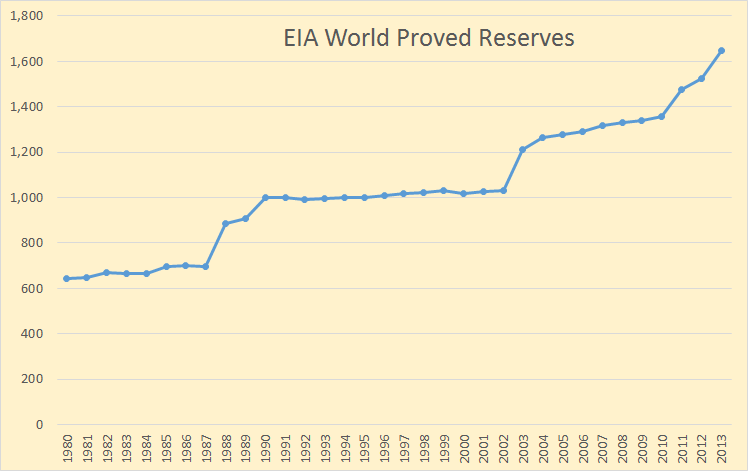

The EIA publishes Annually a list of World Proved Reserves of Crude Oil. Though all charts in this post use the EIA data, BP, the IEA and virtually every other reporting agency in the world uses basically the same data. It is my contention that this data is misleading and totally meaningless. This is especially true of OPEC Middle East Reserves. However because this data is taken as gospel by the media and perhaps 90% of energy analysts in the world, this misinformation becomes a serious problem.

But first let’s look at the data. It dates to 2014 in most cases but some data only goes to 2013. All data is billion barrels of reserves.

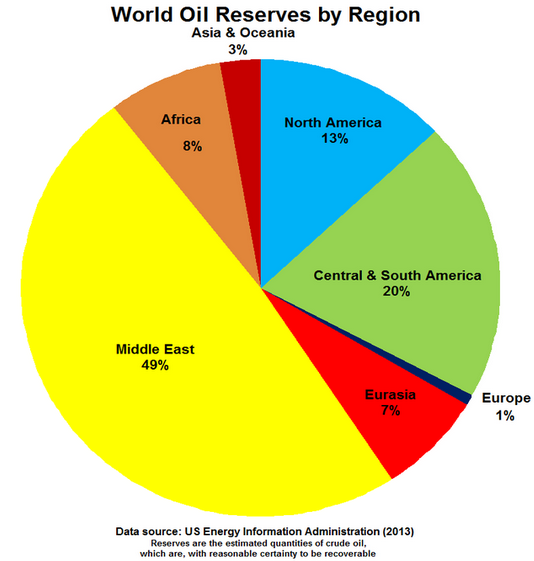

The EIA said we had 1,646 billion barrels of proved reserves in 2013. Other agencies put that figure a bit higher but we will go with this. And just where are these reserves located?

The EIA said we had 1,646 billion barrels of proved reserves in 2013. Other agencies put that figure a bit higher but we will go with this. And just where are these reserves located?

Almost half of the world’s proved reserves are supposed to be located in the Middle East. Actually it would be well over 60% if it were not for the recent additions to world reserves by the Venezuela Bitumen and the Canadian Tar sands.

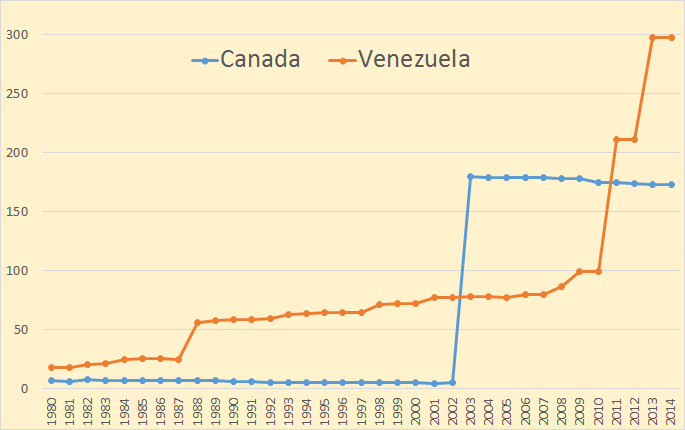

This is the proven reserves claimed by Canada and Venezuela. The EIA describes proved reserves as “reserves of crude oil which are with reasonable certainty to be recoverable.” So Canada has 173 billion barrels of reserves and Venezuela 298 billion barrels of reserves that we can believe has “reasonable certainty to be recoverable? What does that mean?

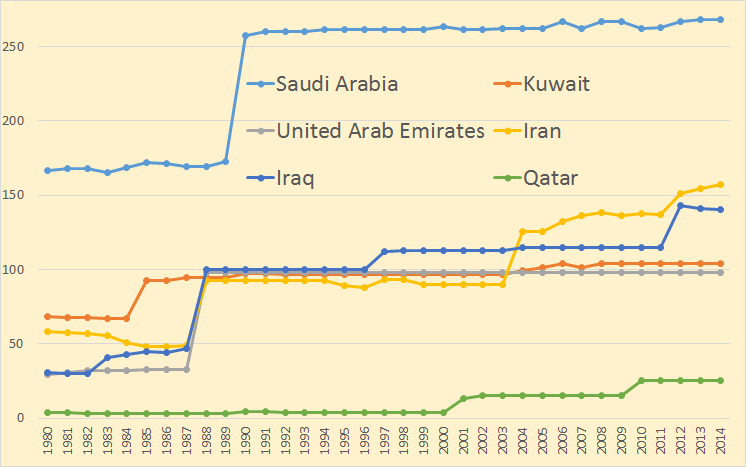

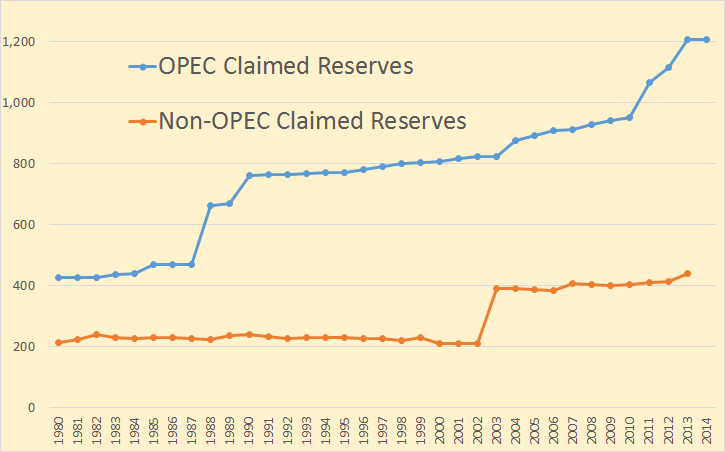

As you can see Middle East proved reserves always increase, they never decrease no matter how much oil is pumped from those reserves every year. And the worlds media accepts this nonsense without question. I once heard a reporter on CNBC point to the increase in world proved reserves in the decade of the 80s as proof that we are finding massive amounts of new oil all the time. No one bothered to point out that all this oil was found in board rooms by bureaucrats who simply “decided” this was how much oil they had.

Russia is the world’s largest crude oil producer so we must look at her chart. (Not zero based.) Does this chart look realistic to anyone? This chart should prove to anyone that so-called proved reserves are simply set by bureaucrats with hardly any connection to actual reserves the country possesses.

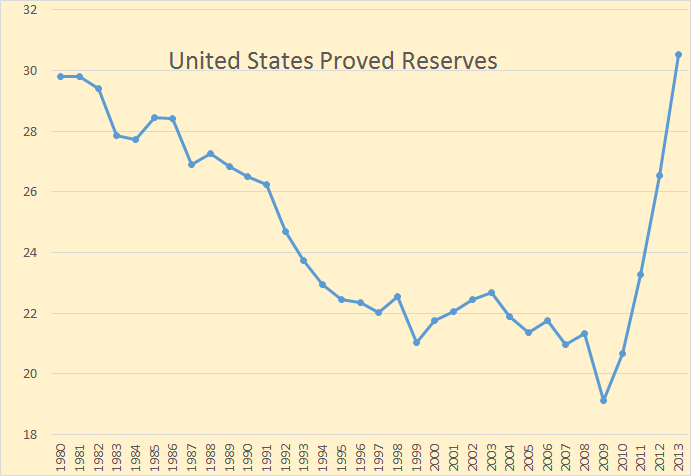

Even the US has gotten in on the act, adding 11.5 billion barrels of proved reserves since 2009. They did not report US 2014 reserves. Most of this increase is light tight oil reserves but some reserves have been added to the Gulf of Mexico. Notice that this chart is not zero based.

I have changed the definition here to “claimed reserves” rather than “proved reserves” because everyone should know by now that the vast majority of those claimed reserves are a joke. So how much oil is left in the ground? I mean oil that can reasonably be recovered at a price that economies can afford to pay. I have no idea and I don’t believe anyone else does either. But we can make an educated guess.

We must start by looking at reserves to production ratios. The RP ratio is expressed in “years of production at current production levels”. An RP ratio of 25 would mean that a has reserves of 25 times its current production. It does not mean that a country could produce at that level for 25 years then suddenly nothing. All reserves decline gradually. There are no hard and fast rules for RP ratios but in general we can say:

1. New fields have a higher RP ratio than old fields.

2. The larger the field the higher the RP ratio. Very large fields tend to produce higher for much longer than small fields.

3. The deeper the field the smaller the RP ratio. Very deep water fields have a very small RP ration.

4. Bitumen and tar sands have a very high RP ratio because their reserves can only be produced at a very slow rate.

4. Light tight oil is a completely different animal. Each well pumps from its own tiny reservoir. It is, or should be, totally independent from all other wells pumping from the formation. Each well would have a very small RP ratio but the RP ratio of the entire field, like the Bakken or Eagle Ford, would have a totally different RP ration from the entire field. Also, more than any other kind of reservoir, the RP ratio of an LTO field would depend on the price of oil.

All that being said we can say that the Middle East, because of its very large fields, should have a higher RP ratio than most other places in the world. But not that much higher. For instance the EIA claims OPEC has reserves of 1,206 billion barrels. OPEC produces about 11.7 billion barrels per year. That would give OPEC an RP ratio o about 103. Non-OPEC, on the other hand, the EIA says has 441 billion barrels of proved reserves. Non-OPEC nations produce about 16.28 billion barrels per year so that gives non-OPEC nations an RP ratio of about 27.

OPEC claims an RP ratio of 103, almost 4 times non-OPEC’s 27. Actually the OPEC Web Site claims non-OPEC nations have only 284 billion barrels of proved reserves. That would give non-OPEC nations an RP ratio of only 17.5.

What can we believe? Well I can only speak for myself but I have always used the reasoning that nations, the vast majority of the time, produce every barrel they possibly can. And also that the more oil one has to produce the more oil they do produce. Therefore OPEC nations should have an RP ratio relatively close to that of non-OPEC, perhaps slightly higher because of their larger fields.

If OPEC has an RP ratio of 35 then that would give them reserves of 410 billion barrels.

If non-OPEC has an RP ratio of 25 then that would give them reserves of 407 billion barrels. And that would give the world about 817 billion barrels of recoverable reserves. I can accept that number. But that is my high pick. I could also accept a slightly smaller number.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com.

As usual Ron, excellent analysis. I hold a very similar opinion about OPEC reserves. I was born in Baghdad, my father used to work in the ministry of industry and minerals. In the 1980s, he used to joke about how every time Iran raised its reserves, the Iraqi government increased its own reserves in order to stay ahead of “the arch enemy” and if you look at the graphs you notice Iraq always had higher reserves than Iran during the 1980s as a result.

One can do something similar to the R/P ratio for net exports, which would be the ratio of estimated remaining CNE (Cumulative Net Exports) divided by annual net exports (NE), which I guess would be CNE/NE.

I estimate post-export peak CNE by extrapolating the rate of decline in the ECI Ratio (Ratio of production to consumption). For example, for the Six Country Case History*, which showed a net export peak in 1995, their estimated remaining post-1995 CNE at the end of 2002 were 2.3 Gb, with 2002 annual NE of 0.67 Gb, resulting in an estimated CNE/NE ratio of 3.4 years. Actual remaining post-1995 CNE at the end of 2002 were only 0.6 Gb, so the actual CNE/NE Ratio at the end of 2002 was 11 months.

A similar exercise for Saudi Arabia puts their estimated CNE/NE Ratio at about 12 years (38 Gb/3.2 Gb per year).

The following chart shows normalized values for Saudi production, net exports, ECI Ratio (ratio of production to consumption) and remaining estimated post-2005 CNE by year (with 2005 values = 100%). The estimate for post-2005 CNE is based on the rate of decline in the Saudi ECI Ratio (at an ECI Ratio of 1.0, net exports = zero). I estimate that in only eight years, through 2013, Saudi Arabia shipped roughly 40% of their post-2005 CNE.

http://i1095.photobucket.com/albums/i475/westexas/Slide21_zps74c9ebac.jpg

A similar chart for the Six Country Case History:

http://i1095.photobucket.com/albums/i475/westexas/Slide2_zps55d9efa7.jpg

*Major net oil exporters that hit or approached zero net exports from 1980 to 2010

And here are some interesting numbers to contemplate, along the lines of what can’t continue, won’t continue (but so far, through 2013, it has continued). Drudge had a headline today to the effect that China has now surpassed the US was the world’s largest economy.

Based on latest EIA data (as of September anyway), the Ratio of GNE to CNI* fell from 9.5 in 2005 to 5.0 in 2013 (at a GNE/CNI Ratio of 1.0, Chindia would theoretically consume 100% of GNE).

Available Net Exports (ANE) = GNE less CNI, and ANE fell from 41 mbpd in 2005 to 34 mbpd in 2013.

Estimated Available post-2005 CNE (estimated cumulative volume of GNE available to importers other than China & India) were 195 Gb at the end of 2005, with 108 Gb have been consumed from 2006 to 2013 inclusive, leaving remaining estimated remaining Available CNE at about 87b Gb at the end of 2013.

The estimated Available CNE/ANE Ratio would be 6.4 years at the end of 2013 (87 Gb/13.5 Gb per year).

*GNE = Combined net exports from Top 33 net exporters in 2005 (EIA data, total petroleum liquids + other liquids)

CNI = Chindia’s Net Imports

Those are some striking stats Jeff. I have been following your updates since the oil drum days and I admire your persistence in sharing this vital information. As professor Bartlett once said “”The greatest shortcoming of the human race is our inability to understand the exponential function.”

Six Country Case History: Major net oil exporters that hit or approached zero net exports from 1980 to 2010 (Excluding China)

Jeffrey,

Thanks for wading in over at the WSJ on the “Peak oil is debunked again” article.

It’s like an ignorance swap-meet over there…doesn’t ever seem worth it to bring facts to a belief festival, but somebody has to do it, so thanks for doing it.

It all seems so easy to me…it’s just numbers…you have a finite quantity of X (fixed), you use it at rate Y (variable), depending on cost Z (variable).

But this is well beyond the capabilities of people who have been raised on the idea that facts and beliefs are essentially the same thing. It all leads me to the conclusion that our chance of avoiding an unpleasant date with a Malthusian future is pretty much nil.

Oh well. Everything happens for a reason, and I guess humans still have a lesson or two to learn in the realm of humility…?

It’s always interesting to read comments from residents of Fantasy Island. What is curious is that no one has, so far at least, responded to my comments. Here is my most recent comment, at the top of the thread (my other comments are down the thread):

It’s kinda complicated. This is one reason why nobody does a good job predicting oil prices. I lean towards segregating liquids, and considering them separately. When I did I derived a total liquids peak in about 20 years. But before we hit such a peak we would see spiking prices. A liquids peak implies either the world economy went to hell or we found a replacement. Or population dropped. Or something radical like that. I’m feeling a little bit grim about what’s coming down the road.

Following are three comments I posted in regard to the WSJ OpEd, among the flood of comments by residents of Fantasy Island. Note that in my opinion, they are taking a counterfactual position, in that the data strongly suggest that actual global crude oil production (45 and lower API gravity crude oil) virtually stopped increasing in 2005, while global natural gas production, and associated liquids (condensate & NGL), have so far continued to increase.

Two relevant charts:

http://i1095.photobucket.com/albums/i475/westexas/Slide1_zps45f11d98.jpg

http://i1095.photobucket.com/albums/i475/westexas/Slide2_zpse294f080.jpg

WSJ Comments:

#1:

From (Debunked) article: “The world relearns that supply responds to necessity and price”

If the Peak Oil “Theory” is that the finite sum of discrete sources of oil that peak and decline will also peak and decline, and if this has been “debunked,” what’s the alternative theory? Is it that the finite sum of discrete sources of oil that peak and decline will show a virtually continuous rate of increase in production?

In any case, North Sea Crude + Condensate (C+C) production peaked at 6 mbpd in 1999, when the annual Brent crude oil price was $18. North Sea C+C production was down to 2.5 mbpd in 2013 (when Brent averaged $109), a 6%/year rate of decline in production versus a 13%/year rate of increase in Brent crude prices.

If discrete regions peak and decline, despite higher oil prices, doesn’t that mean that it’s when, not if, that the sum of the output from discrete regions shows the same pattern? As noted below, it’s likely that actual global crude oil production effectively peaked in 2005.

#2:

When we ask for the price of oil, we get the price of 45 or lower API gravity crude oil, but when we ask for volumes, we get some combination of crude oil + condensate + NGL (natural gas liquids) + biofuels. What the EIA calls “Crude oil” is actually crude oil + condensate (C+C), and condensate, like NGL, is a byproduct of natural gas production.

As annual Brent oil prices rose from $25 in 2002 to $55 in 2005, global C+C production rose from 67 mbpd (million barrels per day) in 2002 to 74 mbpd in 2005. As Brent rose from $55 in 2005 to the $110 range for 2011 to 2013 inclusive, global C+C production only rose by only 3%, up to 76 mbpd in 2013. Note that global dry gas production rose by 22% from 2005 to 2012.

If we subtract out plausible estimates for global condensate production (from global C+C numbers), it’s very likely that actual global crude oil production effectively peaked in 2005, while global natural gas production and associated liquids, condensate and NGL, have (so far) continued to increase.

#3:

In late 2004, Yergin asserted that oil prices would be back down to a long term oil price ceiling of $38 per barrel by late 2005. This caused me to suggests that we price oil in “Yergins,” with One Yergin = $38 per barrel.

As noted elsewhere, it’s very likely that actual global crude oil production (45 and lower API gravity crude oil) has not materially exceeded the 2005 annual production rate for eight straight years, while global natural gas production and associated liquids, condensate and natural gas liquids, have (so far) continued to increase.

And note that Global Net Exports of oil (GNE*) have been below the 2005 annual rate for eight straight years, while developing countries, led by China, have so far consumed an increasing share of a post-2005 declining volume of GNE. The supply of GNE available to importers other than China & India fell from 41 mbpd in 2005 to 34 mbpd in 2013.

*Top 33 net exporters in 2005, total petroleum liquids + other liquids, EIA

Fiction – but reserves are a truly ethereal quantity. The SPE rules that OPEC kind of mirrors are actually better than SEC IMO.

Peak Oil in the Rest of the World

History doesn’t repeat itself, but it does rhyme

The second post is actually about US and ME OPEC drilling stats.

Hi Euan,

You also follow this pretty closely, and are skeptical of reserve numbers. I agree that using 2P reserves makes more sense than 1P (I think that is what you meant by preferring SPE over SEC rules).

If we use BP reserve data (from Statistical Review of World Energy) and deduct Orinoco belt and Tar sands reserves and also 300 Gb of OPEC “speculative reserves” we get 290 Gb of non-OPEC and 640 of OPEC reserves for a total of 930 GB of World reserves at the end of 2010 for C+C less extra heavy (following Laherrere). The BP data may also include reserves of NGL which might explain the 80 Gb difference between Jean Laherrere’s 850 Gb estimate and the modified BP estimate.

If we assume that Jean Laherrere’s estimate is correct (or better than the BP estimate), and assume that 8.6% of the BP reserves are NGL, then at year end 2013 there would be about 910 Gb of C+C less extra heavy reserves (2P), with roughly 280 Gb of non-OPEC reserves and 630 Gb of OPEC reserves.

I see no reason that the R/P ratios (the reciprocal of the depletion rate) must be the same in different regions. In fact the economic behavior of National Oil Companies in OPEC nations and their membership in a cartel will affect the rate that reserves are developed into producing reserves.

The idea that an oil company will produce all the oil it can from producing reserves is likely to be correct. The assumption that all oil companies will choose to develop reserves at a similar rate throughout the World, may be incorrect.

“I agree that using 2P reserves makes more sense than 1P” Why does this make more sense? Using 2P simply dilutes the confidence level in a reserve estimate. But I do agree that it makes more sense if you want to make things look better. Actually, with respect, I don’t understand how anyone other than a qualified group of Petroleum Engineers who spend most of their time doing actual reserve determinations would be qualified to make a statement like that.

Hi Doug,

Do you think Jean Laherrere is qualified? I do.

The stuff below I am pretty sure you already know, but I get a very different sense of whether we should prefer 1P or 2P reserves based on reading Laherrere and the Society of Petroleum Engineers (SPE) material.

It is a matter of statistics, the mean estimate is considered the best guess using available information, that is what the 2P estimate is, see

http://www.spe.org/industry/docs/PRMS_Guidelines_Nov2011.pdf

Under PRMS, therefore, provided that the project satisfies the requirements to have Reserves, there should always be a low (1P) estimate, a best (2P) estimate, and a high (3P) estimate…

Also,

Uncertainty in resource estimates is best communicated by reporting a range of potential results. However, if it is required to report a single representative result, the “best estimate” is considered the most realistic assessment of recoverable quantities

In fact I would argue that using 1P reserves introduces more uncertainty if the goal is an accurate estimate. For example if someone asks how much does that sack of cement weigh? One usually would prefer the best guess, such as 30 kilos, if one is very unsure, they might say around 20 to 40 kilos, but generally if I were going to pick up the sack of cement, I would not want to be told it is 20 kilos, if in fact the best guess should be 30. Maybe you have a stronger back than me. 🙂

In general I like the best estimate when doing statistics especially if that is the only estimate given, better would be a range of estimates low, best and high (1P,2P, and 3P).

See Laherrere paper (quote from page 2) at link below:

http://aspofrance.viabloga.com/files/JL_ComBP2012.pdf

The comparison of the current proved reserves (EIA) with the remaining backdated 2P technical data is drastic. Current proved reserves follows the financial SEC rules for audited data or the political non-audited OPEC sources. Arithmetic aggregation of proved data is incorrect, leading to an underestimate of the reserves and to future reserve growth.

2P reserve chart below from p3 of Laherrere’s paper linked above

In Ghawar need to find the cuts and all will become clear

Let’s say there is 770,000,000,000 barrels left to go, half or less.

In one sentence, more than half of the reserves are wiped out, gone with some words.

Fictions every time you turn around, no matter where you are, no matter where you go.

The EIA makes stuff up, apparently.

770,000,000,000/77,000,000

You will have 10,000 days of oil supply to consume. The demand is there, consuming it is the only way to use it.

10,000/365 is 27 years of oil supply and it could be more, but you can’t count it and can’t count on it if it isn’t there.

It took about three hours to consume half of all known proven reserves.

It is better to have twice as much when you make stuff up.

When you’re making stuff up, might as well inflate the numbers that are high enough to make them believable, even credible. Must be their job to make stuff up.

The end result is: you can’t make this stuff up.

The EIA makes stuff up, apparently.

Ronald if you had bothered to read the post you wouldn’t have made such a silly statement. Do you think the EIA, the IEA, BP all made up the same numbers? Now that would be one hell of a coincidence. All the world uses these same numbers and they did not get them from the EIA. They got them from Saudi Arabia, from Iran, from Iraq and from all the other countries. These are the numbers the countries themselves report, that’s where they came from.

Ronald is our resident court jester and comedian.

The court jester’s job is to spout a lot of nonsense in a way that subtly or not so subtly gores oxes right and left. This goring can take the form of irony or sarcasm or parody or redneck humor or any combination thereof.

The Jester is the only person in the Royal Court who can make fun of just about anybody without getting his head chopped off or at least getting thrown in the dungeon for his temerity.

The Jester is the one person who could speak truth to power – the messenger who could by using irony humor sarcasm parody bring the bad news to the attention of the King ( or Queen ) without getting shot.

At times he would be ”taking a flyer” at the direction of the king or a trusted minister in order to see how the rest of the Court would respond to a certain idea or initiative on the part of the King – who contrary to what popular conceptions mostly had to rule by maintaining a consensus with a variable number of other powerful nobles or royal relatives rather than having absolute power.

The Jester is also expected to have something to say that makes good sense or demonstrates a valid point occasionally.

In other words the only way to take the Jester seriously is to not take him seriously. Then you can read between the lines so to speak.

Now of course a forum such as this one is not well suited to communication by means of humor , parody, irony , sarcasm and other such verbal tools.

If you have watched Saturday Night or a similar show on tv then you will ” get it ” if you read Ronald as if he were a talking head news caster on that sort of show.

I prefer the William Faulkner theme, to-wit, if Faulkner had been a blogger, Ronald’s (stream-of-consciousness) posts might be an example of what we would see.

Faulkner is one of my very favorite writers- not least because I am old enough that my grandparents and great grandparents and a great many people I knew as a youngster lived lives very much like the lives of Faulkner’ s characters in a society much like his creations. Nobody else has portrayed the Old South more faithfully and accurately- nobody that I know of anyway.An evening with Faulkner is a magical evening out of my childhood.

Now reading him is not easy when he is in stream of consciousness mode.

But if you visualize the character and LISTEN to and WATCH that character on a mental stage so that he is gesticulating winking nodding waving his arm or hands in various ways laughing etc THEN all at once you GET IT. Basically what I am saying is that reading Faulkner’s stream of consciousness stuff is like reading a play while visualizing it being performed.

If you want to GET IT when you read Ronald here then imagine him grinning crookedly winking sideways pretending crocodile tears sneering sniveling belly laughing farting gnashing his teeth pretending he believes the bullshit put out by some particular bullshit artist etc etc and generally putting on a show while delivering his written comments as a monologue.

Now of course it COULD be that he is shall we say on the iffy side of the fine line between insanity and genius but except for apple trees and coon hounds and milk complexioned freckle faced corn fed farm girls books are my greatest love and I have read as many or more than most English professors.So I guess I can recognize Ronald’s sort of stuff when I see it.

( Now my reading total is not as big a brag as it might be considering that I am a lot older than most English professors and have never spent any time obsessively studying any one author or one genre or historical period . I read most authors only once or twice at the most.)

Faulkner is worth rereading every decade and in my estimation one of the ten or so best all time American authors.

I wonder if I am sane myself only once or twice most days. 😉

So far the guys in the white jackets haven’t come for me and the neighbors still talk to me so I guess I am ok. 😉

Ronald is just a smart guy or girl who is having some fun playing the smart alec..

I strongly suspect that if he were to ”come out of character” his commentary would be pretty much midstream to doomerish in relation to the run of the mill at this particular site.

Foiled again?

Tee hee!

About reserves, there is the Laherrère data, most probably much closer to the truth (and coherent since the 1998 paper with Campbell) :

http://iiscn.files.wordpress.com/2013/05/jlreserves.jpg

We’ve all seen the rationale presented for this reserve number or that one. KSA has a rationale for their reserves total being constant for many years. One of the recent posts talked about 1P converting to 2P or whatever. There will always be rationales.

It Does Not Matter If We Believe Or Not.

What matters, and probably the only thing that does, is will there be food at the grocery store when you next go there. It’s pretty hard for society to generate passion about it until trucks don’t bring food to shelves.

The ration of reserves to production is not a very useful number since it tends to be a constant value over many decades, regardless of the rate of production. This is simply because total reserves are affected by price, and production/demand sets the price. As production falls relative to demand, price goes up, which thereby increases reserves. If demand falls relative to production, the price of oil declines, which thereby decreases reserves.

Any realistic estimate of reserves should gradually decline with time, but with periodic variations proportional to the change in price. Those variations should have been quite dramatic in recent years with huge reserve increases following the runup in price during the last decade. We should actually see quite dramatic declines in reserves following the recent price collapse. But production will tend to follow the price down thereby keeping the reserve to production ratio constant.

Even near the effective end of the oil era we will still have about the same number of years production available as we do now. The price per barrel will be very high and production very low since only the dregs will remain, but the reserve to production ratio will remain the same.

Let us not forget, that some of those reserves can only be recovered at staggering environmental cost. Tar sand mining leaves behind a poisonous wasteland and fracking pollutes water, perhaps with air, the most precious of all of our resources. CAN be and SHOULD be recovered are two different things entirely. If we value clean water and land management with view of passing fertile and habitable land on to future generations, then much of of the proven reserves should be left alone.

Environmental concerns have zero weight.

No government will ever balk at getting oil to fuel trucks to put food on shelves because it dirties up some remote land. It would be irresponsible for them to do so. How could anyone vote for someone who ranks the well being of caribou above starvation of citizens.

Blockadia

Environmental concerns have zero weight! Mygod, where do you live?

Around my little neck of the woods people are getting together and SUCCESSFULLY going solar or as near as they can get. My house has not spent a nickel on gasoline, propane or natgas, or kW-hr of coal electricity, for a whole year so far, and we are all totally comfortable, all the time.

Why? Environmental concerns, that’s why.

Don’t bother to tell me about the trucks to the food store, presumably from Cal , we are working on food that goes near nowhere but where it came from.

Sure it will take time and ff’s to get off ff’s altogether, but lots of people these days are publishing heavy thinking to the effect that it can be done.

People here know all that.

And lots of people have already published very heavy thinking to the effect that it HAS GOT TO BE DONE- for environmental reasons. People around here believe them.

That’s why I am a little puzzled by all the talk about proven reserves. Doesn’t everybody realize that stuff has to stay in the ground? If it has to stay there, why talk about how much there is that has to stay there?

okay the whole green thing is so stupid and such a scam. humans cant control the tempature of the earth. the tempature has been going up an down since our Lord created the planet. somehow the liberals think they can now control the tempature, by coordinating all the people on earth to “BUY” into there green mantra. its a big joke. keep buying those overpriced green things if it makes you feel good. but its only helping your mind and does nothing for the environment. oil is clean and natural. not like those bird slicing windmill eye soars or those unsightely bird fryer solarpanels that won’t even produce enough electricity to charge my phone.

eye soars?

“oil is clean and natural.” It is also organic and gluten free.

So did a robot make this comment, or someone who can’t spell?

Either way, not very persuasive.

Not if it came from one of those: our Lord created the planet 6000 years ago people anyway.

You guys are responding to a troll.

+1 don’t feed them.

Funny how a bunch of Africans can charge their cell phones from tiny solar panels….

http://www.nytimes.com/2010/12/25/science/earth/25fossil.html

Payback for the $80 panel & charger: at $35/month, a little over 2 months. And that was back in 2010.

Indians too. Sometime for less than they used to pay for kerosene.

http://thinkprogress.org/climate/2014/07/10/3457917/india-solar-revolution/

p.s. Ms. Misinformed – “solar panels” don’t fry birds. A bunch of mirrors at “power tower” type concentrated solar thermal power plants do. Fortunately these are rare, and don’t seem to be as economic as PV panels.

p.p.s – the 29.7 Terawatt-hours photovoltaics produced in 2013 in Germany did more than charge a few cellphones. It was 5.3% of German total electricity consumption.

Tera- = 1000 Giga- = 1,000,000 Mega-

http://www.ise.fraunhofer.de/en/downloads-englisch/pdf-files-englisch/news/electricity-production-from-solar-and-wind-in-germany-in-2013.pdf

Bonnie Girl,

Forgive me for being an unreconstructed Scots Irish dirty old man but your handle alone makes me want to explain to you all about birds and bees and the facts of life.

Now be honest with me at the risk of an internet spanking.

Have you ever seen a strip mine? Have you ever dropped worm in a river than used to be chock full of fish and caught nothing?

I have some insecticide in storage that we used to spray on our apple trees so powerful a single drop on your tender milky white wrist would put you in the hospital. Using them was legal and fully approved and RECCOMENDED by the federal government and the Commonwealth of Virginia until a few years ago.

That particular insecticide breaks down in only a few days in sunlight.

Now I have lead based and benzene based stuff left over that will be hanging around for a thousand years. Once upon a time my Daddy and I used to spread this stuff around by the truckload- a truck load a year on just our one little farm.Some of what I sprayed as a teenager is still in the soil on my place and in the river bottom sediments all the way out in the Gulf of Mexico.

Some of it is in your bones and fat cells and liver. Hopefully not enough to kill you before your time.It got there because you ate it on or in your bread and beans and veggies and burgers and chicken and fish.

Some of the DDT my GRANDFATHERS sprayed is in your body. Not enough to harm you -I hope!!

But there is no way to know that for sure.

You need not be UNDULY alarmed.

I am still around and I actually worked in the stuff personally for many years as well as eating about the same diet as everybody else.Farmers believe it or not get almost all their food at supermarkets.I have been getting most of my food at supermarkets for over half a century now but before that my family actually ate mostly what we produced ourselves.

And anyway you would starve if it were not for farmers like me using all this stuff.

A possible slow death from liver cancer years from now is much to be preferred to starving next month. 😉

thanks wimbo, living in Germany where they are shutting down the utilities to protect the environment and reading that is pretty funny.

In case you haven’t seen this, Europe’s largest utility is getting out of the power plant business.

http://www.dw.de/german-energy-giant-eon-to-focus-on-renewables/a-18104023

For your small community is works fine. even for Switzerland it works well since citizen vote on every little change, building a bridge, for example, or installing street lights using LEDs. But it will not work for a whole country. Do you think 10 Million New Yorkers will get together and do what a few like-minded people do at your place?

The US has one of the most bellicose reps in the government (see McCain, or tea party members etc) and give a shit about environment if the American Dream is threatened. These people will do anything to keep the BAU (and hence their jobs).

The US has one of the most bellicose reps in the government (see McCain, or tea party members etc) and give a shit about environment if the American Dream is threatened. These people will do anything to keep the BAU (and hence their jobs).

Unless things change, I believe money will continue to influence politics. I assume that at some point, the fossil fuel money in politics will decline and the tech money will increase. Hopefully it will be to the advantage of the next generation of very wealthy to advocate for laws more favorable to energy conservation and alternative energy technology. After all, it’s better for them that people spend their money on things other than gasoline in their tanks.

Environmental concerns have zero weight.

You must live on a very different planet than the one I live on because that statement is some very highly refined yak dung!

http://www.environmentmagazine.org/Archives/Back%20Issues/2012/July-August%202012/constitutional-rights-full.html

The Constitutional Right to a Healthy Environment

by David R. Boyd

Do people have a right to clean air, safe drinking water, and a healthy environment? Fifty years ago, the concept of a human right to a healthy environment was viewed as a novel, even radical, idea. Today it is widely recognized in international law and endorsed by an overwhelming proportion of countries. Even more importantly, despite their recent vintage, environmental rights are included in more than 90 national constitutions. These provisions are having a remarkable impact, ranging from stronger environmental laws and landmark court decisions to the cleanup of pollution hot spots and the provision of safe drinking water.1

Emphasis mine. BTW, there are plenty of societies that understand that if the Caribou can’t survive because of irreparable damage to the ecosystem neither can the citizens. There are no longer any remote lands!

Cheers!

I think you know perfectly well that if citizens are starving in a city, constitutional this or that are not going to stop fueling up trucks to feed them. Nothing would. Nothing should.

That’s still a long way from saying ” Environmental concerns have zero weight.” If you don’t get that at the most fundamental level there isn’t any viable society, government or civilization without a stable and healthy environment then I guess my point is moot. Anyways I’ll just agree to disagree because it seems to me that our world views with regards the environment are too far apart for us to have any meaningful dialogue. You seem to of the school of thought that holds humans and their societies to be separate from and not subject to any natural laws. I look at the world from a physical biological and ecological perspective. Apparently there are 90 countries on this planet, that at least in principle, share my views to the extent that they have re written their constitutions to reflect those views. Who knows maybe one day you will join us. It might be time to make some amendments to the US constitution as well. The US seems to be behind the times and on the wrong side of history. I have strong hopes that a new generation of Americans will soon change that.

Who knows maybe one day you will join us. It might be time to make some amendments to the US constitution as well. The US seems to be behind the times and on the wrong side of history. I have strong hopes that a new generation of Americans will soon change that.

I have wondered if other countries will unite against the US to force, in some way, the US to do more for the planet. If countries like China become more aggressive in reducing carbon emissions and the US does comparatively little, perhaps some sort of action will be taken.

I keep hoping that there will be a technology war with China to see who can develop alternative energy fastest. Having the Soviet Union going into space certainly mobilized the US to do the same. And fear of Germany getting the atomic bomb mobilized the US to do develop one.

If alternative energy becomes an economic advantage and a strategic threat, maybe it will become a US priority.

Well, Boomer, I think we can agree that altenergy already is an economic advantage and a strategic threat, and that China is WAY ahead of us.

They have a huge advantage we are not likely to overcome any time soon. Their people running the show know something about science, and use it. Our government is hog-tied by a bunch of ideological fact-deniers who proudly deny any knowledge of science.

They will starve in the not so distant future, due to climate change. Let’s control overpopulation today,develop peri-urban agriculture, significantly lower consumption etc. My country emits 10 times less CO2 than US, but we live a decent life.

a good book for one’s library…

http://www.nytimes.com/2014/11/09/books/review/naomi-klein-this-changes-everything-review.html?_r=0

It is not just the well being of the caribou, it the the well being of our own species. We are fouling our own nest to the point where it is going to bit us.

Doesn’t matter.

If you can’t eat, you die sooner. No government is ever going prioritize trees if citizens are starving.

No government is ever going prioritize trees if citizens are starving.

I don’t think that is true. There are many countries where people are starving now, but they aren’t a priority.

If you ran a country and wanted a pyramid, it doesn’t necessarily matter how many slaves die in the process.

If you run a country and you want to protect your forest more than you want to protect some of your citizens, you may get your way. There are countries where citizens are killed because they don’t fit into someone’s agenda. (If you were a Jew in Nazi Germany, people weren’t making sure you had something to eat.) People, unfortunately, can be quite expendable at times.

Well, legit point. Let’s phrase it as democracy.

Prioritizing trees over starving voters isn’t going to win any elections.

Let’s make this explicit.

A government that prioritizes trees over starving citizens is both irresponsible and immoral and odds are very high that in a democracy they will be booted.

So if you really think your candidates should advocate trees over starvation, insist they be loud and public about it so we don’t really need to wait for them to be booted out — as they’ll never get in.

Watcher,

Without the trees we are toast, sometimes governments need to look at the big picture, and let science guide policy, those that do not are doomed to fail.

Dennis is right, without trees we are toast. And Watcher is right, politicians will always put people above trees.

Conclusion: We are toast.

Dennis is right, Watcher is right, and Ron is right.

But, given the uncertainty principle, we are toast, maybe.

Hi Ron,

How does one explain the existence of the EPA? The clean air and water acts?

Under your assumptions these thinks should just be wishful thinking.

Is the system perfect? No. Can it be improved? Absolutely. Will it? Maybe, time will tell.

How does one explain the existence of the EPA? The clean air and water acts?

What the hell are you talking about? Why do I need to explain the existence of the EPA or the clean air and water acts? I don’t and I won’t.

Every day more trees are cut down in almost every nation in the world. Every day a little more topsoil gets washed away or blown away. Every day the water tables around the world drop a little further. Every day…. well you get the idea. So I guess you think the EPA and similar organizations in other countries are going to change all that?

Naw… you are way, way too smart to believe such shit as that. But then that begs the question, what the hell did you mean by asking me explain the existence of the EPA?

Hi Ron,

Sorry for being cryptic, the trees are a symbol of concern for the environment.

I thought that was obvious, clearly it was not.

So saying that government needs to look at the big picture and by guided by science on environmental policy was supposed to imply that the government would follow good environmental policy.

I believed that you were claiming that the government would always put people before the environment, implying that there would be not environmental regulation.

I disagree that there will be no environmental regulation and I think that concern for the environment will become a majority view before long, you assume people will never come to that view, I have more faith in man’s ability to see the forest.

I would take a slightly more nuanced view of Ron’s position. Those societies who refuse to adapt are running a serious risk of being toast.

There are clearly differences in the way societies act. For example, if the Dutch had been running New Orleans, Katrina would not have been a catastrophe.

I think we are approaching the era predicted by Keynes — when humanity solves its economic problems. The problems of the future are ecological.

Hi Ilambiquated,

I think Ron’s position is clear.

We are toast.

I am with Wimbi,

we are toast, maybe.

but might add that I hope not, and if others do not give up hope, perhaps thing will improve. Wimbi might agree.

I’m not sure who “we” is.

The Earth won’t be toast anytime soon.

Some sort of life on Earth will likely survive no matter what happens.

Some humans will likely survive unless all habitats on Earth are wiped out.

I believe we do what we can to lessen the disasters and keep going. Business as usual isn’t really necessary to keep some part of the human population going, so I think we can or will be forced to phase it out. And as we do that, we’ll see what continues on.

Hi Boomer II,

By “toast”, I mean that things will be very unpleasant, I do not think all of our species will be wiped out, we will survive if we do not cause a catastrophic ecological collapse.

If you picture the Earth without trees, can you imagine human’s surviving on that planet. I cannot, the biosphere would be unrecognizable and life on earth might be reduced to very simple multicellular life forms. This view is probably too extreme, but at minimum there would the current extinction event would accelerate.

Yes, I am hoping we don’t destroy everything. And that’s why I won’t settle into, “Once the oil is gone, civilization collapses and there’s nothing we can do” thinking. Because there is more to save than just modern civilization. The more we do, hopefully the more life that survives on Earth. Even if people are forced to eek out a living, we enable more species to survive when we lessen our damage.

Democracy is being replaced by oligarchy. The oligarchy can sacrifice some population to save most of it. When we are sick and hungry the body eats part of itself.It is not democratic, but it is better than early death for all the cells. The same with society.

Democracy is being replaced by oligarchy. The oligarchy can sacrifice some population to save most of it.

I’m not sure it even has to be a stated decision. As global warming happens, populations around the world will not be effected equally. Some people will likely not make it (there is already extreme poverty in many places).

And if there is income inequality in the places that CAN provide for some parts of the population, politicians may not do anything to correct the situation. Consider the homeless in the US, for example. There are varying efforts to take care of them, depending on the community. But I haven’t seen a national commitment to make sure everyone person in the US has food, housing, health care, and so on.

It won’t necessarily be that people have to say we’ll have trees and not food. It will be that, we’ll make sure people with money or resources will survive and those without we won’t bother to take care of.

Look at the drought situation in Southern California. There are wealthy communities that still water their lawns while in other communities people have no water at all. So you see that in some towns “the trees” are taken care of, while in other places farms are dying for lack of water.

As an Oregonian (native), I have to put up with sentiments like this all the time. I simply don’t understand how the state could have fallen into the hands of all you crazies who have the illusion that the “environment” should be our God and the state must go back to how it appeared 200 or more years ago. All the “never do wrong” liberal utopias along the I-5 Corridor are exempt from this thinking of course. Meanwhile no new jobs or letting the free-enterprise system (of which I am a huge fan) work is ever allowed in rural areas because some dumb endangered lizard or something will go extinct. I can’t even tell you how so many of us in rural areas would like to separate from the radical environmental nutjobs in the western part of the state. And the ironic thing is how good new rural jobs would likely take a lot of pressure off of social assistance governmental programs. But I guess according to the Portlanders her holiness “Mother Nature” wishes for folks out here to stay poor and on welfare.

Sorry for ranting, I just had to get that off my chest.

As oil gets more expensive to get out of the ground, alternative energy technology was going to look better anyway.

And as communities realize they like to see blue skies, they find there are benefits in not having unregulated coal plants in their communities. (Just look at the smog situation in China if you want to see what coal burning can do to the air.)

Alternative energy technologies were going to be adopted anyway.

But now with global warming concerns, there are fears that waiting until the oil runs out might not be soon enough to limit environmental damage. Now increasingly people are viewing this as a matter of global survival.

We already know that oil is getting harder to get. If there was more of it, people wouldn’t be bothering with fracking and tar sands. These expensive, dirty technologies. So we can either start transitioning to alternative energy in an orderly fashion, or we can wait until it becomes so expensive, few can afford it.

You also have to realize that some of the push back against pollution is coming from citizens who are directly affected. Communities don’t want fracking within their city limits. Farmers don’t want oil pipelines running across their land. First Nation groups in Canada don’t want their land threatened by the oil industry.

There are a lot of different groups finding pollution coming into their communities and they are speaking out against it.

Boomer II, I grew up in Pittsburgh in the 50’s. Every time my father drove me past a steel mill smoke stack with smoke coming out, he would say, “see that smoke boy, that puts food on our table.”

In the 80’s the steel mills closed and Pittsburgh lost 100,000 people, because there was no food on their families tables.

Now we got them blue skies but no jobs. I’d much rather have the jobs and food on the table back. You can keep your “hope and change” fantasies.

yeh, but it also killed people – sometimes rather suddenly, or after long debilitating illness.

http://en.wikipedia.org/wiki/1948_Donora_smog

The steel mills closing were mostly to do with unions with inflexible work-rules, mills with obsolete equipment in a market of excess capacity, and hide-bound management vs. nimble non-union mini-mills closer to customers in the booming South and West, along with foreign competition.

Note the 1981-1982 recession caused a massive layoff.

http://en.wikipedia.org/wiki/History_of_Pittsburgh#Collapse_of_steel

Your narrative is comforting to those who paint a false dichotomy of “burn fossil fuels or freeze while starving in the dark” so they can get a hit of that tasty drug “righteousness”.

But that won’t make the problems of un-sustainable use of our resource base go away.

It’s also a comforting narrative because it allows one to think things like “when it gets painful enough, enough people will come to their senses so we can beat up on the environmentalists (blame and righteousness again!), open up ANWR …, then we’ll have all the oil we need.”

It avoids dealing with hard truths about limits in the real world, and taking responsibility.

N.b. the U.S. passed peak coal in terms of energy in 1998.

http://www.eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid=1&pid=7&aid=1&cid=regions&syid=1980&eyid=2012&unit=QBTU

What peak fossil fuels looks like – in Appalachia – today!

http://www.washingtonpost.com/blogs/wonkblog/wp/2013/11/04/heres-why-central-appalachias-coal-industry-is-dying/

When is North Dakota’s turn?

Stay tuned to these pages as the story unfolds…

Everybody’s got a choice – stick to their inflexible “work-rules” and diss the new-fangled “silly renewables”, or be nimble about getting as sustainable as they can while the last echoes of ancient sunlight are still relatively obtainable.

“Change is inevitable. Progress or learning are optional”

It’s also a comforting narrative because it allows one to think things like “when it gets painful enough, enough people will come to their senses so we can beat up on the environmentalists (blame and righteousness again!), open up ANWR …, then we’ll have all the oil we need.”

It avoids dealing with hard truths about limits in the real world, and taking responsibility.

Yes, that’s what worries me. The folks who are making lots of money with business as usual are telling those out of work that it’s because of liberals or environmentalists. That distracts the unemployed or underemployed from the real truths:

jobs having shifted overseas, automation puts people out of work, oil is getting more expensive to get out of the ground, and so on.

So people blame the targets they are told to blame, but the problems don’t get corrected.

Things are likely to get worse. People are likely to get angrier. The wrong people are likely to be blamed for the problems. And there will be more social tension.

Those steel mills are technically obsolete. Creating that smoke costs a lot of money nobody can afford.

There are no jobs in the steel industry much anymore, but that is also caused by technical progress, as productivity has skyrocketed in labor terms as well as energy terms.

I remember how the Brits celebrated the Nissan bluebird plant in the 80s. Jobs! Jobs! Since then output keeps going up and employment keeps falling.

Industrial jobs are disappearing. If it weren’t for cheap Asian labor, it would be happening even faster. Bangladeshi sweatshop workers are the John Henrys of the 21st century. They’ll lay down their hammers pretty soon as well.

‘JOBS’ are for people who don’t know how to fish! >;-)

I’ll take clean air and water any day, I don’t need most of the crap that I used to be told I needed to consume just so I could be a part of the herd. I gave up watching TV years ago. When I see people standing in lines in the snow before dawn to buy a large screen TV on the artificial holiday called Black Friday I think things are really FUBAR!

How’s that free enterprise system doing when Mortgage Backed Securities were a part of TRILLIONS of QE, and probably will be again?

The new normal doesn’t have all that much of a resemblance to capitalism and free enterprise. So what is it one should be a fan of? What’s the role model?

Hi Keith,

So you are not in favor of clean air or water? There is a reason for the existence of the EPA, I agree that it can be overdone, but would you like to go back just 45 years to where some rivers were so polluted they routinely burned.

Keith,

Here in BC we have many protesters who are photographed trying to save some ‘old growth’ patch of woods that if logged will slide us all into environmental hell, and if you look at the clips you see the stumps with springboard notches when the previous trees were felled and processed 100 years ago. The same protesters drive home to their sub-division houses and …. you get the point.

meanwhile, the forestry slowdown officially started:

http://www.cheknews.ca/the-western-forest-products-mill-in-ladysmith-will-halt-production-on-monday-due-to-weak-export-markets/

Keith,

The claim that environmental considerations are harming the economy are mostly humbug. you’d be surprised how delusional most companies are, and American companies have become increasingly ideological.

American companies routinely claim things that simply aren’t true but are politically correct in terms of Republican ideology. For example the company I work for has a strict policy forbidding plants in American offices. This is just repressive, it makes no sense at all. The European offices are overflowing with plants and suffer no harm from it. but it’s politically correct in America to suppress worker rights, so the policy is enforced.

You’ll find similar irrationality in the complaints about environmental laws from right wing fanatics like the Chamber of Commerce.

Ron,

Much as I disliked dick cheney, he was at least perceptive once in his life. This is one of those known unknowns that we could really do with knowing.

I firmly believe that the best policy is made with accurate information. Sadly that’s something we’re sorely lacking, and it’ll make it all that hard to work out how to try to plan for the future. At the moment the best we have is indirect evidence and underfunded public bodies like the eia. If ignorance is bliss then it isn’t all its cracked up to be.

You mean Rumsfeld I think.Admittedly they have been joined at the hip since their days in the Nixon White House when the dictated wages and prices for America.

oh boy….you dang agenda driven celebrities!

“Part of it is that peak oil is more wish than prediction—a desire to see the end of fossil fuels to serve a larger political agenda. It is also a way of scaring governments into pouring money into alternative energy sources that can’t compete with oil and natural gas without subsidies and mandates. Predicting disaster can also be a profitable business and a path to speech-making celebrity.”

http://online.wsj.com/articles/peak-oil-debunked-again-1417739810

ezrydermike, Malthus most definitely wasn’t wrong and neither was the Club of Rome. Physical limits are real and this is still a finite planet that can’t and won’t support an infinite growth paradigm ad infinitum. Despite whatever BS the WSJ spouts, they most certainly are not a credible source when it comes to information about peak oil.

Then again, maybe Ron is raking in the big bucks by hosting this very site…

preaching to the choir Fred.

I am not very good at blog snark.

However, I am painfully aware as most here are, that most people outside of here won’t go past a “credible” publication like the WSJ. The disinformation narrative is very strong.

I am not very good at blog snark.

LOL! I fail at it all time so I’ll just go sit in the corner and eat some humble pie.

Since peak oil is a myth, does that mean there won’t be a push to prop up frackers? If prices going up and down is just business as usual with oil, then we won’t need to worry about companies going out of business or drilling being suspended until prices rise, right?

Low oil prices are what you get when there is unlimited supply, right?

do you ever try to post comments directly on articles like this?

do you think it is even worth while?

It depends on the site and how easy it is to post. I haven’t tried to post comments to any Wall Street Journal articles. Or if I have, it has been at least a couple of years.

Because most of the Wall Street Journal articles are behind a paywall, I don’t have access to some of them anyway.

Ron,

I don’t see much point in even speaking about reserves. Besides a big part being fake, even if we have good numbers there is no way of knowing how much of that reserves could actually be recovered.

Upstream costs of oil production have skyrocketed since 2001. This fact alone tells us that we are running out of economical reserves and already getting part of our production from marginal reserves. We can barely afford a price for oil that pays its cost of production at breakeven and that is the definition of marginal reserves. As costs continue to raise, the wall of subeconomical reserves is approaching real fast. Most of those reserves both real an imaginary must be behind that wall and for all practical purposes they could just as well be in the Moon.

So we don’t have a clue what the real recoverable reserves are, and that is the only important number. Based on current costs, they cannot be very large indeed.

The definition of “Proved Reserves” is that they ARE recoverable.

http://en.wikipedia.org/wiki/Proven_reserves

Actually its not quite like that. If I use the term Proven Reserve it’s done within the context of rules laid down by my Professional Engineering association and it will be respected throughout North America by other engineers, banks, etc. If a Russian engineer comes up with a proven reserve number, to be accepted here, that must be confirmed (audited) a “local” engineer. This process works fine and the numbers are essentially real: The Reserves are Economically Recoverable. If Saudi Arabia says its proven reserves are XXXXXX then to be accepted here the number must be audited. Therein lies the rub. We are not permitted to do an audit Saudi Reserves so, after awhile, it becomes the mess we have today. But, its certainly something well worth discussing.

Since 1982, the Saudis have withheld their well data and any detailed data on their reserves, giving outside experts no way to verify Saudi claims regarding the overall size of their reserves and output. This is not unique to the Saudis of course. Personally I have confidence in Russian reserve numbers having helped audit a number of their reserve figures on specific reservoirs. This was a pain in the ass because the Russian methodology is (was?) somewhat different but in the end we came up with almost exactly the same numbers as they had. Of course I’ve never seen any hard data from the Middle East but a lot of their “reserves” appear to be so-called “political reserves”.

It has occurred to me that if KSA were going dry, and knew they were going dry, the last thing they would want to do is inform the world of it.

Informing the world of it would almost guarantee invasion by whomever was confident that a UN “fair share of what’s left” distribution program was not going to provide what was desired. To avoid invasion, optimal KSA strategy is to keep their mouths shut.

When they are empty, issue a statement of gratitude to all their customers for years of purchases and inform them all that KSA is going out of business and retiring. That avoids a lot of Saudi deaths during the invasion and “defense of innocents” by those who might try to stop the invasion.

A clue to KSA “going dry” might be The House of Saud checking out real estate prices in Switzerland — or buying Switzerland.

Don’t think you want to be anywhere that has serious distance for spare parts for anything to travel.

You probably want to buy land near horses. Nothing else really can be predicted, but horses don’t need spare parts.

This (more or less) Arab friend of mine and real live commy is a representative of Polisario and spent years in the Persian Gulf begging for funds. His take on the House of Saud (and I quote) is that most of those princes are too dim witted to figure out if they are marrying their niece or their cousin this week.

I’m sure there are plenty of wise guys in Arabia that will figure out when the time comes, but I doubt the Saudis themselves will.

Maybe I am all wrong but I would bet my last can of beans that any of the multinational oil companies as well as outfits such as the NSA have the real dope on Middle Eastern oil reserves to the same extent the local folks. If the locals know then so do the industrial spies.

Now a person who wants a job in an atom bomb factory or a shipyard that builds nuclear submarines has to undergo a security check than involves putting a camera with a high wattage light out of sight up his rectum.That sort of person doesn’t talk shop very often but it does happen often enough that we KNOW it happens.

Given the number of people that work in the oil industry in OPEC countries there must be hundreds and thousands that have spilled their guts- some voluntarily out of patriotism, some for money or career advancement, and at least a few who have been quietly informed that if they tell what they know they won’t be arrested for various crimes real or imagined.

There are no secrets that really matter in this world anymore – not secrets as important as the size of oil reserves. Not from multinational oil companies, not from multinational banks, not from national security agencies of major countries.

I am an orchardist. If you give me a few days and all the data that can be easily harvested about any of my competitors such as how many employees he has, how many and how often trucks come and go from his farm, what the trucks are loaded with, aerial photo spreads of his place, and access to his checking account via the customer and supplier end of his business etc etc I can tell you just about as much about his business as he could tell you himself.

IT is said among the smarter country folks these days that the government knows where you SHIT Last – and not only where you did it last but also everyplace you have forgotten about that you took a dump ten or twenty years ago.This is not so big an exaggeration as most folks think.

Give a few real experts in a given industry a few thousand well assorted facts about any company in the industry and time enough and a staff to help them and they will know about as much about it as the people running it.

“Maybe I am all wrong but I would bet my last can of beans that any of the multinational oil companies as well as outfits such as the NSA have the real dope on Middle Eastern oil reserves to the same extent the local folks. If the locals know then so do the industrial spies. ”

I’d say no.

Where would they get this information?

If you work for Saudi Aramco and you do some new measurements and arrive at a number that departs from the official number, and it’s an uncomfortable number, then without question follow up studies (that everyone hopes will disprove yours) will be well funded and done. Odds are pretty good they will disprove yours. More likely, your technique will be challenged, and credibly.

So then your spies are faced with two numbers from good quality studies. They don’t have any better information than anyone else.

And, of course, we also have the redefinition possibilities, where the level of intricacy of the liquid requires only small changes to assay numbers and . . . the spies take home the numbers that everyone else has.

Actually, hmmm, maybe that agrees with you rather than disagrees. haha

I think a few wise guys will figure it out, as mentioned above, but most won’t.

OFM,

Your last paragraph describes the CIA (part of it.)

I want to thank Ron and all who contribute here for putting forth the effort to present quality data and it’s meaning on such important subject matters. This site is a high quality tool that I use frequently to cut through the constant fog of bs that seems to be in endless supply.

I pop in every now and then, but I am more of a lurker. Really do appreciate the work here.

Mike

Hear hear

The New Economist Cover Says It All

“For now, my conclusion is that the US oil industry intends to play the Saudis’ game of chicken,” Ed Yardeni wrote on Wednesday.

“The contest between the shalemen and the sheikhs has tipped the world from a shortage of oil to a surplus,” writes The Economist. “Even if the 3m extra b/d that the United States now pumps out is a tiny fraction of the 90m the world consumes, America’s shale is a genuine rival to Saudi Arabia as the world’s marginal producer. ”

In other words, it’s US shale versus OPEC.

And things don’t look like they’re going to calm down any time soon.

Gotta sell magazines.

To be fair the Economist has been pretty insistent from the start about saudi involvement in the price change.

However in the beginning they were talking about competing against the Iranians, not the Americans, so the story has changed.

It is interesting to be a witness to all of the many different disinformation and propaganda articles that our media channels are pumping out these days. Who could have guessed ten years ago that we would be getting bombarded with so much propaganda bullshit today? The Sheikhs vs Shale drama lampooned above is a great example of the types of falsehoods that are being pumped out for mass consumption these days, all related to oil. It seems pretty obvious (to me) that the purpose of this disinformation and propaganda “campaign” is to distract from the real issues, to suppress widespread recognition of how dire our energy and financial situation is. Sometimes it seems as if some power or force is really intent on keeping people confused and in the dark about huge issues that really concern them. At least, that’s the impression I sometimes get.

What has unfolded during this price crash has been mind boggling. It’s a bit like how Putin went from friend and partner to Satan incarnate in a period of 12 months. Yes, those who don’t know about Victoria Nuland find justification in it, but nevertheless, from friend and partner to Satan in just 12 months.

The Saudis have changed their behavior not one iota from Jan to June vs June to now, but they are headed themselves towards their own Great Satan status.

Media wise, it almost has to be orchestrated, but it’s hard to find the agenda.

I think it is just peachy that we are demonizing the Saudis for low oil prices. Makes me chuckle every time I think about it.

Generally speaking Watcher I believe you are determined to find conspiracies and plots and manipulation by shadowy powers of one sort or another behind just about every bush. IF you were a cowboy in Indian country at night you would assassinate every innocent bush within range of your sixshooter until you ran out of ammo.More power to ya , it takes all kinds and you only need be right once to save the ship when you see a REAL torpedo track in the water.

BUT

Sometimes- lots of times, most of the time, really, shit just happens in this big complicated world without any body in particular DELIBERATELY MAKING it happen.

And SOMETIMES- and most particularly when it comes to the behavior of naked bipedal apes- all you need to know to understand the world is MUCH SIMPLER than all your convoluted theories.

ALL YOU NEED TO KNOW – MOST OF THE TIME- when it comes to people is the ”us” and the ”them” in respect to any particular question, plus the logical extensions and corollaries of the us and them rule.

THIS RULE HAS THE FORCE OF NATURAL LAW..Just about any truly up to date researcher in human behavior will tell you so.

”US ” always looks after ”us” and in the case of media looking after ”us” means ”Gotta sell magazines”…

You said it yourself.

The nature of the media beast is that it FEEDS on gossip, rivalries, and boogermen in the dark that eat little kids for midnight snacks. Adults with children’s minds- meaning about ninety nine percent of humanity – are just as subject to this sort of manipulation as kids.

WE LOVE IT.

We are tribal creatures and anything that strokes the tribal ego is going to sell. When we are deprived of a sufficient daily dose of tribalism then we go out and hunt up a new supply and become sports fans addicted to the triumphs and tragedies of a bunch of pro athletes we have never met and never will meet and who wouldn’t ordinarily even say hello to us except as part of their job description.

There are countless ” US’s” and ”THEM’s” coalitions in this world and the membership in some of each kind is more or less fixed. The membership in the rest is fluid and varies depending on who perceives who as a friend or an ally , real or potential, or an enemy , real or potential.

The umbrella ”us” group we refer to as the media or the mainstream media ”’Gotta sell magazines.”

So simple. So beautiful. So UNDENIABLY TRUE..!!!

And you even said it yourself and then turn around and deny your OWN insight because it is NOT COMPLICATED ENOUGH!!

There is ninety to ninety five percent of your agenda.The other five or ten percent may actually be orchestrated from the shadows by big banks, big political parties, big organizations known by names such as CIA, the Christian Church, the repuglithan and dimmerrat parties and sky daddy alone knows who else.

Anybody who thinks a billionaire who owns a few coal mines and a few magazines and newspapers and has a few hundred journalists in his vest pocket but doesn’t pull the puppet strings to some substantial extent from the shadows is a fool.

There is your part of the truth and the reality. You are most assuredly NOT a fool but rather a very perceptive observer -excepting you WANT to find an explanation involving behind the scenes manipulation for EVERYTHING.You will find it often because it is often there -just not most of the time or all the time because it simply is not always present.

Now this is not to say that the press is not RELATIVELY free in this and other western countries. The ownership of media both print and electronic is widely dispersed among many various competing interests and anybody who has a brain and is willing to use it can usually easily figure out the broad outlines of the truth if he is willing to read competing points of view and do a little investigating to separate the facts from the talking points and the opinions.

There are a couple of problems involved in doing so though. ONE is time and the other is access to competing media. Most of us are not willing to take the time or pay for the access needed so we are generally speaking less than truly well informed about most issues.We listen to NPR OR Rush Limburger or CNN OR Fox or we read our local paper.IF we read a paper at all we probably spend more time on the sports section than any other part.

I am stuck in the house most of the time these days ( family issues) with tons of time, a couple of excellent library cards, and high speed internet. I spend more time right where I am now- in my recliner- than anywhere else and I STILL don’t have time enough to get to be truly well informed about more than a few overarching issues.

Beyond the issues of time and access lies a more important principle or organizing rule.

THE RULE

Most people ARE NOT INTERESTED in THE facts although if confronted with this truth they will hotly deny it and quite a few will get belligerent enough to start a fight if you want one.

What they ARE interested in is any cherry picked fact, opinion, or talking point that reinforces what they ALREADY BELIEVE AND WANT TO BELIEVE.

Ya can’t fool all of the people all of the time but you sure can fool some of them enough of the time that they will follow you blindly to hell even if you intend to sacrifice them on altars to the devil at way stations along the way.

Some showman or another once said nobody ever went broke overestimating the stupidity of the American public. He was dead on.

People do not need to sit together in a smoky room and come to agreements in order to perceive a common interest and act in UNCONSCIOUS CONCERT to pursue that interest.

Nearly everybody in the media industries implicitly understands WITHOUT CONSCIOUS THOUGHT that he has an overriding , an overwhelming , personal interest in the continuation of business as usual.

So he seeks out facts and opinions and talking points that support the continuation of business as usual without even realizing he is doing so. And he repeats these facts and opinions and talking points.. without giving any serious thought to the possibility he might be horribly and tragically mistaken.

The exceptions to this group think have carved out for themselves a new niche in media and cater to people who for one reason or another see thru some of the smoke and mirrors and want to hear stuff that reinforces their OWN interpretation of the facts.

Ron has carved out a niche of his own. I hang out here because generally speaking we are in near total agreement about just about everything.

I am too old now to be afraid of the boogeymen under my bed. I know most of them are imaginary but that enough of them are real that I ain’t getting out of here alive no matter what. Cancer, auto accidents, guns, alcohol, dope, women, money, and just plain old bad luck are real enough boogeymen and they have taken about half of all the people I have known already.

With a little MORE luck PERSONALLY I will fall victim to the last in line real boogerman-OLD AGE. The GRIM REAPER eventually gets us all because our machinery wears out anyway if we escape famine, pandemic disease, ethnic cleansing, environmental toxins, getting et by a starving black bear or a hungry gator, or shot by a jealous husband.

I forgot to mention global warming, overshoot,and resource wars. 😉

Between them they are going to take out the larger part of humanity within the next century..

“Cancer, auto accidents, guns, alcohol, dope, women, money, and just plain old bad luck are real enough boogeymen and they have taken about half of all the people I have known already.”

Maybe I haven’t lived long enough yet, but “women” seems like a mighty odd thing to include on that list. Shouldn’t “men” be on there too for the other half of our species? Even if only because women are most at risk of being killed by the man in her life?

That one’s a head- scratcher OFM. I know you’re a conservative and all, but that does seem a bit out of character. Glaringly so I might say. I mean, women have killed (that’s what I understand “taken” to mean) half the people you know (including the women? Huh?)? Of course you have money on the list too, but at least that correlates to bankruptcy or other such money problems. Women though? I suppose there’s bad marriages, crazy spouses and so on, but that goes both ways don’t it?

Sorry to go all feminist on you, but IT IS a weird item to include on your list in this context.

You probably didn’t live in Hollywood in the 70’s.

However, good point.

Reminds me of the old song they used to sing in my native East Tennessee

Corn whiskey done ruined my health good people

Pretty women done troubled my mind.

Women though? I suppose there’s bad marriages, crazy spouses and so on, but that goes both ways don’t it?

Ah, what I believe you are discounting and though I can’t speak for OFM, I assume he is referring to, are those basic male biological urges that empower a woman to cause an otherwise perfectly rational man to lose all sense of perspective. Trust me on this one, I myself have found myself traveling half way around the world for a woman. I know of many a man that has lost everything for a woman.

To be clear, I think you are correct this is indeed a two way street and can certainly work the other way too. Case in point there was a female astronaut in the news a few years back who seriously damaged here career because she stalked another woman who supposedly took a man she was in love with away from her. If I recall the story she donned diapers so she wouldn’t have to stop on her drive to confront her rival…

I think OFM was just being himself and speaking from his obviously male perspective and perhaps some personal experience >;-)

I’m 99.999% sure that he meant absolutely no disrespect to any women.

Thank you Fred. You nailed it nicely.This comment was intended as humorous . I was thinking about some guys I have known who died of broken hearts and others who were manipulated into doing unwise things to please the women in their lives- such things as dealing and stealing and buying flashy cars on credit in order to provide one with enough bling to win her affection.Or getting into a totally unnecessary fatal fight in order to save face in front of a woman.

Of course it is MOSTLY the fault of the men involved in such cases but we men are generally known to think with our peckers rather than our brains.