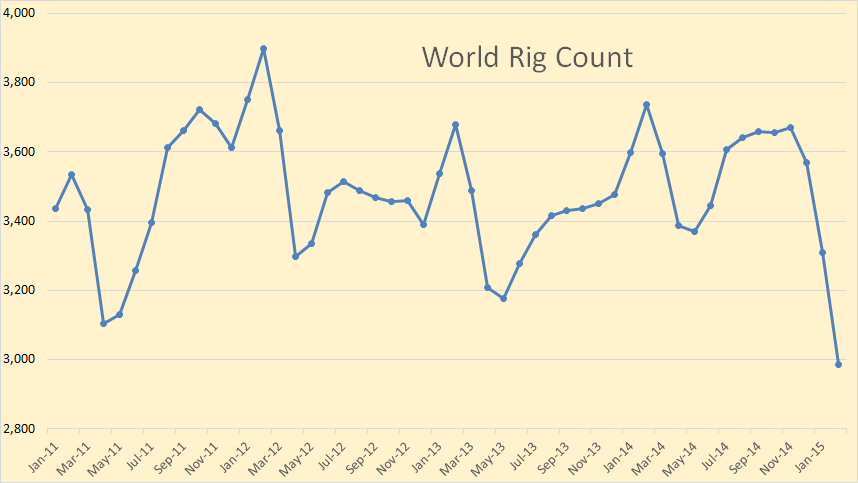

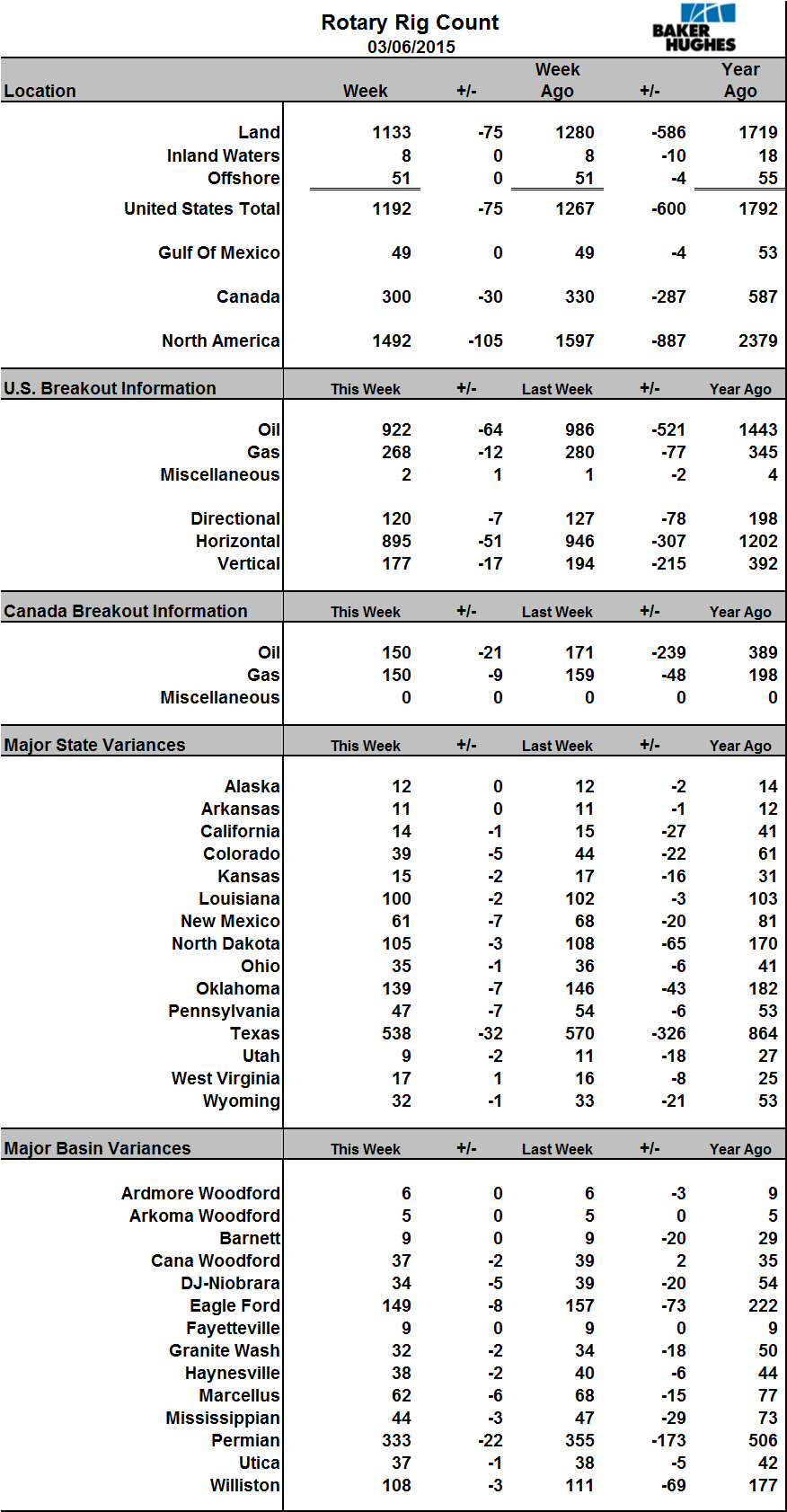

The weekly Baker Hughes Rig Count for North America and the International monthly rig count is out. In the charts below the monthly data is through February 2015 and the weekly data is as of March 6th.

World Rig Count, counting oil, gas and miscellaneous rigs are down 684 rigs over the last three months. The annual spikes you here are caused by Canada.

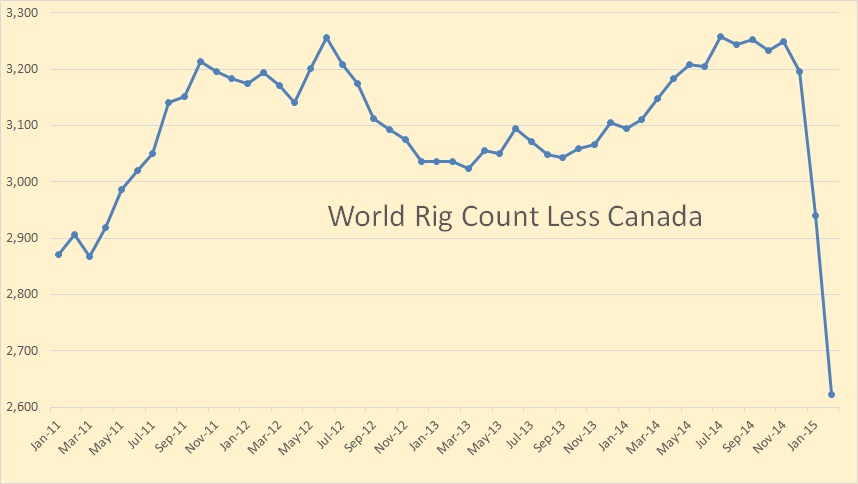

Removing the seasonal Canadian spikes gives you a better picture of what is happening to the world rig count.

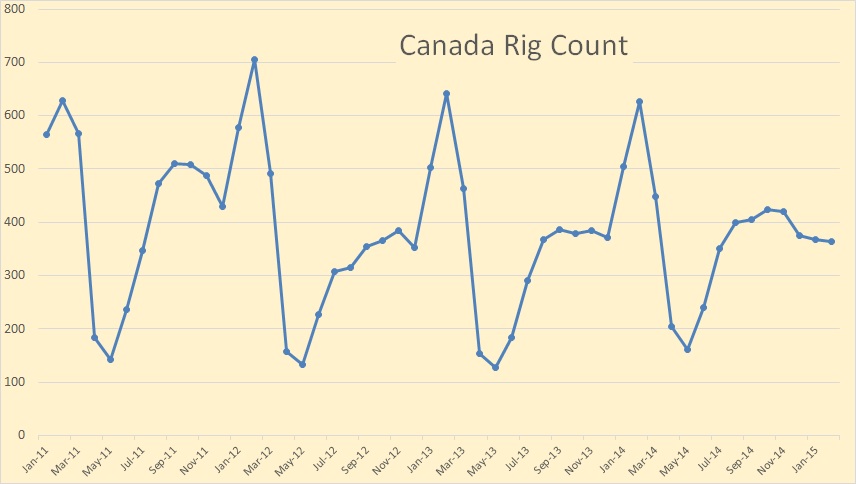

This is the first time since before 2000 when the Canadian rig count did not peak in February.

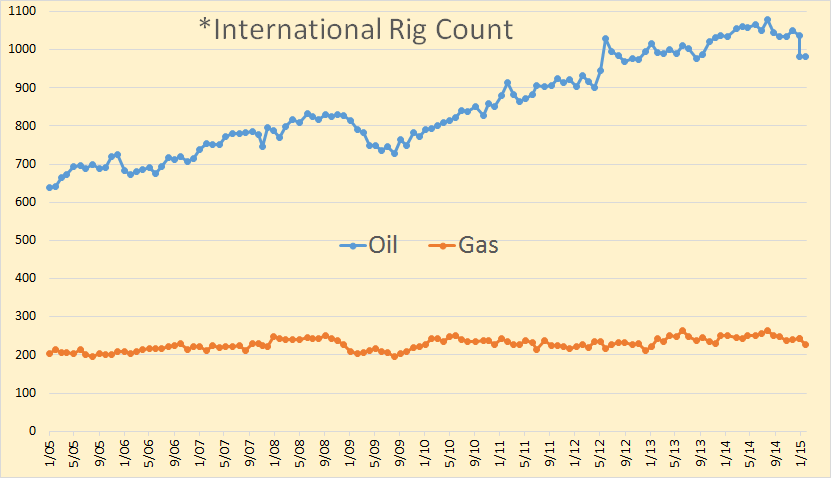

The International Oil Rig Count is down only 67 in the last three months but was unchanged from last month. It now stands at 982. *The US, Canada or FSU countries are not included in this count.

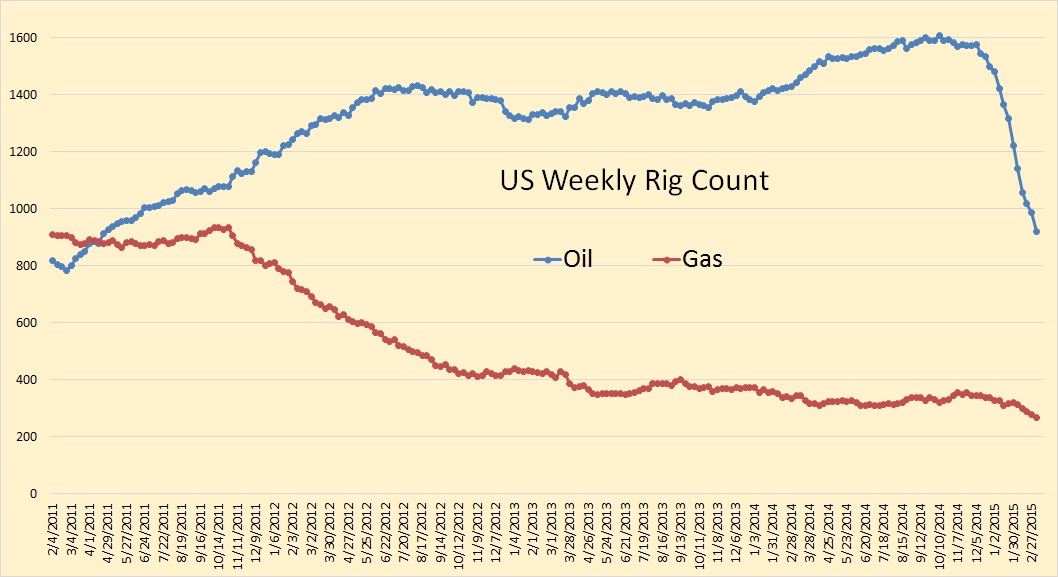

Four years of weekly rig counts shows how dramatic the rig count has dropped. The US total rig count stood at 1920 as late as the first week in December and has dropped 728 rigs to 1192, a drop of 38%. From that same date oil rigs have dropped 41.5% and gas rigs have dropped 22%.

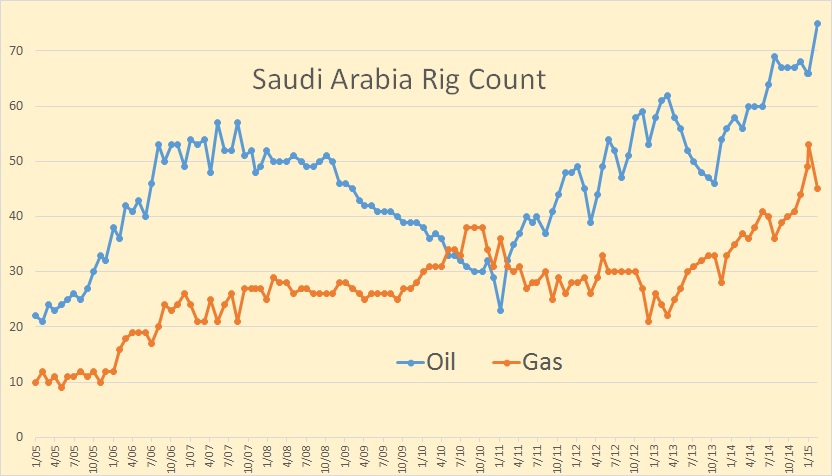

Saudi oil rig count jumped by 9 to 75 in February while the gas rig count fell by 8 to 45.

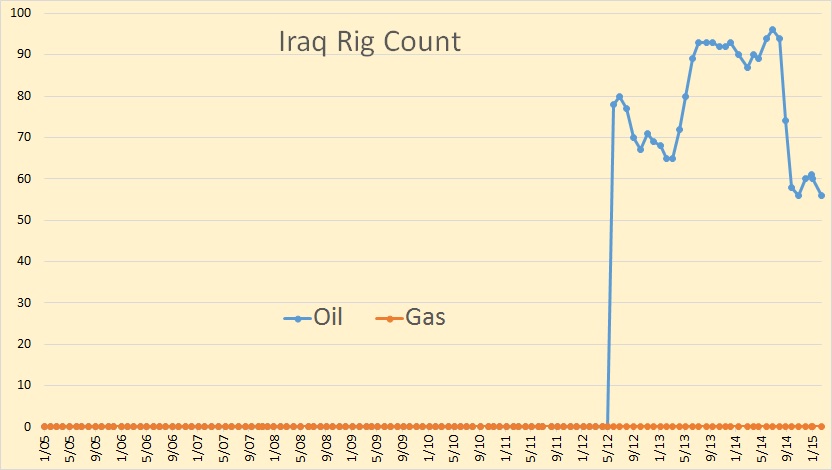

The Iraqi rig count has dropped by 40 since last summer. ISIS likely had a hand in this. However I really don’t understand what is going on here with this Baker Hughes rig count. I know Iraq had rigs working well before May of 2012 yet Baker Hughes says the count was zero.

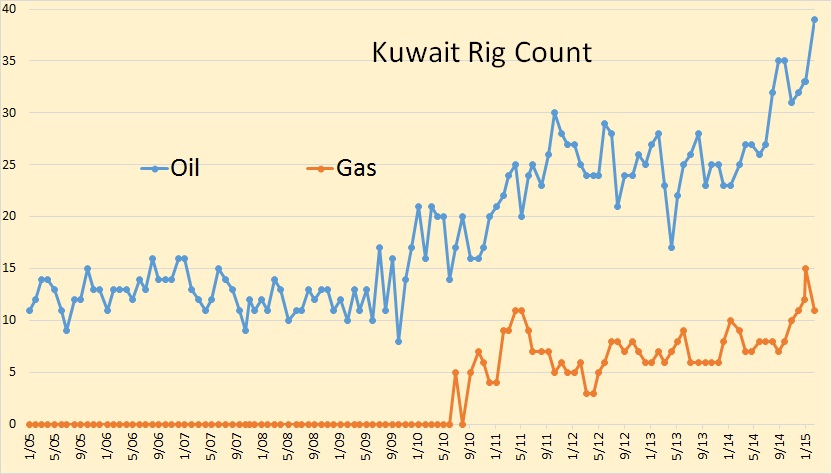

The Kuwaiti rig count has tripled since 2009. They have been working hard to increase their oil production. They appear to have peaked however.

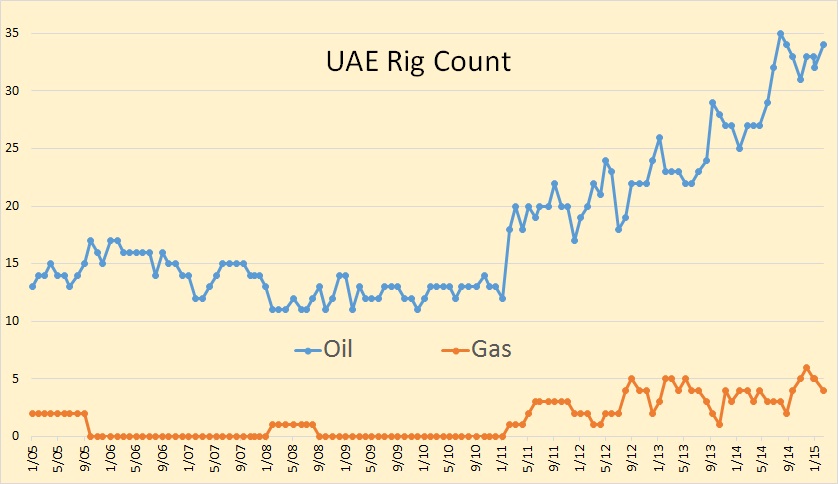

The United Arab Emirates have almost tripled their oil rig count since 2011. They, like Kuwait, have increased their production considerably in the last few years but not they seem to have peaked.

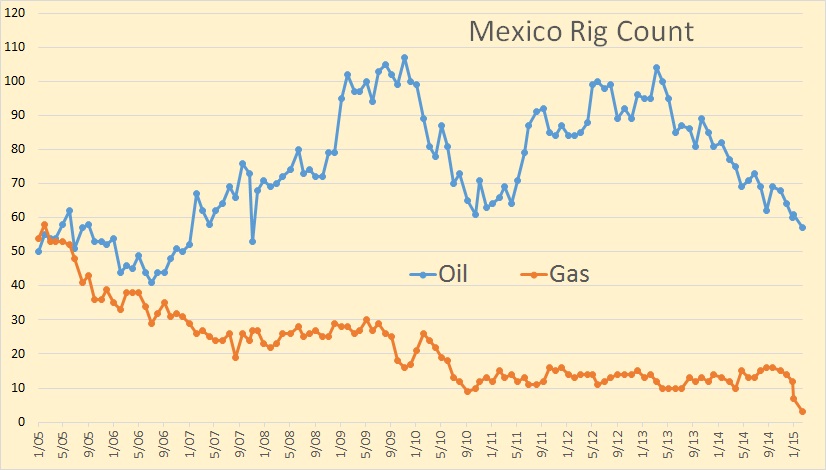

Mexico is an interesting case. In the last two years their oil rig count has dropped from 104 to 57 while their gas rig count has dropped from 16 to 3 just since September.

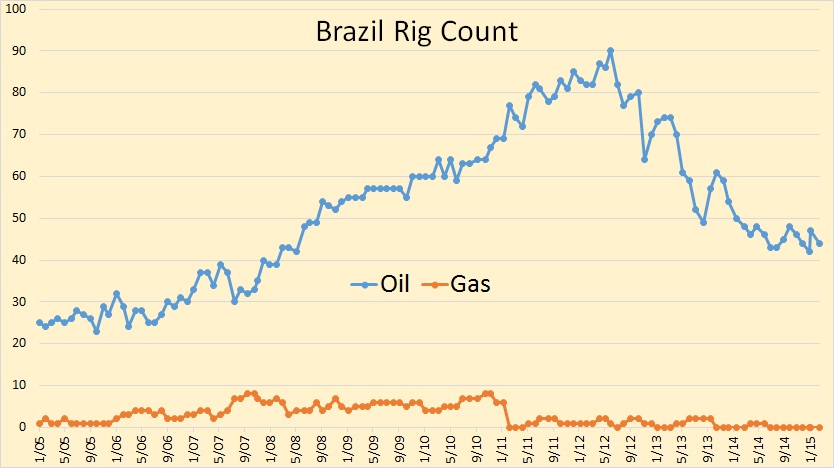

The Brazil oil rig count has dropped from 90 in June of 2012 to 44 in February of 15.

There was another huge drop in the North America Weekly Rig Counts.

Texas dropped 32 rigs this past week. The Permian had the biggest drop, 22 while Eagle Ford dropped 8.

News Items: While reading Google News articles on oil production this morning I came across the following passage from an article about falling oil production in Qatar.

This “heavy investment” in maturing oil fields should “limit further declines” in oil production, QNB said in its ‘Monthly monitor’.

Heavy investment in maturing fields is called “infill drilling”. That is what every major oil producer in the world is doing. Heavy investment in mature fields produces no new found oil, it produces old found oil a lot faster. Limiting declines now increases declines later.

And from the category of “I’m not one to say I told you so… but I did didn’t I?

Russian Oil Production to drop 8% by 2016

Lukoil said oil output in Russia could drop 8 percent by the end of 2016, Reuters reported. One of the biggest oil producers in Russia said its revenues were hit by the plunge in oil prices, The Wall Street Journal reported. The decrease in oil prices combined with the rise in inflation and weak ruble worsened by economic sanctions lowered the company’s net profit by 40 percent in 2014.

Fedun said oil output could decrease by 800,000 barrels per day by the close of 2016, Reuters reported.

“Everyone will reduce production because everyone is reducing drilling,” Fedun said, according to Reuters.

______________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at [email protected]

461 responses to “World Rig Counts Declining”

Thank you for posting this very important information! Appears to me rig count tells the oil production story since 2005 very well. Disproves those who say, “Rig count does not matter.” That group does not understand the lag time from drilling to initial production.

Also, the large increases in KSA, UAE and Kuwait rig count should be news. This site is the only place I have read this information. The Russian story is very important as well. Possibly one million barrel decrease there next year. Thank you for this site!

The “Rig Count Doesn’t Matter” chant has been shot down.

Lessons for U.S. oil production from the gas industry: Kemp

The gas industry’s experience holds two lessons for oil production.

First, gas production would have fallen since 2008 in response to lower prices and drilling had it not been for the boom in crude production and high prices for natural gas.

Second, it is the combined value of all the products from a well (dry gas, natural gas liquids and crude) that determine the profitability of a well.

Continued growth in gas production has been, in large part, a by-product of the oil boom. Oil producers will not be so fortunate. They cannot rely on natural gas sales to improve the financial performance of their wells.

Hi Ron.

“The “Rig Count Doesn’t Matter” chant has been shot down.”

Finally. Wishful thinkers tried to paint the lag between declining rig counts and declining production as some sort of evidence that efficiency was increasing! This was obviously never logical and now we have confirmed it.

Hmmm – what’s going on here?

If I go to eia.gov and look at the gas data.

2008 oil well gas is 5,609 Bcf/year

2013 oil well gas is 5,428 Bcf/year

So gas from oil wells is actually _down_ (marginally), not up like Kemp says.

2008 gas well gas is 15,135 Bcf/year

2013 gas well gas is 11,256 Bcf/year

OK, conventional gas well gas is down a lot, call it 4 trillion cf/year.

2008 shale gas is 2,870 Bcf/year

2013 shale gas is 11,986 Bcf/year

That’s 9 trillion cf/year – a big jump.

while I’m there…

2008 coal seam gas is 2,022 Bcf/year – about what shale gas was in that year.

2013 coal seam gas is 1,326 Bcf/year – dropping off.

Are we past peak coal seam gas?

I kinda believe what he says about shale gas wells producing more condensate

(somebody is, an additional 138 million bbls from 2008 -2013, but that’s only 370 kbpd increase in 5 years, roughly 1/60th of US “all liquids” consumption).

But oil well gas (e.g. associated gas, casinghead gas) seems to be going down.

Did I miss something?

sunnnv,

I agree totally.

Also if you look at the shale gas numbers on the EIA weekly report, the gas plays of Marcellus and Utica, total out weigh any associated gas from the Bakken and Eagle Ford, yet everybody, apart from the two of us seem to think the gas is coming from oil wells???

I agree with the two of you, although I admit I know little about gas. The Marcellus has no equal oil equal.

Shallow,

Correct, there is no equivalent in oil for the Marcellus.

So the result can not be expected to be the same as gas. Therefore after a short time we are going to see the inevitable fall in production, for sure.

Ron,

Do you think Kuwait, Saudi Arabia and UAE are continuing to increase drilling rigs to keep the illusion of high production as they can afford to do so, while the United States drilling rigs are declining because the costs are too high?

Steve

I don’t think that is the reason. These guys started increasing rigs several years ago and have continued to do so while oil prices were very high.

Of course the US rig count is declining because of low oil prices.

SRSrocco,

Fluctuations in rig counts have always been much smaller in regions outside North America.

1/ Investment cycles for large offshore and onshore projects are much longer than for shale/tight oil

projects or small-scale EOR projects in mature North American fields. It doesn’t make sense to put on hold a project where billions of dollars have already been invested, but it is much easier to stop drilling shale wells.

2/ Drilling contracts in most regions are longer-term, than in U.S.

3/ U.S. oil and gas independents are generally highly financially leveraged and have to cut capex significantly when oil prices drop. By contrast, large IOCs and most NOCs usually follow more conservative financial strategies and tend to invest “through the cycle”, which means smaller capex cuts in low oil price environment.

This looks like infill drilling to keep the production steady.

Not really. Both the UAE and Kuwait increased their production by about 200,000 bpd from 2011. Kuwait has declined about 100,000 bpd from its peak in 2013 but he UAE is down only about 45,000 bpd from its peak in 2014.

NN, they are also implementing EOR and changing their waterflood patterns. Ii have a friend who worked in Kuwait and he told me they are getting serious about developing their heavy oil fields.

Ran into this by accident:

OBAMA NOTES CONCERNS OVER ‘EXTRAORDINARILY DIRTY’ CANADA OIL EXTRACTION

http://newsdaily.com/2015/03/obama-notes-concerns-over-extraordinarily-dirty-canada-oil-extraction/

“I haven’t made a final determination on it, but what I’ve said is, ‘we’re not going to authorize a pipeline that benefits largely a foreign company if it can’t be shown that it is safe and if it can’t be shown that overall it would not contribute to climate change,’” Obama said.

Doug,

And yet coal is better? They are still importing 40% of their oil. Fine, use ME and Venezualan oil. War and upheavel is such a cleaner source of petroleum. Of course, it keeps the Military Industrial Complex happy. What a fucking hypocrite.

Thank you for this site. Excellent info.

On the Obama comment, he’s absolutely right environmentally compared to a straw in the dirt. Simplest, and cheapest option is to reduce consumption no matter source if ultimate goal is to be in line with climate change mitigation needs and peak oil security.

But back to the rig counts… Hearing lots of sad stories from friends being laid off from Alberta ops. It should hit the official unemployment rate in Canada soon.

That said, I wonder about whether there is another shoe to drop in Canadian drilling. It seems from the graph that what has been put on hold is the spring drilling boom? So we havent yet seen a signficant decline in the number of more permanent rigs?

Chris,

You are correct about the traditional spring break where all the rigs in frozen country are laid down, as weight restrictions come into the effort for the country roads. But it is what will happen at the other end, that is the problem. Once the ground drys, and a new drilling season begins, will be the time to watch the rig count numbers, and see how few operators actually go to work. If nothing changes to the oil price, then there will not be very many. I am sure the men being laid off during the spring, will all be looking for alternative employment, rather than sitting around, waiting for the new drilling season to begin.

Agreed. And considering the unemployment rate in the rest of Canada currently isnt bad, I doubt very much that there will be the jobs available elsewhere. And certainly not at the wage they previously earned. Major blow in consumer buying power is going to hit the Canadian economy hard, right before or during the federal election in the fall. At least in the States you seem to have a large enough pool for the ex-oil men to go. In Camada, there is nowhere else for the eggs to go.

Paulo, There’s also that so-called free trade thing between Canada and the US defined as the General Agreement on Tariffs and Trade (GATT) whereby duties and other restrictive regulations of commerce are eliminated on substantially all the trade between us. Of course neither of us believe that fantasy. I guess the “substantially all the trade” phrase becomes operative. Why would Obama think: “we’re not going to authorize a pipeline that benefits largely a foreign (Canadian) company be governed by such existing agreements?

Doug,

I am glad you brought up free trade agreements. NAFTA being the agreement in question. For all countries these international free trade agreements seem to take precedent over local laws. So why is it the US says it is illegal for them to sell oil to Mexico, but sells oil to Canada, under licence.

Surely under the free trade rules and agreements of NAFTA, the US should/must allow free trade in all goods.

Note: Mexico did reserve the right not to import oil under NAFTA, except under licence. But to my knowledge, the US did not include any such clauses.

So why doesn’t the Canadian government sue the U.S. government for damages? I have heard numbers like $37 billion per year. Times 6 years, times treble damages = $ 666 billion.

That sounds like the right number to me.

canabuck ,

I am not sure why, but it always seems strange to me, everyone else has to stick to these international treaties, apart from the US. You sound like you have some skin in the game, so maybe you can find out?

Blowback. If the canadian gov sued, they may be legally correct and may actually win the case, and may eventually be paid. BUT, there would be hell to pay in terms of lack of cooperation, petty harassment, and further trade blockages. It is better to have a giant as a fair-weather friend, rather than an enemy.

Possibly because an arbitration case is going to take a long time, the USA Senate is short 6 votes to overcome a veto, and the Canadian oil is going to move anyway.

The obvious solution is to build a pipeline from the border to Houston, then hop the border, shipping the oil using super long trains, which only move 10 km to cross the border and deliver the oil at pump station number one.

Fernando,

Great minds think a like. Unfortunately, I didn’t write mind down, so you get the prize. But sure, a pipeline approaching both side of the border. A short loop by train over the border, and Hey presto, we have a solution.

The train track needs to be real short. The key is to wait until there’s enough votes to override Obama and join the two pipeline ends. The other option is to make a tunnel and run both a train and a pipeline inside the tunnel. The tunnel can be say 100 meters long. This way the system will be safer, the rail cars can be filled with water, and the oil go by pipeline. Obama will be too worried counting CO2 molecules and looking out for sea level rise, and he won’t notice.

So why is it the US says it is illegal for them to sell oil to Mexico, but sells oil to Canada, under licence.

Because Mexico is a foreign country and Canada is a US territory

some would like to think so.

But my Canadian friends still like to talk about the War of 1812 when they knocked on the door of the white house.

I had originally added a smiley face but it seems to have gotten lost GRIN!

I thought the capitol building was burned, and that is why it was painted white.

Aug. 24, 1814.

http://www.history.com/this-day-in-history/british-troops-set-fire-to-the-white-house

Well said Paulo.

It seems the Venezuelan heavy oil is just about the same stuff in terms of pollution as the tar sands oil, or so close it hardly matters.

We are snubbing our closest neighbor while supporting one of the most repressive countries in the hemisphere.

Upcoming, various companies have to restate reserves. It’s done as a function of price.

The reserves are collateral for borrowing. If you restate downwards too much, in keeping with the SEC rules, the lenders dry up.

And so, obvious bailout mechanism is to redefine the rules, just as was done with Mark To Market in 2009. Quiet, obscure and avoids threatening the narrative of all-is-well.

Oh shit Watcher, why did you have to mention reserve definitions. Do you like watching me argue with Dennis?

You’re both wrong. The Fed controls the quoted reserves for everything.

Ron controls what geology says.

Doesn’t the SEC make the rules for US public company reserves?

Since Jan. 2010 the SEC began allowing companies to declare both “2P” (both proven + probable) and “3P” in estimates (with certain conditions). Since 3p = possible. I’m old fashion I certainly don’t consider “possible” a meaningful metric but the reference to Dennis was a joke. In fact, I could care less. Also, the SEC isn’t the world!

Doug, I agree with you that the SEC isn’t the world, especially when it comes to SEC reserve reports. Has the SEC ever reviewed a reserve report and “turned it down” or whatever they are supposed to do?

I like how the reports ALWAYS assume cost of abandonment is equal to equipment salvage value. How can that be true with regard to ALL properties of ALL US public companies?

Shallow Sand,

Please note I’m Canadian and was normally involved with either the Alberta Securities Commission (ASC) or the British Columbia Securities Commission (BCSC). Also, note that I’ve been retired for 10 years. I did do some stuff that was approved by your SEC but that was almost by default. I still sort of keep up with some oil related issues out of what: habit, curiosity, masochism. Probably if it weren’t for Ron’s Blog and the fact I keep in touch with a few old buddies (and a niece in Norway who is active in the business) I would be listening to classical music (or jazz) or grinding through some paper on pulsar physics rather than typing this. You’d be much better off looking to others for information. That said; please keep your knowledge flowing fourth because I always enjoy your input, WE always enjoy your input.

Doug, thanks! I have much respect for you and others here with strong math and science backgrounds. I went the finance route because I couldn’t keep up past first year calculus, physics and chemistry. The required PASCAL programming class first year about did me in. They thought us business students would need to know that, LOL!

Have a young sister in law who is a chemist. Have attempted to talk that with her, also without success.

My oil industry knowledge is completely self taught, so keep that in mind. Our guys in the field, who average 30+ years hands on experience, are teaching me things all the time. Unfortunately, there are not many young people who appear willing to take their place as they begin to retire in a few years.

Keep posting. Although selfish on my part, reading here and posting here helps keep me from laying stuff off on my wife, etc.

Watcher, there has been several articles on this subject recently:

The Price of Oil Is About to Blow a Hole in Corporate Accounting

http://www.bloomberg.com/news/articles/2015-03-04/oil-at-95-a-barrel-discovered-in-sec-rules-on-reserves

The U.S. Securities and Exchange Commission requires drillers to calculate the value of their oil reserves every year using average prices from the first trading days in each of the previous 12 months. Because oil didn’t start its freefall to about $45 till after the OPEC meeting in late November, companies in their latest regulatory filings used $95 a barrel to figure out how much oil they could profitably produce and what it’s worth. Of the 12 days that went into the fourth-quarter average, crude was above $90 a barrel on 10 of them.

So Continental Resources Inc., … reported last month that the present value of its oil and gas operations increased 13 percent last year to $22.8 billion. For Devon Energy Corp., … it jumped 31 percent to $27.9 billion.

This year tells a different story. The average price on the first trading days of January, February and March was $51.28 a barrel. That means a lot of pain — and writedowns — are in store when drillers’ first-quarter numbers are announced in April and May.

===============================================

http://oilprice.com/Energy/Crude-Oil/Why-Value-Per-Barrel-Is-Such-A-Lousy-Metric.html

http://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/reserves-the-next-pressure-point-after-drastic-drop-in-oil-prices/article22321670/

None of which means anything if the rules are changed. I can even give you the verbage:

“It is in no one’s interest to value these properties like this.”

The SEC reporting requirement for the quantity and value of reserves is “supplemental information” that is not audited by the accountants and is required by the SEC only annually in the 10-K. The quarterly 10-Q’s do not have it (unless something changed recently). Nonetheless, the companies will likely feel compelled to make some statements concerning the effect of the lower prices on the supplemental figures, such as Continental Resources did.

Separate and apart from the supplemental information, I believe that the accounting rules require an impairment charge if certain conditions are met. An impairment charge generally is required when the capitalized costs of assets on the balance sheet are greater than the fair market of such assets, so a write-down occurs. If prices go up and the value of the assets shown on the balance sheet are less than their fair market value, a write-up is not permitted: – not even to recapture a previous write-down. Clearly I do not know the current rules in enough detail to say much, except to say that I think that we likely will see accounting write-downs in the 10-Q’s as the year progresses.

Also, I do not think that he determination of the accounting fair market value uses the same arbitrary valuation method that the SEC mandates to determine the unaudited annual supplemental information. That is, I do not think that they use the average of the oil price on the first day of each month to arrive at the fair market value.

Since the accounting rules are now like the IRS rules, there are probably many pages of information explaining them.

The SEC forms (the SMOG) is done once a year. if I were preparing a guidance for a large company I would use the future market projection for three years and increase by inflation after that. The statement would also explains that CAPEX for 2015 would be cut by say 15 %, and that efforts are being made to cut OPEX by 10 %. These figures are reasonable and a company with sound management is probably doing something like this.

Behind the scenes I would also be discussing tax cuts. In some countries the government take is already dropping (Angola, Azerbaijan), in others the government is probably considering it.

Those reserves values are currently overstated by 50-60% at current oil price. The collateral on any current loan is insufficient and companies would need to post more collateral just to roll over existing debt. The collateral used in some 3-4 trillion dollars worth of energy derivative contracts,mainly on oil, owned by large banks is worth 50-60% less now than before oil price decline. When the housing bubble popped the value of the collateral(the homes) collapsed. Derivatives big banks owned on housing was about $2 trillion at the time. When these oil and gas companies start defaulting on their loans. Big banks derivative bets are going to blow up. Fed can’t fix this not even in the aftermath. No collateral to buy up like homes in 2008. Think twice as big as 2008 and no way to pump prices back up.

You think really well.

But as little faith as you have in The System, it is still too much.

If some numbers on a screen say civilization is going to collapse, then those numbers will be adjusted by law, and anyone who complains will be excluded from courtrooms or from breathing, whichever is easiest.

Only oil geology makes if all fall apart. Not numbers on a screen. Not pieces of paper. Only oil geology can’t be changed by law. Nothing else matters, really.

Fuzzy numbers that don’t add up are almost everywhere. Like January’s NFP numbers. If i remember correctly they claimed we added 46’000 retail jobs after November and December’s retail sales data sucked! Or the fact that it appears most of the recent job losses in shale oil and gas aren’t being counted. They can falsify the data to produce whatever desired outcome they want. They will only be able to hide the truth so long. Every can they ever kicked down the road is waiting in one gigantic toxic pile.

Hi Brian.

I think you are correct. Numbers can be fudged only so far. Collapse is imminent.

The whole fragile economic system is subject to forcing, just like the climate system. The climate resists forcing (through negative feedbacks) until it can’t. It then changes quite suddenly.

The negative feedbacks to collapse in the economy are things like bailouts, NIRP, ZIRP, and QE. These are losing their effectiveness with each passing day. Since organic economic growth is no longer possible, the negative feedbacks to economic collapse will soon be overwhelmed. Once that happens, collapse must be very rapid.

Oops, I meant Bryan.

I think much of the shale long term debt is in the form of corporate bonds, which are unsecured and which are held by pension funds, etc. The banks have credit lines which are secured by company assets. I think the banks may come out better than one might think, as long as they can keep enough of the employees in place to operate the existing wells.

However, they will sell the debt to private equity for a discount and then let the hedge funds go in and take over. Hedge funds would do a better job operating wells than banks. The operations staff from the defaulting company will largely be retained. Saw that happen right next door to us in 1999.

The equity holders, common and preferred, and the debt holders will be the ones to get nothing.

Where the banks could be in trouble, as you mention, is being on the wrong side of the hedges. Any media stories about counter party risk turning into counter party failure yet regarding oil and gas derivatives? Wouldn’t that stink, to be fully hedged, only to have your counter party blow up, and you not get paid. That is where the bailouts could occur, IMO. I don’t see the equity and bondholders of shale getting bailed out. No TBTF among that crew.

TBTF underwrote all the derivatives. So they’re exposed no matter who owns the debt. So as long as prices of the underlying collateral of their derivative bets(price of oil) never falls and nobody ever defaults on their debt. TBTF has nothing to worry about. TBTF is praying to the oil prices Gods right now for a dramatic rebound in price. They can probably handle a default or two. Any prolong low oil price that leads to many defaults then TBTF is in serious trouble and will be overwhelmed as they’ve wrote masses of insurance polices they can’t cover in the event of a prolong price slump. So unless this current oil glut ends TBTF have a lot to worry about. I don’t see anyone cutting production as they can’t cause of the load of debt. So unless production is cut elsewhere i’d expect the glut to continue for sometime and for prices to remain low.

Bryan, the oil business isn’t like real estate.

I’m talking about the Banking business, Sir. Derivatives in the oil business work a lot like derivatives in the real estate business. I’m not referring to the derivatives a company will buy to hedge against price. I’m referring to those derivatives that are used by banks to insure debt.

Derivatives that oil companies buy to hedge are called futures and options on those futures. What kind of derivatives are you talking about? What are they called and what kind of product are they derived from?

Oil futures are a derivative of oil, options on oil futures are a derivative of a derivative of oil.

Big Banks insure other big banks exposure to risk. They sell and trade CDS (credit default swaps) among each other. CDS’s are derivatives. Same as CDS’s used to insure government bonds. The reason no country is allowed to default on their debt is because big banks have more CDS exposure on their books than they can cover. Example: 5 largest US banks each have over $40 trillion worth of derivatives on their books. So a total of over $160 trillion worth of derivative exposure. The underlying collateral supporting these bets is just a fraction of the value. I assure you they neither have the cash on hand or collateral to sell to cover. We live in a world where the value of everything is insured. By definition prices can’t go down without someone having to payout. If prices go down and or defaults occur beyond the point that they can cover then said bank is insolvent. Since all banks are trading and selling CDS’s among each other if one is insolvent then they all are! Oil is no different in this regard it is insured by big bank just like government debt.

There is another large exposure to default that the banks have to consider, car loans. Any recession that occurs due to tumbling economies and banks will effect the job market and consumer income. Not only will more houses be foreclosed but the first thing to go is the default on car loan payments.

The sub-prime auto loan market is around 300 billion dollars. The next recession of any kind will take down a lot of those because the loans are much higher and longer termed than in the past.

So banks are going to get nailed from both sides if oil is down in price for a while and the next recession starts.

There is going to be a lot of cheap oil assets and cars on the market during that period.

The instruments don’t work the same. As oil prices drop we see less activity. The lower activity leads to lower oil production, which increases prices. I don’t think it works the same for empty houses, because the system is less volatile.

What is happening now also has a sanitary effect because the price swing will scare away a lot of mullets who really shouldn’t be financing oil plays.

RE: Russian Oil Production to drop 8% by 2016

I would not take Mr. Fedun’s statements too seriously.

Lukoil’s top officials periodically warn about worsening situation in the Russian oil industry and an inevitably decline in oil production. That’s their way to lobby for tax concessions (for the industry in general) and access to “strategic” oil fields (for Lukoil).

Interestingly, “Fedun assured that the company’s own production will stay unchanged from 2014 levels even though all of Russia should see a drop” by 4-20 million tons (100-400 kb/d) this year, or 0.9%-3.8% [http://www.energyintel.com/pages/eig_article.aspx?DocId=878723].

The Russian Energy Ministry announced in early February it expected crude output in the country to fall 0.6% in 2015 [http://blogs.platts.com/2015/02/09/russia-oil-production-2015/]. However, this week the Ministry said production may marginally increase this year [http://www.oilru.com/news/447668/ – in Russian]. Russia’s oil output increased 0.8% year-on-year in the first two months of 2015 [http://www.energyintel.com/pages/eig_article.aspx?DocId=878464].

Monthly oil+condensate output was 10.62 in December, 10.67 in January, and 10.61 in February [Ministry data, using 7.3 barrel/ton conversion rate).

Russian Minister of Energy, Alexander Novak also said the country’s renewed Energy Strategy (to be released this summer) anticipates more or less flat oil production at around 525 million tons for the period to 2035 [http://neftegaz.ru/news/view/135346/ – in Russian].

The one thing Lukoil has a history of quoting correctly is the gross, not net, decline rate for Western Siberian fields. Given that I’ve heard them say 8% on that in the past, pretty reasonable odds the translator got this wrong.

Of course, they also have African output, quote it as Lukoil output, and the Russkies probably pick up the total and call it Russian.

Lukoil is putting on hold its West African projects, as well as some of its Russian gas projects, but they are maintaining investments in domestic oil. Their overall capex

will be cut by some 20%-25% in dollar terms this year (from $15.4 billion in 2014) but will slightly increase in ruble terms. And their cost base in Russia is mainly in rubles. In January-February Lukoil’s oil production in Russia was flat y-o-y, and earlier this year the company’s president said it will remain at last year’s levels for the whole 2015.

“they also have African output, quote it as Lukoil output, and the Russkies probably pick up the total and call it Russian”

In their reports, they give a detailed geographical breakdown of oil and gas production by region. In fact their African projects were a failure, but they have a large project in Iraq (West Qurna 2) and several upstream projects in Central Asia

I can be behind the times on this, but my recall is the Lukoil African flow was purchased flow, not purchased exploration chunks of acreage. Did it run dry early?

Lukoil has stakes in several offshore exploration blocks in West Africa (Cote d’Ivoire, Ghana and Sierra Leone). As I understand, their aim was to gain experience in deepwater exploration and development (as their offshore projects in Russia are in shallow waters).

There were some modest discoveries and several dry holes, which have already resulted in $1.5 billion in write-offs. According to Lukoil’s vice-president Fedun, the company is now freezing its deepwater operations off West Africa due to low oil prices and he also didn’t exclude they would pull out of those projects completely. That said, Lukoil decided last year to farm in to an operational development in Cameroon.

The IEA take on Russian oil production is in my article on the Medium Term Oil Market Report

3/3/2015

IEA report: US shale oil growth practically zero in 2017

http://crudeoilpeak.info/iea-report-us-shale-oil-growth-practically-zero-in-2017

Remember we had a report from Energy Intelligence Weekly in 2006, on Kuwait reserves

http://crudeoilpeak.info/kuwait-reserves

The issue of

http://crudeoilpeak.info/opec-paper-barrels

may hit the world at an inconvenient time

Anadarko have come out with a revised capex.

http://investors.anadarko.com/phoenix.zhtml?c=80451&p=irol-newsArticle&ID=2022088

As a result, we’ve reduced our initial 2015 capital expectations by approximately 33 percent relative to last year, with plans to reduce our short-cycle U.S. onshore rig activity by 40 percent and defer approximately 125 onshore well completions.

But the kicker is, US onshore is down 60%. From what I could see in the 4Q report, they had 37 rigs working US onshore. So they could be down to about 15 rigs, a loss of 20 plus. Of course there is the usual, but our oil production will be up by 5%.

They can say what they like, but when this dropping rig count mule kicks, it is going to kick real good!!

G’day, T. Push, are you still on the beach?

I am not paying much attention to where all the rigs are getting stacked. Three hundred in Texas I’ve read. Half of those, at least, have to be 2000HP rigs capable of long laterals. Those big rigs directly and indirectly employ 250 folks each. That’s a lot of good men and women who have gone to the house. I hate that.

Here is an answer I gave to Dennis earlier on something. I thought you might enjoy playing with the GIS map. BTW, thanks AlexS:

….On another matter, Dennis; drilling and completion costs are really dropping now. I tend to discount quick declines in daily rig rates and pumping related services the first 6 months of a downturn like this, but when pipe (casing and tubing) costs start to come down I interpret that to be an indicator of much lower costs. I am hearing price declines of 30%, even more, for the shale guys. Not that that will save them, but its interesting.

Another interesting observation is the density of working rigs in obvious sweet spots. I saw 12 rigs running in a 5 square mile area the other day, then not another rig for 20 miles. FYI, don’t be fooled by web site dribble about rig days to drill a shale well; one of the shale biz’s neat tricks is to have a smaller rig drilling and setting surface casing (3000 feet plus/minus) on a multi-slot pad, then have the big rigs fall in behind drilling only the radius and lateral and running casing to the toe. When they brag about 12-15 days, IMO that’s big rig time working only below surface casing. 21 to 25 days, with no problems, is the real deal. Not that it matters much.

http://wwwgisp.rrc.state.tx.us/GISViewer2/

Go to Karnes County, or DeWitt; it looks like pixie sticks. How much longer can that go on?

Not much.

Mike

Hey Mike,

12 rigs on 5 sq miles, I don’t care how close their spacing is, it will not take them long to run out of locations. 6 months at the most! Then there will be 12 more rigs on the scrap heap.

Toolpush. I think the US shale companies, and unfortunately conventional people like us too, are going to take it on the chin for awhile even if US production starts to drop soon. Look at a chart comparing oil price to US dollar strength. Pretty correlated.

Add in that Brent WTI could go another $10, and suddenly the rest of the worlds oil production is on solid footing, but US is still hurting.

As I’ve posted, think WTI will stay down long enough to pretty well torpedo the shale oil revolution. That takes 2-3 years to play out.

As long as you stay away from US onshore, should be plenty going on. Did you make it to Qatar?

G’Day Mike and Shallow,

Yes it will take a little while for things to work their way the system, but the deeper the cuts, when the effect finally takes place, the steeper the climb out of it. A short and sharp drop will be better for us all. The revised reserves next month should start to get the financiers attention. When you think there were 3 shale players couldn’t pay their first loan repayments after their first short payment, then I feel there are few more to follow.

Mike thanks for the map. Looks like Texas has more holes than a piece of Swiss cheese. As for time it takes for a rig drilling a well, I am also aware of time to drill your best well is a lot different to time taken for average well, and a hell of a lot different from your worst well. What does “side track mean”? lol.

Exxon had a good chart of their projects.

http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9MjczNDkzfENoaWxkSUQ9LTF8VHlwZT0z&t=1

Page 24

Three of the bottom four profitable projects in Exxon’s fleet are unconventional resources.

I am still on the beach. Thank for asking. I am still waiting for the cogs to turn on the Qatar deal but things should work out there. But I am looking for a fill in trip somewhere if I can. But that will be a nice to have rather than a must have. I learnt early in the oilfield of the ups and downs, so borrowed money has never been high on my agenda, so I have no problems there. I am still technically on my time off rather than between jobs. I know there are lot more people out there in a lot worse position than me.

Keep a bind on it fellas.

Even though Canadian WCS has finally found a direct pipeline route to the Gulf Coast, via the Flanagan line expansion and the twinning of the Seaway pipelines, Exxon seems to be going for crude by rail.

http://www.reuters.com/article/2015/01/15/us-crude-rail-exxon-mobil-idUSKBN0KO1W620150115

Exxon’s new oil-by-rail terminal in Canada gears up for U.S. shipments

(Reuters) – Exxon Mobil Corp’s new joint-venture oil-by-rail terminal in Canada, set to be the nation’s largest, will begin shipping crude directly to its own refineries in Illinois and Louisiana by March, another reminder that pipeline delays are not stopping the rise in oil sands exports.

When they say, shipping to their own refineries, I guess the currently import oil from Saudi and Mexico, will not be in the hunt when it comes trying to compete with fully owned Canadian oil.

Toolpush do you know of any other major expansion of cross border rail capacity ?

Which railroad will be hauling this new production?

OFM,

Canadian National is hauling the Exxon oil, though the Kinder Morgan terminal in Edmonton is hooked up to both Canadian Pacific and Canadian National lines.

Hardisty also got and plans rail terminals for oil, but only appears to hook up to Canadian Pacific.

http://usdg.com/terminal/hardisty/

Our Hardisty rail terminal is connected to Canadian Pacific Railroad’s North Main Line, which is a high capacity line with the ability to connect to all the key refining markets in North America.

WSJ is reporting whiting is trying to sell itself. Anyone read the article?

http://www.wsj.com/articles/whiting-petroleum-seeks-buyer-amid-plunge-in-crude-prices-1425690205

Whiting Petroleum Seeks Buyer Amid Plunge in Crude Prices

Whiting Petroleum Corp. is seeking a buyer after plummeting crude prices took a bite out of the oil-and-gas producer’s results and its shares tumbled.

The company, which has an equity value of $5.8 billion, is in the midst of an auction process, according to people familiar with the matter. It is unclear who may be interested in buying the company and there is no guarantee it will be sold.

Denver-based Whiting, one of the largest producers in the prolific Bakken Shale formation in North Dakota, is suffering from the sharp decline in oil prices just as it begins the process of swallowing rival Kodiak Oil & Gas Corp. The $3.8 billion deal, which closed in December, saddled the company with more than $2 billion of additional debt; Whiting now has a so-called enterprise value, which includes debt, of more than $11 billion, according to S&P Capital IQ.

The company’s increased exposure to declining energy prices and heavy debt load have taken a toll on its shares, which are down more than 60% from their high last summer. Whiting isn’t the only oil producer buffeted by the sharp drop in the price of crude, and it is not the only one seeking a buyer either. Penn Virginia Corp. , which drills for oil and gas in Texas, Oklahoma and Pennsylvania, is exploring a sale after its stock declined and its reserves lost value,

From WSJ November 29th 2012

Whiting Petroleum Explored Sale

http://blogs.wsj.com/deals/2012/11/29/whiting-petroleum-explored-sale/

Whiting Petroleum Corp.WLL -1.36% explored selling itself earlier this year but decided not to proceed after buyers balked over the oil producer’s asking price, according to people familiar with the sale efforts.

Rune, I note at that time whiting “just” had $1.6 billion of debt, so in 27 months they took on an additional $4.2 billion.

Interesting. The funny thing is, they bought Kodiak who put themselves up for sale a while back. Nobody wanted Kodiak, so they called off the sale process. WLL finally bought them. WLL is not very hedged so they will have problems.

However, in the last couple of weeks, numerous companies have raised a few billion in equity and new debt. The fact that money continues to prop up the shale companies. Goodrich raised $150 million in debt and equity. Their reserves are practically worthless at strip prices. Who are the idiots buying this stuff?

Well, borrowing base redeterminations should be interesting next month. We’ll see what the banks plan to do.

Art Berman just published a piece on Whiting

http://www.artberman.com/whiting-fall-reveals-weakness-of-tight-oil-plays/

Have a close look at the table with summary of cash flow and balance sheet data.

Note that Whiting for the full year 2014 had a ratio of total debt ($5.6B) to cash from operating activities ($1.8B) just above 3.

This is for all 2014 with an average WTI at $93/b.

So how will a WTI at $50/b play out for leverage?

The leverage expressed as the ratio of total debt to net cash from operating activities will increase significantly.

If time allow I will simulate the financial dynamics in play as a function of leverage and in a world with a sustained low oil price ($50/b). The key is to understand how the extraction (production) geometry for a portfolio of LTO wells (company) plays out and a leverage of 3 (and certainly below) may be doable (have to adjust for specific companies hedging instruments etc).

A leverage above 4 (for a company primarily exposed to shale oil and with present oil price) is material for sleepless nights.

Nice little article you pointed to, thanks Rune.

Art has a recent 1 hr: 25 minute video (Feb 23, 2015), and his slides in PDF that really sums up the predicament we’re in.

Years Not Decades: Proven Reserves and the Shale Revolution

The video:

https://www.youtube.com/watch?v=5Ae1fg44l7E

The slides:

http://www.artberman.com/wp-content/uploads/HGS-NA-Presentation-23-Feb-2015.pdf

The Q&A on the video is interesting.

good one sunnnv

“Whiting Petroleum Said to Hire Bank to Pursue Potential Sale

The Denver-based company, which has a market value of $5.7 billion, has reached out to potential buyers including Norway’s Statoil ASA, one of the people said, asking not to be identified because the information is private.”

http://www.bloomberg.com/news/articles/2015-03-09/whiting-petroleum-said-to-hire-adviser-to-pursue-potential-sale

Shallow, just read the article. Tnx for the heads up. Article says they may try to suction off company.

Amazing. Annual report was released last week showing near 1 billion barrel reserves, 2014 exit production rate over 130k/day, about one million net leased acres in Bakken and Niobrara.

Someone (Exxon?) may pick up some extensive assets on the cheap.

coffee. This goes to the point I’ve been driving at with you. The shale guys have been doing some amazing things, but bottom line still rules. They got caught up in it, and though they won’t admit it, they are in trouble.

We are in survival mode with no debt and low decline, so I know most of them are in trouble, especially as the hedges roll off. Further, $75 would be huge to us, we could breathe easy and even do a little extra work. I suspect even $75 WTI for a couple years won’t solve it for most shale.

Just guesses of course.

There have not been many takeovers of shale companies by the majors in the last few years (bar the stupid purchase of Athlon by Ecana). The majors realize reserves at the shalies are way overstated. Shell and Sumitomo found that out. Wells will not produce 30 years. That 1 billion barrels is pure fiction. I would bet 75% of them are PUD’s.

Amazing. Annual report was released last week showing near 1 billion barrel reserves, 2014 exit production rate over 130k/day, about one million net leased acres in Bakken and Niobrara.

Someone (Exxon?) may pick up some extensive assets on the cheap.

What’s the matter with you? If this is such a great deal, then WHY THE HELL ARE THEY SELLING? Picking up things on the cheap can be done by company executives of the same company. “Taking it private.” On the other hand they know what crap it is so they managed not to form their own LLC and do that leveraged buyout. Have you not noticed that they didn’t orchestrate a purchase? By themselves . . . or by their family or friends?

Yet you think Exxon will want to buy what the people who know most about it don’t want to buy.

They are selling islands over here, more than what may be usual, and I looked at one in particular along a tidal river, where the maximum influx may just barely lick at it, but I guess the ocean tide is coming in a little more each year, and if the island is a little on the low and flat side, it could be submerged almost overnight.

In a small town where I used to live, over a couple of days its properties along the waterfront got flooded, perhaps more than usual, and what do you know but a few of them are suddenly for sale with a ‘Great View of the Harbor’.

The good thing about a small town like that, however, is that the relatively puny buildings can be placed on stilts or entirely moved uphill without much ado if absolutely necessary. By a team of horses and some logs if need be or however they did it back then.

What are the island coordinates?

46.016948, -60.099873

And a few in the area in general, such as on the Bras D’Or Lakes fjord. What do you think?

Any suggestions on good free online topology maps for the area BTW? Maybe Google has this?

I see a small island near Albert Bridge, in a long enclosed water body, with an outlet to the sea near Mira Gut.

The island is very low level, but it’s in very calm water, so you don’t have to worry about waves.

In these areas one has to worry more about tides and storms, the outlet is 90 meters wide at the narrow spot near the coast.

I would inquire with an insurance company what their terms are for a house on the mainland near the island. Insurance companies have the local flood maps.

If you want to build on that island I suggest to take soil samples and build within 20 meters of the beach on sandy soil. You will need to have a boat with a high pressure pump and jet painted and covered steel pipes about 10 meters down. This will give you a working surface to keep jetting in to build a level surface for a foundation. The deck should be about 2 meters above the highest water level seen in the area in the last 50 years.

I do wonder how you will handle sewage and other utilities? And do they issue permits for this type of activity?

Good day, Fernando,

Thanks for the useful tips. It is very unlikely I will be building there, but it is good to know just in case.

If I did, I might go with a year-round insulated treehouse or even a vertically-set shipping container deal; compost toilet and some kind of rainwater collector in the tree. The river is probably clean enough to use for graywater-type uses and I’d see about some kind of graywater lagoon-treatment system with the right plants.

Interesting timing, coming out rather late on a Friday evening. Anybody read anything into that?

Funnel, the tone of the WSJ article sounds like Whiting has been looking for a buyer for a little while and, perhaps, rumors were starting to arise.

Shallow, mebbe you could put in a bid to buy out Whiting and give ol’ Harold a run for the title of King of the Bakken? I’d invest in ya.

I’d rather wait till the wells have settled out at 10-30 bbl per day, then offer, LOL!

Question to all,

Whiting, is obviously out money, but have 12 rigs drilling in the Bakken. They are very close to being the most active driller in the Bakken. So while their more well heeled brothers have hunkered down, and slowed/stopped spending money. These lot are going hell for leather?

so what is/was their game plan? Drill flat out, keep their flow rates up, and hope to sell before they run out of money?

I think the vultures may have seen through their plan, and are waiting for them to hit the brick wall, and pick up the pieces for peanuts.

I am sure the sale is a very high stakes poker game.

Push, I think a lot of people were surprised that Whiting was so emphatic that they not only WOULD keep producing, but that they COULD produce at these prices and still make a profit.

The three wells that are in the Twin Valley field and frac’d with the CT hardware are producing at a record setting pace.

Your comment about high stakes poker may accurate. Also, maybe the Whiting suits want to buy a fleet of lime green Leafs before that price skyrockets.

Coffee, if you do not work for the API, or the IPAA, you should. You are very good at your message and I compliment you, sir.

I watched a CT frac the other day. Neat. Straddle packer technology that has been around a long time. Couldn’t get a lot of rate down 2 5/8ths OD coiled tubing so they were constantly having to drop sand concentrations. Lots and lots of small “stages.” I say if you are going to be bear, be a grizzly and I’ll take 30, 200 foot, 200,000 pound stages any day. The windows in the frac van need to be rattling.

Whatever, its about the money, not the toys. Any shale company confident in their ability to survive this little oil price thing I would guess would be buying, not selling, and full speed ahead. These 10% IRR’s over 20 years, will take the wind out of anybody’s sails, I guess.

Mike

Mike, No API stuff for me, too much high level politicking, diverse interests, BS in general. (Nice image of the girl scouts peddling oil wells, btw).

Your comment about watching the CT frac and being a griz when doing something prompted me to respond.

The current online issue of American Oil and Gas Reporter has a step by step description of a 29 stage horizontal in the Permian being frac’d with this new generation of Bottom Hole Tool (without mentioning which one, the implication was that it was Baker Hughes’ Opti Port. Enlightening reading, IMHO.

More to the point, that site – aogr.com – had a 2 part article in their Dec 14/Jan 15 issues recounting in extensive detail of a project by WPX that monitored numerous variables in the frac’ing process in an effort to understand just what was occurring two miles down below (an item you have correctly mentioned several times was largely unknown).

Well, the WPX folks discovered a great many things about the events unfolding while frac’ing … and a lot was what they DIDN’T want, like unstimulated areas, WAY out of zone fissures (300/600′ vertical when targeted payzone was no more than 50′. Unwanted water production much?)

In a nutshell, the days of the 30 stage, 200’/300′ long intervals, 200,000 lbs proppant/stage, 11,000+ Hydraulic Horsepower Pump output, may no longer be wanted, let alone required.

The ongoing evolution in the microseismic capabilites is enabling the operators to better target the most productive areas along the 10,000′ long laterals.

Yes, of course these are all toys (along with the techniques to best utilize them), and the bottom line – NOT the bottom hole tool – is what ultimately influences operations – but, if not Whiting, if not Goodrich, Halcon or the others who may falter in the coming months, some outfit will ultimately employ the array of innovations that continue to arise … but sure as shit not for $40/$50 per.

Shallow, I am quite certain when 1st quarter 15 reserve numbers come out you will be able to buy no fewer than 12,000 shale wells in the Bakken and the Eagle Ford. By 2nd quarter you’ll be able to find some deals on Ebay and in September there will be people knocking on your door trying to sell shale wells like Girl Scout cookies. You might actually get to meet Harold himself at that point; he’ll be driving a beat up, lime green Leaf with a sticker on the bumper that says If You Don’t Have an Oil Well, Get One!

Remember those long fat EUR tails are not likely to be as long and fat as the hype, don’t forget the 150-200K plugging and decommissioning costs per well and whatever you do, be sure and get lien releases at closing.

You will of course not be offended if I pass on your new venture.

Mike

There is a way one could see buyers, Mike.

Someone who can orchestrate a bailout might buy.

No different whatsoever from owning some land in your town, getting your son elected to the town planning commission and then having that land zoned commercial, instantly quadrupling its price.

If someone knows a bailout is coming, they might buy.

In that context, the oil majors really haven’t rec’d anywhere near enough notice that they all crashed their CapEx about a year ago, months before the price crash. How very prudent.

Thank you, Mike. Best laugh I’ve had for days.

Mike. I put LOL behind that little comment for a reason. I call a 2,500 ft well a deep well. Don’t think I’ll ever own an interest in one deeper than 2,500 ft.

Had to plug a SWD recently that wouldn’t pass MIT. Cost 4 grand. That’s the level we operate on.

Don’t get the wrong idea, we are small fries all the way. I like the EBAY idea. He he!

OFM,

Here is another good piece, where they mention some of the smaller terminals. Also a comment on why they didn’t expand the oil sands faster. As well some of the likely parties that are benefiting for the delay in Keystone.

http://www.reuters.com/article/2014/04/23/canada-keystone-railway-idUSL2N0NE20J20140423

Companies including Canexus Corp and Gibson Energy Inc are building terminals that will pump Western Canadian crude on to mile-long trains bound for U.S. refiners. In theory, these firms have the most to benefit from a months-long delay in U.S. approval to the 1,200 mile (1,900 km) pipeline that would link Canadian oil fields to refiners on the U.S. Gulf coast.

snip

But many are struggling to get their terminals up and running due to chronic labor shortages in Alberta, a harsh winter and cost overruns. That means they may not be able to fully exploit the growing shortage of pipeline capacity, as they had hoped.

snip

An estimated 1.1 million bpd of rail-terminal capacity will be available in Western Canada by year’s end, but much of that will depend on already-delayed terminal projects sticking to construction schedules.

OFM,

Here is another, it notes 550,000 bopd loading capacity by the the end of 2014.

http://www.reuters.com/article/2013/10/03/canada-rail-canexus-idUSL1N0HR2A120131003

At present, the oil sands are only served by manifest trains hauling smaller loads, a less cost-effective mode of transport, but around 550,000 bpd of unit-train crude-by-rail projects – terminals that can load up to 120 rail cars a day – are due to start up in Western Canada by the end of 2014.

So i seems there is going to be plenty of WCS heading south, east and west in the near future.

Thanks Toolpush,

Perhaps I am somewhat on the cynical side but I AM thinking rail money has more than a little to do with holding up the Keystone given that environmentalists would otherwise be screaming bloody murder over the rail cars hauling such light crude.

I AM not a chemist by any means but I did get thru the first two years at university level back in the dark ages and everybody knows the ultralight crude moving by rail ( which is not tar sands oil of course) has a hell of a lot of very light components prone to evaporating out very quickly if not contained in a pressure vessel. To the best of my knowledge these oil tanker cars are not capable of holding any significant amount of pressure.

Everything that evaporates is extra air pollution pure and simple.

IF somebody were to wave a sniffer over one on a hot day it would likely scream it’s guts out.

Greens are as prone to acting irrationally as anybody else and I am generally as green as anybody else but I try to avoid checking my brain like a hat and coat when I get into a political discussion.

We are NOT going to quit burning oil for a very long time. I won’t go so far as to say that we cannot develop alternative technologies to get away from oil before oil gets away from us ALTOGETHER but it these technologies just aren’t going to scale up fast enough to prevent some extreme pain in the economy as oil supplies dry up.

I tried to tell everybody I know the whole time the debate was going on that refusing the Keystone permit was a HUGE HUGE political mistake. It isn’t over yet. The presidential election is not that far away now.

Joe Sixpack is on average as ignorant as ignorant can be but he can and does understand political pandering when he sees it. Washington can’t say we are letting the states decide this issue as a dodge when at the same time telling the states what will be on a dozen other issues. Joe notices that sort of thing even if he doesn’t know the difference between DOO DOO and apple butter.

It would have been and still WOULD be infinitely better to use the permit as a club to extract money from the tar sands folks to buy up a million acres of sensitive land near the pipeline route and set it aside as parklands and nature preserves. I know things are tough in the oil patch right now but they won’t stay that way very long , maybe a year or two at the most. The money could be paid in the form of a small tax on future oil transported thru the pipeline.

If there is anything the current administration is good at, it is finding ways to do what it pleases. I have no doubt a way could be found to levy an environmental tax on oil passing thru a new pipeline. It wouldn’t have to be very high to produce a LOT of money over few decade’s time. Even fifty cents a barrel would be a handsome revenue stream that could finance some land purchases and do some nice things for poor people along and near the route.

The free trade agreements mentioned above are sort of like the animals in the famous little anti utopian novel.

All the animals are equal – but some of them are more equal than the others.

The agreement gets bent into a pretzel depending on how much influence any given industry has on any given day.

All the animals are equal – but some of them are more equal than the others.

I realize this is a true statement, but I just like to highlight a few of the inconsistencies from time to time and sometimes Americans can forget other people live in the world as well. My wife comes from over there, and I have have good time teasing her about it. smiles

As for the LTO by rail, that is why the oil needs to go through a stabilizer and have the NGLs removed as best as possible.

I still wonder, why not build a pipeline inside the U.S., take rail deliveries and pump all the way to Houston? Obama can’t stop line construction within the US.

Re: AGW

From a NASA website, I see the evidence for GW can be summarized as follows:

http://climate.nasa.gov/evidence/

1- sea level rise

2- global temperature

3- less ice

4- ocean acidification

So, to be a skeptic, one must address each of these issues.

1. The Maldives is the most affected by sea level rise. Has the ocean risen 20 cm there in the last 50 years or so? I have no data on this. Looking for a scientific paper on this subject, I first came up with:

http://myweb.wwu.edu/dbunny/pdfs/Ch7Elsevier.pdf (2011)

Which says two things: a. Over the past 4000 years the sea level has risen and fallen around 1000 mm.

b. There is no sign of sea level rise over the last 50 years. It is an interesting read. This is written by a sea level specialist, and the IPCC report had no sea level specialist. It seems that this person started measuring the sea level in 1999 for the first time.

2. There is some dispute about “heat islands” and “massaging the data” in South America. And the historical record does not go back much more than 50 years. Can we trust this data?

3. 99% of the ice is locked up in Greenland and Antarctica. Solid data of ice loss, makes for a compelling case. The World Glacier Monitoring service http://www.wgms.ch/. says that ice loss began in 1980. This seems an odd date for the start of ice loss.

4. It seems likely that CO2 is being absorbed by the oceans and causing higher acidity. But i don’t see how this warms the earth, unless CO2 in water will warm the water.

Any legitimate comments are welcome. Name-calling is pointless.

canabuck, my take is that, if humans have been burning whatever vast amounts of fossil fuels as they have for the past 180 years or so, something’s going to happen.

First off, oil is useful. (To make an massive understatement).

Public-sector, taxpayer-funded global warming research is mostly just expensive nonsense.

But let’s say we actually were to listen to the public-sector taxpayer-funded climate researchers and spend trillions upon trillions of dollars destroying the only sustainably successful economic system mankind has ever known all so we can produce less CO2, how would your ordinary American citizen actually benefit? How much would we even be able to “save” the planet?

In other words, if we did commit economic suicide, and massively reduced the standard of living for hundreds of millions of people, what would those people get in return? What is the ROI?

I think you would find out of these hypothetical questions the real reason why the only scientists who fully buy into the anthropogenic global warming theory are the ones whose income and livelihood depends on continuing to receive taxpayer-funded government grants which mandate full allegiance to the theory.

In what way is an economy based on burning ever increasing amounts of a finite resource sustainable?

Anyway the economics of the issue are far from settled, but in general it turns out that maintaining a habitable planet might have a positive roi!!! Have a read:

http://scholar.harvard.edu/files/weitzman/files/fattaileduncertaintyeconomics.pdf

Pat I can only conclude you are EITHER abysmally ignorant OR a troll. Respond as you please.

Ignorance is excusable and you can cure it now that you have discovered this forum. I am personally as ignorant as few post in the opinion of some regulars here. LOL

You are abysmally ignorant if you don’t understand that coal oil and gas come out of holes in the ground and don’t grow back like potatoes and thus that they ARE going to run out. Prices are down right now but the historical trend is sharply upward you know. Or maybe you don’t.

We are going to be in very big trouble in terms of being able to pay for fossil fuels in another decade or two at the latest. More people , more exhausted holes, fewer places left every year to make new holes you see.

If you do understand these things then you are just a scummy slimy troll.

Which ???

Just to show that I have your own interests at heart I recommend that unless you have a LOT of money you check the historical record of retail gasoline and diesel fuel prices before you buy a six thousand pound beer hauler on a seventy two month note. 😉

I’ve never been comfortable agreeing to the premise of “infinite growth on a finite world is impossible”. Mainly because of the vocal crowd, represented by blogs like this one, that has existed since the sixties screaming about a population bomb, peak oil, resources like copper and iron being used up, and so on. They keep up the messaging even though none of their predictions of doom and gloom have ever actually come to pass. More people exist now than ever before and we are comfortably feeding all of them. We have more oil and natural gas then we know what to do with, we have 500+ years of coal (China has 300+ years of coal). In short, I look around and see with continually improving technology, the opportunities for further human development are nearly endless. I just guess people here are a glass 1/2 empty kind of people and believe the freedom-stifling hand of a central government should be in control of all aspects of our lives. I, on the other hand, am a free market optimist, realizing capitalism and the entrepreneurial spirit has allowed humanity to overcome all sorts of obstacles in the past and will continue to allow humanity to overcome all obstacles to economic development and prosperity in the future. Never bet against human ingenuity!

Pat,

“I’ve never been comfortable agreeing to the premise of “infinite growth on a finite world is impossible”.”

So are you more comfortable with this?:

Infinite growth on a finite world is possible.

If you are, then you are getting closer to troll territory.

The reality is that you are irrationally discounting real scientific evidence because you have a core political belief that regulating free enterprise is dangerous to economic growth. If you keep trying to say the science is wrong, you will just look like a crank.

But if you stick to your core argument that the economy is in danger if we try to effectively respond to climate change, you might actually have a good argument. It just might not lead where you or anyone else wants to go. Collapse.

If we continue BAU, we will collapse.

If we don’t continue BAU, we will collapse.

Collapse is inevitable.

Rather than a collapsing civilization, we are headed to Mars!

http://en.wikipedia.org/wiki/Mars_Colonial_Transporter

And in less than 25 years.

Hi canabuck.

Let me get this straight. Are you suggesting that SpaceX is going to somehow prevent the collapse that I contend is already underway? That doesn’t make much sense to me. It would seem to be a lot more logical to assume that SpaceX will collapse right along with industrial civilization.

Are you really just ignoring the likelihood of imminent collapse?

everyone is being fed comfortably, eh?

infinite growth is possible in a finite system?

Go away, troll.

Pat, it isn’t about doom and gloom, even less about what you feel comfortable with, it’s about basic physics and the laws of thermodynamics. Reality is what it is regardless of what you think it should be…

I’ve posted this link before:

https://www.youtube.com/watch?v=o_8b6ej0U3g

Tom Murphy: Growth has an Expiration Date

It is fortunate we have 2% of climate scientists financed by the fossil fuel industry who have the integrity to tell us the truth.

Or, perhaps, just tell you what it is that you wish to hear.

“Or, perhaps, just tell you what it is that they wish to hear.”

Fixed.

NAOM

Thanks! I was thinking of that line from an old Paul Simon song, “a man hears what he wants to hear, and disregards the rest”.

“Just a come on from the whores on Seventh Avenue.”

~Paul Simon

Hello Pat.

Old farmer mac had this to say about your comment:

“Pat I can only conclude you are EITHER abysmally ignorant OR a troll.”

I don’t think that is correct at all. I think you are trying to make a very honest argument. One part of your argument is weak and one is strong. Here is a breakdown:

“I think you would find out of these hypothetical questions the real reason why the only scientists who fully buy into the anthropogenic global warming theory are the ones whose income and livelihood depends on continuing to receive taxpayer-funded government grants which mandate full allegiance to the theory.”

Unfortunately, when you draw the conclusion that the science is suspect, you are wrong. It is not just a wrong conclusion. It is a terrible argument as well. It destroys your credibility.

But this statement is another matter entirely:

“But let’s say we actually were to listen to the public-sector taxpayer-funded climate researchers and spend trillions upon trillions of dollars destroying the only sustainably successful economic system mankind has ever known all so we can produce less CO2, how would your ordinary American citizen actually benefit? How much would we even be able to “save” the planet?

In other words, if we did commit economic suicide, and massively reduced the standard of living for hundreds of millions of people, what would those people get in return? What is the ROI?”

This is a pretty strong argument. It is really your core argument and you should stick with it. I admit that your core argument is much more difficult to rebut. That is because you are describing a dilemma, not a problem. You are correct that there are no workable solutions to the climate change problem.

Futilitist: “If we maintain BAU, we are clearly screwed!”

Pat from Vegas: “If we attempt to change BAU, we are clearly screwed!”

Correct conclusion: We are clearly screwed.

You guys always seem to miss that if trillions and trillions of dollars were spent it would be one hell of a boost to businesses and the economy.

NAOM

In net energy terms it would just be a Ponzi scheme.

Spending more money doesn’t solve the problem of scarcity. It actually accelerates the problem of scarcity. When peak unconventional oil happens there will be oil scarcity afterwards. Spending trillions upon trillions of dollars would only bring that day forward in time. BAU will be discontinued at some point after peak unconventional oil happens. When you say spend trillions where exactly do you suppose these trillions will come from? When the Fed creates money there is a debt attached to it that is equal to the amount created + interest so the debt attached is actually greater than the sum created. So spending trillions would amount to going into trillions more debt. Which can’t be serviced due to oil scarcity. This problem can’t be solve by throwing money at it.

Whilst what you say is true, my point is that those who cite the cost of change do not take into account that that cost will generate business. It does not simply go down a drain. Some of that will be transferred from BAU systems to the new systems. The money spent on a coal plant could be spent on renewables. Jobs lost in old industries will be gained in new. Money spent in patching up a grid system for the 1900s to try and keep it running with more and more consumption can be spent on a grid system for the 2100s. Much of it will be a shift.

NAOM

There is a small amount of warming in the satellite data:

http://www.drroyspencer.com/wp-content/uploads/UAH_LT_1979_thru_February_2015_v5.png

However, Solar Power is doubling roughly every 2 years.

Which means in 2029, Solar Power will be 128% of current total power production.

Which means there will be very little industrial CO2 production after that time.

From now until 2029, you could see a 28 PPM increase in CO2, @ the current rate of 2PPM/Yr.

With a 3 degree C sensitivity, that works out to a .21 degree C increase in global average temps.

Bottom line – keep ramping up Solar Power, and there won’t be much Global Warming to talk about.

John B’s link seems problematic. Here’s another chart:

From the annals of the Oil Drum to the lap of John B.

Spencerlicious.

“Bottom line… there won’t be much Global Warming to talk about.”… ~ John B

“…because we’ll be more concerned about our very survival in the face of the ostensible impending Global Warming that’s already in the pipeline and being rampantly fed as solar panels are manufactured.” ~ CM for John B

Hi Caelan,

Here’s another article from “The Oil Drum”

http://www.theoildrum.com/node/2716

Great experts over there eh?

What’s your point regarding the link? There are other sites/links about Spencer. Would you like some more? ‘u’

The point is, that site was BS.

If you don’t like UAH, I can post up the RSS numbers. Or is it that you just don’t like satellite data?

“The UAH TLT dataset was a source of controversy in the 1990s as, at that time, it showed little increase in global mean temperature, at odds with surface measurements. Since then a number of errors in the way the atmospheric temperatures were derived from the raw radiance data have been discovered and corrections made by Christy et al. at UAH.” ~ Wikipedia

Anyway, our cultural complexity is way out of hand.

And, again, burn enough stuff on the planet at vast scales like we are doing and something’s going to happen.

We’re playing with fire.

John B.

Quit trying to say that the science is suspect. It isn’t. Scientist use peer review and you are not a peer.

Stick with your core argument to avoid sounding like a crank.

All of your arguments grow out of your core belief that regulation of the economy leads to economic damage. Stick to that argument. It is hard to rebut when it comes to the issue of climate change, since any realistic solution (if even possible) would require some very drastic measures.

Quit trying to put words in my mouth. And try and study a little, so you can keep up with the conversation.

I am trying to help you make a better argument. I am *WAY* ahead of this conversation, John.

Just ignore him.

Peer review doesn’t guarantee quality. Sometimes experts in other areas can detect serious flaws in a science paper which went undetected by peer review.

Nowadays we see many papers published in Nature and similar journals, which data mine the CMIP5 ( computer model) ensemble used by the IPCC, but this ensemble has been identified to predict temperatures on the high side. This means we are seeing hundreds of papers based on flawed simulations. All of which have passed peer review.

The only reason solar is doubling every year is because it is starting from such a small install base.

I would disagree.

I think the major reason is the falling cost. Also, new tech makes solar panels, and inverters more efficient. There’s also improved racking and installation tech. New financing and leasing options. And concerns about the environment, and possible scarcity of fossil fuels.

So in reality, there are many reasons why Solar has seen sustained growth. Seven more doublings, and we will be @ 100% Solar Power.

We don’t have time for 7 more doublings.

So you are saying that the economy will have totally collapsed by 2029?

Considering that we are at peak oil right now and we are about to experience a long term, extremely severe net energy decline, the answer is obviously yes. How could it be otherwise?

“However, Solar Power is doubling roughly every 2 years.

Which means in 2029, Solar Power will be 128% of current total power production.”

A friend of mine is having his second child later this year. At current rate of doubling he should have over 32,000 children by 2029!

Sam, I don’t think your friend should be having so many kids, college fees will be enormous. Of course if he’s a good Catholic that’s obviously different: Heaven’s Rewards Await.

He might have to move to a slightly bigger house, too.

Unfortunately life usually resides in the realm of reality…here’s my projected increase for the “peak oil” and the “Obama’s wishful thinking” cases:

The temperature anomaly is relative to what historical period? Pre-industrial time or mid-20th century?

Political economist I believe I used the temperature around 1850. The graph shows a 0.75 degree C anomaly in 2013, so it’s easy to work backwards. The model I used is built into a spreadsheet, it simply lays out a set of equations for temperature increases and departs from a given anomaly departure point.

I lost my faith in anything more complex when I realized the CGMs in the ensemble don’t agree on the actual temperature at all. They have a 2 degree C spread, which tells me they are at best a rough directional vector abd their capabilities are oversold.

And here’s the Climate Lab Book update. The skeptical science is mostly propaganda by Nucitelli and friends. It’s pretty useless as a learning site, unless you are into climate onanism.

Hi Fernando.