A Guest Post by David Archibald

The views expressed in this post are those of the author alone.

This assessment is based on the data in the 2017 BP Statistical Review of World Energy available here. As such it uses that review’s definition of oil which is crude and condensate and natural gas liquids, uncompensated for their different energy contents or values of refined product components.

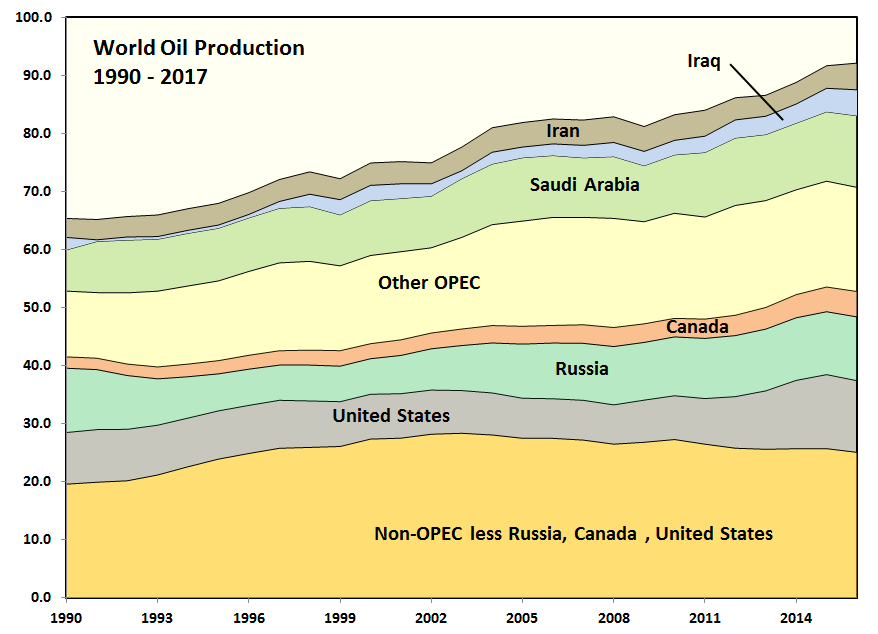

Figure 1: World Oil Production 1990 – 2017

This analysis was prompted by a chart by Ovi showing that Non-OPEC production less Russia, Canada and the United States has been in decline since 2004. That decline rate is 0.25 million barrels/day/annum. It had previously risen strongly from 1990.

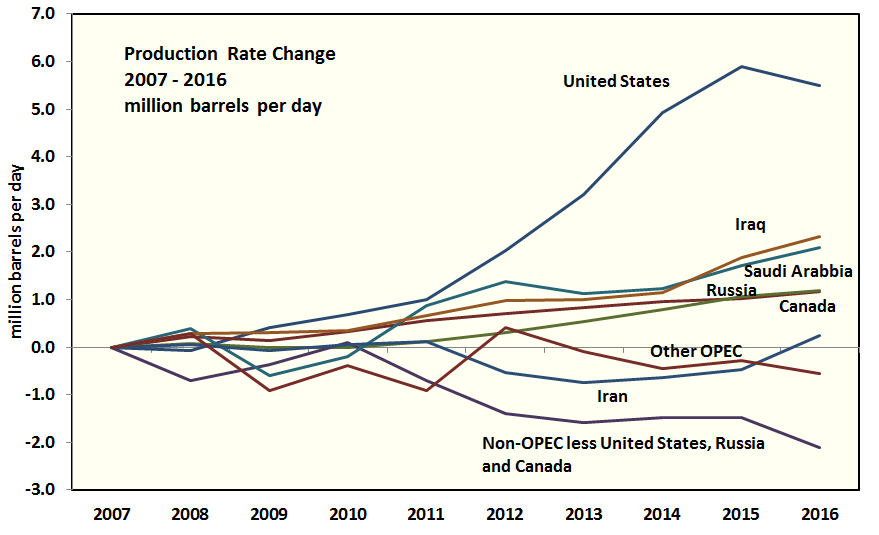

Figure 2: Production Rate Change 2007 – 2016

The United States LTO patch is widely credited with having caused the oil price collapse of 2014. American production had risen by six million barrels per day since 2007. The United States was not alone with four other countries totalling six million barrels per day of production increase. Iraq and Saudi Arabia contributed two million barrels per day each with Russia and Canada contributing one million barrels per day each.

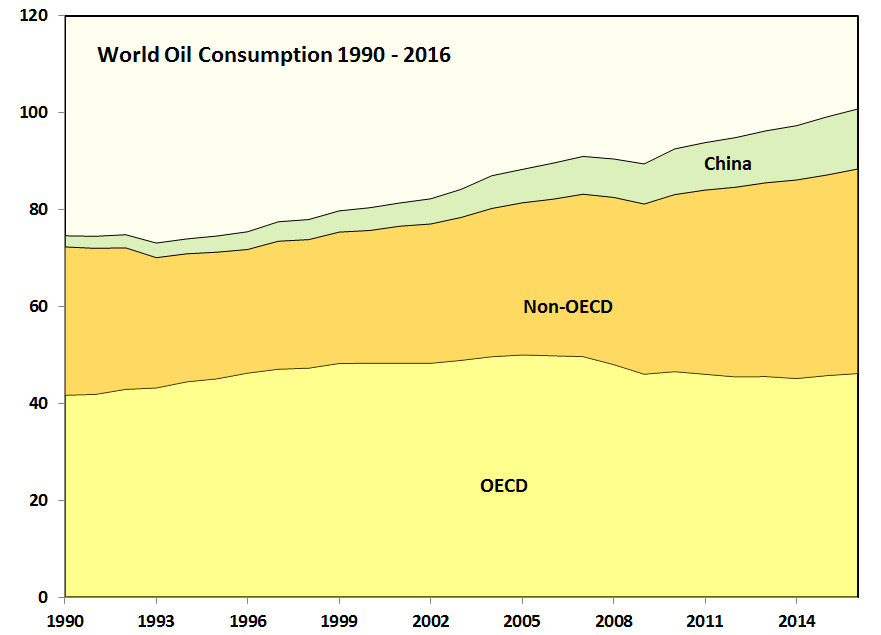

Figure 3: World Oil Consumption 1990 – 2016

OECD consumption has been flat even as OECD countries have had an increase in GDP.

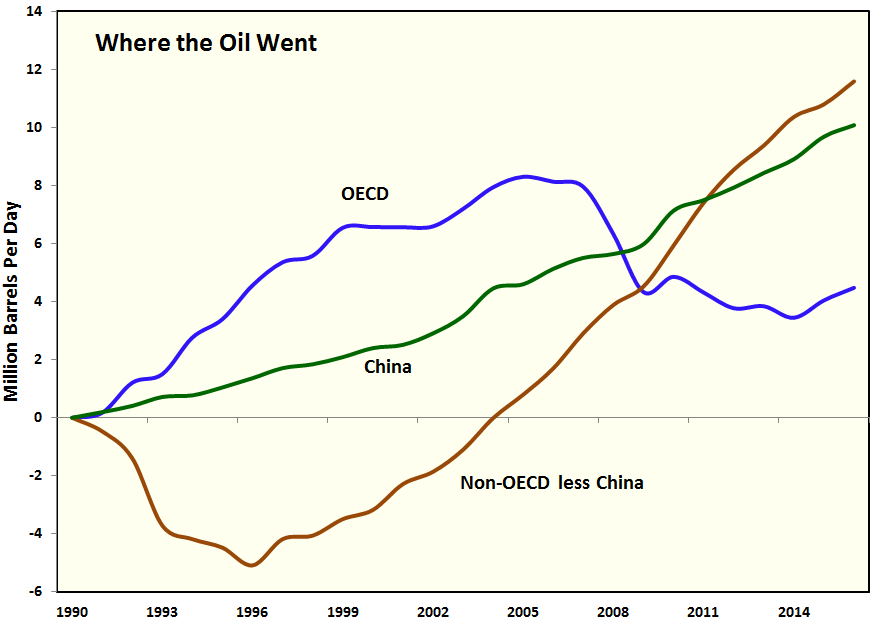

Figure 4: Where the Oil Went

The fall of non-OECD consumption from 1990 to 1996 was due to the dissolution of the Soviet Union. Since then consumption growth has been steady at about 835,000 barrels/day/annum. Chinese consumption growth was 240,000 barrels/day/annum up to 2002 and then steepened to 512,000 barrels/day/annum since. OECD consumption growth was strong up to 2007 and then demand contracted due to higher oil prices. From here it looks like OECD consumption has plateaued. China may have also plateaued. Non-OECD consumption is likely to continue rising with a large part of that being due to India.

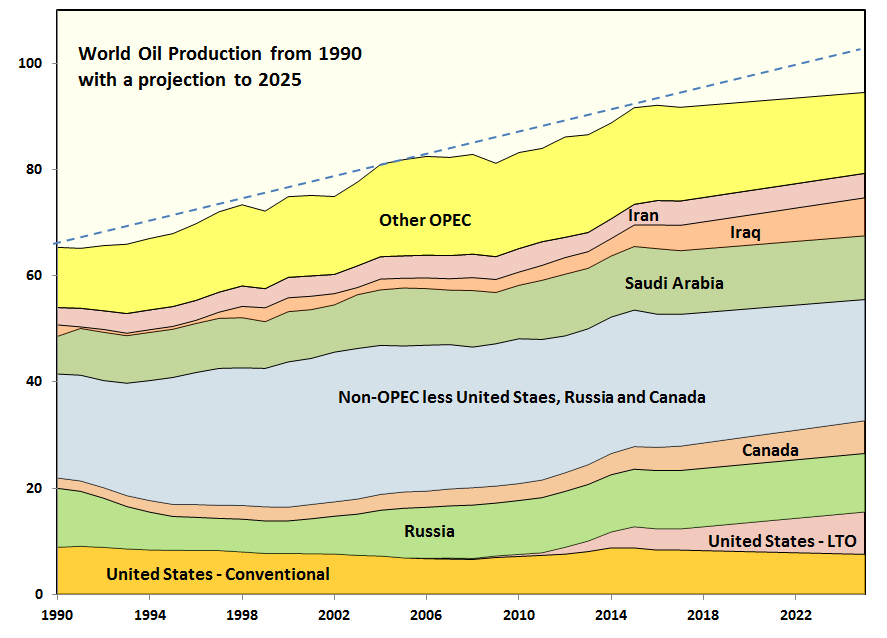

Figure 5: World Oil Production from 1990 with a Projection to 2025

This projection is based on U.S. conventional production resuming long term decline and U.S. LTO production contuing to climb, driven by the Permian Basin. Russian production is in a long plateau. Canadian production continues its slow, capital-intensive climb. Other non-OPEC production continues its established decline of 0.25 million barrels/day/year. Iraqi production rises by 2.0 million barrels/day to 2025. It could be higher than that. Other OPEC production had risen by 3.0 million barrels/day from 2000 to 2005, in response to the lifting of production restrictions, and has been in a plateau since. The projection assumes a decline of 0.3 million barrels/day/year.

The projection shows a gap of about eight million barrels per day by 2025 relative to the established growth rate indicated by the dashed line. This could largely be filled if Permian Basin production ramps up faster than projected and Iraqi production growth ramps up faster than projected now that their civil war is over.

In summary, the market is likely to remain in balance and sustained price excursions are unlikely.

David Archibald is the author of American Gripen: The Solution to the F-35 Nightmare

The summary conclusion does not seem to add up. No major oil price excursions and about an 8 Mb/d gap in supply vs demand by 2025, if prices remained on their present trajectory along with present demand trends (1.35%/year increase from 1990-2016 based on BP data on oil production in barrels) and Mr. Archibald’s supply projection through 2025 is correct.

Compared to my best guess for a medium World URR scenario for oil and natural gas and a continued increase in World demand at the 1990 to 2016 rate for C+C+NGL in energy terms (barrels of oil equivalent), which is 1.27%/year (different from the volume increase due to higher ratios of NGL), the gap will be about 4.6 Mboe/d in 2025, rather than 8 Mb/d as proposed by Archibald (different in part due to using volume units rather than energy units).

In either case I would expect oil prices should rise so that demand will be lower to match demand with available supply. Perhaps by “excursion” Mr. Archibald is implying what I would call a price “spike”.

In that case we would agree, continued small rises in oil price (maybe $1 to $2/b each month for 7 years) might allow the oil market to remain in balance.

My model continues to predict $63 per barrel. I think I’ve failed to factor enough SIN (shale investor nuttiness) which tends to create a slight oversupply at a lower price level.

There won’t be a 63$ price with a 4.6 or 8 mb/d gap – a gap this big would mean 100$+, since only this can reduce demand and reactivate other oilfields than canadian, LTO in USA and brazilian deep salt oil.

Hi Eulenspiegel,

I believe Fernando is poking fun at my constantly changing oil price predictions.

He has consistently said $63/b from his “model”.

His model is like the spoon in the Matrix. The thing you need to remember is there is no spoon.

My model says that as the gap grows prices rise, this closes the gap, there’s overshoot, and prices are too low, so the gap returns. The price average is $63 per barrel. As prices swing back and forth the average increases. It’s sort of like a drunk driving a truck, she doesn’t keep her vehicle in the proper lane (this sentence is my contribution to women’s equality).

Hi Fernando,

What is not clear is where the $63/b comes from.

The concept seems sound from an economics perspective (shortage will tend to increase prices and oversupply will reduce them).

What makes you think that $63/b is the long run equilibrium price where supply will equal demand?

Currently the Brent futures near month contract is about $67/b, but I doubt this price will be high enough so that supply will meet demand over the next 12 months.

I think perhaps you mean prices will oscillate above and below $63/b, maybe roughly $43 to $83/b for the 12 month centered average Brent price with a mean over the next 3 years or so of $63/b?

Dennis, it’s a model I wrote many years ago. I fed it data a couple of years ago, and a voice said “$63 per barrel”. I haven’t updated it. I believe if I rerun it it will say something like “$62”.

The model is intended to set the price for 15-25 year long projects over at least $200 million CAPEX. Therefore it doesn’t bother with oscillations (those are a risk which gets factored in with other risks).

Hi Fernando,

Thanks.

I assume the $63/b price allows an annual ROR of 10-15% for the project. I wonder if there are enough of these 20 year projects to meet World demand for the next 20 years?

Consider that for the past 33 years average annual C+C demand has increased at about 800 kb/d each year, current World C+C output is about 81 Mb/d. So in 10 years (2028), demand would be 89 Mb/d if demand continues to grow at 800 kb/d each year. In addition assuming an average decline rate of 4%/year (about 3 Mb/d each year), we would need projects with total output of 38 Mb/d over the next 10 years to meet World oil demand at $63/b. I just don’t see oil prices averaging $63/b over the next 10 years because I doubt there are (38*365/1000=)13.9 Gb of new projects with a marginal oil price of $63/b (2017$).

Note that I have used a very conservative decline rate to take account of some fields being on a plateau rather than in decline, the higher 6% decline rates refers to the weighted average decline rate of fields that are in decline (I do not believe it includes fields where output is increasing or those that are on a plateau).

Dennis

I think the oil production will be 8 million barrels per day less then if production grew at the same rate as between 1990 and 2006. Global demand has been slowing down in recent years, so the graph does not show a gap of 8 million between demand and supply.

Hi Peter,

I believe he says there will be an 8 Mb/d gap, but note that he uses barrels rather than barrels of oil equivalent, so much of the gap may be in NGL which in boe would be 8*0.7 or 5.6 Mboe/d.

From the second to last paragraph of the piece:

The projection shows a gap of about eight million barrels per day by 2025 relative to the established growth rate indicated by the dashed line.

I am assuming that over the long run (1990-2016) that supply is equal to demand.

So I interpret the author as saying that demand will grow “at the established growth rate indicated by the dashed line” and that supply will grow more slowly as indicated by the top solid line in the chart.

The gap is the difference between these two lines (solid and dashed) in 2025.

Unfortunately we would need the author to comment.

Hi Dennis

The author is not very clear. You are correct that over the long term demand and supply are about the same. Obviously in 2004-2007 demand growth exceeded supply growth and prices increased as a result.

http://www.macrotrends.net/1369/crude-oil-price-history-chart

Then the money printing pushed demand back up, and more recently US Shale and OPEC pumping created an oversupply which drove down prices.

https://www.iea.org/oilmarketreport/omrpublic/

The interesting question is. At what price indicates a balance of supply growth and demand growth?

Hi Peter,

An interesting question, I don’t know the answer, but my guess is $90-110/b for the 2018-2022 period. That might even be too low.

That might even be too low.

Probably not.

But it is not that that I haven’t been wrong before.

Hi Hightrekker,

I never get oil prices correct, my consolation is that most others get this wrong as well.

Fernando has been in the business a long time, maybe his $63/b is right. That suggests we won’t see much of an increase beyond this point.

Note also that Shallow sand likes 55-65 per barrel (though he has never claimed prices will be that level, just that that seems like a good level). Mike has never thrown out a number, but has certainly implied that he does not expect high prices (which may mean he also likes 55-65 per barrel, but he’s never said that specifically).

What is your guess? Less than $90/b?

Dennis, I am not capable of predicting what the price of oil is going to be in six months, much less six years. Neither are you. Shallow and Fernando, both oily folks, might state a “range” scenario but if you were to pen them down they’d likely say they don’t know either.

If the predictor of our hydrocarbon future has to “qualify” those predictions based on what the price of oil might be, I am sorry, I don’t see the point in the prediction at all. You, Mr. Archibald, and many others all miss the point entirely with regard to LTO growth in America. You assume that because LTO has grown, it will continue to grow. You focus on oil prices to make your predictions come true and ignore, entirely, that shale oil extraction in America is not nationalized, it is managed by private enterprise. Private enterprise must succeed, it must be profitable…enough… to drill new wells from old wells. Now, because of poor business decisions in the past the US LTO industry must manage its old debt, ultimately pay down that old debt AND create sufficient net cash flow to drill new wells without getting further in debt. It cannot do that at prices short of $100 or more for a sustained period of time. It is a business, Dennis; I am sorry you cannot seem to grasp that.

In the oil business debt is having stage 2,3 or 4 cancer. Ignoring its treatment is not the cure. Again, take Shallow’s CLR’s diagnosis: it has $6.6B of debt and only $10M of COH. If independently audited its reserves would not cover its long term debt. It is basically insolvent. It belongs in Hospice Care. You are relying on corporations like that to make your predictions come true.

I suggest you quit worrying about the price of oil and start focusing on profitability and debt. You seem to embrace debt as being acceptable in the reserve growth LTO business model. That is a very bad mistake, a mistake common to people that have never been in the oil “business,” that must write checks, receive revenue from the sale of oil and gas production… and be profitable. Or not eat.

Instead I suggest you focus on where the money is going to come from to keep funding this miracle of US LTO growth. That growth potential is not price sensitive, it is capital sensitive.

Hi Mike

I have said I agree with your analysis.

Still do.

I do not know future output or price.

If prices remain low, output will not increase.

In the past 6 months prices have increased by 12/b.

Sorry things have been bad.

I hope I am right about prices. If not it will not be a good year for US I understand it is a business.

I also understand falling supply leads to higher prices.

Hi Mike,

It seems that the price of oil would have an effect on profits.

I imagine even if you don’t know the future price of oil (as nobody does), you must use some price in making a business decision.

In fact the debt situation got much worse for the LTO industry when oil prices decreased, so if I were in the business, I would be concerned with lots of things, but the oil price would be one of them.

Also note that my expectations of LTO output since the price crash have consistently been too low. Last year I expected an annual rate of increase of 450 kb/d, the actual rate of increase has been about 700 kb/d.

Now oil prices are higher than before (an increase of $12/b in the past 6 months), I think if the present oil price is maintained, LTO output might increase by at least 500 kb/d over the next 12 months.

If output in other nations increases by 300 kb/d, my LTO guess of 500 kb/d is correct and demand continues to increase at 800kb/d (as it has on average for 33 years), then perhaps there will be no further price increase and the market will be in balance. I think there is a good chance demand might increase more than 800 kb/d, supply may increase by less than 800 kb/d, or both, which suggests demand may increase more than supply.

That suggests an increase in the price of oil over the next 12 months due to inadequate supply relative to demand.

My guess is you may believe an increase in LTO output is unlikely to be 500 kb/d and perhaps you foresee a decrease in LTO output.

That would suggest a bigger shortage of oil and a bigger increase in prices relative to my scenario (LTO increases by 500 kb/d in 2018).

Where we agree is that LTO is a disaster at the oil price level seen in 2017 (average for the year.)Through Dec 18 the 2017 average spot price for WTI has been $50.53/b. Brent $53.81/b.

Hi Mike,

The best analysis on the profitability and debt is that of Rune Likvern in my opinion.

There is no reason to repeat the work he has done. The fact that LTO needs the oil price to be $90/b or more is the reason it is likely to reach that level or those businesses will fail. I understand this very well, it is impossible to predict with precision when that might occur (either the rise in oil prices or failure of most LTO producers or some combination of both).

A recent article on the Bakken by Mr.Likvern can be found at the link below

https://fractionalflow.com/2017/10/08/a-little-on-the-profitability-of-the-bakkennd/

Rune has a good handle on it all, indeed. Regarding LTO debt and new tax laws, he was kind enough to recently send me this: https://wolfstreet.com/2017/12/22/what-will-the-tax-law-do-to-over-indebted-corporate-america/

Merry Christmas, Dennis.

Thanks Mike.

Merry Christmas to you too.

Interesting on the debt.

Note that these companies are not making any money, so they don’t pay taxes anyway, at least to the Federal Government.

Hi Dennis

If global oil demand increases by around 1.5mbld as it has done over the last few years then $90 + oil is very possible. Obviously it also depends on how strongly US tight oil grows and what OPEC will do.

At the moment US growth and OPEC spare capacity could drive down prices again. I believe in around 3 years time there will be very little OPEC spare capacity and increases from the US, Canada, Brazil, Iraq new developments etc will not be able to meet the extra demand.

Many people do not realise how many electric vehicles would have to be sold to cope with a world where oil production stops growing. About 30 to 40 million of the 100 million vehicles would have to be fully electric, hybrids would not be enough.

Hi Peter,

Plug in hybrids like the Chevy Volt could take a lot of pressure off oil consumption. High prices will lead to people driving smaller cars and hybrids, ride sharing, using more public transport. Consider what happened in 1979 to 1982, high prices will make a difference.

Also the long term trend for C+C from 1982 to 2016 is a linear increase of about 800 kb/d per year and may be a better estimate than the 1200 kb/d estimate of several agencies. If that trajectory is followed and my estimate of an 86 Mb/d peak is correct we might get there by 2023.

It remains unclear if enough oil is profitable to develop at $63/b, or even $93/b to meet this increase in demand.

Also note that wild swings in the oil price have affected this growth in output very little with very slight fluctuations above and below the trend line.

Hi Peter

In other words oil prices are very inelastic and can go quite high before people change their habits.

In the U.K. the price of diesel and petrol is equivalent to oil being $280 per barrel.

Yet even at this high price the number of pure electric vehicles is only 0.5% of sales.

By 2023 there will be a additional 550 million vehicles on the roads of the world. Even at the most optimistic numbers only 50 million of those will be electric. Another 500 million vehicles all wanting their share of a limited resource. This cannot end well, how can it?

Hi Peter

The vehicles can be more efficient especially in US,

EVs and plugin hybrids will ramp quickly as cost falls and oil price rises.

Hi Peter,

The UK uses oil much more efficiently than the US, this is due to the high price of petrol and diesel relative to the US.

VOX put up a good article on the progress of EV’s about a year and half ago. Things are moving faster now.

https://www.vox.com/2016/6/6/11867894/electric-cars-global-sales

Hi Peter,

The oil demand is inelastic in the short run, but over the long run becomes more elastic as people by more efficient vehicles and adjust their behavior for the higher prices over time. This is what happened from 1979-1993 as World demand for C+C fell and then took 14 years to reach its previous peak.

Peter Wrote:

“Global demand has been slowing down in recent years, so the graph does not show a gap of 8 million between demand and supply.”

Seems likely that global demand will likely to decline as Western & Asia populations continue to grow older. Currently the global economy has been propped up by ZIRP and lots of QE (China, Japan, EU, & US). Worldwide Debt has nearly doubled since 2008 due to cheap & easy credit. Sooner or later there will another global recessions that forces a reduction in Oil demand.

The big factors for future energy costs is the lack of CapEx in replacing consumption and the lack of finding replacement reserves. A lot of big western projects that would have replaced depletion were cancelled. Western Oil companies opted to drill in Wall Street (ie Stock buybacks) or buying up smaller companies instead of developing newer fields (Artic and Offshore).

I suppose sooner or later Middle East Producers will follow the Western Oil Companies by choosing to Drill Wall Street instead (ie the Saudi Aramco IPO).

My guess is that Oil pricing does not increase much (excluding geopolitical events/natural disasters) over the next 2 years. I think the odds favor a decrease in prices and consumption over the next 2 years caused by another global recession: Interest rates are rising at a time when consumers are borrowing more to meet ends, and consumers savings rates are near zero (perhaps going negative again).

I don’t do any modeling and number crunching. Couldn’t even if I wanted to, due to lack sufficient statistical and computer skills.

But I don’t see where all this new production is supposed to come from, without the price going up. There’s nothing in the news I read here, or at a number of other places, indicating that any huge new fields that are going to be cheap to produce have been discovered in recent times, and are in the process of being developed.

So how is it that new production adequate to offset the inevitable decline of the huge older fields that still supply the bulk of the oil, PLUS enough more to actually increase production somewhat, can be achieved without the price going up quite a bit?

Where’s the new CHEAP oil supposed to come from, considering that oil companies these days are going after ever smaller and more expensive to produce fields ?

Some of my neighbors, and some of my family members, have amazed everybody who knows them, including their physicians, by continuing to be productive workers right on into their eighties.

But when they did finally ” decline ” or “deplete” they went down hill pretty damned fast. Men and oil fields are subject to the SENECA CLIFF.

I disagree with our honorable and esteemed founder Ron Patterson about the odds of some of us pulling thru the coming bottleneck more or less whole, but I’m of the opinion he’s right about a lot of production being maintained these days by practices such as infield drilling and water flooding and so forth that will result in pretty sharp declines in production at many major oil fields sometime in the not very distant future.

Maybe the people who think like Tony Seba are right,and our need of oil is peaking now, or will peak, very soon. I don’t see it happening within the next ten years though, because I just don’t see electric vehicles displacing oil burners so quickly, considering the size of the vehicle fleet, and the number of relatively new ICE cars that will continue to be sold for some years yet.

Matt Simmons was ahead of his time, like a lot of people who are hailed as visioniaries after they’re gone, but he nailed it when he said rust and depletion never sleep.

Demand for use as auto and light truck fuel may indeed peak and plateau in rich western countries, but unless the world wide economy goes sour, demand overall won’t peak until batteries or fuel cells get to be fully competitive in up front terms.

Money has a hell of a lot of time value, and most people aren’t going to lay out a lot of money up front unless they earn an excellent return by doing so . This is particularly true in the case of small businesses and the large majority of individuals, because they don’t HAVE a lot of money to lay out up front, and lack good enough credit to borrow enough to pay a significant premium for an electric vehicle, considering their other needs for borrowed money.

The oil biz is unlike any other, because most of the key players are GOVERNMENTS, and governments have never been noted for their business acumen.

Sure governments want to make money on their oil, but the ordinary rules that allow us to predict what other industries will do just don’t apply well to oil, because politicians have too many other things to consider, in addition to the bottom line.

Consider this. Suppose you are the head of government, with enormous power, dictatorial power, so that you can do more or less as you please. You must have money coming in at all times, and once you’re selling oil , you’re HOOKED on the money.

So…… you own your country, as a practical matter, and you therefore own your own ( national ) oil company. Oil’s cheap. You expect it to STAY cheap for years. But maybe you know a buyer that will pay you a hell of a lot of money for your oil company, fifty times, a hundred times, maybe , the net cash flow you’re getting after paying the oil company’s expenses. Now if you were an ordinary businessman, such as the ones with an MBA from any of the Ivies, you would sell in a flash, and take that cash and put it into another business.

But since you’re a little tin pot dictator, or even time dictator, like the king of Saudia Arabia, you won’t give selling even a passing THOUGHT. ( Remember it always takes at least an exception or two to prove a rule, lol, and in the case of the Saudi’s selling a little…….. it’s a pig in a poke, and they’re going to maintain total control, and they’re just MAYBE pricing it at a very large premium, lol) .

You CAN’T sell, it just doesn’t work that way, because you have to control the oil industry in order to control your country.Politicians who expect to stay in power more or less forever very rarely sell national assets that generate cash. The money they could skim off isn’t worth as much to them as the power that comes with control. Sure they sell a money losing operation such as a water works sometimes, because that HELPS them stay in power.

But even though they are constrained from selling the assets, they are virtually always compelled to sell produced oil, and the lower the price, the MORE they need to sell, ouch! And the bigger the bind they’re in for cash, the less likely it is that they will be making the long term investments necessary to bring new production online , or even spending the cash to preserve current production by properly managing the oil fields.

The amount of money actually spent by the big independent super national oil companies on new production is trivial, compared to the amounts spent by national oil companies, and they aren’t spending much, not even a piddly hundred million here and there, if they can avoid doing so.

I kept my old Daddy’s orchard up and running right thru some very tough times, losing money a lot of years, making almost nothing some other years, because it was his LIFE, his passion. And I had every reason to believe that good times would return, because almost everybody backed way off on planting new trees, and lots of growers simply quit altogether.

But I didn’t plant new trees, because I was getting old myself. My neighbors who did are doing VERY well the last few years, as farming goes, because prices are very good in relation to costs, and will stay that way until the industry as a whole manages to over do production again. Both oil and apples involve long lead times, lol. If oil production capacity falls short of demand, the price will go up, substantially, and stay up a long time, as long as the economy holds up, and as long as there aren’t viable substitutes. Batteries are nice, but it’s going to take a LONG time for batteries to displace more even five percent of oil consumption.

I’m as far from an expert as east is from west, but according to everything I read, investment in the oil industry is at very low levels, world wide, and oil wells are like apple trees……… Ya gotta have new ones, cause the old ones quit on ya.

I’m dead sure oil will go up unless the world wide economy goes to hell. But….. I’ve been dead wrong before. 😉

Thank you soooo much for that brilliant essay, written clearly and understandably for us laymen.

Mr. Archibald,

Thank you for your report and for presenting your view about future developments.

However, in my view the oil market experienced substantial structural changes besides the volume growth and increased demand from non-OECD countries. The Shale production increased oil volume growth, yet it also shifted growth towards light distillates and left the world oil market short of middle distillates.

This is best demonstrated by the dramatic change in the mix of US hydrocarbon market. As the US market is swamped by light distillates, it is actually hit by an extreme shortage of middle distillates, which is used for the production of diesel, aviation and shipping fuel, as well as heating oil. The recently EIA weekly supply estimate revealed that the US had to import 80% more distillate fuel oil than last year. Distillate fuel oil inventories are 25 mill barrels below last year and reach a multi year low. It is for this reason that the total imports surged again over 10mill bbl per day as the US has to cover the shortage of middle distillates despite a glut of light distillate production. In that sense the US has to import a growing amount of expensive conventional oil containing middle distillates and has to export the surging Shale condensate production, which does not meet the specifications of international crude oil benchmarks, at a low price.

As a consequence, the price of condensate will be falling considerably and the price of crude oil containing middle distillates will be rising in the near future.

Most of the worlds producing countries have production that is gradually getting heavier, condensate is wanted worldwide by refineries for blending and has a premium price over heavy oil grades, which is likely to continue (e.g. EF condensate $53, South Texas Heavy $48; Canadian Condensate $58, Canadian Sweet $49).

Mr. Kaplan,

Condensates in a classic sense are part of light distillate group and are traded at a 20%discount to Brent. There is some demand to upgrade heavy oil, yet this comes at a cost. However, the group of light distillates includes also LPG amongst others.

The US exported last week 3 mill barrels per day of propane and other light distillates which just fetch the price of less than 20 USD per barrel. In my estimate the US has to pay USD 60 per barrel for imports and gets on average USD 30 per barrel for exports. This is a serious mismatch and cannot be solved by an increase of Shale condensate production.

Hi Heinrich,

You are confusing condensate with NGL, propane does not condense at atmospheric pressure and by definition is not condensate. It is separated from natural gas in a processing plant and although it is a part of the “wet gas” stream, it only condenses either at low temperature (below the standard of 25C or at higher pressure than 1 ATM).

On your export numbers the propane export was 1200 kb/d, we don’t know if the “other” category is light or heavy, but the other products are kerosene, gasoline and distillate all of these do not trade at $20/b or less. Kerosene is $75/b, gasoline is $68/b, and distillate is $77/b.

https://www.eia.gov/dnav/pet/pet_pri_spt_s1_d.htm

For net export numbers

propane 1062 kb/d

finished gasoline 795 kb/d

kerosene -255 kb/d (net import of 255 kb/d)

distillate 1170 kb/d

https://www.eia.gov/dnav/pet/pet_move_wkly_dc_NUS-Z00_mbblpd_w.htm

Also note that the imports of crude are mostly heavier grades which trade at a discount, the average refiner cost for imported crude was $52/b in Oct 2017.

https://www.eia.gov/dnav/pet/pet_pri_rac2_dcu_nus_m.htm

Dennis,

We could go now into endless discussions about condensate, NGL, LPG, NGLP…… However I do classify all these grades as light distillates as the main distinction towards middle distillates. Light distillates (containing no middle destillates) carry a substantial discount over middle distillates as the energy density is much lower for light distillates. Many signs (e. g. rising GOR rates) point to a substantial increase of ever lighter components in Shale production, which reduces prices of Shale condensate even more in the future. Any production increase of Shale condensate is contrary productive as this will decrease Shale condensate prices even further and will do nothing to stop further increases of US imports of real crude oil.

Hi Heinrich,

Condensate covers a very wide range and definitions vary see for example

https://www.reuters.com/article/us-oil-condensate/u-s-oil-industrys-billion-dollar-question-what-is-condensate-idUSKCN0HX0BU20141008

and

http://www.ogfj.com/articles/2012/10/fifty-shades.html

So when one says “condensate” it covers a very wide range from API 46 to API 70.

As George Kaplan pointed out Eagle Ford Condensate trades at a good price, not sure where he found that data though. Or where your claimed 20% discount comes from.

Hi George,

Where did you find these prices? for Eagle ford condensate etc.

Hi Heinrich,

There is data on US API gravity at link below:

https://www.eia.gov/dnav/pet/pet_crd_api_adc_mbblpd_m.htm

I added up C+C with API>45 and API 45) has been decreasing and since August 2016 the crude production (API<=45) has been increasing. See chart below (data in kb/d).

Dennis,

However 45 API is still way above the specification of 38 API for WTI. In other words none of the Shale production can be sold as crude oil and must be classified as condensate or more general as light distillates earning substantial price discounts on worldwide market. If the giant South Pars field in Iran starts up, there are gigantic capacities of these grades coming to the market, depressing prices even further. There is no doubt that Shale production experiences a significant quality problem. This is in my view also the reason why Shale companies have such catastrophic financial difficulties:they receive not enough cash to cover the high production costs and high depletion.

Hi Heinrich,

The crude contracts specify a range, data on prices from EIA at link below

https://www.eia.gov/dnav/pet/pet_pri_dfp3_k_m.htm

Chart takes data for 35.1-40 API and greater than 40 API for crude data is in $/barrel. The premium for 35.1 to 40 API crude compared to 40.1 and higher is quite small and for the past 6 months or so has been negligible.

Check the API gravity of WTI at link below

https://en.wikipedia.org/wiki/West_Texas_Intermediate

It is 39.6 not 38 (that’s the API gravity of Brent).

Also see

https://www.petro-online.com/news/fuel-for-thought/13/breaking-news/what-is-api-gravity/33309

Where they say:

In general oils with API gravity of 40 – 45 generate the highest market prices. Any oils with API gravity of 45 or over have shorter molecular chains which are less desirable to refineries.

I’m not gonna go back and find the links again.

WTI is no longer 39.6. It’s well over 40. That’s from the most recent assay data. Historical analysis means nothing if definitions change, and they have changed.

Can search the archives here, or can use rational thought. WTI now includes lighter oil coming out of shale in West Texas. As I recall the assay was at Cushing which also blends it with Bakken flow. The definition has changed.

My recall is officially, not just from the assay.

Watcher,

This is exactly the dilemma of Cushing. Officially it is a WTI trading hub, yet in reality most of the inventory cannot meet the the specifications for a WTI grade. It is therefore very difficult to reduce inventory at Cushing.

See link below 2013-2014 avg was about 41:

API Gravity-≥37 and ≤42 • Monthly averages in 40 to 42 range. Occasional values above 42. • Seasonal variation with winter being slightly higher. • December 2014 average was 41.6. • If your assay does not reflect ~41 API, it probably warrants review.

http://www.coqa-inc.org/docs/default-source/houston-tx-february-2015-presentations/02192015–sutton–wti-quality.pdf?sfvrsn=14346bb_2

and

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRAPUS2&f=M

Dennis,

As far as I can see it from the data this includes all oil input including oil imports, heavy oil from Canada and conventional oil from GOM . Nevertheless, there is a clear upward trend.

Why do you think the US has still to import over 10 mill bbl per day in crude oil and products? There must be a clear reason for it, if not for quality reasons. People would not send for fun oil around the world without reason. And the reason is that Shale does not produce crude oil, but condensate and light distillate products. It is just in the wrong market and Shale condensate and lighter products must be sold in the worldwide market at a cheap price. This is also the reason the US has still a high oil deficit, despite high condensate and light distillate products exports.

Hi Heinrich,

The US exports more products than it imports. So let’s set that aside and look at crude plus condensate and not confuse matters by injecting NGL, natural gas and other matters into the discussion.

The reason the US imports crude is very simple, we produce less than is needed for refineries. Production is about 9.5 Mb/d and refinery crude input is about 17 Mb/d, ergo the difference is imported.

Yes there as been a small increase in the API gravity input to refineries from 2005 to 2017, note that this takes us back to the level of 1985. It started light moved to heavier as we ran out of enough 35-45 API crude and now it has gotten higher as there is 4.5 Mb/d of lighter crude from LTO. The refineries will adjust or the lighter crude can be exported if necessary, about 1.5 Mb/d was exported in Sept 2017. There are refineries elsewhere in the World that can refine lighter crude more efficiently so the crude should go where it can be used most efficiently.

That is the reason free trade is a good idea. The producer should be free to sell their output where they can get the best price.

LTO producers may produce a lot of condensate (about 1.65 Mb/d of C+C above 45 API was produced in Sept 2017 (18.8% of USL48 C+C output). Much of this may have been exported, but note that about 57% of this condensate was between 45 and 50 API and this grade of ultra light oil commands a premium price in many markets. Also Canada needs the light condensate to blend with bitumen so it will flow in pipelines (they imported 342 kb/d in Sept 2017) and this matched the API>55 output in Sept 2017 very closely (368 kb/d).

Much of the condensate above 50 API comes from states besides the main LTO states of North Dakota, Texas, and New Mexico the split is 55/45 LTO/non-LTO for API>50. Thus much may be from Natural gas wells or possibly conventional output.

https://www.eia.gov/dnav/pet/pet_crd_api_adc_mbblpd_m.htm

Dennis,

Thank you for admitting that Shale production must be exported, because it has lighter quality. This is what I have been saying all the time.

Why should anyone export 1.9mill per day of oil to China and then import the same amount and same quality from Nigeria? So, there must be a reason why the US exports oil which it cannot use in its own refineries:it is the quality.

This point was well discussed by Jeff Brown who called it the great condensate con. PAA in the conference call clearly indicated export market is needed for Permian to expand. Delaware basin produces mostly condensates.

Brown asks, “Why would refiners continue to import large–and increasing–volumes of actual crude oil, if they didn’t have to–even as we saw a huge build in [U.S.] C+C [crude oil plus condensate] inventories?”

Hi Heinrich,

The oil is exported to many different nations.

The US refineries were set up to refine heavier crude (imported from OPEC and Canada), there are refineries in Europe and Asia which can refine lighter crude more efficiently (they were designed to handle Brent and Arab light) so it makes sense to move the crude where it can be refined most efficiently.

At link below it shows where the exported crude goes

https://www.eia.gov/dnav/pet/pet_move_expc_a_EPC0_EEX_mbblpd_m.htm

China, Canada, Korea, UK, France, Italy, India, Netherlands, and Germany accounted for about 75% of crude exports in Sept 2017.

Hi Krisvis,

Yes there is condensate produced, though my understanding is that much of this is from the Eagle Ford rather than the Permian Basin.

Now the oil can be exported if the US refineries cannot handle the lighter grades.

There was a time when ultra light crude commanded a premium price because it is very easy to refine, I cannot seem to find prices for some of these light grades.

We don’t have very good historical data on crude vs condensate output, except perhaps in Texas. Chart below uses data from RRC website.

Note that LTO output in Texas mostly took off after 2011. In 2009 average condensate to C+C ratio was 12.66%, in the past 12 months it was 10.77%.

Data from link below

http://webapps.rrc.state.tx.us/PDQ/generalReportAction.do

as always clicking on chart will give a larger view.

Hi Heinrich,

Nigerian Crude imported was about 224 kb/d in Sept 2017, exports of Crude to China were slightly higher at 251 kb/d, interesting.

The Nigerian crude is 30 to 36 API depending on the specific blend (there are 5 blends), so heavier than WTI which lately has averaged around 41 API, and th condensate above 45 API is clearly lighter.

We don’t have data on the API of the exported crude, or I don’t.

What I see now if that EPD and CME are adopting COQA recommendations and implement them in 2019.

US refiners did not like the dumb bell crude when you mixed too light a crude with too heavy a crude. Distillation test will reveal that. Lately the Asian buyers of US crude did not like the fact it produced too much light gas. I saw EPD came up with the specs. and it was immediately followed by CME.

US light oil needs an export market or a condensate splitter is needed

Hi Watcher,

The definition has not changed it has been 38-42 for a long time, but it is correct that the average WTI has increased from about 39.6 historically to about 41 in 2013 and 2014 and it has occasionally risen above 42 on a monthly basis.

Hi Heinrich,

The spec on WTI is API 38-42, so 45 is a bit above that spec, but 40-45 covers 40-42 which is half of the range of the WTI API gravity spec, the EIA does not break it down more that increments of 5 API.

When trying to picture the future price of oil, I believe there may be important predictors other than the fundamentals: money supply/inflation and market sentiment. Any other predictors?

The main catalyst for more oil demand and higher oil prices is actually the US trade deficit. A high US trade deficit weakens the US dollar and thus ignites higher worldwide growth and oil demand. This is why Shale condensate production is so important as it reduces the US trade deficit.

https://www.rystadenergy.com/NewsEvents/PressReleases/all-time-low-discovered-resources-2017

ALL-TIME LOW FOR DISCOVERED RESOURCES IN 2017: AROUND 7 BILLION BARRELS OF OIL EQUIVALENT WAS DISCOVERED

Rystad Energy concluded this week that 2017 was yet another record low year for discovered conventional volumes globally. Less than seven billion barrels of oil equivalent has been discovered YTD.

“We haven’t seen anything like this since the 1940s,” says Sonia Mladá Passos, Senior Analyst at Rystad Energy. “The discovered volumes averaged at ~550 million barrels of oil equivalent per month. The most worrisome is the fact that the reserve replacement ratio* in the current year reached only 11% (for oil and gas combined) – compared to over 50% in 2012.” According to Rystad’s analysis, 2006 was the last year when reserve replacement ratio reached 100%; largely thanks to the giant onshore gas field Galkynysh in Turkmenistan.

Not only did the total volume of discovered resources decrease – so did the resources per discovered field. An average offshore discovery in 2017 held ~100 million barrels of oil equivalent, compared to 150 million boe in 2012. “Low resources per discovered field can influence its commerciality. Under our current base case price scenario, we estimate that over 1 billion boe discovered during 2017 might never be developed”, says Passos.

I think every drilled high impact wildcat well identified by Rystad at the end of 2016 has now turned out dry, with a couple postponed for lack of finance.

Thanks George.

It would be great if they gave the gas/liquids split all rolled up. Does it look to your eyes like a roughly 50/50 gas/liquids split in 2017, as it does to mine? (Talking about Rystad chart.)

2017 looks likes another very disappointing year for conventional discoveries. I wonder how unconventional resource adds have been over the last few years. I suspect that is how many of our big oil friends are achieving their annual resource add goals.

The EIA reserves are going to be interesting: even before the price crash the extension numbers, which is where all the LTO growth came from rather than discoveries, were starting to fall and reserve changes looked like they might be going negative, which I’d guess is due to decreases in URR estimates; e.g. below for Bakken.

And EF.

About 50/50, maybe slightly more gas because of the big BP find, which I thought was 2.5Gboe but they have as 2.

Thanks George,

Yes reserves decreased in 2015, probably due (in part) to a fall in oil prices from $59/b in Dec 2014 to $37/b in Dec 2015, the price in Dec 2016 was $52/b, using spot prices from the EIA, so perhaps reserves increased a bit in 2016, it will be interesting to see the 2016 estimate.

I think they have to use averages for determining economic recovery not spot prices – I can’t remember now if it’s six month or annual (or other – I think maybe six months to March and September when they reevaluate) – 2016 would be bout the same or a bit lower depending on the time frame.

Hi George,

I am not sure exactly how it works.

I found this:

https://sprioilgas.com/sec-oil-and-gas-reserve-reporting/

Initially, SEC rules required a single-day, fiscal-year-end spot price to determine a company’s oil and gas reserves and economic production capability. The SEC Final Rule changes this requirement to a 12-month average of the first-of-the-month prices.

Using this I get

2014, 101

2015, 54

2016, 42

So 2016 reserves should decrease further if prices affect reserves.

EIA reserve estimates were due at the end of November, but still haven’t appeared, maybe they don’t look so good?

Hi George,

Last year it was mid Dec, maybe at the end of the year. Not sure why it takes so long as these are 2016 reserves as of Dec 31, 2016.

https://www.rystadenergy.com/NewsEvents/Newsletters/UsArchive/shale-newsletter-december-2017

EMPIRICAL EVIDENCE FOR COLLAPSING PRODUCTION RATES IN EAGLE FORD

We have recently observed strong empiric evidence for the theory that a positive tendency in initial production rates for shale wells does not always lead to similar improvements in ultimate recovery.

Cabot announced they are selling up in the EF and concentrating on gas (15,000 bpd), maybe more likr them to come.

I have had to work hard over the years to explain to management that oil completions have to be optimized, and that seeking the highest peak rate wasn’t likely to be the best answer. This of course happens because high level oil company managers are good at sales and PowerPoint, but have opportunities for improvement in key areas.

Hi George,

Great article, thanks.

This confirms the suspicion of many that the high peak rates on newer wells (often with longer laterals and more frack stages and proppant, in short more expensive wells) don’t boost cumulative output much. In the case of the Eagle Ford, wells in Karnes county (the core of the play) only increased output by about 40 kb over the older wells with less expensive completion methods.

Looking at Bakken data, it is clear that this is the case as well, with about a 10%to 15 % increase in cumulative output over the first 24 months and then similar output to older wells thereafter.

Many observers assume that a higher peak production from a well leads to higher cumulative output of the same proportion. That is if the peak goes from 400 kbo/d for a well projected to have an EUR of 200 kbo to a peak of 800 kbo/d for a newer well, it is often assumed that the new well will have cumulative output of 400 kbo. This is incorrect, in fact the newer well is more likely to have an output of 240 kbo an increase of only 20% rather than the 100% often assumed.

Another article citing that same Rystad report:

Shale Growth Hides Underlying Problems

However, Rystad Energy argues that there is some evidence that suggests those higher initial production (IP) rates do not necessarily translate into larger gains in the total volume of oil and gas that is ultimately recovered. A sample of wells in the Eagle Ford showed steadily higher IPs in recent years, but they also exhibited steeper and steeper decline rates.

It seems a bit unlikely that Canada is going to continue increasing production as shown above over the next 6 to 8 years (after 2018 ramp ups are complete). There are no major greenfiled developments currently under construction and these take at least 5 years from FEED to production, there are continuing redundancies in the oil patch as some of the large, recent developments move from development to operations, and there is no spare pipeline (or rail) capacity such that the oil is at about $10 to $15 discount which is likely to increase as Fort Hill’s ramps up through next year (and new pipeline permitting and construction is likely to take even longer than the actual oil sands project).

With Iran and Iraq – they may have oil in the ground, but they need huge,new surface production facilites to process it and supply water/gas for injection – those too take about 5 years to construct, assuming they can find some outside funding.

Hi George,

Do you have an alternative prediction for 2025? I imagine OPEC and Russia and perhaps Brazil could increase production and with higher oil prices, US LTO output could increase, these could fill in the 5 year gap until other projects start producing. Imagine supply is short and oil prices increase to $100/b by Dec 2018 and remain at that level or higher until 2025.

Do you believe World C+C output could increase from present levels under such a scenario and what would your guess be as to how high they might increase (50% probability they will be higher or lower than your estimate, aka best guess)?

I don’t understand how US LTO works, though the next EIA reserve numbers might make this clearer, and I think a demand side crash from recession, which is probably due but which I also can’t predict, will have a bigger impact than supply changes, so I don’t know.

Thanks George.

Of course nobody knows.

Your guess is likely to be better than mine, but without one we can only guess that’s true. 🙂

Recessions are also difficult to predict, I am assuming a major recession (like 2008/9 or worse) won’t arrive until 2030 or later.

Why are you assuming that it will not happen before 2030?

Hi FreddyW,

My expectation is that peak World C+C output will be between 2023 and 2026, after that I expect output will decline slowly for a few years at less than 1% per year with very high oil prices (maybe $200/b in 2017$, and perhaps higher). My guess is the World economy will muddle through for a couple of years (many will say we are on an undulating plateau and deny this is really a peak, just a repeat of 2005-2010), eventually there will be a Minsky moment where financial markets may come to the conclusion, “hey maybe we really have reached peak oil output”.

The result is likely to be a financial crisis.

Clearly I could be off, probably a good window would be 2025-2035, if the peak (or mid-point of a plateau) was 2025. The peak will probably need to be 5 years in the past before it gains widespread acceptance.

Hey there may be no financial crisis, in the past 116 years there have been two major financial crises (1929 and 2008), so these do not happen often. Maybe the next one will be in 2087 (79 years after 2008), but my original thinking was Great Depression 2 about 100 years after the Great Depression.

Ok I think that a very high oil price compared to other resources is the only way your predictions will have a chance to be correct. I have doubts though if that is really possible. Personally I think there be a major financial crisis starting in 2018-2019. But it could be later as it depends mostly on how the markets reacts to falling oil stocks. At least in the beginning when there is still lots of oil left in the SPR.

Hi Freddy,

I am not ruling out a mild recession, but at the World level, I think a major recession (like 2008/9 or worse) is pretty low probability before 2020, I would say less than a 5% probability.

If oil stocks fall oil prices will rise, the World watches this pretty closely and OPEC and Russia, along with Brazil, Canadian oil sands and US LTO are likely to be able to fill in any gaps until longer term projects (deep water etc) can be brought online. In the mean time prices will rise to a level that makes the supply available to meet demand at that price level.

Or that’s how I see it.

Natural Gas and coal are already considerably cheaper than oil, for the most part this is also true for the Chevy Bolt and the Tesla Model 3 when oil gets to $90/b in the US (this may already be true in Europe due to higher taxes).

What is the “high oil price” you think is necessary for my scenario to play out, and what do you think the actual oil price might be?

It seems you believe that oil prices will be lower than I have assumed.

My guess at future prices is below, note that 12 month centered average real oil prices are likely to oscillate above and below this projected path, and clearly nobody actually knows what future oil prices will be. Chart will be below in next comment.

“I am not ruling out a mild recession”

It could start as a mild recession and then get worse and worse.

“OPEC and Russia, along with Brazil, Canadian oil sands and US LTO are likely to be able to fill in any gaps”

There are others like Ron who thinks that Opec is producing as much as it can. Russia doesn´t have any spare capacity and oil sands take a long time to develop. So short-term I think we have to rely mostly on US LTO.

“Natural Gas and coal are already considerably cheaper than oil,”

Yes that is exactly my point. In 2014 both oil and coal producers were struggling and then both the oil price and the price difference was higher. So if that was not enough then I can´t see how you scenario could happen.

And I have not tried to make any price forecast. Too much complexity and unknowns for that.

Hi FreddyW,

OPEC has already demonstrated it can produce more, before they cut back in Jan 2017, Russia can also produce more. With high enough prices Canadian oil sands can be moved by rail, truck and pipeline, Brazil can increase output. So in short output will increase by about 4 to 5 Mb/d from all of these sources including LTO, OPEC, Russia, Canada, and Brazil, if oil prices are high enough. By 2025 I expect we will be at the peak and note this is my optimistic scenario. My pessimistic scenario is that we remain on an undulating plateau for 15 years (at the most) with very high oil prices. Maybe $150/b by 2020 and rising to $200/b by 2030. Reality may be somewhere between these two scenarios, maybe 83-84 Mb/d in 2025 (about 2 to 3 Mb/d higher than at present).

I don’t think oil producers were struggling at $100/b, they were overproducing so prices dropped. Coal producers were struggling because low natural gas prices reduced demand for coal as electricity producers substituted cheap natural gas for coal. Eventually oil will suffer this fate as EVs and plugin hybrids take market share from ICE vehicles, but that is probably 20 years away, 10 for very optimistic people. There’s also rail, ridesharing, telecommuting, public transportation etc. High oil prices will lead to changes.

Lets not forget that severe recession can come from causes other than energy shortfall. Number one cause on the list, as I see it, is poor management/policy. This is what caused 2008-9 and it seems to me that the problems from that time have largely been kicked down the road.

I would not be surprised in the least to see a sudden global financial shakeup at any time.

Other issues that could have a big impact are computer system sabotage, trade war, or pandemic. Things like this can grow like wildfire in this interconnected world.

Dennis,

“OPEC has already demonstrated it can produce more, before they cut back in Jan 2017”

Yes OPEC may have some capacity to increase production. But many OPEC countries are in decline and Saudi Arabia does not have any Khurais or Manifa like fields left to develop. If I ruled Saudi Arabia then I wouldn´t produce more than 10 mb/d even if there were shortages. Better to stay on the platau a little bit longer. Iraq is the country with the biggest possibilities for increases. But they will do so when they are able to, not because of shortages. The other countries you mentioned have mainly expensive oil like tar sands in Canada, arctic in Russia and ultra deepwater in Brazil. Sure we can see increases there but it takes a long time to develop.

“I don’t think oil producers were struggling at $100/b, they were overproducing so prices dropped.”

US LTO increased production. But conventional prioduction not so much (outside OPEC). Remember this?

https://www.ft.com/content/35950e2a-a4be-11e3-9313-00144feab7de

(google for “ExxonMobil targets $5.5bn spending cuts”)

“There’s also rail, ridesharing, telecommuting, public transportation etc. High oil prices will lead to changes.”

Yes I agree on that. Changes will have to happen.

Hi FreddyW,

I misunderstood “struggling”, I agree conventional non-OPEC was decreasing, but at the high prices, most oil companies were doing pretty well with profits.

I interpreted struggling as unprofitable.

Why was Exxon cutting investment in 2014?

Perhaps they saw that the market was oversupplied and expected that oil prices would be falling, or they simply did not see profitable opportunities for investment.

Most of the World’s reserves are controlled by National Oil companies and their reserves and operations are far from transparent.

FreddyW Wrote:

“It could start as a mild recession and then get worse and worse.”

Very likely. The current global economy floats on cheap & easy credit. But interest rates are slowly rising and global Debt has doubled since 2008.

I also see that Libor is nearly up to 2%. I am going to presume that the US Fed reserve will overshoot interest rates like the did in 2007/2008. Yellen is out in June and new Fed Chairman is taking over.

Chart with price scenario

DC Wrote: “Chart with price scenario”

Fantasy unless the dollar undergoes large devaluation. The Majority of consumers are broke and use credit to meet ends.

Personally I am leaning to a price decline once another global recession hits. That’s win cheap & easy credit is yanked away from consumers.

Hi Tech guy,

http://www.imf.org/external/datamapper/NGDP_RPCH@WEO/WEOWORLD

World real economic growth has been about 3.5% per year since 2012.

https://www.bis.org/statistics/totcredit.htm?m=6%7C380%7C669

For the World Debt to GDP has increased from 226% in 2012 to 243% in 2Q2017, for advanced economies over the same period debt to GDP went from 272% to 275% and for emerging economies over the same period 145% to 190%.

The story is better access to credit for emerging economies from 2012 to 2017.

A major recession is not very likely.

The IMF forecasts real GDP growth of 3.75% for the World from 2018 to 2022.

Hi Techguy,

Oil prices at over $100/b were no problem for the World economy from 2011-2014, real GDP grew at 3.5% per year. No reason $100/b oil would cause a recession.

The $160/b (2017$) will only be about 3.3% of World GDP in 2026, assuming medium UN population growth scenario and real per capita GDP growth at 1.5%/year and 84 Mb/d C+C output in 2026.

That’s a lower level than 2014.

Seems to me that other than switching to new energy technologies, there is nothing on the horizon to justify economic growth. Therefore, I think most of the growth we see right now is just moving numbers around and has no underlying value.

I expect a recession.

There are so many “we on the verge of war” stories, that should anything like that happen, it will be a major disruptive force.

Whether trying expand defense spending, killing people, and destroying trade will be recessionary or “good” for business, I don’t know. But I would venture that we could spend our money better than simultaneously fighting in the Mideast, Pacific, and Europe, and expanding border security.

One reason the Roman Empire collapsed was that it was trying to police vast areas of land and went broke doing so.

Hi Boomer,

I also expect a recession eventually.

Historically World recessions where World real GDP falls are quite rare (1929 and 2009 over the past 145 years), my expectation is 2030+/-3, what’s yours?

Hi George,

I also don’t understand the economics of US LTO, it seems at current prices output should not be increasing because based on the analysis of Mike and shallow sand it is unprofitable.

For the past 9 months the annual rate of increase for US LTO has been about 700kb/d with 400 kb/d from the Permian Basin. I expect the non-Permian LTO output will increase more slowly in the future (maybe about 100 kb/d for an annual rate), but that the Permian may continue at it’s present rate of increase for a few years (5 or so). Note that for the past 6 months oil prices have risen on average about $2/b per month, if this continues for another 10 months, WTI will be at about $77/b and average LTO wells may be close to profitability (which is around $85/b for an average well). I define profitable as a discounted cash flow (in fixed inflation adjusted dollars) equal to well cost with a real discount rate of 7% over the life of the well at some fixed “breakeven price”, in this case $85/b in 2017$. Chart is in next comment I forgot it.

LTO chart using data from

https://www.eia.gov/energyexplained/data/U.S.%20tight%20oil%20production.xlsx

https://www.eia.gov/petroleum/weekly/

There was another big drop in US crude stocks by the twip – down 6.5 mmbbls with gasoline and diesel up 2 mmbbls combined. The crude level is fast approaching the middle of the 5 year average – how far does it have to undershoot before panic sets in?

US SPR drawdown this year is about 21.5 million barrels, this is usually not included when calculating the 5y average. Planned annual sales are similar for the next couple of years (https://www.eia.gov/todayinenergy/detail.php?id=29692 note that the figure shows fiscal year).

The story being told is that oil markets should be in balance next year or slight surplus if LTO maintains its pace. KSA low production during end of 2017 and the problems in Venezuela should result in continued stock drawdowns or only a small build during the spring (forties supports this too). Next summer driving season can be interesting, assuming the economy remains healthy. 2019 will be _very_ interesting since it will be revealed how much of the OPEC cuts were made voluntary.

Hi George,

If one looks at days of supply compared to historical levels, no need for panic yet.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=W_EPC0_VSD_NUS_DAYS&f=W

As inventories are still way above historical averages, it is important to bear in mind that substantial infrastructure in form of tanks and pipelines have been constructed over the last few years. This increased the necessary working inventory to keep the system functioning. So, the critical inventory level might be much higher than in previous years.

They need a minimum amount of empty capacity to allow for blending and movement, not a minimum amount of stored volume to keep it working. The storage is to cover for upsets and to allow people to make money from arbitrage.

You are wrong on this point. See

https://www.reuters.com/article/us-oil-storage-kemp/should-we-worry-as-oil-stocks-hit-3-billion-barrels-kemp-idUSKCN0T92PP20151120

The lowest value the commercial oil stocks have been since 1982 was 247 mb in 2004:

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCESTUS1&f=W

It was propably close to the point where it was low enough to cause problems at that time. Why? Because from a commercial point of view, it´s just stupid to have more storage than you need. It´s cost money to store it and it´s better to sell it and get the money instead of just having it in storage. Also there is the SPR from where you can get oil if there is supply problems. So really no need to have large amounts of oil in storage.

I was speculating about future undershoot, not current conditions.

Hi George,

Yes that was how I interpreted your original comment. At least for US commercial crude stocks for the current week we are currently about 95 million barrels above the 2012 and 2013 average for the same week of the year, so perhaps another few years before any panic if stocks continue to decrease by 50 Mb per year as they did from 2016 to 2017. I chose 2012 and 2013 because oil prices were relatively high in 2012 and 2013 ($88/b and $98/b in Dec 2012 and Dec 2013 for WTI).

On rereading your original comment, I think when it gets near the lower edge of the 5 year average, panics sets in, it may take a few years.

http://www.zerohedge.com/news/2017-12-20/another-governor-demands-state-pension-abandon-fiduciary-duties-sell-fossil-fuel-inv

A factor in Future production if Pension Shale Patch backing is reduced? A sample position breakout in there.

I think it might be fiscally prudent to get out of fossil fuels. You don’t need to link it to politics or the environment. You can just say it is an industry in decline and there are better places to put one’s money in.

“You can just say it is an industry in decline and there are better places to put one’s money in.” yes you can say “the industry is in decline” but then you would be wrong, not usual for you or many on the board. In this case however, the statement is not only wrong but delusional. Both production and demand are at record highs for oil natural gas and natural gas liquids. Of course why let facts get in the way of your political views, to quote a old line; fat, drunk and stupid in no way to go through life, son?

Hi Texas Tea,

There is money to be made in oil, but I would think at current prices, not so much in natural gas, maybe some in NGL, though don’t you only get about 50% of the price of a barrel of crude for NGL?

What is your expectation for future oil prices in 2018? Higher lower, or about where they are (currently the Feb 2018 futures price is about $58/b)?

“Both production and demand are at record highs for oil natural gas and natural gas liquids. ”

But profits and stock valuations are terrible over the past five to ten years. Drillers, Explorers, Services, I’d be shocked if you could find an index combo that has come even close to matching S&P, Biotech, Semiconductors, NASDAQ. Not positive but E&P et al might not even have beaten transportation over the past decade. If you’ve been invested in Oil and Gas you are officially a loser.

Now, high yield bonds might be a different story. But in the wake of all the bankruptcies for the past five years was 100% of all bonds paid? They might have been, not sure.

Oil companies themselves have changed the way they are investing. So I take that as a sign they, too, think their best times are behind them.

In terms of financial management, there are industries that have done better and are likely to do better than gas and oil. It’s simply not a growth industry anymore.

Hi Boomer II,

I think oil prices have an effect on investment, especially outside the LTO focused companies. For the LTO players they seem to focus on output growth regardless of profits, not a great long term business model.

Regarding the gap, a third of the consumption growth over the last decade was from China. If Chinese consumption plateaus, as it very well might, then consumption growth from here will be less and the gap smaller. But putting in an assumption to change an established trend would just add another point of failure. This piece isn’t so much a model as a creation story, trying to figure out why past expectations weren’t met and where the known unkowns might come from. A big one of these is what the Permian might end up doing. I think that is why industry is paying up to get into the Permian. If you are not in the Permian you don’t have a future. And shareholders will pay any amount of money for you to keep your job.

The piece was prompted by Ovi’s observation that Non-OPEC less the big three has been in decline since 2004 – very encouraging. There are some systems in which a price rise does not result in an increase in production simply because the resource is clapped out. The gold market last decade for example. The gold price rose at an average of about 17% per annum year after year but gold production fell. That is not supposed to happen. Now some mines are digging up rock with just over one part in a million of gold in it and that pays for turning that rock into mud.

https://www.mediamatters.org/blog/2014/04/14/meet-david-archibald-the-fringe-scientist-predi/198886

Thanks Paul. Good to know the bias of the author.

There was a July report for China imports that extrapolated to another 6.6% consumption growth year for them. No evidence of slow down. Ditto India.

Reminder to folks because it is a tad obscure. India’s consumption growth is 8% but it’s concentrated in an unusual way. LPG. They run motors on LPG, mostly motorbikes.

https://fred.stlouisfed.org/series/M12MTVUSM227NFWA/

Vehicle miles driven. The increase is relentless as is US population growth.

In the big smash of 2008/2009 there was a flattening of the increase but not really any sort of collapse. There was in oil price, but there was no need for it since consumption did not decline more than 5%. A quick look at historical consumption not just miles driven shows essentially the same tiniest of down ticks during that timeframe.

So I would say we need a new theory as to why price declines during recession. Doesn’t appear to be less driving to work.

Consumption of oil would seem to decline a little bit right across the board during a recession, especially a big one. Construction machinery runs less, people travel less, buy fewer new things. It doesn’t take very much by way of falling consumption to reduce the price of oil. The price of oil is highly inelastic, in the short term, and it’s like milk.

The price of milk has to fall a long way before you can find uses for more than the usual amount.

People buy as much milk as they want for their kids, and maybe a little to cook with. NO MORE, even if the price goes down a lot. They don’t have any use for it. So….. if it’s coming to market, it has to sell cheaper in order for people to FIND uses for it. You can feed milk to the cat, and even to the pigs, if it’s cheap enough. Farmers have been feeding excess milk to pigs just about forever, lol. I did so myself when we had more than we could use otherwise when I was a kid.

So…. if the price of gasoline falls, maybe you take the ski boat to the lake one extra weekend , which can easily result in burning a couple of hundred gallons, round trip, as opposed to spending the weekend golfing at a cheap nearby course.

Or you drive the old car that’s a gas hog more, because it saves putting miles on a newer car. When the price of gasoline bottomed out, I drove my old four by four truck a lot more than I would have otherwise, because I knew I would be retiring it before long, and wanted to get as many miles out of it as I could, saving wear and tear on the car….. which I’m planning on keeping indefinitely.

It broke down yesterday, and while it’s not quite dead, I ‘m thinking it’s time to euthanize it, lol.

I’m also running my big yellow machines a lot more than usual, because when diesel is down close to two bucks, as opposed to four bucks or so, this saves me a hundred bucks a day, or more, if I stay with it, and I’ve got some pretty big long term projects such as a new lake, which I work on at odd times, whenever circumstances permit.

IF I were hiring out, which I don’t , I would be able to offer a neighbor a hundred bucks or more off for a days work, with diesel at two, as opposed to four bucks. That would result in neighbors with cash, and thrifty Scots habits, spending some of their savings, doing long planned work sooner, or maybe going for a new small project.

Overall though construction falls off during a recession.

Most of the increase in total miles happens as the result of people driving new cars, and by and large, new cars and light trucks are far more fuel efficient than old ones.

And people who are broke spend as much on gasoline as they can afford, period. They MUST spend to get to work. If a tank at twenty bucks will get them to Grandma’s house and back in their old clunker, they go. A tank a forty bucks often means calling rather than visiting.

It is pretty much a given that Permian oil needs export market. This is from PAA conference call.

” PAA comments: If you look at the amount of 45-plus gravity. It’s about 300,000 barrels a day now, growing to 1 million plus. So, a lot of those volumes are coming, and that’s really the crux of the benefit of a Cactus pipeline being able to take that directly to the water because I think we are going to see a lot of pushback from refiners. We are already starting to see it as far as the lightning of the general stream going up to Cushing. The refiners don’t want any lighter. So, it’s an integral part of the strategy and a piece of everything we’ve been building.”

Delaware basin produces 56% oil that is greater than API gravity 50 plus according to Woodmac.

Every week I see announcements to export US oil. Here are some.

https://www.businesswire.com/news/home/20171206005367/en/Wolf-Midstream-Partners-Plans-New-Permian-Basin#.Wik_YewJKuc.twitter

https://www.upi.com/More-US-oil-export-capacity-in-the-works/8051512568297/?spt=su&or=btn_tw

https://www.businesswire.com/news/home/20171222005375/en/EPIC-Announces-Approval-New-Build-730-mile-Permian

“OPINION-

Don’t be taken in by the surge in oil prices

But oil prices have continued to be volatile. They went down from $114 per barrel in June 2014 to $26 per barrel in early 2016 and moved gradually upward to touch $64 per barrel in late November 2017. On the other hand, economic forecasts expect oil prices to continue to rise to a range of between $70 to $80 by the end of the first quarter of 2018. Futurists in the field base their expectations on the following indicators:

1) The cooperative program and understanding between the Kingdom and Russia, the two largest producers in the market.

2) The continuation of efforts to reduce oil surplus in the market

3) The agreement among OPEC members and some non-members to continue their programs of production reduction up to the end of 2018.

8. Last but not least, we need to develop a culture of saving to increase our capital buildup for the economy. This is not an easy task, and requires a total rehabilitation of our consuming behavior.”

http://www.saudigazette.com.sa/article/524652/Opinion/OP-ED/Dont-be-taken-in-by-the-surge-in-oil-prices

I’m putting this here because I think if we head into another recession, it will affect energy.

I have been skeptical that there are enough changes in the economy to trigger a boom.

And I have wondered if consumers are buying on credit.

“Household Saving Rate in the United States decreased to 2.90 percent in November from 3.20 percent in October of 2017. It is the lowest rate since November 2007. Personal Savings in the United States averaged 8.28 percent from 1959 until 2017, reaching an all time high of 17 percent in May of 1975 and a record low of 1.90 percent in July of 2005.”

https://tradingeconomics.com/united-states/personal-savings

Hi Boomer,

The savings rate is often low in Nov due to Christmas shopping.

https://fred.stlouisfed.org/series/PSAVERT

I am not expecting an economic boom (note for energy, especially oil, the energy market is a worldwide one, so I focus on the World economy, rather than just the US).

See

https://fred.stlouisfed.org/series/DDDI081WA156NWDB

If we consider savings as financial system deposits, for the World this has increased for 13.5% of World GDP in 1960 to 49.5% in 2015 (most recent data point.)

World economic growth is likely to continue.

The US may be left behind (as you have often suggested) due to poor economic and energy policy. Hopefully this will change in 2018 and 2020.

The charts show a downward trend in savings rates, so it isn’t just November.

But it still matters if savings goes down for Christmas purchases because the bills still have to be paid. Extra spending on credit for Christmas means less money and credit in the months following.

If what drives our economy is credit spending, then it doesn’t indicate that consumers themselves are getting an economic boost. And if the spending is on something other than income-generating assets, that spending may not provide the means for future growth.

This article from November 2017 said there were people still paying off Christmas 2016 debt.

https://www.cnbc.com/2017/11/17/shoppers-are-still-paying-off-debt-from-2016-holidays.html

“How many Americans will go into debt because of the holidays?

We conducted a poll* of 1,500 Americans and found that more than half (54.60%) expect to have a Christmas debt this year as a result of purchasing gifts, food, decorations, travel and other festive goods. That is an estimated 134 million American adults who will go into debt because of the holidays.

It will take an average of 4.5 months to pay off their Christmas debt.”

https://www.finder.com/holiday-spending-statistics

Why Americans Don’t Save Money