A Guest Post by George Kaplan

Mexico C&C Production

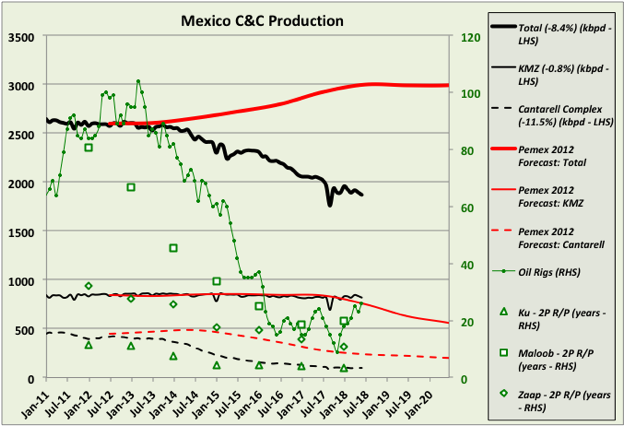

Mexico oil production is in decline though, at the moment, not as steep as it was expected to be (at least by me – IEA predictions are closer).

Data is through June and comes from Pemex and National Hydrocarbons Information Center (CNIH) (both sites are pretty good).

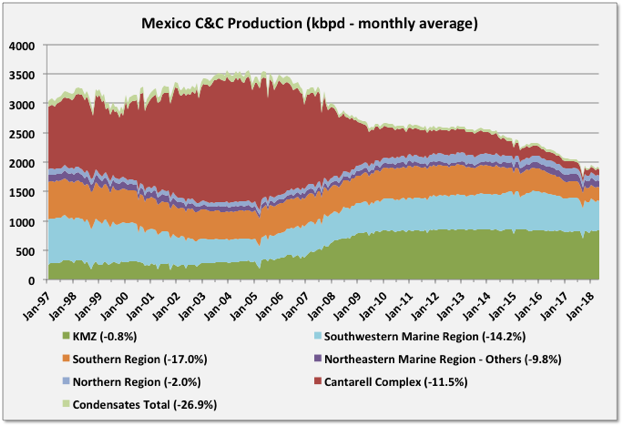

For June C&C was 1870 kbpd, down 25 kbpd from May and 170 kbpd y-o-y. Yearly decline rates for each region are shown in the chart below. Production peaked in 2004/2005 at just over 3500 kbpd, so overall decline is approaching 50%.

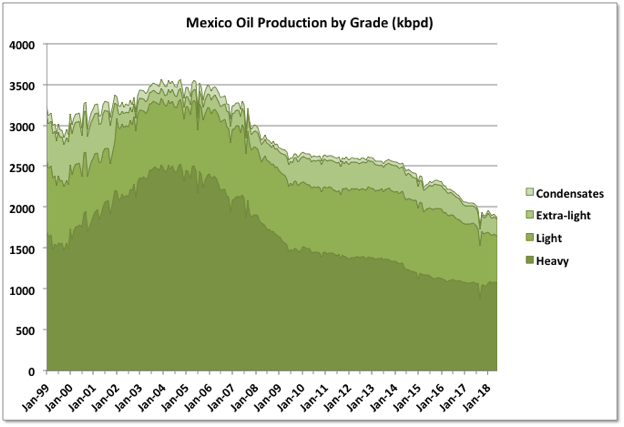

Most of the decline has been in light oil and condensate, with heavy oil holding fairly level.

Ku-Maloob-Zaap

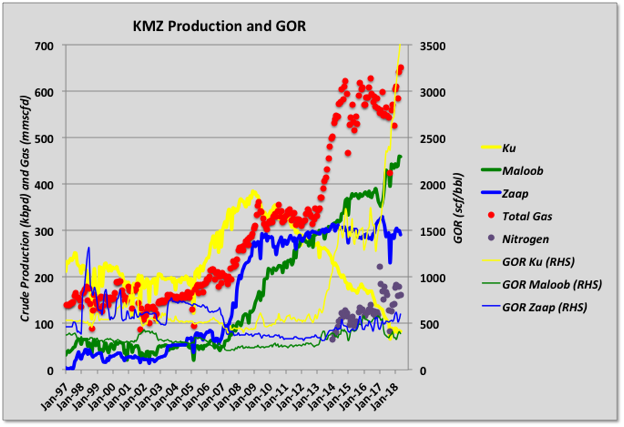

The largest producer is the Ku-Maloob-Zaap complex (KMZ), which has been kept on a plateau, contrary to predictions of a decline starting about now from a Pemex presentation in 2012. The production has been maintained mainly by increasing flow from the Maloob field, and it looks like this has resulted in increased nitrogen production. Ku and Zaap production has been maintained, but the Ku field is getting close to exhaustion now. Ku is a medium oil at API 22°, while Maloob and Zaap produce heavy oil at API 12°. The two types of oil are processed separately so it’s not clear that decline in Ku can be fully replaced by the heavier oil fields, which I think also require more nitrogen for voidage replacement. Nitrogen injection to maintain production there was started in 2014, which was also when overall production came off a temporary plateau and started the current steady decline period. It would be interesting to know how the total available nitrogen is apportioned to the fields; presumably the total available is fixed and therefore so too is the net voidage replacement capacity and hence the total amount of heavy oil that can be produced. The nitrogen gas produced is (again presumably) reinjected so local compression capacity would also be a limit, for example there is still a high amount of nitrogen produced in Cantarell for relatively low oil production and eventually the same fate must befall KMZ.

There’s a six day shut down planned for one FPSO operating on KMZ, which will knock 95 kbpd off, affecting July and August numbers.

Regional Details

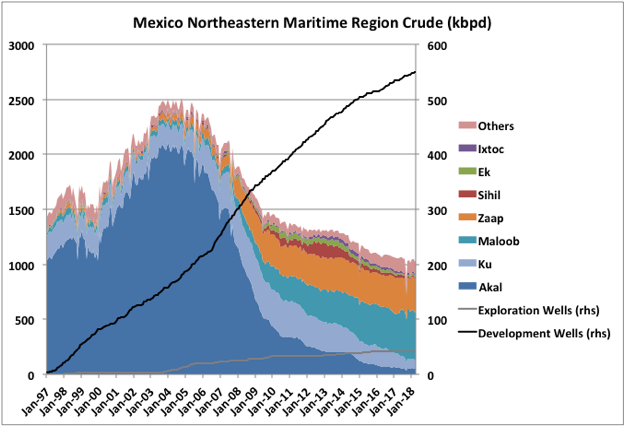

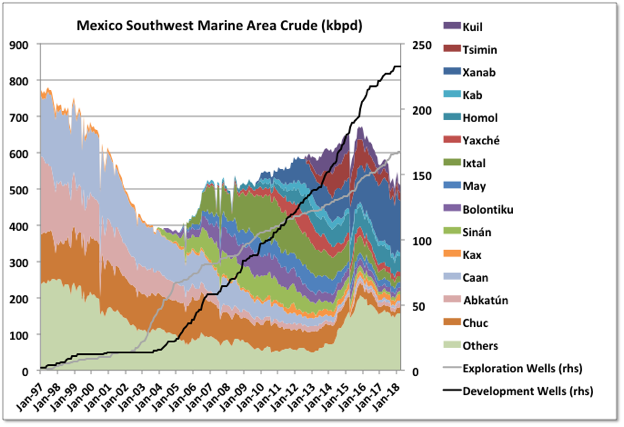

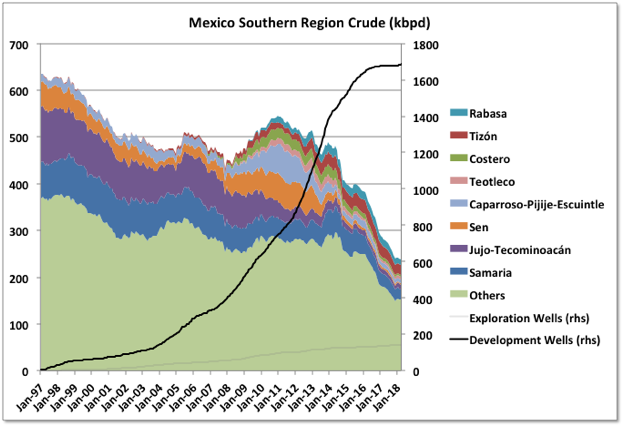

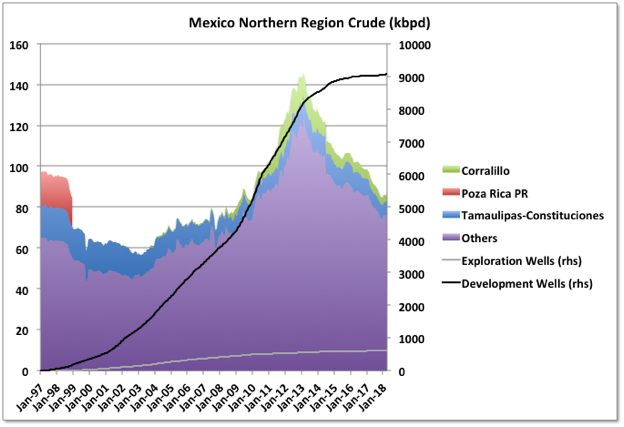

There are four producing regions in Mexico, two onshore and two offshore. The offshore regions are where most of the new drilling and developments are occurring. The onshore basins are mature, show clear creaming curves for drilling, and with few new wells have declines that are steady and almost linear at the moment. Even the two marine areas show evidence that they are in late life stages with declining flow in almost all the fields and creaming of the well numbers. The charts show production stacked but the cumulative completed wildcat and development wells are shown as normal trends.

Note Akal is by far the largest contributor to Cantarell, other fields are almost negligible by comparison.

Mexico Reserves

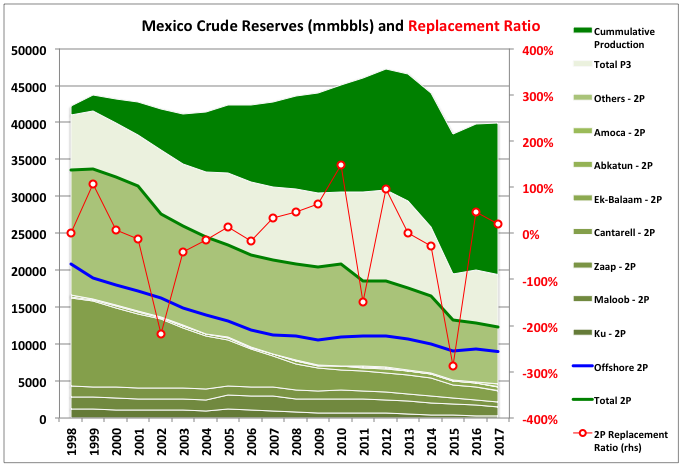

Oil

Remaining Mexico reserves have been falling continuously in all categories for several years. The chart shows estimates for oil reserves with 2P (i.e. ‘proven plus probable’, which is usually the best estimate for what is likely to be ultimately produced), with some of the larger fields highlighted, together with total P3 (‘possible’, which tends to decline to zero as a province plays out) and cumulative production since 1999, when data first became available. The offshore proportion of the 2P reserves is also highlighted. KMZ and Cantarell are still the fields with largest reserves, although Cantarell production is well below what might be expected given that its remaining reserves are nominally still enough to class it as a supergiant (and therefore possibly limited by nitrogen capacity – see above). Ek-Balam has been announced as a redevelopment and Abkatun was a large field, produced mostly in the 80s and 90s and now largely depleted.

The biggest reserve additions this year were for the Amoca, Mizton and Tecoalli shallow fields, which Eni is developing as a fast track project with early production planned for next year and ramping to 100 kbpd in 2021. These fields show 2P total reserves at 413 mmboe, and 3P at 706 mmboe, with most of the ‘possible’ additions being natural gas rather than liquids.

The current overall R/P ratio is a respectable 17 years, representing a rise after fairly consistent slight falls in recent years.

There has been some excitement over the potential for significant deep-water discoveries, but so far there has not been much to show. What discoveries there have been presently only constitute P3 resources, as none of the fields have any firm development plans, and were revised down to a relatively minor 500 mmbbls from 780 mmbbls last year. There may also be some shale oil potential onshore but few exploratory wells have been drilled and I think no reserves booked so far.

Only three years since 1999 have had reserve replacement ratios greater than 100%. Many years’ numbers have actually been negative, some of them significantly so, and the estimated ultimate recovery has been revised slightly downwards overall.

Note I’ve labeled the years against the end date for which the reserves and production apply, which is how most countries report them, but Mexico labels them by the reporting year (i.e. one year later).

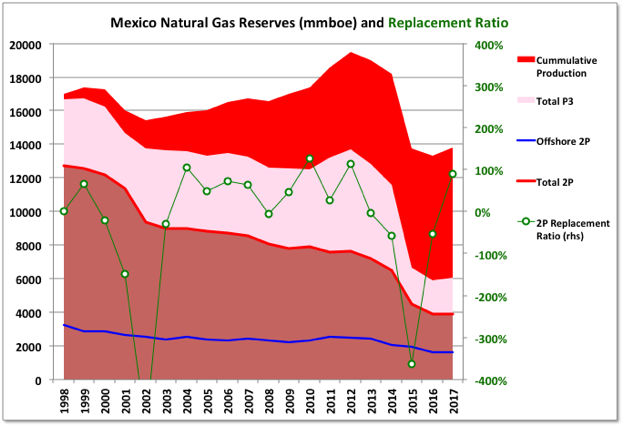

Natural Gas

Natural gas reserves have been declining faster than oil, both for ultimate recovery and those remaining, but flattened out this year because of some onshore discoveries. There might be more discovery potential for gas than oil, with extensions of some of the Texas shale gas plays onshore and the deep water sites maybe turning out to be more gas prone.

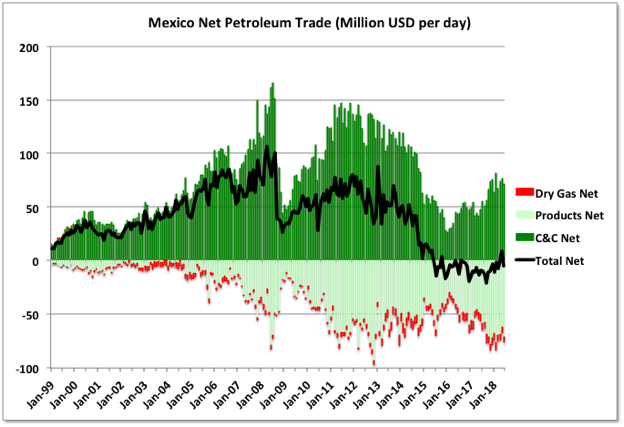

Mexico Petroleum Imports and Exports

As the oil price has increased Mexico has returned to a neutral trade balance for petroleum related goods. The Mexican refining industry is running well below capacity; I think this is mainly because it cannot handle the heavier slate of domestic crude that has resulted as the light grades have been depleted faster, but also from general underinvestment on ageing plant. There have been attempts to open up the Mexico industry to foreign investment, but with limited success and some notably disappointing lease sales, and that effort may now reverse again with a recent change of government. The new Mexican president has said that he intends to end the import of foreign fuel within three years, that is not going to happen by a long way, and reverse the decline in oil production, that is not going to happen at all without several large and easily developed deep water discoveries and even then not in less than five to ten years – in fact some time during his second and third years the decrease from KMZ is likely to get very noticeable

Off Topic Finish

Flying spiders – noted by Darwin on the Beagle. They get aloft by using the atmosphere’s electrostatic fields interacting with static on their silk strands, and use air currents to stay up and move around. They have been recorded as getting over two miles high and travelling a thousand miles. “Life, ah, will find a way.”

https://www.ecowatch.com/mexico-bans-fracking-2592125998.amp.html

Not going to get any shale oil investment this way. Although, if you declare all drilling as illegal, maybe you can get the cartels involved.?

In all seriousness, without a concerted effort by the government to attract investment, México oil and gas production is going nowhere.

On the positive side, capitalism is alive and well in Mexico, so I don’t see a purely socialistic society surviving for very long. My guess.

I lived there last year.

A very politically literate society compared to the US– but that is a low bar.

We shall see.

On the positive side, capitalism is alive and well in Mexico, so I don’t see a purely socialistic society surviving for very long. My guess.

Two observations, one, the drug cartels, like all cartels operate under a for profit capitalistic paradigm.

They may not be recognized under current legal systems and they may appear at first blush to incorporate brutally violent inhumane practices, but on deeper examination they operate much as any other sophisticated multi billion multinational business and marketing operation.

See this TED talk: https://www.ted.com/talks/rodrigo_canales_the_deadly_genius_of_drug_cartels

Rodrigo CanalesatTEDSalon NY2013

The deadly genius of drug cartels

Yale professor Rodrigo Canales in this unflinching talk that turns conventional wisdom about drug cartels on its head. The carnage is not about faceless, ignorant goons mindlessly killing each other but is rather the result of some seriously sophisticated brand management.

And second, unless you happen to be a member of the small group of financially elite beneficiaries of the capitalist system, capitalism sucks big time for the average poor person in places like Mexico and elsewhere. And furthermore as it is currently configured in it’s classical neoliberal incarnation it is destroying the planet. It is obsolete as are most ‘isms‘ and that of course does include socialism, but that, is a separate dissertation!

https://www.youtube.com/watch?v=ZyyfgacCx_c

ESMT Open Lecture with Giacomo Corneo

An open lecture held at ESMT Berlin on January 23, 2018:

Is Capitalism Obsolete?

After communism collapsed in the former Soviet Union, capitalism seemed to many observers like the only game in town, and questioning it became taboo for academic economists. But the financial crisis, chronic unemployment, and the inexorable rise of inequality have resurrected the question of whether there is a feasible and desirable alternative to capitalism. Against this backdrop of growing disenchantment, Giacomo Corneo presents a refreshingly antidogmatic review of economic systems, taking as his launching point a fictional argument between a daughter indignant about economic injustice and her father, a professor of economics.

Worth noting that the minimum wage, in Mexico, for 2018 is $88.36 pesos per day.

NOTA BENE that is pesos per DAY, not hour.

NAOM

Today that comes to 4.65 dollars per day.

Mexican Pesos to US Dollar

Note that despite a drug war killing lotsa young men age 25 or so, the life expectancy for Mexico is only one year less than the US.

Not sure what that says. Maybe superior doctors. How weird is that?

You are way, way overestimating the effect of homicides on the total population of Mexico. Although Mexico’s homicide rate is about three times that of the USA, Mexico’s homicide rate is still only about .15 people per 1,000 people. Or 1.5 per 10,000 people.

That is still not going to affect the overall death rate all that much.

Note that despite a drug war killing lotsa young men age 25 or so, the life expectancy for Mexico is only one year less than the US.

If you watch that TED talk I linked to you might understand that the drug wars are NOT really killing lotsa young men! But that all the violence is rather the result of some seriously sophisticated brand management!

To be clear, I am not in any way minimizing the fact that the violence is very real and young men are certainly being killed! However the actual numbers are much lower than one might think, certainly not high enough to affect national death rates.

It is not in any of the Drug Cartel’s business interests to allow escalating random acts of violence, much less all out warfare among rival factions. The violence is a highly controlled part of their marketing and recruiting campaigns which are employed when they move into any new territory.

Think, Wallmart undermining local mom and pop grocery stores to establish their monopolistic business model as they move into a new territory. The only difference is that Wallmart doesn’t have to depend on actually killing people in the streets because Wallmart is legal and pays taxes…

Watch the video, it clarifies what I’m saying!

If you are not a player, it doesn’t seem to be a problem.

And I have driven the length of the country several times, and being street smart, never had a issue.

Lived there last winter.

Guym,

There is a little bit of a bright spot for Mexico’s oil sales: One of South Korea’s refineries has been upgrading its capacity for refining heavy sour crudes and names Mexican Maya specifically as one that will boost their margins.

The upgrading is to enable the refinery to produce low-sulfur fuels for shipping in order to meet the new sulfur standards the IMO will impose in 2020. It’s cheaper to buy high-sulfur crude if you’re able to refine it. Someone’s looking ahead, anyway.

Maya blend sells better in the US. This could change when the Canadian pipelines reach Houston. The far east refineries seem to have been focusing on Canadian Pacific exports which are hindered by the greens, and some middle east heavies, as well as pdvsa sales in long range trade out of curazao.

Will cartels come to own the shales, or will it be the traditional wealthy class?

Mineral rights in Mexico belong to the Mexican government since 1921.

Which means that Mexico produces a lot less oil than it would otherwise, right?

In the long run, probably more.

We will never know.

How much would the US be producing if it’s oil production was managed like Mexico? Maybe 70% less? Certainly no LTO…

Almost certainly not.

Definitely less.

Yeah. For one example, does Mexico have anything like Shallow Sand’s small operation? Does it have anything like the vast network of stripper wells that provide a large fraction of US oil production?

I have audited, consulted for, appraised properties up for bids, operated properties previously owned by national oil companies in Argentina, Colombia, Ecuador, Venezuela, Russia, Azerbaijan, Kazakstan, China, etc.

In general the state oil companies are inefficient, corrupt, dirty (lots of enviromental damages), have poor relations with local communities, are heavily unionized, drill slow, have political apoointees, etc. PDVSA prior to Chavez was pretty good compared to say the Argentinian YPF.

The Chinese had a huge work force, ancient technology, but they recovered a lot of oil because they seemed to have endless amount of polymers and could produce to really low water cuts.

The worst enviromental damage I’ve ever seen was in former USSR, and Venezuela after Chavez fired 18000 employees in 2003.

This article is two years old but still an interesting read.

Riyadh’s Dirty Secret: Saudi Arabia Thirsty for Yemeni Oil, Gas Reserves

Why does Saudi Arabia continue to bomb Yemen back into the Stone Age? The crux of the matter is that Yemen has oil reserves, while Riyadh is steadily running out of the commodity, American political analyst Phil Butler explains.

It’s always good to review one’s sources: Sputnik is a news agency, news website platform and radio broadcast service established by the Russian government-owned news agency Rossiya Segodnya.

And from a quick look at Phil Butler’s website, he also appears to be a Russian spokesman.

Errrr, and this means that any input on Saudi reserves he gives has to be a damn lie? Or, perhaps he may be far more inclined to tell the truth than someone with Saudi connections.

Well, did I say that?

What I would say is that if you read through their stuff, they have a pretty clear agenda, with some obvious misinformation. And some of the pro-Russia things I’ve seen on TOD have been pretty sad – links to articles by people who claim that the ethnic cleansing in Serbia never really happened, for instance.

So, you have to double check anything you read – you can’t treat it as a primary source of reliable information.

The ethnic cleansing in Serbia never happened. I assume you refer to the Clinton and Blair claims that a genocide was taking place in Kosovo (at that time part Yugoslavia)? That was a lie made up to justify bombing the Serbs because Clinton wanted to show he could help Muslims somewhere on Earth. Sometimes what you think you “know” happens to be the garbage you are fed to make you support the endless wars the US public seems to enjoy paying for.

I was thinking primarily of this:

https://www.hmh.org/la_Genocide_Bosnia.shtml

People tend to confuse Bosnia with Kosovo. The so called genocide was a war crime committed by Bosnian Serbs (murdered 6000 Bosnian Muslims as the UN peacekeepers stood around and did nothing). But that wasnt really associated with Yugoslavia, which had cut off from Bosnia.

The confusion arises because the US pressured to have Milosevic put on trial for the presumed Kosovo genocide. During the trial the prosecutor could not even prove that a genocide had taken place, and this led him to shift the trial to the unrelated Bosnian war crimes. So its easy to get confused.

My nephew spent years digging up and documenting mass graves in Bosnia. The massacres were very real. You’re just inventing lies. I doubt you have any good information.

One of my neighbors is a Serbian refugee from Bosnia. The was a lot of mass killing, and it was the Serbian side who initiated it. For example, the way my neighbor tells it, everything was more or less fine between the Orthodox, Catholic and Moslem communities in the Bosnian village where he lived until some thugs dressed in Serbian army uniforms came in from Serbia (just over the hill) and burned down the mosque and some houses and shot several people. This was the direct result of the Serbian Communists turning fascist to stay in power when their government collapsed. Then the troubles started and got worse and worse. He got the hell out.

He works as a cook in Germany and has built two houses in the village (one for each son). Things are looking up.

Dude, i explained there were massacres in Bosnia, but it wasnt a genocide. The Soviets murdered 15000 poles in a few days at Katyn, and nobody talks of a “Polish genocide”.

You are mixing up terms and locations. The Bosnia war took place BEFORE the Dayton Agreement. Clinton met with the Bosnian contenders and Slobo in Dayton, Ohio, and they worked out a deal which ended the Bosnian war.

Years later, starting around 1997, the Kosovo Liberation Army started a campaign in Kosovo with significant help from Albania. And in 1998 Clinton decided it would be a good idea to ignite a conflict in which he could use bombing to show support for Muslims.

At the time Clinton had taken the Israeli side in peace negotiations, and he feared blowback from the muslim radicals such as Al Qaida. So the Kosovo bombing had to be justified and Clinton with his loyal poodle Blair made up the “Kosovo genocide” and started bombing in March 1999.

Clinton’s bright idea led to the killing of over 600 civilians in Serbia and Kosovo, and this makes Clinton a war criminal. Thus the lie about the genocide has to be maintained at all costs, and you wont read or hear much about the truth.

The fact that the genocide in Kosovo never existed is simple to prove: Slobo spent years on trial in The Hague and was never convicted. They were prepared to extend the trial as long as possible until he died, which he did. This as far as US and UK are concerned, eliminates risks and being exposed as a bunch of criminals.

The blowback over the failed israel-Paalestine peace talks the CIA had warned Clinton about wasnt avoided by bombing the Serbs, and two years later 9_11 happened.

As i am sure you know, the lies and deception arent unique to US democrats, Bush and the media lied about the Iraq WMD, and nowadays we see jingoistic warmongering and all sorts of false flags taking place. Which could take the world to nuclear war, and this in turn will definitely mean peak oil.

Ron,

BP suggests about 3 Gb of proved oil reserves for Yemen. Probably not the reason for the war there, natural gas reserves also not significant at about 0.3 TCM.

Yeah, I realize that. I just thought it interesting that someone else also thought Saudi’s reserves were not what they claim.

Why is Saudi Arabia at War in Yemen?

Criticism of Saudi Arabia’s role in the war against Yemen’s Houthi rebels reflects a fundamental misunderstanding about the Kingdom’s motivations. What drew Saudi Arabia into the conflict was Iran’s effort to build a military alliance with the Houthis – an alliance with only one conceivable target: Saudi Arabia.

Ron,

The 1980 reserve number may be about right for 2P reserves, if the improved technology which has been implemented since 1980 has allowed some reserve growth.

The best we can do is guess. US reserve growth has been about 2% annually from 1980 to 2005 (before tight oil became important).

If we take the 1980 “proved reserves” and assume they are 2P reserves (160 Gb), then a similar reserve growth rate minus 73 Gb of output(BP data) would give about 190 Gb of 2P reserves in 2005. If we further assume all reserve growth and new discoveries in Saudi Arabia stopped in 2005, there are another 49 Gb of output from 2006-2017 and 2P reserves would be down to 140 Gb, if we assume 1% reserve growth from 2006 to 2017, 2P reserves would be 165 Gb at the end of 2017.

All guesses as we don’t know if there has been any reserve growth, an assumption of zero reserve growth and discoveries since 1980 would give us 38 Gb of KSA 2P reserves at the end of 2017, if 2P reserves were 160 Gb in 1980.

Dennis, I am not going to argue with your figures but I must say this. You have a very wrong idea of what reserve growth really is. Reserve growth is a correction of earlier estimates of URR. The reserves of new fields, for companies listed on public exchanges, are usually underestimated for obvious reasons. There are SEC regulations and stiff penalties for overestimating reserves. But after a few years, at most a couple of decades, these estimates are revised upward. This is reserve growth.

However, there is no reason for a national oil company, that is not publically traded to underestimate their reserves. In fact, national bragging rights are what is most important here. National reserves, in this case, are far more overestimated than underestimated. At any rate, after many decades of production, there would be no reserve growth in Saudi’s very old supergiant fields. In fact, since their earlier estimates were likely greatly overestimated, there would be “reserve shrinkage” rather than reserve growth.

I would estimate that Saudi reserves today, would be less than 100 billion barrels. That’s why they are in a panic and putting out statements like the one in this link:

Aramco Ready To Invest To Meet Future Oil Demand

The message: mature oil fields are seeing an increase in declining production rates, and this must be offset by continued investments in the industry if the world is to meet what is thought to be an 1-1.5 million barrel per day annual demand growth rate in coming years.

“To respond to this situation, significant new investments are required in additional capacity and expanded and upgraded infrastructure, as well as the development of pioneering technology to make petroleum energy more sustainable and accessible,” Al-Falih said in his opening message to the 42-page report published on Friday.

What you don’t understand is that reserves don’t just keep growing and growing and growing like the Energizer Bunny just keeps going and going and going. 😉

I agree that national oil companies have no incentive to under report reserves. But, according to l’Histoire de l’Or Noir, When IOC’s controlled M.E. oil fields there was an incentive to under report reserves. That is because during most of that period the big problem was over production. The IOC’s bought the rights to M.E. oil fields, which they did not develop and under reported reserves for those fields to keep competitors from being interested. What I am saying is that under reported reserves in 1970 might have led to under reported reserves in 1980.

I have replied to this comment below where it was wide enough to post a chart.

Hi Ron,

There is the aspect of reserve growth that you give and I agree that is a big part of reserve growth in the first 5 years after a field starts to be developed.

The part you are missing is improved technology and optimization of well placement etc.

In 1980 (before the increases in reported Saudi reserves), BP reports KSA had 168 Gb of reserves.

Also note that on page 378 of Twilight in the Desert, Simmons reported KSA 2P reserves were 177.5 Gb in early 1979. These were based on audited reserves by US oil companies, so the Simmons estimate is likely to be pretty accurate.

Note that the US data is available from the EIA, US reserves grew by 63% from 1980 to 2005 and the US oil fields started development much earlier than KSA so we would expect that if anything KSA reserve growth would be higher than in the US.

Reserve growth from improved technology can be explained very simply.

Let’s assume the OOIP for KSA was about 700 Gb in 1979, cumulative output was about 35 Gb at the end of 1978 and reserves were about 177 Gb for a total URR of 212 Gb (assuming no reserve growth or discoveries after Dec 1978.) Through the end of 2017 about 149 Gb of oil had been produced by KSA which would leave 63 Gb of oil under the no reserve growth and no discovery assumption. (Note that I have switched to EIA C+C data for these estimates).

So 212 Gb 2P reserves divided by 700 Gb OOIP would be a 30% recovery factor if the OOIP estimate is accurate and this is for 1979.

Now fast forward to 2018 and assume for simplicity that there have been no new discoveries since that time for KSA, but that technology has improved over the previous 40 years. Perhaps the average recovery factor has increased to 45% which would give an estimate of 315 Gb(=700times0.45) for cumulative production plus 2P reserves. Note that a Hubbert Linearization for KSA for 1998 to 2017 gives a URR estimate of 325 Gb.

If we take the HL estimate and subtract cumulative output we get an estimate of

325-149=176Gb for 2P reserves at the end of 2017, and typically the HL estimate is very conservative, so this would be my minimum estimate. I do agree the “proved reserve” estimate of 266 Gb at the end of 2017 is too high and might be an estimate of 3P reserves plus contingent resources, and possibly 100 Gb might be a good estimate of 1P reserves.

This remains a guessing game due to the lack of information.

In 1980 (before the increases in reported Saudi reserves), BP reports KSA had 168 Gb of reserves.

NO, no, no! That was not before the increase in reported reserves. That was after Saudi increased their reserves from the 110 GB the Aramco partners had reported a few years before. And those were Saudi reported reserves, BP just reported what Saudi told them they had.

Also note that on page 378 of Twilight in the Desert, Simmons reported KSA 2P reserves were 177.5 Gb in early 1979. These were based on audited reserves by US oil companies, so the Simmons estimate is likely to be pretty accurate.

Well hell, that’s up from 110 GB as reported by the Aramco partners.

Let’s assume the OOIP for KSA was about 700 Gb in 1979,

Oh my goodness! That is some assumption. Where did you get that number?

I don’t think Saudi recovery rate was ever as low as 30%, but that is not really that important. But please tell me what Saudi has done, since 1980, to increase recovery rate that much. Gas injection was introduced at Ghawar in 1958. Water injection began in 1964 to provide additional pressure support. Other than that nothing has been done to increase the recovery rate. Well, they are trying, just recently, CO2 injections in central Ghawar, I don’t know how much success they are having however.

Please see my reply to Schinzy below and past any reply, if you have one, there.

“The part you are missing is improved technology and optimization of well placement etc.” – Mexico, Brazil, GoM, UK – all use pretty sophisticated technology, all have seen level or negative URR revisions on many mature fields and basins since 2007 (and overall for the region). I’m pretty sure Angola and Nigeria would show the same if the data was available.

George,

If we look at GOM discoveries through 1980, in 1980 the 2P reserves were 3 Gb for discoveries through 1980 and 2.6 Gb for discoveries through 1975 as revised by 1980.

In 2016 those same fields (discoveries through Dec, 1980) had produced 7.1 Gb of C+C from Dec 31, 1980 to Dec 31 2016, and for fields discovered by Dec 1975 output was 6.4 Gb from Dec 31, 1980 to Dec 31, 2016.

If we assume most of the reserve “growth” happens in the first 5 years after discovery, then the discoveries through 1975 would give a better estimate of long term reserve growth. So we would have 6.4/2.6=2.46 over 36 years (1981-2016) or an average growth rate of 2.5% per year.

Let’s also consider that maybe a decade is needed for most reserve growth to occur and look at the 1990 estimate for GOM discoveries from 1947 to 1980 (end of year).

In 1990 the 2P reserves for discoveries through 1980 was 1.88 Gb, by 2016 (end of year) those 1947-1980 discoveries had produced 4.15 Gb from 1981 to 2016 (inclusive). So we have 4.15/1.88=2.207, and the growth over the 26 years from 1991 to 2016 is the 26th root of 2.207=3.09% average “reserve growth” for 2P reserves discovered from 1947-1980 over the period from 1991 to 2016 in the Gulf of Mexico.

I used BOEM data from link below

https://www.data.boem.gov/Main/FieldReserves.aspx#ascii

I said since 2007, what you wrote is about something else. See chart below. You like strawmen so you’ll pick out the Mars Uras line – I’ll point out that it has risen becasue it includes new fields of Kaikias, South Deimos and West Boreas in the leases, not from growth of the original discovery.

Chart.

George Kaplan,

Perhaps the “no reserve increase since 2007” could also be considered a strawman. As I was looking at changes in reserve estimates for an entire basin (or nation) since 1980, so looking at how GOM reserves have changed since 1980 seems a better comparison to Saudi changes in reserves since 1980.

I looked at estimates for all fields by year of discovery, I am not choosing specific fields.

Now if certain fields we considered “not reserves” in 1990 and in 2016 for whatever reason those fields are being produced, I would say the initial estimate was revised from non-commercial to commercial and consider this to be a part of “reserve growth”.

You may classify this as a “new discovery”, I consider it a revision of the initial estimate.

George Kaplan,

Correction to comment above: “Now if certain fields we considered ‘not reserves’ ” the “we” should have been “were”.

Took a quick look at 2005 2P original cumulative reserves in both 2005 and 2016 and there was close to zero reserve growth over that period. So I agree there may have been little reserve growth since 2005 and perhaps 2P reserve estimates may continue unchanged (for previous discoveries) in the future.

High oil prices of $150/b as the peak in World C+C output is reached, may result in some possible (P3) reserves and contingent resources to be moved to the 2P category in the future, we will have to wait and see.

The fact remains that 2P remaining reserves for GOM discoveries from 1947 to 1990 were 8 Gb in 1990, and by 2016 about 13.5 Gb had been produced from those 1947 to 1990 discoveries over the 1991-2016 period.

So over the 1991 to 2005 period average annual reserve growth for remaining reserves in 1990 was about 3.56% per year (15th root of 1.69 is 1.0356), if we assume there was zero reserve growth from 2005 to 2016 (which the data shows is roughly correct).

My comment was quite specifically in response to you saying that technology is an answer for reserve growth, there’s plenty of evidence that it might not be. That is not a strawman it is a specific response. Nothing you said afterwards seems to have anything to do with showing technology always leads to reserve growth, especially in mature fields.

George Kaplan,

Can you point out where I said technology applied to mature fields will always lead to reserve growth.

I think you have refuted an argument that was not made.

My point was that just as the US saw reserve growth from 1980 to 2005 (both onshore and offshore) and we might agree that most onshore US fields were fairly mature in 1980, it is possible that the less mature fields of Saudi Arabia (relative to the US) might also have experienced reserve growth from 1980 to 2005 as better technology was applied.

I would never argue that this occurs in every field in every case (or always).

I wouldn’t think that just because there has been little growth from 2007 to 2016 in many basins that one would argue that that must “always” be true.

In addition, technology will reach limits, such that everything that is likely to be found that is commercial at current prices will have already been found. Perhaps in 2007 (the year you suggested) that limit was reached in many areas,

perhaps there was a reason reserve estimates increased from 1990 to 2005 in the Gulf of Mexico besides the application of better technology such as an increase in oil prices, no doubt any possible explanation would have multiple factors.

The proposition was no more than better technology applied to an oil basin will sometimes result in an increase in reserve estimates.

I think it was the case that the Saudis applied a great deal of improved technology from 1980 to 2005 to their oil fields, this may have led to an increase in reserve estimates.

We can only speculate.

“The part you are missing is improved technology and optimization of well placement etc.” – that is a fairly general comment, I shouldn’t have said always maybe, but then in my original comment I didn’t. I’m really not interested much in historic growth on old reservoirs, those arguments don’t apply to mature fields which have had all the net growth they are going to get or new deep water fields (and so it will turn out on LTO, I’m pretty sure), and growth (+ve or -ve) is different between every field and always has been, both in reasons and final outcome, as was pointed it in one old USGS paper and a couple of SPE (or similar organisation) ones (and I don’t have access to those now in case you ask), and despite the other, incorrect USGS paper that you will now quote at me.

George Kaplan,

I agree. Newer fields may not grow at all or they may grow much less than older fields.

Looking at GOM data it seems there was a fair bit of reserve growth (or an upward revision of older 2P reserve estimates) from 1990 to 2005 and almost none from 2005 to 2016, perhaps from 2007 there was none at all (I didn’t check).

There is the possibility that technology will continue to improve and that oil prices will continue to rise and that might result in overall reserves being revised up. For individual fields there will of course be variation in whether reserves are revised up or down and the reasons for those revisions. Also “new discoveries” are often satellites of older discoveries that were either missed by older technology, or thought not to be commercial with older technology, so in some cases what is a revision and what is a new discovery may not be very clear.

I also agree that many of the older reserve growth papers by the USGS were not very good, but it seems clear to me that there has been considerable reserve growth in the past for whatever combination of reasons and even for very mature fields (such as in the US) in well searched areas with the best available technology that there has been reserve growth (US from 1980 to 2005 2P reserves grew about 60%).

We could consider KSA 2P reserves in 1977 at 177 Gb and that they might have grown by 60% from 1978 to 2005 to 283 Gb, at the end of 1977 KSA cumulative C+C output was 32 Gb, add this to the 283 Gb that 1977 2P reserves might have grown to by 2005 and we would have 315 Gb, pretty similar to the HL URR estimate of 325 Gb.

That would require no reserve growth after 2005 and would also assume there were no new discoveries after 1977. In fact there were about 45 named fields discovered from 1978 to 2000 in KSA based on Twilight in the Desert, though not all of these discoveries are oil fields and we don’t have 2P reserve estimates for these discoveries. They may simpy fall in the contingent resource category and might never produce any oil. Potentially there could be some new technology devised that might allow further increases in reserve estimates in the future, or that might not occur.

The fact that there has been almost no reserve growth for the past 11 years in the US GOM during a period when oil prices were quite high by historical standards does not bode well for future “reserve growth”.

In addition as the World moves on to non-fossil fuel energy (after 2050 or so), oil prices may fall (along with the price of coal and natural gas) and fossil fuel reserve estimates might be revised lower.

Invading Yemen for oil seems like a facile explanation. Deep in their hearts, no matter what the numbers say, the Saudis can’t imagine a world where thy are filthy rich on oil. They are invading Yemen to play regional power politics like Saddam did.

If they seriously thought the oil might run out some day, the y would act like the Norwegians and conserve it.

The Saudi prince running the show is a bit nuts. Wants to control the peninsula, and eventually extend his realm all the way to Damascus. Yemen has shiites putting up fierce resistance as the Saudis with US help are committing atrocities and war crimes. The US tax payers are footing part of the bill in wear and tear of tankers used to refuel Saudi fighter bombers, and the US personnel used to help the Saudis find targets, which seem to include buses full of children, water plants, and other strategic sites.

Ron,

Saudi Arabia is planning, or at least looking at, building an oil port in Yemen in the SE of the country, near the border with Oman.

The article is at OilPrice, the source is Al Jazeera.

I really don’t think that is going to happen. At least not as long as they are at war with each other. They may have had those plans a few years ago. But obviously, you cannot build an oil port in a country you are bombing and blowing up their school buses and killing their kids.

U.S. Realizes Its Bombs Are Killing People in Yemen

The conflict has been described by the U.N. as the world’s worst humanitarian disaster and many outlets have reported on mounting civilian casualties incurred by the Saudi-led campaign of airstrikes. Citing local journalists and munitions experts, CNN reported Friday that the bomb used August 9 in an alleged Saudi coalition strike that killed up to 54 people—most of them children in a school bus traveling in the northern Yemeni city of Saada—was provided by the U.S.

Mexico oil production is hanging on a thread. KMZ offshore basin is all that is holding production. Once nitrogen injection can no longer hold pressure in Maloob and Zaap, then its all downhill for another drop of 500k in 5 years. If deepwater offshore auctioning isn’t working out, then Obrador needs to do the opposite of what he said during the election (about closing out foreign drillers).

Why does Mexico use nitrogen pressure rather than water flooding in their fields? Could water flooding drive out further reserves later?

NAOM

Water flooding doesn’t work on the heavy oil fields. I remember one of their reserve write downs was because they had assumed some extra recovery by using it which didn’t work out.

Im definitly not an expert but I think thats because of the density of water and heavy oil. Normal oil swims on water, but heavy might sink down.

So if u pump water in a heavy oil field the water starts to go on the top and u only get dirt water out of your well.

Idk it, im just guessing.

Am I right or wrong?

At API 10 the oil and water densities are the same, Mexico heavy oil is a bit lighter but the density difference is still very small so the settling effect is small. The efficiency of water flood also depends on the reservoir properties (porosity, permiability etc.) and other oil properties. I don’t know all the ins and outs for Mexico, I think they would have used natural gas if they’d had enough, but didn’t.

You have to account for reservoir oil properties. A. 12 API oil with say 100 ft/bsto at reservoir temperature swells and gets to say about 0.92 grams per cc density. Reservoir water tends to be saltier than sea water, so its say about 1.05 grams per cc.

Injecting water can work if the reservoir is fairly homogeneous, but some of those offshore mexico carbonates are dual porosity or really heterogeneous, so water bypasses the oil.

If the oil column is very thick its feasible to inject a gas at the top, and produce wells low in the oil column. This can be done at a really slow rate to get a gravity drainage set up. So what they are probably doing is letting the oil move down by gravity and living with a high nitrogen to oil ratio.

There is a term in petroleum engineering when dealing with displacement flooding called mobility ratio. This is a ratio of the reservoir fluid vs. the fluid used for displacement, and a big factor in this ratio is fluid viscosity. 12 API gravity oil is very heavy and has a very high viscosity. For an analogy, think of pushing molasses with water. It is not going to work very well.

The nitrogen is used to form and fill a gas cap for gravity drainage. It is a very efficient, but relatively slow drive mechanism. Air contains 78% nitrogen so it is available anywhere and I am sure they have installed air/nitrogen separation on site.

Thanks guys, that has helped me to understand it. Quiet_one, ISTR they moved some gas generation from Cantarell to KMZ some time back, not completely sure about that.

NAOM

The air separation plants are onshore (they are really big pieces of kit and large energy users), The N2 is piped to where it’s used. I would imagine all the off gas treatment and reinjection is local offshore.

That is a great explanation. Even I can follow that one.

Supplemental information: we have found that fractional flow curves using viscosity ratios and rock relative permeability properties do not account for field performance, which tends to be slightly better than predicted. This has been confirmed in large laboratory cells as heavy oil fields under waterflood. However, the effect isnt about to put water injection ahead of nitrogen cap gravity drainage. What would really help those mexican fields would be injecting a slug of CO2 and chasing it with N2.

I’m curious. How does that work?

NAOM

How does what work? Heavy oil outperforming the classic fractional flow estimates, or injecting a co2 slug in mexico?

“What would really help those mexican fields would be injecting a slug of CO2 and chasing it with N2.”

That is what caught my curiosity.

NAOM

notanoilman:

We find that supercritical CO2 can be placed in the reservoir, where it dissolves the lighter ends (it has a harder time dissolving the high molecular weight molecules). As the CO2 slug moves through the oil region it picks up a ton of oil molecules. To reduce the amount of CO2 used, since this is a top down process it helps to chase the CO2 with nitrogen.

This works better before the nitrogen has penetrated to the producing wells, but the gravity process should help. Its important to keep that CO2 as light as possible, and that could be a problem.

Ahh, thank you very much. That is a clear explanation that helps me understand the process well.

NAOM

https://oilprice.com/Energy/Energy-General/Trump-Administration-Embraces-Energy-Dominance-Agenda.html

This has to be the most confused concept, yet. We have enough oil, so we don’t need to import??? I’m lost in this thought. Or, is it really thought? Perry was right, they should have killed EIA, before it started affecting everyones’ brain. Now, we have everyone walking around like zombies, spouting “Energy Dominance”! Even Perry has been assimilated. Resistance is futile.

I’m just waiting for them to tax renewables to subsidise fossil fuels. 🙁

NAOM

That memo is so off-base that it will have no impact.

https://oilprice.com/Energy/Energy-General/PDVSA-Settles-With-ConocoPhillips-In-Desperate-Bid-to-Stop-Decline.html

See how long this lasts,

Im working hard to get Maduro dethroned by early 2019. It depends on about 10 individuals some of whom may have been turned. So cross our fingers.

I used to be able to calculate the price of gasoline by the price of WTI divided by 20. At $65, the price would have been close to $3.25. I’m not sure why I used 20 but the price was close to that at the pump 4 to 5 days hence back then. Recently, I’ve been observing the price of gasoline has been a lot less than that factor, in the $2.60 to $2.75 range. To me, it seems low. Is gasoline demand lower? What am I missing?

Maybe you moved to Texas?

Texas initial production is out. 88,859,650 oil, 10,062,524 condensate. I received the pending file early, and am estimating daily production at 4364kb for June. The second month production totals for May were at 4210k, and EIA had 4243. That is damn close. I was about 50k over EIA in my first estimate. Pending file is slowly going down. So, I am guessing a pretty good increase for June (about 120k). That makes a 400k increase from Texas since December, last month NM was up 114k since December. So, Permian less other Texas declines? would be 514k (plus NM increase for June) the end of June. Should be interesting what happens after June.

Sorry Guym, great analyzsis, but cna you maybe dumb it down a bit? I do not understand what you mean with “Permian less other Texas declines” for isntance?

On another note, JODI data is out…. I like to look at Saudis inventories there. Crude is now mainly flat for the last couple o moonths, however oil products are dropping quite a bit (and this counter seasonal)

Texas doesn’t report Permian production, only total production. There are a bunch of other production other than the Permian that in the past few years have had slowly declining production. I’m assuming most of Texas increase comes from the Permian. However, it may be higher, or lower than total Texas change due to other fields, including the Eagle Ford.

Texas reports only production with an official lease number in what they give to the public. The other amount reported to the State is included in a “pending lease” file. Compounding this problem is that operators can report their totals within about two months. Historically, over the past few years, I have found that the total of the pending lease file and the regular production reported matches up to eventual final production and EIA monthlies fairly closely. For $10 a month, Texas RRC will supply you with a text file of the most current pending lease data for years back. Just takes unzipping the file, converting it to excel, and some sorting and totalling. It’s actual Texas reported production.

Alternatively, EIA uses a combination of operator reports (914 reports) and drilling info data. Probably, drilling info reports are more accurate, as the pull their data from RRC, and do their own estimates for the current month, like me, only better, because they do it by lease. Or, the ones they have, anyway.

EIA maligns RRC by stating that they use other sources to estimate Texas production, because it takes the RRC up to nine months to report production, because of late reporting. Which is total BS. They are using RRC data that comes from drilling info. I am a royalty owner, and any of us would be pretty upset if we did not have payment within one month on existing wells, or within two months on new wells. Late reporting of production is probably the number one reason RRC would shut down an operator. It happens, but not as much as portrayed by EIA.

The increase in production from the first month reporting and the second month is now around 350k bbls a day. That’s using both the production report and the pending data file. That is not a constant number, but it is what I currently use for my estimate using the first month reporting of production and the pending data file. It was over 50k more a couple of months ago, but goes down as RRC transfers production from the pending data file, when production is decreasing, or remaining close to flat. That’s why my estimate last month was 50k higher than EIA, and 70k over the second month reporting of RRC data. My current month estimate is always going to be a little off, because of that. However, we are only looking at about one percent on the current month estimate, as of last month. In 2016, when things slowed down, the difference between the first month and second month ran closer to 100k, and one month was zero.

I am guessing that another 100k will top off the Permian until later this year, when another 200k of pipeline will be available. That’s about all, until the fourth quarter of 2019, when the first larger pipeline could be available.

The EIA estimates average US production to be 10.8 million a day for 2018, and 11.7 for 2019. I am guessing it will be closer to averaging 10.55 for 2018, and under 11 million for 2019.

They are estimating that Permian will reach 1.2 million in increase by the end of 2019, other shales increase by 600k, and GOM will increase by 200k. After averaging around 800k for most of 2019, we may see another 200k increase in the Permian toward the last quarter of 2019. Or, we may see operators not increase much when the extra 200k of pipeline is added later this year, opting to lower discount rates, rather than increasing production. Other shales may be up 300k later next year, depending on oil prices. If they stay where they are, don’t expect anything. According to George, expect a decline out of the GOM, not an increase, and Alaska is not looking so healthy, either. So, on an average per day, EIA is probably over estimating by about one million barrels a day through 2019. Their current weekly estimate of 10.9 million may be good sometime much later.

We may see a demand decrease with all the tariff BS, and oil price increase. However, I fail to see how a drop in demand can come close to the decrease in estimated production from the US at around one million, plus the probably one million from the Iran fiasco. Canada is going nowhere fast. According to Ron, who knows a hellava lot more about SA, than I, SA is not up to the task. Batman is just a figment of the imagination, not reality.

Guym,

Are you serious? Batman isn’t real? 🙂

I imagine higher oil prices will be the result of dropping inventories as consumption outpaces C+C output by 2019, this will lead to a reduction in oil consumption and possibly an increase in output (relative to a scenario where oil prices remain at current levels or lower). There could be output increases from Iraq, Kuwait, Saudi Arabia, Brazil, and Canada in response to higher oil prices. If consumption(demand) doesn’t fall enough, prices just continue to rise until the market balances. Oil that is not produced is not consumed, high oil prices will make other energy sources for transport more attractive and hybrids, plugin hybrids, and other high MPG transportation will sell better as we gradually transition to EVs and possibly natural gas vehicles. Maybe urban and suburban consumers will demand better public transit.

Iraq and Kuwait, possibly. Although, Iraq is having some pretty serious internal problems to work through, first. As to SA, Ron, and many others think that would be whipping a dead horse (there ain’t no Batman, Virginia). Brazil has been expected to produce more for quite awhile, and still not much happening. Canada? Their pipeline problems far outstrip the Permian problems, and for them, there is no end in sight. But, I do quickly agree that the public will have strong interest in public and private transportation that is not traditional ICE, because prices will be…higher.

Article regarding Brazil. Doesn’t look like the immediate future per this article. Big time in the future after 2020.

https://oilprice.com/Alternative-Energy/Solar-Energy/Brazils-Opposing-Energy-Views.html

Supposedly a lot more rail cars will become available in the second half of this year, so Canada could see some gains in output if not profit.

Guym,

Short term I agree. Over the next 5 to 7 years we could see things change for OPEC, Russia, Brazil, and Canada as oil prices rise and see a bump up in output as more investment occurs. Also by 2020 the pipeline bottleneck in the Permian will be less of a problem and there is room for more output from the Permian, in addition other tight oil plays in the US could also increase output as oil prices rise.

So there is the potential for the market to adjust, though no doubt this will hurt the poor everywhere. Unfortunately, the poor always get the short stick.

While we may or may not be seeing peakoil, depending a lot on how the demand side goes, we might well be seeing peak exports. One way that could show up is added trouble in emerging markets that are importers – GDP declines or slowing growth, currency issues, talks of austerity, increased fuel subsidies (whatever reduces oil demand), all of which have sprung up in the last couple of months.

THE NORWEGIAN CONTINENTAL SHELF: SHORT-TERM BOOM WITH LONG TERM WORRIES

https://www.rystadenergy.com/newsevents/news/press-releases/Norwegian-Continental-Shelf-Short-term-boom-with-long-term-worries/

I think this is the first article I’ve seen from one of the consultancies that hints that the decline in discoveries might be a bigger problem than just lack of investment that will get solved in the next cycle. Norway drilling has probably been affected less than most places but discoveries have dived.

https://www.zerohedge.com/news/2018-08-20/chinese-oil-imports-iran-surge-beijing-shifts-iran-tankers-bypass-sanctions

Talk in there about Iranian Insurance of their own tankers going to China, as China completely ignores US sanctions. They essentially ignored President Obama’s sanctions as well, but there has been several years of 5+% consumption growth since then. Now they can’t even pretend to comply.

As for insuring the tankers, basically they are self-insuring, and it’s sometimes like people don’t realize the significance of what they’re saying.

Kazakhstan – I don’t know what is happening here, not heard anything??? They also seem to have a refinery down (approx -100 kb/day). The chart is for illustration of outage only.

https://pbs.twimg.com/media/DlHDn2bXsAAwPqB.jpg

Saudi Arabia Domestic Demand (crude oil + products) in June

Up +140 kb/day from May 2018

Down -250 kb/day from June 2017

Down -517 kb/day from June average (2014 to 2017)

https://pbs.twimg.com/media/DlH0QvVX4AAle1u.jpg

Saudi Arabia Net Exports (Crude Oil + Net Total Products) in June

Up +442 kb/day from May 2018

KSA mostly imported

Gasoline 313 kb/day

Fuel oil 425 kb/day

https://pbs.twimg.com/media/DlH0ljHX0AAH4k_.jpg

Saudi Arabia – Closing Stocks (Crude Oil plus Total Products)

https://pbs.twimg.com/media/DlH5KWwXoAYae96.jpg

It is noticeable how Saudi domestic demand for both electricity and fuel is receding. I can think of three reasons on top of my head; subsides on gasoline (and maybe similar products, I have not checked it) was removed in january, the economy is in recession for a number of reasons and there have been some efforts to reduce reliance on oil based power plants. I don’t know if domestic natural gas supplies are sufficient and how fast the plans to increase natural gas power plants and solar power based electricity are proceding however.

Btw, the road is open for KSA to take advantage of using Saudi Amarco’s increasing downstream presence (advanced refineries) to supply sulfur free fuel for shipping, while serving summer electricity demand based on solar panels and natural gas turbines. Wonder if they execute the plan?

What I am saying is that under reported reserves in 1970 might have led to under reported reserves in 1980.

Why? That makes no sense. What Saudi did was greatly increase their “proven reserves” in 1980, from 110 billion barrels to 170 billion barrels. When Saudi took over from the Aramco partners, they immediately, with a pencil, increased their “proven reserves” by 55% to 170 billion barrels. And since then they have increased their “proven reserves” by another 100 billion barrels. And since 1980, they have produced about 130 billion barrels of oil. Are you kidding me?

Saudi Arabia’s oil reserves: how big are they really?

Since 1980, the Saudi government has been the sole owner of Aramco. From 1982, detailed field-by-field information about the company’s reserves and production has been restricted.

Saudi Arabia began reporting to OPEC that its “proved” reserves stood at around 168-170 billion barrels of crude oil.

The Saudi figure was much higher than the 110 billion barrels of proved reserves reported by the Aramco partners a few years before.

Hi Ron,

See pages 325 to 332 of Twilight in the Desert for some of the things that have been done to increase the rate of recovery. Also note that Simmons suggests a range of recovery factors of 20 to 45% for the best fields in KSA (page 267), I just took a number in the middle for average recovery factor.

There are a number of new technologies which have been applied such as MRC wells which may result in less bypassed oil and higher recovery rates, in addition more drilling over time leads to improved estimates of total 2P reserves, in theory they should decrease just as often as they increase. In practice, petroleum engineers tend to be very conservative in their estimates and 2P reserve estimates tend to increase more than they decrease.

I don’t think the Saudis are reporting “proved reserves”, they simply changed to 2P reserves in 1980 and then in 1989 to 3P reserves. The HL for 1998 to 2017 suggests 325 Gb URR with current 2P reserves of about 175 Gb, if we assume no future reserve growth or discoveries.

I was looking at BP Statistical Review for reserves, yes the 168 is higher than the 110 proved reserves reported by the US companies, I have never believed that OPEC reserves were 1P reserves (as reported by BP starting in 1980).

The “quota wars” may have simply been a matter of these countries reporting 3P rather than 2P reserves, or using very optimistic estimates for recovery factors.

Saudi HL chart below, URR=325 Gb for estimate based on 1998 to 2017 data for annual production divided by cumulative production (aP/CP) on the vertical axis and cumulative C+C output on the horizontal axis, the trendline crosses the horizontal axis at 325 Gb which is the estimate if the output curve follows a simple logistic function.

Note that if KSA followed a logistic output function with URR of 325 Gb then cumulative output would reach 50% of URR in 2020 at an output of about 10 Mb/d.

Generally this Hubbert Linearization estimate tends to be too low as the output curve generally does not match the logistic function very well.

Dennis, I am not arguing what Saudi’s recovery rate is, or was. What I will argue is that you assumed Saudi could increase its recovery rate from 30 to 45%. I am sorry but there is not one iota of evidence that they have done any such thing.

Ghawar Oil Field

Gas injection was introduced at Ghawar in 1958. Water injection began in 1964 to provide additional pressure support. The field’s current extensive injection system utilizes water pumped via pipeline from the Qurayyah Seawater Treatment Plant which processes about seven million barrels of Persian Gulf seawater per day.

So just how did Saudi manage, since 1980, to increase their recovery rate by 15%?

Also from that same link:

The field was estimated to contain about 70billion barrels of remaining oil reserves and 90trillion cubic feet of natural gas reserves at the beginning of 2013.

So 70 billion barrels of oil at the beginning of 2013, that would mean about 60 billion barrels left today. But Saudi claimed 266 billion barrels of reserves at the end of 2017. That means that Ghawar, with 60 billion barrels is producing half their oil and the other 206 billion barrels of reserves is producing the other half. That just don’t make any sense.

Ron,

Increased recovery factor is one possibility, the other is increased OOIP, only the Saudis know the specific actions they have taken, as well as what the reserves, and output are for specific fields.

I have often seen the guess that Ghawar produces 5 Mb/d, again Simmons gave output as 5.2 Mb/d in 2003 based on a Saudi publication. Perhaps output has remained 5 Mb/d from 2004 to 2013, my guess is that this figure remains a guess.

Note that we do not know what Ghawar output was in 2013, but based on the HL estimate 2P reserves would have been 194 Gb at the end of 2012 and if Ghawar has 70 Gb of 2P reserves and the estimate does not increase in the future, that would be 36% of remaining Saudi reserves at the end of 2012.

Note that page looks like it was published in 2014, so we don’t really have an estimate for more recent Ghawar output, but if we assume output has remained steady at 5 Mb/d, we’d have 61/175=35% of Saudi 2P reserves are Ghawar reserves at the end of 2017.

We agree that the 266 Gb given by BP is too high, my estimate is 175 Gb or more and yours is 100 Gb or less. Jean Laherrere estimates OPEC 2P reserves as a whole (excluding extra heavy oil in Venezuela) are about 300 Gb less than the “proven reserves” given by BP (as of 2011), but I don’t think he has broken this out by individual OPEC producer (that I have read). If we did the breakdown proportionally, Laherrere’s estimate would be about 150 Gb for KSA 2P reserves in 2011. Assuming no reserve growth or discoveries since 2011, there has been about 20 Gb produced by KSA since 2011 and 2P reserves would drop to 130 Gb at the end of 2017 for Laherrere’s estimate, closer to your 100 Gb estimate than my 175 Gb estimate (which includes any future discoveries or reserve growth).

Also note that if reserves did grow by 1.4% per year for 20 years (or a combination of discoveries plus reserve growth) then Laherrere’s 130 Gb 2P estimate would increase to 175 Gb by 2037 (the 175Gb would be 2P reserves at the end of 2037 plus cumulative output over the 2018-2037 period.)

Increased recovery factor is one possibility, …

No, increased recovery factor is not one possibility. You cannot keep making that claim unless you show some evidence. Saudi has not implimented any new recovery techniques in the last 40 years.

there has been about 20 Gb produced by KSA since 2011…

No, I added it up. From January 2012 through July of 2018, Saudi produced 23,924,627,000 barrels of oil. Let’s just call it 24 billion. And that’s crude only, and does not include condensate, not to mention other liquids.

Also note that if reserves did grow by 1.4% per year for 20 years…

Once again, reserves do not grow. Estimates are simply revised upward. But they could, and often are, revised downward. Saudi’s old supergiant fields were revised upward in 1980 by 55% and then revised upward again by in 1989-1990 by about another 70%. Those old fields did not grow their reserves by one barrel during either of those massive increases. All that massive growth was engineered with a pencil.

Laherrere’s 130 Gb 2P estimate would increase to 175 Gb by 2037…

It simply blows my mind, Dennis, that you assume reserves will simply keep growing and growing and growing. And at 1.4% per year no less. At that rate, reserves would double every 50 years. Hell, we will never run out of oil because reserves will just keep growing and growing and growing.

Engineering is magic to you huh?

I want you to 100% verify your claim that Saudi has done no engineering or science on their fields in the last 40 years. You demand everyone else back up their claims, now it’s your turn.

I’ve worked fields discovered in the 60s and left for dead. We revived them, and recovered 4 times the initial total production. The original operators misunderstood what they had and lacked the technology to do what we did.

It wasnt BS or magic, but proven reserves did increase by 300%. This happens all the time. As geologists and engineers learn more about a field we find more. Who would have thought that diligent application of the scientific method would be so fruitful?

Do you distrust all science, engineering and medicine, or just the disciplines you don’t care for?

TinyTim, you are just full of it. The American partners in Saudi, before they sold everything by 1980, had the best engineers in the field. Back then everything was open, not a deep dark secret as it is today.

But only reserves are a deep dark secret today. Recovery methods are not a secret and never have been. What has been done, and began over two decades ago, was massive infill drilling with horizontal wells, to cream the top of the reservoir because all the old vertical wells were watering out. That is because recovery projects, unlike reserves, are performed by outside contractors who have no such reasons to keep secrets about their contracts. In fact, they want to advertise them in order to get more investors.

A few years ago they did start CO2 injection in Uthmaniyah, the field in south-central Ghawar. They said “Injecting CO2 into Uthmaniyah will boost oil-recovery rates by 10 to 15 percentage points,..” That was written in July 2015 but not a peep has been heard since then. We don’t know how successful that venture was but we do know that no outside contractor has received any new contracts for any other such projects anywhere in Saudi.

All we do know is Saudi has suddenly shut down any news of the success or failure of the Uthmaniyah CO2 injection project. The project began in 2013, so five years later we should have some results.

So TinyTim, I have told you everything that is publically known about Saudi reservoir enhancement projects. So unless you know more then let it be known or shut up.

17 years ago I reviewed development well proposals for a field in Venezuela, and approved two, the second contingent on the first one. A few weeks later I get called to a meeting where they were about to confirm the selected surface spot where the location was supposed to be built, and found they had placed it about 150 meters from a house.

I dont like ruining relations with land owners, so i told them they had better move it away from the house, and i started getting protests from the construction manager, because the spot they had chosen was ideal as far as he was concerned.

I told them to arrange a meeting with the land owner at his house, that we would go over with the construction and field managers, a drilling engineer and a geologist to jointly decide where to put the darned well.

Prior to the visit i had the subsurface team get me map overlays showing the surface topography, structure and net pay so i could put them on the legal plats and aerial photos. And i noticed there was a really good spot much further from the house, located on a flat spot with excellent drainage towards a small creek. To make it even nicer, the spot was located where the fence made a right angle, so the location would be tucked in with a property fence on two sides.

I had them give me our standard pad layout, put it on the map, and picked a spot exactly 150 of my paces from the two fences.

The day we visited the farmer we asked him if he thought the current stake was to his liking, and he politely said it could be further away on account of the noise.

Then i told him, what the hell, i think we can find a spot where theres oil, and told everybody to follow me. I picked up a long stick and started walking around, got to the fence, and walked back 150 paces, turned 90 degrees and walked 150 paces to the other fence, all the time waving the stick in the air and stomping the ground with my boots.

So i had them put the stake where i had made the turn (which i knew was a good spot after reviewing the subsurface maps), and told them the oil was there, to prepare the location, and drill the well.

Imagine the hub hub in the field when they heard i was picking a location with a stick and stomping the ground with my boots. The hub hub was even louder when several months later the well came in at a bit over 2000 BOPD, about triple our average rate. I had them so faked they started questioning whether we needed geoscientists or reservoir engineers as long as i had my stick.

That is funny! My grandfather, who had his own independent drilling company, told a story of a black box years ago. Which was retold by an Uncle who had a geology degree. Some immigrant (I think I remember Dutch) would walk around with the secret box, and point where to drill. He was successful more often, than not. He was supposed to be a local legend in Texas and Okla at the time. But, you have an oil deviner stick.

Good one, Fernando.

A friend of mine with the USGS long ago would help land owners in the Great Basin locate water wells (when the property contained an alluvial fan) by a similar show, ending one third of the way up from the center of the fan margin and saying “Drill here.” That location would be along the midline of the canyon the fan built out of, in the groundwater pathway.

Ron,

I used EIA C+C data for KSA from Dec 2012 to Dec 2017 to get the 20 Gb estimate (mistyped 2011), from Dec 2011 to Dec 2012 it’s 22 Gb. US reserves grew by 2% annually on average from 1980 to 2005. Note that I didn’t say 1.4% forever, just 20 years.

If you want a lower growth rate we could make it 50 years, then the average growth rate in reserves would be 0.6% per year.

Yes reserves do not “grow” like a tree. The reserve estimates are revised to a “larger” number. We can call it something other than “growth”, but often if something increases over time, people call this “growth”.

Of course estimates get revised up and down, but just like the stock market there tend to be more ups than downs over the long term for reserve estimates.

The Saudis have implemented many technological innovations to their fields from 1980 to 2017, Matt Simmons covered many of them in Twilight in the Desert which you probably have a copy of. I have given you several page numbers as a reference, pull it off the shelf and read.

I have no evidence that recovery factor has increased, or that OOIP has increased, only the Hubbert Linearization which in many cases has tended to underestimate URR, the HL points to 325 Gb for Saudi URR for the 1998 to 2017 EIA output data.

There might be discoveries or reserve growth, but the HL suggests about 176 Gb of output after Dec 2017.

Of course estimates get revised up and down, but just like the stock market there tend to be more ups than downs over the long term for reserve estimates.

Dennis, I cannot really believe you did not think this thing over before you wrote the above sentence. No, no, oil field reserves are nothing like the stock market. The stock market can go up, and up and up. Oil in the ground cannot. If someone is pumping it out, it can only go down and down and down. It can never go up if someone is draining it down.

While it is true that new fields often have very conservative reserve estimates and are subject to upward revisions, that is just not a quality of old fields. Old fields and all but a couple of Saudi fields are well over half a century old, have had their reserves estimated, as close as possible, many years ago. Now their reserves can only go down, never up, unless they are being recharged from the center of the earth. 😉 Of course, if you are just making up reserve numbers, with a pencil, then they can always go up.

About Hubbert Linearization, shutting down all the vertical wells and replacing them with horizontal wells, right along the top of the reservoir, will, and has, dramatically decreased the decline rate in production of those old fields… until now. That will cause the HL to give a much greater estimate of reserves than actually exist. In the next few years, you will see a definite downturn in the HL slope.

Ron,

There is a concept called “original reserves” which is the sum of cumulative production and remaining reserves. Over time the estimates of original reserves sometimes increases and sometimes decreases, but I agree it will not increase forever, it will reach some limit.

All of the things that have been done to KSA fields to increase output have been done to fields in the USL48 onshore and a Hubbert curve has been followed relatively closely (if tight oil is excluded from the HL analysis).

In short, I think you are wrong about future output from Saudi Arabia, (I believe Matt Simmons also came to an incorrect conclusion).

We will just have to wait and see, it’s more likely in my view that the HL will underestimate the URR as it has in many cases in the past at the World level, with estimates like 1800 Gb (1998), 2000 Gb (2004), 2200 Gb(2011) and currently about 2500 Gb (2017) for crude plus condensate minus extra heavy oil (possibly about 500 Gb by Jean Laherrere’s estimate).

I estimate about 100 Gb for World tight oil URR (50 Gb from US) and 2800 Gb from C+C-XH-LTO where XH=extra heavy oil (500 Gb URR) and LTO=tight oil. I assume about 1% per year average reserve growth from 2018 to 2040 with no reserve growth beyond 2040. I assume oil prices start to fall due to insufficient oil demand after 2040. This may lead to the bend in the Hubbert curve that you foresee, but it will be due to a fall in oil prices as we transition to other sources of energy that have become cheaper than fossil fuel.

All of the things that have been done to KSA fields to increase output have been done to fields in the USL48 onshore and a Hubbert curve has been followed relatively closely (if tight oil is excluded from the HL analysis).

No, that is not exactly the case. Infill drilling using horizontal wells was introduced in the USA in the early 80s, well after the US had peaked. (Before shale of course.) From 1988:

Infill Drilling Using Horizontal Wells: A Field Development Strategy for Tight Fractured Formations

Infill drilling using horizontal wells is a relatively new concept as a field development strategy. A comprehensive reservoir simulation study has been conducted to compare horizontal shale wells with vertical shale wells for infill drilling and virgin reservoir development in Wayne County, West Virginia, an area where vertical well gas production has been historically high and no permeability anisotropy is thought to exist. This study compares shot vertical wells with both stimulated and unstimulated 2,000 ft (610 m) horizontal shale wells for infill drilling and virgin reservoir development.

Infill drilling has been used extensively in the US For many decades. I have seen oil wells in Long Beach California, in 1959, spaced only a few feet apart. But those were vertical wells of course.

I am going to give this subject a rest right now Dennis. But I am preparing several paragraphs for publication in my OPEC August Oil Production post next month.

I am not sure who can claim to be the expert on oil reserves in KSA, given all the unknowns. If I were to guess the Laherre estimate of 150 Gb of 2P reserves in 2011 seems reasonable. KSA has actually produced accumulated 150 Gb by now and that means we are above 50% exploitation of reserves and that seems about where I suspect they currently are. Not counting reserves that require very high oil prices. (I am sure the Saudis have some shale oil or other reserves that I do not know of to exploit at a certain price; I suspect the neutral zone is high cost oil.) This is the point where the struggle to keep production levels begins. They are struggeling to keep a plateau and all the signs are there that the major powers know this and are covering it up as we speak. I think most of the giant fields are in terminal decline by now, but production overall is still holding up. Better recovery factory is most certainly contributing to the longevity of key fields; but if I had to guess, also fast track exploitation of minor fields found in the key North East region could be an explanation why production is keeping up. A field with a couple of hundred million barrels of reserves can be exploited with a number of horizontal wells producing from multiple oil bearing zones to give 100 kbpd for a few years before a steep decline occurs for example. And there are very probably a dozen or so minor fields around Ghawar alone; that is what the Saudis have reported themselves and if knowledge of other key basins are to be of any guidance – that is the case in KSA also.

What about the other 4 countries? The exact 100 Gb for Iraq in 1988, that just happened to be above Iran’s number was a complete fabrication on Sadam Husseins orders. Every year where new reserves exactly equal production cannot be right. Where Iran and Iraq, and even UAE, have been using IOCs (a good few of whom have walked away) there’s been nothing to support claims of continuous discoveries, growth or even small field developments – really the opposite.

My impression is that the potential in Iraq was very substantial and under exploited due to Saddam Hussain’s rule there. The fact is that there are discoveries made in South Iraq even in 2017 (Rosneft).

https://oilprice.com/Energy/Energy-General/Rosneft-Discovers-Oil-Field-In-Iraq.html