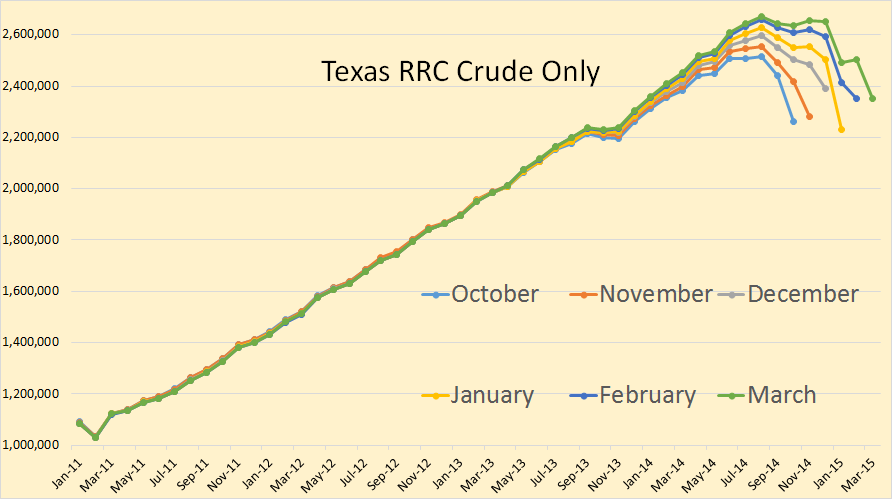

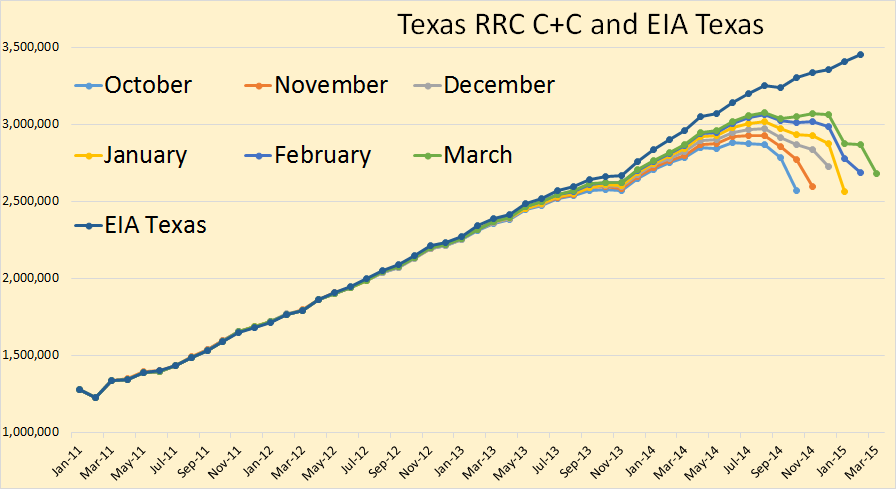

The Texas RRC is out with their latest Oil and Gas Production Data. Looks like oil production has leveled out with March production pretty much level with February. All RRC data is trough March 015.

I always show the last 6 months or the RRC data in order to get a pretty good indication of which way data production is moving. From the data you can see that December was a very good month but January was just awful. February was a lot better and March was about the same as February.

The chart above was created by Dean Fantazzini, PhD, of the Moscow School of Economics. He has developed an algorithm which predicts what the data will reflect after the final data has come in. His data suggests that Texas crude has plateaued.

For more on the underlying methodology of Dr. Fantazzini see:

Nowcasting Texas RRC Oil and Gas data (ongoing project)

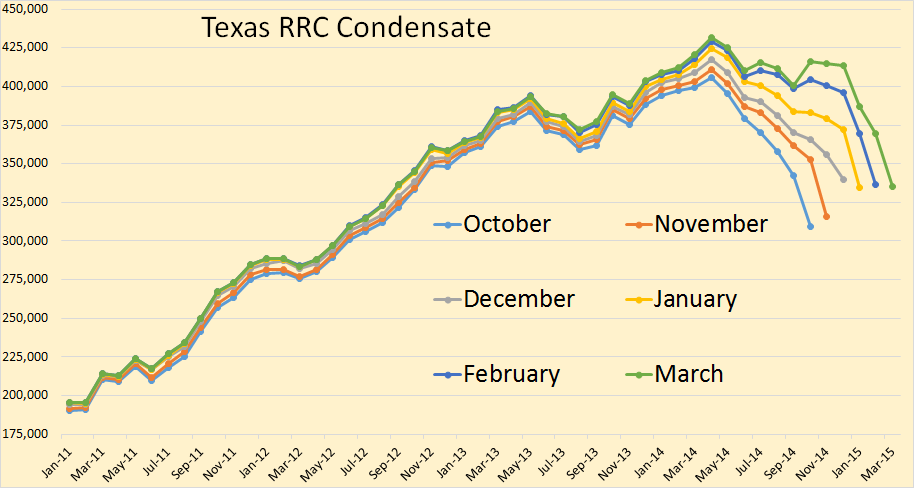

Condensate seems to have plateaued as well.

And Dean’t data confirms that the last three months condensate production comes in at a little below the December numbers.

Adding crude and condensate we get what the EIA counts, crude + condensate. The EIA data is only through February while the RRC data is through March.

Dean has Texas C+C slightly higher than the EIA in December but falling well below them in the last three months. It looks like that Texas has plateaued, so far, at about the December production level.

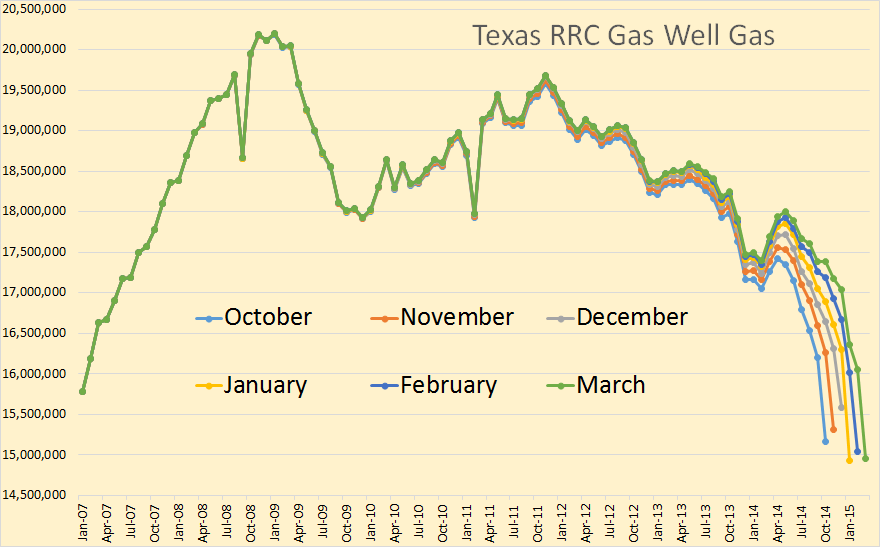

Texas gas well gas seems to be in serious decline.

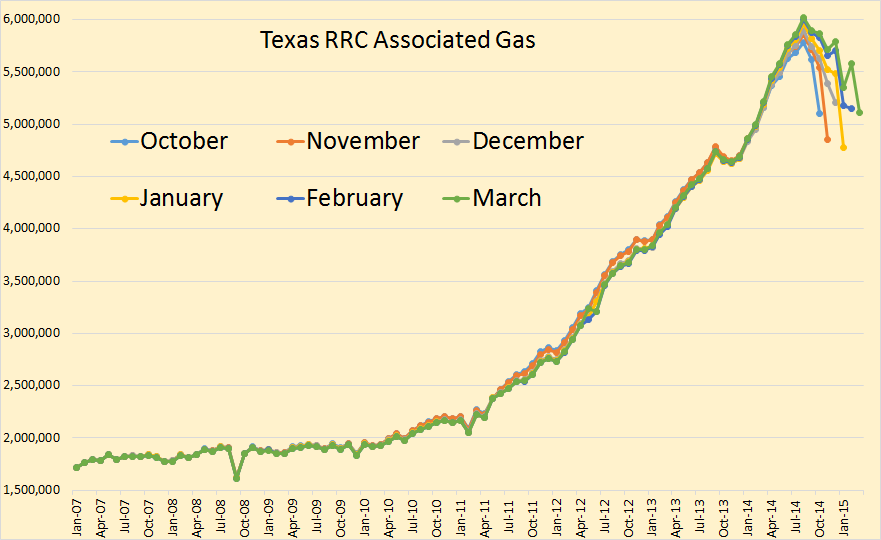

Texas associated gas has been increasing but will now likely plateau along with oil.

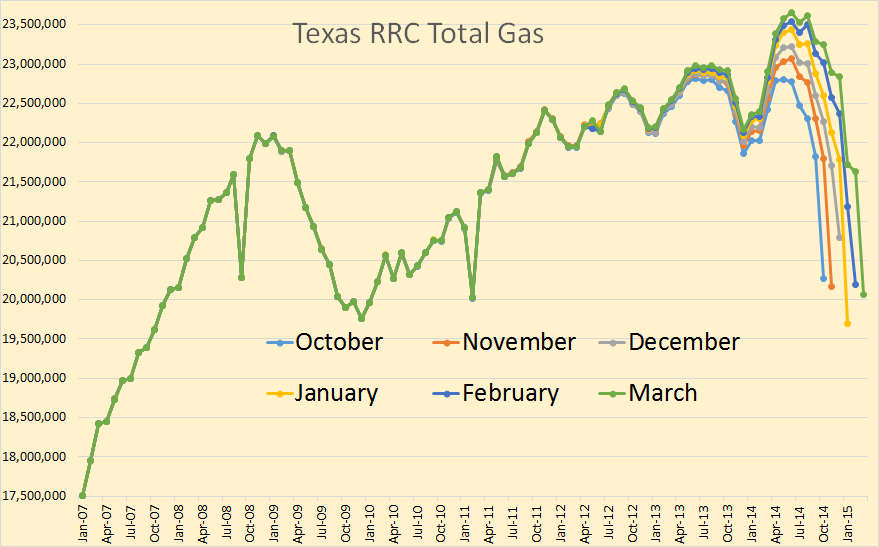

Texas total gas in March comes in above January but well below December.

And Dean’s algorithm has Texas total gas peaking, so far, in December.

Art Burman Oil Prices Will Fall: A Lesson in Gravity

The oil price collapse is not over yet. It is more likely that Brent price could fall back into the mid-$50 range than that it will continue to rise toward $70 per barrel.

That is because oil prices have risen based on sentiment alone. The fundamentals of supply and demand indicate a dismal reality: oil prices will fall and may fall hard in the near term.

David Archibald Thorium: the last great opportunity of the industrial age

It is a significant fact that half the protein the world eats has its origin in fossil fuels. We are all aware of the green revolution that, amongst other things, saw dwarf strains of wheat increase yields by a couple of hundred percent. There was another revolution in agriculture sixty years prior to the green revolution. That was the development of the Haber-Bosch process of combining hydrogen and nitrogen to produce nitrogenous fertiliser.

The plants that produce that fertiliser, the source of half of the protein we eat, run on natural gas or coal. One day these fossil fuels will run out. Does that mean that half of our population starves? It does if we don’t have a way of producing nitrogenous fertilisers cheaply using something other than natural gas or coal.

And it won’t be sunbeams or wisps of the wind that will keep people fed. Those things barely pay for themselves, if that. Take the case of the Ivanpah solar facility in California built at a cost of $2.2 billion. Rated at 392 MW, Ivanpah is a near 20-fold scale up from the previous largest solar thermal facility of 20 MW in Spain. Despite all the engineering that went into the design of Ivanpah, it operated at least 40% below design in 2014.

Shell’s Arctic voyage marks beginning of peak oil era

Although, Mr Simmons was perhaps wrong in focusing on a potential collapse in Saudi Arabia’s oil production he was right in warning about the dangers of “Peak Oil” but too early in predicting its onset. That time is now upon us. Despite, oil prices being forced lower over the last six months the world is entering into a “peak oil” scenario whereby the cost of a barrel could feasibly quadruple to around $200 per barrel over the next 10 years.

And finally a report from the Financial Review that tells it like it is:

BHP Billiton’s Tim Cutt says ‘staggering’ oil discovery shortage trend risks oil price spike

But in the last two decades, the industry has been finding less than half the amount it has consumed each year. Current consumption is running at over 30 billion barrels on an annual basis.

“In the past four years discoveries were less than 10 billion barrels per year and in 2014 they amounted to less than six,” Mr Cutt said.

___________________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com .

569 responses to “Texas RRC March Production Data”

And it won’t be sunbeams or wisps of the wind that will keep people fed.

I’m pretty sure sunbeams are what keep us fed.

EDIT: Although splitting molecular nitrogen into a form that is useful to plants is a high energy operation, the total energy involved is small compared to total energy required to grow a crop.

As usual in biology, the real problem is information, not energy. Nitrogen fixing requires highly focused energy in a single process, so the system has to “know” how to do that. But not a lot of energy is required from a global point of view.

Hi Ilamb’ed

Back in 2009 I asked the International Fertiliser people to check an estimate that about 5% of global methane went to make nitrogen fertiliser – with China making most of their’s as urea from coal. They could not give an accurate figure but thought that must be pretty close.

I’m surprised to hear the number is so high, but I think Wind should be able to keep up the slack.

Thanks Ron. For more details about the underlying methodology see here:

https://sites.google.com/site/deanfantazzini/nowcasting-texas-rrc-oil-and-gas-data-ongoing-project

Thanks Dean, I have added the link to the post.

So, am I correct that December 2014 looks to be the peak, with Feb and Mar of 2015 slightly lower and January 15 lower still due possibly to weather issues?

Yes, I think January will be the highest month for shale production overall. Weather hardly played any role at all this year in oil production, even in North Dakota.

Hi shallow sand

Dean’s estimates are excellent, to my eye Texas c+c output has been flat Dec to Mar.

Hi Dennis,

here the last 6 months corrected:

Oct 2014 3281621

Nov 2014 3342100

Dec 2014 3387371

Jan 2015 3265784

Feb 2015 3343918

Mar 2015 3355709

Hi Dean,

Thanks, was there much change in your estimate over the last couple of months and do your estimates tend to creep higher over time? For example how has your Oct 2014 estimate of Texas C+C output changed over the last 6 months?

it is 3 months that I have (finally) started using the average correcting factors, so that it is too early to say. I would say that after some initial variation the values start to converge.

Anyway, the values for October 2014 estimated in Jan2015, Feb2015 and March2015 with the average corrections are reported below (C+C):

Oct 2014 3235645

Oct 2014 3285867

Oct 2014 3281621

Here is the data with Dean’s adjustment.

All of the green environmentalists in Seattle strapped their kayaks to the roofs of their Outbacks and Xterras, headed down to the Shilshole Bay Marina, kayaked on down to where the Shell rigging is parked in Elliot Bay and raised cane because an oil company is moving equipment to Alaska to explore for oil. The horror, an oil company floats equipment on the ocean and the nature lovers in and around Seattle have a cat.

Next thing you know, the green crew will want to change the name of Black Diamond, Washington to something like Sun Village or some other more eco-friendly name. Coal doesn’t fit into the scheme of things for the green nutjobs.

Looking at a record low temperature out in my neck of the woods here in the real world. Climate change is whimsical, very unpredictable, you just never know what will happen when the weather doesn’t cooperate with global warming.

Weather is is not climate and local weather varies greatly, sometime setting records in either direction irrespective of global warming. This means absolutely nothing except to global warming deniers who don’t know the difference between weather and climate.

Hot, humid climates

Humid climates, mild winters

Humid climates, cold winters

Dry climates

Cold climates

Geography will do the work of which climate is where.

I suggest we run an experiment. Let’s remove the polar sea ice and see what that perturbation does to this complex nonlinear dynamic system. We can then use our observations to refine our models. What could possibly go wrong?

SW,

Taking data now. Experiment in operation. Name is Operation Maui North.

Can the Inuit play ukuleles and wear grass skirts?

“Looking at a record low temperature out in my neck of the woods here in the real world”

Maybe you’re not in the real world, where it’s called “global warming”, not “my neck of the woods warming”.

This was Fairbanks, Alaska, at about 7 PM PDT, last night.

Fairbanks, AK

77.7 °F

Feels Like 77 °F

86 degrees by Fri.

wunderground.com

Right now, Fairbanks and my town in NorCal are at the same temperature.

Laytonville, CA 95454

Monday 9:00 AM

Cloudy

39.7456° N,

54

°F | °C

Fairbanks, AK

Monday 8:00 AM

Mostly Sunny

64.8436° N,

54

°F | °C

On May 12, 2015, a temperature of 80.1°F (or 26.7°C) was recorded in the north of Canada, at a location just north of latitude 63°N.

Below a forecast for May 23, 2015, showing temperatures in Alaska and neighboring parts of Canada that are 36°F (20°C) higher than they used to be (1979-2000 baseline).

The image below shows that temperatures as high as 30.2°C (86.36°F) are forecast for Alaska for May 23, 2015, along the path of the Yukon River, at a latitude of ~66 degrees North (65.98°N)

http://arctic-news.blogspot.de/2015/05/mackenzie-river-warming.html

PIOMAS already has the Arctic Ocean ice volume headed downward from the winter peak.

Here the temperatures are all over the place (latitude 40.7). Highs vary from the 60’s to the 80’s and lows have been ranging from near freezing to the 60’s, oscillating back and forth. One day this month had a high around 80 and a low in the 30’s.

So much for temperate zone stability. Too bad we can’t tap into that energy differential (other than wind).

Here´s a map prepared using the LOTI data set. The referenced web page is included in the map, the software you´ll find in that site allows you to prepare your own maps if you so desire. This beats the endless banter about weather in this or that place.

That red-orange color along the Equator in the Pacific, on Fernando’s map, is El Nino saying Hello.

I may be wrong as wrong can get but I am convinced Ronald is MUCH smarter than many of his posts seem to indicate. I used to refer to him as our resident court jester.

Sometimes he reverts to that role.

@ Art Berman sez:

Much of US petro extraction is hedged, the worth of the hedges skyrocketed as crude prices collapsed beginning last summer. Right now, the hedging counterparties are striving to reduce their exposure, they are doing so by bidding futures contracts. Once the hedges expire the driving force behind the current rally will vanish … oil prices will fall.

90% of fuel use is non-remunerative: it is motorists driving in aimless circles from gas station to gas station = lifestyle. Driving the car does not pay for the car, nor does it pay for the fuel. What pays is debt and lots of it. Underway is the breakdown of the credit system (seen in other venues besides fuel prices): the numbers have become too large for the marginal end users to afford.

The marginal end users are drivers in Japan, China, Russia, Greece, Syria, Egypt, Portugal, Argentina, etc. Also not in labor force- or on food stamps in US.

The end users must borrow in order to retire the drillers’ debts; at the same time, in order to reduce the cost of fuel price hedges the drillers and their ‘investors’ are loading up firms with even more debt … which cannot be retired by the end users. Enlightened self-interest has not only become non-functional but perverse.

Ultimately, the oil price will reflect actual return on its use rather than customers’ access to credit. Because that number is small or negative the target price for petroleum is likely to be small … or very near zero. Sadly, the inexpensive to extract petro resources are long gone: there are likely to be minuscule amounts of -$10/barrel crude. At the same time, to end users that $10 crude will be like $150 crude is to us, today.

We had fun the cocaine party is over.

steve from virginia says:

This is another one of those empirical claims which departs significantly from reality.

http://i.imgur.com/lGAgByJ.jpg

Thanks for this link Glenn. I am saving it for possible future use in a post.

I don’t quite get the non remunerative stuff either.

In the 1950s families went for Sunday afternoon drives. I pretty much don’t think that happens any more. At all.

People in NYC significantly don’t own cars. So they don’t go for drives anywhere.

People around Evanston, Wyoming drive from their ranch or farm into Walmart to pick up groceries and People magazine.

Definitions. Urban is 1500 people, apparently. A “small town America” locale of 1500 people is called “urban”, and oddly there doesn’t seem to be a per square mile addition to that.

With that definition, which is not helpful for oil consumption thinking, 80% of America is “urban”.

The contrary way to think about this is . . . 80% of America is already urban. There are no more significant gains to be made urbanizing people to reduce oil consumption.

Except that your typical “urban center” in America is empty, as this view of Tulsa OK shows

https://www.google.de/maps/place/Tulsa,+OK,+USA/@36.1514167,-95.9903664,2638m/data=!3m1!1e3!4m2!3m1!1s0x87b692b8ddd12e8f:0xe76910c81bd96af7!6m1!1e1

Compare this to Stuttgart, Germany.

https://www.google.de/maps/place/Stuttgart/@48.7739936,9.1667978,2111m/data=!3m1!1e3!4m2!3m1!1s0x4799db34c1ad8fd3:0x79d5c11c7791cfe4!6m1!1e1

No parking lots!

And as a result, no driving around in circles.

What is even more important to reduce driving is zoning laws that allow mixed use neighborhoods. Americans spend most of their lives pointlessly driving around and around a triangle connecting the suburb where they live, the shopping mall where the buy things and the industrial park where they work.

All this driving is in no way productive or or even useful. It is the result of 60 years of disastrously ill advised urban planning.

The solution is simple. Reduce or eliminate the percentage of the right of ways dedicated to private cars and build mixed use neighborhoods on the downtown parking lots. Since nearly all American cities suffer from a huge overcapacity of urban roads and parking lots, the cost is zero

Around here parking lots tend to be underground. The spaces are small, it encourages smaller vehicles. Some parking lots won’t allow SUVs because they have a 2 meter clearance restriction. I have everything within walking distance, the supermarket delivers our shopping basket to the front door for 4 euros.

There are neighborhoods built for foreigners about 20 km from here which tend to imitate American style housing areas, with larger lots, swimming pools, etc. The American copy cats seem to be popular with British, Germans and Norwegians.

Pleasure driving is not part of my lifestyle anymore but a WHOLE LOT of people still do a lot of driving for trivial reasons. I know people who are retired that drive ten thousand miles or more a year. Some people I know make four or five trips a week to the store when one trip would be more than adequate. I know at least four people who drive their kids to school and go back again to pick them up even though a school bus runs directly past their homes.

There is a student parking lot with well over a hundred cars in it every day at our local county high school which has only twelve hundred students enrolled nine thru twelve. Only the juniors and seniors are old enough to get drivers licenses.

Non renumerative in this case is simple as simple can be-unless I am mistaken. It means the driving is paid for out of disposable income rather than generating earnings. When I haul fertilizer on my farm truck that is remunerative.

When I drive it over to the neighbors to go fishing that is non remunerative. But thats only a two mile round trip.

You could make an argument that driving to work as an employee is remunerative in that it allows you to have a job. But if you walked to the same job you would have more disposable income.

Long walk.

Besides which putting labels on what people want to do is not useful. They will continue to want to do it.

If Chinese consumption is getting in the way of that, why should Chinese non remunerative consumption be permitted to eliminate American non remunerative consumption?

No one has the right to tell people what they can do, except by military force. Price won’t do it since money is printed. And any candidate who advocates forcing people to do what they don’t want to do will be booted.

The correct path is victory. If there has to be a victor, correct thinking is that you be it.

Maybe it’s my imagination, but it seems to me that there are still a lot of extra-slow drivers going nowhere fast on Sundays.

Glen,

Interesting charts. I notice this is from 2004. Any chance of a post 2008 chart for a comparison. Oil usage did drop about 4 million barrel per day. It would be interesting to see which segments had the greatest adjustments?

here’s one chart for 2014 that has some of the same data

http://i.imgur.com/Q2v3im4.png

Glenn,

Thanks for all the info. It will take a little time for me to digest it all, but great sources.

here’s another for 2014

http://i.imgur.com/6X0J4go.png

And here’s another from 1981 to 2014

http://i.imgur.com/Xyvk74x.png

Motor gasoline consumed by transportation sector 1949 t 2014

http://i.imgur.com/F7TISE4.png

All this information comes from the EIA’s Annual Energy Review under the section titled “Petroleum and Other Liquids”

Much more information about how petroleum liquids are used in transportation in the United States can be found in the Oakridge National Laboratory Transportation Energy Data Book.

With light vehicles and trucks using the bulk of petroleum liquids, there’s a lot of room for oil use reduction: More efficient vehicles. Less use of vehicles.

How do bets on future oil prices affect the spot price of crude oil?

In any case, if Brent averages $65 for May, the annualized rate of increase in monthly Brent crude oil prices will be about 90%/year from January, 2015 to May, 2015.

China’s oil imports hit an all time record high last month, and US liquids consumption is up by about 4% year over year (early May to early May, four week running average).

On the supply side, as I have frequently noted, post-2005 global CNE (Cumulative Net Exports) depletion marches on.

For example, Saudi Arabia’s estimated net exports last year (about 8.5 MMBPD or so) probably accounted for about one-fourth of the total volume of Global Net Exports of oil (GNE) available to importers other than China & India, and I estimate that Saudi Arabia’s estimated rate of depletion in remaining post-2005 CNE will soon be approaching one percent per month. Last year, I estimate that Saudi Arabia depleted about 9% of their remaining volume of post-2005 CNE (about 0.75% per month depletion rate in 2014).

Hi Jeffrey,

The HL for Saudi Arabia currently shows about a 300 Gb URR, is that what you are using to calculate your cumulative net exports? What are your assumptions for Chinese and Indian C+C consumption and your expectations for the growth rates of their GDP?

Saudi HL below

Est. CNE (Cumulative Net Exports)

Take a multiyear decline in the ECI Ratio (ratio of production to consumption), for a region with declining net exports, and calculate the rate of decline in the ECI Ratio, and calculate the estimated number of years from the net export peak to zero net exports (when ECI Ratio = 1.0).

Est. Post-Net Export Peak CNE = Annual Net Exports at Net Export Peak (Gb/year) X Est. number of years to zero net exports X 0.5 (area under a triangle) less Annual Net Exports at peak

For example, for the Six Country Case History, based on the 1995 to 2002 rate of decline in their ECI Ratio, they would hit zero net exports in 2015, and they had 1.0 Gb/year of annual net exports in 1995 (their combined net export peak).

So, est. post-1995 Six Country CNE were (1.0 Gb/year X 20 years X 0.5) – 1.0 Gb = 9.0 Gb.

The Six Countries hit zero net exports in 12 years, instead of 20 years, and their actual post-1995 CNE were 7.3 Gb, about 80% of the estimate.

Based on the 2005 to 2013 rate of decline Saudi Arabia’s ECI Ratio, their est. post-2005 CNE are on the order of about 60 Gb (total petroleum liquids + other liquids). Note that this is without an actual production decline from 2005 to 2013.

Regarding China & India, as previously discussed, given an ongoing and inevitable decline in Global Net Exports of oil (GNE), unless China & India cut their net imports at the same rate as the rate of decline in GNE, or at as faster rate, it’s a mathematical certainty that rate of decline in ANE (GNE less Chindia’s Net Imports) will exceed the rate of decline in GNE, and the rate of decline in ANE will accelerate with time.

Six Country Data for 1995 to 2002 shown below. Note the huge depletion in post-1995 CNE, that corresponded to the decline in their ECI Ratio, even as production rose slightly from 1995 to 1999.

Assuming Saudi consumption of about 3.1 MMBPD in 2014 (versus 3.0 MMBPD in 2013), the Saudi ECI Ratio fell from 5.8 in 2005 to 3.7 in 2014 (EIA data). Based on current data, Saudi net exports fell from 9.5 MMBPD in 2005 to about 8.5 MMBPD in 2014.

Based on the preliminary 2014 estimates for Saudi Arabia, they would approach zero net exports around the year 2040, and estimated post-2005 CNE would be on the order of 60 Gb, but they had another year of depletion in 2014, and I estimate that Saudi Arabia shipped 9% of their remaining post-2005 CNE in 2014.

Jeff, just some thoughts:

– I have seen your posts about CNE, GNE, ECI, … on Tod and here for years now and still, I can hardly figure out what you really mean. (I am an engineer. I should be capable to understand, so I forced myself to understand your graphs and formula’s. I succeeded, but it took some time.)

– Ask Ron for a guest post where you clearly (for dummies) explain your own private jargon. It will clear things out. It will give you a much broader audience (the audience you diserve,because your message is important!)

– Update your numbers. The 6 country case dates from more than 13 years ago! That is pre-history in terms of peak oil.

– Have you ever thought about making this calculations on natural gas? I think the ECI of natural gas of certain countries nowadays is going down a lot faster than their ECI on oil.

Best regards.

For a full explanation of the methodology, you can search for: Export Capacity Index. One of these days, I’ll update the article.

Of course, the point of the Six Country Case History is that these were the major net exporters (excluding China) that hit or approached zero net exports from 1980 to 2010. Updated data would simply show that they collectively remain large net oil importers. The US and China were special net export case histories, in that they became net importers, even as their production continued to increase.

In regard to understanding what I call “Net Export Math,” I have concluded that even most people who understand it tend to reject the implications, or make qualitative objections to what is a quantitative argument, i.e., cognitive dissonance in action.

In any case, in my opinion there is nothing more important to the global economy than the critical difference between the top line production number for net oil exporters, versus the bottom line rate of depletion in remaining CNE (Cumulative Net Exports).

As noted up the thread, I estimate that Saudi Arabia shipped about 9% of their remaining CNE in 2014.

Jeffrey,

I agree that the ELM perspective/analysis is very useful. Nevertheless….

Verwimp is trying to help you. Don’t dismiss his concerns, or those of others who have tried to give you input. That’s the path to being irrelevant.

The ECI is just a bad ratio. It’s not intuitive, and and it’s misleading in the same way that MPG is misleading* as the number gets larger.

2nd, extrapolating out the ECI (or, perhaps, a better number like “Percent production exported”) is very risky: exporters can eliminate internal price controls and subsidies (as China and India have partially done), and can substitute other things for internal consumption (as KSA is beginning to attempt with solar and NG). That needs to be acknowledged. Really, ELM is a measure of the disconnect of internal country supply & demand from the world market. That disconnect could end.

3rd, the overall global supply vs demand is more important than single country cases. Rising US production is just as important as declining KSA exports. That doesn’t make ELM irrelevant, but it needs to be acknowledged.

*That’s why Europe uses liters per km, or gms per km – “fuel per distance” just makes more sense than “Distance per Fuel”.

I disagree. I chose the production to consumption ratio so that the slope would be in the same direction as declining production, declining net exports and CNE (Cumulative Net Exports) depletion, as shown in the Six Country Case History.

In any case, many things are possible, but given an ongoing production decline in a net oil exporting country, unless they cut their oil consumption at the same rate as the rate of decline in production, or at a faster rate, it’s a mathematical certainty that the resulting net export decline rate will exceed the production decline rate and that the net export decline rate will accelerate with time.

Mr. Brown, you handled that a lot better than I would have.

The internet makes “experts” on everything, out of everybody. It seems it makes oil experts out of folks with very anti-oil agendas. I appreciate your contribution to this…peak oil blog. Your work, and the manner in which you present it, is very relevant.

Mike

I chose the production to consumption ratio so that the slope would be in the same direction as declining production

There’s an easy solution: use “percent production exported”. That will show a decline.

When % of production exported goes from 95% to 90%…that’s not really a big change. But ECI goes from 20 to 10…

Mike,

Jeffrey and I have been discussing these things for a long time.

You might not guess it, but we actually agree on some basics, like that our dependence on imported oil is very, very risky.

Right now, the hedging counterparties are striving to reduce their exposure, they are doing so by bidding futures contracts.

I have roughly the same question as jeffrey. How does “bidding futures contracts” reduce exposure??

Bidding futures contracts? I have never heard that term before, and I have bought and sold futures and once was a commodities broker, albeit was for only a short term. You buy or sell futures contracts but I have never heard of bidding them.

Don’t think HFT is that powerfully into futures yet, but part of the process with equities (and recently bonds) is repeated bids at very high speed with the bid withdrawn when co-located speed sees a sell coming — before the actual transaction computer at the exchange can match the two entities (bid and asked) and complete the transaction.

This of course freezes activity from the seller, like quote stuffing does, until a better moment arrives when the engine allows trading to proceed.

Hey, we are talking futures here not the OTC. (Over The Counter market)

There is no bid-ask in the futures market. One does not bid on futures. You can put in buy or sell orders at a given price and your order does not get executed unless the commodity reaches that price. But only the floor trader, or the computer, has access to those numbers. On the OTC the bid-ask is always listed but not on the NYSE or the futures markets.

But I think you are talking about high speed computer trading. Which is nothing more than legalized front running. It should be illegal but somehow the SEC has not got around to doing that yet.

High Frequency Trading

High-frequency traders typically compete against other HFTs, rather than long-term investors. HFT firms make up the low margins with incredibly high volumes of trades, frequently numbering in the millions. It has been argued that a core incentive in much of the technological development behind high-frequency trading is essentially front running, in which the varying delays in the propagation of orders is taken advantage of by those who have earlier access to information.

Hi steve from virginia,

“90% of fuel use is non-remunerative: it is motorists driving in aimless circles from gas station to gas station = lifestyle. Driving the car does not pay for the car, nor does it pay for the fuel. What pays is debt and lots of it.

The end users must borrow in order to retire the drillers’ debts; at the same time, in order to reduce the cost of fuel price hedges the drillers and their ‘investors’ are loading up firms with even more debt … which cannot be retired by the end users. Enlightened self-interest has not only become non-functional but perverse.”

You pretty much summed up all what you need to know in these two paragraphs 🙂 Great stuff.

All these talk about oil production numbers, supply/demand, break even cost, colored graphs, curves..it is all irrelevant. waste of time. I have visited 3 countries in the last year that are on your list that you mentioned where marginal end users are. Yes, you are very right that they are the one setting the price and these marginal users are broke even if Brent is at $50. But life is still moving over there. I am afraid when marginal oil users start falling off the wagon in urban sprawls of Atlanta, Houston, and Dallas that life in Athens will look like life in Disneyland compared to these megapolises.

Carpooling and EVs.

Horrors.

First of all, if you worked someplace in the old days (not really that long ago), you lived within sight of the place generally. That is what those whistles and clock towers were for, to get you to work on time. So people can do that if things get tough as far as fuel availability.

Also they had electric trolleys in the streets, some going between cities and towns.

And if you have money, call on that autonomous car to pick you up and take you where you want to go. Back in the day we called those taxis.

Like you Nick G, I don’t see oil depletion as a huge problem, merely a force for change.

Of course we now have the mall come to our homes. It’s called the internet and we shop all over the world, then the purchases show up at our doorstep. Sure saves a lot of running around not finding things.

I also phone ahead to see if items I need are in stock or not,

Oh my, times have changed already.

I raised this point in a different thread a few weeks back and was assured the vast efficiency of the logistics and delivery of these items.

But a guy at the office today had a lightbulb, let me say that again, a LIGHTBULB, delivered from China that he had bought on AliExpress. Here you go: http://www.aliexpress.com/wholesale?catId=0&initiative_id=SB_20150519022206&SearchText=lightbulb

Hey, it was only three bucks, and it looked cool. Free shipping. This was delivered in a package about the size of a shoebox, all the way from China. I’m sure the logistics are mind boggling. And I’m sure it all comes over in an air shipping receptacle with a heap of other crap. But somehow that lightbulb has to get from a Chinese factory to a consolidation point, to the airplane, to the airport on another continent, to the hub, to the truck that eventually stops outside the office and the guy runs in with a box with a lightbulb in it. I dunno, Zeppelin. I don’t see how this helps with the oil depletion problem. I’ll continue to throw a lightbulb in the grocery cart during my weekly shopping.

Water shipping is mighty fuel efficient – it’s far more efficient to ship something 6,000 miles in a Panamax container ship, and include it with a truck’s regular route, than it is for you to drive to a local store. If that allows you to reduce your local shopping, then it’s a big saver.

Of course, if you’re determined to shop at the local store every week anyway, then adding a lightbulb doesn’t add much to your car’s fuel consumption.

A single oddball example, however where did the light bulbs in the grocery cart come from? Think about it.

Anyway, all passenger flights carry cargo so the amount of fuel to carry a few ounces extra is probably negligible and since it came direct to the person it probably used less transport energy then the one in the store. One person carrying one small item would outweigh that light bulb package. Or maybe they ate a large meal before boarding.

A nice older lady who serves me occasionally at a nearby fast food restaurant assures me that she will under no circumstances ever give up her job- for the very simple reason that she lives close enough that she can walk to work there.

As things go from bad to worse in terms of gasoline supplies and price I wonder if there will be a trend will develop wherein people who own homes very near to businesses will rent or sell them to people who work there – getting enough of a price premium to make it worthwhile to move themselves.

This could become quite pronounced among retired folks who need the money and could buy or rent elsewhere for less.

If I were a young guy, I would invest in cheap housing close to the ” next big thing” such as the Bakken oil field- understanding that it might be smart to get out early.

But why would anyone pay more rent, and pay all of the costs of moving, when they could just buy a cheap hybrid or EV?

I suppose it could take a while to get one, if oil prices suddenly shoot up. Better to put in your order, and carpool for a few months until it arrives.

Some people can’t afford a new car. Right now you can get a used Prius for 5k. If a oil price spike raises the prices of used hybrids sharply, it will still be cheaper to buy one than to move and pay more rent.

I’m seeing off lease 2011 Nissan Leaf’s for as low as $10k locally. There are a lot of 2011’s in the $12k range.

Bargain.

Using the Tesla Power Wall for value comparison, the battery alone is worth that.

We have had a 2011 Nissan Leaf for 4 years now. It’s a great car. No maintenance to date, except to replace the cabin air filter.

At these low prices, it’s a free car: the money you save on gas will pay for it.

Some numbers from Edmunds, based on 75,000 miles over five years:

Total estimated five year cost for Nissan Leaf EV: $27,000*

Total estimated five year cost for Nissan Versa EV: $32,000

*Without the tax credit, the Nissan would be slightly more expensive

Looking for used 2012 cars, curiously enough a Leaf would be the same cost, $27,000, as a new one (but with no tax credit for used one). A 2012 Versa would be $29,000.

Jeffrey,

I can’t duplicate your numbers. I get:

Nissan Leaf vs Versa

2014 Leaf 2015 Versa Note

True Cost To Own

$23,096 $31,109

Total Cash Price

$26,341 $16,581

Even without the tax credit, the Leaf is $500 cheaper. The cheapest car on the road, with better options than the Versa and much better acceleration.

Nick,

It might help is you specify the style, which I tried to do (when I typed Leaf EV, I meant Leaf SV).

S model is $23K, SV is $27 K, SL is $29K

I suspect that the majority of Leafs sold are SV or SL.

Carmax has 153 used Leafs for sale. 82% of them are SV or SL.

I suspect that the majority of Leafs sold are SV or SL.

That seems very possible to me.

I use the very cheapest model, both for the Leaf and whatever ICE benchmark we might choose (like the Versa), because the heart of these discussions tends to be price: what’s the lowest cost vehicle, what’s the difference in cost, etc. When you buy a new car, you have a choice of model, and if price is your main criterion, you’ll choose the base model.

Jeffrey,

Where are you seeing $27,000 for a 2012 Leaf? There are sixteen 2012 Leafs listed for sale in my area. The most expensive is $15,977 and the least is $11,000, but only three of them are over $13,000.

Total estimated five year cost to own, inclusive of items like depreciation.

Hi Nick,

Rent is NOT necessarily very much or any higher near a lot of jobs, at least in rural areas and small towns. In the small town near where I live there are numerous small cheap houses within a mile or two of most of the stores and restaurants. They rent for only a little more than comparable houses five or ten miles away in less congested areas.

But I think the real key to my scenario is that a whole LOT of people cannot afford to drive at all. Owning even a very cheap car that is seldom driven is apt to run at least three hundred dollars a month if you include insurance tags taxes repairs depreciation fuel and maintenance. Insurance alone costs that much in some places.

Anybody working for fast food wages is not really able to afford a car. If such a person can walk to work and shopping or ride a bike or take a street car etc then they can afford to pay a good bit more for the roof over their head, maybe as much as four or five hundred dollars a month, or even more, extra if they give up driving.

If I still owned a dinky little small house I once lived in in the city I could rent it now for eight fifty. I could rent a better house out in the boonies where I live now for four hundred. Or I could sell it for a hundred g and buy a comparable house in the area I live now for fifty.

Fifty g is a LOT of money, a FORTUNE, if you are hard up. Tens of millions of us are hard up.

Rent is NOT necessarily very much or any higher near a lot of job

But, you were thinking about arbitraging a housing price difference…

the real key to my scenario is that a whole LOT of people cannot afford to drive at all.

PO’s not really the problem. Most of those costs are fixed, so people who can’t afford insurance have already given up their car.

Giving up your car is very hard to do in a rural area. Many people who’ve done so live in urban areas with mass transit.

Senior moments are getting to be common events for me. I got off track talking about people unable to afford to drive at all.

BUT there are many NICE houses in lots of highly desirable close in communities that are occupied by older folks who are retired or soon will retire.

It’s not only the monetary cost of driving- it’s the time and hassle factor as well. A WELL PAID person has to think about five or ten hours a week on the road AVOIDED as being worth an extra five or ten hours of productive work. That is anywhere from a couple of hundred bucks a week on up.

The real arbitrage would turn out to be much more about time than money.Retirees time is worth very little in monetary terms.

.

Hi Nick,

Are you suggesting that the sale of EV, in let’s say Greece as marginal oil user, is skyrocketed since start of the crisis in 2008?

If you are not familiar with car sales stats in Greece, do you have any stats of sale of EV among 50 mil Food stamp strong population in US as Steve quite correctly described as marginal oil users?

If EV is answer to everything then I guess NASCAR fans are safe. They can keep watching their favorites driving in circles in EV’s.

Yes EV’s work beautifully in developing countries like China, where there are 100 million e-bikes.

And they work beautifully for the urban poor (and the middle class and the wealthy) who use EV’s called “trains”.

And, finally, yes there is a new category of car racing with EV’s. It makes sense: EV’s provide incredible acceleration.

Well okey then, next time when I need travel from Atlanta to Dallas I will look for these EV’s called “trains”.

Well, you actually can travel via Amtrak between Atlanta and Dallas…but via a somewhat circuitous route.

http://en.wikipedia.org/wiki/Amtrak#/media/File:Amtrak_System_Map.svg

Now, if there were a line between Birmingham, Memphis, and Little Rock, this city pair would be connected more directly. (see linked Amtrak Map)

Or…drive a line from Tuscaloosa to Monroe to Shreveport and connect to the line coming East out of Dallas.

El Paso-Albuquerque-Denver environs seems a logical line as wll.

When liquid fossil fuels become considerably more scarce, air and auto travel will wither. At that time passenger trains will be more appreciated.

Problem is, if we wait until these facts become manifest and blatantly evident, it will be waaay late in the game to build out train routes. Not impossible, but if our species was adept at long-range planning, we would have seen this coming in 1972 and changed our ways starting back then to adapt to the inevitable future. Watcher’s obsession with hoarding and burning as much oil for us U.S. Americans (and the Brits) in order to keep every possible barrel from being used by those nefarious Chinese is a fascinating and irrelevant mental fetish…the United States ‘wins’ for its peoples’ welfare in the long game by making smart investments to change its energy paradigm well in advance of the dire straights…but we pissed away that idea long ago.

For the love of reason, people need to stop fixating on the freaking Chinese and/or the Castro Brothers and/or any other bogeymen/scapegoats and learn to fixate their attention on altering our own society to adapt to the inevitable future.

Enjoy the slow-motion train wreck that will be the future. Party on, like its Twenty-Ninety-nine!

I know that you can somehow reach Dallas from Atlanta via Kathmandu 🙂

I thought Steve summed it up nicely in just two paragraphs: nature of the oil as “must have lifestyle” commodity as no other commodity, relationship with financial credit that is extended (and pretended) by the finance and the role of marginal buyer. If you understand this you understand why lousy Bakken happened, why the trains with oil will still be rolling from ND, and why the price could easily go down, and why populace in order to afford even these lower prices would have to go into more debt.

oil as “must have lifestyle” commodity

Along with yoga pants?

” Along with yoga pants?”

of course. Everybody got to have pair of Lululemon’s when get on e-bikes and pull RV behind.

RVs?

I hear that in Australia PV is standard on RVs.

Just a matter of time before PV becomes standard on all transportation equipment that’s out in the sun all day, like planes, trains, ships and RVs, reducing fuel consumption by 5 to 10%.

That’s because PV is far cheaper for generating electricity than liquid fuels.

Which brings us back to the nice synergy between renewable energy production, and EV’s, which can buffer the variance of renewables.

it will be waaay late in the game to build out train routes

Yeah, train routes take a long time to build.

It’s too bad – they’re a far superior way to travel. But, EVs will just have to do for most things until we get smarter about this.

Yeah, we lost the electric inter-urbans a while back, somewhere around the time that GM and the oil companies were dismantling urban rail systems and replacing them with buses.

It’ll take a little while to get the oil out of long distance passenger travel – fortunately, that’s a relatively small portion of our oil consumption.

Fortunately people are smart enough to reject all that and recognize that they need not change just to provide China with oil.

Auto racing is a self supporting sport. Nobody goes to the public kitty to get a new track built to run Nascar races.

And for what it is worth- the cars in the parking lot burn MANY times as much gasoline as the cars on the track on race day. This applies equally well to all the non motor sport public events.

Getting forty or fifty thousand or more people together generally results in burning PLENTY of gas.

Just one plane load of people chasing either the sun or the snow for a couple of thousand miles round trip burns more than the Daytona 500 by a substantial margin.

Racing consumes only a minute fraction of the fuel consumed by the spectators of other spectator sports. There is only ONE top level Nascar race per weekend in the season. There are DOZENS of football and baseball games per weekend in season.Ditto college ball, pro basket ball , etc.

So lay off of us long suffering rednecks and pick on the snooty ” more sophisticated than thou” folks who watch football.

Pretty please. LOL

There’s a need for a solar powered vehicle racing circuit. They can have a five mile track with lots of twists and turns. The audience can walk alongside and take close up photos of the drivers as they go about their driving.

That already exists:

http://www.worldsolarchallenge.org/

They aren’t allowed to break speed limits, so it’s not clear what the top speed would be, but there’s no obvious limit. Maybe 200km/hr.

That’s a several day race in Australia, on straight roads in very sunny weather. I propose a racing circuit. Call it the Solar Formula I. A twisting and turning set of circuits in say 20 cities around the world. This will give people a chance to cheer the engineers for a change. The twisty and curvy nature is intended to make vehicle optimization much harder to accomplish. I bet they’ll average 40 kmph.

http://www.cnet.com/news/electric-cars-race-to-the-finish-in-formula-e/

But I want a solar power circuit. We are building a microprocessor controlled miniature. We need to be able to compete with humans using solar powered cars.

You should share more details of your miniature!

“Auto racing is a self supporting sport. Nobody goes to the public kitty to get a new track built to run Nascar races.”

Ummm…

http://jalopnik.com/5972478/70-million-for-nascar-tracks-and-other-surprising-pork-in-the-fiscal-cliff-bill

one of the pork items:

“Extension of a “seven-year cost recovery period for certain motorsports racing track facilities,” tax write-offs which will reportedly benefit NASCAR tracks and other large circuits to the tune of $70 million;”

Missed that one – but compared to the tax money thrown at other spectator sports such as football it is a trivial amount.

Just about EVERY kind of business got a piece of that particular handout.

I should have said Nascar is self supporting in terms of building its own facilities- which is snow white true compared to other sports. I don’t know about other racing venues business models.

And given current day foolishness , some locality or another may soon decide to build a new track gratis for the megamillionaires who own NASCAR.

I wouldn’t be surprised at all but to the best of my knowledge it has not happened YET.I have read many accounts of DIRECT tax money giveaways to other sports – money spent DIRECTLY on building new facilities turned over more or less on a silver platter to team owners.

Once the hedges expire the driving force behind the current rally will vanish … oil prices will fall.

Shale has been contributed the dubious title of “excess supply”. Most seem to think that if shale went away that prices would recover. Prices are now $40 lower than at their high of about $100. That constitutes $270 billion per year in raw material savings for the refining industry. It might cost $20 – $30 billion per year to pump up the shale industry. US refiners could put that in some budget named “Capital Investment Recovery”. Not many would notice!

re: Nitrogen fertilizer costs.

As my wife exclaimed the other day, “Compost, I need more compost. I have to have more compost”!! (I just about pissed myself she was serious and emphatic).

We are really, or really seem to be, reaching limits in so many ways these days. Buckle up and double down, compadres. It’s very interesting outside.

regards

Ilambiquated, Paulo,

This paper on production of ammonia from nitrogen using light, which is what photosynthesis does, caught my eye at the beginning of February:

Photochemical Nitrogen Conversion to Ammonia in Ambient Conditions with FeMoS-chalcogel, Bannerjee et al., Journal of the American Chemical Society.

The chalcogel has large surface area and is black, and “goes and goes and goes and still works.” The article at EurekAlert! says that the “FeMoS co-factor in the chalcogel binds to nitrogen [N2 I guess] and reduces it by eight electrons, making two ammonia molecules and one hydrogen molecule.” The conditions are ambient temperature and pressure.

They ran tests to make sure the ammonia was coming from the nitrogen they were feeding the chalcogel.

I recall reading one of the researchers saying it was weird to watch this thing producing ammonia when they turn the nitrogen flow on. The reaction is much slower than nitrogenase so they’re trying to speed it up. If they succeed the implications, as the saying goes, are astounding.

The researchers are all at Northwestern, and the JAC is as reputable a journal as there is. I’ve seen no response to the paper.

http://tech.slashdot.org/story/15/05/16/1745251/the-economic-consequences-of-self-driving-trucks

Just think, 4000+ 25 ton Robot water hauling trucks pounding North Dakota pavement. Better ND than New Jersey.

Someone mention that Texas collected 1 Billion from LTO production and had 4 Billion of Road damage. Anyone able to confirm similar numbers.

Plateau is a common configuration of a mesa, too.

Previously there were some questions on water and primary production in unconventional reservoirs, I’ll try and answer them from my interpretation and understanding. In the Eagle Ford, the initial Sw is somewhere between 10-20%, though I’m not sure if this is below or above Swirr. In terms of production method, in the oil window its solution-gas drive and in the gas window its initially gas expansion followed by gas desorption.

Hot dog, MBP, gotcha! So, is there enough bound connate water in these dense shale “containers”to hypothetically produce a well for 25 years making 150 BWPD with a 10% OWR?

Mike

Mike, the water saturation can range as high as 50 % in some layers. As the pressure drops the water expands and begins to flow. Plus some of this water is moveable water. As the water moves towards the hydraulic fractures it alters saturation, the higher water saturation allows the water to flow much easier.

I think the wells with higher water cut are simply producing these high water saturation layers. But the ones with anomalous water cuts are simply linked or plumbed to water bearing zones. The lower three forks has quite a bit of water.

What does this mean? Does this mean if the Eagle Ford produces 1 million bpd it also produces 150K bpd of water?

The assumption in decline curve analysis of shale resources is that wells will produce for 25 years; ie., the long fat tail syndrome. 75% of the EUR gets recovered, I believe, in the first 5 years of the well’s life, then what? In my pea brain I think of the reservoir capacity in this dense, low permeable shale as more or less being limited to the area around the well bore than can be hydraulically frac’ed. Will there be sufficient formation water, and energy to allow recovery of the remaining 25% by artificial lift?

Mike, it’s just a definition. The pressure drops as the reservoir is produced, but it never reaches zero. The key is to focus on the rate. What’s the rate you assume at abandonment? Is that rate good enough to pump a well making 50 % water?

Heyzeus, Fernando, I understand that reservoir pressure never reaches zero and I understand very well, thank you, how water moves, just not so much in shale as dense as concrete. I’ve seen a dozen full hole cores of the Eagle Ford; it is a stinking miracle that anything can be wrung out of it.

I don’t think you know for sure there are “layers” of higher water saturation in this shale stuff and as I have said twice now, there are no water bearing zones above or below the Eagle Ford. “Linked” implies vertical permeability; I don’t think so, not in shale. Perhaps I am wrong.

I am trying to understand IF there will be sufficient connate water in these little hydraulically frac’ed ultra tight shale “containers” to produce 75% WOR for 18 more years. You raised the very question yourself with your jet pump lecture. I don’t envision the hydraulically frac’ed area around a horizontal lateral in dense shale as containing 62,000 juicy acre feet of reservoir capacity with an underlying oil/water contact like we’d see in the Frio in the GOM; I see the area drained around the lateral as being a “closed system,” for lack of a better word.

I should not have brought it up; its a lofty conceptual problem I have that relates to this notion that these shale wells will produce for 25 years to recover imaginary EUR. I’ll figure it out, thanks.

Mike

Mike, I find the Bakken a more interesting case study (because it’s oil). The core data shows there are variable saturations. It changes in both the vertical and horizontal direction, so it’s hard to generalize.

I realize it’s hard to envision anything coming in or out of a well drainage volume, but there are exceptions. Otherwise how do we explain wells making 80 % brine?

Regarding the recovery, that’s fairly simple, the key is the economic limit. And this is why I’ve commented several times the OPEX needs to be estimated using constant plus variable equation. And this is also why the well design has to consider what happens in years 5 to 25. A marginal well isn’t going to survive with those down times and interventions they seem to have.

I think they’ll do ok, they’ll figure out how to cut costs, make deals to reduce royalties, and oil prices will rise. That seems to be the way it works.

Fernando. They may be able to cut costs in the Bakken, and I am sure they are trying now. However, the Bakken is in one of the most remote locations in the lower 48, with one of the worst climates. Labor is typically a major operational expense. They have to pay more there per hour for labor than most other places, although I do hear they have been successful in cutting fringe benefits, like moving costs, airfare for home visits, etc.

As for royalties, I do not think there will be much success in cutting those, at least with the private landowners. From my reading, royalties are 12.5-20% in the Bakken, which is already better than places like TX and OK, where I have read 25% is common in LTO leases.

I am beginning to agree with Mike that in a few years many LTO leases will be sold to operators who specialize in operating marginal wells. I suspicion these wells will finally settle out in the 5-15 barrel per day range, which will make them uneconomic for firms with high G & A expenses. OPEX will range from $25-$100 per barrel for the marginal well operators who buy these wells, in today’s dollars. 5 barrel and less, poor well design or high water cut will be the wells on the higher end, and will be uneconomic, absent high oil prices.

The exception to my prediction would be some kind of secondary recovery method.

Based on my review of some lease operating statements for 5-7 year old Bakken wells, $9,000-$12,000 per month in OPEX was common for a well having no down hole or other issues. These wells were producing about 1000 barrels of total fluid per month, with about half being oil.

As I typed previously, pump changes looked to be about $30K and tubing leaks looked to run in the $60-70K range, but as Mike noted, those costs can vary greatly.

Probably look at two failures per year on average, as Mike said. One well I reviewed had 0 failures, one had 4. Low OPEX was $17 per barrel oil, high was $59 per barrel oil. I did not figure in gas sales, that was about 1/2 to 1 mcf of gas sold for each barrel of oil produced.

The wells were on the lower side cumulative wise, from about 95K barrels to 200K barrels in the 5-7 year time span. I guess average is closer to 220-240 for that amount of time.

There were two recent refracked wells, each cost about $3.5 million, each boosted well production from 20-30 barrel range to about 350 bopd for the first two months.

Shallow Sand Wrote:

“There were two recent refracked wells, each cost about $3.5 million, each boosted well production from 20-30 barrel range to about 350 bopd for the first two months.”

Great! All we need is the Price of Oil to rise to about $160 bbl to break even on that $3.5M investment! 🙂

Decades ago the sarcastic comment about investment fraud was: “Do you want to buy the Brooklyn bridge?” . Perhaps in the next decade it will be replaced with “Do you want to buy a shale oil well?”” 🙂

Bakken doesn’t drill for LTO for profit. It drills in Wall street looking to shake down gullible investors desperately chasing alpha.

Hi Shallow sands,

What do you think of Fernando’s fixed plus variable OPEX?

Maybe monthly OPEX= $12,000+$10*o,

where o is monthly output and I assume 1 barrel of water for every barrel of oil?

For 500 b/d (peak output) we would have $164k for monthly OPEX or $11/b in OPEX.

When well output falls to 20 b/d, OPEX rises to $30/b.

We could make the fixed portion higher and the variable portion lower, if you would prefer a 6 to 1 ratio in OPEX from low to high output.

Dennis. I think OPEX would be lower than $11 at a 500 rate. Recently re fracked wells I reviewed were in that ballpark, maybe a little lower and OPEX was $2-3 per barrel of oil.

Two 3/13 completions that averaged 140 barrels of oil per day each for previous year were in $10-$11 per barrel range re OPEX.

Main variables concern water disposal, pump change and tubing leaks. Probably plug in $100,000 per year for one pump change and one tubing leak per year per well. I will look at water disposal charges and see if I can come up with a per barrel cost, many not have time till late tonight to do, just hitting this site a few minutes while I am waiting.

Again, very small sample that I reviewed. Will keep looking for more lease operating statements, but those are hard to come by in public online forums.

Hi Shallowsands,

Thanks. I was using $12,000/ month with a $3000/month charge for maintenance ($9000/month for monthly running costs, disposal, electricity and fuel, and labor). So you are thinking more like $18,000 per month fixed with a lower variable cost such as $3* monthly output, this would give us $4/b at 500 b/d and $33.60/b for 20 b/d.

Note that I have rolled the $100,000 per year into the $18,000 / month fixed cost, so

$100,000/12=$8333/month is set aside for future well repairs (pumps and tubes), and $9667 is just another portion of fixed monthly cost, essentially this just treats ongoing maintenance as a part of OPEX.

Dennis, I think the one thing you should try to incorporate, (maybe you already are) is an average cost per barrel for water disposal. It appears to me that wells that go much past 1/1 oil to water in later years (5+) will be challenged economically at today’s oil prices.

For example, one well I reviewed produced over 1,000 barrels of water per month compared to just about 400 barrels per month of oil, if I recall correctly. This added quite a bit to $ per barrel.

Hope this helps.

Hi Shallow sands,

Thanks for the suggestion. In order to simplify the model I use averages, so I am just using a function of monthly output times a varible faactor at this point where the water disposal cost is rolled in using the assumption of 1 bw per bo. the best I could do is find the water output curve of the average well and plug in different numbers for water cost and oil cost.

I think fernando’s initial guess was 10,000+5*o+5*w is OPEX with o=oil in b/month and w= water in b/month.

Fernando, most of the Eagle Ford is oil also.

I’ve drilled horizontal, fractured carbonates in my career. As depletion set in there was insufficient reservoir energy, or connate water to produce those wells economically. They would pump off. As they got older we put them on time clocks and eventually they were shut in for days at a time allowing for fracture and wellbore replenishment to occur. Those wells would then pump off in 24 hours again and the cycle repeated. It is something along those lines that concerns me about these very dense shale wells with 25 year EUR estimates. It has nothing to do with economics and everything to do with understanding formation water.

Marginal wells can be managed with high WOR; give me a 200 BTFPD with a 15% OWR and I’ll make money till the cows come home. Offer me a low fluid entry well that makes 30 BTFPD with a 15% OWR, that has to be lifted from a medium radius curve at 9000 ft. TVD, and I’ll say no thanks every time.

Costs can only be reduced so much, for reasons Shallow points out, and he is, of course, correct about royalty under private mineral ownership. Reducing royalty in like pulling teeth.

Mike

I have a small bag with a set of syringes, dope, pliers and a hammer. I have seen my company renegotiate just about anything. In 10 years those royalty owners will be sporting dentures.

By the way, I thought the eagle ford being produced is gas condensate?

No.

Looks like it’s a mix of fluids. Gas condensate to volatile oil to oil…

This may be of interest:

http://repository.tamu.edu/bitstream/handle/1969.1/152773/TIAN-DISSERTATION-2014.pdf?sequence=1&isAllowed=y

I did not read the link.

The windows, or liquid legs in the Eagle Ford are definitive enough to know exactly where you are and what to expect, the sequence is pretty much like you googled. Down regional dip from the liquids there is even a dry gas leg. Its not all gas condensate. That was your question.

Hi Mike,

For the average 2008-2012 Bakken well, 196 kb are recovered in the first 5 years, 262 kb at 10 years, 300 kb at 15 years (17 bo/d at month 180), and 327 kb at 20 years (10 bo/d at month 240). At 26 years and output of 6 bo/d the well is abandoned at 344 kb.

About 57% of EUR has been produced at 5 years, if we assume abandonment at 10 b/d, EUR is only 327 kb and 60% of EUR is produced at year 5 in this case.

For the Eagle Ford the EUR is only 206 kb with well abandoned at 17 years ( at 5 bo/d), at 5 years cumulative output is 165 kb or 80% of EUR, so your description applies well to the Eagle Ford average well, but no all that well for the average Bakken well.

On connate water:

With your example to make 150 bwpd you would need somewhere in excess of 1 mmbw over a 25 year life. That would be about 100% RF for water in a well that has a URR of 400 mbo. Unless you find a way to waterflood, there is probably half of that water available to actual flow. Knowing the clay content of the rock would help with determining the % bound water. Also I have no idea of the wettability of the Eagle Ford. Without and detailed information, I’d say you’d get probably half of that water out under primary.

Watcher:

The OWR will change over time. Part of the Sw is bound water held by capillary pressure and will never be moveable. Also, as water cut increases, the relative perm to water increase so if flows easier. If it is something you are interest in learning about, there is a good article on it here:

http://www.ihrdc.com/els/ipims-demo/t26/offline_IPIMS_s23560/resources/data/G4108.htm

Part of it is from Dr. George Asquith, one of the brightest log interpreters I’ve ever met. It should help you, or anyone else, understand (one of the reasons) why it is harder for a oil reservoir to produce oil over time.

Thank you very much, sir. I am actually familiar with Dr. Asquith and might have remembered to look for an answer thru him. The volume of recoverable bound water from a typical shale well, and the absence of significant water sources above or below the EF, has always bugged me about the economics of recovering those long tailed EUR’s.

Mike

Reading American Oil

& Gas Reporter article on all of the horizontal plays in OK with a lot of quotes from the “big boys” like Continental and Newfield. Then at the end some quotes from a private long time OK operator that has been drilling some 5,000′ laterals in the Cleveland and Tonkawa. “I don’t know how well we can produce laterals later in life. All the traditional technology is based on vertical wells and gravity separation where sand settles to the bottom. There is no way to diagnose those conditions in a lateral well bore. You can have a coffee can of sand block the lateral and you don’t know whether you are producing 10 percent or 90 percent of the lateral. Trying to clean out horizontal sections and lifting can be real challenges. The earliest horizontal wells were dry gas in the Barnett. The liquids rich are a different ball game. We have been doing this for only 10 years, so this is still a very young technology.”.

This is what has crossed my mind. Is it off base? Interesting that this doesn’t come from the “big boys” but from a smaller long time private company.

No, shallow, it is not off base. We have many years of historical perspective on horizontal drainage mechanisms and recovery rates in conventional reservoirs, only 7-8 years in tight, low permeability mudstone like the Eagle Ford and Bakken. I think the shale industry is applying EUR type curves to something we don’t really know how is going to work from year 7-9, out. I have always been concerned about this and have therefore always questioned shale industry EUR’s. I have said as much here many times. The recovery factors and the URR the shale industry touts is bunk.

We now have, in an abstract, general way shown, above, that there may not be enough bound, connate water in this shale for wells to produce economically to the magical 25 year mark. I worry about proppant embedment and closure. You have brought up another issue: solids, frac sand, clays, shale collapse; all that stuff entering a horizontal lateral is a very difficult, costly fix, that can, and does, alter the performance and ultimate recovery of a horizontal lateral.

This is very important and seems to be going plumb over the peak oil community’s head, particularly those that are graph and data driven. You have to be IN the oil business, with skin in the game, to know what the data means, if it means anything. You get that, Shallow. People should appreciate your comments here. EUR’s change thru the life of the well and often they can, and do come abruptly to an end.

“I don’t know how well we can produce laterals later in life.”

Exactly.

Thank you, Shallow.

Mike

Mike said:

Well I for one certainly appreciate and can relate to what you and Shallow have to say, maybe because I spent my working life in oil and gas operations and in putting drilling deals together.

Fortunately for me, though, all the working interest is gone, and all that remains is overriding royalty interest, so I don’t have to contend with the many problems you guys do. But nevertheless, I’ve been there and done that, which tends to put a damper on all the pie-in-the-sky visions of those who are in love with theory but lack practical experience.

For me, however, the revolution in big frack jobs and horizontal drilling has been quite a windfall, so my royalty interests dictate I shoud be screaming “drill baby drill” to the top of my lungs. So it’s a mystery to me why I’m so skeptical of these plays. Needless to say, I’m conflicted, not only about the merits of the “shale oil revolution” but about global warming too.

The hands-on experience of those like you and Shallow who are actually “in the business” provides a perspective which is invaluable.

Thank you. I am also a mineral owner. It must work for operators paying all the bills for it to ultimately work for mineral owners.

Mike

Hi Mike,

Isn’t there some experience from the Austin chalk, I thought they used horizontal laterals there, I realize the formation is different, but did they frack those horizontal wells in the Austin chalk?

Wouldn’t someone with experience in that play have a better understanding of the long term problems with horizontal fracked wells?

Using NDIC data for 2008, 2007, 2006, 2005, and 1990 to 2000 wells, I spliced together well profiles out to 23.6 years.

This is not a true well profile, but is based on the assumption that the late years of the average 2008 well will be similar to the late years (years 12-25) of the average 1990 to 2000 well (most of these are horizontal wells). EUR=330 kb

Hi all,

A pretty good review of horizontal drilling (but old, 1992) at link below:

http://www.eia.gov/pub/oil_gas/natural_gas/analysis_publications/drilling_sideways_well_technology/pdf/tr0565.pdf

Based on this paper there were fracked horizontal wells in the Giddings field of the Austin Chalk in Texas.

There were also fracked horizontal wells drilled to the Devonian in the Permian Basin in the 1990s and the early naughties.

All the horizontal wells on the linked map, for instance, were completed in the Devonian at that time.

http://i.imgur.com/AHydx9e.png

Dennis, thanks, interesting. Real quickly looked at RRC PDQ. Take a look at Burleson Co, Giddings (Austin Chalk – 3). Shows many wells still in production, in 2014 oil per day average 3,372, gas 2,440 (BOE 6/1). Looks like Anadarko is a major operator.

Have no idea how many of those are horizontals, may be interesting to look deeper into those.

Maybe Mike can give some information.

Hi Shallow sands,

I couldn’t find the well or operator you referred to, but there are a bunch of wells in Giddings Austin Chalk 3, the following well is in the chart below:

Lease Name: AKIN-FOXFIRE UNIT, Lease No.: 22405

well started production in April 1994 and was abandoned in November 2011 after 17.5 years.

Dennis. I was not referring to a specific well, but production from the entire field per barrel of oil and per boe casinghead gas for 2014, plus indicating that the major operator there at present is Anadarko, which is a large US independent.

I do not know how many of those wells are horizontals, but if there is a way to find out, one would have a lot of data to review if time permitted.

Hi Shallow sands,

Yes a lot of output from the field, I can’t seem to pull up the completion data, I do not have the skills that Mike has, he probably has access to a bigger data set through a subscription.

Dennis, I am not good a providing links, but google “Horizontal Drilling, What Have We Found?” by Gary S. Swindell, consulting engineer, Dallas, TX, that appeared in the Oil & Gas Journal 3/25/1996.

Some interesting information, one part being that 65% of EUR from US horizontal wells at that time was recovered in the first year, on average.

Also, there were several Bakken horizontal wells drilled in North Dakota in the 1990’s it appears.

Holy schnikes, Dennis; I am graphed out.

The first type curve in the Bakken based on previous “horizontal” wells is likely meaningless because prior to 2008 there was no horizontal lateral + stage frac’ing = miracle thing going on before then. The faster you want to get it out of the ground, IMO, the faster its going to poop out, you know that.

In graph #2, is that well, or wells, plural? If that is a one well unit then that is the Mother of all Chalk wells. Some remedial attempt at something occurred in year 8 and it no worky, after that I can’t tell what the well made. Not much, just for a long time. It’s funny, that. I operate a well that was born the same day I was. I can’t plug it for sentimental reasons, consequently the CUMM PROD is very impressive on the old bastard. We’re both going out together, I say.

Graph #3, same thing. It just produced a long time after year 8-10; as I said probably 3 days a month, which significantly reduces CAPEX and makes almost any well profitable and likely to live to an old age.

Graph #4, is neat but I don’t understand it. If that is a data driven reason to suggest maybe my idea about shale wells reaching a mid-life crisis, I buy it!

Mike

Hi Mike,

I am not sure which is graph #4,

I could not find the number of wells for the leases which started producing before 2005, there used to be a nice map tool that let you find it, but the RRC web page has changed and I can’t figure out how to find the number of wells on the lease. I think you are correct that there are probably 2 or 3 wells on that lease (and you would know better than me).

If graph 4 is the one that shows my Eagle Ford average well profile, that was a standard presentation suggested by Rockman (or he gave me that impression).

He told me of you draw an asymptote to the cumulative well profile with a slope equal to the output in barrels per month when the well is at its economic limit (for the “average” well) that points to your EUR.

In this case I assumed the economic limit was 7 b/d (or 212 b/month) and the EUR of the average Eagle Ford well is about 13 years at 210 kb.

When you look at my silly models for the Eagle Ford, that is the well profile that is used. I do adjust the EUR higher when the model underpredicts actual output by more than 5 %. I used to simply move the entire well profile higher by 1 or 2% to make the model match the data.

A problem is that assumes the EUR of the average well has increased by 1 or 2 %.

I believe that assumption is too optimistic and have recently changed the model where the shape of the well profile changes, with higher output in the early months and lower output in later months, but with overall EUR for the “average” well remaining the same as before (210 kb).

This is my “constant EUR assumption” for the average well. Note however that the constant EUR is very temporary, I also assume that at some point the EUR will start to decrease, but am waiting to see a decrease in the 6 month cumulative of the average well over a 6 month period, before declaring that this has occured.

In the mean time, for the Bakken (where data collection is much easier because they report individual well data, rather than by lease as in Texas), cumulative output for the average well has remained relatively consistent from 2008 to 2012. Then the 12 month cumulative rose over the 2008 to 2012 average in 2013 and 2014.

Initially I raised the EUR of the 2013 and 2014 average well to account for this, with the 2014 well rising to 15% higher than the 2008 to 2012 average well.

In my view it makes more sense to keep assuming the EUR in 2013 and 2014 remains at the 2008-2012 average level, with a new well profile that is higher and steeper in the first 12 months than the 2008 to 2012 average well and with lower output in the later months so that overall EUR remains about the same.

Clearly every well does not have a constant EUR, I am talking about the EUR average of the 2000 to 2500 wells completed in 2013 and 2014.

It is very possible that the new well EUR has started to decrease and possibly the higher EUR in the first 12 months for 2013 and 2014 average wells is an indication that EUR has started to decrease. That assumption seems a bridge too far, maybe even the assumption that EUR has not increased in 2013 and 2014 is too conservative.

Dennis, I don’t think your work is silly; I hope that you don’t believe my antidotal way of simplifying very complicated aspects of a complex business like oil production is silly either. I’ve been at this a long time and have learned to trust my instincts.

I’ve made my point, I hope, about long, fat EUR tails in shale wells. I’m not buying it. I’ve never bought it. I might be wrong. If I am right, then shale economics are even worse than we have been yaking about for years, as is the contribution that unconventional resources will have to our energy future.

One of the problems I have with “modeling” everything is, as I have said, extenuating, unforeseen, shit happens stuff that changes the oil landscape overnight. For instance a ULCC upside down in the Strait of Hormuz. Or, yesterday, a 500 bbl. oil spill on the beaches below my beloved UC Santa Barbara. Modeling what an event like that has on the American public, already angry and mistrustful of the oil industry, is impossible. California wants no frac’ing, no offshore development, no more produced water injected into its subsurface; now this. There may never be another oil well drilled in that state, watch.

Mike

Hi Mike,

I appreciate your real world perspective and it helps a lot in making my models more realistic.

I mostly wanted to explain the well profiles that I use are not the “fat-tailed” hyperbolic well profiles with a “b”=1.4 that are used by some people.

I generally use b<=1.2 and the well profile is switched to exponential decline when the monthly decline rate gets to 0.875% (10% annual decline rate) for the hyperbolic model, typically this happens at about 9 years.

Bottom line, my models are fairly "thin-tailed", I also reduce output to zero when the well output gets to 7 b/d or less (which is fairly conservative), this happens at around 25 years.

Your criticism that we do not know what these wells will produce in the future is correct, a lot will depend in oil prices and politics and there is not a good model for any of that.