North Dakota production by county is posted here: ND Historical Barrels of Oil Produced by County Confidential wells are not included in that data however but that estimated data can be found here:Monthly Production Report Index Click on the latest month.

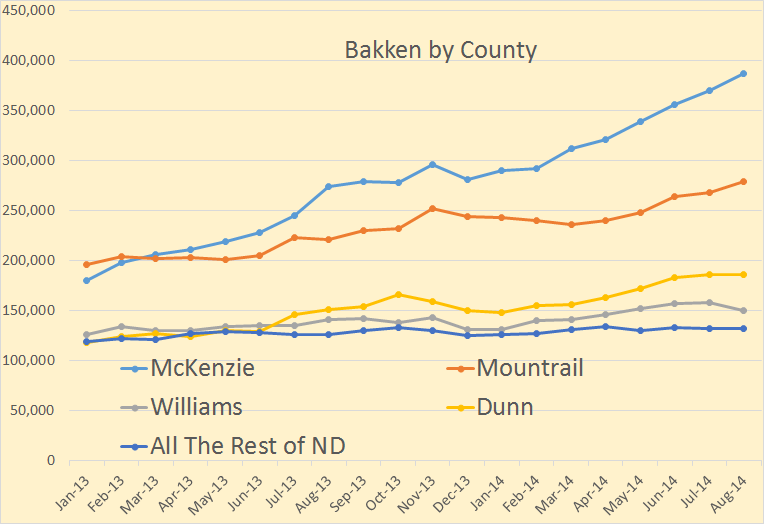

This is a zero based chart and gives a better overall picture of production from each county. The charts below are not zero based but gives an amplified picture of production from each county.

Production in barrels per day for each county was as follows:

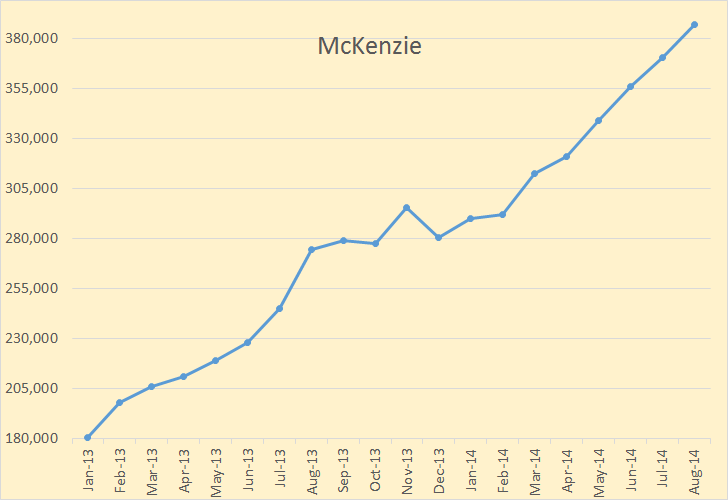

McKenzie 386,715

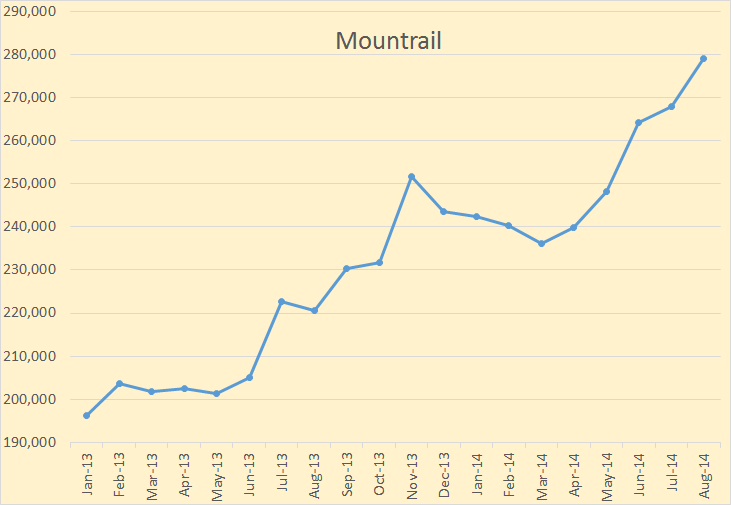

Mountrail 278,940

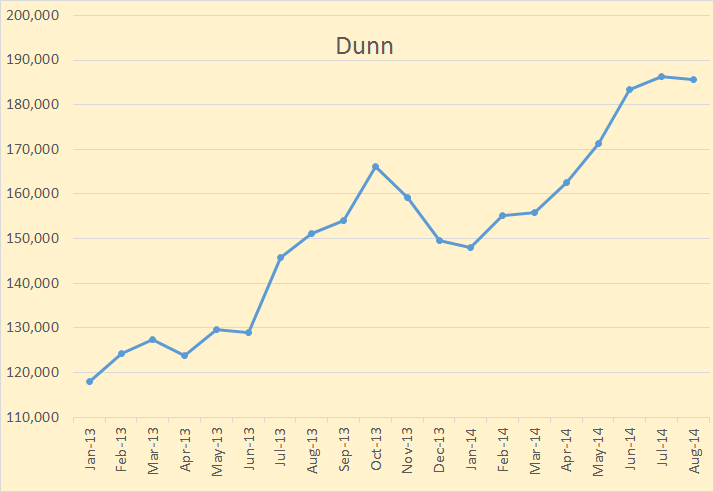

Dunn 185,707

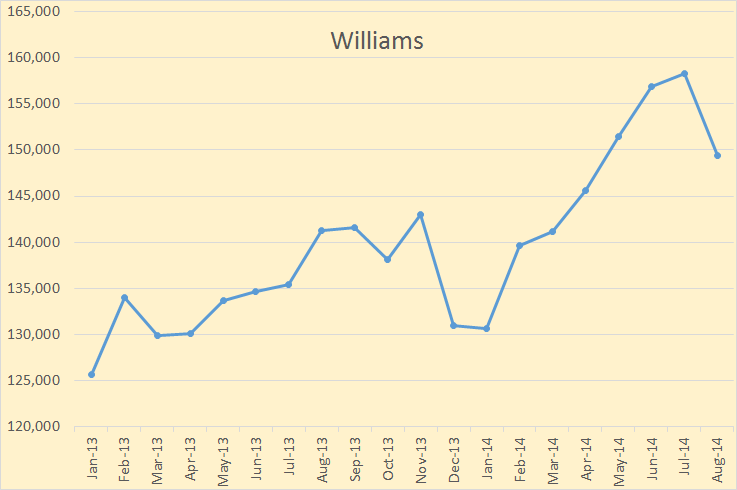

Williams 149,437

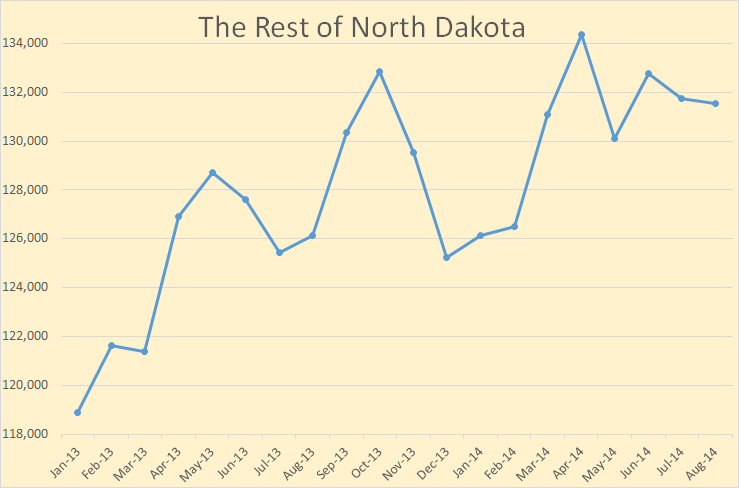

Rest of ND 131,531

McKenzie county production was up by 16,435 barrels per day. McKenzie remains the most productive county in North Dakota.

Mountrail county was up by 11,077 bpd. A surprisingly good month for that county.

Williams County production was down 8,827 bpd. Quite a large drop. I have no idea what is happening there.

Dunn County was down 550 bpd.

All the rest of North Dakota was down 225 barrels per day.

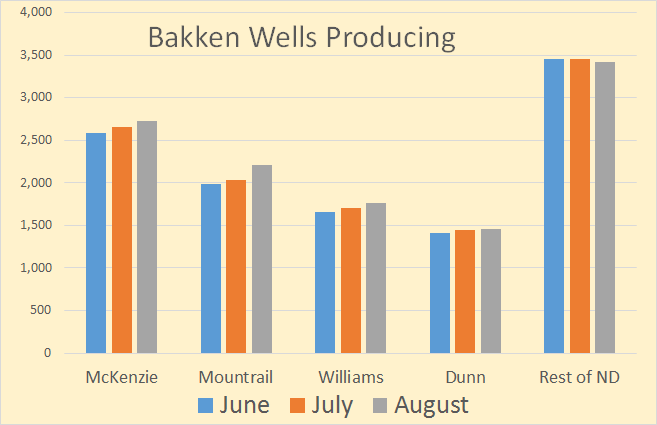

Bakken wells producing in August was:

McKenzie 2,731

Mountrail 2,204

Williams 1,757

Dunn 1,454

Rest of ND 3,417

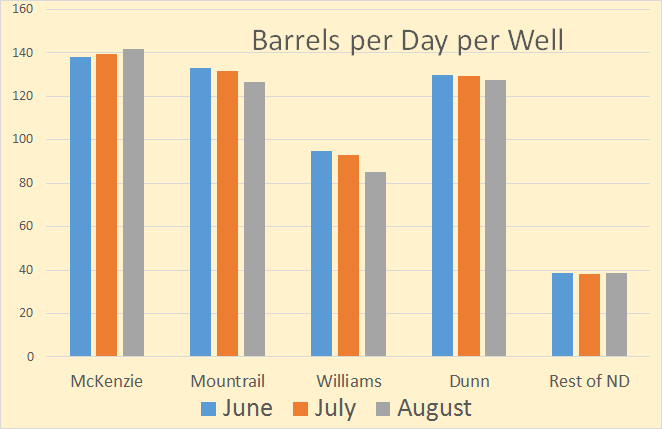

Bakken barrels per day per well in August was as follows:

McKenzie 142

Mountrail 127

Williams 85

Dunn 128

Res of ND 38

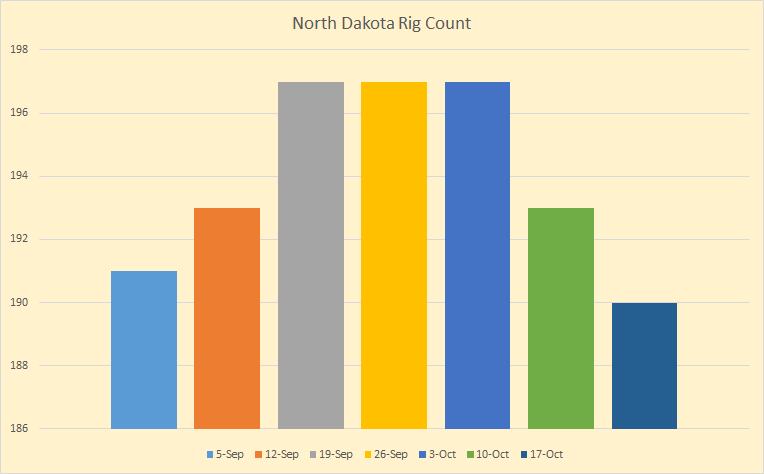

The North Dakota rig count is given every Monday by Bakken Shale but the same data can be gleaned from here, Current ND Active Drilling Rig List three days earlier, Friday evening around 7:00 PM. The number of rigs is not listed but t list can be copied and pasted into Excel, then just read the last line number.

The North Dakota rig count hit about a two year high September 19th at 197, held that level for three weeks but has dropped by 7 in the last two week. The rig count will be the thing to watch over the next few months to see if the low oil price is having any effect on drilling. There will be a several month time lag in oil production but there is no time lag in rig count, we know the very week it happens.

The US drilling rig count declined 12 units to settle at 1,918 rigs working during the week ended Oct. 17, Baker Hughes Inc. reported. That number will bear watching also.

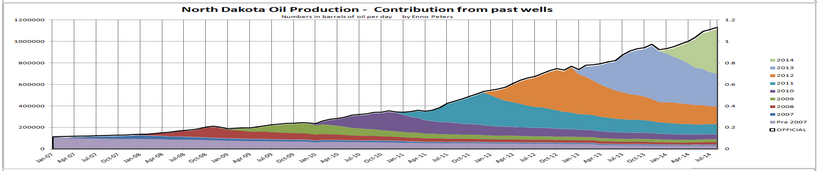

Enno Peters posted this chart two Thursday. Notice the decline rate of all wells drilled prior to this year.

Note: I send an email notice when I publish a new post. If you would like to receive that notice, or talk to me about anything else, then email me at DarwinianOne at Gmail.com

213 responses to “Bakken Oil Production by County”

Retail and other consumer-side industries will be hit before energy producers, well completions will be hit before drillers; that’s where the bulk of the costs are.

Credit will be hit before anyone, no loans = no oil. Lack of credit is why prices are declining in the first place. Absent credit flows from customers’ banks to energy companies, companies borrow in high-yield credit markets. Companies cannot run deficits forever and if customers cannot borrow, who can?

Government is only a stand-in or proxy for customers (it can pretend to be creditworthy longer than customers can). If/When customers are ruined, the government cannot bail out the domestic petroleum industry because it is not an independent entity.

Three cheers for that recurrent Enno chart. 70% of production from wells < 20 months old.

It doesn't take much thought to realize what that means if drilling stops.

Or even if it doesn't? A lousy 18ishK bpd uptick this month for over 200 new wells online? Remember back in days of yore when we thought we could peg breakeven to a new well count?

Yo Ron, columns in that Monthly Production report says wells actually producing in August and another says wells that could produce in August, 120 higher. Do we know what that's about?

I really have no idea but I suppose that a number of wells are shut down for maintenance or other reasons. Otherwise if the wells are actually capable of producing, then why are they not producing?

Running out of trucks? Could not service those wells when the onsite tank filled up, so shut it down.

That would be cool.

Hi Watcher,

Ron’s guess makes more sense. If you look back in time for the past 3 years about 9 % of wells capable of producing were not producing in August 2012, 2013, and 2014. Perhaps there is a shortage of trucks every year in August, but maintenance is a more likely explanation. In general there are about 9% of wells down for maintenance in most months (winter numbers may be higher due to snow).

What maintenance on such wells would require 30 days?

Actually a better question is why don’t we see this with all wells 30 days per year? Do we?

I don’t understand the “fixation” on trucks, trucking and truckers. Y’all need to spend more time mowing your grass, or cleaning out the rain gutters.

Two years ago I sent a young man fresh out of college to North Dakota to work for a crude oil buyer driving a truck; he often works 80 hours a week but his before-tax salary is upwards of 125,000 dollars a year. Vacuum truck drivers hauling produced or flowback water make a little less than that, but not much less. Nobody is going to “quit” a job like that, there are plenty of oil and water trucks in that part of the world, LOTS, and not all trucks mysteriously get serviced at a certain time each year. Commerce in a big play like the Bakken does not stop, or even slow down much, because of a bunch of stinking “trucks.”

Producing oil wells quit producing for any number of different reasons and require constant maintenance. I consider myself lucky to have 85% of my well inventory producing at any given time. Most Bakken wells I suspect are now on rod lift and rod lifting from 9000 feet is a royal pain in the ass. Rods part, pumps wear out, holes get rubbed in tubing, tubing parts, wells paraffin up, wells sand up and have to be washed out; all kinds of stuff goes wrong, all the time. It is incredibly hard to get workover rigs these days anywhere in the oilfield; often the waiting period is 3-5 months. They are all doing completion work. Pulling a well like a Bakken well simply to change a worn out down hole pump can cost 80K these days too, for the record.

You guys are discounting the difficulty of moving liquids product in North Dakota and the lack of infrastructure. August is a tough month for refiners as they are usually doing maintenance before flipping products. Maybe those Bakken producers simply don’t have any place to take that oil; pipelines are full, rail cars are coming and going…its just part of the boom thing.

For instance, oil hotels in Houston and all along the Gulf Coast have no vacancy signs on their front door at the moment; in S. Texas major trunk lines get shut down later in the month, particularly in late summer, simply because there is no place to put the nasty stuff. There is limited storage on each well location; trucks don’t haul oil to a pipeline LACT station if the pipeline shuts down because refiners don’t need any more stock and they don’t have any storage either. Ships make great storage vessels and often sat out in the Gulf for months at a time waiting to be de-lightered as refiners needed the stock. But because we don’t import so much anymore refiners don’t have the floating places to store oil they use to. The RBN Energy website has good poop about the kinds of downstream problems that lead to the upstream problems.

Mike

I don’t understand the “fixation” on trucks, trucking and truckers. Y’all need to spend more time mowing your grass, or cleaning out the rain gutters.

Mike, I know one poster who has a truck fixation. I don’t know any “Y’all” with such a fixation however. Perhaps you should use a narrower brush when painting fixations.

Actually, Mr. Patterson, there has been a bunch of banter about “truckers” of late and my post was a “reply” directed at that specific issue. Truckers work and don’t have time to read blogs so I guess I was sticking up for them a little. I was also trying to contribute real life, practical experiences about how the oilfield actually works (I live in it 24/7) in hopes of helping your readers understand it more and not have to speculate about it constantly. My bad.

Mike

Hi Mike,

I appreciate the contribution. In my opinion you know much more about what is going on in the oil patch from a real world perspective than I do, so I learn much from your comments. ( If I have his right you run a large number of stripper wells in Texas, so you know the score in Texas and it is likely that things are not that different in North Dakota.)

I appreciate the real-world experiences too Mike.

I’m just a consumer, a know-nothing. But everything I depend on everyday of my life from sun-up to sun-down is either grown, manufactured, shipped, or cooked with petroleum products.

So I come here to learn what’s going to happen to me since conventional oil production peaked in 2005 and fracking, tar sands, and ultra-deepwater resources are being produced at prices near the upper limit of what rich countries can afford to pay and the lower limit of what some producers of Bakken shale need for a return on their investment.

Thanks for your insights.

Looked at 4 mos, 2 summer and 2 winter. They list 9% of wells able to produce and not producing in summer (June and Aug) and 11% in winter.

Aug not much diff from June and Feb not much diff from Jan.

Hi Watcher,

I would speculate that the winter summer difference may be due to difficulties getting trucks to all the well sites. Some of the stripper wells may get shut in temporarily during the Dec to March period when the snow is deep. Or it may be in very cold weather more stuff goes wrong with stripper wells and more maintenance is required.

My limited experience with working outside in winter is that stuff takes a little longer to accomplish at -20F than at 40F and above, Mike could probably give us a feel for if more stuff breaks in winter than other seasons. Though this would be less of a problem in Texas where it rarely goes below zero degrees F.

Kinda not the point. The point was there appeared at first to be merit to declaring that August is a month of maintenance and explains 9%. Except no, it’s 9% in June, too. So nothing special about August. Didn’t look at more months.

Yo Mike, re trucks and drivers. A non degreed person is going to value $100K+ jobs, no question but no one likes firing anyone. When drilling slows or stops, apparently not just soon but now, the management of the truckers, like all reasonable management everywhere, is not going to want to fire anyone. It’s not a pleasant thing to do.

So . . . I gotta staff of 10 truckers doing 80 hour weeks and $120K/yr and I got 50% just cut off in demand for work from my customers. I will not fire these guys. I will cut everyone’s hours in half, and apologize, and lay it out for them. This is what is happening to drilling. I don’t want to fire any of you guys because none of you is worthless to me. So . . . sorry but you all now work 40 hr weeks at $60K.

Maybe the next cut I can’t cut hours. I have to let someone go. Now those other guys are not walking away from a $120K job. Now it would be walking from a $60K job, or maybe I *do* find a way to cut hours on the 2nd round of slashed business. Then I have a staff of guys making $40K who see the guy next to them fired. Lots easier to walk from the $40K job than the $120K job.

What will it mean if ISIS achieves wide spread lasting victory?

Two great opposing forces will come into play , with need and greed on one side leading ISIS to produce and sell all the oil possible, and hatred of the Great Satan and all things western on the other leading them to curtail production and sale of oil the the extent they can.

Which will be the greater force?

If they sell oil then it does not matter much in the short term at least if they refuse to sell it to us or Western European countries because oil is fungible and we can just buy what ever is available. The total amount on the market is the important thing.

Another question worth asking is whether ISIS will even be able to maintain the oil fields and continue to produce over the medium and long term. Most of the skilled and professional personnel may haul ass out of ISIS controlled territory.

They can probably keep the oil flowing for a while with whatever people stick around but maybe not for very long at all.

Isis oil production is a pin prick in world terms. They are totally irrelevant to the global oil price. However, the oil they were selling was enough to make them the richest ‘terorist’ group in the world, and more importantly, immune to the commands of their previous funding country or faction. This is why SA agreed to US led attacks on them, they realised they had created a monster that could turn on them. They have well trained , experienced fighters, they have modern advanced weaponry, they have fanatical belief in their cause, and they had the money to attract mercenaries and keep local support or at least aquiesence. They are attracting impressionable young Muslims from all over Europe who have grown up in the shadow of 9/11 and a decade of being treated as the bad guys. Even romantic teenage girls are running away from home to join the cause only to find themselves sex slaves. On the internet, Isis is winning the propaganda war among Sunnis. The bombing has reduced their oil income sharply, but it will take a lot more to defeat them. They are clearly intelligent and well educated and adaptable.

I somewhat doubt many stories about the evil of ISIS. I’ve watched Putin become the great Satan in about 8 months.

Why do we believe anything in the news?

As for how smart they are, think Napoleon and stomach. Intellect is overrated in war. Courage trumps it.

But. Beyond courage there is calories and illness. Napoleon had a bleeding ulcer and only rose from bed the morning of Waterloo at 10 AM. The South in the US Civil War was outnumbered 4:1 in population and manged to fight for 4 years despite this, because they fought in places where supply lines to food (the populace) were short.

ISIS doesn’t have airdrops of food coming in. They have the populace making sure they are fed. They are the people’s choice. The oil dependent world can’t worry too much about the people.

I somewhat doubt many stories about the evil of ISIS.

But of course, they really didn’t decapitate those two Americans or those two Brits. It was all fake, with fake blood.

I’ve watched Putin become the great Satan in about 8 months.

But of course. Putin had nothing to do with marching those Russian troops into the Ukraine, nothing to do with the Russian separatist shooting down that plane, and he is just right now begging his troops to get out of the Ukraine.

Why do we believe anything in the news?

Right, everything in the US news is just an evil plot propagated by Obama and his henchmen. All that news about ebola is just a damn lie.

ISIS doesn’t have airdrops of food coming in. They have the populace making sure they are fed. They are the people’s choice.

Right, they are the choice of all the people in their territory left alive. The others have all been shot, right after they were forced to dig their own graves. ISIS are all heroes.

Why, dear God, why does everyone see an evil plot behind every news report? Why do some people believe every news reporter has an ulterior motive in every story they write? There are literally thousands of reporters reporting for radio, television, newspapers, magazines and the internet. And they all tell basically the same story,* even those working for AlJazeera. And they are all fucking liars?

*Except occasionally those working for RT tell a different story.

I believe that among competing hypotheses, the one with the fewest assumptions should be selected. And if one believes that, then one should believe that the vast, vast, majority of reporters are telling the story exactly as they see it, and are not engaged in some vast conspiracy to lie to the public, for some reason unknown to almost everyone else.

Ron,

I find it quite interesting that not only do you believing the MSM, but you seem to be an outspoken defendant of it. I have a friend who was a staunch Right-Wing Conservative. He thought anyone who critiqued the USA after we have done so much in giving aid and support should be viewed as almost a traitor.

Well, after 5 years of RE-EDUCATING and EXPANDING his horizons by watching news from all over the world, he now tells me that the U.S. MSM is just like the old Soviet Union Pravda. I was actually quite surprised to hear him say that.

Now, I am not here to convince anyone of anything. And of course people will continue to believe what they believe probably until they are six feet under in the grave. However, I find it quite interesting that citizens will continue to believe what they are told through media without QUESTIONING IT. This has gone on forever.

As I said before… GOD HATH A SENSE OF HUMOR.

steve

No Steve, you have it all wrong. I am not defending or criticizing MSM. I just don’t believe that every word in print, spoken on radio or television, by a reporter who is just supposed to be reporting only what they see, is telling a fucking lie. I do not believe that. That is a truly absurd position to take and I just flat don’t believe it.

Now I know that Fox news on the right, and MSNBC on the left, slant their opinions. But they are not reporting the news, they are giving editorial comment, which means “In the opinion of the eidtor”.

I don’t give a harry rats ass what conclusions your right wing friend came to. And you of all people should know that anecdotal evidence is not worth a bucket of warm spit.

No, US newspapers are not the equivalent of Pravda. Every word of Pravda must be approved by the government censors. No one tells the Washington Post or the New York Times what they can print.

I think the belief that all US media is part of a grand conspiracy to lie to the public is just down in the dirt stupid. For what? What would such a conspiracy accomplish? American reporters go into enemy territory just to get the truth and report the truth. They risk their lives, many lose their lives just to get the story. And you guys just think they are telling a bunch of damn lies? Give me a fucking break! They could stay at home and do that.

And I will not be a part of this stupid hate America campaign and I simply cannot understand why people jump on that bandwagon. And I know you will deny being on that bandwagon but your words betray you.

Ron,

Always a pleasure receiving an logical, soft-spoken well thought-out reply from you.

steve

Some of what passes for news today is merely an attempt to grab and maintain audiences. So they focus on stories that they believe their audiences are mostly likely interested in and will keep coming back to, over and over again.

There is such a need to fill up space 24 hours a day that anything that sells is put out there, whether or not it has been based on fact.

In other words, it isn’t media lying so much as it is media giving audiences what they want. It’s entertainment, not news.

I now tune out most of it because it is too time-consuming to keep track of it. And when I stop paying attention to a lot of it, I take a longer perspective. If the story is still around months from now, maybe it was important. But most of what happens minute-by-minute, hour-by-hour, day-by-day, week-by-week isn’t all the significant in the greater scheme of things.

Right now the one story I follow closely is this one: the state of oil in the Bakken. I believe what happens there is going to affect how we view energy production in the US. And how we view energy production in the US will affect the US economy.

Ron, Steve, Please allow me to react as an outsider (non US resident.)

I do not believe there is a large conspiracy whatsoever concerning US MSM. Neither do I believe the US residents get appropriate information through their MSM. That is because the US MSM are all commercial organisations, writing what their clients want to read. And sort of avoiding what their advertisers don’t like. The best (most extreme) example is FOX News. That is not a news channel. That is an advertising channel. And they attract audience by telling stories that just confirm the already existing prejudices of their audience.

I have no single reason to believe reporters abroad, risking their lives, are lying. Still their stories appear in newspapers that create an atmosphere telling you to consume, telling you to behave, telling you to live the American dream, telling you trees grow to heaven and there are no limits to growth.

There is no Pravda-like authority behind American MSM. The result might be very much alike: The audience is kept between the lines of the system.

I don’t even think some of the more outrageous conservative commentators (e.g., Rush Limbaugh, Ann Coulter) even believe what they say. But they know they have an audience that continues to patronize them, so they say whatever keeps that audience coming back.

Verwimp, I agree that Fox News is not a news channel. Also MSNBC is not a news channel. But in truth neither even pretend to report much news. All their shows are political commentary and every American knows that.

But the rest of your opinion is just wrong. Everyone advertises on CNN, CBS, NBC and ABC. Everyone! They don’t slant their stories to patronize their advertisers, they just report the damn news. The idea that someone reporting from Benghazi is slanting his report as not to offend some advertiser is just absurd. Ditto for someone reporting about the drought in California or Ebola in Liberia. The news is the news, they have no reason to slant it.

But about their stories appearing between advertisers… of course. Advertisers pay the bills and if there were no advertisers there would be no news.

I find it rather quaint that you would blame MSM for not telling the people there are limits to growth. Is that what the European media does? I had no idea. I read a few European publications like The Economist and Science News, and they have the same kind of ads ads and none talk about limits to growth. I simply do not believe that is an American phenomenon.

The simple truth is Verwimp, that neither American nor European media, by and large, believe there is any limits to growth. They are both wrong of course but neither are deliberately lying. Remember Hanlon’s Razor:

Never attribute to malice that which is adequately explained by stupidity.

“. All their shows are political commentary and every American knows that.”

Lord above, if only that were true!!

Unfortunately people tend to want their world view confirmed rather than to process something that doesn’t fit.

I see problems ahead for the US and world economy, and I fear that people will blame the wrong causes rather than to sort out the real causes. That wouldn’t be so bad if there were no real harm done. But if, as things get worse, you keep going after the wrong people, you only make matters even worse rather than finding workable solutions. At its most extreme you have something like Nazi Germany where people were led to believe if they killed all the Jews and other outsiders, problems would disappear.

As has been pointed out elsewhere in the comments, if people in Alaska are told there would be more oil there if it weren’t for taxes, they don’t address the fact that they had a limited resource that is disappearing.

Hi Ron,

”All their shows are political commentary and every American knows that.”

I am sure that you overlooked this little boo boo and will agree with me that tens of millions of Americans unfortunately don’t ” know that”.

It may sound a tad elitist but I would not be opposed to some sort of literacy test for voters.

A couple of sample questions might be :

Two plus two is how many?

Is the Earth the center of the universe?

I am with Ron about ninety to ninety five percent of the way.

The other five percent in my estimation is Steve’s portion. The msm does have a tendency to ignore or downplay certain sorts of events that should be headlines sometimes.

I attribute this ten percent or so of failure to not so subtle pressure applied via the purchase of advertising and interlocking ownership of the media and other big businesses.

A local paper that depends on the local new car auto dealer ads to stay in business is not going to put but so much bad news about recalls on the front page.

And outfits such as the Koch brothers own some media either directly or indirectly.

Beyond that although it is an unfortunate grave error on the part of msm media management it seems perfectly safe to say that just about all the editors and management personnel that have to do with content were trained in the business as usual school of business , either formally or on the job.

GIVEN this educational or professional background it is no surprise that a lot of media simply don’t give issues such as peak oil and climate change due unbiased coverage.

Now I for instance don’t believe in witches having supernatural powers but I do believe there are women out there who call themselves witches and that some of them do believe that they do indeed personally possess supernatural powers.

So – if I were an editor I would not run stories giving credence to witches having such powers regardless of the evidence.The only thing that would convince me would be a personal demonstration.

Given this prejudice ( justified in my eyes and in the eyes of most well educated people of course) witches would never get any support from my publication if I could prevent it.

This is perhaps a poor example but an editor trained in business as usual business probably believes we peak oilers are no more credible than witches.So such an editor will tend to consciously or subconsciously downplay peak oil news.

But sooner or later peak oil is going to smack him upside the head like a mugger’s brick and make a believer out of him.

After that he has a choice to make. He can run the stories about climate change and coal fired co2 pollution and quite possibly get fired if his paper belongs to folks who have serious stakes in the coal business or even a business that is dependent on cheap coal fired electricity.

Or he can keep his mouth shut and avoid risking his job and his pension.

Fortunately there are enough msm outlets that at least a few of them are generally willing and able to publish the facts as they find them in respect to any given issue.

Mother Jones is not the equal of the Wall Street Journal but Mother Jones is still mainstream media these days.So is Rolling Stone. Back when I was a long hair this sort of publication was referred to as ” alternative”.

I read a couple of pretty sorry excuses for newspapers that are hard core right wing for just one reason. These papers run a lot of articles about things that other more middle of the road or left leaning papers ignore or soft pedal for various reasons.

There are two aspects of news that could stand some debunking:

1. If we cover it, it must be important.

2. If we cover it, it must be true.

The publication I most like to read these days is New Scientist. I don’t subscribe, but a lot of the articles are available online for free. I find many of the stories to be educational/enlightening.

ProPublica doesn’t cover a lot of stories, but it does seem to do a much better job at in-depth reporting than most. I find those worth the time when I read them.

Beyond that I have trouble finding news sources that always satisfy me. There are some which I consider total BS. And there are some that I find valuable much of the time. But even among publications I like, sometimes I find myself wondering why a particular article was published.

Again, my problem is lack of time. I have to narrow down my news sources and topics to free up time. Right now Bakken oil is the one subject I try to follow very closely. Everything else I tend to skim. I will stop and read stories that interest me, but I no longer try to read lots of sources and lots of headlines. It’s too much and ultimately not very enlightening.

An example of how advertising can work on the web

https://medium.com/@obbybreeden/traq-scores-and-you-3f559a96e166

One needs to be very careful of what one writes.

NAOM

Ron, thanks for this great website. There is no conspiracy in the MSM, it’s just business.

The Fairness Doctrine levied a duty on broadcast media to serve the public interest but was written out of FCC regulations in 1987 when the concept of public service gave way to privatization, deregulation, trickle-down economics, and revolving-door politics.

As of 2011, all major U.S. TV, radio, and newspaper outlets were owned by six media conglomerates: GE, Disney, Time Warner, Viacom, News Corp, and CBS. Look to PBS for good entertainment not news. Frontline is occasionally useful but Bill Moyers has retired again. PBS and NPR are funded by Charles and David Koch not your small dollar contributions.

It’s no longer possible to be well informed if you get your news from TV, radio, and newspaper. That’s why I come to your website as well as a few others.

Maybe a better curiosity is . . . if the populace is all dead, then how do they feed ISIS? Such trucks would be obvious targets for aircraft.

US Government information:

https://www.youtube.com/watch?v=I-lQ3BrzQO4

Watcher, you show a wartime film from 69 years ago as an example of the US Governments attitudes and policy today?

A simple yea or no will do.

This is what I mean by “hate America” campaigne. Puting Japanese Americans in camps was atroceous. And I would bet every American politican would agree with that statement. And only someone who truly hates America would drag that up, or a wartime film about the Japnese, and posit it as an example of the American Government today.

Ron, A wartime film. Why not? Please be aware of the fact the US is at war now, and has been at war for … (I forgot how many) … years now. Propaganda is often debunked only in hindsight. Propaganda is very easy to do. So it happens all the time! So whenever you get information, the first reflex should be: “If somebody wanted to execute propaganda on me, what would it look like?”

Ron, A wartime film. Why not?

Good Good, are you serious? Not even Fox News would ever suggest such a thing. That film was produced at least 69 years ago at a time when such attitudes were the norm everywhere in America. No one would dare produce such a film today. And if you don’t know that then you have a very serious problem.

There is propaganda and then there is propaganda. Both the Republican and Democrat party are busy producing propaganda but neither does anything like that.

What comes from the mouths of politicians on both sides of the aisle should be taken with a grain of salt. But there are no “official wartime films” being released by the government. All wartime films are produced by the networks and I do believe they are just reporting the news. Of course you may believe they are slanting their films to please their advertisers. Photoshopping them perhaps. 😉

Yea.

It’s timeless. Doesn’t change. Why should it? Remember the Maine!!!

Check into what was reported for the Gulf of Tonkin incident, too.

USS Liberty.

Neither now, nor at those times, do you get people to sit at a typewriter and pound out material they know are lies. The information is filtered and provided and the guy starts typing to hit his deadline. At most he’ll make a phone call to achieve his two source rule, and source #1 may suggest a name for that. Make the call, get the quote, start typing before the boss gets angry.

Well, don’t care what was done. Care what was reported. I actually don’t know . . . were the Japanese interment camps splashed on the cover of Time? Or front page NYT? Or page 12 NYT?

Or did it only become Pulitzer material decades later?

You think chopping off the heads of three people is worse than this?

http://coldfusionjuice.com/media/com_hikashop/upload/shock-awe_663649999.jpg

When Rumsfeld and Cheney were high fiving each other on TV about this, the German President did an interview about how the last time he saw his father — he was 12, and his father was on vacation from the Eastern front. They lived in the Barmen district of Wuppertal. The Allied bombing raid downtown Barmen started, and his father got him out of bed. He spent the whole night dragging people dead or alive out of burning houses. Thousands died that night. The next morning his father went back to Stalingrad never to return. He wasn’t too keen on shock and awe, though he didn’t come right out against it.

If you think three beheadings is war…

Agree about the shock and awe and this bothers me too: We have 17 overlapping intelligence agencies any one of which could have kept the ISIL beheadings out of the headlines. A proper response would have been to notify and comfort the grieving families while handing useful intelligence to our vast JSOC apparatus. Instead, with cruel disregard for the victims’ families, lurid pictures were spread to every possible media outlet to gin up support for a new war.

That bothers me.

I have to get this off my chest also. Two beheading. Horrible beyond description. Obviously carried out by psychopaths. But two not 57,650.

That’s how many Americans were killed by gun violence between the Sandy Hook School massacre of 2012 and October 2014. But ISIL, for which we laid the groundwork by invading and occupying two countries that never attacked us, is the threat we choose to engage using the most expensive weapons systems in human history. The country from which the 9/11 hijackers and their funding originated remains unsanctioned.

I was pretty shocked by the intensity of the anti-ISIS propaganda myself. They probably are pretty awful, but still. There’s no way they’ll create as much mayhem as Bush did, for example.

The problem is that they are fighting for a country that is really there, but not on any map. It is Sunni Arab, very arid and covers Western Iraq, Eastern Syria and Northern Jordan.

Everyone understands that Kurdistan is a place, and it would really be a bad idea to have and independent Kurdistan in the region, but nobody even considers the fact that the Sunnis of the region need/want their own country as well.

The only banner they have to rally around is Islam. So the movement gets taken over by insane Islamists.

The region needs to be completely restructured with a Kurdistan including a big chunk of Iran, Iraq, Turkey and Syria, a Sunni homeland (including Western Saudi Arabia I guess), a Levantine Confederation of Western Syria, Lebanon, Israel and Palestine and Western Jordan, and a Shi’ite state including southern Iraq and Eastern Saudi Arabia.

The Levantine confederation sounds hard to do, but the alternative is ethnic cleansing.

Won’t happen anyway, but it’s worth thinking about. The Ba’athists in Tikrit went pro ISIS because they are Sunnis like ISIS, but not because they are interested in the religious wacko part — it’s an ethnic issue.

“I was pretty shocked by the intensity of the anti-ISIS propaganda myself. ”

Been going on for centuries. The country of France under Nazi rule doesn’t get very much attention at all. Women shacked up with German officers in order to feed their kids, because the Germans knew how to properly conquer a country and when they demanded payment for the garrison and francs were offered, they laughed, shut down the French CB and shipped out crops. Lots of hungry folks around

And then when De Gaulle and his folks arrived after the war, those women had their heads shaved to brand them . . . whatever.

Ya just have to dig with a suspicious eye. Did you know that after Germany surrendered, Eisenhower refused to release German POWs? They were relabelled “Disarmed Enemy Forces” so the Geneva Convention on treatment of POWs was not breached. In fact, Eisenhower planned all this in 1943. German surrender(s) was in early May 1945. By October 1945, many of them starved. It’s sort of a reverse Holocaust, in that the numbers estimates on deaths in those DEF camps vary from 3,000 to 1 million.

Hey, thanks. I read here a bunch of paragraphs that appeared as recycled and old or new opinions and sarcasm. I almost fell to sleep. Then you mentioned DEF. Let me give you my highest compliment, “Today you showed me something new. Thanks”

Yes, we have to look at reporting and news very carefully.

You want to look at something buried deep?

Look into rapes of German women post surrender by British and US troops. The Soviet troops . . . easy to find those stories. It’s the US and Brit stories that are out there, but buried deep.

Islamic State is a very proud self-reporter. You don’t need media, just pull up their videos. They *like* displaying that they commit genocide on the unbeliever.

re Mac statement: “Another question worth asking is whether ISIS will even be able to maintain the oil fields and continue to produce over the medium and long term. Most of the skilled and professional personnel may haul ass out of ISIS controlled territory.”

Most? Would you work there? I wouldn’t even consider it. A year ago my son was going to work in Iraq. I was freaking out. Since the the JV team has arisen from hell, I suppose. I cannot imagine anyone thinking it could ever be safe for foreigners after the latest head sawings.

Let Iran fight ’em. Westerners come on home.

Paulo

I certainly would haul ass personally of course.

But there must be some local folks who are favorably disposed towards ISIS who have some expertise. There just might be enough of them to keep the oil fields producing at least in the short term.

If not then they will have to find a way to get the former foreign workers back. The first step would be to pay outrageous salaries to any brave or foolish enough to go back.

My guess is that oil production in any area controlled by ISIS over the medium to long term will go down substantially for quite some time.They won’t likely be able to do much more than routine maintenance work on existing oil field infrastructure and they may have a very hard time doing even that much.

Rumors of a ‘secular stagnation’ driving the Stock Market recently?

http://www.nytimes.com/2014/10/19/business/economy/when-a-stock-market-theory-is-contagious.html?rref=upshot

Be this as it may…I have seen enough Stock Market swings that I couldn’t care less…it is FM to me.

‘Fucking Magic’

I just read this article. Did he actually say anything? Seems like he just said the obvious. Stock markets can be driven up or down by investor perceptions.

Boomer,

Yes…”Seems like he just said the obvious. Stock markets can be driven up or down by investor perceptions.”

…

But that was not the thing that grabbed my attention…it was the promulgation of the idea of potentially decades-long ‘secular stagnation’.

If that idea gains credence, it is a small jump to permanent stagnation, and then to secular decline.

The thought that these kinds of realizations/percetptions may gain traction is what is interesting, not the statement of the obvious that stock market trends react to investor perceptions.

it was the promulgation of the idea of potentially decades-long ‘secular stagnation’.

I guess that hasn’t been news to me. I’ve seen no indication that what we have been through has been a “normal business cycle.” So yes, I welcome a realization of secular stagnation because that seems to be the reality we’re in. I’d LIKE to see the stock market realize that.

The Broader Markets are being driven by the PPT – Plunge Protection Team via the Fed and Member Banks. The market is one giant bubble looking for a pin.

Regardless, I find the current situation in the Copper Markets quite interesting. According to the data put out by the Chilean Copper Commission, the world has a 4.6 day supply of copper inventories. I wrote about this interesting situation in my article:

http://srsroccoreport.com/the-world-has-less-than-5-days-worth-of-copper-inventories/the-world-has-less-than-5-days-worth-of-copper-inventories/

The story goes that the Chinese used copper for financing deals. This went sour back in May of 2013. Anyhow, some copper analysts say the Chinese have a lot of copper in warehouses that doesn’t show up in the typical global inventories…. so no big deal

However, that didn’t stop China from importing 18.7% more copper in the first 7 months of the year compared to the same period in 2014. Furthermore, global copper production for the first 5 months of the year increased 5.6% while consumption fell 2.3%. This is odd… because global copper inventories continued to decline. Something doesn’t smell right.

Will be interesting to see how this plays out in the next 6-12 months.

steve

The Broader Markets are being driven by the PPT – Plunge Protection Team via the Fed and Member Banks.

Yeah right! The purpose of the so called Plunge Protection Team was to protect the investor. That is to protect the market from sudden plunges and not to control the market. The fact that you believe that it controls the market just shows how far from reality your beliefs really are.

Plunge Protection Team: No Different Than Santa and the Tooth Fairy?

There is a common belief that a “Plunge Protection Team” is sitting in a hidden room, somewhere deep within the bowels of our government, with its trigger on a Cramer-like BUY-BUY-BUY button every time the market plummets. Many people feel that this “team” will prevent our markets from acting in a disorderly manner. This, they claim, should cause, you, the investor, to “feel” more confident in our equity markets, since Uncle Sam is always at work protecting you. However, I am not one of those people with such misguided beliefs.

Let’s look at the history behind this mysteriously active Plunge Protection Team, and then let’s see if they have actually been able to “protect” us from plunges.

Creation of the Plunge Protection Team

The last two weeks of October 1987 saw the equity markets shed approximately 22% of their value. After this market crash of 1987, President Ronald Reagan created the President’s Working Group on Financial Markets to recommend solutions for enhancing U.S. financial markets, preventing significant volatility, and maintaining investor confidence. The group consisted of the Secretary of the Treasury and the Chairmen’s of the Federal Reserve, the Securities and Exchange Commission and the Commodity Futures Trading Commission.

Thereafter, this “Working Group” became known as the Plunge Protection Team, and many believed that this “Team” would intervene at the appropriate moments to prevent significant volatility in the markets, which would, thereby, prevent market crashes in the future. As the myth has been perpetuated, it can supposedly do this by convincing banks to buy stock index futures, or by having the Federal Reserve do the buying. The goal was supposedly to allow markets to correct in an “orderly” fashion so as to “maintain investor confidence” in our equity markets.

Have You Felt Protected?

If there really is such a team hard at work, with their ever-present finger on the “buy” trigger, then we should not have had any stock market “plunges” since 1987. Rather, the stock market should have only experienced “orderly” declines since that time, and not plunges of 10%, and certainly not over 20%, within a period of a day to a couple of weeks in the same manner as that experienced in 1987. So, the question we now have to look at is if the facts within our markets actually support the existence of such a “Plunge Protection Team” actively at work in protecting us from significant stock market “plunges.”

Since 1987, I don’t think that anyone can fool themselves into believing that we have not experienced periods of significant volatility. In fact, the following instances are just some of the highlights of volatility since the supposed inception of the Plunge Protection Team:

February of 2001: Equity markets declined of 22% within seven weeks;

September of 2001: Equity markets declined 17% within three weeks;

July of 2002: Equity markets declined 22% within three weeks;

September of 2008: Equity markets declined 12% within one week;

October of 2008: Equity markets declined 30% within two weeks;

November of 2008: Equity markets declined 25% within three weeks;

February of 2008: Equity markets declined 23% within 3 weeks.

May of 2010: Equity markets experienced a “Flash Crash.” Specifically, the market started out the day down over 30 points in the S&P500 and proceeded to lose another 70 points within minutes. That is a loss of 9% in one day, but the market did manage to close down only 3.1% in one day!

The plunge protection team was supposed to protect the market from sudden plunges and nothing else. However it has been a total failure. There are rumors that the “working group” has totally disbanded. And why not, if it is a total failure it should disband.

But a few people pick up on the idea that the PPT somehow “controls” the market. Then again some people believe in Santa Clause.

Actually Blair Hull has been white washed in recent years.

It used to be “he bought derivatives and stopped the Crash and saved civilization”, and why wasn’t he prosecuted for manipulation? Because how can you prosecute someone for saving the world?

But recently, to avoid that issue, he has been repainted as “the man who bought the bottom” (not created the bottom buying obscure instruments).

There’s also the classic story during that Crash hmmm I think it was EF Hutton had a teleconference with its branches and the branch managers came out of their offices and looked around at all the brokers and yelled:

THE NEXT PERSON THAT ANSWERS A PHONE IS FIRED.

Slowed the selling pressures. Manipulated the market in the first manifestation of quote stuffing. Don’t allow people to trade if you don’t want them to.

As oil prices have come down, the interesting question is now which impact that will have on tight oil production. How many fields will become uneconomic?

Iran warns Opec indecision will hit oil prices as crude slumps

Recent research from Deutsche Bank has suggested that 9% of US “tight oil” would be uneconomic at prices below $90 per barrel and around 40% if the prices slips below $80.

http://www.telegraph.co.uk/finance/newsbysector/energy/11156984/Iran-warns-Opec-indecision-will-hit-oil-prices-as-crude-slumps.html

The Deutsche Bank commodity report is here:

There is room for debate over exactly what sequence of events will lead to a curtailment of supply from OPEC and Saudi Arabia in the next year, as well as questions over what price levels will be regarded as sufficiently problematic to trigger a quota reduction. We suggest that in addition to

flat prices, it may be informative to watch front-end contango as a risk factor for OPEC action.

US tight oil appears to be the element of the supply picture most capable of supporting prices based on breakeven costs for new development as well as response times. In the event of a failure of OPEC to respond promptly to oil price declines, we note that 9% of 2015 US tight oil production would become uneconomic at USD90/bbl and 39% at USD80/bbl (Brent equivalent).

http://www.etf.db.com/ESP/SPA/Download/Research-Commodities/49ed1993-2706-4c0c-8b1d-18018db690a2/Commodities-Quarterly.pdf

The WSJ has an article about the impact of declining oil prices on Venezuela. One story is illustrative. One gentleman went to 17 different supermarkets trying–unsuccessfully–to find powdered milk for his grandchildren.

Good post, Ron. Note that, with the release of the August data, the sum of the daily production in the “big four” counties — Dunn, McKenzie, Mountrail, and Williams — comes to 1,000,000 bbl/d for the first time. These four counties are now producing close to 90% of the oil produced each day in North Dakota. This share has also continued to gradually increase every month. The first chart I have attached to this post, of monthly oil production in the “secondary” Bakken counties (that is, counties outside of the “big four” that produce oil from the Bakken), partially explains why. Each of these counties was a part of the current boom, showing big increases in production, relative to the historic averages of each county, in the 2010-2012 time period. However, as the chart indicates, since then production in these counties has either plateaued or, in the case of McLean County, gone into decline. This, as shown in the second chart I have attached, is in spite of continually increasing active well counts.

Those are an interesting set of numbers from those big counties. The increment in daily oil production for MacKenzie + Mountrail + Williams =18, 685 b/d. The increment for all of ND was 16,864.

On another note, I have been investigating North Dakota permitting data for the past six months. Here is what I’ve found:

Over the past six months, there have been 1,561 permits issued for oil wells in North Dakota, 17 of which are for a wildcat. Of the permits, 13 have since been cancelled by the operator (this usually happens because the operator decides to change the well location or configuration to something other than what was specified in the permit application). Of the wells permitted, 721 have been spud, leaving 840 waiting to be drilled.

The breakdown and percentage of permits by county (arranged highest to lowest) is as follows,

County Permits %

MCKENZIE 558 35.7%

WILLIAMS 297 19.0%

MOUNTRAIL 283 18.1%

DUNN 183 11.7%

DIVIDE 84 5.4%

BOTTINEAU 54 3.5%

STARK 27 1.7%

BURKE 24 1.5%

RENVILLE 16 1.0%

BILLINGS 14 0.9%

BOWMAN 7 0.4%

MCLEAN 7 0.4%

SLOPE 4 0.3%

WARD 2 0.1%

GOLDEN VALLEY 1 0.1%

Lastly, the breakdown and percentage of permits by operator (also arranged highest to lowest),

Operator Permits %

HESS BAKKEN INVESTMENTS II, LLC 178 11.4%

CONTINENTAL RESOURCES, INC. 156 10.0%

OASIS PETROLEUM NORTH AMERICA LLC 117 7.5%

XTO ENERGY INC. 114 7.3%

WHITING OIL AND GAS CORPORATION 86 5.5%

BURLINGTON RESOURCES OIL & GAS COMPANY LP 72 4.6%

MARATHON OIL COMPANY 61 3.9%

EOG RESOURCES, INC. 61 3.9%

KODIAK OIL & GAS (USA) INC. 57 3.7%

SLAWSON EXPLORATION COMPANY, INC. 54 3.5%

QEP ENERGY COMPANY 52 3.3%

STATOIL OIL & GAS LP 45 2.9%

NEWFIELD PRODUCTION COMPANY 44 2.8%

EMERALD OIL, INC 43 2.8%

ENDURO OPERATING, LLC 38 2.4%

ZAVANNA, LLC 37 2.4%

TRIANGLE USA PETROLEUM CORPORATION 35 2.2%

WPX ENERGY WILLISTON, LLC 32 2.0%

OXY USA INC. 30 1.9%

SM ENERGY COMPANY 26 1.7%

PETRO-HUNT, L.L.C. 22 1.4%

HRC OPERATING, LLC 21 1.3%

AMERICAN EAGLE ENERGY CORPORATION 20 1.3%

HUNT OIL COMPANY 20 1.3%

LIBERTY RESOURCES MANAGEMENT COMPANY, LLC 18 1.2%

LEGACY OIL & GAS ND, INC. 16 1.0%

SAMSON RESOURCES COMPANY 15 1.0%

FIDELITY EXPLORATION & PRODUCTION COMPANY 13 0.8%

CORINTHIAN EXPLORATION (USA) CORP 10 0.6%

DENBURY ONSHORE, LLC 7 0.4%

ABRAXAS PETROLEUM CORP. 7 0.4%

CRESCENT POINT ENERGY U.S. CORP. 4 0.3%

CORNERSTONE NATURAL RESOURCES LLC 4 0.3%

MUREX PETROLEUM CORPORATION 4 0.3%

MOUNTAIN DIVIDE, LLC 4 0.3%

ENERPLUS RESOURCES USA CORPORATION 4 0.3%

SHD OIL & GAS, LLC 4 0.3%

BAYTEX ENERGY USA LLC 3 0.2%

NORTH PLAINS ENERGY, LLC 3 0.2%

MBI OIL & GAS, LLC 3 0.2%

PETRO HARVESTER OPERATING COMPANY, LLC 2 0.1%

BALLANTYNE OIL, LLC 2 0.1%

PETROGULF CORPORATION 2 0.1%

GADECO, LLC 2 0.1%

SINCLAIR OIL AND GAS COMPANY 2 0.1%

ANSCHUTZ OIL COMPANY, LLC 1 0.1%

ARMSTRONG OPERATING, INC. 1 0.1%

WELTER CONSULTING, INC. 1 0.1%

ROFF OPERATING COMPANY LLC 1 0.1%

STEPHENS PRODUCTION COMPANY 1 0.1%

ST. CROIX OPERATING, INC 1 0.1%

SOLUTIONS ENERGY LLC 1 0.1%

CYNOSURE ENERGY LLC 1 0.1%

FLATIRONS RESOURCES LLC 1 0.1%

RESONANCE EXPLORATION (NORTH DAKOTA) LLC 1 0.1%

BERENERGY CORPORATION 1 0.1%

The size of the spread of companies on the scene says something about the problem of putting in more pipeline and doing less trucking.

Getting that many ducks in a row to sign up and pay for the pipeline would be tough..AND some of them probably don’t have enough production to even interest a potential pipeline operator.

I’ve thought that economics might kill Keystone. Who’s going to commit to paying for it if it becomes increasingly uneconomical to work the tar sands?

I think environmentalists have economics ultimately working for them. If they can stall projects long enough, investors, lenders, and companies may see that current projects aren’t very sustainable and therefore not venture into creating new ones.

From the Deutsche Bank commodities quaterly

“While we would expect an OPEC quota reduction to occur before any non-OPEC curtailments, it has been suggested that OPEC may refrain from immediate cutbacks in order to assess the price sensitivity of US tight oil production. In this unlikely event we would regard US production to be more price responsive than higher-priced (when measured on investment breakevens) Russian or Canadian supply because of shorter drilling contracts. Although the weighted average cost of US tight oil is US$ 72/bbl, close to 200 kb/d (or 9%) of 2015 expected production would not attract new investment below US$ 90/bbl, and a further 650 Kb/d would become unattractive between US$ 80-90/bbl”

http://www.etf.db.com/ESP/SPA/Download/Research-Commodities/49ed1993-2706-4c0c-8b1d-18018db690a2/Commodities-Quarterly.pdf

Fig 5

Is that market price or wellhead price? Wellhead prices are a lot lower, especially for API 50 stuff.

Odds pretty good DB hasn’t got a clue what % of who is economical at what price.

They, like everyone else, have analysts who need to look busy and produce reports that might impress investors enough to entrust money to DB management at 4% annual expense ratio.

This is fake.

Already Bakken + Eagle Ford OVER 2,5 Mb / d, and that’s not counting Permian and Niobarra

The DB report refers to new investment capacity

Hi all,

I took a second look at the EIA’s oil price scenarios from the AEO 2014, the reference scenario has Brent Crude prices falling to $92/b by 2017 and rising from there to $141/b in 2040 (2012$), I adjusted my oil price scenario to $89/b now and remaining at that level to mid 2015 and then rising to $141/b by Dec 2040. I also assumed the fall in oil prices since mid 2014 will result in a fall in the drilling rate in the ND Bakken/Three Forks to 150 new wells per month by Oct 2014 and remain at that average until June 2016, then the drilling rate will fall as EUR/well starts to decrease in June 2015 and reaches its maximum rate of decrease 6 months later. The oil price only climbs back to $95/b by 2019, to $100/b by 2022, and $116/b by 2030 so the oil price scenario is fairly conservative (these are Brent Crude prices). Also EUR30 for the average well is assumed to be 320 kb at present and decreases to 235 kb by 2020.

By 2040 the new well EUR falls to 136 kb.

The North Dakota Bakken Three Forks peaks at about 1.1 million b/d in 2016 and URR to Dec 2030 is 5.5 Gb (URR is 7.3 Gb). Chart below assumes transport cost is $16/b so wellhead price is $73/b in Sept 2014 vs $74.50/b reported in the recent director’s cut for Sept 2014.

There are many shortcomings to this scenario, oil prices are unpredictable, long term output from Bakken wells using current completion techniques is unknown, transport costs will change over time, future well costs may rise or fall. This scenario is simply a best guess based on the well data we have at present and on the assumptions for future drilling rates, oil prices, transport costs, tax rates, OPEX, financial costs ($3.50/barrel), and a 7% real discount rate. (the second chart shows some of these assumptions).

The North Dakota Bakken Three Forks peaks at about 1.1 million b/d in 2016…

Bakken Three Forks production in August 2014 was 1,067,609 bpd. You have then increasing by just 32,391 barrels per day per month over the next two years. That is less than 2,000 barrels per day per month.

Though I think they will peak in 2015, I am still far more optimistic than you. I believe they will peak somewhere around 1.2 million barrels per day, or perhaps a little higher.

But all that still depends on the state of the world economy. If the economy stays in the doldrums and oil prices stay as low as they are today, or go lower, I expect they will still peak next year but earlier next year at between 1.1 and 1.2 barrels per day.

Hi Ron,

The scenario assumes low oil prices will affect the rate that new wells are added so that fewer are added than in previous scenarios.

Do you think oil prices below 90/barrel will have little effect on Bakken output or do you expect that oil prices will quickly rise back to $100/barrel or so. A lot depends on what is assumed about both oil prices and transportation costs going forward. My scenario above assumes transport costs at $16/barrel ($12/barrel was used in the past) and the low oil price forecast shown in the second chart. The old price scenario assumed $100/barrel oil prices until mid 2015 with a slow rise in prices out to 2040 from there reaching 140/b in 2040.

Note that the AEO low price forecast sees oil prices falling to about $70/barrel by 2017 and then rising to only $75/barrel by 2040. That would result in a much lower Bakken Scenario than the one presented above. Likewise the High Oil Price AEO scenario would lead to a more optimistic forecast.

Chart below with EIA AEO 2014 oil price scenarios for Brent crude prices.

Dennis, WTI is $82.76 right this minute and the rail head price in North Dakota is well below that. Yes I do think that will have an effect of Bakken production. However there are 600 wells waiting to be fracked. The price of oil will not affect those. We will not see any effect of the oil price affecting production until next year.

I don’t dig into the nitty details of transportation costs like you do, I just watch what is happening. Right now the thing to watch is the number of active rigs. That will tell us more than anything else what will happen to Bakken and Eagle Ford production next year.

AEO price forecast are just a wild ass guess. My guess or your guess is every bit as good. There are two things that affect the price of oil. Supply is one and demand is the other. But many things affect the price and even more things affect demand. If I could pick the price of oil six months or a year down the road I would be a millionaire many times over. It simply cannot be done.

Just look at your chart of the EIA’s prediction. They are saying “We haven’t a clue where the price of oil will be but our guess is that it will be somewhere between $70 and $190.”

Yeah right.

Hi Ron,

If drilling stops, and the 600 wells waiting to be fracked are completed from Sept to Dec at 150 wells per month, then that fits my scenario exactly, you could be right about the next few months because of wells already drilled, there may be a shift of resources (completion crews etc) to Texas to work in the Eagle Ford and Permian basin, the transport costs may be a problem. I cannot seem to find good data on recent rail costs

“I also assumed the fall in oil prices since mid 2014 will result in a fall in the drilling rate in the ND Bakken/Three Forks to 150 new wells per month by Oct 2014 and remain at that average until June 2016”

220 new wells only got 18K bpd growth this August in the middle of summer. 150 will still grow? Of course, the number of new wells reported is completely unreliable per the Lynn Helms disclaimer, so why use it?

“oil prices are unpredictable, long term output from Bakken wells using current completion techniques is unknown, transport costs will change over time, future well costs may rise or fall. This scenario is simply a best guess ”

blink

“based on the well data we have at present and on the assumptions for future drilling rates, oil prices, transport costs, tax rates, OPEX, financial costs ($3.50/barrel), and a 7% real discount rate.”

So if the entire list is completely wrong, but wrong in alternating ways and alternating directions so that actual output matches the model precisely, what will you conclude?

Here is a ‘blast form the past…not too old, but not current.

Site with some interesting information about Alaskan oil.

http://www.oilempire.us/alaska.html

Does anyone know where a site is with current Alaskan oil production data?

You can get data straight from the state itself

http://dog.dnr.alaska.gov/index.htm

http://doa.alaska.gov/ogc/

The first link has links to pages explaining what the state is trying to do to reverse the decline in oil production.

More magic thinking… Tax bad, oil good, so tax cuts will put oil under the ground.

Ridiculous. Republican pretending that they can outsmart specialized industry at their own game?

Alaska is done because there is no more good oil, not because you don’t give enough tax shelters

Regex, Thanks!

This chart is informative (only goes through 2012, but the Gov’s chart you psoted shows projections).:

http://doa.alaska.gov/ogc/ActivityCharts/Production/130306HistoricalProd1960-2012.pdf

I think that tinkering with taxes will, at best, perhaps slightly slow the production decline.

Since NPR-A is apparently snake eyes for oil in place, that leaves ANWR and offshore Arctic ocean.

I wouldn’t bet too much on either of those prospects.

If we were smart, we would build one or more NG pipelines, pipe it to the lower 48, and displace coal and the most unsafe nuke plants and pump the rest into existing reservoirs that are able to hold it in the lower 48 for future use. But, that would require us (government, most assuredly) to reverse the normal order of things (extracting and using the easiest-to-use resources first) and go extract as much of the most far-flung, expensive resources now, bank what we can’t use in the ground nearby as possible to future consumption, and ‘work our way from the outside in’. This would require substantial government subsides, price floors, and let’s just say it, directing the market with a grand plan. Such a plan may buy us a little more time (to figure something out to mitigate the inevitable FF decline (Nick G’s evangelicalism comes to mind here…again, led/forced by the government for the greater long-term good)…or to party a little longer, who knows…).

Alas, humans are not Vulcans, thus we will do no such rational thing. Of course, if Humans were more Vulcan, we would not have 7.2B humans with the apogee in-progress to go much higher…

Along these lines, we (the U.S.) should have bought all the ME and other oil we could as quickly as possible, used what we needed (it would have been logical to greatly increase efficiencies and minimize that use) and pump all the rest back in the great depleted CONUS oilfields (if they could take it and hold it) and then when the ROW turns the depletion/production corner and heads South, we would have had our nest egg to take us further and further adjust to the new reality…again, working from ‘the outside in’. In that alternative timeline case (Plan: milk the world dry, bank the excess here, massive reduction in our usage), we might not have needed to start to go DW GOM and large-scale fracing for another 15-20 years. By then, if we were Vulcans, we would have robustly built out solar PV, solar thermal and wind generations, both large-scale and widespread distributed point-of-use.

OK, now I have woken up back on Earth…barrel ling along, all thrust, no vector…

Well, wait a minute. Before we go celebrating how Geology bats last and is all powerful, let’s note that a few inches up the thread is a layout of what wells in the Bakken don’t get drilled if the price is too low.

If there’s nothing there, you can’t put it there with dollars. But if there are small bubbles there that are “uneconomic”, government can make them economic with subsidies. And it will.

It has never made sense to me to use up US oil if we can buy it cheaper elsewhere. Deplete another country’s oil first, before we use up our own. Seemed like the best security plan was to keep our own oil as long as possible.

The problem is that you have to do two impossible things:

1) Tell the voters that oil is finite, and that it will cost more in the future, so we should con all of the Saudi’s oil out of them at a low cost before using our own (and keeping all 300 million citizens on their honour not to tell the Saudis)

2) tell the landowners and oil drillers to sit on their hands for 30 or 40 years.

-Lloyd

Most countries don’t have private mineral rights, so for most countries item 2 is not an impediment to saving it for the grandkids. They don’t vote either, so there’s really nothing to stop the truly major producers from just fueling themselves.

And deplete our coffers by importing it.

This kind of beggar-your-neighbor thinking is not the way forward. At the end of the day, we’re all in this together.

The best security plan is to dramatically reduce our reliance on oil.

Oil is expensive, dirty and risky.

I have a question that I am sure has been answered somewhere already, but I’m not sure if I have seen it or where to look.

So a well costs a certain amount of money to drill. The driller borrows the money and plans to pay it back. Most of the oil comes in the first year, but the driller is probably stretching out payment over a number of years. If the driller hasn’t made enough money in the first year to repay most of the debt, wouldn’t it be evident within the first year that there won’t be enough money coming in the future to repay the debt?

People talk about a breakeven price of oil, but once the debt has been incurred, does it make much difference after the first year what the oil sells for? If the debt can’t be covered with first year sales, will it ever be covered?

Is it all a Ponzi scheme where the only way current debt is covered is by taking on more debt or selling stock to cover debt? And then when no new loans can be had, no more stock can be sold, and no buyers can be found for assets, the company goes bankrupt?

If MOST of the debt can be repaid the first year the well owner should be ok financially. Just how much is a question mark but if two thirds is paid off in the first twelve months the second and third year production combined might cover enough of the last third to get it down to a level that can be repaid out of the low production from the fourth year on out.

Everything is a question mark- the average price during the time under consideration, the production of the well in question, the use to which the well owner puts the money, the interest rate.

I believe in an economic contraction coming in my lifetime bad enough to call it a collapse but I don’t think this will happen within the next few years. The price of oil will go back up to a hundred plus in my opinion within a year or a little longer and continue to rise slowly on average.

Countries such as the US can successfully adapt to SLOWLY rising oil prices. Developing countries may have a harder time as poor economic conditions interfere with their earning the money to pay for oil by selling exported finished goods.

There was a discussion last Ronpost.

If it’s small fry, they’ll just service the loan and not repay it. Carry the debt, fund only the interest. Drain the cash. Declare bankruptcy. Screw the lender.

Form a new LLC and approach new lenders for next time. It would be VERY interesting to see stats on bankruptcies in those 4 counties.

“Good post, Ron.” I second that Wes!

Watch the McKenzie 140ish bpd per well, which is increasing. The only one, and the biggest county.

When that one is not drilled anymore (permits peaking?), and when the bpd per well peaks… and goes down.

Then the McKenzie county oil production peaks, Bakken peaks, ND peaks… should I go on?

Certainly this data is mindblowing! many thanks.

S

Farmer’s are receiving $1.78 for their 2014 corn crop at the elevator. 1988 prices on the CBOT. Prices fluctuate with supply and demand. Farmer’s always find a way to wallow through the economic muck, come what may, if they starve, it’s their own fault. That’s the way it goes moving west. Moonshiner’s can make more moonshine at low corn prices. Without the demand, no use for the supply. Always somebody out there wanting some moonshine, so there is job security. Everybody can use a break now and then, a mason jar full of moonshine can do it, those liquids fill the void. Supply and Demand.

Seems to me oil still flowed from the Williston Basin before the Bakken was ‘discovered’, drilled until hell won’t have it, the pre-drilling frenzy oil was sold and shipped to somewhere other than where it was. Somebody was a willing buyer and me thinks that the future will have even more willing buyers of oil from the Williston Basin. The oil supply before 2006 was there and it sold back then long before the Bakken ramped up to ludicrous speed and has now gone plaid.

Oil was discovered in the Williston Basin in 1929, the commercial development didn’t take place until the Iverson well was drilled in 1951 near Tioga. That would be the first oil well completed to obtain oil for someone else to use.

http://aoghs.org/editors-picks/north-dakota-williston-basin/

Demand only increases while the supply is depleted and less is available, enter the dollar value, metering, loading, shipping, refining, use of the refined products to fly airplanes, power train engines, fuel power plants, and to fuel those pesky cars crawling along no matter where you go, and voila, a post-modern civilization that doesn’t know if it is afoot or horseback at times.

Demand will rule the game until the supply is gone. That would be when you drive up to the gas pump and there is no more, it’s gone. Doesn’t matter if you have electricity to power the pump, there is no gas… at all. All gone, none there. Either you walk or ride a bike or rope a horse to ride or wait for some more gas to be trucked in to the station, but it doesn’t get there… ever.

You have to keep drilling for more oil all of the time and a continuous motion rig is what you need for every drill site out there. Might as well go robotic, 75 million barrels per day is not enough supply and the demand is not going to go away, so there better be some oil supply available. If the inventories pile high for a month or so, the price will fall, some. Demand demands it.

If the demand is not met, all hell is going to break loose.

You’re between a rock and a hard place, a Catch 22, damned if you do and damned if you don’t.

Don’t ask me why I used the possessive for farmers and moonshiners, it’s early, mistakes are made.

Oil rig counts fall along with prices

Oil rigs tumbled by 19 to 1,590, the lowest total in six weeks and the biggest weekly decline since Aug. 22, Baker Hughes Inc. said Friday in its weekly report. The tally dropped in almost every major U.S. oil play. The Mississippian in Kansas lost the most, falling by seven to 71. Texas’ Eagle Ford, where drillers are yielding more crude per rig than any other region, lost five to 197.

U.S. benchmark West Texas Intermediate crude has fallen more than $14 a barrel in the three months ended Sept. 30, the biggest quarterly decline since June 2012. The slide threatens to slow a drilling boom that has propelled domestic output to the highest level in 29 years, cut retail gasoline prices by more than 50 cents since April and helped the nation meet 84 percent of its energy demand last year…

Overall, the weekly rig count lost 12 units this week, to 1,918. While oil rigs fell, gas-directed rigs were up eight to 328, Baker Hughes said.

If total US rigs were down 12 but gas rigs were up by 8 that means oil rigs were down 20.

http://www.vox.com/2014/10/18/6995441/map-greatest-threat-country

I provide the foregoing link simply because it’s interesting to see what concerns folks (from a narrow selection of options of course) across the world. It’s markedly different from place to place.

What I found particularly noteworthy is how very few people are very concerned about the environment and pollution except for in China (where they literally can’t breathe the air).

I think the environment is in for a tough time given what I see in this report. Perhaps my pessimism is misplaced, but the facts (such as they are) don’t seem to contradict me.

Religious & ethnic hatred and inequality are running first and second. Both are considered very important with pollution & environment coming in last. Which only proves that most people haven’t a clue.

Anyone notice this?

http://hisz.rsoe.hu/alertmap/site/index.php?pageid=event_desc&edis_id=ED-20141019-45699-USA

Ron, nice work!

I just put up the post

World Crude Oil Production and the Oil Price

It is an updated and expanded post on sources for “expensive” crude oil and oil price formation.

Rune, great post. You are a man after my own heart. I keep telling people that the economy is a very large part of the equation.

I will continue to pound the message that oil prices are also subject to the reality of;

“Demand is what the consumers can pay for!”…

Any forecasts of oil (and gas) demand/supplies and oil price trajectories are NOT very helpful if they do not incorporate forecasts for changes to total global credit/debt, interest rates and developments to consumers’/societies’ affordability.

We peak oilers are forever talking about economists that do not include the availability and costs of energy in their equations. That is really a stupid mistake that most economists make. But what is just as stupid is for peak oilers to not include the economy in their equations. The price of oil will not rise above what people can afford to pay regardless of how little oil is produced. And the price will not drop below the cost of production…. well not for very long anyway.

The price of oil has already risen far above what people can pay. So, they don’t -they just shuffle that payment down the road to the next generations, and go on with their party.

Too bad. That price is real, and somebody is gonna really pay it.

” A sin is that which our grandchildren will regret that we did.”

There are better and cheaper alternatives. They don’t get enough publicity.

The average US car gets 22MPG. The average new car is $31k. You can buy a Leaf for $21k, and never buy fuel again.

Some battery replacement numbers for the Leaf:

http://green.autoblog.com/2014/06/27/nissan-leaf-replacement-battery-costs-5500/

Based on Edmunds numbers, the monthly direct operating costs for a Leaf are about $100 per month (energy, maintenance and repairs) over a five year period and 75,000 miles:

http://www.edmunds.com/nissan/leaf/2014/tco.html?style=200674102

Monthly direct operating costs (fuel, maintenance and repairs) for a Toyota Corolla over a five year period and 75,000 miles would be about $200 per month:

http://www.edmunds.com/toyota/corolla/2014/tco.html?style=200487333

What’s it look like at 10 yrs? Five is probably approaching new battery territory.

Still way better. Simple arithmetic.

I have had corollas since I gave up my vw bug. Last one sold at 25 yrs. Good as far as they went. Did all the maintenance.

Had Leaf one yr so far. Owner’s instruction is a joke compared to what the corrolla took. Check brake fluid, watch tires, 12 v battery is about it.

Only gripe- way too many frills I don’t want and would not pay for if a choice. Instrument panel a confusing mess. Somebody oughta be tarred and feathered for that one.

Prediction- when the news soaks in, big parade toward electric cars and the PV to feed them.

Hi Watcher,

It may be very different for the Leaf, but for the Toyota Prius, battery replacement is not much of an issue. My 2004 Prius has 165k and has never had any battery problems and has been very reliable in general. The system is designed to keep the state of charge between 20% and 80% on the Prius, my guess is that the Leaf is designed to charge only to 90% of capacity and tell the driver they are out of juice at a 10 or 15% state of charge.

As long as a Leaf owner does not routinely run their battery down to zero, the battery will likely go for 150k or 10 years before needing replacement.

The standard criteria for end of battery life is the point of 20-30% loss of battery capacity. I suspect almost all owners will look at a 10-15 year old car, and decide not to replace the battery.

As a practical matter, the Leaf battery will typically last the life of the car.

I would second that comment. We have had our Leaf for 3+ years, and battery still going strong. It could lose 60% and still be good for driving to work and most shopping — so, just live with it and don’t replace the battery.

Most people only need one car with range for their longest trips.

We can expect battery cost to come down over time. $5500 is a lot lower than people used to estimate for a Leaf battery.

Jeffrey,

I have to admit I’m puzzled by Edmunds.com’s costs.

They estimate that the Leaf will cost $3k in maintenance and repairs, about 85% of the Corolla’s. How do they get that? A Leaf will have much lower routine maintenance: brakes will last 3x as long, for instance.

OTOH, they suggest that the Corolla will cost more to insure – that seems odd.

Finally, the depreciation cost for the Leaf for the 1st 5 years is skewed by the tax credit.