A post by Ovi at peakoilbarrel.

Below are a number of oil (C + C ) production charts for Non-OPEC countries created from data provided by the EIAʼs International Energy Statistics and updated to April 2021. Information from other sources such as OPEC, the STEO and country specific sites such as Russia, Norway and China is used to provide a short term outlook for future output and direction for a few countries and the world.

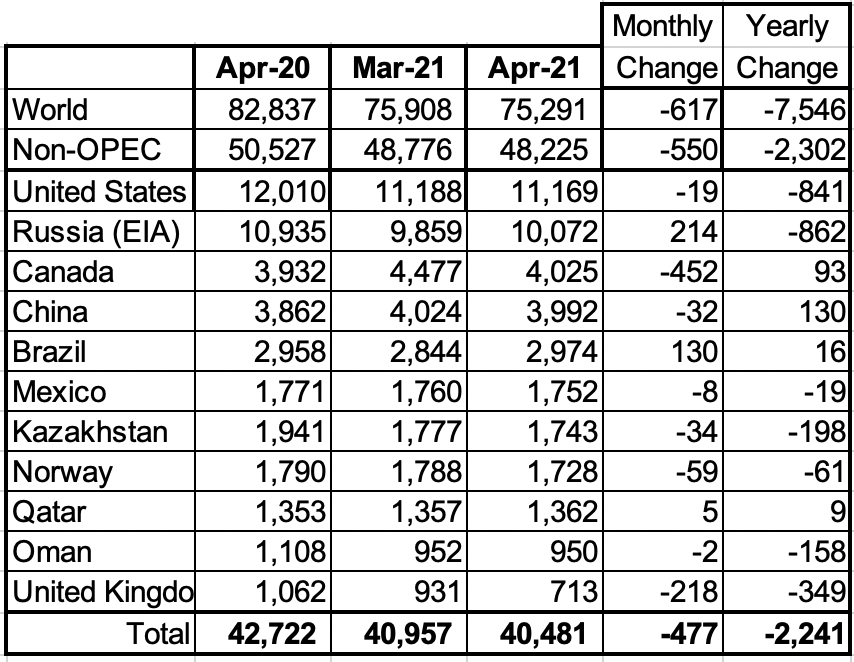

April Non-OPEC production dropped by 550 kb/d to 48,225 kb/d. The biggest contributors to the decrease were Canada, 452 kb/d and the UK, 218 kb/d.

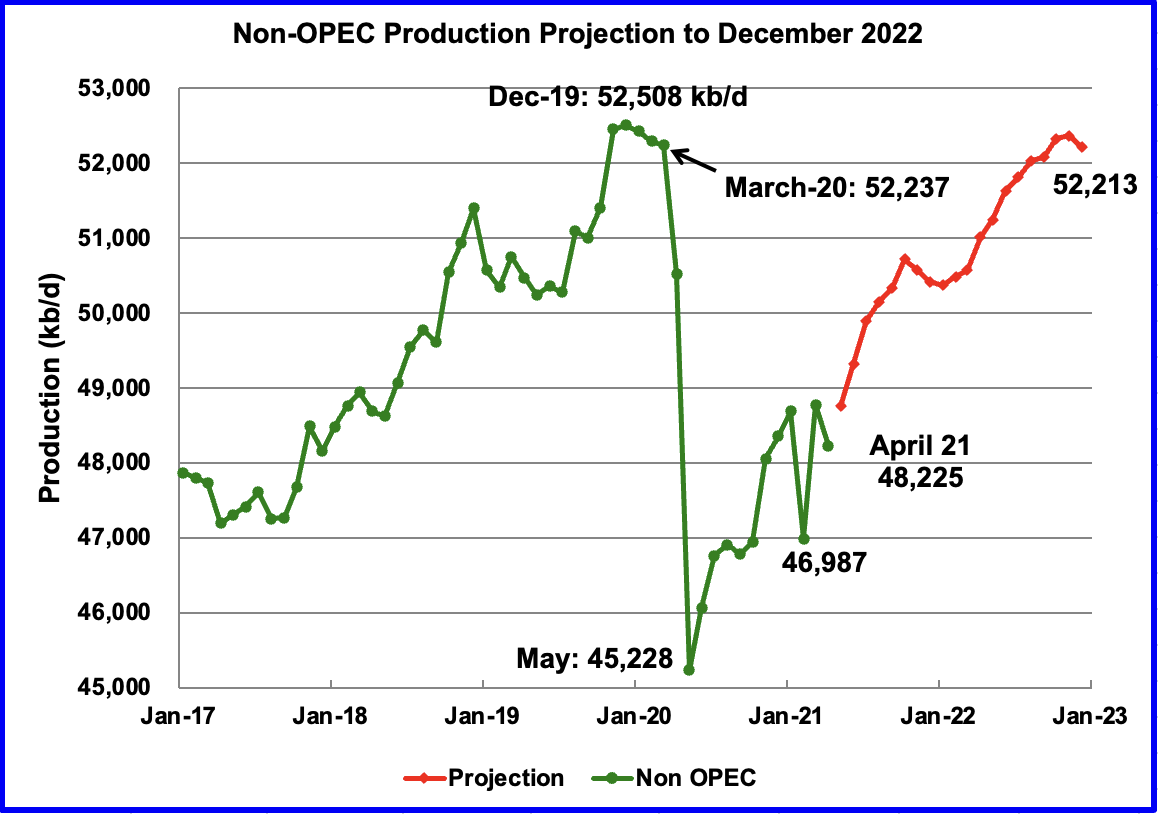

Using data from the August 2021 STEO, a projection for Non-OPEC oil output was made for the time period May 2021 to December 2022 (red graph).

Output is expected to reach 52,213 kb/d in December 2022, which is lower than the previous high of December 2019, by slightly less than 300 kb/d. In the August report, the forecast December 2022 output was revised down from 52,320 by 107 kb/d to 52,213 kb/d.

Ranking Production from NON-OPEC Countries

Above are listed the worldʼs 11th largest Non-OPEC producers. The original criteria for inclusion in the table was that all of the countries produced more than 1,000 kb/d. The last two have currently fallen below 1,000 kb/d.

In April, these 11 countries produced 84% of the Non-OPEC output. On a YoY basis, Non-OPEC production decreased by 2,302 kb/d while on a MoM basis production decreased by 550 kb/d to 48,225 kb/d.

World YoY output was down by 7,546 kb/d. The big drop is a bit artificial since OPEC surged its production last April.

The EIA reported Brazilʼs April production increased by 155 kb/d to 2,974 kb/d. According to this source, June’s output decreased by 71 kb/d from April to 2,903 kb/d. (Red Markers).

According to this report: “Brazil is expected to contribute around 23% (1.3 MMb/d) of global crude oil and condensate production in 2025 from offshore projects coming onstream between 2021 and 2025, according to GlobalData.“

“The company’s report, ‘Global Offshore Upstream Development Outlook, 2021–2025’, reveals that 1.16 MMb/d of crude and condensate production in Brazil in 2025 is expected from planned projects with identified development plans, while 169,000 b/d is expected from early-stage announced projects that are undergoing conceptual studies and are expected to get approval for development.“

I get the impression that there are high hopes for Brazil’s offshore, however it still struggles to exceed Jan 2020 high of 3,168 kb/d.

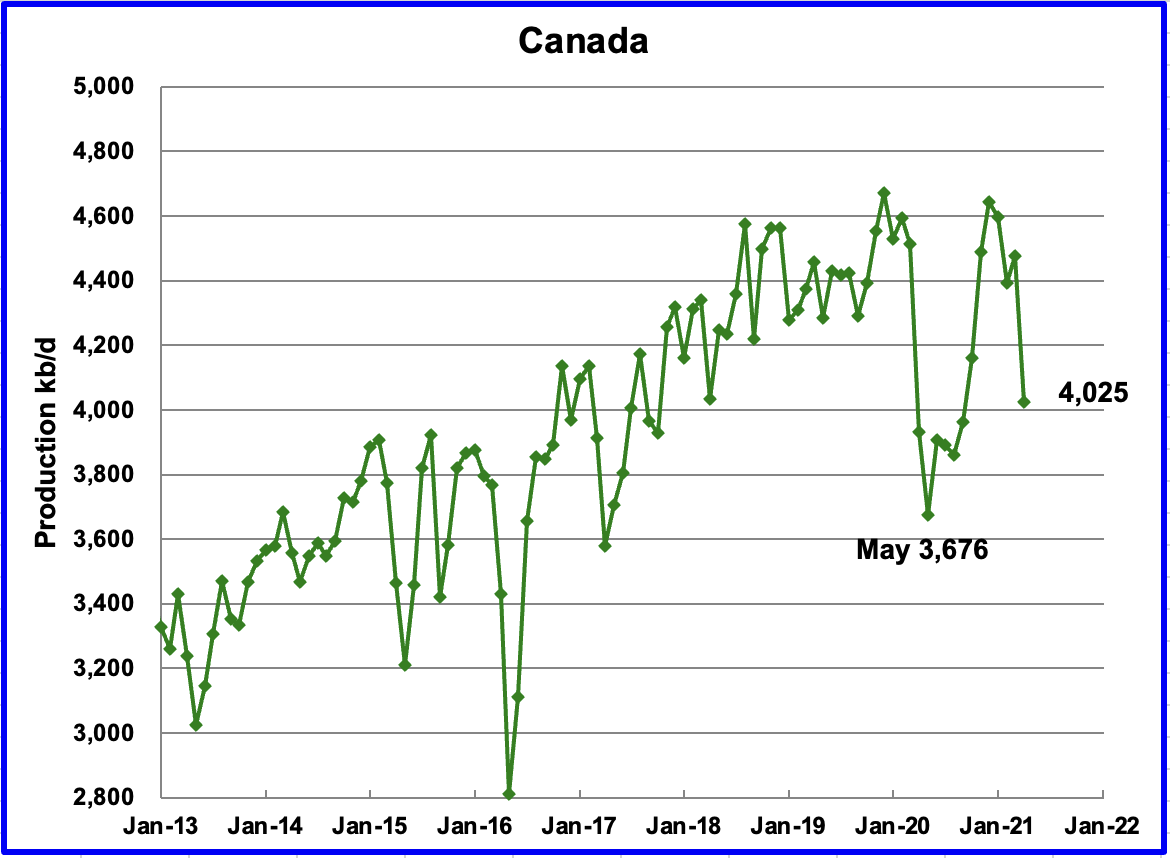

According to the EIA, April’s output decreased by 452 kb/d to 4,025 kb/d. The decrease was due to maintenance on a few oil sand upgraders.

Oil exports by rail to the US in May were 128 kb/d, little changed from April’s 129.7 kb/d.

Enbridge reported in its Q2 earnings report that progress on Line 3 continues and they expect it to be in operation in Q4.

Protests and court challenges continue against Line 3 construction according to this source. One of the claims is that Enbridge has not proven there is demand for this oil from Canada. Looks like the Biden’s administration’s call for OPEC to increase its production may throw a monkey wrench into their argument.

The EIA reported Chinaʼs April output decreased by 32 kb/d from March to 3,992 kb/d. This source reported crude output in June was 16.67 million metric tons. Using 7.3 barrels per ton, June’s output was estimated to be 4,058 kb/d, up 48 kb/d from May. China’s output has increased by 227 kb/d since December 2020.

Mexicoʼs production, as reported by the EIA in April was 1,752 kb/d. Data from Pemex shows that May production was essentially the same at 1,755 kb/d and increased in June to 1,768 kb/d. (Red markers).

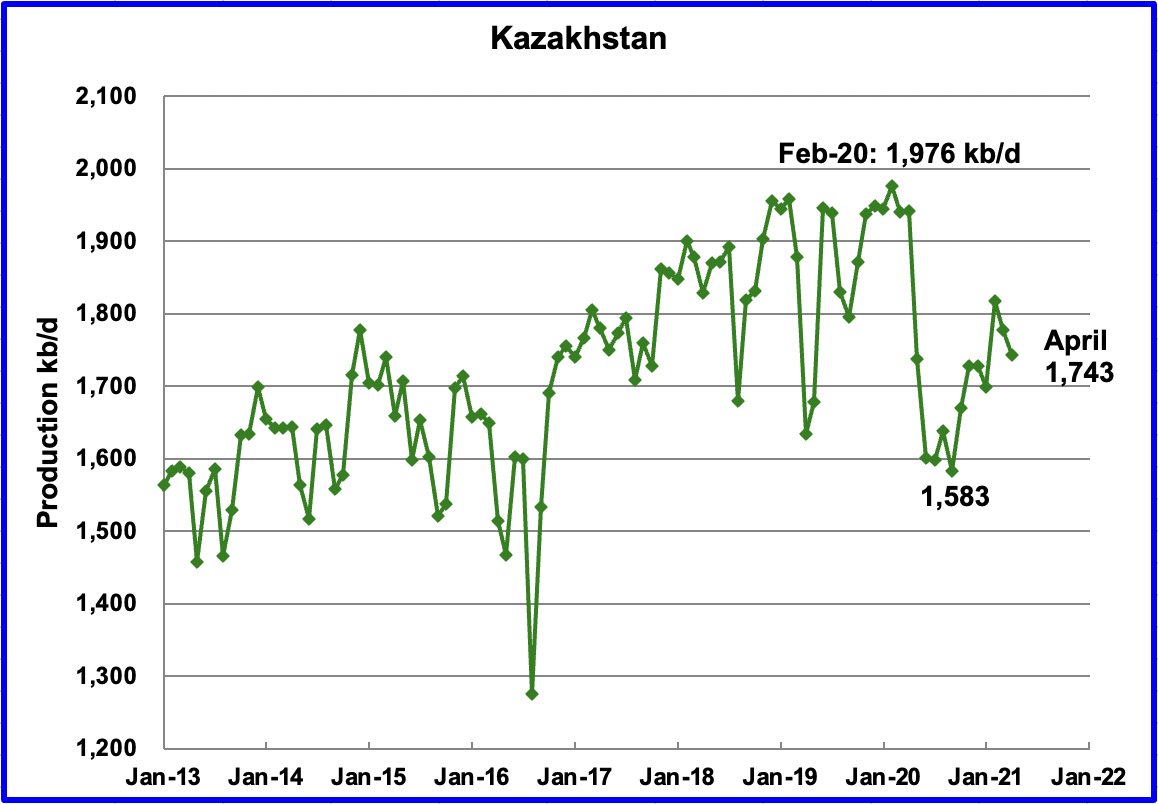

Kazakhstan’s output decreased by 34 kb/d in April to 1,743 kb/d.

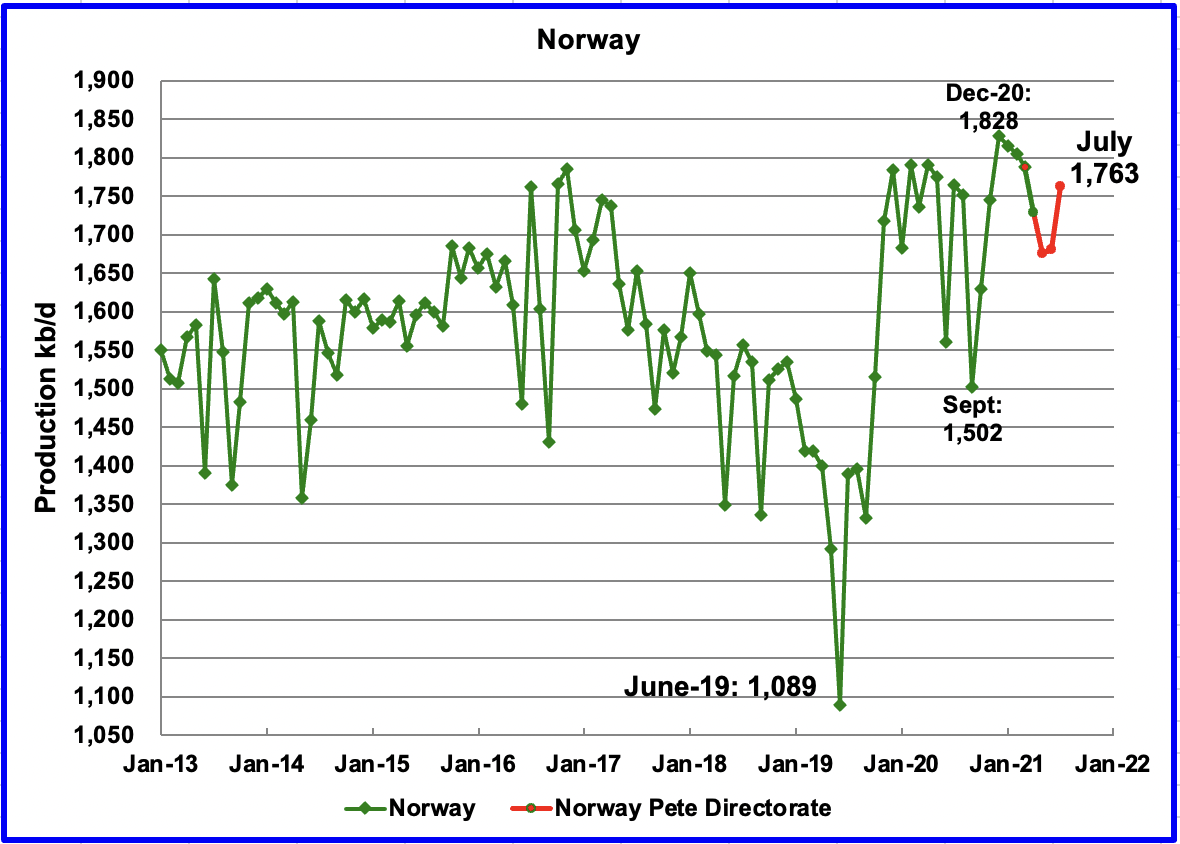

The EIA reported that Norwayʼs April production was 1,728 kb/d, a decrease of 59 kb/d from March. The Norway Petroleum Directorate (NPD) reported that production in May dropped further to 1,674 kb/d before recovering in July to 1,763 kb/d. The production drop from December is partly due to maintenance. The NPD announced earlier this year that production would increase in the second half 2021.

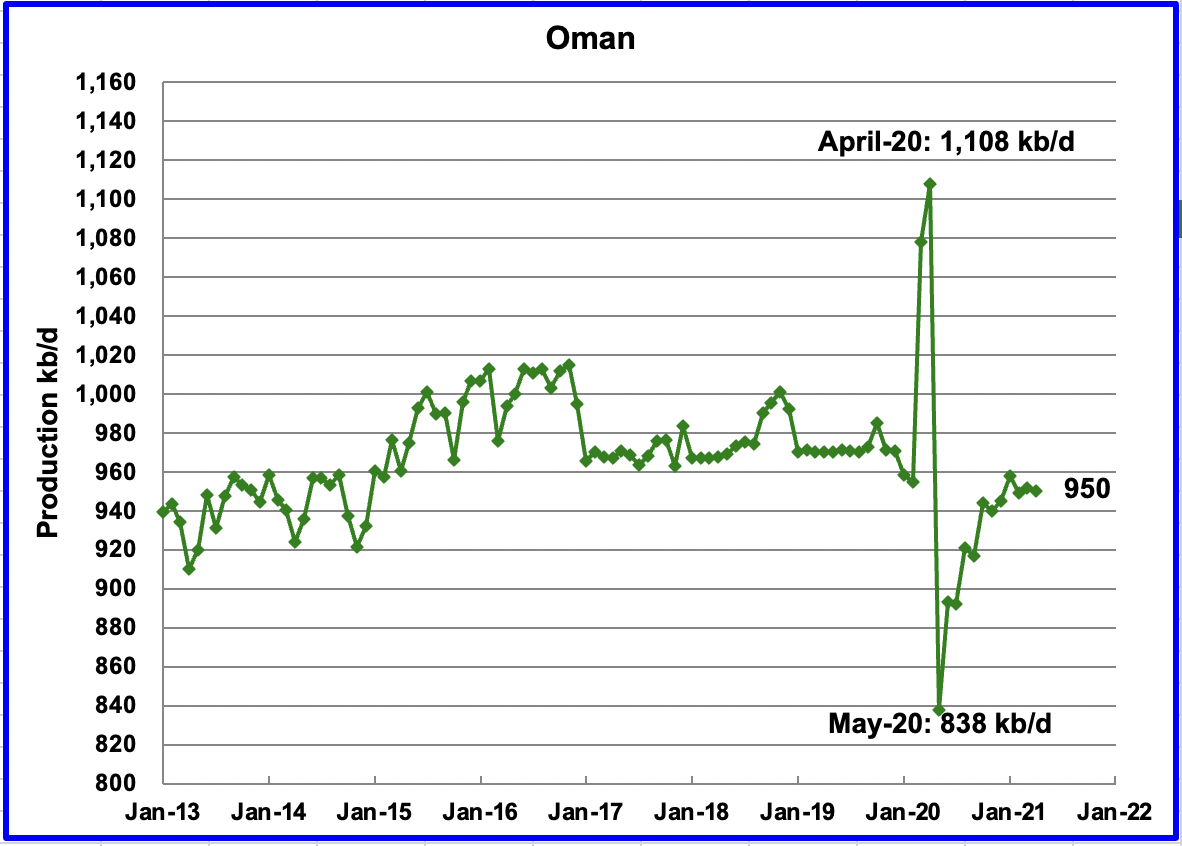

Omanʼs April production decreased by 2 kb/d to 950 kb/d.

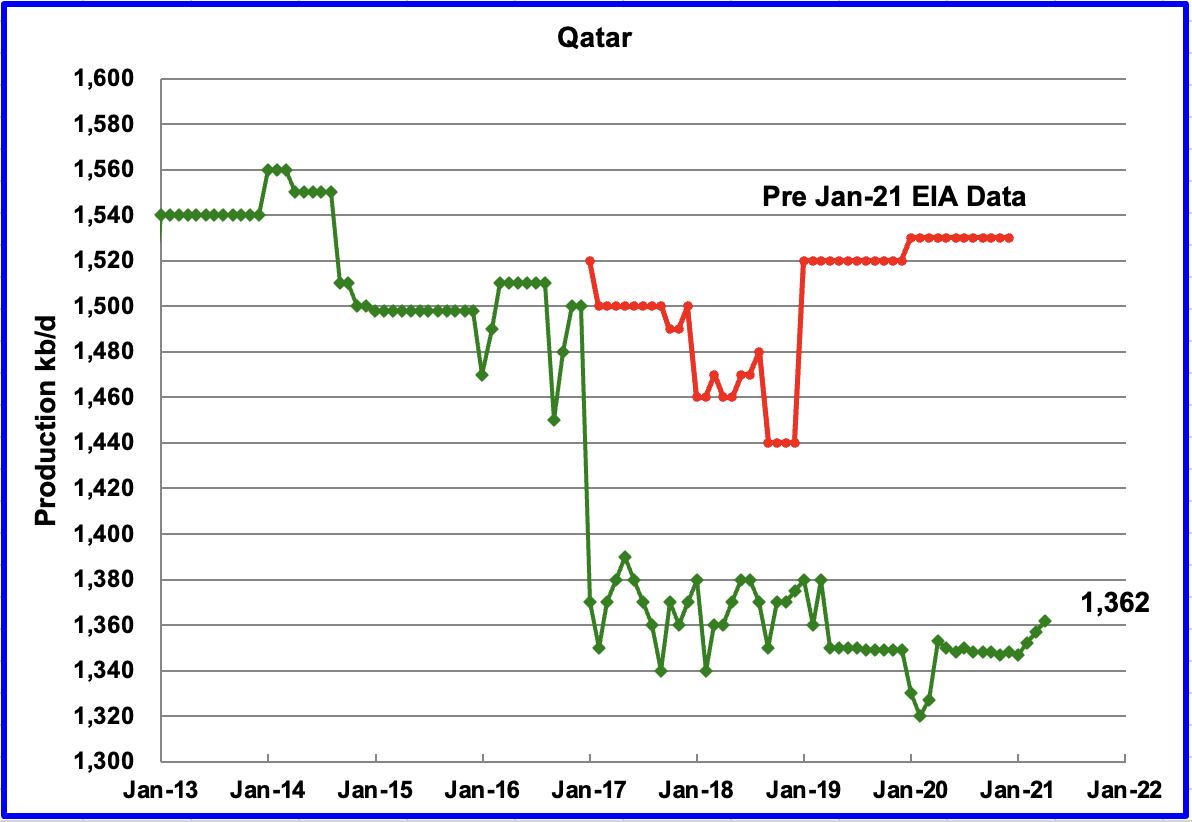

April’s output was 1,362 kb/d, up 5 kb/d from March.

Qatar’s output was drastically revised down by the EIA in its January 2021 report. The red graph represents the EIA’s earlier assessment of Qatar’s production.

The EIA reported that Russian output increased by 214 kb/d in April to 10,072 kb/d.

According to the Russian Ministry of Energy, Russian production in July was 10,461 kb/d.

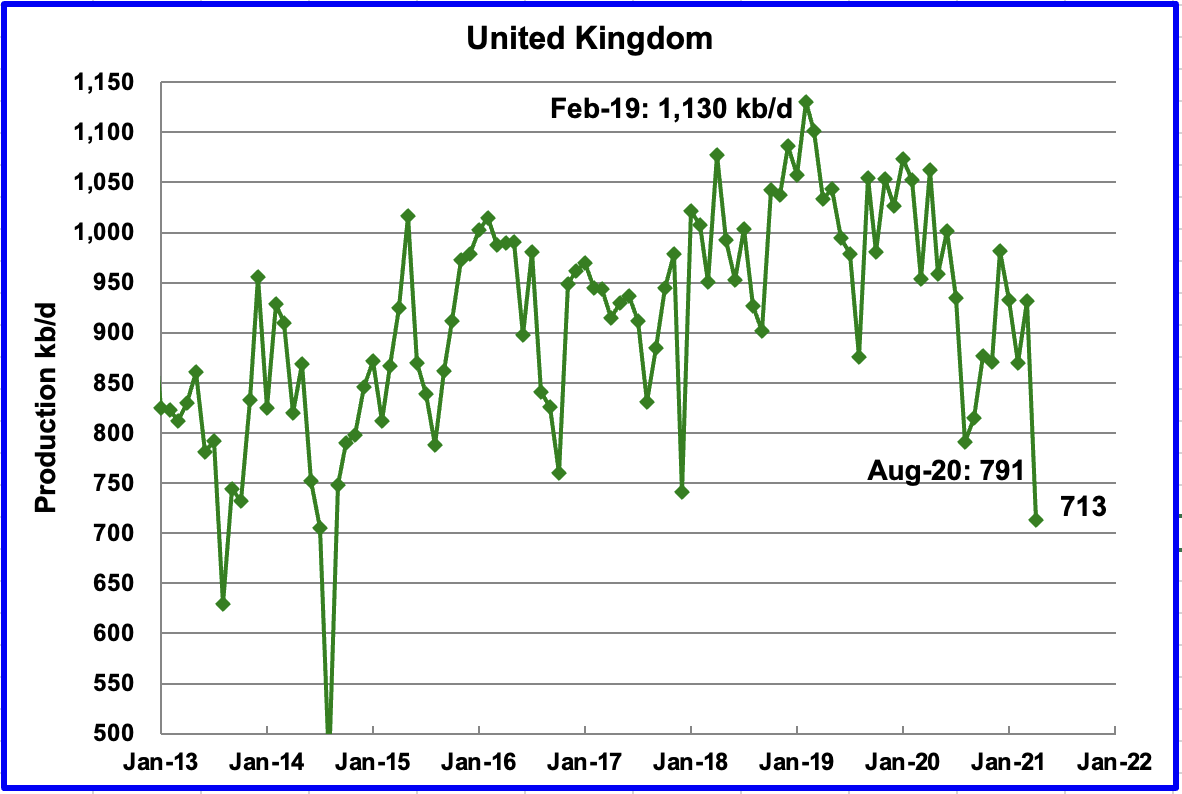

UKʼs production dropped by 218 kb/d in April to 713 kb/d, likely due to maintenance.

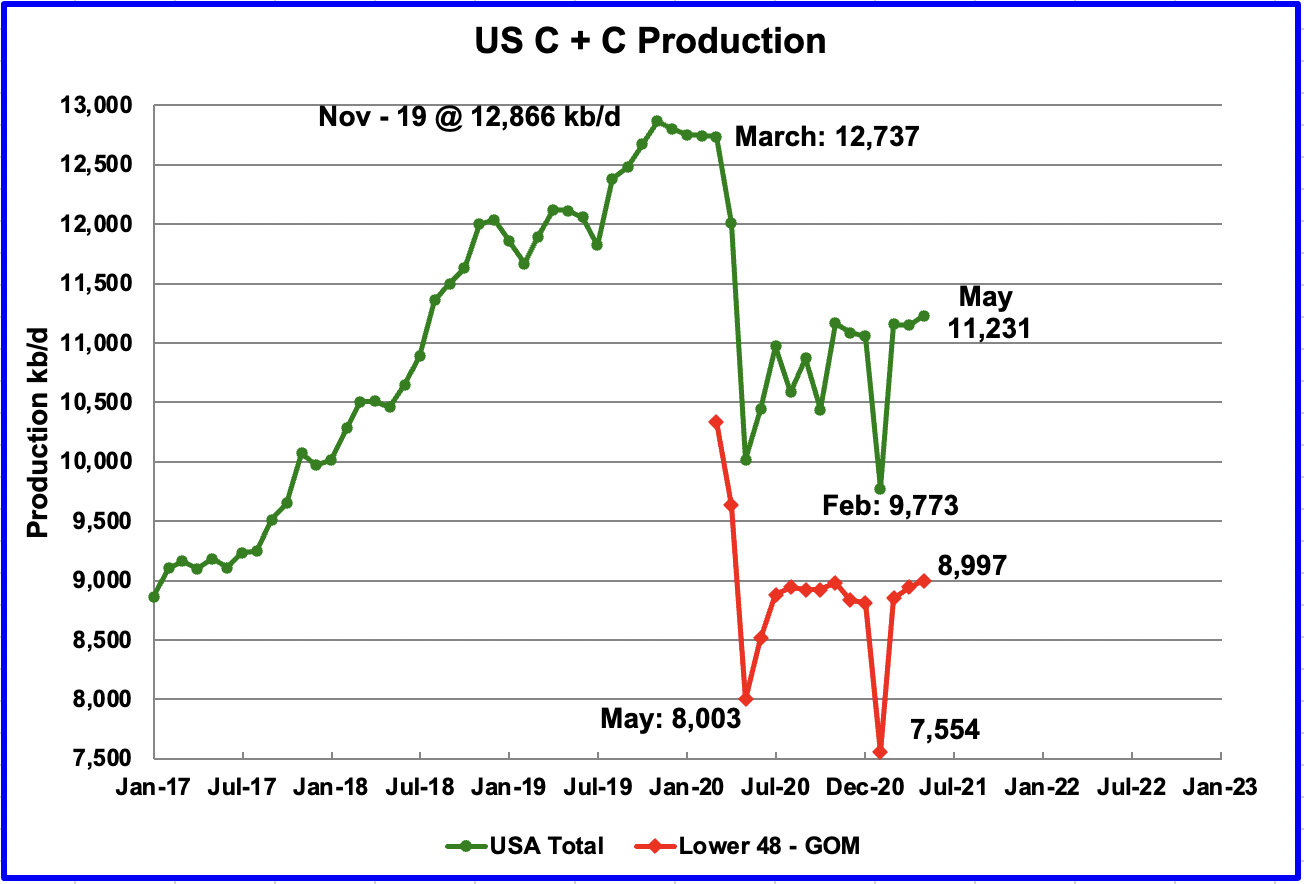

U.S. May production surprised to the upside by 80 kb/d. Production increased from 11,151 kb/d in April to 11,231 kb/d in May. It was also 175 kb/d higher than January’s. Output in the onshore L48 increased by 54 kb/d to 8,997 kb/d.

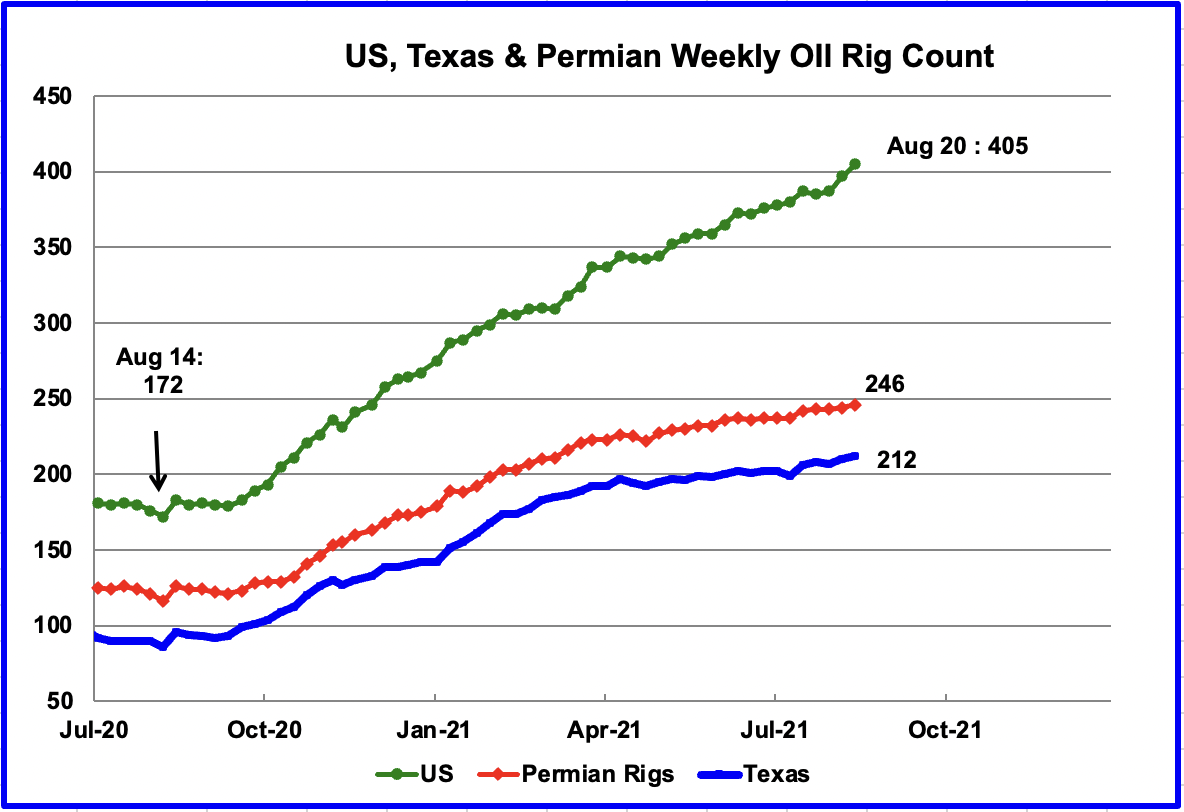

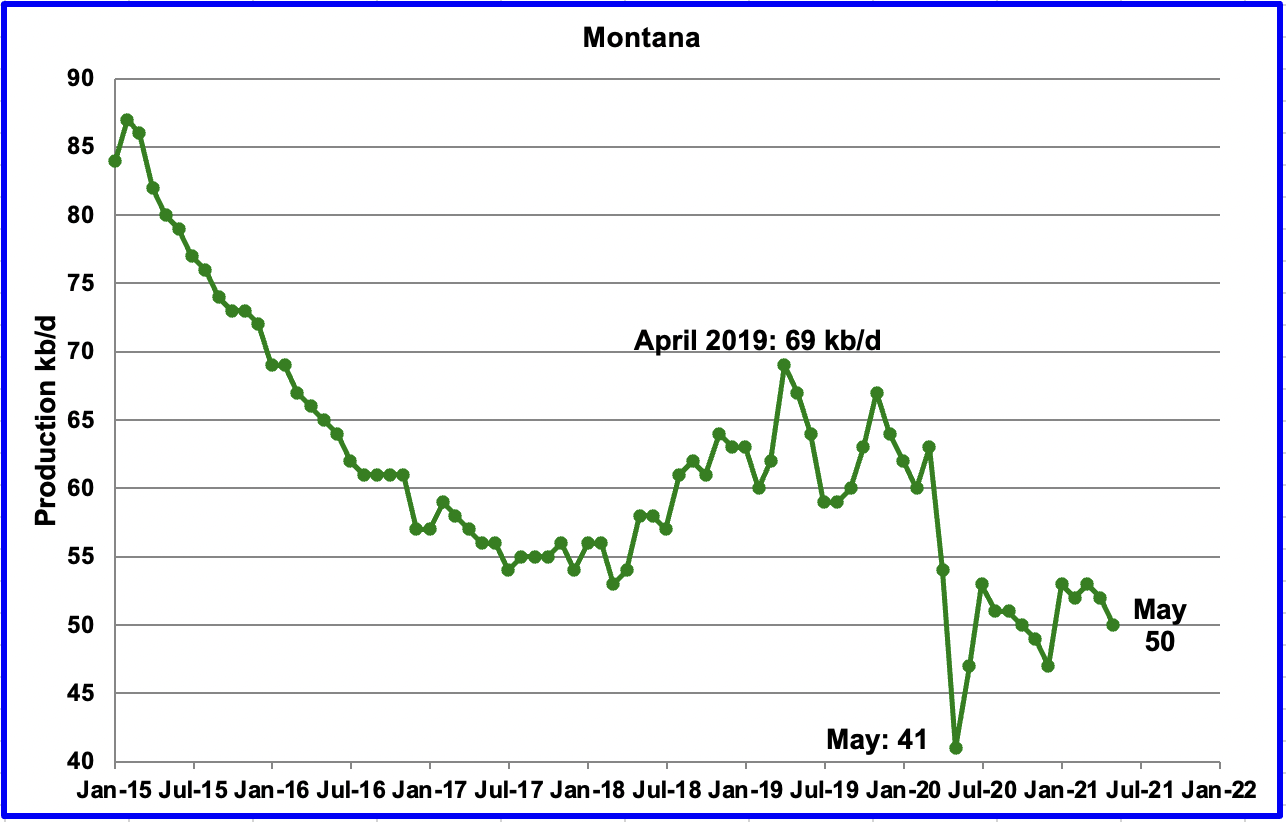

While eight oil rigs were added in the US in the week of August 19, only two rigs were added in Texas and the Permian. The two Permian rigs were equally split between Texas and New Mexico, one each. Interestingly, oil rigs have returned to Montana, 3 and Ohio 1, in the last two weeks. Below is the chart for Montana

The other big addition was 3 rigs in Louisiana in the week of August 20. The 3 could be replacements rigs for the 3 taken out three weeks ago.

Montana saw a production revival 2018 but then collapsed due to covid in 2020. May production was 50 kb/d.

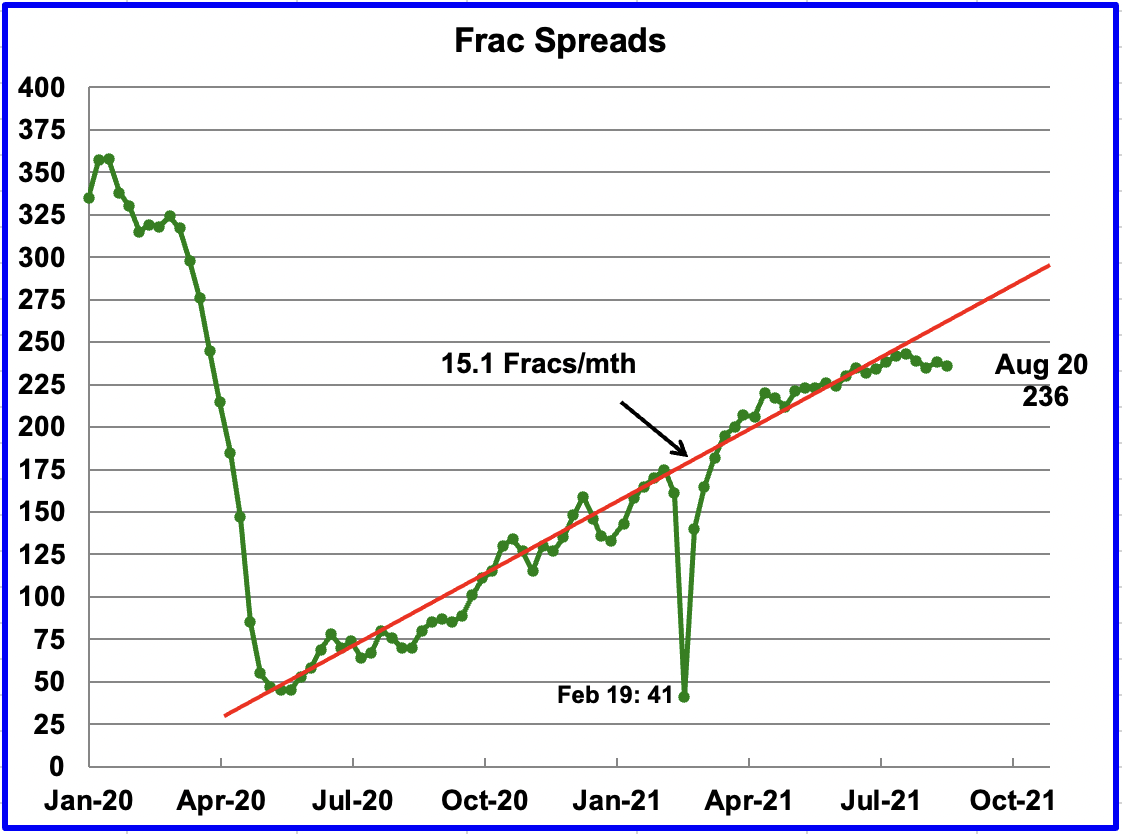

During the week of August 20, 2 frac spreads were taken out of service. The frac count has remained essentially flat since the week of June 18 at 236 spreads. Are Frac spreads starting to plateau?

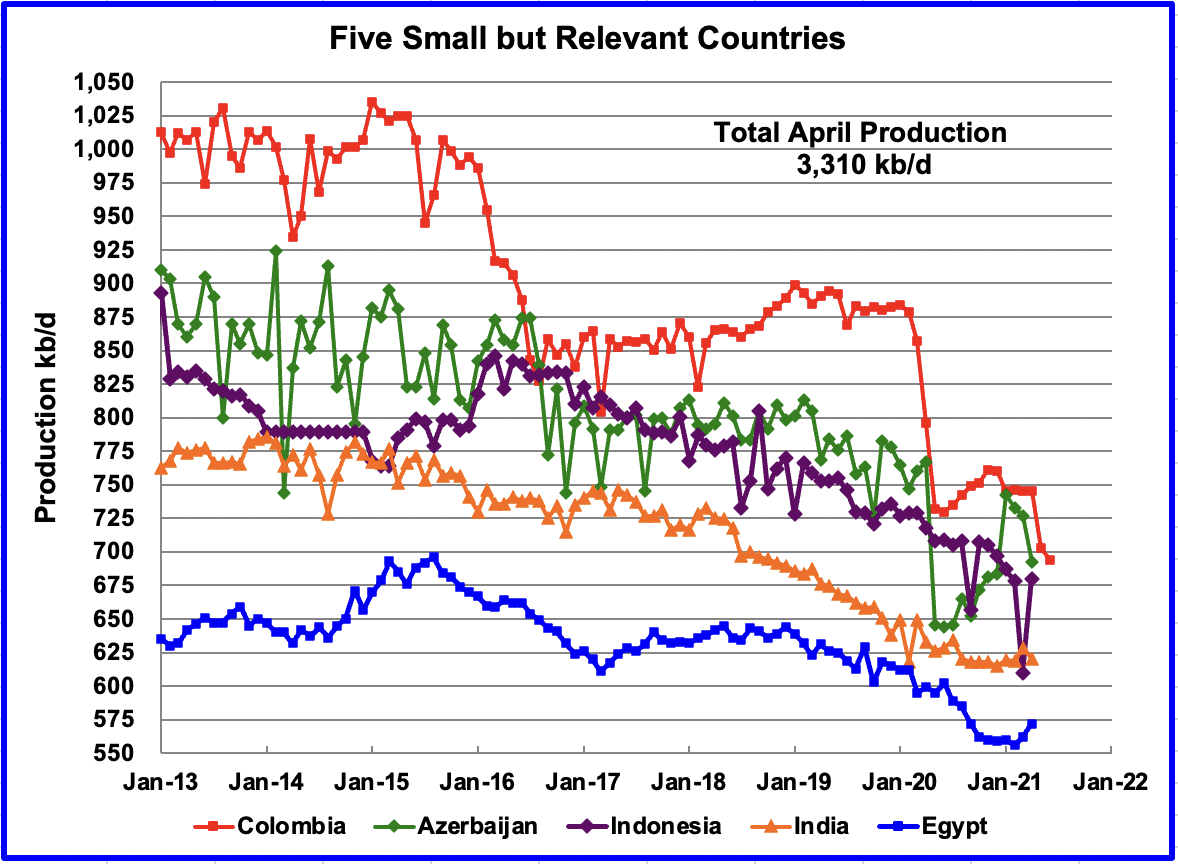

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Their combined April production was 3,310 kb/d, up by 37 kb/d from March. The April recovery is largely due to Indonesia which reversed its 68 kb/d drop in March back to its previous output level of 680 kb/d.

World Oil Production Projection

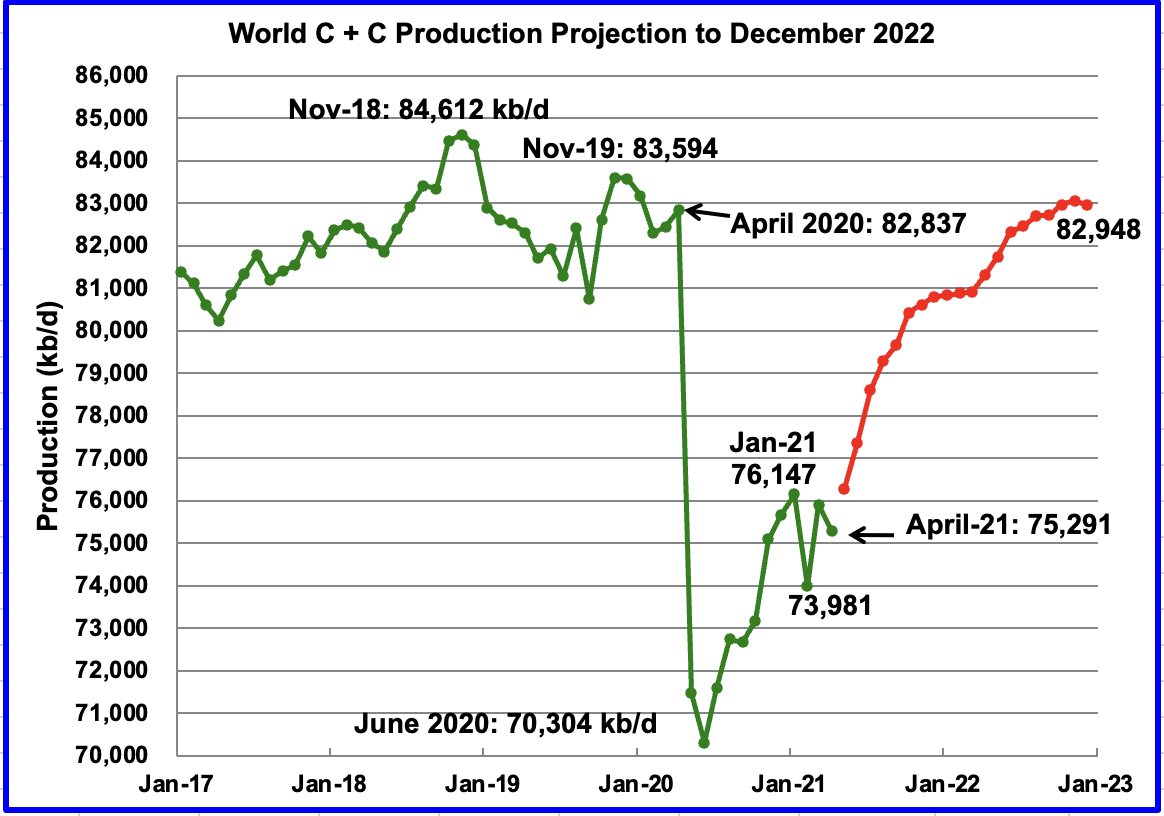

World oil production in April decreased by 617 kb/d to 75,291 kb/d according to the EIA. The biggest contributors to the decrease were Canada, 452 kb/d and the UK, 218 kb/d.

This chart also projects world production out to December 2022. It uses the August STEO report along with the International Energy Statistics to make the projection, red markers. It projects that world crude production in December 2022 will be close to 82,948 kb/d. This is 1,664 kb/d lower than the November 2018 peak of 84,612 kb/d.

Prediction: We will never see 82,948 again. Pie in the sky.

LTO survivor.

Did you mean, 84,612 kb/d?

Ovi, I am sure he meant 82,948 kb/d which is the EIA’s prediction. I agree completely with LTO Survivor. That is pie in the sky. That is not going to happen. Yes, we did see that level of production once before but we will never see that level again. That was his point.

LTO Survivor,

Do you think it likely that the 2018 12 month average will never be exceeded?

I would disagree. I would put the probability that the current maximum 12 month average World C plus C output level will be exceeded before 2030 at about 85%.

Perhaps you simply meant the EIA projection is optimistic, I would agree with that assessment.

Sorry LTO survivor,

It is pretty clear you say never again, I never say never. I would say the odds are low that you will be correct.

Also just realized I hax missed a comment where you expect flat prodution for 3 to 4 years followed by steep decline for US.

Interesting. I think higher oil prices will change things. Certainly if output is as low as you expect the market will be short of oil, that suggests higher oil prices.

The differences between an economist and a businessman are on display. An economist thinks a businessman will continue to invest in increased production if the average price is above a certain amount. But if you’ve actually run a business, you know that you don’t increase capacity based on short term price increases, no matter what the average price is. You are just thankful for the short term windfall, and keep BAU.

Stephen Hren,

The neoclassical microeconomic model is elegant, but highly simplified.

In the real world there are many factors which influence investment decisions besides price and cost and expectations of future price and costs.

If you believe I don’t understand that you are incorrect. If you read opinions of oil men on other blogs such as oil price you will find there are a variety of assessments of the future by those in the oil industry.

LTO survivor and other oil pros at peakoilbarrel might not represent the majority sentiment in the oil industry, and even if they did, sentiment will be very different if oil prices rise.

The resurgance of covid19 is creating a lot of uncertainty, eventually this will pass as a higher percentage of the World gets vaccinated, perhaps by 2023. It may be a rough ride until then.

Stephen,

LTO survivor has said in the past at $150/bo he would be willing to invest, I think he may have been exaggerating, my guess is that $100/b will change things, it certainly did for US oil output and there were not many economists funding those wells (about 84,000 horizontal oil wells were drilled in the big 4 tight oil plays from 2005 to 2021). Pretty sure it was those in the oil business.

Dennis, I agree sustained $100 oil will start to dramatically increase oil production after a year or two. It just seems to me that volatility is here to stay and getting anyone other than tight oil folks to drill more will be a major challenge worldwide for the rest of the decade.

Stephen Hren,

I agree that oil price volatility is a problem.

My expectation is that oil prices will rise to $100/b by 2023 and we will see volatilty between 90 and 120 per barrel until at least 2028, then oil prices might go higher through 2031 and after 2035 we might see a crash in oil prices as OPEC falls apart and big producers compete for a smaller market as demand wanes.

D Coyne Wrote:

“I would put the probability that the current maximum 12 month average World C plus C output level will be exceeded before 2030 at about 85%.”

That seems very improbable:

1. LTO in the US has peaked, and the majority of growth from the 2010-2020 decade was LTO. The US tapped the best LTO locations & the megadrought in the West is going to add drag to new drilling.

2. Most of the ME is running on fumes (metaphorically). They need to invest 10s of billions just to maintain current production levels & there is zero chance for growth, unless by some miracle some very huge discoveries are made (very unlikely)

3. Demand destruction is in full swing: Air travel has all but collapsed & will remain that way for the foreseeable future, the CCPV isn’t going away anytime soon if ever. Also a lot of people are now working from home, reducing the daily commute. Then there are the boomers that are retiring, & no longer traveling (ie sight seeing trips to the EU, or US). Then there is the Massive debt that is going to crush the global economy, probably starting around 2025-2027.

My best guess is we will soon see production declining between 5% & 7% annually.

That’s right Ron. While I believe there be more coming on line I don’t think the grap. The industry requires massive investment and I don’t think it’s coming. There has been such a recoil from fossil fuels that I just don’t know where the money and brains power/talent will come from to discover new reserves. Without the shale, we would have been short energy or the Worldwide economic growth would have been stunted by much higher prices. At the current price and more importantly the volatility it doesn’t make sense to reinvest. Sure there is OPEC capacity but I don’t think we all really know how much. Saudi Arabia and other OPEC countries are faced with depletion.

LTO survivor,

World real GDP Growth was 2.82%/year on average from 2010 to 2015,

2010=66.163 Trillion 2010$ and 2015=76.04 Trillion 2010$, World bank

https://data.worldbank.org/indicator/NY.GDP.MKTP.KD?end=2015&start=2010

Average Brent Price was $105.72/b (2020 $) from 2010 to 2015.

People claim that things are different now and that is true. For example in 2019 World real GDP had increased to 84.97 trillion dollars (2020 $) and then fell to 81.91 trillion (2010 $) in 2020.

If we assume World real GDP eventually returns to the 2019 level or higher (likely in 2022) and that World output of crude returns to the 2019 level in 2022, and also assume consumption is roughly equal to output, then the percentage of World GDP spent on crude was 3.47% in 2015 and would be 3.18% in 2022 if Brent prices were $105.72/bo in 2020$.

When we convert World real GDP to 2020$ we get 2015=$90.25 trillion in 2020$ and 2019=$100.85 triillion in 2020$.

For a similar price to 2015 in terms of percentage of World real GDP spent on crude for the assumptions i have made we would have $114/bo for Brent in 2020 $ in 2022.

My guess is that at that price investment in the oil industry will change from today’s level and if oil supply is short, it will not be long before we see prices climb. On the other hand many reputable energy bodies (IEA, EIA, OPEC, Rystad, etc, think there will be adequate supply in 2022, so we may not see oil prices climb above $75/bo until 2023, if their supply estimates are correct. My assessment of supply in 2022 is some growth, but less than EIA STEO estimates.

Scenario below is my expectation for tight oil through Dec 2022. Tight oil output increases by 780 kb/d from June 2021 to Dec 2022, about 43 kb/d on average each month.

D Coyne Wrote:

“f we assume World real GDP eventually returns to the 2019 level or higher (likely in 2022) and that World output of crude returns to the 2019 level in 2022”

It won’t:

Global Debt is about $390 T, more than 4 times global GDP. The only reason why the world hasn’t collapsed into a severe global depression is the Trillions of money printing. But at this point money printing is just creating stagflation with no growth (dimishing returns). Even in 2019, the global economy started declining, and the Fed had to increase QE in Sept\Oct 2019 just to prevent a recession. The money printing in 2020\2021 just created shortages & rising prices (mostly because people preferred to collect gov’t unemployment checks rather than work).

Boomers are also retiring and will be a burden on the economy as they stop working (paying taxes) and start drawing on entitlements & pensions. Another issue with the boomers retiring as they still make up the bulk of skilled tradesman (carpentry, plumbing, etc). as the younger generations aren’t interested in those jobs. This is going to cause high costs for construction, & maintenance, as there are fewer workers available.

2020 might just be the economic peak as gov’t printing trillions & handed it out to the people. Even if gov’t turn to UBI or more stimulus prices for everything will go up & not have the same impact they did in 2020, before prices really started to soar.

I don’t think the CCPV is going away. The vaccines are ineffective & just turning the vaxxed into super spreaders. The CCPV continues to mutate making it impossible to contain. Its now in about 40% of the deer population in the US. so its now able to jump between humans & other species. If it gets into the Livestock than there is going to be serious food problem as it would force beef & pork processing to completely shutdown.

Looks like Jay Hanson has been right all along.

LTO —

Correct me if I am wrong, but as I recall the whole fracking this started in an era when $100 oil had been the norm for years, and people were predicting $150 or even $200.

$100 oil did put a slight damper on demand growth, but not enough to actually cause the industry to shrink. And if prices had stayed that high, fracking would have been profitable.

Everyone thinks he knows when and why prices go up and down, but ten years ago nobody was talking about prices falling below $100 dollars. Furthermore considering that Europeans routinely pay $6.50 a gallon to fill the tank, I don’t really see why $100 oil should reduce demand all that much.

The average European uses about 18% as much fuel: very roughly 60% as many cars per capita, 60% as much fuel per km, and 60% as many km per vehicle per year.

High prices have a very strong impact.

Alimbiquated wrote:

“$100 oil did put a slight damper on demand growth, but not enough to actually cause the industry to shrink. And if prices had stayed that high, fracking would have been profitable.”

That was in the beginning of the debt super cycle, when gov’t turned to money printing. Issue is that the money printing didn’t stimulate job growth. If you look at the Labor participation rate, it just keep on falling. Higher prices will accelerate job losses (ie demand destruction).

https://fred.stlouisfed.org/series/CIVPART

Less people working means less consumption. Plus the west is diving head first into the climate change agenda. in the US California has banned non EV cars after 2035 & so did the EU. The US may be exiting the ME, which will make security in the region more chaotic. Most of the ME, including KSA are scrambling to work with Russia or China for agreements for Weapons or other equipment & services previous provided by the US:

https://www.rferl.org/a/saudi-russia-arms-weapons-/31425164.html

https://asia.nikkei.com/Politics/International-relations/China-bolsters-ties-with-UAE-a-traditional-US-ally-in-Middle-East

I suspect we will see soon global production declines by about 5% to 7%, due to a combination of demand destruction & rising production costs. Oil prices cannot rise significantly in an economy with ongoing demand destruction.

As a longtime lay observer, I’m curious to know how you can be so sure. I’ve given up trying to have an opinion on the matter, the details being so complex and out of my ken.

Mike B,

Is your question addressed to LTO Survivor?

I would be interested in the answer as well as the man knows the oil industry well.

Yes, to LTO. I have great respect for him, for you, for Ron, for Mike S., all of you. I want to hear more. Lay persons are hopelessly locked out of evaluating the situation for themselves.

Geologically speaking the easy oil has been found and developed. Maybe Iran and are much less developed than their neighbors but most of the rest of the world is in decline. We added 8 million new barrels a day with the shale. This cannot be sustained. Let’s remove the shale production and how tight would this market be? The shale production fall of a cliff. Just looking at our company and the inventory is shrinking quickly and increasing production is very difficult. So what does that mean. Soon we will see a rollover of worldwide production even if all countries are producing every drop that can. Of course if the price reaches $200 per barrel the then money will return but I don’t see that in the cards either.

LTO survivor,

If there had been no tight oil, then oil prices may have continued at $110 per barrel and other reserves would have been developed. Or oil prices may have gone to 130 or higher. More people would have purchased more efficient vehicles and demand for oil would have grown more slowly, also perhaps a faster transition to hybrids plugin hybrids and evs.

There are a lot of non producing reserves in the world and lots to develop. Whether there will be capital depends on many factors, but surely higher oil prices will help both to increase supply and reduce demand.

Post-Peak Nations. As of 2019, there were 58 post-peak nations. Below is a chart that lists these 58 nations and their combined decline since 2010. Every one of these nations is in decline.

Dennis thinks it is silly to list Venezuela as one of my declining nations because they were once one of the world’s greatest producers. Well, Venezuela is a failed state. And failed states seldom ever recover. One fine day in the far distant future, when the world has collapsed for the lack of energy, some government may take over Venezuela and produce the billions of barrels of heavy oil under the Orinoco basin. But that will not happen in my lifetime and not likely in yours. So no, they will stay on my list and in my charts.

One more note, these 58 nations have declined another 1 million barrels per day since 2019. They have recovered somewhat from their covid decline but they will likely recover no more. They will be likely down another half million barrels per day before the covid decline is over.

By 2022, there will likely be another 7 or 8 nations joining this group. And some heavy hitters just might be among them, like Russia and the USA.

Wow, that’s a decline of around 10 million barrels/day since 2010.

Note that if we looked at all the increasing nations, we would obviously see a bigger increase than if we looked at World or top 20 producers, because in those lists the decreasing nations are included. Note that a significant part of the decline is from Venezuela ( about 15% ). Currently Venezuela produces about 500 kbo/d (and I agree with Ron that they are not likely to recover in the next 10 years or perhaps ever) so Venezuela cannot have another 1532 kb/d decline over the next 10 years. Note that most of Venezuela’s decline occurred from 2015 to 2019. Also in 2018 several OPEC producers reduced output because of OPEC cuts, so excluding OPEC producers (whose declines are somewhat affected by OPEC quotas) would give a clearer picture.

Wprld output increased quite a bit from 2010 to 2019, even with the small declin in 2019 from OPEC cuts and sanctions on Venezuela and Iran.

Ron

What are your thoughts on this report?

Rystad: Russia’s oil supply set to break COVID-19 chains

The OPEC+ alliance’s agreement to steadily increase oil production is paving the way for Russia to shrug off COVID-19 curtailments. The country is expected to set a new monthly crude and condensate production record of 11.6 million b/d in July 2022, according to recent Rystad Energy analysis. Russian production will further accelerate, reaching a peak of nearly 12.2 million b/d in mid-2023.

Russia’s current monthly oil and condensate production record was set in December 2018 with 11.5 million b/d. Rystad Energy’s projections point to 2023 as another peak year with annual production expected at 12.16 million b/d. The country’s short- and medium-term production growth will be driven by Rosneft and Gazpromneft’s greenfield projects.

Russia also is expected to set new records for crude oil. Its existing monthly record of 10.7 million b/d from April 2020 will be matched by May 2022, Rystad forecast. Crude production will keep rising to a peak of 11.3 million b/d in mid-2023, before starting to decline.

“Russian production will rise from relatively new fields—fields with early production and producing fields with 25-50% depletion rates. Operators will not be able to increase production from mature fields, as it will be difficult and expensive to bring back online wells that were shut to comply with OPEC+ output cuts,” said Daria Melnik, senior analyst at Rystad.

https://www.ogj.com/drilling-production/article/14208726/rystad-russias-oil-supply-set-to-break-covid19-chains

Ovi , BS crap . They write ” The country is expected to set a new monthly crude and condensate production record of 11.6 million b/d in July 2022, according to recent Rystad Energy analysis. Russian production will further accelerate, reaching a peak of nearly 12.2 million b/d in mid-2023. ”

Ron has given so much evidence that Russia is now past peak that even my memory fades . Anyway I am having less and less respect for Rystad by the day . Example 12.2 mbpd in 2023 . Heck even the Saudi’s don’t claim this level . Put in file 13 .

P.S : File number 13 is the waste paper basket in a lawyers office .

Ovi, I don’t know what to think of that. How could Russia’s Minister of Energy and Rystad be so far apart? Also, the EIA’s Short-Term Energy Outlook also has Russia setting new records. They have Russian production increasing by 120 Kb/d in August and by 140 Kb/d in September. So we will know in about two weeks how close they were with their August prediction. From your link:

The country’s short- and medium-term production growth will be driven by Rosneft and Gazpromneft’s greenfield projects.

Rystad is counting on growth from their new fields to propel them to new heights. What I think might be the case is that Rystad is overlooking the sharp decline that apparently has just set in in Russia’s old brownfields which produce about 60% of all Russian production. But… we shall see.

The chart below is total liquids, not C+C and is in million barrels per day.

I agree Ron.

They have simply taken existing production as flat and added new production. If West Siberia is starting it’s early and steepest decline phase this increase will be wiped out.

Russia’s centered 12 month average production record for average C plus C output was 11254 kb/d in March 2019 using 7.3 bo per metric tonne, for most recent 12 months the average has been 10149 kb/d (Feb 2021 CTMA). If Russia increases output by 100 kb/d per month for 10 months they will be at 11418 kb/d and if they can maintain that level for another 12 months, that would be a new maximum output level. Perhaps they can return to their previous 12 month maximum of 11254, I do not know if they will be able to exceed that level. In 2018 Russian average annual output was 11115 kb/d, a bit under their centered 12 month maximum ( but only 140 kb/d). It will be interesting to see how it plays out, I expect a plateau at around 11000 kb/d for the 2022 to 2026 period, but that is just a WAG.

And the US filled the gap. However they will not fill the gap again. We have been lulled into false security with the shale revolution. It was a phenomenon but not a lasting one.

Colombia is missing, we’ve lost 300kbd.

I notice Ron has Columbia listed below under nations not yet peaked.

That chart was the average oil production change from 2010 to 2019. During that period Colombia was up 100 Kb/d. But after printing their chart, it looks like Colombia has definitely now joined the decliners.

HIH

I’m going to try to answer your question from last post and also try keep conversation on topic. China has the worst demographic outlook on the planet. They will surpass Japan as the fastest aging population later this decade. By the end of the century their population will shrink by over a 3rd. Peak oil hasn’t even been factored into this equation. Oil demand in China is going down in a huge way with or without a move to EV’s.

Their banking sectors is. I don’t even have a word for how bad it is. 40% of all loans on their books are non-preforming currently. But when your the CCP you control the currency inside the borders of China and you can hide the fact.

If China backed their Yuan with gold the yuan would appreciate in value. So much that the goods produced in China that keep millions of people employed would not have a market in USA or Europe.

Even if they did it. Try going to the central bank and ask to exchange the yuan you received as payment for gold. You’d get told no. Otherwise China would run out of gold in a week.

HHH, got it . Tks .

31 nations, including Iran, have not yet peaked. The chart below does not include Iran because it has declined the last few years due to sanctions.

I averaged production for all for 2010 and 2019 and then sorted them by the amount they had declined from 2010 to 2019, just as I did the decliners in the chart above. Notice that the USA has increased almost three times that of Iraq, four times that of Canada, and almost six times that of Russia. The USA has increased production by over six times the amount Iran has declined.

Also, notice the nations that increased the least. These nations will switch sides and become decliners within the next two or three years after 2019. I also believe the USA and Russia has a far better than even chance of becoming a decliner within the same time period.

For completeness there may be some minor new producers coming on line in the next few years: Uganda, Kenya, Senegal, Suriname and condensate from LNG plants in Tanzania and Mozambique but they will be minor contributors. Before the covid crash it looked very much like the first half of a logistic curve.

Thanks Ron,

So increasing nations about 18000 kbpd and decreasing nations about 10000 kbpd, eventually they will balance in 2028 or so.

That’s wishful thinking Dennis. It all depends on what the USA does. The USA has, since 2016, been the only nation keeping the peak oil wolf from the door.

Many other nations will never return to their pre-covid level of production. Even some of the big producers will not reach that level again. And the USA will be one of them.

Then there’s Russia.

2028? Dream on.

Ron,

Time will tell, for nearly every past prediction I have made (with the exception of the pandemic) real oil output has been lower than my best guess estimate, the future may be different. When I have made those predictions in the past there are many who have claimed they were wildy optimistic.

My response then was the same as now, we will see.

Ron the peak was 2018, so it is production in 2018 or the 12 months that the peak occurred where the comparisons should be made.

Top 20 producers in 2018 has ouputs listed below

(average C plus C output for 2018 in kb/d):

10964

10759

10598

4613

4343

4255

3787

3216

2862

2587

1910

1856

1852

1593

1517

1486

1367

1259

1000

978

Only 3 of these nations have higher output than 2018 in 2020, but in 2019 another 9 had higher output than 2018, some had lower output in 2019 due to sanctions (Iran) or because they cut output because they were following the OPEC agreement (Saudi Arabia, Iraq, Kuwait, Angola, and Algeria), so that is 17 out of 20 of these top 20 producers that have had higher output in 2019 or 2020, the 3 nations (of top 20 in 2018) who have had lower output than in both 2019 or 2020 compared to 2018 (and did not have sanctions or OPEC quotas limiting their output in those 2 years) were Qatar, Mexico and Venezuela.

I remain unconvinced that the largest 20 producers in the World (in 2018) will not as a group be able to exceed their 2018 level of output plus offset any decline in the rest of the World.

Note that this might not occur in 2028, that is my best guess (with a 50/50 chance it happens before or after July 2028 for the centered 12 month average of World C plus C output. It could be the peak occurs at any point between Jan 2026 and Dec 2030. It will depend on a multitude of factors such as economic conditions, transition to new technology, and the price of oil and other commodities.

Ron.

The increase is about 18000 kb/d for these increasing nations, the decrease from declining nations was about 10000 kb/d, The difference is 8000 kb/d. The US increase was 6760 kb/d.

If the US has seen a zero increase in output, World output would have increased by 1200 kb/d. See chart for World less US through 2018 annual C plus C in kb/d.

There has been a bit of discussion about “breakeven” oil price for Permian basin tight oil wells. I assume an average well cost of 10 million dollars (2020 US$) for the average Permian basin tight oil well completed in 2019. I use a nominal annual discount rate in the analysis of 30%, the real annual discount rate would be 27.5% if we assume 2.5% average inflation rate over the life of the well. I use an Arps hyperbolic fit to shaleprofile.com data for the first 17 months of production for months 18 to month 65 for the well profile, for first 17 months I use actual average well profile data as published at shaleprofile.com. A least squares fit to minimize the square of the difference between an Arps hyperbolic and the data from month 4 to month 17 is used by using solver in libre open office calc (similar to MS Excel) is used to determine best fit. Then at month 66 when annual decline rate has reached 15%, I assume exponential decline at an annual rate of 15% until the well is shut in at an output of 20 bopd at month 145 (roughly 12 years). The hyperbolic well profile is shown below and breakeven spreadsheet at link below.

It would be interesting for oil pros to look at this and explain where my mistakes are.

https://drive.google.com/file/d/1Mpfq3vjv2Kdo4x1PKdVvormW4tQmtRRW/view?usp=sharing

Arps model parameters at top of chart

Q0=52542, D0=0.60826, b=1.10102

For Arps hyperbolic see equation 1 at link below

https://petrowiki.spe.org/Production_forecasting_decline_curve_analysis

I call qi Q0 and Di is called D0

Chart below is for the average 2019 Permian basin tight oil well profile, first 17 months only.

Dennis , please stop beating a dead horse . Most of those here who are in the front lines have spoken . In school I remember we were given separate marks for theory and separate for practical’s in Physics , Chemistry, Botany and Zoology . Now after 55 years I know why .

Just trying to understand where I have gone wrong, perhaps you could point out the obvious mistakes.

Much of what has gone into this analysis I have learned from comments by oil pros, just trying to improve my analysis,

assumptions:

capital cost for well (full costs)is 10 million dollars (2020 $)

OPEX is about $14/bo (in 2020 $) average over life of well

well is shut in at output of 20 bopd

annual discount rate is 30% (nominal rate, real rate assumed to be 27.5%)

royalties and taxes are 28.5% of wellhead revenue

NGL price is 33% of crude price

natural gas sells for $1.80/MCF at wellhead

For each 1000 cubic feet of natural gas produced I assume about 0.083 barrels of NGL are extracted (this is the average rate for Texas and New Mexico in 2019).

Breakeven oil price is $62/bo at wellhead (in 2020$) where discounted cash flow (or discounted cumulative net revenue) is equal to 10 million at 78 months when cumulative oil output is 348 kbo and daily average output at month 78 is about 46 bopd. Well pays out (net revenue not discounted is equal to 10 million) at month 28 when cumulative oil output is 241 kbo, 768 MMCF natural gas and 63.7 kb of NGL.

The well profile for the associated natural gas output of the average 2019 Permian basin tight oil well is in chart below. EUR at 140 months is 1809 MMCF of natural gas and 150 kb NGL. Arps hyperbolic parameters on chart.

Dennis , I can’t point out the flaws in your argument , it is not my desire and also not my ability . I have no hesitance in admitting I know much less than you but I am not blind . I can see the writing on the wall . Whom do I send out to bat if my life is at stake ? Dennis or SS, LTO , MikeS , Rasputin etc . The choice is obvious .

Hole in head,

They would surely be able to get more oil produced than me.

As I said before I have learned much from all of these guys and no doubt have much more to learn, that is my aim.

Dennis , the issue is not oil production or technics , the issue is price discovery . Your statement that ” shale is going to be viable production at $ 70 ” `has been discounted by the gentlemen in the trenches . I respect your opinion but instead of dragging the matter just let it hang out to dry and see what happens . Just my two piece . Let time decide . Disclaimer : I do not agree with your assessment .

Hole in head,

Only trying to understand their perspective in a technical sense.

For example Mike Shellman says a 36 month payout is needed for a well to be viable, Shallow sand uses a 60 month payout rule. A 30% discount rate is a pretty good return on investment. Typically in 10ks and such a 10% discount rate is used and weighted average cost of capital for these firms is probably around 5%.

Some point to interest rates (which are quite low) or dividends are the problem so those have been included in my Permian basin scenarios (7.5% interest rate is assumed which is very conservative, it is likely 2,5% too high) and 25% of net revenue plowed into dividend payments is assumed, Permian basin debt accumulated since 2010 (about 95 billion in 2020$) gets paid beck by 2024 in all of my scenarios with medium oil price assumptions (oil price no higher than $75/bo at wellhead from 2022 to 2033 and then falling after 2033).

I will note that calling my model “dumbass” does not qualify as an argument in my book. You seem to be convinced, perhaps others are as well.

Dennis. Thanks.

In 2005, when oil was $50s, we were as bullish as can be.

In 2021, when oil is in the $60s, we are very bearish.

Oil producers are pariahs in a lot of circles.

We are finding out our production has greatly fallen in market value. Future is much to uncertain. Not just price, but regulation.

Wonder what oil producers are bullish? I don’t think the few that post here are.

I don’t think the majors are, based on stated plans. Maybe some shale producers?

Shallow sand,

Sentiment may change with higher oil prices. Note that my scenarios assume new wells are financed from net revenue. It is possible all the cash will simply be used to pay back debt and the rest paid out as dividends an no new oil wells will be completed in the tight oil sector. Seems unlikely to me, but anything is possible.

So far, tight oil prodction has been holding up, so at least some wells are being completed up to this point.

I can certainly understand why you would not be bullish, oil prices will be going up, but we may see low prices in 2022, they will recover in 2023.

@Dennis

I think is something in between of no new wells and every penny earned into new wells.

As described by LTO survivor, they already seem to cash out their best acres. Wide spacing to optimize the output of a singular drilled well, using best acres.

This leaves a lot of oil in the ground, but optimizes money – and shortens the remaning years of shales by a lot. And even this is only available for companies that bought good A and A+ acres.

After being drilled with a wide spacing, getting the rest of the oil out would require very high oil prices or a kind of national emergency. A state owned oil company, and economy won’t play a big role anymore. Kind of war economy. Better to build tramways to let people drive to work and downtown in big cities then.

Eulenspiegel,

Note that LTO Survivor has suggested that optimal spacing is 1320 feet for Permian basin, so I adjusted my model to account for that (spacing was increased from 1000 to 1320 feet). Mike Shellman suggested wells would be shut in at 20 bo/d (or higher) so that adjustment was made to average new well EUR. Note however that in my breakeven spreadsheet a minimum of 8 bo/d at the breakeven price still earns money (though that is the limit). OPEX is at $74/bo by that point, revenue from oil, NGL, and Natural gas allows continued operation. There is no doubt some factor I am missing that accounts for why a businessman would leave money on the table (in this example about 500k of net revenue not earned by shutting in at 20 bopd vs 8 bopd.)

There is always oil left in the ground at the end of a fields life. If the USGS mean TRR estimate for Permian basin is correct (75 Gb), and my medium scenario with a 450 well per month maximum completion rate was also correct (depends on oil price scenario being correct which is very doubtful) with an ERR of 46 Gb, that suggests about 29 Gb of technically recoverable oil gets left in the ground. That is a guess based on lots of assumptions any (probably all) of which are likely wrong. I doubt ERR is any less than 40 Gb and it probably wont be more than 52 Gb, probably a 66% probability it will be between 40 and 52 Gb. Higher oil prices would lead to a higher ERR and lower oil prices to a lower ERR though there are a multitude of other factors.

Dennis. You are theoretically correct if the industry is healthy but it is not healthy. Capital has fled the industry. This industry needs so much capital for reinvestment. The profitability of the majority of the industry has been slim and in the instance of the shale industry it has been a disaster. In order for reinvestment to take place one has to make money. Jeez even Exxon is borrowing money to pay dividends as well as Saudi ARAMCO. Please tell me how this is sustainable because it is not.

LTO.

Is the cost of P & A beginning to enter into the discussion regarding shale?

Really, for the first time since 1998-99 crash (when we were told by the media oil would be $8-12 forever) this is really entering into the discussion regarding lease values.

What is being lost by many here is that new oil wells are financed by the producing wells. In terms of collateral, the existing wells where I am are now worth very little. I’m stunned by how much values have dropped since 2018, when oil prices were similar to now (except of course we have just lost over $10, with more room to fall).

Buyers are talking about the end in our field, which really hasn’t been the case in the past, because we have such a low decline rate. But great political uncertainty is here. Begging OPEC for oil while discouraging production here isn’t a good signal. I agree, the discouraging thus far is talk, not a lot of action outside pipelines. But it is real, and I expect the next D President to be far left if Biden on this issue.

Shedding P & A has already been going on in the Bakken for awhile. It doesn’t seem like it has so much in the EFS, and definitely not in the Permian.

I just wonder how much longer it is before we start seeing some liability shedding sales in the EFS? I assume too many locations left in the Permian to exploit before we see that?

My point being, existing production in our field and ones nearby peaked at being valued at a range of $75-125K per barrel in 2012-14. In 2018 things turned up enough to see $40-55K per barrel. Not many sales in 2019, and 2020 nothing at all I am aware of.

2021 some have shaken loose. One of the best leases in our area did sell for $40K. I was extremely surprised it sold, LOE of less than $10 with virtually no decline. But besides that, I am hearing $5-25K per barrel, depending on the LOE. Considering almost all production here cash flows at $50 WTI, and a lot at $40 WTI, this is stunning.

A common discussion point with potential buyers is what the cost will be to abandon the field, less salvage. Yes, buyers should have always been thinking in those terms, but they really haven’t until this year, it seems. The price recovery from the awful 2020 hasn’t helped sentiment much.

Finally, the young buyers have all but disappeared. As have the young workers. Used to be there were several young guys chomping at the bit, who wanted to buy just a few barrels to get a start. There are none now, unless they are generational who are taking over parents and grandparents production.

A huge concern we now have is just how all of these wells will be plugged some day. There has been talk of a federal bailout on that even, but I really question where the labor will be to do that.

I know my post relates to small ball oil production. So maybe the sentiment in shale is way different. I do notice rigs and frac spreads have been added.

I just don’t think you can feel the negative sentiment unless you are in this. For USA to return to any serious growth, that has to change.

Shallow sand,

A market with negative sentiment like this is an opportunity for a smart investor. Sounds like someone who knows what they are doing, (you) could buy some wells on the cheap and make some money down the road when oil prices rise to over $100/bo in 2023 to 2033, look to sell in 2020 to play it safe you will retire a wealthy man. Easy for the arm chair oil investor, but based on your comment it looks that way.

Email me when you get a chance.

Dennis.

There is stuff for sale offsetting us that in prior years we would have bought. In fact there is some we paid more for, and sold for even more. We actually owned it, operated it at a profit for a few years and sold it at a profit.

But now. No way.

First, who are we going to get to pump it 24/7/365? We can’t ourselves. We have too much already.

And if we do find someone to pump it, it’s better than 50/50 the person will “twist off” at some point.

We had a guy that had been really good. COVID hits. We don’t lay him off. He’s now pissed, because not only could he have been sitting home making more $$, but now he’s getting no overtime because we are doing the bare minimum to get by. The month we were shut down, he was given stuff to do. He didn’t do it. Caught him sitting at home with company truck parked in his drive in the middle of the morning more than once.

So, terminated him. He was happy. He is now fighting with state trying to keep on unemployment. During the middle of the biggest labor shortage we have ever seen. He has sat at home almost a year.

This guy could pump that stuff and make $60K per year. But how can you trust someone like that? If he quits chemical, by the time you catch him, you will be in deep in down hole failures. If he unhooks the sensaphone in the injection plant, so he doesn’t get called out at 2 am if the pump stops working, you will have the EPA all over you when the saltwater starts running over the dike, down the road, into the ditch, into the creek. What if he pumps the wells with a set of binoculars, thereby missing a leak?

Meth arrests in 2021 are double 2019 in our county. One of the few rigs running in our field was shut down recently because two of the crew got into a fight. Meth related. I know of two rig operators who have recently went to prison due to meth.

The stripper fields are about to the point where you better only take on what you can personally do yourself, with maybe one hand who you can watch like a hawk.

I know I will get trashed for this, but this is what I am seeing first hand. I know lower income people have been getting the shaft in the USA for a long time. It’s not bad that wages are rising. But the COVID shut down sped up a lot of malfeasance among all workers, not just lower blue collar.

If anyone here wants to take a crack at oil operations, have Dennis shoot me your contact info. I know of a lot of stuff for sale. 2-4 year payouts at $60 WTI. You will need to be able to post a bond. And figure out how you are going to manage it from hundreds or thousands of miles away, unless you decide to move here and do it yourself. And be ready to be written up by the state regardless of what you do, unless again you do it all yourself 24/7/365 and can address the issue immediately (so you will need a back hoe, a tractor and bush hog, weed eater and a water truck, minimum). Of course, you will also need a pumping pick up truck full of tools (Mike has an awesome cartoon he did which explains all you need) plus a four wheeler for when roads are too muddy for a truck.

If you want to control when your wells are pulled you will need at least a single drum rig. I am sure there are some that can be gotten cheap. Then you will need to find a hand that will show up every day. Good luck.

You will need a tank truck, to suck the rain water out of your dikes, if nothing else. Every time it rains you need to do that, otherwise you risk being written up.

Of course, you will need a place to park all this equipment. You cannot keep it on the lease. So you will need to find a shop with some land. You need a place to put your junked rods and tubing, because you can’t keep them on the lease. So you will also need a tubing trailer. If a pumping unit goes kaput, same. So you will need another trailer to haul them. Eventually the junker will come buy your scrap.

You will need to get security cameras, alarms and flood lights for your shop. Guarantee you will be broken into at least once, even with all of that. You cannot keep anything of value, that can be easily carried or hauled away, outside. So don’t leave your pipe wrenches laying. If you get a rig, better be able to padlock all the tools away.

You will need an echometer to shoot fluid levels, or be ready to pay through the nose when you need one, plus waiting. Pray the hands for the only tubing tester in the county don’t quit again, or you will need to find a testing truck, get it fixed up and find people to help pitch pipe every time you need tubing tested.

You will need to establish credit at about ten different supply places. They are usually good about this. Otherwise you need to carry your checkbook with you.

You will need to learn to call the state well inspector at least 48 hours before you have him witness an MIT. And be ready to drop everything and meet him at the well when he arrives. You also need to accept he will be on your lease at anytime M-F. He might even see you there and talk really nice, but you might get an email of a write up a half hour later. He won’t tell you that face to face. You will have 30 days to get that fixed unless you can get his boss to give you an extension.

I could turn this post into a book.

I know the numbers seem so easy sitting at a desk. But these wells don’t operate themselves. The state doesn’t care if you are an investor 1,000 miles away in a nice burb. You will be written up and if you don’t get it done, you will be fined.

Oh yea, and when your triplex plunger pump craps out, and costs you $20K to fix, there goes the lease profit for a few months at $60 WTI. It’s not easy to plug that into a chart or graph, when stuff like that happens. Or when lightening hits your injection plant and you call all over the countryside trying to find an electrician, are down 6 days waiting, pay $10K for a new control box install, yet pray to God thanking him that’s all it was, and that it didn’t cause a fire burning up your plant and tank battery at a cost of over $100K, not counting the weeks all of your production is shut in.

Dennis.

I love the anecdotal, so bear with me.

We own surface on a lot of the places we operate. I will give you an example.

One tract will likely produce around $49,260 of crop share net rental income after payment of real estate taxes (but before income taxes) with soybeans at $12.50 per bushel. If this tract went on the auction block this winter, absent some economic black swan event, it would bring $1.6 to $2 million. 2-3% return for good tillable farmland is very common across the middle of USA where grains are grown. Note, I am not including the value of the oil royalty here. I’ll deal with that down below.

That same tract has oil wells, we operate and own 100% of WI. We just have numbers through July, so I extrapolated them out for 12 months. Barrels to the WI = 2,308. Average price at well head first 7 months $56.53. Using that gross will be $130,471. Extrapolating LOE is $85,367, or $36.99 per barrel. So net of $45,104. My sources tell me we couldn’t get more than $150-175K for this lease.

Now to the RI and ORI. Extrapolated there will be gross barrels of 2,798, as there is 1/8 royalty and 1/20 (5%) overriding royalty. My sources tell me the RI and ORI combined would sell for $150-250K, because the lease has a very steady production history and is low decline.

Of course, the RI and ORI bears no production expense. The RI and ORI bears no P&A. There is a very strong market still for RI and ORI.

The P & A on this lease before salvage would be $100-250K. Notice a wide range, P & A tough to estimate. Salvage is also tough, right now market is ehh, but not bad for used equipment. But when fields like this have to be P & A due to economics, I suspect the used equipment market would stink. Scrap iron only. Tanks might be a liability.

So here is an illustration as to how far things have fallen. Should be a heck of a buying opportunity one would think. But operations have become a nightmare.

Funny thing, without that WI, that RI and ORI is worthless.

Even more humorous, without the WI (oil) that tillable farmland value drops like a rock. At least until man figures out how to manufacture tractors, combines, sprayers, grain semi trucks, etc, that not only do not run on FF, but can be manufactured and maintained entirely without FF!

Shallow sand,

Thanks for all that information.

I have never thought there was anything easy about producing oil. Obviously there are lots of details I don’t know about. It is amazing there are not many good workers where you live, maybe this is a problem everywhere in rural America. I imagine solutions require out of the box thinking.

Or you can close up shop, certainly sounds like a big hassle, but I bet you could find a solution.

Note that oil can still be imported, the US imported about 10 Mbo/d in 2008. So the farmland will be ok, though food prices will need to increase as oil prices increase or farming will no longer be profitable and yes in that case the value of the farmland will decrease.

I would plug those repair expenses in at average levels. That is why I use a fixed plus variable cost model for OPEX.

OPEX= K b times barrels produced per month, OPEX here is monthly operating expense. b is your cost per barrel when everything is going smoothly, it is the expected monthly expenses to produce whatever your monthy average output is for a given well. K is meant to cover the unexpected stuff, it is money you set aside for inevitable pump failures, tube jobs and even for eventual P and A. I would calculate K by looking at my repair bills over the past 5 years, sum them up and divide by 60 and that would be K. I would adjust if things have changed over the past 5 years, maybe I own more or fewer wells etc.

So the model I use assumes a smart businessman like you would set this money aside in a rainy day fund, knowing that the storm always comes. When the pump failure or whatever extra expense arises and there are probably 100 or 1000 of these I have no clue about, you withdraw money from your rainy day account and carry on.

Shallow sand,

Under current political climate what oil price might change the sentiment for you? Say an average price for 12 months or what ever length of time would be needed to change you outlook.

Dennis.

The problem is I don’t foresee a stable oil price. I also don’t see the political pressure easing.

I did say $55-65 WTI price band was what I desired. Now it would be $60-70. It really isn’t just the average annual oil price, it is sustained stable oil price. $30-100 range won’t work as well as $60-70.

What happens with percentage depletion matters greatly to us also. Labor issues are huge.

We have zero plans to drill another well. Never say never, but it has been 7 years. $100+ for 2-3 years could change that. Or we could maybe bail then too? Who knows?

Dennis, respectfully, have you ever been in business for yourself? For instance, did you have a paper route when you were a little boy, have you ever owned a pizza place, or a retail store, have you ever built homes, or poured concrete for a living? You know, money out v. money in, from a check book? Did you ever have nobody to rely on other than yourself to eat, and pay the bills? For example, lets say you could not make a mortgage payment had you not at the last minute gotten paid, say to sell a used car? Have you ever been hungry?

Mr. Hren’s observation up hole regarding economists and businessmen is actually very relevant. You dismissed it like it was nothing. Its actually very relevant. Have you ever been in business for yourself?

As to the use of the term ‘oilmen” that agree with your models about the future of shale oil, on other sites, are they really oilmen, or are they free royalty owners, or petroleum engineers that once worked for Shell, or were they simply somebody who says they use to roughneck when they were kids? Or perhaps they are heavily dependent on shale oil to make a living?

90% of the people that I know that work IN the oil business don’t know squat about well economics. You have to be a working interest owner, a bill payer and a revenue receiver to truly understand what it takes to earn a living IN the business, not just analyze it from the safety of a key board. You understand the difference, don’t you?

The four people here that comment occasionally that I know are working interest owners in oil and gas wells, from a check book, you insult on a regular basis, like they’re stupid. You’ve never seen a shale oil well, I am pretty sure; you have admitted you won’t invest personal money in them (too risky); I am simply looking for a good reason why you are so much smarter than real people IN the oil and gas business.

or were they simply somebody who says they use to roughneck when they were kids?

Well, I was never a roughneck, but in 1959 I was a roustabout for about 30 days, at $1.15 an hour.

Not joking, I really was.

Mike,

No I have never owned my own business. And yes I do realize it is much more difficult to actually run a business than to create a simplified economic model of key aspects of a business. The real world is too complex to model to perfection.

Also I do not think I am smarter than people in the oil business, I ask questions of those who know more than me, that’s how I learn. You may be different than me in this regard.

I apologize for asking questions and trying to learn how the oil industry works.

As far as I can tell all of the insults and innuendo have flowed in one direction.

If disagreeing with your conclusions qualifies as an insult in your view, in that case I guess I have been insulting.

When someone who’s opinion I respect disagrees strongly with the model/scenario I have laid out, I attempt to explain my reasoning so that the flaws in my model can be corrected.

I apologize if these explantions come across as a lecture as if I believe I know more than you. Nothing could be further from the truth, I make the effort to do this in order to learn from you, or LTO survivor, shallow sand, Rasputin, George Kaplan, SouthLaGeo, and other people who have worked in the oil industry.

I have two sibling that have owned their own construction companies and two other siblings that own their own businesses.

Thank you shallow sand,

It is actually surprising the price is that low. So it seems the volatility is a big issue, would $60 to $100 be ok? I expect that is what we will see from now until 2023.

Shallow sand, LTO Survivor, and other oil pros,

Any guess what the P&A cost would be for average Permian basin wells. I am guessing expensive maybe 250 to 500k?

Thanks for any feedback from those who know the details of how this is done, which I do not.

LTO survivor,

See my breakeven spreadsheet and tell me where I have gone wrong.

For Permian basin average 2019 well, I don’t see how one loses money at current prices. Yes productivity may have decreased a little since 2019, maybe 5% at most. I guess the oil industry expects lower oil prices. The industry is wrong medium term, but perhaps short-term they will be right.

I think the futures market is a poor predictor of future oil price.

LTO survivor,

Spreadsheet at link below for Permian 2019 average well breakeven

https://drive.google.com/file/d/1Mpfq3vjv2Kdo4x1PKdVvormW4tQmtRRW/view?usp=sharing

I also tried the breakebven calculation for a well that produced 78% of the average 2019 well. That raises the breakeven at a 30% annual discount rate to $72.80/bo at wellhead.

EUR of average 2019 well is 407 kbo

for the well producing 78% of the average 2019 well the EUR is 318 kbo. Note that my average well includes both parent and child wells, it is all wells completed in 2019, so it is doubtful that the 78% well estimate would be realistic for the average child well in the Permian basin (meaning that I expect the average child well has an EUR higher than the 318 kbo used for my estimate of breakeven).

Can you tell us if the parent wells you are familiar with in the Permian basin have a higher EUR than my average 2019 Permian well? I understand you cannot share too much detail.

Dennis, Shallow Sand and others,

Dennis I odon’t fault your analysis. Your numbers are real and relatively reasonable. The one thing that we never faced as an industry is the overwhelming anti fossil fuel sentiment. The wells do make money but there is debt to repay and dividends to to support. At this price both items simply cannot be achieved. All of us in the shale industry drilled like Madmen hoping to be acquired one day by a major company or a well heeled consolidator. Some were very fortunate like Concho and were able to sell to COP or Anadarko to Oxy but most of the others are left with a pile of debt and no buyers. The market has thinned out because PE for the most part has walked away. The current malaise that exists makes it difficult to attract new capital. It may not seem like a big deal when oil falls from $75 per barrel to $62 per barrel but look at what it does to the energy stocks. They are getting clobbered. It is all about confidence. That includes confidence in the (1) price (2) costs (3) future demand (3) and political sentiment.

1. The price is way too volatile to inspire confidence 2. Costs are rising because of the “transitory” inflation and fewer vendors 3. All we hear about from our energy agencies is that we have hit peak demand and many believe that there exists a real solution to replace fossil fuels. We aren’t there yet and it is still decades away I believe (4) this is probably the most important and frightening factor. The political sentiment against hydrocarbons is overwhelming. It is unpopular to support fossil fuels. It isn’t unpopular to use them for everything from fertilizer to jet fuel but the mainstream media and the political agenda is 100% geared towards a carbon neutral mantra. While this really Isn’t attainable while keeping our way of life, it has still taken center stage. The main reason is the embarrassment of riches provided by Shale which has lulled the public into believing that it is a limitless inexhaustible resource and the market has been oversupplied for some time. When the world realizes that fossil fuels are not limitless and begin to diminish in supply relative to demand, the sentiment will only then begin to change and capital will come back to enjoy a higher return. In the mean time it is not unimportant to observe the entreaties of organizations like Engine One impacting XOP in a meaningful way by forcing them to reduce expenditures on discovering new deposits of oil & gas or Shell announcing a move away from Fossil Duels. These are important and unprecedented departures for oil and gas companies which have survived for over 100 years as mostly oil & gas producers. This is why when I see optimistic charts calculating much higher oil production, I become puzzled because I just don’t know where it will come from. Iraq and Iran are unstable places to be betting on to fill the gap for the lack of investment in a depleting resource. This is just my opinion but I have lived it and felt it for the past few years. We will see if I am correct in my assessment.

I think LTO is right and the most important thing here is sentiment.

Oil prices can climb 10$ again – but when the sentiment and political support is down, that’s it.

One example from Germany – we have a long going anti-nuclear agenda here, starting with public protest, then the media and TV joined and finally even the conservative party.

If we wanted to reintroduce nuclear we would have restart at point zero.

We have 1 (ONE) professor left for nuclear technic, compared to over 100 for gender science.

So even if we wanted to build an own nuclear plant, it would be a herculean task. We can now only order one in Russia or China if we want one.

This is the same danger for the oil industry. No political support – less support at education, closing or thinning geolocical branches at universities, young people do other jobs. And at some point you would have to engage a chinese company with their own workers to drill up a new field.

The worker shortage shallow describes is systemic – first the strippers, later the newer fields.

Just my opinion, but I’ve seen dying industries in my career, too.

Thanks LTO survivor,

I agree the negative sentiment towards and within the oil industry is a real problem and your assessment is no doubt accurate.

My expectation is that a shortage of oil supply will come to the fore in late 2022 to early 2023, lack of oil demand may occur at some point, my guess is about 2035 to 2040 as the World gradually transitions to electric land transport, but in the interrim from 2023 to 2033 we are likely to see oil prices at similar levels to 2011 to 2014 (Brent average was around $120/bo in 2020 $ over this period and WTI about $115/bo). OIl prices are likely to remain volatile, but in the range of $100 to $140/bo for monthly average oil prices. I think sentiment within the oil industry will be different in the oil price environment I envision.

I agree we will need the oil, before long the man on the street will realize that. As the World peaks in 2028 or so, we may see oil prices rise considerably more than $120/bo, the average price from 2028 to 2032 might be more like $150/bo, though this depends on two factors: the speed of the transition to electric powered land transport, and the response of large oil producers to higher oil prices and the move of land transport to electricity.

It is possible if the transition proceeds more quickly than NOCs currently envision tht they will scramble to develop their resources more quickly before their oil resource becomes a stranded asset. In this scenario OPEC falls apart and we see a market glut with large middle east producers and Russia fighting for market share. Potentially this happens as early as 2030 and we would see oil prices crash permanently to under $40/bo in 2020$, possibly as early as 2035.

It would be wise to have exited the oil industry before that occurs if one is a high cost oil producer. Under this type of scenario we would see US tight oil output decline very quickly.

LTO Survivor, Shallow sand, Rasputin, George Kaplan, SouthLaGeo, and Mike Shellman,

I apologize if I have insulted any of you, or if I have given the impression that I believe I am smarter than anyone.

I try to present my findings in a dispassionate way without a lot of drama and when someone disagrees with me I typically try to explain my simple models so that I can see where they can be improved.

The input from all of you has been invaluable in making the models more realistic, but I am sure I have much more to learn.

Clearly no model will be perfect and mine is likely far from the mark.

Thank you all for your patience.

LTO, The collapse in the share price of the E&Ps is a result of hedge funds shorting the energy sector. To illustrate the point, Reconnaissance Africa is an exploration company not producing oil or gas and therefore not tied to the commodity price. The stock has 10x within a year. But within the past 2 months the share price is down nearly 60% on good news their second drill hole encountered oil.

With regards to government’s anti petroleum stance I see this as the government realising oil supply won’t meet demand in the not too distant future and demand has to be dialed down. I recently saw a post by Disclosure TV which stated the Biden administration was considering banning interstate travel to tackle covid.

How many barrels of oil out of the 7 million per day the U.S. imports would this save if implemented?

LTO Survivor,

Imagine a relatively stable monthly oil price of 75 to 95 $/b for the 2022 to 2030 period as a what if scenario. If that were the case does the health of the oil industry improve?

I would think capital spending would increase. Would be interesting to hear if offshore FID migbt change under that scenario.

If such a scenario does not increase investment then oil prices will be higher.

Demand will return to 2019 level by 2023 at latest and grow from there.

ZH is splashing a story of Caspian discovery. Iran has it in its sector, 3.5 Trillion cubic meters. No mention of condensate. Gotta be some. Estimated flow rate capacity — 20% of Europe’s annual consumption. Europe’s annual consumption 540 billion cubic meters. 20% of that is 108 Bcm. Per year.

Various agreements with Russia grant Russia full control of that flow, to where and at what price. So if Iranian gas is going to Europe, it will do so under the auspices of GAZPROM. But Iran will get paid.

Dunno how long to get production going. But 108 Bcm/year at $500ish per 1000 cubic meters. Might drop a decimal but that looks like $54 billion per year sent from Europe to Iran. Someone should check. GAZPROM will take a cut but it can’t be so much that Iran looks for another transit port.

Annual Israeli aid from US — $6 B

Watcher , too late to the party . No surplus energy to undertake the developments of such large projects .

Watcher.

18 Billion barrels of condensate.

HOLE IN HEAD,

Agreed. I remember hearing ExxonMobil bragging they could make money in the Permian at $25-$30 a barrel. In the last four years, with oil prices well above that level, Exxobmobil’s U.S. upstream earnings have been horrible, to say the least.

ExxonMobil invested $32 billion in its U.S. upstream sector to lose $3.8 billion.

steve

Yeah Steve , too many reject the concept of EROEI , but it is a reality . It does not differentiate and it does not take prisoners . Ignore at your own peril .

Like they say, EROEI can be ignored if you don’t mind pissing money up the wall to get liquid hydrocarbons. I think most investors find this somewhat a dubious business strategy, and it now shows.

Kleiber,

Only profits matter, EROEI only matters at a societywide level, no oil man I have ever heard has said EROEI is a consideration in their business. Perhaps real oil men can comment, perhaps I have missed those comments.

The oil business is about producing oil to make a profit, energy in vs energy out does not matter, money in vs money out is what pays the bills.

D Coyne,

You are correct that the oilman doesn’t worry about the EROI, rather, they look in terms of profits today or tomorrow. However, the low EROI of Shale Oil, Tight Oil, has left the public with a huge BILL for destroyed roads and highways.

Because Tight oil needs 100’s-1000s of truckloads to make just one well possible, the public gets stuck with footing the bill for the repair of the roads-highways. Some counties have let the roads return to gravel because they don’t have the funds to repair them.

Furthermore, the UNPROFITABILITY of Shale OIL isn’t a mystery. According to the 2019 Wall Street Journal article, The Unprofitable Oil Boom (LOSS OF HALF TRILLION ) , the industry has decided that the best way forward is CONSOLIDATION. So, this is what we hear now as companies merge to STAY ALIVE a bit longer while continuing to DEFRAUD investors.

We love this TWEET by Clark Derry shown below of EXXONMOBIL’S FREE CASH FLOW over the past three years.

I’d imagine ExxonMobil Management continues to lose SLEEP at night wishing they never bought XTO Energy. And then there is the FRANKENSTEIN called Occidental’s merger with Anadarko.

You can always tell when a Civilization is near the end… INSANITY becomes the norm.

steve

Thanks, Steve, the best damn post I have read all week.

Steve,

XOM was perhaps too optimistic, but free cash flow will tend to be negative when starting a large project and the cash flow accumulates and debt is paid back.

Chart below has cumulative net revenue for Permian basin from 2010 to 2025 for my 450 well completion rate scenario. By end of 2033 cumulative net revenue rises to 500 billion in 2020 US$. Interest on debt is paid at 7.5% per year and 25% of positive net revenue is paid out as dividends for model.

click on chart to enlarge.

Mikey’s revenue predictions for the Permian. Click to enlarge, print to use in the bottom of the bird cage….

Mike , ROFL . 🙂 . 🙂

Mike,

GOR for Permian for my scenario. This is basin wide GOR based on average well profiles using DCA on shaleprofile data for 2010 to 2019 average wells, after Dec 2019 I assume average well productivity decreases each month that wells are completed, more wells completed results in faster decrease in average well productivity.

Mike,

For same permian scenario (ERR= 46 Gb) I assume OPEX per barrel increases as shown in chart below (again this is a basin wide average over time).

Mike

I assume productivity decreases,

Costs are in real dollars so cost in nominal dollars increase at rate of inflation, GOR increase included, scenario makes very conservative oil price assumption, prices $75 per barrel in 2020 $ from 2022 to 2033.

Opex per barrel also increases all wells after May 2020 financed from cash flow so OPM not needed. All debt paid back with 7.5% annual interest bt 2025, dividends paid out at 25% of net revenue. Net revenue is total sales aka gross revenue minus total costs.

Productivity of average new well decreases from 407 kb in 2019 to 330 kb in 2040 based on USGS mean TRR estimate. Total Permian ERR for this scenario is 46 Gb.

Mike,

The scenario for charts above is shown below with well completion rate (new wells completed per month) on right vertical axis. ERR is 46 Gb, peak in 2029 at 5427 kbo/d. Maximum completion rate is 450 wells per month, a bit less than the highest 12 month average to date of about 460 new wells per month in 2019.

Dennis,

I get a kick out of your charts. I actually like Mike’s chart above which could be more accurate. This hampster wheel doesnt work like Exxon believes. You have more and more wells producing but at much lower volumes and slimmer profits. I never used to think that the Shale industry was a Ponzi but now I am convinced that if you cant get your money back within 12 months then one cant make money in this sector. What is the most interesting chart to me is the increasing number of wells for the next fifteen years. Whoever publishes this chart is divorced from reality. I will say it once again the remaining drilling inventory is less than six years on average. Companies are merging because they have all evaluated their future drilling inventory and they are desperate to add revenue without drilling up their inventory. However this is just a game of 3 card monte or hiding the ball so that the analysts don’t really see what is going on behind the curtain. I have seen close up what is going on behind the curtain and it is not pretty. Unless prices rise significantly this game will be exposed as just another attempt to mask the true slim economics of drilling these LTO wells. The charts are fiction even with much higher prices. Inventory is inventory and you can’t dream up more inventory unless the price is astronomical.

LTO survivor,

The estimate is based on the USGS mean TRR estimate as I have explained in detail in the past, I won’t bore everyone with the details yet again.

Perhaps the USGS is way off. The same analysis for the North Dakota Bakken Three/Forks yields an ERR estimate very much in line (within about 1%) with current proved reserves and cumulative production (end of 2019 for both).

Note the economics for this scenario are the same as my breakeven spreadsheet, just added up basin wide, I have interest rate on debt at an annual rate of 7.5% (in reality it is likely more like 5% for large oil companies) and dividends are paid from net revenue with 25% of net revenue assumed to be paid out as dividends, new wells are paid out of gross revenue (the net revenue subtracts all costs including capital costs, so no new financing is needed).

Link to spreadsheet with modified Permian model ERR=27.5 Gb, shows how debt is paid back by 2025. More in line with limited well inventory story.

https://drive.google.com/file/d/1OrwWVxuPNkvu58A38u8rEAuDg2_R4vP3/view?usp=sharing

The oil price scenario for scenario above might be too optimistic. If oil prices drop quickly to $30/bo from $80/bo from 2031 to 2035, we get a scenario with about 27.5 Gb for URR with about 76k total wells completed. see link below

https://peakoilbarrel.com/april-non-opec-oil-output-declines/#comment-723877

Is there any data on the drillable locations in Permian basin?

Seems a lot of the info is anecdotal.

The chart I did on cumulative net revenue id the column to far left of spreadsheet, it takes oil, NG and NGL adds up revenue deducts royalties and taxes, capital costs for wells and infrastructure, and OPEX, ($5/b is deducted from oil price for transport cost for crude), NGL assumed to be 33% price of crude, NG sold at 1.8 dollar per MCF. Mike’s chart is funny, but if my assumptions are reasonable as you have suggested elsewhere, then my chart might be pretty accurate.

Article on Russia from 2020.

West Siberia, an oil producing region in central Russia that extends from the northern border of Kazakhstan to the Arctic Ocean, continues to be Russia’s dominant producing region and contributes more than half of Russia’s total crude oil production. Most fields operating in the region are older, conventional reserves. They are facing permafrost melting and rising associated water levels, which reached 86 percent on average in 2018. According to a study from the SKOLKOVO Energy Centre, Russia’s largest active Siberian brownfields reported a 22 percent increase in drilling rate penetration from 2012 to 2016 but recorded a 5 percent decrease in total crude oil production, demonstrating how Russia’s older fields require more intensive methods to keep production growing.

https://www.cfr.org/blog/russias-complex-oil-reality