A guest post by George Kaplan

EIA Liquids Reserve Estimates

This follows on from Part I, which looked at EIA reserves and revision estimates for US as a whole and the GoM, and concentrates on the on-shore tight oil and (below)gas producing regions.

The EIA issues revision data by whole states or state districts rather than by basin, so some of the reserves and production, but a small proportion, will be from conventional reservoirs. It does give total reserves for each shale basin but not the changes, and I didn’t go to the trouble of pro-rating everything against that. Its data only goes through 2019; the 2020 update will be out in December or January.

The regions for each basins used are Permian – Texas Districts 7C, 8 and 8A and East New Mexico; Bakken – North Dakota and Montana; Eagle Ford – Texas Districts 1, 2, 3 and 4 Onshore; Niobara – Colorado; Marcelus – Pennsylvania and West Virginia; Utica – Ohio; Haynesville – Louisiana South Onshore and Texas District 6; Barnett – Texas Districts 5, 7B and 9; Woodford – Oklahoma ; Fayetteville – Arkansas.

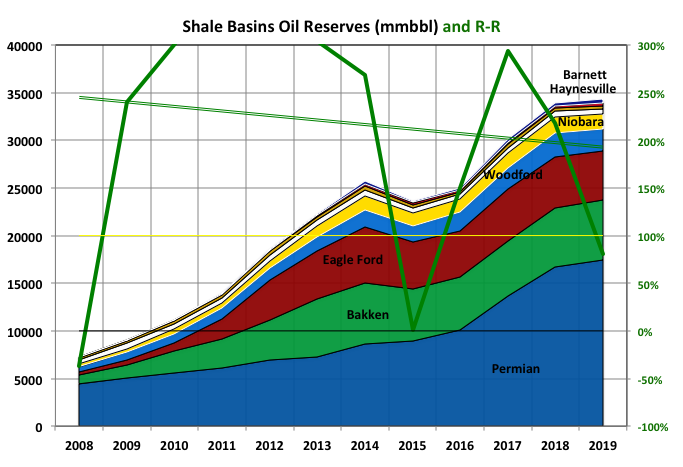

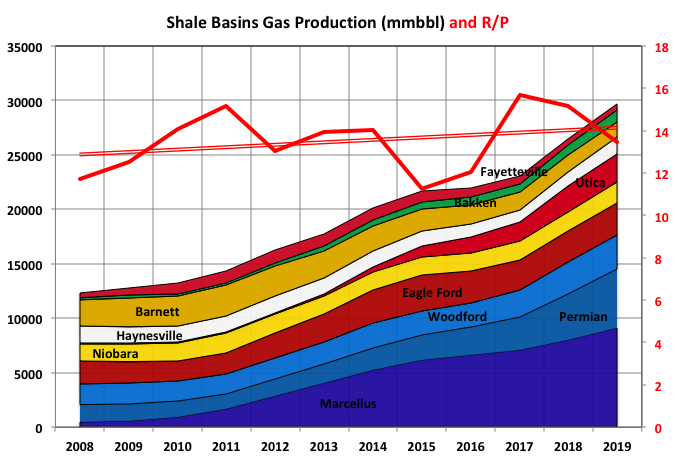

Remaining reserves are for crude, condensate and NGL, which is easier to include here given the way EIA presents its data. Totalled for all the basins these may have peaked in 2019, they were levelling off from 2018 and will certainly fall significantly in 2020.

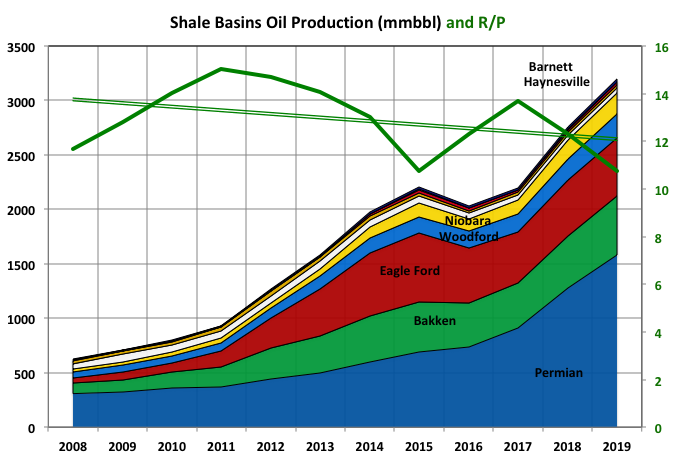

Production was aggressively increasing in 2019, coming mainly from the Permian, but will fall in 2020, and given shale dynamics, a concurrent peak with reserves is not unlikely.

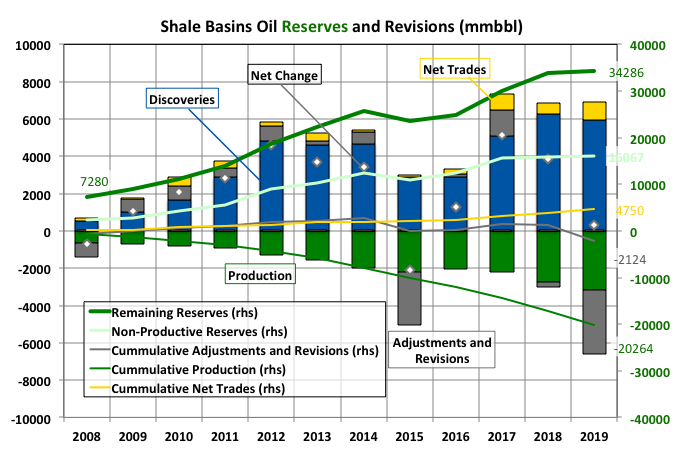

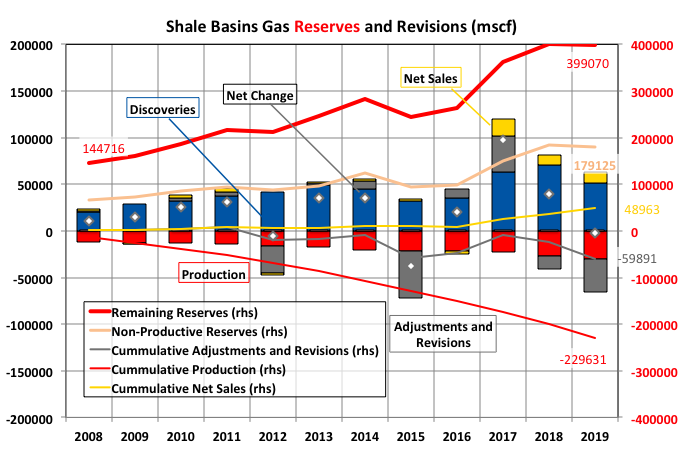

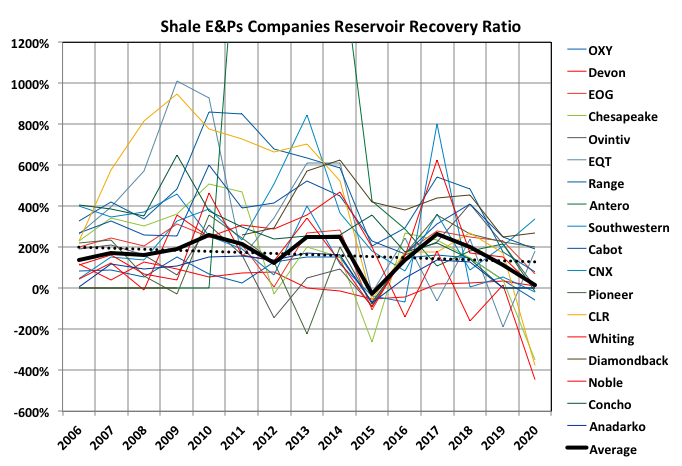

Cumulative adjustments and revisions turned negative in 2019 and I expect will show a major decline for 2020, which may well not be fully recovered even if prices rise significantly. To me this indicates that estimates for recovery factors were over-estimated originally and are gradually being corrected. There are very few successful wild cats now so the discoveries are all extensions of fields or accounting features in which they are booked as FIDs are made (EIA does not backdate to the original field discovery date). Thus the healthy reserve replacement ratio (R-R), of above 200%, is probably an artefact of past discoveries from the early days of a particular basin and will look far worse against backdated reserve numbers.

I don’t understand how there can be overall gains through net purchases versus sales but it is probably something to do with how EIA collects the data and reflecting overall sales from small and private companies to the larger players.

The non-producing reserves, mostly undeveloped areas, have been constant since 2017 so their ratio of the total has been falling, which implies that companies are now having to draw from net inventory of new locations rather than finding attractive new sites.

EIA Natural Gas Reserve Revisions

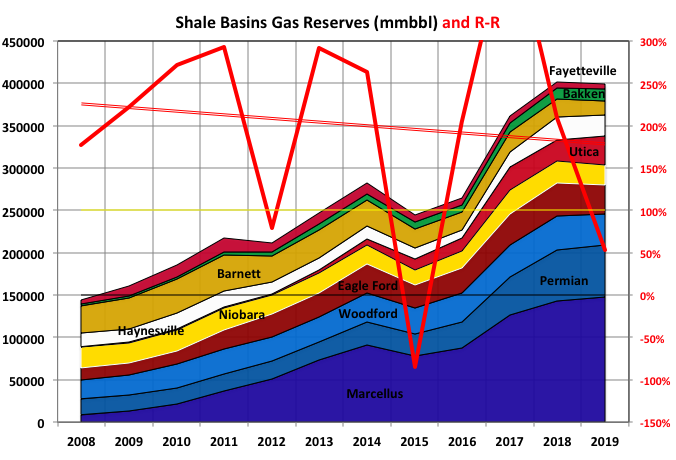

The natural gas shale dynamics seems to precede liquid basins by one or two years, so there’s more likelihood that we are past a global peak there.

The negative cumulative revisions and adjustments started earlier and are so far more pronounced for natural gas than for liquids. Undeveloped reserves seem to have started declining rather than just plateauing.

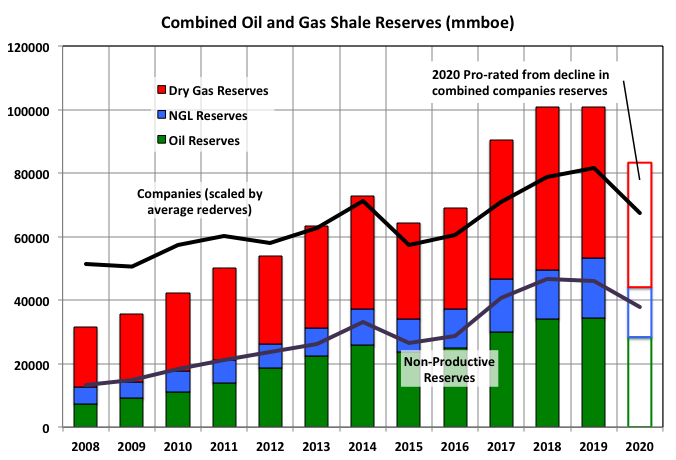

EIA Combined Reserves

A significant and growing proportion of the production is NGLs. It will be interesting to see how this proceeds as decline and depletion sets in. In conventional fields gas gets progressively heavier (i.e. containing more NGLs) as pressures fall below bubble point or a gas cap is blown down, similarly from the start for gas-condensate fields. I’d imagine there are similar effects in shale fields, maybe more so given that pressures decline from the start of production, that the pore restrictions allow gas flow in preference to the oil and that it now appears that wells can significantly effect the pressures in neighbouring drainage zones.

The 2020 column is an estimate of the coming EIA data based on pro-rationing the numbers from companies that have the largest proportions of their reserves and production from shale basins as described in the following section.

Shale Company Reserve Revisions

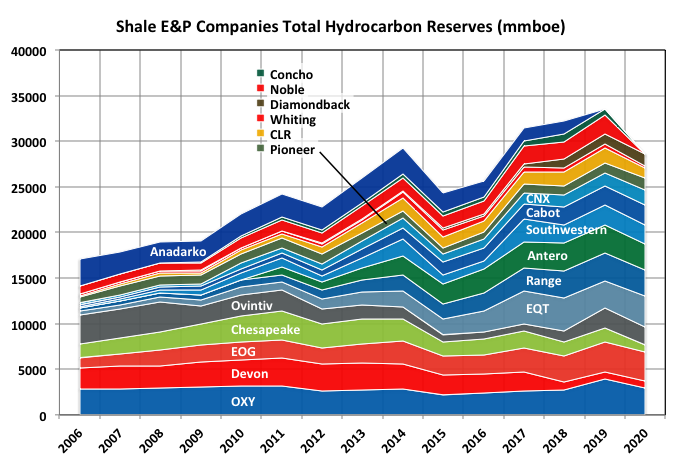

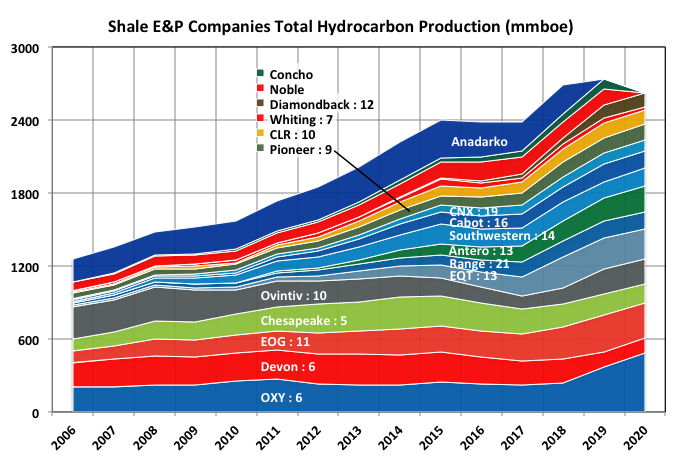

The companies chosen as represented are those with large shale reserves and production, but also a majority of their holdings as shale (all a bit subjective but it does exclude the majors and super-majors and includes most of the familiar shale cheerleaders).

These companies only represent about a quarter to a third of total reserves and production, and they have been closer to plateauing rather than the rapid expansion shown by the overall shale basins, which would suggest that the majors and larger independents have been particularly aggressive.

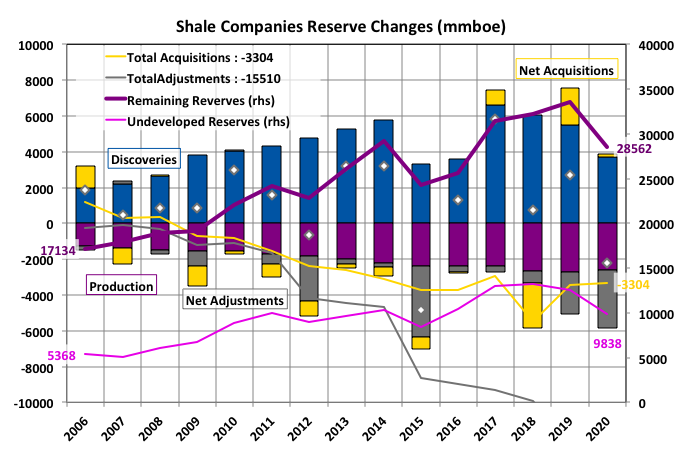

This group of companies has been selling off some assetts overall but the most noticeable change is how the revisions and adjustments has been consistently negative, even in years with large oil price increases. From 2006 these adjustments have been about 25% of discoveries in the same period, suggesting that the original estimates for recovery factors were too optimistic, and there is no reason to think they are not still.

The net revisions and adjustments have been growing negatively since production really took off around 2010/2011, some of the big drop last year will be recovered as prices rise but I doubt all and the companies could well use the opportunity to paper over their previous sins of overestimation. I don’t think it surprising that the corrections are so much more for these companies than for all the shale producers including the large IOCs that tend to have a bit more of spotlight on them.

The organic replacement ratio has trended down to about breakeven and the spread among companies has narrowed – something can probably be read into that.

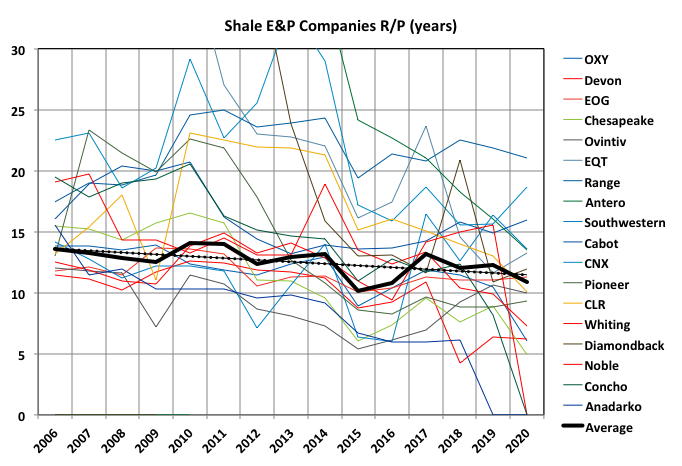

The average R/P ratio has been steadily dropping, all companies have seen similar falls but the spread among for actual values has not seen much compression, which probably reflects the individual company’s philosophy or strategy..

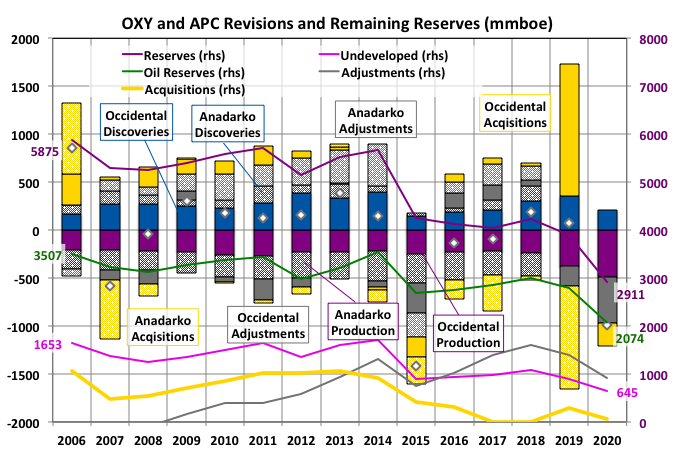

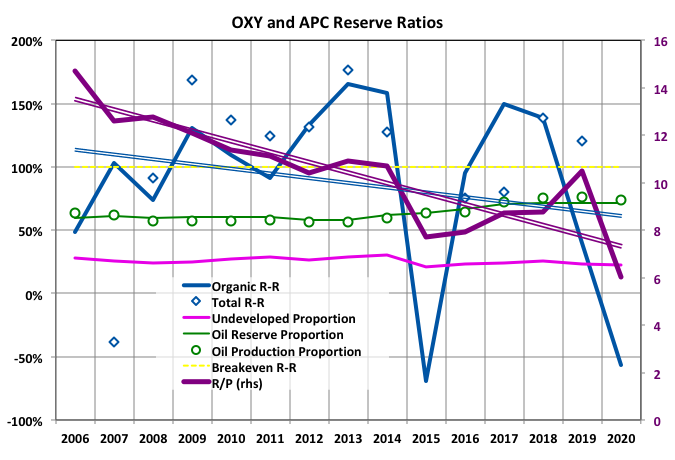

Occidental and Anadarko

These are (or were before then purchase/merger) two of the largest of the shale players. The figures below just seem to reinforce what a disastrous trade this was for Occcidental, I think it is probably on its last legs, and knows it. R/P ratios at six years and continuously declining, a replacement ratio consistently below 100%, steadily declining remaining reserves and net acquisitions moving negative to try and repay debt all point in one direction only.

Off Topic Finish: Waiting for the Great Leap Forward

I have been reading ‘A More Contested World: Global Trends 2040’ by The National Intelligence Council; slowly as there’s a lot in it but also a lot missing. No mention of specific resource limits, no discussion of GM just general ‘technology’ concerns concentrating on AI and of course, god forbid any mention of overpopulation. It is very US-centric – in the good scenarios the world gets to a better place only through US leadership – and humanist focused with no consideration of the rights of the earth in general, only the perpetuation of our civilisation and to that end all future scenarios are some variant of technology led, growth obsessed, centralised BAU (maybe not with full globalism but still based around hegemonic power structures at some level). It’s a view from mainstream economists and politicians carrying all the normal drawbacks that those words imply: i.e. bad things happen when the world doesn’t do as it’s told to do by us, and if you don’t agree with us about what constitutes ‘bad’ then you’re wrong about that too.

I think similar studies from more global or European NGOs and governmental departments (both from individual countries or the EU) tend to be more objective and those from the militaries (from anywhere in the west) tend to be more honestly subjective. See for example: The Adaptation Committee’s Independent Assessment of UK Climate Risk, Decoupling debunked – Evidence and arguments against green growth as a sole strategy for sustainability; Reinforcing Environmental Dimensions of European Foreign and Security Policy; Arctic Climate Change Update 2021: Key Trends And Impacts; Our Future on Earth; and The State of the Global Climate 2020 or, for military sources: Implications of Climate Change for the U.S. Army; NATO is responding to new challenges posed by climate change; Ministry of Defence Climate Change and Sustainability Strategic Approach; and Armed Forces, Capabilities and Technologies in the 21st Century Environmental Dimensions of Security.

The rising wealth gap and other inequality issues are a common theme in these global risk studies. However, theories in some recent studies have proposed that it is not inequality itself that is the problem so much as a prolonged sense of precarity (a new word to me and, apparently, to MS spellchecker, but it is essentially identical to precariousness) of the non-elites that accompanies it.

This makes sense from an evolutionary standpoint, as parents desire a stable and resource abundant household in which their children can be expected to reach a reproductive age. This might be expected to come more from the female side, as they are tied to their offspring more than males, who are free to spread their sperm and move on. I have read reorts, possibly anecdotal only, that it will invariably be the woman that will be the party insisting on buying the largest house that can be attained, whether affordable or not. I’m all for gender equality and women’s rights but some things are innate and equal-rights do not mean equal hormones, ambitions, impulses and behaviours. From this viewpoint therefore, solving the wealth inequality issue is actually anathema to population reduction. For example the already low birth rate in Italy had a further step down caused by the increased precarity due to the economic impact of Covid-19, the government has responded by offering direct incentives for havving children. The apparent short term aims are in direct opposition to the what is best long term, this is called a dilemma rather than a problem.

The US seems to be especially vulnerable to issues caused by lack of precarity as it has such a poor welfare system, previously relying on infinite growth to smooth things over or a, now failing, religious faith to keep things in order; prolonged economic and political success that has led to a sense of entitlement and self-belief in the American way, a history of putting personal liberty above all else, which embraces competition rather than co-operation; and a world beating phobia of death well beyond when reproductive age has passed.

The neologism for the growing proportion of people affected by precarity is the precariat. The always readable Tim Watkins has a new post that touches on some of theses issues, with a particular eye on the possibility (or not) of significant inflationary issues (The Everything Death Spiral).

The gig economy, middle class collapse, MAGA, BLM (and the police actions that prompted its rise), cancel culture, (un)reality TV’s attraction, FOMO, the increase in low level strife, self-harming, on-line pornography addiction, the Oxycodone/Fentanyl epidemic etc. are all manifestations and/or causes of that precarity. Civil wars and major revolts (and almost any that succeed in their aims) tend to happen only when there is intra elite infighting rather than uprisings from below. The most likely catalyst for that at the moment is Trump, which may be a good sign given his ineffectualness, ineptitude and general repulsive lack of charisma; anyone even a bit more like a real human being could cause serious ructions.

207 responses to “Annual Reserve Revisions Part IV: Shale Producers”

Great post George thank you. It is quite evident for the astute observer that western democracy has over the years turned more and more into an amalgam of kleptocracy, oligarchy and plutocracy.

How many countries have colonial Europe and U.S foreign policy destroyed in the name of “democracy” and “freedom” ?

I’ve lost count.

Plato famously is said to have said:

“If you do not take an interest in the affairs of your government, then you are doomed to live under the rule of fools.”

In Platos book the republic, Socrates despises democracy as one of the worst forms of government. His criticism those many years ago still resonates till this day (in my opinion).

WIthout invoking logic, I feel the world is in uncharted waters and heading towards a precipice which no one will see coming.

You have a typo, I believe you mean oxycontin (oxycodone) epidemic.

Thanks – fixed now. I guess we may all be addicted to oxytocin in some way and it’s a good thing (until someone invents an artificial form anyway), very much unlike oxycodone.

Mr Kaplan , tks for your post . Just confirms what many have been postulating from some time . EUR estimates in shale plays are a fraud and this is a Ponzi .

George or other petroleum engineering professionals. Would one of you explain this slide in a

Petroleum Engineering Course at Penn State.

https://www.e-education.psu.edu/png301/node/829

It shows a pressure – temperature diagram for oil and its dissolved gases. I am not very familiar with

liquid mixtures and dissolved gases in them, but for gases Dalton’s model says that the partial pressures add to the mixture pressure. In real situations one speaks of the component pressures which are not additive in the same way as partial pressures are.

If the diagram above represents methane dissolved in oil, then the ordinate is the component pressure of methane. Here is the problem. Pressure and temperature are not independent in the two-phase region. In my view, rather than temperature on the abscissa, it should be replaced by enthalpy for this diagram to make sense. Thanks.

Regarding the off-topic finish, I don’t think most people realize how fragile is the glue holding the US together.

Fragmentation along tribal lines is the biggest theme in American culture.

If a minority collection of tribes succeeds in the attempts to reverse election results, even more than the Electoral College already does, the country will undergo a major restructuring (polite description) with no guarantees on a recognizable outcome.

Hicks , not being based in USA ,my view maybe incorrect . The US is undergoing an identity crisis . Where in the world did we have this gender crisis , male – female heck can’t people see between their thighs ? Red-Blue . White Supremacy vs BLM . North vs South . Growing up in the 70’s US entrepreneurship was my inspiration . My hero’s were Ford, Sloan , Edison etc and what do we have today, Musk ? What changed that a society where work was an ethic has transformed into a system where everyone is looking for an opportunity to suck at the teat of the government . Amazing transformation for someone who has a reference point . Now I am going into the stupid zone . What changed was the net surplus energy available per capita to the US citizen . Once that flipped it was downhill all the way . I reserve the right to be incorrect in my assessment .

I haven’t paid attention for awhile, but I think OXY was the number one producer of CO2 flood oil in the lower 48.

Anadarko also owned a lot of lower 48 secondary and tertiary production, as I recall.

These big, public US operators have a lot more in common with us stripper well folks than they care to admit.

Old freakin fields discovered over a century ago is where they operate.

Don’t worry shallow the Paradox basin will save the day. (Sarc)

https://www.zephyrplc.com/

🙂

Shallow Sand,

You are damned right about that!

On Fri the July futures contact for WTI closed at 74/bo and on June 21, 2021 (last data points at EIA) the spot price for WTI was $73.64/bo and Brent spot price was $74.49/bo, so a spread of under a dollar, quite unusual in the past 5 years or so when typical spread has been roughly $5/bo between WTI and Brent (Brent usually has been higher).

Pardon my naivety on this- why is the price of oil generally so similar in various world markets?

In the USA the vast majority of oil is internally produced and consumed, and not part of the European or Asia markets. The abundance or shortage of USA supply does not seem to be directly correlated to the situation on other continents, until the USA returns to being a large buyer on the world market.

On the other hand, nat gas prices vary widely between countries, as one would expect.

Hickory,

Mostly because oil is cheaper to transport relative to natural gas worldwide.

So oil produced in the US competes at the refinery gate with oil imported from around the World. This keeps prices in a narrow band with the spread largely determined by differential transport cost from wellhead to refinery gate.

Note also that US produces about 11 Mbpd, but refinery input of crude oil was about 16.5 Mbpd in 2019, the US has not been self sufficient in crude oil over the 1973 to 2020 period, I don’t have refinery and blender crude input data before 1973, my guess would be 1965. Others might know.

Bottom line the US imports crude and that means the oil produced in the US is competing against oil produced around the World.

Refineries will buy the cheapest oil delivered that meets their input needs for API gravity, sulfur and other measures I am not familiar with.

Thanks Dennis and Ovi.

I would add that every product that can be transported is set by global price, not just FF energy. I live in Canadian lumber country and the high price I have to pay is determined by the US domestic market. same for fish, meat, vegetables, fruit, etc. The only time this changes is when our supply management systems kick in which usually means even higher prices. 🙂 However, and this is a big big however, our electricity rates and policy are set here and God help any Govt that changes that. They would be voted out next election.

The US has been a net importer of petroleum products since 1949 at least, according to the EIA.

https://science.time.com/2012/03/08/0-44-million-barrels-per-day/

Hickory,

Keep in mind grades of oil too. Most oil fracked in the US is actually exported as it is quite light (API>50). Meanwhile, the majority of US refineries are designed to API 30-40 . . . yet one more reason the prices between WTI and Brent stay fairly tight.

Steven , a good issue to point out . This was(is ) getting side lined and will hit us shortly . Analogy would be the GOR and WOR issues in shale . Everyone ignored them until they hit home .

Dennis

This is where I get the latest price for WTI and Brent. The data is 10 minutes delayed. The market opens at 6:00 PM Est today. I think that the Brent WTI spread has flipped. My recollection is that WTi was $2 more than Brent in the early 2000s. Not sure why it flipped.

https://futures.tradingcharts.com/marketquotes/CL_.html

Ovi, I was going to ask the question as to why the spread between WTI and Brent had decreased but you have answered it , not only has it flipped it has gone into reverse and you don’t know the answer . Anyone like to explain . ? My POV is that the traders have got the message that ” peak oil” is now in the rear view mirror and ” oil is oil ” screw WTI or Brent . If you gotta have it then you gotta have it . From now on it is going to get interesting . I am looking for the 1st July when the CCP celebrates the 100 th year of the Communist Party and what vision does Xi postulate . More important than the 4th July fireworks . Funny ,all the fireworks are imported from China .

Hole in Head

Thought I should ask Dr Google.

Many reasons have been given for this divergence ranging from regional demand variations, to the depletion of the North Sea oil fields.

The US Energy Information Administration attributes the price spread between WTI and Brent to an oversupply of crude oil in the interior of North America (WTI price is set at Cushing, Oklahoma) caused by rapidly increasing oil production from Canadian oil sands and tight oil formations such as the Bakken Formation, Niobrara Formation, and Eagle Ford Formation. Oil production in the interior of North America has exceeded the capacity of pipelines to carry it to markets on the Gulf Coast and east coast of North America; as a result, the oil price on the US and Canadian east coast and parts of the US Gulf Coast since 2011 has been set by the price of Brent Crude, while markets in the interior still follow the WTI price. Much US and Canadian crude oil from the interior is now shipped to the coast by railroad, which is much more expensive than pipeline.[10]

I guess it is as good an explanation as any.

Ovi , not satisfied with the explanation . The traders use horoscopes , astrology to birth charts to make decisions . If it was logic we would never have minus $37 price . It is a tragedy that the guys in Texas who produce the stuff have little say what NYMEX decides thousands of miles away . The same goes for agro and farm produce . My sympathies are with SS , Mike S , LTOS etc and with OFM who have to bear the pain for this anomaly . I think my explanation maybe not correct but better illuminates the situation .

Hole in Head

I’ll even buy that explanation.

I heard that that Italians were able to switch T votes to B votes from satellites. Who knows, they may be even manipulating WTI and Brent?

Hole In Head

The negative pricing of the May ’20 contract upon expiration actually made a lot of sense. If you’re holding the contract once the contract expires, you must take delivery. But taking delivery implies having someplace to put it. At the time, given the unprecedented drop in demand, Cushing was very close to capacity. While I think there were only 13-16 million barrels net outstanding among the open May contracts, that isn’t always clear at the time. And the numbers at Cushing are only any estimate anyway . . .

Plus, with the cancellation of Keystone XL, and the continuing construction of the Trans Mountain pipeline to tidewater at Vancouver, the domestic oil prices in US will more reflect World prices going forward. Just my opinion.

My question is about electricity. So, when the FF ICE vehicles are all converted to battery packs, as well as fast charging stations built everywhere, where is the electricity coming from, methane leaking NG wells…that have inadequate pipeline infrastructure due to being short lived shale plays?

“where is the electricity coming from”

For the next 20 years it will be a combination of coal, hydro. nuclear, nat gas, wind and solar. All in big amounts and varying depending on where you are.

Will it be enough? Yes, it will have to be.

Will be enough to keep doing everything we might wish for? Doubtful, or worse.

Will it be enough to be functional?- yes, in many regions.

Will there be enough batteries? Doubtful.

How long will take for ICE’s (and oil) to decline? A long time.

Will it be much hotter? Yes.

[All time heat records for Portland and Eugene this very day, and just saw Port Alberni at 109 on the map!]

Steven, “The negative pricing of the May ’20 contract upon expiration actually made a lot of sense ” > Of course it does ,it is called a “stop loss” . The point is not that . The point is who entered the contract at the earlier date, after all this was a futures contract . These guys are supposed to be professionals with sophisticated software , models and a MBA to boot . Might as well get a monkey to throw darts . Definitely someone was asleep at the wheel . Covid was already known in end of Jan 2020 just before the Chinese New Year and this event was May 2020 . Anyway now all markets have become manipulated and the real purpose which is ” price discovery ” exists no more .

Ovi , “I guess it is as good an explanation as any. ”

Agree .

Hole In Head,

All those sophisticated algorithms and MBA training courses sometimes play second fiddle to the reptilian brain sitting in front of the screen with the buy and sell buttons. Personally, I blame the CFTC. They should have intervened.

Steven , agree with the reptilian part of your comment .

CFTC, SEC , FINRA = The Fox guarding the hen house . They are like cops in the movies , last to arrive at the crime scene .

World Oil Situation 2021

https://www.youtube.com/watch?v=EaXoAfa1tAw

This is an in-depth video of World production and consumption.

Blackouts Loom in California as Electricity Prices Are ‘Absolutely Exploding’

https://www.realclearenergy.org/articles/2021/06/24/blackouts_loom_in_california_as_electricity_prices_are_absolutely_exploding_782903.html

Adnoc imposes deeper cuts to September crude exports

“Abu Dhabi’s state-owned Adnoc has informed customers that it will implement cuts of around 15pc to client nominations of all its crude exports loading in September, even as the Opec+ coalition considers further relaxing production quotas.

It was unclear why Adnoc is deepening reductions for its September-loading term crude exports, with the decision coming ahead of the next meeting of Opec+ ministers scheduled for 1 July when the group is expected to decide on its production strategy for at least one month”

Russia plans to cut oil exports from its Western ports by 22% in July vs June – schedule

“On a daily basis, loadings will decline by 22% in July compared to the current month, Reuters calculations showed.”

Russia struggles to raise oil output despite price rally -sources

“Russian oil production has declined so far in June from average levels in May despite a price rally in oil market and OPEC+ output cuts easing, two sources familiar with the data told Reuters on Monday.

Russia’s compliance with the OPEC+ oil output deal was at close to 100% in May, which means the state is about to exceed its target in June.

Two industry sources said that lower output levels may be due to technical issues some Russian oil producers are experiencing with output at older oilfields.”

Yes, they are definitely experiencing issues with their older oilfields, it’s called depletion. But that decline is only 33,000 bpd or .3%. But your post above that one says exports in the third quarter will decline by 22%. What gives there?

Their decline in May was 23,000 bpd.

Ron

I just checked the Russia site and they have revised up their original May estimate. It is one week later than the original. Production is now down 9,000 b/d.

Yeah, they revised it up by 14,000 pbd. A pittance. Now they are down only 9,000 bpd instead of 23,000. Nothing to get excited about. Basically, they were flat in May.

”Russia plans to decrease oil loadings from its Western ports to 6.22 million tonnes for July compared to 7.75 million tonnes planned for loading in June, the preliminary schedule showed.” 7,75 x 10^6 – 6,62 x 10^6 = 1130000 t. 1130000×7,3/30 = 274966 b/d. Therefore, these decrease of oil export suggests a decrease of production of 274966 b/d. Precedently, it was announced that oil exports of Russia would decrease of 7,2 % for the period July-September or a decrease of 308222 b/d. Therefore, it’s coherent. https://www.zawya.com/mena/en/markets/story/Russias_quarterly_crude_oil_exports_to_drop_72_schedule-TR20210617nL5N2NY2IQX8/?fbclid=IwAR0ZjvwzjVS427CbUAzTL1vJfqog7R8CDwaJAvI3uUdaw_0z5S5l_57SGFY I notice that it concerns the ”Western ports”, therefore the exports toward EU and USA. Well, EU is also the main customer of Russia with 59% of the oil exports of Russia.

Western Russia is where all the very old supergiant fields are. They produce 60% of Russian crude oil. Or at least they used to.

Ron

If one of the West Siberian giants is rolling over in the same way as Daquing did, things could get very interesting very quickly.

Four of Russia’s five giant fields are in Western Siberia. The fifth is in the Urals, on the European side. All five have been creamed with infill horizontal drilling for almost 20 years. All five are on the verge of a steep decline. Obviously, one and possibly more have already hit that point.

This linked article below is 18 months old but there is a chart here that shows where Russia’s oil is coming from. Notice only a tiny part is coming from Eastern Siberia, the hope for Russia’s oil future. Those hopes are fading fast.

The Worrying Truth About Russia’s Oil Industry

As I have written a few months ago: When you reduce output voluntarily for a longer time, all the nickel nursers from accounting and controlling will cut you any investing in over capacity you can’t use at the moment. That works like this in any industry.

So you have to drill these additional infills and extensions after the cut is liftet. And this will take time, while fighting against the ever lasting decline.

Chad’s ExxonMobil Workers Strike, Reducing Crude Output

“Local media reported that Chad’s daily production of 120,000 barrels of oil will be reduced by a third by the protests.”

Here’s a fun one: https://youtu.be/dw1fiXc6Qs0

I stumbled on this Peak Oil documentary on YouTube a few days back. I didn’t expect much, but was pleasantly surprised to learn a lot about the extreme lengths that the world’s oil companies are now taking in order to drive production. From ultra-deep wells, to custom polymers with the density of oil to replace water during injection, to massive undersea networks of cables and pipes connecting wells hundreds of kilometers apart, and new techniques for boiling tar sands deep beneath the ground in order to release light oil without the need for processing all that sand… I thought I’d discovered a pretty fun look at the current state of the oil industry…

So imagine my surprise when the last 10 minutes of the documentary was about abiotic oil! And took it seriously as a means of avoiding the peak! Now I have to unlearn everything in the doc, since I have no way of knowing what was accurate and what was bullshit.

Niko

I find it strange how people can believe long chain hydrocarbons chains can form via a natural process without biota, it is a very strange belief indeed.

They always seem to bring up Titan. But they always fail to mention that there is no evidence of complex long chain hydrocarbon pools on that planet.

Ahead of talks, OPEC forecasts point to oil supply deficit in August

“The Organization of the Petroleum Exporting Countries and allies, known as OPEC plus, is returning 2.1 million barrels per day (bpd), about 2% of world output, to the market from May through July as part of a plan to ease last year’s record output curbs.

OPEC’s latest forecast of the demand for its crude suggests, if output levels stay the same, OPEC supply will fall short of expected demand by 1.5 million bpd in August. The shortfall widens to 2.2 million bpd in the fourth quarter.”

I am still far from sure OPEC plus will return 2.1 million barrels per day from May through July.

I get a lot of lease auction stuff emailed to me.

I don’t see much conventional lower 48 onshore oil production for sale right now. Not sure if there is a mismatch on price between buyers and sellers?

Seems like a lot of lousy shale projects for sale. Tons of deals where there is maybe less than 100 BOPD gross coming from 3-10 wells, with several locations left to drill. Sometimes a DUC or two.

I guess everyone is trying to unload the Tier 3 junk.

Some conventional gas for sale, but not a lot of conventional oil deals. Chevron sold some earlier this year in the Permian, but nothing recently.

I know replying to my post is in bad taste, but I might add that it is apparent that at least some petroleum will be needed for at least 30 years, if not more.

We continue to fret not only about the oil price and lack of labor, but much more about government intervention.

Is the general consensus here that if the Feds just say too bad, you must shut down, that we should bear 100% of P & A for that? That is the debate we are having.

Yes, if oil prices drop below production costs for too long, that’s too bad for us. We have always accepted this.

But what if oil is $70 and we are making $30-35 net per barrel, and the Feds order us to shut in. Is that a taking? Is it just too bad for us?

See why there isn’t going to be enough oil for the Western countries given this situation? They are providing operators zero clarity.

Shallow sand,

Has the Federal government ordered wells to be shut in on private land that are meeting all environmental regulations?

Even on Federal land and water, so far the Federal governmnet has simply stopped issuing new permits. The Biden team let it be known that they were planning to suspend new deilling permits on Federal land and water so companies loaded up on permits before Jan 20, 2021. My understanding is that the permits are good for 4 years.

See

https://www.nasdaq.com/articles/big-u.s.-oil-drillers-have-federal-permits-to-mute-effect-of-any-biden-ban-2021-01-21-0

Have there been a bunch of new regulations that have been approved recently?

Not sure where the concern is, at some point there might be a lack of demand which might bring oil prices to lower levels, but this seems unlikely before 2035 or so.

Maybe sell your oil investments when WTI reaches $110/bo in 2025 to 2030.

Guess it’s more.

Replacing everything with a post – oil – vehicle will take time. And there is the good samaritan paradox. When all the Bidens and Merkels and Greens of the west get holier than holy and reduce oil usage hard and fast – even for the price of a depression, oil will get cheap (not much oil in the direct western soil). And then Asia and South America will have no incentive to switch away from oil (lot’s of cheap used vehicle on the market), and use it up. Big trouble – but not a litre of oil not consumed.

Change away from oil will come with higher prices and better technology – not green paroles and self flagellation.

The West can’t stop production of any drop of OPEC, African, South American, Russian … oil – so a intra-USA-oil ban would only just be stupid.

Talking about stupid – this year there are elections in Germany. When we get a green successor of Merkel, we can talk again about stupid ideas and shooting in the own foot.

Sorry for the rant 🙂

Talking of post-oil-vehicles, my friend’s Kona EV has used 600kWh in the last 15 months. His PV panels have produced 3200kWh in the same time-frame. Kona does 4.8 miles/kWh. Running on sunshine. Can we transition fast enough?

Eulen , waiting to see what happens in the upcoming elections . Greens seem to be loosing ground , is it because the public suddenly realizes that ” green ” means no goodies ? Well as they say ” Everyone wants to go to heaven but nobody wants to die .” 🙂

My impression of Germany is that interest in renewable energy and electric vehicles has gone way up in the past year.

Nearly five GW of solar were installed in 2020, the most since 2012. Sales of EVs tripled in 2020 and look like they will grow by 50% this year. Last year they were 14% of the new car market.

You see a lot of EVs on the road these days, and quite a few charging in people’s front yards. More and more delivery vehicles are going electric as well. There is a clear increase in the last year. And of course electric bikes are everywhere. It’s also noticeable that electric lawn mowers and hedge clippers are taking over. Sadly, not the leaf blowers yet.

On the other hand installations of wind turbines is much lower than in 2018.

All in all, it sort of looks like the much ballyhooed technology change is actually starting. Coal looks like it’s getting hit hard, but it’s early for the oil industry to get worried. There’s no real sign of change in oil consumption.

“and the Feds order us to shut in”

I can find no news about the Federal government ordering oil producers to shut down.

Perhaps I don’t have access to the correct media?

Dennis and Hickory,

I have addressed this issue on several occasions, the last of which was the previous petroleum thread here. To be honest I do not understand the dismissal of my direct experience and the evidence that industries can be destroyed without a law being passed. Perhaps the owners of the Keystone XL pipeline should’ve waited for Congress to pass a law making the pipeline illegal. Oops, that happened by executive action alone. So far only Shallow Sand has repeatedly had my back but then he is only one of three in the same boat here as owner/operators with common experiences and lighter wallets.

When Executive Branch agencies, whether federal or state, are free to promulgate rules and regulations that materially and sometimes existentially effect business, you are seeing de facto executive orders. The legislative rule stops at the point of creating the agency and it’s vague, open ended mission.

One point of my previous comment if not clearly stated was that regulations can become so expensive or burdensome that some businesses cannot survive. To suggest that such is Darwinian and just ok is ignorant. The issues is not the viability of the company but the viability of the producing asset. You would be surprised to know what the ratio of produced water to produced oil is in this county. In the Permian it is 5-8 to 1. Many old, virtually zero decline rate water drive fields are 95 to 1 or higher. Faced with even conversation or proposition about new overarching rules or laws is threatening and treated seriously on this end. All too often the speculation ends in regulation.

This site is interesting and educational as I am not a statistical analyst or successful financial prognosticator so I get a chance to see how people think in areas beyond my field of experience. That is not to say that some of the basic data used is beyond my ability to question based on what I see and hear firsthand. This pushback of yours comes from what appears to be positions of zero experience yet with some attitude. Normally I let this type of thing slide a bit but the societal and governmental attitudes about oil and gas operations are overwhelmingly damming and work out as psyops to me and many like me. Just wait until you get a first notice letter from the government with the paragraph that states that failure to comply in such a time may result in….staggering maximum fines. Those things, in the aggregate, ruin your day, your outlook and sometimes your marriage. Perhaps a little deference to those that have been there is in order.

And FYI, I can’t sell or give away my properties in CO. If you think that I’m exaggerating, then you replace my surety there and I’ll set you up as an operator and you try it. I could use the 85K. But first I would check with a few of the other 75 or so operators in the state that are likewise screwed.

Sorry Rasputin,

I understand rules have changed in Colorado. Was thta due to the Federal government, I thought it was state regulations.

I believe shallow sand lives in a different state, it is not clear what he is talking about, perhaps you know, he does not live in your state.

Thanks Dennis.

Yes SS lives in another state, a very old producer like Illinois. I am so thankful that he relates to my comments and stepped up the other day.

He also spoke to radical access to their facilities. As an aside, if some dip of an inspector opened or closed some valve and created a big mess, loss or environmental liability it would be hell to pay for the state or the inspector. You would faint if I recounted stories of brain damaged ignorance of or by inspectors even with industry experience. I swear, those guys must take an oath no to ask a question first and accept the answer as the basis for finding the truth before proceeding.

He was also addressing the situation in CO that I’ve often described as an example of rapid political shift. However, he did not address the mechanism only that it would not have seemed likely to happen considering the historical operating environment there.

The fuse that lit this debate was a proposed federal law. While it probably won’t come to pass by way of legislation it can come by way of regulation. Many executive branch environmentalist employees probably never heard of the distinction between solid waste (flowback and produced waters) and more highly regulated hazardous waste. They have now. I repeat, planting bad seed in fertile soil is never good. In the end it matters not what the source of the regulatory catastrophe is; only that it is.

I seldom comment here and that is when I can provide insight, knowledge or experiences related to the mission of the site. Yes my views are sometimes presented too emotionally but they are often wise and almost never offered by others even though they are variables in equations and projections. If you don’t believe me go to Marketed Crude Oil Production at the EIA site and plot the historical curve for CO. Let’s just say that it stands out in the crowd.

Thank you again for the opportunity to address this forum.

Dennis.

My family has operated wells since the 1970s. We have learned over this long time to try to anticipate, not just sit back and wait for things to happen.

Almost all of the regulatory people in our state with any experience have retired. We have people with the authority to fine us who don’t know a producing well from an injection well. We know that because we have had them cite us for not complying with injection well requirements on a producing well and vise versa.

We have to have a well identification sign on every well. We have been cited for not having signs even though they are there. Just figure an inspector needing to fill a quota. I could go on forever about this, but I won’t.

We also get the letters which threaten to fine us $1,000 per day. We T/A a well in the presence of an inspector. Less than 6 months later, another inspector wandered on the lease and cited us for improperly T/A the well. (He didn’t like the way the well head was configured. We just changed it to what he wanted). That resulted in one of those letters that threatens $1,000 per day in fines.

The people in the state office thought we were being too dramatic when we were upset that another inspector wrote us for what an inspector had approved 6 months prior. They actually said, “You should know we won’t fine you for this.”

How the heck would we know that?

Haven’t you heard of the “keep it in the ground” movement? They have been successful in New York. They have been successful in California.

I think it is a legitimate question to ask. All it would take is a one size fits all methane rule or some impossible water disposal rule and we are sunk. Why do you dismiss that? The US EPA is working on the methane rules as we speak and a congressman from New Jersey is proposing to treat produced water as hazardous waste. That is really happening.

We are very familiar with regulators who have little industry experience. I’ll leave you with this.

The sand we primarily produce from was discovered in 1905 by Mike Benedum and Joe Trees. Mike Benedum was one of the greatest wildcatters in the history of the United States. Google him.

This sand was named in 1906 and was first mentioned by name in a state geological survey publication in 1909.

Two years ago, a nice man with a non-oil background got a job with our state regulatory agency. He decided that the name of our sand is incorrect. If anyone files a report with our state and mentions that sand, it gets sent back with a letter that the sand “does not exist.”

Most of our field has depth restrictions to the base of that sand. Now the state says it does not exist. What do you think about that?

I am thankful Mike and Rasputin are here some. Otherwise you’d all think I’m wrong. But I am not. Our biggest fear is regulatory changes that will force is to shut in. The second is lack of labor. Third is oil price.

Keep in mind we survived $8 oil in 1998-99, $100 crash in four months in 2008, $25 oil in 2016 and negative oil in 2020. But we can’t survive the other two fears.

@Shallow

That sounds realistic.

As I have written a few days ago – you can sink any mining / drilling company by just shuffling around with enviromental regulations.

And the greens are near or at the government now. They are kind of maoistic – normal people should not be allowed to drive a car, only bus and trains. Here the greens already think of climate lockdowns after the corona lockdows – just jail the people at home for a few months, promote veganism for all. It’s still only a wing in the party, but they gain influence and have much positive news coverage.

Here most people are brainwashed enough to elect these parties – it’s in TV and all big news sites. We don’t even have a “fox news” here – even the most conservative news sites are 60% “in line”.

I don’t know the situation in the USA – are all the conservative countries now receiving green changes and critical race theory in schools?

PS: I had access to a journalism university here. If you aren’t hard left / green, you won’t finish your study. Oil business is pure evil, it’s capitalism and anti enviroment satanism. At least they think.

Eulenspiegel.

I don’t want to make it too political because here in the USA that just devolves to a screaming match. If you want to go further into politics we can on the non-oil side.

Access to fuel, electricity and food is taken for granted in the USA, and I hope it always will be able to be. A large segment wants to eliminate the fuel part. I include both oil and natural gas in “fuel.” Coal obviously is there too.

What is concerning is those with the power to shut down the fuel maybe don’t know just what will happen and have little expertise in these areas. I’m astonished, for example, that there is no plan on where to locate solar. Prime tillable farmland is being gobbled up merely because it is close to transmission lines.

Shallow sand,

Sorry if I seemed dismissive. It is clearer now that you are very worried about changes in regulations, I jsut had not heard anything specific that had occurred. I agree both the regulators and regulations should be better, it is not clear what could be done about it. Has there been a big shift lately where you live perhaps because of a new governor or something or because of the change in administration. I would think local EPA workers are career people that would not change much with the administration though top down orders would be different. Is the problem more with local and state officials or is it Federal inspectors?

I do not know who enforces existing regulations, (in other words who pays these inspectors, local, state, or federal government?)

Rasputin,

Thanks for your comments, adds to the understanding.

Curious if there is an oil price that will work for you to overcome the stupid regulations.

Dennis.

States most directly regulate upstream oil and gas. However, State regulations derive many times from federal laws.

For example, with regard to injection and disposal of produced water, the US EPA has many stringent regulations. The States are required to have a regulatory framework that complies with US EPA regs. The US EPA monitors the States’ regulation, and has the authority to take over the monitoring from a State if the State regulation is deemed inadequate.

Of course, operators have to comply with all Federal and State regulations. The States generally have a specific agency (not State EPA) that directly regulates oil and gas operations. Inspectors of this agency are the direct contact with operators and the leases/wells/facilities. The inspectors have free rein 24/7/365. They prepare and file reports electronically. Depending on what the report is about, the operator then deals with the persons in the regional or state office who are over that area.

Most state agencies have as one of the first pieces of website information a citizen complaint form. So sometimes matters are initiated that way. However, 99+% are initiated by inspectors.

Of course, the State EPA becomes involved anytime there is a complaint made by a citizen. Same w US EPA. Those complaints typically involve leaking flow or injection lines. Likewise, the state regulatory agency has the authority to contact the state and/or US EPA as well.

Again, there are people in high positions in the Federal government who would like to 100% end both methane emissions from upstream oil and gas and would like to end injection/disposal of produced water. Understandable maybe, but complete end would completely end US upstream oil and gas.

So, then the question becomes where will the Feds draw the lines on these things.

Or, in cases like CO, when something won’t pass the US Senate, the State might just decide to pass the same thing at the state level. As I recall, CO has even had voters vote on upstream oil and gas matters. And as I also recall, when the vote came out favorable to oil and gas, the legislature went ahead and passed the things that had been voted down.

If oil and gas can be phased out with something better, great. But that hasn’t even been proven, has it? Do we know that we can power all transport with wind, solar and hydro in the USA? Do we know that we can heat and electrify all structures in the USA with wind, solar and hydro? Do we know that we can replace all uses of petroleum for plastics etc with some other material?

If we do know these things, how long will it take, and what is the best way to wind down oil, gas and coal? I don’t hear policy makers stating facts such as these, do you?

Shallow sand,

I agree the energy policy in this nation is a mess. I believe most of the people in the center politically, think we should properly regulate industry (not onerous regulations, just plugging leaking wells properly, shutting down wells with excessive methane leaks (and I do not have the knowledge to determine what would be deemed excessive) and gradually transition to alternatives to fossil fuel.

To me the best approach is a market based solution that charges a fee for carbon emitting products at the mine or well head based on carbon emitted by that product when it is used. The fee and dividend approach would refund these fees to citizens in a fee and dividend type system. The carbon price would gradually rise over 10 years from say $30/metric tonne to $100/ metric tonne over a 14 year period with a $5/ metric tonne increase each year.

This way people could plan, in fact perhaps simply a $5/metric tonne increase (in constant 2021$) for 50 years would allow a longer horizon for planning. The risng price of fossil fuel would be an incentive to gradually switch to other sources of power.

At some point the switch will need to be made as all fossil fuel will peak and decline.

Picked this from Peak oil.com . Shale is over .

https://i.ibb.co/HrnVgJj/DE4-A4267-6077-4-BB4-9-A4-C-95-C7-B647665-D.jpg

https://i.ibb.co/sV6msYY/31-AED132-2659-489-B-9-B20-B2528-D59-EC90.jpg

Hole in head,

There is a person over at peakoil.com that knows even less than me that makes silly projections based on Hubbert curves. It is way too early to use Hubbert linearization to make any predictions and in any case Hubbert Linearization doesn’t work vey well. See the well known post by Robert Rapier below.

http://theoildrum.com/node/2357

See also

https://www.rrapier.com/2007/03/peak-oil-and-lunatic-fringe/

In my view, what Mr. Rapier wrote in 2007 remains true today.

Alternative Permian scenario below, output about 4000 kb/d in June 2021, 7000 kb.d in Jan 2025 and a peak in 2033/2034 at 7600 kb/d, URR=60 Gb, all debt paid back by 2031, production ends in 2049 as oil prices fall to a level that make tight oil no longer profitable. Oil price maximum assumed at $78/bo (2021 US$) for WTI, if the WTI/ Brent spread remains $2/bo (Brent at $80/bo max in 2021 US$). Oil prices are assumed to start decreasing in 2033 as transition to EVs removes demand from oil market faster than demand growth from air and water transport, and other uses for crude oil (farming, home heating etc).

The red data is from shale profile through Dec 2020 and EIA data from Jan to May 2021. The shale profile data is for tight oil from horizontal wells only, EIA data is for horizontal and vertical tight oil wells. The model is for horizontal wells only. Note that for most of the period from 2010 to 2021, the model is an underestimate of actual tight oil output in the Permian basin as my well profiles may be a bit too conservative or the well count data might be in error (I use data from shale profile for 2010 to 2019 and estimates based on output data and model output based on estimated well profiles (Using DCA on shaleprofile well quality data) for 2020 to 2021.

There is a person over at peakoil.com that knows even less than me that makes silly projections…

Wow! That guy just doesn’t know shit, does he? 😉 Seriously Dennis, on your chart, draw a line straight down, from the last red plus sign on your chart. Then compare the area under the production line to the left of that line to the area under the production line on the right of that line. Just look at those two areas and ask yourself: “Do I seriously believe that shit?” And there would be even more if you extended your line out to 2050. The area on the right would be about ten times the area on the left.

Dennis, many Permian drillers are already drilling child wells because they have run out of other places to profitably drill. Dennis, your chart cannot possibly be anywhere close to being correct.

Ron,

Based on the data at shaleprofile.com and LTO survivor’s observation that child wells produce roughly 60% of the parent wells, I doubt many child wells are being completed.

Yes I believe this will be a reasonable estimate of future Pemian basin output for the prices assumed in my scenario. I assume the USGS mean TRR estimate of roughly 75 Gb for the Permian basin is correct. The USGS 90% confidence interval is 44 Gb to 114 Gb for Permian basin TRR (technically recoverable resource) with a mean estimate of 75 Gb. My best guess 60 Gb URR estimate is based on this mean estimate which in the case of the North Dakota Bakken/Three Forks mean TRR estimate (11 Gb) leads to a very reasonable URR estimate of about 8.5 Gb (roughly equal to cumulative production plus proved reserves at the end of 2019).

In short, I believe my estimate based on current shale profile data for wells through 2019, output data, completion data and USGS estimates and my estimate for future well cost($10 million in 2021 US$), OPEX (about $13/bo in 2021 US$), and prices (outlined in earlier comment). Any and probably all of these projections and assumptions about the future have a zero probability of being correct, but if all of them were correct, the scenario would also be correct.

Ron,

Well maybe Dennis knows more about Shale oil than Parsley Energy’s CEO who stated the following:

Chief executive of Parsley Energy Matt Gallagher said that the peak production that the United States hit back in March—13.1 million bpd on average—represented shale’s glory days, ne’er to be repeated, according to the Financial Times.

I gather Matt Gallagher just didn’t put enough ZEROs after his well production estimate like Dennis?

steve

Steve,

Dennis is simply calculating different scenarios based on the estimate of TRR the USGS has published. Some people here are arguing these scenarios but not the USGS estimate. Of course not all of the TRR will be produced because some of that oil is too expensive to produce. If you do not agree with Dennis´estimate of URR in the shale patch, what is your estimate and what facts is it based on?

There seems to be a hell of a lot of potential drilling locations in the permian basin and there are no hard arguments against Dennis´scenarios that say that oil production in the permian has the potential to increase for some years.

Best

Toby

there are no hard arguments against Dennis´scenarios that say that oil production in the permian has the potential to increase for some years

Toby, you obviously have not been following this thread very closely, else you would not make such an incorrect statement as that. Mike Shellman, LTO survivor, both oilmen, and many others have produced very hard arguments against Dennis’s overly optimistic estimates. And there were others who have made very sound arguments that the shale patch is in dire trouble. And I myself have posted dozens of articles from the web that tell what a damn mess the shale patch is in:

Is The U.S. Shale Boom Over? Four Major Threats To The Fracking Revolution

I posted a different “shale in deep shit” article this morning. So did Hole in Head, and many such articles have been posted in the last few days and weeks. There are hundreds on them on the net.

And you say there are no hard arguments against shale production increasing for years? What planet are you living on anyway?

Ron,

one statement in the article you linked above says that shale drillers might run out of their most productive acreage within five years. That is far from “the party is over” and far from “there might be 100000 or more locations left in the permian basin”.

I think we have no idea what the URR in the permian basin will be.

A hard argument against Dennis´scenarios would be something like the USGS estimate is too high because

– well results show, that EUR per xy reservoir acres is far less than the USGS estimate or

– the productive area for bench xy is far less than the USGS estimate because well results have disappointed in this and that area.

Dennis´scenarios may turn out to be too optimistic, but he is the only one here who makes predictions on the URR.

Rig count in the permian is rising steadily and at some oil production will go up again. If there is five years of top tier inventory left to drill as stated by Mr. LeBlanc US shale production may exceed the levels reached in late 20219.

I think we have no idea what the URR in the Permian basin will be.

I think you may be on to something there. Now tell Dennis that because all his charts are based on the IEA’s or the USGS’s URR enormous estimates.

Toby, I put great store on what people like Mike Shellman, LTO Survivor, Shallow Sand, and Rasputin say. These guys are actual oil men, they work in the oil patch every day, they know what they are talking about. They all say the shale oil patch is in deep shit yet you, Dennis, and a few others, others who likely have never seen an oil rig, tell these oil guys they are full of shit. Somehow that just doesn’t seem kosher to me.

And I must add, almost every day I read an article by Oilprice.com, or Reuters, or some other oil patch reporting service, telling me basically the same thing that the afore mentioned four oil patch experts are telling me. And I have yet to find even one that tells me the opposite. So you tell me whom I should believe, you, Dennis, and a few other armchair analysts who have never seen an oil rig, or every damn expert in the business?

Ron,

I have never said that anybody is full of shit and I also never said that everything is fine in the shale oil patch. What I am looking for is a reasonable estimate on the future production potential in the permian basin.

When we look at the Bakken, the USGS estimate of TRR is probably not to far off and I think Dennis´estimate of between 28-33000 total drilling locations is also reasonable.

For the permian we have estimates that say the WC is going to crash within two years and others say there are dacades of inventory. Both will be wrong I think.

Without hard data that show where the USGS estimate is either reasonable or far off everything is pure speculation.

I think Parsley Energy’s CEO would know what he is talking about. However, I am a little confused by his numbers. The USA’s peak production, according to the EIA, was back in November 2019 at 12,860,000 barrels per day. But that month does represent shale’s glory days, ne’er to be repeated.

For now shale´s glory days may be over. Many companies are hedged at or below 50$ and that is expensive so a lot of cash flow is lost to hedging. That is going improve if oil prices keep rising.

In the long run the question will be how much of the resource can be extracted at higher oil prices. Matt Gallagher made that statement when WTI was well below 50$.

Toby, every man in the business knows oil prices are volatile. And they all know that oil prices will increase when production starts to decline. Matt Gallagher did not get to be a CEO by being a blooming idiot thinking oil prices would never increase. His estimate was not based on the price of oil at that time.

Steve,

We agree that peak output for the US is likely in the past, I think the decline in conventional (including offshore output) will offset the rise in tight oil output.

Not all oil CEOs may agree that the tight oil peak is behind us.

Dennis , I picked this up from the topic ” New Wolfcamp Data ” posted on peakoil.com . It was posted by “mustang 19 ” who claims it is EIA projection . Several graphs Bakken , Eagle Ford , etc . Suggest you read there . I am not competent enough to analyze the info therein . You know more than me on these issues 24/7 .

Yep, you picked the right thread. Wolfcamp will utterly collapse in 1-2 years.

Made a mistake on my scenario above due to an error in my spreadsheet, revised scenario in chart below, my apologies. Ron was correct the 60 Gb scenario is not realistic for the mean USGS estimate and the oil price scenario with Brent at $80/b in 2021$ maximum.

The revised scenario has a URR of about 46.5 Gb and the peak is about 6600 kb/d in 2030 for Permian basin tight oil.

About 110 thousand wells are assumed to be completed from 2010 to 2037 with about 33 thousand wells completed to date.

No way

Thanks LTO survivor.

We will see. Do you have a URR estimate for the Permian basin? I have a lower estimate that I have done in the past based on the F95 TRR estimate by the USGS of 44 Gb, with ERR of 27 Gb. I asked for comment, but got nothing.

Is the projection at shaleprofile which assumes 270 completions per month from June 2021 to Dec 2029 (27540 wells completed) realistic in your view? Seems higher number of frack spreads operating could lead to a higher number of completions than assumed in Enno’s scenario.

In any case thanks for your comment.

Tight Oil scenario using Permian well profile in 6/29/2021 7:27 am comment, peak is in 2030 at about 9580 kb/d, URR=88 Gb, with about 61 Gb from Permian basin ( difference from earlier 60 Gb URR estimate is that here I use EIA data for Jan 2000 to Feb 2021 and model estimate after February 2021, before it was model only over 2010 to 2048.

Prices similar to what was outlined in comment on Permian scenario.

Really? This data is from Shaleprofile.com? Are you sure? I had no idea Enno Peters made such absurd predictions? I am sorry Dennis, but 88 Gb is a totally absurd prediction. That is nowhere remotely close. I can understand that the EIA might make such an absurd prediction. But I am truly shocked that Enno Petes would concur.

Ron the underlying data for completion rate through the end of 2019, well quality data, and output data comes from shale profile.

The projections for future supply at shale profile assume no change in future rig count from the most recent estimate on June 25, 2021. I do not make the same assumption, my expectation is that rig counts and frac spreads will continue to increase, particularly in the Permian basin which is the source of all of the future increase in tight oil output.

Enno peters asked that I give credit to shaleprofile when I utilize data from his blog.

There is no data from the future (or I don’t have any).

Ron,

EIA AEO estimate to 2050 for tight oil is about 125 Gb, my tight oil estimate is about 70% of the most recent AEO reference case through 2050. My scenario declines sharply around 2039. The EIA has tight oil at 8700 kb/d in 2050, my scenario has US tight oil output at 710 kb/d in 2050 (annual average output).

Note that there are those who would call my estimate absurdly pessimistic and often in the past people have claimed my scenarios were much too optimistic, when in fact the opposite has been true.

Dennis,

your scenario is probably based on the USGS TRR estimate. Their mean estimate for the Wolfcamp in the Midland Basin for example has an average drainage area of 100 acres per well and these wells should make around 167 kbo each.

From shaleprofile we get that the average permian well has an EUR of around 350 kbo and productivity per lateral foot is already in decline.

Do we have good information on the drainage area of these 350 kbo wells? From what I have read here the spacing of those wells is wider and thus the USGS mean estimate for EUR per 100 acres might be too optimistic.

Best

Toby

100 acres per well works out to be 6.4 wells per section. (1 square mile.) I am in communication with one Permian driller who tells me that they are getting about 4 wells per section. So yes, the 100 acres per well is way too optimistic.

Ron,

I think you misunderstand. The average lateral longth is 8500 feet, so it needs more than 5280 feet in length. The driller probably means the section width of one mile and 4 wells per mile of width, so spacing of 1320 feet times 8500 feet for lateral length divided by 43560 sq ft per acre=257.6 acres per well.

I have read that 5 wells per mile is optimal rather than 4.

See

https://jpt.spe.org/how-close-too-close-well-spacing-decisions-come-risks

The problem with 4 wells per mile is you don’t get the most oil out of your leased land. Drilling child wells between wells spaced at 4 per mile is a problem. It may be the way it has been done, but going forward the best companies will use 5 wells per mile to optimize output per acre at the lowest cost.

When the USGS did it’s study, shorter laterals were being used, thus the lower output and smaller number of acres per well.

For my models I take the current optimum well at 8500 feet by 1000 feet (about 200 acres per well) and divide by the 49 million net acres the USGS uses for its mean estimate we get about 245 thousand wells drilled after 2017 (the USGS estimates were produced from 2016 to 2018, I just take 2017 as the average because I don’t have detailed well completion data from each basin).

I base the EUR on decline curve analysis using the well quality data from shaleprofile.com.

In any case, I use their net acre estimate (49 million) and a total of 215 thousand wells drilled in a TRR scenario from Jan 2018 to last well drilled which is about 228 acres per well (a well roughly with 1050 foot spacing, 5 wells per mile, and 9500 foot lateral).

No, I don’t think I misunderstood. But would some oil man correct me if I am mistaken? I am fully aware that the lateral length is more than one mile long. However, this oil man told me that the average was 4 wells per square mile. On 100 square miles, you would have 400 wells.

Hi Ron,

Let’s agree that lateral length is 8500 on average, if spacing was such that we had 4 wells per square mile that indicates a spacing of about 3300 feet between laterals.

According to the research 1000 to 1360 foot spacing is optimal and probably 1000 feet is best.

Perhaps LTO survivor can comment.

Perhaps LTO survivor can comment.

He did.

The models are wrong. 4 wells per mile are optimal. The resource is there but the bottom hole pressures is not !!

LTO survivor,

A mile is 5280 feet so 4 wells per mile implies 1320 foot spacing is optimal, is that correct? Correct spacing in feet would make it crystal clear.

Only 4 wells a section at best. This could go up to 6 if prices were $150 per barrels and CAPEX stays low otherwise the party is over. 🎉

LTO survivor,

So you disagree with the research at JPT suggesting 1000 foot spacing is best? So your wells are spaced at 3300 feet or when you say 4 wells per section do you mean spacing of 5280/4=1320 feet?

I have asked this before, how do you explain the horizontal rig count increasing and the frac spread count increasing?

If the party was indeed over, I would expect the opposite.

1400 feet apart still yield 74% of the parent well.

Lto survivor,

This is confusing, you say 4 wells per mile is optimal (I think that works out to 1320 foot spacing), but 1400 foot spacing gives 75% of parent well. What if wells are drilled and completed as a group and first flow is within weeks for a set of 12 wells on a 3 mile by 2 mile group of leases (6 sections)? I would think that might solve the downhole pressure problem and might maximize output? Expensive though at 120 million.

LTO Survivor,

so the drainage area is 320 acres for wells with a two mile lateral. What is the EUR of those wells compared to the USGS estimate of 167 kbo per 100 acres? I guess that the USGS estimate might be realistic for the top tier areas only.

Toby,

USGS estimates about 70 Gb for 49 million net acres for all of the Permian areas studied (Spraberry, and Wolfcamp formation in Midland and Delaware basins), that is an average of 143 kbo per 100 acres. In my model I assume 9000 foot lateral by 1050 foot spacing or about 220 acres per well, that would suggest an average of 315 kbo if the Permian were fully drilled in a very high oil price scenario (say 200 per barrel). For the revised scenario I presented around 5:30 pm on 6/29/2021, which has 42.7 Gb produced from 121 thousand wells completed after December 2017, average EUR is 353 kbo per well or about 160 kbo per 100 acres.

It’s not a matter of wells per section, it’s a matter of lateral overlap, which completely kills any incremental output. Maybe you could get 4 wells initially but once they start producing there is no gain to adding more than one well in a given area of overlap.

Toby,

I have read that the average lateral length in 2019 for the permian basin was about 8500 feet, I do not have access to this data at shaleprofile.com. I have also read at JPT that optimal spacing for Permian wells is about 1000 feet on average. That would give us a well that is on average about 200 acres. My estimate of average 2019 Permian EUR is about 420 kbo over 221 months at $75/bo for WTI. My model assumes new well EUR starts to decrease starting in Jan 2020 and for a TRR scenario (which either ignores economics completely or assumes very high oil prices through 2050 (say similar to the EIA’s AEO high oil price scenario) we would have the 50 million net acres in the USGS studies (Spraberry, Wolfcamp midland, and Wolfcamp delaware) divided by 200 acres or 50000000/200=250k wells, the scenario for the Permian basin above assumes about 162k wells are completed from Jan 2010 to April 2041, the maximum monthly completion rate is assumed to be 624 new wells completed per month and that rate occurs from June 2026 to November 2033. The maximum completion rate to date was 521 wells per month in April 2019. The recent completion rate has been approximately 350 new wells per month (or that is what I use in my scenario to match model output with the output data).

Note that I do not agree with the 350 kbo EUR estimate. Also the last data I hve on Permian productivity per lateral foot has a peak in 2019. See Permian update published in Dec 2020. Chart at link below

https://shaleprofile.com/wp-content/uploads/2020/12/Productivity.png

post at link below

https://shaleprofile.com/blog/permian/permian-update-through-september-2020/

In every case from 2016 to 2019 my well profiles underestimate cumulative output vs shaleprofile data, for the 2019 well profile cumulative output at 18 months is 189 kbo and at 27 months it is 226 kbo. At shale profile blog the most recent Permian data has cumulative output at 18 months at 199 kbo and at 27 months it is 235 kbo.

Note that my well profiles were estimated over a year ago based on limited data. It is a pain to update so I do it on occasion, but basically my well profiles have been on the low side, which may explain why my models tend to underestimate Permian output from 2010 to 2021. As to future output, we can only estimate/guess based on a number of assumptions. In the past my assumptions about the future have invariably been too conservative, that is I have always tended to underestimate future output.

I do not know if that pattern will continue into the future.

Also in the past Ron Patterson and many others have doubted my future scenarios, always thinking they were absurdly high. They have always missed, but on the low rather than the high side. The exception has been the pandemic, I did not see that coming, but I was not alone.

Wolfcamp wells do 400kb eur spaced 1 mile. A 70gb EUR means extrapolating the current prime acerage to the entire wolfcamp.

USGS never claimed anything like that except to demonstrate and the obvious recovery is going to be like 10gb and production will collapse by 2025.

Mark,

No the USGS has different estimates for different benches of the Permian basin. The 70 Gb undiscovered technically recoverable resource simply ignores the economics. When reasonable economic assumptions are applied to the mean USGS TRR estimate, the URR is approximately 46 Gb with about 120 thousand total horizontal tight oil wells completed from 2010 to 2037. We do not know if the USGS mean TRR estimate is correct, I simply use it as a best guess starting point.

You’re assuming 100% of reserves are recovered which is silly. Permian recovers 30% which is 10% for the shale part.

This is really basic, obvious. If you’re saying 100% of reserves are recovered you’re just proving how easy it is to say dumb things.

Obviously you don’t care but anyone can see how bad every field besides Permian is and shale is over

Mark,

Seems you are basing things on analysis of conventional resources.

The USGS mean estimate for TRR of Permian basin is 75 Gb with a 90% conficence interval of 44 to 114 Gb for studies published in 2016, 2017, and 2018. I base my model on the mean estimate of 75 Gb and get 46 Gb URR for 1000 foot spacing and 40 Gb for 1320 foot well spacing and an average lateral length of 8500 feet (based on 2019 average lateral length).

OOIP for permian tight oil is about 1800 Gb, recovery would be about 2.6%, if it is 46 Gb as in my best guess scenario.

see https://www.beg.utexas.edu/tora/challenges

For Bakken/Three Forks tight oil resource OOIP is about 300 Gb, with my best guess URR of about 8.5 Gb, so about a 2.8% recovery rate, fairly close to the Permian basin.

I see you blocked replies. But in any case your argument is silly enough to speak for itself.

Replies only go a certain number of levels. Reply all you want, use copy and paste.

The trillion barrel numbers are obviously kerogen.

There’s 1 quadrillion barrels of dirt in the Permian.

10% is rock.

10% of that is organic content.

Then 2T of that is soluble bitumen and 5% becomes light tight oil.

Then of that 100B oil 10B is left to extract, which is why rig productivity is falling so hard.

This is just really basic petrophysics, there’s no other way things would work.

TORA stands for Tight Oil Resource Assessment, based at the University of Texas, Bureau of Economic Geology.

The TRR assessment for the Permian is 179 Gb, quite a bit larger than the USGS assessment of 75 Gb, so about 239% larger than the TRR estimate I use in my models.

Screenshot from page linked below

https://www.beg.utexas.edu/tora/challenges

The University of Texas must have hired someone from Saudi Arabia to make that assessment. 😉

Rolling on the floor laughing my ass off.

Dennis,

And where did TORA pull out the 10% recoverable number from? I mean, everything does depend on that one number, doesn’t it and it seems so round and base 10 on top of it.

Did they do detailed analysis to understand it and arrive at an estimate? I mean it could very easily have been 6.325835%, no? But no, it is a round fat 10%. Hard to believe that the 10% is the right number.

I think TORA pulled that tight oil recoverable % estimate from their tight a$$es. That number should be treated like the $hit it is. Don’t build your models based on such a stinking piece of data.

Corrected scenario using corrected Permian scenario from 6/29/2021, 5:32 pm

note that this scenario uses a revised non-Permian tight oil scenario based on a similar oil price scenario as was used in the Permian scenario, the previous scenario used a slightly lower non-Permian tight oil scenario based on lower oil prices.

I’ve worked often with Enno Peters over the years, since the beginning of shaleprofile.com, actually, to help him with TRRC reporting, etc. I am very fond of his work, and of him personally. He came to one of my drilling locations once; how cool is that? From the Netherlands ! He actually knows what a rig looks like and we showed him dozens of stinking shale oil wells, even a frac in process. His software code and algos are way beyond my comprehension but, after using other data services, have learned to trust his, the most.

I am unclear how you are now using shaleprofile.com raw data, provided by Enno (?!) to make your own charts. The chart below is from his Analytics Service and clearly shows at current conditions, including price, a consistent, current rig count, decline, RR factors, terminal decline, etc. he estimates by 2030 the entire Permian tight oil play will be producing < 4.1MM BOPD.

Your chart(s), if I am using the right one ( they change every hour), shows that the Permian will produce something like 9.5MM BOPD. I am unclear, by the way, why the EIA data that tracks your chart, created in 2019, is even relevant. How in the hell did you know about – $36 oil prices, < 135 rig count in the Permian and freezes in Feb. of 2021 in Texas…in January 2019?