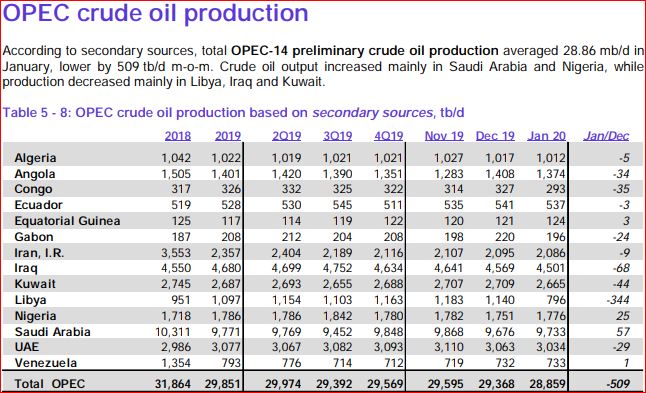

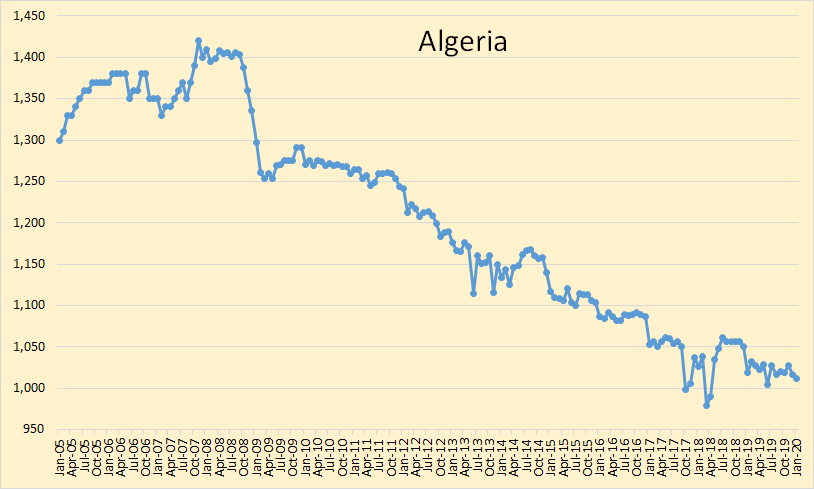

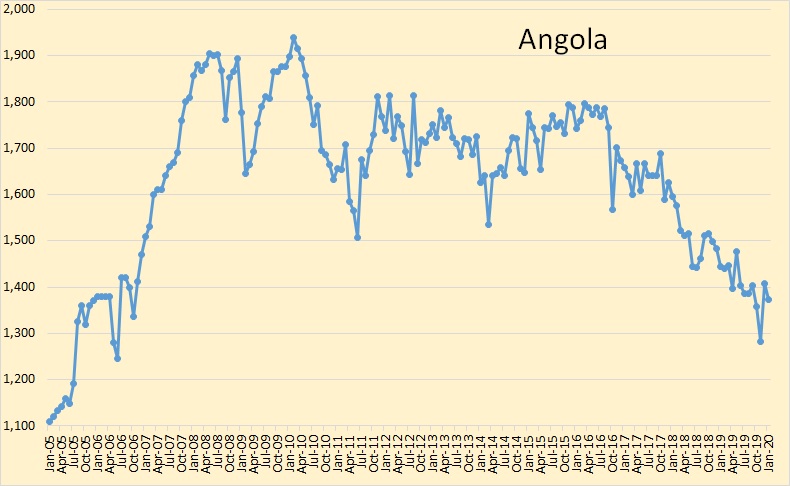

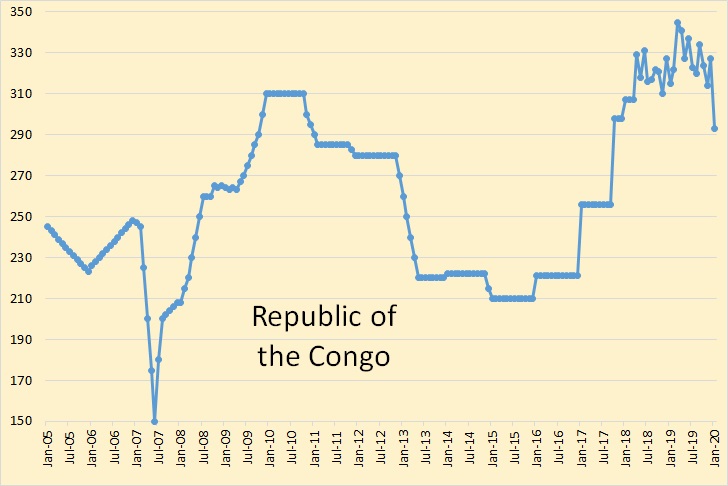

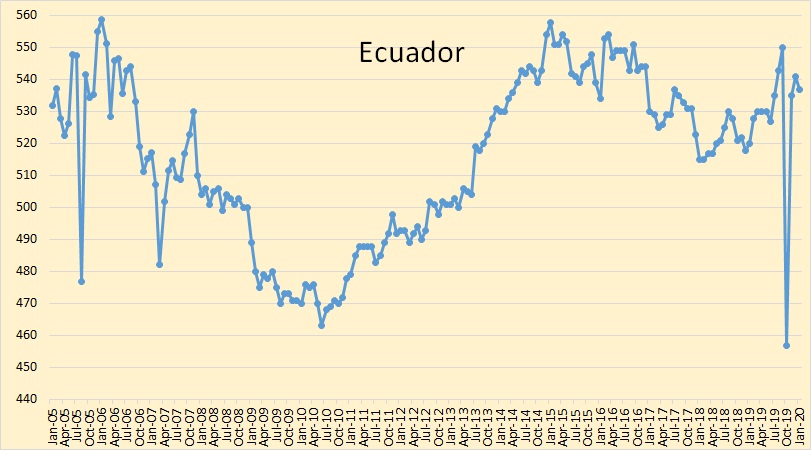

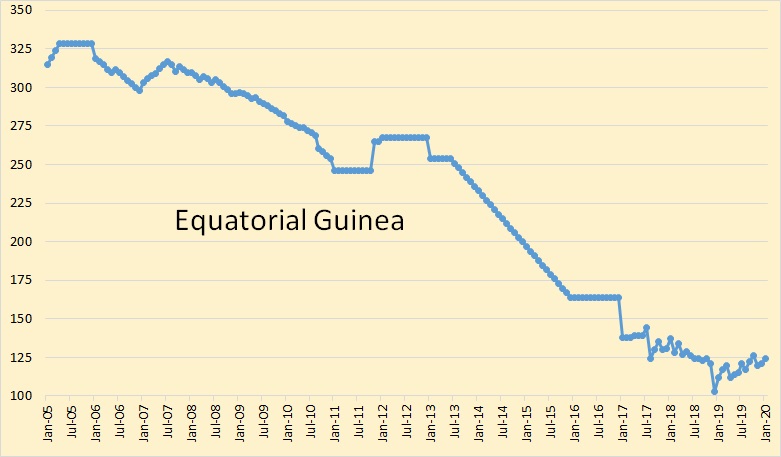

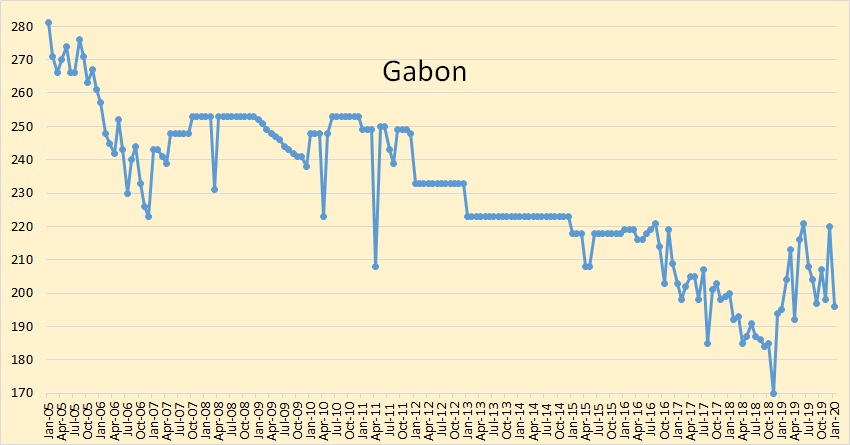

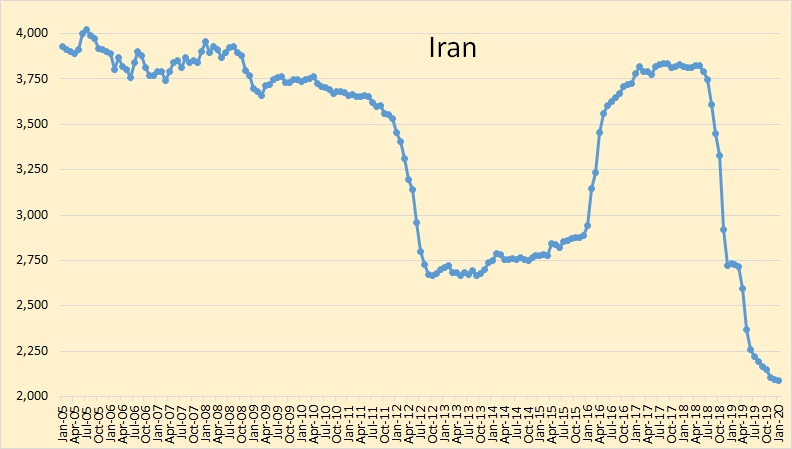

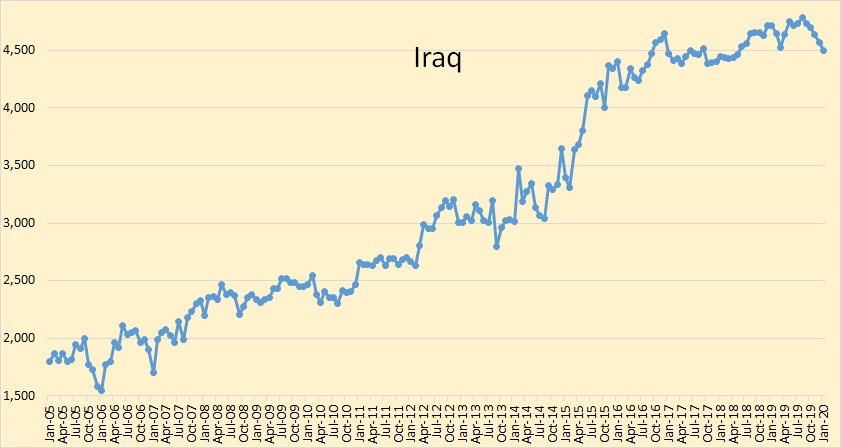

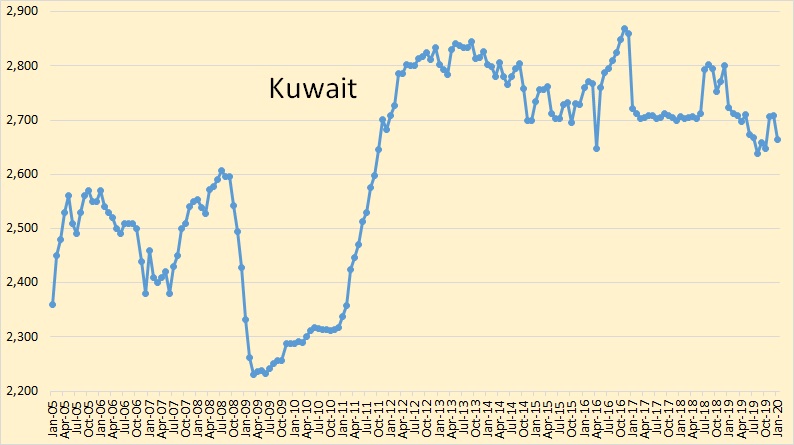

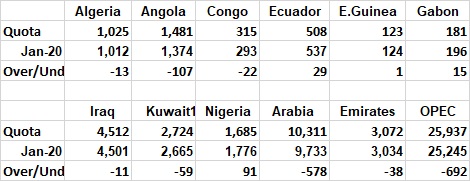

All OPEC data below is from the February edition of the OPEC Monthly Oil Market Report. The data thousand barrels per day and is through January 2020. OPEC Monthly Oil Marker Report

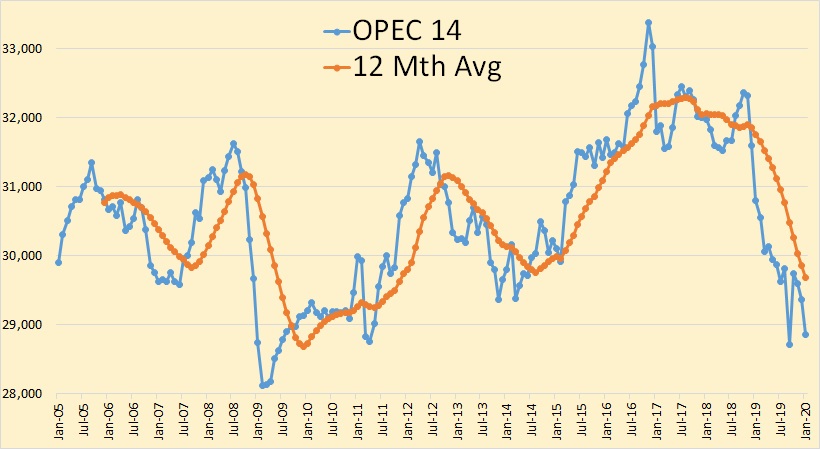

OPEC 14 crude oil production was down 509,000 barrels per day in January. And that was after December production was revised down 86,000 barrels per day.

OPEC announced a couple of months ago that Ecuador was leaving the cartel. However they were still included in January’s data. I have no idea what’s going on.

Ecuador appears to still be with OPEC even though it was announced that they were leaving this month.

Iran appears to be leveling out at just over 2,000,000 barrels per day.

Iraq is at 4.5 million barrels per day. They have averaged 4.56 million barrels per day since the last quarter of 2016. It is my opinion that they are, and have have been, producing flat out for many years.

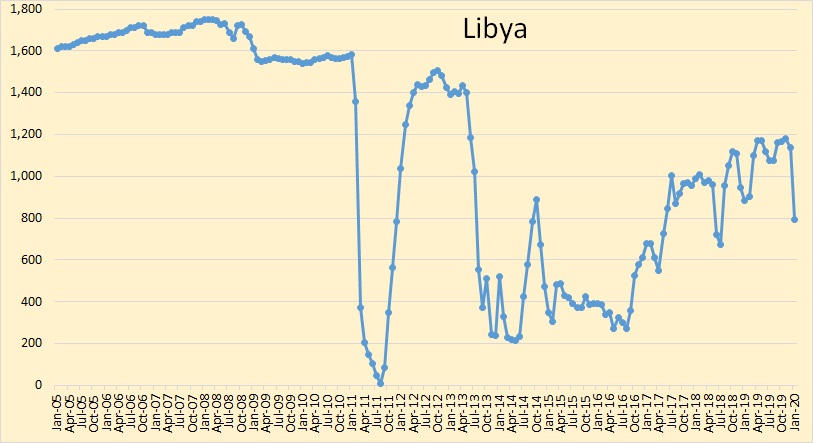

Libya’s production for the last ten days or so of January was only 200,000 barrels per day as the rebels blockaded their main port. The blockade is now in its fourth week so we can expect Libyan production to drop even further in February.

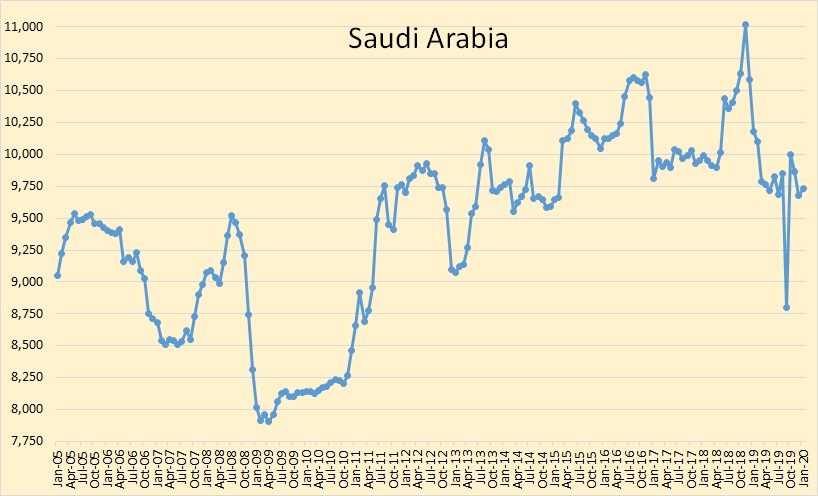

Saudi Arabia’s production was up 57,000 barrels per day in January but that was after their December production had been revised down by 86,000 barrels per day. They are now producing 578,000 barrels per day below their quota.

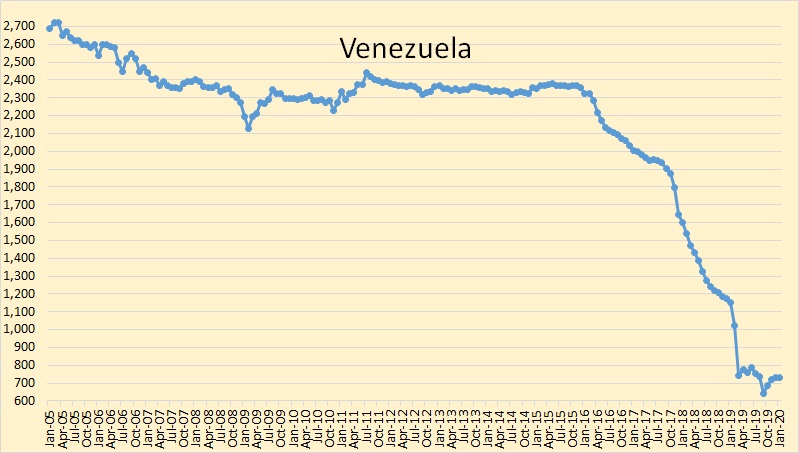

Venezuela’s decline seems to have stopped. They are looking for international help to increase production. Their history of confiscating foreign equipment and paying them pennies on the dollar for it is hindering that effort. But Russia may be able to help as they play by different rules.

Iraq has finally met its quota. Angola wishes they could meet it. Libya, Iran, and Venezuela are exempt from quotas.

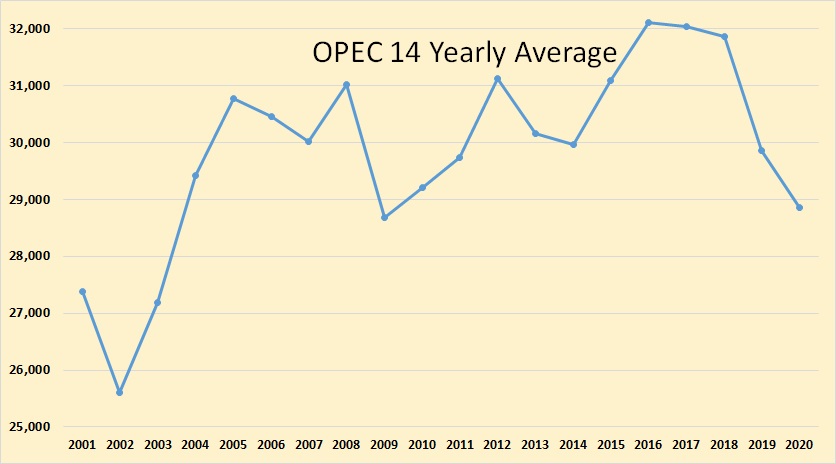

OPEC 14 Yearly average. The 2020 figure is only for one month. If that holds they will be below their 2004 annual average.

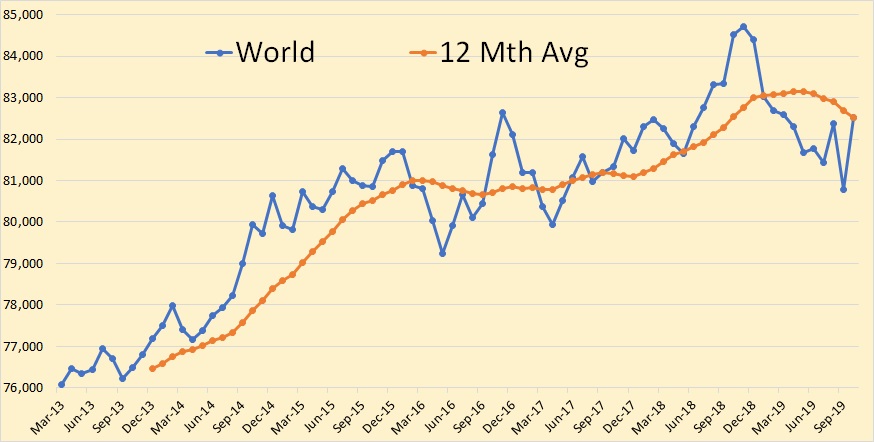

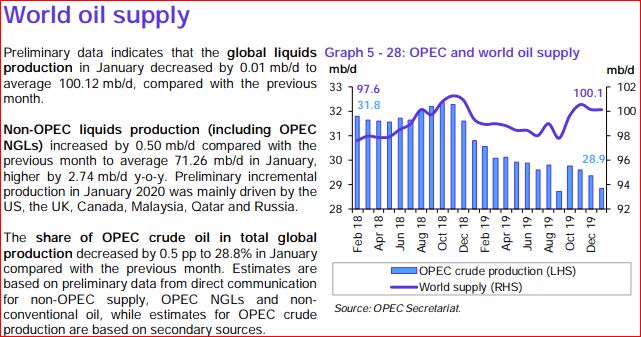

Their world oil supply graph is total liquids. It hardly resembles the C+C chart below. However, they still have the peak in late 2018.

The EIA has redesigned its International Energy Portal to streamline navigation, simplify data presentation, and implement responsive design use, or so they say. EIA World Crude Oil Data They show data for every producing nation, even the very small ones. They do not separate OPEC from Non-OPEC.

The Case For Peak Oil

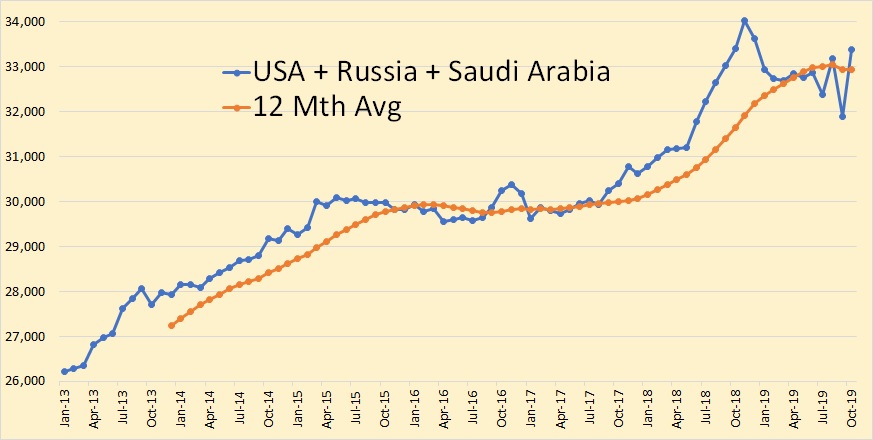

When world oil production peaks depends on when the combine production of the world’s top three producers peaks, the USA, Russia and Saudi Arabia. In fact, it could depend on when the USA peaks because shale production has been perhaps the primary reason the world has not already peaked.

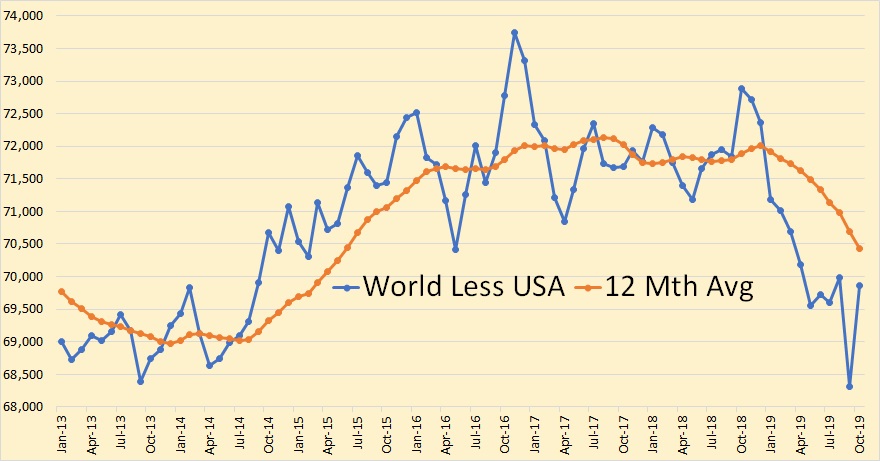

World C+C oil production, less USA production 12-month average, peaked, so far, in August 2017 at 72,134,000 barrels per day.

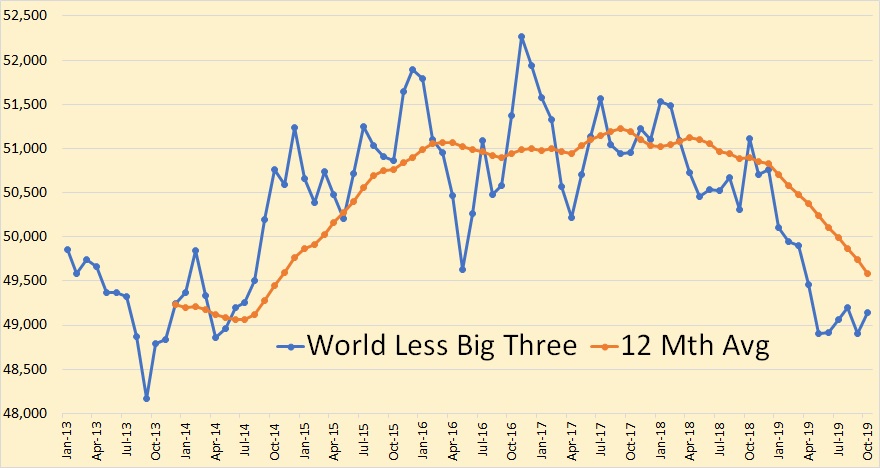

Okay, but what does World C+C production look like less all of the big three, USA, Russia and Saudi Arabia?

World less USA, Russia, and Saudi Arabia, 12-month average, peaked in September 2017 at 51,222,000 barrels per day and was down 400,000 bpd by December 2018 before the OPEC cuts. Obviously every nation other than the big three have not peaked, but cumulatively they have peaked.

Here is the production data of the big three through October 2019.

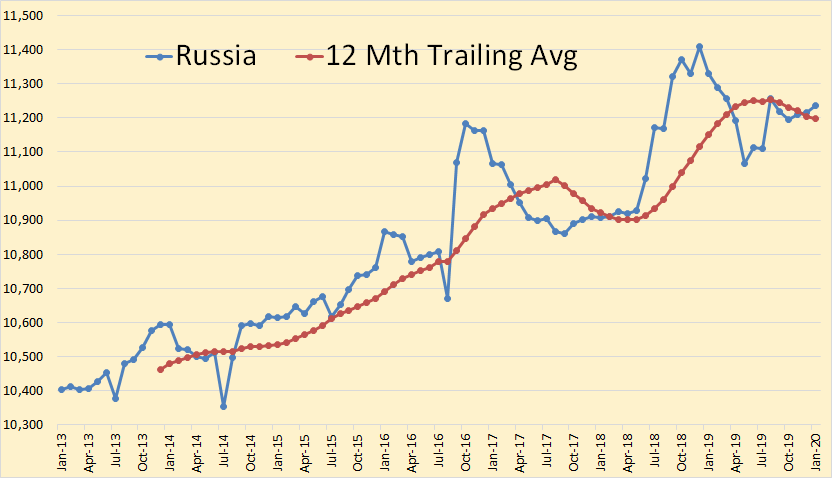

Let’s deal with all three, first Russia.

Russian production was up 20,000 bpd in January. They have stated that they hope to hold at this level through 2023. However they are obviously lobbying for lower taxes on profits. The Russian Minister of Energy has stated:

If current production trends continue, and if Russia doesn’t do anything to further stimulate oil exploration and new field development, after 2021, production may start to fall and reach just 310 million tons by 2035, that is, Russia’s oil production could drop by 44 percent by then, Novak said back then.

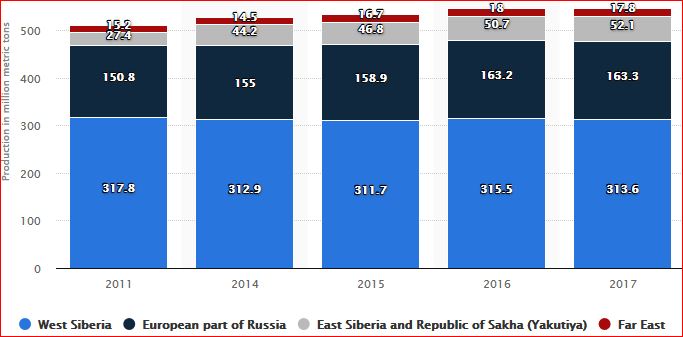

Almost 60% of current Russian oil production comes from their aging super-giants in Western Siberia. From Statista.

But how has Russia been able to keep their old Western Siberian fields from decline? We get a hint from this Russian Analyst back in 2009. Alex Burgansky: Russian Oil and Gas Industry Surprises Analysts

There are plenty of projects in Russia, both, new projects and existing brownfield projects. Russia is a very mature producer. If you exclude all the drilling activity taking place every year, then Russian organic decline in production is close to 19%. To compensate for that organic decline, Russia drills somewhere between 5,000 and 6,000 wells every year.

Many of those wells, perhaps most, are what they refer to as “existing brownfield projects”. That is infill drilling with horizontal wells in their old Western Siberia giants. They are in decline but all that infill drilling has dramatically slowed their decline rate.

In fact: Russia makes its oil reserves work harder as output declines

Such technological solutions as increased share of horizontal drilling, multistage hydraulic fracturing and multi-hole drilling have allowed Rosneft, Russia’s top crude producer, to slow the decline at Samotlor to 1 percent last year. The oilfield dates back to 1965 and is one of the largest in the world.

Last year, in the above article, was 2018. They have gotten the decline rate for their very old super-giant down to 1% per year. Of course, the depletion rate has not declined at all.

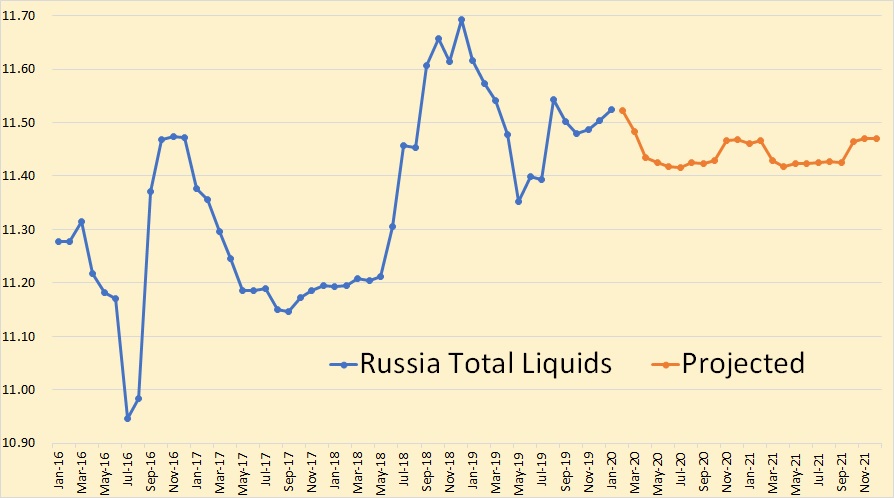

Below: Russia through January 2020 and projected through December 2021

Russia total liquids according to the EIA Short Term Energy Outlook. Russia has much as having said they have peaked and it seems the EIA agrees.

I will not dwell on USA decline because we cover that almost every day here on Peak Oil Barrel. But most of us agree the peak could very well be this year, or in two or three years at the latest. At any rate, it appears that the dramatic growth in USA oil production is a thing of the past. The next few years will, very likely, see a plateau at best and an almost sure decline soon.

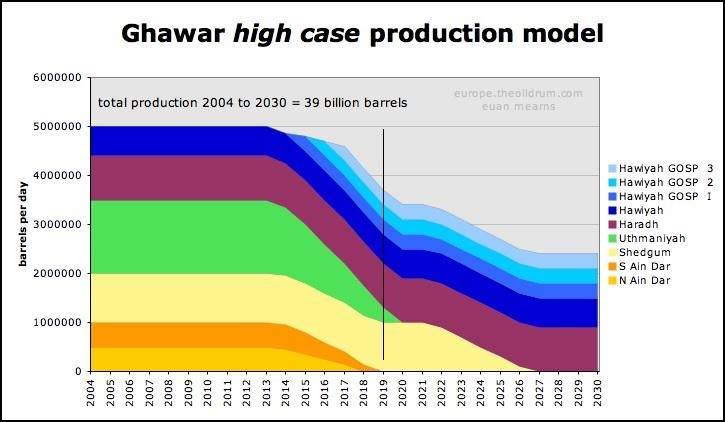

Then there is Saudi Arabia. I posted the Saudi production chart up top and will not re-post it here. However, I will point out a few very obvious things concerning Saudi Arabia and especially the largest field ever discovered, Ghawar.

From Bloomberg in April 2019: The Biggest Saudi Oil Field Is Fading Faster Than Anyone Guessed

When Saudi Aramco on Monday published its first-ever profit figures since its nationalization nearly 40 years ago, it also lifted the veil of secrecy around its mega oil fields. The company’s bond prospectus revealed that Ghawar is able to pump a maximum of 3.8 million barrels a day — well below the more than 5 million that had become conventional wisdom in the market.

Euan Mearns posted in The Oil Drum: Europe in April 2007, the following graph and data.

Notice where the 2019 line dissects Euan’s high case prediction, at exactly 3.8 million barrels per day. Yes, he had a base case that was a bit more pessimistic.

2002 was the last year any reserve figures came out of Saudi Arabia. Euan took those figures and projected them to 2006. What would they look like in 2020? Note: That data was not published by ARAMCO but by the Society Of Petroleum Engineers. Apparently they got their data from engineers who worked for ARAMCO before their total data shutdown. I do not have access to that data but apparently Euan did.

I am convinced that all the recent decline in Saudi production is not deliberate cuts. Some maybe, but definitely not all. They had a reason for issuing that ARAMCO IPO.

What is meant by the term “natural decline rate?

I, and others, have used the term “natural decline rate”. Exactly what is “a natural decline rate”? And what did ARAMCO mean when they used the term?

Without “maintain potential” drilling to make up for production, Saudi oil fields would have a natural decline rate of a hypothetical 8%. As Saudi Aramco has an extensive drilling program with a budget running in the billions of dollars, this decline is mitigated to a number close to 2%.

For starters, it depends on the size of the field and how long that field has been in production. A very small field will reach peak production and start to decline almost immediately. Even a giant field like Prudhoe Bay or Cantrell would begin to decline within a few years after peaking. But a supergiant field may produce for decades before production begins to decline. However, once a field begins to decline, then the decline rate should match the depletion rate. That would be the natural decline rate.

But if a country notices, after many years of level production, that their supergiant fields have begun to decline, that would likely be because the rising water table is rising to a higher level on their vertical wells. That country could counter that problem by shutting off its vertical wells and drilling new horizontal wells that pull only from the very top of the reservoir. They could then dramatically reduce their decline rate. But that would not help their depletion rate a damn bit.

If the depletion rate is far greater than the decline rate, then what must happen is not a theory, it is a hard-cold mathematical fact. The decline rate must, at some point, dramatically increase. The decline rate would look very much like a Seneca Cliff.

Note: A Seneca Cliff decline is experienced by fields, not countries. It is extremely unlikely that any very large producing country would experience a Seneca Cliff type decline.

What is happening right now in Ain Dar, Shedgum, and Uthmaniyah can accurately be called a Seneca Cliff. And since Rusia has gotten Samotlor’s decline rate down to 1% by creaming the top of the reservoir, we can expect a Seneca Cliff there in the near future, if it has not already begun.

Saudi Arabia likely already in decline, Russia likely at a peak plateau, the USA very near its peak, and the rest of the world is, cumulatively, post-peak. Is the world at, or near, peak oil? Or, can the USA continue to increase production enough to overcome the decline in the rest of the world? What would you conclude?

Export Land Model coming into play now?

Getting interesting. Finally?

Hi Ron

Great work as usual

It would seem Nov 2018 is more and more likely as global peak. Coronavirus and sub $50 oil are going to reduce demand as well as reduce upstream investment. And then there is finance.

Nate, good to hear from you. I hope you become a regular. But yes, Coronavirus is going to throw a monkey wrench into everything, not just reduced demand and upstream investment but the entire world economy.

All hell could break loose.

Ron

Despite society being more energy blind than a decade ago I expect purgatory, not hell (unless nukes). We’re in for rude awakening on many fronts. Though the path between fantasy and doom is a narrow one, it is a clear path, and hopefully more people will bushwhack etc to widen it…

/njh

I admire your optimism Nate. And if it were only peak oil, or only climate change, or only the Coronavirus, then I would agree with you. But it is all those things and at least a dozen other environmental disasters.

No, I shudder when I think of the future my children and grandchildren must suffer. The world is marching straight into disaster while singing “Don’t worry, be happy”.

Ah, yeah, Ron: that’s the typical feature of collapses. All the bad things gang up together and the result is the Seneca Cliff. It seems that we have a good chance now to see exactly that.

Jumping In, I thought one would see more reaction to the NDIC cheerleader Lynn Helms announcing to state legislators that the Bakken has peaked and or plateaued and gives it 2 to 5 years and its done.

“We can only grow production for another two to five years, and then all of the drilling activity that we anticipate is only gonna be able to hold that production at a plateau.

It’s not going to be able to grow beyond that,” said Department of Mineral Resources Director Lynn Helms.

Google search “legislators ask lynn helms about nd oil tax revenue”

Its a real fall off your chair moment. No more Pom Poms.

Nate,

Generally I would expect lower oil prices to increase demand, I would agree it would tend to reduce supply as production would be less profitable. Low oil prices will reduce output, eventually the coronavirus outbreak will be brought under control and the economic damage will be recovered from. As economic recovery occurs, oil prices are likely to rise, profits for oil producers will rise and output will rise as the profits are invested. Much will depend on the oil price level, but even in the very conservative EIA AEO 2020 reference oil price case. We could see US tight oil between the low and high cases shown in the chart below, depending on the completion rate chosen by tight oil producers in response to oil price increases.

Curious if anyone sees the problem with the AEO 2020 reference oil price case?

Wouldn’t we expect that the decline in tight oil output (which may coincide with decline in World oil output in 2026 or 2027) might cause oil prices to rise somewhat more steeply after that date as there is likely to be a market shortage of C+C at those price levels? Any guesses as to how much more steeply oil prices might rise? Increase by a factor of 1.5 or 2.5 from the 2020 to 2025 rate of increase, perhaps (annual increase of about $1.4/bo)? Note that in 2026 the oil price is about $66/bo at the wellhead for the AEO 2020 reference oil price scenario. Perhaps by 2035 (earliest likely in my opinion) a transition to more fuel efficient vehicles including hybrids, plugin hybrids and some BEVs might reduce demand enough so that oil prices rise more slowly (perhaps at the rate of increase of the AEO 2020 reference scenario), but from 2026 to 2035 I think a steeper rate of increase is more plausible.

Thoughts?

If demand remains constant, the price of any commodity, including oil, tends to follow the cost of marginal production. Of course, there is always the dynamic connection between price and demand, so prices cannot rise to match marginal costs, but it does give an indication of the upside potential for prices.

However, I have no idea about the cost of a marginal barrel after shale, deepwater or bitumen. Gas-to-liquids or coal-to-liquids perhaps? An additional confounding factor is whether carbon capture would be required for either of those sources.

Prices will rise only to the point where the economy suffers. Many commentors here dispute what that point might be, but as EROI keeps declining, it is certain that energy extraction will make up a larger and larger fraction of the economy.

Joe,

Not clear what you mean about demand being “constant”. Consumption of World C+C has increased at an average annual rate of about 800 kb/d over the 1982 to 2019 period. Perhaps you meant that the rate of increase in demand has been constant. When peak oil arrives in the next 2 to 10 years (2022 to 2030), demand will need to stop increasing.

Note that price is equal to marginal cost only in a Walrasian perfectly competitive economy that only exists in textbooks. In a World where a cartel limits supply, that rule no longer applies.

I should have said “where demand does not decline”. If there is relative demand decline (demand remains below existing productive capacity) for whatever reason, the marginal cost of a commodity’s production becomes irrelevant. That’s because there is no incentive to increase production by adding marginal capacity.

As to the cartel issue: even if a cartel artificially reduces supply, the increase in price will eventually stabilize near the marginal cost of production (that is, if there is anything to produce elsewhere ex-cartel). Besides, if the cartel you are referencing is OPEC+, they are still pretty near their maximum productive capacity even with recent cuts.

And soon, everyone in the world will be producing flat out and looking for more. That is when the cost of the marginal barrel will really come into play. I expect that the limiting price on liquid fuels will be the cost of coal-to-liquids.

The world has lots of coal. When oil prices start rising as oil producers “scrape the bottom of the barrel”, I expect there will be massive construction of coal-to-liquids plants all over the world. Of course, that will be devastating for the climate, so I’m hoping industrial civilization collapses for other reasons well before that happens. Maybe the Holocene will be saved by the coronavirus or something like it.

“massive construction of coal-to-liquids plants ”

I don’t think this this will happen on a grand scale. It is too expensive, and much less viable than electricity for transportation.

If the coal is needed for energy, it will more likely just be burnt raw like it is currently.

People (Japan) have spent considerable brainpower trying to make the process of in-situ coal gamification work- that being the direct underground conversion. Thus far, the process is far too expensive from an energy standpoint, to be worth the effort.

Coal to liquids is coming alright. From about $120/bll.

120 $/b too expensive, not for the U.S and some other developed countries, but for most of the countries yes

If it can be produced at $120/barrel, then coal liquid fuel will fail in the marketplace due its transportation fuel competition- that being both crude oil product and electricity. Electricity for PHEV/EV is much cheaper than any liquid fuel at $120/barrel.

Straight up. If that isn’t clear to a person, they just haven’t been keeping up with energy industry innovations.

For example, note

-An average EV sedan will utilize 4,200 kWh/yr to drive 14,600 miles. At national average grid price in the USA (11 cents/kWh) that is total of $462 of electrical energy/yr.

-Gasoline would have to cost less than 95 cents/gallon to be a better deal than average electricity rates in this country to beat the EV energy cost. [assumes an ICE sedan would get 30 mpg] Coal to liquids for transport just won’t be able to compete in the marketplace.

Nate, just in case you read this, thank you for all the wonderful lectures.

I watch your updated Earth day lecture every year, and use your video series from Reality 101 to launch conversations with friends and family.

Sincerely, thank you.

+1

Hi Ron,

When I think of the Seneca effect or Seneca Cliff, the work of Ugo Bardi comes to mind.

https://cassandralegacy.blogspot.com/2011/08/seneca-effect-origins-of-collapse.html

In Bardi’s use of the term he is talking about World oil production. I have no doubt that individual oil fields might decline very rapidly in some cases, so we agree that is possible and fields such as Canterell have experienced rapid decline. Often these fields have ramped up very quickly as well.

As far as depletion rate and decline rate being the same, if we assume 71.2 Mb/d for conventional C+C world output in 2019, and 1265 Gb of remaining conventional C+C reserves, a decline rate of about 2.1% would result in a depletion rate that is approximately the same as the decline rate. This assumes no future oil discoveries or reserve growth and uses Jean Laherrere’s 2600 Gb URR estimate for conventional C+C.

If the decline rate were 8% (equal to your assumed natural decline rate), the depletion rate would decrease from 2.1% in 2019 to 0.46% in 2040.

In general the depletion rate and decline rate are different. However if they are approximately equal they will remain about the same over time, this is probably what you meant. This only holds if we assume URR remains fixed at some known value. Generally since 1998 World URR C+C estimates have been rising, we do not know what the URR will be, my guess is a bit higher than Mr. Laherrere’s (2800 Gb) for conventional resources, but in this analysis I have used the lower 2600 Gb estimate recently published by Laherrere in 2018.

As far as depletion rate and decline rate being the same, if we assume 71.2 Mb/d for conventional C+C………

No, no, no. I never made any argument whatsoever about world decline rate and world depletion rate. I specifically stated: Note: A Seneca Cliff decline is experienced by fields, not countries. It is extremely unlikely that any very large producing country would experience a Seneca Cliff type decline.

The natural decline rate of a field should match the depletion rate of that field once that field has begun to decline. Also, only the northernmost three fields of Ghawar are in decline. The lower two fields are not in decline at all.

And I stated it only applies to specific fields once they have begun to decline.

If the decline rate were 8% (equal to your assumed natural decline rate), the depletion rate would decrease from 2.1% in 2019 to 0.46% in 2040.

I made no such assumption whatsoever. Saudi said their fields had a hypothetical decline rate of 8%. That is the very only place I used 8%. Saudi said, in a post about 15 years ago, that their fields had a decline rate of 5% to 12%. 8% was just their average.

Again, the natural decline rate of an individual field that is already in decline should match the depletion rate. That is my assertion. It has no application to the entire world whatsoever, not even to an entire country.

Anyway, let’s just forget about the Seneca Cliff and just call it an accelerated decline rate that must happen if the decline rate of an individual field has been kept artificially low for an extended period of time.

One more thing. I make no assumptions about world URR. I will leave that up to you and Jean Laherrere. I just look at production and decline and make all my production guesses from that.

I suppose we could simply assume the natural decline rate and depletion rate will be the same and when they are not, claim the decline rate is not a “natural” decline rate.

For those unclear on “depletion rate”, there are different denominators used by different authors. Ron uses depletion rate=output divided by remaining reserves.

See

https://royalsocietypublishing.org/doi/full/10.1098/rsta.2012.0448

Excerpt from above:

Conceptually, the depletion rate is the ratio of annual production to some estimate of recoverable resources, where the latter can be defined as 1P or 2P reserves, RRRs or the URR (see [26] or [27]). A lack of standardized use has resulted in several studies using depletion rates based on very different definitions of recoverable resources and this has added to the confusion surrounding the concept.

In practice, a depletion rate can refer to two possible things. First, it can relate to the rate of change of the depletion level at time t. Second, it could also refer to the rate at which RRRs are being produced. Unclear definitions have led to confusion surrounding this parameter. This study will differentiate these two definitions by denoting them as depletion rate of URR (URR depletion rate) and depletion rate of RRRs (RRR depletion rate), respectively.

Ron uses what Hook would call the RRR depletion rate. Just a clarification for those who are aware there are several definitions and much confusion about what is meant by the term “depletion rate”.

I don’t think there should be any confusion here other than the fact that you never know how much oil you have left in the ground. But that is the only place where there should be any uncertainty.

The “yearly” depletion rate of anything, whether it is oil in the ground or whiskey in a barrel, is the percentage of the remaining resources, whiskey or oil, that you pump out in one year.

So the depletion rate is the percentage of remaining reserves, that you think you have left, that you produce in one year. As to remaining reserves, you just have to make an educated guess.

That is my very simple definition. You may have a different definition.

But… If in your calculations of depletion rate, you somehow count barrels that you produced 40 years ago, then that makes no sense whatsoever. As for as useful information goes, you may as well be speaking Greek.

Ron,

Your definition is fine, my point is that there are different definitions that have been used by others.

One could use the full barrel of whiskey in the denominator rather than the amount that is left in the barrel. Colin Campbell used the glass of beer analogy. I assume the full glass was considered as the denominator in his “depletion rate”.

I think your definition is better, but not everyone might not agree.

This is a bit off topic, but picking denominators is an interesting topic when you are trying to gauge the quality of a prediction.

Let’s say you make a few true/false predictions, and compare them with the real outcomes. Sounds simple, right? Most peoples’ brains start melting about halfway down the page.

http://queirozf.com/entries/evaluation-metrics-for-classification-quick-examples-references

You may think this is irrelevant to projecting curves, but you can always change these to true/false predictions with a threshold like say within 10%.

Ron,

No doubt there will be fields that decline at high rates and others that will decline at slower rates, I agree that a field can see a high decline rate, typically at the national level we do not see any evidence that the rate of decrease in output is faster than the rate of increase. In fact. for the World, the rate of increase of C+C output from 1910 to 1970 was close to 7%, from 1980 to 2019 the rate of increase slowed to about 1.2%. If we assume extraction rate increases for a while so the peak occurs in 2030 we still see decline rates at less than the increase, no Seneca effect. Extraction rate is output divided by producing reserves (not all reserves are proved developed producing reserves) and in this scenario increases from 5.46% in 2019 to 12% in 2070.

Countries can experience Seneca cliff like declines for political reasons such as in Venezuela, Libya or Iran.

Schinzy,

I agree. When I think of the Seneca effect made famous by Bardi, it refers to the World. A world wide economic depression, a pandemic, or World War 3 might result in a Seneca cliff for World C+C output, I suppose any of these could occur, but probability is low in the next 20 years, with the possible exception of an economic depression, which is not likely to be permanent. In that last case we would see a temporary Seneca cliff, followed by recovery.

Yes and lower oil price is not good for producer countries’ economies in general. Furthermore, the food price has continued to be fairly high (http://www.fao.org/worldfoodsituation/foodpricesindex/en/). Combined high food price and low oil price is unlikely to persist in the medium term. The situation is difficult for oil producers depending on imported food.

Dennis, as I was saying in a previous comment, oil depletion alone won’t bring a Seneca Collapse for the world’s economy. You need several factors reinforcing each other: the virus, oil depletion, climate change, pollution and perhaps a madman in the White House. I think there is a good chance that we are at this kind of juncture right now. But collapses always surprise you.

Ugo,

Seem to me the odds are not very high that all of those problems coincide to cause to a collapse, I expect total fertility ratio for the World will continue to decrease and that World population will peak and decline, as fossil fuel resources become scarce prices will rise and alternatives will become more competitive and will replace fossil fuel, active government policy will be needed to speed the transition which is likely to be difficult to accomplish.

My argument is not that collapse is not possible, simply that it is not likely in my view, especially with good government policy which will become more likely as peak fossil fuel becomes evident in about 5 to 10 years.

A combination of greater efficiency in the use of energy and perhaps a stiff carbon tax to speed the transition to alternatives may help to reduce the likelihood of collapse.

My preference is to look for solutions to avoid collapse.

My preference is to look for solutions to avoid collapse.

My opinions follow. The “you” is the USA as a country, not Dennis personally.

The problem with this is that survival is going to be a zero-sum game with the highest stakes possible: megadeaths for you or for somebody else… most likely caused by one of those somebodies deciding “better your megadeaths than my megadeaths”. I believe that you (or the other, but more likely you) will let the other die (if you don’t do the actual killing yourself, or steal resources with the same effect).

Collapse will not be evenly distributed, and that distribution will be decided politically and/or militarily. Your withdrawal from the Paris Accords and the TPP make me doubt there is any will for a fair (or even a semblance of fair) political solution going forward. More than ever before, I see the impossibility of a political solution that respects the rights of South-sea islanders, Canadian Aboriginal groups (currently fighting against Gas pipelines) and anyone else who is not from the USA…and if you continue to have a Republican administration, anyone who is not a white person from a Red state.

Sooooo…I don’t place any faith at all in greater efficiency or the likelihood of good government policy.

Apocalypse, however… there’s some good odds there.

The only question, in my mind, is the timing.

Lloyd,

From my perspective it is not a zero sum game. Trump does not represent my views and is supported by a minority of the population. Unfortunately the US has a political system where the president is not elected by popular vote, but by the Electoral College.

https://en.wikipedia.org/wiki/United_States_Electoral_College

Humans can cooperate when necessary and sometimes learn from past missteps.

You’re a data guy, Dennis, much moreso than me. The Electoral College is a data point that can’t be changed, and is going to keep your country much more conservative than the majority of it’s citizens for the foreseeable future. Conservative propaganda is going to keep the Right Wing as uninformed as it already is… there would have to be a flood and/or a brush fire in a Fox studio for them to admit there are climate or oil issues (and even then they would call it a Democrat plot)..

There is also the little problem that your elections have been, and are probably still being, tampered with.

I don’t doubt your goodwill or that of the majority of Americans. Unfortunately, that goodwill cannot be acted on, and where you are right now is already a compromise that pisses off the right.

Now, if Bernie is the candidate, the Dems win all three branches with 68 seats in the senate, and take a bunch of statehouses, I’ll take it all back….well, half of it back, anyway.

At this point, though, my money’s on apocalypse.

http://peakoilbarrel.com/eias-electric-power-monthly-january-2020-edition-with-data-for-november-2019/#comment-697351

Hi Lloyd,

The most valuable thing we have is time. Make the best of it. Let it go, everybody else does.

Hi Beach.

I don’t actually dwell on it that much; I accept that it’s a conundrum beyond any one person’s control. Every once in a while it comes out, though.

My preference is to look for solutions to avoid collapse.

And if you find a solution, then just tell 8 billion people what they must do to avoid collapse. And I am sure they will hang on your every word and praise you for saving them. 🙂

Ron,

Not looking for praise, just potential solutions, when there are problems to solve, humans are pretty innovative at finding solutions. Collapse will not occur from a single problem there are multiple problems to be solved.

Solutions can be proposed and debated, and eventually policy wonks will attempt to implement solutions primarily through governments, but possibly through public private partnerships.

I have no novel solutions, this blog can serve as a place where such ideas can be discussed.

Dennis, it was a joke. The whole idea that we will find a solution for the ecological problems the world faces is a joke, a very cruel joke.

Dennis, I have been thrashing this straw for half a century. I was talking about overpopulation when the population of the world was less than half what it is today. The world was overpopulated then and is far more than doubly overpopulated today.

What has been done about deforestation?

Nothing.

What has been done about topsoil being washed and blown away?

Nothing.

What has been done about ocean fisheries disappearing?

Nothing.

What has been done about falling water tables?

Nothing.

What has been done about the ongoing sixth extinction?

Nothing.

What has been done about climate change?

Nothing.

What has been done about depleting natural resources?

Nothing.

What has been done about air pollution?

Nothing.

What has been done about rivers, lakes and inland seas drying up?

Nothing.

What has been done about coral bleaching and reef death?

Nothing.

And I could go on and on and on. But you get the message. Human beings are overpopulating the world and destroying it in the process. And you want to debate it? You want to search for solutions. You think people debating these problems will lead to some kind of fix? Well, good luck with that one.

Total Fertility ratio was about 5.5 in 1965, today it is about 2.5 for the World population. When it falls to under 2.1, World population peaks and declines.

See page 254 of paper linked below

http://admin.globalchange.gov/sites/globalchange/files/Samir%20Demographic%20Scenarios.pdf

Chart below from that paper, education is the key to reducing total fertility ratio in the opinion of these authors.

Why can’t we get like 0.01% of this as a token donation?

https://www.space.com/jeff-bezos-blue-origin-climate-change-fight.html

$10,000,000,000

🙂

Dennis, the world

population has slightly more than doubled since 1972. More than doubled in just 48 years.

The elephant will be extinct in 20 years. Okay, too many links to post but the gorilla will be extinct in 10 to 15 years. And all other great apes, except humans, will be extinct in the next 20 to 40 years. As well as thousands of other species.

Indian farmers are committing suicide at record rates because the water tables are dropping and they can no longer irrigate their farms. Some towns in India are even trucking in drinking water. And I can go on and on and on.

Your chart, the best case still has the population at almost 7 billion 180 years from today. And you believe that is our saving grace. Dennis, give me a fu***** break! We have 50 years at best before total collapse.

Ron,

It is 80 years 2100-2020=80.

Ron,

Also the peak population for that scenario occurs in about 35 years (2055) at a little over 8 billion.

I don’t think the timing of a future global collapse can be predicted. You seem quite confident about what the future will be like, I steadfastly maintain that the future is unknowable.

In 30 years (2050) the world population will be 9.7 Billion. Plus or minus a few 100 mill.

Check the trend graphs. You can’t even see WWII as a blip on the charts.

Its like adding an additional country that’s bigger than the 3rd-13th countries today combined [USA, Indonesia, Pakistan, Brazil, Nigeria, Bangladesh, Russia, Mexico, Japan, Ethiopia and the Philippines, throw in Germany to get closer].

https://ourworldindata.org/world-population-growth

World energy consumption/capita may have just peaked this past decade. anyone have better data on this?

http://www.tsp-data-portal.org/Energy-Consumption-per-Capita#tspQvChart

Hickory,

There are different estimates of what will happen to future World Population, the UN estimates are not definitive, the Wittgenstein Center does a lot of research on this as well.

https://www.iiasa.ac.at/web/home/research/researchPrograms/WorldPopulation/The-Wittgenstein-Centre.en.html

Like most things about the future, we just do not know.

Charts like this tell us to relax because the population will eventually stabilize and decline slightly. But we have too many people NOW. The number 80 years from now will be far larger than now. Yikes!

I’m just crossing my fingers that research into male birth control gets a good investment boost. I don’t think this chart considers that and there are a lot of men that have kids they never wanted.

Deci, look more carefully at the chart I posted, in 80 years popultion will be slight ly less than today and it will continue to decline from there, maybe reaching 3.5 billion by 2200 and halving every 100 years until a sustainable population level is reached.

Solutions can be proposed and debated, and eventually policy wonks will attempt to implement solutions primarily through governments, but possibly through public private partnerships.

Dennis,

It is possible that in the not too distant future politicians of big countries can’t control the combination of problems anymore. The risk that they will become powerless, helpless is certainly not negligible.

Han,

Many things are possible, I think nation states have a lot of power, I am confident this will continue into the future.

You are right, Dennis, I needed to look more closely at the chart. But how much damage will we do while getting there with all those people?

Hello Dennis,

I agree problems can have solutions.

But I very much doubt that we have problems so I don’t believe that looking for solutions is the way to spend our time.

I suspect that reducing our predicament to a mere problem – or even set of problems – with solutions is, to put it mildly, unwise.

Paul Isaacs

The Shale Oil Bubble Accounted For 99% Of U.S. Oil Production Growth Since 2007

In December 2007, the Rest of the U.S. reported 4.6 million barrels per day (mbd) of oil production while shale oil (tight oil) accounted for 0.5 mbd. Now fast forward to December 2019. What do we see? Shale oil production reached 8.3 mbd while the Rest of the U.S. was 4.7 mbd. In 12 years, shale oil production increased 7.8 mbd while the Rest of the U.S. surged by a whopping 0.1 mbd (approximately 100,000 barrels per day).

https://srsroccoreport.com/the-shale-oil-bubble-accounted-for-99-of-u-s-oil-production-growth-since-2007/

SRSrocco,

That chart is completely useless. As you can see, no one in this blog has even commented on it.

Don’t you realize that oil is ABIOTIC and it is made continuously deep in the CREAMY NOUGAT CENTER of the earth? Thus, all these oil wells are going to be refilled.

There is no Peak Oil, only Peak Stupidity.

Bubba

Steve, I would have rejected this if I hadn’t known you posted it yourself. 😉

Ron

Ron,

Thanks. I was just having a little bit of fun. Ron, you don’t know how many emails and comments I receive from articles on my website about PEAK OIL being a SCAM. There are so many STUPID people in the world, it amazes me to no end.

So, instead of getting frustrated as we head over the ENERGY CLIFF, I’d rather poke some fun and enjoy some laughs.

So, if you see some comments by Anti-SRSrocco or Bubba, you’ll know who it really is. 🙂

steve

Bubba,

I agree most of the increase in World c+c output has been from tight oil since 2016. Lack of response to Steve does not imply disagreement all of us agree oil will peak from 2018 to 2030, with differences of opinion on the likely date.

Dennis,

Thanks for your reply, but what about the ABIOTIC OIL ELVES that are creating new oil every day?

Any thoughts on that?

Bubba

Steve,

I actually know someone who not only believes in abiotic oil, he also believes that when God sees we are running low he’ll make some more. He is also a religious nut who was simply brought up that way as a child. No excuse, but there are a lot of religious nut bars out there. Think about, no one before Trump has ever been elected without some kind of faith statement or track record. And then he quickly joined up and invented one.

I often wonder what percentage of folks just cruise through life convinced it is all part of a divine plan? Even today, 24% of Americans still believe the Bible is the literal word of God.

When decline starts in earnest there will be some very very bewildered folks out there.

Bubba,

Not really, are those elves under the flat Earth? 🙂

Yes they live on the other side.

That’s the reasone they are all winged – otherwise they would fall down ;).

Ron

Guyana should start showing up in the EIA and OPEC data shortly. As best as I can figure out, Guyana is expected to add about 200 kb/d/yr over the next five years for a total of 1 Mb/d. Saudi Arabia and Kuwait will start production from the neutral zone shortly and could reach 320 kb/d in 2021. Not clear if it will get back to its production level in 2010 of 600 kb/d. See note below. Then there is Brazil. Some reports indicate that it could possible add another 1 Mb/d over the next two years.

I am not aware of any other big discoveries coming online soon. These new fields could postpone the confirmation of Nov 18 being the peak.

Saudi-Kuwait neutral zone output could reach 320,000 b/d: IEA

Dubai — Saudi Arabia and Kuwait could pump 320,000 b/d from the neutral zone a year after resumption of production that’s shared equally by the two OPEC members, the International Energy Agency said Thursday.

The offshore al-Khafji field, owned by Saudi Arabia’s Aramco Gulf Operations Co. and Kuwait Gulf Oil Co., could produce about 60,000 b/d by August and after one year 175,000 b/d, the Paris-based agency said in its monthly oil report. The onshore Wafra field, which is operated by KGOC and Saudi Arabian Chevron, may produce 80,000 b/d in Q4 2020 and later 145,000 b/d, it said.

Production from the zone has been halted for more than four years. Saudi Arabia and Kuwait signed agreements in December to resume output but didn’t specify a timeline. Chevron has said it will restart “at the appropriate time.”

Saudi energy minister Prince Abdulaziz bin Salman said in December production from Khafji could reach 325,000 b/d by the end of 2020. Both Kuwait and Saudi Arabia have said the resumption of oil production from the divided zone would not clash with their OPEC+ commitments.

Guyana is expected to add about 200 kb/d/yr over the next five years for a total of 1 Mb/d.

I don’t understand that at all. According to the EIA Guyana is producing zero barrels per day. And all I could find on the net was this:

ExxonMobil and Hess reported that new discoveries contain estimated resources exceeding 4 billion barrels of oil equivalent, potentially producing 750,000 barrels per day by 2025. The value of oil dwarfs the roughly $3 billion gross domestic product of Guyana.

However, this, as well as the al-Khafji field coming back online, will make little difference in the big picture. What could make a difference is if sanctions were lifted on Iran next year. But I doubt that would be enough, especially if the US starts to decline in 2022.

Nothing is certain, not in Iran or Venezuela. And as in Libya, conflict in the Middle East and Africa is likely to increase rather than decrease.

Ron

https://www.businesswire.com/news/home/20191220005597/en/ExxonMobil-Begins-Oil-Production-Guyana

A second FPSO, Liza Unity, with a capacity to produce up to 220,000 barrels of oil per day is under construction to support the Liza Phase 2 development, and front-end engineering design is underway for a potential third FPSO, the Prosperity, to develop the Payara field upon government and regulatory approvals. ExxonMobil anticipates that by 2025 at least five FPSOs will be producing more than 750,000 barrels per day from the Stabroek Block. The timely development of these additional projects will ensure that the local workforce and the utilization of local suppliers will continue to grow.

Somewhere else I say the possibility of getting to 1 Mb/d if they make a few more finds

This question may have been answered several times. Does anyone know whether the oil & or gas consumed in production by Saudi Arabia is added to the production figures of the country?

By the way, do Texas producers consider the hydrocarbons they locally consume as production?

Thanks in advance,

m.

I have no idea how oil would be consumed in production. If any is, I think it would be such a small amount as not to matter. But oil consumed by the country itself is counted in production.

I am sure some gas is used but I know of no one that tracks world natural gas production.

KSA is a pretty serious oil consumer. Maybe he means that.

But I’m in your corner on this I have never heard of a quoted amount consumed as a consequence of production.

Maybe five years ago we played around with shale in North Dakota and the truck consumption, but not KSA.

Concerning that question EROEI comes into my mind as well as the Export Land Model.

Ron, Thanks for the update. Insightful analysis and super presentation.

Received this from an email from Matt Mushalik. I thought I would post it here for your information.

Weak demand from the Corona virus may cover up OPEC peak oil

1/10/2019

The Attacks on Abqaiq and Peak Oil in Ghawar

http://crudeoilpeak.info/the-attacks-on-abqaiq-and-peak-oil-in-ghawar

Today, an upward kink in Corona cases and deaths

https://www.worldometers.info/coronavirus/

With travel bans we see impacts similar to a peak oil scenario.

Australia has made itself absolutely dependent on China. Commodity

exports, students studying at Unis, tourists, investors buying up the

suburbs…It’s all Chinese money coming in.

Climate change has hit, too.

4/2/2020

Bush fires cause load shedding in NSW January 2020

http://crudeoilpeak.info/bush-fires-cause-load-shedding-in-new-south-wales-january-2020

Then the other extreme:

Rail tunnel flooded with brown water

https://www.smh.com.au/national/nsw/millions-of-litres-of-water-floods-sydney-s-metro-tunnels-20200211-p53zr8.html

We need to discuss this again:

Government Agency Warns Global Oil Industry Is on the Brink of a Meltdown

https://www.vice.com/en_us/article/8848g5/government-agency-warns-global-oil-industry-is-on-the-brink-of-a-meltdown

The report is here:

http://tupa.gtk.fi/raportti/arkisto/70_2019.pdf

Regards Matt

Shit Happens

If this is peak, it’s because of efficient environmental demand

“This means that although the oil industry can’t cope with the lower prices, the global economy can’t cope with high prices. “I now see peak oil as being defined by a contracting window between an oil price high enough to keep producers in business and a price low enough for consumers to access oil derived goods and services,” said Michaux.

As a result of this combination of geological challenges and above-ground market constraints, Michaux’s government study warns that a global peak in total oil production is either “imminent” over the next few years, or may already have happened, possibly in November 2018. But we will only be able to fully confirm the peak around five years after the fact.”

Nice fine-tuning of the peak oil definition. All of this oil production is propped up by massive quantities of debt, not just shale oil companies but also Pemex, Petrobas, Exxon, Chevron, etc all down the line. Consumers and consumer governments are also drowning in debt. In effect, no one can afford to produce the oil at given prices, and no one can afford to buy it. Yet the system limps on, at least for the time being. The vibe is getting similar to 2007 when stocks kept hitting new highs but the housing market was obviously out of whack on a fundamental scale. The big question in my mind is, when the shale oil companies all go bankrupt here in the next few years, will they drag down all the traditional oil companies as well, including the NOCs?

I’ll play devils advocate here.

Since 1980, the highest percentage of total income the average US household spent on gasoline was slightly above 5% in 1980, the lowest was 2% in 1998, 2011-14 it ran at about 4% and right now it is at 3%.

I am sure there is a price where gasoline becomes unaffordable for US consumers, but we are a long way from it.

Compare this to the increases in the cost of healthcare, housing, college tuition, and yes, automobiles.

Food and fuel continue to be cheap. $80 oil and $5 corn is not unaffordable.

Most families of four spend more on cell phone service than on gasoline.

Shallow sand,

I think the other person may have been thinking of oil and food prices in less developed nations, rather than in the OECD. I agree that this is not a problem in the US, in south Asia and Africa, maybe not. Many believe the high oil and food prices from 2011 to 2014 led to the Arab spring, rising oil prices might lead to another such crisis which could disrupt oil supply from many OPEC nations if a future such uprising might lead to regional wars affecting OPEC nations and disrupting oil supply.

I may be reading too much into the comment though.

Being the devil here. Don’t t need to play being one.

Efficiency is the mother’s milk of capitalism and free markets. Reducing the commodities and energy demand in the manufacturing process adds to the bottom line. Building more efficient vehicles makes them more valuable selling against competition.

EV’s maybe only 1 percent of of new sales today, but over the last decade ICE have become 20 percent more efficient.

The price of gasoline isn’t an economic problem except for oil producers. In time the oil market will return to a supply and demand price balance.

Dennis. Do you have any stats on the percentage of income used in other nations to purchase fuel?

My argument is based on US using 2-5% range from 1980-2019. I agree if other nations have a much higher percentage, $80+ WTI might make a bigger difference.

However, I suspect US consumers also use many more gallons of fuel per capita than those in developing nations.

shallow sand,

I have not actually gathered the data, but I suspect in developing nations average income levels are far lower, you are correct however that fuel use per capita is no doubt much lower.

short answer, I do not have the data to back my claim, sometimes when I actually look at the data, what I think is true is in fact false.

I usually do these calculations at the World level. Rather than focusing on individual nations, as there are many nations and it’s a lot of work to do them all. I could compare China with US, I suppose, but I have never done the calculation.

Dennis. I think from prior comments that you agree that the cost of oil from 2011-14 did not significantly impact developed economies. Same with the cost of food?

As for developing nations, I am not sure about the answer.

Shallow sand,

Actually that was where I used World numbers. I do not think it affected the economic growth rate of the World economy in constant dollars, so called real GWP. Gross World Product.

By it in above comment I mean high oil prices from 2011 to 2014 had little effect on the growth rate of World real GDP over that period. I believe that there is good evidence that food prices rose, a problem for developing nations and perhaps the spark that ignited the Arab spring.

I agree with Shallow Sand- don’t think oil price is anywhere close to a level where the ‘worlds economy’ would find it unaffordable. Most would reallocate money from other uses if they found the price rising.

“This means that although the oil industry can’t cope with the lower prices, the global economy can’t cope with high prices. ”

True, but by high prices I think we would talking about over $100/barrel, not current levels.

I suspect we will come to see these higher prices, this decade.

Hi SS, you seem to state that oil is affordable for producers and consumers, yet across the board they both are drowning in debt almost everywhere in the world. If someone is charging their life’s necessities on their credit card, it may seem affordable, until whoever is in control of the purse strings pulls them shut.

To state it more emphatically, producers are borrowing money to produce oil, and consumers are borrowing money to consume it. Therefore, it is affordable for neither. The system is merely operating on inertia- Wile E. Coyote suspended in air on the wrong side of the cliff.

Stephen,

Doubtful that consumers in general in the US are borrowing to pay for gasoline. For US consumer debt here is some data:

https://fred.stlouisfed.org/series/CDSP

click on chart for larger view.

Stephen. I didn’t say the price of oil currently is high enough for producers. It isn’t high enough for non-conventional sources, which is where the bulk of remaining supply will come from.

I only argue that current prices are affordable for consumers in the United States, given US consumers spend less than 5% of income on gasoline on average, and the range has been from2-5% over the past 40 years. $80 WTI would not have a big impact in the US. As for other nations, I cannot say, I would need to see comparable stats.

It would probably make more sense to calculate the geometric mean instead of the arithmetic mean, since household spending never falls below zero. As a rule of thumb, numbers that can’t fall below zero are poor candidates for arithmetic means. That is why Wall Street models always use percent changes in values and geometric means.

More importantly, the geometric mean is insensitive to outliers. The arithmetic mean is dominated by large values, which makes it a poor measure of typical values, which is what you seems to be looking for. Market prices will tend to be driven by the behavior of the typical consumer.

Alimbiquated,

Put the name of the person you are talking to in your comment. I have no idea who you are talking to or what we are supposed to apply the geometric mean to.

Alimbiquated,

When looking at economic growth rate over time I always use geometric mean.

avg per person income in usa $31099

avg miles per person in usa 13,476

avg mpg in usa 25

number of gallons used to drive 13476 mi: 539

avg cost of gasoline $2.60

average annual cost of gasoline $1400

1400/31099 = 4.5% of income on gasoline

while this confirms the relatively small amount of income (<5%) spent on petrol, it also confirms why EV adoption will meet much foot dragging.

DuaneX,

Gasoline prices are likely to rise faster than income while the price of EVs is likely to decrease over time. Eventually Tesla will introduce a “budget” EV for 20K (in 2020$), perhaps in 5 years or so, at that point ICEVs are done within 10 to 15 years. Also there is the potential for robo taxis which may make car ownership a thing of the past, that is probably 15 to 20 years in the future (government approval will take time).

A lot of electrification will be driven by the industry. Mild hybrids are coming very quickly, and they eliminate a lot of the mechanical gizmos in cars, including cam shafts, power steering, power brakes, passive suspension, turbo chargers powered by exhaust, automatic transmissions with fluids, etc.

Mild hybrids also make the combustion engine second fiddle to the electric motor. They consume less fuel because that is required in the big markets of Europe and Asia. Gas is pretty cheap in China, but the government wants to push electrification to get a jump on the rest of the world.

American car companies have to follow the rest of the industry or abandon the international business, as GM is doing. The problem is that the American market really isn’t big enough to support competitive platform development. That is explains their decision to stick to pickups and leave the rest of the business to foreigners. But since Rivian announced, even this niche is disappearing from the ICE.

Sorry Duane,

Average cost of car ownership US- $8,649

Median income US – $31,099

28% of income. Older cars cost more to maintain. Lower income adults in the US are ready to abandon their cars, as is much of the urban upper classes.

https://www.nerdwallet.com/article/loans/auto-loans/total-cost-owning-car

https://en.m.wikipedia.org/wiki/Personal_income_in_the_United_States

stephen,

Let’s assume all tight oil focused producers go bankrupt, except majors (that seems far fetched because only a portion of their operations are in tight oil). Let’s further assume that all tight oil production gradually stops because it is no longer profitable to produce.

That tales about 8 Mb/d of output off the World market (or more if tight oil output rises to 9.7 Mb/d as I expect in 2026). World C+C output falls to about 74 Mb/d in this scenario, by perhaps 2030 to 2035.

What would you expect will happen to the price of oil under such a scenario?

My expectation that WTI would rise to at least $100/bo in 2020$, at that price the oil companies left standing will be doing just fine, with bankruptcy highly unlikely. Eventually an energy transition will reduce consumption levels of oil so that consumption starts to fall by more than the output of oil falls and at that point oil prices may decrease, at that point OPEC starts to fall apart and NOCs start to compete with each other for market share and may drive oil prices quite low as they over supply the market. My guess is this occurs some time after 2040 and oil prices may fall to $40/bo and some higher cost NOCs might be driven to bankruptcy, perhaps by 2050.

Difficult to guess how quickly the transition to alternative forms of land, sea, and air transport will occur, I think by 2060 to 2070 we might reach only 20 Mb/d of oil demand, but that’s probably on the optimistic side of possible WAGs.

Hi Dennis, I don’t think the remaining oil companies will be just fine. We’ve had several prolonged periods of oil at $100/b and great surges of production have not occurred other than shale oil. There are three primary things going on that make ALL oil companies susceptible to failure as an industry over a brief period of time (less than two years).

1) Lack of prospects/rising costs of new projects and bad debt. Debt taken on for only short-term gains is essentially rot that will inevitably lead to bankruptcy if done for a prolonged period of time. Shale companies do this when they drill wells that deplete quickly; large oil companies do this when they take on debt for dividends and share buybacks; NOCs do this when they used oil companies like piggy-banks for payments to their citizens. At the end of the day, you have the debt and nothing to show for it.

2) Inherent inefficiency of the oil-ICE car paradigm. Cars typically use 5% of their energy to move their human payload around (200 lbs in a two ton car e.g.). Internal combustion engines are about 20% efficient. Therefore we have a transportation paradigm that is 99% inefficient. Technological improvements in structural materials; batteries and EVs; AI; and PV are all improving, while the oil resource is degrading and ICEs are improving only modestly. Systems that are 99% inefficient do not survive crises well.

3) Narrative/Paradigm shift among investors. When oil goes to $100/b in 2030 as you suggest, the remaining oil companies (if there are any) will make some money. There will also be articles about many new EVs are being sold, and/or how the young are abandoning owning a car altogether. Wall Street is not interested in investing in companies who happen upon a windfall but otherwise represent the past, they want to invest in the companies that will be dominant in the future. This narrative will be fully entrenched by 203o if not by 2022.

Add to this an overdue recession and 1-2 years of very low oil prices, likely caused by a travel-destroying bug encircling the globe with plodding intensity. This last item remains something of a hypothetical, but less so every day.

Yes indeed, I agree. That’s why it makes absolutely no sense to give an oil price scenario from 2020 to 2070. There will be spikes in oilprices and periods of oilprices imploding in the coming decades, also because OPEC will fall apart imho.

Stephen quoted the essence of the article of Michaux:

“This means that although the oil industry can’t cope with the lower prices, the global economy can’t cope with high prices. “I now see peak oil as being defined by a contracting window between an oil price high enough to keep producers in business and a price low enough for consumers to access oil derived goods and services,” said Michaux.

A smooth transition, regarding oilprices and EV sales increase for example, is not be expected.

Stephen,

There is a lot of low priced oil that can be produced by OPEC+, those companies might eventually go bankrupt, but not in the short term (next 5 to 10 years). It will take time for EVs, plugin hybrids and hybrids to reduce demand by more than the rate that supply will fall after peak oil, hint, Seba is likely too optimistic, my guess is 2037 at the earliest.

In the mean time, recession is not assured, the corona virus may not be as much of a crisis at the World level as some speculate that it might be and the World can easily afford oil in the $100 to $120/b range (in 2018$) just as it did from 2011 to 2014, in fact higher World real GDP today compared to then means that $120 to $140/bo in 2018$ may be roughly similar from 2023 to 2030 as the 2011 to 2014 price due to higher World real GDP.

The idea that consumers will not be able to afford oil is likely incorrect.

Han,

The oil price scenario by the EIA AEO is a scenario. Perhaps you are not familiar with modelling, and economic model requires an input, I say repeatedly, nobody knows what future oil prices will be, so we guess. All guesses about the future are wrong, whether one week in the future or 100 years.

I use 2070 because a tight oil well produces for 15 to 20 years, if we are considering a well that might be completed in 2050, to do an economic analysis we need the price of oil over the life of the well to see if it makes sense to complete the well or not. The question is will the future discounted net revenue from the well be greater than the cost of the well, the question cannot be answered without a price assumption.

Denise , you are incorrect . The low cost of production price of oil at OPEC is the well head price . I have always said this is not important . What matters is the full cycle price which means keeping MBS in power ,keeping the Al Sabah family in power in Kuwait,and the Princes in power in UAE . Take away the subsidies provided by the regimes and you can see beheadings . The full cycle price is + $ 100 per barrel . If all things were so rosy why did Aramco go for an IPO ? They are all suffering from the low oil price, some more than others . As a passing thought ,this is aggravated with the China crisis . Prices will remain low for eternity ( concede their will be spikes ) . I have always appreciated your work and analysis ,but at the same time criticized your view from rose colored glasses . We are headed in a time of great uncertainty , and my call is that oil prices are not going into any territory except down . Your equation is supply and demand , my equation is affordability .

hole in head,

Agree there will be great uncertainty. The scenarios show what might happen under a certain set of assumptions.

Future is unknown, at least for me.

The future is unknown is not only true for you but for the whole world . Jesus , why go around the effort of making models etc if it is unknown . All of on this forum make an educated /informed decisions based on data available , then some layman who reads the headlines and fires an arrow in the dark . This is in way criticism of you but appreciation of all members of this forum .

Hole in head,

I tend to admit up front that predictions of the future are not likely to be accurate. I make several sets of assumptions that seem reasonable about what might happen in the future, often with low and high scenarios that might bracket the most likely outcomes, based on what we know about what has happened in the past. These are called scenarios, if all the assumptions of the model were correct, the scenario is what might occur (if the model is correct).

I use the past data as an input to see how the model performs relative to the data up to the most recent data to give some measure of confidence that the model represents reality to some degree. Beyond the present we have to make assumptions about future oil prices, well profiles, completion rates, well costs, etc. These are unknown, plain and simple, assumptions must be made to even make a guess, I try to lay out those assumptions so knowledgeable people like Mr, Shellman and Shallow sand can suggest more realistic assumptions.

It is the best I can do, but you are correct to point out that any scenario may be incorrect, I would say the odds that such criticism is correct is about 100%.

Sorry Denise . It should have been ^This is in no way criticism of you^ . Guess should not post while drinking Cabernet Sauvignon ;-).Pls accept my apology .

hole in head,

No apology necessary. Thought you might have meant no criticism, but criticism is good. I prefer this not be an echo chamber where everyone agrees, sorry if I came across as being offended, if so it was not intended.

I appreciate your comments, often I am in fact, incorrect. In many cases, if we are discussing the future, I tend to say, “I disagree”, as there are no correct views of that which is unknown in my opinion.

Dennis,

Yes, I know economic models need input. In the case of future (50 years ahead !) oilprices there are so many variables that indeed it becomes guessing. Any projection could be given, especially the ones more than a few years from now. An optimistic scenario with a more or less smooth transition can be given. My opinion is that the chance for such kind of transition is small. That’s why I expect periods with spikes and implosion of oilprices. Not in the last place because I expect OPEC to fall apart and more military conflicts. Having to be added is any dangerous infectious disease spreading the globe between now and 2070. A ‘bumpy ride scenario’ without giving time frames is more realistic I think. In this case: NO graph. Projecting oilprices between 2020 and 2030 is already more than difficult enough.

Han,

I used the following.

https://www.eia.gov/outlooks/aeo/data/browser/#/?id=12-AEO2020®ion=0-0&cases=ref2020&start=2018&end=2050&f=A&linechart=ref2020-d112119a.4-12-AEO2020&ctype=linechart&sourcekey=0

I agree prices may be volatile, but cannot predict that volatility in advance.

Dennis is this in 2019 dollars or what? Do you adjust for inflation?

Ron,

That is the AEO reference case for WTI oil price in 2019 $/bo (see upper right of chart, click on chart for larger view.

Dennis,

Prices WILL be volatile. This is a graph for ‘fantasy world’, that shows a concerted effort in energy transition.

Maybe in 203o average oilprices will be 70 dollar/b and in 2040 almost 90 dollar/b on average, with a few brief spikes above 100 dollar and a few brief dips below 30 dollar between 2020 and 2040.

In that case Peak oil and the following terminal decline can hardly become the threat that many here on peakoilbarrel fear, because in that case there will be a kind of smooth transition during which hybrids, EV’s, etc will expand steadily rather quickly worldwide. That is possible, but I consider the chance well above 50% that the result will be different. We don’t have only Peakoil (soon) as a problem, and climate change is showing its horrible consequences already in many countries.

Han,

I agree that prices will be volatile. The chart is the EIA’s AEO 2020 reference oil price case for WTI.

I cannot predict the ups and downs of the price of oil, this chart is likely to reflect the centered 12 month average price within +/- 2% in my opinion. Short term oil price volatility has been around for a long time. (1973-2020)

Note that you would need to talk to the EIA about their future expectations, this is not my oil price scenario.

REal prices re interesting, but it’s worth noting that GDP is increasing. I think it’s a safe bet that oil revenues will continue their long term decline as a percentage of the larger economy.

The real price of oil is one number, but the percentage of the economy dedicated to oil is more interesting.

Alimbiquated,

Yes as oil peaks it will become less important if prices remain fixed in real terms, but it is likely that oil prices will rise. I agree the percent of World GDP spent on oil is an interesting figure.

If we assume my World Oil shock model is correct, that World real GDP continues to grow at the 1975-2017 average rate of 2.92% per year and that the AEO 2020 reference oil price case is correct, then we get the following for the percent of real World GDP spent on C+C output (where I use the Brent oil price for the average World oil price).

If we use the same assumptions as my comment above we can deam the 2019 oil price as “affordable” at 1.92% of World real GDP (aka real GWP) spent on C+C at Brent oil prices in 2019$/bo.

We can find the affordable price for oil assuming the percentage of real GWP spent on C+C output is equal to 1.92% (I assume output follows my shock model).

Chart below gives this “affordable” oil price where it is assumed demand remains robust through 2050.

click on chart for larger image

Note that you would need to talk to the EIA about their future expectations, this is not my oil price scenario.

Dennis,

Don’t you think that “the EIA” would like to see nothing more than a smooth slow declining world crude oil production curve together with slow rising oilprices, to fit a smooth energy transition ? Wouldn’t most of EIA staff have children and because of that don’t want to let possible pessimistic scenario’s to get in their heads ?

Han,

I do not know what is in the minds of the economists at the EIA, perhaps this is what they think the most likely scenario is, or it may be wishful thinking.

The future is not known by anyone.

Han,

It has been a bumpy ride for the past 50 years, perhaps the ride will become bumpier as many have been predicting for about 50 years (or more).

Perhaps you have a better crystal ball than me, my predictions up until now have been uniformly too pessimisitic relative to what has occurred.

Though it is certainly true that they have been less pessimistic than many others.

In any case, every scenario of the future is very likely to be wrong. The number of possible futures is infinite, when any one scenario is created, odds are 1/infinity=zero that such a scenario will be correct.

Hi sirs,I want to thank you for this opportunity I’ve been looking for oil information to make some investment if I can warm regards.

Interesting how different one can perceive and make use of information found on this site and others (I’m not an oil investor).

I would disagree of a Seneca cliff like decline of giant fields.

Giant field are more a conclusion of several subfields, with different hight of oil colums in them.

So if you perfectly cream it, pump water pressure / CO2 etc.., oil level in the subsection will develop different.

So it’s more like 2021 south section runs dry, 2022 east section … and 2026 the central (best) section starts to draw water. So the complete field decline will look like a 1x% annual decline, even when the subsection break down very fast – but on there own time scale.

Perhaps even every single well that has to be closed when the water draw gets too high – resulting in an organic looking decline even when single wells die within a few months.

You have documented this here very good on Ghawar – one section already broke down, others still producing.

Giant field are more a conclusion of several subfields, with different hight of oil colums in them.

That is the exact point I made in my post. Ghawar is five fields. We can see a dramatic acceleration of the decline in three of them. Two are not declining at all. But taken as a whole, we still see a Seneca Cliff in Ghawar. If you disagree, then you disagree with exactly what is happening.

This look very much like a cliff to me.

I agree for this single field, there was indeed a Seneca cliff, it is in fact the classic example. For the World this would only occur if all fields exhibited this behavior and the timing of the decline from all fields was simultaneous. Odds of this occurring is approximately zero.

The odds of a simultaneous cliff-decline from all fields is zero, but what about the odds of two or three larger super-giants dropping off the cliff within a few years of each other?

If that were to happen soon the world could quickly lose about 10% of its conventional oil production. But the super-giants will probably be among the last to be sucked dry, so the loss of production at that time might be a far higher percentage of the total. The end of the oil age could easily be a Seneca cliff.

Joe,

Doubtful that will occur in my view. If it did prices would spike and resources that were deemed not profitable to produce might be developed and might blunt the decline. Many of the supergiants are onshore, Canterell was offshore and so far is the exception to the general rule for giant oil fields. Also it is highly unlikely that 3 fields contribute more than 5.8 Mb/d to total World output and they will not drop to zero overnight, 5.8 Mb/d is about 7% of World output and it is not very likely the three largest will all decline sharply within a few years of each other in any case. If they dropped at 20% per year (unlikely), we would see World output drop by 1.14%, prices would rise, other resources would be developed.

Note that currently Ghawar has output of about 3.8 Mb/d, the next largest field is around 1 Mb/d, I assume the 3rd largest is also close to 1 Mb/d which is how I arrive at 5.8 Mb/d for a worst case scenario where the 3 largest producing fields all start to decline steeply simultaneously (a highly unlikely scenario).

Hi Ron,

By Bardi’s definition the Seneca effect means that rate of decrease in output is greater than rate of decrease in output. If we use data from Twilight in the Desert (p. 368) for Ghawar increase from 1957 to 1975, the rate of increase in output averaged about 11.4% over that 18 year period, over the shorter period of 2017 to 2019 the rate of decrease in output the Ghawar decline rate was about 10.6% based on the Mearns model presented in your post (chart). So not really a Seneca cliff at least by Bardi’s definition. Certainly the decline is fairly rapid in Mearns model, it is unclear if that rate of decrease will continue, Mearns model suggests over the longer 2017 to 2030 period the average decline rate is about 4.8%.

Geological Survey of Finland

Of existing world liquids production, 81% is already in decline (excluding possible future redevelopments). By 2040, this means the world could need to replace over 4 times the current crude oil output of Saudi Arabia (>40mb/d), just to keep output consistently flat.

In January 2005, Saudi Arabia increased its number of operating rig count by 144%, to increase oil production by only 6.5%. This suggests that the market swing producer (as Saudi Arabia was seen) was not able increase production enough to meet increasing demand.

Global conventional crude oil plateaued in January 2005. This would prove to be a decisive turning point for the industrial ecosystem. Since then, unconventional oil sources like tight oil (fracked oil shale) and oil sands have made up the demand shortfall, where U.S. shale (tight oil, fracking with horizontal drilling) contributed 71.4% of new global oil supply since 2005. Global conventional oil production broke out of its plateau in late 2013 and has been able to expand incapacity, where deep offshore plays become more important.

Since 2008, the Shale revolution (tight oil or fracked oil) has increased global oil supply which stabilized increased demand. This was achieved with the application of precision horizontal drilling applied to the existing hydraulic fracking industry. Tight oil produced in August 2019 was 7.73 million barrels per day, approximately 8.37% of global supply. The U.S. tight oil sector accounted for 98% of global oil production growth in 2018. Future global demand growth is now dependent on the U.S. tight oil sector.

This report is 497 pages long with many charts. From page 262:

17 Peak Oil

Oil is a finite natural non-renewable resource. The planet Earth is a finite system. At some point, rates of resource discovery and oil extraction rates will peak and decline. Has all the oil deposits been discovered, or is there vast reserves yet to be tapped? A pertinent question is when this date might be. Another pertinent question would be how society might manage this supply gap in oil supply.

Data collected over the last several decades show that peak oil is now an observation in several oil-producing regions (Norway, United Kingdom, etc.) and is not just a theory. In the past, as one region peaked and declined, a new region was developed to take over production growth, thus the global production could continue to grow. So what happens when regions on the planet are in decline and there are no more new regions to exploit?

What is to be remembered is that not all oil deposits are equal and some will be much harder to exploit than others. It is appropriate to state that the easy to find, extract and refine oil deposits have all be exploited decades ago, and what is left is the less economic deposits. Technology has been the mechanism that has allowed the continued economic extraction and delivery to market.

Reading further in this report, I found the following comments very interesting.

17.1 Oil & Gas Industry and Peak Oil