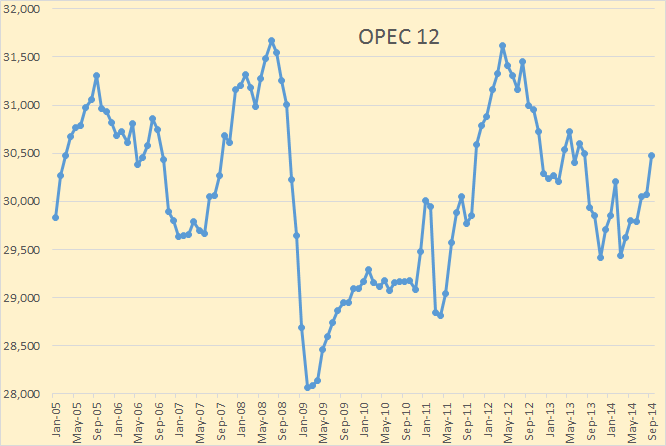

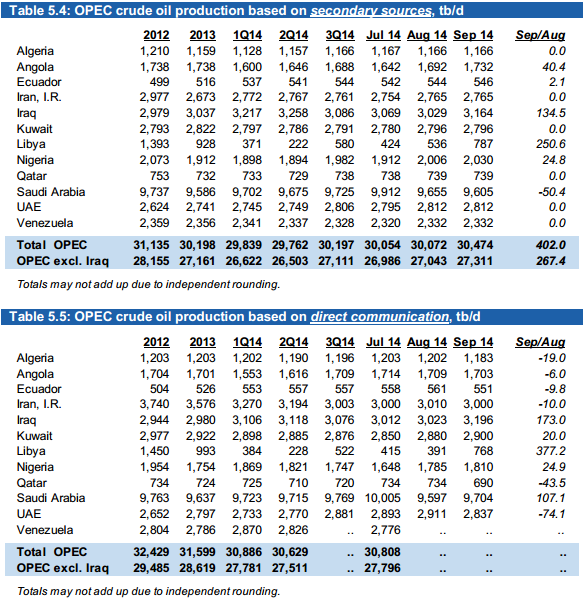

The OPEC Monthly Oil Market Report has just came out with OPEC production data for September 2014. All production numbers are in thousand barrels per day with the last data point September 2014.

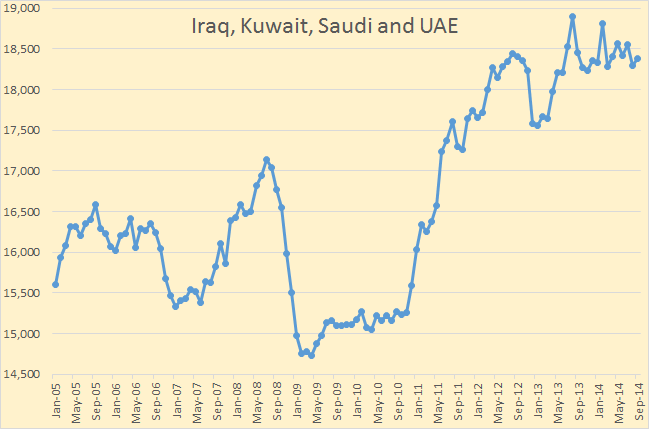

The August production numbers were revised down 275,000 bpd from 30,347 kbd to 30,054 kbd. Current OPEC 12 production stands at 30,474 kbd, up 402 from the revised numbers.

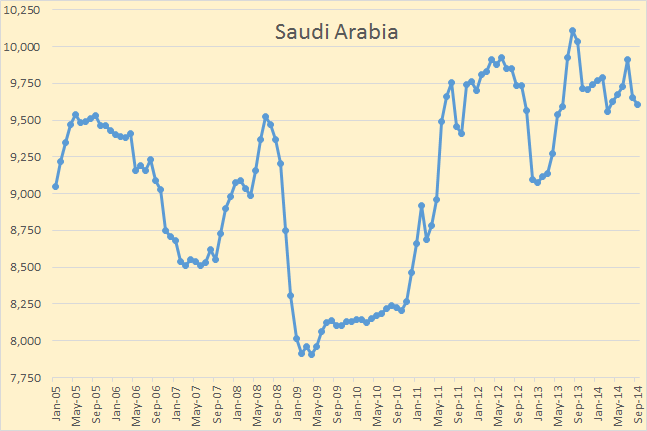

Saudi Arabia’s August production numbers were revised down 202 kbd. With that revision they are down another 50 kbd in Septemer to 9,605 kbd.

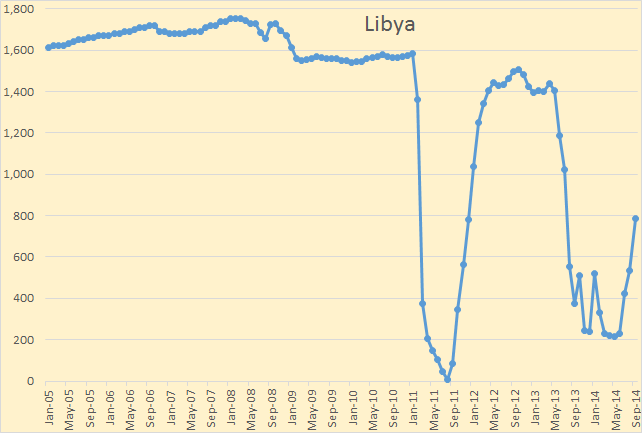

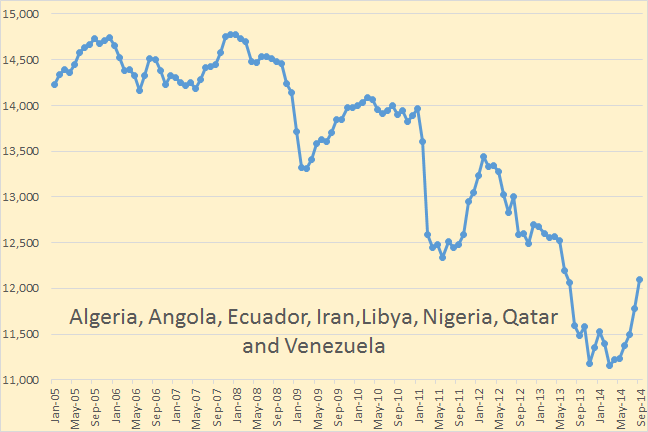

By far the largest change in OPEC production came from Libya, up 251 kbd to 787 kbd.

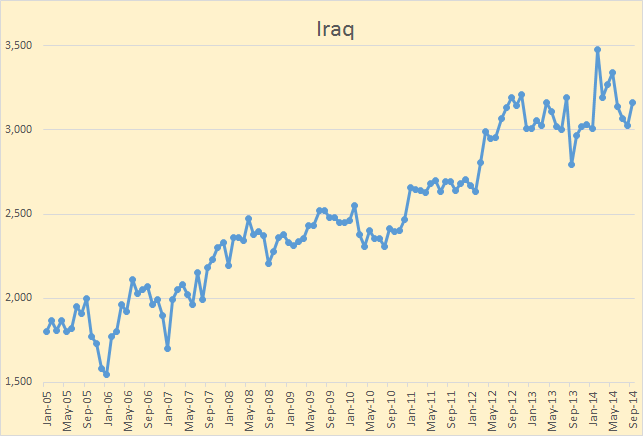

The other big gainer was Iraq, up 135 kbd to 3,164 kbd.

The four OPEC nations that have increased production over twice as much as total OPEC appears to have topped out at around 18.5 million barrels per day.

The other eight “mostly losers” were up 317,000 barrels per day, mostly on the strength of Libya’s recovery.

Saudi “secondary sources” numbers and their “direct communication” came in a lot closer than they did last month.

Is OPEC falling apart? An interesting quote from: Oil & Energy Insider:

Typically, OPEC acts in concert when oil prices slide too quickly, acting collectively to cut back production in order to prop up prices. However, amid the most recent price decline, Saudi Arabia and Kuwait have unilaterally cut prices in order to maintain market share, a decision that caught some market analysts by surprise. The price cut was intended to underprice oil from the United Arab Emirates, a fellow cartel member.

The OPEC basket price dropped to $88.27 a barrel yesterday, the lowest in years.

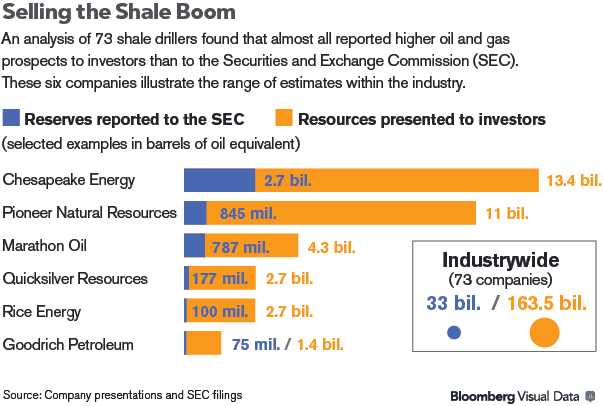

We’re Sitting on 10 Billion Barrels of Oil! OK, Two

It’s all about shale drillers telling the truth to the SEC but lying in reports they present to the public in an attempt to persuade investors to buy their stock. Here is an example:

Lee Tillman, chief executive officer of Marathon Oil Corp., told investors last month that the company was sitting on the equivalent of 4.3 billion barrels in its U.S. shale acreage.

That number was 5.5 times higher than the one Marathon reported to federal regulators.

So it is legal to lie to investors and potential investors. And here’s how they justify it.

Experienced investors know the difference between the two numbers, Scott Sheffield, chairman and CEO of Irving, Texas-based Pioneer, said in an interview.

If experienced investors know you are lying, then why lie?

“Shareholders understand,” Sheffield said. “We’re owned 95 percent by institutions. Now the American public is going into the mutual funds, so they’re trusting what those institutions are doing in their homework.”

That still begs the question, why lie? Are you doing it for the other 5 percent? The truth is that these funds advertise the fact that they are investing in shale oil companies. And we see headlines like New Fund Capitalizes on Shale Oil Revolution. And what does Michael Underhill, who runs the fund, have to say?

Underhill’s message: the surge in oil and gas production that has fostered predictions of U.S. energy independence by 2030 is bigger than you think; indeed, some sources are now forecasting achievement of energy independence as early as 2018-’19.

The funds are telling the same damn lie! Or more correctly, the funds are repeating the same lie told by the drillers, and passing that lie on to investors and potential investors.

The SEC requires drillers to provide an annual accounting of how much oil and gas their properties will produce, a measurement called proved reserves, and company executives must certify that the reports are accurate.

No such rules apply to appraisals that drillers pitch to the public, sometimes called resource potential. In public presentations, unregulated estimates included wells that would lose money, prospects that have never been drilled, acreage that won’t be tapped for decades and projects whose likelihood of success is less than 10 percent, according to data compiled by Bloomberg. The result is a case for U.S. energy self-sufficiency that’s based more on hope than fact.

The Rising Marginal Cost Of Oil Production Highlighted By Kashagan Expense Escalation

So while investors and commodities traders are focused on West Texas, North Dakota and South Texas (Permian, Bakken and Eagle Ford), perhaps they should be focusing on the bulk of oil production, coming from the rest of the world, and the associated high costs, delays and political risks. Geopolitical factors and offshore development challenges may ultimately be the dominant factors in the oil price (and thus, oil producer equity prices). The marginal cost of production for oil just rose another 7%. Perhaps it is time to buy some smaller onshore US oil producer stocks.

Fracking Firms Get Tested by Oil’s Price Drop (Behind pay wall but available via google.)

Weakening oil prices could put a crimp in the U.S. energy boom. At $90 a barrel and below, many hydraulic-fracturing projects start to become uneconomic, according to a recent report by Goldman Sachs Group Inc. While fracking costs run the gamut, producers often break even around $80 to $85.

Rail head prices are well below $80 a barrel in the Bakken.

The OPEC Charts page has been updated.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com

Yo Ron, maybe a sticky sort of permapost would be good as regards methodology of the various sources.

Meaning, why are there revisions? These countries monitor their own output and issue a report. Are they issuing estimates or data in those reports, and when do the estimates completely stop being estimates?

I’m good with upward revisions as delayed reports arrive, but downward revisions . . . . hmmm.

The numbers released by the countries themselves are political and highly unreliable. The “secondary sources” data is far more accurate though they do get it wrong occasionally. So they correct them the next month.

I don’t question the “secondary source” data or revisions. Reporting agencies like Platts and others would have little reason to lie about their data. In fact they have a very high incentive to get it right. If they were ever caught fudging the data it would ruin their reputation forever and no one would subscribe to their services again.

But if only the secondary sources are regarded as reliable (by you and I suppose a number of analysts), how can it be that the official figures released by the countries don`t turn into an embarrassment for them if “noone” believes in them anyway? What is their purpose then? Are they just for the “unsuspecting public” and mainstream media?

Okay, the “direct communication” numbers from Iran and Venezuela are very unreliable. Check them out, they are always way off from the “secondary sources” numbers. Chavez wanted to show that the strike, and him firing all the strikers did not affect production. And Iran wanted to show that the sanctions had no effect.

Iran’s figures were originally about 1 million barrels per day too high. Nowadays they are only about a quarter of a million barrels per day too high. Venezuela’s figures have always been about half a million barrels per day too high. And this is not by “me and a number of analysts” as you put it but by everyone including the EIA and the OPEC MOMR. The MOMR only recently started publishing those “direct communication” numbers because Venezuela would throw a hissy fit at every OPEC meeting because the MOMR was not reporting what they said they were producing.

The numbers from the other ten OPEC nations are fairly reliable.

But really now, Venezuela and Iran don’t seem to be the least bit embarrassed because the production they report don’t match the numbers that the rest of the world says they produce.

Ok, I see, thanks for the clarification!

“Iran’s figures were originally about 1 million barrels per day too high. Nowadays they are only about a quarter of a million barrels per day too high. ”

How was the gap closed? Upper lowered or lower upped?

Upper lowered.

I have a slight problem with this.

The wiki on sanctions quotes huge export reductions and that chart of outright production only dropped 750K bpd over the relevant period. BP on mazamascience says consumption is 2 mbpd and somewhat flat.

There is some talk of above ground storage to protect the wells from being irreparably damaged by shut-in (??? there’s that concept again) but the differentials are over 1 mbpd. There is no way in hell they have 365 million barrel above ground tanks to fill each year.

Do you have any data on what Iranian secondary sources would be, because everything I am seeing says they are exporting far more than quoted and it’s not being measured.

Hello all,

In recent days I have put up a couple of posts.

Some tags escaped therefore another try (hopefully Ron will delete the first attempt).

They are not about crude oil, but a status on natural gas from Norway (Norway has been and presently is Europe’s second biggest supplier of natural gas after Russia) with my forecasts towards 2025.

Status of Norwegian Natural Gas and a Forecast towards 2025

A post about the world’s development in total energy consumption since 1800 and how growth in solar and wind measures up against fossil fuels since 1990.

The Powers of Fossil Fuels

Rune

Saw a Ransqawk blurb last night that Statoil announced a big gas find.

Could this be what Ransquawk referred to?

Small gas discovery northeast of 7220/8-1 Johan Castberg in the Barents Sea – 7220/2-1

” Preliminary estimations of the size of the discovery are between 1 and 2 billion standard cubic meters (Sm3) of recoverable gas.”

1 billion Sm3 approximates 35.3 Bcf

Hard to make the economics work for such a small discovery in the Barents Sea.

It was last night. I’ll try to track it down. Very recent.

No additional info. That does look like it.

“Walk with those seeking the truth, run from those who think they’ve found it.”

Perfect!

That quote is by Deepak Chopra.

“…Chopra is a leader and pioneer in the field of mind-body medicine; he transforms the way the world views physical, mental, emotional, spiritual, and social wellness. Known as a prolific author of eighty books books with twenty-two New York Times best sellers in both fiction and non-fiction, his works have been published in more than forty-three languages.”

Don’t give me ANY credit for knowing anything about this; was impressed by the Rune’s quote just now looked it up.

Thanks for looking up the source.

I found the quote somewhere (and attributed it unknown at the time I put up the post it appeared in) and thought it appropriate.

Deepak is the ultimate Boomer Charlatan.

But if you want to be enlightened, for 3 grand he can make it happen.

That is correct, Chopra is a a pseudo scientific quack. knowing what I know about him I highly doubt he is the true author of that quote. Chopra is not above plagiarism! It seems he just reworded the following quote and appropriated it as his own…

Trust those who seek the truth, but doubt those who say they’ve found it.” – André Gide.

André Paul Guillaume Gide (French: 22 November 1869 – 19 February 1951) was a French author and winner of the Nobel Prize in Literature in 1947 “for his comprehensive and artistically significant writings, in which human problems and conditions have been presented with a fearless love of truth and keen psychological insight”. Source Wikipedia

Having said that I much prefer Albert Einstein’s take on truth and knowledge:

“Whoever undertakes to set himself up as a judge of Truth and Knowledge is shipwrecked by the laughter of the gods.”

A few critiques of “The Powers of Fossil Fuels”. I hope you’re not offended.

While I do agree that we will be using fossil fuels for some time into the future, some of the other points of the post require further examination.

A “Millenium” is 1,000 years. I’m not sure if that was the word you wanted to use.

Energy from fossil fuels is only a tiny fraction of the amount of solar energy used by humans.

Also, studies have shown that only 7% of the square footage of cities in the US, could potentially provide 100% of the country’s electricity, using existing solar PV technology.

And while solar PV is more expensive than some types of fossil fuels, it is certainly cheaper than oil fired electricity at current prices.

Finally, fossil fuel infrastructure has had a huge “head start” over commercial PV production. There must be strong arguments for replacing an existing infrastructure. If fossil fuel resource depletion theories are correct, production will eventually decline, resulting in higher prices. So there could be a strong economic argument in the future. There are also environmental concerns.

John B

Why should I take offense from your comment?

It should be centuries and not millennium. This has been edited in my post.

(Strange no one else caught it, I have had several read the post, emailed me and no one caught it, well that is until you did).

So Thanks!

True about fossil fuels being a fraction, but I hope I made it clear it was about human exogenous energy consumption.

With regard to improved solar coverage, this is also a question about resource allocation.

How FF prices will respond on the downslope is much up to debate. Through several years I have been in the camp that price is about affordability. Demand is what you can pay for. Presently the world struggles with too much debt. Growth in debt allowed to grow FF (and renewables) demand and also for some time negate higher prices.

In most of the major supply disruptions over the years, e.g. the Arab oil embargo, the Iranian revolution, the Libyan civil war, oil prices spiked. Higher prices are required to quash demand, so that supply and demand are in equilibrium. This is basic economics. Even the anticipation of lower production, would cause higher prices through speculation.

Even at the retail level, if there is some supply disruption (hurricane, etc.), there is an economic incentive to raise prices. The dealers who do not raise prices, will quickly run out of product.

When solar cost relative to ff’s is discussed, it is essential to factor in the global climate change component. If that is done, ff’s are obviously far too expensive for us to use, and solar is far less expensive not only in penalty to the future but to right now, and here.

I also suggest that another factor is important- the high probability of a political about-face in the event of a climate-related catastrophe too big to ignore. Such as, for example, a heat-driven city-destroying fire in the US south-west.

All such things considered, it seems highly likely to me that there will be a sudden huge demand for solar in the near future.

I am no expert on solar, but from the little I have understood solar requires energy in its manufacturing process.

So where should the energy come from to allow for this rapid expansion in solar?

If the answer is from FFs, I would say “Houston, we have a bigger problem!”

Exactly Rune. Wimbi is way too optimistic. By the time the demand for solar is clear, it will be many decades too late to supply it.

I am an expert on solar power and a huge fan, but even I think we have waited too long to make the huge investments, both in energy and material, required to replace fossil fuels with solar or any other renewable supply.

I’ve lived off-grid for almost all of my adult life (I’m 66) and know how easy it can be with solar and small hydro, but household power is a minor part of any energy transition for our civilization.

Transportation is the biggest problem. I still have several fossil fueled powered vehicles and, while I could buy an EV, not many in my community could afford it. Also, where I live, all freight is moved by truck after it is offloaded from container ships. There is not a single railroad in the state that could be electrified. Almost every traveler comes and leaves by jet. Have you guessed where I live yet?

Without fossil fuel powered transportation Hawaii would rapidly revert to a lightly populated backwater. But while Hawaii is a worst-case example, most big cities are not very well set up either. When I’m on the mainland I look at all the traffic around me on the freeway and have to shake my head. I see no way it all gets replaced with renewable energy in time to keep even a semblance of BAU going. Never gonna happen.

Pretty much, which is why warfare and victory are the order of the day.

BTW, here’s some delightful Chinese data.

Chinese electric car sales from 2010 to Sept 2014 amount to 70,000 vehicles, in total, including hybrids.

Total car sales

2010 18 million cars

2011 18.5 million cars

2012 19 million cars

2013 20.1 million cars (all time world record for any country)

2014 to date almost 17 million cars.

That’s a sum of 92.6 million cars in 4.75 yrs.

Electric clocks in at . . . let’s see . . . 0.1% of that haha amid the all time greatest hyping ever seen.

Now those benign Chinese btw, are quoted as having 100 cars for every 1000 people. Yet another metric that they MUST address, because the US equivalent is 800 cars for every 1000 people.

So we can expect the Chinese to ramp up a factor of 8 on car derived oil consumption and JUST AS FAST AS THEY CAN to achieve bare parity with the US.

If that’s 80% of their oil consumption (don’t know if it is, but one does hear such things), then their 8 mbpd present such consumption will be going to 64 mbpd AS FAST AS THEY CAN.

Now where were they going to get that again? You listening Tokyo?

correction, that source isn’t clear, might not include hybrids, which doesn’t matter, if it burns gas it burns gas.

You forgot to mention 200,000,000 electric bicycles, brand new subway systems in 20-30 cities and most of the world’s high speed rail. I don’t think China is on America’s trajectory.

Then why did they set the all time record on car buys in 2013, and are on track to beat it this year.

There is no escaping the numbers. They are exploding oil consumption. All the other stuff is wishful thinking.

>Then why did they set the all time record on car buys in 2013

Because things change faster than they used to, and there are a lot of Chinese.

Look at Africa — they went from almost phoneless to 800m mobile phones in about 10 years. All that proves is that they had a deficit before and change is easy nowadays.

The answer is that they’re not.

Chinese oil consumption has stopped growing so dramatically.

How can that be? Partly because Chinese cars aren’t driven nearly as far as American cars, partly because they get much better MPG.

Actually, Hawaii has one of the highest per capita penetrations of solar power in the country.

http://cleantechnica.com/2014/09/03/top-10-solar-energy-states-per-capita-us/

Also, the electric utility is planning for 67% renewable energy in 15 years. Although I suspect their projections are on the conservative side.

http://www.hawaiianelectric.com/heco/_hidden_Hidden/CorpComm/Hawaiian-Electric-Companies-submit-plans-for-Energy-Future-of-Hawaii

Hawaii is also one of the top states for electric car sales.

http://www.treehugger.com/cars/top-10-electric-car-states-are.html

They have an electric rail system under construction as well.

https://www.flickr.com/photos/honolulurail

BAU, never gonna happen. Right, and lucky we are about that.

We can pay for solar by the simplest and most obvious way- we get our ff’s , materials, skills, etc etc needed for solar by doing solar with them INSTEAD OF the idiotic things we are doing with those same ff’s, etc, today.

People, I ask you again, just look around and use your eyes. I now give a few ghastly examples of things we are doing today that, not done at all, could EASILY give us the wherewithall for solar, for good and all.

In domestic life. Too big houses, too little insulation, way way too much mindless driving around for nothing but a pack of peaches. Big deserts called lawns, and big ff’ guzzlers mowing same.

And in commerce. Gawd! Just look at it. Almost all the stuff in any department store is totally lacking of any need. Twenty different kinds of the same damn car part that could just as well be all identical. Fuzzy kids toys from China, which last maybe 15 minutes after christmas and then go to that huge stack of totally unused fuzzy kids toys from China already in the cellar.

Any private car fancier than a Civic.

You can fill in the million other examples well known by all, especially all those folk who spend their life writing adverts for crap which nobody would otherwise never even think of buying.

I easily paid the cost and ff’s to get my house entirely on PV by not buying that pickup, and not taking that jaunt around the country that my good neighbor did. And now, he is shoveling ff into his pickup and I am shoveling kw-hrs into my Leaf.

To say that we can’t afford going to solar is same as saying, what I have actually heard people say–

“Sure, we could save the world from global warming, but we can’t afford to.” !!

Humanity. Too bad. Had some promise, but died of idiocy before getting there.

Reports of the death of Humanity have been greatly exaggerated.

You can always trade your Leaf in for a newer model.

http://www.businessinsider.com/tesla-model-d-features-elon-musk-acceleration-car-speed-2014-10

Indeed you are correct Joe. I’m an engineer, and solar expert myself. When oil goes bye-bye, so will our entire society. The total energy stored in fossil fuel is unimaginable, compared to anything else on Earth. Wind and solar are great, but they are not enough to power our needs, at present. Period. Watch how fast we revert to cavemen after a sustained power outage. I encourage everyone to follow your lead and get a backup solar power system and some food, water and weapons.

Actually, the amount of Solar energy received by the Earth is thousands of times greater than fossil fuels, and nuclear fuel combined.

And no offense, but all the engineers I know, can come up with multiple solutions to virtually any problem, almost instantaneously. It’s in their blood.

Multiple solutions would be nuke Shanghai.

Or nuke the entire Chinese east coast.

Or more gently embargo oil imports to China by force and celebrate compassion.

Yeah, great idea dude, nuke China. Are you still on your meds?

It can come from solar. Solar has a high EROEI.

It doesn’t yet, which is normal. Humans bred horses. Horses built coal mines. Coal (and horses) built oil wells. Now oil builds wind & solar.

The old always builds the new.

Humans bred horses. Horses built coal mines. Coal (and horses) built oil wells. Now oil builds wind & solar.

Thanks for that. I’ve been following peak oil discussions for awhile, but only recently stumbled on some hardcore doomer sites. No matter what I suggested about the future, a few people shot it down. Nothing could convince them that any humans could survive without oil.

Precisely 732,254,389 humans will survive without oil.

What a sunny perspective you find here, yes?

I don’t expect life to continue as usual, and I think resources are overextended already, so I think the human population will decline.

However, the hardcore doomers don’t see a scenario where any humans will survive. They believe that once the oil is gone, humans will become extinct. They can’t envision any energy source working well enough to keep ANY humans alive.

I’m a hardcore doomer, but not quite to the “near-term human extinction” point. Even so, I am certain that lots of people will survive without oil; it’s just that most of those future survivors are already living without oil.

So, if you’re not prepared to live without oil, or money, and all the goodies they both provide, you’ve got a lot of work to do. I know I still do, but less and less every day.

I’m already to the point where I can hope that, to paraphrase Bush, “this sucker does go down”. Here’s to imminent collapse. The sooner it happens the better the chance that we leave a habitable world to those few grandchildren who live through it.

Humans won’t be gone until we’re replaced with something better.

I am a hardcore doomer and I have always maintain that there is no way humans will go extinct. Humans occupy every niche on earth that it is possible for humans to live.

After the collapse there will be undershoot that will last for a few decades then the population will move back up to the sustainable level, somewhere under one billion people.

An extinction scenario is pretty easy post oil derived decline.

So food stops transporting, spare parts do too, and China offers slave labor to Bali in return for sailing ship transport of rice to Shanghai.

Down we go to my 732 million number above. Lifestyle declines. No rubber tires without oil so even bikes get rare. Enclave mobility declines and inbreeding gets more common. Immune systems weaken, disease becomes more frequent and common and enclaves start getting knocked off by epidemics and natural disasters.

They don’t rebuild because there is no migration. Worse, perhaps worst of all, the salt deposits inland are no longer easy to mine without machinery, because they already were. Then the enclaves get limited to shorelines and natural disasters start to pick them off.

Extinction post Peak is a pretty easy scenario — even without the fallout from China’s east coast that would end Texas oil production (similar latitude).

My feeling is that extinction discounts the fact that homo sapiens have survived much worse conditions than a life without oil.

I believe if homo sapiens completely disappear, it will likely be because conditions on earth have changed to such an extent that very little of any kind of life survives. And if that is the case, then oil wouldn’t make much difference.

I guess I was just surprised how little the extreme doomers wanted to think about any other possible scenarios. It was like talking to people waiting for the second coming of Jesus. They had made up their minds and thinking about anything else was a waste of time to them.

“My feeling is that extinction discounts the fact that homo sapiens have survived much worse conditions than a life without oil.”

But all the other easy stuff had not yet been used then. Particularly salt. Look into why inland cities are where they are. It’s usually salt.

It’s been used. Now you go mine halite with gas powered engines shipped in from the factory.

It’s all Occam’s Razor. The path of least probability resistance is extinction.

If homo sapiens could survive pre-oil or pre-coal, I don’t see why they couldn’t survive post-oil and coal. Why would it matter that the easy stuff is gone if they aren’t using it anyway?

I think it is possible that homo sapiens along with a lot of other species become extinct. However, I can’t see that loss of oil would be the reason. As I said, the species has survived much worse.

Again, I think there are other possible scenarios rather than extinction because of loss of oil.

Actually, if you take the global warming scenario to its fullest extent, it might take loss of fossil fuels to give homo sapiens any chance of survival. Better to stop adding CO2 to the atmosphere than to maintain the lifestyle that fossil fuel affords.

I don’t think it is a given that homo sapiens will become extinct BECAUSE of loss of oil.

“My feeling is that extinction discounts the fact that homo sapiens have survived much worse conditions than a life without oil.”

“Homo sapiens (modern humans) is the only surviving species in the genus, all others having become extinct. ” Source Wikipedia

While Homo sapiens is indeed a very clever ape, there is nothing about them that guarantees they will not suffer the same fate as all the other members of the genus, Homo, before them…

“Why would it matter that the easy stuff is gone if they aren’t using it anyway?”

I don’t think you’ve thought through what near zero transport means, and the easy salt being gone.

It’s not the 1880s again. They had salt. They had coal. They had oil.

When you can’t get spare parts, you don’t have anything you think you can have over a period of 40 years. No parts. No medicine. It will all break. The bearings in the car alternators spinning in splashing water will die. You don’t even have to spin them. Materials age even if not used. A tree limb will blow into solar panels, and there will be no replacements.

It’s all about oil and it’s not about anything else.

Extinction is patient. And it’s cruel. It happens slowly, and inexorably everyone will see it happening and coming. The last few generations will KNOW they are going extinct.

It’s not the 1880s again. They had salt. They had coal. They had oil.

There is a big difference between living pre-1880s and extinction.

That’s what I mean by people jumping from the end of BAU to extinction.

A lot has to happen to Earth before homo sapiens as a species completely dies out. The species survived much worse than loss of fossil fuels. If homo sapiens as a species is headed for extinction, then Earth itself is likely to become uninhabitable for many species. If that is the case, loss of oil is the least of anyone’s worries.

I just can’t see going from “civilization is collapsing” to “homo sapiens” is extinct.

Do I think homo sapiens could become extinct? Sure, given the history of Earth, just about any species could be wiped out. But because the oil runs out? No.

In defense of Doomers, I don’t think they believe the loss of oil in and of itself would become an extinction level event. But rather from the resulting economic collapse, and “resource wars”.

So rather than solving rather simple engineering problems, it’s easier to revert back to “R” complex activities, such as fighting. They could be right.

But why would war result in extinction unless it is an all out nuclear war leaving lots of radiation that kills off most of the planet? If that is the case, let’s talk about radiation rather than how people will be inconvenienced by loss of oil.

In other words, we are back to the “On the Beach” doomsday scenario rather than the “peak oil” doomsday scenario.

It’s all Occam’s Razor. The path of least probability resistance is extinction.

Watcher, you usually post really logical post but that one makes no sense whatsoever. Occam’s Razor states that among competing hypotheses, the one with the fewest assumptions should be selected. You are assuming that something would kill off every person in every one of the hundreds of thousands of niches in the world. Such a scenario requires thousands of assumptions.

The Eskimos in Siberia, Alaska, Canada, and Scandinavia would have to be killed or die off. Every one of the thousands of tribes. Every aboriginal of the wilds of of New Guinea, the Amazon, Australia, Borneo and every wild jungle in the world would have to be killed off. And there are hundreds of thousands of other niches in the world where there would likely be survivors.

To simply assume that there would be no survivors anywhere is exactly the opposite of Occams Razor. Such a scenario just requires too many assumptions, way, way too many assumptions.

This is one reason I am skeptical that loss of oil will kill off an entire species. Maybe massive changes to the atmosphere could do it, but not loss of fossil fuels. Man doesn’t need them to keep the species going.

“This suggests the early human population was tiny (so the opportunities for new matrilines to evolve in the first place were limited) and reinforces the idea that Homo sapiens may have come close to extinction (eliminating some matrilines that did previously exist). Indeed, there may, at one point, have been as few as 2,000 people left to carry humanity forward.”

http://www.economist.com/node/11088535

It happens that around here, there are lots of appalachian junk kickers, who pride themselves in their skills in living on junk. Which of course, is wealth beyond measure to most of previous humanity.

I myself have long been of that mindset, so I have no patience with the hordes of people who can’t tell a box wrench from a box- and don’t want to learn.

So, re extinction- certainly not, not even close. It’s not just here in these hills that people know how to cope- it’s here and there all over the planet.

Of, course, there are a few little bothers with that way of life, like, short. No problem, lots left. Easy to replace. Done all the time.

Actually, I’m having fun right now setting up a seminar on simple thermal machines, things anybody can make that take heat and do work.

Start with the simplest of all. A chimney.

Another, real simple- Thermocompressor, aka Bush engine. Big, weak, but works. Fun to do with tin cans.

I’m pretty sure the Amazon Indians who have never contacted the outside world will survive too. Not to mention the Papua highlanders, the Eskimos, and the hundreds of millions (or billions?) without modern energy except maybe kerosene lanterns.

wrt your mentions of salt below (to which reply is not possible) there’s a doc I watched a few years back titled, I believe, ‘Salt’. (Not the one about Lake Eyre) It shows the harvesting of salt from the high Atacama to the coast of Portugal to a moveable railroad in operation somewhere in the ‘Stans, I believe. It seems to have disappeared from the interwebs since I viewed it. Given salt’s critical role, I keep wanting to refer people to it. Anybody got any clues?

There’s certainly been enough salt accumulated over the centuries that if you knew you were heading into tough times, your community could stockpile some, or you could find ways of salvaging what is already out there from other sources.

On the list of survival needs, I don’t think salt will pose the biggest problem.

And again, for those of us who don’t expect extinction based on the loss of oil, we do expect the amount of people living on earth to go down. We expect that at some point the population will size itself to properly fit a post-oil lifestyle. The resources still available should be able to sustain a population appropriate for those resources.

Peak oil won’t reduce population.

Educating women, now…

Peak oil won’t reduce population.

Educating women, now…

I get what you are saying, but my point about peak oil and population reduction is that if there is a transition period where total available energy goes down, then likely some parts of the world will find it harder to feed the people they already have. I think it is reasonable to expect to see declining populations in some places, or perhaps all places.

I’ve been charting a middle path between technology will fix all and support an unlimited population, and oil will be gone and homo sapiens will become extinct.

Well, we don’t have a net energy problem: we have a liquid fuels problem and a climate change problem.

For better or worse, we have a large: surplus of both liquid fuel and food production. The US uses five times as much fuel capita as Europe, for passenger transportation. The world now produces twice as many calories as are needed. Three times as many people in the world die from obesity, then from starvation.

We have quite a bit of leeway with which to handle the transition away from oil.

I am pleased to read some optimistic views. I’d much rather read those than the “there is no hope” ones. If there is no hope, then I don’t really need to know that, do I? How would knowing that make a difference in that case?

It was Francis Bacon who said “People desire to believe what they desire to be true”.

Boomer desires to read what he desires to be true.

True, but you see the same thing with global warming assessments. If scientists said, “There’s no hope. The planet will be warming to catastrophic levels and there is nothing anyone can do about it,” then people wouldn’t even try. They wouldn’t worry about carbon at all, figuring it no longer makes a difference.

So I like to read plausibly good news. If someone says, “Never worry about anything,” I will be skeptical. But if someone says, “Yes, we have problems, but we can solve them,” I’ll listen.

I think Boomer is just pleased to hear good news.

It’s perfectly clear that Boomer is willing to be realistic – based on some comments about climate change.

No, solar is meh; perhaps to shave a percent here or there, or to warm a home, but never when the sun does not shine, except with redundant stations and batteries and transmission and more capital spending than one can shake the stick at that they instead burn in a rocket stove, having not patience for the sun yet to rise. Do without? Consider two tea-sellers, one who burns a concentrated fuel store, and another that relies on the sun. Sun not up? Sale to vendor one. In too much a hurry to wait for the sun to boil the water? Again, sale to vendor one. Try to plaster the planet with an immensity of solar plants coupled with losses from batteries and losses from transmission lines? Well, maybe vendor two might get a sale, but this turns the subject to the high complexity and high capital costs of such an infrastructure, and considerations of how to maintain said infrastructure over time, assuming that it even can be built. (And how exactly vendor one would not still be making sales, and how vendor two could match that price.) The lessons from the “too cheap to meter” nuclear system may be most instructive, as humans have an amazing track record of excessive optimism in technological innovation. Evgeny Morozov in “The Net Delusion” has many examples, for the historically inclined: did you know that the speed of communication offered by the telegraph caused world peace to break out? Ditto for any solar noise.

Solar can handle about 25% of power requirements. No one is really suggesting more than 50%, certainly. Wind, hydro, nuclear, etc would provide the rest.

Wind is slightly stronger at night – there’s a nice synergy.

Solar can easily produce 100% of the world’s energy needs.

Sure. But, that wouldn’t be the low cost option.

The optimal thing is a mix of solar, wind, hydro, nuclear, biomass, etc., etc.

The Chinese solar panel companies invested heavily in solar farms when the prices crashed.

Looking at the growth in total FFs versus renewables consumption since 1990 we should now ask ourselves if we truly are prepared to wean ourselves completely of FFs and transition into a life within an energy budget made up from only renewables (refer also figure 1).

IMHO, the real issue is the mindset of growth itself. We, whoever ‘WE’ really includes, will at some point collectively face the reality that continued growth of any sort is simply no longer possible. ‘WE’ must wean ourselves off of this profoundly destructive paradigm. Not that I think ‘WE’ will…

I guess we can place the blame on Francis Bacon, though it’s hard to say which came first. The so called industrial enlightenment or the harnessing of fossil fuels. In my mind you probably couldn’t have one without the other.

The paper linked below is typical of the disconnect that seems pervasive amongst most economic historians, there is apparently no connecting of the dots between the enormous consequences of humans suddenly having gotten access to the extremely energy dense sources of energy embeded in coal and oil. Neo Classical Economists continue to miss the elephant in the middle of the room because the don’t have a grasp of basic physics, let alone biophysics. They also probably don’t really understand the consequences of the exponential function either. Yet ‘WE’ somehow continue to accept their ideas about the necessity and possibility of continued economic growth. Which is why ‘WE’ continue to think that we can’t wean ourselves off of fossil fuels and live within the energy budget allowed by renewable energy sources alone.

http://www.econ.upf.edu/docs/seminars/mokyr.pdf

“…for the purposes of explaining the Industrial Revolution we need only to

examine a slice of it, which I have termed the Industrial Enlightenment—a

belief in the possibility and desirability of economic progress and growth

through knowledge.14 The idea of improvement involved much more than

economic growth or technological change; it included moral and social

improvement, alleviating the suffering of the poor and the unfortunate, and

more generally such matters as justice and freedom. Yet the idea that production

could be made more efficient through more useful knowledge

gradually gained acceptance. Scotland, again, showed the way, but the idea

diffused throughout Britain and the Western world.15

It surely is true that not all Enlightenment philosophers believed that

material progress was either desirable or inevitable, or were persuaded that

the rise of a commercial and industrial society was a desirable end. And

yet the cultural beliefs that began to dominate the elites of the eighteenthcentury

West created the attitudes, the institutions, and the mechanisms by

which new useful knowledge was created, diffused, and put to good use.

Above all was the increasingly pervasive belief in the Baconian notion that

we can attain material progress (that is, economic growth) through controlling

nature, and that we can only harness nature by understanding her in

order, as he himself put it, to bring about “the relief of man’s estate.” Francis

Bacon, indeed, is a pivotal figure in understanding the Industrial

Enlightenment and its impact. “Lord Bacon,” as he was referred to by his

eighteenth-century admirers, was cited approvingly by many of the leading

lights of the Enlightenment, including Diderot, Lavoisier, Davy, and the

astronomer John Herschel.”

‘WE’ need to somehow leave the ‘Growth’ Paradigm behind and understand that continued economic growth based on fossil fuels is going to have to end sooner or later whether we want it to or not.

Fred,

I believe it is all about our mindsets and our perceptions/ideas about success which we acquire from social/cultural signals (propaganda).

Somewhere in here lies a huge challenge; to redefine our perceptions/ideas about successes (call it reprogramming).

Does bigger, faster, enhanced, more over consumption etc really, really improve our lives?

Is keeping up with the Jones (by going deep into debt) what one really wants?

Some (as in very few) have decided to lower their consumption level (and experienced an improvement in their quality of life).

The majority is likely stuck in some (planted) ideas about success, normality and scared of the alternative(s) as that represents something new/unknown for them.

Rune, I very much agree!

Yep, me too. But around here there are plenty of people who do go for what Rune said, and are in fact getting together to do something about it. In three days they will have a big meeting to brainstorm on this subject.

My entry is to suggest a wiki on a vision of our town from the future, giving everybody a chance to paint their own version. My version is truly lovely–to me. What a surprise!

Us folks here are just ordinary people, nobody special. That means that exactly the same process is going on all over the country -right?

Yep! I just had a nice conversation with a young lady friend of mine who out of the blue asked me what I thought of the idea of ‘Tiny Houses’ she said she was looking into building one for herself.

http://tinyhouseblog.com/

I told her I’d be glad to help her add solar PV to her project whenever she was ready.

Fred and wimbi,

What you both are describing is both interesting and encouraging.

A while back, I discussed the state of affairs with a long time colleague and friend and it appears we have made parallel observations about how things might evolve;

1) The world of human brains will seamlessly move from “There is NO problem” to ”It’s too late, we’re f***ed”.

2) Bloggers, analysts, doomers will quickly shift from attempting to persuade decision makers that we are living in overshoot to writing about “How to live in Overshoot”.

As an additional note awhile back I listened to an in depth/portrait interview with a female on the radio (I got rid of TV ten ears ago) and when asked where she lived (she traveled all over the globe) she answered; “I live inside my head.”

The paper linked below is typical of the disconnect that seems pervasive amongst most economic historians, there is apparently no connecting of the dots between the enormous consequences of humans suddenly having gotten access to the extremely energy dense sources of energy embeded in coal and oil.

I doubt coal is running out, even if oil is. There is also nuclear. The oil crisis is about running out of liquid fuel, not energy. That is why there is strong reason to believe there may be a technical fix.

Batteries may save the day, allowing business more or less as usual. They are inherently clunkier than liquid fuel, but not completely unusable, and they are getting better all the time.

New technology is allowing us to harvest unconcentrated energy, especially solar and wind. I also see a huge potential for geothermal.

All modern societies are extremely wasteful, and technology and pricing can help.

A lot of things could go wrong, but I don’t think it’s a foregone conclusion that they will.

That said, I firmly agree that the sudden amazing boom in the backwater of Eurasia’s far northwest coast was triggered by the discovery of cheap resources in the New World.

Batteries may save the day, allowing business more or less as usual.

There is nothing that can replace liquid fuel. Batteries will never fly an airplane, or drive heavy trucks, or power tractors and farm equipment in the field.

Plastics, rubber tires, fertilizer, asphalt, pesticides and a thousand other petochemical products cannot be made from or produced by batteries. There is simply no replacement for liquid fuel. BAU cannot survive the demise of liquid fuel.

Maybe it’s me feeling grumpy just getting off a cramped transatlantic flight, but I think the world can do with a little less flying 🙂 Anyway it is hardly the end of the world.

Coal can replace gas wherever it is used in the chemical industry, according to BASF anyway. Fertilizer doesn’t actually require gas, just hydrogen. The key thing is splitting the nitrogen triple bonds. Plastics can b made from a variety of raw materials, and a 90% reduction in use is feasible if you count recycling.

I think you are confusing the end of what you are used to with the end of civilization.

There has been a bit of development on electric airplanes.

http://www.technologyreview.com/news/516576/once-a-joke-battery-powered-airplanes-are-nearing-reality/

http://www.dailymail.co.uk/sciencetech/article-2613186/Forget-electric-cars-Airbus-unveils-plans-fly-battery-powered-PLANES-20-years.html

Long haul electric trucks are also a possibility.

http://insideevs.com/scania-testing-electric-big-rig/

Batteries will never fly an airplane, or drive heavy trucks, or power tractors and farm equipment in the field.

Batteries can do all of that, just not for very long ranges. But long range remote uses, like flying, water shipping and seasonal agriculture don’t account for a very large percentage of liquid fuel. Biofuel and synthetic fuel can handle that.

Have you looked at synthetic fuel? It works right now, it’s just a little more expensive.

Plastics, rubber tires, fertilizer, asphalt, pesticides and a thousand other petochemical products cannot be made from or produced by batteries.

You don’t need oil for those. You don’t even need fossil fuels. You just need hydrocarbons: hydrogen and carbon. H2 can come from water and electricity. Carbon can come from biomass, or from seawater.

This isn’t new tech: it’s all here now. Just ask any chemical engineer, like Robert Rapier.

Have you asked any chemical engineers??

When people list what you can’t do without oil or other fossil fuels, my thinking is that technology will continue to look for substitutes. While some people think humanity will just give up and die off completely, I think the people who survive will cope, one way or another. Do I think life will go on as it is today? No. But coming out at the end of this might result in a better, if different, life down the road. Much of what I spend my money on could disappear completely and I wouldn’t miss it.

I think most of us here know that peak oil is coming, or is here already. So we need to deal with it. Saying nothing else will work isn’t really dealing with it.

Sure.

The thing is, substitutes exist *right now*.

Really. Some of them are just taking time scaling up (hybrids, EVs, etc), some of them are a little more expensive (e.g., synthetic fuels) so they can’t compete yet. But they’re all here.

You don’t need oil for those. You don’t even need fossil fuels. You just need hydrocarbons: hydrogen and carbon. H2 can come from water and electricity. Carbon can come from biomass, or from seawater.

We have been over this a thousand times, mostly on TOD. Yes you can get carbon from biomass, hydrogen from water and even make hydrocarbons from air and water. The problem is it takes many times as much energy to manufacture the hydrocarbons than you get back when you burn them.

When fossil fuels are gone they are gone for good. We will not make them from water and air.

Of course synthetic fuels are just a “carrier”. We all understand that, here at least.

But surplus windpower is cheap. And we’ll only need to replace maybe 10% of current liquid fuel consumption with synthetic fuel.

Heck, ethanol can power a US fleet of 240M passenger vehicles, if they’re extended range EVs (like the Volt) which use only 10% as much fuel.

Satellite data shows U.S. methane ‘hot spot’ bigger than expected

American Geophysical Union Newsroom, 9 October 2014, Joint Release

The return of Rossi and the E-Cat

http://www.networkworld.com/article/2824558/infrastructure-management/could-ultra-cheap-clean-energy-be-just-around-the-corner-the-return-of-rossi-and-the-e-cat.html#comments

Rossi’s followers are thinking the recent drop in oil prices has something to do with this new test report on the ECAT. That’s clearly not what’s happening but someday in the next few years it might.

NASA put out an interesting article on LENR last year:

http://climate.nasa.gov/news/864/

I was very interested in reading the misinformation shale companies shill out to investors. On a local note Quicksilver bought out a defunct and shut down pulp mill site at Campbell River, B.C. The first thing they did was erect a huge sign proclaiming it would be a site for a new LNG export terminal. This is spite of the fact that Campbell River is an extra day steaming from Asia, plus it is located another 100 miles west of Juan de Fuca Strait or 200 miles east of the western entrance of the Inside Passage. In addition, while there is currently a nat gas co-gen site operating next door, a new gas pipeline would still have to be built to provide for the LNG facility.

For years I have heard locals say an LNG plant was coming to CR. For years I have said, “nah, this is just to bilk investors and pump up stock”. Furthermore, the site is so polluted I don’t know what liabilities are involved for eventual use? An operating pulp mill of 60 years spills a lot of bad stuff on the ground. presently they are harvesting scrap steel with a small crew.

paulo

“I was very interested in reading the misinformation shale companies shill out to investors.”

Totally agree: In fact, I think Jeff deserves a major metal for bringing the article to our attention (and aws for adding the included figure in subsequent comments).

I just ordered one of these. I might also get a kill-o-watt meter.

BC Hydro offers a rebate reduction. Our monthly bill fluctuates between $49 to $85. I am not sure just why at this point although rates have gone up as well. It might be correlated to how much welding I am doing or how much wood shop time I am pulling down. We are also running two freezers right now, outside, so with the cooler weather that should go down as well even though they are Energy Star rated. The freezers store most of the food we grow and right now they are bursting.

Product:

Rainforest EMU-2™ energy monitoring unit

The EMU-2™ continuously monitors your electricity usage and displays this information, in both dollar cost and kilowatts, on an LCD screen. Information displayed includes the total electricity use for the billing period and the real-time electricity use.

Just bought one in junk shop for $6, unused. Works reasonably well, a sensor strapped to the mains supply cable, a wireless display unit. Carry out round the house and watch power change

As you switch appliances on and off. We have baseline consumption of 0.1KW, sensors, timers, TVs on standby, etc. We consume 6 or 7KW a day total. Electric shower is the biggest load, about 4KW.

I mean 6 or 7 KWh of course.

Measure the transients?

I looked at this gadget on Amazon, and the description said that it only works when one is using one particular brand of smart power meter (provided by the utility). Is that true? Reading these comments I see that no one has mentioned that. Can any provide clarification? If this unit does require a special power meter, are there other whole-house devices to measure electricity usage which do not require a smart power meter?

I have an egauge that monitors electricity use and solar production.

http://www.egauge.net

It works great, gives you a daily graph and tons of historical information.

Not cheap; I got mine free as part of a research project.

BC Hydro has to verify my new meter is configured for this use. Right now it is a new smart meter, but because we live in the boonies they still send a meter reader around. I don’t know if that will affect its ability. I don’t think my meter is set up to ‘talk’ yet. I’ll have to see.

paulo

Ron, thanks for charts. Libya up 600,000 bpd accounts for most of OPEC 12 rise. Surprised that Iraq is totally unaffected by recent unrest. Also surprised that Saudi, Kuwait and UAE have not yet cut production. I guess we are perhaps in mode of pain for high cost producers for several months to see high cost areas shut down before OPEC turns screw – I was going to say for the next ratchet up but i don’t think global economy can tolerate that.

ISIS in Baghdad suburbs. It’s like Basra is a different country.

Should have known bombing would fail.

Classic perpetual Napoleonesque timelessness — an army travels on its stomach. These ISIS guys are getting fed by the civilian populace, who support them. That’s a populace, btw, who are seeing reports of anti women this and anti children that propaganda and laughing at it.

Of rather a lot more interest is who so quickly had anti close air support tactics ready to implement.

These guys are professionals. They aren’t ragtag. Someone has trained them, and someone funded that training. They knew right away the bombing was coming and how to avoid it.

People in the areas ISIS has conquered are enlisting with them. They probably don’t have much of a choice.

https://www.youtube.com/watch?v=ajh2HxBngg0

The reporter in the above piece mentions ISIS’ “version” of Islam. Apparently she has never read the Quran, because ISIS is exactly what the Quran teaches.

Actually the Koran, like the Bible, is a pretty patchy document that doesn’t teach much of anything and doesn’t even make much sense without heavy redaction. It’s hard to exaggerate how low the quality of the original Koran text is. In fact some experts believe that about 20% of the text isn’t even Arabic.

Like the Old Testament, the Koran was originally recorded with no vowels, word separation or punctuation in an otherwise unrecorded Semitic language (or languages). The vowels were added as “diacritic” dots to both texts on the command of Persian caliphs in the Middle Ages.

But unlike the OT, where it is usually assumed that the consonants cover the actual pronunciation at the time, the script used by the Koran only had about half as many consonants as Arabic actually has. So for example in the original texts, the same character could mean b, th, n and j. In modern Arabic these are distinguished by dots (diacritics).

That makes reading the original texts very difficult, especially since Semitic languages are so similar to one another. It may explain the odd pronunciation of some proper nouns like Ibrihim for Abraham and Isu for Jesus.

But German Islamologists generally believe that a lot (20%?) of the Koran is Syrian Christian texts written in Aramaic. These Christians were followers of the “Doubting” Thomas who is slandered in the NT (John 20). Arabic, Hebrew and Aramaic are closely related languages that express most word meaning in the consonants and most grammar in the vowels.

Thomas Christians believe (there are still a few left) that Judas was switched with Jesus by a miracle, so Jesus was never crucified, and that there is no Trinity but one unitarian god. Like the Ethiopian Orthodox Christians, they also believe in the Book of Enoch, with its guardian angels etc, which are barely mentioned by other Christians. The Koran says this too. By this reading Islam is a Christian heresy, like Mormonism.

Getting back to the original point, I don’t believe there is any “true” Islam any more than there is any “true” Christianity, even if everyone claims there is.

A couple of Witnesses appeared on my doorstep the other day who claimed that not only Jehovah’s Witnesses but billions of others will have everlasting life on earth and thus fulfill God’s original plan for humanity when he put Adam and Eve in the Garden of Eden.

Heaven might be a better route to go though considering the way we’ve been fucking up our good old blue planet. And my wife insists half of those who die in combat travel straight to Valhalla upon death so perhaps there’s a better option there: but do Norwegians know about anything (sorry Rune) ?

Whole lot sounds like variations on the same Fairytale to me.

But if my great grandfather and my grandfather and my father an me (probably not) and my kids and my grandchildren, etc. all get to have everlasting life of earth, won’t it start to get pretty clouded here?

And my wife insists half of those who die in combat travel straight to Valhalla upon death…

You have to be joking. The way you have talked about your wife she seems to be a highly intelligent, highly educated person. She does not believe that crap. I refuse to believe that she believes it.

But I am left wondering, what happens to the other half, and why do they not get to go to Valhalla?

Of course I’m joking Ron, give me (us) a brake here. No one in my, or my wife’s, family has had ANY religious convictions in five generations — not a single one. This reminds me of the time you thought I was serious about getting methane from Titan.

But the context in which you wrote it gave no indication that you were joking. If I had said something similar about my extended family, (but not my wife), it would have been the truth.

When I worked at Marshall Space Flight Center I knew PhDs who were fundamentalists and believed the earth is no older than 6,000 years.

When it comes to religion there is no accounting for what some otherwise highly intelligent people believe.

“….PhDs who were fundamentalists and believed the earth is no older than 6,000 years…” I’ve heard stories like that but find them very hard to believe.

I didn`t know this was a religious forum, lol, but there are those also (like me) who believe the World is much older, but mankind only about 6000 years old. Well slightly less since the first 6000 years are supposed to be the years when mankind fully demonstrates we are not able to govern ourselves (we are doing a great job!), and the final “Sabbath Millennium” beginning after 6000 years of Creation, thus making a perfect “7 day cycle” (one day is like a thousand years for God remember) with God`s number being 7 of course :))

Oh yeah, she just told me that the other half go to the goddess Freyja’s field Fólkvangr. And, she said to remind you that, like Christianity, this is a myth: “for Christ’s sake”. Some sarcasm included in there as well perhaps.

Ron,

Those who die in battle go to Valhalla because they will be needed at the last battle–Ragnarok. (slashed “o” to be supplied by the reader.)

Think of it as a mustering center.

I think I have this correct, anyway.

The old Norse Mythology is just a variation of similar mythologies from around the globe. Valhall was a place for dead warriors allegedly, one half ended there the other half of warriors in Folkvang with Freia, but most dead people ended up in “Helheim” or “Helvete” (Hell) which originally was a place where the dead rested until judgement day. Thus Helheim/Hell is a place like e.g the Greek “Hades”, not a place of eternal torture for the damned. This kind of “hellish thinking” which has been incorporated into most of modern Christianity stems largely from Medieval times and the Catholic Church with thinkers like Dante and other minions.

You might want to check out the following:

Ragnarok in Norse Mythology

http://www.viking-mythology.com/ragnarok.php

If KSA cuts production to elevate price, it means Saudi Aramco has no concern about shale, because low price could wipe out the industry.

If KSA maintains output to encourage price decline, shale will be destroyed.

I don’t see any sunny segment in those two scenarios.

Oh and btw, I did see a comment elsewhere that went like this:

Why is the price of oil crashing? When is the election?

Purely speculation but the US & EU seem to be waging financial war with Russia. On one hand the BRICS are working on their own version of an international bank for settlements as a way to manage trade without green backs (and undermine the dollar hegemony). Perhaps the US has encouraged SA to maintain exports at a level sufficient to lower Brent to a point that undermines the Russian economy? This has happened before.

In any case the current oil price is bound to shake out the more marginal players in the LTO world. But lower oil prices also jack up economic activity which in turn drives up oil demand. I’ll be curious to see where oil prices end up this winter.

Except this is the new normal where LTO is a signif % of that economic activity.

The world economy definitely seems to have the flu these days does it not?

Ron and the other good folks who maintain that demand destruction can and will drive down oil prices are certainly winning that particular debate in spectacular fashion at this time.

But if all the figures we have seen concerning the depletion of legacy oil fields are correct to within the ballpark then it seems very unlikely that tight oil and the recovery of production in places such as Iraq things (hopefully )settle down politically can grow fast enough to offset declining production elsewhere for very long- maybe for another couple of years or a little longer.

Then we will find out if declining production can push up prices faster than demand destruction can push prices down.

My opinion is that we will be paying well over a hundred and twenty bucks a barrel in constant current day money in the medium to long term.

A hundred fifty bucks in a decade would not surprise me.This would probably bring about an economic contraction of debatable but very serious proportions of course but we can also adapt to higher oil prices so long as those prices rise slowly and steadily.

There are plenty of ways to spend a little more upfront to save a whole lot on oil over the long term.

A sudden sharp spike that lasts more than a few weeks would most likely gut the business as usual economy and a slow steady rise may eventually kill it by the death of a thousand cuts. But if the rise is slow and steady I think the economy will live until something else kills it even though it will contract considerably on the basis of higher oil prices.

There really is no disputing the magnitude of the dollar run up. That is responsible for what looks like well over 50% of the oil price decline.

Election day approaches. Cheap gas is a boon to the party in power.

QE is ending. Germany seems to hate that more than the US economy (or so it appears until loss of trucking and drilling and railcar activity hits in Q4 GDP for polar vortex rev 2.0.

ISIS and the Kurds are selling way under market price oil.

The one thing we generally know is not happening is there have been no new Ghawars discovered in the past 3 weeks, there has been no spectacular oil production technology advance in the last 3 weeks . . . there really has been nothing on the supply side to drive it.

I can’t escape the conclusion that the dollar going up is basically a zero sum game in terms of oil prices. We Yankees can buy oil cheaper of course but everybody else who buys oil with dollars must ultimately pay for the purchased oil by means of converting their own currency into dollars and when that happens- they get fewer dollars per pound or yen or euro whatever their currency may be.

I realize this process may not correlate perfectly with the total amount people everywhere pay for oil but it ought to work out fairly close.

So the dollar rising doesn’t necessarily hurt oil exporting countries much either depending on what they spend their oil dollars ON.

If for instance the Saudis get fewer dollars because oil prices are going down because of a rising dollar then when they spend the dollars on goods imported from any country losing the dollar race they get more goods.The increased purchasing power of their oil dollars should approximately offset the loss in dollars due to currency fluctuations.

This is not to say that the real price of oil is not falling and that oil exporters and producers are not losing purchasing power as a consequence.

Producers here in the US are certainly getting less dollars per barrel and are compelled to spend most of their revenues here inside this country. I doubt the folks up in ND are buying much in the line of Japanese built oil drilling equipment or heavy trucks for instance.

That would all have merit if oil were priced in some fictitious 3rd party currency like tuks. Then all the currencies have to convert at their rate to the tuk and buy oil as you describe.

But oil is priced in dollars. If a dollar rises for non oil purchase/selling reasons (non oil supply and demand reasons), then oil’s price is affected by factors that are not oil related.

That’s just the way it is. Scotland seeking independence crashed the UK pound (versus everything) and oil’s price fell denominated in the stronger dollar. This would have happened even if Scotland had no oil.

So tell me how the Japanese for instance buy oil cheaper because of a stronger dollar. They buy with dollars but they ultimately get dollars by converting yen into dollars. When the dollar goes up in relation to yen they get less dollars per yen.

Your explanation is like a dog chasing it’s tail. It never closes the circle..

Now if the price of oil is declining not because of a strong dollar but simply because the world economy has the flu and supply is thus outrunning demand at current prices… well then the price will fall in any currency that has a more or less stable relationship to the yankee dollar.

I believe this is the true explanation of falling oil prices.

Well, it IS a dog chasing its tail.

The BOJ has printed yen in totals that made Bernanke look like a hawk. But the yen was mired at 102 despite it. For months and months. They were TRYING to trash the yen and it wouldn’t fall. The NY Fed functions as a conduit for some other CBs that want to intervene in the FX market and that is probably why it would not fall. There was indirect intervention.

This is relevant to your point. Japan paid $100 X 102 yen per USD for a barrel. They didn’t change consumption by 20% (the among of price decline), and global supply hasn’t risen by 20% in the past 4 weeks. That would be 18 mbpd globally.

But Japan now will pay more yen for a barrel. No supply change at all and most certainly no 20% change in either Japan’s or the world’s consumption.

Mario Draghi won’t print. That SHOULD be Euro bullish, but he’s been lying so long that people doubt the Euro can survive. The BOE is similarly pretending and people are staying away from the GBP by the thousands.

And so, relative to those two majors, the dollar rises. A lot of things redenominate.

Amount of price decline . . . tablet.

How will US foreign policy affect oil production in the Persian Gulf?

Washington

Wields the Oil Weapon

Wrong question. It’s how will Gulf oil production affect US foreign policy.

The wonderfully named Dan Dicker tells it as it is – US shale oil production to be cut and companies to get in heaps of trouble at these oil prices:

http://www.cnbc.com/id/102078540?trknav=homestack:topnews:2

The index which tracks most of the US shale oil producers is in free fall (and since it is now down 20% plus in a technical bear market):

http://finance.yahoo.com/q/bc?s=^EPX&t=2y&l=on&z=l&q=l&c=

Couple of more months of this and any number of shale oil operations are going to go tits up. No wonder the Saudis aren’t bothered about the supporting the oil price by cutting production – maybe they got so fed up with all the US shale oil propaganda they decided to see how that bubble would cope with $80 oil 😉

The narratives are so many I have lost count.

Maybe EOG and CLR will have a press conference and announce that out of pure patriotism, they have decided to leave the oil in the ground for the grandchildren.

They can play the Star Spangled Banner when they distribute pink slips. For you non Americans out there, Pink Slips are the little pieces of paper that ask you to report to Human Resources for exit interviews and a briefing on your separation benefits.

Watcher,

I am waiting for the share price of LNG to collapse. Lots of good bets out there

Steve

Another CNBC piece via Yahoo Finance. Is the MSM on a roll or sup’m?

Here’s why shale oil stocks are tanking

It’s a little bit more subtle than CNBC says, but they are worthless so one would expect that.

HYG is a/the high yield bond ETF. If you sashay over to finance.google.com you’ll see it is yielding 5.9%. I looked up EOG and CLR the other day and their latest issuance rated just under Moody’s investment grade threshold, aka junk, but pretty good quality junk.

If EOG and CLR could not get their paper out of junk territory, then the other frackers are worse off ratings wise. Andddddd, if HYG is at 5.9%, then that’s what the frackers are paying to get cash. Now, HYG has been falling with equities so that has goosed that 5.9% number up to where it is, but that’s the number and if they sell paper to the public Monday, that’s what they have to pay.

Contrast that with 10 yr US T paper at 2.3%, or German 10 yr paper at < 1%.

They DO have serious interest to pay.

With oil’s price in the eighties, the US gov’s tax revenues from profits on oil sales will be cut in half or more.

The US gov stands to lose tax dollars in a big way, me thinks.

It’s designed to weaken the US gov’s bottom line and further indebtedness.

I don’t quite understand who is in that conspiracy. The gubmint wants to lose tax revs?

I have consistently argued here that real oil prices can and will increase beyond the hundred twenty plus or minus price that is often mentioned as the max the world economy can support without dieing from oil price disease but I always try to remember to say that I am talking about the medium to long term rather than the short term.By medium term I mean at least four or five years from now to start.

The overall energy efficiency of the economy can be increased a lot faster than some of us expect and it IS INCREASING faster in my personal opinion than most folks realize.There is a huge sum of money being invested annually now on a world wide basis in energy efficiency.

Let’s not forget that a machine operator or a doctor who commutes in a car ten years from now that gets twice the mileage of his current vehicle is still just as productive as ever.The doctor will be able to afford a plug in hybrid and the machine operator will be able to downsize.

You see plenty of new Mustangs and Camaros and Dodge Chargers out there but the vast majority of them are v6 rather than v8 powered these days and get better mileage than my first car- a Chevy with a one barrel straight six and stick shift that took most of a minute to get up to sixty.

Here is a link to an article about energy efficiency.

http://www.scientificamerican.com/article/first-fuel-should-be-elimination-of-wasted-energy/

In the past we have depended on gigantic centralized systems to provide us with energy and water and these systems are so big and expensive that we have had to run them continuously to make them work.

A city bus system works only if you run the buses quite a lot when there are few riders but it still works at least after a fashion.But in a prosperous society it is cheaper to drive an EXISTING car than it is take a bus in as many cases as not if parking is not a big problem.I used to live in a city with a fairly decent bus system and only rode on rare occasions because tickets actually cost me more than gasoline and the short trips TO PLACES SERVICED BY BUSES AT TIMES I WANTED TO GO hardly mattered in terms of my overall cost of owning a car.

MY POINT is that we can afford cars that cost a hell of a lot of money and yet we use them less than an hour a day on average.

I think that if business as usual survives long enough that we will find we can afford to own some pretty nifty energy saving technologies that are not yet on the radar in most cases.

For instance there is no reason why a small engine cannot be totally enclosed and supplied with a top quality exhaust system and run on natural gas.With a tight water jacket and excellent sound proofing it could be installed inside a house just as safely as any fuel burning furnace and make no more noise.ALMOST ALL THE HEAT GENERATED but normally lost could be used to heat the living spaces and the mechanical energy – rotating power- used to power a heat pump or other household loads.

I am not proposing that such a system would provide all the power needed but if properly sized it could run for hours every day during cold weather and if the excess heat of combustion were captured in domestic hot water it could be used an hour or two a couple of times a week in hot weather as well.

This would take combined heat and power to pretty close to one hundred percent efficiency at the onsite basis.

Unless they have gone broke there are a couple of companies out there manufacturing such systems but hardly anybody has yet heard of them and only a few have actually been installed.

Electronic controls will allow such systems to be totally automated and the engines and generators can easily be built to last tens of thousands of hours with very little maintenance because they will be slow running at constant speed burning clean gas and low stressed. They can be cheap in basic design because light weight, wide power band ,variable speed operation and other attributes usually needed will not be necessary. Fuel economy will not matter much either because any heat not converted to mechanical energy will be captured and used anyway.

In the uk these micro chp units are not practical at the domestic level. They produce too little electricity to justify the extra cost, for the amount of heat a averagely insulated average sized house needs in our climate. We always get better return by more insulation.

For now almost anybody anywhere needing heat or cooling energy will get a bigger bang for the dollar by adding more insulation and better windows and doors than by any other means.

The point is not to supply the bulk of the electrical load of any given house but to get the maximum amount of utility out of the fuel burned.

If you have a small chp unit that gets forty percent efficiency mechanically then almost all the remaining sixty percent can be used to heat the house during cold weather and the unit sized accordingly.It should be sized so as to run mostly at peak load times during the winter months so far as that goes thus lowering the peak that has to be supplied thru the grid. Close to sixty percent of the heat in the fuel winds up heating the house directly.

If you feed the forty percent mechanical yield into a heat pump and get two for one on that investment you get a very close to a hundred forty percent yield of heat for your fuel investment. And a heat pump can do better than two for one a lot of the time.

Will this ever be economical in dollars and cents? I personally believe it will be in places with a lot of cold weather and piped gas.In places with a mild climate the system might not ever run enough to pay for itself.

We need to remember that the gas pipes and ductwork are already existing in retrofitted houses and that new houses must still have this stuff. And the combined engine generator can be incorporated into the necessary venting system and necessary furnace if gas heat is to be used.