The OPEC Monthly Oil Market Report is out with OPEC’s crude oil production numbers for March 2017.

All data is through March 2017 and is in thousand barrels per day.

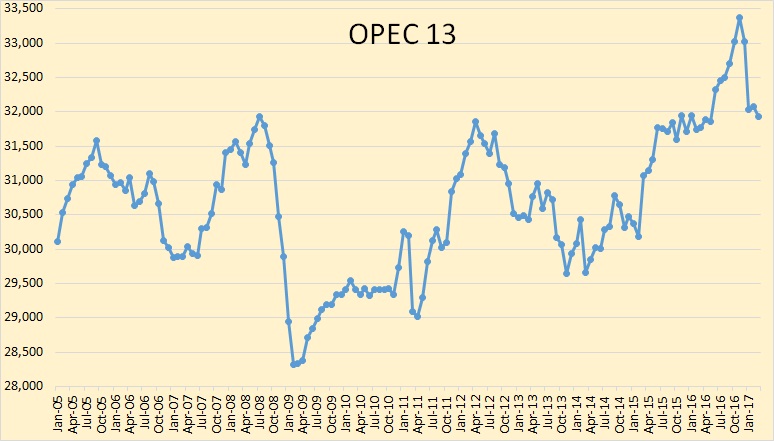

Looking at the above chart it seems obvious what most OPEC nations were doing. They announced in the summer of 2016 that there would likely be quota cuts beginning in 2017. And those cuts would be a percentage of their current production. So everyone began making heroic attempts to increase production by the end of 2016. So now, after everyone who felt that they should cut, has cut, they are right back to the level that they were at before the cuts were proposed.

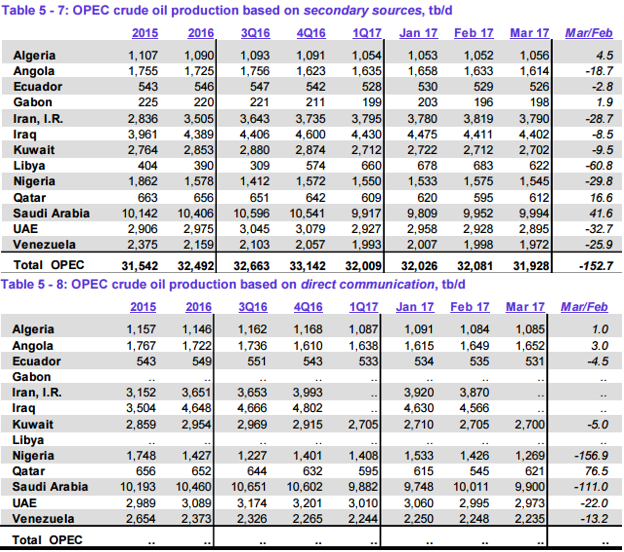

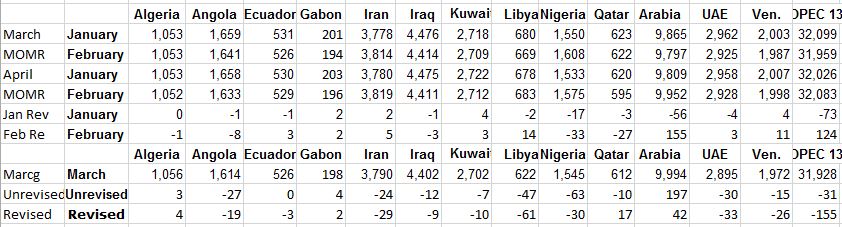

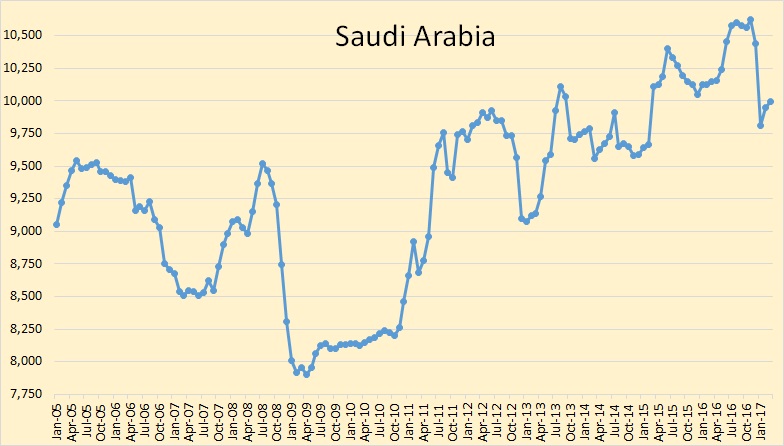

There is always a considerable difference between what the OPEC nations say they are producing and what the “Secondary Sources” say they are producing. The March MOMR had Saudi producing 9,797,000 bpd in February while Saudi said they were producing 10,011,000 bpd. The April MOMR has revised Saudi’s February production up by 155,000 bpd.

This is a snip from one of my Excel spreadsheets. It shows revisions made in the previous two months data by “Secondary Sources”. For instance Saudi Arabia’s January production numbers were revised down by 56,000 bpd while their February production numbers were revised up by 155,000 bp. OPEC 13 Jan. numbers were revised down by 73,000 bpd while their Feb. numbers were revised up by 124,000 bpd.

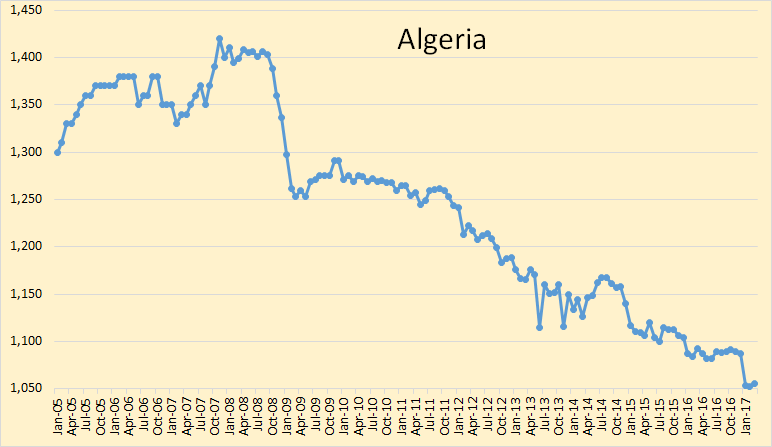

Not much is happening in Algeria. They peaked almost 10 years ago and have been in slow decline ever since.

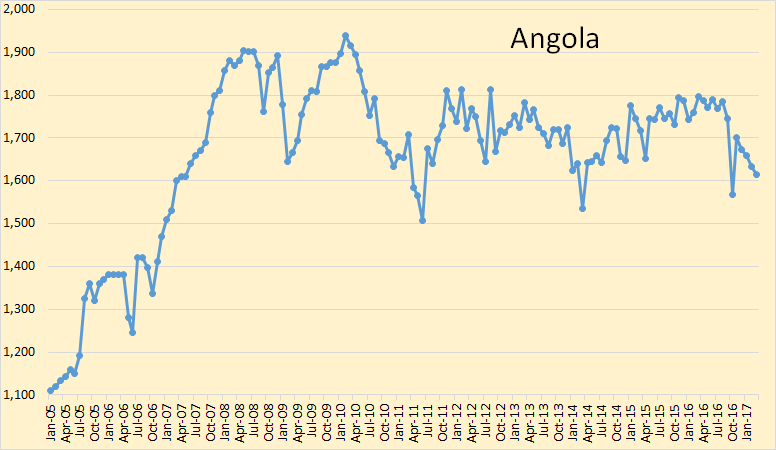

Angola peaked in 2010 but have been holding pretty steady since.

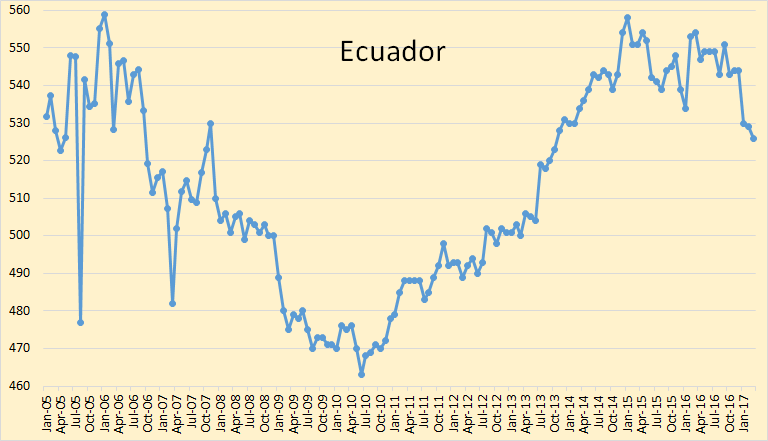

Ecuador peaked in 2015. They will be in a slow decline from now on.

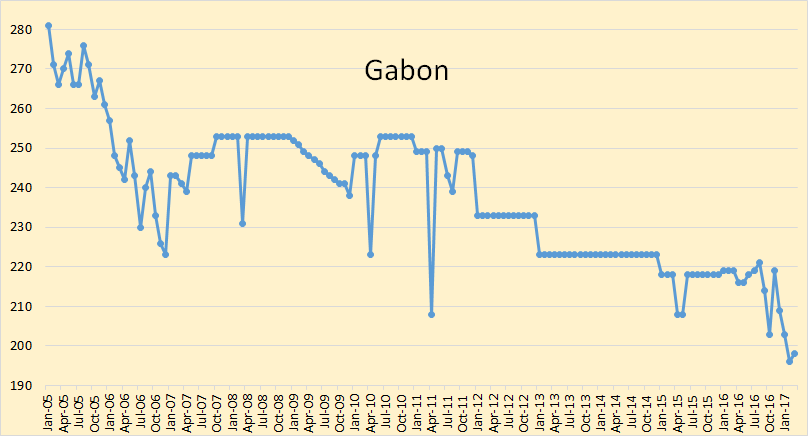

Any change in Gabon crude oil production is too small to make much difference.

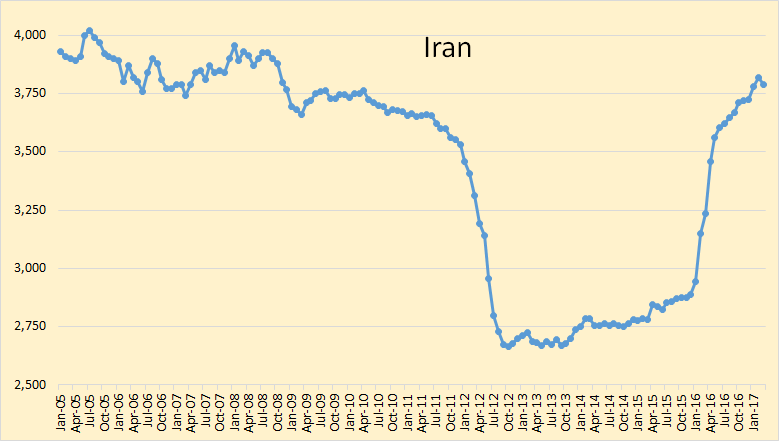

Iran has increased production the last three months, though down slightly in March. However one source says it is a fallacy.

Iran’s Oil Production: Fallacy Or Fallowed

We believe Iranian destocking is being misinterpreted as production, and actual production will decline as the year moves forward.

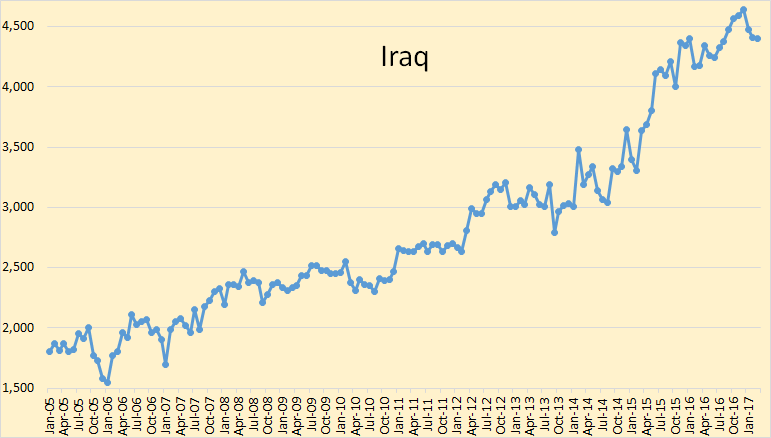

Iraq is down 73,000 bpd from their December peak.

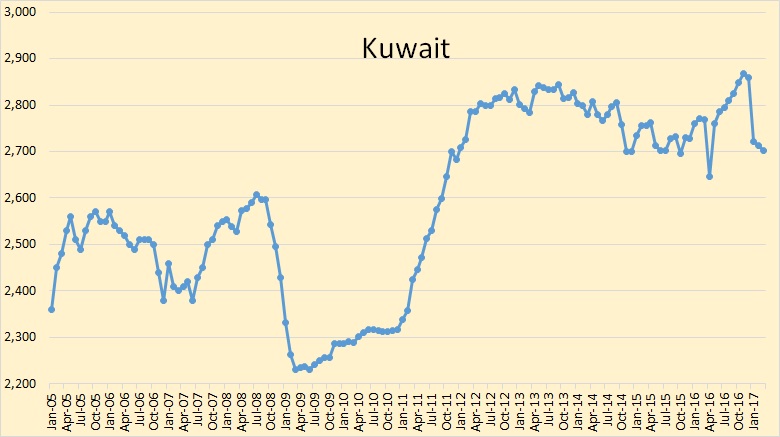

Kuwait is down 166,000 bpd from their November peak. That is about 5.8%.

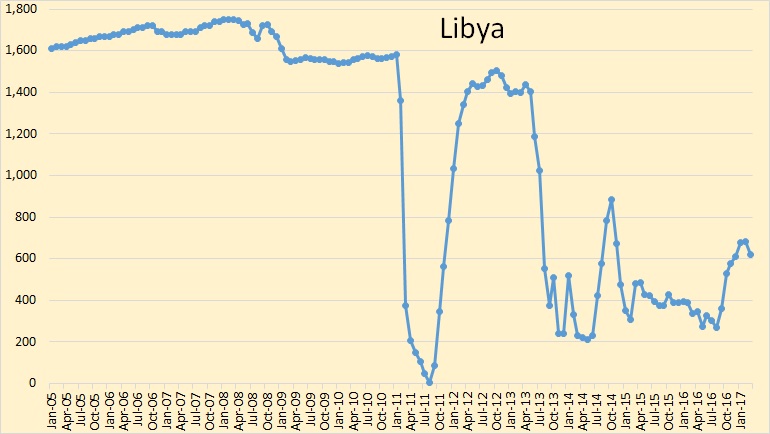

Libya still has problems, and will likely continue to have problems.

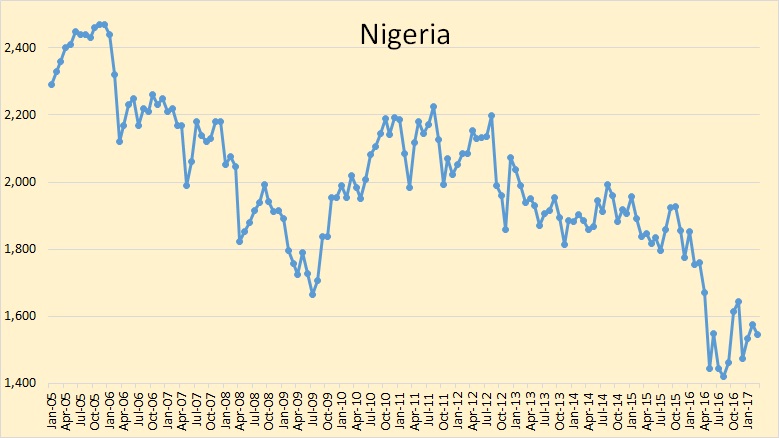

Nigeria and Libya are exempt from quota cuts because of rebel problems. Don’t look for those problems to clear up any way soon.

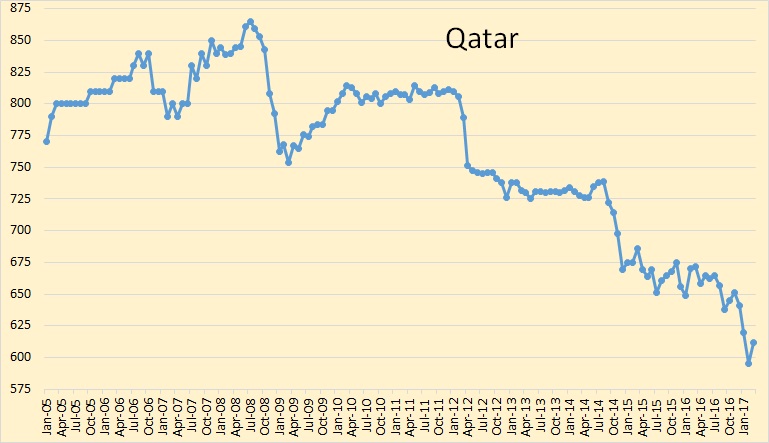

Qatar has been in decline since 2008. Her decline will continue albeit at a very slow pace.

Saudi Arabia cut in January, then stopped cutting. I think this is where we will be for some time unless there is a real shake up in OPEC.

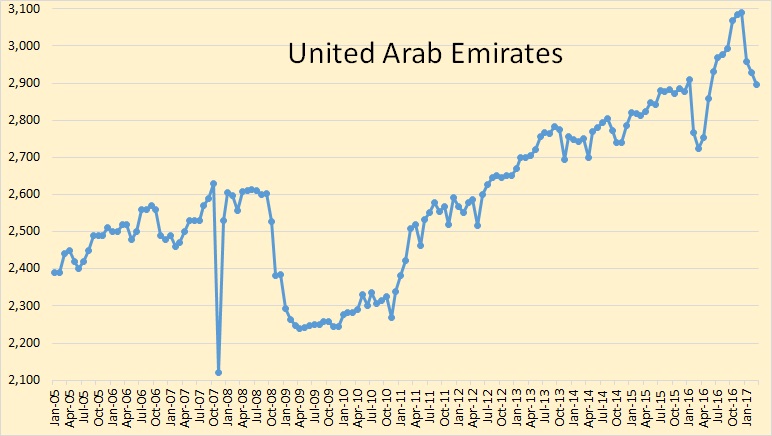

The UAE is down almost 200,000 bpd since December. This is the largest percentage cut in OPEC. I don’t think it is all voluntary.

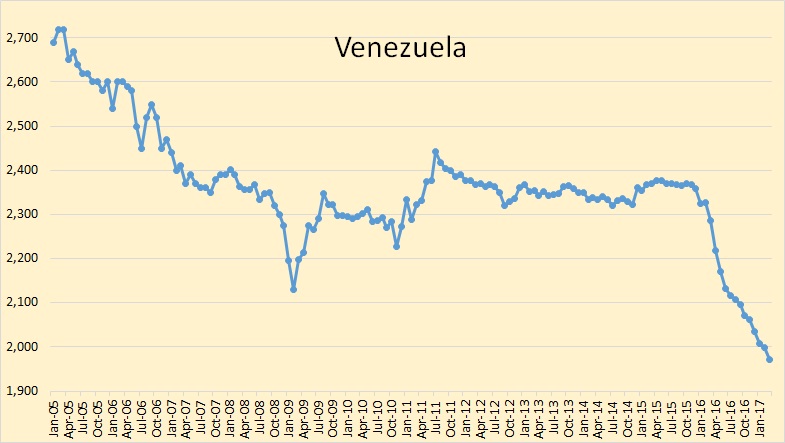

Venezuela’s problems will continue. They ae now below two million barrels per day. They are at 1,972,000 bpd. Last March their production was 2,286,000 bpd. They have dropped 314,000 bpd in 12 months. That’s 13.7% in one year.

Eyeballing the chart, it looks like World oil production, total liquids, is down about two million barrels per day since peaking in November 2016. OPEC crude production is down 1.45 million barrels per day since November so Non-OPEC liquids, plus OPEC NGLs, would be down just over half a million bpd since then.

194 responses to “OPEC March Crude Oil Data”

Hi Ron,

OPEC largely compliant with production cuts, Russia and FSU not as far as I can see which is at odds with commentary from the IEA.

Oil Production Vital Statistics March 2017

Global Energy Graphed now has a tonne of charts for national per capita energy consumption trends on the BP tab.

Euan

These per capita graphs are really interesting!

Thanks a lot!

Angola looks interesting. They only have two rigs operating, which presumably are on the recent installations for the East Hub and Mafumeira Sul. The two other FPSOs due, for Kaomba Sul and Norte, have been delayed a year each to 2018 and (probably) 2019. They have nothing else in the pipeline at the moment, though a number of prospects, which if they started, say, in early 2018 wouldn’t be on plateau until 2023 or 2024. They had 5 big FPSOs installed in 2004 to 2008 which must be coming off plateau, although there was a recent satellite tie in for Kizomba. Their facilities tend to be designed for high rates and short plateau; 15% declines are not unusual. The recent decline may not be all voluntary, despite the, albeit pretty slow, ramp ups of the two recent projects (I thought they’d be the first to break the limits but doesn’t look like it). A couple of their FPSOs only lasted about 11 years from start-up to decommissioning and another two might be coming to the end (Girassol and Gimboa over the next few years).

OPEC reckons KMZ in Mexico is going to add 40 kbpd this year – all recent indications, and Pemex’s own expectations from 2012, are that it is likely to start accelerated decline, so maybe they know something about ongoing brownfield work. It’ll be interesting to see.

OPEC have GoM averaging 1680 kbpd in 2016, which means the exit rate is likely to be below 1600 and declining. The EIA STEO has it at 1860 kbpd and growing for the end of 2017. I think OPEC is closer the mark – and that means the new record for USA production predicted for 2018 by EIA might not be so easy.

George,

Do you have any insights into the status of the presalt discoveries made in Angola 4-5 years ago. Cobalt was the most successful company, but they have since relinquished their acreage.

No idea I’m afraid. Pre salt is beyond my experience and certain to stay there now. I think Cobalt have some financial problems, or is it political, I don’t know that they gave up the licences entirely voluntarily. I guess Angola mirrors Brazil in some way so the E&Ps would likely wait to see what happens there before committing much in Angola, especially given current prices and the other issues they have there.

There’s presalt all the way from Gabón to Angola (i suppose it can range further North?). I’ve seen the presalt section, the best target is a sand right under the salt. It’s not world class super high rate, but some of those accumulations can have 1 billion barrels, and the oil is really good quality. Problem is seismic definition. I have a geometry trick I think can be used to make discoveries close to existing dry holes, but my company didn’t go for my idea, and so I kept it to myself.

Look for the largest Russian shale oilfield’s analysis. Sadly, there aren’t any billions of tons of recoverable reserves in the Bazhenov formation:

http://en.angi.ru/news/765-Alexander%20Khurshudov%3A%20sadly%2C%20there%20aren%92t%20any%20billions%20of%20tons%20of%20recoverable%20reserves%20in%20the%20Bazhenov%20formation/

This is an excellent link and one that mirrors my own (limited) experience working there. My conclusion was there were no reliable methods to assess these reserves as well. The main problem being the presence of clay (and shale layers within it), which plugs fractures after hydraulic fracturing (and the thinness of the productive horizon). Another problem is rapid facies changes over short distances. So, as Khurshudov says, there are no billions of tons of RECOVERABLE reserves of oil in the Bazhenov Formation.

Thanks a lot for your complimentary reply… because Khurshudov – it’s my name.

Another point is that the middle bakken contains more carbonates, then bazhen, so artificial fractures are not blocked with small particles of clay. Eagle Ford shale is the best, it has more than 50% of carbonates.

Thanks AlexK.

Very nice piece. So about 140 million barrels of recoverable LTO in the Bazhenov formation. Any idea (rough estimate) how much LTO in the sandstone (Jurassic and Cretaceous) layers of Siberia?

Including Yamal? Depends on the gas and oil price. I’d say the technical resource is tens of billions of barrels.

Thanks, Dennis. I’m oil production ingeneer, not geologist, so I have no such data at hand…

As to rough estimation, there are hundreds mln ton of oil in Tomsk and Tjumen regions to be recoverable and approximately the same amount in the districts of Khanty-Mansisk and South Yamal.

As well as the district of North Yamal contains a lot of gas-condensate saturated layers; the gas-in-place reserves of Achimovsk formation of Urengoy gas field only amount to 35 tcf of gas and 3,6 bln bbl of condensate.

Thanks AlexK and Fernando,

Seems if 100s is 900, that would be about 2.7 Gb times 2 would be 5.4 Gb and then adding the condsensate we get about 9 Gb of TRR for the region. This estimate is pretty close to Fernando’s estimate (who I believe is a retired petroleum engineer).

As each of you has probably forgotten more than I will ever know about producing oil, I will defer to your expertise.

From ASPO_USA’s latest Peak Oil Review – 10 Apr 2017

‘Fitch Ratings is forecasting that global oil will average $52.50 this year, up from $45.10 in 2016. This figure is still believed to be below the breakeven point for most Middle Eastern oil exporters. Only Kuwait, which is said to have a breakeven point of $45 a barrel is well below the $52 figure. All the others are either close to $52 or well above it Most, especially the Saudis, are slowly frittering away their currency reserves by operating at a loss. It may be a few more years before major changes happen in the oil markets that will drive prices higher. The current situation where oil is being sold below true costs of production simply cannot obtain indefinitely.’

Indeed, what cannot continue indefinitely will definitely stop sometime, possibly abruptly!

…and, re Saudi Arabia and similarly troubled producers, Tom notes:

‘To replace the lack of oil revenues, members of the Gulf Cooperation Council including the Saudis have turned to the bond markets. Bond sales by council members during the first quarter increased by 359 percent to $24.2 billion. This included an $8 billion issue by Kuwait and a $5 billion issue by Oman. Observers are predicting that large bond issues will become the norm for Gulf oil producers in coming years, unless there is a major surge in oil prices.’

Borrowing money to sustain any business which is operating at a loss never ends well.

To clarify, the loss is in terms of national budget deficits, and not in terms of OPEX and CAPEX being greater than oil and gas revenue for the OPEC national oil companies.

When small time operators have profit margins fall from $60-80 per barrel to $0-20 per barrel, they cut back on things like new vehicles, trips, and drilling more wells.

Tougher for countries to slash national budgets.

etp or effluent treatment plants are used to treat waste water produced in industries and in commercial places… for more information please visit : http://cleanwatersolutions.in/effluent-treatment-plant-etp/

The “pump all you can so that your percentage-based cuts will leave you at a higher level” thing is just funny. Even though it’s happened several times before. I wonder why OPEC is still setting quotas on a percentage basis?

North dakota numbers are out and the wild swings seem to continue…up riughly 50000 bpd

Wild swings indeed! The curve thru the production data, which has been rather smooth for years, is really noisy now.

Thanks Verwimp.

Not sure how many completions there were.

May be the seasonal effect of low output wells being brought online in warmer weather.

53 completions, down 3 from previous.

Cowboyistan.

Based on data from shaleprofile.com, there were 62 oil well completions in the Bakken/Three Forks in Feb 2017.

harvesting ducs according to several CC’s may be in play

The overall availability for the wells rose back nearly to around October levels (a bigger increase than was seen in January) so the effects of the bad weather in December have now been corrected. The effects are bigger than the relative values in the chart below suggest as: 1) the availability increase in big producing counties is higher (e.g Mountrail is highest in the last 5 months), 2) there are a significant number of wells that haven’t produced at all in the period shown and knock about 6 or 7% off all the numbers. I’m taking October / November levels as typical but they might be on the high side.

There may also be a short term rebound effect. When wells are shut in they equilibrise along and around the wellbore so when they restart there is a higher delivery pressure and higher flow until the pressure profile is re-established. I don’t know how big the effect is in these wells though (but if there is a significant one it’s observed effect would be enhanced because of the shorter month).

All that said though, I think we could be seeing the start of a move towards a flattening of the production curve decline. Completions are down but initial flows from them seem to be increasing. CLR are clearing their DUC backlog and have had a lot of time to figure out how to optimise the fracking. Drilling rigs numbers aren’t jumping up like other LTO areas but I think we could still see a plateau at around 850 to 900 kbpd in 2018 sometime.

Verwimp,

If you get this message, would you mind contacting me at [email protected]. Thanks. Would like throw a few questions your way and see if I could use some of your charts in an article on my site.

Thanks,

steve

When systems get out of equilibrium, we know they are not healthy.

This is worth a read:

http://oilprice.com/Energy/Energy-General/Supply-Crunch-Or-Oil-Glut-Investment-Banks-Cant-Agree.html

I think I tend to agree with the banks – i.e. I don’t really have a clue, and cover myself by changing my mind every couple of days.. But I tend to now think oil shortages may be sooner rather than later. A couple of big project start-ups for Angola and Kazakhstan have been delayed for a year, Iran and Iraq are not developing at all as quickly as they’d planned (and others expected), there are much fewer, short cycle, small tie backs getting approved than I thought would be the case, offshore drilling in general just isn’t picking up, and there seems to be early indications that the cuts in maintenance and brownfield investments from 2014 are impacting availabilities (e.g. with more unplanned downtime) and decline rates (i.e. steeper). SO instead of late 2018 for start of big stock draws it may be autumn this year.

It depends also, of course, on how demand changes, whether OPEC (really Saudi) are making voluntary cuts and have increasing spare capacity, or are following a forced decline due to surface facility limitations, and what happens in the Permian which at the moment seems increasingly desperate and bonkers by both investors and the E&Ps, but may turn out to be exactly right.

On the other hand IEA OMR report come out yesterday – and their worries about a supply crash soon, which were evident a few months back, seem to have gone away, at least for the moment.

https://www.iea.org/oilmarketreport/omrpublic/

“Indeed, although the oil market will likely tighten throughout the year, overall non-OPEC production, not just in the US, will soon be on the rise again. Even after taking into account production cut pledges from the eleven non-OPEC countries, unplanned outages in Canada as well as in the North Sea, we expect production will grow again on a year-on-year basis by May.”

Hi George,

You said,

I don’t really have a clue, and cover myself by changing my mind every couple of days..

LOL

You are not alone. I tend to think eventually output will fall below demand and oil prices will rise if that ever occurs. When that actually happens? I do not know, perhaps never, my latest guess is first half of 2018 (tomorrow the guess may change.) 🙂

“I tend to think eventually output will fall below demand and oil prices will rise ”

And then output will again rise faster than demand and prices will fall.

And that will repeat several times until the oil age ends.

Hi AlexS,

I suppose over the short term there will be cycles. In a very optimistic scenario by 2032 the 3 year centered moving average of World C+C output will be trending lower (with three year average output peaking at 87 Mb/d). A more pessimistic scenario has the 3 year peak in 2016 at about 80.5 Mb/d and a reasonable guess is mid way between these scenarios with a 3 year average peak in 2024 at about 84 Mb/d. Growth rates will vary with the boom bust cycle, so smooth trend lines will not be followed, output will cycle above and below in ways that are difficult to predict in advance.

AlexS,

I think this is a neoclassic way of thinking. Oil is the strategic, political tool. So price of the oil is a politically important variable. That’s why oil wars were fought. As simple as that.

We already saw that world oil production was virtually flat in 2015 and 2016 (2015: 96.80 vs. 2016: 97.17 ) but demand increased (1.4 Mb/d per year I think, so around 2.8 Mb/d for two years) which for some reason did not affect much oil prices.

I think the elephant in the room is the financial system and its interaction with the oil industry. They are now new OPEC and are able to dictate the price (within certain limits) via derivatives. Probably not without some help from KSA which practiced damping in 2015 and 2016.

I think there are powerful forces that will try to keep oil below $60 because that’s the difference between the US economics in secular stagnation mode and the US economics in recession. .

In this sense the balance of supply and demand does not matter until there are real oil shortages. Only in the latter case derivatives are of no or little help.

It is very interesting how primitive, short-term was behavior of OPEC in late 2016: they decided to cheat on themselves as Ron pointed out. This is almost tribal level of thinking. And it might repeat.

That’s another factor that might limits upside. Unless they are really in trouble and reached peak production capacity.

Rereading posts and articles from early 2015 is also very sobering if you assume neoclassical “supply and demand stochastic equilibrium” exists for oil (which IMHO is a false assumption).

It suggests that few people in 2015 understood the predicament. Most assumed that in a year or year and a half max prices will return to more or less “normal” levels, as non-OPEC producers, which usually have higher cost of production, will be decimated. And then should move higher.

That did not happen. Instead we have had almost flat level of non-OPEC production(2015: 58.77 vs. 2016: 58.18 is ); it lies probably within the accuracy of measurements +- 0.5 MB/d .

At prices below $80 or so shale oil production is impossible without generating junk bonds and that means that money are still flowing to shale drillers. Not as much as in good old times, but they are flowing; despite clear indication that most probably those loans will never be repaid in full. Something is really fishy here.

Also please compare your old views with the current situation:

http://peakoilbarrel.com/open-thread-oil-and-gas/comment-page-1/#comment-541443

I wonder if the USA is able to keep oil under $60 (outside few spikes) for two more years.

well said likbez.

it’s easy to forget that economics consists mainly of weak models and intellectually biased persons (i.e. all of us) in an attempt to create of narrative of complex real-world data systems. and as more and more transparent attempts are used to influence those data systems (e.g. CB QE) it actually makes it harder to use those models, not easier. Like trying to understand architecture while taking a wrecking ball to a building.

posters on the forum are getting better at challenging these assumptions, but it takes time.

The best economic models right now are the smallest and narrowest. The field is in its infancy as a science — it’s like physics back when optics, mechanics, electricity, magnetism, and so on were all competely separate subjects and nobody knew how they related to each other, and they didn’t understand any of the individual subjects very well either.

So I can make tight little models of particular well-documented phenomena which are pretty reliable, and that’s great, but go outside the boundary conditions for which those models work and they break fast. One of the most useful things to do is to know the boundary conditions for your model (i.e. where it stops working)

Interesting thoughts likbez. I too have been wondering about the ‘fishiness’ of the financial machinations that has kept money flowing to the shale industry despite marginal prospects at low oil prices. I suspect a big part of it is inertia, but there must be more to it than that.

Perhaps, far below the transparent surface, old big money has been flowing towards shale production despite poor prospects for decent returns to the investors (pension funds and other such passive investors), as a deliberate policy based on more than just smart dollars and cents.

By that I mean, as a mechanism to undercut the pricing power of Russia and OPEC, and thus to blunt their capacity to exert political influence over our economic partners and over our potential adversaries- places like China, Turkey, S.Korea, India, and much of Europe are all places that rely on fuel coming from R+OPEC massively, and are very vulnerable to economic troubles from rising crude prices. And they are thus potentially vulnerable to geopolitical pressure applied by the likes of the dictators or theocrates that dominate the oil exporting countries.

The other day George did a Bakken model with several different assumed levels of new wells added each month in the future. For comparison, I used my usual well profile with 60 wells per month and 90 wells per month from March 2017 to Jan 2020 to get the scenarios below. I also assume new well EUR starts to decrease in Jan 2018 and depends on completion rate (higher completion rate increases the rate of decrease of new well EUR). Scenarios below (which I believe are very conservative) I expect output is likely to be higher because completion rates will likely be higher than this by 2020.

Dennis

I do not follow these numbers anywhere close to what you do, but you may want to learn more about – and incorporate somehow in your figgerin’ – the inactive wells.

This month alone, 161 inactive wells changed status.

I’m unfamiliar with the particulars involved, but the DMR presentations this past year repetitively pointed out the number of wells on the inactive list. (About 1,600, I think).

Awhile back, Shallow thought these were primarily older wells, but I frequently encountered IA status wells that were recent and in core areas while doing my halo hunting.

Don’t know if or how much this factors in this month’s bump, but 200 wells, more or less, coming online would show an impact.

Edit:

67 wells, not 161, came off IA status. But the number of producing wells increased by 159.

Hi Coffeguyz,

Let’ assume 53 wells were completed. That would mean 106 older wells were brought online. Let’s assume these wells average 15 b/d. That would amount to 1.5 kb/d, which is not very significant out of 940 kb/d, if 61 wells were recently completed that might explain the uneven behavior. I don’t track that IA number.

Dennis

15 barrels a DAY???

Did you say/type 15 as fifteen barrels of freakin’ barrels of bubblin’ crude per day on wells being brought back online???

Man, Dennis, you might best put a little time and effort into that if you think that’s what is going on up in the Bakken.

Hi Coffeguyz

The older wells are not very productive and 15 b/d is probably close it might be 30.

The newer wells decline very fast so after 24 months they would be less than half the average peak output. So we could probably assume the newer wells brought on line might have an average age of 24 months and might be equivalent to half a new well.

Dennis,

The wells that were temporarily shut and then restarted production are not necessarily old.

Hi Alex,

Not all of them no, but particularly in winter a lot of low volume wells get shut in. We would have to look at the specific wells that have been shut in.

I am not going to try and track it down.

Hi AlexS,

I will use the numbers from shaleprofile.com (thank you Enno Peters) completions (62) and the increase in the number of producing wells in the Bakken/TF (141).

This means about 79 wells continued producing in Feb that had not been producing in Jan (these wells are not new wells but had produced oil previously).

The model suggests with 62 completions, output should have decreased by 4 kb/d, but instead output increased by 48 kb/d, so the 79 older wells may have been responsible for a 52 kb/d increase in output. So each of the 79 wells would have produced an average of 658 b/d. This number is surprising because the average Bakken/Three Forks well has a peak output (in month 2 of production) of 542 b/d.

The shape of the well profile changes over time as fracking methods change, so the model does a poor job predicting future output. The assumption of a relatively fixed well profile seems obsolete.

The average lost days per well from October to February are spread fairly evenly, independent of average production. They average around 30 days offline – there were more for very low flow wells compared to those in the range 20 to 200 bpd. But it rises again for higher flows. I should think the wells got shut in because they froze off mostly, not voluntarily. The bigger impact for the low flow wells is that they would have been restarted later – i.e. high flows get done first – not that they were shut in deliberately. Some of the impact on the higher flow wells would have been due to initial start up, but I don’t know how to quantify the difference.

This shows average days lost in the period. There are far more wells in the low producing values so the numbers are noisy, and with various causes possibly dominating other than weather, for the high producers.

Mr. Kaplan

I am not sure that I am correctly interpreting your chart.

Are you saying that that a bunch of wells that produced over 950 bpd each were offline over 2 months of the five month (Oct. to Feb) period?

Thank you, also, for compiling and presenting the data.

They probably hadn’t been started up for the first two months, but as I said above the chart I don’t now how to pick out weather delays versus other. It is more complicated because of confidential wells leaving tight hole status.

Hi George,

If you did a weighted average, what would you get for the “average” inactive well’s output for the wells with output above 20 b/d over the Oct to Feb period?

One way to quantify the difference between wells just starting up and older wells (3 months or older) would be to eliminate wells in their first 2 months of output from the data set.

Dennis – I could try all that, but what is it I’m trying to show? The points I was trying to make were that 1) the increased off line time was mainly due to the bad weather in December and early January, and that has now been made up; and 2) on average it isn’t low producing wells that are being deliberately shut in that decide availability but wells impacted by outside events, I think recently principally because of freezing off associated pipework with delayed start-up because of snow, and all wells can be impacted equally.

The caveat to number 2 is that there are a lot of wells (over 1400) that are shut in for the whole 5 months and produce nothing – that is deliberate and has a big impact on average well availability, though maybe not much on overall production. I could weight availability by streamday, but I don’t even know if that would be very clear given how fast the wells decline (i.e. the loss from decline from maximum would exceed the loss from downtime).

Hi George,

The point was as follows, during winter when there are freezing and other weather problems the completions might be x (62 in Feb 2016) while the change in producing wells might be y. I have an estimate for the output of the average new well, but not for the “other” wells that come back online after a temporary shut in (in February 2017 y=141, so we have 141-62=79 “other” wells that were producing in Feb, but not in Jan), I was looking for the average output of those “other” wells.

I just figured the data was in a spreadsheet so the calculation would not be difficult.

Total output month before shut in of all wells divided by number of wells shut in would give a rough estimate, probably not a lot of decline while the well is not producing so this would be close enough.

When you say “shut-in” it’s like you’re assuming it’s for a month or so, but it’s not like that. The days on line are reported and they can be from 0 to 28 for February. The shut down period can span across two months reporting. The biggest proportion of wells are on all the time, second biggest offline all the time, but lots in between. And wells are going off and on line all the time, it’s just the downtime (apart from those with no production) was suddenly doubled in December.

Hi George,

Got it, thanks.

Yeah, I wonder if Freddie or Enno have a system that could track this, even for just a few wells.

Thing is, it seems the operators are encountering a lot of ‘issues’ doing this downsizing deal with damaging older ‘parent’ wells being a constant peril.

Schlumberger is recommending doing refracs on all older wells when new ones are frac’d (more business for them).

Marathon has a sliding scale of activities to protect older wells depending on numerous potential dangers, all of which keep a well offline for quite awhile.

I know I was surprised at the amount of offline time relatively new wells experienced.

Don’t know the answer, but I suspect the 50,000 bbld bump is tied in directly to those 160 new producers.

Hi Coffeeguys,

Possibly, but it is the newer wells that make the most impact, and there can be month to month variation in productivity, days online etc.

Hopefully everyone involved in defending Bakken production upswings will not disappear into the woodwork next month, or the month after, when production drops again.

Of course marginal shale oil wells that are at or below economic limits get shut in during winter, or get shut in and stay shut in because workover costs to restore production simply do not make economic sense. There are gazillions of those kinds of well in all three of America’s shale oil basins. There need not be a flush ‘uptick’ of production when those wells come back on line (that’s investor presentation dribble), in fact it can be just the opposite because of bubble point/higher water saturations.

Re-frac’s cost more money. At $20.00 per barrel net back prices a $2.5-3.0M re-frac requires ANOTHER 137,000 BO to payout. Productivity should never be confused with profitability (or lack thereof); in the end the latter always wins out.

And this SPE paper pretty much shoots the hell out of all that “halo” bunk: https://www.spe.org/en/jpt/jpt-article-detail/?art=2819. Imagine a situation where you are drilling these $6.5M wells so close together (Marathon at 330 feet, toe to toe) that you have to “protect” them by shutting them in for prolonged periods of time while you frac a new well 3000 feet away. That makes a lot of sense, doesn’t it? A little more time and realized production data will prove that downsizing actually reduced UR per incremental well and was yet another economic disaster in a string of economic disasters for the shale oil industry, the biggest being oversupply and an ensuing 70% drop in product prices.

People do really stupid things with OPM.

Mr. Roughneck

As usual, I appreciate your professional input into these discussions, even though I almost always disagree with your stance.

The problems with close infill work are being addressed in several ways.

The approaches being considered by the Permian boys is highly instructive in this rapidly evolving endeavor of unconventional development.

What some of the Permian operators are tentatively planning on doing (being late to the dance can offer benefits of observing and bypassing pioneers’ missteps) is to drill and complete up to 8 wells at a time along a 1 mile wide lease so as to avoid formation pressure differentials with staggered development.

High risk with big capital outlay and a lot of unknowns.

Familiar territory, in other words, for these guys.

BTW, the next couple month’s Bakken output may well decline, but summertime forward should show large increase.

Hi,

It´s hard to tell what an offline well could produce if it is put online. But I can show you this graph which shows the percentage of wells with a production greater than zero, grouped by year of first production. Maybe its hard to see but the curves start to slowly decline after two years or so. I can´t see any correlation with price really, so I would say that we will not see many wells starting to come back online, if any. 2015 and 2016 has started off about 2 percentage lower though, but it would be strange if they completed wells and then not produced anything from them. Either way, its only about 40 wells we are talking about.

North Dakota Directors Cut – estimated inactive well count – April 13th

I had a quick look for the estimated inactive well count but there doesn’t seem to be any data in the Directors Cut before February 2016

Chart (direct link): https://s15.postimg.org/urwk3cekr/2017-04-13_ND_Directors_Cut_-_DUC_Count_and_Comp.png

North Dakota Directors Cut

Chart (the WTI price is x2): https://s14.postimg.org/zcsahzke9/2017-04-13_ND_Directors_Cut_DUC_Count_Completion.png

Bloomberg – North Dakota oil production won’t hold above 1mb/d in the coming months after averaging ~1.03mb/d in February, Lynn Helms, State Director

And this is worth reading if anyone has missed it – Feb 28, 2017

Lithium-Ion Battery Inventor Introduces Fast-Charging, Noncombustible Batteries

http://www.engr.utexas.edu/news/8203-goodenough-batteries

A correction to one of the charts, completions are on the left axis

Hi all,

The scenario below assumes the average Bakken well starts to become less productive (smaller estimated ultimate recovery or EUR) starting in Jan 2018. The rate of decrease in EUR depends on the number of wells completed. The future wells added is a guess, as is the rate of decrease of new well EUR, if both guesses were correct the future output might follow the scenario shown. The future is difficult to predict. So far the model has tended to underestimate North Dakota (ND) Bakken/Three Forks(TF) C+C output, in Feb 2017 the model predicted 860 kb/d of C+C output while actual output was 982 kb/d, not very good!

Cumulative output for the scenario is 7.9 Gb at the end of 2050 with 32,262 total wells completed from1951-2036. No wells are added after Nov 2036.

Dennis,

You can, of course, assume any number as an ultimate recovery that you think reasonable for the projections but I’m not sure the USGS studies, that you often quote, back up what you say. If you are using this: “Assessment of Undiscovered Oil Resources in the Bakken and Three Forks Formations, Williston Basin Province, Montana, North Dakota, and South Dakota, 2013”, then I think the keyword in undiscovered. To make their assessment they took six production plays and for each assessed the “untested” proportion of the acreage, and then assumed a success rate, drainage area and well recovery for each. It’s not stated exactly what “untested” means so there might be some margin for different interpretations of their results.

The untested proportion and success rates used are pretty high (average around 85% for each in the mean and median cases). In reality almost no wildcats have been drilled since 2012 so most of these resources would seem to me to be still undiscovered. When the wildcats were stopped they were averaging about 50% dry holes (drilling the best locations for new fields) so the USGS 85% number looks highly unlikely, even if exploration drilling is started again.

In the USGS mean case half the resource (about 3.6 Gb) came from the Three Forks. In fact by the latest production figures there are very few producing wells there. The USGS had well recovery numbers of 222,000 barrels for the sweet spots (which represented 3 Gb of the 3.6Gb), but it looks to me like there is only a small fraction of the area that will achieve this.

The actual reserve that is being produced in the Bakken was “discovered, undeveloped and developed” in 2013, and not covered by the USGS. It’s difficult to find break out information for individual areas in most companies reports but I don’t think there was more than about 5 Gb developed and undeveloped reserves in 2013, and it might have declined a bit since then, even including actual production.

Hi George,

When I give the cumulative output of the scenarios, it is from the start of production in the Bakken/TF in ND, about 1.6 Gb had been produced at the end of 2015 and Bakken Three Forks proved reserves were about 5 Gb at the end of 2015, that gets us to 6.6 Gb, typically there are probable reserves as well, though we would have to guess at how much. Also as oil prices increase in the future 2P reserves are likely to increase.

Note that the F95 USGS TRR estimate for the ND Bakken Three Forks is about 7.2 Gb, if we assume probable reserves at the end of 2012 were zero (in my view not a very good assumption). What do you think is a reasonable estimate for probable reserves if proved reserves are 5 Gb? Your guess would be better than mine. For UK North Sea a typical number would be 3 Gb of probable for 5 Gb of proved (all UK North Sea reserves). For the Bakken it would likely be lower, maybe 1 Gb of probable for 5 Gb of proved reserves might be a reasonable guess.

Bakken average well profile from June 2015 to Dec 2017 shown below (after that the EUR decreases).

Hi George,

That is the study I use.

https://pubs.usgs.gov/fs/2013/3013/

If you pull up data at shaleprofile.com

and look at wells from 2014 to 2017, there are 1388 Three Forks wells that have been producing for 20 months (cumulative is 118kb) and there are 1689 Middle Bakken wells (cumulative is 143kb@20 months). So lately (past 3 years) a fairly large proportion of wells have been Three Forks wells (about 45%). After 36 months the difference in cumulative output is about 30 kb (TF is lower at 155kb@36 mo, Bakken is 185 kb at 36 months).

I think you are mixing proved reserves from EIA with the undiscovered numbers from USGS. The proved reserves might have some basis and 5 to 6 might be right, I haven’t sen any kind of detail of how they are arrived at. But that is not the same oil as in the USGS report – it was mostly already known about in 2012 when the E&Ps stopped drilling wildcats. Since then they have been converting probable to proven, and in some cases writing off some of the reserves. If you want to include the USGS data then it should be added to whatever there was as 2P in 2012 as a final recovery.

I don’t know where there 1300+ Three Forks wells come from – the ND production wells for January shows only 1 well in the Three Forks and 45 Three Forks / Bakken. There are other pool’s like Sanish and Madison. Madison is a big producer so maybe that is counted as Three Forks in USGS. The ND DMR overall production up to 2015 gives 10 million for Three Forks / Bakken, 1600 for Bakken, 950 for Madison and < 1 for Three Forks alone.

The 220,000 EUR I quoted was for the Three Forks alone from USGS, not Bakken.

Hi George

My TRR estimate uses proved reserves plus cumulaive at the end of 2012 and adds that to USGS UTRR.

My point about 2015 is that proved plus cumulative output is 6.6 Gb, if we add probable reserves we get 7.6 Gb or about the F95 USGS estimate.

Hi George

The ND TF EUR is probably about 260 kb for the average 2014 to 2016 TF well.

Hi George,

The USGS mean undiscovered technically recoverable resource (UTRR) for the North Dakota Bakken/Three Forks (April 2013) was 5.8 Gb, at the end of 2012 proved reserves plus cumulative production was 3.8 Gb, so TRR was 9.6 if we assume probable reserves at the end of 2012 were zero (1P=2P). The F95 UTRR estimate was about 3.5 Gb, with TRR of 7.3 GB (again assuming 1P=2P at the end of 2012).

A more reasonable assumption in my view is that 2P=1.2*(1P) so mean TRR=10.3 Gb and F95 TRR= 8 Gb for North Dakota Bakken/Three Forks based on USGS April 2013 assessment.

See

https://www.dropbox.com/s/evwtxgsuisewczk/2013_Bakken_ThreeForks_Assessment.pdf?dl=0

Or you could just ignore the USGS numbers because very few successful wildcats wells were drilled after the paper came out, and then the E&Ps stopped drilling them, meaning they don’t think there’s anything left to find. The USGS numbers all came from the E&Ps – they weren’t independently developed, once the E&Ps changed their minds and decided there was nothing much left to find the USGS numbers became invalid. Which means the 2P number form 2013 is about the right one – and probable reserves were not zero. p.s.

The USGS don’t have a single number for anything in 2013 – they have a probability distribution

The profile above is the average of all Bakken and Three Forks wells completed in North Dakota in 2015. Well data from older wells is used to estimate the tail.

https://www.oilandgas360.com/energy-lifetime-usgs-bumps-natgas-estimate-70-tcf-304-tcf-bossier-haynesville/

The money lines which can not be more accurate as it relates to those on this forum who take 1 or 2 data points and make industry wide conclusions? are:

“Changes in technology and industry practices, combined with an increased understanding of the regional geologic framework, can have a significant effect on what resources become technically recoverable. ”

“It’s amazing what a little more knowledge can yield,” said USGS scientist Stan Paxton, lead author of the assessment.”

Which means gas prices will stay low, further killing coal.

And it may also mean more support for the Paris Accord so that gas producers will see pressure for countries to switch from coal to gas. Gas producers will have something to gain if coal burning is phased out.

It also occurred to me that if natural gas prices stay low, that should keep electricity prices low, which should help EVs. I’ve already seen my local utility promoting the Nissan Leaf.

If electric utilities can move into transportation that gives them a very big new market. It also expands their influence.

TT

Both a followup and some perspective on the USGS assessment of Bossier & Haynesville ..

Recent Barnett bump went from 26 to 53 Tcf.

Mancos bump went from less than 2 Tcf to 66 Tcf.

The Bossier, at the moment, is considered bigger than the Mighty Marcellus.

The Haynesville twice the size of the Mighty M.

No one believes that as the USGS assessments for Appalachia (Utica & MM) are dated.

When the new assessments are finally released, people are going to be shocked. WVU’s study put each formation at about 800 Tcf TRR.

Combined, not even including the Upper Devonian formations, the Utica/Marcellus formations would be the biggest on the planet.

All due to sideways drilling, effective fracturing, and a whole bunch of determination.

For those of us who aren’t expert enough to grasp the implications of these assessments, what are the implications of these Nat gas ‘reserves’?

How much of all this is viable for production, and where does this put the USA in terms of global standing on reserves, and consumption?

Thank you.

Hickory

The USGS uses the phrase Technically Recoverable Resource (TRR) to describe material that is known to be there and is able to be extracted with existing technology.

They do not ascribe an economic parameter, but they always include a wide range of economic potentialities with the ‘middle’ one, aka most likely, the number that gets all the press.

Biggest conventional gas field in the world is under Persian Gulf bordering Iran and Qatar, the South Pars/North Dome at 1,400 Trillion cubic feet (Tcf).

Second biggest is Russia’s Urengoy at about 230 Tcf – big difference.

Bossier/Haynesville now said to be 300 Tcf.

West Virginia University’s recent study of the Utica pegged 800 Tcf recoverable, comparable – according to them – to the Marcellus.

A regional study group, Wrighstone Energy, did a piece on the shallower Upper Devonian formations in the Appalachian Basin using the few, at that point, wells developed by 2015.

They estimated 100 Tcf recoverable from those formations alone. (More recent UD wells are showing WAY higher output than Wrightstone’s earlier ones).

What does it mean?

Back of the envelope numbers …

Last year US consumed about 27 Tcf.

Using combined 1,600 Tcf for Utica/Marcellus gives about 60 years supply.

Current available resource/consumption models show US supply measurable in centuries.

Holy Cow! Thanks coffeeguyzz

I’m sure there must be a lot of variability, but rough breakeven production and distribution costs on all this domestic Nat Gas would be an interesting thing to know.

nat gas/hybrid fleet vehicles sure seems like a slam dunk next decade.

Hi Hickory

The price is an important variable.

A lot of the resource may not be viable at low prices.

As wind and solar cost falls a lot of the resource is likely to be uneconomic.

Natural gas has been, to those who think like me, a transition fuel. It has been effective so far, essentially pushing coal into irreversible decline. On-going low prices pretty much guarantee that there won’t be much demand for new coal plants, at least in this country, and perhaps other countries as well.

Natural gas plants also can work well with expanding renewables. They can ramp up and down more easily than coal or nuclear, so natural gas offers more flexibility as renewables develop.

Perhaps by the time natural gas prices rise enough to have a negative impact, renewables will cushion the blow.

It’s unlikely the country would have gone straight from coal to renewables, so natural gas has been a significant aid in that endeavor.

I would offer you all these facts (courtesy, in part, to Enno’s outstanding shaleprofile.com site) to mull over transition, pricing, availability concerns regarding the hydrocarbon world …

There are currently 11 unconventional wells that have produced over one million barrels of oil (barely).

Conversely, there are 756 unconventional wells that have produced the energy equivalent of 1 MMbo in the form of natgas by exceeding 5.8 billion cubic feet output.

The numero uno gas well – the T Flower 2 – has surpassed 19 billion c.f. … oil energy equivalent over 3 million barrels in about 4 years time … and STILL going very strong.

Ships, trucks, locomotive engines, localized power sources are all underway switching into using natgas versus gasoline, bunker fuel or diesel for power.

As has been pointed out on this site numerous times, getting a viscuous fluid, oil, to flow sideways two miles and vertically 1 to 2 miles over a 30/40 year time span is a daunting task.

Gas, by its very physical nature, is WAY easier.

Longer laterals (3 and 4 mile long are being introduced) offer huge economic efficiencies for operators).

We are, in the US, moving into a time where ‘unconventional’ hydrocarbon production will become the norm. Onshore, I believe, it is already above 50% total.

Big, big change is underway.

I definitely think there are advantages to making natural gas the fossil fuel of choice.

Until the past 14 months the weighted price of natgas in the Ap basin has been something in the order of 85 cents per MMBTU. So, as meaningless as it is to say that 5.8BCF is the equivalent of a 1 MBO, 5.8BCF per well would not be sufficient to pay a $6M dollar well out, not by a long shot.

Promoting a specific industry that borrows hundreds of billions of dollars to overproduce a product, that leads to price collapse, to then send tens of thousands of good men and women home, out of work, not pay its vendors for 120-180 days at a time, and bankrupt out of 88 billion (and counting) seems a little slinky to me.

Think of it like this: you have three mortgages on your house, which with mezzanine financing is exactly what the shale oil and shale gas has on all of its production. You’ve lied about the value of your assets (production) anyway and their value will not cover the mortgages, even if you could find a buyer, which you can’t. Your banker is done loaning you money, you pretty much have to pay all your vendors cash on location because they are scared to death to work for you, and all your credit cards are maxed out. The only way you can pay interest and keep debtors away is by lying more about your assets to get more credit cards and borrowing on them, or diluting the value of your shareholders more by reverse splits and selling equity. Your only hope is that the price of your product goes up 70%, and stays there forever, but at the same time you continue to overproduce, so the price of your product does exactly the opposite of what you want it to do. It goes down, not up.

Now that is a business model to really be proud of, and cheerlead for ! That’s a business America can count on for years to come !

So Mike,

what do you think would be a price level for the Nat Gas that would make it viable and sustainable for all parties involved in its production and funding?

Hickory, for unconventional gas resources, and probably DW GOM, certainly over $5 bucks. I think Berman even suggests $8.00; I don’t recall.

The biggest problem facing the profitability of unconventional resource plays is not higher product prices, it is higher price stability.

Hi Mike,

Berman claims that Marcellus and core Utica wells can breakeven at $4/MMBtu.

http://oilprice.com/Energy/Natural-Gas/Why-Cheap-Natural-Gas-Is-History.html

Hi CoffeeGuyz,

How much do those wells with 4 mile laterals cost to drill and frack. If it costs twice as much to get twice the output, one has not accomplished much as far as making more money. The pressure may deplete long before 30 years. We only have data for Marcellus horizontal fracked natural gas wells since 2010, a short 7 years.

Dennis

I do not know the cost of the 18,500′ long lateral Purple Hayes well from Eclipse (TMD was over 28,000′), but the operator was emphatically touting that cost per thousand feet dropped by a third.

All the operators everywhere, Niobrara, Permian, Appalachian Basin, are striving to lengthen the laterals as they feel it greatly boosts economics.

Slawson, in the Bakken, is currently drilling several 15,000 footers as that is the only way to get access under lake Sakawea.

There are numerous challenges in doing this, especially regarding remedial work as coiled tubing cannot – yet – effectively reach these distances.

But the main point in my initially mentioning the long lateral is that gas flow, rather than oil flow, would be more feasible at these lengths.

Hi Coffeeguyz,

Eventually they figure out the optimum setup to reduce cost. The cost to drill is just a small part of the total cost of the well, there may be good reasons not to go longer or everyone would be drilling 5000 mile laterals of it was cost effective. The total cost of the well and the time to payout are the metrics that matter, all the rest is just smoke and mirrors.

At $4, electric heat (via heat pump) is cheaper than natural gas heat.

So if the Marcellus has a gas-only breakeven price of $4… think about it… you can’t sustain that price…

Chart below has US dry natural gas monthly output in Billions of cubic feet per day (BCF/d), also shown is the centered 12 month average (blue line). Peak for 12 month average was Sept 2015 at 74 BCF/d and the most recent 12 months was about 72 BCF/d.

Data from EIA at link below

https://www.eia.gov/dnav/ng/hist/n9070us2m.htm

Wind & Solar Technology Won’t Stop the Collapse Of The U.S. Empire

Americans who believe technology will be the cure for all our problems, don’t count on wind and solar energy to save the day. This is the delusion I see over and over again in the Mainstream and alternative media. I even receive emails from followers who tell me not to worry, because the cost of producing solar will continue to fall. Soon I gather, we will be on our way to driving or flying millions of electric cars, just like in the old cartoon, the Jetsons.

https://srsroccoreport.com/wind-solar-technology-wont-stop-the-collapse-of-the-u-s-empire/

This may be of interest to some. I also include information on the EPIC RISE & FALL of SunEdison. Once a $30 stock, now trading at 6 cents.

Looks like the Solar Industry is turning out to be another BUBBLE.

steve

Hi Steve,

There are always failed companies in new industry.

See

http://www.nrel.gov/news/press/2016/37745

and

https://www.google.com/search?q=solar+industry+update+NREL&ie=&oe=#spf=1

also

https://energy.gov/eere/wind/downloads/2015-wind-technologies-market-report

Yes, but does that help you sell gold investments??

Nick G,

Was that question for me? If so, NO, I don’t sell gold. But now that you brought up the subject matter…. I would imagine precious metals will protect an individuals wealth a lot better than holding onto most STOCKS, BONDS AND REAL ESTATE when global oil production heads south in a BIG WAY.

However, don’t listen to me when the Mainstream media is doing a fine job funneling investors in the BIGGEST PONZI SCHEME in history.

Steve

Remember the old economic principle: in a fully competitive market, profits are zero.

At the moment, solar is very close to fully competive. Eventually this will change and some profits will appear. But for now, solar is expanding at a massive rate and nobody is profiting. Kind of cool…

Wind and solar and electric cars are definitely going to replace fossil fuels.

Nothing, however, can stop the collapse of the US Empire. Myself, I look forward to it. I don’t like living in an Empire. I’d much prefer post-Imperial 1960s Britain to Imperial 1890s Britain.

Empire is an over rated vanity project.

Vanity of vanities, all is vanity, and a striving after wind…

I have a new post on ND, available here.

Hi Enno can you give us an estimate of Three Forks wells vs middle Bakken wells completed in ND for the past 38 months?

Thanks.

Considering wells which started producing from Jan 2015 to Dec 2016, there were 941 Three Forks wells that had been producing for 2 months and 1209 Middle Bakken wells that had been producing for 2 months. About 44% of completed wells in the North Dakota Bakken Three Forks over the 2015 to 2016 period were in the Three Forks formation. At 12 months there was only about a 10 kb difference in cumulative output with 927 Bakken wells at 116.1 kb and 754 Three Forks wells at 96.6 kb.

I notice that the GOR continues to increase for the Bakken. Does the regulatory body in ND require reclassification from oil to gas wells once GOR reaches a certain level?

OPEC, UAE to launch new global oil, gas (data) tool – April 11th, 2017

A new global project to help analyse publicly available oil and gas data has been announced.

The Organisation of the Petroleum Exporting Countries (OPEC) Secretariat and the UAE Ministry of Energy said the first phase of the Oil and Gas Big Data Project will be launched later this month.

The platform will consist of a set of analytic tools, maps and data tables, employing data-driven approaches, optimisation and statistical analysis techniques.

It will initially be linked to publicly available oil market databases and will have the capacity to display raw figures, cross-comparing time series between countries and products.

http://www.energylivenews.com/2017/04/15/opec-uae-to-launch-new-global-oil-gas-tool/

OPEC Secretariat announces ‘Big Data Project’ launch

[Joint Press Release] http://www.opec.org/opec_web/en/press_room/4225.htm

China crude oil imports increased to a record 9.21mb/day in March 2017 versus 8.32mb/day in February 2017 (7.33 barrels per ton conversion) – Chinese customs data. I guess China is still filling it’s SPR. Before I had read this I had been wondering why news articles were saying that world oil inventories had decreased a little. Inventories often build into April. Also news agencies estimates are still saying that OPEC oil exports are holding steady and have not decreased in line with their production cuts, I guess that they have been exporting from their inventories.

inventory declines, news clips…

Reuters Apr 11, 2017 – Nordic bank SEB said global oil inventories in weekly data have dropped by 42 million barrels in the last four weeks.

http://uk.reuters.com/article/uk-oil-opec-storage-idUKKBN17D1NH

Bloomberg 2017-04-04 – Since mid-February, between 10 million and 20 million barrels have left the Caribbean

https://www.bloomberg.com/news/articles/2017-04-03/oil-traders-said-to-drain-caribbean-hoards-as-opec-impact-hits

Clipper Data Apr 6, 2017 – This week we have seen Iranian barrels drop to 5 million barrels, while barrels offshore of United Arab Emirates have halved in the last week, dropping to just under 10 million barrels.

http://blog.clipperdata.com/floating-storage-holding-up-despite-iran-drop

APRIL 12, 2017

U.S. crude oil production in the Federal Gulf of Mexico (GOM) set an annual high of 1.6 million barrels per day (b/d) in 2016, surpassing the previous high set in 2009 by 44,000 b/d. In January 2017, GOM crude oil production increased for the fourth consecutive month, reaching 1.7 million b/d. On an annual basis, oil production in the GOM is expected to continue increasing through 2018, based on forecasts in EIA’s latest Short-Term Energy Outlook (STEO).

https://www.eia.gov/todayinenergy/detail.php?id=30752

I don’t fully understand the EIA comments. They have Son of Bluto 2 and Otis coming onlibe in 2017 and 2018 respectively. In fact they were started in 2015 and 2016 by BOEM data, but then did seem to go offline again, so maybe these are restarts. They have Horn Mountain Deep operated by Freeport McMoran, in fact it was sold to Anadarko last year. They don’t have South Santa Cruz and Baritaria, which are two small tie backs due in May, nor Constellation, which seems likely some time before the end of 2018 (Anadarko tie back – used to be Hopkins under BP), nor Big Foot, which is (was?) due in late 2018, and is probably the biggest potential production increase of them all. I thought Amythest had been producing as well as there was a report of some issues with the well last year, but maybe that was just an appraisal. And apart from that they seem to assume no existing production will ever decline.

I tried to edit this and it seems to have got lost. Apologies if some of this gets repeated. Amethyst is a gas field, single well, which went off line last year and the operator don’t know if they will recover. Maybe there is an oil development due that EIA is referencing, but I’ve seen no news. In addition Atlantis North has been on line for many years, and there was an expansion completed in 2015, so it’s not a new field or lease, though maybe there’s going to be some new drilling.

SouthLaGeo – if you read this, can you offer any further insight?

This is what they list for new fields:

George,

I saw many of the items you mentioned and agree with your comments. Atlantis North as been on few a years or so, since at least 2015, and is responsible for total Atlantis production being over 100 kbopd.

The EIA still separates out Stampede into 2 fields – in fact it will be a single development from an accumulation that covers 2 leases.

And yes, Big Foot is notable in it’s absence, though I do suspect a slow ramp up because I don’t think any additional wells will have been drilled in this intervening period between when it was supposed to start production back in 2015 and when it does come on line in 2018.

A few months ago there was an article discussing the high impact wells Rystad had identified for 2017. So far things aren’t looking too good for these. The three that have been drilled have been dry. Four others look like they will be delayed to next year or as late as 2020. Two others aren’t looking very attractive for this year. The main one remaining is Korpfjell in the Barents Sea Artic, which may be drilled in July or a bit later. If this comes in (might hold 2 Gb ooip, so maybe just about a giant) there will be dancing in the street but if it’s dry or gas prone or with low reserves it will be a blow to Arctic prospectivity equivalent to the Shell dry hole in 2015.

Ironbark: BP: Australia – gas – probably delayed until 2018

Korpfjell: Statoil: Barents – oil – Summer 2017 possible

Halcon: Total: Philippines – gas (FLNG) – licence to 2020, no drill date

Mesurado: ExxonMobil: Guyana – oil – dry

Antelope Deep: Total: PNG – gas appraisal – dry (drill to deeper secondary target ongoing – unknown result)

Eagle Deep: CGX Energy: Guyana – oil – missed expected drill date in late 2016

Magadan-1 / Dukchinskaya: Statoil / Rosneft: Sea of Okhotsk – oil – dry

Prospect B: Chariot / Serica: Namibia – oil – maybe 150 mmbbls – looking for drilling partner (BP pulled out in 2015)

Barque: NZOG Ltd: New Zealand – gas condensate – LNG, gas cycling required – licence extended to 2020

Marina: Karoon: Peru – oil – maybe 250mmbbls, possible issue with protected marine area

Hi George

I agree that their is not much showing at the moment. West of Shetland has seen a sizeable discovery by Hurricane Energy although it is fractured basement.

Do you think the up coming drills in the Porcupine basin may bear fruit?

I wish I could predict drilling results before they happen! I think the Porcupine basin is an extension of the formation which produces some oil offshore Canada, but success there hasn’t been great recently – Statoil thought they had a decent couple of finds but appraisal drilling showed they were too small to be commercial (but they are in a very expensive area, deep and far offshore with iceberg risks). There are more wells planned on the Canada side by Statoil, Suncor and an extensive set by ExxonMobil starting in 2018. Also BP have signed for drilling frontier wells offshore Nova Scotia next year (I don’t know if that is similar formation or not, but it’s in the area where Shell hit two expensive dry holes last year).

The Hurricane discovery will be interesting, and maybe expensive. I don’t think such geology has been exploited offshore before, and not often onshore. I’m not very clear on how the oil gets to flow, do they have to be able to follow the fractures / fault lines with the well, and how many wells would be needed (I think maybe a lot)? And how confident can they be of recovery volumes after only a couple of short term flow tests – e.g. how fast is the decline (presumably it is solution gas drive) and how confident can they be that the fracture density in the areas they’ve looked at would be seen over the formation?

p.s. – the ExxonMobil dry well, above, was in Liberia not Guyana.

I know the Vietnamese have some discoveries and production in the Cuu Long Basin offshore fractured basement.

As for Hurricane they claim that the reservoir has water drive. The uplifted basement rock was naturally fractured and then later charged with oil. So the oil in place excists not in the rock but in the spaces between the rock.

https://www.hurricaneenergy.com/

After a bit more investigation, apparently Genel’s Taq Taq field is a similar basement reservoir, and that has been a disaster. Of course Hurricane don’t have that prat Hayward involved, so should be at less risk.

I’ve worked in a field with fractured basement reservoir. The reservoir porosity is less than 5 % but if the well hits a good rubble zone close to a fault they can crank up 20,000 BOPD. But the volumetrics are poor, and they cone water.

It will be interesting to see if they find anything in Korpfjell. Will Noway be lucky again? It has the potential to be a very big discovery with an area closure 3-4 times larger that Johan Sverdrup. But there hasn’t been any wells drilled in that area before and the closest wells have been dry or small gas discoveries from what I can see. So very high risk.

Up above talk about per capita consumption.

Heads up for the BP Stat Review divided by population.

One country in particular maybe corrupted. Singapore. It is the home to some big refineries. Products sent elsewhere. But consumption logged for Spore.

Not clear if this is right. An examination of Spore consumption going back a lot of years did not show any one year with a big uptick, as might happen when refinery comes online. But still, Spore has maybe the highest consumption in the world per capita and shrug.

Curious

Belgium has the same problem – they have some very large ports which consume quite a lot of fuel, most of which really isn’t attributable to their economy.

Singapore is a corrupt corporation, run by ideologically twisted psychopaths.

Irrelevant.

Saudi Aramco chief warns of looming oil shortage

Link is behind a pay wall but here is the gist of the story.

The head of Saudi Arabia’s state energy giant has warned of a looming oil shortage as a $1tn drop in investments into future production takes effect.

Amin Nasser, chief executive of Saudi Aramco, the world’s largest oil producing company, said on Friday that 20m barrels a day in future production capacity was required to meet demand growth and offset natural field declines in the coming years.

“That is a lot of production capacity, and the investments we now see coming back — which are mostly smaller and shorter term — are not going to be enough to get us there,” he said at the Columbia University Energy Summit in New York.

Mr Nasser said that the oil market was getting closer to rebalancing supply and demand, but the short-term market still points to a surplus as US drilling rig levels rise and growth in shale output returns.

Even so, he said it was not enough to meet supplies required in the coming years, which

were “falling behind substantially”. About $1tn in oil and gas investments had been

deferred and cancelled since the oil downturn began in 2014.

The remarks come as the kingdom embarks on an ambitious task to sell a 5 per cent stake.

Also from the FT article: “Conventional oil discoveries had more than halved over the past four years, Mr Nasser said, compared with the previous four-year period.” – not reported if he mention that discovery rates are still going down?

“He added that it should not be assumed that major oil and gas companies would invest in sizeable projects.” – there aren’t enough discovered, undeveloped conventional greenfield projects to meet 20 mmbpd no matter what the price

“Large new production capacity and investments we will need in the future are lagging, and in fact missing in many cases …. This would lead to a shortfall that would emerge after a time lag and whose duration is difficult to estimate” – and with unknown exact response for any of price, supply, demand, knock on impact to food prices, etc.

The FT says: “In turn, the company is investing heavily in future crude production and aims to increase global refining and marketing capacity by almost half to up to 10m b/d. ” – without apparently realising that refining and marketing is not actually production.

If you go through Google (e.g. search FT, Nasser Aramco, shortage) it bypasses the paywall, at least for one article.

He’s talking his book. A shortage of oil means a high oil price and high profits for Saudi Aramco, who everyone knows has large reserves. He’s talking up the value of Aramco before the IPO.

Arctic Spill:

http://peakoil.com/enviroment/oil-well-leaking-out-of-control-on-arctic-alaska-north-slope

Any insight?

And some people wonder why those Nebraska farmers don’t want a pipeline on their property.

It doesn’t look too major – a low pressure gas cap with a bit of entrained oil, that has mostly been contained in the catchment area. Not good for BP PR again. May be another indication that the maintenance and operations cuts from 2014 onwards are starting to have impacts, especially in the most mature developments.

[…] above graph, taken from the ‘OPEC March Crude Oil Date” post at the Peak Oil Barrel blog, shows total oil production, in thousands of barrels per day, for the 13 members of OPEC, for the […]

Unlike 2016, when pretty much all US LTO production lost $$, it appears 2017 earnings are forecast to be slightly positive. COP forecast to earn .10 per share, OXY .21 per share and EOG .15 per share in Q1. As these companies greatly boost CAPEX, D,D & A will again be on the increase after large declines in 2016. COP’s major divestitures should help pay its dividend. Some arguing these large companies continue to be in liquidation mode despite WTI in the low $50s.

Also, it appears slightly more than 40% of the Permian Hz wells with first production in the year 2015 produced 3,100 BO or more in January, 2017. This is an improvement from prior years.

A Permian Basin well that produces 36,500 BO and 50,000 mcf gas in one year, at the current strip, will generate about $1.1 million, assuming a 1/4 royalty, after deducting severance and $6 per BOE in LOE.

So, more than half of the PB 2015 hz wells likely will not generate $1 million in pre-tax net income in 2017.

When will companies release well or project payout statements for US LTO plays?

Shallow, those Permian wells cost every bit of $9M each so your estimated net income projections are horrible. Respectfully, I think you are being very generous with OPEX; I think its more like $8 dollars and then there is G&A and interest expense per incremental BOE; even Pioneer pays lots of interest each year. So the answer is, those companies won’t discuss payout projections. Its far too ugly and that is not what they want people to focus on. They want people to focus on bogus EUR’s.

Do you believe that Permian shaley-carbonate wells will be any better (UR) than Eagle Ford shale wells when the dust all settles?

Hi Mike,

If you look at Enno’s data it looks like the Permian wells will be around 50 kb more than the Eagle Ford wells (recent well data for past 3 years). I agree that at current oil prices these wells are not likely to be profitable, they need about $65/b or more at the refinery gate to be profitable on a point forward basis and maybe $70 to $75/b full cycle.

Mike-

Was that you honored today on Oilpro as Top Contributor? If so, congratulations. I certainly always enjoy reading your contributions here.

Thank you, Mr. Keller.

Azerbaijan production not looking good. 14% decline y-o-y for March, down 42 kbpd from February. Another worry for BP – the Azerbaijan president takes a personal interest in any drop and expects the BP chief to report directly to him.

Raw Energy has come out with a new article on SA. SA isUsually a cess pit, but Raw Energy knows what he speaks.

For those confused on the difference between productivity/production and profitability, read this.

And pay particular attention to the part labeled “Points of Confusion”

https://seekingalpha.com/article/4062240-e-and-p-bottom-barrel-club-17minus-1-land-confusion

Mr. Hightower, thanks for posting this link; I just finished it myself. It was painful. These points of confusion, in my mind, are quite deliberate on the part of the shale oil industry, designed to hide the truth. It begs the question, how much longer can this charade go on?

This is a game of musical chairs. Just do not be left standing at the end.

RT

That is an outstanding piece of work by Raw Energy and should be a ‘must read’ – start to finish – for anyone wishing to understand what the heck is going on in the US unconventional realm.

Thanks for linking.

My micro-takeaway is …

1) Higher realized prices are necessary for industry wide viability

2) Only the strong will survive

3) The strong will survive

I’d just like to see payout data. The companies already maintain this internally. Not hard to generate this data IMO.

At least they could show it for their best wells. They won’t even do that for some reason.

PXD 2015 I show 207 Permian Hz wells.

83 of those have not hit 150,000 cumulative gross oil and produced less than 3,100 BO in January, 2017.

I would like to see those 83 wells grouped together in terms of payout. Then group those 124 that have surpassed those figures. Have the 124 wells generated enough to overcome the 83 lower volume wells.

We have no idea what any company faces in way of royalty burden. I recently read Chevron is advantaged in this area in the Permian.

We are ten years into US shale and yet the numbers are still very vague in my opinion.

Payout should be all that matters. AT some point, if these wells were truly as profitable as they say, with as many as they are drilling, they should be able to finance through cash flow.

Time to payout should indeed be all that matters, that and ROI. I personally have never been able to work off cash flow unless my ROI’s are 3:1 over the life cycle of the well. Imagine a situation where it takes 5-6 years to reach payout, 65% of your total UR has then been realized, the other 35% takes 18 more years to occur, that at rates of less than 25 BOPD, and the best, the BEST you can hope for is 1.5:1 ROI. Factor in risk (as in the price of oil collapsing 70%) and anybody with any cranial capacity whatsoever would sooner bury the $9M cost of drilling the well in the back yard with the dog bones.

People in the oil business understand that does not work. People not in the oil business focus of the romance of 3% of all the shale oil wells EVER drilled in America and ignore the other 97%.

Mike,

I really appreciate your comments and perspectives. Thank you.

Jim

Thank you, Jim.

It appears a $100,000 investment in PXD stock gets you .70 BOEPD of flowing production, encumbered with $8,000 of debt, that requires $10,000 per year of CAPEX to maintain at .70 BOEPD.

Considering that .70 BOEPD is only generating about $9,300 of revenue per year, BEFORE deduction of any expenses, maybe there are better places to invest $100,000?

More maintenance issues, this time impacting production in Brazil. It seems when they have unplanned outages on their FPSO they hit the whole production system and last a long time. Might be a consequence of using cloned designs, or their general maintenance regime:

“Average oil production in the country was 2.12 million barrels per day (bpd). This volume represents a 3% drop compared to February, mainly due to maintenance stoppages on FPSO Cidade de Angra dos Reis, located in Lula field, in the Santos Basin pre-salt, and on P-37, in Marlim field, in the Campos Basin. The company’s [PetroBras’s] domestic oil output was also down in February for a similar reason, the stoppage of the FPSO Cidade de Paraty.”

http://www.offshoreenergytoday.com/petrobras-oil-output-suffers-due-to-fpso-stoppage/

I tried to find some data that would show how fast Brazil’s deep water fields decline once they come off plateau, but couldn’t. I’ve seen such curves by field and/or basin so it’s out there somewhere though, maybe in PetroBras reports, but not in the Ministry data that I could find. Anyway, for what it’s worth this shows the regional production up to February. March will be another drop because of the maintenance problems cited above.

I’ve thought with all it’s presalt discoveries that Brazil has a lot of upside regarding future production potential. What has surprised me is how quickly they brought some of these discoveries online. I’ve seen sources showing their presalt production already exceeding 1 MMBOPD. I think all of the Espirito Santo production above is presalt. Not sure how it splits out from the other basins shown though.

The major IOCs would have taken more time to appraise, front-end engineer, etc.

Anyone have any insights into all this? Is this “accelerate” strategy typical of Petrobras?

New Jodi data out:

https://www.jodidata.org/oil/

A lot of countries don’t report any more. The one interesting number that I can’t find elsewhere is Saudi storage, and that seems to have stopped falling.

I think I saw that they were producing more in February to replenish their supplies.

Interesting article which supporrs the view of many here ( only partly petroleum related)

http://www.bbc.com/future/story/20170418-how-western-civilisation-could-collapse

Interesting, normally I wouldn’t pay much attention, but Ed Morse was the big old bear predicting oil to go down in 2014 and has been pretty well negative on it since.

https://www.bloomberg.com/news/articles/2017-04-18/citi-sees-oil-surging-10-in-season-to-have-faith-in-commodities

The post below was posted by Mats Lindqvist of ASPO Sweden. It was originally posted on [email protected]. I have reposted it here without his permission. But I am sure he wouldn’t mind. 😉

Once we are past the peak, we will see an associated financial and economic crisis. In a shorter perspective, either of those might seem to precede the other, but in reality the stagnant economy is a consequence of stagnant supply of cheap energy. I think most of you reading these emails agree with this view.