OPEC has released their Annual Statistial Bulletin 2014. Under the heading of “Oil and Gas Data” there are several tables you can download. I was excited to find one labeled “Table 3.21: World Exports of Crude Oil and Petroleum Products by Country”. It turned out to be useless however as it includes a lot of exports of imported products. And they have no table of “Net Imports”. However their their table labeled “Table 3.18: World Crude Oil Exports by Country” turned out to be very useful as it seems to measure the same thing as the EIA does in their International Energy Statistics, Crude Oil Exports which also includes lease condensate.

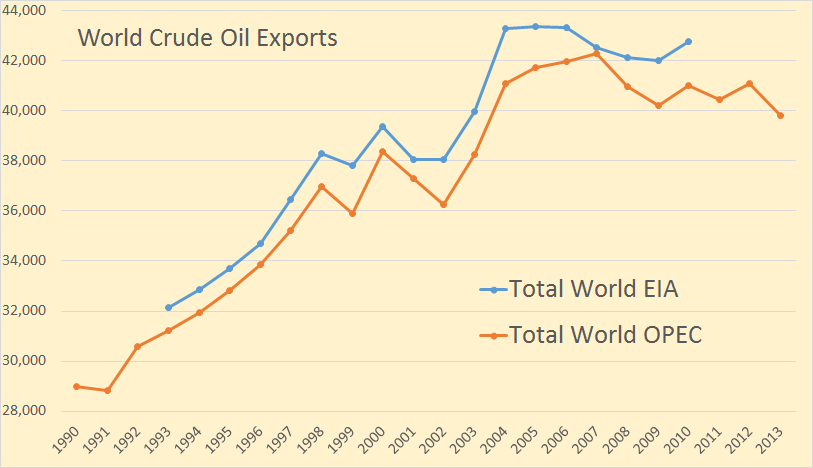

The OPEC export data goes back to 1960 but I have only plotted it from 1990. The EIA data only goes back to 1993. The OPEC data is through 2013 while the EIA data only goes through 2010 except for Canada, Mexico and Norway which goes through 2012. All data is in thousand barrels per day.

World crude oil exports peaked in 2007 and now stand 42,297,000 bp/d and in 2013 stood 2,467,000 bp/d below that point. World crude oil exports in 2013 were 2,467,000 barrels per day below peak and at the lowest point in 10 years.

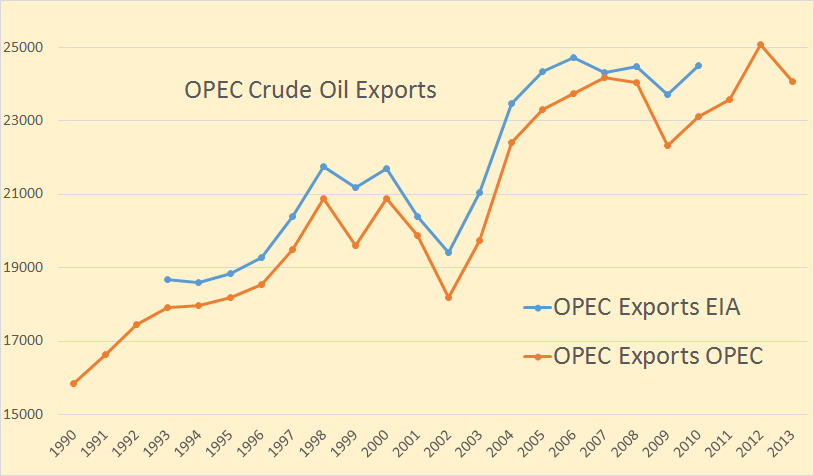

OPEC exports peaked, so far, in 2012 at 25,068,000 barrels per day. Their exports fell by just over 1,000,000 barrels per day last year and I am betting they will fall further this year.

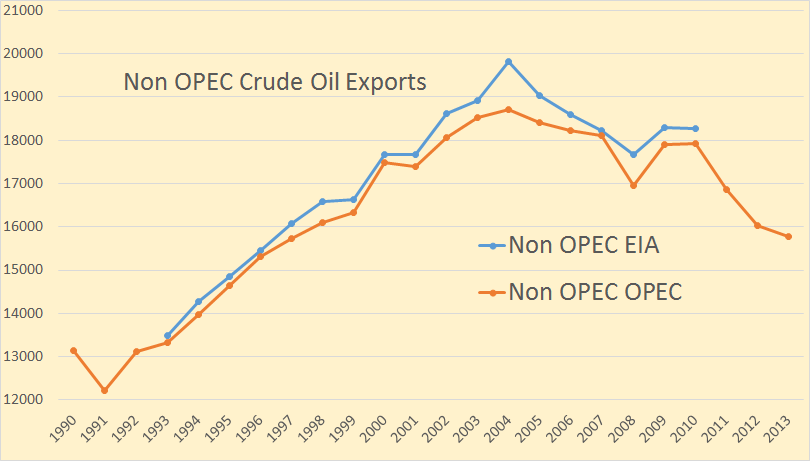

Non-OPEC exports have taken a hit in the last few years, peaking in 2004 and are down just under three million barrels per day since then.

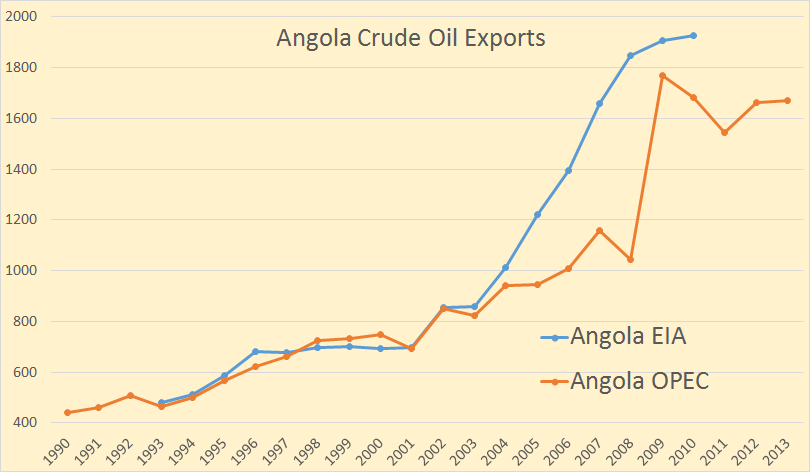

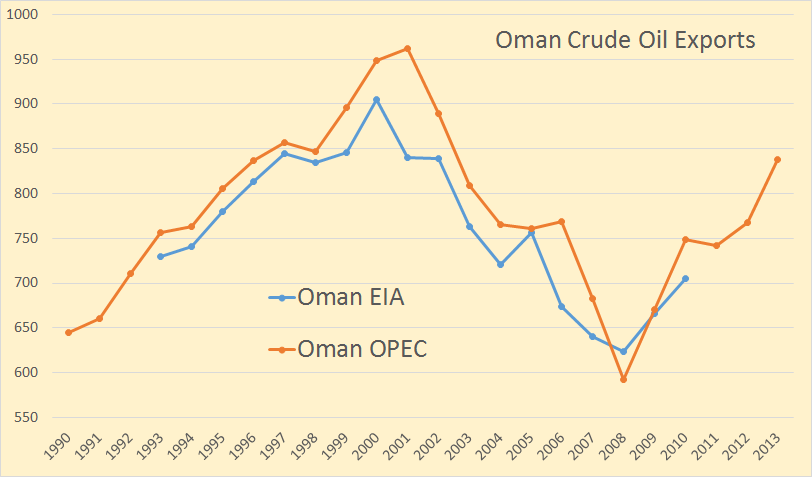

The following charts are the 15 world’s largest exporters in order of their export volume and one chart of all the rest of the world combined. Everything is in thousand barrels per day.

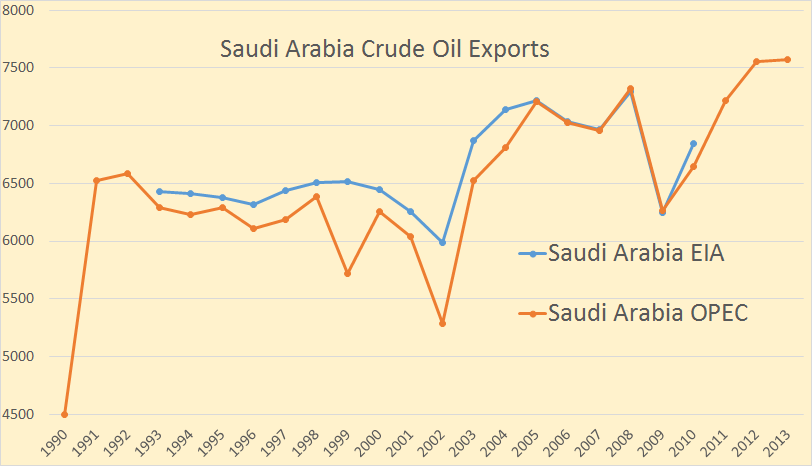

Saudi Arabia’s exports barley edged up last year and in 2013 stood at 7,571,000 bp/d.

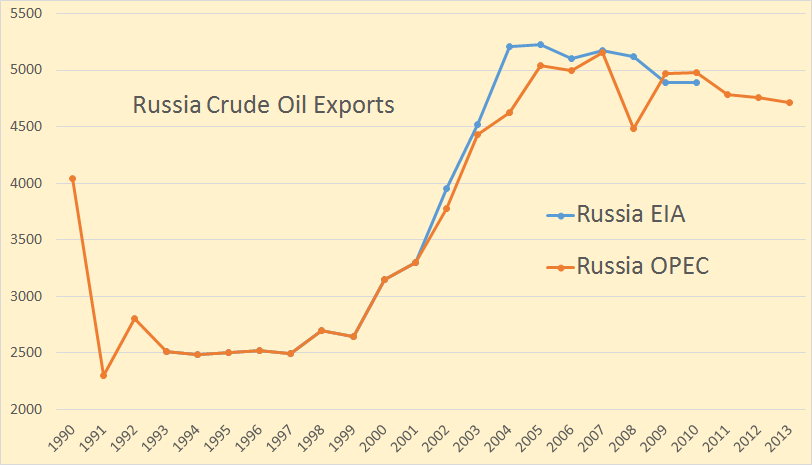

Russian exports peaked back in 2007 though the EIA has them peaking two years earlier. Russian exports are down almost half a million barrels per day since peaking.

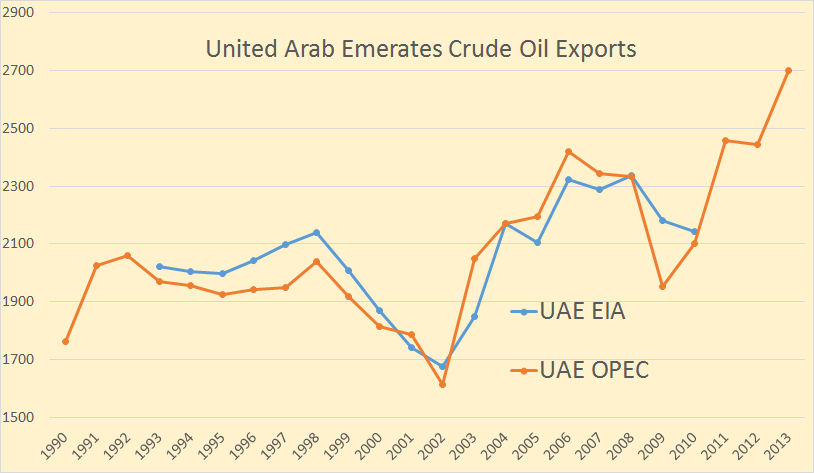

UAE exports have taken off in the last few years. Their exports were up just over 250,000 bp/d last year.

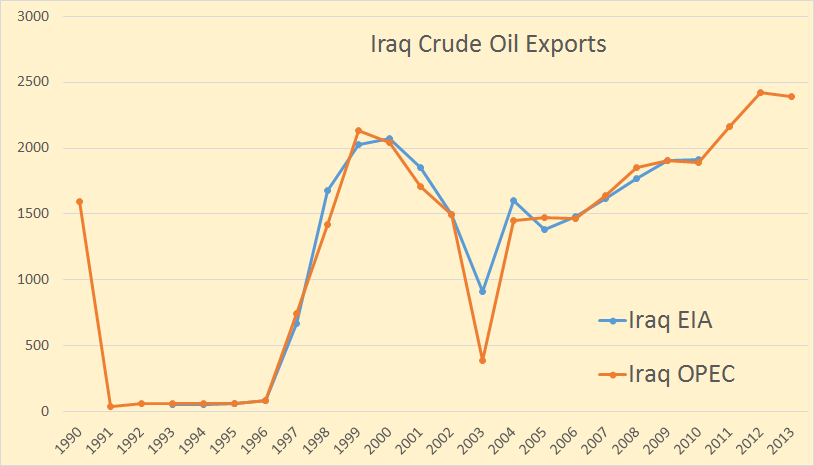

Iraqi exports slipped slightly last year and it looks like they may slip further this year.

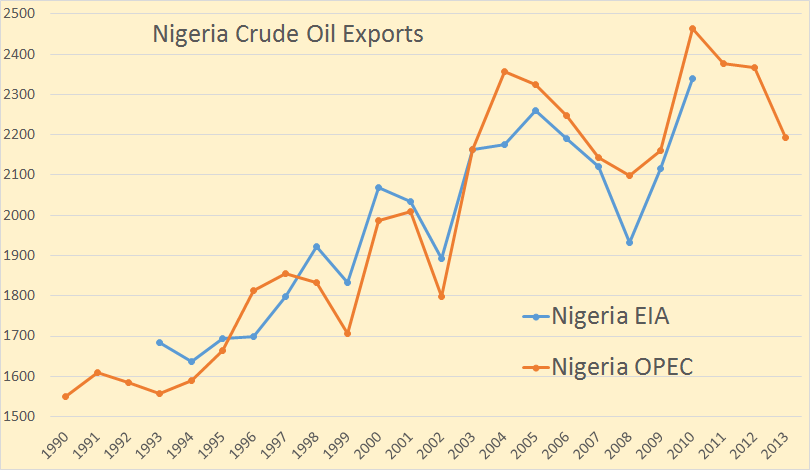

Nigerian exports are down 271,000 bp/d since peaking in 2010.

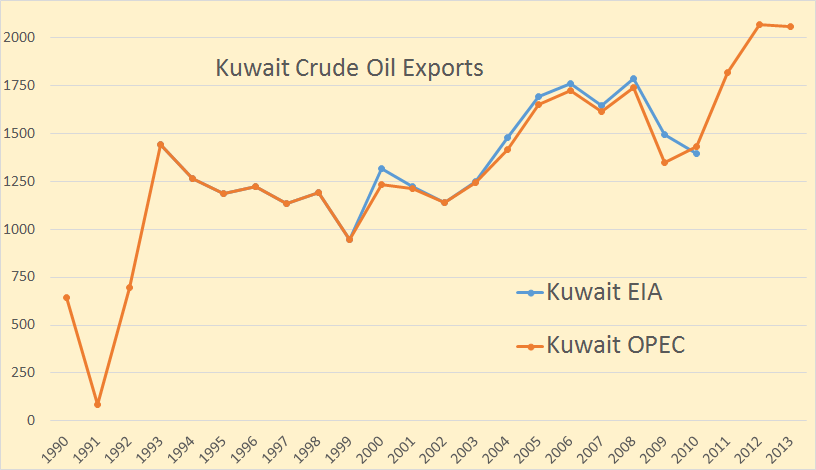

Kuwait exports peaked in 2012 but were down only slightly last year.

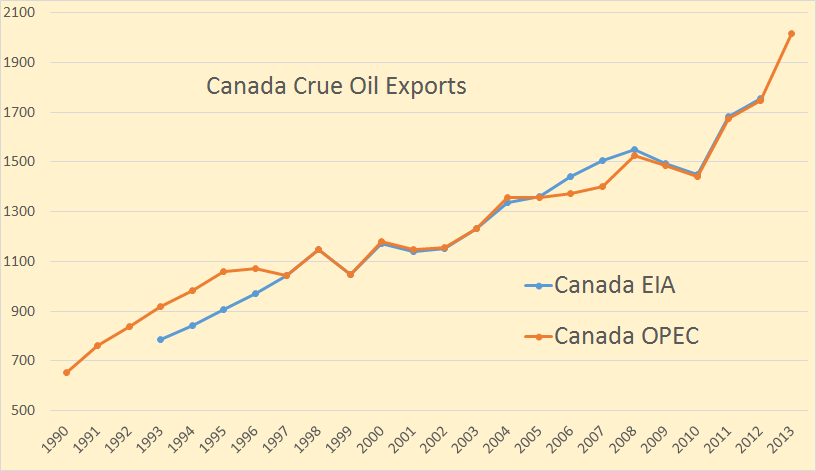

Canadian exports continue to increase, up about half a million barrels per day since 2008.

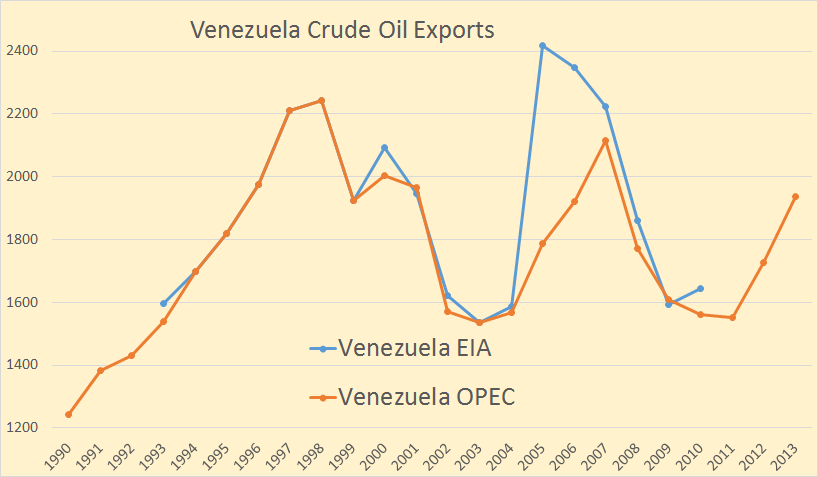

There seems to have been a 600 thousand barrel per day difference of opinion about Venezuelan exports in 2005. It was 2009 before they got back together.

I don’t understand how the EIA and OPEC can be so close together in all the years up to 2003 then to be so far apart by 2008.

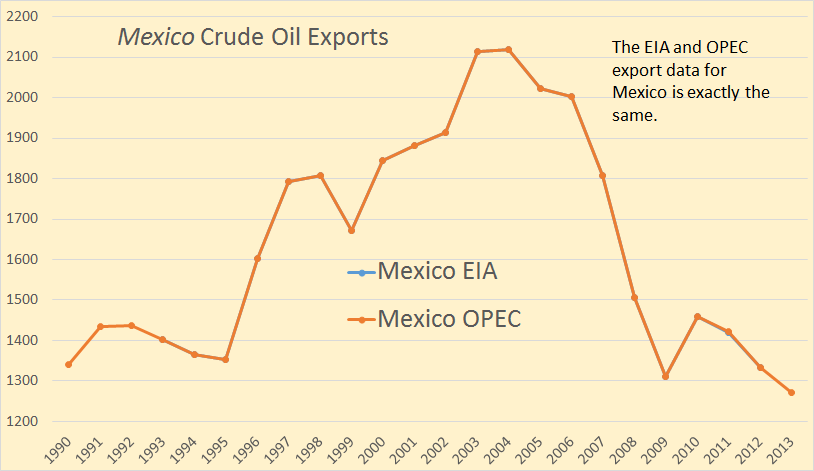

But there is no disagreement about Mexico. The EIA and OPEC data matches barrel per barrel. I strongly suspect one just copied the other’s data here.

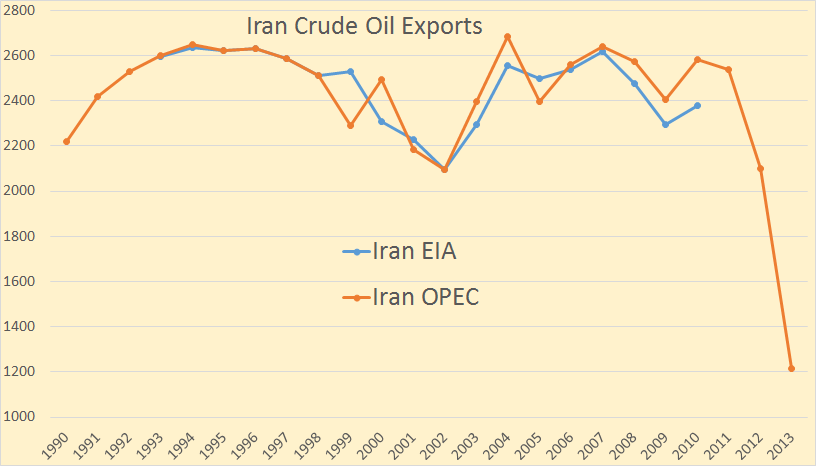

Iran’s exports have really taken a hit. In the two years from 2011 to 2013 Iran’s exports have actually fallen 400,000 barrels per day more than their production has fallen.

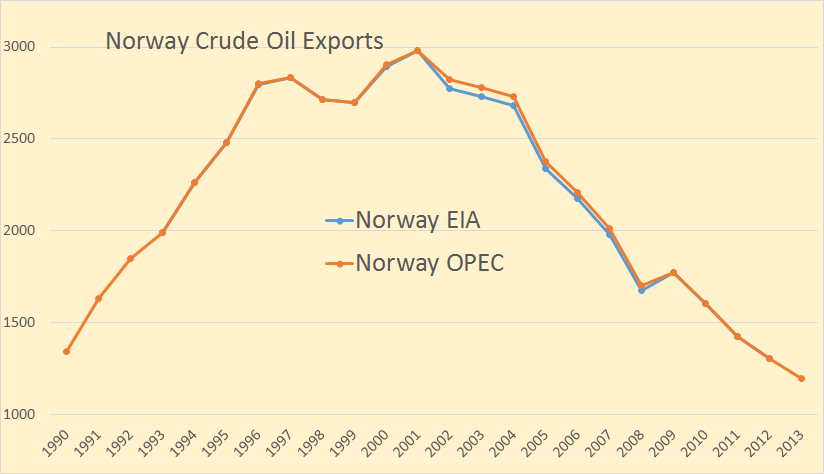

It looks like the EIA and OPEC are also using the same data for Norway. Well almost. The EIA Norway data goes through 2012.

Though crude production is now higher than it was in 2001, exports are still 124 thousand barrels per day below what they were in 2001. I guess that is ELM in action.

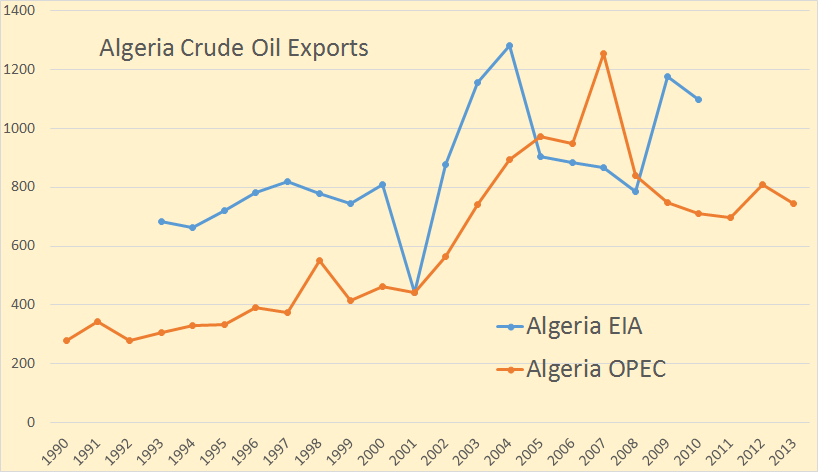

Algeria is the one nation where the EIA and OPEC don’t match at all.

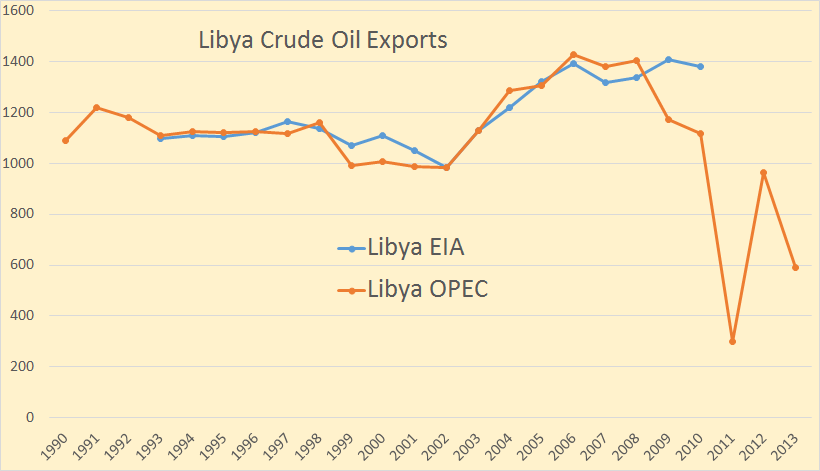

Things are getting worse in Libya. It may take years for them to return to normal… if they ever do.

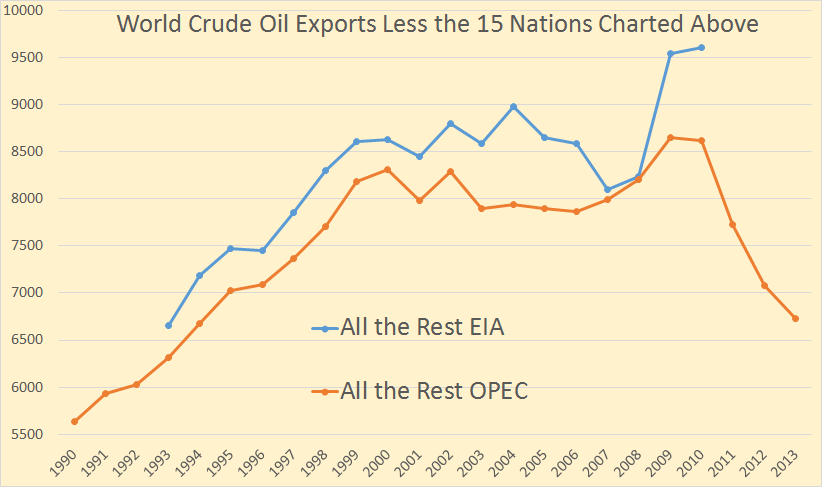

Exports of all the other nations, combined, peaked in 2009 and have dropped almost 2 million barrels per day since.

Just one last note. If you are really interested in Global Warming or Climate Change you can’t miss this article: Naomi Oreskes, A “Green” Bridge to Hell

And I just had to post this. News Googling “Oil Production” this popped up:

Why gas pries remain static despite oil production surge

Although US oil production has increased to 16.8 million barrels of crude per day, gas prices are projected to stay static in the near future.

The US is producing 16.8 million barrels of crude oil per day? I didn’t know that! Here is where they got that figure:

The US Energy Information Agency (EIA) said July 24 in its weekly petroleum report that refineries took in 16.8 million barrels of crude per day for the previous two weeks, more than the last record set in 2005.

So if refineries took in 16.8 million barrels I guess that means the US produced 16.8 million barrels per day… right?

334 responses to “World Crude Oil Exports”

I am surprised to see Saudi exports go up. I had done this post in 2011

27/4/2011

OPEC report: Saudi oil exports to decline

http://crudeoilpeak.info/opec-report-saudi-oil-exports-to-decline

If the OPEC figures are correct, then Saudi local demand growth seems to have slowed substantially

2009: 8,250 kb/d – 6,250 kb/d exports = 2,000 kb/d Saudi consumption

2013: 9,700 kb/d – 7,600 kb/d exports = 2,100 kb/d Saudi consumption

We need to analyse and update what is happening there

I believe that Ron is looking at gross exports of Crude + Condensate (C+C). Based on the net exports metric, using the EIA data base (net exports = total petroleum liquids + other liquids less total liquids consumption), Saudi net exports have been below their 2005 rate of 9.1 mbpd for eight straigh years. Based on EIA production data and BP consumption data, Saudi net exports in 2013 were about 8.5 mbpd, versus 9.1 mbpd in 2005.

And a key point to keep in mind is that many exporters export crude oil and import refined products, e.g., Mexico. Mexico’s net exports (total petroleum liquids + other liquids) fell from 1.8 mbpd in 2004 to 0.7 mbpd in 2012, versus gross exports of over 1.3 mbpd in 2012.

Following is my “Gap Chart” for combined net exports from the (2005) Top 33 net oil exporters (Global Net Exports, GNE). I’m estimating that the GNE value for 2013 was around 43 mbpd.

What OPEC says it is:

Notes: Data may include exports of lease condensates,

re-exports, changes in the quantity of oil in transit.

However it matches pretty close what the EIA calls:

Exports of Crude Oil including Lease Condensate (Thousand Barrels Per Day)

The EIA tracks “Net Imports” for some, but not all, countries. But there is no “Net Exports” category that they track and neither does OPEC. So this is all I have to track.

The EIA had not been updating their net export data, but it looks like they have resumed. Following is their list of the top net oil exporters. The only difference between the data set that I use, versus the EIA, is that they define net exports as total liquids production (inclusive of refinery gains) less total liquids consumption.

http://www.eia.gov/countries/index.cfm?topL=exp

I exclude refinery gains for two reasons: (1) It distorts the production numbers for exporters with low levels of production but lots of refinery capacity and (2) It’s a necessary process, but it’s a net energy loss.

Here is my “Refinery Land” (R) and “Production Land” (P) Model, ignoring refinery gains:

P has production of 2.0 mbpd and consumption of 1.0 mbpd, but no refining capacity.

R has zero production, consumption of 1.0 mbpd, and 2.0 mbpd of refining capacity.

P produces 2.0 mbpd and exports 2.0 mbpd to R.

R refines 2.0 mbpd, consumes 1.0 mbpd, and exports 1.0 mbpd to P.

So, Production – Consumption = Net Exports

For P:

2.0 – 1.0 = +1.0 (net exports)

For R:

0 – 1.0 = -1.0 (net imports)

Jeff, the export data at the EIA link you listed is a lot higher than the OPEC link I used. Your EIA link:

For the EIA, I think it’s due to the differences between total liquids production versus C+C production, plus the fact that the Saudis are burning crude oil in some of their power plants. Regarding OPEC, I don’t know.

Saudi total liquids vs. C+C (EIA)

2011: 11.3 & 9.5

2012: 11.7 & 9.8

Incidentally, I participated in an ASPO-USA meeting with senior EIA/DOE personnel in late 2012, in Washington D.C. (others in attendance were Art Berman, Steven Kopits, etc.).

The first question I asked the EIA staff was if they had modeled future Global Net Exports of oil, assuming flat to declining production in oil exporting countries, versus rising consumption. The answer was “No.”

Following are the 2005 and 2013 Saudi data (BP consumption data for 2013, other data EIA, total petroleum liquids + other liquids for net exports):

Production (mbpd) – Consumption = Net Exports and ECI Ratio also shown (Ratio of production to consumption)

2005: 11.1 – 2.0 = 9.1 & 5.5 (ECI)

2013: 11.6 – 3.1 = 8.5 & 3.7 (ECI)

Based on the 2005 to 2013 rate of decline in the Saudi ECI Ratio, they would approach zero net exports around the year 2039. Estimated post-2005 Saudi CNE (Cumulative Net Exports) would be:

3.3 Gb/year (2005 net exports) X 34 years X 0.5 (area under a triangle) less 3.3 Gb (net exports at export peak) = 53 Gb

Cumulative net exports in the 2006 to 2013 time period inclusive were 24 Gb, putting Saudi Arabia’s estimated post-2005 CNE at about 45% depleted at the end of 2013.

As I have previously noted, we saw a similar pattern with the Six Country Case History from 1995 to 1999. Just like Saudi Arabia from 2005 to 2013, the Six Country Case History from 1995 to 1999 showed rising production, rising consumption, a declining ECI Ratio and an enormous decline in remaining post-1995 CNE (down 54% in only four years, as production increased.

Six Country Case History graph follows.

A “What if” Scenario.

The observed rates of change in Saudi data (EIA mostly, BP data for 2013 cosumption):

2005 to 2013:

Production: +0.6%/year

Consumption: +5.5%/year

Net Exports: -0.9%/year

ECI Ratio: -5.0%/year

The preliminary EIA data showed a slight production decline from 2012 to 2013. For the sake of argument, let’s assume that Saudi Arabia has pulled their last rabbit out of the hat, and they show a -2.0%/year rate of change in production from 2013 to 2023 and let’s assume that their rate of increase in production is cut in half, so their rate of change in consumption would be +2.7%/year from 2013 to 2023.

The 2023 data would look like this:

9.5 – 4.1 = 5.4 mbpd (net exports*)

*Versus net exports of 8.5 mbpd in 2013 and 9.1 mbpd in 2005

Correction: . . . let’s assume that their rate of increase in consumption is cut in half, so their rate of change in consumption would be +2.7%/year from 2013 to 2023 (versus +5.5%/year from 2005 to 2013).

Jeff,

I noticed that Mexico’s oil production is now falling once again. This will impact their net oil exports to a greater degree in the next few years if the trend continues.

It’s interesting that their consumption hasn’t really risen all that much since 2005. According to BP statistical review Mexico consumed 2.03 million barrels a day in 2005, but by 2013 it declined to 2.02. Sure, a few years between it picked up… but not much.

I gather all the corruption and turmoil in Mexico has kept its country from growing its GDP, while its citizens are too poor to increase their oil consumption.

Either way, Mexico’s net oil exports will probably decline more due to the fall in production rather than the increase in consumption.

steve

As noted in the prior thread, I suspect that KMZ is starting to follow the same downward trend as Cantarell. Regarding consumption, it’s interesting to compare Mexico’s consumption since 2005, versus the US.

And following are the “Net Export (Mathematical) Facts of Life.”

Given an (inevitable) ongoing decline in production in a net oil exporting country, unless they cut their internal oil consumption at the same rate as, or at a faster rate than, the rate of decline in production, the resulting net export decline rate will exceed the production decline rate and the net export decline rate will accelerate with time, on a year over year basis. It’s a mathematical certainty.

Given an (inevitable) ongoing decline in Global Net Exports of oil (GNE), unless the Chindia region CUTS their consumption of GNE at the same rate as the rate of decline in GNE, or at a faster rate, the resulting rate of decline in ANE (the volume of net exports available to importers other than China and India) will exceed the GNE decline rate and the ANE decline rate will accelerate with time, on a year over year basis. It’s a mathematical certainty.

Mexico has sort of seen the light regarding their NOC’s vast ineptitude: RIGZONE – Mexico's Pemex to Spend $6B to Maintain Output at Cantarell

We’ll see how that plays out.

Mexico has been growing pretty steadily at about 4% a year for some time.

One needs to consider the impact the 40 GW of solar PV power planned for 2032 will have on consumption.

But then the EIA says that Saudi will increase electricity consumption from 55 GW (2013) to 120 GW in 2020, which is about 10% per year increase. And seems to be way too high.

Does your model use a linear increase in consumption or exponential?

Ron:

Are you retired. Where do you get the time to do such important and informative work?

Yes I am retired and have nothing else to do but putter around with peak oil stuff. I don’t even have a hobby. I did do some kayak sailing. I have a Hobi Adventure Island which I bought 5 years ago but haven’t had it out in over a year.

Now all I have to do is mow the lawn every couple of weeks. My wife accuses me of “playing on the computer” all day. She has no idea what I am doing. But she is in bad health and has serious short term memory problems so I just humor her.

I have three sons, all now in their middle age. They all know what I do but only my oldest has ever read my blog. But he does not follow it. He accepts peak oil but doesn’t believe anything bad will really happen to the world’s economies. He had rather not think about it.

The truth is this peak oil thing has become kind of an obsession of mine. As I have stated before, when you are observing the end of civilization as we know it, it is just damn hard to take your eyes off it.

Ron-

Thanks for all your good work.

Many of us feel a bit isolated, and this is a place of refuge from a toxic society, that many try to be comfortable in.

I can’t.

After LATOC and TOD folded without POB and vodka they would put me in an asylum .Thks Ron .

Hi All

Thanks as always for keeping up the site, and the momentum!

Normally I am a lurker here, though recently I did some quickie work in Excel with Dennis.

While I tend to think Ron’s and Watcher’s estimation of things is more likely than most, I am also keen to OFM’s take on common sense everyday realities. And each day, it seems that even Dennis may be drawing ever closer to the same conclusions.

Were it not for you guys here keeping up the thought stream, the rest of us with our “day job” lives might be lost to the insanity of the daily life of denial.

I am so busy with my life, just trying to keep pace with the bills, that I often haven’t the time to do the research myself. Though Yes I do actually attempt to do so, time permitting , I will often come here first as I have determined POB to be my first source of unbiased – or least biased – or at least alternative – point of view, compared to the usual mantra of “drill-baby-drill” and the so-called bull market of the capital markets.

Still, though I am enthralled with the unfolding story, I am confused what to do next, what should be my next step at every accomplishment, every failure. I have become, at times, reticent to share my concern with others, and still at other times, hopeful, excited, determined.

I hope you will not give up, that you will continue to believe that your message has made a difference and continues to do so. People like me and so -many others not like me – absolutely need the industry- and intellectual- intelligence that you put out here that otherwise remains absent in the mainstream media.

Hi KC,

I tend to agree pretty much with Mac’s point of view. Thanks for dropping by.

Is it a hobie adventure island tandem?

Im planning to buy one next month.

No, it’s a 2009 model. They did not make tandems back then. Email me at DarwinianOne at Gmail.com if you want to talk about it.

Thank you for your time. We appreciate your effort and sharing your knowledge.

Thanks for work and the sharing Ron.

Ron, you have mellowed into a much more polite person since I first started reading your posts more than a dozen years ago. You then reminded me of a in-law relative so I put up with you, got accustom to your ways and look how you have turned out …… you are OK, and your web site work is appreciated,

Thank you. George

P.S. Same age as you and I was a F.E. in Houston, hired in 1964

Thanks George. I assume you mean Field Engineer. 64 was the same year I started in the business. I worked in Houston for a short time, at the Space Center.

Re: The CSMonitor article

It was CSM that injected the bit about 16.8 million barrels per day US production. That text does not occur in Andy Tully’s OilPrice article.

Yes, I think you are right. The Tully peace appears below bit about 16.8 barrels of crude production. Therefore it is not part of the article. I guess Tully would be quite upset if they actually inserted it into the article.

But on news-google search this is what shows up:

Why gas prices remain static despite oil production surge

Christian Science Monitor – 22 hours ago

Although US oil production has increased to 16.8 million barrels of crude per day, gas prices are projected to stay static in the near future.

I suspect that they thought that gross refinery inputs are equivalent to domestic US production (note the 16.8 number for weekly gross refinery inputs):

http://www.eia.gov/dnav/pet/pet_sum_sndw_dcus_nus_w.htm

Net US crude oil imports as a percentage of crude oil inputs (four week running average) were at 43% (7.1/16.4).

I appreciate your effort. Nice to have a replacement for TOD. I too am retired with seemingly lots of time. But have too many hobbies and thus end up with no time. Population, energy and material resources have been a hobby for more than 50 years.

The charts you present week after week speak for themselves but nearly everybody is either oblivious or intentionally blind or so steeped in conventional thinking and tribal loyalties as to be unable to see the obvious.

Now as it happens I am a doomer but not quite so pessimistic as the evidence taken at face value indicates I should be because I am of the opinion people will adapt considerably faster than most doomers anticipate they will. NOT fast enough to outrun depletion and maintain business as usual by any means but still fast enough to delay collapse of business as usual longer than hard core dormers anticipate.

Right now we have a fascinating opportunity to watch and see how importing countries manage ever increasing imported energy costs. Some have basically lost the battle and are not likely to get back to anything like the norms of the last few decades, the PIIG’s being the classic examples.If subsidies from the rest of the developed countries were to be cut off they sure would be ” up the creek without a paddle”.

Now here in my community in the mountains of the American south-Applachia- I have been watching people who are petroleum dependent do what they have to do to maintain their way of life as best they can.So far this is what I am seeing.

Maybe ten percent of us are fast slipping into deep poverty and once in that situation getting out if it can be nearly impossible. Ten percent near the top of the money pyramid are still driving new four by four full sized trucks and Caddys and flying for social purposes.

The eighty percent in the middle are coping with greater or lesser degrees of success. I now have numerous neighbors who habitually ride 50 cc scooters.

( In the event anybody is thinking about buying one I STRONGLY recommend staying away from Chinese scooters. No parts no service. Throwing away a fifty dollar tool is one thing. Junking a two grand scooter two years old is another altogether.)

Hardly anybody is buying an American hot rod car such as a Mustang or Camaro anymore unless it is a luxury make such as a BMW. The kids have to get by these days with ” tuning” four bangers because of the cost of gas in relation to wages.

People are taking vacations close to home and people who I never thought would spend the money are putting on insulated vinyl siding and installing double or triple glazed windows and heat pumps.Wood heat is making a big comeback- as supplementary heat in most cases to be sure but people are finding it worthwhile to buy pickup truck loads from folks out of work who will cut it and deliver it at rock bottom prices.

Curiously enough gardening is declining. It is actually cheaper to buy a lot of stuff from local farmers in bulk than it is to grow it if you count your time as worth anything at all. So while lots of local women are busy canning tomatoes this week they are buying them from local farmers who grow them by the acre rather than by the ” row”. ( These women in many cases still have the ”row” for daily use during the season.)

Older folks who have time to burn used to go shopping in the closest town two or three times a week. Now they are going once a week or once in ten days.

There is little doubt in my mind that once hybrid cars are a bit more common they will be eagerly bought by local people. We have half a dozen used Priuses on the local roads near my house now and the owners simply never quit bragging about how cheap to run and reliable they are.

I do not doubt at all that once a few Leafs make it here- used of course- that they will be shortly eagerly sought after if they prove to be reliable.Personally I believe the reason people don’t buy electric cars is limited range but rather lack of familiarity with them and price of course. Laying out over twenty grand for a car that might give lots of trouble and have poor resale value is a big risk in the eyes of conservative people and when it comes to THEIR OWN MONEY the biggest liberals I know are as conservative as Baptist preachers.

Most people around here live in nice houses and have two or three cars and manage doing so by being damned good managers of their relatively low incomes compared to other parts of the country. Once they see somebody driving a Leaf for a year or two and constantly hear about near zero running costs except for tires and five bucks worth of electricity going as far as twenty bucks worth of gas they will buy Leafs for their daily business of getting to work and errands and keep the conventional car for longer trips until it is old and raggedy and giving trouble.

Maybe I am wrong but once the fear of reliability and poor resale value fade away and gas goes up a couple more bucks I believe Leaf’s and similar cars will sell like ice water in Hell.Ditto Volts which do not have the range problem and are thus suitable for one car owners.

Back to the main point here . It may be possible for people in the US in particular on average to adjust to peak oil faster than most of us expect. We are still going to have one hell of a deep and super long lasting depression though under my most optimistic scenario and that is my MOST OPTIMISTIC guess as to what the future holds.

Wood heat, at least here in Minnesota, if you have to buy it ready to burn is the most expensive heat source there is. I am constantly amazed that almost no-one ever does the numbers.

An average pickup load of wood is about 800 pounds. All wood (inc wood pellets) has about 7000 BTU per pound! [Note: Ya, I know oak has more BTU per cubic foot that pine has per cubic foot – because oak is more dense than pine and therefore has more pounds per cubic foot than pine]. Wood burned in a modern wood stove on average is about 50% efficient. So, 800 x 7000=5,600,000 BTU/2= 2,800,000 BTU per pickup load of heat into the house.

An average price for a pickup load of wood here in southern Minnesota is $100 delivered and stacked. So to get cost per 100,000 BTU divide 100 by 28= $3.57 per 100,000 BTU for wood.

Propane has 91,800 BTU per US Gallon and currently costs $1.59 per gallon. It burns 90% efficient so there is 82,620 BTU per gallon heat going into the house. Divide $1.59 by 82,620 and multiply by 100,000 gives $1.92 per 100,000 BTU for propane. At $5.00 per gallon for propane the cost per 100,000 BTU goes to $6.05 per 100,000 BTU. (But the price per pickup load of wood tends to go up when the price of propane goes up.

I made up a chart with all the energy sources charted out at cost per 100,000 BTU for various prices for each energy source. Makes for some very interesting reading – And is very simple to do!

Considering the cost of chain saws, chains, bars, chain oil, gasoline, log splitters, pickup/tractors to haul it, pile covers/buildings to store it in and all the other little necessities of cutting,splitting and transporting fire wood even if you own your own wood grove it is still getting costly to burn wood (and that is not including your labor time).

As Professor Albert Bartlett stated, Don’t take anyone else’s word, run the numbers yourself.

If everyone had to cut down the trees and process it into firewood and burn the wood for all of their heat for just one year they would suddenly get a whole lot more appreciation for the bargain that petroleum energy is (even at the current high? prices). And I doubt that most people are fit enough to put up and burn wood for a year, even if they wanted to? Post petroleum is going to come as a very big and very cold shock to most?

Jon K. Wrote:

“Wood heat, at least here in Minnesota, if you have to buy it ready to burn is the most expensive heat source there is. I am constantly amazed that almost no-one ever does the numbers.”

I am pretty sure most frugal people do the math. I think most people that burn wood are doing to save money as either source there own wood (from their own woodlot) or scavenge fallen trees. I see lots of people in my region stack wood after a major storm blows down trees. Only Rich Guys with “Money to burn”stock retail split wood. Occasionally I run into people that have patio wood fire pit that by retail wood, Rarely do I see a person buying retail split wood for winter heating. I think people only turn to retail wood if they run out or have a bad year that prevented them from obtaining enough wood for the winter season.

Also a Wood stove can heat a home when there is no power. In rural parts, power outages are common so people turn to wood when they have no power to operate the furnace. It beats running a generator all night long and running a generator is expensive. Lots of Wood stove also have water coils that can be connected to the furnace loop to improve efficiency.

Jon K. Wrote:

“Considering the cost of chain saws, chains, bars, chain oil, gasoline, log splitters, pickup/tractors to haul it, pile covers/buildings to store it in and all the other little necessities of cutting”

People own chain saws not just to harvest firewood. Lots Of people own them to remove fallen trees after a storm, or for landscaping. Same with pickup trucks. People own Pickup truck for other things besides hauling wood.

Jon K. Wrote:

“And I doubt that most people are fit enough to put up and burn wood for a year”

Right, thats pretty much the reason why people choose Petro over Wood or coal. Petro is far, far more convenient.

“Post petroleum is going to come as a very big and very cold shock to most?”

Yes it will.

Jon, you might want to try 60% efficiency for a new wood stove, 8,500 Btu/Lb, and 80% efficiency for propane with distribution losses in a typical system. In my area, a cord of softwood, 2,400lb, is about $180 split and delivered and propane is in the $2.50 to $3.00 range.

As TechGuy says, in rural forested areas a chainsaw is a must so a sunk cost. If someone enjoys cutting wood or needs to, firewood can be cheaper than $180 a cord.

6 years supply of wood heat stacked, dry, and under cover…..less than $100 for chainsaw gas and bar oil. Time spent doing it extremely enjoyable. No gym membership required. Gas spent with the hauling using small tractor…$100? Not much, anyway. I use a home made splitter now, but used to do it by hand. Gas for the splitter? Maybe $5.00 per cord…128 cubic feet.

Plus, the heat is awesome and cozy. Our house is warm with low humidity regardless what we are cooking. Water is pre-heated with jacket before going into HW tank.

There is no greater sense of satisfaction knowing we will be warm for years and years despite what the economy does. When the power is out we are toasty and cook on a wood cookstove as opposed to using the wood heater. When it is really cold and stormy, we fire up both stoves.

If we had to rely on store bought heat such as propane or fuel oil….electricity, I don’t think I could enjoy being warm. We have to open the windows once in awhile when running the woodstove.

Paulo

Keep in mind the problem isn’t so much personal transport, it’s the world economy. How does a system relying on growth suddenly begin contracting (once every fiscal trick in the book has been tested and used until they no longer work) and remain viable? The question becomes particularly troublesome once the descent from peak reaches 3-5% per year.

Also, It’s fine to purchase crops from local farmers, but if the economy tanks then what are they purchased with?

Hi Mac,

I pretty much agree with all of your comment.

I am slightly more optimistic than you in the following sense. In the US and Canada the Great depression that you anticipate is likely to be very bad indeed, but I think the high unemployment which results (let’s say 30% for a nice round number) will result in the government acting to build (or facilitate the building of) railroads, light rail, solar, wind, nuclear, High voltage DC transmission lines, I think it could be a wake up call to resource limits in general and there may be a push to change habits for recycling, soil practices, fishing regulations, and carbon taxes. All of the attempts to mitigate the liquids energy shortage and general resource constraints will tend to slowly increase employment and the situation may gradually improve.

Note that I don’t believe that this will necessarily happen, but if we envision a nation (or World) in crisis as in World War 2, amazing things can happen (both bad and good). There is a possibility that good things (as in the Allied forces in WW2) rather than bad things (as in facism) could result.

I do think we will see a Depression at least as bad as the 1930s, maybe Keynesian economics will make a comeback.

Dennis, “The past is not the future ” When the great depression happened there were not 7 billion on this planet, no globalisation , no instant wire transfers ,no JIT etc,etc . To take lessons from the Great depression and apply them to this time and age is irrelevant and useless . Just because “Carl Lewis was the greatest athlete does that mean he will be the best(leave alone greatest) footballer, cricketer, or ice hockey player” . What worked then will not work now . The problem is that Bernanke and now Yellen are schooled just at that . Just like most of the rules regarding the fall of the Roman empire will not apply to the decline and fall of the American empire since they would occur under a different set of conditions

“The past is not the future.” In 1943 as a ten year old, I spent a week as a guest in a ‘blue collar neighborhood’ located less than a mile from the center of Houston Texas. Every back yard had a garden and laying hens. A few had a little jersey cow and several had a couple of pigs. An ice truck visited the neighbor hood three times a week to refill the ‘ice boxes’. There were few obese folks in that or my rural community but they were tough and possessed essential skills.

There was no social safety net as we know it today. The FDR ‘New Deal had just come into existence a few years previously but there was no Medicare, Medicaid, extended unemployment, WICs, section 8, etc.

As a result people were resilient and because the society was far less mobile family was near by to take up the slack. Most importantly we were a more homogeneous society. Tribalism is real and powerful. When resources are plentiful, tribalism can be held in check but when resources are limited, the tribe comes first.

OFM and his neighbors may be able to cope, but the millions toiling in high rise office buildings are going to be SOL. They lack the skills, resilience, and relationships to survive. A more valid vision of the future in my opinion is 1930’s Ukraine.

About 10 years later, while on a Public Health rotation at Baylor, I was told that approximately 5,000 outdoor toilets remained in Houston. They were becoming less common.

Deceptive stat. I’ve seen it before. It counts RVs in driveways that grandparents may live in and it counts portapotties at construction sites.

Surprised me when I first saw it, too.

This was early 1950’s. My impression was that the Houston Public Health Dept, was actually referring to actual outhouses within the Houston City Limits.

Cool, you know, it may still be that number via pop gain.

It wouldn’t surprise me if there are more than that now. Houston is such a giant, sprawling city, with areas that are little better than shantytowns. My partner taught for a time in a poor school in Fort Bend ISD, some of the kids w/o electricity and running water.

I’ve visited the cabin my grandfather was born in, well built and still standing. At least it has a well with fresh water.

Duh. Perhaps the name “hole in head” is apt.

JIT inventories did not happen overnight; nor will worldwide ruination from JIT come overnight. Just as JIT came into fashion over time, so will it go out of fashion over time. Doesn’t take a knucklehead to figure it out.

Certainly what works now might not work in the future. Yeah. The Romans figured that out.

Ok so?

Duh…. Change course! Is it so difficult to see? Come on!

Ok perhaps if things fall apart overnight, maybe next week , that’s one thing; probably no economy could survive it, period.

Dennis is no idiot, and has proved his merit on this site too many times to count on two hands and two feet. That you or anyone else might suggest that Dennis or others here are such stooges as to have not given considerable thought to their analysis is sheer stupidity itself.

Give the guy some credit. Besides that, if you cannot give constructive, meaningful criticism beyond the negative slugfest that you have presented here, keep your mouth shut.

I know JIT did not happen overnight ,but does it’s dismantling have to be a “bell curve” . It will be a ” Seneca Cliff ” . You a build a building “brick by brick” but the dismantling is always the wrecking ball and never ” brick by brick” .

The Roman’s figured that out . Good for them . But what was the use of figuring this out if you choose inaction ? They went down the tube inspite of figuring it out .

In an earlier post I have already pointed out that we know that we have to change course since Hubbert (+50 years)raised this issue . Where are we today ? ” Up the creek without a paddle ”

Now ,where have I said or indicated that Denise is an idiot? But just for your confirmation I know his inputs are invaluable and just because I have another POV does not mean he is wrong and I am right, it just means we are different . Anyway my comment was not to downgrade Denise (as an individual) and nor was it an effort to criticize him . The POV is that arithmetic fails in front of human behavior .

As to “shutting up”,sorry I will refrain from answering to that . My Guru told me ” Your bad manners are only exceeded by your bad manners “. I hope you get the point .

Hole in the head,

I do not think the World will adjust easily to declining oil output.

In a world where JIT inventory management is the norm, there will be a lot of disruption. Do you think that businesses will be unable to change their inventory practices in response?

I expect another Great Depression, possibly much worse than the 1930s with 30 to 40% unemployment.

I also expect the government will attempt to do something to get people back to work and economists may relearn the Keynesian economics that they once knew. If not and we follow early 1930s economic advice, the depression will be about 10 to 20 years longer than necessary.

Your adaptations might be theoretically possible but in the real world with real human beings aren’t going to happen. Real human beings when faced with resource scarcity go to war. There is historical evidence for this. The Japanese when faced with an oil embargo in WW2 didn’t just go back to using rickshaws, they went to war. The buildup to WW3 is under way right now in Ukraine.

Once serious hostilities between the major powers commence (i.e. nuclear weapons are used) all bets are off. You won’t be able to buy a Leaf or a scooter.

You need to think about how we can prevent people from going to war over resources. I don’t think you can.

Let me second this point generally.

Discussions about adaptations are very useful and have been done many times since knowledge about peak oil has become a little more commonplace.

Very few doubt that human beings, when pushed, will make the transition to a lower energy lifestyle if forced by circumstance.

But the overall doomer view takes in much more than that. It really is about the diminishing marginal returns on complexity, which indeed is happening to our global civilization. When you think about it in these terms, all bets are off. You can no longer safely assume that a combination of things such as electric transport or insulation will save the day. They work on an individual level, but they don’t scale up, because anything of scale is debt and waste dependent.

The idea that WW2 was won with a combination of Yankee ingenuity and communal spirit in hard times is only partly right. It was won because the victors more successfully employed scale to use a tremendous amount of resources to fight the war. America and Russia had the oil.

If one saves resources, it only allows somebody else to use them. It’s all game theory. Ask anybody in Iraq or Ukraine right now what they feel about the soft decline from peak oil.

Fossil fuels are concentrated power. It always makes sense to burn them, it never makes sense not to. As such, everything that will be produced will be burnt by somebody, somewhere in this world, and that somebody will have light, heat, and power, and anybody who opts out of the game won’t.

“Very few doubt that human beings, when pushed, will make the transition to a lower energy lifestyle if forced by circumstance.”

It’s not very difficult with a body temperature of 75 degs F.

OFM Wrote:

“Once they see somebody driving a Leaf for a year or two and constantly hear about near zero running costs except for tires and five bucks worth of electricity going as far as twenty bucks worth of gas they will buy Leafs”

I very much doubt Electricity will remain cheap. The primary reason why Electricity is cheap is because about half of the Power Generated in the US is from coal. Since the gov’t is clamping down on Coal, All those coal fired plants will need to be replaced costing billions and will be replaced using a more expensive fuel source (most likely Nat Gas). The higher consumption of Nat Gas will also cause prices of NatGas to rise.

Realistically, It just makes sense to purchase a more fuel efficient vehicle.

OFM Wrote:

“It may be possible for people in the US in particular on average to adjust to peak oil faster than most of us expect. ”

I doubt it. Lots and lots of people will lose their jobs, and there are an awful lot of people depending on gov’t entitlements and the gov’t already is dead broke and insolvent. We are not just facing an Peak Oil problem, we are facing, a Debt problem, Aging Workforce, Lack of workers with appropriate skill sets, Peak Water, Peak NatGas, Aging transportation infrastructure, etc. It would be difficult to tackle Peak Oil by itself. Add in the long list of other problems and its impossible.

We are already past Peak Cheap Oil and the US economy is in the toilet, heading for the septic tank. We waste Trillions on boondoggles to fulfill pointless political agendas that only exacerbate the problem. Make Self-reliance Plan A, and hope for the best.

I think overall the electric car stuff will die of obvious failure as soon as someone braves the Tesla counterattack and starts quoting results in New England January rather than San Francisco.

But if you really want to achieve fame and fortune, have a talk with John Deere about lawn tractors that run on these magical batteries. Those don’t have to charge up every night. Your basic Briggs and Straton on one of those is only 20 horsepower. 745 X 20 = what, 14.5 kilowatts? Let’s see one of those that runs for just 1 hour every week and fits nicely in the same size and weight form factor.

Hiya Tech,

You write

”We are already past Peak Cheap Oil and the US economy is in the toilet, heading for the septic tank. We waste Trillions on boondoggles to fulfill pointless political agendas that only exacerbate the problem. Make Self-reliance Plan A, and hope for the best.”

If you have been following my comments closely you will realize that you are repeating after me. LOL.

Now that part in the middle -”We waste Trillions on boondoggles’ ‘–is what gives me reason to hope we Yankees and a few other lucky people are not NECESSARILY headed for the septic tank.

We are still incredibly rich and still have a simply mind boggling endowment of natural resources in North America and less than five hundred million of that seven billion reside here.

I would like to hear JUST ONE well though out argument from the doomer camp explaining WHY we will not as a country get our sxxt together once we are FORCED to do so by circumstances. There is no doubt about the coming crisis.

But Hobbe’s Leviathan – the modern nation state – has proven itself to be as tough as cockroaches and nations don’t just generally roll over and die without a fight. When the fecal matter hits the fan Uncle Sam is going to get his butt in gear and institute some very tough new rules that are going to bring about more positive change in a year or two that market forces have brought about in as many decades.

Oversized personal trucks will be outlawed as far as new sales and old ones will be forced off the road by rationed fuel.IF you want a new F250 you will have to have a legitimate business use for it or risk getting it confiscated by the cops the first time they see you cruising in it.

I agree that electricity is going to get to be more expensive but it is apt to always be a damned sight cheaper than gasoline and renewable power is going to continue to grow. IF I had to I could put up enough solar panels out of pocket to keep a Leaf charged adequately for my own personal needs ninety percent of the time – but I don’t commute and could leave it hooked up in the middle of the day most days.

A hell of a lot of the millions of people who are going the be unemployed are going to be put on government payrolls doing useful work (at least part of the time!) such as building bike paths and street car tracks and adding insulation to existing buildings and installing heat pumps and organizing community agriculture and a million other jobs.

The mandated fuel economy of a new car is going to be eighty mpg or more and the mandate will stick.It is bullshit that such a car cannot be built economically but it is true that it will be very small very slow and very ugly by current day standards. On the other hand if it is all that is available…it will sell.

Some groceries will be rationed. Some will simply be outlawed or taxed out of markets. We can live on half or less very easily of what we put into food production these days.I raised apples and peaches and beef cows before I retired.If I could have sold apples that were not as visually appealing I could have sold them for half price.Chickens gain three times as much weight as cows per unit of feed.We can eat chicken and beans instead of hamburger and roast beef.

And we can pay for it all – the parts of it that HAVE to be paid for- out of the waste you rightfully point out. I am not saying it is a foregone conclusion that we will get our act together but it is more likely that we will once forced to than that we will just bitch and whine and shoot each other for the last loaf of bread in a neighborhood store.

Incidentally I have a substantial hoard of guns and ammo in case it comes to that. I think the possibility is real but actually rather low- less than five percent in my area over the next couple of decades which is as long as I can reasonably expect to live.

(Beyond that I expect guns and ammo to appreciate faster in value than just about anything else as times get worse which is why I have more than I ever expect to actually use.One of these days I will trade them off one at a time to younger neighbors for beans and firewood. )

Now in Detroit or LA the odds may be substantially worse…. even though I expect welfare programs to prevent starvation and exposure from being substantial problems here in the US.

Of course a little bad luck and mismanagement is all it would take to make the worst doomer scenarios come true. I would never deny that possibility.

OFM Replied:

“Now that part in the middle -”We waste Trillions on boondoggles’ ‘–is what gives me reason to hope we Yankees and a few other lucky people are not NECESSARILY headed for the septic tank.”

Let me rephrase a bit. “We borrowed Trillions for Boondoggles and lack the resources to pay it back”. America lost is era of exceptionalism 40+ years ago. We had made historic achievements by prompting liberty and entrepreneurship by convincing the worlds brightest and hardworking individuals to immigrate to the US. Now we attract the worse in people seeing entitlement, and imposing socialism and authoritarian government.

“A hell of a lot of the millions of people who are going the be unemployed are going to be put on government payrolls doing useful work”

1. It doesn’t work that way. The Unemployed on long term gov’t payrolls turn in couch potatos.

2. Its very probable that the majority lost their jobs is because they were not very productive or had no useful job skills. I work as an independent technical consultant. It never ceases to amaze me how lazy and incompetent workers and managers are. Fortunately, I am paid well to fix all the Frack-ups they make, and business is booming!

OFM Replied:

“We are still incredibly rich and still have a simply mind boggling endowment of natural resources in North America and less than five hundred million of that seven billion reside here.”

The US is in deep population overshoot. We import energy overseas and from Canada. We are literately reaching the bottom of the barrel by sweeping up the little remaining oil in old, depleted fields with horizontal drilling. We are also literally squeezing Oil from a stone with LTO fracking from source rocks. When we can’t import enough or squeeze enough out the rock, its going to fall to pieces in short order. We should have begun mitigation programs decades ago. In my opinion, we’ve already leaped off the cliff, but just have smacked into the ground yet.

Most of the population now lives in cities which is dependent on an aging farming population (avg is about 59 years) and 99% of city dwellers know zip about farming. Farming isn’t something that you can learn overnight by reading a few chapter’s in a book. My best guess is that it takes at least 10 years of on the job learning. Younger generations have opted for the City life and have avoided continuing the family farm. I don’t see how this will end well.

OFM Replied:

” I am not saying it is a foregone conclusion that we will get our act together but it is more likely that we will once forced to”

The most likely outcome is mass riots in the streets, when the system begins to fall to pieces. Look to At Europe to see what happens under austerity. They riot in the streets and demand that their pensions and entitlement be fully funded. For now in the US, they still get SS, EBT, subsidized housing etc, all on borrow or printing money which for the moment has avoided major riots in the US. Almost have the population is receiving gov’t subsidizes, assistance, or gov’t employment. They will never understand reality, otherwise we would be in the situation to begin with.

OFM Replied:

“The mandated fuel economy of a new car is going to be eighty mpg or more and the mandate will stick.It is bullshit that such a car cannot be built economically but it is true that it will be very small very slow and very ugly by current day standards. ”

That’s not a car, your describing a Moped or a go-cart. Passenger car fuel economy is irrelevant. Its the farming equipment and trucks that bring food and other resources to the masses that matter. Its not possible build an electric tractor or a truck that can get 80 mpg. Once the JIT long distance food haul gets disrupted than its hard to believe anything else will matter.

Hi Tech guy,

So instead of building trucks and roads, we build railroads which use fuel more efficiently and can be electrified. A lot of mining can be done with electric equipment, farming uses very little fuel overall and could potentially be fueled with biofuels if necessary.

Tech Guy has made up his mind that the current ” bau rules” are natural laws rather than just descriptions of the way we do things NOW.When things change enough the old rules no longer work at least after a fashion new ones are fashioned to deal with the new circumstances.

Dyed in the wool thinking is almost impossible to change.

As to oil supplies: We produce as much per capita as rich Germans consume and can probably maintain that production or close to it for a long time.

As for eighty mpg cars being go carts, those same Germans have already built lots of cars that do almost that much if driven very gently, and I am old enough to remember the ”double nickel” when I dared not put a road tractor in ” high” gear for fear of inadvertently exceeding 55. When the crisis hits a second conviction for speeding will be treated the way drunk driving is NOW.Loss of license.Jail.The speed limit may be lowered to 45 this time.

But yes a hundred mpg car will be narrow and low and a two seater fore and aft. VW built some a while back using exotic materials that were hybrids that get well over 200 mpg equivalent.I can provide a link if anybody desires it.There is nothing to prevent them being built out of ordinary steel and still getting eighty percent of that 200 plus mpg.

Personal auto fuel economy is not irrelevant- most of us are compelled to commute and this is not going to change for decades no matter what although we are already gradually getting away from commuting. SLOWLY.

Anybody who has read some history will understand that nation states don’t just roll over and die and that the people who live in them come together in times of crisis.

The old Stalinist USSR had one of the worst and worst feared and hated governments in history, and for the very best of reasons.

But when WWII started the people there pulled together and did what had to be done.

Now as to all that borrowed money: It is NEVER going to be repaid. The people who own the debt are what we country folk describe as SOL Sxxt out of luck. The federal government of this country is big enough and powerful enough to change the rules at the business end of rifles and will do so as necessary when it becomes necessary.

The Egyptians built the pyramids with little or no money involved.Probably no money but I have seen differing opinions on this matter depending on how money is defined.

Money is only a bookkeeping device for real wealth which consists of man(and woman) power and brains and natural resources.

When we go to war and have a draft union craftsmen and professional athletes get paid a few pennies on the dollar as soldiers. And a good many chips of old rich blocks actually join up and tote rifles.

When the building of new houses comes almost to a standstill carpenters will be damned glad to work on a state or federal program for very low wages helping renovate existing houses and buildings for energy efficiency given that choice and the choice of no unemployment benefits.

Will there be riots? For sure.Will there be anarchy? I have not ruled it out. I often mention the possibility of martial law followed by a police state.

In case anybody does not know what a police state is Nazi Germany, the old USSR, and China under Mao are excellent examples.Riots were met with machine guns if necessary but not many people tried it once those police states were well established.

The population of the US is higher than it ought to be considering the long term but we are not in very deep in overshoot on a a short term basis.And when the fecal matter hits the fan history indicates the borders will be closed with a very final hard bang for the duration.I don’t know how the births per woman issue will play out but my guess is that birth rates will decline fast rather than increase. Birth control is very cheap compared to diapers and groceries.

Farming is no harder to learn than any other sophisticated profession or trade. The biggest difference is that it takes longer because of the annual business cycle. Houses get built in a few months and a new carpenter can work on a dozen start to finish in two or three years. Observing a dozen years of crop production takes a dozen years.

People start doing useful work in other trades and professions within a matter of days of being hired as a rule and the ones with brains and good work habits progress rapidly if there is room for progress in the field. I could supervise a dozen beginners without much trouble at all and grow fine crops the first year.Driving a tractor or combine doesn’t require extensive training.Farming as such is about on a par intellectually with running a garage or a small construction business.

Lots of mistakes are made by beginners but despite the mistakes some succeed in becoming experts.We are at any rate never ever going to revert to a nation of small farmers- at least not within the next fifty years. The places the farm land exist and the places the teeming hordes exist are different places and there is hardly any infrastructure in farm country beyond what is necessary to support the local population. The absence of housing and roads and water lines and sewers etc etc guarantees the millions mostly stay put in the cities.IF they don’t they will perish of exposure in the country.

This is not to say that small scale farming will not make a comeback but the ”to the horizon fields” in the American farm states are not well suited to growing fruits and veggies.

If I were a young guy and a city dweller I would give serious consideration to moving close to a small town where I could buy a very large lot with soil and climate suitable for growing some food.Managing a ten mile commute may be easier than paying for fresh and varied food that can be grown at home and growing your own stretches the family income during hard times.A young guy can do ten miles one way on a bicycle and a scooter will do it for a whole week on a gallon of gas.

Mac,

You make a lot of sense.

DC Replied:

“So instead of building trucks and roads, we build railroads which use fuel more efficiently and can be electrified. A lot of mining can be done with electric equipment, farming uses very little fuel overall and could potentially be fueled with biofuels if necessary.”

Come on, even you got to realize this is fantasy land. If your going to go that route, why not throw in Mr. Fusion from Back to the future or Zero Point Energy. We’ll all be flying cars like in the Jetsons! There be piece on Earth. The Palestinians and Jews will join hand and live like brothers and sisters, etcetera, etcetera.

OFM Replied:

“VW built some a while back using exotic materials that were hybrids that get well over 200 mpg equivalent.”

Yup, They built a 200K coffin. Do you have any idea how expensive and energy intensive it is to manufacture Carbon fiber? If you willing to throw unlimited funds, just about anything is possible. But the average American isn’t going to be able to afford it. Lets use a little common sense here, please! Would you really put your life on the line getting into an accident in one of these tiny cars?

OFM Replied:

“But when WWII started the people there pulled together and did what had to be done.”

The global population and the US population was considerably smaller. Back then there was significantly fewer cars and trucks, and what 10% to 20% of the population was in agraculture and 40% of the US population lived in Rural regions. Today less than 2% of the Population works in Agraculture, and about 70% of the population lives in Cities or the Suburbs. We tore up a lot of the best Farm land in America and built strip malls and suburbia.

OFM Replied:

“Money is only a bookkeeping device for real wealth which consists of man(and woman) power and brains and natural resources.”

No, Money is indirectly related to Energy. Money is a means to transfer value that originates from the use or production of energy. Even manual labor uses Energy as it takes energy to grow and transport the food consumed by the workers. You just can’t create value out of thin air. There has to be source of energy to make it all work. The more expensive energy becomes the more dear real money becomes (ie value of money excluding inflation, or devalation by gov’t). You can’t product goods or services without energy. The less energy you have the more difficult it is to employee everyone.

OFM Replied:

“When the building of new houses comes almost to a standstill carpenters will be damned glad to work on a state or federal program”

Any is the gov’t going to stand by the workmanship of these gov’t salaried workers. If I was a carpenter on the gov’t dole. I would bother with quality. I would do the bare minimum needed to complete the job, and if the home or building collapses, its not my problem. This is why gov’t can’t fix this problem. Gov’t is the problem, not the solution.

OFM Replied:

“Farming is no harder to learn than any other sophisticated profession or trade. The biggest difference is that it takes longer because of the annual business cycle. ”

Exactly so why are you arguing with me. You understand that your not going to replace the aging farmers with City dwellers.

“Tech Guy has made up his mind that the current ” bau rules” are natural laws rather than just descriptions of the way we do things NOW”

No i have not. I am just a realist. I don’t try to sugar coat, “what if” scenerios. Its not going to happen. Your being an old fashioned romantic to think that we can just revert to times long gone, as if you can just turn a switch and instantly people can change thier social behavior, adapt, and learn new skills overnight. its not going to happen. Apply some critical thinking and think this through more.

OFM Wrote:

“We produce as much per capita as rich Germans consume and can probably maintain that production or close to it for a long time.”

Germany never built its transportation system on a federal highway system. Unlike the US that had oil priced in dollars they remained frugal and invested in Rail and set up their economy over the past 50 years to minimize the need to import Oil. Germany also built its economy around its Coal reserves, which is nearly depleted. Germany is resorting to destroying towns in order to grab the last of its coal that is sitting under these towns. Germany is also depend on NatGas Imports (mostly from Russia) to run its economy.

OFM Wrote:

“Now as to all that borrowed money: It is NEVER going to be repaid. The people who own the debt are what we country folk describe as SOL Sxxt out of luck. The federal government of this country is big enough and powerful enough to change the rules at the business end of rifles ”

So Solders are going to “protect” and defend the gov’t for free? When the US defaults its game over. The only thing the gov’t has is the US dollar (Read about Alexander Hamiliton and the Connential bonds to understand how the Federal gov’t rules by the US dollar). Once the value of the dollar is gone. People won’t fight its battles, they won’t sell the gov’t goods and services any more, and all of the entitlements go unpaid. Do you think the ~160 Million Americans recieving gov’t checks are simply going to accept this and not get angry and riot. Come on! Apply some critical thinking, please!

Tech ,

You have obviously made up your mind and it is perfectly clear to me at this point that NOTHING could ever convince you to change it.

”Come on, even you got to realize this is fantasy land. If your going to go that route, why not throw in Mr. Fusion from Back to the future or Zero Point Energy. We’ll all be flying cars like in the Jetsons! There be piece on Earth. The Palestinians and Jews will join hand and live like brothers and sisters, etcetera, etcetera.”

Sarcasm is fine but when you compare electrified rail to fusion you are displaying a level of either ignorance or plain old bone headed mulish refusal to think that is hopeless.

Sarcasm is one thing and fine but comparing electrified rail to fusion is not sarcasm. I can’t think of a word that works here that is not offensive and just won’t say any more.

Electrified rail is very real and widely used and totally everyday off the shelf technology. FUSION is as most people have heard the ” energy source of the future forty years from now and always will be”.

I know from other things you have posted you are not ignorant but actually pretty smart. I can’t understand why you are so adamant that our country and society will do NOTHING to save itself in face of a crisis since this would be totally contrary to all the history I have ever read.

I will not respond again to your comments or remarks. It is not possible to DISCUSS possibilities with an ideologue who is utterly convinced ( or maybe just unwilling to admit he may be wrong?) he is right about such matters no matter what contrary evidence can be presented.

+1

OFM Wrote:

“Electrified rail is very real and widely used and totally everyday off the shelf technology. FUSION is as most people have heard the ” energy source of the future forty years from now and always will be”.

I was not trying to be hurtful, The issue I see with electrified rail is where does the energy come from to power it? Hense, the Mr Fusion analogy. To be honest I was hoping you would have thought it be funny, and I assumed you would get the connection about providing the power source for migrating to an all electric economy.

DC also also include text electric mining, leading that we can simply electrify everything as if simple as counting 1, 2, 3. For one, the Grid is barely holding together as is. To switch all energy demand to electricity it would need to increase capacity by 5 to 10 fold. Sorry, but its not going to happen.

FWIW: I am just trying to get you guys to see that you can’t simply make wild assumptions with applying critical thinking on the issue. Please don’t take any of my comments as a verbal attack. Despite my long winded post I am do make an effort to try to be brief, and my comments may come across as abrasive. I am trying to communicate complex issues without writing a 100+ page book.

Thanks for reading.

Hi Techguy,

It is pretty clear that switching to more electric will require both greater energy efficiency (better buildings with more passive solar and heat pumps) and more electric output. Until we can ramp up wind, solar, and nuclear power we will need to use coal and natural gas.

There will need to be a huge investment in upgrading the grid, that is why I always mention more HVDC transmission which will reduce losses when electricity is transmitted over large distances.

In addition, just expanding the rail capacity we have to replace most long distance trucking without converting to electric will use energy more efficiently.

I do not think this will be easy to accomplish, I do think it is possible. In fact when the economy is in a depression, there will be many unemployed people that will be willing to work. If private investment cannot get them to work, as in the great depression, then the government can undertake the investment, they can hire private companies to do the work or form public private partnerships, give tax incentives or do the investments directly.

Or for those that dislike government, we could just let the market work, like 1929 to 1933.

OFM, as an independent observer who does not live in the US so has no skin in the game as far as US is concerned you are a way too optimistic on the outcome’s for US citizens (yes, you as an individual are well positioned) . I think that +/- 50 % of the US is obese and also + 35% are on anti depressants . Who is going to save them ? Will they go bonkers when they don’t have their insulin and valiums or prozacs . I remember reading ( I think it was JHK) , “the US Is two coastlines connected by airways and the highways ” .The railroads run mostly North to South (what I understand, not being a US citizen) . So 50% of the battle is lost when the airlines start curtailing ( 42 gallons of crude gives about only 4.5 gals of ATF and the USAF will want that) . All operations have a “break even” or a “MOL” . You breach them and the party is over . You do not have to go to “zero”. I have often given the analogy that the human body is 80% water but you have to loose only 20% to die because of organ failure . This is talking from my personal experience as a cholera victim .

All your arguments are clouded by two important factors :

1. You look how well you are positioned ,and then you presume that other’s are :or will follow the same path . Believe me , I am happy for you .

2. You absolutely discount the “break even” and MOL factors which are crucial .

Just as a rider I make it a point to always read your POV , and your contribution is greatly appreciated .

P.S : My friends accuse of not talking to much . My answer to them ” I talk to improve on the silence “

>Money is a means to transfer value that originates from the use or production of energy.

Heh, Don’t tell that to the gold bugs. They think gold is money (or the other way around, not sure).

>You just can’t create value out of thin air.

Of course you can create value out of thin air. That is what trade does.

For example, if I’ve got more firewood than I need, and you’ve got more potatoes than you need, then we can trade a few potatoes for some firewood. The trade makes sense for both of us, because the potatoes are worth more to me than the firewood and the firewood is worth more to you than the potatoes.

Boom! Free value out of thin air.

Here’s another example. Lets say everyone in town agrees to drive on the right side of the road instead of down the middle or wherever. Suddenly the traffic gets a lot faster, and the road is much more valuable to all users.

Boom! Free value out of thin air.

Or let’s say we all agree to use the same network protocol. We could have a huge worldwide web hooking up millions of databases around the world. Suddenly all that data is so much more valuable.

Money is a store of value but value is an ephemeral and even subjective thing. Economics has no Law of Conservation of Value like physical laws that conserve mass or spin or hadron number or whatever.

I’ll just chime in here. I fall in to the doomer camp although I agree that a police state is a fairly inevitable outcome for current strong modern states.

A couple of issues that haven’t been discussed are:

1: China owns $1.2 trillion of U.S debt. I can easily foresee that they will come calling for payment in kind if the U.S chooses to default. Chinese efforts to beef up their naval capabilities is worrying. Whether they’d ever go to war over the debt is questionable but they would find an arrangement convenient to them.

2: The U.S is a very divided nation. How well do the recently arrived immigrant populations / disenfranchised non-white populations come out of the police state? The society could easily fracture with ghetto-like situations forming. I doubt that they will receive all the federal bailouts. They’ll be a constant thorn in the side.

3: Youth unemployment(16-24 yr old) is high (at 16.3% in July 2013) although not at European levels. I don’t know if there are any studies but it seems a generally held view that if young people do not find employment during those first 8 years of their career they will find it hard to enter the workforce later. Another problem waiting for future generations to deal with.

4: OFM mentions birth control being a cheap way of keeping population under control. Birth control requires the population to go along with using it. Here in Peru birth control is free but people here fight to defend their right to breed like guinea pigs. The aforementioned minorities (maybe majorities) will not appreciate a predominantly white government informing them they are having too many babies.

Just a few thoughts that came to mind.

Lots of potential problems. Clearly there is not a way to overcome having a lot of immigrants, especially in a nation of immigrants 🙂

Hi Inglorious,

You bring up some good points.VERY good points.

On one: China is an up and coming super power if she doesn’t collapse first.We are still the big dog militarily though and probably will be for a good long while yet.

If and when it comes to a showdown major countries at war don’t pay debts owed except to their allies.At any rate we are deep into financial overshoot the world over and fiat currencies always fail at some point. The dollar will not last forever. The pound sterling didn’t.War at several levels from economic to border clashes to flat-out nuclear is possible and in the cards for sure.Hopefully MAD will prevent the wide scale use of nukes.

TWO : Our recent arrivals are not so numerous YET as to represent a major threat in terms of stability under emergency conditions.Most of them are integrating rather well.IF the worst comes to the worst they may be escorted to the borders or interned or just shot out of hand along with any body else who refuses to go along with the new reality.

I am only argueing that we have a good shot at maintaining something resembling modern day business as usual rather than saying everything is going to be ok.I do not use the terms martial law and police state lightly.

Three : Unemployment is going to be one of our very biggest problems and not just among disenchanted and economically disenfranchised young people.A huge part of our population is going to be on permanent welfare and the allotment is not going to be a generous one no sireee!!! All those unemployed and angry young men are the timbers out of which a police state may be built.

Four:

I have not acquainted myself with your local culture to any great extent but ours is so far different as to figuratively be another world:Your history is so far different from ours that drawing comparisons is almost impossible in using one country to predict the future of the other.

OUR Catholics laugh at the Pope when it comes to the use of birth control and our society hardly even bothers to consider female promiscuity a bad habit let alone a sin any more.I know dozens of Catholics and of them all there are only two families with four or more children. ONE or two is the norm with them locally at least.

Except for a very few ”Native Americans ” with very little influence and only a handful of followers we don’t have anybody here who is convinced the government or any body else is out to exterminate them.

I live in the heart of what we call the Bible Belt here and can say with complete assurance that it is virtually unheard of for one of our Protestant leaders lay or professional to say anything at all against the use of birth control within the institution of marriage although most of them promise the girls who ” do it” before they are married that they are going to burn it hell forever.

Damned few of the girls pay any attention to them when the hormones are raging.

I might be wrong but I am not much worried that we will have a problem with large families unless some religious nut cases come into political power and outlaw easy access to birth control which is actually dirt cheap if provided as socialized medicine and socialized medicine is the future here.

This is not to say our population will not grow for a few more decades yet.It almost for sure will.

But we no longer have a culture that prizes children as old age security measures or child labor to help on the farm etc.

A little late to respond but I’ll put it up anyway.

As I said I think the police state is fairly likely and the answers OFM gave are pretty likely results. And yes Dennis, immigration is part and parcel of the U.S. It’s just the new immigrants aren’t the right sort. The quality has just gone downhill 🙂

Just one thing, Peruvians don’t have babies because they’re Catholic. They have babies because they’re poorly educated, a situation which will worsen in the U.S as things take a turn for the worse. It’s not that they actively want more babies, reject birth control out of hand. It’s just something they don’t do. I imagine there are many similar poorly educated communities in the U.S and the type of people who have more babies than the standard.

Anyway, not saying that the U.S won’t weather through but it’s going to be unpleasant and I can imagine many people coming out on the wrong side of things when things turn bad. In my opinion I can see much greater independence occurring as the years go by. Maintaining a country such as the states in one will be a challenge – regional blocs with similar interests will likely form. The idea of the states may continue but power will likely be devolved.

Inglorious,

As I understand it, when a contractor is looking for a good days work, they tend to find it from recent immigrants. I am in complete disagreement that the quality has gone down hill.

Do you think the illegal immigrants come to the US to collect welfare, they don’t get that, they find the jobs that many citizens find too hard or too low paying.

There are several things I disagree with in your post.

The American government is far from insolvent. Furthermore more investment on infrastructure would be better for economy, because private spending is down. The whole idea of needing to “tighten your belt” is misleading. Energy efficient infrastructure would be a smart bet.

A lot of people are leaving the labor force as the boomers retire, but productivity is still increasing.

Complaints about “government entitlements” sound sensible, but “entitlements” is simply a reference to arcana of the budgeting process. The term has no economic meaning, it is just something the Republicans have been using as a propaganda tool.

The price of energy is less important than the price of energy services. About 14% of electricity at home is used for lighting. With conservation and LEDs you could reduce that 80%. 18% is used for air conditioning. Solar panels, efficient air conditioners and raising the temperature a few degrees could half that. Heck my (Japanese) father-in-law leans a big ole bamboo mat up against the South side of the house when it gets too warm. Another 8% is for refrigeration. I think people will buy smaller fridges if electricity gets expensive. It isn’t the end of the world. The same applies to heating, electronics etc.

(Energy use source here: http://www.eia.gov/tools/faqs/faq.cfm?id=96&t=3)

OFM, my experience is that electric cars are far more reliable than gasoline cars.

We have had a Nissan Leaf for 3 years and a Chevy Volt for 2+ years. The only maintenance we have actually needed was to replace a cabin air filter.

I used to pride myself on a good set of automotive tools, and some 30 years ago I was working on a car every weekend, because the cars broke down a lot. Now my tools are gathering dust and I’m out of that business. I can’t work on the electric cars, but I also don’t need to.

I consider myself pretty frugal, and I still think the electric cars were a good investment.

I wouldn’t be surprised if electric cars are more reliable. Not as many moving parts, and not many fluids under pressure.

Thanks Ron!

It looks like the peak of oil export has already happened in the past 5 years. If all the forces of calm, capital and ingenuity came together it is possible that the peak could be surpassed one more time, but highly unlikely.

This measure is much more important than global oil production, since it reflects factors such as how much internal consumption a producing country has, as well as the ability of consuming countries to pay for the output of high cost oil products.

Interesting set of headlines in past several days from Kurdistan-

The first tanker of Kurd Crude was purchased by Israel, after having trouble finding a buyer.

“Israel accepts first delivery of disputed Kurdish pipeline oil”

http://www.forbes.com/sites/christopherhelman/2014/06/23/iraqs-kurds-sell-oil-to-israel-move-closer-to-independence/

Next , the second tanker has approached the US gulf , but Iraq has obtained a court order to seize the oil-

http://www.bloomberg.com/news/2014-07-29/iraq-gets-u-s-court-order-seizing-tanker-crude-off-texas.html

This morning, a US judge has acted on the motion by the Iraqis-

http://www.reuters.com/article/2014/07/29/us-usa-iraq-kurdishoil-idUSKBN0FY0KX20140729