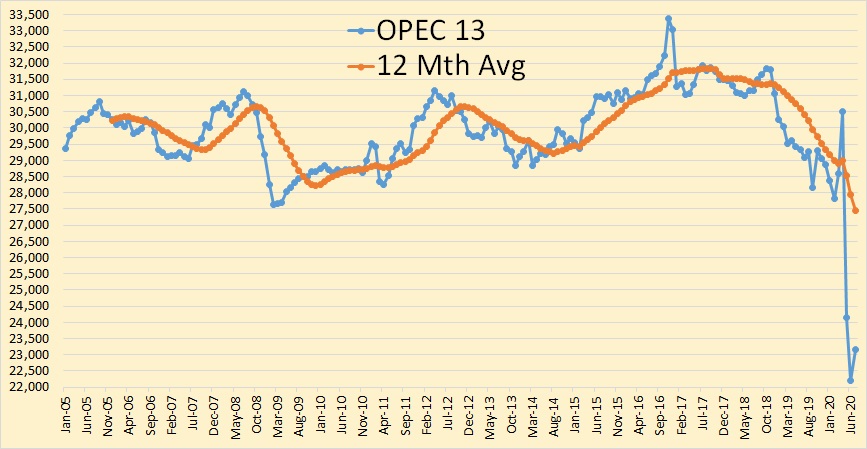

All OPEC data below is from the August OPEC Monthly Oil Market Report. The data is through July 2020 and is in thousand barrels per day.

OPEC crude only was up almost one million barrels per day in July.

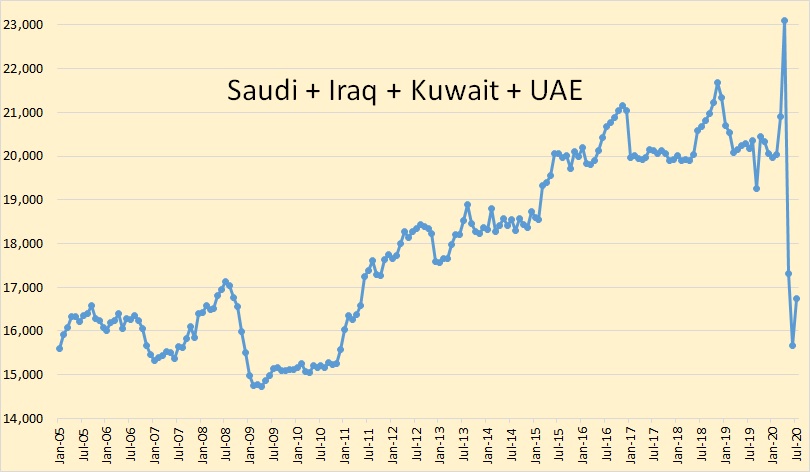

The lions share of the increase in OPEC production came Saudi Arabia. Iraq, Kuwait, and the UAE accounted for the rest.

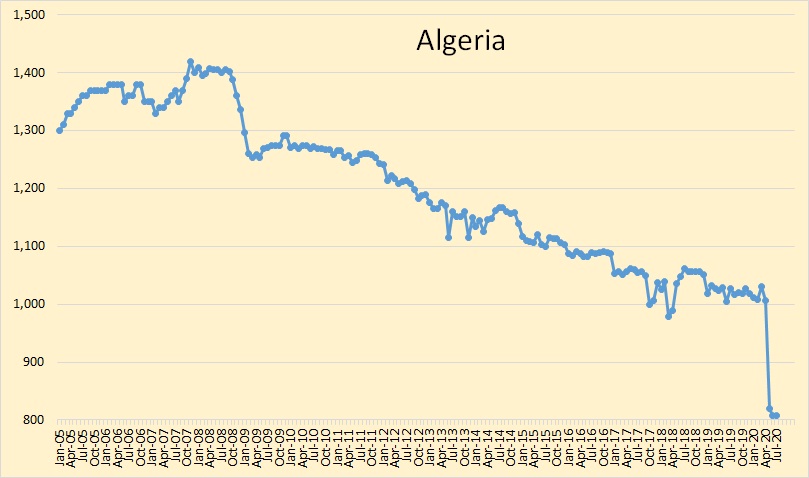

It is a little surprising that Algeria did not increase production in July.

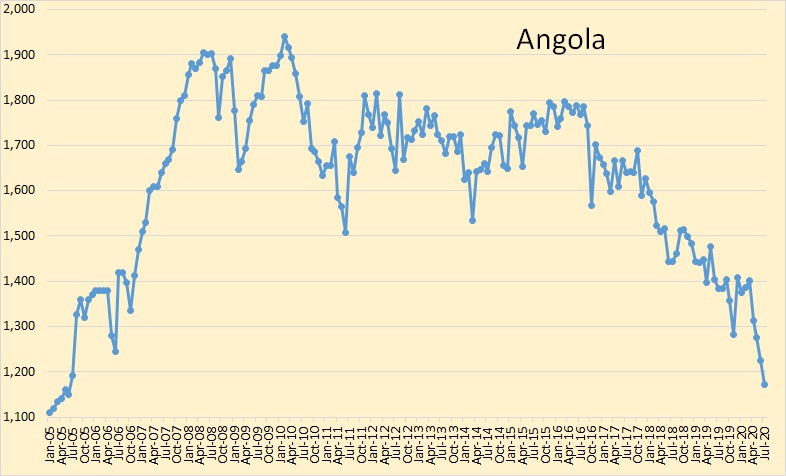

Angola continued to decline in July.

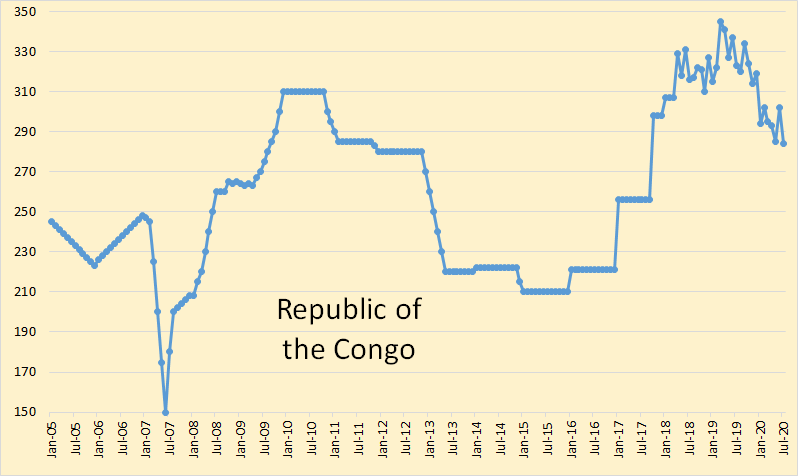

The Congo also suffered a slight decline in July.

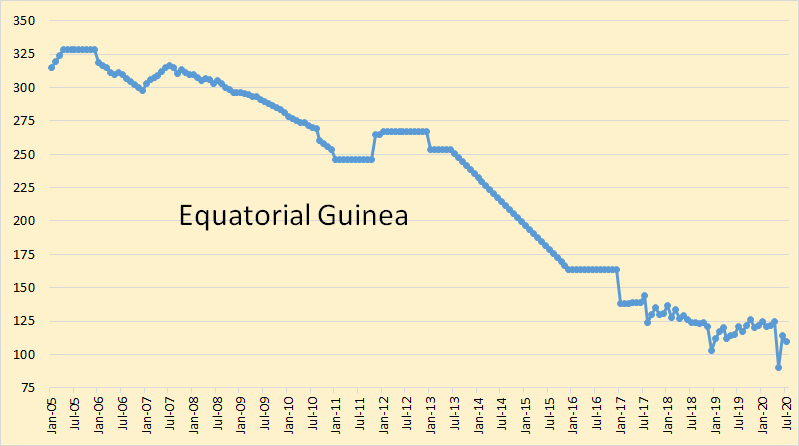

Equatorial Guinea does not produce enough to make a difference either way.

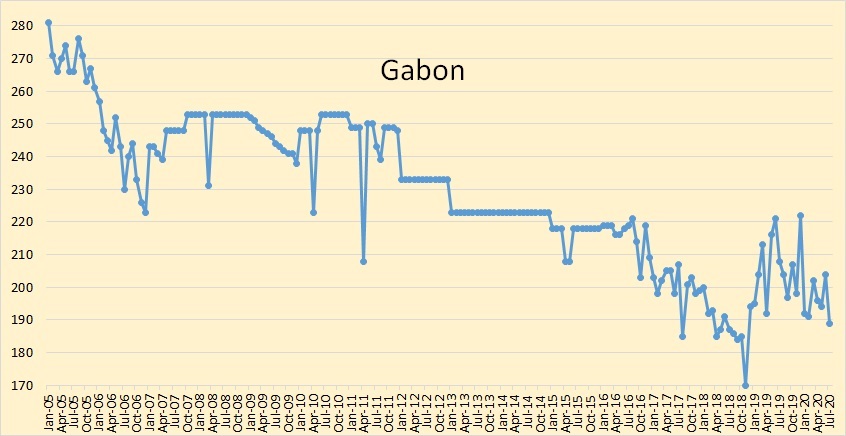

Gabon down slightly. They haven’t been paying much attention to OPEC cuts either.

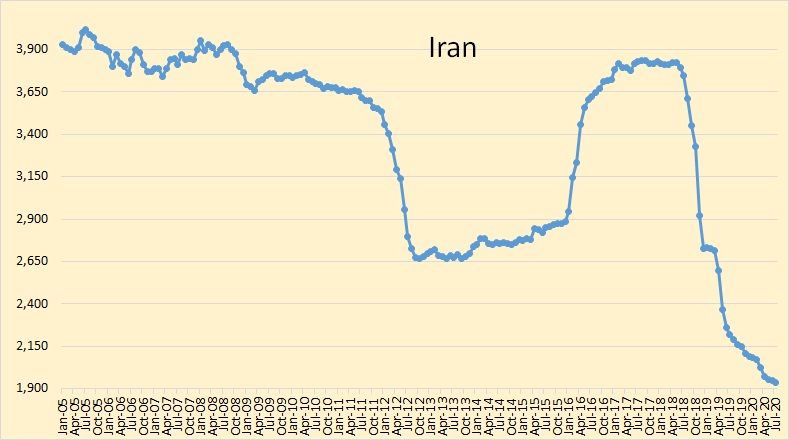

Iran is still suffering under sanctions. It will be interesting to see how the Biden Administration handles Iran.

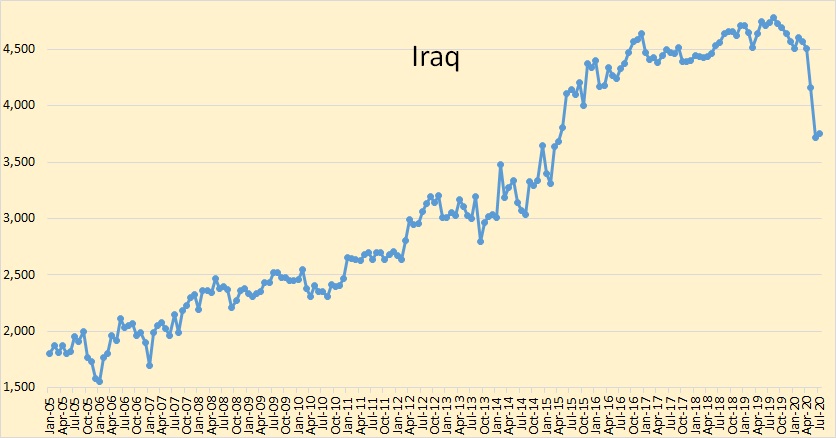

Iraq increased production slightly, 39,000 bpd, in July.

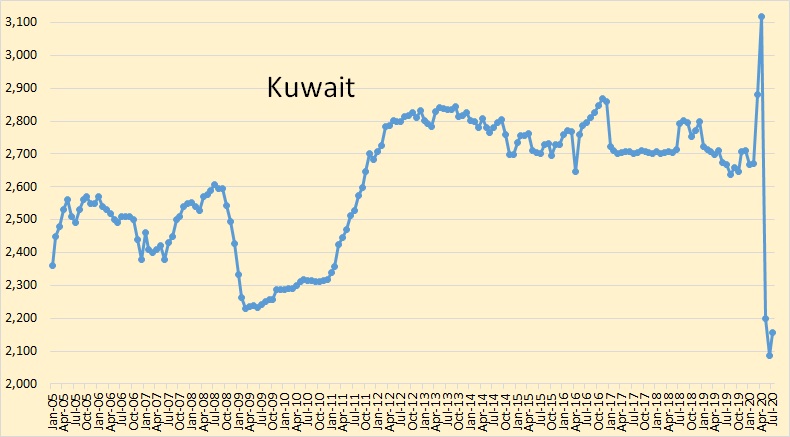

Kuwait increased production by 73,000 bpd in July.

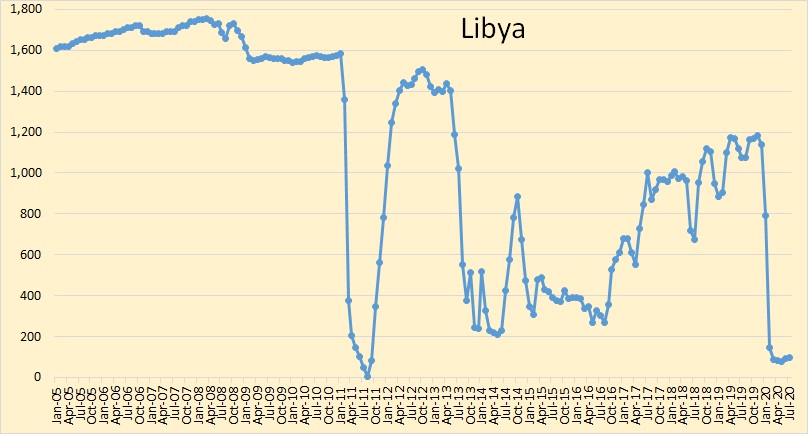

Libya thought they had a deal with the rebels, but they didn’t. Analyst see no hope for Libya in the near future. They all predict things will just get worse, at least in the near term.

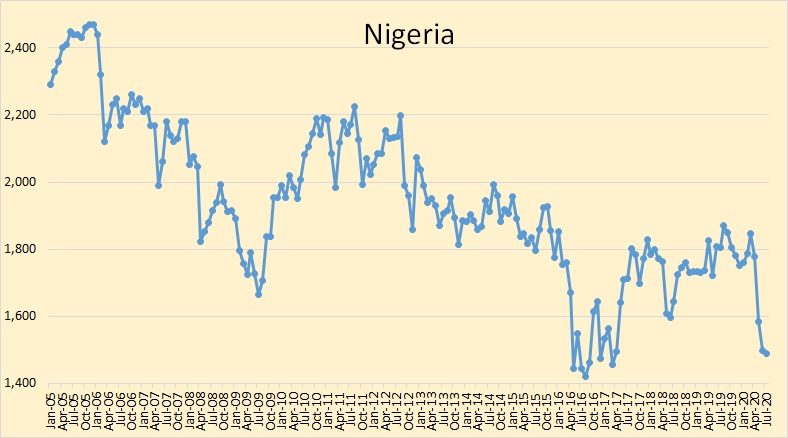

Nigerian oil production showed a slight decline.

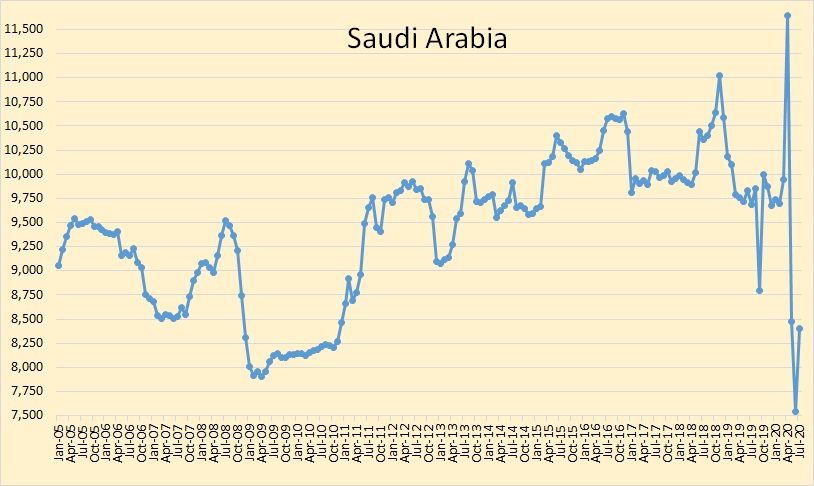

Saudi Arabia increased crude oil production by 866,000 barrels per day in July. That was 88% of the total OPEC increase of 980,000 barrels per day.

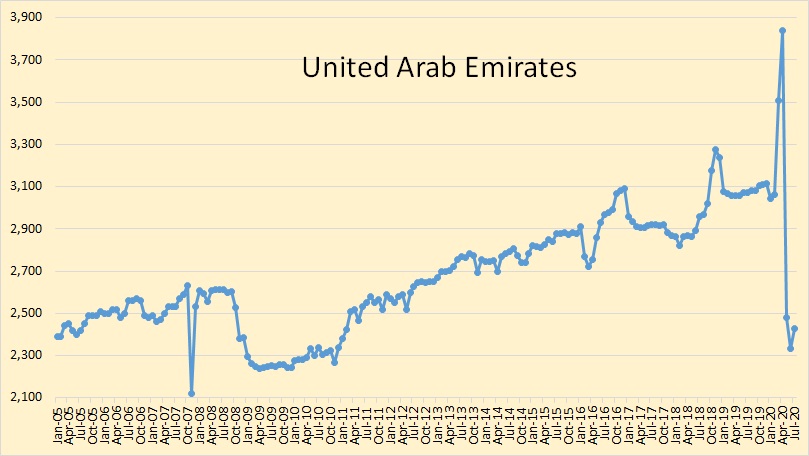

The UAE had the second highest production increase in July, 98,000 barrels per day.

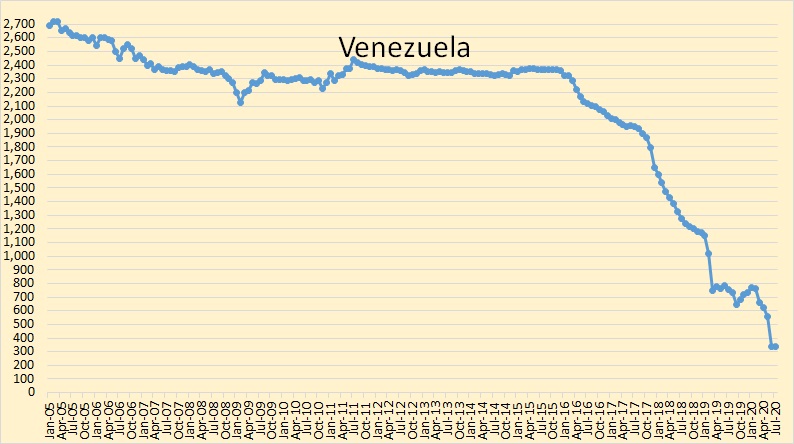

Venezuela’s misery just continues.

Here is where ALL the action is within OPEC.

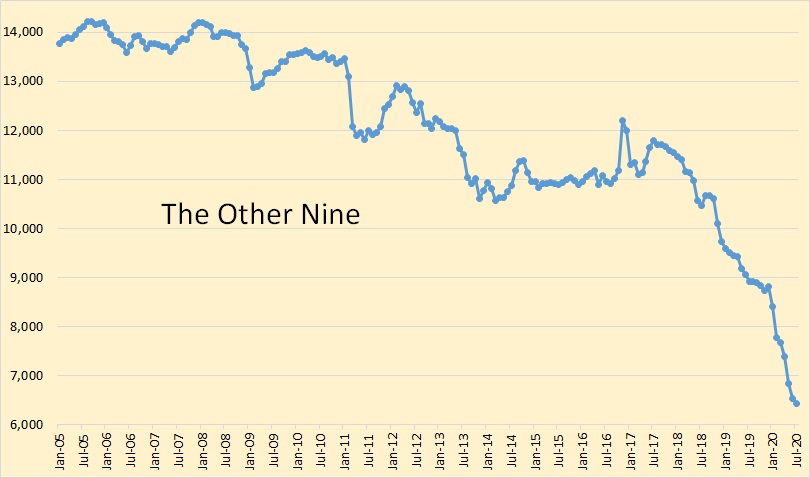

And here is what is happening with the rest of OPEC.

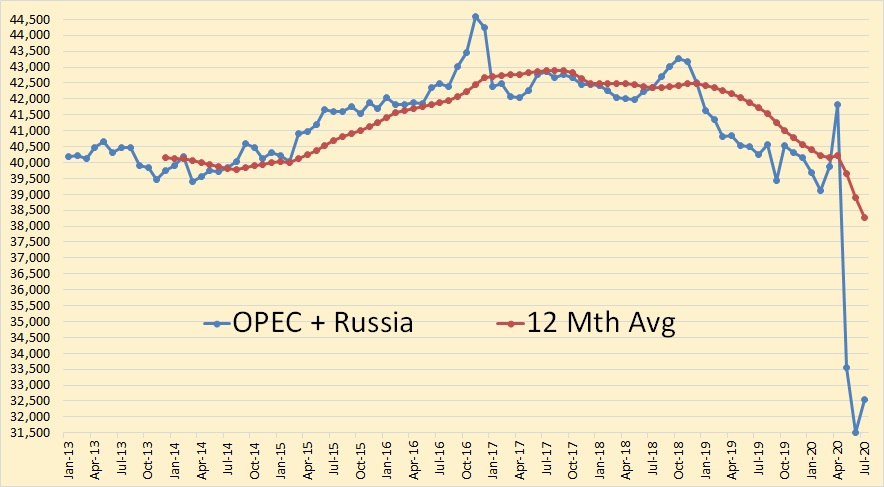

Their claim that OPEC’s share of total global production (26.1%) is simply not correct. They are measuring OPEC crude only as compared with world total liquids, including OPEC’s condensate, NGLs, and other liquids.

Since 2013, OPEC has averaged producing about 40% of world C+C.

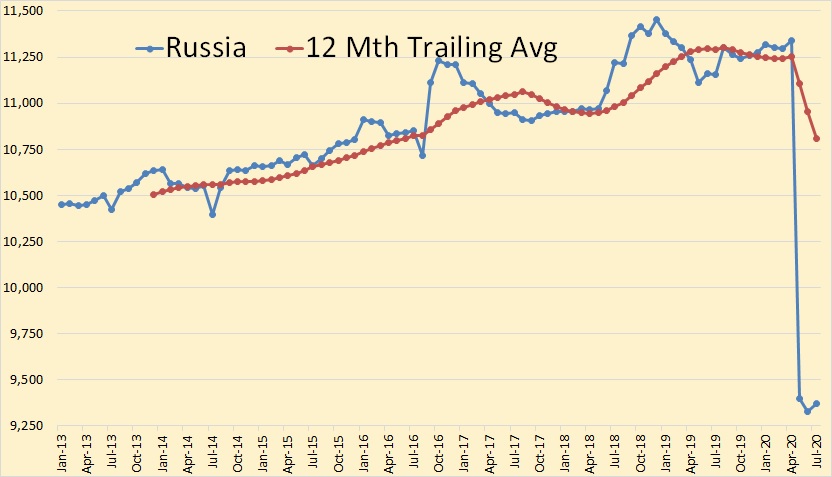

Russia is the only other nation with data through July 2020. Russian C+C production was 9,371.000 barrels per day in July, down from 11,339,000 barrels per day in April.

This is OPEC crude only plus Russian C+C through July 2020. Over the last few years, OPEC plus Russian oil production has averaged about 53% of world oil production.

The case for peak oil!

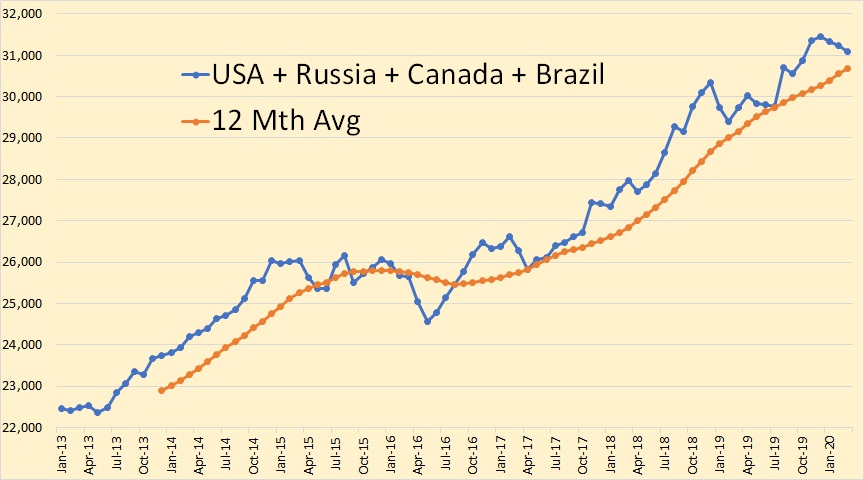

The data for the two charts below is through March 2020, or the month before the virus collapse began.

These four nations are where virtually all the oil production in the last five years has come from. Since 2016 their increase has averaged just over five million barrels per day.

The rest of the world peaked, both average and monthly, in 2016. Since then their average production has declined over 3.6 million barrels per day.

Russia has said that they have peaked at about the point they held in March, around 11.2 million barrels per day. And it looks for all the world that the USA has peaked also, though some may believe this is not the case. Nevertheless, those nations in decline will continue to decline at close to the rate they have declined since 2016.

So the question is, will those four nations that have been responsible for keeping the world oil production increasing since 2016 continue to do so?

No, that is simply not going to happen. Or at least that is my humble opinion.

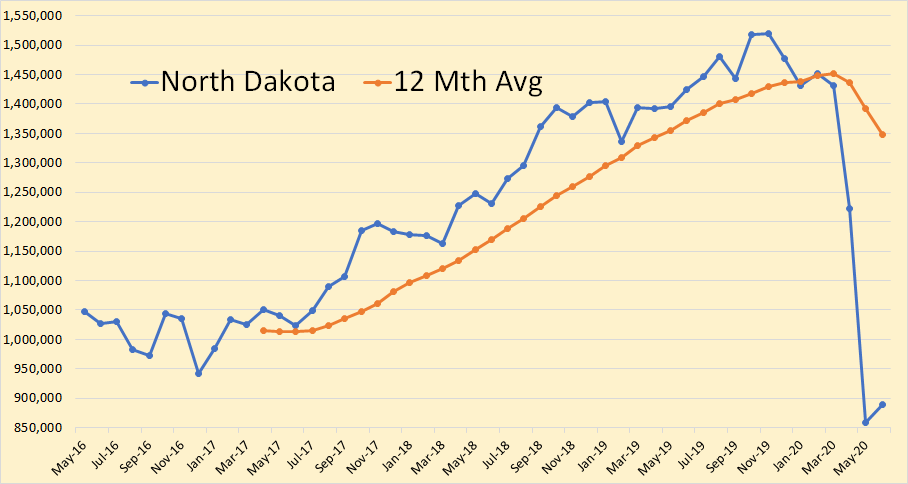

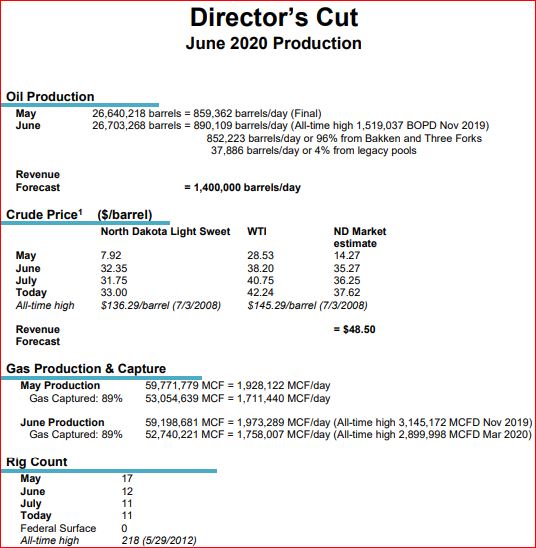

The North Dakota data has just been released. Their production was up 30,748 barrels per day.

The North Dakota Director’s Cut.

15/7/2020

Peak oil in Asia Update June 2020 (part 2)

https://crudeoilpeak.info/peak-oil-in-asia-update-june-2020-part-2

IEA Sees 2020 Oil Demand Down 8.1 Million Bpd

The International Energy Agency expects crude oil demand this year to be 8.1 million bpd lower than it was in 2019, a downward demand forecast revision of 140,000 bpd, the authority said in its latest Oil Market Report.

Have we turned a corner with Nat Gas Pricing? Inventory at Peak with Price Heading up?

NG is the Bridge Fuel no matter what people say. Existing Grid Tie PV Inverters are parasites, These inverters need megaton rotating reserve to wake up and keep the pulse alive.

Most of the decrease in the “rest of the World” (besides US, Russia, Canada, and Brazil) since Oct 2018 was simply OPEC cutting output due to a glut of oil. US output has likely peaked, but is is also likely to increase from current levels once oil prices rise as the pandemic eventually subsides. Also OPEC can likely increase output from the April 2020 level, as can Canada and Brazil in a higher oil price environment. So perhaps peak was 2018, but in my humble opinion the peak is likely to be 2027 or 2028 after demand normalizes and higher oil prices lead to more investment and higher output, perhaps a peak of 84 to 85 Mb/d for World

C plus C output.

The natural decline for the rest of the world for the two years 2016 to 2018 was approximately 1 million barrels per day. That natural decline has continued for another year and one half. That puts the natural decline down about another 1.75 million barrels per day for the rest of the world, since the end of 2018, in my chart. The rest of the decline was OPEC cuts. That decline will continue.

That’s enough, that’s one hell of a lot more than enough. Those four nations will not continue to increase at half a million barrels per day per year for the next several years. I expect the four, combined, to continue on a bumpy plateau for about four years before starting to trend downward.

That is my argument, Dennis. And I am very confident it is correct.

Dennis, look at my chart above labeled “The Other Nine”. Only about half a million barrels per day, if that much, are the result of cuts. The rest of it is natural decline. That will continue. Ditto for the rest of the world.

Dennis you are concentrating on possible increases for some nations. That is dubious enough, however, you seem to be completely overlooking the natural decline of the vast majority of nations that are in decline.

Natural decline as THE production trap was mentioned by me a couple of weeks ago. Dennis then claimed he had it factored in into his models. I also think we‘ve peaked, but that‘s what he stated.

OPEC peaked in 2016, Russia peaked in 2019, and the USA very likely peaked in 2019 also. And the vast majority of all other nations have peaked also as evidenced by their continuing decline. That should be enough evidence for anyone.

Ron.

$40s WTI and Brent are wholly unsustainable prices. I’d argue that $50s and $60s are also if growth is being sought outside of a few areas.

The longer prices stay low due to the pandemic, the more likely the world has passed peak supply.

I don’t see any sign that this pandemic will be over anytime soon.

SS, there is no doubt that the pandemic will hasten peak oil supply. Many shut-in wells will not re-open. Frac spreads are being sold for scrap. Rigs are being decommissioned. Plus we are still producing at 80 to 90% of former levels. That means depletion is still continuing. So when they do get around to producing flat out again, the oil will just not be there.

As to the longevity of the pandemic, one can only guess. But things will never be back to the free and easy ways of the past. International travel will never be back to what it once was. There will be fewer travel vacations even within nations. The possibility of the virus returning will forever be on everyone’s mind.

Also close to 100,000 job losses in the oil industry, many folks in their 50s and 60s. Hard to see how they bring folks on for another boom with the loss of all that skilled labor.

Ron,

Once that a, in most cases, curative combination of medicines is available and one or a few very effective vaccins are registered and rolled out, it remains to be seen how ‘normal’ life will get again.

I don’t think the virus will be forever on everyone’s mind. Already now many young people have started to party like before the pandemic, even in Europe (infections rising in almost all European countries, so a lot of ‘Trumpites’ and Bolsonarites’ also in Europe). When vaccins are widely available at least everyone who is planning to travel by plane will be going to get a vaccin.

A good chance that vacations and air travel is close to normal somewhere in 2022 or 2023.

Shallow sand,

The pandemic will eventually subside an the US and other nations that have responded poorly to the pandemic will eventually learn from nations that have responded relatively better, compare Europe and US.

If peak supply is reached, but demand resumes 1% annual growth, I expect we will soon see Brent at $65/bo+/-5 at minimum, by 2025 to 2030.

Dennis. Brent $65 in 2025-30 is only helpful if one or both of the following happens:

1. Capital markets continue to the pattern of 2015-19 and fund drilling that provides marginal returns or losses, but has no hope of providing superior returns.

2. Some other new, economical supply source is discovered.

Low oil prices to 2025-2030 would seem to mean supply will be constrained unless one or both of the above occur.

Conventional oil pretty much peaked in 2005.

I look at $10K invested in a major oil company in 2010. I look at $10K invested in a shale company in 2010. I then compare that to the S&P 500 return since 2010, all other industry groups, specific companies, etc.

Investing in oil is like investing in tobacco. The only allure is yield. Upstream E & P will have to keep borrowing to pay the dividend even if oil returns to $50 Brent. Same with $60 Brent.

Dennis. One thing that you are missing is just how poor the future of the upstream oil industry is.

When the shale boom started, EV’s were a pipe dream.

When the shale boom started, there wasn’t widespread sentiment against oil. Global warming/climate change was on the radar, but not like now.

BP is trying to remake itself in large part because they cannot find talented and skilled younger workers who want to work for a fossil fuel company.

We have been in this industry since the 1970s. We have some of the best leases in our field and have made more money in this industry than in our professions or in other investments. There is a third generation in our family ranging from late teens to mid twenties. None are interested at all in this family business/investment. Same for one of my best friends who makes his living at this. Same for another, whose engineer son started working with him out of college, but before oil crashed in 2014 left and took a job in a “Green Energy” field.

Mike is in the same boat.

I know all of the major players in our field. All companies are family owned. There are a total of four in all of those families working in oil and gas who are under the age of 50, and those four are at or nearing 40, and started working in their family oil companies at least over 15 years ago.

As I have posted before, our employees range from 47-61 years of age. The two we hired who were in their twenties have both long ago left, and no longer work in upstream E & P.

We have participated in some Zoom meetings with the National Stripper Well Association. Almost all on those meetings is old (50-80 years old).

We hope to sell out on the next recovery, if that ever comes. But we are concerned there will not be any buyers.

So, maybe $100 oil over a period of time could turn this tide, but sub-$50 WTI sure won’t.

Yes, the future is hard to predict. But absent some tremendous financial return potential, why would young people have any interest in making a career of US upstream E & P?

Shallow sand,

If supply becomes short oil prices are likely to rise. Profits will be higher and there may be more investment. If there is no investment supply will remain short until prices rise to a level that increases supply and reduces demand.

I am highly skeptical of a thesis that predicts oil demand will never rise above the 2019 average level. By 2022 or 2023 World demand for oil is very likely to be above the 2019 level and we might see 80/bo for Brent or more. Sell then, or whenever you think the market has reached a top. My guess is that there will be a lot of money that will be made by stripper well operators from 2023 to 2033. I imagine profits will be good at over $65/bo for WTI in your fields.

Shallow sand,

Scenario below has oil prices rising by $2/b each year until reaching $70/b in 2033 and then remaining at that level until 2039 and then decreasing at $2/b per year and then plateauing at $30/bo. It is assumed cash flow after paying interest on debt is used to finance new wells in the Permian basin, well cost is assumed at $9 million in 2019 US$. Permian ERR for this scenario is 51 Gb, about 28000 wells have been comleted in the Permian through June 2020 and the entire scenario has 161000 total wells completed in the Permian basin.

Oil Price scenario used for Permian scenario presented.

For the oil price scenario above (max oil price $70/bo in 2019 US$) and assuming the decline in non-tight oil for the US continues at the rate established from 2010 to 2020, I get the following scenario for centered average 12 month US C plus C output. Click on chart for larger view.

The pandemic will eventually subside an the US and other nations that have responded poorly to the pandemic will eventually learn from nations that have responded relatively better, compare Europe and US.

I am sorry Dennis but this really pisses me off. No, I am not blaming you, I know you were just not thinking clearly when you wrote it. I know you know better.

The US did not and does not need to learn a goddamn thing. We already know what we should have done. We just had a goddamn idiot in the white house and enough damn fools who think he is God that he and his followers really screwed things up.

Dennis, Trump’s idiocy is not our idiocy and your statement implies that it is. I apologize for the rant but dammit Dennis, you know that.

Ron,

Yes I agree poor leadership is a major problem, the fact remains the US as a nation is doing very poorly dealing with the pandemic, based on the data.

No, no, no. The scientific community, that is, the doctors, all the Democrats, and everyone else with an ounce of brains said we should have started in January or February. They all said the shutdown should have been complete instead of half-assed. And they said we should have had a nationwide mask policy mandated. But Trump would do nothing! He said it would magically go away.

But you do have a point. Those goddamn idiot Trumpites make up about 35% of this nation. And they really do have a lot to learn. But you just can’t fix stupid, so they will likely learn nothing.

No, no, fuck no. As a nation, if we had anyone but a blooming idiot in charge we would have had just as good of results as any European nation.

No Dennis, we as a nation, if we had the right person in charge, would have had every bit the results the European nation had.

But instead, our idiot of a president just said it would just go away, we needed to do nothing. And people should be free not to wear a mask. He set the example.

Tight oil scenario, using price scenario above.

I capitulate. Ron you are correct, we are post peak.

Post Peak…

OK, now what?

It is so strange to be post-peak and not have high prices for crude,

and food.

I guess that will be coming.

note- biofuels should not be counted in liquids tally. It is a different animal, with the source being dependent on farming and soil, not drilling and geology. Just because ethanol is used for propulsion shouldn’t matter- electrons and batteries aren’t counted either, and rightly so. Those belong in a different category- transportation energy.

I have argued for several years that peak oil is a low price phenomenon, not a high priced phenomenon.

The most overrated law in economics is that of supply and demand. This law suffers from what Richard Feynman called “vagueness” (see

https://www.youtube.com/watch?v=EYPapE-3FRw). The problem is that it is always satisfied and hence gives absolutely no information about prices.

The latest iteration of our article on the oil cycle can be found at

http://www.math.univ-toulouse.fr/~schindle/articles/2020_oil_cycle_notes.pdf

.

Another problem with market theory (beyond vagueness) is that it lacks a time axis.

The theory states that the relationship between price and supply moves along the demand curve, but doesn’t say how fast, just that “in the long run” the system will reach equilibrium. Being in equilibrium means being somewhere on the demand curve.

https://www.economicsonline.co.uk/Competitive_markets/Demand_curves.html

So for example, if prices go up, the demand quantity is expected to go down. The question is when.

Where does this go wrong? In classical market theory, for example, unemployment is impossible, because if labor supply outstrips demand prices (wages) should fall until until equilibrium is attained. This has been observed to be false on many occasions, including right now.

As Feymann states in the video, “If it disagrees with experiment, it’s WRONG! That’s all there is to it.” Classical economics isn’t just too vague, it is wrong.

Keynes joked about this that in the long term we’ll all be dead. He meant equilibrium will never be reached, so we are never on the demand curve. He argued that “sticky prices”, meaning the unwillingness to accept pay cuts, kept labor markets permanently out of equilibrium.

It’s worth pondering whether oil prices are “sticky” as well. Saying yes is saying the law of supply and demand doesn’t apply (in the short term). This year we have seen that both OPEC’s politicking and panicky traders can cause wild swings in price unrelated to supply and demand.

Where market theory is vague is the shape of the demand curve. For example, if oil supply can’t meet demand in the near future, as some here have posited, how high will prices go? Some claim it will go over $200, as people get desperate for it. Some claim that higher prices would increase efforts to find and drill more, putting a lid on prices. Some claim the shortage would crash the world economy, depressing prices. Some claim that faced with oil shortages, the world would simply switch to EVs, or stop wasting the gunk on poorly designed transportation systems, so prices would stay more or less the same.

Who is right? Nobody knows. So we don’t know the shape of the demand curve. The theory is hopelessly vague.

Good points. For all these reasons it is not surprising that the journalist Robert Samuelson noted last year that frequently economists don’t know what they’re talking about: https://www.washingtonpost.com/opinions/economists-often-dont-know-what-theyre-talking-about/2019/05/12/f91517d4-7338-11e9-9eb4-0828f5389013_story.html?noredirect=on&utm_term=.dc651d463df7.

I have argued for several years that peak oil is a low price phenomenon, not a high priced phenomenon.

Schinzy,

The price of crude oil is only part of the Peakoil phenomenon. How much is left in the ground counts, however more important is at which velocity the remaining Gb can be extracted. I am not a geologist, but common sense says that when an oilfield is well depleted (50-70%) the most of the remaining barrels will be extracted at a much lower speed, even at very high oilprices. With secondary and tertiary EOR technology most conventional oilfields will not produce the same or close to the same amount of barrels/day as before for many more years. That’s also my conclusion from what I have read more than a decade ago.

Of course with high oilprices new, relatively small, oil fields will come online and (more advanced) EOR will start in other fields, but no matter how you look at it: depletion never stops. With most oilfields in the world past-peak, only a tremendous amount of money (needed to develop EOR) can prevent world crude oilproduction from falling like a rock. And all those EOR technologies will deplete oilfields faster. Big gains in the beginning, more disappointments later.

Will there be significant amount of shale oil developed in the future in other countries than the U.S. ? If so, is that wise, regarding an already existing runaway climate change ?

Han,

There are a lot of oil resources that have not been developed, if oil prices rise in the future they will be developed. This will only allow increased World C+C output through 2028 to 2032 (my guess has shifted forward a few years due to the current pandemic). Where you are incorrect is the idea that output will drop like a rock, that only will occur if demand drops like a rock, I doubt that happens before 2045 to 2050. High oil prices will lead to less demand and eventually a transition to other energy sources for transportation may lead to falling oil prices (my best guess is 2035 to 2040, and I lean towards 2040), a lot of current oil resources, especially unconventional and deepwater offshore resources, might never be developed once oil prices start to fall after 2035. I build that into my oil shock model with falling extraction rates after 2040.

There are a lot of oil resources that have not been developed, if oil prices rise in the future they will be developed.

I am curious Dennis. Are you talking about shale oil? If you are then I understand where you are coming from. But if you are talking about undeveloped but discovered resources then I would be very interested in exactly where they are. What nations possesses these resources.

Well we don’t really have that information for most nations.

For the US proved C plus C reserves at the end of 2018 were 47 Gb, 2P reserves were likely about 1.5 times this amount or about 70 Gb.

Proved non-producing C+C reserves were 18.6 Gb at the end of 2018, so proved producing reserves would be 28.4 Gb (47 minus 18.6). The 2P non-producing reserves would be 70-28.4=41.6 Gb.

So for the US only 40% of 2P reserves were producing oil at the end of 2018.

Let’s take World Oil resources at about 3000 Gb minus 1350 Gb cumulative production for remaining resources of 1650 Gb (conventional and non-conventional). We will assume the US is representative at 40% of resources producing, so for the World we have 1650 times 0.4=660 Gb of producing reserves (note that this estimate is likely too high because the US has developed its resources far more aggressively than most nations). In any case this would leave 990 Gb throughout the World of non-producing oil resources.

I do not have access to proprietary databases that show which resources are producing vs non-producing, I have to use a statistical analysis to estimate, that is what the shock model is all about. Using the information we have (discoveries, cumulative output, and estimates of URR) to model past and future output.

Errrr…. okay. I get the gist of your argument.

The model looks at discoveries, future discoveriez and reserve growth. World conventional URR is assumed to be 2800 Gb, most analysts have estimates between 2600 Gb to 3500 Gb for conventional URR, my estimate is on the conservative side. I USE Jean Laherrere’s estimate for extra heavy oil of about 200 Gb, many other estimates are 500 to 1000 Gb for extra heavy oil and tight oil combined. So my estimate is quite conservative there as well.

OPEC, US, Brazil, Canada, and Norway will all increase output when demand returns, this will morecthan offset decline elsewhere.

Ron has predicted the peak on many occasions, in 2025 to 2030 he will be correct. 😉

Ron has predicted the peak on many occasions, in 2025 to 2030 he will be correct. ?

Hey, I did not anticipate the shale phenomenon. And neither did you. That was why I was wrong. And you, thinking this phenomenon will continue into the distant future, as well as dramatically underestimating the decline in the rest of the world, is why you will be wrong.

And I am not wrong with my prediction this time. The peak month for world C plus C production was November 2018. End of story.

Ron,

You have made these predictions in 2015 and 2017 well after the shale phenomenon had begun. You are correct that I have also underestimated when the peak would occur. In 2012 my medium scenario with URR of 2800 Gb had a 2020 peak see

http://oilpeakclimate.blogspot.com/2012/07/further-modeling-for-world-crude-plus.html?m=0

Personally, everyone knew the oil was in the rock and roughly in what quantities. We knew there was a technology to get it out. Most people never thought the MONEY would be available to do so even when it wasn’t profitable. To me, this is the enduring mystery of this strange interlude.

Ron,

Yes right for now Nov 2018 is the centered 12 month peak, we will see what happens when oil prices rise in the future. There have been many peaks in the past. I don’t expect World output will rise much above the level reached in 2018, maybe 2 to 3% higher for the final 12 month average peak for World C plus C in 2027 /-3.

If oil prices stay above $60/b for 5 years and the 2018 peak has not been surpassed, then I will agree that 2018 is the likely peak.

Tesla market cap – $300B v. Exxon at $190B.

Wall Street is very story driven. They wasted a decade throwing money at tight oil and lost billions. It’s hard to see how this tight oil story gets resuscitated. The ‘10s saw free debt, low regulatory regime, no effective alternatives to oil, skilled work force, entrenched globalized oil markets, no pandemics, etc, and they STILL lost hundreds of billions. Wall Street wants to lose their money in new ways. At least they get some novelty out of it.

A comment posted on ^peakoil.com^ . Interesting .

”The price action of WTI shows it quite clearly that the non oil extracting part of the economy can’t afford to pay a high enough price that would allow the extracting, processing and delivery of oil products to it.

It’s that simple, most of the oil still in the ground will stay there unless somehow you find a way to pay $100++ per barrel. The last 12 years has shown that we can’t!

The best yearly average weekly price of WTI was right around $100

Average weekly price of WTI for years 2008 thru 2013 was $88.

Average weekly price of WTI for years 2014 thru 2019 was $53.

The trend is what it is and it shows no signs of changing, the price of WTI is still hitting lower lows and lower high.

I have no idea what the future will bring but the next 3 years are going to be interesting and not in a good way.

Have fun everyone.”

Dennis,repeating myself ,the price of oil is going to trend down . Supply and demand curves do not apply where the world^s economic system is now placed . Alimbiquated has done a very good job explaining that .

hole in head,

I doubt oil prices will continue to fall, my expectation is roughly a $2/bo annual increase in real Brent oil prices (in 2019 US$) over the next 12.5 years with Brent crude prices reaching $70/bo in 2033. I expect this will be a minimum oil price rise, prices could rise much higher more quickly as supply becomes short in 2023 or 2024.

Time will tell us the correct answer.

Ron,

Much of the fall in output of the other 9 is from Iran, Nigeria, Libya, and Venezuela, much of that decline is due to political problems and has little to do with natural decline. Roughly half of the decline in the other 9 from July 2017 to now came from those 4 nations. Higher oil prices increase World output, are you predicting low oil prices, that is under $60 per barrel for Brent in 2019$, up to 2030? If that is your expectation then peak could be 2018. My guess is that Brent oil prices will reach at least $64 per barrel in 2019$ by 2030 and will probably reach at least $75/bo by 2035. World C plus C output is likely to surpass the 2018 peak if I am correct on oil prices.

Much of the fall in output of the other 9 is from Iran, Nigeria, Libya, and Venezuela, much of that decline is due to political problems…

No doubt it was. But political upheaval is part of the story, and always will be. There will be political problems ongoing for decades. Dennis, if your model excludes political problems, then you are living in a dream world.

Anyway, in addition to the political problems that you point out in those four nations, which will most likely continue, we have the natural decline in the other five nations in the chart below.

Nov 2018 is getting further in the rear view mirror—–

Hightrekker,

Yes and oil prices have been low from Nov 2018 until now, do you expect that to continue for the next 10 years? I do not, perhaps that’s the difference. 2025 to 2030 there is likely to be a new peak for World C plus C centered 12 month average output probably 1 to 3 Mb per day higher than the Nov 2018 peak. This assumes oil prices reach $64/bo or higher in 2020$ by June 2030.

Yes, I do not think we will surpass Nov 2018.

But I’m a European Historian, viewing other factors.

I seem to recall, not too long ago, various talking heads prattling on about how USA LTO is now the new “swing producer”/source of swing supply. I guess we’ll now get to see how well it swings on and off, as swing producers are wont to do.

My WAG is that it doesn’t swing back on so well, as the swing off phase seems to be damaging (not just a tap you see), and when demand recovers after COVID, circa 2023, we’ll see a price run up. Perhaps it’ll be a damaging price run up. 2023 will be in the middle of Biden’s first term, presumably.

And: Nigeria and Venezuela could ramp up their production only very, very slowly. They could not stem the general trend. Lybia is too little to make any serious difference. The only real wildcard is Iran. And it‘s the less probable to be played.

Not assuming much ramp up from any of the 4 nations, but probably not a lot of decline either. Libya and Venezuela are already close to zero. Increases will come from the 4 increasing nations that have cut output to raise prices. When prices increase they will increase output.

Ron,

For Venezuela, Libya, and Iran output is not likely to drop much from current levels, in fact an end to sanctions on Iran will lead to a 1500 kb/d increase at minimum for Iranian output.

Political problems are random events which cannot be modelled well. The model uses past history which includes all past political events as a guide to the future. As I often point out the models are future scenarios based on a set of assumptions that are clearly laid out. World War 3 and/or large asteroid strikes are assumed not to occur in the near term. 😉

Those would be different scenarios and if either occurs in the next 5 years, then your guess that 2018 will be the final peak for World C plus C may well be correct. I tend to think the odds are low that you will be correct.

Modelling political instability is the subject of cliodynamcs, see https://en.wikipedia.org/wiki/Cliodynamics. The graph on that page seems to link political instability with inequality. My suspicion is that it is also linked to scarcity.

Schinzy,

How accurately are future political events predicted?

My guess is even less accurate than most economic models.

I don’t know much about these models. I don’t think they are deterministic. Probabilities is all they can do. But my guess is that the probability of political unrest is increasing.

I tend to think the odds are low that you will be correct.

I would give 10 to one odds that the peak month and year will be 2018. I have come to the conclusion that you have no concept of what is happening, depletion and decline, to the world’s supply of crude oil.

Ron,

We will see. We have already made that bet.

Ron,

That looks like about a 100 kb/d annual decrease from Jan 2012 to Jan 2020 for those 5 lower output OPEC members. Easy to make up for tbe larger producers.

Of course Dennis, but what about the couple of dozen non-OPEC nations that are in a similar rate of decline?

Ron,

If we look at non-OPEC minus US, Canada, Brazil, and Russia, the decline rate is not all that high. Also prices have mostly been low over the 2015 to 2019 period which has reduced investment decline rates may change with higher oil prices. Using annual data from 2015 to 2019 NON-OPEC minus US, Russia, Brazil, and Canada had an annual average decline of 85.5 kb/d.

So all together maybe 200 kb/d of decline, which can be made up by OPEC, Canada, and Brazil.

If we look at non-OPEC minus US, Canada, Brazil, and Russia, the decline rate is not all that high.

Oh really now?

I have posted the chart below in order to get greater width.

Ron,

Yes I must have made a mistake trying to do this on a cell phone, no internet access available for computer at the time. For annual output for non-OPEC minus Russia, US, Canada, and Brazil:

2009=23440 kb/d

2019=20782 kb/d

10 year change =2659 kb/d or an average yearly change of 266 kb/d each year over that 10 year period.

Ron/Dennis

I do not consider Canada, Brazil and Russia to be in the same category as the US. The US has what I call “Sustained Surge Capacity”. The other three don’t. For a few years, starting in August 2016, the US increased production at rate of more than 1 Mb/d, forcing OPEC to cut back because the US, by itself was meeting annual world demand increases of 1 Mb/d to 1.3 Mb/d.

From August 2016 to November 2019, US increased production from 8,534 kb/d to 12,866 kb/d an increase of 4,333 kb/d or an average increase of close to 1330 kb/d/yr. No other country could or has done that. Does that capability still exist? I think that will be decided by the future price of oil along with demand.

From Ron’s chart, from August 2016 to November 2019, there was an increase of approximately 6,000 kb/d. Russia, Canada and Brazil only contributed 1,567 kb/d of the 6,000 kb/d, slightly more than 1/3 of of what the US added.

In other words, I think that a world production minus the US chart is more useful in assessing the probability of exceeding the November 2018 peak. On a world minus US chart, the peak occurred in November 2016. That peak was exceeded in November 2018 because the US added 3,102 kb/d over those two years, offset partially by OPEC cutting back. Clearly the US will be a major player in determining whether the November 2018 peak will be exceeded.

The only other countries that have some short term surge capacity is Saudi Arabia, Kuwait and the UAE as shown in Ron’s charts above. However their demonstrated surge capacity may be more related to wells that were drilled and oil coming out of inventory and could not be sustained for three years like the US did.

I think that there is a likelihood that the next peak oil will be lower than the November 2018 peak and it will be a question of whether increasing demand around 2023 to 2024 can be met by supply and whether the associated increasing world oil prices begin to strangle world economic growth.

Thanks Ovi, I agree with almost everything you say. The one place where I disagree is here. You said: The US has what I call “Sustained Surge Capacity”. I would make a slight change in that statement. I would say: “The US had what I call “Sustained Surge Capacity”. Of course, we don’t have that anymore.

That ended in December 2019 but the virus came along and disguised that point. Of course we can increase from where we are today, but not past that December 2019 point.

There was a reason the rig count was dropping during the last half of 2019. There was a reason crack spreads were being decommissioned and sold for scrap well before that peak.

All oil reservoirs contain a finite amount of oil. It is absolutely astonishing that some people simply cannot understand that simple fact.

Ron

I grappled with that statement for a while and then I put it in because I still think that the US has that sustained surge capacity. What I don’t know is whether the remaining/dormant SSC is large enough to exceed the 12,866 kb/d reached in November 2019. At that time the STEO was projecting a small increase into 2020, indicating the US was getting close to peak capacity.

I have no doubt that US production can increase from where it is today. My point was the glory days are over for so-called “Saudi America”. We will never get back to the point we reached in November 2019. Therefore we will never be able to cause world oil production to reach new highs.

Ron,

That is probably correct, but OPEC, Brazil, and Canada will be able to increase production and the US will come close to returning to the 2019 annual average, I am always more interested in annual or 12 month average output, single month records are of little interest in my opinion.

Ovi,

In the Nov 2019 STEO they were predicting fairly low prices in 2020 which accounts for the low output growth. In the Jan 2020 STEO they predicted a 600 kb/d increase in US output from Nov 2019 to Nov 2020, this is a slowdown compared to the previous 12 months where output increased by 860 kb/d. Much depends on the price of oil and the STEO changes their price assumptions each month as the market moves. In Jan 2020 they expected Brent would rise from $63/b in Nov 2019 to $69/b in Dec 2021. In August 2020 the price predictions were quite different with July 2020 Brent at $43/b and rising to only $52/b in Dec 2021. Of course the output has changed significantly with the Jan 2020 STEO expecting 14 Mb/d for Dec 2021 US C plus C, in August this estimate has fallen to 11.5 Mb/d, a full 2.5 Mb/d lower.

NG Price Trajectory

ON THE VERGE OF AN ENERGY CRISIS

This may have been posted before but it makes interesting reading and is a contrary opinion to IEA, EIA and OPEC. It predicts shortages for oil and gas. It’s free but has to be downloaded after registering.

http://info.gorozen.com/2020-q2-goehring-and-rozencwajg-commentary

Thanks George for the wake up call .

Thanks for posting a link for easy download.

North America economy is supported by affordable NG. It’s sure appears more likely that this leg of the stool will evaporate like LNG.

From ON THE VERGE OF AN ENERGY CRISIS

“Gas Supply is Falling: North American natural gas has been in a vicious bear market for 15 years. Surging supply brought about by the shale gas revolution has resulted in a persistent surplus. Although demand has also surged over the same period, it has not been able to keep up with the unrelenting growth in production.

This is all changing as we speak.

Over the last twelve months, the oil-natural gas ratio has averaged approximately 25:1 – still far below its energy-equivalency. If our research is correct, we will see ….”

Remember the Hirsch Report? https://en.wikipedia.org/wiki/Hirsch_report

The North Dakota June production data is out. I have posted a graph of their production along with the data from their latest Directors Cut up top in the main body of this post.

Jean Laherrere has a good paper out on GOM, mainly estimating ultimate recovery and predicting a 2019 peak and fairly fast decline, and exhaustion by 2070.

https://aspofrance.files.wordpress.com/2020/08/us-gomupdated.pdf

I’d recommend the aspofrance site in general there’s good stuff there on shale oil etc. Mostly in French but the papers are usually picture heavy and Google translate does OK as a last resort.

https://aspofrance.org

Thanks to Jean and thanks for the link, George. Lots of good stuff!

SouthLaGeo,

So you agree with his estimate? His stuff is always good, but historically his estimates tend to miss on the low side.

Jean used 3 methods to estimate GOM oil and gas EUR – decline curve (annual production v. cumulative production), Hubbert Linearization and Creaming Curves.

The 3 methods give a shelf oil EUR estimate of 14-15 BBO. The shelf has produced about 13 BBO to date.

The big uncertainty in GOM oil EUR is in the deepwater. The 3 methods give a range from 16-20 BBO. I think the use of multiple estimating methods does a good job of capturing this uncertainty. To date, deepwater has produced about 9 BBO.

These give a range of GOM oil EUR of 30-34 BBO. (Jean states a 31-34 BBO range but his summary table, on p. 20, has what I believe to be a typo. I’m interpreting his deepwater decline curve assessment to show a range from 16-19 BBO. Regardless, this difference in EUR is a quibble.)

I haven’t reviewed the gas data as well as Jean, so I won’t comment on that.

I also agree with Jean’s comment that the GOM oil peak production (shelf plus deepwater) was in 2019. (Gas was way back in 1997).

SouthLaGeo,

I may be remembering incorrectly, I thought fairly recently you thought a plateau in output might be maintained for a few years, the BOEM estimated about a 76 Gb ERR for GOM back in 2011, and in 2016 about 75 Gb for TRR and and an ERR of about 62 Gb at $40/bo and $2.15/MCF for natural gas, at $100/b and $5.34/MCF ERR for GOM is 70 Gb.

Study is at link below, but no doubt you are familiar with it

https://www.boem.gov/sites/default/files/oil-and-gas-energy-program/Resource-Evaluation/Resource-Assessment/BOEM-2017-005.pdf

I also focus on the oil rather than natural gas.

Read Laherrere piece, excellent as always.

The BOEM estimates at link below

https://www.boem.gov/sites/default/files/oil-and-gas-energy-program/Resource-Evaluation/Resource-Assessment/2011-factsheet-12092014.pdf

At $60/bo they estimated about 76 Gb for GOM for economically recoverable resources for the GOM in 2011. Laherrere’s estimate is about half this level with a URR from 33 to 37 Gb.

You’re right, Dennis, regarding my views of near term GOM production. Prior to the pandemic I thought 2020 would be higher than 2019, and that we would see a plateau out to about 2025 with production averaging a little under 2 mmbopd or so. I’m not quite so bullish now. 2019 will be higher than 2020, and, I think, as of now, it will end up being the ultimate peak. I still think we will see a plateau of sorts out to 2025 or so, but not quite as high as I thought previously.

I never bought into BOEM’s EURs in the 60-70 Gb plus range, and I never intended to imply that I did. In my 2016 POB post, my highside estimate was 47 Gb, and that was assuming a new meaningful exploration trend (or two) was discovered. That hasn’t happened, with the closest thing being the Norphlet with Shell’s Appomattox (and a few tie-ins), and Chevron’s Ballymore being the only commercial discoveries to date.

The GOM has produced about 22 Gb of oil to date, and it is a fairly mature basin. There is just no way, in my opinion, that we have only produced a third of the oil EUR, and that is what you need to get to the BOEM estimates.

SouthLaGeo,

Your 47 Gb estimate sounds reasonable, my guess is that URR will be at least 40 Gb and probably 45 Gb. Agree BOEM estimate too high, but I also believe 35 Gb is too low. If we take JL 35 Gb and BOEM 65 Gb ERR estimate we get an average of 50 Gb, quite close to your estimate. Maybe 50 Gb is a good guess. Oil prices will increase to at least $70/bo, new plays will be developed at the price perhaps.

Mainstream economic theory has many problems. I agree with Keynes critique of classical economic theory, which applies to labor markets and argues for government stimulus to correct high unemployment.

Product markets certainly don’t reach equilibrium quickly in every case, but generally a shortage tends to raise prices and generally demand is reduced and supply increases in time. Yes it is very vague and there are no simple experiments to determine human behavior, in fact knowledge of a theory of behavior that predicted outcomes perfectly would immediately become obsolete as that knowledge would change human behavior.

Doesn’t happen in physics and makes things far simpler.

Up above, alimbiquated spoke to the issue of the Demand curve lacking a time axis. Then Schinzy mentioned Cliometrics, which I had never heard of, but find to be a fascinating concept. You allude to human behaviour. I’ll add my little piece: economic theory does not speak to the question of the economic system being watched by those who participate in it, and those people’s desire to use their observations, and their actions, to game the system. The speed of modern communications, and the ability to create ever more complex models of the system, further exacerbate the problem.

Too many actors (each with their own agenda) on too short a time scale (making the use of Cliometrics impractical), with some of those actors actively working to negate the effects of the system for their own ends (eg. Shale Oil shareholder presentations), have lead us here.

My thought is that the (theoretical) time axis for the Demand Curve would have a dependency relationship with the (equally theoretical) time axis for Propaganda Effects. As soon as we’ve got those two things modeled accurately and predictively, the problem solves itself. : )

Dennis stated above: If we look at non-OPEC minus US, Canada, Brazil, and Russia, the decline rate is not all that high.

Ron,

I thougbt non OPEC was roughly 50000 kb/d, those 4 nations might be 26000 kb/d at most so I would expect over 20,000 kb/d. Did you miztakenly use OPEC rather than nonOPEC?

Yeah, I screwed up. Correction in progress.

Here is the correction. The decline since about January 2016 has been about 1,600,000 barrels per day. But that ain’t chicken feed. The late surge you see is from Norway’s Johan Sverdrup. There are not likely to be any more of those so the decline you see will likely now continue.

Ron,

The reason for the change in decline rate starting in Jan 2016 is explained in the chart below. Brent oil prices (12 month average price) below $50/bo leads to low profits, a lack of investment, and the result is higher decline rates.

Dennis, the price of oil will always be half of the peak oil equation. The claim that “oil peaked because the price was too low” is just an excuse. The peak will be the peak regardless of the cause.

The more scarce oil becomes, the higher the cost will be to extract those last few barrels. We knew that from the beginning. And if that cost of production is greater than the price they can sell it for, then no more oil will be produced. The peak will be the peak.

Ron,

In general price matters, but I agree there will be a peak, just 10 years later than your estimate. Ceteris paribus high oil prices result in higher output. Doubtful peak supply will occur when oil prices are under $70/bo in 2019 US$, unless one is a cornucopian, I am not.

The EIA says we are going to have to wait until 2022 to see production level equal to those of 2019. The chart below was taken from the August issue of the EIA’s Short-Term Energy Outlook.

Ron,

If US output ever returns to the Nov 2019 level (and it is not very likely imho) it may take until 2030 for it to occur under a conservative oil price scenario (where oil prices rise by about $2/bo each year from today’s level over the next 12.5 years and then remain at $70/bo until 2040 and then start to fall at $2/bo each year for 20 years and plateau at $30/bo.) The scenario is likely too optimistic, but in the past my scenarios have often underestimated future output and my “optimistic” scenarios have often been more accurate in hindsight.

If US output ever returns to the Nov 2019 level (and it is not very likely imho) it may take until 2030 for it to occur under a conservative oil price scenario

Dennis, even though shale fields are now producing less than 100% of what they would be producing at $70 or better price, they are still depleting their fields. The sweet spots were already getting fewer and further between in early 2020. The very idea that 10 years from now they could still ramp up to 2019 levels boggles the mind.

But that is what you do, you continue to boggle my mind. 😉

Ron,

My estimate has URR for US tight oil at about 75 Gb, based on the conservative oil price scenario laid out. It is assumed that new well EUR gradually decreases and that the mean USGS TRR estimates are correct for fields that have been studied. Those TRR estimates are about 100 Gb for Permian, Bakken, and Eagle Ford combined. EIA has tight oil at 120 Gb cumulative output through 2050. That estimate boggles the mind.

Note that fewer wells drilled results in a lower rate of depletion. The problems mentioned by Shallow sand, which may lead to low investment will make my scenario likely too high, it is about as high as I think is possible for the prices I laid out. I expect you are correct that the US may be beyond its final 12 month average peak C plus C output.

Dennis, it’s that middle R in URR that’s the problem, “Recoverable”. I could be wrong but I think your wild ass guess of 75 GB is not reasonable, it is totally absurd. Yes, lower production results to lower depletion in actual barrels, but not necessarily a lower rate of depletion. Depletion drops but that does not mean the actual percentage of the remaining reserves is actually dropping. However, you being a “math type” means you are fully aware of that fact. 😉

It is just natural that fewer wells are being drilled. If drillers are losing money, they want to stop losing money, so they stop. They stop because their investors are tired of seeing their money disappear down a rabbit hole so they stop giving them more money to throw away.

Dennis, I know a lot of shale oil will still be produced, but at a much lower rate. The shale boom is over. Those glory days will never return.

Ron,

What do you believe will happen to the price of oil if supply becomes lower than demand?

Do you expect that oil demand will be less than oil supply from now until 2030 and that Brent oil prices will not rise to more than $50/bo in 2019 US$ from now until 2030?

The WAG is based on average well profiles developed based on data from shaleprofile.com, on historical well cost and oil prices, on TRR estimates by USGS, the oil price scenario I laid out. TRR is about 100 Gb total for US tight oil, economically recoverable resources (ERR) are about 70 Gb for the tight oil scenario, I recently developed.

Tight oil output falls to 4600 kb/d in 2022, then gradually rises to 8900 kb/d in 2030.

Non-tight oil US C plus C output has declined at about 25 kb/d on average each year from 2005 to 2019. So if that rate is maintained overall US output rises above the 2019 level in 2030.

Dennis, I have no crystal ball but I can make an educated guess. I expect oil to stay below $60 a barrel in 2019 dollars for at least another decade. Most of the time below $50. However, I expect inflation to return with a vengeance because of Trump’s massive tax cut for the rich and the massive spending programs, most of them due to virus relief.

But the main driver in my prediction is I do not expect demand to ever return to 2019 levels…. ever. That is where you and I differ the greatest. You appear to expect everything to return to pre virus levels in a couple of years. No, no, no, that is just not going to happen. There will be a new normal, though I am not sure what it will be. But it will in no way resemble the pre virus world.

Ron said ”However, I expect inflation to return with a vengeance because of Trump’s massive tax cut for the rich and the massive spending programs, most of them due to virus relief.”

I agree but with a different take . First stage we are going to see inflation in essentials and deflation in the non essential items .There will be a gap and then in the second stage, inflation all across the board . All the money printing,tax cuts ,subsidies are not free . There are consequences . Of course going back to pre covid is a pipe dream .

Ron,

I agree things will be different, but World oil demand is likely to increase beyond the level of 2019, perhaps in 5 years time, but definitely by 2030. The pandemic won’t last forever and there is likely to be a lot of pent up demand for travel and the economy will eventually recover, doesn’t mean everything returns to the way it was before, real GDP is simply a measure of economic output, the content of that output (cars, wind turbines, solar panels, homes, oil, etc) will likely be different in 2029 than in 2019, but the number in 2019$ that represents that output is highly likely to be higher in 2029 than in 2019.

Yes our outlooks for the future are far different, we agree that the future will look very different from the past.

Ron,

If demand never increases above the 2019 level, you will be correct, the peak is likely to be 2018. I just think that is a highly unlikely scenario, what some might call an “absurd” scenario.

What when most of the ‘sweet spots’ have gone already ? What kind of information does shale-oil URR of 75 Gb give then ? Maybe somewhat comparable to deepwater crude oil fields URR of 75 Gb. High output the first decade or so and after that much less, for many more decades, no matter if oilprices are $50 or $80.

So far average new well EUR has not decreased to a large degree in any basin, my models assume this decrease starts soon. So sweet spots decreasing is built into the models. Note that mean TRR estimates are about 100 Gb (these also account for different productivities in different areas of the tight oil plays).

Ron,

We seem to conceptualize depletion rate differently.

Let’s say a tight oil play has 10 Gb of resources and annual output of 500 million barrels, I would say the rate of depletion is 500/10000=5%. Now we assume output drops to 250 million barrels due to an economic crisis, there would now be 9500 million barrels of the resource remaining and the rate of depletion would be 250/9500=2.6%. That’s the math, depletion rate decreases.

Ron,

EIA AEO 2020 has US tight oil at 126 Gb from 2000 to 2050 for the reference scenario, that is in my opinion an absurd scenario.

See https://www.eia.gov/outlooks/aeo/data/browser/#/?id=14-AEO2020&cases=ref2020&sourcekey=0

for 2000 to 2019 I used the EIA tight oil estimate by play with cumulative output of 16.2 Gb from 2000 to 2019, the AEO has cumulative tight oil output at 109.7 Gb from 2020 to 2050, combined we get 126 Gb from 2000 to 2050.

An interesting read.

https://www.bnnbloomberg.ca/oil-companies-wonder-if-it-s-worth-looking-for-oil-anymore-1.1480762

As the coronavirus ravages economies and cripples demand, European oil majors have made some uncomfortable admissions in recent months: oil and gas worth billions of dollars might never be pumped out of the ground.

The oil industry was already grappling with the energy transition, copious supply and signs of peak demand as Covid-19 began to spread. The pandemic will likely bring forward that peak and discourage exploration, according to Rystad Energy AS. The consultant expects about 10% of the world’s recoverable oil resources—some 125 billion barrels—to become obsolete.

The most likely scenario is vaccines will emerge and all sorts of pressures will exist to claim they are better than they are. Russia’s vaccine (Japan co developed) will probably be as good as any of them and none of them will be very good. All far sub 50%.

That will leave the US with a kill count on elderly of what looks like an increase of 14% in yearly deaths. That’s what Excess Deaths say. 2 million 65 die per year pre virus. The virus adds 300K deaths per year. 15ish%.

Society will accept this. It will lower life expectancy, but the young are relatively safe for now and the realities of $29T in debt and perpetual deficits will compel a choice by the working public to ignore it all.

So, consumption will resume . . . in the US. One would expect Chinese consumption to drop precipitously with their population loss in the upcoming war. Of course, if they win, it will be US population that will plummet, and ditto consumption.

Unlike wars of the past, this one will be fought for keeps. The US will be stripped of nuclear weapons and starvation like that in Paris during German occupation will take the population down so that it NEVER can challenge China again. The reverse would properly be so, too. The virus, the obvious difficulties with oil, compel playing for keeps upcoming. With the consequent loss of consumption, oil will be forever.

Watcher ,disagree . IF rpt IF we have a vaccine by early 2021 for public use it will be ^ too little ,too late ^ . The financial system would have collapsed by then . You say consumption will resume in the US , yes , it will resume after all after zero ( or almost so) it can only go up ,but will it continue its trajectory of growth from a low base to pull the economy out of doldrums ?My take . 100 % not . In 6 mths time so many negative feedback loops are going to be activated that it will be impossible to go back to BAU .

Hot war with China . I hope sanity will prevail . The US will be annihilated if they take on China in the SCS and Pentagon knows that . What I see is that the US and China are going to be fighting an asymmetrical war like what DT is doing with Huawei and TikTok . The Chinese will do it by poking the eagle in other areas .US interests are all over the globe, vulnerable . No way the Pentagon can assure a 24/7/365 days security worldwide for these .Not enough resources . Both parties know that going nuclear is MAD , but then there are no limits to stupidity .

…., but then there are no limits to stupidity.

No limits, right.

Albert Einstein said/wrote:

“Two things are infinite: the universe and human stupidity; and I’m not sure about the universe”

Ovi, great article but I had to laugh at the picture labeled:

Oil sands operations in Alberta, Canada. Photographer: Ben Nelms/Bloomberg

I had no idea Alberta had such a peninsula, with penguins no less.

However I do agree with this: The pandemic will likely bring forward that peak and discourage exploration, according to Rystad Energy AS.

It is astonishing that many people expect a return to pre-virus normal in a couple of years. There will never be a pre-virus normal. I have no idea what the future holds but I would bet my bottom dollar it will never again resemble the days of 2019.

It is astonishing that many people expect a return to pre-virus normal in a couple of years.

One would have to living in a very small box– but apparently most are.

Ron

I did not know that we had Penguins in the Arctic, Eh. ??? Surprised that no enterprising operators are advertising Arctic penguin tours.

I think the idea for the article you posted below came from the Bloomberg article. Bottom line is that oil companies are going to keep their exploration money in the bank until the right price is reached, which I believe is close to $60 and up. I think that they are coming to their senses and are realizing the need to share the upcoming demand recovery with OPEC so that they can all increase their production, ever so slowly to meet demand. Is it called Live and Let live?

I think that BP, Shell, Total, etc. are signalling their oil brethren that they are cutting back on oil exploration investments and that the rest of the industry should do the same.

“There will never be a pre-virus normal. “

Ron, what when at least 70% of the world population is vaccinated with a highly effective vaccin that provides long term protection ?

Dream on.

Ron,

Even without a vaccine eventually herd immunity develops. The world recovered from the 1918 pandemic. Modern medicine is a bit better making recovery highly likely.

As Doctor Fauci said a couple of days ago, herd immunity means everyone with diabetes is dead, most obese people are dead, all old folks like me are dead, almost all with serious underlining conditions are dead.

This is an entirely different virus from the 1918 version. That flu killed 50 million people, most of them in their 20s and 30s. If this virus kills only as many, percentage-wise, then almost 34 million people will die. Only 785,000 have died so far, so if another 33 million people die because it is only just as bad as the 1018 virus, then that is even worse than most pessimists even imagine.

Even “recovery” is no great shakes in many cases. Even mild cases in the young can lead to permanent long term damage to major organs. This is NOT the god damn flu. A large fraction of dumbass nation has got it into their heads that this is just like a bad cold. Sick for a couple of weeks and then you get on with your life and you never have to worry about it again. Gee, I wonder where they ever got that idea?

Masking Social Collapse, Contagion-Style?

There are other coronaviruses, SW. We have evolved with them, that’s why we have an immune system. We are also apparently part virus. We also have to die, otherwise, this planet would be overrun in short order by births. Death should not be something to be avoided at all costs.

Also, what is or are your sources for the part about ‘permanent long term damage to major organs’? How does, as you characterize, a mild case, manifest as a ‘permanent long term damage to major organs’. That doesn’t seem like a mild case to me. So that’s why I am curious as to your sources. At the same time, however, if this is some kind of engineered collapse by virus, I’d be very cautious about them.

This whole thing stinks like government stinks.

Here are a few off-the-cuff bullet point concerns I very recently posted (awaiting moderation at last look) on an unofficial Nassim Taleb forum about the subject:

“• Is the virus the result of government-funded research (is it from a lab, rather than from a wild animal, and accidentally or deliberately released)

• Do mask mandates set a precedent for the erosion of our liberties

• If [Whether] the virus is a lab escapee, whether deliberate or not

• If masks slow down the infection rate and/or numbers, does it also increase the time by which the more vulnerable populations to this virus remain susceptible?

• Is a quick herd immunity a better strategy?

• What was happening in the news before COVID-19? (Railway blockades? Greta Thunberg? Extinction Rebellion? Peak Oil and/or US Shale Oil? Bad economic forecasts/events? Unfunded or underfunded pensions? [the US losing their ME proxie wars?] Etc.)

• Why should COVID-19 land on such a round year number as 2020?

• Why would COVID-19 break out in the same town– Wuhan– as the virus research lab?

• What was happening with regard to pandemic rehearsals prior to COVID-19– even immediately prior?

• Who and what has to gain from COVID-19 and, say, vaccines for it? [or generating FUD or ‘mandate social engineering’ for that matter?]

• WRT anti-fragile measures, are medical systems anti-fragile? Do they have built-in redundancies, such as for 100-year pandemics? Why should government be too concerned about being overwhelmed by some kinds of pandemics if there are built-in redundancies for just such events. If there aren’t, why not? Efficiency? If so, how’s that working out?

• Any roles or associations WRT CRISPR-Cas9 and gene drives vis-a-vis CV-19?

• COVID-19 and lockdown and related degrowth and relocalization issues?

• Etcetera

I am wondering if Nassim might sometimes miss the forest for the trees. To wear or not to wear a mask would seem to fall into far more contexts than are necessarily taken for granted.”

Also, what is or are your sources for the part about ‘permanent long term damage to major organs’?

Dammit, Caelan, just google it:

can covid-19 cause permanent long term damage to major organs You will get about a hundred or more links saying, Yes, goddammit, it can cause long term damage to major organs. And this news has been in the news every day since day one. Where the fuck have you been? Asleep?

Also, your bullet points are just a lot of shit points.: • Why should COVID-19 land on such a round year number as 2020?

Are you shitting me? That, and the rest of your stupid bullet points are nonsense.

At the moment, I’m interested in SW’s sources, not a long list of your ‘blind’ search engine hits, Ron.

I’m also uninterested in you babying SW either. Here, I asked them.

‘2020’ is as fair a rhetorical question to ask in the same sense as why planes fly into NY buildings on ‘9/11’. (But then it isn’t as rhetorical as it could be when considering psychopathy in or as government).

AFAIK, viruses don’t choose human dates and their contrived contexts to infect people. ‘2020’ just adds to the stink of this whole COVID-19 shit. (Hence my other bullet points, among others.)

BTW, governments have been and are known to willfully kill people– innocent civilians… They are also known to operate coercively… in case you haven’t noticed.

Roll those around in your cranium for awhile.

We are not dealing with ‘Mary Poppins and her tearoom friends’.

Hey, just click on one of them. They all say the same goddamn thing! They all say that the virus can cause long term damage to vital organs.

Just what the hell is your problem Caelan?

The onus is on you to support your position explicitly by specific reference.

If you were a university student, Ron, you’d fail if you simply said, ‘Oh here’s a book, just go open it up and read it.”. That’s for you to do, not your teacher, not me, to build/support your argument.

I’ve gone over some of your links already anyway and so far, they don’t appear to precisely support what you or SW suggest or tell me anything I don’t already know.

For example, I already know that respirators may cause lung damage. But respirators are not the disease, they are a type of treatment. I also already know that some who get bad and die from the disease can already be health-compromised.

3 examples (that you should be providing, not I) from 3 of your links:

“The problem, Gupta said, is that there is ‘very little’ information on COVID so far — so doctors are basing their knowledge on similar infections.” ~ CBC

“Summary…

Early data from China suggest that a majority of coronavirus disease 2019 (COVID-19) deaths have occurred among adults aged ≥60 years and among persons with serious underlying health conditions.” ~ CDC

“Because Covid-19 is a new disease, there are no studies about its long-term trajectory for those with more severe symptoms… ” ~ Vox

So go get some specific references in support/illustration and I’ll take a look. Build a case and do the legwork required. Or don’t. Up to you.

But let’s at least keep in mind where that kind of society already appears to be headed, apparently with you along for the ride.

Caelen said: “Why should COVID-19 land on such a round year number as 2020?”

That is indeed the most intellectually vapid comment I have seen this side of the numerology blogs.

And yet you nevertheless reverse-cherrypick zoom in on it. See here.

Caelan said:

Yes, this is how the internet works. You say something stupid — in this case numerology — and the internet never forgets that fact.

Paul, the point is that people can make decisions based on numbers, dates, tarot card readings, Jesus visions, horoscopes and whatever else.

It’s not that hard a point to grasp. Give it a go.

To underscore my point, the date 9/11 is mentioned with regard to crashing planes into NY buildings then. Why 9/11? Why not 8/12?

I think your comments regarding this are kind of ridiculous and am a little surprised coming from you. But maybe you’re just pulling my leg.

Also, don’t forget that we, to be charitable, ‘may’, be dealing with those corrupt and/or psychopathic in government.

…and your implication is that people chose 2020 to be the year of the pandemic….

Yes, The guy is whack. Now he thinks that 9/11 was chosen because it matches the 911 emergency phone # ?

Ah you’re getting there, Paul, despite the imprecision.

But if you can conceptualize that angle for anyone, then it’s more or less in the general direction I’ve been referring to.

It’s not exactly inputs to a comparatively-simple climate simulation, though.

I mean, we’re talking about conscious entities afterall.

See also here.

“As Doctor Fauci said a couple of days ago, herd immunity means everyone with diabetes is dead, most obese people are dead, all old folks like me are dead, almost all with serious underlining conditions are dead.” ~ Ron Patterson

Where and when did he say that and what was the context? We have other people saying different things. Have you ever looked into Fauci? Associations, agendas, conflicts of interest, history, etc.? Have you consulted other sources of information, especially that are not your usual? What sources do you typically consult for this kind of thing? How much do you understand of it all? Do your sources make attempts at very broad and deep understandings or are they shallow or misleading? Etc..

Where and when did he say that and what was the context?

Matthew McConaughey QnA with Dr. Anthony Fauci | Interview on Instagram Live August 15 2020, at about 12:30 into the video.

We have other people saying different things.

Just who are these other people? What are their credentials? You post a lot of bullshit Caelan but you never post your sources.

Have you ever looked into Fauci? Associations, agendas, conflicts of interest, history, etc.?

Are you shitting me? Everything about Fauci has been in the news for six months. Every aspect of his credentials and history has been looked into. Only ignorant conspiracy theorists now question his credentials.

Caelan, watch this video. It will tell you everything you need to know about Dr. Fauci and just one hell of a lot you quite obviously do not know about Covid-19.

That’s a blatant falsehood and it is resented, especially coming from someone of your apparent age of 82.

I post plenty of sources/support for my comments all the time.

But Matthew McConaughey as interviewer? The guy who acts in movies? Is that an example of how and where you get your information?

Is Fauci your only reference? The guy who appears to be in the US government’s back pocket?

McConaughey and Fauci.

We don’t need a ‘conspiracy theory’ to illustrate government and how it operates. Current and historic examples abound. It’s like being asked to trust someone who has a history of chronically lying, cheating, stealing and murdering.

See also my previous reply.

“Anyone who actually looks at this Wuhan Virology lab knows that they had deep ties to and received tons of funding from the US. Why do none of these stories point this out? It’s super easy to find if you actually bother to look.” ~ Whitney Webb

But Matthew McConaughey as interviewer? The guy who acts in movies? Is that an example of how and where you get your information?

Dear God, what a stupid comeback. The source of my information Caelan was Dr. Fauci, not the person that interviewed him.

Caelan, I am not into stupid conspiracy theories. I think everyone who is a fan of conspiracy theories has a screw loose. And that includes you.

Have a nice day.

What theory? The theory’s yours and your response(s) speak(s) volumes.

In any case, I’ll take a look at your video.

Oh and my day was nice, thank you. I didn’t let you ruin it.

Ron,

I think treatments will be developed and vaccines as well. In 1918 they had to rely on herd immunity, not suggesting it is the best approach.

I also think we will have effective monoclonal antibody treatments this fall, and vaccines next year. Not perfect, but will put a big dent in this pandemic.

Virologists on the front lines:

https://www.microbe.tv/twiv/twiv-654/

Ron,

It is bullshit what Fauci said, because a lot of covid-19 infected who have diabetes, hypertension and/or obesity have recovered already. The mentioned risk factors doesn’t mean a sure death. It are, well…..risk factors to get seriously ill

You cannot compare the 1918 health system and capacity with the one of 2020. Now there will be available a combination of medicines rather soon and effective vaccines in big quantities most probably next year. Anyhow, one or some of the more than hundred vaccine candidates will be effective with long term lasting immunity.

My opinion is that you are way too pessimistic, Ron

Hi Ron.

I don’t read Caelan’s comments anymore, but your obvious irritation was making steam rise from my computer. 🙂 Han, you know as little as Caelan.

I just happen to have at hand what I think is the best evidence for follow-on Covid-19 problems: the German cMRI Study of 100 recovered Symptomatic Covid patients (https://jamanetwork.com/journals/jamacardiology/fullarticle/2768916).

100 people, 50/50 male/female, wide age range, some convalesced at home, some in hospital.

The most important takeaway is that 78 of those 100 had heart abnormalities.

And I had it at hand because I’m trying to stay one step ahead of the Doctors diagnosing my post-Covid heart problems.

I had a Myocardial Perfusion Imaging Test last Thursday, and had the maybe-good luck to have chest pain while in the imaging chamber. They found a Doc to check the pictures immediately, and she said there was a blockage, which I corrected to “reduction in flow”.

I’m 62, have no co-morbidities and before my illness, cycled to work year round. I had a super-clean Angiogram 10 years ago (why is a long story).

So, only a moron would risk getting this.

And if you do get it, don’t let your GP give you only annual physical-type bloodwork (mine still looks normal). You want D-dimer and Troponin blood tests right away, and if your ECG and/or Troponin is even a little hinky (subclinical is the term they use), make them take it seriously. Don’t exercise until you get an ok from a cardiologist, and if you get offered Myocardial perfusion imaging (MPI) or cMRI, take them immediately. If you have chest pain or shortness of breath, it’s not stress or your imagination. Get in front of this, and find a Doctor who will listen.

The thinking back in April (from my GP) was that the tiredness and weakness was “deconditioning”. The thinking was wrong. Based on my personal experience, my estimate is that 95% of GP’s and Emergency Room Docs are still operating on the old thinking.

When I get my follow-up with the Cardiologist, we’ll have some insight into how behind they are…hoping to be pleasantly surprised, but preparing to fight.

Lloyd.

I ran in a half-Marathon at Disney in mid-February. As in all of these things, you get up at 3 am and stand bunched up with thousands of people for hours, and then you run packed so close together that sometimes you have to walk a little, especially early on, as well as in bottle necks.

5 days after this event , back at home, I became very ill. Massive chills and aches and pains is how it started, along with a dry cough. I went to my family doctor. Took flu test, they said I had type A, but the test showed it very faint. Went home.

For the next six days I had a fever, sometimes as high as 103. I ate nothing. I only drank water. Gatorade tasted awful. One night I got violently ill at my stomach. I lost 17 pounds. I have gained 13 of those back.

I missed 9 days of work. Doctor said no way did I have COVID, despite my repeated questioning. I live in a very rural area. I did tell him every time about my Florida trip. Keep in mind, this is mid to late February.

I have barely ran since. I am getting better, but it seems like it has taken forever to get my breath back. For over a month, walking up the three flights of stairs to my office took my breath away. But that has improved a lot.

I have an annual physical coming up. Sounds like I need to have them run some tests if they will?

Lloyd wrote:

“Han, you know as little as Caelan.“

That’s also bullshit Lloyd. Caelan many times just publishes articles here that he didn’t write himself

I follow the pandemic and read about covid-19 for more than 6 month now, a little strange for a pharmacist, I admit.

I wrote that with the mentioned risk factors getting infected does not mean a sure death. I didn’t write that it doesn’t get bad many times. I know it does. I know that if you don’t die you can get invalid for the rest of your life, for example because of decreased lung capacity. Don’t draw conclusions from one or two sentences that apparently you couldn’t interpret correctly

Hi Shallow.

Sorry to hear about your illness. I was a little nervous going into detail the way I did; I ‘m glad it was useful to someone.

It took 3 trips to Emergency in a World-class teaching hospital before they sent me to an Urgent Cardiology clinic (with a 2 week wait). You may face even more of an uphill battle where you are. I’m not going to practice medicine on the web (at least not much)…if I were you, I would assume I had Covid and that I have either lung or heart damage. In my case, they ruled out Lung damage with the D-dimer test and a chest X-ray. They decided on the third visit with chest tightness and shortness of breath that my ECG and Troponin were just odd enough to look into, which led to the Nuclear Study (MPI).

Anyhow, I’m going to bed…I’ll write a bit more in the morning. One or two other papers I found might be helpful.

A little historical context:

“…if you want, make a case here (that’s not as ostensibly inept as Lloyd’s) and so that OG’s folks can read it…” ~ Caelan MacIntyre

See also here.

Given that COVID-19’s symptoms are strong with some individuals, presumably, in some cases, beyond critical cutoff points, it makes sense that they can bring formerly unknown/undetected health issues to the surface, especially in those in the higher-risk age groups. This is to suggest that it is not necessarily CV-19 as the direct cause of some health/organ issues.

The article that Lloyd references above cites the “…median (interquartile range [IQR]) age was 49 (45-53) years.”, which seems about where underlying health issues can slowly begin to creep in, and therefore seems consistent with my point immediately above.

Attached is a simple image that attempts to roughly illustrate what EROEI society might need for its various facets to function. You will notice that health care ranks the second-highest at 12:1.