A guest post by George Kaplan

IOC Reserves and Production

About the only place where properly audited estimates for OPEC’s claimed reserves are available is sub-Saharan Africa, principally Nigeria and Angola, but with Congo, Equatorial Guinea and Gabon as minor players. Except for some on-shore legacy production in Nigeria most of the fields are partly owned and wholly operated by western IOCs that are required to provide accurate estimates for reserves and revisions for SEC and other financial reports.

In the 10-k or 20-f reports the estimates are presented geographically with Africa seprated out and, usually, sub-Saharan Africa separated from North Africa, which is typically lumped with the Middle East (in which the IOCs now have little direct ownership in OPEC countries).

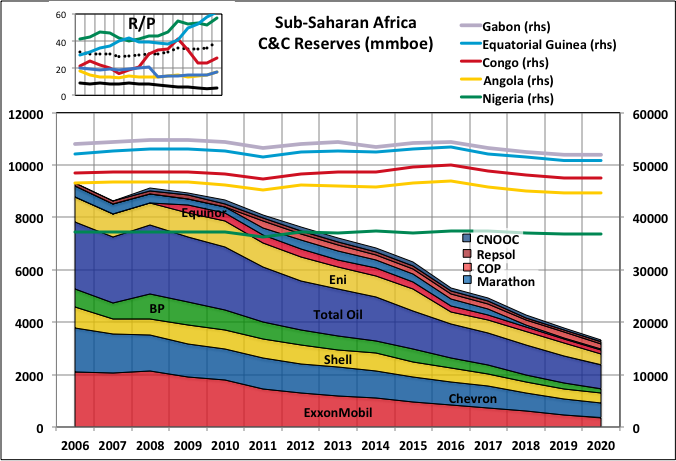

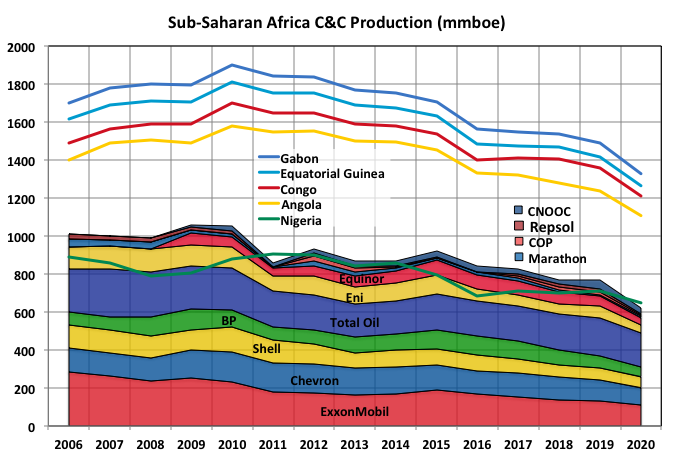

I have included the ten companies shown in the charts, there are, or have been, other minor players like Hess, Perenco, Devon but their contributions are small and sometimes a bit opaque (e.g. Perenco doesn’t report in the USA). Needless to say there is a big difference in the story told by the financial filings and that from the OPEC reports. For reserves the companies reported about 20% of the total claimed for the five countries in 2006, but that dropped to just above 5% in 2020. However the companies claimed 39% of C&C production in 2006, rising to about 54% in 2020. Note that there is a small amount of reserves and production in non-OPEC sub-Saharan countries, principally ExxonMobil in Chad, but not enough to make much difference. A further complication is that OPEC reports crude only whereas the companies report C&C combined and I have include NGLs as well, as it would be difficult to completely separate them out (this actually makes the figures appear even less contradictory than they really are).

The average remaining R/P for the companies had fallen from 9 years to 5 in 2020, whereas that given for the OPEC producers had risen to 39. An R/P of five is indicative of a mature basin and typically would be a threshold where the super-majors would be thinking about selling up and moving (though nowadays they may be asking “to what?”).

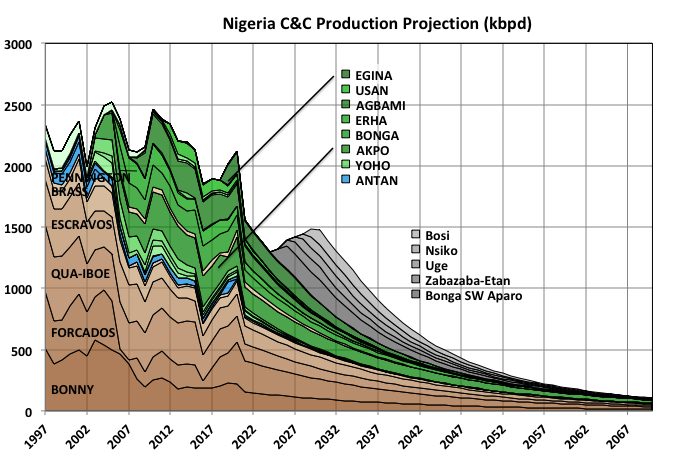

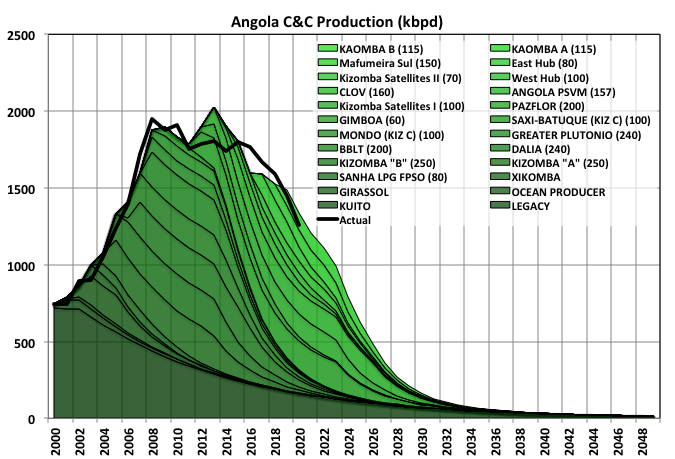

The Shift Project analysis from May 2021: “Future Oil Supply to the European Union: State of Reserves and Production Prospects of the Main sSupplier Countries,” is about the best look at the situation for future oil supplies, possibly thats ever been done. Unfortunately it only looks at countries that supply oil to the EU so notably omits Canada, Brazil, China, UAE and Venezuela. It puts current reserves for Angola at 2.5Gb and Nigeria at 6.9Gb, which are figures more closely in line with the companies’ own than OPEC’s, with potentials, including yet to be discovered reserves, at 7.9 and 15.6 respectively. Given the current level of drilling activity and the increasing wariness of any IOCs with enough technical proficiency to successfully explore the deep waters off West Coast Africa those additional barrels are a long way off yet.

OPEC Reserve Reporting

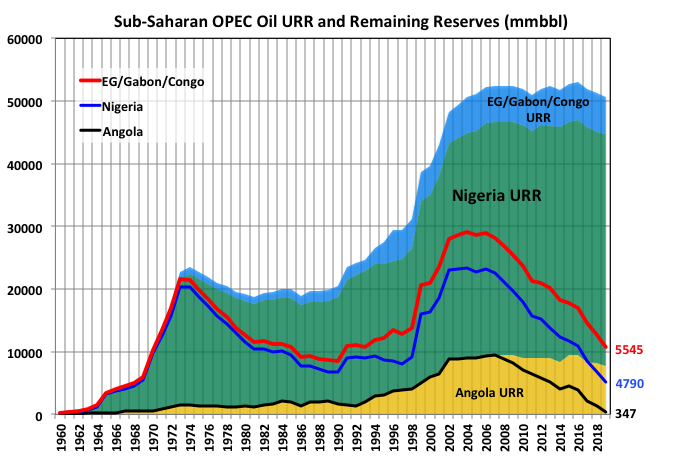

The numbers above assume that the reserves are those remaining for the quoted year. However, it is unclear exactly what OPEC are reporting when they quote reserves. The most reasonable that I can come up with is a backdated estimated of the remaining reserves at the time the country joined OPEC. If true this would give the actual remaining reserves as shown below. I don’t know what this means for Gabon as it has joined OPEC twice, and the remaining reserves for Angola are particularly small (leaving an R/P measured in months rather than years).

Note that the figures shown both as areas (URR) and lines (remaining reserves) are plotted stacked above each other, but I’ve shown the individual countries remaining estimates to the right.

OPEC, EIA, Jodi and Baker Hughes Monthly Reports

OPEC reports crude only production for its members every month. If gives data primary sources (i.e. reported by the producing companies themselves) and those from secondary sources (i.e. based on traders, shippers and user countries); these are considered most reliable and are the ones presented here. EIA and Jodi report various options: crude, C&C, NGL, all liquids. JODI only report data of their members. These organisations also report gas production, but for EIA only as annual averages.

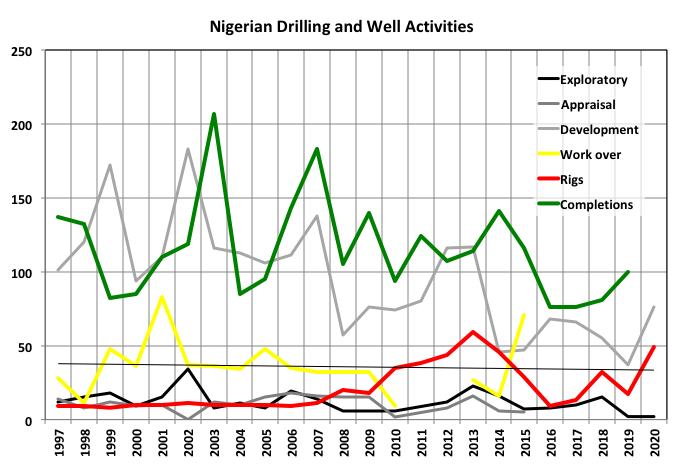

Baker-Hughes provides monthly values for active drilling rigs, but only since 2013 has this been broken down by oil/gas reservoir type, and landward/seaward location.

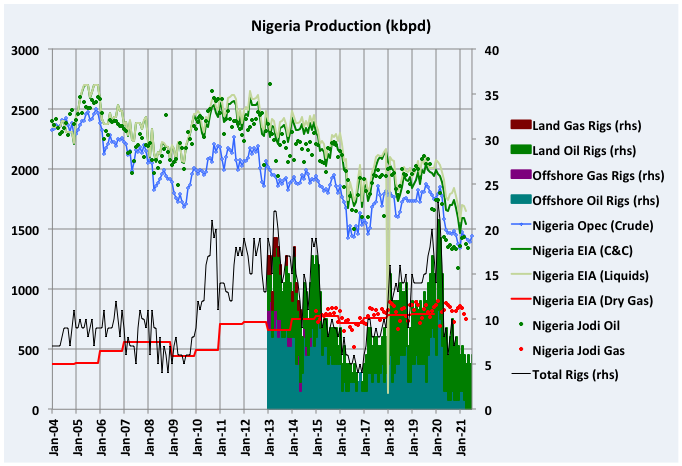

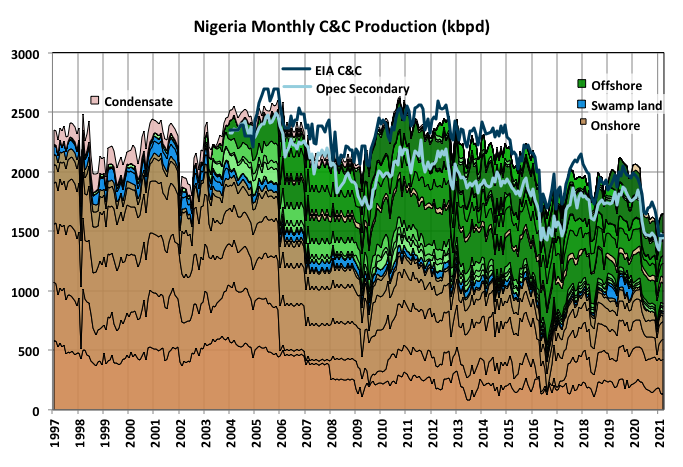

Nigeria

Nigeria is in rapid decline and the absence of drilling would suggest things are unlikely to change near term. The few onshore rigs will be for relatively small wells, the large deep water rigs operated by the majors are what are needed to make a real diffrenc, and those companies aren’t showing much interest, whethwr because of the regime in Nigeria or just because they don’t think there’s much left to find I guess we might eventually discover. Nigeria is highly dependent on oil, has a rapidly growing population, nd serious environmental issues. It has a slightly more enlightened government at the moment but corruption is still quite rife. I know several immigrants from Lagos and the more rural areas, some from quite wealthy families, they all love the country but are glad to be able to raise their children somewhere else. I cna’t see anyway that telling the country as a whole to keep the oil in the ground would work even if some payment was offered and it could easily be the canary in the mine for the possible hell-scape that we get as environmental collapse meets energy collapse meets political and economic collapse.

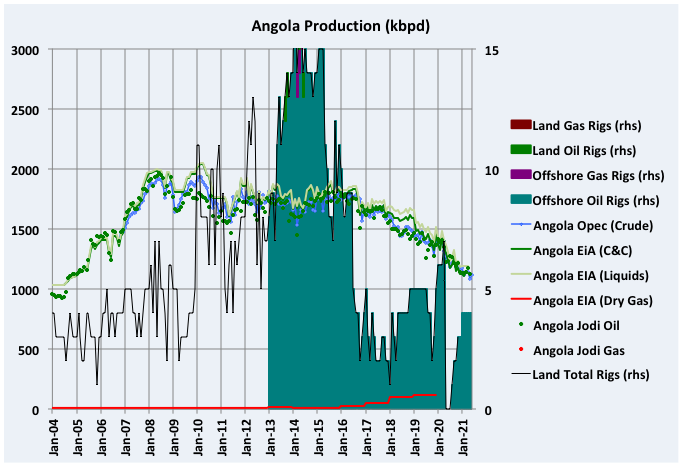

Angola

Angola is in serious decline and the continuing decline in drilling suggests it is not going to end soon. There are few attractive development opportunities, the pre-salt plays, mirrors of Brazilian geologies have been disappointing and the largest IOCs are losing interest, especially as there are growing uncertainties about the royalty regime, local content requirements and project leasing agreements. There are bound to be increasingly frantic attempts to rearrange the deck chairs as the oil revenues decline, I should imagine discontent among the elites will be rising as getting corruption money out the country is blocked, and there is an active independence movement in the main oil province. It’s a country ripe for significant disturbances, any of which would feedback to accelerated production decline.

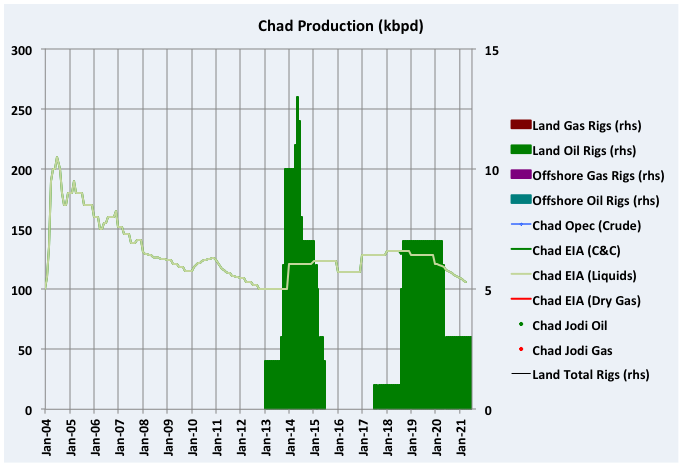

Chad

Chad is the largest Sub-Saharan producer not in OPEC, Cameroon is another small, declining existing producer and Uganda and Kenya may grow as minor oil producers in the next decade and there may be condensate and NGLs coming from LNG plants in Mozambique and Tanzania . Chad considered joining in 2018 and then thought better of it or was black balled. ExxonMobil was the main player in the only major project, which has been a bit of a disaster, best not mentioned in the hallowed halls of the Spring Campus, as it had the largest write-downs from the original recovery estimates. There will be growing production from other countries in the future, and the countries may then chose to join OPEC (e.g. Uganda, Kenya, Senegal, Gambia) and here will be significant LNG supplies coming from the East Coast (Tanzania and Mozambique).

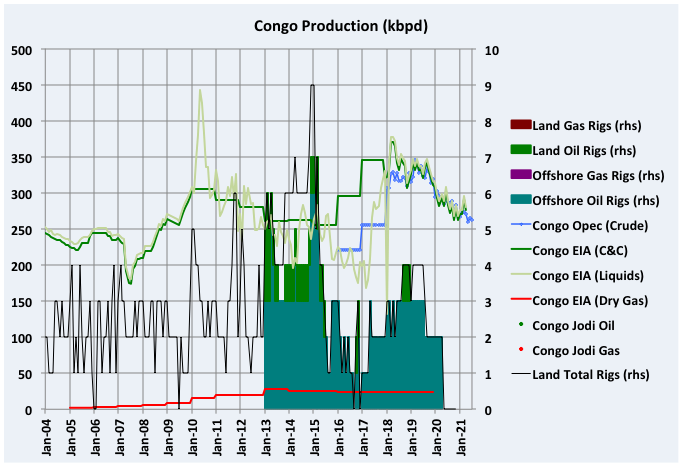

Congo (Brazzerville)

A small to medium producer in terminal decline with drilling completely dried up.

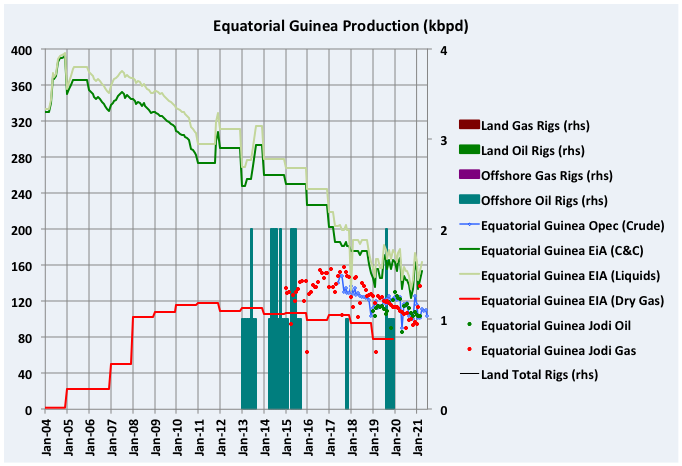

Equatorial Guinea

An absolute dictatorship supported by the oil companies; I don’t think there are property rights of any kind apart from with the president and his close associates. It is showing a rapid decline in oil, though it does have LNG. Recently there have been repeated declarations that production will be boosted followed by announcements of delays. Things are unlikely to end well, the trend down indicates there will be no income left to support continued repression measures against the populace in three to four years..

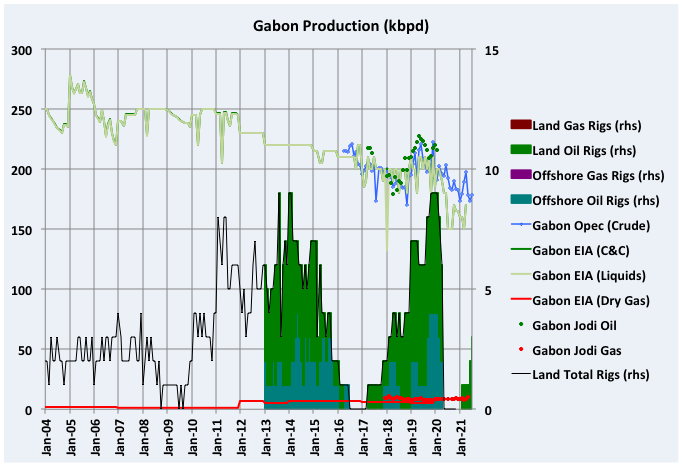

Gabon

Gabon is similar to the others, being in terminal decline with low drilling and few opportunities. I don’t know anything about the politics or economic alternatives to oil but its population is relatively small.

The 2021 IEA oil outlook report (Oil 2021: Analysis and forecast to 2026) has Nigeria declining from 1800 kbpd in 2020 to 1600 in 2026, Equatorial Guinea steady at 100 kbpd, Congo rising to 400, Gabon steady at 200 and Angola falling from 1400 to 1100. All of which seems extremely optimistic given the above production trends, current drilling activity and general level of interest from the IOCS.

Total OPEC Production

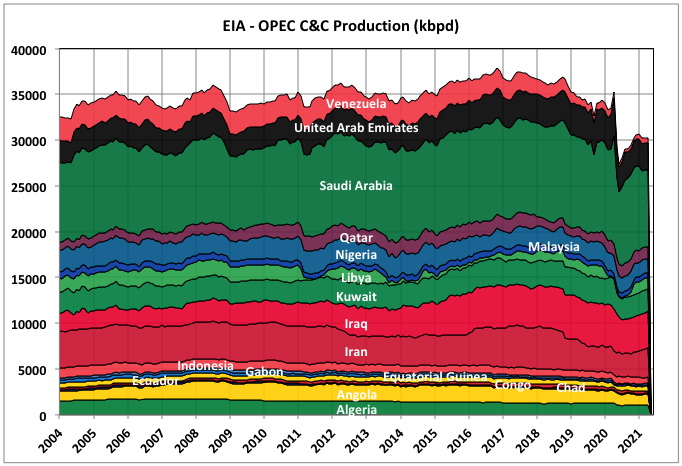

As a part of OPEC the production from the sub-Saharabn countries is relatively small, even if they do represent almost half the remaining members. In the chart below I’ve included all countries that have been past members (Qatar, Indonesia and Ecuador have left) plus Chad and Malaysia who expressed an interest in joing but withdrew (or may have been blocked). The figures are from EIA fore crude and condensate.

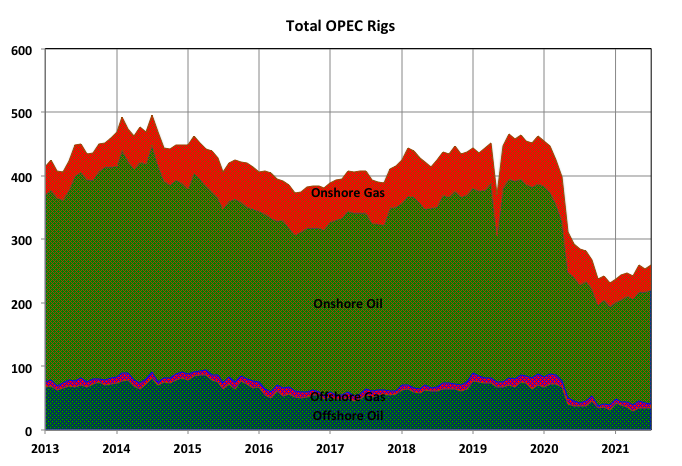

Total OPEC Drilling

The number of rigs started to decline in late 2019 after a couple of years of slow rises but then crashed with the Covid crisis and has yet to show much recovery . It may be of interest that the ratios of oil to gas and onshore to offshore have not changed much over time.

Nigeria Production and Projection

Note that some months data from NNPC cannot be downloaded, I think because of software bugs, so I have had to interpolate. These could be corrected when the NNPC annual statistical bulletin is released, but this is late for this year, presumably because of Covid, though last year was unaffected. Likewise in some other data used here the OPEC ASB is late so I have had to assume a couple of figures for 2020 to be the same as 2019. (Possible related the Brazilian ANP, which usually produces good data, has not released anything since September 2020. It could be Covid, or they are all off setting/fighting fires or Bolsonaro just habitually sacks anyone competent, whatever the case the will be no Brazilian POB update.)

Angola Projection

There are no platform-by-platform data available for Angola fields. The best estimate that I have been able to make has been based on start up dates and design throughputs for each production platform (most of which are FPSOs) and then to apply typical ramp-up times, plateau periods, decay rates and availabilities (downgraded a bit to allow for African logistics). The initial field reserves can be approximated by using a formula relating design rate to reserves to the power of 0.88 to 0.9, although this doesn’t work at all well for tie-backs, and might be an overestimate for African FPSOs, which tend to have shorter plateau periods and lower availabilities than typical offshore projects.

Even so the results have not been too bad with the main difference being that the actual first oil dates have been later and ramp-up slower than I had assumed for new projects from 2010. Angola is in serious decline and there is not much on the cards for new production (just a couple of tie-backs) or new exploration and the sub-salt areas that were expected to match Brazil have been disappointments. With the population souring, the economy heavily dependent on oil, historically high corruption and an independence movement in the main oil producing province things could seriously kick-off.

Sub-Saharan Oil Based Economies and Demographics

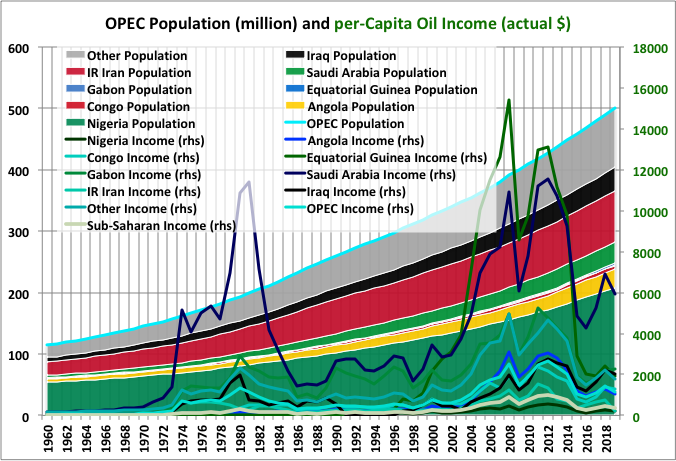

OPEC Population Growth

The years from 2004 to 2014 were good ones for OPEC in terms of income, despite the financial crisis in the middle of it. Even if most of the money never gets to the general population there was enough to go around to keep everybody on side and reasonably placated. The growth in oil revenues has partly driven and allowed population growth, but the demographics now have built up momentum that is not suddenly going to stop as the oil peaks and declines. Revolutions occur mainly when there is inter-elite strife and that is coming to many OPEC countries as the share of wealth available to spread around becomes insufficient to meat all parties idea of fair.

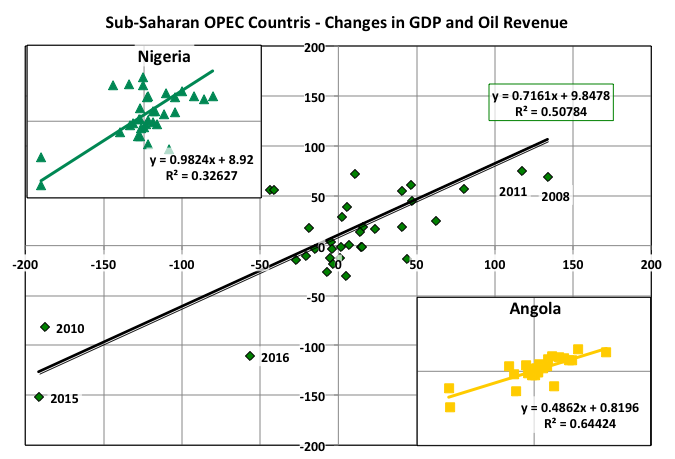

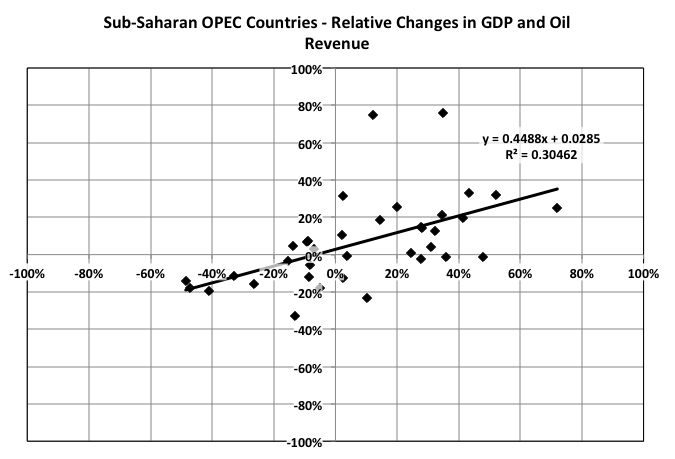

Sub-Saharan Oil Revenues

For each of these countries there is a strong correlation between GDP and income from oil extraction. It is unlikely that local economies such as these affect global oil price so it is reasonable to say that changes in oil revenue cause a large part in the change in the exporting countries GDP. The tightest correlation is in Angola (i.e. a given annual change I oil revenue has the most predictable effect on GDP) but the strongest effect is in Nigeria where it has been almost one-for-one (one dollar of lost revenue equates to one dollar reduction in GDP).

The correlation are tighter in absolute terms than relative terms, maybe suggesting that the economies have a basic non-oil component plus a larger component proportional to the oil revenue, rather than everything acting as a multiplier on the oil income. However there are many other influences such as how to handle overall inflation compared to oil price volatility, how to include value added from local refining or petrochemical industries and the effect of oil grade pricing differences. In general, though, it can be fairly certain that losing the oil income, even if much of it never gets to the non-elites while populations continue rapid growth is not going to end well.

There is no incentive for these countries to leave oil in the ground and no way that they will voluntarily switch to renewables, which is why there are headlines like this about: Africa’s Oil Nations Push Against Global Drive To Shun Oil And Gas.

Africa’s largest oil producers do not plan to abandon oil and gas exploration and production and could consider creating a continent-wide bank to fund new projects when international banks refuse to finance new developments.

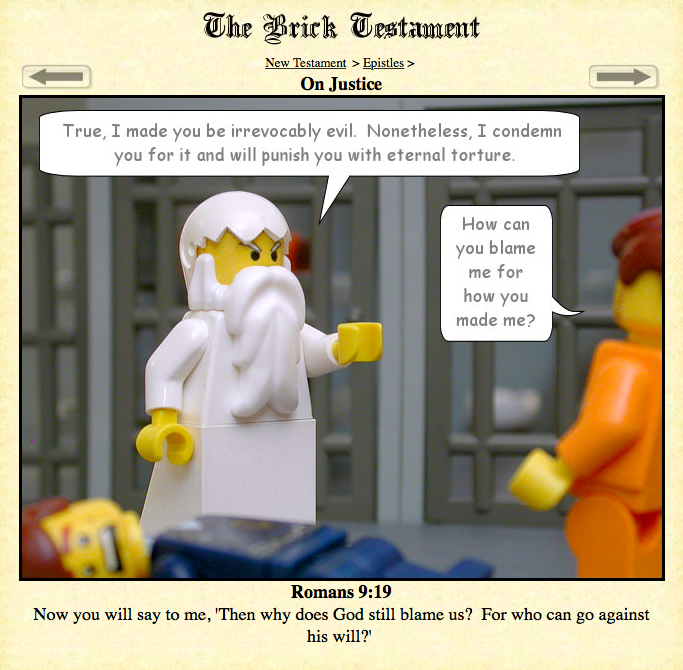

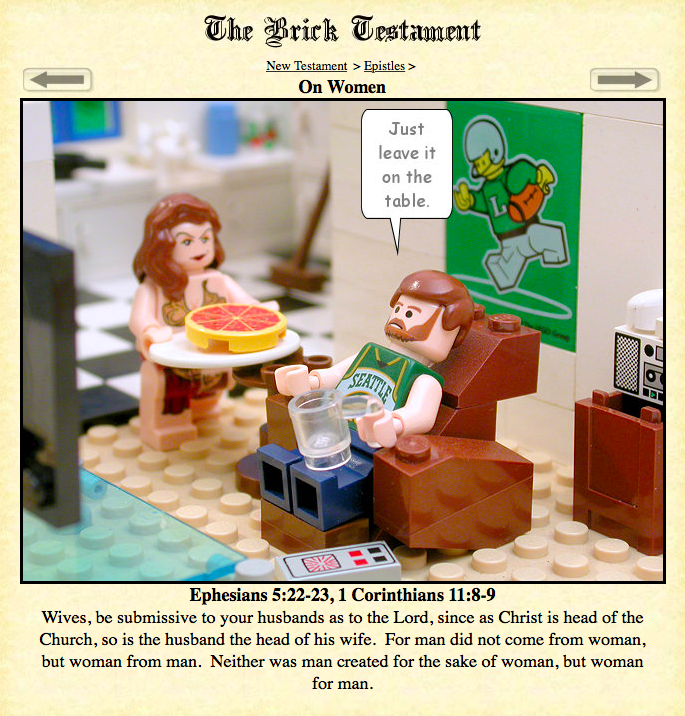

Off-topic Finish: Paul the Apostle and The Epistles

For no particular reason I have been reading the epistles of the New Testament, admittedly using the Skeptics Annotated Bible backed up with The Brick Testament as source material. 21 books of the New Testament are epistles, 13 are attributed to Paul the Apostle, but only 7 are thought to be actually by him and are considered the earliest written books in the New Testament (ca. 50-60 C.E.). Others are attributed to John, James and Jude, but may have been by others and written well after the putative authors’ deaths. Given that three of the other books are virtual copies, one is a heavily embellished version of the same thing and one is a bad LSD trip (or equivalent drug) the letters are rather a big deal in the whole credo.

For me, apart from the books of Ecclesiastes in the Old Testament, the Epistles are the least offensive part of the whole exercise, and more so those not written by the occasionally bonkers or half-cut Paul (a clear case of epistling under the influence, to be followed, presumably, by a lengthy bit of pistling up the wall). They aren’t particularly religious with very little supernatural cobblers. Mostly they read just as guidance, propaganda, cheerleading, cajoling and threats to keep in line a movement against the Jews, who had obviously pissed off Paul quite severely prior to the reported Damascus Road event. Whether his group was really a true apocalypse cult I’m not sure.

Paul (or his forgers) had an unhealthy obsession with circumcision (e.g. recommending that if you have a circumcision you might as well go for the full monty and chop off the whole dangly appurtenance). Presumably he was using it as a synecdoche to represent the Jews. Or should that be metonym – I guess the foreskin would be the synecdoche but, as we’re talking about the absence of one, maybe not. Absence of circumcision would also have been a fairly attractive selling point for winning followers over to his cult; hence he’d likely try to make it sound as bad as possible. (As an interesting aside the Jews actually got circumcision as part of the religion from the Egyptians, I don’t know how they came up with the crackpot idea in the first place.)

Through all the letters there are probably more good bits of philosophy on how to live decently than bad, although still being dodgy on slaves, personal freedom and women; even the commandments get knocked down to the humanistic ones only. I think the bad bits are mostly from the forgeries, but nevertheless Christians have accepted them into their beliefs, or more likely it was necessary to add the misogyny and misanthropy and tone down the egalitarianism before it could become acceptable as a mainstream religion.

Jesus and God are kind of mystery background figures used as the ultimate threat against anyone who get too far above themselves. There’s the usual claptrap about homosexuality but it reads to me more as a caution against excessive power (e.g. powerful men raping youths with impunity) rather than repugnance at the act itself, maybe that is how the anathema started.

Overall I am more and more attracted to the idea that Jesus (at least as a real person rather than an allegorical figure) plus the coincident modifications to the Jewish god were just creations of Paul; i.e. as easily understood figureheads, with characteristics that would attract followers away from other cults or mainstream Judaism; as the ultimate law enforcers for the early Christian groups; and to engender hatred for the Jews as his murderers.

It has been suggested that Paul suffered with temporal lobe epilepsy (logorrhea, especially on religious themes is one symptom), and I can certainly see commonality with Philip K. Dick who definitely had it.

There are books and articles around that cover the apocalyptic views and revolutionary movements as aspects of life in the Middle East at this time so, if my interest holds, I’ll read a few of them, (mostly those that back up the opinion I’ve formed already of course). This chap is particularly interesting on the subject of whether Jesus actually existed and on the mystery cults that thrived in the Mediterranean region at that time. I read his earlier book on applying Bayesian analysis to checking historical claims, but that was less than 200 pages; his latest, On the Historicity of Jesus: Why We Might Have Reason for Doubt, is over 700 so I’m not sure if I’ll get to that yet, but there are several excellent YouTube lectures such as Did Jesus Even Exist? or Mystery Cults & Christianity (2019).

Why did the US sell 7million barrels of oil from the SPR ? Any views . I know they do it regularly but any reason why now .

Hole in head,

Perhaps to reduce the price of oil though a dumb move as it would be very temporary.

The sale is to meet requirements of legislation passed several years ago.

https://www.reuters.com/business/energy/us-announces-planned-sale-up-20-mln-bbls-oil-spr-2021-08-23/

Some have said I am posting negative news . Well enjoy this positive news if you believe it . I don’t make the news , only report it . Don’t worry , be happy .

https://www.rystadenergy.com/newsevents/news/press-releases/us-shale-to-grow-to-14.5-million-bpd-by-2030/

Enno says 6.3 mbpd by Dec 2022 and Dennis is in agreement .

Hole in head,

Actually, I only agree with Enno’s estimate if the assumption of constant completon rate is correct, also note that the estimate does not include all tight oil basins producing in the US, only the largest 4 (Permian, Williston, Eagle Ford, and DJ-Niobrara). The shalprofile projection for all of US tight oil in Dec 2022 is 7053 kb/d, when a fixed completion rate from Aug 2021 to December 2022 is assumed. My low best guess assumes the completion rate will increase over that period and output will be 7559 kb/d by Dec 2022. Peak is 8731 kb/d in 2026 for this scenario which is based on LTO survivor’s assessment that drilling inventory in the Permian basin is very limited.

If LTO survivor is incorrect, then this would be a minimum output under a very low oil price scenario, if on the other hand the USGS mean TRR estimate proves correct and drilling inventory grows as oil prices increase, we might see an ERR of 72 Gb for US tight oil with a peak of 9587 kb/d in 2027.

The rystad report is not news- its 2 years old.

When I read Rystad’s report I just can’t believe people actually get paid to disseminate information that’s not based in reality. I just don’t really see how the shale will produce 11.5 or 14.5 million barrels? Maybe I must have been in a different industry or something. Even if we had the same number of Drilling Rigs and Frac crews running as in 2019, I still don’t see it. I guess there must be some hidden oil zones that were bypassed or something. When the Shale public’s are priced at 5 times earnings and are starved for inventory, then I see a report like this it doesn’t make any sense to me. Maybe I am just missing something.

We have had two rigs running continuously all year and production grew from 18k boepd to 25k boepd in about in about five months and now it is flat a a pancake for the last 90 days and by the way inventory is getting chewed up.

LTO Survivor,

Tight oil has constantly surprised on the high side. I agree 14.5 Mb/d is ridiculous, probably 11.5 is too high as well, but the EIA reference case (about 10 Mb/d) is probably not far off for a peak output level, but their overall expectation for output is too high (about 115 Gb for tight oil URR), a more reasonable estimate is 75 Gb, if oil prices rise to $100/bo and don’t decline too fast due to a transition away from fossil fuel. A fast transition would lead to lower tight oil ERR of perhaps 60 Gb (as in my chart above). Less than that seems low probability to me.

Any guess as to tight oil ERR?

11.5? Everything old like bakken or eagle ford is in terminal decline, only Permian and New Mexico left.

Imagine the traffic jam – they have to double or triple drilling and last but not least fracking. A traffic jam with sand and water trucks all around of Texas. This isn’t making things cheaper, faster or more effective.

LTO extraction has been done all false in my opinion. It could be done if organized on the long slow way like a mining operation. Building railways for the transports, water pipelines for disposing and fracking, water reprocessing facilities and then slowly working through the fields (you can build a field railway extension cheaper than a road being able to carry a stampede of extra heavy trucks). All financed and organized from one company with big pockets. Like the tar sand operations, they need this infrastructure, too. First spend 50 billion on the setup, then work. It would be a let’s say 1mbpd thing, but kind of constant over at least 30 years with no up and downs.

Then things could, I say could, work much more efficient.

Compare brown coal here. It is in a depth of 50 meters.

Every small private company could rent a few big excavators and dig out a part of it, while pumping water. They won’t earn any money.

But the approach was to pump a whole section of 10 square miles dry over years, then building a 500 meters long driving excavation material transporting bridge to continuous undigging one part of the coal and filling the coaled out part again.

The chaotic approach chosen with LTO was copied from the golden age of oil – where drilling a vertical well cost was only a small fraction of the finally oil income – with no fracking cost.

Who gets to define which ‘news’ is positive or negative?

The truth , nothing but the truth . Truth is bitter and so will be the end of the oil age .

https://www.reuters.com/business/energy/brazils-petrobras-sells-reman-refinery-rnest-finds-no-buyers-2021-08-25/

More be happy .

https://oilprice.com/Energy/Energy-General/China-Announces-Major-Shale-Oil-Discovery.html

Last paragraph of the article .

“Yet, China has struggled to develop its huge shale gas and oil resources. The challenges arise because some of the most prolific basins are twice as deep underground as the shale gas resources in some of the most extensive U.S. shale gas plays.

The challenging geology leads to higher well drilling and completion costs, lower margins for exploration and production companies, and, at times, mixed results in gas flows. ”

So twice as deep as deep as US shale .

ROFL .

I don’t make the news , only report it . 🙂

Let’s go get some of that deep China Shale.

It’s interesting that nothing in the synoptic gospels appears in “Paul’s” letters. Apparently, the biography was concocted much later, which is why there is a dearth of Jesus biographical material in Paul.

If the alleged miracles around the birth, ministry, and resurrection had actually happened, then surely Paul would have said something about them.

But no, for him Jesus is just a spiritual entity… Later writers gave this spiritual entity a material existence, cobbling together a bunch of stuff from Judaic and Hellenic source stories.

Mike B,

The stuff on the new testement should probably be discussed in the Open Thread. Thanks.

Note also that further comments on non Oil/gas topics might get deleted, please keep them in the Open Thread.

Thanks.

Also, any replies to comments that get deleted also are automatically deleted. Just the way it works in WordPress.

If you want your comment not to get deleted do not include it as a reply to a comment that might later be deleted.

Thanks. No big deal.

This isn’t exactly oil & gas, but it might help us have better discussions. I also posted it on the “other side”, so comments or further discussion would probably go best over there:

“When it comes to what we believe, humans see what they want to see. In other words, we have what Julia Galef calls a “soldier” mindset. From tribalism and wishful thinking, to rationalizing in our personal lives and everything in between, we are driven to defend the ideas we most want to believe—and shoot down those we don’t.

But if we want to get things right more often, argues Galef, we should train ourselves to have a “scout” mindset. Unlike the soldier, a scout’s goal isn’t to defend one side over the other. It’s to go out, survey the territory, and come back with as accurate a map as possible. Regardless of what they hope to be the case, above all, the scout wants to know what’s actually true.

In The Scout Mindset, Galef shows that what makes scouts better at getting things right isn’t that they’re smarter or more knowledgeable than everyone else. It’s a handful of emotional skills, habits, and ways of looking at the world—which anyone can learn. With fascinating examples ranging from how to survive being stranded in the middle of the ocean, to how Jeff Bezos avoids overconfidence, to how superforecasters outperform CIA operatives, to Reddit threads and modern partisan politics, Galef explores why our brains deceive us and what we can do to change the way we think.”

The Scout Mindset: Why Some People See Things Clearly and Others Don’t

by Julia Galef

George,

Your posts are so great. I really look forward to your analysis and enjoy the additional sub post at the end. Thank you for your contributions.

Revolutions occur mainly when there is inter-elite strife

George, can you point me to an authoritative (or at least useful) discussion of this?

Intra elite rivalry

Shrinking pie, and all that

Try Turchin

https://peterturchin.com/cliodynamica/intra-elite-competition-a-key-concept-for-understanding-the-dynamics-of-complex-societies/

https://en.m.wikipedia.org/wiki/Elite_overproduction

George

You conveniently left off Ephesians 5:25 (NAS) “Husbands, love your wives, just as Christ loved the church and gave Himself up for her….”

Last time I checked He died for her. Pretty certain that’s pretty selfless and not misogynistic.

I came to follow this site and learn from those that comment here.

It was fun for a while.

I’m out.

Rasputin,

I read George’s post very differently from you. It was a criticism of the writings of the Church. You do realize that the writings in the Bible were written by men and not by God. To criticise those writings has very little to do with Jesus and what he may or may not have done and why.

You can believe what you wish. Your comments about the oil industry have been enlightening.

Sorry to see you go.

Rasputin

Hate to see you go. Would like to discuss things w you one on one.

Rasputin,

let me know if you are interested in talking privately with shallow sand. I can connect you guys by email.

Rasputin , request don’t leave . Your explanation on what a ” mud engineer ” is was beyond what anyone even in the major’s could have given . We need ” hands on ” guys like you . There are admirers of folks like you though they may not exhibit it . Kindly reconsider your decision . Take care and be well .

Rasputin,

We all really value your input and appreciate your insight. Everyone would like you to stay involved. Perhaps religion should not be discussed on this site as it is an emotionally charged issue for some. I do not know or study the new testament as others do so I find it interesting to see one person’s interpretation but if it is offensive to one then it is offensive to all and should be shyed away from on this blog. Hope you reconsider.

Rasputin – Another plea for you to stay. I am usually a lurker, but have to speak up here. God loves you, and and we love you!!!! God also loves those who hate him or don’t believe. Don’t let the actions of a few deter you from sharing truth and light. From one Christian oil man to another, let’s grin and bear the alternative views of others while we keep the knowledge flowing regarding oil and gas matters.

Although you may feel you are in a minority, rest assured there are many of us out here who share your beliefs and opinions.

Ron, Dennis, and all contributors on this page are doing a good deed for society by facilitating these discussions on energy, and oil and gas in particular. Your industry input is strong and beneficial to all readers. (As is EVERYONE’S input here, whether you follow Christ, or perhaps bow to the Spaghetti Monster.)

Either way, take care and God Bless you and your family!

Thanks for the another great report George. The comments on OPEC Population particularly insightful.

Oil is going to decline in availability this decade.

And many people have correctly pointed out that BAU (business as usual) will not be able to continue as before.

The decline in oil could be quick and/or severe, and it behooves all of us to think of and take actions to adapt to a situation where fuel becomes very expensive and/or simply is not available to purchase at will.

When thinking about how to live life with less fuel, the individual and country will have to make choices of priority use- What is essential/what is optional, what is irreplaceable, what is wasteful, what is for survival, what is for fun, which sectors of the economy are frivolous?

And how will fuel in short supply be distributed? As we all know, the super wealthy will get what they want for their yachts and jets (some things never change). For the rest of us the price/market mechanism will be what determines how much we can afford to use. And it is likely that at some point government policy may be enacted to ration short supply, like it did in 1973.

Before we encounter severe shortage in supply or escalation of prices or government restrictions on use, we will be in a time period where we can make voluntary adjustments/adaptations. We are in that period now.

When thinking about how to live with less fuel, the personal light transport sector is the big target for change-

“U.S. Transportation fuel consumption accounts for over 70 percent of total U.S. oil consumption, and more than 65 percent of that amount is for personal vehicles. American drivers consume about nine million barrels of gasoline per day for personal transportation—about 45 percent of total U.S. oil consumption.” US EIA

How much of the driving is important? If gas was 7$/gallon we would find out that answer within a year.

And if it was $7/g what would you do to adjust? Does your job depend on cheap fuel? Do you live far from work and market? Are you satisfied with living local for your produce and other food? Are you ready to give up travel during your time off? Are your relatives and friends close by?

And, is your electric utility strong and proactive? Do you have a 220v circuit available ready for installation of a vehicle charger by your driveway? Will you be able to purchase an electric vehicle when the lines for purchase stretch to the horizon? [at the US average price of electricity of $0.11/kWh a person can travel 100 miles in an electric car for less than $3.30]

The industrial sector accounts for about 25% of total crude oil use. Examples of industrial/non-combustion use of petroleum products include feedstock for chemicals and plastics, lubricants, asphalt. Much of this use is not optional for a modern industrial/commercial society and the use for these purposes will be prioritized by a rational country (if you can find one).

One additional note regarding the agriculture sector- total annual on farm use of diesel and gasoline is currently about 10% less than the energy supplied by the corn ethanol industry.

Hickory,

The only thing likely to lead to a Seneca cliff in C plus C output is a lack of demand. If oil prices become very high people will switch to more efficient ICEVs, hybrids, plugin hybrids and EVs. The transition could be gradual at lower oil prices and it may accelerate at higher oil prices, but oil supply is unlikely to be a significant constraint on World economic growth.

Hi Dennis.

“oil supply is unlikely to be a significant constraint on World economic growth”

Perhaps- Its all depends on the rate of change in the various factors.

I do hope you are right. I have no interest in the chaos that a cliff scenario would entail. But many others do think we are in for a quick depletion scenario and they may be correct. There are so many variables that are completely unpredictable, and which could torpedo a smooth glide path downward.

Either way most of what I raised will be relevant questions to grapple with somewhere between right now and 2040.

Ron Patterson’s post in the last article about depletion rates associated with infill drilling suggests the end of the fossil fuel era is upon us. The problem is partly governmental and societal. Society as a whole has come to expect cheap hydrocarbons for everyday use. The government wants this to remain despite the obvious decline in discovery and production. In a free market oil would be $200 – $300 and no one (other than the well to do) would fill up their cars.

But obviously we don’t have a free market as the populace make irrational demands of the government regarding resources.

To my mind EVs are not the answer as they require an expanded energy grid which would rely heavily on nuclear or coal for power generation.

If everyone had to ride a bicycle, they would appreciate the energy it took to heat their homes.

“To my mind EVs are not the answer as they require an expanded energy grid which would rely heavily on nuclear or coal for power generation.”

have you really though that line of thinking?

Its happening right before your eyes, and its a good thing to get a grasp on.

Infrastructure is what a smart country spends money on, rather than nation building in Asia.

Which state got 57% of its electricity from wind last year? Hint- its about 1000 miles to an ocean from there.

“More wind energy was installed in 2020 than any other energy source, accounting for 42% of new U.S. capacity. The U.S. wind industry supports 116,800 jobs.”

Great new report on the industry (land based only) here from the US DOE-

https://emp.lbl.gov/sites/default/files/land-based_wind_market_report_2021_edition_final.pdf

Ex-fracker at Walmart reveals one risk to U.S. oil supply growth

Interesting article on people leaving oil jobs. Reflects anecdotes posted here by a few real oil people.

“For more than a year, Kristopher Guidry crisscrossed the Texas oil patch, fixing up electrical equipment on drilling rigs. Today, he’s studying to become a home appraiser. Abhinav Mishra was an oil engineer in some of the same fields. In January, he started an internship in Silicon Valley. And Andrew Crum, who ran digital operations for fracking outfits, headed to Kansas City, Missouri, where he joined Walmart Inc.’s supply-chain management team.

All three men say they’ve probably left the industry for good.

After three oil busts in the past seven years alone, they’re fed up with the stomach-churning volatility of it all. The boom years may be wonderful, but the trips to the unemployment line that follow are devastating. Besides, some workers say, the industry is on the decline now as the government and corporate America pivot to a greener future. Who wants to be part of a dying business?

“I would have to be pretty desperate to consider going back,” said Crum, who had followed three earlier generations of his family into the oil fields.

Of all the labor shortages that are wreaking havoc on the U.S. economy — from cashiers to chefs — few are as thorny or potentially as permanent as the one that has a grip on the oil sector. Thousands of roughnecks and engineers are, like Guidry, Mishra and Crum, wary of returning to jobs like the ones they lost when the pandemic sent the price of crude oil crashing last year.

It doesn’t help that oil producers, trying to display a newfound financial discipline to their frustrated Wall Street backers, are hesitant to offer the signing bonuses and double-digit pay hikes that have become commonplace in other industries. Average pay in the Permian shale basin of West Texas and New Mexico remains below pre-COVID levels. All of which, analysts say, could add up to a cap on production in the Permian and other shale formations that collectively pump out more than two-thirds of all U.S. oil. Drillers may be promising to avoid rushing back into expansion mode — as part of that same pledge to Wall Street — but the lack of workers frankly gives them no choice.“If reported labor shortages continue, it would be impossible to grow production,” said Elisabeth Murphy, an analyst at research firm ESAI Energy.

Complete article here.

https://www.bnnbloomberg.ca/ex-fracker-at-walmart-reveals-one-risk-to-u-s-oil-supply-growth-1.1644482

Ovi. Heck of a find.

This is what I have been saying for months here.

We finally have a rig for a couple weeks. Five tubing jobs, one rod job, one running in tubing and packer on a producer we converted to injection, and one cased hole we are plugging.

Isn’t it something we should be able to get all of that done with one rig in two weeks or so? The benefit of 900’ well bores.

Shallow sand,

If the labor shortage continues, supply will decrease and oil prices will rise, eventually they will rise to a level that higher wages will be offered to workers so that the jobs become more attractive.

Or that’s the theory. I would think in a boom and bust industry like oil, you would have seen this before. It seems this time seems different. If so, something different will need to be done to solve the labor shortage issue. Up to the industry to figure it out. I would know less than you how best to proceed, but out of the box thinking might to be a potential way forward.

Best of luck.

Dennis.

There would be a lot more labor if we could figure out a cure for the meth epidemic.

I have been racking my brain for over 20 years on that one and failing. Meth arrests here are at an all-time high.

Secondarily, oil is located almost exclusively in rural areas, which continue to shed population. That won’t help the labor pool.

Third, oil is a dying industry, we are told, similar to tobacco and coal.

Our company was started by our father over 40 years ago. The third generation is not interested, nor have we encouraged them.

Dennis, charge up the 3. You could be in west Texas in 3 days to give a hand. You’ll have a great trip.

Huntingtonbeach,

I am sure I would learn a lot, but be of little help.

Shallow sand,

You indicated you went to law school so I will assume you are a lawyer (though not necessarily).

Can you legally require employees to submit to random drug testing, if you are suspicious they are abusing drugs? Not sure this is a solution, but I imagine not all rural youths are using meth.

Though finding the good workers that want to remain in a rural area is no doubt a challenge.

One has to make rural employment attractive by offering competitive wages, I would think, better wages than the local refinery to attract the best talent and to account for the harder work.

I imagine you have thought of all this obvious stuff. I suppose you could work the field and try to bring a crew up to speed, let the young guys do the hard labor and you do the supervising, planning, etc, that’s if you can find some bodies who are not drug users.

Plan B is to hang in there as best you can, hope for higher oil prices, then get out at an opportune time. Perhaps that is your plan.

In any case hope things work out.

There are obviously folks you can talk to in the business that would know infinitely more than me as they have been there done that.

Hi Dennis.

Unless it is specifically part of an employment contract, demanding drug testing after the fact is constructive dismissal- the equivalent of firing without cause (at least under Ontario law).

Lloyd,

I am not a lawyer, and am unfamiliar with distinctions between Canadian and US legal systems. Could a small employer simply include that language as part of the employment contract when hiring a worker?

I really have no idea, it seems in the US some employers do require employees to be drug free and I assume random drug testing might be included in their employment contract.

Lloyd, Dennis,

Sadly, in 49 of the 50 US states businesses have managed to eliminate most protections against arbitrary firing. It’s referred to as “at-will” employment.

The only protections are for protected classes like gender, race, religion, etc.

SS, thanks for your comments on Meth.

>> 222 patients in a treatment facility were surveyed about their use of meth and specifically on why they used the drug. It was published via the Center for Social Work Research at the University of Texas at Austin.

Participants were 18-years old or above and had used meth at least six times in the past six months. When asked what the top five benefits of using meth were, the females responding said the ability to do more housework, being able to take care of their children, losing weight, getting over depression, and increasing their confidence.

Males overwhelmingly cited sexual benefits such as energy and overall enjoyment of sex but also listed higher energy and the ability to stay awake, the general experience of feeling “high,” using meth as a way to have fun, and finally creating positive changes in their mood.

<<

https://www.shadowmountainrecovery.com/inside-the-texas-meth-problem/

We have never seen this before and usually in a time of recovery there is a ramp up of services but today with the ESG mandate, there is not the capital flows coming in to bring labor and services back to the field. On our new project with my new company, we can’t get casing or line pipe/ We have been told that all new steel is being committed to Amazon’s new construction of fulfillment centers around the county. This is a real current problem. I dont know if others are facing the same issues. Would like to hear.

LTO survivor,

Perhaps part of the problem is the worldwide pandemic. Seems there are a number of bottlenecks in the system causing disruption. We have not seen this kind of pandemic since 1918 and there was far less global trade at that point in history. I wasn’t around to see it, nor my father, my father’s parents and mothers parents were around, but I never discussed it with them.

These are unusual times, of that there can be little doubt.

That also

“We have been told that all new steel is being committed to Amazon’s new construction of fulfillment centers around the county.”

Atlas Shrugged 😉

“but today with the ESG mandate, there is not the capital flows coming in to bring labor and services back to the field”

Surprised by this interpretation of the scenario.

First, what mandate? There is no ‘authoritative command’ to restrict capital. The majority of the investment assets under management in the USA (many trillions of dollars) are under no ESG restriction criteria- [voluntary or otherwise] and this does not even consider all of the vast private investment hoard held by the super wealthy and corporations.

Secondly, interest rates are low and capital is readily available for all sorts of projects- courtesy of an expansive central bank monetary policy and huge investment funds eager for small but solid return on investment.

Third, if there is indeed a difficulty for the industry to attract capital it is more likely due to past performance. As you very well know, the very success of the LTO industry production has caused a temporary relative glut with lower pricing since 2014. The stock performance of most of the US oil industry public companies has been extremely poor for the past 7 years. For example

S&P 500 122%

PXD negative 23%

EOG negative 37%

DVN negative 55%

I suspect performance to improve from here, but no surprise that investors are wary based on the dismal return on investment since 2014. Negative return is the opposite of return on investment for the unfortunate savers who put up the money.

I know that there is a growing sentiment to direct investment money toward non-depleting and ‘cleaner’ forms of energy, but currently it looks more like competition for capital rather than restriction being the bigger force at play currently.

In the end, I think energy scarcity will be a much bigger driver of capital flow than environmental concerns, but there will be growing competition for capital by the electric transport industry (including development of the vast US solar reserve) which is still in its its infancy phase.

@ HiH and others

The inflation corrected oil price continously goes down. The downward trend is valid for the maxima and the time-average. The only exception is the last months, but the 6000 Billion Dollar spent by the US Government for Covid-19 subsidies can explain this.

What is your explanation for the downward trend ?

Berndt,

Good to see you once again. Nice chart. It will be interesting to see how the oil price plays out over the next several years. It is true that the U.S. added nearly $7 trillion in debt in 2020, to prop up the GDP from being a total disaster. But, I doubt that will be replayed again anytime soon. So, again… it will be interesting to see how the oil price trades over the next 2-5 years.

While I believe the market has under-estimated the impact of Thermodynamics on the oil industry, we still could see price spikes due to shocks in the market. But, I doubt these will be long-lived.

By the way, are you still conversing with Arnoux?

steve

To Steve

Steve, sorry, but the last months i had no contact to Arnoux.

Thermodynamics and oil: Nearly all people, especially in the oil sector, have overlooked, that one important law of physics is, of course, valid for the oil industry. This will have severe consequences. And this explains the diagram above.

Berndt , frankly speaking I have been thinking on the same line for quite some time . Why the price is so low in real terms after discounting for inflation ? I don’t have a clue . Maybe you can fire some shots for us to catch ?

To HIH

There is a long explanation and two short ones:

Long:

https://limitstogrowth.de/wp-content/uploads/2020/01/Mar_2020_Thermo_EN_09.pdf

Short #1:

Nobody pays more for oil than he can earn with it.

Short #2:

The production energy of oil is continuously rising. When the production energy of oil is as high as the energ content of oil, the world economy will not need it and not pay for it. Therefore, the price of oil must go down in the long run.

Thanks Brendt , I am going to read it over the weekend . So many riddles and lies to be unraveled in the oil industry . Tks once again .

Is this paper not just the Hills Group work again which was already discredited?

Kleiber,

Yes, it is and it shows how dangerous a little knowledge is. Steve still uses (in one of his graphs), a “result” from the Hill’s group.

To Kleiber,

this is not the Hills paper. If you would know the Hills paper, you would not ask. And “already discredited” is not the right word. Please use “difficult to understand”.

Kleiber and Bernt,

—

If it is not the Hill’s group’s paper, it is very similar to it. Both their paper and that of Bernt develop an idea that somehow the geothermal temperature gradient is linked fundamentally to the oil production process and then try to do some calculations based on estimated losses in various parts of the oil extraction process to come up with, what appears to be the Carnot limit.

The thermal energy convected by the oil stream to the surface is unimportant, as the local cooling is soon replaced by heat transfer from the surroundings, i.e. ultimately from the earth’s core, which is the reason the geothermal gradient exists. We will not run out of this energy in the remaining time of human’s on this planet.

—

This linking of the geothermal gradient to oil extraction is very strange notion.

Bernt says that Kleiber does not understand his paper. Well, it is for good reason, since the paper is not understandable.

@Berndt: But this is building on that work, no? If so…

https://www.resilience.org/stories/2017-03-01/debunking-hills-group-analysis-future-oil-industry/

Well, back in 2014 the hills group did predict that the price of WTI would hit zero.

And it did

Hi Seppo,

nice to hear from you. You are the guy, who has written the rebuttal of the Hills Group report.

I will not fuzz around. Lets go directly in medias res. The Hills Groups report is filled with bugs. But now lets analyze your report and eliminate the bugs of your report.

1, The PPS (Petroleum Producing System) is the totality of the devices, into which crude oil and water enter. Oil products and water exit it. As for all systems of the world, the second law is valid for it. Because all masses entering it are leaving it, the ingoing masses and exiting masses are equal.

Therefor, the steady state entropy rate balance for closed volumes from Moran/Shapiro is adequate and to be used for the PPS:

Please check the equation you use and replace it.

2. The refining process separates the fluids of the crude oil, only some of it is chemically altered. For incompressible fluids the specific entropies are the same as the specific heat capacities, So we have :

If we concentrate on the first order terms and neclect second order terms, ingoing and outgoing terms are equal and cancel.

Please include this in your report.

3. Because the terms cancel, we get:

This is the same equation you show, but derived in a much more straightforward way. If the heat currents are inserted, this equation allows to calculate the entropies the PPS generates. Okay ? Next time i will explain the integration.

Hello Berndt

Let’s do this exchange off-line. I have used LaTex to get the equations into my writing since 1989 and even if it might be easier to do it in HTML today, I prefer to do write them into a LaTex document directly. We could then go through the development line by line and see where we agree and disagree. Dennis can give you my email address.

best, Seppo

Sorry, Seppo, i must do it online.

4. The last equation can be rewritten because all heat currents end at the Earth surface, which is the reference temperature.

4. The last equation can be rewritten because all heat currents end at the Earth surface, which is the reference temperature.

5. The heat currents of oil and water are:

6. The irregularities are the entropies generated. If they are multiplied with the temperature, the exergy which is converted to anergy by the PPS results:

7. This equation is still the derivation with respect to time. To get a function of time, an integration has to be done. The upper integration limit is the center of the time period delta t.

8. This is the exergy necessary at the time tE + delta t. In the time span between tE and delta t, the mass of crude oil produced is:

9. If we divide the required exergy by the mass, the ETP-Equation results. I prefer the term TNE instead of ETP. TNE stands for Thermodynamic Necessary Exergy. This is the exergy per unit of mass required for oil production.

This TNE equation is the same as Equation #7 of the HG report, but with a better notation. Seppo, please replace your equation with this one.

In my opinion, the formulas of the HG report are buggy, but the physics involved is absolutely correct. And the consequence is correct too: The exergy required today to produce oil is in the order of magnitude of the exergy content of oil. Unfotunately, the HG Group has not recognized that all this exergy is required to change the temperature of the earth crust. If they would have recognize it, much more people would understand the model. (It took me more than a year to tecognize).

Seppo, most of your conclusions for the HG Report are as incorrect as your understanding of the formulas. The best is, you cancel your rebuttal.

Berndt and Seppo,

I sent Seppo’s email address to Berndt as Seppo asked. I will leave it to Berndt if he wants to reply to Seppo. Berndt if you would like me to give your email address to Seppo, just ask me here as I do not check the peakoilbarrel account very often.

Berndt, I spent (almost) my entire career trying to satisfy computer owners that I was sure I Knew what their problem was and I was there to solve their problems. (I worked on huge mainframes, now called dinosaurs.) But we field engineers, (that’s a fancy term for “computer repairman”), had a saying: If you can’t dazzle them with brilliance, then baffle them with bullshit. I am not sure which of the two you are trying to do, but I am sure it is one or the other.

Berndt: in the note on 08/30/2021 at 3:11 am

you claim to have given an alternative method at arriving to the

equation that relates entropy production to heat transfer.

You say that “neglecting second order effects” you come up with the equations in that note. From an equation with 4 terms, you claim that two are equal and by eliminating them the other two are also equal. True enough! But how do you know that the first two are equal?

After eliminating them, you come up with the balance for the “second order term”. Usually, after such terms are neglected, the main result is embedded in the terms that are not neglected. In your case the main result comes from the “second order terms”.

So the question is. On what basis are the two terms consisting of the entropy inflow and outflow by the bulk motion neglected?

To all:

It is clear, that most people do not understand the equations nor their meaning. But they will understand, that SKs rebuttal has false formulas, and they will understand, that serious doubts about his report exist.

But some people, skilled in thermodynamics, are able to check my formulas and the Hills report. They can now recognize some of the HGs typing errors and inaccuracies, and that the physics of the report is correct.

In my own report (link see above) i use a total different approach than the HG uses, but get the same result.

Seppo asks if the “approx equal sign” in #2 may be replaced by an equality.

1. In my own report i do not need the formel #2.

2. It is allowed to replace the “approx equal”, because the heat capacities of a mixture of fluids is the corresponding mixture of heat capabilities. Crude oil is a mixture of different fluids, which get separated by the refining process. Remark: Some of the fluids are chemically altered, that is the reason to use the “approx equal sign” in #2. The changing of the chemics alters the heat capacity. But they are similar.

Berndt,

Both short explanations are wrong.

For #2 this would imply that the price of electricity produced with a steam turbine should be zero. Is that your argument?

It is obviously wrong.

Berndt,

It has nothing to do with thermodynamics as it is not an input into business decisions in the oil industry.

The explanation for real oil price trending down is quite simple, there was an oversupply of oil on the market both because US tight oil producers overproduced and because OPEC was fed up and decided to try to take back market share.

You picked a very short time frame, also your trend on Brent for the past 11 years will not continue from 2021 to 2033.

Berndt,

The trajectory from 2020 to 2030 is much more likely to look like 2000 to 2011 than 2011 to 2021 (I doubt we will see another glut until demand starts to decrease faster than supply around 2035.)

To Dennis,

i am interested if there is another explanation for the falling trend than thermodynamics. How many people have touted in 2010 to 2014, that oil prices must go up because oil production gets more and more costly ?A thirteen year trend, which is against all of these predictions, It MUST have an explanation.

But i see, nobody gives another explanation. HHH says, the oil price trend is unimportant, and you say the same. So nobody knows neither a different explanation, nor a better, at least in this blog.

Some remarks:

1. The second law of thermodynamics is the only (with a unimportant exception) law of physics which defines a time direction. It says, tomorrow is not the same as today. 2021 to 2030 will not be the same as 2000-2008. Oil prices from the last years are the only one which can be used to make a projection for the near future. So, your mentioning of oil prices from +2000 to +2010 has the same importance as mentioning the oil prices of the roman empire. They say nothing about the near future, only the last data is important.

2. Oil prices are not determined by oil companies. The are determined by the customers of the oil companies. And if the customers of the companies do not pay what the companies wish…..the companies can do….nothing but accept.

3. The second law can be used to make predictions for the oil prices customers are able to afford. Thats it.

4. The only thing oil companies can do to increase the oil price is to reduce the oil at the market. And OPEC is the only association which is powerful enough to reduce by a significant amount. Look at the dark yellow dashed line connecting the oil price minima. There you see the OPEC actions.

5. I had a lot of discussions about thermodynamics for oil production with different people. I am always astonished, that one of the most important laws of physics is totally ignored in the oil field: The law defining the direction of time. Not understanding is one thing, but to ignore it…?

Brendt , yet to read your link but a question . Am I to understand that the computer boys at NYMEX have no say in setting the price of oil ? My understanding from what you have posted to Dennis is that where as the physical market sets the base price of let us say $ 70 the computer boys can only nudge it to $ 69 or $ 71 depending upon where the profit lies . Tks

“Am I to understand that the computer boys at NYMEX have no say in setting the price of oil ?”

Well, almost no say. News and emotions can cause wild swings in the price of anything, but in the end, it is supply and demand that dictates the price of any commodity.

Think of it as a skier behind a boat. The skier can make wide swings on either side of the boat, but regardless of how wide the swings he must follow the boat. The skier’s wide swings are market rumors, news, and emotions. The boat is supply and demand. In the long run, supply and demand always dictate the price of oil

Thanks Ron, for your example. This is my opinion too. But the last sentence seems to be not correct. The inflation corrected oil price in 2011-2013 has been roughly twice the price afterwards. Has demand decreased or supply increased ? How work supply and demand so that the price decay can get explained ?

Berndt, in the short run anything can happen as the traders try to out-guess the market. But in the long run supply and demand always dictate the price. If the price is too high, demand will drop creating a glut, driving down prices. If the price is too low, a shortage will occur, causing prices to increase.

That is the way it works. No other explanation is needed.

Berndt,

The second law is important at a society wide level, but not for individual products.

Your explanation for falling oil prices if correct would suggest that electricity produced with fossil fuel should have a zero price as energy out is less than energy in. Is that what you expect?

The price is set by the interaction of suppliers and consumers. If price that consumers are willing to pay is less than the price required to make a profit then supply will be zero. Note that for the consumer the energy used to produce the product is not part of their decision, they have no idea and could care less.

Likewise producers are concerned with making money they are concerned with cost of production and revenue from selling their product. Energy used is only a concern as it relates to cost, no producer cares about EROEI.

Prices for oil decreased because supply was greater than demand, it really is that simple.

The market sends a signal to producers to reduce output through a drop in price. Also consumers will consume more at a lower price. There are large lags in response as changes in industry investment and in consumer choice in vehicles takes a few years to affect supply or demand. On top of this their are political difficulties in OPEC plus, pandemic problems, etc.

For a thermodynamic analysis to be useful it has to look at total World energy use for every type of energy because energy is transferred between different sectors.

If you look at Sankey diagrams you see this for the US, but I am not sure if we have these for the World.

I

Dennis,

“Your explanation for falling oil prices if correct would suggest that electricity produced with fossil fuel should have a zero price as energy out is less than energy in. Is that what you expect?”

I expect this for exergy (to be correct), if the

1. electricity of your example is used as the only source to produce the fossil fuels.

2. If one Joule of electricity produces about one Joule of fossil fuels.

For consumer products etc. i do not expect this.

“For a thermodynamic analysis to be useful it has to look at total World energy use for every type of energy because energy is transferred between different sectors.”

This can be done and has been done. But i will not present the results here, to discuss it with people who do not accept that the second law is valid for oil production.

Berndt,

You have a basic assumption in your analysis that the second law of thermodynamics has some relevance to the price of oil. Oil price increases and decreases primarily because in some cases supply grows more slowly than demand for oil, leading to a shortage (at current price level) and causing an increase in price to balance the market (by increasing quantity supplied and decreasing the quantity of demand at the new higher price). This describes the Oil market from 2001 to 2011. In other cases the supply of oil grows faster than the demand for oil leading to oversupply at the current oil price level, in this case oil price falls leading to a smaller quantity supplied and a larger quantity of demand at the new lower oil price. This is what occurred during the price drop from 2014 to 2019.

I will note that you said the recent period is the period of interest, recently oil prices have been increasing. Chart below has real Brent prices in 2020$ from Jan 2016 to Dec 2019, I assume you realize the pandemic caused an obvious drop in oil demand which caused oil prices to drop. Also the spat between Saudi Arabia and Russia in late 2019 early 2020 exacerbated the oil glut.

Berndt,

Lots of different energy inputs into petroleum production process, second law of thermodynamics applies for an isolated system. You have to consider both energy and mass flow across the pps boundry.

Dennis,

Yes, both mass and energy are important. Berndt seems ignore both: oil production has lots of non-oil inputs and outputs, including grid electricity, natural gas, hydrogen, etc.

Here’s a WTI chart with the Hill’s Group’s MAP price, it starts the chart just under $140 and crosses zero in November 2021.

They published this prediction in 2014. It’s basically what they predicted the value of oil is to the world economy. They said ‘Price’ in their model but in hindsight I think ‘Value’ is a better word for it.

Bahamased,

Yes I have seen that chart which assumes the price of a product is related to its exergy.

It is not. If this were the case electricity produced by fossil fuel or nuclear power would be priced at less than zero. The two are not related. The exergy content of a product has little (or nothing) to do with its price.

Berndt,

Here is recent trend in Brent real oil prices (monthly spot prices through July 2021 from EIA adjusted to constant 2020$ using CPI).

If you want to use recent data, here it is. The trend is an increase at an annual rate of 36 dollars per year. I do not expect this trend will continue at this slope, but we could see $100/bo by 2025 and perhaps $120 to $130/bo by 2028 in 2020 US$.

Dennis, i am always astonished why you refer to time periods, which evidently are not relevant for the problem. You seem to have no feeling what could be of importance.

Some time ago, a guy told me that in science of economy laws exist, which are equivalent to the first law of thermodynamics, but nothing exists, which is equivalent to the second law. Might this be the reason that you think all time periods are equivalent ?

Blair Fix has once published a report about “econospeak”, the language of economics. and that this language misses terms which describe the real world. I will read it again.

Berndt,

So only the time periods you choose are relevant? That is funny. Is their something magical about the period you choose, besides that it confirms your theory?

Can you explain why electricity produced with fossil fuels is not priced at zero?

It obviously has negative net energy, maybe consumers should be paid for accepting such an inferior source of energy?

Thermodynamics as applied to an economic system only makes sense for the entire system.

It is also difficult to conceptualize the oil production and distribution system as an isolated system where the second law of thermodynamics could be applied. Lots of mass and energy transfer applies across any boundry one could attempt to create.

To Dennis

The theory says, that the thermodynamic effect starts to work about 2012. So it makes little sense for me consider time periods much before 2010. It makes some sense to compare the time before 2010 with the time after 2010 to see if something has altered, but using a linear fit for 2000-2021 is humbug.

And using short time periods make no sense, at least some years should be used. Corona makes severe disturbances of the oil price, which now last for 1,5 years. After the disturbance has finished, a disturbance time period can be determined. If this period is multiplied by three or four, a adequate time span for examination results. This gives 6-8 years.

As long as you think, the world runs by money, you are not able to understand the problem.

To produce oil, exergy is needed. If the amount of exergy gets in the order of magnitude of oils exergy content, oil production will stop. Oil productions life can be extended using exergy from other sources, but it will stop. It can’t work anymore. All the money the central banks can create, will not help. Despite central banks can create money out of thin air, this does not help.

Berndt,

As long a on a society wide basis there is enough exergy produced for the entire system then which things get produced is a matter of consumer preference and profitibility of the producers and their interaction. This just happens to be how most social systems are organized.

A claim that exergy determines output is clearly false for individual products.

I notice you have failed to come up with a good explanation why electricity is produced with steam turbines. This lends itself very nicely to a thermodynamic analysis, do you still want to argue that prices are determined by exergy?

Bahamas , your ” price ” vs ” value argument does not cut ice . Absolutely unsatisfactory . Maybe another try ?

It doesn’t matter any more, it’s all in the history books now. The Hill’s Group reports predictions end at the end of this year so I don’t see much point in trying to change anyone’s mind about it.

A simple statement of the 2nd law: “the entropy of an isolated system always increases.”

Okay, is the Earth an isolated system? With 100,000,000 gigawatts of sunlight flowing into it continuously?

Earth is an Open System. It receives incoming energy in the form of electromagnetic radiation, and it also emits electromagnetic radiation. This is why the Earth maintains a stable average temperature and therefore a (relatively) stable climate.

I agree: it has very large energy inputs and outputs.

Berndt, what do you think?

As far as oil is concerned it’s a closed system within the time frame we’re talking about, the last 200 years

To Nick:

For open systems the “entropy rate balance for closed volumes” is to be applied. See the book of Moran/Shapiro.

Bahamased,

I think you have to treat oil as open and non-isolated (these refer to matter and energy flows, respectively.

As far as energy goes: let’s say a litre of diesel has 10 kilowatt hours of chemical energy. Let’s say a litre is selling for $1: that’s 10 cents per kWh. And, let’s say you can buy some electrical power for 3 cents per kWh, and it takes 10 kWh of power to produce this diesel.

So, energy inputs are equal to energy outputs, yet the inputs cost only 30% as much as the outputs, and such a project has a plausible chance of paying for itself (depending on other costs of course, but this is just a proof of principle).

As far as matter goes, think of Canadian tar sands: very cheap local gas and bitumen can be used to produce expensive oil, even if the energy return on investment is low or negative.

Make sense?

Bahamas, the price went to zero but the cause was not extraction cost or temperature differential or even a buyer/seller problem . . The problem was storage . The computer boys at NYMEX got their arithmetic wrong and so the anomaly . This was a flick on the computer screen and then back to normal . Sorry , does not count .

Shale oil

LTO survivor

???

I think one thing that is actually more important than what the price of oil is. Is what will the cost of capital be for LTO producers in the future. Think about it like this. If 30 year mortgages on houses went from say 3% to 4-5% How many people can afford a house at today’s prices if cost of capital were to rise. Mortgage rates are not going to rise but that is besides the point.

What if the average corporate bond interest rate went from it’s current 4% to say 7-8% How much economic growth could we expect to see if that happened? My point is cost of capital and future cost of capital will determine how much LTO we have in future. What happens if these LTO producers ever have to roll over their debts at a higher interest rate? Just because they need a higher price to make this work doesn’t mean they are going to get a higher price.

If you slam borrowing cost below the rate of inflation just to keep the hamster wheel turning then the lender of the money gets to experience a negative rate of return on their capital in real terms. Capital always flows were it is treated the best.

Oil could be $150 and borrowing cost for LTO producers could go to 3% but if inflation is 5% or way higher because of $150 oil. Then the flow of capital gets cut off. Maybe oil will flow by other means than capitalism. But until then LTO need OPM to flow.

Let’s look to Jackson Hole today then. The FED controls these long terms interrest rates.

Many speculate they will begin to taper – this would be bullish for long term interrest rates, with all effects you described. Or if they don’t, access to OPM for shale and housing will continue.

A friend of my who studied economics thinks the longer we get QE the more we move to a socialism. More and more of the economy gets controlled by the state – In Japan the central bank (it is an extension of the state) is already the biggest stock owner, the state defines short AND long time interrest rates. And the economonic boost packages from the state get bigger and bigger (“New green deal”). For companies, the question “What dows the state want” gets more and more important than “What does the customer want”).

I don’t need to say that a more and more state economy is a slow meltdown. Yes, they can get all the LTO – but it will cost double.

I expect long term interest rates to fall towards zero because they taper and are going to force money further out on yield curve. By paying more on reverse repo. But we shall wait and see.

If interest rates rise 300 basis points most of the corporations would be banktupt unless they can pass through the higher costs. This is misery caused by QE forever. Without QE, the bubble bursts and I believe with current globalization, the world would fall into a massive recession/depression. QE=Heroin. Kicking the habit may be to hard to do.

“ A friend of my who studied economics thinks the longer we get QE the more we move to a socialism. “

“ Permit me to issue and control the money of a nation, and I care not who makes its laws”. Attributed to Mayer Amschel Rothschild

HHH,

In my analysis of the Permian I assume interest on debt is 7.5% per year. After May 2021 at the WTI prices I assume (rising from $60/bo to $75/bo over next 12 months in 2020$) no new capital is needed all wells for the scenario are financed using cash flow. So your “what if interest rates rise to 7.5%” scenario is already baked into the scenario.

Bigger problem could be interest rates falling below rate of inflation.

HHH , real interest rates are already negative .

Despite all the gloom and doom (and condescension) spread here, it’s worth mentioning that the sub-Saharan African countries mentioned have some of the fastest growing economies in the world. Nigeria, Congo Brazzaville Equatorial Guinea and Gabon all average well over 5% economic growth since 2000, even though the last couple of years have been rough.

All of them have falling oil revenues, but they clearly don’t need them for economic growth. The stereotypes of Africa you grew up with haven’t been valid for decades.

Blow the dust off the clock. Your watches are behind the times. Throw open the heavy curtains which are so dear to you. You do not even suspect that the day has already dawned outside.

-Aleksandr Solzhenitsyn

5% growth in Nigeria means no personal income growth for anyone – the population grows with rates like this. You need much more there than 5%.

Less than 5% will be decline and crisis.

Only states who stall their population growth can really grow with 5%.

Nigeria’s population growth is about 2.6%, so 5% growth should mean that per capita income is growing.

General opinion seems to blame corruption and income inequality, so that the poor stay poor.

Nigeria GDP per capita in constant 2017 international $ (PPP)

https://data.worldbank.org/indicator/NY.GDP.PCAP.PP.KD?locations=NG

It has been falling since 2015 after strong growth from 2000 to 2014 according to World Bank data.

Nigeria is a textbook curse of resource wealth case. The corruption led to major attacks on oil infrastructure because none of that wealth was going to anything useful for the people. See also Congo and their mining.

Well said Eulenspiegel.

And unless they’re living off a sense of self-satisfaction, they will be consuming resources with their newfound wealth. Why, exactly, am I to celebrate this again?

Markets will take a little time to digest what FED’s next move will be. 7.5 million people fall off unemployment benefits September 6. So at the first Friday of October’s payroll data the unemployment % will be low. Market knows this. And will price in taper.

The labor shortage shallow talks about in the oil fields is real and wide spread and everywhere you look. So wage inflation is high as it’s been in a really long time. Rate hikes will follow if wage inflation is here to stay.

HHH , Powell gave a nothing burger at Jackson hole . The market went up . Just my opinion , the market will go up even if a 1000 hostages are taken on 31st August in Afghanistan . FED cannot disappoint Wall Street . Main street is dead , Wall street is the only game in town . I disagree with you on rates . Interest rates will remain low whether wage inflation or CPI or any other index . The FED has lost control . The only way out is inflation/stag inflation leading into a deflationary cycle ( permanent ) or defaults on a massive scale ( you mentioned corporate debt , bullseye ) which will again be deflationary . What does this do to oil prices ? Deflation = lower oil prices .