I have been supplied an Excel spreadsheet of all North Dakota wells back to 2006, thanks to Enno Peters and Dennis Coyne. I only used the data back to 2007 however. This is a wealth of information for if we want to know how many wells came on line in a given month, we simply count them. We are given the monthly production data for each month. And since we have the monthly production data we can very easily figure the decline rate of each well, or any group of wells for any month or year.

A note on the data. The first month data was almost always for a partial month. Sometimes the well came on line near the first of the month and sometimes near the end of the month. To get around this problem I have started with the second month, which is the first full month, and used that month as the first month of all my data. All data and charts below include all North Dakota wells, not just the Bakken.

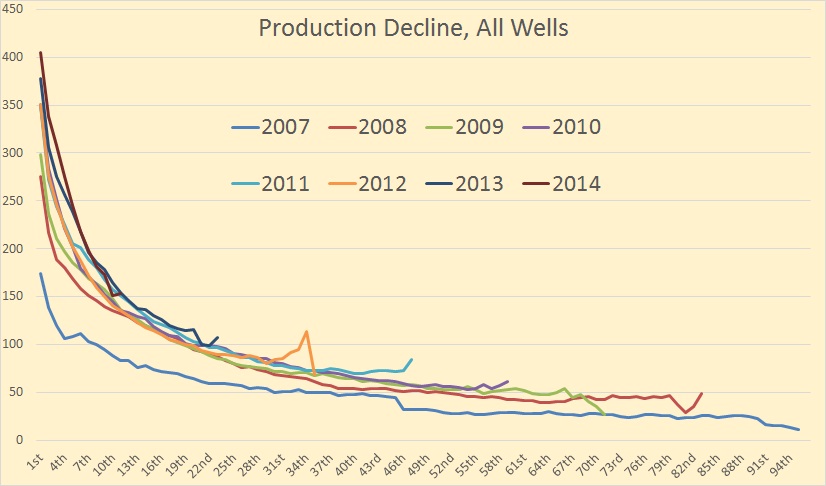

Production per well has gradually increased each year. 2014 was the highest first month production but also the highest decline rate. Note that on the first month 2014 production is 29 barrels per day above 2013 1st month and 131 barrels per day above 2008 1st month. But the 2014 10th month was 7 bpd below the 2013 10th month. And by the 13th month only 7 barrels per day separated the 2008 data and the 2013 data.

Bottom line is, though the new wells produce more, they decline a lot faster.

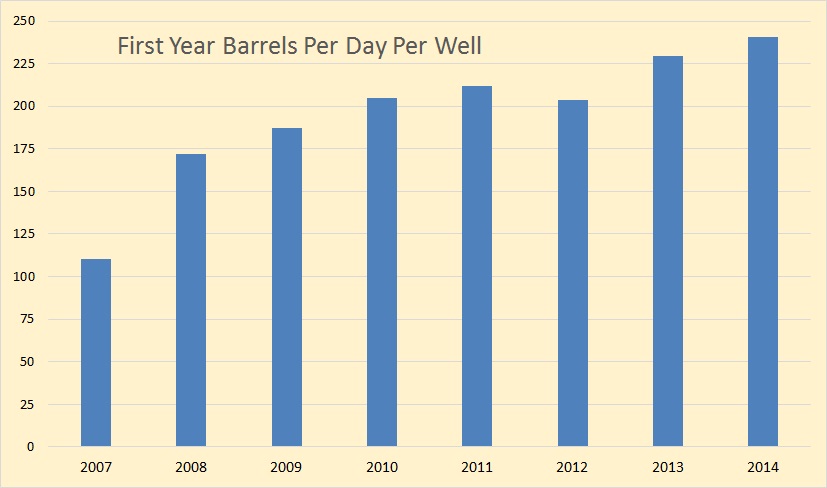

Barrels per day per well, for the entire year, discarding the first partial month and measuring the 2nd through 13th month, averaged 230 BPD for 2013 and 241 BPD for 2014. The first-year barrels per day per well has increased every year except for 2012.

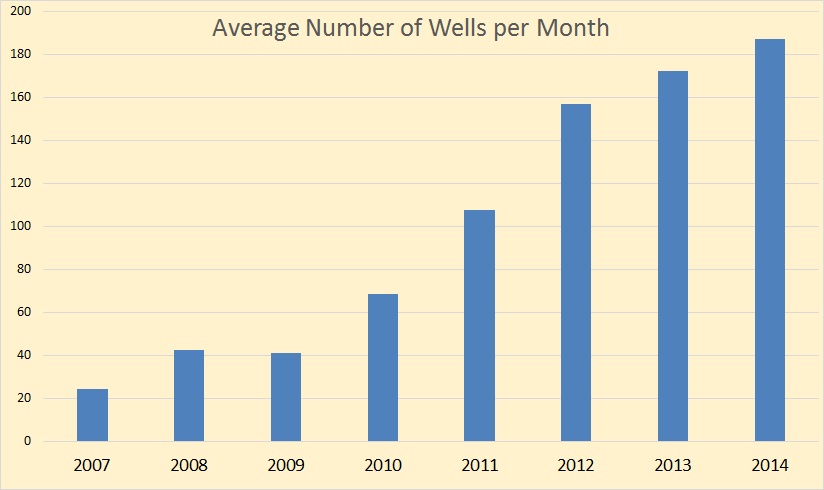

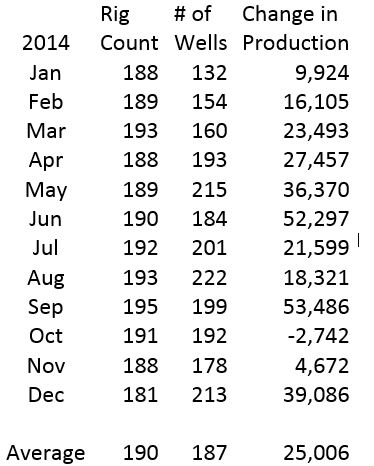

The average number of rigs per month peaked in 2012 at 218 yet wells per month continued to increase. This is wells completed, not wells drilled. Yet wells drilled have increased even more than wells completed. At the end of 2013 there were 635 wells awaiting fracking. At the end of 2014 there were 750 wells awaiting fracking. Below is the Year – Wells per Month data represented in the chart above.

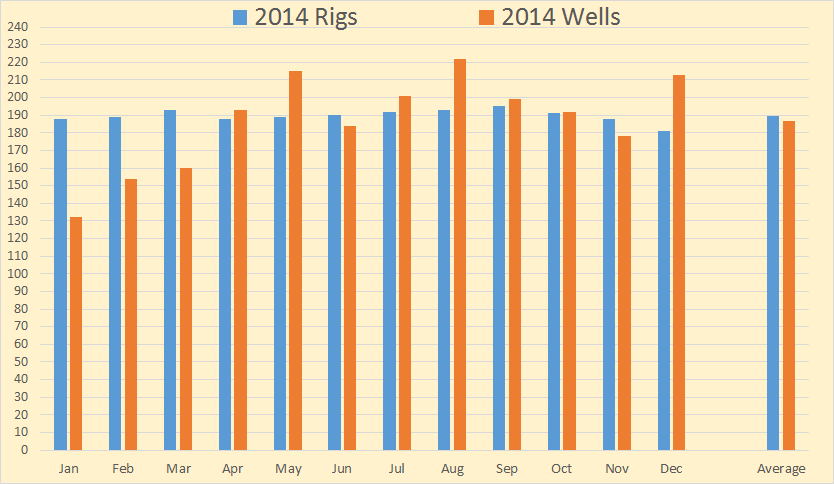

There is close to a 1 to 1 ratio between wells per month and active rigs per month. But remember there is a lag between when a well is drilled and when it is completed.

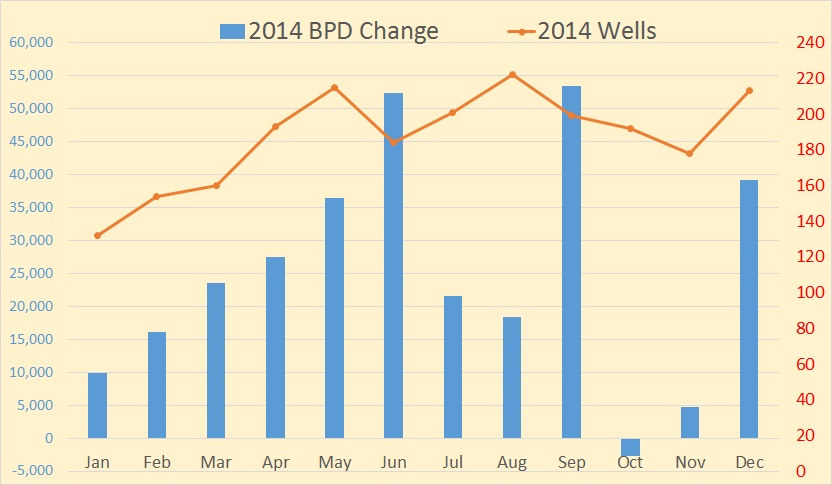

There is only a very rough correlation between production increase, (left axis) and wells completed, (right axis).

The above is the data used for the previous two charts. The production change is in barrels per day.

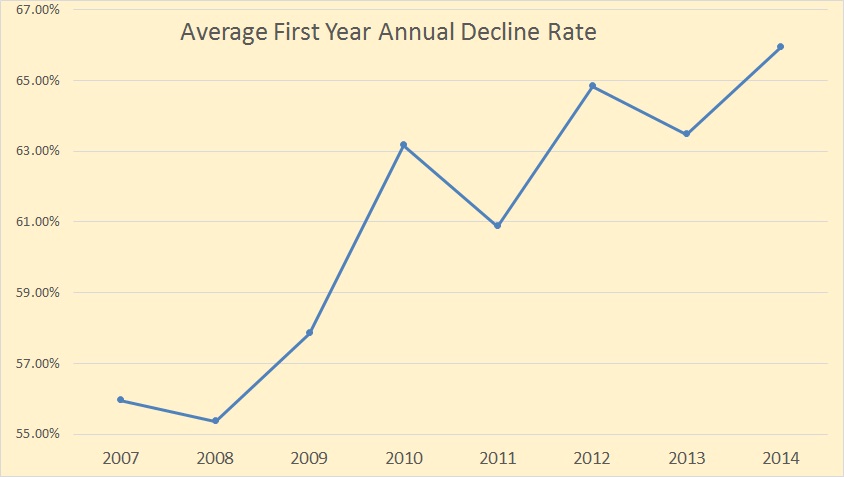

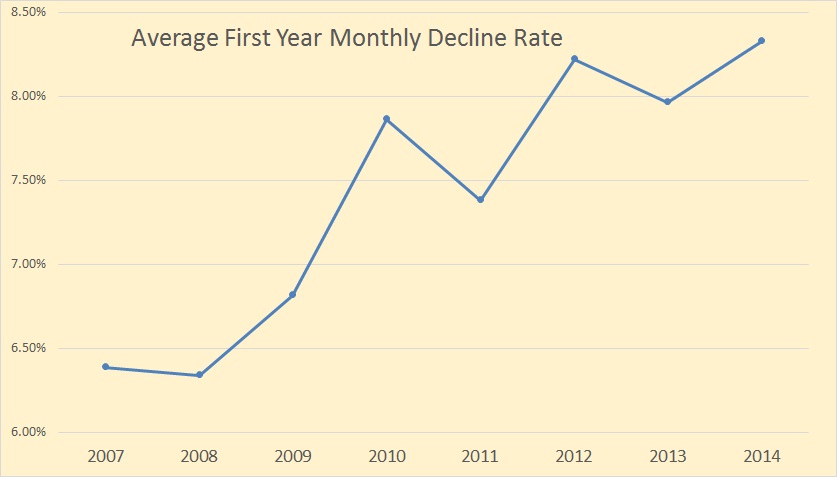

Now lets deal with decline rates.

The first year decline rate has continued to increase. One reason is the vast majority of new wells in 2014 are horizontal fracked wells where many of the 2007 through 2009 were conventional wells. But I doubt that this is the only reason.

First year monthly decline rates jumped to a whopping 8.33% in 2014 versus 7.97% in 2013. However the 2014 decline rate is only for the first 10 months as December had only a partial months data so the decline for November could not be calculated.

Also, the monthly decline rate is erratic and not exact. Some months are shut down for part of the month causing the figures to jump around. The Annual decline rates are much better but still not exact.

The question still remains is how many wells must be completed each month for production to remain flat. I have figured it every way possible and I come up with 130 wells using the data above but using the EIA’s legacy decline rate I come up with 143. But it is the number of wells fracked each month that counts, not the number of wells drilled.

There were 730 wells awaiting fracking crews at the end of December. At the end of December 2013 there were 635. From the Directors Cut for February 2014:

We estimate that at the end of Dec there were about 635 wells waiting on completion services, an increase of 125.

And it jumped 50 the previous month, November 2013. Apparently this was because of the weather. When it gets very cold it slows fracking down rather dramatically, far more than it does the drilling crews. From what I can tell February 2015 will be a very slow fracking month. I am not so sure about January.

But the point is, they could drill only 120 wells per month and but frack 150 and keep production increasing. And with 750 wells waiting to be fracked they could continue at this pace, fracking just 30 more wells than drilled, for about two years before production starts to drop. But the rig count may drop much lower. And are fracking crews suffering the same attrition as drilling rigs and crews?

On another subject, this was emailed to me a couple of days ago:

I wanted to pass on to you that a friend in management at a local NYSE listed company told me last week that wells may have to be shut in if some storage capacity doesn’t open up soon. Every tank battery, truck, tank farm, and pipeline is full.

Storage reported today, for Friday February 20, was up another 8.427 million barrels to 434.071 million barrels.

Take away from that what you will.

And then there is this. We talked about this a month or so ago but now new information and pictures are available. And be sure to go to the link below. They have a lot more pictures there:

Are Siberia’s mysterious craters caused by climate change?

Scientists find four new enormous holes in northern Russia

- Four new craters have been spotted by scientists in the Yamal peninsula, in Siberia

- May be caused by gas from underground and fear craters becoming more common due to rising temperatures

- Bright flash of light seen close to one crater which led to theories that buried gas pockets in the soil may be igniting

- Another new crater has been found less than six miles from a major gas plant and experts have called for an urgent investigation into the phenomenon

Until now, the existence of only three Siberian craters had been established when great caverns in the frozen landscape were spotted by passing helicopter pilots.

‘We know now of seven craters in the Arctic area,’ Professor Bogoyavlensky told The Siberian Times.

‘Five are directly on the Yamal peninsula, one in Yamal Autonomous district, and one is on the north of the Krasnoyarsk region, near the Taimyr peninsula.

‘We have exact locations for only four of them.

‘The other three were spotted by reindeer herders.

‘But I am sure that there are more craters on Yamal, we just need to search for them. I would compare this with mushrooms.

‘When you find one mushroom, be sure there are few more around. I suppose there could be 20 to 30 craters more.’

______________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne@gmail.com

The IEA Medium Term Oil Market Report assumes that US growth will practically be zero by 2017

See slide 5 in:

https://www.iea.org/newsroomandevents/speeches/150210_MTOMR_slides.pdf

GDP is a joke on so many levels.

“Ex-Plunge Protection Team Whistleblower: “Governments Control Markets; There Is No Price Discovery Anymore”

http://www.zerohedge.com/news/2015-02-23/ex-plunge-protection-team-whistleblower-governments-control-markets-there-no-price-d

Jef, I listened to the entire 38 minutes and 24 seconds of the Dr. Pippa Malmgren interview. She never mentions the Plunge Protection Team and her comments on “Governments Control of the Markets” is entirely misleading. Her entire argument is:

It is all done with Quantitative Easing!

She argues that quantitative easing influences interest rates and inflation rates and thereby influences the market. I cannot disagree with that but I would argue that this is a far cry from controlling the markets. Quantitative easing may indeed affect the long term trends in the market but that is not the same thing we think of when we talk about “controlling the market”.

I also watched the entire 6 minutes and 20 seconds of the CNBC video at the same link. And I must say this one was really great. I laughed my ass off at the poor damn fool they had on there claiming the Plunge Protection Team was influencing the S&P movements. And the whole CNBC crew laughed their asses off at him as well. They made the poor fool look like the idiot he was. Art Cashin called the entire PPT – S&P rumor “A pile of crap”.

What I really can’t understand is why the author of the piece, one Tyler Durden, posted this video to support his argument. What it really did was make him look like a complete fool just like the poor fool on the CNBC video.

And one more point. I have heard at least one poster over on the “Peak Oil Discussion Group”, as well as a few others elsewere, comment that the ZeroHedge web site posted a lot of crap and should not be quoted because of their tendency to exaggerate and print lies. I never agreed with them… until now.

Tyler Durden is a psuedonym for the staff of people who usually forward articles rather than write them.

ZH has a history of error. They also have a history of excellence. And they have a history of paying their bills with sensationalism.

They are the best financial blog going. Certainly the most widely read. Not much different from DrudgeReport, but with a focus on money. In contrast, CNBC’s viewership numbers are falling.

In contrast, CNBC’s viewership numbers are falling.

In contrast, CNBC’s audience would be a huge multiple of ZH’s readership.

CNBC shares a a viewership with Bloomberg Business Chanel. I don’t know which one is gaining or losing audience but Bloomberg is a late comer to the business and did trail CNBC by a wide margin. I don’t know where they stand now but I see CNBC quoted and linked to far more often than Bloomberg.

The recent numbers are 215,000 total and 40,000 (for the 25-54 demographic) for daytime CNBC viewership — the lowest recorded viewership since 2005. Can’t be good for ad rates.

No idea of ZH ad rates. Eyeballs are stickier reading articles, one supposes, than glancing up at a ticker walking to an airplane gate.

Just scrolled down the ZH list and found most read count for articles in the single digit thousands, no nothing is on there of a blockbuster subject today, and the articles scroll off in a few hours. Given everyone uses ad block, no idea what this means for revenues.

Watcher nailed it here.

Zerohedge is incredibly useful so long as you read it with the knowledge they have an agenda. It is the penultimate site for bearish news. The data is accurate, but selective and with narrowly defined analysis.

Prime example: recent posts on the Bulk Dry Index. The data is there, but the analysis leaves out factors such as overproduction of ships, radically reduced fuel costs (the primary cost of shipping), and other nuanced factors that reveal it is largely, although not fully, explained by factors unrelated to immediate global economic Armageddon.

Combine an oversupply of ships with significantly reduced costs and you get a competitive collapse in shipping rates through competition. Since these factors go against Zerohedges agenda, your perspective will be highly flawed if you:

A) Use Zerohedge and websites with similar agendas as your only sources of info (likely due to an innate desire for what psychologists call confirmation bias)

B) Take the info and analysis presented at face value without seeking equivalent amounts of data and analysis from websites with opposed agendas

Zerohedge points out legitimate data and nuances in that data that you will not hear from any other news source, and does it in real time, as it happens. This is only beneficial if it is a small, knowingly biased, piece of your own personal daily research.

As a side note, Tyler Durden is a reference to Fight Club. “Tyler Durden” does not exit as an individual, but as an idea. The book ends much differently than the movie (thank you test audiences), but Zerohedge and its use of Tyler Durden is appreciably comical (or insanely brilliant depending on how self-aware they are of their bias) to anyone who knows how it all ends.

The character Tyler Durden rips you from your facile, complacent understanding of the world. Tyler Durden changes you; there is no going back – typical Joseph Campbell hero’s journey stuff . BUT his worldview is revealed as being just as displaced as the real main characters complacent view.

Tyler Durden ends up being just as ideological and irrational as the main characters original materialistic life. The truth lies in-between. I cannot figure out for the life of me if the crew behind Zerohedge gets this and runs with it, or is completely oblivious to the fact that they fulfill that narrative.

That being said, Zerohedge and Tyler Durden are incredibly useful, but only from a skeptical distance.

Hopefully others can expand on or reveal their misgivings with this view of Zerohedge and its role. I sincerely wish I knew if the sites content contributors, collectively known as Tyler Durden, see the irony.

I hung out there for five years, although I’m not part of the typical ZH demographic – in any way.

The “articles” with hard statistical information can sometimes be interesting; everything else is pretty much either sensationalistic click-bait, or repetitive essays on how economics and society “really” work.

The comment section is inane.

Mr. Rose, of the several thousands of comments I have read over the years, yours ranks, IMHO, at/near the top in lucidity, comprehensiveness, and accuracy.

As a longtime ZH follower, the past few years – particularly after the sale of the site – have seen a decline in quality and a drift towards commercial (monetary return) bias.

Still, it is an up to the moment source for financial happenings.

As to your comment on ‘confirmation bias’, it is so true of so many sites on the net with the seeming result of more entrenched positions being “validated” by readers as opposed to differing views prompting a continual evaluation of affairs.

To have the internet promote the growth of a worldwide, cyber version of the two grumps in the balcony from Sesame Street would be a tragic/comedy of vast proportions.

I am sure you understand that corporations borrowing near 0% money and buying back record amounts of shares, driving up share price then selling high is not productive.

“Claims about the Working Group generally propose that it is an orchestrated mechanism that attempts to manipulate U.S. stock markets in the event of a market crash by using government funds to buy stocks, or other instruments such as stock index futures—acts which are forbidden by law[citation needed]. In August 2005, Sprott Asset Management released a report that argued that there is little doubt that the PPT intervened to protect the stock market.[11] However, these articles usually refer to the Working Group using moral suasion to attempt to convince banks to buy stock index futures.[12]”

Hi Ron.

I don’t believe in authoritative sources like CNBC pretends to be. All so called authoritative sources have an underlying BAU agenda. I think Zerohedge is a good source for lots of unfiltered news. Finding the truth is work, but at least there is some truth to be found there.

For example, here is something I posted about a zerohedge story:

Here is something really interesting:

War And Petroleum Reserves

http://www.zerohedge.com/news/2015-02-2 … m-reserves

“In the interest of analytical balance, we would do well to consider the possibility of war strategies when it comes to the global stockpiling of petroleum reserves. In the years leading up to the German invasion of Poland, the world witnessed dramatic decreases in the price of oil as well as massive increases in petroleum inventories, especially as the Texas fields began to produce.

These shifts in the global oil markets ran parallel to the deflation which had begun in October, 1929, and as such, we can see the same pattern repeating today as oil prices collapse, inventories are growing, and world wide deflation is deepening.

Whether by design or not, the lack of reduction in crude production around the world, and the growing stockpiles which isn’t slowing down, will only mean further decreases in the price of oil.

The growing deflation will obviously drive down the demand for petroleum products even further, while at the same time decreasing oil prices will continue to feed the deflationary pressure from the opposite macro position.”

It looks like Old farmer mac’s Leviathans are gearing up for war! The historical parallels are chilling. I love the part about US production leading the way into a glut back then too.

Lots of automatic mechanisms are lining up to set the stage for WWIII:

Exponential Growth ->

Overproduction ->

Crash ->

Massive Productive Capacity Overhang Prevents Growth ->

Deflation ->

Oil Glut ->

Lot’s of Excess Fuel for War ->

War ->

Productive Capacity Overhang Eliminated ->

Exponential Growth Resumes

It seems that WWII averted a collapse by eliminating the overhang in productive capacity, creating room for economic growth. Can WWIII do the same thing for us today? I think peak oil will mean that history only repeats itself up to a point. But who knows? I don’t think we will have to wait much longer to find out.

———-

The short article basically takes Catton’s ecological perspective and applies it to what we can see developing in the world right now. I think it is totally fascinating. And you will never see anything like that on CNBC.

Futilitist,

You are right, I won’t see anything like that on CNBC. And the folks at CNBC don’t know a lot of things. There are just a whole lot of things they are not authorities on. But there is one thing they are authorities on. And that is how the market works. They know what the Standard & Poor’s Index is and how it is traded.

And in particular, there is one person at CNBC who knows everything there is to know about the S&P Index and how its futures are traded. That person is Art Cashin who has, for many years, traded the index, on the floor of the exchange, himself. And when Art Cashin says that the idea that some Plunge Protection Team can run the index up and down at will is a pile of crap it, by God, is a pile of crap. And when some yahoo who has never set foot on the floor himself claims that the index can be manipulated by a bunch of guys in the White House, then that yahoo is full of crap.

When ZeroHedge agrees with that yahoo, they are way, way out of their league. And, they are full of crap also.

Gotta say, as I read this I was hoping you would name Art Cashin as that guy. He is 90% of the reason is ever tune in to CNBC. He never gives ultimatums, and generally has a “we’ll see what happens with this” attitude. A true pro who understands no one will ever truly understand day to day, week to week, and even month to month moves in the markets.

Instead of saying “this means this and WILL DEFINITELY lead to this” he says “I’d figure this likely means that, but my knowledge is as limited as the next guys, so I’m probly just as wrong as everyone is”.

He has a monk-like appreciation for the understanding that he’ll never understand it, and doesn’t get his jollys from having to validate his often wrong (as is true of everyone) interpretation. In that sense, he doesn’t ever really have a solid interpretation, mostly a “this is interesting, let’s see what happens” king of mentality. Love that man.

Hi Ron.

I think you and Art Cashin are right about the whole plunge protection team thing. It is a pile of crap.

Thanks Futilitist and Brian,

The S&P Index is an index of 500 stocks. The index is computer generated from the price of those 500 equities, several times a second. Of course the S&P futures trades either at a premium or discount to the actual index, by a few points, depending on the sentiment of the market.

If the futures price moves too far from the actual index then computer generated arbitration programs kick in and pulls the futures and the index back closer together. That is the computer will either buy or sell a basket of stocks on one side and the futures on the other side, and close the deal out a few seconds later when the two come back together, locking in a profit. It is computer generated programmed trading. Nasty but it happens all the time.

Now the point is, there is no way in holy hell that a group of nurds in the White House can manipulate the index because it is tied to the price of 500 different equities. They would have to buy or sell many millions of dollars worth of stocks then unload their positions at some time or another, and very likely losing a few million in the process. It would be almost impossible to make a profit under such circumstances.

The government is not allowed to buy stock, except in certain bailout cases which are authorized by Congress. So there is no way in hell any “Plunge Protection Team” could possibly run the S&P index up or down, or stop a plunge if one happens. That is just a stupid rumor created by people who don’t know diddly squat about how the market operates.

The Refinery Yield chart, showing the product yield as API gravity increases, is shown below. As I have previously pointed out, note the large decline in distillate yield, just going from 39 API to 42 API (labeled as “Condensate” on the chart). It looks like the distillate yield drops from about 25% at 39 API to about 10% at 42 API.

I have previously wondered if condensate and light crude represents an increasing percentage of US C+C inventories, and I think that ratio of the condensate price to WTI spot price would tell us a lot about the US demand for condensate, if anyone has the data.

For the week ending 2/14/14, C+C inventories were 362 mb. Four week running average C+C inputs were 15.2 mbpd. Estimated four week running average US C+C production was 8.1 mbpd, and net crude oil imports were 7.5 mbpd.

For the week ending 2/13/15, C+C inventories were 426 mb. Four week running average C+C inputs were 15.5 mbpd. Estimated four week running average US C+C production was 9.2 mbpd, and net crude oil imports were 6.8 mbpd.

The question is, why are net crude oil imports imports still so high, given the inventory build? If condensate represents an increasing percentage of C+C inventories, one would presumably expect to have seen condensate prices dropping more than WTI, percentage wise.

Because of declining production, Mexico no longer has sufficient domestic light/sweet crude oil production to meet the domestic demand from refineries designed to process light crude, so they are going to have to start importing light/sweet crude, although they remain a net oil exporter.

And the question I have asked before is, wouldn’t the following comment by the Pemex CEO be representative of the feedstock needs of refiners in the US too?

Mexico’s Pemex aims to start importing light crude this year (2014)

http://uk.reuters.com/article/2014/08/28/mexico-pemex-idUKL1N0QX2TL20140828

Hi Jeff,

I believe the Canadians need some of the condensate to dilute the bitumen so it will flow in pipelines, it may be that Venezuela also needs condensate to dilute their extra heavy oil from the Orinoco.

The net crude (C+C) import number would incorporate condensate exports.

Hi Jeff,

I wonder how the dilbit is counted by the EIA. In other words if all condensate that goes to Canada is mixed with bitumen and then comes back to the US, then the net imports of condensate would be zero.

My main point was that there is some demand for this condensate from the Canadians, though we are probably producing more condensate than they need. The Eagle Ford alone produces roughly 300 kb/d of condensate, for all of Texas C+C about 11% is condensate and if we assume that applies to all of the US (it is likely to be lower than this for all US output) then there is about 990 kb/d of US condensate output.

If we assume about 2 Mb/d of bitumen are produced and the diluted bitumen requires about 40% condensate, then all of the condensate currently produced in the US would have a market in Canada to be mixed with bitumen to produce dilbit (diluted bitumen). This assumes the condensate is not recycled but gets used in the refining process along with the bitumen.

Hi Jeff,

Texas condensate is about 14% of Texas C+C output(not 11% as I mistakenly said above) so if we assume this also applies to the US as a whole we would have 1270 kb/d of condensate output rather than the 990 kb/d, I calculated before. The actual US condensate output is unknown, but may be between 1000 and 1200 kb/d. If 2 Mb/d of bitumen is produced, Canada would need about 1300 kb/d of condensate if all of the bitumen was shipped as dilbit in pipelines.

Well with the Keystone XL pipeline vetoed we won’t need as much dilbit.

Doug,

Even most of the railed Oil Sand oil, is Dilbit. Some is railbit, with less condensate, but very little is strait Bitumen, as these require heated and insulated tankers, though some capacity is/was being built.

But shipping dilbit by rail is so simple and efficient! All you need to do is drop the concentration by up to 33%, for up to 50% more total volume shipped, and when you get to the refinery spend vast amounts of energy boiling this 50% out of solution in a very expensive high-tech refinery, and then you can ship that 50% back to where it came from and put it back in again! Simple and efficient!

All very much more simple and efficient than, say, heating up the rail cars before you unload them.

Blaine,

I note a lot of sarcasm in you note. But I will ignore that.

Most of and all of the the large projects are north of the Athabasca River. As I understand it there are several pipelines under the river but no railway bridge over it. So the vast amount of the oil is shipped south to Hardisty Al. which is use as a distributions point such as Cushing Ok is used in the US.

Some of the smaller player truck their oil to rail sidings, but these are for manifest loads, not unit 100 car trains. There are plans to strip the condensate out of dilbit at Hardisty. From memory I believe that one is actually under construction. I am not sure of the separation process, but I am sure some form centrifuge would be used.

Unless a rail bridge is built over the river, then raw bitumen to rail car is not possible.

Took push, there are several options, but the most efficient scheme involves using a very light diluent. In Venezuela’s large projects (technically led by Exxon, Total, Arco, and ConocoPhillips) the agreed solution was light naphtha diluent to achieve 18 degrees API using the 8 degree API field crude. The naphtha is separated using a distillation tower, and shipped back to the field.

I heard PDV is purchasing Algerian light crude to blend, but this is shipped all the way to the refineries abroad.

A centrifuge can’t separate a hydrocarbon stream. We can separate the asphalt using a pentane or similar light hydrocarbon mix, but that yields a product that looks more like a black piece of glass.

Thanks Fernando,

I was only guessing at the process, but I know they are actually building a plant to strip out the diluent in Hardisty.

http://navigator.oilsandsreview.com/blog/diluent-and-crude-rail-dilbit-railbit-or-neatbit/

I am not finding it easy to actually find information on the process, except for DRU for upgraders and refineries.

The optimum heavy blend (diluted bitumen) is 18 to 19 degrees API. This requires ~20 to 30 % diluent (it depends on the diluent API gravity).

Depending on the refinery or upgrading design the feed stream can be introduced into a pipe still and the light ends removed to be shipped back to the field. The heavy ends (the pipe still bottoms) can be fed to the coker. The coker cracks the crude, turns about 20 % into petcoke and the remaining 80% is taken on to hydrogenation and cat cracking as needed.

The long term answer for the Canadian crude is to upgrade it using a nuclear powered upgrade heater with cogeneration. But that’s exotic technology.

Just how hot does most of the equipment at an oil refinery run? I am guessing at anywhere from ambient to maybe five or six hundred F.

I know about the enormous amount of heat dumped into cooling water or towers at nukes but not if a nuke can be operated in such a way that the coolant is hot enough to use it to run a heavy oil refinery.

It seems to me that you are saying the coolant IS or CAN BE sufficiently hot by mentioning cogeneration.

In that case the nuke could generate electricity to support local nearby communities and maybe some more for the oil companies plus some for transmission to any city near enough to build a transmission line.

But maybe the tar sands operations use enough electricity to make full use of a nukes output of BOTH electricity and heat?

OFM – how hot???

On this wiki page:

http://en.wikipedia.org/wiki/Fluid_catalytic_cracking#Reactor_and_Regenerator

they have a nice schematic of a fluid catalytic cracker, with the temps and pressures (in deg. C and bar gauge – 1 bar approx. 1 atmosphere).

cat feed is a high boiling fraction from distillation,

boiling at around 340 deg. C (644 deg. F).

Distillation isn’t much hotter, or you start to clog your distillation column, etc. with coke due to thermal cracking.

The regenerator runs the hottest, as it is making heat by burning coke off the catalyst = 715 deg C is 1,319 deg. F.

The main part is at 535 deg. C (995 F).

There’s a schematic with some temps of the primary distillation at:

http://en.wikipedia.org/wiki/Oil_refinery#The_crude_oil_distillation_unit

It shows firing the crude oil feed at 398 C (748 F).

Note that an oil refinery typically has enough junk, either like butanes (4 carbon molecules) at the light end or really heavy crap (>= 30 carbons per molecule) to burn to power the process; and they do a lot of heat exchanger use to optimize things.

(one of the issues with refineries is the “turn around” where they do, among other maintenance items, cleaning all the heat exchangers).

But a tar sands bitumen upgrader is more of a cracking plant (thus the expense), since the bitumen is “all” heavy stuff,

mostly too heavy to distill at atmospheric pressure (to boil it would require heating above cracking -> coking temperatures), so they have to use vacuum distillation in upgraders, then crack the different heavy streams into something useful.

http://en.wikipedia.org/wiki/Upgrader

http://en.wikipedia.org/wiki/Vacuum_distillation#Vacuum_distillation_in_petroleum_refining

An ok schematic-ish drawing of what the innards of a tray type industrial distillation column (that would make up the main distillation step at an oil refinery) is like is all the way down at the bottom in fig. 5 of:

http://en.wikipedia.org/wiki/Fractionating_column

… wouldn’t the following comment by the Pemex CEO be representative of the feedstock needs of refiners in the US too?

Umm, no.

What happened was that as Mexican production expanded, they mostly built refineries to use the light oil, and exported most of the heavy and more difficult oil to the US. Hence the decline of Mexican production leaves Mexico with a shortage of light crude oil and the US with a shortage of heavy crude oil. Additionally, the US built refineries to use Venezuelan extra heavy crude, of which output has been declining as well, although there is still plenty of that in the ground.

The US has a glut of light sweet crude, especially on the Gulf Coast and in in the Midwest. This is exactly what Mexico needs for their refineries.

You can run light sweet crude through a refinery designed for heavy crude, but you end up being choked waiting for the distillation column, with the rest of the refinery mostly sitting idle. It’s not economically efficient. So the US has kept importing heavy crudes to the Gulf Coast, even though it’s illegal to export the light sweet crude which is piling up there.

So, some refiners need light/sweet crude and some need heavy/sour crude. Do ya think?

The question is, who needs more condensate?

Your comment is totally irrelevant to the point I was making (as evidenced by the Pemex CEO’s comment about condensate), to-wit, refiners really don’t want or need more condensate (generally defined as liquid over 45 API gravity).

Interesting chart of API gravity versus sulphur content for global crude oils (note the API cutoff):

Those light condensates still have only a few percent lighter than C5, and are just about perfect feedstock for making gasoline. Yes, as has always been the case, you lose some to C4 and lighter when running catalytic reforming of the heavier components when improving octane. Yes, there’s a glut of C4 and lighter at the moment, but condensate is still selling for around 80% of what gasoline sells for, meaning that someone at least doesn’t find the condensate useless, even if one not especially nimble national oil company doesn’t want it.

Yes, there’s currently a glut of gasoline relative to diesel, but this is a sharp reversal of the long-term trend, and unless oil from shale continues to grow very rapidly is unlikely to continue at the same rate. Extra-heavy oil converts to a high fraction of diesel when the residual fuel is coked, and the long-term trend in conventional crude is definitely towards heavier.

We’ve seen a lot of diesel cars in Europe, and fuel efficiency has gone up more for gasoline engines because they were less efficient in the first place. However, longer-term gasoline is still a perfectly acceptable motor fuel, even for large trucks.

Which brings us back to the same point, t0-wit, that refiners like Pemex need crude oil feedstock, not condensate.

Jeffrey, Can you explain cat feed ? Petro chemical feedstock?

Thank You for your work and best regards,

Philip

I assume it’s heavy hydrocarbons used as inputs for cracking (thus the considerable decline in cat feeds going from 39 to 42 API gravity):

http://en.wikipedia.org/wiki/Cracking_(chemistry)

Thank You Sir, For your answer.

Since you first posted this chart some months ago, I don’t think people really understood that it is more important than just about all else we examine.

You don’t even have to get above 45 to lose your food growing and transporting diesel.

Can you explain why it is important?

All that I can see is that condensate (higher API) produces a lot of gasoline, and that heavy oil has a low API.

It’s the yellow colored snippet. That’s diesel and kerosene.

Jeffrey,

I have been asking myself this question too. Your suggestion that LTO and condensate do not satisfactorily replace imported crude seems reasonable. If so, then once US storage becomes full one would expect LTO and condensate price to fall relative to WTI and equivalents. Presumably this could lead to a rapid reduction in new shale oil well production and subsequent fracking.

Or condensate exports will be allowed. The usa government has irrational energy policy.

These charts show that fracking is turning into an exact science. Whatever resources that can be extracted is getting extraced as fast as possible. My guess is that while EUR of each well is improving, the improvement is only marginal.

Companies are not completing the wells maybe because of this reason. If you frack it, you will get most of the oil in the first few months which you have to sell into a low priced market. they would wait for the prices to recover. This also means the rig count is going to drop pretty fast to the 50 – 60 range (in ND); and stay there for a while till oil prices rebound.

Having made these observations on topic, I am now open for some generic doomer porn.

As noted, the backlog of drilled-awaiting-completion well totals has been increasing for a period of time predating the price fall.

It is one thing for it to be increasing when the driling crews are working at breakneck speed and an entirely different thing for it to be increasing when the rig count is crashing. If the completion crews were working as fast, we would be seeing a rapid decline in the wells awaiting completion. At the very least, it should remain constant.

Thirunagar, not much was changing in December. The rig count was 181 and fracking crews were still working full force. 213 wells were completed in December!

Why don’t you just wait until the January and February numbers come in then start spouting your cornucopian bullshit.

Sure!

Yes very interesting data indeed, thanks a lot to Ron for that, and was asking myself the same question about the EUR or the evolution of the total production of each well.

New ones start higher decrease faster but for instance the 2013 curve goes below the 2014 one around the eight month, would be interesting to also have the total production on 2 or 3 years (or longer for the older ones) per “starting year”.

As a retired accountant, I think that unless there is some law of physics that overrides [such as a drilled well HAS to be fracked within X # of days, or it is worthless], it is pointless to frack wells in ND at these prices.

I have read, that in ND they have 12 months to complete the well after drilling. Not sure what the penalty is?

“The barrels per day per well has increased every year except for 2012.”

Hi, Ron.

Excellent article, as usual.

One detail: I presume that you meant to say, “The first-year barrels per day per well has increased every year except for 2012.”

According to ND-DMR, the average barrels per day per well has decreased to around 130 from the high of 144 bpd in mid-2012.

Yeah, I just made the correction. Thanks

Hi all,

A small clarification on the data from the NDIC which Ron used. Enno Peters is the person who should be thanked, my involvement was simply to forward the data file that Enno provided to Ron.

Thank you Ron, for your excellent analysis of the NDIC Data provided by Enno Peters.

One question:

Is the data in your post for all North Dakota wells or did you separate the Bakken/Three Forks wells from the rest of the North Dakota wells in your analysis?

The data is for all North Dakota. I used all the data and did no separation. I have updated the post to indicate this.

Apache’s comments on completing drilled but uncompleted wells from Q4 2014 Transcript (Feb. 12 – Not very fresh though)

“We will come into 15 with a pretty deep backlog of wells and we have pushed a lot of those completions back, because quite honestly, we’ve got to get the completion cost to come in line as well. So we are going to very methodically push those back. If I can defer those, see the benefits of lower completion costs and then bring those back on and potential higher price environment and later there is a big win there. So we’ve got the benefit this year of having a backlog of completions and we can spread those out and it’s kind of how we planned it.”

“Well in terms of completion backlog we’ve got – that’s kind of at our disposal as to when we would complete those wells and obviously if we’re an under 50 and prices have come on down and we will probably get some of those on and may choose to wait and see an increase in price when we go ahead and complete some of those wells.”

http://seekingalpha.com/article/2913806-apaches-apa-ceo-john-christmann-on-q4-2014-results-earnings-call-transcript

This is something I have been wondering about for a while now. If fracking is so expensive why would anybody in their right mind bother to “complete” a well unless they absolutely had to? After drilling has been completed, what is the maximum length of time that can be allowed to elapse before it is fracked? If I were in the business I would slow down all drilling and completion activity to the minimum rrequired to hold on to the leases or whatever, until the price rises to a level where I can realize a profit. That assumes that existing assets can generate enough cash to keep me afloat.

That’s what I interpret Apache to be saying.

Alan from the islands

And, for example, EOG on same regard

Q4 2014 Results – Earnings Call Transcript

(Feb. 19, 2015)

I will now explain in further detail how we plan to prepare for the oil price recovery. First, we will reduce average rigs 50% down to 27% for 2015 and intentionally delay any of our completions, building a significant inventory of approximately 350 uncompleted wells. This allows EOG to use rigs under existing commitments and when prices improve we will be poised to ramp up completions.

Oil price improvement of even a few dollars generates incremental MPV. So delaying completions and wait for improved prices as evidenced by the forward curve will add significant value. Please see Slide 8 of our investor presentation for a play specific example.

Yes certainly, we’re deferring these completions because we do believe that prices will be better in the future and even at $10 increase in oil price gives us a significant additional return on our investment and NPV upside. So, really our rate of return focus and our capital return focus is really what’s driving the deferral. And let me kind of walk you through, there is two parts of this deferral, one is as Gary said we’re starting out 2015 with about 200 uncompleted wells in our inventory and that uncompleted well inventory will grow throughout 2015. And if oil prices improve and they look something like the forward curve in the $60 range then we would begin completing many of those wells starting in the third quarter of 2015 and that would reflect additional growth in the fourth quarter heading into 2016.

http://seekingalpha.com/article/2931896-eog-resources-eog-ceo-bill-thomas-on-q4-2014-results-earnings-call-transcript

In other words, they can stiff the fracking companies more easily than the could the drill rig companies. The frackers must not have had the same magnitude of cancellation penalties in their contracts.

What does the spreadsheet look like if there is an oil price decline for a few years? Suppose Russia and KSA want them destroyed and underprice their oil, regardless of quantity? There is nothing novel or unusual about a big competitor under pricing his products to destroy competition. Happens all the time.

They might not have contracted as far ahead on Fracking as they did on drilling.

The big boys might bankrupt the little ones but they are not going to be able to keep people from working the tight oil patch AND keep prices up at the same time.

The amount of money it takes to get into drilling and Fracking a few tight oil wells say half a billion to a billion is peanuts in terms of the big picture. The drillers will be back with either borrowed money when the price goes back up – or else they will be working AS EMPLOYEE of people who don’t NEED to borrow money.

There is a very successful furniture company still operating near my home after eighty percent or ninety percent of the domestic competition has folded.

The OWNER often has meeting and tells his employees that since his family has ALWAYS put the profits back in the company rather than chasing other opportunities the company doesn’t owe ANYBODY a dime except for whatever it has bought within the last thirty days.His philosophy is that if somebody else can make money renting a warehouse to a furniture manufacturer then he can save money by owning his own warehouse.

There will be plenty of people out there who have enough money in hand to go back into the tight oil fields when the prices go high enough.

And this time around – most of the smoke hiding the real costs of operation and the real production figures will have blown away. The new people going back in won’t be idiots unable to work up a budget. If they were then they would not HAVE half a billion or more on hand.

OK, but you haven’t looked into the issue of financing ehough

The companies holding leases for the shale oil are mostly heavily leveraged; a bunch of them are about to default on their debt. So, assume that they go under due to temporary low prices. And since they aren’t paying the drilling rig guys, and they aren’t paying the frackers, a bunch of those companies will lay off workers and shut down.

Now, who’s going to replace the leveraged leaseholders? New borrowed money? No. The investing world is starting to wake up to what a risky, dangerous, and generally bad bet these companies are.

New equity? Sure, a few people will go into the tight oil fields the next time prices spike… but a lot of people will be more sensible, because they know that *prices can crash again before they finish the wells*.

And here’s the kicker: with the drill rig operators and the frackers having laid off a bunch of their skilled workers, who will have gotten other jobs, the price for going back in is going to go UP.

Yes, the smoke and mirrors of the shale oil boom will have blown away. But when the wealthy look at what’s left… the sensible will have the sense not to invest. ExxonMobil’s entire exploration expenditures for the past decade have been unprofitable!

Basically, the shale oil boom depended on fly-by-nighters taking advantage of the wishful thinking of oilmen. This was actually the explicit business plan of Cheseapeake Energy.

Hi Ron,

I’ve been working on this exact dataset for my job since the latest release of Director’s Cut. Our numbers are in broad agreement – we solved the ‘first peak month’ problem by searching for the peak month then multiplying by the average ramp-up factor to provide a first month figure with peak in the second month. All this means our average well has a higher initial production – the profiles look basically the same.

What is interesting to note is that if completion rates remain the same as last year, but rig rates hit Lynn Helms’s estimates (average rigs for 2015: 140 – we make this ~1500 producing wells for the year), average daily LTO production will rise less than 50kbpd this year (presumably as ND conventional sinks), and will be essentially flat in 2016 (assuming an average WTI of $55 this year and recovery to $75 next).

We know, as another poster has stated, companies expect to radically slow their completion rates to preserve production for higher prices. This may well mean a sharper drop in the early part of this year – I have no data on just how quickly completions can be done, other than the max month for completions was last year with 270 in one summer month.

It is also interesting that the dataset shows Harold Hamm’s promises to his investors to be difficult to achieve, to put it mildly. He recently promised them 188 wells with an average 30 day initial production of 855 – if you search by operator, you’ll see that less than 5% of CLR’s existing wells fulfil this criterion, for a grand total of 41 wells. CLR has consistently performed below Bakken average wells.

Hi gwalke,

Is it possible to post the average well profiles that you have or is it proprietary?

Thanks for the information. Does Ron’s 130 new wells per month estimate to keep output relatively flat sound reasonable? I get something a little lower (about 120 new wells per month if the 2014 average well profile does not decrease in 2015).

Hi Dennis,

It’s proprietary I’m afraid. But, yes, Ron’s 130 is definitely in line with what we have – our estimate of ~1500 wells in a year is an average of ~125 a month, and remember “our” wells have better 30 day IP than Ron’s (and maybe yours). This accounts for the fact that we see a slight growth in 2015 average bpd, and very small decrease in 2016 despite assuming a price recovery, whereas your 2015 is flat. I assumed that our 1500 wells in 2015 follow the 2014 profile that we have.

It is also worth noting, if you are attempting a production forecast for the whole Bakken, that you will need to make an allowance for confidential wells, if you haven’t already.

The dispersive diffusion decline model applied to Ron’s data chart

http://imageshack.com/a/img661/4388/MCcfLm.gif

DC, so much for the “proprietary” analysis — no need for that stuff, as it is likely substandard in any case.

graph rendered

Hi Webhubble telescope,

If you are interested in the data file, just shoot me an email. The dispersive diffusion works quite well especially after 12 to 24 months, the early part of the well profile matches the hyperbolic a little better, but the high b needed eventually must give way to an exponential decline when the well decline reaches about a 10% annual decline. Nice chart.

DC, The tail-end is when we the Ornstein-Uhlenbeck process gets invoked. This cuts the tail into an exponential decline.

Talking about “proprietary”, look at this comment from a climate blog today

No wonder we can clean up in the analysis realm. No one else is doing it, and if they were they wouldn’t be sharing!

Mr. Web, it will most likely come as a big shock to you, sir, but 99.9999% of the oil and natural gas industry does not have a lot to share with you, or the rest of the world, about the peak oil analysis “realm” because it simply does not give a rats ass about it. We are in the business of finding the nasty, 80-150 million year old stuff down there in the dark, miles below the surface. Once we find it, then we have to get it out of the ground, economically and safely, so people like yourself can sit at the computer all day long and predict the end of oil. Guessing about the future is not our gig. That’s YOUR gig.

Who are you to be getting in a chicken fight with a reservoir engineer with 40 years of worldwide experience, like Fernando, about diffusional flow, whatever the hell that means? How many barrels of oil has that “theory” gotten you into the stock tanks over the years?

My industry does lots of research. We are not “backwards.” We are full of brilliant, highly educated, imaginative men and women who make things happen.

I could not do what you do, sir. I respect you for that. On the other hand, with only a high school education, I would embarrass you in about 5 minutes with the things I know, that you don’t know, about the oil business. I mean flat out, red face, embarrass you. I’d have you back in the pickup by 9 am in the morning wanting to go home to mama.

So what?

Humble up, man. Don’t look down your nose at my industry. You don’t know shit about it.

Mike

Needed to be said.

Oh please, spare me. As long as this is all proprietary info, it’s all talk and no action.

This is a numbers game and unless you know how to do the math and physics, you won’t get anywhere with hand-waving.

Yet, it is also entertaining to see someone get so defensive about seeping black goo.

I know shit.

What research have you done? Do you have any examples of industry led research?

“Col. Jessep: *You can’t handle the truth!*

…You see Danny, I can deal with the bullets, and the bombs, and the blood… What I do want is for you to stand there in that faggoty white uniform and with your Harvard mouth extend me some fucking courtesy…” ~ A Few Good Men

Mike,

An excellent insight regarding the oil and gas industries focus on production in the micro, not the macro.

The industry and its suppliers spend money on engineers to analyze data to locate reserves, do a cost analysis, and produce them. It’s R&D focuses on refining current technology and creating novel groundbreaking tech for more precisely locating and more cheaply exploiting resources.

From your perspective this is probably so obvious that it doesn’t even bear mentioning.

People on the outside, especially people like me and this community, look at the overarching macro trend in cumulative data, and tend to think each player INSIDE the industry MUST see where this leads. When really your average petroleum geologist is spending their days researching very small, specific geological formations, and pinpointing a cost/benefit analysis on that micro scale.

The industry on the individual, person to person, level finds snowflakes and their unique structure. Us outsiders look at a field of snow and see a completely different reality.

We tend to ignore all the nitty gritty details you insiders know, and you insiders tend to ignore the overall picture because it is a waste of time and money for an oil company to pay people to research the prospects of peak oil. They pay people to find and exploit reserves and refine the technology to better accomplish that goal, not to hypothesize about the machinations of industrial civilization, global decline rates, exports, etc.

We have much to learn from you – we looked at the past data and said “look, peak must be happening!”

Your industry said “The past should not be used to define the future, new tech does happen, and higher prices do bring tremendous quantities of reserves into production”

The future always lies in between the two: Past trends should act as a starting point for anticipating the future, but the bulk of our conclusions should be dependent on analyzing the myriad of reasons why the future of production will be detached from the historical trend.

No, Nick, I am not insulted by the possibility of climate change; I have no idea where you got that. I am concerned about it, same as you, actually. Forgive me but anybody getting their feathers ruffled about cartoon depictions of Al Gore needs to get out of the house more often.

I don’t like snooty people who feel they might be intellectually superior to others. Its a particularly annoying form of arrogance to me. Most of those kinds of folks can’t close a wire gap without getting confused. I like doers, not dooes and most of the doers I know are humbled up about life. I took offense to the insults directed at my industry, then towards me, personally. If the initial implication was that the oil and gas industry is “backwards” with regard to climate change “research,” that may indeed be right. I did not get the memo that says I have to research climate change just because I produce hydrocarbons. I don’t understand the association. Like guns, I guess, the oil business does not cause climate change, people do.

The same holds true for peak oil analysis; I did not get that memo either. Why is it the oil and gas industry’s responsibility to society to research and predict peak oil? Its not, of course; its our business to keep producing the stuff. I am quite certain that EOG does not have a peak oil research division.

I think that lots of smart people have determined that the shale oil industry embellishes the truth with regards to EUR’s, etc. The shale oil industry’s business plan was flawed from the start (the # 2 rule in the oilfield is never borrow money to drill wells) and then the unthinkable happened, oil prices went down. Now they are sucking hind tit. What’s the rocket science in that? If Americans are feeling duped all of a sudden, they shoulda been paying attention.

Shale oil production represents less than 5% of worldwide production. The probable ultimately recovering from shale resources in America was never going to have an enormous impact on peak production rates and it absolutely was never, ever going to keep us out of a bind. Yet, that’s about all anybody can focus on is shale oil decline and shale oil rig counts and shale oil this and shale oil that. People take all this shale oil stuff way too seriously. CLR cutting their Bakken budget, or whether it takes 19 days or 23 days to drill one of those stinking shale wells, means squat in the big scheme of things.

By the way, Nick, I am all the above kind of guy with regards to energy.

Mike

I know more about the industry than you do, Mike.

Hands down, I could embarass you in five minutes.

This is not intended to be rude; take it in the spirit in which you gave your comment.

And I have nine words of advice for you, since you seem like a decent guy:

Get out. Your industry is dead in 20 years.

(Make sure you can provide for your family by moving into an industry which isn’t dying.)

The problem is, indeed, that “oilmen” think of their job in a very micro fashion, as being finding and extracting oil. This is gonna bankrupt all of your companies. Basically every dollar ExxonMobil spent on exploration in the last 10 years was wasted. Investors *notice* this sort of thing. And from the financial end, the companies collapse *suddenly*.

Web,

I assume you have no direct interaction so I’ll allow your ignorance to to slide, but to those in the industry calling it “seeping black goo” is as silly someone getting defensive about it. The exploration and production of hydrocarbons is a science. I am a scientist, not a witch. The seeping black goo doesn’t power your life because I put a spell on the ground to make it rise, it is a viable source of energy because thousands of geologists, engineers, and chemists devote their lives to the SCIENCE of hydrocarbon production.

As you said, there is some information that the industry keeps proprietary for the sake of competition, just like every other industry on the planet. But there are also thousands of papers that are available to those outside of the industry. OnePetro.org, AAPG.org, PetroWiki.org, and many others provide scientific papers on geological and engineering data from the industry.

If you don’t understand stuff about the industry then fine, I’m sure I don’t understand most of what you do. But insulting people like Mike, who has a vast amount of knowledge that he is providing people on this site for free, is not the way to expand your knowledge of the industry.

If learning about the industry is something that you want, then ask. There are plenty (or at least a couple?) of industry people here that I am sure would take the time to go into more detail then a simple comment can do. But being rude will give you the exact opposite result and turn the people who actually have experience with what is discussed here away.

Oh, and I am sure that you using the handle ManBearPig is not insulting to Al Gore.

Spare me the threat that some dude will leave this site because he was indirectly offended by locker room talk on my part.

Hi Mike and ManBearpig,

I am happy that both of you and gwalke, Fernando, and others share your knowledge here at Ron’s blog and I enjoy learning from you guys. Thanks.

Web,

My name stems from the fact that I happened to be watching that particular episode of South Park the first time I commented on this blog. It has nothing to do with my views on Al Gore, climate science, or anything else. I have often thought about changing it since I know it could be taken to mean something that it doesn’t, but have decided not to so it was easy to tell what I have said in the past and who I was. If you honestly find my name insulting, I can easily change it.

But all of that is besides the point. You are insulting the work and knowledge of people who are contributing to this site, and it is unneeded. There is nothing anti-science about people keeping company information confidential so they can keep their jobs. As I said before, there are plenty of sources of information that you can look to for data that are in the public domain. If you find the information provided to be unsatisfactory, then do the research yourself. And if your aren’t going to, at least tap the breaks on the rudeness. If you are a jerk about what you say, even if it contains good content, no one is going to listen to it.

I simply referenced a comment from another site by someone called AnOilMan, who I know to be an analyst in the oil industry.. The extent of my criticism was that unobtainable proprietary research results are worthless to me.

If you honestly find my name insulting, I can easily change it.

I’d guess that’s a good idea. You don’t want to wear a political sign if you don’t have a strong desire to send that message.

You could imitate corporations that buy other companies and change their name: transition with a new name on the back, then move it to the front, then drop the old one.

Nick, what difference does it make how ManBearPig refers to himself when he posts? He is clearly a learned geologist who has found his way around the Permian Basin in W. Texas, one of the richest producing oil basins in the entire world, in good fashion and who is occasionally willing to share his knowledge with all of us. What he contributes here is important to a better understanding of our hydrocarbon energy future. Its a peak oil blog, not a peak battery blog.

It is unusual to have someone like ManBearPig, who is actually in the oil business, with real life experience, engaged in a peak oil blog. I am sure you if you were to ask him he would say he is not an “oil analyst,” whatever the hell that is, just a guy who has found a lot of black goo in his career. How could anybody with an ounce of brain matter not respect, or appreciate that?

I knew a mud engineer down in Cameron one time by the name of Al Gore. Wasn’t much of a hand, really. Couldn’t keep his viscosity funnel unplugged. Claimed he invented top drives. We use to have to duck tape his hard hat on his head so they would quit blowing over the rail. He was bad about polluting the Gulf with his hard hats; must have lost a dozen over the rail the couple of wells I worked with him on.

Last I heard he was shucking oysters in Morgan City and living in a double wide. If that’s the guy y’all are yaking about, good grief.

Mike

what difference does it make how ManBearPig refers to himself when he posts?

It makes a difference to him. He said so: “If you honestly find my name insulting, I can easily change it.”

WebHubTelescope thought that it was insulting. He said: “I am sure that you using the handle ManBearPig is not insulting to Al Gore.”

And, I think any reasonable person can see that there’s a strong political statement to the name ManBearPig. I actually hadn’t heard about it before yesterday, but the Southpark episode it came from is clearly meant to insult Al Gore and the whole concept of Climate Change. Imagine if it was a something similar aimed at someone you respect – for instance, if you like Ronald Reagan how would you react to a name like “Ronnie Raygun”?

So, if the person going by ManBearPig doesn’t want to insult anybody, he should change his name.

—————————————————————–

Now, I think there’s a different question here, which is that I get the impression that you’re feeling insulted by the idea of Climate Change.

All I can say is that I don’t think any of the people here who feel that Climate Change is an important problem harbor any disrespect for hardworking oil industry people like you.

Of course, they’d prefer that the oil industry had an open mind about things like Climate Change – some companies and people do, of course, but not all.

MBP,

I’m eager for your thoughts on something I’ve been debating with myself. I’d really appreciate any insight you might have.

We often have all this talk about the price at which fracked oil can be produced. What are your thoughts on how much the “break even” price point is dropping through the combination of better tech, economies of scale (on both the “fixed cost” of infrastructure now being in place and variable costs such as larger contracts with equipment suppliers driving down prices per well, rig, water truck, rail car, etc), and any other factor you think adds to this.

All new industries start with high costs that decline significantly over time. A reasonably comparable example would be falling costs of TVs even as they become more advanced.

Feel free to speak a bit loosely since this is all theoretical. It seems like this will combine with the consolidation of less efficient companies as they’re bought out by larger, more efficient ones during this lower price period.

To me it seems like the cost of fracking could decline significantly over the next few years, and we may be shocked to find a situation where we can frack the less fruitful non-sweet spots for $45.

That being said, just because the fracking boom may draw out for longer than many here expect that certainly doesn’t mean total barrels produced will keep growing, just plateau and decline at a slower than expected pace.

Please, anyone and everyone give your thoughts on this line of reasoning. Thank you all!

Brian,

That is the billion barrel question. If you create a situation where the process of fracing is economic at $45/bbl, you move hydrocarbons from resources to reserves. As far as exact amounts of reduction, I’m not sure I’m qualified to quantify that. My job is finding the hydrocarbons, I leave it up to the engineers to get it to surface.

Now, obviously that is an exaggeration as I have some insight into the engineering world, but I would not call it my area of expertise; so take what I say with respect to it with a grain of salt.

Processes like changing from geometric to engineered fracs, optimizing the proppant, understanding maximum stress and preferential permeability of the formation for horizontal placement, more accurate geosteering, better contracts with service companies, new technologies, as well as many others increase the value to the producer and decrease relative break even price. Will these costs continue to decrease over time? Yea, I’m sure they will to a certain extent. I just have a hard time seeing $45/bbl be economic for unconventional wells. You would need basically a 50% reduction in cost, which may happen, but someone smarter then I will have to tell you where that could come fr0m. I’m sure in the future economic costs could be lower then they are now, but if $45/bb is your goal we have a long way to go.

Mr. Rose, a couple of data points …

Whiting announced yesterday that they intend to keep drilling AND fracturing/producing wells throughout 2015. They indicate that their efficiency will allow profitable extraction even at current low prices, something no other operator appears to be able to do. The specifics of their completion process includes using a Coiled Tubing conveyed Bottom Hole Assembly Tool that may be starting to ‘revolutionize’ this aspect of the frac process.

The current, online issue of drillingcontractor.org has a piece -dated 1/27/15 which describes several cutting edge technologies that are enabling so-called ‘intelligent fracs’ when operators effectively employ them.

The North Dakota DMR site’s main page has a link to their several presentations. (The ‘North Dakota Update’ presentation, dated 8/6/14, is a wealth of info, easily taken in with numerous graphics and aerial photography – some of which was displayed recently on this site by Mr. Nolan).

The 1/9/15 presentation has, on slide 29, an extremely informative view of the Bakken’s entire 60 day IP output displayed in short color-coded dashes. (In his Drilling Deeper work, Mr. Hughes used a similar graphic but his oversized dots were not nearly as clear as the DNR’s slide).

If one were to look at that slide 29, Mr. Rose, and extrapolate BOTH a reduced cost to drill and complete, AND a much more extensive recovery from each well, the number of bright yellow/white dashes would increase significantly.

One final note, and on this Mr. Patterson has clearly expressed a contrary view from my own … EOR.

The Bakken, and other shale formations are in the process of having a massive infrastructure consisting of tens of thousands of wellbores – each being one to two miles long, and located within 300′ to 1,000′ from one another – being built right this moment. The research work being done by the EERC folks in ND, as well as many, many more throughout the world, will definitely show results in years to come, with this upcoming summer’s pilot test being eagerly awaited by many.

Thanks for judging my work sight unseen. I happen to agree with you re: the closed nature of research in the oil industry – see my comments on CLR, for example. If I was running the consultancy I’m working for, I’d be at liberty to release the work I’ve done. As I’m not, and I like my job, it remains under wraps. Saying the work is substandard without seeing it is hilariously prejudicial though.

Of course it is substandard because it is not visible to us. If I had a bunch of research findings and I had to rank them, yours would go into the circular bin. That automatically makes it on the bottom 50% and by definition makes it substandard, where the standard is being able to actually apply the research.

Kind of humorous that “roughnecks” are so sensitive to mild banter on my part.

Just because it is not visible to you, it does not follow that it is substandard. Kind of humorous that that’s your idea of logic.

I produce something people in the world need, Mr. Scope. I am fiercely proud of that.

We are intellectual equivalents, you and I. In the future you may please address me as Mr. Roughneck.

If it wasn’t for the inscrutability of those that work in the oil industry, this forum would be unnecessary.

In the case of a tie, the winner is the guy that gives away the stuff for free. Google The Oil Conundrum

Clearly I don’t have a dog in this fight, but it is a complex world out there and becoming more complex by the day. I work for a government agency and once upon a time I thought that because of that my employer was the American Taxpayer and I my highest duty was to make everything that I did available to the general public as efficiently as possible. Then sometime in the mid nineties and accelerating after the turn of the century there have been rather large budgetary constraints put on the research infrastructure and funding forcing us to look to ‘industrial partners’ to fund a significant fraction of our work. This funding always comes with strings usually regarding disclosure. But I can say from personal experience that the quality of the work done under the cloak of non disclosure agreements is just as good as that done in an open environment. At least from our end. Painting proprietary work with a broad brush questioning its quality is a mistake. Living on both sides of the issue involved in both proprietary and peer reviewed research I must point out that the peer review process is not without profound flaws that are evident to anyone who is a participant. I would certainly prefer that we lived in a world where there was an open sharing of scientific information. But we don’t. That is in my view a bad thing. But it is not the fault of the researchers nor is it a signal that the research is inherently flawed. It is just an impediment to general scientific advancement.

I find the whole discussion about names and handles highly amusing and given that I gave up the idiot box cold turkey about forty five years ago I had no idea at all about MBP being an insult directed at Al Gore who is probably actually a pretty decent guy and one who does have a working brain.

All those evenings spent reading good books for the last forty five years plus a few hundred more as a child HAVE resulted in my having a somewhat exaggerated opinion of my own intellect no question. But not such an exaggerated opinion that I chose a handle like WHT. 😉

Gore would be a lot better spokesperson for environmental responsibility if he would walk the walk to a greater extent.

It does occur to me that a guy who decides to use a handle like WHT just might have somewhat of a high opinion of his own abilities and just might as a result get ribbed a little when he presumes to question somebody else’s internet handle.

I am unable to judge myself in this case(having mostly forgotten what calculus and statistics I learned close to fifty years ago and which might not have been enough in any case ) but I remember what Yogi had to say about Mickey waving his bat at the outfield fence.

” It ain’t bragging if you can do it.”

Maybe WHT really can see to the far corners of the universe as well as a few miles down into the Earth. I am reserving judgement.

But so far all the actual predictions I have seen made using his stuff -just here and at the old TOD site – seem to indicate than the people using the same old same old are predicting pretty much the same thing.

But new knowledge of any sort may well turn out to be extremely useful at some point. NO research is ever wasted if it is placed in the public domain and I salute Mr Telescope for doing so.

Honestly.

Some of us will remember what Edison said about his work on the electric light bulb after approaching ten thousand failed experiments.

paraphrased

I know eight (?) thousand things that DON’T work.

Even if the oil shock model turns out to be fatally flawed it will still be useful work in that it will save somebody else from having to repeat the same mistakes.

The origin of the name is a merging of the lawyer Webster Hubble and Hubble Telescope. A nonsense name that goes back over 10 years ago.

‘It ain’t braggin’ if you can’t do it.” That’s exactly right, OFM; well said. That comes from cracked hands and lots of callouses, I know.

We have a saying about Texas weather, which I am sure is the same in your pasture; if you don’t like it, wait a minute and it will change. After 50 years of making a living producing oil and gas, the minute you think you have something figured out, you don’t. It will change, then confuse you for the next 3 years. It’s dark down there, and hard to see. Nobody has Mother Nature figured out. Nobody. Trying to make the oil business an exact science is like pissing into a strong north wind. It always ends up on your boots.

Thanks, Brian. And Gerd. SW.

Y’all don’t run the guys off like MBP and Push and Fernando; there the ones that keep it in real. If you want to know about the future, listen to them. Its not anything like you read on websites, trust me.

Mike

Hi Webhubbletelescope,

Gwalke’s analysis may be excellent, it agrees, as far as I can tell with the analysis that Ron and I have done, and hopefully the work I have done is not substandard, and in my opinion, Ron’s work is outstanding.

The trash talk really is not helpful. Gwalke is bound by the agreements with his employer and I am happy he is sharing what he can here.

On the subject of petroleum engineering Fernando Leanme has likely forgotten more than I will ever know about the subject.

Clearly he is not an expert on climate change, but then I am not either.

Put me in the “lets hear more from Mike, toolpush, man bear pig et al and less from webhubble” camp too. Unfortunately on the web one person with an attitude can ruin things for everyone else. Personally I have learned to read some posters and tune others out, that’s the only way to survive on the web.

The anti-science faction has always been strong, going back to the TOD forum.

I prefer to call it the anti-a***ole faction.

I have been here all the time, and what you are reading into what I said is not so much negativity on others work, but positivity on what I do.

All the work I have done is open and you can get it from my blog, which is linked in my handle.

A couple of blog posts:

http://contextearth.com/2013/10/06/bakken-projections/

http://www.theoildrum.com/node/10221

A white paper on diffusional regimes is available from the menu. And of course if you want to consume a treatise, check out the online PDF book The Oil Conundrum. This has a new section on Bakken.

Nothing is proprietary.

Mr. Web, Gotta thank you for being the spark for a somewhat humorous preceding ten minutes of reading comments.

Pretty much any regular reader must recognize the extent of your negativity coupled with the targeting of the hydrocarbon industry in particular. Mr. Roughneck, MBP, gwalke and others not only work – and I’m certain labor long and hard – in a field that you view askance, they have chosen to give time to this site for the educational benefit of us all.

Setting aside any ‘psycho babble’ regarding what lies behind your demeanor, I would like to see, if possible, more details of your work in that it apparently aligns with real world results. While I can guarantee that my understanding would be limited, there are many here far more gifted than I who could possibly benefit from seeing your work. Unless, of course, there may be some proprietary restrictions.

see comment above.

Mr. Web, I just read and re-read your two links from down below. The exchange between you and Luke H on TOD link was fascinating as, to a non-science bumpkin such as moi, his clear as drill mud description of flow NOT being random (although the fractures/paths may be), it rather MUST flow to the lower pressure area provided by the horizontal wellbore seems kinda self-evident. If those guys standing near the well head 10,000 above the enclosed production tubing let’er rip with no choke restriction, my understanding is the approximate 8,000 or so psi differential from topside to bottomhole would kick those little oil molecules in the ass towards the wellbore with no randomness whatsoever.

All seeming frivolity aside, sir, your final response to Luke H was a little perplexing … to wit

“Without direct evidence that the flow is not random, the best we can do is look at the empirical flow rate of a typical well”.

Way above my paygrade to pass judgement on your work, Web, but the legions of oil-industry fuzzy heads may boast a fair degree of proficiency of their own.

Diffusional flow, no doubt. The flow is a random walk through a maze.

Lithium ion batteries are also largely diffusional flow because of the enclosing random matrix that the ions have to travel through.

That’s the way nature works.

Dennis, my “130 wells to keep production flat” was based on an initial first months 2014’s increased production of 25,000 barrels per day above legacy decline. In other words, how many wells does it take to produce 25,000 barrels per day. I come up with 130, give or take 5 or so. I have 2014 first months production at about 407 barrels per day. But notice I was using the first full months production, which was actually the second month.

The unknown here is the actual legacy decline in barrels per day.