A guest post by Dr. Minqi Li, Professor

Department of Economics, University of Utah

E-mail: minqi.li@economics.utah.edu

July 2018

This is Part 2 of the World Energy Annual Report in 2018. This part of the Annual Report provides updated analysis of world oil production and consumption, evaluates the future prospect of world oil supply and considers the implications of peak oil production for global economic growth.

(See Figure 18 near end of paper)

American geologist M. King Hubbert proposed Hubbert linearization as a statistical method to estimate the ultimately recoverable oil resources (Hubbert 1982). Hubbert linearization plots the annual production to cumulative production ratios against the historical cumulative production. It uses the downward linear trend of the annual production to cumulative production ratios to determine the ultimately recoverable resources. The parameters from the linear trend are then used to estimate peak production time and level.

This report uses Hubbert linearization to evaluate a region’s ultimately recoverable oil resources where a Hubbert linear trend can be meaningfully established, .that is, where a clear downward trend of the annual production to cumulative production ratios can be identified and has been established for at least several years. Otherwise, this report uses alternative sources to establish a region’s ultimately recoverable oil resources, such as official reserves, official projections, or ultimately recoverable resources estimated by energy research institutions.

Figures are placed at the end of each section.

Oil Consumption by Major Economies, 1990-2017

According to the BP Statistical Review of World Energy, world oil consumption (including crude oil, natural gas liquids, biofuels, and other liquid fuels made from coal and natural gas) reached 4,622 million tons of oil equivalent (4,470 million metric tons or 98.2 million barrels per day) in 2017. Between 2007 and 2017, world oil consumption grew at an average annual rate of 1.0 percent.

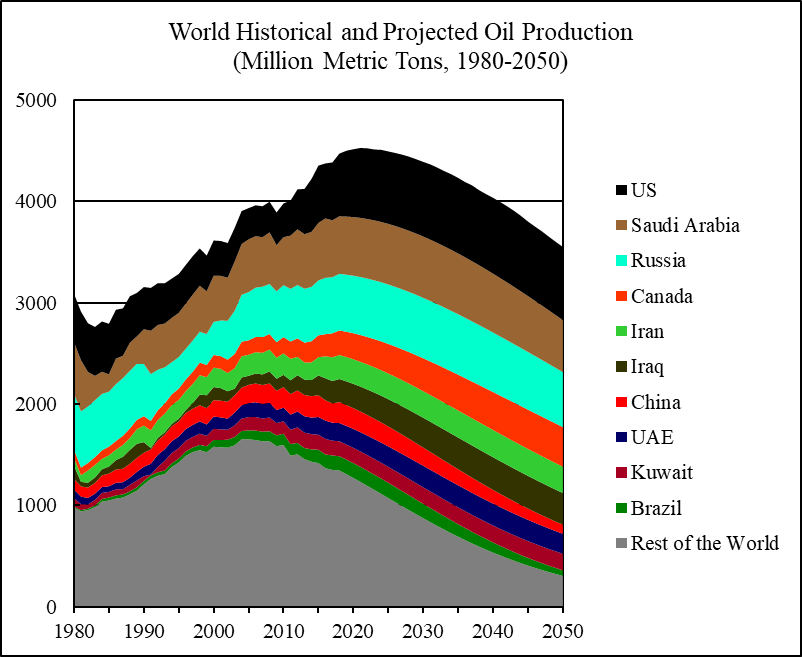

Figure 1 compares the historical world economic growth rates and the oil consumption growth rates from 1991 to 2017. The oil consumption growth rate has an intercept of -0.008 at zero economic growth rate and a slope of 0.612. That is, oil consumption has an “autonomous” tendency to fall by about 0.8 percent a year when economic growth rate is zero. When economic growth rate rises above zero, an increase in economic growth rate by one percentage point is associated with an increase in oil consumption by 0.61 percent. R-square for the linear trend is 0.51. In 2017, world oil consumption grew by 1.4 percent, a rate that is 0.2 percentage points below what is implied by the historical trend.

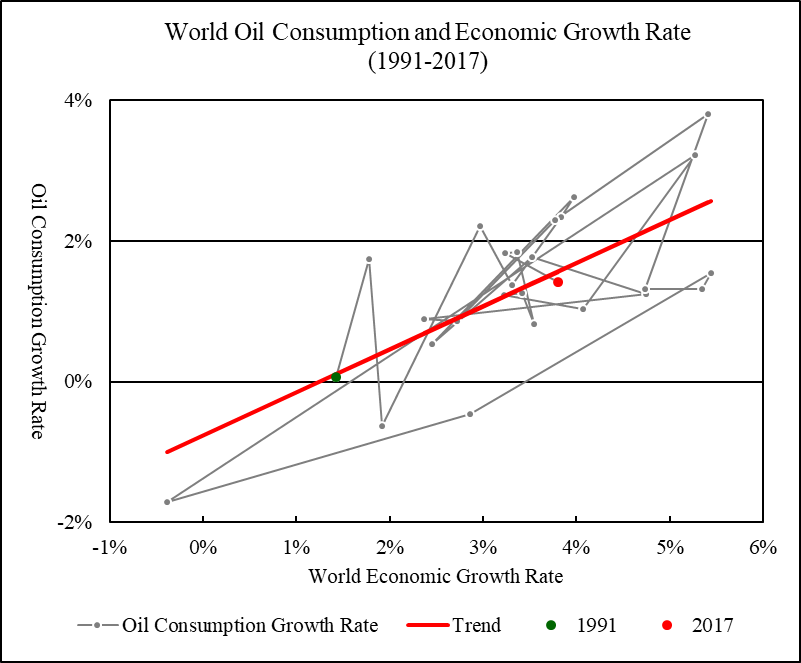

Figure 2 compares the per capita oil consumption in relation to per capita GDP for the world’s six largest national oil consumers and the European Union.

The United States is the world’s largest oil consumer. In 2017, the US oil consumption was 913 million tons of oil equivalent (19.9 million barrels per day), accounting for 20 percent of the world oil consumption. The US per capita oil consumption peaked at 3.32 tons of oil equivalent in 2004 and declined to 2.73 tons of oil equivalent by 2012. Since then, the US per capita oil consumption has slowly recovered, reaching 2.81 tons of oil equivalent by 2017.

The European Union is the world’s second largest oil consumer. In 2017, the EU oil consumption was 645 million tons of oil equivalent (13.2 million barrels per day), accounting for 14 percent of the world oil consumption. The EU per capita oil consumption peaked at 1.51 tons of oil equivalent in 1998. The EU per capita oil consumption stabilized around 1.5 tons of oil equivalent from 1999 to 2016 before falling sharply to 1.21 tons of oil equivalent by 2012. In 2017, the EU per capita oil consumption recovered to 1.26 tons of oil equivalent.

China is the world’s third largest oil consumer. In 2017, China’s oil consumption reached 608 million tons of oil equivalent (12.8 million barrels per day), accounting for 13 percent of the world oil consumption. From 1990 to 2017, China’s per capita oil consumption surged from 101 kilograms of oil equivalent to 439 kilograms of oil equivalent, which is still substantially below the per capita oil consumption levels of advanced capitalist economies.

If China’s per capita oil consumption continues to follow its historical trend in relation to per capita GDP, China’s per capita oil consumption will rise to 972 kilograms of oil equivalent by 2050 (when China’s per capita GDP is projected to rise to about 50,000 dollars). China’s population is expected to peak before 2030 and decline to 1.36 billion by 2050. Given these projections, China’s oil demand will exceed 1,300 million tons of oil equivalent by 2050.

India is the world’s fourth largest oil consumer. In 2017, India’s oil consumption reached 222 million tons of oil equivalent (4.7 million barrels per day), accounting for 4.8 percent of the world oil consumption. From 1990 to 2017, India’s per capita oil consumption increased from 69 kilograms of oil equivalent to 166 kilograms of oil equivalent. If India’s per capita oil consumption continues to follow its historical trend in relation to per capita GDP, India’s per capita oil consumption will rise to 335 kilograms of oil equivalent by 2050 (when India’s per capita GDP is projected to rise to about 19,000 dollars). India’s population is expected to grow to 1.72 billion by 2050. Given these projections, India’s oil demand will rise to about 580 million tons of oil equivalent by 2050.

Japan is the world’s fifth largest oil consumer. In 2017, Japan’s oil consumption was 188 million tons of oil equivalent (4.0 million barrels per day), accounting for 4.1 percent of the world oil consumption. Japan’s per capita oil consumption peaked at 2.22 tons of oil equivalent in 1996. Since then, Japan’s per capita oil consumption has tended to decline. By 2017, Japan’s per capita oil consumption fell to 1.48 tons of oil equivalent.

Saudi Arabia is the world’s sixth largest oil consumer. In 2017, Saudi Arabia’s oil consumption was 172 million tons of oil equivalent (3.9 million barrels per day), accounting for 3.7 percent of the world oil consumption. The Saudi per capita oil consumption increased from 3.21 tons of oil equivalent in 1990 to 5.49 tons of oil equivalent in 2015. As the Saudi economy declined in 2016 and 2017, the per capita oil consumption fell to 5.22 tons of oil equivalent by 2017.

The Russian Federation is the world’s seventh largest oil consumer. In 2017, the Russian Federation’s oil consumption was 153 million tons of oil equivalent (3.2 million barrels per day), accounting for 3.2 percent of the world oil consumption. Russia’ per capita oil consumption was 1.73 tons of oil equivalent in 1990, when Russia was a part of the Soviet Union. By 1998, Russia’s per capita oil consumption collapsed to 852 kilograms of oil equivalent. Since then, Russia’s oil consumption has slowly recovered. In 2017, Russia’s per capita oil consumption was 1.06 tons of oil equivalent.

Figure 1 World Oil Consumption and Economic Growth, 1991-2017

Linear Trend: Oil Consumption Growth Rate = -0.008 + 0.612 * Economic Growth Rate (R-square = 0.506)

Sources: World oil consumption from 1990 to 2017 is from BP (2018). Gross world product in constant 2011 international dollars from 1990 to 2016 is from World Bank (2018), extended to 2017 using growth rate reported by IMF (2018, Statistical Appendix, Table A1).

Figure 2 Per Capita GDP and Oil Consumption, Major Economies, 1990-2017

Sources: Per capita oil consumption and per capita GDP are calculated using data for oil consumption, GDP, and population. National and regional oil consumption from 1990 to 2017 is from BP (2018). National and regional GDP from 1990 to 2016 is from World Bank (2018), extended to 2017 using growth rates reported by IMF (2018, Statistical Appendix, Table A1, A2, and A4). National and regional population from 1990 to 2016 is from World Bank (2018), extended to 2017 by assuming that the 2017 population growth rates are the same as the 2016 growth rates. To project China’s and India’s per capita oil consumption, a log-linear relationship is estimated between the per capita oil consumption and per capita GDP for the period 1990-2017. China’s and India’s GDP and population projections from 2018 to 2050 are from EIA (2017, Reference Case, Table A3 and Table J4), adjusted to make the projected GDP and population levels in 2017 matching the levels reported by World Bank (2018).

The United States

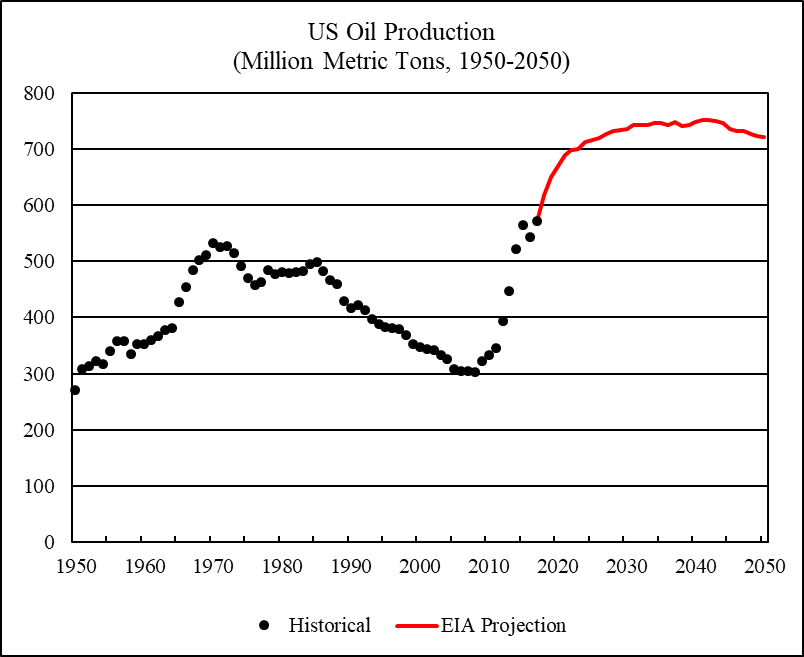

The United States is currently the world’s largest oil producer. In 2017, the US produced 571 million metric tons of oil (13.1 million barrels per day), accounting for 13 percent of the world oil production (according to the BP definition, oil production includes crude oil and natural gas liquids only, excluding biofuels and liquid fuels made from coal and natural gas).

The US conventional oil production peaked in 1970 (when the US oil production reached 534 million tons). By 2008, the US oil production declined to 302 million tons. Since then, the US oil production has experienced a spectacular expansion because of the shale oil boom. The US Energy Information Administration projects that the US oil production will keep growing rapidly until 2022, when the US oil production is expected to approach 700 million tons. The US oil production is projected to peak in 2042 at 751 million tons (EIA 2018, Reference Case, Table A1).

The US cumulative oil production up to 2017 was 33.5 billion metric tons (cumulative production up to 2007 is from BGR 2009, Table A 3-2, extended to 2017 using annual production data from BP 2018). Applying Hubbert linearization to the annual production to cumulative production ratios implied by the projected US oil production from 2041 to 2050, the US ultimately recoverable oil resources are estimated to be 93.4 billion metric tons and the remaining recoverable oil resources are estimated to be 59.9 billion metric tons. By comparison, the US “proved” oil reserves at the end of 2017 were reported to be 6 billion metric tons (BP 2018).

Figure 3 shows the historical US oil production and the future oil production projected by EIA.

Figure 3 US Oil Production, 1950-2050

Sources: The US historical oil production from 1965 to 2017 is from BP (2018); historical oil production from 1950 to 1964 is from Rutledge (2007). Projected US oil production from 2018 to 2050 is from EIA (2018, Reference Case, Table A1), adjusted to make the projected oil production level in 2017 matching the production level reported by BP (2018).

Saudi Arabia

Saudi Arabia is the world’s second largest oil producer. In 2017, Saudi Arabia produced 562 million metric tons of oil (12.0 million barrels per day), accounting for about 13 percent of the world oil production.

Saudi Arabia maintained a significant amount of “spare capacity” and the Saudi oil production is often influenced by market or geopolitical factors. In 2014, Saudi Arabia decided to increase oil production in order to compete with the US shale oil for market share, leading to the collapse of world oil prices. By 2016, Saudi Arabia’s oil production reached 587 million metric tons, the highest production level in history. Since then, Saudi Arabia has cooperated with Russia to limit oil production and has succeeded in raising the world oil prices.

Citing information from Saudi Aramco, Aleklett (2012: 173-175) argued that Saudi Arabia had about 700 billion barrels of original crude oil in place and the ultimately recoverable amount was estimated to be about 390 billion barrels. Aleklett (2012: 182-184) believed that Saudi Arabia could maintain a crude oil production level at about 12 million barrels per day up to 2030.

This report assumes that Saudi Arabia’s ultimately recoverable oil resources are the sum of historical cumulative production and the official reserves. Saudi Arabia’s cumulative oil production up to 2017 was 21.5 billion metric tons (cumulative production up to 2007 is from BGR 2009, Table A 3-2, extended to 2017 using annual production data from BP 2018). Saudi Arabia’s official oil reserves at the end of 2017 were reported to be 36.6 billion metric tons (BP 2018). The ultimately recoverable oil resources are estimated to be 58.1 billion metric tons, or about 424 billion barrels (1 metric ton of oil = 7.3 barrels).

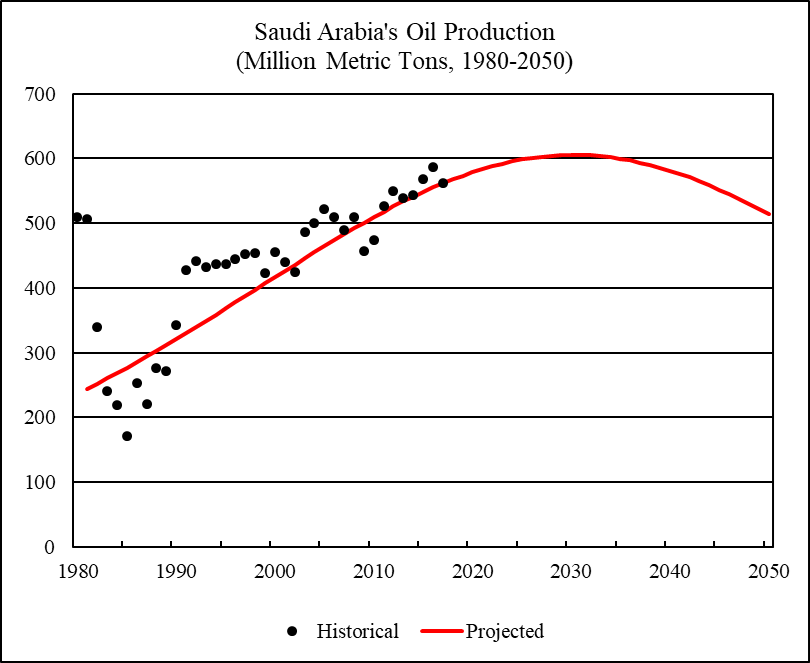

Based on the above assumptions, the Saudi oil production is projected to peak in 2030 at 606 million metric tons. Figure 4 shows the historical and projected Saudi Arabia’s oil production.

Figure 4 Saudi Arabia’s Oil Production, 1980-2050

Sources: Saudi Arabia’s historical oil production from 1980 to 2017 is from BP (2018).

Russian Federation

The Russian Federation is the world’s third largest oil producer. In 2017, Russia produced 554 million metric tons of oil (11.3 million barrels per day), accounting for about 13 percent of the world oil production.

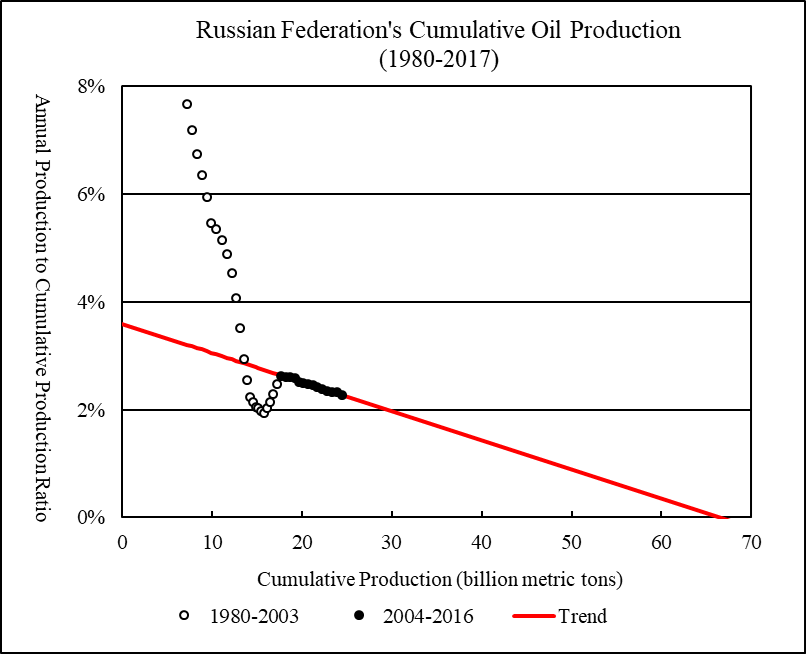

Figure 5 projects Russia’s annual production to cumulative production ratios against the historical cumulative oil production from 1980 to 2017. Hubbert linearization is applied to the annual production to cumulative production ratios from 2004 to 2017. Regression R-square is 0.979. Where the downward linear trend meets the horizontal axis indicates Russia’s ultimately recoverable oil resources to be 66.5 billion metric tons. Russia’s cumulative oil production up to 2017 was 24.5 billion metric tons. Thus, Russia’s remaining recoverable oil resources are estimated to be 42 billion metric tons. By comparison, Russia’s official oil reserves at the end of 2017 were 14.5 billion metric tons (BP 2018).

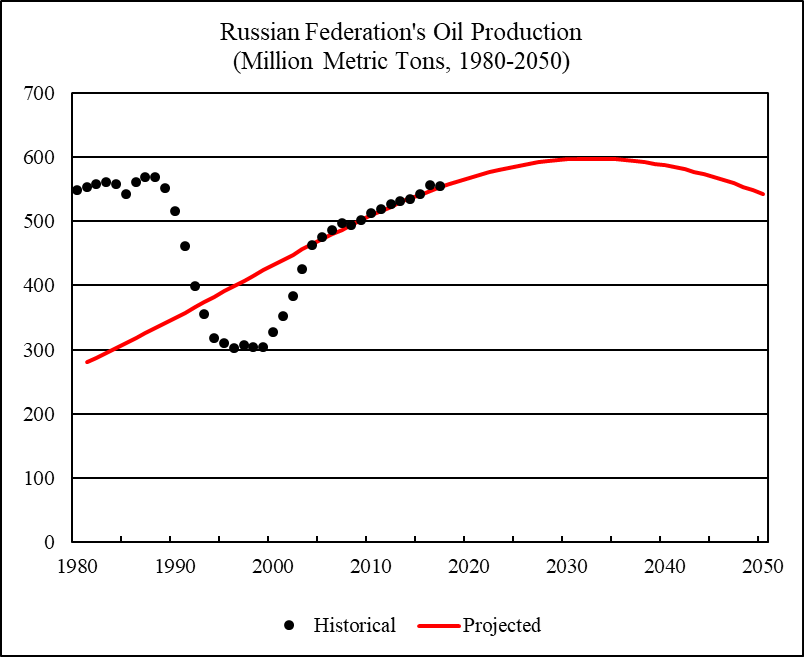

The parameters from the Hubbert linear trend are used to project Russia’s future oil production. Figure 6 shows Russia’s historical and projected oil production. Russia’s oil production is projected to peak at 598 million metric tons in 2033.

Figure 5 Russian Federation’s Cumulative Oil Production, 1980-2017

Sources: Russia’s cumulative oil production up to 2007 is from BGR (2009, Table A 3-2). This is used as the reference point. Cumulative production ending in other years is then calculated using annual production data reported by BP (2018).

Figure 6 Russian Federation’s Oil Production, 1980-2050

Sources: Russia’s historical oil production from 1985 to 2017 is from BP (2018). For 1980-1984, Russia’s oil production is assumed to be 91 percent of the Soviet Union’s total oil production.

Canada

In 2017, Canada produced 236 million metric tons of oil (4.8 million barrels per day) and became the world’s fourth largest oil producer in term of tons. Canada accounted for 5.4 percent of the world oil production.

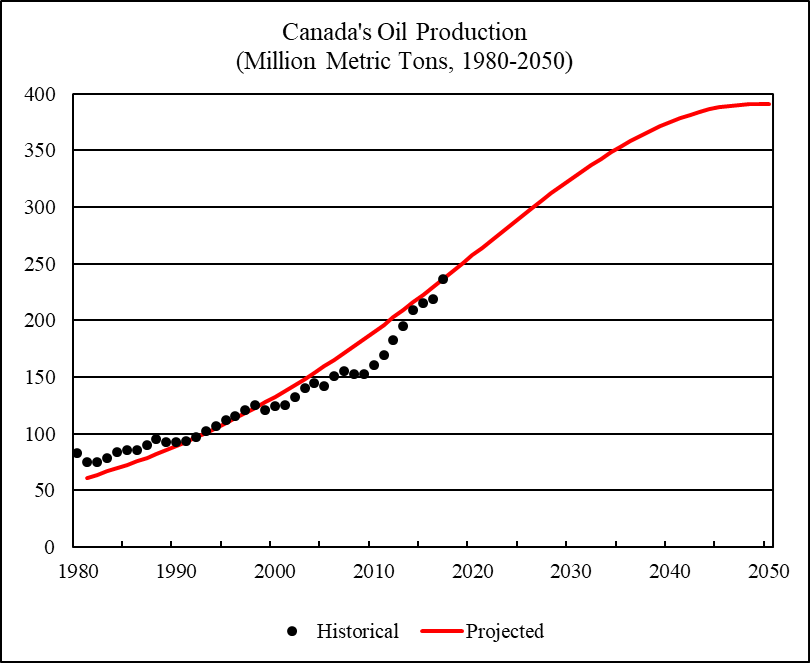

This report assumes that Canada’s ultimately recoverable oil resources are the sum of historical cumulative production and the official reserves. Canada’s cumulative oil production up to 2017 was 6.3 billion metric tons (cumulative production up to 2007 is from BGR 2009, Table A 3-2, extended to 2017 using annual production data from BP 2018). Canada’s official oil reserves at the end of 2017 were reported to be 27.2 billion metric tons (BP 2018, including 26.6 billion tons of oil sands reserves). The ultimately recoverable oil resources are estimated to be 33.5 billion metric tons.

Based on the above assumptions, Canada’s oil production is projected to peak in 2049 at 391 million metric tons. Figure 7 shows the historical and projected Canada’s oil production.

Figure 7 Canada’s Oil Production, 1980-2050

Sources: Canada’s historical oil production from 1980 to 2017 is from BP (2018).

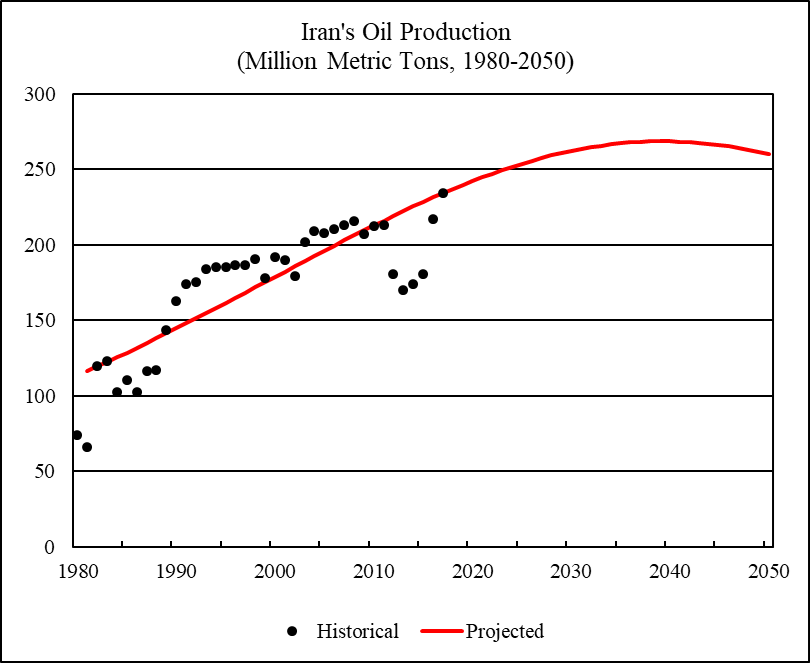

Iran

In 2017, Iran produced 234 million metric tons of oil (5.0 million barrels per day) and was the world’s fourth largest oil producer in term of barrels. Iran accounted for 5.3 percent of the world oil production.

Since 1979, Iran’s oil production has often fallen substantially below its potential due to geopolitical instabilities. This report assumes that Iran’s ultimately recoverable oil resources are the sum of historical cumulative production and the official reserves. Iran’s cumulative oil production up to 2017 was 10.4 billion metric tons (cumulative production up to 2007 is from BGR 2009, Table A 3-2, extended to 2017 using annual production data from BP 2018). Iran’s official oil reserves at the end of 2017 were reported to be 21.6 billion metric tons (BP 2018). The ultimately recoverable oil resources are estimated to be 32 billion metric tons.

Based on the above assumptions, Iran’s oil production is projected to peak in 2039 at 267 million metric tons. Figure 8 shows the historical and projected Iran’s oil production.

Figure 8 Iran’s Oil Production, 1980-2050

Sources: Iran’s historical oil production from 1980 to 2017 is from BP (2018).

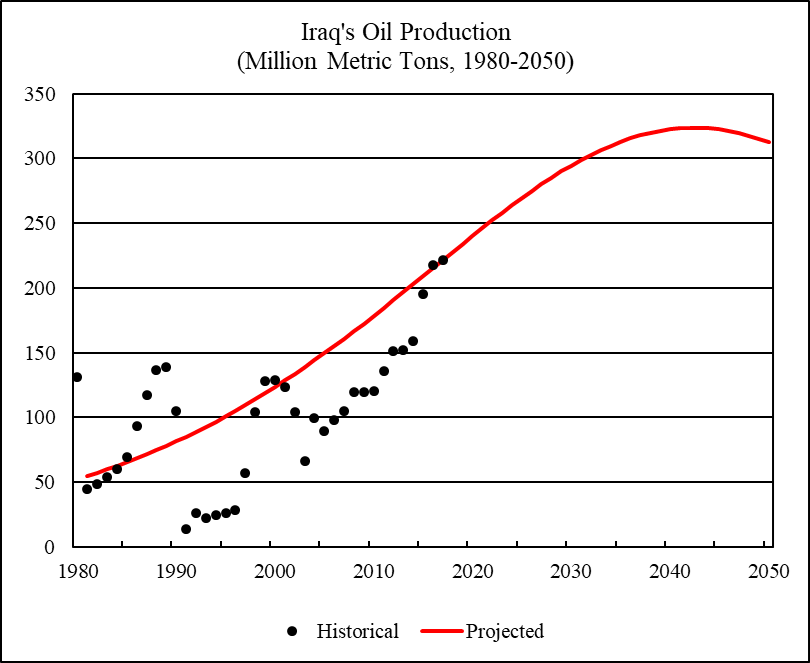

Iraq

Iraq is the world’s sixth largest oil producer. In 2017, Iraq produced 222 million metric tons of oil (4.5 million barrels per day), accounting for 5 percent of the world oil production.

Iraq’s oil production collapsed during the Iran-Iraq war in the 1980s, the first Gulf War in the 1990s, and the American Invasion with intense military actions from 2003 to 2007. The Iraqi oil production has grown rapidly since then. This report assumes that Iraq’s ultimately recoverable oil resources are the sum of historical cumulative production and the official reserves. Iraq’s cumulative oil production up to 2017 was 5.8 billion metric tons (cumulative production up to 2007 is from BGR 2009, Table A 3-2, extended to 2017 using annual production data from BP 2018). Iraq’s official oil reserves at the end of 2017 were reported to be 20.1 billion metric tons (BP 2018). The ultimately recoverable oil resources are estimated to be 25.9 billion metric tons.

Based on the above assumptions, Iraq’s oil production is projected to peak in 2042 at 324 million metric tons. Figure 9 shows the historical and projected Iraq’s oil production.

Figure 9 Iraq’s Oil Production, 1980-2050

Sources: Iraq’s historical oil production from 1980 to 2017 is from BP (2018).

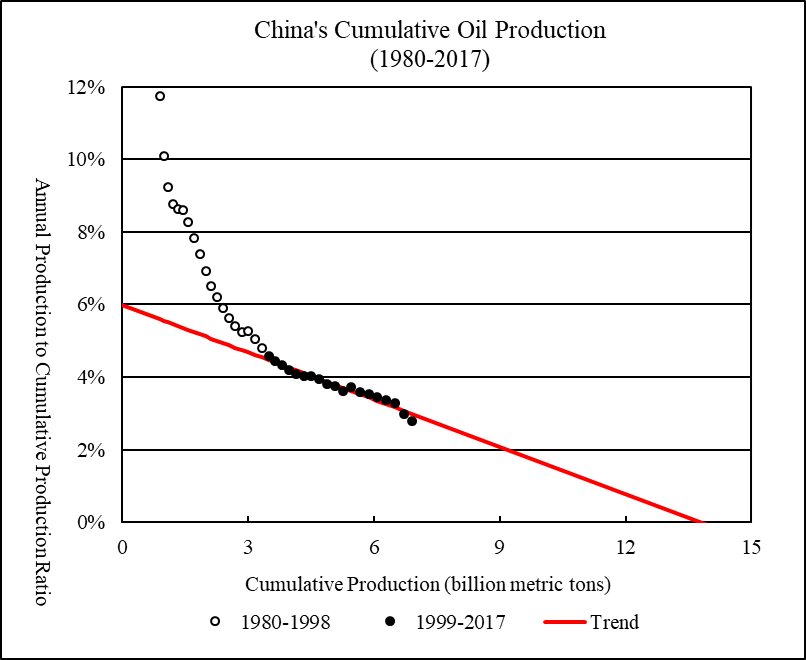

China

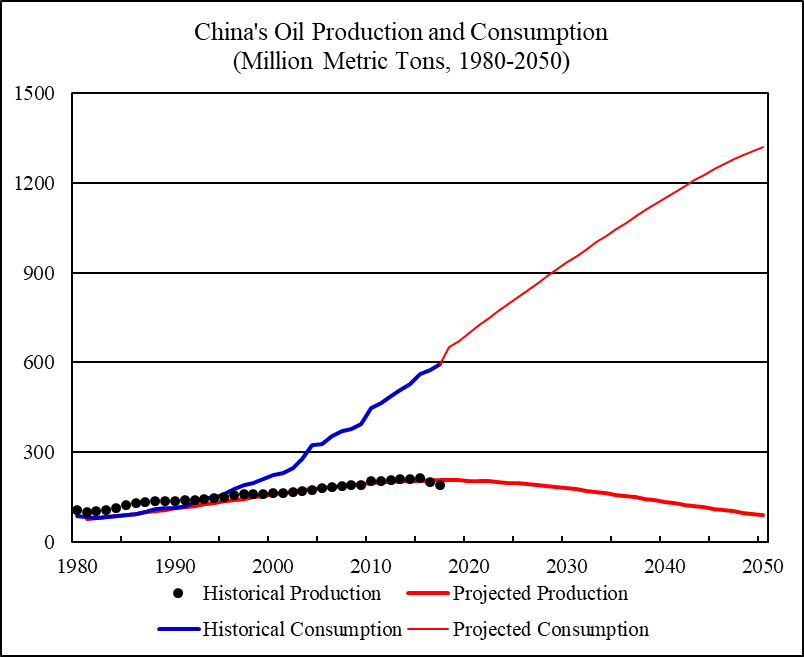

China is the world’s seventh largest oil producer in term of tons. In 2017, China produced 192 million metric tons of oil (3.8 million barrels per day), accounting for 4.4 percent of the world oil production. China’s oil production peaked at 215 million metric tons in 2015.

Figure 10 projects China’s annual production to cumulative production ratios against the historical cumulative oil production from 1980 to 2017. Hubbert linearization is applied to the annual production to cumulative production ratios from 1999 to 2017. Regression R-square is 0.958. Where the downward linear trend meets the horizontal axis indicates China’s ultimately recoverable oil resources to be 13.8 billion metric tons. China’s cumulative oil production up to 2017 was 6.9 billion metric tons. Thus, China’s remaining recoverable oil resources are estimated to be 6.9 billion metric tons. By comparison, China’s official oil reserves at the end of 2017 were 3.5 billion metric tons (BP 2018).

The parameters from the Hubbert linear trend are used to project China’s future oil production. Figure 11 compares China’s historical and projected oil production and consumption. China’s oil consumption is projected to rise from 595 million metric tons in 2017, to 699 million tons in 2020, 934 million tons in 2030, 1,149 million tons in 2040, and 1,320 million tons in 2050.

China is already the world’s largest oil importer. Under the projections, China’s net oil imports (consumption less production) will rise from 389 million metric tons in 2017, to 494 million tons in 2020, 754 million tons in 2030, 1,014 million tons in 2040, and 1,230 million tons in 2050. This will be equivalent to 28 percent of the world oil production in 2017 or more than twice the oil production of Saudi Arabia.

If China’s oil consumption does follow the projections shown in Figure 11, it can be expected that China’s oil demand will impose an overwhelming burden on the global oil market over the coming decades, contributing to major global economic and geopolitical instabilities. Alternatively, the inability of the world oil market to meet China’s oil demand may impose an insurmountable limit to China’s future economic growth.

Figure 10 China’s Cumulative Oil Production, 1980-2017

Sources: China’s cumulative oil production up to 2007 is from BGR (2009, Table A 3-2). This is used as the reference point. Cumulative production ending in other years is then calculated using annual production data reported by BP (2018).

Figure 11 China’s Oil Production and Consumption, 1980-2050

Sources: China’s historical oil production and consumption from 1980 to 2017 is from BP (2018). China’s future per capita oil consumption is projected by assuming that per capita oil consumption will grow in accordance with the historical relationship between per capita oil consumption and per capita GDP (see Figure 2). Future oil consumption is then calculated as the product between per capita oil consumption and projected population. China’s population projection from 2018 to 2050 is from EIA (2017, Reference Case, Table J4), adjusted to make the projected population level in 2017 matching the population level used by this report.

United Arab Emirates

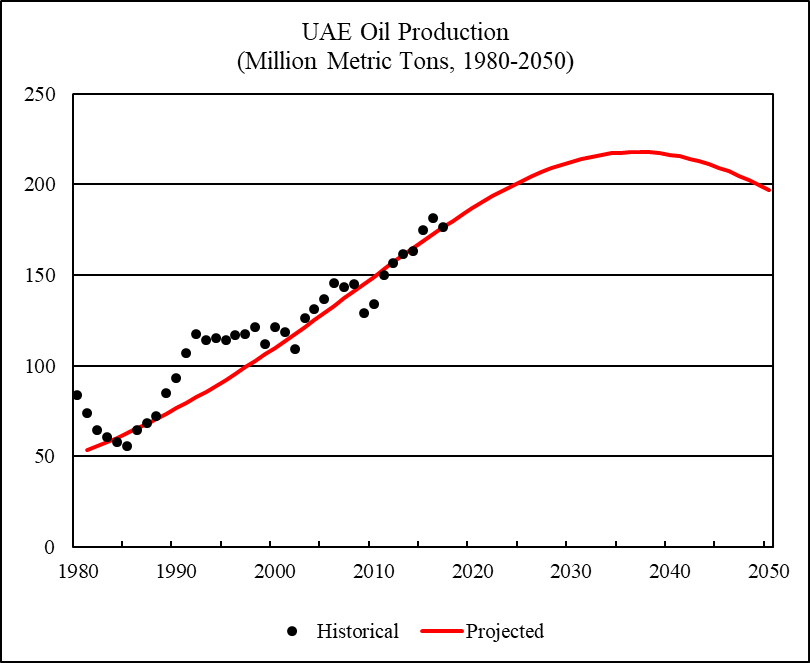

United Arab Emirates (UAE) is the world’s seventh largest oil producer in term of barrels. In 2017, UAE produced 176 million metric tons of oil (3.9 million barrels per day), accounting for 4 percent of the world oil production.

This report assumes that UAE’s ultimately recoverable oil resources are the sum of historical cumulative production and the official reserves. UAE’s cumulative oil production up to 2017 was 5.2 billion metric tons (cumulative production up to 2007 is from BGR 2009, Table A 3-2, extended to 2017 using annual production data from BP 2018). UAE’s official oil reserves at the end of 2017 were reported to be 13 billion metric tons (BP 2018). The ultimately recoverable oil resources are estimated to be 18.2 billion metric tons.

Based on the above assumptions, UAE’s oil production is projected to peak in 2037 at 218 million metric tons. Figure 12 shows the historical and projected UAE oil production.

Figure 12 UAE Oil Production, 1980-2050

Sources: UAE’s historical oil production from 1980 to 2017 is from BP (2018).

Kuwait

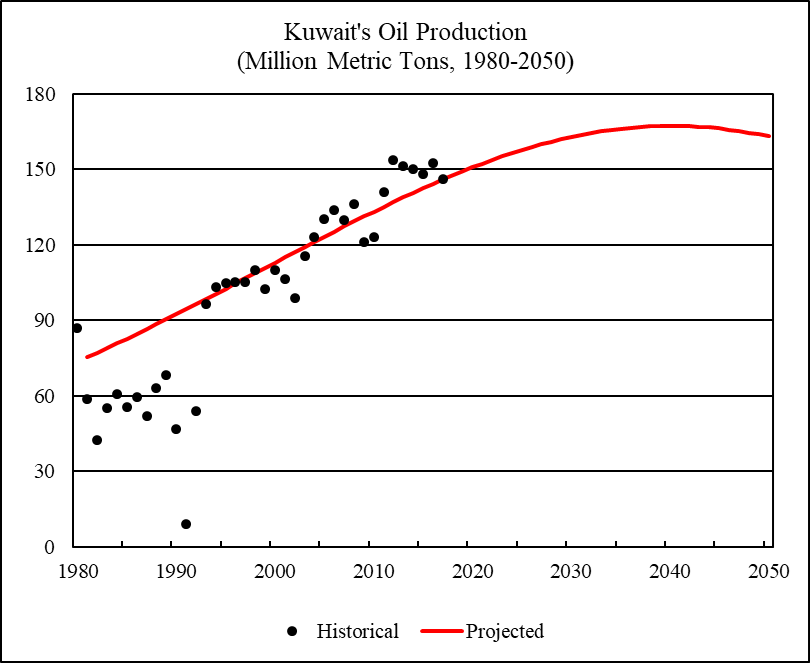

Kuwait is the world’s ninth largest oil producer. In 2017, Kuwait produced 146 million metric tons of oil (3.0 million barrels per day), accounting for 3.3 percent of the world oil production.

This report assumes that Kuwait’s ultimately recoverable oil resources are the sum of historical cumulative production and the official reserves. Kuwait’s cumulative oil production up to 2017 was 6.7 billion metric tons (cumulative production up to 2007 is from BGR 2009, Table A 3-2, extended to 2017 using annual production data from BP 2018). Kuwait’s official oil reserves at the end of 2017 were reported to be 14 billion metric tons (BP 2018). The ultimately recoverable oil resources are estimated to be 20.7 billion metric tons.

Based on the above assumptions, Kuwait’s oil production is projected to peak in 2040 at 167 million metric tons. Figure 13 shows the historical and projected Kuwait’s oil production.

Figure 13 Kuwait’s Oil Production, 1980-2050

Sources: Kuwait’s historical oil production from 1980 to 2017 is from BP (2018).

Brazil

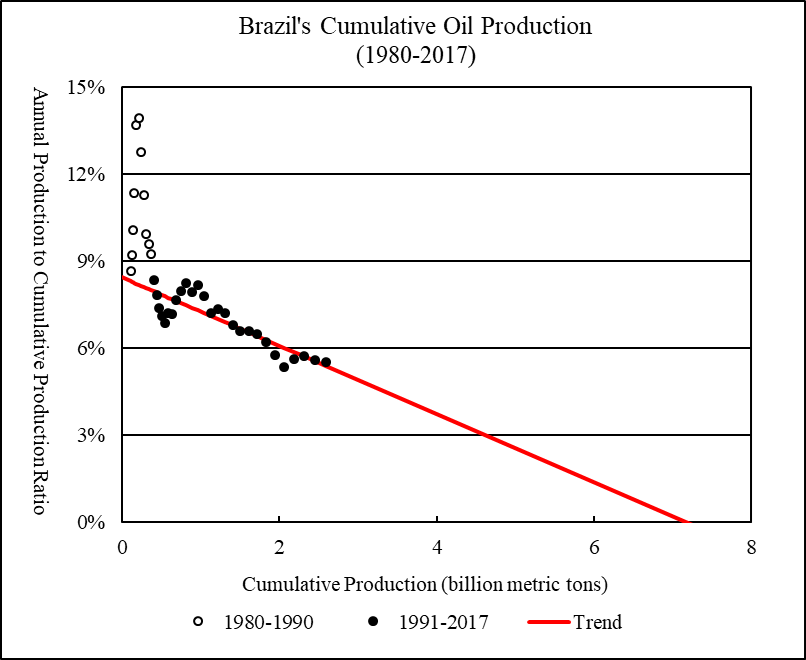

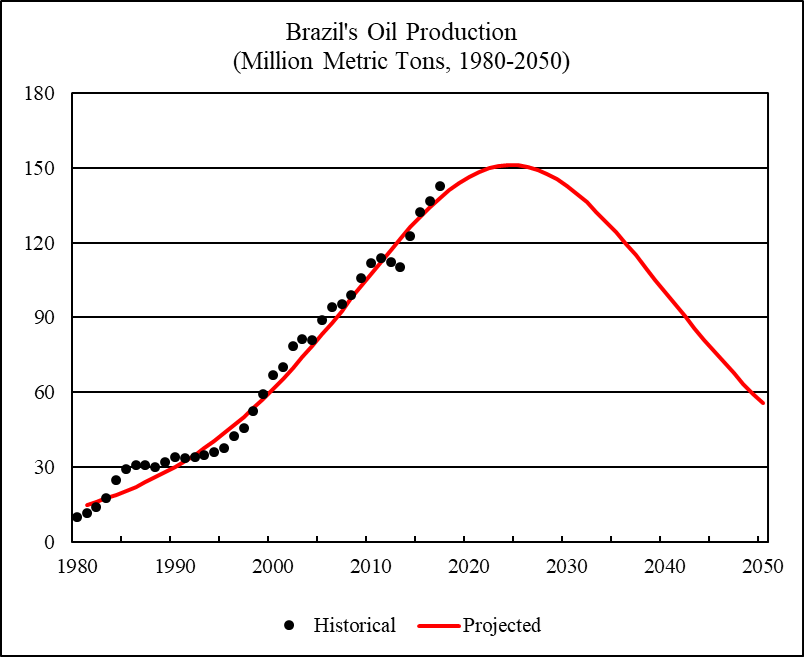

Brazil is the world’s tenth largest oil producer. In 2017, Brazil produced 143 million metric tons of oil (2.7 million barrels per day), accounting for 3.3 percent of the world oil production.

Figure 14 projects Brazil’s annual production to cumulative production ratios against the historical cumulative oil production from 1980 to 2017. Hubbert linearization is applied to the annual production to cumulative production ratios from 1991 to 2017. Regression R-square is 0.756. Where the downward linear trend meets the horizontal axis indicates Brazil’s ultimately recoverable oil resources to be 7.2 billion metric tons. Brazil’s cumulative oil production up to 2017 was 2.6 billion metric tons. Thus, Brazil’s remaining recoverable oil resources are estimated to be 4.6 billion metric tons. By comparison, Brazil’s official oil reserves at the end of 2017 were 1.9 billion metric tons (BP 2018).

The parameters from the Hubbert linear trend are used to project Brazil’s future oil production. Brazil’s oil production is projected to peak in 2024 at 151 million metric tons. Figure 15 shows Brazil’s historical and projected oil production.

Figure 14 Brazil’s Cumulative Oil Production, 1980-2017

Sources: Brazil’s cumulative oil production up to 2007 is from BGR (2009, Table A 3-2). This is used as the reference point. Cumulative production ending in other years is then calculated using annual production data reported by BP (2018).

Figure 15 Brazil’s Oil Production, 1980-2050

Sources: Brazil’s historical oil production from 1980 to 2017 is from BP (2018).

Rest of the World

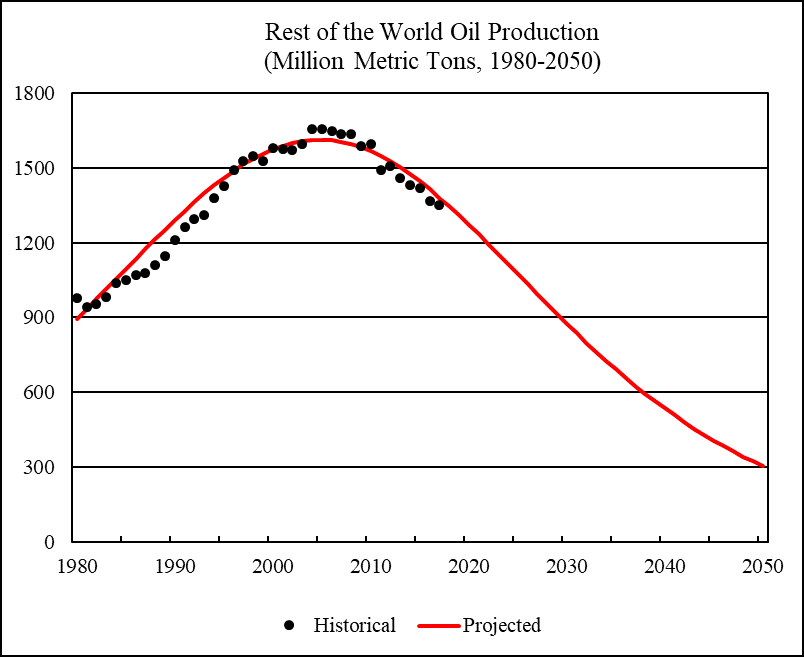

Rest of the world is defined as the world total excluding the ten largest oil producers. In 2017, rest of the world produced 1,351 million metric tons of oil, accounting for 31 percent of the world oil production. Rest of the world’s oil production peaked in 2005 at 1,654 million metric tons.

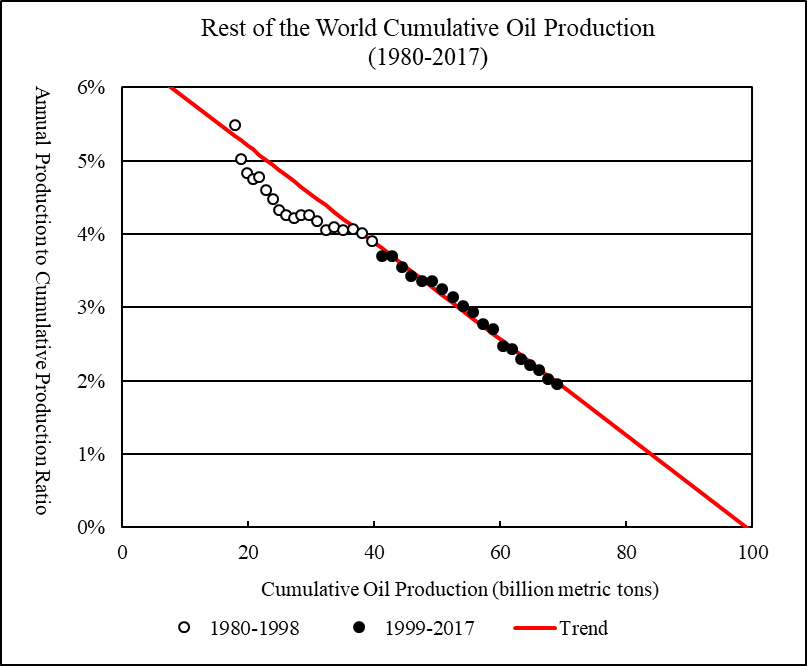

Figure 16 projects rest of the world’s annual production to cumulative production ratios against the historical cumulative oil production from 1980 to 2017. Hubbert linearization is applied to the annual production to cumulative production ratios from 1991 to 2017. Regression R-square is 0.989. Where the downward linear trend meets the horizontal axis indicates rest of the world’s ultimately recoverable oil resources to be 99 billion metric tons. Rest of the world’s cumulative oil production up to 2017 was 68.9 billion metric tons. Thus, the rest of the world’s remaining recoverable oil resources are estimated to be 30.1 billion metric tons.

The parameters from the Hubbert linear trend are used to project rest of the world’s future oil production. Figure 17 shows rest of the world’s historical and projected oil production.

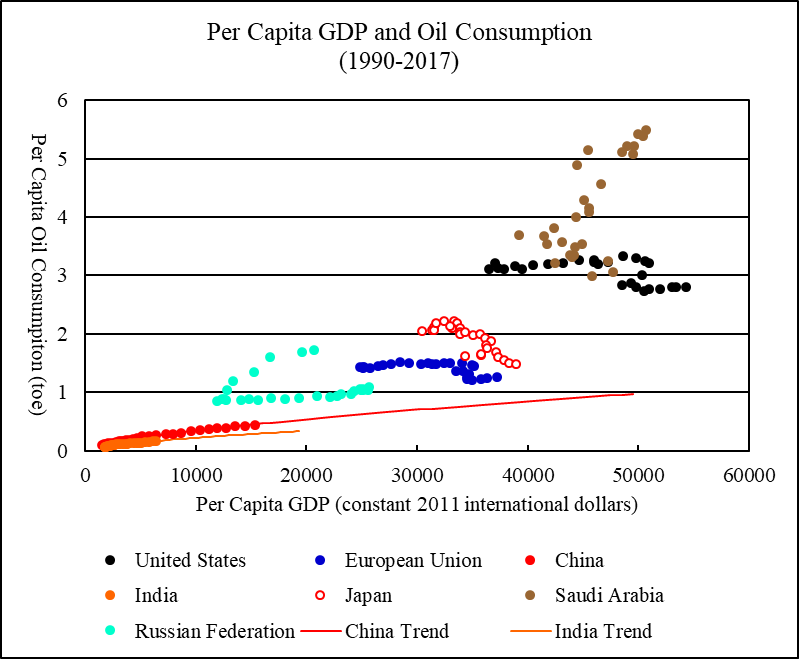

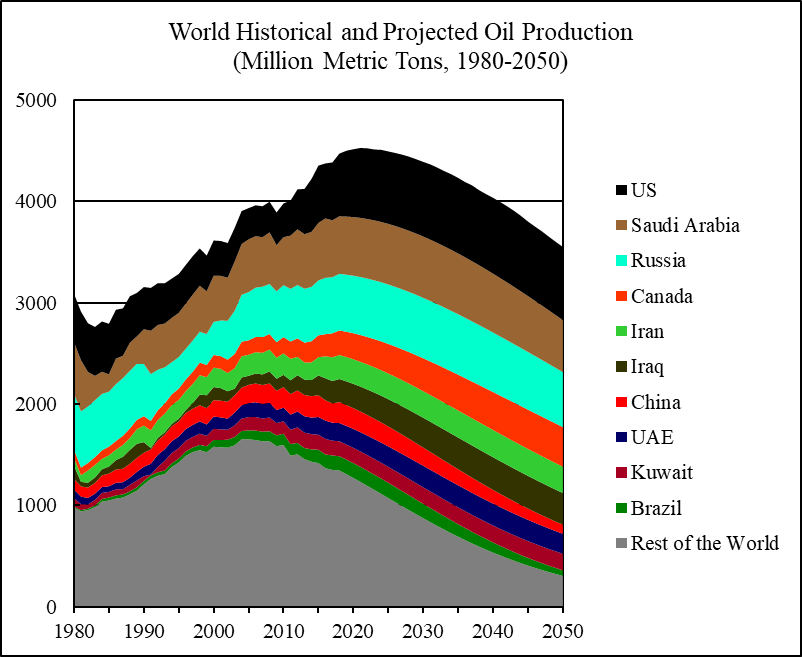

Figure 18 shows the historical and projected world oil production. World cumulative oil production up to 2017 was 192 billion metric tons. World ultimately recoverable oil resources are estimated to be 468 billion metric tons. World remaining recoverable oil resources are estimated to be 276 billion metric tons. By comparison, world oil reserves at the end of 2017 were reported to be 239 billion metric tons by BP (2018).

World oil production is projected to peak in 2,021 at 4,529 million metric tons and decline to 3,552 million metric tons by 2050. According to the historical linear relationship between world economic growth and oil consumption growth estimated in Figure 1, zero oil consumption growth is associated with a world economic growth rate of 1.2 percent. Other things being equal, absolute declines in world oil consumption will be associated with global economic growth rates less than 1.2 percent.

Figure 16 Rest of the World’s Cumulative Oil Production, 1980-2017

Sources: Rest of the world’s cumulative oil production up to 2007 is from BGR (2009, Table A 3-2). This is used as the reference point. Cumulative production ending in other years is then calculated using annual production data reported by BP (2018).

Figure 17 Rest of the World’s Oil Production, 1980-2050

Sources: Rest of the world’s historical oil production from 1980 to 2017 is from BP (2018).

Figure 18 World Historical and Projected Oil Production, 1980-2050

Sources: Historical oil production from 1980 to 2017 is from BP (2018).

References

Minqi,

Great post thanks. The estimated URR for Brazil is a bit suspect because the recent annual production divided by cumulative production (aP/CP) is only about 5%. The HL method gives poor results at such an early level of the production history.

Consider the following HL for the US from 1924 to 1945 when aP/CP is in the same range you used for Brazil (5% to 9%), the projected URR is about 67 Gb, when cumulative production through 2014 was 212 Gb.

Dennis, I think you are right about Brazil.

I also suspect the Brazil HL exercise could prove to be too conservative. But the implied remaining recoverable is still much larger than the “official” reserves. So at least it’s preferred to the reserves.

Since some of my estimates are likely to have erred on the optimistic side (such as for the US and Iran), this Brazil pessimistic bias might be a useful correction.

Minqi,

The US resources are probably overstated, but the AEO projection through 2025 is probably reasonable, after that the LTO resources are far lower than estimated by the EIA so the US C+C output from 2025 to 2050 will be far lower than forecast by the EIA.

In my view your Iran prediction looks ok, and Iraq might be a bit conservative from 2018 to 2025, based on the rate of increase for the past 7 or 8 years. Again the logistic was used by Hubbert as a convenient bell shaped curve, not every country’s output (or even the World) is likely to have that shape.

Thanks for this summary. We need to deduct OPEC’s paper barrels, so often mentioned by Jean Laherrere

http://crudeoilpeak.info/opec-paper-barrels

It’s not only China which has peaked 2010-15, but the whole Asia Pacific region which is supposed to be the growth engine for the next decades

Peak oil in Asia Pacific (part 1)

http://crudeoilpeak.info/peak-oil-in-asia-pacific-part-1

In the meantime, Australia is selling off all its gas as alternative transport fuel

Australia is exporting itself gas poor, plans LNG import terminals

http://crudeoilpeak.info/australia-is-exporting-itself-gas-poor-plans-lng-import-terminals

There is talk of $200 oil if Iran blocks the Strait of Hormuz

https://www.forbes.com/sites/edhirs/2018/07/25/oil-at-200-plus-per-barrel-iran-can-make-it-happen/#540814696840

If Iran blocks the Strait of Hormuz there will be war.

Iran would not try to block anything unless it is under attack by the US. The Pentagon is opposed to such an attack, but Trump is heavily influenced by Netanyahu and is advised by the same neocons who got the US into the fiasco in Iraq. Given the inability of the US Congress to enforce the constitution by denying the Prsident to start a war without a congressional declaration of war, it seems the USA may be on its way to destroy the world economy to please an extremist Israeli right wing government.

I write destroy the world economy because it’s doubtful Iran would respond as anticipated by the Americans, who have a tendency to fight wars with strategies based on previous wars and an excess of complex gadgets and extremely expensive technology. I don’t know what they have in mind, but I’m sure it would be unexpected, calibrated to avoid nuclear retaliation, and may evolve over time. But I’m sure others will see the risks, and the oil market will take off into the $100’s and possibly $200’s unless there’s adults left in the USA senate to block this craziness.

Shutting down the Straits of Hormuz would probably be Iran’s first step.

I have said it before and I will say it again. Iran shutting down the Straits of Hormuz would be Trump’s wet dream. He would like nothing better to happen. It would give him a chance to have “Trump’s War”, and to revel in what he thinks would be a quick victory and propel him to the heights of stardom.

If you think he would listen to advisors who would advise him against it, then you have not been paying attention. Trump listens to no one except himself. He sees himself as a “stable genius” and believes no one knows better than himself.

But of course, Iran knows this and would not likely try to shut down the Straits. Anyway, a strong American naval fleet in the Persian Gulf and Arabian Sea would probably prevent Iran from starting anything.

Iran has most of the world on their side regarding the sanctions on their nuclear ambitions. If they shut off the world’s access to oil, nobody will be happy with them, and would be more likely to side with the current US position. Nothing about shutting off the access, and setting themselves up as the “bad guys” makes sense. Then, again, I’m not an Iranian ruler, so who’s to say?

See the paper referenced by Aleklett et al 2012.

The “paper” barrels for OPEC may be real. We don’t have great information on OPEC reserves.

If the paper barrels were real and assuming a realistic depletion rate, Saudi Arabia would be producing 35 million barrels/day. And similarly Kuwait, Iraq, UAE, and Iran would be producing triple of what they’re producing today.

Frugal,

Only if one assumes that OPEC develops and extracts its oil resources as quickly as the US, UK, and Norway. As I said before read the first title in the references, a simple assumption is that OPEC has chosen to develop their resources slowly so that oil prices are not driven to under $30/b (2018$). Supply is constrained by demand and profitability. Even OPEC struggles with oil at $30/b as they subsidize consumption at home by charging below market prices for fuel.

Governments might be overthrown in OPEC nations if this policy was changed.

At some point OPEC may develop and extract resources more quickly to drive down oil prices to compete with EVs and possibly natural gas in the land transport sector, but this is unlikely to occur before 2035 to 2045 in my view.

Incorrect.

Here is something:

Trump, Iran and the New Guns of August

https://www.bloomberg.com/view/articles/2018-07-24/trump-iran-and-the-new-guns-of-august

Interesting commentary. I think that over time, oil export restrictions on Iran as part of sanctions are going to be very hard to enforce, since its oil exports are increasingly more critical to places like India, China, Korea, Japan. They will be more concerned with their energy imports than the regional conflict over the horizon.

I agree– and with all those KSA installations just 15 minutes away by unstoppable missile technology (1970 midrange seems a little hard for current technology), we have a quandary, not a problem.

Exactly. But I’m not sure US National Security advisor Bolton knows anything about low technology midrange missiles and drones, some of which, in a pinch, can be piloted by small light weight kamikaze martyrs.

Have I read this right that the outlier ist the USA with 59 Btons reserves with only 6 proven.

With all other countries, the reserves proven ratio is more in line with about 30% error.

So: Ist there an huge additional oil reserve in the USA we just haven’t found so far, or does the Hubbert model, which was created when there was only conventional oil production, just not work on shale oil + easy wallstreet money.

Another thing: Does the Hubbert model work with creaming oil fields, keeping production rates constant with a sharp decline in contrast to traditional oil production with it’s long slow decline.

Another big outlier is Russland with about 300% – it’s also known for creaming a lot, but in the big areas of Siberia the exsistence of undiscovered ressources is more likely than at any other place in the world.

EIA projections may eventually prove to be too optimistic.

On the other hand, the US “proved” reserves have always been too conservative. That’s the case even before the shale oil boom.

Great post Dr. Minqi Li, thanks.

I think the Hubbert Linearization trend line for China has changed. Daqing has started to decline very fast. This is because of water has hit the horizontal infill wells at the top of the reservoir. This will be the case for a lot of other wells that have been creamed by infill drilling with horizontal wells right along the top of the reservoir.

“This will be the case for a lot of other wells that have been creamed by infill drilling with horizontal wells right along the top of the reservoir.”

Do you think this keeps certain people up at night? It seems pretty harrowing to me. Worse than a beer bong.

Edit: How interesting to find this shit has been going on since the 90s:

https://www.ogj.com/articles/print/volume-98/issue-19/drilling-production/horizontal-wells-find-varied-applications-in-saudi-fields.html

There have been no problems since then, apparently. So we should conclude the oil is infinite…

Ron, many thanks for the comments.

I checked China’s National Bureau of Statistics. For the first six months of this year, it appears that China’s oil production has stabilized just above 500,000 tons per day or approximately 3.5 million barrels/day. So perhaps the annual to cumulative production ratios will begin to decline somewhat more slowly.

Ron, Daqing field has numerous relatively thin reservoirs, it has been water and polymer flooded, and the water cut has been really high for many years. I suspect the shift to a steeper production decline is a result of field operations optimization, which leads to well shut in when prices are too low.

If my guess is right, the production should stabilize and possibly increase a bit as prices go up. However, there’s a factor we see in fields like Daqing which won’t allow production to bounce back to the previous decline trend. Many wells making high water cut from a heterogenous and thick perforated section will produce 100% water after being shut in for several months. There’s a reason for it, but it’s too technical to explain here.

FWIW (which is to say, not much): As a lay person who has taken this seriously for years (learning about it first in the 80s in a geology class, doing lots of reading and monitoring of websites in the 2000s), I have to say–I believe none of it.

The peak oil experts were dreadfully wrong with their HL 15 years ago, so what prevents their being just as wrong now? I’m not even saying the date predicted here (+/-2020) will come and go and oil extraction will keep rising with demand.: No, I find it so untrustworthy that it might be wrong the other way: Perhaps the water will hit those horizontals in Ghawar tomorrow and production will fall off a cliff. Perhaps drilling won’t happen fast enough in the tight oil plays to stave off festering decline rates. Perhaps all the estimates of reserves by OPEC are big fat lies. How are we going to tell?

Note that it was the perfectly ignorant who turned out to be right 15 years ago–and not because they made any effort to be. The scholars–brilliant, well-meaning, well-informed–were shockingly off-base, but those who just screamed “Drill, baby, drill!” were right on. And fiddle-dee-doo.

I have a feeling were all just running blind into a future which is perfectly unpredictable and for which we cannot hope to be prepared. Over & out.

Yes, you can count on the projections being wrong. But its the best wrong we’ve got, overall.

“But its the best wrong we’ve got, overall.”

Perhaps you’re right. How would we know?

You don’t know who’s right until all the oil is gone.

Only hindsight is 20/20.

The worst thing for a date to guess is politics.

There are 10 countries that have to grow oil production to avoid peak oil – these with still big reserves.

One knocked out itself – Venezuela

One is under attack from the USA – Iran

Irak isn’t that stable, either.

A hot war can break out every moment, or a civil war devasting and blocking infrastructure for years, while other countries deplete.

Or peace can come and these ressources can get used.

These combined 10 mb/d alone will determine peak oil – by 5 years or more in either direction. These 10 mb/day can’t be replaced by russion oil tsars, US rednecks with too much Wallstreet money or Saudis opening secret valves of instant oil wonder production.

Venezuela can get a new government and increase production by a big amount, helped by international money. It has the ressources to get one of the big producers when the tar oil is lifted.

So in my eyes, it looks like somewhere between 2020 and 2030, perhaps even later.

The best we can hope for is that increasing renewable energy and EV’s take a big bite out of that proposed production curve. Of course falling population and industrial failure could do the same.

Win win?

I think that EVs will start to have a serious influence in a few years. I think the influence won’t be so much on volume as on price. EVs are much cheaper to operate than combustion engines, so the effectively cap the oil price.

The “economic” argument against peak oil is that as supply gets constrained, marginal sources come into play. EVs may limit that. High oil prices are more likely to increase demand for EVs than for marginal oil, simply because it’s faster and easier to build an electric car fleet than it is to accessed a new oil field.

Hi Michael B,

Couldn’t agree with you more regarding OPEC reserve estimates, they are all full of shit, and no one except a handful of people in those countries would know how much they have left.

Solving this peak oil timing is more similar to a quantum mechanics problem rather than a Newtonian mechanics one. It complexity, lack of transparency and political and economic implication make it impossible to have a deterministic answer, its pure probability, and also speculations.

Like you i think all these projections are wrong. Maybe we will extract a lot more oil with newer technologies or new field discoveries and end up cooking the planet with climate change, and we won’t see a “peak oil” for 100s of years who knows.

It’s one of those things in life which you just don’t know what the hell will happen. But so far the Cornucopians have been right and the Malthusians wrong.

Probably won’t find a lot of new fields, but there may be a bit of reserve growth. USGS estimates about 3000 Gb of “conventional” (not extra heavy oil or tight oil) and perhaps 1000 Gb of “continuous” oil, my medium or best guess is 2800 Gb conventional and 500 Gb extra heavy and 100 Gb tight oil (entire World). If the USGS is correct, we would still be likely to see a peak n C+C output before 2035. The extra heavy oil is difficult to develop quickly, but if there is 500 Gb of tight oil (5 times more than my guess) the peak could move 10 years to the future (from 2025 to 2035). My guess is that if there is tight oil developed outside North America, China might be the most likely place, Russia still has a lot of conventional reserves and may be slow to develop there tight oil resources the same rule applies to most OPEC nations.

Yes I agree with that and also if oil prices rise we might see more supply coming online. Canada for e.g. seems to have a lot of oil sands. It costs a lot more to produce so at higher oil prices they might ramp up their production also, which might lead to an oversupply and prices will fall until production is cut short.

But again i have no clue what the future holds. But i am almost certain we are probably all wrong in our predictions lol

To ramp up production in oil sands would take megabucks, and years of completion time. In the meantime, the decline rates march on. I see them doing that, but by the time it is online, peak oil has come and gone.

I recently decided to read the signs the most simple way possible: World oil production is flat since 2005, with the exception of sands and fracking. Now most of this was added and we’re entering a new flat period that might last about a decade. Then alternative energy sources should be ready to compensate for the decline. Otherwise …

Westtexasfanclub,

Not quite right, World C+C minus extra heavy and LTO output has increased since 2005, not by much, about 1 Mb/d, peak for “conventional” C+C (excludes extra heavy and LTO output) may be around 2021.

“But so far the Cornucopians have been right and the Malthusians wrong.”

That is a very interesting thought. How much further can we push the system past natural limits and still maintain a techno-industrial civilization with high population in a viable world?

Currently some think the fossil fuels will end this century, but they possibly could be extended well into the next. Eventually we will have to move to other energy sources, as we are starting to now.

Indicators now show loss of fresh water and soil to be greatly limiting factors.

Some think population will stall at 9 billion and fall (slow or fast), while others project 11 billion at the end of the century.

In the long run, unless we move to a whole new level of civilization, say a Type I civilization, natural limits will be the major factor sooner or later.

The further reality is that even an energetic Type I civilization needs to eat and drink, implying a reduced population and/or one that has strong knowledge and control over biological/ecological processes.

Will population crash before we move to the theoretical Type I civilization? Possibly, and with present knowledge, probably. But that does not fully exclude a rise to a Type I civilization later, unless the planet enters a toxic and anoxic phase of climate.

And then of course there is the proceeding of the extinction event. The breakdown of the fabric of the living system. A huge factor that may override history completely.

How much further can we push the system past natural limits and still maintain a techno-industrial civilization with high population in a viable world?

That’s the key question which no one knows in my opinion.

Environmental degradation and climate change might bite first I suppose. You can logically predict that eventually this expanding balloon of human civilization will pop, but what will trigger the popping could be so many different things.

At the moment I am not so sure anymore that energy will be the needle to pop the western civilization balloon.

I can’t “project” us being a type-1 civilization, (ignoring the inhibiting and relentless influence of entropy) humans are so divided. Religion, nationalism, racism, and political affliations being the main divisive agents, and i can’t see us ever getting rid of any of them. The human brain is still very primitive, and it seems it can’t keep up with the exponential change that has being occurring since the industrial revolution. But yea that’s just my worthless opinion.

Oswald Spengler wrote a book in 1919 predicting the end of western civilization by 2200AD i think. Very interesting book.

“But so far the Cornucopians have been right and the Malthusians wrong.”

Yep! As the pile of shit get’s higher and higher that chances of some of it catastrophically hitting the fan sooner or later gets higher as well. Yet the Cornucopians are totally convinced that because it hasn’t happened yet the Malthusians are totally wrong!

Guess the Cornucopians don’t get that past performance is no guarantee of future results. They should have a long sit down chat with the major global insurance companies to get a better understanding of risk assessment.

Malthus was right, only those that haven’t spent the time to actually read what he said will disagree.

Some of the damage is irreversible, meaning that as excess “shit” is trimmed off by the “fan”, there will be no recovery and continued destruction means more trimming. A pulsed decline, until it tumbles over the edge into complete oblivion or the source of decline is removed.

As far as things not happening yet, the only people that do not see that many losses have occurred already and more are occurring now, are blatantly and probably purposefully delusional.

“so far the Cornucopians have been right and the Malthusians wrong.”

I remember when cornucopians used to predict space travel, flying cars, prices for energy and raw materials so low as to be too cheap to meter/matter, political harmony, etc.

I think if we can look out at a world with extinctions proceeding at breakneck pace, global warming proceeding past the point of no return, coral reefs dying, oceans filled with plastic, life expectancy gains slowing or even reversing, energy prices and materials prices remaining stubbornly high, rising debt, inequality, stagnant wages, generations growing up with less income and more debt than those who came before, too poor to get married or buy a house, let alone have children, increasing military spending, authoritarianism, refugee flows, renewed arms races and angry populations the world over turning to populist leaders and looking to turn back the tide of globalization and put their little corner of the world first and we can call that a cornucopian vision come true, then this speaks more to how even the idea of what cornucopian means has been so reduced by the last few decades of struggle and stagnation, that we don’t even recognize how far we’ve fallen from what we once expected of our economies, our societies and ourselves.

Michael, look at the “rest of the world”. How can we say there has been no “peak oil”?

“The peak oil experts were dreadfully wrong with their HL 15 years ago, so what prevents their being just as wrong now? ”

Why is Oil at $70/bbl? Back in 1999 its was about $10/bbl. If there no supply constraints why did the price increase ~7 fold in less than 20 years? Also why the need to to drill for Shale Oil (Source Rocks) & develop in Deep & ultradeep water?

Conventional oil peaked in 2005, All the growth is coming from offshore & Shale. New Oil discoveries have dropped off the cliff. We found almost nothing in 2017. Oil Discoveries peaked in 1960s and been in permanent decline. Thus if we are discovery less and less new oil fields every year, below the rate of consumption, Oil production will have to fall to match discoveries at some point in the future.

Other clues:

1. Oil Majors perfer to drill on Wall street (aka using debt to fund stock buybacks) instead of developing new fields for future production.

2. Shale Debt: Shale drilling never made a profit, except for using OPM (other People’s money) to fund CapEx\OpEx.

3. US invaded or targeted with Regime change in Middle East Oil producing nations. Only Iran remains and you can already hear the War drumbeats for Iran.

Indeed, and thanks. Note that your answer has to do not with HL but with obvious signs & symptoms. Believe me, I’ve been watching, too. The uncertainty is killing me.

In a society driven and controlled by money, the common good will be forgotten to be replaced with the uncommon profit.

Michael, I have never been a peak oiler. I come at this from a different perspective: about 30 years ago I noticed exploration results were decaying, and started working in areas which would allow producing oil and gas in the far future from sources we weren’t tapping much at the time.

I remember sitting in a meeting around 1990 and suggesting to managers in a committee I was briefing that we needed to focus on locking up hydrocarbon molecules, wherever they were, cut down exploration and use that money on technology and getting access.

This is one reason why eventually I got involved in gas conversion to liquids, heavy oil, and the former Soviet Union, which to us appeared like a happy hunting ground, including its Arctic targets in the Barents, Kara, Yamal, etc. I also had colleagues who went into deep water, EOR, North America Arctic, and of course the hydraulic fracturing of vertical horizontal wells drilled in low perm formations.

So in my case I’ve been about 30 years now working on replacing conventional oil barrels with more difficult barrels. And those difficult barrels require higher prices. So the question is, what can poor countries afford?

So, “not a peak oiler” means you think the fate of conventional oil is not really all that important, and cost is the ultimate arbiter, not the resource?

Not a peak oiler means I don’t use Hubbert Linearization or similar techniques. In the past, my job has included the estimate of resources (not reserves). The preferred technique was to estimate technical reserves, meaning we supposedly didn’t focus on economics. But I couldn’t have staff working out numbers doing endless iterations and model runs for highly speculative cases, so I gave them the guidance to assume a really high price, a higher OPEX and CAPEX environment, and prepare conceptual field redevelopments and marginal field developments or targeting really low quality reservoirs. We devoted about 5% of the time budget for this effort. And I told head office I wasn’t about to use more manpower working such hypothetical figures, because we had to focus on reserve studies, and preparing projects to move reserves along the reserve progression pathway so we could meet our targets.

The fate of conventional oil is already written, in the sense that most of the extra oil we get from conventional fields comes from redevelopments which rely on higher prices, and EOR. The typical field with say 45% recovery factor can be pounded hard to push it to say 55%, going above 55% gets mighty hard, and pushing to 60% is nearly impossible. So there are limits, which involve the huge amount of resources (cash, steel, chemicals, and people) we use up to get those extra barrels.

One issue to consider is that these redevelopments which include EOR are not contributing that much extra rate. They stop decline, get a slight bump, and then yield a slower decline rate for 10-20 years. This means investments take tine to payout and if the world is suffering from acute shortages they don’t help that much. The on,y fast reaction comes from fracturing “shales” and low permeability sands, infills in newer fields, and workovers.

Thanks. If you were doing this in the 90s, sounds like you were “predicting” the future!

Sure sounds like a long explanation for your understanding of ‘peak conventional oil’. Nothing to be ashamed of.

Fernando,

Many people define peak oil as simply World output of C+C reaching some maximum level and then declining at some future point (there might be a plateau in output for 5 to 7 years before decline becomes rapid (more than 1.5%/year). I imagine that by that definition you might be a peak oiler.

In any case , I don’t think HL is a viable method and tend to use the estimates of the USGS and other experts for TRR along with discovery data as the basis for my scenarios. I do consider myself a “peak oiler”.

Peak oil on conventional reserves was called quite accurately. That peaked in 2005. The only reason production has risen since is different resources – tar sands and fracking. EOR running flat out as well but we’d still be way down without Canada + USA.

Also, Iraq finally came online and sanctions ended against Iran but those look like they have run their course now.

With oil discoveries the last 3 years in the toilet due to lack of capital investment and lack of major fields its just a matter of time mathematically. Be thankful we still have time before peak production hits cause I don’t think it will be fun post peak. Hopefully still 5 years until its official maybe less…When will Ghawar give up the ghost….?

Saudi Arabia may keep going for many years at 10 Mb/d, probably until 2030, perhaps beyond.

One can hope….they can produce 10 Mb/d to infinity according to their reserve numbers which never budge….I’d be curious what posters think their reserves are. 175-225 GB?

It’ll be interesting to see how KSA shakes out when oil consumption begins to zero in on oil production, and exports decrease.. ELM.

https://ycharts.com/indicators/saudi_arabia_oil_consumption

While other countries’ fields continue to deplete at the same time.

Get your looms and home gardens ready…

As Michael B. says, those Saudi MRC wells could hit 100% water tomorrow. There was a lot of lying done by everyone for decades.

Including the EIA.

I’m not sure where to jump in so, here goes:

1) Exxon Mobil publishes a yearly outlook: A view to 2040 is often in the title. Here is a link to their latest:

https://cdn.exxonmobil.com/~/media/global/files/outlook-for-energy/2018/2018-outlook-for-energy.pdf The graph on page 35 depicts crude oil and condensate production peaking in the 2040 timeframe. The 2005 peak in conventional production can be seen but is masked. The 2016 version of this graph clearly shows that peak that was famously called by Deffeyes as occurring on Thanksgiving Day 2005. Their 2015 graph is at the bottom of this reply.

2) I’m driving an EV now. It’s averaging about 4.6 miles per kwhr or roughly 46 miles to the “gallon” where the “gallon of electricity” (e.g., 10 kwhr) costs $1.00

3) The PV on my roof provides about 300 kwhr in January where my home has used a max of 2200 kwhrs. In the late spring to early fall, I am overall a very very very slight exporter of electrical energy.

4) I’m trying to figure out if solar thermal might be of use in January or adding more PV would be more efficient.

5) When Matt Simmons challenged Saudi Aramco back in 2004, the Saudis said they could pump 10 million a day starting in 2004 before peaking in 2042 or rising to 12 million a day by 2016 before peaking in 2033. If they followed a Hubbert Curve, they would peak around 2025. The graph above shows the Saudi production peaking at 600 million metric tons (a year) which works out to 12 million barrels a day. This graph shows them peaking a little before 2034 at 2030. Not sure how to tie Dr. Li and the Saudi Aramco graphs together. I have a copy of both the Simmons and Saudi Aramco presentations in PDF form (3 and 5 MBs, respectively).

I’m hoping that solar cell efficiency climbs to 40 to 60% and battery storage falls to a few cents/kwhr. I know we are on our way there. It’s an interesting horse race.

They say:

• Global liquids production rises by 20 percent to meet demand growth

They figured demand growth would rise by 20% so they just said that supply would grow by 20% to match it. It’s just an assumption that supply will automatically grow to meet demand. So they need to figure out where that growth will come from. Most of the increase, they say, will come from natural gas liquids and tight oil with deepwater and oil sands supplying most of the rest.

They have natural gas liquids almost doubling and tight oil increasing by about three fold. Their take below, bold mine.

• Technology innovations lead to growth in natural gas liquids, tight oil, deepwater, oil sands and biofuels

• Technology enables efficient production from conventional sources, which still account for more than 50 percent of production in 2040

• Most growth over the Outlook period is seen in tight oil and natural gas liquids, which reach nearly 30 percent of global liquids supply by 2040

• Continued investment is needed to mitigate decline and meet growing demand

• Liquids trade balances shift as supply and demand evolve

• North America swings to a net exporter as shale growth continues

• Latin America exports increase from deepwater, oil sands and tight oil supplies

• The Middle East and Russia/Caspian remain major oil exporters to 2040, and Africa shifts to an importer

• Europe remains a net oil importer, as demand and production both decline

• Asia Pacific imports increase to 80 percent of oil demand in 2040

You’ve pointed out why it’s impossible for a lay observer to get a firm handle on this.

Pete, if the cost per watt of PV is low enough, why are further gains in efficiency all that important?

Well, we did discover that ‘elephant” in Azerbaijan in 2000–

It has only been 18 years.

There was no elephant oil discovery in Azerbaijan in 2000.

Ah—-

Kazakhstan

So sorry

Another consideration is discoveries and reserve appreciation. Consider estimates of conventional C+C using Hubbert Linearization by Jean Laherrere which have gradually increased from 1998 (1800 Gb) to 2016 (2500 Gb.) In addition, there is not any particular reason that output would tend to follow a “Hubbert” type logistical function.

Generally estimates based on Hubbert Linearization would be a minimum estimate in my view.

In addition conventional oil Extraction rates (output divided by producing reserves) in the World (5.6% in 2016) are far lower than the United States (14.8% in 2016, all C+C), so there is the potential that with higher oil prices the average extraction rate for the World may increase. The World conventional extraction rate was about 11.6% in 1979. A gradually increasing rate of extraction might allow a plateau in output to be extended for many years (to 2030 at least). Impossible to predict of course, the number of scenarios that can be created is large.

One such scenario is presented below (peak in 2025 at 85.5 Mb/d of C+C or 4275 Mt/year).

The analysis using the logistic function does not account for this potential.

International Energy Agency – Oil Market Report: 12 July 2018

now available to non-subscribers

download from here: https://www.iea.org/oilmarketreport/omrpublic/currentreport/

https://pbs.twimg.com/media/DjC5s79XcAA0_xG.jpg

https://pbs.twimg.com/media/DjC564-W0AETF5a.jpg

https://srsroccoreport.com/top-u-s-shale-oil-fields-decline-rate-reaches-new-record-half-million-barrels-per-day/

“While the U.S. reached a new record of 11 million barrels of oil production per day last week, the top five shale oil fields also suffered the highest monthly decline rate ever.”

Good article.

I disagree. Oil prices are more likely to increase than to fall to $30/b and more of these companies are likely to be profitable as oil prices rise, also 3 of the top companies are profitable, so a “well run” oil company can indeed be profitable, those that are less well run will either change the way they operate or they will go out of business. The better companies buy the worthwhile assets on the cheap and life goes on.

It’s called capitalism folks. 🙂

Also the DPR is not very good, I ignore that report and use EIA’s tight oil estimates (link below) and shaleprofile.com for good information.

https://www.eia.gov/energyexplained/data/U.S.%20tight%20oil%20production.xlsx

“Also the DPR is not very good”, is an understatement. I have never seen an analysis use so many different fruits to come up with bananas expected.

Dennis.

A lot of lying was done by the shale guys for at least the last 5 years. Few of them have made money, and all of them would lie to their own mother on her deathbed if they thought it would get them a nickle.

You are far too cornocopian and credulous. These shale guys are over $350 billion in debt (yes, billion) which is unrepayable at any oil price. The EIA wants to believe desperately in their shale narative because that’s how they get paid. Why would you listen to people hopelessly in debt, to the tune of hundreds of billions? I would consider that to be a very serious miscalculation.

Sounds like another 2008 Wall Street debacle to me.

Michael Sutherland,

I dont believe the shale companies. I take the data from Shaleprofile, Enno Peters excellent website, and EIA tight oil data, see link in previous comment.

I also base costs on the comments of Mike Shellman and the excellent blog posts of Rune Likvern.

The reality is that the debt will be paid back by 2027 and after that there will be positive cash flow under reasonable oil price scenarios.

The whole debt will never be repaid argument depends on $75/b oil forever.

Not likely to happen as peak oil is approached and supply cannot meet demand at $75/b.

I suppose by “decline rate” they are talking about the “legacy decline”

As an example, I will use approximate data from a fairly good tier 2 well in the Eagle Ford. It starts off production at 33k the first month, and drops rapidly after that to reach 8k by the final month. Let’s say it produces 175k the first year, which would be profitable at today’s prices. The next year it produces 55k, and the next year 36k. By the fourth year it is producing less than 100 barrels a day, and by the sixth year it is questionable to keep up. Little better than stripper status. Tier three stuff is much worse, it may reach stripper status by the third year. Eventually, all will be tier two and three status wells. That’s the majority of reserves estimated. Estimating future production from current production doesn’t touch on reality. Eventually, to keep up on initial production, you would have to drill twice as many wells. But, you won’t keep up with twice as many, because the decline rates will be higher. There is a lot of difference between a 600k EUR well, and a 300k EUR, or a 150k EUR. 2042 for US peak? Not hardly.

Guym,

I agree, probably 2023 to 2025 will be the US peak, after that decline is likely to be rapid because mostly tier 2 and tier 3 wells will be left, high oil prices may make them profitable, but it will be impossible to keep up with the decline rate of legacy wells after 2025 and US output will decline rapidly (4 or 5% per year) after 2030.

Exactly.

One snag: The Shale Debt starts coming due in 2019 and continues through to 2024. Shale drillers were successful since the borrowed at rock bottom interest rates and investors practically fought each other begging Shale drillers to take their money. Not so sure it will work if interest rates are higher, and The Shale sweet spots aren’t endless.

That might slow the start up, for sure. If the price of oil gets high enough, that will barrier will be short lived.

As oil prices increase so does the costs. It takes a lot of diesel to haul Water, Sand, and oil. Shale drillers never really made a real profit, even when Oil was over $100/bbl. One must consider the EROEI for Shale & rising CapEx\OpEx as the cost of Oil rises.

Second, its likely that consumers cannot afford high oil prices. As prices rise, Consumers will cut back and it will plunge the global economy back into recession. Perhaps the Worlds Central banks can coach something back into the global economy, but it won’t work over the long term.

FWIW: Some of the recent data is showing weakness in the global economy: Housing sales are falling and prices in the hot regions are flatlining. Trumps tariffs are also taking a toll as global trade is falling. And there are cracks in the developing world credit markets. We might see a stock market correction this fall, which would likely see commodity prices fall (including Oil).

” consumers cannot afford high oil prices. As prices rise, Consumers will cut back and it will plunge the global economy back into recession.”

Well, that likely depends on how fast and far the prices go. Slow steady rise can be well tolerated pretty far. Energy is so cheap for what you get, after all.

Many other countries have a much better GDP/unit energy consumed than the USA, and with price pressure the USA could get there too. I suspect we could shed 10-20% of our oil consumption without big effect, particularly if we did it slowly. For example, it wouldn’t affect the GDP at all if we slowed down to max 60 mph. Painless saving of energy, if you choose good music.

It is the fast changes in price that really tend to hurt.

“I suspect we could shed 10-20% of our oil consumption without big effect, particularly if we did it slowly.”

It doesn’t work that way. Consumers cut back on spending, from eating out, going on vacations. They loss confidence and delay major purchases like new cars, homes, etc.

Most of the population commute to work well below 60 mph. Traffic usually limits speeds to 40 mph or less during commuting hours.

To understand how high oil prices affect the economy just research the events around 2007/2008. Schools & business were planning to reduce work & school days to 3 or 4 days a week. Thieves were draining fuel from parked trucks and cars. The higher oil prices caused food prices to soar, which lead to the arab spring in Africa & the middle east. Europe had frequent riots. Airlines & shipping companies impose fuel surcharges. People homes had utilities shutoff. since they could afford their energy bills.

Funny how quickly people forget the aftermath of high energy prices. Doesn’t anyone read or study economics?

Funny how quickly people forget the aftermath of high energy prices. Doesn’t anyone read or study economics?

LOL! Given that this is a comments thread on a post from Dr. Minqi Li, professor

Department of Economics, University of Utah, I think at least some of the people commenting might have actually read it!

But maybe more people should read and study ecology instead! Then they might understand that the ‘economy’ is actually a subsidiary of Ecosystems Inc.

And if they read and studied physics and chemistry they might also understand that fossil fuels are not synonymous with energy.

They might even understand that combusting fossil fuels to produce heat energy, is a very dirty and inefficient process and it produces CO2 which when emitted into the atmosphere changes the climate and causes floods and droughts which cause crops to fail and therefore cause food prices to soar, which lead to the arab spring in Africa & the middle east and other places.

Who’d thunk it?

Fred, wouldn’t you say as well that both Economics Inc and Ecology Inc are subsidiaries of Entropy Corp?

Michael B,

Entropy Corp

Sure! That would fall under the Venn diagram of the intersection between Ecology, Chemistry and Physics and perhaps an approximation of a circular, synergistic, non linear biophysical economic model.

http://www.uni-kiel.de/ecology/users/fmueller/salzau2006/ea_presentations/Data/2006-07-05_-_Thermodynamics_II.pdf

Ecosystem Thermodynamics

Presentation given in the course of the

Master’s Programme

Environmental Management

– Module 2.1.1 “Ecosystem Analysis” –

You can also Google: Kate Raworth’s, Donut Economics, if interested in an example of that.

Cheers!

Tech guy- one way or another people will have to get used to living with less oil. If it needs a depression to make the adjustment, so be it. If it happens gradually, and with strong attempts at adaptation, maybe it will less painful.

I certainly wouldn’t want to have a livelihood that was dependent on discretionary energy use by average income people. Thats a recipe for painful downsizing.

Fred Wrote:

“CO2 which when emitted into the atmosphere changes the climate and causes floods and droughts which cause crops to fail and therefore cause food prices to soar”

Thats not it, since food prices fell when oil prices fell. Petrochemicals are used to fertilize land, pesticides, fungicides. Fuel is needed to irrigate crops (pumps), harvest crops & transport it to markets.

In the poor countries, they got out-priced by the wealthier nations, so they didn’t get the fuel they needed to support their agracultural needs. Also wealther nations turned food in to fuel (ie ethanol) so there was less surplus grain getting exported to the poorer nations.

None of this had anything to do with climate change. But Fred, you only have your climate change “hammer” so every problem (nail) is a result of climate change. I presume when you stub your toe you blame climate change.

When Oil becomes expensive, People will resort to cutting down all of the trees. Consider that in Brazil they destroy the rain forest to make way for sugar cane to produce ethanol fuel for there cars. When the soil is exhausted of nuetrients they move to another section of rain forest. Thus increasing CO2 emissions as well as destroying a valuable CO2 sink. The real elephant in the room is over population. The global environment will not improve once Oil supplies are constrained. They get much much worse.

90%+ of the global population lives in poverty and don’t give a rats ass about the environment. They do what every they need to get by. Environment degradation will accelerate once Oil production begins to decline, as people find alternative ways to get by

The destruction won’t be limited to the third world. I recall the EU made plans to tap undersea coal reserves by igniting them to produce coal gas, when Oil was expensive back in 2007-2008.

Techguy wrote:

None of this had anything to do with climate change. But Fred, you only have your climate change “hammer” so every problem (nail) is a result of climate change. I presume when you stub your toe you blame climate change.

Not going to get into a long dissertation here about causes and effects of climate change. I don’t traffic in simplistic one trick pony views. suffice it to say you are wrong. If you care to discuss this in detail I’ll be happy to address it point by point over on the non petroleum thread.

When Oil becomes expensive, People will resort to cutting down all of the trees. Consider that in Brazil they destroy the rain forest to make way for sugar cane to produce ethanol fuel for there cars. When the soil is exhausted of nuetrients they move to another section of rain forest. Thus increasing CO2 emissions as well as destroying a valuable CO2 sink.

Again you are wrong on so many levels here it is difficult to know where to start! Suffice it to say,

that I’m Brazilian by birth with a background in Biosciences and first hand knowledge about the Amazonian deforestation and sugarcane agricultural practices in Brazil I also know about the Brazilian Ethanol program, Ironically I owned a made in Brazil 100% ethanol powered VW back in the early 80s while working as a subcontractor for Petrobras, I’m also well versed in Brazilian politics and culture. Sugarcane is ill suited to the climate and the soils of the Amazon it is not a main driver of Amazonian deforestation.

To be clear, I’m not for a moment suggesting that deforestation is not a major problem in Brazil, it is! But it has other causes.

Sugarcane is mostly produced in southern Brazil in drier climates.

Maybe watch this 20 minute video on how things are changing in Brazil with regards agricultural practices in general and sugarcane production specifically.

https://www.youtube.com/watch?v=G-pr0cYzuDQ

The real elephant in the room is over population. The global environment will not improve once Oil supplies are constrained. They get much much worse.

On the population point we can agree! Though things will get worse with or without constraints on oil supplies. Another dissertation needed on this point alone.

90%+ of the global population lives in poverty and don’t give a rats ass about the environment. They do what every they need to get by. Environment degradation will accelerate once Oil production begins to decline, as people find alternative ways to get by

Wrong again! The problem is wealthy nations and the high consumption patterns that they take for granted. BAU is not sustainable. To blame the less fortunate for the outsourcing of the problems of the rich is unconscionable to say the least!

Again I don’t want to get bogged down in a long discussion here on topics better suited to the non petroleum thread but would be happy to discuss this in more detail there, if you should be so inclined.

Cheers!

“Brazil senate considers lifting ban on sugarcane production in Amazon”

https://www.theguardian.com/world/2018/mar/26/brazil-senate-considers-lifting-ban-on-sugarcane-production-in-amazon

“Rainforest rapidly cleared for sugarcane in Bolivia”

https://www.google.com/url?url=https://news.mongabay.com/2016/10/exclusive-rainforest-rapidly-cleared-for-sugarcane-in-bolivia/&rct=j&q=&esrc=s&sa=U&ved=0ahUKEwi5wP-h3sPcAhVMKqwKHe9pDtwQFggcMAE&usg=AOvVaw3gr-owfpnbdJL5Ff83RHZa

“Sugar cane, Palm oil, and Biofuels in the Amazon”

https://globalforestatlas.yale.edu/amazon/land-use-and-agriculture/biofuels

[wile sugar cane is mostly grown outside of the Amazon, some groups allege that this cultivation displaces cattle ranching, encouraging deforestation in the Amazon.]

[Soy: The other biofuel crop fueling deforestation. include Brazil]

https://www.nytimes.com/2017/02/24/business/energy-environment/deforestation-brazil-bolivia-south-america.html

If not the amazon, then in indonesia, australia, etc.

https://news.mongabay.com/2018/01/biofuel-boost-threatens-even-greater-deforestation-in-indonesia-malaysia-study/

You are a pain in the ass. You literately hang on to every word and declare it totally wrong unless the details down to 15 decimal places. Bottom line: biofuels have caused deforestation worldwide and will continue to do so as the cost of oil rises.

You still failed to disprove anything I’ve said. You just nitpick at the details and declare I am wrong, Yet provided zero evidence that food shortages that triggered riots were caused by Climate change. Did Climate change suddenly reverse, causing food prices to decrease? If climate change is to blame why aren’t the riots worse today?

Or perhaps the real reason for falling food prices was the collapse in energy prices?

Again You wield your “Climate change Hammer” for all problems. When your argument is weak, you nitpick on the details using misdirection to change the argument. What are you, a 10 year old man-child?

Seriously?!

Yes, there is sugarcane in the Amazon region but it is NOT a MAJOR driver of Amazonian deforfestation! Have you ever been to the Brazilian Amazon?!

Just about everything you have put forth are basically cherry picked strawman arguments!

Since the best you have been able to come up with is a personal insult to me, I conclude you are not all that interested in a serious discussion about facts that contradict your world view!

You might want to start by reading this paper in the Journal of Geophysical Research:

https://agupubs.onlinelibrary.wiley.com/doi/full/10.1002/2015JD023929

Spatiotemporal drought variability in the Mediterranean over the last 900 years

If you care to prove me wrong than please respond under my latest comment in the non petroleum thread.

http://peakoilbarrel.com/open-thread-july-26-2018/#comment-646883

If not, that’s fine too. And in that case we can consider this discussion over.

Techguy,