increasing total purchasing power of that society.

In other words China’s current GDP growth has transitioned from being composed of increases in raw material demand from construction to increases in per capita purchasing power from service sector job growth. This lessens China’s CURRENT growth in materials demand, but sets up for a vast and more diverse rise in resource consumption once the new purchasing power in Chinese citizens pockets is spent.

China is in a consolidation process of transitioning from growth in industrial resources to growth in consumer resources. Their increases in demand for copper, cement, steel, etc may permanently slow, but this will be more than made up for in demand for plastics, circuitry, furniture, cosmetics, fabrics, animal products (food, clothes), and numerous other commodities.

Long story short, China’s linear growth is far higher than it ever has been. 7% growth today is equal to 31% growth in 2005. That insane growth is a growth in purchasing power (potential consumption), rather than growth in demand for building material commodities. This creates a lag effect where commodity demand in China is currently consolidating, but will soon rise rapidly. That rapid rise in commodity demand will be far more diverse, effecting a wider pool of resources than had previously been effected.

This should put negative pressure on that historic run of copper prices and other construction commodities, but is setting up for a broad rise in all other commodities. ESPECIALLY, if the world were to experience a bad year for global food commodity harvests.

That’s legit. 7% of 5 Trillion is less than 7% of 10 Trillion.

This is my fave site to watch consumption:

http://mazamascience.com/OilExport/

Select China in the dropdown and there is their 45 degree black line that is going to be 11 mbpd this year. And more. And more. And more.

Thank you for that link. Very streamlined, intuitive, and informative interactive chart!

I highly recommend everyone here to visit that link.

Really does a great job revealing the unfolding decline in global exports of oil. For any given group of countries 1 of 2 things has happened:

1. Oil consumption is down resulting in lower imports.

2. Oil production is rising, but not as fast as internal consumption, so the headline figure, PRODUCTION, is up, but the only thing that matters, EXPORTS, is declining.

Somehow every economist the world over seems to miss what is happening. Years of declining exports forced importing countries to continually lower imports because you can’t import what doesn’t exist. This is the root cause of slow growth and recession since 2007.

Unfortunately, economists are trained to think the world works in a completely opposite fashion. They believe slow growth is causing lower imports, which, because the imports therefore “aren’t needed” causes lower exports.

The difference in paradigm is this:

An Economists view begins with the axiom that humans cause economic cycles through policy. They look at the data, and then invent reasons to match economic changes to human actions.

Those with a background in the physical sciences look at growth in resource and energy availability, and predict economic trends from there. It’s important to note that labor is a resource and for the last 150 years the only resource to experience scarcity was specific labor roles; much like an organism that has the food and nutrition it needs, but has too little of a specific enzyme – growth will slow as the lack of that enzyme (labor) is the rate limiting step.

As a result, economists have a limited view because for 150 years economic cycles unfolded when growth was too fast to keep up with labor creation, resulting in inflating wages. Since labor was the primary cost of any business wage inflation would create broad inflation. Raising interest rates would allow labor to catch up, lowering wage inflation, and thus lowering broader inflation measurements. Once labor supply caught up to labor demand (as indicated by lower inflation) interest rates would be lowered, and the “business cycle” begins anew.

People with a scientific view do not negate this fact; they embrace it. For the last 150 years labor the demand/supply curve WAS generally the cause of inflation. This narrow lens had economists scratching their heads in the 1970s and early 80s when there was inflation AND slow growth at the same time. In their minds inflation is only and always a result of strong growth in wages because labor is the only resource that can ever be scarce.

Turned out that there are numerous resource inputs needed to maintain and grow an economy. Since labor is produced WITHIN the economy (like an enzyme is produced within an organism), it is the ideal resource to run low on because it is the only resource you’re actually in control of. If an economy or organism runs low on any EXTERNALLY received input the consequences are very different and very harmful as they cannot be produced.

If an organism runs low on a fatty acid it can produce by itself it simply diverts some of its resources from other functions to produce it. This slows the rate of reaction for other processes, but is of no real consequence.

If an organism runs low on an essential fatty acid, which means it cannot produce it (like omega-3 or omega-6 in humans), then the process must simply shut down. This can be anywhere from a mere inconvenience to extremely harmful or even deadly to the overall organism depending on how essential that process is to maintaining the essential functions of the organism. However, and this is key, millions of INDIVIDUAL cells will be significantly harmed, even though the organism as a whole goes on unfettered.

Run out of essential fatty acids, and you’ll survive seemingly unfazed, but your immune system will be partially compromised, which makes you more susceptible to various diseases. This is equivalent to an economy temporarily running out of wood. The economy will not breakdown (die) because wood isn’t essential to an economies life support (just as running out of omega-3s will not stop your heart or breathing), but the sectors that rely on wood as an input will stop, and this will effect all processes (industries) downstream from that “metabolic pathway” of the economy. Just like running out of omega-3s this will not destroy the whole economy, but WILL significantly damage individuals who rely on those processes.

If an economy or organism runs out of energy inputs it is a worst case scenario. All processes occurring in the universe, including inside an economy or organism, happen by tapping the energy released as entropy increases in a system.

All organisms have evolved ways of temporarily handling an “energy crisis” by having storage vacuoles, and modifying metabolic processes (such as when your body begins catabolizing amino acids for energy, which is highly, highly inefficient, and is thus a last resort by your metabolism, but is nonetheless better than dying).

As far as I can see, the economy of industrial civilization has minimal metabolic pathways for accomodating an energy crisis. Where a mammal has (1) its glycogen reserves, then (2) 6 weeks of fat reserves, and THEN (3) ketogenesis through amino acid catabolism, our global economy has (1) transient storage like Cushing, Oklahoma, (2) strategic reserves amounting to, ironically, 6 weeks of reserves (4.1 billion in global reserves at 92 mbpd consumption), and (3) vastly less efficient sources like of energy like other liquid fuels, bicycles, or shuttering oil power plants to put coal plants at max capacity.

In this way we oddly enough have a very similar coping system to that of an organism when adjusting to energy crisis. The primary difference is this – our coming energy crisis will be more like a plant slowly running out of sunlight than an animal just waiting for its next meal. As oil peaks and we dip into our reserves to maintain our economic system there will be no “next meal” waiting.

Our economy has a lot of reserves in the form of enormously inefficient conversion of energy. In the US, about 9M bpd are used for personal transportation: that could be cut in half overnight by increasing the average number of people per car from about 1.2 to 2.4. Further, the average MPG is only about 22, when there are vehicles available that range from 30 all the way to 2o0MPG.

Beyond that, of course, there are EVs that use other energy sources. Wind is cheap and scalable. Solar is affordable, and is available in quantities on the order of 1,000 as large as fossil fuels.

Nick G,

I didn’t want to make my comment too long (it was already quite lengthy!), so I didn’t delve into the other half of how an organism handles resource scarcity.

You are 100% correct; not only does an organism or economy dip into reserves of other substitutable resources, but it also, simultaneously, shuts off non-essential processes to conserve whatever energy is left.

I was really, really hoping to get into this because it is the other half of the equation, so thank you for your critic!

In our economy the way to conserve resources is to shut down R&D because R&D is where excess capital goes. This is why the 2005 Hirsch Report concluded that a 10-20 year lead is needed in developing and bringing online alternative energy sources.

Elon Musk is, by a large margin, my self-motivation for how a single person can make a difference. In a multi-cellular organism no single cell can make a true difference. In this sense, our economy is more like a Portuguese Man-Of-War, a multicellular organism where every cell is an individual, instead of a single being. Portugese Man-Of-Wars are, of course, a very ancient relic of the transition from single celled to multi-celled organisms, but that’s an entirely divergent subject matter…

The point being, if the next few years are used effectively we will make a manageable transition without collapse. In 2008 Tesla was bankrupt, SpaceX was bankrupt, even GM and Chrysler were bankrupt. If production decline had set in then we would have used the remaining daily production to try to maintain current systems (our current metabolic rate). All ancillary processes were shutting down to prevent the collapse of our economies essential systems. Like a Portugese Man-Of-War, we very well could have chose our individual benefits over saving the whole organism.

TARP didn’t pass the first time; that day the Dow set the all-time record point drop. I have strong opposition to our current system that rewards bankers millions of dollars and prevents prosecution when they engage in activities that are intentionally and provably harmful, but I would not want to live in the world that would have existed had TARP not passed the second time around.

We were hours from economic collapse, the equivalent of organism death. Money is the economic equivalent of ATP; if the financial system had collapsed, and it was provably hours away from freezing, then the heart of our collective organism would have stopped beating.

In 2008 we were truly that close to collapse; hours away. Now matter how pessimistic the future turns out I will forever be embarrassingly happy. I thought the year 2014 would be… I honestly can’t put words to it. Bleak, depressing, grim, terrifying, you name it, no words would have done justice to how absolutely abysmal I thought it would turn out as 2008 unfolded… yet here we are.

I am well fed; my income is higher than any previous year, yet I put less CO2 in the atmosphere than ever before as I use that wealth to optimize a food forest, switch to an electric vehicle, buy more energy efficient appliances, and install solar panels.

Just as you were saying, wealth does not have to equal higher oil consumption. In fact, wealth, when appropriated correctly, can mean LESS oil consumption.

There will be another energy crisis. Those who suffer the most will be those most dependent on oil as a means to living. Unfortunately, many of those who suffer will be those who never had the income or education to enforce a personal transition.

It is not entirely unlikely that this inequality could lead to social breakdown, which is generally not as bad as financial breakdown, as finances still exist to keep the system running as it undergoes a phase change.

No matter the end result of what awaits us I am a Cornucopian compared to what I was just 3 years ago. This is due to changes in my personal preparedness as well as knowledge about where we stand in using our current energy source to build the infrastructure for our future energy source. Given a severe crisis in oil supplies I know I can permanently weather it, and I have a fragile and growing confidence that our economy can weather it.

Not that my opinion is of any value, especially more so than anyone else’s, I believe that we will face a difficult and jagged transition from oil to alternatives that is met with success. However, this will align us with a much more difficult problem after we’ve transitioned to renewable energy – growth itself, which is, by definition, impossible with or without oil.

I believe 2016-2018 will bring about a new energy crisis, which will mark a new economic crisis, but we will likely make it through (barring rash moves, like if TARP had not passed in 2008). I also believe that growth is more axiomatic than oil to our civilization, and in combination with a changing climate it is likely that a more profound and unsolvable crisis will unfold in the 2030s… but that’s a long time off, so lets focus on our current limb deep energy crisis, and not our future organ deep growth crisis.

the way to conserve resources is to shut down R&D because R&D is where excess capital goes.

That’s possible, but I’d say it’s not likely. For instance, it’s not what happened during the Great Depression: investment continued at high levels.

The simple way for resources to be freed up from less important uses is for prices to rise: people automatically stop using oil for less valuable things.

Of course, it would be far better to plan ahead and tax oil heavily to accelerate the transition. And, I agree, some people will be hurt by the transition, especially people driving SUVs and pickups who don’t have ready cash to switch to a hybrid or EV when the crunch comes. They could switch easily with foresight, but TPTB don’t want that…

it would be far better to plan ahead and tax oil heavily to accelerate the transition.

A lot of places have already done just that.

“Elon Musk is, by a large margin, my self-motivation”

I see Musk as more likely a manifestation the disease of our system, rather than as a leader towards our better future. I am impressed that many people, much wiser and more intelligent than I, admire, almost idolize him, but he just seems like a dream weaver and a con man. I will be happily surprised if any of his great plans profit society, not just himself.

Elon Musk’s big idea is to apply Silicon Valley business methods to non-IT businesses. It is a very popular idea among the more egg-headed venture capitalists.

So for example the whole battery / electric car / solar panel idea is about building an “ecosystem”, something every software platform vendor tries to do. Each of these ideas is pretty risky by themselves, but each feeds the other two, so together they have a chance of making it.

If all three succeed it would be a major shift in modern technology. Not sure what your attack is based on (other that your apparent personal animosity).

Musk strikes me as someone who has a big ego. But I hope Tesla and his batteries win the day. Or, at least I hope transportation and energy technology evolve, and if he helps that along, so be it. Better him than no one.

Modern civilization is not the same beast as it was even 50 years ago, let alone 150. That is where you “organism” analogy fails.

I agree it is not a perfect analogy. Any analogy falls apart when scrutinized thoroughly because it is just that, an analogy.

I also agree that our economy is an economy that works the way that economies work, and not an organism that works the way organisms work. But that strictly literal evaluation doesn’t tell us much does it!

Our economy is an island of low entropy energy, and an organism is identical at this rudimentary level. To maintain a low entropy system processes are developed, which require resources and energy, to find, capture, and integrate low entropy energy from outside our “island of low entropy”. At this fundamental level organisms and an economy are identical.

It is above this level that different strategies evolve, but those strategies always come down to this basic dilemma of thermodynamics. A plant might look like it’s doing something completely different than an animal, but really they’re doing the exact same thing albeit with different strategies. I would say the same our economy compared to an organism, it’s just that there are 1 million rays that all lead to the same Sun.

Basically just reflecting the old adage that there’s nothing new under the Sun and we could become more stable and resilient if we emulated some of the processes organisms have evolved to maximize their fitness.

I absolutely do not for a moment believe that the Chinese economy is currently growing at anywhere near 7%!

Especially If we remember what the late Dr. Bartlett tells us about growth. If you divide 70 by 7 you get a doubling of the economy in a decade.

Doesn’t anyone understand the exponential function?! Rhetorical question in honor of Al Bartlett. Remember the grain of rice on the first square of the chess board? The progression if you recall is: 1,2,,8,16.32.64,128,256… What that means is if the Chinese economy is growing at 7% per year, after 10 years the Chinese economy will have doubled!

Substitute any commodity, product or service of your choice in the text of the graphic below! IT AIN”T HAPPENING!

It’s growth by decree, like most economic parameters since 2008 when central planning became ascendant.

It’s growth by decree

Apparently the Chinese need to learn a lesson from Ole King Canute…

Cnut set his throne by the sea shore and commanded the incoming tide to halt and not wet his feet and robes. Yet “continuing to rise as usual [the tide] dashed over his feet and legs without respect to his royal person. Then the king leapt backwards, saying: ‘Let all men know how empty and worthless is the power of kings, for there is none worthy of the name, but He whom heaven, earth, and sea obey by eternal laws.’

Back then they still deified the laws of physics. Today some of us no longer believe in omnipotent rulers of the universe but the laws of nature continue to be just as immutable as they were then.

Growth by ‘Decree’ is just as stupid!

I spend a lot of time arguing you don’t need increased resource consumption for growth.

But in the case of China the main driver of growth right now is their newfound ability to import cheap resources from around the world.

A rise from $2T to 9T in 9 years (350% increase) would be a growth rate of 18% per year. OTOH, 9% per year would give a total increase of 117%.

Perhaps one of those figures was adjusted for purchasing power, and one was not?

Hmmm that is odd.

China growth when measured in U.S. Dollars averaged about 23% during that decade while its growth measured in renminbi averaged ~13%, and it’s real growth %, since those are nominal, was around 9%. Then there’s measuring it based on PPP growth…

I was just hoping to demonstrate with real numbers the extreme difference between 7% growth in modern China compared to even 20% growth in China just 10 years ago.

Using the nominal dollarized number is almost assuredly NOT the most accurate reflection of genuine purchasing power and commodity demand. Thank you for pointing that out.

Thank you, Ron; clearly a lot of time was spent on this study.

I am aware of a new consciousness in the S. Texas shale play regarding choke management during flow back procedures. There was even a seminar in San Antonio about that very thing recently; the theory of restricting flow back rates has to do with preservation of gas to oil ratios and ultimate EUR. Reported 24 hour flow back rates in North Dakota, which I assume is also initial production (IP) rates (?), would be related directly to flow back practices anywhere in a tight oil play. So my first reaction to this data is that what we are seeing is operators restricting flow back rates intentionally as they have gotten further down the learning curve.

But that theory gets tossed in Graph 3 where percentage of produced water is brought into the picture. Within the first few days of the wells life the water to oil ratio would, in my opinion, be pretty stable; if anything WOR would be going down, not up, as the well unloaded more and more frac water and cleaned up. Restricting flow back rates thru choke management would not cause water cuts to go up, I don’t think. Increased WOR is a function of something going on in the shale itself. That something is probably not too good.

Mike

Mike, what you’ve just said would support Ron’s underlying thesis of loss of sweet spots. Water is filling pores in the rock more frequently than oil in the areas now being fracked.

Shrug. If geology has arrived on the scene, they will get all the speaking parts and price won’t matter much. You can’t create oil in pores with more money.

“Water is filling pores in the rock more frequently than oil in the areas now being fracked.”

That sentence doesn’t make any sense to me. How can water fill pores in the “tight” rock more frequently? Unless you mean the inherent ratio of water to oil is higher away from sweet spots. Remember that LTO host rock is virtually impermeable before being fracked, hence the phrase Light Tight Oil.

Doug, like you I might have a host of explanations for water in conventional reservoirs; in shale, I don’t know. Its not, as you imply, bottom connate water. It would make sense to me the gazillions of nanopores per square inch of dense shale, besides hydrocarbons, also contains interstitial water. And, there is of course, oceans of water getting pumped into this stuff during the frac procedure; when wells are getting drilled on 40 acre spacing sooner or later there will be communication between them. Where is the water coming from and what is it’s nature? I don’t know.

“Where is the water coming from and what is it’s nature?”

That would be

https://en.wikipedia.org/wiki/Western_Interior_Seaway

The idea would be the rock is porous whether there were tiny organisms in that spot to be cut off from oxygen and cooked or not. If not, the pore is still there, and water will be in that pore. Or hell, maybe theory is pores are half filled with oil and half water, as opposed to areas of oil pores and water pores separate, but connected by permeability — fracked or natural. But one way or another, more water flows than oil, because the pores contain it more so than oil.

ORRRR, as has been suggested, water from rock underneath the formation flows thru the fracs into the pores from pressure differential, and then up the pipe to the surface.

Frack water totals are 5 millionish gallons or 119,000 barrels. Wow, I never looked at that before. That’s half the damn EUR of the Bakken wells? Frack water is going to flow for the lifetime of the well at 50% cuts?

Wow, does this mean the water doesn’t really have to come from the Western Inland Sea or any natural source? It’s just coming up because it was put down there? This would mean water cut will not be the death procedure. If this is true, it would run out.

Watcher, I’m not sure how but you may be onto something re your water comments. But first reread Mike’s comments above. Idly, I mentioned this stuff to my wife, who of course knows naught about oil wells, and she said: Knowing absolutely nothing about oil wells, but looking for a trend I’d go with water cut because its a ratio and not as dependent on flow rates or measurements or disruptions or definitions. Her thinking (and Mike’s/Ron’s) seems to be similar probably for analogous reasons.

Nod. Grabbing water from the adjacent frack, would be the theory then. The guar gum makes it more viscous to carry the proppant so if there is intra well interference, would we see it in water before oil? Does the thick water go to the end of the fracks and leave the proppant behind?

Don’t know, but my eyes did pop open at the barrel total for frack water. That’s fully 1/2 the total multi year oil EUR. It isn’t going to be a “the frack water comes up first in a week or two and then other water”. That frack water can flow as long as the well is alive.

With respect to Mr. Hughes, an indication of interference from down spacing could, however, be found thru increasing water to oil ratios reported during initial production rates.

Thanks for the Wikipedia lesson; that is what interstitial water is; its water that is bound at deposition. The extent to which dense shale is artificially fractured is believed to be a 300 ft. radius around the lateral; water is not migrating up induced fractures from below. As I said, there is a lot of water being shoved into the Bakken during frac’ing; the question I posed was relative to increasing water cuts during initial 24 hour test periods. Holler if you can find that answer on Wikipedia.

“there is a lot of water being shoved into the Bakken during frac’ing; the question I posed was relative to increasing water cuts during initial 24 hour test periods. Holler if you can find that answer on Wikipedia.”

You were suggesting frack water weeks ago and I don’t think any of us were signed on because the amount didn’t seem to support a 10 year flow, but 119,000 barrels is a LOT of water and it WOULD support a 10 year flow.

We really, at this point, don’t need another source of water. 119,000 barrels (and it can be more with some of the megafracks that have been described) would last a very long time.

Not too clear why it would vary. Should be evenly distributed along the horizontal where it carried the proppant. But if it does, I’ll bet this is a surprise to the engineers. There would not seem to be a reason why frack water would come up at different rates.

Correction/clarification, the 5 million is not all initial frack. It is also the periodic flush down to wash out salt encrustation.

I think water being produced is more than simply frac water and that is what I can’t get my head around. If it is only frac water, and has nothing to do with bound water in shale nanopores, then an increase in water cut the first 24 hrs. of production over time, in sweet spots, definitely has something to do with interference between wells, IMO.

I am unaware of salt intrusion into a wellbore, I have never heard of that before (subsalt stuff offshore, maybe); it must be something unique to the Bakken. There is no such thing in the EF that I am aware of.

For the record, a fairly typical 25 stage frac in a shale well actually requires about 135,000 BW, or more.

I think this research was interesting; I think some people, not you, Watcher, offsite are misinterpreting this work to be it is some kind of effort in tying IP’s into EUR’s. I cannot speak for Ron but I did not take it that way. It was a legitimate attempt at determining productivity in sweet spots.

Finally, I don’t see how they can put anymore stinking wells in some of those areas in North Dakota; if you drive thru it, or fly over it, it will knock your socks off.

Mike, Rockman over on Peakoil.com said basically the same thing, it’s all in choke management. But one thing I cannot figure out is why the drillers would choke back more on wells as their well number increased? They would have to choke more on the 25000 wells than they did on the 24000s. And more on the 26000s than the 25000s. And more on the 27000s and still more on the 28000s.

Why would the choke opening get progressively smaller as the well number increased?

Okay, you said the choke could not cause the water cut to go up so you now agree with me. But I don’t think Rockman is convinced.

Incidentally Rockman said the reason he does not post over here is that he works 60 to 70 hours a week and has time for only one blog.

Ron, I think that initial potential rates, or fist 24 hour rates, are being brought down intentionally thru choke management during the flow back and subsequent well testing procedures and that’s simply part of the learning curve. I hate to use the term “reservoir” when describing dense shale but for lack of a better word choke management is reservoir management. One of the answers to your question is that these guys are just getting smarter as they believe restricting flow rates from the get go would improve well performance.

In sweet spots where well densities are very high and getting higher, in my opinion the potential for communication, or interference between wells becomes even greater and restricting flow rates even more important, that might be another answer. Its all about preserving gas to oil ratios, which is reservoir management.

There could be all kinds of other extenuating circumstances whereby operators are intentionally restricting flow; new flaring rules, for instance. Or bottlenecks in transporting liquids to market, lack of storage, rail cars, etc.. I think, however, its simply an attempt at reservoir preservation.

The WOR’s are what interest me. From a practical standpoint, if at some point in the flow back the well stabilizes at 35% WOR on a 32/64ths choke it seems logical to me if you adjust that choke size down to a 24/64ths choke, for reservoir management reasons, the WOR will stay the same, not go up. Ultimately WOR will go up as depletion occurs, but its interesting it appears to be happening so soon after the well is born.

60-70 hours a week is a slow week for me. I am not an shale engineer; for the sake of knowledge I would like to understand the dynamics of produced water in shale production. I just don’t have the time. Its early, it will all become self evident in time, I guess, but it is curious to me how and why WOR appears to be going up. Water is ultimately going to effect economics, EUR, longevity, URR, all kinds of stuff.

Thank you again.

Mike

Thanks Mike, but I still don’t understand why chokes would be closed gradually as they worked their way up through their permits. Unless, as you say, they are going through a learning curve.

And what happened in September when production jumped 52.5 thousand barrels per day? And that on fewer new wells? Did they decide to open all chokes in September?

I think what is going on here does not lend itself to simple definitions. Something far more complex is going on and I don’t know what it is. But we should have our answer early next year.

Ron, I do believe that choke management is now become a science and operators are still learning about that. I cannot rule out the possibility, however, that initial rates are going down in dense sweet spots…because of depletion dynamics.

As a matter of interest, a production engineer working in the Bakken would know the answers to lots of questions we all have. But one, they don’t adhere to the concept of peak production and don’t likely stalk peak oil blogs to contribute; and two, I do not think they would want us to know lots of the details anyway. “It’s revolutionary folks, you don’t need to know how, just trust us…and by the way, keep buying stock.”

And the big jump in September’s production? Oil prices were high the first part of the month and were off the cliff by the end of the month; maybe it just was a fire sale, I don’t know.

I am sorry I don’t have more answers. I have learned after 50 years of being in the oil business that often there are no definitive answers for lots of things, above or below ground, just educated guesses. Everybody has a theory, but that’s all they are. As you suggest, time always sort it out.

Mike

Yeah, I agree. But we will have our answer by the time the first couple of months of 2015 data comes in. It is going to be very interesting no matter which way it goes.

Exactly. The choke thing works when the horizontal axis is time, but not when it is permit number. Unless the two are more or less the same.

Here’s a simple hypothesis:

Let’s say operators are choking back flow rates on the first day.

Let’s also say that after completion there’s going to be a fair amount of water in the hole. The oil will have to push out water for a few hours before oil starts appearing in large amounts. That suggests that the water to oil ratio will fall quickly in the first few hours and days.

If you reduce flow rates, then you prolong the number of hours of high water production.

Presto: lower production, higher water:oil ratio in the first 24 hours.

Excellent and insightful piece of work Ron.

Nice plot. From the graph showing 24h production over time, one can see a big decrease (to be confirmed) in November. It might be that they managed to mix high production (24000s) with lower production wells up to November. Production in the next few months will be very indicative.

Interestingly, a high decrease of production could be mistakenly attributed to oil prices instead of production decrease in new wells. Of course if they multiply the number of wells they could maintain the global level of production in the next few months, but where the cash will be coming from?

A superb post! So the key parameter missing is how the first 24 hours of production relates to the first month or first year of production. If the relationship is linear, then future ND production could be estimated with a fair degree of confidence.

In some ways I think well number is more important than well production start date. The lower the well number, the more important the oil extraction companies regarded that well. They will always try to get their hands on the best wells first.

Hi Ron,

I guess I would question if they are running out of sweet spots at present. There could be a lot of permit numbers assigned in the sweet spots and waiting to be drilled. I have no doubt that the sweet spots will run out of room, your study does not suggest to me that this has occurred.

I checked median 3 month cumulative output by month for the period from Jan 2013 to April 2014, the value fluctuates, but there is no trend through April (or it is slightly increasing). I show 3 month cumulative median output and a 3 month centered moving average of 3 month cumulative median output.

The relationship between the first 24 hours of production and well number is obviously a leading indicator of future well productivity. It’s bound to show up in the monthly production numbers at some point.

I guess I would question if they are running out of sweet spots at present.

Dennis, it is not that they are running out of sweet spots, there are only about four of them, three in North Dakota and one in Montana. It is that most of these few sweet spots have been drilled up. Now they must drill outside these sweet spots where the shale is less productive.

The below graph is courtesy of David Hughes. It is a screen grab and a little fuzzy. I was unable to locate the original.

Hi Ron,

I phrased that badly. I question whether drilling locations in the sweet spots have run out. There is no doubt that there are fewer locations now than in early 2013, but the implication of your post is that all locations have been used up and now production is substantially lower because new drilling is occurring primarily outside of the sweet spots.

Actual production data based on cumulative average and median 3 month well output from Jan 2013 to July 2014 (well start dates Jan 2013 to April 2014) shows no downward trend.

Another chart with 2013 well profiles from Jan to Dec and average, no trend is evident. Well profile falls below average Feb to May then rises in summer then falls back to average, essentially random fluctuation.

Something is amiss, this chart is in direct contrast with the one that follows below it.

Watcher, Dennis’ chart is a cumulative production chart.

If the average production over 6 months is falling slightly and includes early 2014, it should have appeared in the late 2013 cumulative totals, yes?

Uh oh, I may not have resolved the two yellows. One is brownish. That higher yellow may not be the December item

Well, hell, that lower (and shorter) yellow/brown is also in contrast with next chart. It’s not lower than others. Something is still not right.

Hi Watcher,

The Dec 2013 line covers output from Dec2013 to May 2014. My guess is that David Hughes last two months start dates are Jan and Feb 2014. Without those two points his curve would not have dipped that much, also his curve is a smoothed fit which probably projects forward in time by a few months.

From David Hughes along with the graph below.

I don’t use 24 hour IPs as they are unreliable given that it is such a short time period and many things can affect them other than well quality (although companies do use them in investor presentations usually along with longer periods). That said they should on average give some indication. The shortest period I used in Drilling Deeper (DD) was for the maps which is highest one-month production rates. Also there is some discussion in the post that permit numbers may not correspond to chronological order of actual first production.

I plotted six month average IPs for the Bakken in DD (see fig from DD reproduced below) using all wells drilled that had a least six months of production and fitted a trend line which is dropping recently after rising. I also plotted average first year production by year at the county level which is how I developed the parameters for sweet spots vs the rest in looking at future production as discussed in DD.

Also Ron I believe the statement you quoted for shale gas from DD in your post is also reproduced for tight oil in the tight oil part of Drilling Deeper.

For the Drilling Deeper projections I modelled a gradual decline from current average first year production rates to the production rates observed outside of sweet spots (the bulk of the play) and expected them to start dropping soon. But to err on the conservative side I gave them and extra year (2014) of growth allowing for all the reputed downspacing going on in sweet spots (likely I was too conservative here but I knew that industry would try to pick the analysis apart and didn’t want to give them a foothold – the picture is bleak enough as it is).

We’ll see…average well quality should start dropping soon although it depends on who is drilling and where their land is and the success and lack of interference in down-spacing pilots. Even if there is significant interference from downspacing it is unlikely to show up in 24 hour IPs – interference will show up after longer periods – 12 months+.

Best,

Dave

That looks like a small but distinct decline in 2014, which would support Ron’s offering.

Watcher,

The error bars either side of that trendline are going to be something like +/- 50 either way. I would very much doubt if the dip at the end would prove to be statistically significant.

That’s my only bugbear with a lot of these charts, no error bars! Without them it’s impossible to know whether a change in trend is significant or just noise.

Maybe, but then the error would have to be the same, in the same direction, 4-5 months in a row.

True, but that’s not to say it would be a statistically significant deviation from the trend yet.

Hi all,

The chart below shows the trend in cumulative output at 3, 6, 9, and 12 months for wells which started producing between Jan 2013 and April 2014. Not really much of a trend, but any linear trend is increasing.

Hi all,

I attempted to reproduce David Hughes’ chart. I was unable to create a smooth trend line, but a 301 well centered moving average is shown in red along with a black dashed linear trend. There was a bump up in the summer of 2013, but since mid-2011 output has been flat for the 6 month cumulative.

The estimated oil reservoir in the Bakken formation is between 500 and 900 billion barrels, and most of it is where the depocenter is located right about where Tioga is then headed down south to McKenzie County.

A three percent extraction of the total in the reservoir is 15 billion barrels, tops out at 45 billion. At a rate of one billion barrels every three years, one million barrels per day, it will take 45 years at a minimum to retrieve those 15 billion barrels. If it is 45 billion barrels, it will take 135 years to make it happen. 15,000 wells with a 300,000 barrel 25 year production is how much? 4,500,000,000 barrels of oil. Still has upwards of 495,500,000,000 barrels to go. A sweet spot to have. Ain’t an oil company on the face of the earth that is much willing to let it go.

A one percent extraction is 5 billion to 9 billion barrels of oil produced in a 45 to 135 year time period. That makes it only between 495 to 890 billion barrels to go. With improved drilling techniques, extraction could become a higher percentage, ten percent extraction translates to 50 billion barrels of oil, maybe even 90 billion.

You just never know what is going to happen. Too difficult to determine what will actually happen, hence the wild speculation.

If everybody in the US buys electric cars, the Chinese will have more gasoline available for consumption. Electricity will give birth to a gas war in China. The price of gas will be at fire sale prices in Beijing. The Chinese can have all of that Bakken crude, nobody else will want it. Who wants gas when all you have to do is use electricity to charge the battery? Why bother with gas? It’s a thing of the past, a covered wagon, days gone by.

Can’t the State of North Dakota wait for oil prices to bottom out, the subsequent bottoming of stock prices of oil companies with a financial stake in Bakken oil development, buy a percentage of those equities with the oil tax revenues provided by those oil company taxed revenues and acquire them for a song and a dance, i.e. end up owning those bankrupt companies and rake in a handsome booty, all of the oil left in place, that would be 97 plus percent of it and leave the oil companies holding the bag? A state-owned oil company like Statoil is a real possibility. It would look like they are left holding the bag, down the rabbit hole, but in reality, the state owns the oil. Forget about decline rates and depletion, no room for such nonsense, the oil is what matters. The necessary obfuscation and subterfuge to subvert the reality, that is to lie to everybody, once again, would be understood and no explanation required.

The oil companies can eat crow and dine on humble pie. Be good for them.

Here is a graph showing average production and water cut monthly 1 month after completion. I reverted the y-axis with water cut so that a correlation with production would be easier to spot. I can´t detect any decrease in production. A slight increase over time if anything. The last data point was completed in August though, so a bit older than Ron´s data. Water cut increases over time, but does not seem to affect production for some reason.

It would have been interesting to see a graph with 24 h IP with the month they started production on the x-axis.

Here is the graph for Mountrail. Not much is happening with production. Water cut started to increase by end of 2013 and then even more second half of 2014. So something has happend there. But it does not seem to affect production that much. Maybe production started to decrease a bit second half of 2014 or its just normal variation.

Per a conversation upthread, it’s very possible the water source is just the frack water. The totals for fracking are so large that they could flow for the life of the well. This would mean watercut does not define what it defines for conventional wells and may not tell us much.

5 million gallons is 119,000 barrels. That’s about half EUR. And some wells are using more than 5. Note this is combination of initial frack and occasional flush out of salt encrustation.

Where did you get the number of 5 million gallons of frac water required, as my sources/business contacts that are suppliers to Bakken drillers say 1.5 million gallons per well? I do agree that the water cut may be mostly from frac water and not water that is captive to the formation prior to drilling.

http://news.nationalgeographic.com/news/energy/2013/11/131111-north-dakota-wells-maintenance-water/

On a tablet and can’t extract quotes easily. NoDak does appear to be saltier than most and this flush process is only there.

The total is up to 8.8 million gallons over well life time. This gets my attention in another aspect in that we may not know how measurements are taken. If a given month’s oil and water flow is measured and reported on the 30th of the month (or whenever) there would be a risk that maintenance flush out was done the day before, or some measurement artifact like that.

Interesting, thank you. If this “flushing” thing is going on across the whole trend then oil to water ratios are not going to tell us much about anything.

I agree that trying to find trends based on short time frames is risky.

About water cut. I have attached a graph I showed some time ago in another post. You can see that the water cut starts high, then decreases until it hits the lowest point after about 3-4 month and then increases again. My interpretation is that it takes 3-4 month to clean up most of the fracking water. Then it increases slowly again because formation water finds its way to the well. Note that water cut seems to depend more on where the well was drilled than for how long it has been producing. I suppose its because of the extremely low permeability.

Well, maybe. The frack water is a few million gallons, but then you pour more in every month for maintenance. It will sum to 8.8 million gallons over the life of the well. But maybe that initial spike and decline is what you say.

Do the numbers add up? Call it 2 million gallons / 42 = 47,619 barrels.

These things flow only about 650 bpd for month 1 (average of the days of that steep declining month). 650 X 30 = 19,500 barrels total.

50% water cut means the same water total that month. There would still be 28,000 barrels of initial frack water left to come out, and then you pour more water in. (maybe when flow rate is high you don’t add more, maybe adding more starts after flow rate gets lower and salt encrustation is able to form, I don’t know)

I’d say no, the initial decline in cut can’t be frack water depletion because it all hasn’t come up. There is still plenty down there and you add more to it.

Isn’t it interesting how the water cut increases every year, with the exception of 2013. But in 2014 the trend picked right back up. At 6 months in 2009 it was at 24%, now in 2014 at six months it is at 44%. I think that tells us a lot right there.

But it sort of goes to the question Mike poses . . . where the hell is the water coming from? That’s impermeable rock outside the frack radius. Water can’t flow from elsewhere. Other than up.

We do pour it down the well often. A constant available water total with a decreasing oil total . . . I guess would increase the cut.

I read that Natl Geog article a few inches up the page about a year ago, but there are paras in it that are suddenly eyebrow raising now that weren’t then. Specifically:

“In North Dakota, Suggs said that the future price and availability of fresh water may well determine how long wells remain economical to operate. “If water becomes too expensive, that might potentially decrease the life of the well,” he said.”

That goes right to the heart of EUR. Those 6% bond holder candidates are expecting a year total of flow that may not happen. Come year 4 or so, there may not be cash flow to pay interest. This magnifies things at $75.

I read the salty wells article. Interesting, but

“each of North Dakota’s wells is daily drinking down an average of more than 600 gallons (2,300 liters) in maintenance water”

That´s 2300/151=15,2 barrels per day. It adds up to huge amount over its lifetime. But the wells can flow alot more than that per day.

Also the rock is not impermeable. Middle Bakken has a permeability of 0,04 MD. It´s not much but I suppose thats why the drill horizontal well and frack. To get as much contact area as possible.

Freddy, that would make sense to me from an operational standpoint, the well unloads frac water and gradually OWR increases and even stabilizes over time. Then formation water (interstitial water that exists in each nanopore of the shale matrix, along with hydrocarbons), begins to move more freely and OWR decreases. This is pretty common in conventional reservoir performance; it is usually associated with depletion. I want to understand water saturations and capillary pressure better in this shale stuff; why, I don’t know, as it as nothing to do with feeding my family. But I am determined.

Shale is not homogenous, it has different clay contents, brittleness and associated carbonate content; over a mile length of lateral the quality of the shale must change radically. Each section (stage) that is stimulated in the lateral is not the same. One stage will definitely have different induced permeability factors (from the frac) than another and have different pressure differentials than another stage down the line. The lateral does not drain uniformly.

Stay with me on this, Freddy. Your water data is very helpful. Maybe we can figure some of it out.

Mike

“Shale is not homogenous, it has different clay contents, brittleness and associated carbonate content; over a mile length of lateral the quality of the shale must change radically.

. . .

The lateral does not drain uniformly.”

That’s a big deal.

CLR and EOG have the money to instrument their wells and they can see what is happening along the length, but the small fry probably just wing it.

It would be useful to know if oil flow comes first from near the vertical bore and then later from farther along the lateral, but we may not even know if that is true. The whole length may be flowing at once and mixing together.

Hmmm, but that would not make sense, flush wise. The flushing that takes place is (I guess) just cleaning salt from the vertical pipe and maybe some short distance horizontally . . . or hell, we don’t even know that. Maybe it dissolves salt along the whole length.

Thank you Mike. I´m glad I can be of any help.

Oh there was a graph showing 24 h IP with month on the x-axis. I missed that for some reason. Interesting, so production decreases alot in November.

I have one theory why production stays the same while water cut is increasing. If there are areas with different combinations of pressure and water cut and first more wells are drilled with low water cut and moderate pressure. If that then shifts so that more and more wells instead are drilled in areas with moderate water cut and high pressure, it is possible that it evens out so that the production stays the same but water cut increases. If that is the case I would expect that next step sometime in the future would be to drill in areas with moderate water cut and moderate pressure. Water cut would in that case stay the same but production will start to decrease.

Or maybe more likely that next step is low water cut and low pressure. Both water cut and production will decrease in that case.

It would also be very interesting to see the permits mapped geographically. The idea would be to color code the permit numbers from say black to white and then put a dot on the map of the corresponding color on the map. Then you could see things like whether the peak around permit 26700 was because one sweet spot was permitted relatively late.

I can work on doing that right now for all permitted, and drilled, wells. Output will be in the form of a Google Earth file.

https://www.dropbox.com/s/471lrgl2ah726b3/ndwellspreviousyear.kmz?dl=0

Download that file and load in Google Earth. All wells drilled since September 2013 are mapped and grouped according to permit number. To see which color corresponds to which grouping of wells, the best thing to do would probably be to use the sidebar (which should show up automatically, but can otherwise be turned on under tools->sidebar) to toggle the visibility of the groups. There is also a layer, by default invisible, showing the wells that have been permitted, but have not yet been drilled. You can turn this layer on and off through the sidebar as well.

Wow, nicely done. Unfortunately I can’t see any geographical pattern around the late peak in Ron’s chart.

David Hughes has posted me a better link of the Bakken. It is from Drilling Deeper and gives a look at the full analysis and projections for the Bakken and other plays.

The water reservoir is oddly decisive.

At fractraker.org you can see the area under the resevoir is not thoroughly fracked.

Was thinking in terms of nearby source availability.

http://www.csmonitor.com/World/Europe/2014/1121/Russia-China-plan-war-games-arms-sales.-Could-alliance-be-in-the-cards

Off topic for the moment but relevant none the less.

Whatever the Russians want that they can’t supply easily for themselves they can get from the Chinese.

And while the Chinese are undoubtedly capable of designing and manufacturing their own cutting edge weapons doing so is expensive and time consuming and the Russians have some very good stuff to sell …..

History ain’t over.

WE have for sure passed peak oil per capita world wide and we have probably passed peak oil per capita in the US and most of the richer western countries.

The economic question now may be whether world wide production declines slowly enough that we can adapt to ever less oil from one year to the next without suffering a hard crash.

I am not a number cruncher but I will hazard a guess that everything else held equal we could in the US adapt to one percent less oil per year in total without too much trouble for a few years. We are making progress on efficiency and conservation of energy – not enough to be sure but enough to encourage me to think we need not suffer an immediate crash as the result of stagnant or slightly smaller oil supplies.

But whether we could still have a growing economy even with this slow a decline (one percent) is another question altogether.

It is counterintuitive but we better be praying for a few muggers bricks upside our collective heads.

Other wise we are surely going to experience a very deep and long lasting depression before too many more years pass as the result of peak oil.This depression could easily metastasize into a more or less permanent economic collapse.

http://www.washingtontimes.com/news/2014/nov/20/nsa-director-china-can-damage-us-power-grid/

Shale ain’t so easy down China way:

http://www.bloomberg.com/news/2014-11-21/china-shale-boom-fizzles-as-clean-energy-imports-take-spotlight.html

”Drilling costs in the U.S. are as low as $3 million a well, according to Neil Beveridge, a Hong Kong-based analyst at Sanford C. Bernstein & Co. The cost for PetroChina and Sinopec are as much as four times that, according to company data.

In one case, it took 89 days to drill a well in Sinopec’s Fuling blocks, versus an 18-day average in the Bakken region of North Dakota, according to Bloomberg Intelligence Energy Analyst Grace Lee. Fuling is considered China’s best shale gas discovery. ”

Of course you can drill a well in the US for $3 million. But you cannot drill one two miles deep, turn horizontal and go another two miles, then add 30 frack stages for 3 million. That will cost you between 7.5 and 10 million.