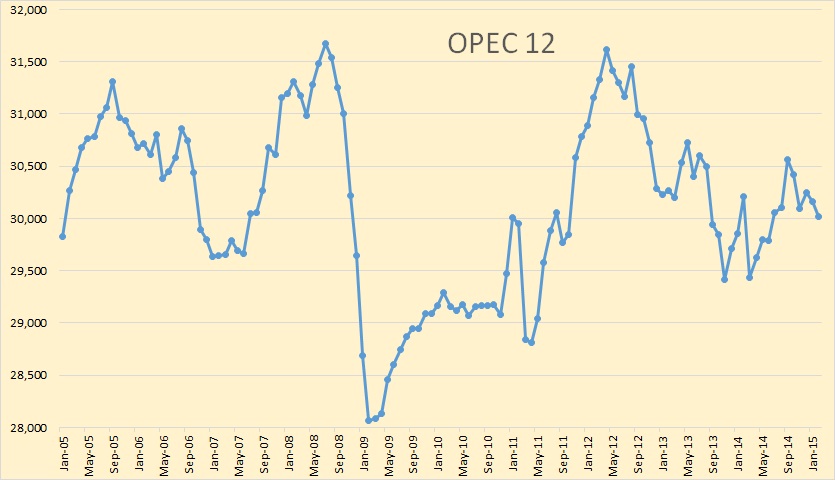

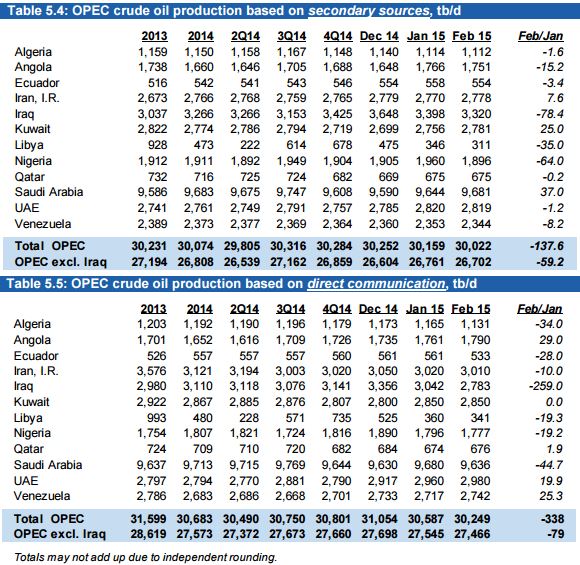

The katest OPEC Monthly Oil Market Report is out with OPEC crude only production numbers for February. All data in the OPEC charts below is in thousand barrels per day and the last data point is February 2015.

Total OPEC crude only production was down 137,600 barrels per day in February.

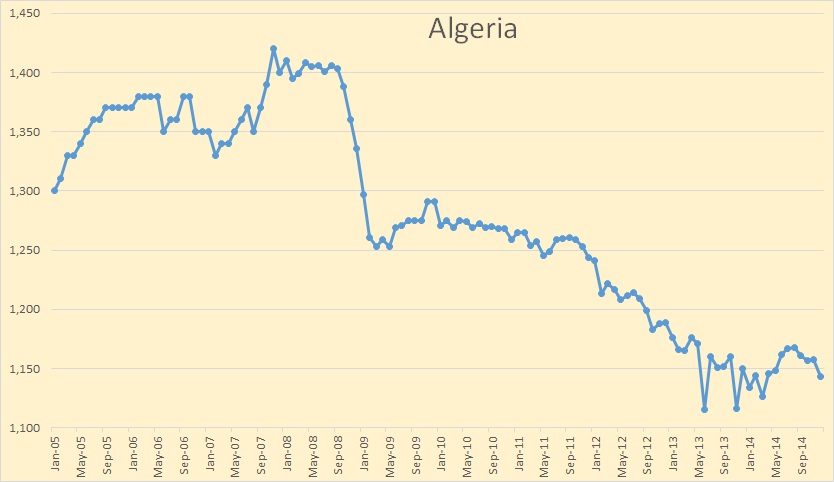

Algeria seems to have stabilized their decline.

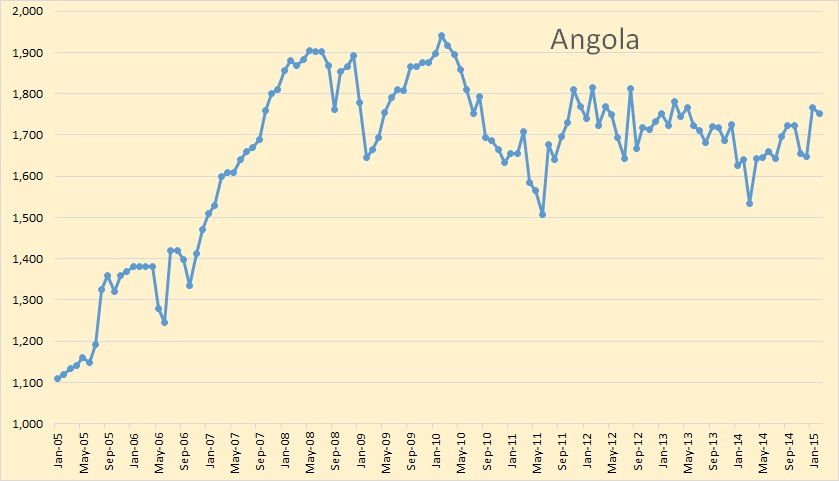

Angola is holding steady.

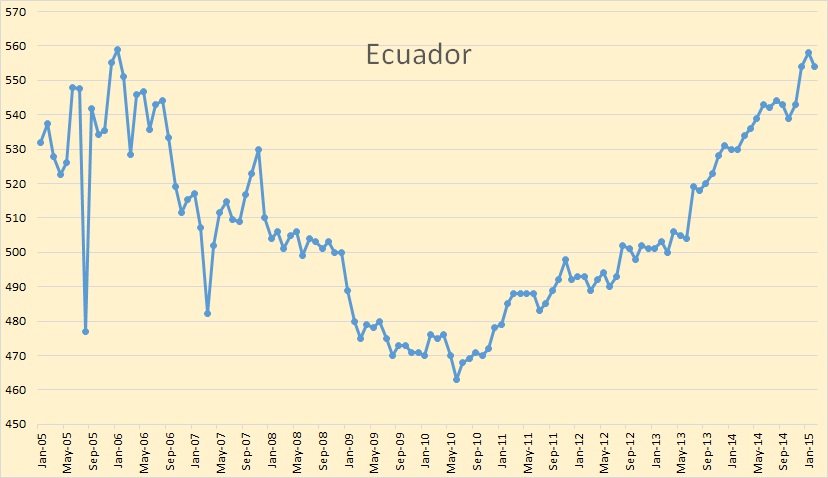

Ecuador has been slowly increasing production at a rate of about 25,000 barrels per day per year. I don’t think they can hold that for another year however.

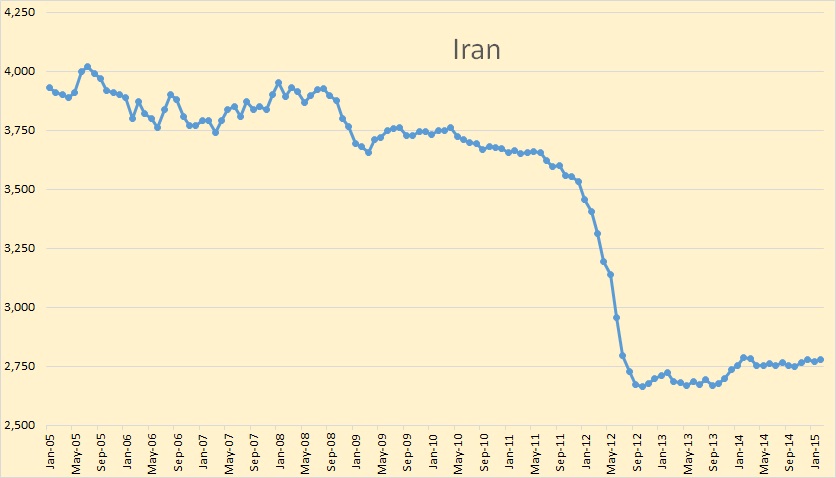

Iran production has been remarkably flat for about two and one half years. It is a question as to how much their production could increase if sanctions were removed.

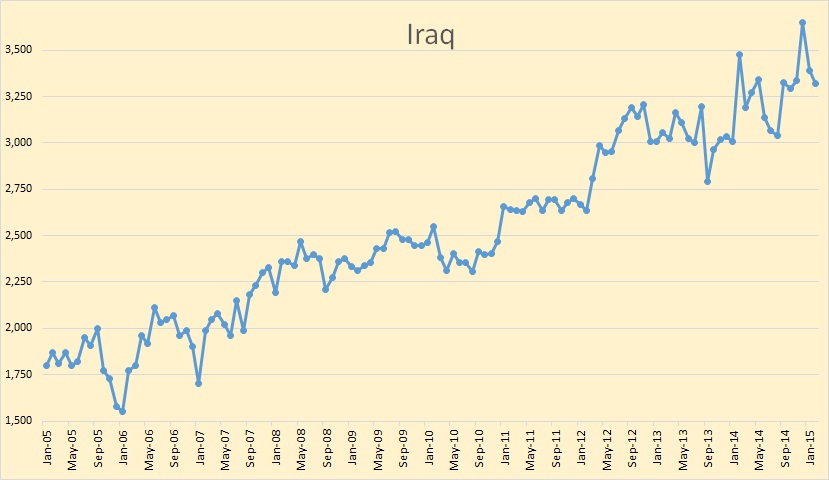

It is remarkable that Iraq has been able to keep production as high as it is with all the ISIS problems they are having.

It is remarkable that Iraq has been able to keep production as high as it is with all the ISIS problems they are having.

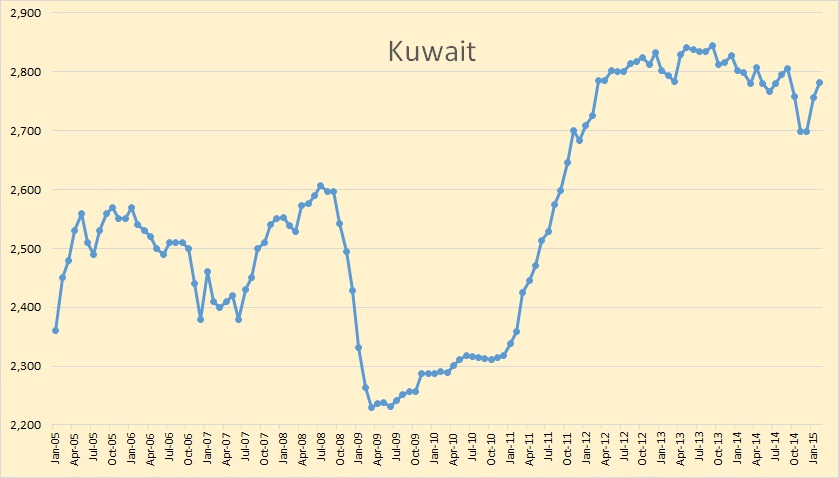

Kuwait was producing flat out in 2008 at 2,600,000 bpd. But when quotas were lifted in early 2011 due to the Libyan civil conflict, they began a huge infill drilling program and have managed increase production by around 200,000 bpd above their peak in 2008. production pretty much maxed out about two years ago.

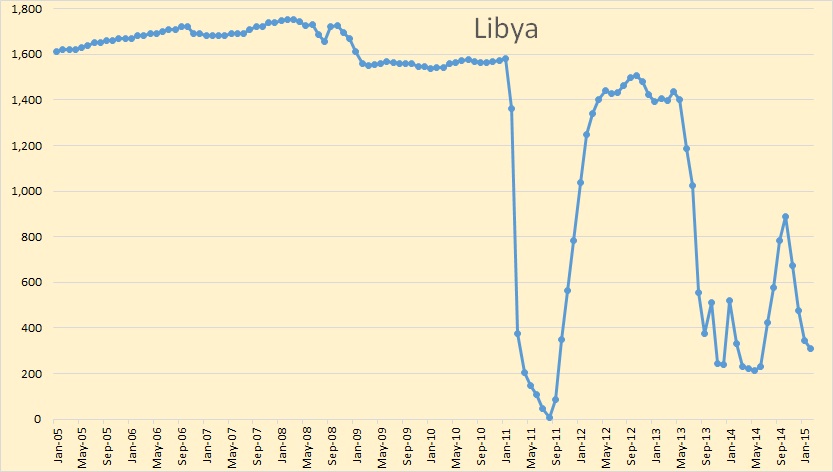

The Libyan conflict continues to impede production. They are now barely above 300,000 bpd.

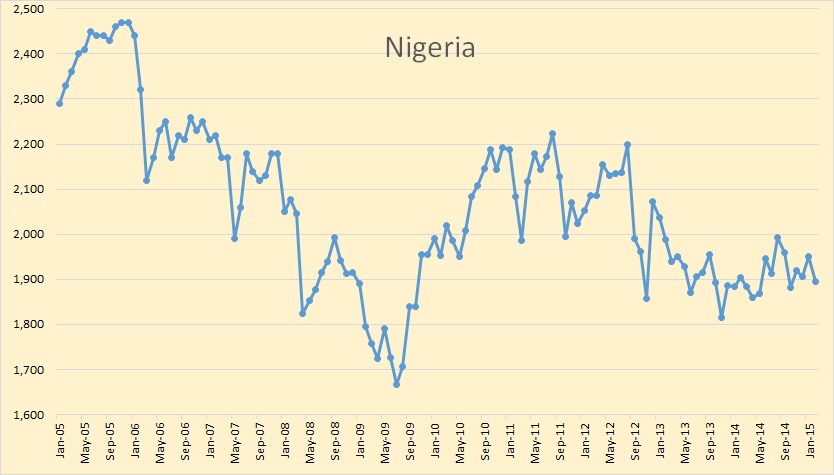

Nigeria is holding steady at around 1,900,000 bpd.

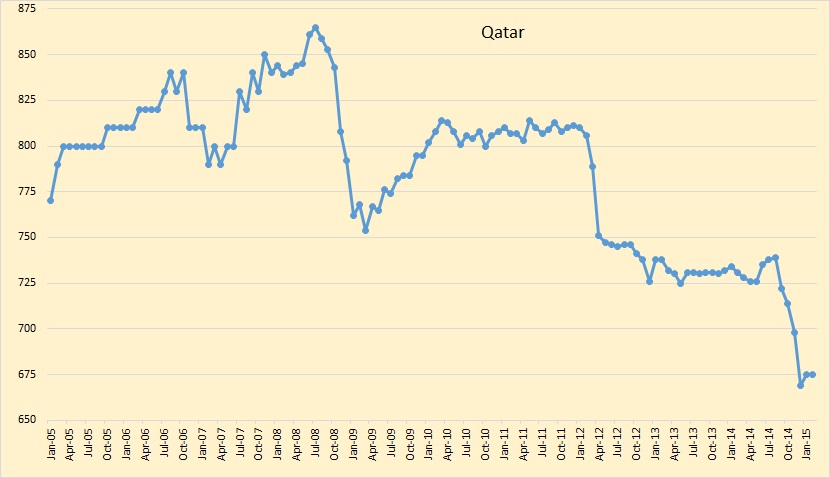

Qatar has stopped their decline, at least for now.

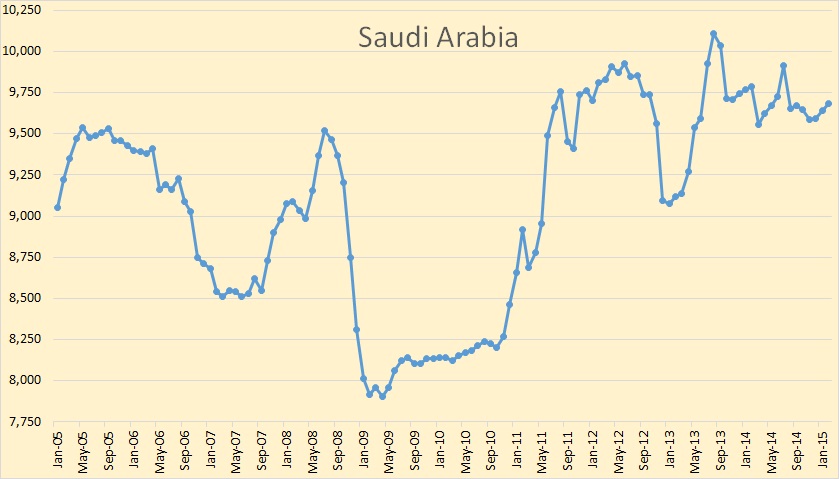

Saudi production has been holding relatively steady for about a year and a half now. They show no sign of either increasing or cutting production.

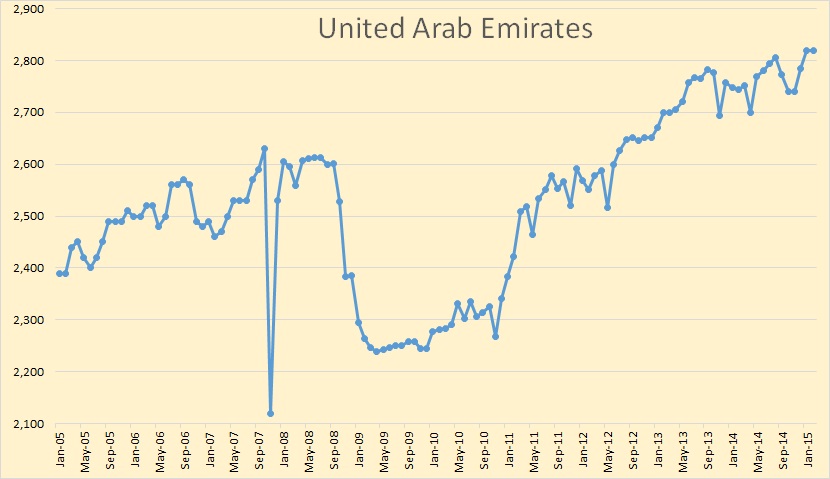

UAE, like Kuwait, began a huge infill drilling program in 2011. I think it has pretty much maxed out now.

I keep waiting for something to happen in Venezuela… but nothing.

Here are the actual production numbers produced by the OPEC MOMR. The top chart, “secondary sources” is the one used for all my charts. The bottom chart, “direct communication” is what the countries reported when they were called by the MOMR. Notice that Iraq reported a decline of 259,000 bpd while the “secondary sources” had them down only 78,400 bpd.

In Other News: The Motley Fool says any decline in US oil production could be far in the future.

American Oil Production Is Still Skyrocketing: Will Oil Prices Tumble?

With oil prices having dropped by roughly 50% since last summer, U.S. oil companies have quickly reduced their investment plans and idled drilling rigs. Many pundits have assumed these actions would quickly be followed by falling production numbers.

While that might seem intuitive, it did not prove true. At some point, reduced drilling activity will inevitably lead to a fall in crude oil output — but that point could be far in the future. For the moment, domestic oil production is still rising steadily.

Output on the rise

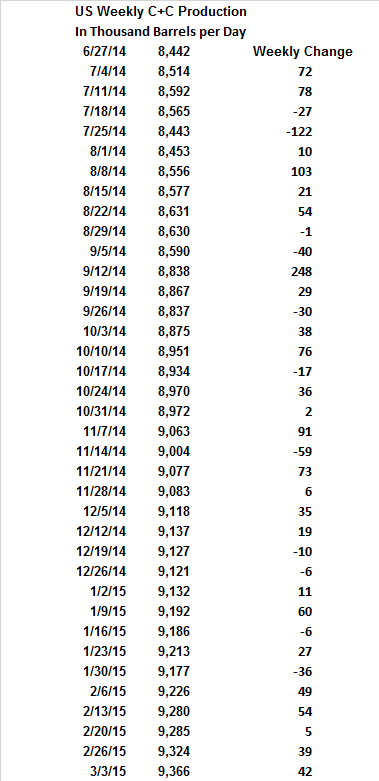

Last week, U.S. crude oil production rose by 42,000 barrels per day compared to the previous week, reaching 9.37 million bpd.

The EIA said Wednesday that US C+C production reached 9.366 million barrels per day the week ending March 3rd. And because most people believe that was an actual measured number, oil prices have dropped steeply every day since. I have tried to explain to people that this number really has no hard foundation, it is an estimate.

I am sure the EIA uses some kind of algorithm to arrive at their estimate. It is likely based on the storage numbers, imports and refinery inputs. But all this depends on many reports from oil companies, pipeline officials and refinery officials and the truthfulness of those doing the reporting.

As an indication of the EIA past production estimating skills, I showed in my last post, how their estimate of production of six weeks ago, was off by a country mile. They estimated, on March 10th, that Bakken January production would be up by 27,300 barrels per day over December. But when the actual data came in from North Dakota, production was down by 37,000 barrels per day. Of course total Bakken production is somewhat different from total North Dakota production but the numbers give us a pretty good indication of the accuracy of their estimate. The total Bakken was likely down by pretty much the same number as was North Dakota.

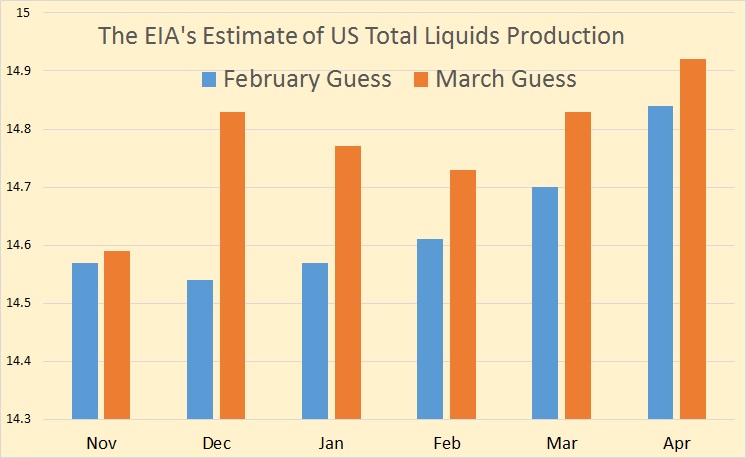

The data for the above chart was taken from the February and the March Short Term Energy Outlook. The data is in 1,000 barrels per day of Total Liquids. They decided in March that their February guess of what December production was, was 290,000 barrels per day too low. In other words, when the production they were trying to estimate was only 6 weeks in the past, they thought it was one figure, but after the data was 10 weeks in the past they had a better view so they jacked it up by 290,000 bpd.

But last Wednesday, they looked 5 days in the past and told us what the total US production of C+C was.

The above is the EIA’s estimate of US Weekly C+C production from the Weekly Petroleum Status Report. Notice the week ending 9/5/14 US production was down 40,000 barrels per day. But the next week it was up 248,000 barrels per day. Now it is highly unlikely that US production was actually down 40,000 barrels per day that week since the general trend was up. But it is a near impossibility that production was up a quarter of a million barrels per day in one week.

The EIA never revises the weekly numbers, they just adjust each weeks numbers to make up for any previous over or under errors in the data. So I am looking for another huge adjustment in the weekly production numbers soon.

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne@gmail.com

Re: Revisions

FreddyW posts graphs after each Bakken Directors Cut and my recall is that at least one of those does wait a period of time to record data. But on the other hand I don’t recall seeing much in the way of Bakken revisions after the initial release, other than for well completions. Hmmm. Surprising the EIA doesn’t just use that.

Editing here, 13 minutes to go!!

Just revisited FreddyW’s stuff last Ronpost. I think the whole matter leans on the fact the data comes out for 2 months prior. This may serve to reduce revisions.

One of the more powerful items in Freddy’s stuff was a fairly focused examination of the concept of sweet spots, and failure to find evidence of them (being drilled first).

I think companies in North Dakota are forced by regulations to report production within 2 month. In for example Texas it can take years until all the data has been collected.

ooo, very interesting.

I’m an amateur, but there *did* seem to be internal consistency with ND going down 37K in January vis-à-vis the reported increase in wells awaiting completion, rigs operating, and the decline rates that one usually encounters on the web (6% month-over-month in the first 3 years).

What puzzles me is this: Is this not what one *usually* expects for ND in January? Wells don’t get completed right away in winter, so production dips? What was surprising was that the EIA reported an increase. Perhaps I’m too new to statistic chasing…

It is often a seasonal thing, but Helms said this was not a harsh January.

http://headlines.ransquawk.com/headlines/iranian-oil-minster-zanganeh-says-the-country-could-boost-its-oil-exports-by-1mln-bpd-if-a-nuclear-deal-leads-to-sanctions-being-removed-16-03-2015

Anybody else noticing Nigeria is down 25% in 10 yrs?

Watcher,

Anybody notice they shot at people over there and kidnap people.

Not a nice place to work at all. I have personally spoken to half a dozen people that have been kidnapped at some stage in Nigeria.

I have been told Bongo, a large deep water FPSO along way off the coast, has numerous bullet holes in it.

I doubt very much oil at all is coming from swamp country these days?

Many years ago I was in Congo and we lost track of an accountant. The guy was flying in from Paris to Braza with a layover in Lagos. He was a cherry, so when the plane landed in Lagos he picked up his carry on and went to find his “facilitator”. He wandered around looking for the woman, couldn’t find her, and decided to go to the inmigration line. Eventually he got to the booth, handed over his passport, and was told in Nigerian accented English he didn’t have a visa.

He argued for a while with the official, didn’t realize Congolese speak French, and by the time he figured out he was in the wrong country the plane was gone.

Eventually he made it to Braza in one piece, but we heard he spent a few days going in his pants. To celebrate his reappearance we had a local woman prepare him a shirt which read “I went to Nigeria and all I got was this shirt”.

Ron:

The EIA lies. Your posts comparing Texas oil production vs. the EIA’s report of Texas oil production highlights the growing lies from the EIA. Each month the EIA adds roughly 50k/b/d for at least the last 12 months. How can that be? Texas has been dropping rigs almost as fast as North Dakota. Their production has surely been dropping now and quite probably since January.

The EIA and IEA work for banksters trying to destroy the oil industry so they can buy it up cheap. Next month, Goldman Sacks is starting a distressed energy bond fund. How convenient that they and the media and the EIA and IEA paint a bearish picture of oil fundamentals now.

“Next month, Goldman Sacks is starting a distressed energy bond fund. ”

Where did you get this?

http://www.nytimes.com/2015/02/25/business/dealbook/goldman-seeks-to-raise-fund-to-buy-energy-sector-debt.html?_r=0

That’s a good find. It looks like it adds up (among Goldman, Blackstone and others) to about $25 Billion and the word is energy, not shale. The Goldman offering is not all junk bonds, either.

This doesn’t look like the required bailout, but it’s definitely money risked — maybe with people like Transocean.

EVERYONE,

A Bit off topic, but thought I would share the newest interview on the Russia-Ukraine-USA-Europe situation by John Bachelor and Prof. Stephen Cohen. Normally, Prof. Cohen does a weekly interview, but was off for 10 days as he and another U.S. Professor, experts on Russia, spoke to a large group of German Bankers last week on the subject of Russia & the Ukraine.

http://www.tfmetalsreport.com/podcast/6679/batchelor-cohen-return

I am simply amazed at the WAR PARTY in the US and NATO who are pushing for war. Germany, France and nearly a dozen other countries want no PART of the U.S. War policy against Russia.

Things are about the get very interesting going forward.

steve

…indeed Steve,

sadly!

Listen to what a former joint chiefs of staff member, a major general- a true and utter moron, really and actually- said a few days ago:

https://www.youtube.com/watch?v=b6Nnn8S1XbE

Sadly, he and people akin to him lead this country now…

That is the real reason I commented (in response to Dennis and Mac) in an earlier post that there will be no market for oil or anything in 2030-2050.

Oil is falling again and when, this time, what was drilled and put on line BEFORE oil reached $50-$60 peaks and starts the 40%-80% per year decline rate shale oil well “army”, the morons like the general in the video will gain ground…and then power….and then russians (or chinesse, or anybody) and Putin shall be the “devil” that crushed our economy….and the false flag type of events whe marines are floating drowned in blood killed by the “evil Putin” soldiers are going to make the fat moronic masses “patriotic”…and then, the 99.99% brainwashed, fat moronic herd who think that our soldiers are fighting for our freedom will “volunteer” to go to war and defeat the ennemy.

As alwayz, they shall be blissfully ignorant of the fact that “the ennemy” this time has more nucelarweapons than us and we all shall lose.

It is an unwineable war!

And us few who say otherwise shall be the unpatriotic “spies” who must be eleminated…because “generals” like the one in the video and crowds who dump vodka on the streets (like they did with french wine in 2003 when french refused to join bush-chenney in irak) will take over.

The everlasting historic lesson:

“when all fails, govt takes you to war!”

Even your beloved gold and silver shall not save us this time….pray.

The next few yoars seem to be very “interesting”

Be well and hedge accordingly!

Petro

P.S.: great article Ron! Thank you for updating us.

Steve,

US real after-tax income less debt service (“rentier taxes”) and “illth” care (a.k.a. as “dis-ease” or “health” care) spending peaked YoY in Q1-Q2 ’14 and rapidly decelerated and contracted YoY in Q3-Q4 ’14.

Moreover, the oil and gas extraction and energy-related transport sectors have heavily skewed higher capital goods orders, business sales, and industrial production (IP) since 2011-12 to an unsustainable cyclical rate.

It’s not surprising, therefore, that retail sales, business sales, orders, nominal real hourly earnings, and IP/IP mfg. have been falling since last summer-fall, the point at which the price of oil began crashing. This is the stuff of cyclical business cycle contractions.

And the point, Mr. BC, one might ask? The powers that be (TPTB) are keenly aware of the foregoing and know that the US economy is decelerating rapidly in response to the deflating of the shale bubble, weather and port and refinery labor strikes notwithstanding, along with the rest of the world economy. The current cyclical trajectory is not unlike that which occurred in summer 2001 (prior to 9/11) and winter-spring 2008, both instances coinciding with the US economy having already rolled over into recession.

Thus, the US is due yet another imperial war cycle in order to goose the goods-producing sector (especially the “defense” sector) in response to recession, which in turn will justify increasing fiscal deficits, maintenance of ZIRP/NIRP, and a resumption of the Fed’s QEternity/QEn+1 later in the year.

IOW, economics is politics. Politics is war by other means. The business of empire is war. War is good business for imperialists. Ergo, economics is politics is war is the business of empire, and the owners and financial facilitators, i.e., Wall St. and The City, of Anglo-American-Zionist empire need another regional (or eventual world) war for business, geopolitical (say again imperial business), and domestic social control purposes.

Wall St., DC, the Saudi royals, Bibi and his thugs, and the US-UK war profiteers are maneuvering to release yet again the ravenous hounds of war for profits and power against “Radical Islam”, Putin’s Russia, and, if history and human nature are a guide, eventually a regional war (or Cold War- or cyberwar) in the Pacific against China.

This begs the question of what kind of “Pearl Harbor-like” event will be required this time to compel the unsuspecting American and western public to support (tacitly acquiesce to) the next phase of the never-ending war for Anglo-American-Zionist, rentier oil empire (in the post-growth, LTG era)?

Same as it ever was . . .

Parable of The Violent Tribe…

This is a 46 second-long video worth watching and/as it seems to put a cherry on top of BC’s good comment.

Same program from JB podcast 3/10/15

http://johnbatchelorshow.com/podcasts/tues-31015-hr-2-jbs-stephen-f-cohen-nyu-princeton-professor-emeritus-author-soviet-fates

Don’t hear about American misinformation or complete loss of confidence of american foreign policy in the MSM. West drives Putin into a corner, extremely dangerous situation.

Along these lines, I found these words from Malcolm Fraser Ozzie PM ’75-’83 interesting:

here’s one paragraph snip:

As painful as a reassessment of relations may be for intellectual and policy elites, there are four principal reasons why one is long overdue. First, despite much blather about a supposed unanimity of national purpose, the truth is that the United States and Australia have substantially different values systems. The idea of American exceptionalism is contrary to Australia’s sense of egalitarianism. Second, we have seen the United States act in an arbitrary, imprudent and capricious fashion. It has made a number of ill-advised and ill-informed decisions concerning Eastern Europe, Russia and the Middle East. Third, at the moment, because of U.S. military installations in Australia, if America goes to war in the Pacific, it will take us to war as well—without an independent decision by Australia. Finally, under current circumstances, in any major contest in the Pacific, our relationship with America would make us a strategic target for America’s enemies. It is not in Australia’s interest to be in that position.

http://nationalinterest.org/feature/america-australias-dangerous-ally-11858

EIA production numbers include NGLs, Texas RRC numbers do not. Texas RRC acknowledges as much on their website:

The production data in PDQ doesn’t match the data I get from the federal Energy Information Administration. Can you explain the difference?

The Railroad Commission of Texas’ crude oil production data reflects only crude oil produced from oil leases as reported by operators. The Commission’s data does not include condensate, which are liquid hydrocarbons produced from a gas well. Our data comes directly from production reports filed by operators.

Who is “our”?

Texas RRC.

There are other issues as well. (Producers not reporting, Reporting late, etc.

The website is very helpful.

PeakOil NOT does this mean you represent or are somehow affiliated to the Texas RRC?

Hi PeakOil NOT.

Nice screen name. What made you choose it?

Peak Oil NOT,

I agree that this web site reports only C+C unless otherwise noted. It is Ron’s site and that is what he wants to report. I appreciate the effort he puts in especially the graphs.

But total liquids would seem to give a better picture of supply and production changes. After all NGLs, refinery gain, and the other differences are part of mix which make the economy produce.

Hi Danlxyz,

One problem with total liquids is that it is not adjusted for energy content. The typical barrel of NGL contains only 65% of the energy of crude, same is true of ethanol. So total liquids adjusted to barrels of oil equivalent is useful, also some NGL is not really used for energy (ethane is used mostly as an industrial input in plastic and cryogenic processes, rather than burned for energy). This is more work than just using C+C data. Also we can use BP data in tonnes of oil to estimate barrels f oil equivalent.

a carryover thank you…

It read as a sort of age-targeted unemployed-wage-slave flyer/ad for the unsustainable North Dakota shale/fracking industry, complete with age, income, corrupted values, etc..

And much more in the crony-capitalist plutarchy global industrial uneconomic monster– which farts in our general direction, Gerd– and that we just can’t help feeding… with our children, alive (like those two in question if they are real or part of the monster, or both), as well as with our values, future, and planet.

Pushpush, toolpusher. Make ‘er scream. We know abuse when we see it.

Hey Ron,

Any chance of an ignore button?

That way it would avoid a lot of knee replies one is temped to write.

“I mix with professional people and and I know i have earnt up to double their pay scale…” ~ toolpusher

I believe we have a Chameleon, in our midst?

Better a chameleon than a car.

I think the rooster’s a ridiculous riot, along with the name, like much of life, but anyway, yes, hugz, ’tis I.

Now, let’s get on with appropriate blog business/topics…

…The rooster can be eaten of course, we don’t have to dress it up, except maybe in a nice gravy with the usual trimmings, and it is probably a good idea to consider/look into local home resilience like that– backyard chicken coops, etc.– as things wind down in the oil fields.

I look forward to your writing, even if ridiculous, like the double pay scale professional mix nonsense. I might have a hard time understanding some of it, but do try sometimes, such as when my head is clear of climate change denialism and corporate, etc. crap.

*bwokbwokbwok*

Yes, the ignore button would be really nice.

Just use your head and stop being silly by asking for it. Or don’t. S’up to you. *bwokbwok*?

Say, incidentally, was it you who took the snap of the dockside shipping containers that were ostensibly being used as housing for foreign wage-slave labor-power?

It begs the wonder of how meat-machine wage-slave labor is all going to shake out when the planet runs slowly lower of the metal-machine energy-slave kinds.

I’ll close this comment with some graffiti text once seen in Ottawa some years ago: ‘You are not your job’

ignored

So you’re telling me that you have ignored me?! lol You’re too cute! …I think I love you. ^u’

Hi Toolpush, Caelan, and everybody.

Just a little talk here about confirmation bias and finding one’s people.

These little rants from Caelan and Futilitist, and the backlash from Mike and Toolpush make me wonder about the site’s purpose and audience.

It is, on the surface, what Ron wants it to be- a place to discuss a specific type of data, the implications of that data, and the outside noise that affects the data (though he does leave it open to other things.) A place where we disagree on what the data means, but where there is a central agreement: that the data means something. And that the analysis of that data is not something that has to be confined to “experts”: that scientific inquiry can be carried out, in limited ways (like me) or with intense devotion and expenditures of time (like Ron and Rune and Dennis and Jeff.)

What I found irritating about the young lady’s post yesterday was her sense that she was better than her contemporaries- that this was the obvious answer, and she couldn’t see why everyone wasn’t in the Bakken, ignoring the fact that there aren’t enough jobs or accommodation for all of her friends (or people in similar financial positions) to go there, and that there are lots of reasons not to work on an oil rig.

I have a nephew in Fort McMurray. A Motor Operator, if I have the terminology right. He has told his mother that he feels like an outsider on his Gas Rig, at least among the other roughnecks, partly because he has a degree.

A business degree.

He has been embraced by the Toolpush and one of the other managers, probably because he is trainable. Though it is on the down-low.

So we have a culture that is anti-education and anti-knowledge, and somewhat narcissistic. One that for those starting out, requires a big gamble: can I get in before the downturn? Can I stay in for the long haul? Can I outlast my contemporaries through the layoffs?

An emotional argument, not a fact-based one.

I am not surprised that Mike was so incensed yesterday. The question of “Who are my people?” comes up here. I am sure the young lady and her husband remind Mike of people he works with, and whom he may have had to lay off recently.

His people.

And they probably remind him of himself.

Now it’s tempting to psychoanalyze Mike from a distance, and I will admit that he fascinates me. He seems to be a man between two worlds: on the one hand, a man who admires the graphs and thought, and on the other, the guy who lays everything on big bets, and has done since he was nobody 40 years ago.

On the other side we have Caelan and Futilitist (and to a lesser extent me), who see in dn_girl’s rant the undercurrent of Right-wing populism, which blames the victim (all her friends who were going to go on welfare: the lack of good jobs and wealth inequity was not something she concerned herself with) and the anti-intellectualism involved in her embrace of the company’s figures (My husband’s company has it’s own studies saying to expect 2 million barrels a day from this state in 2019 and staying at that level until around 2030.) She is not, to my mind, engaging with the data in the way I would prefer her to (and yes, that’s my problem.)

I see this post, and most posts denying global warming (those that see it as a left-wing conspiracy,etc.) as anti-fact. The spewing of doubt, of choosing to believe the less-likely thing, or to base a stance on ideology, are problematic for me, and disagree with my personal narrative. A narrative that in many ways is reinforced by this site. I see most of the usual posters as people involved in the same type of inquiry that I am: people engaged with the data.

Why is dn_girl here? Her post supports her personal narrative, that much is certain. It reads like unalloyed boosterism to me, someone trying to convince herself more than us. Her post adds few useful facts, and adds political noise that pisses some of us off.

Would the comment have generated the same protective response from the oilfield types if it had been written by a man?

Geeze, I’m starting to ramble, and this post is reaching OFM length…should make some kind of point and get back to work.

We all have personal narratives. Some of us have our narratives supported here, some feel that the hive mind spits on theirs. Posting here means exposing your ideas and your narrative to scrutiny. Sometimes withering scrutiny. If you challenge facts without sources, you get called on it. If you present your personal narrative as the subject of discussion, it will be challenged.

Did dn_girl realize she was trying to change the culture here (as we all do, with every post we write?) Does she deserve special treatment because she’s:

-young?

-uneducated? (assumption.)

-unsophisticated (or extremely sophisticated and disingenuous…who can say?)

-female?

On this kind of forum, the community aspect and “my kind of person” aspect seem to be the hardest things to manage. With dozens of posters and hundreds of comments, we break down into cabals and look for reasons to present our bona fides to our supporters, and to make the community more like us.

I don’t have any good answers, and a call of “why can’t we all just get along?” beggars the purpose of the site.

My ignore button is in my head. I could name the people I use it on, but in the interest of getting along…

-Lloyd

Hi Lloyd,

Thanks for this. I can see why some people may not have liked the comment from the young woman (which I did not read carefully). I don’t think that is a reason to be rude (though sometimes I am), and I can see why some would have been turned off by the responses to her comment which struck me as unkind.

It would be nice if people typed comments that they would say to someone’s face. Some are quite harsh and lack basic politeness.

I like the range of views that Ron allows and think it best that conversation not be shut down due to name calling. A blog where everyone agreed on everything would not be very interesting.

Hi Dennis.

“It would be nice if people typed comments that they would say to someone’s face. Some are quite harsh and lack basic politeness.”

I think if people were more straight forward, direct, clear, honest, and non-deceptive, that genuine politeness would be the natural outcome.

And I would say that to your face if we were in the same room, pal. I hope you aren’t offended by that. 😉

A group of us are at a cafe around a big table and some young woman sits down with us– say, she knows someone at the table– and starts talking, point-blank, like that, ‘My husband earns 6 figures, bad winters, nothing to do but drink and drugs, friends back home want babies and to governmooch, we will go back home, the work-ethic-for-the-brainwashed rocks, so come to ND, fun to be had by all, bla bla…

Well, for awhile, as I’m listening and getting to know the person, I’d likely sort of nod and say, ‘Oh ya?’ and ‘I see.’, etc., but maybe would want to start to respond/engage more meaningfully to what she was talking about. You can’t plop yourself down somewhere with people, start talking and expect no one will respond beyond the superficial.

Of course it is important to bear in mind, too, that this kind of communication is text-based. There is a lot of body language and paralanguage, that is missed and just impossible in this mode of communication.

dn_girl was/is most likely a thinly-veiled guerrilla marketing tool for the failing industry/region that is North Dakota.

So I decided to approach it somewhat as such, where she could be that, or not. (It can instructive what/who can come out of the woodwork in some occasions sometimes…)

It doesn’t look at all like a typical 19 year old chick’s comment or approach would; it covers, right off the bat, practically all corporate angles/agendas for that context; and if you go back and take a look, and compare it to the rest of our comments, there are no line breaks. This is relevant because it both looks like a cut-and-paste job, such as for multiple uses elsewhere, and young women, of all people, can be pretty particular with appearance(/interaction/preoccupations).

And you know? This is highly relevant to this blog, such as where industry ‘microeconomic’ dynamics are concerned, and where the difficult/costly oil industries seem to be going down the crapper in realtime. This is interspersed– quel surprise– with the likes of none other than (*face-down-at-the-bottom-of-a-pit-)Mike and his industry-layoff sob stories. (If you listen closely, you can almost hear a violin or two playing in the background.) (I appreciated his comments for the most part, though, and would be fine with his return.)

Futilitist, like many, including myself, is likely not a happy camper, and seems to want this outrageous fraud we call civilization to crash and burn spectacularly and without further ado, so he and the rest of us can get on with real, meaningful lives.

Now, Lloyd, I have yet to read your entire comment, believe it or not, but I’ll get to it later, maybe before the edit function timer stops.

* Was that his comment?

Hi Caelan and Lloyd.

We all have a tendency to project a bit in our individual quests for tribe.

“These little rants from Caelan and Futilitist, and the backlash from Mike and Toolpush make me wonder about the site’s purpose and audience.”

~Lloyd

First off, it is not correct to see Caelan and Futilitist as some sort of team. Like everyone else here, we often agree on some things, but certainly not all things.

Caelan and Futilitist have very different approaches to debate here. Caelan is more concerned with politics and social justice than Futilitist. Futilitist is relentlessly focused on collapse, and it’s near universal denial.

Both Caelan and Futilitist are iconoclasts, who bring a breath of fresh air to discussions that can sometimes be a little stuffy. This is a necessary function within a tribe. It can help keep Groupthink from running rampant.

And while both Caelan and Futilitist may seem to share a similar flamboyance, our styles are really quite different.

I don’t know what set Mike off, but prior to that, I hadn’t had much interaction with him. I have never had any conflict Toolpush, that I know of. It feels like Caelan may have had some tension with both in the past. I am not part of that. And I don’t know what the current problem is between Caelan and Toolpush. I personally think the chicken thing was *WAY* over the top, though.

And, Lloyd, I share your curiosity concerning the site’s purpose and audience.

“On the other side we have Caelan and Futilitist (and to a lesser extent me), who see in dn_girl’s rant the undercurrent of Right-wing populism, which blames the victim (all her friends who were going to go on welfare: the lack of good jobs and wealth inequity was not something she concerned herself with) and the anti-intellectualism involved in her embrace of the company’s figures…”

~Lloyd

I would not group the three of us the way you do.

I was not involved at all in the discussion with dn_girl. Any opinion you may think I have of that discussion can only be your assumption. I didn’t even read her comments, I just skimmed them. I thought her comments were quite trivial (an opinion that I think we share), and I would not have said anything to her at all. Here, once again, I found Caelan’s comment significantly over the top. I see why it has created a fuss. But I still support Caelan’s right to self expression. While not the kind of approach I would have used, I still think it may have opened the door for some needed dialog.

“dn_girl was/is most likely a thinly-veiled guerrilla marketing tool for the failing industry/region that is North Dakota.”

~Caelan MacIntyre

I would not necessarily draw that conclusion. But I tend to skim comments like those of dn_girl, and I am not as familiar this meme family and it’s particular modes of deception. Caelan may have some expertise here.

“Futilitist, like many, including myself, is likely not a happy camper, and seems to want this outrageous fraud we call civilization to crash and burn spectacularly and without further ado, so he and the rest of us can get on with real, meaningful lives.”

~Caelan MacIntyre

Okay, this one really is mostly projection. While I am not super happy with industrial civilization, I am not really looking forward to it’s spectacular destruction, either. I sure don’t think the demise of civilization will result in us living “real, meaningful lives”. It is far too late for such dreams. The collapse of civilization will not be a good thing for us.

Hi Futilitist.

I would not group the three of us the way you do.

You are correct. It was an over-generalization, probably a result of Mike mentioning you specifically on his way out, and the fact that the three of us frequently end up on similar sides of things, though with differing levels of vehemence, different reasoning, and, as you say, different styles. And like you, I think that Caelan has gone over the top recently.

The collapse of civilization will not be a good thing for us.

You and I are in agreement here.

-Lloyd

Along with the rest of my fellow species– collapse, climate change and peak oil, etc., being ‘over the top’– I also happen to believe that you both can be a little ‘over the top’ too, but I’m willing to pretend otherwise and to shift my baseline a little (for example as ‘Planet Suction Cup’ to one of Lloyd’s wacky comments) to help make you feel comfortable. ^u^

Futilitist, your top-notch wince-worthiness with OFM nothwithstanding, the chicken was over the top, lol, even to me, but it’s friends with Fernando’s pigeon, you see, and at least it, and its other feathered friends, don’t create the kinds over the top issues we humans do, yes?

I mean, come on.

Hi Caelan and Lloyd. (aka my tribe)

It is always difficult to form a tribe composed of independent thinkers.

We may have done it, though. 🙂

And speaking of pigeons…

“We will eat the songbirds out of the trees.”

~Ron Patterson (aka Darwinian)

“The collapse of civilization will not be a good thing for us.”

Why not? It will stop the hated BAU. But more important, and perhaps it is just wishful thinking, it will relieve the incessant attacks on the fauna and flora. Yet, I believe, this can only be achieved by enormous reduction in world population.

I was just casualy taking a stab, Fut’, but do think that if we, as a species, survive the collapse (Guy McPherson and perhaps a few others don’t think we will), whatever it entails, our future may be meaningful at least in the sense of being closer to what’s left of nature and to the relatively-small scale and relatively-lateral hierarchies, and stuff like that, that we seem wired/evolved for. This is old TOD hat.

I think we will all have a meaningful future much closer to nature. Pushing up daisies.

It does seem like a very real possibility.

As Keynes put it, in the long term we’ll all be dead.

Hi Ilambiquated.

Keynes wasn’t talking about social collapse. So, not really relevant.

I got thick skin and all but don’t understand the comments coming toward me here. I already told how I found this sight, living in the Dickinson ND area for the last 3 and a half years, I here lots of rumors all the time about this Tyler activity picking up any time now, and the area just to the south of us booming with many thousands of the new Tyler wells. My husband works in the production of bakken wells but most of his work is like at least 60 miles away from where we live, sometimes he has to go 100-150 miles away one way each day to work. yes this is why we paid cash last Summer for a 2004 Dodge ram so he can be taking that to/from the fields instead of his newer 2010 f150 which is for city driving only, but if the Tyler activity really did hit it off big in the Stark county area right to the south of us he wouldn’t need to drive so far every day since it would be right to the south of us. I searched a Comment leading me here about the Tyler and lodgepole and other wells going on in the Dickinson area so that’s what got me here, but theres soooo many other discussions about the bakken I thought you guys would appreciate some opinions of what life is actually like here because with all the bakken talk I thought there are people here reading that are thinking of making a move to ND to work in the oil fields for themselves. Maybe I get to beside myself with excitement about the opportunities out here but to pastime and not think about the family & friends I left behind in Cali I try to blog about living in the bakken for others to realize what they can achieve if they are willing to pull up sleeves, move across the country and get set up in western north Dakota. I can’t even explain how much respect I got for all the other people & families I met up here. So many had to leave home or completely uproot families just so they could make a living by moving here. they work extremely long and difficult hours in tough jobs in some of the worst weather in the country but they do it because they want to make something better for themselves & their families. Sure half of the people who came here could sit back where they originally came from and collect a government check for doing nothing but they didn’t want to so I guess go ahead and say something about how much we make up here and how we’re not smart enough for you if you want but please don’t disrespect all the people trying to make a better life for themselves and families without government assistance.

Hi dn_girl.

Don’t worry so much about the politics.

Please try the Futilitist Collapse Challenge to better understand the future of your industry.

http://peakoilbarrel.com/eia-confusion/comment-page-1/#comment-504528

I respect the fact that people in the oil industry work very hard to provide an essential product that most people simply take for granted. But you aren’t doing anyone any favors by encouraging them to enthusiastically join your dying industry.

DN Girl,

Good on you. Most people can’t be bother to get off their arse’s and do something for themselves. There is good money in the oilfield, but it has its is ups and down. The production side is more stable than drilling, but they still have them. The money is in your bank account, not the naysayers, so sit back and enjoy your hard work and rewards.

I hope all works out well for you, but it is a matter of surviving the hard times, and making gravy during the good time.

All the best to you and your husband.

Hi toolpush.

It is not a good time to plan a career in the oil industry because the oil industry is set to shrink drastically from here on out. Check out the Futilitist Collapse Challenge to see why:

http://peakoilbarrel.com/eia-confusion/comment-page-1/#comment-504528

Or, you could be wrong.

How?

dn girl. I enjoy reading your posts. Please use paragraphs to make it easier to read. I get lost because it’s all bunched up.

Ok, fair enough, then kindly respect people who want to stay where they are, such as with their communities, neighbors and loved ones; take back the government money that is really just stolen money; and do little in the way of helping to wreck the planet, and promoting that kind of lifestyle, like you and/or your husband seem to be doing in North Dakota.

By the way, I did a writeup for you, (or perhaps more for others reading posts like yours), based on the good legacy work of our recently-departed Mike.

I second Fernando’s suggestion.

Really?!! Driving a 2004 Dodge Ram 100-150 miles each way to work so you can park your 2010 F-150 which is for city driving only…

ROFLMAO!

The comment you read about the Tyler and Lodgepole formations around the Dickinson area sounds like something I might have written, many months ago. Both of those formations have been known about in that area for some time, but, of the two, the Tyler has gotten more of the attention lately as potentially being a good source rock for unconventional wells.

Unfortunately from your perspective, very little about that notion has actually panned out at this time. Marathon drilled and completed a couple of Bakken-like horizontal wells in the Tyler of eastern Slope County from late 2013 to the middle of 2014. As of January, one was producing 6 bpd, while the other was doing 2 bpd. They have consistently produced quite a bit more water than oil. For expensive horizontal wells that have been active for less than a year, these are not good numbers.

Aside from the two Marathon wells, Armstrong drilled a vertical Tyler well in the Amidon area of Slope County last year, but came up dry. MBI also drilled a few vertical wells last year in the general area of the others. However, I don’t believe any actually began producing. On the other hand, I have also read MBI was more interested in obtaining cores of the Tyler and wasn’t expecting to complete the wells in the first place.

Anyway, long story short, the Tyler formation could still turn out to be on a level with the Bakken and lead to a few thousand drilling locations. But, for the time being, don’t expect activity to start picking up in the way you would like.

Wes, what is the Tyler oil specific gravity and gas to oil ratio? I looked up the geology and source rock potential here

https://www.dmr.nd.gov/ndgs/Publication_List/pdf/RI%20SERIES/RI_111.pdf

But it doesn’t have the oil properties. I’m teased by the Upper Tyler, mostly because I like wild cards. But it’s not worth pursuing if the oil is too viscous or is too undersaturated.

Stick around and you will soon learn who is who around here 😉 . Who is in the oil business and who just like to play. We’ve had a large helping of trolls, recently, and I think you set off a few alarm bells.I hope your optimism plays out with the falling oil prices, see Wes’s comment too. Interesting to get your side of the business too. I can understand the ripping up of roots and moving as that is what I have done myself.

NAOM

Hello notanoilman,

It feels like you guys are circling the wagons and searching for a common enemy. This is the wrong thing to do. We all need to listen to each other. Especially now.

I don’t think the oil industry is “evil”, like you seem to think I do. I admire what you do, and I am very grateful for it. You are under appreciated and that isn’t fair. None of us ungrateful, selfish, assholes could ever enjoy the lazy assed, couch potato, comfortable, profligate lifestyle we have all become accustomed to if it weren’t for what you guys and gals do.

I think we are all stuck in a farcical tragedy driven by human nature and physics.

You guys and gals out in the oil patch are already experiencing some of the pain that all of us are about to feel. It is going to get almost unimaginably worse. I am so sorry for you, and all of us, that I cannot keep from weeping as I type this…

Okay, I’m back. Enough of that shit. It is time for all of us to stop acting like spoiled children and grow up and face some very hard reality. Reality driven mostly by physics and made worse by human nature. And we are running out of time to understand it.

Please read all 5 pages to understand the inescapable dilemma we all face:

http://www.thehillsgroup.org/depletion2_022.htm

The production of oil, and the economy it drives, is ruled by the laws of physics. The second law of thermodynamics is about entropy. Entropy is inescapable. The production life of oil, like all processes in the universe, is subject to entropy over time.

When the price of oil dropped below the cost of production, in June of 2014, it marked the end of the growth of your industry, and it’s very rapid unwinding. And with that, the rapid, total collapse of industrial civilization.

We all face a common enemy. That enemy is collapse. The great human die-off is about to begin. The FED can’t fix it. The President can’t fix it. World War III won’t fix it (not that we won’t probably try it anyway). Basically we’re FUCKED. Now that this process has begun, it simply cannot be stopped. Period. Laws of physics. We are about to ride an unstoppable energy gradient straight into the ground in a gigantic, non-linear, brutal, social collapse and die-off.

Hoping for the best is a waste of time.

Please just remember, I am only the messenger. 🙂

I would suggest that you bother to read my nym before hurling a whole torrent of rubbish and allegations at me.

NAOM

notanoilman,

Dude, I am so sorry, I messed that up. I was just skimming comments and I misunderstood. Sometimes it is hard to tell from an individual comment who is saying what. I am new here. Forgive me. My message was meant for

someone elseeveryone.

Who are the trolls in your mind?

What do you think of my message?

—EDIT—

Wait, what torrent of rubbish and allegations? I am trying to tell a very difficult truth, and I never made any allegations that don’t apply to all humans. My post was very heartfelt and sincere. I must admit your reaction baffles me. Please explain why you reacted that way. Thank you.

Hello? Anybody out there?

Am I being shunned?

What the fuck for?

For trying to say the truth?

Wow. This place sucks.

I’m sorry, this page from the hillsgroup is a bunch of nonsense.

The increase in the cost to produce oil I can easily believe.

The other curve, though, the maximum amount consumers can pay and the economic value of oil (which goes to zero, and apparently even negative, shortly after 2020), is nonsense. No real support is given for this curve, except to say that it is derived from some model (not presented) that is claimed to be very accurate.

No, this is not physics nor thermodynamics.

I am inherently skeptical of any argument about “the maximum amount that consumers can pay”. There is no such animal. If gas is cheap, people will use more; if gas is expensive, they will use less. Supply and demand will come into balance; this is economics 101.

If you want to claim there is a maximum amount consumers can pay, I want to see real support for that, not just references to some magical formula or obscure (but unstated) references to physics. If you want to claim physics or thermodynamics, let’s see your formulas and calculations.

Techsan,

“I’m sorry, this page from the hillsgroup is a bunch of nonsense.”

So you didn’t read all 5 pages, but you are sure it is wrong. Okay.

“Supply and demand will come into balance; this is economics 101.”

The rules have changed.

Supply and demand are in balance right now, but at a price that will not pay the cost of current oil production plus investment in future oil production. The current cost of oil production is north of $100/barrel. But the world cannot afford $100 oil now. As the oil industry shrinks, so will the economy. That means we will never be able to pay the full cost of oil production ever again. The economy will shrink until it collapses. How could it be otherwise?

“No real support is given for this curve, except to say that it is derived from some model (not presented) that is claimed to be very accurate.”

I think the model is well described in the link. But I have a very strong physics background. I am not making the argument from authority here, more like the argument from astonishment that it isn’t intuitive to everyone.

“No, this is not physics nor thermodynamics.”

Yes, actually it is.

“I am inherently skeptical of any argument about “the maximum amount that consumers can pay”.”

I can tell. But the consumers of oil have to bear the full cost of that oil’s current and continued future production. And the oil consumer’s income depends on getting enough economic activity from the use of that oil to feed, clothe, shelter, and entertain himself, plus have enough left over to pay for more oil. If we can’t even do that now, how can you possibly think we can ever do it again?

Catch-22.

I can see that it is hard for you to believe the implications to society derived from the model. But you are not actually making an informed argument. You are making an argument from astonishment.

“If you want to claim physics or thermodynamics, let’s see your formulas and calculations.”

If you don’t understand the physics being described, how would the exact formulas derived from the second law of thermodynamics used in the model help you in any way?

I’ve had lots of physics, and made an A in statistical thermodynamics. Bring it on.

Lloyd,

Interesting you comment about education being looked down upon. It was along time before I put my qualifications on my CV. I was also very careful of what I said, because as a roughneck, you are not suppose to know anything. I was not until I got a few steps up the ladder that I could relax a bit and be taken seriously.

The oilfield usually works in small remote groups and places. We are geographically spread but a close community. So anybody that is willing to get out, work and hold their own, deserves support, but you do need to work as a team and fit in, which can be difficult sometime due to different backgrounds.

As for DN Girl. Somehow she is seen as a threat for the couch potatoes, who are more interested in conspiracy theories, than someone doing a real job, earning real money.

I say good luck to her and her hubby. They have made decisions, taken chances and doing well. As long as they watch for the pit falls, they can do well.

The key to being a good rookie is to work hard, listen and ask good questions. I found that letting people know what was going on, what we were expected to get accomplished over the next 24 hours, and feeding the tool pusher croissants with Swiss cheese and mushrooms was the key to a successful well.

Oil’s price is a whirling dervish in a whirlpool swirling ten thousand feet deep into the ocean’s depths driving its way thirty feet into the fifty feet of ocean mud then yo-yo-ing back up to a water spout forming a hurricane then somehow spawning a spectacular display of aurora borealis and australis, then whirling to a swirling chaotic ten thousand times Texas-sized twister, crazy cyclone, twirling its way around the world only to be crushed by a crashing smash into the ground of reality.

Tomorrow’s whiplash will be just as exciting. Heckle and Jeckle taunting and tormenting oil’s price to a humbled fool, a dunce.

The present zeitgiest using some hyperbole, the cognitive dissonance reeling the brain dizzy. How can it be that the price of oil is where it is? It makes no sense. Could just as well pump it back to where it came from, it’ll cost less, or don’t drill for it at all, it will be useless, you won’t make a dime.

With my discounts, the price of gas today is under a dollar per gallon, might as well say it’s free. It don’t make no sense. No, it is not ‘It doesn’t make any sense’, it’s ‘it don’t make no sense’.

In the old days of oil, one had to change the engine oil every 1500 miles, the old wear and tear, heat damage to the oil, etc., shortens the life of engine oil, the good ol’ Oklahoma crude would break down and cause engine damage if you didn’t change the engine oil. The Purol from yesteryear did the job for only so long.

The new world of synthetic oils is here, it is not a problem to operate a passenger vehicle up to 15,000 miles between oil changes thereby reducing the cost of engine maintenance by nine times and a ninety percent reduction in oil consumption for oils used for engine lubrication. Synthetic oil saved the day for engine life, saves oil for other purposes. In other words, for every ten quarts of oil used, nine are free of charge, you will never use them, therefore, they’re free and free to use for some other purpose.

What was once a gallon tank for fuel is now a one quart tank for greater efficiency and the engine oil is topnotch there too, so engine life is much greater, for some engines and specific applications, it can’t get much better. With much less consumption of fuel to do the job better, new engines are far superior. Specifically, Honda small engines.

The ICE is at the top of its game these days, nothing better and can’t be beat, for now anyhow. Honda small engines are the finest money can buy. Can’t hurt to plug capitalism, Honda engines perform flawlessly.

Stihl chainsaws will be in the same category, the best. If you are considering a chainsaw purchase, the Stihl dealer will tell you not to purchase any other brand, ‘don’t do it’ are words you will hear from a Stihl chainsaw owner if the buyer is considering purchasing a different brand of chainsaw. Have a double-bladed axe too, along with a limb saw and a bow saw. Work with those for a couple of hours and then switch to the chainsaw, see which does the better job with greater ease and efficiency.

Those two name-brand businesses are in it to make products that definitely reduce the effort to get something done. It will be with effortless ease, if you think about it. Sorry for the digression.

Without oil, they wouldn’t be in business.

43 dollar oil helps defray costs for eight dollar per pound brisket, six dollar per pound bacon, eight dollar per pound cheddar cheese and fourteen dollar per pound steak. Dirt cheap foodstuffs.

Groceries are at some of the lowest prices in many years, absolute bargain basement prices.

The madness continues.

The junkyard owner and mechanic will always advise you to use your seat belt and obey all traffic rules and signs.

Ron, i agree with you about Venezuela. I suspect those third party numbers opec uses may be getting confused because venezuela is importing diluent crude, the venezuelan refineries are having trouble, and there are internal stock changes nobody is tracking. I’m aware of gasoline sales from the USA and now Trinidad towards Venezuela. Their production is “measured” to a large extent by counting tanker loads. But even though crude production is down they may be just shipping crude they can’t refine in the three refineries we know are having serious problems.

In other news w have a scandal breaking out as the police in Madrid investigate a bank which was laundering money for venezuelan officials including several viceministers. I think the eventual outcome will be the indictment of both venezuelans as well as Spaniards cooperating in the laundering operations. Some of this money seems to have been routed to pay for hard left political campaigns in several countries, and to buy politicians. It’s a huge can of worms. They report anything between $2 usd billion to $4.2 usd billion laundered over about a 10 year period. And some of the money appears to have been routed to usa policians?

I did some napkin arithmetic.

Likely world oil consumption increase by 2020: 5 to 7 million bpd.

Likely OPEC oil production increase, under the rosiest of scenarios by 2020 (Iranian sanctions lifted, end of Libyan Civil War, continued Iraqi and Kuwaiti production increases, rest of OPEC held steady): 2.5 to 3.5 million bpd.

Now, if the rest of the world outside of OPEC is in decline, and U.S. shale production has peaked, you’re still looking at a 1.5 to 4.5 million gap that needs to be made up for. A deficit of 500,000 to 1 million put us at $100+ oil.

We’re in trouble.

Of course, if China goes into a Japan-like slump and Indian growth never takes off, we’ll have nothing to worry about.

Where did you get the increase in demand?

Total consumption went from 88 million bpd in 2010 to what is likely to be 93 million bpd in 2015 during a period in which growth in the developed countries was sluggish and oil was priced pretty high.

Basically, I am assuming that the world adds 1 million bpd of consumption per year for at least the next 5 years.

This only happens of course if:

1) U.S. consumption stays flat or slightly increases YOY

2) China doesn’t spiral down into a recession and keeps growth at 7%, on average, for the next 5 years.

3) E.U. stays out of recession and perhaps recovers a bit.

5 million in increased demand is a much safer bet than 7, which I think would require a major takeoff in India.

I suggest you segregate products. The figures you use include NGL and biofuels. Ron focuses on crude and condensate, which is the proper approach. Try again the crude and condensate, remember some condensate components don’t yield the desired refinery products.

Then account for potential increases in refinery gain as refineries try to increase hydrogen addition and swell the output. I think we may see a diesel price increase which in turn drives more gasoline driven vehicles, and the plug in hybrid fleet should take up a little slack.

When you go through these gyrations you may end up making a peak oil projection within the next five years. But it will be driven in part with market share gains by other sources.

Consumption will go up by exactly the amount production goes up. If production goes down then consumption will go down.

It is my opinion that C+C is at peak right now. Therefore, if I am correct, then consumption will go down by 2020. It will go down by the exact amount that production goes down.

I have no idea what NGLs, (bottled gas), will do.

I suspect NGLs will depend on gas production. Ethane is an interesting NGL. It’s mostly used as a chemical feedstock. it’s also the most abundant of the light components after methane.

If, as the IEA believes, oil prices average about $55/bbl in 2015 and not reach $73 until 2020, a lot of assumptions will have to be modified: Because, these prices are clearly well below those needed to justify investment in and exploitation of expensive-oil options like tar sands and Arctic oil.

It seems to me as if a new reality is being signaled by the many recently stalled or cancelled mega-projects. For example, Shell has abandoned plans for a huge petrochemical plant in Qatar; Chevron shelved its plan to drill in the Beaufort; and, Statoil has turned its back on Greenland. If Majors are moving away from expensive future projects it’s probably because they doubt their viability, not because they can’t raise the cash.

And committing to mega-projects is committing to a predictable future. Could it be that Big Oil has decided the next decade contains too many unknowns: AGW issues, upsurge in renewables, a mega recession, you name it? Or, maybe they’ve just discovered Ron’s Blog?

Hi Doug,

Great comment. Thanks!

I hear they communicate with Ron by e-mail. All those Big Oil CEOs report to Mr. Patterson:)

Thanks Dennis. I thought you might be mad at me. But of course, maybe you are? 🙁

At some points, I thought quite a few were mad at Dennis, including Rune. At first, I thought it was my astigmatism acting up again with multiple apologies here and there.

But then, maybe the sun shines out of his behind as the saying goes with regard to certain questionable forms of optimism perhaps, which is probably less of a convenient place for the sun to shine from, such as if for a PV setup for a large town.

You want PV or not? Well then give us our sun back.

In any case, perhaps minimum sunspot cycles reduce swelling.

This post dedicated to our beloved Ronald Walter.

(Throwing my remaining edit time over to Watcher)

“At some points, I thought quite a few were mad at Dennis, including Rune.”

Hey Caelan, we may have a memory hole at peakoilbarrel. Check out:

http://peakoilbarrel.com/eia-confusion/comment-page-1/#comment-504975

Something seems, I don’t know, somehow different. Scroll up a little to see if you notice anything.

Comment was really not placed appropriately by me I was answering a comment further down the thread. My bad.

Hi Doug,

Why would I be mad?

I need you to keep me in line when I say particularly stupid things. 🙂

Or even to question my usual BS.

“I need you to keep me in line when I say particularly stupid things.”

I can help, too, when Doug needs to rest. 😉

Hi Doug,

That was supposed to be a 🙂 at the end, I forgot the space.

And many major were already cutting upstream capex, even before the decline in oil prices.

A reality that has managed to capture more or less no attention.

BTW given China’s appetite for new cars, pretty easy to find 400K bpd just from them in additional consumption. The other 600K can’t be too hard. Let’s start with India. mazamascience’s gizmo shows a delightful upslope on their black consumption line. Ditto KSA.

Now, of course, if the production is not there, then we’ll have growing demand, but lower consumption.

Now, of course, if the production is not there, then we’ll have growing demand, but lower consumption.

The EIA measures demand by what is delivered to refineries. Consumption is products delivered. They are basically the same thing with a refinery in between.

You are thinking of demand as what people want. I don’t know how you would measure that.

You could measure it in feet.

How long the line is at a gas station that will sell only 5 gallons per person.

“I literally can’t stand being on the American highway. To me it is almost like being in a prison of madness. I can stand the background; but I can’t stand the highways in Canada or here. Driving like crazy people. Where are they going? And why are so many of them going in that direction? They are all fleeing something. I would like to inquire what is in those trucks that are tearing down the road. Is it something of no use at all? Or something which is present where it is going? And often I have seen trucks, apparently carrying identical cargo, going in opposite directions, carting it here and there.” ~ Bill Mollison

Watcher,

Are the car sales in China dominantly diesel, or gasoline, or what?

From a line of text read somewhere a year ago it was said China mostly diesel. And from a radio blurb heard a month ago someone said Europe burns diesel vs the US gasoline.

It’s a working hypothesis.

Europe is about 50-60% diesel, 59% according to this note, table 8. I have seen 50% as well. That would probably be sales not fleet but diesel has been high for a long time

http://www.rff.org/RFF/Documents/RFF-DP-14-08.pdf

China is gasoline according to this below and so a blurb from Bosch

Bosch overview of global diesel markets; optimistic about US, China

7 August 2013

China. China currently represents only 1% of the global market for diesel passenger cars. The introduction of the China 4 emission standards on 1 July 2013 imposes even more stringent requirements for commercial vehicles.

https://www.google.com/search?q=china+diesel+mix+passenger+car&rlz=1C1GGGE_enUS466&espv=2&biw=1777&bih=1265&tbm=isch&imgil=DaEqeMIjOXDdiM%253A%253BFdKKMGRLcsaIbM%253Bhttp%25253A%25252F%25252Finfocusrevue.com%25252F2013%25252F03%25252F04%25252Fshould-we-ban-diesel-engines%25252F&source=iu&pf=m&fir=DaEqeMIjOXDdiM%253A%252CFdKKMGRLcsaIbM%252C_&usg=__1zZBDyCcg_0kEpy2fChYa-zSfs4%3D&dpr=0.9&ved=0CEQQyjc&ei=Ix4IVdDYA8uVyATe7oLQBA#imgrc=DaEqeMIjOXDdiM%253A%3BFdKKMGRLcsaIbM%3Bhttp%253A%252F%252Finfocusrevue.files.wordpress.com%252F2013%252F03%252Fscreen-shot-2013-03-04-at-3-14-50-pm.png%3Bhttp%253A%252F%252Finfocusrevue.com%252F2013%252F03%252F04%252Fshould-we-ban-diesel-engines%252F%3B1119%3B557

Synapsid,

UK diesel sales account for more than half of all cars sold and Britain lags Europe which has long preferred diesel to gas. Don’t know about China but since VW is so big there I expect diesel car sales are as well established as in Europe. You’d think that would be an easy number to come up with but not for me apparently!

Compelling stuff for diesel light shale.

The preference for diesel and – to some degree LNG – as fuels is largely shaped by the tax regime on transportation fuels in the EU.

To what extend that’s a function of giving preferential treatment to the hauling sector (re diesel of course) vs. resource based planning I don’t know.

rgds

WP

I occasionally post to a motorcycle user blog site for a new model I now ride, a Honda cb500X. I am absolutely amazed at the number of people who commute on them in England, year round. One fellow has a 2 hour commute (each way) into London. Housing unaffordable, plus…apparently rail service for commuters now privatized and cost is prohibitive.

Yesterday, I had some errands to do in town and rode in the 75 km at 10:00am with frost on the side of the road. It was frigging colddddbrr. I would hate to commute this distance on a bike, in fact it is downright dangerous in icy conditions.

These commuters are really suited up, use carrying boxes for lunch and suits, heated grips, windscreens, good gear all around.

regards

Doug L and all Y’all,

Thanks. The US has been exporting diesel to Europe and Europe has been supplying the US with gasoline for some time, though I don’t know if that is currently the case.

For All: There’s an article on Bloomberg today about Saudi Aramco’s focused recruiting efforts–they are looking specifically for expertise in shale and aiming at (surprise!) laid-off US oil workers. Makes sense.

I am in China. Basically all the passenger cars sold in China are gasoline-powered, except a small number of SUV models.

Ya my phrasing shaky. What I read from somewhere forgotten was the bulk of new Chinese overall oil consumption was diesel. I should have been more explicit following a question about car sales.

Thanks Skywalker. Stick with this site, please; you are just what it needs.

Good points, Doug…

Oh, those impending fractally knock-on effects…

But it does seem reasonable to expect that, yes, increasingly, those who have more leisure, even desperate, time on their hands will discover Ron’s blog, and maybe even run a few camouflaged ads on it. ‘u^

Well, maybe Ron could start charging sliding rates relative to topic deviation, via Paypal, with vile name, etc., surcharges and discounts for highly-rated comments.

Hi Doug.

“It seems to me as if a new reality is being signaled by the many recently stalled or cancelled mega-projects. For example…”

Yes. The oil industry is beginning to wind down, as should be expected. Conditions fundamentally changed when the cost of production exceeded the ability of consumers to support that production, around June of 2014. So it’s all down hill from here. How could it be otherwise?

Oil breaks $43.00 and bounces of new low of $42.64

current WTIC spot $42.87

WTIC spot $42.51

I don’t know about worldwide, but here in Europe we pay a huge fuel tax. The overall cost of energy is inflated by taxes and mandates. I suspect it’s similar in the USA to some extent. Can’t tell about China, maybe PE can help.

Conclusion: we ain’t there yet. What we are seeing is a strong effort to cut fossil fuel use (mostly because of energy security concerns).

Hi Fernando,

There is a bit of this effect in the electricity market in the US, but in many markets (Midwest mostly, and parts of the south) electricity prices are quite low.

On a federal level taxes on liquid fuels are very low, a few states (New York, and California and a few others) have somewhat higher fuel taxes, but they are still very low by European standards. The US can easily afford European levels of energy taxation, it is the smart way to transition away from fossil fuels, which must be done eventually.

In Canada it varies widely. However, it is pretty much standard that our costs are 2X what US pump prices are. $1.219/litre, yesterday….more in Vancouver where the transit taxes are imposed.

Gas price in China right now is about US$1.0/liter, which translates into roughly US$3.785/gallon. Roughly 44% of that price is tax. Chinese government quickly raised gasoline related consumption taxes after recent drop in oil price because it wants to continue to push the consumers to use less gasoline.

Hi Futilitist,

Can you explain why consumers could no longer afford oil in June 2014? The better explanation is that more supply was introduced to the market (Libya has a big increase around that time) and that excess supply drove down prices, a little.

Prices moved down more quickly when OPEC claimed they they would not decrease output (around early Novenmber this was being reported). Many people (myself included) thought this was political posturing, but when OPEC met and did not decrease output quotas as many had expected around the end of November, then oil prices really dove.

The story is much more of a supply story than a demand story.

For many years OPEC acted a stabilizing force in the Oil Market, they have relinquished this role for now an it will take time for the market to adjust. Currently there is plently of oil supply so prices are low, and despite what you believe, the World economy is doing pretty well at present, low oil prices with adequate oil supply will only improve the economy.

As the oil supplies become tighter as demand increases due to higher economic growth, oil prices will eventually increase.

Your premise that the economy cannot afford $50/b or even $80/b oil is false.

Hi Futilitist,

Eventually the oil industry will wind down, but it will be high prices that will accomplish this, low prices only cause people to think that there is plenty of oil so they go buy an F150 for buying groceries in the city or suburbs. When oil prices are high, then consumers will not be able to afford oil, oil companies will produce all they can at the high prices and if prices remain high, or increase even more as oil depletes, then consumers make different choices.

The drop off in oil supply may be less rapid than you believe. Without action by OPEC or some entity to control oil output, we could see a lot of volatility in oil prices because it takes some time to adjust oil supply in a free market situation. This is the reason that the RRC controlled oil output, and when Texas peaked and could no longer serve as the swing producer, OPEC took over that role, which allowed relative market stability.

It would be great if the NDIC and RRC of Texas acted to limit output in order to stabilize the oil market. The RRC already has the power to do this (unless the laws have been changed in Texas). The NDIC would need to be given this authority by the ND legislature.

Hi Dennis.

“The drop off in oil supply may be less rapid than you believe.”

I do not believe the drop off in oil supply will be rapid. Up until the very moment of catastrophic social collapse, I believe oil supply will be abundant relative to the diminishing needs of an increasingly impoverished population. The price will remain depressed, below the aggregate cost of production. This will positively feed back and wind down the oil industry, just as it is doing today.

Consumers have to bear the entire cost of oil production for civilization. The cost of production is currently too high for consumers to do this because they have been having their purchasing power continuously eroded since the start of the Great Recession. $100+ oil finally became too much.

Oil no longer provides enough benefit to society to pay for it’s own continuing production. Catch-22.

This new economic paradigm began in june of 2014. There is no way to stop the positive feedback cycle that will shrink the oil industry and, thus, civilization itself, until complete social collapse finally overtakes and dissolves the system.

How could it be otherwise?

Hi Futilitist,

On oil not providing benefit to society. If it did not, it would not be used. Your argument that oil collapse leads to social collapse depends on the notion that oil provides many benefits to society. You are confusing a short term drop in oil prices (which has happened repeatedly in the past), with the signal that the collapse has begun.

“This time is different! “, you claim. Probably not, this has been seen before. When the peak has arrived and it is clear to everyone, not just those of us who believe that peak oil is either here or will arrive within 5 years, then things will be different and perhaps there will be societal collapse, there will be a recession or even a depression, but collapse is not a given.

The peak is not likely to be recognized until 4 or 5 years after it occurs by average person, they will see rising oil prices, followed by recession and the peak in oil output will be blamed on the poor economy and lack of demand for oil, it is only if (or when) the economy begins to recover and oil output never rises to previous levels that people will realize that those peak oil guys had it right. Maybe something will be done by society once a crisis arrives, there is much that could be done. it is unknown what will be done.

Oil provides plenty of benefits to society at $50, $80/b, or even $100b. If not why was the World economy functioning pretty well from 2011 to the present with Oil between $90/b and $120/b over most of that period? The IMF data suggests World real GDP growth was steady at about 3.2 to 3.3% from 2012 to 2014. Chart below using data from EIA real prices viewer and IMF World Outlook.

Hi Dennis.

One more time.

Oil consumers have to bear the entire cost of oil production for civilization. Oil no longer provides enough benefit to consumers to pay for their own needs, plus the cost of continuing oil production. Future production is being curtailed as we speak, while oil companies concentrate on current production just to meet cash flow requirements. This is a paradigm shift. Oil’s overall utility to civilization has turned negative. This cannot be ‘fixed’ and will, very soon, result in the total collapse of industrial civilization.

“Oil provides plenty of benefits to society at $50, $80/b, or even $100b. If not why was the World economy functioning pretty well from 2011 to the present with Oil between $90/b and $120/b over most of that period?”

Oil used to provide those benefits to society when we could still afford to pay for it’s continuing production. We can no longer afford to do this.

As I said, oil consumer’s aggregate ability to afford oil (oil affordability), has been dropping steadily, since the Great Recession. At the same time, the cost of oil production has been steadily rising. In june of 2014, the cost of oil production exceeded the ability of oil consumers to meet their own needs, as well as pay for future oil production.

The cost of oil production overtook oil affordability in June of 2014. Since then, lower prices have resulted in more production, which keeps lowering the price.

This is simply a fact. It is an observation of actual reality. All I am saying is that this new condition, which has existed since june of 2014, and continues to exist today, is now a permanent condition. There is no way to stop this feedback loop.

Oil no longer provides enough benefit to society to pay for it’s own continuing production. Catch-22.

This time really is different.

Please take the Futilitist Collapse Challenge at:

http://peakoilbarrel.com/eia-confusion/comment-page-1/#comment-504528

If you can’t come up with a logical way to somehow get the green line (oil affordability) back above the black line (oil production cost), and get oil to trade in between the two lines, then you will not win the challenge. Sorry.

But perhaps, then, you will finally comprehend the true nature of our current dilemma. Good luck with all that.

Hi Futilitist,

For the World economy, real income was increasing by an average of 3.9 % from 2010 to 2014, oil prices were relatively flat or decreasing in real terms over this period, so oil affordability was increasing.

Your charts cherry pick data points on the oil price chart, not a very viable measure of oil affordability. Not an an impressive theory at minimum you should use the running 12 month average price. Nor it is a given that less oil availability leads to collapse, it will lead to changes which you assume cannot prevent collapse, I think it will lead to slow growth at minimum and likely a depression, the crisis may lead to positive changes or negative changes.

Just as it is silly to assume only positive changes can occur, it is equally silly to assume that only negative social changes are possible during a crisis.

Dennis,

“For the World economy, real income was increasing by an average of 3.9 % from 2010 to 2014, oil prices were relatively flat or decreasing in real terms over this period, so oil affordability was increasing.

Your charts cherry pick data points on the oil price chart, not a very viable measure of oil affordability. Not an an impressive theory at minimum you should use the running 12 month average price. Not an an impressive theory at minimum you should use the running 12 month average price.”

Bullshit! That is fallacious averaging. It is like erasing good data. Doing what you suggest would only serve to obscure any useful pattern. (Like this current dialog between us).

“Nor it is a given that less oil availability leads to collapse, it will lead to changes which you assume cannot prevent collapse, I think it will lead to slow growth at minimum and likely a depression, the crisis may lead to positive changes or negative changes.”